Item 1. Report to Stockholders.

the Jensen Portfolio

Letter from The Investment Adviser

DEAR FELLOW SHAREHOLDERS:

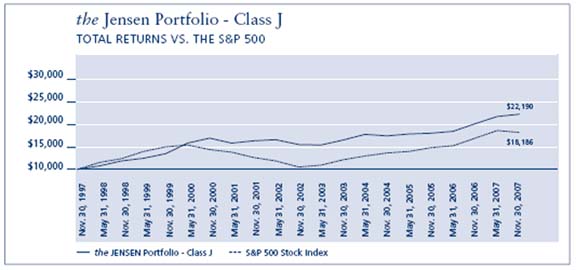

The Jensen Portfolio—Class J Shares—returned 2.15% for the six months ended November 30, 2007, compared to a decline of 2.33% over this period for the Standard & Poor’s 500 Index. Please see pages 4 through 6 of this report for complete standardized performance information for the Portfolio.

Market Perspective

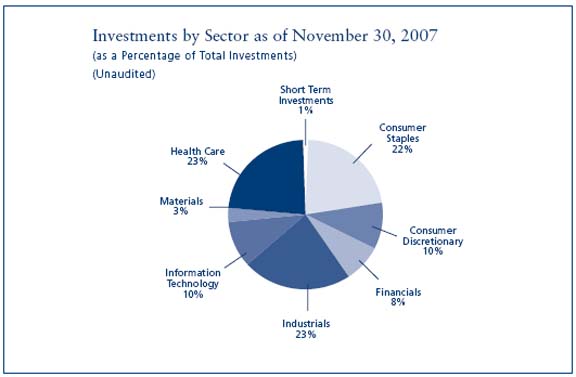

As market volatility increased over the last six months, the Jensen Portfolio was able to outperform its benchmark due to the downside protection we expected (and received) from the quality growth companies we purchased at discounts to their intrinsic values. This was particularly true during November, a month marked by the most significant market declines since September 2002. Holdings in the Consumer Staples, Healthcare and Industrials sectors generally added to the outperformance of the Portfolio. The overall quality of companies in these sectors held up well as investors looked to minimize risk. Our holdings in the Financial sector of The Jensen Portfolio, although they declined during the period, are generally perceived as more conservative than many companies in the broader sector and helped provide outperformance versus the broader index.

Holdings in the Consumer Discretionary sector, namely McGraw-Hill and Bed, Bath and Beyond, detracted from our performance. McGraw-Hill continues to suffer due to concerns about its Standard & Poor’s ratings business and the impact of the housing downturn. Bed, Bath and Beyond is perceived to be hindered by a slowing economy and financially hamstrung consumers. The underlying fundamental strength of both of these companies and their solid long-term opportunities give us confidence that our patience with these holdings should be rewarded once the short-term concerns dissipate.

The Energy sector, which represents a significant weighting within the S&P 500 index, saw relative outsized returns of nearly 9% for the period. However, there are no companies in this sector that meet Jensen’s strict investment criteria primarily due to the commodity-like nature of the industry and the relative volatility of both earnings and free cash flows.

Portfolio Additions and Eliminations

During the first six months of our fiscal year CDW Corporation, a high volume, low cost distributor of name brand computer hardware, software and accessory products, and an excellent example of what we look for in a quality growth company, was acquired by private equity firm Madison Dearborn Partners. While pleased by the gains we realized in the stock, we were disappointed to lose the long-term opportunity to hold this position.

We are pleased to have added Waters Corporation to The Jensen Portfolio during this period. The company is a technology leader—with a 25% share of the industry—in liquid chromatography, the process of separating the chemical components of an unknown substance. Waters also engages in mass spectrometry, a technique used to identify molecules based on their mass. Pharmaceutical and biotechnology businesses rely on their products for ongoing quality control.

Waters is a geographically diverse company with significant sales in Europe, Asia and the United States. Nearly 45% of revenues come from recurring consumable sales and service contracts. This figure jumps to 75% of revenues if instrument replacement sales are added. Free cash flow has grown at a compounded annual growth rate of more than 17% for the past ten years. We anticipate that both free cash flow and long-term earnings can continue to grow at rates in the mid-teens. Waters’ experienced management team has ably reinvested in the business, bought back shares and made incremental acquisitions. Jensen entered this position at what we believe to be a significant discount to the company’s intrinsic value.

The Jensen Perspective

Much as we try to spend it, Americans’ faith in our currency is resolute. And we suspect that the greenback is acceptable tender in nearly every corner of the globe. It has been decades since our dollars were redeemable in gold, yet we are satisfied that our currency will allow us to receive in its exchange an asset that we desire even more.

So it is with securities markets. Investors, willing to swap dollars for certificates, have faith that the issuer will deliver as promised.

the Jensen Portfolio

Throughout history, investors have been eager to hop on an accelerating bandwagon without fear of consequences. It is a seduction that is every bit as powerful as iron shavings dancing obediently toward an electromagnet.

However, the period covered by this semi-annual report, June 1st to November 30th, was yet another time the bandwagon ran amok. This time the certificates were produced in the credit market. It is always a surprise when the fixed income market bubbles because these investors are, in the main, institutional, professional and risk averse.

This market, like the dot-com market in 2001, or the currency market in 1998, or the junk bond market a decade earlier, and no doubt hundreds of others, had its own personality, its own time line, its own vocabulary and all the characteristics of a herd. The electromagnet had become fully charged.

Subprime Seduction

This market’s tagline will no doubt be “subprime,” which is a term that refers to a class of mortgages that are most likely to default due to the weak credit histories of the borrowers. Since they were imbedded in some exotic securities that were thought by their owners—the investors—to be ironclad, the trigger was pulled for the rout in the credit markets when the defaults began to mount.

In earlier times, banks largely retained the mortgages they initiated and were therefore aware of the credit histories of borrowers. But banks found it much more profitable to generate fees by packaging (known as “securitizing”) these loans and generating more fees selling them across the globe to eager buyers anxious to earn higher returns. Of course, one bank could not stand another one reaping those fees, and the bandwagon soon became loaded.

The fixed income market is all about risk, and as John Plender wrote in the Financial Times1 , “They have now expensively relearned the age-old lesson that high returns reflect high risk.” In 2007 speak, by combining large numbers of high risk instruments, so the theory went, risk was reduced. That theory may well become a valid one in the years ahead when investors demand more transparency in the securities they buy.

We do not presume to know whether the credit crisis is largely behind us or if it will play out over the next year or so. However, as in the dot-com bubble, when investors were willing to pay for revenues and earnings that didn’t exist, to the credit markets where investors were willing to buy packages that they couldn’t untie, there are lessons to be learned.

From John Maynard Keynes, Graham and Dodd, to Warren Buffett, the lessons they taught were all about investing safely. “Don’t lose money” and “Safety First” were their mantras. While they recognized that all investments involve risk, their mantras require having knowledge about the securities being considered for purchase.

The Business of Investing

Business today is a more complicated affair because of an array of issues: globalization, accounting rules and governmental regulations. These complications no doubt account for the proliferation of packaged products such as flavor-of-the-month mutual funds and exchange-traded funds, and even more exotic products since analysts are constantly tending the store.

From Jensen’s point of view, investors need a break from the thousands of packaged products from which to choose. Instead of buying a company headquartered in a developing country—or any foreign country for that matter—wouldn’t a domestic company doing business across the globe be easier to rationalize? Wouldn’t one of those few companies that had a competitive advantage evidenced by a 15% return on equity for 10 consecutive years be a candidate for a conservative portfolio?

We clearly think so. So when we add a company to the Portfolio, it is likely to stay there for a long period of time, which is what long-term investing is all about. We are dedicated to the proposition that the best way to create wealth, in conjunction with downside protection, is by allowing a company’s intrinsic value to compound as it puts its excess cash flow to work.

We appreciate your continued support, and we hope you’ll consider adding to your positions as the contagion from the credit markets provides opportunities to equity investors.

Cordially,

The Jensen Portfolio

and

The Jensen Investment Committee

1 John Plender, Financial Times, “Investors pray for acts of God, but even they come at a cost”, p. 19, December 29, 2007.

the Jensen Portfolio

This discussion and analysis of the Fund is as of November 2007 and is subject to change, and any forecasts made cannot be guaranteed.

Past performance is no guarantee of future results. Fund holdings and sector weightings are subject to change and are not recommendations to buy or sell any security. The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. One cannot invest directly in an index. For more complete information regarding performance and holdings, please refer to the financial statements and schedule of investments headings of this report.

The Fund is nondiversified, meaning that it may concentrate its assets in fewer individual holdings than a diversified fund and is therefore more exposed to individual stock volatility than a diversified fund.

Free Cash Flow: Is equal to the after-tax net income of a company plus depreciation and amortization less capital expenditures.

Return on Equity: Is equal to a company’s after-tax earnings (excluding non-recurring items) divided by its average stockholder equity for the year.

(01/08)

the Jensen Portfolio

| | | |

Average Annual – FOR PERIODS ENDED NOVEMBER 30, 2007 | | |

| | 1 YEAR | 3 YEARS | 5 YEARS | 1O YEARS |

the Jensen Portfolio - Class J | 10.36% | 8.36% | 7.50% | 8.30% |

| S&P 500 Stock Index | 7.72% | 10.10% | 11.62% | 6.16% |

| | | | | |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on November 30, 1997 for Class J, the original share class of the fund. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

the Jensen Portfolio

| |

Average Annual – FOR PERIODS ENDED NOVEMBER 30, 2007 |

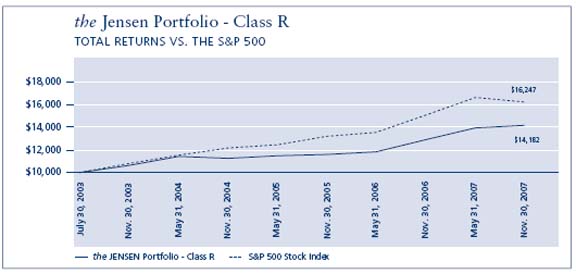

| | 1 YEAR | 3 YEARS | SINCE INCEPTION |

| | | | JULY 30,2003 |

the Jensen Portfolio - Class R | 10.04% | 8.09% | 8.38% |

| S&P 500 Stock Index | 7.72% | 10.10% | 11.82% |

| | | | |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on July 30, 2003, the inception date for Class R shares. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

Average Annual – FOR PERIODS ENDED NOVEMBER 30, 2007 |

| | 1 YEAR | 3 YEARS | SINCE INCEPTION |

| | | | JULY 30,2003 |

the Jensen Portfolio - Class I | 10.54% | 8.56% | 8.85% |

| S&P 500 Stock Index | 7.72% | 10.10% | 11.82% |

| | | | |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $1,000,000 made on July 30, 2003, the inception date for Class I shares. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

the Jensen Portfolio

Statement of Assets & Liabilities

November 30, 2007 (UNAUDITED)

Assets: | | | |

| | | | |

| Investments, at value (cost $1,628,328,413) | | $ | 2,289,718,490 | |

| Income receivable | | | 3,779,182 | |

| Receivable for investments sold | | | 14,996,399 | |

| Receivable for capital stock issued | | | 9,635,123 | |

| Other assets | | | 82,969 | |

| Total Assets | | | 2,318,212,163 | |

| | | | | |

Liabilities: | | | | |

| Payable to Investment Adviser | | | 928,352 | |

| Payable to Directors | | | 31,072 | |

| Payable for capital stock redeemed | | | 2,929,950 | |

| Other accrued expenses | | | 850,000 | |

| Total Liabilities | | | 4,739,374 | |

| NET ASSETS | | $ | 2,313,472,789 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Capital stock | | | 1,628,310,002 | |

| Unrealized appreciation on investments | | | 661,390,077 | |

| Accumulated undistributed net investment income | | | 4,292,148 | |

| Accumulated undistributed net realized gain | | | 19,480,562 | |

| Total Net Assets | | $ | 2,313,472,789 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Class J Shares: | | | | |

| Net assets | | $ | 1,928,911,495 | |

| Shares outstanding | | | 66,452,752 | |

| Net Asset Value Per Share | | | | |

| (2,000,000,000 shares authorized, $.001 par value) | | $ | 29.03 | |

| | | | | |

| Class R Shares: | | | | |

| Net assets | | $ | 20,957,075 | |

| Shares outstanding | | | 724,552 | |

| Net Asset Value Per Share | | | | |

| (1,000,000,000 shares authorized, $.001 par value) | | $ | 28.92 | |

| | | | | |

| Class I Shares: | | | | |

| Net assets | | $ | 363,604,219 | |

| Shares outstanding | | | 12,527,660 | |

| Net Asset Value Per Share | | | | |

| (1,000,000,000 shares authorized, $.001 par value) | | $ | 29.02 | |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

the Jensen Portfolio

Schedule of Investments

November 30, 2007 (UNAUDITED)

| SHARES | | | | VALUE | |

| | | Common Stock - 98.62% | | | |

| | | Beverages - 6.91% | | | |

| | 928,000 | | The Coca-Cola Company | | $ | 57,628,800 | |

| | 1,323,000 | | PepsiCo, Inc. | | | 102,109,140 | |

| | | | | | | 159,737,940 | |

| | | | Capital Markets - 4.10% | | | | |

| | 1,544,000 | | T. Rowe Price Group, Inc. | | | 94,925,120 | |

| | | | Chemicals - 3.30% | | | | |

| | 1,595,000 | | Ecolab, Inc. | | | 76,400,500 | |

| | | | Commercial Banks - 3.34% | | | | |

| | 2,381,000 | | Wells Fargo & Company | | | 77,215,830 | |

| | | | Commercial Services & Supplies - 3.49% | | | | |

| | 2,170,000 | | Equifax, Inc. | | | 80,789,100 | |

| | | | Electrical Equipment - 5.81% | | | | |

| | 2,359,000 | | Emerson Electric Co. | | | 134,510,180 | |

| | | | Food & Staples Retailing - 2.95% | | | | |

| | 2,097,000 | | Sysco Corporation | | | 68,173,470 | |

| | | | Health Care Equipment & Supplies - 9.44% | | | | |

| | 1,821,400 | | Medtronic, Inc. | | | 92,618,190 | |

| | 1,733,000 | | Stryker Corporation | | | 125,867,790 | |

| | | | | | | 218,485,980 | |

| | | | Health Care Providers & Services - 1.89% | | | | |

| | 1,359,000 | | Patterson Companies Inc. (a) | | | 43,732,620 | |

| | | | Household Products - 12.20% | | | | |

| | 644,000 | | The Clorox Company | | | 41,782,720 | |

| | 1,387,000 | | Colgate-Palmolive Company | | | 111,070,960 | |

| | 1,747,000 | | The Procter & Gamble | | | | |

| | | | Company | | | 129,278,000 | |

| | | | | | | 282,131,680 | |

| | | | Industrial Conglomerates - 9.74% | | | | |

| | 1,281,500 | | 3M Co. | | | 106,697,690 | |

| | 3,098,800 | | General Electric Company | | | 118,653,052 | |

| | | | | | | 225,350,742 | |

| | | | IT Services - 5.93% | | | | |

| | 2,004,500 | | Automatic Data Processing, | | | | |

| | | | Inc. | | | 90,322,770 | |

| | 1,203,000 | | Paychex, Inc. | | | 46,917,000 | |

| | | | | | | 137,239,770 | |

| SHARES | | | | VALUE | |

| | | Life Science Tools & Services - 2.12% | | | |

| | 629,000 | | Waters Corporation (a) | | $ | 49,087,160 | |

| | | | Machinery - 3.51% | | | | |

| | 936,000 | | Danaher Corporation | | | 81,263,520 | |

| | | | Media - 7.84% | | | | |

| | 1,656,000 | | The McGraw-Hill | | | | |

| | | | Companies, Inc. | | | 81,276,480 | |

| | 2,051,000 | | Omnicom Group, Inc. | | | 99,986,250 | |

| | | | | | | 181,262,730 | |

| | | | Pharmaceuticals - 9.41% | | | | |

| | 1,958,000 | | Abbott Laboratories | | | 112,604,580 | |

| | 1,551,500 | | Johnson & Johnson | | | 105,098,610 | |

| | | | | | | 217,703,190 | |

| | | | Software - 4.37% | | | | |

| | 3,007,200 | | Microsoft Corporation | | | 101,041,920 | |

| | | | Specialty Retail - 2.27% | | | | |

| | 1,672,000 | | Bed Bath & Beyond, Inc. (a) | | | 52,584,400 | |

| | | | Total Common Stock | | | | |

| | | | (Cost $1,620,245,775) | | | 2,281,635,852 | |

| | | | | | | | |

| PRINCIPAL AMOUNT |

| | | | Short Term Investments - 0.35% | | | | |

| | | | Commercial Paper - 0.34% | | | | |

| $ | 7,870,140 | | Prudential, 4.56%, 12/3/2007 | | | 7,870,140 | |

| | | | Variable Rate Demand Notes (b) - 0.01% | | | | |

| | 212,498 | | Wisconsin Corporate Central | | | | |

| | | | Credit Union, 4.99% | | | 212,498 | |

| | | | Total Short Term Investments | | | | |

| | | | (Cost $8,082,638) | | | 8,082,638 | |

| | | | Total Investments (Cost | | | | |

| | | | $1,628,328,413) - 98.97% | | | 2,289,718,490 | |

| | | | Other Assets in Excess of | | | | |

| | | | Liabilities - 1.03% | | | 23,754,299 | |

| | | | NET ASSETS - 100.00% | | $ | 2,313,472,789 | |

| (a) Non-Income Producing |

| (b) Variable rate demand notes are considered short-term |

| obligations and are payable on demand. Interest rates |

| change periodically on specified dates. The rates shown |

| are as of November 30, 2007. |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

the Jensen Portfolio

Statement of Operations |

| Six Months Ended November 30, 2007 (UNAUDITED) |

Investment Income: | | | |

| | | | |

| Dividend income | | $ | 19,259,713 | |

| Interest income | | | 632,088 | |

| | | | 19,891,801 | |

| | | | | |

Expenses: | | | | |

| | | | | |

| Investment advisory fees | | | 5,709,082 | |

| 12b-1 fees - Class J | | | 2,398,959 | |

| Administration fees | | | 433,463 | |

| Transfer agent fees - Class J | | | 144,018 | |

| Custody fees | | | 107,467 | |

| Directors’ fees and expenses | | | 85,218 | |

| Reports to shareholders - Class J | | | 79,931 | |

| Fund accounting fees | | | 75,140 | |

| Federal and state registration fees | | | 57,892 | |

| Professional fees | | | 53,380 | |

| 12b-1 fees - Class R | | | 52,820 | |

| Transfer agent expenses | | | 45,757 | |

| Shareholder servicing fees - Class I | | | 39,687 | |

| Reports to shareholders - Class I | | | 5,579 | |

| Reports to shareholders - Class R | | | 1,370 | |

| Transfer agent fees - Class I | | | 1,108 | |

| Transfer agent fees - Class R | | | 371 | |

| Other | | | 26,011 | |

| Total expenses | | | 9,317,253 | |

| | | | | |

| NET INVESTMENT INCOME | | | 10,574,548 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN | | | | |

| ON INVESTMENTS: | | | | |

| Net realized gain on investment | | | | |

| transactions | | | 41,731,275 | |

| Change in unrealized appreciation on | | | | |

| investments | | | (3,178,738 | ) |

| Net gain on investments | | | 38,552,537 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING | | | | |

| FROM OPERATIONS | | $ | 49,127,085 | |

| Statements of Changes in | | | | |

| Net Assets | | | | | | |

| | | SIX MONTHS | | | | |

| | | ENDED NOV. 30, ‘07 | | | YEAR ENDED | |

| | | (UNAUDITED) | | | MAY 31, ‘07 | |

Operations: | | | | | | |

| Net investment income | | $ | 10,574,548 | | | $ | 19,019,871 | |

| Net realized gain on | | | | | | | | |

| investment transactions | | | 41,731,275 | | | | 38,884,573 | |

| Change in unrealized | | | | | | | | |

| appreciation on | | | | | | | | |

| investments | | | (3,178,738 | ) | | | 302,562,999 | |

| Net increase in net assets | | | | | | | | |

| resulting from operations | | | 49,127,085 | | | | 360,467,443 | |

Capital Share Transactions: | | | | | | | | |

| Shares sold - Class J | | | 163,955,197 | | | | 428,024,945 | |

| Shares sold - Class R | | | 3,464,625 | | | | 8,505,307 | |

| Shares sold - Class I | | | 63,841,526 | | | | 194,283,893 | |

| Shares issued to holders in | | | | | | | | |

| reinvestment of | | | | | | | | |

| dividends - Class J | | | 7,110,277 | | | | 13,964,384 | |

| Shares issued to holders in | | | | | | | | |

| reinvestment of | | | | | | | | |

| dividends - Class R | | | 56,938 | | | | 126,551 | |

| Shares issued to holders in | | | | | | | | |

| reinvestment of | | | | | | | | |

| dividends - Class I | | | 1,515,723 | | | | 3,653,721 | |

| Shares redeemed - Class J | | | (239,229,096 | ) | | | (525,071,602 | ) |

| Shares redeemed - Class R | | | (5,186,510 | ) | | | (10,918,934 | ) |

| Shares redeemed - Class I | | | (49,338,997 | ) | | | (221,507,714 | ) |

| Net (decrease) | | | (53,810,317 | ) | | | (108,939,449 | ) |

| DIVIDENDS AND DISTRIBUTIONS | | | | | | | | |

| TO SHAREHOLDERS: | | | | | | | | |

| Net investment | | | | | | | | |

| income - Class J | | | (7,484,006 | ) | | | (14,846,342 | ) |

| Net investment | | | | | | | | |

| income - Class R | | | (56,938 | ) | | | (126,551 | ) |

| Net investment | | | | | | | | |

| income - Class I | | | (1,684,593 | ) | | | (4,072,037 | ) |

| Total dividends and | | | | | | | | |

| distributions | | | (9,225,537 | ) | | | (19,044,930 | ) |

| INCREASE (DECREASE) IN | | | | | | | | |

| NET ASSETS | | | (13,908,769 | ) | | | 232,483,064 | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 2,327,381,558 | | | | 2,094,898,494 | |

| End of period (including | | | | | | | | |

| undistributed net | | | | | | | | |

| investment income of | | | | | | | | |

| $4,292,148 and $2,942,007, | | | | | | | | |

| respectively) | | $ | 2,313,472,789 | | | $ | 2,327,381,558 | |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

| Financial Highlights | | | | | | | | | | | | | | | | | | |

Class J | | | | | | | | | | | | | | | | | | |

| | | SIX MONHTS | | | | | | | | | | | | | | | | |

| | | ENDED | | | | | | | | | | | | | | | | |

| | | NOV. 30, ‘07 | | | YEAR ENDED | | | YEAR E NDED | | | YEAR ENDED | | | YEAR ENDED | | | YEAR ENDED | |

| | | (UNAUDITED) | | | MAY 31, ‘07 | | | MAY 31, ‘06 | | | MAY 31, ‘05 | | | MAY 31, ‘04 | | | MAY 31, ‘03 | |

Per Share Data: | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning | | | | | | | | | | | | | | | | | | |

| of period | | $ | 28.53 | | | $ | 24.37 | | | $ | 23.79 | | | $ | 23.82 | | | $ | 20.80 | | | $ | 22.51 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.14 | | | | 0.22 | | | | 0.22 | | | | 0.18 | | | | 0.16 | | | | 0.11 | |

| Net realized and unrealized gains | | | | | | | | | | | | | | | | | | | | | | | | |

| (losses) on investments | | | 0.47 | | | | 4.16 | | | | 0.56 | | | | (0.03 | )(1) | | | 3.01 | | | | (1.73) | |

| Total from investment | | | | | | | | | | | | | | | | | | | | | | | | |

| operations | | | 0.61 | | | | 4.38 | | | | 0.78 | | | | 0.15 | | | | 3.17 | | | | (1.62) | |

Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment | | | | | | | | | | | | | | | | | | | | | | | | |

| income | | | (0.11 | ) | | | (0.22 | ) | | | (0.20 | ) | | | (0.18 | ) | | | (0.15 | ) | | | (0.09 | ) |

| Total distributions | | | (0.11 | ) | | | (0.22 | ) | | | (0.20 | ) | | | (0.18 | ) | | | (0.15 | ) | | | (0.09 | ) |

| Net asset value, end of period | | $ | 29.03 | | | $ | 28.53 | | | $ | 24.37 | | | $ | 23.79 | | | $ | 23.82 | | | $ | 20.80 | |

Total return(2) | | | 2.15 | % | | | 18.05 | % | | | 3.30 | % | | | 0.61 | % | | | 15.28 | % | | | -7.17 | % |

Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 1,928,912 | | | $ | 1,963,520 | | | $ | 1,764,212 | | | $ | 2,680,169 | | | $ | 2,046,288 | | | $ | 1,453,069 | |

| Ratio of expenses to average | | | | | | | | | | | | | | | | | | | | | | | | |

net assets(3) | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % | | | 0.88 | % | | | 0.90 | % |

| Ratio of net investment income to | | | | | | | | | | | | | | | | | | | | | | | | |

average net assets(3) | | | 0.90 | % | | | 0.83 | % | | | 0.85 | % | | | 0.77 | % | | | 0.71 | % | | | 0.62 | % |

Portfolio turnover rate(2) | | | 2.88 | % | | | 13.77 | % | | | 10.20 | % | | | 8.81 | % | | | 5.32 | % | | | 7.22 | % |

| (1) The amount shown may not correlate with the aggregate gains (losses) of portfolio securities due to timing of |

| subscriptions and redemption of fund shares. |

| (2) Not annualized for the six months ended November 30, 2007. |

| (3) Annualized for the six months ended November 30, 2007. |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

the Jensen Portfolio

| Financial Highlights | | | | | | | | | | | | | | | |

Class R | | | | | | | | | | | | | | | |

| | | SIX MONTHS | | | | | | | | | | | | | |

| | | ENDED | | | | | | | | | | | | PERIOD FROM | |

| | | NOV. 30, ‘07 | | | YEAR ENDED | | | YEAR ENDED | | | YEAR ENDED | | | JUL. 30, ‘03(1) | |

| | | (UNAUDITED) | | | MAY 31, ‘07 | | | MAY 31, ‘06 | | | MAY 31, ‘05 | | | TO MAY 31, ‘04 | |

Per Share Data: | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 28.43 | | | $ | 24.29 | | | $ | 23.71 | | | $ | 23.76 | | | $ | 20.93 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.11 | | | | 0.15 | | | | 0.14 | | | | 0.14 | | | | 0.13 | |

| Net realized and unrealized gains (losses) | | | | | | | | | | | | | | | | | | | | |

| on investments | | | 0.45 | | | | 4.14 | | | | 0.59 | | | | (0.05 | )(2) | | | 2.83 | |

| Total from investment operations | | | 0.56 | | | | 4.29 | | | | 0.73 | | | | 0.09 | | | | 2.96 | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.07 | ) | | | (0.15 | ) | | | (0.15 | ) | | | (0.14 | ) | | | (0.13 | ) |

| Total distributions | | | (0.07 | ) | | | (0.15 | ) | | | (0.15 | ) | | | (0.14 | ) | | | (0.13 | ) |

| Net asset value, end of period | | $ | 28.92 | | | $ | 28.43 | | | $ | 24.29 | | | $ | 23.71 | | | $ | 23.76 | |

Total return(3) | | | 1.99 | % | | | 17.73 | % | | | 3.07 | % | | | 0.40 | % | | | 14.13 | % |

Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 20,957 | | | $ | 22,272 | | | $ | 21,100 | | | $ | 23,884 | | | $ | 799 | |

Ratio of expenses to average net assets(4) | | | 1.09 | % | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.12 | % |

| Ratio of net investment income to | | | | | | | | | | | | | | | | | | | | |

average net assets(4) | | | 0.65 | % | | | 0.58 | % | | | 0.60 | % | | | 0.54 | % | | | 0.45 | % |

Portfolio turnover rate(3) | | | 2.88 | % | | | 13.77 | % | | | 10.20 | % | | | 8.81 | % | | | 5.32 | % |

| (1) Commencement of operations. |

| (2) The amount shown may not correlate with the aggregate gains (losses) of portfolio securities due to timing of |

| subscriptions and redemption of fund shares. |

| (3) Not annualized for periods less than one year. |

| (4) Annualized for periods less than one year. |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

the Jensen Portfolio

| Financial Highlights | | | | | | | | | | | | | | | |

Class I | | | | | | | | | | | | | | | |

| | | SIX MONTHS | | | | | | | | | | | | | |

| | | ENDED | | | | | | | | | | | | PERIOD FROM | |

| | | NOV. 30, ‘07 | | | YEAR ENDED | | | YEAR ENDED | | | YEAR ENDED | | | JUL. 30, ‘03(1) | |

| | | (UNAUDITED) | | | MAY 31, ‘07 | | | MAY 31, ‘06 | | | MAY 31, ‘05 | | | TO MAY 31, ‘04 | |

Per Share Data: | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 28.53 | | | $ | 24.38 | | | $ | 23.80 | | | $ | 23.82 | | | $ | 20.93 | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.12 | | | | 0.25 | | | | 0.24 | | | | 0.23 | | | | 0.12 | |

| Net realized and unrealized gains (losses) | | | | | | | | | | | | | | | | | | | | |

| on investments | | | 0.51 | | | | 4.16 | | | | 0.59 | | | | (0.04 | )(2) | | | 2.92 | |

| Total from investment operations | | | 0.63 | | | | 4.41 | | | | 0.83 | | | | 0.19 | | | | 3.04 | |

Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.14 | ) | | | (0.26 | ) | | | (0.25 | ) | | | (0.21 | ) | | | (0.15 | ) |

| Total distributions | | | (0.14 | ) | | | (0.26 | ) | | | (0.25 | ) | | | (0.21 | ) | | | (0.15 | ) |

| Net asset value, end of period | | $ | 29.02 | | | $ | 28.53 | | | $ | 24.38 | | | $ | 23.80 | | | $ | 23.82 | |

Total return(3) | | | 2.22 | % | | | 18.23 | % | | | 3.56 | % | | | 0.77 | % | | | 14.54 | % |

Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 363,604 | | | $ | 341,589 | | | $ | 309,587 | | | $ | 288,428 | | | $ | 227,561 | |

Ratio of expenses to average net assets(4) | | | 0.60 | % | | | 0.65 | % | | | 0.67 | % | | | 0.67 | % | | | 0.70 | % |

| Ratio of net investment income to | | | | | | | | | | | | | | | | | | | | |

average net assets(4) | | | 1.10 | % | | | 1.03 | % | | | 1.03 | % | | | 0.95 | % | | | 0.87 | % |

Portfolio turnover rate(3) | | | 2.88 | % | | | 13.77 | % | | | 10.20 | % | | | 8.81 | % | | | 5.32 | % |

| (1) Commencement of operations. |

| (2) The amount shown may not correlate with the aggregate gains (losses) of portfolio securities due to timing of |

| subscriptions and redemption of fund shares. |

| (3) Not annualized for periods less than one year. |

| (4) Annualized for periods less than one year. |

THE ACCOMPANYING NOTES ARE AN INTEGRAL PART OF THESE FINANCIAL STATEMENTS.

Notes to the Financial Statements

November 30, 2007 (UNAUDITED)

1. Organization and Significant Accounting Policies

The Jensen Portfolio, Inc. (the “Fund”) was organized as an Oregon Corporation on April 17, 1992, and is registered as an open-end, nondiversified management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Fund commenced operations on August 3, 1992. Effective July 30, 2003, the Fund issued two new classes of shares, Class R and Class I and renamed the existing class as Class J. Class J shares are subject to a 0.25% 12b-1 fee; Class R shares are subject to a 0.50% 12b-1 fee and Class I shares are subject to a 0.10% shareholder servicing fee, as described in each Class’ prospectus. Each class of shares has identical rights and privileges except with respect to the 12b-1 fees and shareholder servicing fee, and voting rights on matters affecting a single class of shares. The principal investment objective of the Fund is long-term capital appreciation. The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America.

a) Investment Valuation – Securities that are listed on United States stock exchanges or the Nasdaq Stock Market are valued at the last sale price on the day the securities are valued or, if there has been no sale on that day, at their current bid price. Quotations are taken from the market in which the security is primarily traded. Over-the-counter securities are valued at current bid price. Securities for which market quotations are not readily available are valued at fair value as determined by the Investment Adviser at or under the direction of the Fund’s Board of Directors. There were no securities valued by the Board of Directors as of November 30, 2007. Variable rate demand notes are valued at cost which approximates fair value. Notwithstanding the above, fixed-income securities may be valued on the basis of prices provided by an established pricing service when the Board believes that such prices better reflect market values.

b) Federal Income Taxes – No provision for federal income taxes has been made since the Fund has complied to date with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and intends to continue to so comply in the future and to distribute substantially all of its net investment income and realized capital gains in order to relieve the Fund from all federal income taxes.

c) Accounting Pronouncements – Effective November 30, 2007, the Fund adopted Financial Accounting Standards Board (FASB) Interpretation No. 48 (FIN 48), “Accounting for Uncertainty in Income Taxes”. FIN 48 requires the evaluation of tax positions taken on previously filed tax returns or expected to be taken on future returns. These positions must meet a “more-likely-than-not” standard that, based on the technical merits, have a more than fifty percent likelihood of being sustained upon examination. In evaluating whether a tax position has met the recognition threshold, the Fund must presume that the position will be examined by the appropriate taxing authority that has full knowledge of all relevant information. Tax positions not deemed to meet the “more-likely-than-not” threshold are recorded as a tax expense in the current year.

FIN 48 requires the Fund to analyze all open tax years, as defined by the Statute of Limitations, for all major jurisdictions. Open tax years are those that are open for exam by taxing authorities. As of November 30, 2007, open Federal tax years include the tax years ended May 31, 2005 through 2007. The Fund has no examination in progress.

The Fund has reviewed all open tax years and major jurisdictions and concluded that the adoption of FIN 48 resulted in no effect to the Fund’s financial position or results of operations. There is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken for the period ended November 30, 2007. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

In September, 2006, FASB issued FASB Statement No. 157, “Fair Value Measurement” (“SFAS 157”), which defines fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements. SFAS 157 is effective for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. The Fund believes the adoption of SFAS 157 will have no material impact on its financial statements.

d) Distributions to Shareholders – Dividends to shareholders are recorded on ex-dividend date. Dividends from net investment income are declared and paid quarterly by the Fund. Distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. Permanent differences between financial reporting and tax are reclassified to capital stock.

e) Use of Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

f) Guarantees and Indemnifications – In the normal course of business the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

g) Other – Investment and shareholder transactions are recorded on trade date. Gains or losses from the investment transactions are determined on the basis of identified carrying value. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. The Fund has investments in short-term variable rate demand notes, which are unsecured instruments. These notes may present credit risk to the extent the issuer defaults on its payment obligation. The credit-worthiness of the issuer is monitored, and these notes are considered to present minimal credit risk in the opinion of the Investment Adviser. Income, expenses (other than those deemed attributable to a specific share class), and gains and losses of the Fund are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a specific class of shares are charged against the operations of such class.

14

2. Capital Share Transactions | | | | | | |

| Transactions in shares of the Fund were as follows: | |

| | | SIX MONTHS | | | | |

| | | ENDED | | | YEAR ENDED | |

| | | NOV. 30, ‘07 | | | MAY 31, ‘07 | |

Class J | | | | | | |

| Shares sold | | | 5,831,414 | | | | 16,272,974 | |

| Shares issued to holders in | | | | | | | | |

| reinvestment of dividends | | | 250,752 | | | | 543,529 | |

| Shares redeemed | | | (8,461,059 | ) | | | (20,364,667 | ) |

| Net (decrease) | | | (2,378,893 | ) | | | (3,548,164 | ) |

| Shares outstanding: | | | | | | | | |

| Beginning of year | | | 68,831,645 | | | | 72,379,809 | |

| End of year | | | 66,452,752 | | | | 68,831,645 | |

| | | | | | | | | |

Class R | | | | | | | | |

| Shares sold | | | 122,456 | | | | 328,331 | |

| Shares issued to holders in | | | | | | | | |

| reinvestment of dividends | | | 2,014 | | | | 4,944 | |

| Shares redeemed | | | (183,456 | ) | | | (418,468 | ) |

| Net (decrease) | | | (58,986 | ) | | | (85,193 | ) |

| Shares outstanding: | | | | | | | | |

| Beginning of year | | | 783,538 | | | | 868,731 | |

| End of year | | | 724,552 | | | | 783,538 | |

| | | | | | | | | |

Class I | | | | | | | | |

| Shares sold | | | 2,246,068 | | | | 7,479,267 | |

| Shares issued to holders in | | | | | | | | |

| reinvestment of dividends | | | 53,471 | | | | 141,075 | |

| Shares redeemed | | | (1,746,885 | ) | | | (8,346,303 | ) |

| Net increase (decrease) | | | 552,654 | | | | (725,961 | ) |

| Shares outstanding: | | | | | | | | |

| Beginning of year | | | 11,975,006 | | | | 12,700,967 | |

| End of year | | | 12,527,660 | | | | 11,975,006 | |

3. Investment Transactions

The aggregate purchases and aggregate sales of securities, excluding short-term investments, by the Fund for the period ended November 30, 2007, were $65,269,218 and $130,025,866; respectively.

4. Income Taxes

At May 31, 2007, the Fund had accumulated net realized capital loss carryovers of $22,240,768 of which 844,642 and 21,396,126 will expire on 5/31/2013 and 5/31/2014, respectively. To the extent the Fund realizes future net capital gains, taxable distributions to its shareholders will be offset by any unused capital loss carryover.

The cost of investments differ for financial statement and tax purposes primarily due to differing treatments of wash sales. The distributions of $22,901,891 and $19,044,930 paid during the years ended May 31, 2006 and May 31, 2007, respectively, were classified as ordinary for income tax purposes.

At May 31, 2007, the cost of investments, net unrealized appreciation (depreciation) and undistributed ordinary income and undistributed long term capital gains for income tax purposes were as follows:

| Cost of investments | | $ | 1,665,687,287 | |

| Gross unrealized appreciation | | | 669,174,584 | |

| Gross unrealized depreciation | | | (4,614,584 | ) |

| Net unrealized appreciation | | $ | 664,560,000 | |

| Undistributed ordinary income | | $ | 2,942,007 | |

| Undistributed long-term capital gain | | | — | |

| Total distributable earnings | | $ | 2,942,007 | |

| Other accumulated losses | | $ | (22,240,768 | ) |

| Total accumulated earnings | | $ | 645,261,239 | |

5. Line of Credit

The Fund has a $250 million revolving credit facility for temporary emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The interest rate on the outstanding principal amount is equal to the prime rate less 1/2%. The Fund did not borrow on the line of credit during the six month period ended November 30, 2007.

6. Investment Advisory Agreement

The Fund has entered into an Investment Advisory and Service Contract with Jensen Investment Management, Inc. Pursuant to its advisory agreement with the Fund, the Investment Adviser is entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 0.50% as applied to the Fund’s daily net assets.

Certain officers of the Fund are also officers and directors of the Investment Adviser.

15

the Jensen Portfolio

7. Distribution and Shareholder Servicing

The Fund has adopted a distribution and shareholder servicing plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), which provides that the Fund may make payment to the Fund’s distributor or others at an annual rate of up to 0.25% of the average daily net assets attributable to Class J shares and up to 0.50% of the average daily net assets attributable to Class R shares. Payments under the 12b-1 Plan shall be used to compensate or reimburse the Fund’s distributor or others for services provided and expenses incurred in connection with the sale of shares.

In addition, the Fund has adopted a Shareholder Servicing Plan (the “Servicing Plan”) under which the Fund can pay for shareholder support services from the Fund’s assets pursuant to a Shareholder Servicing Agreement in an amount not to exceed 0.10% of the Fund’s average daily net assets attributable to Class I shares.

Expense Example – November 30, 2007 (Unaudited)

As a shareholder of The Jensen Portfolio (the “Fund”), you incur ongoing costs, including investment advisory fees, distribution and/or shareholder servicing fees, and other Fund expenses, which are indirectly paid by shareholders. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six month period (June 1, 2007 – November 30, 2007).

Actual Expenses

The first line of the table below for each share class of the Fund provides information about actual account values and actual expenses. However, the table does not include shareholder specific fees, such as the $15.00 fee charged to IRA accounts, or the $12.00 fee charged for wire redemptions. The table also does not include portfolio trading commissions and related trading costs. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the actual expense ratios for each share class of the Fund and an assumed rate of return of 5%per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees which, although not charged by the Fund, may be charged by other funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Expense Example Tables

The Jensen Portfolio–Class J | | | | | |

| | BEGINNING | | ENDING | | EXPENSES PAID |

| | ACCOUNT VALUE | | ACCOUNT VALUE | | DURING PERIOD* |

| | JUNE 1, 2007 | | NOVEMBER 30, 2007 | | JUNE1 , 2007 – NOVEMBER 30, 2007 |

| Actual | $1,000.00 | | $1,021.50 | | $4.31 |

| Hypothetical (5% annual return before expenses) | 1,000.00 | | 1,020.81 | | 4.31 |

*Expenses are equal to the Fund’s annualized expense ratio of 0.85%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period.

16

The Jensen Portfolio–Class R | | | | | |

| | BEGINNING | | ENDING | | EXPENSES PAID |

| | ACCOUNT VALUE | | ACCOUNT VALUE | | DURING PERIOD* |

| | JUNE 1, 2007 | | NOVEMBER 30, 2007 | | JUNE 1, 2007 – NOVEMBER 30, 2007 |

| Actual | $1,000.00 | | $1,019.90 | | $5.52 |

| Hypothetical (5% annual return before expenses) | 1,000.00 | | 1,019.60 | | 5.52 |

* Expenses are equal to the Fund’s annualized expense ratio of 1.09%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

| | | | | | |

The Jensen Portfolio–Class I | | | | | |

| | BEGINNING | | ENDING | | EXPENSES PAID |

| | ACCOUNT VALUE | | ACCOUNT VALUE | | DURING PERIOD* |

| | JUNE 1, 2007 | | NOVEMBER 30, 2007 | | JUNE 1, 2007 – NOVEMBER 30, 2007 |

| Actual | $1,000.00 | | $1,022.20 | | $3.04 |

| Hypothetical (5% annual return before expenses) | 1,000.00 | | 1,022.06 | | 3.04 |

* Expenses are equal to the Fund’s annualized expense ratio of 0.60%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

Additional Information (Unaudited)

1. INVESTMENT ADVISORY AGREEMENT DISCLOSURE

Section 15(c) of the Investment Company Act of 1940 (the “1940 Act”) requires that a fund’s board of directors, including a majority of independent directors voting separately, approve any new investment advisory contract for the fund and thereafter to review and approve the terms of the fund’s investment advisory agreement on an annual basis. In addition, Section 15(a) of the 1940 Act requires that any new investment advisory agreement be approved by the fund’s shareholders.

In their most recent deliberations concerning whether to renew The Jensen Portfolio’s (the “Fund”) existing Investment Advisory Agreement (“Existing Agreement”) and whether to approve a proposed new Investment Advisory Agreement (“New Agreement”), the Fund’s Board of Directors, including the independent directors (the “Board”), conducted the review and made the determinations that are described below. During its deliberations, the Board requested from Jensen Investment Management, Inc., the Fund’s investment adviser (the “Adviser”), and the Adviser furnished, all information reasonably necessary for it to evaluate both the renewal of the Existing Agreement and the approval of the New Agreement.

The entire Board first met on October 12, 2005 and January 11 , 2006 to consider the planned retirement of Gary Hibler and the effects his retirement and the resulting change of control of the Adviser might have on the Fund’s and the Adviser’s operations. The entire Board met again on April 12, 2006 to consider the information provided by the Adviser in connection with the annual renewal of the Existing Agreement and the approval of the New Agreement. At the April 12 meeting, the independent directors (“Independent Directors”) met separately with their legal counsel to consider the information provided by the Adviser and identify additional information they needed to evaluate the Existing Agreement and the New Agreement. The entire Board then met again on July 19, 2006 to consider the annual continuation of the Existing Agreement and the approval of the New Agreement. At the July 19 meeting, the Independent Directors reconvened in a separate meeting with their legal counsel to consider the additional information provided by the Adviser and to consider the annual continuation of the Existing Agreement and the approval of the New Agreement. During those meetings, the Board considered the factors and reached the conclusions described below, among others. The Board did not identify any single factor as controlling. Moreover, not every factor was given the same weight by each Director.

Nature, Extent and Quality of Services

The Board of Directors, including the Independent Directors, considered the nature, extent and quality of services provided to the Fund by the Adviser under the Existing Agreement and the services proposed to be provided under the New Agreement. The Board reviewed the terms of the Existing Agreement and the New Agreement, as well as the history of the Adviser and its investment discipline, its investment performance, and its day to day management of the Fund. The Board noted the Adviser’s focus on the business of the Fund, the additions to the Adviser’s staff to support research activities, compliance and other servicing aspects of the Fund, and the Adviser’s oversight of the Fund’s service providers. In particular, the Board noted the Adviser’s recent addition of two research analysts and new investment research tools and analysis services to enhance the Adviser’s research capabilities.

17

the Jensen Portfolio

The Board considered the proposed changes in the Adviser’s ownership and management and the potential impact on the Fund and the Adviser. The Board studied the Adviser’s succession plans, its organizational and ownership structure, and the composition of its five-person investment committee, which makes all investment decisions for the Fund. Based on these and other factors, including those referenced below, the Board concluded that the services provided to the Fund continued to be satisfactory and were not likely to change materially under the New Agreement.

Investment Performance

The Board examined the investment performance of the Fund compared to appropriate securities indices, to appropriate Lipper and Morningstar categories, and to other mutual funds of similar asset size and with similar investment objectives and strategies. Performance over one-, three-, five- and ten-year periods for the Fund was analyzed. The Board noted that the Fund outperformed its benchmark index and comparable funds for the five- and ten-year periods, but underperformed its benchmark index and comparable funds for the one- and three-year periods. Moreover, the Board found that redemptions of Fund shares during the last 12 months significantly exceeded sales of new Fund shares, resulting in lower overall assets in the Fund from the prior year. The Board understood, based on the data presented, that approximately 20% of the Fund’s underperformance compared to its benchmark index for the three-year period was due to the Fund’s lack of exposure to the energy and utility sectors, which contained no companies that qualified under the Fund’s investment criteria.

The Board observed that the Adviser appeared to have adhered to its strict investment discipline. The Board also considered the Fund’s long-term investment strategy and the Adviser’s belief that over time the favorable business performance of the Fund’s portfolio companies would be reflected in similar market returns. As a result of these and other factors, although the Board encouraged the Adviser to take steps to ensure that the Fund’s short-term results were consistent with the Fund’s long-term investment objective and to address the net redemption of Fund shares, the Board concluded that the long term investment performance of the Fund continued to be satisfactory.

Advisory Fee and Expense Ratio

The Board compared the Fund’s advisory fee with those of other comparable mutual funds in the Fund’s Lipper category. The Board noted that the Fund’s advisory fee of 0.50% continued to be below the average and the median for the category. The Board also noted that the Fund is a single fund (as opposed to a larger complex of funds) and that, while the Adviser employs a relatively straightforward investment discipline, the Fund appeared to be an efficiently run operation with a high service component for shareholders.

The Board compared the fees charged to the Fund with the advisory fees charged to the non-Fund advisory clients of the Adviser. The Board observed that, with the exception of a few existing clients, the Adviser charges its separate accounts a minimum of 0.50%. The Board considered the Fund’s expense ratio and the expense ratios of funds in the Fund’s Lipper category. The Board noted that the Fund’s expense ratio continued to be below the average and the median for the category and that the Fund had a low portfolio turnover rate.

The Board also noted that the advisory fee rate and the expenses for which the Fund would be responsible under the New Agreement would be unchanged from those under the Existing Agreement.

Based on these considerations and other factors, the Board concluded that the Fund’s advisory fee and expense ratio were reasonable relative to the Fund’s peer group.

Profitability of the Adviser

The Board considered the profitability of the Existing Agreement to the Adviser, including the methodology used to calculate the Adviser’s profitability, and compared the Adviser’s profitability with that of selected publicly traded mutual fund advisers. When adjusted for certain marketing revenues and expenses, it appeared that the Adviser’s pre-tax profit was not significantly higher than the average pre-tax profit margin of the group of publicly traded investment advisory firms. It was noted that the Adviser’s profitability may have been overstated due to the relatively low salaries and bonuses paid to its investment professionals, who may receive distributions of profits through their equity ownership in the firm. The Board also considered the facts that the Adviser pays certain administrative expenses of the Fund, including certain sub-transfer agency costs and the cost of the Fund’s Chief Compliance Officer, that the Fund had been subsidized by the Adviser during the early years of the Fund’s existence, and that only in the most recent four to five years, as the Fund’s assets under management have grown, has the Fund contributed significantly to the Adviser’s profits.

18

The Board also examined the Adviser’s profitability from the Fund on a stand-alone basis against the Adviser’s profitability from its separate account advisory business and found that the Fund provided a higher profit margin to the Adviser. The Board understood that economies of scale are realized from managing one fund compared to managing over 100 separate accounts and that the Adviser had been conservative in its method of allocating expenses to its Fund business relative to other acceptable allocation methodologies. The Board noted that the Adviser’s profitability from the Fund for 2006 was projected to be lower as a result of the declining asset levels of the Fund. The Board acknowledged the inherent limitations of profitability analyses, including the use of comparative data that is incomplete or dissimilar, such as financial information of publicly traded mutual fund advisers which have more diversified business lines and different cost structures than those of the Adviser, and the uncertainty of the various allocations and other assumptions used. Based on this and other information, the Board concluded that profits earned by the Adviser were not excessive.

Economies of Scale

The Board considered whether there have been economies of scale with respect to the management of the Fund, whether the Fund has benefited from any such economies, and whether the implementation of breakpoints in the Fund’s advisory fee was appropriate. The Board observed that, during a period of rapid Fund growth, the Fund’s expense ratio (for the Class J shares) had fallen from about 1% for the fiscal year ended May 31, 2002 to 0.85% for the nine months ended February 28, 2006. Regarding the issue of breakpoints, the Board observed from the data presented that most funds with breakpoints below the Fund’s 0.50% advisory fee had higher overall advisory fees at the same asset levels. The Board acknowledged the significant decline in Fund assets in the past year, making economies of scale less likely since the last time the Board considered a breakpoint in the Fund’s advisory fee. Based on the data presented, the Board concluded that a breakpoint in the Fund’s advisory fee was not warranted at this time.

Other Benefits

The Board considered the potential fall-out benefits realized by the Adviser from services as investment manager of the Fund. The Board noted that the Adviser has no affiliated entities that provide services to the Fund and that the Adviser prohibits the receipt of third-party “soft dollars.” The Board understood that the Adviser’s non-Fund business was approximately 20% of the Adviser’s total business. The Board concluded that, while the Adviser’s non-Fund business might benefit from the Adviser’s association with the Fund, any such benefit was difficult to quantify and likely not significant.

Other Factors and Considerations

The Board periodically reviews and considers other material information throughout the year relating to the quality of services provided to the Fund, such as the allocation of Fund brokerage, the marketing, administration and compliance program of the Fund, the Adviser’s management of its relationship with the Fund’s administrator, custodian, transfer agent and other service providers, and the expenses paid to those service providers. At its regular meetings, the Board also reviews detailed information relating to the Fund’s portfolio and performance, and interviews the Fund’s portfolio managers.

Based on its evaluation of all material factors and the information provided to it, the Board of Directors, including all of the Independent Directors, voted unanimously on July 19, 2006 (i) to renew the Existing Agreement for a one-year period until July 31, 2007 and (ii) to approve the New Agreement and recommend that shareholders approve the New Agreement.

2. RESULTS OF SPECIAL MEETING OF SHAREHOLDERS

A Special Meeting of Shareholders of The Jensen Portfolio, Inc. (the “Fund”), adjourned on November 13, 2006, was held on December 13, 2006 (the “Special Meeting”) at the offices of Jensen Investment Management, Inc., the investment adviser to the Fund (the “Adviser”). The purpose of the Special Meeting was to approve a new investment advisory agreement between the Fund and the Adviser. As of the record date, September 7, 2006, there were 81,890,299 shares issued and outstanding and entitled to vote at the Special Meeting. A total of 43,538,504.24 shares were present in person or by proxy at the Special Meeting.

19

| The results of the vote at the Special Meeting with respect to the new investment advisory agreement were as follows: |

| |

| | NUMBER OF | | PERCENT OF | | PERCENT OF |

| | SHARES VOTED | | SHARES OUTSTANDING | | SHARES PRESENT |

| For | 42,343,639.51 | | 51.70% | | 97.26% |

| Against | 457,985.13 | | 0.56% | | 1.05% |

| Withhold/ | | | | | |

| Abstain | 736,879.60 | | 0.90% | | 1.69% |

Accordingly, the proposal was approved by the Fund’s shareholders.

3. SHAREHOLDER NOTIFICATION OF FEDERAL TAX STATUS

The Fund designates 100% of dividends declared during the fiscal year ended May 31, 2007 as dividends qualifying for the dividends received deduction available to corporate shareholders.

The Fund designates 100% of dividends declared from net investment income during the fiscal year ended May 31, 2007 as qualified dividend income under the Jobs and Growth Tax Relief Reconciliation Act of 2003.

Additional Information Applicable to Foreign Shareholders Only:

The Fund designates 4% of ordinary income distributions as interest-related dividends under Internal Revenue Code Section 871(k)(1)(c).

4. AVAILABILITY OF PROXY VOTING INFORMATION

Information regarding how the Fund votes proxies relating to portfolio securities is available without charge, upon request by calling toll-free, 1-800-221-4384, or by accessing the SEC’s website at www.sec.gov.

5. PORTFOLIO HOLDINGS

The Jensen Portfolio will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q will be available on the EDGAR database on the SEC’s website at www.sec.gov. These Forms may also be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information about the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

6. ADDITIONAL DISCLOSURE REGARDING FUND DIRECTORS AND OFFICERS

| Independent Directors | | | | | | | | |

| | | | | | | | | # OF | | |

| | | | | | | | | PORTFOLIOS | | |

| | | | | TERM OF | | PRINCIPAL | | IN FUND | | OTHER |

| | | POSITION(S) | | OFFICE AND | | OCCUPATION | | CO MPLEX | | DIRECTORSHIPS |

| | | HELD WITH | | LENGTH O F | | DURING PAST | | OVERSEEN | | HELD BY |

| NAME, AGE AND ADDRESS | | THE COMPANY | | TIME SERVED** | | FIVE YEARS | | BY DIRECTOR | | DIRECTOR |

| | | | | | | | | | | |

| Norman W. Achen J.D., 86 | | Independent | | Indefinite Term; | | President of N.W. | | 1 | | None |

| The Jensen Portfolio, Inc. | | Director | | Served since | | Achen Professional | | | | |

| 2130 Pacwest Center | | | | inception. | | Corporation | | | | |

| 1211 SW Fifth Avenue | | | | | | (1980 – present). | | | | |

| Portland, OR 97204 | | | | | | | | | | |

20

the Jensen Portfolio

| | | | | | | | | # OF | | |

| | | | | | | | | PORTFOLIOS | | |

| | | | | TERM OF | | PRINCIPAL | | IN FUND | | OTHER |

| | | POSITION(S) | | OFFICE AND | | OCCUPATION | | CO MPLEX | | DIRECTORSHIPS |

| | | HELD WITH | | LENGTH O F | | DURING PAST | | OVERSEEN | | HELD BY |

| NAME, AGE AND ADDRESS | | THE COMPANY | | TIME SERVED** | | FIVE YEARS | | BY DIRECTOR | | DIRECTOR |

| | | | | | | | | | | |

| Roger A. Cooke J.D., 59 | | Independent | | Indefinite Term; | | Vice President – Regulatory | | 1 | | None |

| The Jensen Portfolio, Inc. | | Director | | since June 1999. | | and Legal Affairs of | | | | |

| 2130 Pacwest Center | | | | | | Precision Castparts Corp., | | | | |

| 1211 SW Fifth Avenue | | | | | | an investment casting and | | | | |

| Portland, OR 97204 | | | | | | forging company, | | | | |

| | | | | | | (2000 – present); | | | | |

| | | | | | | Executive Vice President – | | | | |

| | | | | | | Regulatory and Legal | | | | |

| | | | | | | Affairs of Fred Meyer, Inc., | | | | |

| | | | | | | a grocery and general | | | | |

| | | | | | | merchandise company, | | | | |

| | | | | | | (1992 – 2000). | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Robert E. Harold | | Independent | | Indefinite Term; | | Senior Director of | | 1 | | Director of |

| C.P.A. (Retired), 60 | | Director | | since | | Financial Planning | | | | StoriedLearning, |

| The Jensen Portfolio, Inc. | | | | September | | of Nike, Inc., a footwear | | | | Inc. (2000 – 2003); |

| 2130 Pacwest Center | | | | 2000. | | and apparel company | | | | Director of St. Mary’s |

| 1211 SW Fifth Avenue | | | | | | (2001 – 2002); Global | | | | Academy, a non-profit |

| Portland, OR 97204 | | | | | | Brand Controller for Nike, | | | | high school |

| | | | | | | Inc. (1996, 1997, 2000 – | | | | (2000 – present); |

| | | | | | | 2001); Interim Chief | | | | Director of Laika, Inc. |

| | | | | | | Financial Officer for Nike, | | | | (formerly Will Vinton |

| | | | | | | Inc. (1998 – 1999); Interim | | | | Studios), an animation |

| | | | | | | Chief Executive Officer | | | | studio (2002 – present); |

| | | | | | | for Laika, Inc. (formerly | | | | Director of The |

| | | | | | | Will Vinton Studios), an | | | | Sisters of the Holy |

| | | | | | | animation studio (March | | | | Names Foundation |

| | | | | | | 2005 – October 2005). | | | | (2004 – present). |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Thomas L. Thomsen, Jr., 63 | | Independent | | Indefinite Term; | | Private rancher and | | 1 | | None |

| The Jensen Portfolio, Inc. | | Director | | since | | real estate investor | | | | |

| 2130 Pacwest Center | | | | December 2003 | | (2002 – Present); | | | | |

| 1211 SW Fifth Ave. | | | | | | Chief Executive Officer | | | | |

| Portland, OR 97204 | | | | | | (2000 – 2002) | | | | |

| | | | | | | and President (1998 – | | | | |

| | | | | | | 2000) of Columbia Man- | | | | |

| | | | | | | agement Company (now | | | | |

| | | | | | | called Columbia Manage- | | | | |

| | | | | | | ment Advisors, Inc.), | | | | |

| | | | | | | investment adviser to the | | | | |

| | | | | | | Columbia Funds family of | | | | |

| | | | | | | mutual funds and to insti- | | | | |

| | | | | | | tutional and individual | | | | |

| | | | | | | investors. | | | | |

21

| | | | | | | | | # OF | | |

| | | | | | | | | PORTFOLIOS | | |

| | | | | TERM OF | | PRINCIPAL | | IN FUND | | OTHER |

| | | POSITION(S) | | OFFICE AND | | OCCUPATION | | COMPLEX | | DIRECTORSHIPS |

| | | HELD WITH | | LENGTH O F | | DURING PAST | | OVERSEEN | | HELD BY |

| NAME, AGE AND ADDRESS | | THE COMPANY | | TIME SERVED** | | FIVE YEARS | | BY DIRECTOR | | DIRECTOR |

| | | | | | | | | | | |

| Kenneth Thrasher, 57 | | Independent | | Indefinite | | Chairman and CEO | | 1 | | Northwest Natural Gas |

| The Jensen Portfolio, Inc. | | Director | | Term; | | of Complí, a web- | | | | Company (a natural gas |

| 2130 Pacwest Center | | | | since July 2007. | | based automotive | | | | distribution and service |

| 1211 SW Fifth Ave. | | | | | | dealership software | | | | provider). |

| Portland, OR 97204 | | | | | | solution company | | | | |

| | | | | | | (2002 – present). | | | | |

| | | | | | | | | | | |

DIRECTOR EMERITUS | | | | | | | | | | |

| | | | | | | | | | | |

| Louis B. Perry, Ph.D, 89 | | Director | | Indefinite Term; | | Retired | | 1 | | None |

| The Jensen Portfolio, Inc. | | Emeritus | | Served since | | | | | | |

| 2130 Pacwest Center | | | | inception | | | | | | |

| 1211 SW Fifth Ave. | | | | (at times as | | | | | | |

| Portland, OR 97204 | | | | Director | | | | | | |

| | | | | Emeritus). | | | | | | |

22

| Interested Directors and Officers | | | | | | |

| | | | | | | | | # OF | | |

| | | | | | | | | PORTFOLIOS | | |

| | | | | TERM OF | | PRINCIPAL | | IN FUND | | OTHER |

| | | POSITION(S) | | OFFICE AND | | OCCUPATION | | COMPLEX | | DIRECTORSHIPS |

| | | HELD WITH | | LENGTH OF | | DURING PAST | | OVERSEEN | | HELD BY |

| NAME, AGE AND ADDRESS | | THE CO MPANY | | TIME SERVED** | | FIVE YEARS | | BY DIRECTOR | | DIRECTOR |

| | | | | | | | | | | |

| Val E. Jensen,* 78 | | Director and | | Indefinite Term; | | Chairman and Director | | 1 | | None |

| The Jensen Portfolio, Inc. | | Chairman | | Served as | | of Jensen Investment | | | | |

| 2130 Pacwest Center | | | | Director since | | Management, Inc. | | | | |

| 1211 SW Fifth Avenue | | | | inception; Served as | | (1988 – 2004). | | | | |

| Portland, OR 97204 | | | | President from inception | | | | | | |

| | | | | to March 2002; | | | | | | |

| | | | | Served as Chairman since | | | | | | |

| | | | | March 2002. | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Gary W. Hibler,* Ph.D., 64 | | Director | | Indefinite Term; | | President and Director | | 1 | | None |

| The Jensen Portfolio, Inc. | | | | Served as Director since | | of Jensen Investment | | | | |

| 2130 Pacwest Center | | | | inception; Served as | | Management, Inc. | | | | |

| 1211 SW Fifth Avenue | | | | Secretary from | | (1999 – February 2007); | | | | |

| Portland, OR 97204 | | | | inception to | | Secretary and Director | | | | |

| | | | | March 2002; | | of Jensen Investment | | | | |

| | | | | Served as Treasurer | | Management, Inc. | | | | |

| | | | | from December 2002 | | (1994 – 1999). | | | | |

| | | | | to March 2004; | | | | | | |

| | | | | Served as | | | | | | |

| | | | | President from | | | | | | |

| | | | | March 2002 to | | | | | | |

| | | | | February 2007. | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Robert D. McIver,* 41 | | President | | 1 Year Term; | | President of Jensen | | N/A | | N/A |

| Jensen Investment | | | | Served as President since | | Investment Management, | | | | |

| Management, Inc. | | | | February 2007. | | Inc. (February 2007- | | | | |

| 2130 Pacwest Center | | | | | | present); Director of | | | | |

| 1211 SW Fifth Ave. | | | | | | Operations of Jensen | | | | |

| Portland, OR 97204 | | | | | | Investment Management, | | | | |

| | | | | | | Inc. (2004-February | | | | |

| | | | | | | 2007); General Manager | | | | |

| | | | | | | of Fairmont Villa | | | | |

| | | | | | | Management and Vice | | | | |

| | | | | | | President of Fairmont | | | | |

| | | | | | | Riverside Golf Estates Ltd | | | | |

| | | | | | | (2001-2004). | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Robert F. Zagunis,* 54 | | Vice President | | 1 Year Term; | | Vice President and | | N/A | | N/A |

| Jensen Investment | | | | Served since | | Director of Jensen | | | | |

| Management, Inc. | | | | inception. | | Investment Management, | | | | |

| 2130 Pacwest Center | | | | | | Inc. (1993 – present). | | | | |

| 1211 SW Fifth Avenue | | | | | | | | | | |

| Portland, OR 97204 | | | | | | | | | | |

23

| | | | | | | | | # OF | | |

| | | | | | | | | PORTFOLIOS | | |

| | | | | TERM OF | | PRINCIPAL | | IN FUND | | OTHER |

| | | POSITION(S) | | OFFICE AND | | OCCUPATION | | COMPLEX | | DIRECTORSHIPS |

| | | HELD WITH | | LENGTH OF | | DURING PAST | | OVERSEEN | | HELD BY |

| NAME, AGE AND ADDRESS | | THE CO MPANY | | TIME SERVED** | | FIVE YEARS | | BY DIRECTOR | | DIRECTOR |

| Robert G. Millen,* 60 | | Vice President | | 1 Year Term; | | Vice President and | | N/A | | N/A |

| Jensen Investment | | and Secretary | | Served as Vice | | Director of Jensen | | | | |

| Management, Inc. | | | | President from July | | Investment Management, | | | | |

| 2130 Pacwest Center | | | | 2001 to March | | Inc. (2000 – present); | | | | |

| 1211 SW Fifth Avenue | | | | 2002 and since June | | Vice President of | | | | |

| Portland, OR 97204 | | | | 2005; Served as | | Principal Financial | | | | |

| | | | | Secretary since | | Group, an insurance | | | | |

| | | | | March 2002. | | company (1997 – 2000). | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Brian S. Ferrie,* 49 | | Treasurer and | | 1 Year Term; Served | | Vice President, Director | | N/A | | N/A |

| Jensen Investment | | Chief | | since March 2004. | | of Finance and Chief | | | | |

| Management, Inc. | | Compliance | | | | Compliance Officer | | | | |

| 2130 Pacwest Center | | Officer | | | | for Jensen Investment | | | | |

| 1211 SW Fifth Avenue | | | | | | Management, Inc. | | | | |

| Portland, OR 97204 | | | | | | (2003 – present); Vice | | | | |

| | | | | | | President and CFO of | | | | |

| | | | | | | Berger Financial Group | | | | |

| | | | | | | LLC (2001 – 2003); Vice | | | | |

| | | | | | | President and Chief | | | | |

| | | | | | | Compliance Officer of | | | | |

| | | | | | | Berger Financial Group | | | | |

| | | | | | | LLC (1994 – 2001). | | | | |

| | | | | | | | | | | |

* This individual is an “interested person” of the Fund within the meaning of the 1940 Act. | | | | |

** Each Director serves for an indefinite term in accordance with the Bylaws of the Fund until the date a Director resigns, retires or is removed in accordance with the Bylaws of the Fund. |

24

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Schedule of Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

Not Applicable.

Item 11. Controls and Procedures.

| (a) | The Registrant’s President/Chief Executive Officer and Treasurer/Chief Financial Officer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |