UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number: | | 811-07692 |

Legg Mason Investors Trust, Inc.

| | |

| 100 Light Street, Baltimore, MD | | 21202 |

| Address of Principal Executive Offices: | | |

Robert I. Frenkel

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

|

| Name and address of agent for service: |

Registrant’s telephone number, including area code: (410) 539-0000

| | |

Date of fiscal year end: March 31 | | |

Date of reporting period: March 31, 2009

Item 1. Report to Shareholders

Legg Mason

Investors Trust, Inc.

Investment Commentary and

Annual Report to Shareholders

March 31, 2009

American Leading Companies Trust

U.S. Small-Capitalization Value Trust

American Leading Companies Trust

Market Commentary

The stock market experienced one of the worst twelve-month periods in history during the fiscal year ended March 31, 2009, as all of the major U.S. market indices posted declines in excess of 32%. The decline persisted with little respite throughout the year, as the widely followed Dow Jones Industrial Average (“DJIA”)A and S&P 500 IndexB both registered declines in all four quarters of the fiscal year. Value-based investment styles were especially hard hit during the year, as the Russell 1000 Value IndexC underperformed the S&P 500 Index by more than four percentage points and also underperformed the Russell 1000 Growth IndexD by over eight percentage points.

Equity returns for the twelve-month period ended March 31, 2009 are shown below:

| | |

| | | Total ReturnsE |

| | | 12 Months |

S&P 500 Index | | –38.09% |

DJIA | | –35.94% |

NASDAQ Composite IndexF | | –32.25% |

S&P MidCap 400 IndexG | | –36.09% |

Russell 2000 IndexH | | –37.50% |

Dow Jones Wilshire 5000 IndexI | | –37.96% |

S&P 100 IndexJ | | –36.68% |

Russell 1000 Growth Index | | –34.28% |

Russell 1000 Value Index | | –42.42% |

The recession that began in the fourth calendar quarter of 2007 deepened throughout 2008, and, in September 2008, morphed into a full blown financial crisis following the bankruptcy of Lehman Brothers and the effective nationalization of Fannie Mae, Freddie Mac and AIG. Credit markets froze up, credit spreads widened to multi-decade highs and financial markets worldwide went into a freefall. Financial stocks were at the epicenter of the crisis and were especially hard hit, with the S&P 500 Financial IndexK down 63.03% for the fiscal year. The breathtaking declines in the financial markets in the fall of 2008 stunned both business leaders and consumers, alike, causing a sharp drop in economic activity, as U.S. gross domestic product (“GDP”)L fell 6.3% in the last three months of 2008, its largest quarterly drop since 1982. Financial markets appeared for a time to have bottomed in late November 2008 and rallied more than +20% off their lows into the early days of the new year. Markets turned down again in 2009 as questions arose about the financial soundness of the major U.S. banks. At its March 6th inter-day low of 666.79, the S&P 500 Index was nearly 900 points (-57.4%) below its October 9, 2007 closing high of 1565.15. Even following a spirited rally through the end of the month, the S&P 500 Index closed the fiscal year ended March 31, 2009 at barely more than half its October 9, 2007 value.

The Investment Commentary is not a part of the Annual Report to Shareholders.

| | |

Investment Commentary | | iii |

As bad as returns were in the U.S., they were mostly worse overseas. Of the major foreign markets listed below, only Japan’s NIKKEI 225 IndexM and China’s Shanghai Stock Exchange Composite IndexN posted smaller declines than our S&P 500 Index.

Overseas returns in U.S. dollars for the twelve-month period ended March 31, 2009 are shown below:

| | |

| | | Total ReturnsE |

| | | 12 Months |

FTSE 100 IndexO (UK) | | –48.06% |

DAX IndexP (Germany) | | –47.70% |

CAC 40 IndexQ (France) | | –48.02% |

MICEX IndexR (Russia) | | –67.09% |

NIKKEI 225 Index (Japan) | | –33.76% |

Hang Seng IndexS (Hong Kong) | | –38.27% |

Kospi IndexT (South Korea) | | –48.68% |

Shanghai Stock Exchange Composite Index (China) | | –28.86% |

BSE Sensex 30 IndexU (India) | | –50.26% |

The recent behavior of the economy and stock market is, in many respects, without precedent in the post-WWII era. Not since the Great Depression era of the 1930s have we witnessed some of the things we are seeing today. Until very recently, the parallels have all been about how bad things are now, with this or that market or economic condition being the worst “since the Great Depression.” We should all probably agree to use the acronym STGD as short-hand for “since the Great Depression” to save time and ink. In this vein, Barrons’s writer Michael Santoli recently noted in an article entitled “Listening to the Echoes of 1938” that, at their early March low, the broad indices were as far below their 200-day moving averages as they had been at any time since 1938. He further observed that large companies (including GE) were on track to cut their dividends by a larger percentage than any year since 1938. We ourselves have reported that the trailing ten-year return on the S&P 500 Index has recently reached an all-time record low, worse even than the decade from 1929 to 1939, the previous record holder.

We think it is quite likely that all the recent references by news commentators, market pundits and political leaders – including our new president – to this being the worst economy STGD have served to exacerbate the downturn, as both businesses and consumers have been frozen into inaction fearing that we might be facing another depression. We have no hard evidence of this assertion, but anecdotally it seems valid. On a personal basis, it certainly rings true to me. My parents – who were born in 1910 and 1912 – were in their 20s during the depression of the 1930s, and the economic devastation of that period was burned into their psyches such that they were both highly risk-averse until the day they died.

The Investment Commentary is not a part of the Annual Report to Shareholders.

More happily, the market’s recent strength is without precedent since the 1930s as well. According to Robert Farrell of Farrell Advisory Associates, the S&P 500 Index’s ten-day gain of +21.64% through Monday, March 23, 2009 was its best since the ten days ended April 29, 1933. Farrell also noted that the ten-day breadth thrust through March 23rd was also an impressive 2.26 times advances over declines. In the post-WWII period, ten-day breadth thrusts over 1.97 times have all heralded the beginning of a new bull market. Frustratingly for the bulls, this pattern did not hold in the 1930s, when breadth thrusts over 1.97 times sometimes heralded new bull markets and sometimes only bear rallies, according to Farrell.

So far, it is unclear whether the market’s recent strength – which has continued in the first two weeks of the new quarter and taken the S&P 500 Index up +31.3% from its March 6th inter-day low of 666.79 to a recent inter-day high on April 17th of 875.63 – is “only” a bear market rally or the start of a new bull market cycle. We have wrongly called “the turn” a couple of times in the last year, so we want to be somewhat cautious in calling it now, but we believe that a plausible case can be made for the March 6th inter-day low being “the low” for this market cycle. One thing we find encouraging is the massive policy response to the crisis by the U.S. government, which is without precedent in the post-WWII era. After a few missteps and false starts, the Obama Administration, together with the U.S. Department of the Treasury, the Federal Reserve Board (“Fed”)V and the U.S. Congress, has implemented a broad range of monetary and fiscal measures designed to stabilize the financial markets, unfreeze the credit markets and get the U.S. economy growing again. Economic prospects remain highly uncertain, but some improvement in credit conditions and the recent rally in the financial markets offer tentative hope that the worst of the recession and the market decline may be behind us.

The Investment Commentary is not a part of the Annual Report to Shareholders.

Investment Results

Total returns for the Fund for various periods ended March 31, 2009 are presented below, along with those of comparative indices:

| | | | | | | | | | | | |

| | | | | | | Average Annual Total Returns |

| | | Three Months | | One

Year | | Three

Years | | Five

Years | | Ten

Years | | Since

Inception |

Without Sales Charges | | | | | | | | | | | | |

Class A | | N/A | | N/A | | N/A | | N/A | | N/A | | –9.96% |

Class C* | | –17.41% | | –51.32% | | –24.23% | | –11.63% | | –6.02% | | +1.97% |

Institutional Class | | –17.29% | | –50.86% | | –23.47% | | –10.75% | | N/A | | –6.20% |

S&P 500 IndexW | | –11.01% | | –38.09% | | –13.06% | | –4.77% | | –3.00% | | +5.52% |

Lipper Large-Cap Value Funds Category AverageX | | –13.15% | | –39.80% | | –14.40% | | –5.11% | | –1.11% | | +5.07% |

With Sales Charges | | | | | | | | | | | | |

Class A | | N/A | | N/A | | N/A | | N/A | | N/A | | –15.16% |

Class C* | | –18.24% | | –51.80% | | –24.23% | | –11.63% | | –6.02% | | +1.97% |

Institutional Class | | –17.29% | | –50.86% | | –23.47% | | –10.75% | | N/A | | –6.20% |

The performance data quoted represent past performance and do not guarantee future results. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website at www.leggmason.com/individualinvestors. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume the reinvestment of dividends and capital gain distributions. Performance would have been lower if fees and expenses had not been waived and/or reimbursed in various periods. Performance figures for periods shorter than one year represent cumulative figures and are not annualized. Please note that Class A has been in existence for less than one year. Results for longer periods may differ, in some cases, substantially.

For performance data including the effects of sales charges, Class A shares reflect the deduction of a maximum initial sales charge of 5.75%, and Class C shares reflect the deduction of a contingent deferred sales charge of 1.00%, which applies if shares are redeemed within one year of purchase.

The inception dates of the A, C and Institutional Classes are February 3, 2009, September 1, 1993 and June 14, 2001, respectively. The Index return is for the period beginning September 1, 1993. The Lipper return is for the period beginning August 31, 1993. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The Investment Commentary is not a part of the Annual Report to Shareholders.

The gross expense ratios for the A, C and Institutional Classes were 1.14%, 1.89% and 0.86%, respectively, as indicated in the Fund’s most current prospectus dated February 1, 2009. These expenses include management fees, 12b-1 distribution and/or service fees and other expenses.

* Prior to February 1, 2009, Class C was known as the Primary Class. In addition, on February 1, 2009, the class began to charge a contingent deferred sales charge for shares bought by investors on and after that date and redeemed within one year of purchase.

For the twelve months ended March 31, 2009, Class C shares of Legg Mason American Leading Companies Trust, excluding sales charges, returned -51.32%. The Fund’s unmanaged benchmark, the S&P 500 Index, returned -38.09% for the same period. The Lipper Large-Cap Value Funds Category Average returned -39.80% over the same time frame. Following two very poor years, the longer-term performance results – which until about mid-2007 were reasonably respectable – are now painful to look at.

By far, the largest factor contributing to the underperformance of the portfolio in the quarter and for the full year was an overweighting in Financials stocks, which were the worst performing stocks in the S&P 500 Index for the twelve months ended March 31, 2009. Particularly damaging were large positions in Bank of America Corp., Citigroup Inc. and American International Group. These three stocks alone cost the portfolio nearly 700 basis pointsY of relative performance versus the S&P 500 Index during the year, thus accounting for about half of the portfolio’s shortfall versus its benchmark for the fiscal year. Other Financials stocks which hurt performance were Lloyds TSB Group PLC, Freddie Mac and Merrill Lynch and Co. Inc. (which was acquired during the reporting period by Bank of America). Other major contributors to the portfolio’s poor results for the reporting period were: General Electric Co. and UAL Corporation, the parent company of United Airlines.

There were not a lot of bright spots in the portfolio in a year in which most stocks in the market declined. An exception was Amgen Inc. which advanced 18.4% during the fiscal year, outperforming the S&P 500 Index by over fifty percentage points. A number of other holdings – while declining in value for the fiscal year – held up much better than the overall market and, therefore, helped the portfolio on a relative return basis. These included Johnson and Johnson and WellPoint Inc. in Health Care; Kraft Foods Inc., Philip Morris International Inc. and Altria Group Inc. in Consumer Staples; International Business Machines Corp. and Accenture Ltd. in Information Technology; The TJX Cos. Inc. in Consumer Discretionary; and Exxon Mobil Corp. in the Energy group. Following the market’s severe decline in the fall, a number of purchases contributed positively to performance in the last few months of the fiscal year. Notable among these were: Freeport McMoRan Copper and Gold Inc., The Goldman Sachs Group Inc. and National Oilwell Varco Inc.

The Investment Commentary is not a part of the Annual Report to Shareholders.

| | |

Investment Commentary | | vii |

In an effort to broaden the Fund’s diversification and reduce downside volatility without compromising upside potential, I added fifteen new stocks to the portfolio during the quarter. A sixteenth stock was added via the spin-off of Time Warner Cable to Time Warner shareholders, bringing the total number of holdings to sixty-two as of March 31, 2009. In Financials, insurance companies Aflac Inc. and MetLife Inc. were added, as well as Morgan Stanley and Wells Fargo & Co., while Bank of America, Citigroup Inc. and Merrill Lynch and Co. Inc. were eliminated. To boost our Consumer Staples holdings, we bought Costco Wholesale Corp., PepsiCo Inc. and Proctor and Gamble Co. In Industrials, we added Emerson Electric Co., United Technologies Corp. and Delta Air Lines Inc. In Information Technology, we bought Cisco Systems Inc. and storage provider EMC Corp. We also bought Freeport-McMoRan Copper and Gold Inc. in the Materials sector, global power producer The AES Corp. in the Utilities sector, and re-acquired shares of Sprint Nextel Corp. in Telecommunication Services.

In aggregate, the purchases were intended to improve the overall quality of the portfolio, while still retaining solid appreciation potential. Based on data from Mellon Analytical Solutions, at March fiscal year end, the portfolio had a forward twelve-month price-to-earnings (“P/E”) ratioZ of 11.1X, versus 12.2X for the S&P 500 Index, while offering a return-on-equity comparable to the benchmark (21.7% versus 21.9%) and higher estimated long-term growth prospects than the S&P 500 Index (11.1% versus 10.0%). Of course, these characteristics do not guarantee success in the future, but they do offer evidence that our efforts to buy good quality companies at attractive valuations are being reflected in the portfolio.

Outlook

In addition to the massive monetary and fiscal stimuli that have been put in place since last fall, there have been a number of encouraging developments of late on the economic, policy and regulatory fronts that, in combination, give us growing confidence that we may be near an important inflection point, both in terms of the economy and the stock market. We believe these developments, together with the brutal market decline through early March that we believe discounted an enormous amount of bad news, have set the stage for a potentially strong rally in the market. As we will argue further on, we think that we may be in the early stages of a new cyclical bull market, rather than just enjoying yet another bear market rally.

On the economic front, we think the economy may have bottomed in the first quarter of 2009. We believe the U.S. economy contracted at a slightly slower pace in the first three months of 2009 as compared to the fourth quarter of 2008 (-6.3%).

The Investment Commentary is not a part of the Annual Report to Shareholders.

| | |

viii | | Investment Commentary |

Things have been so bad for the last 180 days that mathematically, they almost have to get better. We are seeing that in car sales, which despite falling 34% year-over-year in March, were at an annualized pace of 9.86 million vehicles, up over +8% from February’s 9.12 million annualized rate. We are also seeing it in the manufacturing sector generally, where the Institute for Supply Management’s Composite PMI IndexAA was up in March for the third month in a row. Recent data on housing activity are also coming in better than expected, and even mall traffic and restaurant sales seem to be perking up.

On the policy front, we believe the Treasury’s recently announced Public-Private Partnership Investment Program (dubbed “PPIP” in Washington), designed to assist banks in removing legacy assets from their balance sheets, has a reasonably good chance of working. The devil is always in the details, but we think the size of the program is meaningful, and we like the shared risk/shared profits aspect of the program. With the non-recourse leverage the government is providing buyers, the returns from the program should be reasonably attractive, even if asset pricing is not as distressed as it might have been without the refinements in mark-to-market accounting regulations that were approved by the Financial Accounting Standards Board (“FASB”).

It is these regulatory changes with respect to mark-to-market accounting that we find most encouraging. We know this is a controversial topic, with passionate views on both sides. In our opinion, the key issue is determining what best constitutes “fair value” for an asset. The “mark-to-model” regime that existed prior to the implementation of FASB 157 in November 2007 led to substantial abuses. FASB 157 was an honest effort to curb those abuses by requiring that “observable market inputs” be the primary determinant of “fair value” in pricing securities. When credit markets became dysfunctional, however, we believe “market” prices began giving overly pessimistic signals as to what many assets were worth. In our view, forcing banks and other financial institutions to mark assets to these increasingly distressed and illiquid “market” prices greatly exacerbated the banking crisis and subsequent economic downturn. In our opinion, the latest modification of “fair value” guidelines (FASB 157-e) allowing greater use of cash flow-based valuation methodologies takes a more balanced and sensible approach to how securities should be valued when markets are under great stress, as they have been for the last year or so. We disagree with those who view this as a cave-in or cop-out.

Interestingly, a similar move away from strict adherence to mark-to-market accounting for regulatory capital purposes is thought to have been an important step to ending the Great Depression, according to a March 20, 2009 article by Peter Niculescu in American Banker entitled “Lesson Learned in ‘30s: End Marking to Market.” Mr. Niculescu writes that the Office of the Comptroller of the Currency (“OCC”) ended mark-to-market securities evaluations for banks in 1938, saying, “Bank investments should be considered in the light of inherent soundness rather than on a basis of day-to-day market fluctuations” (Federal Reserve Bulletin, July 1938). He goes

The Investment Commentary is not a part of the Annual Report to Shareholders.

on to quote the OCC as saying in 1938, “By severing appraisal of bank investments from current market quotations, it is believed that the banks will be encouraged to purchase securities of sound business and industrial concerns, whether large or small, for their true worth and not speculative gains.” And “as the banks avail themselves of the opportunity, the necessity will be diminished for the creation of government agencies to furnish credit facilities which the banks should provide.” This sounds eminently sensible to us. The Obama Administration wants the banks to start lending again. By relieving or greatly diminishing the banks’ need to raise capital to fill balance sheet holes caused by accounting convention, the modified mark-to-market accounting rules increase the likelihood of that happening, in our opinion.

Now that a more balanced interpretation of the mark-to-market accounting rules has been put in place, we have two items left on our wish list: (1) reinstating the “uptick” rule and (2) reining in abusive practices in the credit default swap (“CDS”) market. In our opinion, these changes would re-level the financial playing field, which we believe has been tilted in favor of the bear since 2007.

The uptick rule was instituted in 1938 by then Chairman of the Securities and Exchange Commission (“SEC”) Joseph Kennedy, who, as a veteran short-seller himself, knew what a powerful weapon it was to be able to short stocks into weakness in distressed markets and wanted to remove that arrow from the short’s quiver. The uptick rule remained in place for sixty-nine years, until July 2007, when intense lobbying by a number of hedge funds convinced the SEC to rescind the rule. Since the elimination of the uptick rule, the downside volatility of stocks, especially financial stocks, has been enormous. Shorts have used the absence of the uptick rule in conjunction with purchases of CDSs to initiate “bear raids” on financial institutions regularly since mid-2007. The shorts’ playbook has been very effective, in our judgment: blow out the CDS spreads while simultaneously shorting the stock, then lobby the rating agencies to downgrade the company because of the poor market action of its CDS, bonds and stock price.

As George Soros argued persuasively in a must-read op-ed piece entitled “One Way to Stop Bear Raids” (The Wall Street Journal, Tuesday, March 24, 2009), the shorts’ playbook was particularly effective against financial companies because their business is so dependent upon trust and confidence, and once confidence is shaken, bear raids can be self-validating. Soros opines that “AIG, Bear Stearns, Lehman Brothers and others were destroyed by bear raids in which the shorting of stocks and buying CDSs mutually amplified and reinforced each other. The unlimited shorting of stocks was made possible by the abolition of the uptick rule, which would have hindered bear raids by allowing short selling only when prices were rising. The unlimited shorting of bonds was facilitated by the CDS market. The two made a lethal combination.”

Soros’s prescription for leveling the playing field is to reinstate the uptick rule and to require that only those who own the underlying bonds ought to be allowed to buy

The Investment Commentary is not a part of the Annual Report to Shareholders.

CDSs on those bonds. We think both of those ideas have merit. Our preference would be to have the uptick rule reinstated in its original form, but, as a compromise, we would also be supportive of the “modified uptick rule” proposed by the four major U.S. stock exchanges that would be triggered after the price of a stock fell by a certain percentage (suggested at 10%). With respect to the CDS market, we could see expanding the list of eligible CDS buyers to include entities, such as suppliers, creditors or customers, who had some economic relationship with the company in question.

As always, we thank you for your support and welcome your comments.

David E. Nelson, CFA

Chairman, Investment Policy Committee

Legg Mason Capital Management

April 20, 2009

All investments are subject to risk including possible loss of principal.

The value approach to investing involves the risk that those stocks deemed to be undervalued by the portfolio manager may remain undervalued. The Fund may focus its investments in certain regions or industries, thereby increasing its potential vulnerability to market volatility. Please see the Fund’s prospectus for more information on these and other risks.

The views expressed in this commentary reflect those solely of the portfolio manager as of the date of this commentary and may differ from those of Legg Mason, Inc. as a whole or the other portfolio managers of its affiliates. Any such views are subject to change at any time based on market or other conditions, and the portfolio manager, Legg Mason Investors Trust, Inc. and Legg Mason Investor Services, LLC disclaim any responsibility to update such views. These views are not intended to be a forecast of future events, a guarantee of future results or investment advice. Because investment decisions for the Legg Mason Funds are based on numerous factors, these views may not be relied upon as an indication of trading intent on behalf of any Legg Mason Fund. The information contained herein has been prepared from sources believed to be reliable, but is not guaranteed by the portfolio manager, Legg Mason Investors Trust, Inc. or Legg Mason Investor Services, LLC as to its accuracy or completeness. Predictions are inherently limited and should not be relied upon as an indication of actual or future performance.

References to particular securities are intended only to explain the rationale for the Adviser’s action with respect to such securities. Such references do not include all material information about such securities, including risks, and are not intended to be recommendations to take any action with respect to such securities. Please note that an investor cannot invest directly in an index.

The Investment Commentary is not a part of the Annual Report to Shareholders.

A | The Dow Jones Industrial Average (“DJIA”) is a widely followed measurement of the stock market. The average is comprised of thirty stocks that represent leading companies in major industries. These stocks, widely held by both individual and institutional investors, are considered to be all blue-chip companies. |

B | The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S. |

C | The Russell 1000 Value Index measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. |

D | The Russell 1000 Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. |

F | The NASDAQ Composite Index is a market-value weighted index, which measures all securities listed on the NASDAQ stock market. |

G | The S&P MidCap 400 Index is a market value weighted index which consists of 400 domestic stocks chosen for market size, liquidity and industry group representation. |

H | The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. |

I | The Dow Jones Wilshire 5000 Index represents the broadest index for the U.S. equity market, measuring the performance of all U.S. equity securities with readily available price data. |

J | The S&P 100 Index is a market-capitalization weighted index consisting of 100 large blue-chip stocks covering a broad range of industries. |

K | The S&P 500 Financial Index is a capitalization-weighted index representing nine financial groups and fifty-three financial companies, calculated monthly with dividends reinvested at month end. |

L | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

M | The NIKKEI 225 Index is a price-weighted average of 225 top-rated Japanese companies listed in the First Section of the Tokyo Stock Exchange. |

N | The Shanghai Stock Exchange Composite Index is a capitalization-weighted index. The Index tracks the daily price performance of all A-shares and B-shares listed on the Shanghai Stock Exchange. |

O | The FTSE 100 Index comprises the 100 most highly capitalized blue-chip companies, representing approximately 81% of the UK market. It is used extensively as a basis for investment products, such as derivatives and exchange-traded funds. |

P | The DAX Index is a total return index of thirty selected German blue-chip stocks traded on the Frankfurt Stock Exchange. The equities use free float shares in the index calculation. The Index has a base value of 1,000 as of December 31, 1987. As of June 18, 1999 only XETRA equity prices are used to calculate all DAX indices. |

Q | The CAC 40 Index is a narrow-based, modified capitalization-weighted index of 40 companies listed on the Paris Bourse. The Index was developed with a base level of 1,000 as of December 31, 1987. As of December 1, 2003, the Index has become a free float weighted index. |

R | The MICEX Index is the real-time cap-weighted Russian composite index. It comprises the thirty most liquid stocks of Russia’s largest and most developed companies from ten main economy sectors. |

S | The Hang Seng Index is a free-float capitalization-weighted index of a selection of companies from the Stock Exchange of Hong Kong. The components of the Index are divided into four sub-indices: Commerce and Industry, Finance, Utilities and Properties. |

T | The Kospi Index is a capitalization-weighted index of all common shares on the Korean Stock Exchanges. |

The Investment Commentary is not a part of the Annual Report to Shareholders.

| | |

xii | | Investment Commentary |

U | The Bombay Stock Exchange Sensitive Index (“BSE Sensex”) is a cap-weighted index. The selection of the index members has been made on the basis of liquidity, depth, and floating-stock-adjustment depth and industry representation. Sensex has a base date and value of 100 in 1978-1979. The Index uses free float. |

V | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

W | The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S. |

X | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. The Lipper Large-Cap Value Funds Category Average is comprised of the Fund’s peer group of mutual funds. |

Y | A basis point is one one-hundredth (1/100 or 0.01) of one percent. |

Z | The price-to-earnings (“P/E”) ratio is a stock’s price divided by its earnings per share. |

AA | The Institute for Supply Management’s Composite PMI Index is based on a survey of purchasing executives who buy the raw materials for manufacturing at more than 350 companies. It offers an early reading on the health of the manufacturing sector. |

N/A — Not applicable.

The Investment Commentary is not a part of the Annual Report to Shareholders.

| | |

Investment Commentary | | xiii |

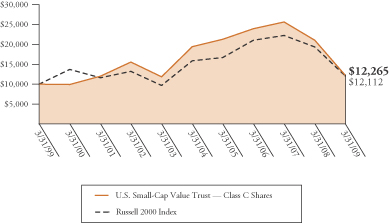

U.S. Small–Capitalization Value Trust

Total returns for the Fund for various periods ended March 31, 2009 are presented below, along with those of comparative indices:

| | | | | | | | | | | | |

| | | | | | | Average Annual Total Returns |

| | | Three

Months | | One

Year | | Three

Years | | Five

Years | | Ten

Years | | Since

Inception |

Without Sales Charges | | | | | | | | | | | | |

Class A | | N/A | | N/A | | N/A | | N/A | | N/A | | –7.54% |

Class C* | | –19.09% | | –41.75% | | –20.03% | | –8.78% | | +2.06% | | –0.40% |

Institutional Class | | –18.96% | | –41.24% | | –19.27% | | –7.84% | | +3.09% | | +0.69% |

Russell 2000 IndexA | | –14.95% | | –37.50% | | –16.80% | | –5.24% | | +1.93% | | +1.06% |

Lipper Small-Cap Value Funds Category AverageB | | –15.26% | | –39.49% | | –17.56% | | –5.26% | | +4.86% | | +2.38% |

With Sales Charges | | | | | | | | | | | | |

Class A | | N/A | | N/A | | N/A | | N/A | | N/A | | –12.80% |

Class C* | | –19.90% | | –42.33% | | –20.03% | | –8.78% | | +2.06% | | –0.40% |

Institutional Class | | –18.96% | | –41.24% | | –19.27% | | –7.84% | | +3.09% | | +0.69% |

The performance data quoted represent past performance and do not guarantee future results. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website at www.leggmason.com/individualinvestors. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume the reinvestment of dividends and capital gain distributions. Performance would have been lower if fees and expenses had not been waived and/or reimbursed in various periods. Performance figures for periods shorter than one year represent cumulative figures and are not annualized. Please note that Class A has been in existence for less than one year. Results for longer periods may differ, in some cases, substantially.

For performance data including the effects of sales charges, Class A shares reflect the deduction of a maximum initial sales charge of 5.75%, and Class C shares reflect the deduction of a contingent deferred sales charge of 1.00%, which applies if shares are redeemed within one year of purchase.

The inception dates of the A, C and Institutional Classes are February 3, 2009, June 15, 1998 and June 19, 1998, respectively. The Index return is for the period beginning June 15, 1998. The Lipper return is for the period beginning June 30, 1998. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The gross expense ratios for the A, C and Institutional Classes were 1.52%, 2.27% and 1.26%, respectively, as indicated in the Fund’s most current prospectus dated February 1, 2009. These expenses include management fees, 12b-1 distribution and/or service fees and other expenses. As a result of voluntary expense limitations, the ratio of expenses, other than interest, brokerage, taxes and extraordinary expenses, to average net assets will not

The Investment Commentary is not a part of the Annual Report to Shareholders.

| | |

xiv | | Investment Commentary |

exceed 1.25% for Class A, 2.00% for Class C and 1.00% for the Institutional Class. These voluntary waivers are currently expected to continue until August 1, 2009, but may be terminated at any time.

* Prior to February 1, 2009, Class C was known as the Primary Class. In addition, on February 1, 2009, the class began to charge a contingent deferred sales charge for shares bought by investors on and after that date and redeemed within one year of purchase.

Market Commentary

After the Lehman Brothers bankruptcy in September 2008, credit markets from auction rate bonds to conventional mortgages to short-term lines of credit locked up as lenders became too fearful to put capital at risk. Coordinated efforts from the Federal Reserve Board (“Fed”)C, the U.S. Department of the Treasury and global governmental agencies sought to provide liquidity and backing to help unlock the credit markets. Unprecedented governmental response occurred as the Fed cut interest rates to near zero. In addition, the Treasury became the banker for Main Street and Wall Street when Congress intervened with the $700 billion Troubled Asset Relief Program (“TARP”) in an effort to unfreeze credit and recapitalize the banking system. The Volatility Index (“VIX”)D reached record highs in October, credit spreads widened dramatically, and credit remained tight. Volatility was especially evident in the prices of commodities, and oil in particular. Oil reached a peak of over $145 per barrel in July, then plummeted to nearly $30 per barrel in late December, and ended the fiscal year at nearly $50 per barrel. After years of resiliency, consumers finally retrenched as consumer confidence hit record lows and the 2008 holiday shopping period was the worst in decades. The National Bureau of Economic Research (“NBER”) confirmed that which consumers intuitively knew with the December 2008 announcement that the economy had entered recession in December of 2007.

In the twelve months ended March 31, 2009, employment figures, housing prices, new home construction, industrial activity, and other economic indicators continued at severe recession levels. Investors, however, received more encouraging news in March as several major troubled banks reported seeing stronger positive profits developing for the quarter. Citigroup’s encouraging first quarter comments, on the same day the Treasury provided greater details on the public-private TARP to buy distressed assets, ignited a market upturn that lasted most of the month. The rally also gained support from the Fed’s announced plans to buy Treasury debt to lower interest rates and inject additional liquidity into the financial system. Enormous uncertainty remains on many fronts, but the stock market historically has begun to move higher well before the economy provides conclusive evidence of a turnaround.

The Fund outperformed as the markets rebounded recently, but the Fund trailed the benchmark over the last fiscal year. Poor performance in Information Technology and Industrials holdings detracted from results as capital projects and spending were curtailed due to economic pressures. Although the Fund sold Energy names in mid-2008 as oil climbed, the Fund, on average, remained overweighted in Energy

The Investment Commentary is not a part of the Annual Report to Shareholders.

which detracted from performance as oil prices collapsed. On the positive side, Financials holdings, particularly insurance companies, were defensive. The Fund’s consumer-related stocks also outperformed as earnings expectations fell significantly last year and consequently some of our holdings in these areas produced upside earnings surprises.

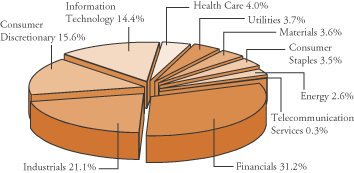

Regarding portfolio positioning, we are below the benchmark weight in Utilities and Consumer Staples as these stocks have been among the most defensive stocks during the bear market and no longer appear as attractive on a valuation basis. We also sold oil services firms, banks and insurance companies, often because the stocks had fallen less than other small-caps and exceeded our capitalization sell target. The portfolio is now well below the benchmark’s Financials weighting with a below benchmark weighting in banks and an overweight in insurance. We increased our weighting in consumer-oriented stocks in the restaurant, leisure and retailing areas as earnings held up better than expected and price momentum leveled out after a difficult period last year. We also added to our Information Technology weighting, particularly in hardware and equipment. The portfolio also has above benchmark weights in Consumer Discretionary, Information Technology and Industrials.

Outlook

We believe that the portfolio is more economically-sensitive and is now positioned to benefit more from signs of economic recovery and positive equity markets. As always, this stance is the result of our bottom-up stock selection process rather than a macro call on our part. Defensive sectors have performed relatively well over the last year of down markets and many of these stocks no longer look attractive on a valuation basis. With respect to more cyclical stocks, such as retailing, technology, manufacturing and basic materials, many have fallen significantly during the bear market and have low valuation metrics. Stock price declines have slowed and fewer companies are being excluded by the price momentum screens we used to avoid the worst recent performers. Much of the economic news remains gloomy, particularly employment figures that often continue to drop well after other economic signs improve. However, the dire news in some areas has been balanced with reports that show moderating, though usually not improving conditions. As we have discussed in the past, the equity markets often rally, sometimes quite powerfully, upon these early signs of an economic bottom. We also have seen historically, that small-cap value stocks do relatively well through the middle of the recession and often have been lead performers during the recovery phase.

As always, we appreciate your investment in the Fund and look forward to better times for the equity markets and for the Fund.

Henry F. Otto

Steven M. Tonkovich

April 15, 2009

The Investment Commentary is not a part of the Annual Report to Shareholders.

| | |

xvi | | Investment Commentary |

Investment risks: A fund that invests in small companies may involve higher risk than a fund that invests in larger, more established companies. Small companies may have limited product lines, markets or financial resources. Therefore, the Fund may involve considerably more risk of loss and its returns may differ significantly from funds investing in large-cap companies or other asset classes.

The value approach to investing involves the risk that those stocks deemed to be undervalued by the portfolio manager may remain undervalued. Please see the Fund’s prospectus for more information on these and other risks.

The views expressed in this commentary reflect those solely of the portfolio managers as of the date of this commentary and may differ from those of Legg Mason, Inc. as a whole or the other portfolio managers of its affiliates. Any such views are subject to change at any time based on market or other conditions, and the portfolio manager, Legg Mason Investors Trust, Inc. and Legg Mason Investor Services, LLC disclaim any responsibility to update such views. These views are not intended to be a forecast of future events, a guarantee of future results or investment advice. Because investment decisions for the Legg Mason Funds are based on numerous factors, these views may not be relied upon as an indication of trading intent on behalf of any Legg Mason Fund. The information contained herein has been prepared from sources believed to be reliable, but is not guaranteed by the portfolio manager, Legg Mason Investors Trust, Inc. and Legg Mason Investor Services, LLC as to its accuracy or completeness.

References to particular securities are intended only to explain the rationale for the Adviser’s action with respect to such securities. Such references do not include all material information about such securities, including risks, and are not intended to be recommendations to take any action with respect to such securities.

A | The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. |

B | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. The Lipper Small-Cap Value Funds Category Average is comprised of the Fund’s peer group of mutual funds. |

C | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

D | VIX is a volatility index for the Chicago Board Options Exchange, known by its ticker symbol, VIX. It is calculated by taking a weighted average of the implied volatility from eight calls and puts on the S&P 100 Index. The S&P 100 Index is a market-capitalization weighted index consisting of 100 large blue-chip stocks covering a broad range of industries. |

N/A — Not applicable.

The Investment Commentary is not a part of the Annual Report to Shareholders.

Annual Report to Shareholders

Legg Mason

Investors Trust, Inc.

March 31, 2009

| | |

Annual Report to Shareholders | | 1 |

To Our Shareholders

We are pleased to provide you with Legg Mason Investors Trust’s annual report for American Leading Companies Trust and U.S. Small-Capitalization Value Trust for the twelve months ended March 31, 2009.

Total returns, excluding sales charges, for periods ended March 31, 2009 were:

| | | | | | |

| | | Three

Months | | Six

Months | | Twelve

Months |

American Leading Companies Trust: | | | | | | |

Class C* | | –17.41% | | –39.90% | | –51.32% |

Institutional Class | | –17.29% | | –39.65% | | –50.86% |

U.S. Small-Capitalization Value Trust: | | | | | | |

Class C* | | –19.09% | | –38.98% | | –41.75% |

Institutional Class | | –18.96% | | –38.75% | | –41.24% |

The performance data quoted represent past performance and do not guarantee future results. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website at www.leggmason.com/individualinvestors. The investment return and principal value of the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume the reinvestment of dividends and capital gain distributions. Returns have not been adjusted to include sales charges that may apply or the deduction of taxes that a shareholder would pay on Fund distributions. If sales charges were reflected, the performance quoted would be lower. Performance would have been lower if fees and expenses had not been waived and/or reimbursed in various periods. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Performance of Class A shares of American Leading Companies Trust is not shown because this share class commenced operations on February 3, 2009.

Performance of Class A shares of U.S. Small-Capitalization Value Trust is not shown because this share class commenced operations on February 3, 2009.

* Prior to February 1, 2009, Class C was known as the Primary Class. In addition, on February 1, 2009, the class began to charge a contingent deferred sales charge for shares bought by investors on and after that date and redeemed within one year of purchase.

The market environment of the past twelve months has been among the most challenging seen by equity investors for generations. Concerns about our global financial system and the health of the global economy have negatively affected virtually all asset classes, including, of course, U.S. equities.

We understand the concerns created by market turmoil and declining prices. While no one can predict with certainty when the current crisis will end, we are heartened by the recent actions of the U.S. government to support and repair our financial system.

| | |

2 | | Annual Report to Shareholders |

We continue to believe in the resiliency of the U.S. economy. We believe that turmoil and downturn will eventually be followed by recovery and appreciation. And we believe in the long-term potential of our equity markets to provide rewards to patient investors. We remain committed to helping you, our shareholders, build wealth over the long term.

Information about each Fund’s performance over longer periods of time is shown in the respective Performance Information sections within this report. For more information about the Funds’ share classes included in this report, please contact your financial advisor.

PricewaterhouseCoopers LLP, the Funds’ independent registered public accounting firm, has completed its annual examination of the Funds, and audited financial statements for the fiscal year ended March 31, 2009 are included in this report.

Many Class A and Class C shareholders invest regularly in Fund shares on a dollar cost averaging basis. Most do so by authorizing automatic, monthly transfers of $50 or more from their bank checking or brokerage accounts. Dollar cost averaging is a convenient and sensible way to invest, as it encourages continued purchases over time regardless of fluctuating price levels. Of course, it does not ensure a profit nor protect against declines in the value of your investment. Your financial advisor will be happy to help you establish a dollar cost averaging account should you wish to do so.

On behalf of the Board and the entire team at Legg Mason, we appreciate your support.

| | |

Sincerely, | | |

Mark R. Fetting Chairman | |

David R. Odenath President |

May 19, 2009

| | |

Annual Report to Shareholders | | 3 |

Management’s Discussion of Fund Performance

American Leading Companies Trust

Total returns, excluding sales charges, for the Fund for periods ended March 31, 2009 are presented below, along with those of comparative indices:

| | | | |

| | | Six

Months | | Twelve

Months |

Class C* | | –39.90% | | –51.32% |

Institutional Class | | –39.65% | | –50.86% |

S&P 500 IndexA | | –30.54% | | –38.09% |

Lipper Large-Cap Value Funds Category AverageB | | –32.00% | | –39.80% |

The performance data quoted represent past performance and do not guarantee future results. Current performance may be lower or higher than the performance data quoted. To obtain performance data current to the most recent month-end, please visit our website at www.leggmason.com/individualinvestors. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Calculations assume the reinvestment of dividends and capital gain distributions. Returns have not been adjusted to include sales charges that may apply or the deduction of taxes that a shareholder would pay on Fund distributions. If sales charges were reflected, the performance quoted would be lower. Performance would have been lower if fees and expenses had not been waived and/or reimbursed in various periods. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

Performance of Class A shares is not shown because this share class commenced operations on February 3, 2009.

* Prior to February 1, 2009, Class C was known as the Primary Class. In addition, on February 1, 2009, the class began to charge a contingent deferred sales charge for shares bought by investors on and after that date and redeemed within one year of purchase.

The stock market experienced one of the worst twelve-month periods in history during the fiscal year ended March 31, 2009, as all of the major U.S. market indices posted declines in excess of 32%. The decline persisted with little respite throughout the year, as the widely followed Dow Jones Industrial Average (“DJIA”)C and S&P 500 Index both registered declines in all four quarters of the fiscal year. Value-based investment styles were especially hard hit during the year, as the Russell 1000 Value IndexD underperformed the S&P 500 Index by more than four percentage points and also underperformed the Russell 1000 Growth IndexE by over eight percentage points.

| | |

4 | | Annual Report to Shareholders |

Management’s Discussion of Fund Performance — Continued

Equity returns for the year ended March 31, 2009 are shown below:

| | |

| | | Total ReturnsF |

| | | 12 Months |

S&P 500 Index | | –38.09% |

DJIA | | –35.94% |

NASDAQ Composite IndexG | | –32.25% |

S&P MidCap 400 IndexH | | –36.09% |

Russell 2000 IndexI | | –37.50% |

Dow Jones Wilshire 5000 IndexJ | | –37.96% |

S&P 100 IndexK | | –36.68% |

Russell 1000 Growth Index | | –34.28% |

Russell 1000 Value Index | | –42.42% |

The recession that began in the fourth calendar quarter of 2007 deepened throughout 2008, and, in September, morphed into a full blown financial crisis following the bankruptcy of Lehman Brothers and the effective nationalization of Fannie Mae, Freddie Mac and AIG. Credit markets froze up, credit spreads widened to multi-decade highs and financial markets worldwide went into a freefall. Financial stocks were at the epicenter of the crisis and were especially hard hit, with the S&P 500 Financial IndexL down 63.03% for the fiscal year. The breathtaking declines in the financial markets in the fall stunned both business leaders and consumers, alike, causing a sharp drop in economic activity, as U.S. real gross domestic product (“GDP”)M fell 6.3% in the last three months of 2008, its largest quarterly drop since 1982. Financial markets appeared for a time to have bottomed in late November 2008 and rallied more than +20% off their lows into the early days of the new year. Markets turned down again in 2009 as questions arose about the financial soundness of the major U.S. banks, and the equity market made a new low in early March 2009. After a few missteps and false starts, the monetary and fiscal response by the U.S. government to the financial crisis has been without precedent in the post-WWII era. The Obama Administration, together with the U.S. Department of the Treasury, the Federal Reserve Board (“Fed”)N and the U.S. Congress, has implemented a broad range of monetary and fiscal measures designed to stabilize the financial markets, unfreeze the credit markets and get the U.S. economy growing again. Economic prospects remain highly uncertain, but some improvement in credit conditions and a rally in the financial markets in late March offer tentative hope that the worst of the recession may be behind us.

For the twelve months ended March 31, 2009, Class C shares of Legg Mason American Leading Companies Trust, excluding sales charges, returned -51.32%. The Fund’s unmanaged benchmark, the S&P 500 Index, returned -38.09% for the same

| | |

Annual Report to Shareholders | | 5 |

period. The Lipper Large-Cap Value Funds Category Average returned -39.80% over the same time frame.

By far, the largest factor contributing to the underperformance of the portfolio in the quarter and for the fiscal year was an overweighting in Financials stocks, which were the worst performing stocks in the S&P 500 Index for the twelve months ended March 31, 2009. Particularly damaging were large positions in Bank of America Corp., Citigroup Inc. and American International Group. These three stocks alone cost the portfolio nearly 700 basis pointsO of relative performance versus the S&P 500 Index during the year, thus accounting for about half of the portfolio’s shortfall versus its benchmark for the fiscal year. Other Financials stocks which hurt performance were Lloyds TSB Group PLC, Freddie Mac and Merrill Lynch and Co. Inc. (which was acquired during the year by Bank of America). Other major contributors to the portfolio’s poor results for the year were: General Electric Co. and UAL Corporation, the parent company of United Airlines. There were not a lot of bright spots in the portfolio in a year in which most stocks in the market declined. An exception was Amgen Inc. which advanced 18.4% during the fiscal year, outperforming the S&P 500 Index by over fifty percentage points. A number of other holdings — while declining in value for the year — held up much better than the overall market and, therefore, helped the portfolio on a relative return basis. These included Johnson and Johnson and WellPoint Inc. in Health Care; Kraft Foods Inc., Philip Morris International Inc. and Altria Group Inc. in Consumer Staples; International Business Machines Corp. and Accenture Ltd. in Information Technology; The TJX Cos. Inc. in Consumer Discretionary; and Exxon Mobil Corp. in the Energy group. Following the market’s severe decline in the fall, a number of purchases contributed positively to performance in the last few months of the fiscal year. Notable among these were: Freeport McMoRan Copper and Gold Inc., The Goldman Sachs Group Inc. and National Oilwell Varco Inc.

David E. Nelson, CFA

April 15, 2009

| | |

6 | | Annual Report to Shareholders |

Management’s Discussion of Fund Performance — Continued

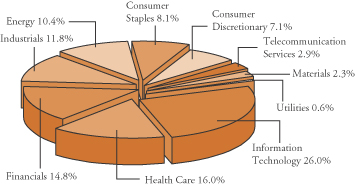

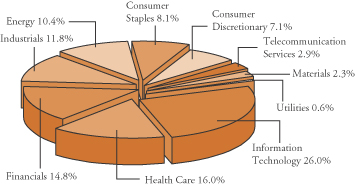

Portfolio holdings and breakdowns are as of March 31, 2009 and are subject to change and may not be representative of the portfolio manager’s current or future investments. The Fund’s top ten holdings (as a percentage of net assets) as of this date were: International Business Machines Corp. (4.2%), Hewlett-Packard Co. (4.0%), Texas Instruments Inc. (4.0%), UnitedHealth Group Inc. (3.6%), The TJX Cos. Inc. (3.6%), Nokia Oyj - ADR (3.3%), J.P. Morgan Chase and Co. (3.3%), Microsoft Corp. (3.3%), Johnson and Johnson (3.1%) and WellPoint Inc. (2.8%). Please refer to pages 17 through 21 for a list and percentage breakdown of the Fund’s holdings.

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of March 31, 2009 were: Information Technology (25.6%), Health Care (15.8%), Financials (14.6%), Industrials (11.6%) and Energy (10.3%). The Fund’s portfolio composition is subject to change at any time.

All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

A | The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S. |

B | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the period ended March 31, 2009, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 608 funds for the six-month period and among the 589 funds for the twelve-month period in the Fund’s Lipper category, and excluding sales charges. |

C | The Dow Jones Industrial Average (“DJIA”) is a widely followed measurement of the stock market. The average is comprised of thirty stocks that represent leading companies in major industries. These stocks, widely held by both individual and institutional investors, are considered to be all blue-chip companies. |

D | The Russell 1000 Value Index measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. (A price-to-book ratio is the price of a stock compared to the difference between a company’s assets and liabilities.) The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. |

E | The Russell 1000 Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. |

| | |

Annual Report to Shareholders | | 7 |

G | The NASDAQ Composite Index is a market-value weighted index, which measures all securities listed on the NASDAQ stock market. |

H | The S&P MidCap 400 Index is a market value weighted index which consists of 400 domestic stocks chosen for market size, liquidity and industry group representation. |

I | The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index. |

J | The Dow Jones Wilshire 5000 Index represents the broadest index for the U.S. equity market, measuring the performance of all U.S. equity securities with readily available price data. |

K | The S&P 100 Index is a market-capitalization weighted index consisting of 100 large blue-chip stocks covering a broad range of industries. |

L | The S&P 500 Financial Index is a capitalization-weighted index representing nine financial groups and fifty-three financial companies, calculated monthly with dividends reinvested at month end. |

M | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

N | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

O | A basis point is one one-hundredth (1/100 or 0.01) of one percent. |

| | |

8 | | Annual Report to Shareholders |

Expense Example

American Leading Companies Trust

As a shareholder of the Fund, you may incur two types of costs (1) transactions costs, including front-end and back-end sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

For Class CA and Institutional Class shares, the examples are based on an investment of $1,000 invested on October 1, 2008 and held through March 31, 2009. For Class A shares the example is based on an investment of $1,000 invested on February 3, 2009 (commencement of operations) and held through March 31, 2009. The ending value assumes dividends were reinvested at the time they were paid.

Actual Expenses

The first line for each class in the table below provides information about actual account values and actual expenses for each class. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account if your shares were held through the entire period.

Hypothetical Example for Comparison Purposes

The second line for each class in the table below provides information about hypothetical account values and hypothetical expenses based on the relevant class’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the class’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples for the relevant class that appear in the shareholder reports of other funds. Because the example is intended to be comparable to the examples provided by other funds, it is based on a hypothetical investment of $1,000 invested on October 1, 2008 and held through March 31, 2009 for each class, even though the Class A shares did not begin operations until February 3, 2009. The ending values assume dividends were reinvested at the time they were paid.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore the second line for each class of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | |

Annual Report to Shareholders | | 9 |

| | | | | | | | | | | |

| | | Beginning

Account Value

(See footnotes

below) | | | Ending

Account

Value

3/31/09 | | Expenses Paid

During the Period

(See footnotes below) | |

Class A | | | | | | | | | | | |

Actual | | $ | 1,000.00 | B | | $ | 900.40 | | $ | 1.60 | C |

Hypothetical (5% return before expenses) | | | 1,000.00 | D | | | 1,019.45 | | | 5.54 | E |

Class CA | | | | | | | | | | | |

Actual | | $ | 1,000.00 | D | | $ | 601.00 | | $ | 7.78 | E |

Hypothetical (5% return before expenses) | | | 1,000.00 | D | | | 1,015.21 | | | 9.80 | E |

Institutional Class | | | | | | | | | | | |

Actual | | $ | 1,000.00 | D | | $ | 603.50 | | $ | 4.00 | E |

Hypothetical (5% return before expenses) | | | 1,000.00 | D | | | 1,019.95 | | | 5.04 | E |

A | On February 1, 2009, Primary Class shares were renamed Class C shares. |

B | Beginning account value is as of February 3, 2009 (commencement of operations). |

C | This calculation is based on expenses incurred from February 3, 2009 (commencement of operations) to March 31, 2009. The dollar amount shown as “Expenses Paid” is equal to the annualized expense ratio of 1.10% for Class A shares, multiplied by the average values over the period, multiplied by the number of days in the fiscal period (56) and divided by 365. |

D | Beginning account value is as of October 1, 2008. |

E | These calculations are based on expenses incurred in the most recent fiscal half-year, unless otherwise noted. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratios of 1.10%, 1.95% and 1.00% for Class A, Class C and Institutional Class shares respectively, multiplied by the average values over the period, multiplied by the number of days in the most recent fiscal half-year (182) and divided by 365. |

| | |

10 | | Annual Report to Shareholders |

Performance Information

Fund Performance (Unaudited)

| | | | | | | | | |

Average Annual Total ReturnsA | | | | | | | | | |

| | | Without Sales ChargesB | |

| | | Class A | | | Class CC | | | Institutional

Class | |

Twelve Months Ended 3/31/09 | | N/A | | | –51.32 | % | | –50.86 | % |

Five Years Ended 3/31/09 | | N/A | | | –11.63 | | | –10.75 | |

Ten Years Ended 3/31/09 | | N/A | | | –6.02 | | | N/A | |

Inception* through 3/31/09 | | –9.96 | %D | | 1.97 | | | –6.20 | |

| | | | |

| | | With Sales ChargesE | |

| | | Class A | | | Class CC | | | Institutional

Class | |

Twelve Months Ended 3/31/09 | | N/A | | | –51.80 | % | | –50.86 | % |

Five Years Ended 3/31/09 | | N/A | | | –11.63 | | | –10.75 | |

Ten Years Ended 3/31/09 | | N/A | | | –6.02 | | | N/A | |

Inception* through 3/31/09 | | –15.16 | %D | | 1.97 | | | –6.20 | |

| | | | | | | | | |

Cumulative Total ReturnsA | | | | | | | | | |

| | | Without Sales ChargesB | |

Class A (Inception date of 2/3/09 through 3/31/09) | | | | | –9.96 | % | | | |

Class CC (3/31/99 through 3/31/09) | | | | | –46.25 | | | | |

Institutional Class

(Inception date of 6/14/01 through 3/31/09) | | | | | –39.28 | | | | |

A | All figures represent past performance and are not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. |

B | Assumes the reinvestment of all distributions, including return of capital, if any, at net asset value and does not reflect the deduction of the applicable sales charge with respect to Class A shares or the applicable contingent deferred sales charges (“CDSC”) with respect to Class C shares. On February 1, 2009, Class C shares began to charge a CDSC for shares bought by investors on and after that date and redeemed within one year of purchase. |

C | On February 1, 2009, Primary Class shares were renamed Class C shares. |

E | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. In addition, Class A shares reflect the deduction of the maximum initial sales charge of 5.75%. Class C shares reflect the deduction of a 1.00% CDSC, which applies if shares are redeemed within one year from purchase payment. |

| * | Inception dates for Class A, Class C and Institutional Class shares are February 3, 2009, September 1, 1993 and June 14, 2001, respectively. |

| | |

Annual Report to Shareholders | | 11 |

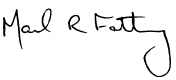

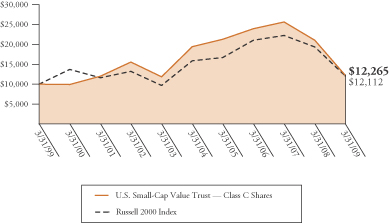

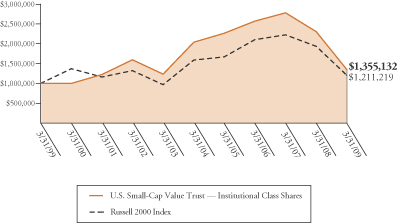

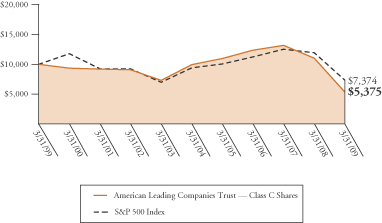

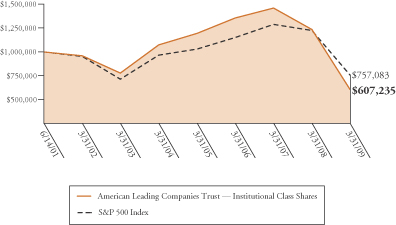

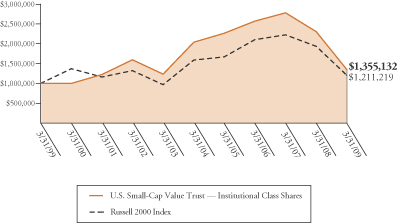

American Leading Companies Trust

The graphs on the following pages compare the Fund’s total returns to those of a closely matched broad-based securities market index. The graphs illustrate the cumulative total return of an initial $10,000 investment in Class CA shares and an initial $1,000,000 investment in Institutional Class shares, for the periods indicated. The lines for the Fund represent the total return after deducting all Fund investment management and other administrative expenses and the transaction costs of buying and selling securities. The lines representing the securities market Index do not take into account any transaction costs associated with buying and selling portfolio securities in the Index or other administrative expenses. Due to the limited operating history of Class A, a performance graph is not presented.

Total return measures investment performance in terms of appreciation or depreciation in a fund’s net asset value per share, plus dividends and any capital gain distributions. Both the Fund’s results and the Index’s results assume the reinvestment of all dividends and distributions at the time they were paid. Average annual returns tend to smooth out variations in a fund’s return, so that they differ from actual year-to-year results.

A | On February 1, 2009 Primary Class shares were renamed Class C shares. |

| | |

12 | | Annual Report to Shareholders |

Performance Information — Continued

Growth of a $10,000 Investment — Class CA Shares

Hypothetical illustration of $10,000 invested in Class C shares on March 31, 1999, assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through March 31, 2009. The performance data quoted represent past performance and do not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information, please visit www.leggmason.com/individualinvestors. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Performance would have been lower if fees and expenses had not been waived and/or reimbursed in various periods. Performance for other share classes will vary due to differences in sales charge structure and class expenses.

The graph does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

A | On February 1, 2009, Primary Class shares were renamed Class C shares. |

| | |

Annual Report to Shareholders | | 13 |

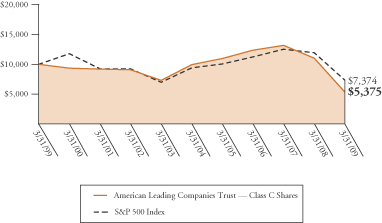

Growth of a $1,000,000 Investment — Institutional Class Shares

Hypothetical illustration of $1,000,000 invested in Institutional Class shares on June 14, 2001 (commencement of operations), assuming the reinvestment of all distributions, including returns of capital, if any, at net asset value through March 31, 2009. The performance data quoted represent past performance and do not guarantee future results. The performance stated may have been due to extraordinary market conditions, which may not be duplicated in the future. Current performance may be lower or higher than the performance data quoted. To obtain the most recent month-end performance information, please visit www.leggmason.com/individualinvestors. The investment return and principal value of the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Performance would have been lower if fees and expenses had not been waived and/or reimbursed in various periods. Performance for other share classes will vary due to differences in sales charge structure and class expenses.

The graph does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| | |

14 | | Annual Report to Shareholders |

Performance Information — Continued

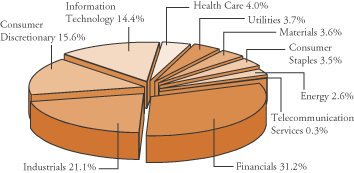

Portfolio Composition (as of March 31, 2009)A

(As a percentage of the portfolio)

Top 10 Holdings (as of March 31, 2009)

| | |

| Security | | % of

Net Assets |

International Business Machines Corp. | | 4.2% |

Hewlett-Packard Co. | | 4.0% |

Texas Instruments Inc. | | 4.0% |

UnitedHealth Group Inc. | | 3.6% |

The TJX Cos. Inc. | | 3.6% |

Nokia Oyj — ADR | | 3.3% |

J.P. Morgan Chase and Co. | | 3.3% |

Microsoft Corp. | | 3.3% |

Johnson and Johnson | | 3.1% |

WellPoint Inc. | | 2.8% |

A | The Fund is actively managed. As a result, the composition of its portfolio holdings and sectors is subject to change at any time. |

| | |

Annual Report to Shareholders | | 15 |

American Leading Companies Trust

Selected Portfolio PerformanceA

| | | | |

| Strongest performers for the year ended March 31, 2009B |

| 1 | | Amgen Inc. | | 18.4% |

| 2 | | WellPoint Inc. | | –13.5% |

| 3 | | International Business Machines Corp. | | –14.5% |

| 4 | | Johnson and Johnson | | –16.4% |

| 5 | | Exxon Mobil Corp. | | –17.7% |

| 6 | | Accenture Ltd. | | –18.8% |

| 7 | | The TJX Cos. Inc. | | –21.1% |

| 8 | | Altria Group Inc. | | –23.7% |

| 9 | | Kraft Foods Inc. | | –25.5% |

| 10 | | Philip Morris International Inc. | | –26.0% |

| | | | |

| Weakest performers for the year ended March 31, 2009B |

| 1 | | UAL Corp. | | –78.5% |

| 2 | | Capital One Financial Corp. | | –72.2% |

| 3 | | General Electric Co. | | –70.1% |

| 4 | | Caterpillar Inc. | | –62.7% |

| 5 | | Nokia Oyj — ADR | | –62.4% |

| 6 | | Baker Hughes Inc. | | –58.9% |

| 7 | | eBay Inc. | | –57.9% |

| 8 | | Devon Energy Corp. | | –57.1% |

| 9 | | Transocean Ltd. | | –56.6% |

| 10 | | Yahoo! Inc. | | –56.2% |

A | Individual security performance is measured by the change in the security’s price; for stocks, dividends are assumed to be reinvested at the time they were paid. |

B | Securities held for the entire year. |

| | |

16 | | Annual Report to Shareholders |

Portfolio Changes

| | |

New positions established during

the quarter | | Positions completely sold during

the quarter |

Aflac Inc. | | Bank of America Corp. |

The AES Corp. | | Citigroup Inc. |

Cisco Systems Inc. | | Merrill Lynch & Co., Inc. |

Costco Wholesale Corp. | | The Mosaic Co. |

Delta Air Lines Inc. | | |

EMC Corp. | | |

Emerson Electric Co. | | |

Freeport-McMoRan Copper

and Gold Inc. | | |

MetLife Inc. | | |

Morgan Stanley | | |

PepsiCo Inc. | | |

Procter and Gamble Co. | | |

Sprint Nextel Corp. | | |

Time Warner Cable Inc. | | |

United Technologies Corp. | | |

Wells Fargo & Co. | | |

| | |

Annual Report to Shareholders | | 17 |

Portfolio of Investments

American Leading Companies Trust

March 31, 2009

| | | | | | |

| | | Shares | | Value | |

| | | | | | |

Common Stocks and Equity Interests — 98.6% | | | | |

| | |

Consumer Discretionary — 7.0% | | | | | | |

Media — 3.4% | | | | | | |

CBS Corp. | | 320,000 | | $ | 1,228,800 | |

Time Warner Cable Inc. | | 47,608 | | | 1,180,684 | |

Time Warner Inc. | | 189,667 | | | 3,660,567 | |

| | | | | | |

| | | | | 6,070,051 | |

| | | | | | |

| | |

Specialty Retail — 3.6% | | | | | | |

The TJX Cos. Inc. | | 250,000 | | | 6,410,000 | |

| | | | | | |

| | |

Consumer Staples — 8.0% | | | | | | |