UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07704

Schwab Capital Trust – Schwab Target Index Funds

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Jonathan de St. Paer

Schwab Capital Trust

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: March 31

Date of reporting period: March 31, 2022

Item 1: Report(s) to Shareholders.

| Total Returns For the 12 Months Ended March 31, 2022 | |

| Schwab Target 2010 Index Fund (Ticker Symbol: SWYAX) | 1.55% |

| Target 2010 Passive Composite Index | 1.72% |

| Fund Category: Morningstar Target-Date 2000-20101 | 0.67% |

| Performance Details | pages 8-10 |

| Schwab Target 2015 Index Fund (Ticker Symbol: SWYBX) | 1.92% |

| Target 2015 Passive Composite Index | 2.08% |

| Fund Category: Morningstar Target-Date 20151 | 1.28% |

| Performance Details | pages 11-13 |

| Schwab Target 2020 Index Fund (Ticker Symbol: SWYLX) | 2.13% |

| Target 2020 Passive Composite Index | 2.31% |

| Fund Category: Morningstar Target-Date 20201 | 1.47% |

| Performance Details | pages 14-16 |

| Schwab Target 2025 Index Fund (Ticker Symbol: SWYDX) | 3.02% |

| Target 2025 Passive Composite Index | 3.28% |

| Fund Category: Morningstar Target-Date 20251 | 1.90% |

| Performance Details | pages 17-19 |

| Schwab Target 2030 Index Fund (Ticker Symbol: SWYEX) | 4.11% |

| Target 2030 Passive Composite Index | 4.39% |

| Fund Category: Morningstar Target-Date 20301 | 2.61% |

| Performance Details | pages 20-22 |

| Schwab Target 2035 Index Fund (Ticker Symbol: SWYFX) | 4.88% |

| Target 2035 Passive Composite Index | 5.20% |

| Fund Category: Morningstar Target-Date 20351 | 3.37% |

| Performance Details | pages 23-25 |

| 1 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| Total Returns For the 12 Months Ended March 31, 2022 | |

| Schwab Target 2040 Index Fund (Ticker Symbol: SWYGX) | 5.53% |

| Target 2040 Passive Composite Index | 5.90% |

| Fund Category: Morningstar Target-Date 20401 | 4.00% |

| Performance Details | pages 26-28 |

| Schwab Target 2045 Index Fund (Ticker Symbol: SWYHX) | 6.11% |

| Target 2045 Passive Composite Index | 6.48% |

| Fund Category: Morningstar Target-Date 20451 | 4.42% |

| Performance Details | pages 29-31 |

| Schwab Target 2050 Index Fund (Ticker Symbol: SWYMX) | 6.37% |

| Target 2050 Passive Composite Index | 6.80% |

| Fund Category: Morningstar Target-Date 20501 | 4.59% |

| Performance Details | pages 32-34 |

| Schwab Target 2055 Index Fund (Ticker Symbol: SWYJX) | 6.51% |

| Target 2055 Passive Composite Index | 7.00% |

| Fund Category: Morningstar Target-Date 20551 | 4.64% |

| Performance Details | pages 35-37 |

| Schwab Target 2060 Index Fund (Ticker Symbol: SWYNX) | 6.74% |

| Target 2060 Passive Composite Index | 7.19% |

| Fund Category: Morningstar Target-Date 20601 | 4.72% |

| Performance Details | pages 38-40 |

| Schwab Target 2065 Index Fund (Ticker Symbol: SWYOX) | 6.69% |

| Target 2065 Passive Composite Index | 7.24% |

| Fund Category: Morningstar Target-Date 2065+1 | 4.72% |

| Performance Details | pages 41-43 |

| 1 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

President of Schwab Asset

Management and the funds

covered in this report.

| * | The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes. |

| * | The net version of the index reflects reinvested dividends net of withholding taxes, but reflects no deductions for expenses or other taxes. |

| Zifan Tang, Ph.D., CFA, Senior Portfolio Manager, is responsible for the co-management of the funds. Prior to joining Schwab in 2012, Ms. Tang was a product manager at Thomson Reuters and from 1997 to 2009 worked as a portfolio manager at Barclays Global Investors (now known as BlackRock). |

| Patrick Kwok, CFA, Portfolio Manager, is responsible for the co-management of the funds. Previously, Mr. Kwok served as an associate portfolio manager from 2012 to 2016. Prior to that, he worked as a fund administration manager, where he was responsible for oversight of sub-advisers, trading, cash management, and fund administration supporting the Charles Schwab Trust Bank Collective Investment Trusts and multi-asset Schwab Funds. Prior to joining Schwab Asset Management in 2008, Mr. Kwok spent two years as an asset operations specialist at Charles Schwab Trust Company. He also worked for one year at State Street Bank & Trust as a portfolio accountant and pricing specialist. |

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

| Fund and Inception Date | 1 Year | 5 Years | Since Inception |

| Schwab Target 2010 Index Fund (8/25/16) | 1.55% | 6.11% | 5.87% |

| Dow Jones U.S. Total Stock Market IndexSM | 11.67% | 15.31% | 15.59% |

| Bloomberg US Aggregate Bond Index | -4.15% | 2.14% | 1.51% |

| Target 2010 Passive Composite Index | 1.72% | 6.19% | 5.95% |

| Fund Category: Morningstar Target-Date 2000-20103 | 0.67% | 5.80% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.13% | |||

| 1 | Fund expenses have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Shares and Institutional Shares share classes were combined into a single class of shares of the fund. Accordingly, the performance history of the fund, prior to July 24, 2017, is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.05% of acquired fund fees and expenses (AFFE), which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual expense ratios during the period, not including AFFE, refer to the financial highlights section of the financial statements. |

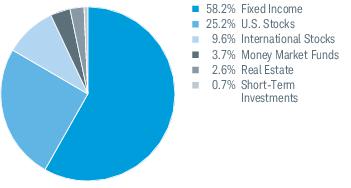

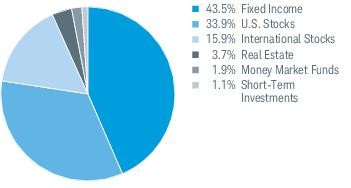

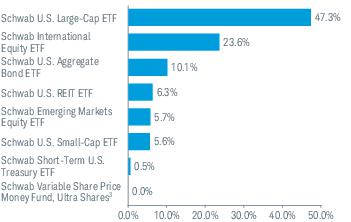

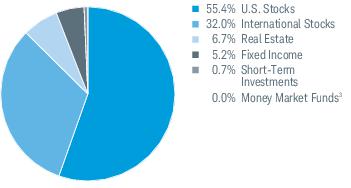

| Number of Holdings | 9 |

| Portfolio Turnover Rate | 27% |

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab Funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 2 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The holdings listed exclude any temporary liquidity investments. |

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

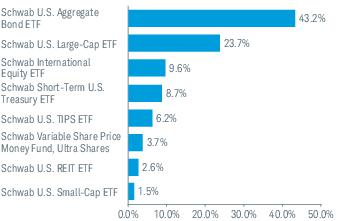

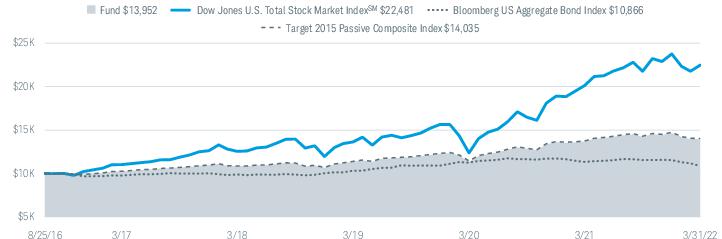

| Fund and Inception Date | 1 Year | 5 Years | Since Inception |

| Schwab Target 2015 Index Fund (8/25/16) | 1.92% | 6.36% | 6.13% |

| Dow Jones U.S. Total Stock Market IndexSM | 11.67% | 15.31% | 15.59% |

| Bloomberg US Aggregate Bond Index | -4.15% | 2.14% | 1.51% |

| Target 2015 Passive Composite Index | 2.08% | 6.47% | 6.24% |

| Fund Category: Morningstar Target-Date 20153 | 1.28% | 6.37% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.12% | |||

| 1 | Fund expenses have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Shares and Institutional Shares share classes were combined into a single class of shares of the fund. Accordingly, the performance history of the fund, prior to July 24, 2017, is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.04% of acquired fund fees and expenses (AFFE), which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual expense ratios during the period, not including AFFE, refer to the financial highlights section of the financial statements. |

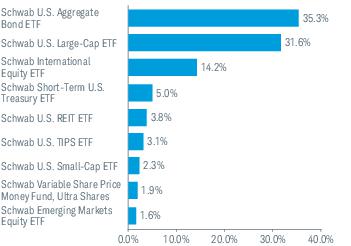

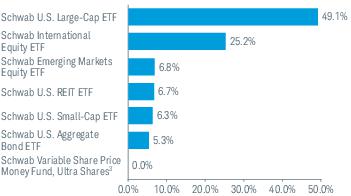

| Number of Holdings | 9 |

| Portfolio Turnover Rate | 23% |

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab Funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 2 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The holdings listed exclude any temporary liquidity investments. |

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

| Fund and Inception Date | 1 Year | 5 Years | Since Inception |

| Schwab Target 2020 Index Fund (8/25/16) | 2.13% | 6.84% | 6.78% |

| Dow Jones U.S. Total Stock Market IndexSM | 11.67% | 15.31% | 15.59% |

| Bloomberg US Aggregate Bond Index | -4.15% | 2.14% | 1.51% |

| Target 2020 Passive Composite Index | 2.31% | 6.93% | 6.86% |

| Fund Category: Morningstar Target-Date 20203 | 1.47% | 6.79% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.13% | |||

| 1 | Fund expenses have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Shares and Institutional Shares share classes were combined into a single class of shares of the fund. Accordingly, the performance history of the fund, prior to July 24, 2017, is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.05% of acquired fund fees and expenses (AFFE), which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual expense ratios during the period, not including AFFE, refer to the financial highlights section of the financial statements. |

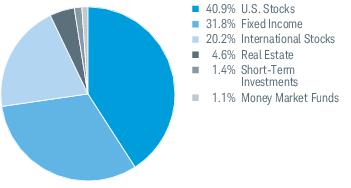

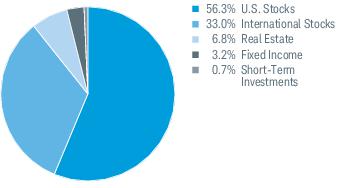

| Number of Holdings | 9 |

| Portfolio Turnover Rate | 18% |

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab Funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 2 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The holdings listed exclude any temporary liquidity investments. |

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

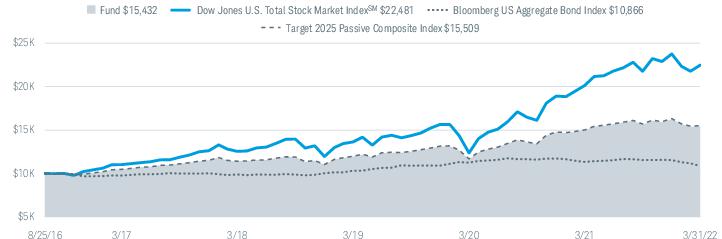

| Fund and Inception Date | 1 Year | 5 Years | Since Inception |

| Schwab Target 2025 Index Fund (8/25/16) | 3.02% | 8.04% | 8.06% |

| Dow Jones U.S. Total Stock Market IndexSM | 11.67% | 15.31% | 15.59% |

| Bloomberg US Aggregate Bond Index | -4.15% | 2.14% | 1.51% |

| Target 2025 Passive Composite Index | 3.28% | 8.15% | 8.16% |

| Fund Category: Morningstar Target-Date 20253 | 1.90% | 7.48% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.12% | |||

| 1 | Fund expenses have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Shares and Institutional Shares share classes were combined into a single class of shares of the fund. Accordingly, the performance history of the fund, prior to July 24, 2017, is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.04% of acquired fund fees and expenses (AFFE), which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual expense ratios during the period, not including AFFE, refer to the financial highlights section of the financial statements. |

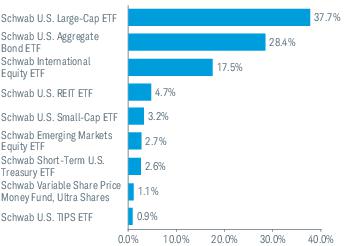

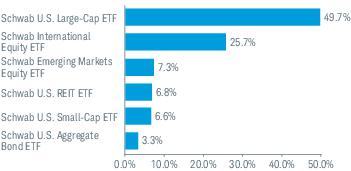

| Number of Holdings | 11 |

| Portfolio Turnover Rate | 12% |

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab Funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 2 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The holdings listed exclude any temporary liquidity investments. |

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

| Fund and Inception Date | 1 Year | 5 Years | Since Inception |

| Schwab Target 2030 Index Fund (8/25/16) | 4.11% | 9.02% | 9.09% |

| Dow Jones U.S. Total Stock Market IndexSM | 11.67% | 15.31% | 15.59% |

| Bloomberg US Aggregate Bond Index | -4.15% | 2.14% | 1.51% |

| Target 2030 Passive Composite Index | 4.39% | 9.11% | 9.18% |

| Fund Category: Morningstar Target-Date 20303 | 2.61% | 8.48% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.12% | |||

| 1 | Fund expenses have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Shares and Institutional Shares share classes were combined into a single class of shares of the fund. Accordingly, the performance history of the fund, prior to July 24, 2017, is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.04% of acquired fund fees and expenses (AFFE), which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual expense ratios during the period, not including AFFE, refer to the financial highlights section of the financial statements. |

| Number of Holdings | 11 |

| Portfolio Turnover Rate | 9% |

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab Funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 2 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The holdings listed exclude any temporary liquidity investments. |

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

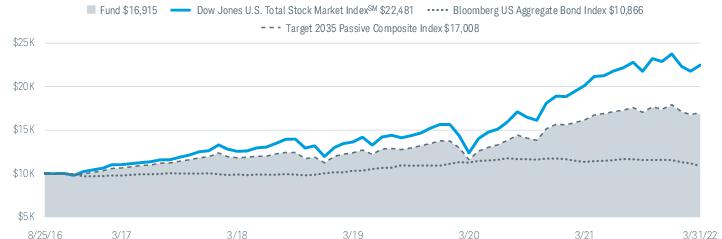

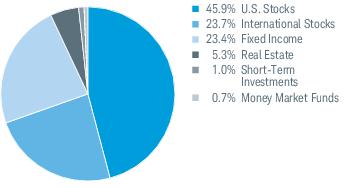

| Fund and Inception Date | 1 Year | 5 Years | Since Inception |

| Schwab Target 2035 Index Fund (8/25/16) | 4.88% | 9.71% | 9.85% |

| Dow Jones U.S. Total Stock Market IndexSM | 11.67% | 15.31% | 15.59% |

| Bloomberg US Aggregate Bond Index | -4.15% | 2.14% | 1.51% |

| Target 2035 Passive Composite Index | 5.20% | 9.83% | 9.96% |

| Fund Category: Morningstar Target-Date 20353 | 3.37% | 9.36% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.12% | |||

| 1 | Fund expenses have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Shares and Institutional Shares share classes were combined into a single class of shares of the fund. Accordingly, the performance history of the fund, prior to July 24, 2017, is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.04% of acquired fund fees and expenses (AFFE), which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual expense ratios during the period, not including AFFE, refer to the financial highlights section of the financial statements. |

| Number of Holdings | 10 |

| Portfolio Turnover Rate | 12% |

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab Funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 2 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The holdings listed exclude any temporary liquidity investments. |

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

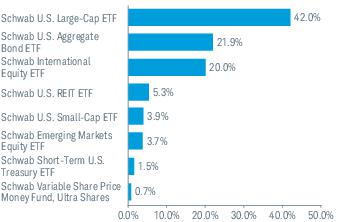

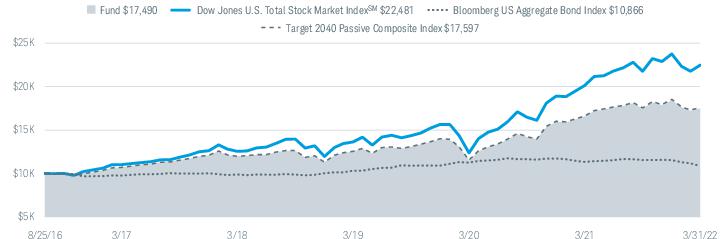

| Fund and Inception Date | 1 Year | 5 Years | Since Inception |

| Schwab Target 2040 Index Fund (8/25/16) | 5.53% | 10.31% | 10.50% |

| Dow Jones U.S. Total Stock Market IndexSM | 11.67% | 15.31% | 15.59% |

| Bloomberg US Aggregate Bond Index | -4.15% | 2.14% | 1.51% |

| Target 2040 Passive Composite Index | 5.90% | 10.43% | 10.63% |

| Fund Category: Morningstar Target-Date 20403 | 4.00% | 9.97% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.12% | |||

| 1 | Fund expenses have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Shares and Institutional Shares share classes were combined into a single class of shares of the fund. Accordingly, the performance history of the fund, prior to July 24, 2017, is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.04% of acquired fund fees and expenses (AFFE), which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual expense ratios during the period, not including AFFE, refer to the financial highlights section of the financial statements. |

| Number of Holdings | 10 |

| Portfolio Turnover Rate | 9% |

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab Funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 2 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The holdings listed exclude any temporary liquidity investments. |

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

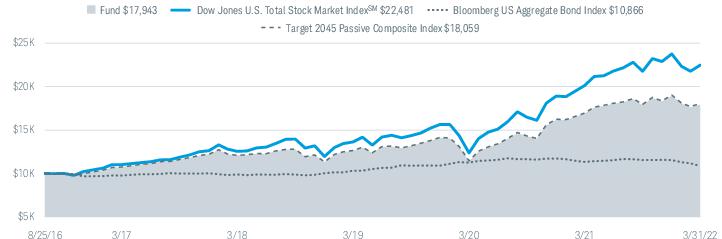

| Fund and Inception Date | 1 Year | 5 Years | Since Inception |

| Schwab Target 2045 Index Fund (8/25/16) | 6.11% | 10.79% | 11.01% |

| Dow Jones U.S. Total Stock Market IndexSM | 11.67% | 15.31% | 15.59% |

| Bloomberg US Aggregate Bond Index | -4.15% | 2.14% | 1.51% |

| Target 2045 Passive Composite Index | 6.48% | 10.92% | 11.14% |

| Fund Category: Morningstar Target-Date 20453 | 4.42% | 10.43% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.13% | |||

| 1 | Fund expenses have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Shares and Institutional Shares share classes were combined into a single class of shares of the fund. Accordingly, the performance history of the fund, prior to July 24, 2017, is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.05% of acquired fund fees and expenses (AFFE), which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual expense ratios during the period, not including AFFE, refer to the financial highlights section of the financial statements. |

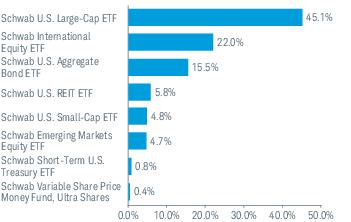

| Number of Holdings | 9 |

| Portfolio Turnover Rate | 10% |

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab Funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 2 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 3 | Less than 0.05%. |

| 4 | This list is not a recommendation of any security by the investment adviser. |

| 5 | The holdings listed exclude any temporary liquidity investments. |

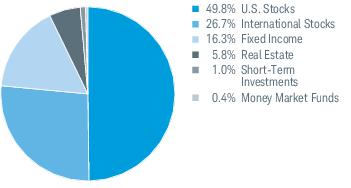

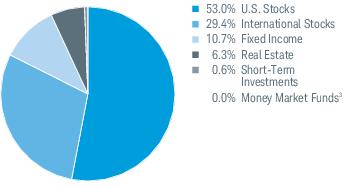

| 1 | Percentages may not add up to 100% due to rounding. |

| 2 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

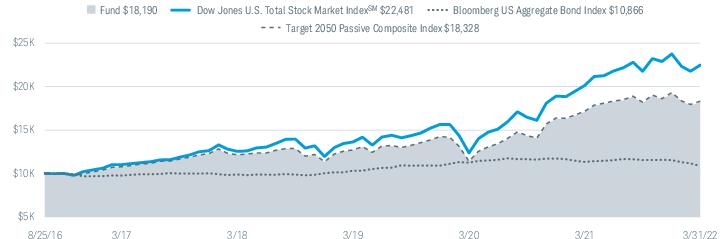

| Fund and Inception Date | 1 Year | 5 Years | Since Inception |

| Schwab Target 2050 Index Fund (8/25/16) | 6.37% | 11.03% | 11.28% |

| Dow Jones U.S. Total Stock Market IndexSM | 11.67% | 15.31% | 15.59% |

| Bloomberg US Aggregate Bond Index | -4.15% | 2.14% | 1.51% |

| Target 2050 Passive Composite Index | 6.80% | 11.19% | 11.43% |

| Fund Category: Morningstar Target-Date 20503 | 4.59% | 10.55% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.13% | |||

| 1 | Fund expenses have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Shares and Institutional Shares share classes were combined into a single class of shares of the fund. Accordingly, the performance history of the fund, prior to July 24, 2017, is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.05% of acquired fund fees and expenses (AFFE), which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual expense ratios during the period, not including AFFE, refer to the financial highlights section of the financial statements. |

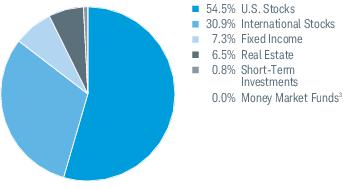

| Number of Holdings | 8 |

| Portfolio Turnover Rate | 8% |

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab Funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 2 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 3 | Less than 0.05%. |

| 4 | This list is not a recommendation of any security by the investment adviser. |

| 5 | The holdings listed exclude any temporary liquidity investments. |

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

| Fund and Inception Date | 1 Year | 5 Years | Since Inception |

| Schwab Target 2055 Index Fund (8/25/16) | 6.51% | 11.23% | 11.51% |

| Dow Jones U.S. Total Stock Market IndexSM | 11.67% | 15.31% | 15.59% |

| Bloomberg US Aggregate Bond Index | -4.15% | 2.14% | 1.51% |

| Target 2055 Passive Composite Index | 7.00% | 11.39% | 11.66% |

| Fund Category: Morningstar Target-Date 20553 | 4.64% | 10.66% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.13% | |||

| 1 | Fund expenses have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Shares and Institutional Shares share classes were combined into a single class of shares of the fund. Accordingly, the performance history of the fund, prior to July 24, 2017, is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.05% of acquired fund fees and expenses (AFFE), which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual expense ratios during the period, not including AFFE, refer to the financial highlights section of the financial statements. |

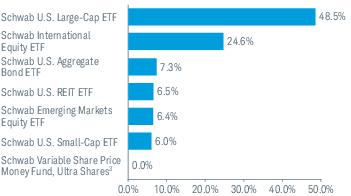

| Number of Holdings | 8 |

| Portfolio Turnover Rate | 7% |

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab Funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 2 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 3 | Less than 0.05%. |

| 4 | This list is not a recommendation of any security by the investment adviser. |

| 5 | The holdings listed exclude any temporary liquidity investments. |

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

| Fund and Inception Date | 1 Year | 5 Years | Since Inception |

| Schwab Target 2060 Index Fund (8/25/16) | 6.74% | 11.37% | 11.64% |

| Dow Jones U.S. Total Stock Market IndexSM | 11.67% | 15.31% | 15.59% |

| Bloomberg US Aggregate Bond Index | -4.15% | 2.14% | 1.51% |

| Target 2060 Passive Composite Index | 7.19% | 11.54% | 11.80% |

| Fund Category: Morningstar Target-Date 20603 | 4.72% | 10.72% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.13% | |||

| 1 | Fund expenses have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Shares and Institutional Shares share classes were combined into a single class of shares of the fund. Accordingly, the performance history of the fund, prior to July 24, 2017, is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.05% of acquired fund fees and expenses (AFFE), which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual expense ratios during the period, not including AFFE, refer to the financial highlights section of the financial statements. |

| Number of Holdings | 7 |

| Portfolio Turnover Rate | 6% |

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab Funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 2 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The holdings listed exclude any temporary liquidity investments. |

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the fair value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

| Fund and Inception Date | 1 Year | Since Inception |

| Schwab Target 2065 Index Fund (2/25/21) | 6.69% | 8.14% |

| Dow Jones U.S. Total Stock Market IndexSM | 11.67% | 13.83% |

| Bloomberg US Aggregate Bond Index | -4.15% | -4.18% |

| Target 2065 Passive Composite Index | 7.24% | 8.03% |

| Fund Category: Morningstar Target-Date 2065+2 | 4.72% | N/A |

| Fund Expense Ratios3: Net 0.08%; Gross 0.13% | ||

| 1 | Fund expenses have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 3 | As stated in the prospectus. Includes 0.05% of acquired fund fees and expenses (AFFE), which are based on estimated amounts for the current fiscal year and are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as the investment adviser serves as adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual expense ratios during the period, not including AFFE, refer to the financial highlights section of the financial statements. |

| Number of Holdings | 8 |

| Portfolio Turnover Rate | 19% |

| 1 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab Funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 2 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The holdings listed exclude any temporary liquidity investments. |

| EXPENSE RATIO (ANNUALIZED)1,2 | EFFECTIVE EXPENSE RATIO (ANNUALIZED)3,4 | BEGINNING ACCOUNT VALUE AT 10/1/21 | ENDING ACCOUNT VALUE (NET OF EXPENSES) AT 3/31/222 | EXPENSES PAID DURING PERIOD 10/1/21-3/31/222,5 | EFFECTIVE EXPENSES PAID DURING PERIOD 10/1/21-3/31/224,5 | |

| Schwab Target 2010 Index Fund | ||||||

| Actual Return | 0.03% | 0.08% | $1,000.00 | $ 980.20 | $0.15 | $0.39 |

| Hypothetical 5% Return | 0.03% | 0.08% | $1,000.00 | $1,024.78 | $0.15 | $0.40 |

| Schwab Target 2015 Index Fund | ||||||

| Actual Return | 0.03% | 0.08% | $1,000.00 | $ 981.70 | $0.15 | $0.40 |

| Hypothetical 5% Return | 0.03% | 0.08% | $1,000.00 | $1,024.78 | $0.15 | $0.40 |

| Schwab Target 2020 Index Fund | ||||||

| Actual Return | 0.03% | 0.08% | $1,000.00 | $ 982.80 | $0.15 | $0.40 |

| Hypothetical 5% Return | 0.03% | 0.08% | $1,000.00 | $1,024.78 | $0.15 | $0.40 |

| Schwab Target 2025 Index Fund | ||||||

| Actual Return | 0.04% | 0.08% | $1,000.00 | $ 987.40 | $0.20 | $0.40 |

| Hypothetical 5% Return | 0.04% | 0.08% | $1,000.00 | $1,024.73 | $0.20 | $0.40 |

| Schwab Target 2030 Index Fund | ||||||

| Actual Return | 0.04% | 0.08% | $1,000.00 | $ 993.50 | $0.20 | $0.40 |

| Hypothetical 5% Return | 0.04% | 0.08% | $1,000.00 | $1,024.73 | $0.20 | $0.40 |

| Schwab Target 2035 Index Fund | ||||||

| Actual Return | 0.04% | 0.08% | $1,000.00 | $ 997.80 | $0.20 | $0.40 |

| Hypothetical 5% Return | 0.04% | 0.08% | $1,000.00 | $1,024.73 | $0.20 | $0.40 |

| Schwab Target 2040 Index Fund | ||||||

| Actual Return | 0.04% | 0.08% | $1,000.00 | $1,001.40 | $0.20 | $0.40 |

| Hypothetical 5% Return | 0.04% | 0.08% | $1,000.00 | $1,024.73 | $0.20 | $0.40 |

| Schwab Target 2045 Index Fund | ||||||

| Actual Return | 0.03% | 0.08% | $1,000.00 | $1,004.40 | $0.15 | $0.40 |

| Hypothetical 5% Return | 0.03% | 0.08% | $1,000.00 | $1,024.78 | $0.15 | $0.40 |

| Schwab Target 2050 Index Fund | ||||||

| Actual Return | 0.03% | 0.08% | $1,000.00 | $1,005.50 | $0.15 | $0.40 |

| Hypothetical 5% Return | 0.03% | 0.08% | $1,000.00 | $1,024.78 | $0.15 | $0.40 |

| Schwab Target 2055 Index Fund | ||||||

| Actual Return | 0.03% | 0.08% | $1,000.00 | $1,006.80 | $0.15 | $0.40 |

| Hypothetical 5% Return | 0.03% | 0.08% | $1,000.00 | $1,024.78 | $0.15 | $0.40 |

| Schwab Target 2060 Index Fund | ||||||

| Actual Return | 0.03% | 0.08% | $1,000.00 | $1,008.00 | $0.15 | $0.40 |

| Hypothetical 5% Return | 0.03% | 0.08% | $1,000.00 | $1,024.78 | $0.15 | $0.40 |

| EXPENSE RATIO (ANNUALIZED)1,2 | EFFECTIVE EXPENSE RATIO (ANNUALIZED)3,4 | BEGINNING ACCOUNT VALUE AT 10/1/21 | ENDING ACCOUNT VALUE (NET OF EXPENSES) AT 3/31/222 | EXPENSES PAID DURING PERIOD 10/1/21-3/31/222,5 | EFFECTIVE EXPENSES PAID DURING PERIOD 10/1/21-3/31/224,5 | |

| Schwab Target 2065 Index Fund | ||||||

| Actual Return | 0.03% | 0.08% | $1,000.00 | $1,007.70 | $0.15 | $0.40 |

| Hypothetical 5% Return | 0.03% | 0.08% | $1,000.00 | $1,024.78 | $0.15 | $0.40 |

| 1 | Based on the most recent six-month expense ratio. |

| 2 | Excludes acquired fund fees and expenses, which are indirect expenses incurred by the fund through its investments in underlying funds. |

| 3 | Based on the most recent six-month acquired fund fees and expenses and the expense ratio; may differ from the acquired fund fees and expenses and the expense ratios in the prospectus. |

| 4 | Includes acquired fund fees and expenses, which are indirect expenses incurred by the fund through its investments in underlying funds. |

| 5 | Expenses for each fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by the 182 days of the period, and divided by the 365 days of the fiscal year. |

| 4/1/21– 3/31/22 | 4/1/20– 3/31/21 | 4/1/19– 3/31/20 | 4/1/18– 3/31/19 | 4/1/17– 3/31/181 | ||

| Per-Share Data | ||||||

| Net asset value at beginning of period | $12.49 | $10.70 | $10.88 | $10.59 | $10.15 | |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)2 | 0.25 | 0.22 | 0.27 | 0.27 | 0.22 | |

| Net realized and unrealized gains (losses) | (0.04) | 1.82 | (0.19) | 0.23 | 0.34 | |

| Total from investment operations | 0.21 | 2.04 | 0.08 | 0.50 | 0.56 | |

| Less distributions: | ||||||

| Distributions from net investment income | (0.25) | (0.21) | (0.25) | (0.20) | (0.12) | |

| Distributions from net realized gains | (0.08) | (0.04) | (0.01) | (0.01) | (0.00) 3 | |

| Total distributions | (0.33) | (0.25) | (0.26) | (0.21) | (0.12) | |

| Net asset value at end of period | $12.37 | $12.49 | $10.70 | $10.88 | $10.59 | |

| Total return | 1.55% | 19.04% | 0.58% | 4.81% | 5.57% | |

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Net operating expenses4 | 0.03% | 0.03% | 0.03% | 0.03% | 0.03% | |

| Gross operating expenses4 | 0.08% | 0.08% | 0.08% | 0.08% | 0.08% | |

| Net investment income (loss) | 1.90% | 1.83% | 2.43% | 2.53% | 2.11% | |

| Portfolio turnover rate | 27% | 21% | 19% | 30% | 28% | |

| Net assets, end of period (x 1,000) | $55,048 | $55,137 | $35,614 | $25,391 | $14,185 | |

| 1 | Effective July 24, 2017, the Investor Shares and Institutional Shares share classes were combined into a single class of shares of the fund. The financial history as shown in the financial highlights is that of the former Institutional Shares. |

| 2 | Calculated based on the average shares outstanding during the period. |

| 3 | Per-share amount was less than $0.005. |

| 4 | Ratio excludes acquired fund fees and expenses, which are indirect expenses incurred by the fund through its investments in underlying funds. If the expenses incurred by the underlying funds were included in these ratios they would have increased by 0.05%, 0.05%, 0.05%, 0.05% and 0.05%, respectively, for the periods ended March 31, 2022 March 31, 2021, March 31, 2020, March 31, 2019 and March 31, 2018 (see financial note 4). |

| SECURITY | NUMBER OF SHARES | VALUE ($) |

| AFFILIATED UNDERLYING FUNDS 99.2% OF NET ASSETS | ||

| U.S. Stocks 25.2% | ||

| Large-Cap 23.7% | ||

| Schwab U.S. Large-Cap ETF | 242,519 | 13,059,648 |

| Small-Cap 1.5% | ||

| Schwab U.S. Small-Cap ETF | 17,121 | 810,851 |

| 13,870,499 | ||

| International Stocks 9.6% | ||

| Developed Markets 9.6% | ||

| Schwab International Equity ETF | 143,286 | 5,261,462 |

| Real Estate 2.6% | ||

| U.S. REITs 2.6% | ||

| Schwab U.S. REIT ETF | 57,971 | 1,442,898 |

| Fixed Income 58.1% | ||

| Inflation-Protected Bond 6.2% | ||

| Schwab U.S. TIPS ETF | 56,641 | 3,438,675 |

| Intermediate-Term Bond 43.2% | ||

| Schwab U.S. Aggregate Bond ETF | 470,140 | 23,774,980 |

| Treasury Bond 8.7% | ||

| Schwab Short-Term U.S. Treasury ETF | 96,116 | 4,761,586 |

| 31,975,241 | ||

| SECURITY | NUMBER OF SHARES | VALUE ($) |

| Money Market Funds 3.7% | ||

| Schwab Variable Share Price Money Fund, Ultra Shares 0.20% (a) | 2,037,571 | 2,037,571 |

| Total Affiliated Underlying Funds (Cost $48,646,873) | 54,587,671 | |

| ISSUER | FACE AMOUNT ($) | VALUE ($) |

| SHORT-TERM INVESTMENTS 0.7% OF NET ASSETS | ||

| Time Deposits 0.7% | ||

| Sumitomo Mitsui Trust Bank, Ltd. | ||

| 0.15%, 04/01/22 (b) | 409,193 | 409,193 |

| Total Short-Term Investments (Cost $409,193) | 409,193 | |

| Total Investments in Securities (Cost $49,056,066) | 54,996,864 | |

| (a) | The rate shown is the 7-day yield. |

| (b) | The rate shown is the current daily overnight rate. |

| ETF — | Exchange traded fund |

| REIT — | Real Estate Investment Trust |

| TIPS — | Treasury Inflation Protected Securities |

| VALUE AT 3/31/21 | PURCHASES | SALES | REALIZED GAINS (LOSSES) | NET CHANGE IN UNREALIZED APPRECIATION (DEPRECIATION) | VALUE AT 3/31/22 | BALANCE OF SHARES HELD AT 3/31/22 | DISTRIBUTIONS RECEIVED* | |

| AFFILIATED UNDERLYING FUNDS 99.2% OF NET ASSETS | ||||||||

| U.S. Stocks 25.2% | ||||||||

| Large-Cap 23.7% | ||||||||

| Schwab U.S. Large-Cap ETF | $12,348,690 | $4,106,796 | ($4,950,980) | $431,147 | $1,123,995 | $13,059,648 | 242,519 | $173,715 |

| Small-Cap 1.5% | ||||||||

| Schwab U.S. Small-Cap ETF | 799,851 | 243,264 | (195,257) | 4,512 | (41,519) | 810,851 | 17,121 | 9,183 |

| 13,870,499 | ||||||||

| International Stocks 9.6% | ||||||||

| Developed Markets 9.6% | ||||||||

| Schwab International Equity ETF | 5,021,292 | 1,455,081 | (1,102,805) | 21,371 | (133,477) | 5,261,462 | 143,286 | 169,391 |

| Real Estate 2.6% | ||||||||

| U.S. REITs 2.6% | ||||||||

| Schwab U.S. REIT ETF | 952,795 | 554,646 | (279,533) | 28,977 | 186,013 | 1,442,898 | 57,971 | 18,767 |

| Fixed Income 58.1% | ||||||||

| Inflation-Protected Bond 6.2% | ||||||||

| Schwab U.S. TIPS ETF | 3,603,364 | 574,357 | (716,489) | (1,517) | (21,040) | 3,438,675 | 56,641 | 183,660 |

| Intermediate-Term Bond 43.2% | ||||||||

| Schwab U.S. Aggregate Bond ETF | 24,867,066 | 7,263,572 | (6,724,136) | (277,233) | (1,354,289) | 23,774,980 | 470,140 | 555,989 |

| Treasury Bond 8.7% | ||||||||

| Schwab Short-Term U.S. Treasury ETF | 4,941,717 | 1,255,572 | (1,258,858) | (17,138) | (159,707) | 4,761,586 | 96,116 | 19,200 |

| 31,975,241 | ||||||||

| Money Market Funds 3.7% | ||||||||

| Schwab Variable Share Price Money Fund, Ultra Shares | 2,037,532 | 650 | — | — | (611) | 2,037,571 | 2,037,571 | 766 |

| Total Affiliated Underlying Funds | $54,572,307 | $15,453,938 | ($15,228,058) | $190,119 | ($400,635) | $54,587,671 | $1,130,671 | |

| * | Distributions received include distributions from net investment income and capital gains, if any, from the underlying funds. |

| DESCRIPTION | QUOTED PRICES IN ACTIVE MARKETS FOR IDENTICAL ASSETS (LEVEL 1) | OTHER SIGNIFICANT OBSERVABLE INPUTS (LEVEL 2) | SIGNIFICANT UNOBSERVABLE INPUTS (LEVEL 3) | TOTAL |

| Assets | ||||

| Affiliated Underlying Funds1 | $54,587,671 | $— | $— | $54,587,671 |

| Short-Term Investments1 | — | 409,193 | — | 409,193 |

| Total | $54,587,671 | $409,193 | $— | $54,996,864 |

| 1 | As categorized in the Portfolio Holdings. |

| Assets | ||

| Investments in securities, at value - affiliated (cost $48,646,873) | $54,587,671 | |

| Investments in securities, at value - unaffiliated (cost $409,193) | 409,193 | |

| Receivables: | ||

| Investments sold | 701,158 | |

| Fund shares sold | 71,657 | |

| Dividends | + | 144 |

| Total assets | 55,769,823 | |

| Liabilities | ||

| Payables: | ||

| Investments bought | 547,291 | |

| Fund shares redeemed | 172,739 | |

| Investment adviser fees | + | 1,565 |

| Total liabilities | 721,595 | |

| Net assets | $55,048,228 | |

| Net Assets by Source | ||

| Capital received from investors | $49,544,915 | |

| Total distributable earnings | + | 5,503,313 |

| Net assets | $55,048,228 | |

| Net Asset Value (NAV) | ||||

| Net Assets | ÷ | Shares Outstanding | = | NAV |

| $55,048,228 | 4,451,055 | $12.37 | ||

| For the period April 1, 2021 through March 31, 2022 | ||

| Investment Income | ||

| Dividends received from securities - affiliated | $1,130,671 | |

| Interest received from securities - unaffiliated | + | 110 |

| Total investment income | 1,130,781 | |

| Expenses | ||

| Investment adviser fees | 46,677 | |

| Total expenses | 46,677 | |

| Expense reduction | – | 27,075 |

| Net expenses | – | 19,602 |

| Net investment income | 1,111,179 | |

| REALIZED AND UNREALIZED GAINS (LOSSES) | ||

| Net realized gains on sales of securities - affiliated | 190,119 | |

| Net change in unrealized appreciation (depreciation) on securities - affiliated | + | (400,635) |

| Net realized and unrealized losses | (210,516) | |

| Increase in net assets resulting from operations | $900,663 | |

| OPERATIONS | |||

| 4/1/21-3/31/22 | 4/1/20-3/31/21 | ||

| Net investment income | $1,111,179 | $834,578 | |

| Net realized gains | 190,119 | 68,428 | |

| Net change in unrealized appreciation (depreciation) | + | (400,635) | 6,372,932 |

| Increase in net assets resulting from operations | $900,663 | $7,275,938 | |

| DISTRIBUTIONS TO SHAREHOLDERS | |||

| Total distributions | ($1,460,719) | ($992,119) | |

| TRANSACTIONS IN FUND SHARES | |||||

| 4/1/21-3/31/22 | 4/1/20-3/31/21 | ||||

| SHARES | VALUE | SHARES | VALUE | ||

| Shares sold | 1,420,137 | $18,277,254 | 2,108,080 | $25,488,388 | |

| Shares reinvested | 104,962 | 1,363,444 | 75,235 | 935,167 | |

| Shares redeemed | + | (1,490,015) | (19,169,445) | (1,096,596) | (13,184,147) |

| Net transactions in fund shares | 35,084 | $471,253 | 1,086,719 | $13,239,408 | |

| SHARES OUTSTANDING AND NET ASSETS | |||||

| 4/1/21-3/31/22 | 4/1/20-3/31/21 | ||||

| SHARES | NET ASSETS | SHARES | NET ASSETS | ||

| Beginning of period | 4,415,971 | $55,137,031 | 3,329,252 | $35,613,804 | |

| Total increase (decrease) | + | 35,084 | (88,803) | 1,086,719 | 19,523,227 |

| End of period | 4,451,055 | $55,048,228 | 4,415,971 | $55,137,031 | |

| 4/1/21– 3/31/22 | 4/1/20– 3/31/21 | 4/1/19– 3/31/20 | 4/1/18– 3/31/19 | 4/1/17– 3/31/181 | ||

| Per-Share Data | ||||||

| Net asset value at beginning of period | $12.58 | $10.68 | $10.92 | $10.61 | $10.17 | |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)2 | 0.25 | 0.22 | 0.28 | 0.27 | 0.22 | |

| Net realized and unrealized gains (losses) | 0.01 3 | 1.97 | (0.26) | 0.22 | 0.38 | |

| Total from investment operations | 0.26 | 2.19 | 0.02 | 0.49 | 0.60 | |

| Less distributions: | ||||||

| Distributions from net investment income | (0.25) | (0.22) | (0.25) | (0.17) | (0.15) | |

| Distributions from net realized gains | (0.11) | (0.07) | (0.01) | (0.01) | (0.01) | |

| Total distributions | (0.36) | (0.29) | (0.26) | (0.18) | (0.16) | |

| Net asset value at end of period | $12.48 | $12.58 | $10.68 | $10.92 | $10.61 | |

| Total return | 1.92% | 20.52% | (0.02%) | 4.74% | 5.83% | |

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Net operating expenses4 | 0.03% | 0.04% | 0.03% | 0.03% | 0.03% | |

| Gross operating expenses4 | 0.08% | 0.08% | 0.08% | 0.08% | 0.08% | |

| Net investment income (loss) | 1.91% | 1.85% | 2.45% | 2.54% | 2.06% | |

| Portfolio turnover rate | 23% | 30% | 24% | 29% | 47% | |

| Net assets, end of period (x 1,000) | $75,362 | $73,384 | $57,790 | $45,688 | $20,229 | |

| 1 | Effective July 24, 2017, the Investor Shares and Institutional Shares share classes were combined into a single class of shares of the fund. The financial history as shown in the financial highlights is that of the former Institutional Shares. |

| 2 | Calculated based on the average shares outstanding during the period. |

| 3 | The per share amount does not accord with the change in aggregate gains and losses in securities during the period because of the timing of sales and repurchases of fund shares in relation to fluctuating market values. |

| 4 | Ratio excludes acquired fund fees and expenses, which are indirect expenses incurred by the fund through its investments in underlying funds. If the expenses incurred by the underlying funds were included in these ratios they would have increased by 0.05%, 0.04%, 0.05%, 0.05% and 0.05%, respectively, for the periods ended March 31, 2022 March 31, 2021, March 31, 2020, March 31, 2019 and March 31, 2018 (see financial note 4). |

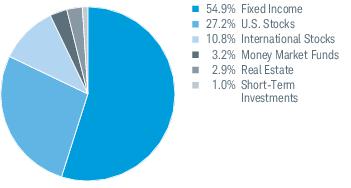

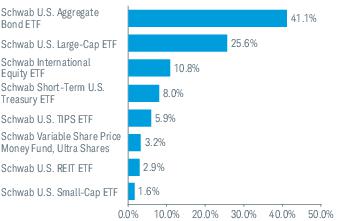

| SECURITY | NUMBER OF SHARES | VALUE ($) |

| AFFILIATED UNDERLYING FUNDS 99.1% OF NET ASSETS | ||

| U.S. Stocks 27.2% | ||

| Large-Cap 25.6% | ||

| Schwab U.S. Large-Cap ETF | 358,123 | 19,284,923 |

| Small-Cap 1.6% | ||

| Schwab U.S. Small-Cap ETF | 26,296 | 1,245,379 |

| 20,530,302 | ||

| International Stocks 10.8% | ||

| Developed Markets 10.8% | ||

| Schwab International Equity ETF | 221,992 | 8,151,546 |

| Real Estate 2.9% | ||

| U.S. REITs 2.9% | ||

| Schwab U.S. REIT ETF | 87,198 | 2,170,358 |

| Fixed Income 55.0% | ||

| Inflation-Protected Bond 5.9% | ||

| Schwab U.S. TIPS ETF | 73,117 | 4,438,933 |

| Intermediate-Term Bond 41.1% | ||

| Schwab U.S. Aggregate Bond ETF | 612,100 | 30,953,897 |

| Treasury Bond 8.0% | ||

| Schwab Short-Term U.S. Treasury ETF | 122,011 | 6,044,425 |

| 41,437,255 | ||

| SECURITY | NUMBER OF SHARES | VALUE ($) |

| Money Market Funds 3.2% | ||

| Schwab Variable Share Price Money Fund, Ultra Shares 0.20% (a) | 2,436,557 | 2,436,557 |

| Total Affiliated Underlying Funds (Cost $65,352,436) | 74,726,018 | |

| ISSUER | FACE AMOUNT ($) | VALUE ($) |

| SHORT-TERM INVESTMENTS 1.0% OF NET ASSETS | ||

| Time Deposits 1.0% | ||

| Sumitomo Mitsui Trust Bank, Ltd. | ||

| 0.15%, 04/01/22 (b) | 722,379 | 722,379 |

| Total Short-Term Investments (Cost $722,379) | 722,379 | |

| Total Investments in Securities (Cost $66,074,815) | 75,448,397 | |

| (a) | The rate shown is the 7-day yield. |

| (b) | The rate shown is the current daily overnight rate. |

| ETF — | Exchange traded fund |

| REIT — | Real Estate Investment Trust |

| TIPS — | Treasury Inflation Protected Securities |

| VALUE AT 3/31/21 | PURCHASES | SALES | REALIZED GAINS (LOSSES) | NET CHANGE IN UNREALIZED APPRECIATION (DEPRECIATION) | VALUE AT 3/31/22 | BALANCE OF SHARES HELD AT 3/31/22 | DISTRIBUTIONS RECEIVED* | |

| AFFILIATED UNDERLYING FUNDS 99.1% OF NET ASSETS | ||||||||

| U.S. Stocks 27.2% | ||||||||

| Large-Cap 25.6% | ||||||||

| Schwab U.S. Large-Cap ETF | $17,590,679 | $5,853,095 | ($6,373,217) | $579,615 | $1,634,751 | $19,284,923 | 358,123 | $247,183 |

| Small-Cap 1.6% | ||||||||

| Schwab U.S. Small-Cap ETF | 1,170,824 | 260,915 | (127,030) | (3,214) | (56,116) | 1,245,379 | 26,296 | 13,704 |

| 20,530,302 | ||||||||

| International Stocks 10.8% | ||||||||

| Developed Markets 10.8% | ||||||||

| Schwab International Equity ETF | 7,511,284 | 2,283,990 | (1,460,994) | 33,329 | (216,063) | 8,151,546 | 221,992 | 257,330 |

| Real Estate 2.9% | ||||||||

| U.S. REITs 2.9% | ||||||||

| Schwab U.S. REIT ETF | 1,382,802 | 1,057,958 | (581,800) | 35,175 | 276,223 | 2,170,358 | 87,198 | 26,946 |

| Fixed Income 55.0% | ||||||||

| Inflation-Protected Bond 5.9% | ||||||||

| Schwab U.S. TIPS ETF | 4,572,933 | 697,297 | (799,719) | (1,994) | (29,584) | 4,438,933 | 73,117 | 232,964 |

| Intermediate-Term Bond 41.1% | ||||||||

| Schwab U.S. Aggregate Bond ETF | 31,762,091 | 8,474,846 | (7,176,110) | (295,426) | (1,811,504) | 30,953,897 | 612,100 | 713,559 |

| Treasury Bond 8.0% | ||||||||

| Schwab Short-Term U.S. Treasury ETF | 6,191,783 | 1,072,902 | (996,998) | (13,909) | (209,353) | 6,044,425 | 122,011 | 24,101 |

| 41,437,255 | ||||||||

| Money Market Funds 3.2% | ||||||||

| Schwab Variable Share Price Money Fund, Ultra Shares | 2,436,510 | 778 | — | — | (731) | 2,436,557 | 2,436,557 | 917 |

| Total Affiliated Underlying Funds | $72,618,906 | $19,701,781 | ($17,515,868) | $333,576 | ($412,377) | $74,726,018 | $1,516,704 | |

| * | Distributions received include distributions from net investment income and capital gains, if any, from the underlying funds. |

| DESCRIPTION | QUOTED PRICES IN ACTIVE MARKETS FOR IDENTICAL ASSETS (LEVEL 1) | OTHER SIGNIFICANT OBSERVABLE INPUTS (LEVEL 2) | SIGNIFICANT UNOBSERVABLE INPUTS (LEVEL 3) | TOTAL |

| Assets | ||||

| Affiliated Underlying Funds1 | $74,726,018 | $— | $— | $74,726,018 |

| Short-Term Investments1 | — | 722,379 | — | 722,379 |

| Total | $74,726,018 | $722,379 | $— | $75,448,397 |

| 1 | As categorized in the Portfolio Holdings. |

| Assets | ||

| Investments in securities, at value - affiliated (cost $65,352,436) | $74,726,018 | |

| Investments in securities, at value - unaffiliated (cost $722,379) | 722,379 | |

| Receivables: | ||

| Investments sold | 811,671 | |

| Fund shares sold | 13,188 | |

| Dividends | + | 178 |

| Total assets | 76,273,434 | |

| Liabilities | ||

| Payables: | ||

| Investments bought | 906,273 | |

| Fund shares redeemed | 2,563 | |

| Investment adviser fees | + | 2,177 |

| Total liabilities | 911,013 | |

| Net assets | $75,362,421 | |

| Net Assets by Source | ||

| Capital received from investors | $66,536,252 | |

| Total distributable earnings | + | 8,826,169 |

| Net assets | $75,362,421 | |

| Net Asset Value (NAV) | ||||

| Net Assets | ÷ | Shares Outstanding | = | NAV |

| $75,362,421 | 6,040,766 | $12.48 | ||

| For the period April 1, 2021 through March 31, 2022 | ||

| Investment Income | ||

| Dividends received from securities - affiliated | $1,516,704 | |

| Interest received from securities - unaffiliated | + | 137 |

| Total investment income | 1,516,841 | |

| Expenses | ||

| Investment adviser fees | 62,394 | |

| Total expenses | 62,394 | |

| Expense reduction | – | 35,818 |

| Net expenses | – | 26,576 |

| Net investment income | 1,490,265 | |

| REALIZED AND UNREALIZED GAINS (LOSSES) | ||

| Net realized gains on sales of securities - affiliated | 333,576 | |

| Net change in unrealized appreciation (depreciation) on securities - affiliated | + | (412,377) |

| Net realized and unrealized losses | (78,801) | |

| Increase in net assets resulting from operations | $1,411,464 | |

| OPERATIONS | |||

| 4/1/21-3/31/22 | 4/1/20-3/31/21 | ||

| Net investment income | $1,490,265 | $1,225,059 | |

| Net realized gains | 333,576 | 429,126 | |

| Net change in unrealized appreciation (depreciation) | + | (412,377) | 10,180,159 |

| Increase in net assets resulting from operations | $1,411,464 | $11,834,344 | |

| DISTRIBUTIONS TO SHAREHOLDERS | |||

| Total distributions | ($2,126,395) | ($1,653,449) | |

| TRANSACTIONS IN FUND SHARES | |||||

| 4/1/21-3/31/22 | 4/1/20-3/31/21 | ||||

| SHARES | VALUE | SHARES | VALUE | ||

| Shares sold | 1,612,364 | $20,853,291 | 2,294,441 | $28,073,103 | |

| Shares reinvested | 153,206 | 2,008,520 | 125,594 | 1,568,669 | |

| Shares redeemed | + | (1,559,156) | (20,168,590) | (1,997,955) | (24,228,989) |

| Net transactions in fund shares | 206,414 | $2,693,221 | 422,080 | $5,412,783 | |

| SHARES OUTSTANDING AND NET ASSETS | |||||

| 4/1/21-3/31/22 | 4/1/20-3/31/21 | ||||

| SHARES | NET ASSETS | SHARES | NET ASSETS | ||

| Beginning of period | 5,834,352 | $73,384,131 | 5,412,272 | $57,790,453 | |

| Total increase | + | 206,414 | 1,978,290 | 422,080 | 15,593,678 |

| End of period | 6,040,766 | $75,362,421 | 5,834,352 | $73,384,131 | |

| 4/1/21– 3/31/22 | 4/1/20– 3/31/21 | 4/1/19– 3/31/20 | 4/1/18– 3/31/19 | 4/1/17– 3/31/181 | ||

| Per-Share Data | ||||||

| Net asset value at beginning of period | $13.05 | $10.93 | $11.18 | $10.92 | $10.30 | |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)2 | 0.26 | 0.23 | 0.29 | 0.27 | 0.23 | |

| Net realized and unrealized gains (losses) | 0.03 | 2.12 | (0.29) | 0.22 | 0.52 | |

| Total from investment operations | 0.29 | 2.35 | 0.00 3 | 0.49 | 0.75 | |

| Less distributions: | ||||||

| Distributions from net investment income | (0.26) | (0.21) | (0.25) | (0.23) | (0.13) | |

| Distributions from net realized gains | (0.07) | (0.02) | (0.00) 3 | (0.00) 3 | (0.00) 3 | |

| Total distributions | (0.33) | (0.23) | (0.25) | (0.23) | (0.13) | |

| Net asset value at end of period | $13.01 | $13.05 | $10.93 | $11.18 | $10.92 | |

| Total return | 2.13% | 21.51% | (0.17%) | 4.73% | 7.30% | |

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Net operating expenses4 | 0.03% | 0.03% | 0.03% | 0.03% | 0.03% | |

| Gross operating expenses4 | 0.08% | 0.08% | 0.08% | 0.08% | 0.08% | |

| Net investment income (loss) | 1.92% | 1.86% | 2.46% | 2.48% | 2.15% | |

| Portfolio turnover rate | 18% | 13% | 22% | 13% | 21% | |

| Net assets, end of period (x 1,000) | $286,650 | $277,678 | $172,353 | $129,760 | $70,841 | |

| 1 | Effective July 24, 2017, the Investor Shares and Institutional Shares share classes were combined into a single class of shares of the fund. The financial history as shown in the financial highlights is that of the former Institutional Shares. |

| 2 | Calculated based on the average shares outstanding during the period. |

| 3 | Per-share amount was less than $0.005. |

| 4 | Ratio excludes acquired fund fees and expenses, which are indirect expenses incurred by the fund through its investments in underlying funds. If the expenses incurred by the underlying funds were included in these ratios they would have increased by 0.05%, 0.05%, 0.05%, 0.05% and 0.05%, respectively, for the periods ended March 31, 2022, March 31, 2021, March 31, 2020, March 31, 2019, March 31, 2018 (see financial note 4). |

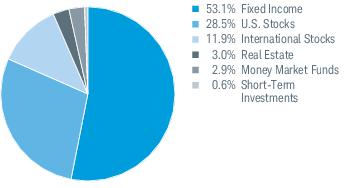

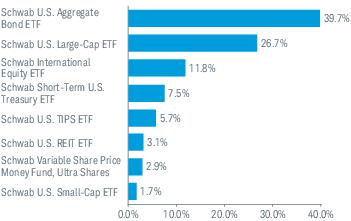

| SECURITY | NUMBER OF SHARES | VALUE ($) |

| AFFILIATED UNDERLYING FUNDS 99.1% OF NET ASSETS | ||

| U.S. Stocks 28.4% | ||

| Large-Cap 26.7% | ||

| Schwab U.S. Large-Cap ETF | 1,420,007 | 76,467,377 |

| Small-Cap 1.7% | ||

| Schwab U.S. Small-Cap ETF | 106,667 | 5,051,749 |

| 81,519,126 | ||

| International Stocks 11.8% | ||

| Developed Markets 11.8% | ||

| Schwab International Equity ETF | 923,764 | 33,920,614 |

| Real Estate 3.1% | ||

| U.S. REITs 3.1% | ||

| Schwab U.S. REIT ETF | 349,964 | 8,710,604 |

| Fixed Income 52.9% | ||

| Inflation-Protected Bond 5.7% | ||

| Schwab U.S. TIPS ETF | 267,347 | 16,230,636 |

| Intermediate-Term Bond 39.7% | ||

| Schwab U.S. Aggregate Bond ETF | 2,251,866 | 113,876,864 |

| Treasury Bond 7.5% | ||

| Schwab Short-Term U.S. Treasury ETF | 435,279 | 21,563,722 |

| 151,671,222 | ||

| SECURITY | NUMBER OF SHARES | VALUE ($) |

| Money Market Funds 2.9% | ||

| Schwab Variable Share Price Money Fund, Ultra Shares 0.20% (a) | 8,381,809 | 8,381,809 |

| Total Affiliated Underlying Funds (Cost $251,328,935) | 284,203,375 | |

| ISSUER | FACE AMOUNT ($) | VALUE ($) |

| SHORT-TERM INVESTMENTS 0.6% OF NET ASSETS | ||

| Time Deposits 0.6% | ||

| BNP Paribas SA | ||

| 0.15%, 04/01/22 (b) | 1,680,488 | 1,680,488 |

| Total Short-Term Investments (Cost $1,680,488) | 1,680,488 | |

| Total Investments in Securities (Cost $253,009,423) | 285,883,863 | |

| (a) | The rate shown is the 7-day yield. |

| (b) | The rate shown is the current daily overnight rate. |

| ETF — | Exchange traded fund |

| REIT — | Real Estate Investment Trust |

| TIPS — | Treasury Inflation Protected Securities |

| VALUE AT 3/31/21 | PURCHASES | SALES | REALIZED GAINS (LOSSES) | NET CHANGE IN UNREALIZED APPRECIATION (DEPRECIATION) | VALUE AT 3/31/22 | BALANCE OF SHARES HELD AT 3/31/22 | DISTRIBUTIONS RECEIVED* | |

| AFFILIATED UNDERLYING FUNDS 99.1% OF NET ASSETS | ||||||||

| U.S. Stocks 28.4% | ||||||||

| Large-Cap 26.7% | ||||||||

| Schwab U.S. Large-Cap ETF | $69,291,983 | $19,455,941 | ($21,041,519) | $2,004,054 | $6,756,918 | $76,467,377 | 1,420,007 | $991,563 |

| Small-Cap 1.7% | ||||||||

| Schwab U.S. Small-Cap ETF | 4,665,354 | 1,082,014 | (449,391) | (23,990) | (222,238) | 5,051,749 | 106,667 | 56,402 |

| 81,519,126 | ||||||||

| International Stocks 11.8% | ||||||||

| Developed Markets 11.8% | ||||||||

| Schwab International Equity ETF | 31,002,115 | 6,919,366 | (3,125,239) | 12,727 | (888,355) | 33,920,614 | 923,764 | 1,079,045 |

| Real Estate 3.1% | ||||||||

| U.S. REITs 3.1% | ||||||||

| Schwab U.S. REIT ETF | 5,518,387 | 3,475,600 | (1,543,125) | 136,527 | 1,123,215 | 8,710,604 | 349,964 | 110,712 |

| Fixed Income 52.9% | ||||||||

| Inflation-Protected Bond 5.7% | ||||||||

| Schwab U.S. TIPS ETF | 16,753,131 | 1,683,033 | (2,077,560) | (17,199) | (110,769) | 16,230,636 | 267,347 | 865,349 |

| Intermediate-Term Bond 39.7% | ||||||||

| Schwab U.S. Aggregate Bond ETF | 117,167,693 | 25,590,256 | (21,030,947) | (874,314) | (6,975,824) | 113,876,864 | 2,251,866 | 2,652,981 |

| Treasury Bond 7.5% | ||||||||

| Schwab Short-Term U.S. Treasury ETF | 22,051,960 | 4,603,735 | (4,288,576) | (62,533) | (740,864) | 21,563,722 | 435,279 | 86,838 |

| 151,671,222 | ||||||||

| Money Market Funds 2.9% | ||||||||

| Schwab Variable Share Price Money Fund, Ultra Shares | 8,381,645 | 2,678 | — | — | (2,514) | 8,381,809 | 8,381,809 | 3,155 |

| Total Affiliated Underlying Funds | $274,832,268 | $62,812,623 | ($53,556,357) | $1,175,272 | ($1,060,431) | $284,203,375 | $5,846,045 | |

| * | Distributions received include distributions from net investment income and capital gains, if any, from the underlying funds. |

| DESCRIPTION | QUOTED PRICES IN ACTIVE MARKETS FOR IDENTICAL ASSETS (LEVEL 1) | OTHER SIGNIFICANT OBSERVABLE INPUTS (LEVEL 2) | SIGNIFICANT UNOBSERVABLE INPUTS (LEVEL 3) | TOTAL |

| Assets | ||||

| Affiliated Underlying Funds1 | $284,203,375 | $— | $— | $284,203,375 |

| Short-Term Investments1 | — | 1,680,488 | — | 1,680,488 |

| Total | $284,203,375 | $1,680,488 | $— | $285,883,863 |

| 1 | As categorized in the Portfolio Holdings. |

| Assets | ||

| Investments in securities, at value - affiliated (cost $251,328,935) | $284,203,375 | |

| Investments in securities, at value - unaffiliated (cost $1,680,488) | 1,680,488 | |

| Receivables: | ||

| Investments sold | 3,517,529 | |

| Fund shares sold | 303,880 | |

| Dividends | + | 600 |

| Total assets | 289,705,872 | |

| Liabilities | ||

| Payables: | ||

| Investments bought | 2,700,683 | |

| Fund shares redeemed | 346,434 | |

| Investment adviser fees | + | 8,439 |

| Total liabilities | 3,055,556 | |

| Net assets | $286,650,316 | |

| Net Assets by Source | ||

| Capital received from investors | $254,725,551 | |

| Total distributable earnings | + | 31,924,765 |

| Net assets | $286,650,316 | |

| Net Asset Value (NAV) | ||||

| Net Assets | ÷ | Shares Outstanding | = | NAV |

| $286,650,316 | 22,031,801 | $13.01 | ||

| For the period April 1, 2021 through March 31, 2022 | ||

| Investment Income | ||

| Dividends received from securities - affiliated | $5,846,045 | |

| Interest received from securities - unaffiliated | + | 582 |

| Total investment income | 5,846,627 | |

| Expenses | ||

| Investment adviser fees | 238,893 | |

| Total expenses | 238,893 | |

| Expense reduction | – | 135,483 |

| Net expenses | – | 103,410 |

| Net investment income | 5,743,217 | |

| REALIZED AND UNREALIZED GAINS (LOSSES) | ||

| Net realized gains on sales of securities - affiliated | 1,175,272 | |

| Net change in unrealized appreciation (depreciation) on securities - affiliated | + | (1,060,431) |

| Net realized and unrealized gains | 114,841 | |

| Increase in net assets resulting from operations | $5,858,058 | |

| OPERATIONS | |||

| 4/1/21-3/31/22 | 4/1/20-3/31/21 | ||

| Net investment income | $5,743,217 | $4,308,014 | |

| Net realized gains | 1,175,272 | 274,486 | |

| Net change in unrealized appreciation (depreciation) | + | (1,060,431) | 36,384,546 |

| Increase in net assets resulting from operations | $5,858,058 | $40,967,046 | |

| DISTRIBUTIONS TO SHAREHOLDERS | |||

| Total distributions | ($7,308,160) | ($4,687,144) | |

| TRANSACTIONS IN FUND SHARES | |||||

| 4/1/21-3/31/22 | 4/1/20-3/31/21 | ||||

| SHARES | VALUE | SHARES | VALUE | ||

| Shares sold | 6,413,180 | $86,878,636 | 11,635,221 | $145,527,249 | |