Wilshire Mutual Funds |

ANNUAL REPORT Large Company Growth Portfolio Large Company Value Portfolio Small Company Growth Portfolio Small Company Value Portfolio Wilshire 5000 Indexsm Fund Wilshire Large Cap Core Plus Fund |

http://advisor.wilshire.com |

Wilshire Mutual Funds Table of Contents |  |

| Shareholder Letter | 1 |

| Commentary: | |

| Large Company Growth Portfolio | 3 |

| Large Company Value Portfolio | 7 |

| Small Company Growth Portfolio | 11 |

| Small Company Value Portfolio | 15 |

Wilshire 5000 IndexSM Fund | 19 |

| Wilshire Large Cap Core Plus Fund | 25 |

| Disclosure of Fund Expenses | 29 |

| Condensed Schedules of Investments: | |

| Large Company Growth Portfolio | 32 |

| Large Company Value Portfolio | 34 |

| Small Company Growth Portfolio | 36 |

| Small Company Value Portfolio | 38 |

Wilshire 5000 IndexSM Fund | 40 |

| Schedule of Investments: | |

| Wilshire Large Cap Core Plus Fund | 42 |

| Schedule of Securities Sold Short: | |

| Wilshire Large Cap Core Plus Fund | 47 |

| Statements of Assets and Liabilities | 50 |

| Statements of Operations | 52 |

| Statements of Changes in Net Assets | 53 |

| Statement of Cash Flows | 57 |

| Financial Highlights: | |

| Large Company Growth Portfolio | 58 |

| Large Company Value Portfolio | 60 |

| Small Company Growth Portfolio | 62 |

| Small Company Value Portfolio | 64 |

Wilshire 5000 IndexSM Fund | 66 |

| Wilshire Large Cap Core Plus Fund | 70 |

| Notes to Financial Statements | 72 |

| Report of Independent Registered Public Accounting Firm | 83 |

| Additional Fund Information | 84 |

| Tax Information | 89 |

| Board Approval of Advisory and Subadvisory Agreements | 91 |

This report is for the general information of the shareholders of Large Company Growth Portfolio, Large Company Value Portfolio, Small Company Growth Portfolio, Small Company Value Portfolio, Wilshire 5000 IndexSM Fund and Wilshire Large Cap Core Plus Fund. Its use in connection with any offering of a Portfolio’s shares is authorized only if accompanied or preceded by the Portfolio’s current prospectus.

Wilshire Mutual Funds, Inc. are distributed by SEI Investments Distribution Co.

Wilshire Mutual Funds Letter to Shareholders |  |

Dear Wilshire Mutual Fund Shareholder:

We are pleased to present this annual report to all shareholders of the Wilshire Mutual Funds. This report covers the period from January 1, 2012 to December 31, 2012, for all share classes of the Large Company Growth Fund, Large Company Value Fund, Small Company Growth Fund, Small Company Value Fund, Wilshire 5000 IndexSM Fund, and Wilshire Large Cap Core Plus Fund.

Market Environment

U.S. Equity Market

Despite short-term volatility in equities mainly due to uncertainty surrounding the situation in the euro-zone, domestic markets were able to push ahead in 2012, with the Wilshire 5000 IndexSM gaining 15.54% for the year. This advance marked the Wilshire 5000’s fourth consecutive year of positive returns, and a 76.17% advance since the end of 2008. All style and size segments delivered very strong returns across the board, with growth stocks outpacing value in the large cap segment (16.90% v. 14.56%), and small cap outperforming large cap for the year (18.76% v. 15.74%). Markets suffered through the months of October and November as concerns over the outcome of the Presidential election, as well as the fallout from Superstorm Sandy, began to weigh on investor sentiment. In the fourth quarter, markets remained volatile as the “fiscal cliff” negotiations heated up, but ultimately rose when an agreement was reached. Financials was the best performing sector for the year, returning 26.44%, while the Energy and Utilities sectors lagged, returning 3.85% and 2.17%, respectively.

International Equity Market

Despite continued fiscal upheaval in Europe, 2012 proved to be a good year for global stocks overall, with the MSCI EAFE Index and MSCI Emerging Markets Index gaining 17.32% and 18.23%, respectively. In July, European Central Bank President Mario Draghi said he would do “whatever it takes” to preserve the euro, boosting investor confidence worldwide. The euro received additional support from the European Central Bank through several stimulus packages, averting a potential breakup of the euro-zone. European stocks rallied at the end of the year, with the MSCI Europe Index rising 19.12% for 2012, its strongest annual gain since 2009. China also made headlines as investors grew nervous about a possible slowdown in the world’s second largest economy. While China’s economy did cool down, expanding at an annualized rate of 7.4% in the third quarter, by the end of the year the country was showing increasing signs of renewed economic growth.

Bond Market

Fixed income securities rallied in 2012, with all sectors of the debt market gaining and the Barclays U.S. Aggregate Bond Index returning 4.22%. As Federal Reserve policy kept Treasury yields depressed, investors in search of higher yield ventured farther out on the yield curve. The 10-year Treasury yield remained volatile over the year, soaring to over 2.39% in March, and then falling to an all-time low of 1.38% in July as concerns over the euro-zone debt crisis rapidly escalated. At the end of the year, the 10-year Treasury ended up just about where it started at 1.76%. High yield and corporate sectors performed well, as the Barclays U.S. Corporate High Yield Index and Barclays U.S. Credit Index rose 15.81% and 9.89%, respectively. The Barclays EM Local Currency Government Universal Index posted strong performance, returning 11.21%. However, the Barclays Global Aggregate Index posted returns in line with its U.S. counterpart, gaining 4.32%.

Fund Performance Review

The Wilshire Mutual Funds turned in mixed performance in 2012. The Wilshire Large Company Growth Portfolio Institutional Class returned 14.04% for the year, underperforming the Russell 1000 Growth Index return of 15.26%. The Wilshire Large Company Value Portfolio Institutional Class returned 16.18% for the year, underperforming the Russell

Wilshire Mutual Funds Letter to Shareholders - (Continued) |  |

1000 Value Index return of 17.51%. The Wilshire Small Company Growth Portfolio Institutional Class returned 13.80% for the year, underperforming the Russell 2000 Growth Index return of 14.59%. The Wilshire Small Company Value Portfolio Institutional Class returned 17.41% for the year, underperforming the Russell 2000 Value Index return of 18.05%. The Wilshire 5000 IndexSM Fund Institutional Class returned 15.54% for the year, underperforming the Wilshire 5000 IndexSM return of 16.07%. Lastly, the Wilshire Large Cap Core Plus Fund Institutional Class returned 13.63% for the year, underperforming the S&P 500 Index return of 16.00%.

We are mindful that markets can behave erratically and current trends shift swiftly. You can expect us to continue to work diligently to manage your investments and seek to generate returns commensurate with the Funds’ investment objectives. As always, we sincerely appreciate your continued support and confidence in Wilshire Associates.

Sincerely,

Jason Schwarz

President

Wilshire Mutual Funds, Inc.

Large Company Growth Portfolio Commentary |  |

INVESTMENT CLASS SHARES

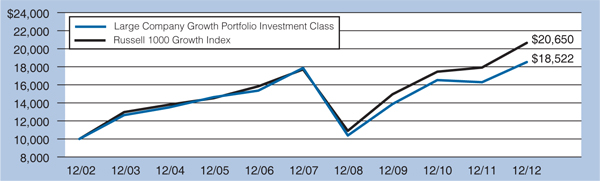

Average Annual Total Return*

| One Year Ended 12/31/12 | 13.72% |

| Five Years Ended 12/31/12 | 0.72% |

| Ten Years Ended 12/31/12 | 6.36% |

RUSSELL 1000® GROWTH INDEX(1)

Average Annual Total Return

| One Year Ended 12/31/12 | 15.26% |

| Five Years Ended 12/31/12 | 3.12% |

| Ten Years Ended 12/31/12 | 7.52% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Large Company Growth

Portfolio, Investment Class Shares and the Russell 1000 Growth Index through 12/31/12.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2012, there were no waivers. |

| | |

| (1) | The Russell 1000® Growth Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Large Company Growth Portfolio Commentary - (Continued) |  |

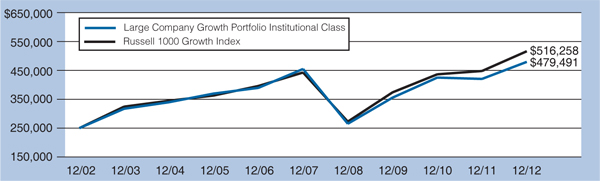

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

| One Year Ended 12/31/12 | 14.04% |

| Five Years Ended 12/31/12 | 1.06% |

| Ten Years Ended 12/31/12 | 6.73% |

RUSSELL 1000® GROWTH INDEX(1)

Average Annual Total Return

| One Year Ended 12/31/12 | 15.26% |

| Five Years Ended 12/31/12 | 3.12% |

| Ten Years Ended 12/31/12 | 7.52% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Large Company Growth

Portfolio, Institutional Class Shares and the Russell 1000 Growth Index through 12/31/12.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2012, there were no waivers. |

| | |

| (1) | The Russell 1000® Growth Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

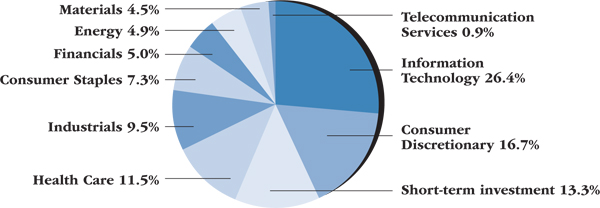

Large Company Growth Portfolio Commentary - (Continued) |  |

Stock markets around the world rallied in 2012 as stimulus measures by central banks overshadowed continuing concerns about a slowing global economy. After getting off to a fast start in the first quarter, equity markets sold off in the second quarter as fears over the European debt crisis and a “hard-landing” in the Chinese economy rattled investors. Markets reversed course in July as concerns over a euro-zone breakup subsided when European Central Bank President Mario Draghi declared that the ECB would do “whatever it takes” to preserve the monetary union. Markets trended downwards to start the fourth quarter as election jitters and worries about the upcoming “fiscal cliff” weakened investor confidence. Equity markets rallied on the final trading day of the year as U.S. political leaders hinted that an agreement to avoid the “fiscal cliff” was imminent. Supported by generally strong corporate earnings, investors shifted out of defensive sectors and into the more cyclical, economically-sensitive areas of the market in 2012. Financials and Consumer Discretionary were the best performing sectors for the year, returning 26.4% and 23.9%, respectively, while Utilities was the worst, returning 2.2%. For 2012, small capitalization stocks outperformed large capitalization stocks returning 18.8% and 15.7%, respectively, and across market capitalizations, value stocks generally outperformed growth stocks. The small value style delivered the best returns for the year, up 21.5%, while large value and mid growth trailed other styles, returning 14.6% and 13.5%, respectively.

The Wilshire Large Company Growth Portfolio Institutional Class (the “Fund”) returned 14.04% for the year ended December 31, 2012, underperforming the benchmark (the Russell 1000 Growth Index) return of 15.26%. Underperformance was driven by poor stock selection in Information Technology, Consumer Discretionary and Materials. Underperformance was modestly offset by strong stock selection in Health Care and Consumer Staples.

Large Company Growth Portfolio Commentary - (Continued) |  |

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2012)

| † | Based on percent of the Portfolio’s total investments in securities, at value. |

Large Company Value Portfolio Commentary |  |

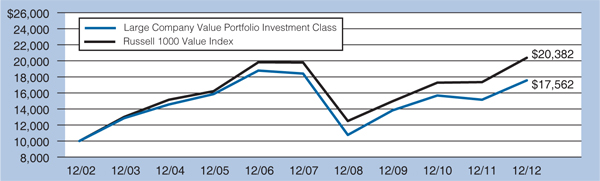

INVESTMENT CLASS SHARES

Average Annual Total Return*

| One Year Ended 12/31/12 | 15.92% |

| Five Years Ended 12/31/12 | (0.94)% |

| Ten Years Ended 12/31/12 | 5.79% |

RUSSELL 1000® VALUE INDEX(1)

Average Annual Total Return

| One Year Ended 12/31/12 | 17.51% |

| Five Years Ended 12/31/12 | 0.59% |

| Ten Years Ended 12/31/12 | 7.38% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Large Company Value

Portfolio, Investment Class Shares and the Russell 1000 Value Index through 12/31/12.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2012, there were no waivers. |

| | |

| (1) | The Russell 1000® Value Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Large Company Value Portfolio Commentary - (Continued) |  |

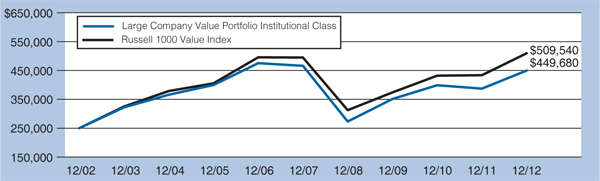

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

| One Year Ended 12/31/12 | 16.18% |

| Five Years Ended 12/31/12 | (0.71)% |

| Ten Years Ended 12/31/12 | 6.05% |

RUSSELL 1000® VALUE INDEX(1)

Average Annual Total Return

| One Year Ended 12/31/12 | 17.51% |

| Five Years Ended 12/31/12 | 0.59% |

| Ten Years Ended 12/31/12 | 7.38% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Large Company Value

Portfolio, Institutional Class Shares and the Russell 1000 Value Index through 12/31/12.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2012, there were no waivers. |

| | |

| (1) | The Russell 1000® Value Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Large Company Value Portfolio Commentary - (Continued) |  |

Stock markets around the world rallied in 2012 as stimulus measures by central banks overshadowed continuing concerns about a slowing global economy. After getting off to a fast start in the first quarter, equity markets sold off in the second quarter as fears over the European debt crisis and a “hard-landing” in the Chinese economy rattled investors. Markets reversed course in July as concerns over a euro-zone breakup subsided when European Central Bank President Mario Draghi declared that the ECB would do “whatever it takes” to preserve the monetary union. Markets trended downwards to start the fourth quarter as election jitters and worries about the upcoming “fiscal cliff” weakened investor confidence. Equity markets rallied on the final trading day of the year as U.S. political leaders hinted that an agreement to avoid the “fiscal cliff” was imminent. Supported by generally strong corporate earnings, investors shifted out of defensive sectors and into the more cyclical, economically-sensitive areas of the market in 2012. Financials and Consumer Discretionary were the best performing sectors for the year, returning 26.4% and 23.9%, respectively, while Utilities was the worst, returning 2.2%. For 2012, small capitalization stocks outperformed large capitalization stocks returning 18.8% and 15.7%, respectively, and across market capitalizations, value stocks generally outperformed growth stocks. The small value style delivered the best returns for the year, up 21.5%, while large value and mid growth trailed other styles, returning 14.6% and 13.5%, respectively.

The Wilshire Large Company Value Portfolio Institutional Class (the “Fund”) returned 16.18% for the year ended December 31, 2012, underperforming the benchmark (the Russell 1000 Value Index) return of 17.51%. Underperformance was driven by poor stock selection in Consumer Discretionary and Consumer Staples, as well as an overweight allocation to Information Technology. Underperformance was modestly offset by strong stock selection in Energy, Materials and Industrials.

Large Company Value Portfolio Commentary - (Continued) |  |

PORTFOLIO SECTOR WEIGHTING†

(As of December 31 2012)

| † | Based on percent of the Portfolio’s total investments in securities, at value. |

Small Company Growth Portfolio Commentary |  |

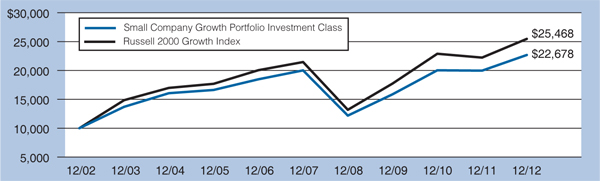

INVESTMENT CLASS SHARES

Average Annual Total Return*

| One Year Ended 12/31/12 | 13.58% |

| Five Years Ended 12/31/12 | 2.53% |

| Ten Years Ended 12/31/12 | 8.53% |

RUSSELL 2000® GROWTH INDEX(1)

Average Annual Total Return

| One Year Ended 12/31/12 | 14.59% |

| Five Years Ended 12/31/12 | 3.49% |

| Ten Years Ended 12/31/12 | 9.80% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Small Company Growth

Portfolio, Investment Class Shares and the Russell 2000 Growth Index through 12/31/12.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2012, fees totaling 0.49% of average net assets were waived for the Investment Class Shares. |

| | |

| (1) | The Russell 2000® Growth Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Small Company Growth Portfolio Commentary - (Continued) |  |

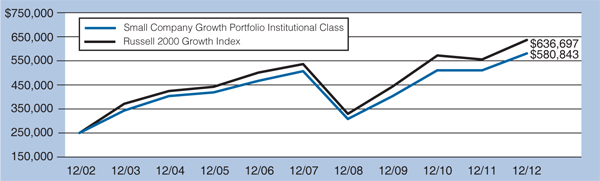

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

| One Year Ended 12/31/12 | 13.80% |

| Five Years Ended 12/31/12 | 2.76% |

| Ten Years Ended 12/31/12 | 8.80% |

RUSSELL 2000® GROWTH INDEX(1)

Average Annual Total Return

| One Year Ended 12/31/12 | 14.59% |

| Five Years Ended 12/31/12 | 3.49% |

| Ten Years Ended 12/31/12 | 9.80% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Small Company Growth

Portfolio, Institutional Class Shares and the Russell 2000 Growth Index through 12/31/12.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2012, fees totaling 0.50% of average net assets were waived for the Institutional Class Shares. |

| | |

| (1) | The Russell 2000® Growth Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Small Company Growth Portfolio Commentary - (Continued) |  |

Stock markets around the world rallied in 2012 as stimulus measures by central banks overshadowed continuing concerns about a slowing global economy. After getting off to a fast start in the first quarter, equity markets sold off in the second quarter as fears over the European debt crisis and a “hard-landing” in the Chinese economy rattled investors. Markets reversed course in July as concerns over a euro-zone breakup subsided when European Central Bank President Mario Draghi declared that the ECB would do “whatever it takes” to preserve the monetary union. Markets trended downwards to start the fourth quarter as election jitters and worries about the upcoming “fiscal cliff” weakened investor confidence. Equity markets rallied on the final trading day of the year as U.S. political leaders hinted that an agreement to avoid the “fiscal cliff” was imminent. Supported by generally strong corporate earnings, investors shifted out of defensive sectors and into the more cyclical, economically-sensitive areas of the market in 2012. Financials and Consumer Discretionary were the best performing sectors for the year, returning 26.4% and 23.9%, respectively, while Utilities was the worst, returning 2.2%. For 2012, small capitalization stocks outperformed large capitalization stocks returning 18.8% and 15.7%, respectively, and across market capitalizations, value stocks generally outperformed growth stocks. The small value style delivered the best returns for the year, up 21.5%, while large value and mid growth trailed other styles, returning 14.6% and 13.5%, respectively.

The Wilshire Small Company Growth Portfolio Institutional Class (the “Fund”) returned 13.80% for the year ended December 31, 2012, underperforming the benchmark (the Russell 2000 Growth Index) return of 14.59%. Underperformance was driven primarily by poor stock selection in Health Care and Financials, as well as an underweight in Industrials. Underperformance was modestly offset by strong stock selection in Information Technology and Energy.

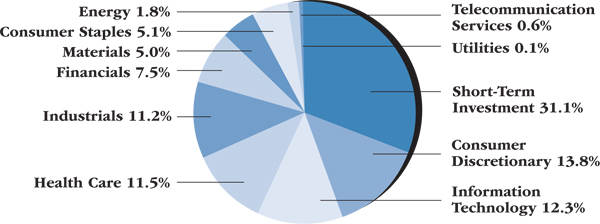

Small Company Growth Portfolio Commentary - (Continued) |  |

PORTFOLIO SECTOR WEIGHTING†

(As of December 31 2012)

| † | Based on percent of the Portfolio’s total investments in securities, at value. |

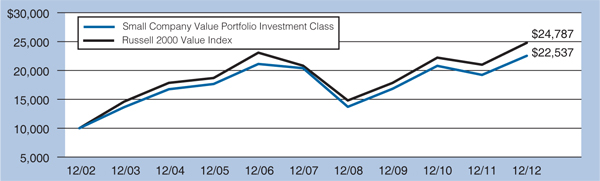

Small Company Value Portfolio Commentary |  |

INVESTMENT CLASS SHARES

Average Annual Total Return*

| One Year Ended 12/31/12 | 17.20% |

| Five Years Ended 12/31/12 | 2.02% |

| Ten Years Ended 12/31/12 | 8.47% |

RUSSELL 2000® VALUE INDEX(1)

Average Annual Total Return

| One Year Ended 12/31/12 | 18.05% |

| Five Years Ended 12/31/12 | 3.55% |

| Ten Years Ended 12/31/12 | 9.50% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Small Company Value

Portfolio, Investment Class Shares and the Russell 2000 Value Index through 12/31/12.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2012, fees totaling 0.34% of average net assets were waived in the Investment Class Shares. |

| | |

| (1) | The Russell 2000® Value Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Small Company Value Portfolio Commentary - (Continued) |  |

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

| One Year Ended 12/31/12 | 17.41% |

| Five Years Ended 12/31/12 | 2.40% |

| Ten Years Ended 12/31/12 | 8.83% |

RUSSELL 2000® VALUE INDEX(1)

Average Annual Total Return

| One Year Ended 12/31/12 | 18.05% |

| Five Years Ended 12/31/12 | 3.55% |

| Ten Years Ended 12/31/12 | 9.50% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Small Company Value

Portfolio, Institutional Class Shares and the Russell 2000 Value Index through 12/31/12.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2012, fees totaling 0.34% of average net assets were waived in the Institutional Class Shares. |

| | |

| (1) | The Russell 2000® Value Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Small Company Value Portfolio Commentary - (Continued) |  |

Stock markets around the world rallied in 2012 as stimulus measures by central banks overshadowed continuing concerns about a slowing global economy. After getting off to a fast start in the first quarter, equity markets sold off in the second quarter as fears over the European debt crisis and a “hard-landing” in the Chinese economy rattled investors. Markets reversed course in July as concerns over a euro-zone breakup subsided when European Central Bank President Mario Draghi declared that the ECB would do “whatever it takes” to preserve the monetary union. Markets trended downwards to start the fourth quarter as election jitters and worries about the upcoming “fiscal cliff” weakened investor confidence. Equity markets rallied on the final trading day of the year as U.S. political leaders hinted that an agreement to avoid the “fiscal cliff” was imminent. Supported by generally strong corporate earnings, investors shifted out of defensive sectors and into the more cyclical, economically-sensitive areas of the market in 2012. Financials and Consumer Discretionary were the best performing sectors for the year, returning 26.4% and 23.9%, respectively, while Utilities was the worst, returning 2.2%. For 2012, small capitalization stocks outperformed large capitalization stocks returning 18.8% and 15.7%, respectively, and across market capitalizations, value stocks generally outperformed growth stocks. The small value style delivered the best returns for the year, up 21.5%, while large value and mid growth trailed other styles, returning 14.6% and 13.5%, respectively.

The Wilshire Small Company Value Portfolio, Institutional Class (the “Fund”) returned 17.41% for the year ended December 31, 2012, underperforming the benchmark (the Russell 2000 Value Index) return of 18.05%. Underperformance was driven by poor stock selection in Financials and Health Care. Underperformance was modestly offset by an underweight allocation and strong stock selection in Information Technology, as well as strong stock selection in Energy.

Small Company Value Portfolio Commentary - (Continued) |  |

PORTFOLIO SECTOR WEIGHTING†

(As of December 31 2012)

| † | Based on percent of the Portfolio’s total investments in securities, at value. |

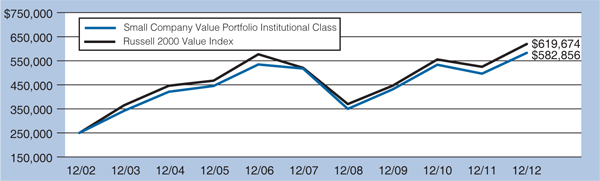

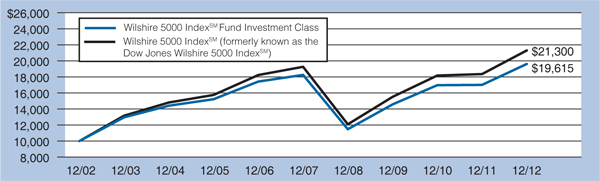

Wilshire 5000 Indexsm Fund Commentary |  |

INVESTMENT CLASS SHARES

Average Annual Total Return*

| One Year Ended 12/31/12 | 15.36% |

| Five Years Ended 12/31/12 | 1.46% |

| Ten Years Ended 12/31/12 | 6.97% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Return

| One Year Ended 12/31/12 | 16.07% |

| Five Years Ended 12/31/12 | 2.04% |

| Ten Years Ended 12/31/12 | 7.85% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Wilshire 5000 IndexSM

Fund, Investment Class Shares and the Wilshire 5000 IndexSM through 12/31/12.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2012, there were no waivers. |

| | |

| (1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

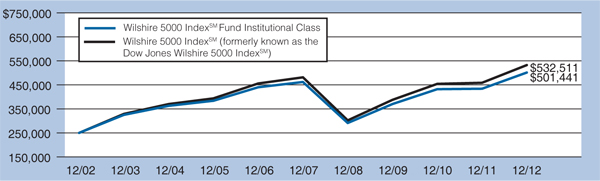

Wilshire 5000 Indexsm Fund Commentary - (Continued) |  |

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

| One Year Ended 12/31/12 | 15.54% |

| Five Years Ended 12/31/12 | 1.65% |

| Ten Years Ended 12/31/12 | 7.21% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Return

| One Year Ended 12/31/12 | 16.07% |

| Five Years Ended 12/31/12 | 2.04% |

| Ten Years Ended 12/31/12 | 7.85% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Wilshire 5000 IndexSM

Fund, Institutional Class Shares and the Wilshire 5000 IndexSM through 12/31/12.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2012, there were no waivers. |

| | |

| (1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

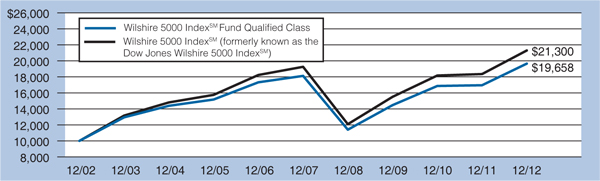

Wilshire 5000 Indexsm Fund Commentary - (Continued) |  |

QUALIFIED CLASS SHARES

Average Annual Total Return*

| One Year Ended 12/31/12 | 15.93% |

| Five Years Ended 12/31/12 | 1.64% |

| Ten Years Ended 12/31/12 | 6.99% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Return

| One Year Ended 12/31/12 | 16.07% |

| Five Years Ended 12/31/12 | 2.04% |

| Ten Years Ended 12/31/12 | 7.85% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Wilshire 5000 IndexSM

Fund, Qualified Class Shares and the Wilshire 5000 IndexSM through 12/31/12.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2012, there were no waivers. |

| | |

| (1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

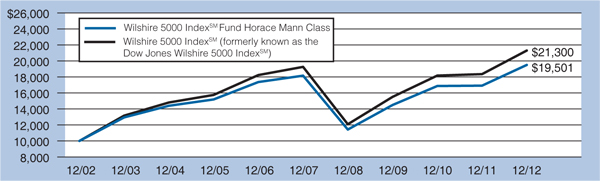

Wilshire 5000 Indexsm Fund Commentary - (Continued) |  |

HORACE MANN CLASS SHARES

Average Annual Total Return*

| One Year Ended 12/31/12 | 15.31% |

| Five Years Ended 12/31/12 | 1.43% |

| Ten Years Ended 12/31/12 | 6.91% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Return

| One Year Ended 12/31/12 | 16.07% |

| Five Years Ended 12/31/12 | 2.04% |

| Ten Years Ended 12/31/12 | 7.85% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Wilshire 5000 IndexSM

Fund, Horace Mann Class Shares and the Wilshire 5000 IndexSM through 12/31/12.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2012, there were no waivers. |

| | |

| (1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

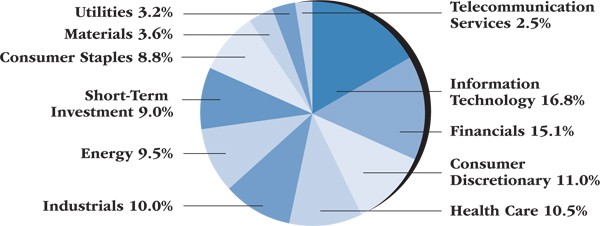

Wilshire 5000 Indexsm Fund Commentary - (Continued) |  |

Stock markets around the world rallied in 2012 as stimulus measures by central banks overshadowed continuing concerns about a slowing global economy. After getting off to a fast start in the first quarter, equity markets sold off in the second quarter as fears over the European debt crisis and a “hard-landing” in the Chinese economy rattled investors. Markets reversed course in July as concerns over a euro-zone breakup subsided when European Central Bank President Mario Draghi declared that the ECB would do “whatever it takes” to preserve the monetary union. Markets trended downwards to start the fourth quarter as election jitters and worries about the upcoming “fiscal cliff” weakened investor confidence. Equity markets rallied on the final trading day of the year as U.S. political leaders hinted that an agreement to avoid the “fiscal cliff” was imminent. Supported by generally strong corporate earnings, investors shifted out of defensive sectors and into the more cyclical, economically-sensitive areas of the market in 2012. Financials and Consumer Discretionary were the best performing sectors for the year, returning 26.4% and 23.9%, respectively, while Utilities was the worst, returning 2.2%. For 2012, small capitalization stocks outperformed large capitalization stocks returning 18.8% and 15.7%, respectively, and across market capitalizations, value stocks generally outperformed growth stocks. The small value style delivered the best returns for the year, up 21.5%, while large value and mid growth trailed other styles, returning 14.6% and 13.5%, respectively.

The Wilshire 5000 IndexSM Fund Institutional Class returned 15.54% for the year ended December 31, 2012, underperforming the Fund’s benchmark (the Wilshire 5000 IndexSM) return of 16.07% by 0.53%. The slight underperformance is well within the range of historical experience.

Wilshire 5000 Indexsm Fund Commentary - (Continued) |  |

PORTFOLIO SECTOR WEIGHTING†

(As of December 31 2012)

| † | Based on percent of the Fund’s total investments in securities, at value. |

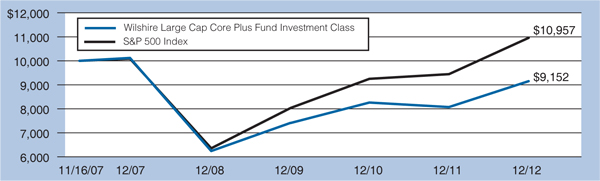

Wilshire Large Cap Core Plus Fund Commentary |  |

INVESTMENT CLASS SHARES

Average Annual Total Return*

| One Year Ended 12/31/12 | 13.36% |

| Five Years Ended 12/31/12 | (1.99)% |

| Inception (11/15/07) through 12/31/12 | (1.71)% |

S&P 500 INDEX(1)

Average Annual Total Return

| One Year Ended 12/31/12 | 16.00% |

| Five Years Ended 12/31/12 | 1.66% |

| Inception (11/15/07) through 12/31/12 | 1.80% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Wilshire Large Cap

Core Plus Fund, Investment Class Shares and the S&P 500 Index through 12/31/12.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2012, fees totaling 0.04% of average net assets were waived in the Investment Class Shares. |

| | |

| (1) | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value weighted index (stock price times the number of shares outstanding), with each stock’s weight in the index proportionate to its market value. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Wilshire Large Cap Core Plus Fund Commentary - (Continued) |  |

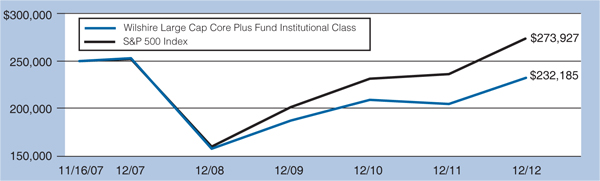

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

| One Year Ended 12/31/12 | 13.63% |

| Five Years Ended 12/31/12 | (1.71)% |

| Inception (11/15/07) through 12/31/12 | (1.43)% |

S&P 500 INDEX(1)

Average Annual Total Return

| One Year Ended 12/31/12 | 16.00% |

| Five Years Ended 12/31/12 | 1.66% |

| Inception (11/15/07) through 12/31/12 | 1.80% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Wilshire Large Cap

Core Plus Fund, Institutional Class Shares and the S&P 500 Index through 12/31/12.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| * | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2012, there were no waivers in the Institutional Class Shares. |

| | |

| (1) | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value weighted index (stock price times the number of shares outstanding), with each stock’s weight in the index proportionate to its market value. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

Wilshire Large Cap Core Plus Fund Commentary - (Continued) |  |

Stock markets around the world rallied in 2012 as stimulus measures by central banks overshadowed continuing concerns about a slowing global economy. After getting off to a fast start in the first quarter, equity markets sold off in the second quarter as fears over the European debt crisis and a “hard-landing” in the Chinese economy rattled investors. Markets reversed course in July as concerns over a euro-zone breakup subsided when European Central Bank President Mario Draghi declared that the ECB would do “whatever it takes” to preserve the monetary union. Markets trended downwards to start the fourth quarter as election jitters and worries about the upcoming “fiscal cliff” weakened investor confidence. Equity markets rallied on the final trading day of the year as U.S. political leaders hinted that an agreement to avoid the “fiscal cliff” was imminent. Supported by generally strong corporate earnings, investors shifted out of defensive sectors and into the more cyclical, economically-sensitive areas of the market in 2012. Financials and Consumer Discretionary were the best performing sectors for the year, returning 26.4% and 23.9%, respectively, while Utilities was the worst, returning 2.2%. For 2012, small capitalization stocks outperformed large capitalization stocks returning 18.8% and 15.7%, respectively, and across market capitalizations, value stocks generally outperformed growth stocks. The small value style delivered the best returns for the year, up 21.5%, while large value and mid growth trailed other styles, returning 14.6% and 13.5%, respectively.

The Wilshire Large Cap Core Plus Fund Institutional Class (the “Fund”) returned 13.63% for the year ended December 31, 2012, underperforming the benchmark (the S&P 500 Index) return of 16.00%. Underperformance was driven by poor stock selection and an underweight allocation in Financials, as well as poor stock selection in Information Technology. Underperformance was modestly offset by strong stock selection in Health Care and Energy.

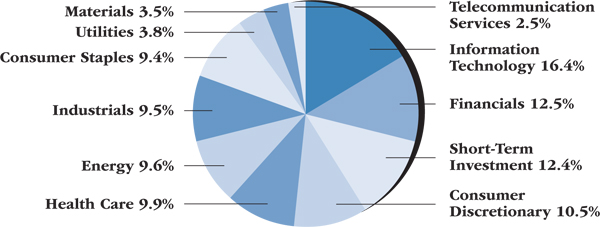

Wilshire Large Cap Core Plus Fund Commentary - (Continued) |  |

PORTFOLIO SECTOR WEIGHTING†

(As of December 31 2012)

| † | Based on percent of the Fund’s total investments in securities, at value. |

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses For the Six Months Ended December 31, 2012 (Unaudited) |  |

All mutual funds have operating expenses. As a shareholder of a portfolio (or a “fund”), you incur ongoing costs, which include costs for investment advisory, administrative services, distribution and/or shareholder services and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund. A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing fees (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table on the next page illustrates your Portfolio’s costs in two ways:

Actual Fund Return: This section helps you to estimate the actual expenses, after any applicable fee waivers, that you paid over the period. The “Ending Account Value” shown is derived from the Portfolio’s actual return for the period. The “Expense Ratio” column shows the period’s annualized expense ratio and the “Expenses Paid During Period” column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Portfolio at the beginning of the period.

You may use the information here, together with your account value, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Portfolio in the first line under the heading entitled “Expenses Paid During Period.”

Hypothetical 5% Return: This section is intended to help you compare your Portfolio’s costs with those of other mutual funds. The “Ending Account Value” shown is derived from hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and assumed rate of return. It assumes that the Portfolio had an annual return of 5% before expenses, but that the expense ratio is unchanged. In this case, because the return used is not the Portfolio’s actual return, the results do not apply to your investment. This example is useful in making comparisons to other mutual funds because the Securities and Exchange Commission (“SEC”) requires all mutual funds to calculate expenses based on an assumed 5% annual return. You can assess your Portfolio’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees. Wilshire Mutual Funds, Inc. has no such charges, but these may be present in other funds to which you compare this data. Therefore, the hypothetical portions of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses - (Continued) For the Six Months Ended December 31, 2012 (Unaudited) |  |

| | Beginning Account Value 07/01/12 | | Ending Account Value 12/31/12 | | | | Expenses Paid During Period 07/01/12-12/31/12(2) |

Large Company Growth Portfolio |

| Actual Fund Return | | | | | | | |

| Investment Class | $1,000.00 | | $1,033.00 | | 1.35% | | $6.91 |

| Institutional Class | $1,000.00 | | $1,034.20 | | 1.15% | | $5.87 |

| Hypothetical 5% Return | | | | | | | |

| Investment Class | $1,000.00 | | $1,018.33 | | 1.35% | | $6.87 |

| Institutional Class | $1,000.00 | | $1,019.37 | | 1.15% | | $5.82 |

Large Company Value Portfolio |

| Actual Fund Return | | | | | | | |

| Investment Class | $1,000.00 | | $1,077.40 | | 1.36% | | $7.11 |

| Institutional Class | $1,000.00 | | $1,079.20 | | 1.14% | | $5.96 |

| Hypothetical 5% Return | | | | | | | |

| Investment Class | $1,000.00 | | $1,018.29 | | 1.36% | | $6.91 |

| Institutional Class | $1,000.00 | | $1,019.40 | | 1.14% | | $5.79 |

Small Company Growth Portfolio |

| Actual Fund Return | | | | | | | |

| Investment Class | $1,000.00 | | $1,062.40 | | 1.48% | | $7.68 |

| Institutional Class | $1,000.00 | | $1,062.40 | | 1.32% | | $6.85 |

| Hypothetical 5% Return | | | | | | | |

| Investment Class | $1,000.00 | | $1,017.69 | | 1.48% | | $7.51 |

| Institutional Class | $1,000.00 | | $1,018.49 | | 1.32% | | $6.70 |

Small Company Value Portfolio |

| Actual Fund Return | | | | | | | |

| Investment Class | $1,000.00 | | $1,096.20 | | 1.48% | | $7.82 |

| Institutional Class | $1,000.00 | | $1,097.50 | | 1.30% | | $6.85 |

| Hypothetical 5% Return | | | | | | | |

| Investment Class | $1,000.00 | | $1,017.67 | | 1.48% | | $7.53 |

| Institutional Class | $1,000.00 | | $1,018.60 | | 1.30% | | $6.60 |

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses - (Continued) For the Six Months Ended December 31, 2012 (Unaudited) |  |

| | Beginning Account Value 07/01/12 | | Ending Account Value 12/31/12 | | | | Expenses Paid During Period 07/01/12-12/31/12(2) |

Wilshire 5000 IndexSM Fund |

| Actual Fund Return | | | | | | | |

| Investment Class | $1,000.00 | | $1,060.40 | | 0.67% | | $3.49 |

| Institutional Class | $1,000.00 | | $1,060.30 | | 0.43% | | $2.24 |

| Qualified Class | $1,000.00 | | $1,063.40 | | 0.00%(4) | | $0.00 |

| Horace Mann Class | $1,000.00 | | $1,059.90 | | 0.73% | | $3.79 |

| Hypothetical 5% Return | | | | | | | |

| Investment Class | $1,000.00 | | $1,021.75 | | 0.67% | | $3.43 |

| Institutional Class | $1,000.00 | | $1,022.96 | | 0.43% | | $2.20 |

| Qualified Class | $1,000.00 | | $1,025.14 | | 0.00%(4) | | $0.00 |

| Horace Mann Class | $1,000.00 | | $1,021.45 | | 0.73% | | $3.72 |

Wilshire Large Cap Core Plus Fund |

| Actual Fund Return | | | | | | | |

| Investment Class | $1,000.00 | | $1,056.10 | | 1.49%(3) | | $7.68 |

| Institutional Class | $1,000.00 | | $1,056.40 | | 1.24%(3) | | $6.39 |

| Hypothetical 5% Return | | | | | | | |

| Investment Class | $1,000.00 | | $1,017.67 | | 1.49%(3) | | $7.54 |

| Institutional Class | $1,000.00 | | $1,018.92 | | 1.24%(3) | | $6.28 |

| (1) | Annualized, based on the Portfolio’s most recent fiscal half-year expenses. |

| | |

| (2) | Expenses are equal to the Portfolio’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the period, then divided by 366. |

| | |

| (3) | The annualized expense ratios include dividend expense, interest expense and rebates on securities sold short during the six-month period. |

| | |

| (4) | There were no expenses accrued in the Wilshire 5000 IndexSM Fund Qualified Class for the six months ended December 31, 2012 due to the low average net assets (of approximately $125) relative to the other classes of this Fund. |

Wilshire Mutual Funds, Inc. Large Company Growth Portfolio Condensed Schedule of Investments | December 31, 2012 |  |

| | | | Percentage of Net Assets (%) | | | | |

| COMMON STOCK — 99.0%†† | |

| Consumer Discretionary — 19.1% | | | | | | |

| | 14,058 | | Amazon.com, Inc. | | | 1.9 | | | $ | 3,530,526 | |

| | 96,772 | | Apollo Group, Inc., Class A(a) | | | 1.1 | | | | 2,024,470 | |

| | 47,932 | | Dollar General Corp. | | | 1.1 | | | | 2,113,322 | |

| | 82,131 | | Johnson Controls, Inc.(a) | | | 1.3 | | | | 2,521,422 | |

| | 38,880 | | NIKE, Inc., Class B | | | 1.1 | | | | 2,006,208 | |

| | 2,280 | | priceline.com, Inc.† | | | 0.8 | | | | 1,416,336 | |

| | 31,668 | | Starbucks Corp. | | | 0.9 | | | | 1,698,038 | |

| | 29,870 | | Walt Disney Co. (The) | | | 0.8 | | | | 1,487,227 | |

| | 430,857 | | Other Securities | | | 10.1 | | | | 18,834,216 | |

| | | | | | | | | | | 35,631,765 | |

| Consumer Staples — 8.3% | | | | | | | | |

| | 90,625 | | Coca-Cola Co. (The) | | | 1.8 | | | | 3,285,156 | |

| | 14,135 | | Costco Wholesale Corp. | | | 0.8 | | | | 1,396,114 | |

| | 17,422 | | Diageo PLC ADR | | | 1.1 | | | | 2,031,057 | |

| | 40,974 | | Philip Morris International, Inc. | | | 1.8 | | | | 3,427,065 | |

| | 93,120 | | Other Securities | | | 2.8 | | | | 5,312,924 | |

| | | | | | | | | | | 15,452,316 | |

| Energy — 5.6% | | | | | | | | |

| | 91,814 | | Cobalt International Energy, Inc.† | | | 1.2 | | | | 2,254,952 | |

| | 53,154 | | Schlumberger, Ltd. | | | 2.0 | | | | 3,683,040 | |

| | 156,657 | | Other Securities | | | 2.4 | | | | 4,528,003 | |

| | | | | | | | | | | 10,465,995 | |

| Financials — 5.7% | | | | | | | | |

| | 22,106 | | Camden Property Trust‡ | | | 0.8 | | | | 1,507,850 | |

| | 33,478 | | Capital One Financial Corp. | | | 1.0 | | | | 1,939,381 | |

| | 210,973 | | Other Securities | | | 3.9 | | | | 7,249,356 | |

| | | | | | | | | | | 10,696,587 | |

| Health Care — 13.1% | | | | | | | | |

| | 19,560 | | Alexion Pharmaceuticals, Inc.† (a) | | | 1.0 | | | | 1,834,923 | |

| | 14,833 | | Allergan, Inc. | | | 0.7 | | | | 1,360,631 | |

| | 11,784 | | Biogen Idec, Inc. | | | 0.9 | | | | 1,728,359 | |

| | 18,237 | | Celgene Corp.† | | | 0.8 | | | | 1,435,617 | |

| | 46,762 | | Express Scripts Holding Co. | | | 1.4 | | | | 2,525,148 | |

| | 78,613 | | Hologic, Inc.(a) | | | 0.9 | | | | 1,574,618 | |

| | 45,329 | | Teva Pharmaceutical Industries, Ltd. ADR | | | 0.9 | | | | 1,692,585 | |

| | 48,164 | | WellPoint, Inc.(a) | | | 1.6 | | | | 2,934,151 | |

| | 154,397 | | Other Securities | | | 4.9 | | | | 9,361,168 | |

| | | | | | | | | | | 24,447,200 | |

| | | Percentage of Net Assets (%) | | | | |

| Industrials — 10.9% | | | | | | | | |

| | 19,825 | | Caterpillar, Inc. | | | 1.0 | | | $ | 1,775,924 | |

| | 89,490 | | CSX Corp. | | | 0.9 | | | | 1,765,638 | |

| | 28,545 | | Fastenal Co.(a) | | | 0.7 | | | | 1,332,766 | |

| | 36,664 | | Fluor Corp. | | | 1.2 | | | | 2,153,643 | |

| | 26,785 | | Joy Global, Inc.(a) | | | 0.9 | | | | 1,708,347 | |

| | 14,255 | | Union Pacific Corp. | | | 1.0 | | | | 1,792,139 | |

| | 166,202 | | Other Securities | | | 5.2 | | | | 9,692,615 | |

| | | | | | | | | | | 20,221,072 | |

| Information Technology — 30.1% | | | | | | | | |

| | 62,744 | | Acme Packet, Inc.† (a) | | | 0.7 | | | | 1,387,897 | |

| | 27,532 | | Apple, Inc. | | | 7.9 | | | | 14,675,382 | |

| | 23,305 | | Baidu, Inc. ADR† (a) | | | 1.3 | | | | 2,337,258 | |

| | 44,164 | | Citrix Systems, Inc.(a) | | | 1.6 | | | | 2,903,783 | |

| | 17,750 | | Cognizant Technology Solutions Corp., Class A† | | | 0.7 | | | | 1,314,388 | |

| | 62,495 | | eBay, Inc.† | | | 1.7 | | | | 3,188,495 | |

| | 58,920 | | EMC Corp.† | | | 0.8 | | | | 1,490,676 | |

| | 4,564 | | Google, Inc., Class A† | | | 1.7 | | | | 3,237,565 | |

| | 11,933 | | International Business Machines Corp. | | | 1.2 | | | | 2,285,766 | |

| | 86,085 | | Microsoft Corp. | | | 1.2 | | | | 2,301,052 | |

| | 41,992 | | Oracle Corp. | | | 0.7 | | | | 1,399,173 | |

| | 98,613 | | QUALCOMM, Inc. | | | 3.3 | | | | 6,115,978 | |

| | 29,824 | | Visa, Inc., Class A | | | 2.4 | | | | 4,520,722 | |

| | 174,532 | | Western Union Co. (The) | | | 1.3 | | | | 2,375,381 | |

| | 164,748 | | Other Securities | | | 3.6 | | | | 6,619,653 | |

| | | | | | | | | | | 56,153,169 | |

| Materials — 5.2% | | | | | | | | |

| | 22,766 | | Monsanto Co. | | | 1.2 | | | | 2,154,802 | |

| | 35,360 | | Mosaic Co. (The) | | | 1.1 | | | | 2,002,437 | |

| | 8,293 | | Sherwin-Williams Co. (The) | | | 0.7 | | | | 1,275,629 | |

| | 91,088 | | Other Securities | | | 2.2 | | | | 4,151,812 | |

| | | | | | | | | | | 9,584,680 | |

| Telecommunication Services — 1.0% | | | | | | | | |

| | 32,850 | | Verizon Communications, Inc. | | | 0.8 | | | | 1,421,420 | |

| | 11,450 | | Other Securities | | | 0.2 | | | | 469,004 | |

| | | | | | | | | | | 1,890,424 | |

| Utilities — 0.0% | | | | | | | | |

| | 1,480 | | Other Securities | | | 0.0 | | | | 63,270 | |

| | | | | | | | | | | | |

| Total Common Stock | | | | | | | | |

| (Cost $151,523,255) | | | | | | | 184,606,478 | |

See Notes to Financial Statements.

Wilshire Mutual Funds, Inc. Large Company Growth Portfolio Condensed Schedule of Investments - (Continued) | December 31, 2012 |  |

| | | Percentage of Net Assets (%) | | | | |

| SHORT-TERM INVESTMENTS — 15.2% | | | | | | | | |

| | 26,397,533 | | Northern Institutional Liquid Asset Portfolio, 0.010% (b),(c) | | | 14.1 | | | $ | 26,397,533 | |

| | 2,007,875 | | Northern Trust Institutional Government Select Portfolio, 0.010% (c) | | | 1.1 | | | | 2,007,875 | |

| | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | |

| (Cost $28,405,408) | | | | | | | 28,405,408 | |

| | | | | | | | | | | | |

| Total Investments — 114.2% | | | | | | | | |

| (Cost $179,928,663) | | | | | | | 213,011,886 | |

| Other Assets & Liabilities, Net — (14.2)% | | | | | | | (26,419,056 | ) |

| | | | | | | | | | | | |

| NET ASSETS — 100.0% | | | | | | $ | 186,592,830 | |

| † | Non-income producing security. |

| †† | More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes. |

| (a) | This security or a partial position of this security is on loan at December 31, 2012. The total market value of securities on loan at December 31, 2012 was $26,432,210. |

| (b) | This security was purchased with cash collateral held from securities on loan. The total value of such securities as of December 31, 2012 was $26,397,533. Securities on loan are also collateralized by various U.S. Treasury obligations in the amount of $124,857 (Note 6). |

| (c) | Rate shown is the 7-day effective yield as of December 31, 2012. |

ADR — American Depositary Receipt

Ltd. — Limited

PLC — Public Limited Company

The Condensed Schedule of Investments does not reflect the complete portfolio holdings. It includes the Portfolio’s 50 largest holdings and each investment of any issuer that exceeds 1% of the Portfolio’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 607-2200; (ii) on the SEC’s website at http://www.sec.gov; and (iii) on our website at http://advisor.wilshire.com.

As of December 31, 2012, all of the Portfolio’s investments were considered Level 1. For the year ended December 31. 2012, there have been no transfers between Level 1 and Level 2 assets and liabilities. For the year ended December 31, 2012, there have been no transfers between Level 2 and Level 3 assets and liabilities. Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

See Notes to Financial Statements.

Wilshire Mutual Funds, Inc. Large Company Value Portfolio Condensed Schedule of Investments | December 31, 2012 |  |

| | | | Percentage of Net Assets (%) | | | | |

| COMMON STOCK — 98.7%†† | |

| Consumer Discretionary — 9.3% | | | | | | |

| | 10,891 | | Comcast Corp., Class A | | | 0.9 | | | $ | 407,106 | |

| | 17,300 | | Delphi Automotive PLC(a) | | | 1.5 | | | | 661,725 | |

| | 10,800 | | Omnicom Group, Inc. | | | 1.2 | | | | 539,568 | |

| | 47,875 | | Staples, Inc.(a) | | | 1.2 | | | | 545,775 | |

| | 83,652 | | Other Securities | | | 4.5 | | | | 2,013,650 | |

| | | | | | | | | | | 4,167,824 | |

| Consumer Staples — 7.3% | | | | | | | | |

| | 13,266 | | CVS Caremark Corp. | | | 1.4 | | | | 641,411 | |

| | 11,090 | | Procter & Gamble Co. (The) | | | 1.7 | | | | 752,900 | |

| | 56,776 | | Other Securities | | | 4.2 | | | | 1,873,872 | |

| | | | | | | | | | | 3,268,183 | |

| Energy — 16.4% | | | | | | | | |

| | 11,525 | | Baker Hughes, Inc. | | | 1.0 | | | | 470,681 | |

| | 16,343 | | BP PLC ADR(a) | | | 1.5 | | | | 680,523 | |

| | 4,675 | | Chevron Corp.(a) | | | 1.1 | | | | 505,554 | |

| | 9,291 | | ConocoPhillips | | | 1.2 | | | | 538,785 | |

| | 16,674 | | Exxon Mobil Corp. | | | 3.2 | | | | 1,443,135 | |

| | 6,209 | | Marathon Petroleum Corp. | | | 0.9 | | | | 391,167 | |

| | 10,049 | | Royal Dutch Shell PLC ADR, Class A(a) | | | 1.5 | | | | 692,852 | |

| | 10,340 | | Valero Energy Corp. | | | 0.8 | | | | 352,801 | |

| | 67,528 | | Other Securities | | | 5.2 | | | | 2,310,106 | |

| | | | | | | | | | | 7,385,604 | |

| Financials — 27.8% | | | | | | | | |

| | 15,450 | | Allstate Corp. (The) | | | 1.4 | | | | 620,626 | |

| | 29,632 | | American International Group, Inc.† | | | 2.3 | | | | 1,046,010 | |

| | 15,650 | | Axis Capital Holdings, Ltd.(a) | | | 1.2 | | | | 542,116 | |

| | 56,300 | | Bank of America Corp. | | | 1.4 | | | | 653,080 | |

| | 5,639 | | Berkshire Hathaway, Inc., Class B | | | 1.1 | | | | 505,818 | |

| | 29,396 | | Citigroup, Inc. | | | 2.6 | | | | 1,162,906 | |

| | 17,873 | | Discover Financial Services(a) | | | 1.5 | | | | 689,004 | |

| | 15,575 | | Invesco, Ltd. | | | 0.9 | | | | 406,352 | |

| | 30,510 | | JPMorgan Chase & Co. | | | 3.0 | | | | 1,341,524 | |

| | 23,225 | | MetLife, Inc. | | | 1.7 | | | | 765,032 | |

| | 17,425 | | Morgan Stanley | | | 0.7 | | | | 333,166 | |

| | 12,279 | | PNC Financial Services Group, Inc. | | | 1.6 | | | | 715,989 | |

| | 29,875 | | UBS AG(a) | | | 1.0 | | | | 470,232 | |

| | | Percentage of Net Assets (%) | | | | |

| Financials (continued) | | | | | | | | |

| | 115,811 | | Other Securities | | | 7.4 | | | $ | 3,273,699 | |

| | | | | | | | | | | 12,525,554 | |

| Health Care — 11.1% | | | | | | | | |

| | 10,737 | | Abbott Laboratories | | | 1.6 | | | | 703,273 | |

| | 5,575 | | Becton Dickinson and Co.(a) | | | 1.0 | | | | 435,909 | |

| | 9,268 | | Eli Lilly & Co. | | | 1.0 | | | | 457,098 | |

| | 17,009 | | Merck & Co., Inc.(a) | | | 1.5 | | | | 696,348 | |

| | 35,471 | | Pfizer, Inc. | | | 2.0 | | | | 889,613 | |

| | 37,746 | | Other Securities | | | 4.0 | | | | 1,824,687 | |

| | | | | | | | | | | 5,006,928 | |

| Industrials — 8.3% | | | | | | | | |

| | 6,300 | | Eaton Corp. PLC(a) | | | 0.8 | | | | 341,460 | |

| | 23,050 | | General Electric Co. | | | 1.1 | | | | 483,820 | |

| | 4,675 | | L-3 Communications Holdings, Inc., Class 3 | | | 0.8 | | | | 358,199 | |

| | 19,550 | | Masco Corp. | | | 0.7 | | | | 325,703 | |

| | 9,137 | | Northrop Grumman Corp. | | | 1.4 | | | | 617,478 | |

| | 89,333 | | Other Securities | | | 3.5 | | | | 1,617,566 | |

| | | | | | | | | | | 3,744,226 | |

| Information Technology — 10.8% | | | | | | | | |

| | 18,700 | | Cisco Systems, Inc. | | | 0.8 | | | | 367,455 | |

| | 575 | | Google, Inc., Class A† | | | 0.9 | | | | 407,888 | |

| | 46,700 | | Hewlett-Packard Co. | | | 1.5 | | | | 665,475 | |

| | 13,098 | | Microsoft Corp. | | | 0.8 | | | | 350,109 | |

| | 17,700 | | Oracle Corp. | | | 1.3 | | | | 589,764 | |

| | 14,825 | | TE Connectivity, Ltd. | | | 1.2 | | | | 550,304 | |

| | 92,428 | | Other Securities | | | 4.3 | | | | 1,933,488 | |

| | | | | | | | | | | 4,864,483 | |

| Materials — 3.0% | | | | | | | | |

| | 6,870 | | LyondellBasell Industries NV, Class A | | | 0.9 | | | | 392,208 | |

| | 15,392 | | Other Securities | | | 2.1 | | | | 940,172 | |

| | | | | | | | | | | 1,332,380 | |

| Telecommunication Services — 2.0% | | | | | | | | |

| | 11,950 | | AT&T, Inc. | | | 0.9 | | | | 402,834 | |

| | 8,537 | | Verizon Communications, Inc.(a) | | | 0.8 | | | | 369,396 | |

| | 6,435 | | Other Securities | | | 0.3 | | | | 142,471 | |

| | | | | | | | | | | 914,701 | |

| Utilities — 2.7% | | | | | | | | |

| | 6,075 | | Entergy Corp.(a) | | | 0.8 | | | | 387,281 | |

| | 18,370 | | PPL Corp.(a) | | | 1.2 | | | | 525,933 | |

See Notes to Financial Statements.

Wilshire Mutual Funds, Inc. Large Company Value Portfolio Condensed Schedule of Investments - (Continued) | December 31, 2012 |  |

| | | Percentage of Net Assets (%) | | | | |

| Utilities (continued) | | | | | | | | |

| | 11,485 | | Other Securities | | | 0.7 | | | $ | 305,518 | |

| | | | | | | | | | | 1,218,732 | |

| Total Common Stock | | | | | | | | |

| (Cost $40,099,694) | | | | | | | 44,428,615 | |

| | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS — 22.6% | | | | | | | | |

| | 9,489,195 | | Northern Institutional Liquid Asset Portfolio, 0.010% (b),(c) | | | 21.1 | | | | 9,489,195 | |

| | 678,662 | | Northern Trust Institutional Government Select Portfolio, 0.010% (c) | | | 1.5 | | | | 678,662 | |

| | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | |

| (Cost $10,167,857) | | | | | | | 10,167,857 | |

| | | | | | | | | | | | |

| Total Investments — 121.3% | | | | | | | | |

| (Cost $50,267,551) | | | | | | | 54,596,472 | |

| Other Assets & Liabilities, Net — (21.3)% | | | | | | | (9,576,440 | ) |

| | | | | | | | | | | | |

| NET ASSETS — 100.0% | | | | | | $ | 45,020,032 | |

| † | Non-income producing security. |

| †† | More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes. |

| (a) | This security or a partial position of this security is on loan at December 31, 2012. The total market value of securities on loan at December 31, 2012 was $9,367,300 (Note 6). |

| (b) | This security was purchased with cash collateral held from securities on loan. The total value of such securities as of December 31, 2012 was $9,489,195. Securities on loan are also collateralized by various U.S. Treasury obligations in the amount of $5,424 (Note 6). |

| (c) | Rate shown is the 7-day effective yield as of December 31, 2012. |

ADR — American Depositary Receipt

Ltd. — Limited

PLC — Public Limited Company

The Condensed Schedule of Investments does not reflect the complete portfolio holdings. It includes the Portfolio’s 50 largest holdings and each investment of any issuer that exceeds 1% of the Portfolio’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 607-2200; (ii) on the SEC’s website at http://www.sec.gov; and (iii) on our website at http://advisor.wilshire.com.

As of December 31, 2012, all of the Portfolio’s investments were considered Level 1. For the year ended December 31. 2012, there have been no transfers between Level 1 and Level 2 assets and liabilities. For the year ended December 31, 2012, there have been no transfers between Level 2 and Level 3 assets and liabilities. Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

See Notes to Financial Statements.

Wilshire Mutual Funds, Inc. Small Company Growth Portfolio Condensed Schedule of Investments | December 31, 2012 |  |

| | | | Percentage of Net Assets (%) | | | | |

| COMMON STOCK — 99.1%†† | |

| Consumer Discretionary — 19.8% | | | | | | |

| | 1,676 | | Ameristar Casinos, Inc.(a) | | | 0.6 | | | $ | 43,978 | |

| | 812 | | ANN, Inc. | | | 0.4 | | | | 27,478 | |

| | 750 | | Cabela's, Inc. | | | 0.4 | | | | 31,312 | |

| | 992 | | Cheesecake Factory, Inc. (The)(a) | | | 0.4 | | | | 32,458 | |

| | 587 | | Coinstar, Inc.(a) | | | 0.4 | | | | 30,530 | |

| | 461 | | Cracker Barrel Old Country Store, Inc. | | | 0.4 | | | | 29,624 | |

| | 788 | | Domino's Pizza, Inc.(a) | | | 0.5 | | | | 34,317 | |

| | 530 | | Hibbett Sports, Inc.† (a) | | | 0.4 | | | | 27,931 | |

| | 490 | | HSN, Inc.(a) | | | 0.4 | | | | 26,989 | |

| | 600 | | Life Time Fitness, Inc.† (a) | | | 0.4 | | | | 29,526 | |

| | 1,510 | | Pier 1 Imports, Inc.(a) | | | 0.4 | | | | 30,200 | |

| | 62,739 | | Other Securities | | | 15.1 | | | | 1,091,787 | |

| | | | | | | | | | | 1,436,130 | |

| Consumer Staples — 7.3% | | | | | | | | |

| | 990 | | B&G Foods, Inc., Class A(a) | | | 0.4 | | | | 28,027 | |

| | 27,128 | | Other Securities | | | 6.9 | | | | 499,854 | |

| | | | | | | | | | | 527,881 | |

| Energy — 2.6% | | | | | | | | |

| | 11,210 | | Other Securities | | | 2.6 | | | | 189,193 | |

| | | | | | | | | | | 189,193 | |

| Financials — 10.8% | | | | | | | | |

| | 1,424 | | CBL & Associates Properties, Inc.(a) | | | 0.4 | | | | 30,203 | |

| | 2,840 | | Glimcher Realty Trust | | | 0.4 | | | | 31,496 | |

| | 1,280 | | Greenlight Capital Re, Ltd., Class A | | | 0.4 | | | | 29,542 | |

| | 1,270 | | Omega Healthcare Investors, Inc. (a) | | | 0.4 | | | | 30,289 | |

| | 495 | | SVB Financial Group | | | 0.4 | | | | 27,705 | |

| | 670 | | Texas Capital Bancshares, Inc.† (a) | | | 0.4 | | | | 30,029 | |

| | 469 | | World Acceptance Corp.(a) | | | 0.5 | | | | 34,969 | |

| | 33,212 | | Other Securities | | | 7.9 | | | | 570,019 | |

| | | | | | | | | | | 784,252 | |

| Health Care — 16.5% | | | | | | | | |

| | 894 | | Air Methods Corp.(a) | | | 0.5 | | | | 32,980 | |

| | 1,564 | | Alkermes PLC(a) | | | 0.4 | | | | 28,965 | |

| | 806 | | Centene Corp.† | | | 0.5 | | | | 33,046 | |

| | 1,243 | | Cubist Pharmaceuticals, Inc.(a) | | | 0.7 | | | | 52,281 | |

| | Percentage of Net Assets (%) | | | |

| Health Care (continued) | | | | | | | | |

| | 1,390 | | Emeritus Corp. | | | 0.5 | | | $ | 34,361 | |

| | 1,290 | | HealthSouth Corp.(a) | | | 0.4 | | | | 27,232 | |

| | 512 | | Jazz Pharmaceuticals PLC(a) | | | 0.4 | | | | 27,238 | |

| | 1,080 | | Owens & Minor, Inc.(a) | | | 0.4 | | | | 30,791 | |

| | 903 | | Pharmacyclics, Inc.† | | | 0.7 | | | | 52,284 | |

| | 790 | | STERIS Corp. | | | 0.4 | | | | 27,437 | |

| | 57,003 | | Other Securities | | | 11.6 | | | | 848,048 | |

| | | | | | | | | | | 1,194,663 | |

| Industrials — 16.1% | | | | | | | | |

| | 566 | | 3D Systems Corp.† (a) | | | 0.4 | | | | 30,196 | |

| | 1,380 | | Avis Budget Group, Inc.† (a) | | | 0.4 | | | | 27,352 | |

| | 1,260 | | CAI International, Inc.† (a) | | | 0.4 | | | | 27,657 | |

| | 419 | | Chart Industries, Inc.† | | | 0.4 | | | | 27,935 | |

| | 803 | | HEICO Corp.(a) | | | 0.5 | | | | 35,942 | |

| | 1,090 | | MasTec, Inc.(a) | | | 0.4 | | | | 27,174 | |

| | 885 | | Old Dominion Freight Line, Inc. | | | 0.4 | | | | 30,338 | |

| | 1,896 | | TAL International Group, Inc.(a) | | | 0.9 | | | | 68,977 | |

| | 2,330 | | US Airways Group, Inc.(a) | | | 0.4 | | | | 31,455 | |

| | 1,250 | | USG Corp.(a) | | | 0.5 | | | | 35,087 | |

| | 42,633 | | Other Securities | | | 11.4 | | | | 825,884 | |

| | | | | | | | | | | 1,167,997 | |

| Information Technology — 17.7% | | | | | | | | |

| | 1,027 | | Cirrus Logic, Inc. | | | 0.4 | | | | 29,752 | |

| | 426 | | CommVault Systems, Inc.† (a) | | | 0.4 | | | | 29,696 | |

| | 934 | | Fair Isaac Corp. | | | 0.5 | | | | 39,256 | |

| | 1,594 | | Heartland Payment Systems, Inc.(a) | | | 0.6 | | | | 47,023 | |

| | 481 | | Manhattan Associates, Inc. | | | 0.4 | | | | 29,023 | |

| | 430 | | MAXIMUS, Inc. | | | 0.4 | | | | 27,184 | |

| | 440 | | WEX, Inc.(a) | | | 0.5 | | | | 33,163 | |

| | 65,581 | | Other Securities | | | 14.5 | | | | 1,042,217 | |

| | | | | | | | | | | 1,277,314 | |

| Materials — 7.3% | | | | | | | | |

| | 3,675 | | Myers Industries, Inc.(a) | | | 0.8 | | | | 55,676 | |

| | 700 | | Schweitzer-Mauduit International, Inc. | | | 0.4 | | | | 27,321 | |

| | 22,313 | | Other Securities | | | 6.1 | | | | 443,518 | |

| | | | | | | | | | | 526,515 | |

| Telecommunication Services — 0.9% | | | | | | | | |

| | 6,300 | | Other Securities | | | 0.9 | | | | 65,434 | |

| | | | | | | | | | | 65,434 | |

See Notes to Financial Statements.

Wilshire Mutual Funds, Inc. Small Company Growth Portfolio Condensed Schedule of Investments - (Continued) | December 31, 2012 |  |

| | | Percentage of Net Assets (%) | | | | |

| Utilities — 0.1% | | | | | | | | |

| | 360 | | Other Securities | | | 0.1 | | | $ | 9,576 | |

| | | | | | | | | | | | |

| Total Common Stock | | | | | | | | |

| (Cost $6,349,114) | | | | | | | 7,178,955 | |

| | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS — 44.7% | | | | | | | | |

| | 3,153,425 | | Northern Institutional Liquid Asset Portfolio, 0.010% (b),(c) | | | 43.6 | | | | 3,153,425 | |

| | 80,931 | | Northern Trust Institutional Government Select Portfolio, 0.010% (c) | | | 1.1 | | | | 80,931 | |

| | | | | | | | | | | | |

| Total Short-Term Investments | | | | | | | | |

| (Cost $3,234,356) | | | | | | | 3,234,356 | |

| | | | | | | | | | | | |

| Total Investments — 143.8% | | | | | | | | |

| (Cost $9,583,470) | | | | | | | 10,413,311 | |