As filed with the Securities and Exchange Commission on February 5, 2007.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6653

The Jensen Portfolio, Inc.

(Exact name of registrant as specified in charter)

2130 Pacwest Center, 1211 SW Fifth Avenue

Portland, OR 97204-3721

(Address of principal executive offices) (Zip code)

Gary Hibler

2130 Pacwest Center, 1211 SW Fifth Avenue

Portland, OR 97204-3721

(Name and address of agent for service)

(800) 221-4384

Registrant's telephone number, including area code

Date of fiscal year end: May 31

Date of reporting period: November 30, 2006

Item 1. Report to Stockholders.

Letter from The Investment Adviser

DEAR FELLOW SHAREHOLDERS:

The Jensen Portfolio—Class J Shares returned 9.27% for the six months ended November 30, 2006, compared to an 11.34% return over this period for the Standard & Poor’s 500 Index. Please see page 3 of this report for complete standardized information for the Fund. The Jensen Portfolio’s relative market underperformance was due, in part, to a nearly 12% decline in First Data Corporation, a company we sold during the period and which is discussed below. Additionally, the market produced rather meager returns for industrial holdings such as 3M and General Electric, particularly when considering their consistent growth in revenues and free cash flow and solid long-term outlooks for their respective business strategies. We remain confident that the market will reward our patience in these holdings. In contrast, the energy, telecom service and utilities sectors saw outsized returns of over 13%, 20% and 17%, respectively, for the period. There are very few companies in these sectors, if any, that meet Jensen’s strict investment criteria primarily due to the highly cyclical or regulatory nature of the industries and the relative volatility of both earnings and cash flows.

Portfolio Additions and Eliminations

During the first six months of our fiscal year we sold Pfizer. Although Pfizer has a strong financial foundation pressures could impact future business performance. Certain key products face patent expiration while others face increased generic competition. We feel that growth prospects for the company are diminished due to rising health care costs and a more stringent regulatory environment.

As noted above, we also sold First Data Corporation. We acquired First Data in 2005 primarily because of its Western Union money transfer business, but that business was subsequently spun off. A somewhat weak outlook for First Data appeared to cause much of the company’s decline during the period, and we could no longer justify holding First Data. Further, the historical financial information on Western Union that our discipline requires is unavailable. Thus we were precluded from investing in Western Union once it became a separate entity.

We are pleased to have added Bed, Bath & Beyond and Microsoft to The Jensen Portfolio during this period. Bed, Bath & Beyond is a leading retailer that sells brand name, domestic merchandise and home furnishings. With nearly 820 stories nationwide, and a number of stores under two alternative brands, the company’s operating margins are the highest in the industry. We believe that a key to its success is the autonomy afforded to store managers who make inventory decisions and can position the store to take on local competitors. This strategy has enabled the planned opening of hundreds of new stores over the next few years. The company also possesses high cash reserves and self finances expansion of its additional locations.

Microsoft has long been an industry leader and we believe Microsoft offers a solid investment opportunity. We expect existing franchises and new development areas such as office productivity, next-generation operating systems, and gaming to provide continued growth. Also, of the $93 billion in cash used over the past five years, all but $7 billion was distributed to shareholders and we believe that future free cash flow generation will increase. Additionally, the company recently announced a $36 billion share buyback plan. Lastly, management has actively begun its leadership transition from Bill Gates and Steve Ballmer to the next generation of leaders.

Alternative Investing and Compounding

While we at Jensen are steadfast in the belief that investing in quality growth companies for the long term can offer great rewards, the frequent mention of “alternative investments” in the financial press may have investors wondering if they are missing something. It is a fair concern since this investment classification appears to be both exciting and capable of generating huge returns. Since the category itself continues to expand, any definition of alternative investments will not likely stand the test of time. For purpose of this letter, an Internet definition we found is: alternative investments are securities that do not trade publicly on an organized exchange. Examples include, but are not limited to, partnership funds that focus on private equity (previously known as “leveraged buyouts”), venture capital, buyout and mezzanine financing, natural resources or hedge funds.

In practice, these investments usually involve a degree of leverage and limited exit points as they are not liquid (easily bought or sold.) In contrast, publicly-held companies that consistently generate excess cash flow are easily bought and sold. Of course, in a perfect world, our favorite holding period would be forever. But the high degree of liquidity that our fund’s securities generally possess proves valuable when we buy or sell securities.

Instead of asking what investors are missing, we believe a more valid question is: What are many investors in alternative investments missing?

They are missing what Albert Einstein called the most powerful force in the universe. They are missing the opportunity for compounding.

Compounding requires two elements: time and return. In order to illustrate the benefits of compounding, Benjamin Franklin gave $5,000 each to his two favorite cities, Philadelphia and Boston, with the stipulation that after 100 years each city could withdraw $500,000 for public works projects with the balance to be withdrawn after 200 years. When the time expired in 1991, each city received approximately $20 million.

Famed investor Warren Buffett, who taught night school in the 1950s, illustrated the magical effect of compounding by having students calculate compound interest problems.

Short term, compounding does not appear to offer much incentive for investors; $100 at 10% interest compounded over three years only nets $3 more over simple interest. But in just 10 years it becomes quite worthwhile to utilize as compounding gains a $59 advantage.

Equities become a case in point for the advantages of compounding. According to Ibbotson Associates (as noted in Todd E. Grady’s, The Miracle of Compound Interest, in The Babson Staff Letter, July 3, 2003), large cap stocks have increased in value at a 10.7% clip from 1925 to 2001. One dollar invested at the end of 1925 would have compounded to $2,279 by 2001, but only $90 would have come from appreciation. All of the remaining $2,189 would have come from dividends and compounding. Therein lies the magic!

A hallmark of the securities held in The Jensen Portfolio is the cash generated beyond the need to operate the business. This excess cash flow is returned to shareholders in dividends (which, if reinvested in additional shares, offers the benefit of compounding), buying back shares, creating new products and services through research and development, and building new plants or buying more efficient machinery. Such items annually increase the worth of the businesses thereby compounding their values. While this rarely occurs in lock-step with the companies’ stock market value, we have observed that over time the market reflects the cumulative value.

To “get rich quick” is complicated. There are all sorts of risks and a low probability of success, whether we’re discussing the gold rush of the 19th Century or the Internet boom at the close of the 20th Century. Alternative investments may offer that kind of reward and risk. But investors should be mindful that there is another side to the compounding coin: compounding is equally as powerful in destroying wealth when one loses capital.

When considering the current rage of wagering on the direction of interest rates, commodities, options, or stocks, investors should keep in mind the message and opportunity of compounding.

We appreciate your continued support.

Cordially,

This discussion and analysis of the Fund is as of November 2006 and is subject to change, and any forecasts made cannot be guaranteed.

Past performance is no guarantee of future results. Fund holdings and sector weightings are subject to change and are not recommendations to buy or sell any security. For more complete information regarding performance and holdings, please refer to the financial statements and schedule of investments headings of this report.

The Fund is nondiversified, meaning that it concentrates its assets in fewer individual holdings than a diversified fund and is therefore more exposed to individual stock volatility than a diversified fund.

“Free Cash Flow” measures the cash generating capability of a company by adding non-cash charges (e.g. depreciation) to after tax income and subtracting capital expenditures.

For use only when preceded or accompanied by a current prospectus for the Fund.

The Jensen Portfolio is distributed by Quasar Distributors, LLC (01/07).

| | | | | |

| | Average Annual - FOR PERIODS ENDED NOVEMBER 30, 2006 | | | |

| | | 1 YEAR | 3 YEARS | 5 YEARS | 1O YEARS | |

| | the Jensen Portfolio - Class J | 11.68% | 6.96% | 4.33% | 9.09% | |

| | S&P 500 Stock Index | 14.24% | 11.81% | 6.08% | 8.05% | |

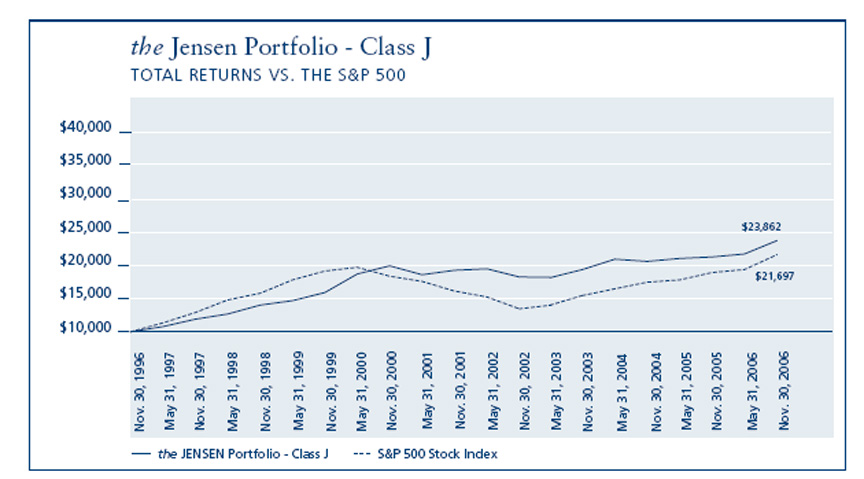

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on November 30, 1996 for Class J, the original share class of the fund. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| | | | |

| | Average Annual - FOR PERIODS ENDED NOVEMBER 30, 2006 | | |

| | | 1 YEAR | 3 YEARS | SINCE INCEPTION | |

| | | | | JULY 30,2003 | |

| | the Jensen Portfolio - Class R | 11.41% | 6.71% | 7.89% | |

| | S&P 500 Stock Index | 14.24% | 11.81% | 13.07% | |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on July 30, 2003, the inception date for Class R shares. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| | | | |

| | Average Annual - FOR PERIODS ENDED NOVEMBER 30, 2006 | | |

| | | 1 YEAR | 3 YEARS | SINCE INCEPTION | |

| | | | | JULY 30,2003 | |

| | the Jensen Portfolio - Class I | 11.89% | 7.16% | 8.34% | |

| | S&P 500 Stock Index | 14.24% | 11.81% | 13.07% | |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $1,000,000 made on July 30, 2003, the inception date for Class I shares. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

Statement of Assets & Liabilities | | | | | |

| | | | | | |

| November 30, 2006 (UNAUDITED) | | | | | |

| | | | | | |

| | | | | | |

Assets: | | | | | |

| | | | | | | | |

| Investments, at value (cost $1,710,683,547) | | | | | $ | 2,249,748,704 | |

| Income receivable | | | . | | | 3,373,288 | |

| Receivable for capital stock issued | | | | | | 5,118,100 | |

| Other assets | | | | | | 100,484 | |

| Total Assets | | | | | | 2,258,340,576 | |

| | | | | | | | |

Liabilities: | | | | | | | |

| Payable to Investment Adviser | | | | | | 919,785 | |

| Payable to Directors | | | | | | 28,006 | |

| Payable for capital stock redeemed | | | | | | 2,054,119 | |

| Other accrued expenses | | | | | | 801,463 | |

| Total Liabilities | | | | | | 3,803,373 | |

| NET ASSETS | | | | | $ | 2,254,537,203 | |

| | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | |

| Capital stock | | | | | | 1,773,637,023 | |

| Unrealized appreciation on investments | | | | | | 539,065,157 | |

| Accumulated undistributed net investment income | | | | | | 3,467,075 | |

| Accumulated undistributed net realized loss | | | | | | (61,632,052 | ) |

| Total Net Assets | | | | | $ | 2,254,537,203 | |

| | | | | | | | |

| NET ASSETS CONSIST OF: | | | | | | | |

| Class J Shares: | | | | | | | |

| Net assets | | | | | $ | 1,791,447,149 | |

| Shares outstanding | | | | | | 67,547,365 | |

| Net Asset Value Per Share | | | | | | | |

| (2,000,000,000 shares authorized, $.001 par value) | | | | | $ | 26.52 | |

| | | | | | | | |

| Class R Shares: | | | | | | | |

| Net assets | | | | | $ | 22,327,636 | |

| Shares outstanding | | | | | | 844,857 | |

| Net Asset Value Per Share | | | | | | | |

| (1,000,000,000 shares authorized, $.001 par value) | | | | | $ | 26.43 | |

| | | | | | | | |

| Class I Shares: | | | | | | | |

| Net assets | | | | | $ | 440,762,418 | |

| Shares outstanding | | | | | | 16,620,972 | |

| Net Asset Value Per Share | | | | | | | |

| (1,000,000,000 shares authorized, $.001 par value) | | | | | $ | 26.52 | |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

| Schedule of Investments | | | | | |

| November 30, 2006 (UNAUDITED) | | | | | |

| | | | | | | |

| SHARES | | | | | VALUE | |

| | Common Stock - 98.41% | | | | | |

| | Beverages - 5.60% | | | | | |

| 938,000 | The Coca-Cola Company | | | | | $ | 43,926,540 | |

| 1,330,000 | PepsiCo, Inc | | | . | | | 82,420,100 | |

| | | | | | | | 126,346,640 | |

| | Capital Markets - 4.02% | | | | | | | |

| 2,092,000 | T. Rowe Price Group Inc | | | .. | | | 90,646,360 | |

| | Chemicals - 3.17% | | | | | | | |

| 1,613,000 | Ecolab, Inc | | | . | | | 71,536,550 | |

| | Commercial Banks - 3.08% | | | | | | | |

| 1,968,000 | Wells Fargo & Company | | | | | | 69,352,320 | |

| | Commercial Services & Supplies - 3.68% | | | | | | | |

| 2,182,000 | Equifax, Inc | | | | | | 82,894,180 | |

| | Electrical Equipment - 4.88% | | | | | | | |

| 1,270,000 | Emerson Electric Co. | | | | | | 110,109,000 | |

| | Electronic Equipment & Instruments - 3.35% | | | | | | | |

| 1,071,000 | CDW Corporation | | | . | | | 75,505,500 | |

| | Food & Staples Retailing - 4.08% | | | | | | | |

| 2,563,000 | Sysco Corporation | | | . . | | | 91,883,550 | |

| | Health Care Equipment & Supplies - 9.16% | | | | | | | |

| 1,737,000 | Medtronic, Inc | | | . | | | 90,549,810 | |

| 2,234,000 | Stryker Corporation | | | | | | 115,855,240 | |

| | | | | | | | 206,405,050 | |

| | Health Care Providers & Services - 3.83% | | | | | | | |

| 2,328,000 | Patterson Companies Inc. (a) | | | | | | 86,392,080 | |

| | | | | | | | | |

| | Household Products - 10.77% | | | | | | | |

| 651,000 | | | | | | | 41,664,000 | |

| 1,403,000 | Colgate-Palmolive Company | | | | | | 91,265,150 | |

| 1,750,000 | | | | | | | | |

| | Company | | | | | | 109,882,500 | |

| | | | | | | | 242,811,650 | |

| | Industrial Conglomerates - 9.26% | | | | | | | |

| 1,261,500 | | | | | | | 102,761,790 | |

| 3,005,000 | | | | | | | 106,016,400 | |

| | | | | | | | 208,778,190 | |

| | | | | | | | | |

| SHARES | | | | | | | VALUE | |

| | IT Services - 7.05% | | | | | | | |

| 1,978,000 | Automatic Data Processing | | | | | | | |

| | Inc. | | | | | $ | 95,398,940 | |

| 1,613,000 | Paychex, Inc | | | | | | 63,568,330 | |

| | | | | | | | 158,967,270 | |

| | | | | | | | | |

| | Media - 11.04% | | | | | | | |

| 1,996,000 | | | | | | | | |

| | Companies, Inc | | | | | | 133,033,400 | |

| 1,134,500 | | | | | | | 115,900,520 | |

| | | | | | | | 248,933,920 | |

| | Pharmaceuticals - 8.78% | | | | | | | |

| 2,105,000 | | | | | | | 98,219,300 | |

| 1,513,000 | | | | | | | 99,721,830 | |

| | | | | | | | 197,941,130 | |

| | Software - 3.76% | | | | | | | |

| 2,888,000 | | | | | | | 84,705,040 | |

| | Specialty Retail - 2.90% | | | | | | | |

| 1,688,000 | Bed Bath & Beyond, Inc. (a ) | | | | | | 65,410,000 | |

| | Total Common Stock | | | | | | | |

| | (Cost $1,679,553,273) | | | | | | 2,218,618,430 | |

| | | | | | | | | |

| PRINCIPAL AMOUNT | | | | | | | |

| | Short Term Investments - 1.38% | | | | | | | |

| | Commerical Paper - 1.35% | | | | | | | |

| | | | | | | | | |

| $30,495,000 | Prudential Funding, 5.26%, | | | | | | | |

| | 12/1/2006 | | | | | | 30,495,000 | |

| | | | | | | | | |

| | Variable Rate Demand Notes (b) - 0.03% | | | | | | | |

| 635,274 | Wisconsin Corporate Central | | | | | | | |

| | Credit Union, 4.99% | | | | | | 635,274 | |

| | | | | | | | | |

| | Total Short Term Investments | | | | | | | |

| | | | | | | | | |

| | (Cost $31,130,274). | | | | | | 31,130,274 | |

| | Total Investments - 99.79% | | | | | | | |

| | (Cost $1,710,683,547) | | | | | | 2,249,748,704 | |

| | Other Assets in Excess of | | | | | | | |

| | Liabilities - 0.21% | | | | | | 4,788,499 | |

| | NET ASSETS - 100.00% | | | | | $ | 2,254,537,203 | |

| | | | | | | | | |

(a) Non-Income Producing |

(b) Variable rate demand notes are considered short-term |

obligations and are payable on demand. Interest rates |

change periodically on specified dates. The rates shown |

are as of November 30, 2006. |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

Statement of Operations | | | |

| | | | |

| Six Months Ended November 30, 2006 (UNAUDITED) | |

| | | | | | |

Investment Income: | | | | | |

| | | | | | |

| Dividend income | | | | | $ | 17,097,633 | |

| Interest income | | | | | | 716,993 | |

| | | | | | | 17,814,626 | |

Expenses: | | | | | | | |

| | | | | | | | |

| Investment advisory fees | | | | | | 5,232,239 | |

| 12b-1 fees - Class J | | | | | | 2,148,683 | |

| Administration fees | | | | | | 403,163 | |

| Transfer agent fees and expenses | | | | | | 213,840 | |

| Shareholder servicing fees - Class I | | | | | | 118,836 | |

| Custody fees | | | | | | 104,876 | |

| Reports to shareholders | | | | | | 98,123 | |

| Directors’ fees and expenses | | | | | | 72,519 | |

| Fund accounting fees | | | | | | 70,674 | |

| Professional fees | | | | | | 62,854 | |

| Federal and state registration fees | | | | | | 58,694 | |

| 12b-1 fees - Class R | | | | | | 53,853 | |

| Other | | | | | | 29,270 | |

| Total expenses | | | | | | 8,667,624 | |

| | | | | | | | |

| NET INVESTMENT INCOME | | | | | | 9,147,002 | |

| | | | | | | | |

| REALIZED AND UNREALIZED GAIN | | | | | | | |

| (LOSS) ON INVESTMENTS: | | | | | | | |

| Net realized loss on investment | | | | | | | |

| transactions | | | | | | (497,896 | ) |

| Change in unrealized appreciation on | | | | | | | |

| investments | | | | | | 177,059,341 | |

| Net gain on investments | | | | | | 176,561,445 | |

| | | | | | | | |

| NET INCREASE IN NET ASSETS RESULTING | | | | | | | |

| FROM OPERATIONS | | | | | $ | 185,708,447 | |

Statements of Changes in | | | |

Net Assets | | | | | |

| | | SIX MONTHSENDED NOV. 30, ‘06(UNAUDITED) | | | |

| | | | | | |

Operations: | | | | | |

| Net investment income | | $ | 9,147,002 | | $ | 22,734,285 | |

| Net realized gain (loss) on | | | | | | | |

| investment transactions | | | (497,896 | ) | | 5,903,020 | |

| Change in unrealized | | | | | | | |

| appreciation on | | | | | | | |

| investments | | | 177,059,341 | | | 52,872,656 | |

| Net increase in net assets | | | | | | | |

| resulting from operations | | | 185,708,447 | | | 81,509,961 | |

Capital Share Transactions: | | | | | | | |

| Shares sold - Class J | | | 169,185,427 | | | 455,075,202 | |

| Shares sold - Class R | | | 4,408,134 | | | 9,197,191 | |

| Shares sold - Class I | | | 118,887,610 | | | 106,445,423 | |

| Shares issued to holders in | | | | | | | |

| reinvestment of | | | | | | | |

| dividends - Class J | | | 6,491,549 | | | 17,159,885 | |

| Shares issued to holders in | | | | | | | |

| reinvestment of | | | | | | | |

| dividends - Class R | | | 59,193 | | | 141,934 | |

| Shares issued to holders in | | | | | | | |

| reinvestment of | | | | | | | |

| dividends - Class I | | | 1,462,202 | | | 2,546,748 | |

| Shares redeemed - Class J | | | (291,960,598 | ) | | (1,439,196,668 | ) |

| Shares redeemed - Class R | | | (5,078,302 | ) | | (12,687,317 | ) |

| Shares redeemed - Class I | | | (20,877,960 | ) | | (94,872,855 | ) |

| Net decrease | | | (17,422,745 | ) | | (956,190,457 | ) |

| DIVIDENDS AND DISTRIBUTIONS | | | |

| TO SHAREHOLDERS: | | | | | | | �� |

| Net investment | | | | | | | |

| income - Class J. | | | (6,919,637 | ) | | (19,575,552 | ) |

| Net investment | | | | | | | |

| income - Class R | | | (59,194 | ) | | (141,934 | ) |

| Net investment | | | | | | | |

| income - Class I | | | (1,668,162 | ) | | (3,184,405 | ) |

| Total dividends and | | | | | | | |

| distributions | | | (8,646,993 | ) | | (22,901,891 | ) |

| INCREASE (DECREASE) IN | | | | | | | |

| NET ASSETS | | | 159,638,709 | | | (897,582,387 | ) |

| | | | | | | | |

| NET ASSETS: | | | | | | | |

| Beginning of period | | | 2,094,898,494 | | | 2,992,480,881 | |

| End of period (including | | | | | | | |

| undistributed net | | | | | | | |

| investment income of | | | | | | | |

| $3,467,075 and $2,967,066, | | | | | | | |

| respectively) | | $ | 2,254,537,203 | | $ | 2,094,898,494 | |

| | | | |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

Financial Highlights | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Class J | | | | | | | | | | | | | | | | | | |

| | | SIX MONTHS | | | | | | | | | | | | | | | | |

| | ENDED | | | | | | | | | | | | | | | | |

| | NOV. 30, ’06 | | | YEAR ENDED | | | YEAR ENDED | | | YEAR ENDED | | | YEAR ENDED | | | YEAR ENDED | |

| | | (UNAUDITED) | | | MAY 31, ’06 | | | MAY 31, ’05 | | | MAY 31, ’04 | | | MAY 31, ’03 | | | MAY 31, ’02 | |

| | | | | | | | | | | | | | | | | | | |

Per Share Data: | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning | | | | | | | | | | | | | | | | | | |

| of period | $ | 24.37 | $ | | 23.79 | $ | | 23.82 | $ | | 20.80 | | $ | 22.51 | | $ | 21.53 | |

| | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | |

| Net investment income | | 0.11 | | | 0.22 | | | 0.18 | | | 0.16 | | | 0.11 | | | 0.05 | |

| Net realized and unrealized gains | | | | | | | | | | | | | | | | | | |

| (losses) on investments | | 2.14 | | | 0.56 | | | (0.03)(1) | | | 3.01 | | | (1.73) | | | 1.00 | |

| Total from investment | | | | | | | | | | | | | | | | | | |

| operations | | 2.25 | | | 0.78 | | | 0.15 | | | 3.17 | | | (1.62) | | | 1.05 | |

| | | | | | | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | | | | | | |

| Dividends from net investment | | | | | | | | | | | | | | | | | | |

| income | | (0.10) | | | (0.20) | | | (0.18) | | | (0.15) | | | (0.09) | | | (0.07) | |

| Total distributions. | | (0.10) | | | (0.20) | | | (0.18) | | | (0.15) | | | (0.09) | | | (0.07) | |

| Net asset value, end of period | $ | 26.52 | $ | | 24.37 | $ | | 23.79 | $ | | 23.82 | | $ | 20.80 | | $ | 22.51 | |

Total return(2) | | 9.27% | | | 3.30% | | | 0.61% | | | 15.28% | | | -7.17% | | | 4.88% | |

| | | | | | | | | | | | | | | | | | | |

Supplemental data and ratios: | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | $ | 1,791,447 | $ | | 1,764,212 | $ | | 2,680,169 | $ | | 2,046,288 | | $ | 1,453,069 | | $ | 473,414 | |

| | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average | | | | | | | | | | | | | | | | | | |

net assets(3) | | 0.86% | | | 0.85% | | | 0.85% | | | 0.88% | | | 0.90% | | | 1.00% | |

| | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to | | | | | | | | | | | | | | | | | | |

average net assets(3) | | 0.85% | | | 0.85% | | | 0.77% | | | 0.71% | | | 0.62% | | | 0.23% | |

| | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate(2) | | 8.54% | | | 10.20% | | | 8.81% | | | 5.32% | | | 7.22% | | | 0.78% | |

| | | | | | | | | | | | | | | | | | | |

(1) The amount shown may not correlate with the aggregate gains (losses) of portfolio securities due to timing of subscriptions and redemption of fund shares. | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

(2) Not annualized for periods less than one year. | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| (3) Annualized for periods less than one year. | | | | | | | |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

Financial Highlights | | | | | | | | | |

| | | | | | | | | | |

Class R | | | | | | | | | |

| | | SIX MONTHS | | | | | | | |

| | | ENDED | | | | | | PERIOD FROM | |

| | | NOV. 30, ’06 | | YEAR ENDED | | YEAR E NDED | | JUL. 30, ‘03(1) | |

| | | (UNAUDITED) | | MAY 31, ’06 | | MAY 31, ’05 | | TO MAY 31, ‘04 | |

Per Share Data: | | | | | | | | | |

| | | $ | 24.29 | | $ | 23.71 | | $ | 23.76 | | $ | 20.93 | |

Income from investment operations: | | | | | | | | | | | | | |

| Net investment income | | | 0.07 | | | 0.14 | | | 0.14 | | | 0.13 | |

| Net realized and unrealized gains (losses) | | | | | | | | | | | | | |

| on investments | | | 2.13 | | | 0.59 | | | (0.05(2 | ) | | 2.83 | |

| Total from investment operations | | | 2.20 | | | 0.73 | | | 0.09 | | | 2.96 | |

Less distributions: | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.06 | ) | | (0.15 | ) | | (0.14 | ) | | (0.13 | ) |

| Total distributions | | | (0.06 | ) | | (0.15 | ) | | (0.14 | ) | | (0.13 | ) |

| | | $ | 26.43 | | $ | 24.29 | | $ | 23.71 | | $ | 23.76 | |

| | | | 9.12 | % | | 3.07 | % | | 0.40 | % | | 14.13 | % |

Supplemental data and ratios: | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 22,328 | | $ | 21,100 | | $ | 23,884 | | $ | 799 | |

| | | | | | | | | | | | | | |

Ratio of expenses to average net assets(4) | | | 1.11 | % | | 1.10 | % | | 1.10 | % | | 1.12 | % |

| | | | | | | | | | | | | | |

| Ratio of net investment income to | | | | | | | | | | | | | |

average net assets(4) | | | 0.59 | % | | 0.60 | % | | 0.54 | % | | 0.45 | % |

| | | | | | | | | | | | | | |

Portfolio turnover rate(3) | | | 8.54 | % | | 10.20 | % | | 8.81 | % | | 5.32 | % |

| | | | | | | | | | | | | | |

| (1) | Commencement of operations. |

| (2) | The amount shown may not correlate with the aggregate gains (losses) of portfolio securities due to timing of subscriptions and redemption of fund shares. |

| (3) | Not annualized for periods less than one year. |

| (4) | Annualized for periods less than one year. |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

Financial Highlights | | | | | | | | | |

| | | | | | | | | | |

Class I | | | | | | | | | |

| | | SIX MONTHS | | | | | | | |

| | | ENDED | | | | | | PERIOD FROM | |

| | | NOV. 30, ’06 | | YEAR ENDED | | YEAR ENDED | | JUL. 30, ‘03(1) | |

| | | (UNAUDITED) | | MAY 31, ’06 | | MAY 31, ’05 | | TO MAY 31, ‘04 | |

| | | | | | | | | | |

Per Share Data: | | | | | | | | | |

| Net asset value, beginning of period | | $ | 24.38 | | $ | 23.80 | | $ | 23.82 | | $ | 20.93 | |

| | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | |

| Net investment income | | | 0.13 | | | 0.24 | | | 0.23 | | | 0.12 | |

| Net realized and unrealized gains (losses) | | | | | | | | | | | | | |

| on investments | | | 2.13 | | | 0.59 | | | (0.04(2 | )) | | 2.92 | |

| Total from investment operations | | | 2.26 | | | 0.83 | | | 0.19 | | | 3.04 | |

| | | | | | | | | | | | | | |

Less distributions: | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.12 | ) | | (0.25 | ) | | (0.21 | ) | | (0.15 | ) |

| Total distributions | | | (0.12 | ) | | (0.25 | ) | | (0.21 | ) | | (0.15 | ) |

| Net asset value, end of period | | $ | 26.52 | | $ | 24.38 | | $ | 23.80 | | $ | 23.82 | |

Total return(3) | | | 9.33 | % | | 3.56 | % | | 0.77 | % | | 14.54 | % |

| | | | | | | | | | | | | | |

Supplemental data and ratios: | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 440,762 | | $ | 309,587 | | $ | 288,428 | | $ | 227,561 | |

| | | | | | | | | | | | | | |

Ratio of expenses to average net assets(4) | | | 0.67 | % | | 0.67 | % | | 0.67 | % | | 0.70 | % |

| | | | | | | | | | | | | | |

| Ratio of net investment income to | | | | | | | | | | | | | |

average net assets(4) | | | 1.03 | % | | 1.03 | % | | 0.95 | % | | 0.87 | % |

| | | | | | | | | | | | | | |

Portfolio turnover rate(3) | | | 8.54 | % | | 10.20 | % | | 8.81 | % | | 5.32 | % |

| | | | | | | | | | | | | | |

| (1) | Commencement of operations. |

| (2) | The amount shown may not correlate with the aggregate gains (losses) of portfolio securities due to timing ofsubscriptions and redemption of fund shares. |

| (3) | Not annualized for periods less than one year. |

| (4) | Annualized for periods less than one year. |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

Notes to the Financial Statements

November 30, 2006 (UNAUDITED)

1. Organization and Significant Accounting Policies

The Jensen Portfolio, Inc. (the “Fund”) was organized as an Oregon Corporation on April 17, 1992, and is registered as an open-end, nondiversified management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Fund commenced operations on August 3, 1992. Effective July 30, 2003, the Fund issued two new classes of shares, Class R and Class I and renamed the existing class as Class J. Class J shares are subject to a 0.25% 12b-1 fee; Class R shares are subject to a 0.50% 12b-1 fee and Class I shares are subject to a 0.10% shareholder servicing fee, as described in each Class’ prospectus. Each class of shares has identical rights and privileges except with respect to the 12b-1 fees and shareholder servicing fee, and voting rights on matters affecting a single class of shares. The principal investment objective of the Fund is long-term capital appreciation.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America.

a) Investment Valuation - Securities that are listed on United States stock exchanges or the Nasdaq Stock Market are valued at the last sale price on the day the securities are valued or, if there has been no sale on that day, at their current bid price. Quotations are taken from the market in which the security is primarily traded. Over-the-counter securities are valued at current bid price. Securities for which market quotations are not readily available are valued at fair value as determined by the Investment Adviser at or under the direction of the Fund’s Board of Directors. There were no securities valued by the Board of Directors as of November 30, 2006. Variable rate demand notes are valued at cost which approximates fair value. Notwithstanding the above, fixed-income securities may be valued on the basis of prices provided by an established pricing service when the Board believes that such prices better reflect market values.

b) Federal Income Taxes - No provision for federal income taxes has been made since the Fund has complied to date with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and intends to continue to so comply in the future and to distribute substantially all of its net investment income and realized capital gains in order to relieve the Fund from all federal income taxes.

On July 13, 2006, the Financial Accounting Standards Board (“FASB”) released FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (“FIN 48”). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Adoption of FIN 48 is required as of the date of the last Net Asset Value (“NAV”) calculation in the first required financial statement reporting period for fiscal years beginning after December 15, 2006 and is to be applied to all open tax years as of the effective date. At this time, management is evaluating the implications of FIN 48 and its impact in the financial statements has not yet been determined.

In September, 2006, FASB issued FASB Statement No. 157, “Fair Value Measurement” (“SFAS 157”), which defines fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements. SFAS 157 is effective for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. The Fund believes the adoption of SFAS 157 will have no material impact on its financial statements.

c) Distributions to Shareholders - Dividends to shareholders are recorded on ex-dividend date. Dividends from net investment income are declared and paid quarterly by the Fund. Distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. Permanent differences between financial reporting and tax are reclassified to capital stock.

d) Use of Estimates - The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

e) Guarantees and Indemnifications - In the normal course of business the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

f) Other - Investment and shareholder transactions are recorded on trade date. Gains or losses from the investment transactions are determined on the basis of identified carrying value. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. The Fund has investments in short-term variable rate demand notes, which are unsecured instruments. These notes may present credit risk to the extent the issuer defaults on its payment obligation. The credit-worthiness of the issuer is monitored, and these notes are considered to present minimal credit risk in the opinion of the Investment Adviser. Income, expenses (other than those deemed attributable to a specific share class), and gains and losses of the Fund are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a specific class of shares are charged against the operations of such class.

2. Capital Share Transactions

Transactions in shares of the Fund were as follows:

| | | SIX MONTHS | | | |

| | | ENDED | | YEAR E NDED | |

| | | NOV. 30, ’06 | | MAY 31, ’06 | |

Class J | | | | | |

| Shares sold. | | | 6,713,338 | | | 19,041,206 | |

| Shares issued to holders in | | | | | | | |

| reinvestment of dividends | | | 266,084 | | | 717,440 | |

| Shares redeemed | | | ( 11 ,811,866 | ) | | (60,051,647 | ) |

| Net Decrease | | | (4,832,444 | ) | | (40,293,001 | ) |

| Shares outstanding: | | | | | | | |

| Beginning of period | | | 72,379,809 | | | 112,672,810 | |

| End of period | | | 67,547,365 | | | 72,379,809 | |

Class R | | | | | | | |

| Shares sold | | | 176,234 | | | 386,312 | |

| Shares issued to holders in | | | | | | | |

| reinvestment of dividends | | | 2,436 | | | 5,928 | |

| Shares redeemed | | | (202,544 | ) | | (530,971 | ) |

| Net Decrease | | | (23,874 | ) | | (138,731 | ) |

| Shares outstanding: | | | | | | | |

| Beginning of period | | | 868,731 | | | 1,007,462 | |

| End of period | | | 844,857 | | | 868,731 | |

Class I | | | | | | | |

| Shares sold | | | 4,705,530 | | | 4,420,414 | |

| Shares issued to holders in | | | | | | | |

| reinvestment of dividends | | | 59,686 | | | 106,100 | |

| Shares redeemed | | | (845,211 | ) | | (3,946,669 | ) |

| Net Increase | | | 3,920,005 | | | 579,845 | |

| Shares outstanding: | | | | | | | |

| Beginning of period | | | 12,700,967 | | | 12,121,122 | |

| End of period | | | 16,620,972 | | | 12,700,967 | |

3. Investment Transactions

The aggregate purchases and aggregate sales of securities, excluding short-term investments, by the Fund for the period ended November 30, 2006, were $176,809,789 and $195,339,950; respectively.

4. Income Taxes

At May 31, 2006, the Fund had accumulated net realized capital loss carryovers of $767,052, $14,029,552, $24,932,611, and $21,396,126 which will expire on May 31, 2010, May 31, 2012, May 31, 2013, and May 31, 2014, respectively. To the extent the Fund realizes future net capital gains, taxable distributions to its shareholders will be offset by any unused capital loss carryover.

The cost of investments differ for financial statement and tax purposes primarily due to differing treatments of wash sales. The distributions of $20,019,581 and $22,901,891 paid during the years ended May 31, 2005 and May 31, 2006, respectively, were classified as ordinary for income tax purposes.

At May 31, 2006, the cost of investments, net unrealized appreciation (depreciation) and undistributed ordinary income and undistributed long term capital gains for income tax purposes were as follows:

| Cost of investments | | $ | 1,733,214,876 | |

| Gross unrealized appreciation | | | 391,640,829 | |

| Gross unrealized depreciation | | | (29,643,828 | ) |

| Net unrealized appreciation | | $ | 361,997,001 | |

| Undistributed ordinary income | | $ | 2,967,066 | |

| Undistributed long-term capital gain | | | - | |

| Total distributable earnings . | | $ | 2,967,066 | |

| Other accumulated losses | | $ | (61,125,341 | ) |

| Total accumulated earnings | | $ | 303,838,726 | |

5. Line of Credit

The Fund has a $250 million revolving credit facility for temporary emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The interest rate on the outstanding principal amount is equal to the prime rate less 1/2%. The Fund did not borrow on the line of credit during the six month period ended November 30, 2006.

6. Investment Advisory Agreement

The Fund has entered into an Investment Advisory and Service Contract with Jensen Investment Management, Inc. Pursuant to its advisory agreement with the Fund, the Investment Adviser is entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 0.50% as applied to the Fund’s daily net assets.

Certain officers and directors of the Fund are also officers and directors of the Investment Adviser.

7. Distribution and Shareholder Servicing

The Fund has adopted a distribution and shareholder servicing plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), which provides that the Fund may reimburse the Fund’s distributor or others at an annual rate of up to 0.25% of the average daily net assets attributable to Class J shares and up to 0.50% of the average daily net assets attributable to Class R shares. Payments under the 12b-1 Plan shall be used to compensate or reimburse the Fund’s distributor or others for services provided and expenses incurred in connection with the sale of shares.

In addition, the Fund has adopted a Shareholder Servicing Plan (the “Servicing Plan”) under which the Fund can pay for shareholder support services from the Fund’s assets pursuant to a Shareholder Servicing Agreement in an amount not to exceed 0.10% of the Fund’s average daily net assets attributable to Class I shares.

Expense Example - November 30, 2006 (Unaudited)

As a shareholder of The Jensen Portfolio (the “Fund”), you incur ongoing costs, including investment advisory fees, distribution and/or shareholder servicing fees, and other Fund expenses, which are indirectly paid by shareholders. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six month period (June 1, 2006 - November 30, 2006).

Actual Expenses

The first line of the table below for each share class of the Fund provides information about actual account values and actual expenses. However, the table does not include shareholder specific fees, such as the $15.00 fee charged to IRA accounts, or the $12.00 fee charged for wire redemptions. The table also does not include portfolio trading commissions and related trading costs. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the actual expense ratios for each share class of the Fund and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees which, although not charged by the Fund, may be charged by other funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Expense Example Tables | | | | | | | |

| | | | | | | | |

The Jensen Portfolio-Class J | | | | | | | |

| | | BEGINNING | | ENDING | | EXPENSES PAID | |

| | | ACCOUNT VALUE | | ACCOUNT VALUE | | DURING PERIOD* | |

| | | JUNE 1, 2006 | | NOVEMBER 30, 2006 | | JUNE 1, 2006 - NOVEMBER 30, 2006 | |

| Actual. | | $ | 1,000.00 | | $ | 1,092.70 | | $ | 4.51 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,020.76 | | | 4.36 | |

| | | | | | | | | | | |

*Expenses are equal to the Fund’s annualized expense ratio of 0.86%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period. | | | . | | | | | | | |

| | | | | | | | | | | |

The Jensen Portfolio-Class R | | | | | | | | | | |

| | | | BEGINNING | | | ENDING | | | EXPENSES PAID | |

| | | | | | | ACCOUNT VALUE | | | DURING PERIOD* | |

| | | | JUNE 1, 2006 | | | | | | JUNE 1, 2006 - NOVEMBER 30, 2006 | |

| Actual. | | $ | 1,000.00 | | $ | 1,091.20 | | $ | 5.82 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,019.50 | | | 5.62 | |

| | | | | | | | | | | |

| *Expenses are equal to the Fund’s annualized expense ratio of 1.11%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period | | | . | | | | | | | |

| | | | | | | | | | | |

The Jensen Portfolio-Class I | | | | | | | | | | |

| | | | BEGINNING | | | ENDING | | | EXPENSES PAID | |

| | | | | | | ACCOUNT VALUE | | | DURING PERIOD* | |

| | | JUNE 1, 2006 | | | NOVEMBER 30, 2006 | | | JUNE 1, 2006 - NOVEMBER 30, 2006 | |

| Actual. | | $ | 1,000.00 | | $ | 1,093.30 | | $ | 3.52 | |

| Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,021.71 | | | 3.40 | |

| | | | | | | | | | | |

| *Expenses are equal to the Fund’s annualized expense ratio of 0.67%, multiplied by the average account value over the period, multiplied by 183/365 to reflect the one-half year period | | | . | | | | | | | |

Additional Information (Unaudited)

1. INVESTMENT ADVISORY AGREEMENT DISCLOSURE

Section 15(c) of the Investment Company Act of 1940 (the “1940 Act”) requires that a fund’s board of directors, including a majority of independent directors voting separately, approve any new investment advisory contract for the fund and thereafter to review and approve the terms of the fund’s investment advisory agreement on an annual basis. In addition, Section 15(a) of the 1940 Act requires that any new investment advisory agreement be approved by the fund’s shareholders.

In their most recent deliberations concerning whether to renew The Jensen Portfolio’s (the “Fund”) existing Investment Advisory Agreement (“Existing Agreement”) and whether to approve a proposed new Investment Advisory Agreement (“New Agreement”), the Fund’s Board of Directors, including the independent directors (the “Board”), conducted the review and made the determinations that are described below. During its deliberations, the Board requested from Jensen Investment Management, Inc., the Fund’s investment adviser (the “Adviser”), and the Adviser furnished, all information reasonably necessary for it to evaluate both the renewal of the Existing Agreement and the approval of the New Agreement.

The entire Board first met on October 12, 2005 and January 11, 2006 to consider the planned retirement of Gary Hibler and the effects his retirement and the resulting change of control of the Adviser might have on the Fund’s and the Adviser’s operations. The entire Board met again on April 12, 2006 to consider the information provided by the Adviser in connection with the annual renewal of the Existing Agreement and the approval of the New Agreement. At the April 12 meeting, the independent directors (“Independent Directors”) met separately with their legal counsel to consider the information provided by the Adviser and identify additional information they needed to evaluate the Existing Agreement and the New Agreement. The entire Board then met again on July 19, 2006 to consider the annual continuation of the Existing Agreement and the approval of the New Agreement. At the July 19 meeting, the Independent Directors reconvened in a separate meeting with their legal counsel to consider the additional information provided by the Adviser and to consider the annual continuation of the Existing Agreement and the approval of the New Agreement. During those meetings, the Board considered the factors and reached the conclusions described below, among others. The Board did not identify any single factor as controlling. Moreover, not every factor was given the same weight by each Director.

Nature, Extent and Quality of Services

The Board of Directors, including the Independent Directors, considered the nature, extent and quality of services provided to the Fund by the Adviser under the Existing Agreement and the services proposed to be provided under the New Agreement. The Board reviewed the terms of the Existing Agreement and the New Agreement, as well as the history of the Adviser and its investment discipline, its investment performance, and its day to day management of the Fund. The Board noted the Adviser’s focus on the business of the Fund, the additions to the Adviser’s staff to support research activities, compliance and other servicing aspects of the Fund, and the Adviser’s oversight of the Fund’s service providers. In particular, the Board noted the Adviser’s recent addition of two research analysts and new investment research tools and analysis services to enhance the Adviser’s research capabilities.

The Board considered the proposed changes in the Adviser’s ownership and management and the potential impact on the Fund and the Adviser. The Board studied the Adviser’s succession plans, its organizational and ownership structure, and the composition of its five-person investment committee, which makes all investment decisions for the Fund. Based on these and other factors, including those referenced below, the Board concluded that the services provided to the Fund continued to be satisfactory and were not likely to change materially under the New Agreement.

Investment Performance

The Board examined the investment performance of the Fund compared to appropriate securities indices, to appropriate Lipper and Morningstar categories, and to other mutual funds of similar asset size and with similar investment objectives and strategies. Performance over one-, three-, five- and ten-year periods for the Fund was analyzed. The Board noted that the Fund outperformed its benchmark index and comparable funds for the five- and ten-year periods, but underperformed its benchmark index and comparable funds for the one- and three-year periods. Moreover, the Board found that redemptions of Fund shares during the last 12 months significantly exceeded sales of new Fund shares, resulting in lower overall assets in the Fund from the prior year. The Board understood, based on the data presented, that approximately 20% of the Fund’s underperformance compared to its benchmark index for the three-year period was due to the Fund’s lack of exposure to the energy and utility sectors, which contained no companies that qualified under the Fund’s investment criteria.

The Board observed that the Adviser appeared to have adhered to its strict investment discipline. The Board also considered the Fund’s long-term investment strategy and the Adviser’s belief that over time the favorable business performance of the Fund’s portfolio companies would be reflected in similar market returns. As a result of these and other factors, although the Board encouraged the Adviser to take steps to ensure that the Fund’s short-term results were consistent with the Fund’s long-term investment objective and to address the net redemption of Fund shares, the Board concluded that the long term investment performance of the Fund continued to be satisfactory.

Advisory Fee and Expense Ratio

The Board compared the Fund’s advisory fee with those of other comparable mutual funds in the Fund’s Lipper category. The Board noted that the Fund’s advisory fee of 0.50% continued to be below the average and the median for the category. The Board also noted that the Fund is a single fund (as opposed to a larger complex of funds) and that, while the Adviser employs a relatively straightforward investment discipline, the Fund appeared to be an efficiently run operation with a high service component for shareholders.

The Board compared the fees charged to the Fund with the advisory fees charged to the non-Fund advisory clients of the Adviser. The Board observed that, with the exception of a few existing clients, the Adviser charges its separate accounts a minimum of 0.50%.

The Board considered the Fund’s expense ratio and the expense ratios of funds in the Fund’s Lipper category. The Board noted that the Fund’s expense ratio continued to be below the average and the median for the category and that the Fund had a low portfolio turnover rate.

The Board also noted that the advisory fee rate and the expenses for which the Fund would be responsible under the New Agreement would be unchanged from those under the Existing Agreement.

Based on these considerations and other factors, the Board concluded that the Fund’s advisory fee and expense ratio were reasonable relative to the Fund’s peer group.

Profitability of the Adviser

The Board considered the profitability of the Existing Agreement to the Adviser, including the methodology used to calculate the Adviser’s profitability, and compared the Adviser’s profitability with that of selected publicly traded mutual fund advisers. When adjusted for certain marketing revenues and expenses, it appeared that the Adviser’s pre-tax profit was not significantly higher than the average pre-tax profit margin of the group of publicly traded investment advisory firms. It was noted that the Adviser’s profitability may have been overstated due to the relatively low salaries and bonuses paid to its investment professionals, who may receive distributions of profits through their equity ownership in the firm. The Board also considered the facts that the Adviser pays certain administrative expenses of the Fund, including certain sub-transfer agency costs and the cost of the Fund’s Chief Compliance Officer, that the Fund had been subsidized by the Adviser during the early years of the Fund’s existence, and that only in the most recent four to five years, as the Fund’s assets under management have grown, has the Fund contributed significantly to the Adviser’s profits.

The Board also examined the Adviser’s profitability from the Fund on a stand-alone basis against the Adviser’s profitability from its separate account advisory business and found that the Fund provided a higher profit margin to the Adviser. The Board understood that economies of scale are realized from managing one fund compared to managing over 100 separate accounts and that the Adviser had been conservative in its method of allocating expenses to its Fund business relative to other acceptable allocation methodologies. The Board noted that the Adviser’s profitability from the Fund for 2006 was projected to be lower as a result of the declining asset levels of the Fund. The Board acknowledged the inherent limitations of profitability analyses, including the use of comparative data that is incomplete or dissimilar, such as financial information of publicly traded mutual fund advisers which have more diversified business lines and different cost structures than those of the Adviser, and the uncertainty of the various allocations and other assumptions used. Based on this and other information, the Board concluded that profits earned by the Adviser were not excessive.

Economies of Scale

The Board considered whether there have been economies of scale with respect to the management of the Fund, whether the Fund has benefited from any such economies, and whether the implementation of breakpoints in the Fund’s advisory fee was appropriate. The Board observed that, during a period of rapid Fund growth, the Fund’s expense ratio (for the Class J shares) had fallen from about 1% for the fiscal year ended May 31, 2002 to 0.85% for the nine months ended February 28, 2006.

Regarding the issue of breakpoints, the Board observed from the data presented that most funds with breakpoints below the Fund’s 0.50% advisory fee had higher overall advisory fees at the same asset levels. The Board acknowledged the significant decline in Fund assets in the past year, making economies of scale less likely since the last time the Board considered a breakpoint in the Fund’s advisory fee. Based on the data presented, the Board concluded that a breakpoint in the Fund’s advisory fee was not warranted at this time.

Other Benefits

The Board considered the potential fall-out benefits realized by the Adviser from services as investment manager of the Fund. The Board noted that the Adviser has no affiliated entities that provide services to the Fund and that the Adviser prohibits the receipt of third-party “soft dollars.” The Board understood that the Adviser’s non-Fund business was approximately 20% of the Adviser’s total business. The Board concluded that, while the Adviser’s non-Fund business might benefit from the Adviser’s association with the Fund, any such benefit was difficult to quantify and likely not significant.

Other Factors and Considerations

The Board periodically reviews and considers other material information throughout the year relating to the quality of services provided to the Fund, such as the allocation of Fund brokerage, the marketing, administration and compliance program of the Fund, the Adviser’s management of its relationship with the Fund’s administrator, custodian, transfer agent and other service providers, and the expenses paid to those service providers. At its regular meetings, the Board also reviews detailed information relating to the Fund’s portfolio and performance, and interviews the Fund’s portfolio managers.

Based on its evaluation of all material factors and the information provided to it, the Board of Directors, including all of the Independent Directors, voted unanimously on July 19, 2006 (i) to renew the Existing Agreement for a one-year period until July 31, 2007 and (ii) to approve the New Agreement and recommend that shareholders approve the New Agreement.

2. SHAREHOLDER NOTIFICATION OF FEDERAL TAX STATUS

The Fund designates 100% of dividends declared during the fiscal year ended May 31, 2006 as dividends qualifying for the dividends received deduction available to corporate shareholders.

The Fund designates 100% of dividends declared from net investment income during the fiscal year ended May 31, 2006 as qualified dividend income under the Jobs and Growth Tax Relief Reconciliation Act of 2003.

Additional Information Applicable to Foreign Shareholders Only:

The Fund designates 1.91% of ordinary income distributions as interest-related dividends under Internal Revenue Code Section 871(k)(1)(c).

3. AVAILABILITY OF PROXY VOTING INFORMATION

Information regarding how the Fund votes proxies relating to portfolio securities is available without charge, upon request by calling toll-free, 1-800-221-4384, or by accessing the SEC’s website at www.sec.gov.

4. PORTFOLIO HOLDINGS

The Jensen Portfolio will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q will be available on the EDGAR database on the SEC’s website at www.sec.gov. These Forms may also be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information about the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

5. ADDITIONAL DISCLOSURE REGARDING FUND DIRECTORS AND OFFICERS

| Independent Directors | | | | | | | | |

| | | | | | | | | # OF | | |

| | | | | | | | | PORTFOLIOS | | |

| | | | | TERM OF | | PRINCIPAL | | IN FUND | | OTHER |

| | | POSITION(S) | | OFFICE AND | | OCCUPATION | | CO MPLEX | | DIRECTORSHIPS |

| | | HELD WITH | | LENGTH O F | | DURING PAST | | OVERSEEN | | HELD BY |

| NAME, AGE AND ADDRESS | | THE COMPANY | | TIME SERVED** | | FIVE YEARS | | BY DIRECTOR | | DIRECTOR |

| | | | | | | | | | | |

| Norman W. Achen J.D., 85 | | Independent | | Indefinite Term; | | President of N.W. | | 1 | | None |

| The Jensen Portfolio, Inc. | | Director | | Served since | | Achen Professional | | | | |

| 2130 Pacwest Center | | | | inception. | | Corporation | | | | |

| 1211 SW Fifth Avenue | | | | | | (1980 - present). | | | | |

| Portland, OR 97204 | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Roger A. Cooke J.D., 58 | | Independent | | Indefinite Term; | | Vice President - Regulatory | | 1 | | None |

| The Jensen Portfolio, Inc. | | Director | | since June 1999. | | and Legal Affairs of | | | | |

| 2130 Pacwest Center | | | | | | Precision Castparts Corp., | | | | |

| 1211 SW Fifth Avenue | | | | | | an investment casting and | | | | |

| Portland, OR 97204 | | | | | | forging company, | | | | |

| | | | | | | (2000 - present); | | | | |

| | | | | | | Executive Vice President - | | | | |

| | | | | | | Regulatory and Legal | | | | |

| | | | | | | Affairs of Fred Meyer, Inc., | | | | |

| | | | | | | a grocery and general | | | | |

| | | | | | | merchandise company, | | | | |

| | | | | | | (1992 - 2000). | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Robert E. Harold | | Independent | | Indefinite Term; | | Senior Director of | | 1 | | Director of |

| C.P.A. (Retired), 59 | | Director | | since | | Financial Planning | | | | StoriedLearning, |

| The Jensen Portfolio, Inc. | | | | September | | of Nike, Inc., a footwear | | | | Inc. (2000 - 2003); |

| 2130 Pacwest Center | | | | 2000. | | and apparel company | | | | Director of St. Mary’s |

| 1211 SW Fifth Avenue | | | | | | (2001 - 2002); Global | | | | Academy, a non- |

| Portland, OR 97204 | | | | | | Brand Controller for Nike, | | | | profit high school |

| | | | | | | Inc. (1996, 1997, 2000 - | | | | (2000 - present); |

| | | | | | | 2001); Interim Chief | | | | Director of Laika, Inc. |

| | | | | | | Financial Officer for Nike, | | | | (formerly Will Vinton |

| | | | | | | Inc. (1998 - 1999); Interim | | | | Studios), an animation |

| | | | | | | Chief Executive Officer | | | | studio (2002 - present); |

| | | | | | | for Laika, Inc. (formerly | | | | Director of The |

| | | | | | | Will Vinton Studios), an | | | | Sisters of the Holy |

| | | | | | | animation studio (March | | | | Names Foundation |

| | | | | | | 2005 - October 2005). | | | | (2004 - present). |

| | | | | | | | | # OF | | |

| | | | | | | | | PORTFOLIOS | | |

| | | | | TERM OF | | PRINCIPAL | | IN FUND | | OTHER |

| | | POSITION(S) | | OFFICE AND | | OCCUPATION | | COMPLEX | | DIRECTORSHIPS |

| | | HELD WITH | | LENGTH O F | | DURING PAST | | OVERSEEN | | HELD BY |

| NAME, AGE AND ADDRESS | | THE COMPANY | | TIME SERVED** | | FIVE YEARS | | BY DIRECTOR | | DIRECTOR |

| | | | | | | | | | | |

| Thomas L. Thomsen, Jr., 62 | | Independent | | Indefinite Term; | | Private rancher and | | 1 | | None |

| The Jensen Portfolio, Inc. | | Director | | since | | real estate investor | | | | |

| 2130 Pacwest Center | | | | December 2003 | | (2002 - Present); | | | | |

| 1211 SW Fifth Ave. | | | | | | Chief Executive Officer | | | | |

| Portland, OR 97204 | | | | | | (2000 - 2002) | | | | |

| | | | | | | and President (1998 - | | | | |

| | | | | | | 2000) of Columbia Man- | | | | |

| | | | | | | agement Company (now | | | | |

| | | | | | | called Columbia Manage- | | | | |

| | | | | | | ment Advisors, Inc.), | | | | |

| | | | | | | investment adviser to the | | | | |

| | | | | | | Columbia Funds family of | | | | |

| | | | | | | mutual funds and to insti- | | | | |

| | | | | | | tutional and individual | | | | |

| | | | | | | investors. | | | | |

DIRECTOR EMERITUS | | | | | | | | | | |

| | | | | | | | | | | |

| Louis B. Perry, Ph.D, 88 | | Director | | Indefinite Term; | | Retired | | 1 | | None |

| The Jensen Portfolio, Inc. | | Emeritus | | Served since | | | | | | |

| 2130 Pacwest Center | | | | inception | | | | | | |

| 1211 SW Fifth Ave. | | | | (at times as | | | | | | |

| Portland, OR 97204 | | | | Director | | | | | | |

| | | | | Emeritus). | | | | | | |

| Interested Directors and Officers | | | | | | | | |

| | | | | | | | | # OF | | |

| | | | | | | | | PORTFOLIOS | | |

| | | | | TERM OF | | PRINCIPAL | | IN FUND | | OTHER |

| | | POSITION(S) | | OFFICE AND | | OCCUPATION | | COMPLEX | | DIRECTORSHIPS |

| | | HELD W ITH | | LENGTH O F | | DURING PAST | | OVERSEEN | | HELD BY |

| NAME, AGE AND ADDRESS | | THE COMPANY | | TIME SERVED** | | FIVE Y EARS | | BY DIRECTOR | | DIRECTOR |

| | | | | | | | | | | |

| Val E. Jensen,* 77 | | Director and | | Indefinite Term; | | Chairman and Director | | 1 | | None |

| The Jensen Portfolio, Inc. | | Chairman | | Served as | | of Jensen Investment | | | | |

| 2130 Pacwest Center | | | | Director since | | Management, Inc. | | | | |

| 1211 SW Fifth Avenue | | | | inception; Served as | | (1988 - 2004). | | | | |

| Portland, OR 97204 | | | | President from inception | | | | | | |

| | | | | to March 2002; | | | | | | |

| | | | | Served as Chairman since | | | | | | |

| | | | | March 2002. | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Gary W. Hibler,* Ph.D., 63 | | Director and | | Indefinite Term; | | President and Director | | 1 | | None |

| Jensen Investment | | President | | Served as Director since | | of Jensen Investment | | | | |

| Management, Inc. | | | | inception; Served as | | Management, Inc. | | | | |

| 2130 Pacwest Center | | | | Secretary from | | (1999 - present); | | | | |

| 1211 SW Fifth Avenue | | | | inception to | | Secretary and Director | | | | |

| Portland, OR 97204 | | | | March 2002; | | of Jensen Investment | | | | |

| | | | | Served as Treasurer | | Management, Inc. | | | | |

| | | | | from December 2002 | | (1994 - 1999). | | | | |

| | | | | to March 2004; | | | | | | |

| | | | | Served as | | | | | | |

| | | | | President since | | | | | | |

| | | | | March 2002. | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Robert F. Zagunis,* 53 | | Vice President | | 1 Year Term; | | Vice President and | | N/A | | N/A |

| Jensen Investment | | | | Served since | | Director of Jensen | | | | |

| Management, Inc. | | | | inception. | | Investment Management, | | | | |

| 2130 Pacwest Center | | | | | | Inc. (1993 - present). | | | | |

| 1211 SW Fifth Avenue | | | | | | | | | | |

| Portland, OR 97204 | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Robert G. Millen,* 59 | | Vice President | | 1 Year Term; | | Vice President and | | N/A | | N/A |

| Jensen Investment | | and Secretary | | Served as Vice | | Director of Jensen | | | | |

| Management, Inc. | | | | President from July | | Investment Management, | | | | |

| 2130 Pacwest Center | | | | 2001 to March | | Inc. (2000 - present); | | | | |

| 1211 SW Fifth Avenue | | | | 2002 and since June | | Vice President of | | | | |

| Portland, OR 97204 | | | | 2005; Served as | | Principal Financial | | | | |

| | | | | Secretary since | | Group, an insurance | | | | |

| | | | | March 2002. | | company (1997 - 2000). | | | | |

| | | | | | | | | # OF | | |

| | | | | | | | | PORTFOLIOS | | |

| | | | | TERM OF | | PRINCIPAL | | IN FUND | | OTHER |

| | | POSITION(S) | | OFFICE AND | | OCCUPATION | | COMPLEX | | DIRECTORSHIPS |

| NAME, AGE AND | | HELD WITH | | LENGTH OF | | DURING PAST | | OVERSEEN | | HELD BY |

| ADDRESS | | THE CO MPANY | | TIME SERVED** | | FIVE YEARS | | BY DIRECTOR | | DIRECTOR |

| | | | | | | | | | | |

| Brian S. Ferrie,* 48 | | Treasurer, | | 1 Year Term; | | Director of Finance and | | N/A | | N/A |

| Jensen Investment | | Chief Compliance | | Served since | | Chief Compliance O fficer | | | | |

| Management, Inc. | | Officer and AML | | March 2004. | | for Jensen Investment | | | | |

| 2130 Pacwest Center | | Compliance | | | | Management, Inc. | | | | |

| 1211 SW Fifth Avenue | | Officer | | | | (2003 - present); Vice | | | | |

| Portland, OR 97204 | | | | | | President and CFO of | | | | |

| | | | | | | Berger Financial Group | | | | |

| | | | | | | LLC (2001 - 2003); Vice | | | | |

| | | | | | | President and Chief | | | | |

| | | | | | | Compliance Officer of | | | | |

| | | | | | | Berger Financial Group | | | | |

| | | | | | | LLC (1994 - 2001). | | | | |

| | * | This individual is an “interested person” of the Fund within the meaning of the 1940 Act. |

| | ** | Each Director serves for an indefinite term in accordance with the Bylaws of the Fund until the date a Director resigns, retires or is removed in accordance with the Bylaws of the Fund. |

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Schedule of Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

Not Applicable.

Item 11. Controls and Procedures.

| (a) | The Registrant’s President/Chief Executive Officer and Treasurer/Chief Financial Officer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the Registrant’s last fiscal half-year that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Incorporated by reference to the Registrant’s Form N-CSR filed August 9, 2004. |

(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

| (b) | Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) The Jensen Portfolio, Inc.

By (Signature and Title)* /s/ Gary Hibler

Gary Hibler, President

Date 2/2/07

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title) /s/ Gary Hibler

Gary Hibler, President

Date 2/2/07

By (Signature and Title) /s/ Brian Ferrie

Brian Ferrie, Treasurer

Date 2/2/07