UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07170

TCW Funds, Inc.

(Exact name of registrant as specified in charter)

865 South Figueroa Street, Suite 1800, Los Angeles, CA 90017

(Address of principal executive offices)

Patrick W. Dennis, Esq.

Vice President and Assistant Secretary

865 South Figueroa Street, Suite 1800

Los Angeles, CA 90017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (213) 244-0000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2021

| Item 1. | Reports to Shareholders. |

| (a) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”): |

EQUITY FUNDS

TCW Artificial Intelligence Equity Fund

TCW Global Real Estate Fund

TCW New America Premier Equities Fund

TCW Relative Value Dividend Appreciation Fund

TCW Relative Value Large Cap Fund

TCW Relative Value Mid Cap Fund

TCW Select Equities Fund

ASSET ALLOCATION FUND

TCW Conservative Allocation Fund

Paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.tcw.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge. You can call 1-800-FUND-TCW (1-800-386-3829), if you invest directly with the Funds or contact your financial intermediary, if you invest though a financial intermediary, to inform the Funds or the financial intermediary that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held directly with TCW or through your financial intermediary.

TCW Funds, Inc.

Table of Contents

|

| |

| The Letter to Shareholders and/or Management Discussions contained in this Annual Report are the opinions of each Fund’s portfolio managers and are not the opinions of TCW Funds, Inc. or its Board of Directors. Various matters discussed in the Letter to Shareholders and/or Management Discussions constitute forward-looking statements within the meaning of the federal securities laws. Actual results and the timing of certain events could differ materially from those projected or contemplated by these forward-looking statements due to a number of factors, including general economic conditions, overall availability of securities for investment by a Fund, the level of volatility in the securities markets and in the share price of a Fund, and other risk factors discussed in the SEC filings of TCW Funds, Inc. The data presented in the Letter to Shareholders and/or Management Discussions represents past performance and cannot be used to predict future results. |

| | |

To Our Valued Shareholders | | |

| | |

| | David B. Lippman President, Chief Executive Officer and Director |

Dear Valued Investors,

I am pleased to present the 2021 annual report for the TCW Funds, Inc. covering the 12-month period ended October 31, 2021. I would like to express our appreciation for your continued investment in the TCW Funds as well as to welcome new shareholders to our fund family. As of October 31, 2021, the TCW Funds held total net assets of approximately $16.4 billion.

This report contains information and portfolio management discussions of our Equity Funds and the TCW Conservative Allocation Fund.

The U.S. Stock Market

U.S. stocks surged 42.9% (S&P 500 Total Return Index) to a record high during the one-year period ending 10/31/21. The U.S. Federal Reserve’s vast quantitative easing and asset purchases, coupled with massive fiscal stimulus, provided robust support to risk assets including stocks despite the COVID-19 Delta variant’s disruption to the process of reopening the global economy. Early in the year, the Biden Administration secured passage of the $1.9 trillion American Rescue Plan Act of 2021, which placed stimulus checks into the hands of consumers and provided for expanded unemployment benefits through early September of this year. Retail sales surged, unemployment fell to a new post-pandemic low, and both the manufacturing and services sectors of the US economy experienced sharp rebounds. Against this macro backdrop, and with the Federal Reserve reiterating its zero interest rate policy and continued monthly asset purchases, it was little surprise that the U.S. economy posted real GDP growth of 6.4% and 6.7% (Quarter-over-Quarter), respectively, in the first and second quarters of the year. Equity prices were also fueled higher by first quarter corporate earnings results, which showed stellar year-over-year revenue and earnings per share rebounds of approximately 50% in the first quarter and 87% in the second quarter (Credit Suisse, 5/21/21 and 8/20/21). At the same time, however, the U.S. Fed Chair Powell’s narrative

that the pick-up in inflation would prove “transitory” came under investor scrutiny, as multiple inflation gauges pointed to potentially persistent inflation. Indeed, in October both the headline (6.2%) and core CPI (4.6%) year-over-year figures hit their highest level in 30 years. Powell was forced to acknowledge that current inflationary pressures have been “larger and longer lasting than anticipated,” and following its November 2021 Federal Open Market Committee (FOMC) meeting, the Fed announced that it would begin to taper its monthly asset purchases. Thus, just three months after the 10-year U.S. Treasury Note yield had dipped to 1.17% due largely to Delta variant concerns, the bellwether rate surged as high as 1.70%.

Looking Ahead

Looking forward, supply chain bottlenecks, higher energy prices, and labor market wage pressures have underscored a real potential for higher-than-expected inflation in the near-to-medium term. At the same time, considerable uncertainty remains with respect to the U.S. and global economic growth outlook given the uncertain evolution of the COVID pandemic in the U.S. and abroad, despite vaccination progress. And after successive years of massive fiscal stimulus, including the recently enacted $1.2 trillion Infrastructure and Investment Jobs Act, we think that burgeoning federal debt and deficits, in combination with higher interest rates, will eventually present considerable headwinds to the equity market. With respect to the corporate earnings growth outlook, many companies have called out supply chain issues and input cost pressures, such that the consensus expectation for high single-digit earnings per share growth for U.S. stocks in 2022 — presently at 8% — remains subject to revision. We highlight the potential for a pick-up in market volatility and a period of protracted choppiness in the equity markets, as investors grapple with the Fed taper, inflationary pressures, continued supply chain issues, and the still uncertain growth trajectory as the global economy

1

| | |

Letter to Shareholders (Continued) | | |

emerges from COVID. Against this backdrop, our equity portfolio managers and analysts continue to seek out those quality companies which possess resilience, strong balance sheets, and skilled management that will ultimately separate the winners from the losers during such a period of heightened uncertainty.

We truly value our relationship with you and thank you for making the TCW Funds part of your long-term investment plan. If you have any questions or require further information, I invite you to visit our website at www.tcw.com, or call our shareholder services department at 800-386-3829.

I look forward to further correspondence with you through our semi-annual report next year.

Sincerely,

David B. Lippman

President, Chief Executive Officer and Director

2

TCW Artificial Intelligence Equity Fund

Management Discussions

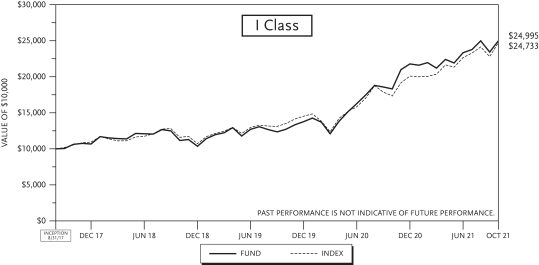

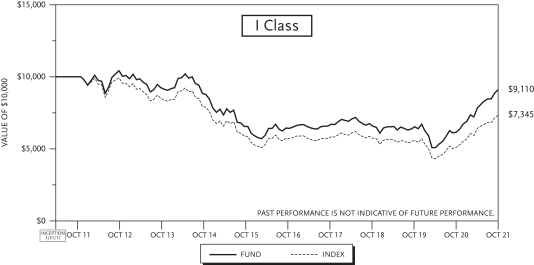

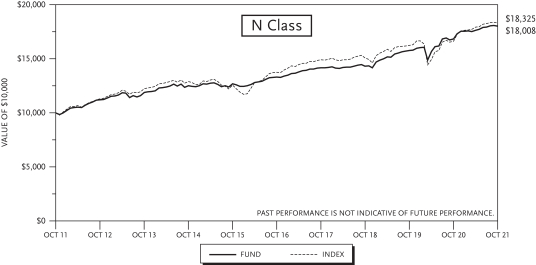

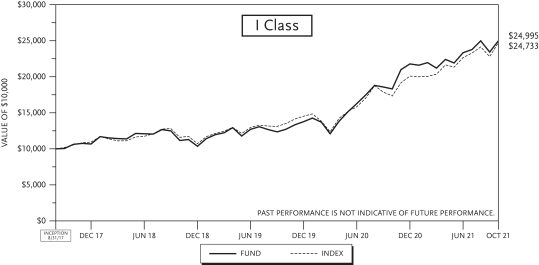

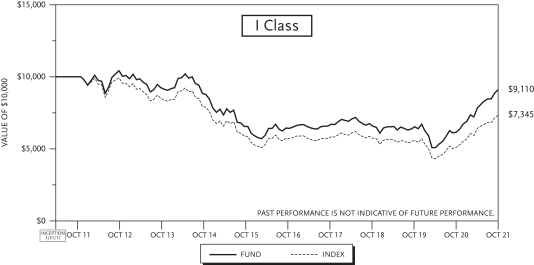

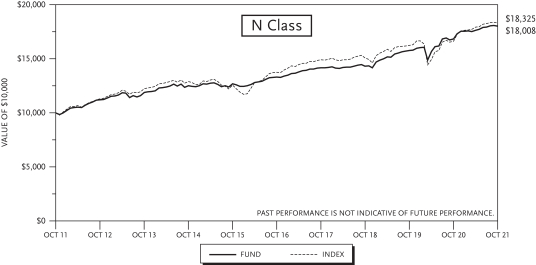

For the year ended October 31, 2021, the TCW Artificial Intelligence Equity Fund (the “Fund”) returned +36.5% while the Russell 3000 Growth Index returned +42.8% over the same period.

Strongest and Weakest Performers

Our two biggest stock contributors during the year were Alphabet and ASML Holding.

Alphabet performed very well in the period, reporting impressive earnings results in subsequent quarters, largely driven by an improving environment in digital advertising as well as strong revenues from its Search, YouTube, and Network segments. Management offered little in the way of forward commentary beyond cautioning about tougher comps in the back half of the year, but the outlook is bright. Google has significant exposure to travel in the reopening environment, it is better protected from changes in digital advertising privacy than peers, and it has two rising growth businesses that are reaching scale in YouTube Ads and Google Cloud.

The company is also working to integrate AI into its search engine, which in the past produced results using preset rules and algorithms, but now is working to incorporate deep learning features into the process. Alphabet uses an artificial intelligence neural network in its Google Translate technology in order to improve fluency and the accuracy of the tool. YouTube, Google Maps, and Gmail also use machine learning technology to improve functionality and user experience.

Alphabet’s self-driving, ride-hailing subsidiary company, Waymo, ramped up its testing during the period. The service has been tested in Phoenix and was just recently granted a permit to offer rides in San Francisco. As of now, the cars are operating from 10 p.m. to 6 a.m. and require a “safety driver” to oversee the ride. Waymo has recently begun mapping in New York City, where the company hopes to expand testing and ultimately offer the service in the future.

ASML Holding had a strong year as the company benefitted from strong semiconductor demand and tight supply. The company specializes in developing and producing semiconductor-manufacturing equipment. The semiconductor industry needs to increase production to satisfy long-term growth and is increasing its purchases from ASML.

Our two weakest stock contributors during the year were Alibaba Group and Baidu.

Both Alibaba and Baidu struggled as the Chinese government tightened regulations and levied penalties against many of its major corporations. In July, the government announced further regulations, specifically targeting the technology sector. The plan includes collecting information, listing problem areas for companies, and holding offenders legally responsible.

Investors also expressed concern that Chinese companies’ stocks, which trade on U.S. stock exchanges as American Depository Receipts (ADRs), may be delisted and only traded on Hong Kong’s stock exchange. The risk comes from both the U.S. and Chinese governments as tension between the countries has grown in recent years. Mounting pressure has come from U.S. regulators who have highlighted the potential for inaccurate financial statements from Chinese companies, as China doesn’t adhere to the same auditing standards that public U.S. companies must follow. The U.S. regulators have called on China to allow examinations of its companies, or risk them being delisted within the next three years.

As one might expect, many Chinese companies’ stock prices have been negatively impacted by these actions and announcements, and Alibaba and Baidu were among those affected.

3

TCW Artificial Intelligence Equity Fund

Management Discussions (Continued)

AI Outlook and Recent Developments

We believe AI will be the foundational technology of the information age. The leap from computing built on the foundation of humans telling computers how to act, to computing built on the foundation of computers learning how to act, has significant implications for every industry.

In our view, there are many structural drivers that are accelerating the need for AI. These include:

| • | | Trend in demographics towards an aging global population |

| • | | Need for greater energy efficiency |

| • | | Drive for greater urbanization as demand for convenience increases |

| • | | Efforts to increase human capital productivity |

The broad applicability of AI also leads us to believe that it is a paradigm-shifting technology for the global economy and a driver behind improving productivity. AI very well could end the period of stagnant productivity growth in the U.S. We believe that AI-technology-driven improvements to productivity could, similar to the 1990’s, drive corporations to invest in more capital and labor intensive projects, accelerating growth, improving profitability, and expanding equity valuations. We believe the trend towards AI-enhanced products is accelerating and we highlight recent developments as evidence:

| • | | Zoox Unveils Autonomous Robotaxi. Zoox, which is owned by Amazon, introduced its first electric robotaxi. The vehicle is driverless and comes without a steering wheel, includes airbags for four passengers that face each other on two benches in a carriage-style format, and travels up to 75 miles per hour. The vehicle can also run up to 16 hours on a single charge. The intention is to first offer the robotaxis in a commercial service for human passengers, with the potential to offer last-mile services for packages down the line. Annie Palmer. CNBC. Amazon Zoox Unveils Self-Driving Robotaxi. December 14, 2020 (https://www.cnbc.com/2020/12/14/amazons-self-driving-company-zoox-unveils-autonomous-robotaxi.html) |

| • | | Cruise and GM Partner with Microsoft for Self-Driving Vehicles. Cruise and General Motors announced that they will team with Microsoft to commercialize self-driving vehicles via a long-term partnership. Cruise will use Microsoft’s Azure platform, while Microsoft (along with General Motors, Honda, and others) will invest over $2 billion of equity into Cruise. GM is aiming to launch 30 new electric vehicles globally by 2025. Automotive World. Cruise and GM Team Up with Microsoft to Commercialize Self-Driving Vehicles. January 19, 2021 (https://www.automotiveworld.com/news-releases/cruise-and-gm-team-up-with-microsoft-to-commercialize-self-driving-vehicles/) |

| • | | Forbes Showcases Top 50 Most Promising U.S. Companies. Forbes highlighted 50 companies in the U.S. that are worth watching from an artificial intelligence development perspective. These businesses are privately-held and utilize machine learning, natural language processing, or computer vision and were compiled through a submission process. Companies were identified in partnership with Sequoia Capital and Meritech Capital. Alan Ohnsman and Kenrick Cai. Forbes. AI 50 Companies to Watch 2021. April 26, 2021 (https://www.forbes.com/sites/alanohnsman/2021/04/26/ai-50-americas-most-promising-artificial-intelligence-companies/?sh=3d5247a177cf) |

| • | | AI Could Help to Mitigate the Risk of Future Pandemics. In 2016, a woman in rural Thailand noticed a cow frothing at the mouth and quickly reported it; by doing so, authorities were able to isolate 3 cows which had been infected with foot-and-mouth disease, and stop any further infection. Some researchers |

4

TCW Artificial Intelligence Equity Fund

Management Discussions (Continued)

| | are convinced that by creating a system for reporting similar cases and incorporating AI, we will be able to avoid future outbreaks. Participatory One Health Disease Direction is an example of a company hoping to do just that. Located in Thailand, the company is working on developing AI that will expand monitoring, improve data analysis, and enhance vaccine development. Other countries across the globe are seeing countless similar companies emerging, which may help stop outbreaks early. James Paton and Randy Thanthong-Knight. Bloomberg. The Next Pandemic Could Be Averted With AI, Apps and Big Data. July 15, 2021 (https://blinks.bloomberg.com/news/stories/QW9PU2DWRGG6) |

| • | | Waymo, a Google Spinoff, Starts Giving Rides in San Francisco. San Francisco’s streets are known for being tight, busy with pedestrians, bicyclists, and trolleys, and lacking space to park. Alphabet’s Waymo, is hoping to make getting around the city a little easier as it has begun testing its self-driving technology. Similar to other rideshare companies, the service allows a “driver” to hail a car and get a ride to a destination of their choosing, although currently the rider must sit in the driver’s seat, ready to act in case of emergency. Waymo is currently only accepting a handful of riders, but the company hopes to be fully available to everyone in the next couple years. Paresh Dave. Reuters. Google self-driving spinoff Waymo begins testing with public in San Francisco. August 24, 2021 (https://www.reuters.com/technology/google-self-driving-spinoff-waymo-begins-testing-with-public-san-francisco-2021-08-24/) |

We continuously survey the artificial intelligence investment landscape by drawing upon our deep technical knowledge and fundamental research efforts. Our research effort seeks the most attractive opportunities in the AI ecosystem. We appreciate your confidence in and support of the TCW Global Artificial Intelligence Equity Fund.

5

TCW Artificial Intelligence Equity Fund

Management Discussions (Continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Annualized Total Return as of October 31, 2021(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | |

TCW Artificial Intelligence Equity Fund | | | | | | | | | | | | | | | | | | | | |

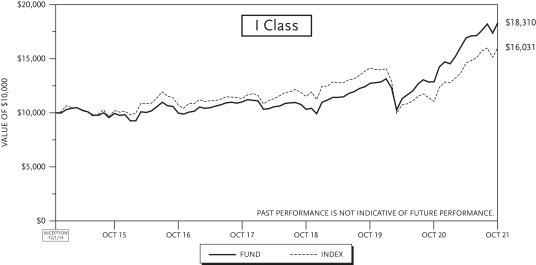

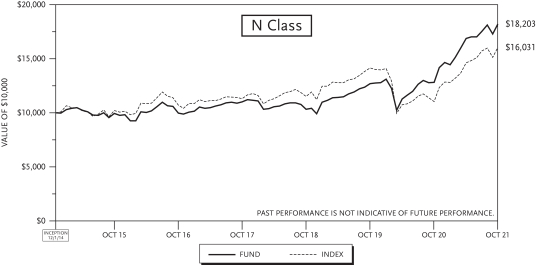

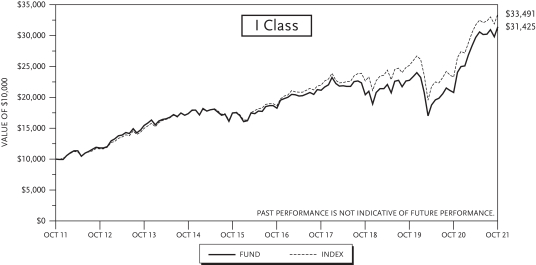

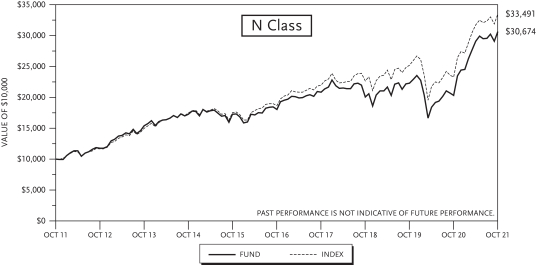

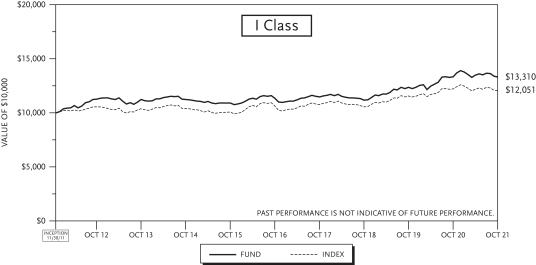

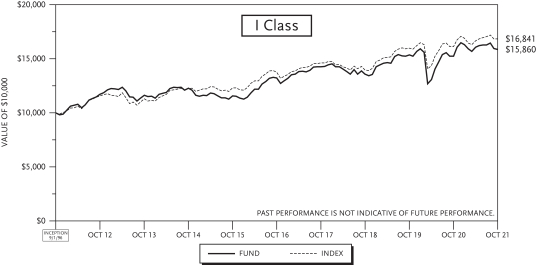

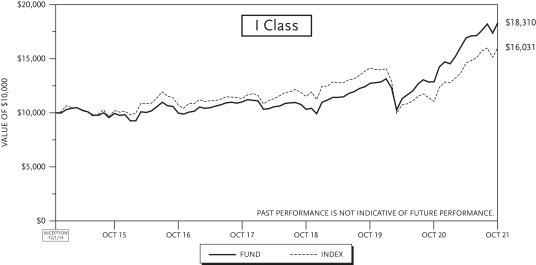

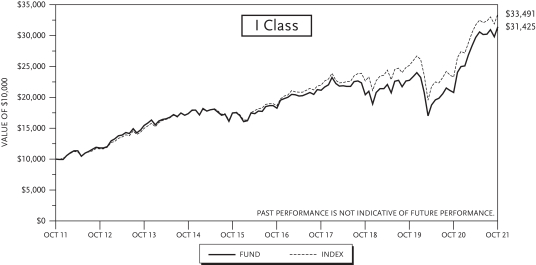

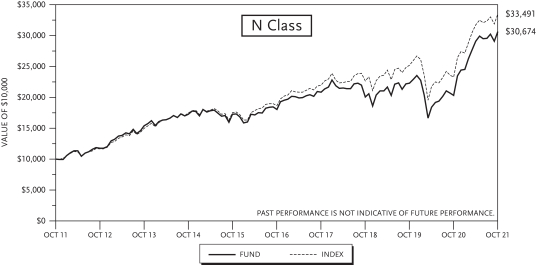

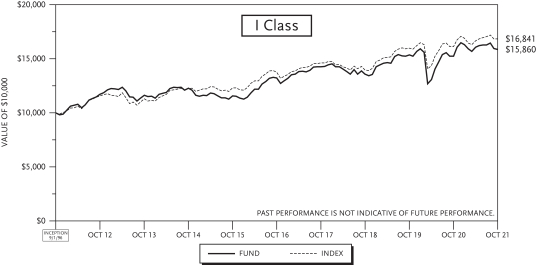

Class I (Inception: 09/01/2017) | | | 36.48 | % | | | 30.75 | % | | | — | | | | — | | | | 24.57 | % |

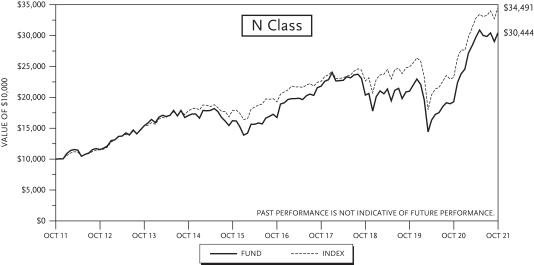

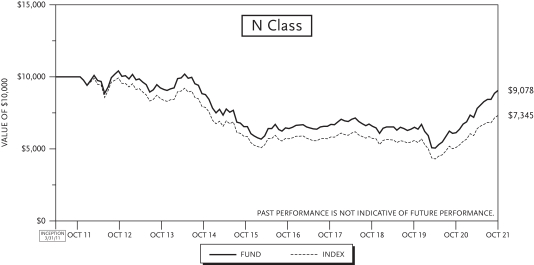

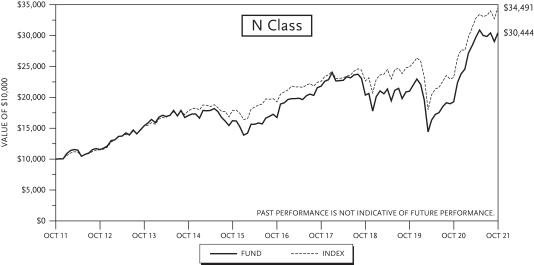

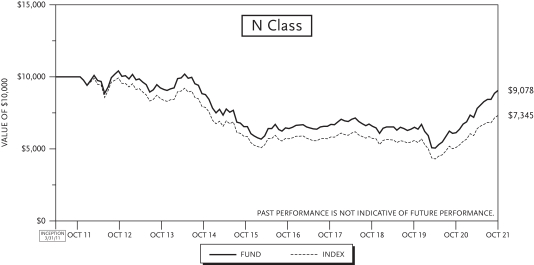

Class N (Inception: 09/01/2017) | | | 36.34 | % | | | 30.65 | % | | | — | | | | — | | | | 24.47 | % |

Russell 3000 Growth Index | | | 42.81 | % | | | 28.66 | % | | | — | | | | — | | | | 24.25 | % |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

6

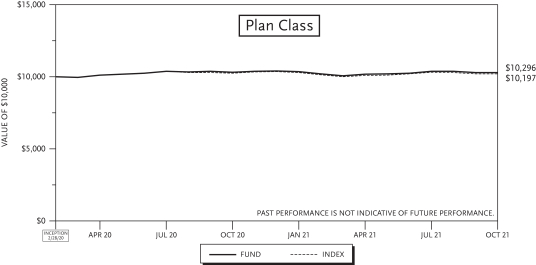

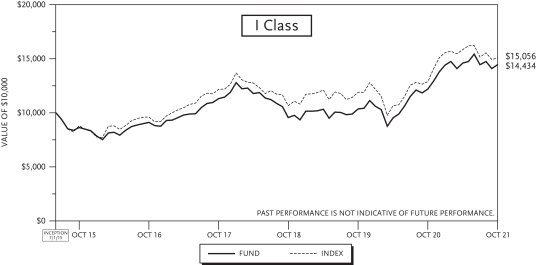

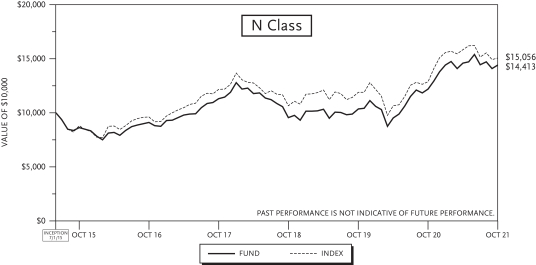

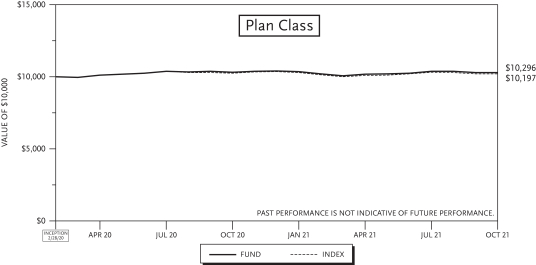

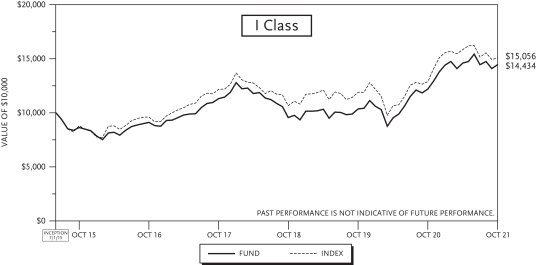

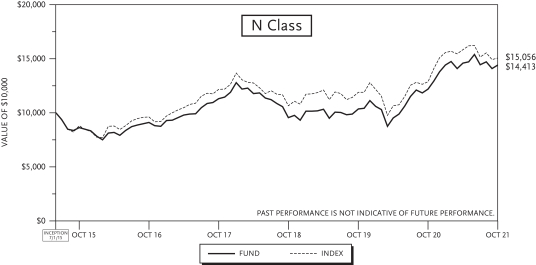

TCW Conservative Allocation Fund

Management Discussions

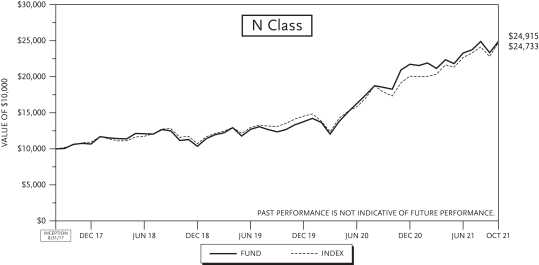

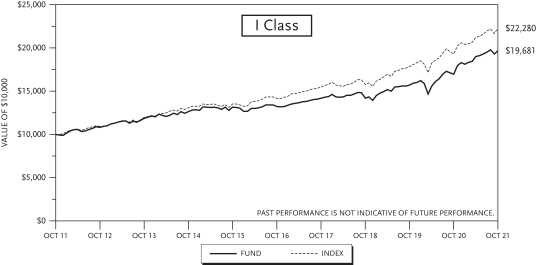

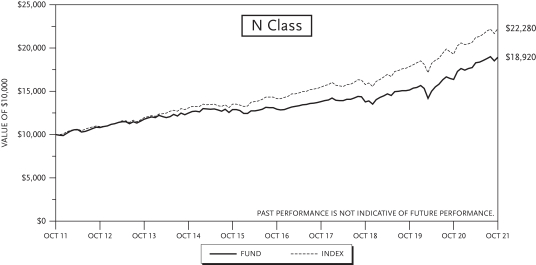

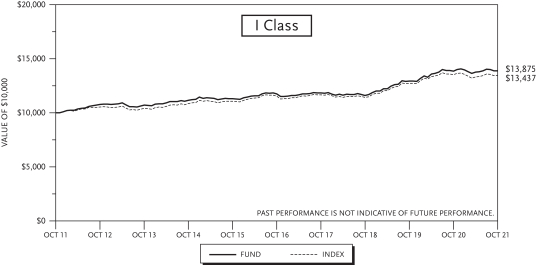

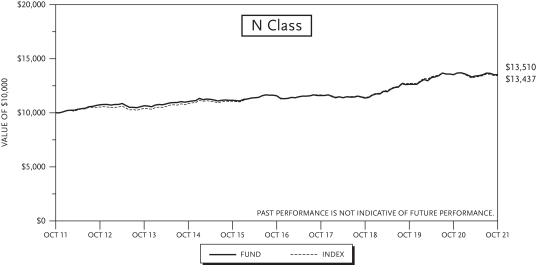

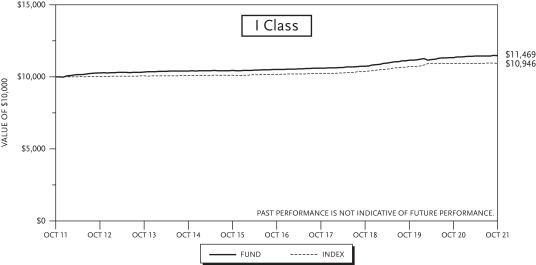

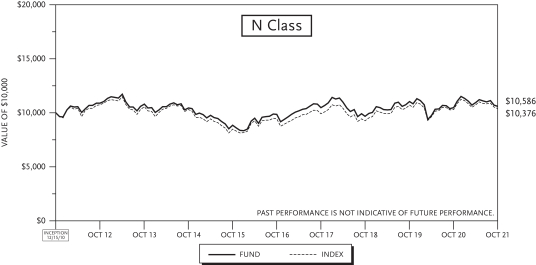

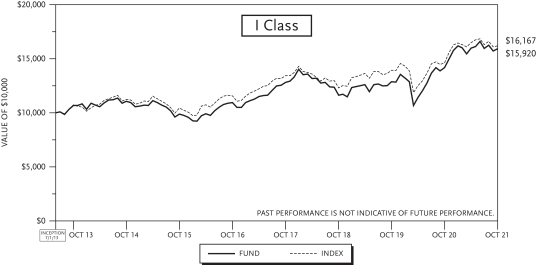

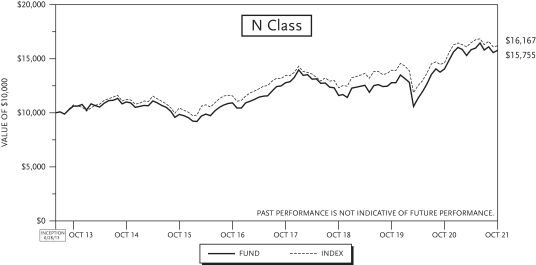

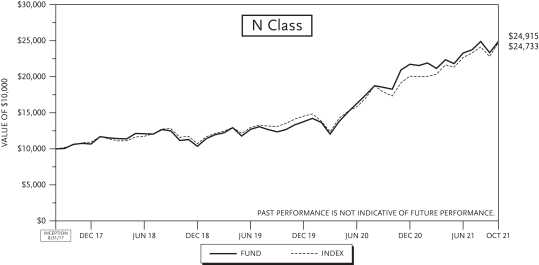

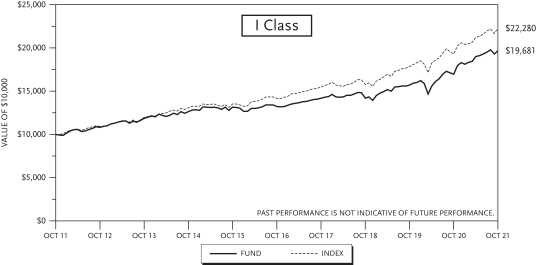

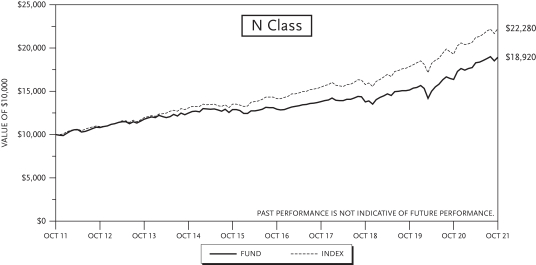

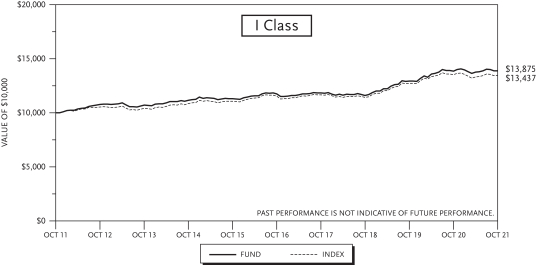

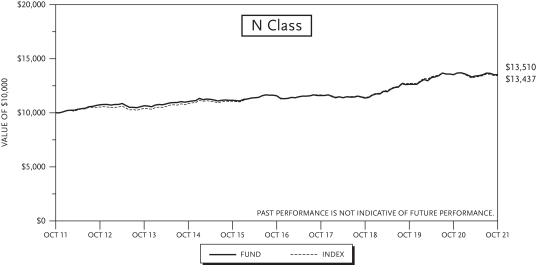

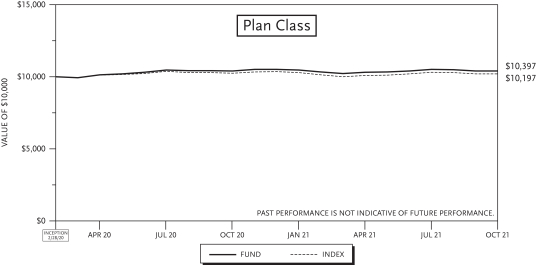

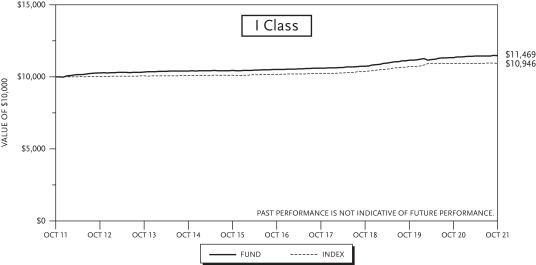

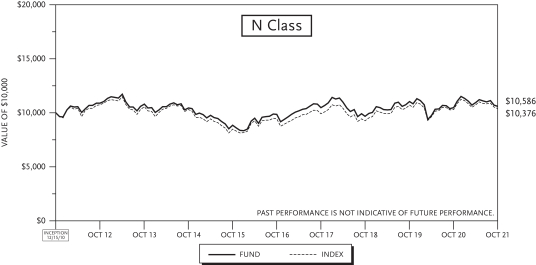

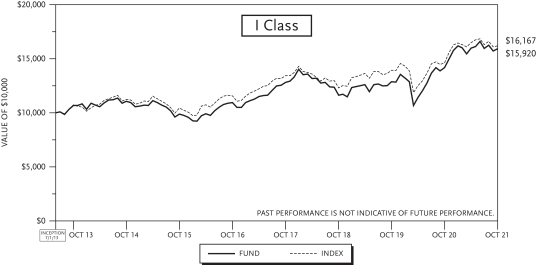

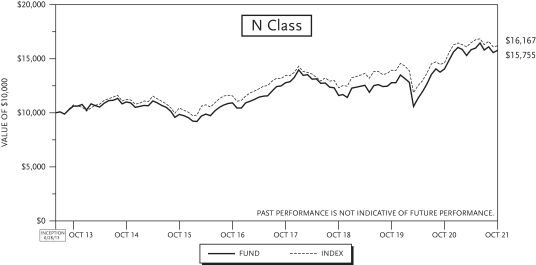

For the year ended October 31, 2021, the TCW Conservative Allocation Fund (the “Fund”) posted a gain of 15.92% for the I Class and 15.64% for the N Class shares. The performance of the Fund’s classes varies because of differing expenses. The Fund’s blended benchmark of 40% S&P 500 Index and 60% Bloomberg U.S. Aggregate Bond Index returned 15.36% over the same time period.

The Fund posted positive returns over the past year with positive contributions coming from U.S. Equities. The strongest returns came from the TCW Relative Value Large Cap Fund (10.7% allocation and 51% return) and the TCW New America Premier Equities Fund (8.4% allocation and 40% return). The equity portion of the fund was up over 40% for the past 12 months, slightly lagging the S&P 500 Index return of 42%. At the asset allocation level, the decision to overweight large cap growth and underweight large cap value equities helped relative performance. Within Fixed Income, the strongest returns came from the MetWest High Yield Bond Fund (1% allocation and 7.7% return) and the TCW Emerging Market Bond Fund (1% allocation and 5% return). Both funds outperformed the Bloomberg U.S. Aggregate Bond Index return of -1.0%.

As of the end of October, the allocation for the Fund was 35% equities, 9% alternatives and 56% fixed income. The Fund had a slight underweight to both equities and fixed income and an overweight allocation to alternatives relative to its blended index. The baseline allocation is 40% Equities and 60% Fixed Income. Over the past 12 months, the Fund had slightly decreased the allocation to equities, specifically large growth funds. Within Equities, the allocation to Large and Mid Value funds were increased to give the Fund a more balanced allocation between growth and value within equities. In Fixed Income, the allocation to shorter duration US Fixed Income funds were increased along with initiating an allocation to a commodities fund.

U.S. stocks surged 7.0% to a record high in the month of October, bringing their year-to-date advance to 24.0% (S&P 500 Total Return Index). Moves by U.S. Senate moderate Democrats to force a scaling back of the Biden Administration’s Build Back Better reconciliation bill from $3.5 trillion to $1.75 trillion proved supportive of the equity market given the elimination of most planned corporate and capital gains tax hikes. At the same time, macroeconomic data releases were generally positive, including the September employment report, which showed a sharp drop in the unemployment rate from 5.2% to 4.8%. Encouragingly, average hourly earnings were up 4.6% (Year-over-Year), and weekly initial unemployment claims fell mid-month to a post-pandemic low of 290k. While U.S. Fed Chair Powell signaled a November announcement of asset purchase “tapering,” equity market investors appear to have embraced his narrative that tapering will be an orderly process through the middle of next year prior to any interest rate hikes. So although inflation data have been running hotter than expected — Core CPI was up 4.0% (Year-over-Year) in September — there has been just a modest uptick in the market’s inflation expectations, with the U.S. Treasury Inflation-Protected Securities’ (TIPS) 10-year breakeven rate rising from 2.37% to 2.53% over the course of the month.

Following a 6.7% growth rate in the second quarter, the first estimate of 3Q GDP growth came in at a 2.0% annualized rate, the softest pace of the pandemic recovery period. The deceleration was driven by a slowdown in personal consumption (+1.6% versus +12% prior). Meanwhile, the Fed’s closely watched gauge of inflation, the core PCE index, notched a 4.5% annualized growth rate. While this is still elevated, it has come down from an over 6% jump in the prior period.

On the labor front, payrolls reported in early September showed just 194,000 jobs were added, far below expectations for a +500k gain. The unemployment rate dipped 0.4% to 4.8%, though the participation rate

7

TCW Conservative Allocation Fund

Management Discussions (Continued)

also decreased to 61.6%, showing little sign that the expiration of enhanced unemployment benefits spurred workers to re-enter the labor force (many economists believe that a substantial number of Americans have permanently left the job market due to the pandemic). In the bond market, sovereign yield curves experienced considerable flattening late in the month as central banks globally have either removed accommodative policies or signaled that this would be imminent (the most notable movements came in the U.K., Australia and Canada).

In the U.S., the yield on the 30-Year Treasury dropped below 2% for the first time in a month, and the 5-30 Year gap moved to as little as 75 basis points — a level last seen in March 2020. Meanwhile, the yield on the 20-Year Treasury was just 4 bps lower, leading to an inverted curve for 20s/30s. In contrast, short/intermediate yields were higher.

Returns were mixed in the fixed income market. The Bloomberg U.S. Aggregate Index was roughly flat on a total and excess return basis, with securitized sectors down modestly while corporate credit posted positive returns. Meanwhile, high yield experienced its first month of negative returns in 2021 with a 0.2% loss in October, though excess returns over duration-matched Treasuries came to +14 bps. Investment grade credit spreads were largely range-bound as volatility remains historically low, and yields were modestly higher, though the sector gained 0.2% overall in October due to lower 30-Year Treasury yields. Areas that have benefitted from the economy “reopening” such as airlines and lodging were the best performers for the month, while banks and tobacco lagged.

Looking forward, it will be critical to monitor the persistence of what is certainly an elevated inflation dynamic at present. Even though the market shook off a very weak third-quarter GDP print of 2.0% (down from 6.1% Quarter-over-Quarter in 2Q), incremental data releases which point to a weaker economic growth outlook could indeed stoke stagflation concerns. And while supply chain bottlenecks, higher energy prices, and labor market wage pressures have appeared manageable to this point, should they worsen, the narrative associated with corporate earnings reports and forward guidance may indeed begin to undercut consensus expectations for earnings growth next year, which presently stands at a reasonably attractive level of around 8% (with the forward market P/E at 20 times). We continue to anchor to our constructive outlook for corporate earnings growth while at the same time cautioning that the risks to the outlook are building given the prospect of Fed tightening, supply-chain bottlenecks, elevated inflation, and slowing economic growth. The Fund allocation remains defensively positioned given historically tight spreads and abundant risks, with ample levels of liquidity to respond to potential volatility. Duration positioning is shorter than the Index given relatively low Treasury yields and an expectation for intermediate and longer rates to move modestly higher, with short rates anchored at least until the latter half of 2022. Corporate credit positioning is underweight that of the Index, with current holdings focused on high conviction, high quality names and defensive sectors like communications and non-cyclicals, while cyclical sectors represent a relative underweight.

8

TCW Conservative Allocation Fund

Management Discussions (Continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Annualized Total Return as of October 31, 2021(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | |

TCW Conservative Allocation Fund | | | | | | | | | | | | | | | | | | | | |

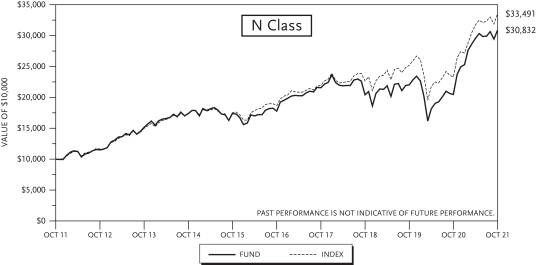

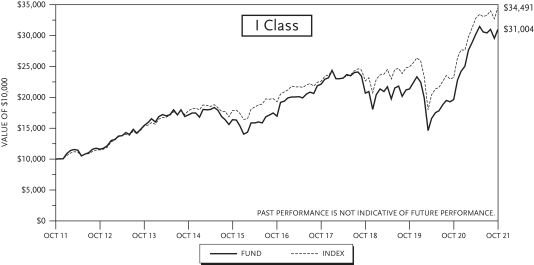

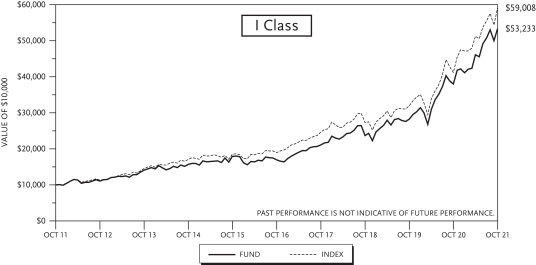

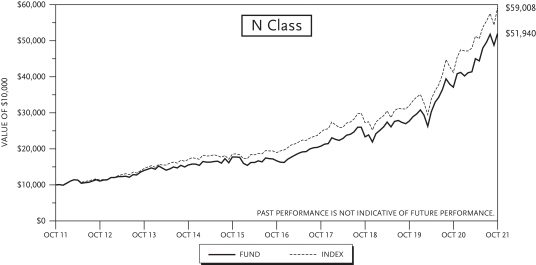

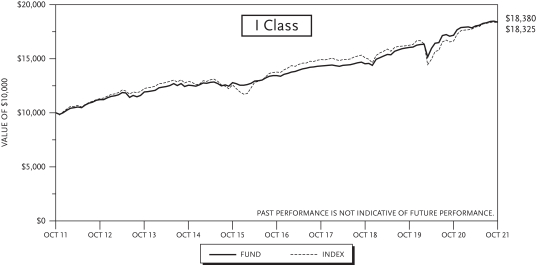

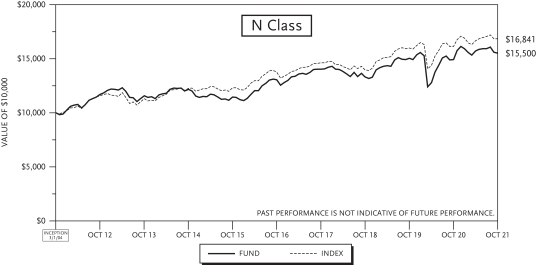

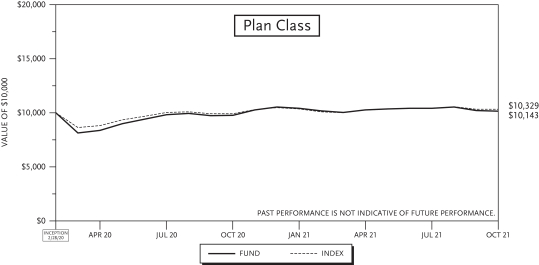

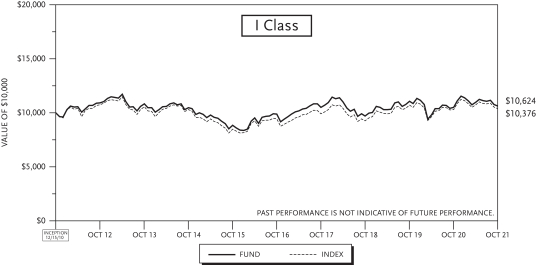

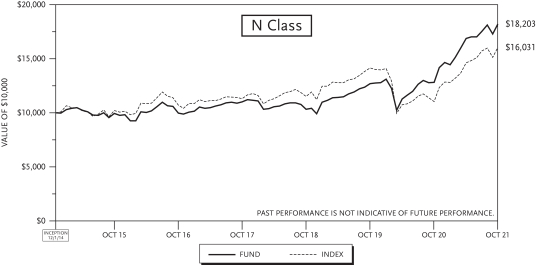

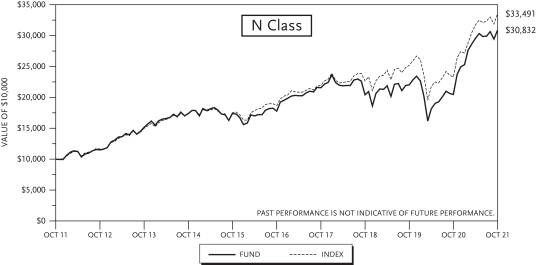

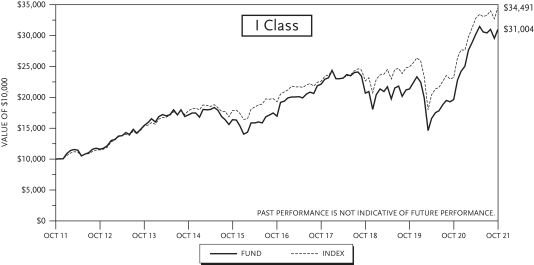

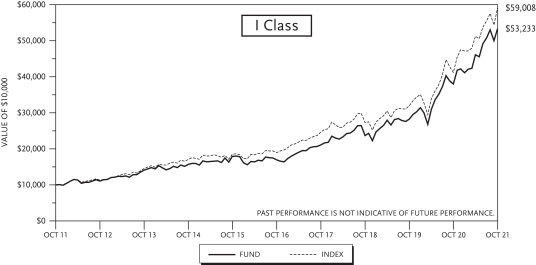

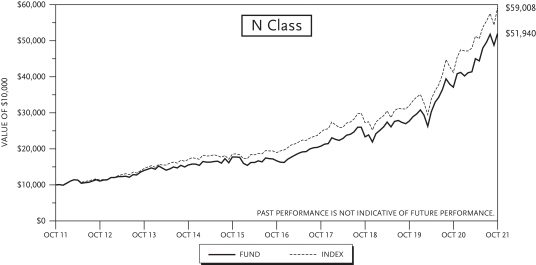

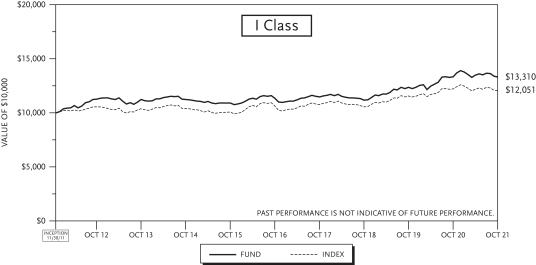

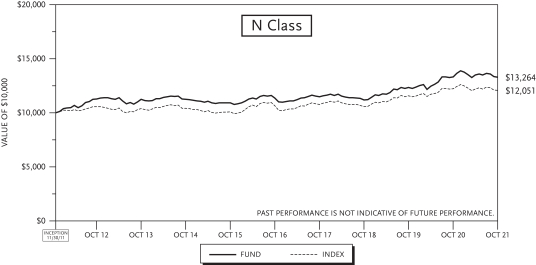

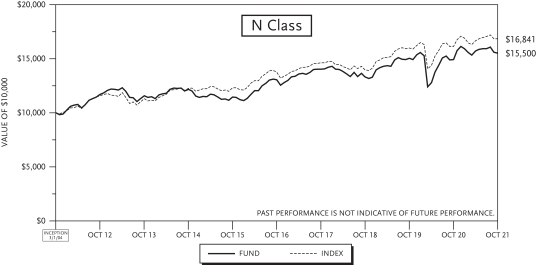

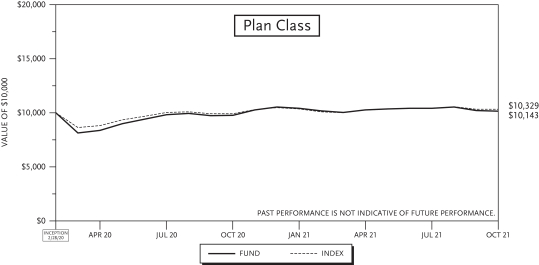

Class I (Inception: 11/16/2006) | | | 15.92 | % | | | 11.48 | % | | | 8.25 | % | | | 7.01 | % | | | 6.09 | % |

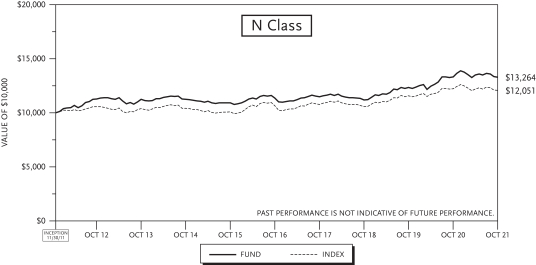

Class N (Inception: 11/16/2006) | | | 15.64 | % | | | 11.17 | % | | | 7.88 | % | | | 6.58 | % | | | 5.81 | % |

40% S&P 500 Index/60% Bloomberg U.S. Aggregate Bond Index | | | 15.36 | % | | | 12.19 | % | | | 9.50 | % | | | 8.34 | % | | | 6.96 | % |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

9

TCW Global Real Estate Fund

Management Discussions

For the year ended October 31, 2021, the TCW Global Real Estate Fund (the “Fund”) generated returns of 42.32% and 42.10% on its I Class and N Class shares, respectively. The performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the S&P Global REIT Index, had a return of 45.37% over the same period.

On an attribution basis, the Fund’s underperformance relative to its benchmark during the period was predominantly driven by sector allocation as well as stock selection. The Fund’s largest sector underweight was in Retail REITs (average weight of 1.72% and up 3.23% for the Fund vs. average weight of 16.43% and up 65.73% for the index), which detracted from performance. From a relative standpoint, the Fund’s largest sector overweight was in Mortgage REITs (average weight of 12.67% and up 75.33% for the Fund vs. average weight of 0.00% for the index), which benefitted performance. From a stock selection perspective, positive contributors included Chatham Lodging Trust (CLDT) and Iron Mountain (IRM). Conversely, notable detractors from performance included Americold Realty Trust (COLD) and Alexander and Baldwin Call Options (ALEX Calls) which we sold as a hedge against our long position in ALEX.

U.S. stocks advanced 42.89% for the 12 months ending in October 2021 (S&P 500 Total Return Index). The reopening of the global economy from the COVID-19 pandemic has been a positive driving factor in markets, despite some uncertainty around the Delta variant causing new spikes in infected cases in certain geographies. Macroeconomic data has also generally been supportive, and although inflation data has been running hotter than expected, investors seem to have embraced the U.S. Fed’s narrative that tapering will be an orderly process through the middle of next year prior to any interest rate hikes.

Global REIT indices outperformed the broader markets (as measured by the MSCI World Index), gaining 45.36% through October 31, 2020 compared to 41.08% for the MSCI World Index. Drivers of the outperformance may include the pronounced underperformance in previous years, low interest rates, above average inflation, and the potential for increased tax rates for tax paying entities (which REITs are shielded from). Moving forward, there is still much uncertainty with respect to the longer-lasting impacts of the pandemic. For example, the office sub-sector is an industry that has historically been saddled with relatively high maintenance capital expenditure requirements in addition to high tenant improvement expenditures and leasing costs. Couple these overhangs with a significant change in consumer preference to work from home, and what will undoubtedly be a long period of future technological improvement in telecommuting and virtual meetings, and it becomes very risky to deploy capital in this space. We believe that there are other potentially disrupted areas of the real estate market. While there are counterbalancing forces which may sustain demand in certain sectors/geographies, real estate seems to be more prone to disruption today than it ever has been in our recent memory.

That said, our strategy for navigating the current environment remains largely unchanged. We source most of our holdings from two separate pools. The first is in underappreciated, undervalued companies that could benefit from a change in sentiment. The issues facing these businesses are typically transitory and the discount is largely unfounded when viewed on a longer time horizon. The second set is in the quality franchises which exhibit high barriers to entry and sustainably generate strong cash flows. These companies generally also have an ability to invest capital at high rates of return and typically will compound capital at a pace that exceeds that of their peers. While in prior years the portfolio was more heavily weighted towards the second set of high quality companies, we have found more compelling opportunities this year in the first group of “value” businesses. In a prior year’s letter we mentioned that we would not be taking risks by owning lower-quality businesses at lower valuations because we believed that risk was not

10

TCW Global Real Estate Fund

Management Discussions (Continued)

appropriately priced at the time. This year, as we navigated through the pandemic, we continued to cycle out of some of our more fully valued “quality” holdings into more misunderstood value names at very deep discounts. We believe the disruption caused by the pandemic remains pronounced and that the dispersion in company valuations is still very high. This should continue to be a great opportunity for active stock selection.

| | | | | | | | | | | | | | | | | | | | |

| | | Annualized Total Return as of October 31, 2021(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | |

TCW Global Real Estate Fund | | | | | | | | | | | | | | | | | | | | |

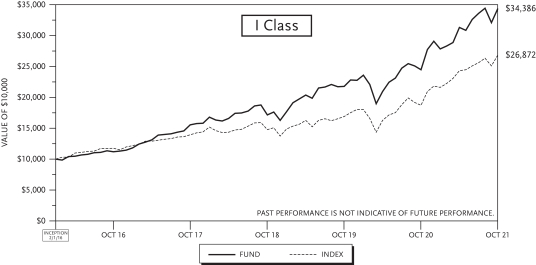

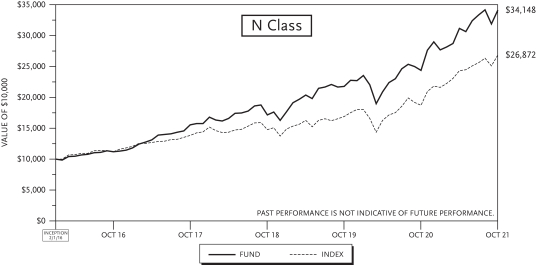

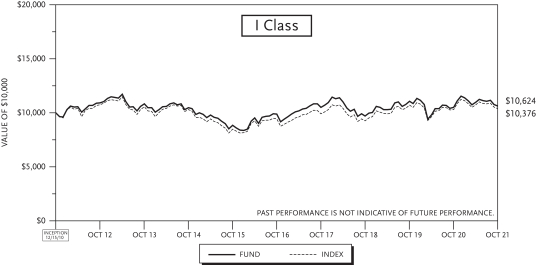

Class I (Inception: 12/01/2014) | | | 42.32 | % | | | 21.03 | % | | | 12.93 | % | | | — | | | | 9.14 | % |

Class N (Inception: 12/01/2014) | | | 42.10 | % | | | 20.83 | % | | | 12.80 | % | | | — | | | | 9.04 | % |

S&P Global REIT Index | | | 45.37 | % | | | 11.74 | % | | | 8.41 | % | | | — | | | | 7.06 | % |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

11

TCW New America Premier Equities Fund

Management Discussions

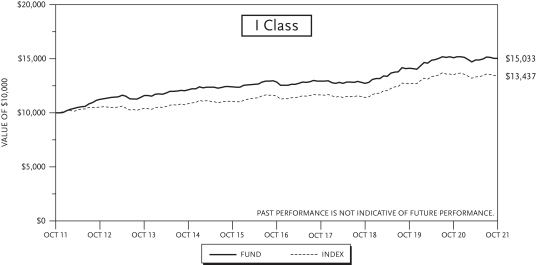

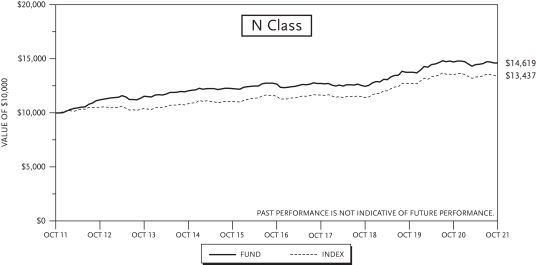

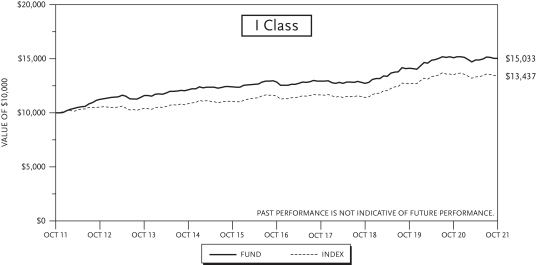

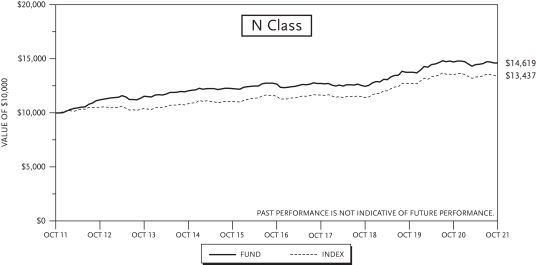

For the fiscal year that ended October 31, 2021, the TCW New America Premier Equities Fund (the “Fund”) returned 40.46% and 40.07% on the I Class and N Class shares. The performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the Russell 1000 Index, returned 43.51% over the same period.

The Fund’s performance benefited from investments in Constellation Software Inc., Microsoft Corporation, Dye & Durham Ltd., MSCI Inc., and IHS Markit Ltd. The Fund’s performance was negatively impacted by investments in PayPal Holdings, Inc., Clarivate PLC, Cricut, Inc., Pinterest, Inc., and Ortho Clinical Diagnostics Holdings PLC.

As we have indicated in the past we eschew a reliance on macroeconomic forecasts and projections of the future direction of markets — our view is that these factors are unknowable. We therefore focus on what we think is knowable. We believe that a careful assessment of investment opportunities at the security level will provide us, in some cases, with a high probability view of the future free cash flows of a business. Risk-adjusted cash flow stream is a key determinant of the future returns of an investment and therefore a key determinant of the portfolio’s future returns. We believe that we have made good decisions in this respect and that the portfolio of companies is built to weather most market environments.

Investment Philosophy

The Fund seeks to outperform the broad U.S. indices in both rising and falling markets with less risk and volatility. We seek to accomplish this objective by investing in a concentrated portfolio of businesses that carefully manage their environmental and social resources and that employ best in class corporate governance practices. We invest in businesses that have high barriers to entry, are stable, generate substantial free cash flow and are managed by prudent leaders.

Risk control: Our primary objective, as stewards of your capital, is to control risk while seeking attractive returns. We control risk in a unique manner; initially we apply our proprietary ESG quantitative framework to identify better managed businesses that have lower quantifiable and unquantifiable risks. Subsequently we hone our efforts on those businesses that we believe operate in stable industries with attractive industry structures, businesses that produce products that are critical to their customers, and businesses that we believe are led by proven, appropriately incentivized leaders. We endeavor to further control valuation risk by purchasing securities at attractive prices relative to the current free cash flow generation of the businesses. We believe that businesses that fit our profile produce fairly stable cash flow streams and are less prone to macroeconomic fluctuations, competitive pressures and valuation risks.

Consistency: It is also our objective to deliver a consistently positive outcome. We would view outsized outperformance in one year and poor performance in the subsequent year as a poor outcome for our clients. Our bottom-up investment process is focused on selecting undervalued businesses that we believe should perform well in most market environments and hold up well in negative periods. We believe consistency in approach and consistency in outcome gives us the best chance of minimizing a left-tail outcome in any given year. It is our view that if we can consistently deliver above average risk-adjusted performance over a long period of time the outcome likely would be outperformance relative to our peers over the full period. That is our goal.

Environmental, Social, Governance Analysis: Traditional fundamental analysis does not capture risks associated with managing environmental resources nor does it assess the performance of businesses from the perspective of resource efficiency. Traditional analysis does not typically assess the risks associated with

12

TCW New America Premier Equities Fund

Management Discussions (Continued)

a heterogeneous workforce nor does it assess the competence, quality and engagement level of the Board of Directors. Our investment framework not only pays close attention to these issues, we quantify, score, and rank companies and exclude businesses based on these risk factors. While those risks are not quantified through traditional financial analysis, we have found a significant correlation between companies that manage their resources prudently and businesses that sport strong financial metrics. Businesses that meet our rigorous ESG performance requirements typically have higher free cash flow yields, higher total yields, higher margins and lower levels of financial leverage.

Focus on Dominant, Predictable Businesses with High Barriers to Entry: In the long run the investment performance of a portfolio is inextricably linked to the underlying performance of the earnings and cash flows of the businesses comprising the portfolio. We believe one of the greatest risks in investing is valuing a business based on an erroneous view of the future free cash flows of the business. Such a circumstance results in an investor typically overpaying for a business and therefore generating a poor return on the investment.

In fast-growing businesses or in industries that are undergoing rapid changes it is extraordinarily difficult and often dangerous to make an investment in a business when the long-term cash generation potential of the enterprise has a wide spectrum of outcomes. We seek to avoid companies and industries that are undergoing rapid changes.

What we do seek, however, are stable businesses that have dominant market positions, and whose long-term cash flows we believe can be predicted reasonably well. The qualitative characteristics that we seek, including attractive industry structures, pricing power and dominant market positions, make us confident in our forecast of the future cash flows of the businesses and therefore provide greater confidence that our valuation of the business is reasonably accurate. The famed value investor Benjamin Graham once said, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” Our view is that the market weighs cash flows and in order to consistently purchase a security for less than what it is worth, one should have high confidence in the future free cash flows of a business.

Thank you for joining us as fellow shareholders in the TCW New America Premier Equities Fund. We will continue to work hard to justify your confidence in us.

13

TCW New America Premier Equities Fund

Management Discussions (Continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Annualized Total Return as of October 31, 2021(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | |

TCW New America Premier Equities Fund | | | | | | | | | | | | | | | | | | | | |

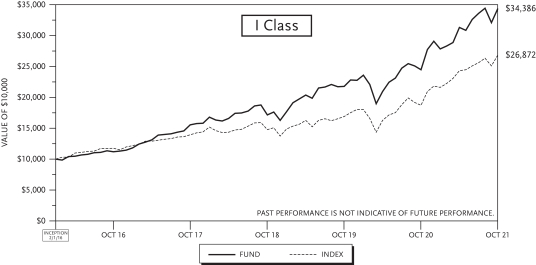

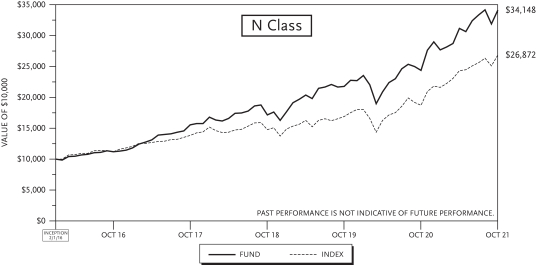

Class I (Inception: 02/01/2016) | | | 40.46 | % | | | 26.00 | % | | | 25.08 | % | | | — | | | | 23.96 | % |

Class N (Inception: 02/01/2016) | | | 40.07 | % | | | 25.70 | % | | | 24.91 | % | | | — | | | | 23.81 | % |

Russell 1000 Index | | | 43.51 | % | | | 22.01 | % | | | 19.16 | % | | | — | | | | 18.76 | % |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

14

TCW Relative Value Dividend Appreciation Fund

Management Discussions

For the year ended October 31, 2021, the TCW Relative Value Dividend Appreciation Fund (the “Fund”) posted a return of 51.22% and 50.90% on its I Class and N Class shares, respectively. The performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the Russell 1000 Value Index, returned 43.76% over the same period.

Market Outlook

The Federal Reserve, as expected, announced that it intends to begin its taper of the $120 billion bond purchase program ($80 billion of Treasury securities and $40 billion of agency mortgage-backed securities) which has been in effect since the onset of the pandemic in March 2020. The reduction will begin this November at a rate of $15 billion ($10 billion of Treasuries and $5 billion of agency mortgage-backed). The pace is not “set in stone” as the decisions for mid-November and mid-December were the only ones formally announced. However, the guidance states that “similar reductions in the pace of net asset purchases will likely be appropriate each month” save for a significant change in the economic outlook. Unless the economy suffers a setback, expectations are the program will be fully wound down by mid-2022. Fed Fund futures are still pricing one or two 25 basis points (bps) hikes in the second half of 2022 but the bond market vigilantes got a lot quieter after the Federal Open Market Committee (FOMC) meeting and Powell’s press conference bolstered by European Central Bank (ECB) President Christine Laggard’s dovish comments and the Bank of England’s’ decision to hold rates steady. Mr. Powell stated that the Fed would be “very transparent” and will be prepared for any outcome, adding that the central bank’s policy will adapt accordingly and that it is ready to speed up or slow down the taper. The Fed’s goal is maximum employment and price stability. Mr. Powell estimates that the economy will reach the former by the middle of 2022. At present, approximately five million jobs are still missing as a result of the pandemic, but this has been difficult to interpret as the labor market is tight with rising wages and businesses having difficulty hiring. In addition to supply chain problems and shortages, signs of higher inflation abound due in part to increased pricing power, wage increases (4%+ year-over-year), along with increased transportation costs. The Core Personal Consumption Expenditure (PCE) Index came in at a 3.6% annual rate yet the monthly rate of 0.2% annualizes at 2.4% while employment costs (ECI) rose at record pace (+3.7% year-over-year) in September. October’s Consumer Price Index (CPI) reflected a 6.2% year-over-year gain, the highest level in 30 years. Inflation is serious as it impacts cost of goods sold. Wage increases, on the other hand, can have a positive effect on consumer confidence and increased purchasing power. While wage inflation will need to be absorbed through productivity enhancements and/or price increases, higher wages historically have translated to higher consumer confidence and purchasing power. Additionally, consumers, on average, have nearly $2 trillion in excess savings that could be spent. S&P 500 operating margins improved the last four times average hourly earnings accelerated. Upon exiting an economic downturn, both wages and corporate earnings can rise with the duration of margin expansion historically ranging from 15 to 90 months.

The U.S. economy slowed in 3Q21 from the robust pace set in the first half of the year with the preliminary report for GDP coming in at 2.0% quarter-over-quarter (less than consensus estimates of 2.6%) led by an over 6% gain in consumer spending. Trade was the biggest detraction. The automobile sector was a notable drag knocking off 2.7 points from the figure due to a shortage of parts, not demand. The confluence of factors including the Delta variant, chip shortages, and supply chain bottlenecks also detracted from growth. The economy faces supply chain bottlenecks at key West Coast ports, but the White House has taken action to keep these ports open 24/7 and fines have been levied for unloaded containers

15

TCW Relative Value Dividend Appreciation Fund

Management Discussions (Continued)

which is starting to alleviate the problem. The Atlanta Fed GDPNow forecast for 4Q21 GDP is over 8% (Street consensus at 5%) due to the rebuilding of inventories and increased motor vehicles and parts sales and this should almost certainly spill over into 2022. Per Credit Suisse, every 1% increase in nominal GDP translates to a 2-3% gain in S&P 500 revenues and margin improvement as greater sales diminish the percent of costs. Positive earnings revisions can be a trend change that lasts 2-3 years. Finally, the odds of a recession (per NY Fed) over the next twelve months remain less than 10% and ~20% over the next 2-3 years.

3Q21 earnings are coming in much better than expected. With almost all S&P 500 companies reporting, per Fundstrat, most are exceeding revenue and 80% are exceeding earnings expectations. Company profits in aggregate are on pace for 32% year-over-year growth in 3Q versus expectations of 27% at the quarter’s onset and year-over-year revenues are up over 14%. 4Q21 estimates are increasing. Calendar year 2021 earnings per share (EPS) growth estimates have jumped from 22% at the start of the year to 55% today. Despite growth’s outperformance in October, Tech+ lagged both Financials and Cyclical earnings growth, and Information Technology earning’s growth faces much more difficult comparisons for the remainder of the year. Per Credit Suisse, growth and Tech+ stocks appear overvalued while the “rest of market” are the cheapest. On average, over the past 10 years, the S&P 500 Growth Index has traded at 2.6 times price-to-earnings (P/E) points above the market. As of November 1, for 2022 estimates, the Growth Index trades at a 5.8 times premium (S&P 500 Growth: 26.1 times, S&P 500: 20.3 times). Historically, Tech+ has traded at 2.3 times P/E points above the market. Today, it trades at a 6.3 times premium (Tech+: 26.6 times, S&P 500: 20.3 times). Financials appear the most attractively valued, trading at a -6.6 times discount. Earnings estimates have surged higher all year. According to Cornerstone Macro, 90% of industry earnings are above pre-COVID levels.

Investor fund flows follow earnings and earnings growth and we expect value to outperform. We believe the U.S. may be in the early stages of a super value cycle, and we are watching closely. We believe the recent gain in growth versus value stocks has been purely on multiple expansion and is not a reflection of higher earnings power. Information Technology stocks, specifically software and other members of the high price-to-earnings multiple cadre of growth stocks, have benefited from the decline in interest rates. All other things being equal, lower interest rates aid growth stocks (as well as interest sensitive stocks like Real Estate and Utilities) because typically the bulk of their earnings are in the future. While we are big believers in the nascent value super cycle, it is never a straight line. Third quarter cyclical earnings followed by stronger revisions and easier comparisons for the rest of 2021, even given the impact of the Delta variant, should demonstrate robust cyclical strength tilting investor attention back to value. For example, the U.S. Manufacturing Purchasing Managers Index (PMI) continues to rise with some street models not indicating a decline until 2Q22.

We believe value will return to favor as the positive Comprehensive Capital Analysis and Review (CCAR) results have led to increased buybacks and dividend growth for the banks. Additionally, 4Q21 S&P 500 estimates for cyclical companies (i.e. Consumer Discretionary ex-Internet Retail, Energy, Industrials, and Materials) are expected to grow earnings per share at multiples of the rate of non-cyclicals. Further, we believe value is poised for multiple years of outperformance over growth similar to the results post the 1970, 1975, 1982, 1991, and 2000 recessions.

The fourth quarter for U.S. markets is seasonally the strongest with the S&P up on average 4.5% over the last 30 years. Also boding well, holiday spending is projected to shatter previous records with the National

16

TCW Relative Value Dividend Appreciation Fund

Management Discussions (Continued)

Retail Federation forecasting year-over-year growth of 8.5%-10.5%. A correction before the end of the calendar year has historical precedence but is likely to be less severe given the stimulus backdrop. Former NY Fed President Dudley stated that the last time the Fed started to taper in 2013 it created a “taper tantrum” as officials had no prior experience with winding down asset purchase programs. Officials and investors now have experience which should provide some confidence and perhaps less volatility with the onset of the taper.

Per Barron’s (12/28/20), the stock market (S&P 500) has fared considerably well (at a 16.8% annualized rate) when the U.S. 10-Year Treasury yield climbs from sub-3% levels. From the recent low of 0.5% on August 6, 2020, the 10-Year yield has risen to 1.6% as of October 31. Additionally, the stock market has moved up 68% of the time when 10-Year yields rose from an initial level below 3%. The massive global monetary and fiscal stimulus programs could be the exact drivers to upend the “growth versus value” cycle. The current dynamics of 1) extreme two standard deviation valuation disparities between growth and value, 2) the beginning of a new economic cycle post the 1Q-2Q20 recession, 3) the new pro-growth administration, 4) the most concentrated Russell 1000 Growth Index ever and one of the most concentrated S&P 500 Indices, and 5) the unprecedented fiscal and monetary stimulus, all should help continue to drive value and Relative Value Dividend Appreciation (RVDA) performance. The RVDA two-year annualized projected consensus earnings per share growth rate is notably higher than the Russell 1000 Value while trading at a considerable discount based on the next 12 months’ price-to-earnings ratios; consequently there is a lot of earnings power in the portfolio. We believe the seeds of great opportunity are being sown today and thank you for your continued confidence in our time-tested disciplined philosophy, process, and team.

Fund Review

Over the course of the one-year period ending October 31, 2021, the Fund’s top ten holdings by average weight outperformed the portfolio and its benchmark index returning 59.9%, on average, led by JPMorgan Chase, Johnson Controls, General Electric, Chevron, and MetLife, each with 70%+ returns. Led by the aforementioned Johnson Controls and General Electric along with nVent and Textron the Fund’s Industrials names were the best relative performers returning 69.6% versus the group gain of 43.5%. Freeport-McMoRan’s strong return led to the outperformance in Materials where the portfolio’s names gained 64.7% — far outpacing their peers’ rise of 38.0%, while its Utilities names outperformed 25.4% versus 11.4%. The portfolio‘s Financials names rose 82.01% versus 74.3% led by Blackstone, MetLife, and Ameriprise, while also benefiting from stock selection in Information Technology and Consumer Discretionary led by Seagate Technology and Dick’s Sporting Goods. On the downside, the portfolio’s Energy stocks returned an admirable 75.3% but did not keep pace with the group’s soaring 112.5% gain over the one-year period. To a much lesser degree, the portfolio’s Communication Services lost value, returning 21.1% versus 26.0% with AT&T largely responsible, while PepsiCo and Conagra were the biggest detractors in Consumer Staples. Other notable detractors included Novartis, Gilead, and IBM. With respect to sector weightings, the portfolio benefited noticeably due to the underweight in Consumer Staples and overweight in Energy.

17

TCW Relative Value Dividend Appreciation Fund

Management Discussions (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Annualized Total Return as of October 31, 2021(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | | | Inception

Index | |

TCW Relative Value Dividend Appreciation Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class I (Inception: 11/01/2004) | | | 51.22 | % | | | 15.38 | % | | | 11.44 | % | | | 12.13 | % | | | 8.13 | % | | | 8.65 | % |

Class N (Inception: 09/19/1986) | | | 50.90 | % | | | 15.14 | % | | | 11.20 | % | | | 11.86 | % | | | 9.35 | % | | | 10.43 | % |

Russell 1000 Value Index | | | 43.76 | % | | | 13.90 | % | | | 12.39 | % | | | 12.85 | % | | | | | | | | |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

18

TCW Relative Value Large Cap Fund

Management Discussions

For the year ended October 31, 2021, the TCW Relative Value Large Cap Fund (the “Fund”) posted a return of 50.84% and 50.56% on its I Class and N Class shares, respectively. The performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the Russell 1000 Value Index, returned 43.76% over the same period.

Market Outlook

The Federal Reserve, as expected, announced that it intends to begin its taper of the $120 billion bond purchase program ($80 billion of Treasury securities and $40 billion of agency mortgage-backed securities) which has been in effect since the onset of the pandemic in March 2020. The reduction will begin this November at a rate of $15 billion ($10 billion of Treasuries and $5 billion of agency mortgage-backed). The pace is not “set in stone” as the decisions for mid-November and mid-December were the only ones formally announced. However, the guidance states that “similar reductions in the pace of net asset purchases will likely be appropriate each month” save for a significant change in the economic outlook. Unless the economy suffers a setback, expectations are the program will be fully wound down by mid-2022. Fed Fund futures are still pricing one or two 25 basis points (bps) hikes in the second half of 2022 but the bond market vigilantes got a lot quieter after the Federal Open Market Committee (FOMC) meeting and Powell’s press conference bolstered by European Central Bank (ECB) President Christine Laggard’s dovish comments and the Bank of England’s’ decision to hold rates steady. Mr. Powell stated that the Fed would be “very transparent” and will be prepared for any outcome, adding that the central bank’s policy will adapt accordingly and that it is ready to speed up or slow down the taper. The Fed’s goal is maximum employment and price stability. Mr. Powell estimates that the economy will reach the former by the middle of 2022. At present, approximately five million jobs are still missing as a result of the pandemic, but this has been difficult to interpret as the labor market is tight with rising wages and businesses having difficulty hiring. In addition to supply chain problems and shortages, signs of higher inflation abound due in part to increased pricing power, wage increases (4%+ year-over-year), along with increased transportation costs. The Core Personal Consumption Expenditure (PCE) Index came in at a 3.6% annual rate yet the monthly rate of 0.2% annualizes at 2.4% while employment costs (ECI) rose at record pace (+3.7% year-over-year) in September. October’s Consumer Price Index (CPI) reflected a 6.2% year-over-year gain, the highest level in 30 years. Inflation is serious as it impacts cost of goods sold. Wage increases, on the other hand, can have a positive effect on consumer confidence and increased purchasing power. While wage inflation will need to be absorbed through productivity enhancements and/or price increases, higher wages historically have translated to higher consumer confidence and purchasing power. Additionally, consumers, on average, have nearly $2 trillion in excess savings that could be spent. S&P 500 operating margins improved the last four times average hourly earnings accelerated. Upon exiting an economic downturn, both wages and corporate earnings can rise with the duration of margin expansion historically ranging from 15 to 90 months.

The U.S. economy slowed in 3Q21 from the robust pace set in the first half of the year with the preliminary report for GDP coming in at 2.0% quarter-over-quarter (less than consensus estimates of 2.6%) led by an over 6% gain in consumer spending. Trade was the biggest detraction. The automobile sector was a notable drag knocking off 2.7 points from the figure due to a shortage of parts, not demand. The confluence of factors including the Delta variant, chip shortages, and supply chain bottlenecks also detracted from growth. The economy faces supply chain bottlenecks at key West Coast ports, but the White House has taken action to keep these ports open 24/7 and fines have been levied for unloaded containers

19

TCW Relative Value Large Cap Fund

Management Discussions (Continued)

which is starting to alleviate the problem. The Atlanta Fed GDPNow forecast for 4Q21 GDP is over 8% (Street consensus at 5%) due to the rebuilding of inventories and increased motor vehicles and parts sales and this should almost certainly spill over into 2022. Per Credit Suisse, every 1% increase in nominal GDP translates to a 2-3% gain in S&P 500 revenues and margin improvement as greater sales diminish the percent of costs. Positive earnings revisions can be a trend change that lasts 2-3 years. Finally, the odds of a recession (per NY Fed) over the next twelve months remain less than 10% and ~20% over the next 2-3 years.

3Q21 earnings are coming in much better than expected. With almost all S&P 500 companies reporting, per Fundstrat, most are exceeding revenue and 80% are exceeding earnings expectations. Company profits in aggregate are on pace for 32% year-over-year growth in 3Q versus expectations of 27% at the quarter’s onset and year-over-year revenues are up over 14%. 4Q21 estimates are increasing. Calendar year 2021 earnings per share (EPS) growth estimates have jumped from 22% at the start of the year to 55% today. Despite growth’s outperformance in October, Tech+ lagged both Financials and Cyclical earnings growth, and Information Technology earning’s growth faces much more difficult comparisons for the remainder of the year. Per Credit Suisse, growth and Tech+ stocks appear overvalued while the “rest of market” are the cheapest. On average, over the past 10 years, the S&P 500 Growth Index has traded at 2.6 times price-to-earnings (P/E) points above the market. As of November 1, for 2022 estimates, the Growth Index trades at a 5.8 times premium (S&P 500 Growth: 26.1 times, S&P 500: 20.3 times). Historically, Tech+ has traded at 2.3 times P/E points above the market. Today, it trades at a 6.3 times premium (Tech+: 26.6 times, S&P 500: 20.3 times). Financials appear the most attractively valued, trading at a -6.6 times discount. Earnings estimates have surged higher all year. According to Cornerstone Macro, 90% of industry earnings are above pre-COVID levels.

Investor fund flows follow earnings and earnings growth and we expect value to outperform. We believe the U.S. may be in the early stages of a super value cycle, and we are watching closely. We believe the recent gain in growth versus value stocks has been purely on multiple expansion and is not a reflection of higher earnings power. Information Technology stocks, specifically software and other members of the high price-to-earnings multiple cadre of growth stocks, have benefited from the decline in interest rates. All other things being equal, lower interest rates aid growth stocks (as well as interest sensitive stocks like Real Estate and Utilities) because typically the bulk of their earnings are in the future. While we are big believers in the nascent value super cycle, it is never a straight line. Third quarter cyclical earnings followed by stronger revisions and easier comparisons for the rest of 2021, even given the impact of the Delta variant, should demonstrate robust cyclical strength tilting investor attention back to value. For example, the U.S. Manufacturing Purchasing Managers Index (PMI) continues to rise with some street models not indicating a decline until 2Q22.

We believe value will return to favor as the positive Comprehensive Capital Analysis and Review (CCAR) results have led to increased buybacks and dividend growth for the banks. Additionally, 4Q21 S&P 500 estimates for cyclical companies (i.e. Consumer Discretionary ex-Internet Retail, Energy, Industrials, and Materials) are expected to grow earnings per share at multiples of the rate of non-cyclicals. Further, we believe value is poised for multiple years of outperformance over growth similar to the results post the 1970, 1975, 1982, 1991, and 2000 recessions.

The fourth quarter for U.S. markets is seasonally the strongest with the S&P up on average 4.5% over the last 30 years. Also boding well, holiday spending is projected to shatter previous records with the National

20

TCW Relative Value Large Cap Fund

Management Discussions (Continued)

Retail Federation forecasting year-over-year growth of 8.5%-10.5%. A correction before the end of the calendar year has historical precedence but is likely to be less severe given the stimulus backdrop. Former NY Fed President Dudley stated that the last time the Fed started to taper in 2013 it created a “taper tantrum” as officials had no prior experience with winding down asset purchase programs. Officials and investors now have experience which should provide some confidence and perhaps less volatility with the onset of the taper.

Per Barron’s (12/28/20), the stock market (S&P 500) has fared considerably well (at a 16.8% annualized rate) when the U.S. 10-Year Treasury yield climbs from sub-3% levels. From the recent low of 0.5% on August 6, 2020, the 10-Year yield has risen to 1.6% as of October 31. Additionally, the stock market has moved up 68% of the time when 10-Year yields rose from an initial level below 3%. The massive global monetary and fiscal stimulus programs could be the exact drivers to upend the “growth versus value” cycle. The current dynamics of 1) extreme two standard deviation valuation disparities between growth and value, 2) the beginning of a new economic cycle post the 1Q-2Q20 recession, 3) the new pro-growth administration, 4) the most concentrated Russell 1000 Growth Index ever and one of the most concentrated S&P 500 Indices, and 5) the unprecedented fiscal and monetary stimulus, all should help continue to drive value and Relative Value Large Cap (RVLC) performance. The RVLC two-year annualized projected consensus earnings per share growth rate is notably higher than the Russell 1000 Value while trading at a considerable discount based on the next 12 months’ price-to-earnings ratios; consequently there is a lot of earnings power in the portfolio. We believe the seeds of great opportunity are being sown today and thank you for your continued confidence in our time-tested disciplined philosophy, process, and team.

Fund Review

Over the course of the one-year period ending October 31, 2021, the Fund’s top ten holdings by average weight outperformed the portfolio and its benchmark index returning 60.4%, on average, led by Freeport-McMoRan, JPMorgan Chase, General Electric, and Johnson Controls. Led by Freeport-McMoRan’s strong gain, the Fund’s Materials names were the best relative performers, returning 94.4% — far outpacing the group gain of 38.0%. Textron, Johnson Controls, and General Electric led to the outperformance in Industrials where the portfolio’s names gained 69.9% versus their peers’ rise of 43.5%, while Dick’s Sporting Goods, Target, and Darden Restaurants in Consumer Discretionary and ViacomCBS and Discovery in Communication Services highlighted in their respective sectors. The portfolio also outperformed with its Financials, Real Estate, Information Technology, and Health Care holdings led by Blackstone, Jones Lang LaSalle, onsemi (formerly ON Semiconductor), and Molina Healthcare, respectively. On the downside, the portfolio’s Energy stocks returned an admirable 71.1% but did not keep pace with the group’s soaring 112.5% gain. To a much lesser degree, the portfolio’s Consumer Staples holdings lost value, returning 8.7% versus 18.6% with Conagra largely responsible. Other notable detractors included Fiserv, Centene, and AT&T. The portfolio’s relative sector weights detracted due to the underweights in Financials and Energy as well as the overweight in Communication Services, while the underweights in the traditionally defensive Consumer Staples and Utilities were beneficial but were more than offset by stock selection.

21

TCW Relative Value Large Cap Fund

Management Discussions (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Annualized Total Return as of October 31, 2021(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | | | Inception

Index | |

TCW Relative Value Large Cap Fund | | | | | | | | | | | | | | | | | | | | | | | | |

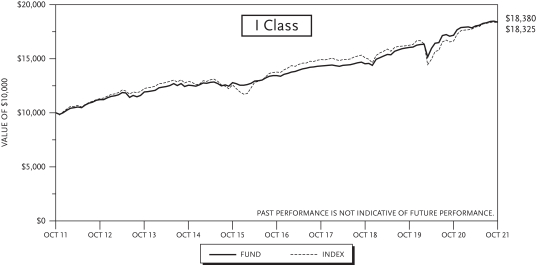

Class I (Inception: 01/02/2004) | | | 50.84 | % | | | 14.89 | % | | | 11.83 | % | | | 12.17 | % | | | 8.33 | % | | | 8.66 | % |

Class N (Inception: 01/02/1998) | | | 50.56 | % | | | 14.68 | % | | | 11.60 | % | | | 11.92 | % | | | 7.09 | % | | | 7.85 | % |

Russell 1000 Value Index | | | 43.76 | % | | | 13.90 | % | | | 12.39 | % | | | 12.85 | % | | | | | | | | |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

22

TCW Relative Value Mid Cap Fund

Management Discussions

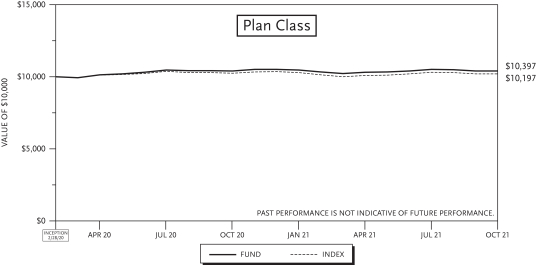

For the year ended October 31, 2021, the TCW Relative Value Mid Cap Fund (the “Fund”) posted a return of 57.90% and 57.78% on its I Class and N Class shares, respectively. The performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the Russell Midcap Value Index, returned 48.60% over the same period.

Market Outlook

The Federal Reserve, as expected, announced that it intends to begin its taper of the $120 billion bond purchase program ($80 billion of Treasury securities and $40 billion of agency mortgage-backed securities) which has been in effect since the onset of the pandemic in March 2020. The reduction will begin this November at a rate of $15 billion ($10 billion of Treasuries and $5 billion of agency mortgage-backed). The pace is not “set in stone” as the decisions for mid-November and mid-December were the only ones formally announced. However, the guidance states that “similar reductions in the pace of net asset purchases will likely be appropriate each month” save for a significant change in the economic outlook. Unless the economy suffers a setback, expectations are the program will be fully wound down by mid-2022. Fed Fund futures are still pricing one or two 25 basis points (bps) hikes in the second half of 2022 but the bond market vigilantes got a lot quieter after the Federal Open Market Committee (FOMC) meeting and Powell’s press conference bolstered by European Central Bank (ECB) President Christine Laggard’s dovish comments and the Bank of England’s’ decision to hold rates steady. Mr. Powell stated that the Fed would be “very transparent” and will be prepared for any outcome adding that the central bank’s policy will adapt accordingly and that it is ready to speed up or slow down the taper. The Fed’s goal is maximum employment and price stability. Mr. Powell estimates that the economy will reach the former by the middle of 2022. At present, approximately five million jobs are still missing as a result of the pandemic, but this has been difficult to interpret as the labor market is tight with rising wages and businesses having difficulty hiring. In addition to supply chain problems and shortages, signs of higher inflation abound due in part to increased pricing power, wage increases (4%+ year-over-year), along with increased transportation costs. The Core Personal Consumption Expenditure (PCE) Index came in at a 3.6% annual rate yet the monthly rate of 0.2% annualizes at 2.4% while employment costs (ECI) rose at record pace (+3.7% year-over-year) in September. October’s Consumer Price Index (CPI) reflected a 6.2% year-over-year gain, the highest level in 30 years. Inflation is serious as it impacts cost of goods sold. Wage increases, on the other hand, can have a positive effect on consumer confidence and increased purchasing power. While wage inflation will need to be absorbed through productivity enhancements and/or price increases, higher wages historically have translated to higher consumer confidence and purchasing power. Additionally, consumers, on average, have nearly $2 trillion in excess savings that could be spent. S&P 500 operating margins improved the last four times average hourly earnings accelerated. Upon exiting an economic downturn, both wages and corporate earnings can rise with the duration of margin expansion historically ranging from 15 to 90 months.

The U.S. economy slowed in 3Q21 from the robust pace set in the first half of the year with the preliminary report for GDP coming in at 2.0% quarter-over-quarter (less than consensus estimates of 2.6%) led by an over 6% gain in consumer spending. Trade was the biggest detraction. The automobile sector was a notable drag knocking off 2.7 points from the figure due to a shortage of parts, not demand. The confluence of factors including the Delta variant, chip shortages, and supply chain bottlenecks also detracted from growth. The economy faces supply chain bottlenecks at key West Coast ports, but the White House has taken action to keep these ports open 24/7 and fines have been levied for unloaded containers

23

TCW Relative Value Mid Cap Fund

Management Discussions (Continued)

which is starting to alleviate the problem. The Atlanta Fed GDPNow forecast for 4Q21 GDP is over 8% (Street consensus at 5%) due to the rebuilding of inventories and increased motor vehicles and parts sales and this should almost certainly spill over into 2022. Per Credit Suisse, every 1% increase in nominal GDP translates to a 2-3% gain in S&P 500 revenues and margin improvement as greater sales diminish the percent of costs. Positive earnings revisions can be a trend change that lasts 2-3 years. Finally, the odds of a recession (per NY Fed) over the next twelve months remain less than 10% and ~20% over the next 2-3 years.

3Q21 earnings are coming in much better than expected. With almost all S&P 500 companies reporting, per Fundstrat, most are exceeding revenue and 80% are exceeding earnings expectations. Company profits in aggregate are on pace for 32% year-over-year growth in 3Q versus expectations of 27% at the quarter’s onset and year-over-year revenues are up over 14%. 4Q21 estimates are increasing. Calendar year 2021 earnings per share (EPS) growth estimates have jumped from 22% at the start of the year to 55% today. Despite growth’s outperformance in October, Tech+ lagged both Financials and Cyclical earnings growth, and Information Technology earning’s growth faces much more difficult comparisons for the remainder of the year. Per Credit Suisse, growth and Tech+ stocks appear overvalued while the “rest of market” are the cheapest. On average, over the past 10 years, the S&P 500 Growth Index has traded at 2.6 times price-to-earnings (P/E) points above the market. As of November 1, for 2022 estimates, the Growth Index trades at a 5.8 times premium (S&P 500 Growth: 26.1 times, S&P 500: 20.3 times). Historically, Tech+ has traded at 2.3 times P/E points above the market. Today, it trades at a 6.3 times premium (Tech+: 26.6 times, S&P 500: 20.3 times). Financials appear the most attractively valued, trading at a -6.6 times discount. Earnings estimates have surged higher all year. According to Cornerstone Macro, 90% of industry earnings are above pre-COVID levels.

Investor fund flows follow earnings and earnings growth and we expect value to outperform. We believe the U.S. may be in the early stages of a super value cycle, and we are watching closely. We believe the recent gain in growth versus value stocks has been purely on multiple expansion and is not a reflection of higher earnings power. Information Technology stocks, specifically software and other members of the high price-to-earnings multiple cadre of growth stocks, have benefited from the decline in interest rates. All other things being equal, lower interest rates aid growth stocks (as well as interest sensitive stocks like Real Estate and Utilities) because typically the bulk of their earnings are in the future. While we are big believers in the nascent value super cycle, it is never a straight line. Third quarter cyclical earnings followed by stronger revisions and easier comparisons for the rest of 2021, even given the impact of the Delta variant, should demonstrate robust cyclical strength tilting investor attention back to value. For example, the U.S. Manufacturing Purchasing Managers Index (PMI) continues to rise with some street models not indicating a decline until 2Q22.

We believe value will return to favor as the positive Comprehensive Capital Analysis and Review (CCAR) results have led to increased buybacks and dividend growth for the banks. Additionally, 4Q21 S&P 500 estimates for cyclical companies (i.e. Consumer Discretionary ex-Internet Retail, Energy, Industrials, and Materials) are expected to grow earnings per share at multiples of the rate of non-cyclicals. Further, we believe value is poised for multiple years of outperformance over growth similar to the results post the 1970, 1975, 1982, 1991, and 2000 recessions.

The fourth quarter for U.S. markets is seasonally the strongest with the S&P up on average 4.5% over the last 30 years. Also boding well, holiday spending is projected to shatter previous records with the National

24

TCW Relative Value Mid Cap Fund

Management Discussions (Continued)

Retail Federation forecasting year-over-year growth of 8.5%-10.5%. A correction before the end of the calendar year has historical precedence but is likely to be less severe given the stimulus backdrop. Former NY Fed President Dudley stated that the last time the Fed started to taper in 2013 it created a “taper tantrum” as officials had no prior experience with winding down asset purchase programs. Officials and investors now have experience which should provide some confidence and perhaps less volatility with the onset of the taper.

Per Barron’s (12/28/20), the stock market (S&P 500) has fared considerably well (at a 16.8% annualized rate) when the U.S. 10-Year Treasury yield climbs from sub-3% levels. From the recent low of 0.5% on August 6, 2020, the 10-Year yield has risen to 1.6% as of October 31. Additionally, the stock market has moved up 68% of the time when 10-Year yields rose from an initial level below 3%. The massive global monetary and fiscal stimulus programs could be the exact drivers to upend the “growth versus value” cycle. The current dynamics of 1) extreme two standard deviation valuation disparities between growth and value, 2) the beginning of a new economic cycle post the 1Q-2Q20 recession, 3) the new pro-growth administration, 4) the most concentrated Russell Midcap Growth Index since the end of 2000, and 5) the unprecedented fiscal and monetary stimulus, all should help continue to drive value and Relative Value Mid Cap (RVMC) performance. The RVMC two-year annualized projected consensus earnings per share growth rate is notably higher than the Russell 1000 Value while trading at a considerable discount based on the next 12 months’ price-to-earnings ratios; consequently there is a lot of earnings power in the portfolio. We believe the seeds of great opportunity are being sown today and thank you for your continued confidence in our time-tested disciplined philosophy, process, and team.

Fund Review

Over the course of the one-year period ending October 31, 2021, the Fund’s top ten holdings by average weight outperformed the portfolio and its benchmark index returning 63.8%, on average, led by Freeport-McMoRan, Textron, and Popular. Led by strong gains from Manitowoc and Textron, the Fund’s Industrials names were the best relative performers, returning 66.1% — outpacing the group gain of 44.5%. Freeport-McMoRan highlighted in Materials where the portfolio’s names gained 76.9% versus their peers’ rise of 53.7%, while Popular, Innovative Industrial Properties, Discovery, and Acadia Healthcare led in their respective Financials, Real Estate, Communication Services, and Health Care sectors generating noticeable relative gains. On the downside, the portfolio’s Energy stocks returned an admirable 91.4% but did not keep pace with the group’s soaring 128.8% gain, the best performing sector in the Russell Midcap Value Index. The portfolio’s Information Technology holdings lost value, returning 34.8% versus 47.9% with Flex and TTM Technologies largely responsible, while Conagra detracted in Consumer Staples. Other notable detractors included health care company Centene and utility Sempra Energy. The portfolio’s relative sector weights were beneficial due largely to the underweight in Utilities.

25

TCW Relative Value Mid Cap Fund

Management Discussions (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Annualized Total Return as of October 31, 2021(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | | | Inception

Index | |

TCW Relative Value Mid Cap | | | | | | | | | | | | | | | | | | | | | | | | |

Class I (Inception: 11/01/1996) | | | 57.90 | % | | | 14.41 | % | | | 12.80 | % | | | 11.98 | % | | | 10.52 | %(2) | | | 10.82 | % |

Class N (Inception: 11/01/2000) | | | 57.78 | % | | | 14.32 | % | | | 12.67 | % | | | 11.78 | % | | | 8.46 | % | | | 10.32 | % |

Russell Midcap Value Index | | | 48.60 | % | | | 15.03 | % | | | 12.30 | % | | | 13.18 | % | | | | | | | | |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

| (2) | Performance data includes the performance of the predecessor entity for periods before the Fund’s registration became effective. The predecessor entity was not registered under the 1940 Act and, therefore, was not subject to certain investment restrictions that are imposed by the 1940 Act. If the predecessor entity had been registered under the 1940 Act, the predecessor entity’s performance may have been lower. |

26

TCW Select Equities Fund

Management Discussions