SEPTEMBER 30, 2008

RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

ESSENTIAL PORTFOLIOS

ESSENTIAL PORTFOLIO CONSERVATIVE FUND

ESSENTIAL PORTFOLIO MODERATE FUND

ESSENTIAL PORTFOLIO AGGRESSIVE FUND

GO GREEN!

ELIMINATE MAILBOX CLUTTER

Go paperless with Rydex eDelivery—a service giving you full

online access to account information and documents. Save time,

cut down on mailbox clutter and be a friend to the environment

with eDelivery.

With Rydex eDelivery you can:

•

View online confirmations and statements at your

convenience.

•

Receive email notifications when your most recent

confirmations, statements and other account documents

are available for review.

•

Access prospectuses, annual reports and semiannual

reports online.

It’s easy to enroll:

1/ Visit www.rydexinvestments.com

e

RYDEX

DELIVERY

2/ Click on the Rydex eDelivery logo

3/ Follow the simple enrollment instructions

If you have questions about Rydex eDelivery services,

contact one of our Shareholder Service Representatives

at 800.820.0888.

This report and the financial statements contained herein are submitted for the general information of our shareholders. The

report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

Distributed by Rydex Distributors, Inc.

TABLE OF CONTENTS

LETTER TO OUR SHAREHOLDERS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

ABOUT SHAREHOLDERS’ FUND EXPENSES

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

FUND PROFILES

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

SCHEDULES OF INVESTMENTS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

STATEMENTS OF ASSETS AND LIABILITIES

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

STATEMENTS OF OPERATIONS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

STATEMENTS OF CHANGES IN NET ASSETS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

FINANCIAL HIGHLIGHTS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

NOTES TO FINANCIAL STATEMENTS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

OTHER INFORMATION

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

INFORMATION ON BOARD OF TRUSTEES AND OFFICERS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

1

LETTER TO OUR SHAREHOLDERS

DEAR SHAREHOLDER:

Most economic and market surveys tend to focus on more recent events because those that occurred earlier

seem distant and less important. That dynamic was never so evident as in the April-to-September period,

when events of just the previous three weeks completely overwhelmed everything that came before. In an

incredibly short period of time, the entire global financial system seized up as the lubricant of any

economy—bank lending—came to a complete halt. The resulting crash in global stock markets that began in

September continued well into October.

In less than a month, the shape of the entire financial system was changed forever. The Wall Street model of

large, aggressive, risk-taking investment banks was completely swept aside, as financial titans such as Merrill

Lynch, Morgan Stanley, Goldman Sachs and Lehman Brothers collapsed, merged with, or were reborn as

commercial banks. It’s clear now that the decision by the U.S. Government to let Lehman Brothers fail was the

catalytic event, as the dramatic failure of an institution that weathered the Great Depression and two world

wars, laid bare the failings of the traditional investment banking model. Financial dominos tumbled as a wave of

commercial bank failures—the most since the savings and loan crisis of the 1990s—unfolded in the third

quarter, culminating with the collapse of Washington Mutual, the largest bank failure in U.S. history.

The other huge and profound shift was the nationalization of the global financial system. Several events point

to a nearly total takeover of the global financial system: the takeover of Fannie Mae and Freddie Mac, AIG

and Washington Mutual; the seizure of IndyMac; the forced merger of Wachovia; and the massive capital

infusion and government guarantee of nearly every financial instrument available (both here and in Europe).

In this history-making period, government at all levels moved with unprecedented speed, scope and

coordination to save the financial system, and with it, the global economy. In the United States, this

culminated with the U.S. Treasury’s $700 billion bail-out plan that will essentially buy up all the bad

mortgage assets clogging the financial system.

Rejection of that plan by the House of Representatives in late September sent the markets into a tailspin, with

the Dow suffering its largest point drop in history, while sending the index to three-year lows. Over the past six

months, the Dow Jones IndustrialSM Average and the S&P 500® Index each lost more than 10% of their value,

with virtually all of those declines coming in the last two weeks of September. T-Bill yields fell to near zero and

interest rates on longer-dated Treasuries fell to decade lows in the market’s massive flight to safety.

It’s not all doom and gloom, however. This volatile market environment has burst the commodity bubble and

has resulted in a huge slowdown in global inflation. This helps the emerging markets whose economies have

been pummeled by the rise in food and energy costs. Slowing inflation has also ushered in a period of

unprecedented dollar strength, which gives the Federal Reserve additional room to ease. Interest rates could

hardly be lower and stocks are cheaper than they have been in some time. With the massive amounts of

liquidity pumped into the system, stocks could rally sharply in the months ahead.

Having gone through multiple false bottoms so far this year, the question that still remains is: Can any rally

be sustained? The answer to that question is fairly straightforward. First, the allocation of credit in bond and

money markets needs to resume. Simply put: A stock market recovery is not possible without it. As I write

this, there is definite improvement on that front, but it remains slow and sporadic. Also, the process of

de-leveraging (that is, selling assets accumulated during boom times) will be with us for a while. All of this

is occurring during a period where global economic growth is downshifting rapidly. While this does not

preclude any stock market rallies, it may make them temporary. Astute stock selection, the use of rotational

strategies, exposure to currency movements, the implementation of long/short strategies and a focus on

quality—above all else—are the keys to investment success in difficult and uncharted terrain.

We appreciate the trust you have placed in our firm’s quality and integrity by investing with Rydex Investments.

Sincerely,

David C. Reilly, CFA

Director of Portfolio Strategy

2

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)

All mutual funds have operating expenses and it is important for our shareholders to understand the

impact of costs on their investments. Shareholders of a Fund incur two types of costs: (i) transaction costs,

including sales charges (loads) on purchase payments, reinvested dividends, or other distributions;

redemption fees; and exchange fees; and (ii) ongoing costs, including management fees, administrative

services, and shareholder reports, among others. These ongoing costs, or operating expenses, are

deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense

ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of

investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for

the entire six-month period beginning March 31, 2008 and ending September 30, 2008.

The following tables illustrate a Fund’s costs in two ways:

Table 1. Based on actual Fund return. This section helps investors estimate the actual expenses paid

over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the

fourth column shows the dollar amount that would have been paid by an investor who started with

$1,000 in the Fund. Investors may use the information here, together with the amount invested, to

estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for

example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number

provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return. This section is intended to help investors compare a Fund’s

cost with those of other mutual funds. The table provides information about hypothetical account

values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of

return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account

values and expenses may not be used to estimate the actual ending account balance or expenses paid

during the period. The example is useful in making comparisons because the U.S. Securities and

Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5%

return. Investors can assess a Fund’s costs by comparing this hypothetical example with the

hypothetical examples that appear in shareholder reports of other funds.

Certain retirement plans such as IRA, SEP, Roth IRA and 403(b) accounts are charged an annual $15

maintenance fee. Upon liquidating a retirement account, a $15 account-closing fee will be taken from the

proceeds of the redemption.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs

may have been higher or lower, depending on the amount of investment and the timing of any purchases

or redemptions.

Note that the expenses shown in the table are meant to highlight and help compare ongoing costs only

and do not reflect any transactional costs which may be incurred by a Fund.

More information about a Fund’s expenses, including annual expense ratios for the past five years, can be

found in the Financial Highlights section of this report. For additional information on operating expenses

and other shareholder costs, please refer to the appropriate Fund prospectus.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

3

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) (concluded)

Beginning

Ending

Expenses

Expense

Account Value

Account Value

Paid During

Ratio†

March 31, 2008

September 30, 2008

Period*

Table 1. Based on actual Fund return

Essential Portfolio Conservative Fund

A-Class

0.00%

$1,000.00

$

923.70

$

—

C-Class

0.75%

1,000.00

919.81

3.61

H-Class

0.00%

1,000.00

923.72

—

Essential Portfolio Moderate Fund

A-Class

0.00%

1,000.00

922.40

—

C-Class

0.75%

1,000.00

919.40

3.61

H-Class

0.00%

1,000.00

922.40

—

Essential Portfolio Aggressive Fund

A-Class

0.03%

1,000.00

927.76

0.14

C-Class

0.78%

1,000.00

924.69

3.76

H-Class

0.03%

1,000.00

928.79

0.15

Table 2. Based on hypothetical 5% return

Essential Portfolio Conservative Fund

A-Class

0.00%

1,000.00

1,025.07

—

C-Class

0.75%

1,000.00

1,021.31

3.80

H-Class

0.00%

1,000.00

1,025.07

—

Essential Portfolio Moderate Fund

A-Class

0.00%

1,000.00

1,025.07

—

C-Class

0.75%

1,000.00

1,021.31

3.80

H-Class

0.00%

1,000.00

1,025.07

—

Essential Portfolio Aggressive Fund

A-Class

0.03%

1,000.00

1,024.92

0.15

C-Class

0.78%

1,000.00

1,021.16

3.95

H-Class

0.03%

1,000.00

1,024.92

0.15

* Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by the number

of days in the most recent fiscal half-year, then divided by 365.

† Annualized and excludes expenses of the underlying funds in which the Funds invest.

4

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

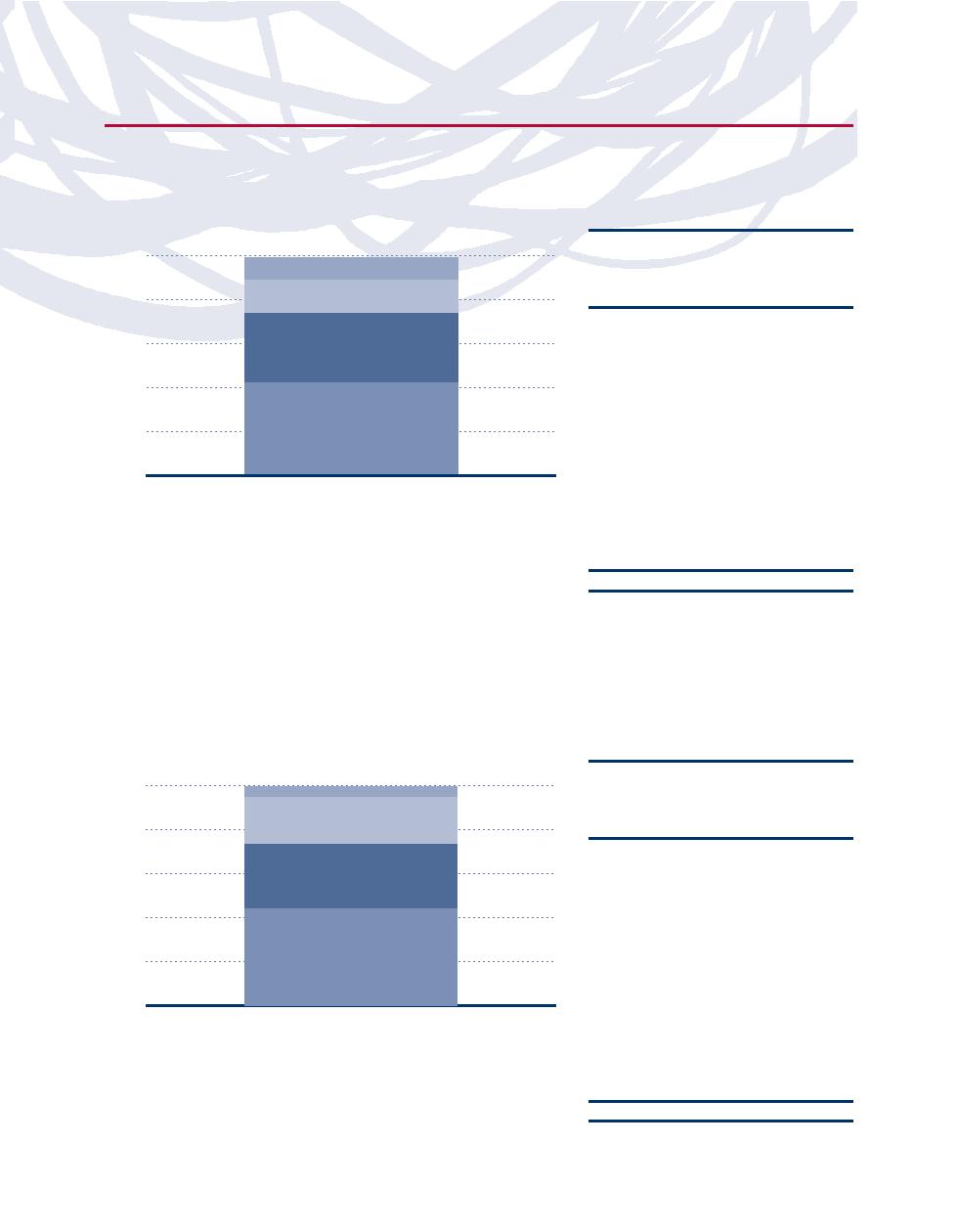

FUND PROFILES (Unaudited)

ESSENTIAL PORTFOLIO CONSERVATIVE FUND

OBJECTIVE: To primarily seek preservation of capital and, secondarily, to seek long-term growth of capital.

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

A-Class

June 30, 2006

100%

C-Class

June 30, 2006

Money Market Fund

H-Class

June 30, 2006

80%

Domestic Equity Funds

Ten Largest Holdings (Sum of % of Net Assets)

Rydex Series Funds — Government Long

60%

Bond 1.2x Strategy Fund

16.5%

Fixed-Income Funds

Rydex Series Funds — High Yield

Strategy Fund

15.0%

40%

Rydex Series Funds — Absolute Return

Strategies Fund

13.4%

Rydex Series Funds — Managed Futures

20%

Alternative Investment Funds

Strategy Fund

13.0%

Rydex Series Funds — S&P 500 Fund

11.9%

Rydex Series Funds — U.S. Government

0%

Money Market Fund

10.0%

Essential Portfolio Conservative Fund

Rydex Series Funds — International

Rotation Fund

7.7%

Rydex Series Funds — Sector Rotation Fund

6.2%

“Industry Diversification (Market Exposure as % of Net Assets)”

Rydex Series Funds — Real Estate Fund

2.1%

excludes any temporary cash investments.

Rydex Series Funds — Hedged Equity Fund

1.6%

Top Ten Total

97.4%

“Ten Largest Holdings” exclude any temporary

cash or derivative investments.

ESSENTIAL PORTFOLIO MODERATE FUND

OBJECTIVE: To primarily seek growth of capital and, secondarily, to seek preservation of capital.

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

A-Class

June 30, 2006

100%

Money Market Fund

C-Class

June 30, 2006

H-Class

June 30, 2006

80%

Domestic Equity Funds

Ten Largest Holdings (Sum of % of Net Assets)

Rydex Series Funds — Managed Futures

60%

Strategy Fund

16.9%

Fixed-Income Funds

Rydex Series Funds — Sector Rotation Fund

14.9%

Rydex Series Funds — Absolute Return

40%

Strategies Fund

13.5%

Rydex Series Funds — International

Rotation Fund

11.5%

20%

Alternative Investment Funds

Rydex Series Funds — Government Long

Bond 1.2x Strategy Fund

10.8%

0%

Rydex Series Funds — High Yield

Strategy Fund

10.1%

Essential Portfolio Moderate Fund

Rydex Series Funds — S&P 500 Fund

8.3%

Rydex Series Funds — U.S. Government

Money Market Fund

5.0%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes

Rydex Series Funds — Russell 2000® Fund

4.0%

any temporary cash investments.

Rydex Series Funds — Real Estate Fund

2.3%

Top Ten Total

97.3%

“Ten Largest Holdings” exclude any temporary

cash or derivative investments.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

5

FUND PROFILES (Unaudited) (concluded)

ESSENTIAL PORTFOLIO AGGRESSIVE FUND

OBJECTIVE: To primarily seek growth of capital.

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

A-Class

June 30, 2006

100%

Fixed-Income Funds

C-Class

June 30, 2006

H-Class

June 30, 2006

80%

Ten Largest Holdings (Sum of % of Net Assets)

Domestic Equity Funds

Rydex Series Funds — Managed Futures

60%

Strategy Fund

18.2%

Rydex Series Funds — Sector Rotation Fund

16.8%

Rydex Series Funds — International

40%

Rotation Fund

15.6%

Rydex Series Funds — Absolute Return

Alternative Investment Funds

Strategies Fund

12.2%

20%

Rydex Series Funds — S&P 500 Fund

10.5%

Rydex Series Funds — Russell 2000® Fund

7.5%

0%

Rydex Series Funds — High Yield

Essential Portfolio Aggressive Fund

Strategy Fund

4.9%

Rydex Series Funds — Real Estate Fund

4.8%

Rydex Series Funds — Hedged Equity Fund

4.7%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes

Rydex Series Funds — Government Long

any temporary cash investments.

Bond 1.2x Strategy Fund

4.2%

Top Ten Total

99.4%

“Ten Largest Holdings” exclude any temporary

cash or derivative investments.

6

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2008

ESSENTIAL PORTFOLIO CONSERVATIVE FUND

MARKET

FACE

MARKET

SHARES

VALUE

AMOUNT

VALUE

MUTUAL FUNDS† 99.0%

REPURCHASE AGREEMENT 1.0%

Rydex Series Funds —

Repurchase Agreement (Note 5)

Government Long Bond

Credit Suisse Group

1.2x Strategy Fund

179,496

$

2,107,279

issued 09/30/08 at 0.25%

Rydex Series Funds —

due 10/01/08

$130,473

$

130,473

High Yield Strategy Fund

79,315

1,916,240

Total Repurchase Agreement

Rydex Series Funds —

(Cost $130,473)

130,473

Absolute Return

Total Investments 100.0%

Strategies Fund

71,987

1,712,563

(Cost $13,002,910)

$12,739,428

Rydex Series Funds —

Managed Futures

Liabilities in Excess of

Strategy Fund

61,711

1,656,931

Other Assets – 0.0%

$

(3,140)

Rydex Series Funds —

Net Assets – 100.0%

$12,736,288

S&P 500 Fund

65,651

1,513,912

Rydex Series Funds —

U.S. Government

Money Market Fund

1,273,588

1,273,588

Rydex Series Funds —

International Rotation Fund

51,913

974,399

Rydex Series Funds —

Sector Rotation Fund

65,812

795,010

Rydex Series Funds —

Real Estate Fund

8,471

266,161

Rydex Series Funds —

Hedged Equity Fund

9,448

206,248

Rydex Series Funds —

Russell 2000® Fund

8,055

186,624

Total Mutual Funds

(Cost $12,872,437)

12,608,955

† A-Class shares of Affiliated Funds

See Notes to Financial Statements.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

7

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2008

ESSENTIAL PORTFOLIO MODERATE FUND

MARKET

FACE

MARKET

SHARES

VALUE

AMOUNT

VALUE

MUTUAL FUNDS† 99.5%

REPURCHASE AGREEMENT 1.0%

Rydex Series Funds —

Repurchase Agreement (Note 5)

Managed Futures

Credit Suisse Group

Strategy Fund

275,381

$

7,393,989

issued 09/30/08 at 0.25%

Rydex Series Funds —

due 10/01/08

$443,986

$

443,986

Sector Rotation Fund

539,203

6,513,571

Total Repurchase Agreement

Rydex Series Funds —

(Cost $443,986)

443,986

Absolute Return

Total Investments 100.5%

Strategies Fund

248,121

5,902,792

(Cost $47,193,874)

$44,088,201

Rydex Series Funds —

International Rotation Fund

268,204

5,034,192

Liabilities in Excess of

Rydex Series Funds —

Other Assets – (0.5)%

$

(225,854)

Government Long Bond

Net Assets – 100.0%

$43,862,347

1.2x Strategy Fund

403,902

4,741,812

Rydex Series Funds —

High Yield Strategy Fund

184,086

4,447,508

Rydex Series Funds —

S&P 500 Fund

157,207

3,625,204

Rydex Series Funds —

U.S. Government

Money Market Fund

2,177,495

2,177,495

Rydex Series Funds —

Russell 2000® Fund

75,596

1,751,563

Rydex Series Funds —

Real Estate Fund

32,760

1,029,322

Rydex Series Funds —

Hedged Equity Fund

47,035

1,026,767

Total Mutual Funds

(Cost $46,749,888)

43,644,215

† A-Class shares of Affiliated Funds

8

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

See Notes to Financial Statements.

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2008

ESSENTIAL PORTFOLIO AGGRESSIVE FUND

MARKET

FACE

MARKET

SHARES

VALUE

AMOUNT

VALUE

MUTUAL FUNDS† 99.4%

REPURCHASE AGREEMENT 0.4%

Rydex Series Funds —

Repurchase Agreement (Note 5)

Managed Futures

Credit Suisse Group

Strategy Fund

118,580

$

3,183,861

issued 09/30/08 at 0.25%

Rydex Series Funds —

due 10/01/08

$76,478

$

76,478

Sector Rotation Fund

242,614

2,930,779

Total Repurchase Agreement

Rydex Series Funds —

(Cost $76,478)

76,478

International Rotation Fund

145,083

2,723,205

Total Investments 99.8%

Rydex Series Funds —

(Cost $18,895,449)

$17,405,324

Absolute Return

Strategies Fund

89,072

2,119,023

Other Assets in Excess

Rydex Series Funds —

of Liabilities – 0.2%

$

33,581

S&P 500 Fund

79,148

1,825,148

Net Assets – 100.0%

$17,438,905

Rydex Series Funds —

Russell 2000® Fund

56,370

1,306,099

Rydex Series Funds —

High Yield Strategy Fund

35,677

861,948

Rydex Series Funds —

Real Estate Fund

26,471

831,732

Rydex Series Funds —

Hedged Equity Fund

37,165

811,313

Rydex Series Funds —

Government Long Bond

1.2x Strategy Fund

62,669

735,738

Total Mutual Funds

(Cost $18,818,971)

17,328,846

† A-Class shares of Affiliated Funds

See Notes to Financial Statements.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

9

STATEMENTS OF ASSETS AND LIABILITIES (Unaudited)

September 30, 2008

Essential

Essential

Essential

Portfolio

Portfolio

Portfolio

Conservative

Moderate

Aggressive

Fund

Fund

Fund

ASSETS

Investment Securities

$12,608,955

$43,644,215

$17,328,846

Repurchase Agreements

130,473

443,986

76,478

Total Investments

12,739,428

44,088,201

17,405,324

Receivable for Securities Sold

—

—

100,000

Receivable for Fund Shares Sold

—

27,440

7,152

Investment Income Receivable

6,088

13,380

1,802

Total Assets

12,745,516

44,129,021

17,514,278

LIABILITIES

Payable for Securities Purchased

6,458

13,733

1,860

Payable for Fund Shares Redeemed

—

236,580

69,913

Distribution and Service Fees Payable

2,748

16,332

3,600

Custody Fees Payable

22

29

—

Total Liabilities

9,228

266,674

75,373

NET ASSETS

$12,736,288

$43,862,347

$17,438,905

NET ASSETS CONSIST OF

Paid-In Capital

$13,995,828

$49,870,582

$20,506,796

Undistributed Net Investment Income

86,239

87,862

406,424

Accumulated Net Realized Loss on Investments

(1,082,297)

(2,990,424)

(1,984,190)

Net Unrealized Depreciation on Investments

(263,482)

(3,105,673)

(1,490,125)

NET ASSETS

$12,736,288

$43,862,347

$17,438,905

A-Class

$

3,913,032

$

8,053,590

$

7,995,216

C-Class

4,114,253

26,421,378

5,743,884

H-Class

4,709,003

9,387,379

3,699,805

SHARES OUTSTANDING

A-Class

394,411

857,433

888,890

C-Class

421,777

2,860,788

649,868

H-Class

474,035

999,389

411,298

NET ASSET VALUES

A-Class

$

9.92

$9.39

$8.99

A-Class Maximum Offering Price*

10.41

9.86

9.44

C-Class

9.75

9.24

8.84

H-Class

9.93

9.39

9.00

Cost of Investments

$13,002,910

$47,193,874

$18,895,449

* Net asset value adjusted for the maximum sales charge of 4.75% of offering price, calculated NAV/(1-4.75%).

10

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

See Notes to Financial Statements.

STATEMENTS OF OPERATIONS (Unaudited)

Period Ended September 30, 2008

Essential

Essential

Essential

Portfolio

Portfolio

Portfolio

Conservative

Moderate

Aggressive

Fund

Fund

Fund

INVESTMENT INCOME

Interest

$

1,706

$

4,274

$

1,704

Dividends from Affiliated Funds

60,690

104,397

18,919

Total Income

62,396

108,671

20,623

EXPENSES

Distribution & Service Fees:

C-Class

19,910

112,064

24,390

Tax Expense

—

—

2,706

Custody Fees

277

92

11

Total Expenses

20,187

112,156

27,107

Net Investment Income (Loss)

42,209

(3,485)

(6,484)

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS

Net Realized Gain (Loss) on:

Affiliated Investment Securities

(843,387)

(2,443,335)

(769,637)

Total Net Realized Loss

(843,387)

(2,443,335)

(769,637)

Net Change in Unrealized Appreciation (Depreciation) on:

Investment Securities

(392,501)

(1,494,906)

(687,677)

Net Change in Unrealized Appreciation (Depreciation)

(392,501)

(1,494,906)

(687,677)

Net Loss on Investments

(1,235,888)

(3,938,241)

(1,457,314)

Net Decrease in Net Assets from Operations

$(1,193,679)

$(3,941,726)

$(1,463,798)

See Notes to Financial Statements.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

11

STATEMENTS OF CHANGES IN NET ASSETS

Essential Portfolio

Essential Portfolio

Conservative Fund

Moderate Fund

Period

Year

Period

Year

Ended

Ended

Ended

Ended

September 30,

March 31,

September 30,

March 31,

2008†

2008

2008†

2008

FROM OPERATIONS

Net Investment Income (Loss)

$

42,209

$

219,873

$

(3,485)

$

537,734

Net Realized Gain (Loss) on Investments

(843,387)

43,082

(2,443,335)

802,204

Net Change in Unrealized Appreciation (Depreciation)

on Investments

(392,501)

(22,730)

(1,494,906)

(2,171,265)

Net Increase (Decrease) in Net Assets from Operations

(1,193,679)

240,225

(3,941,726)

(831,327)

Distributions to Shareholders from:*

Net Investment Income

A-Class

—

(47,300)

—

(125,284)

C-Class

—

(85,100)

—

(310,460)

H-Class

—

(104,141)

—

(101,990)

Realized Gain on Investments

A-Class

—

(28,001)

—

(204,413)

C-Class

—

(50,378)

—

(506,546)

H-Class

—

(61,650)

—

(166,406)

Total Distributions to Shareholders

—

(376,570)

—

(1,415,099)

SHARE TRANSACTIONS

Proceeds from Shares Purchased

A-Class

1,473,467

3,994,722

1,541,530

6,330,674

C-Class

2,606,618

5,682,278

3,899,018

20,118,009

H-Class

2,597,032

8,551,489

4,656,566

13,258,002

Redemption Fees Collected

A-Class

707

3,856

1,990

1,253

C-Class

820

7,073

6,471

2,938

H-Class

1,104

8,303

2,869

1,229

Value of Shares Purchased through Dividend Reinvestment

A-Class

—

57,742

—

299,996

C-Class

—

119,384

—

744,996

H-Class

—

156,752

—

248,187

Cost of Shares Redeemed

A-Class

(1,621,818)

(389,163)

(3,080,598)

(5,688,827)

C-Class

(3,161,333)

(3,474,923)

(5,418,513)

(7,644,269)

H-Class

(4,485,755)

(5,282,222)

(5,660,408)

(10,463,848)

Net Increase (Decrease) in Net Assets From

Share Transactions

(2,589,158)

9,435,291

(4,051,075)

17,208,340

Net Increase (Decrease) in Net Assets

(3,782,837)

9,298,946

(7,992,801)

14,961,914

NET ASSETS—BEGINNING OF PERIOD

16,519,125

7,220,179

51,855,148

36,893,234

NET ASSETS—END OF PERIOD

$12,736,288

$16,519,125

$ 43,862,347

$51,855,148

Undistributed Net Investment Income—End of Period

$

86,239

$

44,030

$

87,862

$

91,347

* For financial reporting purposes, certain distributions from net investment income for federal income tax purposes have been reclassified to

distributions from realized gains.

† Unaudited

12

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

See Notes to Financial Statements.

Essential Portfolio

Aggressive Fund

Period

Year

Ended

Ended

September 30,

March 31,

2008†

2008

$

(6,484)

$

223,684

(769,637)

92,520

(687,677)

(952,545)

(1,463,798)

(636,341)

—

(54,939)

—

(39,975)

—

(24,441)

—

(158,306)

—

(115,188)

—

(70,426)

—

(463,275)

1,007,718

4,810,125

915,422

4,081,423

1,580,630

5,559,805

1,586

4,539

1,179

2,410

821

2,140

—

104,716

—

147,234

—

93,263

(973,071)

(9,752,150)

(839,326)

(4,072,572)

(2,012,682)

(7,538,079)

(317,723)

(6,557,146)

(1,781,521)

(7,656,762)

19,220,426

26,877,188

$17,438,905

$19,220,426

$

406,424

$

412,908

See Notes to Financial Statements.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

13

FINANCIAL HIGHLIGHTS

This table is presented to show selected data for a share outstanding throughout each period, and to assist shareholders in evaluating a Fund’s performance for the periods presented.

RATIOS TO

AVERAGE NET ASSETS:

Net Realized

Net Increase

Net

NET ASSET

Net

and

(Decrease)

Distributions

Distributions

Increase

NET ASSET

Net

Net Assets,

VALUE,

Investment

Unrealized

in Net Asset

from Net

from Net

Redemption

(Decrease)

VALUE,

Total

Investment

Portfolio

End of

BEGINNING

Income

Gains (Losses)

Value Resulting

Investment

Realized

Total

Fees

in Net Asset

END OF

Investment

Total

Income

Turnover

Period (000’s

Period Ended

OF PERIOD

(Loss)†

on Investments

from Operations

Income***

Gains***

Distributions

Collected

Value

PERIOD

Return†††

Expenses††

(Loss)

Rate

omitted)

Essential Portfolio Conservative Fund A-Class

September 30, 2008D

$10.74

$

.04

$

(.86)

$

(.82)

$

—

$

—

$

—

$

—§

$

(.82)

$

9.92

(7.63)%

0.00%**

0.76%**

115%

$

3,913

March 31, 2008

10.70

.26

.12

.38

(.22)

(.14)

(.36)

.02

.04

10.74

3.70%

0.01%

2.39%

119%

4,431

March 31, 2007*

10.00

.20

.56

.76

(.09)

—

(.09)

.03

.70

10.70

7.94%

0.01%**

2.47%**

105%

782

Essential Portfolio Conservative Fund C-Class

September 30, 2008D

10.60

—§

(.85)

(.85)

—

—

—

—§

(.85)

9.75

(8.02)%

0.75%**

0.02%**

115%

4,114

March 31, 2008

10.65

.17

.12

.29

(.22)

(.14)

(.36)

.02

(.05)

10.60

2.86%

0.75%

1.53%

119%

5,074

March 31, 2007*

10.00

.08

.63

.71

(.09)

—

(.09)

.03

.65

10.65

7.44%

0.76%**

1.05%**

105%

2,804

Essential Portfolio Conservative Fund H-Class

September 30, 2008D

10.75

.04

(.86)

(.82)

—

—

—

—§

(.82)

9.93

(7.63)%

0.00%**

0.78%**

115%

4,709

March 31, 2008

10.71

.25

.13

.38

(.22)

(.14)

(.36)

.02

.04

10.75

3.69%

0.01%

2.28%

119%

7,014

March 31, 2007*

10.00

.15

.62

.77

(.09)

—

(.09)

.03

.71

10.71

8.04%

0.01%**

1.93%**

105%

3,634

Essential Portfolio Moderate Fund A-Class

September 30, 2008D

10.18

.02

(.81)

(.79)

—

—

—

—§

(.79)

9.39

(7.76)%

0.00%**

0.42%**

96%

8,054

March 31, 2008

10.56

.17

(.24)

(.07)

(.12)

(.19)

(.31)

—§

(.38)

10.18

(0.75)%

0.01%

1.58%

125%

10,214

March 31, 2007*

10.00

.18

.79

.97

(.10)

(.32)

(.42)

.01

.56

10.56

9.90%

0.00%**

2.26%**

66%

9,719

Essential Portfolio Moderate Fund C-Class

September 30, 2008D

10.05

(.02)

(.79)

(.81)

—

—

—

—§

(.81)

9.24

(8.06)%

0.75%**

(0.33)%**

96%

26,421

March 31, 2008

10.50

.10

(.24)

(.14)

(.12)

(.19)

(.31)

—§

(.45)

10.05

(1.43)%

0.76%

0.90%

125%

30,282

March 31, 2007*

10.00

.11

.80

.91

(.10)

(.32)

(.42)

.01

.50

10.50

9.29%

0.75%**

1.34%**

66%

18,551

Essential Portfolio Moderate Fund H-Class

September 30, 2008D

10.18

.02

(.81)

(.79)

—

—

—

—§

(.79)

9.39

(7.76)%

0.00%**

0.42%**

96%

9,387

March 31, 2008

10.56

.13

(.20)

(.07)

(.12)

(.19)

(.31)

—§

(.38)

10.18

(0.75)%

0.01%

1.22%

125%

11,359

March 31, 2007*

10.00

.18

.79

.97

(.10)

(.32)

(.42)

.01

.56

10.56

9.90%

0.00%**

2.32%**

66%

8,623

Essential Portfolio Aggressive Fund A-Class

September 30, 2008D

9.69

.01

(.71)

(.70)

—

—

—

—§

(.70)

8.99

(7.22)%

0.03%**

0.18%**

132%

7,995

March 31, 2008

10.28

.11

(.48)

(.37)

(.06)

(.16)

(.22)

—§

(.59)

9.69

(3.77)%

0.01%

1.01%

120%

8,596

March 31, 2007*

10.00

.24

.77

1.01

(.10)

(.64)

(.74)

.01

.28

10.28

10.37%

0.00%**

3.11%**

92%

13,854

Essential Portfolio Aggressive Fund C-Class

September 30, 2008D

9.56

(.03)

(.69)

(.72)

—

—

—

—§

(.72)

8.84

(7.53)%

0.78%**

(0.57)%**

132%

5,744

March 31, 2008

10.22

.06

(.50)

(.44)

(.06)

(.16)

(.22)

—§

(.66)

9.56

(4.48)%

0.76%

0.60%

120%

6,178

March 31, 2007*

10.00

(.03)

.98

.95

(.10)

(.64)

(.74)

.01

.22

10.22

9.76%

0.75%**

(0.34)%**

92%

6,537

Essential Portfolio Aggressive Fund H-Class

September 30, 2008D

9.69

.01

(.70)

(.69)

—

—

—

—§

(.69)

9.00

(7.12)%

0.03%**

0.18%**

132%

3,700

March 31, 2008

10.29

.08

(.46)

(.38)

(.06)

(.16)

(.22)

—§

(.60)

9.69

(3.87)%

0.01%

0.80%

120%

4,447

March 31, 2007*

10.00

.15

.87

1.02

(.10)

(.64)

(.74)

.01

.29

10.29

10.48%

0.00%**

1.94%**

92%

6,486

* Since the commencement of operations: June 30, 2006.

** Annualized

*** For financial reporting purposes, certain distributions from net investment income for federal income tax purposes have been reclassified to distributions from realized gains.

† Calculated using the average daily shares outstanding for the period.

†† Does not include expenses of the underlying funds in which the Funds invest.

††† Total investment return does not reflect the impact of any applicable sales charges and has not been annualized.

§ Less than $.01 per share.

D Unaudited

NOTES TO FINANCIAL STATEMENTS (Unaudited)

1.

Organization and Significant Accounting Policies

A. The underlying funds are valued at their Net Asset

Organization

Value (“NAV”) as of the close of business, usually 4:00

The Rydex Series Funds (the “Trust”) is registered with

p.m. on the valuation date. Exchange Traded Funds

the SEC under the Investment Company Act of 1940

(“ETFs”) and closed-end investments companies are

(the “1940 Act”) as a non-diversified, open-ended

valued at the last quoted sales price.

investment company. The Trust offers five separate

B. Securities transactions are recorded on the trade

classes of shares, Investor Class Shares, Advisor Class

date for financial reporting purposes. Realized gains

Shares, A-Class Shares, C-Class Shares, and H-Class

and losses from securities transactions are recorded

Shares. C-Class Shares have a 1% contingent deferred

using the identified cost basis. Dividend income is

sales charge (“CDSC”) if shares are redeemed within

recorded on the ex-dividend date, net of applicable

12 months of purchase. Sales of shares of each Class

taxes withheld by foreign countries. Interest income,

are made without a sales charge at the net asset value

including amortization of premiums and accretion of

per share, with the exception of A-Class Shares. A-Class

discount, is accrued on a daily basis.

Shares are sold at net asset value, plus the applicable

C. Interest and dividend income, most expenses, all

front-end sales charge, except for U.S. Government

realized gains and losses, and all unrealized gains and

Money Market Fund. The sales charge varies depending

losses are allocated to the Classes based upon the

on the amount purchased, but will not exceed 4.75%.

value of the outstanding shares in each Class. Certain

A-Class Share purchases of $1 million or more are

costs, such as distribution and service fees related to

exempt from the front-end sales charge but have a

C-Class Shares, are charged directly to such class. In

1% CDSC if shares are redeemed within 18 months

addition, certain expenses have been allocated to the

of purchase.

individual Funds in the Trust on a pro rata basis upon

At September 30, 2008, the Trust consisted of fifty-four

the respective aggregate net assets of each Fund

separate Funds: twenty-two Benchmark Funds, one

included in the Trust.

Money Market Fund, seventeen Sector Funds, eleven

D. Distributions of net investment income and net real-

Alternative Strategy Funds, and three Essential

ized capital gains, if any, are declared and paid at least

Portfolio Funds. This report covers the Essential

annually. Distributions are recorded on the ex-dividend

Portfolio Funds (the “Funds”), while the Benchmark

date and are determined in accordance with income

Funds, the Money Market Fund, the Sector Funds, and

tax regulations which may differ from U.S. generally

the Alternative Strategy Funds are contained in sepa-

accepted accounting principles.

rate reports.

E. The Funds may also purchase American Depository

Each Essential Portfolio Fund is a “fund of funds,” which

Receipts, U.S. Government securities, and enter into

means that each Fund seeks to achieve its investment

repurchase agreements.

objective by investing primarily in other Rydex mutual

funds (the “underlying funds”) instead of individual

F. The preparation of financial statements in conformity

securities. At September 30, 2008, only A-Class, C-Class

with U.S. generally accepted accounting principles

and H-Class Shares had been issued by the Funds. All

requires management to make estimates and assump-

share classes of the Funds are subject to a 1% redemp-

tions that affect the reported amount of assets and lia-

tion fee if redeemed within 30 days of purchase.

bilities and disclosure of contingent assets and liabilities

at the date of the financial statements and the reported

Rydex Investments provides advisory, transfer agent

amounts of revenues and expenses during the report-

and administrative services, and accounting services to

ing period. Actual results could differ from these esti-

the Trust. Rydex Distributors, Inc. (the “Distributor”)

mates.

acts as principal underwriter for the Trust. Both Rydex

Investments and the Distributor are affiliated entities.

G. Throughout the normal course of business, the

underlying funds enter into contracts that contain a

Significant Accounting Policies

variety of representations and warranties which provide

The following significant accounting policies are in con-

general indemnifications. The underlying funds’ maxi-

formity with U.S. generally accepted accounting princi-

mum exposure under these arrangements is unknown,

ples and are consistently followed by the Trust. All time

as this would involve future claims that may be made

references are based on Eastern Time.

against the underlying funds and/or their affiliates that

have not yet occurred. However, based on experience,

the underlying funds expect the risk of loss to be remote.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

15

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

2.

Financial Instruments

obligation. Although the Trust will not invest in any

As part of their investment strategies, the underlying

structured notes unless Rydex Investments believes that

funds may utilize short sales and a variety of derivative

the issuer is creditworthy, an underlying fund does bear

instruments including, options, futures, options on

the risk of loss of the amount expected to be received

futures, structured notes and swap agreements. These

in the event of the default or bankruptcy of the issuer.

investments involve, to varying degrees, elements of

There are several risks associated with the use of swap

market risk and risks in excess of the amounts reflected

agreements that are different from those associated

in the underlying funds’ NAVs.

with ordinary portfolio securities transactions. Swap

Short sales are transactions in which an underlying fund

agreements may be considered to be illiquid. Although

sells an equity or fixed income security it does not own.

the Trust will not enter into any swap agreement unless

If the security sold short goes down in price between

Rydex Investments believes that the other party to the

the time the underlying fund sells the security and

transaction is creditworthy, the underlying funds bear

closes its short position, that underlying fund will realize

the risk of loss of the amount expected to be received

a gain on the transaction. Conversely, if the security

under a swap agreement in the event of the default or

goes up in price during the period, that underlying

bankruptcy of the agreement counterparty.

fund will realize a loss on the transaction. The risk of

There are several risks associated with credit default

such price increases is the principal risk of engaging in

swaps. Credit default swaps involve the exchange of a

short sales.

fixed-rate premium for protection against the loss in

The risk associated with purchasing options is limited to

value of an underlying debt instrument in the event of

the premium originally paid. The risk in writing a covered

a defined credit event (such as payment default or

call option is that an underlying fund may forego the

bankruptcy). Under the terms of the swap, one party

opportunity for profit if the market price of the underly-

acts as a “guarantor,” receiving a periodic payment

ing security increases and the option is exercised. The

that is a fixed percentage applied to a notional princi-

risk in writing a covered put option is that an underly-

pal amount. In return, the party agrees to purchase the

ing fund may incur a loss if the market price of the

notional amount of the underlying instrument, at par, if

underlying security decreases and the option is exer-

a credit event occurs during the term of the swap. An

cised. In addition, there is the risk that an underlying

underlying fund may enter into credit default swaps in

fund may not be able to enter into a closing transaction

which that underlying fund or its counterparty act as

because of an illiquid secondary market or, for over-

guarantors. By acting as the guarantor of a swap, that

the-counter options, because of the counterparty’s

underlying fund assumes the market and credit risk of

inability to perform.

the underlying instrument, including liquidity and loss

of value.

There are several risks in connection with the use of

futures contracts. Risks may be caused by an imperfect

In conjunction with the use of short sales, options,

correlation between movements in the price of the

futures, options on futures, structured notes and swap

instruments and the price of the underlying securities.

agreements, the underlying funds are required to main-

In addition, there is the risk that an underlying fund

tain collateral in various forms. The underlying funds use,

may not be able to enter into a closing transaction

where appropriate, depending on the financial instrument

because of an illiquid secondary market.

utilized and the broker involved, margin deposits at the

broker, cash and/or securities segregated at the custo-

There are several risks associated with the use of struc-

dian bank, discount notes, or the repurchase agreements

tured notes. Structured securities are leveraged, thereby

allocated to each underlying fund.

providing an exposure to the underlying benchmark

greater than the face amount and increasing the volatility

The risks inherent in the use of short sales, options,

of each note relative to the change in the underlying

futures contracts, options on futures contracts, structured

linked financial instrument. A highly liquid secondary

notes and swap agreements include i) adverse changes

market may not exist for the structured notes an under-

in the value of such instruments; ii) imperfect correlation

lying fund invests in which may make it difficult for that

between the price of the instruments and movements in

underlying fund to sell the structured notes it holds at

the price of the underlying securities, indices, or futures

an acceptable price or to accurately value them. In addi-

contracts; iii) the possible absence of a liquid secondary

tion, structured notes are subject to the risk that the

market for any particular instrument at any time; and iv)

counterparty to the instrument, or issuer, might not pay

the potential of counterparty default.

interest when due or repay principal at maturity of the

16

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

The Trust has established strict counterparty credit

The Funds have adopted a Distribution and Shareholder

guidelines and enters into transactions only with finan-

Services Plan applicable to its C-Class Shares that allows

cial institutions of investment grade or better.

the Funds to pay annual distribution and service fees of

3.

Fees And Other Transactions With Affiliates

0.75% of the Funds’ C-Class Shares average daily net

assets. The annual 0.25% service fee compensates the

Rydex Investments manages the investment and

shareholder’s financial advisor for providing on-going

reinvestment of the assets of each of the Funds in

services to the shareholder. The annual 0.50% distribu-

accordance with the investment objectives, policies,

tion fee reimburses the Distributor for paying the share-

and limitations of each Fund, however, the Funds do

holder’s financial advisor an ongoing sales commission.

not pay Rydex Investments a management fee. As part

The Distributor advances the first year’s service and

of its agreement with the Trust, Rydex Investments will

distribution fees to the financial advisor. The Distributor

pay all expenses of the Funds, including the cost of

retains the service and distribution fees on accounts

transfer agency, fund administration, audit and other

with no authorized dealer of record.

services, excluding interest expense, taxes (expected

to be de minimis), brokerage commissions and other

During the period ended September 30, 2008,

expenses connected with the execution of portfolio

the Distributor retained sales charges of $557,030,

transactions, short dividend expenses, and extraordi-

relating to sales of A-Class Shares of the Trust.

nary expenses.

Certain officers and trustees of the Trust are also officers

Each Fund indirectly bears a proportionate share of the

of Rydex Investments and the Distributor.

total operating expenses (including investment man-

4.

Federal Income Tax Information

agement, shareholder servicing, custody, transfer

The Funds intend to comply with the provisions of

agency, audit and other expenses) of the underlying

Subchapter M of the Internal Revenue Code applicable

funds in which the Fund invests. In addition, some

to regulated investment companies and will distribute

underlying funds charge redemption fees if a share-

substantially all net investment income and capital

holder, including a Fund, redeems shares before the

gains to shareholders. Therefore, no Federal income

end of the funds’ requisite holding period. Therefore, if

tax provision has been recorded.

a Fund sells shares of an underlying fund that is subject

to a redemption fee, that Fund will be responsible for

The Funds adopted Financial Accounting Standards

paying the redemption fee to the underlying fund.

Board (FASB) Interpretation No. 48 “Accounting for

Uncertainty in Income Taxes” (“FIN 48”). FIN 48 provides

Rydex Investments provides transfer agent, accounting

guidance for how uncertain tax positions should be

services and administrative services to the Funds.

recognized, measured, presented and disclosed in the

However, the related fees are paid by Rydex Investments,

financial statements. FIN 48 requires the evaluation

as noted above.

of tax positions taken or expected to be taken in the

The Funds have not adopted a Distribution Plan or a

course of preparing the Fund’s tax returns to determine

Shareholder Services Plan with respect to A-Class

whether the tax positions are “more-likely-than-not”

Shares and H-Class Shares. Instead, the Funds invest in

of being sustained by the applicable tax authority. Tax

underlying funds that have a distribution plan that

positions not deemed to meet the more-likely-than-not

allows the underlying funds to pay distribution fees to

threshold would be recorded as a tax benefit or expense

the Distributor and other firms that provide distribution

in the current year. Management has analyzed the Funds’

services (“Service Providers”). The underlying funds will

tax positions taken on federal income tax returns for all

pay distribution fees to the Distributor at an annual rate

open tax years for purposes of complying with FIN 48,

not to exceed 0.25% of average daily net assets, pur-

and has concluded that no provision for income tax was

suant to Rule 12b-1 under the 1940 Act, as amended. If

required in the Funds’ financial statements.

a Service Provider provides distribution or shareholder

The Funds file U.S. federal income tax returns and returns

services, the Distributor will, in turn, pay the Service

in various foreign jurisdictions in which they invest. While

Provider for the services it provides at an annual rate

the statute of limitations remains open to examine the

not to exceed 0.25% of the average daily net assets of

Funds’ U.S. federal income tax returns filed for the fiscal

a Fund.

years 2004 to 2007, no examinations are in progress or

anticipated at this time.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

17

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

Income and capital gain distributions are determined in accordance with Federal income tax regulations, which may dif-

fer from U.S. generally accepted accounting principles. These differences are primarily due to differing treatments for

losses deferred due to wash sales, losses deferred due to post-October losses, and excise tax regulations.

Permanent book and tax basis differences, if any, will result in reclassifications. This includes net operating losses not uti-

lized during the current period, and capital loss carry-forward expired, and the utilization of earnings and profits distrib-

uted to the shareholders on redemption of shares as part of the dividends paid deduction for income tax purposes.

These reclassifications have no effect on net assets or net asset values per share. Any undistributed ordinary income or

long-term capital gain remaining at fiscal year end is distributed in the following year.

The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the

statement of operations. During the period, the Funds did not incur any interest or penalties.

At September 30, 2008, the cost of securities for Federal income tax purposes, the aggregate gross unrealized gain for

all securities for which there was an excess of value over tax cost and the aggregate gross unrealized loss for all securi-

ties for which there was an excess of tax cost over value, were as follows:

Tax

Tax

Net

Tax

Unrealized

Unrealized

Unrealized

Fund

Cost

Gain

Loss

Loss

Essential Portfolio Conservative Fund

$13,002,910

$311,525

$

(575,007)

$

(263,482)

Essential Portfolio Moderate Fund

47,193,874

763,810

(3,869,483)

(3,105,673)

Essential Portfolio Aggressive Fund

18,895,449

139,165

(1,629,290)

(1,490,125)

5.

Repurchase Agreements

The Funds transfer uninvested cash balances into a single joint account, the daily aggregate balance of which is invested

in one or more repurchase agreements collateralized by obligations of the U.S. Treasury and/or U.S. Government Agencies.

The collateral is in the possession of the Funds’ custodian and is evaluated to ensure that its market value exceeds by, at

a minimum, 102% of the original face amount of the repurchase agreements. Each Fund holds a pro rata share of the

collateral based on the dollar amount of the repurchase agreement entered into by each Fund.

The repurchase agreements executed by the joint account and outstanding as of September 30, 2008, were as follows:

Counterparty

Terms of Agreement

Face Value

Market Value

Repurchase Price

Credit Suisse Group

0.25% due 10/01/08

$50,881,212

$50,881,212

$50,881,565

$50,881,212

$50,881,565

As of September 30, 2008, the collateral for the repurchase agreements in the joint account was as follows:

Security Type

Maturity Date

Rate

Par Value

Market Value

U.S. Treasury Bond

08/15/27

6.375%

$40,425,000

$51,905,245

$51,905,245

In the event of counterparty default, the Funds have the right to collect the collateral to offset losses incurred. There is

potential loss to the Funds in the event the Funds are delayed or prevented from exercising its rights to dispose of the

collateral securities, including the risk of a possible decline in the value of the underlying securities during the period

while the Funds seek to assert its rights. The Funds’ investment advisor, acting under the supervision of the Board of

Trustees, reviews the value of the collateral and the credit worthiness of those banks and dealers with which the Funds

enter into repurchase agreements to evaluate potential risks.

18

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

6.

Fair Value Measurement

The Funds adopted Statement of Financial Accounting Standard No. 157 (“FAS 157”) Fair Value Measurement which

provided enhanced guidance for using fair value to measure assets and liabilities. The standard requires companies to

provide expanded information about the assets and liabilities measured at fair value and the potential effect of these

fair valuations on an entity’s financial performance. The standard does not expand the use of fair value in any new cir-

cumstances, but provides clarification on acceptable fair valuation methods and applications.

Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three

broad levels:

Level 1 — quoted prices in active markets for identical securities.

Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment

speeds, credit risk, etc.).

Level 3 — significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of

investments).

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with

investing in those securities.

The following table summarizes the inputs used to value the Funds’ net assets as of September 30, 2008:

Level 1

Level 1

Level 2

Level 2

Level 3

Level 3

Investments

Other Financial

Investments

Other Financial

Investments

Other Financial

Fund

In Securities

Instruments

In Securities

Instruments

In Securities

Instruments

Total

Assets

Essential Portfolio

Conservative Fund

$12,739,428

$

—

$

—

$

—

$

—

$

—

$12,739,428

Essential Portfolio

Moderate Fund

44,088,201

—

—

—

—

—

44,088,201

Essential Portfolio

Aggressive Fund

17,405,324

—

—

—

—

—

17,405,324

7.

Securities Transactions

During the period ended September 30, 2008, the cost of purchases and proceeds from sales of investment securities,

excluding short-term and temporary cash investments, were:

Essential Portfolio

Essential Portfolio

Essential Portfolio

Conservative Fund

Moderate Fund

Aggressive Fund

Purchases

$18,089,220

$48,272,507

$25,704,977

Sales

$20,519,511

$52,058,338

$25,838,999

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

19

NOTES TO FINANCIAL STATEMENTS (continued)

8.

Share Transactions

The Trust is authorized to issue an unlimited number of shares (no par value). Transactions in shares for the periods presented were:

Purchased through

Net Shares

Shares Purchased

Dividend Reinvestment

Shares Redeemed

Purchased (Redeemed)

Period Ended

Year Ended

Period Ended

Year Ended

Period Ended

Year Ended

Period Ended

Year Ended

September 30,

March 31,

September 30,

March 31,

September 30,

March 31,

September 30,

March 31,

2008†

2008

2008†

2008

2008†

2008

2008†

2008

Essential Portfolio Conservative Fund

A-Class

137,479

369,840

—

5,356

(155,583)

(35,755)

(18,104)

339,441

C-Class

249,041

529,764

—

11,189

(305,914)

(325,681)

(56,873)

215,272

H-Class

242,141

786,204

—

14,514

(420,307)

(487,803)

(178,166)

312,915

Essential Portfolio Moderate Fund

A-Class

153,538

588,146

—

28,409

(299,699)

(533,666)

(146,161)

82,889

C-Class

384,734

1,900,579

—

71,291

(538,446)

(724,002)

(153,712)

1,247,868

H-Class

441,742

1,244,646

—

23,503

(558,406)

(968,734)

(116,664)

299,415

Essential Portfolio Aggressive Fund

A-Class

101,144

452,957

—

10,079

(99,221)

(923,091)

1,923

(460,055)

C-Class

91,831

390,478

—

14,336

(88,190)

(397,980)

3,641

6,834

H-Class

158,260

534,927

—

8,976

(205,740)

(715,671)

(47,480)

(171,768)

† Unaudited

NOTES TO FINANCIAL STATEMENTS (Unaudited) (concluded)

9.

New Accounting Pronouncements

In March 2008, the FASB issued FAS 161, “Disclosures about Derivative Instruments and Hedging Activities.” The new

requirement is intended to improve disclosures around an entity’s derivatives activity and help investors understand how

entities use derivatives, how they are accounted for and how they affect the financial position and operations of that

entity. FAS 161 is effective for fiscal years and interim periods beginning after November 15, 2008.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

21

OTHER INFORMATION (Unaudited)

Proxy Voting Information

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to securities

held in the Funds’ portfolios is available, without charge and upon request, by calling 1-800-820-0888. This information

is also available from the EDGAR database on the SEC’s website at http://www.sec.gov.

Information regarding how the Funds voted proxies relating to portfolio securities during the most recent 12-month

period ended June 30 is available without charge, upon request, by calling 1-800-820-0888. This information is also

available from the EDGAR database on the SEC’s website at http://www.sec.gov.

Quarterly Portfolio Schedules Information

The Trust files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year

on Form N-Q; which are available on the SEC’s website at http://www.sec.gov. The Funds’ Forms N-Q may be reviewed

and copied at the SEC’s Public Reference Room in Washington, DC, and that information on the operation of the Public

Reference Room may be obtained by calling 1-800-SEC-0330. Copies of the portfolio holdings are also available to

shareholders, without charge and upon request, by calling 1-800-820-0888.

Rydex Investments Board Review and Approval of the Investment Advisory Agreement

The Advisory Agreements dated January 18, 2008 between Rydex Series Funds, on behalf of the Funds, and PADCO

Advisors, Inc. were last approved by shareholders at Special Meetings held on October 4, 2007, November 1, 2007,

January 31, 2008 and February 12, 2008. Subject to the terms and conditions provided for in the Advisory Agreements,

each Advisory Agreement remains in effect for an initial two year term from the date of the Agreement and remains in

effect for periods of one year thereafter subject to Board approval. Therefore, the Advisory Agreements are next sched-

uled to be approved by the Board of Trustees at the Trust’s August 2009 Meeting.

22

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

INFORMATION ON BOARD OF TRUSTEES AND OFFICERS (Unaudited)

A Board of Trustees oversees all Rydex Investments, in which its members have no stated term of service, and continue to serve

after election until resignation. The Statement of Additional Information includes further information about Fund Trustees and

Officers, and can be obtained without charge by calling 1-800-820-0888.

All Trustees and Officers may be reached c/o Rydex Investments, 9601 Blackwell Rd., Suite 500, Rockville, MD 20850.

TRUSTEES AND OFFICERS

Length of Service

Name, Position and

As Trustee

Number of

–––––––––––––––––––––

Year of Birth

––––––––––––––––––––––––––––

(Year Began)

––––––––––——––––––

Funds Overseen

Carl G. Verboncoeur*

Rydex Series Funds – 2004

158

Trustee, President (1952)

Rydex Variable Trust – 2004

Rydex Dynamic Funds – 2004

Rydex ETF Trust – 2004

Principal Occupations During Past Five Years: Treasurer of Rydex Specialized Products, LLC (2005 to present) Chief Executive

Officer of Rydex Specialized Products, LLC (2005 to 2008); Chief Executive Officer of Rydex Investments and Rydex Distributors,

Inc. (2003 to present); Executive Vice President of Rydex Investments (2000 to 2003)

Michael P. Byrum*

Rydex Series Funds – 2005

150

Trustee, Vice President

Rydex Variable Trust – 2005

(1970)

Rydex Dynamic Funds – 2005

Rydex ETF Trust – 2005

Principal Occupations During Past Five Years: Chief Investment Officer of Rydex Investments (2003 to present); Secretary of

Rydex Specialized Products, LLC (2005 to 2008); Vice President of Rydex Series Funds (1997 to present); Vice President of Rydex

Variable Trust (1998 to present); Vice President of Rydex Dynamic Funds (1999 to present); Vice President of Rydex ETF Trust

(2002 to present); President and Trustee of Rydex Capital Partners SPhinX Fund (2003 to 2006); President of Rydex Investments

(2004 to present); Chief Operating Officer of Rydex Investments and Rydex Distributors, Inc. (2003 to 2004)

INDEPENDENT TRUSTEES

Length of Service

Name, Position and

As Trustee

Number of

–––––––––––––––––––––––––

Year of Birth

––––––––––––––––––––––––––––

(Year Began)

––––––––––——––––––

Funds Overseen

John O. Demaret

Rydex Series Funds – 1997

150

Trustee, Chairman of the

Rydex Variable Trust – 1998

Board (1940)

Rydex Dynamic Funds – 1999

Rydex ETF Trust – 2003

Principal Occupations During Past Five Years: Retired

Corey A. Colehour

Rydex Series Funds – 1993

150

Trustee (1945)

Rydex Variable Trust – 1998

Rydex Dynamic Funds – 1999

Rydex ETF Trust – 2003

Principal Occupations During Past Five Years: Retired (2006 to present); Owner and President of Schield Management

Company, registered investment adviser (2005 to 2006); Senior Vice President of Marketing and Co-Owner of Schield

Management Company, registered investment adviser (1985 to 2005)

J. Kenneth Dalton

Rydex Series Funds – 1995

150

Trustee (1941)

Rydex Variable Trust – 1998

Rydex Dynamic Funds – 1999

Rydex ETF Trust – 2003

Principal Occupations During Past Five Years: Mortgage Banking Consultant and Investor, The Dalton Group

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

23

INFORMATION ON BOARD OF TRUSTEES AND OFFICERS (Unaudited) (concluded)

Name, Position and

Length of Service As Trustee

Number of

–––––––––––––––––––––

Year of Birth

––––––––––––––––––––––––––––

(Year Began)

––––––––––——––––––

Funds Overseen

Werner E. Keller

Rydex Series Funds - 2005

150

Trustee (1940)

Rydex Variable Trust - 2005

Rydex Dynamic Funds - 2005

Rydex ETF Trust - 2005

Principal Occupations During Past Five Years: Retired (2001 to present); Chairman, Centurion Capital Management (1991 to 2001)

Thomas F. Lydon, Jr.

Rydex Series Funds – 2005

150

Trustee (1960)

Rydex Variable Trust - 2005

Rydex Dynamic Funds - 2005

Rydex ETF Trust - 2005

Principal Occupations During Past Five Years: President, Global Trends Investments

Patrick T. McCarville

Rydex Series Funds – 1997

150

Trustee (1942)

Rydex Variable Trust – 1998

Rydex Dynamic Funds – 1999

Rydex ETF Trust – 2003

Principal Occupations During Past Five Years: Founder and Chief Executive Officer, Par Industries, Inc.

Roger Somers

Rydex Series Funds – 1993

150

Trustee (1944)

Rydex Variable Trust – 1998

Rydex Dynamic Funds – 1999

Rydex ETF Trust – 2003

Principal Occupations During Past Five Years: Owner, Arrow Limousine

EXECUTIVE OFFICERS

Name, Position and

Principal Occupations

––––––––––––––––––––––––––

Year of Birth

–––––––––––––––––––––

During Past Five Years

Nick Bonos*

Chief Financial Officer of Rydex Specialized Products, LLC (2005

Vice President and Treasurer (1963)

to present); Vice President and Treasurer of Rydex Series Funds,

Rydex Variable Trust, Rydex Dynamic Funds, and Rydex ETF Trust

(2003 to present); Senior Vice President of Rydex Investments

(2003 to present); Vice President and Treasurer of Rydex Capital

Partners SPhinX Fund (2003 to 2006)

Joanna M. Haigney*

Chief Compliance Officer of Rydex Series Funds, Rydex Variable

Chief Compliance Officer and

Trust, and Rydex Dynamic Funds (2004 to present); Secretary of

Secretary (1966)

Rydex Series Funds, Rydex Variable Trust, and Rydex Dynamic

Funds (2000 to present); Secretary of Rydex ETF Trust (2002 to

present); Vice President of Compliance of Rydex Investments

(2000 to present); Secretary of Rydex Capital Partners SPhinX

Fund (2003 to 2006)

Joseph Arruda*

Assistant Treasurer of Rydex Series Funds, Rydex Variable Trust,

Assistant Treasurer (1966)

Rydex Dynamic Funds, Rydex ETF Trust (2006 to present); Senior

Vice President of Rydex Investments (2008 to present); Vice President

of Rydex Investments (2004 to 2008); Director of Accounting of

Rydex Investments (2003 to 2004)

Paula Billos*

Controller of Rydex Series Funds, Rydex Variable Trust, Rydex

Controller (1974)

Dynamic Funds, Rydex ETF Trust (2006 to present); Director of

Fund Administration of Rydex Investments (2001 to present)

* Officers of the Funds are deemed to be “interested persons” of the Trust, within the meaning of Section 2(a)(19) of the 1940 Act, inasmuch as

this person is affiliated with Rydex Investments.

24

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

This page intentionally left blank.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

25

9601 Blackwell Road, Suite 500

Rockville, MD 20850

www.rydexinvestments.com

800-820-0888

RSEP-SEMI-0908x0309