UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-07168)

Hennessy Funds Trust

(Exact name of registrant as specified in charter)

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Address of principal executive offices) (Zip code)

Neil J. Hennessy

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Name and address of agent for service)

800-966-4354

Registrant's telephone number, including area code

Date of fiscal year end: October 31, 2013

Date of reporting period: October 31, 2013

Item 1. Reports to Stockholders.

ANNUAL REPORT

OCTOBER 31, 2013

| | DOMESTIC EQUITY | Investor | | Institutional | |

| | Hennessy Cornerstone Growth Fund | HFCGX | | | HICGX | |

| | Hennessy Focus Fund | HFCSX | | | HFCIX | |

| | Hennessy Cornerstone Mid Cap 30 Fund | HFMDX | | | HIMDX | |

| | Hennessy Cornerstone Large Growth Fund | HFLGX | | | HILGX | |

| | Hennessy Cornerstone Value Fund | HFCVX | | | HICVX | |

| | Hennessy Large Value Fund | HLVFX | | | HLVIX | |

| | Hennessy Total Return Fund | HDOGX | | | | |

| | | | | | | |

| | BALANCED & FIXED INCOME | | | | | |

| | Hennessy Equity and Income Fund | HEIFX | | | HEIIX | |

| | Hennessy Balanced Fund | HBFBX | | | | |

| | Hennessy Core Bond Fund | HCBFX | | | HCBIX | |

| | | | | | | |

| | SECTOR & SPECIALTY | | | | | |

| | Hennessy Gas Utility Index Fund | GASFX | | | | |

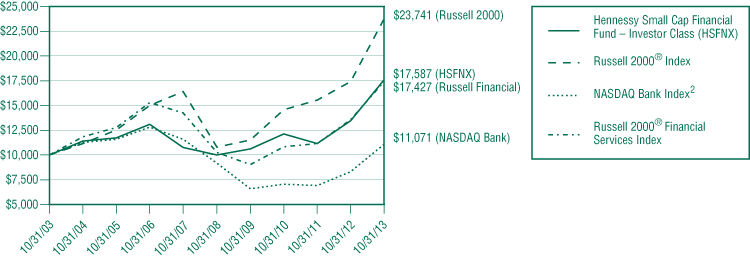

| | Hennessy Small Cap Financial Fund | HSFNX | | | HISFX | |

| | Hennessy Large Cap Financial Fund | HLFNX | | | | |

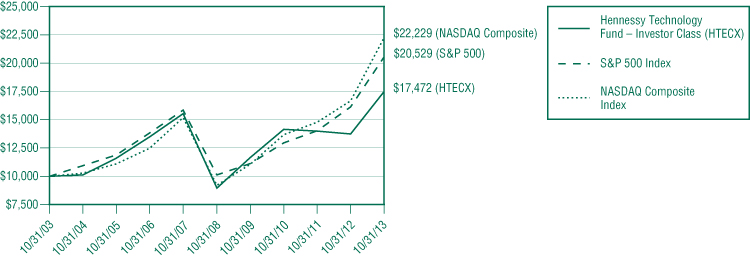

| | Hennessy Technology Fund | HTECX | | | HTCIX | |

| | Hennessy Japan Fund | HJPNX | | | HJPIX | |

| | Hennessy Japan Small Cap Fund | HJPSX | | | | |

hennessyfunds.com | 1-800-966-4354

(This Page Intentionally Left Blank.)

Contents

| Letter to shareholders | 2 |

| Performance overview | 4-31 |

| Financial statements | |

| Schedules of investments | |

| Domestic Equity | |

| Hennessy Cornerstone Growth Fund | 32 |

| Hennessy Focus Fund | 36 |

| Hennessy Cornerstone Mid Cap 30 Fund | 39 |

| Hennessy Cornerstone Large Growth Fund | 42 |

| Hennessy Cornerstone Value Fund | 45 |

| Hennessy Large Value Fund | 48 |

| Hennessy Total Return Fund | 51 |

| Balanced & Fixed Income | |

| Hennessy Equity and Income Fund | 55 |

| Hennessy Balanced Fund | 61 |

| Hennessy Core Bond Fund | 64 |

| Sector & Specialty | |

| Hennessy Gas Utility Index Fund | 68 |

| Hennessy Small Cap Financial Fund | 71 |

| Hennessy Large Cap Financial Fund | 74 |

| Hennessy Technology Fund | 77 |

| Hennessy Japan Fund | 80 |

| Hennessy Japan Small Cap Fund | 83 |

| Statements of assets and liabilities | 86 |

| Statements of operations | 90 |

| Statements of changes in net assets | 94 |

| Statements of cash flows – Hennessy Total Return Fund | 102 |

| Financial highlights | 104-134 |

| Notes to the financial statements | 135 |

| Reports of Independent Registered Public Accounting Firms | 146-147 |

| Directors/Trustees and Officers of the Funds | 148 |

| Expense example | 151 |

| Proxy voting policy | 154 |

| Quarterly Filings on Form N-Q | 154 |

| Federal Tax Distribution Information | 154 |

| Householding | 155 |

| Privacy Policy | 156 |

| Board Approval of Continuation of Investment Sub-Advisory Agreements | 157 |

HENNESSY FUNDS 1-800-966-4354

December 2013

Dear Hennessy Funds Shareholder:

Looking back at 2013, it was a year of many highs and lows economically, politically, and socially here in the U.S. and around the globe. The year was marked with some fond memories: we survived two fiscal cliffs, anointed a new Pope, watched the Red Sox don facial hair and keep their town “Boston Strong,” and home prices began to rebound around the country. But the year was also scarred by worsening political partisanship, civil unrest in many countries, flooding in Colorado, wildfires in the West, and the tragedy of the Boston Marathon.

We understand that the economic landscape is still rife with problems. Economic progress and growth are uneven, at best, and unemployment remains high. The hurdles that, in my opinion, are stalling a more robust recovery here in the U.S. are the same ones we’ve faced for several years: we are no closer to receiving the clarity we need from our leaders in Washington on taxes, regulation, and healthcare. Companies are still sitting on record amounts of cash, but they appear reluctant to hire in earnest until they feel they have clear guidelines on these major issues. Instead, these cash-rich companies continue to increase and initiate dividends, buy back stock and participate in accretive mergers and acquisitions. We are seeing these activities spread beyond just large, value-oriented companies to more small and mid-cap and growth-oriented firms. While these activities should benefit the shareholders of these companies, these initiatives are not creating jobs, which I believe is the critical missing piece to a thriving and growing economy.

Even through this slow-growth economy, the U.S. stock market has found ways to carve out healthy returns. For the twelve months ended October 31, 2013, the Dow Jones Industrial Average (DJIA) returned 21.82%, while the S&P 500 Index returned 27.18%. Companies comprising the DJIA and the S&P 500 continue to have strong balance sheets and are generating respectable profits. There are many attractive stocks with strong and improving fundamentals that I believe present compelling investment opportunities. In fact, through the mutual fund portfolios that we manage, we are seeing improvement across asset classes and in many sectors, including financials, natural gas, housing, and consumer discretionary. I believe that innovative business leaders in this country will continue to find ways to make money for their shareholders.

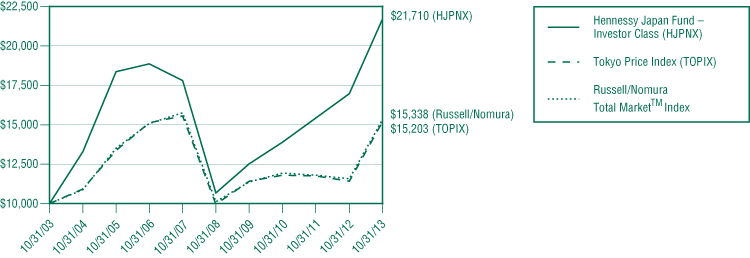

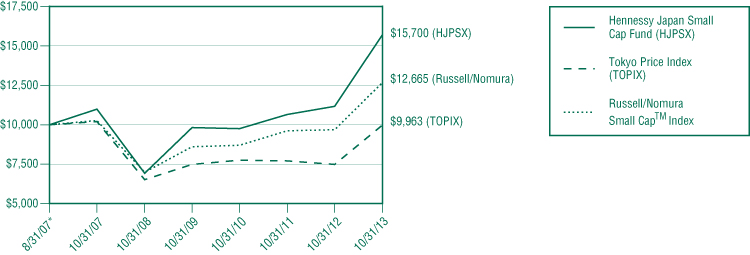

Japan Market

We have witnessed a strong resurgence in the Japanese market over the past year. While some may have been surprised by strength of this recovery, we believe that we are finally seeing the result of the structural and political reforms that have been taking place in Japan for a number of years. The Japan market was among the top performing markets worldwide over the past year, with the Tokyo Price Index (TOPIX) returning over 33% (in USD terms) for the twelve month period ended October 31, 2013, and Japan was by far the highest performing Asian market.

Japan’s prime minister, Shinzo Abe, and his bold monetary, stimulus and growth policies, termed the “Three Arrows” of “Abenomics,” appear to be reversing almost two decades of slow growth and deflation and moving the country into a new cycle of recovery that we believe will be sustainable. The Bank of Japan has undertaken an aggressive Quantitative Easing program, similar to what the Federal Reserve did here in the U.S., causing the Yen to weaken, which in turn has increased the demand for high quality Japanese products throughout the world. However, while the weakening of the Yen may be a catalyst to attract investors to Japan, we have never believed that the Japanese equity market is simply a Yen play.

With anticipated political stability for the next few years and with a strengthening relationship between government and Japanese businesses, we believe that many of the economic growth strategies proposed by Prime Minister Abe will have the support needed to succeed. Despite strong returns over the past year, we do not believe that the Japanese market is currently overvalued, but rather we continue to believe that there remain strong values in high-quality, Japanese companies today and for the long-term.

I am very confident that we are in a long-term, secular bull market fueled by solid economic fundamentals. I am encouraged by the strong returns for the major U.S. and global financial market indices and also by the positive performance of each of the 16 Hennessy Funds over the past twelve months. However, while we have seen consumer and investor confidence on the rise, we still don’t believe that investors have fully returned to investing in equities, and particularly in U.S. equities. When investors do return to equities in earnest, it should bode well for the economy.

At Hennessy we remain focused on investing with fundamentals and committed to our proven investment strategies. Treating clients honestly and ethically, building strong partnerships and managing money for the sole benefit of shareholders are the principles that our business was founded on, and those same principles guide us today, nearly 25 years later. If you have any questions or want to speak with us directly, please don’t hesitate to call us at (800) 966-4354.

Best regards,

Neil J. Hennessy

President and Chief Investment Officer

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible.

Opinions expressed are those of Neil Hennessy and are subject to change, are not guaranteed and should not be considered investment advice.

The Dow Jones Industrial Average and S&P 500 are unmanaged indices commonly used to measure the performance of U.S. stocks. The Tokyo Price Index (TOPIX) is a market capitalization-weighted index of all companies listed on the First Section of the Tokyo Stock Exchange. One cannot invest directly in an index.

HENNESSY FUNDS 1-800-966-4354

Performance Overview (Unaudited)

The opinions expressed in the following commentaries reflect those of the Portfolio Managers as of the date written. Any such opinions are subject to change based on market or other conditions and are not guaranteed. These opinions may not be relied upon as investment advice. Investment decisions for the Hennessy Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any Hennessy Fund. Security positions can and do change.

Hennessy Cornerstone Growth Fund (HFCGX/HICGX)

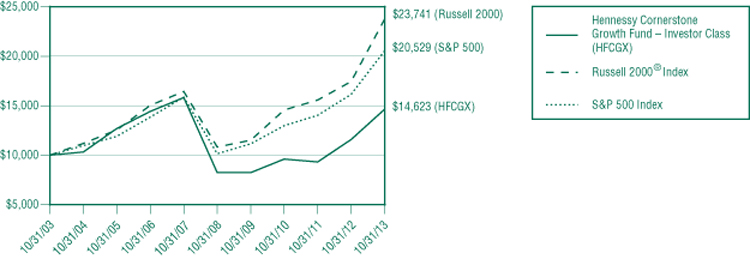

CHANGE IN VALUE OF $10,000 INVESTMENT – INVESTOR CLASS (HFCGX)

This chart assumes an initial gross investment of $10,000 made on October 31, 2003. Returns shown include the reinvestment of all dividends. The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2013

| | One Year | Five Years | Ten Years |

| Hennessy Cornerstone Growth Fund – Investor Class (HFCGX) | 26.41% | 12.20% | 3.87% |

Hennessy Cornerstone Growth Fund – Institutional Class (HICGX)1 | 26.81% | 12.57% | 4.06% |

Russell 2000® Index | 36.28% | 17.04% | 9.03% |

| S&P 500 Index | 27.18% | 15.17% | 7.46% |

| Expense ratio: 1.35% (Investor Class) | | | Expense ratio: Gross 1.12%, Net 0.99%2 (Institutional Class) |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting hennessyfunds.com.

The expense ratios presented are from the most recent prospectus.

| 1 | Represents the performance of the Institutional Class shares after March 3, 2008 (inception of the share class) and Investor Class for periods prior to that date. |

| 2 | With regard to Institutional Class shares, the investment advisor has contractually agreed to waive a portion of its expenses indefinitely. |

PERFORMANCE NARRATIVE

Portfolio Manager, Neil Hennessy, and Co-Portfolio Manager, Brian Peery

Over the previous twelve months, how did the Fund perform and what factors contributed to this performance?

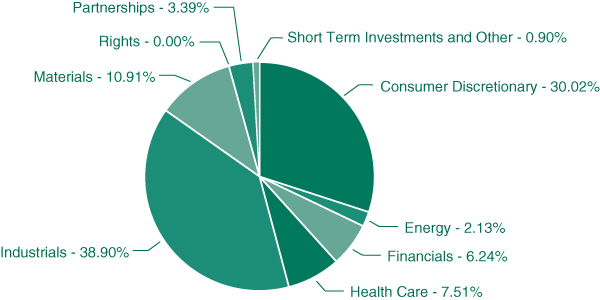

For the twelve-month period ended October 31, 2013, the Investor Class of the Hennessy Cornerstone Growth Fund returned 26.41%, underperforming the Russell 2000® Index, the S&P 500 Index, and the Morningstar Small Blend Category Average, which returned 36.28%, 27.18%, and 35.17% for the same period, respectively.

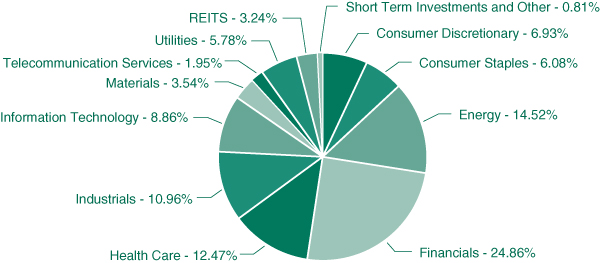

While the Fund had strong absolute performance for the twelve-month period, its performance versus its benchmark was hampered by both asset allocation and stock selection. The Fund’s overweighting in the Consumer Discretionary sector versus the benchmark was the primary driver of the Fund’s relative underperformance for the twelve-month period, due in large part to disappointing levels of consumer spending. This impact was, however, offset in part by favorable stock selection within the Consumer Discretionary sector. The biggest positive contribution to overall Fund performance came from both asset allocation and stock selection in the Financials sector. The largest negative contribution to overall Fund performance came from the Industrials sector, and predominantly from stock selection within the sector.

Delta Air Lines Inc., which was up 175% for the twelve-month period due to stronger than expected revenues and earnings growth, was the single largest contributor to Fund performance during the twelve-month period. The Fund’s single largest performance detractor was InnerWorkings Inc. The managed print services vendor’s stock was down 34% during the twelve-month period as a result of having lowered revenue and profit projections twice. The Fund continues to hold both positions.

Additional Portfolio Manager commentary and related investment outlook:

During the last twelve months, we saw a continued trend of companies beating earnings expectations, but not quite meeting revenue targets. We believe this trend is beginning to abate and that we should see better earnings and revenue numbers in the coming twelve-month period. While top line revenue growth is muted due to a slow growth environment, companies are still doing well. Corporate profits continue to reach new highs due to deferred capital expenditure plans, combined with tempered cost cutting, and we are seeing a broad trend materializing with respect to what companies are doing with their profits to reward shareholders.

Over the last twelve-month period, we have seen a much broader mix of companies choosing to initiate or increase dividends or make accretive acquisitions. While acquisitions may begin to slow due to an increase in asset prices, making it more expensive to grow other than through organic means, we believe that companies will continue to use dividends as a means of rewarding shareholders. As the Federal Reserve continues tapering and we remain in a low interest rate environment, we believe stocks with good growth prospects and earnings will likely lead the way in the coming twelve-month period, as investors seek to capture income while also generating capital gains through stock price appreciation.

We are confident that there are opportunities in the Small-Cap and Mid-Cap space, especially in some of the more cyclical sectors. We believe the cyclical companies, which are those companies most sensitive to economic growth, should do well as the economy continues to improve. The Fund is currently overweight cyclical stocks versus the benchmarks and will remain so until its portfolio is rebalanced later this winter.

The Russell 2000® Index is an unmanaged index commonly used to measure the performance of U.S. small-capitalization stocks. The S&P 500 Index is an unmanaged index commonly used to measure the performance of U.S. stocks. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund invests in small- and medium-capitalization companies, which may have limited liquidity and greater price volatility than large-capitalization companies. Investments in foreign securities involve greater volatility and political, economic and currency risk and differences in accounting methods. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Each Morningstar category average represents a universe of funds with similar investment objectives. ©Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

Hennessy Focus Fund (HFCSX/HFCIX)

CHANGE IN VALUE OF $10,000 INVESTMENT – INVESTOR CLASS (HFCSX)

This chart assumes an initial gross investment of $10,000 made on October 31, 2003. Returns shown include the reinvestment of all dividends. The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

HENNESSY FUNDS 1-800-966-4354

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2013

| | One Year | Five Years | Ten Years |

| Hennessy Focus Fund – Investor Class (HFCSX) | 33.54% | 20.18% | 12.02% |

Hennessy Focus Fund – Institutional Class (HFCIX)1 | 33.94% | 20.57% | 12.22% |

Russell 3000® Index2 | 28.99% | 15.94% | 7.92% |

Russell Midcap® Growth Index | 33.93% | 20.32% | 9.60% |

| Expense ratio: 1.43% (Investor Class) | | | Expense ratio: 1.14% (Institutional Class) |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting hennessyfunds.com. Performance for periods prior to October 26, 2012 is that of the FBR Focus Fund.

The expense ratios presented are from the most recent prospectus.

| 1 | Represents the performance of the Institutional Class shares after May 30, 2008 (inception of the share class) and Investor Class for periods prior to that date. |

| 2 | The Fund’s primary index has changed. Previously, the Fund used the Russell 2000® Index, which is a small-capitalization index, as its primary index. The Fund is now compared to the Russell 3000® Index, which is a broader market index than the Russell 2000® Index, because it better reflects both the underlying holdings of the Fund and the investible stock universe for the Fund. The Russell 3000® Index is a combination of the Russell 2000® Index and the Russell 1000® Index, which is a small-capitalization index and a large-capitalization index, respectively. The average annual total returns of the Russell 2000® Index for the one-year, five-year and ten-year periods ended October 31, 2013 were 36.28%, 17.04%, and 9.03%, respectively. |

PERFORMANCE NARRATIVE

BROAD RUN INVESTMENT MANAGEMENT, LLC, SUB-ADVISOR

Portfolio Managers Brian Macauley, CFA, David Rainey, CFA, and Ira Rothberg, CFA, Broad Run Investment Management, LLC (sub-advisor).

Over the previous twelve months, how did the Fund perform and what factors contributed to this performance?

For the twelve-month period ended October 31, 2013, the Investor Class of the Hennessy Focus Fund returned 33.54%, outperforming both the Russell 3000® Index and the Morningstar Mid-Cap Growth Category Average, which returned 28.99% and 32.45% for the same period, respectively, and slightly underperforming the Russell Midcap® Growth Index, which returned 33.93% for the same period.

The Fund’s performance during the twelve-month period was the result of improved business prospects for its key holdings, owing to a better overall economic outlook and company-specific developments. Leading contributors to the Fund’s performance were O’Reilly Automotive Inc., Bally Technologies, Inc., and Penn National Gaming Inc. The Fund continues to hold all of these positions. There were no negative contributors to performance this twelve-month period; each of the Fund’s 24 portfolio companies contributed positively to performance.

We invest with a long-term time horizon and encourage shareholders to do the same. Despite the discussion of twelve-month results referenced above, we encourage fellow shareholders to evaluate the Fund’s performance over three-, five-, and ten-year periods since shorter time periods can be influenced by many transitory issues unrelated to the growth in intrinsic value of the Fund’s holdings.

Additional Portfolio Manager commentary and related investment outlook:

We continue to have a positive long-term outlook for the Fund. The Fund’s holdings are predominately a collection of what we believe to be secular growth businesses trading at reasonable valuations. Our expectation is that the Fund will own these businesses for five or even ten-year periods. Over this long-term time horizon, we expect that the Fund’s returns will be determined primarily by the growth in earnings power of these businesses.

We believe that many of the Fund’s largest holdings are well positioned to potentially grow cash earnings per share over the next several years, even if we remain stuck in a low-growth environment. These companies have their own profit drivers that are largely independent of the overall economy. For example, American Tower’s growth is driven by the adoption of data intensive smartphones in the U.S. and a rapidly growing subscriber base across its international markets. Markel’s underwriting discipline, investment acumen, and unique culture have allowed the company to create value in both hard and soft insurance markets. O’Reilly Automotive’s growth is driven by its continued consolidation of the aftermarket auto parts distribution industry.

With the broader market now trading at close to the long-run average price to earnings multiple, we believe that multiple expansion is unlikely to provide the same tailwind that it has over the last few years. Recent market appreciation makes it more difficult to identify compelling investment ideas now as compared to twelve month ago, but as a “focus fund,” we only need to find two dozen good ideas from among the thousands of available opportunities. We continue to like the outlook for the companies in the Fund, and we are finding select opportunities that we believe should enhance the portfolio.

The Russell 3000® Index is an unmanaged index commonly used to measure the performance of U.S. stocks. The Russell Midcap® Growth Index is an unmanaged index commonly used to measure the performance of U.S. medium-capitalization growth stocks. The Russell 2000® Index is an unmanaged index commonly used to measure the performance of U.S. small-capitalization stocks. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund is non-diversified, meaning it concentrates its assets in fewer holdings than a diversified fund and is therefore more exposed to individual stock volatility than a diversified fund. The Fund may invest in small- and medium-capitalization companies, which

may have limited liquidity and greater price volatility than large-capitalization companies. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Each Morningstar category average represents a universe of funds with similar investment objectives. ©Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

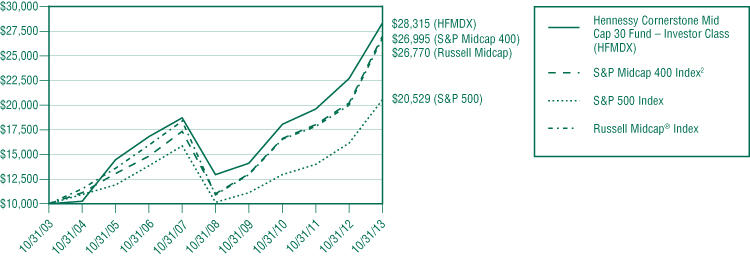

Hennessy Cornerstone Mid Cap 30 Fund (HFMDX/HIMDX)

CHANGE IN VALUE OF $10,000 INVESTMENT – INVESTOR CLASS (HFMDX)

This chart assumes an initial gross investment of $10,000 made on October 31, 2003. Returns shown include the reinvestment of all dividends. The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2013

| | One Year | Five Years | Ten Years |

| Hennessy Cornerstone Mid Cap 30 Fund – Investor Class (HFMDX) | 24.78% | 16.95% | 10.97% |

Hennessy Cornerstone Mid Cap 30 Fund – Institutional Class (HIMDX)1 | 25.15% | 17.37% | 11.20% |

Russell Midcap® Index2 | 33.79% | 19.67% | 10.35% |

| S&P 500 Index | 27.18% | 15.17% | 7.46% |

| Expense ratio: 1.38% (Investor Class) | | | Expense ratio: Gross 1.17%, Net 0.99%3 (Institutional Class) |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting hennessyfunds.com.

The expense ratios presented are from the most recent prospectus.

| 1 | Represents the performance of the Institutional Class shares after March 3, 2008 (inception of the share class) and Investor Class for periods prior to that date. |

| 2 | The Fund’s primary index has changed. Previously, the Fund used the S&P Midcap 400 Index as its primary index. The Fund is now compared to the Russell Midcap® Index so that the fund complex is consistently benchmarking against the appropriate Russell index when benchmarking against discrete asset classes. The average annual total returns of the S&P Midcap 400 Index for the one-year, five-year and ten-year periods ended October 31, 2013 were 33.48%, 19.63%, and 10.44%, respectively. |

| 3 | With regard to Institutional Class shares, the investment advisor has contractually agreed to waive a portion of its expenses indefinitely. |

HENNESSY FUNDS 1-800-966-4354

PERFORMANCE NARRATIVE

Portfolio Manager, Neil Hennessy, and Co-Portfolio Manager, Brian Peery

Over the previous twelve months, how did the Fund perform and what factors contributed to this performance?

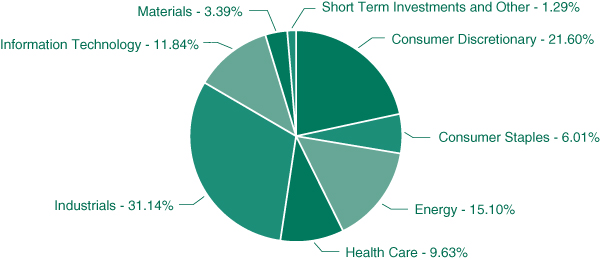

For the twelve-month period ended October 31, 2013, the Investor Class of the Hennessy Cornerstone Mid Cap 30 Fund returned 24.78%, underperforming the Russell Midcap® Index, the S&P 500 Index, and the Morningstar Mid-Cap Blend Category Average, which returned 33.79%, 27.18%, and 32.84% for the same period, respectively.

The Fund’s performance benefited from asset allocation and stock selection in the Healthcare and Industrial sectors, but stock selection in the Consumer Discretionary and Energy sectors created the Fund’s relative underperformance to its benchmarks. The best performing stock in the portfolio was PAREXELA International Corporation, which contributed nearly a full percentage of outperformance relative to the benchmark during the time period in which the Fund held the stock. The single largest detractor to performance during the twelve-month period was Axiall Corporation, which experienced lower volumes and profits from its building segments in both the domestic market as well as a slowdown in the Canadian housing market. Both of these stocks were replaced when the Fund was rebalanced in the fall.

Additional Portfolio Manager commentary and related investment outlook:

Prior to the Fund’s recent rebalancing, the portfolio was biased towards a housing recovery. We witnessed a solid resurgence in the Housing sector during the first half of the twelve-month period, but weakness during the second half of the twelve-month period hurt performance in the Fund’s portfolio, with many of the stocks in both the home building and peripheral industries underperforming the Fund’s benchmarks. As a result, the Fund’s overall performance lagged that of its benchmarks when housing related stocks softened upon both builders and suppliers experiencing mixed results during the spring and summer seasons. While we did see money flowing into the Housing sector from consumers who began putting money into their homes after many years of deferral, a stagnant economy, stagnant job market, and rising interest rate environment put a damper on revenues and earnings for the sector.

With the rebalance of the Fund’s portfolio completed during the fall, we identified a new trend emerging from the stocks now held by the Fund. Whereas in the past we have seen sector specific trends, the current portfolio is pointing to broader trends where companies are deploying excess cash by initiating and/or raising dividends, buying back stock and making acquisitions. As of this writing, well over half of the stocks in the Fund’s portfolio pay dividends, with nearly three-quarters of those dividend-paying companies having increased or initiated dividends within the last year.

The Fund’s portfolio also now includes several companies – approximately 60% of the portfolio – that have made recent acquisitions. In the current slow-growth environment where our economy seems to be stalled, companies have been seeking ways to drive earnings in the absence of the top line revenue growth that would be expected to accompany a vibrant economy. As such, a number of companies have been using earnings to make accretive acquisitions. This should help companies over time as they assimilate acquired businesses, eliminate redundancies, and leverage economies of scale. Although this will not necessarily promote job creation, it is likely to benefit shareholders. We expect that acquisitions may begin to slow due to increase in asset prices, making it more expensive to grow other than organic means.

We have also continued to see a number of companies running stock buyback programs, another activity that is not necessarily beneficial to the overall economy but is beneficial to shareholders. Within the Fund’s portfolio, over 40% of the companies currently have a stock buyback program in place, averaging approximately 10% of their total market capitalization.

Although the equity markets have experienced double digit returns this year, we are confident that opportunities still exist. We believe the continued low interest rate environment, coupled with the possibility of improved economic growth prospects, presents an attractive opportunity for equities going forward. As the great bond exodus that pundits are predicting seems to be emerging, the resulting capital flowing out of the bond markets into the equity markets has largely been directed toward foreign investments. Once the economy beings to gather some steam and domestic job creation begins in earnest, we would not be surprised to see money once again flowing back into U.S. companies and acting as a catalyst for another leg of the bull market that we are currently enjoying.

The Russell Midcap® Index is an unmanaged index commonly used to measure the performance of U.S. medium-capitalization stocks. The S&P 500 Index and the S&P Midcap 400 Index are unmanaged indices commonly used to measure the performance of U.S. stocks. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund invests in small- and medium-capitalization companies, which may have limited liquidity and greater price volatility than large-capitalization companies. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Each Morningstar category average represents a universe of funds with similar investment objectives. ©Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

Hennessy Cornerstone Large Growth Fund (HFLGX/HILGX)

CHANGE IN VALUE OF $10,000 INVESTMENT – INVESTOR CLASS (HFLGX)

* Inception date

This chart assumes an initial gross investment of $10,000 made on March 20, 2009 (inception date of the Fund). Returns shown include the reinvestment of all dividends. The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2013

| | | | Since Inception |

| | One Year | Three Years | (3/20/09) |

| Hennessy Cornerstone Large Growth Fund – Investor Class (HFLGX) | 27.32% | 14.03% | 22.89% |

| Hennessy Cornerstone Large Growth Fund – Institutional Class (HILGX) | 27.63% | 14.33% | 23.24% |

Russell 1000® Index | 28.40% | 16.83% | 22.77% |

| S&P 500 Index | 27.18% | 16.56% | 22.17% |

| Expense ratio: 1.27% (Investor Class) | | | Expense ratio: Gross 1.41%, Net 0.98%1 (Institutional Class) |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting hennessyfunds.com.

The expense ratios presented are from the most recent prospectus.

| 1 | With regard to Institutional Class shares, the investment advisor has contractually agreed to waive a portion of its expenses indefinitely. |

PERFORMANCE NARRATIVE

Portfolio Manager, Neil Hennessy, and Co-Portfolio Manager, Brian Peery

Over the previous twelve months, how did the Fund perform and what factors contributed to this performance?

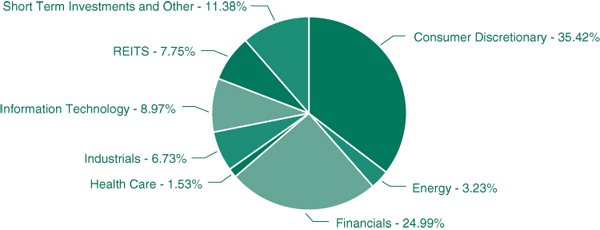

For the twelve-month period ended October 31, 2013, the Investor Class of the Hennessy Cornerstone Large Growth Fund returned 27.32%, underperforming the Russell 1000® Index, which returned 28.40% for the same period, but outperforming the S&P 500 Index and the Morningstar Large Blend Category Average, which returned 27.18% and 27.16% for the same period, respectively.

The Fund’s performance benefited from stock selection within the Information Technology, Consumer Staples, and Energy sectors, but stock selection within the Consumer Discretionary and Materials sectors hampered its overall relative performance to its benchmarks. In addition, sector allocation contributed positively to the Fund’s overall performance relative to its benchmark. The best performing stock within the portfolio was Delta Air Lines Inc., which was up 175% for the twelve-month period due to stronger than expected revenues and earnings growth. The single largest detractor to performance during the twelve-month period was The Gap, Inc. The Fund continues to hold both positions.

Additional Portfolio Manager commentary and related investment outlook:

During the last twelve months, we saw a continued trend of companies beating earnings expectations, but not quite meeting revenue targets. We believe this trend is beginning to abate and that we should see better earnings and revenue numbers in the coming twelve-month period. While top line revenue growth is muted due to a slow growth environment, companies are still doing well. Corporate profits are continuing to reach new highs due to deferred capital expenditure plans combined with tempered cost cutting.

Over the last twelve-month period, we have seen a much broader mix of companies choosing to initiate or increase dividends, and we believe the financial markets are beginning, and will continue to, reward companies who return money to their shareholders

HENNESSY FUNDS 1-800-966-4354

through dividends. While not part of our selection process for the Fund’s portfolio, 45 of the 50 stocks within the portfolio currently pay dividends. This is a trend we do not believe we would have seen just a few short years ago within this asset class. One of the criteria we use in the stock selection process for the Fund is return on total capital, which demonstrates how effectively a company turns capital into profit and is very useful in predicting the potential returns that will be generated by the business operation itself. With top line revenue growth difficult to achieve in the current environment, we are pleased that the companies selected for inclusion in the Fund’s portfolio through our stock selection methodology appear to be leading their respective industries in creating value for their shareholders.

We believe the attractiveness of equity prices in general, coupled with an extremely low interest rate environment have many investors seeking high quality, dividend-paying growth companies. In our view, the prospect of generating current income while investing in growth companies, provides an exciting potential for investors to replace the income derived from bonds in a low yield environment, while maintaining exposure to appreciation from the underlying stock.

The Russell 1000® Index and the S&P 500 Index are unmanaged indices commonly used to measure the performance of U.S. stocks. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund may invest in medium-capitalization companies, which may have more limited liquidity and greater price volatility than large-capitalization companies. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Each Morningstar category average represents a universe of funds with similar investment objectives. © Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

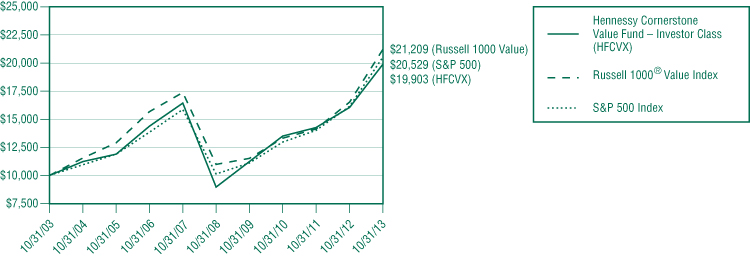

Hennessy Cornerstone Value Fund (HFCVX/HICVX)

CHANGE IN VALUE OF $10,000 INVESTMENT – INVESTOR CLASS (HFCVX)

This chart assumes an initial gross investment of $10,000 made on October 31, 2003. Returns shown include the reinvestment of all dividends. The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2013

| | One Year | Five Years | Ten Years |

| Hennessy Cornerstone Value Fund – Investor Class (HFCVX) | 23.84% | 17.30% | 7.13% |

Hennessy Cornerstone Value Fund – Institutional Class (HICVX)1 | 24.13% | 17.65% | 7.30% |

Russell 1000® Value Index | 28.29% | 14.06% | 7.81% |

| S&P 500 Index | 27.18% | 15.17% | 7.46% |

| Expense ratio: 1.26% (Investor Class) | | | Expense ratio: Gross 1.20%, Net 0.98%2 (Institutional Class) |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting hennessyfunds.com.

The expense ratios presented are from the most recent prospectus.

| 1 | Represents the performance of the Institutional Class shares after March 3, 2008 (inception of the share class) and Investor Class for periods prior to that date. |

| 2 | With regard to Institutional Class shares, the investment advisor has contractually agreed to waive a portion of its expenses indefinitely. |

PERFORMANCE NARRATIVE

Portfolio Manager, Neil Hennessy, and Co-Portfolio Manager, Brian Peery

Over the previous twelve months, how did the Fund perform and what factors contributed to this performance?

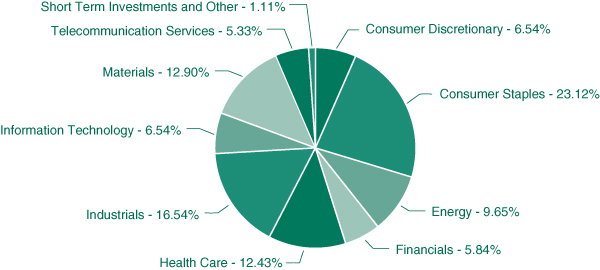

For the twelve-month period ended October 31, 2013, the Investor Class of the Hennessy Cornerstone Value Fund returned 23.84%, underperforming the Russell 1000® Value Index, the S&P 500 Index, and the Morningstar Large Value Category Average, which returned 28.29%, 27.18%, and 26.84% for the same period, respectively.

While the Fund had strong absolute performance for the twelve-month period, its performance versus its benchmark was hampered by both asset allocation and stock selection. Relative overweighting in the Consumer Staples sector and stock selection within the Consumer Discretionary and Consumer Staples sectors were the two largest contributors to the Fund’s relative underperformance. Stock selection within most of the other sectors invested in by the Fund contributed positively to performance, but was not enough to overcome the negative performance contributed by Consumer stocks, which made up nearly 30% of the Fund’s portfolio. The best performing stock within the Fund was Bristol-Meyers Squibb, which was up over 63% for the twelve-month period as a result of earnings and revenue growth. The largest detractor to performance during the time period held by the Fund was ExxonMobil, which was roughly flat from the previous twelve-month period as oil prices declined. The Fund continues to hold Bristol-Myers, but no longer holds ExxonMobil.

Additional Portfolio Manager commentary and related investment outlook:

We believe the financial markets are beginning to reward companies who return money to shareholders in the form of higher dividends, and we expect this trend to continue. We continue to believe it is risky to be over invested in bonds and underinvested in equities, especially since there are many companies whose stock yields are currently higher than that of a 10-Year U.S. Treasury. As of the end of October, the Fund’s 30-day SEC Yield was 2.39%. As investors continue to seek out opportunities to generate income while having exposure to the upside potential of the equity markets, we believe that large capitalization, dividend-paying companies should continue to do well.

Until the uncertainty surrounding fiscal policy, taxes and healthcare costs subside, we believe corporate capital expenditures will remain in a holding pattern. As such, we expect large capitalization companies to utilize excess cash to buy back stock, pay dividends, or make accretive acquisitions, all of which should have a positive effect on shareholders.

30-Day SEC Yield is a standardized yield computed by dividing the net investment income per share earned during the past 30-day period by the share price at the end of the period, expressed as an annual percentage rate.

The Russell 1000® Value Index is an unmanaged index commonly used to measure the performance of U.S. large-capitalization value stocks. The S&P 500 Index is an unmanaged index commonly used to measure the performance of U.S. stocks. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund may invest in medium-capitalization companies, which tend to have more limited liquidity and greater price volatility than large-capitalization companies. Investments in foreign securities involve greater volatility and political, economic and currency risk and differences in accounting methods. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Each Morningstar category average represents a universe of funds with similar investment objectives. © Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

HENNESSY FUNDS 1-800-966-4354

Hennessy Large Value Fund (HLVFX/HLVIX)

CHANGE IN VALUE OF $10,000 INVESTMENT – INVESTOR CLASS (HLVFX)

This chart assumes an initial gross investment of $10,000 made on October 31, 2003. Returns shown include the reinvestment of all dividends.

The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2013

| | One Year | Five Years | Ten Years |

| Hennessy Large Value Fund – Investor Class (HLVFX) | 25.64% | 12.23% | 6.12% |

Hennessy Large Value Fund – Institutional Class (HLVIX)1 | 26.08% | 12.62% | 6.31% |

Russell 1000® Value Index | 28.29% | 14.06% | 7.81% |

| S&P 500 Index | 27.18% | 15.17% | 7.46% |

| Expense ratio: 1.40% (Investor Class) | | | Expense ratio: Gross 1.22%, Net 0.98%2 (Institutional Class) |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance for periods prior to March 20, 2009 reflects the performance of the Tamarack Value Fund, the predecessor to the Hennessy Select Large Value Fund. Performance data current to the most recent month end may be obtained by visiting hennessyfunds.com.

The expense ratios presented are from the most recent prospectus.

| 1 | Represents the performance of the Institutional Class shares after March 20, 2009 (inception of the share class) and Investor Class for periods prior to that date. |

| 2 | With regard to Institutional Class shares, the investment advisor has contractually agreed to waive a portion of its expenses indefinitely. |

PERFORMANCE NARRATIVE

RBC GLOBAL ASSET MANAGEMENT (U.S.) INC., SUB-ADVISOR

Portfolio Managers Stuart Lippe, Barbara Browning, CFA, and Adam Scheiner, CFA, RBC Global Asset Management (U.S.) Inc. (sub-advisor)

Over the previous twelve months, how did the Fund perform and what factors contributed to this performance?

For the twelve-month period ended October 31, 2013, the Investor Class of the Hennessy Large Value Fund returned 25.64%, underperforming the Russell 1000® Value Index, the S&P 500 Index, and the Morningstar Large Value Category Average, which returned 28.29%, 27.18%, and 26.84% for the same period, respectively.

While the Fund had strong absolute performance for the twelve-month period, its relative outperformance was driven by stock selection across a number of sectors, led by Utilities, Health Care, and Materials. Conversely, stock selection in the Information Technology and Consumer Discretionary sectors hampered the Fund’s relative performance versus its benchmark. Sector allocation detracted modestly from performance as the Fund’s sector neutral mandate, by design, limits the impact of sector weighting decisions. We instead make investment decisions at the industry level.

Within the Utilities sector, Dominion Resources, Inc. was a significant contributor to absolute performance for the twelve-month period, with returns of over 26%. Dominion Resources, Inc. received approval from the Department of Energy to export Liquid Natural Gas and also announced the formation of a master limited partnership, which is a tax-advantaged structure for mid-stream assets. The Fund recently realized its profits by selling completely out of the position. Positions in Northeast Utilities and NRG Energy, Inc., which were up over 13% and 18% for the twelve-month period, respectively, also added to absolute performance within the Utilities sector. The Fund no longer owns NRG Energy, Inc., but does still hold Northeast Utilities.

The Healthcare sector was also a significant contributor to relative outperformance for the twelve-month period. The biggest contributor to performance within the Healthcare sector by far was Johnson & Johnson, which was up over 35% during this twelve-month period. The Fund has owned Johnson & Johnson for a long period of time because the Fund’s managers believe it has the best portfolio of any drug company. We strongly believe that pharmaceuticals are a key growth engine and that a consumer turnaround will help the stock as well. Also contributing to the Fund’s performance was McKesson Corporation, a medical distribution company, which beat both earnings and revenue estimates in the most recent quarter. The Fund continues to hold both of these companies.

Stock selection within the Materials sector, and specifically within Chemicals, also contributed positively to performance. Although the Fund is sector neutral, the Fund’s managers do sometimes make industry-specific bets, and being overweight in the Chemicals sector over the past twelve-month period benefited the portfolio. Eastman Chemical Co., LyondellBasell Industries NV, and PPG Industries Inc. were top performers for the portfolio within the Chemicals sector. Eastman Chemical Co. continues to execute and reposition itself as a more specialty chemical company. We believe there is still room for further actions on the portfolio management side, and potential double digit earnings growth through 2015 is also visible. The stock still trades at a discount not only to peers but also to several pure commodity chemical companies, leaving ample room for the revaluation story. LyondellBasell Industries NV is generating significant free cash flow and has been buying back shares, thereby boosting its stock price. Capital projects have had quick paybacks and have been on time and on budget. PPG Industries Inc. is becoming a pure play coatings leader and has significant cash on its balance sheet. The market has also responded positively to share buybacks by PPG Industries Inc., which has pushed its stock price even higher. The Fund has since sold both LyondellBasell Industries NV and PPG Industries Inc. because both stocks reached our price targets, but continues to hold Eastman Chemical Co.

On the negative side of the ledger, the Consumer Discretionary sector detracted from relative performance, although it contributed positively to absolute performance. The relative performance of the Fund was negatively impacted by stocks it did not own, including Best Buy Co., Inc., GameStop Corp., and Twenty-First Century Fox, Inc., which were up over 191%, 148%, and 40%, respectively. Our weak relative performance in the sector was partially offset by our overweight to Time Warner Inc., which was up over 61%, as the company continued to see improving ratings at Turner networks and affiliate fee increases as its multi-year fee deals were renegotiated. It also benefited from the announced separation of its publishing business. The Fund continues to hold Time Warner Inc.

Within the Information Technology sector, the largest detractor from performance (and the second largest detractor from the overall portfolio) was Broadcom Corp., which was down 14% for the twelve-month period, as the company recently had a very disappointing quarter following lower guidance for future results. Its Smartphone Wi-Fi chip business is experiencing increased competition and it is not gaining as much share as it had expected. Hewlett-Packard Company was also a headwind within the Information Technology sector for the portfolio, as the PC environment has suffered multiple quarters of double digit declines. We continue to believe in the longer-term prospects of both companies and maintain their positions in the Fund.

Additional Portfolio Manager commentary and related investment outlook:

Despite the strong performance of the last year, we remain cautiously optimistic that markets can continue their ascent into 2014 (though we expect periods of heightened volatility as investors remain in limbo with regard to the timing and amount of the Federal Reserve Board’s expected tapering). We remain bullish on the market for the next 12 months, with the caveat that at some point we will probably experience a period of volatility and discomfort much greater than we have endured over the past 12 months. The positive forces include the fact that interest rates and inflation are low, money continues to flow out of bond funds, corporate balance sheets are flush with cash, company management teams seem to be more conscious of wasting capital, and many sectors of both the U.S. economy (e.g., automobiles) and the world economy (e.g., Latin America) are still far from their peaks. On the negative side, many stocks are factoring in greater long-term growth than we expect to be realized and we believe stock prices in general have been bid up for macroeconomic reasons. In this environment, we expect the ability to avoid blowups will become an increasingly important skill.

We remain confident in our stock selection process and our ability to find special situation stocks that can outperform regardless of the market environment. While investment decisions are the result of bottom-up stock selection and our sector-neutral mandate requires investment in all ten major sectors, there are a number of industry-based themes that we believe could lead to outperformance in the next twelve-month period. With respect to consumer spending, consumers are spending more of their dollars on housing related, durable goods related, and hard-line retail related (e.g., home and automobile) items, and less on soft-line and multi-line retail-related items (e.g., apparel and shoes) and we are positioning the Fund’s portfolio accordingly. We also expect a continued rebound in capital market activity to positively impact the Fund’s holdings in asset managers and money center banks; increased utilization in the health care industry prompted by health care reform (specifically with regard to managed care) to support our overweight in health care providers and services; and a growing Smartphone market with increased complexity in handheld devices to support semiconductor manufacturers.

The Russell 1000® Value Index is an unmanaged index commonly used to measure the performance of U.S. large-capitalization value stocks. The S&P 500 Index is an unmanaged index commonly used to measure the performance of U.S. stocks. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund may invest in medium-capitalization companies, which may have more limited liquidity and greater price volatility than large-capitalization companies. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Each Morningstar category average represents a universe of funds with similar investment objectives. © Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

HENNESSY FUNDS 1-800-966-4354

Earnings Growth is not indicative of the Fund’s future returns. Free Cash Flow is calculated as operating cash flow minus capital expenditures and represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base.

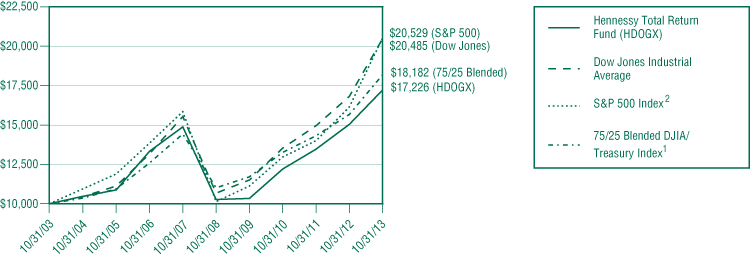

Hennessy Total Return Fund (HDOGX)

CHANGE IN VALUE OF $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on October 31, 2003. Returns shown include the reinvestment of all dividends. The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2013

| | One Year | Five Years | Ten Years |

| Hennessy Total Return Fund (HDOGX) | 14.49% | 10.90% | 5.59% |

75/25 Blended DJIA/Treasury Index1,2 | 16.10% | 10.54% | 6.16% |

| Dow Jones Industrial Average | 21.82% | 13.91% | 7.43% |

Expense ratio: 1.38%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting hennessyfunds.com.

The expense ratio presented is from the most recent prospectus.

| 1 | The 75/25 Blended DJIA/Treasury Index consists of 75% common stocks represented by the Dow Jones Industrial Average and 25% short-duration Treasury securities represented by the BofA Merrill Lynch 90-day Treasury Bill Index. |

| 2 | The Fund’s indices have changed. Previously, the Fund used the Dow Jones Industrial Average as its primary index and the S&P 500 Index as its secondary index. The Fund will now use the 75/25 Blended DJIA/Treasury Index as its primary index and the Dow Jones Industrial Average as its secondary index. The Fund changed its primary index to the 75/25 Blended DJIA/Treasury Index because the new index more closely reflects the investment strategy of the Fund. The average annual total returns of the S&P 500 Index for the one-year, five-year and ten-year periods ended October 31, 2013 were 27.18%, 15.17%, and 7.46%, respectively. |

PERFORMANCE NARRATIVE

Portfolio Manager, Neil Hennessy, and Co-Portfolio Manager, Brian Peery

Over the previous twelve months, how did the Fund perform and what factors contributed to this performance?

For the twelve-month period ended October 31, 2013, the Hennessy Total Return Fund returned 14.49%, underperforming the 75/25 Blended DJIA/Treasury Index*, the Dow Jones Industrial Average, and the Morningstar Large Value Category Average, which returned 16.10%, 21.82%, and 26.84% for the same period, respectively.

The Fund’s roughly 25% weighting of U.S. Treasuries was a detriment to overall performance, as yields continued near historic lows. The Fund’s approximately 75% equity weighting was able to capture nearly the weighted return of the entire Dow Jones Industrial Average.

During the twelve-month period ended October 31, 2013, all but one of the Fund’s 17 equity positions had positive returns, with only Merck & Co., Inc. posting a negative return. Hewlett-Packard and E. I. du Pont de Nemours and Company led the way with returns of 74% and 36% for the period, respectively. Although Hewlett-Packard is no longer a member of the Dow Jones Industrial Average, the stock will remain in the Fund until the next rebalancing of the Fund portfolio occurs, at which time the newest “Dogs of the Dow” stocks will replace the stocks that are no longer in the index.

While the Fund’s portfolio may underperform its benchmarks in periods where equities rise sharply, the strategy is geared to capture near market returns with a lower risk profile, since only three quarters of the assets are invested in equities. Conversely, if equity markets were to fall sharply, we would expect the Fund to perform better than its benchmarks due to its 25% exposure to short-term U.S. Treasuries that are held to maturity. Ultimately, the overall goal of this portfolio is to capture near-market upside performance while mitigating some of the potential market downside risk.

Additional Portfolio Manager commentary and related investment outlook:

We continue to believe that the Dow Jones Industrial Average stocks, and in particular the stocks comprising the high dividend-yielding “Dogs of the Dow” (the methodology employed within the Hennessy Total Return Fund), provide an excellent way to gain equity exposure to the markets. With U.S. Treasury yields still trading near historic lows, many investors are seeking high quality, dividend-paying companies as a means of generating current income. We believe that the rotation out of bonds and into equities, where investors have historically received higher yields as well as the potential for capital appreciation, will continue.

As the market reaches new highs and investors become more wary of a potential pullback, we believe that a trend of moving some money away from more risky asset classes and into the perceived “safety” of very large dividend-paying companies will prevail. We believe the Fund is well positioned for the more moderately conservative investor as the equity portion of the portfolio holds what we would deem to be high quality, high dividend-paying companies, while the short duration of the Treasury component (all less than three months) will allow us the ability to roll into higher yielding treasuries, should U.S. Government yields rise.

| * | The 75/25 Blended DJIA/Treasury Index consists of 75% common stocks represented by the Dow Jones Industrial Average and 25% short-duration Treasury securities represented by the BofA Merrill Lynch 90-day U.S. Treasury Bill Index. |

The Dow Jones Industrial Average is unmanaged index commonly used to measure the performance of U.S. stocks. The BofA Merrill Lynch 90-day U.S. Treasury Bill Index is an unmanaged index of Treasury securities maturing in 90 days. The S&P 500 Index is an unmanaged index commonly used to measure the performance of the U.S. stocks. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund is non-diversified, meaning it concentrates its assets in fewer individual holdings than a diversified fund and is therefore more exposed to individual stock volatility than a diversified fund. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Each Morningstar category average represents a universe of funds with similar investment objectives. © Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

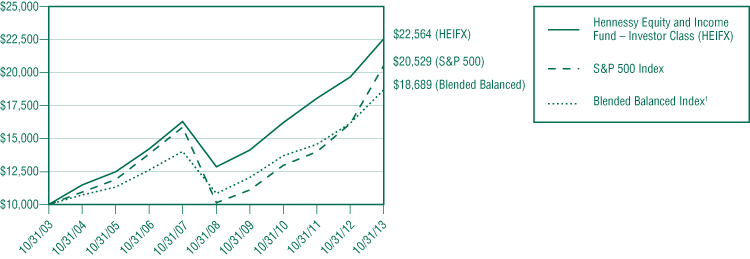

Hennessy Equity and Income Fund (HEIFX/HEIIX)

CHANGE IN VALUE OF $10,000 INVESTMENT – INVESTOR CLASS (HEIFX)

This chart assumes an initial gross investment of $10,000 made on October 31, 2003. Returns shown include the reinvestment of all dividends. The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

HENNESSY FUNDS 1-800-966-4354

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2013

| | One Year | Five Years | Ten Years |

| Hennessy Equity and Income Fund – Investor Class (HEIFX) | 14.72% | 11.91% | 8.48% |

| Hennessy Equity and Income Fund – Institutional Class (HEIIX) | 14.99% | 12.18% | 8.74% |

Blended Balanced Index1 | 15.65% | 11.52% | 6.45% |

| S&P 500 Index | 27.18% | 15.17% | 7.46% |

| Expense ratio: 1.35% (Investor Class) | | | Expense ratio: 1.08% (Institutional Class) |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting hennessyfunds.com. Performance for periods prior to October 26, 2012 is that of the FBR Balanced Fund from March 12, 2010 to October 25, 2012 and that of the AFBA 5 Star Balanced Fund for periods prior to March 12, 2010.

The expense ratios presented are from the most recent prospectus.

| 1 | The Blended Balanced Index consists of 60% common stocks represented by the S&P 500 Index and 40% bonds represented by the Barclays Capital Intermediate U.S. Government/Credit Index. |

PERFORMANCE NARRATIVE

THE LONDON COMPANY, SUB-ADVISOR (EQUITY PORTION)

FINANCIAL COUNSELORS, INC., SUB-ADVISOR (FIXED INCOME PORTION)

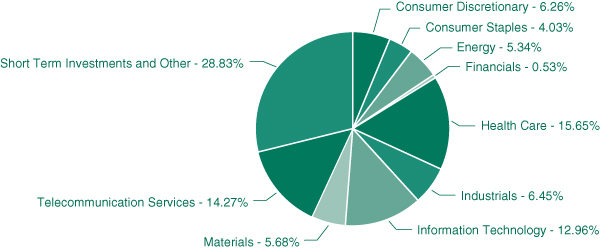

For the twelve-month period ended October 31, 2013, the Investor Class of the Hennessy Equity and Income Fund returned 14.72%, underperforming the Blended Balanced Index*, the S&P 500 Index, and the Morningstar Moderate Allocation Category Average, which returned 15.65%, 27.18%, and 15.85% for the same period, respectively.

Portfolio Managers: Stephen M. Goddard, CFA (Lead Portfolio Manager for the Fund), Jonathan T. Moody, CFA, J. Brian Campbell, CFA, Mark DeVaul, CFA, CPA, The London Company of Virginia, LLC (sub-advisor of the equity portion of the Fund)

Over the previous twelve months, how did the equity portion of the Fund perform and what factors contributed to this performance?

Domestic equity returns for the twelve-month period ended October 31, 2013 were very strong. Slow growth in the domestic economy, rising consumer confidence, and a relative downshift in some of the macroeconomic uncertainties around the globe helped drive the market higher. The market was also led higher by the Health Care, Industrials, and Consumer Discretionary sectors. Relative to its benchmarks, the Fund’s stock selection had a positive effect on performance, but sector selection had a negative effect. Relative underweighting in the Industrials, Consumer Discretionary, and Health Care sectors had a negative impact on performance.

Additional Portfolio Manager commentary on the equity portion of the Fund and the related investment outlook:

While we are aware of macroeconomic factors that may impact the market, our strategy is to focus on stocks from a bottom-up standpoint. Our approach is to own companies with strong returns on capital and flexibility to enhance shareholder value using their balance sheets. Low interest rates and a high equity risk premium enable companies to increase shareholder value by changing the capital structure of the company. Separately, with elevated cash levels on corporate balance sheets and dividend payout ratios below average, we expect investors to reward companies that wisely deploy capital by increasing dividends, repurchasing shares, and undertaking accretive acquisitions. We believe the Fund’s portfolio is well positioned for a slow-growth environment that rewards strong capital allocation.

Portfolio Managers: Gary B. Cloud, CFA and Peter G. Greig, CFA, Financial Counselors, Inc. (sub-advisor of the fixed income portion of the Fund)

Over the previous twelve months, how did the fixed income portion of the Fund perform and what factors contributed to this performance?

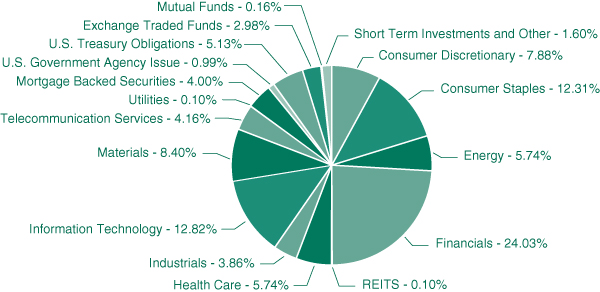

A pro-cyclical asset allocation in the Fund helped relative performance due to an overweight position in Corporate bonds and an underweight position in U.S. Treasury securities. Higher yielding fixed income securities in the portfolio boosted the interest income component of total return, adding to relative performance. Fixed income sector asset allocation and the income effect provided the biggest boost to relative returns for the Fund. The amortization and effective duration effect had the largest negative impact on relative Fund performance.

Additional Portfolio Manager commentary on the fixed income portion of the Fund and the related investment outlook:

Investors were caught off guard leading up to the more hawkish rhetoric from the Federal Reserve Board (Fed) and were whipsawed again when the Fed backtracked on tapering bond purchases in September. We believe the prospect of a government shutdown and potential debt default played into and will continue to factor in the Fed’s calculus on the timing of monetary policy direction.

The new year will witness a change of leadership at the Fed and a likely reduction in the size and scope of asset purchases. We hope the Fed learned some valuable lessons from its summer taper talk and will find a less disruptive communication strategy for policy initiatives over the near term.

Looking forward, moderate economic growth, mild inflation and continued purchases by the Fed would be consistent with a range-bound Treasury market for the balance of the year and into early 2014. We are on guard for more upward pressure on interest

rates later in 2014. Any decline below 2.50% should be used as an opportunity to shorten duration. We expect corporate credit to again prove favorable in the final quarter of the year and into 2014.

| * | The Blended Balanced Index consists of 60% common stocks represented by the S&P 500 Index and 40% bonds represented by the Barclays Capital Intermediate U.S. Government/Credit Index. |

The S&P 500 Index is an unmanaged index commonly used to measure the performance of U.S. stocks. The Barclays Capital Intermediate U.S. Government/Credit Index is an unmanaged index commonly used to measure the performance of U.S. bonds. You cannot invest directly in an index. Performance data for an index does not reflect any deductions for fees, expenses or taxes. The Fund may invest in debt securities, which typically decrease in value when interest rates rise. The risk is greater for longer term debt securities. Investments by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities. Investments in Asset-Backed and Mortgage-Backed securities include additional risks that investors should be aware of, including credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Investments in foreign securities may involve greater volatility and political, economic and currency risk and differences in accounting methods. The Fund may invest in IPOs, which may fluctuate considerably due to the absence of a prior public market and may have a magnified impact on the Fund. References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Each Morningstar category average represents a universe of funds with similar investment objectives. © Morningstar, Inc. All Rights Reserved. The information contained herein: 1) is proprietary to Morningstar; 2) may not be copied or distributed and 3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance does not guarantee future results.

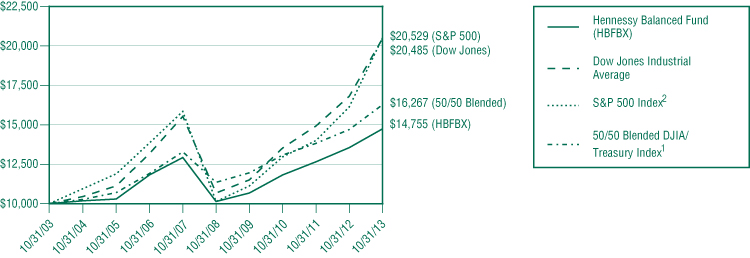

Hennessy Balanced Fund (HBFBX)

CHANGE IN VALUE OF $10,000 INVESTMENT

This chart assumes an initial gross investment of $10,000 made on October 31, 2003. Returns shown include the reinvestment of all dividends. The table and the graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

AVERAGE ANNUAL TOTAL RETURN PERIODS ENDED OCTOBER 31, 2013

| | One Year | Five Years | Ten Years |

| Hennessy Balanced Fund (HBFBX) | 8.77% | 7.80% | 3.97% |

50/50 Blended DJIA/Treasury Index1,2 | 10.69% | 7.44% | 4.99% |

| Dow Jones Industrial Average | 21.82% | 13.91% | 7.43% |

Expense ratio: 1.55%

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting hennessyfunds.com.

The expense ratio presented is from the most recent prospectus.

| 1 | The 50/50 Blended DJIA/Treasury Index consists of 50% common stocks represented by the Dow Jones Industrial Average and 50% short-duration Treasury securities represented by the BofA Merrill Lynch 1-Year Treasury Note Index. |

HENNESSY FUNDS 1-800-966-4354

| 2 | The Fund’s indices have changed. Previously, the Fund used the Dow Jones Industrial Average as its primary index and the S&P 500 Index as its secondary index. The Fund will now use the 50/50 Blended DJIA/Treasury Index as its primary index and the Dow Jones Industrial Average as its secondary index. The Fund changed its primary index to the 50/50 Blended DJIA/Treasury Index because the new index more closely reflects the investment strategy of the Fund. The average annual total returns of the S&P 500 Index for the one-year, five-year and ten-year periods ended October 31, 2013 were 27.18%, 15.17%, and 7.46%, respectively. |

PERFORMANCE NARRATIVE

Portfolio Manager, Neil Hennessy, and Co-Portfolio Manager, Brian Peery

Over the previous twelve months, how did the Fund perform and what factors contributed to this performance?

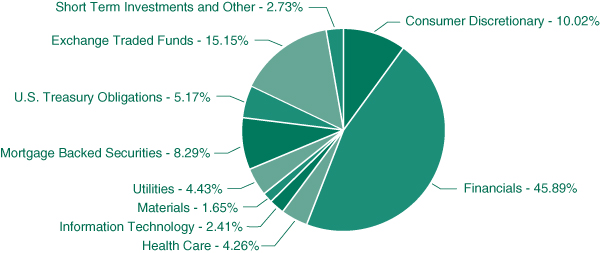

For the twelve-month period ended October 31, 2013, the Hennessy Balanced Fund returned 8.77%, underperforming the 50/50 Blended DJIA/Treasury Index*, the Dow Jones Industrial Average, and the Morningstar Moderate Allocation Category Average, which returned 10.69%, 21.82%, and 15.85% for the same period, respectively.

The Fund’s relative underperformance to its benchmarks is due primarily to the continued low yields on Treasury Bills. The Fund’s position of approximately 50% in U.S. Treasuries did not allow it to fully capture the performance of the equity markets over the twelve-month period. While the Fund’s portfolio may underperform its benchmarks in periods where equities rise sharply, the strategy is geared to capture near-market returns with a lower risk profile, since only half of the assets of the Fund are invested in equities. Conversely, if equity markets were to fall sharply, we would expect the Fund to perform better than its benchmarks due to its 50% exposure to short-term U.S. Treasuries that are held to maturity. Ultimately, the overall goal of this portfolio is to capture upside performance while mitigating downside risk.

During the twelve-month period ended October 31, 2013, all but one of the Fund’s 13 equity positions had positive returns, with only Merck & Co., Inc. posting a negative return. Cisco Systems, Inc. and Pfizer Inc. led the way with returns of 29% and 25% for the twelve-month period, respectively.

Additional Portfolio Manager commentary and related investment outlook:

We continue to believe that the Dow Jones Industrial Average stocks, and in particular the stocks comprising the high dividend-yielding “Dogs of the Dow” (the methodology employed within the Hennessy Balanced Fund), provide an excellent way to gain equity exposure to the markets. With U.S. Treasury yields still trading near historic lows, many investors are seeking high quality, dividend-paying companies as a means of generating current income. We believe that the rotation out of bonds and into equities, where investors have historically received higher yields as well as the potential for capital appreciation, will continue.

As the overall markets reach new highs and investors become more wary of a potential pullback, we believe that a trend of moving some money away from more risky asset classes and into the perceived “safety” of very large dividend-paying companies will prevail. We believe the Fund is well positioned for the more conservative investor as the equity portion of the portfolio holds what we would deem to be high quality, high-dividend paying companies, while the relatively short duration of the Treasury component (all less than one year) will allow us the ability to roll into higher yielding treasuries in the event U.S. Government yields continue to rise.

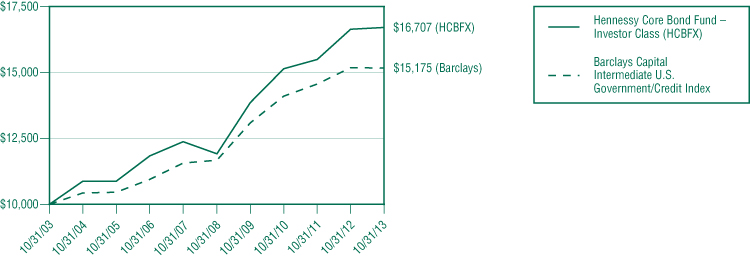

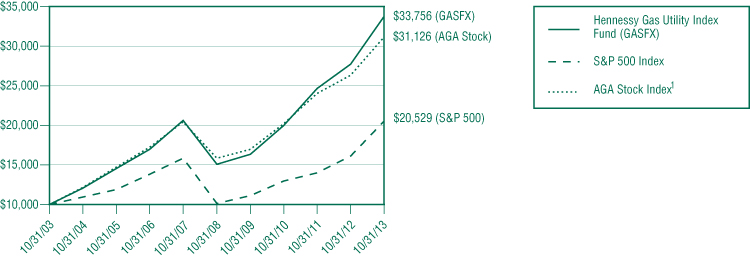

| * | The 50/50 Blended DJIA/Treasury Index consists of 50% common stocks represented by the Dow Jones Industrial Average and 50% short duration Treasury securities represented by the BofA Merrill Lynch 1-Year U.S. Treasury Note Index. |