UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6653

The Jensen Quality Growth Fund Inc.

(Exact name of registrant as specified in charter)

5500 Meadows Road, Suite 200

Lake Oswego, OR 97035-8234

(Address of principal executive offices) (Zip code)

Robert McIver

5500 Meadows Road, Suite 200

Lake Oswego, OR 97035-8234

(Name and address of agent for service)

(800) 221-4384

Registrant's telephone number, including area code

Date of fiscal year end: May 31

Date of reporting period: May 31, 2021

Item 1. Reports to Stockholders.

(a)

Letter from The Investment Adviser

Dear Fellow Shareholders,

The Jensen Quality Growth Fund -- Class I Shares -- returned 34.24% for the year ended May 31, 2021, compared to a return of 40.32% for the Standard & Poor’s 500 Index over this period. Please see pages 8 through 11 of this report for complete standardized performance information for the Fund.

Market Perspective

After the substantial market volatility in the first few months of 2020, the experience for most market participants has been largely positive as investors looked through the strong declines in corporate earnings and other pandemic induced economic uncertainties. In more recent months, investors have appeared more exuberant in anticipation of a broad reopening of the economy as vaccination approvals and rollouts have enabled substantial numbers of people in the United States and elsewhere to be vaccinated and begin a return to relative normalcy. Many companies have seen improving quarterly business results, albeit against very easy comparisons. Investor sentiment for much of the period has also been buoyed by substantial monetary and fiscal support provided by the Federal Reserve and U.S. Executive and Legislative branches. Such support has continued even with the change in administrations after last year’s election with overall levels of assistance exceeding that provided during the financial crisis of the late 2000s.

Despite some very positive results from many of the companies that we own in the Fund over the last twelve months, it has underperformed the S&P 500 Index. This is not uncommon in a “risk on” market environment where more speculative options have led the rally and our analysis indicates a clear lack of focus on quality factors by market participants for the last twelve months, although we have noted some rotation favoring quality investments more recently.

One indication of the lack of appreciation for consistent, quality businesses can be found by reviewing market returns for the period measured by the S&P Earnings and Dividend Quality Rankings. Companies with more consistent earnings and dividend payments are ranked higher by S&P than those companies that are typically more volatile. Given the nature of the rankings, companies rated A- or above are considered higher quality businesses. Attribution comparisons to the S&P 500 Index indicates that over the last twelve months, the Fund’s underperformance in the A- and above categories exceeded the Fund’s overall relative shortfall by more than 200 basis points. We have been pleased by the 34.24% appreciation of the Fund during this period, but with nearly two-thirds of our companies rated A- or better, we believe the Fund’s underperformance is more indicative of a frothy market than the businesses results of the companies in the Fund.

The Effect at Jensen

During the period, specific stock selection added value in the Communication Services and Consumer Discretionary sectors, while detracting from returns primarily in the Consumer Staples and Healthcare sectors. From a sector perspective, our relative overweight in Healthcare as well as our lack of presence in the Financial sector detracted from performance. In contrast, our lack of exposure to Utilities and a relative overweight to Industrials added value. Typically, very few

| Annual Report | The Jensen Quality Growth Fund Inc. | 1 |

companies in the Financial and Utilities sectors qualify for our strict requirement for high and prolonged profitability, as measured by Return on Equity, and consequently, our lack of exposure to sectors that do not deliver consistently high business returns will add or detract value periodically.

Leading contributors to performance during the period were Alphabet (GOOGL) and UPS (UPS). Continuing recovery in macroeconomic activity has helped boost business performance at Alphabet over the last three fiscal quarters with increases in advertiser spending producing solid recovery in margins for the business. The stock price has reflected this favorable performance and the resiliency of Alphabet’s business model. In our view, competitive advantages for the company remain intact despite the shocks to economic activity experienced over the last twelve months and investments in the Google cloud business are also showing strength.

UPS delivered very strong business performance over the last twelve months as secular growth resulting from the shift to online economic activity due to the pandemic benefitted shipping companies – particularly those with the scale of UPS. Primary drivers for growth included strong volume growth and higher pricing together with solid cost control that resulted from business enhancement efforts instituted by the company’s leadership team. The stock price responded favorably during the period reflecting the business performance during the pandemic. Nevertheless, we remain conservative in our outlook for the company, mindful that no guidance has been provided. Likewise, the upcoming year over year earnings comparisons could prove challenging and it has yet to be seen whether the pandemic-induced secular shift benefitting shipping companies will last. Consequently, we have opportunistically trimmed our position in UPS given the strong stock performance of the past twelve months.

Two holdings detracted from the Fund’s performance for the period – Becton Dickinson (BDX) and Verisk Analytics (VRSK). Verisk Analytics is a recent addition to the Fund and is discussed further below.

Becton Dickinson has experienced less consistent business performance over the last twelve months. Although there has been strong demand for its needles and syringes, lower global healthcare utilization rates caused by the pandemic reduced usage of many of the company’s other products. Sporadic resurgences of COVID-19 around the globe also dampened short-term results. Additionally, the market reacted negatively to the news that the company is addressing a recall related to one of its products. More recently there has been recovery in the business results as increasing vaccination and healthcare utilization rates continue to enable healthcare facilities to reopen. The company has continued to invest in its business, including several small acquisitions that we believe will enhance future growth prospects. Despite the short-term challenges to the business, we believe Becton Dickinson continues to warrant its position within the Fund given the company’s solid competitive advantages and long-term growth expectations.

We are constantly evaluating all of the businesses owned by the Fund as well as other investment candidates to determine whether better opportunities exist in our investable universe. Such determinations ultimately reflect a combination of fundamental considerations, valuation opportunities and overall risk profiles for our companies.

| 2 | The Jensen Quality Growth Fund Inc. | Annual Report |

Fund Additions and Eliminations

During the period, the Fund’s investment team sold its holdings in Emerson Electric Company (EMR), Oracle (ORCL), Omnicom (OMC), Amphenol (APH) and VF Corporation (VFC) and initiated new positions in Starbucks (SBUX), Home Depot (HD), Waste Management (WM) and Verisk Analytics (VRSK) due to solid business fundamentals and attractive valuations for these stocks. A brief synopsis of the changes follows:

During the year ended May 31, 2021, we completed the liquidation of Emerson Electric Company (EMR). With operations in a mix of businesses, historically, we have been attracted to the company’s solid market positions, strong innovation capabilities and the high switching costs in the company’s automation solutions business. Several years ago, the company embarked on a material corporate transformation. As part of the transformation, EMR sold a number of its lower margin businesses and made numerous acquisitions in the automation solutions and consumer and residential solutions segments. The primary goals of the transformation were to bring more focus to the company’s operations and to boost margins, cash flows and business value. As patient, long-term investors, we applauded the company’s efforts to achieve these goals.

Unfortunately, the transformation has fallen short of management’s goals and targets. Of note, the acquisition of twenty-four companies over the past four fiscal years has made it difficult to assess management’s success in integrating those businesses and the strength of the company’s competitive advantages going forward. Given this lack of visibility, the investment committee decided to liquidate the position and deploy the proceeds in names with more clarity in their strategic vision, stronger competitive advantages and fundamental outlooks.

The Fund’s investment team also sold Oracle from the Fund during the period due to fundamental concerns with the company’s revenue growth trends and with the ongoing transitions in company leadership in the face of key executive losses.

We also completed the sale of Omnicom Group. OMC and its subsidiaries provide advertising, marketing, and public relations services through a network of advertising agencies, including well-known companies BBDO, DAS, DDB, OMG, and TBWA. While the company still displays many positive attributes, including global scale, strong brands, solid balance sheet, and high profitability, we have successively reduced our holdings in OMC over recent years due to increasing concerns over slowing growth and disruptive competition. Consequently, we decided to fully exit the position, which represented less than 1% of Fund assets and redeploy the proceeds into what we believe are more attractive investment opportunities.

Amphenol is a global leader in the development and production of electric connectors and sensors. Competitive advantages remain intact and include technology leadership and manufacturing scale. We began reducing the Fund’s position in Amphenol in 2019 when the stock price became elevated relative to multiple valuation metrics. We continue to closely monitor Amphenol and may consider repurchasing a position should we see improvement in the combination of business fundamentals and stock price valuation.

| Annual Report | The Jensen Quality Growth Fund Inc. | 3 |

During the first quarter of 2021, we sold VF Corporation (VFC). VFC sells apparel, footwear, and accessories through over 30 brands including The North Face®, Vans®, Timberland®, Dickies®, and Supreme® with a focus on outdoor and lifestyle designs. VFC possesses considerable competitive advantages, including well-known brands, proven design and innovation capabilities, and large economies of scale. Additionally, VFC has strengths in revenue diversification, a solid balance sheet and effective management. VFC was a relatively small position in the Fund, and due to extraordinary challenges retailers have faced during the coronavirus pandemic, we elected to sell the position in VFC and focus on other opportunities.

Starbucks is a widely known restaurant company and coffee roaster, selling coffee and food worldwide in over 30,000 restaurants. Approximately two-thirds of sales comprise the Americas (primarily the U.S. and Canada), one quarter are outside the Americas (primarily China, Japan, and Europe), and the remainder are generated from consumer-packaged goods including whole bean and ground coffees, single-serve drinks, and other branded products. Half of Starbucks’ stores are company-owned, with the balance licensed to large-scale, long-term partners.

Driving our investment thesis are the company’s strong competitive advantages, including its brand equity, economies of scale, network effect from its digital loyalty program and large store base, and its track record of successful menu and technological innovation. Other positives include diversified revenue sources and a solid management team.

Tempering our enthusiasm are current weaknesses driven by the ongoing coronavirus containment efforts, including reduced air travel and commuting, and longer-term challenges due to the competitive industry and low customer switching costs. While we consider that Starbucks is well-positioned to recover from the current crisis, we recognize that there are near-term headwinds requiring a long-term view. Overall, given the strength of Starbucks’ underlying business model and the attractive valuation of the company’s stock, we were pleased to add the company to the Fund.

Home Depot built its market leadership by embarking on an aggressive early-mover store build-out starting in the late 1990s through the early 2000s. The company further cemented its dominance through additional competitive advantages such as high barriers to entry, brand equity, and economies of scale.

We believe Home Depot’s leadership team has done an excellent job integrating e-commerce into its retail model and we consider it to be one of the best models that blend online, physical stores, and rapid fulfillment distribution centers. The company has done well in merchandising its stores and serving both professional contractors and do it yourself (DIY) consumers. Stable and long-term demand is driven by the ongoing need for housing, aging housing stock that requires more repairs than newer homes, and home sales transactions. As a result, we believe the company can consistently grow its top line in the mid-single digits and leverage revenues by scaling its operations to enable the business to increase earnings in the high single digits.

Waste Management is the largest waste disposal company in North America with approximately a 20% market share in a business characterized by high entry barriers. The company’s primary competitive advantage is its industry-leading waste collection and disposal network. This network

| 4 | The Jensen Quality Growth Fund Inc. | Annual Report |

allows Waste Management to efficiently collect and process waste while generating transfer and disposal fees from competitors. We expect WM to grow and create business value due to pricing power, business mix opportunities, population growth and new business formation. Our investment thesis incorporates concerns including the current cyclical weakness and ongoing disruption in the global recycling market. However, we view these risks as manageable due to the diversity of Waste Management’s customer base, the essential nature of its services and ongoing contractual negotiations designed to improve recycling service economics.

Home Depot and Waste Management demonstrate many of the ‘Quality Growth’ attributes we prize including competitive advantages, high returns on capital and consistent free cash flow generation. We are pleased to add both companies to the Fund.

Founded in 1971, Verisk Analytics (Verisk) is a data analytics provider serving customers in the property and casualty (P&C) insurance, natural resources, and financial services end markets. Network effect is the primary competitive advantage across Verisk’s business. The company operates within a consortium that runs a ‘give-to-get’ business model where customers provide raw data to Verisk free of charge. In return, Verisk anonymizes the data, builds industry-specific analytics, and sells these solutions back to customers. These tools often become integrated into customer workflows which creates high customer switching costs. We expect Verisk to create business value due to pricing power, end market growth, and new product development. Our investment thesis incorporates risks to the company’s success, notably increasing competition in the financial services end market and cyclical demand patterns among energy customers. However, we view these risks as manageable due to the diversity of Verisk’s customer base and the high degree of revenue generated under subscription agreements.

In addition to these changes, the Investment Committee remained active in trimming positions seen as more fully valued or fundamentally challenged to reflect Jensen’s convictions in the businesses and relative valuation opportunities within the context of the ongoing economic upheaval.

The Jensen Outlook

Much has been written about the recent rise in the U.S. inflation data, manifested in rising wage and commodity costs, as well as in supply chain dislocations and exacerbated by overall strength in consumer balance sheets arising from the substantial stimulus and assistance distributed since the pandemic was declared in early 2020.

Inflationary pressures are very real, what remains to be seen and is harder to predict, is how long such pressures remain. Combined with potential upward pressure on interest rates and a likely return to slower overall growth rates for business performance once the easy comparisons come to an end, there is meaningful potential for volatility going forward in the markets.

While stimulus programs have acted as a salve during the pandemic it is temporary in nature and concerns about the cost and how to pay for all the massive distributions that have been added to sovereign debt levels around the globe are increasing. Assuming such stimulus programs are not repeated, we are mindful of a potential “fiscal cliff” appearing in 2022 that we do not believe has been fully discounted by the markets thus far.

| Annual Report | The Jensen Quality Growth Fund Inc. | 5 |

Should inflationary and related concerns become more prevalent we are confident that the quality businesses that we favor are well positioned to navigate the consequent stresses. We seek to invest in high-quality businesses because of the very attributes that solid competitive advantages and successful long-term business models provide. High-quality businesses are characterized by robust financial strength and consistent free cash flow that reduce their dependence on debt capital and the negative impact from higher borrowing costs. Further, the market dominance of high-quality companies provides pricing power that we believe can offset inflationary headwinds that erode the value proposition of lower quality businesses.

At Jensen we remain focused on the long term, investing in individual companies we deem to be of highest quality as evidenced by strong and durable business characteristics. Our research prizes dominant competitive advantages, balance sheet strength and free cash flow consistency and provides a framework to understand the companies in which we invest: our decision making is driven by this critical bottom-up fundamental business analysis. While the Fund companies are not immune to global stresses, we remain confident that they possess business models that can mitigate economic risk and reduce the volatility of the Fund’s returns. Our goal has been and remains to produce strong long-term returns while minimizing the risk of permanent loss of capital.

We believe the companies in the Fund have the potential to perform relatively well from a fundamental standpoint given their competitive positions and strong cash flow generation. Further, because of higher valuations and continued emphasis on equities by most investors, short-term market volatility stemming from any of the factors discussed earlier could also provide us with attractive opportunities as it has in the past. We see this as a key activity for a high conviction, active investment management firm – utilizing market volatility and pricing dislocations as an opportunity to take advantage of disconnects in the stocks of these businesses.

As we look to the remainder of 2021 and beyond, our near-term investment focus will be to analyze additional information about our companies’ revenue, earnings and cash flow growth expectations, the evolving trends associated with the global economic reopening and the impact of some of the pressures discussed earlier. This will further shape our outlook for each business model and their future prospects. We believe the environment will continue to improve for high-quality businesses as economic reality highlights the inherent strengths that such businesses possess and differentiates these companies from less robust competition.

We are tremendously grateful for the ongoing support of our firm and investment strategies from our shareholders, partners and clients and we trust that we will continue to deliver the results you expect of us.

We invite you to seek additional information about The Jensen Quality Growth Fund at www.jenseninvestment.com where additional content, including updated holdings and performance information, is available. We take our investment responsibilities seriously and appreciate the trust you have placed in us. As always, we welcome your feedback.

Sincerely,

The Jensen Quality Growth Investment Team

| 6 | The Jensen Quality Growth Fund Inc. | Annual Report |

Past performance is no guarantee of future results. Fund holdings and sector weightings are subject to change and are not recommendations to buy or sell any security.

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. One cannot invest directly in an index.

For more complete information regarding performance and holdings, please refer to the financial statements and schedule of investments headings of this report. Current and future portfolio holdings are subject to risk.

The Fund is nondiversified, meaning that it may concentrate its assets in fewer individual holdings than a diversified fund and is therefore more exposed to individual stock volatility than a diversified fund.

Return on Equity: Is equal to a company’s after-tax earnings (excluding non-recurring items) divided by its average stockholder equity for the year.

Free Cash Flow: Is equal to the after-tax net income of a company plus depreciation and amortization less capital expenditures.

Basis Point: Is a value equaling one one-hundredth of a percent (1/100 of 1%).

Return on Invested Capital: A calculation used to assess a company’s efficiency at allocating the capital under its control to profitable investments. Return on invested capital gives a sense of how well a company is using its money to generate returns.

For use only when preceded or accompanied by a current prospectus for the Fund.

The Jensen Quality Growth Fund is distributed by Quasar Distributors, LLC.

| Annual Report | The Jensen Quality Growth Fund Inc. | 7 |

Jensen Quality Growth Fund Inc. - Class J (Unaudited)

| Average Annual Returns – For year ended May 31, 2021 | 1 year | 3 years | 5 years | 10 years | |

| Jensen Quality Growth Fund - Class J | 33.95% | 18.07% | 17.01% | 13.85% | |

| S&P 500 Stock Index | 40.32% | 18.00% | 17.16% | 14.38% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on May 31, 2011 for Class J. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| 8 | The Jensen Quality Growth Fund Inc. | Annual Report |

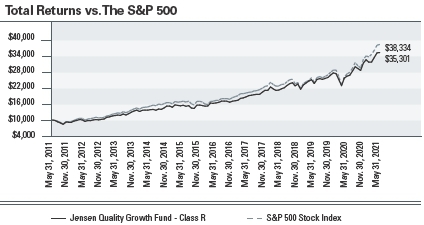

Jensen Quality Growth Fund Inc. - Class R (Unaudited)

| Average Annual Returns – For year ended May 31, 2021 | 1 year | 3 years | 5 years | 10 years | |

| Jensen Quality Growth Fund - Class R | 33.36% | 17.58% | 16.54% | 13.44% | |

| S&P 500 Stock Index | 40.32% | 18.00% | 17.16% | 14.38% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on May 31, 2011 for Class R. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| Annual Report | The Jensen Quality Growth Fund Inc. | 9 |

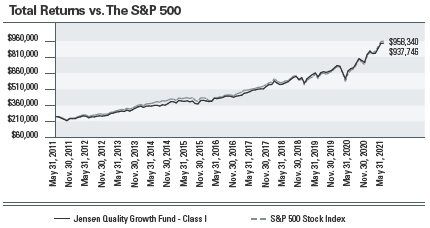

Jensen Quality Growth Fund Inc. - Class I (Unaudited)

| Average Annual Returns – | 1 year | 3 years | 5 years | 10 years |

| For year ended May 31, 2021 | ||||

| Jensen Quality Growth Fund - Class I | 34.24% | 18.35% | 17.30% | 14.13% |

| S&P 500 Stock Index | 40.32% | 18.00% | 17.16% | 14.38% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $250,000 made on May 31, 2011 for Class I. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| 10 | The Jensen Quality Growth Fund Inc. | Annual Report |

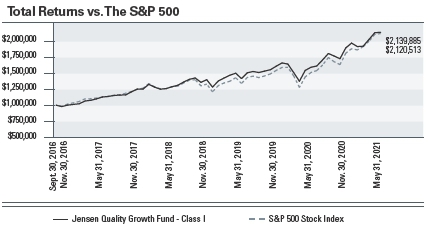

Jensen Quality Growth Fund Inc. - Class Y (Unaudited)

| Total Returns – | 1 Year | 3 Year | Since Inception |

| For periods ended May 31, 2021 | (September 30, 2016) | ||

| Jensen Quality Growth Fund - Class Y | 34.34% | 18.43% | 17.71% |

| S&P 500 Stock Index | 40.32% | 18.00% | 17.48% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $1,000,000 made on September 30, 2016 (commencement of operations for Class Y). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| Annual Report | The Jensen Quality Growth Fund Inc. | 11 |

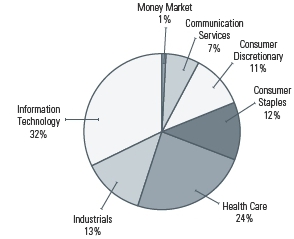

Investments by Sector as of May 31, 2021

(as a Percentage of Total Investments) (Unaudited)

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC doing business as U.S. Bank Global Fund Services.

| 12 | The Jensen Quality Growth Fund Inc. | Annual Report |

Statement of Assets & Liabilities

As of May 31, 2021

| Assets: | |

| Investment, at value (cost $5,480,451,330) | $10,324,953,907 |

| Dividend and interest income receivable | 16,351,011 |

| Receivable for capital stock issued | 6,695,800 |

| Other assets | 158,503 |

| Total assets | $10,348,159,221 |

| Liabilities: | |

| Payable to Investment Adviser | 4,393,231 |

| Payable for capital stock redeemed | 6,415,473 |

| Accrued distribution fees | 1,064,493 |

| Accrued director fees | 58,937 |

| Accrued expenses and other liabilities | 1,423,429 |

| Total liabilities | 13,355,563 |

| Total Net Assets | $10,334,803,658 |

| Net Assets Consist of: | |

| Capital stock | 5,235,514,177 |

| Total distributable earnings | 5,099,289,481 |

| Total Net Assets | $10,334,803,658 |

| Net Assets Consist of: | |

| Class J Shares | |

| Net Assets | $2,549,593,720 |

| Shares outstanding | 42,493,628 |

| Net Asset Value - Offering Price and Redemption Price Per Share | |

| (2,000,000,000 shares authorized) | $60.00 |

| Class R Shares | |

| Net Assets | $26,380,176 |

| Shares outstanding | 442,198 |

| Net Asset Value - Offering Price and Redemption Price Per Share | |

| (1,000,000,000 shares authorized) | $59.66 |

| Class I Shares | |

| Net Assets | $5,003,473,512 |

| Shares outstanding | 83,398,534 |

| Net Asset Value - Offering Price and Redemption Price Per Share | |

| (1,000,000,000 shares authorized) | $59.99 |

| Class Y Shares | |

| Net Assets | $2,755,356,250 |

| Shares outstanding | 45,935,621 |

| Net Asset Value - Offering Price and Redemption Price Per Share | |

| (1,000,000,000 shares authorized) | $59.98 |

The accompanying notes are an integral part of these financial statements.

| Annual Report | The Jensen Quality Growth Fund Inc. | 13 |

Schedule of Investments

May 31, 2021 (showing percentage of total net assets)

Common Stocks - 99.01%

| shares | Air Freight & Logistics - 2.28% | value |

| 1,098,000 | United Parcel Service, Inc. - Class B | $235,630,800 |

| shares | Beverages - 6.17% | value |

| 4,310,000 | PepsiCo, Inc. | $637,621,400 |

| shares | Commercial Services & Supplies - 2.02% | value |

| 1,486,000 | Waste Management, Inc. | $209,050,480 |

| shares | Food Products - 3.13% | value |

| 5,140,000 | General Mills, Inc. | $323,100,400 |

| shares | Health Care Equipment & Supplies - 9.99% | value |

| 2,200,000 | Becton Dickinson and Company | $532,158,000 |

| 1,959,000 | Stryker Corporation | $500,073,930 |

| $1,032,231,930 | ||

| shares | Health Care Providers & Services - 4.46% | value |

| 1,120,000 | UnitedHealth Group, Inc. | $461,350,400 |

| shares | Hotels, Restaurants & Leisure - 2.77% | value |

| 2,518,000 | Starbucks Corporation | $286,749,840 |

| shares | Household Products - 2.28% | value |

| 1,747,000 | The Procter & Gamble Company | $235,582,950 |

| shares | Industrial Conglomerates - 5.49% | value |

| 2,795,600 | 3M Company | $567,618,624 |

| shares | Interactive Media & Services - 6.98% | value |

| 306,000 | Alphabet, Inc. - Class A (a) | $721,196,100 |

The accompanying footnotes are an integral part of the Financial Statements.

| 14 | The Jensen Quality Growth Fund Inc. | Annual Report |

Schedule of Investments continued

May 31, 2021 (showing percentage of total net assets)

| shares | IT Services - 15.18% | value |

| 1,656,000 | Accenture PLC - Class A (b) | $467,256,960 |

| 1,629,000 | Automatic Data Processing, Inc. | $319,316,580 |

| 1,564,000 | Broadridge Financial Solutions, Inc. | $249,426,720 |

| 4,255,000 | Cognizant Technology Solutions Corporation - Class A | $304,487,800 |

| 634,000 | Mastercard, Inc. - Class A | $228,607,720 |

| $1,569,095,780 | ||

| shares | Pharmaceuticals - 9.51% | value |

| 3,644,000 | Johnson & Johnson | $616,747,000 |

| 9,446,000 | Pfizer, Inc. | $365,843,580 |

| $982,590,580 | ||

| shares | Professional Services - 3.58% | value |

| 1,144,000 | Equifax, Inc. | $268,885,760 |

| 585,000 | Verisk Analytics, Inc. | $101,105,550 |

| $369,991,310 | ||

| shares | Semiconductors & Semiconductor Equipment - 2.39% | value |

| 1,299,000 | Texas Instruments, Inc. | $246,576,180 |

| shares | Software - 10.27% | value |

| 846,000 | Intuit, Inc. | $371,470,140 |

| 2,764,000 | Microsoft Corporation | $690,115,520 |

| $1,061,585,660 | ||

| shares | Specialty Retail - 4.37% | value |

| 821,000 | The Home Depot, Inc. | $261,825,110 |

| 2,809,600 | The TJX Companies, Inc. | $189,760,384 |

| $451,585,494 | ||

| shares | Technology Hardware, Storage & Peripherals - 4.20% | value |

| 3,482,000 | Apple, Inc. | $433,892,020 |

| shares | Textiles, Apparel & Luxury Goods - 3.94% | value |

| 2,986,000 | NIKE, Inc. - Class B | $407,469,560 |

The accompanying footnotes are an integral part of the Financial Statements.

| Annual Report | The Jensen Quality Growth Fund Inc. | 15 |

Schedule of Investments continued

May 31, 2021 (showing percentage of total net assets)

| Total Common Stocks | value | |

| (Cost $5,388,416,930) | $10,232,919,508 | |

| Short-Term Investment - 0.89% | ||

| shares | Money Market Fund - 0.89% | value |

| 92,034,399 | First American Treasury Obligations Fund - Class X, 0.016% (c) | $92,034,399 |

| Total Short-Term Investment | value | |

| (Cost $ 92,034,399) | $92,034,399 | |

| Total Investments | value | |

| (Cost $5,480,451,330) - 99.90% | $10,324,953,907 | |

| Other Assets in Excess of Liabilities - 0.10% | $ 9,849,751 | |

| TOTAL NET ASSETS - 100.00% | $10,334,803,658 | |

Percentages are stated as a percent of net assets.

PLC - Public Limited Company

| (a) | Non-income producing security. |

| (b) | Foreign issued security. Foreign concentration (including ADRs) was as follows: Ireland 4.52% as a percentage of net assets. |

| (c) | Variable rate security. Rate listed is the 7-day effective yield as of May 31, 2021. |

| The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC ("S&P"). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC. |

The accompanying footnotes are an integral part of the Financial Statements.

| 16 | The Jensen Quality Growth Fund Inc. | Annual Report |

Statement of Operations

Year Ended May 31, 2021

| Investment Income: | |

| Dividend income | $164,710,188 |

| Interest income | 79,766 |

| Total investment income | 164,789,954 |

| Expenses: | |

| Investment advisory fees | 46,527,639 |

| 12b-1 - Class J | 6,283,043 |

| Shareholder servicing fees - Class I | 2,872,712 |

| Administration fees | 1,446,892 |

| Sub-transfer agent expenses - Class J | 1,144,685 |

| Transfer agent fees - Class I | 939,271 |

| Fund Accounting fees | 512,722 |

| Transfer agent expenses | 455,811 |

| Federal and state registration fees | 318,548 |

| Custody fees | 242,998 |

| Reports to shareholders - Class I | 228,515 |

| Directors’ fees and expenses | 227,617 |

| Professional fees | 133,911 |

| 12b-1 fees - Class R | 126,619 |

| Reports to shareholders - Class Y | 106,591 |

| Other | 103,633 |

| Reports to shareholders - Class J | 72,047 |

| Chief Compliance Officer Fees | 70,809 |

| Transfer agent fees -Class J | 62,551 |

| Shareholder servicing fees - Class R | 43,683 |

| Transfer agent fees - Class Y | 17,956 |

| Transfer agent fees - Class R | 16,376 |

| Reports to shareholders - Class R | 1,389 |

| Interest Expense | 47 |

| Total expenses | 61,956,065 |

| Net Investment Income | 102,833,889 |

| Realized and Unrealized Gain on Investments: | |

| Net realized gain on investment transactions | 754,073,361 |

| Change in unrealized appreciation on investments | 1,973,675,055 |

| Net realized and unrealized gain on investments | 2,727,748,416 |

| Net Increase in Net Assets Resulting from Operations | $2,830,582,305 |

The accompanying notes are an integral part of these financial statements.

| Annual Report | The Jensen Quality Growth Fund Inc. | 17 |

Statements of Changes in Net Assets

| Year Ended | Year Ended | |

| Operations: | May 31, 2021 | May 31, 2020 |

| Net investment income | 102,833,889 | 105,308,049 |

| Net realized gain on investment transactions | 754,073,361 | 825,438,612 |

| Change in unrealized appreciation(depreciation) on investments | 1,973,675,055 | (36,972,752) |

| Net increase in net assets resulting from operations | 2,830,582,305 | 893,773,909 |

| Capital Share Transactions: | ||

| Shares Sold - Class J | 154,063,153 | 247,444,169 |

| Shares Sold - Class R | 3,286,762 | 5,272,964 |

| Shares Sold - Class I | 961,148,978 | 2,319,477,243 |

| Shares Sold - Class Y | 426,227,232 | 1,681,573,385 |

| Shares issued in reinvestment of dividends - Class J | 241,204,504 | 215,395,135 |

| Shares issued in reinvestment of dividends - Class R | 2,328,246 | 2,025,318 |

| Shares issued in reinvestment of dividends - Class I | 443,377,575 | 303,957,720 |

| Shares issued in reinvestment of dividends - Class Y | 196,499,842 | 71,318,754 |

| Shares redeemed - Class J | (756,653,996) | (828,418,623) |

| Shares redeemed - Class R | (8,158,234) | (12,679,950) |

| Shares redeemed - Class I | (1,280,407,831) | (2,235,266,160) |

| Shares redeemed - Class Y | (665,921,652) | (333,286,627) |

| Net increase (decrease) | (283,005,421) | 1,436,813,328 |

| Dividends and Distributions to Shareholders: | ||

| Net dividends and distributions to shareholders - Class J | (244,438,799) | (219,321,651) |

| Net dividends and distributions to shareholders - Class R | (2,328,720) | (2,038,825) |

| Net dividends and distributions to shareholders - Class I | (465,739,568) | (359,624,284) |

| Net dividends and distributions to shareholders - Class Y | (255,336,769) | (94,198,350) |

| Total dividends and distributions | (967,843,856) | (675,183,110) |

| Increase in Net Assets | 1,579,733,028 | 1,655,404,127 |

| Net Assets: | ||

| Beginning of Year | 8,755,070,630 | 7,099,666,503 |

| End of Year | $10,334,803,658 | $8,755,070,630 |

The accompanying notes are an integral part of these financial statements.

| 18 | The Jensen Quality Growth Fund Inc. | Annual Report |

Financial Highlights

Class J

| year ended | year ended | year ended | year ended | year ended | |

| May 31, | May 31, | May 31, | May 31, | May 31, | |

| Per Share Data: | 2021 | 2020 | 2019 | 2018 | 2017 |

| Net asset value, beginning of year | $49.46 | $47.79 | $47.87 | $43.44 | $38.78 |

| Income from investment | |||||

| operations: | |||||

| Net investment income(1) | 0.52 | 0.58 | 0.47 | 0.44 | 0.45 |

| Net realized and unrealized gains | |||||

| on investments | 15.63 | 5.30 | 3.88 | 5.49 | 6.00 |

| Total from investment | |||||

| operations | 16.15 | 5.88 | 4.35 | 5.93 | 6.45 |

| Less distributions: | |||||

| Dividends from net | |||||

| investment income | (0.52) | (0.54) | (0.46) | (0.41) | (0.43) |

| Distributions from | |||||

| capital gains | (5.09) | (3.67) | (3.97) | (1.09) | (1.36) |

| Total distributions | $(5.61) | $(4.21) | $(4.43) | $(1.50) | $(1.79) |

| Net asset value, end of year | $60.00 | $49.46 | $47.79 | $47.87 | $43.44 |

| Total return | 33.95% | 12.15% | 9.58% | 13.77% | 17.12% |

| Supplemental data and ratios: | |||||

| Net assets, end of | |||||

| year(000’s) | $2,549,594 | $2,422,553 | $2,700,303 | $2,594,126 | $2,604,964 |

| Ratio of expenses to average | |||||

| net assets | 0.82% | 0.84% | 0.86% | 0.87% | 0.87% |

| Ratio of net investment income to | |||||

| average net assets | 0.89% | 1.11% | 0.97% | 0.92% | 1.12% |

| Portfolio turnover rate | 12.33% | 23.38% | 17.50% | 9.06% | 6.80% |

| (1) | Net investment income per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustments for permanent book-to-tax differences. |

The accompanying notes are an integral part of these financial statements.

| Annual Report | The Jensen Quality Growth Fund Inc. | 19 |

Financial Highlights

Class R

| Per Share Data: | year ended May 31, 2021 | year ended May 31, 2020 | year ended May 31, 2019 | year ended May 31, 2018 | year ended May 31, 2017 | |

| Net asset value, beginning of year | $49.18 | $47.53 | $47.62 | $43.23 | $38.59 | |

| Income from investment | ||||||

| operations: | ||||||

| Net investment income(1) | 0.25 | 0.34 | 0.28 | 0.26 | 0.29 | |

| Net realized and unrealized gains | ||||||

| on investments | 15.57 | 5.30 | 3.86 | 5.47 | 5.98 | |

| Total from investment | ||||||

| operations | 15.82 | 5.64 | 4.14 | 5.73 | 6.27 | |

| Less distributions: | ||||||

| Dividends from net | ||||||

| investment income | (0.25) | (0.32) | (0.26) | (0.25) | (0.27) | |

| Distributions from | ||||||

| capital gains | (5.09) | (3.67) | (3.97) | (1.09) | (1.36) | |

| Total distributions | $(5.34) | $(3.99) | $(4.23) | $(1.34) | $(1.63) | |

| Net asset value, end of year | $59.66 | $49.18 | $47.53 | $47.62 | $43.23 | |

| Total return | 33.36% | 11.66% | 9.17% | 13.34% | 16.69% | |

| Supplemental data and ratios: | ||||||

| Net assets, end of | ||||||

| year(000’s) | $26,380 | $23,995 | $28,197 | $31,597 | $27,300 | |

| Ratio of expenses to average | ||||||

| net assets | 1.26% | 1.27% | 1.24% | 1.24% | 1.24% | |

| Ratio of net investment income to | ||||||

| average net assets | 0.44% | 0.68% | 0.58% | 0.56% | 0.75% | |

| Portfolio turnover rate | 12.33% | 23.38% | 17.50% | 9.06% | 6.80% | |

| (1) | Net investment income per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustments for permanent book-to-tax differences. |

The accompanying notes are an integral part of these financial statements.

| 20 | The Jensen Quality Growth Fund Inc. | Annual Report |

Financial Highlights

Class I

| Per Share Data: | year ended May 31, 2021 | year ended May 31, 2020 | year ended May 31, 2019 | year ended May 31, 2018 | year ended May 31, 2017 | |

| Net asset value, beginning of year | $49.46 | $47.81 | $47.90 | $43.46 | $38.80 | |

| Income from investment | ||||||

| operations: | ||||||

| Net investment income(1) | 0.61 | 0.66 | 0.60 | 0.55 | 0.56 | |

| Net realized and unrealized gains | ||||||

| on investments | 15.65 | 5.34 | 3.87 | 5.51 | 6.00 | |

| Total from | ||||||

| investment operations | 16.26 | 6.00 | 4.47 | 6.06 | 6.56 | |

| Less distributions: | ||||||

| Dividends from net | ||||||

| investment income | (0.64) | (0.68) | (0.59) | (0.53) | (0.54) | |

| Distributions from | ||||||

| capital gains | (5.09) | (3.67) | (3.97) | (1.09) | (1.36) | |

| Total distributions | $(5.73) | $(4.35) | $(4.56) | $(1.62) | $(1.90) | |

| Net asset value, end of year | $59.99 | $49.46 | $47.81 | $47.90 | $43.46 | |

| Total return | 34.24% | 12.41% | 9.85% | 14.08% | 17.42% | |

| Supplemental data and ratios: | ||||||

| Net assets, end of | ||||||

| year(000’s) | $5,003,474 | $4,002,485 | $3,454,461 | $3,261,893 | $3,052,698 | |

| Ratio of expenses to average | ||||||

| net assets | 0.61% | 0.60% | 0.61% | 0.62% | 0.60% | |

| Ratio of net investment income to | ||||||

| average net assets | 1.10% | 1.37% | 1.22% | 1.18% | 1.38% | |

| Portfolio turnover rate | 12.33% | 23.38% | 17.50% | 9.06% | 6.80% | |

| (1) | Net investment income per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustments for permanent book-to-tax differences. |

The accompanying notes are an integral part of these financial statements.

| Annual Report | The Jensen Quality Growth Fund Inc. | 21 |

Financial Highlights

Class Y

| Per Share Data: | year ended May 31, 2021 | year ended May 31, 2020 | year ended May 31, 2019 | year ended May 31, 2018 | September 30, 2016(1) through May 31, 2017 | |

| Net asset value, beginning | ||||||

| of year | $49.46 | $47.80 | $47.90 | $43.46 | $40.12 | |

| Income from investment | ||||||

| operations: | ||||||

| Net investment | ||||||

| income(2) | 0.66 | 0.73 | 0.63 | 0.58 | 0.34 | |

| Net realized and unrealized | ||||||

| gains on investments | 15.64 | 5.31 | 3.87 | 5.51 | 4.65 | |

| Total from | ||||||

| investment operations | 16.30 | 6.04 | 4.50 | 6.09 | 4.99 | |

| Less distributions: | ||||||

| Dividends from net | ||||||

| investment income | (0.69) | (0.71) | (0.63) | (0.56) | (0.29) | |

| Distributions from | ||||||

| capital gains | (5.09) | (3.67) | (3.97) | (1.09) | (1.36) | |

| Total distributions | $(5.78) | $(4.38) | $(4.60) | $(1.65) | $(1.65) | |

| Net asset value, end of year | $59.98 | $49.46 | $47.80 | $47.90 | $43.46 | |

| Total return | 34.34% | 12.51% | 9.90% | 14.16% | 12.85%(3) | |

| Supplemental data | ||||||

| and ratios: | ||||||

| Net assets, end | ||||||

| of period(000’s) | $2,755,356 | $2,306,038 | $916,705 | $536,621 | $440,892 | |

| Ratio of expenses to | ||||||

| average net assets | 0.52% | 0.54% | 0.55% | 0.55% | 0.56%(4) | |

| Ratio of net investment | ||||||

| income to average net | ||||||

| assets | 1.18% | 1.46% | 1.31% | 1.25% | 1.55%(4) | |

| Portfolio turnover rate | 12.33% | 23.38% | 17.50% | 9.06% | 6.80%(3) | |

| (1) | Commencement of Operations |

| (2) | Net investment income per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustments for permanent book-to-tax differences. |

| (3) | Not annualized |

| (4) | Annualized |

The accompanying notes are an integral part of these financial statements.

| 22 | The Jensen Quality Growth Fund Inc. | Annual Report |

Notes to the Financial Statements

May 31, 2021

1. Organization and Significant Accounting Policies

The Jensen Quality Growth Fund Inc. (the “Fund”), was incorporated as an Oregon corporation on April 17, 1992, and is registered as an open-end, nondiversified management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Fund commenced operations on August 3, 1992. Effective March 1, 2018, the name of the Fund was changed from The Jensen Portfolio, Inc. doing business as Jensen Quality Growth Fund to The Jensen Quality Growth Fund Inc. The Fund is authorized to issue 5,000,000,000 shares of common stock, all of which have been authorized for the existing share classes. The Fund currently offers four different classes of shares; Class J, Class I, Class R, and Class Y. Class J shares are subject to a 0.25% 12b-1 fee and a sub-transfer agency fee, Class R shares are subject to a 0.50% 12b-1 fee and up to a 0.25% shareholder servicing fee, Class I shares are subject to a shareholder servicing fee up to 0.10%, and Class Y shares are not subject to any 12b-1, shareholder servicing or sub transfer agency fee as described in the separate prospectuses for each of the funds share classes. Each class of shares has identical rights and privileges except with respect to the 12b-1 fees, sub-transfer agency fees, shareholder servicing fees, and voting rights on matters affecting a single class of shares. The principal investment objective of the Fund is long-term capital appreciation.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services Investment Companies”.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in United States of America (“GAAP”).

a) Investment Valuation – Securities that are listed on United States stock exchanges are valued at the last sale price at the close of the exchange. Equity securities listed on the NASDAQ Stock Market are valued at the NASDAQ Official Closing Price or, if there has been no sale on that day, at their current bid price. Investments in open-end and closed-end registered investment companies, including money market funds, that do not trade on an exchange are valued at the end of day net asset value per share. Quotations are taken from the market in which the security is primarily traded. Over-the-counter securities are valued at the current bid price in the absence of a closing price. Securities for which market quotations are not readily available are valued at fair value as determined by Jensen Investment Management, Inc. (the “Investment Adviser”) at or under the direction of the Fund’s Board of Directors.

There is no definitive set of circumstances under which the Fund may elect to use fair value procedures to value a security. Although the Fund only invests in publicly traded securities, the large majority of which are large capitalization, highly liquid securities, they nonetheless may become securities for which market quotations are not readily available, such as in instances where the

| Annual Report | The Jensen Quality Growth Fund Inc. | 23 |

market quotation for a security has become stale, sales of a security have been infrequent, trading in the security has been suspended, or where there is a thin market in the security. Securities for which market quotations are not readily available will be valued at their fair value as determined under the Fund’s fair valuation procedures established by the Board of Directors. The Fund is prohibited from investing in restricted securities (securities issued in private placement transactions that may not be offered or sold to the public without registration under the securities laws); therefore, fair value pricing considerations for restricted securities are generally not applicable to the Fund.

Fair Value Measurement – The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the year. The three levels of the fair value hierarchy are as follows:

| Level 1 | Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date. |

| Level 2 | Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active and prices for similar securities, interest rates, credit risk, etc. |

| Level 3 | Inputs that are unobservable (including the Fund’s own assumptions in determining the fair value of investments). |

Inputs refer broadly to the assumptions that market participants use to make valuation decisions, including assumptions about risk. Inputs may include price information, volatility statistics, specific and broad credit data, liquidity statistics, and other factors. A financial instrument’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Fund. The Fund considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant market. The categorization of a financial instrument within the hierarchy is based upon the pricing transparency of the instrument and does not necessarily correspond to the Fund’s perceived risk of that instrument.

Investments whose values are based on quoted market prices in active markets, include common stocks and certain money market securities, and are classified within Level 1. Investments that trade in markets that are not considered to be active, but are valued based on quoted market prices, dealer quotations or alternative pricing sources supported by observable inputs are classified within Level 2. Investments classified within Level 3 have significant unobservable inputs, as they trade infrequently or not at all.

| 24 | The Jensen Quality Growth Fund Inc. | Annual Report |

The following is a summary of the inputs used, as of May 31, 2021, to value the Fund’s investments carried at fair value. The inputs and methodology used for valuing securities may not be an indication of the risk associated with investing in those securities.

| Investments at Value | Total | Level 1 | Level 2 | Level 3 | |||||

| Total Common Stocks* | $ | 10,232,919,508 | $ | 10,232,919,508 | $ | — | $ | — | |

| Total Short-Term Investment | $ | 92,034,399 | $ | 92,034,399 | — | — | |||

| Total Investments | $ | 10,324,953,907 | $ | 10,324,953,907 | $ | — | $ | — | |

| * | For further information regarding security characteristics and industry classifications, please see the Schedule of Investments. |

The Fund did not hold any investments during the period ended May 31, 2021 with significant unobservable inputs which would be classified as Level 3. The Fund did not hold any derivative instruments during the reporting year.

b) Federal Income Taxes – No provision has been made for Federal income taxes since the Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all net investment company taxable income and net capital gains to its shareholders and otherwise comply with the provision of the Internal Revenue Code applicable to regulated investment companies.

The Fund has reviewed all open tax years and major jurisdictions and concluded that there is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken as of and for the year ended May 31, 2021. The Fund recognizes interest and penalties, if any, related to uncertain tax benefits in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. Open tax years are those that are open for exam by taxing authorities. The Fund has no examination in progress. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

c) Distributions to Shareholders – Dividends to shareholders are recorded on the ex-dividend date. Dividends from net investment income are declared and paid quarterly by the Fund. Distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from GAAP. The Fund may utilize earnings and profits distributed to shareholders on redemption of shares as part of the dividend paid deduction.

d) Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| Annual Report | The Jensen Quality Growth Fund Inc. | 25 |

e) Guarantees and Indemnifications – Under the Fund’s organizational documents, each director, officer, employee or other agent of the Fund is indemnified, to the extent permitted by the 1940 Act, against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and believes the risk of loss to be remote.

f) Allocation of Income, Expenses and Gains/Losses – Income, expenses (other than those deemed attributable to a specific share class), and gains and losses of the Fund are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a class of shares are recorded by the specific class. Most Fund expenses are allocated by class based on relative net assets. Transfer agent fees and reports to shareholders are allocated based on the number of shareholder accounts in each class. Sub-transfer agency fees are expensed to the Class J shares based on the actual number of shareholder accounts held and serviced by certain financial intermediaries as described in the Class J shares’ prospectus. 12b-1 fees are expensed at 0.25% of average daily net assets of Class J shares and 0.50% of average daily net assets of Class R shares. Shareholder servicing fees are expensed at up to 0.10% and up to 0.25% of the average daily net assets of Class I shares and Class R shares, respectively.

g) Other – Investment and shareholder transactions are recorded on trade date. Gains or losses from investment transactions are determined on the basis of identified carrying value using the specific identification method. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis.

2. Capital Share Transactions

Transactions in shares of the Fund were as follows:

| year ended | year ended | |||

| Class J | May 31, 2021 | May 31, 2020 | ||

| Shares sold | 2,789,619 | 4,965,464 | ||

| Shares issued in reinvestment of dividends | 4,452,045 | 4,237,996 | ||

| Shares redeemed | (13,730,284 | ) | (16,727,817 | ) |

| Net decrease | (6,488,620 | ) | (7,524,357 | ) |

| Shares outstanding: | ||||

| Beginning of year | 48,982,248 | 56,506,605 | ||

| End of year | 42,493,628 | 48,982,248 |

| 26 | The Jensen Quality Growth Fund Inc. | Annual Report |

| year ended | year ended | |||

| Class R | May 31, 2021 | May 31, 2020 | ||

| Shares sold | 59,842 | 106,858 | ||

| Shares issued in reinvestment of dividends | 43,132 | 39,951 | ||

| Shares redeemed | (148,707 | ) | (252,144 | ) |

| Net decrease | (45,733 | ) | (105,335 | ) |

| Shares outstanding: | ||||

| Beginning of year | 487,931 | 593,266 | ||

| End of year | 442,198 | 487,931 | ||

| year ended | year ended | |||

| Class I | May 31, 2021 | May 31, 2020 | ||

| Shares sold | 17,470,732 | 46,606,590 | ||

| Shares issued in reinvestment of dividends | 8,186,385 | 5,987,147 | ||

| Shares redeemed | (23,177,801 | ) | (43,932,667 | ) |

| Net increase | 2,479,316 | 8,661,070 | ||

| Shares outstanding: | ||||

| Beginning of year | 80,919,218 | 72,258,148 | ||

| End of year | 83,398,534 | 80,919,218 | ||

| year ended | year ended | |||

| Class Y | May 31, 2021 | May 31, 2020 | ||

| Shares sold | 7,775,824 | 33,017,448 | ||

| Shares issued in reinvestment of dividends | 3,630,317 | 1,414,135 | ||

| Shares redeemed | (12,098,519 | ) | (6,980,668 | ) |

| Net increase (decrease) | (692,378 | ) | 27,450,915 | |

| Shares outstanding: | ||||

| Beginning of year | 46,627,999 | 19,177,084 | ||

| End of year | 45,935,621 | 46,627,999 | ||

3. Investment Transactions

The aggregate purchases and aggregate sales of securities, excluding short-term investments, by the Fund for the Year ended May 31, 2021, were $1,174,220,843 and $2,180,703,935, respectively.

| Annual Report | The Jensen Quality Growth Fund Inc. | 27 |

4. Income Taxes

The distributions of $107,389,201 and $103,370,615 paid during the years ended May 31, 2021 and 2020, respectively, were classified as ordinary income for tax purposes. The distributions of $860,454,655 and $571,812,495 paid during the years ended May 31, 2021 and 2020, respectively, were classified as long-term capital gain for income tax purposes.

Additionally, U.S. generally accepted accounting principles require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended May 31, 2021, distributable earnings decreased by $96,318,294 and capital stock increased by $96,318,294. The permanent difference relates to tax equalization.

At May 31, 2021, the cost of investments, net unrealized appreciation (depreciation) and undistributed ordinary income and undistributed long term capital gains for income tax purposes were as follows:

| Cost of investments | $5,487,477,105 | |

| Gross unrealized appreciation | $4,851,805,269 | |

| Gross unrealized depreciation | $(14,328,467 | ) |

| Net unrealized appreciation | $4,837,476,802 | |

| Undistributed ordinary income | $14,866,033 | |

| Undistributed long-term capital gain | $246,946,645 | |

| Distributable earnings | $261,812,678 | |

| Other accumulated gains | $1 | |

| Total distributable earnings | $5,099,289,481 |

The cost of investments differ for financial statement and tax purposes primarily due to the deferral of losses on wash sales.

5. Line of Credit

The Fund has the lesser of (i) $400 million, (ii) 20% of the gross market value of the Fund, or (iii) 33.33% of the net market value of the unencumbered assets of the Fund available under a revolving credit facility, subject to certain restrictions, for temporary emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The secured line of credit has a one-year term and is reviewed annually by the Board of Directors. The credit facility is with the Fund’s custodian, U.S. Bank. The current credit facility runs through December 13, 2021. The interest rate on the outstanding principal amount is equal to the prime rate less 1%. As of May 31, 2021, the average interest rate on the Fund’s line of credit was 2.25%. During the year ended May 31, 2021, the Jensen Quality Growth Fund’s maximum borrowing was $250,000 and average daily borrowing was $2,055. The Fund’s max borrowing was on January 25, 2021.

| 28 | The Jensen Quality Growth Fund Inc. | Annual Report |

6. Investment Advisory Agreement

The Fund is a party to an Investment Advisory and Service Contract with the Investment Adviser. Pursuant to the terms of the Investment Advisory and Service Contract approved by Fund shareholders, the Investment Adviser is entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 0.50% as applied to the Fund’s average daily net assets of $4 billion or less, 0.475% as applied to the Fund’s average daily net assets of more than $4 billion and up to $8 billion, 0.45% as applied to the Fund’s average daily net assets of more than $8 billion and up to $12 billion, and 0.425% as applied to the Fund’s average daily net assets of more than $12 billion.

Certain officers and a director of the Fund are also officers and directors of the Investment Adviser.

7. Distribution and Shareholder Servicing

The Fund has adopted a distribution and shareholder servicing plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), which provides that the Fund make payments to the Fund’s distributor at an annual rate of 0.25% of average daily net assets attributable to Class J shares and 0.50% of the average daily net assets attributable to Class R shares. The Fund’s distributor may then make payments to financial intermediaries or others at an annual rate of up to 0.25% of the average daily net assets attributable to Class J shares and up to 0.50% of the average daily net assets attributable to Class R shares. Payments under the 12b-1 Plan shall be used to compensate the Fund’s distributor or others for services provided and expenses incurred in connection with the sale and/or servicing of shares. 12b-1 fees incurred for the year ended May 31, 2021, are disclosed on the Statement of Operations and the amount payable at year end is disclosed on the Statement of Assets and Liabilities.

In addition, the Fund has adopted a Shareholder Servicing Plan for Class I shares under which the Fund can pay for shareholder support services from the Fund’s assets pursuant to a Shareholder Servicing Agreement in an amount not to exceed 0.10% of the Fund’s average daily net assets attributable to Class I shares. The amount actually incurred for the year ended May 31, 2021 was 0.06%.

The Fund has also adopted a Shareholder Servicing Plan for the Class R shares. Under the Shareholder Servicing Plan, the Fund can pay for shareholder support services, which include the recordkeeping and administrative services provided by retirement plan administrators to retirement plans (and their participants) that are shareholders of the class. Payments will be made pursuant to a Shareholder Servicing Agreement in an amount not to exceed 0.25% of the Fund’s average daily net assets attributable to Class R shares. The amount actually incurred for the year ended May 31, 2021 was 0.17%.

8. Beneficial Ownership

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. At May 31, 2021, Charles Schwab & Co., Inc., for the benefit of its customers, held 46.05% of the outstanding shares of the Class J share class. At May 31, 2021, Wells Fargo Clearing Services LLC, for the benefit of its customers, held 44.62% of the outstanding shares of the Class I share class. At May 31, 2021, Great-West Trust Company LLC, for the benefit of its customers, held 41.04% of the outstanding shares of the Class R share class. At May 31, 2021, Edward D Jones and Co., for the benefit of its customers, held 34.25% of the outstanding shares of the Class Y share class.

| Annual Report | The Jensen Quality Growth Fund Inc. | 29 |

9. Liquidity Risk Management Program

Consistent with Rule 22e-4 under the Investment Company Act of 1940, the Fund has established a liquidity risk management program to manage “liquidity risk” (the “LRMP”). “Liquidity Risk” is defined as the risk that the Fund could not meet requests to redeem shares issued by a Fund without significant dilution of remaining investors’ interest in the Fund. The LRMP is overseen by the Program Administrator, a committee comprised of representatives of the Fund’s investment adviser and officers of the Fund. The Fund’s Board of Directors has approved the designation of the Program Administrator to oversee the LRMP.

The LRMP’s principal objectives include supporting the Fund’s compliance with limits on investments in illiquid assets and mitigating the risk that the Fund will be unable to meet its redemption obligations timely. The LRMP also includes a number of elements that support the management and assessment of liquidity risk, including an annual assessment of factors that influence the Fund’s liquidity and the periodic classification and re-classification of the Fund’s investments into groupings that reflect the Program Administrator’s assessment of their relative liquidity under current market conditions.

During the period covered by the report, it was determined that that: (1) the LRMP continues to be reasonably designed to effectively assess and manage the Funds’ Liquidity Risk; and (2) the LRMP has been adequately and effectively implemented with respect to the Fund during the reporting period. There can be no assurance that the LRMP will achieve its objectives in the future. Please refer to the Fund’s prospectuses for more information regarding the Fund’s exposure to liquidity risk and other principal risks to which an investment in the Fund may be subject.

10. COVID-19

The global outbreak of coronavirus disease 2019 (“COVID-19”) has disrupted global economic markets and adversely affected individual companies and investment products. The prolonged economic impact of COVID-19 is uncertain. The operational and financial performance of the issuers of securities in which the Fund invests depends on future developments, including the duration and spread of the outbreak, and such uncertainty may in turn impact the value of the Fund’s investments.

11. Subsequent Events

On June 10, 2021, The Fund declared and paid a distribution from ordinary income of $0.10082587, $0.13329764, $0.03990240, and $0.14157103 for Class J, Class I, Class R and Class Y, respectively, to shareholders of record as of June 9, 2021.

On July 7, 2021, Foreside Financial Group, LLC (“Foreside”), the parent company of Quasar Distributors, LLC (“Quasar”), the Fund’s distributor, announced that it had entered into a definitive purchase and sale agreement with Genstar Capital (“Genstar”) such that Genstar would acquire a majority stake in Foreside. The transaction is expected to close at the end of the third quarter of 2021. The Board of Directors approved on July 20, 2021 the continuance of Quasar as the Fund’s distributor following the close of the transaction.

| 30 | The Jensen Quality Growth Fund Inc. | Annual Report |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of

The Jensen Quality Growth Fund Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of The Jensen Quality Growth Fund Inc. (the “Fund”) as of May 31, 2021, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of May 31, 2021, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of May 31, 2021, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2010.

COHEN & COMPANY, LTD.

Cleveland, Ohio

July 28, 2021

| Annual Report | The Jensen Quality Growth Fund Inc. | 31 |

Expense Example - May 31, 2021 (Unaudited)

As a shareholder of The Jensen Quality Growth Fund Inc. (the “Fund”), you incur ongoing costs, including investment advisory fees, distribution and/or shareholder servicing fees, and other Fund expenses, which are indirectly paid by shareholders. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period (December 1, 2020 - May 31, 2021).

Actual Expenses

The first line of the table below for each share class of the Fund provides information about actual account values and actual expenses. However, the table does not include shareholder specific fees, such as the $15.00 fee charged to IRA accounts, or the $15.00 fee charged for wire redemptions. The table also does not include portfolio trading commissions and related trading costs. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the actual expense ratios for each share class of the Fund and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees which, although not charged by the Fund, may be charged by other funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| 32 | The Jensen Quality Growth Fund Inc. | Annual Report |

Expense Example Tables

| Jensen Quality Growth Fund – Class J | Beginning Account Value December 1, 2020 | Ending Account Value May 31, 2021 | Expenses Paid During Period* Dec 1, 2020 – May 31, 2021 |

| Actual | $1,000.00 | $1,127.40 | $4.30 |

| Hypothetical (5% annual return before expenses) | 1,000.00 | 1,020.89 | 4.08 |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 0.81%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

| Jensen Quality Growth Fund – Class R | Beginning Account Value December 1, 2020 | Ending Account Value May 31, 2021 | Expenses Paid During Period* Dec 1, 2020 – May 31, 2021 |

| Actual | $1,000.00 | $1,125.00 | $6.68 |

| Hypothetical (5% annual return before expenses) | 1,000.00 | 1,018.65 | 6.34 |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.26%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

| Jensen Quality Growth Fund – Class I | Beginning Account Value December 1, 2020 | Ending Account Value May 31, 2021 | Expenses Paid During Period* Dec 1, 2020 – May 31, 2021 |

| Actual | $1,000.00 | $1,128.40 | $3.34 |

| Hypothetical (5% annual return before expenses) | 1,000.00 | 1,021.79 | 3.18 |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 0.63%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. |

| Jensen Quality Growth Fund – Class Y | Beginning Account Value December 1, 2020 | Ending Account Value May 31, 2021 | Expenses Paid During Period* Dec 1, 2020 – May 31, 2021 |