UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-07076

| |

| Wilshire Mutual Funds, Inc. |

| (Exact name of registrant as specified in charter) |

| |

Wilshire Associates Incorporated 1299 Ocean Avenue, Suite 700 Santa Monica, CA 90401-1085 |

| (Address of principal executive offices) (Zip code) |

| |

Jason Schwarz, President 1299 Ocean Avenue, Suite 700 Santa Monica, CA 90401-1085 |

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: 310-260-6639

Date of fiscal year end: December 31

Date of reporting period: December 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

| |

| |

|

| |

| |

ANNUAL REPORT Large Company Growth Portfolio Large Company Value Portfolio Small Company Growth Portfolio Small Company Value Portfolio Wilshire 5000 Indexsm Fund Wilshire Large Cap Core Plus Fund |

| |

| |

December 31, 2011

www.wilfunds.com |

| |

| |

Wilshire Mutual Funds, Inc.

| Shareholder Letter | 1 |

| Commentary: | |

| Large Company Growth Portfolio | 2 |

| Large Company Value Portfolio | 6 |

| Small Company Growth Portfolio | 10 |

| Small Company Value Portfolio | 14 |

Wilshire 5000 IndexSM Fund | 18 |

| Wilshire Large Cap Core Plus Fund | 24 |

| Disclosure of Fund Expenses | 28 |

| Condensed Schedules of Investments: | |

| Large Company Growth Portfolio | 31 |

| Large Company Value Portfolio | 33 |

| Small Company Growth Portfolio | 35 |

| Small Company Value Portfolio | 37 |

Wilshire 5000 IndexSM Fund | 39 |

| Schedule of Investments: | |

| Wilshire Large Cap Core Plus Fund | 41 |

| Schedule of Securities Sold Short: | |

| Wilshire Large Cap Core Plus Fund | 47 |

| Statements of Assets and Liabilities | 50 |

| Statements of Operations | 52 |

| Statements of Changes in Net Assets | 53 |

| Statement of Cash Flows | 57 |

| Financial Highlights: | |

| Large Company Growth Portfolio | 58 |

| Large Company Value Portfolio | 60 |

| Small Company Growth Portfolio | 62 |

| Small Company Value Portfolio | 64 |

Wilshire 5000 IndexSM Fund | 66 |

| Wilshire Large Cap Core Plus Fund | 70 |

| Notes to Financial Statements | 72 |

| Report of Independent Registered Public Accounting Firm | 83 |

| Additional Fund Information | 84 |

| Tax Information | 89 |

| Board Approval of Advisory and Subadvisory Agreements | 91 |

This report is for the general information of the shareholders of Large Company Growth Portfolio, Large Company Value Portfolio, Small Company Growth Portfolio, Small Company Value Portfolio, Wilshire 5000 IndexSM Fund and Wilshire Large Cap Core Plus Fund. Its use in connection with any offering of a Portfolio’s shares is authorized only if accompanied or preceded by the Portfolio’s current prospectus.

Wilshire Mutual Funds, Inc. are distributed by SEI Investments Distribution Co.

Dear Wilshire Mutual Fund Shareholder:

We are pleased to present the 2011 Annual Report to all shareholders of the Wilshire Mutual Funds, Inc. This report covers the twelve month period (the “Period”) ended December 31, 2011, for all share classes of the Large Company Growth Portfolio, Large Company Value Portfolio, Small Company Growth Portfolio, Small Company Value Portfolio, Wilshire 5000 IndexSM Fund and Wilshire Large Cap Core Plus Fund (the “Funds”).

MARKET ENVIRONMENT

Volatility and uncertainty were defining attributes of 2011 as macroeconomic events weighed on markets worldwide. The Japanese earthquake and tsunami roiled markets in the first quarter, casting substantial doubt on the future of the world’s third largest economy and disrupting global supply chains. Geopolitical unrest in the Middle East exploded with the “Arab Spring,” which played out for the duration of the year with a revolutionary spate of protests across the region. During the second quarter protracted political gridlock in Washington caused a delay in raising the debt ceiling, with an agreement finally coming in the eleventh hour but not until after the damage was done. Standard and Poor’s downgraded the U.S.’s debt rating from AAA to AA+ on August 5th, 2011, contributing to the largest one-day market move of 2011 on August 8, 2011, when the Wilshire 5000 Total Market IndexSM lost $1.0 trillion. The Federal Reserve continued the expansion of its balance sheet by announcing “Operation Twist” in the third quarter, a policy maneuver that involved selling short-term assets and buying long-term assets in an effort to push down long-term interest rates. Lastly, the European debt crisis continued unabated in the fourth quarter, with questions surrounding Greece, Italy, and Portugal’s fiscal futures all hanging in the balance.

Against the backdrop of significant and ongoing macroeconomic uncertainty, markets continued to disregard stock-specific fundamentals. The Wilshire 5000 Total Market IndexSM returned 0.99 percent for the year, heartily outpacing developed and emerging international market equities which fell by -12.1 percent and -18.4 percent, respectively. Performance of most U.S. equity sub-asset class styles closed the year down with the exceptions of large cap value and U.S. real estate, which ended 2011 up 3.7 percent and 9.2 percent, respectively. One of the worst performing equity styles this year was microcap, which closed the year down -13.5 percent. Fixed income investors watched interest rates sink to historic lows as the U.S. 10-year Treasury bond dropped below two percent as global investors shifted towards higher quality assets en masse. Additionally, the U.S. dollar reversed its trend by appreciating against other foreign currencies.

FUND PERFORMANCE OVERVIEW

Against this backdrop, markets continued to focus on the macroeconomic headlines, flocking to the perceived safety of defensively-oriented stocks and making 2011 a difficult year for active management. The S&P 500 Index outperformed roughly four-fifths of the managers in the large core mutual fund universe, while the MSCI EAFE Index outperformed nearly 2/3 of all actively-managed funds. The Funds were not immune to this trend, with all Funds—with the exception of the Small Company Growth Portfolio—underperforming their respective benchmarks.

We are always mindful that markets can behave erratically and current trends shift swiftly. You can expect us to continue to work diligently to manage your investments and seek to generate returns commensurate with the Funds’ investment objectives. As always, we appreciate your continued support and confidence.

Sincerely,

Jamie Ohl

President

Large Company Growth Portfolio Commentary |  |

INVESTMENT CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/11 | (1.44)% |

Five Years Ended 12/31/11 | 1.18% |

Ten Years Ended 12/31/11 | 2.45% |

RUSSELL 1000® GROWTH INDEX(1)

Average Annual Total Return

One Year Ended 12/31/11 | 2.64% |

Five Years Ended 12/31/11 | 2.50% |

Ten Years Ended 12/31/11 | 2.60% |

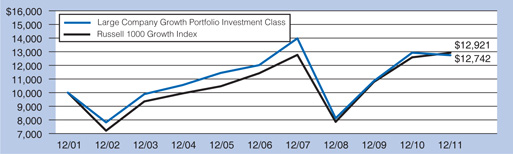

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Large Company Growth

Portfolio, Investment Class Shares and the Russell 1000 Growth Index through 12/31/11.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2011, there were no waivers. |

| (1) | The Russell 1000® Growth Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Large Company Growth Portfolio Commentary - (Continued) |  |

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/11 | (1.09)% |

Five Years Ended 12/31/11 | 1.54% |

Ten Years Ended 12/31/11 | 2.81% |

RUSSELL 1000® GROWTH INDEX(1)

Average Annual Total Return

One Year Ended 12/31/11 | 2.64% |

Five Years Ended 12/31/11 | 2.50% |

Ten Years Ended 12/31/11 | 2.60% |

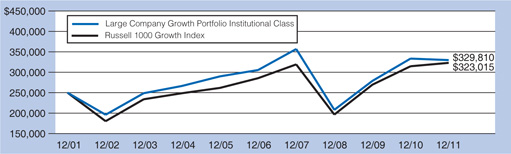

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Large Company Growth

Portfolio, Institutional Class Shares and the Russell 1000 Growth Index through 12/31/11.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2011, there were no waivers. |

| (1) | The Russell 1000® Growth Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Large Company Growth Portfolio Commentary - (Continued) |  |

On the heels of a positive 2010, equity investors were bullish as 2011 began, but turned increasingly defensive as the year wore on. After trading sideways for the first two quarters of 2011, equity markets sold-off in August when the U.S. lost its AAA credit rating, prompting a worldwide retrenchment from risk assets. Markets rallied back in the fourth quarter of 2011 even though the headwinds from uncertainty in the euro zone increased. Despite record profits at U.S. companies, investors generally shifted out of cyclical, economically–sensitive sectors in favor of more defensive and stable areas of the market, particularly well-capitalized large cap companies with strong, recurring revenue streams. Utilities and Consumer Staples were the best performing sectors for the year, returning 18.7 percent and 13.9 percent, respectively, while Financials and Materials performed the worst, falling by -14.7 and -8.9 percent, respectively. For 2011, small capitalization stocks were down -3.4 percent against gains of 1.6 percent for large capitalization stocks. The large value style delivered the best returns for the year, up 3.7 percent, while small value and microcap stocks trailed other styles, down -5.3 percent and –13.5 percent, respectively.

The Wilshire Large Company Growth Portfolio Institutional Class returned -1.09% for the year ended December 31, 2011, underperforming the benchmark (the Russell 1000 Growth Index) return of 2.64%. Underperformance was driven by poor stock selection in Financials, Materials and Information Technology as well as an underweight in Consumer Staples. Underperformance was modestly offset by strong stock selection in Health Care.

Despite the Fund’s underperformance versus its benchmark, we remain confident in our sub-advisers, who continue to follow through with the disciplined investment approaches that have made them successful over the long-term. It is our belief that the Fund is well positioned going into 2012 and should benefit as macroeconomic fears are allayed and investors return their focus to company fundamentals.

Large Company Growth Portfolio Commentary - (Continued) |  |

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2011)

| † | Based on percent of the Portfolio’s total investments in securities, at value. |

Large Company Value Portfolio Commentary |  |

INVESTMENT CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/11 | (3.36)% |

Five Years Ended 12/31/11 | (4.21)% |

Ten Years Ended 12/31/11 | 2.29% |

RUSSELL 1000® VALUE INDEX(1)

Average Annual Total Return

One Year Ended 12/31/11 | 0.39% |

Five Years Ended 12/31/11 | (2.64)% |

Ten Years Ended 12/31/11 | 3.89% |

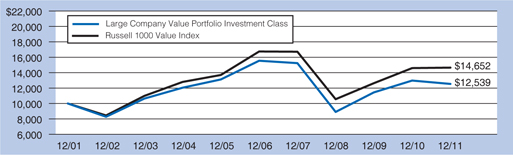

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Large Company Value

Portfolio, Investment Class Shares and the Russell 1000 Value Index through 12/31/11.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2011, there were no waivers. |

| (1) | The Russell 1000® Value Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Large Company Value Portfolio Commentary - (Continued) |  |

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/11 | (2.95)% |

Five Years Ended 12/31/11 | (4.02)% |

Ten Years Ended 12/31/11 | 2.53% |

RUSSELL 1000® VALUE INDEX(1)

Average Annual Total Return

One Year Ended 12/31/11 | 0.39% |

Five Years Ended 12/31/11 | (2.64)% |

Ten Years Ended 12/31/11 | 3.89% |

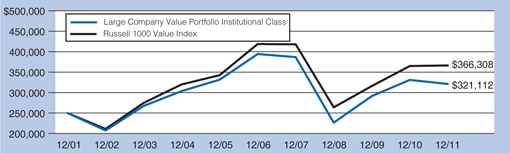

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Large Company Value

Portfolio, Institutional Class Shares and the Russell 1000 Value Index through 12/31/11.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2011, there were no waivers. |

| (1) | The Russell 1000® Value Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Large Company Value Portfolio Commentary - (Continued) |  |

On the heels of a positive 2010, equity investors were bullish as 2011 began, but turned increasingly defensive as the year wore on. After trading sideways for the first two quarters of 2011, equity markets sold-off in August when the U.S. lost its AAA credit rating, prompting a worldwide retrenchment from risk assets. Markets rallied back in the fourth quarter of 2011 even though the headwinds from uncertainty in the euro zone increased. Despite record profits at U.S. companies, investors generally shifted out of cyclical, economically–sensitive sectors in favor of more defensive and stable areas of the market, particularly well-capitalized large cap companies with strong, recurring revenue streams. Utilities and Consumer Staples were the best performing sectors for the year, returning 18.7 percent and 13.9 percent, respectively, while Financials and Materials performed the worst, falling by -14.7 and -8.9 percent, respectively. For 2011, small capitalization stocks were down -3.4 percent against gains of 1.6 percent for large capitalization stocks. The large value style delivered the best returns for the year, up 3.7 percent, while small value and microcap stocks trailed other styles, down -5.3 percent and -13.5 percent, respectively.

The Wilshire Large Company Value Portfolio Institutional Class returned -2.95% for the year ended December 31, 2011, underperforming the benchmark (the Russell 1000 Value Index) return of 0.39%. Underperformance was driven by poor stock selection in Information Technology, Industrials and Consumer Staples. Underperformance was modestly offset by strong stock selection in Financials and Energy.

Despite the Fund’s underperformance versus its benchmark, we remain confident in our sub-advisers, who continue to follow through with the disciplined investment approaches that have made them successful over the long-term. It is our belief that the Fund is well positioned going into 2012 and should benefit as macroeconomic fears are allayed and investors return their focus to company fundamentals.

Large Company Value Portfolio Commentary - (Continued) |  |

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2011)

| † | Based on percent of the Portfolio’s total investments in securities, at value. |

Small Company Growth Portfolio Commentary |  |

INVESTMENT CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/11 | (0.31)% |

Five Years Ended 12/31/11 | 1.57% |

Ten Years Ended 12/31/11 | 5.56% |

RUSSELL 2000® GROWTH INDEX(1)

Average Annual Total Return

One Year Ended 12/31/11 | (2.91)% |

Five Years Ended 12/31/11 | 2.09% |

Ten Years Ended 12/31/11 | 4.48% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Small Company Growth

Portfolio, Investment Class Shares and the Russell 2000 Growth Index through 12/31/11.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2011, fees totaling 0.52% of average net assets were waived for the Investment Class Shares. |

| (1) | The Russell 2000® Growth Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Small Company Growth Portfolio Commentary - (Continued) |  |

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/11 | (0.06)% |

Five Years Ended 12/31/11 | 1.80% |

Ten Years Ended 12/31/11 | 5.81% |

RUSSELL 2000® GROWTH INDEX(1)

Average Annual Total Return

One Year Ended 12/31/11 | (2.91)% |

Five Years Ended 12/31/11 | 2.09% |

Ten Years Ended 12/31/11 | 4.48% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Small Company Growth

Portfolio, Institutional Class Shares and the Russell 2000 Growth Index through 12/31/11.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2011, fees totaling 0.46% of average net assets were waived for the Institutional Class Shares. |

| (1) | The Russell 2000® Growth Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Small Company Growth Portfolio Commentary - (Continued) |  |

On the heels of a positive 2010, equity investors were bullish as 2011 began, but turned increasingly defensive as the year wore on. After trading sideways for the first two quarters of 2011, equity markets sold-off in August when the U.S. lost its AAA credit rating, prompting a worldwide retrenchment from risk assets. Markets rallied back in the fourth quarter of 2011 even though the headwinds from uncertainty in the euro zone increased. Despite record profits at U.S. companies, investors generally shifted out of cyclical, economically–sensitive sectors in favor of more defensive and stable areas of the market, particularly well-capitalized large cap companies with strong, recurring revenue streams. Utilities and Consumer Staples were the best performing sectors for the year, returning 18.7 percent and 13.9 percent, respectively, while Financials and Materials performed the worst, falling by -14.7 and -8.9 percent, respectively. For 2011, small capitalization stocks were down -3.4 percent against gains of 1.6 percent for large capitalization stocks. The large value style delivered the best returns for the year, up 3.7 percent, while small value and microcap stocks trailed other styles, down -5.3 percent and -13.5 percent, respectively.

The Wilshire Small Company Growth Portfolio Institutional Class returned -0.06% for the year ended December 31, 2011, outperforming the benchmark (the Russell 2000 Growth Index) return of -2.91% by 2.85%. Outperformance was driven primarily by strong stock selection in Health Care, Materials and Industrials, mitigated slightly by poor stock selection in Information Technology.

We are pleased with the performance of the Fund and are encouraged by the current activities and positioning of our sub-advisers, who continue to follow through with the disciplined investment approaches that have made them successful over the long-term. It is our belief that the Fund is well positioned going into 2012 and should benefit as macroeconomic fears are allayed and investors return their focus on company fundamentals.

Small Company Growth Portfolio Commentary - (Continued) |  |

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2011)

| † | Based on percent of the Portfolio’s total investments in securities, at value. |

Small Company Value Portfolio Commentary |  |

INVESTMENT CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/11 | (7.54)% |

Five Years Ended 12/31/11 | (1.86)% |

Ten Years Ended 12/31/11 | 5.87% |

RUSSELL 2000® VALUE INDEX(1)

Average Annual Total Return

One Year Ended 12/31/11 | (5.50)% |

Five Years Ended 12/31/11 | (1.87)% |

Ten Years Ended 12/31/11 | 6.40% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Small Company Value

Portfolio, Investment Class Shares and the Russell 2000 Value Index through 12/31/11.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2011, fees totaling 0.40% of average net assets were waived in the Investment Class Shares. |

| (1) | The Russell 2000® Value Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Small Company Value Portfolio Commentary - (Continued) |  |

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/11 | (6.95)% |

Five Years Ended 12/31/11 | (1.47)% |

Ten Years Ended 12/31/11 | 6.24% |

RUSSELL 2000® VALUE INDEX(1)

Average Annual Total Return

One Year Ended 12/31/11 | (5.50)% |

Five Years Ended 12/31/11 | (1.87)% |

Ten Years Ended 12/31/11 | 6.40% |

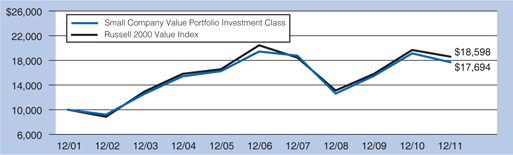

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Small Company Value

Portfolio, Institutional Class Shares and the Russell 2000 Value Index through 12/31/11.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2011, fees totaling 0.40% of average net assets were waived in the Institutional Class Shares. |

| (1) | The Russell 2000® Value Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Small Company Value Portfolio Commentary - (Continued) |  |

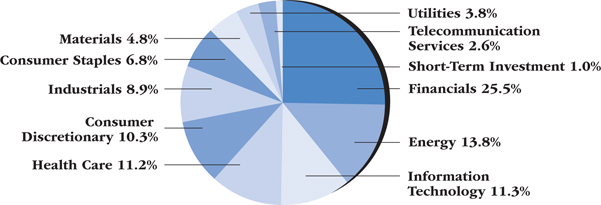

On the heels of a positive 2010, equity investors were bullish as 2011 began, but turned increasingly defensive as the year wore on. After trading sideways for the first two quarters of 2011, equity markets sold-off in August when the U.S. lost its AAA credit rating, prompting a worldwide retrenchment from risk assets. Markets rallied back in the fourth quarter of 2011 even though the headwinds from uncertainty in the euro zone increased. Despite record profits at U.S. companies, investors generally shifted out of cyclical, economically–sensitive sectors in favor of more defensive and stable areas of the market, particularly well-capitalized large cap companies with strong, recurring revenue streams. Utilities and Consumer Staples were the best performing sectors for the year, returning 18.7 percent and 13.9 percent, respectively, while Financials and Materials performed the worst, falling by -14.7 and -8.9 percent, respectively. For 2011, small capitalization stocks were down -3.4 percent against gains of 1.6 percent for large capitalization stocks. The large value style delivered the best returns for the year, up 3.7 percent, while small value and microcap stocks trailed other styles, down -5.3 percent and -13.5 percent, respectively.

The Wilshire Small Company Value Portfolio, Institutional Class returned -6.95% for the year ended December 31 2011, underperforming the benchmark (the Russell 2000 Value Index) return of -5.50%. Underperformance was driven by poor stock selection in Financials, Consumer Discretionary and information Technology and poor sector allocation in Utilities.

Despite the Fund’s underperformance versus its benchmark, we remain confident in our sub-advisers, who continue to follow through with the disciplined investment approaches that have made them successful over the long-term. It is our belief that the Fund is well positioned going into 2012 and should benefit as macroeconomic fears are allayed and investors return their focus to company fundamentals.

Small Company Value Portfolio Commentary - (Continued) |  |

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2011)

| † | Based on percent of the Portfolio’s total investments in securities, at value. |

Wilshire 5000 Indexsm Fund Commentary |  |

INVESTMENT CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/11 | 0.21% |

Five Years Ended 12/31/11 | (0.48)% |

Ten Years Ended 12/31/11 | 2.95% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Return

One Year Ended 12/31/11 | 0.99% |

Five Years Ended 12/31/11 | 0.13% |

Ten Years Ended 12/31/11 | 3.80% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Wilshire 5000 IndexSM

Fund, Investment Class Shares and the Wilshire 5000 IndexSM through 12/31/11.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2011, there were no waivers. |

| (1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Wilshire 5000 Indexsm Fund Commentary - (Continued) |  |

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/11 | 0.43% |

Five Years Ended 12/31/11 | (0.28)% |

Ten Years Ended 12/31/11 | 3.20% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Return

One Year Ended 12/31/11 | 0.99% |

Five Years Ended 12/31/11 | 0.13% |

Ten Years Ended 12/31/11 | 3.80% |

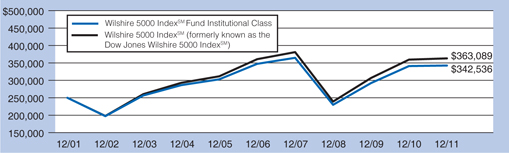

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Wilshire 5000 IndexSM

Fund, Institutional Class Shares and the Wilshire 5000 IndexSM through 12/31/11.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2011, there were no waivers. |

| (1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Wilshire 5000 Indexsm Fund Commentary - (Continued) |  |

QUALIFIED CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/11 | 0.54% |

Five Years Ended 12/31/11 | (0.43)% |

Ten Years Ended 12/31/11 | 2.92% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Return

One Year Ended 12/31/11 | 0.99% |

Five Years Ended 12/31/11 | 0.13% |

Ten Years Ended 12/31/11 | 3.80% |

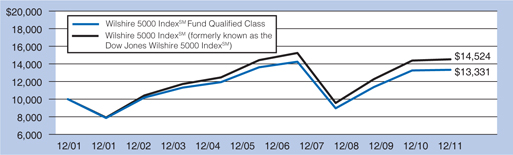

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Wilshire 5000 IndexSM

Fund, Qualified Class Shares and the Wilshire 5000 IndexSM through 12/31/11.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2011, there were no waivers. |

| (1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Wilshire 5000 Indexsm Fund Commentary - (Continued) |  |

HORACE MANN CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/11 | 0.25% |

Five Years Ended 12/31/11 | (0.53)% |

Ten Years Ended 12/31/11 | 2.90% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Return

One Year Ended 12/31/11 | 0.99% |

Five Years Ended 12/31/11 | 0.13% |

Ten Years Ended 12/31/11 | 3.80% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Wilshire 5000 IndexSM

Fund, Horace Mann Class Shares and the Wilshire 5000 IndexSM through 12/31/11.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2011, there were no waivers. |

| (1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Wilshire 5000 Indexsm Fund Commentary - (Continued) |  |

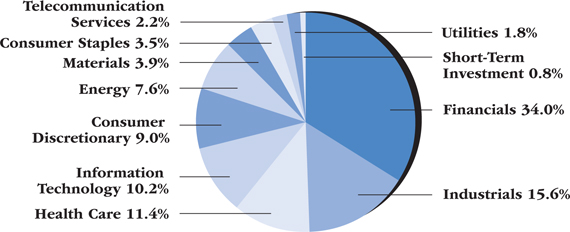

On the heels of a positive 2010, equity investors were bullish as 2011 began, but turned increasingly defensive as the year wore on. After trading sideways for the first two quarters of 2011, equity markets sold-off in August when the U.S. lost its AAA credit rating, prompting a worldwide retrenchment from risk assets. Markets rallied back in the fourth quarter of 2011 even though the headwinds from uncertainty in the euro zone increased. Despite record profits at U.S. companies, investors generally shifted out of cyclical, economically–sensitive sectors in favor of more defensive and stable areas of the market, particularly well-capitalized large cap companies with strong, recurring revenue streams. Utilities and Consumer Staples were the best performing sectors for the year, returning 18.7 percent and 13.9 percent, respectively, while Financials and Materials performed the worst, falling by -14.7 and -8.9 percent, respectively. For 2011, small capitalization stocks were down -3.4 percent against gains of 1.6 percent for large capitalization stocks. The large value style delivered the best returns for the year, up 3.7 percent, while small value and microcap stocks trailed other styles, down -5.3 percent and -13.5 percent, respectively.

The Wilshire 5000 IndexSM Fund Institutional Class returned 0.43% for the year ended December 31, 2011, slightly trailing the Fund’s benchmark (the Wilshire 5000 IndexSM) return of 0.99% by 0.56%. The slight underperformance is well within the range of historical experience.

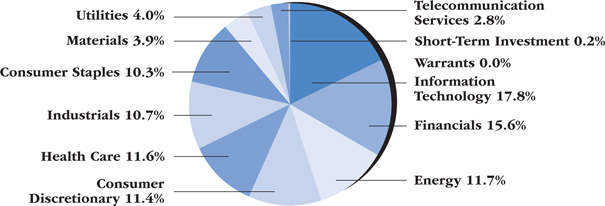

Wilshire 5000 Indexsm Fund Commentary - (Continued) |  |

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2011)

| † | Based on percent of the Fund’s total investments in securities, at value. |

Wilshire Large Cap Core Plus Fund Commentary |  |

INVESTMENT CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/11 | (2.28)% |

Inception (11/15/07) through 12/31/11 | (5.06)% |

S&P 500 INDEX(1)

Average Annual Total Return

One Year Ended 12/31/11 | 2.11% |

Inception (11/15/07) through 12/31/11 | (1.37)% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Wilshire Large Cap

Core Plus Fund, Investment Class Shares and the S&P 500 Index through 12/31/11.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2011, fees totaling 0.06% of average net assets were waived in the Investment Class Shares. |

| (1) | The S&P 500 Index is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. |

Wilshire Large Cap Core Plus Fund Commentary - (Continued) |  |

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/11 | (2.11)% |

Inception (11/15/07) through 12/31/11 | (4.77)% |

S&P 500 INDEX(1)

Average Annual Total Return

One Year Ended 12/31/11 | 2.11% |

Inception (11/15/07) through 12/31/11 | (1.37)% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Wilshire Large Cap

Core Plus Fund, Institutional Class Shares and the S&P 500 Index through 12/31/11.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at www.wilfunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2011, fees totaling 0.03% of average net assets were waived in the Institutional Class Shares. |

| (1) | The S&P 500 Index is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. |

Wilshire Large Cap Core Plus Fund Commentary - (Continued) |  |

On the heels of a positive 2010, equity investors were bullish as 2011 began, but turned increasingly defensive as the year wore on. After trading sideways for the first two quarters of 2011, equity markets sold-off in August when the U.S. lost its AAA credit rating, prompting a worldwide retrenchment from risk assets. Markets rallied back in the fourth quarter of 2011 even though the headwinds from uncertainty in the euro zone increased. Despite record profits at U.S. companies, investors generally shifted out of cyclical, economically–sensitive sectors in favor of more defensive and stable areas of the market, particularly well-capitalized large cap companies with strong, recurring revenue streams. Utilities and Consumer Staples were the best performing sectors for the year, returning 18.7 percent and 13.9 percent, respectively, while Financials and Materials performed the worst, falling by -14.7 and -8.9 percent, respectively. For 2011, small capitalization stocks were down -3.4 percent against gains of 1.6 percent for large capitalization stocks. The large value style delivered the best returns for the year, up 3.7 percent, while small value and microcap stocks trailed other styles, down -5.3 percent and -13.5 percent, respectively.

The Wilshire Large Cap Core Plus Fund Institutional Class returned -2.11% for the year ended December 31, 2011, underperforming the benchmark (the S&P 500 Index) return of 2.11%. Underperformance was driven entirely from poor stock selection, particularly in Energy, Financials, and Health Care.

Despite the Fund’s underperformance versus its benchmark, we remain confident in our sub-advisers, who continue to follow through with the disciplined investment approaches that have made them successful over the long-term. It is our belief that the Fund is well positioned going into 2012 and should benefit as macroeconomic fears are allayed and investors return their focus to company fundamentals.

Wilshire Large Cap Core Plus Fund Commentary - (Continued) |  |

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2011)

| † | Based on percent of the Fund’s total investments in securities, at value. |

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses For the Six Months Ended December 31, 2011 (Unaudited) |  |

All mutual funds have operating expenses. As a shareholder of a portfolio (or a “fund”), you incur ongoing costs, which include costs for investment advisory, administrative services, distribution and/or shareholder services and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund. A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing fees (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table on the next page illustrates your Portfolio’s costs in two ways:

Actual Fund Return: This section helps you to estimate the actual expenses, after any applicable fee waivers, that you paid over the period. The “Ending Account Value” shown is derived from the Portfolio’s actual return for the period. The “Expense Ratio” column shows the period’s annualized expense ratio and the “Expenses Paid During Period” column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Portfolio at the beginning of the period.

You may use the information here, together with your account value, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund in the first line under the heading entitled “Expenses Paid During Period.”

Hypothetical 5% Return: This section is intended to help you compare your fund’s costs with those of other mutual funds. The “Ending Account Value” shown is derived from hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and assumed rate of return. It assumes that the Portfolio had an annual return of 5% before expenses, but that the expense ratio is unchanged. In this case, because the return used is not the Portfolio’s actual return, the results do not apply to your investment. This example is useful in making comparisons to other mutual funds because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on an assumed 5% annual return. You can assess your Portfolio’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees. Wilshire Mutual Funds, Inc. has no such charges, but these may be present in other funds to which you compare this data. Therefore, the hypothetical portions of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses - (Continued) For the Six Months Ended December 31, 2011 (Unaudited) |  |

| | Beginning Account Value 07/01/11 | | Ending Account Value 12/31/11 | | | | Expenses Paid During Period 07/01/11-12/31/11(2) |

Large Company Growth Portfolio |

| Actual Fund Return | | | | | | | |

Investment Class | $1,000.00 | | $934.80 | | 1.43% | | $6.98 |

Institutional Class | $1,000.00 | | $936.60 | | 1.07% | | $5.24 |

| Hypothetical 5% Return | | | | | | | |

Investment Class | $1,000.00 | | $1,017.99 | | 1.43% | | $7.28 |

Institutional Class | $1,000.00 | | $1,019.79 | | 1.07% | | $5.46 |

Large Company Value Portfolio |

| Actual Fund Return | | | | | | | |

Investment Class | $1,000.00 | | $906.00 | | 1.43% | | $6.88 |

Institutional Class | $1,000.00 | | $908.20 | | 0.91% | | $4.37 |

| Hypothetical 5% Return | | | | | | | |

Investment Class | $1,000.00 | | $1,017.99 | | 1.43% | | $7.28 |

Institutional Class | $1,000.00 | | $1,020.63 | | 0.91% | | $4.63 |

Small Company Growth Portfolio |

| Actual Fund Return | | | | | | | |

Investment Class | $1,000.00 | | $899.30 | | 1.49% | | $7.15 |

Institutional Class | $1,000.00 | | $900.70 | | 1.16% | | $5.55 |

| Hypothetical 5% Return | | | | | | | |

Investment Class | $1,000.00 | | $1,017.67 | | 1.49% | | $7.60 |

Institutional Class | $1,000.00 | | $1,019.37 | | 1.16% | | $5.90 |

Small Company Value Portfolio |

| Actual Fund Return | | | | | | | |

Investment Class | $1,000.00 | | $895.00 | | 1.50% | | $7.16 |

Institutional Class | $1,000.00 | | $899.40 | | 0.51%(5) | | $2.44 |

| Hypothetical 5% Return | | | | | | | |

Investment Class | $1,000.00 | | $1,017.64 | | 1.50% | | $7.63 |

Institutional Class | $1,000.00 | | $1,022.64 | | 0.51%(5) | | $2.60 |

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses - (Continued) For the Six Months Ended December 31, 2011 (Unaudited) |  |

| | Beginning Account Value 07/01/11 | | Ending Account Value 12/31/11 | | | | Expenses Paid During Period 07/01/11-12/31/11(2) |

Wilshire 5000 IndexSM Fund |

| Actual Fund Return | | | | | | | |

Investment Class | $1,000.00 | | $948.10 | | 0.78% | | $3.81 |

Institutional Class | $1,000.00 | | $949.30 | | 0.57% | | $2.81 |

Qualified Class | $1,000.00 | | $948.30 | | 0.00%(4) | | $0.00 |

Horace Mann Class | $1,000.00 | | $951.10 | | 0.82% | | $4.04 |

| Hypothetical 5% Return | | | | | | | |

Investment Class | $1,000.00 | | $1,021.30 | | 0.78% | | $3.95 |

Institutional Class | $1,000.00 | | $1,022.32 | | 0.57% | | $2.91 |

Qualified Class | $1,000.00 | | $1,025.21 | | 0.00%(4) | | $0.00 |

Horace Mann Class | $1,000.00 | | $1,021.06 | | 0.82% | | $4.18 |

Wilshire Large Cap Core Plus Fund |

| Actual Fund Return | | | | | | | |

Investment Class | $1,000.00 | | $930.10 | | 1.74%(3) | | $8.46 |

Institutional Class | $1,000.00 | | $932.00 | | 1.49%(3) | | $8.84 |

| Hypothetical 5% Return | | | | | | | |

Investment Class | $1,000.00 | | $1,016.43 | | 1.74%(3) | | $7.26 |

Institutional Class | $1,000.00 | | $1,017.69 | | 1.49%(3) | | $7.58 |

| (1) | Annualized, based on the Portfolio’s most recent fiscal half-year expenses. |

| | |

| (2) | Expenses are equal to the Portfolio’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the period, then divided by 365. |

| | |

| (3) | The annualized expense ratios include dividend expense, interest expense and rebates on securities sold short during the six-month period. |

| | |

| (4) | There were no expenses accrued in the Wilshire 5000 IndexSM Fund Qualified Class for the six months ended December 31, 2011 due to the low average net assets (of approximately $108) relative to the other classes of this Fund. |

| | |

| (5) | Expenses were low for the 12 months ended December 31, 2011 relative to prior years in part because there was a reimbursement to shareholders of approximately 0.37% for shareholder services fees accrued but not paid. |

Wilshire Mutual Funds, Inc. Large Company Growth Portfolio Condensed Schedule of Investments | December 31, 2011 |  |

| Shares | | | Percentage of Net Assets (%) | | | Value | |

COMMON STOCK — 99.0% †† | |

| Consumer Discretionary — 16.4% | |

| 16,931 | | Amazon.com, Inc.† | 1.7 | | $ | 2,930,756 | |

| 38,331 | | Burberry Group PLC ADR | 0.8 | | | 1,419,780 | |

| 3,725 | | Chipotle Mexican Grill, Inc., Class A† | 0.7 | | | 1,258,081 | |

| 86,551 | | Johnson Controls, Inc. | 1.6 | | | 2,705,584 | |

| 25,248 | | McDonald's Corp. | 1.5 | | | 2,533,132 | |

| 2,985 | | priceline.com, Inc.† | 0.8 | | | 1,396,114 | |

| 18,167 | | TJX Cos., Inc. | 0.7 | | | 1,172,680 | |

| 32,050 | | Walt Disney Co. (The) | 0.7 | | | 1,201,875 | |

| 321,359 | | Other Securities | 7.9 | | | 13,104,514 | |

| | | | | | | 27,722,516 | |

| Consumer Staples — 9.2% | |

| 16,732 | | British American Tobacco PLC ADR | 0.9 | | | 1,587,532 | |

| 23,103 | | Coca-Cola Co. (The) | 1.0 | | | 1,616,517 | |

| 22,195 | | Diageo PLC ADR | 1.1 | | | 1,940,287 | |

| 11,537 | | Estee Lauder Cos., Inc. (The), Class A | 0.8 | | | 1,295,836 | |

| 50,667 | | General Mills, Inc. | 1.2 | | | 2,047,453 | |

| 35,336 | | Philip Morris International, Inc. | 1.7 | | | 2,773,169 | |

| 18,897 | | Wal-Mart Stores, Inc. | 0.7 | | | 1,129,285 | |

| 41,650 | | Other Securities | 1.8 | | | 3,195,507 | |

| | | | | | | 15,585,586 | |

| Energy — 10.6% | |

| 23,325 | | Cameron International Corp.† | 0.7 | | | 1,147,357 | |

| 80,970 | | Cobalt International Energy, Inc.† | 0.7 | | | 1,256,654 | |

| 64,016 | | Exxon Mobil Corp. | 3.2 | | | 5,425,996 | |

| 22,441 | | Hess Corp. | 0.8 | | | 1,274,649 | |

| 31,496 | | Schlumberger, Ltd. | 1.3 | | | 2,151,492 | |

| 159,991 | | Other Securities | 3.9 | | | 6,713,515 | |

| | | | | | | 17,969,663 | |

| Financials — 3.8% | |

| 32,247 | | Visa, Inc., Class A | 1.9 | | | 3,274,038 | |

| 81,971 | | Other Securities | 1.9 | | | 3,200,057 | |

| | | | | | | 6,474,095 | |

| Shares | | | Percentage of Net Assets (%) | | | Value | |

| Health Care — 13.5% | |

| 23,495 | | Alexion Pharmaceuticals, Inc.† | 1.0 | | $ | 1,679,893 | |

| 22,158 | | Allergan, Inc. | 1.1 | | | 1,944,143 | |

| 11,819 | | Biogen Idec, Inc.† | 0.8 | | | 1,300,681 | |

| 33,342 | | Express Scripts, Inc., Class A† | 0.9 | | | 1,490,054 | |

| 69,567 | | Gilead Sciences, Inc.† | 1.7 | | | 2,847,377 | |

| 21,158 | | Johnson & Johnson | 0.8 | | | 1,387,542 | |

| 29,381 | | Medco Health Solutions, Inc.† | 1.0 | | | 1,642,398 | |

| 14,175 | | Perrigo Co. | 0.8 | | | 1,379,227 | |

| 24,161 | | WellPoint, Inc. | 0.9 | | | 1,600,666 | |

| 217,781 | | Other Securities | 4.5 | | | 7,584,325 | |

| | | | | | | 22,856,306 | |

| Industrials — 11.8% | |

| 23,700 | | Caterpillar, Inc. | 1.3 | | | 2,147,220 | |

| 26,800 | | Fastenal Co. | 0.7 | | | 1,168,748 | |

| 22,527 | | Fluor Corp. | 0.7 | | | 1,131,982 | |

| 24,326 | | General Dynamics Corp. | 1.0 | | | 1,615,490 | |

| 15,300 | | Union Pacific Corp. | 1.0 | | | 1,620,882 | |

| 308,532 | | Other Securities | 7.1 | | | 12,183,734 | |

| | | | | | | 19,868,056 | |

| Information Technology — 28.4% | |

| 64,074 | | Acme Packet, Inc.† | 1.2 | | | 1,980,527 | |

| 26,626 | | Apple, Inc.† | 6.4 | | | 10,783,530 | |

| 35,787 | | Citrix Systems, Inc.† | 1.3 | | | 2,172,987 | |

| 26,275 | | Cognizant Technology Solutions Corp., Class A† | 1.0 | | | 1,689,745 | |

| 56,900 | | EMC Corp.† | 0.7 | | | 1,225,626 | |

| 10,163 | | Google, Inc., Class A† | 3.9 | | | 6,564,282 | |

| 17,983 | | International Business Machines Corp. | 2.0 | | | 3,306,714 | |

| 89,145 | | Microsoft Corp. | 1.4 | | | 2,314,204 | |

| 102,712 | | QUALCOMM, Inc. | 3.3 | | | 5,618,347 | |

| 12,482 | | Salesforce.com, Inc.† | 0.7 | | | 1,266,424 | |

| 120,827 | | Western Union Co. (The) | 1.3 | | | 2,206,301 | |

| 256,834 | | Other Securities | 5.2 | | | 8,862,854 | |

| | | | | | | 47,991,541 | |

See Notes to Financial Statements.

Wilshire Mutual Funds, Inc. Large Company Growth Portfolio Condensed Schedule of Investments - (Continued) | December 31, 2011 |  |

| Shares | | | Percentage of Net Assets (%) | | | Value | |

| Materials — 5.2% | |

| 60,948 | | Freeport-McMoRan Copper & Gold, Inc. | 1.3 | | $ | 2,242,277 | |

| 20,116 | | Monsanto Co. | 0.8 | | | 1,409,528 | |

| 33,730 | | Mosaic Co. | 1.0 | | | 1,701,004 | |

| 63,073 | | Other Securities | 2.1 | | | 3,391,665 | |

| | | | | | | 8,744,474 | |

| Telecommunication Services — 0.1% | |

| 4,210 | | Other Securities | 0.1 | | | 168,905 | |

| | | | | | | | |

| Total Common Stock | | | | | |

| (Cost $139,501,599) | | | | 167,381,142 | |

| | | | | | | | |

| SHORT-TERM INVESTMENT — 1.1% | |

| 1,883,379 | | Northern Trust Institutional Government Select Portfolio, 0.01% (a) (Cost $1,883,379) | 1.1 | | | 1,883,379 | |

| | | | | | | | |

| Total Investments — 100.1% | | | | | |

| (Cost $141,384,978) | | | | 169,264,521 | |

| Other Assets & Liabilities, Net — (0.1)% | | | | (191,179 | ) |

| | | | | | | | |

| NET ASSETS — 100.0% | | | $ | 169,073,342 | |

| † | Non-income producing security. |

| †† | More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes. |

| (a) | Rate shown is the 7-day effective yield as of December 31, 2011. |

ADR — American Depositary Receipt

PLC — Public Limited Company

The Condensed Schedule of Investments does not reflect the complete portfolio holdings. It includes the Portfolio’s 50 largest holdings and each investment of any issuer that exceeds 1% of the Portfolio’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 607-2200; (ii) on the SEC’s website at http://www.sec.gov; and (iii) on our website at www.wilfunds.com.

As of December 31, 2011, all of the Portfolio’s investments were considered Level 1. For the year ended December 31, 2011, there were no Level 3 securities. Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

See Notes to Financial Statements.

Wilshire Mutual Funds, Inc. Large Company Growth Portfolio Condensed Schedule of Investments | December 31, 2011 |  |

| Shares | | | Percentage of Net Assets (%) | | | Value | |

COMMON STOCK — 99.1% †† | |

| Consumer Discretionary — 10.3% | |

| 6,500 | | J.C. Penney Co., Inc. | 0.7 | | $ | 228,475 | |

| 7,950 | | Omnicom Group, Inc. | 1.1 | | | 354,411 | |

| 34,025 | | Staples, Inc. | 1.5 | | | 472,607 | |

| 75,010 | | Other Securities | 7.0 | | | 2,218,852 | |

| | | | | | | 3,274,345 | |

| Consumer Staples — 6.8% | |

| 12,862 | | Avon Products, Inc. | 0.7 | | | 224,699 | |

| 9,921 | | CVS Caremark Corp. | 1.2 | | | 404,578 | |

| 1,993 | | Lorillard, Inc. | 0.7 | | | 227,202 | |

| 8,525 | | Molson Coors Brewing Co., Class B | 1.2 | | | 371,179 | |

| 11,195 | | Smithfield Foods, Inc.† | 0.8 | | | 271,815 | |

| 18,940 | | Other Securities | 2.2 | | | 673,178 | |

| | | | | | | 2,172,651 | |

| Energy — 13.8% | |

| 9,405 | | BP PLC ADR | 1.3 | | | 401,970 | |

| 8,159 | | Chevron Corp. | 2.7 | | | 868,117 | |

| 7,208 | | ConocoPhillips | 1.6 | | | 525,247 | |

| 9,674 | | Exxon Mobil Corp. | 2.6 | | | 819,968 | |

| 7,345 | | Royal Dutch Shell PLC ADR, Class A | 1.7 | | | 536,846 | |

| 31,376 | | Other Securities | 3.9 | | | 1,231,584 | |

| | | | | | | 4,383,732 | |

| Financials — 25.6% | |

| 3,276 | | ACE, Ltd. | 0.7 | | | 229,713 | |

| 16,900 | | Allstate Corp. (The) | 1.5 | | | 463,229 | |

| 10,150 | | Axis Capital Holdings, Ltd. | 1.0 | | | 324,394 | |

| 7,079 | | Capital One Financial Corp. | 1.0 | | | 299,371 | |

| 17,914 | | Citigroup, Inc. | 1.5 | | | 471,317 | |

| 19,073 | | Discover Financial Services | 1.4 | | | 457,752 | |

| 2,650 | | Franklin Resources, Inc. | 0.8 | | | 254,559 | |

| 2,625 | | Goldman Sachs Group, Inc. (The) | 0.7 | | | 237,379 | |

| 15,625 | | JPMorgan Chase & Co. | 1.6 | | | 519,531 | |

| 37,883 | | KeyCorp | 0.9 | | | 291,320 | |

| 13,198 | | MetLife, Inc. | 1.3 | | | 411,514 | |

| 11,315 | | PNC Financial Services Group, Inc. | 2.1 | | | 652,536 | |

| 9,062 | | State Street Corp. | 1.2 | | | 365,289 | |

| Shares | | | Percentage of Net Assets (%) | | | Value | |

| Financials (continued) | |

| 22,575 | | UBS AG | 0.8 | | $ | 267,062 | |

| 161,964 | | Other Securities | 9.1 | | | 2,864,962 | |

| | | | | | | 8,109,928 | |

| Health Care — 11.2% | |

| 6,300 | | Abbott Laboratories | 1.1 | | | 354,249 | |

| 6,667 | | Bristol-Myers Squibb Co. | 0.7 | | | 234,945 | |

| 13,922 | | Merck & Co., Inc. | 1.7 | | | 524,860 | |

| 37,761 | | Pfizer, Inc. | 2.6 | | | 817,148 | |

| 11,669 | | UnitedHealth Group, Inc. | 1.9 | | | 591,385 | |

| 21,768 | | Other Securities | 3.2 | | | 1,046,969 | |

| | | | | | | 3,569,556 | |

| Industrials — 8.9% | |

| 19,100 | | General Electric Co. | 1.1 | | | 342,081 | |

| 4,100 | | L-3 Communications Holdings, Inc., Class 3 | 0.9 | | | 273,388 | |

| 23,275 | | Masco Corp. | 0.8 | | | 243,922 | |

| 13,137 | | Northrop Grumman Corp. | 2.4 | | | 768,252 | |

| 42,564 | | Other Securities | 3.7 | | | 1,206,097 | |

| | | | | | | 2,833,740 | |

| Information Technology — 11.3% | |

| 14,575 | | CA, Inc. | 0.9 | | | 294,634 | |

| 11,100 | | Computer Sciences Corp. | 0.8 | | | 263,070 | |

| 27,737 | | Dell, Inc.† | 1.3 | | | 405,792 | |

| 25,103 | | Hewlett-Packard Co. | 2.1 | | | 646,653 | |

| 11,948 | | Intel Corp. | 0.9 | | | 289,739 | |

| 11,751 | | Microsoft Corp. | 1.0 | | | 305,056 | |

| 8,500 | | TE Connectivity, Ltd. | 0.8 | | | 261,885 | |

| 43,294 | | Other Securities | 3.5 | | | 1,109,838 | |

| | | | | | | 3,576,667 | |

| Materials — 4.8% | |

| 2,909 | | Domtar Corp. | 0.7 | | | 232,604 | |

| 9,571 | | Freeport-McMoRan Copper & Gold, Inc. | 1.1 | | | 352,117 | |

| 4,475 | | PPG Industries, Inc. | 1.2 | | | 373,618 | |

| 2,850 | | Sherwin-Williams Co. (The) | 0.8 | | | 254,419 | |

| 8,858 | | Other Securities | 1.0 | | | 295,814 | |

| | | | | | | 1,508,572 | |

| Telecommunication Services — 2.6% | |

| 22,851 | | AT&T, Inc. | 2.2 | | | 691,014 | |

| 5,439 | | Other Securities | 0.4 | | | 140,816 | |

| | | | | | | 831,830 | |

See Notes to Financial Statements.

Wilshire Mutual Funds, Inc. Large Company Value Portfolio Condensed Schedule of Investments - (Continued) | December 31, 2011 |  |

| Shares | | | Percentage of Net Assets (%) | | | Value | |

| Utilities — 3.8% | |

| 6,323 | | FirstEnergy Corp. | 0.9 | | $ | 280,109 | |

| 23,305 | | Other Securities | 2.9 | | | 924,007 | |

| | | | | | | 1,204,116 | |

| Total Common Stock | | | | | |

| (Cost $29,596,347) | | | | 31,465,137 | |

| | | | | | | | |

| SHORT-TERM INVESTMENT — 1.1% | |

| 327,267 | | Northern Trust Institutional Government Select Portfolio, 0.01% (a) (Cost $327,267) | 1.1 | | | 327,267 | |

| | | | | | | | |

| Total Investments — 100.2% | | | | | |

| (Cost $29,923,614) | | | | 31,792,404 | |

| Other Assets & Liabilities, Net — (0.2)% | | | | (51,192 | ) |

| | | | | | | | |

| NET ASSETS — 100.0% | | | $ | 31,741,212 | |

| † | Non-income producing security. |

| †† | More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes. |

| (a) | Rate shown is the 7-day effective yield as of December 31, 2011. |

ADR — American Depositary Receipt

PLC — Public Limited Company

The Condensed Schedule of Investments does not reflect the complete portfolio holdings. It includes the Portfolio’s 50 largest holdings and each investment of any issuer that exceeds 1% of the Portfolio’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 607-2200; (ii) on the SEC’s website at http://www.sec.gov; and (iii) on our website at www.wilfunds.com.

As of December 31, 2011, all of the Portfolio’s investments were considered Level 1. For the year ended December 31, 2011, there were no Level 3 securities. Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

See Notes to Financial Statements.

Wilshire Mutual Funds, Inc. Small Company Growth Portfolio Condensed Schedule of Investments | December 31, 2011 |  |

| Shares | | | Percentage of Net Assets (%) | | | Value | |

| COMMON STOCK — 99.6% | |

| Consumer Discretionary — 15.6% | |

| 3,006 | | AFC Enterprises, Inc.† | 0.6 | | $ | 44,188 | |

| 4,296 | | Ameristar Casinos, Inc. | 1.1 | | | 74,278 | |

| 1,142 | | Blue Nile, Inc.† | 0.7 | | | 46,685 | |

| 2,312 | | Cheesecake Factory, Inc. (The)† | 1.0 | | | 67,857 | |

| 1,511 | | Cracker Barrel Old Country Store, Inc. | 1.1 | | | 76,169 | |

| 3,220 | | Pier 1 Imports, Inc.† | 0.7 | | | 44,855 | |

| 450 | | Strayer Education, Inc. | 0.7 | | | 43,736 | |

| 1,300 | | Sturm Ruger & Co., Inc. | 0.6 | | | 43,498 | |

| 23,814 | | Other Securities | 9.1 | | | 627,003 | |

| | | | | | | 1,068,269 | |

| Consumer Staples — 4.5% | |

| 1,252 | | Nu Skin Enterprises, Inc., Class A | 0.9 | | | 60,809 | |

| 3,522 | | Pantry, Inc. (The)† | 0.6 | | | 42,159 | |

| 3,217 | | Vector Group, Ltd. | 0.8 | | | 57,134 | |

| 7,237 | | Other Securities | 2.2 | | | 147,489 | |

| | | | | | | 307,591 | |

| Energy — 10.6% | |

| 511 | | Apco Oil and Gas International, Inc. | 0.6 | | | 41,759 | |

| 1,348 | | Complete Production Services, Inc.† | 0.7 | | | 45,239 | |

| 2,842 | | CVR Energy, Inc.† | 0.8 | | | 53,231 | |

| 1,814 | | Energy XXI Bermuda, Ltd.† | 0.9 | | | 57,830 | |

| 3,280 | | Goodrich Petroleum Corp.† | 0.7 | | | 45,034 | |

| 1,212 | | Rosetta Resources, Inc.† | 0.8 | | | 52,722 | |

| 2,180 | | World Fuel Services Corp. | 1.3 | | | 91,516 | |

| 22,642 | | Other Securities | 4.8 | | | 335,564 | |

| | | | | | | 722,895 | |

| Financials — 4.6% | |

| 503 | | Credit Acceptance Corp.† | 0.6 | | | 41,266 | |

| 1,140 | | World Acceptance Corp.† | 1.2 | | | 83,790 | |

| 7,171 | | Other Securities | 2.8 | | | 190,192 | |

| | | | | | | 315,248 | |

| Shares | | | Percentage of Net Assets (%) | | | Value | |

| Health Care — 20.6% | |

| 2,068 | | Cepheid, Inc.† | 1.1 | | $ | 71,160 | |

| 940 | | Chemed Corp. | 0.7 | | | 48,137 | |

| 2,533 | | Cubist Pharmaceuticals, Inc.† | 1.5 | | | 100,357 | |

| 2,602 | | Emergent Biosolutions, Inc.† | 0.6 | | | 43,818 | |

| 1,102 | | Jazz Pharmaceuticals, Inc.† | 0.6 | | | 42,570 | |

| 1,295 | | Medicis Pharmaceutical Corp., Class A | 0.7 | | | 43,059 | |

| 2,858 | | Momenta Pharmaceuticals, Inc.† | 0.7 | | | 49,701 | |

| 7,720 | | PDL BioPharma, Inc. | 0.7 | | | 47,864 | |

| 1,025 | | Questcor Pharmaceuticals, Inc.† | 0.6 | | | 42,620 | |

| 1,466 | | Salix Pharmaceuticals, Ltd.† | 1.1 | | | 70,148 | |

| 3,394 | | Spectrum Pharmaceuticals, Inc.† | 0.7 | | | 49,654 | |

| 3,555 | | Team Health Holdings, Inc.† | 1.2 | | | 78,459 | |

| 49,025 | | Other Securities | 10.4 | | | 715,427 | |

| | | | | | | 1,402,974 | |

| Industrials — 15.7% | |

| 1,461 | | Allegiant Travel Co., Class A† | 1.1 | | | 77,930 | |

| 2,307 | | DXP Enterprises, Inc.† | 1.1 | | | 74,285 | |

| 1,789 | | Hexcel Corp.† | 0.6 | | | 43,312 | |

| 560 | | National Presto Industries, Inc. | 0.8 | | | 52,416 | |

| 1,496 | | TAL International Group, Inc. | 0.6 | | | 43,070 | |

| 1,495 | | Tennant Co. | 0.8 | | | 58,111 | |

| 1,048 | | Woodward Governor Co. | 0.6 | | | 42,895 | |

| 37,070 | | Other Securities | 10.1 | | | 679,531 | |

| | | | | | | 1,071,550 | |

| Information Technology — 21.7% | |

| 1,020 | | CACI International, Inc., Class A† | 0.8 | | | 57,038 | |

| 1,642 | | Forrester Research, Inc.† | 0.8 | | | 55,729 | |

| 1,784 | | Heartland Payment Systems, Inc. | 0.6 | | | 43,458 | |

| 3,149 | | j2 Global, Inc. | 1.3 | | | 88,613 | |

| 600 | | MicroStrategy, Inc., Class A† | 1.0 | | | 64,992 | |

| 2,283 | | Quest Software, Inc.† | 0.6 | | | 42,464 | |

| 1,390 | | Tyler Technologies, Inc.† | 0.6 | | | 41,853 | |

| 2,570 | | Veeco Instruments, Inc.† | 0.8 | | | 53,456 | |

| 56,190 | | Other Securities | 15.2 | | | 1,034,379 | |

| | | | | | | 1,481,982 | |

See Notes to Financial Statements.

Wilshire Mutual Funds, Inc. Small Company Growth Portfolio Condensed Schedule of Investments - (Continued) | December 31, 2011 |  |

| Shares | | | Percentage of Net Assets (%) | | | Value | |

| Materials — 4.9% | |

| 1,164 | | Innophos Holdings, Inc. | 0.8 | | $ | 56,524 | |

| 450 | | NewMarket Corp. | 1.3 | | | 89,149 | |

| 13,492 | | Other Securities | 2.8 | | | 186,835 | |

| | | | | | | 332,508 | |

| Telecommunication Services — 1.4% | |

| 4,790 | | General Communication, Inc., Class A† | 0.7 | | | 46,894 | |

| 4,814 | | Other Securities | 0.7 | | | 48,732 | |

| | | | | | | 95,626 | |

| Utilities — 0.0% | |

| 134 | | Other Securities | 0.0 | | | 1,063 | |

| | | | | | | | |

| Total Common Stock | | | | | |

| (Cost $6,276,429) | | | | 6,799,706 | |

| | | | | | | | |

| Short-Term Investment — 0.5% | |

| 36,585 | | Northern Trust Institutional Government Select Portfolio, 0.01% (a) (Cost $36,585) | 0.5 | | | 36,585 | |

| | | | | | | | |

| Total Investments — 100.1% | | | | | |

| (Cost $6,313,014) | | | | 6,836,291 | |

| Other Assets & Liabilities, Net — (0.1)% | | | | (10,092 | ) |

| | | | | | | | |

| NET ASSETS — 100.0% | | | $ | 6,826,199 | |

| † | Non-income producing security. |

| (a) | Rate shown is the 7-day effective yield as of December 31, 2011. |

The Condensed Schedule of Investments does not reflect the complete portfolio holdings. It includes the Portfolio’s 50 largest holdings and each investment of any issuer that exceeds 1% of the Portfolio’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 607-2200; (ii) on the SEC’s website at http://www.sec.gov; and (iii) on our website at www.wilfunds.com.

As of December 31, 2011, all of the Portfolio’s investments were considered Level 1. For the year ended December 31, 2011, there were no Level 3 securities. Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

See Notes to Financial Statements.

Wilshire Mutual Funds, Inc. Small Company Value Portfolio Condensed Schedule of Investments | December 31, 2011 |  |

| Shares | | | Percentage of Net Assets (%) | | | Value | |

COMMON STOCK — 99.2% †† | |

| Consumer Discretionary — 9.0% | |

| 4,056 | | Cabela's, Inc.† | 1.2 | | $ | 103,104 | |

| 1,800 | | Scholastic Corp. | 0.6 | | | 53,946 | |

| 20,004 | | School Specialty, Inc.† | 0.6 | | | 50,010 | |

| 37,346 | | Other Securities | 6.6 | | | 588,866 | |

| | | | | | | 795,926 | |

| Consumer Staples — 3.5% | |

| 4,300 | | Pantry, Inc. (The)† | 0.6 | | | 51,471 | |

| 1,266 | | TreeHouse Foods, Inc.† | 0.9 | | | 82,771 | |

| 11,463 | | Other Securities | 2.0 | | | 174,919 | |

| | | | | | | 309,161 | |

| Energy — 7.7% | |

| 1,827 | | Swift Energy Co.† | 0.6 | | | 54,298 | |

| 3,359 | | World Fuel Services Corp. | 1.6 | | | 141,011 | |

| 43,157 | | Other Securities | 5.5 | | | 482,858 | |

| | | | | | | 678,167 | |

| Financials — 34.0% | |

| 14,422 | | American Equity Investment Life Holding Co. | 1.7 | | | 149,989 | |

| 8,707 | | Banco Latinoamericano de Comercio Exterior SA, Class E | 1.6 | | | 139,747 | |

| 7,045 | | Boston Private Financial Holdings, Inc. | 0.6 | | | 55,937 | |

| 4,303 | | CBL & Associates Properties, Inc.‡ | 0.8 | | | 67,557 | |

| 2,282 | | DuPont Fabros Technology, Inc.‡ | 0.6 | | | 55,270 | |

| 1,359 | | Entertainment Properties Trust‡ | 0.7 | | | 59,402 | |

| 6,668 | | Equity One, Inc.‡ | 1.3 | | | 113,223 | |

| 1,429 | | FBL Financial Group, Inc., Class A | 0.5 | | | 48,614 | |

| 10,934 | | First Busey Corp. | 0.6 | | | 54,670 | |

| 11,946 | | First Commonwealth Financial Corp. | 0.7 | | | 62,836 | |

| 4,042 | | FirstMerit Corp. | 0.7 | | | 61,155 | |

| 2,384 | | Hatteras Financial Corp.‡ | 0.7 | | | 62,866 | |

| 1,778 | | Highwoods Properties, Inc.‡ | 0.6 | | | 52,753 | |

| 4,649 | | MB Financial, Inc. | 0.9 | | | 79,498 | |

| Shares | | | Percentage of Net Assets (%) | | | Value | |

| Financials (continued) | |

| 1,500 | | National Health Investors, Inc.‡ | 0.7 | | $ | 65,970 | |

| 16,968 | | National Penn Bancshares, Inc. | 1.6 | | | 143,210 | |

| 2,140 | | ProAssurance Corp. | 1.9 | | | 170,815 | |

| 3,809 | | Safeguard Scientifics, Inc.† | 0.7 | | | 60,144 | |

| 1,250 | | Sovran Self Storage, Inc.‡ | 0.6 | | | 53,337 | |

| 11,166 | | Susquehanna Bancshares, Inc. | 1.1 | | | 93,571 | |

| 2,355 | | SVB Financial Group† | 1.3 | | | 112,310 | |

| 5,326 | | Webster Financial Corp. | 1.2 | | | 108,597 | |

| 82,419 | | Other Securities | 12.9 | | | 1,144,893 | |

| | | | | | | 3,016,364 | |

| Health Care — 11.4% | |

| 2,259 | | Centene Corp.† | 1.0 | | | 89,434 | |

| 3,061 | | Magellan Health Services, Inc.† | 1.7 | | | 151,428 | |

| 17,383 | | Maxygen, Inc.† | 1.1 | | | 97,866 | |

| 2,613 | | Viropharma, Inc.† | 0.8 | | | 71,570 | |

| 33,982 | | Other Securities | 6.8 | | | 602,039 | |

| | | | | | | 1,012,337 | |

| Industrials — 15.5% | |

| 11,221 | | Aircastle, Ltd. | 1.6 | | | 142,731 | |

| 1,394 | | FTI Consulting, Inc.† | 0.7 | | | 59,134 | |

| 2,094 | | Hexcel Corp.† | 0.6 | | | 50,696 | |

| 1,862 | | Mueller Industries, Inc. | 0.8 | | | 71,538 | |