UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07170

TCW Funds, Inc.

(Exact name of registrant as specified in charter)

515 South Flower Street, Los Angeles, CA 90071

(Address of principal executive offices)

Peter Davidson, Esq.

Vice President and Assistant Secretary

515 South Flower Street

Los Angeles, CA 90071

(Name and address of agent for service)

Registrant’s telephone number, including area code: (213) 244-0000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2023

| Item 1. | Reports to Shareholders. |

| (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”): |

EQUITY FUNDS

TCW Artificial Intelligence Equity Fund

TCW Global Real Estate Fund

TCW New America Premier Equities Fund

TCW Relative Value Dividend Appreciation Fund

TCW Relative Value Large Cap Fund

TCW Relative Value Mid Cap Fund

TCW Select Equities Fund

ASSET ALLOCATION FUND

TCW Conservative Allocation Fund

TCW Funds, Inc.

Table of Contents

|

| |

| The Letter to Shareholders and/or Management Discussions contained in this Annual Report are the opinions of each Fund’s portfolio managers and are not the opinions of TCW Funds, Inc. or its Board of Directors. Various matters discussed in the Letter to Shareholders and/or Management Discussions constitute forward-looking statements within the meaning of the federal securities laws. Actual results and the timing of certain events could differ materially from those projected or contemplated by these forward-looking statements due to a number of factors, including general economic conditions, overall availability of securities for investment by a Fund, the level of volatility in the securities markets and in the share price of a Fund, and other risk factors discussed in the SEC filings of TCW Funds, Inc. The data presented in the Letter to Shareholders and/or Management Discussions represents past performance and cannot be used to predict future results. |

| | |

To Our Valued Shareholders | | |

| | |

| | Kathryn Koch President and Chief Executive Officer |

Dear Valued Investors,

I am pleased to present the 2023 annual report for the TCW Funds, Inc. covering the 12-month period ended October 31, 2023. I would like to express our appreciation for your continued investment in the TCW Funds as well as to welcome new shareholders to our fund family. As of October 31, 2023, the TCW Funds held total net assets of approximately $8.6 billion.

This report contains information and portfolio management discussions of our Equity Funds and the TCW Conservative Allocation Fund.

The U.S. Stock Market

U.S. stocks advanced 10.1% (S&P 500 Total Return Index) during the one-year period ending October 31, 2023, as stock market investors cheered the deceleration of core inflation (CPI less food and energy) from its peak 6.6% annual rate in September of last year to the recent 4.1% pace in September of this year. Market participants were hopeful that a steady decline in inflation might lead the Fed to conclude that it was making adequate progress towards its 2% target and thus end its series of rate hikes. For a brief period last March, fears of an economic slowdown were prompted when a run on deposits forced regulators to close Silicon Valley Bank and Signature Bank, with the fallout from the banking sector turmoil amounting to a de facto tightening of financial conditions. However, the decisive response by regulatory authorities assuaged worries of a broader crisis and helped fuel a rebound in stock prices on hopes that the resulting reduction in credit availability would allow the Fed to relent from its rate hike campaign. For the equity market, the prospect of the real economy potentially achieving a “soft landing” rather than a painful recession stoked hopes that corporate earnings would remain resilient in the process. To be sure, macroeconomic data continued to reflect strength in the labor market, where job creation continued to be solid and unemployment claims remained muted. Importantly, corporate earnings reports for the first several

quarters of the calendar year came in better than expected, as companies were generally able to raise prices to cover rising input costs. As the year progressed, though, hopes for a “soft landing” gave way to worries that the Fed might have to hold interest rates “higher for longer” due to “sticky” core services inflation resulting from the tight labor market. At the same time, investors started to focus on heavy U.S. Treasury refunding needs due to the spiraling budget deficit, which reached an annual run-rate of nearly $2 trillion or close to 8% of U.S. GDP. These factors contributed to a surge in the 10-year U.S. Treasury Note yield from 3.84% to 4.93% during the final four months of the period under review, which in part explains the pullback in the equity market from its end-July peak.

Looking Ahead

Looking forward, the outlook for the stock market has been clouded by several key developments. Receding inflation, coupled with a gradual rise in the unemployment rate from a cycle low of 3.4% in January to 3.9% in October, may indeed signal the end of the Fed’s interest rate hike campaign but also portends a potential economic recession in the coming months. At the same time, the global macroeconomic backdrop has dimmed, with the Eurozone facing a near-recessionary growth outlook while China’s own growth prospects continue to disappoint. The attack on Israel by Hamas not only plunged that region into war, but also raised the risk of a broader regional conflict, with no end in sight to Russia’s war in Ukraine. Also, we are mindful that we are heading into a presidential election year, which may provide another catalyst for market volatility. So, while stocks are presently trading at around 18 times forward earnings, which is elevated relative to its five-decade average of just under 16, we are doubtful that the Bloomberg consensus estimate of 12% earnings growth for 2024 can be achieved. Given these headwinds, we believe that our active management approach to equity investing is particularly relevant in the present environment. Our equity portfolio managers and

2

| | |

Letter to Shareholders (Continued) | | |

analysts remain focused on identifying quality companies which possess resilient business models, strong balance sheets, and skilled management that will ultimately separate the winners from the losers during this period of heightened uncertainty.

We truly value our relationship with you and thank you for making the TCW Funds part of your long-term investment plan. If you have any questions or require further information, we invite you to visit our website

at www.tcw.com, or call our shareholder services department at 800-386-3829.

We look forward to further correspondence with you through our semi-annual report next year.

Sincerely,

Kathryn Koch

President and Chief Executive Officer

3

TCW Artificial Intelligence Equity Fund

Management Discussions

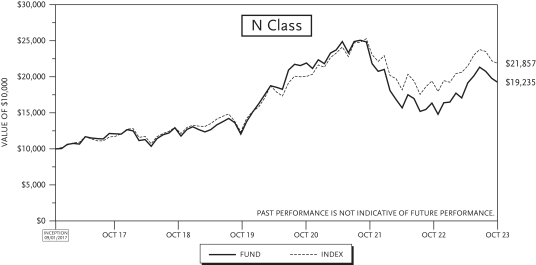

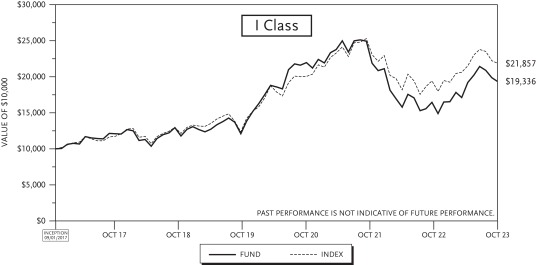

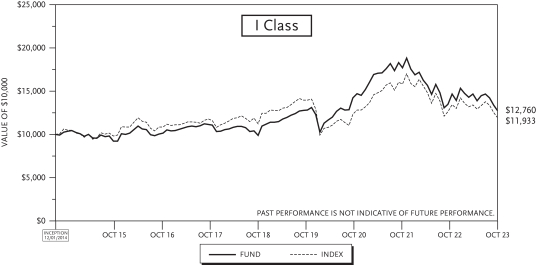

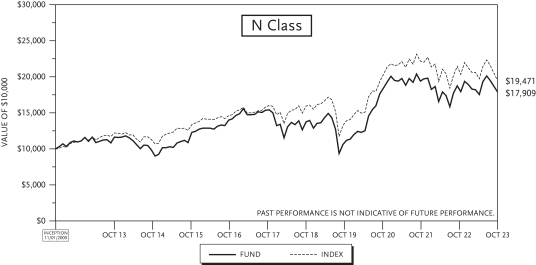

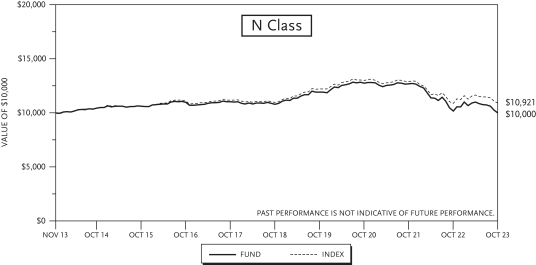

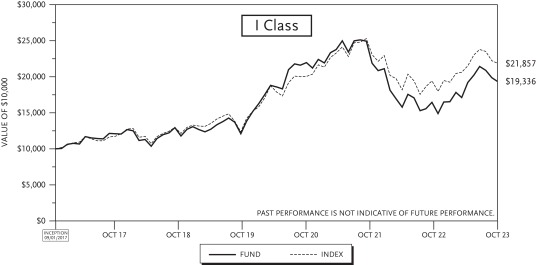

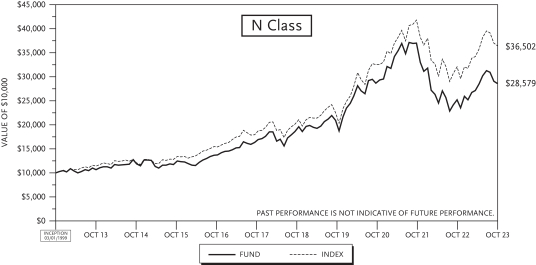

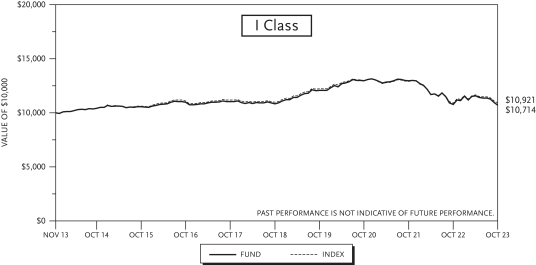

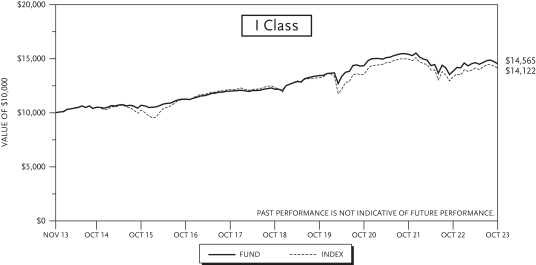

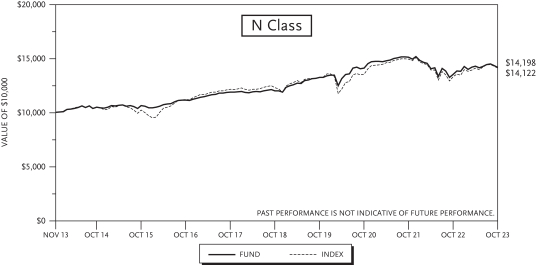

For the year ended October 31, 2023, the TCW Artificial Intelligence Equity Fund (the “Fund”) returned 24.40% and 24.22% on its I Class and N Class shares, respectively. The performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the Russell 3000 Growth Index, returned 17.32% over the same period.

Strongest and Weakest Performers

The last year has been a dynamic and volatile period in the market on many fronts. Geopolitical risks included one ongoing war and, late in the year, a second war that threatens to escalate into a regional conflict; heightened macro concerns early in the year around global recession gave way later in the year to a general feeling that a soft landing was possible; inflation peaked prior to the start of the fiscal year and has fallen steadily for most of the year but remains stubbornly above target; interest rates, as measured by the key 10-year U.S. treasury note, were stable for the first half of the year but started rising again in earnest in July, at one point reaching their highest level since 2007; employment, meanwhile, has been remarkably resilient in the face of so much economic data pulling in opposing directions.

Despite all of this market noise, the rapid pace of innovation continues with no better example than the commercial release of generative artificial technology early in the year. This exciting launch ushers in a new era of possibility with respect to productivity, efficiency, and cost structure for enterprises across all sectors of the economy. We continue to view this secular trend as a multi-decade growth opportunity and the beauty from an investing standpoint is that we are just getting started. We believe there are still exciting investable opportunities to be found and, in fact, that many more will come into existence as the technology and the companies developing it mature.

Our two biggest stock contributors during the year were NVIDIA and Meta Platforms.

NVIDIA was the top performer in the period as there was no shortage of good news. After a difficult run in 2022, the shares surged following the release of OpenAI’s ChatGPT late last year. The company emerged as the clear leader in AI-enabling semiconductors thanks to its state-of-the art chips. The release led to a sort of “AI Frenzy” across the market as investors digested the potential uses for AI in the workplace and beyond. The company offered strong guidance in subsequent quarters that was better than consensus estimates and proceeded to beat those forecasts. In the second quarter, revenues topped $13.5 billion, a 101% year-over-year increase. CEO Jensen Huang noted that there was potential for a “trillion-dollar upgrade” to datacenters in order to retool the underlying infrastructure to handle the accelerated computing needed for emerging AI technology like ChatGPT and other generative AI technologies.

Meta Platforms shares bounced back in the period following a difficult run where the company came under scrutiny for its spending and competition from rival social media platform, TikTok. As economic conditions tightened in 2022, Meta was ramping up research and development costs for its Metaverse projects, all while showing signs of slowing growth among its users. In the past year, CEO Mark Zuckerberg has led an aggressive cost-cutting campaign within the company, including multiple rounds of layoffs. The company also reported some growth in its user metrics across its family of apps, an important trend reversal coming out of the pandemic. The shares also benefitted as digital advertising held up throughout the period, even though many analysts trimmed expectations as macro conditions became more volatile.

Our two weakest stock contributors during the year were Enphase Energy and BILL Holdings.

Enphase Energy shares struggled in the period after a strong run in 2022. The shares fell early in the year after the company offered weaker-than-expected revenue guidance, which led to price target cuts from a

4

TCW Artificial Intelligence Equity Fund

Management Discussions (Continued)

number of analysts. Management cited weakening macro measures and higher interest rates leading to softness in demand, particularly within the U.S. We note that we closed our position in the stock in June.

BILL Holdings shares were down after the company offered a weak outlook early in the year, citing slowing demand among small businesses as the broader economy remained volatile. Small businesses, which make up most of BILL’s customer base, are among the first to feel the pinch of a slowing economy, and as concerns about recession rose, the stock sold off sharply. BILL’s shares suffered later in the year as investors reacted to the news that the company had approximately $300 million (of its $2.6 billion corporate cash, cash equivalents, and short-term investments) held at Silicon Valley Bank, which failed in March. Even though the shares sold off quickly, analysts were quick to note that the selloff was likely “overdone” as the cash at risk was equal to approximately $3 per share, and eventually all deposits at the bank were made whole. The shares recouped some of their losses as the story developed. We note that we closed the position subsequent to the fiscal year end.

AI Outlook and Recent Developments

We believe AI will be the foundational technology of the information age. The leap from computing built on the foundation of humans telling computers how to act, to computing built on the foundation of computers learning how to act has significant implications for every industry.

In our view, there are many structural drivers that are accelerating the need for AI. These include:

| • | | Trend in demographics towards an aging global population |

| • | | Need for greater energy efficiency |

| • | | Drive for greater urbanization as demand for convenience increases |

| • | | Efforts to increase human capital productivity |

| • | | And particularly in a down economy, the ability to take cost out of operations |

The broad applicability of AI also leads us to believe that it is a paradigm-shifting technology for the global economy and a driver of improving productivity. AI very well could end the period of stagnant productivity growth in the U.S. We believe that AI-driven improvements to productivity could, similar to the 1990’s, lead corporations to invest in more capital-intensive projects that would no longer be as labor-intensive, accelerating growth, improving profitability, and expanding equity valuations. Moreover, we believe AI and generative AI can have a positive impact on workplace equality. The jobs most at risk of displacement by AI tend to be higher-earning white-collar jobs. But the biggest impact may be that less-skilled workers will suddenly have the tools necessary to perform tasks they were not previously able to and thereby increase their upward mobility.

From an AI perspective, there were a number of recent developments that support our bullish view on the technology, which we highlight with excerpts from the articles cited in the following section.

Foxconn and NVIDIA to Collaborate on Autonomous Vehicle Platforms. In January, NVIDIA announced that it would be partnering with the world’s largest electronics manufacturer, Foxconn, in order to develop automated and autonomous vehicle platforms. The platform will use NVIDIA’s Orin semiconductor that is capable of 254 trillion operations per second and is the current standard for self-driving vehicle computers. Both companies are hoping that the partnership allows them to grab part of the market share for intelligent vehicles that is expected to boom in the coming years as the technology continues to develop. Zacks Equity

5

TCW Artificial Intelligence Equity Fund

Management Discussions (Continued)

Research. Nasdaq.com. NVIDIA (NVDA), Foxconn Team up for Autonomous Vehicle Platform. January 4, 2023 (https://www.nasdaq.com/articles/nvidia-nvda-foxconn-team-up-for-autonomous-vehicle-platform)

Microsoft Invests Billions into ChatGPT-Maker, OpenAI. After ChatGPT’s quick rise to fame, Microsoft announced that it was investing in the creator of the chatbot, OpenAI. While the specific dollar amount is not known, it is believed to be somewhere around $10 billion over the life of the deal. The recent investment actually marks the company’s third investment into OpenAI; in 2019, Microsoft injected $1 billion into the company in order to become the exclusive provider of cloud computing to OpenAI. Last month we wrote about ChatGPT’s capabilities; the chatbot only needs a few inputs, for example, a topic and essay length, and it will write an essay tailored to the specifications the user provides. Both companies hope the newest partnership will help AI technology advance and provide opportunities for commercialization of the technology. Ashley Capoot. CNBC. Microsoft announces new multibillion-dollar investment in ChatGPT-maker OpenAI. January 23, 2022 (https://www.cnbc.com/2023/01/23/microsoft-announces-multibillion-dollar-investment-in-chatgpt-maker-openai.html)

Google Introduces AI Chatbot ‘Bard’ to Challenge ChatGPT. As excitement surrounding artificial intelligence chatbots has continued to rage, Google unveiled its own AI chatbot, called ‘Bard,’ that it hopes will rival OpenAI’s ChatGPT. Recall, ChatGPT was released in recent months and social media, corporations, and news groups were abuzz as the technology seemed to stun anybody who used it. Seeing the success, Google quickly unveiled Bard with hopes to capture some of the excitement. Google and Microsoft have said they expect these AI systems to vastly improve their respective search engines, and there are likely many other uses of the technology. Q.ai contributing to Forbes. Google Announces Bard, Its Rival To Microsoft-Backed ChatGPT. February 8, 2023 (https://www.forbes.com/sites/qai/2023/02/08/google-announces-bard-its-rival-to-microsoft-backed-chatgpt/?sh=613917a33791)

GM’s Cruise Looks to Expand Driverless Vehicle Testing to all of California. General Motors’ Cruise is seeking permits from the California DMV to test its driverless cars across all of California, including San Francisco and Los Angeles. Cruise currently conducts autonomous vehicle testing in San Francisco and Phoenix, Arizona. The company aims to expand its testing beyond these locations. Cruise plans to test a fleet of self-driving cars without human safety drivers, according to the permit applications filed with the DMV. Overall, Cruise is looking to further advance its autonomous vehicle technology and operations in California. Mike Murphy. MarketWatch. GM’s Cruise seeks to test its driverless cars across all of California. March 20, 2023 (https://www.marketwatch.com/story/gms-cruise-seeks-to-test-its-driverless-cars-across-all-of-california-80df5724)

Bill Gates Weighs in on Self-Driving Vehicles. Bill Gates believes that self-driving cars could be as revolutionary as personal computers, as he sees autonomous vehicles bringing immense benefits in reducing accidents and emissions. Gates, who has previously invested in autonomous driving technology, also expressed his optimism about electric cars, noting the improvements in battery technology and range. However, he cautioned that there are still challenges to overcome, including the cost of electric vehicles, charging infrastructure, and the need for new regulations. Gates added that he believes artificial intelligence will play a key role in solving some of these challenges, such as optimizing transportation networks and reducing energy consumption. Tim Levin. Business Insider. Bill Gates says self-driving cars will be as revolutionary as the PC after riding in one. March 31, 2023 (https://www.businessinsider.com/bill-gates-ai-self-driving-cars-as-revolutionary-as-pc-2023-3)

6

TCW Artificial Intelligence Equity Fund

Management Discussions (Continued)

Elon Musk Says Tesla Will Invest More than $1 Billion on its Dojo Supercomputer in the Next Year. Elon Musk made headlines in July when he announced that Tesla would spend more than $1 billion on its Dojo supercomputer by the end of 2024. Dojo is ultimately being designed to handle the massive amount of data processing required for autonomous driving that the company has been working towards for years. Tesla has reported that it has collected data from over 300 million miles of driving that its cars have done, which the company believes will be key in training its autonomous vehicles. Dana Hull & Sean O’Kane. yahoo!finance & Bloomberg. Musk Says Tesla to Spend Over $1 Billion on Dojo Supercomputer. July 19, 2023 (https://finance.yahoo.com/news/musk-says-tesla-spend-over-233834154.html)

Apple Joins the Generative AI Race. In July, news broke that Apple was reportedly working on its own form of ChatGPT to take on OpenAI, Microsoft, Google, and Meta. The chatbot is currently being referred to as “Apple GPT” or AJAX and does not come as a huge surprise to many people within the tech world. Apple recently increased hiring for its generative AI division and collects a massive amount of data thanks to the big user base of its various products. The company did not comment on the news. Mark Gurman. Bloomberg. Apple Tests ‘Apple GPT,’ Develops Generative AI Tools to Catch OpenAI. July 19, 2023 (https://www.bloomberg.com/news/articles/2023-07-19/apple-preps-ajax-generative-ai-apple-gpt-to-rival-openai-and-google#xj4y7vzkg)

Microsoft to Begin Offering AI Assistant Software in November. In September, Microsoft announced that it would begin offering Microsoft 365 Copilot, an “AI assistant” to select customers starting in November. Copilot will supplement core apps like Word and Excel. Copilot is a result of the collaboration with OpenAI, which of course is the creator of ChatGPT, which really started the generative AI wave late in 2022. Microsoft has offered a beta version of the assistant to clients since March and as of May had customers from about 600 large organizations that it calls customers. Jordan Novet. CNBC. Microsoft to sell AI assistant software to biggest clients starting Nov. 1. September 21, 2023 (https://www.cnbc.com/2023/09/21/microsoft-365-copilot-software-becomes-available-to-enterprises-nov-1.html)

Mercedes Releases First Publicly Available Level 3 Autonomous Driving Vehicle. Mercedes announced that its S-Class and EQS Sedans will now have “Drive Pilot” systems, which are “level 3” on the autonomous driving scale. Currently Tesla and GM have level 2 autonomous driving systems available but with level 3, the car is fully in control of itself for certain periods of time. Mercedes Drive Pilot will be in control if the following conditions are met: Lane lines and/or Botts’ dots are present and clearly visible, lane width is sufficient, the road is dry and all sensors are free of obstruction, the car is on an approved freeway, and vehicle speed is 40 mph or lower. Karl Brauer. Forbes. Mercedes-Benz Drive Pilot: The Self-Driving Car Has (Sort Of) Arrived. September 27, 2023 (https://www.forbes.com/sites/kbrauer/2023/09/27/mercedes-benz-drive-pilot-the-self-driving-car-has-sort-of-arrived/?sh=23c15dccea67)

Jamie Dimon Says AI will Shorten the Standard Work Week. JPMorgan CEO Jamie Dimon said that thousands of employees at his bank have already begun using AI in a number of different way and predicted that the technology could eventually lead to a shortened work week thanks to the increased productivity it can add. Dimon had a number of other controversial opinions like the next generation of children will live to 100 and never have cancer thanks to technological advancements. While these were more ominous claims towards technology in general, Dimon expressed his bullishness towards tech and AI. CNBC. Jennifer Liu. JPMorgan CEO Jamie Dimon says AI could bring a 31⁄2-day workweek. October 3, 2023 (https://www.cnbc.com/2023/10/03/jpmorgan-ceo-jamie-dimon-says-ai-could-bring-a-3-day-workweek.html)

7

TCW Artificial Intelligence Equity Fund

Management Discussions (Continued)

Concluding Remarks

We have stated many times that stocks rarely go up in a straight line (at least not for long) and point out that during the smartphone super-cycle in tech, a basket of stocks in the midst of a triple-digit percentage gain experienced at least one 30% drawdown from a local peak. Even in secular moves, we can, and usually do, see broad pullbacks that make investors question whether the game is over. We seem to be in just such a period of stock market consolidation right now, with the SOX index down 18%, the NASDAQ Composite down 11%, the S&P 500 down 9% and the Russell 3000 Growth Index down 9% since the end of July. The SOX, a semiconductor index, is in bear market territory and the other indexes — all of which have high technology exposure — are at or near correction levels.

Fundamental analysis has taken a back seat to macroeconomic forces for many stocks. Results among S&P 500 technology companies that have reported 3Q23 earnings as of this writing have topped expectations far more often than missing (60% beat on revenue, 88% beat on EPS (Earnings per Share)), while 4Q23 earnings estimates went up for nearly half of the companies that have reported (but therefore down for slightly over half). The fundamentals suggest demand is holding up well, but management teams across the board are citing macro uncertainty, falling consumer confidence, and higher rates as reasons to be more cautious in their outlooks. Meanwhile, stocks that beat expectations are generally flat at best following earnings announcements, and those that missed have been routinely punished severely. Volatility feels extreme with even some of the largest market-cap companies suffering double-digit price moves following earnings. The market seems to be geared up for a downturn in the short run with the only question being whether the moves in individual stocks and indexes have adequately discounted the risks for the companies yet to report. Indeed, earnings results for companies that have reported more recently have been met with a much less harsh reaction. The glass is either half full or half empty, depending on which data you choose to focus on.

When we see situations where we think the market may be getting ahead of itself, we try to adjust accordingly without losing sight of the long-term objectives. We typically try to put excess cash to work when the market is feeling bearish, and take some profits when the market is acting overly bullish. Otherwise, we remain focused on the long-term objective of the fund, which is to generate significant capital appreciation by investing in companies at the leading edge of the AI revolution. Major technology cycles tend to run for 10 years or more, and we think AI is just such a super-cycle.

From the time the industry started shipping 10 million cell phones per year, it took around 25 years for unit sales to plateau. It took 30 years for PC sales to peak. The Internet of Things and public cloud are both about 15 years old and neither is showing any signs of peaking. The era of publicly available generative AI will celebrate its first birthday in about a month. As cost comes down and performance goes up, we expect AI to follow previous technology curves and enter a period of exponential growth — a period that could last into the next generation.

Of course, investors have to mark their portfolios to market, and saying “don’t worry, we’ll get through this” doesn’t feel like active management, even if it’s true. Our research effort seeks the most attractive opportunities in the AI ecosystem, and we believe there are many very attractive investment opportunities for the fund available to us today. Moreover, we expect the number of investment candidates to increase significantly when the market’s IPO window next opens, and as more companies outside of traditional technology and infrastructure providers find ways to use AI to create competitive advantages. We think we

8

TCW Artificial Intelligence Equity Fund

Management Discussions (Continued)

are still in the very early stages of this AI cycle; the game is definitely not over. There have been no changes to the objectives of the fund.

We thank you for the opportunity to provide our views on the TCW Global Artificial Intelligence Fund and for the trust that you have placed in us as managers.

| | | | | | | | | | | | | | | | | | | | |

| | | Annualized Total Return as of October 31, 2023(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | |

TCW Artificial Intelligence Equity Fund | | | | | | | | | | | | | | | | | | | | |

Class I (Inception: 09/01/2017) | | | 24.40 | % | | | 1.83 | % | | | 11.58 | % | | | — | | | | 11.28 | % |

Class N (Inception: 09/01/2017) | | | 24.22 | % | | | 1.72 | % | | | 11.48 | % | | | — | | | | 11.19 | % |

Russell 3000 Growth Index | | | 17.32 | % | | | 8.07 | % | | | 13.49 | % | | | | | | | 13.51 | % |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

9

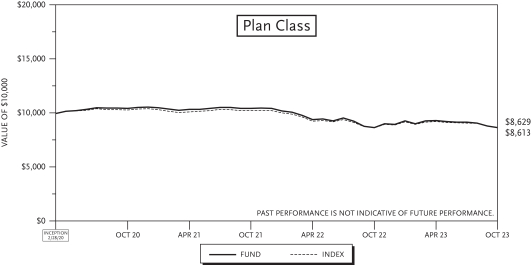

TCW Conservative Allocation Fund

Management Discussions

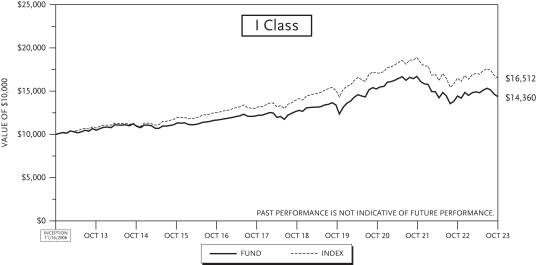

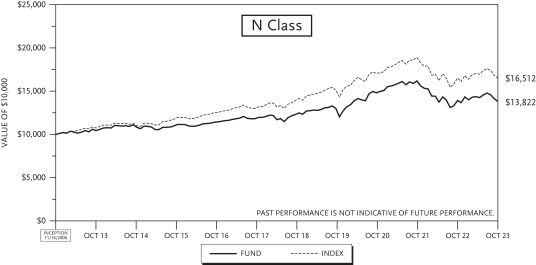

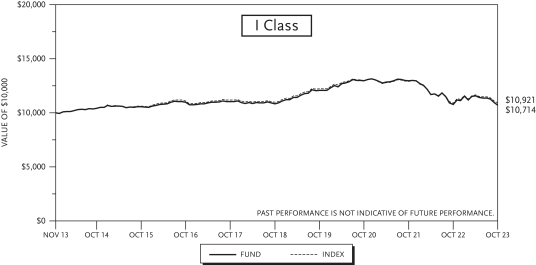

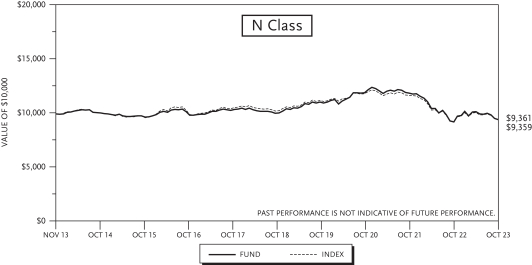

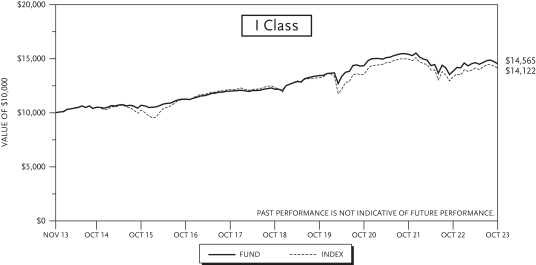

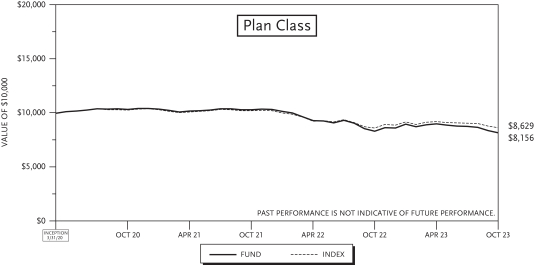

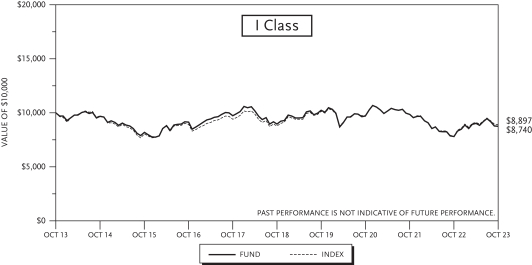

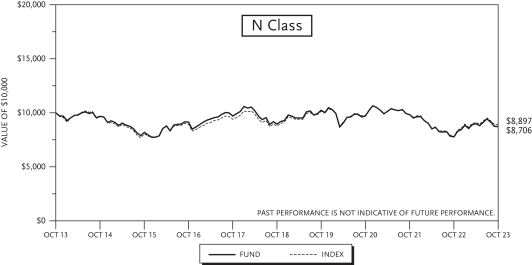

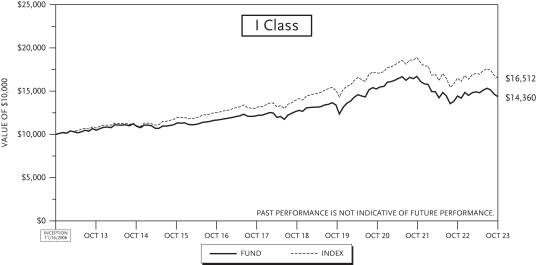

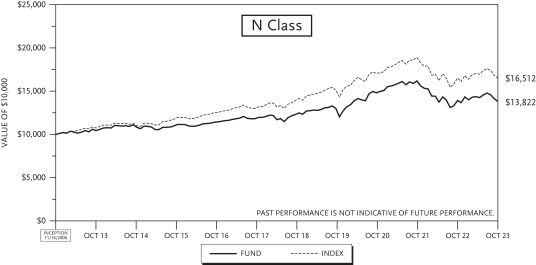

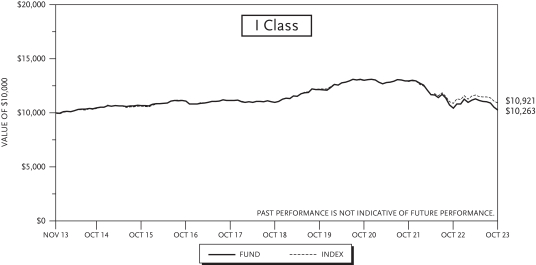

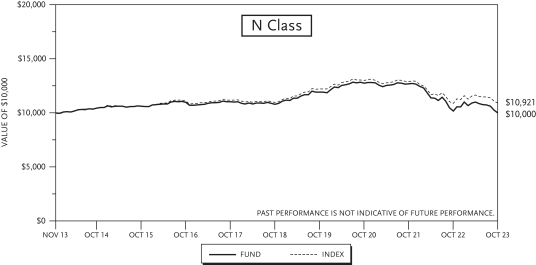

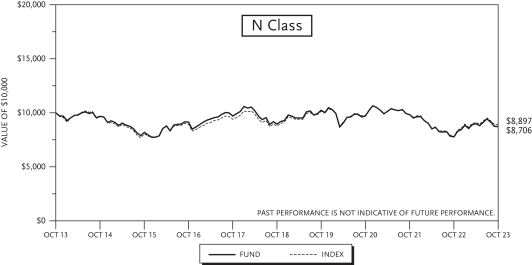

For the year ended October 31, 2023, the TCW Conservative Allocation Fund (the “Fund”) posted a gain of 3.97% for the I Class and 3.78% for the N Class shares. The performance of the Fund’s classes varies because of differing expenses. The Fund’s blended benchmark of 40% S&P 500 Index and 60% Bloomberg U.S. Aggregate Bond Index returned 4.30% over the same time period.

The Fund posted positive returns over the past year with the biggest contributors coming from the TCW Select Equities Fund and the TCW Artificial Intelligence Equities Fund. The best relative returns within the fixed income asset class came from the MetWest High Yield and MetWest Unconstrained Funds.

As of the end of October, the allocation for the Fund was 31% equities, 8% alternatives and 60% fixed income. The fund had an underweight to equities along with overweight allocations to fixed income and alternatives relative to its blended Index. The baseline allocation is 40% Equities and 60% Fixed Income. Over the past 12 months, the Fund had decreased the allocation to equities, specifically large cap stocks. In Fixed Income, the allocation to longer duration, higher-quality U.S fixed income funds were increased along with increasing the allocation to commodities.

U.S. stocks declined 2.1% during the month of October, trimming their year-to-date gain to 10.7% (S&P 500 Total Return Index). A number of strong macroeconomic readings pointed to a solid outlook for the economy, which in turn stoked fears that the Fed would need to leave interest rates “higher for longer.” For instance, third quarter GDP advanced 4.9% (year-over-year), well in advance of the 4.5% consensus expectation, and retail sales in September were up 0.6% sequentially, versus expectations for just 0.1% growth. Nonfarm payrolls, unemployment claims, and new home sales all came in better than expected, pushing the 10-year U.S. Treasury note yield above 5% for the first time in 16 years due, in part, to concern that it would be difficult for the Fed to achieve its 2% inflation target. Investors also fretted that rising yields in Japan, coupled with heavy U.S. Treasury refunding needs, might lead to continued upward pressure on U.S. interest rates. The surge in interest rates hurt equity market sentiment and prospects for the housing market, where the average 30-year fixed-rate mortgage hit 7.90% — its highest level since September 2000. The equity market’s “risk-off” mode was also reinforced by the fallout from Hamas’ attack on Israel, which prompted worries that a broader Mideast conflict might lead to a period of elevated energy prices.

Looking forward, early November macro data have revealed the first significant deterioration in the labor market, given weaker job creation and a higher unemployment rate, thereby permitting interest rates to decline from their October peak. If anything, we think it’s quite possible that the equity market narrative turns back to concerns about softening in the economy and the risk of recession. Target’s CEO recently expressed caution about consumers cutting back, and the increase in credit card debt and auto loan delinquencies appear to echo that concern. At the same time, the global outlook has dimmed considerably, with Eurozone economic growth barely above zero, and China’s PMI (Purchasing Manager’s Index) back in contractionary territory. To be sure, however, the bright spot in the outlook has been U.S. corporate earnings, with third-quarter earnings reports suggesting that most companies have been able to navigate the equation of higher input prices, higher interest rates and weaker global demand reasonably well. Bloomberg consensus figures are for flat EPS growth this year followed by 10% growth next year. While the economy has indeed been resilient, we do expect that the cumulative impact of tightening credit conditions and weakening consumer purchasing power is likely to translate into a recessionary economic backdrop at some point in the next few quarters. As such, we believe that earnings growth expectations for next year may be too optimistic. Stocks are trading on a forward price/earnings multiple of around 18 times, which is elevated relative to the median of the past few decades, so we remain cautious about the outlook and

10

TCW Conservative Allocation Fund

Management Discussions (Continued)

continue to focus on those all-weather businesses which exhibit proven management skill, low levels of indebtedness, strong free cash flow generation, and secular advantages which may help cushion the impact of a slowing economy.

The increased expectations for a soft landing notwithstanding, it has to be recognized that 525 bps of hikes to-date is not subtle and the sharply higher rates now coursing through the curve will increase the likelihood and hasten the timing of a hard landing. Higher costs of capital have yet to affect a broad swath of the economy; namely, the corporate credit market where only a small share of debt has been reset so far, while other COVID-related distortions have extended the typical lagged effect of monetary policy. Furthermore, the pandemic-related savings that fueled consumers have dwindled, implying a measure of belt-tightening ahead. Once it becomes clear that growth is slowing, unemployment is rising, and inflation is firmly on track to a 2% level, the Fed will likely be forced to ease. History would indicate that the Fed typically eases faster than they hike, so the gradual pace of rate cuts priced into markets isn’t likely. Instead, experience with the Fed suggests rates will be held high too long, with an aggressive ease once the slowdown is apparent. Though timing is notoriously difficult to predict, and the economy has been performing thus far, indications are that the hard landing becomes clear in the first half of 2024. Until then, portfolio construction will continue to be based on a foundation of bottom-up issue selection, a strong valuation framework and a disciplined allocation of capital until higher-yielding opportunities (at much more attractive prices) emerge.

With the continued rise in rates during the third quarter, the Fund added incrementally to the duration positioning. Though rates are not expected to move substantially higher from here, the approach will be patient, recognizing that it might be mid-next year before the Fed starts to ease and rates move lower. Once rates do start to fall, the long-duration position will be maintained for a time in an effort to maximize the benefit and recoup the losses generated thus far, before gradually trimming the position once rates have fallen to levels near or below what we would consider to be long-term fair value.

Sector positioning remains consistent; while corporate holdings bear a slight market value overweight, the exposure is a spread contribution (credit risk) underweight. Financials remain the most constructive theme, namely the U.S. money center bank issues, for which Dodd-Frank’s rigors kept clear of the trouble that visited the regional banks earlier this year. The securitized area is another area of focus, reflected in a market value and spread overweight to agency MBS (mortgage-backed securities). The cheapening of last year and persistent volatility have the market at wider spreads that the team finds attractive, especially given a government guarantee and pull-to-par convexity of discount pricing. Non-agency MBS remains among the best values in fixed income with good yields and solid fundamentals. Years of amortization and housing price appreciation have built up substantial equity in such properties, underscoring the fundamentals, and an overall lag in housing supply in the decade-plus since the GFC (Global Financial Crisis) have been supportive as well. Finally, CMBS (commercialized mortgage-backed securities) continues to be an area of concern, with significant declines in some office property valuations, given substantially higher rates and elevated vacancies given the work from home dynamic.

Expectations are for ongoing appraisals lower, more defaults, more delinquencies, and wider spreads for lower-quality deals with questionable collateral; however, there are also many parts of the CMBS market that don’t have these same challenging dynamics (logistics/warehouses, hospitality, multifamily, retail, and even high quality office space), and portfolio holdings reflect these more targeted positions, where we can get comfortable with the risk profile and the specific properties.

11

TCW Conservative Allocation Fund

Management Discussions (Continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Annualized Total Return as of October 31, 2023(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | |

TCW Conservative Allocation Fund | | | | | | | | | | | | | | | | | | | | |

Class I (Inception: 11/16/2006) | | | 3.97 | % | | | 0.09 | % | | | 3.69 | % | | | 3.69 | % | | | 4.46 | % |

Class N (Inception: 11/16/2006) | | | 3.78 | % | | | (0.16 | %) | | | 3.40 | % | | | 3.29 | % | | | 4.19 | % |

40% S&P 500 Index/60% Bloomberg U.S. Aggregate Bond Index | | | 4.30 | % | | | 0.78 | % | | | 4.61 | % | | | 5.14 | % | | | 5.37 | % |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

12

TCW Global Real Estate Fund

Management Discussions

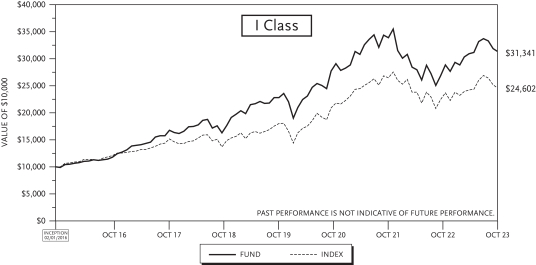

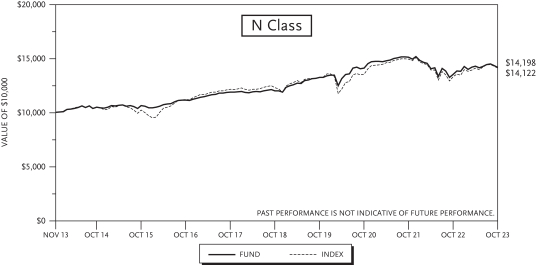

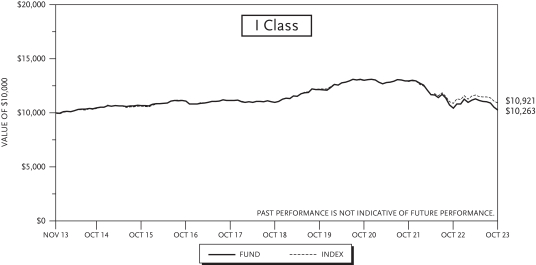

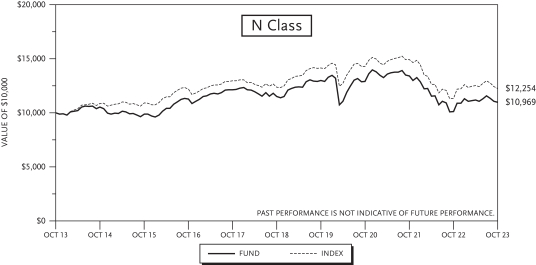

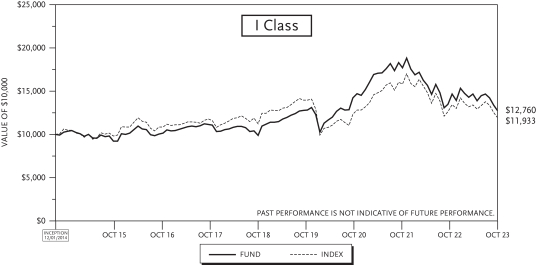

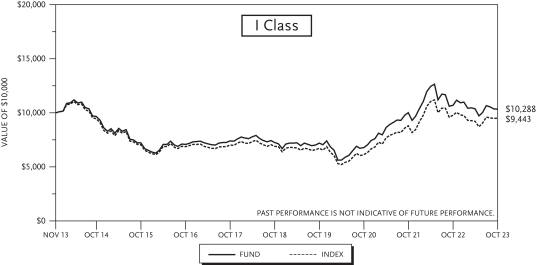

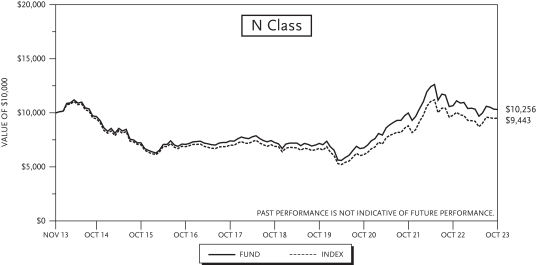

For the year ended October 31, 2023, the TCW Global Real Estate Fund (the “Fund”) generated losses of 5.34% and 5.54% on its I Class and N Class shares, respectively. The performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the S&P Global REIT Index, had a return of 5.43% over the same period.

On an attribution basis, the Fund’s underperformance relative to its benchmark during the period was predominantly driven by security selection. The Fund’s largest sector overweight was in Diversified Real Estate Activities (average weight of 5.43% and up 6.87% for the Fund vs. an average weight of 0% for the Index), which benefitted performance. From a relative standpoint, the Fund’s largest sector underweight was in Retail REITs (average weight of 8.97% and up 4.74% for the Fund vs. average weight of 18.30% and down 5.27% for the Index), which benefitted performance. From a stock selection perspective, positive contributors included Taylor Morrison Home (TMHC) and Equinix (EQIX). Conversely, notable detractors from performance included Independence Realty Trust (IRT) and Public Storage (PSA).

U.S. stocks gained 10.12% in the twelve months ending October 31, 2023 as the market climbed a wall of worry. A number of strong macroeconomic readings pointed to a solid outlook for the economy, which in turn stoked fears that the Fed would need to leave interest rates “higher for longer.” For instance, third quarter GDP advanced 4.9% (year-over-year), well in advance of the 4.5% consensus expectation, and retail sales in September were up 0.6% sequentially, versus expectations for just 0.1% growth. Nonfarm payrolls, unemployment claims, and new home sales all came in better than expected, pushing the 10-year U.S. Treasury note yield above 5% for the first time in 16 years due, in part, to concern that it would be difficult for the Fed to achieve its 2% inflation target. Investors also fretted that rising yields in Japan, coupled with heavy U.S. Treasury refunding needs, might lead to continued upward pressure on U.S. interest rates. The surge in interest rates hurt equity market sentiment and prospects for the housing market, where the average 30-year fixed-rate mortgage hit 7.90% — its highest level since September 2000. The equity market’s “risk-off” mode was also reinforced by the fallout from Hamas’ attack on Israel, which prompted worries that a broader Mideast conflict might lead to a period of elevated energy prices.

Global REIT indices underperformed the broader markets (as measured by the MSCI World Index), declining 5.43% through October 31, 2020 compared to gains of 11.07% for the MSCI World Index. Drivers of the underperformance likely include a more acute impact from rising rates on real estate valuations. Moving forward, there is still much uncertainty with respect to the longer-lasting impacts of the pandemic and the inflationary conditions that have ensued as a result of massive monetary accommodation. For example, the office subsector is an industry that has historically been saddled with relatively high maintenance capital expenditure requirements in addition to high tenant improvement expenditures and leasing costs. Couple these overhangs with a significant change in consumer preference to work from home, and what will undoubtedly be a long period of future technological improvement in telecommuting and virtual meetings, and it becomes very risky to deploy capital in this space. We believe that there are other potentially disrupted areas of the real estate market. While there are counterbalancing forces which may sustain demand in certain sectors/geographies, real estate seems to be more prone to disruption today than it ever has been in our recent memory.

That said, our strategy for navigating the current environment remains largely unchanged. We source most of our holdings from two separate pools. The first is in the quality franchises which exhibit high barriers to entry and sustainably generate strong cash flows. These companies generally also have an ability to invest capital at high rates of return and typically will compound capital at a pace that exceeds that of their peers.

13

TCW Global Real Estate Fund

Management Discussions (Continued)

The second set is in underappreciated, undervalued companies that could benefit from a change in sentiment. The issues facing these businesses are typically transitory and the discount is largely unfounded when viewed on a longer time horizon. In the current environment, it seems that the higher-quality, higher-growth businesses have been impacted as much as the lower-quality “value” names and accordingly we have added to some excellent companies that are as cheap as they have been in years. This should continue to be a great opportunity for active stock selection.

14

TCW Global Real Estate Fund

Management Discussions (Continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Annualized Total Return as of October 31, 2023(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | |

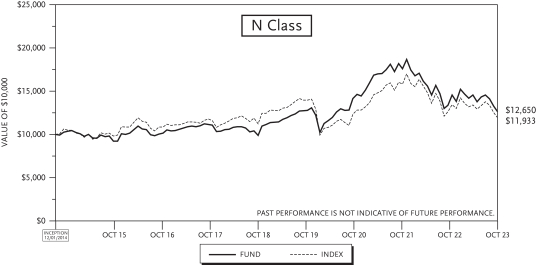

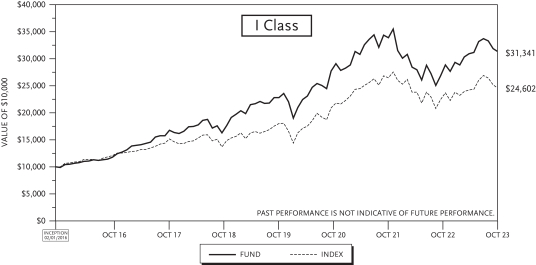

TCW Global Real Estate Fund | | | | | | | | | | | | | | | | | | | | |

Class I (Inception: 12/01/2014) | | | (5.34 | %) | | | (0.27 | %) | | | 4.32 | % | | | — | | | | 2.77 | % |

Class N (Inception: 12/01/2014) | | | (5.54 | %) | | | (0.42 | %) | | | 4.16 | % | | | — | | | | 2.67 | % |

S&P Global REIT Index | | | (5.43 | %) | | | 2.67 | % | | | 0.76 | % | | | | | | | 2.00 | % |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

15

TCW New America Premier Equities Fund

Management Discussions

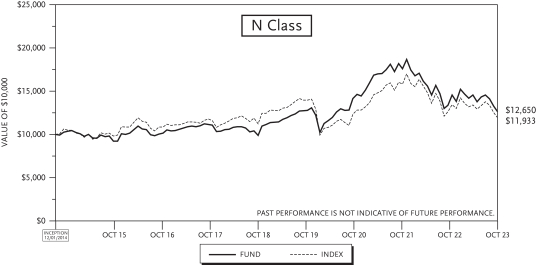

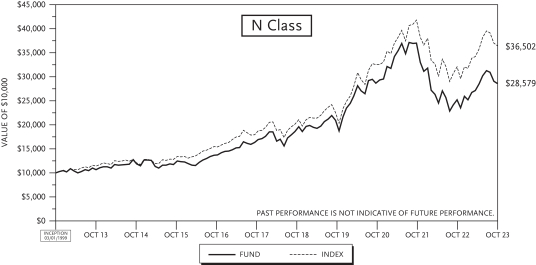

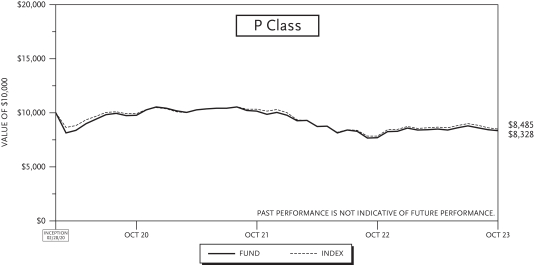

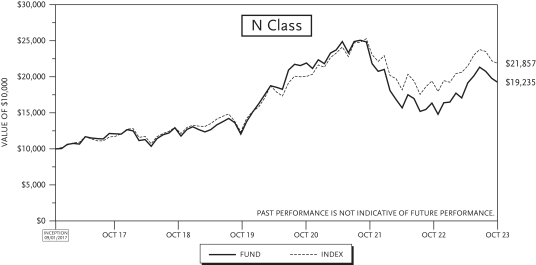

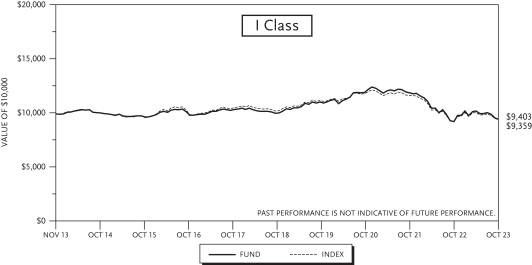

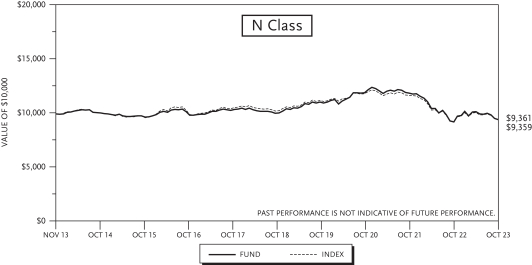

For the fiscal year that ended October 31, 2023, the TCW New America Premier Equities Fund (the “Fund”) returned 16.78% and 16.47% on the I Class and N Class shares, respectively. The performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the Russell 1000 Index, returned 9.48% over the same period.

The Fund’s performance benefited from investments in Constellation Software, Broadcom, Oracle, Microsoft, and Linde. The Fund’s performance was negatively impacted by investments in Mettler-Toledo, HEICO, Danaher, Morningstar, and Waste Connections.

As we have indicated in the past, we eschew a reliance on macroeconomic forecasts and projections of the future direction of markets — our view is that these factors are unknowable. We therefore focus on what we think is knowable. We believe that a careful assessment of investment opportunities at the security level will provide us, in some cases, with a high probability view of the future free cash flows of a business. Risk-adjusted cash flow stream is a key determinant of the future returns of an investment and therefore a key determinant of the portfolio’s future returns. We believe that we have made good decisions in this respect and that the portfolio of companies is built to weather most market environments.

Investment Philosophy

The Fund seeks to outperform the broad U.S. indices in both rising and falling markets with less risk and volatility. We seek to accomplish this objective by investing in a concentrated portfolio of businesses that carefully manage their environmental and social resources and that employ best-in-class corporate governance practices. We invest in businesses that have high barriers to entry, are stable, generate substantial free cash flow and are managed by prudent leaders.

Focus on Dominant, Predictable Businesses with High Barriers to Entry: In the long run, the investment performance of a portfolio is inextricably linked to the underlying performance of the earnings and cash flows of the businesses comprising the portfolio. We believe one of the greatest risks in investing is valuing a business based on an erroneous view of the future free cash flows of the business. Such a circumstance results in an investor typically overpaying for a business and therefore generating a poor return on the investment.

In fast-growing businesses or in industries that are undergoing rapid changes it is extraordinarily difficult and often dangerous to make an investment in a business when the long-term cash generation potential of the enterprise has a wide spectrum of outcomes. We seek to avoid companies and industries that are undergoing rapid changes. What we do seek, however, are stable businesses that have dominant market positions, and whose long-term cash flows we believe can be predicted reasonably well. The qualitative characteristics that we seek, including attractive industry structures, pricing power and dominant market positions, make us confident in our forecast of the future cash flows of the businesses and therefore provide greater confidence that our valuation of the business is reasonably accurate. The famed value investor Benjamin Graham once said, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” Our view is that the market weighs cash flows and in order to consistently purchase a security for less than what it is worth, one should have high confidence in the future free cash flows of a business.

Risk control: Our primary objective, as stewards of your capital, is to control risk while seeking attractive returns. We hone our efforts on those businesses that we believe operate in stable industries with attractive industry structures, businesses that produce products that are critical to their customers, and businesses

16

TCW New America Premier Equities Fund

Management Discussions (Continued)

that we believe are led by proven, appropriately incentivized leaders. We endeavor to further control valuation risk by purchasing securities at attractive prices relative to the current free cash flow generation of the businesses. We believe that businesses that fit our profile produce fairly stable cash flow streams and are less prone to macroeconomic fluctuations, competitive pressures and valuation risks.

Consistency: It is also our objective to deliver a consistently positive outcome. We would view outsized outperformance in one year and poor performance in the subsequent year as a poor outcome for our clients. Our bottoms-up investment process is focused on selecting undervalued businesses that we believe should perform well in most market environments and hold up well in negative periods. We believe consistency in approach and consistency in outcome gives us the best chance of minimizing a left-tail outcome in any given year. It is our view that if we can consistently deliver above-average risk-adjusted performance over a long period of time the outcome likely would be outperformance relative to our peers over the full period. That is our goal.

Thank you for joining us as fellow shareholders in the TCW New America Premier Equities Fund. We will continue to work hard to justify your confidence in us.

17

TCW New America Premier Equities Fund

Management Discussions (Continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Annualized Total Return as of October 31, 2023(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | |

TCW New America Premier Equities Fund | | | | | | | | | | | | | | | | | | | | |

Class I (Inception: 02/01/2016) | | | 16.78 | % | | | 8.58 | % | | | 12.76 | % | | | — | | | | 15.88 | % |

Class N (Inception: 02/01/2016) | | | 16.47 | % | | | 8.28 | % | | | 12.48 | % | | | — | | | | 15.69 | % |

Russell 1000 Index | | | 9.48 | % | | | 9.53 | % | | | 10.71 | % | | | | | | | 12.32 | % |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

18

TCW Relative Value Dividend Appreciation Fund

Management Discussions

For the year ended October 31, 2023, the TCW Relative Value Dividend Appreciation Fund (the “Fund”) posted a return of 3.61% and 3.40% on its I Class and N Class shares, respectively, an outperformance of the benchmark by over 325 bps. The performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the Russell 1000 Value Index, returned 0.13% over the same period.

Market Outlook

U.S. recession timing has been put off. After the strong showing in 3Q23, the economy is expected to grow in 4Q23, albeit by 1-2%. While employment remains strong it is important to remember it is a lagging indicator, as is inflation. Average hourly earnings, a “sticky” inflation contributor, declined to 4.1% year-over-year but buoys consumers as wages are outpacing inflation with the latest CPI reading of 3.7% year-over-year.

Interest sensitive names and asset classes are adjusting to the normalization of rates to higher levels versus the zero lower bound experienced for most of the last 15 years. The drumbeat in the background is that higher rates will cause something to break, either consumers, banks, corporations, or all of the above. Certainly, mortgage rates close to 8% (significantly higher than the 5% average 30-year rate for the last 50 years) have given buyers pause. Providing some relief, well-financed homebuilders are offering “buydown” rates of 5.5-6.0% at current levels. Some U.S. consumers face a headwind with the resumption of student loan payments begun in September. We expect the repayment process to be gradual and it could be mitigated by President Biden’s proposed major expansion of the income-driven repayment program and 12-month payment postponements.

The spring regional banking crisis, with unrealized losses on bank assets available for sale and held to maturity outweighing deposit demands, turned into bank runs for those that could not satisfy withdrawals. So far, the Federal Home Loan Banking system, the Fed window, and the one-year March 2023 Fed Bank Term Funding Program have contained rolling bank funding crises at a cost to net interest income, but $3.0 billion of small bank mergers occurred in 3Q23 up from $600 million in the first half of 2023.

Corporations, as measured by constituents in Bloomberg U.S. Corporate Bond Index, prudently extended debt maturities at low interest rates with the Index’s average maturity of 10.5 years. High corporate cash levels are earning above 5% adding potentially as much as 1.5% to 3Q23 earnings. Third quarter sales and earnings to date have resoundingly best expectations although guidance is coming down. Both fourth quarter and calendar year 2024 EPS are still estimated to be high single-digit growth.

Wartime economies can crowd out traditional business investments but also provide growth for industries servicing war efforts. Dire events saturate the current economic outlook and with 5% interest rates available in money market funds and 2-year Treasuries, there are reliable safe havens. However, patience rewards the investor. The S&P 500 historically has averaged 10% per year, nearly twice the current short rates.

19

TCW Relative Value Dividend Appreciation Fund

Management Discussions (Continued)

If the U.S. has reached a peak in the fed funds rate, it is possible for further stock market gains ahead. The table below highlights how well the U.S. stock markets do one year post the peak fed funds rate in each of the last six Fed hike cycles.

Fed Hiking Cycles

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Fed Funds Rate | | | 12 month return post | |

| Start Date | | End Date | | | Initial | | | Cycle Peak | | | Russ MC TR | | | SPX TR | |

03/30/83 | | | 08/09/84 | | | | 8.50 | % | | | 11.50 | % | | | n/a | | | | 18.0 | % |

01/04/87 | | | 02/24/89 | | | | 5.88 | % | | | 9.75 | % | | | 12.1 | % | | | 18.9 | % |

02/03/94 | | | 02/01/95 | | | | 3.00 | % | | | 6.00 | % | | | 34.5 | % | | | 38.2 | % |

06/29/99 | | | 05/16/00 | | | | 4.75 | % | | | 6.50 | % | | | 4.9 | % | | | (10.5 | %) |

06/29/04 | | | 06/29/06 | | | | 1.00 | % | | | 5.25 | % | | | 20.8 | % | | | 20.5 | % |

12/15/15 | | | 12/20/18 | | | | 0.13 | % | | | 2.38 | % | | | 30.5 | % | | | 31.3 | % |

03/17/22 | | | 07/26/23 | | | | 0.25 | % | | | 5.50 | % | | | n/a | | | | n/a | |

Average | | | | | | | | | | | | | | | 20.6 | % | | | 19.4 | % |

The inception date of the Russell Midcap® Index is November 1, 1991. All performance presented prior to the index inception date is back-tested performance. Source: TCW, Bloomberg

From the peak fed funds rate, starting with the Black Monday (1987) crisis and not including the seventh current cycle, mid-caps, as represented by the Russell Midcap (RMC) Index and the S&P 500 have returned 20.6% and 19.4%, on average, for the next twelve months. The lowest 12-month total return was 4.9% and -10.5% for the RMC and S&P 500, respectively post the 5/16/00 peak and the highest was 34.5% and 38.2% post the 2/1/95 peak. Mid-caps outperformed large caps by a 120 basis points (bps) margin per year. History and current extreme valuations indicate that the “era” for mega cap outperformance soon may be behind us.

Eurozone preliminary 3Q23 GDP contracted slightly (-0.1%) versus consensus estimates for flat growth and has been tepid since 4Q21. Germany was the weakest of the bloc contracting -0.3 in 3Q23 year-over-year, but there were upward revisions to the two prior quarters. Despite revisions, Germany is still lagging behind the broader Euro area economy. The statistics office noted that consumer spending was the main drag while equipment investment rose. Eurozone inflation data declined notably to 2.9% in October from prior month read of 4.3%, its lowest level since July 2021. The UK grew at a 0.6% annual rate in 3Q23 matching the prior quarter. The country’s CPI was unchanged from prior month at 6.7% while core inflation is at 6.1%. The BOE (Bank of England) held rates steady and signaled that they are to stay elevated for an “extended” period and that economic growth is expected to be flat over next 1-2 years. The ECB (European Central Bank) hiking cycle could be over, while the BOE signaled there is the potential for additional hikes should inflation not continue to fall.

China’s GDP grew at 4.9% in 3Q23 and is on target for 5% in 2023. The country’s manufacturing sector (PMI) unexpectedly swung back to contraction while non-manufacturing activity fell to the lowest level since the economy reopened from the lockdown earlier this year. Deflation remains a risk; CPI has essentially been flat for past six months ending September and youth unemployment (ages 16-24) is greater than 20% as of June (latest data point). The PBOC (People’s Bank of China) is likely to cut rates further before year end. Japan’s economy grew at 4.8% rate in 2Q23 due to surging exports and tourists flooding the country. The drop in domestic consumption has economists worried. The BOJ (Bank of Japan) is leaving short-term rates in negative territory and the YCC (Yield Curve Control) cap on 10-year

20

TCW Relative Value Dividend Appreciation Fund

Management Discussions (Continued)

JGBs (Japanese Government Bonds) unchanged at 1% with the upper bound “as a reference”. Japan CPI has exceeded the stated 2% target for 18 consecutive months with forecast inflation not to drop below 2% in 2025. The yen/USD is at the symbolic 150 mark after the YCC decision as traders focused on the BOJ’s dovish pledge to “patiently” maintain accommodative policy.

There are no worries about breaching the debt ceiling until early 2025, but the government faces a potential shutdown on November 17th. Back to school and Halloween sales holding up herald 2-4% for the holiday season, less than last year but still positive. Historically, the fourth quarter of the calendar year is the strongest for U.S. stocks with the S&P gaining 3.8%, on average, in price since 1945 and rising 77% of the time. That is something to look forward to. On the other hand, Middle East hostilities on top of the Ukraine/Russia war about to enter its third year pose risks; however, the U.S. continues to be a global safe haven for all asset classes.

We remain true to our diversified and disciplined portfolio strategy, diligent, and ever watchful for changes. All portfolio holdings are stress tested for a recession over the next two years. We are busy and actively working to make the best portfolio decisions possible with the information we have and will make adjustments should the “facts” change. We are excited about the future but maintain strong risk controls for unexpected events. We thank you for your continued confidence and look forward to better markets ahead.

Fund Review

Over the course of the one-year period ending October 31, 2023, stock selection contributed quite favorably (by nearly 450 bps) relative to the benchmark. The Fund’s top ten holdings by average weight (over the course of the fiscal year) outperformed the portfolio and its benchmark index returning 19.9% led by solid gains from Broadcom, General Electric, and Lennar.

The best contribution came from the portfolio’s Health Care stocks which outperformed the group 2.3% versus -10.1% led by Novartis and McKesson. The portfolio’s Information Technology rose 33.8% far ahead of their peers’ gain of 8.8% led largely by Broadcom while Lennar was the stalwart in Consumer Discretionary where that group returned 11.2% versus -4.0%. General Electric and nVent highlighted in Industrials and the portfolio also benefited from stock selection in Energy, Real Estate, and Financials led by Baker Hughes, Simon Property Group, and Intercontinental Exchange, respectively. One additional notable contributor was Dupont.

On the downside, the portfolio’s Communication Services stocks were the biggest detractors returning 6.3% versus the group’s strong gain of 30.4% (the best performing sector in the Russell 1000 Value) due mostly to not owning Meta Platforms which was up an astounding 223% over the course of the one-year period. It is to be noted that Meta exited the value benchmark at its June reconfiguration. To a lesser effect Warner Bros. Discovery dampened the Communications Services results. AES was key for the loss suffered in Utilities where the portfolio’s names returned -41.6% versus -8.0% while each of the portfolio’s Consumer Staples names struggled with the group as a whole returning -17.5% versus their peers’ slight -1.7% decline with Target, Keurig Dr Pepper, PepsiCo, and Conagra the biggest laggards. Both Target and Conagra were eliminated in August. Other notable detractors included MetLife, Elevance Health, UPS, and Johnson Controls.

21

TCW Relative Value Dividend Appreciation Fund

Management Discussions (Continued)

The Fund’s sector weights detracted 29 bps to relative performance due to the overweights in Health Care and Consumer Discretionary and underweight in Communication Services. The positive underweights in Utilities and Real Estate and overweight in Industrials were a partial offset.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Annualized Total Return as of October 31, 2023(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | | | Inception

Index | |

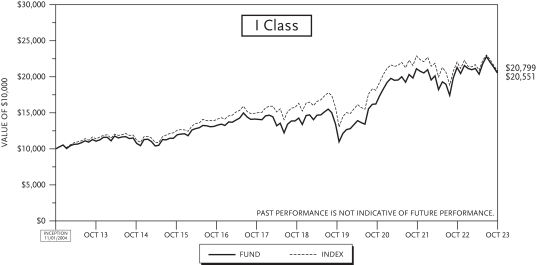

TCW Relative Value Dividend Appreciation Fund | | | | | | | | | | | | | | | | | | | | | | | | |

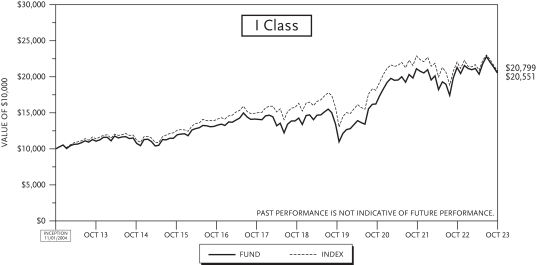

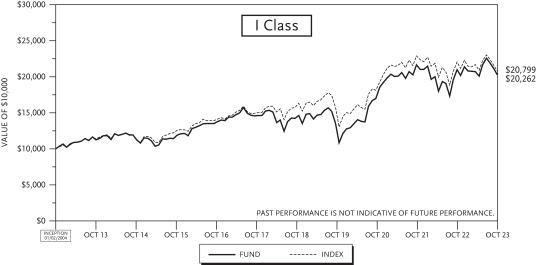

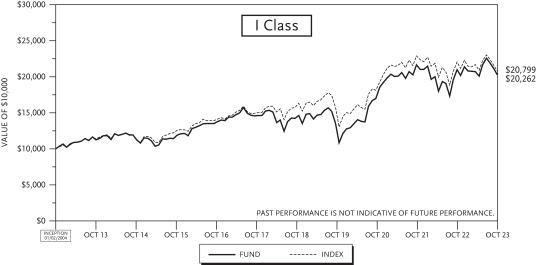

Class I (Inception: 11/01/2004) | | | 3.61 | % | | | 15.22 | % | | | 9.22 | % | | | 7.47 | % | | | 7.32 | % | | | 9.63 | % |

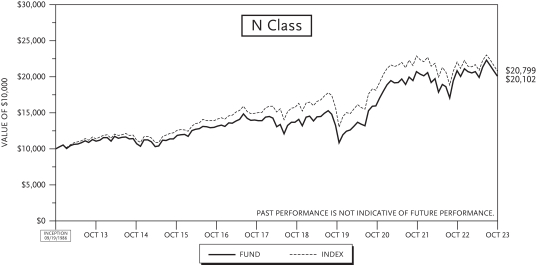

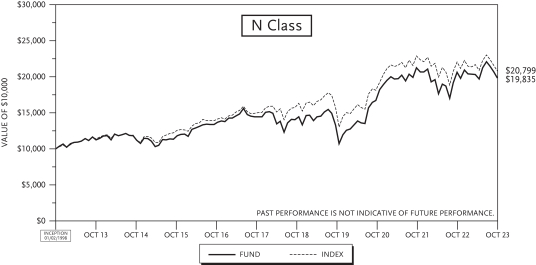

Class N (Inception: 09/19/1986) | | | 3.40 | % | | | 15.00 | % | | | 9.00 | % | | | 7.23 | % | | | 8.85 | % | | | 7.31 | % |

Russell 1000 Value Index | | | 0.13 | % | | | 10.21 | % | | | 6.60 | % | | | 7.60 | % | | | | | | | | |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

22

TCW Relative Value Large Cap Fund

Management Discussions

For the year ended October 31, 2023, the TCW Relative Value Large Cap Fund (the “Fund”) posted a return of 3.61% and 3.41% on its I Class and N Class shares, respectively, an outperformance of the benchmark by over 325 bps. The performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the Russell 1000 Value Index, returned 0.13% over the same period.

Market Outlook

U.S. recession timing has been put off. After the strong showing in 3Q23, the economy is expected to grow in 4Q23, albeit by 1-2%. While employment remains strong it is important to remember it is a lagging indicator, as is inflation. Average hourly earnings, a “sticky” inflation contributor, declined to 4.1% year-over-year but buoys consumers as wages are outpacing inflation with the latest CPI reading of 3.7% year-over-year.

Interest sensitive names and asset classes are adjusting to the normalization of rates to higher levels versus the zero lower bound experienced for most of the last 15 years. The drumbeat in the background is that higher rates will cause something to break, either consumers, banks, corporations, or all of the above. Certainly, mortgage rates close to 8% (significantly higher than the 5% average 30-year rate for the last 50 years) have given buyers pause. Providing some relief, well-financed homebuilders are offering “buydown” rates of 5.5-6.0% at current levels. Some U.S. consumers face a headwind with the resumption of student loan payments begun in September. We expect the repayment process to be gradual and it could be mitigated by President Biden’s proposed major expansion of the income-driven repayment program and 12-month payment postponements.

The spring regional banking crisis, with unrealized losses on bank assets available for sale and held to maturity outweighing deposit demands, turned into bank runs for those that could not satisfy withdrawals. So far, the Federal Home Loan Banking system, the Fed window, and the one-year March 2023 Fed Bank Term Funding Program have contained rolling bank funding crises at a cost to net interest income, but $3.0 billion of small bank mergers occurred in 3Q23 up from $600 million in the first half of 2023.

Corporations, as measured by constituents in Bloomberg U.S. Corporate Bond Index, prudently extended debt maturities at low interest rates with the Index’s average maturity of 10.5 years. High corporate cash levels are earning above 5% adding potentially as much as 1.5% to 3Q23 earnings. Third quarter sales and earnings to date have resoundingly best expectations although guidance is coming down. Both fourth quarter and calendar year 2024 EPS are still estimated to be high single-digit growth.

Wartime economies can crowd out traditional business investments but also provide growth for industries servicing war efforts. Dire events saturate the current economic outlook and with 5% interest rates available in money market funds and 2-year Treasuries, there are reliable safe havens. However, patience rewards the investor. The S&P 500 historically has averaged 10% per year, nearly twice the current short rates.

23

TCW Relative Value Large Cap Fund

Management Discussions (Continued)

If the U.S. has reached a peak in the fed funds rate, it is possible for further stock market gains ahead. The table below highlights how well the U.S. stock markets do one year post the peak fed funds rate in each of the last six Fed hike cycles.

Fed Hiking Cycles

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Fed Funds Rate | | | 12 month return post | |

| Start Date | | End Date | | | Initial | | | Cycle Peak | | | Russ MC TR | | | SPX TR | |

03/30/83 | | | 08/09/84 | | | | 8.50 | % | | | 11.50 | % | | | n/a | | | | 18.0 | % |

01/04/87 | | | 02/24/89 | | | | 5.88 | % | | | 9.75 | % | | | 12.1 | % | | | 18.9 | % |

02/03/94 | | | 02/01/95 | | | | 3.00 | % | | | 6.00 | % | | | 34.5 | % | | | 38.2 | % |

06/29/99 | | | 05/16/00 | | | | 4.75 | % | | | 6.50 | % | | | 4.9 | % | | | (10.5 | %) |

06/29/04 | | | 06/29/06 | | | | 1.00 | % | | | 5.25 | % | | | 20.8 | % | | | 20.5 | % |

12/15/15 | | | 12/20/18 | | | | 0.13 | % | | | 2.38 | % | | | 30.5 | % | | | 31.3 | % |

03/17/22 | | | 07/26/23 | | | | 0.25 | % | | | 5.50 | % | | | n/a | | | | n/a | |

Average | | | | | | | | | | | | | | | 20.6 | % | | | 19.4 | % |

The inception date of the Russell Midcap® Index is November 1, 1991. All performance presented prior to the index inception date is back-tested performance. Source: TCW, Bloomberg

From the peak fed funds rate, starting with the Black Monday (1987) crisis and not including the seventh current cycle, mid-caps, as represented by the Russell Midcap (RMC) Index and the S&P 500 have returned 20.6% and 19.4%, on average, for the next twelve months. The lowest 12-month total return was 4.9% and -10.5% for the RMC and S&P 500, respectively post the 5/16/00 peak and the highest was 34.5% and 38.2% post the 2/1/95 peak. Mid-caps outperformed large caps by a 120 bps margin per year. History and current extreme valuations indicate that the “era” for mega cap outperformance soon may be behind us.

Eurozone preliminary 3Q23 GDP contracted slightly (-0.1%) versus consensus estimates for flat growth and has been tepid since 4Q21. Germany was the weakest of the bloc contracting -0.3 in 3Q23 year-over-year but there were upward revisions to the two prior quarters. Despite revisions, Germany is still lagging behind the broader Euro area economy. The statistics office noted that consumer spending was the main drag while equipment investment rose. Eurozone inflation data declined notably to 2.9% in October from prior month read of 4.3%, its lowest level since July 2021. The UK grew at a 0.6% annual rate in 3Q23 matching the prior quarter. The country’s CPI was unchanged from prior month at 6.7% while core inflation is at 6.1%. The BOE held rates steady and signaled that they are to stay elevated for an “extended” period and that economic growth is expected to be flat over next 1-2 years. The ECB hiking cycle could be over, while the BOE signaled there is the potential for additional hikes should inflation not continue to fall.

China’s GDP grew at 4.9% in 3Q23 and is on target for 5% in 2023. The country’s manufacturing sector (PMI) unexpectedly swung back to contraction while non-manufacturing activity fell to the lowest level since the economy reopened from the lockdown earlier this year. Deflation remains a risk; CPI has essentially been flat for past six months ending September and youth unemployment (ages 16-24) is greater than 20% as of June (latest data point). The PBOC is likely to cut rates further before year end. Japan’s economy grew at 4.8% rate in 2Q23 due to surging exports and tourists flooding the country. The drop in domestic consumption has economists worried. The BOJ is leaving short-term rates in negative territory and the YCC cap on 10-year JGBs unchanged at 1% with the upper bound “as a reference”. Japan CPI has exceeded the stated 2% target for 18 consecutive months with forecast inflation

24

TCW Relative Value Large Cap Fund

Management Discussions (Continued)

not to drop below 2% in 2025. The yen/USD is at the symbolic 150 mark after the YCC decision as traders focused on the BOJ’s dovish pledge to “patiently” maintain accommodative policy.

There are no worries about breaching the debt ceiling until early 2025, but the government faces a potential shutdown on November 17TH. Back to school and Halloween sales holding up herald 2-4% for the holiday season, less than last year but still positive. Historically, the fourth quarter of the calendar year is the strongest for U.S. stocks with the S&P gaining 3.8%, on average, in price since 1945 and rising 77% of the time. That is something to look forward to. On the other hand, Middle East hostilities on top of the Ukraine/Russia war about to enter its third year pose risks; however, the U.S. continues to be a global safe haven for all asset classes.

We remain true to our diversified and disciplined portfolio strategy, diligent, and ever watchful for changes. All portfolio holdings are stress tested for a recession over the next two years. We are busy and actively working to make the best portfolio decisions possible with the information we have and will make adjustments should the “facts” change. We are excited about the future but maintain strong risk controls for unexpected events. We thank you for your continued confidence and look forward to better markets ahead.

Fund Review

Over the course of the one-year period ending October 31, 2023, stock selection contributed quite favorably (by nearly 350 bps) relative to the benchmark. The Fund’s top ten holdings by average weight (over the course of the fiscal year) outperformed the portfolio and its benchmark index returning 20.3% led by solid gains from Broadcom, General Electric, and Lennar.

The best contribution came from the portfolio’s Information Technology stocks which outperformed the group 23.7% versus 8.8% led by Broadcom, Flex, and onsemi. Largely due to Lennar, the portfolio’s Consumer Discretionary names bested their peers 8.4% versus -4.0% while Apollo Global Management and McKesson were the stalwarts in Financials and Health Care, respectively. The portfolio also benefited from stock selection in Energy, Materials, and Industrials with Baker Hughes, Dupont, and General Electric the top performers in their respective sector.

On the downside, the portfolio’s Communication Services stocks were the biggest detractors returning 1.9% versus the group’s strong gain of 30.4% (the best performing sector in the Russell 1000 Value) due mostly to not owning Meta Platforms which was up an astounding 223% over the course of the one-year period. It is to be noted that Meta exited the value benchmark at its June reconfiguration. To a lesser effect Warner Bros. Discovery and Paramount Global both dampened the Communications Services results. Each of the portfolio’s Consumer Staples names struggled with the group returning -18.6% versus their peers’ slight -1.8% decline with Target, Keurig Dr Pepper, and Conagra the biggest laggards. Both Target and Conagra were eliminated in August. AES was almost solely responsible for the loss suffered in Utilities. Other notable detractors included managed care companies Centene and Molina Healthcare.

In addition to positive stock selection, the Fund also benefited from its sector weights which contributed 70 bps to relative performance. The overweight in Information Technology and underweights in Utilities and Financials were all additive. The underweight in Communication Services and overweight in Consumer Discretionary detracted.

25

TCW Relative Value Large Cap Fund

Management Discussions (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Annualized Total Return as of October 31, 2023(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | | | Inception

Index | |

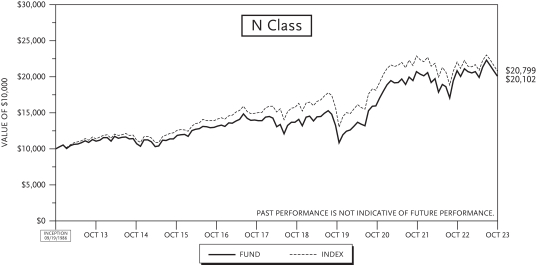

TCW Relative Value Large Cap Fund | | | | | | | | | | | | | | | | | | | | | | | | |

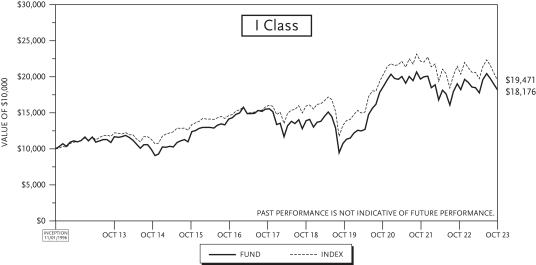

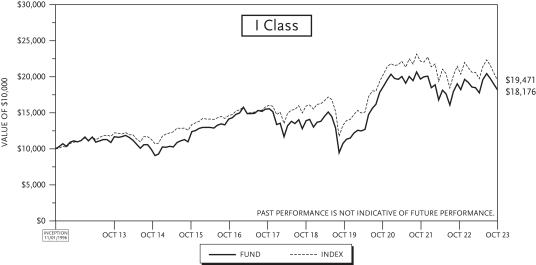

Class I (Inception: 01/02/2004) | | | 3.61 | % | | | 13.86 | % | | | 8.21 | % | | | 7.32 | % | | | 7.34 | % | | | 6.93 | % |

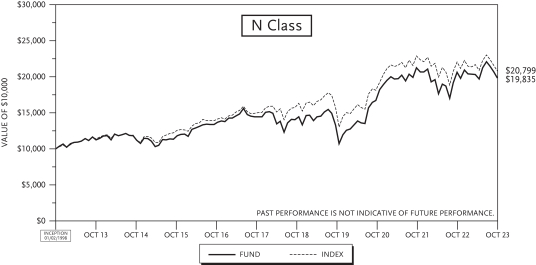

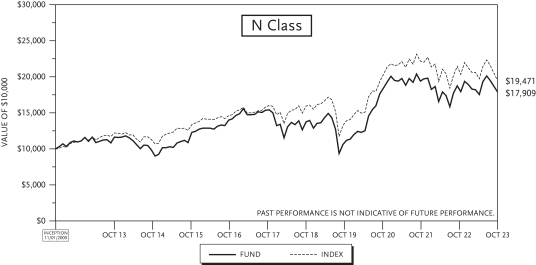

Class N (Inception: 01/02/1998) | | | 3.41 | % | | | 13.65 | % | | | 8.02 | % | | | 7.09 | % | | | 6.43 | % | | | 7.37 | % |

Russell 1000 Value Index | | | 0.13 | % | | | 10.21 | % | | | 6.60 | % | | | 7.60 | % | | | | | | | | |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

26

TCW Relative Value Mid Cap Fund

Management Discussions

For the year ended October 31, 2023, the TCW Relative Value Mid Cap Fund (the “Fund”) posted a return of 1.15% and 1.05% on its I Class and N Class shares, respectively, an outperformance of the benchmark by over 460 bps. The performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the Russell Midcap Value Index, returned -3.56% over the same period.

Market Outlook

U.S. recession timing has been put off. After the strong showing in 3Q23, the economy is expected to grow in 4Q23, albeit by 1-2%. While employment remains strong it is important to remember it is a lagging indicator as is inflation. Average hourly earnings, a “sticky” inflation contributor, declined to 4.1% year-over-year but buoys consumers as wages are outpacing inflation with the latest CPI reading of 3.7% year-over-year.

Interest sensitive names and asset classes are adjusting to the normalization of rates to higher levels versus the zero lower bound experienced for most of the last 15 years. The drumbeat in the background is that higher rates will cause something to break, either consumers, banks, corporations, or all of the above. Certainly, mortgage rates close to 8% (significantly higher than the 5% average 30-year rate for the last 50 years) have given buyers pause. Providing some relief, well-financed homebuilders are offering “buydown” rates of 5.5-6.0% at current levels. Some U.S. consumers face a headwind with the resumption of student loan payments begun in September. We expect the repayment process to be gradual and it could be mitigated by President Biden’s proposed major expansion of the income-driven repayment program and 12-month payment postponements.

The spring regional banking crisis, with unrealized losses on bank assets available for sale and held to maturity outweighing deposit demands, turned into bank runs for those that could not satisfy withdrawals. So far, the Federal Home Loan Banking system, the Fed window, and the one-year March 2023 Fed Bank Term Funding Program have contained rolling bank funding crises at a cost to net interest income, but $3.0 billion of small bank mergers occurred in 3Q23 up from $600 million in the first half of 2023.

Corporations, as measured by constituents in Bloomberg U.S. Corporate Bond Index, prudently extended debt maturities at low interest rates with the Index’s average maturity of 10.5 years. High corporate cash levels are earning above 5% adding potentially as much as 1.5% to 3Q23 earnings. Third quarter sales and earnings to date have resoundingly best expectations although guidance is coming down. Both fourth quarter and calendar year 2024 EPS are still estimated to be high single-digit growth.

Wartime economies can crowd out traditional business investments but also provide growth for industries servicing war efforts. Dire events saturate the current economic outlook and with 5% interest rates available in money market funds and 2-year Treasuries, there are reliable safe havens. However, patience rewards the investor. The S&P 500 historically has averaged 10% per year, nearly twice the current short rates.

27

TCW Relative Value Mid Cap Fund

Management Discussions (Continued)

If the U.S. has reached a peak in the fed funds rate, it is possible for further stock market gains ahead. The table below highlights how well the U.S. stock markets do one year post the peak fed funds rate in each of the last six Fed hike cycles.

Fed Hiking Cycles

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Fed Funds Rate | | | 12 month return post | |

| Start Date | | End Date | | | Initial | | | Cycle Peak | | | Russ MC TR | | | SPX TR | |

03/30/83 | | | 08/09/84 | | | | 8.50 | % | | | 11.50 | % | | | n/a | | | | 18.0 | % |

01/04/87 | | | 02/24/89 | | | | 5.88 | % | | | 9.75 | % | | | 12.1 | % | | | 18.9 | % |

02/03/94 | | | 02/01/95 | | | | 3.00 | % | | | 6.00 | % | | | 34.5 | % | | | 38.2 | % |

06/29/99 | | | 05/16/00 | | | | 4.75 | % | | | 6.50 | % | | | 4.9 | % | | | (10.5 | %) |

06/29/04 | | | 06/29/06 | | | | 1.00 | % | | | 5.25 | % | | | 20.8 | % | | | 20.5 | % |

12/15/15 | | | 12/20/18 | | | | 0.13 | % | | | 2.38 | % | | | 30.5 | % | | | 31.3 | % |

03/17/22 | | | 07/26/23 | | | | 0.25 | % | | | 5.50 | % | | | n/a | | | | n/a | |

Average | | | | | | | | | | | | | | | 20.6 | % | | | 19.4 | % |

The inception date of the Russell Midcap® Index is November 1, 1991. All performance presented prior to the index inception date is back-tested performance. Source: TCW, Bloomberg