BANKING FUND

BASIC MATERIALS FUND

BIOTECHNOLOGY FUND

CONSUMER PRODUCTS FUND

ELECTRONICS FUND

ENERGY FUND

SEPTEMBER 30, 2008

RYDEX SERIES FUNDS SECTOR FUNDS SEMI-ANNUAL REPORT

ENERGY SERVICES FUND

FINANCIAL SERVICES FUND

HEALTH CARE FUND

INTERNET FUND

LEISURE FUND

PRECIOUS METALS FUND

RETAILING FUND

TECHNOLOGY FUND

TELECOMMUNICATIONS FUND

TRANSPORTATION FUND

UTILITIES FUND

GO GREEN!

ELIMINATE MAILBOX CLUTTER

Go paperless with Rydex eDelivery—a service giving you full

online access to account information and documents. Save time,

cut down on mailbox clutter and be a friend to the environment

with eDelivery.

With Rydex eDelivery you can:

•

View online confirmations and statements at your

convenience.

•

Receive email notifications when your most recent

confirmations, statements and other account documents

are available for review.

•

Access prospectuses, annual reports and semiannual

reports online.

It’s easy to enroll:

1/ Visit www.rydexinvestments.com

e

RYDEX

DELIVERY

2/ Click on the Rydex eDelivery logo

3/ Follow the simple enrollment instructions

If you have questions about Rydex eDelivery services,

contact one of our Shareholder Service Representatives

at 800.820.0888.

This report and the financial statements contained herein are submitted for the general information of our shareholders. The

report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

Distributed by Rydex Distributors, Inc.

TABLE OF CONTENTS

LETTER TO OUR SHAREHOLDERS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

ABOUT SHAREHOLDERS’ FUND EXPENSES

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

FUND PROFILES

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

SCHEDULES OF INVESTMENTS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

STATEMENTS OF ASSETS AND LIABILITIES

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

38

STATEMENTS OF OPERATIONS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

42

STATEMENTS OF CHANGES IN NET ASSETS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

46

FINANCIAL HIGHLIGHTS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

52

NOTES TO FINANCIAL STATEMENTS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

63

OTHER INFORMATION

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

72

INFORMATION ON BOARD OF TRUSTEES AND OFFICERS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

73

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

1

LETTER TO OUR SHAREHOLDERS

DEAR SHAREHOLDER:

Most economic and market surveys tend to focus on more recent events because those that occurred earlier

seem distant and less important. That dynamic was never so evident as in the April-to-September period, when

events of just the previous three weeks completely overwhelmed everything that came before. In an incredibly

short period of time, the entire global financial system seized up as the lubricant of any economy—bank

lending—came to a complete halt. The resulting crash in global stock markets that began in September

continued well into October.

In less than a month, the shape of the entire financial system was changed forever. The Wall Street model of large,

aggressive, risk-taking investment banks was completely swept aside, as financial titans such as Merrill Lynch,

Morgan Stanley, Goldman Sachs and Lehman Brothers collapsed, merged with, or were reborn as commercial

banks. It’s clear now that the decision by the U.S. Government to let Lehman Brothers fail was the catalytic event,

as the dramatic failure of an institution that weathered the Great Depression and two world wars, laid bare the

failings of the traditional investment banking model. Financial dominos tumbled as a wave of commercial bank

failures—the most since the savings and loan crisis of the 1990s—unfolded in the third quarter, culminating with

the collapse of Washington Mutual, the largest bank failure in U.S. history.

The other huge and profound shift was the nationalization of the global financial system. Several events point

to a nearly total takeover of the global financial system: the takeover of Fannie Mae and Freddie Mac, AIG and

Washington Mutual; the seizure of IndyMac; the forced merger of Wachovia; and the massive capital infusion

and government guarantee of nearly every financial instrument available (both here and in Europe).

In this history-making period, government at all levels moved with unprecedented speed, scope and coordination

to save the financial system, and with it, the global economy. In the United States, this culminated with the

U.S. Treasury’s $700 billion bail-out plan that will essentially buy up all the bad mortgage assets clogging the

financial system.

Rejection of that plan by the House of Representatives in late September sent the markets into a tailspin, with

the Dow suffering its largest point drop in history, while sending the index to three-year lows. Over the past six

months, the Dow Jones IndustrialSM Average and the S&P 500® Index each lost more than 10% of their value,

with virtually all of those declines coming in the last two weeks of September. T-Bill yields fell to near zero and

interest rates on longer-dated Treasuries fell to decade lows in the market’s massive flight to safety.

It’s not all doom and gloom, however. This volatile market environment has burst the commodity bubble and has

resulted in a huge slowdown in global inflation. This helps the emerging markets whose economies have been

pummeled by the rise in food and energy costs. Slowing inflation has also ushered in a period of unprecedented

dollar strength, which gives the Federal Reserve additional room to ease. Interest rates could hardly be lower and

stocks are cheaper than they have been in some time. With the massive amounts of liquidity pumped into the

system, stocks could rally sharply in the months ahead.

Having gone through multiple false bottoms so far this year, the question that still remains is: Can any rally be

sustained? The answer to that question is fairly straightforward. First, the allocation of credit in bond and money

markets needs to resume. Simply put: A stock market recovery is not possible without it. As I write this, there is

definite improvement on that front, but it remains slow and sporadic. Also, the process of de-leveraging (that is,

selling assets accumulated during boom times) will be with us for a while. All of this is occurring during a period

where global economic growth is downshifting rapidly. While this does not preclude any stock market rallies, it may

make them temporary. Astute stock selection, the use of rotational strategies, exposure to currency movements,

the implementation of long/short strategies and a focus on quality—above all else—are the keys to investment

success in difficult and uncharted terrain.

We appreciate the trust you have placed in our firm’s quality and integrity by investing with Rydex Investments.

Sincerely,

David C. Reilly, CFA

Director of Portfolio Strategy

2

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)

All mutual funds have operating expenses and it is important for our shareholders to understand the

impact of costs on their investments. Shareholders of a Fund incur two types of costs: (i) transaction

costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions;

redemption fees; and exchange fees; and (ii) ongoing costs, including management fees, administrative

services, and shareholder reports, among others. These ongoing costs, or operating expenses, are

deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense

ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of

investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for

the entire six-month period beginning March 31, 2008 and ending September 30, 2008.

The following tables illustrate a Fund’s costs in two ways:

Table 1. Based on actual Fund return. This section helps investors estimate the actual expenses paid over

the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth

column shows the dollar amount that would have been paid by an investor who started with $1,000 in

the Fund. Investors may use the information here, together with the amount invested, to estimate the

expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an

$8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under

the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return. This section is intended to help investors compare a Fund’s

cost with those of other mutual funds. The table provides information about hypothetical account

values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of

return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account

values and expenses may not be used to estimate the actual ending account balance or expenses

paid during the period. The example is useful in making comparisons because the U.S. Securities and

Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5%

return. Investors can assess a Fund’s costs by comparing this hypothetical example with the hypotheti-

cal examples that appear in shareholder reports of other funds.

Certain retirement plans such as IRA, SEP, Roth IRA and 403(b) accounts are charged an annual $15

maintenance fee. Upon liquidating a retirement account, a $15 account-closing fee will be taken from

the proceeds of the redemption.

The calculations illustrated above assume no shares were bought or sold during the period. Actual

costs may have been higher or lower, depending on the amount of investment and the timing of any

purchases or redemptions.

Note that the expenses shown in the table are meant to highlight and help compare ongoing costs only

and do not reflect any transactional costs which may be incurred by a Fund.

More information about a Fund’s expenses, including annual expense ratios for the past five years, can be

found in the Financial Highlights section of this report. For additional information on operating expenses

and other shareholder costs, please refer to the appropriate Fund prospectus.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

3

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) (continued)

Beginning

Ending

Expenses

Expense

Account Value

Account Value

Paid During

Ratio†

March 31, 2008

September 30, 2008

Period*

Table 1. Based on actual fund return

Banking Fund

Investor Class

1.38%

$1,000.00

$

863.80

$

6.45

Advisor Class

1.87%

1,000.00

862.80

8.73

A-Class

1.60%

1,000.00

862.90

7.47

C-Class

2.39%

1,000.00

859.00

11.14

Basic Materials Fund

Investor Class

1.37%

1,000.00

754.60

6.03

Advisor Class

1.87%

1,000.00

752.60

8.22

A-Class

1.62%

1,000.00

753.50

7.14

C-Class

2.37%

1,000.00

750.10

10.40

Biotechnology Fund

Investor Class

1.38%

1,000.00

1,086.00

7.22

Advisor Class

1.88%

1,000.00

1,082.40

9.81

A-Class

1.63%

1,000.00

1,084.20

8.52

C-Class

2.38%

1,000.00

1,080.90

12.42

Consumer Products Fund

Investor Class

1.37%

1,000.00

953.00

6.71

Advisor Class

1.88%

1,000.00

950.50

9.19

A-Class

1.63%

1,000.00

951.80

7.98

C-Class

2.37%

1,000.00

948.50

11.58

Electronics Fund

Investor Class

1.35%

1,000.00

850.90

6.26

Advisor Class

1.90%

1,000.00

848.30

8.80

A-Class

1.61%

1,000.00

848.70

7.46

C-Class

2.46%

1,000.00

847.50

11.39

Energy Fund

Investor Class

1.37%

1,000.00

843.20

6.31

Advisor Class

1.87%

1,000.00

840.80

8.62

A-Class

1.62%

1,000.00

842.20

7.48

C-Class

2.37%

1,000.00

838.80

10.92

Energy Services Fund

Investor Class

1.37%

1,000.00

834.40

6.30

Advisor Class

1.87%

1,000.00

832.30

8.59

A-Class

1.62%

1,000.00

833.50

7.45

C-Class

2.37%

1,000.00

830.10

10.86

Financial Services Fund

Investor Class

1.37%

1,000.00

865.40

6.41

Advisor Class

1.88%

1,000.00

863.00

8.78

A-Class

1.62%

1,000.00

864.10

7.57

C-Class

2.37%

1,000.00

861.20

11.06

Health Care Fund

Investor Class

1.34%

1,000.00

991.60

6.69

Advisor Class

1.96%

1,000.00

988.90

9.77

A-Class

1.64%

1,000.00

989.80

8.18

C-Class

2.40%

1,000.00

986.40

11.95

4

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) (continued)

Beginning

Ending

Expenses

Expense

Account Value

Account Value

Paid During

Ratio†

March 31, 2008

September 30, 2008

Period*

Internet Fund

Investor Class

1.37%

$1,000.00

$

845.40

$

6.34

Advisor Class

1.87%

1,000.00

843.30

8.64

A-Class

1.62%

1,000.00

844.20

7.49

C-Class

2.37%

1,000.00

841.20

10.94

Leisure Fund

Investor Class

1.37%

1,000.00

805.20

6.20

Advisor Class

1.87%

1,000.00

803.40

8.45

A-Class

1.62%

1,000.00

804.30

7.33

C-Class

2.37%

1,000.00

801.10

10.70

Precious Metals Fund

Investor Class

1.27%

1,000.00

670.90

5.32

Advisor Class

1.77%

1,000.00

669.20

7.41

A-Class

1.52%

1,000.00

670.10

6.36

C-Class

2.27%

1,000.00

667.30

9.49

Retailing Fund

Investor Class

1.37%

1,000.00

923.70

6.61

Advisor Class

1.88%

1,000.00

919.80

9.05

A-Class

1.63%

1,000.00

923.10

7.86

C-Class

2.38%

1,000.00

919.10

11.45

Technology Fund

Investor Class

1.37%

1,000.00

876.00

6.44

Advisor Class

1.88%

1,000.00

874.00

8.83

A-Class

1.63%

1,000.00

875.40

7.66

C-Class

2.36%

1,000.00

871.40

11.07

Telecommunications Fund

Investor Class

1.34%

1,000.00

821.00

6.12

Advisor Class

1.96%

1,000.00

819.20

8.94

A-Class

1.64%

1,000.00

820.00

7.48

C-Class

2.38%

1,000.00

816.50

10.84

Transportation Fund

Investor Class

1.37%

1,000.00

929.40

6.63

Advisor Class

1.87%

1,000.00

927.10

9.03

A-Class

1.62%

1,000.00

927.80

7.83

C-Class

2.37%

1,000.00

924.90

11.44

Utilities Fund

Investor Class

1.37%

1,000.00

884.90

6.47

Advisor Class

1.87%

1,000.00

882.50

8.82

A-Class

1.62%

1,000.00

883.60

7.65

C-Class

2.37%

1,000.00

880.40

11.17

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

5

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) (continued)

Beginning

Ending

Expenses

Expense

Account Value

Account Value

Paid During

Ratio†

March 31, 2008

September 30, 2008

Period*

Table 2. Based on hypothetical 5% return (before expenses)

Banking Fund

Investor Class

1.38%

$1,000.00

$1,018.15

$

6.98

Advisor Class

1.87%

1,000.00

1,015.69

9.45

A-Class

1.60%

1,000.00

1,017.05

8.09

C-Class

2.39%

1,000.00

1,013.09

12.06

Basic Materials Fund

Investor Class

1.37%

1,000.00

1,018.20

6.93

Advisor Class

1.87%

1,000.00

1,015.69

9.45

A-Class

1.62%

1,000.00

1,016.95

8.19

C-Class

2.37%

1,000.00

1,013.19

11.96

Biotechnology Fund

Investor Class

1.38%

1,000.00

1,018.15

6.98

Advisor Class

1.88%

1,000.00

1,015.64

9.50

A-Class

1.63%

1,000.00

1,016.90

8.24

C-Class

2.38%

1,000.00

1,013.14

12.01

Consumer Products Fund

Investor Class

1.37%

1,000.00

1,018.20

6.93

Advisor Class

1.88%

1,000.00

1,015.64

9.50

A-Class

1.63%

1,000.00

1,016.90

8.24

C-Class

2.37%

1,000.00

1,013.19

11.96

Electronics Fund

Investor Class

1.35%

1,000.00

1,018.30

6.83

Advisor Class

1.90%

1,000.00

1,015.54

9.60

A-Class

1.61%

1,000.00

1,017.00

8.14

C-Class

2.46%

1,000.00

1,012.73

12.41

Energy Fund

Investor Class

1.37%

1,000.00

1,018.20

6.93

Advisor Class

1.87%

1,000.00

1,015.69

9.45

A-Class

1.62%

1,000.00

1,016.95

8.19

C-Class

2.37%

1,000.00

1,013.19

11.96

Energy Services Fund

Investor Class

1.37%

1,000.00

1,018.20

6.93

Advisor Class

1.87%

1,000.00

1,015.69

9.45

A-Class

1.62%

1,000.00

1,016.95

8.19

C-Class

2.37%

1,000.00

1,013.19

11.96

Financial Services Fund

Investor Class

1.37%

1,000.00

1,018.20

6.93

Advisor Class

1.88%

1,000.00

1,015.64

9.50

A-Class

1.62%

1,000.00

1,016.95

8.19

C-Class

2.37%

1,000.00

1,013.19

11.96

Health Care Fund

Investor Class

1.34%

1,000.00

1,018.35

6.78

Advisor Class

1.96%

1,000.00

1,015.24

9.90

A-Class

1.64%

1,000.00

1,016.85

8.29

C-Class

2.40%

1,000.00

1,013.04

12.11

6

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) (concluded)

Beginning

Ending

Expenses

Expense

Account Value

Account Value

Paid During

Ratio†

March 31, 2008

September 30, 2008

Period*

Internet Fund

Investor Class

1.37%

$1,000.00

$1,018.20

$

6.93

Advisor Class

1.87%

1,000.00

1,015.69

9.45

A-Class

1.62%

1,000.00

1,016.95

8.19

C-Class

2.37%

1,000.00

1,013.19

11.96

Leisure Fund

Investor Class

1.37%

1,000.00

1,018.20

6.93

Advisor Class

1.87%

1,000.00

1,015.69

9.45

A-Class

1.62%

1,000.00

1,016.95

8.19

C-Class

2.37%

1,000.00

1,013.19

11.96

Precious Metals Fund

Investor Class

1.27%

1,000.00

1,018.70

6.43

Advisor Class

1.77%

1,000.00

1,016.19

8.95

A-Class

1.52%

1,000.00

1,017.45

7.69

C-Class

2.27%

1,000.00

1,013.69

11.46

Retailing Fund

Investor Class

1.37%

1,000.00

1,018.20

6.93

Advisor Class

1.88%

1,000.00

1,015.64

9.50

A-Class

1.63%

1,000.00

1,016.90

8.24

C-Class

2.38%

1,000.00

1,013.14

12.01

Technology Fund

Investor Class

1.37%

1,000.00

1,018.20

6.93

Advisor Class

1.88%

1,000.00

1,015.64

9.50

A-Class

1.63%

1,000.00

1,016.90

8.24

C-Class

2.36%

1,000.00

1,013.24

11.91

Telecommunications Fund

Investor Class

1.34%

1,000.00

1,018.35

6.78

Advisor Class

1.96%

1,000.00

1,015.24

9.90

A-Class

1.64%

1,000.00

1,016.85

8.29

C-Class

2.38%

1,000.00

1,013.14

12.01

Transportation Fund

Investor Class

1.37%

1,000.00

1,018.20

6.93

Advisor Class

1.87%

1,000.00

1,015.69

9.45

A-Class

1.62%

1,000.00

1,016.95

8.19

C-Class

2.37%

1,000.00

1,013.19

11.96

Utilities Fund

Investor Class

1.37%

1,000.00

1,018.20

6.93

Advisor Class

1.87%

1,000.00

1,015.69

9.45

A-Class

1.62%

1,000.00

1,016.95

8.19

C-Class

2.37%

1,000.00

1,013.19

11.96

*

Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by

the number of days in the most recent fiscal half-year, then divided by 365.

†

Annualized

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

7

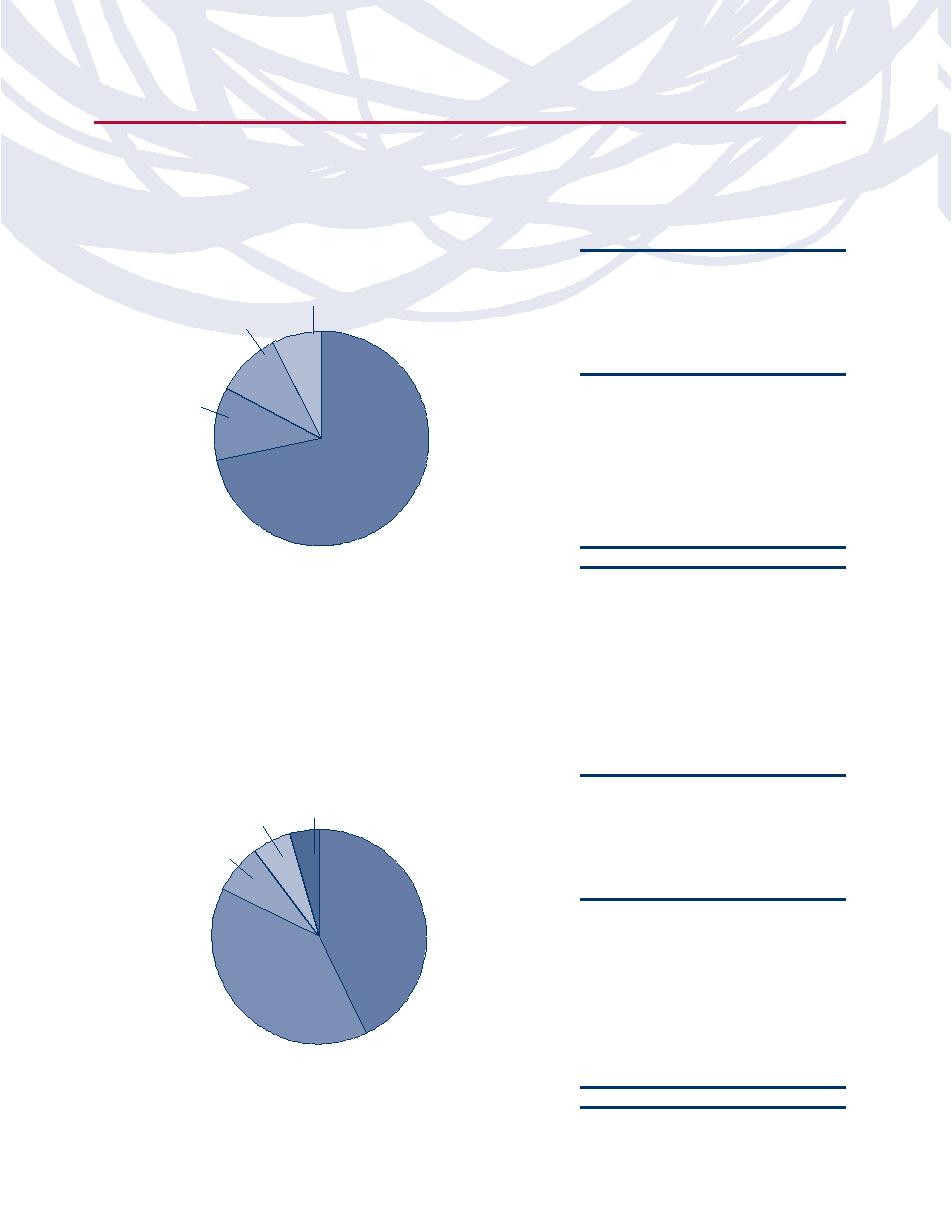

FUND PROFILES (Unaudited)

BANKING FUND

OBJECTIVE:

Seeks capital appreciation by investing in companies that are involved in the banking sector, including

commercial banks (and their holding companies) and savings and loan institutions.

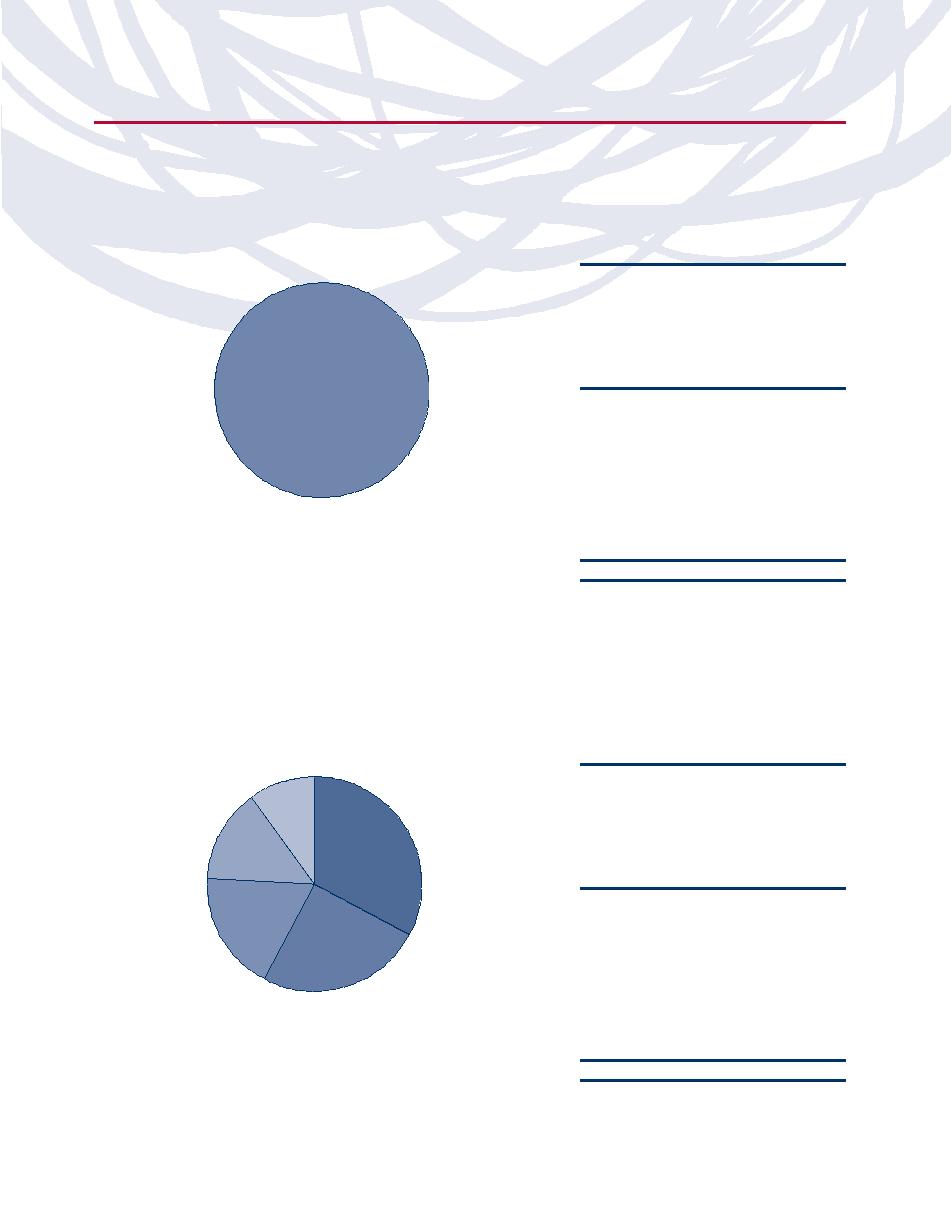

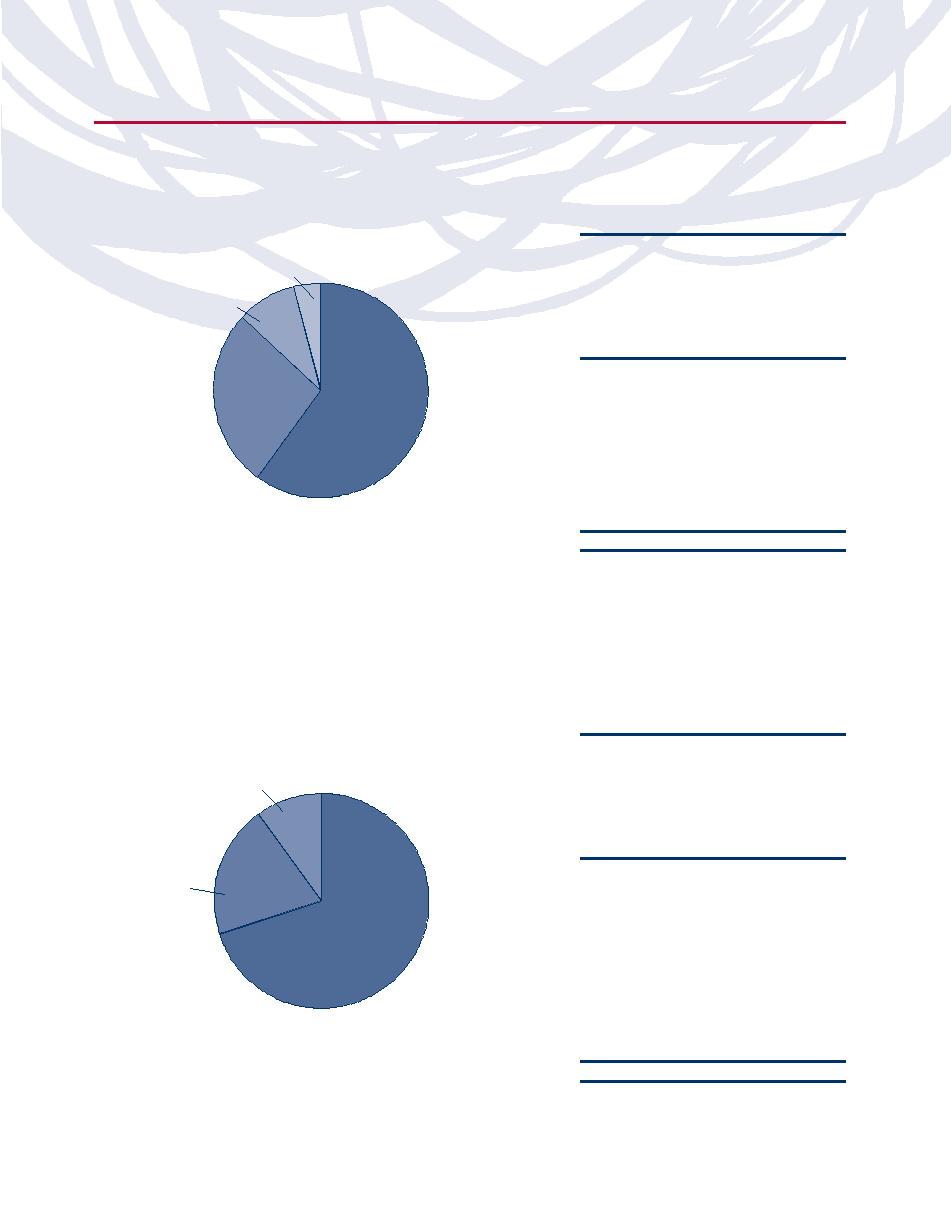

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Capital

Investor Class

April 1, 1998

Diversified

Markets

Advisor Class

April 1, 1998

Financial

7%

A-Class

September 1, 2004

Services

C-Class

March 30, 2001

10%

Ten Largest Holdings

(% of Total Net Assets)

Wells Fargo & Co.

5.7%

Thrifts &

Bank of America Corp.

4.9%

Mortgage

Commercial

U.S. Bancorp

4.8%

Finance

Banks

JPMorgan Chase & Co.

4.8%

11%

72%

HSBC Holdings PLC — SP ADR

4.4%

Credit Suisse Group AG — SP ADR

4.2%

Barclays PLC — SP ADR

3.5%

UBS AG — SP ADR

3.1%

PNC Financial Services Group, Inc.

2.9%

BB&T Corp.

2.8%

Top Ten Total

41.1%

Banking Fund

“Ten Largest Holdings” exclude any

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

temporary cash or derivative investments.

temporary cash investments.

BASIC MATERIALS FUND

OBJECTIVE:

Seeks capital appreciation by investing in companies engaged in the mining, manufacture or sale of basic

materials, such as lumber, steel, iron, aluminum, concrete, chemicals and other basic building and manufacturing materials.

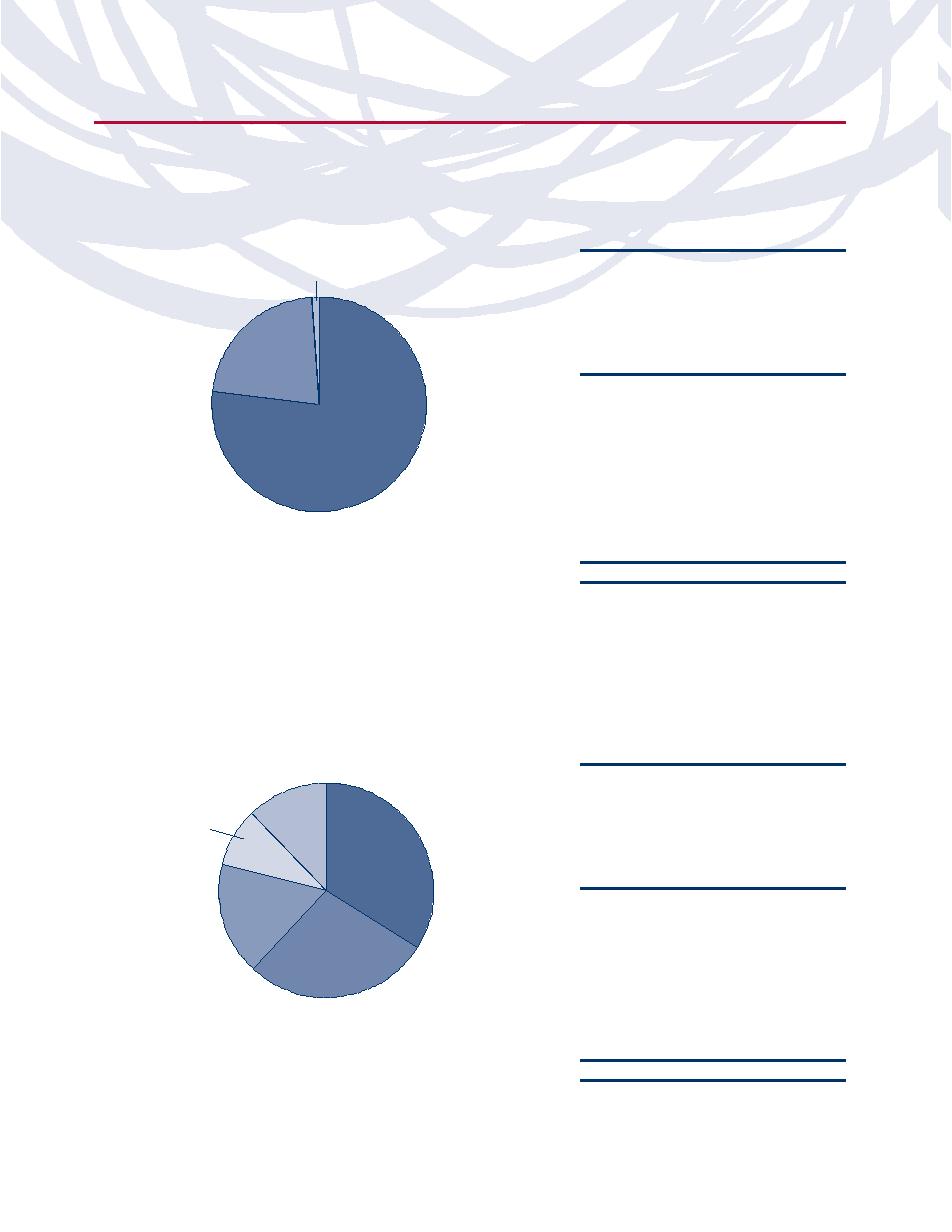

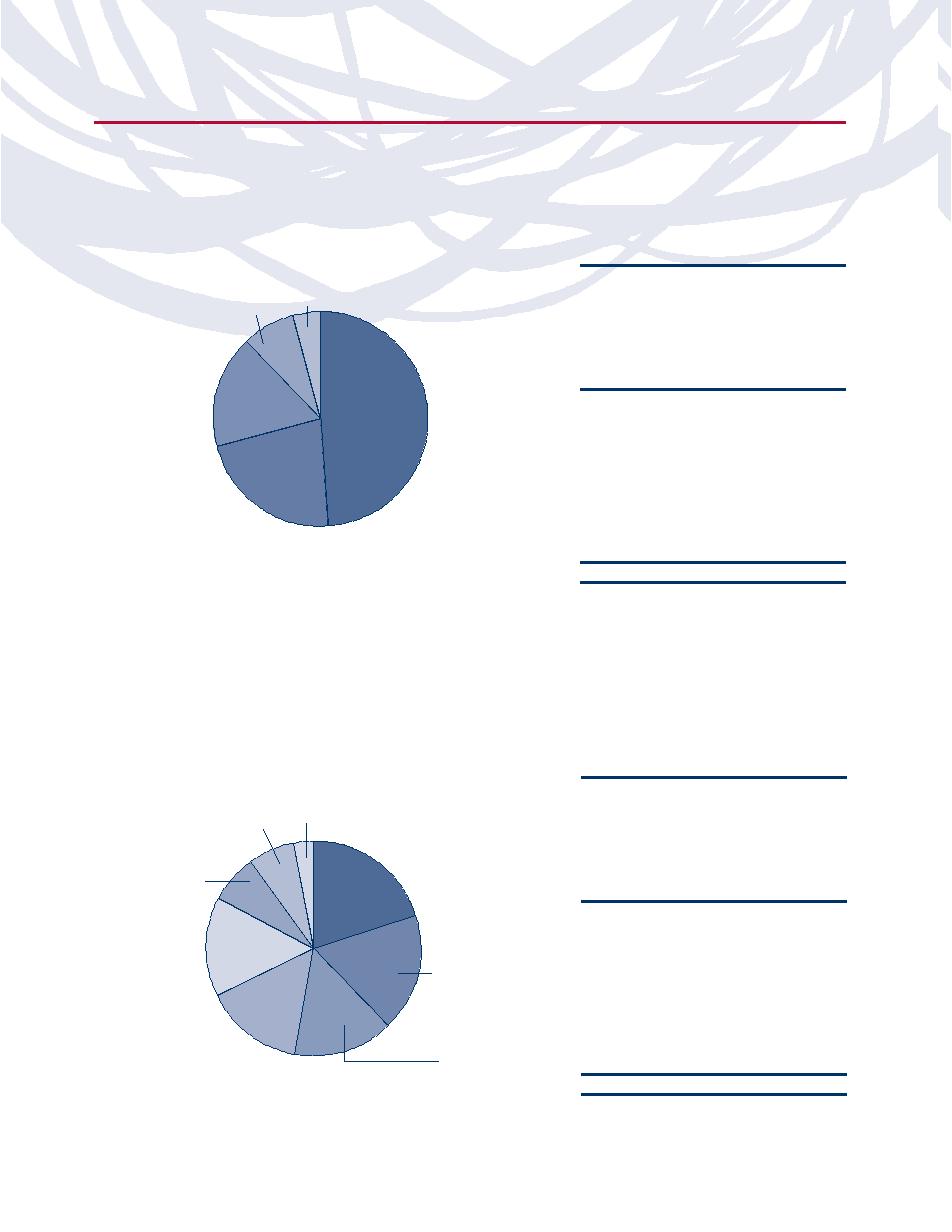

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Construction

Investor Class

April 1, 1998

Paper & Forest

Products

Materials 4%

Advisor Class

April 14, 1998

A-Class

September 1, 2004

6%

C-Class

May 3, 2001

Containers

& Packaging

Ten Largest Holdings

8%

(% of Total Net Assets)

Metals

BHP Billiton Ltd. — SP ADR

3.9%

& Mining

Monsanto Co.

3.4%

43%

ArcelorMittal

3.2%

Chemicals

Rio Tinto PLC — SP ADR

3.1%

39%

Companhia Vale do Rio Doce —

SP ADR

3.0%

E.I. du Pont de Nemours and Co.

2.8%

Dow Chemical Co.

2.6%

Potash Corporation of Saskatchewan

2.5%

Basic Materials Fund

Barrick Gold Corp.

2.4%

Praxair, Inc.

2.0%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

Top Ten Total

28.9%

temporary cash investments.

“Ten Largest Holdings” exclude any

temporary cash or derivative investments.

8

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

FUND PROFILES (Unaudited) (continued)

BIOTECHNOLOGY FUND

OBJECTIVE:

Seeks capital appreciation by investing in companies that are involved in the biotechnology industry, including

companies involved in research and development, genetic or biological engineering and in the design, manufacture or sale of

related biotechnology products or services.

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Investor Class

April 1, 1998

Advisor Class

April 1, 1998

A-Class

September 1, 2004

C-Class

March 30, 2001

Ten Largest Holdings

Biotechnology

(% of Total Net Assets)

100%

Genentech, Inc.

12.4%

Amgen, Inc.

10.4%

Gilead Sciences, Inc.

7.2%

Celgene Corp.

6.1%

Genzyme Corp.

5.8%

Biogen Idec, Inc.

4.2%

ImClone Systems, Inc.

3.4%

Biotechnology Fund

Cephalon, Inc.

2.9%

Vertex Pharmaceuticals, Inc.

2.7%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

Myriad Genetics, Inc.

2.2%

temporary cash investments.

Top Ten Total

57.3%

“Ten Largest Holdings” exclude any

temporary cash or derivative investments.

CONSUMER PRODUCTS FUND

OBJECTIVE:

Seeks capital appreciation by investing in companies engaged in manufacturing finished goods and services both

domestically and internationally.

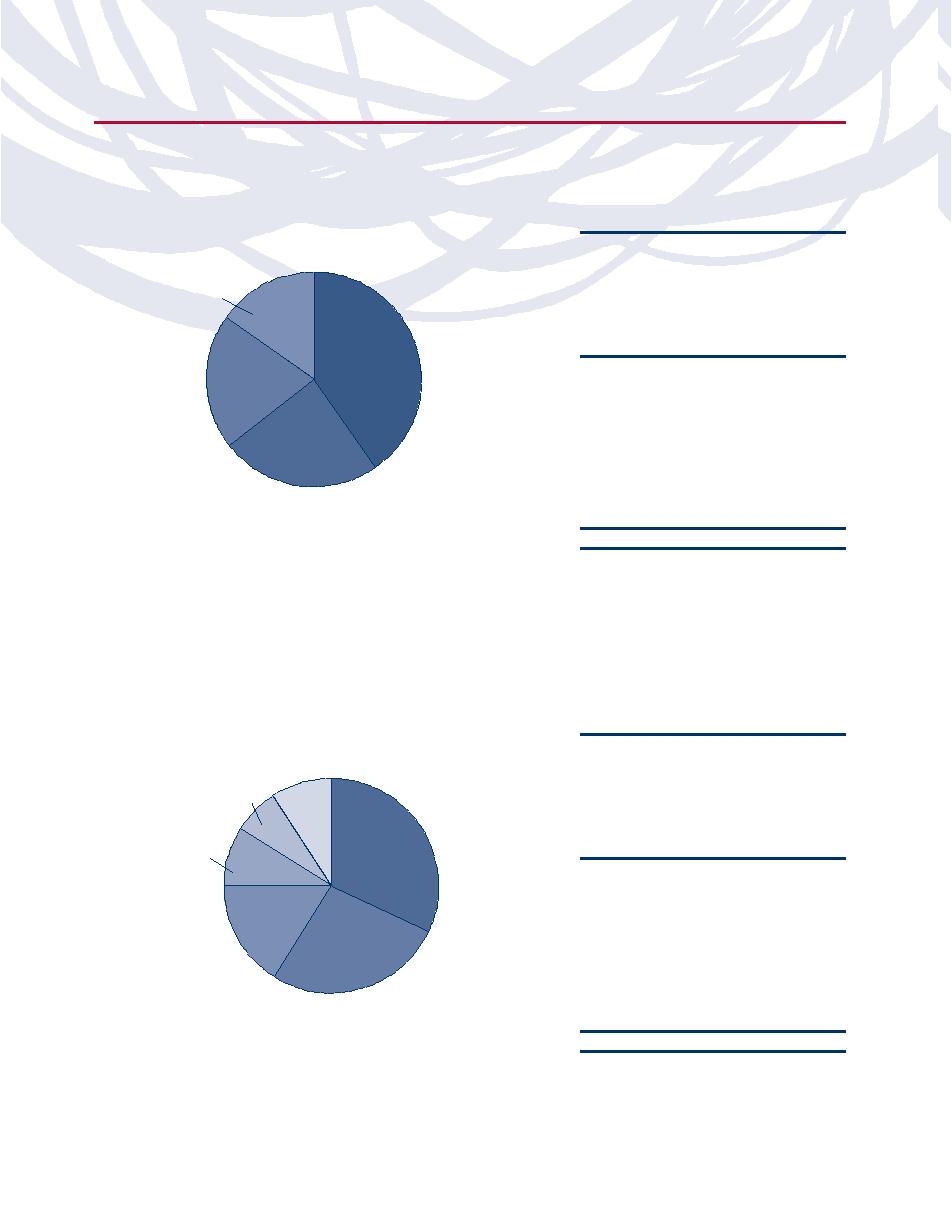

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Investor Class

July 6, 1998

Other

Advisor Class

August 17, 1998

10%

A-Class

September 1, 2004

C-Class

July 24, 2001

Tobacco

14%

Food Products

Ten Largest Holdings

33%

(% of Total Net Assets)

Household

Procter & Gamble Co.

7.7%

Products

Coca-Cola Co.

5.8%

18%

PepsiCo, Inc.

5.6%

Beverages

Philip Morris International, Inc.

5.0%

25%

Kraft Foods, Inc. — Class A

3.7%

Unilever NV

3.5%

Anheuser-Busch Companies, Inc.

3.4%

Consumer Products Fund

Colgate-Palmolive Co.

3.3%

Diageo PLC — SP ADR

3.2%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

Altria Group, Inc.

3.2%

temporary cash investments.

Top Ten Total

44.4%

“Ten Largest Holdings” exclude any

temporary cash or derivative investments.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

9

FUND PROFILES (Unaudited) (continued)

ELECTRONICS FUND

OBJECTIVE:

Seeks capital appreciation by investing in companies that are involved in the electronics sector, including

semiconductor manufacturers and distributors, and makers and vendors of other electronic components and devices.

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Investor Class

April 1, 1998

Other 1%

Advisor Class

April 2, 1998

A-Class

September 1, 2004

C-Class

March 26, 2001

Ten Largest Holdings

Semiconductor

(% of Total Net Assets)

Equipment

22%

Intel Corp.

10.1%

Taiwan Semiconductor Manufacturing

Company Ltd. — SP ADR

7.0%

Semiconductors

Texas Instruments, Inc.

4.9%

77%

Applied Materials, Inc.

4.3%

STMicroelectronics NV — SP ADR

3.1%

Xilinx, Inc.

2.7%

Analog Devices, Inc.

2.7%

Linear Technology Corp.

2.7%

Electronics Fund

Altera Corp.

2.6%

ASML Holding NV

2.5%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

Top Ten Total

42.6%

temporary cash investments.

“Ten Largest Holdings” exclude any

temporary cash or derivative investments.

ENERGY FUND

OBJECTIVE:

Seeks capital appreciation by investing in companies involved in the energy field, including the exploration,

production and development of oil, gas, coal and alternative sources of energy.

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Investor Class

April 21, 1998

Advisor Class

May 5, 1998

Oil & Gas

Other

A-Class

September 1, 2004

Drilling

12%

C-Class

April 19, 2001

9%

Integrated

Oil & Gas

Ten Largest Holdings

34%

(% of Total Net Assets)

Oil & Gas

Equipment &

Exxon Mobil Corp.

7.2%

Services

Chevron Corp.

4.6%

17%

Oil & Gas

BP PLC — SP ADR

4.1%

Exploration &

ConocoPhillips

3.6%

Production

28%

Royal Dutch Shell PLC — SP ADR

3.3%

Petroleo Brasiliero SA

3.3%

Schlumberger Ltd.

3.1%

Energy Fund

Occidental Petroleum Corp.

2.7%

Devon Energy Corp.

2.2%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

Apache Corp.

2.1%

temporary cash investments.

Top Ten Total

36.2%

“Ten Largest Holdings” exclude any

temporary cash or derivative investments.

10

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

FUND PROFILES (Unaudited) (continued)

ENERGY SERVICES FUND

OBJECTIVE:

Seeks capital appreciation by investing in companies that are involved in the energy services field, including those

that provide services and equipment in the areas of oil, coal and gas exploration and production.

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Investor Class

April 1, 1998

Advisor Class

April 2, 1998

A-Class

September 1, 2004

C-Class

March 30, 2001

Ten Largest Holdings

Energy Equipment

(% of Total Net Assets)

& Services

Schlumberger Ltd.

10.7%

100%

Transocean, Inc.

6.4%

Halliburton Co.

5.5%

Baker Hughes, Inc.

4.7%

National-Oilwell Varco, Inc.

4.6%

Tenaris SA — SP ADR

4.5%

Diamond Offshore Drilling, Inc.

4.3%

Energy Services Fund

Smith International, Inc.

4.3%

Weatherford International Ltd.

4.1%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

Noble Corp.

3.8%

temporary cash investments.

Top Ten Total

52.9%

“Ten Largest Holdings” exclude any

temporary cash or derivative investments.

FINANCIAL SERVICES FUND

OBJECTIVE:

Seeks capital appreciation by investing in companies that are involved in the financial services sector.

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Investor Class

April 2, 1998

Advisor Class

April 6, 1998

Other

A-Class

September 1, 2004

Diversified

7%

C-Class

April 19, 2001

Financial

Services

12%

Insurance

Ten Largest Holdings

27%

(% of Total Net Assets)

Capital

Bank of America Corp.

2.7%

Markets

HSBC Holdings PLC — SP ADR

2.6%

17%

Commercial

JPMorgan Chase & Co.

2.5%

Real Estate

Banks

Wells Fargo & Co.

2.4%

Investment

19%

Citigroup, Inc.

2.0%

Trusts

U.S. Bancorp

1.7%

18%

AXA — SP ADR

1.6%

Credit Suisse Group AG — SP ADR

1.5%

Financial Services Fund

Allianz SE — SP ADR

1.3%

Barclays PLC — SP ADR

1.2%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

temporary cash investments.

Top Ten Total

19.5%

“Ten Largest Holdings” exclude any

temporary cash or derivative investments.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

11

FUND PROFILES (Unaudited) (continued)

HEALTH CARE FUND

OBJECTIVE:

Seeks capital appreciation by investing in companies that are involved in the health care industry.

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Investor Class

April 17, 1998

Advisor Class

May 11, 1998

Biotechnology

A-Class

September 1, 2004

16%

C-Class

March 30, 2001

Ten Largest Holdings

(% of Total Net Assets)

Health Care

Pharmaceuticals

Johnson & Johnson, Inc.

4.3%

Providers

40%

Novartis AG — SP ADR

3.4%

& Services

Pfizer, Inc.

3.4%

20%

GlaxoSmithKline PLC — SP ADR

3.1%

Health Care

Equipment

Genentech, Inc.

3.1%

& Supplies

Abbott Laboratories

2.9%

24%

Sanofi-Aventis — SP ADR

2.7%

Amgen, Inc.

2.6%

Health Care Fund

AstraZeneca PLC — SP ADR

2.4%

Merck & Company, Inc.

2.3%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

Top Ten Total

30.2%

temporary cash investments.

“Ten Largest Holdings” exclude any

temporary cash or derivative investments.

INTERNET FUND

OBJECTIVE:

Seeks capital appreciation by investing in companies that provide products or services designed for or related to

the Internet.

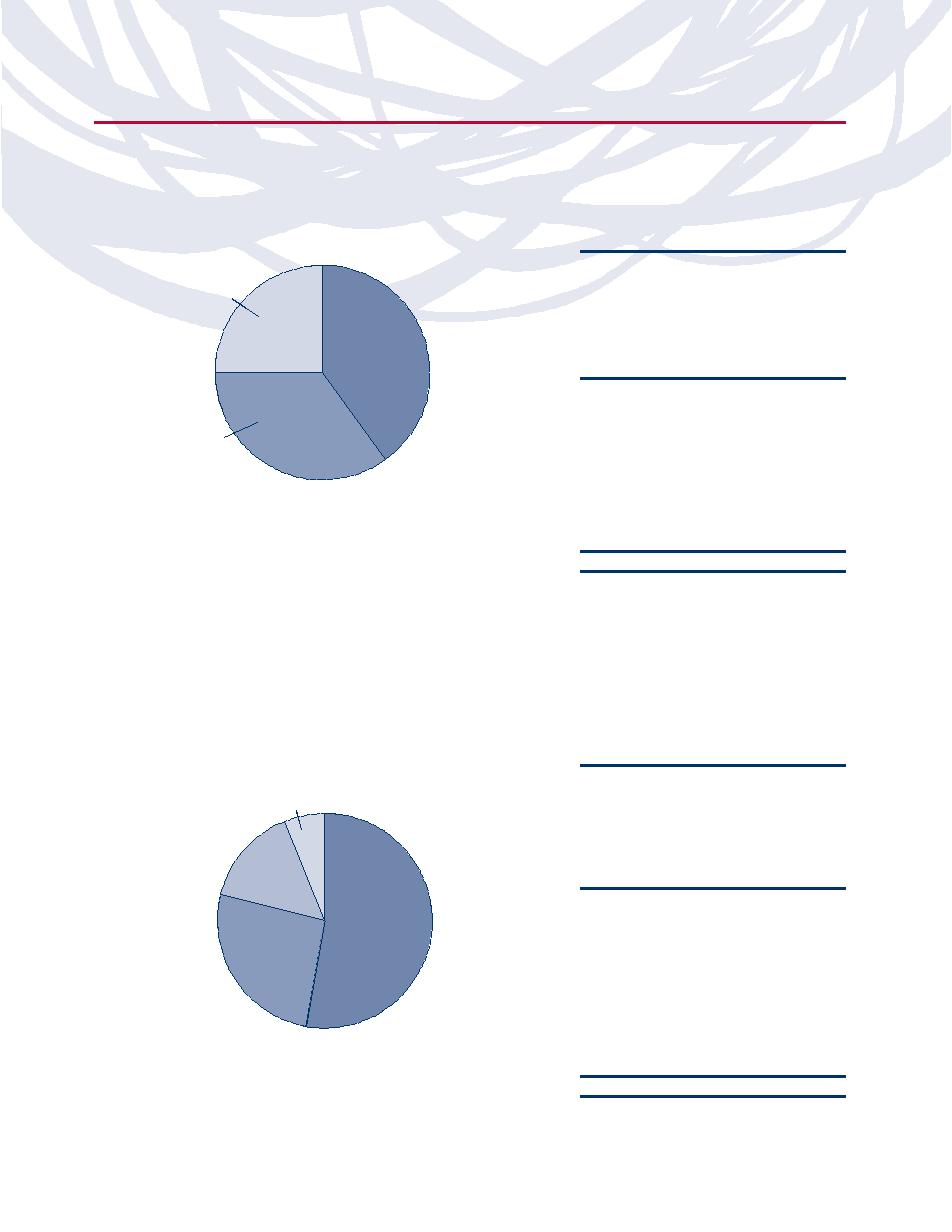

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Investor Class

April 6, 2000

Advisor Class

April 6, 2000

Media

A-Class

September 1, 2004

7%

Other

C-Class

April 19, 2001

9%

Internet &

Catalog Retail

Ten Largest Holdings

9%

Communications

(% of Total Net Assets)

Equipment

Cisco Systems, Inc.

11.9%

32%

Google, Inc. — Class A

8.5%

Software

Qualcomm, Inc.

8.2%

16%

Internet

Time Warner, Inc.

6.5%

Software

Amazon.com, Inc.

5.6%

& Services

eBay, Inc.

5.3%

27%

Research In Motion Ltd.

4.9%

Yahoo!, Inc.

4.3%

Internet Fund

Symantec Corp.

4.1%

Intuit, Inc.

3.4%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

Top Ten Total

62.7%

temporary cash investments.

“Ten Largest Holdings” exclude any

temporary cash or derivative investments.

12

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

FUND PROFILES (Unaudited) (continued)

LEISURE FUND

OBJECTIVE:

Seeks capital appreciation by investing in companies in the leisure and entertainment businesses.

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Software

Investor Class

April 1, 1998

4%

Advisor Class

June 3, 1998

Leisure Equipment

A-Class

September 1, 2004

& Products

C-Class

May 3, 2001

9%

Ten Largest Holdings

(% of Total Net Assets)

McDonald’s Corp.

7.6%

Walt Disney Co.

6.8%

Media

27%

Time Warner, Inc.

5.8%

Hotels, Restaurants

Carnival Corp.

4.1%

& Leisure

News Corp. — Class A

3.8%

60%

Yum! Brands, Inc.

3.4%

Las Vegas Sands Corp.

3.1%

Viacom, Inc. — Class B

3.1%

Starbucks Corp.

3.0%

Leisure Fund

Electronic Arts, Inc.

2.7%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

Top Ten Total

43.4%

temporary cash investments.

“Ten Largest Holdings” exclude any

temporary cash or derivative investments.

PRECIOUS METALS FUND

OBJECTIVE:

To provide capital appreciation by investing in U.S. and foreign companies that are involved in the precious

metals sector, including exploration, mining, production and development, and other precious metals-related services.

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Diversified Metals

Investor Class

December 1, 1993

& Mining

Advisor Class

August 1, 2003

10%

A-Class

September 1, 2004

C-Class

April 27, 2001

Ten Largest Holdings

Precious Metals

(% of Total Net Assets)

& Minerals

Freeport-McMoRan Copper

20%

& Gold, Inc.

9.1%

Barrick Gold Corp.

8.4%

Newmont Mining Corp.

8.2%

Goldcorp, Inc.

7.0%

Gold

70%

Agnico-Eagle Mines Ltd.

6.5%

Kinross Gold Corp.

5.0%

Yamana Gold, Inc.

4.6%

Gold Fields Ltd. — SP ADR

4.5%

AngloGold Ashanti Ltd. — SP ADR

3.9%

Precious Metals Fund

Cia de Minas Buenaventura SA —

SP ADR

3.7%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

Top Ten Total

60.9%

temporary cash investments.

“Ten Largest Holdings” exclude any

temporary cash or derivative investments.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

13

FUND PROFILES (Unaudited) (continued)

RETAILING FUND

OBJECTIVE:

Seeks capital appreciation by investing in companies engaged in merchandising finished goods and services,

including department stores, restaurant franchises, mail-order operations and other companies involved in selling products to

consumers.

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Other

Investor Class

April 1, 1998

Internet &

4%

Advisor Class

April 21, 1998

Catalog Retail

A-Class

September 1, 2004

8%

C-Class

May 9, 2001

Ten Largest Holdings

Multiline

(% of Total Net Assets)

Retail

Wal-Mart Stores, Inc.

9.7%

17%

Specialty Retail

Home Depot, Inc.

4.3%

49%

CVS Caremark Corp.

4.0%

Food & Drug

Lowe’s Companies, Inc.

4.0%

Retailing

Target Corp.

3.9%

22%

Amazon.com, Inc.

3.4%

Walgreen Co.

3.3%

Costco Wholesale Corp.

3.1%

Staples, Inc.

2.5%

Retailing Fund

Kohl’s Corp.

2.4%

Top Ten Total

40.6%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

temporary cash investments.

“Ten Largest Holdings” exclude any

temporary cash or derivative investments.

TECHNOLOGY FUND

OBJECTIVE:

Seeks capital appreciation by investing in companies that are involved in the technology sector, including

computer software and service companies, semiconductor manufacturers, networking and telecommunications equipment

manufacturers, PC hardware and peripherals companies.

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Investor Class

April 14, 1998

Internet Software

Other

& Services

3%

Advisor Class

April 29, 1998

A-Class

September 1, 2004

7%

C-Class

April 18, 2001

Electronic Equipment

& Instruments

7%

Ten Largest Holdings

Software

(% of Total Net Assets)

20%

Microsoft Corp.

4.2%

International Business Machines Corp.

3.3%

IT Consulting

Semiconductor

& Services

Cisco Systems, Inc.

3.2%

& Semiconductor

15%

Equipment

Hewlett-Packard Co.

3.0%

18%

Oracle Corp.

2.7%

Computers &

Intel Corp.

2.6%

Peripherals

Google, Inc. — Class A

2.3%

15%

Communications

Apple, Inc.

2.2%

Equipment

Qualcomm, Inc.

2.2%

15%

SAP AG — SP ADR

2.1%

Technology Fund

Top Ten Total

27.8%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

“Ten Largest Holdings” exclude any

temporary cash investments.

temporary cash or derivative investments.

14

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

FUND PROFILES (Unaudited) (continued)

TELECOMMUNICATIONS FUND

OBJECTIVE: Seeks capital appreciation by investing in companies engaged in the development, manufacture or sale of

communications services or communications equipment.

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Wireless

Investor Class

April 1, 1998

Telecommunication

Advisor Class

April 1, 1998

Services

A-Class

September 1, 2004

25%

C-Class

April 18, 2001

Ten Largest Holdings

Communications

(% of Total Net Assets)

Equipment

40%

AT&T, Inc.

8.5%

Cisco Systems, Inc.

8.3%

Vodafone Group PLC — SP ADR

6.6%

Diversified

Telecommunication

Verizon Communications, Inc.

6.4%

Services

Qualcomm, Inc.

5.7%

35%

Deutsche Telekom AG — SP ADR

5.4%

Nokia Oyj — SP ADR

4.9%

Telecommunications Fund

America Movil SAB de CV — SP ADR

4.9%

BCE, Inc.

3.5%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

Research In Motion Ltd.

3.4%

temporary cash investments.

Top Ten Total

57.6%

“Ten Largest Holdings” exclude any

temporary cash or derivative investments.

TRANSPORTATION FUND

OBJECTIVE: Seeks capital appreciation by investing in companies engaged in providing transportation services or companies

engaged in the design, manufacture, distribution or sale of transportation equipment.

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Marine

Investor Class

April 2, 1998

6%

Advisor Class

June 9, 1998

A-Class

September 1, 2004

C-Class

May 14, 2001

Ten Largest Holdings

Airlines

(% of Total Net Assets)

15%

United Parcel Service, Inc. — Class B

8.8%

Road & Rail

Union Pacific Corp.

7.8%

53%

Burlington Northern Santa Fe Corp.

7.3%

Air Freight

Norfolk Southern Corp.

6.7%

& Couriers

26%

FedEx Corp.

6.5%

Canadian National Railway Co.

6.1%

CSX Corp.

4.8%

Southwest Airlines Co.

4.2%

CH Robinson Worldwide, Inc.

3.7%

Transportation Fund

Expeditors International of

Washington, Inc.

3.2%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

Top Ten Total

59.1%

temporary cash investments.

“Ten Largest Holdings” exclude any

temporary cash or derivative investments.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

15

FUND PROFILES (Unaudited) (concluded)

UTILITIES FUND

OBJECTIVE:

Seeks capital appreciation by investing in companies that operate public utilities.

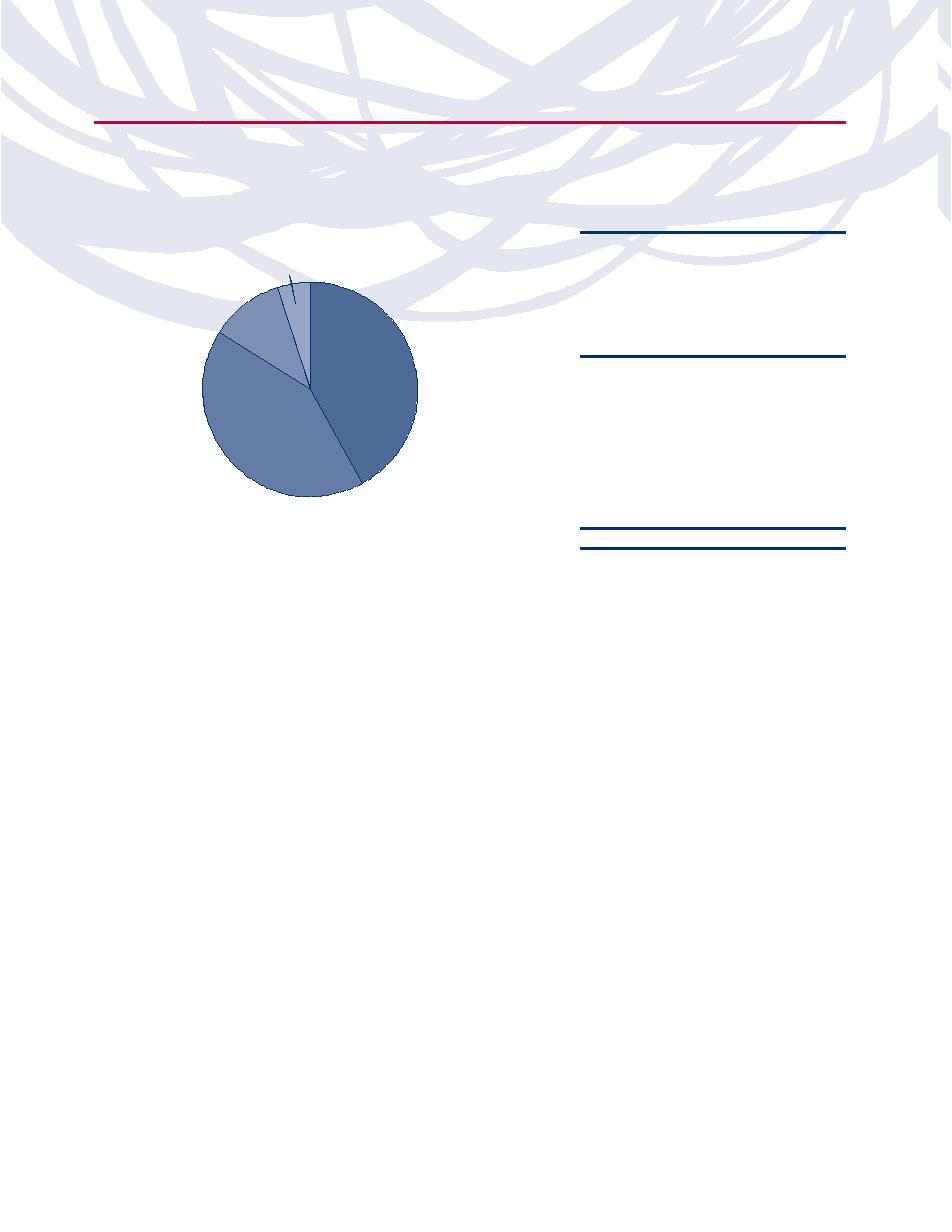

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Investor Class

April 3, 2000

Other

5%

Advisor Class

April 3, 2000

A-Class

September 1, 2004

C-Class

April 27, 2001

Gas

Utilities

Ten Largest Holdings

11%

(% of Total Net Assets)

Multi-Utilities

Exelon Corp.

3.9%

42%

Southern Co.

3.9%

Dominion Resources, Inc.

3.4%

Duke Energy Corp.

3.3%

Electric Utilities

FirstEnergy Corp.

3.0%

42%

FPL Group, Inc.

2.8%

American Electric Power Company, Inc.

2.6%

Entergy Corp.

2.6%

Consolidated Edison, Inc.

2.6%

Utilities Fund

PG&E Corp.

2.6%

Top Ten Total

30.7%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

temporary cash investments.

“Ten Largest Holdings” exclude any

temporary cash or derivative investments.

16

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2008

BANKING FUND

MARKET

MARKET

SHARES

VALUE

SHARES

VALUE

COMMON STOCKS 99.2%

Hancock Holding Co.

3,500

$

178,500

Webster Financial Corp.

7,038

177,710

Wells Fargo & Co.

36,716

$

1,377,951

PrivateBancorp, Inc.

4,260

177,472

Bank of America Corp.

33,651

1,177,785

First Niagara Financial Group, Inc.

11,240

177,030

U.S. Bancorp

32,498

1,170,578

Astoria Financial Corp.

8,514

176,495

JPMorgan Chase & Co.

25,046

1,169,648

FNB Corp.

10,870

173,703

HSBC Holdings PLC — SP ADR

13,055

1,055,236

NewAlliance Bancshares, Inc.

11,548

173,566

Credit Suisse Group AG — SP ADR

21,079

1,017,694

Washington Federal, Inc.

9,284

171,290

Barclays PLC — SP ADR

34,407

849,853

Glacier Bancorp, Inc.

6,800

168,436

UBS AG — SP ADR*

42,414

743,942

Prosperity Bancshares, Inc.

4,950

168,251

PNC Financial Services Group, Inc.

9,258

691,573

Old National Bancorp

8,400

168,168

BB&T Corp.

18,175

687,015

Investors Bancorp, Inc.*

11,075

166,679

SunTrust Banks, Inc.

12,860

578,571

MB Financial Corp.

4,990

165,019

UnionBanCal Corp.

7,052

516,841

Northwest Bancorp, Inc.

5,884

162,045

M&T Bank Corp.

5,180

462,315

CVB Financial Corp.

11,360

157,904

Hudson City Bancorp, Inc.

21,825

402,671

First Midwest Bancorp, Inc.

6,419

155,597

People’s United Financial, Inc.

19,007

365,885

Park National Corp.†

1,946

151,788

Marshall & Ilsley Corp.

17,273

348,051

Trustmark Corp.

7,220

149,743

Regions Financial Corp.†

34,440

330,624

Sovereign Bancorp, Inc.

37,678

148,828

KeyCorp

27,440

327,634

Signature Bank*

4,100

143,008

Zions Bancorporation†

7,981

308,865

First Financial Bankshares, Inc.

2,680

139,038

Comerica, Inc.

9,322

305,668

National Penn Bancshares, Inc.

9,490

138,554

Fifth Third Bancorp

25,420

302,498

Provident Financial Services, Inc.

7,930

130,924

New York Community Bancorp, Inc.

17,781

298,543

National City Corp.

54,874

96,030

TFS Financial Corp

22,493

281,612

Washington Mutual, Inc.

58,616

4,777

Cullen/Frost Bankers, Inc.

4,263

255,780

Total Common Stocks

Capitol Federal Financial

5,589

247,760

(Cost $22,191,195)

24,024,030

Synovus Financial Corp.

23,725

245,554

Commerce Bancshares, Inc.

5,144

238,682

SECURITIES LENDING COLLATERAL 2.7%

Valley National Bancorp†

11,243

235,653

Mount Vernon Securities Lending

BOK Financial Corp.

4,866

235,563

Trust Prime Portfolio (Note 8)

638,933

638,933

TCF Financial Corp.

12,397

223,146

Total Securities Lending Collateral

Huntington Bancshares, Inc.

27,691

221,251

(Cost $638,933)

638,933

BancorpSouth, Inc.

7,845

220,680

City National Corp.

4,057

220,295

FACE

Popular, Inc.†

26,549

220,091

AMOUNT

Bank of Hawaii Corp.

4,112

219,786

REPURCHASE AGREEMENT 1.2%

Associated Banc-Corp.

10,910

217,654

Repurchase Agreement (Note 4)

Susquehanna Bancshares, Inc.†

10,150

198,128

Credit Suisse Group

International Bancshares Corp.

7,186

194,022

issued 09/30/08 at 0.25%

First Horizon National Corp.

20,560

192,446

due 10/01/08

$299,237

299,237

Fulton Financial Corp.†

17,481

190,718

Colonial BancGroup, Inc.

23,935

188,129

Total Repurchase Agreement

United Bankshares, Inc.

5,340

186,900

(Cost $299,237)

299,237

SVB Financial Group*

3,182

184,301

Total Investments 103.1%

UMB Financial Corp.

3,505

184,083

(Cost $23,129,365)

$24,962,200

Wilmington Trust Corp.

6,361

183,388

Liabilities in Excess of

Whitney Holding Corp.†

7,558

183,281

Other Assets – (3.1)%

$

(750,239)

FirstMerit Corp.

8,708

182,868

Net Assets – 100.0%

$24,211,961

Wachovia Corp.

51,809

181,331

Westamerica Bancorporation

3,145

180,932

* Non-Income Producing Security.

† All or a portion of this security is on loan at September 30, 2008 — See Note 8.

ADR—American Depository Receipt.

See Notes to Financial Statements.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

17

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2008

BASIC MATERIALS FUND

MARKET

MARKET

SHARES

VALUE

SHARES

VALUE

COMMON STOCKS 99.8%

International Flavors & Fragrances,

Inc.

10,825

$

427,155

BHP Billiton Ltd. — SP ADR

37,496

$

1,949,417

Ball Corp.

10,780

425,702

Monsanto Co.

16,903

1,673,059

Yamana Gold, Inc.

51,039

425,155

ArcelorMittal

32,628

1,611,171

Huntsman Corp.

32,927

414,880

Rio Tinto PLC — SP ADR

6,133

1,530,184

Sonoco Products Co.

13,859

411,335

Companhia Vale do Rio Doce —

Bemis Co.

15,601

408,902

SP ADR

78,800

1,509,020

Lubrizol Corp.

9,466

408,363

E.I. du Pont de Nemours and Co.

35,041

1,412,152

FMC Corp.

7,932

407,625

Dow Chemical Co.

40,579

1,289,601

Crown Holdings, Inc.*

18,166

403,467

Potash Corporation of Saskatchewan

9,400

1,240,894

Celanese Corp.

14,324

399,783

Barrick Gold Corp.

33,131

1,217,233

Cleveland-Cliffs, Inc.

7,442

393,979

Praxair, Inc.

14,264

1,023,299

Randgold Resources Ltd. —

Syngenta AG — SP ADR

23,100

977,592

SP ADR

9,400

385,682

The Mosaic Co.

14,355

976,427

AptarGroup, Inc.

9,690

378,976

Goldcorp, Inc.

30,571

966,961

Hercules, Inc.

18,507

366,254

Weyerhaeuser Co.

15,720

952,318

Packaging Corporation of America

15,791

366,035

Newmont Mining Corp.

23,433

908,263

Nalco Holding Co.

19,715

365,516

Ecolab, Inc.

18,270

886,460

Albemarle Corp.

11,838

365,084

Rohm & Haas Co.†

12,519

876,330

Domtar Corp.*

79,000

363,400

International Paper Co.

33,180

868,652

RPM International, Inc.†

18,635

360,401

Freeport-McMoRan Copper &

Sociedad Quimica y Minera de

Gold, Inc.

15,164

862,073

Chile SA — SP ADR

13,000

327,730

Alcoa, Inc.

38,051

859,192

Steel Dynamics, Inc.

19,130

326,932

Cemex SA de CV — SP ADR*

46,429

799,507

Terra Industries, Inc.†

10,990

323,106

Southern Copper Corp.

41,375

789,435

Eldorado Gold Corp.*

51,038

319,498

Air Products & Chemicals, Inc.

11,296

773,663

Allegheny Technologies, Inc.

10,597

313,141

Vulcan Materials Co.

10,063

749,694

Reliance Steel & Aluminum Co.†

8,110

307,937

PPG Industries, Inc.

12,698

740,547

AK Steel Holding Corp.

11,800

305,856

Nucor Corp.

17,693

698,874

Ashland, Inc.

9,691

283,365

Kinross Gold Corp.

40,424

651,635

Rockwood Holdings, Inc.*

10,896

279,591

Agnico-Eagle Mines Ltd.

11,146

613,810

Cytec Industries, Inc.

7,113

276,767

Sigma-Aldrich Corp.

11,537

604,770

Compass Minerals International,

Gerdau SA — SP ADR

51,600

572,760

Inc.

5,141

269,337

Agrium, Inc.

9,993

560,407

Pan American Silver Corp.*

12,000

266,760

AngloGold Ashanti Ltd. — SP ADR

24,200

559,020

Commercial Metals Co.

15,282

258,113

United States Steel Corp.

6,951

539,467

Aracruz Celulose SA — SP ADR

6,800

249,628

Martin Marietta Materials, Inc.

4,792

536,608

Silver Wheaton Corp.*†

30,372

247,532

Cia de Minas Buenaventura SA —

Olin Corp.

12,700

246,380

SP ADR

22,600

530,648

Century Aluminum Co.*

7,100

196,599

Gold Fields Ltd. — SP ADR

54,871

526,213

Total Common Stocks

MeadWestvaco Corp.

20,883

486,783

(Cost $44,689,503)

49,750,482

Sealed Air Corp.

21,877

481,075

Pactiv Corp.*

18,926

469,933

SECURITIES LENDING COLLATERAL 2.2%

Airgas, Inc.

9,199

456,730

Mount Vernon Securities Lending

Eastman Chemical Co.

8,182

450,501

Trust Prime Portfolio (Note 8)

1,069,448

1,069,448

Owens-Illinois, Inc.*

14,725

432,915

Total Securities Lending Collateral

Harmony Gold Mining Co. Ltd. —

(Cost $1,069,448)

1,069,448

SP ADR*†

44,450

430,276

CF Industries Holdings, Inc.

4,690

428,947

18

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

See Notes to Financial Statements.

SCHEDULE OF INVESTMENTS (Unaudited) (concluded)

September 30, 2008

BASIC MATERIALS FUND

FACE

MARKET

AMOUNT

VALUE

REPURCHASE AGREEMENT 1.0%

Repurchase Agreement (Note 4)

Credit Suisse Group

issued 09/30/08 at 0.25%

due 10/01/08

$521,524

$

521,524

Total Repurchase Agreement

(Cost $521,524)

521,524

Total Investments 103.0%

(Cost $46,280,475)

$51,341,454

Liabilities in Excess of

Other Assets – (3.0)%

$ (1,480,724)

Net Assets – 100.0%

$49,860,730

* Non-Income Producing Security.

† All or a portion of this security is on loan at September 30, 2008 — See Note 8.

ADR—American Depository Receipt.

See Notes to Financial Statements.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

19

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2008

BIOTECHNOLOGY FUND

MARKET

MARKET

SHARES

VALUE

SHARES

VALUE

COMMON STOCKS 99.9%

SECURITIES LENDING COLLATERAL 8.0%

Mount Vernon Securities Lending

Genentech, Inc.*

125,920

$11,166,586

Trust Prime Portfolio (Note 8)

7,182,660

$

7,182,660

Amgen, Inc.*

158,307

9,382,856

Total Securities Lending Collateral

Gilead Sciences, Inc.*

142,782

6,508,003

(Cost $7,182,660)

7,182,660

Celgene Corp.*

86,378

5,466,000

Genzyme Corp.*

64,480

5,215,787

FACE

Biogen Idec, Inc.*

75,141

3,778,841

AMOUNT

ImClone Systems, Inc.*

48,933

3,055,376

Cephalon, Inc.*†

33,679

2,609,786

REPURCHASE AGREEMENT 0.2%

Vertex Pharmaceuticals, Inc.*†

72,683

2,415,983

Repurchase Agreement (Note 4)

Myriad Genetics, Inc.*†

30,130

1,954,834

Credit Suisse Group

Alexion Pharmaceuticals, Inc.*

49,482

1,944,643

issued 09/30/08 at 0.25%

OSI Pharmaceuticals, Inc.*

37,854

1,865,824

due 10/01/08

$202,446

202,446

United Therapeutics Corp.*

16,035

1,686,401

Total Repurchase Agreement

BioMarin Pharmaceuticals, Inc.*†

62,550

1,656,949

(Cost $202,446)

202,446

Amylin Pharmaceuticals, Inc.*

79,864

1,614,850

Total Investments 108.1%

Regeneron Pharmaceuticals, Inc.*

73,710

1,609,089

(Cost $61,704,464)

$97,130,594

Isis Pharmaceuticals, Inc.*

87,557

1,478,838

Liabilities in Excess of

Onyx Pharmaceuticals, Inc.*

40,000

1,447,200

Other Assets – (8.1)%

$ (7,299,156)

Celera Corp.*

87,425

1,350,716

Net Assets – 100.0%

$89,831,438

Cubist Pharmaceuticals, Inc.*†

59,020

1,312,015

Alkermes, Inc.*

89,372

1,188,648

Alnylam Pharmaceuticals, Inc.*

39,608

1,146,652

Seattle Genetics, Inc.*

102,420

1,095,894

Martek Biosciences Corp.

33,900

1,065,138

PDL BioPharma, Inc.

114,303

1,064,161

Human Genome Sciences, Inc.*

160,135

1,016,857

CV Therapeutics, Inc.*

93,226

1,006,841

Rigel Pharmaceuticals, Inc.*

42,300

987,705

GTx, Inc.*†

51,312

975,954

InterMune, Inc.*†

54,654

935,130

Genomic Health, Inc.*†

40,119

908,695

Medarex, Inc.*

134,865

872,576

Dendreon Corp.*†

149,270

852,332

Theravance, Inc.*†

68,200

849,772

Acorda Therapeutics, Inc.*

35,248

840,665

Incyte Corp.*

107,357

821,281

Indevus Pharmaceuticals, Inc.*†

231,500

775,525

Savient Pharmaceuticals, Inc.*

50,123

747,334

Momenta Pharmaceuticals, Inc.*

55,700

730,227

Cepheid, Inc.*

49,100

679,053

Zymogenetics, Inc.*†

97,226

647,525

Enzon Pharmaceuticals, Inc.*

85,878

633,780

Progenics Pharmaceuticals, Inc.*†

47,176

627,912

Arena Pharmaceuticals, Inc.*

120,151

600,755

Sangamo Biosciences, Inc.*†

68,000

523,600

Metabolix, Inc.*†

47,700

518,976

Cell Genesys, Inc.*†

189,700

111,923

Total Common Stocks

(Cost $54,319,358)

89,745,488

* Non-Income Producing Security.

† All or a portion of this security is on loan at September 30, 2008 — See Note 8.

20

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

See Notes to Financial Statements.

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2008

CONSUMER PRODUCTS FUND

MARKET

MARKET

SHARES

VALUE

SHARES

VALUE

COMMON STOCKS 99.7%

Smithfield Foods, Inc.*

9,273

$

147,255

Central European Distribution

Procter & Gamble Co.

25,112

$

1,750,055

Corp.*

2,899

131,644

Coca-Cola Co.

24,679

1,305,026

Total Common Stocks

PepsiCo, Inc.

17,876

1,274,023

(Cost $19,342,389)

22,593,243

Philip Morris International, Inc.

23,377

1,124,434

Kraft Foods, Inc. — Class A

25,860

846,915

SECURITIES LENDING COLLATERAL 1.2%

Unilever NV

27,903

785,748

Mount Vernon Securities Lending

Anheuser-Busch Companies, Inc.

11,901

772,137

Trust Prime Portfolio (Note 8)

268,570

268,570

Colgate-Palmolive Co.

9,808

739,033

Total Securities Lending Collateral

Diageo PLC — SP ADR

10,612

730,742

(Cost $268,570)

268,570

Altria Group, Inc.

36,583

725,807

Kimberly-Clark Corp.

9,986

647,492

FACE

General Mills, Inc.

8,316

571,476

AMOUNT

Kellogg Co.

9,799

549,724

REPURCHASE AGREEMENT 0.2%

Avon Products, Inc.

12,439

517,089

Repurchase Agreement (Note 4)

Sysco Corp.

16,379

504,965

Credit Suisse Group

Wm. Wrigley Jr. Co.

6,034

479,100

issued 09/30/08 at 0.25%

Kroger Co.

17,215

473,068

due 10/01/08

$41,585

41,585

H.J. Heinz Co.

9,175

458,475

Campbell Soup Co.

11,732

452,855

Total Repurchase Agreement

Reynolds American, Inc.

8,739

424,890

(Cost $41,585)

41,585

Lorillard, Inc.

5,767

410,322

Total Investments 101.1%

UST, Inc.

6,023

400,770

(Cost $19,652,544)

$22,903,398

Cadbury PLC — SP ADR

9,576

392,041

Liabilities in Excess of

Archer-Daniels-Midland Co.

17,225

377,400

Other Assets – (1.1)%

$

(250,658)

Clorox Co.

5,811

364,292

Net Assets – 100.0%

$22,652,740

Safeway, Inc.

14,695

348,565

ConAgra Foods, Inc.

17,580

342,107

Sara Lee Corp.

26,607

336,046

Coca-Cola Enterprises, Inc.

19,557

327,971

Hershey Co.

7,936

313,789

Pepsi Bottling Group, Inc.

10,223

298,205

Estee Lauder Companies, Inc. —

Class A†

5,879

293,421

Molson Coors Brewing Co. —

Class B

5,866

274,235

Energizer Holdings, Inc.*

3,295

265,412

Hormel Foods Corp.

7,075

256,681

Bunge Ltd.

4,009

253,289

Church & Dwight Co., Inc.

4,033

250,409

Brown-Forman Corp. — Class B

3,466

248,893

McCormick & Co., Inc.

6,262

240,774

Dean Foods Co.*

10,128

236,590

Constellation Brands, Inc. —

Class A*

10,817

232,133

SUPERVALU, INC.

9,505

206,258

Tyson Foods, Inc. — Class A

15,273

182,360

Whole Foods Market, Inc.†

9,059

181,452

Corn Products International, Inc.

4,581

147,875

* Non-Income Producing Security.

† All or a portion of this security is on loan at September 30, 2008 — See Note 8.

ADR—American Depository Receipt.

See Notes to Financial Statements.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

21

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2008

ELECTRONICS FUND

MARKET

MARKET

SHARES

VALUE

SHARES

VALUE

COMMON STOCKS 99.6%

Formfactor, Inc.*

3,829

$

66,701

RF Micro Devices, Inc.*

22,390

65,379

Intel Corp.

39,594

$

741,596

Cymer, Inc.*

2,489

63,046

Taiwan Semiconductor Manufacturing

Triquint Semiconductor, Inc.*

12,220

58,534

Company Ltd. — SP ADR†

54,704

512,576

Power Integrations, Inc.*

2,370

57,117

Texas Instruments, Inc.

16,537

355,545

Diodes, Inc.*

3,068

56,605

Applied Materials, Inc.

20,901

316,232

Cypress Semiconductor Corp.*

5,926

30,934

STMicroelectronics NV — SP ADR

21,971

223,665

Total Common Stocks

Xilinx, Inc.

8,382

196,558

(Cost $5,249,093)

7,284,117

Analog Devices, Inc.

7,410

195,253

Linear Technology Corp.†

6,324

193,894

SECURITIES LENDING COLLATERAL 4.6%

Altera Corp.

9,163

189,491

Mount Vernon Securities Lending

ASML Holding NV

10,555

185,874

Trust Prime Portfolio (Note 8)

338,218

338,218

Nvidia Corp.*

17,145

183,623

Total Securities Lending Collateral

Broadcom Corp. — Class A*

9,611

179,053

(Cost $338,218)

338,218

Microchip Technology, Inc.

5,885

173,196

KLA-Tencor Corp.

5,044

159,643

FACE

Lam Research Corp.*

4,725

148,790

AMOUNT

MEMC Electronic Materials, Inc.*

5,055

142,854

REPURCHASE AGREEMENT 0.4%

National Semiconductor Corp.

8,157

140,382

Repurchase Agreement (Note 4)

Marvell Technology Group Ltd.*

15,075

140,197

Credit Suisse Group

Advanced Micro Devices, Inc.*

26,257

137,849

issued 09/30/08 at 0.25%

Infineon Technologies AG —

due 10/01/08

$32,884

32,884

SP ADR*

23,680

132,371

LSI Logic Corp.*†

24,280

130,141

Total Repurchase Agreement

Micron Technology, Inc.*

28,993

117,422

(Cost $32,884)

32,884

Cree, Inc.*

5,097

116,110

Total Investments 104.6%

Microsemi Corp.*

4,330

110,328

(Cost $5,620,195)

$7,655,219

Sunpower Corp.*

1,581

109,171

Liabilities in Excess of

ON Semiconductor Corp.*

16,055

108,532

Other Assets – (4.6)%

$

(338,599)

Novellus Systems, Inc.*

5,324

104,563

Net Assets – 100.0%

$7,316,620

Atmel Corp.*

28,635

97,073

PMC - Sierra, Inc.*

12,883

95,592

Varian Semiconductor Equipment

Associates, Inc.*

3,703

93,019

Silicon Laboratories, Inc.*

2,968

91,118

International Rectifier Corp.*

4,774

90,801

Intersil Corp. — Class A

5,418

89,830

Skyworks Solutions, Inc.*

9,512

79,520

Rambus, Inc.*

6,078

78,102

Hittite Microwave Corp.*

2,322

78,019

Integrated Device Technology, Inc.*

10,000

77,800

Teradyne, Inc.*

9,955

77,749

Atheros Communications, Inc.*

3,283

77,413

Semtech Corp.*

5,050

70,498

FEI Co.*

2,934

69,859

Amkor Technology, Inc.*

10,877

69,286

MKS Instruments, Inc.*

3,476

69,207

Fairchild Semiconductor International,

Inc.*

7,750

68,898

Tessera Technologies, Inc.*

4,107

67,108

* Non-Income Producing Security.

† All or a portion of this security is on loan at September 30, 2008 — See Note 8.

ADR—American Depository Receipt.

22

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

See Notes to Financial Statements.

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2008

ENERGY FUND

MARKET

MARKET

SHARES

VALUE

SHARES

VALUE

COMMON STOCKS 99.4%

Cimarex Energy Co.

11,075

$

541,678

Helmerich & Payne, Inc.

12,324

532,274

Exxon Mobil Corp.

75,301

$

5,847,876

Denbury Resources, Inc.*

26,499

504,541

Chevron Corp.

45,567

3,758,366

Arch Coal, Inc.

15,000

493,350

BP PLC — SP ADR

66,318

3,327,174

Tidewater, Inc.

8,776

485,839

ConocoPhillips

40,029

2,932,124

Frontline Ltd.†

10,085

484,786

Royal Dutch Shell PLC — SP ADR

45,939

2,710,860

PetroHawk Energy Corp.*

22,225

480,727

Petroleo Brasileiro SA†

61,400

2,698,530

Cabot Oil & Gas Corp.

13,117

474,048

Schlumberger Ltd.

32,575

2,543,782

Rowan Companies, Inc.

15,444

471,814

Occidental Petroleum Corp.

30,665

2,160,349

Whiting Petroleum Corp.*

6,545

466,397

Devon Energy Corp.

19,854

1,810,685

Newfield Exploration Co.*

14,475

463,055

Apache Corp.

16,080

1,676,822

Dresser-Rand Group, Inc.*

14,622

460,154

Canadian Natural Resources Ltd.

23,320

1,596,487

Oceaneering International, Inc.*

8,305

442,823

Transocean, Inc.*

13,912

1,528,094

CNX Gas Corp.*

19,458

435,665

Marathon Oil Corp.

37,470

1,493,929

Plains Exploration & Production Co.*

12,024

422,764

Hess Corp.

17,022

1,397,166

Quicksilver Resources, Inc.*

21,515

422,339

XTO Energy, Inc.

28,884

1,343,684

Patterson-UTI Energy, Inc.

20,910

418,618

Halliburton Co.

40,271

1,304,378

Alpha Natural Resources, Inc.*

7,985

410,668

EOG Resources, Inc.

14,260

1,275,700

IHS Inc.*

8,270

393,983

Anadarko Petroleum Corp.

25,506

1,237,296

Atwood Oceanics, Inc.*

10,750

391,300

Valero Energy Corp.

36,842

1,116,313

Comstock Resources, Inc.*

7,600

380,380

Baker Hughes, Inc.

18,337

1,110,122

St. Mary Land & Exploration Co.

10,600

377,890

Spectra Energy Corp.

45,703

1,087,731

Unit Corp.*

7,480

372,654

National-Oilwell Varco, Inc.*

21,625

1,086,224

Superior Energy Services*

11,938

371,749

Chesapeake Energy Corp.

30,043

1,077,342

Encore Acquisition Co.*

8,737

365,032

Tenaris SA — SP ADR

28,530

1,063,884

Helix Energy Solutions Group, Inc.*

14,982

363,763

Diamond Offshore Drilling, Inc.†

9,897

1,019,985

Massey Energy Co.

9,985

356,165

Talisman Energy, Inc.

68,980

980,896

SandRidge Energy, Inc.*

16,725

327,810

Weatherford International Ltd.*

38,635

971,284

Teekay Shipping Corp.

12,235

322,759

Murphy Oil Corp.

14,368

921,563

W&T Offshore, Inc.

11,620

317,110

Williams Companies, Inc.

38,849

918,779

Exterran Holdings, Inc.*

9,485

303,141

Noble Corp.

20,474

898,809

EXCO Resources, Inc.*

17,600

287,232

Nexen, Inc.

37,350

867,640

Foundation Coal Holdings, Inc.

7,600

270,408

Smith International, Inc.

14,770

866,113

Patriot Coal Corp.*†

9,000

261,450

Southwestern Energy Co.*

27,855

850,692

Total Common Stocks

Peabody Energy Corp.†

18,850

848,250

(Cost $51,990,010)

80,530,350

Noble Energy, Inc.

13,586

755,246

ENSCO International, Inc.†

13,033

751,092

SECURITIES LENDING COLLATERAL 5.0%

Ultra Petroleum Corp.*

13,345

738,512

Mount Vernon Securities Lending

Cameron International Corp.*

19,106

736,345

Trust Prime Portfolio (Note 8)

4,061,970

4,061,970

El Paso Corp.

57,516

733,904

Total Securities Lending Collateral

Pioneer Natural Resources Co.

12,675

662,649

(Cost $4,061,970)

4,061,970

Range Resources Corp.

15,239

653,296

Total Investments 104.4%

Consol Energy, Inc.

13,792

632,915

(Cost $56,051,980)

$84,592,320

Cameco Corp.

27,439

612,164

Liabilities in Excess of

Nabors Industries Ltd.*

24,084

600,173

Other Assets – (4.4)%

$ (3,584,360)

FMC Technologies, Inc.*

12,759

593,931

Sunoco, Inc.†

16,536

588,351

Net Assets – 100.0%

$81,007,960

BJ Services Co.

30,381

581,188

Continental Resources, Inc.*

14,530

570,012

Pride International, Inc.*

18,997

562,501

Forest Oil Corp.*

11,185

554,776

* Non-Income Producing Security.

† All or a portion of this security is on loan at September 30, 2008 — See Note 8.

ADR—American Depository Receipt.

See Notes to Financial Statements.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

23

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2008

ENERGY SERVICES FUND

MARKET

FACE

MARKET

SHARES

VALUE

AMOUNT

VALUE

COMMON STOCKS 100.2%

REPURCHASE AGREEMENT 0.0%

Repurchase Agreement (Note 4)

Schlumberger Ltd.

189,604

$

14,806,177

Credit Suisse Group

Transocean, Inc.*

80,850

8,880,564

issued 09/30/08 at 0.25%

Halliburton Co.

234,453

7,593,933

due 10/01/08

$15,721

$

15,721

Baker Hughes, Inc.

106,813

6,466,459

Total Repurchase Agreement