Washington, D.C. 20549

the Jensen Portfolio

Semi-Annual Report, November 30, 2005

the Jensen Portfolio

Letter from The Investment Adviser

DEAR FELLOW SHAREHOLDERS:

The Jensen Portfolio—Class J Shares returned 1.07% for the six months ended November 30, 2005, compared to a 5.88% return for this period for the Standard & Poor’s 500 Index. Please see page 3 of this report for complete standardized information for the Fund.

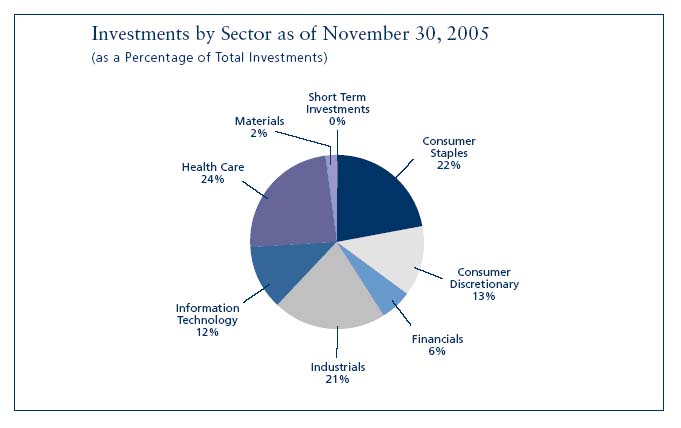

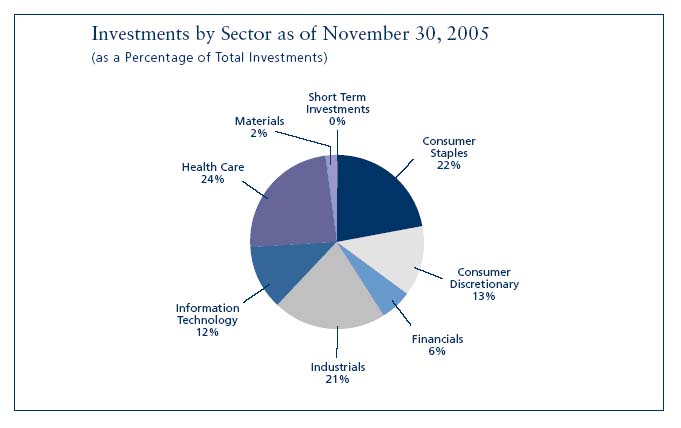

The Jensen Portfolio’s relative market underperformance was largely due to declines in the health care sector, including declines exceeding 20% for the six-month period in Patterson Companies, Pfizer and Abbott Labs. These companies have demonstrated strong growth in earnings and free cash flows over the last 10 years and we continue to believe their future long-term growth prospects remain bright.

We acknowledge market concerns for the health care arena: declining research productivity, cost pressures from health insurance providers and heightened regulatory scrutiny. We’re convinced, however, that these short term concerns will be overcome by favorable long term demographic trends, strong business fundamentals and dominant market positions that produce high levels of excess free cash flow reinvested within the companies. Ultimately, we think short term price weakness provide opportunities for the patient investor to buy shares at relatively low prices.

In contrast, the energy sector saw outsized returns of approximately 15% for the period, but the companies in this highly cyclical sector do not meet Jensen’s strict investment criteria.

During the first six months of our fiscal year we sold Dionex Corporation, one of the smallest companies that qualify for consideration by The Jensen Portfolio. We’ve been pleased by its consistently strong business performance, but Dionex has been constrained by the small amount of the company’s outstanding shares and we believed it necessary to look for another opportunity where we could make a more meaningful investment.

We also sold Anheuser-Busch. Despite a dominant market share of the US beer industry and growing international prospects, Anheuser-Busch’s business performance has lagged over the last few quarters. The company has been unable to execute its business plan and had to reconfigure aspects of it. The level of patience required for Anheuser-Busch to exhibit growth again is more than Jensen Investment Management is comfortable with at this time.

We are pleased to have added T. Rowe Price Group and Ecolab Inc. T. Rowe Price has long been one of the best performing investment groups, with a collegial management team. Consistently solid operating margins and high levels of free cash flow have allowed the company to pay down all of its debt and T. Rowe continues making investments in its business to facilitate future growth. Its mutual funds sport strong long-term performance and are led by management teams, allowing the company to develop talented people. It is also a major force in the retirement industry and has promising prospects overseas.

Ecolab, developer and marketer of premium cleaning products and services for the hospitality, food service, institutional and industrial markets, isn’t a household name but it is the dominant player in its $38 billion (and growing) industry with a market share of 11%. Ecolab’s competitive advantage is its large and deeply trained sales force of 12,000 who build strong relationships. Customer retention nears 90%. Ecolab has produced consistent quality growth, averaging solid double-digit growth in earnings and free cash flows, something we expect will continue as the company works to gain market share.

Pondering Business and Investing

Of the abundance of investment guidebooks in existence, there is one writer that should be on every investor’s shelf. Dr. Peter Drucker, who passed away this past November just short of his 96th birthday, long provided investment wisdom without ever dwelling on the mechanics of the market. He authored countless books and articles as well as teaching at Claremont Graduate University and regularly addressed the academic and business worlds.

Most businesspeople believe that a healthy bottom line is the primary purpose of a business. Dr. Drucker’s explanation was different: “The purpose of a business is to create a customer.” And his definition of quality was succinct: “Quality in a product or service is not what the supplier puts in. It is what the customer gets out and is willing to pay for. A product is not quality because it is hard to make and costs a lot of money, as manufacturers typically believe. This is incompetence. Customers pay only for what is of use to them and gives them value. Nothing else constitutes quality.”

For the investor, creating customers is the essence of a successful company because the investor shares in the long term outcome of the business.

Dr. Drucker championed management. “Management is the organ of institutions . . . the organ that coverts a mob into an organization, and human efforts into performance,” he once noted. Again, for the investor, a judgment of management skills is a critical factor in making a successful investment.

Often regarded as a maverick, choosing to spend his career at Claremont rather than Harvard or Yale, Dr. Drucker eschewed the large management consulting firms. He was a true iconoclast and provided direction for investors who habitually succumb to group-think.

the Jensen Portfolio

A Voice in the Wilderness

The stock market activity we witness daily is a beacon to academia, no doubt because of the huge involvement of people, their institutions and their money. In the main is the Efficient Market Theory (EMT), an explanation of how the market works.

“No B-School student has escaped it; no economics professor has won tenure without paying his respects . . . It is, indeed, an appealingly simple idea, that in order to make money in the stock market one must compete against the ‘smart money,’ the so-called rational investors, who are constantly scouring the market for opportunities. Because of them, all relevant new information is quickly captured by the market. No point in doing research by oneself. Trust prices; the rational investors will already have erased most any discrepancy between price and value. Since you cannot beat the market, buy a diversified portfolio, say the Standard and Poor’s 500 index fund, and save yourself the cost and sweat of an actively traded account,” writes Louis Lowenstein in his paper, “Searching for Rational Investors in a Perfect Storm”.1

The author clearly has the credentials for taking on most of academia. After a successful career as a securities lawyer on Wall Street, he became the CEO of a New York Stock Exchange listed company, followed by a teaching career at the Center for Law and Economic Studies at Columbia Law School.

“Obviously, the theory was wrong—woefully so,” Lowenstein concludes.

Lowenstein’s working paper does not describe what brought about the 1999-2003 market rise and fall and subsequent recovery, but instead how a few investment managers avoided the storm. He describes the investment habits of those managers: owning a few stocks rather than many, holding companies for long periods, low turnover, and buying at a significant discount to future cash flow.

Since other scholars attribute the success of Warren Buffett as an anomaly—a person with the “right” combination of electrons to attain the results Buffett has, Lowenstein does not include him among his examples. Nor, alas, did he include The Jensen Portfolio.

Reflection and Comment

We heartily agree with Lowenstein’s depiction of the investment habits of top managers, including looking past short term concerns to the demonstrated long term fundamentals of quality growth companies.

We appreciate your continued support and look forward to the future.

Cordially,

Val Jensen, Chairman

The Jensen Portfolio

And

The Jensen Investment Committee

This discussion and analysis of the Fund is as of November 2005 and is subject to change, and any forecasts made cannot be guaranteed.

Past performance is no guarantee of future results. Fund holdings and sector weightings are subject to change and are not recommendations to buy or sell any security. For more complete information regarding performance and holdings, please refer to the financial statements and schedule of investments headings of this report.

The Fund is nondiversified, meaning that it concentrates its assets in fewer individual holdings than a diversified fund and is therefore more exposed to individual stock volatility than a diversified fund.

For use only when preceded or accompanied by a current prospectus for the Fund.

The Jensen Portfolio is distributed by Quasar Distributors, LLC (01/06).

| 1 | Louis Lowenstein, “Searching for Rational Investors in a Perfect Storm,” October 4, 2004, Social Science Research Network. This important article can be downloaded free of charge at: www.ssrn.com. |

the Jensen Portfolio

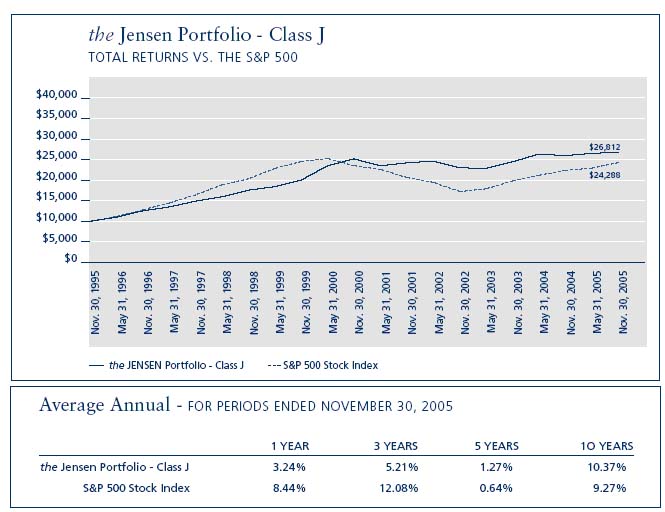

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on 11/30/95 for Class J, the original share class of the fund. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| |

Average Annual - FOR PERIODS ENDED NOVEMBER 30, 2005 |

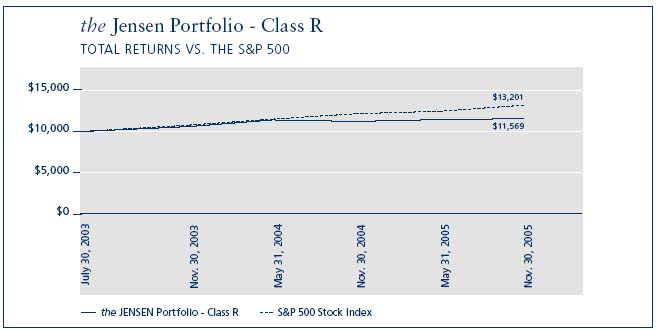

| | 1 YEAR | SINCE INCEPTIONJULY 30, 2003 |

the Jensen Portfolio - Class R | 3.00% | 6.42% |

| S&P 500 Stock Index | 8.44% | 12.58% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on 7/30/03, the inception date for Class R shares. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| |

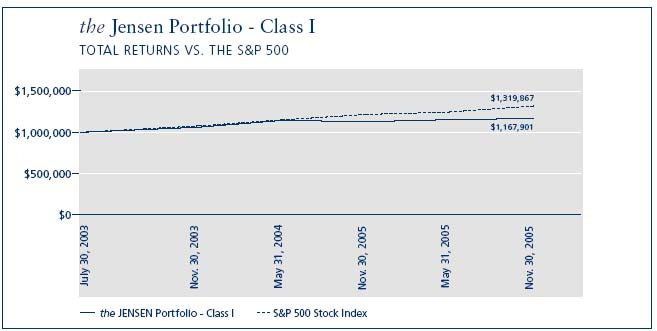

Average Annual - FOR PERIODS ENDED NOVEMBER 30, 2005 |

| | 1 YEAR | SINCE INCEPTIONJULY 30, 2003 |

the Jensen Portfolio - Class I | 3.45% | 6.86% |

| S&P 500 Stock Index | 8.44% | 12.58% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $1,000,000 made on 7/30/03, the inception date for Class I shares. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| Statement of Assets & Liabilities | | | |

| | | | |

| November 30, 2005 (UNAUDITED) | | | |

| | | | |

| | | | |

Assets: | | | |

| | | | |

| Investments, at value (cost $2,313,807,128) | $ | 2,669,823,526 | |

| Income receivable | | 4,314,492 | |

| Receivable for capital stock issued | | 5,280,086 | |

| Receivable for securities sold | | 29,762,181 | |

| Other assets | | 81,081 | |

| Total Assets | | 2,709,261,366 | |

| | | | |

Liabilities: | | | |

| | | | |

| Payable to Investment Adviser | | 1,121,245 | |

| Payable to Directors | | 11,412 | |

| Payable for capital stock redeemed | | 8,920,806 | |

| Other accrued expenses | | 945,465 | |

| Total Liabilities | | 10,998,928 | |

| NET ASSETS | $ | 2,698,262,438 | |

| | | | |

| NET ASSETS CONSIST OF: | | | |

| Capital stock | $ | 2,435,988,677 | |

| Unrealized appreciation on investments | | 356,016,398 | |

| Accumulated undistributed net investment income | | 4,945,772 | |

| Accumulated undistributed net realized loss | | (98,688,409) | |

| Total Net Assets | $ | 2,698,262,438 | |

| | | | |

| NET ASSETS CONSIST OF: | | | |

| Class J Shares: | | | |

| Net assets | $ | 2,368,228,828 | |

| Shares outstanding | | 98,849,151 | |

| Net Asset Value Per Share | | | |

| (2,000,000,000 shares authorized, $.001 par value) | $ | 23.96 | |

| | | | |

| Class R Shares: | | | |

| Net assets | $ | 23,355,350 | |

| Shares outstanding | | 978,141 | |

| Net Asset Value Per Share | | | |

| (1,000,000,000 shares authorized, $.001 par value) | $ | 23.88 | |

| | | | |

| Class I Shares: | | | |

| Net assets | $ | 306,678,260 | |

| Shares outstanding | | 12,794,193 | |

| Net Asset Value Per Share | | | |

| (1,000,000,000 shares authorized, $.001 par value) | $ | 23.97 | |

SEE NOTES TO FINANCIAL STATEMENTS.

Schedule of Investments November 30, 2005 (UNAUDITED) |

| SHARES | | | | VALUE | | SHARES | | | | VALUE |

| | | Common Stock 98.75% | | | | | | IT Services 12.32% | | |

| | | | | | | 2,569,000 | | Automatic Data Processing, Inc. | $ | 120,743,000 |

| | | Beverages 6.77% | | | | 2,435,000 | | First Data Corporation | | 105,362,450 |

| 1,360,000 | | The Coca-Cola Company | $ | 58,058,400 | | 2,506,000 | | Paychex, Inc. | | 106,279,460 |

| | | PepsiCo, Inc. | | 124,497,600 | | | | | | 332,384,910 |

| | | | | 182,556,000 | | | | | | |

| | | | | | | | | | | |

| | | Capital Markets 3.65% | | | | | | Media 12.40% | | |

| 1,3691000 | | T. Rowe Price Group Inc. | | 98,499,550 | | 918,000 | | Gannett Co., Inc. | | 56,567,160 |

| | | | | | | | | Omicom Group Inc. | | 137,283,160 |

| | | Chemicals 2.32% | | | | | | The McGraw-Hill Companies, Inc. | | 140,741,650 |

| 1,883,000 | | Ecolab, Inc. | | 62,647,410 | | | | | | 334,591,970 |

| | | | | | | | | | | |

| | | Commercial Services & Supplies 4.50% | | | | | | | | |

| 3,171,000 | | Equifax, Inc. | | 121,449,300 | | | | Pharmaceuticals 10.36% | | |

| | | | | | | 2,737,000 | | Abbott Laboratories | | 103,212,270 |

| | | Consumer Finance 2.19% | | | | 1,967,000 | | Johnson & Johnson | | 121,462,250 |

| 2,203,000 | | MBNA Corporation | | 58,974,310 | | 2,593,000 | | Pfizer Inc. | | 54,971,600 |

| | | | | | | | | | | 279,646,120 |

| | | Electrical Equipment 5.47% | | | | | | Total Common Stock | | |

| 1,954,000 | | Emerson Electric Co. | | 147,741,940 | | | | (Cost $2,308,480,162) | | 2,664,496,560 |

| | | | | | | | | | | |

| | | Food & Staples Retailing 3.94% | | | | PRINCIPAL AMOUNT | | |

| 3,288,000 | | Sysco Corporation | | 106,268,160 | | | | Short Term Investments 0.20% | | |

| | | | | | | | | | | |

| | | Health Care Equipment & Supplies 9.39% | | | | | | Commercial Paper 0.20% | | |

| 2,248,000 | | Medtronic, Inc. | | 124,921,360 | $ | 5,310,000 | | Prudential Funding, 3.93%, 12/1/2005 | | 5,310,000 |

| 2,966,000 | | Stryker Corporation | | 128,427,800 | | | | | | |

| | | | | 253,349,160 | | | | Variable Rate Demand Notes (b) 0.00% | | |

| | | | | | | 16,966 | | Wisconsin Corporate Central Credit Union, 3.96% | | 16,966 |

| | | Health Care Providers & Services 3.95% | | | | | | Total Short Term Investments | | |

| 3,047,000 | | Patterson Companies Inc. (a). | | 106,462,180 | | | | (Cost $5,326,966) | | 5,326,966 |

| | | | | | | | | Total Investments 98.95 | | |

| | | Household Products 11.10% | | | | | | (Cost $2,313,807,128) | | 2,669,823,526 |

| 993,000 | | The Clorox Company | | 53,900,040 | | | | Other Assets in Excess of Liabilities 1.05% | | 28,438,912 |

| 1,881,000 | | Colgate-Palmolive Company | | 102,552,120 | | | | NET ASSETS 100.00% | | $2,698,262,438 |

| 2,501,000 | | The Procter & Gamble Company | | 143,032,190 | | | | | | |

| | | | | 299,484,350 | (a) | Non-Income Producing | | |

| | | | | | | | | | | |

| | | Industrial Conglomerates 10.39% | | | (b) | Variable rate demand notes are considered short-term | | |

| 1,649,500 | | 3M Co. | | 129,452,760 | | obligations and are payable on demand. Interest rates | | |

| 4,227,000 | | General Electric Company | | 150,988,440 | | change periodically on specified dates. The rates shown | | |

| | | | | 280,441,200 | | are as of November 30, 2005. | | |

| | | | | | | | | | | |

| | | |

SEE NOTES TO FINANCIAL STATEMENTS.

Statement of Operations | | | Statement of Changes in Net Assets | | | | |

Six Months Ended November 30, 2005 (UNAUDITED) Investment Income: | | | | SIX MONTHS ENDED NOV.30, 05' (UNAUDITED) | | YEAR ENDED MAY 31, 05' |

| Dividend income | $ | 23,808,240 | | Operations | | | | |

| Interest income | 539,737 | | Net investment income | $ | 12,317,697 | $ | 21,056,422 |

| | | 24,347,977 | | Net realized loss on investment transactions | | (31,651,233) | | (51,494,706) |

| | | | | Change in unrealized appreciation on investments | | 46,883,238 | | 53,989,222 |

| Expenses | | | | Net increase in net assets resulting from operations | | 27,549,702 | | 23,550,938 |

| | | | | | | | | |

| Investment advisory fees | | 7,269,704 | | Capital Share Transactions: | | | | |

| 12b-1 fees-Class J | | 3,230,994 | | Shares sold-Class J | | 308,745,738 | | 1,224,500,116 |

| Administration fees | | 524,199 | | Shares sold-Class R | | 5,565,133 | | 30,163,911 |

| Transfer agent fees and expenses | | 236,986 | | Shares sold-Class I | | 50,850,335 | | 112,803,778 |

| Custody fees | | 162,305 | | Shares issued to holders in reinvestment of dividends-Class J | | 7,900,902 | | 15,207,731 |

| Reports to shareholders | | 112,899 | | Shares issued to holders in reinvestment of dividends-Class R | | 54,736 | | 102,198 |

| Fund accounting fees | | 90,794 | | Shares issued to holders in reinvestment of dividends-Class I | | 1,004,624 | | 2,040,511 |

| Shareholder servicing fees-Class I | | 88,997 | | Shares redeemed-Class J | | (643,179,977) | | (608,603,947) |

| Federal and state registration fees | | 85,819 | | Shares redeemed-Class R | | (6,327,465) | | (8,124,061) |

| Directors' fees and expenses | | 63,699 | | Shares redeemed-Class I | | (35,875,574) | | (53,789,230) |

| Professional fees | | 63,098 | | Net increase (decrease) | | (311,261,548) | | 714,301,007 |

| 12b-1 fees-Class R | | 59,189 | | | | | | |

| Interest expense | | 8,773 | | DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | | | |

| Other | | 32,824 | | Net investment income-Class J | | (9,180,340) | | (17,644,045) |

| Total expenses | | 12,030,280 | | Net investment income-Class R | | (54,736) | | (102,198) |

| | | | | Net investment income-Class I | | (1,271,521) | | (2,273,338) |

| NET INVESTMENT INCOME | | 12,317,697 | | Total dividends and distributions | | (10,506,597) | | (20,019,581) |

| | | | | | | | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | INCREASE (DECREASE) IN NET ASSETS | | (294,218,443) | | 717,832,364 |

| Net realized loss on investment transactions | | (31,651,233) | | NET ASSETS: Beginning of period | | 2,992,480,881 | | 2,274,648,517 |

| Change in unrealized appreciation on investments | | 46,883,238 | | End of period (including undistributed net investment income of $4,945,722 and $3,134,672, respectively) | $ | 2,698,262,438 | $ | 2,992,480,881 |

| Net gain on investments | | 15,232,005 | | | | | | |

| | | | | | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 27,549,702 | | | | | | |

| | | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

Financial Highlights

Class J

| | | SIX MONTHS | | | | | |

| | | ENDED | | | | | |

| | | NOV. 30, ‘05 | YEAR ENDED | YEAR ENDED | YEAR ENDED | YEAR ENDED | YEAR ENDED |

| | | (UNAUDITED) | MAY 31, ‘05 | MAY 31, ‘04 | MAY 31, ‘03 | MAY 31, ‘02 | MAY 31, ‘01 |

Per Share Data: | | | | | | | |

| Net asset value, beginning of period | | $23.79 | $23.82 | $20.80 | $22.51 | $21.53 | $22.25 |

Income from investment operations: | | | | | | | |

| Net investment income | 0.10 | 0.18 | 0.16 | 0.11 | 0.05 | 0.09 |

| Net realized and unrealized gains | | | | | | | |

| (losses) on investments | 0.15 | (0.03)(1) | 3.01 | (1.73) | 1.00 | (0.14) |

| Total from investment operations | 0.25 | 0.15 | 3.17 | (1.62) | 1.05 | (0.05) |

Less distributions: | | | | | | | |

| Dividends from net investment income | (0.08) | (0.18) | (0.15) | (0.09) | (0.07) | (0.10) |

| From net realized gains | - | | | | | (0.57) |

| Total distributions | (0.08) | (0.18) | (0.15) | (0.09) | (0.07) | (0.67) |

| Net asset value, end of period | $23.96 | $23.79 | $23.82 | $20.80 | $22.51 | $21.53 |

Total return(2) | 1.07% | 0.61% | 15.28% | -7.17% | 4.88% | -0.18% |

| Supplemental data and ratios: | | | | | | | |

| Net assets, end of period (000’s) | | $2,368,229 | 2,680,169 | $2,046,288 | 1,453,069 | $473,414 | $46,119 |

| Ratio of expenses to average | | | | | | | |

net assets(3) | 0.84% | 0.85% | 0.88% | 0.90% | 1.00% | 0.95% |

| Ratio of net investment income to | | | | | | | |

average net assets(3) | 0.83% | 0.77% | 0.71% | 0.62% | 0.23% | 0.45% |

Portfolio turnover rate(2) | 5.43% | 8.81% | 5.32% | 7.22% | 0.78% | 6.53% |

| (1) | The amount shown may not correlate with the aggregate gains (losses) of portfolio securities due to timing of subscriptions and redemption of fund shares. |

| (2) | Not annualized for the six months ended November 30, 2005. |

| (3) | Annualized for the six months ended November 30, 2005. |

SEE NOTES TO FINANCIAL STATEMENTS.

Financial Highlights

Class R

| | SIX MONTHS | | |

| | ENDED | | PERIOD FROM |

| | NOV. 30, ’05 | YEAR ENDED | JUL. 30, ‘03(1) |

| | (UNAUDITED) | MAY 31, ’05 | TO MAY 31, ‘04 |

Per Share Data: | | | |

| Net asset value, beginning of period | $23.71 | $23.76 | $20.93 |

Income from investment operations: | | | |

| Net investment income | 0.07 | 0.14 | 0.13 |

| Net realized and unrealized gains (losses) on investments | 0.15 | (0.05)(2) | 2.83 |

| Total from investment operations | 0.22 | 0.09 | 2.96 |

Less distributions: | | | |

| Dividends from net investment income | (0.05) | (0.14) | (0.13) |

| Total distributions | (0.05) | (0.14) | (0.13) |

| Net asset value, end of period | $23.88 | $23.71 | $23.76 |

Total return(3) | 0.95% | 0.40% | 14.13% |

Supplemental data and ratios: | | | |

| Net assets, end of period (000’s) | $23,355 | $23,884 | $ 799 |

Ratio of expenses to average net assets(4) | 1.10% | 1.10% | 1.12% |

Ratio of net investment income to average net assets(4) | 0.58% | 0.54% | 0.45% |

Portfolio turnover rate(3) | 5.43% | 8.81% | 5.32% |

| (1) | Commencement of operations. |

| (2) | The amount shown may not correlate with the aggregate gains (losses) of portfolio securities due to timing of subscriptions and redemption of fund shares. |

| (3) | Not annualized for periods less than one year. |

| (4) | Annualized for periods less than one year. |

SEE NOTES TO FINANCIAL STATEMENTS.

Financial Highlights

Class I

| | SIX MONTHS | | |

| | ENDED | | PERIOD FROM |

| | NOV. 30, ’05 | YEAR ENDED | JUL. 30, ‘03(1) |

| | (UNAUDITED) | MAY 31, ’05 | TO MAY 31, ‘04 |

Per Share Data: | | | |

| Net asset value, beginning of period | $23.80 | $23.82 | $20.93 |

Income from investment operations: | | | |

| Net investment income | 0.12 | 0.23 | 0.12 |

| Net realized and unrealized gains (losses) on investments | 0.15 | (0.04)(2) | 2.92 |

| Total from investment operations | 0.27 | 0.19 | 3.04 |

Less distributions: | | | |

| Dividends from net investment income | (0.10) | (0.21) | (0.15) |

| Total distributions | (0.10) | (0.21) | (0.15) |

| Net asset value, end of period | $23.97 | $23.80 | $23.82 |

Total return(3) | 1.19% | 0.77% | 14.54% |

Supplemental data and ratios: | | | |

| Net assets, end of period | $306,678 | $288,428 | $227,561 |

Ratio of expenses to average net assets(4) | 0.66% | 0.67% | 0.70% |

Ratio of net investment income to average net assets(4) | 1.03% | 0.95% | 0.87% |

Portfolio turnover rate(3) | 5.43% | 8.81% | 5.32% |

| (1) | Commencement of operations. |

| (2) | The amount shown may not correlate with the aggregate gains (losses) of portfolio securities due to timing of subscriptions and redemption of fund shares. |

| (3) | Not annualized for periods less than one year. |

| (4) | Annualized for periods less than one year. |

SEE NOTES TO FINANCIAL STATEMENTS.

Notes to the Financial Statements

November 30, 2005 (UNAUDITED)

1. Organization and Significant Accounting Policies

The Jensen Portfolio, Inc. (the “Fund”) was organized as an Oregon Corporation on April 17, 1992, and is registered as an open-end, nondiversified management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Fund commenced operations on August 3, 1992. Effective July 30, 2003, the Fund issued two new classes of shares, Class R and Class I and renamed the existing class as Class J. Class J shares are subject to a 0.25% 12b-1 fee; Class R shares are subject to a 0.50% 12b-1 fee and Class I shares are subject to a 0.10% shareholder servicing fee, as described in each Class’ prospectus. Each class of shares has identical rights and privileges except with respect to the 12b-1 fees and shareholder servicing fee, and voting rights on matters affecting a single class of shares. The principal investment objective of the Fund is long-term capital appreciation.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America.

a) Investment Valuation - Securities that are listed on United States stock exchanges or the Nasdaq Stock Market are valued at the last sale price on the day the securities are valued or, if there has been no sale on that day, at their current bid price. Quotations are taken from the market in which the security is primarily traded. Over-the-counter securities are valued at current bid price. Securities for which market quotations are not readily available are valued at fair value as determined by the Investment Adviser at or under the direction of the Fund’s Board of Directors. There were no securities valued by the Board of Directors as of November 30, 2005. Variable rate demand notes are valued at cost which approximates fair value. Notwithstanding the above, fixed-income securities may be valued on the basis of prices provided by an established pricing service when the Board believes that such prices better reflect market values.

b) Federal Income Taxes - No provision for federal income taxes has been made since the Fund has complied to date with the provisions of the Internal Revenue Code applicable to regulated investment companies and intends to continue to so comply in the future and to distribute substantially all of its net investment income and realized capital gains in order to relieve the Fund from all federal income taxes.

c) Distributions to Shareholders - Dividends to shareholders are recorded on ex-dividend date. Dividends from net investment income are declared and paid quarterly by the Fund. Distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. Permanent differences between financial reporting and tax are reclassified to capital stock.

d) Use of Estimates - The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

e) Guarantees and Indemnifications - In the normal course of business the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

f) Other - Investment and shareholder transactions are recorded on trade date. Gains or losses from the investment transactions are determined on the basis of identified carrying value. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. The Fund has investments in short-term variable rate demand notes, which are unsecured instruments. These notes may present credit risk to the extent the issuer defaults on its payment obligation. The credit-worthiness of the issuer is monitored, and these notes are considered to present minimal credit risk in the opinion of the Investment Adviser. Income, expenses (other than those deemed attributable to a specific share class), and gains and losses of the Fund are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a specific class of shares are charged against the operations of such class.

2. Capital Share Transactions | | |

| Transactions in shares of the Fund were as follows: |

| | SIX MONTHS | | |

| | ENDED | | YEAR ENDED |

| | NOV. 30, ’05 | | MAY 31, ’05 |

Class J | | | |

| Shares sold | 13,010,268 | | 51,799,028 |

| Shares issued to holders in | | | |

| reinvestment of dividends | 338,969 | | 639,759 |

| Shares redeemed | (27,172,896) | | (25,682,314) |

| Net Increase (Decrease) | (13,823,659) | | 26,756,473 |

| Shares outstanding: | | | |

| Beginning of period | 112,672,810 | | 85,916,337 |

| End of period | 98,849,151 | | 112,672,810 |

| | | | |

| | SIX MONTHS | | |

| | ENDED | | YEAR ENDED |

| | NOV. 30, ’05 | | MAY 31, ’05 |

Class R | | | |

| Shares sold | 236,376 | | 1,312,508 |

| Shares issued to holders in | | | |

| reinvestment of dividends | 2,355 | | 4,348 |

| Shares redeemed | (268,052) | | (343,028) |

| Net Increase (Decrease) | (29,321) | | 973,828 |

| Shares outstanding: | | | |

| Beginning of period | 1,007,462 | | 33,634 |

| End of period | 978,141 | | 1,007,462 |

Class I | | | |

| Shares sold | 2,140,514 | | 4,746,946 |

| Shares issued to holders in | | | |

| reinvestment of dividends | 43,111 | | 85,840 |

| Shares redeemed | (1,510,554) | | (2,265,289) |

| Net Increase | 673,071 | | 2,567,497 |

| Shares outstanding: | | | |

| Beginning of period | 12,121,122 | | 9,553,625 |

| End of period | 12,794,193 | | 12,121,122 |

| | | | |

3. Investment Transactions

The aggregate purchases and aggregate sales of securities, excluding short-term investments, by the Fund for the six months ended November 30, 2005, were $154,918,925 and $439,265,014; respectively.

4. Income Taxes

At May 31, 2005, the Fund had accumulated net realized capital loss carryovers of $767,052, $14,029,552 and $24,932,611 which will expire on May 31, 2010, May 31, 2012 and May 31, 2013, respectively. To the extent the Fund realizes future net capital gains, taxable distributions to its shareholders will be offset by any unused capital loss carryover.

At May 31, 2005, the Fund deferred on a tax basis to the first day of the next taxable year, post-October losses of $26,865,519.

The cost of investments differ for financial statement and tax purposes primarily due to differing treatments of wash sales.

The distributions of $12,398,062 and $20,019,581 paid during the years ended May 31, 2004 and May 31, 2005, respectively, were classified as ordinary for income tax purposes.

At May 31, 2005, the cost of investments, net unrealized appreciation (depreciation) and undistributed ordinary income and undistributed long term capital gains for income tax purposes were as follows:

| | | |

| Cost of investments | $ | 2,678,467,684 |

| Gross unrealized appreciation | | 385,595,911 |

| Gross unrealized depreciation | | (76,905,193) |

| Net unrealized appreciation | $ | 308,690,718 |

| Undistributed ordinary income | $ | 3,134,672 |

| Undistributed long-term capital gain | | - |

| Total distributable earnings | $ | 3,134,672 |

| Other accumulated losses | $ | (66,594,734) |

| Total accumulated earnings | $ | 245,230,656 |

| | | |

5. Line of Credit

The Fund has a $250 million revolving credit facility for temporary emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The interest rate on the outstanding principal amount is equal to the prime rate less 1/2%. During the six months ended November 30, 2005, the Fund borrowed on the line of credit on nine days, with an average borrowing on those days of $5,763,861.

6. Investment Advisory Agreement

The Fund has entered into an Investment Advisory and Service Contract with Jensen Investment Management, Inc. Pursuant to its advisory agreement with the Fund, the Investment Adviser is entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 0.50% as applied to the Fund’s daily net assets.

Certain officers and directors of the Fund are also officers and directors of the Investment Adviser.

7. Distribution and Shareholder Servicing

The Fund has adopted a distribution and shareholder servicing plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), which provides that the Fund may reimburse the Fund’s distributor or others at an annual rate of up to 0.25% of the average daily net assets attributable to Class J shares and up to 0.50% of the average daily net assets attributable to Class R shares. Payments under the 12b-1 Plan shall be used to compensate or reimburse the Fund’s distributor or others for services provided and expenses incurred in connection with the sale of shares.

In addition, the Fund has adopted a Shareholder Servicing Plan (the “Servicing Plan”) under which the Fund can pay for shareholder support services from the Fund’s assets pursuant to a Shareholder Servicing Agreement in an amount not to exceed 0.10% of the Fund’s average daily net assets attributable to Class I shares.

the Jensen Portfolio

Expense Example - November 30, 2005 (Unaudited)

As a shareholder of The Jensen Portfolio (the “Fund”), you incur ongoing costs, including investment advisory fees, distribution and/or shareholder servicing fees, and other Fund expenses, which are indirectly paid by shareholders. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six month period (June 1, 2005 - November 30, 2005).

Actual Expenses

The first line of the table below for each share class of the Fund provides information about actual account values and actual expenses. However, the table does not include shareholder specific fees, such as the $15.00 fee charged to IRA accounts, or the $15.00 fee charged for wire redemptions. The table also does not include portfolio trading commissions and related trading costs. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the actual expense ratios for each share class of the Fund and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees which, although not charged by the Fund, may be charged by other funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | |

| Expense Example Tables | | | | | | |

| | | | | | | |

The Jensen Portfolio-Class J | | | | | | |

| | | | | | | EXPENSES PAID DURING PERIOD* |

| | | JUNE 1, 2005 | | NOVEMBER 30, 2005 | | JUNE 1, 2005 - NOVEMBER 30, 2005 |

| Actual | $ | 1,000.00 | $ | 1,010.70 | $ | 4.23 |

| Hypothetical (5% annual return before expenses) | | 1,000.00 | | 1,020.86 | | 4.26 |

| * Expenses are equal to Class J’s annualized expense ratio of 0.84%, multiplied by the average account value over the |

| period, muliplied by 183/365 to reflect the one-half year period. |

| |

The Jensen Portfolio-Class R | | | | | | |

| | | BEGINNING | | ENDING | | EXPENSES PAID |

| | | ACCOUNT VALUE | | ACCOUNT VALUE | | DURING PERIOD* |

| | | JUNE 1, 2005 | | NOVEMBER 30, 2005 | | JUNE 1, 2005 - NOVEMBER 30, 2005 |

| Actual | $ | 1,000.00 | $ | 1,009.50 | $ | 5.54 |

| Hypothetical (5% annual return before expenses) | | 1,000.00 | | 1,019.55 | | 5.57 |

| * Expenses are equal to Class R’s annualized expense ratio of 1.10%, multiplied by the average account value over the |

| period, muliplied by 183/365 to reflect the one-half year period. | | |

The Jensen Portfolio-Class I | | | | | | |

| | | BEGINNING | | ENDING | | EXPENSES PAID |

| | | ACCOUNT VALUE | | ACCOUNT VALUE | | DURING PERIOD* |

| | | JUNE 1, 2005 | | NOVEMBER 30, 2005 | | JUNE 1, 2005 - NOVEMBER 30, 2005 |

| Actual | $ | 1,000.00 | $ | 1,011.90 | $ | 3.33 |

| Hypothetical (5% annual return before expenses) | | 1,000.00 | | 1,021.76 | | 3.35 |

| * Expenses are equal to Class I’s annualized expense ratio of 0.66%, multiplied by the average account value over the period, |

| muliplied by 183/365 to reflect the one-half year period. | | |

Additional Information (Unaudited)

1. INVESTMENT ADVISORY AGREEMENT DISCLOSURE

Section 15(c) of the 1940 Act requires that a fund’s board of directors, including a majority of those whom are not “interested persons” of the fund or the investment adviser as that term is defined under the 1940 Act (“Independent Directors”) voting separately, review and approve the terms of the fund’s investment advisory agreement on an annual basis.

In its most recent deliberations concerning whether to renew the Fund’s Investment Advisory and Service Agreement (the “Advisory Agreement”) with Jensen Investment Management, Inc. (the “Adviser”), the Fund’s Board of Directors, including the Independent Directors (the “Board”), conducted the review and made the determinations that are described below. During its deliberations, the Board requested from the Adviser, and the Adviser furnished, all information reasonably necessary for it to evaluate the Advisory Agreement.

The entire Board first met on April 13, 2005 to consider the information provided by the Adviser and discuss the proposed renewal of the Advisory Agreement. The Independent Directors met separately with their legal counsel on April 22, 2005 to review the Adviser’s presentation and identify additional information they needed to evaluate the Advisory Agreement. The Independent Directors reconvened in a separate meeting with their legal counsel on July 13, 2005 to consider additional materials provided by the Adviser at their request. The entire Board then met again on July 13, 2005 to consider the continuation of the Advisory Agreement. At those meetings, the Board considered the factors and reached the conclusions described below, among others. The Board did not identify any single factor as controlling. Moreover, not every factor was given the same weight by each director.

Nature, Extent and Quality of Services

The Board of Directors, including the Independent Directors, considered the nature, extent and quality of services provided to the Fund by the Adviser under the Advisory Agreement. The Board reviewed the history of the Adviser, its investment discipline, its investment performance, and its day to day management of the Fund. The Board also noted the Adviser’s increasing focus on the business of the Fund, the recent additions to the Adviser’s staff, the Fund’s low and declining expense ratio and very low turnover rate, and the Adviser’s oversight of the Fund’s service providers. Based on these and other factors, including those referenced below, the Board concluded that the services provided to the Fund were of high quality.

Investment Performance

The Board examined the investment performance of the Fund compared to an appropriate securities index, to appropriate Lipper and Morningstar categories, and to other mutual funds of similar asset size and with similar investment objectives and strategies. Performance over one-, three-, five- and ten-year periods for the Fund was analyzed. The Board noted that the long-term performance of the Fund was good, but that the Fund’s short-term results under-performed its benchmark. The Board found that the Fund’s assets had grown dramatically during the same short-term period, reflecting an attractive fund from a shareholder perspective. In addition, the Board observed that the Adviser had appeared to adhere to its strict, long-term investment discipline. As a result of these and other factors, the Board concluded that the investment performance of the Fund was satisfactory.

Advisory Fees and Expense Ratio

The Board compared the Fund’s advisory fees with those of other comparable mutual funds in the Fund’s peer group. The Board noted that the Fund’s advisory fee of 0.50% was below the average and the median for its Lipper category. The Board also noted that the Fund is a single fund (as opposed to a larger complex of funds) and that, while the Advisor deploys a strict and less complicated investment discipline, the Fund appeared to be an efficiently run operation with a high service component for shareholders.

The Board compared the fees charged to the Fund with the advisory fees charged to the non-Fund advisory clients of the Adviser. The Board observed that, with the exception of a few existing clients, the Adviser charges its separate accounts a minimum of 0.50%.

The Board considered the Fund’s expense ratio and expense ratios of funds in the Fund’s peer group. The Board noted that the Fund’s expense ratio was below the average and the median for its Lipper category.

Based on these considerations and other factors, the Board concluded that the Fund’s advisory fee and expense ratios were reasonable relative to the Fund’s peer group.

Profitability of the Adviser

The Board considered the profitability of the Advisory Agreement to the Adviser, including the methodology used to calculate the Adviser’s profitability, and compared the Adviser’s profitability with that of selected publicly traded mutual fund advisers. When adjusted for certain marketing revenues and expenses, it appeared that the Adviser’s pre-tax profit was not significantly higher than the average pre-tax profit margin of the group of publicly traded investment advisory firms. It was noted that the Adviser’s profitability may have been overstated due to the relatively low salaries and bonuses paid to its investment professionals, who receive additional compensation through their equity ownership in the firm. The Board also considered the facts that the Adviser pays certain administrative expenses of the Fund, including certain sub-transfer agency costs and the cost of the Fund’s Chief Compliance Officer, that the Fund had been subsidized by the Adviser for the early years of the Fund’s existence, and that only in the most recent three to four years has the Fund generated profits to any sizable degree for the Adviser. Finally, the Board acknowledged the inherent limitations of profitability analyses, including the incomplete or dissimilar data available and the uncertainty of the various allocations and other assumptions used. Based on this and other information, the Board concluded that profits earned by the Adviser were not excessive.

Economies of Scale

The Board considered whether there have been economies of scales with respect to the management of the Fund, whether the Fund has benefited from any economies of scale, and whether the implementation of breakpoints in the Fund’s advisory fee was appropriate. The Board observed that, during a period of rapid growth, the Fund’s expense ratio had fallen from about 1% for the fiscal year ended May 31, 2002 to 0.86% for the nine months ended February 28, 2005. Regarding the issue of breakpoints, the Board noted that, although some funds in the Fund’s peer group had advisory fee breakpoints below 0.50%, many of these funds were index funds, classes of much larger funds, or funds offered by much larger fund groups. The Board also noted that a number of funds with lower breakpoints had higher overall advisory fees and significantly higher asset levels. Based on the data presented, the Board concluded that a breakpoint in the Fund’s advisory fee was not warranted at this time, but that the issue of breakpoints should be revisited each year.

Other Benefits

The Board considered the potential fall-out benefits realized by the Adviser from services as investment manager of the Fund. The Board noted that the Adviser has no affiliated entities that provide services to the Fund and that the Adviser prohibits the receipt of third-party “soft dollars.” The Board understood that the Adviser’s non-Fund business was approximately 10% of the Adviser’s total business. The Board concluded that, while there might be some benefit to the Adviser’s non-Fund business from the favorable publicity received by the Fund, it was likely not significant.

Other Factors and Considerations

The Board periodically reviews and considers other material information throughout the year relating to the quality of services provided to the Fund, such as allocation of Fund brokerage, if any, to brokers, the Adviser’s management of its relationship with the Fund’s custodian, transfer agent and other service providers, and expenses paid to those third parties. At its regular meetings, the Board also reviews detailed information relating to the Fund’s portfolio and performance, and interviews the Fund’s portfolio managers.

Based on its evaluation of all material factors and the information provided to it, the Board of Directors, including all of the Independent Directors, voted unanimously to renew the Advisory Agreement for a one-year period until July 31, 2006.

2. SHAREHOLDER NOTIFICATION OF FEDERAL TAX STATUS

The Fund designates 100% of dividends declared during the fiscal year ended May 31, 2005 as dividends qualifying for the dividends received deduction available to corporate shareholders.

The Fund designates 100% of dividends declared from net investment income during the fiscal year ended May 31, 2005 as qualified dividend income under the Jobs and Growth Tax Relief Reconciliation Act of 2003.

3. AVAILABILITY OF PROXY VOTING INFORMATION

Information regarding how the Fund votes proxies relating to portfolio securities is available without charge, upon request by calling toll-free, 1-800-221-4384, or by accessing the SEC’s website at www.sec.gov.

the Jensen Portfolio

4. PORTFOLIO HOLDINGS

The Jensen Portfolio will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q will be available on the EDGAR database on the SEC’s website at www.sec.gov. These Forms may also be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information about the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

5. ADDITIONAL DISCLOSURE REGARDING FUND DIRECTORS AND OFFICERS

Independent Directors

NAME, AGE AND ADDRESS | | | | # OF | DIRECTOR |

| | | | | | |

Norman W. Achen J.D., 842842 Luciernaga St.Carlsbad, CA 92009 | | | President of N.W.Achen ProfessionalCorporation(1980 - present). | 1 | Director of BrentwoodBiomedical ResearchInstitute (1998 - present);Director of ClinicalResearch Administrationat V.A. Hospital inLos Angeles, CA(2002 - present). |

| | | | | | |

Roger A. Cooke J.D., 57The Jensen Portfolio, Inc.2130 Pacwest Center1211 SW Fifth AvenuePortland, OR 97204 | | Indefinite Term;since June 1999. | Vice President - Regulatoryand Legal Affairs ofPrecision Castparts Corp.,an investment casting andforging company,(2000 - present);Executive Vice President -Regulatory and LegalAffairs of Fred Meyer, Inc.,a grocery and generalmerchandise company,(1992 - 2000). | 1 | None |

Robert E. HaroldC.P.A. (Retired), 58The Jensen Portfolio, Inc.2130 Pacwest Center1211 SW Fifth AvenuePortland, OR 97204 | | | Senior Director ofFinancial Planningof Nike, Inc. (2001 -2002); Global BrandController for Nike, Inc.(1996, 1997, 2000 - 2001);Interim Chief FinancialOfficer for Nike, Inc.(1998 - 1999); InterimChief Executive Officer forLaika, Inc. (formerlyWill Vinton Studios)(March 2005 - October2005). | 1 | Director ofStoriedLearning,Inc. (2000 - 2003);Director of St. Mary’sAcademy, a non-profit high school(2000 - present);Director of Laika, Inc.(formerly Will VintonStudios), an animationstudio (2002 - present);Director of TheSisters of the HolyNames Foundation(2004 - present). |

NAME, AGE AND ADDRESS | | | | # OF | DIRECTOR |

| | | | | | |

Thomas L. Thomsen, Jr., 61The Jensen Portfolio, Inc.2130 Pacwest Center1211 SW Fifth Ave.Portland, OR 97204 | | | Private rancher andreal estate investor(2002 - Present);Chief Executive Officer(2000 - 2002)and President (1998 -2000) of Columbia Man-agement Company (nowcalled Columbia Manage-ment Advisors, Inc.),investment adviser to theColumbia Funds family ofmutual funds and to insti-tutional and individualinvestors. | 1 | None |

| | | | | |

Louis B. Perry, Ph.D, 871585 Gray Lynn DriveWalla Walla, WA 99362 | | | Retired | 1 | None |

Interested Directors and Officers NAME, AGE AND ADDRESS | | | | # OF | DIRECTOR |

| | | | | | |

Val E. Jensen,* 76The Jensen Portfolio, Inc.2130 Pacwest Center1211 SW Fifth AvenuePortland, OR 97204 | | Indefinite Term;Served asDirector sinceinception; Served asPresident from inceptionto March 2002;Served as Chairman sinceMarch 2002. | Chairman and Directorof Jensen InvestmentManagement, Inc.(1988 - 2004). | 1 | None |

Gary W. Hibler,* Ph.D., 62Jensen Investment Management, Inc.2130 Pacwest Center1211 SW Fifth AvenuePortland, OR 97204 | | Indefinite Term;Served as Director sinceinception; Served asSecretary frominception toMarch 2002;Served as Treasurerfrom December 2002to March 2004;Served asPresident sinceMarch 2002. | President of JensenInvestment Management,Inc. (1994 - present). | 1 | None |

Robert F. Zagunis,* 52Jensen Investment Management, Inc.2130 Pacwest Center1211 SW Fifth AvenuePortland, OR 97204 | Vice President | | Vice President andDirector of JensenInvestment Management,Inc. (1993 - present). | N/A | N/A |

Robert G. Millen,* 58Jensen Investment Management, Inc.2130 Pacwest Center1211 SW Fifth AvenuePortland, OR 97204 | Vice Presidentand Secretary | 1 Year Term;Served as VicePresident from July2001 to March2002 and since June2005; Served asSecretary sinceMarch 2002. | Vice President andDirector of JensenInvestment Management,Inc. (2000 - present);Vice President ofPrincipal FinancialGroup, an insurancecompany (1997 - 2000). | N/A | N/A |

NAME, AGE AND ADDRESS | | | | # OF | DIRECTOR |

| | | | | | |

Brian S. Ferrie,* 47Jensen InvestmentManagement, Inc.2130 Pacwest Center1211 SW Fifth AvenuePortland, OR 97204 | | | Director of Finance andChief Compliance Officerfor Jensen InvestmentManagement, Inc.(2003 - present); VicePresident and CFO ofBerger Financial GroupLLC (2001 - 2003); VicePresident and ChiefCompliance Officerof Berger Financial GroupLLC (1994 - 2001). | N/A | N/A |

| * | This individual is an “interested person” of the Fund within the meaning of the 1940 Act. |

| ** | Each Director serves for an indefinite term in accordance with the Bylaws of the Fund until the date a Director resigns, retires or is removed in accordance with the Bylaws of the Fund. |

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Not applicable to open-end investment companies.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Not applicable to open-end investment companies.

Not applicable to open-end investment companies.

Not applicable to open-end investment companies.

Not Applicable.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.