UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07170

TCW Funds, Inc.

(Exact name of registrant as specified in charter)

865 South Figueroa Street, Suite 1800, Los Angeles, CA 90017

(Address of principal executive offices)

Patrick W. Dennis, Esq.

Vice President and Assistant Secretary

865 South Figueroa Street, Suite 1800

Los Angeles, CA 90017

(Name and address of agent for service)

Registrant’s telephone number, including area code: (213) 244-0000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2019

| Item 1. | Reports to Shareholders. |

EQUITY FUNDS

TCW Artificial Intelligence Equity Fund

TCW Global Real Estate Fund

TCW New America Premier Equities Fund

TCW Relative Value Dividend Appreciation Fund

TCW Relative Value Large Cap Fund

TCW Relative Value Mid Cap Fund

TCW Select Equities Fund

ASSET ALLOCATION FUND

TCW Conservative Allocation Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.TCW.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications electronically by contacting your financial intermediary (such as a broker-dealer, bank, or retirement plan), or by calling 1-800-FUND-TCW (1-800-386-3829) if you invest directly with the Funds.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. You can call 1-800-FUND-TCW (1-800-386-3829), if you invest directly with the Funds, or contact your financial intermediary, if you invest though a financial intermediary, to inform the Funds or the financial intermediary that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held directly with TCW or through your financial intermediary.

TCW Funds, Inc.

Table of Contents

|

| |

| The Letter to Shareholders and/or Management Discussions contained in this Annual Report are the opinions of each Fund’s portfolio managers and are not the opinions of TCW Funds, Inc. or its Board of Directors. Various matters discussed in the Letter to Shareholders and/or Management Discussions constitute forward-looking statements within the meaning of the federal securities laws. Actual results and the timing of certain events could differ materially from those projected or contemplated by these forward-looking statements due to a number of factors, including general economic conditions, overall availability of securities for investment by a Fund, the level of volatility in the securities markets and in the share price of a Fund, and other risk factors discussed in the SEC filings of TCW Funds, Inc. The data presented in the Letter to Shareholders and/or Management Discussions represents past performance and cannot be used to predict future results. |

| | |

To Our Valued Shareholders | | |

| | |

| | David S. DeVito President, Chief Executive Officer and Director |

Dear Valued Investors,

I am pleased to present the annual report for the TCW Funds, Inc. covering the 12-month period ended October 31, 2019. I would like to express our appreciation for your continued investment in the TCW Funds as well as welcome new shareholders to our fund family. As of October 31, 2019, the TCW Funds held total net assets of approximately $15 billion.

This report contains information and portfolio management discussions of our Equity Funds and the TCW Conservative Allocation Fund.

The U.S. Stock Market

U.S. stocks advanced 13.1% (S&P 500 Total Return Index) during the one-year period ending 10/31/19, as concerns that the US/China trade war might tip the US economy into recession were allayed by expectations of a trade truce together with renewed interest rate cuts by the US Fed. During the course of the year, the US economy was not immune from the global growth slowdown witnessed across the globe, which saw the German economy teetering on the cusp of recession. The breakdown of trade negotiations between the US and China in May unleashed an escalation in tit-for-tat retaliatory measures by both sides, and ultimately US manufacturing data reflected a contraction in that segment of the economy. In August, the US treasury yield curve (3 months vs 10 years) reached its most inverted level in 12 years, and in the following month the 10-year US Treasury yield plunged to a three-year low of 1.46%, prompting worries that the US economy was headed for recession. The US Fed responded by cutting its benchmark Fed Funds reference rate by 25 basis points at each of its July, September, and October meetings, leaving the door open to additional cuts as warranted by economic developments. Although US stocks struggled during the summer months, the resilience of the labor market (unemployment hit its lowest level in 50 years) and continued strength in housing

due to low interest rates helped propel stock prices to a record high at the end of the period.

Looking Ahead

Looking forward, equity investors have once again become accustomed to global central banks providing highly accommodative monetary policy as an underpinning for stock prices, which in turn has made global equity markets more susceptible to negative macroeconomic developments. To the extent the US and China are able to seal a “Phase I” trade truce agreement, a big overhang for stocks will have been placed in abeyance, and perhaps capital spending plans will gradually shift out of their present paralysis. At the company level, corporate earnings reports in the third quarter pointed to modest, low single-digit earnings per share growth for the full year, but whether companies can achieve the double-digit earnings growth embedded in consensus expectations for calendar year 2020 remains an open question. While US equity prices are somewhat elevated with respect to their historical levels of the past several decades (forward P/E ratio is presently about 17.6 versus an average of 15.7), we believe that investors are likely to focus on whether there is a resumption of US and global growth that more decisively assuages the risk of recession and translates into stronger corporate earnings. While the near-term outlook remains mixed, we believe that the medium-to-long term prospects for stocks possessing strong fundamentals remain compelling, and we generally maintain a preference for US stocks relative to those in the other major developed markets because of its more resilient relative economic growth prospects.

We know that you have many choices when it comes to the management of your financial assets. On behalf of everyone at TCW, I would like to thank you for making the TCW Funds part of your long-term investment plan. We truly value our relationship with you. If you have any

1

| | |

Letter to Shareholders (Continued) | | |

questions or require further information, I invite you to visit our website at www.tcw.com, or call our shareholder services department at 800-386-3829.

I look forward to further correspondence with you through our semi-annual report next year.

Sincerely,

David S. DeVito

President, Chief Executive Officer and Director

2

TCW Artificial Intelligence Equity Fund

Management Discussions

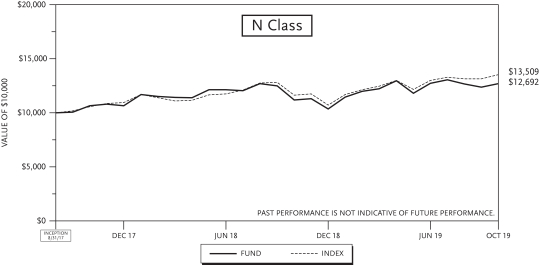

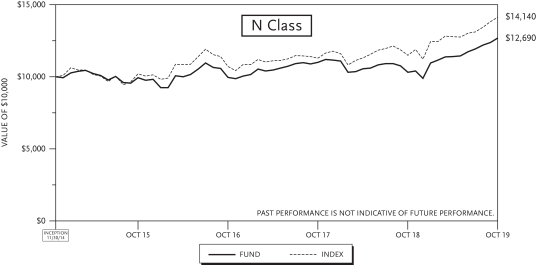

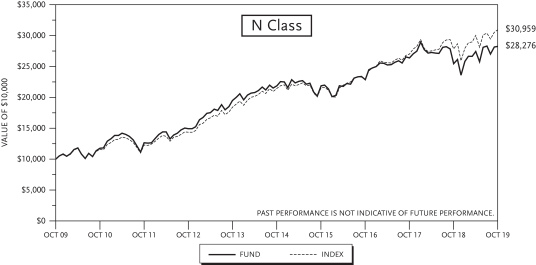

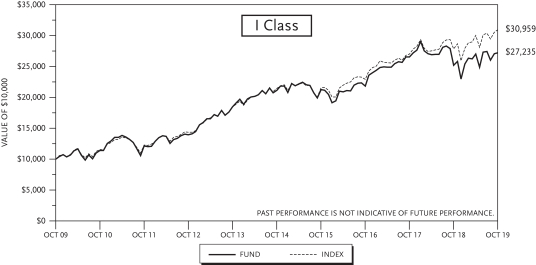

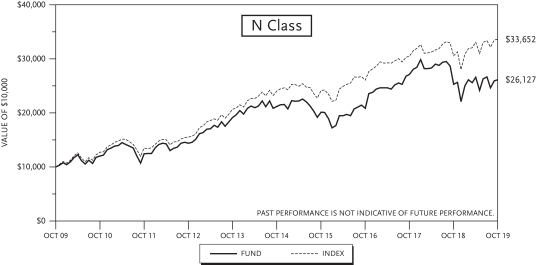

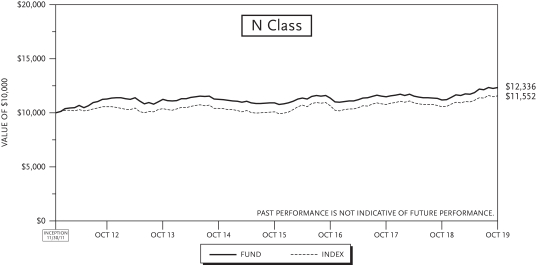

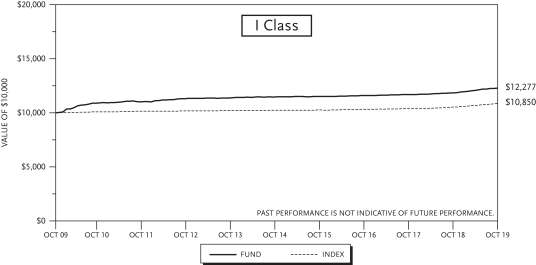

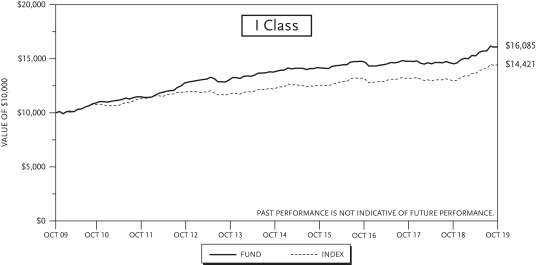

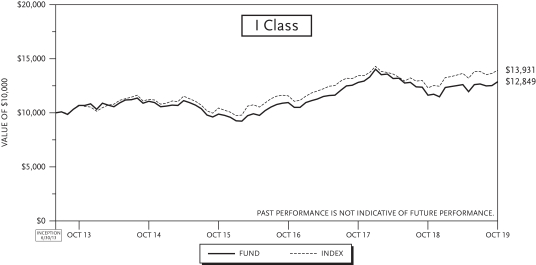

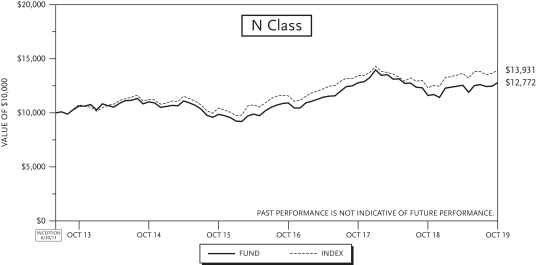

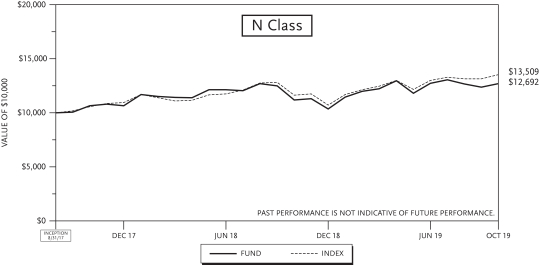

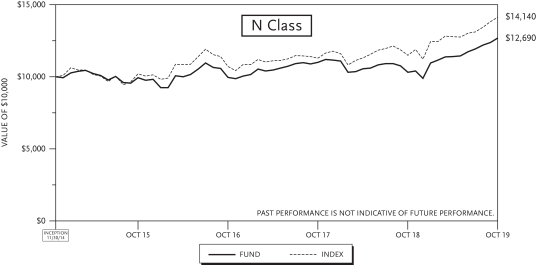

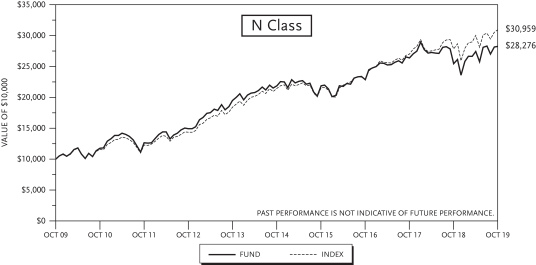

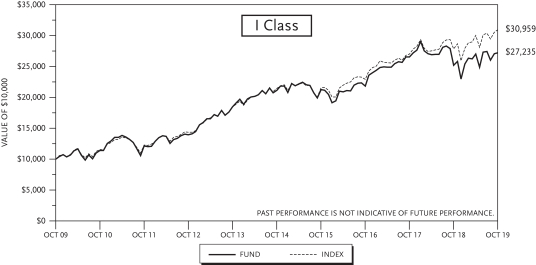

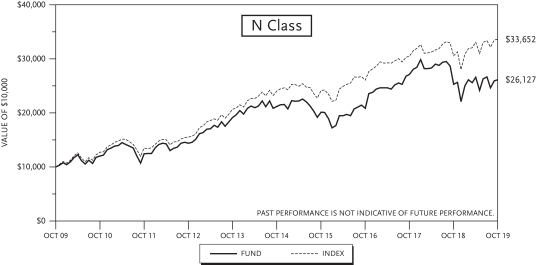

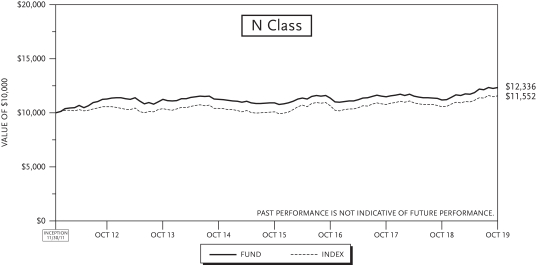

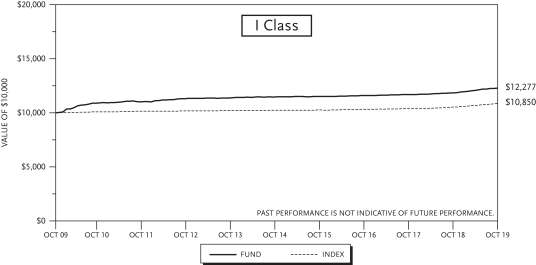

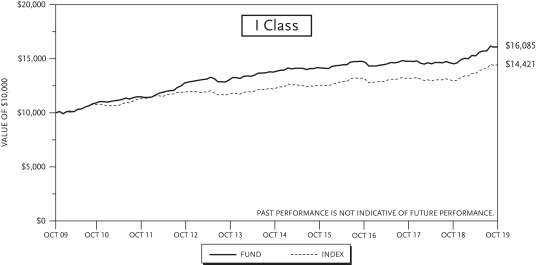

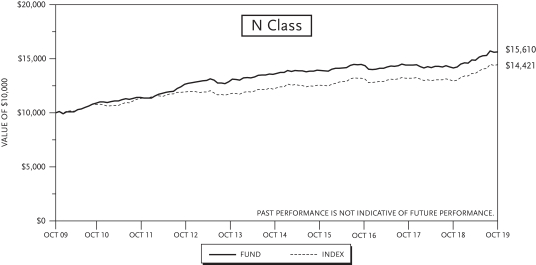

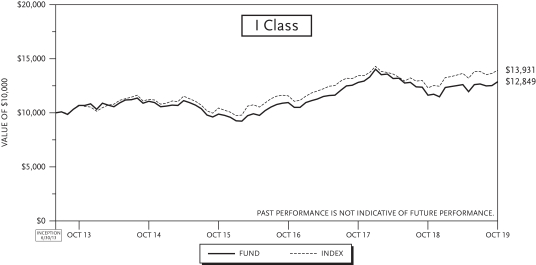

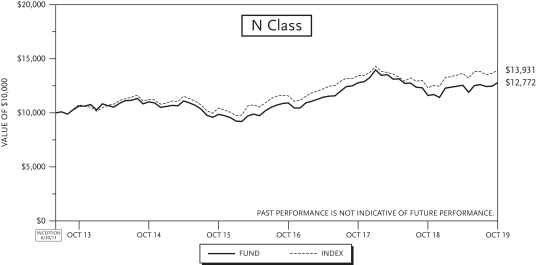

For the year ended October 31, 2019, the TCW Artificial Intelligence Equity Fund (the “Fund”) posted a return of 13.60% and 13.61% on its I Class and N Class, respectively. The Fund’s benchmark, Russell 3000 Growth Index, returned 16.34% over the same period.

The first half of the period was marked by volatility as the major U.S. stock market indices were nearly pushed into bear market territory after an almost 10-year bull-market run. Weaker macroeconomic data weighed on the market and stock market observers digested the implications of a divided government in the wake of the Democratic party’s success in capturing the House in the midterm election.

U.S. stocks rebounded sharply to post their best January performance in 30 years, registering an 8.0% return. Following the severe 4th quarter equity market sell-off, investors were focused on the U.S. Fed’s policy trajectory as well as the prospects for corporate earnings. After initially conveying an undeterred mission to normalize monetary policy by hiking its reference rate and pursuing an “autopilot” run-off of its balance sheet, the Fed moderated its guidance and professed to be “patient” and “data dependent,” which relieved equity market participants’ concerns of a more hawkish interest rate trajectory.

At the same time, global growth continued to falter, with Eurozone manufacturing numbers near a seven-month low and China’s industrial production posting the worst start to a year in nearly a decade. Despite the string of weak macro data, equity prices proved resilient, as many investors attributed first-quarter weakness to the residual effect of the 4Q18 government shutdown, poor weather, and the lingering impact of the U.S./China trade dispute.

Although fallout from the US/China trade war eroded investor sentiment during the second half of the year, President Trump’s decision to delay previously announced tariff increases appeared to boost the prospects for a potential resolution to the ongoing dispute. Furthermore, stock market participants’ concerns about a rising risk of recession were assuaged by other macro data pointing to a strong labor market, a resilient housing backdrop, a still healthy consumer, and the largest monthly gain in US industrial production in the past year.

Looking forward, we believe the equity market will be susceptible to increased volatility given that recession worries will ebb and flow as macroeconomic data points provide clues as to the trajectory of the economy. The possibility of further interest rate cuts by the Fed may provide support to equity prices, and any breakthrough in US/China trade negotiations in the coming weeks and months could serve to allay recession worries. As always, we continue to closely monitor bottom-up corporate fundamentals as we endeavor to identify the most compelling investment targets that meet our growth and valuation criteria.

Our two biggest stock contributors during the year were Lam Research Corp. and ServiceNow Inc., both of which are on the forefront of artificial intelligence technology. Lam Research is a leading semiconductor equipment manufacturer with strong exposure to the memory sector. In a rising data economy that is fueled by artificial intelligence applications and workloads, we believe there will be strong demand for memory solutions. Given its formidable position in this space, we expect Lam Research will be one of the key beneficiaries of this trend.

Lam Research saw positive stock momentum due to a more favorable supply-demand balance in the memory market. Lam Research benefits from upswings in the memory capex cycle and investors are beginning to believe that that memory capex recovery will take hold in 2020. In conversations with investors, management reiterated the view that supply growth in 2019 has been below long-term demand levels and the company’s tracking of pricing, utilization, and inventory metrics all point to a recovery in demand in 2020. Lam Research reported strong earnings results during the tail end of the reporting period,

3

TCW Artificial Intelligence Equity Fund

Management Discussions (Continued)

beating analyst estimates and, further backing its optimistic commentary regarding the recovery of the NAND market. Management raised its outlook for wafer fabrication equipment as the capital expenditure cycle in the industry begins to ramp up. Management also spoke to positive trends emerging in the NAND flash market that should result in strong results in 2020.

ServiceNow, Inc. is an enterprise software company that provides automated workflow processes for its clients. While initial deployments were for managing information technology assets, the company is now seeing use cases expand to security, human resources, and customer service. ServiceNow recently launched a machine learning engine called Intelligent Automation Engine, which will be used to forecast outages, automate routing, predict outcomes, and benchmark performance for clients. In a ServiceNow survey, 86% of companies said that they will need increased automation in order to manage the volume of work that they expect to have in 2020.

ServiceNow continued to deliver strong share price appreciation following strong earnings results announced at the very end of January, which set up positive momentum throughout the period. During its earnings announcement, the company demonstrated impressive growth despite macroeconomic headwinds and delivered billings growth guidance that surpassed investor expectations for 2019. ServiceNow continues to deliver a strong combination of hyper growth with margin expansion.

Our biggest detractor in the period was Tesla Inc. In the first quarter of 2019, Tesla released a memo stating that it would reduce headcount at the company. The cost-cutting measure was a move to maintain profitability as the Model 3 production ramps up and average selling prices come down to an eventual $35,000 price point. Upon holding a press conference to announce the price cut to $35K and a seemingly more modest estimate of Model 3 demand (Musk referenced 500K units versus 700-800K a couple weeks prior), some investors took the news as negative data points as it relates to market demand. Tesla reported disappointing first quarter earnings in April, citing weaker deliveries, lower pricing, and lighter gross margins due to lack of operating leverage on fixed costs. While this fueled negative price momentum throughout the quarter, we would note that Tesla reaffirmed its full year guidance for 360,000 to 400,000 vehicle deliveries, which would imply a significant acceleration in the second half of 2019. Tesla also hosted an investor day during the month, in which it discussed operating a robo-taxi business over a proprietary autonomous network controlled by Tesla. Given the near-term cash flow headwinds the company was facing due to its international expansion and very aggressive autonomous driving programs, we sold shares in the company to fund opportunities that offer what we considered to be better risk/reward prospects.

We believe AI will be the foundational technology of the information age. The leap from computing built on the foundation of humans telling computers how to act, to computing built on the foundation of computers learning how to act has significant implications for every industry.

In our view, there are many structural drivers that are accelerating the need for AI. These include:

| • | | Trend in demographics towards an aging global population |

| • | | Need for greater energy efficiency |

| • | | Drive for greater urbanization as demand for convenience increases |

| • | | Efforts to increase human capital productivity |

The broad applicability of AI also leads us to believe that it is a paradigm-shifting technology for the global economy and a driver behind improving productivity. AI very well could end the period of stagnant

4

TCW Artificial Intelligence Equity Fund

Management Discussions (Continued)

productivity growth in the U.S. We believe that AI technology driven improvements to productivity could, similar to the 1990’s, drive corporations to invest in more capital and labor intensive projects, accelerating growth, improving profitability, and expanding equity valuations. We believe the trend towards AI-enhanced products is accelerating and we highlight recent developments as evidence:

| • | | AI Patents are Rapidly Growing. Patent filings for artificial intelligence technology have dramatically increased since 2013. More than half of all patents related to artificial intelligence have been filed since 2013. The top five applicants fueling the boom are IBM, Microsoft, Toshiba, Samsung, and NEC. The large increase in patents is an indication of how many new AI-based productions, applications, and techniques are expected to hit the market in the coming years. Nick Whigham. Global Patents Show How the AI Race Wants to Change Everything Around Us. news.com.au. February 1, 2019 (https://www.news.com.au/technology/innovation/design/patent-files-show-how-the-ai-race-is-changing-everything-around-us/news-story/5aec1f6a3a291b06cad53d26212e1aad) |

| • | | Russia Raises $2 Billion for AI Investment. The Russian Direct Investment Fund raised $2 billion from foreign investors for the purposes of investing in domestic companies that focus on developing artificial intelligence. Thus far, between five to ten investments related to artificial intelligence are planned on an annual basis. Examples include Oncobox, which selects oncology treatments and develops functional prosthetics using AI, and VisionLabs, which develops face recognition technology. Russia Raises $2 Billion for Investment in Artificial Intelligence. The Moscow Times. May 31, 2019 (https://www.themoscowtimes.com/2019/05/31/russia-raises-2bln-for-investment-in-artificial-intelligence-a65824) |

| • | | McDonald’s Acquires AI Speech Company. McDonald’s announced the acquisition of Apprente, which is an artificial intelligence company that will give McDonald’s the ability to understand speech at its drive-thru locations and self-order kiosks. McDonald’s believes that giving customers the ability to self-order via speech will cut down on service times. McDonald’s has been more aggressive in hiring data scientists and other tech experts, and is also more active in acquiring technology companies. Amelia Lucas. McDonald’s Acquires A.I. Company to Help Automate the Drive-Thru, Its Third Tech Deal This Year. CNBC. September 10, 2019 (https://www.cnbc.com/2019/09/10/mcdonalds-acquires-ai-company-trying-to-automate-the-drive-thru.html) |

We continuously survey the artificial intelligence investment landscape by drawing upon our deep technical knowledge and fundamental research efforts. Our research effort seeks the most attractive opportunities in the AI ecosystem. We appreciate your confidence in and support of the TCW Global Artificial Intelligence Equity Fund.

5

TCW Artificial Intelligence Equity Fund

Management Discussions (Continued)

| | | | | | | | |

| | | Annualized Returns(1) | |

| | | 1 Yr

Return | | | Inception

to Date | |

TCW Artificial Intelligence Equity Fund | | | | | | | | |

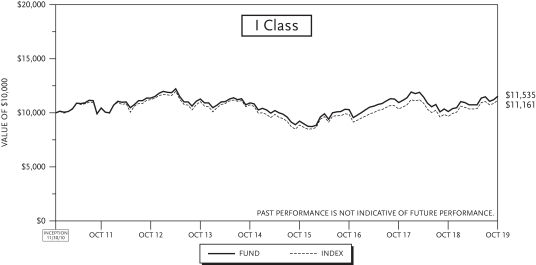

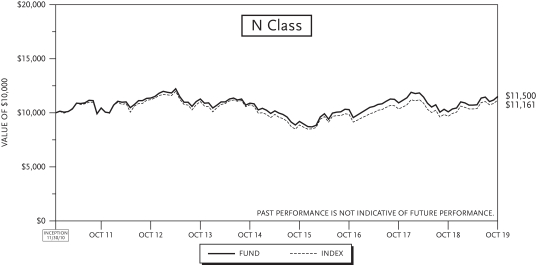

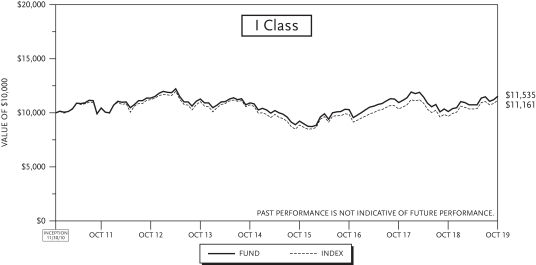

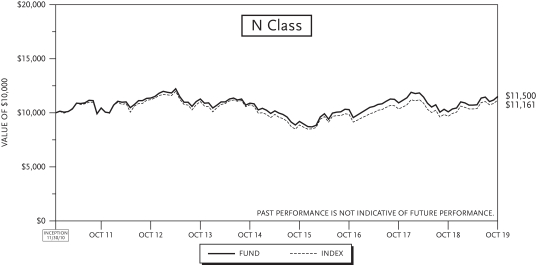

Class I (Inception: 8/31/2017) | | | 13.60 | % | | | 11.67 | % |

Class N (Inception: 8/31/2017) | | | 13.61 | % | | | 11.63 | % |

Russell 3000 Growth Index | | | 16.34 | % | | | 14.89 | % |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

6

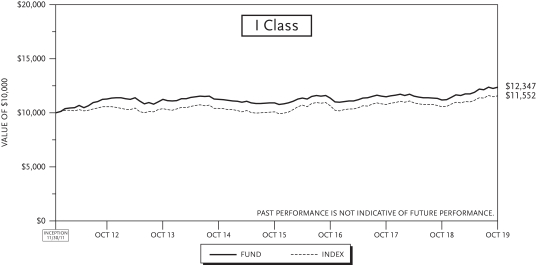

TCW Conservative Allocation Fund

Management Discussions

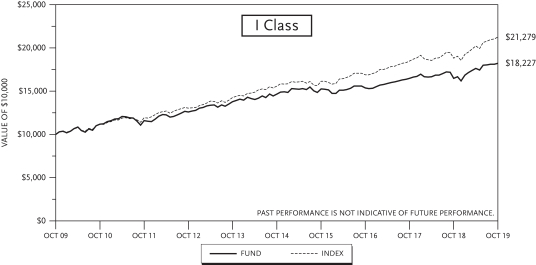

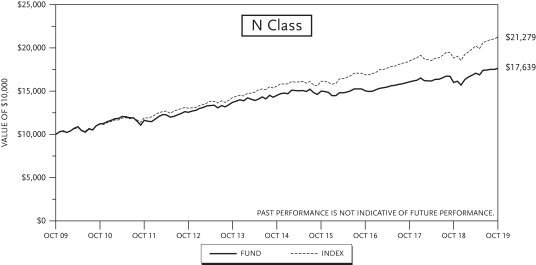

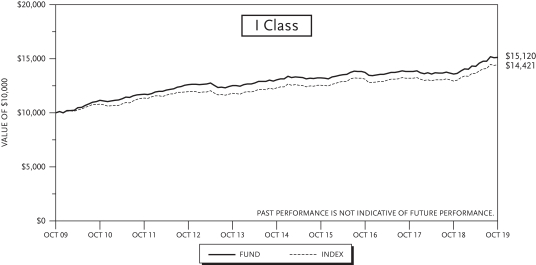

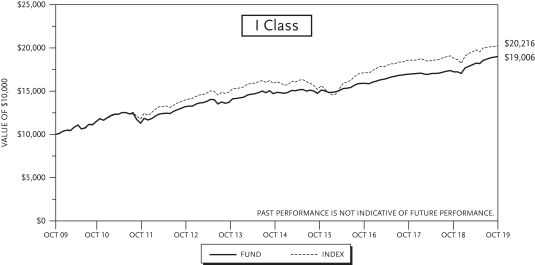

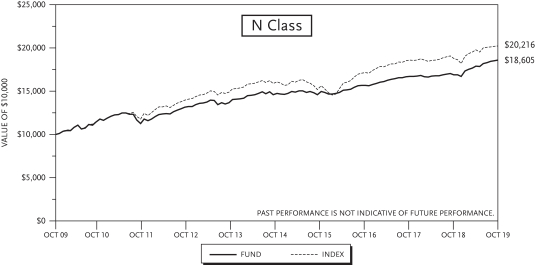

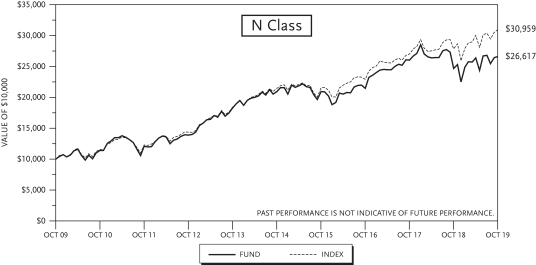

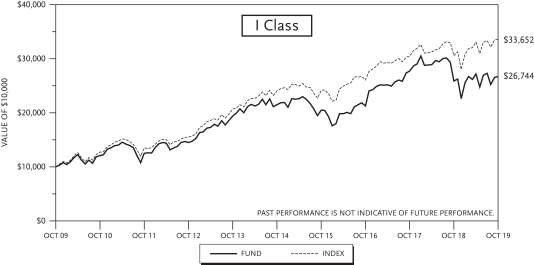

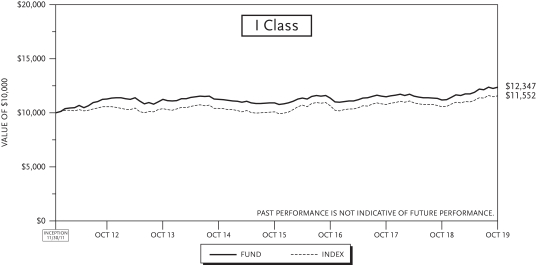

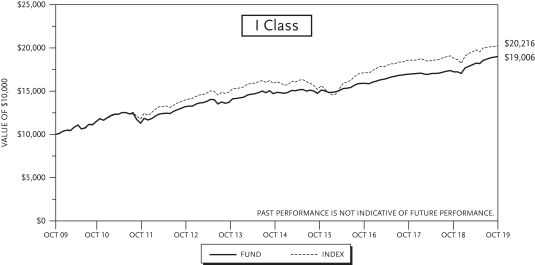

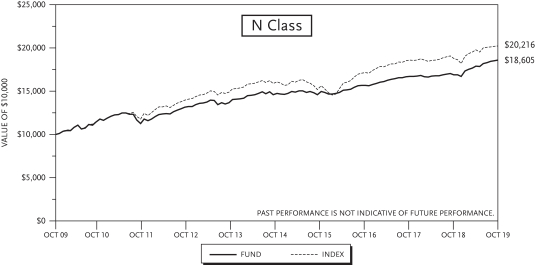

For the year ended October 31, 2019, the TCW Conservative Allocation Fund (the “Fund”) posted a gain of 10.46% for the I Class and 10.16% for the N Class shares. The performance of the Fund’s classes varies because of differing expenses. The Fund’s blended benchmark of 40% S&P 500 Index and 60% Bloomberg Barclay Capital U.S. Aggregate Bond Index returned 13.07% over the same time period.

The Fund posted positive returns over the past year with a positive contributions coming from U.S. equities. The strongest returns came from TCW New America Premier Equities Fund (13.5% allocation) and TCW Global Real Estate Fund (6.4% allocation), with both funds up over 20% over the past year outpacing the S&P 500 Index. At the asset allocation level, the decision to over overweight large cap U.S. equities helped relative performance.

As of October, the allocation for the Fund was 40% equities and 60% fixed income. This gives the Fund a neutral weight to both equities and fixed income as compared to its blended index. Over the past 12 months, the Fund has slightly changed the allocation to Fixed Income. Within Fixed Income, the allocation has been weighted towards higher grade and mortgage-backed fixed income securities. The Fund increased its allocation to TCW Total Return Bond Fund over the past year. Within equites, the fund continued to allocate more to less volatile and defensive equities. The allocation to TCW New America Premier Equities Fund was increased. An allocation to the TCW Global Real Estate Fund was initiated in the early part of the year and was a strong contributor to returns.

U.S. stocks registered strong gains over the past year ending Oct 2019. Equity market performance throughout the year has been marked by volatility as trade war worries intensified and soft macroeconomic data weighed on the market. Equity market investors saw their investments buoyed by the well-telegraphed expectation that the Fed would cut its benchmark interest rate for the first time since 2008, in response to slower macroeconomic growth and tame inflation. Equity prices were further supported by expectations of continued monetary policy easing by the Fed, which at its September meeting lowered its Fed Funds effective rate by 25 basis points to a range of 1.75% - 2.0%. Importantly, Fed Chair Powell noted that additional quantitative easing would be possible should it be needed.

Looking forward, we believe that successful implementation of a US/China trade war “truce” — no matter how limited its scope — would be supportive of the equity markets if only by virtue of its effective impact of forestalling an escalation of a trade dispute which has unequivocally dampened US economic growth. We are of course mindful that the US stock market’s strong advance this year to an all-time high presents risks of its own, particularly given the fact that the vast majority of the gains have been fueled by increased risk appetite and multiple expansion rather than by strong corporate earnings growth. With the US Fed now appearing to be clearly on the sidelines, we believe that the stock market’s trajectory from here will be largely dictated by the extent to which the US and global economies see improved growth, and whether said growth translates into stronger corporate earnings. With US stocks presently trading at a price-to-earnings multiple of 17.5 times forward earnings — compared to an average of 13.9 times over the past five decades — we note that the market remains susceptible to a spike in volatility should the economy show renewed signs of weakness or if trade negotiations get derailed.

Equities and bonds continue to send diverging signals. Though difficult to identify a catalyst to higher growth, which would justify current equity and credit market valuations, the list of downside risks to the market and global economy has grown substantially. Consumer spending has thus far mitigated the manufacturing slowdown, though we believe heightened uncertainty will likely dampen risk appetite and contribute to a broader deleveraging across markets.

7

TCW Conservative Allocation Fund

Management Discussions (Continued)

Unresolved trade tensions, weakening growth, and rising geopolitical risks lifted the global economic policy uncertainty index to record highs during the third calendar quarter of 2019, surpassing peak episodes last seen during the 2008 financial crisis. With estimates of recession probabilities over the next year rising by some measures to as high as 50%, this level of uncertainty could easily translate into further declines in business confidence and investment despite the Fed’s recent efforts to bolster growth. U.S. Treasuries were particularly affected as 10-Year Treasury yields fell over 60 bps on global growth fears, touching as low as 1.4% before rebounding by over 40 bps in September, in what was the largest weekly rise in six years.

The global economy continued to slow with the Organisation for Economic Co-operation and Development (OECD) cutting its 2019 growth forecast to 2.9%, the slowest annual pace since the financial crisis. Contributing to the downgrade was notable slowing in the U.S., China, and Germany. Weak incoming data from business surveys and investment spending underpin these projections. In particular, manufacturing Purchasing Managers’ Indexes (PMIs) indicate that the global economy has dipped into a manufacturing recession, with nearly 70% of economies reporting a decline this quarter.

8

TCW Conservative Allocation Fund

Management Discussions (Continued)

| | | | | | | | | | | | | | | | | | | | |

| | | Annualized Returns(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | |

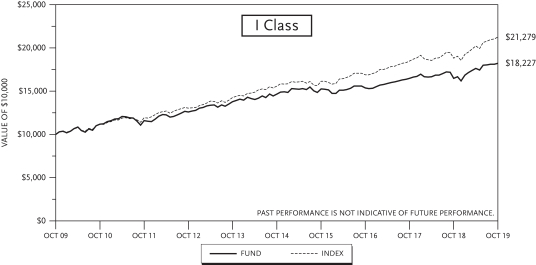

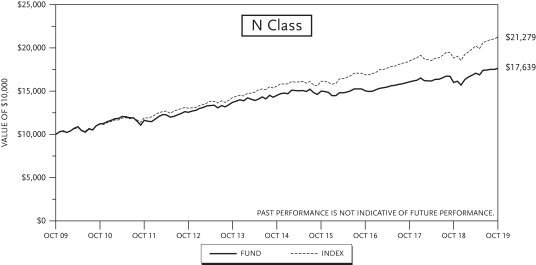

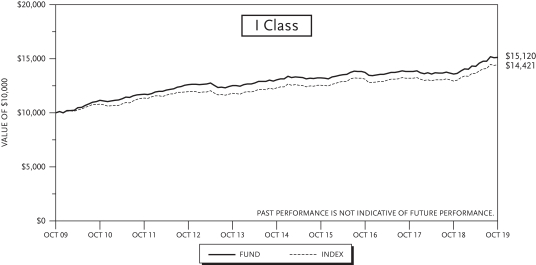

TCW Conservative Allocation Fund | | | | | | | | | | | | | | | | | | | | |

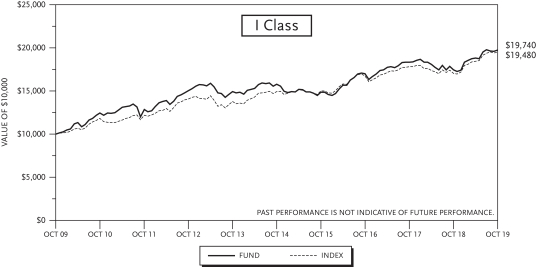

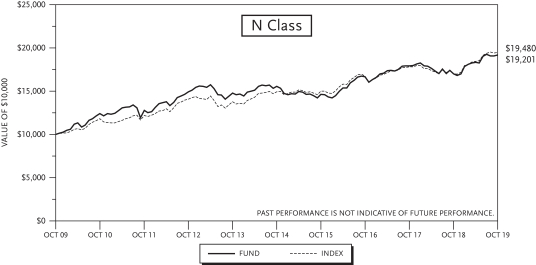

Class I (Inception: 11/16/2006) | | | 10.46 | % | | | 5.83 | % | | | 4.41 | % | | | 6.19 | % | | | 5.22 | % |

Class N (Inception: 11/16/2006) | | | 10.16 | % | | | 5.42 | % | | | 3.96 | % | | | 5.84 | % | | | 4.94 | % |

40% S&P 500 Index/60% Bloomberg Barclays U.S. Aggregate Bond Index | | | 13.07 | % | | | 8.02 | % | | | 6.40 | % | | | 7.84 | % | | | 6.24 | % |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on redemption of fund shares. |

9

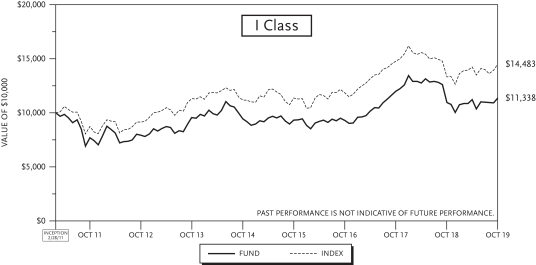

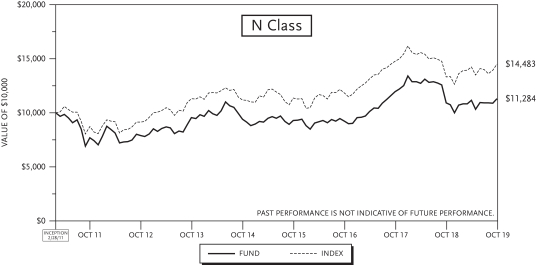

TCW Global Real Estate Fund

Management Discussions

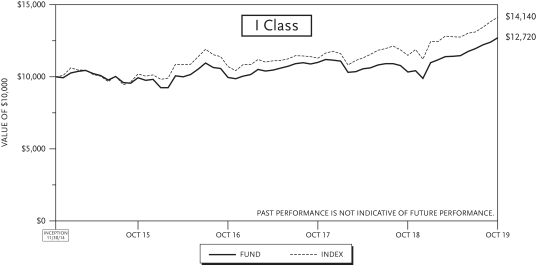

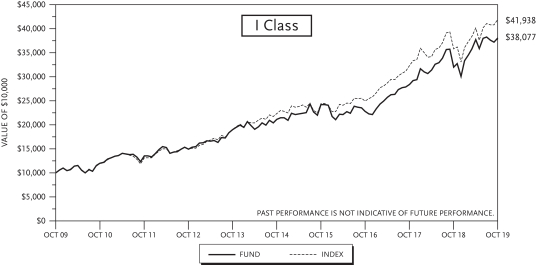

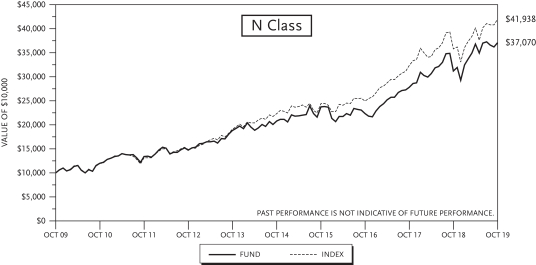

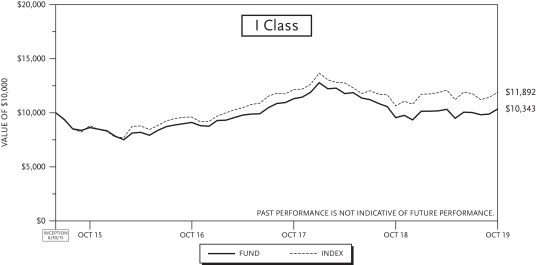

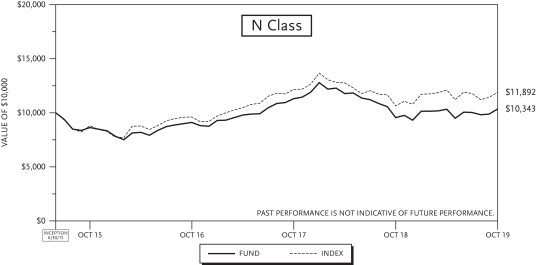

For the year ended October 31, 2019, the TCW Global Real Estate Fund (the “Fund”) generated returns of 23.17% and 22.99% on its I Class and N Class shares, respectively. The performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the S&P Global REIT Index, had a positive return of 23.07% over the same period.

On an attribution basis, the Fund’s in-line performance relative to its benchmark during the period was the result of good stock selection and sector allocation offset by excess cash. From a relative standpoint, the Fund’s largest sector overweight was in Industrial REITs (average weight of 19.67% and up 35.74% for the Fund vs. average weight of 11.16% and up 39.30% for the index), which benefitted performance. The Fund’s largest sector underweight was in Diversified REITs (average weight of 2.80% and up 10.60% for the Fund vs. average weight of 13.92% and up 29.73% for the index), which hurt performance. From a stock selection perspective, positive contributors included Equinix (EQIX) and Goodman Group (GMG AU). Conversely, notable detractors from performance included Deutsche Wohnen (DWNI GR) and Simon Property Group (SPG). Cash was also a drag to performance of around 0.45%.

As US markets closed 2018 with significant volatility and a pronounced sell off in equity markets, by contrast 2019 produced a strong recovery with the S&P 500 advancing 14% from October 31, 2018 to October 31, 2019. Fears of the Federal Reserve rate increases were quickly put to rest early in the year and turned from policy tightening to more accommodation as the global economy showed mounting signs of weakness. The US/China trade war, while not yet resolved, has increasingly been viewed as a potential catalyst for potential upward momentum in an otherwise stalled economy. It still remains unclear to us why markets have responded to softening conditions with such strong performance, but the most likely explanation may just be that US equity markets are still the best asset class to own in a world of low rates and arguably inflated valuations.

While REIT indices underperformed in both 2017 and 2018, they recovered in 2019. Part of this reflation was due to a collapse in rates as the 10 year treasury yield peaked in 2018 above 3.0% and bottomed as low as 1.5% in 2019. Accordingly, many bond proxy like assets found a strong bid in the year as valuations spreads tightened relative to fixed income securities. Because a large fraction of the gains in the year have come from multiple expansion rather than organic earnings or cash flow growth, we have become more concerned that risk is not being properly accounted for in certain sectors.

Our strategy for navigating the current environment is to continue our focus on process and portfolio construction. We source most of our holdings from two separate pools. The first is in underappreciated undervalued companies that could benefit from a change in sentiment. The issues these businesses face are typically transitory and the discount is largely unfounded when viewed on a longer time horizon. The second set of companies that make up the bulk of our portfolio is in the best franchises with high barriers to entry and strong cash flow generation. These companies may also have an ability to invest capital at high rates of return and typically will compound capital at a pace that exceeds that of their peers. The Fund’s portfolio is currently more heavily weighted towards these types of high quality companies. We believe taking risks by owning lower quality businesses at relatively attractive valuations is the wrong approach at this juncture. While our strategy produced adequate returns in absolute terms over the past year, we recognize that relative returns have been lackluster. We believe that a broader market sell off may be an opportunity for the Fund to outperform from a relative standpoint by avoiding losses as well as finding better entry points on more value oriented names.

10

TCW Global Real Estate Fund

Management Discussions (Continued)

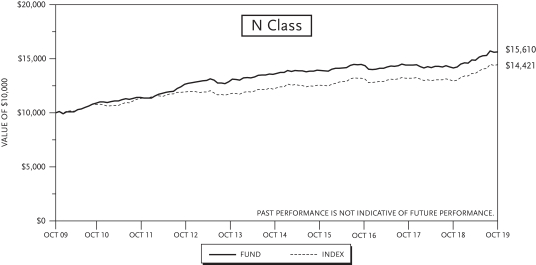

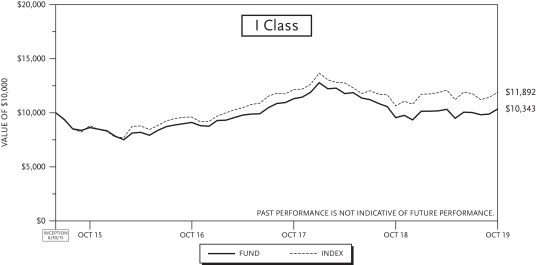

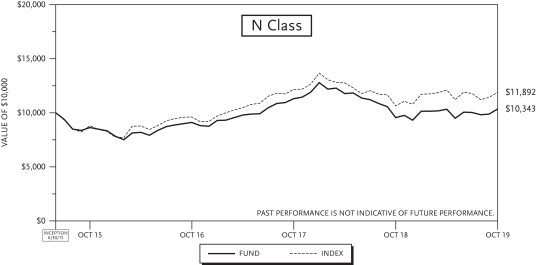

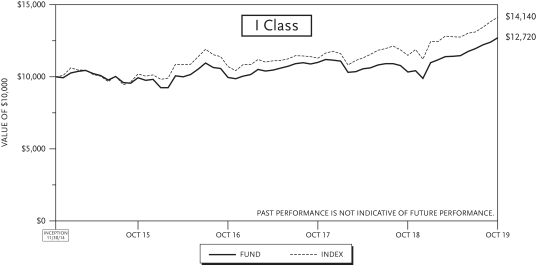

| | | | | | | | | | | | |

| | | Annualized Returns(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | Inception

to Date | |

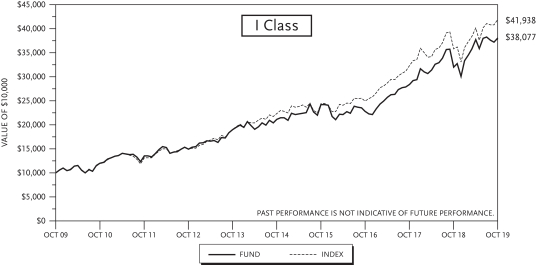

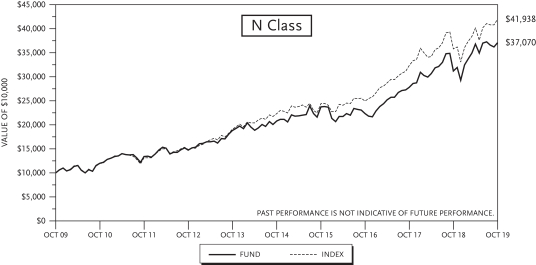

TCW Global Real Estate Fund | | | | | | | | | | | | |

Class I (Inception: 11/28/2014) | | | 23.17 | % | | | 8.46 | % | | | 5.01 | % |

Class N (Inception: 11/28/2014) | | | 22.99 | % | | | 8.38 | % | | | 4.96 | % |

S&P Global REIT Index | | | 23.07 | % | | | 9.72 | % | | | 7.30 | % |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

11

TCW New America Premier Equities Fund

Management Discussions

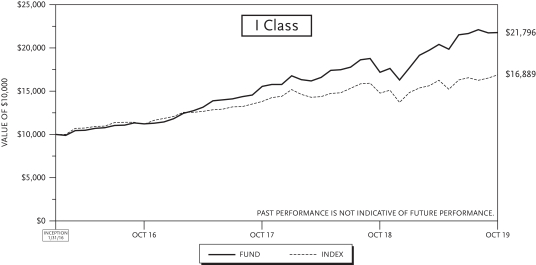

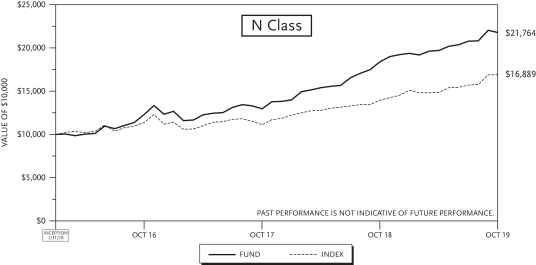

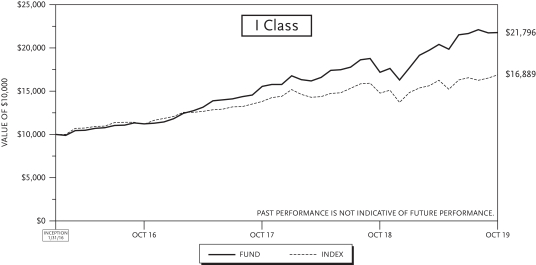

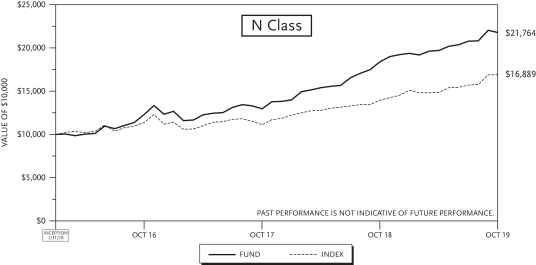

For the fiscal year that ended October 31, 2019, the TCW New America Premier Equities Fund (the “Fund”) returned 26.79% and 26.60% on the I Class and N Class shares, respectively. The Fund’s benchmark, the Russell 1000 Index, returned 14.15% over the same period.

The Fund’s performance benefited from investments in Transdigm, The Trade Desk Inc. and Constellation Software. The Fund’s performance was negatively impacted by investments in Transunion LLC, Broadcom Corporation and Chase Corporation. Security selection was the primary driver of the Fund’s performance during the year.

As we have indicated in the past we eschew a reliance on macroeconomic forecasts and projections of the future direction of markets — our view is that these factors are unknowable. We therefore focus on what we think is knowable. We believe that a careful assessment of investment opportunities at the security level will provide us, in some cases, with a high probability view of the future free cash flows of a business. Risk adjusted cash flow steam is a key determinant of the future returns of an investment and therefore a key determinant of the portfolio’s future returns. We believe that we have made good decisions in this respect and that the portfolio of companies is built to weather most market environments.

Investment Philosophy

The Fund seeks to outperform the broad U.S. indices in both rising and falling markets with less risk and volatility. We seek to accomplish this objective by investing in a concentrated portfolio of businesses that carefully manage their environmental and social resources and that employ best in class corporate governance practices. We invest in businesses that have high barriers to entry, are stable, generate substantial free cash flow and are managed by prudent leaders.

Risk control. Our primary objective, as stewards of your capital, is to control risk while seeking attractive returns. We control risk in a unique manner; initially we apply our proprietary ESG quantitative framework to identify better managed businesses that have lower quantifiable and unquantifiable risks. Subsequently we hone our efforts on those businesses that we believe operate in stable industries with attractive industry structures, businesses that produce products that are critical to their customers, and businesses that we believe are led by proven, appropriately incentivized leaders. We endeavor to further control valuation risk by purchasing securities at attractive prices relative to the current free cash flow generation of the businesses. We believe that businesses that fit our profile produce fairly stable cash flow streams and are less prone to macroeconomic fluctuations, competitive pressures and valuation risks.

Consistency. It is also our objective to deliver a consistently positive outcome. We would view outsized outperformance in one year and poor performance in the subsequent year as a poor outcome for our clients. Our bottom-up investment process is focused on selecting undervalued businesses that we believe should perform well in most market environments and hold up well in negative periods. We believe consistency in approach and consistency in outcome gives us the best chance of minimizing a left tail outcome in any given year. It is our view that if we can consistently deliver above average risk adjusted performance over a long period of time the outcome likely would be outperformance relative to our peers over the full period. That is our goal.

Environmental, Social, Governance Analysis: Traditional fundamental analysis does not capture risks associated with managing environmental resources nor does it assess the performance of businesses from the perspective of resource efficiency. Traditional analysis does not typically assess the risks associated with

12

TCW New America Premier Equities Fund

Management Discussions (Continued)

a heterogeneous workforce nor does it assess the competence, quality and engagement level of a company’s board of directors. Our investment framework not only pays close attention to these issues, we quantify, score, and rank companies and exclude businesses based on these risk factors. While those risks are not quantified through traditional financial analysis, we have found a significant correlation between companies that manage their resources prudently and businesses that sport strong financial metrics. Businesses that meet our rigorous ESG performance requirements typically have higher free cash flow yields, higher total yields, higher margins and lower levels of financial leverage.

Focus on Dominant, Predictable Businesses with High Barriers to Entry: In the long run the investment performance of a portfolio is inextricably linked to the underlying performance of the earnings and cash flows of the businesses comprising the portfolio. We believe one of the greatest risks in investing is valuing a business based on an erroneous view of the future free cash flows of the business. Such a circumstance results in an investor typically overpaying for a business and therefore generating a poor return on the investment.

In fast growing businesses or in industries that are undergoing rapid changes it is extraordinarily difficult and often dangerous to make an investment in a business when the long-term cash generation potential of the enterprise has a wide spectrum of outcomes. We seek to avoid companies and industries that are undergoing rapid changes. What we do seek, however, are stable businesses that have dominant market positions, and whose long term cash flows we believe can be predicted reasonably well. The qualitative characteristics that we seek, including attractive industry structures, pricing power and dominant market positions, make us confident in our forecast of the future cash flows of the businesses and therefore provide greater confidence that our valuation of the business is reasonably accurate. The famed value investor Benjamin Graham once said, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” Our view is that the market weighs cash flows and in order to consistently purchase a security for less than what it is worth, one should have high confidence in the future free cash flows of a business.

Thank you for joining us as fellow shareholders in the TCW New America Premier Equities Fund. We will continue to work hard to justify your confidence in us.

13

TCW New America Premier Equities Fund

Management Discussions (Continued)

| | | | | | | | | | | | |

| | | Annualized Returns(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | Inception

to Date | |

TCW New America Premier Equities Fund | | | | | | | | | | | | |

Class I (Inception: 1/29/2016) | | | 26.79 | % | | | 24.74 | % | | | 23.09 | % |

Class N (Inception: 1/29/2016) | | | 26.60 | % | | | 24.68 | % | | | 23.04 | % |

Russell 1000 Index | | | 14.15 | % | | | 14.73 | % | | | 15.01 | % |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

14

TCW Relative Value Dividend Appreciation Fund

Management Discussions

For the year ended October 31, 2019, the TCW Relative Value Dividend Appreciation Fund (the “Fund”) posted a return of 11.27% and 11.02% on its I Class and N Class shares, respectively. The performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the Russell 1000 Value Index, returned 11.21% over the same period.

Market Outlook

The Federal Reserve cut rates for the third time in 2019 in October (reversing all of the hikes conducted in 2018) to “provide some insurance against ongoing risks.” Fed Chair Jerome Powell stated “there’s plenty of risk left” but also added that some of the obstacles have eased. It appears as if the Fed is “on pause” with Mr. Powell adding that rate hikes were unlikely in the near future unless inflation moves higher.

The U.S. economy and markets remain attractive. The first reading (advance estimate) for 3Q:19 U.S. GDP came in at 1.9% (2.0% year-over-year) reflecting strong personal consumption and single family housing expenditures which offset declines in nonresidential fixed and private inventory investments. The October jobs report surprised to the upside with nonfarm payrolls rising by 128,000, far better than estimates for 75,000 gains (even accounting for the GM auto strike), and was buttressed by noticeable upward revisions in the prior two months’ figures. With nearly all S&P 500 companies reporting, 3Q:19 corporate earnings have come in better than expected; Earnings are currently flat to slightly positive year-over-year versus expectations of -2% to -3%, with revenue growth of ~4% year-over-year. The third quarter is likely to be the trough in this mid-cycle correction as earnings are estimated to be up slightly in 4Q:19, mid-single digits in each of the first two quarters of 2020, and accelerating into double-digits in the third and fourth quarters. While the Trump impeachment process creates headlines, thus far the proceedings and findings have not had much market impact. For reference, markets movements during the two most recent impeachment inquiries (Richard Nixon; down and Bill Clinton; up) were much more dependent on underlying economic growth.

The risk of a U.S. recession has subsided. Indeed, with the solid jobs report, a resilient U.S. consumer, and a “cease-fire” for the October and December Chinese tariffs, recession fears have faded. Additionally, the 2-10 U.S. Treasury positive yield spread has grown to ~25 bps, and despite contracting for the last three months, there was an uptick in the U.S. ISM Manufacturing Purchasing Managers Index (PMI) report for October. While not in evidence, the classic recessionary causes, such as an overheated economy, earnings recession, runaway inflation, and financial imbalances must be monitored vigilantly.

We believe the U.S. is still the best place to invest given exports of goods and services only account for approximately 12% of GDP. While tariffs are painful and literally counterproductive, the U.S., in general, is a self-sustaining economy. Due in part to trade tensions, global growth concerns remain with China’s official GDP slowing to 6.0% in 3Q:19 and the Eurozone’s largest economy Germany teetering on recession while the UK/Brexit situation remains thorny with a deadline being extended again, now to January 31, 2020, and a UK general election has been called for December 12. Argentina facing a deepening economic crisis, Hong Kong protests, Iran, and Syria are each dampening business confidence. To combat the slowdown, a massive global easing cycle has gained traction with the U.S., Chinese, European, New Zealand, Thailand, Indian, Australian, and most recently Japanese central banks all now in stimulus mode. The transmission mechanisms for central bank easing tend to lag by six to nine months thus positive evidence of their efforts should be felt by year end and into the first half of 2020.

15

TCW Relative Value Dividend Appreciation Fund

Management Discussions (Continued)

There have been many times when the macro has overwhelmed the micro company specific fundamentals, but the “truth will out.” Companies, when faced with adversity, tend to undertake cost cutting and restructuring, and reinvest in the people and technology to stay relevant and competitive. Historically, extreme growth valuation levels have reversed with value sizably outperforming growth over multiple years. The dilemma investors face is whether 1) they should continue to “ride” momentum and the S&P 500 (which are showing signs of fatigue), or 2) consider value stocks as “insurance” with attractive valuations that have been overlooked and oversold as a result of the growth decade. While an allocation to value has been an “insurance” policy over the last few years, we believe strongly it should now be part of an investors’ offensive lineup. As value investors, it is imperative to stick to the fundamentals (cash flow, earnings, and company specific catalysts) and those companies with the balance sheets and management teams to prevail over time. Stocks trading at attractive valuations, with ample long-term growth prospects, should ultimately win investor favor. Finally, prudent investors should maintain diversification in both styles to avoid chasing potential seismic changes as well as curtail risk and be in the position to gain throughout economic cycles which should smooth returns over time.

The Fund remains attractively valued versus both the S&P 500 and the Russell 1000 Value with higher growth potential than the Value Index underscoring the “Search for Value Poised for Growth” Relative Value investment philosophy.

Fund Review

Over the course of the one-year period ending October 31, 2019, the Fund’s top ten conviction-weighted holdings outperformed the portfolio and both benchmarks returning 26.3%, on average, led by Cypress Semiconductor, Johnson Controls, AT&T, Intercontinental Exchange, and Maxim Integrated Products. The Fund’s Consumer Staples names were the best relative performers returning 33.2% versus the group gain of 12.2% led by Procter & Gamble and PepsiCo. Due largely to Cypress Semiconductor and aided and abetted by Seagate Technology and Maxim Integrated Products, the Fund’s Information Technology names outperformed 28.7% versus 22.9% while its Health Care and Communication Services holdings also performed admirably led by Royal Philips, Merck, AT&T, and Comcast. The portfolio’s Energy names outperformed -6.4% versus -12.5%, the only group not to be in the positive for the period. Homebuilder Lennar in the Consumer Discretionary space was additive on an absolute and relative basis. On the downside, holdings in the portfolio’s second smallest sector weight, Materials, were the biggest detractors declining -13.8% below the group rise of 7.4% with disappointing results from Freeport-McMoRan and DuPont. Largely due to Textron and secondly nVent, the portfolio’s Industrials names underperformed their peers 9.8% versus 17.1%; top ten holding Johnson Controls was one notable Industrial contributor offsetting some of the loss. Other detractors included Tapestry in the Consumer Discretionary space and Energy holdings Schlumberger and Baker Hughes. The Fund also lost value due to its overweight in Energy and underweight in Real Estate; offsetting some of this loss was the notable contribution from the overweight in Information Technology.

16

TCW Relative Value Dividend Appreciation Fund

Management Discussions (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Annualized Returns(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | | | Inception

Index | |

TCW Relative Value Dividend Appreciation Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class I (Inception: 10/29/2004) | | | 11.27 | % | | | 7.58 | % | | | 5.52 | % | | | 11.26 | % | | | 6.95 | % | | | 10.14 | % |

Class N (Inception: 09/19/1986) | | | 11.02 | % | | | 7.34 | % | | | 5.27 | % | | | 10.95 | % | | | 8.89 | % | | | 7.80 | % |

Russell 1000 Value Index | | | 11.21 | % | | | 10.51 | % | | | 7.61 | % | | | 11.96 | % | | | | | | | | |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or the redemption of fund shares. |

17

TCW Relative Value Large Cap Fund

Management Discussions

For the year ended October 31, 2019, the TCW Relative Value Large Cap Fund (the “Fund”) posted a return of 8.13% and 7.92% on its I Class and N Class shares, respectively. The performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the Russell 1000 Value Index, returned 11.21% over the same period.

Market Outlook

The Federal Reserve cut rates for the third time in 2019 in October (reversing all of the hikes conducted in 2018) to “provide some insurance against ongoing risks.” Fed Chair Jerome Powell stated “there’s plenty of risk left” but also added that some of the obstacles have eased. It appears as if the Fed is “on pause” with Mr. Powell adding that rate hikes were unlikely in the near future unless inflation moves higher.

The U.S. economy and markets remain attractive. The first reading (advance estimate) for 3Q:19 U.S. GDP came in at 1.9% (2.0% year-over-year) reflecting strong personal consumption and single family housing expenditures which offset declines in nonresidential fixed and private inventory investments. The October jobs report surprised to the upside with nonfarm payrolls rising by 128,000, far better than estimates for 75,000 gains (even accounting for the GM auto strike), and was buttressed by noticeable upward revisions in the prior two months’ figures. With nearly all S&P 500 companies reporting, 3Q:19 corporate earnings have come in better than expected; Earnings are currently flat to slightly positive year-over-year versus expectations of -2% to -3%, with revenue growth of ~4% year-over-year. The third quarter is likely to be the trough in this mid-cycle correction as earnings are estimated to be up slightly in 4Q:19, mid-single digits in each of the first two quarters of 2020, and accelerating into double-digits in the third and fourth quarters. While the Trump impeachment process creates headlines, thus far the proceedings and findings have not had much market impact. For reference, markets movements during the two most recent impeachment inquiries (Richard Nixon; down and Bill Clinton; up) were much more dependent on underlying economic growth.

The risk of a U.S. recession has subsided. Indeed, with the solid jobs report, a resilient U.S. consumer, and a “cease-fire” for the October and December Chinese tariffs, recession fears have faded. Additionally, the 2-10 U.S. Treasury positive yield spread has grown to ~25 bps, and despite contracting for the last three months, there was an uptick in the U.S. ISM Manufacturing Purchasing Managers Index (PMI) report for October. While not in evidence, the classic recessionary causes, such as an overheated economy, earnings recession, runaway inflation, and financial imbalances must be monitored vigilantly.

We believe the U.S. is still the best place to invest given exports of goods and services only account for approximately 12% of GDP. While tariffs are painful and literally counterproductive, the U.S., in general, is a self-sustaining economy. Due in part to trade tensions, global growth concerns remain with China’s official GDP slowing to 6.0% in 3Q:19, the Eurozone’s largest economy Germany teetering on recession, while the UK/Brexit situation remains thorny with a deadline being extended again, now to January 31, 2020, and a UK general election has been called for December 12. Argentina facing a deepening economic crisis, Hong Kong protests, Iran, and Syria are each dampening business confidence. To combat the slowdown, a massive global easing cycle has gained traction with the U.S., Chinese, European, New Zealand, Thailand, Indian, Australian, and most recently Japanese central banks all now in stimulus mode. The transmission mechanisms for central bank easing tend to lag by six to nine months thus positive evidence of their efforts should be felt by year end and into the first half of 2020.

There have been many times when the macro has overwhelmed the micro company specific fundamentals, but the “truth will out.” Companies, when faced with adversity, tend to undertake cost cutting and

18

TCW Relative Value Large Cap Fund

Management Discussions (Continued)

restructuring, and reinvest in the people and technology to stay relevant and competitive. Historically, extreme growth valuation levels have reversed with value sizably outperforming growth over multiple years. The dilemma investors face is whether 1) they should continue to “ride” momentum and the S&P 500 (which are showing signs of fatigue), or 2) consider value stocks as “insurance” with attractive valuations that have been overlooked and oversold as a result of the growth decade. While an allocation to value has been an “insurance” policy over the last few years, we believe strongly it should now be part of an investors’ offensive lineup. As value investors, it is imperative to stick to the fundamentals (cash flow, earnings, and company specific catalysts) and those companies with the balance sheets and management teams to prevail over time. Stocks trading at attractive valuations, with ample long-term growth prospects, should ultimately win investor favor. Finally, prudent investors should maintain diversification in both styles to avoid chasing potential seismic changes as well as curtail risk and be in the position to gain throughout economic cycles which should smooth returns over time.

The Fund remains attractively valued versus both the S&P 500 and the Russell 1000 Value with higher growth potential than the Value Index underscoring the “Search for Value Poised for Growth” Relative Value investment philosophy.

Fund Review

Most of the Fund’s underperformance over the one-year period ending October 31, 2019 occurred in the last two months of calendar year 2018. With high dividend yield a most significant factor in 4Q:18 (per Barra Analytics’ thirteen risk indices), the RVLC strategy had a difficult quarter. Usually a long-term positive, the strategy’s diversified portfolio structure was hampered by economically sensitive companies and industries being negatively impacted by President Trump’s trade war along with the rotation to U.S. domestic, high dividend oriented sectors. Equity markets were jilted once again in May and August amid heightened concerns over trade between U.S. and China.

Over the course of the one-year period ending October 31, 2019, the Fund’s top ten conviction-weighted holdings outperformed the portfolio and both benchmarks returning 24.7%, on average, led by Cypress Semiconductor, Intercontinental Exchange, Comcast, and JPMorgan Chase. The Fund’s Information Technology names were the best relative performers returning 28.2% versus the group gain of 22.9% led in large part to Cypress Semiconductor and secondly First Data. With strong returns from Procter & Gamble and PepsiCo, the portfolio’s Consumer Staples names returned 27.3% besting their peers’ rise of 12.2% while Intercontinental Exchange and Hartford Financial Services led to the outperformance in Financials. Lastly, the portfolio’s Energy names outperformed -6.7% versus -12.5%, the only group not to be in the positive for the period. Other positive performers included Lennar and Johnson Controls. On the downside, the portfolio’s Industrials names were the biggest detractors gaining 0.2% below the group rise of 17.1% with disappointing results from Fluor, Textron, and Terex; after a fundamental review Fluor was completely sold. With Health Care coming under some pressure due to the potential of a Warren/Sanders presidency and prospect of “Medicare for All”, the portfolio’s holdings in the sector underperformed their peers -0.6% versus 8.0% due to managed care companies Centene and Molina Healthcare along with pharmaceutical companies Amneal Pharmaceuticals and Gilead which struggled as these companies face potential drug pricing challenges. The portfolio’s Materials stocks also detracted returning -14.6% versus 7.4% with Freeport-McMoRan being the biggest factor. Other notable detractors included Tapestry and Baker Hughes.

19

TCW Relative Value Large Cap Fund

Management Discussions (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Annualized Returns(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | | | Inception

Index | |

TCW Relative Value Large Cap Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class I (Inception: 12/31/2003) | | | 8.13 | % | | | 7.64 | % | | | 5.16 | % | | | 10.54 | % | | | 7.12 | % | | | 7.20 | % |

Class N (Inception: 12/31/1997) | | | 7.92 | % | | | 7.40 | % | | | 4.92 | % | | | 10.28 | % | | | 6.13 | % | | | 7.86 | % |

Russell 1000 Value Index | | | 11.21 | % | | | 10.51 | % | | | 7.61 | % | | | 11.96 | % | | | | | | | | |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

20

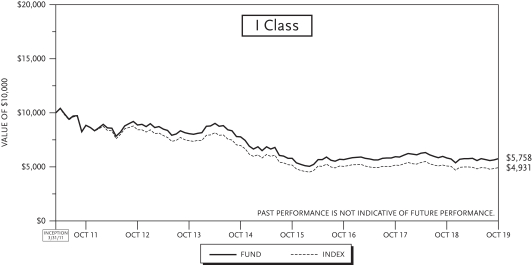

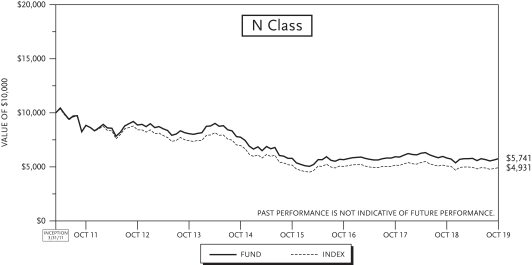

TCW Relative Value Mid Cap Fund

Management Discussions

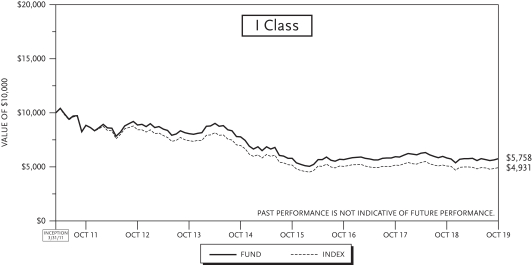

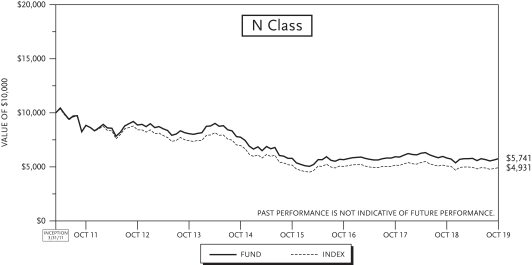

For the year ended October 31, 2019, the TCW Relative Value Mid Cap Fund (the “Fund”) posted a return of 3.18% and 3.12% on its I Class and N Class shares, respectively. The performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, the Russell Midcap Value Index, returned 10.08% over the same period. Calendar year-to-date through October 31, the Fund’s I Class and N Class shares have returned 18.25% and 18.14% versus the benchmark gain of 20.11%.

Market Outlook

The Federal Reserve cut rates for the third time in 2019 in October (reversing all of the hikes conducted in 2018) to “provide some insurance against ongoing risks.” Fed Chair Jerome Powell stated “there’s plenty of risk left” but also added that some of the obstacles have eased. It appears as if the Fed is “on pause” with Mr. Powell adding that rate hikes were unlikely in the near future unless inflation moves higher.

The U.S. economy and markets remain attractive. The first reading (advance estimate) for 3Q:19 U.S. GDP came in at 1.9% (2.0% year-over-year) reflecting strong personal consumption and single family housing expenditures which offset declines in nonresidential fixed and private inventory investments. The October jobs report surprised to the upside with nonfarm payrolls rising by 128,000, far better than estimates for 75,000 gains (even accounting for the GM auto strike), and was buttressed by noticeable upward revisions in the prior two months’ figures. With nearly all Russell Midcap companies reporting, despite being negative, 3Q:19 corporate earnings have come in better than expected; Earnings are currently -8% to -9% with revenue growth of 2-3% year-over-year, providing an unbiased view of underlying economic strength. The third quarter is likely to be the trough in this mid-cycle correction as earnings are estimated to be up high single-digits in 4Q:19, maintain that pace through the first half of 2020, and accelerating into double-digits in the third and fourth quarters. While the Trump impeachment process creates headlines, thus far the proceedings and findings have not had much market impact. For reference, markets movements during the two most recent impeachment inquiries (Richard Nixon; down and Bill Clinton; up) were much more dependent on underlying economic growth.

The risk of a U.S. recession has subsided. Indeed, with the solid jobs report, a resilient U.S. consumer, and a “cease-fire” for the October and December Chinese tariffs, recession fears have faded. Additionally, the 2-10 U.S. Treasury positive yield spread has grown to ~25 bps, and despite contracting for the last three months, there was an uptick in the U.S. ISM Manufacturing Purchasing Managers Index (PMI) report for October. While not in evidence, the classic recessionary causes, such as an overheated economy, earnings recession, runaway inflation, and financial imbalances must be monitored vigilantly.

We believe the U.S., and especially mid cap stocks, are the best place to invest given exports of goods and services only account for approximately 12% of GDP. While tariffs are painful and literally counterproductive, the U.S., in general, is a self-sustaining economy. Due in part to trade tensions, global growth concerns remain with China’s official GDP slowing to 6.0% in 3Q:19 and the Eurozone’s largest economy Germany teetering on recession while the UK/Brexit situation remains thorny with a deadline being extended again, now to January 31, 2020, and a UK general election has been called for December 12. Argentina facing a deepening economic crisis, Hong Kong protests, Iran, and Syria are each dampening business confidence. To combat the slowdown, a massive global easing cycle has gained traction with the U.S., Chinese, European, New Zealand, Thailand, Indian, Australian, and most recently Japanese central banks all now in stimulus mode. The transmission mechanisms for central bank easing tend to lag by six to nine months thus positive evidence of their efforts should be felt by year end and at least into the first half of 2020.

21

TCW Relative Value Mid Cap Fund

Management Discussions (Continued)

There have been many times when the macro has overwhelmed the micro company specific fundamentals, but the “truth will out.” Companies, when faced with adversity, tend to undertake cost cutting and restructuring, and reinvest in the people and technology to stay relevant and competitive. In addition, historically, extreme growth valuation levels should reverse with value primed to outperform growth over the next few years. The dilemma investors face is whether 1) they should continue to “ride” momentum or 2) consider mid cap value stocks as “insurance” with attractive valuations that have been overlooked and oversold. While an allocation to mid cap value has been an “insurance” policy over the last few years, we believe strongly it should now be part of an investors’ offensive lineup. Furthermore, mid cap stocks present a compelling investment case as they have outperformed their large cap brethren by over 300 basis points on an annualized basis over the last 20 years (as measured by Russell Midcap and S&P 500 indices) ending October 2019. As value investors, it is imperative to stick to the fundamentals (cash flow, earnings, and company specific catalysts) and those companies with the balance sheets and management teams to prevail over time. Stocks trading at attractive valuations, with ample long-term growth prospects, should ultimately win investor favor. Finally, prudent investors should maintain diversification to curtail risk and be in the position to gain throughout economic cycles which should smooth returns over time.

The Fund remains attractively valued versus the Russell Midcap Value Index and has higher growth potential underscoring the “Search for Value Poised for Growth” Relative Value investment philosophy.

Fund Review

A notable portion of the Fund’s underperformance over the one-year period ending October 31, 2019 occurred in the last two months of calendar year 2018. With the highest quintile dividend yields the most significant alpha contributor in 4Q:18 (per Barra Analytics’ thirteen risk indices), the RVMC strategy’s emphasis on five conservative valuation factors (including but not exclusively dividend yield) led to a difficult quarter. Usually a long-term positive, the strategy’s diversified portfolio structure was hampered by economically sensitive companies and industries being negatively impacted by President Trump’s trade war. Over the course of the one-year period ending October 31, 2019, the Fund’s top ten conviction-weighted holdings outperformed the portfolio and both benchmarks returning 24.3%, on average, led by Cypress Semiconductor, KB Home, and Jacobs Engineering. The Fund’s Information Technology names were the best relative performers returning 49.0% versus the group gain of 17.7% led in large part to Cypress Semiconductor and secondly First Data. With strong returns from homebuilders KB Home, Lennar, and Beazer Homes, the portfolio’s Consumer Discretionary names returned 21.4% besting their peers’ rise of 6.2% while AES led to the outperformance in Utilities. Other positive performers included Santander Consumer USA and Mid-America Apartment Communities in Financials and Real Estate, respectively. On the downside, the portfolio’s Industrials names were the biggest detractors gaining 2.7%, below the group rise of 21.2% with disappointing results from Manitowoc, Textron, and Fluor; after a fundamental review Fluor was completely sold. With Health Care coming under some pressure due to the potential of a Warren/Sanders presidency and prospect of “Medicare for All”, the portfolio’s holdings in the sector underperformed their peers -17.6% versus 4.4% due to managed care companies Centene and Molina Healthcare, behavior care company Acadia Healthcare, and Amneal Pharmaceuticals. Centene and Molina were both reduced and Amneal completely sold on fundamental reviews. The portfolio’s Financials stocks also detracted with their flat return underperforming the group gain of 11.1% with Umpqua Holdings, Comerica, Synovus Financial, and E*Trade the biggest factors; all four were reduced or sold. Other notable detractors included Tapestry, Newpark Resources, and ConAgra.

22

TCW Relative Value Mid Cap Fund

Management Discussions (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Annualized Returns(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | | | Inception

Index | |

TCW Relative Value Mid Cap Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Class I (Inception: 11/01/1996) | | | 3.18 | % | | | 7.96 | % | | | 4.45 | % | | | 10.34 | % | | | 9.70 | %(2) | | | 10.25 | % |

Class N (Inception: 10/31/2000) | | | 3.12 | % | | | 7.82 | % | | | 4.27 | % | | | 10.08 | % | | | 7.27 | % | | | 9.59 | % |

Russell Midcap Value Index | | | 10.08 | % | | | 8.90 | % | | | 6.95 | % | | | 12.90 | % | | | | | | | | |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

| (2) | Performance data includes the performance of the predecessor entity for periods before the Fund’s registration became effective. The predecessor entity was not registered under the 1940 Act and, therefore, was not subject to certain investment restrictions that are imposed by the 1940 Act. If the predecessor entity had been registered under the 1940 Act, the predecessor entity’s performance may have been lower. |

23

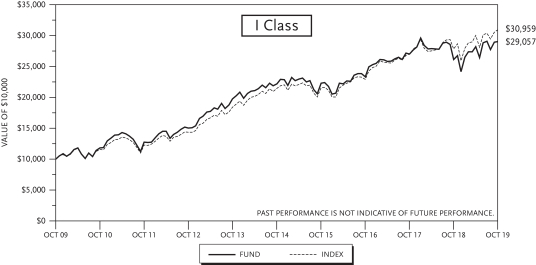

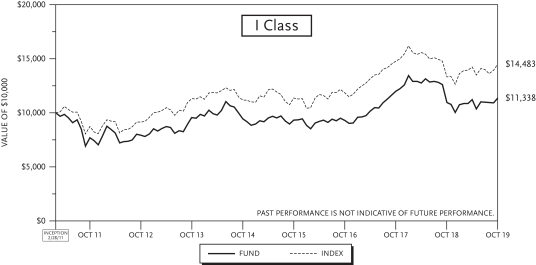

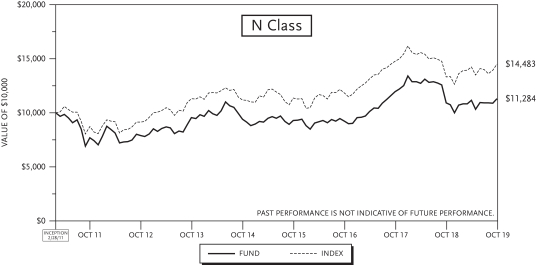

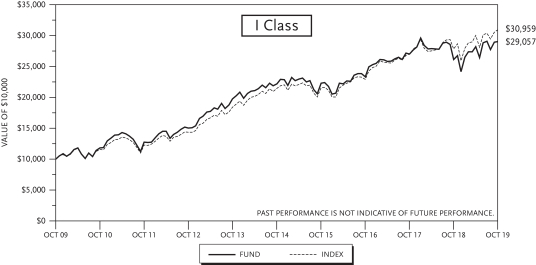

TCW Select Equities Fund

Management Discussions

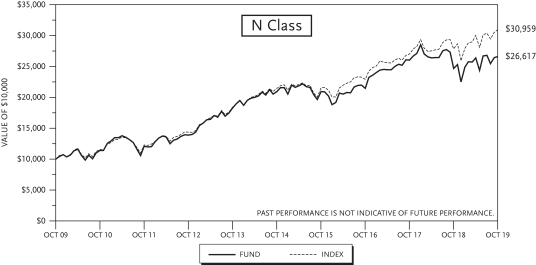

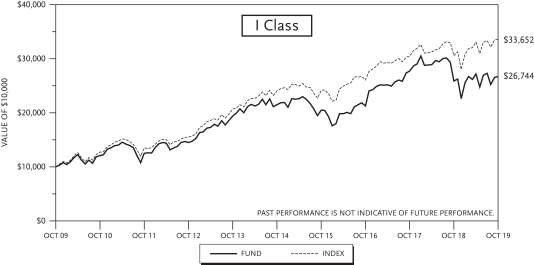

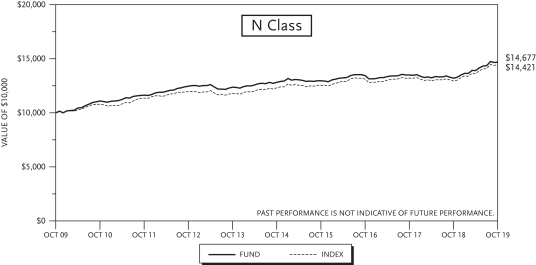

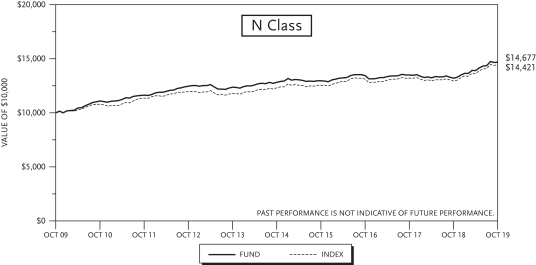

For the year ended October 31, 2019, the TCW Select Equities Fund (the “Fund”) posted a return of 18.98% and 18.74% on its I Class and N Class shares, respectively. The performance of the Fund’s classes varies because of differing expenses. The Fund’s benchmark, Russell 1000 Growth Index, returned 17.10% over the same period.

Fiscal 2019 was marked by increased volatility and a Federal Reserve intent on monetary intervention to extend the longest economic expansion on record. Despite breakeven inflation expectations dropping, financial conditions tightening and the U.S. Treasury 2-10 yield curve flattening, the Fed elected to raise rates in December 2018 (ninth hike since 2015), bringing the target rate for the Fed Funds rate to 2.25%-2.50%. The S&P 500 finished the month down 9% and finished calendar year 2018 -4.4%, the first negative total return year for the S&P 500 since 2008. In January 2019, the Fed abruptly pivoted with Chairman Powell noting that “we can afford to be patient.” By April, the S&P 500 was back to new all-time highs on the heels of a more dovish Fed and a better than expected 1Q19 real GDP report (+3.2%). The unemployment rate remained low (3.8%) and the bond market began to price in rate cuts for the remainder of 2019. The ongoing US-China trade war remained an overhang throughout the year, but thanks in part to an accommodative Fed (three 1/4 point cuts in 2019), the S&P 500 finished fiscal 2019 near an all-time high. Investor focus now turns to whether a long-awaited trade deal will be struck in front of an important 2020 election cycle.

Net of expenses, the Fund outperformed for the year primarily as a result of positive security selection results. Our biggest stock contributors during the year came from the real estate and information technology sectors. Shares of American Tower Corporation (AMT) rallied due to a string of solid earnings reports, as well as news that the company signed a new master lease agreement with AT&T that we believe may streamline wireless network deployments on AMT’s U.S. sites and accelerate AT&T’s deployment of FirstNet and 5G. Mobile data usage continues to increase at a rapid pace, and we believe AMT is uniquely positioned to benefit as carriers roll out 5G and continue to densify their 4G networks. We believe AMT is one of the key beneficiaries of global mobile data growth and we remain bullish on shares give the company’s scale, global footprint and recurring revenue streams. Shares of ServiceNow, Inc. (NOW) moved higher after several earnings reports that included both operating margin as well as TAM (Total Addressable Market) expansion. We believe NOW is a disruptive share gainer with a unique platform that automates workflow processes across several corners of a business enterprise and we remain constructive on shares.

Our biggest stock detractors during the year came from the energy and consumer discretionary sectors. Shares of Concho Resources Inc. (CXO) underperformed due to a value-destroying acquisition as well as a broader energy sector downward rerating. We exited our position earlier in the fiscal year. Shares of ULTA Beauty, Inc. (ULTA) declined after 2Q19 earnings results missed consensus estimates and the company lowered full year EPS guidance due to an abrupt cosmetics sales slowdown in July and August 2019. We believe ULTA is still gaining share in cosmetics, its non-cosmetic business is still comping double-digits and ecommerce is still growing greater than 20% year-over-year but recent trends are a concern given the relative strength of the U.S. consumer. As such, we have placed shares under review.

24

TCW Select Equities Fund

Management Discussions (Continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Annualized Returns(1) | |

| | | 1 Yr

Return | | | 3 Yr

Return | | | 5 Yr

Return | | | 10 Yr

Return | | | Inception

to Date | | | Inception

Index | |

TCW Select Equities Fund | | | | | | | | | | | | | | | | | | | | | | | | |

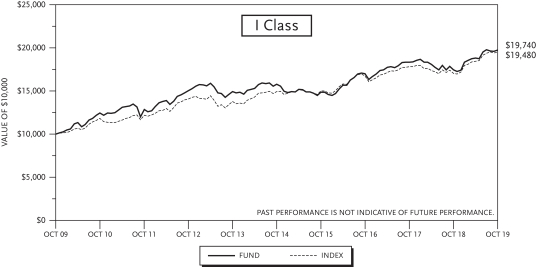

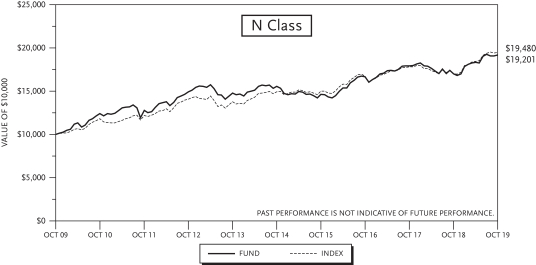

Class I (Inception: 07/01/1991) | | | 18.98 | % | | | 18.58 | % | | | 12.52 | % | | | 14.31 | % | | | 10.42 | %(2) | | | 9.73 | % |

Class N (Inception: 2/26/1999) | | | 18.74 | % | | | 18.33 | % | | | 12.26 | % | | | 14.00 | % | | | 6.92 | % | | | 6.04 | % |

Russell 1000 Growth Index | | | 17.10 | % | | | 18.92 | % | | | 13.43 | % | | | 15.41 | % | | | | | | | | |

| (1) | The total returns do not reflect taxes that a shareholder would pay on fund distribution or on the redemption of fund shares. |

| (2) | Performance data includes the performance of the predecessor entity for periods before the Fund’s registration became effective. The predecessor entity was not registered under the 1940 Act and, therefore, was not subject to certain investment restrictions that are imposed by the 1940 Act. If the predecessor entity had been registered under the 1940 Act, the predecessor entity’s performance may have been lower. |

25

TCW Artificial Intelligence Equity Fund

Schedule of Investments

| | | | | | | | |

| Issues | | Shares | | | Value | |

|

COMMON STOCK — 99.7% of Net Assets | |

|

| Application Software — 16.2% | |

| | |

Adobe, Inc. (1) | | | 397 | | | $ | 110,338 | |

| | |

Alteryx, Inc. (1) | | | 184 | | | | 16,836 | |

| | |

Anaplan, Inc. (1) | | | 837 | | | | 39,506 | |

| | |

Autodesk, Inc. (1) | | | 688 | | | | 101,384 | |

| | |

Salesforce.com, Inc. (1) | | | 968 | | | | 151,482 | |

| | |

Splunk, Inc. (1) | | | 795 | | | | 95,368 | |

| | |

Trade Desk, Inc. (The) (1) | | | 301 | | | | 60,441 | |

| | |

Workday, Inc. (1) | | | 374 | | | | 60,648 | |

| | | | | | | | |

| |

| | | | 636,003 | |

| | | | | |

|

| Auto Parts & Equipment — 1.0% | |

| | |

Aptiv PLC | | | 415 | | | | 37,163 | |

| | | | | | | | |

|

| Cable & Satellite — 6.6% | |

| | |

Altice USA, Inc. (1) | | | 2,721 | | | | 84,215 | |

| | |

Charter Communications, Inc. (1) | | | 228 | | | | 106,672 | |

| | |

Comcast Corp. | | | 1,527 | | | | 68,440 | |

| | | | | | | | |

| |

| | | | 259,327 | |

| | | | | |

|

| Communications Equipment — 2.7% | |

| | |

Palo Alto Networks, Inc. (1) | | | 469 | | | | 106,646 | |

| | | | | | | | |

|

| Data Processing & Outsourced Services — 6.2% | |

| | |

Mastercard, Inc. | | | 319 | | | | 88,302 | |

| | |

Square, Inc. (1) | | | 1,094 | | | | 67,205 | |

| | |

Visa, Inc. | | | 498 | | | | 89,072 | |

| | | | | | | | |

| |

| | | | 244,579 | |

| | | | | |

|

| Health Care Equipment — 3.2% | |

| | |

IDEXX Laboratories, Inc. (1) | | | 262 | | | | 74,673 | |

| | |

Intuitive Surgical, Inc. (1) | | | 92 | | | | 50,871 | |

| | | | | | | | |

| |

| | | | 125,544 | |

| | | | | |

|

| Home Entertainment Software — 3.8% | |

| | |

Activision Blizzard, Inc. | | | 1,613 | | | | 90,376 | |

| | |

Electronic Arts, Inc. (1) | | | 606 | | | | 58,419 | |

| | | | | | | | |

| |

| | | | 148,795 | |

| | | | | |

|

| Internet & Direct Marketing Retail — 4.4% | |

| | |

Amazon.com, Inc. (1) | | | 78 | | | | 138,579 | |

| | |

Revolve Group, Inc. (1) | | | 1,705 | | | | 35,396 | |

| | | | | | | | |

| |

| | | | 173,975 | |

| | | | | |

|

| Internet Services & Infrastructure — 10.9% | |

| | |

Alibaba Group Holding, Ltd. (SP ADR) (1) | | | 515 | | | | 90,985 | |

| | |

Alphabet, Inc. (1) | | | 97 | | | | 122,104 | |

| | |

Facebook, Inc. (1) | | | 723 | | | | 138,563 | |

| | |

Tencent Holdings, Ltd. (SP ADR) (China) | | | 1,918 | | | | 77,679 | |

| | | | | | | | |

| |

| | | | 429,331 | |

| | | | | |

| | | | | | | | |

| Issues | | Shares | | | Value | |

|

| IT Consulting & Other Services — 4.1% | |

| | |

Accenture PLC | | | 368 | | | $ | 68,235 | |

| | |

EPAM Systems, Inc. (1) | | | 522 | | | | 91,851 | |

| | | | | | | | |

| |

| | | | 160,086 | |

| | | | | |

|

| Semiconductor Equipment — 12.6% | |

| | |

Analog Devices, Inc. | | | 726 | | | | 77,413 | |

| | |

ASML Holding NV (Netherlands) | | | 617 | | | | 161,636 | |

| | |

Lam Research Corp. | | | 544 | | | | 147,446 | |

| | |

Texas Instruments, Inc. | | | 457 | | | | 53,921 | |

| | |

Xilinx, Inc. | | | 578 | | | | 52,448 | |

| | | | | | | | |

| |

| | | | 492,864 | |

| | | | | |

|

| Semiconductors — 12.2% | |

| | |

Broadcom, Inc. | | | 206 | | | | 60,327 | |

| | |

Intel Corp. | | | 1,594 | | | | 90,109 | |

| | |

Micron Technology, Inc. (1) | | | 2,818 | | | | 133,996 | |

| | |

NVIDIA Corp. | | | 393 | | | | 79,001 | |

| | |

QUALCOMM, Inc. | | | 1,429 | | | | 114,948 | |

| | | | | | | | |

| |

| | | | 478,381 | |

| | | | | |

|

| Specialized REITs — 5.2% | |

| | |

American Tower Corp. | | | 506 | | | | 110,349 | |

| | |

Equinix, Inc. | | | 166 | | | | 94,085 | |

| | | | | | | | |

| |

| | | | 204,434 | |

| | | | | |

|

| Systems Software — 7.8% | |

| | |

Microsoft Corp. | | | 1,136 | | | | 162,868 | |

| | |

ServiceNow, Inc. (1) | | | 587 | | | | 145,142 | |

| | | | | | | | |

| |

| | | | 308,010 | |

| | | | | |

|

| Technology Hardware, Storage & Peripherals — 1.7% | |

| | |

Western Digital Corp. | | | 1,323 | | | | 68,333 | |

| | | | | | | | |

|

| Wireless Telecommunication Services — 1.1% | |

| | |

T-Mobile US, Inc. (1) | | | 521 | | | | 43,066 | |

| | | | | | | | |

|

Total Common Stock | |

| |

(Cost: $3,415,661) | | | | 3,916,537 | |

| | | | | |

|

| MONEY MARKET INVESTMENTS — 2.5% | |

| | |

State Street Institutional U.S. Government Money Market Fund — Premier Class, 1.75% (2) | | | 100,121 | | | | 100,121 | |

| | | | | | | | |

|

Total Money Market Investments | |

| |

(Cost: $100,121) | | | | 100,121 | |

| | | | | |

| | |

Total Investments (102.2%) | | | | | | | | |

| |

(Cost: $3,515,782) | | | | 4,016,658 | |

| |

Liabilities in Excess of Other Assets (-2.2%) | | | | (87,363 | ) |

| | | | | |

| |

Net Assets (100.0%) | | | $ | 3,929,295 | |

| | | | | |

See accompanying notes to financial statements.

26

TCW Artificial Intelligence Equity Fund

October 31, 2019

Notes to the Schedule of Investments

| (1) | | Non-income producing security. |

| (2) | | Rate disclosed is the 7-day net yield as of October 31, 2019. |

| REIT | | Real Estate Investment Trust. |

| SP ADR | | Sponsored American Depositary Receipt. ADRs are receipts, typically issued by a U.S. bank or trust company, evidencing ownership of underlying securities issued by a foreign corporation. Sponsored ADRs are ADRs issued with the cooperation of the foreign corporation. |

See accompanying notes to financial statements.

27

TCW Artificial Intelligence Equity Fund

Investments by Sector | October 31, 2019 |

| | | | |

| Sector | | Percentage of

Net Assets | |

Application Software | | | 16.2 | % |

Auto Parts & Equipment | | | 1.0 | |

Cable & Satellite | | | 6.6 | |

Communications Equipment | | | 2.7 | |

Data Processing & Outsourced Services | | | 6.2 | |

Health Care Equipment | | | 3.2 | |

Home Entertainment Software | | | 3.8 | |

Internet & Direct Marketing Retail | | | 4.4 | |

Internet Services & Infrastructure | | | 10.9 | |

IT Consulting & Other Services | | | 4.1 | |

Semiconductor Equipment | | | 12.6 | |

Semiconductors | | | 12.2 | |

Specialized REITs | | | 5.2 | |

Systems Software | | | 7.8 | |

Technology Hardware, Storage & Peripherals | | | 1.7 | |

Wireless Telecommunication Services | | | 1.1 | |

Money Market Investments | | | 2.5 | |

| | | | |

Total | | | 102.2 | % |

| | | | |

Fair Valuation Summary

The following is a summary of the fair valuations according to the inputs used as of October 31, 2019 in valuing the Fund’s investments:

| | | | | | | | | | | | | | | | |

Description | | Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1) | | | Other

Significant

Observable

Inputs

(Level 2) | | | Significant

Unobservable

Inputs

(Level 3) | | | Total | |

Common Stock | | | | | | | | | | | | | | | | |

Application Software | | $ | 636,003 | | | $ | — | | | $ | — | | | $ | 636,003 | |

Auto Parts & Equipment | | | 37,163 | | | | — | | | | — | | | | 37,163 | |

Cable & Satellite | | | 259,327 | | | | — | | | | — | | | | 259,327 | |

Communications Equipment | | | 106,646 | | | | — | | | | — | | | | 106,646 | |

Data Processing & Outsourced Services | | | 244,579 | | | | — | | | | — | | | | 244,579 | |

Health Care Equipment | | | 125,544 | | | | — | | | | — | | | | 125,544 | |

Home Entertainment Software | | | 148,795 | | | | — | | | | — | | | | 148,795 | |