UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6653

The Jensen Quality Growth Fund, Inc.

(Exact name of registrant as specified in charter)

5500 Meadows Road, Suite 200

Lake Oswego, OR 97035-8234

(Address of principal executive offices) (Zip code)

Robert McIver

5500 Meadows Road, Suite 200

Lake Oswego, OR 97035-8234

(Name and address of agent for service)

(800) 221-4384

Registrant's telephone number, including area code

Date of fiscal year end: May 31

Date of reporting period: May 31, 2018

Item 1. Reports to Stockholders.

Letter from The Investment Adviser

Dear Fellow Shareholders,

The Jensen Quality Growth Fund -- Class I Shares -- returned 14.08% for the year ended May 31, 2018, compared to a return of 14.38% for the Standard & Poor’s 500 Index over this period. Please see pages 4 through 7 of this report for complete standardized performance information for the Fund.

Market Perspective

The US equity markets continued to move higher over the last year. Despite a pause in the early part of 2018, overall market performance was solid for the second consecutive fiscal year as consumer confidence remained high and the market began to recognize the positive impact of the changes in tax legislation that were signed into law in late 2017. Momentum stocks continued to influence the markets and benchmark performance was dominated by a small number of companies and specific sectors, notably the technology sector.

At the same time, volatility also impacted the markets more noticeably in 2018 as concerns about a rising interest rate environment, the threat of a global trade war and overall geopolitical issues have become more pronounced. Despite these concerns, domestic markets achieved new highs as investors shook off various threats to performance of stocks given limited alternatives for sound returns.

Against this backdrop we are pleased that the companies in the Fund continued to execute well in the face of these challenges and create value for shareholders as a result of strong market positions, durable competitive advantages and robust free cash flow – hallmarks of quality that we have long believed are important factors in mitigating business and pricing risks that investors face.

The Effect at Jensen

During the Fund’s fiscal year, specific stock selection added value in the Health Care and Materials sectors, while detracting from returns primarily in the Consumer Discretionary sector. From a sector perspective, our relative overweight in Information Technology as well as our lack of presence in the Utilities sector added value. Typically, very few companies in the Utilities sector qualify for our strict requirement for high and prolonged profitability, as measured by Return on Equity.

Our top contributors to performance for the fiscal year were Microsoft, UnitedHealth Group and Mastercard, all of which continued to issue reasonably strong earnings reports and reassuring guidance indicating they are successfully navigating economic challenges.

Significant detractors from the Fund’s performance for the fiscal year included PepsiCo, Procter & Gamble and Omnicom Group, as the market reacted to concerns about slowing growth and disruptive competition.

Continuing a trend in recent quarters, PepsiCo (PEP) posted weaker growth in organic sales and experienced a decline in margins in its most recent quarterly earnings report. This combined with generally weaker performance in the Consumer Staples sector in a rising interest rate environment pressured the company’s stock price over the past year. The company also noted that advertising spending in its key North America market has risen sharply in recent weeks and that PEP would need to step up brand investments for its core carbonated soft drinks. We believe the company remains positioned for consistent growth long term, but we also recognize that pressure on companies in the Consumer Staples sector is a potential headwind to stock performance thus requiring a nuanced approach to our investment thesis.

Similar headwinds impacted the performance of Proctor & Gamble (PG) during the year. The company has seen market conditions in its product categories become more challenging over the last year as disruptions occur in the industry, and the stock is also under pressure due to the rising interest rate environment noted above. We believe that profitable growth opportunities in the company’s categories remain and that as disruptions continue, the strongest companies will be in the best position to take advantage of opportunities for growth that should ultimately benefit patient investors. Nonetheless, we continue to pay close attention to the events impacting PG and our investment and valuation thesis for the company.

Omnicom continued to see solid top line growth, although the growth rate has slowed over the last year. Earnings and cash flow growth has also shown more volatility in recent quarters. At the same time, market concerns over the disruptions occurring in the advertising industry generally have pressured the stock price of Omnicom, particularly as competition for digital advertising changes with new entrants such as Accenture and Amazon. We note that Omnicom has consistently invested in its own digital capabilities over the last few years and recognizes that innovation in additional methods for delivering advertising services is necessary to maintain solid business performance. We continue to monitor developments in Omnicom’s business and remain comfortable that the company warrants a position in the Fund.

We are constantly evaluating the businesses owned by the Fund as well as other investment candidates to determine whether better opportunities exist in our investable universe. Such determinations ultimately reflect a combination of fundamental considerations as well as valuation opportunities and overall risk profiles for our companies individually and on a relative basis.

| Annual Report | Jensen Quality Growth Fund | 1 |

Fund Additions and Eliminations

During the fiscal year, Jensen purchased a position in Intuit and sold its position in Automatic Data Processing. The Fund also initiated a position in Pfizer and the sale of its position in Broadridge, both of which reached completion shortly after the end of the fiscal year. These changes were in addition to normal add and trim trades during the period. A brief synopsis of the changes follows:

Intuit is a leading provider of financial software and cloud services for small businesses and consumers. Competitive advantages for the company include brand equity derived from well-known products including QuickBooks and TurboTax and high customer switching costs arising from a steep product learning curve and retention of user financial data.

QuickBooks is a software product that enables the self-employed, small business and accountants to accept payments, manage and pay bills, and carry out payroll functions. In essence, it’s the operating system of small businesses, and it contributes to approximately half of Intuit’s revenue. The other half of Intuit’s business is tax preparation software which is divided between consumers and professional accountants. This part of the business is driven by Intuit’s well-known and highly regarded consumer tax product, TurboTax. Intuit dominates both the professional and do-it-yourself markets with leading market share in each by successfully creating software that makes the onerous task of preparing and filing taxes relatively easy. Despite anemic underlying market growth, Intuit’s consumer tax preparation segment generated average growth in the high single digits over the past 5 years due to pricing power and its ability to take share.

As long term quality growth investors, we favor Intuit’s shifting businesses mix. Additionally, we maintain a favorable outlook on the company’s migration to a cloud-based delivery model, which creates the potential for more stable top-line growth and improved profitability.

Founded in 1849, Pfizer is a global biopharmaceutical company, operating a broad set of businesses including Innovative Pharmaceuticals, Generic Pharmaceuticals, Biosimilars, and Consumer Healthcare.

The investment case for Pfizer is bolstered by its diversified drug portfolio and an underappreciated drug pipeline. The company’s largest drug franchise, Prevnar, accounts for only 10% of consolidated sales and its five largest drug franchises together account for a little more than 40%. In contrast, our analysis indicates that competing biopharmaceutical companies are often characterized by extreme revenue concentration, creating the risk of dramatic sales decline when a drug loses market exclusivity. We believe this distinction is crucial, as Pfizer’s revenue diversity should insulate it from draconian ‘patent cliff’ exposure.

Over the past ten years, Pfizer has methodically revitalized its drug pipeline. At present, the company has approximately 100 drug programs at various stages of clinical development and expects 25-30 new drug approvals over the next five years. Key drug pipeline programs include immune-system based cancer treatments, novel approaches to diabetes drug regimens, vaccines targeting hospital-acquired infections, and a broad-based biosimilar effort.

In our view, Pfizer is nearing a key inflection point in terms of top-line growth. In the near-term, we expect revenue to be pressured from the loss of exclusivity on Lyrica, which currently accounts for nearly 9% of total sales. However, our model expects revenue headwinds from the loss of drug exclusivity to peak in 2020 and to subside thereafter. Simultaneously, we expect revenue contribution from Pfizer’s drug pipeline to accelerate. As a result, we expect the passage of this inflection point to result in gradual revenue growth improvement.

We believe Pfizer benefits from important ‘Quality Growth’ characteristics including competitive advantages, a consistently high return on equity, and robust free cash flow generation. Importantly, our valuation metrics indicate the stock price does not fully value the strengths of Pfizer’s business and its growth opportunities, even with our relatively conservative assumptions. We expect this disconnect between business fundamentals and stock price valuation to resolve itself as the company demonstrates the ability to monetize its drug pipeline while managing competitive threats to existing drug franchises.

Automatic Data Processing (ADP) is the leading North American payroll processor, serving mid-market businesses to large enterprises. Additionally, ADP offers human resources, outsourcing services, and tax/benefits administration. The company’s leading market position is crucial in a business characterized by extremely high customer switching costs, as evidenced by ADP’s 90%+ customer retention rate. We sold the stock solely due to valuation concerns as we retain a favorable outlook on the business. Prior to our sale decision, ADP shares appreciated considerably following the announcement of a proxy battle with an activist investor. Going forward, we will monitor ADP as a bench company and will consider adding it back to the Fund if its fundamentals, risk profile and valuation align with our strict investment criteria.

Broadridge was also sold due to the high valuation on the company’s stock and in keeping with our longstanding sell discipline.

We retain a positive view on Broadridge as a high quality company with a dominant position in the North American investor communications market. The company provides the de facto platform on which corporate issuers connect with individual investors for proxy vote dissemination and tabulation. Additionally, the company is a

| 2 | Jensen Quality Growth Fund | Annual Report |

leading provider of trade processing software used by capital markets companies. We expect Broadridge to benefit from continued growth in holdings of financial instruments and the company’s ability to use the data collected across its business to create value-added products to financial services companies.

We do not take lightly the decision to sell a fundamentally strong business such as Broadridge. However, since our initial purchase in April of 2017, Broadridge stock appreciated more than 70% and, as a result, all of our valuation metrics indicated that its stock was trading in excess of full value at the time of liquidation.

We will continue to closely monitor Broadridge, and should the stock become more attractively priced relative to business fundamentals, we may reintroduce a position in the future.

The Jensen Outlook

As we move into the second half of calendar 2018, the market environment looks likely to be influenced by the enhanced volatility that was evident in the first five months of the year. Much has been made of market leadership from so-called momentum stocks although such leadership can shift at any point, particularly as investors react to different concerns.

Among these concerns we note geopolitical challenges such as tariffs and potential trade wars, trade negotiations and the impact of the recent summit with North Korea. Dysfunction in Washington remains top of mind for many investors as investigations continue and the mid-term elections have begun to take center stage. The impact of more fundamental events, including the spending of savings arising from tax reductions, a rising interest rate environment, a stronger dollar, and threats of regulation against tech companies due to anti-trust and data privacy concerns also have the potential to unsettle the market.

As we consider these items, we believe that our long-term focus on risk management remains as important as ever. Offsetting market risks, we note that economic data is solid, with low employment and rising wages benefitting consumers as reflected in robust consumer confidence. Earnings growth for companies within the broad market benchmarks is strong and projected to remain so for at least the remainder of the year as year over year comparisons are easier for the next few quarters, although we believe they will get tougher as we move into 2019.

Closer to home, we remain impressed with the performance of the companies in the Fund and the resilience of their business models to economic events and disruptive competition. Such resilience and the ability to consistently reinvest growing free cash flow in long term growth opportunities have long been central tenets of our investment strategy. We constantly seek information that will inform and enhance our decision making in mitigating business, pricing and positioning risk in the Fund and believe that the current environment is an opportunity for focused, active investment managers such as Jensen to make a positive difference on behalf of our investors.

Whatever happens during the remainder of 2018, we believe that paying attention to company fundamentals helps Fund shareholders manage risk, should provide a measure of capital protection in volatile markets and delivers an opportunity for long-term capital appreciation.

We invite you to seek additional information about The Jensen Quality Growth Fund at www.jenseninvestment.com where additional content, including updated holdings and performance information, is available. We take our investment responsibilities seriously and appreciate the trust you have placed in us. As always, we welcome your feedback.

Sincerely,

The Jensen Investment Committee

This discussion and analysis of the Fund is as of May 2018 and is subject to change, and any forecasts made cannot be guaranteed. Past performance is no guarantee of future results. Fund holdings and sector weightings are subject to change and are not recommendations to buy or sell any security. The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. One cannot invest directly in an index. For more complete information regarding performance and holdings, please refer to the financial statements and schedule of investments headings of this report. Current and future portfolio holdings are subject to risk. The Fund is nondiversified, meaning that it may concentrate its assets in fewer individual holdings than a diversified fund and is therefore more exposed to individual stock volatility than a diversified fund. Return on Equity: Is equal to a company's after-tax earnings (excluding non-recurring items) divided by its average stockholder equity for the year. Free Cash Flow: Is equal to the after-tax net income of a company plus depreciation and amortization less capital expenditures. For use only when preceded or accompanied by a current prospectus for the Fund. The Jensen Quality Growth Fund is distributed by Quasar Distributors, LLC. |

| Annual Report | Jensen Quality Growth Fund | 3 |

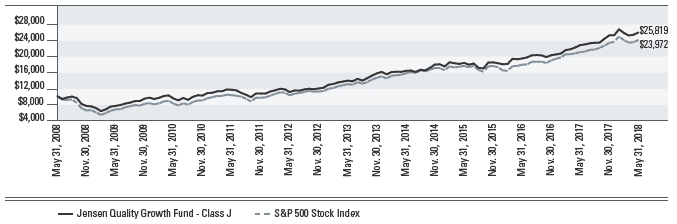

Jensen Quality Growth Fund - Class J (Unaudited)

Total Returns vs. The S&P 500

| Average Annual Returns – For periods ended May 31, 2018 | 1 year | 3 years | 5 years | 10 years |

| Jensen Quality Growth Fund - Class J | 13.77% | 12.20% | 13.22% | 9.95% |

| S&P 500 Stock Index | 14.38% | 10.97% | 12.98% | 9.14% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on May 31, 2008 for Class J. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| 4 | Jensen Quality Growth Fund | Annual Report |

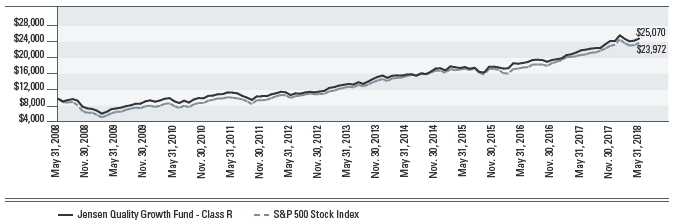

Jensen Quality Growth Fund - Class R (Unaudited)

Total Returns vs. The S&P 500

| Average Annual Returns – For periods ended May 31, 2018 | 1 year | 3 years | 5 years | 10 years |

| Jensen Quality Growth Fund - Class R | 13.34% | 11.79% | 12.81% | 9.63% |

| S&P 500 Stock Index | 14.38% | 10.97% | 12.98% | 9.14% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on May 31, 2008 for Class R. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| Annual Report | Jensen Quality Growth Fund | 5 |

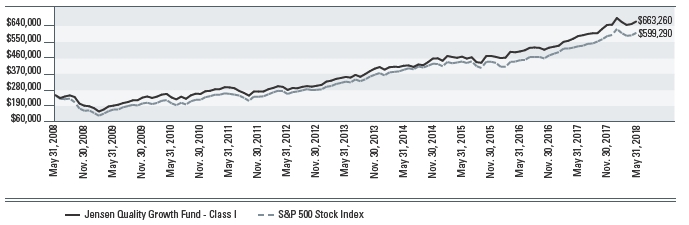

Jensen Quality Growth Fund - Class I (Unaudited)

Total Returns vs. The S&P 500

| Average Annual Returns – For periods ended May 31, 2018 | 1 year | 3 years | 5 years | 10 years |

| Jensen Quality Growth Fund - Class I | 14.08% | 12.49% | 13.51% | 10.25% |

| S&P 500 Stock Index | 14.38% | 10.97% | 12.98% | 9.14% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $250,000 made on May 31, 2008 for Class I. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| 6 | Jensen Quality Growth Fund | Annual Report |

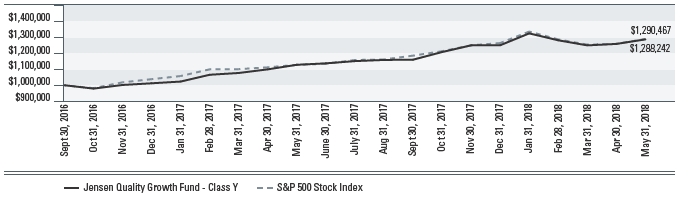

Jensen Quality Growth Fund - Class Y (Unaudited)

Total Returns vs. The S&P 500

| Total Returns – For periods ended May 31, 2018 | 1 Month | 3 Month | 1 Year | Since Inception |

| (September 30, 2016) | ||||

| Jensen Quality Growth Fund - Class Y | 2.26% | 0.45% | 14.16% | 16.42% |

| S&P 500 Stock Index | 2.41% | 0.19% | 14.38% | 16.54% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $1,000,000 made on September 30, 2016 (commencement of operations for Class Y). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| Annual Report | Jensen Quality Growth Fund | 7 |

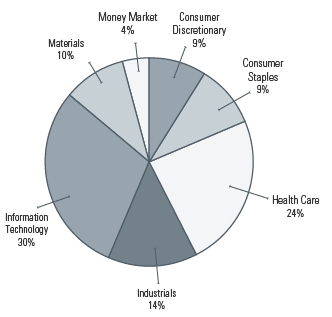

Investments by Sector as of May 31, 2018

(as a Percentage of Total Investments) (Unaudited)

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

| 8 | Jensen Quality Growth Fund | Annual Report |

Statement of Assets & Liabilities

May 31, 2018

| Assets: | ||

| Investment, at value (cost $3,470,591,822) | $6,424,621,322 | |

| Receivable for investments sold | 34,007,192 | |

| Income receivable | 13,256,601 | |

| Receivable for capital stock issued | 20,363,132 | |

| Other assets | 85,268 | |

| Total assets | 6,492,333,515 | |

| Liabilities: | ||

| Payable to Investment Adviser | 2,861,929 | |

| Payable for investments purchased | 56,148,450 | |

| Payable for capital stock redeemed | 6,609,326 | |

| Accrued distribution fees | 874,053 | |

| Accrued director fees | 80,032 | |

| Accrued custodian fees | 99,689 | |

| Accrued expenses and other liabilities | 1,423,836 | |

| Total liabilities | 68,097,315 | |

| Total Net Assets | $6,424,236,200 | |

| Net Assets Consist of: | ||

| Capital stock | 3,174,842,006 | |

| Accumulated net investment income | 13,768,569 | |

| Accumulated net realized gain | 281,596,125 | |

| Unrealized appreciation on investments | 2,954,029,500 | |

| Total Net Assets | $6,424,236,200 | |

| Net Assets Consist of: | ||

| Class J Shares | ||

| Net Assets | $2,594,126,055 | |

| Shares outstanding | 54,189,662 | |

| Net Asset Value - Offering Price and Redemption Price Per Share (2,000,000,000 shares authorized) | $47.87 | |

| Class R Shares | ||

| Net Assets | $31,596,700 | |

| Shares outstanding | 663,473 | |

| Net Asset Value - Offering Price and Redemption Price Per Share (1,000,000,000 shares authorized) | $47.62 | |

| Class I Shares | ||

| Net Assets | $3,261,892,877 | |

| Shares outstanding | 68,101,422 | |

| Net Asset Value - Offering Price and Redemption Price Per Share (1,000,000,000 shares authorized) | $47.90 | |

| Class Y Shares | ||

| Net Assets | $536,620,568 | |

| Shares outstanding | 11,203,465 | |

| Net Asset Value - Offering Price and Redemption Price Per Share (1,000,000,000 shares authorized) | $47.90 |

The accompanying notes are an integral part of these financial statements.

| Annual Report | Jensen Quality Growth Fund | 9 |

Schedule of Investments

May 31, 2018 (showing percentage of total net assets)

| Common Stocks - 96.08% | ||||

| shares | Aerospace & Defense - 5.07% | value | ||

| 2,609,000 | United Technologies Corporation | $325,655,380 | ||

| shares | Air Freight & Logistics - 2.40% | value | ||

| 1,326,000 | United Parcel Service, Inc. - Class B | $153,975,120 | ||

| shares | Beverages - 6.51% | value | ||

| 2,344,000 | The Coca-Cola Company | $100,792,000 | ||

| 3,163,000 | PepsiCo, Inc. | $317,090,750 | ||

| $417,882,750 | ||||

| shares | Chemicals - 9.96% | value | ||

| 2,220,000 | Ecolab, Inc. | $316,594,200 | ||

| 2,069,000 | Praxair, Inc. | $323,301,940 | ||

| $639,896,140 | ||||

| shares | Electrical Equipment - 2.41% | value | ||

| 2,187,000 | Emerson Electric Company | $154,927,080 | ||

| shares | Electronic Equipment, Instruments & Components - 2.56% | value | ||

| 1,892,000 | Amphenol Corporation - Class A | $164,471,560 | ||

| shares | Health Care Equipment & Supplies - 10.77% | value | ||

| 1,692,000 | Becton Dickinson and Company | $374,930,280 | ||

| 1,821,000 | Stryker Corporation | $316,890,420 | ||

| $691,820,700 | ||||

| shares | Health Care Providers & Services - 5.02% | value | ||

| 1,336,000 | UnitedHealth Group, Inc. | $322,657,360 | ||

| shares | Household Products - 2.77% | value | ||

| 2,434,000 | The Procter & Gamble Company | $178,095,780 | ||

| shares | Industrial Conglomerates - 3.83% | value | ||

| 1,246,600 | 3M Company | $245,866,918 | ||

| shares | Internet Software & Services - 3.27% | value | ||

| 191,000 | Alphabet, Inc. - Class A (a) | $210,100,000 | ||

| shares | IT Services - 9.08% | value | ||

| 1,503,000 | Accenture PLC - Class A (b) | $234,077,220 | ||

| 134,873 | Broadridge Financial Solutions, Inc. | $15,571,088 | ||

| 2,355,000 | Cognizant Technology Solutions | |||

| Corporation - Class A | $177,449,250 | |||

| 821,000 | Mastercard, Inc. - Class A | $156,088,520 | ||

| $583,186,078 | ||||

| shares | Life Sciences Tools & Services - 2.60% | value | ||

| 868,300 | Waters Corporation (a) | $167,251,946 | ||

| shares | Media - 2.86% | value | ||

| 2,547,000 | Omnicom Group, Inc. | $183,587,760 | ||

| shares | Pharmaceuticals - 5.38% | value | ||

| 2,078,000 | Johnson & Johnson | $248,570,360 | ||

| 2,700,000 | Pfizer, Inc. | $97,011,000 | ||

| $345,581,360 | ||||

| shares | Software - 12.50% | value | ||

| 885,000 | Intuit, Inc. | $178,416,000 | ||

| 3,436,000 | Microsoft Corporation | $339,614,240 | ||

| 6,095,000 | Oracle Corporation | $284,758,400 | ||

| $802,788,640 | ||||

| shares | Specialty Retail - 3.27% | value | ||

| 2,326,000 | The TJX Companies, Inc. | $210,084,320 | ||

| shares | Technology Hardware, Storage & Peripherals - 3.16% | value | ||

| 1,087,000 | Apple, Inc. | $203,127,690 | ||

| shares | Textiles, Apparel & Luxury Goods - 2.66% | value | ||

| 2,384,000 | NIKE, Inc. - Class B | $171,171,200 | ||

| Total Common Stocks | value | |||

| (Cost $3,218,098,282) | $6,172,127,782 | |||

The accompanying footnotes are an integral part of the financial statements.

| 10 | Jensen Quality Growth Fund | Annual Report |

Schedule of Investments continued

May 31, 2018 (showing percentage of total net assets)

| Short-Term Investment- 3.93% | ||||

| shares | Money Market Fund - 3.93% | value | ||

| 252,493,540 | Morgan Stanley Institutional Liquidity Funds - | $252,493,540 | ||

| Treasury Portfolio - Class I, 1.61% (c) | ||||

| Total Short-Term Investment | value | |||

| (Cost $252,493,540) | $252,493,540 | |||

| Total Investments | value | |||

| (Cost $3,470,591,822) - 100.01% | $6,424,621,322 | |||

| Liabilities in Excess of Other Assets - (0.01)% | $(385,122) | |||

| TOTAL NET ASSETS - 100.00% | $6,424,236,200 | |||

| (a) | Non-income producing security. |

| (b) | Foreign issued security. Foreign concentration (including ADRs) was as follows: Ireland 3.64% as a percentage of net assets. |

| (c) | Variable rate security. Rate listed is the 7-day effective yield as of May 31, 2018. |

The accompanying footnotes are an integral part of the financial statements.

| Annual Report | Jensen Quality Growth Fund | 11 |

Statement of Operations

Year Ended May 31, 2018

| Investment Income: | |||

| Dividend income | $113,089,624 | ||

| Interest income | 2,244,223 | ||

| Total investment income | 115,333,847 | ||

| Expenses: | |||

| Investment advisory fees | 31,518,782 | ||

| 12b-1 fees - Class J | 6,704,528 | ||

| Administration fees | 2,061,752 | ||

| Shareholder servicing fees - Class I | 1,722,999 | ||

| Sub-transfer agent expenses - Class J | 1,581,378 | ||

| Reports to shareholders - Class I | 378,247 | ||

| Custody fees | 371,529 | ||

| Fund Accounting fees | 357,289 | ||

| Directors' fees and expenses | 266,149 | ||

| Federal and state registration fees | 242,842 | ||

| Reports to shareholders - Class J | 227,100 | ||

| 12b-1 fees - Class R | 160,129 | ||

| Transfer agent fees - Class I | 159,821 | ||

| Professional fees | 152,703 | ||

| Other | 120,898 | ||

| Transfer agent fees -Class J | 114,409 | ||

| Transfer agent expenses | 109,419 | ||

| Shareholder servicing fees - Class R | 56,372 | ||

| Reports to shareholders - Class Y | 8,729 | ||

| Reports to shareholders - Class R | 3,300 | ||

| Transfer agent fees - Class R | 1,613 | ||

| Transfer agent fees - Class Y | 479 | ||

| Total expenses | 46,320,467 | ||

| Net Investment Income | 69,013,380 | ||

| Realized and Unrealized Gain on Investments: | |||

| Net realized gain on investment transactions | 379,440,936 | ||

| Change in unrealized appreciation on investments | 387,963,164 | ||

| Net realized and unrealized gain on investments | 767,404,100 | ||

| Net Increase in Net Assets Resulting | |||

| from Operations | $836,417,480 | ||

The accompanying notes are an integral part of these financial statements.

| 12 | Jensen Quality Growth Fund | Annual Report |

Statements of Changes in Net Assets

| Year Ended | Year Ended | |||||||

| Operations: | May 31, 2018 | May 31, 2017 | ||||||

| Net investment income | 69,013,380 | 69,905,229 | ||||||

| Net realized gain on investment | ||||||||

| transactions | 379,440,936 | 143,464,792 | ||||||

| Change in unrealized appreciation | ||||||||

| on investments | 387,963,164 | 682,483,465 | ||||||

| Net increase in net assets resulting | ||||||||

| from operations | 836,417,480 | 895,853,486 | ||||||

| Year Ended | Year Ended | |||||||

| Capital Share Transactions: | May 31, 2018 | May 31, 2017 | ||||||

| Shares Sold - Class J | 318,777,023 | 644,690,416 | ||||||

| Shares Sold - Class R | 11,103,721 | 7,375,334 | ||||||

| Shares Sold - Class I | 601,695,778 | 1,028,203,361 | ||||||

| Shares Sold - Class Y | 133,538,669 | 425,367,893 | ||||||

| Shares issued in reinvestment of | ||||||||

| dividends - Class J | 85,647,642 | 106,633,839 | ||||||

| Shares issued in reinvestment of | ||||||||

| dividends - Class R | 967,593 | 1,147,418 | ||||||

| Shares issued in reinvestment of | ||||||||

| dividends - Class I | 104,958,206 | 130,286,612 | ||||||

| Shares issued in reinvestment of | ||||||||

| dividends - Class Y | 16,537,081 | 3,414,381 | ||||||

| Shares redeemed - Class J | (672,727,820) | (747,070,527) | ||||||

| Shares redeemed - Class R | (10,941,650) | (13,593,863) | ||||||

| Shares redeemed - Class I | (807,098,857) | (1,242,047,786) | ||||||

| Shares redeemed - Class Y | (103,110,798) | (9,872,884) | ||||||

| Net increase (decrease) | (320,653,412) | 334,534,194 | ||||||

| Dividends and Distributions | Year Ended | Year Ended | ||||||

| to Shareholders: | May 31, 2018 | May 31, 2017 | ||||||

| Net investment income - Class J | (24,194,817) | (26,287,796) | ||||||

| Net investment income - Class R | (174,830) | (196,550) | ||||||

| Net investment income - Class I | (37,011,500) | (39,122,661) | ||||||

| Net investment income - Class Y | (5,824,051) | (1,077,099) | ||||||

| Net realized gains - Class J | (62,954,202) | (82,456,674) | ||||||

| Net realized gains - Class R | (797,290) | (956,401) | ||||||

| Net realized gains - Class I | (75,185,067) | (98,816,152) | ||||||

| Net realized gains - Class Y | (11,240,428) | (2,396,539) | ||||||

| Total dividends and distributions | (217,382,185) | (251,309,872) | ||||||

| Year Ended | Year Ended | |||||||

| Increase in Net Assets | May 31, 2018 | May 31, 2017 | ||||||

| 298,381,883 | 979,077,808 | |||||||

| Year Ended | Year Ended | |||||||

| Net Assets: | May 31, 2018 | May 31, 2017 | ||||||

| Beginning of Year | 6,125,854,317 | 5,146,776,509 | ||||||

| End of Year (including undistributed | ||||||||

| net investment income of | ||||||||

| $13,768,569, and $11,960,387, | ||||||||

| respectively) | $6,424,236,200 | $6,125,854,317 | ||||||

The accompanying notes are an integral part of these financial statements.

| Annual Report | Jensen Quality Growth Fund | 13 |

Financial Highlights

Class J

| year ended | year ended | year ended | year ended | year ended | ||||||||||||

| Per Share Data: | May 31, 2018 | May 31, 2017 | May 31, 2016 | May 31, 2015 | May 31, 2014 | |||||||||||

| Net asset value, beginning of year | $43.44 | $38.78 | $40.88 | $38.33 | $33.98 | |||||||||||

| Income from investment operations: | ||||||||||||||||

| Net investment income(1) | 0.44 | 0.45 | 0.46 | 0.44 | 0.37 | |||||||||||

| Net realized and unrealized gains on investments | 5.49 | 6.00 | 1.72 | 4.14 | 5.52 | |||||||||||

| Total from investment operations | 5.93 | 6.45 | 2.18 | 4.58 | 5.89 | |||||||||||

| Less distributions: | ||||||||||||||||

| Dividends from net investment income | (0.41) | (0.43) | (0.49) | (0.40) | (0.35) | |||||||||||

| Distributions from capital gains | (1.09) | (1.36) | (3.79) | (1.63) | (1.19) | |||||||||||

| Total distributions | $(1.50) | $(1.79) | $(4.28) | $(2.03) | $(1.54) | |||||||||||

| Net asset value, end of year | $47.87 | $43.44 | $38.78 | $40.88 | $38.33 | |||||||||||

| Total return | 13.77% | 17.12% | 5.99% | 12.07% | 17.57% | |||||||||||

| Supplemental data and ratios: | ||||||||||||||||

| Net assets, end of year (000's) | $2,594,126 | $2,604,964 | $2,317,939 | $2,273,979 | $2,447,876 | |||||||||||

| Ratio of expenses to average net assets | 0.87% | 0.87% | 0.87% | 0.87% | 0.87% | |||||||||||

| Ratio of net investment income to average net assets | 0.92% | 1.12% | 1.18% | 1.08% | 1.00% | |||||||||||

| Portfolio turnover rate | 9.06% | 6.80% | 14.12% | 14.42% | 14.10% |

| (1) | Net investment income per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustment for permanent book-to-tax differences. |

The accompanying notes are an integral part of these financial statements.

| 14 | Jensen Quality Growth Fund | Annual Report |

Financial Highlights

Class R

| year ended | year ended | year ended | year ended | year ended | ||||||||||||

| Per Share Data: | May 31, 2018 | May 31, 2017 | May 31, 2016 | May 31, 2015 | May 31, 2014 | |||||||||||

| Net asset value, beginning of year | $43.23 | $38.59 | $40.69 | $38.16 | $33.83 | |||||||||||

| Income from investment operations: | ||||||||||||||||

| Net investment income(1) | 0.26 | 0.29 | 0.32 | 0.28 | 0.23 | |||||||||||

| Net realized and unrealized gains on investments | 5.47 | 5.98 | 1.72 | 4.14 | 5.50 | |||||||||||

| Total from investment operations | 5.73 | 6.27 | 2.04 | 4.42 | 5.73 | |||||||||||

| Less distributions: | ||||||||||||||||

| Dividends from net investment income | (0.25) | (0.27) | (0.35) | (0.26) | (0.21) | |||||||||||

| Distributions from capital gains | (1.09) | (1.36) | (3.79) | (1.63) | (1.19) | |||||||||||

| Total distributions | $(1.34) | $(1.63) | $(4.14) | $(1.89) | $(1.40) | |||||||||||

| Net asset value, end of year | $47.62 | $43.23 | $38.59 | $40.69 | $38.16 | |||||||||||

| Total return | 13.34% | 16.69% | 5.63% | 11.67% | 17.13% | |||||||||||

| Supplemental data and ratios: | ||||||||||||||||

| Net assets, end of year (000's) | $31,597 | $27,300 | $29,181 | $38,976 | $50,478 | |||||||||||

| Ratio of expenses to average net assets | 1.24% | 1.24% | 1.22% | 1.22% | 1.25% | |||||||||||

| Ratio of net investment income to average net assets | 0.56% | 0.75% | 0.83% | 0.71% | 0.63% | |||||||||||

| Portfolio turnover rate | 9.06% | 6.80% | 14.12% | 14.42% | 14.10% |

| (1) | Net investment income per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustment for permanent book-to-tax differences. |

The accompanying notes are an integral part of these financial statements.

| Annual Report | Jensen Quality Growth Fund | 15 |

Financial Highlights

Class I

| year ended | year ended | year ended | year ended | year ended | |||||||||||

| Per Share Data: | May 31, 2018 | May 31, 2017 | May 31, 2016 | May 31, 2015 | May 31, 2014 | ||||||||||

| Net asset value, beginning of year | $43.46 | $38.80 | $40.90 | $38.35 | $34.00 | ||||||||||

| Income from investment operations: | |||||||||||||||

| Net investment income(1) | 0.55 | 0.56 | 0.56 | 0.53 | 0.46 | ||||||||||

| Net realized and unrealized gains on investments | 5.51 | 6.00 | 1.72 | 4.14 | 5.53 | ||||||||||

| Total from investment operations | 6.06 | 6.56 | 2.28 | 4.67 | 5.99 | ||||||||||

| Less distributions: | |||||||||||||||

| Dividends from net investment income | (0.53) | (0.54) | (0.59) | (0.49) | (0.45) | ||||||||||

| Distributions from capital gains | (1.09) | (1.36) | (3.79) | (1.63) | (1.19) | ||||||||||

| Total distributions | $(1.62) | $(1.90) | $(4.38) | $(2.12) | $(1.64) | ||||||||||

| Net asset value, end of year | $47.90 | $43.46 | $38.80 | $40.90 | $38.35 | ||||||||||

| Total return | 14.08% | 17.42% | 6.25% | 12.32% | 17.87% | ||||||||||

| Supplemental data and ratios: | |||||||||||||||

| Net assets, end of year (000's) | $3,261,893 | $3,052,698 | $2,799,657 | $3,062,182 | $2,821,194 | ||||||||||

| Ratio of expenses to average net assets | 0.62% | 0.60% | 0.63% | 0.62% | 0.63% | ||||||||||

| Ratio of net investment income to average net assets | 1.18% | 1.38% | 1.42% | 1.33% | 1.25% | ||||||||||

| Portfolio turnover rate | 9.06% | 6.80% | 14.12% | 14.42% | 14.10% |

| (1) | Net investment income per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustment for permanent book-to-tax differences. |

The accompanying notes are an integral part of these financial statements.

| 16 | Jensen Quality Growth Fund | Annual Report |

Financial Highlights

Class Y

| year ended | September 30, 2016(1) | ||||||

| Per Share Data: | May 31, 2018 | through May 31, 2017 | |||||

| Net asset value, beginning of year | $43.46 | $40.12 | |||||

| Income from investment operations: | |||||||

| Net investment income(2) | 0.58 | 0.34 | |||||

| Net realized and unrealized gains on investments | 5.51 | 4.65 | |||||

| Total from investment operations | 6.09 | 4.99 | |||||

| Less distributions: | |||||||

| Dividends from net investment income | (0.56) | (0.29) | |||||

| Distributions from capital gains | (1.09) | (1.36) | |||||

| Total distributions | $(1.65) | $(1.65) | |||||

| Net asset value, end of year | $47.90 | $43.46 | |||||

| Total return | 14.16% | 12.85% | |||||

| Supplemental data and ratios: | |||||||

| Net assets, end of year (000's) | $536,621 | $440,892 | |||||

| Ratio of expenses to average net assets | 0.55% | 0.56% | |||||

| Ratio of net investment income to average net assets | 1.25% | 1.55% | |||||

| Portfolio turnover rate | 9.06% | 6.80% |

| (1) | Commencement of Operations |

| (2) | Net investment income per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustment for permanent book-to-tax differences. |

The accompanying notes are an integral part of these financial statements.

| Annual Report | Jensen Quality Growth Fund | 17 |

Notes to the Financial Statements

May 31, 2018

1. Organization and Significant Accounting Policies

The Jensen Quality Growth Fund, Inc. (the “Fund”), was organized as an Oregon Corporation on April 17, 1992, and is registered as an open-end, nondiversified management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Fund commenced operations on August 3, 1992. Effective March 1, 2018, the name of the Fund was changed from The Jensen Portfolio, Inc. doing business as Jensen Quality Growth Fund to The Jensen Quality Growth Fund, Inc. The Fund is authorized to issue 5,000,000,000 shares of common stock, all of which have been authorized for the existing share classes. The Fund currently offers four different classes of shares. Effective July 30, 2003 the Fund issued two new classes of shares, Class R and Class I, and renamed the existing class as Class J. Effective September 30, 2016, the Fund issued a new class of shares, Class Y. Class J shares are subject to a 0.25% 12b-1 fee and a sub-transfer agency fee, Class R shares are subject to a 0.50% 12b-1 fee and up to a 0.25% shareholder servicing fee, and Class I shares are subject to a shareholder servicing fee up to 0.10%, as described in each Class’ prospectus. Each class of shares has identical rights and privileges except with respect to the 12b-1 fees, sub-transfer agency fees and shareholder servicing fees, and voting rights on matters affecting a single class of shares. The principal investment objective of the Fund is long-term capital appreciation.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services Investment Companies”.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in United States of America (“GAAP”).

a) Investment Valuation – Securities that are listed on United States stock exchanges are valued at the last sale price at the close of the exchange. Equity securities listed on the NASDAQ Stock Market are valued at the NASDAQ Official Closing Price or, if there has been no sale on that day, at their current bid price. Investments in open-end and closed-end registered investment companies, including money market funds, that do not trade on an exchange are valued at the end of day net asset value per share. Quotations are taken from the market in which the security is primarily traded. Over-the-counter securities are valued at the current bid price in the absence of a closing price. Securities for which market quotations are not readily available are valued at fair value as determined by Jensen Investment Management, Inc. (the “Investment Adviser”) at or under the direction of the Fund’s Board of Directors.

There is no definitive set of circumstances under which the Fund may elect to use fair value procedures to value a security. Although the Fund only invests in publicly traded securities, the large majority of which are large capitalization, highly liquid securities, they nonetheless may become securities for which market quotations are not readily available, such as in instances where the market quotation for a security has become stale, sales of a security have been infrequent, trading in the security has been suspended, or where there is a thin market in the security. Securities for which market quotations are not readily available will be valued at their fair value as determined under the Fund’s fair valuation procedures established by the Board of Directors. The Fund is prohibited from investing in restricted securities (securities issued in private placement transactions that may not be offered or sold to the public without registration under the securities laws); therefore, fair value pricing considerations for restricted securities are generally not applicable to the Fund.

Fair Value Measurement – The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. The three levels of the fair value hierarchy are as follows:

| Level 1 | Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date. |

| Level 2 | Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active and prices for similar securities, interest rates, credit risk, etc. |

| Level 3 | Inputs that are unobservable (including the Fund’s own assumptions in determining the fair value of investments). |

Inputs refer broadly to the assumptions that market participants use to make valuation decisions, including assumptions about risk. Inputs may include price information, volatility statistics, specific and broad credit data, liquidity statistics, and other factors. A financial instrument’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Fund. The Fund considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by

| 18 | Jensen Quality Growth Fund | Annual Report |

independent sources that are actively involved in the relevant market. The categorization of a financial instrument within the hierarchy is based upon the pricing transparency of the instrument and does not necessarily correspond to the Fund’s perceived risk of that instrument.

Investments whose values are based on quoted market prices in active markets, include common stocks and certain money market securities, and are classified within Level 1. Investments that trade in markets that are not considered to be active, but are valued based on quoted market prices, dealer quotations or alternative pricing sources supported by observable inputs are classified within Level 2. Investments classified within Level 3 have significant unobservable inputs, as they trade infrequently or not at all.

The following is a summary of the inputs used, as of May 31, 2018, to value the Fund’s investments carried at fair value. The inputs and methodology used for valuing securities may not be an indication of the risk associated with investing in those securities.

| Investments at Value | Total | Level 1 | Level 2 | Level 3 | |||||||||

| Total Common | |||||||||||||

| Stocks* | $6,172,127,782 | $6,172,127,782 | $— | $— | |||||||||

| Total Short-Term | |||||||||||||

| Investment | 252,493,540 | 252,493,540 | — | — | |||||||||

| Total Investments | $6,424,621,322 | $6,424,621,322 | $— | $— |

| * | For further information regarding security characteristics and industry classifications, please see the Schedule of Investments. |

The Fund did not hold any investments during the year ended May 31, 2018 with significant unobservable inputs which would be classified as Level 3. There were no transfers of securities between levels during the reporting period. It is the Fund’s policy to record transfers between levels as of the end of the reporting period. The Fund did not hold any derivative instruments during the reporting period.

b) Federal Income Taxes – No provision has been made for Federal income taxes since the Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all net investment company taxable income and net capital gains to its shareholders and otherwise comply with the provision of the Internal Revenue Code applicable to regulated investment companies.

The Fund has reviewed all open tax years and major jurisdictions and concluded that there is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken as of and for the year ended May 31, 2018. The Fund recognizes interest and penalties, if any, related to uncertain tax benefits in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. Open tax years are those that are open for exam by taxing authorities. The Fund has no examination in progress. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

c) Distributions to Shareholders – Dividends to shareholders are recorded on the ex-dividend date. Dividends from net investment income are declared and paid quarterly by the Fund. Distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from GAAP. The Fund may utilize earnings and profits distributed to shareholders on redemption of shares as part of the dividend paid deduction.

d) Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

e) Guarantees and Indemnifications – Under the Fund’s organizational documents, each director, officer, employee or other agent of the Fund is indemnified, to the extent permitted by the 1940 Act, against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and believes the risk of loss to be remote.

f) Allocation of Income, Expenses and Gains/Losses – Income, expenses (other than those deemed attributable to a specific share class), and gains and losses of the Fund are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a class of shares are recorded by the specific class. Most Fund expenses are allocated by class based on relative net assets. Transfer agent fees and reports to shareholders are allocated based on the number of shareholder accounts in each class. Sub-transfer agency fees are expensed to the Class J shares based on the actual number of shareholder accounts held and serviced by certain financial intermediaries as described in the Class J shares’ prospectus. 12b-1 fees are expensed at 0.25% of average daily net assets of Class J shares and 0.50% of average daily net assets of Class R shares. Shareholder servicing fees are expensed at up to 0.10% and up to 0.25% of the average daily net assets of Class I shares and Class R shares, respectively.

| Annual Report | Jensen Quality Growth Fund | 19 |

g) Other – Investment and shareholder transactions are recorded on trade date. Gains or losses from investment transactions are determined on the basis of identified carrying value using the specific identification method. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis.

2. Capital Share Transactions

Transactions in shares of the Fund were as follows:

| Class J | year ended May 31, 2018 | year ended May 31, 2017 | |||||

| Shares sold | 6,916,189 | 16,052,231 | |||||

| Shares issued in | |||||||

| reinvestment of dividends | 1,839,471 | 2,690,481 | |||||

| Shares redeemed | (14,534,746 | ) | (18,544,674 | ) | |||

| Net increase(decrease) | (5,779,086 | ) | 198,038 | ||||

| Shares outstanding: | |||||||

| Beginning of year | 59,968,748 | 59,770,710 | |||||

| End of year | 54,189,662 | 59,968,748 | |||||

| Class R | year ended May 31, 2018 | year ended May 31, 2017 | |||||

| Shares sold | 247,836 | 184,486 | |||||

| Shares issued in | |||||||

| reinvestment of dividends | 20,824 | 29,094 | |||||

| Shares redeemed | (236,737 | ) | (338,204 | ) | |||

| Net increase(decrease) | 31,923 | (124,624 | ) | ||||

| Shares outstanding: | |||||||

| Beginning of year | 631,550 | 756,174 | |||||

| End of year | 663,473 | 631,550 | |||||

| Class I | year ended May 31, 2018 | year ended May 31, 2017 | |||||

| Shares sold | 12,998,023 | 25,464,604 | |||||

| Shares issued in | |||||||

| reinvestment of dividends | 2,256,807 | 3,285,839 | |||||

| Shares redeemed | (17,387,620 | ) | (30,666,180 | ) | |||

| Net decrease | (2,132,790 | ) | (1,915,737 | ) | |||

| Shares outstanding: | |||||||

| Beginning of year | 70,234,212 | 72,149,949 | |||||

| End of year | 68,101,422 | 70,234,212 | |||||

| Class Y | year ended May 31, 2018 | Sept. 30, 2016(1) through May 31, 2017 | |||||

| Shares sold | 2,895,833 | 10,302,036 | |||||

| Shares issued in | |||||||

| reinvestment of dividends | 355,721 | 85,362 | |||||

| Shares redeemed | (2,192,051 | ) | (243,436 | ) | |||

| Net increase | 1,059,503 | 10,143,962 | |||||

| Shares outstanding: | |||||||

| Beginning of year | 10,143,962 | — | |||||

| End of year | 11,203,465 | 10,143,962 | |||||

| (1) | Share class commenced operations on September 30, 2016. |

3. Investment Transactions

The aggregate purchases and aggregate sales of securities, excluding short-term investments, by the Fund for the year ended May 31, 2018, were $560,872,432 and $996,261,088, respectively.

4. Income Taxes

The cost of investments differ for financial statement and tax purposes primarily due to the deferral of losses on wash sales.

The distributions of $67,221,763 and $66,684,106 paid during the years ended May 31, 2018 and 2017, respectively, were classified as ordinary income for tax purposes. The distributions of $150,160,422 and $184,625,766 paid during the years ended May 31, 2018 and 2017, respectively, were classified as long-term capital gain for income tax purposes.

Additionally, U.S. generally accepted accounting principles require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended May 31, 2018, accumulated net realized gain decreased by $26,514,797 and capital stock increased by $26,514,797. The permanent difference relates to tax equalization.

| 20 | Jensen Quality Growth Fund | Annual Report |

At May 31, 2018, the cost of investments, net unrealized appreciation (depreciation) and undistributed ordinary income and undistributed long term capital gains for income tax purposes were as follows:

| Cost of investments | 3,470,646,724 | ||

| Gross unrealized appreciation | 2,970,777,929 | ||

| Gross unrealized depreciation | (16,803,331 | ) | |

| Net unrealized appreciation | 2,953,974,598 | ||

| Undistributed ordinary income | 14,808,945 | ||

| Undistributed long-term capital gain | 280,610,651 | ||

| Total distributable earnings | 295,419,596 | ||

| Other accumulated gains | — | ||

| Total accumulated gains | 3,249,394,194 |

At May 31, 2018, the Fund had total tax basis capital losses of $0.

On June 20, 2018, The Fund declared and paid a distribution from ordinary income of $7,077,062, $10,868,370, $53,337, and $1,994,425 for Class J, Class I, Class R and Class Y, respectively, to shareholders of record as of June 19, 2018.

5. Line of Credit

The Fund has the lesser of (i) $400 million, (ii) 20% of the gross market value of the Fund, or (iii) 33.33% of the net market value of the unencumbered assets of the Fund revolving credit facility, subject to certain restrictions, for temporary emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The unsecured line of credit has a one-year term and is reviewed annually by the Board of Directors. The current agreement runs through December 16, 2018. The interest rate on the outstanding principal amount is equal to the prime rate less 1%. As of May 31, 2018, the rate on the Fund’s line of credit was 3.75%. The Fund did not borrow on the line of credit during the year ended May 31, 2018.

6. Investment Advisory Agreement

The Fund is a party to an Investment Advisory and Service Contract with the Investment Adviser. Due to the planned retirement of Mr. Robert Zagunis and the resulting change of control of the Investment Adviser a special meeting of Fund shareholders was held on November 15, 2017 to consider approving a new Investment Advisory and Service Contract between the Investment Adviser, and the Fund. The Fund’s shareholders approved the new Investment Advisory and Service Contract with the Investment Adviser, which became effective on February 28, 2018. Pursuant to the terms of the Investment Advisory and Service Contract approved by Fund shareholders, the Investment Adviser is entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 0.50% as applied to the Fund’s average daily net assets of $4 billion or less, 0.475% as applied to the Fund’s average daily net assets of more than $4 billion and up to $8 billion, 0.45% as applied to the Fund’s average daily net assets of more than $8 billion and up to $12 billion, and 0.425% as applied to the Fund’s average daily net assets of more than $12 billion.

Certain officers and a director of the Fund are also officers and directors of the Investment Adviser.

7. Distribution and Shareholder Servicing

The Fund has adopted a distribution and shareholder servicing plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), which provides that the Fund make payments to the Fund’s distributor at an annual rate of 0.25% of average daily net assets attributable to Class J shares and 0.50% of the average daily net assets attributable to Class R shares. The Fund’s distributor may then make payments to financial intermediaries or others at an annual rate of up to 0.25% of the average daily net assets attributable to Class J shares and up to 0.50% of the average daily net assets attributable to Class R shares. Payments under the 12b-1 Plan shall be used to compensate the Fund’s distributor or others for services provided and expenses incurred in connection with the sale and/or servicing of shares.

In addition, the Fund has adopted a Shareholder Servicing Plan for Class I shares under which the Fund can pay for shareholder support services from the Fund’s assets pursuant to a Shareholder Servicing Agreement in an amount not to exceed 0.10% of the Fund’s average daily net assets attributable to Class I shares. The amount actually incurred for the year ended May 31, 2018 was 0.05% on an annualized basis.

The Fund has also adopted a Shareholder Servicing Plan for the Class R shares. Under the Shareholder Servicing Plan, the Fund can pay for shareholder support services, which include the recordkeeping and administrative services provided by retirement plan administrators to retirement plans (and their participants) that are shareholders of the class. Payments will be made pursuant to a Shareholder Servicing Agreement in an amount not to exceed 0.25% of the Fund’s average daily net assets attributable to Class R shares. The amount actually incurred for the year ended May 31, 2018 was 0.18% on an annualized basis.

8. Beneficial Ownership

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. At May 31, 2018, Charles Schwab & Co., Inc., for the benefit of its customers, held 47.88% of the outstanding shares of the Class J share class. At May 31, 2018, Edward D. Jones and Co., for the benefit of its customers, held 31.22% of the outstanding shares of the Class I share class. At May 31, 2018, Great-West Trust Company LLC and Great-West Life & Annuity for the benefit of its customers, held 35.98% and 26.94%, respectively, of the outstanding shares of the Class R share class.

| Annual Report | Jensen Quality Growth Fund | 21 |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of

Jensen Quality Growth Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Jensen Quality Growth Fund (the “Fund”), as of May 31, 2018, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, including the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of May 31, 2018, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits include performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and confirmation of securities owned as of May 31, 2018, by correspondence with the custodian and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2010.

COHEN & COMPANY, LTD.

Cleveland, Ohio

July 26, 2018

| 22 | Jensen Quality Growth Fund | Annual Report |

Expense Example - May 31, 2018 (Unaudited)

As a shareholder of Jensen Quality Growth Fund, you incur ongoing costs, including investment advisory fees, distribution and/or shareholder servicing fees, and other Fund expenses, which are indirectly paid by shareholders. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period (December 1, 2017 - May 31, 2018).

Actual Expenses

The first line of the table below for each share class of the Fund provides information about actual account values and actual expenses. However, the table does not include shareholder specific fees, such as the $15.00 fee charged to IRA accounts, or the $15.00 fee charged for wire redemptions. The table also does not include portfolio trading commissions and related trading costs. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the actual expense ratios for each share class of the Fund and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees which, although not charged by the Fund, may be charged by other funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Annual Report | Jensen Quality Growth Fund | 23 |

Expense Example Tables

| Beginning Account Value | Ending Account Value | Expenses Paid During Period* December 1, 2017 – | |

| Jensen Quality Growth Fund – Class J | December 1, 2017 | May 31, 2018 | May 31, 2018 |

| Actual | $1,000.00 | $1,028.10 | $4.40 |

| Hypothetical (5% annual return before expenses) | 1,000.00 | 1,020.59 | 4.38 |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 0.87%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

| Expenses Paid During | |||

| Beginning Account Value | Ending Account Value | Period* December 1, 2017 – | |

| Jensen Quality Growth Fund – Class R | December 1, 2017 | May 31, 2018 | May 31, 2018 |

| Actual | $1,000.00 | $1,026.30 | $6.26 |

| Hypothetical (5% annual return before expenses) | 1,000.00 | 1,018.75 | 6.24 |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.24%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

| Expenses Paid During | |||

| Beginning Account Value | Ending Account Value | Period* December 1, 2017 – | |

| Jensen Quality Growth Fund – Class I | December 1, 2017 | May 31, 2018 | May 31, 2018 |

| Actual | $1,000.00 | $1,029.70 | $3.14 |

| Hypothetical (5% annual return before expenses) | 1,000.00 | 1,021.84 | 3.13 |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 0.62%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

| Expenses Paid During | |||

| Beginning Account Value | Ending Account Value | Period* December 1, 2017 – | |

| Jensen Quality Growth Fund – Class Y | December 1, 2017 | May 31, 2018 | May 31, 2018 |

| Actual | $1,000.00 | $1,030.00 | $2.78 |

| Hypothetical (5% annual return before expenses) | 1,000.00 | 1,022.19 | 2.77 |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 0.55%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

| 24 | Jensen Quality Growth Fund | Annual Report |

Additional Information (Unaudited)

1. Shareholder Notification of Federal Tax Status

The Fund designates 100% of dividends declared during the fiscal year ended May 31, 2018 as dividends qualifying for the dividends received deduction available to corporate shareholders.

The Fund designates 100% of dividends declared from net investment income during the fiscal year ended May 31, 2018 as qualified dividend income under the Jobs and Growth Tax Relief Reconciliation Act of 2003.

The Fund designates as a long-term capital gain dividend, pursuant to the Internal Revenue Code Section 852(b)(3), the amount necessary to reduce earnings and profits of the Fund related to net capital gain to zero for the fiscal year ended May 31, 2018.

Additional Information Applicable to Foreign Shareholders Only:

The Fund designates 1.70% of ordinary income distributions as interest-related dividends under Internal Revenue Code Section 871(k)(1)(c).

The Fund designates 0.025% of ordinary income distributions as short-term capital gain distributions under Internal Revenue Section 871(k)(2)(c).

2. Availability of Proxy Voting Information

Information regarding how the Fund votes proxies relating to portfolio securities is available without charge, upon request by calling toll-free, 1-800-221-4384, or by accessing the SEC’s website at www.sec.gov.

3. Portfolio Holdings

The Jensen Quality Growth Fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q will be available on the EDGAR database on the SEC’s website at www.sec.gov. These Forms may also be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information about the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| Annual Report | Jensen Quality Growth Fund | 25 |

4. Additional Disclosure Regarding Fund Directors and Officers

Independent Directors

| # of Portfolios | |||||

| in Fund | |||||

| Position(s) | Term of Office and | Complex | Other Directorships | ||

| Held with | Length of Time | Principal Occupation During | Overseen | Held by Director During the | |

| Name, Address and Age | the Fund | Served** | Past Five Years | by Director | Past Five Years |

| Roger A. Cooke | Independent | Indefinite Term; since | Retired. Senior Vice President, | 1 | None |

| Jensen Quality Growth Fund | Director | June 1999. | General Counsel and Secretary | ||

| 5500 Meadows Road | of Precision Castparts Corp., | ||||

| Suite 200 | a diversified manufacturer of | ||||

| Lake Oswego, OR 97035 | complex metal products, (2000 – | ||||

| Year of Birth: 1948 | 2013); Executive Vice President | ||||

| – Regulatory and Legal Affairs of | |||||

| Fred Meyer, Inc., a retail grocery | |||||

| and general merchandise company | |||||

| (1992 – 2000). | |||||

| Robert E. Harold | Chairman | Indefinite Term; | Retired. Senior Director of Financial | 1 | Director of St. Mary’s Academy, |

| Jensen Quality Growth Fund | and | Chairman since July | Planning of Nike, Inc., a footwear | a non-profit high school (2000 – | |

| 5500 Meadows Road | Independent | 2015 and Independent | and apparel company (2001 – | 2013, and 2015-present); Director | |

| Suite 200 | Director | Director since | 2002); Global Brand Controller | of Laika, Inc., an animation studio | |

| Lake Oswego, OR 97035 | September 2000. | for Nike, Inc. (1996, 1997, 2000 | (2002 – present) | ||

| Year of Birth: 1947 | – 2001); Interim Chief Financial | ||||

| Officer for Nike, Inc. (1998 – 1999); | |||||

| Interim Chief Executive Officer for | |||||

| Laika, Inc., an animation studio | |||||

| (March 2005 – October 2005). | |||||

| Thomas L. Thomsen, Jr. | Independent | Indefinite Term; since | Private rancher and real estate | 1 | None |

| Jensen Quality Growth Fund | Director | December 2003. | investor (2002 – present); Chief | ||

| 5500 Meadows Road | Executive Officer (2000 – 2002) | ||||

| Suite 200 | and President (1998 – 2000) | ||||

| Lake Oswego, OR 97035 | of Columbia Management | ||||

| Year of Birth: 1944 | Company (now called Columbia | ||||

| Management Investment Advisors, | |||||

| Inc.), investment adviser to the | |||||

| Columbia Funds family of mutual | |||||

| funds and to institutional and | |||||

| individual investors. | |||||

| Kenneth Thrasher | Independent | Indefinite Term; since | Chairman (2002 – present) and | 1 | Northwest Natural Gas Company (a |

| Jensen Quality Growth Fund | Director | July 2007. | CEO (2002 – 2009) of Complí, | natural gas distribution and service | |

| 5500 Meadows Road | a web-based compliance and | provider). | |||

| Suite 200 | risk management software | ||||

| Lake Oswego, OR 97035 | solution company. | ||||

| Year of Birth: 1949 | |||||

| Janet G. Hamilton, PhD, CFA | Independent | Indefinite Term; since | Associate Professor, Finance, | 1 | None |

| Jensen Quality Growth Fund | Director | October 2016. | Portland State University’s School | ||

| 5500 Meadows Road | of Business (1986 – present); | ||||

| Suite 200 | Finance Faculty, Oregon Executive | ||||

| Lake Oswego, OR 97035 | MBA, University of Oregon | ||||

| Year of Birth: 1955 | (1989 – 2012). |

| 26 | Jensen Quality Growth Fund | Annual Report |

Interested Director

| # of Portfolios | |||||

| in Fund | |||||

| Position(s) | Term of Office and | Complex | Other Directorships | ||

| Held with | Length of Time | Principal Occupation During | Overseen | Held by Director During the | |

| Name, Address and Age | the Fund | Served** | Past Five Years | by Director | Past Five Years |

| Robert D. McIver* | Director and | Indefinite Term; | Director (since July 2015) of the | 1 | Jensen Investment Management, |

| Jensen Investment | President | since July 2015; | Fund; President and Director | Inc. (since February 2007) | |

| Management, Inc. | 1 Year Term as | (February 2007 – present) and | |||

| 5500 Meadows Road | President of the Fund; | Director of Operations (2004 | |||

| Suite 200 | Served as President | – February 2007) of Jensen | |||

| Lake Oswego, OR 97035 | since February 2007. | Investment Management, Inc.; | |||

| Year of Birth: 1965 | General Manager of Fairmont Villa | ||||

| Management and Vice President | |||||

| of Fairmont Riverside Golf Estates | |||||

| Ltd (2001 – 2004); Chief Investment | |||||

| Officer, Schroder & Co. Trust Bank | |||||

| (1999 – 2001); Portfolio Manager, | |||||

| Schroder Investment Management | |||||

| (1989 – 1999). |

| Annual Report | Jensen Quality Growth Fund | 27 |

Officers of the Fund

| # of Portfolios | |||||

| in Fund | |||||

| Position(s) | Term of Office and | Complex | Other Directorships | ||

| Held with | Length of Time | Principal Occupation During | Overseen | Held by Director During the | |

| Name, Address and Age | the Fund | Served** | Past Five Years | by Director | Past Five Years |

| Robert D. McIver* | |||||

| SEE ABOVE | |||||

| Brian S. Ferrie* | Treasurer and Chief | 1 Year Term; Served | Vice President, Treasurer and | N/A | N/A |

| Jensen Investment | Compliance Officer | since March 2004. | Director (February 2007 – present), | ||

| Management, Inc. | Chief Compliance Officer (February | ||||

| 5500 Meadows Road | 2007 – March 2011, and July 2012 | ||||

| Suite 200 | – September 2012), and Director | ||||

| Lake Oswego, OR 97035 | of Finance and Chief Compliance | ||||