UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number: | | 811-07692 |

Legg Mason Investors Trust, Inc.

|

| 100 Light Street, Baltimore, MD 21202 |

| Address of Principal Executive Offices: |

Richard M. Wachterman, Esq.

Legg Mason & Co., LLC

100 Light Street

Baltimore, MD 21202

|

| Name and address of agent for service: |

Registrant’s telephone number, including area code: (410) 539-0000

Date of fiscal year end: March 31, 2008

Date of reporting period: March 31, 2008

| Item 1. | Report to Shareholders |

| | |

| Annual Report to Shareholders | | 1 |

To Our Shareholders

We are pleased to provide you with Legg Mason Investors Trust’s annual report for American Leading Companies Trust and U.S. Small-Capitalization Value Trust, for the year ended March 31, 2008.

| | | | | | |

| | | Total Returns | |

| | | 3 Months | | | 1 Year | |

American Leading Companies Trust: | | | | | | |

Primary Class | | –14.39 | % | | –16.24 | % |

Institutional Class | | –14.18 | % | | –15.37 | % |

S&P 500 Stock Composite IndexA | | –9.44 | % | | –5.08 | % |

| | |

U.S. Small-Capitalization Value Trust: | | | | | | |

Primary Class | | –4.23 | % | | –17.94 | % |

Institutional Class | | –4.00 | % | | –17.17 | % |

Russell 2000 IndexB | | –9.90 | % | | –13.00 | % |

The performance data quoted represent past performance and do not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information for the Primary Class please visit www.leggmason.com/individualinvestors. For the Institutional Class please visit www.lminstitutionalfunds.com. The investment return and principal value of the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

PricewaterhouseCoopers LLP, the Funds’ independent registered public accounting firm, has completed its annual audit, and audited financial statements for the fiscal year ended March 31, 2008, are included in this report.

Information about each Fund’s performance over longer periods of time is shown in the respective Performance Information sections within this report. For more information about each Fund’s share classes included in this report, please contact your financial advisor.

Many Primary Class shareholders invest regularly in Fund shares on a dollar cost averaging basis. Most do so by authorizing automatic, monthly transfers of $50 or more

A | S&P 500 Stock Composite Index — A market capitalization-weighted index, composed of 500 widely held common stocks, that is generally considered representative of the U.S. stock market. |

B | Russell 2000® Index — An unmanaged index comprised of the 2,000 smallest companies of the 3,000 largest U.S. companies based on market capitalization. |

| | |

| 2 | | Annual Report to Shareholders |

from their bank checking or brokerage accounts. Dollar cost averaging is a convenient and sensible way to invest, as it encourages continued purchases over time regardless of fluctuating price levels. Of course, it does not ensure a profit nor protect against declines in the value of your investment. Your financial advisor will be happy to help you establish a dollar cost averaging account should you wish to do so.

|

| Sincerely, |

|

|

| Mark R. Fetting |

| President |

|

| April 21, 2008 |

| | |

| Annual Report to Shareholders | | 3 |

Management’s Discussion of Fund Performance

American Leading Companies

Total returns for the American Leading Companies Trust for various periods ended March 31, 2008, are presented below along with those of some comparative indicesA:

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | Average Annual Total Returns

Through March 31, 2008 | |

| | | First Quarter

2008 | | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

InceptionB | |

American Leading | | | | | | | | | | | | | | | | | | |

Companies | | | | | | | | | | | | | | | | | | |

Primary Class | | –14.39 | % | | –16.24 | % | | +0.19 | % | | +8.62 | % | | +2.81 | % | | +7.28 | % |

Institutional Class | | –14.18 | % | | –15.37 | % | | +1.20 | % | | +9.72 | % | | N/A | | | +3.16 | % |

S&P 500 Stock Composite | | | | | | | | | | | | | | | | | | |

Index | | –9.44 | % | | –5.08 | % | | +5.85 | % | | +11.32 | % | | +3.50 | % | | +9.45 | % |

Dow Jones Industrial | | | | | | | | | | | | | | | | | | |

Average | | –6.92 | % | | +1.57 | % | | +7.75 | % | | +11.46 | % | | +5.51 | % | | +11.02 | % |

NASDAQ Composite | | | | | | | | | | | | | | | | | | |

Index | | –13.88 | % | | –5.12 | % | | +5.27 | % | | +11.92 | % | | +2.70 | % | | 7.99 | %C |

S&P Mid-Cap 400 index | | –8.85 | % | | –6.97 | % | | +7.06 | % | | +15.10 | % | | +9.02 | % | | +12.31 | % |

Russell 2000 Index | | –9.90 | % | | –13.00 | % | | +5.06 | % | | +14.90 | % | | +4.96 | % | | +8.73 | % |

Dow Jones Wilshire 5000 | | | | | | | | | | | | | | | | | | |

Index | | –9.52 | % | | –5.75 | % | | +6.37 | % | | +12.45 | % | | +3.95 | % | | +9.37 | % |

Russell 1000 Growth Index | | –10.18 | % | | –0.75 | % | | +6.33 | % | | +9.96 | % | | +1.28 | % | | +7.94 | % |

Russell 1000 Value Index | | –8.72 | % | | –9.99 | % | | +6.01 | % | | +13.68 | % | | +5.54 | % | | +10.45 | % |

The performance data quoted represent past performance and do not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information for the Primary Class please visit www.leggmason.com/individualinvestors. For the Institutional Class please visit www.lminstitutionalfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

The fiscal year ended March 31, 2008, was a difficult one for the stock market as the Dow Jones Industrial Average was the only major market index to post a positive return.

A | See Glossary of Index Definitions on page 76. Although it is not possible to invest directly in an index, it is possible to purchase investment vehicles designed to track the performance of certain indices. Past performance does not guarantee future results. |

B | The inception date of the Primary Class is September 1, 1993. The inception date of the Institutional Class is June 14, 2001. Index returns are for the periods beginning August 31, 1993. |

C | This return does not include reinvestment of dividends or capital distributions. |

| | |

| 4 | | Annual Report to Shareholders |

Management’s Discussion of Fund Performance — Continued

Value-based investment styles were especially hard hit during the year, as the Russell 1000 Value Index underperformed the S&P 500 Stock Composite Index (S&P 500) by nearly five percentage points and also underperformed the Russell 1000 Growth Index by over nine percentage points.

The fiscal year began positively with the S&P 500 posting mid-single-digit returns through June 2007. During the summer, and especially in August, deterioration in the subprime mortgage market, which had begun to surface in the spring morphed into a full-blown financial crisis as credit concerns expanded to include more highly rated mortgages and an alphabet soup of structured investment products including collateralized debt obligations (CDO), asset-backed commercial paper (ABCP), mortgage-backed securities (MBS) and the like. Following the Federal Reserve Board’sD (Fed) initial efforts in August to restore liquidity and confidence to the credit markets, the S&P 500 rallied to an all-time high of 1,565.15 on October 9, 2007, five years to the day from its bear market low of 776.76 on October 9, 2002. The financial crisis took a renewed turn for the worse in the December 2007 and March 2008 quarters, as credit spreads on a broad range of fixed-income instruments widened substantially, subprime mortgage delinquency and default rates spiked up, and massive asset write-downs were recorded by a wide range of financial institutions. As the housing market continued to deteriorate and losses on Wall Street mounted, the financial crisis moved from Wall Street to Main Street. Declining stock prices and weakening home prices, coupled with soaring oil and commodity prices, knocked consumer confidence for a loop, causing a slowdown in consumer spending, which has pushed the economy to the brink of recession. From its closing high in October 2007, the S&P 500 dropped 18.4% to a closing low of 1276.60 on March 17, 2008. Since then, the market has rallied somewhat as the Fed-brokered acquisition of Bear Stearns by JPMorgan Chase and its aggressive measures to restore liquidity to the credit markets appears to have steadied the equity market, at least for the time being.

American Leading Companies Trust (ALC) substantially underperformed its primary benchmark, the S&P 500, during the year ended March 31, 2008, declining 16.24% versus a 5.08% decline in the index. ALC also significantly trailed other major market indices and peer fund averages. Roughly half of ALC’s underperformance relative to the S&P 500 was attributable to its financial holdings, where the Fund entered the year with an overweighted position in what proved to be the worst-performing sector of the market in fiscal 2008. ALC’s financial stocks also performed worse than the sector, on average, with Countrywide Financial Corporation, Citigroup Inc., Ambac Financial Group Inc. (sold during the year), American International Group,

D | Federal Reserve Board (Fed) — is charged with, among other things, managing the nation’s monetary policy by influencing the monetary and credit conditions in the economy in pursuit of maximum employment, stable prices, and moderate long-term interest rates. |

| | |

| Annual Report to Shareholders | | 5 |

Inc., Washington Mutual Inc. and XL Capital Ltd. being the most significant negative contributors. Next on the list of detractors from performance were the managed care stocks – UnitedHealth Group Inc., WellPoint Inc. and Health Net Inc. – whose poor showing accounted for about 20% of the shortfall in Fund results versus the S&P 500. Other significant detractors from performance included: Jabil Circuit, Inc., Sprint Nextel Corp., and UAL Corp., which collectively reduced results by about five and one-half percentage points. There were a few bright spots in the portfolio in an otherwise disappointing year. Nokia Oyj – Sponsored ADR was up 42.0% for the fiscal year and contributed about 125 basis pointsE (bps) to performance. In addition, ALC’s energy stocks were up an average of 38.9% versus a 22.1% return for the energy stocks in the S&P 500. This superior stock selection in the energy group helped offset the portfolio’s underweighting in energy versus the benchmark, enabling the portfolio’s energy stocks to match the market’s energy sector in terms of total contribution to return. Finally, despite the fact that consumer discretionary stocks were the second worst-performing sector in the market last year, ALC’s holdings in this group were stronger, on average, and thus contributed positively to relative returns. Amazon.com, Inc. (sold during the year), Apollo Group Inc. (also sold before year end) and The TJX Cos., Inc. were notable positive contributors in this group.

|

| David E. Nelson, CFA |

|

| April 21, 2008 |

| DJIA: 12,825.02 |

E | 100 basis points (bps) = 1% |

| | |

| 6 | | Annual Report to Shareholders |

Expense Example

American Leading Companies Trust

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution and service (12b-1) fees on Primary Class shares, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested on October 1, 2007, and held through March 31, 2008. The ending value assumes dividends were reinvested at the time they were paid.

Actual Expenses

The first line for each class in the table below provides information about actual account values and actual expenses for each class. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account if your shares were held through the entire period.

Hypothetical Example for Comparison Purposes

The second line for each class in the table below provides information about hypothetical account values and hypothetical expenses based on the relevant class’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the class’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples for the relevant class that appear in the shareholder reports of other funds.

| | | | | | | | | |

| | | Beginning

Account

Value

10/1/07 | | Ending

Account

Value

3/31/08 | | Expenses PaidA

During the Period

10/1/07 to 03/31/08 |

Primary Class | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 785.40 | | $ | 8.17 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,015.92 | | | 9.22 |

Institutional Class | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 789.40 | | $ | 3.53 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,021.12 | | | 3.99 |

A | These calculations are based on expenses incurred in the most recent fiscal half-year. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratios of 1.83% and 0.79% for the Primary Class and Institutional Class respectively, multiplied by the average values over the period, multiplied by the number of days in the most recent fiscal half-year (183) and divided by 366. |

| | |

| Annual Report to Shareholders | | 7 |

Performance Information

American Leading Companies Trust

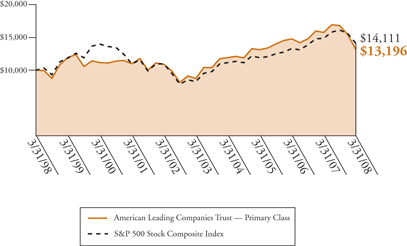

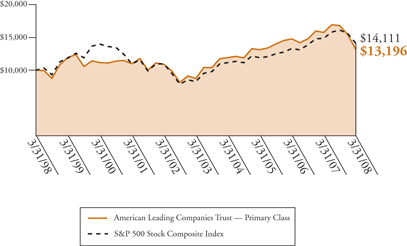

The graphs on the following pages compare the Fund’s total returns to that of the S&P 500 Stock Composite Index. The graphs illustrate the cumulative total return of an initial $10,000 investment in the Primary Class and an initial $1,000,000 investment in the Institutional Class, for the periods indicated. The lines for the Fund represent the total return after deducting all Fund investment management and other administrative expenses and the transaction costs of buying and selling securities. The lines representing the securities market index do not take into account any transaction costs associated with buying and selling securities in the index or other administrative expenses. Both the Fund’s results and the index’s results assume reinvestment of all dividends and distributions.

Total return measures investment performance in terms of appreciation or depreciation in a fund’s net asset value per share, plus dividends and any capital gain distributions. Average annual returns tend to smooth out variations in a fund’s return, so that they differ from actual year-to-year results.

| | |

| 8 | | Annual Report to Shareholders |

Performance Information — Continued

Growth of a $10,000 Investment — Primary Class

Periods Ended March 31, 2008

| | | | | | |

| | | Cumulative

Total Return | | | Average Annual

Total Return | |

One Year | | –16.24 | % | | –16.24 | % |

Five Years | | +51.19 | % | | +8.62 | % |

Ten Years | | +31.96 | % | | +2.81 | % |

The performance data quoted represent past performance and do not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information please visit www.leggmason.com/individual investors. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | |

| Annual Report to Shareholders | | 9 |

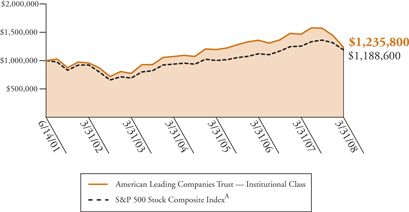

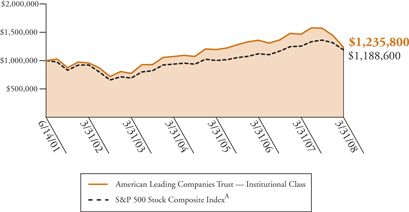

Growth of a $1,000,000 Investment — Institutional Class

Periods Ended March 31, 2008

| | | | | | |

| | | Cumulative

Total Return | | | Average Annual

Total Return | |

One Year | | –15.37 | % | | –15.37 | % |

Five Years | | +58.99 | % | | +9.72 | % |

Life of Class* | | +23.58 | % | | +3.16 | % |

| * | Inception date: June 14, 2001 |

The performance data quoted represent past performance and do not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information please visit www.lminstitutionalfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

A | Index returns are for periods beginning May 31, 2001. |

| | |

| 10 | | Annual Report to Shareholders |

Performance Information — Continued

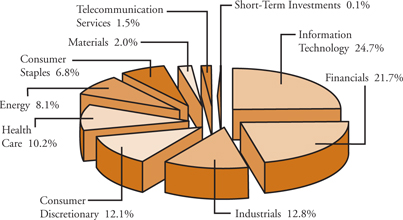

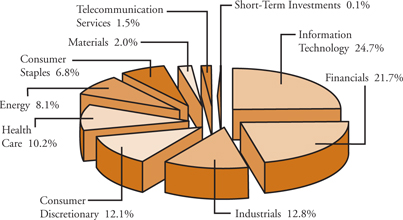

Portfolio Composition (as of March 31, 2008)B

(As a percentage of the portfolio)

Top Ten Holdings (as of March 31, 2008)

| | | |

Security | | % of

Net Assets | |

J.P. Morgan Chase and Co. | | 5.0 | % |

General Electric Co. | | 3.6 | % |

Yahoo! Inc. | | 3.4 | % |

American International Group Inc. | | 3.3 | % |

Nokia Oyj – ADR | | 3.2 | % |

Philip Morris International Inc. | | 3.0 | % |

International Business Machines Corp. | | 2.9 | % |

Lloyds TSB Group PLC | | 2.9 | % |

Texas Instruments Inc. | | 2.8 | % |

UAL Corp. | | 2.8 | % |

B | The Fund is actively managed. As a result, the composition of its portfolio holdings and sectors is subject to change at any time. |

| | |

| Annual Report to Shareholders | | 11 |

Selected Portfolio Performance C

| | | | | |

Strongest performers for the year ended March 31, 2008D | |

1. | | Apache Corp. | | +72.2 | % |

2. | | Transocean Inc. | | +56.0 | % |

3. | | Devon Energy Corp. | | +51.7 | % |

4. | | Anadarko Petroleum Corp. | | +47.6 | % |

5. | | Nokia Oyj – ADR | | +42.0 | % |

6. | | United States Steel Corp. | | +29.1 | % |

7. | | Noble Corp. | | +26.6 | % |

8. | | The TJX Cos. Inc. | | +24.2 | % |

9. | | International Business Machines Corp. | | +24.0 | % |

10. | | Caterpillar Inc. | | +19.0 | % |

| | | | | |

Weakest performers for the year ended March 31, 2008D | |

1. | | Countrywide Financial Corp. | | –82.9 | % |

2. | | Washington Mutual Inc. | | –73.0 | % |

3. | | Sprint Nextel Corp. | | –64.6 | % |

4. | | XL Capital Ltd. | | –56.6 | % |

5. | | Citigroup Inc. | | –56.3 | % |

6. | | Merrill Lynch and Co. Inc. | | –49.1 | % |

7. | | WellPoint Inc. | | –45.6 | % |

8. | | Pulte Homes Inc. | | –44.4 | % |

9. | | Health Net Inc. | | –42.8 | % |

10. | | Centex Corp. | | –41.8 | % |

Portfolio Changes

| | |

Securities added during the quarter | | Securities sold during the quarter |

Capital One Financial Corp. | | Ambac Financial Group |

Philip Morris International Inc. | | Intel Corp. |

| | XM Satellite Radio Holdings Inc. |

C | Individual security performance is measured by the change in the security’s price; for stocks, dividends are assumed to be reinvested at the time they were paid. |

D | Securities held for the entire year. |

| | |

| 12 | | Annual Report to Shareholders |

Portfolio of Investments

American Leading Companies Trust

March 31, 2008

| | | | | | |

| | | Shares/Par | | Value | |

Common Stocks and Equity Interests — 100.1% | | | | | | |

Consumer Discretionary — 12.1% | | | | | | |

Automobiles — 0.7% | | | | | | |

General Motors Corp. | | 235,000 | | $ | 4,476,750 | |

| | | | | | |

Household Durables — 3.4% | | | | | | |

Centex Corp. | | 180,000 | | | 4,357,800 | |

Lennar Corp. | | 415,000 | | | 7,806,150 | |

Pulte Homes Inc. | | 570,000 | | | 8,293,500 | |

| | | | | | |

| | | | | 20,457,450 | |

| | | | | | |

Internet and Catalog Retail — 1.1% | | | | | | |

Expedia Inc. | | 300,000 | | | 6,567,000 | A |

| | | | | | |

Media — 3.6% | | | | | | |

The DIRECTV Group Inc. | | 600,000 | | | 14,874,000 | A |

Time Warner Inc. | | 480,000 | | | 6,729,600 | |

| | | | | | |

| | | | | 21,603,600 | |

| | | | | | |

Multiline Retail — 1.4% | | | | | | |

Sears Holdings Corp. | | 80,000 | | | 8,167,200 | A |

| | | | | | |

Specialty Retail — 1.9% | | | | | | |

The TJX Cos. Inc. | | 340,000 | | | 11,243,800 | |

| | | | | | |

Consumer Staples — 6.8% | | | | | | |

Beverages — 1.1% | | | | | | |

The Pepsi Bottling Group Inc. | | 200,000 | | | 6,782,000 | |

| | | | | | |

Food Products — 1.4% | | | | | | |

Kraft Foods Inc. | | 276,809 | | | 8,583,847 | |

| | | | | | |

| | |

| Annual Report to Shareholders | | 13 |

| | | | | | |

| | | Shares/Par | | Value | |

Consumer Staples — Continued | | | | | | |

Tobacco — 4.3% | | | | | | |

Altria Group Inc. | | 350,000 | | $ | 7,770,000 | |

Philip Morris International Inc. | | 350,000 | | | 17,703,000 | A |

| | | | | | |

| | | | | 25,473,000 | |

| | | | | | |

Energy — 8.1% | | | | | | |

Energy Equipment and Services — 3.6% | | | | | | |

Baker Hughes Inc. | | 71,000 | | | 4,863,500 | |

Noble Corp. | | 175,000 | | | 8,692,250 | |

Transocean Inc. | | 58,000 | | | 7,841,600 | A |

| | | | | | |

| | | | | 21,397,350 | |

| | | | | | |

Oil, Gas and Consumable Fuels — 4.5% | | | | | | |

Anadarko Petroleum Corp. | | 94,000 | | | 5,924,820 | |

Apache Corp. | | 70,000 | | | 8,457,400 | |

Devon Energy Corp. | | 100,000 | | | 10,433,000 | |

Exxon Mobil Corp. | | 30,000 | | | 2,537,400 | |

| | | | | | |

| | | | | 27,352,620 | |

| | | | | | |

Financials — 21.7% | | | | | | |

Capital Markets — 1.4% | | | | | | |

Merrill Lynch and Co. Inc. | | 100,000 | | | 4,074,000 | |

Morgan Stanley | | 90,000 | | | 4,113,000 | |

| | | | | | |

| | | | | 8,187,000 | |

| | | | | | |

Commercial Banks — 2.9% | | | | | | |

Lloyds TSB Group PLC | | 1,950,000 | | | 17,454,011 | |

| | | | | | |

Consumer Finance — 0.5% | | | | | | |

Capital One Financial Corp. | | 60,000 | | | 2,953,200 | |

| | | | | | |

| | |

| 14 | | Annual Report to Shareholders |

Portfolio of Investments — Continued

American Leading Companies Trust — Continued

| | | | | | |

| | | Shares/Par | | Value | |

Financials — Continued | | | | | | |

Diversified Financial Services — 9.6% | | | | | | |

Bank of America Corp. | | 395,000 | | $ | 14,974,450 | |

Citigroup Inc. | | 597,500 | | | 12,798,450 | |

J.P. Morgan Chase and Co. | | 700,000 | | | 30,065,000 | |

| | | | | | |

| | | | | 57,837,900 | |

| | | | | | |

Insurance — 5.4% | | | | | | |

American International Group Inc. | | 450,000 | | | 19,462,500 | |

The Travelers Cos. Inc. | | 190,000 | | | 9,091,500 | |

XL Capital Ltd. | | 140,000 | | | 4,137,000 | |

| | | | | | |

| | | | | 32,691,000 | |

| | | | | | |

Thrifts and Mortgage Finance — 1.9% | | | | | | |

Countrywide Financial Corp. | | 1,330,000 | | | 7,315,000 | |

Washington Mutual Inc. | | 373,000 | | | 3,841,900 | |

| | | | | | |

| | | | | 11,156,900 | |

| | | | | | |

Health Care — 10.3% | | | | | | |

Biotechnology — 1.1% | | | | | | |

Amgen Inc. | | 160,000 | | | 6,684,800 | A |

Health Care Providers and Services — 6.0% | | | | | | |

Health Net Inc. | | 268,000 | | | 8,254,400 | A |

UnitedHealth Group Inc. | | 480,000 | | | 16,492,800 | |

WellPoint Inc. | | 250,000 | | | 11,032,500 | A |

| | | | | | |

| | | | | 35,779,700 | |

| | | | | | |

Pharmaceuticals — 3.2% | | | | | | |

Johnson and Johnson | | 180,000 | | | 11,676,600 | |

Pfizer Inc. | | 350,000 | | | 7,325,500 | |

| | | | | | |

| | | | | 19,002,100 | |

| | | | | | |

| | |

| Annual Report to Shareholders | | 15 |

| | | | | | |

| | | Shares/Par | | Value | |

Industrials — 12.8% | | | | | | |

Aerospace and Defense — 4.9% | | | | | | |

General Dynamics Corp. | | 180,000 | | $ | 15,006,600 | |

Lockheed Martin Corp. | | 145,000 | | | 14,398,500 | |

| | | | | | |

| | | | | 29,405,100 | |

| | | | | | |

Airlines — 2.8% | | | | | | |

UAL Corp. | | 770,000 | | | 16,578,100 | |

| | | | | | |

Industrial Conglomerates — 3.6% | | | | | | |

General Electric Co. | | 585,000 | | | 21,650,850 | |

| | | | | | |

Machinery — 1.5% | | | | | | |

Caterpillar Inc. | | 119,000 | | | 9,316,510 | |

| | | | | | |

Information Technology — 24.8% | | | | | | |

Communications Equipment — 3.2% | | | | | | |

Nokia Oyj — ADR | | 599,703 | | | 19,088,546 | |

| | | | | | |

Computers and Peripherals — 5.6% | | | | | | |

Hewlett-Packard Co. | | 350,000 | | | 15,981,000 | |

International Business Machines Corp. | | 152,000 | | | 17,501,280 | |

| | | | | | |

| | | | | 33,482,280 | |

| | | | | | |

Electronic Equipment and Instruments — 2.6% | | | | | | |

Flextronics International Ltd. | | 575,000 | | | 5,399,250 | A |

Jabil Circuit Inc. | | 1,100,000 | | | 10,406,000 | |

| | | | | | |

| | | | | 15,805,250 | |

| | | | | | |

Internet Software and Services — 5.4% | | | | | | |

eBay Inc. | | 400,000 | | | 11,936,000 | A |

Yahoo! Inc. | | 700,000 | | | 20,251,000 | A |

| | | | | | |

| | | | | 32,187,000 | |

| | | | | | |

| | |

| 16 | | Annual Report to Shareholders |

Portfolio of Investments — Continued

American Leading Companies Trust — Continued

| | | | | | |

| | | Shares/Par | | Value |

Information Technology — Continued | | | | | | |

IT Services — 1.5% | | | | | | |

Accenture Ltd. | | | 250,000 | | $ | 8,792,500 |

| | | | | | |

Semiconductors and Semiconductor Equipment — 4.6% | | | | | | |

Applied Materials Inc. | | | 550,000 | | | 10,730,500 |

Texas Instruments Inc. | | | 600,000 | | | 16,962,000 |

| | | | | | |

| | | | | | 27,692,500 |

| | | | | | |

Software — 1.9% | | | | | | |

Microsoft Corp. | | | 405,000 | | | 11,493,900 |

| | | | | | |

Materials — 2.0% | | | | | | |

Metals and Mining — 2.0% | | | | | | |

Alcoa Inc. | | | 50,000 | | | 1,803,000 |

United States Steel Corp. | | | 80,000 | | | 10,149,600 |

| | | | | | |

| | | | | | 11,952,600 |

| | | | | | |

Telecommunication Services — 1.5% | | | | | | |

Wireless Telecommunication Services — 1.5% | | | | | | |

Sprint Nextel Corp. | | | 1,300,000 | | | 8,697,000 |

| | | | | | |

Total Common Stocks and Equity Interests

(Cost — $451,492,547) | | | | | | 599,993,364 |

| | | | | | |

Repurchase Agreements — 0.1% | | | | | | |

| | |

Goldman Sachs & Co. | | | | | | |

2.60%, dated 3/31/08, to be repurchased at $338,466 on 4/1/08 (Collateral: $348,158 Fannie Mae mortgage-backed securities, 5.00% due 10/1/35, value $346,998) | | $ | 338,442 | | | 338,442 |

| | |

| Annual Report to Shareholders | | 17 |

| | | | | | | |

| | | Shares/Par | | Value | |

| | | | | | | |

JPMorgan Chase and Co.

2.30%, dated 3/31/08, to be repurchased at $338,464 on 4/1/08 (Collateral: $334,000 Fannie Mae note, 5.25%, due 1/15/09, value $345,634) | | $ | 338,442 | | $ | 338,442 | |

| | | | | | | |

Total Repurchase Agreements (Cost — $676,884) | | | | | | 676,884 | |

| | | | | | | |

Total Investments — 100.2% (Cost — $452,169,431)B | | | | | | 600,670,248 | |

Other Assets Less Liabilities — (0.2)% | | | | | | (925,299 | ) |

| | | | | | | |

Net Assets — 100.0% | | | | | $ | 599,744,949 | |

| | | | | | | |

B | At March 31, 2008, the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were substantially as follows: |

| | | | |

Gross unrealized appreciation | | $ | 202,481,431 | |

| |

Gross unrealized depreciation | | | (56,662,698 | ) |

| | | | |

| |

Net unrealized appreciation | | $ | 145,818,733 | |

| | | | |

| ADR | — American Depository Receipt |

See notes to financial statements.

| | |

| 18 | | Annual Report to Shareholders |

Statement of Assets and Liabilities

American Leading Companies Trust

March 31, 2008

| | | | | | | |

Assets: | | | | | | | |

Investment securities at market value

(Cost – $451,492,547) | | | | | $ | 599,993,364 | |

Short-term securities at value (Cost – $676,884) | | | | | | 676,884 | |

Receivable for securities sold | | | | | | 1,976,676 | |

Dividends and interest receivable | | | | | | 1,542,971 | |

Receivable for fund shares sold | | | | | | 264,265 | |

Other assets | | | | | | 6,976 | |

| | | | | | | |

Total assets | | | | | | 604,461,136 | |

| | |

Liabilities: | | | | | | | |

Payable for fund shares repurchased | | $ | 3,587,021 | | | | |

Accrued distribution and service fees | | | 462,844 | | | | |

Accrued management fee | | | 365,256 | | | | |

Accrued expenses | | | 301,066 | | | | |

| | | | | | | |

Total liabilities | | | | | | 4,716,187 | |

| | | | | | | |

Net Assets | | | | | $ | 599,744,949 | |

| | | | | | | |

Net assets consist of: | | | | | | | |

Accumulated paid-in-capital | | | | | $ | 456,037,128 | |

Undistributed net investment income | | | | | | 1,667,958 | |

Accumulated net realized loss on investments and foreign currency transactions | | | | | | (6,456,548 | ) |

Unrealized appreciation of investments | | | | | | 148,496,411 | |

| | | | | | | |

Net Assets | | | | | $ | 599,744,949 | |

| | | | | | | |

Net Asset Value Per Share: | | | | | | | |

Primary Class (27,216,359 shares outstanding) | | | | | $ | 19.52 | |

| | | | | | | |

Institutional Class (3,332,677 shares outstanding) | | | | | $ | 20.57 | |

| | | | | | | |

See notes to financial statements.

| | |

| Annual Report to Shareholders | | 19 |

Statement of Operations

American Leading Companies Trust

For the Year Ended March 31, 2008

| | | | | | | | |

Investment Income: | | | | | | | | |

Dividends | | $ | 15,360,674 | | | | | |

Interest | | | 328,048 | | | | | |

Less: Foreign taxes withheld | | | (81,087 | ) | | | | |

| | | | | | | | |

Total income | | | | | | $ | 15,607,635 | |

| | |

Expenses: | | | | | | | | |

Management fees | | | 5,590,730 | | | | | |

Distribution and service fees: | | | | | | | | |

Primary Class | | | 7,223,571 | | | | | |

Audit and legal fees | | | 40,292 | | | | | |

Custodian fees | | | 94,214 | | | | | |

Directors’ fees and expenses | | | 67,300 | | | | | |

Registration fees | | | 43,904 | | | | | |

Reports to shareholders | | | 195,027 | | | | | |

Transfer agent and shareholder servicing expense: | | | | | | | | |

Primary Class | | | 469,530 | | | | | |

Institutional Class | | | 15,264 | | | | | |

Other expenses | | | 78,985 | | | | | |

| | | | | | | | |

| | | 13,818,817 | | | | | |

Less: Compensating balance credits | | | (5,076 | ) | | | | |

| | | | | | | | |

Net expenses | | | | | | | 13,813,741 | |

| | | | | | | | |

Net Investment Income | | | | | | | 1,793,894 | |

| | |

Net Realized and Unrealized Gain/(Loss) on Investments: | | | | | | | | |

| | |

Net realized gain on: | | | | | | | | |

Investments | | | 38,762,908 | | | | | |

Foreign currency transactions | | | 20,912 | | | | | |

| | | | | | | | |

| | | | | | | 38,783,820 | |

| | | | | | | | |

Change in unrealized appreciation/(depreciation) of: | | | | | | | | |

Investments | | | (160,516,555 | ) | | | | |

Assets and liabilities denominated in foreign currency | | | (21,681 | ) | | | | |

| | | | | | | | |

| | | | | | | (160,538,236 | ) |

| | | | | | | | |

Net Realized and Unrealized Loss on Investments | | | | | | | (121,754,416 | ) |

| | | | | | | | |

Change in Net Assets Resulting From Operations | | | | | | $ | (119,960,522 | ) |

| | | | | | | | |

See notes to financial statements.

| | |

| 20 | | Annual Report to Shareholders |

Statement of Changes in Net Assets

American Leading Companies Trust

| | | | | | | | |

| | | For the Year Ended

March 31, 2008 | | | For the Year Ended

March 31, 2007 | |

Change in Net Assets: | | | | | | | | |

| | |

Net investment income (loss) | | $ | 1,793,894 | | | $ | (1,390,777 | ) |

| | |

Net realized gain | | | 38,783,820 | | | | 32,569,446 | |

| | |

Change in unrealized appreciation/ (depreciation) | | | (160,538,236 | ) | | | 20,679,721 | |

| | | | | | | | |

Change in net assets resulting from operations | | | (119,960,522 | ) | | | 51,858,390 | |

| | |

Distributions to shareholders from: | | | | | | | | |

Net investment income: | | | | | | | | |

Primary Class | | | — | | | | (442,116 | ) |

Institutional Class | | | — | | | | (122,938 | ) |

Net realized gain on investments: | | | | | | | | |

Primary Class | | | (44,369,956 | ) | | | (39,878,038 | ) |

Institutional Class | | | (4,690,375 | ) | | | (1,711,197 | ) |

| | |

Change in net assets from fund share transactions: | | | | | | | | |

Primary Class | | | (82,074,308 | ) | | | (2,542,988 | ) |

Institutional Class | | | 13,294,031 | | | | 31,278,504 | |

| | | | | | | | |

Change in net assets | | | (237,801,130 | ) | | | 38,439,617 | |

| | |

Net Assets: | | | | | | | | |

| | |

Beginning of year | | | 837,546,079 | | | | 799,106,462 | |

| | | | | | | | |

End of year | | $ | 599,744,949 | | | $ | 837,546,079 | |

| | | | | | | | |

Undistributed net investment income and overdistributed net investment income, respectively | | $ | 1,667,958 | | | $ | (47,362 | ) |

| | | | | | | | |

See notes to financial statements.

| | |

| Annual Report to Shareholders | | 21 |

Financial Highlights

American Leading Companies Trust

For a share of each class of capital stock outstanding:

Primary Class:

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended March 31, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

Net asset value, beginning of year | | $ | 24.87 | | | $ | 24.59 | | | $ | 21.85 | | | $ | 19.85 | | | $ | 14.54 | |

| | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income/(loss) | | | .03 | A | | | (.06 | )A | | | .01 | | | | — | B | | | .01 | |

Net realized and unrealized gain/(loss) | | | (3.81 | ) | | | 1.64 | | | | 2.73 | | | | 2.01 | | | | 5.30 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (3.78 | ) | | | 1.58 | | | | 2.74 | | | | 2.01 | | | | 5.31 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | (.01 | ) | | | — | | | | (.01 | ) | | | — | B |

Net realized gain on investments | | | (1.57 | ) | | | (1.29 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.57 | ) | | | (1.30 | ) | | | — | | | | (.01 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 19.52 | | | $ | 24.87 | | | $ | 24.59 | | | $ | 21.85 | | | $ | 19.85 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | (16.24 | )% | | | 6.68 | % | | | 12.54 | % | | | 10.12 | % | | | 36.54 | % |

| | | | | |

Ratios to Average Net Assets:C | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | 1.83 | % | | | 1.85 | % | | | 1.86 | % | | | 1.88 | % | | | 1.90 | % |

Expenses net of waivers, if any | | | 1.83 | % | | | 1.85 | % | | | 1.86 | % | | | 1.88 | % | | | 1.90 | % |

Expenses net of all reductions | | | 1.83 | % | | | 1.85 | % | | | 1.86 | % | | | 1.88 | % | | | 1.90 | % |

Net investment income (loss) | | | .12 | % | | | (.23 | )% | | | .04 | % | | | (.01 | )% | | | .05 | % |

Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 28.4 | % | | | 19.0 | % | | | 14.3 | % | | | 19.4 | % | | | 19.6 | % |

Net assets, end of year (in thousands) | | $ | 531,186 | | | $ | 765,000 | | | $ | 757,630 | | | $ | 654,019 | | | $ | 585,295 | |

| | | | | | | | | | | | | | | | | | | | |

A | Computed using average daily shares outstanding. |

B | Amount less than $.01 per share. |

C | Total expenses reflects operating expenses prior to any voluntary expense waivers and/or compensating balance credits. Expenses net of waivers reflects total expenses before compensating balance credits but net of any voluntary expense waivers. Expenses net of all reductions reflects expenses less any compensating balance credits and/or voluntary expense waivers. |

See notes to financial statements.

| | |

| 22 | | Annual Report to Shareholders |

Financial Highlights — Continued

American Leading Companies Trust

Institutional Class:

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended March 31, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

Net asset value, beginning of year | | $ | 25.86 | | | $ | 25.33 | | | $ | 22.34 | | | $ | 20.28 | | | $ | 14.83 | |

| | | | | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | .31 | A | | | .23 | A | | | .22 | | | | .21 | | | | .20 | |

Net realized and unrealized gain/(loss) | | | (4.03 | ) | | | 1.67 | | | | 2.82 | | | | 2.06 | | | | 5.42 | |

| | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (3.72 | ) | | | 1.90 | | | | 3.04 | | | | 2.27 | | | | 5.62 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | (.08 | ) | | | (.05 | ) | | | (.21 | ) | | | (.17 | ) |

Net realized gain on investments | | | (1.57 | ) | | | (1.29 | ) | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total distributions | | | (1.57 | ) | | | (1.37 | ) | | | (.05 | ) | | | (.21 | ) | | | (.17 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, end of year | | $ | 20.57 | | | $ | 25.86 | | | $ | 25.33 | | | $ | 22.34 | | | $ | 20.28 | |

| | | | | | | | | | | | | | | | | | | | |

Total return | | | (15.37 | )% | | | 7.77 | % | | | 13.63 | % | | | 11.21 | % | | | 37.96 | % |

| | | | | |

Ratios to Average Net Assets:C | | | | | | | | | | | | | | | | | | | | |

Total expenses | | | .79 | % | | | .82 | % | | | .84 | % | | | .90 | % | | | .85 | % |

Expenses net of waivers, if any | | | .79 | % | | | .82 | % | | | .84 | % | | | .90 | % | | | .85 | % |

Expenses net of all reductions | | | .79 | % | | | .82 | % | | | .84 | % | | | .90 | % | | | .85 | % |

Net investment income | | | 1.22 | % | | | .90 | % | | | 1.09 | % | | | .99 | % | | | 1.14 | % |

Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 28.4 | % | | | 19.0 | % | | | 14.3 | % | | | 19.4 | % | | | 19.6 | % |

Net assets, end of year (in thousands) | | $ | 68,559 | | | $ | 72,546 | | | $ | 41,476 | | | $ | 21,386 | | | $ | 16,996 | |

| | | | | | | | | | | | | | | | | | | | |

See notes to financial statements.

| | |

| Annual Report to Shareholders | | 23 |

Management’s Discussion of Fund Performance

U.S. Small-Capitalization Value Trust

Total returns for the U.S. Small-Capitalization Value Trust (“Fund”) for various periods ended March 31, 2008, are presented below, along with those of some comparative indicesA:

| | | | | | | | | | | | | | | |

| | | | | | | | | Average Annual Total Returns

Through March 31, 2008 | |

| | | First Quarter

2008 | | | One

Year | | | Three

Years | | | Five

Years | | | Since

InceptionB | |

U.S. Small-Cap Value Trust | | | | | | | | | | | | | | | |

Primary Class | | –4.23 | % | | –17.94 | % | | –0.37 | % | | +12.17 | % | | +5.21 | % |

Institutional Class | | –4.00 | % | | –17.17 | % | | +0.63 | % | | +13.37 | % | | +6.39 | % |

Russell 1000 Index | | –9.48 | % | | –5.40 | % | | +6.19 | % | | +11.86 | % | | +4.02 | % |

Russell 1000 Growth Index | | –10.18 | % | | –0.75 | % | | +6.33 | % | | +9.96 | % | | +1.46 | % |

Russell 1000 Value Index | | –8.72 | % | | –9.99 | % | | +6.01 | % | | +13.68 | % | | +5.72 | % |

Russell 2000 Index | | –9.90 | % | | –13.00 | % | | +5.06 | % | | +14.90 | % | | +5.58 | % |

Russell 2000 Value Index | | –6.53 | % | | –16.88 | % | | +4.33 | % | | +15.45 | % | | +7.93 | % |

Russell 2500 Index | | –9.37 | % | | –11.27 | % | | +6.01 | % | | +15.67 | % | | +7.49 | % |

Russell 2500 Value Index | | –7.22 | % | | –16.54 | % | | +4.41 | % | | +15.56 | % | | +8.36 | % |

Russell Midcap Index | | –9.98 | % | | –8.92 | % | | +7.36 | % | | +16.31 | % | | +8.11 | % |

Russell Midcap Value Index | | –8.64 | % | | –14.12 | % | | +6.57 | % | | +16.77 | % | | +8.62 | % |

S&P 500 Stock Composite Index | | –9.44 | % | | –5.08 | % | | +5.85 | % | | +11.32 | % | | +3.64 | % |

The performance data quoted represent past performance and do not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information for the Primary Class please visit www.leggmason.com/individual investors. For the Institutional Class please visit www.lminstitutionalfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

The last 12 months have been an extraordinary period for the U.S. economy and for global financial markets. The relative calm of a year ago was disrupted by a series of unanticipated crises, originating primarily from the collapsing U.S. housing market.

A | See Glossary of Index Definitions on page 76. Although it is not possible to invest directly in an index, it is possible to purchase investment vehicles designed to track the performance of certain indices. Past performance does not guarantee future results. |

B | The inception date of the Primary Class is June 15, 1998. The inception date of the Institutional Class is June 19, 1998. Index returns are for the periods beginning May 31, 1998. |

| | |

| 24 | | Annual Report to Shareholders |

Management’s Discussion of Fund Performance — Continued

Declining U.S. home prices severely impaired the mortgage market and its problem then spread throughout the financial world to infect various banks (domestically and globally), hedge funds, the municipal bond market, investment banks, and money market funds. Investors, financial institutions, and regulators seemed constantly caught off guard by the pervasive impact that the declining value of mortgages had on global financial markets.

U.S. equity returns reflected the troubled times, as stock prices fell through much of the period, including the latest quarter. For the 12 months, larger stocks declined the least, with the S&P 500 Index off –5.1% and the Russell 1000 Index down –5.4%, while the Russell 2000 Index dropped –13.0% and the Russell 2000 Value Index retreated –16.9%. Value stocks also trailed growth over the year, although smaller cap stocks and value stocks performed better relatively in the most recent quarter. The financial stocks were some of the worst performers this last year, reflecting the turmoil among these companies while consumer durable and retailer stock suffered as consumer spending slowed. Materials, commodity, and energy stocks performed quite well as continued global growth pushed demand and prices for their products.

Monetary authorities, particularly the U.S. Federal Reserve Board (Fed)C, moved aggressively to maintain financial stability. In addition to supporting the Bear Stearns rescue by JPMorgan, the Fed took the historic action of broadening its practices to allow for direct lending to investment banks. The Fed also cut short rates on March 18, 2008 to 2.25%, a full 3.0% reduction from a year ago. As the first quarter of 2008 closed, these measures seemed to succeed, at least for the short-run, in restoring liquidity and relieving stress in the financial markets. News on the economic front also deteriorated over the last year as mortgage delinquencies and foreclosures continued to rise and housing prices continued to fall. Additional reports confirmed that the slowdown was moving from Wall Street to the broader economy as consumer confidence fell, retail sales were weak, and employment softened. The Fed also had to contend with inflation as energy, grains, and other commodities traded near record levels, compounded by a weaker dollar. Globally, economic news was mixed, but growth seemed more resilient outside the U.S.

Over the last year, the Fund’s return trailed the returns for the Russell 2000 Index and Russell 2000 Value Index. The Fund has generally been underweight in the materials stocks, including steel and fertilizer producers, which hurt performance, but overweight in energy services firms, which helped to offset those losses. One negative for the Fund was that its industrial holdings have not benefited as much from the resilient global

C | Federal Reserve Board (Fed) – is charged with, among other things, managing the nation’s monetary policy by influencing the monetary and credit conditions in the economy in pursuit of maximum employment, stable prices, and moderate long-term interest rates. |

| | |

| Annual Report to Shareholders | | 25 |

economy as the typical small cap industrial and its holdings’ returns lagged. In the financial sector, the Fund’s significant position in the mortgage lenders was a negative for it as this group was one of the worst performers for the year. On the other hand, the Fund’s small-cap banks and insurance companies held up relatively well and benefited the Fund’s performance. Finally, utility stocks have been defensive in this difficult year, and the Fund both had an overweight position in these stocks and our holdings performed better than the typical small-cap utility.

During the last year, we reduced the Fund’s holdings in consumer discretionary stocks, while increasing our weighting in energy and information technology stocks. These changes have been the result of both the relative performance of each group and the changes to their valuation within our quantitative models. Our weight in the financial sector is relatively unchanged and this remains the largest sector in about a third of the portfolio.

|

Henry Otto |

Steve Tonkovich |

|

April 24, 2008 |

DJIA: 12,848.95 |

| | |

| 26 | | Annual Report to Shareholders |

Expense Example

U.S. Small-Capitalization Value Trust

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution and service (12b-1) fees on Primary Class shares, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested on October 1, 2007, and held through March 31, 2008. The ending value assumes dividends were reinvested at the time they were paid.

Actual Expenses

The first line for each class in the table below provides information about actual account values and actual expenses for each class. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account if your shares were held through the entire period.

Hypothetical Example for Comparison Purposes

The second line for each class in the table below provides information about hypothetical account values and hypothetical expenses based on the relevant class’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the class’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples for the relevant class that appear in the shareholder reports of other funds.

| | | | | | | | | |

| | | Beginning

Account

Value

10/1/07 | | Ending

Account

Value

3/31/08 | | Expenses PaidA

During the

Period

10/1/07 to 3/31/08 |

Primary Class: | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 862.30 | | $ | 9.31 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,015.07 | | | 10.08 |

| | | |

Institutional Class: | | | | | | | | | |

Actual | | $ | 1,000.00 | | $ | 866.60 | | $ | 4.67 |

Hypothetical (5% return before expenses) | | | 1,000.00 | | | 1,020.07 | | | 5.05 |

| A | These calculations are based on expenses incurred in the most recent fiscal half-year. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratios of 2.00% and 1.00% for the Primary Class and Institutional Class respectively, multiplied by the average values over the period, multiplied by the number of days in the most recent fiscal half-year (183) and divided by 366. |

| | |

| Annual Report to Shareholders | | 27 |

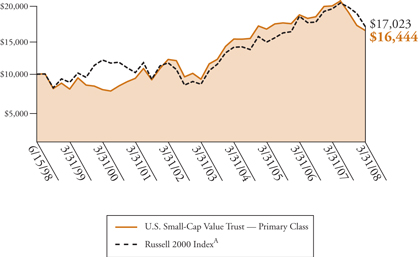

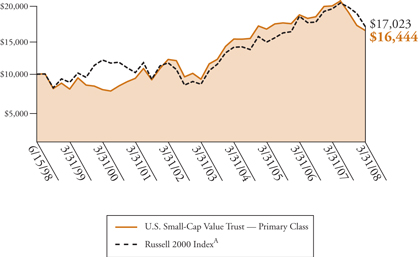

Performance Information

U.S. Small-Capitalization Value Trust

The graphs on the following pages compare the Fund’s total returns to that of the Russell 2000 Index. The graphs illustrate the cumulative total return of an initial $10,000 investment in the Primary Class and an initial $1,000,000 investment in the Institutional Class, for the periods indicated. The lines for the Fund represent the total return after deducting all Fund investment management and other administrative expenses and the transaction costs of buying and selling securities. The lines representing the securities market index do not take into account any transaction costs associated with buying and selling securities in the index or other administrative expenses. Both the Fund’s results and the index’s results assume reinvestment of all dividends and distributions.

Total return measures investment performance in terms of appreciation or depreciation in a fund’s net asset value per share, plus dividends and any capital gain distributions. Average annual returns tend to smooth out variations in a fund’s return, so that they differ from actual year-to-year results.

| | |

| 28 | | Annual Report to Shareholders |

Performance Information — Continued

Growth of a $10,000 Investment — Primary Class

Periods Ended March 31, 2008

| | | | | | |

| | | Cumulative

Total Return | | | Average Annual

Total Return | |

One Year | | -17.94 | % | | -17.94 | % |

Five Years | | +77.54 | % | | +12.17 | % |

Life of Class* | | +64.44 | % | | +5.21 | % |

| | | | | | |

| * | Inception date: June 15, 1998 |

The performance data quoted represent past performance and do not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information please visit www.leggmason.com/individual investors. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

A | Index returns are for periods beginning May 31, 1998. |

| | |

| Annual Report to Shareholders | | 29 |

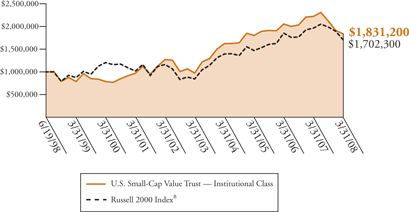

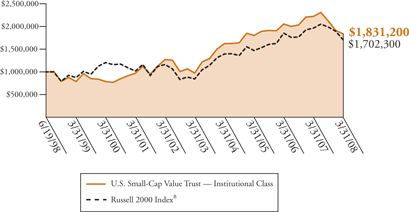

Growth of a $1,000,000 Investment — Institutional Class

Periods Ended March 31, 2008

| | | | | | |

| | | Cumulative

Total Return | | | Average Annual

Total Return | |

One Year | | -17.17 | % | | -17.17 | % |

Five Years | | +87.29 | % | | +13.37 | % |

Life of Class* | | +83.20 | % | | +6.39 | % |

| | | | | | |

| * | Inception date: June 19, 1998 |

The performance data quoted represent past performance and do not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information please visit www.lminstitutionalfunds.com. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume reinvestment of dividends and capital gain distributions. Performance would have been lower if fees had not been waived in various periods.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

B | Index returns are for periods beginning June 30, 1998. |

| | |

| 30 | | Annual Report to Shareholders |

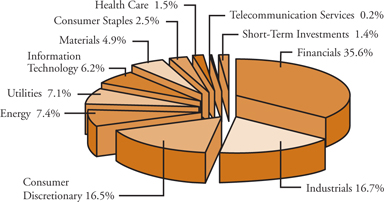

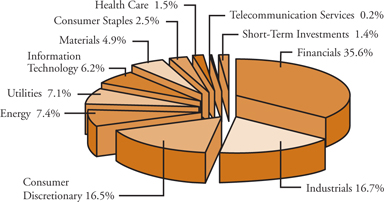

Performance Information — Continued

Portfolio Composition (as of March 31, 2008)C

(As a percentage of the portfolio)

Top Ten Holdings (as of March 31, 2008)

| | | |

Security | | % of

Net Assets | |

Odyssey Re Holdings Corp. | | 1.4 | % |

Westar Energy Inc. | | 1.3 | % |

Con-way Inc. | | 1.3 | % |

SkyWest Inc. | | 1.2 | % |

Del Monte Foods Co. | | 1.1 | % |

Rent-A-Center Inc. | | 1.1 | % |

Stone Energy Corp. | | 1.1 | % |

StanCorp Financial Group Inc. | | 1.1 | % |

Atmos Energy Corp. | | 1.1 | % |

Hanover Insurance Group Inc. | | 1.1 | % |

C | The Fund is actively managed. As a result, the composition of its portfolio holdings and sectors is subject to change at any time. |

| | |

| Annual Report to Shareholders | | 31 |

Selected Portfolio Performance D

| | | | | |

Strongest performers for the year ended March 31, 2008E | |

1. | | GrafTech International Ltd. | | +78.5 | % |

2. | | Stone Energy Corp. | | +76.2 | % |

3. | | Hornbeck Offshore Services Inc. | | +59.4 | % |

4. | | Ampco-Pittsburgh Corp. | | +51.2 | % |

5. | | Industrial Services of America Inc. | | +51.0 | % |

6. | | Bristow Group Inc. | | +47.2 | % |

7. | | Ameron International Corp. | | +43.6 | % |

8. | | Callon Petroleum Co. | | +33.3 | % |

9. | | Hastings Entertainment Inc. | | +28.9 | % |

10. | | Gulfmark Offshore Inc. | | +25.4 | % |

| | | | | |

Weakest performers for the year ended March 31, 2008E | |

1. | | USEC Inc. | | –77.2 | % |

2. | | PFF Bancorp Inc. | | –71.6 | % |

3. | | Mesa Air Group Inc. | | –68.8 | % |

4. | | YRC Worldwide Inc. | | –67.4 | % |

5. | | Provident Bankshares Corp. | | –65.6 | % |

6. | | Mercantile Bank Corp. | | –65.6 | % |

7. | | Marlin Business Services Corp. | | –65.5 | % |

8. | | Big 5 Sporting Goods Corp. | | –65.5 | % |

9. | | Tuesday Morning Corp. | | –65.1 | % |

10. | | McClatchy Co. | | –64.5 | % |

D | Individual security performance is measured by the change in the security’s price; for stocks, dividends are assumed to be reinvested at the time they were paid. Portfolio changes are not reported for U.S. Small-Cap due to the Fund’s high volume of trading. |

E | Securities held for the entire year. |

| | |

| 32 | | Annual Report to Shareholders |

Portfolio of Investments

U.S. Small-Capitalization Value Trust

March 31, 2008

| | | | | | |

| | | Shares/Par | | Value | |

Common Stocks and Equity Interests — 99.3% | | | | | | |

Consumer Discretionary — 16.6% | | | | | | |

Auto Components — 1.1% | | | | | | |

Aftermarket Technology Corp. | | 3,815 | | $ | 74,164 | A |

ArvinMeritor Inc. | | 33,110 | | | 414,206 | |

Dorman Products Inc. | | 11,250 | | | 120,937 | A |

Modine Manufacturing Co. | | 14,610 | | | 211,699 | |

Superior Industries International Inc. | | 6,500 | | | 134,875 | |

TRW Automotive Holdings Corp. | | 18,760 | | | 438,421 | A |

| | | | | | |

| | | | | 1,394,302 | |

| | | | | | |

Distributors — 0.1% | | | | | | |

Audiovox Corp. | | 5,000 | | | 53,400 | A |

Core-Mark Holding Co. Inc. | | 900 | | | 25,866 | A |

| | | | | | |

| | | | | 79,266 | |

| | | | | | |

Diversified Consumer Services — 0.4% | | | | | | |

Pre-Paid Legal Services Inc. | | 12,140 | | | 514,857 | A |

| | | | | | |

Hotels, Restaurants and Leisure — 1.9% | | | | | | |

Bluegreen Corp. | | 35,830 | | | 240,061 | A |

CBRL Group Inc. | | 27,250 | | | 974,733 | |

CEC Entertainment Inc. | | 12,340 | | | 356,379 | A |

Domino’s Pizza Inc. | | 7,100 | | | 95,779 | |

Dover Downs Gaming and Entertainment Inc. | | 5,900 | | | 50,209 | |

Frisch’s Restaurants Inc. | | 5,800 | | | 133,400 | |

Interstate Hotels and Resorts Inc. | | 3,000 | | | 14,340 | A |

Landry’s Restaurants Inc. | | 3,100 | | | 50,468 | |

Ruth’s Chris Steak House Inc. | | 1,900 | | | 13,129 | A |

Speedway Motorsports Inc. | | 19,740 | | | 494,882 | |

| | | | | | |

| | | | | 2,423,380 | |

| | | | | | |

Household Durables — 1.9% | | | | | | |

Bassett Furniture Industries Inc. | | 2,800 | | | 34,552 | |

Blyth Inc. | | 4,700 | | | 92,684 | |

Craftmade International Inc. | | 8,581 | | | 69,077 | |

CSS Industries Inc. | | 17,370 | | | 607,255 | |

| | |

| Annual Report to Shareholders | | 33 |

| | | | | | |

| | | Shares/Par | | Value | |

Consumer Discretionary — Continued | | | | | | |

Household Durables — Continued | | | | | | |

Ethan Allen Interiors Inc. | | 41,530 | | $ | 1,180,698 | |

Furniture Brands International Inc. | | 11,800 | | | 138,060 | |

Hooker Furniture Corp. | | 13,430 | | | 300,026 | |

La-Z-Boy Inc. | | 8,400 | | | 70,056 | |

| | | | | | |

| | | | | 2,492,408 | |

| | | | | | |

Internet and Catalog Retail — N.M. | | | | | | |

FTD Group Inc. | | 3,400 | | | 45,628 | |

Systemax Inc. | | 300 | | | 3,618 | |

| | | | | | |

| | | | | 49,246 | |

| | | | | | |

Leisure Equipment and Products — 1.2% | | | | | | |

Aldila Inc. | | 5,200 | | | 59,280 | |

Escalade Inc. | | 8,065 | | | 71,537 | |

JAKKS Pacific Inc. | | 34,060 | | | 939,034 | A |

MarineMax Inc. | | 15,200 | | | 189,392 | A |

Polaris Industries Inc. | | 8,490 | | | 348,175 | |

| | | | | | |

| | | | | 1,607,418 | |

| | | | | | |

Media — 1.2% | | | | | | |

AH Belo Corp. | | 7,148 | | | 81,702 | A |

Alloy Inc. | | 3,300 | | | 24,458 | A |

Belo Corp. | | 35,740 | | | 377,772 | |

Cox Radio Inc. | | 3,500 | | | 41,580 | A |

Getty Images Inc. | | 4,670 | | | 149,440 | A |

Journal Communications Inc. | | 40,380 | | | 298,004 | |

McClatchy Co. | | 5,720 | | | 61,204 | |

Saga Communications Inc. | | 15,100 | | | 84,560 | A |

Scholastic Corp. | | 300 | | | 9,081 | A |

Valassis Communications Inc. | | 35,040 | | | 380,184 | A |

| | | | | | |

| | | | | 1,507,985 | |

| | | | | | |

Multiline Retail — 0.1% | | | | | | |

Tuesday Morning Corp. | | 38,110 | | | 197,410 | A |

| | | | | | |

| | |

| 34 | | Annual Report to Shareholders |

Portfolio of Investments — Continued

U.S. Small-Capitalization Value Trust — Continued

| | | | | | |

| | | Shares/Par | | Value | |

Consumer Discretionary — Continued | | | | | | |

Specialty Retail — 6.9% | | | | | | |

Aaron Rents Inc. | | 5,500 | | $ | 118,470 | |

America’s Car-Mart Inc. | | 1,200 | | | 15,108 | A |

Asbury Automotive Group Inc. | | 47,380 | | | 651,949 | |

Big 5 Sporting Goods Corp. | | 20,790 | | | 182,328 | |

Build-A-Bear Workshop Inc. | | 11,510 | | | 104,626 | A |

Charlotte Russe Holding Inc. | | 9,280 | | | 160,915 | A |

Charming Shoppes Inc. | | 79,696 | | | 384,932 | A |

Collective Brands Inc. | | 10,190 | | | 123,503 | A |

Conn’s Inc. | | 26,900 | | | 438,739 | A |

Foot Locker Inc. | | 6,000 | | | 70,620 | |

Genesco Inc. | | 9,240 | | | 213,536 | A |

Group 1 Automotive Inc. | | 30,800 | | | 723,184 | |

Hastings Entertainment Inc. | | 18,850 | | | 148,161 | A |

Haverty Furniture Cos. Inc. | | 4,100 | | | 43,624 | |

Jos. A Bank Clothiers Inc. | | 3,998 | | | 81,959 | A |

Lithia Motors Inc. | | 18,520 | | | 188,163 | |

Penske Automotive Group Inc. | | 62,150 | | | 1,209,439 | |

Rent-A-Center Inc. | | 78,320 | | | 1,437,172 | A |

REX Stores Corp. | | 17,055 | | | 335,472 | A |

Shoe Carnival Inc. | | 3,300 | | | 44,649 | A |

Sonic Automotive Inc. | | 43,240 | | | 888,582 | |

Stage Stores Inc. | | 20,115 | | | 325,863 | |

The Cato Corp. | | 22,210 | | | 331,818 | |

The Dress Barn Inc. | | 18,260 | | | 236,284 | A |

Zale Corp. | | 21,270 | | | 420,295 | A |

| | | | | | |

| | | | | 8,879,391 | |

| | | | | | |

Textiles, Apparel and Luxury Goods — 1.8% | | | | | | |

Brown Shoe Co. Inc. | | 16,880 | | | 254,382 | |

Columbia Sportswear Co. | | 3,000 | | | 132,090 | |

Culp Inc. | | 3,000 | | | 22,560 | A |

Jones Apparel Group Inc. | | 27,260 | | | 365,829 | |

K-Swiss Inc. | | 18,410 | | | 291,246 | |

Lakeland Industries Inc. | | 500 | | | 5,845 | A |

Maidenform Brands Inc. | | 8,390 | | | 136,505 | A |

| | |

| Annual Report to Shareholders | | 35 |

| | | | | | |

| | | Shares/Par | | Value | |

Consumer Discretionary — Continued | | | | | | |

Textiles, Apparel and Luxury Goods — Continued | | | | | | |

Perry Ellis International Inc. | | 1,700 | | $ | 37,111 | A |

Skechers U.S.A. Inc. | | 12,540 | | | 253,433 | A |

Steven Madden Ltd. | | 5,423 | | | 92,896 | A |

The Timberland Co. | | 35,850 | | | 492,221 | A |

Unifi Inc. | | 9,300 | | | 26,877 | A |

UniFirst Corp. | | 6,500 | | | 241,085 | |

| | | | | | |

| | | | | 2,352,080 | |

| | | | | | |

Consumer Staples — 2.5% | | | | | | |

Food Products — 1.5% | | | | | | |

Chiquita Brands International Inc. | | 6,100 | | | 140,971 | A |

Del Monte Foods Co. | | 154,390 | | | 1,471,337 | |

Monterey Gourmet Foods Inc. | | 4,100 | | | 12,546 | A |

Sanderson Farms Inc. | | 7,700 | | | 292,677 | |

| | | | | | |

| | | | | 1,917,531 | |

| | | | | | |

Personal Products — 0.5% | | | | | | |

CCA Industries Inc. | | 2,700 | | | 24,516 | |

Elizabeth Arden Inc. | | 3,000 | | | 59,850 | A |

Mannatech Inc. | | 19,500 | | | 139,035 | |

NBTY Inc. | | 7,900 | | | 236,605 | A |

Nutraceutical International Corp. | | 10,270 | | | 133,510 | A |

Parlux Fragrances Inc. | | 2,100 | | | 6,174 | A |

Schiff Nutrition International Inc. | | 10,660 | | | 63,853 | |

| | | | | | |

| | | | | 663,543 | |

| | | | | | |

Tobacco — 0.5% | | | | | | |

Universal Corp. | | 10,460 | | | 685,444 | |

| | | | | | |

Energy — 7.5% | | | | | | |

Energy Equipment and Services — 4.5% | | | | | | |

Allis-Chalmers Energy Inc. | | 1,300 | | | 17,927 | A |

Basic Energy Services Inc. | | 4,800 | | | 105,984 | A |

Bristow Group Inc. | | 10,110 | | | 542,604 | A |

Bronco Drilling Co. Inc. | | 9,480 | | | 152,723 | A |

Cal Dive International Inc. | | 14,435 | | | 149,835 | A |

| | |

| 36 | | Annual Report to Shareholders |

Portfolio of Investments — Continued

U.S. Small-Capitalization Value Trust — Continued

| | | | | | |

| | | Shares/Par | | Value | |

Energy — Continued | | | | | | |

Energy Equipment and Services — Continued | | | | | | |

Complete Production Services Inc. | | 6,900 | | $ | 158,286 | A |

Grey Wolf Inc. | | 81,960 | | | 555,689 | A |

Gulfmark Offshore Inc. | | 13,230 | | | 723,945 | A |

Hercules Offshore Inc. | | 900 | | | 22,608 | A |

Hornbeck Offshore Services Inc. | | 9,080 | | | 414,684 | A |

Key Energy Services Inc. | | 1,300 | | | 17,446 | A |

Lufkin Industries Inc. | | 6,500 | | | 414,830 | |

Oil States International Inc. | | 14,800 | | | 663,188 | A |

Parker Drilling Co. | | 7,300 | | | 47,158 | A |

PHI Inc. | | 1,100 | | | 34,694 | A |

Pioneer Drilling Co. | | 22,200 | | | 353,646 | A |

SEACOR Holdings Inc. | | 1,500 | | | 128,040 | A |

Superior Well Services Inc. | | 17,180 | | | 375,727 | A |

Trico Marine Services Inc. | | 6,700 | | | 261,099 | A |

Union Drilling Inc. | | 15,400 | | | 269,346 | A |

Unit Corp. | | 900 | | | 50,985 | A |

W-H Energy Services Inc. | | 5,800 | | | 399,330 | A |

| | | | | | |

| | | | | 5,859,774 | |

| | | | | | |

Oil, Gas and Consumable Fuels — 3.0% | | | | | | |

Alon USA Energy Inc. | | 9,030 | | | 137,346 | |

Brigham Exploration Co. | | 47,680 | | | 289,418 | A |

Callon Petroleum Co. | | 19,250 | | | 348,232 | A |

Delek US Holdings Inc. | | 23,400 | | | 296,478 | |

Overseas Shipholding Group Inc. | | 2,000 | | | 140,080 | |

Rosetta Resources Inc. | | 2,000 | | | 39,475 | A |

St Mary Land and Exploration Co. | | 600 | | | 23,100 | |

Stone Energy Corp. | | 27,070 | | | 1,416,032 | A |

Swift Energy Co. | | 7,300 | | | 328,427 | A |

USEC Inc. | | 28,820 | | | 106,634 | A |

VAALCO Energy Inc. | | 600 | | | 2,982 | A |

W&T Offshore Inc. | | 20,400 | | | 695,844 | |

| | | | | | |

| | | | | 3,824,048 | |

| | | | | | |

| | |

| Annual Report to Shareholders | | 37 |

| | | | | | |

| | | Shares/Par | | Value | |

Financials — 35.8% | | | | | | |

Capital Markets — N.M. | | | | | | |

FirstCity Financial Corp. | | 1,100 | | $ | 6,930 | A |

SWS Group Inc. | | 4,200 | | | 51,366 | |

| | | | | | |

| | | | | 58,296 | |

| | | | | | |

Commercial Banks — 15.4% | | | | | | |

1st Source Corp. | | 7,500 | | | 157,875 | |

American National Bankshares Inc. | | 9,480 | | | 199,080 | |

Ameris Bancorp | | 4,200 | | | 67,452 | |

Arrow Financial Corp. | | 11,087 | | | 249,347 | |

BancFirst Corp. | | 11,008 | | | 503,946 | |

BancorpSouth Inc. | | 18,160 | | | 420,586 | |

Cadence Financial Corp. | | 5,300 | | | 84,641 | |

Camden National Corp. | | 11,750 | | | 397,620 | |

Cathay General Bancorp | | 17,670 | | | 366,299 | |

Chemical Financial Corp. | | 19,211 | | | 457,990 | |

Citizens Banking Corp. | | 60,334 | | | 749,951 | |

City Bank | | 6,000 | | | 133,620 | |

Columbia Banking System Inc. | | 18,943 | | | 423,944 | |

Community Bank System Inc. | | 21,210 | | | 520,918 | |

Community Trust Bancorp Inc. | | 20,876 | | | 611,667 | |

F.N.B. Corp. | | 50,840 | | | 793,612 | |

First Bancorp | | 7,078 | | | 141,065 | |

First Community Bancshares Inc. | | 11,450 | | | 417,009 | |

First M&F Corp. | | 10,686 | | | 154,947 | |

First Merchants Corp. | | 7,500 | | | 214,050 | |

First Midwest Bancorp Inc. | | 16,290 | | | 452,373 | |

First United Corp. | | 8,086 | | | 160,265 | |

Firstbank Corp. | | 1,201 | | | 16,096 | |

FNB Corp. | | 6,737 | | | 70,738 | |

Fulton Financial Corp. | | 76,210 | | | 936,621 | |

German American Bancorp Inc. | | 9,870 | | | 125,546 | |

Great Southern Bancorp Inc. | | 5,600 | | | 87,416 | |

Greene Bancshares Inc. | | 2,900 | | | 51,301 | |

Harleysville National Corp. | | 2,270 | | | 32,733 | |

IBERIABANK Corp. | | 5,775 | | | 255,544 | |

| | |

| 38 | | Annual Report to Shareholders |

Portfolio of Investments — Continued

U.S. Small-Capitalization Value Trust — Continued

| | | | | | |

| | | Shares/Par | | Value | |

Financials — Continued | | | | | | |

Commercial Banks — Continued | | | | | | |

Independent Bank Corp. | | 10,370 | | $ | 107,641 | |

International Bancshares Corp. | | 41,106 | | | 928,173 | |

Lakeland Financial Corp. | | 11,060 | | | 250,509 | |

Macatawa Bank Corp. | | 6,725 | | | 70,007 | |

MainSource Financial Group Inc. | | 16,214 | | | 251,319 | |

Mercantile Bank Corp. | | 2,455 | | | 25,336 | |

Merchants Bancshares Inc. | | 4,200 | | | 96,096 | |

National Penn Bancshares Inc. | | 22,683 | | | 412,604 | |

NBT Bancorp Inc. | | 35,190 | | | 781,218 | |

Northrim BanCorp Inc. | | 8,820 | | | 160,348 | |

Old Point Financial Corp. | | 1,971 | | | 37,710 | |

PAB Bankshares Inc. | | 13,520 | | | 185,900 | |

Pacific Capital Bancorp | | 19,150 | | | 411,725 | |

Park National Corp. | | 6,600 | | | 467,610 | |

Penns Woods Bancorp Inc. | | 4,680 | | | 155,142 | |

Peoples Bancorp Inc. | | 11,558 | | | 278,663 | |

Prosperity Bancshares Inc. | | 4,100 | | | 117,506 | |

Provident Bankshares Corp. | | 16,505 | | | 177,264 | |

Renasant Corp. | | 9,102 | | | 204,795 | |

Republic First Bancorp Inc. | | 14,418 | | | 71,081 | A |

Royal Bancshares of Pennsylvania Inc. | | 1,450 | | | 20,981 | |

S&T Bancorp Inc. | | 7,900 | | | 254,143 | |

Sierra Bancorp | | 5,840 | | | 126,202 | |

Simmons First National Corp. | | 8,290 | | | 246,462 | |

Southwest Bancorp Inc. | | 10,460 | | | 183,155 | |

Susquehanna Bancshares Inc. | | 23,890 | | | 486,639 | |

Taylor Capital Group Inc. | | 5,564 | | | 91,361 | |

TriCo Bancshares | | 13,377 | | | 231,556 | |

Trustmark Corp. | | 52,630 | | | 1,172,596 | |

Union Bankshares Corp. | | 5,800 | | | 112,346 | |

United Bankshares Inc. | | 17,670 | | | 470,905 | |

Univest Corp. of Pennsylvania | | 9,970 | | | 261,114 | |

Washington Trust Bancorp Inc. | | 6,100 | | | 151,402 | |

WesBanco Inc. | | 14,410 | | | 356,071 | |

West Bancorporation | | 7,700 | | | 101,332 | |

| | |

| Annual Report to Shareholders | | 39 |

| | | | | | |

| | | Shares/Par | | Value | |

Financials — Continued | | | | | | |

Commercial Banks — Continued | | | | | | |

West Coast Bancorp | | 9,230 | | $ | 134,666 | |

Whitney Holding Corp. | | 36,820 | | | 912,768 | |

Wintrust Financial Corp. | | 2,400 | | | 83,880 | |

Yadkin Valley Financial Corp. | | 6,100 | | | 77,165 | |

| | | | | | |

| | | | | 19,919,643 | |

| | | | | | |

Consumer Finance — 0.6% | | | | | | |

AmeriCredit Corp. | | 43,930 | | | 442,375 | A |

Credit Acceptance Corp. | | 11,550 | | | 179,371 | A |

Nelnet Inc. | | 12,880 | | | 151,340 | |

World Acceptance Corp. | | 1,700 | | | 54,145 | A |

| | | | | | |

| | | | | 827,231 | |

| | | | | | |

Diversified Financial Services — 0.6% | | | | | | |

Asset Acceptance Capital Corp. | | 32,820 | | | 316,057 | |

California First National Bancorp | | 6,600 | | | 63,756 | |

Financial Federal Corp. | | 12,340 | | | 269,135 | |

Marlin Business Services Corp. | | 8,180 | | | 61,677 | A |

Medallion Financial Corp. | | 1,800 | | | 16,272 | |

| | | | | | |

| | | | | 726,897 | |

| | | | | | |

Insurance — 14.6% | | | | | | |

21st Century Holding Co. | | 800 | | | 10,248 | |

American Equity Investment Life Holding Co. | | 54,000 | | | 501,120 | |

American Physicians Capital Inc. | | 900 | | | 41,724 | |

Amtrust Financial Services Inc. | | 5,600 | | | 90,776 | |

Baldwin and Lyons Inc. | | 1,300 | | | 33,384 | |

CNA Surety Corp. | | 43,930 | | | 675,643 | A |

Conseco Inc. | | 46,960 | | | 478,992 | A |

Delphi Financial Group Inc. | | 42,825 | | | 1,251,775 | |

Donegal Group Inc. — Class A | | 7,245 | | | 126,063 | |

Donegal Group Inc. — Class B | | 3,672 | | | 65,912 | |

Eastern Insurance Holdings Inc. | | 1,000 | | | 14,480 | |

EMC Insurance Group Inc. | | 5,962 | | | 160,318 | |

FBL Financial Group Inc. | | 35,900 | | | 1,022,791 | |

First Mercury Financial Corp. | | 1,700 | | | 29,597 | A |

| | |

| 40 | | Annual Report to Shareholders |

Portfolio of Investments — Continued

U.S. Small-Capitalization Value Trust — Continued

| | | | | | |

| | | Shares/Par | | Value | |

Financials — Continued | | | | | | |

Insurance — Continued | | | | | | |

FPIC Insurance Group Inc. | | 900 | | $ | 42,426 | A |

Hallmark Financial Services Inc. | | 1,900 | | | 21,204 | A |

Hanover Insurance Group Inc. | | 33,270 | | | 1,368,728 | |

Harleysville Group Inc. | | 18,260 | | | 659,003 | |

Horace Mann Educators Corp. | | 43,930 | | | 767,897 | |

Infinity Property and Casualty Corp. | | 24,980 | | | 1,039,168 | |

IPC Holdings Ltd. | | 5,900 | | | 165,200 | |

Max Capital Group Ltd. | | 5,300 | | | 138,807 | |

Meadowbrook Insurance Group Inc. | | 47,090 | | | 367,773 | |

Mercer Insurance Group Inc. | | 1,900 | | | 33,041 | |

Mercury General Corp. | | 440 | | | 19,496 | |

Montpelier Re Holdings Ltd. | | 9,100 | | | 146,055 | |

National Interstate Corp. | | 8,090 | | | 188,902 | |

National Western Life Insurance Co. | | 3,200 | | | 693,728 | |

Navigators Group Inc. | | 7,300 | | | 397,120 | A |

Nymagic Inc. | | 8,190 | | | 185,995 | |