UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-6653

The Jensen Quality Growth Fund Inc.

(Exact name of registrant as specified in charter)

5500 Meadows Road, Suite 200

Lake Oswego, OR 97035-3623

(Address of principal executive offices) (Zip code)

Robert McIver

5500 Meadows Road, Suite 200

Lake Oswego, OR 97035-3623

(Name and address of agent for service)

(800) 221-4384

Registrant's telephone number, including area code

Date of fiscal year end: May 31

Date of reporting period: May 31, 2020

Item 1. Reports to Stockholders.

Beginning on January 1, 2021, as permitted by regulations adopted by the SEC, paper copies of shareholder reports from The Jensen Quality Growth Fund Inc. (“the Fund”) like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund’s website (www.jenseninvestment.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-992-4144 or by sending an e-mail request to funds@jenseninvestment.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call 1-800-992-4144 or by sending an e-mail request to funds@jenseninvestment.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary.

Letter from The Investment Adviser

Dear Fellow Shareholders,

The Jensen Quality Growth Fund -- Class I Shares -- returned 12.41% for the year ended May 31, 2020, compared to a return of 12.84% for the Standard & Poor’s 500 Index over this period. Please see pages 7 through 10 of this report for complete standardized performance information for the Fund.

Market Perspective

While the term may feel overused in the last few months, a rollercoaster ride feels very apropos to describe the stock market’s performance for the year ended May 31, 2020. With a relatively robust economy and consumer optimism as backdrops, the market, using the S&P 500 Index as a proxy, returned nearly 25% from May 31, 2019 through February 19, 2020. After the official recognition of the COVID-19 pandemic and the resulting economic fallout, the Index proceeded to drop nearly 34% before bottoming on March 23, 2020, followed by a surprising rebound of nearly 37% thereafter to the end of May 2020. Such peaks and troughs within the same twelve-month period are unprecedented, leaving many market participants trying to catch their breath in the face of such wild swings. Of note, four of the twenty largest daily percentage changes, positive and negative, in the market’s history occurred in March of 2020 alone.

Throughout the second half of 2019, the US Federal Reserve lowered the Federal Funds rate three times in an attempt to engineer an economic soft landing in the face of the aging bull market. As the pandemic spread and the resulting economic shutdown began (which resulted in the fastest bear market in history earlier this year) the Federal Reserve and the U.S. Executive and Legislative branches unleashed record levels of assistance in the form of lowering the Federal Funds rate, committing to growing the balance sheet of the Federal Reserve and providing substantial stimulus support for businesses and individuals in an effort to mitigate some of the economic damage. It is clear that one of the longest economic expansions in history is over and the economic data now shows the United States has officially entered a recession.

While the country’s fiscal and monetary responses appear to have contributed to much of the market rise through the end of May 2020, it remains to be seen whether the stimulus and support will have a meaningful and sustained impact on economic activity that is so critical to the long-term viability and success of nearly every business or whether these actions merely act to prop up asset prices in the market in hopes of an economic recovery, that will be dependent upon how quickly the pandemic is brought under control.

The Effect at Jensen

During the period, specific stock selection added value in the Consumer Staples and Industrial sectors, while detracting from returns primarily in the Information Technology sector. From a sector perspective, our relative overweight in Information Technology as well as our lack of presence in the Energy and Financial sectors added value. Typically, very few companies in the Energy and Financial sectors qualify for our strict requirement for high and prolonged profitability, as measured by Return on Equity.

| | |

| Annual Report | The Jensen Quality Growth Fund Inc. | 1 |

Leading contributors to performance during the period were Microsoft Corporation and Apple, Inc., both of which continued to issue reasonably strong earnings reports and reassuring guidance despite the uncertain economic climate. In our view, competitive advantages for Microsoft include the network effect derived from the ubiquitous nature of its products, brand equity, and high customer switching costs. The company’s share price responded favorably to the business offerings that enabled the transition from traditional office environments to the work-from-home structures that capitalized on the company’s cloud enabled offerings and strategies. Similarly, we believe Apple benefits from deep competitive advantages such as an iconic brand, a powerful network effect, and an innovation-focused company culture. In our view, Apple’s shares benefited from continued strength in the higher-margin Services segment and evidence of demand stabilization in China as that economy reopened and Apple was able to reopen its stores and manufacturing facilities. Sentiment was also buoyed by anticipation of new products and services expected in coming months.

Significant detractors from the Fund’s performance for the period included Raytheon Technologies (Raytheon) and VF Corporation, as the market reacted to the economic lockdown and its impact on both of these companies’ business models in the last three months as their end markets were effectively shut down.

Raytheon Technologies was formed on April 3, 2020 via the merger of Raytheon Company and United Technologies Corporation (UTX), a long-time Fund holding. Immediately prior to the merger, UTX spun-off its elevator and escalator business, Otis Worldwide Corporation (Otis), and its heating, ventilation and air conditioning (HVAC) business, Carrier Global Corporation (Carrier). After assessing the long-term opportunities for the merged entity, the Jensen Investment Committee commenced liquidating the position in Raytheon in early June. As the sale occurred after the end of the Fund’s fiscal year, we will provide further commentary as part of our update on the three months ending June 30, 2020.

VF Corporation (VFC) serves end markets that are more financially sensitive to economic change, particularly the hard-hit retail industry, the primary channel through which the vast majority of VFC’s apparel products are sold. We believe the brands that VFC sells remain in demand and we are encouraged that the company’s primary wholesale outlets are specialty retailers rather than the more structurally challenged department store channels that largely remain under tighter quarantine restrictions. We believe the company is financially sound, having suspended share buybacks and boosting liquidity through additional debt. However, recovery in retail will likely be slow and we will be monitoring developments closely.

We are constantly evaluating all of the businesses owned by the Fund as well as other investment candidates to determine whether better opportunities exist in our investable universe. Such determinations ultimately reflect a combination of fundamental considerations as well as valuation opportunities and overall risk profiles for our companies.

| | |

| 2 | The Jensen Quality Growth Fund Inc. | Annual Report |

Fund Additions and Eliminations

During the period, the Jensen Investment Committee initiated new positions in General Mills, Inc., Automatic Data Processing, Inc. and Equifax, Inc. and sold the holdings of Waters Corporation and Ecolab, Inc. These changes to the Fund were in addition to normal add and trim trades during the period that were executed based upon our ongoing assessment of fundamental strengths and valuation opportunities of companies in the Fund. A brief synopsis of the changes follows:

General Mills, Inc. is one of the world’s largest packaged foods companies, producing a wide variety of well-known branded goods, including Cheerios cereal, Yoplait yogurt, Nature Valley granola bars, Haagen-Dazs ice cream, Progresso soup, Pillsbury baking products and Blue Buffalo pet food. While growth in the packaged foods industry is relatively muted, demand for most of the company’s products is not highly sensitive to the overall economic cycle. Further, we expect sales to increase over time as the business introduces new products, invests in advertising and marketing, expands into new distribution channels and grows its overseas operations. In summary, General Mills possesses many of the characteristics we look for in a high-quality business, and we were pleased to have added the name to the Fund at what we considered an attractive valuation.

Automatic Data Processing, Inc. is a leading Human Capital Management (HCM) software and cloud services company that serves a wide range of businesses from small companies to multinationals. The company provides its services via two business segments, Employer Services and Professional Employer Organization (PEO). Employer Services offers a comprehensive suite of human resource services such as payroll, benefits administration, talent acquisition and management to name a few. ADP’s PEO business segment provides small and mid-sized businesses an HR outsourcing solution through a co-employment model, and ADP’s PEO offering is the largest in the US.

We expect the company’s revenue growth to be driven by cloud adoption, expanding services, incorporating new technologies such as artificial intelligence (AI), and taking market share. The company recently completed a significant restructuring that consolidated much of its physical office footprint into regional sales and support centers which has improved margins. The company also revamped its sales force to better serve its cloud-based clients.

We believe the company is well-positioned to deliver stable, profitable growth into the future. In summary, ADP possesses many of the characteristics we look for in a high-quality business, and we were pleased to add the company to the Fund at attractive valuation levels at the time of purchase.

Equifax, Inc. provides consumer and corporate credit information to potential lenders. This information is vital to the efficient operation of the credit markets as it improves lending decisions and results in lower financing costs for borrowers. Significant entry barriers exist in the credit reporting industry, which is dominated by Equifax and its two primary competitors, Transunion and Experian. We believe Equifax’s strategy of acquiring unique data assets and combining those assets with sophisticated analytics to improve customer decision-making capabilities is a sound one. The company’s business is characterized by strong margins, solid free cash flow and attractive growth prospects.

| | |

| Annual Report | The Jensen Quality Growth Fund Inc. | 3 |

Long-term Jensen clients might recall that we previously owned Equifax’s stock and liquidated it in August of 2015 for valuation reasons. From the time of sale in 2015 to the date of our recent purchase, the company’s stock underperformed the S&P 500 by 7.59%. Part of this underperformance was due to a data breach suffered by the company in 2017. Criminals hacked into the company’s systems and stole personal information on more than 145 million consumers. In the wake of the breach, Equifax faced numerous regulatory investigations and lawsuits and embarked on an ambitious $1.25 billion expenditure program to upgrade the quality and security of its IT systems. The company subsequently settled the vast majority of the investigations and lawsuits in 2019, and we are confident the company’s efforts to improve its cybersecurity systems have reduced the probability of another data breach.

First added to the Fund in 2007, Waters Corporation is a global leader in the development of scientific instruments used for pharmaceutical research and quality control testing. In this business, the company benefits from high customer switching costs and steady recurring revenue generated from consumable and service offerings. We believe this component of the investment thesis remains intact, and, as a result, we retain a favorable long-term business outlook on Waters. However, market share losses in a portion of its business and ongoing leveraging of its balance sheet have increased near-term uncertainty.

We began reducing the stake in Waters’ shares early in 2019 when a sharp stock price advance tripped our valuation triggers. Since that time, we steadily lowered the Fund’s exposure, and, prior to its sale, the position remained among the Fund’s smallest over the past year. We will continue to closely monitor Waters and may consider adding it back to the Fund should we see improvement in the combination of business fundamentals and stock price valuation.

Originally purchased in 2005, Ecolab, Inc. is a global leader in the development and production of cleaning and sanitation chemicals. The company serves a broad range of industry verticals including food and beverage manufacturing, restaurants, lodging, and energy production. Across all its businesses, Ecolab generates a high degree of recurring revenue and benefits from scale advantages relative to competitors. At present, there is a high level of near-term uncertainty due to potential weakness across several end markets impacted by COVID-19 mitigation efforts. However, this was not the primary reason for our sale decision as we retain a favorable long-term outlook on the company.

We began reducing the Fund’s stake in Ecolab shares early in 2019 when the stock price became elevated relative to multiple valuation metrics. At the time of the initial trim, Ecolab was a top-five Fund holding but was systematically reduced in response to heightened valuation. We intend to closely monitor Ecolab and may consider re-adding it to the Fund should we see improvement in the combination of business fundamentals and stock price valuation.

The Jensen Outlook

We believe volatility will remain a defining characteristic of the market environment in the short – medium term. Fundamental financial information remains challenging with most companies having withdrawn or reduced earnings projections since the pandemic was declared and the subsequent economic dislocation began. Further complicating matters is an apparent negative disconnect between business fundamentals and the recent market surge. As we write this in late June, the total return produced by the S&P 500 Index is down low to mid-single digits, contrasted

| | |

| 4 | The Jensen Quality Growth Fund Inc. | Annual Report |

with the sharp decline in earnings for the Index companies that depreciated by nearly 49% for the first calendar quarter of 2020 and projections calling for a further drop of 42% for second quarter earnings. While some market participants are expecting a V-shaped recovery to take place in the second half of the calendar year, the projections for full year 2020 Index earnings still anticipate more than a 30% decline for the year an expected rebound of 47% in calendar 2021.

Given that the health pandemic has not subsided either globally or in the United States, such bullish estimates for a recovery in 2021 seems to be extremely aggressive whereas we believe that fundamental support has not yet been sufficiently strong to justify the market returns thus far in 2020. We also note that the lack of earnings visibility is fueling an environment of heightened speculation where the recognition of stable earnings and dividends, hallmarks of quality companies such as the ones that Jensen favors, simply has yet to be evidenced. It is, however, those very strengths, built upon a foundation of sustainable competitive advantages and plentiful cash flow generation, that, in our minds, ultimately support stock price appreciation for the companies in our Fund.

In times of such ongoing market stress, we believe it is crucial to ‘know what you own’ and focus on the underlying long-term business attributes that create shareholder value. Our research process focuses on identifying competitive advantages, balance sheet strength and free cash flow consistency and provides a framework to understand the companies in which we invest. We are confident that while our Portfolio companies are not immune to global stresses, they possess business models that have the potential to mitigate economic risk. Our goal has been and remains to produce strong long-term returns while minimizing the risk of permanent loss of capital.

As we look to the remainder of 2020 and beyond, our near-term investment focus will be to analyze additional information about our companies’ top-line revenue expectations, the evolving trends of the global economic shutdown and the nascent attempts to reopen the national and global economy. This will further shape our outlook for each business model and their future prospects once the worst of the crisis passes and the global economic recovery begins. We believe the environment will improve for high-quality businesses as more fundamental information highlights the inherent strengths that such businesses possess and differentiates these companies from less robust competition.

Whatever the future holds, we continue to believe that paying attention to important company fundamentals helps manage risk. We have long preferred to invest in businesses that are supported by solid foundations of strong cash flow and more consistent financial outcomes as opposed to speculating on the stocks of businesses with more limited and perhaps more uncertain expectations.

We are tremendously grateful for the ongoing support of our firm and investment strategies from our shareholders, partners and clients and we will continue to aim to deliver the results you expect of us.

Be safe and stay healthy. We remain confident we will all get through this together.

| | |

| Annual Report | The Jensen Quality Growth Fund Inc. | 5 |

We invite you to seek additional information about The Jensen Quality Growth Fund at www.jenseninvestment.com where additional content, including updated holdings and performance information, is available. We take our investment responsibilities seriously and appreciate the trust you have placed in us. As always, we welcome your feedback.

Sincerely,

The Jensen Investment Committee

This discussion and analysis of the Fund is as of May 2020 and is subject to change, and any forecasts made cannot be guaranteed.

Past performance is no guarantee of future results. Fund holdings and sector weightings are subject to change and are not recommendations to buy or sell any security.

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. One cannot invest directly in an index.

For more complete information regarding performance and holdings, please refer to the financial statements and schedule of investments headings of this report. Current and future portfolio holdings are subject to risk.

The Fund is nondiversified, meaning that it may concentrate its assets in fewer individual holdings than a diversified fund and is therefore more exposed to individual stock volatility than a diversified fund. The prices of growth stocks may be sensitive to changes in current or expected earnings, may experience larger price swings and may be out of favor with investors at different periods of time.

Earnings growth is not a measure of the fund’s future performance.

S&P Quality Rankings: S&P analyzes about 4,000 stocks trade on the NYSE, AMEX and Nasdaq exchange based upon each firm’s per-share earnings and dividend records, then recalculates “core earnings” by backing out certain items (extraordinary items, discontinued operations, impairment changes, etc.) Figures are also adjusted for changes in rates of earnings/dividend growth, stability over a long-term trend and cyclicality. S&P then divides stocks into a quality category matrix, rating each stock from A+ to D, basing ratings upon each individual company’s growth and stability of earnings and dividends.

Return on Equity: Is equal to a company’s after-tax earnings (excluding non-recurring items) divided by its average stockholder equity for the year.

Free Cash Flow: Is equal to the after-tax net income of a company plus depreciation and amortization less capital expenditures.

For use only when preceded or accompanied by a current prospectus for the Fund.

The Jensen Quality Growth Fund is distributed by Quasar Distributors, LLC.

| | |

| 6 | The Jensen Quality Growth Fund Inc. | Annual Report |

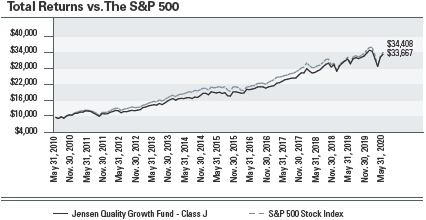

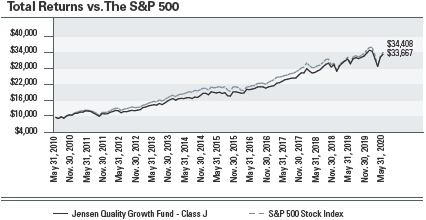

Jensen Quality Growth Fund Inc. - Class J (Unaudited)

Average Annual Returns –

For periods ended May 31, 2020 | | 1 year | 3 years | 5 years | 10 years |

| Jensen Quality Growth Fund - Class J | | 12.15% | 11.82% | 11.66% | 12.91% |

| S&P 500 Stock Index | | 12.84% | 10.23% | 9.86% | 13.15% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on May 31, 2010 for Class J. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| | |

| Annual Report | The Jensen Quality Growth Fund Inc. | 7 |

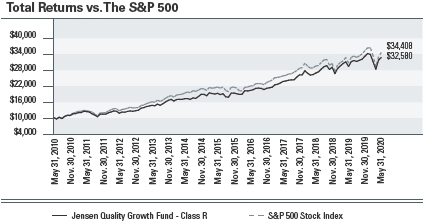

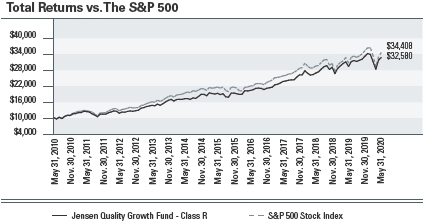

Jensen Quality Growth Fund Inc. - Class R (Unaudited)

Average Annual Returns –

For periods ended May 31, 2020 | | 1 year | 3 years | 5 years | 10 years |

| Jensen Quality Growth Fund - Class R | | 11.66% | 11.38% | 11.23% | 12.54% |

| S&P 500 Stock Index | | 12.84% | 10.23% | 9.86% | 13.15% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $10,000 made on May 31, 2010 for Class R. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| | |

| 8 | The Jensen Quality Growth Fund Inc. | Annual Report |

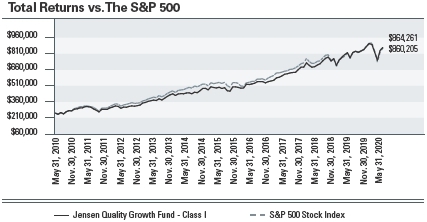

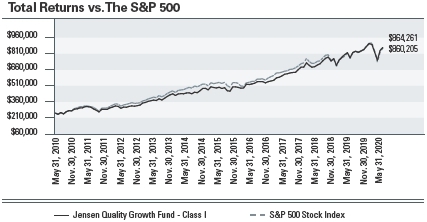

Jensen Quality Growth Fund Inc. - Class I (Unaudited)

Average Annual Returns –

For periods ended May 31, 2020 | | 1 year | 3 years | 5 years | 10 years |

| Jensen Quality Growth Fund - Class I | | 12.41% | 12.10% | 11.94% | 13.21% |

| S&P 500 Stock Index | | 12.84% | 10.23% | 9.86% | 13.15% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $250,000 made on May 31, 2010 for Class I. Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| | |

| Annual Report | The Jensen Quality Growth Fund Inc. | 9 |

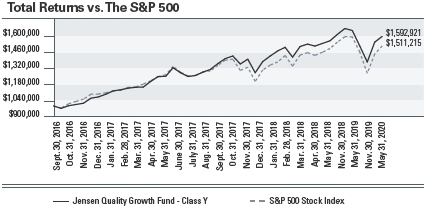

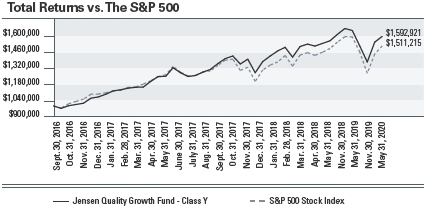

Jensen Quality Growth Fund Inc. - Class Y (Unaudited)

Total Returns –

For periods ended May 31, 2020 | | 1 Year | 3 Year | Since Inception

(September 30, 2016) |

| Jensen Quality Growth Fund - Class Y | | 12.51% | 12.18% | 13.54% |

| S&P 500 Stock Index | | 12.84% | 10.23% | 11.92% |

The S&P 500 Stock Index is an unmanaged but commonly used measure of common stock total return performance. This chart assumes an initial gross investment of $1,000,000 made on September 30, 2016 (commencement of operations for Class Y). Returns shown include the reinvestment of all dividends. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Performance data shown represents past performance; Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1-800-992-4144 or by visiting www.jenseninvestment.com.

| | |

| 10 | The Jensen Quality Growth Fund Inc. | Annual Report |

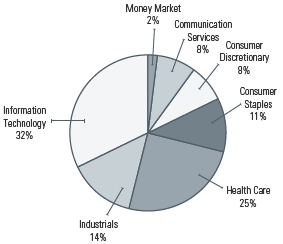

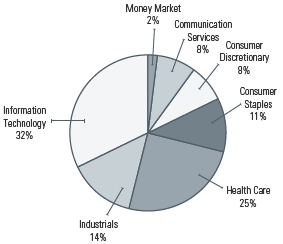

Investments by Sector as of May 31, 2020

(as a Percentage of Total Investments) (Unaudited)

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC doing business as U.S. Bank Global Fund Services.

| | |

| Annual Report | The Jensen Quality Growth Fund Inc. | 11 |

Statement of Assets & Liabilities

May 31, 2020

| Assets: | | |

| Investments, at value (cost $5,864,687,228) | | $8,735,514,750 |

| Dividend and interest income receivable | | 19,642,333 |

| Receivable for capital stock issued | | 10,721,820 |

| Other assets | | 215,009 |

| Total assets | | $8,766,093,912 |

| | | |

| Liabilities: | | |

| Payable to Investment Adviser | | 3,672,756 |

| Payable for capital stock redeemed | | 5,044,120 |

| Accrued distribution fees | | 805,895 |

| Accrued director fees | | 59,140 |

| Accrued expenses and other liabilities | | 1,441,371 |

| Total liabilities | | 11,023,282 |

| Total Net Assets | | $8,755,070,630 |

| | | |

| Net Assets Consist of: | | |

| Capital stock | | 5,422,201,304 |

| Total distributable earnings | | 3,332,869,326 |

| Total Net Assets | | $8,755,070,630 |

| | | |

| Net Assets Consist of: | | |

| Class J Shares | | |

| Net Assets | | $2,422,553,324 |

| Shares outstanding | | 48,982,248 |

| Net Asset Value - Offering Price and Redemption Price Per Share | | |

| (2,000,000,000 shares authorized) | | $49.46 |

| | | |

| Class R Shares | | |

| Net Assets | | $23,994,585 |

| Shares outstanding | | 487,931 |

| Net Asset Value - Offering Price and Redemption Price Per Share | | |

| (1,000,000,000 shares authorized) | | $49.18 |

| | | |

| Class I Shares | | |

| Net Assets | | $4,002,484,643 |

| Shares outstanding | | 80,919,218 |

| Net Asset Value - Offering Price and Redemption Price Per Share | | |

| (1,000,000,000 shares authorized) | | $49.46 |

| | | |

| Class Y Shares | | |

| Net Assets | | $2,306,038,078 |

| Shares outstanding | | 46,627,999 |

| Net Asset Value - Offering Price and Redemption Price Per Share | | |

| (1,000,000,000 shares authorized) | | $49.46 |

The accompanying notes are an integral part of these financial statements.

| | |

| 12 | The Jensen Quality Growth Fund Inc. | Annual Report |

Schedule of Investments

May 31, 2020 (showing percentage of total net assets)

Common Stocks - 97.22%

| shares | Aerospace & Defense - 2.52% | value |

| 3,421,000 | Raytheon Technologies Corporation | $220,722,920 |

| |

| shares | Air Freight & Logistics - 2.90% | value |

| 2,546,000 | United Parcel Service, Inc. - Class B | $253,861,660 |

| |

| shares | Beverages - 6.63% | value |

| 4,410,000 | PepsiCo, Inc. | $580,135,500 |

| |

| shares | Electrical Equipment - 1.69% | value |

| 2,429,000 | Emerson Electric Company | $148,217,580 |

| |

| shares | Electronic Equipment, Instruments & Components - 0.64% | value |

| 575,000 | Amphenol Corporation - Class A | $55,522,000 |

| |

| shares | Food Products - 3.49% | value |

| 4,845,000 | General Mills, Inc. | $305,428,800 |

| |

| shares | Health Care Equipment & Supplies - 10.06% | value |

| 2,251,000 | Becton Dickinson and Company | $555,839,430 |

| 1,662,000 | Stryker Corporation | $325,303,260 |

| | $881,142,690 |

| |

| shares | Health Care Providers & Services - 4.51% | value |

| 1,294,000 | UnitedHealth Group, Inc. | $394,475,900 |

| |

| shares | Household Products - 0.61% | value |

| 458,000 | The Procter & Gamble Company | $53,091,360 |

| |

| shares | Industrial Conglomerates - 5.11% | value |

| 2,860,600 | 3M Company | $447,512,264 |

| |

| shares | Interactive Media & Services - 5.93% | value |

| 362,000 | Alphabet, Inc. - Class A (a) | $518,934,240 |

The accompanying footnotes are an integral part of the Financial Statements.

| | |

| Annual Report | The Jensen Quality Growth Fund Inc. | 13 |

Schedule of Investments continued

May 31, 2020 (showing percentage of total net assets)

| shares | IT Services - 13.56% | value |

| 1,945,000 | Accenture PLC - Class A (b) | $392,150,900 |

| 1,092,000 | Automatic Data Processing, Inc. | $159,967,080 |

| 1,601,000 | Broadridge Financial Solutions, Inc. | $193,881,100 |

| 4,354,000 | Cognizant Technology Solutions Corporation - Class A | $230,762,000 |

| 700,000 | Mastercard, Inc. - Class A | $210,623,000 |

| | $1,187,384,080 |

| |

| shares | Media - 1.81% | value |

| 2,885,000 | Omnicom Group, Inc. | $158,069,150 |

| |

| shares | Pharmaceuticals - 10.01% | value |

| 3,728,000 | Johnson & Johnson | $554,540,000 |

| 8,430,000 | Pfizer, Inc. | $321,941,700 |

| | $876,481,700 |

| |

| shares | Professional Services - 1.84% | value |

| 1,051,000 | Equifax, Inc. | $161,391,560 |

| |

| shares | Semiconductors & Semiconductor Equipment - 1.80% | value |

| 1,329,000 | Texas Instruments, Inc. | $157,805,460 |

| |

| shares | Software - 11.83% | value |

| 917,000 | Intuit, Inc. | $266,223,440 |

| 3,430,000 | Microsoft Corporation | $628,547,500 |

| 2,620,000 | Oracle Corporation | $140,877,400 |

| | $1,035,648,340 |

| |

| shares | Specialty Retail - 1.73% | value |

| 2,874,600 | The TJX Companies, Inc. | $151,663,896 |

| |

| shares | Technology Hardware, Storage & Peripherals - 4.49% | value |

| 1,237,000 | Apple, Inc. | $393,291,780 |

The accompanying footnotes are an integral part of the Financial Statements.

| | |

| 14 | The Jensen Quality Growth Fund Inc. | Annual Report |

Schedule of Investments continued

May 31, 2020 (showing percentage of total net assets)

| shares | Textiles, Apparel & Luxury Goods - 6.06% | value |

| 3,570,000 | NIKE, Inc. - Class B | $351,930,600 |

| 3,191,000 | VF Corporation | $179,015,100 |

| | $530,945,700 |

| |

| Total Common Stocks | value |

| (Cost $5,640,899,058) | $8,511,726,580 |

| |

| Short-Term Investment - 2.56% | |

| | |

| shares | Money Market Fund - 2.56% | value |

| 223,788,170 | First American Treasury Obligations Fund - | |

| Class X, 0.10% (c) | $223,788,170 |

| |

| Total Short-Term Investment | value |

| (Cost $223,788,170) | $223,788,170 |

| |

| Total Investments | value |

| (Cost $5,864,687,228) - 99.78% | $8,735,514,750 |

| Other Assets in Excess of Liabilities - 0.22% | $19,555,880 |

| TOTAL NET ASSETS - 100.00% | $8,755,070,630 |

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Foreign issued security. Foreign concentration (including ADRs) was as follows: Ireland 4.48% as a percentage of net assets. |

| (c) | Variable rate security. Rate listed is the 7-day effective yield as of May 31, 2020. |

The accompanying footnotes are an integral part of the Financial Statements.

| | |

| Annual Report | The Jensen Quality Growth Fund Inc. | 15 |

Statement of Operations

Year Ended May 31, 2020

| Investment Income: | |

| Dividend income | $155,331,063 |

| Interest income | 4,277,050 |

| Total investment income | 159,608,113 |

| | |

| Expenses: | |

| Investment advisory fees | 39,408,775 |

| 12b-1 - Class J | 6,727,372 |

| Administration fees | 1,650,632 |

| Sub-transfer agent expenses - Class J | 1,462,491 |

| Shareholder servicing fees - Class I | 1,370,571 |

| Transfer agent fees - Class I | 1,086,486 |

| Federal and state registration fees | 475,857 |

| Fund Accounting fees | 437,588 |

| Custody fees | 282,322 |

| Transfer agent expenses | 231,077 |

| Directors’ fees and expenses | 215,022 |

| Other | 175,462 |

| Professional fees | 147,011 |

| Reports to shareholders - Class I | 139,684 |

| 12b-1 fees - Class R | 134,776 |

| Reports to shareholders - Class J | 101,062 |

| Reports to shareholders - Class Y | 88,788 |

| Transfer agent fees -Class J | 80,203 |

| Shareholder servicing fees - Class R | 46,902 |

| Transfer agent fees - Class Y | 20,207 |

| Transfer agent fees - Class R | 14,686 |

| Reports to shareholders - Class R | 3,090 |

| Total expenses | 54,300,064 |

| | |

| Net Investment Income | 105,308,049 |

| | |

| Realized and Unrealized Gain on Investments: | |

| Net realized gain on investment transactions | 825,438,612 |

| Change in unrealized depreciation on investments | (36,972,752) |

| Net realized and unrealized gain on investments | 788,465,860 |

| | |

| Net Increase in Net Assets Resulting from Operations | $893,773,909 |

The accompanying notes are an integral part of these financial statements.

| | |

| 16 | The Jensen Quality Growth Fund Inc. | Annual Report |

Statements of Changes in Net Assets

| Year Ended | Year Ended |

| Operations: | May 31, 2020 | May 31, 2019 |

| Net investment income | 105,308,049 | 76,385,479 |

| Net realized gain on investment transactions | 825,438,612 | 580,075,042 |

| Change in unrealized depreciation on investments | (36,972,752) | (46,229,226) |

| Net increase in net assets resulting from operations | 893,773,909 | 610,231,295 |

| | | |

| | Year Ended | Year Ended |

| Capital Share Transactions: | May 31, 2020 | May 31, 2019 |

| Shares Sold - Class J | 247,444,169 | 533,926,355 |

| Shares Sold - Class R | 5,272,964 | 7,530,735 |

| Shares Sold - Class I | 2,319,477,243 | 1,049,002,736 |

| Shares Sold - Class Y | 1,681,573,385 | 534,927,566 |

| Shares issued in reinvestment of dividends - Class J | 215,395,135 | 230,092,588 |

| Shares issued in reinvestment of dividends - Class R | 2,025,318 | 2,552,375 |

| Shares issued in reinvestment of dividends - Class I | 303,957,720 | 273,739,108 |

| Shares issued in reinvestment of dividends - Class Y | 71,318,754 | 55,807,450 |

| Shares redeemed - Class J | (828,418,623) | (668,700,938) |

| Shares redeemed - Class R | (12,679,950) | (14,033,851) |

| Shares redeemed - Class I | (2,235,266,160) | (1,146,065,109) |

| Shares redeemed - Class Y | (333,286,627) | (194,596,353) |

| Net increase | 1,436,813,328 | 664,182,662 |

| | | |

| | Year Ended | Year Ended |

| Dividends and Distributions to Shareholders: | May 31, 2020 | May 31, 2019 |

| Net dividends and distributions to shareholders - Class J | (219,321,651) | (234,506,653) |

| Net dividends and distributions to shareholders - Class R | (2,038,825) | (2,566,702) |

| Net dividends and distributions to shareholders - Class I | (359,624,284) | (298,290,314) |

| Net dividends and distributions to shareholders - Class Y | (94,198,350) | (63,619,985) |

| Total dividends and distributions | (675,183,110) | (598,983,654) |

| | | |

| | Year Ended | Year Ended |

| Increase in Net Assets | May 31, 2020 | May 31, 2019 |

| | 1,655,404,127 | 675,430,303 |

| | | |

| | Year Ended | Year Ended |

| Net Assets: | May 31, 2020 | May 31, 2019 |

| Beginning of Year | 7,099,666,503 | 6,424,236,200 |

| End of Year | $8,755,070,630 | $7,099,666,503 |

The accompanying notes are an integral part of these financial statements.

| | |

| Annual Report | The Jensen Quality Growth Fund Inc. | 17 |

Financial Highlights

Class J

| Per Share Data: | year ended

May 31, 2020 | year ended

May 31, 2019 | year ended

May 31, 2018 | year ended

May 31, 2017 | year ended

May 31, 2016 |

| Net asset value, beginning of year | $47.79 | $47.87 | $43.44 | $38.78 | $40.88 |

| Income from | | | | | |

| investment operations: | | | | | |

| Net investment income(1) | 0.58 | 0.47 | 0.44 | 0.45 | 0.46 |

| Net realized and unrealized gains | | | | | |

| on investments | 5.30 | 3.88 | 5.49 | 6.00 | 1.72 |

| Total from investment operations | 5.88 | 4.35 | 5.93 | 6.45 | 2.18 |

| Less distributions: | | | | | |

| Dividends from net investment income | (0.54) | (0.46) | (0.41) | (0.43) | (0.49) |

| Distributions from capital gains | (3.67) | (3.97) | (1.09) | (1.36) | (3.79) |

| Total distributions | $(4.21) | $(4.43) | $(1.50) | $(1.79) | $(4.28) |

| Net asset value, end of year | $49.46 | $47.79 | $47.87 | $43.44 | $38.78 |

| Total return | 12.15% | 9.58% | 13.77% | 17.12% | 5.99% |

| Supplemental data | | | | | |

| and ratios: | | | | | |

| Net assets, end of year (000’s) | $2,422,553 | $2,700,303 | $2,594,126 | $2,604,964 | $2,317,939 |

| Ratio of expenses to average net assets | 0.84% | 0.86% | 0.87% | 0.87% | 0.87% |

| Ratio of net investment income to | | | | | |

| average net assets | 1.11% | 0.97% | 0.92% | 1.12% | 1.18% |

| Portfolio turnover rate | 23.38% | 17.50% | 9.06% | 6.80% | 14.12% |

| (1) | Net investment income per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustments for permanent book-to-tax differences. |

The accompanying notes are an integral part of these financial statements.

| | |

| 18 | The Jensen Quality Growth Fund Inc. | Annual Report |

Financial Highlights

Class R

| | year ended | year ended | year ended | year ended | year ended |

| Per Share Data: | May 31, 2020 | May 31, 2019 | May 31, 2018 | May 31, 2017 | May 31, 2016 |

| Net asset value, beginning of year | $47.53 | $47.62 | $43.23 | $38.59 | $40.69 |

| Income from investment operations: | | | | | |

| Net investment income(1) | 0.34 | 0.28 | 0.26 | 0.29 | 0.32 |

| Net realized and unrealized gains | | | | | |

| on investments | 5.30 | 3.86 | 5.47 | 5.98 | 1.72 |

| Total from investment operations | 5.64 | 4.14 | 5.73 | 6.27 | 2.04 |

| Less distributions: | | | | | |

| Dividends from net investment income | (0.32) | (0.26) | (0.25) | (0.27) | (0.35) |

| Distributions from capital gains | (3.67) | (3.97) | (1.09) | (1.36) | (3.79) |

| Total distributions | $(3.99) | $(4.23) | $(1.34) | $(1.63) | $(4.14) |

| Net asset value, end of year | $49.18 | $47.53 | $47.62 | $43.23 | $38.59 |

| Total return | 11.66% | 9.17% | 13.34% | 16.69% | 5.63% |

| Supplemental data and ratios: | | | | | |

| Net assets, end of year (000’s) | $23,995 | $28,197 | $31,597 | $27,300 | $29,181 |

| Ratio of expenses to average net assets | 1.27% | 1.24% | 1.24% | 1.24% | 1.22% |

| Ratio of net investment income to | | | | | |

| �� average net assets | 0.68% | 0.58% | 0.56% | 0.75% | 0.83% |

| Portfolio turnover rate | 23.38% | 17.50% | 9.06% | 6.80% | 14.12% |

| (1) | Net investment income per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustments for permanent book-to-tax differences. |

The accompanying notes are an integral part of these financial statements.

| | |

| Annual Report | The Jensen Quality Growth Fund Inc. | 19 |

Financial Highlights

Class I

| | year ended | year ended | year ended | year ended | year ended |

| Per Share Data: | May 31, 2020 | May 31, 2019 | May 31, 2018 | May 31, 2017 | May 31, 2016 |

| Net asset value, beginning of year | $47.81 | $47.90 | $43.46 | $38.80 | $40.90 |

| Income from investment operations: | | | | | |

| Net investment income(1) | 0.66 | 0.60 | 0.55 | 0.56 | 0.56 |

| Net realized and unrealized gains | | | | | |

| on investments | 5.34 | 3.87 | 5.51 | 6.00 | 1.72 |

| Total from investment operations | 6.00 | 4.47 | 6.06 | 6.56 | 2.28 |

| Less distributions: | | | | | |

| Dividends from net investment income | (0.68) | (0.59) | (0.53) | (0.54) | (0.59) |

| Distributions from capital gains | (3.67) | (3.97) | (1.09) | (1.36) | (3.79) |

| Total distributions | $(4.35) | $(4.56) | $(1.62) | $(1.90) | $(4.38) |

| Net asset value, end of year | $49.46 | $47.81 | $47.90 | $43.46 | $38.80 |

| Total return | 12.41% | 9.85% | 14.08% | 17.42% | 6.25% |

| Supplemental data | | | | | |

| and ratios: | | | | | |

| Net assets, end of year (000’s) | $4,002,485 | $3,454,461 | $3,261,893 | $3,052,698 | $2,799,657 |

| Ratio of expenses to average net assets | 0.60% | 0.61% | 0.62% | 0.60% | 0.63% |

| Ratio of net investment income to | | | | | |

| average net assets | 1.37% | 1.22% | 1.18% | 1.38% | 1.42% |

| Portfolio turnover rate | 23.38% | 17.50% | 9.06% | 6.80% | 14.12% |

| (1) | Net investment income per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustments for permanent book-to-tax differences. |

The accompanying notes are an integral part of these financial statements.

| | |

| 20 | The Jensen Quality Growth Fund Inc. | Annual Report |

Financial Highlights

Class Y

| | year ended | year ended | year ended | September 30, 2016(1) |

| Per Share Data: | May 31, 2020 | May 31, 2019 | May 31, 2018 | through May 31, 2017 |

| Net asset value, beginning of year | $47.80 | $47.90 | $43.46 | $40.12 |

| Income from investment operations: | | | | |

| Net investment income(2) | 0.73 | 0.63 | 0.58 | 0.34 |

| Net realized and unrealized gains on | | | | |

| investments | 5.31 | 3.87 | 5.51 | 4.65 |

| Total from investment operations | 6.04 | 4.50 | 6.09 | 4.99 |

| Less distributions: | | | | |

| Dividends from net | | | | |

| investment income | (0.71) | (0.63) | (0.56) | (0.29) |

| Distributions from | | | | |

| capital gains | (3.67) | (3.97) | (1.09) | (1.36) |

| Total distributions | $(4.38) | $(4.60) | $(1.65) | $(1.65) |

| Net asset value, end of year | $49.46 | $47.80 | $47.90 | $43.46 |

| Total return | 12.51% | 9.90% | 14.16% | 12.85%(3) |

| Supplemental data and ratios: | | | | |

| Net assets, end of year (000’s) | $2,306,038 | $916,705 | $536,621 | $440,892 |

| Ratio of expenses to average net | | | | |

| assets | 0.54% | 0.55% | 0.55% | 0.56%(4) |

| Ratio of net investment income to | | | | |

| average net assets | 1.46% | 1.31% | 1.25% | 1.55%(4) |

| Portfolio turnover rate | 23.38% | 17.50% | 9.06% | 6.80%(3) |

| (1) | Commencement of Operations |

| (2) | Net investment income per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustments for permanent book-to-tax differences. |

| (3) | Not annualized |

| (4) | Annualized |

The accompanying notes are an integral part of these financial statements.

| | |

| Annual Report | The Jensen Quality Growth Fund Inc. | 21 |

Notes to the Financial Statements

May 31, 2020 (unaudited)

1. Organization and Significant Accounting Policies

The Jensen Quality Growth Fund Inc. (the “Fund”), was incorporated as an Oregon corporation on April 17, 1992, and is registered as an open-end, nondiversified management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Fund commenced operations on August 3, 1992. Effective March 1, 2018, the name of the Fund was changed from The Jensen Portfolio, Inc. doing business as Jensen Quality Growth Fund to The Jensen Quality Growth Fund Inc. The Fund is authorized to issue 5,000,000,000 shares of common stock, all of which have been authorized for the existing share classes. The Fund currently offers four different classes of shares; Class J, Class I, Class R, and Class Y. Class J shares are subject to a 0.25% 12b-1 fee and a sub-transfer agency fee, Class R shares are subject to a 0.50% 12b-1 fee and up to a 0.25% shareholder servicing fee, Class I shares are subject to a shareholder servicing fee up to 0.10%, and Class Y shares are not subject to any 12b-1, shareholder servicing or sub transfer agency fee as described in the separate prospectuses for each of the funds share classes. Each class of shares has identical rights and privileges except with respect to the 12b-1 fees, sub-transfer agency fees, shareholder servicing fees, and voting rights on matters affecting a single class of shares. The principal investment objective of the Fund is long-term capital appreciation.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services Investment Companies”.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in United States of America (“GAAP”).

a) Investment Valuation – Securities that are listed on United States stock exchanges are valued at the last sale price at the close of the exchange. Equity securities listed on the NASDAQ Stock Market are valued at the NASDAQ Official Closing Price or, if there has been no sale on that day, at their current bid price. Investments in open-end and closed-end registered investment companies, including money market funds, that do not trade on an exchange are valued at the end of day net asset value per share. Quotations are taken from the market in which the security is primarily traded. Over-the-counter securities are valued at the current bid price in the absence of a closing price. Securities for which market quotations are not readily available are valued at fair value as determined by Jensen Investment Management, Inc. (the “Investment Adviser”) at or under the direction of the Fund’s Board of Directors.

There is no definitive set of circumstances under which the Fund may elect to use fair value procedures to value a security. Although the Fund only invests in publicly traded securities, the large majority of which are large capitalization, highly liquid securities, they nonetheless may become securities for which market quotations are not readily available, such as in instances where the

| | |

| 22 | The Jensen Quality Growth Fund Inc. | Annual Report |

market quotation for a security has become stale, sales of a security have been infrequent, trading in the security has been suspended, or where there is a thin market in the security. Securities for which market quotations are not readily available will be valued at their fair value as determined under the Fund’s fair valuation procedures established by the Board of Directors. The Fund is prohibited from investing in restricted securities (securities issued in private placement transactions that may not be offered or sold to the public without registration under the securities laws); therefore, fair value pricing considerations for restricted securities are generally not applicable to the Fund.

Fair Value Measurement – The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the year. The three levels of the fair value hierarchy are as follows:

Level 1 | Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date. |

| | |

Level 2 | Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active and prices for similar securities, interest rates, credit risk, etc. |

| | |

Level 3 | Inputs that are unobservable (including the Fund’s own assumptions in determining the fair value of investments). |

Inputs refer broadly to the assumptions that market participants use to make valuation decisions, including assumptions about risk. Inputs may include price information, volatility statistics, specific and broad credit data, liquidity statistics, and other factors. A financial instrument’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. However, the determination of what constitutes “observable” requires significant judgment by the Fund. The Fund considers observable data to be that market data which is readily available, regularly distributed or updated, reliable and verifiable, not proprietary, and provided by independent sources that are actively involved in the relevant market. The categorization of a financial instrument within the hierarchy is based upon the pricing transparency of the instrument and does not necessarily correspond to the Fund’s perceived risk of that instrument.

Investments whose values are based on quoted market prices in active markets, include common stocks and certain money market securities, and are classified within Level 1. Investments that trade in markets that are not considered to be active, but are valued based on quoted market prices, dealer quotations or alternative pricing sources supported by observable inputs are classified within Level 2. Investments classified within Level 3 have significant unobservable inputs, as they trade infrequently or not at all.

| | |

| Annual Report | The Jensen Quality Growth Fund Inc. | 23 |

The following is a summary of the inputs used, as of May 31,2020, to value the Fund’s investments carried at fair value. The inputs and methodology used for valuing securities may not be an indication of the risk associated with investing in those securities.

| Investments at Value | Total | Level 1 | Level 2 | Level 3 |

| Total Common Stocks* | $8,511,726,580 | $8,511,726,580 | $— | $— |

| Total Short-Term Investment | $223,788,170 | $223,788,170 | — | — |

| Total Investments | $8,735,514,750 | $8,735,514,750 | $— | $— |

| * | For further information regarding security characteristics and industry classifications, please see the Schedule of Investments. |

The Fund did not hold any investments during the period ended May 31, 2020 with significant unobservable inputs which would be classified as Level 3. The Fund did not hold any derivative instruments during the reporting year.

b) Federal Income Taxes – No provision has been made for Federal income taxes since the Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all net investment company taxable income and net capital gains to its shareholders and otherwise comply with the provision of the Internal Revenue Code applicable to regulated investment companies.

The Fund has reviewed all open tax years and major jurisdictions and concluded that there is no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken as of and for the year ended May 31, 2020. The Fund recognizes interest and penalties, if any, related to uncertain tax benefits in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. Open tax years are those that are open for exam by taxing authorities. The Fund has no examination in progress. The Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

c) Distributions to Shareholders – Dividends to shareholders are recorded on the ex-dividend date. Dividends from net investment income are declared and paid quarterly by the Fund. Distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from GAAP. The Fund may utilize earnings and profits distributed to shareholders on redemption of shares as part of the dividend paid deduction.

d) Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| | |

| 24 | The Jensen Quality Growth Fund Inc. | Annual Report |

e) Guarantees and Indemnifications – Under the Fund’s organizational documents, each director, officer, employee or other agent of the Fund is indemnified, to the extent permitted by the 1940 Act, against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund has not had prior claims or losses pursuant to these contracts and believes the risk of loss to be remote.

f) Allocation of Income, Expenses and Gains/Losses – Income, expenses (other than those deemed attributable to a specific share class), and gains and losses of the Fund are allocated daily to each class of shares based upon the ratio of net assets represented by each class as a percentage of the net assets of the Fund. Expenses deemed directly attributable to a class of shares are recorded by the specific class. Most Fund expenses are allocated by class based on relative net assets. Transfer agent fees and reports to shareholders are allocated based on the number of shareholder accounts in each class. Sub-transfer agency fees are expensed to the Class J shares based on the actual number of shareholder accounts held and serviced by certain financial intermediaries as described in the Class J shares’ prospectus. 12b-1 fees are expensed at 0.25% of average daily net assets of Class J shares and 0.50% of average daily net assets of Class R shares. Shareholder servicing fees are expensed at up to 0.10% and up to 0.25% of the average daily net assets of Class I shares and Class R shares, respectively.

g) Other – Investment and shareholder transactions are recorded on trade date. Gains or losses from investment transactions are determined on the basis of identified carrying value using the specific identification method. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis.

2. Capital Share Transactions

Transactions in shares of the Fund were as follows:

| year ended | year ended |

| Class J | May 31, 2020 | May 31, 2019 |

| Shares sold | 4,965,464 | 11,046,211 |

| Shares issued in reinvestment of dividends | 4,237,996 | 5,035,431 |

| Shares redeemed | (16,727,817) | (13,764,699) |

| Net increase (decrease) | (7,524,357) | 2,316,943 |

| Shares outstanding: | | |

| Beginning of year | 56,506,605 | 54,189,662 |

| End of year | 48,982,248 | 56,506,605 |

| | |

| Annual Report | The Jensen Quality Growth Fund Inc. | 25 |

| year ended | year ended |

| Class R | May 31, 2020 | May 31, 2019 |

| Shares sold | 106,858 | 157,385 |

| Shares issued in reinvestment of dividends | 39,951 | 56,253 |

| Shares redeemed | (252,144) | (283,845) |

| Net decrease | (105,335) | (70,207) |

| Shares outstanding: | | |

| Beginning of year | 593,266 | 663,473 |

| End of year | 487,931 | 593,266 |

| |

| | year ended | year ended |

| Class I | May 31, 2020 | May 31, 2019 |

| Shares sold | 46,606,590 | 21,513,214 |

| Shares issued in reinvestment of dividends | 5,987,147 | 5,979,462 |

| Shares redeemed | (43,932,667) | (23,335,950) |

| Net increase | 8,661,070 | 4,156,726 |

| Shares outstanding: | | |

| Beginning of year | 72,258,148 | 68,101,422 |

| End of year | 80,919,218 | 72,258,148 |

| |

| year ended | year ended |

| Class Y | May 31, 2020 | May 31, 2019 |

| Shares sold | 33,017,448 | 10,783,455 |

| Shares issued in reinvestment of dividends | 1,414,135 | 1,220,077 |

| Shares redeemed | (6,980,668) | (4,029,913) |

| Net increase | 27,450,915 | 7,973,619 |

| Shares outstanding: | | |

| Beginning of year | 19,177,084 | 11,203,465 |

| End of year | 46,627,999 | 19,177,084 |

3. Investment Transactions

The aggregate purchases and aggregate sales of securities, excluding short-term investments, by the Fund for the year ended May 31, 2020, were $2,657,163,350 and $1,815,869,993, respectively.

| | |

| 26 | The Jensen Quality Growth Fund Inc. | Annual Report |

4. Income Taxes

The distributions of $103,370,615 and $74,982,000 paid during the years ended May 31, 2020 and 2019, respectively, were classified as ordinary income for tax purposes. The distributions of $571,812,495 and $524,001,654 paid during the years ended May 31, 2020 and 2019, respectively, were classified as long-term capital gain for income tax purposes.

Additionally, U.S. generally accepted accounting principles require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. For the year ended May 31, 2020, distributable earnings decreased by $94,132,461 and capital stock increased by $94,132,461. The permanent difference relates to tax equalization.

At May 31, 2020, the cost of investments, net unrealized appreciation (depreciation) and undistributed ordinary income and undistributed long term capital gains for income tax purposes were as follows:

| Cost of investments | $5,872,010,361 |

| Gross unrealized appreciation | $3,112,739,688 |

| Gross unrealized depreciation | $(249,235,299) |

| Net unrealized appreciation | $2,863,504,389 |

| Undistributed ordinary income | $19,421,345 |

| Undistributed long-term capital gain | $449,943,592 |

| Distributable earnings | $469,364,937 |

| Other accumulated gains | — |

| Total distributable earnings | $3,332,869,326 |

The cost of investments differ for financial statement and tax purposes primarily due to the deferral of losses on wash sales.

5. Line of Credit

The Fund has the lesser of (i) $400 million, (ii) 20% of the gross market value of the Fund, or (iii) 33.33% of the net market value of the unencumbered assets of the Fund available under a revolving credit facility, subject to certain restrictions, for temporary emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The unsecured line of credit has a one-year term and is reviewed annually by the Board of Directors. The credit facility is with the Funds’ custodian, U.S. Bank. The current agreement runs through December 15, 2020. The interest rate on the outstanding principal amount is equal to the prime rate less 1%. As of May 31, 2020, the rate on the Fund’s line of credit was 2.25%. The Fund did not borrow on the line of credit during the year ended May 31, 2020.

| | |

| Annual Report | The Jensen Quality Growth Fund Inc. | 27 |

6. Investment Advisory Agreement

The Fund is a party to an Investment Advisory and Service Contract with the Investment Adviser. Pursuant to the terms of the Investment Advisory and Service Contract approved by Fund shareholders, the Investment Adviser is entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 0.50% as applied to the Fund’s average daily net assets of $4 billion or less, 0.475% as applied to the Fund’s average daily net assets of more than $4 billion and up to $8 billion, 0.45% as applied to the Fund’s average daily net assets of more than $8 billion and up to $12 billion, and 0.425% as applied to the Fund’s average daily net assets of more than $12 billion.

Certain officers and a director of the Fund are also officers and directors of the Investment Adviser.

7. Distribution and Shareholder Servicing

The Fund has adopted a distribution and shareholder servicing plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), which provides that the Fund make payments to the Fund’s distributor at an annual rate of 0.25% of average daily net assets attributable to Class J shares and 0.50% of the average daily net assets attributable to Class R shares. The Fund’s distributor may then make payments to financial intermediaries or others at an annual rate of up to 0.25% of the average daily net assets attributable to Class J shares and up to 0.50% of the average daily net assets attributable to Class R shares. Payments under the 12b-1 Plan shall be used to compensate the Fund’s distributor or others for services provided and expenses incurred in connection with the sale and/or servicing of shares. 12b-1 fees incurred for the period ended May 31, 2020, are disclosed on the Statement of Operations and the amount payable at year end is disclosed on the Statement of Assets and Liabilities.

In addition, the Fund has adopted a Shareholder Servicing Plan for Class I shares under which the Fund can pay for shareholder support services from the Fund’s assets pursuant to a Shareholder Servicing Agreement in an amount not to exceed 0.10% of the Fund’s average daily net assets attributable to Class I shares. The amount actually incurred for the period ended May 31, 2020 was 0.04% on an annualized basis.

The Fund has also adopted a Shareholder Servicing Plan for the Class R shares. Under the Shareholder Servicing Plan, the Fund can pay for shareholder support services, which include the recordkeeping and administrative services provided by retirement plan administrators to retirement plans (and their participants) that are shareholders of the class. Payments will be made pursuant to a Shareholder Servicing Agreement in an amount not to exceed 0.25% of the Fund’s average daily net assets attributable to Class R shares. The amount actually incurred for the period ended May 31, 2020 was 0.17% on an annualized basis.

8. Beneficial Ownership

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates presumption of control of the fund, under Section 2(a)(9) of the 1940 Act. At May 31, 2020, Charles Schwab & Co., Inc., for the benefit of its customers, held 48.20% of the outstanding shares of the Class J share class. At May 31, 2020, Wells Fargo Clearing Services LLC, for the benefit of its customers, held 38.62% of the outstanding shares of the Class I share class. At May 31, 2020, Great-West Trust Company LLC, for the benefit of its customers, held 38.68% of the outstanding shares of the Class R share class. At May 31, 2020, Edward D Jones and Co., for the benefit of its customers, held 38.01% of the outstanding shares of the Class Y share class.

| | |

| 28 | The Jensen Quality Growth Fund Inc. | Annual Report |

9. Liquidity Risk Management Program

Consistent with Rule 22e-4 under the Investment Company Act of 1940, the Fund has established a liquidity risk management program to manage “liquidity risk” (the “LRMP”). “Liquidity Risk” is defined as the risk that the Fund could not meet requests to redeem shares issued by a Fund without significant dilution of remaining investors’ interest in the Fund. The LRMP is overseen by the Program Administrator, a committee comprised of representatives of the Fund’s investment adviser and officers of the Fund. The Fund’s Board of Directors has approved the designation of the Program Administrator to oversee the LRMP.

The LRMP’s principal objectives include supporting the Fund’s compliance with limits on investments in illiquid assets and mitigating the risk that the Fund will be unable to meet its redemption obligations timely. The LRMP also includes a number of elements that support the management and assessment of liquidity risk, including an annual assessment of factors that influence the Fund’s liquidity and the periodic classification and re-classification of the Fund’s investments into groupings that reflect the Program Administrator’s assessment of their relative liquidity under current market conditions.

During the period covered by the report, it was determined that that: (1) the LRMP continues to be reasonably designed to effectively assess and manage the Funds’ Liquidity Risk; and (2) the LRMP has been adequately and effectively implemented with respect to the Fund during the reporting period. There can be no assurance that the LRMP will achieve its objectives in the future. Please refer to the Fund’s prospectuses for more information regarding the Fund’s exposure to liquidity risk and other principal risks to which an investment in the Fund may be subject.

10. COVID-19

The global outbreak of coronavirus disease 2019 (“COVID-19”) has disrupted global economic markets and adversely affected individual companies and investment products. The prolonged economic impact of COVID-19 is uncertain. The operational and financial performance of the issuers of securities in which the Fund invests depends on future developments, including the duration and spread of the outbreak, and such uncertainty may in turn impact the value of the Fund’s investments.

11. Subsequent Events

On June 12, 2020, The Fund declared and paid a distribution from ordinary income of $0.13747996, $0.16571665, $0.07128122, and $0.17244654 for Class J, Class I, Class R and Class Y, respectively, to shareholders of record as of June 11, 2020.

| | |

| Annual Report | The Jensen Quality Growth Fund Inc. | 29 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of

The Jensen Quality Growth Fund Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of The Jensen Quality Growth Fund Inc. (the “Fund”) as of May 31, 2020, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, including the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of May 31, 2020, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of May 31, 2020, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2010.

COHEN & COMPANY, LTD.

Cleveland, Ohio

July 24, 2020

| | |

| 30 | The Jensen Quality Growth Fund Inc. | Annual Report |

Expense Example - May 31, 2020 (Unaudited)

As a shareholder of The Jensen Quality Growth Fund Inc. (the “Fund”), you incur ongoing costs, including investment advisory fees, distribution and/or shareholder servicing fees, and other Fund expenses, which are indirectly paid by shareholders. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period (December 1, 2019 - May 31, 2020).

Actual Expenses

The first line of the table below for each share class of the Fund provides information about actual account values and actual expenses. However, the table does not include shareholder specific fees, such as the $15.00 fee charged to IRA accounts, or the $15.00 fee charged for wire redemptions. The table also does not include portfolio trading commissions and related trading costs. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the actual expense ratios for each share class of the Fund and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees which, although not charged by the Fund, may be charged by other funds. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | |

| Annual Report | The Jensen Quality Growth Fund Inc. | 31 |

Expense Example Tables

| Jensen Quality Growth Fund – Class J | Beginning

Account Value

December 1, 2019 | Ending

Account Value

May 31, 2020 | Expenses Paid

During Period*

Dec 1, 2019 –

May 31, 2020 |

| Actual | $ | 1,000.00 | | | $987.80 | | $ | 4.17 | |

Hypothetical (5% annual return

before expenses) | | 1,000.00 | | | 1,020.80 | | | 4.24 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 0.84%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

| Jensen Quality Growth Fund – Class R | Beginning

Account Value

December 1, 2019 | Ending

Account Value

May 31, 2020 | Expenses Paid

During Period*

Dec 1, 2019 –

May 31, 2020 |

| Actual | $ | 1,000.00 | | | $985.30 | | $ | 6.55 | |

Hypothetical (5% annual return

before expenses) | | 1,000.00 | | | 1,018.40 | | | 6.66 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 1.32%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

| Jensen Quality Growth Fund – Class I | Beginning

Account Value

December 1, 2019 | Ending

Account Value

May 31, 2020 | Expenses Paid

During Period*

Dec 1, 2019 –

May 31, 2020 |

| Actual | $ | 1,000.00 | | | $988.80 | | $ | 2.98 | |

Hypothetical (5% annual return

before expenses) | | 1,000.00 | | | 1,022.00 | | | 3.03 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 0.60%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

| Jensen Quality Growth Fund – Class Y | Beginning

Account Value

December 1, 2019 | Ending

Account Value

May 31, 2020 | Expenses Paid

During Period*

Dec 1, 2019 –

May 31, 2020 |

| Actual | $ | 1,000.00 | | | $989.40 | | $ | 2.69 | |

Hypothetical (5% annual return

before expenses) | | 1,000.00 | | | 1,022.30 | | | 2.73 | |

| * | Expenses are equal to the Fund’s annualized six-month expense ratio of 0.54%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. |

| | |

| 32 | The Jensen Quality Growth Fund Inc. | Annual Report |

Additional Information

1. Shareholder Notification of Federal Tax Status

The Fund designates 100% of dividends declared during the fiscal year ended May 31, 2020 as dividends qualifying for the dividends received deduction available to corporate shareholders.

The Fund designates 100% of dividends declared from net investment income during the fiscal year ended May 31, 2020 as qualified dividend income under the Jobs and Growth Tax Relief Reconciliation Act of 2003.