UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-01136

SECURITY EQUITY FUND

(Exact name of registrant as specified in charter)

ONE SECURITY BENEFIT PLACE, TOPEKA, KANSAS 66636-0001

(Address of principal executive offices) (Zip code)

RICHARD M. GOLDMAN, PRESIDENT

SECURITY EQUITY FUND

ONE SECURITY BENEFIT PLACE

TOPEKA, KANSAS 66636-0001

(Name and address of agent for service)

Registrant’s telephone number, including area code: (785) 438-3000

Date of fiscal year end: September 30

Date of reporting period: September 30, 2009

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

| Item 1. | Reports to Stockholders. |

Annual Report

September 30, 2009

| | • | | Rydex | SGI Equity Fund® |

| | • | | Alpha Opportunity Series |

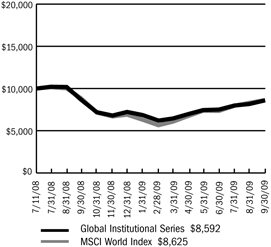

| | • | | Global Institutional Series |

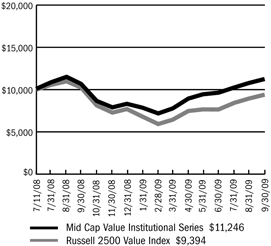

| | • | | Mid Cap Value Institutional Series |

| | • | | Small Cap Growth Series |

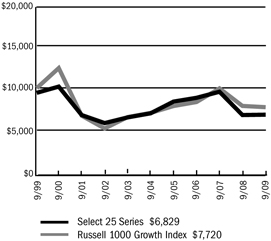

| | • | | Rydex | SGI Large Cap Value Fund |

| | • | | Large Cap Value Institutional Series |

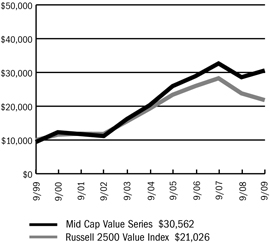

| | • | | Rydex | SGI Mid Cap Growth Fund |

Rydex | SGI Equity Fund

Rydex | SGI Large Cap Value Fund

Rydex | SGI Mid Cap Growth Fund

September 30, 2009

Annual Report

Table of Contents

1

This page left blank intentionally.

2

Managers’ Commentary

November 16, 2009

To Our Shareholders:

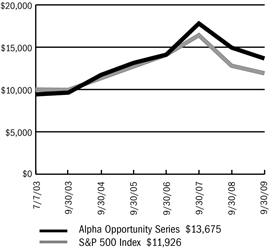

From its inception on October 3, 2008 through the fiscal year ended September 30, 2009, the Rydex| SGI Equity Fund All Cap Value Series gained 2.10%1 while the Series’ benchmark, the Russell 2000 Value Index, was down –5.48% during the same period.

Our strategy is to buy companies, across the market capitalization spectrum, trading at a significant discount to their intrinsic value. Our investment approach is a defined and disciplined process with three clear philosophical tenets that drive our investment decisions: a valuation focus, a long-term perspective and an opportunistic approach.

Our investment process is fundamentally driven and quantitatively aided. We use proprietary screens to identify potential companies for investment and then perform rigorous fundamental analysis to identify the best ideas. Through this fundamental research, we determine an estimate of intrinsic value and a valuation target for each idea. We construct the portfolios based on the level of conviction generated by the bottom-up analysis and the upside/downside profile associated with each company.

Industrials, Materials, and Health Care Top Performers

The Series’ industrials holdings, a large overweight position consisting of 19% of portfolio assets, gained approximately 2% compared to a 19% loss for the Index. Leading performers included McDermott International, Inc., URS Corporation (up around 40%), and United Technologies Corporation.

The materials sector contributed to portfolio performance though superior stock selection that allowed holdings to increase by approximately 55% versus a loss of about 5% for the benchmark. Leaders in the sector for the Series were Schweitzer-Mauduit International, Inc., which gained more than 200%, Eagle Materials, Inc., and Rohm & Hass Company.

Health care was an underweight position in the portfolio, but good stock picking led to a gain of approximately 23% for the sector while the Index lost 2%. Schering-Plough Corporation gained about 64% for the Series while Hospira, Inc. and Medco Health Solutions, Inc. contributed positive returns.

Financials and Utilities Disappoint

The largest drag on portfolio performance was due to cash. While in a fully invested position of around 6% during the fiscal year, the lack of any returns from the asset class hurt overall returns.

The financials sector was a large underweight position but fared no better in performance than the Index, each losing about 24%. Capital One Financial Corporation lost nearly 80%. Berkshire Hathaway, Inc. (Cl B), which was not a security in the Index, had a 3% average weighting during the fiscal year but was down more than 25%. Other detractors in the sector included JPMorgan Chase & Company and Wilmington Trust Corporation

The utilities sector in the Series had a nearly even weight and return with the Index, losing approximately 7%. The Series took a solid position of about 2.5% in Edison International but the security gave up 10% of its value for the period. Other securities holding down performance were Great Plains Energy, Inc. and Allete, Inc.

Market Outlook

While there are indications that the economy may be stabilizing from a macroeconomic standpoint, the economy and markets remain uncertain with contradictory information. Our bottom-up approach looks at market uncertainty in the context of the potential long-term impact on individual companies.

We are maintaining flexibility in the portfolios to take advantage of these opportunities as they arise. Our focus is on identifying companies with the ability to be substantially better over the next three to five years or have the potential to maintain their return on capital at current levels in a difficult economic environment. We are confident in our ability to find these companies.

We believe that investing is a long-term pursuit that requires patience and a consistent approach. We recognize there are many investment alternatives available today and thank you for your business and the confidence you place in us.

|

| Sincerely, |

|

| |

| James P. Schier, Portfolio Manager |

|

| |

| Mark A. Mitchell, Portfolio Manager |

| 1 | Performance figures are based on Class A shares and do not reflect deduction of the sales charges or taxes that a shareholder would pay on distributions or the redemption of shares. Fee waivers and/or reimbursements reduce Series expenses and in the absence of such waivers, the performance quoted would be reduced. |

| | The strategies discussed herein do not assure a profit. The Fund is distributed by Rydex Distributors, Inc. |

3

| | |

| | Rydex | SGI Equity Fund |

| Performance Summary | | All Cap Value Series |

| September 30, 2009 | | (unaudited) |

PERFORMANCE

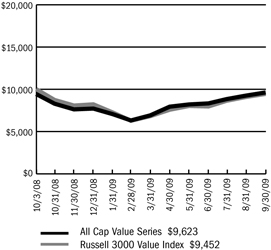

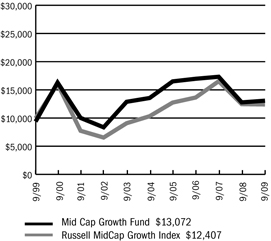

All Cap Value Series vs. Russell 3000 Value Index

$10,000 Since Inception

This chart assumes a $10,000 investment in Class A shares of All Cap Value Series on October 3, 2008 (date of inception), reflects deduction of the 5.75% sales load and assumes all dividends reinvested. The chart does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. The Russell 3000 Value Index is an unmanaged index that measures the performance of the broad value segment of the U.S. equity universe. It includes those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values.

Average Annual Returns

| | | |

Periods Ended 9-30-09 | | Since Inception

(10-03-08) | |

A Shares | | 2.10 | % |

A Shares with sales charge | | (3.77 | %) |

C Shares | | 1.30 | % |

C Shares with CDSC | | 0.30 | % |

Institutional Class | | 2.40 | % |

The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Series will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The figures above do not reflect deduction of the maximum front-end sales charge of 5.75% for Class A shares or the contingent deferred sales charge of 1% for Class C shares, as applicable, except where noted. The figures do not reflect the deduction of taxes that a shareholder would pay on distributions or redemption of shares. Such figures would be lower if the maximum sales charge and any applicable taxes were deducted. Fee waivers and/or reimbursements reduced expenses of the Series and in the absence of such waiver, the performance quoted would be reduced.

Portfolio Composition by Sector as of 9-30-09

| | | |

Consumer Discretionary | | 10.46 | % |

Consumer Staples | | 9.30 | |

Energy | | 10.01 | |

Financials | | 13.44 | |

Health Care | | 6.31 | |

Industrials | | 18.65 | |

Information Technology | | 9.86 | |

Materials | | 3.38 | |

Telecommunication Services | | 1.08 | |

Utilities | | 5.95 | |

Exchange Traded Funds | | 6.79 | |

Cash & Other Assets, Less Liabilities | | 4.77 | |

| | | |

Total Net Assets | | 100.00 | % |

| | | |

The accompanying notes are an integral part of the financial statements

4

| | |

| | Rydex | SGI Equity Fund |

| Performance Summary | | All Cap Value Series |

| September 30, 2009 | | (unaudited) |

Information About Your Series Expenses

Calculating your ongoing Series expenses

Example

As a shareholder of the Series, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; contingent deferred sales charges on redemptions; and redemption fees, if any; and (2) ongoing costs, including management fees; distribution and/or service fees (12b-1); and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period April 1, 2009 through September 30, 2009.

Actual Expenses

The first line for each class of shares in the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each class of shares in the table provides information about hypothetical account values and hypothetical expenses based on the Series actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions, and redemption fees, if any. Therefore, the second line for each class of shares is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Series Expenses

| | | | | | | | | |

| | | Beginning

Account

Value

4/1/2009 | | Ending

Account

Value

9/30/2009 1 | | Expenses

Paid

During

Period 2 |

All Cap Value Series - Class A | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,391.01 | | $ | 8.09 |

Hypothetical | | | 1,000.00 | | | 1,018.30 | | | 6.83 |

All Cap Value Series - Class C | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,383.88 | | | 12.55 |

Hypothetical | | | 1,000.00 | | | 1,014.54 | | | 10.61 |

All Cap Value Series - Institutional Class | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,393.20 | | | 6.60 |

Hypothetical | | | 1,000.00 | | | 1,019.55 | | | 5.57 |

| 1 | The actual ending account value is based on the actual total return of the Series for the period April 1, 2009 to September 30, 2009 after actual expenses and will differ from the hypothetical ending account value which is based on the Series expense ratio and a hypothetical annual return of 5% before expenses. The actual cumulative return at net asset value for the period April 1, 2009 to September 30, 2009 was 39.10%, 38.39% and 39.32%, for Class A, C and Institutional Class shares, respectively. |

| 2 | Expenses are equal to the Series annualized expense ratio (1.35%, 2.10% and 1.10% for Class A, C, and Institutional Class shares, respectively), net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

| | |

| Schedule of Investments | | Rydex | SGI Equity Fund |

| September 30, 2009 | | All Cap Value Series |

| | | | | |

| | | Shares | | Value |

COMMON STOCKS - 95.2% | | | | | |

Aerospace & Defense - 2.8% | | | | | |

GeoEye, Inc. * | | 336 | | $ | 9,005 |

Orbital Sciences Corporation * | | 430 | | | 6,437 |

Precision Castparts Corporation | | 36 | | | 3,667 |

United Technologies Corporation | | 620 | | | 37,777 |

| | | | | |

| | | | | 56,886 |

| | | | | |

Air Freight & Logistics - 2.3% | | | | | |

FedEx Corporation | | 617 | | | 46,411 |

| | | | | |

Apparel Retail - 0.9% | | | | | |

Brown Shoe Company, Inc. | | 721 | | | 5,782 |

Chico’s FAS, Inc. 1,* | | 797 | | | 10,362 |

Talbots, Inc. | | 223 | | | 2,058 |

| | | | | |

| | | | | 18,202 |

| | | | | |

Apparel, Accessories & Luxury Goods - 0.6% | | | | | |

Fossil, Inc. 1,* | | 149 | | | 4,239 |

Maidenform Brands, Inc. * | | 517 | | | 8,303 |

| | | | | |

| | | | | 12,542 |

| | | | | |

Asset Management & Custody Banks - 0.6% | | | | | |

Bank of New York Mellon Corporation | | 107 | | | 3,102 |

Fifth Street Finance Corporation | | 762 | | | 8,329 |

| | | | | |

| | | | | 11,431 |

| | | | | |

Biotechnology - 0.0% | | | | | |

Combinatorx, Inc. * | | 521 | | | 729 |

| | | | | |

Building Products - 1.0% | | | | | |

Trex Company, Inc. * | | 289 | | | 5,260 |

USG Corporation * | | 934 | | | 16,046 |

| | | | | |

| | | | | 21,306 |

| | | | | |

Coal & Consumable Fuels - 0.4% | | | | | |

Evergreen Energy, Inc. * | | 5,429 | | | 3,366 |

USEC, Inc. 1,* | | 835 | | | 3,916 |

| | | | | |

| | | | | 7,282 |

| | | | | |

Communications Equipment - 0.4% | | | | | |

Symmetricom, Inc. 2,* | | 1,745 | | | 9,039 |

| | | | | |

Computer & Electronics Retail - 0.2% | | | | | |

Conn’s, Inc. * | | 289 | | | 3,263 |

| | | | | |

Computer Hardware - 1.7% | | | | | |

Hewlett-Packard Company | | 733 | | | 34,605 |

| | | | | |

Construction & Engineering - 1.0% | | | | | |

Insituform Technologies, Inc. * | | 649 | | | 12,422 |

URS Corporation * | | 183 | | | 7,988 |

| | | | | |

| | | | | 20,410 |

| | | | | |

Construction & Farm Machinery & Heavy Trucks - 0.2% | | | | | |

Force Protection, Inc. * | | 700 | | | 3,822 |

| | | | | |

Construction Materials - 0.8% | | | | | |

Eagle Materials, Inc. 1 | | 517 | | | 14,776 |

| | | | | |

Consumer Finance - 0.3% | | | | | |

First Marblehead Corporation * | | 2,329 | | | 5,124 |

| | | | | |

| | | | | |

| | | Shares | | Value |

COMMON STOCKS - 95.2% (continued) | | | | | |

Data Processing & Outsourced Services - 5.1% | | | | | |

Affiliated Computer Services, Inc. * | | 210 | | $ | 11,376 |

Computer Sciences Corporation * | | 593 | | | 31,257 |

Western Union Company | | 3,250 | | | 61,489 |

| | | | | |

| | | | | 104,122 |

| | | | | |

Department Stores - 3.0% | | | | | |

JC Penney Company, Inc. | | 1,821 | | | 61,458 |

| | | | | |

Diversified Banks - 1.5% | | | | | |

U.S. Bancorp | | 477 | | | 10,427 |

Wells Fargo & Company | | 726 | | | 20,459 |

| | | | | |

| | | | | 30,886 |

| | | | | |

Diversified Chemicals - 0.7% | | | | | |

Dow Chemical Company | | 546 | | | 14,234 |

| | | | | |

Drug Retail - 1.9% | | | | | |

CVS Caremark Corporation | | 1,088 | | | 38,885 |

| | | | | |

Electric Utilities - 3.6% | | | | | |

Allete, Inc. 1 | | 263 | | | 8,829 |

American Electric Power Company, Inc. | | 17 | | | 527 |

Edison International | | 1,360 | | | 45,668 |

Empire District Electric Company | | 87 | | | 1,574 |

Great Plains Energy, Inc. | | 507 | | | 9,100 |

Northeast Utilities | | 212 | | | 5,033 |

Westar Energy, Inc. | | 190 | | | 3,707 |

| | | | | |

| | | | | 74,438 |

| | | | | |

Electrical Components & Equipment - 0.2% | | | | | |

Power-One, Inc. 2,* | | 2,307 | | | 4,499 |

| | | | | |

Electronic Manufacturing Services - 2.0% | | | | | |

Maxwell Technologies, Inc. * | | 839 | | | 15,463 |

Tyco Electronics, Ltd. | | 1,132 | | | 25,221 |

| | | | | |

| | | | | 40,684 |

| | | | | |

Environmental & Facilities Services - 0.5% | | | | | |

Covanta Holding Corporation * | | 550 | | | 9,350 |

| | | | | |

Exchange Traded Funds - 6.8% | | | | | |

iShares Russell 1000 Value Index Fund | | 1,260 | | | 69,917 |

iShares S&P 500 Value Index Fund | | 1,350 | | | 69,107 |

| | | | | |

| | | | | 139,024 |

| | | | | |

Forest Products - 0.5% | | | | | |

Louisiana-Pacific Corporation 1,* | | 1,560 | | | 10,405 |

| | | | | |

Gas Utilities - 0.3% | | | | | |

Atmos Energy Corporation | | 216 | | | 6,087 |

| | | | | |

Health Care Equipment - 2.7% | | | | | |

Aspect Medical Systems, Inc. * | | 381 | | | 4,564 |

Covidien plc | | 328 | | | 14,190 |

Hologic, Inc. * | | 409 | | | 6,683 |

Hospira, Inc. * | | 609 | | | 27,162 |

| | | | | |

| | | | | 52,599 |

| | | | | |

The accompanying notes are an integral part of the financial statements

6

| | |

| Schedule of Investments | | Rydex | SGI Equity Fund |

| September 30, 2009 | | All Cap Value Series |

| | | | | |

| | | Shares | | Value |

COMMON STOCKS - 95.2% (continued) | | | | | |

Health Care Services - 1.4% | | | | | |

Amedisys, Inc. * | | 115 | | $ | 5,017 |

Medco Health Solutions, Inc. * | | 244 | | | 13,496 |

Mednax, Inc. * | | 149 | | | 8,183 |

Providence Service Corporation * | | 81 | | | 944 |

RehabCare Group, Inc. * | | 72 | | | 1,562 |

| | | | | |

| | | | | 29,202 |

| | | | | |

Highways & Railtracks - 0.0% | | | | | |

Quixote Corporation 2 | | 204 | | | 508 |

| | | | | |

Home Furnishings - 0.5% | | | | | |

Leggett & Platt, Inc. | | 567 | | | 11,000 |

| | | | | |

Home Improvement Retail - 2.3% | | | | | |

Lowe’s Companies, Inc. | | 2,219 | | | 46,466 |

| | | | | |

Human Resources & Employment Services - 0.2% | | | | | |

Administaff, Inc. | | 182 | | | 4,781 |

| | | | | |

Hypermarkets & Super Centers - 2.4% | | | | | |

Wal-Mart Stores, Inc. | | 980 | | | 48,108 |

| | | | | |

Independent Power Producers & Energy Traders - 1.0% | | | | | |

NRG Energy, Inc. * | | 729 | | | 20,551 |

| | | | | |

Industrial Conglomerates - 2.8% | | | | | |

General Electric Company | | 1,047 | | | 17,192 |

McDermott International, Inc. * | | 1,598 | | | 40,380 |

| | | | | |

| | | | | 57,572 |

| | | | | |

Industrial Machinery - 2.1% | | | | | |

Dover Corporation | | 357 | | | 13,837 |

Harsco Corporation | | 149 | | | 5,276 |

Parker Hannifin Corporation | | 442 | | | 22,914 |

| | | | | |

| | | | | 42,027 |

| | | | | |

Insurance Brokers - 0.8% | | | | | |

AON Corporation | | 359 | | | 14,607 |

Arthur J Gallagher & Company | | 107 | | | 2,608 |

| | | | | |

| | | | | 17,215 |

| | | | | |

Integrated Oil & Gas - 3.8% | | | | | |

Chevron Corporation | | 450 | | | 31,694 |

ConocoPhillips | | 440 | | | 19,870 |

Exxon Mobil Corporation | | 390 | | | 26,758 |

| | | | | |

| | | | | 78,322 |

| | | | | |

Integrated Telecommunication Services - 1.1% | | | | | |

Windstream Corporation | | 2,172 | | | 22,002 |

| | | | | |

IT Consulting & Other Services - 0.3% | | | | | |

Satyam Computer Services, Ltd. ADR | | 894 | | | 5,883 |

| | | | | |

Managed Health Care - 1.5% | | | | | |

Aetna, Inc. | | 1,129 | | | 31,420 |

| | | | | |

Movies & Entertainment - 1.8% | | | | | |

Time Warner, Inc. | | 1,297 | | | 37,328 |

| | | | | |

| | | | | |

| | | Shares | | Value |

COMMON STOCKS - 95.2% (continued) | | | | | |

Multi-Line Insurance - 0.8% | | | | | |

American Financial Group, Inc. | | 610 | | $ | 15,555 |

| | | | | |

Multi-Utilities - 1.0% | | | | | |

Alliant Energy Corporation | | 389 | | | 10,833 |

Black Hills Corporation | | 150 | | | 3,776 |

SCANA Corporation 1 | | 172 | | | 6,003 |

| | | | | |

| | | | | 20,612 |

| | | | | |

Office Services & Supplies - 0.1% | | | | | |

United Stationers, Inc. * | | 47 | | | 2,238 |

| | | | | |

Oil & Gas Equipment & Services - 2.4% | | | | | |

Global Industries, Ltd. * | | 2,584 | | | 24,548 |

Halliburton Company | | 929 | | | 25,194 |

| | | | | |

| | | | | 49,742 |

| | | | | |

Oil & Gas Exploration & Production - 1.7% | | | | | |

Chesapeake Energy Corporation | | 569 | | | 16,160 |

Goodrich Petroleum Corporation * | | 183 | | | 4,723 |

Gulfport Energy Corporation * | | 240 | | | 2,098 |

PetroHawk Energy Corporation * | | 520 | | | 12,589 |

| | | | | |

| | | | | 35,570 |

| | | | | |

Oil & Gas Storage & Transportation - 1.7% | | | | | |

Southern Union Company | | 483 | | | 10,042 |

Williams Companies, Inc. | | 1,340 | | | 23,945 |

| | | | | |

| | | | | 33,987 |

| | | | | |

Other Diversified Financial Services - 1.3% | | | | | |

JPMorgan Chase & Company | | 610 | | | 26,730 |

| | | | | |

Packaged Foods & Meats - 3.2% | | | | | |

Del Monte Foods Company | | 900 | | | 10,422 |

Hormel Foods Corporation 1 | | 369 | | | 13,107 |

JM Smucker Company | | 381 | | | 20,197 |

Ralcorp Holdings, Inc. * | | 100 | | | 5,847 |

TreeHouse Foods, Inc. 1,* | | 493 | | | 17,585 |

| | | | | |

| | | | | 67,158 |

| | | | | |

Paper Packaging - 0.7% | | | | | |

Bemis Company, Inc. | | 334 | | | 8,654 |

Sonoco Products Company | | 221 | | | 6,086 |

| | | | | |

| | | | | 14,740 |

| | | | | |

Paper Products - 0.6% | | | | | |

Schweitzer-Mauduit International, Inc. | | 235 | | | 12,775 |

| | | | | |

Personal Products - 0.5% | | | | | |

Elizabeth Arden, Inc. * | | 859 | | | 10,110 |

| | | | | |

Pharmaceuticals - 0.7% | | | | | |

Schering-Plough Corporation | | 539 | | | 15,227 |

| | | | | |

Property & Casualty Insurance - 5.5% | | | | | |

Alleghany Corporation * | | 33 | | | 8,549 |

Berkshire Hathaway, Inc. (Cl.B) * | | 17 | | | 56,490 |

Employers Holdings, Inc. | | 439 | | | 6,796 |

Hanover Insurance Group, Inc. | | 544 | | | 22,484 |

W.R. Berkley Corporation | | 816 | | | 20,628 |

| | | | | |

| | | | | 114,947 |

| | | | | |

The accompanying notes are an integral part of the financial statements

7

| | |

| Schedule of Investments | | Rydex | SGI Equity Fund |

| September 30, 2009 | | All Cap Value Series |

| | | | | |

| | | Shares | | Value |

COMMON STOCKS - 95.2% (continued) | | | | | |

Railroads - 1.5% | | | | | |

Union Pacific Corporation | | 510 | | $ | 29,759 |

| | | | | |

Regional Banks - 2.6% | | | | | |

Associated Banc-Corporation | | 509 | | | 5,813 |

Fifth Third Bancorp | | 500 | | | 5,065 |

First Horizon National Corporation * | | 360 | | | 4,758 |

Old National Bancorp | | 713 | | | 7,986 |

Regions Financial Corporation | | 4,750 | | | 29,497 |

| | | | | |

| | | | | 53,119 |

| | | | | |

Research & Consulting Services - 3.7% | | | | | |

Equifax, Inc. | | 2,160 | | | 62,941 |

ICF International, Inc. * | | 149 | | | 4,518 |

Navigant Consulting, Inc. * | | 715 | | | 9,653 |

| | | | | |

| | | | | 77,112 |

| | | | | |

Restaurants - 0.5% | | | | | |

Burger King Holdings, Inc. | | 578 | | | 10,167 |

| | | | | |

Semiconductors - 0.4% | | | | | |

IXYS Corporation 2 | | 884 | | | 7,523 |

| | | | | |

Specialty Chemicals - 0.1% | | | | | |

Zoltek Companies, Inc. * | | 214 | | | 2,247 |

| | | | | |

Specialty Stores - 0.7% | | | | | |

Cabela’s, Inc. * | | 1,023 | | | 13,647 |

| | | | | |

Tobacco - 1.3% | | | | | |

Philip Morris International, Inc. | | 532 | | | 25,930 |

| | | | | |

Trucking - 0.2% | | | | | |

Saia, Inc. * | | 302 | | | 4,856 |

| | | | | |

TOTAL COMMON STOCKS (cost $1,800,547) | | | | $ | 1,948,635 |

| | | | | |

Total Investments - 95.2% 3 (cost $1,800,547) | | | | $ | 1,948,635 |

Cash & Other Assets, Less Liabilities - 4.8% | | | | | 97,581 |

| | | | | |

Total Net Assets - 100.0% | | | | $ | 2,046,216 |

| | | | | |

For federal income tax purposes the identified cost of investments owned at September 30, 2009 was $1,801,574.

| ADR | American Depositary Receipt |

| plc | Public Limited Company |

| * | Non-income producing security |

| 1 | Security is segregated as collateral for open written option contracts. |

| 2 | Security is deemed illiquid. The total market value of illiquid securities is $21,569 (cost $21,127), or 1.1% of total net assets. |

| 3 | Unless otherwise indicated, the values of the securities of the Portfolio are determined based on Level 1 inputs established by ASC 820. |

The accompanying notes are an integral part of the financial statements

8

Rydex | SGI Equity Fund

All Cap Value Series

Statement of Assets and Liabilities

September 30, 2009

| | | | |

Assets: | | | | |

Investments, at value* | | $ | 1,948,635 | |

Cash | | | 170,987 | |

Receivables: | | | | |

Fund shares sold | | | 100 | |

Securities sold | | | 332 | |

Dividends | | | 2,302 | |

Security Investors | | | 3,181 | |

Prepaid expenses | | | 17,908 | |

| | | | |

Total assets | | | 2,143,445 | |

| | | | |

Liabilities: | | | | |

Payable for: | | | | |

Securities purchased | | | 82,856 | |

Written options, at value

(premiums received, $2,233) | | | 1,610 | |

Management fees | | | 1,128 | |

Custodian fees | | | 265 | |

Transfer agent/maintenance fees | | | 344 | |

Administration fees | | | 431 | |

Professional fees | | | 7,400 | |

12b-1 distribution plan fees | | | 591 | |

Directors’ fees | | | 163 | |

Other | | | 2,441 | |

| | | | |

Total liabilities | | | 97,229 | |

| | | | |

Net assets | | $ | 2,046,216 | |

| | | | |

Net assets consist of: | | | | |

Paid in capital | | $ | 1,917,712 | |

Undistributed net investment income | | | 3,576 | |

Accumulated net realized loss on sale of investments | | | (23,783 | ) |

Net unrealized appreciation in value of investments | | | 148,711 | |

| | | | |

Net assets | | $ | 2,046,216 | |

| | | | |

Class A: | | | | |

Capital shares outstanding

(unlimited number of shares authorized) | | | 129,256 | |

Net assets | | $ | 1,319,277 | |

Net asset value and redemption price per share | | $ | 10.21 | |

| | | | |

Maximum offering price per share (net asset value divided by 94.25%) | | $ | 10.83 | |

| | | | |

Class C: | | | | |

Capital shares outstanding

(unlimited number of shares authorized) | | | 42,982 | |

Net assets | | $ | 435,612 | |

Net asset value, offering and redemption price per share (excluding any applicable contingent deferred sales charge) | | $ | 10.13 | |

| | | | |

Institutional Class: | | | | |

Capital shares outstanding (unlimited number of shares authorized) | | | 28,464 | |

Net assets | | $ | 291,327 | |

Net asset value, offering and redemption price per share (excluding any applicable contingent deferred sales charge) | | $ | 10.24 | |

| | | | |

* Investments, at cost | | $ | 1,800,547 | |

Statement of Operations

For the Period Ended September 30, 2009*

| | | | |

Investment Income: | | | | |

Dividends | | $ | 17,025 | |

Interest | | | 144 | |

| | | | |

Total investment income | | | 17,169 | |

| | | | |

Expenses: | | | | |

Management fees | | | 6,241 | |

Transfer agent/maintenance fees | | | 977 | |

Administration fees | | | 1,553 | |

Custodian fees | | | 4,340 | |

Directors’ fees | | | 223 | |

Professional fees | | | 8,373 | |

Reports to shareholders | | | 2,281 | |

Registration fees | | | 39,483 | |

Other expenses | | | 2,986 | |

12b-1 distribution fees - Class A | | | 1,027 | |

12b-1 distribution fees - Class C | | | 2,597 | |

| | | | |

Total expenses | | | 70,081 | |

Less: | | | | |

Reimbursement of expenses - Class A | | | (22,184 | ) |

Reimbursement of expenses - Class C | | | (17,634 | ) |

Reimbursement of expenses - Institutional Class | | | (16,670 | ) |

| | | | |

Net expenses | | | 13,593 | |

| | | | |

Net investment income | | | 3,576 | |

| | | | |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain (loss) during the period on: | | | | |

Investments | | | (23,783 | ) |

| | | | |

Net realized loss | | | (23,783 | ) |

| | | | |

Net unrealized appreciation (depreciation) during the period on: | | | | |

Investments | | | 148,088 | |

Options written | | | 623 | |

| | | | |

Net unrealized appreciation | | | 148,711 | |

| | | | |

Net realized and unrealized gain | | | 124,928 | |

| | | | |

Net increase in net assets resulting from operations | | $ | 128,504 | |

| | | | |

| * | For the period from October 3, 2008 (commencement of operations) to September 30, 2009. |

The accompanying notes are an integral part of the financial statements

9

| | |

| | Rydex | SGI Equity Fund |

| Statement of Changes in Net Assets | | All Cap Value Series |

| | | | |

| | | Period Ended

September 30,

2009* | |

Increase (decrease) in net assets from operations: | | | | |

Net investment income | | $ | 3,576 | |

Net realized loss during the period on investments | | | (23,783 | ) |

Net unrealized appreciation during the period on investments | | | 148,711 | |

| | | | |

Net increase in net assets resulting from operations | | | 128,504 | |

| | | | |

Capital share transactions: | | | | |

Proceeds from sale of shares | | | | |

Class A | | | 1,271,992 | |

Class C | | | 418,597 | |

Institutional Class | | | 284,637 | |

Cost of shares redeemed | | | | |

Class A | | | (56,559 | ) |

Class C | | | (955 | ) |

| | | | |

Net increase from capital share transactions | | | 1,917,712 | |

| | | | |

Net increase in net assets | | | 2,046,216 | |

| | | | |

Net assets: | | | | |

Beginning of period | | | — | |

| | | | |

End of period | | $ | 2,046,216 | |

| | | | |

Undistributed net investment income at end of period | | $ | 3,576 | |

| | | | |

Capital share activity: | | | | |

Shares sold | | | | |

Class A | | | 134,995 | |

Class C | | | 43,096 | |

Institutional Class | | | 28,464 | |

Shares redeemed | | | | |

Class A | | | (5,739 | ) |

Class C | | | (114 | ) |

| * | For the period October 3, 2008 (commencement of operations) to September 30, 2009. |

The accompanying notes are an integral part of the financial statements

10

| | |

| Financial Highlights | | Rydex | SGI Equity Fund |

Selected data for each share of capital stock outstanding throughout each period | | All Cap Value Series |

| | | | |

Class A | | Year Ended

September 30,

2009 a | |

Per Share Data | | | | |

Net asset value, beginning of period | | $ | 10.00 | |

| | | | |

Income (loss) from investment operations: | | | | |

Net investment income b | | | 0.04 | |

Net gain on securities (realized and unrealized) | | | 0.17 | |

| | | | |

Total from investment operations | | | 0.21 | |

| | | | |

Net asset value, end of period | | $ | 10.21 | |

| | | | |

Total Return c | | | 2.10 | % |

| | | | |

Ratios/Supplemental Data | | | | |

Net assets, end of period (in thousands) | | $ | 1,319 | |

| | | | |

Ratios to average net assets: | | | | |

Net investment income | | | 0.51 | % |

Total expenses d | | | 6.75 | % |

Net expenses e | | | 1.35 | % |

Net expenses prior to custodian earning credits and net of expense waivers | | | 1.35 | % |

| | | | |

Portfolio turnover rate | | | 17 | % |

| | | | |

Class C | | Year Ended

September 30,

2009a | |

Per Share Data | | | | |

Net asset value, beginning of period | | $ | 10.00 | |

| | | | |

Income (loss) from investment operations: | | | | |

Net investment loss b | | | (0.02 | ) |

Net gain on securities (realized and unrealized) | | | 0.15 | |

| | | | |

Total from investment operations | | | 0.13 | |

| | | | |

Net asset value, end of period | | $ | 10.13 | |

| | | | |

Total Return c | | | 1.30 | % |

| | | | |

Ratios/Supplemental Data | | | | |

Net assets, end of period (in thousands) | | $ | 436 | |

| | | | |

Ratios to average net assets: | | | | |

Net investment loss | | | (0.18 | %) |

Total expenses d | | | 8.89 | % |

Net expenses e | | | 2.10 | % |

Net expenses prior to custodian earning credits and net of expense waivers | | | 2.10 | % |

| | | | |

Portfolio turnover rate | | | 17 | % |

The accompanying notes are an integral part of the financial statements

11

| | |

| Financial Highlights | | Rydex | SGI Equity Fund |

Selected data for each share of capital stock outstanding throughout each period | | All Cap Value Series |

| | | | |

Institutional Class | | Year Ended

September 30,

2009a | |

Per Share Data | | | | |

Net asset value, beginning of period | | $ | 10.00 | |

| | | | |

Income (loss) from investment operations: | | | | |

Net investment income b | | | 0.07 | |

Net gain on securities (realized and unrealized) | | | 0.17 | |

| | | | |

Total from investment operations | | | 0.24 | |

| | | | |

Net asset value, end of period | | $ | 10.24 | |

| | | | |

Total Return c | | | 2.40 | % |

| | | | |

Ratios/Supplemental Data | | | | |

Net assets, end of period (in thousands) | | $ | 291 | |

| | | | |

Ratios to average net assets: | | | | |

Net investment income | | | 0.82 | % |

Total expenses d | | | 8.19 | % |

Net expenses e | | | 1.10 | % |

Net expenses prior to custodian earning credits and net of expense waivers | | | 1.10 | % |

| | | | |

Portfolio turnover rate | | | 17 | % |

| a | The All Cap Value Series was initially capitalized on October 3, 2008 with a net asset value of $10 per share. Percentage amounts for the period, except total return, have been annualized. |

| b | Net investment income (loss) was computed using average shares outstanding throughout the period. |

| c | Total return information does not reflect deduction of any sales charges imposed at the time of purchase for Class A shares or upon redemption for Class C shares. |

| d | Total expense information reflects expense ratios absent expense reductions by the Investment Manager and custodian earnings credits, as applicable. |

| e | Net expense information reflects the expense ratios after voluntary expense waivers, reimbursements and custodian earnings credits, as applicable. |

The accompanying notes are an integral part of the financial statements

12

Managers’ Commentary

November 16, 2009

To Our Shareholders:

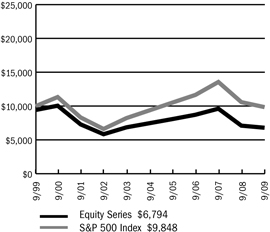

For the fiscal year ended September 30, 2009, the Rydex|SGI Equity Fund Alpha Opportunity Series returned –8.55%1 compared to –6.91% for the Series’ benchmark, the S&P 500 Index.

The Series pursues its objective by investing approximately 37.5% of its total assets according to a long/short strategy in domestic equity securities and 37.5% of its total assets according to a long/short strategy in non-U.S. securities. The manager invests the remaining 25% of total assets in a portfolio of equity securities, equity derivative securities, and fixed income securities intended to track the S&P 500 Index.

The Series pursues its domestic long/short strategy using fundamental and technical analysis to identify quality securities trading at attractive valuations. The domestic strategy uses a top-down perspective to formulate long-term themes and a bottom-up approach to identify individual securities. The Series pursues its global long/short strategy using quantitative and qualitative techniques to identify long and short investment opportunities.

Domestic Strategy Performance

For the domestic strategy, contributors to performance included the utilities and telecommunications sectors. Investments in utility companies Calpine Corporation and Dominion Reserves, Inc. added positive returns. In the telecommunications sector, leading holdings included MetroPCS Communications, Inc. and Vivo Participacoes S/A.

Sector detractors in the domestic strategy included industrials, financials, and consumer discretionary. Air transportation companies Southwest Airlines Company and Delta Air Lines, Inc. lowered performance in the industrials sector. Other laggards included Watson Wyatt Worldwide, Inc. (Cl A) and Granite City Construction, Inc. In the financials sector, holdings contributing negatively to performance were Wells Fargo & Company, JPMorgan Chase & Company, and Prudential Financial, Inc. Holdings in the consumer discretionary sector that hurt returns included Urban Outfitters, Inc., Lowe’s Companies, Best Buy Company, Inc., and 99 Cents Only Stores.

Global Strategy Performance

For the global strategy, top performing sectors included consumer discretionary, health care, and consumer staples. Leading securities in the consumer discretionary sector included Volkswagen AG, Shanda Interactive Entertainment, Ltd., and Marvel Entertainment. In the health care sector, Sequenom, Inc., Basilea Pharmaceutica AG, and XenoPort, Inc. added to overall returns. Philip Morris International, Inc. and Wal-Mart Stores, Inc. led holdings in the consumer staples sector.

The financials and information technology sectors hurt performance in the global strategy part of the portfolio. As in the United States, financial companies have been hit hard all around the globe. Financial holdings in the portfolio dragging down returns included Mizuho Financial Group, Inc., Erste Group Bank AG, Anglo Irish Bank, and UBI Banca. Negative contributors in the information technology sector included Cree, Inc., Baidu, Inc., VMware, Inc., ZTE Corporation, and Riverbed Technology, Inc.

Due to a previous brokerage relationship with Lehman Brothers International Europe (“LBIE”) (which was placed into administration on September 15, 2008), the Series has certain short sale positions that it is currently unable to settle and certain long positions held by its custodian that are pledged to LBIE which the Series currently cannot access. As a result, the Series is currently unable to actively pursue the global long/short portion of its investment strategy. The Series is unable to determine when it will resume its full investment program.

Market Outlook

There are signs that the economy may be stabilizing from a macroeconomic perspective. In September, the Federal Open Market Committee reported data indicating a slowly improving economy. Moody’s Investor Service lowered their outlook for corporate bond defaults, which will make owning riskier assets more rewarding as the implied default rate declines. Fixed income factors suggests improving economic growth as the yield curve remains historically steep and monetary policy continues to be accommodative.

We thank you for your investment and appreciate the trust and confidence you have placed in us.

Sincerely,

Bill Jenkins, Portfolio Manager

(Mainstream Investment Advisers)

Charles Craig, Portfolio Manager

(Mainstream Investment Advisers)

David Whittall, Portfolio Manager

(Security Global Investors, LLC

Scott Klimo, Portfolio Manager

(Security Global Investors, LLC)

Mark Kress, Portfolio/Risk Manager

(Security Global Investors, LLC)

Yon Perullo, Portfolio/Risk Manager

(Security Global Investors, LLC)

Christi Fletcher, Portfolio Manager

(Security Investors, LLC)

| 1 | Performance figures are based on Class A shares and do not reflect deduction of the sales charges or taxes that a shareholder would pay on distributions or the redemption of shares. Fee waivers and/or reimbursements reduce Series expenses and in the absence of such waivers, the performance quoted would be reduced. |

| | The strategies discussed herein do not assure a profit. The Fund is distributed by Rydex Distributors, Inc. |

13

| | |

| | Rydex | SGI Equity Fund |

| Performance Summary | | Alpha Opportunity Series |

| September 30, 2009 | | (unaudited) |

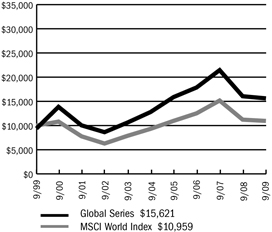

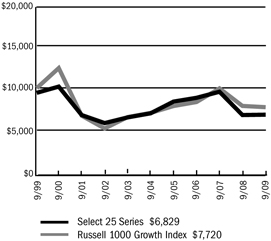

PERFORMANCE

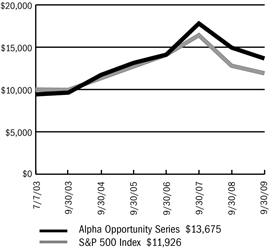

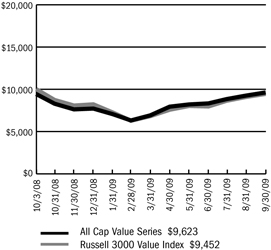

Alpha Opportunity Series vs. S&P 500 Index

$10,000 Since Inception

This chart assumes a $10,000 investment in Class A shares of Alpha Opportunity Series on July 7, 2003 (date of inception), reflects deduction of the 5.75% sales load and assumes all dividends reinvested. The chart does not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of fund shares. The S&P 500 Index is a capitalization weighted index composed of 500 selected common stocks that represent the broad domestic economy and is a widely recognized unmanaged index of market performance.

Average Annual Returns

| | | | | | | | |

Periods Ended 9-30-09 | | 1 Year | | | 5 Years | | | Since Inception |

A Shares | | (8.55 | %) | | 3.14 | % | | 6.15% |

| | | | | | | | (7-07-03) |

A Shares with sales charge | | (13.80 | %) | | 1.92 | % | | 5.15% |

| | | | | | | | (7-07-03) |

B Shares | | (9.15 | %) | | 2.36 | % | | 5.36% |

| | | | | | | | (7-07-03) |

B Shares with CDSC | | (13.69 | %) | | 2.11 | % | | 5.36% |

| | | | | | | | (7-07-03) |

C Shares | | (9.48 | %) | | 2.31 | % | | 5.32% |

| | | | | | | | (7-07-03) |

C Shares with CDSC | | (10.39 | %) | | 2.31 | % | | 5.32% |

| | | | | | | | (7-07-03) |

Institutional Shares | | — | | | — | | | 17.30% |

| | | | | | | | (11-07-08) |

The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Series will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The figures above do not reflect deduction of the maximum front-end sales charge of 5.75% for Class A shares or the contingent deferred sales charge of 5% for Class B shares and 1% for Class C shares, as applicable, except where noted. The figures do not reflect the deduction of taxes that a shareholder would pay on distributions or redemption of shares. Such figures would be lower if the maximum sales charge and any applicable taxes were deducted. Fee waivers and/or reimbursements reduced expenses of the Series and in the absence of such waiver, the performance quoted would be reduced.

Portfolio Composition by Sector as of 9-30-09*

| | | |

Consumer Discretionary | | (2.95 | %) |

Consumer Staples | | 8.88 | |

Energy | | 2.06 | |

Financials | | (1.95 | ) |

Health Care | | 2.08 | |

Industrials | | 7.29 | |

Information Technology | | 13.35 | |

Materials | | 4.98 | |

Telecommunication Services | | 0.20 | |

Utilities | | (0.53 | ) |

Exchange Traded Funds | | 3.54 | |

U.S. Government Sponsored Agencies | | 9.65 | |

Repurchase Agreement | | 10.79 | |

Short Term Investments | | 15.83 | |

Cash & Other Assets, Less Liabilities | | 26.78 | |

| | | |

Total Net Assets | | 100.00 | % |

| | | |

| * | Securities sold short are netted with long positions in common stocks in the appropriate sectors. |

The accompanying notes are an integral part of the financial statements

14

| | |

| | Rydex | SGI Equity Fund |

| Performance Summary | | Alpha Opportunity Series |

September 30, 2009 | | (unaudited) |

Information About Your Series Expenses

Calculating your ongoing Series expenses

Example

As a shareholder of the Series, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; contingent deferred sales charges on redemptions; and redemption fees, if any; and (2) ongoing costs, including management fees; distribution and/or service fees (12b-1); and other Series expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Series and to compare these costs with ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period April 1, 2009 through September 30, 2009.

Actual Expenses

The first line for each class of shares in the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each class of shares in the table provides information about hypothetical account values and hypothetical expenses based on the Series actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Series actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Series and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions, and redemption fees, if any. Therefore, the second line for each class of shares is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Series Expenses

| | | | | | | | | |

| | | Beginning

Account

Value

4/1/2009 | | Ending

Account

Value

9/30/2009 1 | | Expenses

Paid

During

Period 2 |

Alpha Opportunity Series - Class A | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 1,329.19 | | $ | 11.39 |

Hypothetical | | | 1,000.00 | | | 1,015.29 | | | 9.85 |

Alpha Opportunity Series - Class B | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,324.55 | | | 15.73 |

Hypothetical | | | 1,000.00 | | | 1,011.53 | | | 13.62 |

Alpha Opportunity Series - Class C | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,323.43 | | | 15.73 |

Hypothetical | | | 1,000.00 | | | 1,011.53 | | | 13.62 |

Alpha Opportunity Series - Class Institutional | | | | | | | | | |

Actual | | | 1,000.00 | | | 1,329.93 | | | 9.93 |

Hypothetical | | | 1,000.00 | | | 1,016.55 | | | 8.59 |

| 1 | The actual ending account value is based on the actual total return of the Series for the period April 1, 2009 to September 30, 2009 after actual expenses and will differ from the hypothetical ending account value which is based on the Series expense ratio and a hypothetical annual return of 5% before expenses. The actual cumulative return at net asset value for the period April 1, 2009 to September 30, 2009 was 32.92%, 32.45%, 32.34% and 32.99%, for Class A, B, C and Institutional Class shares, respectively. |

| 2 | Expenses are equal to the Series annualized expense ratio (1.95%, 2.70%, 2.70% and 1.70% for Class A, B, C and Institutional Class shares, respectively), net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

| | |

| Schedule of Investments | | Rydex | SGI Equity Fund |

| September 30, 2009 | | Alpha Opportunity Series |

| | | | | |

| | | Shares | | Value |

COMMON STOCKS - 87.6% | | | | | |

Aerospace & Defense - 2.3% | | | | | |

Lockheed Martin Corporation 1,2 | | 3,753 | | $ | 293,034 |

Northrop Grumman Corporation 1,2 | | 1,100 | | | 56,925 |

| | | | | |

| | | | | 349,959 |

| | | | | |

Agricultural Products - 1.6% | | | | | |

AgFeed Industries, Inc. * | | 2,930 | | | 15,646 |

Archer-Daniels-Midland Company 3 | | 8,176 | | | 238,903 |

| | | | | |

| | | | | 254,549 |

| | | | | |

Airlines - 0.5% | | | | | |

Airtran Holdings, Inc. * | | 13,007 | | | 81,294 |

| | | | | |

Aluminum - 0.6% | | | | | |

Alcoa, Inc. | | 2,248 | | | 29,494 |

Century Aluminum Company * | | 6,336 | | | 59,241 |

| | | | | |

| | | | | 88,735 |

| | | | | |

Apparel Retail - 3.8% | | | | | |

Gap, Inc. 1,2 | | 6,000 | | | 128,400 |

Gymboree Corporation 1,2,* | | 3,000 | | | 145,140 |

Ltd. Brands, Inc. 1,2 | | 5,100 | | | 86,649 |

Ross Stores, Inc. 1,2 | | 2,100 | | | 100,317 |

TJX Companies, Inc. 1,2 | | 3,600 | | | 133,740 |

| | | | | |

| | | | | 594,246 |

| | | | | |

Apparel, Accessories & Luxury Goods - 0.2% | | | | | |

Phillips-Van Heusen Corporation 1,2 | | 800 | | | 34,232 |

| | | | | |

Automobile Manufacturers - 0.2% | | | | | |

Ford Motor Company * | | 4,088 | | | 29,474 |

| | | | | |

Biotechnology - 0.7% | | | | | |

Amgen, Inc. 1,2,* | | 1,800 | | | 108,414 |

| | | | | |

Coal & Consumable Fuels - 0.6% | | | | | |

Alpha Natural Resources, Inc. * | | 2,453 | | | 86,100 |

| | | | | |

Communications Equipment - 1.3% | | | | | |

ADC Telecommunications, Inc. * | | 4,701 | | | 39,206 |

Cisco Systems, Inc. * | | 409 | | | 9,628 |

Harmonic, Inc. 1,2,* | | 11,000 | | | 73,480 |

JDS Uniphase Corporation * | | 4,088 | | | 29,066 |

Oplink Communications, Inc. * | | 2,591 | | | 37,621 |

Opnext, Inc. * | | 2,084 | | | 6,106 |

| | | | | |

| | | | | 195,107 |

| | | | | |

Computer & Electronics Retail - 1.2% | | | | | |

Best Buy Company, Inc. | | 2,656 | | | 99,653 |

RadioShack Corporation 1,2 | | 5,100 | | | 84,507 |

| | | | | |

| | | | | 184,160 |

| | | | | |

Computer Hardware - 0.3% | | | | | |

International Business Machines Corporation | | 409 | | | 48,920 |

| | | | | |

Computer Storage & Peripherals - 0.4% | | | | | |

Logitech International S.A. * | | 381 | | | 7,003 |

Seagate Technology | | 2,044 | | | 31,089 |

| | | | | |

| | | Shares | | Value |

COMMON STOCKS - 87.6% (continued) | | | | | |

Computer Storage & Peripherals - 0.4% (continued) | | | | | |

Western Digital Corporation * | | 1,022 | | $ | 37,334 |

| | | | | |

| | | | | 75,426 |

| | | | | |

Construction & Engineering - 2.0% | | | | | |

Fluor Corporation 3 | | 4,291 | | | 218,197 |

Insituform Technologies, Inc. * | | 1,022 | | | 19,561 |

KBR, Inc. | | 3,065 | | | 71,384 |

| | | | | |

| | | | | 309,142 |

| | | | | |

Construction & Farm Machinery & Heavy Trucks - 4.1% | | | | | |

Joy Global, Inc. 1,2 | | 9,080 | | | 444,375 |

Lindsay Corporation | | 613 | | | 24,140 |

Trinity Industries, Inc. 1,2 | | 10,200 | | | 175,338 |

| | | | | |

| | | | | 643,853 |

| | | | | |

Construction Materials - 1.3% | | | | | |

Eagle Materials, Inc. | | 817 | | | 23,350 |

Martin Marietta Materials, Inc. | | 1,021 | | | 94,003 |

Texas Industries, Inc. | | 613 | | | 25,746 |

Vulcan Materials Company | | 1,226 | | | 66,290 |

| | | | | |

| | | | | 209,389 |

| | | | | |

Diversified Banks - 0.7% | | | | | |

Banco Latinoamericano de Comercio Exterior S.A. | | 586 | | | 8,333 |

Barclays plc ADR | | 3,662 | | | 86,570 |

| | | | | |

| | | | | 94,903 |

| | | | | |

Diversified Metals & Mining - 2.6% | | | | | |

Brush Engineered Materials, Inc. * | | 1,680 | | | 41,093 |

General Moly, Inc. * | | 3,950 | | | 12,443 |

Horsehead Holding Corporation * | | 5,986 | | | 70,156 |

iPath Dow Jones-UBS Copper Subindex Total Return ETN 1 | | 7,154 | | | 276,931 |

Titanium Metals Corporation | | 409 | | | 3,922 |

| | | | | |

| | | | | 404,545 |

| | | | | |

Diversified Real Estate Activities - 0.5% | | | | | |

St. Joe Company * | | 2,509 | | | 73,062 |

| | | | | |

Drug Retail - 1.1% | | | | | |

CVS Caremark Corporation 3 | | 4,701 | | | 168,014 |

| | | | | |

Electrical Components & Equipment - 1.7% | | | | | |

AO Smith Corporation 1,2 | | 2,800 | | | 106,680 |

General Cable Corporation * | | 2,453 | | | 96,035 |

GrafTech International, Ltd. * | | 4,088 | | | 60,094 |

| | | | | |

| | | | | 262,809 |

| | | | | |

Electronic Components - 0.7% | | | | | |

AVX Corporation | | 2,003 | | | 23,896 |

Corning, Inc. | | 5,314 | | | 81,357 |

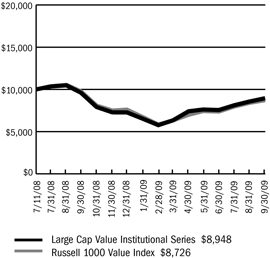

| | | | | |

| | | | | 105,253 |

| | | | | |

Electronic Manufacturing Services - 0.1% | | | | | |

Flextronics International, Ltd. * | | 1,226 | | | 9,146 |

Sanmina-SCI Corporation * | | 564 | | | 4,850 |

| | | | | |

| | | | | 13,996 |

| | | | | |

The accompanying notes are an integral part of the financial statements

16

| | |

| Schedule of Investments | | Rydex | SGI Equity Fund |

| September 30, 2009 | | Alpha Opportunity Series |

| | | | | |

| | | Shares | | Value |

COMMON STOCKS - 87.6% (continued) | | | | | |

Environmental & Facilities Services - 0.4% | | | | | |

Industrial Services of America, Inc. * | | 109 | | $ | 943 |

Metalico, Inc. * | | 14,074 | | | 58,688 |

| | | | | |

| | | | | 59,631 |

| | | | | |

Exchange Traded Funds - 4.8% | | | | | |

iPath Dow Jones-UBS Commodity Index Total Return ETN | | 3,242 | | | 125,012 |

iShares Dow Jones US Regional Banks Index Fund | | 3,474 | | | 72,815 |

PowerShares DB Agriculture Fund | | 1,226 | | | 31,214 |

PowerShares DB Base Metals Fund | | 4,497 | | | 82,205 |

Regional Bank HOLDERs Trust * | | 876 | | | 70,150 |

SPDR KBW Regional Banking ETF | | 3,680 | | | 78,458 |

United States Oil Fund, LP 1,* | | 7,758 | | | 280,761 |

| | | | | |

| | | | | 740,615 |

| | | | | |

Fertilizers & Agricultural Chemicals - 0.4% | | | | | |

Potash Corporation of Saskatchewan, Inc. | | 732 | | | 66,129 |

| | | | | |

Food Retail - 0.5% | | | | | |

Safeway, Inc. 1,2 | | 3,900 | | | 76,908 |

| | | | | |

Forest Products - 0.1% | | | | | |

Weyerhaeuser Company | | 408 | | | 14,953 |

| | | | | |

General Merchandise Stores - 0.6% | | | | | |

Family Dollar Stores, Inc. 1,2 | | 3,700 | | | 97,680 |

| | | | | |

Gold - 0.8% | | | | | |

Iamgold Corporation | | 732 | | | 10,350 |

Jaguar Mining, Inc. * | | 3,310 | | | 29,526 |

Newmont Mining Corporation | | 1,634 | | | 71,929 |

| | | | | |

| | | | | 111,805 |

| | | | | |

Health Care Distributors - 0.8% | | | | | |

Owens & Minor, Inc. 1,2 | | 2,700 | | | 122,175 |

| | | | | |

Health Care Equipment - 0.7% | | | | | |

Baxter International, Inc. 1,2 | | 1,800 | | | 102,618 |

| | | | | |

Health Care Facilities - 0.4% | | | | | |

Kindred Healthcare, Inc. 1,2,* | | 3,900 | | | 63,297 |

| | | | | |

Health Care Services - 0.8% | | | | | |

Lincare Holdings, Inc. 1,2,* | | 3,800 | | | 118,750 |

| | | | | |

Health Care Technology - 0.9% | | | | | |

athenahealth, Inc. * | | 3,653 | | | 140,166 |

| | | | | |

Home Entertainment Software - 4.9% | | | | | |

Shanda Interactive Entertainment, Ltd. ADR 1,2,* | | 15,100 | | | 773,120 |

| | | | | |

| | | | | |

| | | Shares | | Value |

COMMON STOCKS - 87.6% (continued) | | | | | |

Human Resources & Employment Services - 0.6% | | | | | |

Watson Wyatt Worldwide, Inc. 1,2 | | 2,200 | | $ | 95,832 |

| | | | | |

Hypermarkets & Super Centers - 0.7% | | | | | |

Wal-Mart Stores, Inc. 1,2 | | 2,200 | | | 107,998 |

| | | | | |

Independent Power Producers & Energy Traders - 1.1% | | | | | |

Constellation Energy Group, Inc. 1,2 | | 5,100 | | | 165,087 |

| | | | | |

Industrial Conglomerates - 0.4% | | | | | |

General Electric Company 1,2 | | 4,200 | | | 68,964 |

| | | | | |

Industrial Machinery - 0.6% | | | | | |

LB Foster Company * | | 427 | | | 13,058 |

Watts Water Technologies, Inc. 1,2 | | 2,800 | | | 84,700 |

| | | | | |

| | | | | 97,758 |

| | | | | |

Integrated Oil & Gas - 1.7% | | | | | |

ConocoPhillips 1,2 | | 2,726 | | | 123,106 |

StatoilHydro ASA ADR | | 732 | | | 16,499 |

Suncor Energy, Inc. | | 3,662 | | | 126,558 |

| | | | | |

| | | | | 266,163 |

| | | | | |

Integrated Telecommunication Services - 1.8% | | | | | |

AT&T, Inc. 1,2 | | 10,600 | | | 286,306 |

| | | | | |

Internet Software & Services - 0.2% | | | | | |

Open Text Corporation * | | 732 | | | 27,326 |

| | | | | |

Investment Banking & Brokerage - 0.4% | | | | | |

Lazard, Ltd. | | 576 | | | 23,795 |

Nomura Holdings, Inc. ADR | | 3,834 | | | 23,464 |

| | | | | |

| | | | | 47,259 |

| | | | | |

IT Consulting & Other Services - 0.0% | | | | | |

Yucheng Technologies, Ltd. * | | 732 | | | 5,248 |

| | | | | |

Life & Health Insurance - 0.4% | | | | | |

MetLife, Inc. | | 818 | | | 31,141 |

Sun Life Financial, Inc. | | 1,095 | | | 34,208 |

| | | | | |

| | | | | 65,349 |

| | | | | |

Life Sciences Tools & Services - 2.1% | | | | | |

Charles River Laboratories International, Inc. 1,2,* | | 2,000 | | | 73,960 |

Life Technologies Corporation 1,2,* | | 2,800 | | | 130,340 |

Millipore Corporation 1,2,* | | 1,800 | | | 126,594 |

| | | | | |

| | | | | 330,894 |

| | | | | |

Managed Health Care - 0.7% | | | | | |

Centene Corporation * | | 3,065 | | | 58,051 |

WellCare Health Plans, Inc. 1,2,* | | 2,300 | | | 56,695 |

| | | | | |

| | | | | 114,746 |

| | | | | |

The accompanying notes are an integral part of the financial statements

17

| | |

| Schedule of Investments | | Rydex | SGI Equity Fund |

| September 30, 2009 | | Alpha Opportunity Series |

| | | | | |

| | | Shares | | Value |

COMMON STOCKS - 87.6% (continued) | | | | | |

Marine - 0.6% | | | | | |

Kirby Corporation * | | 2,655 | | $ | 97,757 |

| | | | | |

Movies & Entertainment - 1.7% | | | | | |

Marvel Entertainment, Inc.1,2,* | | 5,400 | | | 267,948 |

| | | | | |

Multi-Line Insurance - 0.3% | | | | | |

Genworth Financial, Inc.1,2 | | 4,000 | | | 47,800 |

| | | | | |

Oil & Gas Equipment & Services - 0.5% | | | | | |

Cameron International Corporation * | | 409 | | | 15,468 |

FMC Technologies, Inc. * | | 362 | | | 18,911 |

Matrix Service Company * | | 1,226 | | | 13,327 |

National Oilwell Varco, Inc. * | | 204 | | | 8,799 |

Oceaneering International, Inc. * | | 409 | | | 23,210 |

| | | | | |

| | | | | 79,715 |

| | | | | |

Oil & Gas Exploration & Production - 2.2% | | | | | |

Anadarko Petroleum Corporation1,2 | | 2,755 | | | 172,820 |

Encore Acquisition Company * | | 3,474 | | | 129,928 |

Georesources, Inc. * | | 1,835 | | | 20,277 |

Gran Tierra Energy, Inc. * | | 5,018 | | | 20,875 |

| | | | | |

| | | | | 343,900 |

| | | | | |

Paper Packaging - 0.6% | | | | | |

Bemis Company, Inc. | | 613 | | | 15,883 |

Rock-Tenn Company | | 1,637 | | | 77,119 |

Temple-Inland, Inc. | | 204 | | | 3,350 |

| | | | | |

| | | | | 96,352 |

| | | | | |

Paper Products - 0.1% | | | | | |

International Paper Company | | 612 | | | 13,605 |

| | | | | |

Personal Products - 0.6% | | | | | |

China-Biotics, Inc. * | | 732 | | | 11,712 |

Herbalife, Ltd. 1,2 | | 2,500 | | | 81,850 |

| | | | | |

| | | | | 93,562 |

| | | | | |

Pharmaceuticals - 4.2% | | | | | |

Forest Laboratories, Inc.1,2,* | | 3,400 | | | 100,096 |

Johnson & Johnson 1,2 | | 7,452 | | | 453,752 |

Viropharma, Inc. 1,2,* | | 9,900 | | | 95,238 |

| | | | | |

| | | | | 649,086 |

| | | | | |

Precious Metals & Minerals - 0.5% | | | | | |

E-TRACS UBS Long Platinum ETN * | | 5,410 | | | 84,450 |

| | | | | |

Property & Casualty Insurance - 1.8% | | | | | |

ACE, Ltd. | | 409 | | | 21,865 |

Amtrust Financial Services, Inc.1,2 | | 6,000 | | | 68,460 |

Berkshire Hathaway, Inc. (CI.B) * | | 36 | | | 119,628 |

Travelers Companies, Inc. | | 1,225 | | | 60,307 |

| | | | | |

| | | | | 270,260 |

| | | | | |

Railroads - 0.3% | | | | | |

Genesee & Wyoming, Inc. * | | 1,398 | | | 42,387 |

| | | | | |

Regional Banks - 0.5% | | | | | |

East West Bancorp, Inc. | | 2,453 | | | 20,360 |

| | | | | |

| | | Shares | | Value |

COMMON STOCKS - 87.6% (continued) | | | | | |

Regional Banks - 0.5% (continued) | | | | | |

First Horizon National Corporation * | | 3,511 | | $ | 46,449 |

Republic Bancorp, Inc. | | 595 | | | 11,876 |

| | | | | |

| | | | | 78,685 |

| | | | | |

Reinsurance - 0.8% | | | | | |

Endurance Specialty Holdings, Ltd.1,2 | | 3,000 | | | 109,410 |

Validus Holdings, Ltd. | | 613 | | | 15,815 |

| | | | | |

| | | | | 125,225 |

| | | | | |

Restaurants - 0.7% | | | | | |

BJ’s Restaurants, Inc. * | | 1,839 | | | 27,567 |

Jack in the Box, Inc.1,2,* | | 4,000 | | | 81,960 |

| | | | | |

| | | | | 109,527 |

| | | | | |

Semiconductor Equipment - 0.8% | | | | | |

Amkor Technology, Inc.1,2,* | | 9,200 | | | 63,295 |

Applied Materials, Inc. | | 2,044 | | | 27,390 |

Teradyne, Inc. * | | 2,931 | | | 27,112 |

Veeco Instruments, Inc. * | | 44 | | | 1,026 |

| | | | | |

| | | | | 118,823 |

| | | | | |

Semiconductors - 5.3% | | | | | |

Atmel Corporation3,* | | 42,133 | | | 176,538 |

Cypress Semiconductor Corporation * | | 6,950 | | | 71,794 |

Fairchild Semiconductor International, Inc. * | | 3,268 | | | 33,432 |

Intel Corporation3 | | 8,649 | | | 169,261 |

Linear Technology Corporation | | 3,269 | | | 90,322 |

LSI Corporation * | | 13,584 | | | 74,576 |

ON Semiconductor Corporation * | | 9,820 | | | 81,015 |

Skyworks Solutions, Inc. * | | 2,453 | | | 32,478 |

Taiwan Semiconductor Manufacturing Company, Ltd. ADR | | 3,397 | | | 37,231 |

Texas Instruments, Inc. | | 2,249 | | | 53,279 |

TriQuint Semiconductor, Inc. * | | 3,039 | | | 23,461 |

| | | | | |

| | | | | 843,387 |

| | | | | |

Specialized REIT’s - 0.4% | | | | | |

Potlatch Corporation | | 2,044 | | | 58,152 |

| | | | | |

Specialty Chemicals - 0.1% | | | | | |

OM Group, Inc. * | | 409 | | | 12,430 |

| | | | | |

Steel - 0.5% | | | | | |

Cliffs Natural Resources, Inc. | | 1,022 | | | 33,072 |

Steel Dynamics, Inc. | | 2,044 | | | 31,355 |

Universal Stainless & Alloy Products, Inc. * | | 1,079 | | | 19,692 |

| | | | | |

| | | | | 84,119 |

| | | | | |

Systems Software - 3.4% | | | | | |

CA, Inc.1,2 | | 19,362 | | | 425,770 |

Symantec Corporation1,2,* | | 5,900 | | | 97,173 |

| | | | | |

| | | | | 522,943 |

| | | | | |

Technology Distributors - 1.0% | | | | | |

Arrow Electronics, Inc.1,2,* | | 2,600 | | | 73,190 |

Avnet, Inc.1,2,* | | 3,100 | | | 80,507 |

| | | | | |

| | | | | 153,697 |

| | | | | |

Tobacco - 5.0% | | | | | |

Altria Group, Inc.1,2 | | 16,700 | | | 297,427 |

The accompanying notes are an integral part of the financial statements

18

| | |

| Schedule of Investments | | Rydex | SGI Equity Fund |

| September 30, 2009 | | Alpha Opportunity Series |

| | | | | | | | |

| | | Shares | | | Value | |

COMMON STOCKS - 87.6% (continued) | | | | | | | | |

Tobacco - 5.0% (continued) | | | | | | | | |

Philip Morris International, Inc. 1,2 | | | 9,800 | | | $ | 477,653 | |

| | | | | | | | |

| | | | | | | 775,080 | |

| | | | | | | | |

Trucking - 0.4% | | | | | | | | |

Con-Way, Inc.1,2 | | | 1,700 | | | | 65,144 | |

Quality Distribution, Inc. * | | | 1,225 | | | | 4,128 | |

| | | | | | | | |

| | | | | | | 69,272 | |

| | | | | | | | |

TOTAL COMMON STOCKS

(cost $14,695,794) | | | | | | $ | 13,620,521 | |

| | | | | | | | |

| | |

| | | Principal

Amount | | | Value | |

U.S. GOVERNMENT SPONSORED AGENCY BONDS & | | | | | | | | |

NOTES - 9.7% | | | | | | | | |

Federal Home Loan Bank 0.04%, 10/28/2009 3,4 | | $ | 1,500,000 | | | $ | 1,499,955 | |

| | | | | | | | |

TOTAL U.S. GOVERNMENT SPONSORED AGENCY BONDS & NOTES

(cost $1,499,955) | | | | | | $ | 1,499,955 | |

| | | | | | | | |

| | |

| | | Principal

Amount | | | Value | |

SHORT TERM INVESTMENTS - 15.8% | | | | | | | | |

State Street General Account U.S. | | | | | | | | |

Government Fund 4 | | $ | 2,458,882 | | | $ | 2,458,882 | |

| | | | | | | | |

TOTAL SHORT TERM INVESTMENTS

(cost $2,458,882) | | | | | | $ | 2,458,882 | |

| | | | | | | | |

| | |

| | | Principal

Amount | | | Value | |

REPURCHASE AGREEMENT - 10.8% | | | | | | | | |

State Street, 0.01%, dated 9/30/09, matures 10/1/09; repurchase amount $516,826 (Collateralized by U.S. Treasury Note, 12/24/09 with a value of $529,841) 4 | | $ | 516,826 | | | $ | 516,826 | |

State Street, 0.01%, dated 9/30/09, matures 10/01/09; repurchase amount $1,160,190 (Collateralized by U.S. Treasury Note, 3/18/10 with a value of $1,184,052) 4 | | | 1,160,190 | | | | 1,160,190 | |

| | | | | | | | |

TOTAL REPURCHASE AGREEMENT

(cost $1,677,016) | | | | | | $ | 1,677,016 | |

| | | | | | | | |

Total Investments - 123.9% 5

(cost $20,331,647) | | | | | | $ | 19,256,374 | |

Liabilities, Less Cash & Other Assets - (23.9)% | | | | | | | (3,718,876 | ) |

| | | | | | | | |

Total Net Assets - 100.0% | | | | | | $ | 15,537,498 | |

| | | | | | | | |

|

| Schedule of Securities Sold Short | |

| | |

| | | Shares | | | Value | |

COMMON STOCKS - (27.2)% | | | | | | | | |

Advertising - (0.5)% | | | | | | | | |

Focus Media Holding, Ltd. ADR 6,7,* | | | (2,130 | ) | | $ | (63,900 | ) |

| | | | | | | | |

Airlines - 0.0% | | | | | | | | |

UAL Corporation * | | | (619 | ) | | | (5,707 | ) |

| | | | | | | | |

Alternative Carriers - (0.4)% | | | | | | | | |

Clearwire Corporation 6,7,* | | | (2,530 | ) | | | (28,665 | ) |

| | | | | | | |

| | | Shares | | | Value | |

COMMON STOCKS - (27.2)% (continued) | | | | | | | |

Alternative Carriers - (0.4)% (continued) | | | | | | | |

Global Crossing, Ltd. 6,7,* | | (1,800 | ) | | $ | (28,746 | ) |

| | | | | | | |

| | | | | | (57,411 | ) |

| | | | | | | |

Auto Parts & Equipment - (0.1)% | | | | | | | |

BorgWarner, Inc. | | (465 | ) | | | (14,071 | ) |

| | | | | | | |

Biotechnology - (4.4)% | | | | | | | |

Acorda Therapeutics, Inc. 6,7,* | | (2,800 | ) | | | (74,900 | ) |

Alnylam Pharmaceuticals, Inc. 6,7,* | | (2,900 | ) | | | (85,288 | ) |

AMAG Pharmaceuticals, Inc. 6,7,* | | (1,900 | ) | | | (82,953 | ) |

Cepheid, Inc. 6,7,* | | (5,300 | ) | | | (81,620 | ) |

Exelixis, Inc. 6,7,* | | (4,500 | ) | | | (28,845 | ) |

Genzyme Corporation * | | (619 | ) | | | (35,116 | ) |

Gilead Sciences, Inc. * | | (310 | ) | | | (14,440 | ) |

Regeneron Pharmaceuticals, Inc. 6,7,* | | (3,180 | ) | | | (69,038 | ) |

Rigel Pharmaceuticals, Inc. 6,7,* | | (3,050 | ) | | | (78,324 | ) |

Savient Pharmaceuticals, Inc. 6,7,* | | (2,420 | ) | | | (48,013 | ) |

Vertex Pharmaceuticals, Inc. 6,7,* | | (2,600 | ) | | | (71,942 | ) |

| | | | | | | |

| | | | | | (670,479 | ) |

| | | | | | | |

Building Products - (0.9)% | | | | | | | |

USG Corporation6,7,* | | (4,940 | ) | | | (141,877 | ) |

| | | | | | | |

Communications Equipment - (0.3)% | | | | | | | |

Nokia Oyj ADR | | (310 | ) | | | (4,532 | ) |

Riverbed Technology, Inc. 6,7,* | | (3,280 | ) | | | (43,624 | ) |

| | | | | | | |

| | | | | | (48,156 | ) |

| | | | | | | |

Computer Storage & Peripherals - (0.4)% | | | | | | | |

Intermec, Inc. 6,7,* | | (2,740 | ) | | | (54,307 | ) |

Lexmark International, Inc. * | | (465 | ) | | | (10,016 | ) |

| | | | | | | |

| | | | | | (64,323 | ) |

| | | | | | | |

Department Stores - (0.2)% | | | | | | | |

Sears Holdings Corporation * | | (575 | ) | | | (37,553 | ) |

| | | | | | | |

Diversified Banks - (3.6)% | | | | | | | |

Wells Fargo & Company 6,7 | | (12,384 | ) | | | (539,688 | ) |

| | | | | | | |

Diversified Metals & Mining - (0.2)% | | | | | | | |

Ivanhoe Mines, Ltd. 6,7,* | | (4,440 | ) | | | (37,030 | ) |

| | | | | | | |

Diversified Real Estate Activities - 0.0% | | | | | | | |

Consolidated-Tomoka Land Company | | (83 | ) | | | (3,179 | ) |

| | | | | | | |

Electric Utilities - (1.6)% | | | | | | | |

Korea Electric Power Corporation ADR 6,7 | | (18,310 | ) | | | (247,734 | ) |

| | | | | | | |

Exchange Traded Funds - (1.2)% | | | | | | | |

iShares Barclays 20+ Year Treasury Bond Fund | | (1,859 | ) | | | (183,409 | ) |

United States Natural Gas Fund, LP * | | (619 | ) | | | (7,267 | ) |

| | | | | | (190,676 | ) |

Health Care Equipment - (0.4)% | | | | | | | |

Intuitive Surgical, Inc.6,7,* | | (200 | ) | | | (56,100 | ) |

The accompanying notes are an integral part of the financial statements

19

| | |

| Schedule of Investments | | Rydex | SGI Equity Fund |

| September 30, 2009 | | Alpha Opportunity Series |

| | | | | | | |

| | | Shares | | | Value | |

COMMON STOCKS - (27.2)% (continued) | | | | | | | |

Health Care Equipment - (0.4)% (continued) | | | | | | | |

Palomar Medical Technologies, Inc. * | | (480 | ) | | $ | (7,781 | ) |

| | | | | | | |

| | | | | | (63,881 | ) |

| | | | | | | |

Health Care Supplies - (0.5)% | | | | | | | |

Align Technology, Inc. 6,7,* | | (6,100 | ) | | | (74,420 | ) |

| | | | | | | |

Health Care Technology - (0.6)% | | | | | | | |

athenahealth, Inc. 6,7,* | | (2,500 | ) | | | (89,625 | ) |

IMS Health, Inc. | | (443 | ) | | | (6,800 | ) |

| | | | | | | |

| | | | | | (96,425 | ) |

| | | | | | | |

Home Entertainment Software - (0.2)% | | | | | | | |

Electronic Arts, Inc. 6,7,* | | (900 | ) | | | (36,720 | ) |

| | | | | | | |

Integrated Oil & Gas - (0.1)% | | | | | | | |

Exxon Mobil Corporation | | (155 | ) | | | (10,635 | ) |

Hess Corporation | | (155 | ) | | | (8,286 | ) |

| | | | | | | |

| | | | | | (18,921 | ) |

| | | | | | | |

Integrated Telecommunication Services - (0.2)% | | | | | | | |

Frontier Communications Corporation | | (2,478 | ) | | | (18,684 | ) |

Qwest Communications International, Inc. | | (1,394 | ) | | | (5,311 | ) |

Verizon Communications, Inc. | | (465 | ) | | | (14,076 | ) |

| | | | | | | |

| | | | | | (38,071 | ) |

| | | | | | | |

Internet Software & Services - (1.6)% | | | | | | | |

Baidu, Inc. ADR 6,7,* | | (200 | ) | | | (53,726 | ) |

Equinix, Inc. 6,7,* | | (1,000 | ) | | | (79,940 | ) |

SAVVIS, Inc. 6,7,* | | (5,700 | ) | | | (84,018 | ) |

VeriSign, Inc. 6,7,* | | (1,200 | ) | | | (30,756 | ) |

| | | | | | | |

| | | | | | (248,440 | ) |

| | | | | | | |

Leisure Products - (1.9)% | | | | | | | |

Callaway Golf Company | | (889 | ) | | | (6,765 | ) |

Pool Corporation 6,7 | | (11,639 | ) | | | (288,065 | ) |

| | | | | | | |

| | | | | | (294,830 | ) |

| | | | | | | |

Life Sciences Tools & Services - (1.1)% | | | | | | | |

Luminex Corporation 6,7,* | | (2,500 | ) | | | (63,725 | ) |

Pharmaceutical Product Development, Inc. | | (996 | ) | | | (21,852 | ) |

Sequenom, Inc. 6,7,* | | (3,810 | ) | | | (78,524 | ) |

| | | | | | | |

| | | | | | (164,101 | ) |

| | | | | | | |

Oil & Gas Exploration & Production - (0.7)% | | | | | | | |

BPZ Resources, Inc. 6,7,* | | (5,700 | ) | | | (107,160 | ) |

| | | | | | | |

Oil & Gas Refining & Marketing - (0.1)% | | | | | | | |

Sunoco, Inc. | | (458 | ) | | | (13,031 | ) |

Valero Energy Corporation | | (155 | ) | | | (3,005 | ) |

Western Refining, Inc. * | | (465 | ) | | | (2,999 | ) |

| | | | | | | |

| | | | | | (19,035 | ) |

| | | | | | | |

Pharmaceuticals - (0.9)% | | | | | | | |

Auxilium Pharmaceuticals, Inc. 6,7,* | | (1,540 | ) | | | (56,703 | ) |

Sepracor, Inc. 6,7,* | | (1,400 | ) | | | (24,500 | ) |

XenoPort, Inc. 6,7,* | | (1,376 | ) | | | (63,062 | ) |

| | | | | | | |

| | | | | | (144,265 | ) |

| | | | | | | |

| | | | | | | |

| | | Shares | | | Value | |

COMMON STOCKS - (27.2)% (continued) | | | | | | | |

Publishing - (0.1)% | | | | | | | |

Interactive Data Corporation | | (774 | ) | | $ | (20,286 | ) |

| | | | | | | |

Regional Banks - (0.7)% | | | | | | | |

PrivateBancorp, Inc. 6,7 | | (2,390 | ) | | | (102,770 | ) |

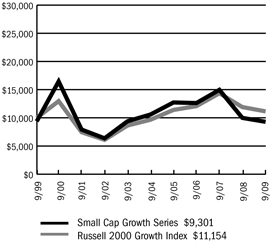

| | | | | | | |