| As filed with the Securities and Exchange Commission on February 7, 2005 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6653

The Jensen Portfolio, Inc.

(Exact name of registrant as specified in charter)

2130 Pacwest Center, 1211 SW Fifth Avenue

Portland, OR 97204-3721

(Address of principal executive offices) (Zip code)

Gary Hibler

2130 Pacwest Center, 1211 SW Fifth Avenue

Portland, OR 97204-3721

(Name and address of agent for service)

(800) 221-4384

Registrant's telephone number, including area code

Date of fiscal year end: May 31

Date of reporting period: November 30, 2004

Item 1. Report to Stockholders.

THE JENSEN PORTFOLIO

LETTER FROM THE INVESTMENT ADVISER

Dear Fellow Shareholders:

The increase in the price of oil and the decrease in the value of the dollar occupied much of the financial headlines this past six months. Both are essential commodities, of course, so the wide swings in their prices are having significant ramifications for the economy. These were not the only items to experience significant price changes. The Commodity Research Bureau’s index of commodity prices, which excludes energy, has risen around 20% just over the past two years. (The Wall Street Journal, 12/20/04, “Getting the Goods”).

According to The Economist, over the past three years the dollar has fallen 35% against the Euro and by 24% against the yen. The last week of December the dollar hit another low. The cheaper dollar makes our goods and services less expensive globally (in non-dollar pegged currencies) that, in the short term, can extend our economic recovery. However that carries some risks. One is that we induce a recession in countries with whom we trade (since their nationally produced goods and services will be relatively more expensive). Another is that inflation is facilitated here since domestic producers wil l typically raise their prices to match the higher prices of foreign goods.

All this is not lost on The Federal Reserve, which recently raised the Federal Funds interest rate for the fifth consecutive time to 2.25%. The Fed has left little doubt that these increases will continue; an open question is whether the increases will be continued on a “measured” basis.

The problem, however, lies outside of The Federal Reserve’s jurisdiction. The weaker dollar devalues the substantial foreign holdings of U.S. Treasuries. This raises the specter that foreign central banks may withhold further investment until higher current yields in the U.S. counteract their losses in principal value. There is some chatter that Japan and China may consider using a second reserve currency, such as the Euro, until more satisfactory returns can be obtained from U.S. securities.

CHEAP MONEY

Not only is money relatively cheap today, world economies are awash in liquidity. This is evidenced by the Bear Stearns High Yield Index of junk bonds which is yielding 6.9%—the lowest level for that benchmark since the index was created in 1985. Indeed, cheap money enables easy acquisition of assets. That encourages lenders to take greater risks in order to obtain traditional returns, and borrowers to take on more debt.

To permit a climate for extreme volatility seems particularly reckless to us.

The memory of The Federal Reserve Bank of New York arranging for the bail out of Long-Term Capital Management—the troubled hedge fund which was managed by a brilliant group of academicians but teetered on the brink of financial ruin—is all too vivid to suggest that another blow up is unlikely. Long-Term Capital not only made incorrect bets, it was able to borrow funds that made the financial health of its lenders (principally U.S. money center banks) suspect.

Easy money was the culprit there. But we don’t have to look far to find other beneficiaries today in a climate of even easier money, both in housing and automobiles. Housing continues to be on a tear and its excesses are often compared to the dot.com bubble. Automobiles enjoy high production rates and are consumed mostly “on the cuff.”

We are concerned that these two “aces in the hole”—the high employment created by the housing and auto industries—are already being spent while the economy is undergoing its third year of expansion.

The number of ways the economy could play out this scenario probably approaches infinity. We are comforted that successful businesses deal moment to moment with the current economic climate and adjust their tactics and strategies to accommodate it. The advantage of owning a common stock portfolio versus fixed income securities is that the latter must assume present conditions will stay the same until bonds and notes mature. That has, at least historically, been a most incorrect assumption. On the other hand, common stocks are the beneficiaries of companies’ assessments of business today as well as all future business judgments.

ALL WEATHER COMMON STOCKS

Although the economic outcome is unpredictable, we continue to believe that certain types of common stocks can provide investors less risk than the overall securities market along with continued prospects for growth. With interest rates rising, companies that have little debt and generate strong cash flows will have a clear business advantage by not having to absorb the prospective higher costs of capital.

THE JENSEN PORTFOLIO

Secondly, owning companies that enjoy a competitive advantage is critical in an economy that is experiencing prices of commodities increasing rapidly. These companies can price their goods or services at a level for their benefit and to the disadvantage of their competitors.

As fixed income yields become more attractive, a third component of a conservative investment strategy is to own equity in companies that can either increase dividends or purchase shares in the open market, or both.

Identifying companies that meet these criteria is instrumental for success. For one, we believe that businesses that have a tradition of achieving high economic returns are most likely to continue doing so. Our hurdle of a 15 percent return-on-equity for each of the past ten years has been achieved by only about 150 companies out of the ten thousand companies that are publicly traded. We recognize that a conservative investment strategy may not keep pace with the popular indexes during certain periods of time. (Alan Abelson recently wrote in Barron’s that “if the past decade or so has yie lded any significant insight about the present breed of investors, it’s that their horizons are strictly short-term and seem to get steadily shorter. There are three long-term investors left and they’re all over 70.”) We are confident that over the long run, the market will reflect the increased value created by these 150 companies and their ability to withstand the rigors of the economy.

PERFORMANCE AND CHANGES IN PORTFOLIO HOLDINGS

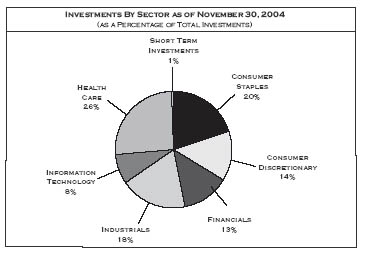

The Jensen Portfolio—Class J Shares declined 1.50% for the six months ended November 30, 2004, compared to a 5.67% return for this period for the Standard & Poor’s 500 Index. Please see page 3 of this report for complete standardized performance information for the Fund. Market performance for this period was led by outsized returns from the energy, utilities and telecom service sectors which, when combined, grew by an average of nearly 20%. The Jensen Portfolio was notably absent from these market segments as companies within these sectors have not typically been able to produce the consistently strong business performance that our uncompromising investment discipline demands.

During the first six months of our fiscal year there were two changes in the make-up of The Jensen Portfolio. We sold Merck on September 30, 2004. Merck had been a holding in The Jensen Portfolio since its inception as it had exhibited the qualities we look for in a long-term holding. However, on September 30, 2004, Merck pulled one of its largest drugs used to ease debilitating arthritis pain, know as Vioxx, from the marketplace due to safety concerns. Even though Merck continues to meet our high standard for return-on-equity and generates significant free cash flow, we decided that better opportunities existed elsewhere. Our decision to sell quickly was based on further evidence of the stress that exists on their pipeline portending lower growth rates and the prospect for potential and protracted liti gation that is expected from users of Vioxx.

In early October we added a position in Anheuser-Busch. Anheuser-Busch is a familiar name to most everyone, with its well known brands in the beer industry and a long history of strong business performance. Its traditional growth engine has been its dominant market share in the domestic beer market, accounting for 80% of sales and moreimportantly,93%ofitsnetearnings.Itsmarketshare gives the company the leverage to grow revenues through price as well as volume increases. It also is entering into leading positions internationally. It expects to be able to grow its international business significantly over the next few years, particularly in China through whole or partial acquisitions of Harbin and Tsingtao, two significant Chinese brewers. The company also pays an increasing dividend and repurchases its s hares, thereby enhancing shareholder returns.

We appreciate your continued support.

Cordially,

Val Jensen, Chairman

The Jensen Portfolio

The above discussion and analysis of the Fund is as of November 2004 and is subject to change, and any forecasts made cannot be guaranteed.

Past performance is no guarantee of future results. Fund holdings and sector weightings are subject to change and are not recommendations to buy or sell any security. For more complete information regarding performance and holdings, please refer to the financial statement and portfolio holdings headings of this report.

The Fund is non-diversified, meaning that it concentrates its assets in fewer individual holdings than a diversified fund, and is therefore more exposed to individual stock volatility than a diversified fund.

For use only when preceded or accompanied by a current prospectus for the Fund.

The Jensen Portfolio is distributed by Quasar Distributors, LLC (01/05).

THE JENSEN PORTFOLIO

THE S&P 500 STOCK INDEX IS AN UNMANAGED BUT COMMONLY USED MEASURE OF COMMON STOCK TOTAL RETURN PERFORMANCE. THIS CHART ASSUMES AN INITIAL GROSS INVESTMENT OF $10,000 MADE ON 11/30/94 FOR CLASS J, THE ORIGINAL SHARE CLASS OF THE FUND. RETURNS SHOWN INCLUDE THE REINVESTMENT OF ALL DIVIDENDS. RETURNS SHOWN DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES.

PERFORMANCE DATA SHOWN REPRESENTS PAST PERFORMANCE; PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. THE INVESTMENT RETURN AND PRINCIPAL VALUE OF AN INVESTMENT WILL FLUCTUATE SO THAT AN INVESTOR’S SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. CURRENT PERFORMANCE OF THE FUND MAY BE LOWER OR HIGHER THAN THE PERFORMANCE SHOWN. PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END MAY BE OBTAINED BY CALLING 1-800-992-4144 OR BY VISITING WWW.JENSENINVESTMENT.COM.

FOR THE PERIOD ENDING November 30, 2004 |

| | Average Annual |

| | One | | Three | | Five | | Ten |

| | Year | | Year | | Year | | Year |

| | | | | | | |

| | | | | | | | |

| The Jensen Portfolio - Class J | 6.13% | | 2.35% | | 5.35% | | 12.74% |

| S&P 500 Stock Index | 12.86% | | 2.73% | | —1.83% | | 11.85% |

THE JENSEN PORTFOLIO

FOR THE PERIOD ENDING November 30, 2004 | | | |

| | Average Annual |

| | One | | Since |

| | Year | | Inception |

| | | | (7-30-03) |

| The Jensen Portfolio - Class R | 5.89% | | 9.06% |

| S&P 500 Stock Index | 12.86% | | 15.76 % |

THE S&P 500 STOCK INDEX IS AN UNMANAGED BUT COMMONLY USED MEASURE OF COMMON STOCK TOTAL RETURN PERFORMANCE. THIS CHART ASSUMES AN INITIAL GROSS INVESTMENT OF $10,000 MADE ON 7/30/03, THE INCEPTION DATE FOR CLASS R SHARES. RETURNS SHOWN INCLUDE THE REINVESTMENT OF ALL DIVIDENDS. RETURNS SHOWN DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES.

PERFORMANCE DATA SHOWN REPRESENTS PAST PERFORMANCE; PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. THE INVESTMENT RETURN AND PRINCIPAL VALUE OF AN INVESTMENT WILL FLUCTUATE SO THAT AN INVESTOR’S SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. CURRENT PERFORMANCE OF THE FUND MAY BE LOWER OR HIGHER THAN THE PERFORMANCE SHOWN. PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END MAY BE OBTAINED BY CALLING 1-800-992-4144 OR BY VISITING WWW.JENSENINVESTMENT.COM.

THE JENSEN PORTFOLIO

FOR THE PERIOD ENDING November 30, 2004 |

| | Average Annual |

| | One | | Since |

| | Year | | Inception |

| | | | (7-30-03) |

| The Jensen Portfolio - Class I | 6.30% | | 9.48% |

| S&P 500 Stock Index | 12.86% | | 15.76 % |

THE S&P 500 STOCK INDEX IS AN UNMANAGED BUT COMMONLY USED MEASURE OF COMMON STOCK TOTAL RETURN PERFORMANCE. THIS CHART ASSUMES AN INITIAL GROSS INVESTMENT OF $1,000,000 MADE ON 7/30/03, THE INCEPTION DATE FOR CLASS I SHARES. RETURNS SHOWN INCLUDE THE REINVESTMENT OF ALL DIVIDENDS. RETURNS SHOWN DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES.

PERFORMANCE DATA SHOWN REPRESENTS PAST PERFORMANCE; PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. THE INVESTMENT RETURN AND PRINCIPAL VALUE OF AN INVESTMENT WILL FLUCTUATE SO THAT AN INVESTOR’S SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. CURRENT PERFORMANCE OF THE FUND MAY BE LOWER OR HIGHER THAN THE PERFORMANCE SHOWN. PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END MAY BE OBTAINED BY CALLING 1-800-992-4144 OR BY VISITING WWW.JENSENINVESTMENT.COM.

THE JENSEN PORTFOLIO

THE JENSEN PORTFOLIO

STATEMENT OF ASSETS & LIABILITIES

November 30, 2004 (Unaudited)

| ASSETS: | | |

| Investments, at value (cost $2,448,204,042) | $ | 2,685,994,768 |

| Income receivable | | 3,897,278 |

| Receivable for capital stock issued | | 7,981,452 |

| Other assets | | 131,462 |

Total Assets | | 2,698,004,960 |

| | | |

| LIABILITIES: | | |

| Payable to Investment Adviser | | 1,105,307 |

| Payable to Directors | | 34,816 |

| Payable for capital stock redeemed | | 3,529,491 |

| Other accrued expenses | | 1,131,049 |

Total Liabilities | | 5,800,663 |

| | | |

| NET ASSETS | $ | 2,692,204,297 |

| | | |

| NET ASSETS CONSIST OF: | | |

| Capital stock | | 2,490,839,710 |

| Unrealized appreciation on investments | | 237,790,726 |

| Accumulated undistributed net investment income | | 3,745,517 |

| Accumulated undistributed net realized loss | | (40,171,656) |

Total Net Assets | $ | 2,692,204,297 |

| | | |

| NET ASSETS CONSIST OF: | | |

Class J Shares: | | |

| Net assets | $ | 2,416,041,666 |

| Shares outstanding | | 103,346,241 |

Net Asset Value Per Share (2,000,000,000 shares authorized, $.001 par value) | | $23.38 |

| | | |

Class R Shares: | | |

| Net assets | $ | 21,502,281 |

| Shares outstanding | | 922,822 |

Net Asset Value Per Share (1,000,000,000 shares authorized, $.001 par value) | | $23.30 |

| | | |

Class I Shares: | | |

| Net assets | $ | 254,660,350 |

| Shares outstanding | | 10,891,873 |

Net Asset Value Per Share (1,000,000,000 shares authorized, $.001 par value) | | $23.38 |

SEE NOTES TO FINANCIAL STATEMENTS. |

| | | 7 |

|

THE JENSEN PORTFOLIO

SCHEDULE OF INVESTMENTS

November 30, 2004 (Unaudited)

| NUMBER OF SHARES | | | MARKET VALUE |

| | | | | |

| | | COMMON STOCK 99.20% | | |

| | | | | |

| | | Beverages 9.14% | | |

| 1,550,000 | | Anheuser-Busch | | |

| | | Companies, Inc. | $ | 77,639,500 |

| 1,705,000 | | The Coca-Cola Company ... | | 67,023,550 |

| 2,030,000 | | PepsiCo, Inc. | | 101,317,300 |

| | | | | 245,980,350 |

| | | | | |

| | | Capital Markets 4.10% | | |

| 2,476,000 | | State Street Corporation | | 110,330,560 |

| | | | | |

| | | Commercial Services & Supplies 3.94% | | |

| 3,844,000 | | Equifax, Inc. | | 106,171,280 |

| | | | | |

| | | Consumer Finance 5.31% | | |

| 5,385,000 | | MBNA Corporation | | 143,025,600 |

| | | | | |

| | | Electrical Equipment 5.03% | | |

| 2,026,000 | | Emerson Electric Co. | | 135,377,320 |

| | | | | |

| | | Electronic Equipment & Instruments 1.52% | | |

| 713,000 | | Dionex Corporation (a) | | 40,919,070 |

| | | | | |

| | | Health Care Equipment & Supplies 9.16% | | |

| 2,096,000 | | Medtronic, Inc. | | 100,712,800 |

| 3,318,000 | | Stryker Corporation | | 145,958,820 |

| | | | | 246,671,620 |

| | | | | |

| | | Health Care Providers & Services 4.19% | | |

| 2,763,000 | | Patterson Companies, | | |

| | | Inc. (a) | | 112,896,180 |

| | | | | |

| | | Household Products 10.69% | | |

| 1,670,000 | | The Clorox Company | | 92,050,400 |

| 1,674,000 | | Colgate-Palmolive | | |

| | | Company | | 76,987,260 |

| 2,221,000 | | The Procter & Gamble | | |

| | | Company | $ | 118,779,080 |

| | | | | 287,816,740 |

| | | | | |

| | | Industrial Conglomerates 9.54% | | |

| 1,511,000 | | 3M Co. | | 120,260,490 |

| 3,863,000 | | General Electric Company. | | 136,595,680 |

| | | | | 256,856,170 |

| | | | | |

| | | IT Services 6.72% | | |

| 2,251,000 | | Automatic Data | | |

| | | Processing, Inc. | | 102,488,030 |

| 2,360,000 | | Paychex, Inc. | | 78,257,600 |

| | | | | 180,745,630 |

| | | | | |

| | | Media 13.79% | | |

| 1,357,000 | | Gannett Co., Inc. | | 111,938,930 |

| 1,816,000 | | Omnicom Group, Inc. | | 147,096,000 |

| 1,280,000 | | The McGraw-Hill | | |

| | | Companies, Inc. | | 112,294,400 |

| | | | | 371,329,330 |

| | | | | |

| | | Pharmaceuticals 12.38% | | |

| 2,570,000 | | Abbott Laboratories | | 107,837,200 |

| 1,776,000 | | Johnson & Johnson | | 107,128,320 |

| 4,261,000 | | Pfizer, Inc. | | 118,327,970 |

| | | | | 333,293,490 |

| | | Thrifts & Mortgage Finance 3.69% |

| 1,445,000 | | Fannie Mae | | 99,271,500 |

| | | Total Common Stock | | |

| | | (Cost $2,432,894,114) | $ | 2,670,684,840 |

SEE NOTES TO FINANCIAL STATEMENTS. |

| 8 | | |

|

THE JENSEN PORTFOLIO

SCHEDULE OF INVESTMENTS

November 30, 2004 (Unaudited) (Continued)

| | | MARKET VALUE |

| | | | | |

| | | SHORT TERM INVESTMENTS 0.57% | | |

| | | | | |

| | | Commercial Paper 0.57% | | |

| $15,295,000 | | Prudential Funding Corp | | |

| | | Commercial Paper, | | |

| | | 1.88%, 12/1/04 | $ | 15,295,000 |

| | | | | |

| | | Variable Rate Demand Notes (b) 0.00% | | |

| 14,928 | | Wisconsin Corporate | | |

| | | Central Credit Union, | | |

| | | 1.85% | | 14,928 |

| | | | | |

| | | Total Short Term Investments | | |

| | | (Cost $15,309,928) | | 15,309,928 |

| | | | | |

| | | Total Investments 99.77% | | |

| | | (Cost $2,448,204,042) | | 2,685,994,768 |

| | | | | |

| | | Other Assets in Excess of Liabilities 0.23% | | 6,209,529 |

| | | | | |

| | | NET ASSETS 100.00% | | |

| | | | $ | 2,692,204,297 |

STATEMENT OF OPERATIONS

Six Months Ended November 30, 2004 (Unaudited)

| INVESTMENT INCOME: | | | | |

| Dividend income | | | $ | 20,820,712 |

| Interest income | | | | 258,482 |

| | | | | 21,079,194 |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees | | | | 6,211,280 |

| 12b-1 fees—Class J | | | | 2,780,559 |

| Administration fees | | | | 464,895 |

| Transfer agent fees and expenses | | | | 224,578 |

| Reports to shareholders | | | | 182,817 |

| Custody fees | | | | 175,480 |

| Federal and state registration fees | | | | 135,603 |

| Shareholder servicing fees—Class I | | | | 122,896 |

| Fund accounting fees | | | | 80,037 |

| Directors’ fees and expenses | | | | 63,867 |

| Professional fees | | | | 47,946 |

| 12b-1 fees—Class R | | | | 35,680 |

| Other | | | | 13,359 |

| Total expenses | | | | 10,538,997 |

| | | | | |

| NET INVESTMENT INCOME | | | | 10,540,197 |

| | | | | |

| REALIZED AND UNREALIZED LOSS | | | | |

| ON INVESTMENTS: | | | | |

| | | | | |

| Net realized loss on investment | | | | |

| transactions | | | | (24,629,186) |

| Change in unrealized appreciation | | | | |

| on investments | | | | (17,353,212) |

| Net loss on investments | | | | (41,982,398) |

| | | | | |

| NET DECREASE IN NET ASSETS | | | | |

| RESULTING FROM OPERATIONS | | | | $(31,442,201) |

SEE NOTES TO FINANCIAL STATEMENTS. |

| | | 9 |

|

STATEMENT OF CHANGES IN NET ASSETS

| | | SIX MONTHS

ENDED

NOV. 30, ’04 | | YEAR ENDED

MAY 31, ’04 |

| | | (UNAUDITED) | | |

| OPERATIONS: | | | | |

| Net investment income | $ | 10,540,197 | $ | 13,219,295 |

| Net realized loss on investment transactions | | (24,629,186) | | (14,332,976) |

| Change in unrealized appreciation on investments | | (17,353,212) | | 253,944,024 |

| Net increase (decrease) in net assets resulting from operations | | (31,442,201) | | 252,830,343 |

| | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | |

| Shares sold—Class J | | 654,637,108 | 1,052,489,921 |

| Shares sold—Class R | | 23,075,160 | | 820,616 |

| Shares sold—Class I | | 47,206,752 | | 220,916,375 |

| Shares issued to holders in reinvestment of dividends—Class J | | 6,705,016 | | 9,460,817 |

| Shares issued to holders in reinvestment of dividends—Class R | | 42,371 | | 101 |

| Shares issued to holders in reinvestment of dividends—Class I | | 948,083 | | 1,178,769 |

| Shares redeemed—Class J | | (254,987,256) | | (696,368,981) |

| Shares redeemed—Class R | | (3,010,818) | | (34,763) |

| Shares redeemed—Class I | | (16,725,924) | | (7,315,906) |

| Net increase | | 457,890,492 | | 581,146,949 |

| | | | | |

| DIVIDENDS AND DISTRIBUTIONS | | | | |

| TO SHAREHOLDERS: | | | | |

| Net investment income—Class J | | (7,809,832) | | (11,163,757) |

| Net investment income—Class R | | (42,371) | | (101) |

| Net investment income—Class I | | (1,040,308) | | (1,234,204) |

| Total dividends and distributions | | (8,892,511) | | (12,398,062) |

| | | | | |

| INCREASE IN | | | | |

| NET ASSETS | | 417,555,780 | | 821,579,230 |

| | | | | |

| NET ASSETS: | | | | |

| Beginning of period | | 2,274,648,517 | | 1,453,069,287 |

| End of period (including undistributed net investment income | | | | |

| of $3,745,517 and $2,097,831, respectively) | $ | 2,692,204,297 | $ | 2,274,648,517 |

SEE NOTES TO FINANCIAL STATEMENTS. |

| 10 | | |

|

THE JENSEN PORTFOLIO

FINANCIAL HIGHLIGHTS

CLASS J

| | | SIX MONTHS ENDED | | YEAR ENDED | | YEAR ENDED | | YEAR ENDED | | YEAR ENDED | | YEAR ENDED | |

| | NOV. 30, ’04 | | MAY 31, ’04 | | MAY 31, ’03 | | MAY 31, ’02 | | MAY 31, ’01 | | MAY 31, ’00 | |

| | | (UNAUDITED) | | | | | | | | | | | |

| PER SHARE DATA: | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 23.82 | | $ | 20.80 | | $ | 22.51 | | $ | 21.53 | | $ | 22.25 | | $ | 19.42 | |

| | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.09 | | | 0.16 | | | 0.11 | | | 0.05 | | | 0.09 | | | 0.06 | |

| Net realized and unrealized gains | | | | | | | | | | | | | | | | | | | |

| (losses) on investments | | | (0.45 | ) | | 3.01 | | | (1.73 | ) | | 1.00 | | | (0.14 | ) | | 5.30 | |

| Total from investment operations ... | | | (0.36 | ) | | 3.17 | | | (1.62 | ) | | 1.05 | | | (0.05 | ) | | 5.36 | |

Less distributions: | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment | | | | | | | | | | | | | | | | | | | |

| income | | | (0.08 | ) | | (0.15 | ) | | (0.09 | ) | | (0.07 | ) | | (0.10 | ) | | (0.03 | ) |

| From net realized gains | | | — | | | — | | | — | | | — | | | (0.57 | ) | | (2.50 | ) |

| Total distributions | | | (0.08 | ) | | (0.15 | ) | | (0.09 | ) | | (0.07 | ) | | (0.67 | ) | | (2.53 | ) |

| Net asset value, end of period | | $ | 23.38 | | $ | 23.82 | | $ | 20.80 | | $ | 22.51 | | $ | 21.53 | | $ | 22.25 | |

| | | | | | | | | | | | | | | | | | | | |

Total return(1) | | | -1.50 | % | | 15.28 | % | | -7.17 | % | | 4.88 | % | | -0.18 | % | | 27.65 | % |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 2,416,042 | | $ | 2,046,288 | | $ | 1,453,069 | | $ | 473,414 | | $ | 46,119 | | $ | 30,525 | |

| | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to average net assets(2) | | | 0.86 | % | | 0.88 | % | | 0.90 | % | | 1.00 | % | | 0.95 | % | | 0.94 | % |

| | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to | | | | | | | | | | | | | | | | | | | |

average net assets(2) | | | 0.83 | % | | 0.71 | % | | 0.62 | % | | 0.23 | % | | 0.45 | % | | 0.31 | % |

Portfolio turnover rate(1) | | | 1.81 | % | | 5.32 | % | | 7.22 | % | | 0.78 | % | | 6.53 | % | | 32.35 | % |

(1) Not annualized for the six months ended November 30, 2004.

(2) Annualized for the six months ended November 30, 2004.

SEE NOTES TO FINANCIAL STATEMENTS. |

| | | 11 |

|

THE JENSEN PORTFOLIO

FINANCIAL HIGHLIGHTS

CLASS R

| | | SIX MONTHS | | PERIOD FROM |

| | ENDED | | JUL. 30, ’03(1) |

| | NOV. 30, ’04 | | TO MAY 31, ’04 |

| | | (UNAUDITED) | | |

| PER SHARE DATA: | | | | |

| Net asset value, beginning of period | $ | 23.76 | $ | 20.93 |

| | | | | |

Income from investment operations: | | | | |

| Net investment income | | 0.08 | | 0.13 |

| Net realized and unrealized gains (losses) on investments | | (0.46) | | 2.83 |

| Total from investment operations | | (0.38) | | 2.96 |

| | | | | |

Less distributions: | | | | |

| Dividends from net investment income | | (0.08) | | (0.13) |

| Total distributions | | (0.08) | | (0.13) |

| Net asset value, end of period | | $23.30 | | $23.76 |

| | | | | |

Total return(2) | | -1.59% | | 14.13% |

| Supplemental data and ratios: | | | | |

| Net assets, end of period (000’s) | $ | 21,502 | $ | 799 |

Ratio of expenses to average net assets(3) | | 1.11% | | 1.12% |

Ratio of net investment income to average net assets(3) | | 0.65% | | 0.45% |

Portfolio turnover rate(2) | | 1.81% | | 5.32% |

(1) Commencement of operations.

(2) Not annualized.

(3) Annualized.

.

SEE NOTES TO FINANCIAL STATEMENTS |

| 12 | | |

|

THE JENSEN PORTFOLIO

Financial Highlights Class I

| | | SIX MONTHS | | PERIOD FROM |

| | ENDED | | JUL. 30, ’03(1) |

| | NOV. 30, ’04 | | TO MAY 31, ’04 |

| | (UNAUDITED) | | |

| PER SHARE DATA: | | | | |

| Net asset value, beginning of period | $ | 23.82 | $ | 20.93 |

| | | | | |

Income from investment operations: | | | | |

| Net investment income | | 0.12 | | 0.12 |

| Net realized and unrealized gains (losses) on investments | | (0.46) | | 2.92 |

| Total from investment operations | | (0.34) | | 3.04 |

| | | | | |

Less distributions: | | | | |

| Dividends from net investment income | | (0.10) | | (0.15) |

| Total distributions | | (0.10) | | (0.15) |

| Net asset value, end of period | $ | 23.38 | $ | 23.82 |

| | | | | |

Total return(2) | | -1.43% | | 14.54% |

| Supplemental data and ratios: | | | | |

| Net assets, end of period | $ | 254,660 | $ | 227,561 |

Ratio of expenses to average net assets(3) | | 0.71% | | 0.70% |

Ratio of net investment income to average net assets(3) | | 0.98% | | 1.87% |

Portfolio turnover rate(2) | | 1.81% | | 5.32% |

(1) Commencement of operations.

(2) Not annualized.

(3) Annualized.

SEE NOTES TO FINANCIAL STATEMENTS. |

| | | 13 |

|

THE JENSEN PORTFOLIO

NOTES TO THE FINANCIAL STATEMENTS

November 30, 2004 (Unaudited)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

The Jensen Portfolio, Inc. (the “Fund”) was organized as an Oregon Corporation on April 17, 1992, and is registered as an open-end, nondiversified management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Fund commenced operations on August 3, 1992. Effective July 30, 2003, the Fund issued two new classes of shares, Class R and Class I and renamed the existing class as Class J. Class J shares are subject to a 0.25% 12b-1 fee; Class R shares are subject to a 0.50% 12b-1 fee and Class I shares are subject to a 0.10% shareholder servicing fee, as described in each Class’ prospectus. Each class of shares has identical rights and privileges except with respect to the 12b-1 fees and shareholder servicing fee, and voting rights on matters affecting a single class of shares. The principal investment objective of the Fund is long-term capital appreciation.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America.

a) Investment Valuation - Securities that are listed on United States stock exchanges or the Nasdaq Stock Market are valued at the last sale price on the day the securities are valued or, if there has been no sale on that day, at their current bid price. Quotations are taken from the market in which the security is primarily traded. Over-the-counter securities are valued at their current bid price. Securities for which market quotations are not readily available are valued at fair value as determined by the Investment Adviser at or under the direction of the Fund’s Board of Directors. There were no securities valued by the Board of Directors as of November 30, 2004. Variable rate demand notes are valued at cost which approximates fair value. Notwithstanding the above, fixed-income securities may be valued on the basis of prices provided by an established pricing service when the Board believes that such prices better reflect market values.

b) Federal Income Taxes - No provision for federal income taxes has been made since the Fund has complied to date with the provisions of the Internal Revenue Code applicable to regulated investment companies and intends to continue to so comply in the future and to distribute substantially all of its net investment income and realized capital gains in order to relieve the Fund from all federal income taxes.

c) Distributions to Shareholders - Dividends to shareholders are recorded on ex-dividend date. Dividends from net investment income are declared and paid quarterly by the Fund. Distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. Permanent differences between financial reporting and tax are reclassified to capital stock.

d) Use of Estimates - The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

e) Guarantees and Indemnifications - In the normal course of business the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

f) Other - Investment and shareholder transactions are recorded on trade date. Gains or losses from the investment transactions are determined on the basis of identified carrying value. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. The Fund has investments in short-term variable rate demand notes, which are unsecured instruments. These notes may present credit risk to the extent the issuer defaults on its payment obligation. The credit-worthiness of the issuer is monitored, and these notes are considered to present minimal credit risk in the opinion of the Investment Adviser. Income, expenses (other than those deemed attributable to a specific share class), and gains and losses of the Fund are allocated daily to each class of shares based up on the ratio of net assets represented by each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a specific class of shares are charged against the operations of such class.

2. CAPITAL SHARE TRANSACTIONS

Transactions in shares of the Fund were as follows:

| | | SIX MONTHS | | |

| | ENDED | | YEAR ENDED |

| | NOV. 30, ’04 | | MAY 31, ’04 |

Class J | | | | |

| Shares sold | | 28,134,643 | | 46,904,454 |

| Shares issued to holders | | | | |

| in reinvestment of | | | | |

| dividends | | 287,444 | | 426,590 |

| Shares redeemed | | (10,992,183) | | (31,268,846) |

| Net increase | | 17,429,904 | | 16,062,198 |

| Shares outstanding: | | | | |

| Beginning of period | | 85,916,337 | | 69,854,139 |

| End of period | | 103,346,241 | | 85,916,337 |

Class R | | | | |

| Shares sold | | 1,018,562 | | 35,075 |

| Shares issued to holders | | | | |

| in reinvestment of | | | | |

| dividends | | 1,861 | | 5 |

| Shares redeemed | | (131,235) | | (1,446) |

| Net increase | | 889,188 | | 33,634 |

| Shares outstanding: | | | | |

| Beginning of period | | 33,634 | | — |

| End of period | | 922,822 | | 33,634 |

| | | | | |

| | | SIX MONTHS | | |

| | ENDED | | YEAR ENDED |

| | NOV. 30, ’04 | | MAY 31, ’04 |

Class I | | | | |

| Shares sold | | 2,020,410 | | 9,817,146 |

| Shares issued to holders | | | | |

| in reinvestment of | | | | |

| dividends | | 40,590 | | 51,203 |

| Shares redeemed | | (722,752) | | (314,724) |

| Net increase | | 1,338,248 | | 9,553,625 |

| Shares outstanding: | | | | |

| Beginning of period | | 9,553,625 | | — |

| End of period | | 10,891,873 | | 9,553,625 |

3. INVESTMENT TRANSACTIONS

The aggregate purchases and aggregate sales of securities, excluding short-term investments, by the Fund for the year ended November 30, 2004, were $510,464,004 and $44,335,126, respectively.

4. INCOME TAXES

At May 31, 2004, the Fund had accumulated net realized capital loss carryovers of $767,052 and $14,029,552 which will expire on May 31, 2010 and May 31, 2012, respectively. To the extent the Fund realizes future net capital gains, taxable distributions to its shareholders will be offset by any unused capital loss carryover.

At May 31, 2004, the Fund deferred on a tax basis to the first day of the next taxable year, a post-October loss of $303,424.

The cost of investments differ for financial statement and tax purposes primarily due to differing treatments of wash sales.

The distributions of $4,123,525 and $12,398,062 paid during the years ended May 31, 2003 and May 31, 2004, respectively were classified as ordinary for income tax purposes.

THE JENSEN PORTFOLIO

At May 31, 2004, the cost of investments, net unrealized appreciation (depreciation) and undistributed ordinary income and undistributed long term capital gains for income tax purposes were as follows:

| Cost of investments | $ | 2,022,672,161 |

| Gross unrealized appreciation | $ | 292,555,744 |

| Gross unrealized depreciation | | (37,854,248) |

| Net unrealized appreciation | $ | 254,701,496 |

| Undistributed ordinary income | $ | 2,097,831 |

| Undistributed long-term capital gains .. | | — |

| Total distributable earnings | $ | 2,097,831 |

| Other accumulated losses | $ | (15,100,028) |

| Total accumulated earnings | $ | 241,699,299 |

5. LINE OF CREDIT

The Fund has a $250 million revolving credit facility for temporary emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The interest rate on the outstanding principal amount is equal to the prime rate less 1/2%. The Fund did not borrow on the line of credit during the six months ended November 30, 2004.

6. INVESTMENT ADVISORY AND OTHER AGREEMENTS

The Fund has entered into an Investment Advisory and Service Contract with Jensen Investment Management, Inc. Pursuant to its advisory agreement with the Fund, the Investment Adviser is entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 0.50% as applied to the Fund’s daily net assets.

Certain officers and directors of the Fund are also officers and directors of the Investment Adviser.

7. DISTRIBUTION AND SHAREHOLDER SERVICING

The Fund has adopted a distribution and shareholder servicing plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), which provides that the Fund may reimburse the Fund’s distributor or others at an annual rate of up to 0.25% of the average daily net assets attributable to Class J shares and up to 0.50% of the average daily net assets attributable to Class R shares. Payments under the 12b-1 Plan shall be used to compensate or reimburse the Fund’s distributor or others for services provided and expenses incurred in connection with the sale of shares.

In addition, the Fund has adopted a Shareholder Servicing Plan (the “Servicing Plan”) under which the Fund can pay for shareholder support services from the Fund’s assets pursuant to a Shareholder Servicing Agreement in an amount not to exceed 0.10% of the Fund’s average daily net assets attributable to Class I shares.

THE JENSEN PORTFOLIO

Expense Example — November 30, 2004

As a shareholder of The Jensen Portfolio (the “Fund”), you incur ongoing costs, including investment advisory fees, distribution and/or shareholder servicing fees, and other Fund expenses, which are indirectly paid by shareholders. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six month period (June 1, 2004 — November 30, 2004).

Actual Expenses

The first line of the table below for each share class of the Fund provides information about actual account values and actual expenses. However, the table does not include shareholder specific fees, such as the $15.00 fee charged to IRA accounts, or the $15.00 fee charged for wire redemptions. The table also does not include portfolio trading commissions and related trading costs. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the actual expense ratios for each share class of the Fund and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees which, although not charged by the Fund, may be charged by other funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Expense Example Tables

The Jensen Portfolio—Class J

| | BEGINNING | | ENDING | | EXPENSES PAID |

| | ACCOUNT VALUE | | ACCOUNT VALUE | | DURING PERIOD* |

| | JUNE 1, 2004 | | NOVEMBER 30, 2004 | | JUNE 1, 2004 - NOVEMBER 30, 2004 |

| Actual | $1,000.00 | | $ 985.00 | | $4.28 |

| Hypothetical (5% return before expenses) | 1,000.00 | | 1,020.76 | | 4.36 |

* Expenses are equal to Class J’s annualized expense ratio of 0.86%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

The Jensen Portfolio—Class R

| | BEGINNING ACCOUNT VALUE JUNE 1, 2004 | | ENDING ACCOUNT VALUE NOVEMBER 30, 2004 | | EXPENSES PAID DURING PERIOD* JUNE 1, 2004 - NOVEMBER 30, 2004 |

| Actual | $1,000.00 | | $ 984.10 | | $5.52 |

| Hypothetical (5% return before expenses) | 1,000.00 | | 1,019.50 | | 5.62 |

* Expenses are equal to Class R’s annualized expense ratio of 1.11%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

The Jensen Portfolio—Class I

| | BEGINNING | | ENDING | | EXPENSES PAID |

| | ACCOUNT VALUE | | ACCOUNT VALUE | | DURING PERIOD* |

| | JUNE 1, 2004 | | NOVEMBER 30, 2004 | | JUNE 1, 2004 - NOVEMBER 30, 2004 |

| Actual | $1,000.00 | | $ 985.70 | | $3.53 |

| Hypothetical (5% return before expenses) | 1,000.00 | | 1,021.51 | | 3.60 |

* Expenses are equal to Class I’s annualized expense ratio of 0.71%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period.

ADDITIONAL INFORMATION (UNAUDITED)

1. SHAREHOLDER NOTIFICATION OF FEDERAL TAX STATUS

The Fund designates 100% of dividends declared during the fiscal year ended May 31, 2004 as dividends qualifying for the dividends received deduction available to corporate shareholders.

The Fund designates 100% of dividends declared from net investment income during the fiscal year ended May 31, 2004 as qualified income under the Jobs and Growth Tax Relief Reconciliation Act of 2003.

2. AVAILABILITY OF PROXY VOTING INFORMATION

Information regarding how the Fund votes proxies relating to portfolio securities is available without charge, upon request by calling toll-free, 1-800-221-4384, or by accessing the SEC’s website at www.sec.gov.

3. PORTFOLIO HOLDINGS

The Jensen Portfolio will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q will be available on the EDGAR database on the SEC’s website at www.sec.gov. These Forms may also be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information about the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

4. ADDITIONAL DISCLOSURE REGARDING FUND DIRECTORS AND OFFICERS

INDEPENDENT DIRECTORS

| NAME, AGE AND ADDRESS | POSITION(S) HELD WITH THE COMPANY | TERM OF OFFICE AND LENGTH OF TIME SERVED** | PRINCIPAL OCCUPATION DURING PAST FIVE YEARS | # OF PORTFOLIOS IN FUND COMPLEX OVERSEEN BY DIRECTOR | OTHER DIRECTORSHIPS HELD BY DIRECTOR |

|

|

|

|

|

|

| Norman W. Achen J.D., 83 | Independent | Indefinite Term; | President of N.W. | 1 | Director of Brentwood |

| 2842 Luciernaga St. | Director | Served since | Achen Professional | | Biomedical Research |

| Carlsbad, CA 92009 | | inception. | Corporation | | Institute (1998 - present); |

| | | | (1980 - present). | | Director of Clinical |

| | | | | | Research Administration |

| | | | | | at V.A. Hospital in |

| | | | | | Los Angeles, CA |

| | | | | | (2002 - present). |

| Roger A. Cooke J.D., 56 | Independent | Indefinite Term; | Vice President - Regulatory | 1 | None |

| The Jensen Portfolio, Inc. | Director | 4 years served. | and Legal Affairs of | | |

| 2130 Pacwest Center | | | Precision Castparts Corp., | | |

| 1211 SW Fifth Avenue | | | an investment casting and | | |

| Portland, OR 97204 | | | forging company, | | |

| | | | (2000 - present); | | |

| | | | Executive Vice President - | | |

| | | | Regulatory and Legal | | |

| | | | Affairs of Fred Meyer, Inc., | | |

| | | | a grocery and general | | |

| | | | merchandise company, | | |

| | | | (1992 - 2000). | | |

| NAME, AGE AND ADDRESS | POSITION(S) HELD WITH THE COMPANY | TERM OF OFFICE AND LENGTH OF TIME SERVED** | PRINCIPAL OCCUPATION DURING PAST FIVE YEARS | # OF PORTFOLIOS IN FUND COMPLEX OVERSEEN BY DIRECTOR | OTHER DIRECTORSHIPS HELD BY DIRECTOR |

|

|

|

|

|

|

| Robert E. Harold | Independent | Indefinite Term; | Senior Director of | 1 | Director of |

| C.P.A. (Retired), 57 | Director | 3 years served. | Financial Planning | | StoriedLearning, |

| The Jensen Portfolio, Inc. | | | of Nike, Inc. (2001 - | | Inc. (2000 - 2003); |

| 2130 Pacwest Center | | | 2002); Global Brand | | Director of St. Mary’s |

| 1211 SW Fifth Avenue | | | Controller for Nike, Inc. | | Academy, a non- |

| Portland, OR 97204 | | | (1996, 1997, 2000 - | | profit high school |

| | | | 2001); | | (2000 - present); |

| | | | CFO (Interim) for Nike, Inc. | | Director of Will |

| | | | (1998 - 1999). | | Vinton Studios, an |

| | | | | | animation studio |

| | | | | | (2002 - present); |

| | | | | | Director of The |

| | | | | | Sisters of the Holy |

| | | | | | Names Foundation |

| | | | | | (2004 - present). |

| Thomas L. Thomsen, Jr., 59 | Independent | Indefinite Term; | Private rancher and | 1 | None |

| The Jensen Portfolio, Inc. | Director | since | real estate investor | | |

| 2130 Pacwest Center | | December 2003 | (2002 - Present); | | |

| 1211 SW Fifth Ave. | | | Chief Executive Officer | | |

| Portland, OR 97204 | | | (2000 - 2002) | | |

| | | | and President (1998 - | | |

| | | | 2000) of Columbia Man- | | |

| | | | agement Company, invest- | | |

| | | | ment adviser to the Colum- | | |

| | | | bia Funds family of mutual | | |

| | | | funds and to institutional | | |

| | | | and individual investors. | | |

| Director Emeritus | | | | | |

| Louis B. Perry, Ph.D, 86 | Director | Indefinite Term; | Retired | 1 | None |

| 1585 Gray Lynn Drive | Emeritus | Served since | | | |

| Walla Walla, WA 99362 | | inception | | | |

| | | (at times as | | | |

| | | Director | | | |

| | | Emeritus). | | | |

INTERESTED DIRECTORS AND OFFICERS

| | | | | # OF | |

| | | | | PORTFOLIOS | |

| | | TERM OF | PRINCIPAL | IN FUND | OTHER |

| | POSITION(S) | OFfiCE AND | OCCUPATION | COMPLEX | DIRECTORSHIPS |

| | HELD WITH | LENGTH OF | DURING PAST | OVERSEEN | HELD BY |

| NAME, AGE AND ADDRESS | THE COMPANY | TIME SERVED** | FIVE YEARS | BY DIRECTOR | DIRECTOR |

|

|

|

|

|

|

| Val E. Jensen,* 75 | Director and | Indefinite Term; | Chairman and Director | 1 | None |

| Jensen Investment | Chairman | Served as | of Jensen Investment | | |

| Management, Inc. | | Director since | Management, Inc. | | |

| 2130 Pacwest Center | | inception; Served as | (1988 - 2004). | | |

| 1211 SW Fifth Avenue | | President from inception | | | |

| Portland, OR 97204 | | to March 2002; | | | |

| | | Served as Chairman since | | | |

| | | March 2002. | | | |

| Gary W. Hibler,* Ph.D., 61 | Director and | Indefinite Term; | President of Jensen | 1 | None |

| Jensen Investment | President | Served as Director since | Investment Management | | |

| Management, Inc. | | inception; Served as | (1994 - present). | | |

| 2130 Pacwest Center | | Secretary from | | | |

| 1211 SW Fifth Avenue | | inception to | | | |

| Portland, OR 97204 | | March 2002; | | | |

| | | Served as Treasurer | | | |

| | | from December 2002 | | | |

| | | to March 2004; | | | |

| | | Served as | | | |

| | | President since | | | |

| | | March 2002. | | | |

| Robert F. Zagunis,* 51 | Vice President | 1 Year Term; | Vice President and | N/A | N/A |

| Jensen Investment | | Served since | Director of Jensen | | |

| Management, Inc. | | inception. | Investment Management, | | |

| 2130 Pacwest Center | | | Inc. (1993 - present). | | |

| 1211 SW Fifth Avenue | | | | | |

| Portland, OR 97204 | | | | | |

| Robert G. Millen,* 57 | Secretary | 1 Year Term; | Vice President and | N/A | N/A |

| Jensen Investment | | Served as Vice | Director of Jensen | | |

| Management, Inc. | | President from July | Investment Management, | | |

| 2130 Pacwest Center | | 2001 to March | Inc. (2000 - present); | | |

| 1211 SW Fifth Avenue | | 2002; Served as | Vice President of | | |

| Portland, OR 97204 | | Secretary since | Principal Financial | | |

| | | March 2002. | Group, an insurance | | |

| | | | company (1997 - 2000). | | |

THE JENSEN PORTFOLIO

| AND ADDRESS | POSITION(S) HELD WITH THE COMPANY | TERM OF OFFICE AND LENGTH OF TIME SERVED** | PRINCIPAL OCCUPATION DURING PAST FIVE YEARS | # OF PORTFOLIOS IN FUND COMPLEX OVERSEEN BY DIRECTOR | OTHER DIRECTORSHIPS HELD BY DIRECTOR |

|

|

|

|

|

|

| Brian S. Ferrie,* 46 | Treasurer | 1 Year Term; | Director of Finance and | N/A | N/A |

| Jensen Investment | and | Served since | Compliance for Jensen | | |

| Management, Inc. | Chief | March 2004. | Investment Management, | | |

| 2130 Pacwest Center | Compliance | | Inc. (2003 - present); Vice | | |

| 1211 SW Fifth Avenue | Officer | | President and CFO of | | |

| Portland, OR 97204 | | | Berger Financial Group | | |

| | | | LLC (2001 - 2003); Vice | | |

| | | | President and Chief | | |

| | | | Compliance Officer | | |

| | | | of Berger Financial Group | | |

| | | | LLC (1994 - 2001). | | |

| | * | This individual is an “interested person” of the Fund within the meaning of the 1940 Act. |

| | ** | Each Director serves for an indefinite term in accordance with the Bylaws of the Fund until the date a Director resigns, retires or is removed in accordance with the Bylaws of the Fund. |

[This page intentionally left blank]

[This page intentionally left blank]

THE JENSEN PORTFOLIO

INVESTMENT ADVISER

Jensen Investment Management, Inc.

2130 Pacwest Center

1211 SW Fifth Avenue

Portland, OR 97204-3721

(800) 992-4144

www.jenseninvestment.com

FUND ADMINISTRATIOR,

TRANSFER AGENT, AND

FUND ACCOUNTANT

U.S. Bancorp Fund Services, LLC.

615 East Michigan Street

Milwaukee, WI 53202

CUSTODIAN

US Bank, NA

425 Walnut Street

Cincinnati, OH 45202

LEGAL COUNSEL

Stoel Rives LLP

Standard Insurance Center

900 SW Fifth Avenue

Suite 2300

Portland, OR 97204-1268

INDEPENDENT AUDITORS

PricewaterhouseCoopers LLP

100 East Wisconsin Avenue

Suite 1500

Milwaukee, WI 53202

DISTRIBUTOR

Quasar Distributors, LLC

615 East Michigan Street

Milwaukee, WI 53202

This report has been prepared for shareholders and may be distributed to others only if preceded or accompanied by a current prospectus.

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to open-end investment companies.

Item 6. Schedule of Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchases.

Not applicable to open-end investment companies.

Item 9. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 10. Controls and Procedures.

| (a) | The Registrant’s President/Chief Executive Officer and Treasurer/Chief Financial Officer have concluded that the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “1940 Act”)) are effective as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act and Rules 15d-15(b) under the Securities Exchange Act of 1934, as amended. |

| (b) | There were no significant changes in the Registrant's internal controls over financial reporting that occurred during the Registrant's last fiscal half-year that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 11. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not Applicable. |

(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

| (b) | Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) The Jensen Portfolio, Inc.

By (Signature and Title) /s/ Gary Hibler

Gary Hibler, President

Date 2/4/05

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/ Gary Hibler

Gary Hibler, President

Date 2/4/05

By (Signature and Title)* /s/ Brian Ferrie

Brian Ferrie, Treasurer

Date 2/4/05