UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07704

Schwab Capital Trust

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Jonathan de St. Paer

Schwab Capital Trust

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2022

Item 1: Report(s) to Shareholders.

Annual Report | October 31, 2022

Schwab International Opportunities Fund

(formerly Laudus International MarketMasters Fund™)

Schwab International Opportunities Fund

Fund investment adviser: Charles Schwab Investment Management, Inc., dba Schwab Asset ManagementTM

Distributor: Charles Schwab & Co., Inc. (Schwab)

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS) which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Schwab.

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabfunds_prospectus.

| Total Return for the 12 Months Ended October 31, 2022 |

| Schwab International Opportunities Fund1 (Ticker Symbol: SWMIX) | -34.83% 2 |

| MSCI EAFE® Index (Net)3 | -23.00% |

| Fund Category: Morningstar Foreign Large Growth4 | -32.07% |

| Performance Details | pages 7-10 |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s total return would have been lower. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares.

Foreign securities can involve risks such as political and economic instability and currency risk. These risks may be greater in emerging markets.

| 1 | The fund’s performance relative to the index may be affected by fair-value pricing and timing differences in foreign exchange calculations. See financial note 2 for more information. |

| 2 | Total return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual and semiannual reports. |

| 3 | The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes. |

| 4 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds and ETFs within the category as of the report date. |

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

Jonathan de St. Paer

President of Schwab Asset

Management and the fund

covered in this report.

Dear Shareholder,

Geopolitical, economic, and market challenges abounded during the 12-month reporting period ended October 31, 2022. Although the period started off strong, with markets reaching new highs in the final months of 2021, the subsequent 10 months were beset by rapidly rising inflation, sharply climbing interest rates, steeply declining stock prices, and the onset of a war in Europe as Russia invaded Ukraine. Economic growth in the United States and most of the world slowed. By the end of the period, the S&P 500® Index, a bellwether for the overall U.S. stock market, lost nearly 20% of its value from its early-January 2022 peak and returned -14.6% for the reporting period. The MSCI EAFE® Index (Net)*, a broad measure of developed international equity performance, declined by more than 25% between early-January 2022 highs and the end of the reporting period and returned -23.0% for the reporting period. Among international markets, commodity producers—aside from Russia and Ukraine—were buoyed by soaring oil and gas prices as well as steeply rising prices for other agricultural and industrial raw materials. However, most developed and developing international markets suffered as Europe faced mounting geopolitical and economic challenges and as China experienced slowing growth due to rolling COVID-19 lockdowns and restrictive regulatory policies affecting key industries.

At Schwab Asset Management, we recognize that today’s turbulent investment environment may be unsettling for many investors. Market declines and volatility can rattle confidence even in well-established investment plans and can cause investors to impulsively react to market movements. At such times, it is helpful to remember that, even in the face of market turmoil and volatility, most investors are best served by maintaining a diversified portfolio that reflects their risk tolerance and long-term goals.

The Schwab International Opportunities Fund offers diversified access to multiple international investment managers, each with their own focus and style and overseen by our investment manager research team. The fund provides exposure to international developed and emerging markets, large- and small-capitalization, and growth and value stocks. On February 25, 2022, Schwab Asset Management reduced the fund’s management fee from a tiered rate to 0.63% and reduced the fund’s expense limitation from 1.25% to 0.86%. Along with these reductions, Schwab Asset Management made changes to the fund’s name and portfolio management team and allocated a portion of the fund’s assets to a passive international sleeve.

Thank you for investing with Schwab Asset Management, and for trusting us to help you achieve your financial goals. For more information about the Schwab International Opportunities Fund, please continue reading this report. In addition, you can find further details about the fund by visiting our website at www.schwabassetmanagement.com. We are also happy to hear from you at 1-877-824-5615.

Sincerely,

“ On February 25, 2022, Schwab Asset Management reduced the fund’s management fee from a tiered rate to 0.63% and reduced the fund’s expense limitation from 1.25% to 0.86%.”

Past performance is no guarantee of future results.

Diversification and asset allocation strategies do not ensure a profit and cannot protect against losses in a declining market.

Management views may have changed since the report date.

Schwab Asset Management is the dba name for Charles Schwab Investment Management, Inc., the investment adviser for Schwab Funds and Schwab ETFs.

| * | The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes. |

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

The Investment Environment

For the 12-month reporting period ended October 31, 2022, international equity markets lost ground. After several key market indices hit record highs through early January, equity markets around the globe began to slide in reaction to growing headwinds, including accelerating inflation and the increasing likelihood of rising interest rates. In late February 2022, Russia’s invasion of Ukraine drove oil prices to over $100 per barrel for the first time since 2014 and roiled stock markets around the world. Albeit decelerating, COVID-19 continued to weigh on economies worldwide, with highly transmissible variants and subvariants keeping infection rates high in many areas. As the reporting period progressed, economic growth slowed, interest rates rose, and recession fears mounted. The U.S. dollar continued to exhibit strength against a basket of foreign currencies, ending the reporting period significantly stronger and generally reducing the returns of overseas investments in U.S. dollar terms. For the reporting period, the S&P 500® Index, a bellwether for the overall U.S. stock market, returned -14.61%. Outside the United States, the MSCI EAFE® Index (Net)*, a broad measure of developed international equity performance, returned -23.00% and the MSCI Emerging Markets Index (Net)* returned -31.03%.

After a recovery from the dramatic impact of the COVID-19 pandemic through the end of 2021, U.S. gross domestic product (GDP) increased at an annualized rate of 6.9% for the fourth quarter. However, amid fading government stimuli, ongoing supply chain disruptions, persisting inflation, a tight labor market, and a widening U.S. trade deficit, GDP decreased at an annualized rate of -1.6% and -0.6% for the first and second quarters of 2022, respectively. GDP growth was positive for the third quarter of 2022, increasing at an annualized rate of 2.9%, driven primarily by energy exports.

Outside the United States, global economies also wrestled with the fallout of the COVID-19 pandemic, high energy costs, rising inflation, and the war in Ukraine. After spiking in early March 2022 as sanctions were imposed on Russian imports—and again in June on supply-and-demand imbalances—oil prices generally fell through the rest of the reporting period, ending at just over $86 per barrel. The eurozone, heavily impacted by the war in Ukraine and associated commodity price spikes, managed to eke out small gains in GDP for the fourth quarter of 2021 and first and second quarters of 2022, as COVID-19 restrictions eased and tourism increased in response to pent-up demand. The

Asset Class Performance Comparison % returns during the 12 months ended October 31, 2022

Index figures assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. Past performance is not a guarantee of future results.

For index definitions, please see the Glossary.

Data source: Index provider websites and Schwab Asset Management.

Nothing in this report represents a recommendation of a security by the investment adviser.

Management views may have changed since the report date.

| * | The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes. |

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

The Investment Environment (continued)

United Kingdom also posted small gains in GDP growth for the fourth quarter of 2021 and first and second quarters of 2022. Among emerging markets, China’s GDP growth rate remained positive but slowed notably as China dealt with numerous headwinds including the political landscape, an emphasis on domestic consumption over globalization, lockdowns and quarantines, and a severe property downturn as a result of stalled demand, a decline in financing for property development, halted construction on in progress projects, and homeowners pausing mortgage payments on incomplete builds. India’s GDP growth also remained positive over the reporting period, particularly in the second quarter of 2022, on rising consumer demand and a rapid decline in COVID-19 cases.

Monetary policy around the world varied. In the United States, after maintaining the federal funds rate in a range of 0.00% to 0.25% through mid-March 2022, as inflation continued to rise and indicators of economic activity and employment continued to strengthen, the U.S. Federal Reserve (Fed) shifted its stance. After issuing successively stronger signals that interest rates could begin to rise sooner in 2022 than previously anticipated, the Fed raised the federal funds rate five times during the reporting period—by 0.25% in mid-March, 0.50% in early May, 0.75% in mid-June, 0.75% in late July, and 0.75% in late September—in its ongoing efforts to achieve a return to price stability. The federal funds rate ended the reporting period in a range of 3.00% to 3.25%. Outside the United States, central banks were similarly responsive. After holding its policy rate unchanged since March 2015, at 0.00%, the European Central Bank raised its interest rate three times over the reporting period in an effort to dampen demand and control inflation, which in October 2022 rose into double-digits. The Bank of England raised its key official bank rate seven times during the reporting period, bringing borrowing costs to a 13-year high as the Bank of England wrestles with soaring inflation. In contrast, the Bank of Japan continued to uphold its short-term interest rate target of -0.1%, unchanged since 2016, but raised its inflation forecast at its October 2022 meeting. Monetary policies in emerging markets were mixed. Central banks in India, Indonesia, Brazil, Mexico, and Pakistan raised their rates multiple times over the reporting period to counteract the impacts of inflation. In contrast, China cut its interest rate three times over the reporting period, in part as a result of a resurgence of COVID-19 cases and a lingering property downturn. Russia raised its benchmark policy rate to 20% in late February 2022 amid the broadening fallout of Western sanctions in retaliation against Russia’s invasion of Ukraine, but subsequently reduced it several times.

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

| John Greves, CFA, Managing Director and Head of Multi-Asset Strategies, is responsible for the day-to-day co-management of the fund. Prior to joining Schwab in 2016, Mr. Greves worked at Russell Investment Management Company (Russell Investments) for 13 years, most recently as a portfolio manager for multi-asset solutions where he managed multiple target date funds, chaired the multi-asset advisory team, and co-authored papers on glide path methodology and benchmarking. Prior to that, he served in several roles for Russell Investments including associate portfolio manager for multi-asset solutions and senior portfolio analyst for multi-asset solutions. |

| Tony Creasy, CFA, Senior Portfolio Manager, is responsible for the day-to-day co-management of the fund. Prior to his current role, he was a portfolio manager on the Multi-Asset Strategies Team, responsible for the daily management of several multi-asset portfolios. He also spent several years as lead analyst on the Schwab Asset Management Investment Manager Research Team. Prior to that, Mr. Creasy was an institutional investment analyst for Schwab’s retirement investment services group, providing mutual fund analysis to support the Schwab Focus List™. |

| Daniel Piquet, CFA, Portfolio Manager, is responsible for the day-to-day co-management of the fund. Prior to joining Schwab, Mr. Piquet spent two years as an analyst at Santander Asset Management providing sub-adviser oversight in the firm’s global multi-asset solutions team. Before that, he was a portfolio analyst with Natixis Global Asset Management, performing portfolio risk analysis as well as equity, fixed income, and alternative mutual fund research. He also spent six years at The Vanguard Group, including two years as an investment analyst. |

| Chuck Craig, CFA, Senior Portfolio Manager, is responsible for the oversight and day-to-day co-management of the portion of the fund that is invested in accordance with a particular index. Prior to joining Schwab in 2012, Mr. Craig worked at Guggenheim Funds (formerly Claymore Group), where he spent more than five years as a managing director of portfolio management and supervision, and three years as vice president of product research and development. Prior to that, he worked as an equity research analyst at First Trust Portfolios (formerly Niké Securities), and a trader and analyst at PMA Securities, Inc. |

| David Rios, Portfolio Manager, is responsible for the day-to-day co-management of the portion of the fund that is invested in accordance with a particular index. Prior to this role, Mr. Rios was an associate portfolio manager on the equity index strategies team for four years. His first role with Schwab Asset Management was as a trade operations specialist. Prior to joining Schwab in 2008, Mr. Rios was a senior fund accountant at Investors Bank & Trust (subsequently acquired by State Street Corporation). |

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

The Schwab International Opportunities Fund (the fund) uses a multi-manager strategy. Charles Schwab Investment Management, Inc., dba Schwab Asset Management—the fund’s investment adviser—selects investment subadvisers with strong long-term track records to manage a portion of the fund’s assets. In addition to selecting investment subadvisers and allocating assets among them, Schwab Asset Management is responsible for managing a portion of the fund in accordance with an index and monitoring and coordinating the overall management of the fund. Each subadviser’s and Schwab Asset Management’s portfolio is compared to its respective comparative index that reflects its individual process and philosophy. These comparative indices may differ from the fund’s comparative index.

Market Highlights. For the 12-month reporting period ended October 31, 2022, international equity markets lost ground. After several key market indices hit record highs through early January, equity markets around the globe began to slide in reaction to growing headwinds, including accelerating inflation and the increasing likelihood of rising interest rates. In late February 2022, Russia’s invasion of Ukraine drove oil prices to over $100 per barrel for the first time since 2014 and roiled stock markets around the world. Albeit decelerating, COVID-19 continued to weigh on economies worldwide, with highly transmissible variants and subvariants keeping infection rates high in many areas. As the reporting period progressed, economic growth slowed, interest rates rose, and recession fears mounted. The U.S. dollar continued to exhibit strength against a basket of foreign currencies, ending the reporting period significantly stronger and generally reducing the returns of overseas investments in U.S. dollar terms.

Performance. For the 12-month period ended October 31, 2022, the fund returned -34.83%1, underperforming the fund’s comparative index, the MSCI EAFE® Index (Net) (the index), which returned -23.00%2.

Positioning and Strategies. Over the 12-month reporting period, all four of the fund’s current active subadvisers posted negative returns, detracting from the fund’s total return. All four of the fund’s current active subadvisers also underperformed their comparative indices.

Among the fund’s four current active subadvisers, Baillie Gifford Overseas Limited posted a negative return and underperformed its international growth comparative index. Stock selection was weakest in the consumer discretionary, health care, information technology, and consumer staples sectors and detracted from relative return while stock selection was strongest in the industrials sector and contributed to relative return. An overweight to the health care sector and an underweight to the real estate sector contributed to the relative performance. From a regional perspective, stock selection in Germany and an overweight to the United States detracted from relative performance and an underweight to Russia and stock selection in Italy contributed to relative performance.

Harris Associates L.P. also posted a negative return and underperformed its international comparative index. Stock selection was weakest in the financials and consumer discretionary sectors and detracted from relative return while stock selection was strongest in the materials sector and contributed to relative return. An underweight to the energy sector and an overweight to the consumer discretionary sector detracted from relative return while an underweight to the real estate and utilities sectors and a slight overweight to the health care sector contributed to relative return. From a regional perspective, an overweight to Germany and stock selection in the United Kingdom detracted from relative performance and an overweight to India and an underweight to Hong Kong contributed to relative performance.

American Century Investment Management, Inc., which focuses on international small-cap growth, also posted a negative return and underperformed its comparative index. Stock selection was weakest in the industrials, health care, and communication services sectors and detracted from relative return while stock selection in the real estate and financials sectors was strongest and contributed to relative return. An overweight to the energy sector also contributed to relative return. From a regional perspective, an overweight to the United States and stock selection in Japan detracted from relative performance and stock selection in the United States and India contributed to relative performance.

Mondrian Investment Partners Limited, with its international small-cap value focus, also posted a negative return and underperformed its comparative index. Stock selection was weakest in the industrials, information technology, energy, and materials sectors and detracted from relative return while stock selection in the real estate and consumer staples sectors contributed to relative return. An underweight to the real estate and materials sectors also contributed to relative return. From a regional perspective, stock selection in Japan and Germany detracted from relative performance and stock selection in France and the United Kingdom contributed to relative performance.

Effective February 25, 2022, Charles Schwab Investment Management, Inc., dba Schwab Asset Management, began managing a portion of the fund. Schwab Asset Management seeks to track the performance of the FTSE Developed ex US Quality Factor Index. Over the period of February 25, 2022, through October 31, 2022, the fund’s allocation to Schwab Asset Management performed in line with this objective.

Effective February 25, 2022, William Blair Investment Management, LLC and Mellon Investments Corporation were removed as subadvisers. For the period of November 1, 2021, through February 25, 2022, William Blair detracted from the performance of the fund. Assets managed by William Blair and Mellon were reallocated across Schwab Asset Management and the other subadvisers of the fund.

Management views and portfolio holdings may have changed since the report date.

| 1 | Total return for the report period above differs from the return in the Financial Highlights. The total return presented above is calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual and semiannual reports. |

| 2 | The total return cited for the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes. |

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

Performance and Fund Facts as of October 31, 2022

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visit www.schwabassetmanagement.com/schwabfunds_prospectus.

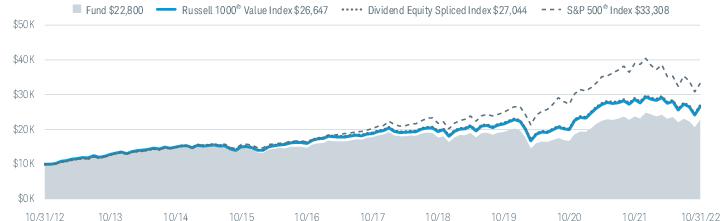

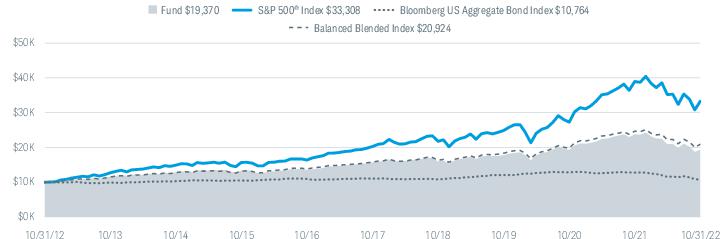

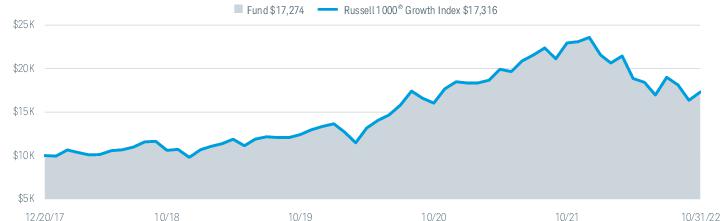

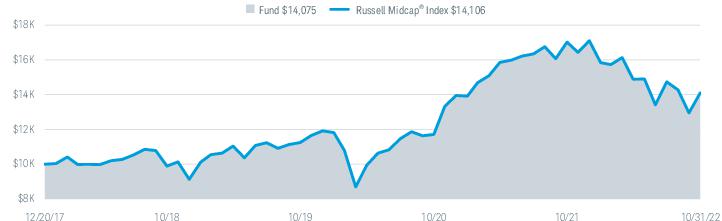

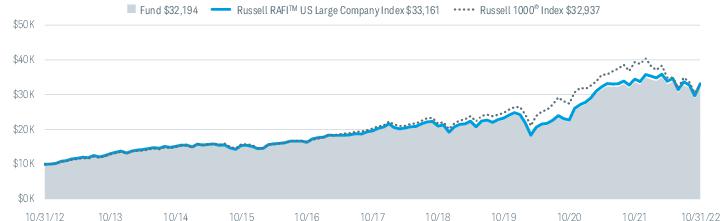

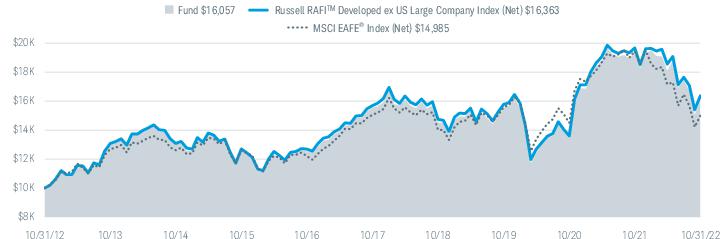

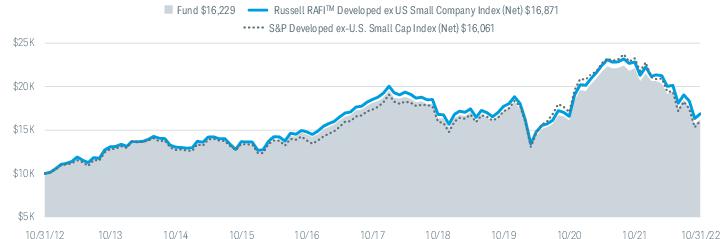

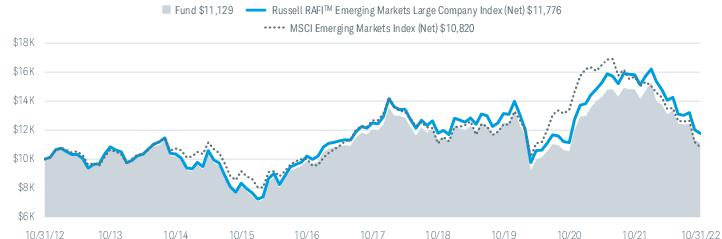

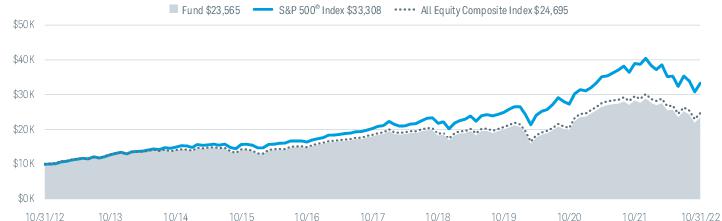

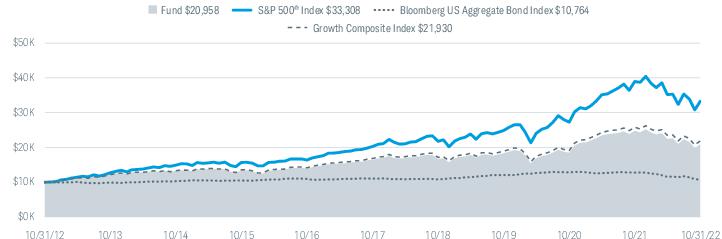

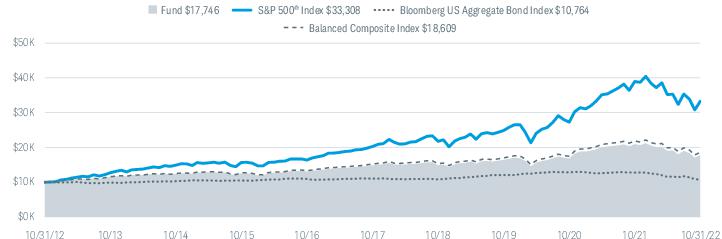

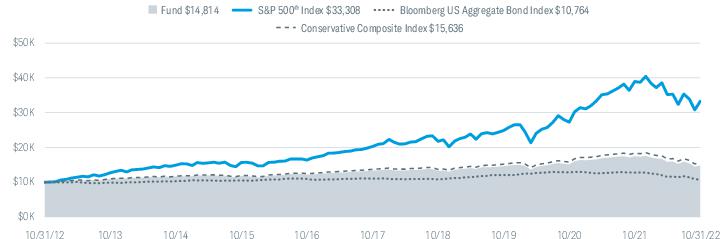

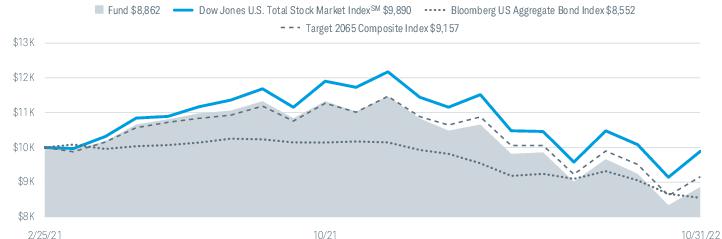

Performance of Hypothetical $10,000 Investment (October 31, 2012 – October 31, 2022)1,2,3

Average Annual Total Returns1,3

| Fund and Inception Date | 1 Year | 5 Years | 10 Years |

| Fund: Schwab International Opportunities Fund (4/2/04)2 | -34.83% 4 | -1.48% | 4.17% |

| MSCI EAFE® Index (Net)5 | -23.00% | -0.09% | 4.13% |

| Fund Category: Morningstar Foreign Large Growth6 | -32.07% | 0.81% | 4.87% |

| Fund Expense Ratio7: 0.83% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

For index definitions, please see the Glossary.

| 1 | Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | The fund commenced operations on October 16, 1996 which became the Schwab International Opportunities Fund (formerly Laudus International MarketMasters Fund) Investor Shares. The Investor Shares were consolidated into Select Shares on February 26, 2019. The performance presented is that of the former Select Shares which commenced operations on April 2, 2004. |

| 3 | The fund’s performance relative to the index may be affected by fair-value pricing. See financial note 2 for more information. |

| 4 | Total return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual and semiannual reports. |

| 5 | The net version of the index reflects reinvested dividends net of withholding taxes but reflects no deductions for expenses or other taxes. |

| 6 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds and ETFs within the category as of the report date. |

| 7 | As stated in the prospectus. Reflects the total annual fund operating expenses without contractual fee waivers. For actual expense ratios during the period, refer to the financial highlights section of the financial statements. |

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

Performance and Fund Facts as of October 31, 2022 (continued)

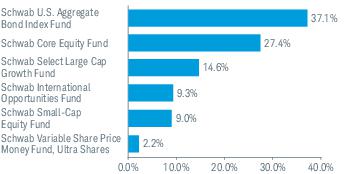

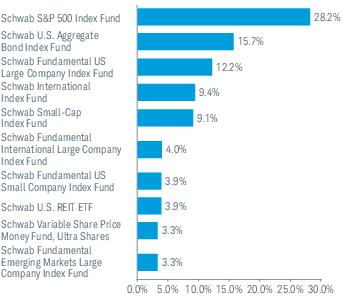

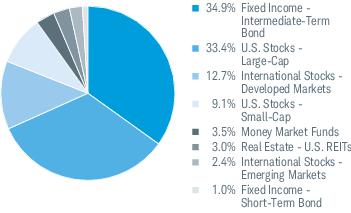

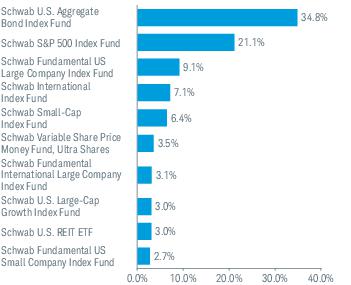

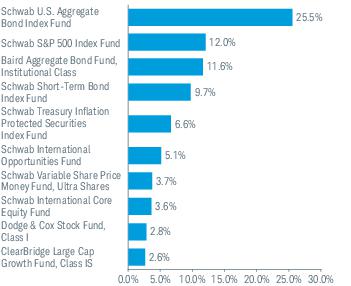

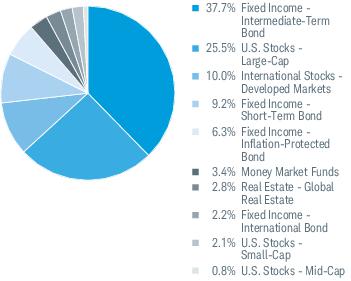

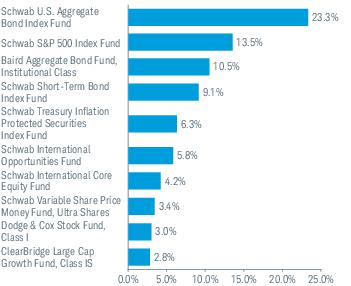

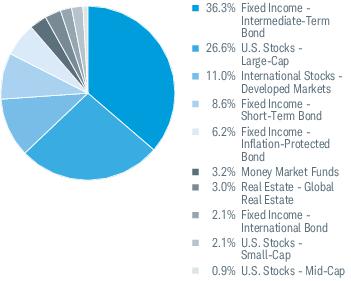

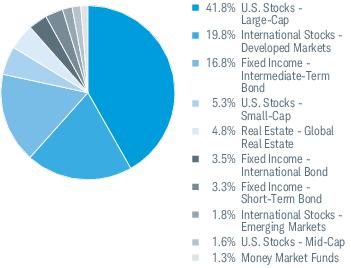

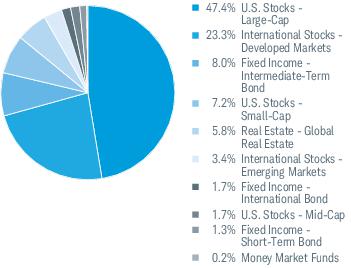

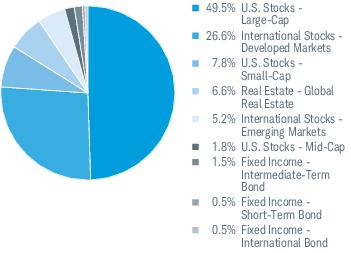

Investment Managers and Allocations1

| Investment Managers | Investment Style | % of

Net Assets |

| American Century Investment Management, Inc. | International Small-Cap Growth | 27.0% |

| Harris Associates L.P. | International Large-Cap Value | 21.7% |

| Charles Schwab Investment Management, Inc., dba Schwab Asset Management2 | International Large-Cap Developed | 21.0% |

| Mondrian Investment Partners Limited | International Small-Cap Value | 17.2% |

| Baillie Gifford Overseas Limited | International Growth | 7.0% |

| Cash and other assets3 | | 6.1% |

| 1 | For more information about each of the investment manager’s investment styles, refer to the fund’s prospectus. |

| 2 | Charles Schwab Investment Management, Inc. manages a portion of the fund by primarily investing in stocks that are included in the FTSE Developed ex US Quality Factor Index. The Schwab International Opportunities Fund has been developed solely by Schwab Asset Management. Index Ownership – The fund is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the LSE Group). FTSE Russell is a trading name of certain of the LSE Group companies. All rights in the FTSE Developed ex US Quality Factor Index (the Index) vest in the relevant LSE Group company which owns the Index. “FTSE®” is a trade mark of the relevant LSE Group company and is used by any other LSE Group company under license. |

| 3 | Charles Schwab Investment Management, Inc. can allocate a portion of the fund to particular market sectors, such as emerging markets, utilizing securities, exchange-traded funds (ETFs) and/or other registered investment companies and may also directly manage additional portions of the fund during transitions between investment managers. Charles Schwab Investment Management, Inc. also manages the cash portion of the fund. |

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

Performance and Fund Facts as of October 31, 2022 (continued)

| Number of Holdings | 1,338 |

| Weighted Average Market Cap (millions) | $32,634 |

| Price/Earnings Ratio (P/E) | 12.4 |

| Price/Book Ratio (P/B) | 1.7 |

| Portfolio Turnover Rate | 81% |

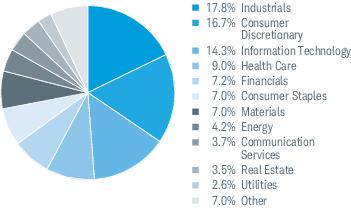

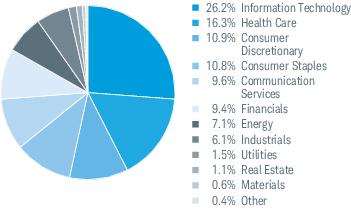

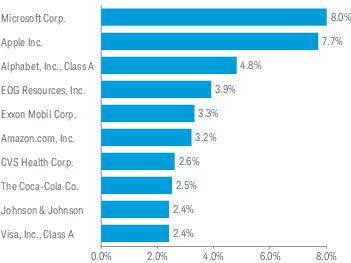

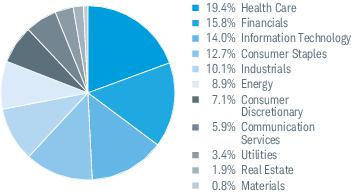

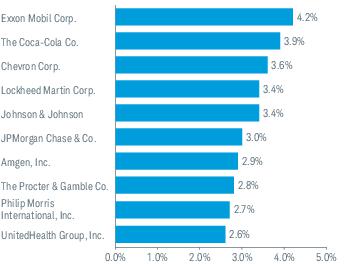

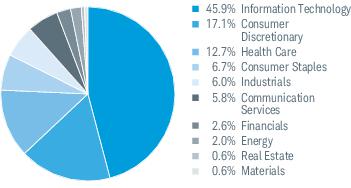

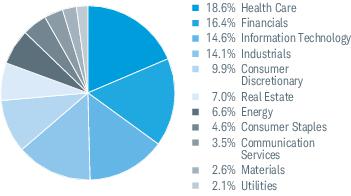

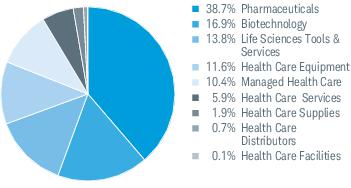

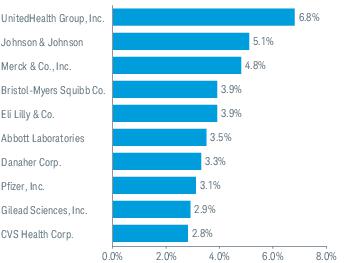

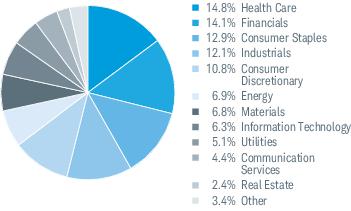

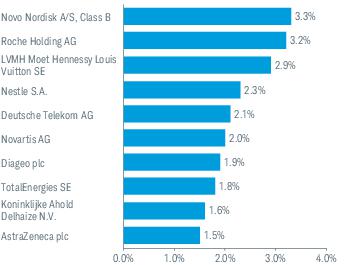

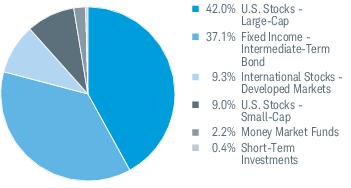

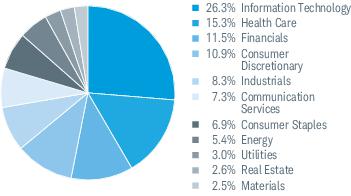

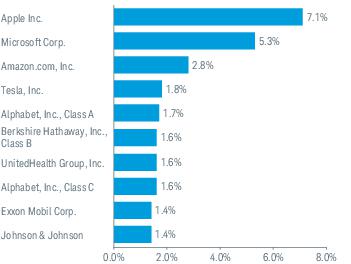

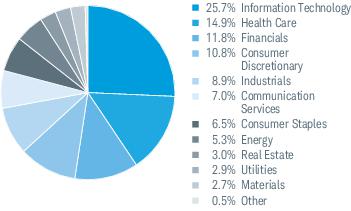

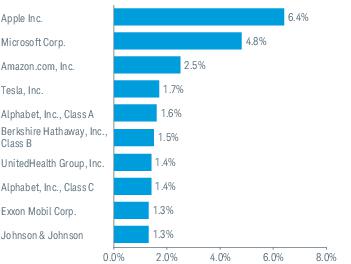

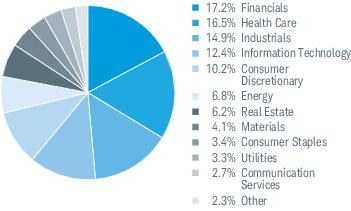

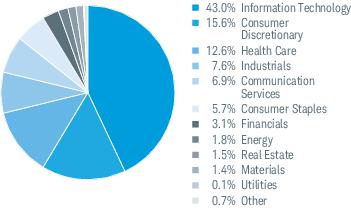

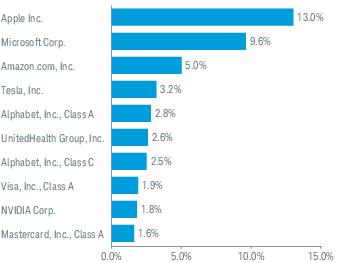

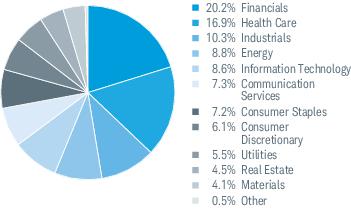

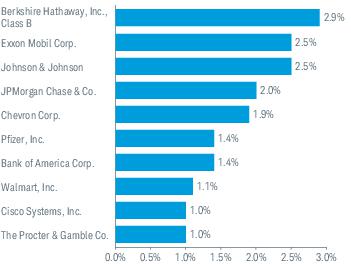

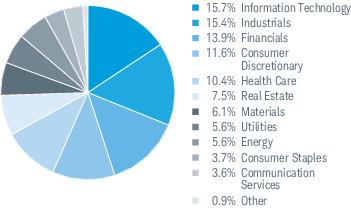

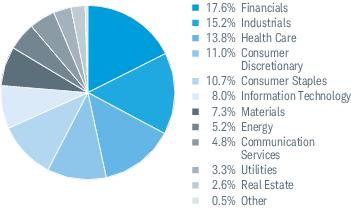

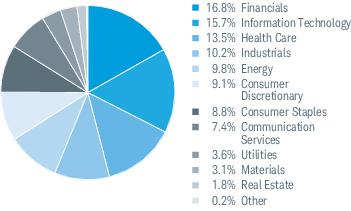

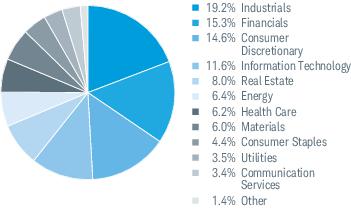

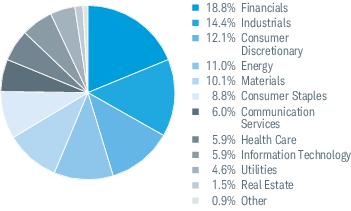

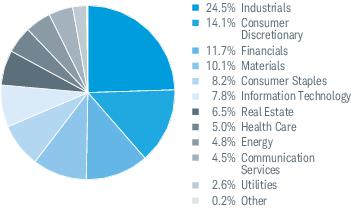

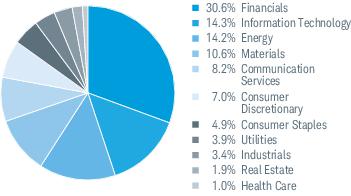

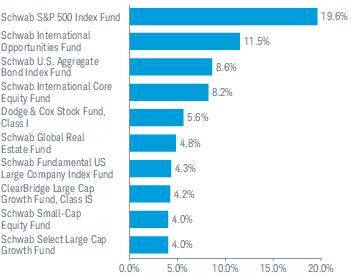

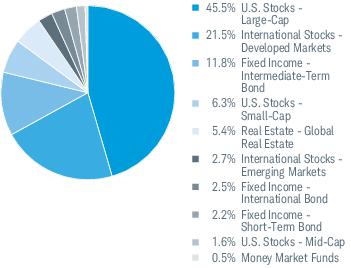

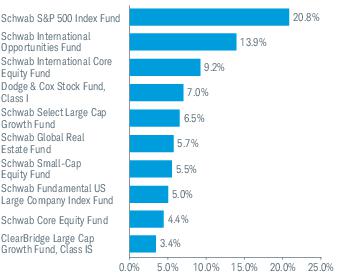

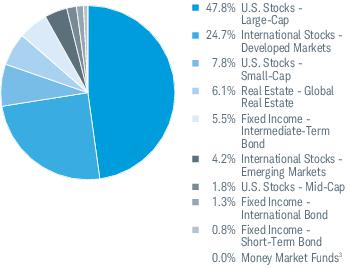

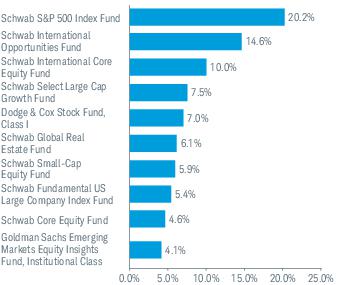

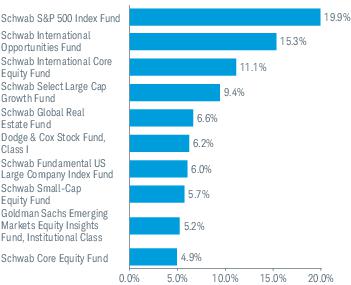

Sector Weightings % of Investments1

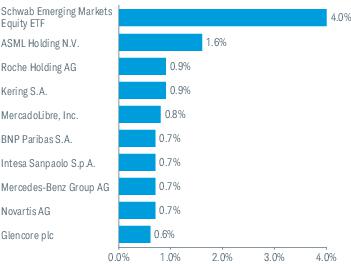

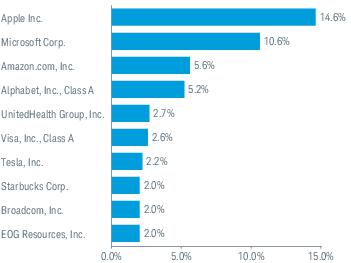

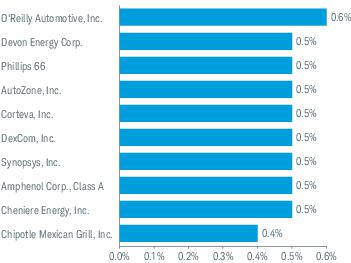

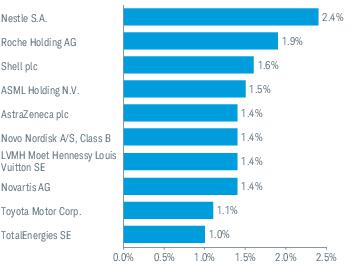

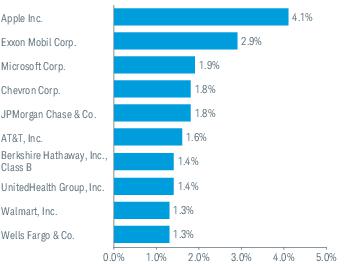

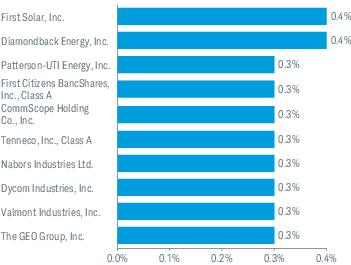

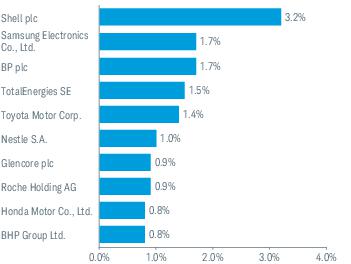

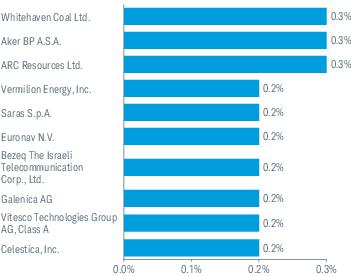

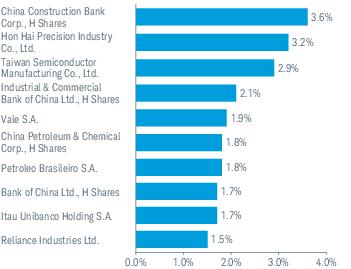

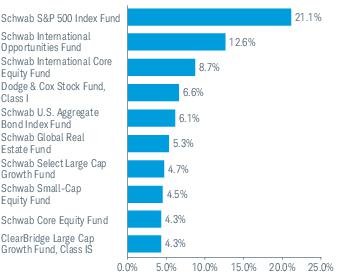

Top Equity Holdings % of Net Assets2

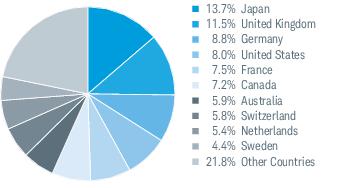

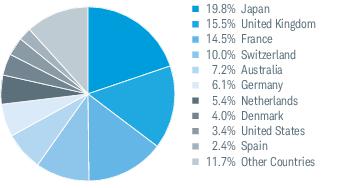

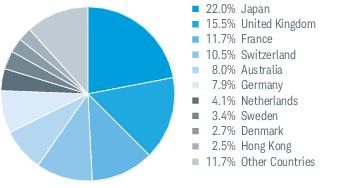

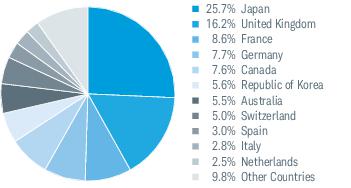

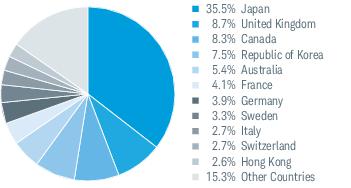

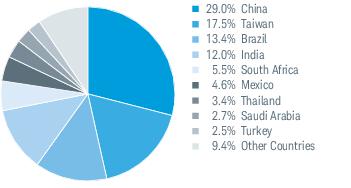

Top Country Weightings % of Investments3

Portfolio holdings may have changed since the report date.

Source of Sector Classification: S&P and MSCI.

International investments are subject to additional risks such as currency fluctuation, geopolitical risk and the potential for illiquid markets. Investing in emerging markets may accentuate these risks.

| 1 | Excludes derivatives. |

| 2 | This list is not a recommendation of any security by the investment adviser. |

| 3 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

Fund Expenses (Unaudited)

Examples for a $1,000 Investment

As a fund shareholder, you may incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fees, transfer agent and shareholder services fees, and other fund expenses.

The expense examples below are intended to help you understand your ongoing cost (in dollars) of investing in the fund and to compare this cost with the ongoing cost of investing in other mutual funds. These examples are based on an investment of $1,000 invested for six months beginning May 1, 2022 and held through October 31, 2022.

Actual Return lines in the table below provide information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number given for the fund under the heading entitled “Expenses Paid During Period.”

Hypothetical Return lines in the table below provide information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed return of 5% per year before expenses. Because the return used is not an actual return, it may not be used to estimate the actual ending account value or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the hypothetical return lines of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | EXPENSE RATIO

(ANNUALIZED) 1 | BEGINNING

ACCOUNT VALUE

AT 5/1/22 | ENDING

ACCOUNT VALUE

(NET OF EXPENSES)

AT 10/31/22 | EXPENSES PAID

DURING PERIOD

5/1/22-10/31/22 2 |

| Schwab International Opportunities Fund | | | | |

| Actual Return | 0.85% | $1,000.00 | $ 851.80 | $3.97 |

| Hypothetical 5% Return | 0.85% | $1,000.00 | $1,020.92 | $4.33 |

| 1 | Based on the most recent six-month expense ratio; may differ from the expense ratio provided in the Financial Highlights. |

| 2 | Expenses for the fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by the 184 days of the period, and divided by the 365 days of the fiscal year. |

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

Financial Statements

FINANCIAL HIGHLIGHTS

| | 11/1/21–

10/31/22 | 11/1/20–

10/31/21 | 11/1/19–

10/31/20 | 11/1/18–

10/31/191 | 11/1/17–

10/31/18 | |

| Per-Share Data |

| Net asset value at beginning of period | $30.60 | $24.37 | $22.89 | $22.89 | $26.96 | |

| Income (loss) from investment operations: | | | | | | |

| Net investment income (loss)2 | 0.26 | 0.01 | 0.00 3 | 0.31 | 0.24 | |

| Net realized and unrealized gains (losses) | (9.58) | 7.94 | 1.95 | 1.74 | (3.09) | |

| Total from investment operations | (9.32) | 7.95 | 1.95 | 2.05 | (2.85) | |

| Less distributions: | | | | | | |

| Distributions from net investment income | (0.28) | — | (0.43) | (0.29) | (0.36) | |

| Distributions from net realized gains | (4.10) | (1.72) | (0.04) | (1.76) | (0.86) | |

| Total distributions | (4.38) | (1.72) | (0.47) | (2.05) | (1.22) | |

| Net asset value at end of period | $16.90 | $30.60 | $24.37 | $22.89 | $22.89 | |

| Total return | (34.79%) | 33.50% | 8.56% | 10.50% | (11.09%) | |

| Ratios/Supplemental Data |

| Ratios to average net assets: | | | | | | |

| Net operating expenses | 0.99% 4,5 | 1.25% | 1.25% | 1.25% | 1.25% | |

| Gross operating expenses | 1.08% 5 | 1.47% | 1.51% | 1.50% | 1.51% | |

| Net investment income (loss) | 1.24% | 0.05% | 0.00% 6 | 1.43% | 0.92% | |

| Portfolio turnover rate | 81% | 59% | 65% | 54% | 69% | |

| Net assets, end of period (x 1,000,000) | $982 | $1,495 | $1,243 | $1,413 | $1,127 | |

| 1 | Effective February 26, 2019, the Investor Share class, and the Select Share class were consolidated into a single class of shares of the fund. The financial history as shown in the financial highlights is that of the former Select Shares. |

| 2 | Calculated based on the average shares outstanding during the period. |

| 3 | Per-share amount was less than $0.005. |

| 4 | Effective February 25, 2022, the net operating expense limitation was lowered from 1.25% to 0.86%. The ratio presented for the period ended October 31, 2022 is a blended ratio. |

| 5 | Ratio includes less than 0.005% of non-routine proxy expenses. |

| 6 | Less than 0.005% |

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

Portfolio Holdings as of October 31, 2022

This section shows all the securities in the fund’s portfolio and their values as of the report date.

The fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-PORT Part F. The fund’s Form N-PORT Part F is available on the SEC’s website at www.sec.gov. You can also obtain this information at no cost on the fund’s website at www.schwabassetmanagement.com/schwabfunds_prospectus, by calling 1-866-414-6349, or by sending an email request to orders@mysummaryprospectus.com. The fund also makes available its complete schedule of portfolio holdings 15 to 20 days after calendar quarters on the fund’s website.

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| COMMON STOCKS 92.3% OF NET ASSETS |

| |

| Argentina 0.8% |

| MercadoLibre, Inc. * | 8,760 | 7,898,191 |

| |

| Australia 5.9% |

| Adbri Ltd. | 9,208 | 9,283 |

| AGL Energy Ltd. | 10,925 | 47,598 |

| Allkem Ltd. * | 143,776 | 1,328,441 |

| ALS Ltd. | 375,539 | 2,747,075 |

| Altium Ltd. | 57,555 | 1,299,551 |

| Alumina Ltd. | 54,895 | 47,443 |

| Amcor plc | 30,415 | 353,217 |

| AMP Ltd. * | 16,292 | 13,138 |

| Ampol Ltd. | 7,053 | 123,017 |

| Ansell Ltd. | 2,232 | 40,295 |

| APA Group | 17,529 | 118,012 |

| Appen Ltd. | 497,996 | 806,807 |

| Aristocrat Leisure Ltd. | 16,525 | 392,236 |

| Atlas Arteria Ltd. | 13,334 | 56,133 |

| Aurizon Holdings Ltd. | 35,902 | 83,198 |

| Bank of Queensland Ltd. | 6,540 | 30,799 |

| Beach Energy Ltd. | 54,515 | 55,745 |

| Bendigo & Adelaide Bank Ltd. | 6,166 | 35,594 |

| BHP Group Ltd. | 156,818 | 3,766,800 |

| BlueScope Steel Ltd. | 11,759 | 118,413 |

| Boral Ltd. | 9,720 | 17,910 |

| Brambles Ltd. | 31,756 | 237,749 |

| carsales.com Ltd. | 120,403 | 1,559,679 |

| Centuria Office REIT | 2,093,054 | 2,016,230 |

| Challenger Ltd. | 8,129 | 36,526 |

| Charter Hall Group | 15,764 | 130,855 |

| Charter Hall Long Wale REIT | 816,064 | 2,275,443 |

| Cleanaway Waste Management Ltd. | 32,988 | 57,060 |

| Cochlear Ltd. | 2,000 | 255,487 |

| Computershare Ltd. | 19,663 | 318,305 |

| Corporate Travel Management Ltd. | 131,635 | 1,469,657 |

| Costa Group Holdings Ltd. | 883,057 | 1,436,932 |

| CSR Ltd. | 15,997 | 47,387 |

| Deterra Royalties Ltd. | 9,191 | 24,117 |

| Domino's Pizza Enterprises Ltd. | 944 | 38,490 |

| Downer EDI Ltd. | 12,852 | 36,936 |

| Endeavour Group Ltd. | 34,672 | 158,704 |

| Flight Centre Travel Group Ltd. * | 1,720 | 18,307 |

| Goodman Group | 61,296 | 666,944 |

| Harvey Norman Holdings Ltd. | 11,820 | 31,445 |

| IDP Education Ltd. | 159,245 | 3,004,442 |

| IGO Ltd. | 288,016 | 2,816,781 |

| Iluka Resources Ltd. | 11,830 | 65,544 |

| Inghams Group Ltd. | 1,617,309 | 2,616,523 |

| Insignia Financial Ltd. | 7,089 | 14,291 |

| James Hardie Industries plc | 13,510 | 294,964 |

| JB Hi-Fi Ltd. | 3,480 | 95,394 |

| Johns Lyng Group Ltd. | 354,331 | 1,473,268 |

| Lendlease Corp., Ltd. | 2,690 | 14,958 |

| Lynas Rare Earths Ltd. * | 496,751 | 2,649,564 |

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| Magellan Financial Group Ltd. | 9,921 | 62,907 |

| Medibank Pvt Ltd. | 192,604 | 346,816 |

| Metcash Ltd. | 19,684 | 51,673 |

| Mirvac Group | 88,148 | 116,793 |

| National Storage REIT | 1,193,695 | 1,997,449 |

| NEXTDC Ltd. * | 395,665 | 2,099,467 |

| Northern Star Resources Ltd. | 22,309 | 124,509 |

| Nufarm Ltd. | 3,357 | 11,964 |

| Orica Ltd. | 200,131 | 1,780,213 |

| Orora Ltd. | 18,391 | 35,688 |

| OZ Minerals Ltd. | 112,345 | 1,739,553 |

| Perpetual Ltd. | 2,946 | 46,945 |

| Pilbara Minerals Ltd. * | 80,589 | 261,934 |

| Pinnacle Investment Management Group Ltd. | 193,036 | 1,003,250 |

| Platinum Asset Management Ltd. | 40,306 | 46,144 |

| Pro Medicus Ltd. | 1,258 | 44,819 |

| Qantas Airways Ltd. * | 20,843 | 77,885 |

| Qube Holdings Ltd. | 37,739 | 65,702 |

| REA Group Ltd. | 1,683 | 130,442 |

| Reece Ltd. | 3,067 | 30,455 |

| Rio Tinto Ltd. | 10,765 | 610,909 |

| SEEK Ltd. | 6,777 | 93,291 |

| Seven Group Holdings Ltd. | 3,085 | 36,176 |

| Shopping Centres Australasia Property Group | 1,206,331 | 2,101,086 |

| Sims Ltd. | 5,369 | 41,977 |

| Sonic Healthcare Ltd. | 12,537 | 262,468 |

| South32 Ltd. | 88,050 | 202,010 |

| Steadfast Group Ltd. | 881,753 | 2,856,655 |

| Stockland | 65,166 | 150,149 |

| Tabcorp Holdings Ltd. | 70,263 | 43,379 |

| Technology One Ltd. | 226,762 | 1,744,482 |

| Telstra Group Ltd. | 72,617 | 182,082 |

| The GPT Group | 59,430 | 164,239 |

| The Lottery Corp., Ltd. * | 34,067 | 93,458 |

| The Star Entertainment Grp Ltd. * | 10,437 | 19,633 |

| TPG Telecom Ltd. | 6,138 | 19,255 |

| Treasury Wine Estates Ltd. | 10,615 | 87,964 |

| Vicinity Ltd. | 113,255 | 141,191 |

| Washington H Soul Pattinson & Co., Ltd. | 6,136 | 109,810 |

| Wesfarmers Ltd. | 23,616 | 685,313 |

| Whitehaven Coal Ltd. | 26,346 | 153,039 |

| WiseTech Global Ltd. | 4,547 | 168,162 |

| Woodside Energy Group Ltd. | 45,486 | 1,051,566 |

| Worley Ltd. | 185,136 | 1,691,053 |

| | | 58,136,642 |

| |

| Austria 0.0% |

| ANDRITZ AG | 857 | 39,831 |

| Erste Group Bank AG | 1,360 | 33,517 |

| OMV AG | 4,043 | 186,153 |

| Telekom Austria AG * | 2,982 | 17,334 |

| Verbund AG | 1,289 | 100,974 |

| Voestalpine AG | 1,926 | 41,814 |

| | | 419,623 |

| |

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

Portfolio Holdings as of October 31, 2022 (continued)

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| Belgium 0.7% |

| Ackermans & van Haaren N.V. | 226 | 31,487 |

| Ageas S.A./N.V. | 745 | 25,790 |

| Anheuser-Busch InBev S.A./N.V. | 76,400 | 3,821,557 |

| D'ieteren Group | 486 | 80,884 |

| Elia Group S.A./N.V. | 890 | 112,525 |

| Etablissements Franz Colruyt N.V. | 774 | 18,657 |

| Euronav N.V. | 110,042 | 1,918,448 |

| Groupe Bruxelles Lambert N.V. | 428 | 31,555 |

| Proximus SADP | 2,892 | 30,319 |

| Sofina S.A. | 974 | 189,929 |

| UCB S.A. | 2,238 | 168,673 |

| Umicore S.A. | 4,773 | 157,346 |

| Warehouses De Pauw CVA | 4,150 | 106,514 |

| | | 6,693,684 |

| |

| Brazil 1.4% |

| Cia Brasileira de Aluminio | 402,900 | 861,101 |

| Locaweb Servicos de Internet S.A. * | 1,363,100 | 2,884,267 |

| Multiplan Empreendimentos Imobiliarios S.A. | 857,900 | 4,377,939 |

| Santos Brasil Participacoes S.A. | 1,165,900 | 2,053,952 |

| TOTVS S.A. | 557,400 | 3,578,237 |

| YDUQS Participacoes S.A. | 137,800 | 430,300 |

| | | 14,185,796 |

| |

| Canada 7.2% |

| Agnico Eagle Mines Ltd. | 6,980 | 307,051 |

| Alimentation Couche-Tard, Inc. | 22,140 | 991,331 |

| Altus Group Ltd. | 63,849 | 2,268,822 |

| Aritzia, Inc. * | 112,649 | 4,369,195 |

| ATS Automation Tooling Systems, Inc. * | 55,169 | 1,745,355 |

| Barrick Gold Corp. | 28,686 | 431,443 |

| BCE, Inc. | 4,500 | 202,977 |

| Boralex, Inc., Class A | 164,696 | 4,670,024 |

| Brookfield Infrastructure Corp., Class A | 85,733 | 3,696,807 |

| Canadian National Railway Co. | 16,308 | 1,932,037 |

| Canadian Natural Resources Ltd. | 31,870 | 1,911,475 |

| Canadian Tire Corp., Ltd., Class A | 896 | 100,422 |

| Canadian Utilities Ltd., Class A | 1,907 | 50,742 |

| Capstone Copper Corp. * | 616,286 | 1,429,489 |

| Cenovus Energy, Inc. | 24,001 | 485,182 |

| CGI, Inc. * | 4,216 | 339,607 |

| Colliers International Group, Inc. | 10,680 | 1,002,345 |

| Constellation Software, Inc. | 347 | 501,745 |

| Dollarama, Inc. | 7,439 | 442,021 |

| Fairfax Financial Holdings Ltd. | 774 | 380,134 |

| Finning International, Inc. | 110,195 | 2,343,267 |

| Franco-Nevada Corp. | 4,108 | 507,579 |

| George Weston Ltd. | 1,037 | 114,140 |

| Hydro One Ltd. | 4,658 | 116,796 |

| IGM Financial, Inc. | 3,571 | 95,595 |

| Imperial Oil Ltd. | 6,079 | 330,689 |

| Innergex Renewable Energy, Inc. | 269,008 | 2,961,882 |

| Kinaxis, Inc. * | 29,669 | 3,166,711 |

| Loblaw Cos., Ltd. | 2,552 | 209,090 |

| Magna International, Inc. | 6,614 | 368,580 |

| Metro, Inc. | 4,497 | 235,586 |

| Mullen Group Ltd. | 278,294 | 2,796,524 |

| Open Text Corp. | 110,851 | 3,210,761 |

| Pason Systems, Inc. | 274,123 | 2,911,557 |

| Restaurant Brands International, Inc. | 17,612 | 1,045,801 |

| Ritchie Bros. Auctioneers, Inc. | 23,004 | 1,502,812 |

| Saputo, Inc. | 3,298 | 80,274 |

| Shaw Communications, Inc., Class B | 7,845 | 201,488 |

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| Shopify, Inc., Class A * | 24,920 | 853,012 |

| SNC-Lavalin Group, Inc. | 83,551 | 1,446,741 |

| Spin Master Corp. | 71,955 | 2,223,588 |

| Stantec, Inc. | 81,308 | 3,978,413 |

| Suncor Energy, Inc. | 35,306 | 1,214,401 |

| SunOpta, Inc. * | 162,415 | 1,823,920 |

| The Descartes Systems Group, Inc. * | 36,522 | 2,519,960 |

| Thomson Reuters Corp. | 11,771 | 1,251,881 |

| Tourmaline Oil Corp. | 7,800 | 439,482 |

| Vermilion Energy, Inc. | 87,184 | 2,034,411 |

| Waste Connections, Inc. | 4,754 | 627,458 |

| Wheaton Precious Metals Corp. | 9,607 | 314,298 |

| Whitecap Resources, Inc. | 296,211 | 2,296,024 |

| | | 70,480,925 |

| |

| China 1.5% |

| Alibaba Group Holding Ltd. * | 588,020 | 4,571,801 |

| Kerry Properties Ltd. | 14,000 | 22,147 |

| Meituan, B Shares * | 230,700 | 3,693,630 |

| NIO, Inc., ADR * | 68,321 | 660,664 |

| Tencent Holdings Ltd. | 85,900 | 2,257,175 |

| Tongcheng Travel Holdings Ltd. * | 1,225,200 | 1,912,449 |

| Vipshop Holdings Ltd., ADR * | 237,423 | 1,654,838 |

| | | 14,772,704 |

| |

| Denmark 2.1% |

| ALK-Abello A/S * | 123,063 | 2,034,707 |

| AP Moller - Maersk A/S, Class A | 97 | 194,066 |

| AP Moller - Maersk A/S, Class B | 174 | 363,516 |

| Carlsberg A/S, Class B | 2,059 | 242,438 |

| Coloplast A/S, Class B | 4,126 | 459,926 |

| Danske Bank A/S | 1,958 | 31,585 |

| Demant A/S * | 2,377 | 64,909 |

| DSV A/S | 17,700 | 2,391,770 |

| Genmab A/S * | 8,321 | 3,205,312 |

| GN Store Nord A/S | 2,625 | 55,785 |

| H Lundbeck A/S | 3,243 | 12,134 |

| Jyske Bank A/S * | 59,817 | 3,228,273 |

| NKT A/S * | 42,084 | 2,100,294 |

| Novo Nordisk A/S, Class B | 48,276 | 5,249,110 |

| Novozymes A/S, B Shares | 4,744 | 249,015 |

| Orsted A/S | 4,786 | 394,873 |

| Pandora A/S | 3,026 | 159,178 |

| Rockwool A/S, Class B | 191 | 38,038 |

| Royal Unibrew A/S | 1,190 | 67,978 |

| SimCorp A/S | 1,241 | 74,101 |

| Vestas Wind Systems A/S | 18,628 | 367,226 |

| | | 20,984,234 |

| |

| Finland 0.8% |

| Elisa Oyj | 3,750 | 181,224 |

| Fortum Oyj | 7,829 | 110,187 |

| Huhtamaki Oyj | 81,309 | 2,922,194 |

| Kesko Oyj, B Shares | 6,516 | 126,806 |

| Kojamo Oyj | 6,668 | 86,781 |

| Kone Oyj, B Shares | 12,208 | 499,866 |

| Metso Outotec Oyj | 270,251 | 2,050,960 |

| Neste Oyj | 12,942 | 567,228 |

| Orion Oyj, B Shares | 3,112 | 143,209 |

| Stora Enso Oyj, R Shares | 8,347 | 108,835 |

| UPM-Kymmene Oyj | 24,800 | 833,712 |

| Valmet Oyj | 5,006 | 113,853 |

| Wartsila Oyj Abp | 12,174 | 82,993 |

| | | 7,827,848 |

| |

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

Portfolio Holdings as of October 31, 2022 (continued)

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| France 7.5% |

| Accor S.A. * | 186,132 | 4,459,992 |

| Aeroports de Paris * | 237 | 32,050 |

| Airbus SE | 9,375 | 1,014,410 |

| Alstom S.A. | 3,861 | 79,464 |

| Alten S.A. | 10,974 | 1,282,095 |

| Amundi S.A. | 1,625 | 76,667 |

| ArcelorMittal S.A. | 16,620 | 371,518 |

| Arkema S.A. | 1,209 | 95,678 |

| BioMerieux | 1,158 | 102,458 |

| BNP Paribas S.A. | 153,103 | 7,179,593 |

| Bollore SE | 10,455 | 52,291 |

| Bouygues S.A. | 3,961 | 113,012 |

| Bureau Veritas S.A. | 4,262 | 105,443 |

| Capgemini SE | 14,500 | 2,376,415 |

| Carrefour S.A. | 9,147 | 147,225 |

| Cie de Saint-Gobain | 8,596 | 351,412 |

| Cie Generale des Etablissements Michelin S.C.A. | 11,920 | 303,770 |

| Covivio | 409 | 21,898 |

| Danone S.A. | 48,500 | 2,410,425 |

| Dassault Aviation S.A. | 731 | 108,567 |

| Dassault Systemes SE | 10,636 | 356,506 |

| Edenred | 40,700 | 2,086,533 |

| Eiffage S.A. | 1,160 | 104,889 |

| Electricite de France S.A. | 10,768 | 127,170 |

| Elis S.A. | 192,012 | 2,198,903 |

| Eurazeo SE | 3,431 | 195,791 |

| Euroapi S.A. * | 1,101 | 19,266 |

| Faurecia SE * | 1,418 | 21,169 |

| Gaztransport Et Technigaz S.A. | 32,351 | 3,763,667 |

| Gecina S.A. | 598 | 53,314 |

| Hermes International | 2,876 | 3,722,651 |

| Ipsen S.A. | 973 | 99,993 |

| JCDecaux SE * | 910 | 11,489 |

| Kering S.A. | 18,034 | 8,258,866 |

| Klepierre S.A. * | 1,026 | 20,621 |

| Korian S.A. | 170,088 | 1,607,134 |

| La Francaise des Jeux SAEM | 2,604 | 84,861 |

| L'Oreal S.A. | 11,442 | 3,592,836 |

| LVMH Moet Hennessy Louis Vuitton SE | 5,201 | 3,281,803 |

| Neoen S.A. | 348 | 12,138 |

| OVH Groupe SAS * | 131,652 | 1,709,471 |

| Publicis Groupe S.A. | 69,970 | 3,918,626 |

| Remy Cointreau S.A. | 514 | 78,610 |

| Rexel S.A. * | 3,054 | 54,500 |

| Rubis S.C.A. | 113,834 | 2,585,094 |

| Sartorius Stedim Biotech | 763 | 242,130 |

| SCOR SE | 832 | 12,512 |

| SEB S.A. | 493 | 32,095 |

| SOITEC * | 397 | 50,834 |

| Somfy S.A. | 261 | 27,803 |

| STMicroelectronics N.V. | 17,707 | 550,580 |

| Teleperformance | 912 | 244,352 |

| TotalEnergies SE | 48,641 | 2,653,530 |

| UbiSoft Entertainment S.A. * | 1,146 | 31,442 |

| Valeo S.A. | 188,509 | 3,105,304 |

| Verallia S.A. | 96,596 | 2,737,038 |

| Vivendi SE | 17,223 | 140,970 |

| Wendel SE | 1,481 | 115,965 |

| Worldline S.A. * | 115,500 | 5,041,165 |

| | | 73,636,004 |

| |

| Germany 8.7% |

| 1&1 AG | 773 | 10,183 |

| adidas AG | 42,378 | 4,136,731 |

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| AIXTRON SE | 67,573 | 1,660,514 |

| Allianz SE | 33,770 | 6,075,372 |

| Aroundtown S.A. | 4,419 | 8,760 |

| BASF SE | 18,013 | 808,255 |

| Bayer AG | 100,723 | 5,296,119 |

| Bayerische Motoren Werke AG | 77,400 | 6,075,270 |

| Bechtle AG | 822 | 28,397 |

| Beiersdorf AG | 2,878 | 276,274 |

| Carl Zeiss Meditec AG, Class B | 1,039 | 125,764 |

| Commerzbank AG * | 3,187 | 25,463 |

| Continental AG | 102,156 | 5,291,238 |

| Covestro AG | 4,906 | 166,539 |

| CTS Eventim AG & Co., KGaA * | 1,850 | 88,313 |

| Daimler Truck Holding AG * | 160,431 | 4,279,108 |

| Delivery Hero SE * | 104,077 | 3,425,058 |

| Dermapharm Holding SE | 55,654 | 2,115,986 |

| Deutsche Lufthansa AG * | 3,093 | 21,147 |

| Deutsche Post AG | 21,092 | 745,598 |

| Duerr AG | 88,882 | 2,349,393 |

| DWS Group GmbH & Co. KGaA | 1,832 | 49,531 |

| Eckert & Ziegler Strahlen- und Medizintechnik AG | 26,437 | 1,045,153 |

| Evonik Industries AG | 3,504 | 64,550 |

| Evotec SE * | 1,124 | 21,438 |

| Fielmann AG | 65,601 | 2,089,819 |

| Fraport AG Frankfurt Airport Services Worldwide * | 403 | 15,526 |

| Fresenius Medical Care AG & Co. KGaA | 66,300 | 1,833,896 |

| Fresenius SE & Co. KGaA | 201,300 | 4,632,545 |

| Friedrich Vorwerk Group SE | 65,404 | 1,266,517 |

| FUCHS PETROLUB SE | 1,104 | 26,618 |

| GEA Group AG | 4,907 | 171,521 |

| Gerresheimer AG | 29,140 | 1,669,390 |

| HeidelbergCement AG | 2,296 | 105,586 |

| HelloFresh SE * | 5,495 | 109,840 |

| Henkel AG & Co. KGaA | 56,747 | 3,331,338 |

| Infineon Technologies AG | 23,234 | 563,784 |

| KION Group AG | 1,140 | 25,274 |

| Knorr-Bremse AG | 1,184 | 53,305 |

| LANXESS AG | 441 | 14,914 |

| LEG Immobilien SE | 2,288 | 149,372 |

| Mercedes-Benz Group AG | 113,894 | 6,592,361 |

| Merck KGaA | 2,100 | 342,226 |

| METRO AG * | 1,999 | 15,249 |

| MTU Aero Engines AG | 961 | 171,979 |

| Nemetschek SE | 1,468 | 69,990 |

| Norma Group SE | 105,071 | 1,665,652 |

| Novem Group S.A. | 182,905 | 1,141,699 |

| Puma SE | 1,683 | 74,407 |

| QIAGEN N.V. * | 4,679 | 202,054 |

| Rational AG | 155 | 87,374 |

| Rheinmetall AG | 877 | 142,558 |

| RTL Group S.A. * | 1,152 | 39,106 |

| RWE AG | 15,297 | 588,860 |

| SAP SE | 47,900 | 4,610,507 |

| Sartorius AG | 28 | 8,254 |

| Scout24 SE | 2,137 | 109,510 |

| Siemens AG | 37,500 | 4,095,336 |

| Siemens Energy AG (a) | 9,077 | 105,816 |

| Sixt SE | 149 | 13,975 |

| Telefonica Deutschland Holding AG | 19,382 | 42,231 |

| ThyssenKrupp AG * | 476,177 | 2,506,562 |

| United Internet AG | 1,725 | 32,246 |

| Vantage Towers AG | 1,813 | 50,990 |

| Varta AG | 331 | 8,870 |

| Volkswagen AG | 380 | 64,954 |

| Wacker Chemie AG | 401 | 46,687 |

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

Portfolio Holdings as of October 31, 2022 (continued)

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| Zalando SE * | 83,819 | 1,931,874 |

| | | 85,010,726 |

| |

| Hong Kong 1.4% |

| ASMPT Ltd. | 217,000 | 1,193,609 |

| BOC Aviation Ltd. | 2,600 | 17,399 |

| Budweiser Brewing Co. APAC Ltd. | 54,100 | 113,866 |

| Cafe de Coral Holdings Ltd. | 1,496,000 | 1,745,889 |

| Chow Tai Fook Jewellery Group Ltd. | 52,600 | 90,055 |

| CK Asset Holdings Ltd. | 33,500 | 185,207 |

| CK Infrastructure Holdings Ltd. | 9,000 | 42,757 |

| CLP Holdings Ltd. | 32,000 | 214,778 |

| ESR Group Ltd. | 35,800 | 61,052 |

| First Pacific Co., Ltd. | 44,000 | 11,651 |

| Hang Lung Properties Ltd. | 14,000 | 17,611 |

| Henderson Land Development Co., Ltd. | 14,000 | 34,276 |

| HKBN Ltd. | 2,162,983 | 1,460,867 |

| Hong Kong & China Gas Co., Ltd. | 205,000 | 158,008 |

| Hongkong Land Holdings Ltd. | 2,700 | 10,395 |

| Hysan Development Co., Ltd. | 4,000 | 8,718 |

| JS Global Lifestyle Co., Ltd. | 34,500 | 27,790 |

| Kerry Logistics Network Ltd. | 9,500 | 15,080 |

| Lenovo Group Ltd. | 164,000 | 131,070 |

| L'Occitane International S.A. | 9,750 | 23,938 |

| Man Wah Holdings Ltd. | 46,000 | 25,667 |

| MTR Corp., Ltd. | 22,500 | 99,004 |

| New World Development Co., Ltd. | 6,000 | 12,273 |

| Nexteer Automotive Group Ltd. | 26,000 | 14,072 |

| NWS Holdings Ltd. | 16,000 | 11,346 |

| Orient Overseas International Ltd. | 4,500 | 65,759 |

| PCCW Ltd. | 63,000 | 24,069 |

| Power Assets Holdings Ltd. | 42,500 | 203,216 |

| Prada S.p.A. | 13,800 | 62,871 |

| Samsonite International S.A. * | 1,430,400 | 3,073,138 |

| Sands China Ltd. * | 29,200 | 51,048 |

| Sino Land Co., Ltd. | 80,000 | 85,425 |

| SITC International Holdings Co., Ltd. | 40,000 | 65,512 |

| SUNeVision Holdings Ltd. | 4,022,000 | 2,130,708 |

| Swire Pacific Ltd., A Shares | 6,500 | 43,118 |

| Swire Pacific Ltd., B Shares | 12,500 | 12,881 |

| Swire Properties Ltd. | 10,000 | 19,219 |

| The Bank of East Asia Ltd. | 10,452 | 10,017 |

| The Wharf Holdings Ltd. | 13,000 | 37,225 |

| United Energy Group Ltd. | 238,000 | 23,025 |

| Vitasoy International Holdings Ltd. * | 8,000 | 13,661 |

| VTech Holdings Ltd. | 3,700 | 19,696 |

| Want Want China Holdings Ltd. | 88,000 | 57,806 |

| WH Group Ltd. | 202,500 | 102,265 |

| Wynn Macau Ltd. * | 19,600 | 7,814 |

| Xinyi Glass Holdings Ltd. | 67,000 | 86,105 |

| Yue Yuen Industrial Holdings Ltd. | 1,365,000 | 1,387,722 |

| | | 13,308,678 |

| |

| India 2.2% |

| Axis Bank Ltd. | 100,532 | 1,102,482 |

| Max Healthcare Institute Ltd. * | 880,782 | 4,855,388 |

| Persistent Systems Ltd. | 51,067 | 2,278,656 |

| Prestige Estates Projects Ltd. | 450,067 | 2,407,258 |

| PVR Ltd. * | 90,767 | 1,948,844 |

| Varun Beverages Ltd. | 242,364 | 3,075,322 |

| WNS Holdings Ltd., ADR * | 69,701 | 5,999,862 |

| | | 21,667,812 |

| |

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| Ireland 0.7% |

| Bank of Ireland Group plc | 3,798 | 27,348 |

| Glanbia plc | 177,701 | 2,052,316 |

| Kingspan Group plc | 2,088 | 105,270 |

| Ryanair Holdings plc ADR * | 59,021 | 4,065,957 |

| Smurfit Kappa Group plc | 4,175 | 137,703 |

| | | 6,388,594 |

| |

| Israel 1.1% |

| Airport City Ltd. * | 2,114 | 35,002 |

| Alony Hetz Properties & Investments Ltd. | 2,017 | 23,658 |

| Amot Investments Ltd. | 361,370 | 2,186,004 |

| Ashtrom Group Ltd. | 709 | 15,431 |

| Azrieli Group Ltd. | 946 | 70,085 |

| Bezeq The Israeli Telecommunication Corp., Ltd. | 46,009 | 81,447 |

| Big Shopping Centers Ltd. | 255 | 28,593 |

| CyberArk Software Ltd. * | 14,837 | 2,328,074 |

| Delek Group Ltd. * | 220 | 33,497 |

| Elbit Systems Ltd. | 472 | 95,502 |

| Energix-Renewable Energies Ltd. | 2,550 | 8,902 |

| Enlight Renewable Energy Ltd. * | 13,145 | 26,622 |

| Fattal Holdings 1998 Ltd. * | 113 | 11,478 |

| Fox Wizel Ltd. | 162 | 19,749 |

| ICL Group Ltd. | 21,359 | 192,607 |

| Inmode Ltd. * | 104,094 | 3,572,506 |

| Israel Corp., Ltd. | 91 | 39,390 |

| Kenon Holdings Ltd. | 331 | 12,681 |

| Maytronics Ltd. | 1,166 | 12,572 |

| Melisron Ltd. | 403 | 29,900 |

| Mivne Real Estate KD Ltd. | 15,049 | 46,788 |

| Mizrahi Tefahot Bank Ltd. | 879 | 33,228 |

| Nice Ltd. * | 1,806 | 340,375 |

| Nova Ltd. *(b) | 395 | 28,909 |

| Nova Ltd. *(b) | 18,373 | 1,354,274 |

| Paz Oil Co., Ltd. * | 324 | 38,706 |

| Sapiens International Corp. N.V. | 798 | 15,679 |

| Shikun & Binui Ltd. * | 3,109 | 12,343 |

| Shufersal Ltd. | 3,051 | 20,828 |

| Strauss Group Ltd. | 1,082 | 27,069 |

| Teva Pharmaceutical Industries Ltd. * | 17,615 | 157,494 |

| The First International Bank of Israel Ltd. | 392 | 16,927 |

| The Phoenix Holdings Ltd. | 1,294 | 14,017 |

| Tower Semiconductor Ltd. * | 2,532 | 108,207 |

| | | 11,038,544 |

| |

| Italy 1.9% |

| A2A S.p.A. | 36,704 | 40,699 |

| Amplifon S.p.A. | 1,673 | 41,564 |

| Brembo S.p.A. | 126,067 | 1,317,953 |

| Buzzi Unicem S.p.A. | 1,722 | 28,580 |

| Davide Campari-Milano N.V. | 9,828 | 88,259 |

| De'Longhi S.p.A. | 1,841 | 31,764 |

| DiaSorin S.p.A. | 106 | 13,858 |

| Enel S.p.A. | 142,649 | 637,263 |

| Eni S.p.A. | 50,420 | 662,202 |

| Esprinet S.p.A. | 184,393 | 1,228,302 |

| Ferrari N.V. | 20,906 | 4,121,373 |

| FinecoBank Banca Fineco S.p.A. | 3,350 | 45,143 |

| Hera S.p.A. | 18,461 | 43,987 |

| Infrastrutture Wireless Italiane S.p.A. | 4,835 | 42,674 |

| Intercos S.p.A. * | 125,917 | 1,253,085 |

| Interpump Group S.p.A. | 1,272 | 49,246 |

| Intesa Sanpaolo S.p.A. | 3,729,400 | 7,110,203 |

| Italgas S.p.A. | 9,579 | 49,353 |

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

Portfolio Holdings as of October 31, 2022 (continued)

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| Leonardo S.p.A. | 183,497 | 1,474,232 |

| Mediobanca Banca di Credito Finanziario S.p.A. | 3,586 | 32,488 |

| Moncler S.p.A. | 4,031 | 173,914 |

| Pirelli & C S.p.A. | 6,102 | 23,017 |

| Poste Italiane S.p.A. | 1,941 | 16,914 |

| Prysmian S.p.A. | 4,165 | 135,563 |

| Recordati Industria Chimica e Farmaceutica S.p.A. | 2,513 | 94,417 |

| Reply S.p.A. | 568 | 61,783 |

| Telecom Italia S.p.A. * | 78,920 | 15,440 |

| Tenaris S.A. | 7,737 | 121,093 |

| | | 18,954,369 |

| |

| Japan 13.7% |

| ABC-Mart, Inc. | 800 | 35,658 |

| Acom Co., Ltd. | 14,100 | 30,804 |

| Activia Properties, Inc. | 6 | 17,772 |

| Advance Residence Investment Corp. | 14 | 32,594 |

| Advantest Corp. | 5,200 | 273,736 |

| AEON REIT Investment Corp. | 17 | 18,303 |

| AGC, Inc. | 3,900 | 122,206 |

| Aica Kogyo Co., Ltd. | 1,300 | 27,940 |

| Ain Holdings, Inc. | 700 | 29,407 |

| Air Water, Inc. | 2,900 | 32,378 |

| Aisin Corp. | 2,200 | 56,473 |

| Alfresa Holdings Corp. | 2,900 | 33,387 |

| Amada Co., Ltd. | 9,800 | 68,929 |

| Amano Corp. | 2,000 | 34,225 |

| ANA Holdings, Inc. * | 1,900 | 36,934 |

| Anritsu Corp. | 3,900 | 39,253 |

| Aozora Bank Ltd. | 800 | 13,761 |

| Ariake Japan Co., Ltd. | 400 | 13,858 |

| As One Corp. | 500 | 21,321 |

| Asahi Intecc Co., Ltd. | 2,400 | 40,884 |

| Asahi Kasei Corp. | 20,700 | 132,727 |

| Asics Corp. | 182,900 | 2,802,710 |

| ASKUL Corp. | 1,100 | 11,488 |

| Astellas Pharma, Inc. | 31,900 | 440,162 |

| Azbil Corp. | 3,700 | 100,550 |

| Bandai Namco Holdings, Inc. | 6,300 | 416,448 |

| BayCurrent Consulting, Inc. | 222,000 | 6,228,693 |

| Benefit One, Inc. | 1,600 | 22,135 |

| Benesse Holdings, Inc. | 900 | 13,277 |

| Bic Camera, Inc. | 1,500 | 11,662 |

| BIPROGY, Inc. | 800 | 17,281 |

| Brother Industries Ltd. | 4,000 | 68,144 |

| Calbee, Inc. | 1,600 | 32,139 |

| Canon Marketing Japan, Inc. | 800 | 16,882 |

| Canon, Inc. | 18,200 | 385,794 |

| Capcom Co., Ltd. | 6,000 | 166,890 |

| Casio Computer Co., Ltd. | 4,200 | 36,505 |

| Chugai Pharmaceutical Co., Ltd. | 16,100 | 373,067 |

| COMSYS Holdings Corp. | 1,500 | 24,574 |

| Comture Corp. | 166,500 | 2,708,983 |

| Concordia Financial Group Ltd. | 6,200 | 18,918 |

| Cosmo Energy Holdings Co., Ltd. | 1,200 | 30,911 |

| Cosmos Pharmaceutical Corp. | 300 | 29,014 |

| Credit Saison Co., Ltd. | 900 | 9,620 |

| CyberAgent, Inc. | 9,600 | 78,866 |

| Dai Nippon Printing Co., Ltd. | 5,600 | 112,172 |

| Daicel Corp. | 4,500 | 25,676 |

| Daido Steel Co., Ltd. | 500 | 12,964 |

| Daifuku Co., Ltd. | 2,942 | 134,670 |

| Daiichikosho Co., Ltd. | 800 | 22,938 |

| Daikin Industries Ltd. | 4,700 | 704,000 |

| Daio Paper Corp. | 1,000 | 7,378 |

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| Daito Trust Construction Co., Ltd. | 1,900 | 188,145 |

| Daiwa Office Investment Corp. | 2 | 9,449 |

| Daiwa Securities Group, Inc. | 8,900 | 34,725 |

| Daiwa Securities Living Investments Corp. | 18 | 13,972 |

| Dena Co., Ltd. | 900 | 11,738 |

| Denka Co., Ltd. | 1,600 | 37,066 |

| Dentsu Group, Inc. | 3,500 | 108,862 |

| Descente Ltd. | 1,300 | 31,201 |

| DIC Corp. | 700 | 11,753 |

| Digital Arts, Inc. | 56,900 | 2,391,167 |

| Disco Corp. | 800 | 191,344 |

| DMG Mori Co., Ltd. | 1,700 | 19,673 |

| Dowa Holdings Co., Ltd. | 1,400 | 44,453 |

| Ebara Corp. | 2,300 | 74,732 |

| Eisai Co., Ltd. | 5,200 | 313,576 |

| Electric Power Development Co., Ltd. | 2,900 | 40,332 |

| ENEOS Holdings, Inc. | 68,700 | 226,618 |

| en-japan, Inc. | 120,100 | 2,086,251 |

| Exeo Group, Inc. | 1,599 | 23,428 |

| Ezaki Glico Co., Ltd. | 800 | 17,998 |

| Fancl Corp. | 1,900 | 35,996 |

| FANUC Corp. | 6,000 | 785,110 |

| Fast Retailing Co., Ltd. | 1,200 | 668,569 |

| Food & Life Cos., Ltd. | 1,600 | 26,914 |

| FP Corp. | 700 | 16,653 |

| Frontier Real Estate Investment Corp. | 6 | 21,183 |

| Fuji Electric Co., Ltd. | 2,100 | 81,196 |

| Fujitsu Ltd. | 8,400 | 966,492 |

| Fukuoka Financial Group, Inc. | 900 | 15,314 |

| GMO Financial Gate, Inc. | 17,400 | 1,623,686 |

| GMO Payment Gateway, Inc. | 300 | 21,572 |

| Goldwin, Inc. | 1,100 | 57,446 |

| GS Yuasa Corp. | 800 | 12,179 |

| GungHo Online Entertainment, Inc. | 1,000 | 14,781 |

| H.U. Group Holdings, Inc. | 800 | 14,892 |

| Hakuhodo DY Holdings, Inc. | 1,300 | 10,953 |

| Hamamatsu Photonics K.K. | 4,000 | 180,965 |

| Hankyu Hanshin Holdings, Inc. | 2,900 | 86,132 |

| Haseko Corp. | 4,400 | 45,312 |

| Heiwa Corp. | 900 | 14,520 |

| Hikari Tsushin, Inc. | 200 | 24,159 |

| Hino Motors Ltd. * | 4,700 | 19,532 |

| Hirose Electric Co., Ltd. | 700 | 90,805 |

| Hisamitsu Pharmaceutical Co., Inc. | 1,400 | 34,540 |

| Hitachi Construction Machinery Co., Ltd. | 1,500 | 29,346 |

| Hitachi Metals Ltd. * | 500 | 7,302 |

| Hitachi Transport System Ltd. * | 600 | 35,908 |

| Horiba Ltd. | 900 | 36,925 |

| Hoshizaki Corp. | 3,500 | 100,275 |

| House Foods Group, Inc. | 1,200 | 22,443 |

| Hoya Corp. | 9,200 | 855,244 |

| Hulic Co., Ltd. | 4,100 | 29,784 |

| Ibiden Co., Ltd. | 1,800 | 60,673 |

| Idemitsu Kosan Co., Ltd. | 6,600 | 144,410 |

| IHI Corp. | 89,000 | 1,985,057 |

| Iida Group Holdings Co., Ltd. | 900 | 12,497 |

| Industrial & Infrastructure Fund Investment Corp. | 23 | 24,291 |

| Infomart Corp. | 365,100 | 1,181,107 |

| Information Services International-Dentsu Ltd. | 500 | 15,292 |

| Inpex Corp. | 23,100 | 233,134 |

| Insource Co., Ltd. | 136,000 | 2,746,177 |

| Internet Initiative Japan, Inc. | 167,000 | 2,621,304 |

| Invincible Investment Corp. | 14,615 | 4,587,844 |

| Isetan Mitsukoshi Holdings Ltd. | 1,500 | 13,323 |

| Isuzu Motors Ltd. | 7,900 | 92,901 |

| ITOCHU Corp. | 24,200 | 625,438 |

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

Portfolio Holdings as of October 31, 2022 (continued)

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| Itochu Techno-Solutions Corp. | 1,800 | 41,731 |

| Iwatani Corp. | 834 | 30,709 |

| Izumi Co., Ltd. | 500 | 10,087 |

| J. Front Retailing Co., Ltd. | 2,500 | 20,208 |

| Japan Airlines Co., Ltd. * | 1,500 | 28,017 |

| Japan Airport Terminal Co., Ltd. * | 39,300 | 1,682,075 |

| Japan Aviation Electronics Industry Ltd. | 900 | 14,008 |

| Japan Logistics Fund, Inc. | 9 | 19,282 |

| Japan Post Bank Co., Ltd. | 2,200 | 14,659 |

| Japan Post Insurance Co., Ltd. | 1,100 | 16,283 |

| Japan Prime Realty Investment Corp. | 10 | 27,158 |

| Japan Tobacco, Inc. | 19,500 | 326,575 |

| JCR Pharmaceuticals Co., Ltd. | 900 | 13,376 |

| JEOL Ltd. | 37,500 | 1,372,244 |

| JFE Holdings, Inc. | 10,200 | 93,443 |

| JGC Holdings Corp. | 3,300 | 39,691 |

| JMDC, Inc. | 60,500 | 2,142,576 |

| JSR Corp. | 600 | 11,401 |

| JTEKT Corp. | 3,600 | 25,415 |

| Justsystems Corp. | 800 | 16,826 |

| Kadokawa Corp. | 1,400 | 25,066 |

| Kagome Co., Ltd. | 600 | 11,992 |

| Kajima Corp. | 4,800 | 45,183 |

| Kakaku.com, Inc. | 3,500 | 59,195 |

| Kaken Pharmaceutical Co., Ltd. | 506 | 12,951 |

| Kamigumi Co., Ltd. | 2,700 | 51,345 |

| Kandenko Co., Ltd. | 2,600 | 14,614 |

| Kaneka Corp. | 1,100 | 27,277 |

| Kansai Paint Co., Ltd. | 2,400 | 31,318 |

| Kawasaki Heavy Industries Ltd. | 2,200 | 37,416 |

| Kawasaki Kisen Kaisha Ltd. | 3,600 | 54,588 |

| KDDI Corp. | 47,100 | 1,392,133 |

| Keihan Holdings Co., Ltd. | 1,100 | 28,299 |

| Keikyu Corp. | 3,500 | 35,928 |

| Keio Corp. | 1,100 | 38,567 |

| Keisei Electric Railway Co., Ltd. | 1,500 | 39,813 |

| Kenedix Office Investment Corp. | 6 | 13,668 |

| Kewpie Corp. | 2,000 | 31,575 |

| Keyence Corp. | 6,200 | 2,337,803 |

| Kikkoman Corp. | 4,300 | 233,017 |

| Kinden Corp. | 3,700 | 37,649 |

| Kobayashi Pharmaceutical Co., Ltd. | 1,200 | 63,680 |

| Kobe Bussan Co., Ltd. | 1,500 | 32,536 |

| Kobe Steel Ltd. | 6,100 | 25,015 |

| Koei Tecmo Holdings Co., Ltd. | 4,000 | 60,356 |

| Koito Manufacturing Co., Ltd. | 6,400 | 90,860 |

| Kokuyo Co., Ltd. | 2,600 | 32,249 |

| Komatsu Ltd. | 126,100 | 2,470,323 |

| Konami Group Corp. | 3,000 | 131,494 |

| Kose Corp. | 700 | 69,874 |

| Kotobuki Spirits Co., Ltd. | 600 | 30,758 |

| K's Holdings Corp. | 2,600 | 20,375 |

| Kuraray Co., Ltd. | 5,000 | 34,383 |

| Kurita Water Industries Ltd. | 1,900 | 69,549 |

| Kyocera Corp. | 5,200 | 251,817 |

| Kyowa Kirin Co., Ltd. | 4,900 | 115,403 |

| Kyudenko Corp. | 154,700 | 3,281,251 |

| Kyushu Electric Power Co., Inc. | 5,700 | 28,221 |

| Kyushu Railway Co. | 2,400 | 50,193 |

| LaSalle Logiport REIT | 18 | 19,212 |

| Lawson, Inc. | 400 | 12,779 |

| Lintec Corp. | 1,400 | 21,005 |

| Lion Corp. | 4,700 | 47,501 |

| Lixil Corp. | 3,700 | 55,890 |

| M3, Inc. | 98,700 | 2,941,277 |

| Mabuchi Motor Co., Ltd. | 1,400 | 37,988 |

| Mani, Inc. | 1,200 | 17,481 |

| Marubeni Corp. | 24,600 | 215,346 |

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| Marui Group Co., Ltd. | 2,200 | 35,993 |

| Maruichi Steel Tube Ltd. | 1,800 | 33,976 |

| MatsukiyoCocokara & Co. | 120,600 | 4,390,882 |

| Mazda Motor Corp. | 10,300 | 69,350 |

| Medipal Holdings Corp. | 3,100 | 38,434 |

| Meidensha Corp. | 204,000 | 2,714,076 |

| MEIJI Holdings Co., Ltd. | 1,900 | 78,183 |

| Menicon Co., Ltd. | 100,900 | 1,722,762 |

| Milbon Co., Ltd. | 19,500 | 804,058 |

| MINEBEA MITSUMI, Inc. | 5,800 | 85,715 |

| MISUMI Group, Inc. | 8,700 | 185,305 |

| Mitsubishi Chemical Group Corp. | 21,300 | 96,220 |

| Mitsubishi Electric Corp. | 50,400 | 443,450 |

| Mitsubishi Gas Chemical Co., Inc. | 4,300 | 54,641 |

| Mitsubishi HC Capital, Inc. | 6,300 | 27,034 |

| Mitsubishi Logistics Corp. | 1,100 | 24,138 |

| Mitsubishi Materials Corp. | 1,900 | 24,834 |

| Mitsubishi Motors Corp. * | 16,100 | 54,237 |

| Mitsui & Co., Ltd. | 30,800 | 681,579 |

| Mitsui Chemicals, Inc. | 2,700 | 49,974 |

| Mitsui Fudosan Logistics Park, Inc. | 5 | 16,589 |

| Mitsui High-Tec, Inc. | 200 | 10,338 |

| Mitsui Mining & Smelting Co., Ltd. | 1,300 | 26,257 |

| Mitsui O.S.K. Lines Ltd. | 5,800 | 114,812 |

| Miura Co., Ltd. | 2,900 | 59,060 |

| MonotaRO Co., Ltd. | 7,100 | 107,777 |

| Mori Hills Reit Investment Corp. | 14 | 15,335 |

| Morinaga & Co., Ltd. | 1,000 | 25,012 |

| m-up Holdings, Inc. | 229,300 | 2,420,187 |

| Murata Manufacturing Co., Ltd. | 9,800 | 463,926 |

| Musashi Seimitsu Industry Co., Ltd. | 131,800 | 1,521,134 |

| Nabtesco Corp. | 3,400 | 72,217 |

| Nagoya Railroad Co., Ltd. | 115,400 | 1,767,814 |

| Nankai Electric Railway Co., Ltd. | 1,200 | 24,275 |

| NEC Networks & System Integration Corp. | 1,900 | 20,360 |

| Nexon Co., Ltd. | 12,300 | 205,831 |

| Nextage Co., Ltd. | 123,600 | 2,382,329 |

| NGK Insulators Ltd. | 4,900 | 57,164 |

| NGK Spark Plug Co., Ltd. | 4,000 | 72,976 |

| NHK Spring Co., Ltd. | 3,800 | 21,052 |

| Nichirei Corp. | 900 | 13,997 |

| Nifco, Inc. | 93,200 | 2,164,518 |

| Nihon Kohden Corp. | 1,200 | 26,871 |

| Nihon M&A Center Holdings, Inc. | 19,900 | 224,548 |

| Nikon Corp. | 5,100 | 49,323 |

| Nintendo Co., Ltd. | 32,700 | 1,327,590 |

| Nippon Accommodations Fund, Inc. | 4 | 17,033 |

| Nippon Electric Glass Co., Ltd. | 2,000 | 34,631 |

| Nippon Express Holdings, Inc. | 1,200 | 60,298 |

| Nippon Gas Co., Ltd. | 235,000 | 3,413,845 |

| Nippon Kayaku Co., Ltd. | 5,000 | 39,716 |

| Nippon Sanso Holdings Corp. | 2,100 | 33,435 |

| Nippon Shinyaku Co., Ltd. | 1,000 | 55,366 |

| Nippon Shokubai Co., Ltd. | 900 | 32,284 |

| Nippon Steel Corp. | 19,000 | 260,652 |

| Nippon Yusen K.K. | 10,800 | 195,636 |

| Nishi-Nippon Railroad Co., Ltd. | 1,300 | 25,498 |

| Nissan Chemical Corp. | 4,314 | 194,196 |

| Nisshin Seifun Group, Inc. | 2,400 | 25,934 |

| Nissin Foods Holdings Co., Ltd. | 1,700 | 110,039 |

| Nitori Holdings Co., Ltd. | 2,300 | 208,419 |

| Nitto Denko Corp. | 4,600 | 242,354 |

| Noevir Holdings Co., Ltd. | 500 | 18,483 |

| NOF Corp. | 2,100 | 72,233 |

| NOK Corp. | 2,600 | 21,269 |

| Nomura Real Estate Holdings, Inc. | 1,000 | 22,604 |

| NS Solutions Corp. | 700 | 16,089 |

| NSK Ltd. | 5,300 | 28,012 |

Schwab International Opportunities Fund | Annual Report

Schwab International Opportunities Fund

Portfolio Holdings as of October 31, 2022 (continued)

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| Obayashi Corp. | 10,200 | 65,470 |

| OBIC Business Consultants Co., Ltd. | 700 | 20,121 |

| Obic Co., Ltd. | 1,100 | 165,069 |

| Odakyu Electric Railway Co., Ltd. | 2,800 | 33,286 |

| Oji Holdings Corp. | 14,500 | 50,268 |

| OKUMA Corp. | 900 | 30,127 |

| Ono Pharmaceutical Co., Ltd. | 10,300 | 242,396 |

| Open House Group Co., Ltd. | 2,300 | 81,810 |

| Oracle Corp. Japan | 1,000 | 53,272 |

| Oriental Land Co., Ltd. | 3,400 | 455,354 |

| Orix JREIT, Inc. | 22 | 29,516 |

| Osaka Gas Co., Ltd. | 7,200 | 106,615 |

| OSG Corp. | 2,400 | 30,512 |

| Otsuka Corp. | 2,200 | 69,283 |

| Otsuka Holdings Co., Ltd. | 6,700 | 214,765 |

| PALTAC Corp. | 98,900 | 2,809,335 |

| Pan Pacific International Holdings Corp. | 8,300 | 136,209 |

| Park24 Co., Ltd. * | 1,800 | 23,990 |

| PeptiDream, Inc. * | 2,000 | 21,881 |

| Persol Holdings Co., Ltd. | 5,500 | 110,123 |

| Pigeon Corp. | 2,000 | 26,198 |

| Pola Orbis Holdings, Inc. | 2,400 | 26,508 |

| Prestige International, Inc. | 371,300 | 1,793,419 |

| Rakuten Group, Inc. | 3,500 | 15,625 |

| Recruit Holdings Co., Ltd. | 46,100 | 1,418,551 |

| Relo Group, Inc. | 2,300 | 32,417 |

| Renesas Electronics Corp. * | 1,500 | 12,549 |

| Rengo Co., Ltd. | 2,800 | 15,556 |

| Resorttrust, Inc. | 1,100 | 16,931 |

| Ricoh Co., Ltd. | 3,100 | 22,716 |

| Rinnai Corp. | 1,000 | 68,065 |

| Rohm Co., Ltd. | 1,800 | 126,476 |

| Rohto Pharmaceutical Co., Ltd. | 92,600 | 2,880,605 |

| Ryohin Keikaku Co., Ltd. | 7,100 | 66,811 |

| Sankyo Co., Ltd. | 1,400 | 46,231 |

| Sankyu, Inc. | 1,400 | 41,743 |

| Sanrio Co., Ltd. | 1,144 | 30,505 |

| Santen Pharmaceutical Co., Ltd. | 6,000 | 41,058 |

| Sanwa Holdings Corp. | 3,716 | 32,010 |

| SCREEN Holdings Co., Ltd. | 1,100 | 60,376 |

| SCSK Corp. | 84,300 | 1,243,717 |

| Secom Co., Ltd. | 5,800 | 330,429 |

| Sega Sammy Holdings, Inc. | 4,600 | 58,840 |

| Seibu Holdings, Inc. | 3,000 | 26,854 |

| Seiko Epson Corp. | 2,200 | 29,868 |

| Seino Holdings Co., Ltd. | 3,900 | 29,967 |

| Sekisui Chemical Co., Ltd. | 10,000 | 124,880 |

| Sekisui House REIT, Inc. | 38 | 20,476 |

| Seven Bank Ltd. | 8,100 | 14,611 |

| SG Holdings Co., Ltd. | 11,200 | 148,412 |

| SHIFT, Inc. * | 100 | 15,614 |

| Shikoku Electric Power Co., Inc. | 2,000 | 9,622 |

| Shimadzu Corp. | 8,300 | 218,646 |

| Shimamura Co., Ltd. | 700 | 56,607 |

| Shimano, Inc. | 2,500 | 386,858 |

| Shimizu Corp. | 5,900 | 29,441 |

| Shin-Etsu Chemical Co., Ltd. | 12,900 | 1,340,696 |

| Shinko Electric Industries Co., Ltd. | 1,700 | 40,853 |

| Shionogi & Co., Ltd. | 4,200 | 195,036 |

| Shiseido Co., Ltd. | 11,000 | 379,909 |

| Shizuoka Financial Group, Inc. | 2,900 | 18,313 |

| SHO-BOND Holdings Co., Ltd. | 69,000 | 2,984,945 |

| Shochiku Co., Ltd. | 100 | 7,938 |

| Showa Denko K.K. | 3,700 | 54,015 |

| Skylark Holdings Co., Ltd. * | 1,900 | 20,268 |

| SMC Corp. | 1,800 | 722,524 |

| SMS Co., Ltd. | 1,400 | 32,117 |

| Sohgo Security Services Co., Ltd. | 1,900 | 47,362 |

| SECURITY | NUMBER

OF SHARES | VALUE ($) |

| Sojitz Corp. | 3,000 | 44,226 |

| Sotetsu Holdings, Inc. | 800 | 12,115 |

| Square Enix Holdings Co., Ltd. | 2,400 | 107,093 |

| Stanley Electric Co., Ltd. | 3,900 | 66,302 |

| Subaru Corp. | 9,000 | 140,677 |

| Sugi Holdings Co., Ltd. | 800 | 32,084 |

| SUMCO Corp. | 3,800 | 48,164 |

| Sumitomo Bakelite Co., Ltd. | 800 | 21,653 |

| Sumitomo Chemical Co., Ltd. | 24,600 | 82,835 |

| Sumitomo Forestry Co., Ltd. | 3,600 | 56,317 |

| Sumitomo Heavy Industries Ltd. | 2,200 | 41,700 |

| Sumitomo Metal Mining Co., Ltd. | 5,800 | 162,579 |

| Sumitomo Rubber Industries Ltd. | 3,000 | 25,737 |

| Sundrug Co., Ltd. | 1,400 | 32,554 |

| Suntory Beverage & Food Ltd. | 2,500 | 83,642 |

| Suzuken Co., Ltd. | 1,700 | 37,848 |

| Suzuki Motor Corp. | 7,900 | 267,098 |

| Sysmex Corp. | 3,800 | 204,531 |