0000892071tcw:TCWIndexBloombergUSAggregateBondIndex10186BroadBasedIndexMember2019-03-310000892071tcw:C000218396Member2024-01-310000892071tcw:TCWIndexMSCIACWI10212BroadBasedIndexMember2016-10-310000892071tcw:TCWIndexRussell1000ValueIndex10176AdditionalIndexMember2016-08-310000892071tcw:TCWIndexRussellMidcapValueIndex10196AdditionalIndexMember2017-10-310000892071tcw:TCWIndexRussell1000GrowthIndex10193AdditionalIndexMember2022-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07170

TCW Funds, Inc.

(Exact name of registrant as specified in charter)

515 South Flower Street, Los Angeles, CA 90071

(Address of principal executive offices)

Peter Davidson, Esq.

Vice President and Secretary

515 South Flower Street

Los Angeles, CA 90071

(Name and address of agent for service)

Registrant’s telephone number, including area code: (213) 244-0000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

| Item 1. | Reports to Shareholders. |

| (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”): |

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about the TCW Central Cash Fund for the period ended October 31, 2024. You can find additional information about the Fund at www.tcw.com/Literature/Fund-Literature. You can also request this information by contacting us at 800-FUND-TCW (800-386-3829).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

| TCW Central Cash Fund | $1 | 0.01% |

- Total Net Assets$2,727,562,302

- # of Portfolio Holdings18

- Total Advisory Fees Paid - Net$0

What did the Fund invest in?

Asset Allocation (as a % of Net Assets)

| U.S. Treasury Securities | 55.6% |

| Repurchase Agreement | 29.3% |

| U.S. Government Agency Obligations | 18.4% |

| Money Market Investments | 0.3% |

| Liabilities in Excess of Other Assets | (3.6%) |

Top Ten Holdings (as a % of Net Assets)

| Bank of America NA, 4.83%, due 11/01/24 | 20.2% |

| U.S. Treasury Bills, 4.79%, due 05/20/11 | 12.7% |

| U.S. Treasury Bills, 4.76%, due 11/19/24 | 12.7% |

| JP Morgan Securities, 4.83%, due 11/01/24 | 9.2% |

| U.S. Treasury Bills, 5.02%, due 12/20/11 | 9.2% |

| U.S. Treasury Bills, 5.05%, due 05/20/11 | 6.4% |

| U.S. Treasury Bills, 4.80%, due 05/20/11 | 5.4% |

| U.S. Treasury Bills, 4.76%, due 12/20/11 | 4.0% |

| Federal Home Loan Banks, 4.81%, due 11/19/24 | 3.7% |

| Federal Home Loan Banks, 4.82%, due 04/08/25 | 3.7% |

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact 800-FUND-TCW (800-386-3829).

If you wish to view additional information about the Fund, including but not limited to the Fund's prospectus, financial information, holdings, and proxy voting information, please visit www.tcw.com/Literature/Fund-Literature.

Phone: 800-FUND-TCW (800-386-3829)

Annual Shareholder Report — October 31, 2024

TCW Conservative Allocation Fund

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about the TCW Conservative Allocation Fund for the period ended October 31, 2024. You can find additional information about the Fund at www.tcw.com/Literature/Fund-Literature. You can also request this information by contacting us at 800-FUND-TCW (800-386-3829).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

| Class I | $57 | 0.52% |

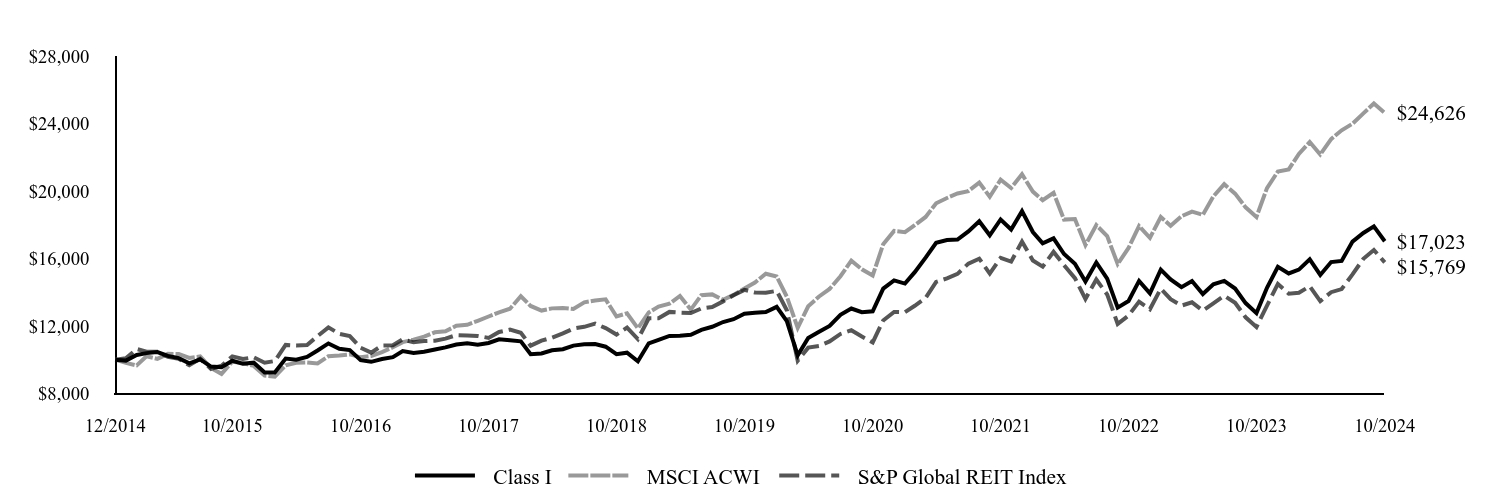

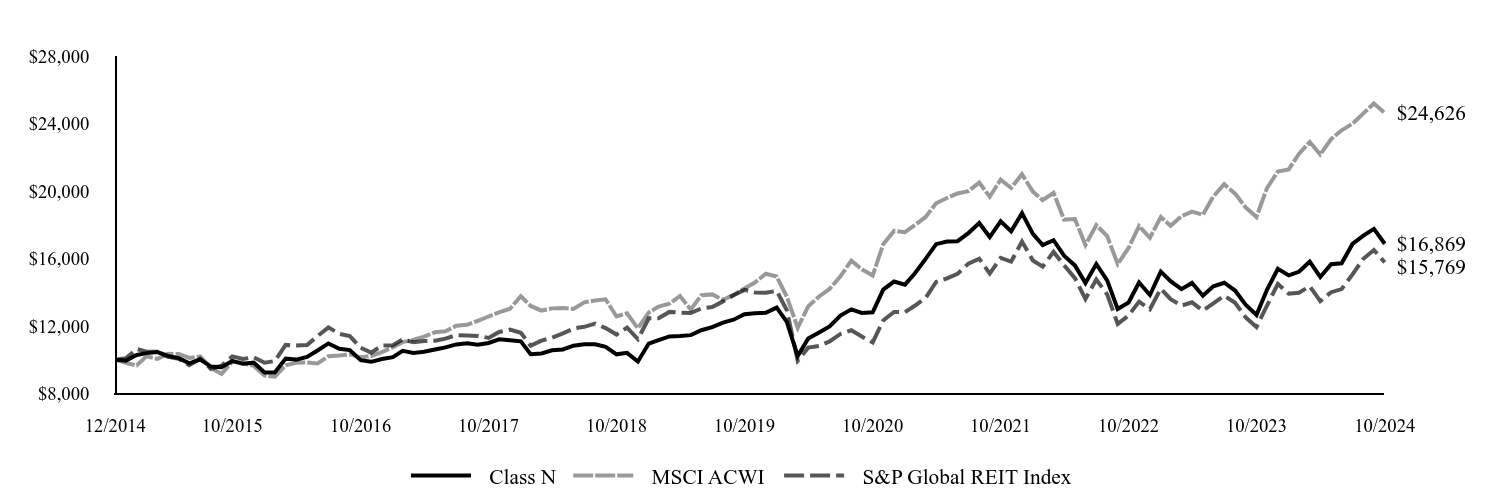

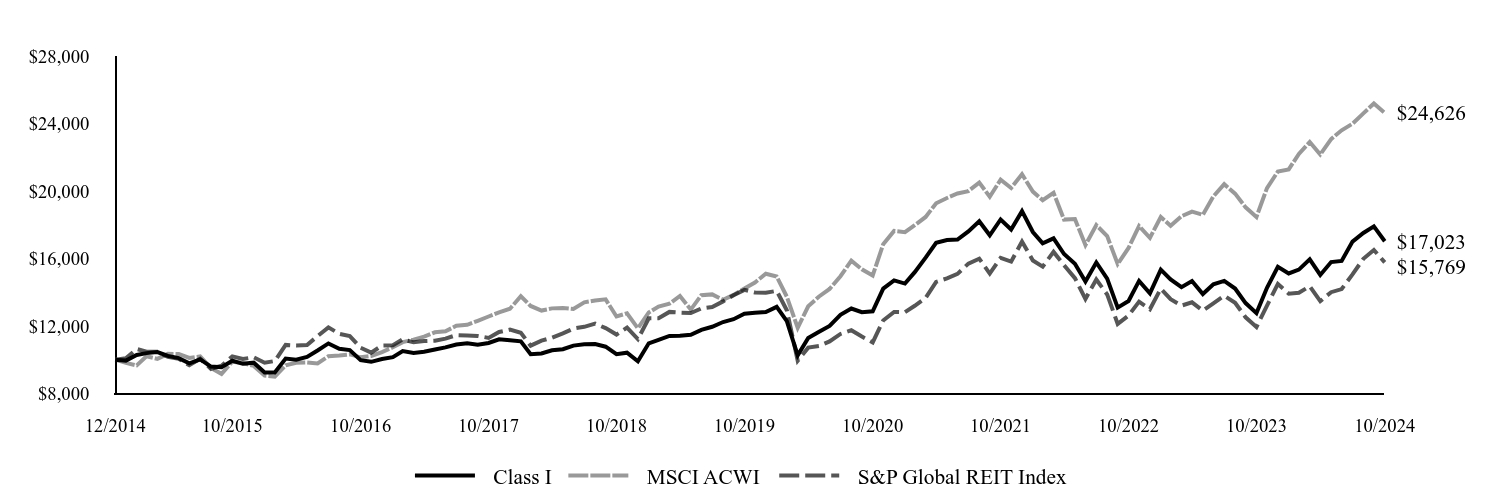

How did the Fund perform last year and what affected its performance?

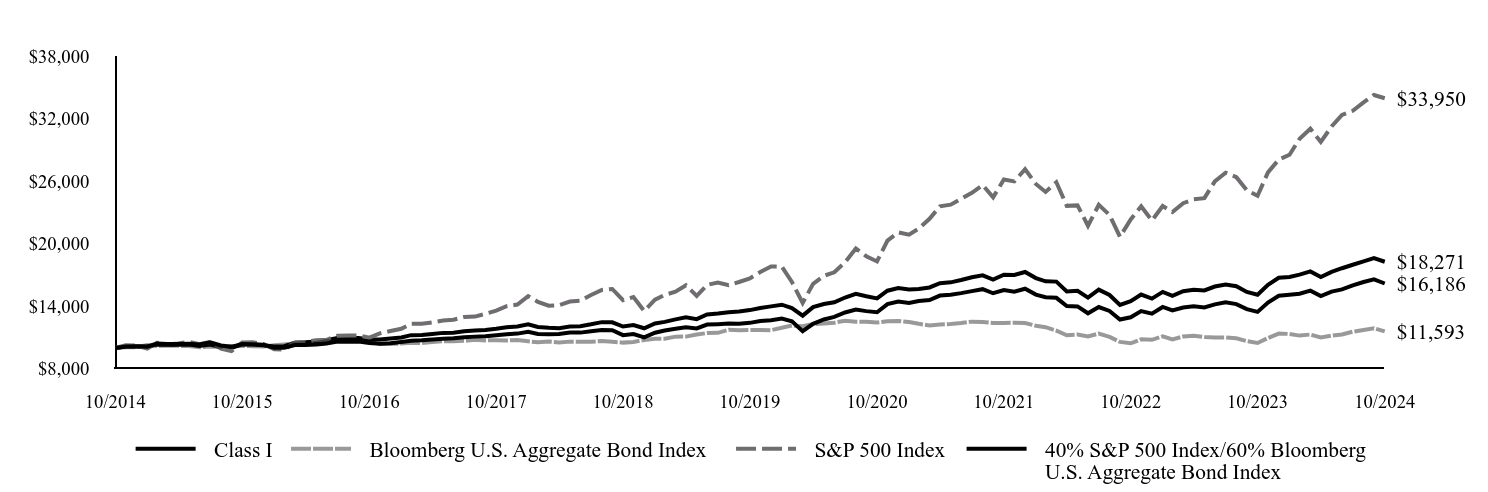

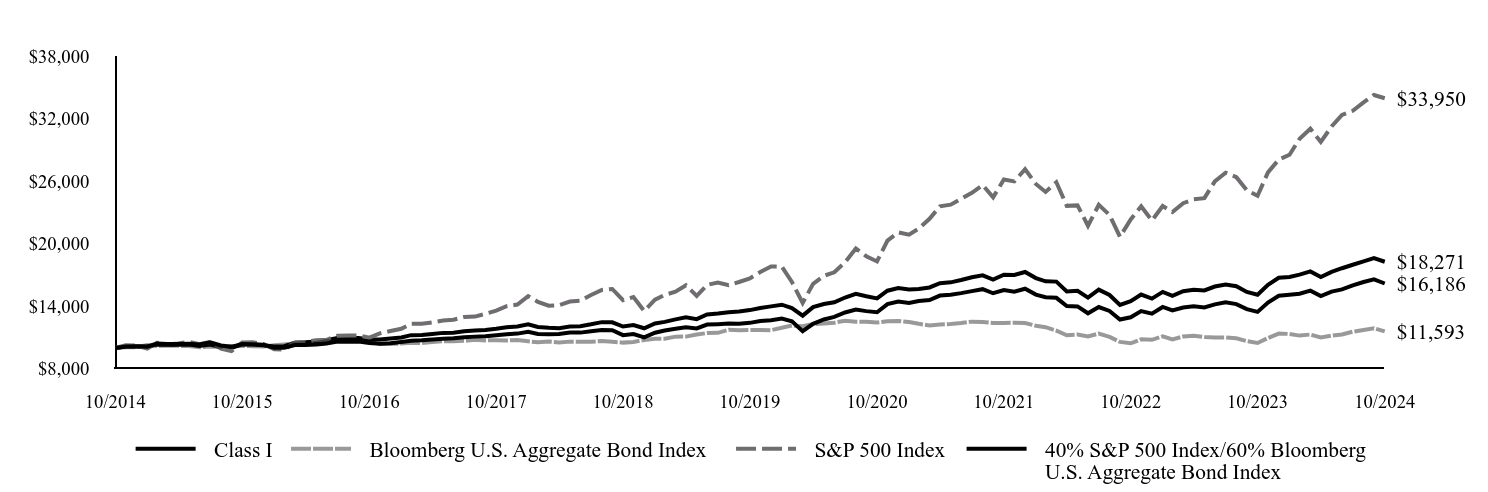

For the year ended October 31, 2024, the TCW Conservative Allocation Fund returned 20.22% net of fees on its Class I shares. On a relative basis the Fund outperformed its first broad-based benchmark, the Bloomberg U.S. Aggregate Bond Index, which returned 10.55%, though it lagged its second broad-based benchmark, the S&P 500 Index, which returned 38.02% in the same period. This period was marked by a significant gain in stock market valuation driven primarily by strong earnings growth and increased attention to technologies underpinning the expansion of artificial intelligence. At the same time the bond market was very responsive to a variety of high frequency data releases in anticipation of the beginning of cuts to the federal funds rate, leading to volatility in the market. In this period the Fund was generally defensively positioned with an emphasis on high quality fixed income assets with extended interest rate duration, including agency mortgage-backed securities. Exposure to high yield corporate debt and emerging market sovereigns was small but contributed positively to the returns. The Fund’s exposure to large cap technology stocks was reduced, which detracted from performance. The focus on stocks of high margin, cashflow-generating business was a positive for performance and volatility though economically sensitive stocks with strong relative value relative to the benchmark had muted returns in this period. Given an elevated correlation between stocks and bonds, exposure to alternative assets classes such as gold, other commodities and liquid real assets was increased to provide added diversification and contributed positively to returns.

| Class I | Bloomberg U.S. Aggregate Bond Index | S&P 500 Index | 40% S&P 500 Index/60% Bloomberg U.S. Aggregate Bond Index |

|---|

| 10/2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| 11/2014 | $10,139 | $10,071 | $10,269 | $10,150 |

| 12/2014 | $10,172 | $10,080 | $10,243 | $10,146 |

| 01/2015 | $10,122 | $10,292 | $9,936 | $10,151 |

| 02/2015 | $10,430 | $10,195 | $10,507 | $10,328 |

| 03/2015 | $10,396 | $10,242 | $10,340 | $10,291 |

| 04/2015 | $10,380 | $10,206 | $10,440 | $10,308 |

| 05/2015 | $10,413 | $10,181 | $10,574 | $10,346 |

| 06/2015 | $10,330 | $10,070 | $10,369 | $10,199 |

| 07/2015 | $10,538 | $10,140 | $10,586 | $10,327 |

| 08/2015 | $10,239 | $10,125 | $9,948 | $10,069 |

| 09/2015 | $10,114 | $10,194 | $9,702 | $10,010 |

| 10/2015 | $10,388 | $10,196 | $10,520 | $10,348 |

| 11/2015 | $10,372 | $10,169 | $10,551 | $10,344 |

| 12/2015 | $10,305 | $10,136 | $10,385 | $10,259 |

| 01/2016 | $10,029 | $10,275 | $9,869 | $10,140 |

| 02/2016 | $10,029 | $10,348 | $9,856 | $10,178 |

| 03/2016 | $10,279 | $10,443 | $10,525 | $10,510 |

| 04/2016 | $10,296 | $10,483 | $10,566 | $10,551 |

| 05/2016 | $10,340 | $10,486 | $10,755 | $10,628 |

| 06/2016 | $10,435 | $10,674 | $10,783 | $10,754 |

| 07/2016 | $10,616 | $10,742 | $11,181 | $10,953 |

| 08/2016 | $10,607 | $10,729 | $11,196 | $10,952 |

| 09/2016 | $10,616 | $10,723 | $11,199 | $10,949 |

| 10/2016 | $10,469 | $10,641 | $10,994 | $10,818 |

| 11/2016 | $10,417 | $10,389 | $11,401 | $10,825 |

| 12/2016 | $10,456 | $10,404 | $11,627 | $10,920 |

| 01/2017 | $10,576 | $10,425 | $11,847 | $11,016 |

| 02/2017 | $10,705 | $10,495 | $12,318 | $11,235 |

| 03/2017 | $10,742 | $10,489 | $12,332 | $11,237 |

| 04/2017 | $10,816 | $10,570 | $12,459 | $11,335 |

| 05/2017 | $10,899 | $10,651 | $12,634 | $11,451 |

| 06/2017 | $10,936 | $10,641 | $12,713 | $11,473 |

| 07/2017 | $11,028 | $10,686 | $12,974 | $11,597 |

| 08/2017 | $11,092 | $10,782 | $13,014 | $11,673 |

| 09/2017 | $11,139 | $10,731 | $13,283 | $11,736 |

| 10/2017 | $11,231 | $10,737 | $13,593 | $11,850 |

| 11/2017 | $11,314 | $10,723 | $14,009 | $11,986 |

| 12/2017 | $11,380 | $10,773 | $14,165 | $12,072 |

| 01/2018 | $11,562 | $10,649 | $14,976 | $12,265 |

| 02/2018 | $11,351 | $10,548 | $14,424 | $12,015 |

| 03/2018 | $11,322 | $10,615 | $14,058 | $11,939 |

| 04/2018 | $11,351 | $10,536 | $14,112 | $11,904 |

| 05/2018 | $11,476 | $10,612 | $14,451 | $12,070 |

| 06/2018 | $11,476 | $10,598 | $14,540 | $12,090 |

| 07/2018 | $11,601 | $10,601 | $15,081 | $12,272 |

| 08/2018 | $11,736 | $10,669 | $15,573 | $12,480 |

| 09/2018 | $11,707 | $10,600 | $15,662 | $12,460 |

| 10/2018 | $11,235 | $10,517 | $14,591 | $12,060 |

| 11/2018 | $11,341 | $10,580 | $14,888 | $12,201 |

| 12/2018 | $11,025 | $10,774 | $13,544 | $11,895 |

| 01/2019 | $11,466 | $10,888 | $14,629 | $12,352 |

| 02/2019 | $11,682 | $10,882 | $15,099 | $12,507 |

| 03/2019 | $11,846 | $11,091 | $15,393 | $12,748 |

| 04/2019 | $12,000 | $11,094 | $16,016 | $12,956 |

| 05/2019 | $11,877 | $11,291 | $14,998 | $12,765 |

| 06/2019 | $12,246 | $11,432 | $16,055 | $13,221 |

| 07/2019 | $12,287 | $11,458 | $16,286 | $13,315 |

| 08/2019 | $12,339 | $11,755 | $16,028 | $13,437 |

| 09/2019 | $12,328 | $11,692 | $16,328 | $13,495 |

| 10/2019 | $12,411 | $11,727 | $16,681 | $13,636 |

| 11/2019 | $12,585 | $11,721 | $17,287 | $13,830 |

| 12/2019 | $12,658 | $11,713 | $17,809 | $13,991 |

| 01/2020 | $12,834 | $11,938 | $17,802 | $14,151 |

| 02/2020 | $12,559 | $12,153 | $16,336 | $13,837 |

| 03/2020 | $11,614 | $12,082 | $14,319 | $13,105 |

| 04/2020 | $12,317 | $12,297 | $16,154 | $13,917 |

| 05/2020 | $12,735 | $12,354 | $16,923 | $14,221 |

| 06/2020 | $12,977 | $12,432 | $17,260 | $14,388 |

| 07/2020 | $13,405 | $12,617 | $18,233 | $14,841 |

| 08/2020 | $13,680 | $12,515 | $19,544 | $15,196 |

| 09/2020 | $13,537 | $12,509 | $18,801 | $14,960 |

| 10/2020 | $13,427 | $12,453 | $18,301 | $14,761 |

| 11/2020 | $14,207 | $12,575 | $20,305 | $15,494 |

| 12/2020 | $14,461 | $12,592 | $21,085 | $15,745 |

| 01/2021 | $14,327 | $12,502 | $20,872 | $15,614 |

| 02/2021 | $14,505 | $12,321 | $21,448 | $15,651 |

| 03/2021 | $14,595 | $12,168 | $22,387 | $15,808 |

| 04/2021 | $15,029 | $12,264 | $23,582 | $16,220 |

| 05/2021 | $15,107 | $12,304 | $23,747 | $16,297 |

| 06/2021 | $15,264 | $12,390 | $24,301 | $16,518 |

| 07/2021 | $15,453 | $12,529 | $24,878 | $16,786 |

| 08/2021 | $15,643 | $12,505 | $25,635 | $16,971 |

| 09/2021 | $15,252 | $12,397 | $24,443 | $16,567 |

| 10/2021 | $15,565 | $12,393 | $26,155 | $17,028 |

| 11/2021 | $15,408 | $12,430 | $25,974 | $17,011 |

| 12/2021 | $15,683 | $12,398 | $27,138 | $17,290 |

| 01/2022 | $15,119 | $12,131 | $25,734 | $16,709 |

| 02/2022 | $14,874 | $11,996 | $24,963 | $16,397 |

| 03/2022 | $14,813 | $11,662 | $25,890 | $16,367 |

| 04/2022 | $14,029 | $11,220 | $23,632 | $15,423 |

| 05/2022 | $13,992 | $11,292 | $23,676 | $15,494 |

| 06/2022 | $13,330 | $11,115 | $21,721 | $14,837 |

| 07/2022 | $13,931 | $11,387 | $23,724 | $15,602 |

| 08/2022 | $13,551 | $11,065 | $22,757 | $15,083 |

| 09/2022 | $12,730 | $10,587 | $20,661 | $14,136 |

| 10/2022 | $12,950 | $10,450 | $22,334 | $14,484 |

| 11/2022 | $13,538 | $10,834 | $23,582 | $15,127 |

| 12/2022 | $13,297 | $10,785 | $22,223 | $14,738 |

| 01/2023 | $13,939 | $11,117 | $23,619 | $15,380 |

| 02/2023 | $13,605 | $10,829 | $23,043 | $14,992 |

| 03/2023 | $13,888 | $11,105 | $23,889 | $15,440 |

| 04/2023 | $14,004 | $11,172 | $24,262 | $15,593 |

| 05/2023 | $13,888 | $11,050 | $24,367 | $15,518 |

| 06/2023 | $14,184 | $11,011 | $25,977 | $15,895 |

| 07/2023 | $14,389 | $11,003 | $26,812 | $16,093 |

| 08/2023 | $14,209 | $10,933 | $26,385 | $15,928 |

| 09/2023 | $13,734 | $10,655 | $25,127 | $15,382 |

| 10/2023 | $13,464 | $10,487 | $24,599 | $15,107 |

| 11/2023 | $14,363 | $10,962 | $26,845 | $16,069 |

| 12/2023 | $15,007 | $11,381 | $28,065 | $16,730 |

| 01/2024 | $15,100 | $11,350 | $28,536 | $16,815 |

| 02/2024 | $15,206 | $11,190 | $30,060 | $17,032 |

| 03/2024 | $15,497 | $11,293 | $31,027 | $17,345 |

| 04/2024 | $14,981 | $11,008 | $29,760 | $16,799 |

| 05/2024 | $15,404 | $11,194 | $31,236 | $17,303 |

| 06/2024 | $15,616 | $11,300 | $32,356 | $17,650 |

| 07/2024 | $16,000 | $11,564 | $32,750 | $17,983 |

| 08/2024 | $16,332 | $11,731 | $33,545 | $18,312 |

| 09/2024 | $16,583 | $11,888 | $34,261 | $18,616 |

| 10/2024 | $16,186 | $11,593 | $33,950 | $18,271 |

The performance data quoted represents past performance and does not guarantee future results. The total returns do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s Average Total Returns are based on net asset values calculated for shareholder transactions which are not reflective of adjustments required pursuant to GAAP. Accordingly, differences may exist between this data and similar information reported in the financial statements.

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | 10 Years |

|---|

| Class I | 20.22% | 5.46% | 4.93% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| S&P 500 Index | 38.02% | 15.26% | 13.00% |

| 40% S&P 500 Index/60% Bloomberg U.S. Aggregate Bond Index | 20.95% | 6.02% | 6.21% |

- Total Net Assets$32,950,692

- # of Portfolio Holdings19

- Portfolio Turnover Rate31%

- Total Advisory Fees Paid - Net$0

What did the Fund invest in?

Asset Allocation (as a % of Net Assets)

| Diversified Fixed Income Funds | 66.0% |

| Diversified Equity Funds | 19.2% |

| Exchange-Traded Funds | 13.5% |

| Exchange-Traded Notes | 1.0% |

| Short-Term Investments | 0.3% |

Top Ten Holdings (as a % of Net Assets)

| TCW Securitized Bond Fund (formerly TCW Total Return Bond Fund), Class I | 25.5% |

| TCW MetWest Total Return Bond Fund, Class I | 21.7% |

| TCW MetWest Unconstrained Bond Fund, Class I | 10.2% |

| TCW Compounders ETF | 9.7% |

| TCW Relative Value Large Cap Fund, Class I | 9.5% |

| TCW Select Equities Fund, Class I | 5.2% |

| TCW MetWest Low Duration Bond Fund, Class I | 4.1% |

| TCW Global Real Estate Fund, Class I | 3.9% |

| TCW Global Bond Fund, Class I | 3.4% |

| iShares MSCI EAFE ETF | 1.3% |

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact 800-FUND-TCW (800-386-3829).

If you wish to view additional information about the Fund, including but not limited to the Fund's prospectus, financial information, holdings, and proxy voting information, please visit www.tcw.com/Literature/Fund-Literature.

Phone: 800-FUND-TCW (800-386-3829)

TCW Conservative Allocation Fund

Annual Shareholder Report — October 31, 2024

TCW Conservative Allocation Fund

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about the TCW Conservative Allocation Fund for the period ended October 31, 2024. You can find additional information about the Fund at www.tcw.com/Literature/Fund-Literature. You can also request this information by contacting us at 800-FUND-TCW (800-386-3829).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

| Class N | $75 | 0.68% |

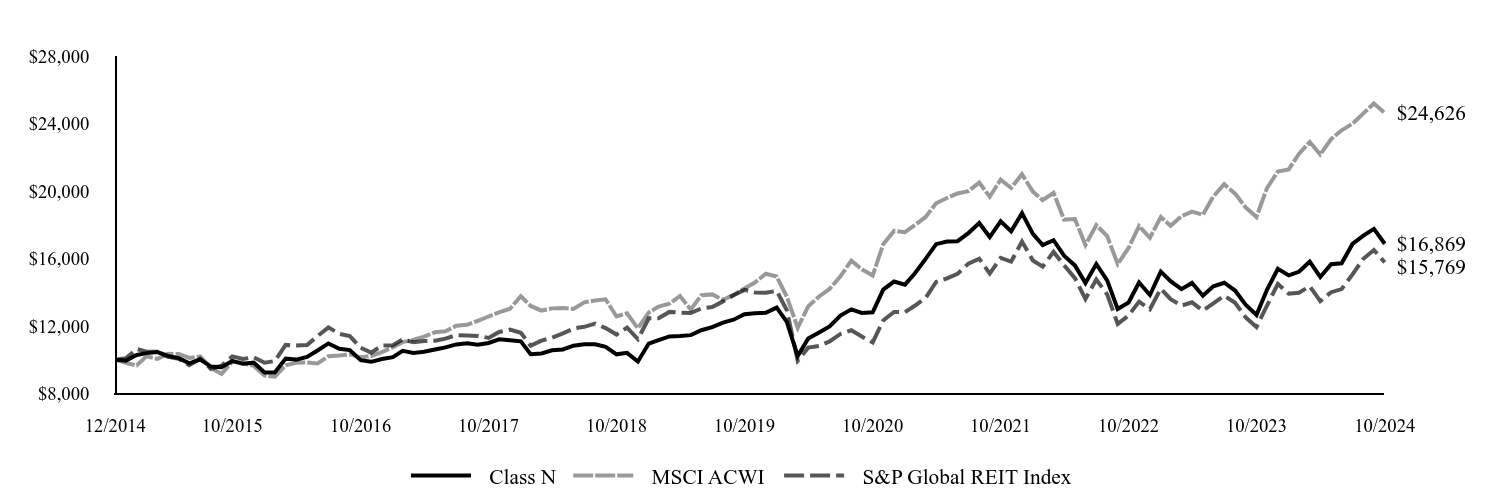

How did the Fund perform last year and what affected its performance?

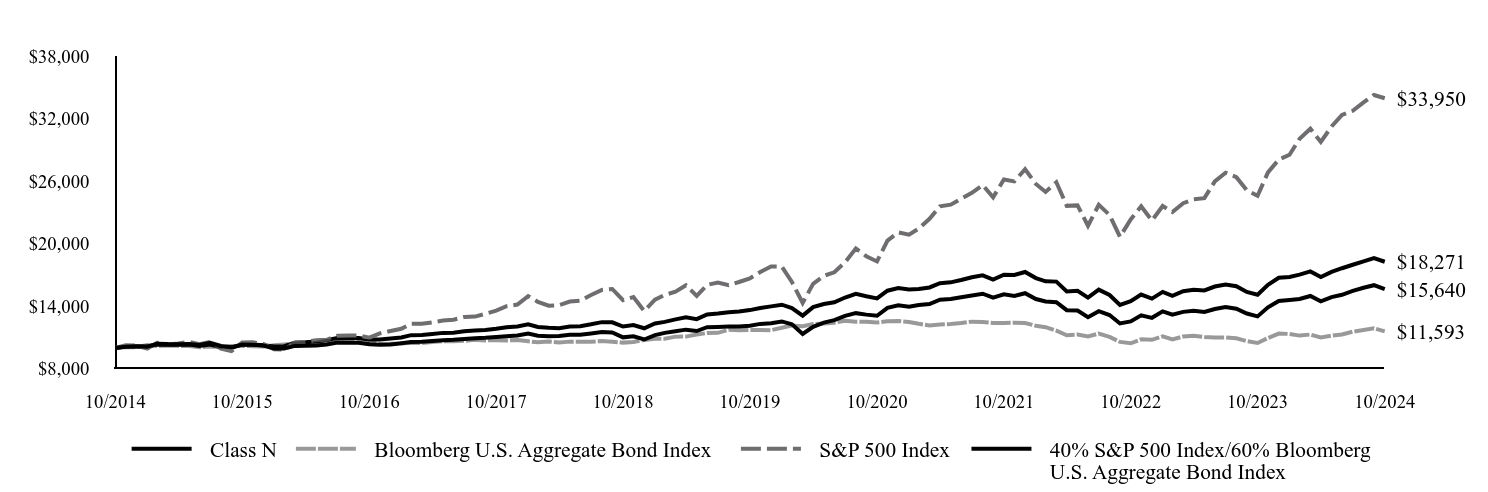

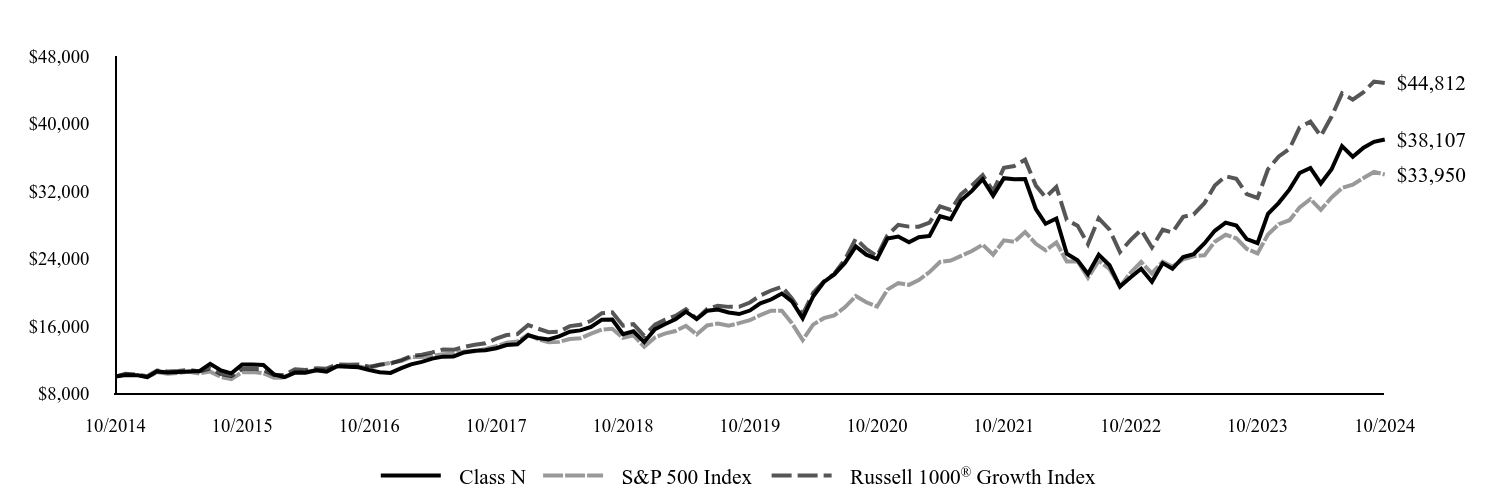

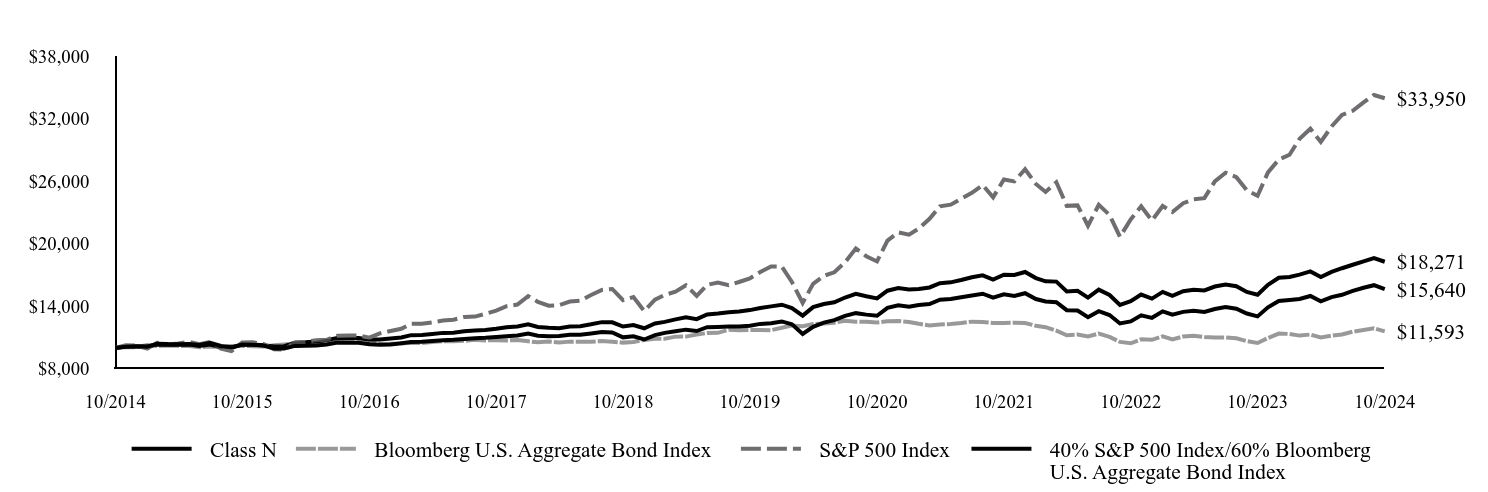

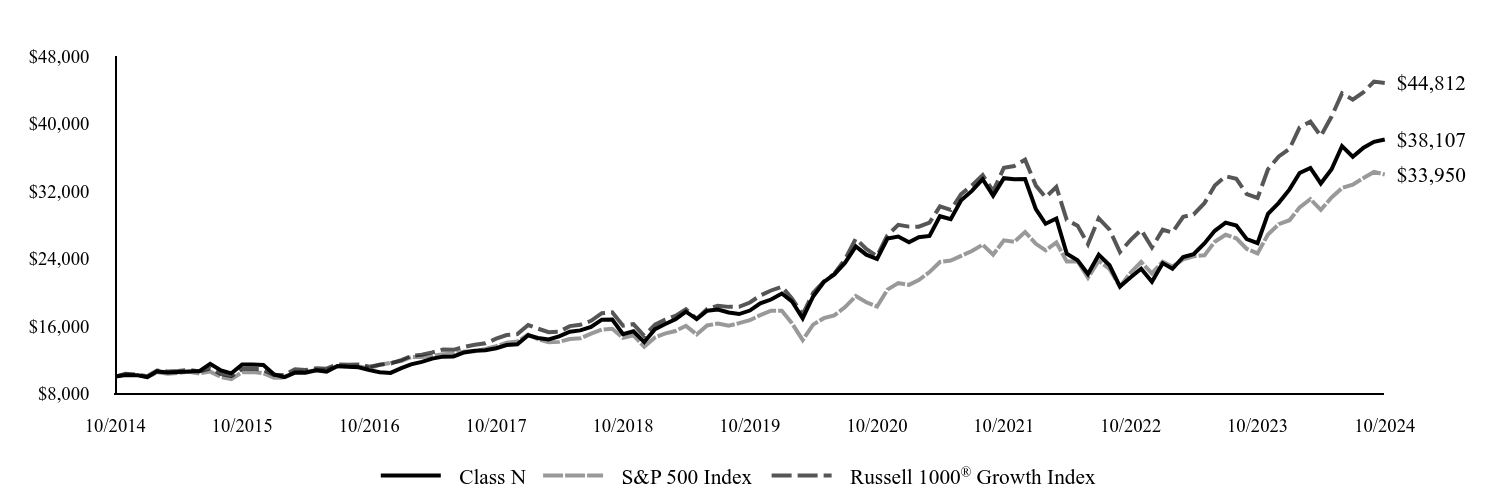

For the year ended October 31, 2024, the TCW Conservative Allocation Fund returned 20.02% net of fees on its Class N shares. On a relative basis the Fund outperformed its first broad-based benchmark, the Bloomberg U.S. Aggregate Bond Index, which returned 10.55%, though it lagged its second broad-based benchmark, the S&P 500 Index, which returned 38.02% in the same period. This period was marked by a significant gain in stock market valuation driven primarily by strong earnings growth and increased attention to technologies underpinning the expansion of artificial intelligence. At the same time the bond market was very responsive to a variety of high frequency data releases in anticipation of the beginning of cuts to the federal funds rate, leading to volatility in the market. In this period the Fund was generally defensively positioned with an emphasis on high quality fixed income assets with extended interest rate duration, including agency mortgage-backed securities. Exposure to high yield corporate debt and emerging market sovereigns was small but contributed positively to the returns. The Fund’s exposure to large cap technology stocks was reduced, which detracted from performance. The focus on stocks of high margin, cashflow-generating business was a positive for performance and volatility though economically sensitive stocks with strong relative value relative to the benchmark had muted returns in this period. Given an elevated correlation between stocks and bonds, exposure to alternative assets classes such as gold, other commodities and liquid real assets was increased to provide added diversification and contributed positively to returns.

| Class N | Bloomberg U.S. Aggregate Bond Index | S&P 500 Index | 40% S&P 500 Index/60% Bloomberg U.S. Aggregate Bond Index |

|---|

| 10/2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| 11/2014 | $10,132 | $10,071 | $10,269 | $10,150 |

| 12/2014 | $10,165 | $10,080 | $10,243 | $10,146 |

| 01/2015 | $10,115 | $10,292 | $9,936 | $10,151 |

| 02/2015 | $10,414 | $10,195 | $10,507 | $10,328 |

| 03/2015 | $10,373 | $10,242 | $10,340 | $10,291 |

| 04/2015 | $10,356 | $10,206 | $10,440 | $10,308 |

| 05/2015 | $10,381 | $10,181 | $10,574 | $10,346 |

| 06/2015 | $10,298 | $10,070 | $10,369 | $10,199 |

| 07/2015 | $10,489 | $10,140 | $10,586 | $10,327 |

| 08/2015 | $10,190 | $10,125 | $9,948 | $10,069 |

| 09/2015 | $10,065 | $10,194 | $9,702 | $10,010 |

| 10/2015 | $10,331 | $10,196 | $10,520 | $10,348 |

| 11/2015 | $10,315 | $10,169 | $10,551 | $10,344 |

| 12/2015 | $10,234 | $10,136 | $10,385 | $10,259 |

| 01/2016 | $9,960 | $10,275 | $9,869 | $10,140 |

| 02/2016 | $9,960 | $10,348 | $9,856 | $10,178 |

| 03/2016 | $10,200 | $10,443 | $10,525 | $10,510 |

| 04/2016 | $10,209 | $10,483 | $10,566 | $10,551 |

| 05/2016 | $10,251 | $10,486 | $10,755 | $10,628 |

| 06/2016 | $10,346 | $10,674 | $10,783 | $10,754 |

| 07/2016 | $10,518 | $10,742 | $11,181 | $10,953 |

| 08/2016 | $10,509 | $10,729 | $11,196 | $10,952 |

| 09/2016 | $10,509 | $10,723 | $11,199 | $10,949 |

| 10/2016 | $10,363 | $10,641 | $10,994 | $10,818 |

| 11/2016 | $10,303 | $10,389 | $11,401 | $10,825 |

| 12/2016 | $10,334 | $10,404 | $11,627 | $10,920 |

| 01/2017 | $10,452 | $10,425 | $11,847 | $11,016 |

| 02/2017 | $10,570 | $10,495 | $12,318 | $11,235 |

| 03/2017 | $10,607 | $10,489 | $12,332 | $11,237 |

| 04/2017 | $10,671 | $10,570 | $12,459 | $11,335 |

| 05/2017 | $10,752 | $10,651 | $12,634 | $11,451 |

| 06/2017 | $10,789 | $10,641 | $12,713 | $11,473 |

| 07/2017 | $10,871 | $10,686 | $12,974 | $11,597 |

| 08/2017 | $10,925 | $10,782 | $13,014 | $11,673 |

| 09/2017 | $10,980 | $10,731 | $13,283 | $11,736 |

| 10/2017 | $11,062 | $10,737 | $13,593 | $11,850 |

| 11/2017 | $11,135 | $10,723 | $14,009 | $11,986 |

| 12/2017 | $11,202 | $10,773 | $14,165 | $12,072 |

| 01/2018 | $11,382 | $10,649 | $14,976 | $12,265 |

| 02/2018 | $11,174 | $10,548 | $14,424 | $12,015 |

| 03/2018 | $11,136 | $10,615 | $14,058 | $11,939 |

| 04/2018 | $11,155 | $10,536 | $14,112 | $11,904 |

| 05/2018 | $11,278 | $10,612 | $14,451 | $12,070 |

| 06/2018 | $11,269 | $10,598 | $14,540 | $12,090 |

| 07/2018 | $11,391 | $10,601 | $15,081 | $12,272 |

| 08/2018 | $11,524 | $10,669 | $15,573 | $12,480 |

| 09/2018 | $11,495 | $10,600 | $15,662 | $12,460 |

| 10/2018 | $11,023 | $10,517 | $14,591 | $12,060 |

| 11/2018 | $11,127 | $10,580 | $14,888 | $12,201 |

| 12/2018 | $10,817 | $10,774 | $13,544 | $11,895 |

| 01/2019 | $11,239 | $10,888 | $14,629 | $12,352 |

| 02/2019 | $11,450 | $10,882 | $15,099 | $12,507 |

| 03/2019 | $11,600 | $11,091 | $15,393 | $12,748 |

| 04/2019 | $11,761 | $11,094 | $16,016 | $12,956 |

| 05/2019 | $11,630 | $11,291 | $14,998 | $12,765 |

| 06/2019 | $11,992 | $11,432 | $16,055 | $13,221 |

| 07/2019 | $12,022 | $11,458 | $16,286 | $13,315 |

| 08/2019 | $12,072 | $11,755 | $16,028 | $13,437 |

| 09/2019 | $12,062 | $11,692 | $16,328 | $13,495 |

| 10/2019 | $12,143 | $11,727 | $16,681 | $13,636 |

| 11/2019 | $12,313 | $11,721 | $17,287 | $13,830 |

| 12/2019 | $12,377 | $11,713 | $17,809 | $13,991 |

| 01/2020 | $12,549 | $11,938 | $17,802 | $14,151 |

| 02/2020 | $12,270 | $12,153 | $16,336 | $13,837 |

| 03/2020 | $11,348 | $12,082 | $14,319 | $13,105 |

| 04/2020 | $12,024 | $12,297 | $16,154 | $13,917 |

| 05/2020 | $12,431 | $12,354 | $16,923 | $14,221 |

| 06/2020 | $12,667 | $12,432 | $17,260 | $14,388 |

| 07/2020 | $13,084 | $12,617 | $18,233 | $14,841 |

| 08/2020 | $13,342 | $12,515 | $19,544 | $15,196 |

| 09/2020 | $13,202 | $12,509 | $18,801 | $14,960 |

| 10/2020 | $13,095 | $12,453 | $18,301 | $14,761 |

| 11/2020 | $13,845 | $12,575 | $20,305 | $15,494 |

| 12/2020 | $14,102 | $12,592 | $21,085 | $15,745 |

| 01/2021 | $13,961 | $12,502 | $20,872 | $15,614 |

| 02/2021 | $14,124 | $12,321 | $21,448 | $15,651 |

| 03/2021 | $14,211 | $12,168 | $22,387 | $15,808 |

| 04/2021 | $14,633 | $12,264 | $23,582 | $16,220 |

| 05/2021 | $14,698 | $12,304 | $23,747 | $16,297 |

| 06/2021 | $14,861 | $12,390 | $24,301 | $16,518 |

| 07/2021 | $15,034 | $12,529 | $24,878 | $16,786 |

| 08/2021 | $15,208 | $12,505 | $25,635 | $16,971 |

| 09/2021 | $14,828 | $12,397 | $24,443 | $16,567 |

| 10/2021 | $15,143 | $12,393 | $26,155 | $17,028 |

| 11/2021 | $14,991 | $12,430 | $25,974 | $17,011 |

| 12/2021 | $15,253 | $12,398 | $27,138 | $17,290 |

| 01/2022 | $14,695 | $12,131 | $25,734 | $16,709 |

| 02/2022 | $14,457 | $11,996 | $24,963 | $16,397 |

| 03/2022 | $14,398 | $11,662 | $25,890 | $16,367 |

| 04/2022 | $13,626 | $11,220 | $23,632 | $15,423 |

| 05/2022 | $13,590 | $11,292 | $23,676 | $15,494 |

| 06/2022 | $12,949 | $11,115 | $21,721 | $14,837 |

| 07/2022 | $13,531 | $11,387 | $23,724 | $15,602 |

| 08/2022 | $13,162 | $11,065 | $22,757 | $15,083 |

| 09/2022 | $12,355 | $10,587 | $20,661 | $14,136 |

| 10/2022 | $12,556 | $10,450 | $22,334 | $14,484 |

| 11/2022 | $13,139 | $10,834 | $23,582 | $15,127 |

| 12/2022 | $12,894 | $10,785 | $22,223 | $14,738 |

| 01/2023 | $13,516 | $11,117 | $23,619 | $15,380 |

| 02/2023 | $13,193 | $10,829 | $23,043 | $14,992 |

| 03/2023 | $13,466 | $11,105 | $23,889 | $15,440 |

| 04/2023 | $13,565 | $11,172 | $24,262 | $15,593 |

| 05/2023 | $13,453 | $11,050 | $24,367 | $15,518 |

| 06/2023 | $13,739 | $11,011 | $25,977 | $15,895 |

| 07/2023 | $13,938 | $11,003 | $26,812 | $16,093 |

| 08/2023 | $13,764 | $10,933 | $26,385 | $15,928 |

| 09/2023 | $13,304 | $10,655 | $25,127 | $15,382 |

| 10/2023 | $13,031 | $10,487 | $24,599 | $15,107 |

| 11/2023 | $13,901 | $10,962 | $26,845 | $16,069 |

| 12/2023 | $14,516 | $11,381 | $28,065 | $16,730 |

| 01/2024 | $14,605 | $11,350 | $28,536 | $16,815 |

| 02/2024 | $14,707 | $11,190 | $30,060 | $17,032 |

| 03/2024 | $14,988 | $11,293 | $31,027 | $17,345 |

| 04/2024 | $14,477 | $11,008 | $29,760 | $16,799 |

| 05/2024 | $14,886 | $11,194 | $31,236 | $17,303 |

| 06/2024 | $15,103 | $11,300 | $32,356 | $17,650 |

| 07/2024 | $15,474 | $11,564 | $32,750 | $17,983 |

| 08/2024 | $15,781 | $11,731 | $33,545 | $18,312 |

| 09/2024 | $16,023 | $11,888 | $34,261 | $18,616 |

| 10/2024 | $15,640 | $11,593 | $33,950 | $18,271 |

The performance data quoted represents past performance and does not guarantee future results. The total returns do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s Average Total Returns are based on net asset values calculated for shareholder transactions which are not reflective of adjustments required pursuant to GAAP. Accordingly, differences may exist between this data and similar information reported in the financial statements.

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | 10 Years |

|---|

| Class N | 20.02% | 5.19% | 4.57% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

| S&P 500 Index | 38.02% | 15.26% | 13.00% |

| 40% S&P 500 Index/60% Bloomberg U.S. Aggregate Bond Index | 20.95% | 6.02% | 6.21% |

- Total Net Assets$32,950,692

- # of Portfolio Holdings19

- Portfolio Turnover Rate31%

- Total Advisory Fees Paid - Net$0

What did the Fund invest in?

Asset Allocation (as a % of Net Assets)

| Diversified Fixed Income Funds | 66.0% |

| Diversified Equity Funds | 19.2% |

| Exchange-Traded Funds | 13.5% |

| Exchange-Traded Notes | 1.0% |

| Short-Term Investments | 0.3% |

Top Ten Holdings (as a % of Net Assets)

| TCW Securitized Bond Fund (formerly TCW Total Return Bond Fund), Class I | 25.5% |

| TCW MetWest Total Return Bond Fund, Class I | 21.7% |

| TCW MetWest Unconstrained Bond Fund, Class I | 10.2% |

| TCW Compounders ETF | 9.7% |

| TCW Relative Value Large Cap Fund, Class I | 9.5% |

| TCW Select Equities Fund, Class I | 5.2% |

| TCW MetWest Low Duration Bond Fund, Class I | 4.1% |

| TCW Global Real Estate Fund, Class I | 3.9% |

| TCW Global Bond Fund, Class I | 3.4% |

| iShares MSCI EAFE ETF | 1.3% |

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact 800-FUND-TCW (800-386-3829).

If you wish to view additional information about the Fund, including but not limited to the Fund's prospectus, financial information, holdings, and proxy voting information, please visit www.tcw.com/Literature/Fund-Literature.

Phone: 800-FUND-TCW (800-386-3829)

TCW Conservative Allocation Fund

Annual Shareholder Report — October 31, 2024

TCW Core Fixed Income Fund

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about the TCW Core Fixed Income Fund for the period ended October 31, 2024. You can find additional information about the Fund at www.tcw.com/Literature/Fund-Literature. You can also request this information by contacting us at 800-FUND-TCW (800-386-3829).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

| Class I | $52 | 0.49% |

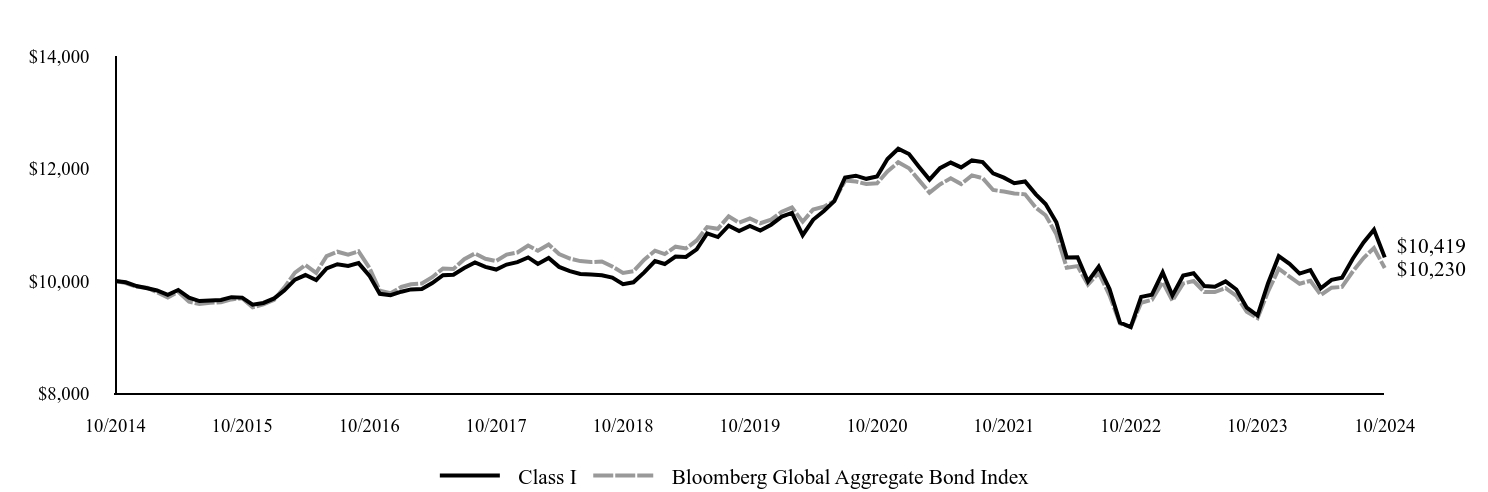

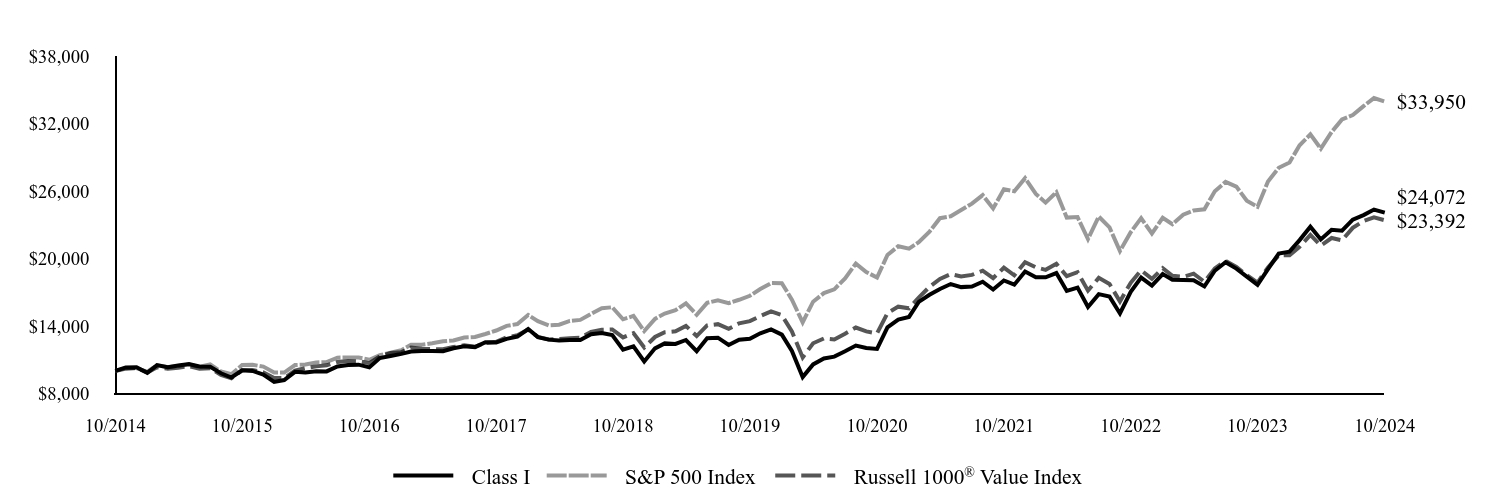

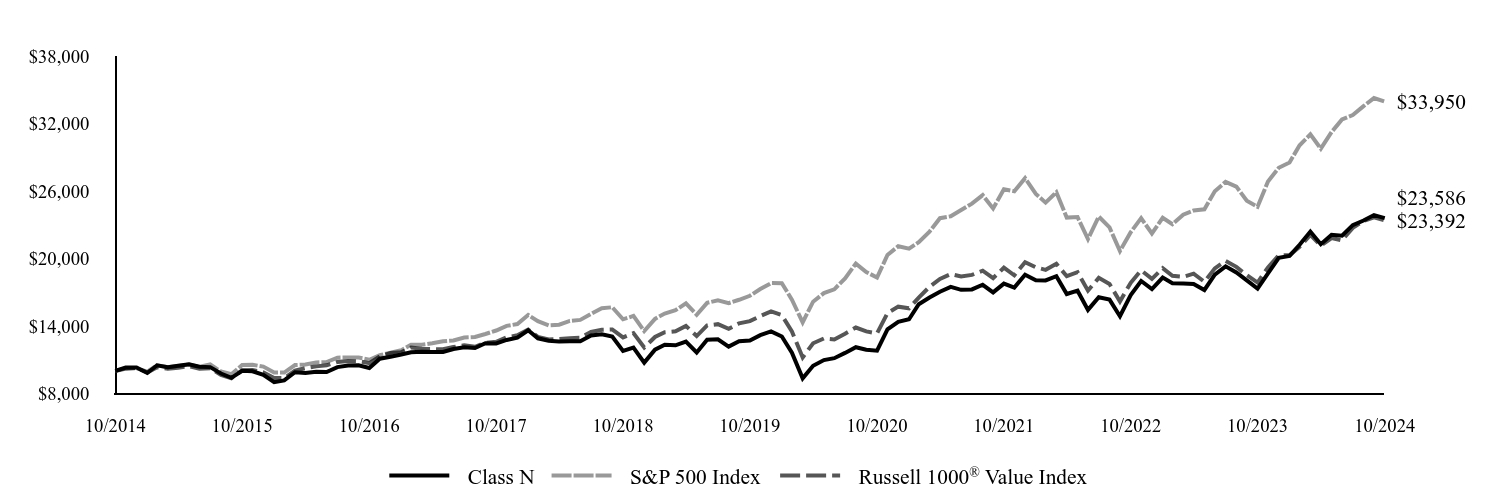

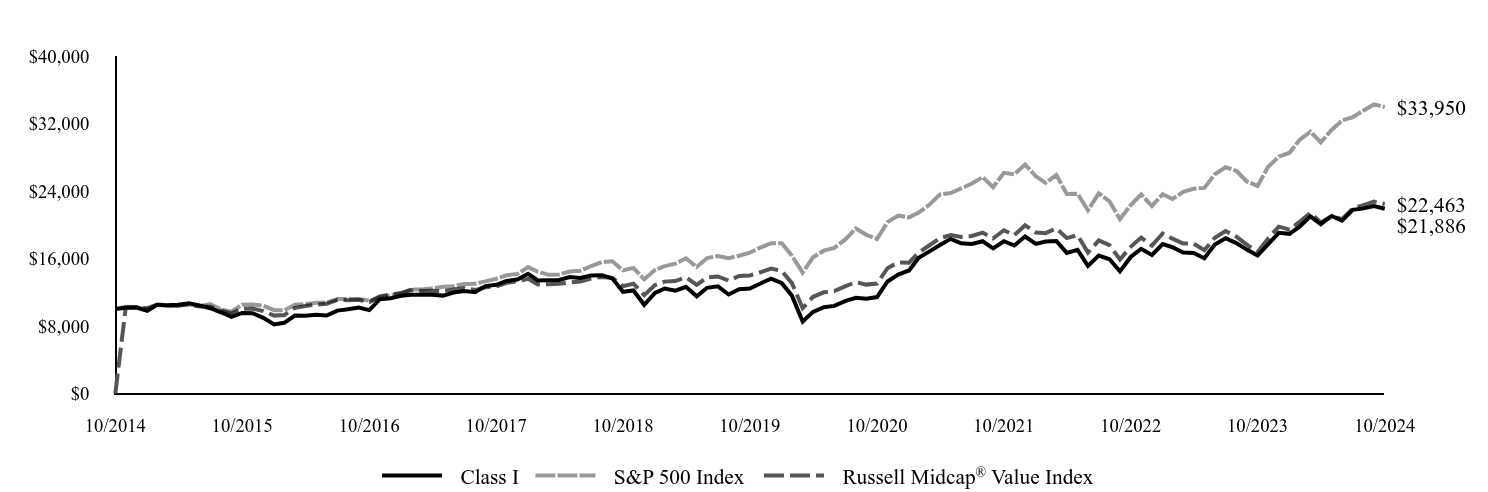

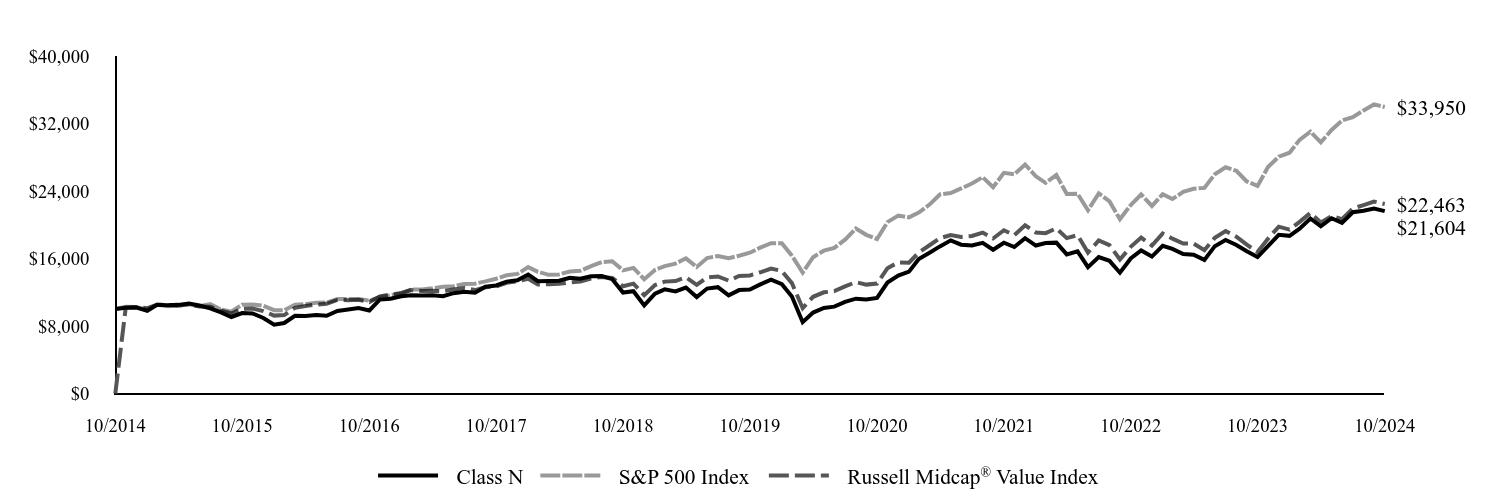

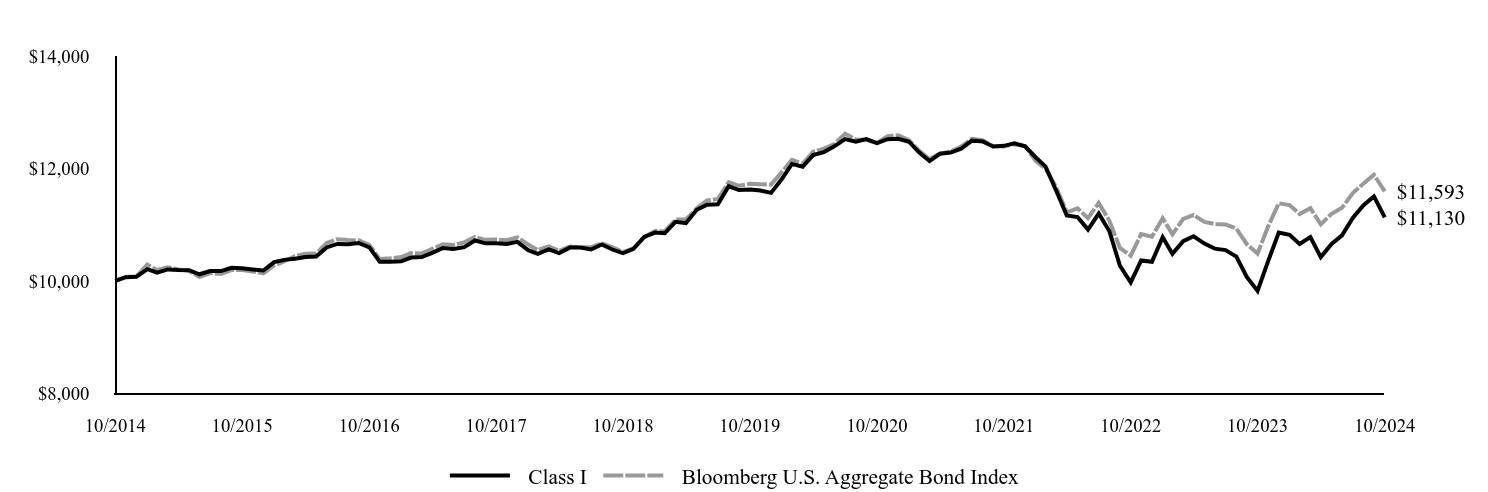

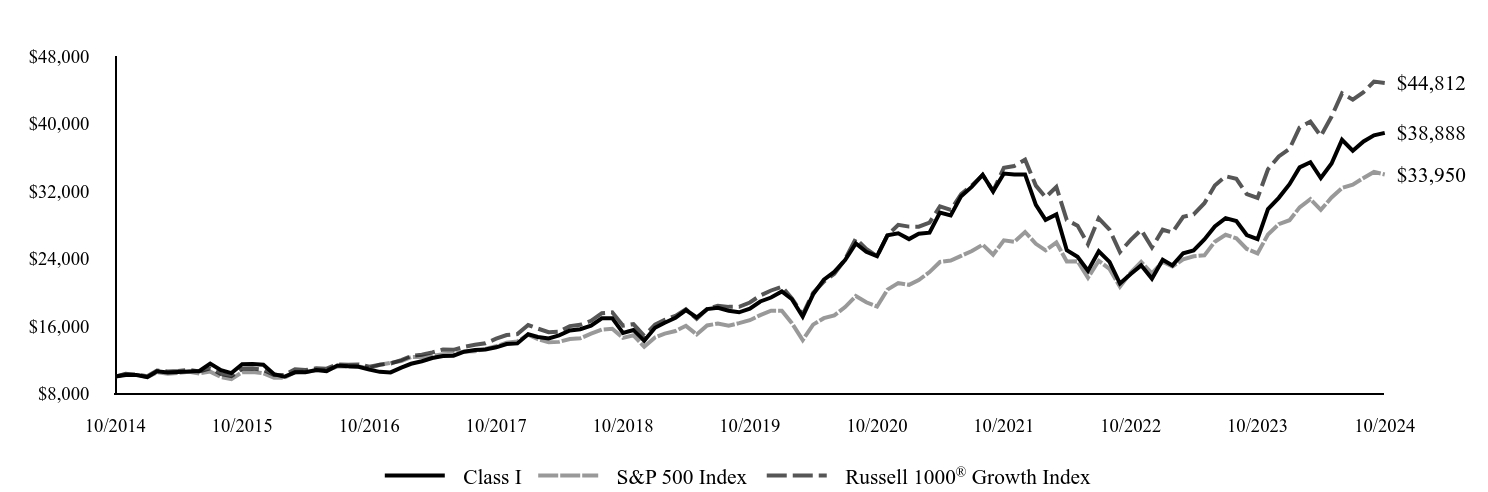

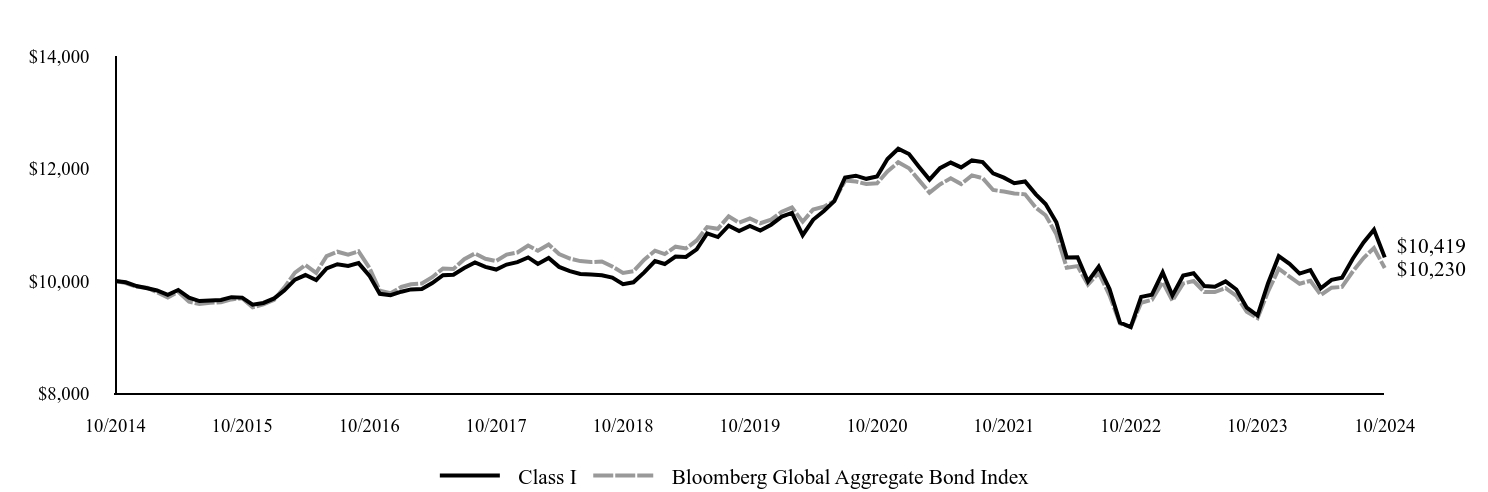

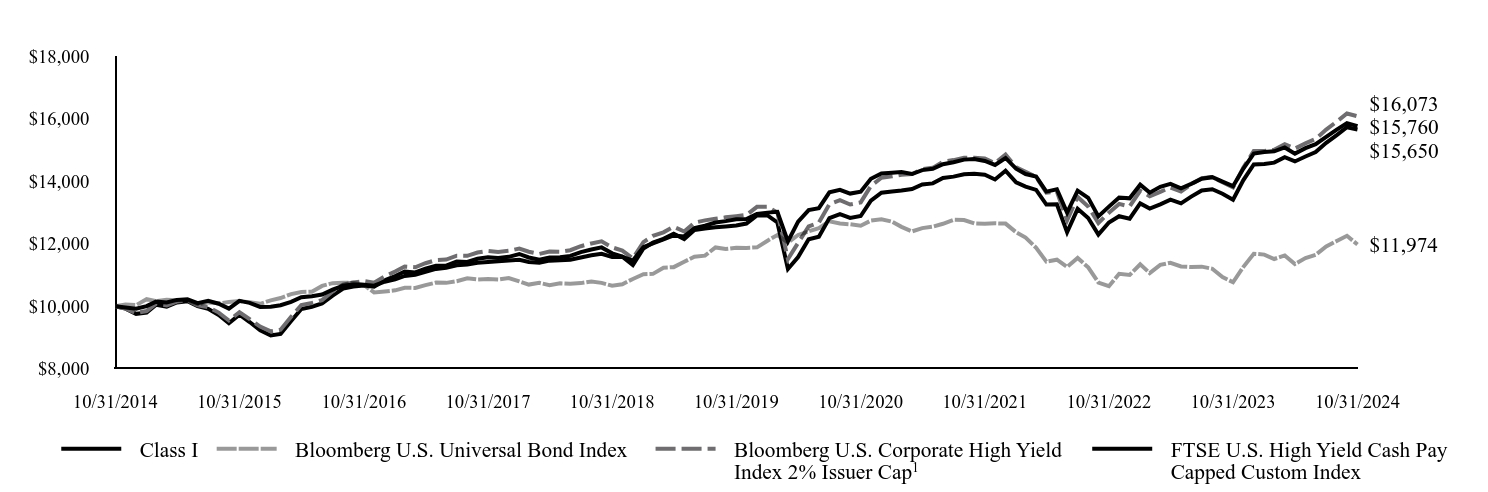

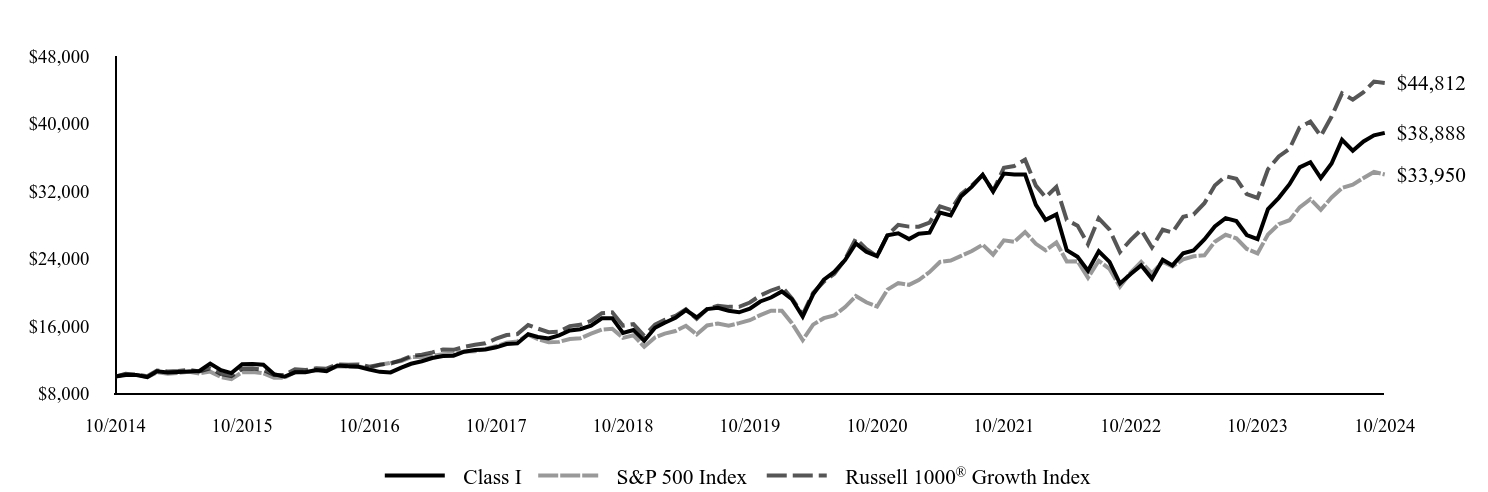

How did the Fund perform last year and what affected its performance?

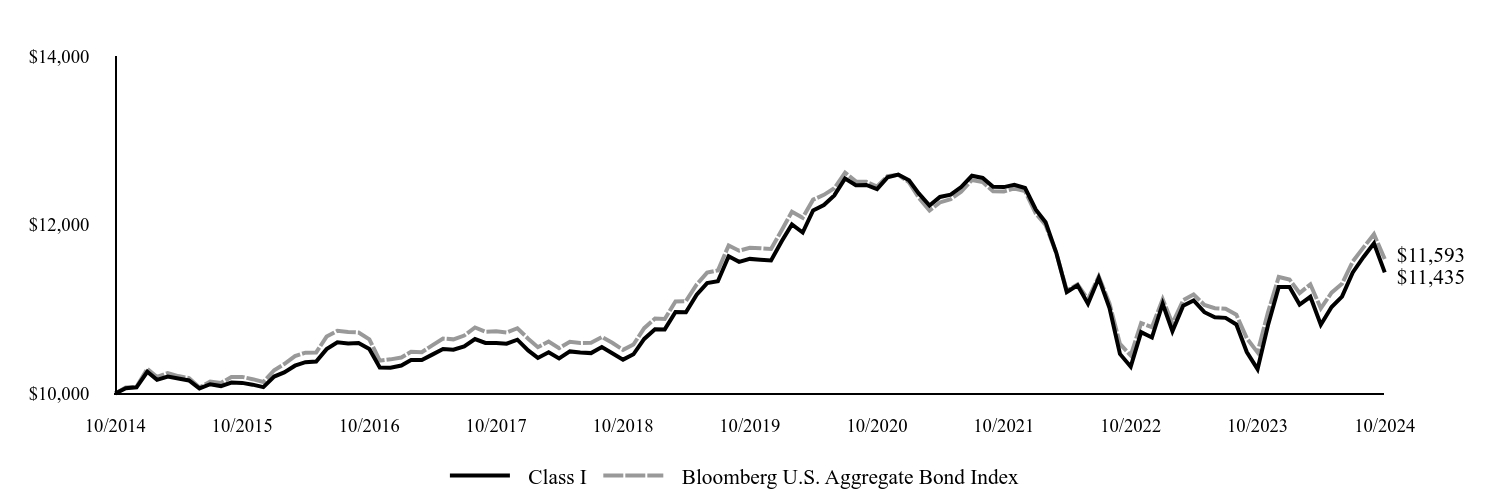

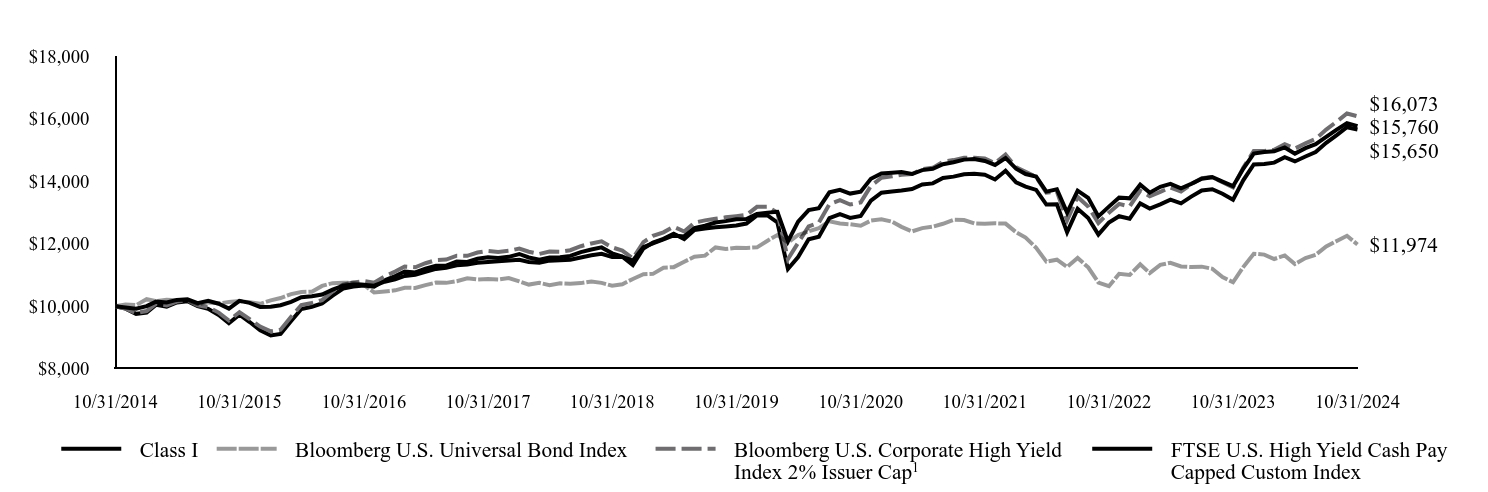

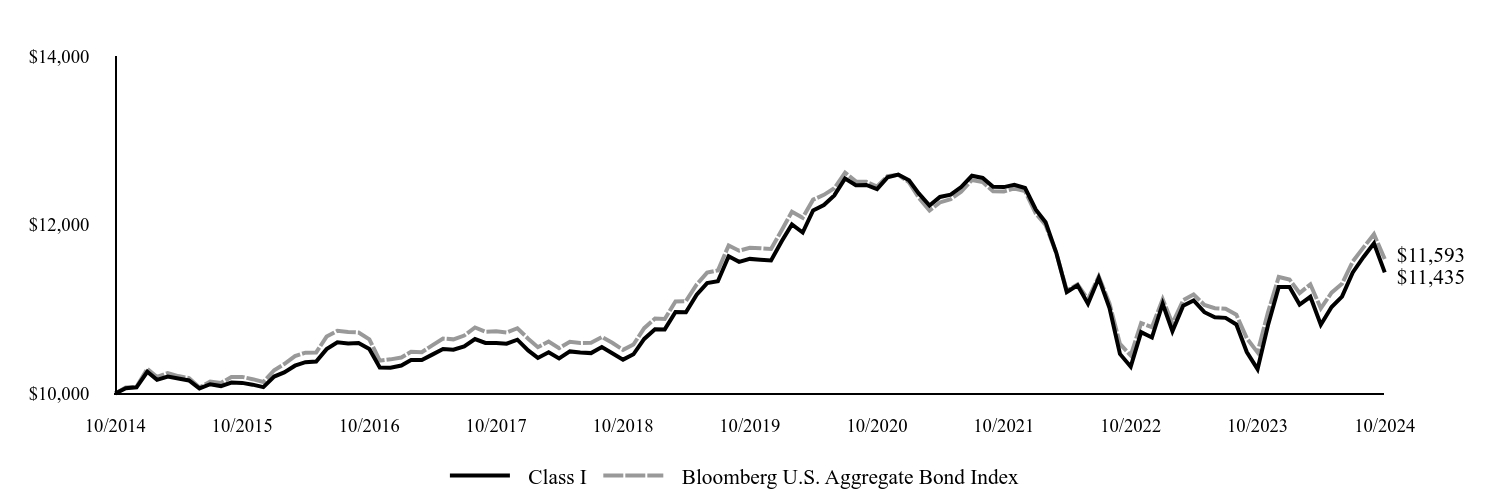

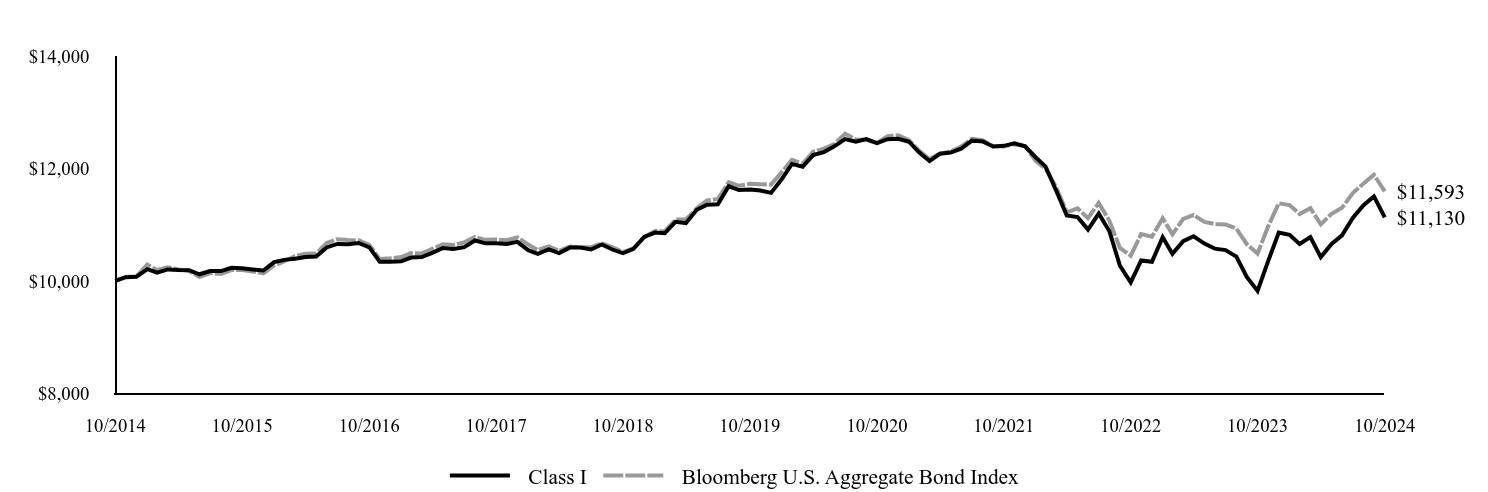

Given the sizeable moves lower in rates in both 4Q23 and 3Q24, the longer-than-Index duration position was the largest contributor to relative returns, while the overweight to front-end maturities provided a further, yet smaller, boost. From a sector allocation perspective, returns benefitted from the overweight to agency MBS (mortgage-backed securities) as lower yields and a steeper curve were especially conducive to performance in the sector, resulting in duration-adjusted outperformance relative to Treasuries and sizeable spread compression from the 190 bps (basis points) levels last October to 150 bps as of this October. In addition to the broad-based contribution from exposure to the agency MBS space, returns were further enhanced by issue selection, including a preference for lower and belly agency MBS coupons that outperformed higher coupons as rates fell and prepayment concerns weighed on the higher coupons. Meanwhile, the underweight to corporate credit produced a drag given the strong performance across industries, bolstered by the seemingly permanent risk-on market sentiment and attendant tightening of credit spreads. However, strong issue selection more than offset the drag from being underweight, led by banking, communications, and consumer non-cyclical names. Finally, the overweight positions in CMBS (commercial MBS) and ABS (asset-backed securities) were additive as yield spreads tightened, with the focus on CLOs (collateralized loan obligations) and single asset single borrower CMBS further supporting relative returns given strong issue-level contributions.

| Class I | Bloomberg U.S. Aggregate Bond Index |

|---|

| 10/2014 | $10,000 | $10,000 |

| 11/2014 | $10,062 | $10,071 |

| 12/2014 | $10,073 | $10,080 |

| 01/2015 | $10,257 | $10,292 |

| 02/2015 | $10,161 | $10,195 |

| 03/2015 | $10,199 | $10,242 |

| 04/2015 | $10,177 | $10,206 |

| 05/2015 | $10,154 | $10,181 |

| 06/2015 | $10,059 | $10,070 |

| 07/2015 | $10,109 | $10,140 |

| 08/2015 | $10,087 | $10,125 |

| 09/2015 | $10,129 | $10,194 |

| 10/2015 | $10,125 | $10,196 |

| 11/2015 | $10,104 | $10,169 |

| 12/2015 | $10,075 | $10,136 |

| 01/2016 | $10,200 | $10,275 |

| 02/2016 | $10,250 | $10,348 |

| 03/2016 | $10,329 | $10,443 |

| 04/2016 | $10,371 | $10,483 |

| 05/2016 | $10,379 | $10,486 |

| 06/2016 | $10,525 | $10,674 |

| 07/2016 | $10,606 | $10,742 |

| 08/2016 | $10,593 | $10,729 |

| 09/2016 | $10,597 | $10,723 |

| 10/2016 | $10,527 | $10,641 |

| 11/2016 | $10,308 | $10,389 |

| 12/2016 | $10,305 | $10,404 |

| 01/2017 | $10,331 | $10,425 |

| 02/2017 | $10,396 | $10,495 |

| 03/2017 | $10,395 | $10,489 |

| 04/2017 | $10,460 | $10,570 |

| 05/2017 | $10,527 | $10,651 |

| 06/2017 | $10,519 | $10,641 |

| 07/2017 | $10,558 | $10,686 |

| 08/2017 | $10,645 | $10,782 |

| 09/2017 | $10,598 | $10,731 |

| 10/2017 | $10,599 | $10,737 |

| 11/2017 | $10,590 | $10,723 |

| 12/2017 | $10,637 | $10,773 |

| 01/2018 | $10,510 | $10,649 |

| 02/2018 | $10,421 | $10,548 |

| 03/2018 | $10,489 | $10,615 |

| 04/2018 | $10,415 | $10,536 |

| 05/2018 | $10,498 | $10,612 |

| 06/2018 | $10,484 | $10,598 |

| 07/2018 | $10,478 | $10,601 |

| 08/2018 | $10,550 | $10,669 |

| 09/2018 | $10,476 | $10,600 |

| 10/2018 | $10,401 | $10,517 |

| 11/2018 | $10,464 | $10,580 |

| 12/2018 | $10,646 | $10,774 |

| 01/2019 | $10,762 | $10,888 |

| 02/2019 | $10,759 | $10,882 |

| 03/2019 | $10,966 | $11,091 |

| 04/2019 | $10,963 | $11,094 |

| 05/2019 | $11,171 | $11,291 |

| 06/2019 | $11,308 | $11,432 |

| 07/2019 | $11,329 | $11,458 |

| 08/2019 | $11,626 | $11,755 |

| 09/2019 | $11,560 | $11,692 |

| 10/2019 | $11,595 | $11,727 |

| 11/2019 | $11,586 | $11,721 |

| 12/2019 | $11,577 | $11,713 |

| 01/2020 | $11,806 | $11,938 |

| 02/2020 | $12,004 | $12,153 |

| 03/2020 | $11,908 | $12,082 |

| 04/2020 | $12,170 | $12,297 |

| 05/2020 | $12,234 | $12,354 |

| 06/2020 | $12,347 | $12,432 |

| 07/2020 | $12,548 | $12,617 |

| 08/2020 | $12,469 | $12,515 |

| 09/2020 | $12,472 | $12,509 |

| 10/2020 | $12,423 | $12,453 |

| 11/2020 | $12,561 | $12,575 |

| 12/2020 | $12,595 | $12,592 |

| 01/2021 | $12,526 | $12,502 |

| 02/2021 | $12,371 | $12,321 |

| 03/2021 | $12,227 | $12,168 |

| 04/2021 | $12,329 | $12,264 |

| 05/2021 | $12,356 | $12,304 |

| 06/2021 | $12,446 | $12,390 |

| 07/2021 | $12,580 | $12,529 |

| 08/2021 | $12,554 | $12,505 |

| 09/2021 | $12,451 | $12,397 |

| 10/2021 | $12,446 | $12,393 |

| 11/2021 | $12,473 | $12,430 |

| 12/2021 | $12,435 | $12,398 |

| 01/2022 | $12,179 | $12,131 |

| 02/2022 | $12,030 | $11,996 |

| 03/2022 | $11,665 | $11,662 |

| 04/2022 | $11,202 | $11,220 |

| 05/2022 | $11,281 | $11,292 |

| 06/2022 | $11,064 | $11,115 |

| 07/2022 | $11,368 | $11,387 |

| 08/2022 | $11,011 | $11,065 |

| 09/2022 | $10,468 | $10,587 |

| 10/2022 | $10,317 | $10,450 |

| 11/2022 | $10,726 | $10,834 |

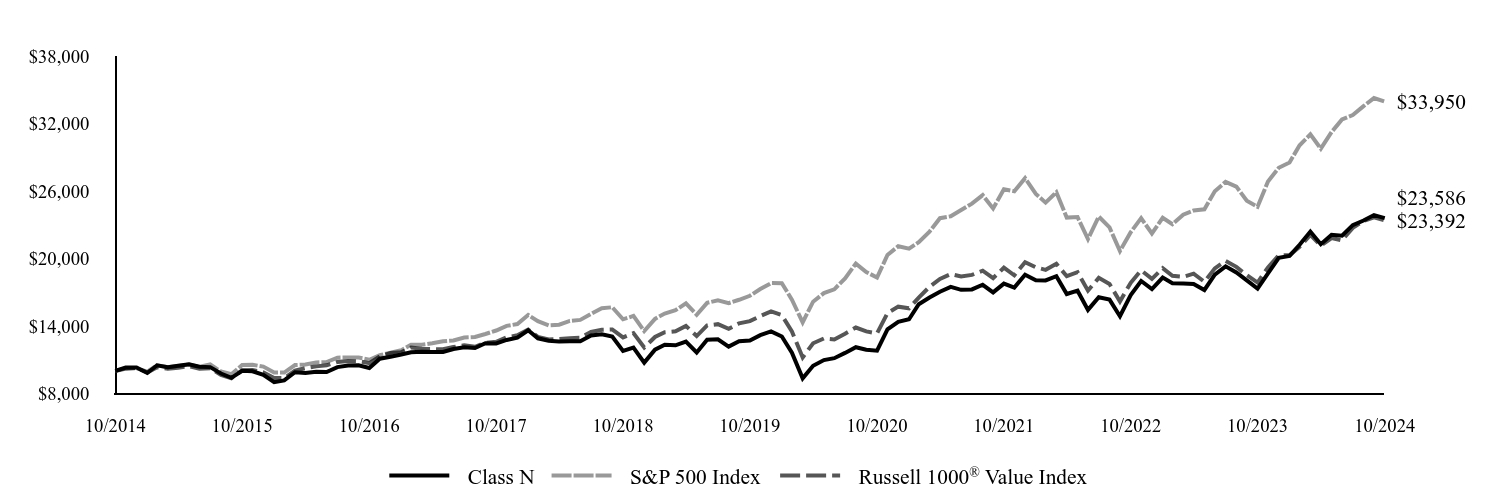

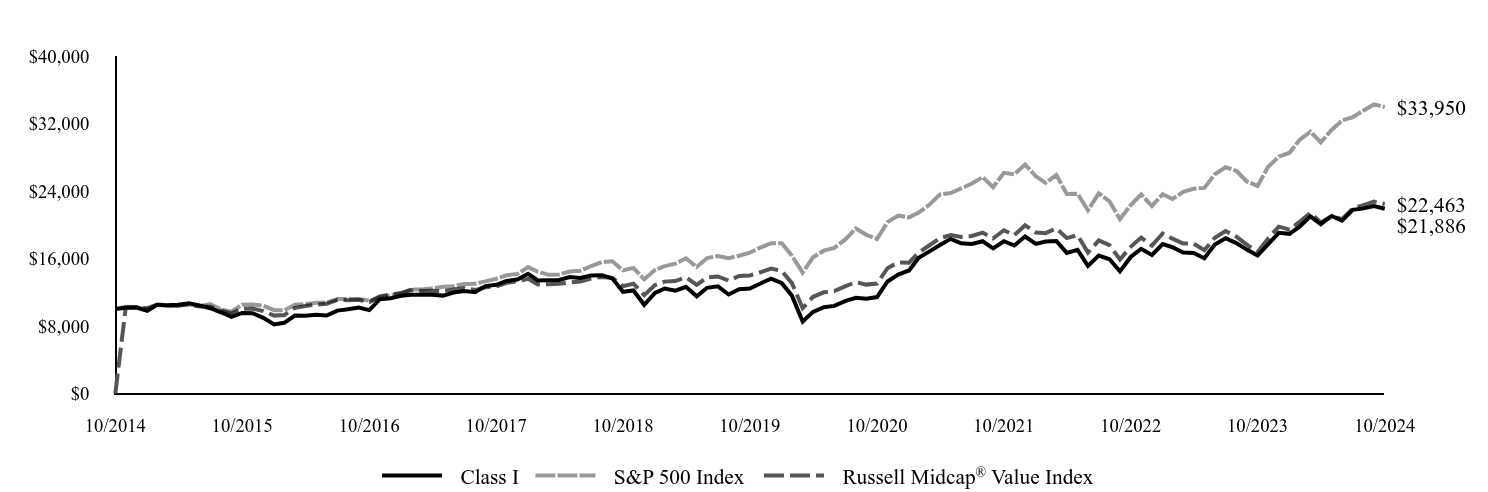

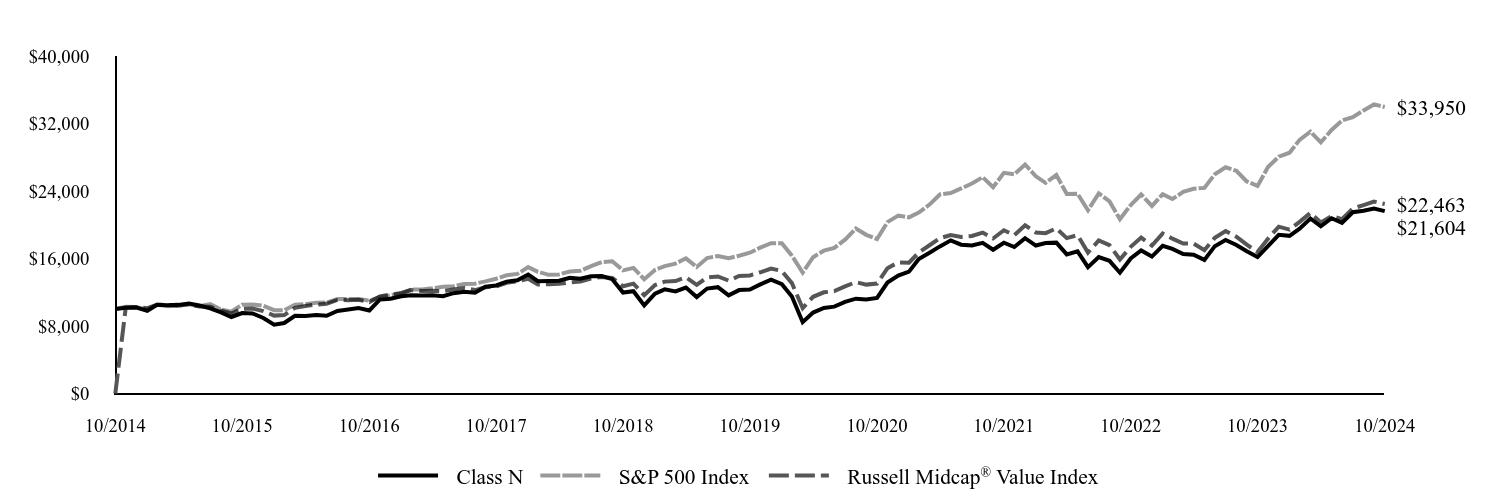

| 12/2022 | $10,663 | $10,785 |

| 01/2023 | $11,063 | $11,117 |

| 02/2023 | $10,737 | $10,829 |

| 03/2023 | $11,041 | $11,105 |

| 04/2023 | $11,102 | $11,172 |

| 05/2023 | $10,963 | $11,050 |

| 06/2023 | $10,902 | $11,011 |

| 07/2023 | $10,896 | $11,003 |

| 08/2023 | $10,818 | $10,933 |

| 09/2023 | $10,491 | $10,655 |

| 10/2023 | $10,288 | $10,487 |

| 11/2023 | $10,809 | $10,962 |

| 12/2023 | $11,261 | $11,381 |

| 01/2024 | $11,261 | $11,350 |

| 02/2024 | $11,054 | $11,190 |

| 03/2024 | $11,146 | $11,293 |

| 04/2024 | $10,814 | $11,008 |

| 05/2024 | $11,025 | $11,194 |

| 06/2024 | $11,148 | $11,300 |

| 07/2024 | $11,434 | $11,564 |

| 08/2024 | $11,618 | $11,731 |

| 09/2024 | $11,780 | $11,888 |

| 10/2024 | $11,435 | $11,593 |

The performance data quoted represents past performance and does not guarantee future results. The total returns do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s Average Total Returns are based on net asset values calculated for shareholder transactions which are not reflective of adjustments required pursuant to GAAP. Accordingly, differences may exist between this data and similar information reported in the financial statements.

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | 10 Years |

|---|

| Class I | 11.15% | -0.28% | 1.35% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

Past Performance: Performance data represent past performance which does not guarantee future result.

- Total Net Assets$838,704,498

- # of Portfolio Holdings429

- Portfolio Turnover Rate454%

- Total Advisory Fees Paid - Net$3,246,419

What did the Fund invest in?

Asset Allocation (as a % of Net Assets)

| Residential Mortgage-Backed Securities - Agency | 38.3% |

| U.S. Treasury Securities | 32.5% |

| Corporate Bonds | 16.1% |

| Short-Term Investments | 7.0% |

| Residential Mortgage-Backed Securities - Non-Agency | 6.9% |

| Asset-Backed Securities | 6.5% |

| Commercial Mortgage-Backed Securities - Non-Agency | 3.8% |

| Municipal Bonds | 0.7% |

Other Security TypesFootnote Reference* | 0.6% |

| Liabilities in Excess of Other Assets | (12.4%) |

| Footnote | Description |

Footnote* | Please refer to the Fund’s Annual Financial Statements which are available on the Fund’s website at www.tcw.com/Literature/Fund-Literature for a complete listing of all categories. |

Top Ten Holdings (as a % of Net Assets)

| U.S. Treasury Notes, 4.13%, due 10/31/29 | 10.0% |

| U.S. Treasury Notes, 3.88%, due 08/15/34 | 5.6% |

| U.S. Treasury Bonds, 4.13%, due 08/15/44 | 5.5% |

| U.S. Treasury Bonds, 4.25%, due 08/15/54 | 4.9% |

| U.S. Treasury Notes, 4.13%, due 10/31/26 | 4.5% |

| Uniform Mortgage-Backed Security, TBA, 3.50%, due 02/01/52 | 1.7% |

| U.S. Treasury Notes, 3.50%, due 09/30/29 | 1.5% |

| Government National Mortgage Association, TBA, 5.00%, due 06/01/54 | 1.3% |

| Government National Mortgage Association, TBA, 2.50%, due 12/01/51 | 1.3% |

| Uniform Mortgage-Backed Security, TBA, 5.00%, due 11/01/54 | 1.2% |

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact 800-FUND-TCW (800-386-3829).

If you wish to view additional information about the Fund, including but not limited to the Fund's prospectus, financial information, holdings, and proxy voting information, please visit www.tcw.com/Literature/Fund-Literature.

Phone: 800-FUND-TCW (800-386-3829)

TCW Core Fixed Income Fund

Annual Shareholder Report — October 31, 2024

TCW Core Fixed Income Fund

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about the TCW Core Fixed Income Fund for the period ended October 31, 2024. You can find additional information about the Fund at www.tcw.com/Literature/Fund-Literature. You can also request this information by contacting us at 800-FUND-TCW (800-386-3829).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

| Class N | $65 | 0.62% |

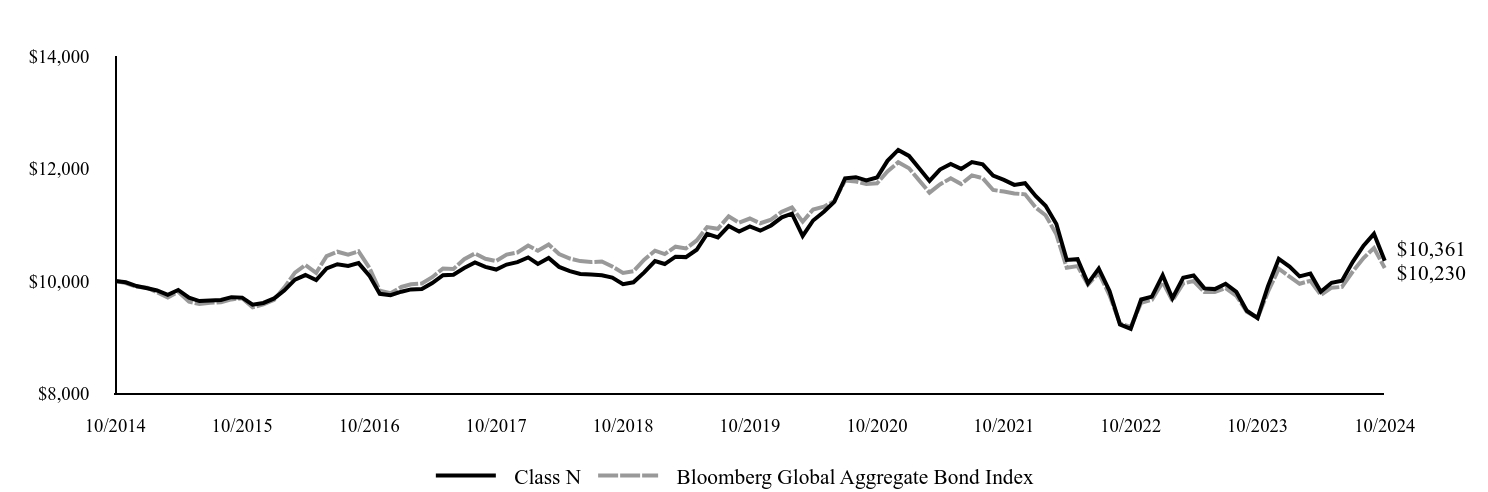

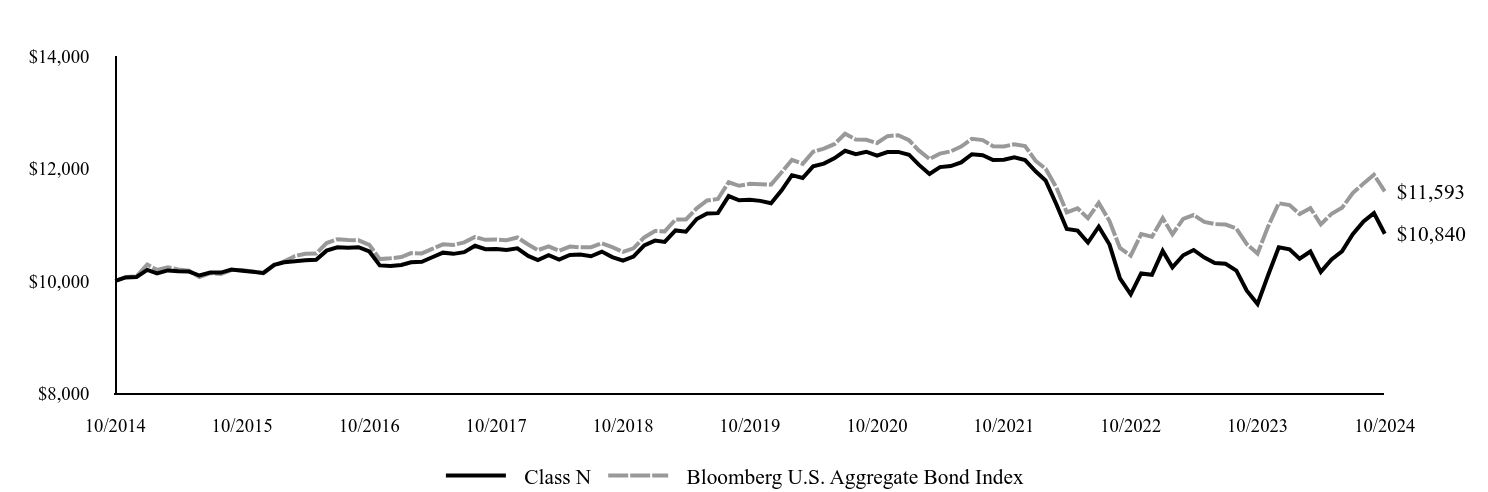

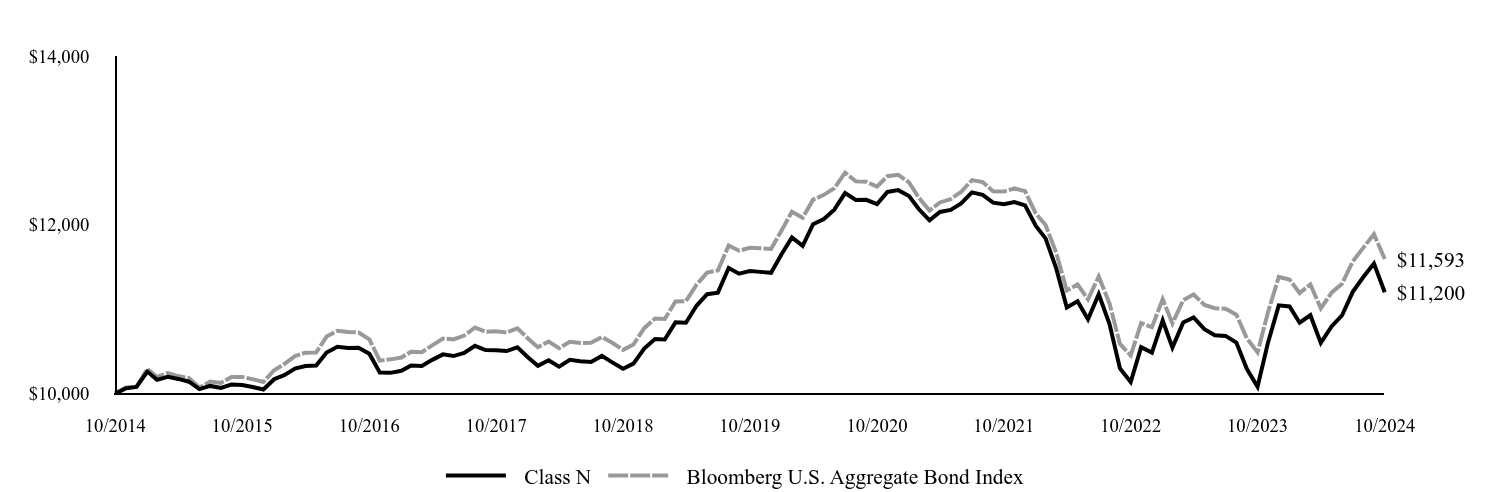

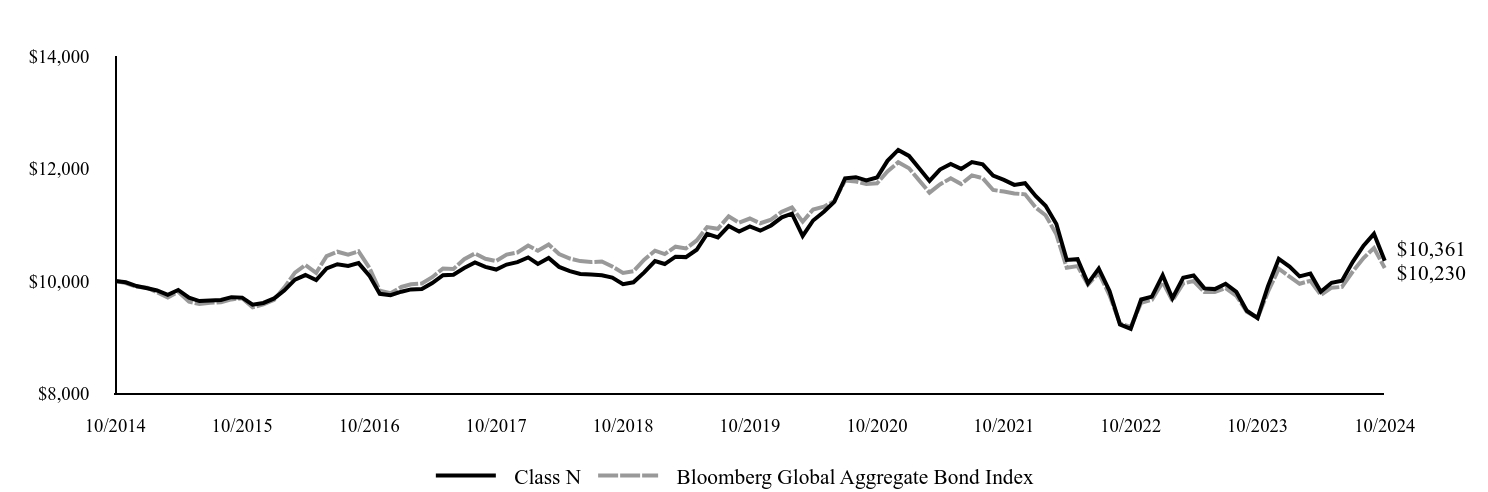

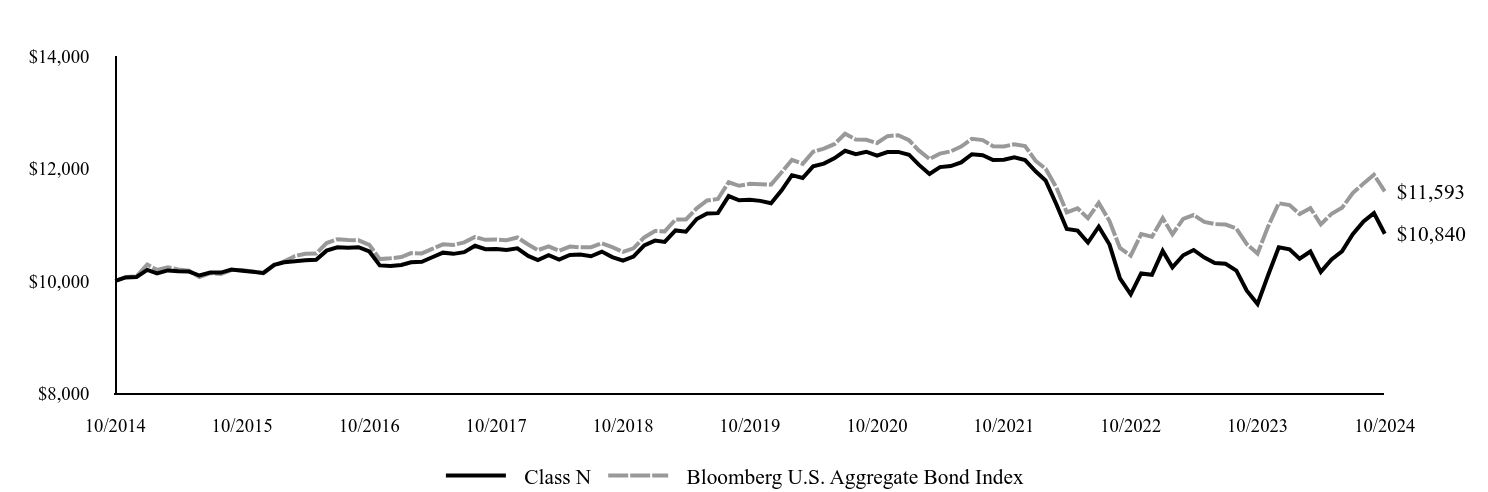

How did the Fund perform last year and what affected its performance?

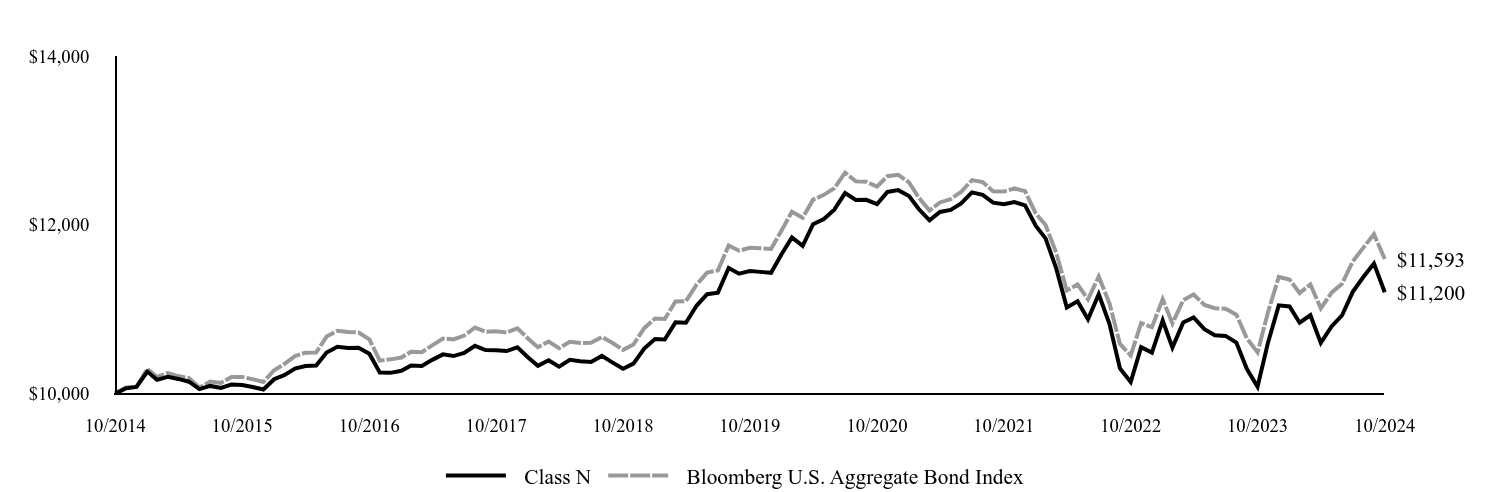

Given the sizeable moves lower in rates in both 4Q23 and 3Q24, the longer-than-Index duration position was the largest contributor to relative returns, while the overweight to front-end maturities provided a further, yet smaller, boost. From a sector allocation perspective, returns benefitted from the overweight to agency MBS (mortgage-backed securities) as lower yields and a steeper curve were especially conducive to performance in the sector, resulting in duration-adjusted outperformance relative to Treasuries and sizeable spread compression from the 190 bps (basis points) levels last October to 150 bps as of this October. In addition to the broad-based contribution from exposure to the agency MBS space, returns were further enhanced by issue selection, including a preference for lower and belly agency MBS coupons that outperformed higher coupons as rates fell and prepayment concerns weighed on the higher coupons. Meanwhile, the underweight to corporate credit produced a drag given the strong performance across industries, bolstered by the seemingly permanent risk-on market sentiment and attendant tightening of credit spreads. However, strong issue selection more than offset the drag from being underweight, led by banking, communications, and consumer non-cyclical names. Finally, the overweight positions in CMBS (commercial MBS) and ABS (asset-backed securities) were additive as yield spreads tightened, with the focus on CLOs (collateralized loan obligations) and single asset single borrower CMBS further supporting relative returns given strong issue-level contributions.

| Class N | Bloomberg U.S. Aggregate Bond Index |

|---|

| 10/2014 | $10,000 | $10,000 |

| 11/2014 | $10,060 | $10,071 |

| 12/2014 | $10,077 | $10,080 |

| 01/2015 | $10,259 | $10,292 |

| 02/2015 | $10,161 | $10,195 |

| 03/2015 | $10,197 | $10,242 |

| 04/2015 | $10,172 | $10,206 |

| 05/2015 | $10,139 | $10,181 |

| 06/2015 | $10,051 | $10,070 |

| 07/2015 | $10,089 | $10,140 |

| 08/2015 | $10,066 | $10,125 |

| 09/2015 | $10,105 | $10,194 |

| 10/2015 | $10,100 | $10,196 |

| 11/2015 | $10,076 | $10,169 |

| 12/2015 | $10,046 | $10,136 |

| 01/2016 | $10,168 | $10,275 |

| 02/2016 | $10,217 | $10,348 |

| 03/2016 | $10,294 | $10,443 |

| 04/2016 | $10,325 | $10,483 |

| 05/2016 | $10,331 | $10,486 |

| 06/2016 | $10,484 | $10,674 |

| 07/2016 | $10,554 | $10,742 |

| 08/2016 | $10,539 | $10,729 |

| 09/2016 | $10,542 | $10,723 |

| 10/2016 | $10,470 | $10,641 |

| 11/2016 | $10,249 | $10,389 |

| 12/2016 | $10,244 | $10,404 |

| 01/2017 | $10,268 | $10,425 |

| 02/2017 | $10,330 | $10,495 |

| 03/2017 | $10,326 | $10,489 |

| 04/2017 | $10,398 | $10,570 |

| 05/2017 | $10,463 | $10,651 |

| 06/2017 | $10,443 | $10,641 |

| 07/2017 | $10,479 | $10,686 |

| 08/2017 | $10,564 | $10,782 |

| 09/2017 | $10,514 | $10,731 |

| 10/2017 | $10,513 | $10,737 |

| 11/2017 | $10,502 | $10,723 |

| 12/2017 | $10,547 | $10,773 |

| 01/2018 | $10,427 | $10,649 |

| 02/2018 | $10,328 | $10,548 |

| 03/2018 | $10,394 | $10,615 |

| 04/2018 | $10,318 | $10,536 |

| 05/2018 | $10,399 | $10,612 |

| 06/2018 | $10,382 | $10,598 |

| 07/2018 | $10,374 | $10,601 |

| 08/2018 | $10,445 | $10,669 |

| 09/2018 | $10,368 | $10,600 |

| 10/2018 | $10,292 | $10,517 |

| 11/2018 | $10,353 | $10,580 |

| 12/2018 | $10,532 | $10,774 |

| 01/2019 | $10,645 | $10,888 |

| 02/2019 | $10,640 | $10,882 |

| 03/2019 | $10,843 | $11,091 |

| 04/2019 | $10,838 | $11,094 |

| 05/2019 | $11,042 | $11,291 |

| 06/2019 | $11,177 | $11,432 |

| 07/2019 | $11,195 | $11,458 |

| 08/2019 | $11,487 | $11,755 |

| 09/2019 | $11,420 | $11,692 |

| 10/2019 | $11,452 | $11,727 |

| 11/2019 | $11,441 | $11,721 |

| 12/2019 | $11,430 | $11,713 |

| 01/2020 | $11,655 | $11,938 |

| 02/2020 | $11,849 | $12,153 |

| 03/2020 | $11,750 | $12,082 |

| 04/2020 | $12,007 | $12,297 |

| 05/2020 | $12,068 | $12,354 |

| 06/2020 | $12,178 | $12,432 |

| 07/2020 | $12,375 | $12,617 |

| 08/2020 | $12,294 | $12,515 |

| 09/2020 | $12,295 | $12,509 |

| 10/2020 | $12,245 | $12,453 |

| 11/2020 | $12,389 | $12,575 |

| 12/2020 | $12,410 | $12,592 |

| 01/2021 | $12,340 | $12,502 |

| 02/2021 | $12,186 | $12,321 |

| 03/2021 | $12,052 | $12,168 |

| 04/2021 | $12,151 | $12,264 |

| 05/2021 | $12,175 | $12,304 |

| 06/2021 | $12,252 | $12,390 |

| 07/2021 | $12,383 | $12,529 |

| 08/2021 | $12,354 | $12,505 |

| 09/2021 | $12,262 | $12,397 |

| 10/2021 | $12,244 | $12,393 |

| 11/2021 | $12,269 | $12,430 |

| 12/2021 | $12,230 | $12,398 |

| 01/2022 | $11,986 | $12,131 |

| 02/2022 | $11,838 | $11,996 |

| 03/2022 | $11,476 | $11,662 |

| 04/2022 | $11,018 | $11,220 |

| 05/2022 | $11,093 | $11,292 |

| 06/2022 | $10,878 | $11,115 |

| 07/2022 | $11,176 | $11,387 |

| 08/2022 | $10,823 | $11,065 |

| 09/2022 | $10,297 | $10,587 |

| 10/2022 | $10,136 | $10,450 |

| 11/2022 | $10,548 | $10,834 |

| 12/2022 | $10,484 | $10,785 |

| 01/2023 | $10,865 | $11,117 |

| 02/2023 | $10,543 | $10,829 |

| 03/2023 | $10,841 | $11,105 |

| 04/2023 | $10,900 | $11,172 |

| 05/2023 | $10,762 | $11,050 |

| 06/2023 | $10,689 | $11,011 |

| 07/2023 | $10,682 | $11,003 |

| 08/2023 | $10,603 | $10,933 |

| 09/2023 | $10,292 | $10,655 |

| 10/2023 | $10,080 | $10,487 |

| 11/2023 | $10,602 | $10,962 |

| 12/2023 | $11,044 | $11,381 |

| 01/2024 | $11,031 | $11,350 |

| 02/2024 | $10,838 | $11,190 |

| 03/2024 | $10,927 | $11,293 |

| 04/2024 | $10,599 | $11,008 |

| 05/2024 | $10,794 | $11,194 |

| 06/2024 | $10,924 | $11,300 |

| 07/2024 | $11,204 | $11,564 |

| 08/2024 | $11,383 | $11,731 |

| 09/2024 | $11,541 | $11,888 |

| 10/2024 | $11,200 | $11,593 |

The performance data quoted represents past performance and does not guarantee future results. The total returns do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s Average Total Returns are based on net asset values calculated for shareholder transactions which are not reflective of adjustments required pursuant to GAAP. Accordingly, differences may exist between this data and similar information reported in the financial statements.

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | 10 Years |

|---|

| Class N | 11.12% | -0.44% | 1.14% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -0.23% | 1.49% |

Past Performance: Performance data represent past performance which does not guarantee future result.

- Total Net Assets$838,704,498

- # of Portfolio Holdings429

- Portfolio Turnover Rate454%

- Total Advisory Fees Paid - Net$3,246,419

What did the Fund invest in?

Asset Allocation (as a % of Net Assets)

| Residential Mortgage-Backed Securities - Agency | 38.3% |

| U.S. Treasury Securities | 32.5% |

| Corporate Bonds | 16.1% |

| Short-Term Investments | 7.0% |

| Residential Mortgage-Backed Securities - Non-Agency | 6.9% |

| Asset-Backed Securities | 6.5% |

| Commercial Mortgage-Backed Securities - Non-Agency | 3.8% |

| Municipal Bonds | 0.7% |

Other Security TypesFootnote Reference* | 0.6% |

| Liabilities in Excess of Other Assets | (12.4%) |

| Footnote | Description |

Footnote* | Please refer to the Fund’s Annual Financial Statements which are available on the Fund’s website at www.tcw.com/Literature/Fund-Literature for a complete listing of all categories. |

Top Ten Holdings (as a % of Net Assets)

| U.S. Treasury Notes, 4.13%, due 10/31/29 | 10.0% |

| U.S. Treasury Notes, 3.88%, due 08/15/34 | 5.6% |

| U.S. Treasury Bonds, 4.13%, due 08/15/44 | 5.5% |

| U.S. Treasury Bonds, 4.25%, due 08/15/54 | 4.9% |

| U.S. Treasury Notes, 4.13%, due 10/31/26 | 4.5% |

| Uniform Mortgage-Backed Security, TBA, 3.50%, due 02/01/52 | 1.7% |

| U.S. Treasury Notes, 3.50%, due 09/30/29 | 1.5% |

| Government National Mortgage Association, TBA, 5.00%, due 06/01/54 | 1.3% |

| Government National Mortgage Association, TBA, 2.50%, due 12/01/51 | 1.3% |

| Uniform Mortgage-Backed Security, TBA, 5.00%, due 11/01/54 | 1.2% |

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact 800-FUND-TCW (800-386-3829).

If you wish to view additional information about the Fund, including but not limited to the Fund's prospectus, financial information, holdings, and proxy voting information, please visit www.tcw.com/Literature/Fund-Literature.

Phone: 800-FUND-TCW (800-386-3829)

TCW Core Fixed Income Fund

Annual Shareholder Report — October 31, 2024

TCW Core Fixed Income Fund

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about the TCW Core Fixed Income Fund for the period ended October 31, 2024. You can find additional information about the Fund at www.tcw.com/Literature/Fund-Literature. You can also request this information by contacting us at 800-FUND-TCW (800-386-3829).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

| Class P | $46 | 0.44% |

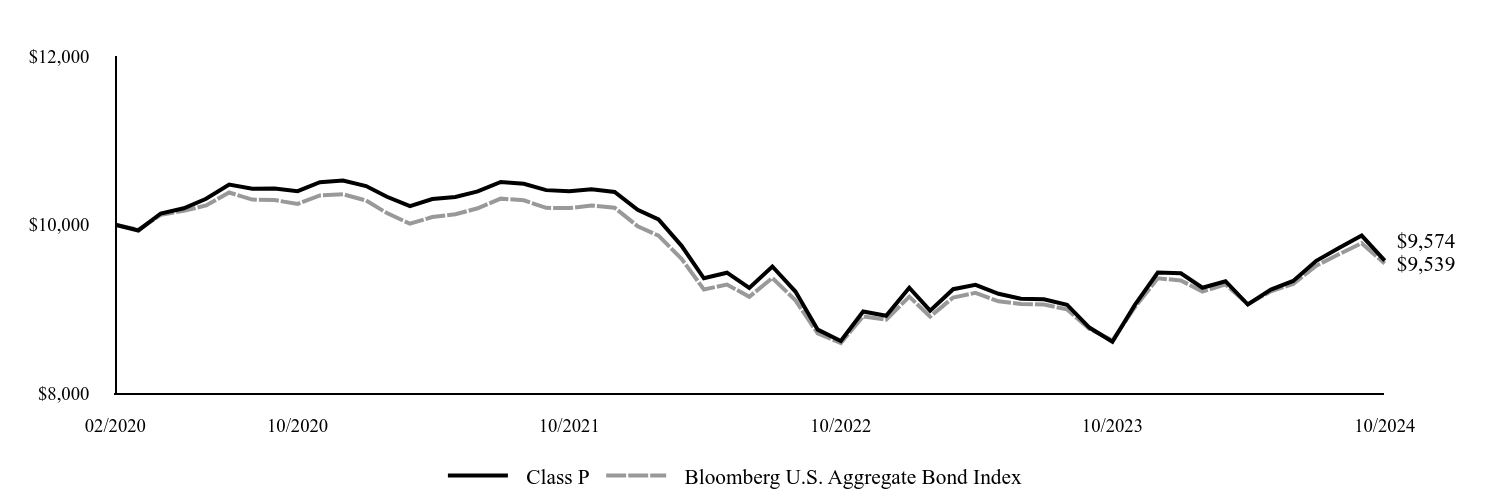

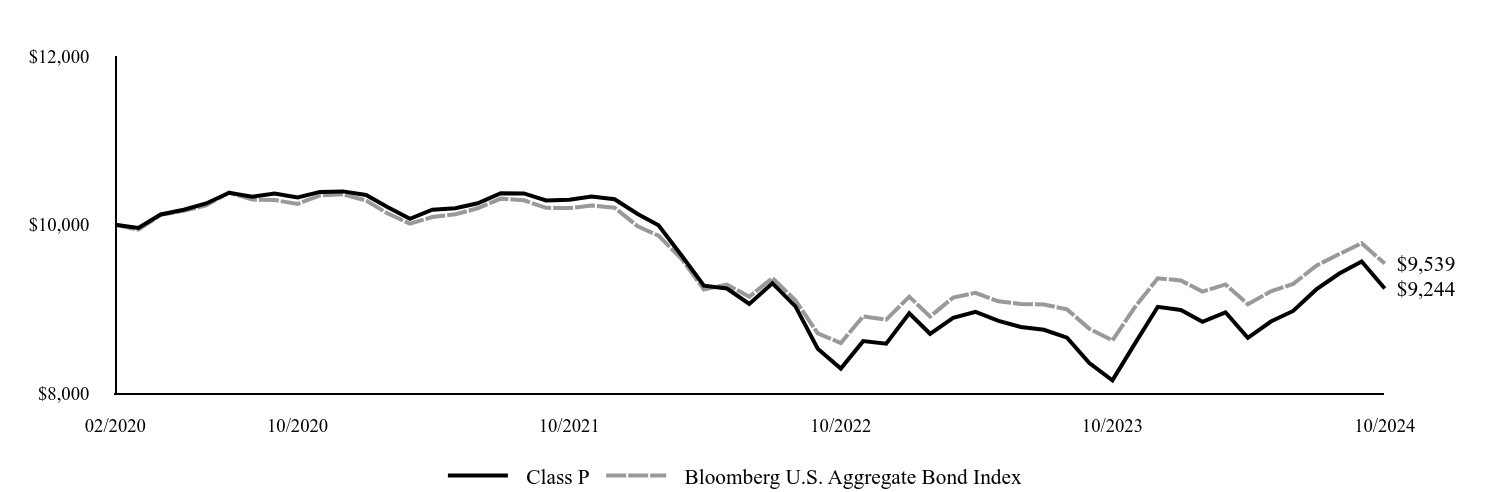

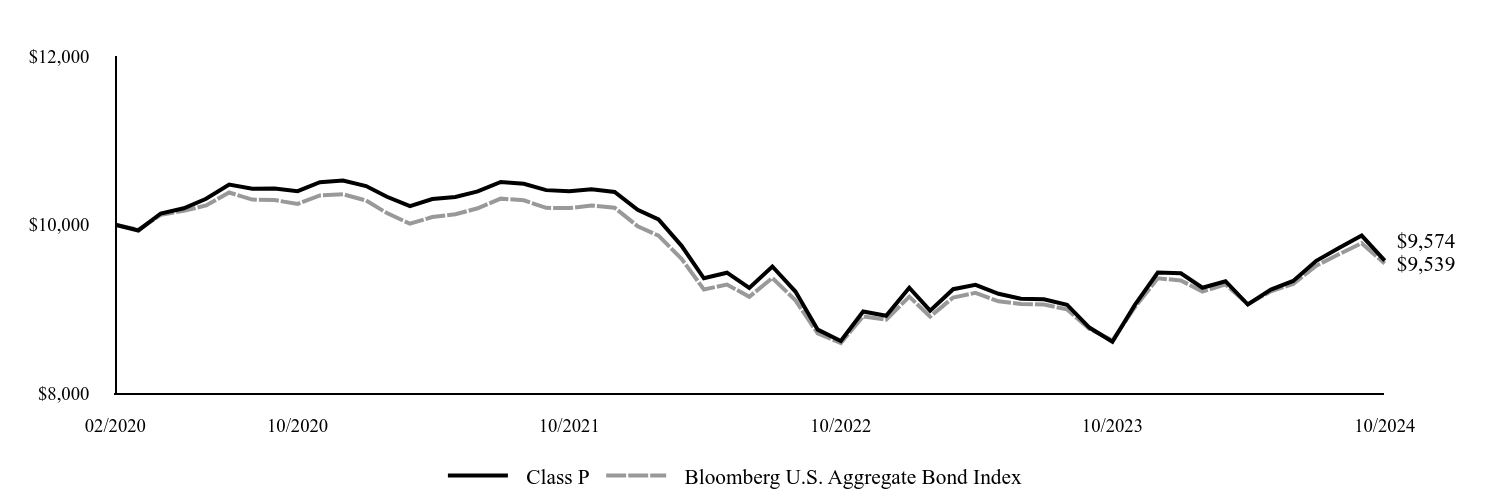

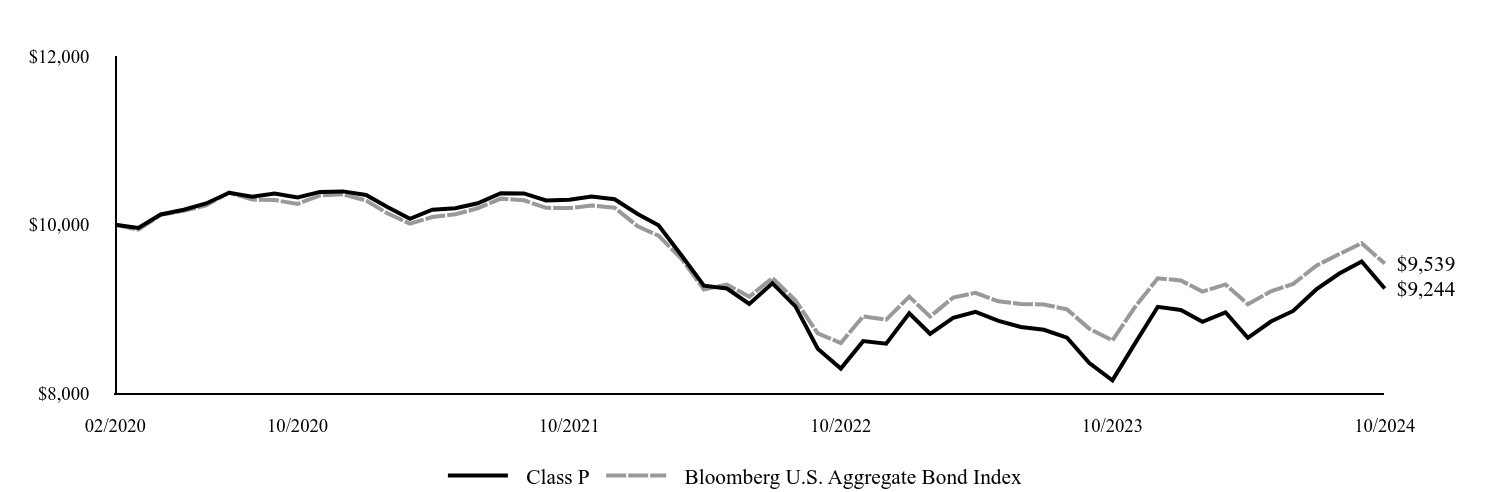

How did the Fund perform last year and what affected its performance?

Given the sizeable moves lower in rates in both 4Q23 and 3Q24, the longer-than-Index duration position was the largest contributor to relative returns, while the overweight to front-end maturities provided a further, yet smaller, boost. From a sector allocation perspective, returns benefitted from the overweight to agency MBS (mortgage-backed securities) as lower yields and a steeper curve were especially conducive to performance in the sector, resulting in duration-adjusted outperformance relative to Treasuries and sizeable spread compression from the 190 bps (basis points) levels last October to 150 bps as of this October. In addition to the broad-based contribution from exposure to the agency MBS space, returns were further enhanced by issue selection, including a preference for lower and belly agency MBS coupons that outperformed higher coupons as rates fell and prepayment concerns weighed on the higher coupons. Meanwhile, the underweight to corporate credit produced a drag given the strong performance across industries, bolstered by the seemingly permanent risk-on market sentiment and attendant tightening of credit spreads. However, strong issue selection more than offset the drag from being underweight, led by banking, communications, and consumer non-cyclical names. Finally, the overweight positions in CMBS (commercial MBS) and ABS (asset-backed securities) were additive as yield spreads tightened, with the focus on CLOs (collateralized loan obligations) and single asset single borrower CMBS further supporting relative returns given strong issue-level contributions.

| Class P | Bloomberg U.S. Aggregate Bond Index |

|---|

| 02/2020 | $10,000 | $10,000 |

| 03/2020 | $9,932 | $9,941 |

| 04/2020 | $10,133 | $10,118 |

| 05/2020 | $10,195 | $10,165 |

| 06/2020 | $10,307 | $10,229 |

| 07/2020 | $10,475 | $10,382 |

| 08/2020 | $10,426 | $10,298 |

| 09/2020 | $10,429 | $10,292 |

| 10/2020 | $10,398 | $10,246 |

| 11/2020 | $10,504 | $10,347 |

| 12/2020 | $10,524 | $10,361 |

| 01/2021 | $10,458 | $10,287 |

| 02/2021 | $10,331 | $10,138 |

| 03/2021 | $10,221 | $10,012 |

| 04/2021 | $10,305 | $10,091 |

| 05/2021 | $10,328 | $10,124 |

| 06/2021 | $10,395 | $10,195 |

| 07/2021 | $10,507 | $10,309 |

| 08/2021 | $10,485 | $10,289 |

| 09/2021 | $10,410 | $10,200 |

| 10/2021 | $10,397 | $10,197 |

| 11/2021 | $10,420 | $10,228 |

| 12/2021 | $10,389 | $10,201 |

| 01/2022 | $10,176 | $9,982 |

| 02/2022 | $10,062 | $9,870 |

| 03/2022 | $9,750 | $9,596 |

| 04/2022 | $9,365 | $9,232 |

| 05/2022 | $9,431 | $9,291 |

| 06/2022 | $9,251 | $9,146 |

| 07/2022 | $9,505 | $9,369 |

| 08/2022 | $9,208 | $9,104 |

| 09/2022 | $8,756 | $8,711 |

| 10/2022 | $8,622 | $8,598 |

| 11/2022 | $8,972 | $8,914 |

| 12/2022 | $8,920 | $8,874 |

| 01/2023 | $9,253 | $9,147 |

| 02/2023 | $8,982 | $8,911 |

| 03/2023 | $9,236 | $9,137 |

| 04/2023 | $9,288 | $9,192 |

| 05/2023 | $9,181 | $9,092 |

| 06/2023 | $9,122 | $9,060 |

| 07/2023 | $9,117 | $9,054 |

| 08/2023 | $9,052 | $8,996 |

| 09/2023 | $8,781 | $8,767 |

| 10/2023 | $8,613 | $8,629 |

| 11/2023 | $9,047 | $9,020 |

| 12/2023 | $9,433 | $9,365 |

| 01/2024 | $9,424 | $9,339 |

| 02/2024 | $9,253 | $9,207 |

| 03/2024 | $9,330 | $9,292 |

| 04/2024 | $9,054 | $9,057 |

| 05/2024 | $9,231 | $9,211 |

| 06/2024 | $9,333 | $9,298 |

| 07/2024 | $9,572 | $9,515 |

| 08/2024 | $9,726 | $9,652 |

| 09/2024 | $9,871 | $9,781 |

| 10/2024 | $9,574 | $9,539 |

The performance data quoted represents past performance and does not guarantee future results. The total returns do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s Average Total Returns are based on net asset values calculated for shareholder transactions which are not reflective of adjustments required pursuant to GAAP. Accordingly, differences may exist between this data and similar information reported in the financial statements.

Average Annual Total Returns (%)

| Name | 1 Year | Since Inception 2/28/20 |

|---|

| Class P | 11.17% | -0.93% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | -1.00% |

Past Performance: Performance data represent past performance which does not guarantee future result.

- Total Net Assets$838,704,498

- # of Portfolio Holdings429

- Portfolio Turnover Rate454%

- Total Advisory Fees Paid - Net$3,246,419

What did the Fund invest in?

Asset Allocation (as a % of Net Assets)

| Residential Mortgage-Backed Securities - Agency | 38.3% |

| U.S. Treasury Securities | 32.5% |

| Corporate Bonds | 16.1% |

| Short-Term Investments | 7.0% |

| Residential Mortgage-Backed Securities - Non-Agency | 6.9% |

| Asset-Backed Securities | 6.5% |

| Commercial Mortgage-Backed Securities - Non-Agency | 3.8% |

| Municipal Bonds | 0.7% |

Other Security TypesFootnote Reference* | 0.6% |

| Liabilities in Excess of Other Assets | (12.4%) |

| Footnote | Description |

Footnote* | Please refer to the Fund’s Annual Financial Statements which are available on the Fund’s website at www.tcw.com/Literature/Fund-Literature for a complete listing of all categories. |

Top Ten Holdings (as a % of Net Assets)

| U.S. Treasury Notes, 4.13%, due 10/31/29 | 10.0% |

| U.S. Treasury Notes, 3.88%, due 08/15/34 | 5.6% |

| U.S. Treasury Bonds, 4.13%, due 08/15/44 | 5.5% |

| U.S. Treasury Bonds, 4.25%, due 08/15/54 | 4.9% |

| U.S. Treasury Notes, 4.13%, due 10/31/26 | 4.5% |

| Uniform Mortgage-Backed Security, TBA, 3.50%, due 02/01/52 | 1.7% |

| U.S. Treasury Notes, 3.50%, due 09/30/29 | 1.5% |

| Government National Mortgage Association, TBA, 5.00%, due 06/01/54 | 1.3% |

| Government National Mortgage Association, TBA, 2.50%, due 12/01/51 | 1.3% |

| Uniform Mortgage-Backed Security, TBA, 5.00%, due 11/01/54 | 1.2% |

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact 800-FUND-TCW (800-386-3829).

If you wish to view additional information about the Fund, including but not limited to the Fund's prospectus, financial information, holdings, and proxy voting information, please visit www.tcw.com/Literature/Fund-Literature.

Phone: 800-FUND-TCW (800-386-3829)

TCW Core Fixed Income Fund

Annual Shareholder Report — October 31, 2024

TCW Emerging Markets Income Fund

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about the TCW Emerging Markets Income Fund for the period ended October 31, 2024. You can find additional information about the Fund at www.tcw.com/Literature/Fund-Literature. You can also request this information by contacting us at 800-FUND-TCW (800-386-3829).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

| Class I | $93 | 0.85% |

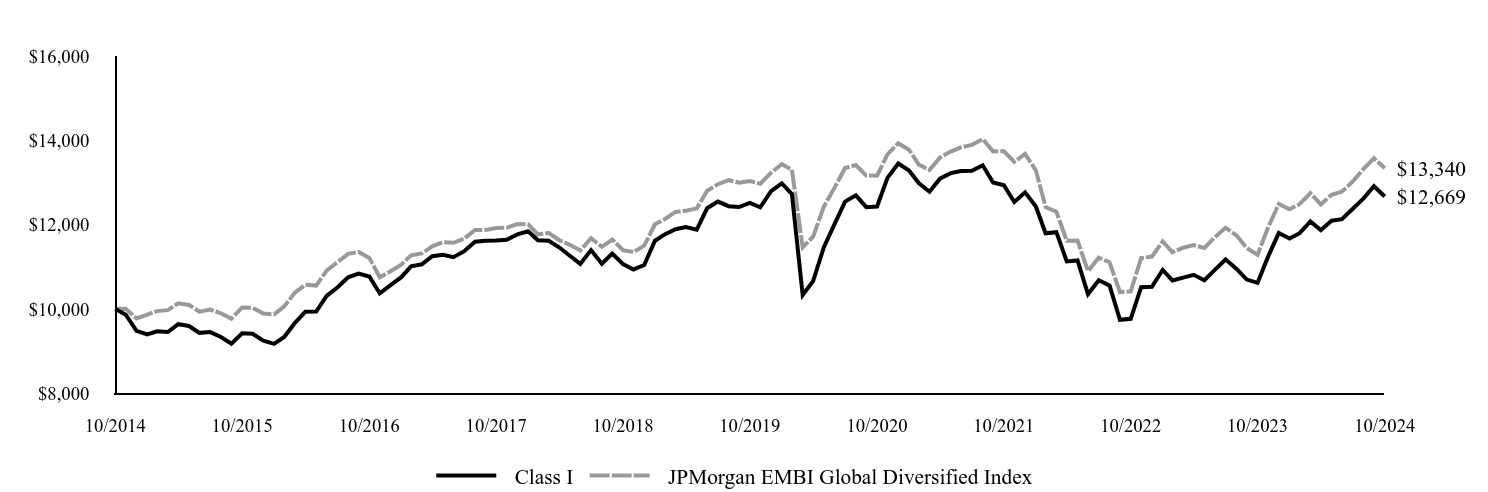

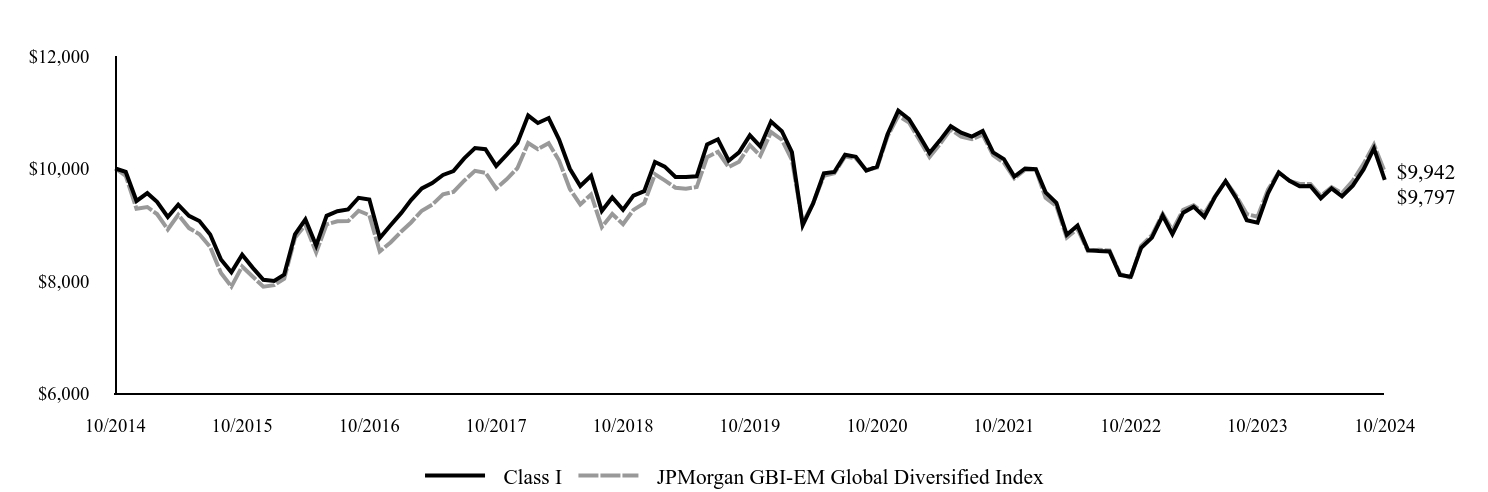

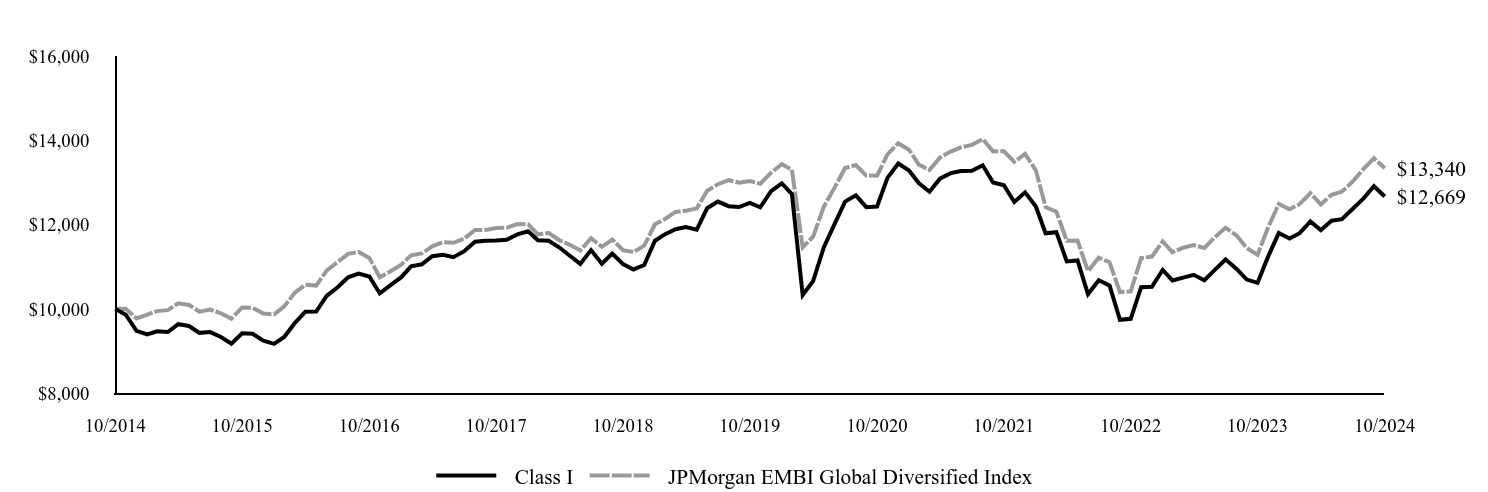

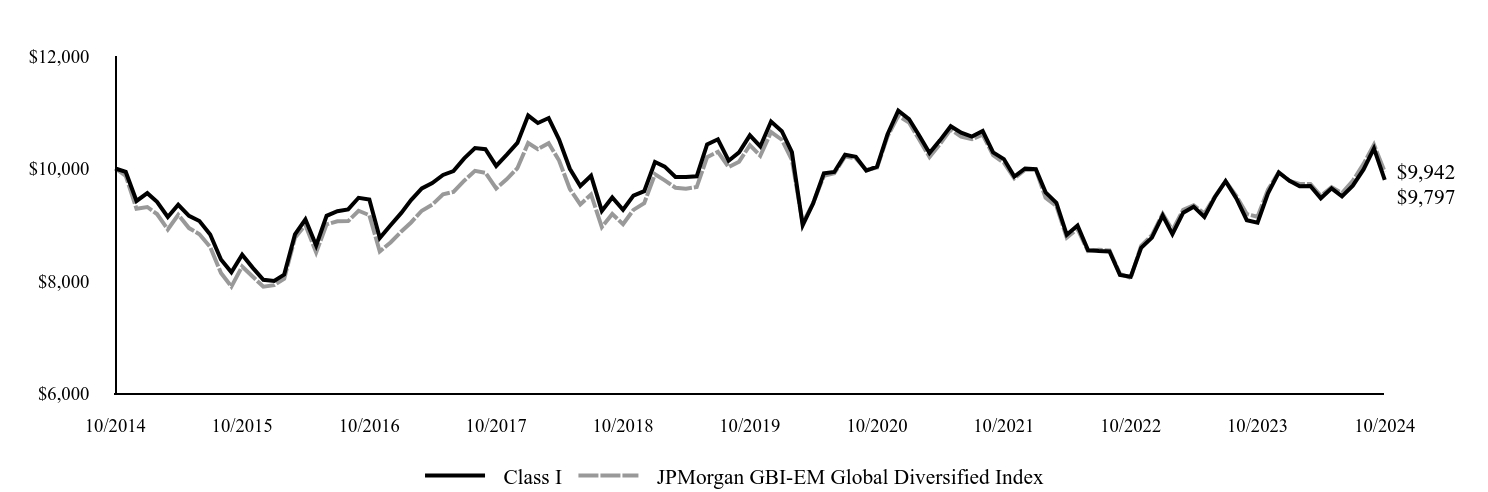

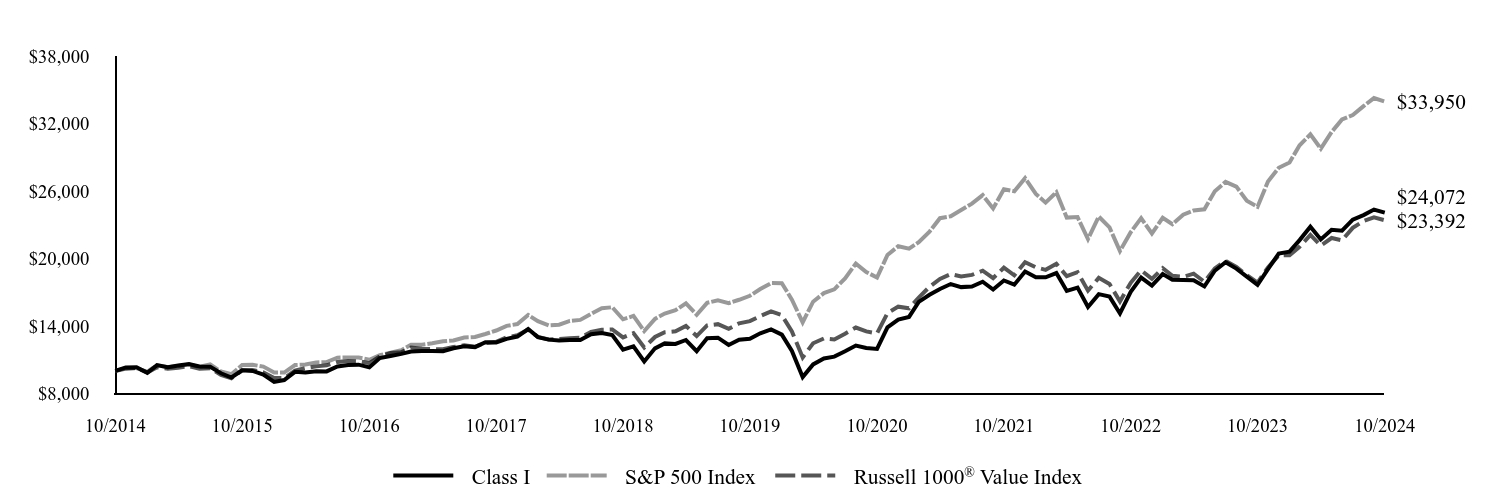

How did the Fund perform last year and what affected its performance?

For the year ended October 31, 2024, the TCW Emerging Markets Income Fund (the “Fund”) returned 19.27% net of fees on its Class I shares. Performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the JPMorgan EMBI Global Diversified Index (“EMBI”), returned 18.16% over the same period. Relative outperformance for the one-year period was driven by security selection as well as overweight positioning to high yield. From a country perspective, the portfolio’s exposure to Egypt, Ukraine, Pakistan, Brazil and Turkey were among the larger drivers of relative outperformance. Emerging Markets (EM) benefited from factors including a more benign macro environment, fundamental improvement and attractive valuations. We remain constructive on EM as most countries continue to gradually adjust towards long-term potential growth and inflation targets. While China’s growth has slowed, other large economies like India or Brazil continue to exhibit higher-than-expected levels of economic activity. Recently announced China stimulus should help to contain its deceleration. EM financial resilience has increased since the 2013 taper tantrum, with many major EM countries establishing a track record of more prudent macro policies. Moreover, current account balances, a major source of EM vulnerability in earlier periods of stress, have turned positive. It remains early to assess the macroeconomic impact of potential policy measures to be adopted by the new U.S. administration, but campaign proposals suggest higher import tariffs, a crackdown on illegal immigration, a reduction of some taxes, and increases on defense spending, as well as economic de-regulation. We anticipate winners and losers, and the sequencing of the policy rollouts will matter. As such, differentiation remains key.

| Class I | JPMorgan EMBI Global Diversified Index |

|---|

| 10/2014 | $10,000 | $10,000 |

| 11/2014 | $9,866 | $10,009 |

| 12/2014 | $9,485 | $9,777 |

| 01/2015 | $9,397 | $9,868 |

| 02/2015 | $9,474 | $9,952 |

| 03/2015 | $9,456 | $9,974 |

| 04/2015 | $9,641 | $10,137 |

| 05/2015 | $9,599 | $10,098 |

| 06/2015 | $9,436 | $9,940 |

| 07/2015 | $9,454 | $9,989 |

| 08/2015 | $9,339 | $9,899 |

| 09/2015 | $9,181 | $9,771 |

| 10/2015 | $9,425 | $10,039 |

| 11/2015 | $9,413 | $10,033 |

| 12/2015 | $9,250 | $9,893 |

| 01/2016 | $9,176 | $9,875 |

| 02/2016 | $9,338 | $10,063 |

| 03/2016 | $9,675 | $10,392 |

| 04/2016 | $9,938 | $10,576 |

| 05/2016 | $9,942 | $10,557 |

| 06/2016 | $10,312 | $10,913 |

| 07/2016 | $10,512 | $11,110 |

| 08/2016 | $10,752 | $11,308 |

| 09/2016 | $10,839 | $11,354 |

| 10/2016 | $10,772 | $11,213 |

| 11/2016 | $10,371 | $10,754 |

| 12/2016 | $10,566 | $10,897 |

| 01/2017 | $10,757 | $11,055 |

| 02/2017 | $11,013 | $11,276 |

| 03/2017 | $11,061 | $11,319 |

| 04/2017 | $11,254 | $11,487 |

| 05/2017 | $11,288 | $11,589 |

| 06/2017 | $11,230 | $11,572 |

| 07/2017 | $11,372 | $11,669 |

| 08/2017 | $11,596 | $11,876 |

| 09/2017 | $11,619 | $11,877 |

| 10/2017 | $11,628 | $11,921 |

| 11/2017 | $11,645 | $11,927 |

| 12/2017 | $11,771 | $12,015 |

| 01/2018 | $11,846 | $12,010 |

| 02/2018 | $11,630 | $11,771 |

| 03/2018 | $11,618 | $11,805 |

| 04/2018 | $11,465 | $11,634 |

| 05/2018 | $11,264 | $11,524 |

| 06/2018 | $11,072 | $11,387 |

| 07/2018 | $11,398 | $11,678 |

| 08/2018 | $11,075 | $11,476 |

| 09/2018 | $11,318 | $11,649 |

| 10/2018 | $11,065 | $11,398 |

| 11/2018 | $10,939 | $11,350 |

| 12/2018 | $11,045 | $11,503 |

| 01/2019 | $11,621 | $12,011 |

| 02/2019 | $11,771 | $12,130 |

| 03/2019 | $11,893 | $12,303 |

| 04/2019 | $11,945 | $12,333 |

| 05/2019 | $11,880 | $12,384 |

| 06/2019 | $12,390 | $12,804 |

| 07/2019 | $12,548 | $12,960 |

| 08/2019 | $12,439 | $13,057 |

| 09/2019 | $12,419 | $12,997 |

| 10/2019 | $12,518 | $13,034 |

| 11/2019 | $12,414 | $12,972 |

| 12/2019 | $12,794 | $13,233 |

| 01/2020 | $12,979 | $13,434 |

| 02/2020 | $12,724 | $13,304 |

| 03/2020 | $10,334 | $11,462 |

| 04/2020 | $10,662 | $11,719 |

| 05/2020 | $11,468 | $12,430 |

| 06/2020 | $12,002 | $12,867 |

| 07/2020 | $12,548 | $13,345 |

| 08/2020 | $12,697 | $13,414 |

| 09/2020 | $12,416 | $13,165 |

| 10/2020 | $12,432 | $13,161 |

| 11/2020 | $13,111 | $13,669 |

| 12/2020 | $13,450 | $13,929 |

| 01/2021 | $13,284 | $13,777 |

| 02/2021 | $12,987 | $13,426 |

| 03/2021 | $12,783 | $13,296 |

| 04/2021 | $13,091 | $13,591 |

| 05/2021 | $13,223 | $13,735 |

| 06/2021 | $13,275 | $13,836 |

| 07/2021 | $13,277 | $13,894 |

| 08/2021 | $13,408 | $14,030 |

| 09/2021 | $13,001 | $13,739 |

| 10/2021 | $12,935 | $13,742 |

| 11/2021 | $12,538 | $13,490 |

| 12/2021 | $12,768 | $13,678 |

| 01/2022 | $12,433 | $13,289 |

| 02/2022 | $11,797 | $12,419 |

| 03/2022 | $11,824 | $12,308 |

| 04/2022 | $11,129 | $11,620 |

| 05/2022 | $11,153 | $11,623 |

| 06/2022 | $10,353 | $10,900 |

| 07/2022 | $10,685 | $11,216 |

| 08/2022 | $10,559 | $11,110 |

| 09/2022 | $9,747 | $10,403 |

| 10/2022 | $9,770 | $10,418 |

| 11/2022 | $10,520 | $11,209 |

| 12/2022 | $10,529 | $11,246 |

| 01/2023 | $10,927 | $11,602 |

| 02/2023 | $10,679 | $11,346 |

| 03/2023 | $10,745 | $11,455 |

| 04/2023 | $10,812 | $11,516 |

| 05/2023 | $10,684 | $11,450 |

| 06/2023 | $10,929 | $11,706 |

| 07/2023 | $11,176 | $11,930 |

| 08/2023 | $10,957 | $11,750 |

| 09/2023 | $10,700 | $11,444 |

| 10/2023 | $10,622 | $11,289 |

| 11/2023 | $11,237 | $11,929 |

| 12/2023 | $11,802 | $12,493 |

| 01/2024 | $11,672 | $12,366 |

| 02/2024 | $11,800 | $12,487 |

| 03/2024 | $12,077 | $12,748 |

| 04/2024 | $11,871 | $12,483 |

| 05/2024 | $12,095 | $12,708 |

| 06/2024 | $12,132 | $12,786 |

| 07/2024 | $12,377 | $13,025 |

| 08/2024 | $12,624 | $13,327 |

| 09/2024 | $12,912 | $13,573 |

| 10/2024 | $12,669 | $13,340 |

The performance data quoted represents past performance and does not guarantee future results. The total returns do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s Average Total Returns are based on net asset values calculated for shareholder transactions which are not reflective of adjustments required pursuant to GAAP. Accordingly, differences may exist between this data and similar information reported in the financial statements.

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | 10 Years |

|---|

| Class I | 19.27% | 0.24% | 2.39% |

| JPMorgan EMBI Global Diversified Index | 18.16% | 0.47% | 2.92% |

Past Performance: Performance data represent past performance which does not guarantee future result.

- Total Net Assets$3,505,272,750

- # of Portfolio Holdings269

- Portfolio Turnover Rate106%

- Total Advisory Fees Paid - Net$26,231,860

What did the Fund invest in?

Asset Allocation (as a % of Net Assets)

| Government | 69.2% |

| Energy | 10.7% |

| Basic Materials | 6.4% |

| Utilities | 5.7% |

| Financial | 4.9% |

| Consumer Discretionary | 1.3% |

| Short-Term Investments | 0.8% |

| Consumer Staples | 0.3% |

OtherFootnote Reference* | 0.2% |

| Other Assets in Excess of Liabilities | 0.5% |

| Footnote | Description |

Footnote* | Please refer to the Fund’s Annual Financial Statements which are available on the Fund’s website at www.tcw.com/Literature/Fund-Literature for a complete listing of all categories. |

Top Ten Holdings (as a % of Net Assets)

| Ukraine Government International Bonds, 0.00%, due 08/01/41 | 2.0% |

| Greensaif Pipelines Bidco SARL, 6.13%, due 02/23/38 | 1.8% |

| Oman Government International Bonds, 6.25%, due 01/25/31 | 1.2% |

| Israel Government International Bonds, 5.50%, due 03/12/34 | 1.2% |

| Argentina Republic Government International Bonds, 0.75%, due 07/09/30 | 1.1% |

| Republic of Poland Government International Bonds, 4.88%, due 10/04/33 | 1.1% |

| Saudi Arabian Oil Co., 5.25%, due 07/17/34 | 1.1% |

| Oman Government International Bonds, 6.00%, due 08/01/29 | 1.0% |

| Corp. Nacional del Cobre de Chile, 6.30%, due 09/08/53 | 1.0% |

| Istanbul Metropolitan Municipality, 10.50%, due 12/06/28 | 1.0% |

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact 800-FUND-TCW (800-386-3829).

If you wish to view additional information about the Fund, including but not limited to the Fund's prospectus, financial information, holdings, and proxy voting information, please visit www.tcw.com/Literature/Fund-Literature.

Phone: 800-FUND-TCW (800-386-3829)

TCW Emerging Markets Income Fund

Annual Shareholder Report — October 31, 2024

TCW Emerging Markets Income Fund

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about the TCW Emerging Markets Income Fund for the period ended October 31, 2024. You can find additional information about the Fund at www.tcw.com/Literature/Fund-Literature. You can also request this information by contacting us at 800-FUND-TCW (800-386-3829).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

| Class N | $104 | 0.95% |

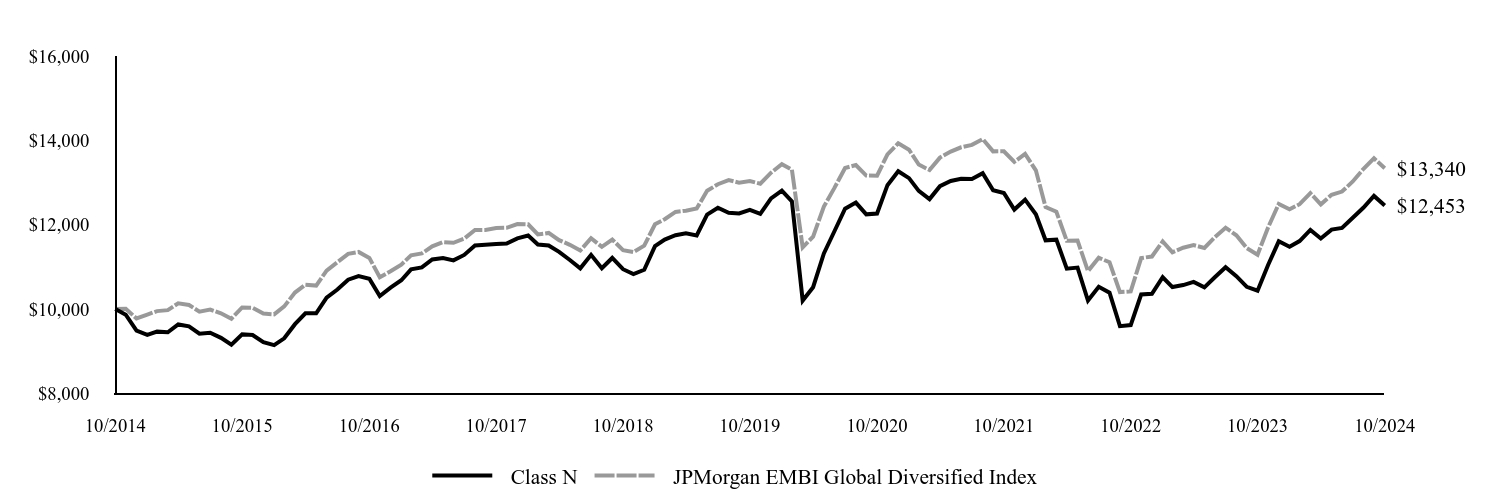

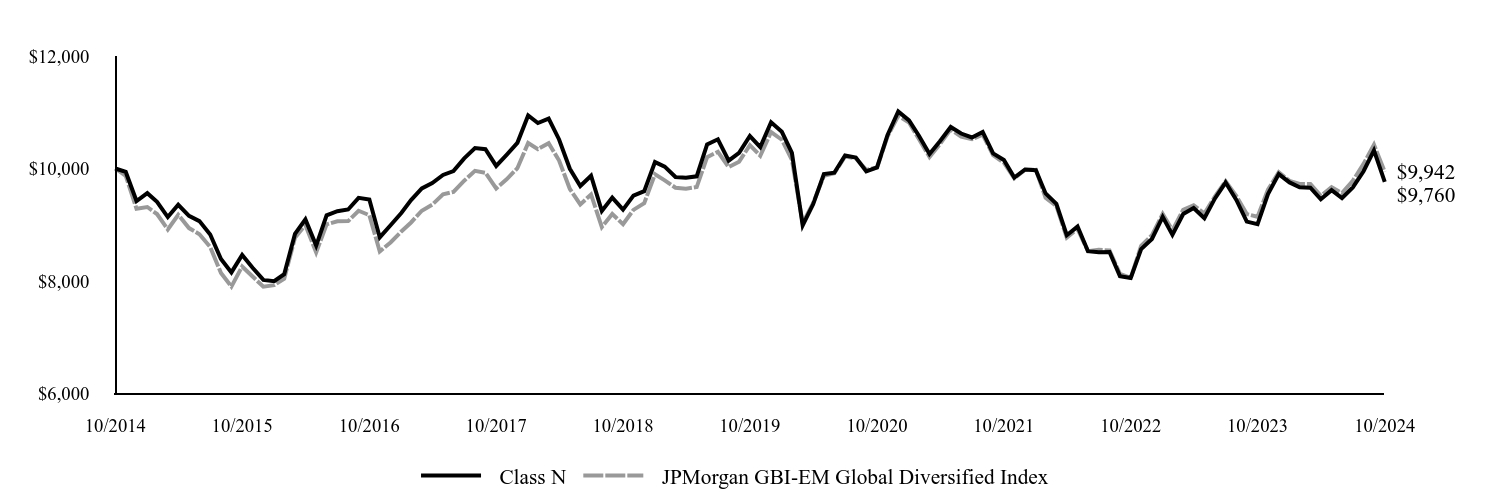

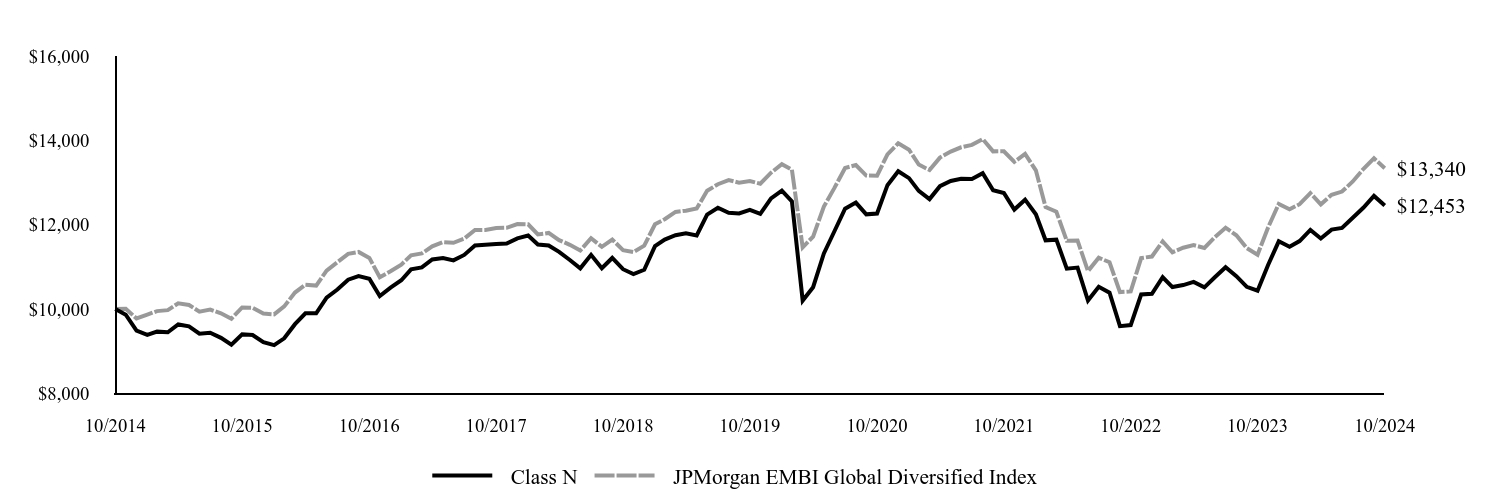

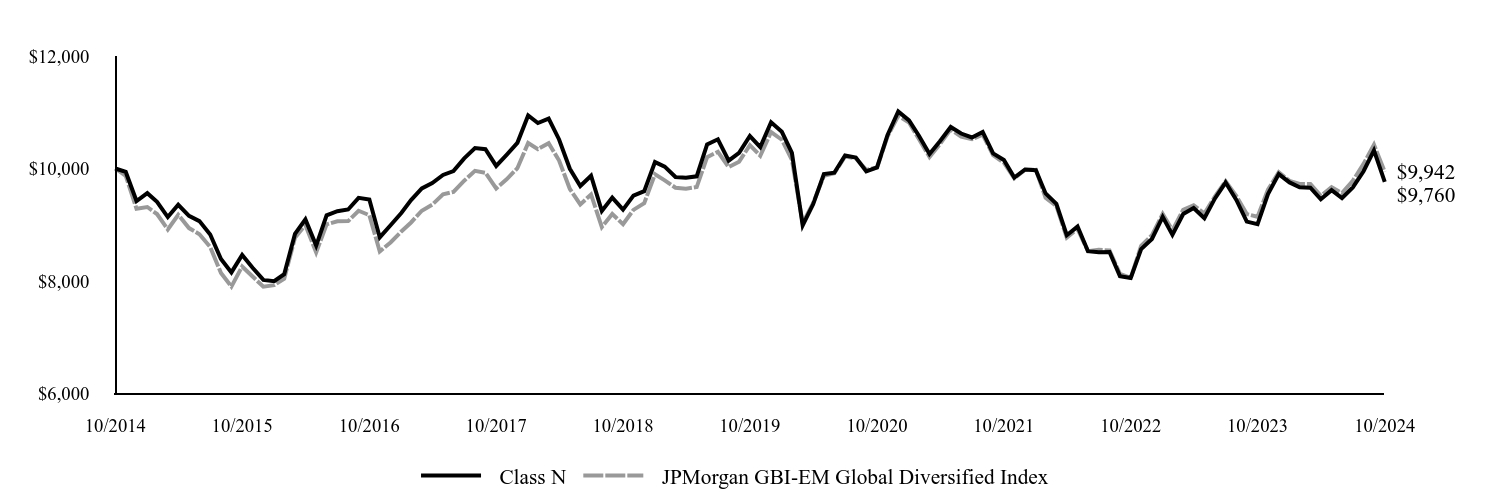

How did the Fund perform last year and what affected its performance?

For the year ended October 31, 2024, the TCW Emerging Markets Income Fund (the “Fund”) returned 19.33% net of fees on its Class N shares. Performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the JPMorgan EMBI Global Diversified Index (“EMBI”), returned 18.16% over the same period. Relative outperformance for the one-year period was driven by security selection as well as overweight positioning to high yield. From a country perspective, the portfolio’s exposure to Egypt, Ukraine, Pakistan, Brazil and Turkey were among the larger drivers of relative outperformance. Emerging Markets (EM) benefited from factors including a more benign macro environment, fundamental improvement and attractive valuations. We remain constructive on EM as most countries continue to gradually adjust towards long-term potential growth and inflation targets. While China’s growth has slowed, other large economies like India or Brazil continue to exhibit higher-than-expected levels of economic activity. Recently announced China stimulus should help to contain its deceleration. EM financial resilience has increased since the 2013 taper tantrum, with many major EM countries establishing a track record of more prudent macro policies. Moreover, current account balances, a major source of EM vulnerability in earlier periods of stress, have turned positive. It remains early to assess the macroeconomic impact of potential policy measures to be adopted by the new U.S. administration, but campaign proposals suggest higher import tariffs, a crackdown on illegal immigration, a reduction of some taxes, and increases on defense spending, as well as economic de-regulation. We anticipate winners and losers, and the sequencing of the policy rollouts will matter. As such, differentiation remains key.

| Class N | JPMorgan EMBI Global Diversified Index |

|---|

| 10/2014 | $10,000 | $10,000 |

| 11/2014 | $9,867 | $10,009 |

| 12/2014 | $9,487 | $9,777 |

| 01/2015 | $9,389 | $9,868 |

| 02/2015 | $9,465 | $9,952 |

| 03/2015 | $9,449 | $9,974 |

| 04/2015 | $9,636 | $10,137 |

| 05/2015 | $9,592 | $10,098 |

| 06/2015 | $9,417 | $9,940 |

| 07/2015 | $9,438 | $9,989 |

| 08/2015 | $9,318 | $9,899 |

| 09/2015 | $9,158 | $9,771 |

| 10/2015 | $9,404 | $10,039 |

| 11/2015 | $9,385 | $10,033 |

| 12/2015 | $9,218 | $9,893 |

| 01/2016 | $9,147 | $9,875 |

| 02/2016 | $9,307 | $10,063 |

| 03/2016 | $9,642 | $10,392 |

| 04/2016 | $9,900 | $10,576 |

| 05/2016 | $9,900 | $10,557 |

| 06/2016 | $10,271 | $10,913 |

| 07/2016 | $10,464 | $11,110 |

| 08/2016 | $10,697 | $11,308 |

| 09/2016 | $10,782 | $11,354 |

| 10/2016 | $10,719 | $11,213 |

| 11/2016 | $10,309 | $10,754 |

| 12/2016 | $10,508 | $10,897 |

| 01/2017 | $10,684 | $11,055 |

| 02/2017 | $10,941 | $11,276 |

| 03/2017 | $10,987 | $11,319 |

| 04/2017 | $11,176 | $11,487 |

| 05/2017 | $11,211 | $11,589 |

| 06/2017 | $11,155 | $11,572 |

| 07/2017 | $11,284 | $11,669 |

| 08/2017 | $11,508 | $11,876 |

| 09/2017 | $11,524 | $11,877 |

| 10/2017 | $11,541 | $11,921 |

| 11/2017 | $11,553 | $11,927 |

| 12/2017 | $11,677 | $12,015 |

| 01/2018 | $11,743 | $12,010 |

| 02/2018 | $11,532 | $11,771 |

| 03/2018 | $11,508 | $11,805 |

| 04/2018 | $11,355 | $11,634 |

| 05/2018 | $11,163 | $11,524 |

| 06/2018 | $10,966 | $11,387 |

| 07/2018 | $11,286 | $11,678 |

| 08/2018 | $10,967 | $11,476 |

| 09/2018 | $11,212 | $11,649 |

| 10/2018 | $10,945 | $11,398 |

| 11/2018 | $10,831 | $11,350 |

| 12/2018 | $10,931 | $11,503 |

| 01/2019 | $11,492 | $12,011 |

| 02/2019 | $11,648 | $12,130 |

| 03/2019 | $11,750 | $12,303 |

| 04/2019 | $11,799 | $12,333 |

| 05/2019 | $11,747 | $12,384 |

| 06/2019 | $12,238 | $12,804 |

| 07/2019 | $12,403 | $12,960 |

| 08/2019 | $12,283 | $13,057 |

| 09/2019 | $12,266 | $12,997 |

| 10/2019 | $12,351 | $13,034 |

| 11/2019 | $12,257 | $12,972 |

| 12/2019 | $12,626 | $13,233 |

| 01/2020 | $12,810 | $13,434 |

| 02/2020 | $12,553 | $13,304 |

| 03/2020 | $10,202 | $11,462 |

| 04/2020 | $10,518 | $11,719 |

| 05/2020 | $11,318 | $12,430 |

| 06/2020 | $11,839 | $12,867 |

| 07/2020 | $12,381 | $13,345 |

| 08/2020 | $12,525 | $13,414 |

| 09/2020 | $12,246 | $13,165 |

| 10/2020 | $12,266 | $13,161 |

| 11/2020 | $12,938 | $13,669 |

| 12/2020 | $13,268 | $13,929 |

| 01/2021 | $13,104 | $13,777 |

| 02/2021 | $12,802 | $13,426 |

| 03/2021 | $12,607 | $13,296 |

| 04/2021 | $12,914 | $13,591 |

| 05/2021 | $13,037 | $13,735 |

| 06/2021 | $13,088 | $13,836 |

| 07/2021 | $13,086 | $13,894 |

| 08/2021 | $13,221 | $14,030 |

| 09/2021 | $12,819 | $13,739 |

| 10/2021 | $12,753 | $13,742 |

| 11/2021 | $12,359 | $13,490 |

| 12/2021 | $12,594 | $13,678 |

| 01/2022 | $12,247 | $13,289 |

| 02/2022 | $11,630 | $12,419 |

| 03/2022 | $11,646 | $12,308 |

| 04/2022 | $10,958 | $11,620 |

| 05/2022 | $10,984 | $11,623 |

| 06/2022 | $10,202 | $10,900 |

| 07/2022 | $10,528 | $11,216 |

| 08/2022 | $10,389 | $11,110 |

| 09/2022 | $9,595 | $10,403 |

| 10/2022 | $9,620 | $10,418 |

| 11/2022 | $10,345 | $11,209 |

| 12/2022 | $10,361 | $11,246 |

| 01/2023 | $10,755 | $11,602 |

| 02/2023 | $10,522 | $11,346 |

| 03/2023 | $10,569 | $11,455 |

| 04/2023 | $10,643 | $11,516 |

| 05/2023 | $10,515 | $11,450 |

| 06/2023 | $10,753 | $11,706 |

| 07/2023 | $10,993 | $11,930 |

| 08/2023 | $10,781 | $11,750 |

| 09/2023 | $10,527 | $11,444 |

| 10/2023 | $10,436 | $11,289 |

| 11/2023 | $11,039 | $11,929 |

| 12/2023 | $11,606 | $12,493 |

| 01/2024 | $11,476 | $12,366 |

| 02/2024 | $11,612 | $12,487 |

| 03/2024 | $11,877 | $12,748 |

| 04/2024 | $11,674 | $12,483 |

| 05/2024 | $11,884 | $12,708 |

| 06/2024 | $11,924 | $12,786 |

| 07/2024 | $12,165 | $13,025 |

| 08/2024 | $12,408 | $13,327 |

| 09/2024 | $12,683 | $13,573 |

| 10/2024 | $12,453 | $13,340 |

The performance data quoted represents past performance and does not guarantee future results. The total returns do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Fund’s Average Total Returns are based on net asset values calculated for shareholder transactions which are not reflective of adjustments required pursuant to GAAP. Accordingly, differences may exist between this data and similar information reported in the financial statements.

Average Annual Total Returns (%)

| Name | 1 Year | 5 Years | 10 Years |

|---|

| Class N | 19.33% | 0.16% | 2.22% |

| JPMorgan EMBI Global Diversified Index | 18.16% | 0.47% | 2.92% |

Past Performance: Performance data represent past performance which does not guarantee future result.

- Total Net Assets$3,505,272,750

- # of Portfolio Holdings269

- Portfolio Turnover Rate106%

- Total Advisory Fees Paid - Net$26,231,860

What did the Fund invest in?

Asset Allocation (as a % of Net Assets)

| Government | 69.2% |

| Energy | 10.7% |

| Basic Materials | 6.4% |

| Utilities | 5.7% |

| Financial | 4.9% |

| Consumer Discretionary | 1.3% |

| Short-Term Investments | 0.8% |

| Consumer Staples | 0.3% |

OtherFootnote Reference* | 0.2% |

| Other Assets in Excess of Liabilities | 0.5% |

| Footnote | Description |

Footnote* | Please refer to the Fund’s Annual Financial Statements which are available on the Fund’s website at www.tcw.com/Literature/Fund-Literature for a complete listing of all categories. |

Top Ten Holdings (as a % of Net Assets)

| Ukraine Government International Bonds, 0.00%, due 08/01/41 | 2.0% |

| Greensaif Pipelines Bidco SARL, 6.13%, due 02/23/38 | 1.8% |

| Oman Government International Bonds, 6.25%, due 01/25/31 | 1.2% |

| Israel Government International Bonds, 5.50%, due 03/12/34 | 1.2% |

| Argentina Republic Government International Bonds, 0.75%, due 07/09/30 | 1.1% |

| Republic of Poland Government International Bonds, 4.88%, due 10/04/33 | 1.1% |

| Saudi Arabian Oil Co., 5.25%, due 07/17/34 | 1.1% |

| Oman Government International Bonds, 6.00%, due 08/01/29 | 1.0% |

| Corp. Nacional del Cobre de Chile, 6.30%, due 09/08/53 | 1.0% |

| Istanbul Metropolitan Municipality, 10.50%, due 12/06/28 | 1.0% |

In order to reduce the amount of mail you receive and to help reduce expenses, we generally send a single copy of any shareholder report to each household. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact 800-FUND-TCW (800-386-3829).

If you wish to view additional information about the Fund, including but not limited to the Fund's prospectus, financial information, holdings, and proxy voting information, please visit www.tcw.com/Literature/Fund-Literature.

Phone: 800-FUND-TCW (800-386-3829)

TCW Emerging Markets Income Fund

Annual Shareholder Report — October 31, 2024

TCW Emerging Markets Income Fund

Annual Shareholder Report — October 31, 2024

This annual shareholder report contains important information about the TCW Emerging Markets Income Fund for the period ended October 31, 2024. You can find additional information about the Fund at www.tcw.com/Literature/Fund-Literature. You can also request this information by contacting us at 800-FUND-TCW (800-386-3829).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment |

|---|

| Class P | $85 | 0.77% |

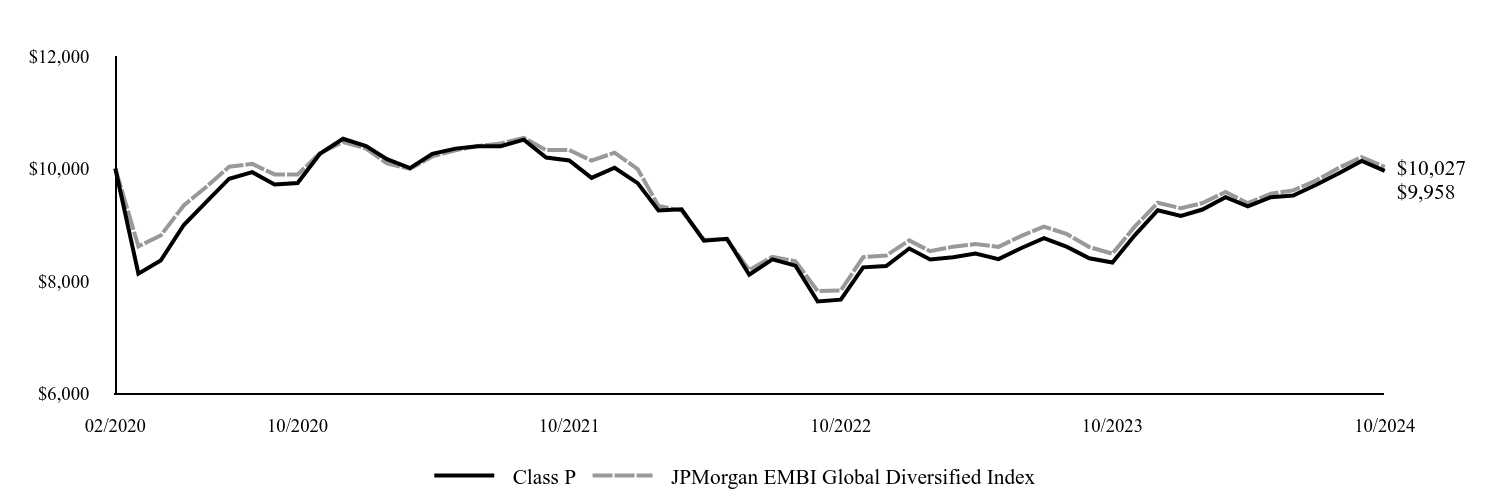

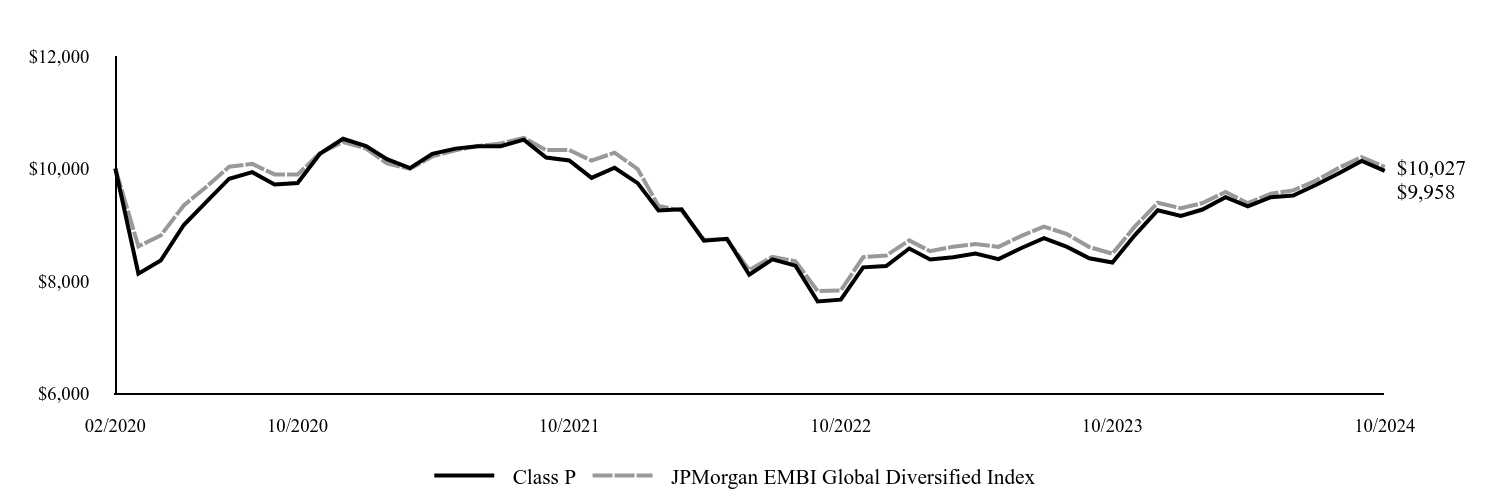

How did the Fund perform last year and what affected its performance?

For the year ended October 31, 2024, the TCW Emerging Markets Income Fund (the “Fund”) returned 19.57% net of fees on its Class P shares. Performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the JPMorgan EMBI Global Diversified Index (“EMBI”), returned 18.16% over the same period. Relative outperformance for the one-year period was driven by security selection as well as overweight positioning to high yield. From a country perspective, the portfolio’s exposure to Egypt, Ukraine, Pakistan, Brazil and Turkey were among the larger drivers of relative outperformance. Emerging Markets (EM) benefited from factors including a more benign macro environment, fundamental improvement and attractive valuations. We remain constructive on EM as most countries continue to gradually adjust towards long-term potential growth and inflation targets. While China’s growth has slowed, other large economies like India or Brazil continue to exhibit higher-than-expected levels of economic activity. Recently announced China stimulus should help to contain its deceleration. EM financial resilience has increased since the 2013 taper tantrum, with many major EM countries establishing a track record of more prudent macro policies. Moreover, current account balances, a major source of EM vulnerability in earlier periods of stress, have turned positive. It remains early to assess the macroeconomic impact of potential policy measures to be adopted by the new U.S. administration, but campaign proposals suggest higher import tariffs, a crackdown on illegal immigration, a reduction of some taxes, and increases on defense spending, as well as economic de-regulation. We anticipate winners and losers, and the sequencing of the policy rollouts will matter. As such, differentiation remains key.

| Class P | JPMorgan EMBI Global Diversified Index |

|---|

| 02/2020 | $10,000 | $10,000 |

| 03/2020 | $8,129 | $8,615 |

| 04/2020 | $8,363 | $8,809 |

| 05/2020 | $8,995 | $9,343 |

| 06/2020 | $9,401 | $9,672 |

| 07/2020 | $9,818 | $10,031 |

| 08/2020 | $9,935 | $10,082 |