UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-7762 |

|

First Eagle Funds |

(Exact name of registrant as specified in charter) |

|

1345 Avenue of the Americas New York, NY | | 10105 |

(Address of principal executive offices) | | (Zip code) |

|

Robert Bruno First Eagle Funds 1345 Avenue of the Americas New York, NY 10105 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-212-632-2700 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | April 30, 2013 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Semi-Annual Report

APRIL 30, 2013

Global Fund

Overseas Fund

U.S. Value Fund

Gold Fund

Global Income Builder Fund

High Yield Fund

Fund of America

ADVISED BY FIRST EAGLE INVESTMENT MANAGEMENT, LLC

Forward-Looking Statement Disclosure

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements". Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "may", "will", "believe", "attempt", "seem", "think", "ought", "try" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Letter from the President | | | 4 | | |

Management's Discussion of Fund Performance | | | 8 | | |

Performance Chart | | | 15 | | |

First Eagle Global Fund: | |

Fund Overview | | | 20 | | |

Schedule of Investments | | | 22 | | |

First Eagle Overseas Fund: | |

Fund Overview | | | 44 | | |

Schedule of Investments | | | 46 | | |

First Eagle U.S. Value Fund: | |

Fund Overview | | | 68 | | |

Schedule of Investments | | | 70 | | |

First Eagle Gold Fund: | |

Fund Overview | | | 86 | | |

Consolidated Schedule of Investments | | | 88 | | |

First Eagle Global Income Builder Fund: | |

Fund Overview | | | 94 | | |

Schedule of Investments | | | 96 | | |

First Eagle High Yield Fund: | |

Fund Overview | | | 108 | | |

Schedule of Investments | | | 110 | | |

First Eagle Fund of America: | |

Fund Overview | | | 122 | | |

Schedule of Investments | | | 124 | | |

Statements of Assets and Liabilities | | | 132 | | |

Statements of Operations | | | 140 | | |

Statements of Changes in Net Assets | | | 144 | | |

Financial Highlights | | | 148 | | |

Notes to Financial Statements | | | 162 | | |

Fund Expenses | | | 198 | | |

General Information | | | 202 | | |

Consideration of Investment Advisory Agreements | | | 203 | | |

Letter from the President

Dear Fellow Shareholders,

At First Eagle, we remain committed to the mission that has guided our investment approach over our long history: To provide prudent stewardship of the assets you have placed in our care. Regardless of short-term market events, swings in investor confidence or the pressures to follow new market paradigms, we continue to seek to provide our shareholders with attractive absolute returns over the long-term.

Market Overview

Since I wrote you last December, financial markets have been characterized by a near absence of fear and caution. Given that this time last year we were in the midst of a period of unusual change and uncertainty driven by historic macro interventions, it is noteworthy and perhaps troubling that a mere twelve months later investors appear to be generally ignoring potential signs of distress.

For instance, during the six-month period ending April 30, 2013, the American and Japanese markets have expanded rapidly — largely as a result of accommodative monetary policy. In the U.S., the stock market began 2013 with the strongest first quarter since 19981. Similarly, Japan's equity market, as measured by the Nikkei 225, has risen approximately 55% since the start of First Eagle's fiscal year on November 1, 2012.

It is important to note that this expansion has not been uniform across the globe. In fact, markets remained sluggish in Europe as the region digested fiscal austerity measures and Europe's recession deepened. In addition, China experienced the pressure of challenging property markets, a slowdown in GDP growth2 and higher real exchange rates.

During the same time period, global corporate fixed income yields have touched and often moved below their past lows. Nonetheless, it is important to note that while absolute yields are very low, high yield market spreads over treasuries — while gradually eroding — remained within historical ranges3, during the six-month period.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

4

Letter from the President (continued)

In the first half of our fiscal year, the gold spot price has declined. This was punctuated by the 9% drop on April 15th, driven by fears (later proven to be unfounded) that European central banks would follow Cyprus's Finance Minister by liquidating gold reserves to raise capital in order to qualify for economic aid. We continue to believe that predicting the price of gold is a fool's errand. Bullion's price declines have been steep; nonetheless, we remain comfortable with our view of gold as a potential hedge against unforeseen circumstances.

In our quest to protect our clients' capital while providing absolute returns, we continue to focus on seeking to identify quality businesses and quality credit at what we believe to be attractive prices. We are global, fundamental investors. While we do not make decisions based on macro views, we stay abreast of macro changes across the globe as large shifts may impact the long-term fundamentals of the businesses we own on behalf of our shareholders.

Global Value Team

The First Eagle Global, Overseas, and U.S. Value Funds continue to seek opportunities to invest in high-quality companies at what we consider to be attractive prices. With the rapid rise of equity valuations in the U.S. and Japan, it seems that we may have entered a market period where equity valuations are on the higher side of fair. Even in Europe, where market valuations grew at a more measured pace, we've found that good companies are generally fairly valued. In this type of environment, it has been more difficult to find opportunities with what we believe to be an adequate margin of safety in price. In addition, several of our investments have reached what we believe to be their intrinsic values. As a result, we have trimmed or exited several long-term holdings.

Since cash is a residual of our investment process, in times like these, our cash levels grow as a percentage of our Global Value Funds. This period has been no exception.

The price of gold has also been volatile, declining approximately 12% since January 1st. Gold mining stocks have displayed the historical 2 to 3 times price movement of the metal and have lost approximately 34% since the start of the year4. Nonetheless, we remain committed to our views about gold. In this regard, the First Eagle Gold Fund continues to invest in gold bullion and gold mining companies with the objective of providing our shareholders exposure to the investment characteristics of gold and, to a limited extent, other precious metals.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

5

Letter from the President (continued)

The current low-yield environment can be very troubling for income-oriented investors. With traditional income sources such as CDs and Treasury Bonds providing low to negative yields after inflation, we believe it is essential to not only focus on generating income today, but also to seek to preserve purchasing power for the future. The First Eagle Global Income Builder Fund's portfolio management team searches the globe in an attempt to deliver meaningful and sustainable income in today's low-yield environment.

When equity markets are rising to new heights, it can be challenging for value investors to search patiently, one security at a time, for companies priced with what we view to be a margin of safety. Under the thoughtful leadership of Matthew McLennan alongside Portfolio Managers Abhay Deshpande, Kimball Brooker, Rachel Benepe, Giorgio Caputo, Robert Hordon, Edward Meigs and Sean Slein, First Eagle's Global Value Team remains disciplined and continues to demonstrate the patient temperament required to weather this part of the cycle.

High Yield Team

While high yield debt is charting new territory in terms of absolute yields, First Eagle Portfolio Managers Ed Meigs and Sean Slein feel that high-yield spreads at 432 bps5, while gradually narrowing, remain reasonable given the level of credit risk in the market today. The team also continued its attempts to manage interest rate risk. As a result the team continued to favor single B credits over longer duration BB rated credits. In addition, over the first six months of this fiscal year, it increased the Fund's exposure to bank loans. These loans have floating interest rates and are generally senior to the bonds in a company's capital structure. As of April 30th, loans comprised approximately 18% of our High Yield Fund and 7% of our Global Income Builder Fund.

Fund of America Team

Although the broader markets have rallied substantially over the last five quarters, Portfolio Managers Harold Levy and David Cohen believe that numerous global concerns remain, which are commonly overlooked by investors. Building on their belief that the Fed will be the dominant influence on debt and equity markets in 2013, the First Eagle Fund of America portfolio managers remain optimistic that the combination of strong corporate balance sheets, relative regulatory clarity and historically low borrowing costs could lead to a significant reacceleration of merger and acquisition activity through the

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

6

Letter from the President (continued)

year. So, the team continues to adhere to its philosophy of investing in companies undergoing significant corporate change, with strong free cash flows and solid management teams. Over time and across a variety of market environments, this philosophy has generally served shareholders well.

Closing

Please be assured that we remain dedicated to our goal of managing your investments in our Funds in the same prudent manner we have been practicing for over 30 years. Our portfolio managers and senior executives have substantial investments alongside yours. We are grateful for your continued confidence.

Sincerely,

John P. Arnhold

President

June 2013

1 As measured by the change in the Dow Jones Industrial Average from January 1, 2013 to April 30, 2013. Source: Factset

2 Source: Bloomberg

3 Source: Barclays. Average high-yield spread from 2003 to 2013 is 565 basis points. Across the same period, one standard deviation is 303 basis points. Absolute low was 233 basis points (May 2007).

4 As measured by the FTSE Gold Mines Index from January 1st, 2013 to April 30, 2013.

5 Barclays U.S. High Yield — Corporate Index as of April 30, 2013. Source: Factset

The commentary represents the opinion of John Arnhold as of June 2013 and is subject to change based on market and other conditions. These materials are provided for informational purposes only. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. The views expressed herein may change at any time subsequent of the date of issue hereof. The information provided is not to be construed as a recommendation or an offer to buy or sell or the solicitation of an offer to buy or sell any fund or security.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

7

Management's Discussion of Fund Performance

In the six months ending April 30, 2013, the MSCI World Index increased 14.7%, while in the U.S., the S&P 500 Index increased 14.4%. In Europe, the German DAX Index rose 9.0% and the French CAC 40 Index rose 12.5% during the period. The Nikkei 225 Index surged 55.2% during the six-month period. This large move was, in part, the result of the December election of Shinzo Abe and the belief that his reflationary policies would be fully enacted. Although our portfolio benefited from a rising Japanese equity market, these gains were partially offset by the weakness in gold mining stocks and gold bullion. Crude oil rose 8.4% to $93 a barrel, and the price of gold fell 14.2% to $1,476 an ounce as of April 30th. On April 15th, gold fell 9%. Market participants appeared to react strongly to comments by the Cyprian Finance Minister that the Central Bank of Cyprus might sell some of its gold reserves to help Cyprus qualify for international aid. Over the six-month period, the Japanese Yen weakened 22.2% against the U.S. Dollar, and in Europe, the U.S. Dollar strengthened 1.6% against the Euro.

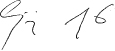

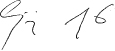

First Eagle Global Fund

The net asset value ("NAV") of the Fund's Class A shares increased 10.3% for the six-month period while the MSCI World Index rose 14.7%. The Fund's cash & cash equivalents position increased from 18.8% at the end of October to 20.6% on April 30, 2013.

The five largest contributors to the performance of First Eagle Global Fund over the period were Mitsubishi Estate Company Limited (real estate, Japan), Cisco Systems, Inc. (networking, U.S.), HeidelbergCement AG (cement, Germany), MS&AD Insurance Group Holdings (insurance, Japan) and Shimano, Inc. (bicycle parts, Japan) collectively accounting for 2.1% of this period's performance.

The five largest detractors were gold bullion, Newcrest Mining Limited (mining, Australia), Goldcorp, Inc. (mining, Canada), Gold Fields Limited, ADR (mining, South Africa) and Fresnillo PLC (mining, Mexico). Their combined negative performance over the six months subtracted 1.8% from the Fund's performance.

As of April 30, 2013, the Fund was approximately 35% hedged versus the Japanese Yen and 30% hedged versus the Euro.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

8

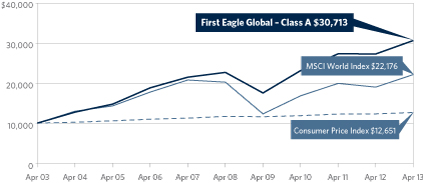

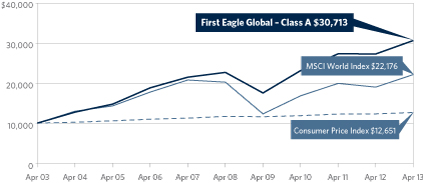

First Eagle Overseas Fund

The NAV of the Fund's Class A shares rose 10.8% for the six-month period while the MSCI EAFE Index increased 16.9%. The Fund's cash and cash equivalents position increased from 21.2% at the end of October to 23.6% on April 30, 2013.

The five largest contributors to the performance of First Eagle Overseas Fund over the period were MS&AD Insurance Group Holdings (insurance, Japan), Mitsubishi Estate Company Limited (real estate, Japan), Shimano, Inc. (bicycle parts, Japan), HeidelbergCement AG (cement, Germany) and NKSJ Holdings, Inc. (insurance, Japan) collectively accounting for 2.9% of this period's performance.

The five largest detractors were gold bullion, Agnico-Eagle Mines Limited (mining, Canada), Newcrest Mining Limited (mining, Australia), Gold Fields Limited (mining, South Africa) and Penn West Petroleum Limited (oil, Canada). Their combined negative performance over the six-month period subtracted 2.2% from the Fund's performance.

As of April 30, 2013, the Fund was approximately 35% hedged versus the Japanese Yen and 30% hedged versus the Euro.

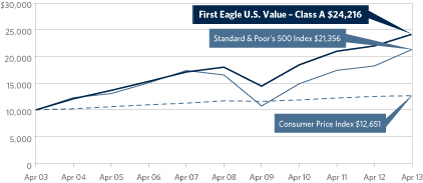

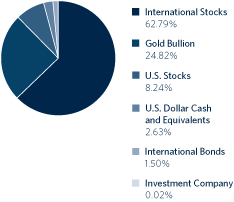

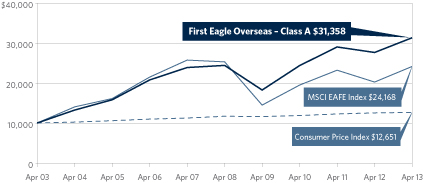

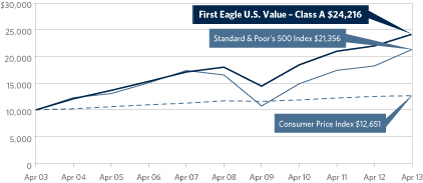

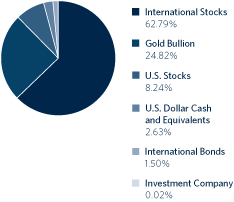

First Eagle U.S. Value Fund

The NAV of the Fund's Class A shares increased 7.3% for the six-month period while the S&P 500 Index rose 14.4%. The Fund's cash and cash equivalents position decreased from 21.5% at the beginning of the period to 16.7% on April 30, 2013.

The five largest contributors to the performance of First Eagle U.S. Value Fund over the period were Cisco Systems, Inc. (networking), Alliant Techsystems, Inc. (defense manufacturer), Rofin-Sinar Technologies, Inc. (laser-based products), Microsoft Corporation (software) and Cincinnati Financial Corporation (property & casualty insurance) collectively accounting for 2.4% of this period's performance.

The five largest detractors were Agnico-Eagle Mines Limited (mining), gold bullion, Newcrest Mining Limited (mining), Newmont Mining Corporation (mining) and Penn West Petroleum Limited (oil). Their combined negative performance over the six-month period subtracted 2.3% from the Fund's performance.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

9

Management's Discussion of Fund Performance (continued)

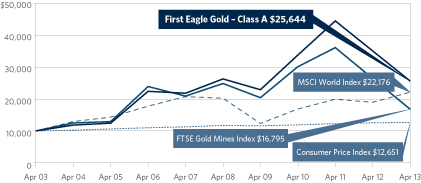

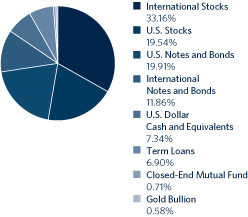

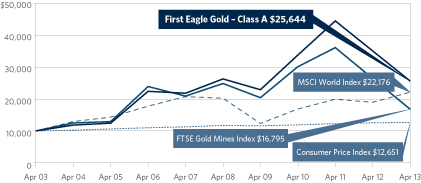

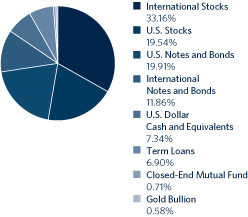

First Eagle Gold Fund

The NAV of the Fund's Class A shares fell 33.7% for the six-month period while the FTSE Gold Mines Index declined 42.2%. The Fund's cash and cash equivalents position decreased from 6.1% in October to 2.6% on April 30, 2013.

The five largest contributors to the performance of First Eagle Gold Fund over the period were Primero Mining Corporation (Canada), Detour Gold Corporation 5.5% bond due 11/30/17 (Canada), Great Basin Gold Limited 8.0% bond due 11/30/14 (South Africa), Aurizon Mines Limited (Canada) and CGA Mining Limited (Canada) collectively accounting for no benefit to the period's performance.

The five largest detractors were Agnico-Eagle Mines Limited (Canada), Barrick Gold Corporation (Canada), gold bullion, Kinross Gold Corporation (Canada) and AngloGold Ashanti Limited, ADR (South Africa). Their combined negative performance over the six-month period subtracted 12.5% from the Fund's performance.

First Eagle Global Income Builder Fund

The NAV of the Fund's Class A shares rose 7.5% for the six-month period while the Barclays US Aggregate Bond Index rose 0.9% and the MSCI World Index increased 14.7%. The Fund's cash and cash equivalents position increased from 5.6% in October to 7.3% on April 30, 2013.

The five largest contributors to the performance of First Eagle Global Income Builder Fund over the period were Bouygues SA (infrastructure construction, France), H&R Block, Inc. (professional services, U.S.), Sanofi (pharmaceuticals, France), Investor AB, Class 'A' (holding company, Sweden) and Microsoft Corporation (software, U.S.), collectively accounting for 1.6% of this period's performance.

The five largest detractors were Barrick Gold Corporation (mining, Canada), Newmont Mining Corporation (mining, U.S.), Penn West Petroleum Limited (oil, Canada), Newcrest Mining Limited (mining, Australia) and Goldcorp, Inc. (mining, Canada). Their combined negative performance over the six-month period subtracted 1.59% from the Fund's performance.

As of April 30, 2013, the First Eagle Global Income Builder Fund was approximately 35% hedged against the Japanese Yen and 30% hedged against the Euro on equities. The Fund was 100% hedged on Euro-denominated bonds.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

10

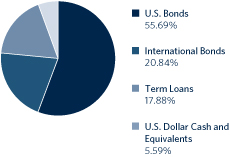

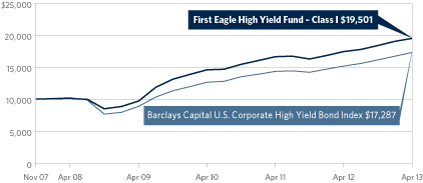

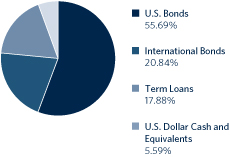

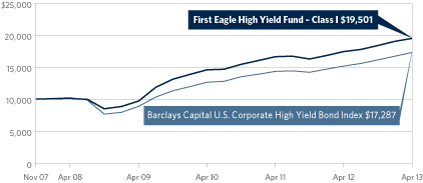

First Eagle High Yield Fund

The NAV of the Fund's Class I shares rose 6.1% for the six-month period, while the Barclays Capital U.S. Corporate High Yield Index increased 7.3%. We continued to favor B-rated issues, which accounted for more than half of the Fund's assets as of April 30, 2013. The Fund's cash and cash equivalents position increased from 3.9% in October to 5.6% on April 30, 2013.

The five largest contributors to the performance of the Fund for the six-month period were Bi-Lo LLC, Offshore Group Investments Limited, Advanced Micro Devices, Inc., HeidelbergCement Finance BV, and Sheridan Group, Inc., collectively accounting for 0.76% of this period's performance.

The five largest detractors were OGX Petroleo E Gas Participacoes, Mood Media Corporation, OGX Austria GmbH, Quiksilver, Inc., and Sugarhouse HSP Gaming Prop. Mezz L.P. Their combined negative performance over the six month period subtracted 0.35% from this period's performance.

As of April 30, 2013, the Fund was 98% hedged against the Euro.

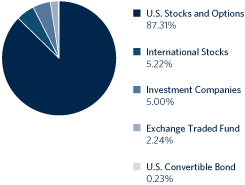

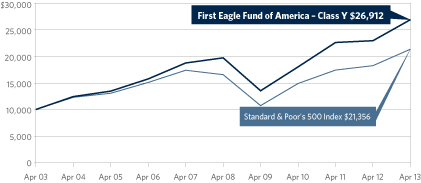

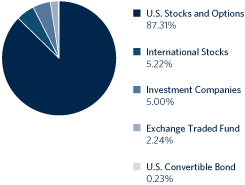

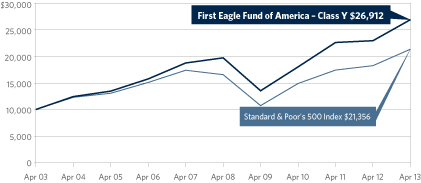

First Eagle Fund of America

The NAV of the Fund's Class Y shares increased 15.3% for the six months ended April 30, 2013 versus 14.4% for the S&P 500 Index. We continue to find a number of new investment opportunities despite the broader markets' recent rally. Our primary focus continues to be investing in quality companies that are trading at what we believe to be a discount to their intrinsic values.

The five largest contributors to the performance of the First Eagle Fund of America over the period were Rockwood Holdings Inc., Valeant Pharmaceuticals International Inc., Seagate Technology PLC, Packaging Corporation of America, and Wyndham Worldwide Corporation, collectively accounting for 7.5% of the Fund's performance.

The five largest detractors were SPDR Gold Trust, Garmin Limited, General Dynamics Corporation, Lowe's Companies, Inc., and Atlas Resource Partners LP. Their combined negative performance over the six-month period subtracted 0.47% from the Fund's performance.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

11

Management's Discussion of Fund Performance (continued)

| |

| |

Matthew McLennan | | Abhay Deshpande | |

Head of the Global Value Team

Portfolio Manager

Global, Overseas,

U.S. Value and Gold Funds | | Portfolio Manager

Global, Overseas

and U.S. Value Funds

| |

| |

| |

T. Kimball Brooker, Jr. | | Rachel Benepe | |

Portfolio Manager

Global, Overseas and U.S. Value Funds | | Portfolio Manager

Gold Fund | |

| |

| |

Giorgio Caputo | | Robert Hordon | |

Portfolio Manager

Global Income Builder Fund | | Portfolio Manager

Global Income Builder Fund | |

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

12

| |

| |

Edward Meigs | | Sean Slein | |

Portfolio Manager

Global Income Builder and High Yield Funds | | Portfolio Manager

Global Income Builder and High Yield Funds | |

Harold Levy

Portfolio Manager

Fund of America

June 2013

The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund's short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance data through the most recent month end is available at firsteaglefunds.com or by calling 800.334.2143.

The commentary represents the opinion of the Portfolio Management Teams as of June 2013 and is subject to change based on market and other conditions. These materials are provided for informational purposes only. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. The views expressed herein may change at any time subsequent of the date of issue hereof. The information provided is not to be construed as a recommendation or an offer to buy or sell or the solicitation of an offer to buy or sell any fund or security.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

13

Management's Discussion of Fund Performance (continued)

There are risks associated with investing in funds that invest in securities of foreign countries, such as erratic market conditions, economic and political instability and fluctuations in currency exchange rates. Funds whose investments are concentrated in a specific industry or sector may be subject to a higher degree of risk than funds whose investments are diversified and may not be suitable for all investors. Hedging can reduce exposure to currency exchange movements, but cannot eliminate that exposure. It is possible to lose money under a hedge. Results from hedging transactions, which for the Funds are primarily currency forward contracts, are further described in the financial statements that follow this commentary.

Investment in gold and gold related investments present certain risks, including negative tax consequences (e.g., a change in a fund's tax status causing the fund to be subject to tax at the fund level on its taxable income), political and economic risks affecting the price of gold and other precious metals like changes in U.S. or foreign tax, currency or mining laws, increased environmental costs, international monetary and political policies, economic conditions within an individual country, trade imbalances, and trade or currency restrictions between countries. The price of gold, in turn, is likely to affect the market prices of securities of companies mining or processing gold, and accordingly, the value of investments in such securities may also be affected. Gold related investments as a group have not performed as well as the stock market in general during periods when the U.S. dollar is strong, inflation is low and general economic conditions are stable. In addition, returns on gold related investments have traditionally been more volatile than investments in broader equity or debt markets.

The First Eagle Global Income Builder Fund and High Yield Fund invest in high yield securities that are non-investment grade (commonly known as "junk bonds") which are generally considered speculative because they may be subject to greater levels of interest rate, credit (including issuer default) and liquidity risk than investment grade securities and may be subject to greater volatility. High yield securities are rated lower than investment-grade securities because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities.

Funds that invest in bonds are subject to interest-rate risk and can lose principal value when interest rates rise. Bonds are also subject to credit risk, in which the bond issuer may fail to pay interest and principal in a timely manner, or that negative perception of the issuer's ability to make such payments may cause the price of that bond to decline.

Bank loans are often less liquid than other types of debt instruments. There is no assurance that the liquidation of any collateral from a secured bank loan would satisfy the borrower's obligation, or that such collateral could be liquidated.

The High Yield Fund's investment strategies may result in high turnover rates. This may increase the Fund's brokerage commission costs, which would reduce performance. Rapid portfolio turnover also exposes shareholders to a higher current realization of short-term gains, which could cause you to pay higher taxes.

Income generation and dividends are not guaranteed. If dividend paying stocks in the Fund's portfolio stop paying or reduce dividends, the fund's ability to generate income will be adversely affected.

The event-driven investment style used by First Eagle Fund of America carries the additional risk that the event anticipated occurs later than expected, does not occur at all or does not have the desired effect on the market price of the securities.

The principal risk of investing in value stocks is that the price of the security may not approach its anticipated value or may decline in value.

All investments involve the risk of loss.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

14

Performance Chart1 (unaudited)

Average Annual Returns as of April 30, 2013

| | |

ONE-YEAR | |

THREE-YEARS | |

FIVE-YEARS | |

TEN-YEARS | | SINCE

INCEPTION | | INCEPTION

DATE | |

First Eagle Global Fund | |

Class A (SGENX) | |

without sales charge | | | 12.45 | % | | | 9.89 | % | | | 6.22 | % | | | 12.45 | % | | | 14.14 | % | | 1/1/19792 | |

with sales charge | | | 6.83 | | | | 8.03 | | | | 5.14 | | | | 11.88 | | | | 14.01 | | | 1/1/19792 | |

Class C (FESGX) | | | 10.61 | | | | 9.07 | | | | 5.42 | | | | 11.61 | | | | 11.50 | | | 06/05/00 | |

Class I (SGIIX) | | | 12.73 | | | | 10.17 | | | | 6.48 | | | | 12.73 | | | | 12.08 | | | 07/31/98 | |

MSCI World Index3 | | | 16.70 | | | | 9.59 | | | | 1.81 | | | | 8.29 | | | | 9.73 | | | 01/01/79 | |

First Eagle Overseas Fund | |

Class A (SGOVX) | |

without sales charge | | | 13.28 | % | | | 8.75 | % | | | 5.13 | % | | | 12.69 | % | | | 11.96 | % | | 08/31/93 | |

with sales charge | | | 7.60 | | | | 6.90 | | | | 4.06 | | | | 12.11 | | | | 11.74 | | | 08/31/93 | |

Class C (FESOX) | | | 11.43 | | | | 7.94 | | | | 4.34 | | | | 11.84 | | | | 11.23 | | | 06/05/00 | |

Class I (SGOIX) | | | 13.54 | | | | 9.00 | | | | 5.38 | | | | 12.96 | | | | 12.35 | | | 07/31/98 | |

MSCI EAFE Index4 | | | 19.39 | | | | 7.44 | | | | -0.93 | | | | 9.23 | | | | 5.15 | | | 08/31/93 | |

First Eagle U.S. Value Fund | |

Class A (FEVAX) | |

without sales charge | | | 9.91 | % | | | 9.45 | % | | | 6.09 | % | | | 9.81 | % | | | 9.50 | % | | 09/04/01 | |

with sales charge | | | 4.41 | | | | 7.60 | | | | 5.00 | | | | 9.25 | | | | 9.02 | | | 09/04/01 | |

Class C (FEVCX) | | | 8.05 | | | | 8.62 | | | | 5.30 | | | | 8.99 | | | | 8.68 | | | 09/04/01 | |

Class I (FEVIX) | | | 10.17 | | | | 9.71 | | | | 6.35 | | | | 10.08 | | | | 9.76 | | | 09/04/01 | |

Standard & Poor's

500 Index5 | | | 16.89 | | | | 12.80 | | | | 5.21 | | | | 7.88 | | | | 5.04 | | | 09/04/01 | |

First Eagle Gold Fund | |

Class A (SGGDX) | |

without sales charge | | | -26.95 | % | | | -8.79 | % | | | -0.53 | % | | | 10.44 | % | | | 7.42 | % | | 08/31/93 | |

with sales charge | | | -30.62 | | | | -10.34 | | | | -1.54 | | | | 9.87 | | | | 7.21 | | | 08/31/93 | |

Class C (FEGOX) | | | -28.25 | | | | -9.48 | | | | -1.28 | | | | — | | | | 8.99 | | | 05/15/03 | |

Class I (FEGIX) | | | -26.77 | | | | -8.58 | | | | -0.29 | | | | — | | | | 10.08 | | | 05/15/03 | |

FTSE Gold Mines Index6 | | | -36.48 | | | | -17.70 | | | | -7.55 | | | | 5.32 | | | | -0.06 | | | 08/31/93 | |

MSCI World Index3 | | | 16.70 | | | | 9.59 | | | | 1.81 | | | | 8.29 | | | | 6.46 | | | 08/31/93 | |

Please see the following pages for important notes to this table.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

15

Performance Chart1 (unaudited) (continued)

| | | ONE-YEAR | | THREE-YEARS | | FIVE-YEARS | | TEN-YEARS | | SINCE

INCEPTION | | INCEPTION

DATE | |

First Eagle Global Income Builder Fund | |

Class A (FEBAX) | |

without sales charge | | | — | | | | — | | | | — | | | | — | | | | 12.21 | % | | 05/01/12 | |

with sales charge | | | — | | | | — | | | | — | | | | — | | | | 6.56 | | | 05/01/12 | |

Class C (FEBCX) | | | — | | | | — | | | | — | | | | — | | | | 10.34 | | | 05/01/12 | |

Class I (FEBIX) | | | — | | | | — | | | | — | | | | — | | | | 12.44 | | | 05/01/12 | |

MSCI World Index3 | | | — | | | | — | | | | — | | | | — | | | | 16.42 | | | 05/01/12 | |

Barclays Capital U.S.

Aggregate Bond Index7 | | | — | | | | — | | | | — | | | | — | | | | 3.81 | | | 05/01/12 | |

First Eagle High Yield Fund | |

Class A (FEHAX) | |

without sales charge | | | 11.34 | % | | | — | | | | — | | | | — | | | | 13.23 | % | | 01/03/12 | |

with sales charge | | | 6.33 | | | | — | | | | — | | | | — | | | | 9.38 | | | 01/03/12 | |

Class C (FEHCX) | | | 9.51 | | | | — | | | | — | | | | — | | | | 12.28 | | | 01/03/12 | |

Class I (FEHIX) | | | 11.80 | | | | 10.16 | % | | | 14.14 | % | | | — | | | | 13.05 | | | 11/19/078 | |

Barclays Capital U.S.

Corporate High Yield

Index9 | | | 13.98 | | | | 11.05 | | | | 11.11 | | | | — | | | | 10.53 | | | 11/19/07 | |

First Eagle Fund of America | |

Class A (FEFAX) | |

without sales charge | | | 17.26 | % | | | 14.26 | % | | | 6.42 | % | | | 10.41 | % | | | 8.45 | % | | 11/20/98 | |

with sales charge | | | 11.40 | | | | 12.32 | | | | 5.33 | | | | 9.84 | | | | 8.07 | | | 11/20/98 | |

Class C (FEAMX) | | | 15.39 | | | | 13.42 | | | | 5.63 | | | | 9.59 | | | | 7.67 | | | 03/02/98 | |

Class I (FEAIX) | | | — | | | | — | | | | — | | | | — | | | | 1.77 | | | 03/08/13 | |

Class Y (FEAFX)10 | | | 17.28 | | | | 14.28 | | | | 6.42 | | | | 10.41 | | | | 12.05 | | | 04/10/87 | |

Standard & Poor's

500 Index5 | | | 16.89 | | | | 12.80 | | | | 5.21 | | | | 7.88 | | | | 9.19 | | | 04/10/87 | |

1 The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the funds' short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance data through the most recent month end is available at firsteaglefunds.com or by calling 800.334.2143. Performance figures represent certain fee waivers and/or expense limitations, without which returns would have been lower. The average annual returns for Class A Shares "with sales charge" of First Eagle Global,

Please see the following page for important notes to this table.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

16

Average Annual Returns as of April 30, 2013 (unaudited)

Overseas, U.S. Value, Gold, Global Income Builder and Fund of America give effect to the deduction of the maximum sales charge of 5.00%. The average annual returns for Class A Shares "with sales charge" of First Eagle High Yield Fund gives effect to the deduction of the maximum sales charge of 4.50%.

The average annual returns for Class C Shares reflect the CDSC (Contingent Deferred Sales Charge) of 1.00% which pertains to the first year or less of investment only.

Class I Shares of First Eagle Global Fund, First Eagle Overseas Fund, First Eagle U.S. Value Fund, First Eagle Gold Fund, First Eagle Global Income Builder Fund, First Eagle High Yield Fund, and First Eagle Fund of America require $1mm minimum investment and are offered without sales charge.

Class Y Shares of First Eagle Fund of America are offered without charge.

2 Commencement of management by Jean-Marie Eveillard. Mr. Eveillard transitioned to senior adviser on March 26, 2009, a position he also held from January 2005 to March 2007, and continues to be a member of First Eagle Fund's Board of Trustees and a Senior Adviser to First Eagle Investment Management, LLC. The Fund commenced operation April 28, 1970.

3 The MSCI World Index is a widely followed, unmanaged group of stocks from 23 international markets and is not available for purchase. The index provides total returns in U.S. dollars with net dividends reinvested.

4 The MSCI EAFE Index is a total return index, reported in U.S. dollars, based on share prices and reinvested net dividends of approximately 1,100 companies from 22 countries and is not available for purchase.

5 The Standard & Poor's 500 Index is a widely recognized unmanaged index including a representative sample of 500 leading companies in leading sectors of the U.S. economy and is not available for purchase. Although the Standard & Poor's 500 Index focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also considered a proxy for the total market. The Standard & Poor's 500 Index includes dividends reinvested.

6 The FTSE Gold Mines Index is an unmanaged index composed of approximately 19 mining companies, is available without dividends reinvested, and is not available for purchase.

7 The Barclays Capital U.S. Aggregate Bond Index is an unmanaged broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS and is not available for purchase.

8 First Eagle High Yield Fund commenced operations in its present form on December 30, 2011, and is successor to another mutual fund pursuant to a reorganization December 30, 2011. Information prior to December 30, 2011 is for this predecessor fund. Immediately after the reorganization, changes in net asset value of the Class I shares were partially impacted by differences in how the Fund and the predecessor fund price portfolio securities.

9 The Barclays Capital U.S Corporate High Yield Bond Index is composed of fixed-rate, publicly issued, non-investment grade debt, is unmanaged, with dividends reinvested, and is not available for purchase. The index includes both corporate and non-corporate sectors. The corporate sectors are Industrial, Utility, and Finance, which include both U.S. and non-U.S. corporations. The index is presented here for comparison purposes only. One cannot invest directly in an index.

10 As of September 1, 2005 First Eagle Fund of America Class Y is closed to new accounts.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

17

Performance Chart1 (unaudited) (continued)

Expense Ratios As Stated In The Most Recent Prospectus

Total Annual Gross Operating Expense Ratios

| | | CLASS A | | CLASS C | | CLASS I | | CLASS Y | |

First Eagle Global Fund | | | 1.15 | % | | | 1.89 | % | | | 0.90 | % | | | — | | |

First Eagle Overseas Fund | | | 1.17 | | | | 1.92 | | | | 0.92 | | | | — | | |

First Eagle U.S. Value Fund | | | 1.17 | | | | 1.92 | | | | 0.93 | | | | — | | |

First Eagle Gold Fund | | | 1.21 | | | | 1.96 | | | | 0.96 | | | | — | | |

First Eagle Global Income Builder* | | | 2.13 | | | | 2.88 | | | | 2.20 | | | | — | | |

First Eagle High Yield Fund** | | | 1.27 | | | | 2.02 | | | | 1.03 | | | | — | | |

First Eagle Fund of America | | | 1.45 | | | | 2.20 | | | | 1.20 | *** | | | 1.45 | | |

* These are the actual fund operating expenses prior to the application of fee waivers and/or expense reimbursements. The Adviser has contractually agreed to limit operating expenses of the Fund to an annual rate of 1.30% for A Shares, 2.05% for C Shares, and 1.05% for I Shares with gross operating expenses of 2.13%, 2.88%, and 2.20% respectively. This limitation excludes certain expenses as described in the Fees and Expenses section of the prospectus. This limitation will continue until December 31, 2013. The expense limitation may be terminated by the Adviser in future years.

** These are the actual fund operating expenses prior to the application of fee waivers and/or expense reimbursements. The Adviser has contractually agreed to limit operating expenses of the Fund to an annual rate of 0.80% for I Shares, 1.25% for A Shares, and 2.00% for C Shares, with gross operating expenses of 1.03%, 1.27%, and 2.02 % respectively. This limitation excludes certain expenses as described in the Fees and Expenses section of the prospectus. This limitation will continue until December 31, 2013. The expense limitation may be terminated by the Adviser in future years.

*** The Fund's Class I Shares commenced investment operations on March 8, 2013. The percentages shown above are based on anticipated expenses of Class I for the first fiscal year. However, the rate at which expenses are accrued during the fiscal year may not be constant and, at any particular point, may be greater or less than the stated average percentage.

These expense ratios are presented as of October 31, 2012 and may differ from corresponding ratios shown elsewhere in this report because of differing time periods (and/or, if applicable, because these expense ratios do not include expense credits or waivers).

There are risks associated with investing in funds that invest in securities of foreign countries, such as erratic market conditions, economic and political instability and fluctuations in currency exchange rates. Funds whose investments are concentrated in a specific industry or sector may be subject to a higher degree of risk than funds whose investments are diversified and may not be suitable for all investors. Hedging can reduce exposure to currency exchange movements, but cannot eliminate that exposure. It is possible to lose money under a hedge. Results from hedging transactions, which for the Funds are primarily currency forward contracts, are further described in the financial statements that follow this commentary.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

18

Average Annual Returns as of April 30, 2013 (unaudited)

Investment in gold and gold related investments present certain risks, including negative tax consequences (e.g., a change in a fund's tax status causing the fund to be subject to tax at the fund level on its taxable income), political and economic risks affecting the price of gold and other precious metals like changes in U.S. or foreign tax, currency or mining laws, increased environmental costs, international monetary and political policies, economic conditions within an individual country, trade imbalances, and trade or currency restrictions between countries. The price of gold, in turn, is likely to affect the market prices of securities of companies mining or processing gold, and accordingly, the value of investments in such securities may also be affected. Gold related investments as a group have not performed as well as the stock market in general during periods when the U.S. Dollar is strong, inflation is low and general economic conditions are stable. In addition, returns on gold related investments have traditionally been more volatile than investments in broader equity or debt markets.

First Eagle Global Income Builder Fund and First Eagle High Yield Fund invest in high yield securities that are non-investment grade (commonly known as "junk bonds") which are generally considered speculative because they may be subject to greater levels of interest rate, credit (including issuer default) and liquidity risk than investment grade securities and may be subject to greater volatility. High yield securities are rated lower than investment-grade securities because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities.

Funds that invest in bonds are subject to interest-rate risk and can lose principal value when interest rates rise. Bonds are also subject to credit risk, in which the bond issuer may fail to pay interest and principal in a timely manner, or that negative perception of the issuer's ability to make such payments may cause the price of that bond to decline.

Bank loans are often less liquid than other types of debt instruments. There is no assurance that the liquidation of any collateral from a secured bank loan would satisfy the borrower's obligation, or that such collateral could be liquidated.

The First Eagle High Yield Fund's investment strategies may result in high turnover rates. This may increase the Fund's brokerage commission costs, which would reduce performance. Rapid portfolio turnover also exposes shareholders to a higher current realization of short-term gains, which could cause you to pay higher taxes.

Income generation and dividends are not guaranteed. If dividend paying stocks in the Fund's portfolio stop paying or reduce dividends, the Fund's ability to generate income will be adversely affected.

The event-driven investment style used by First Eagle Fund of America carries the additional risk that the event anticipated occurs later than expected, does not occur at all or does not have the desired effect on the market price of the securities.

The principal risk of investing in value stocks is that the price of the security may not approach its anticipated value or may decline in value.

All investments involve the risk of loss.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

19

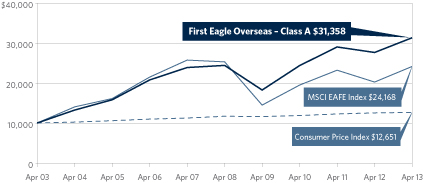

Fund Overview | Data as of April 30, 2013 (unaudited)

INVESTMENT OBJECTIVE

First Eagle Global Fund seeks long-term growth of capital by investing in a range of asset classes from markets in the United States and around the world. This truly global fund is managed with a highly disciplined, bottom-up, value oriented style.

Average Annual Returns | |

| | | ONE-YEAR | | FIVE-YEARS | | TEN-YEARS | |

First Eagle Global

Fund (A Shares) | |

without sales load | | | 12.45 | % | | | 6.22 | % | | | 12.45 | % | |

with sales load | | | 6.83 | | | | 5.14 | | | | 11.88 | | |

MSCI World Index | | | 16.70 | | | | 1.81 | | | | 8.29 | | |

Consumer Price Index | | | 1.06 | | | | 1.60 | | | | 2.38 | | |

Countries** | |

United States | | | 37.63 | % | |

Japan | | | 15.75 | | |

France | | | 5.44 | | |

Canada | | | 3.95 | | |

Germany | | | 2.36 | | |

Mexico | | | 2.31 | | |

United Kingdom | | | 2.26 | | |

Switzerland | | | 1.95 | | |

South Korea | | | 1.06 | | |

Australia | | | 0.97 | | |

Sweden | | | 0.65 | | |

South Africa | | | 0.61 | | |

Thailand | | | 0.59 | | |

Ireland | | | 0.52 | | |

Belgium | | | 0.52 | | |

Bermuda | | | 0.45 | | |

Austria | | | 0.44 | | |

Spain | | | 0.42 | | |

Malaysia | | | 0.39 | | |

Hong Kong | | | 0.37 | | |

Italy | | | 0.31 | | |

Israel | | | 0.23 | | |

Netherlands | | | 0.19 | | |

Singapore | | | 0.05 | | |

Norway | | | 0.03 | | |

* Asset Allocation and Countries percentages are based on total investments in the portfolio.

** Country allocations reflect country of the issuer (not currency of issue) and exclude short term investments. Bonds of non-U.S. issuers may be U.S. dollar denominated.

The Fund's portfolio composition is subject to change at any time.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

20

Growth of a $10,000 Initial Investment

Performance data quoted herein represents past performance and should not be considered indicative of future results. Performance data quoted herein does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. The average annual returns shown above are historical and reflect changes in share price, reinvested dividends and are net of expenses.

The average annual returns for Class A Shares give effect to the deduction of the maximum sales charge of 5.00%.

The MSCI World Index is a widely followed, unmanaged group of stocks from 23 international markets and is not available for purchase. The index provides total returns in U.S. dollars with net dividends reinvested. The Consumer Price Index (CPI) represents the change in price of all goods and services purchased for consumption by urban households.

| Top 10 Holdings* | |

| Gold Bullion (precious metal) | | | 3.89 | % | |

| Comcast Corporation, Class 'A' (U.S. cable/satellite television company) | | | 1.64 | | |

| Microsoft Corporation (U.S. software developer) | | | 1.58 | | |

| Cisco Systems, Inc. (U.S. computer communications company) | | | 1.55 | | |

| Secom Company Limited (Japanese security services provider) | | | 1.55 | | |

| Sysco Corporation (U.S. food services distributor) | | | 1.46 | | |

| Keyence Corporation (Japanese sensors manufacturer) | | | 1.43 | | |

| Cintas Corporation (U.S. commercial services equipment supplier) | | | 1.41 | | |

| Intel Corporation (U.S. computer components and related products manufacturer) | | | 1.36 | | |

| HeidelbergCement AG (German cement company) | | | 1.34 | | |

Total | | | 17.21 | % | |

* Holdings in cash, commercial paper and other short term cash equivalents have been excluded. Percentages are based on total net assets.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

21

SHARES | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

Common Stocks — 74.44% | |

U.S. Common Stocks — 33.35% | | | |

Consumer Discretionary 2.81% | | | |

| | 17,414,912 | | | Comcast Corporation, Class 'A' | | $ | 296,976,000 | | | $ | 684,231,893 | | |

| | 6,208,490 | | | Omnicom Group, Inc. | | | 186,093,077 | | | | 371,081,447 | | |

| | 3,992,318 | | | H&R Block, Inc. | | | 67,554,206 | | | | 110,746,901 | | |

| | 2,485 | | | JG Boswell Company | | | 573,840 | | | | 2,107,280 | | |

| | 33,892 | | | Mills Music Trust (a)(b) | | | 1,015,863 | | | | 1,106,235 | | |

| 184,753 | | | St. John Knits International,

Inc. (b)(c) | | | 3,174,837 | | | | 1,025,379 | | |

| | | | 555,387,823 | | | | 1,170,299,135 | | |

Consumer Staples 3.07% | | | |

| | 17,479,577 | | | Sysco Corporation | | | 495,705,689 | | | | 609,338,054 | | |

| | 8,055,054 | | | Lorillard, Inc. | | | 232,652,802 | | | | 345,481,266 | | |

| | 1,629,490 | | | Colgate-Palmolive Company | | | 125,309,063 | | | | 194,577,401 | | |

| | 1,693,404 | | | Wal-Mart Stores, Inc. | | | 82,465,011 | | | | 131,611,359 | | |

| | | | 936,132,565 | | | | 1,281,008,080 | | |

Energy 2.14% | | | |

| | 6,224,163 | | | ConocoPhillips | | | 250,797,600 | | | | 376,250,653 | | |

| | 5,498,448 | | | Devon Energy Corporation | | | 312,965,847 | | | | 302,744,547 | | |

| | 1,442,501 | | | Apache Corporation | | | 90,693,920 | | | | 106,571,974 | | |

| | 3,908,035 | | | San Juan Basin Royalty Trust (a) | | | 138,744,050 | | | | 60,379,141 | | |

| | 806,395 | | | Helmerich & Payne, Inc. | | | 17,026,317 | | | | 47,270,875 | | |

| | | | 810,227,734 | | | | 893,217,190 | | |

Financials 8.52% | | | |

| | 7,529,993 | | | American Express Company | | | 317,870,387 | | | | 515,126,821 | | |

| 17,571,107 | | | Bank of New York

Mellon Corporation | | | 441,008,507 | | | | 495,856,640 | | |

| 2,714 | | | Berkshire Hathaway, Inc.,

Class 'A' (c) | | | 218,995,900 | | | | 431,526,000 | | |

| | 6,930,015 | | | Cincinnati Financial Corporation | | | 173,611,074 | | | | 338,947,034 | | |

| | 9,921,397 | | | Weyerhaeuser Company, REIT | | | 154,182,567 | | | | 302,701,822 | | |

| | 9,693,682 | | | BB&T Corporation | | | 245,863,323 | | | | 298,274,595 | | |

| 5,719,208 | | | Plum Creek Timber Company,

Inc., REIT | | | 212,342,604 | | | | 294,767,980 | | |

| | 7,819,459 | | | U.S. Bancorp | | | 192,949,644 | | | | 260,231,596 | | |

| | 4,386,051 | | | WR Berkley Corporation | | | 117,583,057 | | | | 190,442,334 | | |

| | 2,858,553 | | | Rayonier, Inc., REIT | | | 27,837,041 | | | | 169,855,219 | | |

| | 743,437 | | | Visa, Inc., Class 'A' | | | 53,618,674 | | | | 125,239,397 | | |

| | 202,406 | | | Mastercard, Inc., Class 'A' | | | 40,702,513 | | | | 111,916,350 | | |

See Notes to Financial Statements.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

22

Schedule of Investments | Six-Month Period Ended April 30, 2013 (unaudited)

SHARES | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

U.S. Common Stocks — 33.35% — (continued) | | | |

Financials 8.52% — (continued) | | | |

| | 40,182 | | | Alleghany Corporation (c) | | $ | 13,132,071 | | | $ | 15,821,261 | | |

| | | | 2,209,697,362 | | | | 3,550,707,049 | | |

Health Care 1.00% | | | |

| | 4,469,770 | | | WellPoint, Inc. | | | 240,056,531 | | | | 325,935,629 | | |

| | 1,059,980 | | | Johnson & Johnson | | | 59,610,843 | | | | 90,342,095 | | |

| | | | 299,667,374 | | | | 416,277,724 | | |

Industrials 4.63% | | | |

| | 13,051,511 | | | Cintas Corporation (a) | | | 438,387,413 | | | | 585,621,298 | | |

| | 4,069,880 | | | 3M Company | | | 315,646,157 | | | | 426,157,135 | | |

| | 3,069,252 | | | Lockheed Martin Corporation | | | 217,057,860 | | | | 304,132,181 | | |

| | 3,867,416 | | | Northrop Grumman Corporation | | | 231,724,655 | | | | 292,918,088 | | |

| | 3,638,247 | | | Alliant Techsystems, Inc. (a) | | | 314,316,906 | | | | 270,540,047 | | |

| | 558,107 | | | Unifirst Corporation | | | 7,536,171 | | | | 50,815,642 | | |

| | | | 1,524,669,162 | | | | 1,930,184,391 | | |

Information Technology 7.59% | | | |

| | 19,924,734 | | | Microsoft Corporation | | | 501,658,947 | | | | 659,508,695 | | |

| | 30,972,653 | | | Cisco Systems, Inc. | | | 507,076,395 | | | | 647,947,901 | | |

| | 23,729,320 | | | Intel Corporation | | | 444,931,301 | | | | 568,317,214 | | |

| | 14,959,315 | | | Oracle Corporation | | | 426,029,947 | | | | 490,366,346 | | |

| | 8,019,789 | | | Linear Technology Corporation | | | 227,165,656 | | | | 292,722,298 | | |

| | 282,275 | | | Google, Inc., Class 'A' (c) | | | 149,382,648 | | | | 232,755,497 | | |

| | 2,365,411 | | | Automatic Data Processing, Inc. | | | 85,148,200 | | | | 159,286,777 | | |

| | 2,031,390 | | | Texas Instruments, Inc. | | | 55,783,759 | | | | 73,556,632 | | |

| | 1,137,229 | | | NetApp, Inc. (c) | | | 36,048,304 | | | | 39,677,920 | | |

| | | | 2,433,225,157 | | | | 3,164,139,280 | | |

Materials 1.63% | | | |

| | 4,056,879 | | | Vulcan Materials Company | | | 200,596,336 | | | | 202,357,124 | | |

| 4,172,577 | | | Scotts Miracle-Gro Company,

Class 'A' (a) | | | 182,102,946 | | | | 189,226,367 | | |

| | 1,752,640 | | | Martin Marietta Materials, Inc. | | | 155,134,877 | | | | 176,999,114 | | |

| | 1,780,037 | | | Newmont Mining Corporation | | | 45,037,176 | | | | 57,673,199 | | |

| | 811,480 | | | Deltic Timber Corporation (a) | | | 39,544,384 | | | | 50,701,270 | | |

| | | | 622,415,719 | | | | 676,957,074 | | |

Utilities 1.96% | | | |

| | 9,696,381 | | | FirstEnergy Corporation | | | 353,449,107 | | | | 451,851,354 | | |

| | 3,760,485 | | | IDACorp, Inc. (a) | | | 124,066,738 | | | | 185,053,467 | | |

See Notes to Financial Statements.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

23

SHARES | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

U.S. Common Stocks — 33.35% — (continued) | | | |

Utilities 1.96% — (continued) | | | |

| | 2,491,660 | | | Entergy Corporation | | $ | 164,249,120 | | | $ | 177,480,942 | | |

| | | | 641,764,965 | | | | 814,385,763 | | |

Total U.S. Common Stocks | | | 10,033,187,861 | | | | 13,897,175,686 | | |

International Common Stocks — 41.09% | | | |

Australia 0.97% | | | |

| | 23,189,619 | | | Newcrest Mining Limited | | | 627,125,396 | | | | 403,928,746 | | |

Austria 0.43% | | | |

| | 3,857,199 | | | OMV AG | | | 157,989,372 | | | | 181,040,671 | | |

Belgium 0.52% | | | |

| | 2,788,865 | | | Groupe Bruxelles Lambert SA | | | 234,732,253 | | | | 215,747,088 | | |

Bermuda 0.45% | | | |

| 2,875,070 | | | Jardine Matheson

Holdings Limited | | | 141,681,818 | | | | 186,678,295 | | |

Canada 3.90% | | | |

| | 15,808,675 | | | Goldcorp, Inc. | | | 530,262,725 | | | | 467,620,606 | | |

| 10,343,600 | | | Canadian Natural

Resources Limited | | | 297,690,279 | | | | 303,408,160 | | |

| 7,007,471 | | | Potash Corporation of

Saskatchewan, Inc. | | | 276,000,358 | | | | 295,014,529 | | |

| | 6,608,500 | | | Cenovus Energy, Inc. | | | 184,336,874 | | | | 197,858,490 | | |

| | 5,216,450 | | | Agnico-Eagle Mines Limited | | | 173,749,110 | | | | 168,392,847 | | |

| | 17,645,244 | | | Penn West Petroleum Limited | | | 273,529,232 | | | | 162,865,602 | | |

| | 4,951,070 | | | Kinross Gold Corporation | | | 26,309,629 | | | | 26,933,821 | | |

| 1,493,910 | | | Postmedia Network Canada

Corporation (b)(c)(d) | | | 6,692,131 | | | | 2,891,726 | | |

| 1,008,427 | | | Catalyst Paper

Corporation (a)(b)(c)(e) | | | 17,346 | | | | 2,016,854 | | |

| | | | 1,768,587,684 | | | | 1,627,002,635 | | |

France 5.26% | | | |

| | 4,179,227 | | | Sanofi | | | 323,385,924 | | | | 457,576,588 | | |

| | 8,485,204 | | | Total SA | | | 432,228,230 | | | | 427,229,147 | | |

| | 10,735,807 | | | Bouygues SA | | | 391,146,130 | | | | 299,299,351 | | |

| | 3,330,779 | | | Sodexo | | | 88,582,313 | | | | 277,871,301 | | |

| | 8,755,798 | | | Carrefour SA | | | 363,896,634 | | | | 259,190,080 | | |

| | 2,044,437 | | | Neopost SA (a) | | | 184,799,958 | | | | 134,340,164 | | |

| | 11,803,362 | | | Société Télévision Francaise 1 (a) | | | 184,371,882 | | | | 124,745,135 | | |

| | 921,669 | | | Wendel SA | | | 19,716,342 | | | | 99,747,911 | | |

| | 1,130,913 | | | Legrand SA | | | 35,203,833 | | | | 52,648,805 | | |

See Notes to Financial Statements.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

24

Schedule of Investments | Six-Month Period Ended April 30, 2013 (unaudited)

SHARES | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

International Common Stocks — 41.09% — (continued) | | | |

France 5.26% — (continued) | | | |

| | 157,260 | | | Robertet SA (a)(c) | | $ | 20,623,058 | | | $ | 29,377,589 | | |

| | 42,252 | | | Robertet SA CI (b)(c)(f)(g) | | | 800,508 | | | | 5,597,793 | | |

| | 385,000 | | | Sabeton SA (a)(c) | | | 4,841,233 | | | | 6,524,042 | | |

| | 12,000,000 | | | FINEL (a)(b)(c)(e)(f)(h) | | | 0 | | | | 5,683,605 | | |

| | 69,500 | | | NSC Groupe (a)(b) | | | 12,298,421 | | | | 5,577,695 | | |

| | 104,457 | | | Gaumont SA | | | 6,087,824 | | | | 5,098,608 | | |

| | | | 2,067,982,290 | | | | 2,190,507,814 | | |

Germany 2.07% | | | |

| | 7,775,691 | | | HeidelbergCement AG | | | 424,710,748 | | | | 559,278,586 | | |

| | 4,285,909 | | | Daimler AG | | | 200,355,962 | | | | 236,912,206 | | |

| | 693,440 | | | Fraport AG | | | 20,976,007 | | | | 41,401,255 | | |

| | 773,684 | | | Hornbach Baumarkt AG | | | 21,504,161 | | | | 25,289,646 | | |

| | | | 667,546,878 | | | | 862,881,693 | | |

Hong Kong 0.37% | | | |

| | 12,693,580 | | | Guoco Group Limited | | | 115,086,260 | | | | 151,545,360 | | |

| | 20,738,780 | | | City e-Solutions Limited (a)(b)(c) | | | 936,898 | | | | 2,004,276 | | |

| | | | 116,023,158 | | | | 153,549,636 | | |

Ireland 0.52% | | | |

| | 10,094,915 | | | CRH PLC | | | 175,024,030 | | | | 216,703,442 | | |

Israel 0.22% | | | |

| | 7,864,560 | | | Israel Chemicals Limited | | | 81,267,220 | | | | 93,520,229 | | |

Italy 0.31% | | | |

| | 18,139,395 | | | Italcementi S.p.A. RSP | | | 249,186,230 | | | | 55,844,291 | | |

| | 4,682,069 | | | Italcementi S.p.A. | | | 86,201,872 | | | | 29,013,414 | | |

| | 1,734,972 | | | Italmobiliare S.p.A. RSP (c) | | | 121,356,934 | | | | 22,769,081 | | |

| | 1,021,137 | | | Italmobiliare S.p.A. (c) | | | 107,360,738 | | | | 20,810,166 | | |

| | | | 564,105,774 | | | | 128,436,952 | | |

Japan 15.69% | | | |

| | 11,590,430 | | | Secom Company Limited | | | 528,330,685 | | | | 646,255,719 | | |

| | 1,882,590 | | | Keyence Corporation | | | 348,832,346 | | | | 596,238,723 | | |

| | 2,684,256 | | | SMC Corporation | | | 293,714,079 | | | | 536,768,663 | | |

| | 10,288,400 | | | KDDI Corporation | | | 327,454,046 | | | | 493,514,191 | | |

| | 8,483,960 | | | Astellas Pharma, Inc. | | | 340,690,755 | | | | 493,046,207 | | |

| | 5,025,290 | | | Shimano, Inc. (a) | | | 86,342,617 | | | | 436,265,119 | | |

| | 2,888,400 | | | Fanuc Corporation | | | 255,486,281 | | | | 435,191,718 | | |

| | 14,618,720 | | | MS&AD Insurance Group Holdings | | | 356,085,457 | | | | 390,921,339 | | |

See Notes to Financial Statements.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

25

SHARES | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

International Common Stocks — 41.09% — (continued) | | | |

Japan 15.69% — (continued) | | | |

| | 14,917,300 | | | NKSJ Holdings, Inc. | | $ | 402,645,728 | | | $ | 377,347,372 | | |

| 2,307,100 | | | Hirose Electric

Company Limited (a) | | | 244,784,088 | | | | 331,055,194 | | |

| 9,491,980 | | | Mitsubishi Estate

Company Limited | | | 139,735,575 | | | | 307,918,995 | | |

| | 14,298,940 | | | Hoya Corporation | | | 305,848,299 | | | | 285,495,158 | | |

| | 8,807,560 | | | MISUMI Group, Inc. (a) | | | 146,993,290 | | | | 268,203,359 | | |

| 3,007,000 | | | Ono Pharmaceutical

Company Limited | | | 124,896,566 | | | | 197,867,473 | | |

| 6,464,110 | | | Nomura Research

Institute Limited | | | 135,171,359 | | | | 194,456,648 | | |

| 4,274,630 | | | Nissin Foods Holdings

Company Limited | | | 152,059,580 | | | | 191,463,466 | | |

| | 59,245 | | | NTT DoCoMo, Inc. | | | 90,107,766 | | | | 97,765,028 | | |

| 3,526,280 | | | Chofu Seisakusho

Company Limited (a) | | | 64,322,538 | | | | 81,574,478 | | |

| | 5,147,000 | | | T. Hasegawa Company Limited (a) | | | 79,849,658 | | | | 75,808,323 | | |

| 1,100,560 | | | Shin-Etsu Chemical

Company Limited | | | 51,374,809 | | | | 73,998,602 | | |

| | 1,959,900 | | | Seikagaku Corporation | | | 20,639,723 | | | | 26,717,235 | | |

| | | | 4,495,365,245 | | | | 6,537,873,010 | | |

Malaysia 0.38% | | | |

| | 129,221,380 | | | Genting Malaysia Berhad | | | 111,924,255 | | | | 159,695,115 | | |

Mexico 2.31% | | | |

| | 15,044,166 | | | Grupo Televisa S.A.B., ADR | | | 289,394,927 | | | | 380,918,283 | | |

| | 17,363,483 | | | Fresnillo PLC | | | 235,897,571 | | | | 310,702,268 | | |

| | 6,401,020 | | | Industrias Peñoles S.A.B. de C.V. | | | 7,339,323 | | | | 269,284,563 | | |

| | | | 532,631,821 | | | | 960,905,114 | | |

Netherlands 0.19% | | | |

| | 10,519,454 | | | TNT Express NV | | | 115,928,316 | | | | 80,742,045 | | |

Singapore 0.05% | | | |

| 13,467,250 | | | ComfortDelGro

Corporation Limited | | | 3,279,184 | | | | 21,684,370 | | |

South Africa 0.61% | | | |

| | 25,019,071 | | | Gold Fields Limited, ADR | | | 233,463,377 | | | | 186,642,270 | | |

| 8,092,307 | | | Harmony Gold Mining Company

Limited, ADR | | | 69,852,451 | | | | 41,513,535 | | |

| | 4,769,860 | | | Sibanye Gold Limited, ADR (c) | | | 28,713,214 | | | | 18,363,961 | | |

See Notes to Financial Statements.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

26

Schedule of Investments | Six-Month Period Ended April 30, 2013 (unaudited)

SHARES | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

International Common Stocks — 41.09% — (continued) | | | |

South Africa 0.61% — (continued) | | | |

| | 324,020 | | | AngloGold Ashanti

Limited, ADR | | $ | 5,810,748

| | | $ | 6,318,390

| | |

| | | | 337,839,790 | | | | 252,838,156 | | |

South Korea 0.99% | | | |

| | 3,898,597 | | | KT&G Corporation | | | 216,376,344 | | | | 280,721,640 | | |

| 51,900 | | | Lotte Confectionery

Company Limited | | | 21,157,499 | | | | 90,482,158 | | |

| 39,989 | | | Namyang Dairy Products

Company Limited (a) | | | 7,325,466 | | | | 42,301,993 | | |

| | | | 244,859,309 | | | | 413,505,791 | | |

Spain 0.42% | | | |

| | 3,295,234 | | | Red Electrica Corporation SA | | | 165,292,750 | | | | 175,105,681 | | |

Sweden 0.65% | | | |

| | 5,939,940 | | | Investor AB, Class 'A' | | | 116,378,542 | | | | 171,667,683 | | |

| | 3,394,798 | | | Investor AB, Class 'B' | | | 63,888,333 | | | | 99,996,363 | | |

| | | | 180,266,875 | | | | 271,664,046 | | |

Switzerland 1.95% | | | |

| | 5,091,560 | | | Nestlé SA | | | 146,056,201 | | | | 363,213,992 | | |

| | 4,327,670 | | | Pargesa Holding SA | | | 272,881,781 | | | | 301,281,710 | | |

| | 26,528 | | | Lindt & Spruengli AG PC | | | 23,885,815 | | | | 102,600,774 | | |

| | 388,803 | | | Kuehne & Nagel International AG | | | 7,503,142 | | | | 44,444,176 | | |

| | | | 450,326,939 | | | | 811,540,652 | | |

Thailand 0.58% | | | |

| | 30,023,200 | | | Bangkok Bank PCL, NVDR | | | 97,800,376 | | | | 231,183,754 | | |

| | 577,000 | | | OHTL PCL (b) | | | 2,636,473 | | | | 11,795,571 | | |

| | | | 100,436,849 | | | | 242,979,325 | | |

United Kingdom 2.25% | | | |

| | 7,749,898 | | | Berkeley Group Holdings PLC (a) | | | 93,521,018 | | | | 250,990,420 | | |

| | 55,018,479 | | | WM Morrison Supermarkets PLC | | | 243,196,894 | | | | 249,629,115 | | |

| | 7,387,420 | | | GlaxoSmithKline PLC | | | 140,774,624 | | | | 190,540,267 | | |

| | 4,355,040 | | | Willis Group Holdings PLC | | | 119,957,625 | | | | 172,807,987 | | |

| | 3,052,693 | | | Anglo American PLC | | | 74,109,213 | | | | 74,208,315 | | |

| | | | 671,559,374 | | | | 938,176,104 | | |

Total International Common Stocks | | | 14,011,776,580 | | | | 17,126,706,610 | | |

Total Common Stocks | | | 24,044,964,441 | | | | 31,023,882,296 | | |

See Notes to Financial Statements.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

27

SHARES | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

International Preferred Stock — 0.28% | | | |

Germany 0.28% | | | |

| | 1,754,484 | | | Hornbach Holding AG | | $ | 63,837,360 | | | $ | 117,491,735 | | |

Warrant — 0.19% | | | |

United States — 0.19% | | | |

| | 5,806,899 | | | JPMorgan Chase & Company

Warrant expire 10/28/18 (c) | | | 75,108,859

| | | | 80,425,551

| | |

OUNCES | | | | | | | |

Commodity — 3.89% | | | |

| | 1,097,527 | | | Gold bullion (c) | | | 799,578,304 | | | | 1,619,895,681 | | |

PRINCIPAL | | | | | | | |

Notes and Bonds — 0.35% | | | |

U.S. Corporate Bonds — 0.07% | | | |

$ | 5,467,000 | | | Bausch & Lomb, Inc.

7.125% due 08/01/28 (b) | | | 4,781,483

| | | | 5,084,310

| | |

| | 22,554,000 | | | Yankee Candle Company, Inc.

Series 'B' 9.75% due 02/15/17 | | | 22,103,094

| | | | 23,428,193

| | |

Total U.S. Corporate Bonds | | | 26,884,577 | | | | 28,512,503 | | |

International Notes and Bonds — 0.28% | | | |

International Corporate Notes and Bonds — 0.22% | | | |

Canada 0.03% | | | |

| 17,593,454

USD | | | Catalyst Paper Corporation

11.00% due 10/30/17 (e)(i) | | | 21,613,126

| | | | 13,634,927

| | |

France 0.16% | | | |

| 15,000,000

EUR | | | Emin Leydier SA FRN

7.32% due 07/31/16 (b)(e)(f)(j) | | | 21,437,036

| | | | 19,734,739

| | |

| 12,000,000

EUR | | | FINEL

9.50% due 06/30/17 (b)(e)(f) | | | 14,495,954

| | | | 11,840,843

| | |

| 12,050,000

EUR | | | Wendel SA

4.375% due 08/09/17 | | | 12,488,633

| | | | 16,709,666

| | |

| 10,000,000

EUR | | | Wendel SA

4.875% due 09/21/15 | | | 11,792,715

| | | | 13,995,219

| | |

| 3,500,000

EUR | | | Wendel SA

4.875% due 05/26/16 | | | 3,254,781

| | | | 4,924,804

| | |

| | | | 63,469,119 | | | | 67,205,271 | | |

See Notes to Financial Statements.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

28

Schedule of Investments | Six-Month Period Ended April 30, 2013 (unaudited)

PRINCIPAL | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

International Corporate Notes and Bonds — 0.22% — (continued) | | | |

Norway 0.03% | | | |

| 5,500,000

USD | | | Den Norske Bank ASA FRN

0.625% due 08/30/13 (b)(j) | | $ | 3,974,431

| | | $ | 3,052,500

| | |

| 3,170,000

USD | | | Den Norske Creditbank FRN

0.563% due 05/31/13 (b)(j) | | | 2,111,394

| | | | 1,711,800

| | |

| 3,500,000

USD | | | Den Norske Creditbank FRN

0.607% due 08/30/13 (b)(j) | | | 2,659,615

| | | | 1,890,000

| | |

| 10,000,000

USD | | | Nordea Bank Norge ASA FRN

0.711% due 11/21/13 (b)(j) | | | 6,992,567

| | | | 5,450,000

| | |

| | | | 15,738,007 | | | | 12,104,300 | | |

Total International Corporate Notes and Bonds | | | 100,820,252 | | | | 92,944,498 | | |

International Government Bond — 0.06% | | | |

South Korea 0.06% | | | |

| 25,729,620,000

KRW | | | Inflation Linked Korea Treasury Bond

2.75% due 03/10/17 (k) | | | 24,503,766

| | | | 25,302,592

| | |

Total International Notes and Bonds | | | 125,324,018 | | | | 118,247,090 | | |

Total Notes and Bonds | | | 152,208,595 | | | | 146,759,593 | | |

Commercial Paper — 20.48% | | | |

International Commercial Paper — 6.36% | | | |

Canada 0.53% | | | |

| 53,227,000

USD | | | Canadian Natural Resources Limited

0.32% due 05/22/13 | | | 53,217,064

| | | | 53,217,064

| | |

| 32,543,000

USD | | | Canadian Natural Resources Limited

0.33% due 05/10/13 | | | 32,540,315

| | | | 32,540,315

| | |

| 16,941,000

USD

| | | Potash Corporation of

Saskatchewan, Inc.

0.27% due 05/29/13 | | | 16,937,443

| | | | 16,937,443

| | |

| 26,769,000

USD | | | Suncor Energy, Inc.

0.29% due 06/12/13 | | | 26,759,943

| | | | 26,759,943

| | |

| 55,833,000

USD | | | Suncor Energy, Inc.

0.29% due 06/13/13 | | | 55,813,660

| | | | 55,813,660

| | |

| 35,905,000

USD | | | Suncor Energy, Inc.

0.29% due 06/24/13 | | | 35,889,382

| | | | 35,889,382

| | |

France 1.35% | | | |

| 39,699,000

USD | | | GDF Suez SA

0.22% due 07/09/13 | | | 39,682,260

| | | | 39,680,707

| | |

| 72,318,000

USD | | | Sanofi

0.11% due 06/17/13 | | | 72,307,614

| | | | 72,307,614

| | |

| 34,775,000

USD | | | Sanofi

0.13% due 06/20/13 | | | 34,768,721

| | | | 34,768,721

| | |

See Notes to Financial Statements.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

29

PRINCIPAL | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

International Commercial Paper — 6.36% — (continued) | | | |

France 1.35% — (continued) | | | |

| 67,959,000

USD | | | Sanofi

0.13% due 07/15/13 | | $ | 67,940,595

| | | $ | 67,939,584

| | |

| 85,598,000

USD | | | Sanofi

0.14% due 06/25/13 | | | 85,579,691

| | | | 85,579,691

| | |

| 50,534,000

USD | | | Total SA

0.09% due 05/01/13 | | | 50,534,000

| | | | 50,534,000

| | |

| 67,797,000

USD | | | Total SA

0.12% due 05/02/13 | | | 67,796,774

| | | | 67,796,774

| | |

| 73,591,000

USD | | | Total SA

0.12% due 05/22/13 | | | 73,585,849

| | | | 73,585,849

| | |

| 70,167,000

USD | | | Total SA

0.12% due 06/04/13 | | | 70,159,048

| | | | 70,159,048

| | |

Germany 0.61% | | | |

| 36,651,000

USD | | | BASF AG

0.11% due 05/29/13 | | | 36,647,864

| | | | 36,647,864

| | |

| 43,430,000

USD | | | BASF AG

0.13% due 06/18/13 | | | 43,422,472

| | | | 43,422,472

| | |

| 60,967,000

USD | | | Siemens Company

0.12% due 06/18/13 | | | 60,957,245

| | | | 60,957,245

| | |

| 33,220,000

USD | | | Siemens Company

0.12% due 06/19/13 | | | 33,214,574

| | | | 33,214,574

| | |

| 81,514,000

USD | | | Siemens Company

0.12% due 06/21/13 | | | 81,500,143

| | | | 81,500,143

| | |

Italy 0.38% | | | |

| 27,766,000

USD | | | Eni S.p.A.

0.34% due 05/15/13 | | | 27,762,329

| | | | 27,762,329

| | |

| 20,871,000

USD | | | Eni S.p.A.

0.38% due 05/21/13 | | | 20,866,710

| | | | 20,866,710

| | |

| 34,393,000

USD | | | Eni S.p.A.

0.40% due 05/01/13 | | | 34,393,000

| | | | 34,393,000

| | |

| 61,832,000

USD | | | Eni S.p.A.

0.40% due 05/20/13 | | | 61,819,273

| | | | 61,819,273

| | |

| 14,803,000

USD | | | Eni S.p.A.

0.42% due 05/09/13 | | | 14,801,651

| | | | 14,801,651

| | |

Japan 0.63% | | | |

| 21,175,000

USD | | | Hitachi Limited

0.31% due 05/23/13 | | | 21,170,989

| | | | 21,170,989

| | |

| 38,105,000

USD | | | Honda Corporation

0.12% due 06/07/13 | | | 38,100,300

| | | | 38,100,300

| | |

| 106,232,000

USD | | | Honda Corporation

0.13% due 05/10/13 | | | 106,228,547

| | | | 106,228,547

| | |

| 43,036,000

USD | | | Honda Corporation

0.14% due 06/07/13 | | | 43,029,808

| | | | 43,029,808

| | |

See Notes to Financial Statements.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

30

Schedule of Investments | Six-Month Period Ended April 30, 2013 (unaudited)

PRINCIPAL | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

International Commercial Paper — 6.36% — (continued) | | | |

Japan 0.63% — (continued) | | | |

| 32,108,000

USD | | | Mitsui & Company Limited

0.18% due 06/25/13 | | $ | 32,099,170

| | | $ | 32,099,170

| | |

| 20,067,000

USD | | | Mitsui & Company Limited

0.19% due 07/22/13 | | | 20,058,316

| | | | 20,055,664

| | |

Luxembourg 0.09% | | | |

| 35,905,000

USD | | | Michelin Luxembourg S.C.S.

0.25% due 05/23/13 | | | 35,899,515

| | | | 35,899,515

| | |

Switzerland 0.99% | | | |

| 71,233,000

USD | | | Nestlé SA

0.12% due 05/08/13 | | | 71,231,338

| | | | 71,231,338

| | |

| 68,801,000

USD | | | Nestlé SA

0.12% due 05/09/13 | | | 68,799,165

| | | | 68,799,165

| | |

| 20,773,000

USD | | | Nestlé SA

0.12% due 05/15/13 | | | 20,772,031

| | | | 20,772,031

| | |

| 34,393,000

USD | | | Nestlé SA

0.12% due 06/05/13 | | | 34,388,987

| | | | 34,388,987

| | |

| 74,396,000

USD | | | Nestlé SA

0.14% due 06/04/13 | | | 74,386,163

| | | | 74,386,163

| | |

| 16,622,000

USD | | | Nestlé SA

0.14% due 06/11/13 | | | 16,619,350

| | | | 16,619,350

| | |

| 20,555,000

USD | | | Nestlé SA

0.14% due 06/25/13 | | | 20,550,603

| | | | 20,550,603

| | |

| 9,380,000

USD | | | Nestlé SA

0.14% due 07/09/13 | | | 9,377,483

| | | | 9,378,116

| | |

| 30,403,000

USD | | | Nestlé SA

0.15% due 06/03/13 | | | 30,398,820

| | | | 30,398,820

| | |

| 17,737,000

USD | | | Roche Holdings, Inc.

0.12% due 06/20/13 | | | 17,734,044

| | | | 17,734,044

| | |

| 47,967,000

USD | | | Roche Holdings, Inc.

0.13% due 06/20/13 | | | 47,958,339

| | | | 47,958,339

| | |

United Arab Emirates 0.55% | | | |

| 68,728,000

USD | | | Xstrata Finance Dubai Limited

0.39% due 05/09/13 | | | 68,722,196

| | | | 68,722,196

| | |

| 33,655,000

USD | | | Xstrata Finance Dubai Limited

0.39% due 05/17/13 | | | 33,649,316

| | | | 33,649,316

| | |

| 33,655,000

USD | | | Xstrata Finance Dubai Limited

0.39% due 05/21/13 | | | 33,647,895

| | | | 33,647,895

| | |

| 32,453,000

USD | | | Xstrata Finance Dubai Limited

0.39% due 05/24/13 | | | 32,445,121

| | | | 32,445,121

| | |

| 62,576,000

USD | | | Xstrata Finance Dubai Limited

0.41% due 06/10/13 | | | 62,548,189

| | | | 62,548,189

| | |

See Notes to Financial Statements.

FIRST EAGLE FUNDS | SEMI-ANNUAL REPORT | APRIL 30, 2013

31

PRINCIPAL | | DESCRIPTION | | COST (NOTE 1) | | VALUE (NOTE 1) | |

International Commercial Paper — 6.36% — (continued) | | | |

United Kingdom 1.23% | | | |

| 20,619,000

USD | | | AstraZeneca PLC

0.09% due 05/09/13 | | $ | 20,618,588

| | | $ | 20,618,588

| | |

| 35,485,000

USD | | | AstraZeneca PLC

0.10% due 06/10/13 | | | 35,481,057

| | | | 35,481,057

| | |

| 34,895,000

USD | | | AstraZeneca PLC

0.10% due 06/14/13 | | | 34,890,735

| | | | 34,890,735

| | |

| 40,136,000

USD | | | AstraZeneca PLC

0.10% due 07/25/13 | | | 40,126,524

| | | | 40,115,194

| | |

| 27,901,000

USD | | | AstraZeneca PLC

0.11% due 05/01/13 | | | 27,901,000

| | | | 27,901,000

| | |

| 36,681,000

USD | | | AstraZeneca PLC

0.11% due 05/13/13 | | | 36,679,655

| | | | 36,679,655

| | |

| 51,601,000

USD | | | AstraZeneca PLC

0.11% due 05/20/13 | | | 51,598,004

| | | | 51,598,004

| | |

| 33,643,000

USD | | | AstraZeneca PLC

0.11% due 07/17/13 | | | 33,635,085

| | | | 33,627,548

| | |

| 69,145,000

USD | | | AstraZeneca PLC

0.12% due 05/03/13 | | | 69,144,539

| | | | 69,144,539

| | |