Washington, D.C. 20549

Wilshire Mutual Funds, Inc.

Jason A. Schwarz, President

The Report to Shareholders is attached herewith.

Wilshire Mutual Funds |

ANNUAL REPORT Large Company Growth Portfolio Large Company Value Portfolio Small Company Growth Portfolio Small Company Value Portfolio Wilshire 5000 Indexsm Fund Wilshire International Equity Fund |

December 31, 2015

http://advisor.wilshire.com |

Wilshire Mutual Funds Table of Contents |

|

Shareholder Letter | 1 |

Commentary: | |

Large Company Growth Portfolio | 4 |

Large Company Value Portfolio | 8 |

Small Company Growth Portfolio | 12 |

Small Company Value Portfolio | 16 |

Wilshire 5000 IndexSM Fund | 20 |

Wilshire International Equity Fund | 26 |

Disclosure of Fund Expenses | 32 |

Condensed Schedules of Investments: | |

Large Company Growth Portfolio | 35 |

Large Company Value Portfolio | 37 |

Small Company Growth Portfolio | 39 |

Small Company Value Portfolio | 41 |

Wilshire 5000 IndexSM Fund | 43 |

Wilshire International Equity Fund | 45 |

Statements of Assets and Liabilities | 49 |

Statements of Operations | 52 |

Statements of Changes in Net Assets | 54 |

Financial Highlights: | |

Large Company Growth Portfolio | 60 |

Large Company Value Portfolio | 62 |

Small Company Growth Portfolio | 64 |

Small Company Value Portfolio | 66 |

Wilshire 5000 IndexSM Fund | 68 |

Wilshire International Equity Fund | 72 |

Notes to Financial Statements | 74 |

Report of Independent Registered Public Accounting Firm | 86 |

Additional Fund Information | 87 |

Tax Information | 90 |

Board Approval of Advisory and Subadvisory Agreements | 92 |

This report is for the general information of the shareholders of Large Company Growth Portfolio, Large Company Value Portfolio, Small Company Growth Portfolio, Small Company Value Portfolio, Wilshire 5000 IndexSM Fund and Wilshire International Equity Fund. Its use in connection with any offering of a Portfolio’s shares is authorized only if accompanied or preceded by the Portfolio’s current prospectus.

Wilshire Mutual Funds, Inc. are distributed by SEI Investments Distribution Co.

Wilshire Mutual Funds Letter to Shareholders - (Unaudited) |

|

Dear Wilshire Mutual Fund Shareholder:

We are pleased to present this annual report to all shareholders of the Wilshire Mutual Funds. This report covers the period from January 1, 2015 to December 31, 2015, for all share classes of the Large Company Growth Portfolio, Large Company Value Portfolio, Small Company Growth Portfolio, Small Company Value Portfolio, Wilshire 5000 Index Fund, and Wilshire International Equity Fund.

Market Environment

U.S. Equity Market

The U.S. stock market, as represented by the Wilshire 5000 Total Market IndexSM, returned 0.68% during 2015 marking the Index’s seventh consecutive annual gain. After posting its 12th consecutive quarterly gain during the second quarter, markets were shaken in the third quarter in August as China surprised investors by devaluing its currency and then again in September after the Federal Reserve announced that it would not raise the Fed Funds rate at that time. Markets rebounded strongly in October and were positive overall for the fourth quarter as most major developed economies continued to strengthen on supportive central bank policies, lower fuel prices and strong consumer spending.

During the year, large-cap stocks outpaced small-cap stocks, with the Wilshire U.S. Large-Cap IndexSM and the Wilshire U.S. Small-Cap IndexSM returning 1.27% and -4.86%, respectively, while growth oriented stocks handily outpaced value stocks within large-cap stocks and value oriented stocks outpaced growth stocks within smaller capitalization securities. The relatively flat return for the Wilshire 5000 Total Market IndexSM hid the wide performance dispersion among industries for the year. Commodity-influenced and interest rate sensitive sectors trailed while Health Care and Consumer Discretionary had strong performance. For the year, Health Care, Consumer Discretionary, and Consumer Staples were the top performing sectors returning 8.4%, 7.5%, and 5.9%, respectively, while Energy, Materials, Utilities, and Industrials lagged, returning -22.1%, -10.7%, -4.2%, and -3.1%, respectively.

International Equity Market

After leading domestic equities during the first half of the year, international developed equities trailed during the second half of the year, and ended the year in negative territory with the MSCI EAFE Index returning -0.81% for 2015. Emerging markets trailed foreign developed markets with the MSCI Emerging Markets Index returning -14.92% for the year.

Global equity markets started 2015 with European stocks leading the charge as quantitative easing bond-buying programs propelled equity markets higher. Investors worldwide were shaken in the third quarter by fears regarding the impact of China’s economic slowdown on global commerce. Markets rebounded strongly in October as European Central (ECB) Bank President Mario Draghi indicated that he was prepared to ramp up the ECB’s stimulus program and the People’s Bank of China raised liquidity in its economy by reducing its benchmark interest rate and lowering banks’ reserve requirement ratios. Emerging markets suffered throughout the year both from China’s weakness and the worldwide collapse in commodities. The strong U.S. dollar has also impacted emerging market companies, since much of their debt financing is transacted in dollars and therefore has become much more expensive.

Bond Market

The U.S. fixed income market, as measured by the Barclays U.S. Aggregate Bond Index, fell -0.57% for the 4th quarter, reversing gains from the prior quarter, but ending the year in positive territory at 0.55%. The Federal Reserve’s decision on December 16th to raise the key federal-funds rate to a 0.25-0.50% target range had little real impact on Treasury markets. The pressure of rising yields on bond prices was tempered by the special status Treasuries enjoy as a global safe-haven asset, resulting in relatively little movement in this market sector. Credit spreads, which had tightened as investors sought out higher yields, widened during 2015, especially at year-end. Non-investment grade corporate bonds, as measured by the Barclays U.S. Corporate High Yield index, continued their slide and finished the year down -4.47%.

1

Wilshire Mutual Funds Letter to Shareholders (Unaudited) - (Continued) |

|

Continued weakness in the energy and materials sectors weighed on high yield, but other sectors also contributed to losses as investors became more concerned about the future availability of credit to leveraged companies and the liquidity of those issues.

Fund Performance Review

The Large Company Growth Portfolio Institutional Class shares returned 6.52%, outperforming the Russell 1000 Growth Index by 0.85%. The Large Company Value Portfolio Institutional Class shares returned -5.07%, underperforming the Russell 1000 Value Index by 1.24%. The Small Company Growth Portfolio Institutional Class shares returned 2.53%, outperforming the Russell 2000 Growth Index by 3.91%. The Small Company Value Portfolio Institutional Class shares returned -3.52%, outperforming the Russell 2000 Value Index by 3.95%. The Wilshire 5000 Index Fund Institutional Class shares returned 0.36%, underperforming the Wilshire 5000 Total Market IndexSM by 0.32%. The Wilshire International Equity Fund Institutional Class shares returned -1.37%, outperforming the MSCI All Country World ex-U.S. Index by 4.29%. We are pleased with the Funds’ performance for 2015 and we are confident that each Fund is well positioned for future growth.

As always, we sincerely appreciate your continued support and confidence in Wilshire Associates.

Sincerely,

Jason Schwarz

President, Wilshire Mutual Funds

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Returns assume reinvestment of all distributions.

Index returns are for illustrative purposes only and do not represent actual Fund performance. Index performance returns do not reflect any management fees, transactions costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

In addition to the normal risks associated with investing, international investments may involves risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. Investments in smaller companies typically exhibit higher volatility.

Investing involves risk including loss of principal. This report identifies the Portfolio’s investments on December 31, 2015. These holdings are subject to change. Not all investments in each Portfolio performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

The MSCI EAFE Index is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the US and Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

2

Wilshire Mutual Funds Letter to Shareholders (Unaudited) - (Continued) |

|

Barclays U.S. Aggregate Bond Index is made up of the Barclays U.S. Government/Corporate Bond Index, Mortgage-Backed Securities Index, and Asset-Backed Securities Index, including securities that are of investment grade quality or better, have at least one year to maturity, and have an outstanding par value of at least $100 million.

Barclays U.S. Corporate High Yield Index is composed of fixed-rate, publicly issued, non-investment grade debt.

The Wilshire 5000 Total Market IndexSM is widely accepted as the definitive benchmark for the U.S. equity market, and measures performance of all U.S. equity securities with readily available price data.

The Wilshire U.S. Large-Cap IndexSM is a benchmark of the large-sized (based on capitalization) companies in the U.S. equity market and is a float-adjusted, market capitalization-weighted index of the issues ranked above 750 market capitalization of the Wilshire 5000®.

The Wilshire U.S. Small-Cap IndexSM is a benchmark of the small-sized (based on capitalization) companies in the U.S. equity market and is a float-adjusted, market capitalization-weighted index of the issues ranked between 750 and 2,500 by market capitalization of the Wilshire 5000®.

3

Large Company Growth Portfolio Commentary (Unaudited) |

|

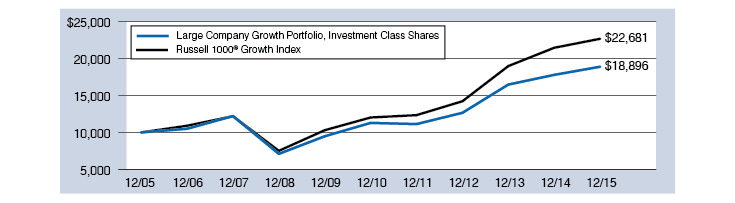

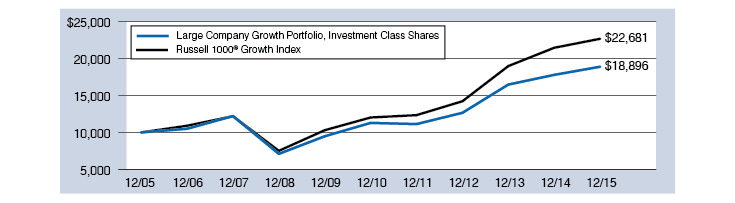

INVESTMENT CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/15 | 6.18% |

Five Years Ended 12/31/15 | 10.85% |

Ten Years Ended 12/31/15 | 6.57% |

RUSSELL 1000® GROWTH INDEX(1)

Average Annual Total Return

One Year Ended 12/31/15 | 5.67% |

Five Years Ended 12/31/15 | 13.53% |

Ten Years Ended 12/31/15 | 8.53% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Large Company Growth

Portfolio, Investment Class Shares and the Russell 1000 Growth Index through 12/31/15.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Assumes reinvestment of all distributions. |

(1) | The Russell 1000® Growth Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

4

Large Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

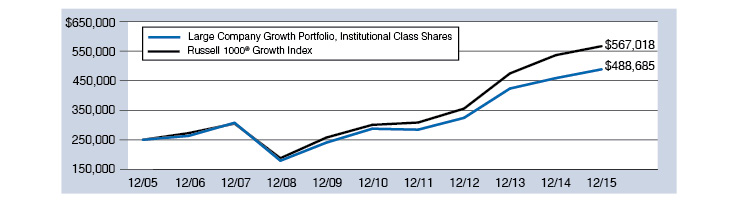

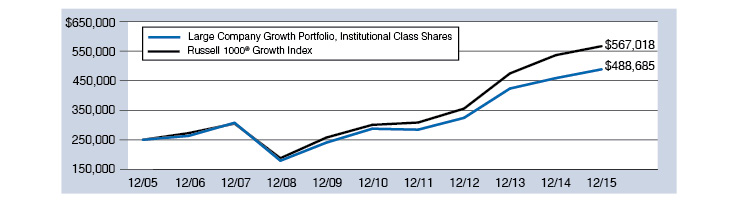

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/15 | 6.52% |

Five Years Ended 12/31/15 | 11.19% |

Ten Years Ended 12/31/15 | 6.93% |

RUSSELL 1000® GROWTH INDEX(1)

Average Annual Total Return

One Year Ended 12/31/15 | 5.67% |

Five Years Ended 12/31/15 | 13.53% |

Ten Years Ended 12/31/15 | 8.53% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Large Company Growth

Portfolio, Institutional Class Shares and the Russell 1000 Growth Index through 12/31/15.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Assumes reinvestment of all distributions. |

(1) | The Russell 1000® Growth Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

5

Large Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

The U.S. stock market, as represented by the Wilshire 5000 Total Market IndexSM, returned 0.68% during 2015. The year started with a loss as increased market volatility triggered by the continued sell off in oil, quantitative easing in the Eurozone, and the Swiss National Bank’s decision to remove its currency cap with the euro spooked investors. However, domestic investors rallied around the Federal Reserve’s patience with raising interest rates and the Wilshire 5000 Total Market IndexSM hit an all-time high in mid-June. Worldwide, equities experienced a sharp sell-off during the third quarter, marking the first negative quarter in three years. The first major sell-off of the third quarter occurred in August after China devalued its currency, which had been strengthening versus both the euro and yen at a time when China’s economic growth was failing to meet its official growth target. Another minor sell-off occurred in September after the Federal Open Market Committee announced it would not raise the Fed Funds rate at that time. Stocks recorded gains in the final quarter of the year, driven by a strong October rally that outweighed losses in November and December, and pushed large-cap benchmarks back into positive territory for 2015. Following positive economic news, including accelerating job growth in October and November and weekly jobless claims remaining near multi-decade lows, on December 16th the Federal Reserve raised its target for short-term interest rates—the first increase in nearly a decade.

Sector performance for the Wilshire 5000 Total Market IndexSM was mixed for the year as defensive stocks outpaced economically sensitive sectors. Health Care and Consumer stocks rallied, while Energy and Materials stocks plummeted amid falling commodities prices. Health Care continued its first half of the year dominance and was the top performing sector for the year, returning 8.4%. Consumer Discretionary and Consumer Staples retuned 7.5% and 5.9%, respectively, while Energy and Materials returned -22.1% and -10.7%, respectively.

The Wilshire Large Company Growth Portfolio Institutional Class shares returned 6.52% for 2015, outperforming the Russell 1000 Growth Index return of 5.67% by 0.85%. The Fund benefited from strong stock selection and sector allocation positioning. Strong stock selection in the Consumer Discretionary and Health Care sectors as well as an underweight allocation to the Industrials sector drove performance. Weak stock selection in the Industrials and Information Technology sectors weighed on relative performance.

We are pleased with the Fund’s outperformance for 2015 and believe the Fund is well positioned going into 2016 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

6

Large Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2015)

† | Based on percent of the Portfolio’s total investments in securities, at value. Includes investments held as collateral for securities on loan (see Note 6 in Notes to Financial Statements). |

7

Large Company Value Portfolio Commentary (Unaudited) |

|

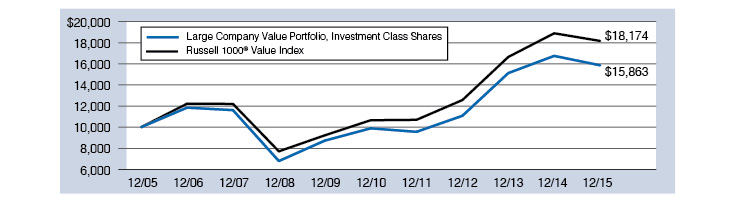

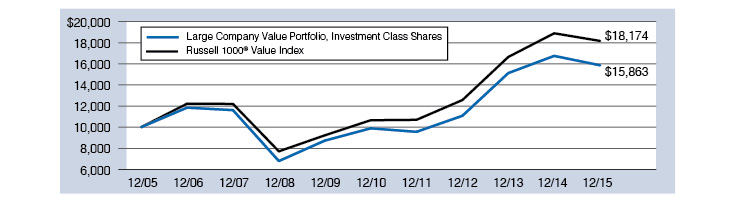

INVESTMENT CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/15 | -5.33% |

Five Years Ended 12/31/15 | 9.91% |

Ten Years Ended 12/31/15 | 4.72% |

RUSSELL 1000® VALUE INDEX(1)

Average Annual Total Return

One Year Ended 12/31/15 | -3.83% |

Five Years Ended 12/31/15 | 11.27% |

Ten Years Ended 12/31/15 | 6.16% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Large Company Value

Portfolio, Investment Class Shares and the Russell 1000 Value Index through 12/31/15.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Assumes reinvestment of all distributions. |

(1) | The Russell 1000® Value Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

8

Large Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

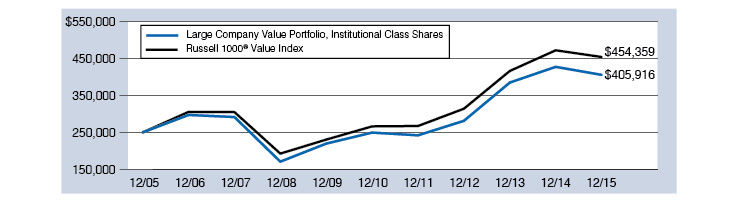

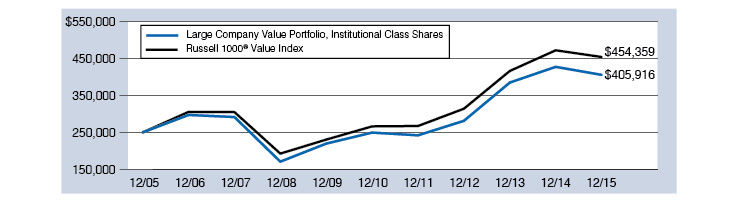

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/15 | -5.07% |

Five Years Ended 12/31/15 | 10.22% |

Ten Years Ended 12/31/15 | 4.97% |

RUSSELL 1000® VALUE INDEX(1)

Average Annual Total Return

One Year Ended 12/31/15 | -3.83% |

Five Years Ended 12/31/15 | 11.27% |

Ten Years Ended 12/31/15 | 6.16% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Large Company Value

Portfolio, Institutional Class Shares and the Russell 1000 Value Index through 12/31/15.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Assumes reinvestment of all distributions. |

(1) | The Russell 1000® Value Index is an unmanaged index that measures the performance of the largest 1,000 U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

9

Large Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

The U.S. stock market, as represented by the Wilshire 5000 Total Market IndexSM, returned 0.68% during 2015. The year started with a loss as increased market volatility triggered by the continued sell off in oil, quantitative easing in the Eurozone, and the Swiss National Bank’s decision to remove its currency cap with the euro spooked investors. However, domestic investors rallied around the Federal Reserve’s patience with raising interest rates and the Wilshire 5000 Total Market IndexSM hit an all-time high in mid-June. Worldwide, equities experienced a sharp sell-off during the third quarter, marking the first negative quarter in three years. The first major sell-off of the third quarter occurred in August after China devalued its currency, which had been strengthening versus both the euro and yen at a time when China’s economic growth was failing to meet its official growth target. Another minor sell-off occurred in September after the Federal Open Market Committee announced it would not raise the Fed Funds rate at that time. Stocks recorded gains in the final quarter of the year, driven by a strong October rally that outweighed losses in November and December, and pushed large-cap benchmarks back into positive territory for 2015. Following positive economic news, including accelerating job growth in October and November and weekly jobless claims remaining near multi-decade lows, on December 16th the Federal Reserve raised its target for short-term interest rates—the first increase in nearly a decade.

Sector performance for the Wilshire 5000 Total Market IndexSM was mixed for the year as defensive stocks outpaced economically sensitive sectors. Health Care and Consumer stocks rallied, while Energy and Materials stocks plummeted amid falling commodities prices. Health Care continued its first half of the year dominance and was the top performing sector for the year, returning 8.4%. Consumer Discretionary and Consumer Staples retuned 7.5% and 5.9%, respectively, while Energy and Materials returned -22.1% and -10.7%, respectively.

The Wilshire Large Company Value Portfolio Institutional Class shares returned -5.07% for 2015, underperforming the Russell 1000 Value Index return of -3.83% by 1.24%. The Fund was hindered by weak stock selection in the Information Technology, Consumer Discretionary, and Financials sectors. Strong stock selection in the Health Care and Energy sectors helped mitigate relative underperformance.

Despite the Fund’s underperformance versus its benchmark, we believe the Fund is well positioned going into 2016 as the market deals with ongoing macroeconomic and geopolitical issues.

10

Large Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2015)

† | Based on percent of the Portfolio’s total investments in securities, at value. Includes investments held as collateral for securities on loan (see Note 6 in Notes to Financial Statements). |

11

Small Company Growth Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/15 | 2.29% |

Five Years Ended 12/31/15 | 11.09% |

Ten Years Ended 12/31/15 | 7.39% |

RUSSELL 2000® GROWTH INDEX(1)

Average Annual Total Return

One Year Ended 12/31/15 | -1.38% |

Five Years Ended 12/31/15 | 10.67% |

Ten Years Ended 12/31/15 | 7.95% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Small Company Growth

Portfolio, Investment Class Shares and the Russell 2000 Growth Index through 12/31/15.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Assumes reinvestment of all distributions. During the ten years ended December 31, 2015, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements (excluding fees paid indirectly), historical total returns would have been lower. For the year ended December 31, 2015, 0.17% of average net assets was waived or reimbursed through other expenses in the Investment Class Shares. |

(1) | The Russell 2000® Growth Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

12

Small Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/15 | 2.53% |

Five Years Ended 12/31/15 | 11.36% |

Ten Years Ended 12/31/15 | 7.64% |

RUSSELL 2000® GROWTH INDEX(1)

Average Annual Total Return

One Year Ended 12/31/15 | -1.38% |

Five Years Ended 12/31/15 | 10.67% |

Ten Years Ended 12/31/15 | 7.95% |

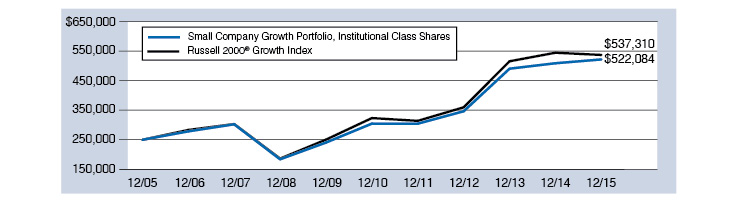

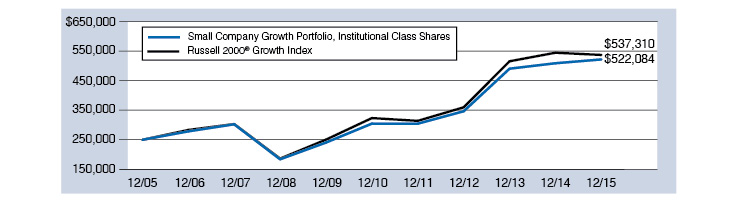

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Small Company Growth

Portfolio, Institutional Class Shares and the Russell 2000 Growth Index through 12/31/15.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Assumes reinvestment of all distributions. During the ten years ended December 31, 2015, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements (excluding fees paid indirectly), historical total returns would have been lower. For the year ended December 31, 2015, 0.17% of average net assets was waived or reimbursed through other expenses in the Institutional Class Shares. |

(1) | The Russell 2000® Growth Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with higher price-to-book ratios and higher forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

13

Small Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

The U.S. stock market, as represented by the Wilshire 5000 Total Market IndexSM, returned 0.68% during 2015. The year started with a loss as increased market volatility triggered by the continued sell off in oil, quantitative easing in the Eurozone, and the Swiss National Bank’s decision to remove its currency cap with the euro spooked investors. However, domestic investors rallied around the Federal Reserve’s patience with raising interest rates and the Wilshire 5000 Total Market IndexSM hit an all-time high in mid-June. Worldwide, equities experienced a sharp sell-off during the third quarter, marking the first negative quarter in three years. The first major sell-off of the third quarter occurred in August after China devalued its currency, which had been strengthening versus both the euro and yen at a time when China’s economic growth was failing to meet its official growth target. Another minor sell-off occurred in September after the Federal Open Market Committee announced it would not raise the Fed Funds rate at that time. Stocks recorded gains in the final quarter of the year, driven by a strong October rally that outweighed losses in November and December, and pushed large-cap benchmarks back into positive territory for 2015. Following positive economic news, including accelerating job growth in October and November and weekly jobless claims remaining near multi-decade lows, on December 16th the Federal Reserve raised its target for short-term interest rates—the first increase in nearly a decade.

Sector performance for the Wilshire 5000 Total Market IndexSM was mixed for the year as defensive stocks outpaced economically sensitive sectors. Health Care and Consumer stocks rallied, while Energy and Materials stocks plummeted amid falling commodities prices. Health Care continued its first half of the year dominance and was the top performing sector for the year, returning 8.4%. Consumer Discretionary and Consumer Staples retuned 7.5% and 5.9%, respectively, while Energy and Materials returned -22.1% and -10.7%, respectively.

The Wilshire Small Company Growth Portfolio Institutional Class shares returned 2.53%, outperforming the Russell 2000 Growth Index return of -1.38% by 3.91%. The Fund benefited from strong stock selection in the Health Care and Financials sectors as well as an underweight allocation to the Materials sector. Weak stock selection in the Industrials sector weighed on relative performance.

We are pleased with the Fund’s outperformance for 2015 and believe the Fund is well positioned going into 2016 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

14

Small Company Growth Portfolio Commentary (Unaudited) - (Continued) |

|

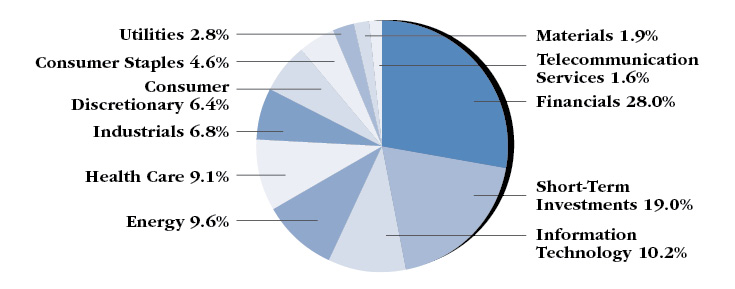

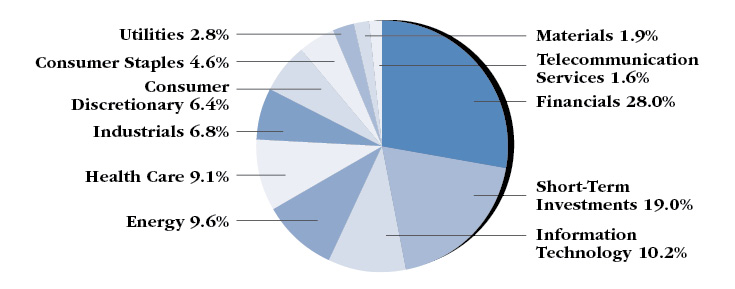

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2015)

† | Based on percent of the Portfolio’s total investments in securities, at value. Includes investments held as collateral for securities on loan (see Note 6 in Notes to Financial Statements). |

15

Small Company Value Portfolio Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/15 | -3.83% |

Five Years Ended 12/31/15 | 9.73% |

Ten Years Ended 12/31/15 | 6.48% |

RUSSELL 2000® VALUE INDEX(1)

Average Annual Total Return

One Year Ended 12/31/15 | -7.47% |

Five Years Ended 12/31/15 | 7.67% |

Ten Years Ended 12/31/15 | 5.57% |

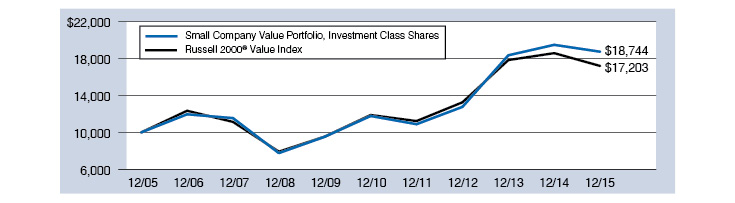

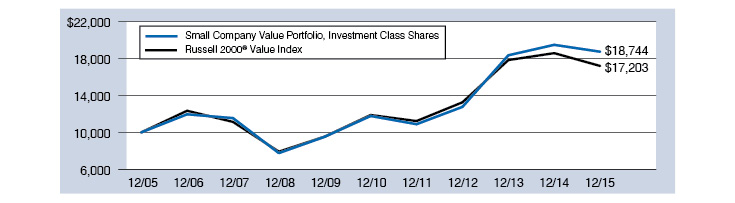

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Small Company Value

Portfolio, Investment Class Shares and the Russell 2000 Value Index through 12/31/15.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Assumes reinvestment of all distributions. During the ten years ended December 31, 2015, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements (excluding fees paid indirectly), historical total returns would have been lower. For the year ended December 31, 2015, 0.06% of average net assets was waived or reimbursed through other expenses in the Investment Class Shares. |

(1) | The Russell 2000® Value Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

16

Small Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/15 | -3.52% |

Five Years Ended 12/31/15 | 10.10% |

Ten Years Ended 12/31/15 | 6.84% |

RUSSELL 2000® VALUE INDEX(1)

Average Annual Total Return

One Year Ended 12/31/15 | -7.47% |

Five Years Ended 12/31/15 | 7.67% |

Ten Years Ended 12/31/15 | 5.57% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Small Company Value

Portfolio, Institutional Class Shares and the Russell 2000 Value Index through 12/31/15.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares.

* | Assumes reinvestment of all distributions. During the ten years ended December 31, 2015, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements (excluding fees paid indirectly), historical total returns would have been lower. For the year ended December 31, 2015, 0.04% of average net assets was waived or reimbursed through other expenses in the Institutional Class Shares. |

(1) | The Russell 2000® Value Index is an unmanaged index that measures the performance of the 2,000 smallest U.S. companies with lower price-to-book ratios and lower forecasted growth values. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

17

Small Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

The U.S. stock market, as represented by the Wilshire 5000 Total Market IndexSM, returned 0.68% during 2015. The year started with a loss as increased market volatility triggered by the continued sell off in oil, quantitative easing in the Eurozone, and the Swiss National Bank’s decision to remove its currency cap with the euro spooked investors. However, domestic investors rallied around the Federal Reserve’s patience with raising interest rates and the Wilshire 5000 Total Market IndexSM hit an all-time high in mid-June. Worldwide, equities experienced a sharp sell-off during the third quarter, marking the first negative quarter in three years. The first major sell-off of the third quarter occurred in August after China devalued its currency, which had been strengthening versus both the euro and yen at a time when China’s economic growth was failing to meet its official growth target. Another minor sell-off occurred in September after the Federal Open Market Committee announced it would not raise the Fed Funds rate at that time. Stocks recorded gains in the final quarter of the year, driven by a strong October rally that outweighed losses in November and December, and pushed large-cap benchmarks back into positive territory for 2015. Following positive economic news, including accelerating job growth in October and November and weekly jobless claims remaining near multi-decade lows, on December 16th the Federal Reserve raised its target for short-term interest rates—the first increase in nearly a decade.

Sector performance for the Wilshire 5000 Total Market IndexSM was mixed for the year as defensive stocks outpaced economically sensitive sectors. Health Care and Consumer stocks rallied, while Energy and Materials stocks plummeted amid falling commodities prices. Health Care continued its first half of the year dominance and was the top performing sector for the year, returning 8.4%. Consumer Discretionary and Consumer Staples retuned 7.5% and 5.9%, respectively, while Energy and Materials returned -22.1% and -10.7%, respectively.

The Wilshire Small Company Value Portfolio Institutional Class shares returned -3.52% for 2015, outperforming the Russell 2000 Value Index return of -7.47% by 3.95%. The Fund benefited from strong stock selection and sector allocation positioning. Strong stock selection in the Consumer Discretionary, Materials and Financials sectors and an underweight allocation to the Energy sector drove performance. Weak stock selection in the Consumer Staples sector weighed on relative performance.

We are pleased with the Fund’s outperformance for 2015 and believe the Fund is well positioned going into 2016 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

18

Small Company Value Portfolio Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2015)

† | Based on percent of the Portfolio’s total investments in securities, at value. Includes investments held as collateral for securities on loan (see Note 6 in Notes to Financial Statements). |

19

Wilshire 5000 Indexsm Fund Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/15 | 0.08% |

Five Years Ended 12/31/15 | 11.43% |

Ten Years Ended 12/31/15 | 6.71% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Return

One Year Ended 12/31/15 | 0.68% |

Five Years Ended 12/31/15 | 12.11% |

Ten Years Ended 12/31/15 | 7.40% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Wilshire 5000 IndexSM

Fund, Investment Class Shares and the Wilshire 5000 IndexSM through 12/31/15.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | Assumes reinvestment of all distributions. |

(1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

20

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/15 | 0.36% |

Five Years Ended 12/31/15 | 11.68% |

Ten Years Ended 12/31/15 | 6.94% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Return

One Year Ended 12/31/15 | 0.68% |

Five Years Ended 12/31/15 | 12.11% |

Ten Years Ended 12/31/15 | 7.40% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Wilshire 5000 IndexSM

Fund, Institutional Class Shares and the Wilshire 5000 IndexSM through 12/31/15.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | Assumes reinvestment of all distributions. |

(1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

21

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

QUALIFIED CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/15 | 0.34% |

Five Years Ended 12/31/15 | 12.02% |

Ten Years Ended 12/31/15 | 6.97% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Return

One Year Ended 12/31/15 | 0.68% |

Five Years Ended 12/31/15 | 12.11% |

Ten Years Ended 12/31/15 | 7.40% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Wilshire 5000 IndexSM

Fund, Qualified Class Shares and the Wilshire 5000 IndexSM through 12/31/15.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | Assumes reinvestment of all distributions. |

(1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

22

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

HORACE MANN CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/15 | 0.08% |

Five Years Ended 12/31/15 | 11.42% |

Ten Years Ended 12/31/15 | 6.67% |

WILSHIRE 5000 INDEXSM(1)

Average Annual Total Return

One Year Ended 12/31/15 | 0.68% |

Five Years Ended 12/31/15 | 12.11% |

Ten Years Ended 12/31/15 | 7.40% |

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Wilshire 5000 IndexSM

Fund, Horace Mann Class Shares and the Wilshire 5000 IndexSM through 12/31/15.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | Assumes reinvestment of all distributions. |

(1) | The Wilshire 5000 IndexSM is an unmanaged index that measures the performance of all U.S. headquartered equity securities with readily available price data. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index. |

23

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

The U.S. stock market, as represented by the Wilshire 5000 Total Market IndexSM, returned 0.68% during 2015. The year started with a loss as increased market volatility triggered by the continued sell off in oil, quantitative easing in the Eurozone, and the Swiss National Bank’s decision to remove its currency cap with the euro spooked investors. However, domestic investors rallied around the Federal Reserve’s patience with raising interest rates and the Wilshire 5000 Total Market IndexSM hit an all-time high in mid-June. Worldwide, equities experienced a sharp sell-off during the third quarter, marking the first negative quarter in three years. The first major sell-off of the third quarter occurred in August after China devalued its currency, which had been strengthening versus both the euro and yen at a time when China’s economic growth was failing to meet its official growth target. Another minor sell-off occurred in September after the Federal Open Market Committee announced it would not raise the Fed Funds rate at that time. Stocks recorded gains in the final quarter of the year, driven by a strong October rally that outweighed losses in November and December, and pushed large-cap benchmarks back into positive territory for 2015. Following positive economic news, including accelerating job growth in October and November and weekly jobless claims remaining near multi-decade lows, on December 16th the Federal Reserve raised its target for short-term interest rates—the first increase in nearly a decade.

Sector performance for the Wilshire 5000 Total Market IndexSM was mixed for the year as defensive stocks outpaced economically sensitive sectors. Health Care and Consumer stocks rallied, while Energy and Materials stocks plummeted amid falling commodities prices. Health Care continued its first half of the year dominance and was the top performing sector for the year, returning 8.4%. Consumer Discretionary and Consumer Staples retuned 7.5% and 5.9%, respectively, while Energy and Materials returned -22.1% and -10.7%, respectively.

The Wilshire 5000 IndexSM Fund Institutional Class shares returned 0.36% for 2015, underperforming the Fund’s benchmark (the Wilshire 5000 IndexSM) return of 0.68% by 0.32%. Underperformance is attributable to Fund expenses and is well within the range of historical experiences.

24

Wilshire 5000 Indexsm Fund Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2015)

† | Based on percent of the Fund’s total investments in securities, at value. Includes investments held as collateral for securities on loan (see Note 6 in Notes to Financial Statements). |

25

Wilshire International Equity Fund Commentary (Unaudited) |

|

INVESTMENT CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/15 | -1.55% |

Five Years Ended 12/31/15 | 3.96% |

Inception (11/16/07) through 12/31/15 | 0.04% |

MSCI ALL COUNTRY WORLD INDEX EX-U.S.(1)

Average Annual Total Return

One Year Ended 12/31/15 | -5.66% |

Five Years Ended 12/31/15 | 1.06% |

Inception (11/16/07) through 12/31/15 | -1.21% |

On April 2, 2013, the Wilshire International Equity Fund’s investment strategy was changed. Consequently, prior period performance may have been different if the new investment strategy had been in effect during these periods. Effective May 28, 2014, the MSCI All Country World Index Ex-U.S. replaced the MSCI EAFE Index as the Wilshire International Equity Fund’s primary benchmark index. The adviser believes the MSCI All Country World Index Ex-U.S. is a more appropriate index given the Wilshire International Equity Fund’s investment strategy.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2015, 0.25% of average net assets was waived or reimbursed through other expenses in the Investment Class Shares. |

(1) | The MSCI All Country World Ex-U.S. Index is an unmanaged capitalization-weighted measure of stock markets of developed and emerging markets, with the exception of U.S.-based companies. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot invest directly in an index. Index performance is presented for general comparative purposes. |

26

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $10,000 Investment in Shares of Wilshire International Equity

Fund, Investment Class Shares and the MSCI ACWI ex-US Index through 12/31/15.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

27

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

INSTITUTIONAL CLASS SHARES

Average Annual Total Return*

One Year Ended 12/31/15 | -1.37% |

Five Years Ended 12/31/15 | 4.16% |

Inception (11/16/07) through 12/31/15 | 0.29% |

MSCI ALL COUNTRY WORLD INDEX EX-U.S.(1)

Average Annual Total Return

One Year Ended 12/31/15 | -5.66% |

Five Years Ended 12/31/15 | 1.06% |

Inception (11/16/07) through 12/31/15 | -1.21% |

On April 2, 2013, the Wilshire International Equity Fund’s investment strategy was changed. Consequently, prior period performance may have been different if the new investment strategy had been in effect during these periods. Effective May 28, 2014, the MSCI All Country World Index Ex-U.S. replaced the MSCI EAFE Index as the Wilshire International Equity Fund’s primary benchmark index. The adviser believes the MSCI All Country World Index Ex-U.S. is a more appropriate index given the Wilshire International Equity Fund’s investment strategy.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

* | Assumes reinvestment of all distributions. During certain periods since inception, certain fees and expenses were waived or reimbursed. Without waivers and reimbursements, historical total returns would have been lower. For the year ended December 31, 2015, 0.04% of average net assets was waived or reimbursed through other expenses in the Institutional Class Shares. |

(1) | The MSCI All Country World Ex-U.S. Index is an unmanaged capitalization-weighted measure of stock markets of developed and emerging markets, with the exception of U.S.-based companies. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot invest directly in an index. Index performance is presented for general comparative purposes. |

28

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

COMPARATIVE PERFORMANCE

Comparison of Change in Value of $250,000 Investment in Shares of Wilshire International Equity

Fund, Institutional Class Shares and the MSCI ACWI ex-US Index through 12/31/15.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

29

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

International stock markets underperformed the U.S. for 2015 as the MSCI All Country World ex-U.S. Index returned -5.66%. Foreign developed securities fared far better emerging economy stocks with the MSCI EAFE Index and the MSCI Emerging Markets Index returning -0.81% and -14.92%, respectively, for the year. Global equity markets started 2015 with strong gains, with European stocks leading the charge. Despite Greece’s ongoing fiscal woes, the Eurozone began to show signs of economic recovery as moves by European central banks to relax monetary policy sent stock prices soaring. The European stock market rally was brought to an abrupt end by the late-June breakdown in negotiations between the European Central Bank and beleaguered Greece. Pacific region stocks also lost ground in June, but returned positive performance for the second quarter, adding to strong first quarter returns. Stock markets worldwide were rocked in the third quarter by fears regarding the impact of China’s economic slowdown on global commerce. European equities experienced somewhat smaller losses than Asia-Pacific region stocks, as the Eurozone’s economy in the second quarter grew at a higher rate than analysts had expected. International markets experienced a modest recovery in the fourth quarter as investors were cheered by Europe’s nascent economic recovery, the European Central Bank’s accommodative monetary policy, and overall resilience in the Asia-Pacific region outside of China. Emerging markets continue to suffer from China’s weakness and the worldwide collapse in commodities. The strong U.S. dollar also impacted emerging market companies, since much of their debt financing is transacted in dollars and therefore has become much more expensive.

Sector performance for the MSCI All Country World ex-U.S. Index was mixed for 2015. Only Health Care and Consumer Staples had positive performance for the year, returning 6.5% and 5.6%, respectively. Similar to domestic securities, in foreign markets Energy and Materials stocks plummeted amid falling commodities prices. The Energy and Materials sectors returned -21.3% and -19.4%, respectively.

The Wilshire International Equity Fund Institutional Class shares returned -1.37% for 2015, outperforming the MSCI All Country World ex U.S. Index return of -5.66% by 4.29%. The Fund benefited from strong stock selection in the Materials, Health Care, and Consumer Discretionary sectors. Weak stock selection in the Industrials and Financials sectors weighed on relative performance. Regionally, the Fund benefited from strong stock selection in the United Kingdom, Canada and Hong Kong as well as an overweight allocation to Denmark and Canada. Weak stock selection in South Korea weighed on relative performance.

We are pleased with the Fund’s outperformance for 2015 and believe the Fund is well positioned going into 2016 as the market deals with ongoing macroeconomic and geopolitical uncertainties.

30

Wilshire International Equity Fund Commentary (Unaudited) - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING†

(As of December 31, 2015)

† | Based on percent of the Fund’s total investments in securities, at value. Includes investments held as collateral for securities on loan (see Note 6 in Notes to Financial Statements). |

31

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses For the Six Months Ended December 31, 2015 (Unaudited) |

|

All mutual funds have operating expenses. As a shareholder of a portfolio (or a “fund”), you incur ongoing costs, which include costs for investment advisory, administrative services, distribution and/or shareholder services and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund. A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing fees (in dollars) of investing in your fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire period from July 1, 2015 to December 31, 2015.

The table on the next page illustrates your Portfolio’s costs in two ways:

Actual Fund Return: This section helps you to estimate the actual expenses, after any applicable fee waivers, that you paid over the period. The “Ending Account Value” shown is derived from the Portfolio’s actual return for the period. The “Expense Ratio” column shows the period’s annualized expense ratio and the “Expenses Paid During Period” column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Portfolio at the beginning of the period.

You may use the information here, together with your account value, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Portfolio in the first line under the heading entitled “Expenses Paid During Period.”

Hypothetical 5% Return: This section is intended to help you compare your Portfolio’s costs with those of other mutual funds. The “Ending Account Value” shown is derived from hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and assumed rate of return. It assumes that the Portfolio had an annual return of 5% before expenses, but that the expense ratio is unchanged. In this case, because the return used is not the Portfolio’s actual return, the results do not apply to your investment. This example is useful in making comparisons to other mutual funds because the Securities and Exchange Commission (“SEC”) requires all mutual funds to calculate expenses based on an assumed 5% annual return. You can assess your Portfolio’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees. Wilshire Mutual Funds, Inc. has no such charges, but these may be present in other funds to which you compare this data. Therefore, the hypothetical portions of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

32

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses - (Continued) For the Six Months Ended December 31, 2015 (Unaudited) |

|

| | Beginning

Account

Value

07/01/2015 | Ending

Account

Value

12/31/2015 | Expense

Ratio(1) | Expenses Paid

During Period

07/01/15-12/31/15(2) |

Large Company Growth Portfolio |

Actual Fund Return | | | | |

Investment Class | $1,000.00 | $1,018.10 | 1.33% | $6.75 |

Institutional Class | $1,000.00 | $1,019.80 | 1.00% | $5.09 |

Hypothetical 5% Return | | | | |

Investment Class | $1,000.00 | $1,018.51 | 1.33% | $6.76 |

Institutional Class | $1,000.00 | $1,020.16 | 1.00% | $5.09 |

Large Company Value Portfolio |

Actual Fund Return | | | | |

Investment Class | $1,000.00 | $948.90 | 1.30% | $6.37 |

Institutional Class | $1,000.00 | $950.20 | 1.04% | $5.10 |

Hypothetical 5% Return | | | | |

Investment Class | $1,000.00 | $1,018.67 | 1.30% | $6.60 |

Institutional Class | $1,000.00 | $1,019.97 | 1.04% | $5.28 |

Small Company Growth Portfolio |

Actual Fund Return | | | | |

Investment Class | $1,000.00 | $941.00 | 1.47% | $7.21 |

Institutional Class | $1,000.00 | $941.90 | 1.21% | $5.95 |

Hypothetical 5% Return | | | | |

Investment Class | $1,000.00 | $1,017.78 | 1.47% | $7.49 |

Institutional Class | $1,000.00 | $1,019.08 | 1.21% | $6.18 |

Small Company Value Portfolio |

Actual Fund Return | | | | |

Investment Class | $1,000.00 | $945.60 | 1.49% | $7.32 |

Institutional Class | $1,000.00 | $946.90 | 1.19% | $5.86 |

Hypothetical 5% Return | | | | |

Investment Class | $1,000.00 | $1,017.68 | 1.49% | $7.59 |

Institutional Class | $1,000.00 | $1,019.19 | 1.19% | $6.07 |

33

Wilshire Mutual Funds, Inc. Disclosure of Fund Expenses - (Concluded) For the Six Months Ended December 31, 2015 (Unaudited) |

|

| | Beginning

Account

Value

07/01/2015 | Ending

Account

Value

12/31/2015 | Expense

Ratio(1) | Expenses Paid

During Period

07/01/15-12/31/15(2) |

Wilshire 5000 IndexSM Fund |

Actual Fund Return | | | | |

Investment Class | $1,000.00 | $989.20 | 0.63% | $3.16 |

Institutional Class | $1,000.00 | $990.40 | 0.38% | $1.92 |

Qualified Class | $1,000.00 | $992.30 | 0.36% | $1.81 |

Horace Mann Class | $1,000.00 | $989.20 | 0.59% | $2.96 |

Hypothetical 5% Return | | | | |

Investment Class | $1,000.00 | $1,022.03 | 0.63% | $3.21 |

Institutional Class | $1,000.00 | $1,023.28 | 0.38% | $1.95 |

Qualified Class | $1,000.00 | $1,023.39 | 0.36% | $1.84 |

Horace Mann Class | $1,000.00 | $1,022.23 | 0.59% | $3.01 |

Wilshire International Equity Fund |

Actual Fund Return | | | | |

Investment Class | $1,000.00 | $942.90 | 1.50% | $7.35 |

Institutional Class | $1,000.00 | $943.30 | 1.25% | $6.12 |

Hypothetical 5% Return | | | | |

Investment Class | $1,000.00 | $1,017.64 | 1.50% | $7.63 |

Institutional Class | $1,000.00 | $1,018.90 | 1.25% | $6.36 |

(1) | Annualized, based on the Portfolio’s most recent fiscal half-year expenses. |

(2) | Expenses are equal to the Portfolio’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

34

Wilshire Mutual Funds, Inc. Large Company Growth Portfolio Condensed Schedule of Investments | December 31, 2015 |

|

Shares | | | Percentage of

Net Assets (%) | | | Value | |

COMMON STOCK — 99.2%†† | | | | | | |

Consumer Discretionary — 19.6% | | | | | | |

17,616 | | Amazon.com, Inc.† | | | 5.2 | | | $ | 11,906,478 | |

25,900 | | Delphi Automotive PLC | | | 1.0 | | | | 2,220,407 | |

30,183 | | Lowe's Cos., Inc. | | | 1.0 | | | | 2,295,115 | |

39,308 | | NIKE, Inc., Class B | | | 1.1 | | | | 2,456,750 | |

9,725 | | O'Reilly Automotive, Inc.† | | | 1.1 | | | | 2,464,509 | |

1,950 | | Priceline Group, Inc.† | | | 1.1 | | | | 2,486,152 | |

66,075 | | Starbucks Corp. | | | 1.7 | | | | 3,966,482 | |

27,675 | | Tractor Supply Co. | | | 1.0 | | | | 2,366,213 | |

16,395 | | Ulta Salon Cosmetics & Fragrance, Inc.† | | | 1.3 | | | | 3,033,075 | |

30,433 | | Yum! Brands, Inc. | | | 1.0 | | | | 2,223,131 | |

126,949 | | Other Securities | | | 4.1 | | | | 9,674,553 | |

| | | | | | | | | | 45,092,865 | |

Consumer Staples — 12.8% | | | | | | | | |

93,841 | | Coca-Cola Co. (The) | | | 1.8 | | | | 4,031,409 | |

16,770 | | Costco Wholesale Corp. | | | 1.2 | | | | 2,708,355 | |

217,694 | | Danone SA ADR | | | 1.3 | | | | 2,962,815 | |

46,566 | | Monster Beverage Corp.† (a) | | | 3.0 | | | | 6,936,472 | |

36,249 | | Procter & Gamble Co. (The) | | | 1.3 | | | | 2,878,533 | |

36,087 | | SABMiller PLC ADR | | | 0.9 | | | | 2,162,694 | |

121,389 | | Other Securities | | | 3.3 | | | | 7,707,127 | |

| | | | | | | | | | 29,387,405 | |

Energy — 1.0% | | | | | | | | |

29,568 | | Schlumberger, Ltd. | | | 0.9 | | | | 2,062,368 | |

2,936 | | Other Securities | | | 0.1 | | | | 242,668 | |

| | | | | | | | | | 2,305,036 | |

Financials — 4.8% | | | | | | | | |

70,625 | | Charles Schwab Corp. (The) | | | 1.0 | | | | 2,325,681 | |

112,439 | | Other Securities | | | 3.8 | | | | 8,745,077 | |

| | | | | | | | | | 11,070,758 | |

Health Care — 16.7% | | | | | | | | |

12,925 | | Alexion Pharmaceuticals, Inc.† (a) | | | 1.1 | | | | 2,465,444 | |

19,182 | | Amgen, Inc. | | | 1.3 | | | | 3,113,814 | |

33,678 | | Celgene Corp.† | | | 1.8 | | | | 4,033,277 | |

33,625 | | Centene Corp.† (a) | | | 1.0 | | | | 2,212,861 | |

56,099 | | Cerner Corp.† (a) | | | 1.5 | | | | 3,375,477 | |

23,300 | | Edwards Lifesciences Corp.† | | | 0.8 | | | | 1,840,234 | |

39,475 | | Gilead Sciences, Inc. | | | 1.7 | | | | 3,994,475 | |

24,175 | | IDEXX Laboratories, Inc.† (a) | | | 0.8 | | | | 1,762,841 | |

23,822 | | Novartis AG ADR(a) | | | 0.9 | | | | 2,049,645 | |

49,860 | | Novo Nordisk ADR(a) | | | 1.3 | | | | 2,895,869 | |

25,148 | | Varian Medical Systems, Inc.† (a) | | | 0.9 | | | | 2,031,958 | |

116,027 | | Other Securities | | | 3.6 | | | | 8,572,087 | |

| | | | | | | | | | 38,347,982 | |

Industrials — 5.8% | | | | | | | | |

16,725 | | Canadian Pacific Railway, Ltd. | | | 0.9 | | | | 2,134,110 | |

53,909 | | Expeditors International of Washington, Inc.(a) | | | 1.1 | | | | 2,431,296 | |

25,021 | | United Parcel Service, Inc., Class B | | | 1.0 | | | | 2,407,771 | |

73,962 | | Other Securities | | | 2.8 | | | | 6,267,631 | |

| | | | | | | | | | 13,240,808 | |

Information Technology — 35.7% | | | | | | | | |

36,500 | | Adobe Systems, Inc.† | | | 1.5 | | | | 3,428,810 | |

41,628 | | Alibaba Group Holding, Ltd. ADR† (a) | | | 1.5 | | | | 3,383,107 | |

6,196 | | Alphabet, Inc., Class A† | | | 2.1 | | | | 4,820,550 | |

9,497 | | Alphabet, Inc., Class C† | | | 3.1 | | | | 7,207,083 | |

68,122 | | Apple, Inc. | | | 3.1 | | | | 7,170,522 | |

39,256 | | Autodesk, Inc.† (a) | | | 1.1 | | | | 2,391,868 | |

147,937 | | Cisco Systems, Inc. | | | 1.7 | | | | 4,017,229 | |

40,620 | | Electronic Arts, Inc.† | | | 1.2 | | | | 2,791,406 | |

103,304 | | Facebook, Inc., Class A† (a) | | | 4.7 | | | | 10,811,797 | |

64,911 | | Microsoft Corp. | | | 1.6 | | | | 3,601,262 | |

24,653 | | NXP Semiconductor NV† | | | 0.9 | | | | 2,077,028 | |

96,707 | | Oracle Corp. | | | 1.5 | | | | 3,532,707 | |

57,934 | | QUALCOMM, Inc. | | | 1.3 | | | | 2,895,831 | |

22,975 | | Salesforce.com, Inc.† | | | 0.8 | | | | 1,801,240 | |

22,410 | | Skyworks Solutions, Inc.(a) | | | 0.8 | | | | 1,721,760 | |

122,880 | | Visa, Inc., Class A(a) | | | 4.1 | | | | 9,529,344 | |

245,878 | | Other Securities | | | 4.7 | | | | 10,819,492 | |

| | | | | | | | | | 82,001,036 | |

Materials — 2.2% | | | | | | | | |

10,965 | | Sherwin-Williams Co. (The) | | | 1.2 | | | | 2,846,514 | |

23,250 | | Other Securities | | | 1.0 | | | | 2,162,240 | |

| | | | | | | | | | 5,008,754 | |

Telecommunication Services — 0.6% | | | | | | | | |

32,129 | | Other Securities | | | 0.6 | | | | 1,365,887 | |

| | | | | | | | | | | |

Total Common Stock | | | | | | | | |

(Cost $167,122,168) | | | | | | | 227,820,531 | |

See Notes to Financial Statements.

35

Wilshire Mutual Funds, Inc. Large Company Growth Portfolio Condensed Schedule of Investments - (Continued) | December 31, 2015 |

|

Shares | | | Percentage of

Net Assets (%) | | | Value | |

SHORT-TERM INVESTMENTS (b) — 21.9% | |

827,993 | | Northern Trust Institutional Government Select Portfolio, Institutional Class, 0.010% | | | 0.4 | | | $ | 827,993 | |

49,384,840 | | Northern Trust Institutional Liquid Asset Portfolio, Institutional Class, 0.010%(c) | | | 21.5 | | | | 49,384,840 | |

| | | | | | | | | | | |

Total Short-Term Investments | | | | | | | | |

(Cost $50,212,833) | | | | | | | 50,212,833 | |

| | | | | | | | | | | |

Total Investments — 121.1% | | | | | | | | |

(Cost $217,335,001) | | | | | | | 278,033,364 | |

Other Assets & Liabilities, Net — (21.1)% | | | | | | | (48,433,432 | ) |

| | | | | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 229,599,932 | |

†† | More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes. |

† | Non-income producing security. |

(a) | This security or a partial position of this security is on loan at December 31, 2015. The total market value of securities on loan at December 31, 2015 was $48,141,410 (Note 6). |

(b) | Rate shown in the 7-day effective yield as of December 31, 2015. |

(c) | This security was purchased with cash collateral held from securities on loan. The total value of such securities as of December 31, 2015 was $49,384,840. Securities on loan are also collateralized by various U.S. Treasury obligations in the amount of $391,320 (Note 6). |

ADR — American Depository Receipt

Ltd. — Limited

PLC — Public Limited Company

The Condensed Schedule of Investments does not reflect the complete portfolio holdings. It includes the Portfolio’s 50 largest holdings and each investment of any issuer that exceeds 1% of the Portfolio’s net assets. “Other Securities” represent all issues not required to be disclosed under the rules adopted by the U.S. Securities and Exchange Commission (“SEC”). The complete schedule of portfolio holdings is available (i) without charge, upon request, by calling (800) 607-2200; (ii) on the SEC’s website at http://www.sec.gov; and (iii) on our website at http://advisor.wilshire.com.

As of December 31, 2015, all of the Portfolio’s investments were considered Level 1. For the year ended December 31, 2015, there have been no transfers between Level 1 and Level 2 assets and liabilities. For the year ended December 31, 2015, there have been no transfers between Level 2 and Level 3 assets and liabilities. Please see Note 2 in Notes to Financial Statements for further information regarding fair value measurements.

See Notes to Financial Statements.

36

Wilshire Mutual Funds, Inc. Large Company Value Portfolio Condensed Schedule of Investments | December 31, 2015 |

|

Shares | | | Percentage of

Net Assets (%) | | | Value | |

COMMON STOCK — 99.1%†† | |

Consumer Discretionary — 7.9% | |

64,311 | | Ford Motor Co. | | | 0.8 | | | $ | 906,142 | |

53,975 | | News Corp., Class A | | | 0.7 | | | | 721,106 | |

10,275 | | Omnicom Group, Inc.(a) | | | 0.7 | | | | 777,406 | |

64,813 | | Staples, Inc. | | | 0.6 | | | | 613,779 | |

141,549 | | Other Securities | | | 5.1 | | | | 5,328,164 | |

| | | | | | | | | | 8,346,597 | |

Consumer Staples — 5.6% | |

7,448 | | CVS Health Corp. | | | 0.7 | | | | 728,191 | |

8,660 | | Kellogg Co.(a) | | | 0.6 | | | | 625,858 | |

6,945 | | Philip Morris International, Inc. | | | 0.6 | | | | 610,535 | |

8,749 | | Procter & Gamble Co. (The) | | | 0.6 | | | | 694,758 | |

13,875 | | Wal-Mart Stores, Inc. | | | 0.8 | | | | 850,537 | |

42,224 | | Other Securities | | | 2.3 | | | | 2,441,089 | |

| | | | | | | | | | 5,950,968 | |

Energy — 11.7% | |

17,115 | | Apache Corp. | | | 0.7 | | | | 761,104 | |

35,503 | | BP PLC ADR(a) | | | 1.1 | | | | 1,109,824 | |

8,104 | | Chevron Corp. | | | 0.7 | | | | 729,036 | |

32,653 | | Exxon Mobil Corp. | | | 2.4 | | | | 2,545,301 | |

13,315 | | Hess Corp.(a) | | | 0.6 | | | | 645,511 | |

35,810 | | Royal Dutch Shell PLC ADR, Class A(a) | | | 1.5 | | | | 1,639,718 | |

19,385 | | Valero Energy Corp. | | | 1.3 | | | | 1,370,713 | |

113,612 | | Other Securities | | | 3.4 | | | | 3,675,143 | |

| | | | | | | | | | 12,476,350 | |

Financials — 34.2% | |

14,715 | | Allstate Corp. (The) | | | 0.9 | | | | 913,654 | |

16,080 | | American International Group, Inc. | | | 0.9 | | | | 996,478 | |

11,000 | | Axis Capital Holdings, Ltd. | | | 0.6 | | | | 618,420 | |

171,843 | | Bank of America Corp. | | | 2.7 | | | | 2,892,118 | |

6,367 | | Berkshire Hathaway, Inc., Class B† | | | 0.8 | | | | 840,699 | |

49,612 | | Citigroup, Inc. | | | 2.4 | | | | 2,567,421 | |

6,112 | | Goldman Sachs Group, Inc. (The) | | | 1.0 | | | | 1,101,566 | |

48,301 | | JPMorgan Chase & Co. | | | 3.0 | | | | 3,189,315 | |

62,275 | | KeyCorp | | | 0.8 | | | | 821,407 | |

32,400 | | MetLife, Inc. | | | 1.5 | | | | 1,562,004 | |

24,225 | | Morgan Stanley | | | 0.7 | | | | 770,597 | |

15,854 | | PNC Financial Services Group, Inc. | | | 1.4 | | | | 1,511,045 | |

8,985 | | State Street Corp. | | | 0.6 | | | | 596,245 | |

40,275 | | UBS Group AG(a) | | | 0.7 | | | | 780,127 | |

26,600 | | Voya Financial, Inc. | | | 0.9 | | | | 981,806 | |

37,968 | | Wells Fargo & Co. | | | 2.0 | | | | 2,063,940 | |

17,450 | | XL Group PLC, Class A(a) | | | 0.7 | | | | 683,691 | |

468,419 | | Other Securities | | | 12.6 | | | | 13,466,488 | |

| | | | | | | | | | 36,357,021 | |

Health Care — 11.1% | | | | | |

9,720 | | Aetna, Inc. | | | 1.0 | | | | 1,050,926 | |

5,844 | | Cigna Corp. | | | 0.8 | | | | 855,153 | |

17,574 | | Johnson & Johnson | | | 1.7 | | | | 1,805,201 | |

17,242 | | Merck & Co., Inc. | | | 0.9 | | | | 910,723 | |

60,212 | | Pfizer, Inc.(a) | | | 1.8 | | | | 1,943,643 | |

86,460 | | Other Securities | | | 4.9 | | | | 5,204,512 | |

| | | | | | | | | | 11,770,158 | |

Industrials — 8.3% | |

12,725 | | Dover Corp.(a) | | | 0.7 | | | | 780,170 | |

44,166 | | General Electric Co.(a) | | | 1.3 | | | | 1,375,771 | |

9,950 | | Parker-Hannifin Corp.(a) | | | 0.9 | | | | 964,951 | |

12,534 | | Stanley Black & Decker, Inc.(a) | | | 1.2 | | | | 1,337,754 | |

77,633 | | Other Securities | | | 4.2 | | | | 4,359,987 | |

| | | | | | | | | | 8,818,633 | |

Information Technology — 12.4% | | | | | | | | |

62,841 | | Cisco Systems, Inc.(a) | | | 1.6 | | | | 1,706,447 | |

46,471 | | Hewlett Packard Enterprise Co. | | | 0.7 | | | | 706,359 | |

67,551 | | HP, Inc. | | | 0.7 | | | | 799,804 | |

42,975 | | Intel Corp. | | | 1.4 | | | | 1,480,489 | |

38,988 | | Microsoft Corp. | | | 2.0 | | | | 2,163,054 | |

24,850 | | Oracle Corp. | | | 0.9 | | | | 907,771 | |

134,875 | | Other Securities | | | 5.1 | | | | 5,463,155 | |

| | | | | | | | | | 13,227,079 | |

Materials — 2.4% | |

38,750 | | Other Securities | | | 2.4 | | | | 2,520,504 | |

| | | | | |

Telecommunication Services — 2.0% | | | | | |

34,623 | | AT&T, Inc. | | | 1.1 | | | | 1,191,378 | |

21,253 | | Other Securities | | | 0.9 | | | | 937,815 | |

| | | | | | | | | | 2,129,193 | |

See Notes to Financial Statements.

37

Wilshire Mutual Funds, Inc. Large Company Value Portfolio Condensed Schedule of Investments - (Continued) | December 31, 2015 |

|

Shares | | | Percentage of

Net Assets (%) | | | Value | |

Utilities — 3.5% | | | | | | |

93,248 | | Other Securities | | | 3.5 | | | $ | 3,682,324 | |

| | | | | | | | | | | |

Total Common Stock | | | | | | | | |

(Cost $93,886,959) | | | | | | | 105,278,827 | |

| | | | | | | | | | | |

SHORT-TERM INVESTMENTS (b) — 23.2% | |

174,295 | | Northern Trust Institutional Government Select Portfolio, Institutional Class, 0.010% | | | 0.2 | | | | 174,295 | |

24,469,794 | | Northern Trust Institutional Liquid Asset Portfolio, Institutional Class, 0.010%(c) | | | 23.0 | | | | 24,469,794 | |

| | | | | | | | | | | |

Total Short-Term Investments | | | | | | | | |

(Cost $24,644,089) | | | | | | | 24,644,089 | |

| | | | | | | | | | | |

RIGHTS — 0.0% | | | | | | | | |

Number

Of Rights | | | | | | | | |

United States — 0.0% | | | | | | |

2,236 | | Other Securities | | | 0.0 | | | | 1,189 | |

Total Rights (Cost $—) | | | | | | | 1,189 | |

| | | | | | | | | | | |

Total Investments — 122.3% | | | | | | | | |

(Cost $118,531,048) | | | | | | | 129,924,105 | |