UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811- 01136 |

| | |

| Guggenheim Funds Trust |

| |

| (Exact name of registrant as specified in charter) |

| | 805 King Farm Boulevard, Suite 600 |

| Rockville, Maryland 20850 |

| |

| (Address of principal executive offices) (Zip code) |

| | Donald C. Cacciapaglia, President |

| Guggenheim Funds Trust |

| 805 King Farm Boulevard, Suite 600 |

| Rockville, Maryland 20850 |

| |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | 1-301-296-5100 |

| | |

| | |

| Date of fiscal year end: | September 30 |

| | |

| Date of reporting period: | March 31, 2014 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

| Item 1. | | Reports to Stockholders. |

3.31.2014

Guggenheim Funds Semi-Annual Report

Floating Rate Strategies Fund

High Yield Fund

Investment Grade Bond Fund

Limited Duration Fund

Macro Opportunities Fund

Municipal Income Fund

Total Return Bond Fund

| SBINC-SEMI-0314x0914 | guggenheiminvestments.com |

Go Green! Eliminate Mailbox Clutter

Go paperless with Guggenheim Investments eDelivery—a service giving you full online access to account information and documents. Save time, cut down on mailbox clutter and be a friend to the environment with eDelivery.

With Guggenheim Investments eDelivery you can:

| • | View online confirmations and statements at your convenience. |

| | |

| • | Receive email notifications when your most recent confirmations, statements and other account documents are available for review. |

| | |

| • | Access prospectuses, annual reports and semiannual reports online. |

| | |

| | It’s easy to enroll: |

| | |

| | 1. Visit guggenheiminvestments.com/edelivery |

| | |

| | 2. Follow the simple enrollment instructions |

| | |

If you have questions about the Guggenheim Investments eDelivery service, contact one of our Shareholder Service Representatives at 800.820.0888.

This report and the financial statements contained herein are submitted for the general information of our shareholders. The report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

Distributed by Guggenheim Funds Distributors, LLC. GI-GOGREEN-0414 x0415 #12604

| TABLE OF CONTENTS | | |

| |

| | | |

| DEAR SHAREHOLDER | | 2 |

| | | |

| ECONOMIC AND MARKET OVERVIEW | | 3 |

| | | |

| ABOUT SHAREHOLDERS’ FUND EXPENSES | | 4 |

| | | |

| FLOATING RATE STRATEGIES FUND | | 8 |

| | | |

| HIGH YIELD FUND | | 22 |

| | | |

| INVESTMENT GRADE BOND FUND | | 34 |

| | | |

| LIMITED DURATION FUND | | 46 |

| | | |

| MACRO OPPORTUNITIES FUND | | 54 |

| | | |

| MUNICIPAL INCOME FUND | | 70 |

| | | |

| TOTAL RETURN BOND FUND | | 78 |

| | | |

| NOTES TO FINANCIAL STATEMENTS | | 90 |

| | | |

| OTHER INFORMATION | | 105 |

| | | |

| INFORMATION ON BOARD OF TRUSTEES AND OFFICERS | | 110 |

| | | |

| GUGGENHEIM INVESTMENTS PRIVACY POLICIES | | 112 |

| |

| THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 1 |

Dear Shareholder:

Security Investors, LLC and Guggenheim Partners Investment Management (the “Investment Advisers”) are pleased to present the semi-annual shareholder report for seven Funds in our Guggenheim Funds Trust (the “Funds”) for the six-month period ended March 31, 2014.

The Investment Advisers are part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC, (“Guggenheim”) a global, diversified financial services firm.

Guggenheim Funds Distributors, LLC is the distributor of the Funds. Guggenheim Funds Distributors, LLC is affiliated with Guggenheim and the Investment Advisers.

We encourage you to read the Economic and Market Overview section of the report, which follows this letter.

We are committed to providing innovative investment solutions and appreciate the trust you place in us.

Sincerely,

Donald C. Cacciapaglia

President

April 30, 2014

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at guggenheiminvestments.com or call 800.820.0888.

There can be no assurance that any investment product will achieve its investment objective(s). There are risks associated with investing, including the entire loss of principal invested. Investing involves market risks. The investment return and principal value of any investment product will fluctuate with changes in market conditions.

| |

| 2 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

| ECONOMIC AND MARKET OVERVIEW | March 31, 2014 |

| |

Investment markets continued to rally through the six months ended March 31, 2014, thanks to a steadily improving U.S. economy and ongoing U.S. central bank easing. Contributing to performance of equities were growing confidence in the sustainability of the U.S. economic recovery, favorable corporate profit growth, supportive valuations, interest rates below their long-run level, and positive inflows, as investors concerned about the end of quantitative easing and its impact on interest rates rotated out of fixed-income investments into equities.

In January 2014, based on positive economic data and a better jobs picture, the U.S. Federal Reserve (the “Fed”) began its long-expected tapering program, reducing monthly purchases by $10 billion. The Fed continued to taper even after acknowledging in March that the economy had slowed during the winter months, which were unusually harsh for much of the U.S. By April, it was buying only $55 billion a month, down from $85 billion in December 2013.

In March 2014, while noting that the U.S. economy has not yet reached full employment, the Fed also unlinked attainment of a 6.5% unemployment level with a potential rate hike, since the unemployment rate in February was approaching that level. Revised guidance from new Fed Chair Janet Yellen seemed to indicate that a rise might not be considered until mid-2015, at the earliest, although she stressed that it would depend on labor market conditions and the inflation rate. Still, the date was earlier than many market participants had expected, which knocked the market off record highs reached earlier in the six-month period.

Even though upcoming economic reports may reflect the impacts from the severe winter weather, and international tensions remain high, the arrival of spring was expected to return the U.S. economy to its improving trend. Pent-up demand resulting from the huge gap in household formation over the prior several years continues to buoy the housing market, while a pickup in global demand bodes well for the U.S. manufacturing sector. Consumption is rising due to an increase in net worth, resulting from the rebound in housing and asset prices, which has boosted retail sales, and consumer sentiment measures. The consensus expectation for 2014 growth stands at 3.0%, compared with 1.9% for 2013.

Momentum driven by the favorable macro environment is supporting equities and moving spreads tighter, helping perpetuate the risk-on mode that has prevailed in the U.S. since 2008. Investors who want income will have to keep investing, but buying cheap securities may be a thing of the past. Recent volatility indicates that investors must guard against becoming complacent about the quality of investments they make and their inherent risks. The Fed continues pumping enormous amounts of liquidity into the system, but with little expectation that it will raise interest rates before 2015, the expansion is likely to continue. Even when the Fed does hike, it typically takes another two years before a recession threatens growth. While the economy may be entering a new era where interest rates head higher over the long term, there is likely a ceiling on how high rates can rise in advance of eventual monetary tightening.

For the six months ended March 31, 2014, the Standard & Poor’s 500® (“S&P 500”) Index* returned 12.51%. The Morgan Stanley Capital International (“MSCI”) Europe-Australasia-Far East (“EAFE”) Index* returned 6.41%. The return of the MSCI Emerging Markets Index* was 1.39%.

In the bond market, the Barclays U.S. Aggregate Bond Index* posted a 1.70% return for the period, while the Barclays U.S. Corporate High Yield Index* returned 6.67%. The return of the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index* was 0.03% for the six-month period.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

*Index Definitions:

The following indices are referenced throughout this report. Indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS.

Barclays U.S. Corporate High Yield Index measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

S&P 500® Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad economy, representing all major industries and is considered a representation of the U.S. stock market.

| |

| THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 3 |

| ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) |

| |

All mutual funds have operating expenses and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a Fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and exchange fees; and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning September 30, 2013 and ending March 31, 2014.

The following tables illustrate a Fund’s costs in two ways:

Table 1. Based on actual Fund return. This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return. This section is intended to help investors compare a Fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about a Fund’s expenses, including annual expense ratios for the past five years, can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

| |

| 4 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

| ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) (continued) |

| |

| | | | | | | | | | | Beginning | | | Ending | | | Expenses | |

| | | Expense | | | Fund | | | Account Value | | | Account Value | | | Paid During | |

| | | Ratio1 | | | Return | | | September 30, 2013 | | | March 31, 2014 | | | Period2 | |

| |

| Table 1. Based on actual Fund return3 |

| Floating Rate Strategies Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.05 | % | | | 3.30 | % | | | $1,000.00 | | | | $1,033.00 | | | | $5.32 | |

C-Class | | | 1.80 | % | | | 2.91 | % | | | 1,000.00 | | | | 1,029.10 | | | | 9.11 | |

Institutional Class | | | 0.80 | % | | | 3.38 | % | | | 1,000.00 | | | | 1,033.80 | | | | 4.06 | |

| High Yield Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.24 | % | | | 8.11 | % | | | 1,000.00 | | | | 1,081.10 | | | | 6.43 | |

B-Class | | | 0.96 | % | | | 8.26 | % | | | 1,000.00 | | | | 1,082.60 | | | | 4.98 | |

C-Class | | | 1.97 | % | | | 7.76 | % | | | 1,000.00 | | | | 1,077.60 | | | | 10.20 | |

Institutional Class | | | 0.97 | % | | | 8.28 | % | | | 1,000.00 | | | | 1,082.80 | | | | 5.04 | |

| Investment Grade Bond Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.07 | % | | | 4.75 | % | | | 1,000.00 | | | | 1,047.50 | | | | 5.46 | |

B-Class | | | 1.82 | % | | | 4.43 | % | | | 1,000.00 | | | | 1,044.30 | | | | 9.28 | |

C-Class | | | 1.82 | % | | | 4.37 | % | | | 1,000.00 | | | | 1,043.70 | | | | 9.27 | |

Institutional Class | | | 0.82 | % | | | 4.82 | % | | | 1,000.00 | | | | 1,048.20 | | | | 4.19 | |

| Limited Duration Fund4 | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.30 | % | | | 0.52 | % | | | 1,000.00 | | | | 1,005.20 | | | | 3.79 | 5 |

C-Class | | | 1.53 | % | | | 0.33 | % | | | 1,000.00 | | | | 1,003.30 | | | | 4.45 | 5 |

Institutional Class | | | 0.54 | % | | | 0.62 | % | | | 1,000.00 | | | | 1,006.20 | | | | 1.57 | 5 |

| Macro Opportunities Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.40 | % | | | 5.72 | % | | | 1,000.00 | | | | 1,057.20 | | | | 7.18 | |

C-Class | | | 2.14 | % | | | 5.34 | % | | | 1,000.00 | | | | 1,053.40 | | | | 10.96 | |

Institutional Class | | | 1.08 | % | | | 5.93 | % | | | 1,000.00 | | | | 1,059.30 | | | | 5.54 | |

| Municipal Income Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 0.83 | % | | | 4.63 | % | | | 1,000.00 | | | | 1,046.30 | | | | 4.23 | |

C-Class | | | 1.58 | % | | | 4.15 | % | | | 1,000.00 | | | | 1,041.50 | | | | 8.04 | |

Institutional Class | | | 0.58 | % | | | 4.67 | % | | | 1,000.00 | | | | 1,046.70 | | | | 2.96 | |

| Total Return Bond Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.10 | % | | | 4.97 | % | | | 1,000.00 | | | | 1,049.70 | | | | 5.62 | |

C-Class | | | 1.66 | % | | | 4.60 | % | | | 1,000.00 | | | | 1,046.00 | | | | 8.47 | |

Institutional Class | | | 0.56 | % | | | 5.13 | % | | | 1,000.00 | | | | 1,051.30 | | | | 2.86 | |

| | | | | | | | | | | | | | | | | | | | | |

| |

| |

| THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 5 |

| ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) (concluded) |

| |

| | | | | | | | | | | Beginning | | | Ending | | | Expenses | |

| | | Expense | | | Fund | | | Account Value | | | Account Value | | | Paid During | |

| | | Ratio1 | | | Return | | | September 30, 2013 | | | March 31, 2014 | | | Period2 | |

| |

| Table 2. Based on hypothetical 5% return (before expenses) |

| Floating Rate Strategies Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.05 | % | | | 5.00 | % | | | $1,000.00 | | | | $1,019.70 | | | | $5.29 | |

C-Class | | | 1.80 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,015.96 | | | | 9.05 | |

Institutional Class | | | 0.80 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.94 | | | | 4.03 | |

| High Yield Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.24 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,018.75 | | | | 6.24 | |

B-Class | | | 0.96 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.14 | | | | 4.84 | |

C-Class | | | 1.97 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,015.11 | | | | 9.90 | |

Institutional Class | | | 0.97 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.09 | | | | 4.89 | |

| Investment Grade Bond Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.07 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,019.60 | | | | 5.39 | |

B-Class | | | 1.82 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,015.86 | | | | 9.15 | |

C-Class | | | 1.82 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,015.86 | | | | 9.15 | |

Institutional Class | | | 0.82 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.84 | | | | 4.13 | |

| Limited Duration Fund4 | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.30 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,018.45 | | | | 6.54 | 5 |

C-Class | | | 1.53 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,017.30 | | | | 7.70 | 5 |

Institutional Class | | | 0.54 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,022.24 | | | | 2.72 | 5 |

| Macro Opportunities Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.40 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,017.95 | | | | 7.04 | |

C-Class | | | 2.14 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,014.26 | | | | 10.75 | |

Institutional Class | | | 1.08 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,019.55 | | | | 5.44 | |

| Municipal Income Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 0.83 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.79 | | | | 4.18 | |

C-Class | | | 1.58 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,017.05 | | | | 7.95 | |

Institutional Class | | | 0.58 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,022.04 | | | | 2.92 | |

| Total Return Bond Fund | | | | | | | | | | | | | | | | | | | | |

A-Class | | | 1.10 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,019.45 | | | | 5.54 | |

C-Class | | | 1.66 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,016.65 | | | | 8.35 | |

Institutional Class | | | 0.56 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,022.14 | | | | 2.82 | |

| | | | | | | | | | | | | | | | | | | | | |

| |

| 1 | This ratio represents annualized net expenses, which includes interest expense related to reverse repurchase agreements.Excluding interest expense, the operating expense ratios would be: |

| | | Floating Rate | | High Yield | | Investment Grade | | Macro Opportunities | | Total Return |

| | | Strategies Fund | | Fund | | Bond Fund | | Fund | | Bond Fund |

| |

| A-Class | | 1.04 | % | | 1.18 | % | | 1.03 | % | | 1.31 | % | | 0.93 | % |

| B-Class | | — | | | 0.91 | % | | 1.78 | % | | — | | | — | |

| C-Class | | 1.79 | % | | 1.91 | % | | 1.78 | % | | 2.04 | % | | 1.49 | % |

| Institutional Class | | 0.80 | % | | 0.91 | % | | 0.78 | % | | 0.98 | % | | 0.40 | % |

| 2 | Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| 3 | Actual cumulative return at net asset value for the period September 30, 2013 to March 31, 2014. |

| 4 | Since commencement of operations: December 16, 2013. |

| 5 | Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 106/365 (to reflect the since inception period). |

| |

| 6 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

This page intentionally left blank.

| |

| THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 7 |

| FUND PROFILE (Unaudited) | March 31, 2014 |

| |

| FLOATING RATE STRATEGIES FUND |

| OBJECTIVE: Seeks to provide a high level of current income while maximizing total return. |

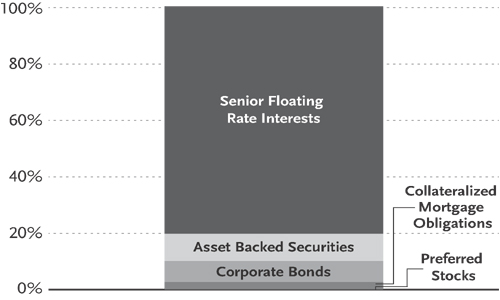

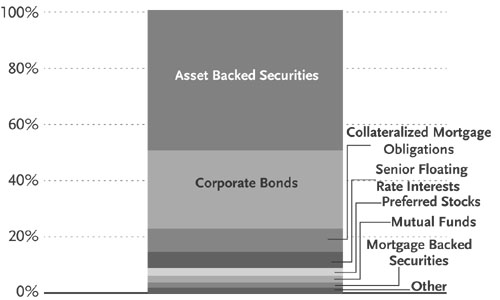

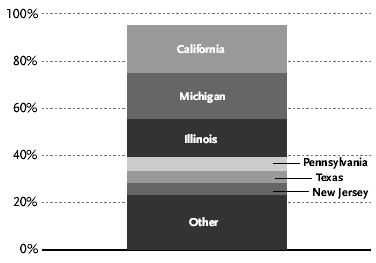

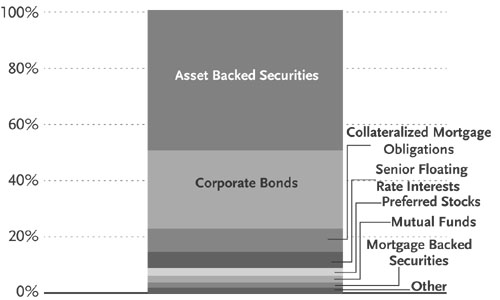

Holdings Diversification

(Market Exposure as % of Net Assets)

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

| Ten Largest Holdings (% of Total Net Assets) | | | |

| |

| Alliance Boots Ltd. | | 1.3 | % |

| Scout24 AG | | 1.2 | % |

| Flakt Woods | | 1.2 | % |

| Infor (US), Inc. | | 1.1 | % |

| HUB International Ltd. | | 1.0 | % |

| Crosby Worldwide | | 1.0 | % |

| National Financial Partners | | 0.9 | % |

| Smart & Final Stores LLC | | 0.9 | % |

| Sears Holdings Corp. | | 0.9 | % |

| Chromaflo Technologies | | 0.9 | % |

| |

| Top Ten Total | | 10.4 | % |

| |

| Inception Dates: | | |

| |

| A-Class | | November 30, 2011 |

| C-Class | | November 30, 2011 |

| Institutional Class | | November 30, 2011 |

| Portfolio Composition by Quality Rating* |

| |

| Rating | | | |

| |

| Fixed Income Instruments | | | |

AAA | | 0.3 | % |

AA | | 1.2 | % |

A | | 1.8 | % |

BBB | | 8.0 | % |

BB | | 21.4 | % |

B | | 54.4 | % |

CCC | | 6.7 | % |

CC | | 0.2 | % |

NR | | 1.6 | % |

| Other Instruments | | | |

Short Term Investments | | 4.2 | % |

Preferred Stocks | | 0.2 | % |

| |

| Total Investments | | 100.0 | % |

| |

The chart above reflects percentages of the value of total investments.

| * | Source: Factset. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). All securities have been rated by Moody’s, Standard & Poor’s (“S&P”), or Fitch, which are all a Nationally Recognized Statistical Rating Organization (“NRSRO”). For purposes of this presentation, when ratings are available from more than one agency, the highest rating is used. Guggenheim Investments has converted Moody’s and Fitch ratings to the equivalent S&P rating. Unrated securities do not necessarily indicate low credit quality. Security ratings are determined at the time of purchase and may change thereafter. |

| |

| 8 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT |

| SCHEDULE OF INVESTMENTS (Unaudited) | | March 31, 2014 |

| |

| FLOATING RATE STRATEGIES FUND | | |

| | | | SHARES | | | VALUE | |

| |

| | | | | | | | |

| PREFERRED STOCKS† - 0.2% | | | | | | | |

| Aspen Insurance Holdings Ltd. 5.95%1,2 | | | 96,000 | | $ | 2,381,760 | |

| | | | | | | |

| Total Preferred Stocks | | | | | | | |

(Cost $2,400,000) | | | | | | 2,381,760 | |

| | | | | | | |

| | | | | | | | |

| SHORT TERM INVESTMENTS† - 4.5% | | | | | | | |

| Federated U.S. Treasury Cash Reserve Fund | | | 59,798,206 | | | 59,798,206 | |

| | | | | | | |

| Total Short Term Investments | | | | | | | |

(Cost $59,798,206) | | | | | | 59,798,206 | |

| | | | | | | |

| | | | | | | | |

| | | | FACE | | | | |

| | | | AMOUNT | | | | |

| | | | | | | |

| SENIOR FLOATING RATE INTERESTS†† - 80.6% | | | | | | | |

| | | | | | | | |

| CONSUMER DISCRETIONARY - 18.5% | | | | | | | |

Alliance Boots Ltd. | | | | | | | |

3.96% due 07/09/17 | | $ | 10,521,726 | | | 17,594,093 | |

3.46% due 07/09/15 | | | 2,986,900 | | | 4,974,731 | |

Smart & Final Stores LLC | | | | | | | |

4.75% due 11/15/19 | | | 12,463,336 | | | 12,463,336 | |

Sears Holdings Corp. | | | | | | | |

5.50% due 06/30/18 | | | 11,870,250 | | | 11,920,699 | |

BJ’s Wholesale Club, Inc. | | | | | | | |

4.50% due 09/26/19 | | | 11,540,105 | | | 11,568,955 | |

Neiman Marcus Group, Inc. | | | | | | | |

4.25% due 10/25/20 | | | 10,224,375 | | | 10,250,958 | |

Laureate Education, Inc. | | | | | | | |

5.00% due 06/15/18 | | | 9,727,484 | | | 9,630,209 | |

Guitar Center, Inc. | | | | | | | |

8.25% due 04/09/17 | | | 9,492,851 | | | 9,449,374 | |

Go Daddy Operating Company LLC | | | | | | | |

4.00% due 12/17/18 | | | 8,182,388 | | | 8,198,753 | |

Alexander Mann Solutions Ltd. | | | | | | | |

5.75% due 12/20/19 | | | 7,980,000 | | | 7,999,950 | |

Steinway Musical Instruments, Inc. | | | | | | | |

4.75% due 09/19/19 | | | 4,389,000 | | | 4,424,683 | |

9.25% due 09/18/20 | | | 3,300,000 | | | 3,399,000 | |

Hilton Worldwide Holdings, Inc. | | | | | | | |

3.50% due 10/26/20 | | | 7,631,579 | | | 7,640,432 | |

Lions Gate Entertainment Corp. | | | | | | | |

5.00% due 07/19/20 | | | 7,400,000 | | | 7,529,500 | |

Hudson’s Bay Co. | | | | | | | |

4.75% due 11/04/20 | | | 6,250,000 | | | 6,328,125 | |

IntraWest Holdings S.à.r.l. | | | | | | | |

7.75% due 12/10/186 | | | 5,300,000 | | | 5,096,737 | |

5.50% due 12/09/20 | | | 1,057,350 | | | 1,070,567 | |

CHG Healthcare Services, Inc. | | | | | | | |

4.25% due 11/19/19 | | | 5,131,410 | | | 5,137,825 | |

Connolly Holdings, Inc. | | | | | | | |

5.00% due 01/29/21 | | | 4,937,625 | | | 4,982,903 | |

TI Automotive Ltd. | | | | | | | |

5.50% due 03/28/19 | | | 4,950,000 | | | 4,962,375 | |

PSAV-Audio Visual Services Corp. | | | | | | | |

4.50% due 01/25/21 | | | 4,350,000 | | | 4,371,750 | |

William Morris Endeavor | | | | | | | |

5.25% due 03/19/21 | | | 3,400,000 | | | 3,376,642 | |

8.25% due 03/21/22 | | | 930,000 | | | 937,561 | |

Pinnacle Entertainment, Inc. | | | | | | | |

3.75% due 08/13/20 | | | 4,265,263 | | | 4,271,916 | |

Playa Resorts Holdings | | | | | | | |

4.00% due 08/09/19 | | | 4,179,000 | | | 4,192,080 | |

Landry’s, Inc. | | | | | | | |

4.00% due 04/24/18 | | | 4,053,655 | | | 4,073,924 | |

Party City Holdings, Inc. | | | | | | | |

4.00% due 07/27/19 | | | 4,008,881 | | | 4,008,120 | |

CPA Global | | | | | | | |

4.50% due 12/03/20 | | | 3,950,000 | | | 3,987,051 | |

Digital Cinema | | | | | | | |

3.25% due 05/17/21 | | | 3,870,000 | | | 3,840,975 | |

Warner Music Group | | | | | | | |

3.75% due 07/01/20 | | | 3,731,250 | | | 3,709,795 | |

ValleyCrest Companies LLC | | | | | | | |

5.50% due 06/13/19 | | | 3,573,000 | | | 3,599,798 | |

Ollies Bargain Outlet | | | | | | | |

5.25% due 09/28/19 | | | 3,365,444 | | | 3,352,824 | |

Capital Automotive LP | | | | | | | |

6.00% due 04/30/20 | | | 2,000,000 | | | 2,042,500 | |

4.00% due 04/10/19 | | | 1,141,519 | | | 1,144,019 | |

Armored AutoGroup, Inc. | | | | | | | |

6.00% due 11/05/16 | | | 3,144,148 | | | 3,161,850 | |

Fender Musical Instruments Corp. | | | | | | | |

5.75% due 04/03/19 | | | 2,856,000 | | | 2,866,710 | |

Serta Simmons Holdings LLC | | | | | | | |

4.25% due 10/01/19 | | | 2,849,110 | | | 2,857,828 | |

Arby’s | | | | | | | |

5.00% due 11/15/20 | | | 2,836,463 | | | 2,851,524 | |

California Pizza Kitchen, Inc. | | | | | | | |

5.25% due 03/29/18 | | | 2,964,384 | | | 2,808,754 | |

Centaur LLC | | | | | | | |

5.25% due 02/20/19 | | | 2,631,848 | | | 2,636,796 | |

Boyd Gaming Corp. | | | | | | | |

4.00% due 08/14/20 | | | 2,447,700 | | | 2,448,924 | |

Mitel Networks Corp. | | | | | | | |

5.25% due 01/31/20 | | | 2,384,025 | | | 2,406,387 | |

Fleetpride Corp. | | | | | | | |

5.25% due 11/19/19 | | | 1,977,475 | | | 1,949,790 | |

9.25% due 05/15/20 | | | 380,000 | | | 373,350 | |

Compucom Systems, Inc. | | | | | | | |

4.25% due 05/07/20 | | | 2,277,700 | | | 2,272,712 | |

SNL Financial | | | | | | | |

4.50% due 10/23/18 | | | 2,094,750 | | | 2,104,344 | |

Hoyts Group Holdings LLC | | | | | | | |

4.00% due 05/29/20 | | | 2,081,763 | | | 2,080,472 | |

NES Global Talent | | | | | | | |

6.50% due 10/03/19 | | | 1,987,500 | | | 1,987,500 | |

Southern Graphics, Inc. | | | | | | | |

4.25% due 10/17/19 | | | 1,860,439 | | | 1,858,114 | |

Totes Isotoner Corp. | | | | | | | |

7.25% due 07/07/17 | | | 1,599,776 | | | 1,603,775 | |

La Quinta Intermediate Holdings | | | | | | | |

4.00% due 02/19/21 | | | 1,500,000 | | | 1,499,070 | |

AlixPartners, LLP | | | | | | | |

4.00% due 07/10/20 | | | 1,422,755 | | | 1,424,533 | |

1-800 Contacts, Inc. | | | | | | | |

4.25% due 01/31/21 | | | 1,300,000 | | | 1,302,275 | |

Men’s Wearhouse | | | | | | | |

7.75% due 03/11/15†††,6 | | | 1,100,000 | | | 1,100,000 | |

Cooper Standard Automotive, Inc. | | | | | | | |

4.00% due 03/26/21 | | | 940,000 | | | 940,592 | |

| |

| SEE NOTES TO FINANCIAL STATEMENTS. | | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 9 |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | | March 31, 2014 |

| |

| FLOATING RATE STRATEGIES FUND | | |

| | | | FACE | | | | |

| | | | AMOUNT | | | VALUE | |

| |

| | | | | | | | |

NAB Holdings LLC | | | | | | | |

7.00% due 04/24/18 | | $ | 912,500 | | $ | 915,922 | |

Container Store, Inc. | | | | | | | |

4.25% due 04/06/19 | | | 895,380 | | | 896,499 | |

Rite Aid Corp. | | | | | | | |

5.75% due 08/21/20 | | | 500,000 | | | 510,315 | |

Equinox Fitness | | | | | | | |

4.25% due 01/31/20 | | | 495,000 | | | 496,648 | |

Jacobs Entertainment, Inc. | | | | | | | |

5.25% due 10/29/18 | | | 492,500 | | | 494,963 | |

Reynolds Group Holdings | | | | | | | |

4.00% due 12/01/18 | | | 493,762 | | | 494,903 | |

Sleepy’s LLC | | | | | | | |

5.00% due 03/30/19 | | | 490,000 | | | 492,450 | |

Navistar, Inc. | | | | | | | |

5.75% due 08/17/17 | | | 312,500 | | | 317,447 | |

David’s Bridal, Inc. | | | | | | | |

5.03% due 10/11/19 | | | 246,875 | | | 246,566 | |

Targus Group International, Inc. | | | | | | | |

12.00% due 05/24/166 | | | 231,236 | | | 191,348 | |

CKX Entertainment, Inc. | | | | | | | |

9.00% due 06/21/176 | | | 145,875 | | | 126,911 | |

| | | | | | | |

| Total Consumer Discretionary | | | | | | 249,251,432 | |

| | | | | | | |

| | | | | | | | |

| INDUSTRIALS - 16.5% | | | | | | | |

Flakt Woods | | | | | | | |

8.00% due 04/01/17 | | | 12,115,820 | | | 16,191,148 | |

Crosby Worldwide | | | | | | | |

4.00% due 11/23/20 | | | 12,967,500 | | | 12,891,898 | |

Brickman Group Holdings, Inc. | | | | | | | |

4.00% due 12/18/20 | | | 10,077,000 | | | 10,087,984 | |

7.50% due 12/17/21 | | | 1,400,000 | | | 1,424,500 | |

Travelport Holdings Ltd. | | | | | | | |

6.25% due 06/26/19 | | | 5,093,883 | | | 5,206,917 | |

9.50% due 01/31/16 | | | 4,935,000 | | | 5,095,388 | |

US Shipping Corp. | | | | | | | |

9.00% due 04/30/18 | | | 9,707,806 | | | 9,901,963 | |

Minimax Viking | | | | | | | |

4.50% due 08/14/20 | | | 9,452,500 | | | 9,519,424 | |

Mitchell International, Inc. | | | | | | | |

4.50% due 10/12/20 | | | 6,384,000 | | | 6,393,576 | |

8.50% due 10/11/21 | | | 3,050,000 | | | 3,114,813 | |

Rexnord LLC/ RBS Global, Inc. | | | | | | | |

4.00% due 08/21/20 | | | 8,358,000 | | | 8,357,916 | |

Doncasters Group Ltd. | | | | | | | |

9.50% due 10/09/20 | | | 6,950,000 | | | 7,054,250 | |

5.50% due 04/09/20 | | | 1,257,300 | | | 1,262,543 | |

US Infrastructure Corp. | | | | | | | |

4.00% due 07/10/20 | | | 6,848,250 | | | 6,835,444 | |

Thermasys Corp. | | | | | | | |

5.25% due 05/03/19 | | | 6,739,688 | | | 6,705,989 | |

SIRVA Worldwide, Inc. | | | | | | | |

7.50% due 03/27/19 | | | 5,940,000 | | | 6,058,800 | |

Tank & Rast | | | | | | | |

4.06% due 12/10/19 | | | 2,340,000 | | | 3,252,015 | |

3.81% due 12/10/18 | | | 1,750,000 | | | 2,412,847 | |

Berlin Packaging LLC | | | | | | | |

4.75% due 04/02/19 | | | 3,582,000 | | | 3,599,910 | |

8.75% due 04/10/20 | | | 1,900,000 | | | 1,942,750 | |

SRA International, Inc. | | | | | | | |

6.50% due 07/20/18 | | | 5,055,529 | | | 5,065,033 | |

Power Borrower, LLC | | | | | | | |

4.25% due 05/06/20 | | | 2,955,637 | | | 2,938,406 | |

8.25% due 11/06/20 | | | 1,670,000 | | | 1,653,300 | |

Quikrete | | | | | | | |

4.00% due 09/28/20 | | | 4,577,000 | | | 4,581,760 | |

HD Supply, Inc. | | | | | | | |

4.00% due 06/28/18 | | | 4,431,106 | | | 4,432,036 | |

IPC Systems, Inc. | | | | | | | |

7.75% due 07/31/17 | | | 4,121,091 | | | 4,120,433 | |

NaNa Development Corp. | | | | | | | |

8.00% due 03/15/18 | | | 4,080,000 | | | 4,039,200 | |

Filtration Group Corp. | | | | | | | |

4.50% due 11/20/20 | | | 3,840,375 | | | 3,862,764 | |

Sutherland Global Services, Inc. | | | | | | | |

7.25% due 03/06/19 | | | 3,800,000 | | | 3,819,000 | |

syncreon | | | | | | | |

5.25% due 10/28/20 | | | 3,790,500 | | | 3,795,238 | |

Ceva Logistics US Holdings | | | | | | | |

6.50% due 03/19/21 | | | 3,783,251 | | | 3,767,475 | |

Knowledge Learning Corp. | | | | | | | |

5.25% due 03/12/21 | | | 3,550,000 | | | 3,569,987 | |

Multiplan, Inc. | | | | | | | |

4.00% due 03/31/21 | | | 3,400,000 | | | 3,391,500 | |

Emerald Expositions | | | | | | | |

5.50% due 06/17/20 | | | 3,132,123 | | | 3,153,014 | |

Camp Systems International | | | | | | | |

4.75% due 05/31/19 | | | 1,895,213 | | | 1,914,165 | |

8.25% due 11/29/19 | | | 1,150,000 | | | 1,171,563 | |

GYP Holdings III Corp. | | | | | | | |

4.75% due 03/26/21 | | | 2,800,000 | | | 2,786,000 | |

Ceva Logistics Holdings BV (Dutch) | | | | | | | |

6.50% due 03/19/21 | | | 2,742,857 | | | 2,731,419 | |

Mast Global | | | | | | | |

8.75% due 09/12/19†††,6 | | | 2,715,625 | | | 2,688,469 | |

Osmose Holdings, Inc. | | | | | | | |

4.75% due 11/26/18 | | | 2,619,792 | | | 2,632,891 | |

Ceva Group Plc (United Kingdom) | | | | | | | |

6.50% due 03/19/21 | | | 2,600,985 | | | 2,590,139 | |

Ranpak | | | | | | | |

4.50% due 04/25/19 | | | 2,005,124 | | | 2,015,149 | |

8.50% due 04/23/20 | | | 500,000 | | | 510,000 | |

Univision Communications, Inc. | | | | | | | |

4.00% due 03/01/20 | | | 2,504,700 | | | 2,499,791 | |

Nord Anglia Education Finance LLC | | | | | | | |

4.50% due 03/19/21 | | | 2,500,000 | | | 2,496,875 | |

Realogy Corp. | | | | | | | |

3.75% due 03/05/20 | | | 2,475,047 | | | 2,482,472 | |

MRC Global, Inc. | | | | | | | |

4.75% due 11/08/19 | | | 2,417,850 | | | 2,445,559 | |

GCA Services Group, Inc. | | | | | | | |

4.27% due 11/01/19 | | | 1,796,465 | | | 1,798,711 | |

9.25% due 11/01/20 | | | 200,000 | | | 202,250 | |

Berry Plastics Corp. | | | | | | | |

3.50% due 02/08/20 | | | 1,094,472 | | | 1,089,000 | |

3.75% due 01/06/21 | | | 900,000 | | | 897,624 | |

ServiceMaster Co. | | | | | | | |

4.25% due 01/31/17 | | | 1,757,934 | | | 1,758,303 | |

Dematic S.A. | | | | | | | |

4.25% due 12/28/19 | | | 1,361,681 | | | 1,363,955 | |

CareCore National LLC | | | | | | | |

5.50% due 03/05/21 | | | 1,350,000 | | | 1,357,317 | |

| |

| 10 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | | SEE NOTES TO FINANCIAL STATEMENTS. |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | | March 31, 2014 |

| |

| FLOATING RATE STRATEGIES FUND | | |

| | | | FACE | | | | |

| | | | AMOUNT | | | VALUE | |

| |

| | | | | | | | |

Helm Financial Corp. | | | | | | | |

6.25% due 06/01/17 | | $ | 1,150,133 | | $ | 1,147,258 | |

Travelport LLC | | | | | | | |

5.50% due 06/21/18†††,6 | | | 833,333 | | | 752,859 | |

CPM Acquisition Corp. | | | | | | | |

6.25% due 08/29/17 | | | 379,192 | | | 381,561 | |

10.25% due 03/01/18 | | | 325,000 | | | 329,063 | |

Panolam Industries International, Inc. | | | | | | | |

7.25% due 08/23/17 | | | 572,763 | | | 557,012 | |

Wireco Worldgroup, Inc. | | | | | | | |

6.00% due 02/15/17 | | | 492,500 | | | 494,963 | |

Ceva Logistics Canada, ULC | | | | | | | |

6.50% due 03/19/21 | | | 472,906 | | | 470,934 | |

Omnitracs, Inc. | | | | | | | |

8.75% due 05/25/21 | | | 350,000 | | | 354,375 | |

Advanced Disposal Services, Inc. | | | | | | | |

3.75% due 10/09/19 | | | 351,369 | | | 350,442 | |

Total Safety U.S., Inc. | | | | | | | |

5.75% due 03/13/20 | | | 198,000 | | | 198,248 | |

9.25% due 09/13/20 | | | 99,750 | | | 99,750 | |

Hamilton Sundstrand | | | | | | | |

4.00% due 12/13/19 | | | 257,117 | | | 256,394 | |

SI Organization | | | | | | | |

5.50% due 11/22/16 | | | 243,759 | | | 238,124 | |

Hunter Fan Co. | | | | | | | |

6.50% due 12/20/17 | | | 223,010 | | | 222,731 | |

Wyle Services Corp. | | | | | | | |

5.00% due 03/26/17 | | | 190,786 | | | 190,786 | |

Awas Aviation Holdings LLC | | | | | | | |

3.50% due 06/10/16 | | | 189,229 | | | 189,229 | |

DynCorp International, Inc. | | | | | | | |

6.25% due 07/07/16 | | | 84,224 | | | 84,698 | |

| | | | | | | |

| Total Industrials | | | | | | 223,249,300 | |

| | | | | | | |

| | | | | | | | |

| INFORMATION TECHNOLOGY - 11.5% | | | | | | | |

Infor (US), Inc. | | | | | | | |

3.75% due 06/03/20 | | | 18,521,036 | | | 18,450,198 | |

Sabre, Inc. | | | | | | | |

4.50% due 02/19/19 | | | 8,361,491 | | | 8,357,310 | |

4.25% due 02/19/19 | | | 2,952,035 | | | 2,950,795 | |

Active Network, Inc., The | | | | | | | |

5.50% due 11/13/20 | | | 9,875,250 | | | 9,955,536 | |

Greenway Medical Technologies | | | | | | | |

6.00% due 11/04/20 | | | 9,975,000 | | | 9,912,656 | |

GlobalLogic Holdings, Inc. | | | | | | | |

6.25% due 05/31/19 | | | 9,725,625 | | | 9,628,369 | |

CallCredit Info Group Ltd. | | | | | | | |

7.75% due 03/26/21 | | | 5,300,000 | | | 8,901,809 | |

LANDesk Group, Inc. | | | | | | | |

5.00% due 02/25/20 | | | 8,457,500 | | | 8,460,122 | |

Aspect Software, Inc. | | | | | | | |

7.25% due 05/07/16 | | | 8,101,342 | | | 8,202,608 | |

Applied Systems, Inc. | | | | | | | |

4.25% due 01/25/21 | | | 7,331,625 | | | 7,349,954 | |

Activision Blizzard | | | | | | | |

3.25% due 10/12/20 | | | 6,356,250 | | | 6,349,894 | |

ION Trading Technologies Ltd. | | | | | | | |

4.50% due 05/22/20 | | | 3,937,500 | | | 3,941,201 | |

8.25% due 05/22/21 | | | 1,800,000 | | | 1,818,000 | |

EIG Investors Corp. | | | | | | | |

5.00% due 11/09/19 | | | 5,409,320 | | | 5,436,366 | |

Deltek, Inc. | | | | | | | |

4.50% due 10/10/18 | | | 5,117,024 | | | 5,142,609 | |

P2 Energy Solutions | | | | | | | |

5.00% due 10/30/20 | | | 4,568,550 | | | 4,602,814 | |

9.00% due 04/30/21 | | | 390,000 | | | 396,338 | |

CDW LLC | | | | | | | |

3.25% due 04/29/20 | | | 4,950,012 | | | 4,900,511 | |

Sophos | | | | | | | |

5.00% due 01/29/21 | | | 4,800,000 | | | 4,812,000 | |

Paradigm Ltd | | | | | | | |

4.75% due 07/30/196 | | | 4,129,316 | | | 4,133,198 | |

Verint Systems, Inc. | | | | | | | |

3.50% due 09/06/19 | | | 3,467,000 | | | 3,455,732 | |

Blue Coat Systems, Inc. | | | | | | | |

4.00% due 05/31/19 | | | 3,286,000 | | | 3,291,488 | |

Kronos, Inc. | | | | | | | |

4.50% due 10/30/19 | | | 2,424,996 | | | 2,441,365 | |

SRS Distribution, Inc. | | | | | | | |

4.75% due 08/28/19 | | | 2,279,019 | | | 2,279,019 | |

Eze Castle Software, Inc. | | | | | | | |

7.25% due 04/04/21 | | | 1,441,176 | | | 1,448,382 | |

8.50% due 03/14/21 | | | 800,000 | | | 810,000 | |

Lantiq Deutschland GmbH | | | | | | | |

11.00% due 11/16/156 | | | 1,881,406 | | | 1,862,592 | |

Attachmate Group, Inc., The | | | | | | | |

7.25% due 11/22/17 | | | 1,119,620 | | | 1,125,923 | |

Hyland Software, Inc. | | | | | | | |

4.75% due 02/19/21 | | | 1,089,000 | | | 1,098,529 | |

Wall Street Systems | | | | | | | |

5.75% due 10/25/19 | | | 641,875 | | | 641,875 | |

9.25% due 10/25/20 | | | 150,000 | | | 151,125 | |

American Builders & Contractors | | | | | | | |

Supply Co., Inc. | | | | | | | |

3.50% due 04/16/20 | | | 696,500 | | | 694,139 | |

Sophia, LP | | | | | | | |

4.00% due 07/19/18 | | | 382,139 | | | 382,139 | |

Epicor Software | | | | | | | |

4.00% due 05/16/18 | | | 374,063 | | | 374,717 | |

SumTotal Systems | | | | | | | |

6.25% due 11/16/18 | | | 331,073 | | | 329,004 | |

| | | | | | | |

| Total Information Technology | | | | | | 154,088,317 | |

| | | | | | | |

| | | | | | | | |

| TELECOMMUNICATION SERVICES - 10.3% | | | | | | | |

Ziggo BV | | | | | | | |

3.75% due 01/15/22 | | | 6,445,200 | | | 8,830,328 | |

3.50% due 01/15/22 | | | 5,854,800 | | | 8,021,443 | |

Scout24 AG | | | | | | | |

4.48% due 02/05/21 | | | 12,000,000 | | | 16,689,398 | |

Alcatel-Lucent, Inc. | | | | | | | |

4.50% due 01/30/19 | | | 11,444,482 | | | 11,492,778 | |

Cumulus Media, Inc. | | | | | | | |

4.25% due 12/23/20 | | | 10,967,750 | | | 11,008,879 | |

Zayo Group LLC | | | | | | | |

4.00% due 07/02/19 | | | 9,875,481 | | | 9,877,950 | |

Expert Global Solutions | | | | | | | |

8.50% due 04/03/18 | | | 8,973,458 | | | 8,737,905 | |

7.80% due 04/02/176 | | | 937,500 | | | 883,575 | |

Asurion Corp. | | | | | | | |

4.25% due 07/08/20 | | | 4,128,800 | | | 4,111,831 | |

6.00% due 05/24/19 | | | 3,891,170 | | | 3,897,512 | |

| |

| SEE NOTES TO FINANCIAL STATEMENTS. | | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 11 |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | | March 31, 2014 |

| |

| FLOATING RATE STRATEGIES FUND | | |

| | | | FACE | | | | |

| | | | AMOUNT | | | VALUE | |

| |

| | | | | | | | |

Avaya, Inc. | | | | | | | |

6.50% due 03/31/18 | | $ | 4,933,593 | | $ | 4,938,724 | |

4.73% due 10/26/17 | | | 2,338,791 | | | 2,281,538 | |

Light Tower Fiber LLC | | | | | | | |

4.00% due 04/13/20 | | | 6,458,731 | | | 6,414,360 | |

Cengage Learning Acquisitions, Inc. | | | | | | | |

7.00% due 03/06/20 | | | 5,650,000 | | | 5,708,873 | |

Trader Media Corporation Ltd. | | | | | | | |

5.00% due 12/08/17 | | | 3,376,319 | | | 5,645,041 | |

Gogo LLC | | | | | | | |

11.25% due 06/21/176 | | | 4,342,631 | | | 4,690,042 | |

CBS Outdoor Americas Capital LLC | | | | | | | |

3.00% due 01/31/21 | | | 4,600,000 | | | 4,579,898 | |

Associated Partners, Inc. | | | | | | | |

6.66% due 12/21/15†††,6 | | | 3,250,000 | | | 3,258,125 | |

Univision Communications, Inc. | | | | | | | |

4.00% due 03/01/20 | | | 3,006,951 | | | 3,010,289 | |

Live Nation Worldwide, Inc. | | | | | | | |

3.50% due 08/14/20 | | | 2,985,000 | | | 2,978,463 | |

Hemisphere Media Group, Inc. | | | | | | | |

6.25% due 07/30/20 | | | 2,580,500 | | | 2,586,951 | |

EMI Music Publishing | | | | | | | |

3.75% due 06/29/18 | | | 2,367,010 | | | 2,365,329 | |

Virgin Media Investment Holdings Ltd. | | | | | | | |

3.50% due 06/08/20 | | | 2,000,000 | | | 1,994,660 | |

Anaren, Inc. | | | | | | | |

5.50% due 02/18/21 | | | 1,596,000 | | | 1,603,980 | |

9.25% due 08/18/21 | | | 275,000 | | | 277,750 | |

Syniverse Technologies, Inc. | | | | | | | |

4.00% due 04/23/19 | | | 1,163,426 | | | 1,163,914 | |

Level 3 Communications, Inc. | | | | | | | |

4.00% due 08/01/19 | | | 750,000 | | | 751,688 | |

Clientlogic Corp. | | | | | | | |

6.99% due 01/30/17 | | | 250,000 | | | 252,500 | |

Telx Group | | | | | | | |

5.25% due 09/25/17 | | | 243,789 | | | 245,312 | |

| | | | | | | |

| Total Telecommunication Services | | | | | | 138,299,036 | |

| | | | | | | |

| | | | | | | | |

| FINANCIALS - 9.2% | | | | | | | |

HUB International Ltd. | | | | | | | |

4.75% due 10/02/20 | | | 13,731,000 | | | 13,736,766 | |

National Financial Partners | | | | | | | |

5.25% due 07/01/20 | | | 12,530,831 | | | 12,589,601 | |

First Data Corp. | | | | | | | |

4.15% due 03/23/18 | | | 9,300,000 | | | 9,315,531 | |

4.15% due 03/24/21 | | | 1,374,285 | | | 1,376,291 | |

4.15% due 09/24/18 | | | 400,000 | | | 400,388 | |

Magic Newco, LLC | | | | | | | |

5.00% due 12/12/18 | | | 9,903,160 | | | 9,989,813 | |

12.00% due 06/12/19 | | | 500,000 | | | 572,500 | |

Ceridian Corp. | | | | | | | |

4.40% due 05/09/17 | | | 5,848,903 | | | 5,869,374 | |

American Stock Transfer & Trust | | | | | | | |

5.75% due 06/26/20 | | | 5,828,800 | | | 5,848,210 | |

WTG Holdings | | | | | | | |

4.75% due 01/15/21 | | | 5,735,625 | | | 5,749,964 | |

AmWINS Group, LLC | | | | | | | |

5.00% due 09/06/19 | | | 4,755,955 | | | 4,784,206 | |

International Lease Finance | | | | | | | |

3.50% due 03/06/21 | | | 4,700,000 | | | 4,700,987 | |

Wastequip, Inc. | | | | | | | |

5.50% due 08/09/19 | | | 4,429,031 | | | 4,462,249 | |

Nuveen Investments, Inc. | | | | | | | |

4.15% due 05/13/17 | | | 4,000,000 | | | 4,009,280 | |

6.50% due 02/28/19 | | | 400,000 | | | 400,500 | |

RCS Capital | | | | | | | |

6.50% due 03/29/19 | | | 4,350,000 | | | 4,371,750 | |

STG-Fairway Acquisitions, Inc. | | | | | | | |

6.25% due 02/28/19 | | | 2,977,505 | | | 2,984,949 | |

10.50% due 08/28/19††† | | | 1,300,000 | | | 1,287,000 | |

Topaz Power Holdings LLC | | | | | | | |

5.25% due 02/26/20 | | | 3,950,000 | | | 3,864,404 | |

Cetera Financial Group, Inc. | | | | | | | |

6.50% due 08/07/19 | | | 3,555,000 | | | 3,555,000 | |

Lineage Logistics LLC | | | | | | | |

4.50% due 03/31/21 | | | 3,250,000 | | | 3,241,875 | |

Fly Leasing Ltd. | | | | | | | |

4.50% due 08/09/19 | | | 2,660,078 | | | 2,685,562 | |

Intertrust Group | | | | | | | |

4.65% due 02/04/20 | | | 2,616,000 | | | 2,605,379 | |

Transunion Holding Co. | | | | | | | |

4.00% due 03/19/21 | | | 2,500,000 | | | 2,504,175 | |

Grosvenor Capital Management | | | | | | | |

Holdings, LLLP | | | | | | | |

3.75% due 01/04/21 | | | 2,169,563 | | | 2,157,370 | |

USI Holdings Corp. | | | | | | | |

4.25% due 12/27/19 | | | 1,970,125 | | | 1,976,291 | |

iStar Financial, Inc. | | | | | | | |

4.50% due 10/15/17 | | | 1,952,824 | | | 1,957,100 | |

Cunningham Lindsey U.S., Inc. | | | | | | | |

5.00% due 12/10/19 | | | 1,631,602 | | | 1,630,917 | |

9.25% due 06/10/20 | | | 194,886 | | | 194,399 | |

AssuredPartners | | | | | | | |

0.00% due 01/31/193 | | | 1,600,000 | | | 1,584,000 | |

Alliant Holdings I, LLC | | | | | | | |

4.25% due 12/20/19 | | | 1,425,543 | | | 1,430,290 | |

CNO Financial Group, Inc. | | | | | | | |

3.75% due 09/28/18 | | | 727,926 | | | 727,475 | |

Knight/Getco | | | | | | | |

5.75% due 12/05/17 | | | 607,477 | | | 608,236 | |

Hamilton Lane Advisors LLC | | | | | | | |

5.25% due 02/28/18 | | | 196,875 | | | 196,875 | |

| | | | | | | |

| Total Financials | | | | | | 123,368,707 | |

| | | | | | | |

| | | | | | | | |

| CONSUMER STAPLES - 4.6% | | | | | | | |

Performance Food Group | | | | | | | |

6.25% due 11/14/19 | | | 9,921,453 | | | 10,053,705 | |

CTI Foods Holding Co. LLC | | | | | | | |

8.25% due 06/28/21 | | | 8,650,000 | | | 8,693,250 | |

4.50% due 06/28/20 | | | 1,343,250 | | | 1,343,250 | |

Dole Food Company, Inc. | | | | | | | |

4.50% due 11/01/18 | | | 7,980,000 | | | 8,009,925 | |

Reddy Ice Holdings, Inc. | | | | | | | |

6.75% due 04/01/19 | | | 4,853,481 | | | 4,804,946 | |

10.75% due 10/01/19 | | | 2,000,000 | | | 1,920,000 | |

Arctic Glacier Holdings, Inc. | | | | | | | |

5.00% due 05/10/19 | | | 6,433,607 | | | 6,441,649 | |

Grocery Outlet, Inc. | | | | | | | |

5.50% due 12/17/18 | | | 6,048,438 | | | 6,059,809 | |

| |

| 12 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | | SEE NOTES TO FINANCIAL STATEMENTS. |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | | March 31, 2014 |

| |

| FLOATING RATE STRATEGIES FUND | | |

| | | | FACE | | | | |

| | | | AMOUNT | | | VALUE | |

| |

| | | | | | | | |

Darling International, Inc. | | | | | | | |

3.25% due 01/08/21 | | $ | 6,000,000 | | $ | 5,987,520 | |

Hostess Brands | | | | | | | |

6.75% due 04/09/20 | | | 2,800,000 | | | 2,908,500 | |

DS Waters of America, Inc. | | | | | | | |

5.25% due 08/30/20 | | | 2,487,500 | | | 2,524,813 | |

AdvancePierre Foods, Inc. | | | | | | | |

5.75% due 07/10/17 | | | 1,706,360 | | | 1,711,036 | |

9.50% due 10/10/17 | | | 751,000 | | | 728,470 | |

Aramark Corp. | | | | | | | |

3.25% due 02/24/21 | | | 1,220,000 | | | 1,207,544 | |

| | | | | | | |

| Total Consumer Staples | | | | | | 62,394,417 | |

| | | | | | | |

| | | | | | | | |

| MATERIALS - 3.5% | | | | | | | |

Chromaflo Technologies | | | | | | | |

4.50% due 12/02/19 | | | 11,720,625 | | | 11,749,926 | |

Oxbow Carbon | | | | | | | |

8.00% due 01/19/20 | | | 4,900,000 | | | 4,998,000 | |

4.25% due 07/19/19 | | | 3,940,158 | | | 3,958,204 | |

WR Grace & Co. | | | | | | | |

3.00% due 02/03/21 | | | 8,842,105 | | | 8,816,286 | |

Royal Adhesives and Sealants | | | | | | | |

5.50% due 07/31/18 | | | 5,045,605 | | | 5,105,547 | |

CPG International, Inc. | | | | | | | |

4.75% due 09/30/20 | | | 3,710,345 | | | 3,716,541 | |

Atkore International, Inc. | | | | | | | |

4.50% due 03/26/21 | | | 2,300,000 | | | 2,295,699 | |

7.75% due 09/27/21 | | | 400,000 | | | 402,000 | |

Ennis-Flint | | | | | | | |

4.25% due 03/31/21 | | | 2,100,000 | | | 2,096,073 | |

7.75% due 09/30/21 | | | 550,000 | | | 550,000 | |

United Central Industrial Supply | | | | | | | |

9.50% due 10/09/17†††,6 | | | 1,700,000 | | | 1,700,000 | |

Fortescue Metals Group Ltd. | | | | | | | |

4.25% due 06/30/19 | | | 995,000 | | | 1,002,174 | |

Kloeckner Pentaplast S.A. | | | | | | | |

4.75% due 12/21/16 | | | 285,529 | | | 288,028 | |

| | | | | | | |

| Total Materials | | | | | | 46,678,478 | |

| | | | | | | |

| | | | | | | | |

| HEALTH CARE - 3.1% | | | | | | | |

Community Health Systems, Inc. | | | | | | | |

4.25% due 01/27/21 | | | 10,623,375 | | | 10,705,069 | |

Akorn, Inc. | | | | | | | |

4.50% due 11/13/20 | | | 6,300,000 | | | 6,355,125 | |

Valeant Pharmaceuticals International, Inc. | | | | | | | |

3.75% due 08/05/20 | | | 5,602,430 | | | 5,615,652 | |

Merge Healthcare, Inc. | | | | | | | |

6.00% due 04/23/196 | | | 4,512,406 | | | 4,241,662 | |

Learning Care Group (US), Inc. | | | | | | | |

5.75% due 05/08/19 | | | 4,227,174 | | | 4,240,405 | |

Harvard Drug | | | | | | | |

5.00% due 08/16/20 | | | 3,320,163 | | | 3,337,794 | |

DJO Finance LLC | | | | | | | |

4.75% due 09/15/17 | | | 2,567,500 | | | 2,574,715 | |

Ceramtec GMBH | | | | | | | |

4.25% due 08/30/20 | | | 2,284,515 | | | 2,286,410 | |

Catalent Pharma Solutions, Inc. | | | | | | | |

4.25% due 09/15/17 | | | 1,178,462 | | | 1,181,149 | |

Healthport, Inc. | | | | | | | |

5.25% due 10/04/19 | | | 748,125 | | | 755,606 | |

| | | | | | | |

Total Health Care | | | | | | 41,293,587 | |

| | | | | | | |

| | | | | | | | |

| ENERGY - 2.5% | | | | | | | |

Ocean Rig ASA | | | | | | | |

6.00% due 03/31/21 | | | 7,788,691 | | | 7,926,628 | |

Rice Energy | | | | | | | |

8.50% due 10/25/18 | | | 6,538,714 | | | 6,653,142 | |

Pacific Drilling | | | | | | | |

4.50% due 05/18/18 | | | 5,705,631 | | | 5,724,175 | |

PSS Companies | | | | | | | |

5.50% due 01/28/20 | | | 5,250,000 | | | 5,276,250 | |

Panda Temple II Power | | | | | | | |

7.25% due 04/03/19 | | | 4,500,000 | | | 4,606,875 | |

Varel International Energy Funding Corp. | | | | | | | |

9.25% due 07/17/17 | | | 956,250 | | | 963,422 | |

Crestwood | | | | | | | |

7.00% due 06/19/19 | | | 731,855 | | | 744,209 | |

Panda Sherman | | | | | | | |

9.00% due 09/14/18 | | | 600,000 | | | 613,500 | |

EP Energy LLC | | | | | | | |

4.50% due 04/30/19 | | | 281,250 | | | 281,835 | |

Sheridan Production Partners | | | | | | | |

4.25% due 10/01/19 | | | 244,375 | | | 245,494 | |

| | | | | | | |

Total Energy | | | | | | 33,035,530 | |

| | | | | | | |

| | | | | | | | |

| UTILITIES - 0.9% | | | | | | | |

Astoria Generating Company | | | | | | | |

Acquisitions LLC | | | | | | | |

8.50% due 10/26/17 | | | 6,825,000 | | | 7,029,750 | |

Linden Cogeneration Power | | | | | | | |

3.75% due 12/17/20 | | | 4,800,507 | | | 4,820,525 | |

| | | | | | | |

| Total Utilities | | | | | | 11,850,275 | |

| | | | | | | |

| | | | | | | | |

| Total Senior Floating Rate Interests | | | | | | | |

(Cost $1,075,198,469) | | | | | | 1,083,509,079 | |

| | | | | | | |

| | | | | | | | |

| ASSET BACKED SECURITIES†† - 9.6% | | | | | | | |

Gramercy Real Estate CDO 2007-1 Ltd. | | | | | | | |

2007-1A, 0.52% due 08/15/561,4 | | | 11,647,489 | | | 9,969,087 | |

Castlelake Aircraft Securitization Trust | | | | | | | |

2014-1, 5.25% due 02/15/29††† | | | 4,705,825 | | | 4,752,883 | |

2014-1, 7.50% due 02/15/29††† | | | 3,500,000 | | | 3,535,000 | |

Cedar Woods CRE CDO Ltd. | | | | | | | |

0.42% due 07/25/51††† | | | 8,849,225 | | | 7,224,507 | |

GreenPoint Mortgage Funding Trust | | | | | | | |

2005-HE4, 0.86% due 07/25/301 | | | 6,800,000 | | | 6,153,544 | |

RAIT CRE CDO I Ltd. | | | | | | | |

2006-1X, 0.49% due 11/20/46†††,1 | | | 6,498,237 | | | 5,498,808 | |

N-Star REL CDO VIII Ltd. | | | | | | | |

2006-8A, 0.51% due 02/01/411,4 | | | 3,250,000 | | | 2,811,900 | |

2006-8A, 0.44% due 02/01/41†††,1,4 | | | 1,779,618 | | | 1,677,112 | |

Structured Asset Securities Corporation | | | | | | | |

Mortgage Loan Trust | | | | | | | |

2006-OPT1, 0.41% due 04/25/361 | | | 4,300,000 | | | 3,697,200 | |

2007-BC1, 0.28% due 02/25/371 | | | 900,000 | | | 732,559 | |

N-Star Real Estate CDO IX Ltd. | | | | | | | |

0.51% due 02/01/41†††,6 | | | 4,804,968 | | | 4,366,275 | |

KKR Financial CLO 2007-1 Ltd. | | | | | | | |

2007-1A, 2.49% due 05/15/211,4 | | | 4,100,000 | | | 3,942,560 | |

Newstar Commercial Loan | | | | | | | |

Funding 2013-1 LLC | | | | | | | |

2013-1A, 4.78% due 09/20/231,4 | | | 2,750,000 | | | 2,750,000 | |

2013-1A, 5.53% due 09/20/231,4 | | | 250,000 | | | 249,350 | |

| |

| SEE NOTES TO FINANCIAL STATEMENTS. | | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 13 |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | | March 31, 2014 |

| |

| FLOATING RATE STRATEGIES FUND | | |

| | | | FACE | | | | |

| | | | AMOUNT | | | VALUE | |

| |

| | | | | | | | |

Lehman XS Trust | | | | | | | |

2007-9, 0.27% due 06/25/371 | | $ | 3,226,703 | | $ | 2,820,500 | |

Jasper CLO Ltd. | | | | | | | |

2005-1A, 1.14% due 08/01/171,4 | | | 3,000,000 | | | 2,813,322 | |

Halcyon Loan Advisors Funding 2012-1 Ltd. | | | | | | | |

2012-1A, 3.24% due 08/15/231,4 | | | 2,600,000 | | | 2,594,280 | |

Wachovia Asset Securitization | | | | | | | |

Issuance II LLC 2007-HE1 Trust | | | | | | | |

2007-HE1, 0.29% due 07/25/371,4 | | | 2,914,538 | | | 2,438,099 | |

Highland Park CDO I Ltd. | | | | | | | |

2006-1A, 0.56% due 11/25/511,4,7 | | | 2,616,693 | | | 2,402,909 | |

Tricadia CDO 2006-6 Ltd. | | | | | | | |

2006-6A, 0.79% due 11/05/41†††,1,4 | | | 1,750,000 | | | 1,627,675 | |

2006-6A, 0.99% due 11/05/41†††,1,4 | | | 550,000 | | | 499,675 | |

TCW Global Project Fund III Ltd. | | | | | | | |

2005-1A, 0.89% due 09/01/17†††,1,4 | | | 1,750,000 | | | 1,625,400 | |

2005-1A, 1.09% due 09/01/17†††,1,4 | | | 500,000 | | | 427,250 | |

GSAMP Trust | | | | | | | |

2005-HE6, 0.59% due 11/25/351 | | | 2,250,000 | | | 2,001,276 | |

Duane Street CLO IV Ltd. | | | | | | | |

2007-4A, 2.49% due 11/14/211,4 | | | 2,000,000 | | | 1,907,000 | |

West Coast Funding Ltd. | | | | | | | |

2006-1A, 0.37% due 11/02/411,4 | | | 1,853,939 | | | 1,785,714 | |

Acis CLO 2013-2 Ltd. | | | | | | | |

4.09% due 10/14/221,4 | | | 1,800,000 | | | 1,758,780 | |

Northwoods Capital VII Ltd. | | | | | | | |

2006-7A, 3.74% due 10/22/211,4 | | | 1,000,000 | | | 969,100 | |

2006-7A, 1.79% due 10/22/211,4 | | | 700,000 | | | 669,550 | |

Rockwall CDO II Ltd. | | | | | | | |

2007-1A, 0.49% due 08/01/241,4 | | | 1,740,241 | | | 1,614,073 | |

HSI Asset Securitization Corporation Trust | | | | | | | |

2007-WF1, 0.32% due 05/25/371 | | | 1,728,004 | | | 1,597,234 | |

DIVCORE CLO Ltd. | | | | | | | |

2013-1A B, 4.05% due 11/15/32††† | | | 1,600,000 | | | 1,592,800 | |

Home Equity Asset Trust | | | | | | | |

2006-3, 0.46% due 07/25/361 | | | 1,717,393 | | | 1,562,293 | |

MCF CLO I LLC | | | | | | | |

2013-1A, 3.79% due 04/20/231,4 | | | 1,500,000 | | | 1,482,900 | |

Copper River CLO Ltd. | | | | | | | |

2007-1A, 1.74% due 01/20/21†††,1,4 | | | 1,000,000 | | | 914,000 | |

2007-1A, 1.04% due 01/20/211,4 | | | 500,000 | | | 452,650 | |

New Century Home Equity Loan Trust | | | | | | | |

2004-4, 0.95% due 02/25/351 | | | 1,441,499 | | | 1,308,169 | |

GSAA Home Equity Trust | | | | | | | |

2007-7, 0.42% due 07/25/371 | | | 1,464,803 | | | 1,269,005 | |

Global Leveraged Capital Credit | | | | | | | |

Opportunity Fund | | | | | | | |

2006-1A, 1.24% due 12/20/181,4 | | | 1,288,000 | | | 1,238,154 | |

Newcastle Cdo Viii 1 Ltd. | | | | | | | |

2006-8A, 0.43% due 11/25/52†††,1,4 | | | 1,201,297 | | | 1,150,242 | |

Putnam Structured Product CDO 2002-1 Ltd. | | | | | | | |

2002-1A, 0.83% due 01/10/381,4 | | | 1,270,409 | | | 1,129,902 | |

Grayson CLO Ltd. | | | | | | | |

2006-1A, 0.65% due 11/01/211,4 | | | 1,200,000 | | | 1,104,600 | |

Halcyon Structured Asset Management | | | | | | | |

Long Secured/Short Unsecured 2007-1 Ltd. | | | | | | | |

2007-1A, 2.54% due 08/07/211,4 | | | 1,100,000 | | | 1,083,830 | |

Cerberus Onshore II CLO LLC | | | | | | | |

2014-1A, 4.25% due 10/15/23†††,1,4 | | | 600,000 | | | 573,060 | |

2014-1A, 3.75% due 10/15/23†††,1,4 | | | 500,000 | | | 486,900 | |

Telos CLO 2007-2 Ltd. | | | | | | | |

2007-2A, 2.44% due 04/15/221,4 | | | 1,100,000 | | | 1,043,350 | |

Genesis Funding Ltd. | | | | | | | |

2006-1A, 0.40% due 12/19/321,4 | | | 1,108,835 | | | 1,033,323 | |

Telos CLO Ltd. | | | | | | | |

2013-3A, 4.49% due 01/17/241,4 | | | 1,050,000 | | | 1,032,675 | |

ARES XXVI CLO Ltd. | | | | | | | |

2013-1A, 0.00% due 04/15/253,4 | | | 1,250,000 | | | 1,028,875 | |

Salus CLO 2012-1 Ltd. | | | | | | | |

2013-1AN, 6.99% due 03/05/21†††,1,4 | | | 1,000,000 | | | 1,001,900 | |

Aerco Ltd. | | | | | | | |

2000-2A, 1.12% due 07/15/251 | | | 1,657,879 | | | 1,001,028 | |

Acis CLO 2013-1 Ltd. | | | | | | | |

2013-1A, 4.74% due 04/18/241,4 | | | 1,000,000 | | | 1,000,000 | |

COA Summit CLO Ltd. | | | | | | | |

2014-1A, 4.09% due 04/20/23†††,1,4 | | | 1,000,000 | | | 996,200 | |

Halcyon Structured Asset Management | | | | | | | |

Long Secured/Short Unsecured 2007-2 Ltd. | | | | | | | |

2007-2A, 3.99% due 10/29/211,4 | | | 1,000,000 | | | 986,200 | |

Hewett’s Island CDO Ltd. | | | | | | | |

2007-6A, 2.49% due 06/09/191,4 | | | 1,000,000 | | | 975,400 | |

Liberty CLO Ltd. | | | | | | | |

2005-1A, 0.74% due 11/01/171,4 | | | 1,000,000 | | | 965,600 | |

NewStar Commercial Loan Trust | | | | | | | |

2007-1A, 2.53% due 09/30/22†††,1,4 | | | 500,000 | | | 481,750 | |

2007-1A, 1.53% due 09/30/221,4 | | | 500,000 | | | 468,350 | |

Churchill Financial Cayman Ltd. | | | | | | | |

2007-1A, 2.84% due 07/10/191,4 | | | 1,000,000 | | | 930,700 | |

Airplanes Pass Through Trust | | | | | | | |

2001-1A, 0.71% due 03/15/191 | | | 1,705,538 | | | 801,603 | |

Shackleton II CLO Ltd. | | | | | | | |

2012-2A, 4.29% due 10/20/231,4 | | | 750,000 | | | 750,375 | |

Garrison Funding 2013-2 Ltd. | | | | | | | |

2013-2A, 4.98% due 09/25/231,4 | | | 750,000 | | | 745,125 | |

Westchester CLO Ltd. | | | | | | | |

2007-1A, 0.58% due 08/01/221,4 | | | 750,000 | | | 705,750 | |

KKR Financial CLO Ltd. | | | | | | | |

5.24% due 05/15/21 | | | 650,000 | | | 648,245 | |

Drug Royalty Limited Partnership | | | | | | | |

2012-1, 5.49% due 07/15/241,4 | | | 508,462 | | | 528,274 | |

ACA CLO 2007-1 Ltd. | | | | | | | |

2007-1A, 1.19% due 06/15/221,4 | | | 575,000 | | | 526,413 | |

Cent CLO | | | | | | | |

2012-16A, 3.74% due 08/01/241,4 | | | 500,000 | | | 502,700 | |

CIFC Funding 2012-II Ltd. | | | | | | | |

2012-2A, 4.49% due 12/05/241,4 | | | 500,000 | | | 501,400 | |

Cerberus Offshore Levered I, LP | | | | | | | |

2012-1A, 6.23% due 11/30/181,4 | | | 250,000 | | | 250,575 | |

2012-1A, 4.98% due 11/30/181,4 | | | 250,000 | | | 249,825 | |

Fraser Sullivan CLO VI Ltd. | | | | | | | |

2011-6A, 4.74% due 11/22/221,4 | | | 500,000 | | | 500,363 | |

Gleneagles CLO Ltd. | | | | | | | |

2005-1A, 1.14% due 11/01/171,4 | | | 500,000 | | | 475,200 | |

Pangaea CLO Ltd. | | | | | | | |

2007-1A, 0.74% due 10/21/211,4 | | | 500,000 | | | 469,800 | |

Kingsland III Ltd. | | | | | | | |

2006-3A, 1.84% due 08/24/211,4 | | | 500,000 | | | 464,850 | |

Westwood CDO I Ltd. | | | | | | | |

2007-1A, 0.90% due 03/25/211,4 | | | 500,000 | | | 463,050 | |

Kingsland IV Ltd. | | | | | | | |

2007-4A, 1.69% due 04/16/21†††,1,4 | | | 500,000 | | | 461,600 | |

| |

| 14 | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | | SEE NOTES TO FINANCIAL STATEMENTS. |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | | March 31, 2014 |

| |

| FLOATING RATE STRATEGIES FUND | | |

| | | | FACE | | | | |

| | | | AMOUNT | | | VALUE | |

| |

| | | | | | | | |

MCF CLO III LLC | | | | | | | |

2014-3A, 3.46% due 01/20/24†††,1,4 | | $ | 500,000 | | $ | 459,300 | |

ACS 2007-1 Pass Through Trust | | | | | | | |

2007-1A, 0.46% due 06/14/371,4 | | | 479,036 | | | 455,707 | |

Northwind Holdings LLC | | | | | | | |

2007-1A, 1.02% due 12/01/371,4 | | | 456,875 | | | 419,320 | |

Babcock & Brown Air Funding I Ltd. | | | | | | | |

2007-1A, 0.62% due 11/14/331,4 | | | 484,789 | | | 402,375 | |

Newcastle CDO IX 1 Ltd. | | | | | | | |

2007-9A, 0.41% due 05/25/521,4,7 | | | 379,732 | | | 378,592 | |

Aircraft Lease Securitisation Ltd. | | | | | | | |

2007-1A, 0.42% due 05/10/321,4 | | | 389,463 | | | 376,806 | |

OFSI Fund Ltd. | | | | | | | |

2006-1A, 1.08% due 09/20/191,4 | | | 370,000 | | | 356,199 | |

Raspro Trust | | | | | | | |

2005-1A, 0.63% due 03/23/241,4 | | | 370,274 | | | 336,949 | |

Credit Card Pass-Through Trust | | | | | | | |

2012-BIZ, 0.00% due 12/15/49†††,3,4 | | | 369,709 | | | 317,543 | |

Eastland CLO Ltd. | | | | | | | |

2007-1A, 0.64% due 05/01/221,4 | | | 350,000 | | | 311,675 | |

Asset Backed Securities Corporation | | | | | | | |

Home Equity Loan Trust Series | | | | | | | |

2004-HE8, 1.20% due 12/25/341 | | | 347,746 | | | 307,280 | |

Accredited Mortgage Loan Trust | | | | | | | |

2007-1, 0.28% due 02/25/371 | | | 324,514 | | | 302,040 | |

Diversified Asset Securitization | | | | | | | |

Holdings II, LP | | | | | | | |

2000-1A, 0.72% due 09/15/351,4 | | | 281,963 | | | 281,737 | |

Ivy Hill Middle Market Credit Fund Ltd. | | | | | | | |

2011-3A, 6.74% due 01/15/221,4 | | | 250,000 | | | 250,000 | |

Black Diamond CLO 2005-2 Delaware Corp. | | | | | | | |

2005-2A, 2.03% due 01/07/181,4 | | | 250,000 | | | 238,125 | |

Structured Asset Receivables Trust Series | | | | | | | |

2005-1A, 0.74% due 01/21/151,4 | | | 217,655 | | | 206,229 | |

Castle Trust | | | | | | | |

2003-1AW, 0.91% due 05/15/271,4 | | | 58,623 | | | 55,692 | |

Vega Containervessel plc | | | | | | | |

2006-1A, 5.56% due 02/10/21†††,4 | | | 44,130 | | | 43,261 | |

Legg Mason Real Estate CDO I Ltd. | | | | | | | |

2006-1A, 0.43% due 03/25/381,4 | | | 24,969 | | | 24,544 | |

| | | | | | | |

| Total Asset Backed Securities | | | | | | | |

(Cost $126,781,313) | | | | | | 129,775,000 | |

| | | | | | | |

| | | | | | | | |

| CORPORATE BONDS†† - 7.4% | | | | | | | |

| FINANCIALS - 2.0% | | | | | | | |

Icahn Enterprises Limited | | | | | | | |

Partnership / Icahn | | | | | | | |

Enterprises Finance Corp. | | | | | | | |

5.88% due 02/01/224 | | | 5,000,000 | | | 5,074,999 | |

6.00% due 08/01/204 | | | 1,700,000 | | | 1,802,000 | |

4.88% due 03/15/194 | | | 1,750,000 | | | 1,780,625 | |

3.50% due 03/15/174 | | | 1,000,000 | | | 1,010,000 | |

Citigroup, Inc. | | | | | | | |

5.35% due 05/29/491,2 | | | 4,000,000 | | | 3,710,000 | |

Credit Acceptance Corp. | | | | | | | |

6.13% due 02/15/214 | | | 3,100,000 | | | 3,224,000 | |

Wilton Re Finance LLC | | | | | | | |

5.88% due 03/30/331,4 | | | 2,750,000 | | | 2,736,250 | |

Cabot Financial Luxembourg S.A. | | | | | | | |

6.50% due 04/01/214 | | | 1,300,000 | | | 2,171,283 | |

Nationstar Mortgage LLC/Nationstar | | | | | | | |

Capital Corp. | | | | | | | |

6.50% due 07/01/21 | | | 2,000,000 | | | 1,885,000 | |

Opal Acquisition, Inc. | | | | | | | |

8.88% due 12/15/214 | | | 1,775,000 | | | 1,783,875 | |

Ally Financial, Inc. | | | | | | | |

3.50% due 01/27/19 | | | 1,750,000 | | | 1,750,000 | |

Oxford Finance LLC / Oxford Finance | | | | | | | |

Company-Issuer, Inc. | | | | | | | |

7.25% due 01/15/184 | | | 650,000 | | | 689,000 | |

Fidelity & Guaranty Life Holdings, Inc. | | | | | | | |

6.38% due 04/01/214 | | | 450,000 | | | 479,250 | |

LCP Dakota Fund | | | | | | | |

10.00% due 08/17/156 | | | 30,933 | | | 30,933 | |

| | | | | | | |

| Total Financials | | | | | | 28,127,215 | |

| | | | | | | |

| | | | | | | | |

| ENERGY - 1.6% | | | | | | | |

Unit Corp. | | | | | | | |

6.63% due 05/15/21 | | | 4,000,000 | | | 4,240,000 | |

Eagle Rock Energy Partners | | | | | | | |

Limited Partnership / Eagle | | | | | | | |

Rock Energy Finance Corp. | | | | | | | |

8.38% due 06/01/19 | | | 2,600,000 | | | 2,821,000 | |

Rosetta Resources, Inc. | | | | | | | |

5.88% due 06/01/22 | | | 2,700,000 | | | 2,760,750 | |

Midstates Petroleum Company | | | | | | | |

Incorporated / Midstates | | | | | | | |

Petroleum Co LLC | | | | | | | |

10.75% due 10/01/20 | | | 2,000,000 | | | 2,210,000 | |

BreitBurn Energy Partners Limited | | | | | | | |

Partnership / BreitBurn Finance Corp. | | | | | | | |

7.88% due 04/15/22 | | | 2,000,000 | | | 2,165,000 | |

Ultra Petroleum Corp. | | | | | | | |

5.75% due 12/15/184 | | | 1,750,000 | | | 1,837,500 | |

Penn Virginia Resource Partners Limited | | | | | | | |

Partnership / Penn Virginia | | | | | | | |

Resource Finance Corp. | | | | | | | |

8.38% due 06/01/20 | | | 1,612,000 | | | 1,809,470 | |

Atlas Energy Holdings Operating | | | | | | | |

Company LLC / Atlas Resource | | | | | | | |

Finance Corp. | | | | | | | |

9.25% due 08/15/214 | | | 1,500,000 | | | 1,650,000 | |

Gibson Energy, Inc. | | | | | | | |

6.75% due 07/15/214 | | | 1,055,000 | | | 1,131,488 | |

Bill Barrett Corp. | | | | | | | |

7.63% due 10/01/19 | | | 800,000 | | | 867,000 | |

| | | | | | | |

| Total Energy | | | | | | 21,492,208 | |

| | | | | | | |

| | | | | | | | |

| UTILITIES - 0.8% | | | | | | | |

Crestwood Midstream Partners Limited | | | | | | | |

Partnership / Crestwood Midstream | | | | | | | |

Finance Corp. | | | | | | | |

6.00% due 12/15/20 | | | 6,300,000 | | | 6,599,250 | |

Legacy Reserves Limited Partnership / Legacy | | | | | | | |

Reserves Finance Corp. | | | | | | | |

8.00% due 12/01/20 | | | 2,750,000 | | | 2,942,500 | |

LBC Tank Terminals Holding Netherlands BV | | | | | | | |

6.88% due 05/15/234 | | | 630,000 | | | 672,525 | |

| | | | | | | |

| Total Utilities | | | | | | 10,214,275 | |

| | | | | | | |

| |

| SEE NOTES TO FINANCIAL STATEMENTS. | | THE GUGGENHEIM FUNDS SEMI-ANNUAL REPORT | 15 |

| SCHEDULE OF INVESTMENTS (Unaudited) (continued) | | March 31, 2014 |

| |

| FLOATING RATE STRATEGIES FUND | | |

| | | | FACE | | | | |

| | | | AMOUNT | | | VALUE | |

| |

| | | | | | | | |

| INDUSTRIALS - 0.6% | | | | | | | |

Premier Foods Finance plc | | | | | | | |

5.52% due 03/15/201,4 | | $ | 2,750,000 | | $ | 4,660,123 | |

Ultra Resources, Inc. | | | | | | | |

4.66% due 10/12/22†††,6 | | | 1,800,000 | | | 1,618,200 | |

Travelport LLC | | | | | | | |

11.88% due 09/01/16 | | | 1,300,000 | | | 1,326,000 | |

Travelport LLC / Travelport Holdings, Inc. | | | | | | | |

6.36% due 03/01/161,4 | | | 1,012,539 | | | 1,020,133 | |

| | | | | | | |

| Total Industrials | | | | | | 8,624,456 | |

| | | | | | | |

| | | | | | | | |

| CONSUMER DISCRETIONARY - 0.6% | | | | | | | |

GRD Holdings III Corp. | | | | | | | |

10.75% due 06/01/194 | | | 3,680,000 | | | 4,048,000 | |

Checkers Drive-In Restaurants, Inc. | | | | | | | |

11.00% due 12/01/174 | | | 1,000,000 | | | 1,115,000 | |

MDC Partners, Inc. | | | | | | | |

6.75% due 04/01/204 | | | 1,000,000 | | | 1,052,500 | |

Laureate Education, Inc. | | | | | | | |

9.25% due 09/01/194 | | | 970,000 | | | 1,033,050 | |

Continental Airlines 2012-2 | | | | | | | |

Class B Pass Through Trust | | | | | | | |

5.50% due 10/29/20 | | | 400,000 | | | 421,000 | |

Atlas Air 1999-1 Class A-1 Pass Through Trust | | | | | | | |

7.20% due 01/02/196 | | | 91,923 | | | 99,621 | |

WMG Acquisition Corp. | | | | | | | |

11.50% due 10/01/18 | | | 50,000 | | | 56,825 | |

| | | | | | | |

| Total Consumer Discretionary | | | | | | 7,825,996 | |

| | | | | | | |

| | | | | | | | |

| TELECOMMUNICATION SERVICES - 0.6% | | | | | | | |

Alcatel-Lucent USA, Inc. | | | | | | | |

6.75% due 11/15/204 | | | 3,000,000 | | | 3,172,500 | |

Virgin Media Secured Finance plc | | | | | | | |

5.38% due 04/15/214 | | | 1,800,000 | | | 1,858,500 | |

SITEL LLC / Sitel Finance Corp. | | | | | | | |

11.00% due 08/01/174 | | | 670,000 | | | 719,413 | |

CyrusOne Limited Partnership / CyrusOne | | | | | | | |

Finance Corp. | | | | | | | |

6.38% due 11/15/22 | | | 600,000 | | | 633,000 | |

Avaya, Inc. | | | | | | | |

7.00% due 04/01/194 | | | 610,000 | | | 605,425 | |

UPCB Finance VI Ltd. | | | | | | | |

6.88% due 01/15/224 | | | 530,000 | | | 577,700 | |

| | | | | | | |

| Total Telecommunication Services | | | | | | 7,566,538 | |

| | | | | | | |

| | | | | | | | |

| CONSUMER STAPLES - 0.4% | | | | | | | |

Harbinger Group, Inc. | | | | | | | |

7.88% due 07/15/19 | | | 2,300,000 | | | 2,524,250 | |

Central Garden and Pet Co. | | | | | | | |

8.25% due 03/01/18 | | | 2,000,000 | | | 2,062,500 | |

Vector Group Ltd. | | | | | | | |

7.75% due 02/15/21 | | | 1,000,000 | | | 1,075,000 | |

| | | | | | | |

| Total Consumer Staples | | | | | | 5,661,750 | |

| | | | | | | |

| | | | | | | | |

| MATERIALS - 0.3% | | | | | | | |

TPC Group, Inc. | | | | | | | |

8.75% due 12/15/204 | | | 2,000,000 | | | 2,192,500 | |

Unifrax I LLC / Unifrax Holding Co. | | | | | | | |

7.50% due 02/15/194 | | | 1,525,000 | | | 1,616,500 | |

Mirabela Nickel Ltd. | | | | | | | |

8.75% due 04/15/184,5,6 | | | 2,000,000 | | | 480,000 | |

| | | | | | | |

| Total Materials | | | | | | 4,289,000 | |

| | | | | | | |

| | | | | | | | |

| INFORMATION TECHNOLOGY - 0.3% | | | | | | | |

NCR Corp. | | | | | | | |

6.38% due 12/15/234 | | | 1,800,000 | | | 1,912,500 | |

Eagle Midco, Inc. | | | | | | | |

9.00% due 06/15/184 | | | 1,400,000 | | | 1,470,000 | |

| | | | | | | |

| Total Information Technology | | | | | | 3,382,500 | |

| | | | | | | |

| | | | | | | | |

| HEALTH CARE - 0.2% | | | | | | | |

Valeant Pharmaceuticals International, Inc. | | | | | | | |

5.63% due 12/01/214 | | | 2,000,000 | | | 2,100,000 | |

| | | | | | | |

| Total Corporate Bonds | | | | | | | |

(Cost $98,441,862) | | | | | | 99,283,938 | |

| | | | | | | |

| | | | | | | | |

| COLLATERALIZED MORTGAGE OBLIGATION†† - 2.5% | | | | | | | |

Lehman XS Trust Series | | | | | | | |

2005-7N,0.42% due 12/25/351 | | | 3,147,702 | | | 2,967,112 | |

2006-16N,0.34% due 11/25/461 | | | 3,499,141 | | | 2,851,030 | |

HarborView Mortgage Loan Trust | | | | | | | |

2006-12,0.35% due 01/19/381 | | | 4,693,221 | | | 3,943,193 | |

Nomura Resecuritization Trust | | | | | | | |