UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-7762 |

|

First Eagle Funds |

(Exact name of registrant as specified in charter) |

|

1345 Avenue of the Americas New York, NY | | 10105 |

(Address of principal executive offices) | | (Zip code) |

|

Suzan Afifi First Eagle Funds 1345 Avenue of the Americas New York, NY 10105 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-212-632-2700 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | April 30, 2015 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Advised by First Eagle Investment Management, LLC

Forward-Looking Statement Disclosure

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements". Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "may", "will", "believe", "attempt", "seem", "think", "ought", "try" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

2

Table of Contents

Letter from the President | | | 4 | | |

Management's Discussion of Fund Performance | | | 6 | | |

Performance Chart | | | 7 | | |

Fund Overview | | | 10 | | |

Schedule of Investments | | | 12 | | |

Statement of Assets and Liabilities | | | 16 | | |

Statement of Operations | | | 18 | | |

Statements of Changes in Net Assets | | | 19 | | |

Financial Highlights | | | 20 | | |

Notes to Financial Statements | | | 22 | | |

Fund Expenses | | | 39 | | |

General Information | | | 43 | | |

Consideration of Investment Advisory Agreement | | | 44 | | |

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

3

Letter from the President

Dear Fellow Shareholders,

At First Eagle we remain committed to protecting and preserving our shareholders' purchasing power over time. Irrespective of short-term market events, swings in investor confidence or the pressure to follow a new market paradigm, our first priority is unwavering: to provide prudent stewardship of the assets you have placed in our care.

For the six months ended April 30, 2015, the S&P 500 index increased 4.4% while the MSCI World and EAFE indices increased 5.1% and 6.8% respectively, reflecting the continued strength of the global equity markets. In Europe, the German DAX Index rose 22.8% and the French CAC 40 Index increased 19.2%. In Japan, the Nikkei 225 Index increased 19.7%. During the same time period, the dollar has strengthened 10.4% versus the Euro and 6.3% versus the Yen. Not surprisingly, dollar-linked commodity prices have suffered with crude oil falling 30% to $59.63 a barrel. However, the price of gold remained relatively unchanged, increasing less than 1% to $1,184.37 an ounce.

During the same period, the Barclay's U.S. Aggregate Bond Index returned 2.1% and the Barclay's U.S. High Yield Corporate Index returned 1.5%. High yield spreads ended April at 459 bps.

The appreciating dollar has been a major theme over the last few months and may prove to be a headwind for an already slow U.S. recovery. In addition to the stronger dollar, the U.S. continues to face the looming prospect of rate normalization. The Federal Reserve has made clear its intention to eventually increase rates, but the timing of the increase and its impact on the equity and debt markets remains to be seen. While the age of Quantitative Easing (QE) is over in the U.S., the European Central Bank is embarking on its own version of QE, which may prove to have a profound impact on global markets.

It seems clear that growth in China is slowing, and that this slowdown is having many effects across the globe, but the full extent of the change in both current growth and future expectations is difficult to ascertain. While the Chinese leadership is taking measures intended to stimulate domestic growth, the mere fact that such measures are deemed necessary confirms the slowdown.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

4

Letter from the President

It is possible that Japan is beginning to move out of its twenty year period of deflation; but it is not yet certain. Thus the major parts of the world's economy—the U.S., Europe, China and Japan—are all at best experiencing "slow growth" and perhaps "no growth."

As usual, we have many concerns surrounding the global macroeconomic landscape, but as you would expect, we are not focused on predicting the outcomes of global events or the direction of the markets. Rather, we continue to strive to build what we believe are durable portfolios that can participate in the upside of rising markets, but also should provide some protection in distressed markets.

Consistent with this notion, the Portfolio Managers of the First Eagle Absolute Return Fund seek to help investors meet their goal of positive long term absolute returns by focusing on risk and the market cycles' effect on asset classes. We believe that benchmark agnostic, globally flexible portfolios should produce the best results for clients over the long term. The First Eagle Absolute Return Fund abides by these core tenets and offers clients a multi-asset solution for a changing investment landscape.

Sincerely,

John P. Arnhold

President

June 2015

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

5

Management's Discussion of Fund Performance

The NAV of the Fund's Class A shares rose 0.50% for the six months ended April 30, 2015. For the same time period, the Barclays Global Aggregate Bond Index decreased by 1.9% while there was no change to the Citigroup 3-Month Treasury Bill Index.

The largest contributor to performance over the period was our bar-belled bond/duration exposure represented by a 30-year Treasury bond and an Intermediate Aggregate Index total return swap. A bar-belled bond trade is represented by a combination of long-term and short-term bonds. This position accounted for 1.1% points of this period's performance.

The largest detractor was our real return/commodity exposure represented by PowerShares DB Commodity Index Tracking Fund, an Exchange-Traded Fund. This position subtracted 1.3% points from the Fund's performance.

| |

| |

Joel McKoan

Portfolio Manager | | Michael Ning

Portfolio Manager | |

June 2015

The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund's short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost.

The commentary represents the opinion of the Portfolio Management Team as of June 2015 and is subject to change based on market and other conditions. These materials are provided for informational purposes only. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. The views expressed herein may change at any time subsequent of the date of issue hereof. The information provided is not to be construed as a recommendation or an offer to buy or sell or the solicitation of an offer to buy or sell any fund or security.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

6

Performance Chart1 (unaudited)

| | | One-

Month | | Three-

Month | | Since

Inception | | Inception Date | |

First Eagle Absolute Return Fund | |

Class A (FEXAX)

without sales charge | | | 0.30 | % | | | 0.10 | % | | | 1.40 | % | | 05/14/14 | |

with sales charge | | | -4.70 | | | | -4.88 | | | | -3.70 | | | 05/14/14 | |

| Class C (FEXCX) | | | -0.70 | | | | -1.00 | | | | -0.30 | | | 05/14/14 | |

| Class I (FEXIX) | | | 0.30 | | | | 0.10 | | | | 1.60 | | | 05/14/14 | |

Barclays Capital Global Aggregate

Bond Index2 | | | 1.06 | | | | -0.72 | | | | -4.11 | | | 05/14/14 | |

Citigroup 3-Month Treasury Bill Index3 | | | 0.00 | | | | 0.01 | | | | 0.03 | | | 05/14/14 | |

1 The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund's short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. The returns for Class A Shares "with sales charge" give effect to the deduction of the maximum sales charge of 5.00%.

The average annual returns for Class C Shares reflect the CDSC (Contingent Deferred Sales Charge) of 1.00% which pertains to the first year or less of investment only.

Because the Fund is less than one year old, the return figures are not annualized and represent an aggregate total return for each period.

A contingent deferred sales charge of 1.00% may apply on redemptions of Class A shares made within 18 months following a purchase of $1,000,000 or more without an initial sales charge.

Class I Shares of First Eagle Absolute Return Fund require $1,000,000 minimum investment and are offered without sales charge.

Expense Ratios As Stated In The Most Recent Prospectus

Total Annual Gross Operating Expense Ratios

| | | Class A | | Class C | | Class I | |

First Eagle Absolute Return Fund | | | 3.57 | % | | | 4.31 | % | | | 3.32 | % | |

These are the Fund's operating expenses in the most recent prospectus prior to the application of fee waivers and/or expense reimbursements.

The Adviser has contractually agreed to waive its management fee and/or reimburse expenses, so that the total annual operating expenses (excluding acquired fund fees and expenses, interest, taxes, dividend expense, borrowing costs, interest expense relating to short sales and extraordinary expenses) of Class A, Class C and Class I shares do not exceed 1.35%, 2.10% and 1.10%, respectively, through the date that is one calendar year after the shares of the Fund are made available for purchase by the general public (the "Fee Waiver and Expense Reimbursement Agreement"). The Fee Waiver and Expense Reimbursement Agreement may be terminated before its expiration only by a decision of the Board of Trustees. The Adviser is permitted to recoup advisory fees waived and expenses reimbursed for up to

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

7

three years after the fiscal year in which the waiver or reimbursement took place, provided that such recoupment would not cause the Fund to exceed the Fund's operating expense limit in effect at the time of either the recoupment (if any) or the waiver/reimbursement.

The expense ratios presented as of October 31, 2014 may differ from corresponding ratios shown elsewhere in this report because of differing time periods (and/or, if applicable, because these expense ratios do not include expense credits or waivers).

2 The Barclays Global Aggregate Bond Index measures global investment grade debt from twenty-four different local currency markets. This multi-currency benchmark includes fixed-rate treasury, government-related corporate and securitized bonds from both developed and emerging market issuers. One cannot invest directly in the index.

3 The Citigroup 3M Treasury Bill Index is an unmanaged index that represents the performance of threemonth Treasury bills. One cannot invest directly with the index.

The Fund is a non-diversified fund. The Fund may invest in securities of a smaller number of issuers or deal with a smaller number of counterparties and may be more exposed to the risks associated with and developments affecting an individual issuer or counterparty than a fund that invests more widely, which may, therefore, have greater impact on the Fund's performance.

The Fund has only a limited operating history and there can be no assurance that the fund will grow or maintain an economically viable size.

The Fund's investment in fixed income instruments like bonds are subject to interest-rate risk and can lose principal value when interest rates rise. Bonds and other fixed income instruments are also subject to credit risk, in which the issuer may fail to pay interest or principal in a timely manner or that changes in an issuer's credit rating or the market's negative perception of an issuer's ability to make such payments may cause the price of that bond to decline. The Fund may invest in debt instruments that are below investment grade, i.e., "junk bonds," which are considered speculative, and may be subject to greater levels of interest rate, credit (including issuer default) and liquidity risk than investment grade securities and may be subject to greater volatility. Swaps may also be less liquid. Holding less liquid securities restricts or otherwise limits the ability for the Fund to freely dispose of its investments for specific periods of time. The Fund might not be able to sell less liquid securities at its desired price or time.

Exposure to the commodities markets may subject the Fund to greater volatility than investments in traditional securities. The value of commodity-linked derivative investments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or sectors affecting a particular industry or commodity, regulatory and natural conditions.

There are risks associated with investing in funds that invest in securities of foreign countries, such as erratic market conditions, economic and political instability and fluctuations in currency exchange rates.

Shareholders bear both their proportionate share of expenses in the Fund (including management and advisory fees) and, indirectly, the expenses of any investment companies the Fund invests in.

Futures contracts, forward contracts, swaps and certain other derivatives may provide the economic effect of financial leverage by creating additional investment exposure, as well as the potential for greater loss. If the Fund uses leverage in an effort to increase its returns, the Fund has the risk of magnified capital losses. The net asset value of the Fund employing leverage of any kind will be more volatile and sensitive to market movements. Leverage may involve the creation of a liability that requires the Fund to pay interest. Short selling may result in losses if the securities appreciate in value.

Futures contracts, swap contracts or other "derivatives," including hedging strategies, present risks related to their significant price volatility and involve the risk of the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. Swap agreements involve special risks because they may be difficult to value, are highly susceptible to liquidity and credit risk.

The Fund may purchase instruments designed to mitigate tail event risk. These instruments involve a high degree of risk. The type, frequency and severity of tail events are difficult to predict or model, and securities or instruments related to the occurrence or non-occurrence of tail events cannot be guaranteed to perform.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

8

An "opportunistic" or event driven investment approach carries the risk that the event (sometimes called a catalyst) required to create value in a particular investment occurs later than expected, does not occur at all, or does not have the desired effect on the market price of investment.

The Fund is subject to certain other risks. Please see the current prospectus for more information regarding the risks associated with an investment in the Fund.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

9

First Eagle Absolute Return Fund

Data as of April 30, 2015 (unaudited)

Investment Objective

The First Eagle Absolute Return Fund seeks long-term absolute returns.

Returns (%) | | | | | | One-

Month | | Three-

Months | | Since

Inception

(5/14/2014) | |

First Eagle Absolute Return Fund | | Class A | | without sales load | | | 0.30 | | | | 0.10 | | | | 1.40 | | |

| | | | | with sales load | | | -4.70 | | | | -4.88 | | | | -3.70 | | |

Barclays Capital Global Aggregate Bond Index | | | | | | | 1.06 | | | | -0.72 | | | | -4.11 | | |

Citigroup 3-Month Treasury Bill Index | | | | | | | 0.00 | | | | 0.01 | | | | 0.03 | | |

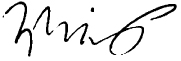

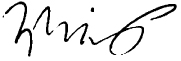

*Asset Allocation percentages are based on total investments in the portfolio. The above excludes 0.04% in net covered call options written.

The Fund's portfolio composition is subject to change at any time.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

10

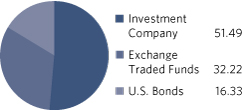

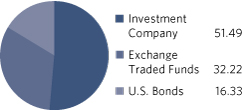

Growth of a $10,000 Initial Investment

Performance data quoted herein represents past performance and should not be considered indicative of future results. Performance data quoted herein does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. The average annual returns shown above are historical and reflect changes in share price, reinvested dividends and are net of expenses.

The average annual returns for Class A Shares give effect to the deduction of the maximum sales charge of 5.00%.

The Citigroup 3M Treasury Bill Index is an unmanaged index that represents the performance of three-month Treasury Bills. One cannot invest directly with the index.

The Barclays Global Aggregate Bond Index measures global investment grade debt from twenty-four different local currency markets. This multi-currency benchmark includes fixed-rate treasury, government-related, corporate and securitized bonds from both developed and emerging market issuers. One cannot invest directly in the index.

Holdings* (%)

SPDR S&P 500 ETF Trust | | | 25.19 | | |

U.S. Treasury Bond | | | 8.87 | | |

U.S. Treasury Inflation Indexed Bond | | | 6.92 | | |

PowerShares DB Commodity Index Tracking Fund | | | 5.98 | | |

Total | | | 46.96 | | |

*Holdings in cash, commercial paper and other short term cash equivalents have been excluded.

Percentages are based on total net assets.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

11

First Eagle Absolute Return Fund | Schedule of Investments | Six-Month Period Ended April 30, 2015 (unaudited)

Shares | | Description | | | | Cost (Note 1) | | Value (Note 1) | |

Exchange Traded Funds — 31.17% | | | |

| | 83,000 | | | PowerShares DB Commodity Index

Tracking Fund (a) | |

| | $ | 2,179,450

| | | $ | 1,518,070

| | |

| | 30,700 | | | SPDR S&P 500 ETF Trust | | | | | 5,863,233 | | | | 6,401,564 | | |

| | Total Exchange Traded Funds | | | | | | | | 8,042,683 | | | | 7,919,634 | | |

Investment Company — 49.81% | | | |

| | 12,655,745 | | | State Street Institutional U.S. Government

Money Market Fund, Institutional Class | | |

| | | | 12,655,745

| | | | 12,655,745

| | |

Principal | | | | | | | | | |

U.S. Bonds — 15.79% | | | |

Government Obligations 15.79% | | | |

$ | 2,000,000 | | | U.S. Treasury Bond 3.375% due 05/15/44 | | | | | 1,996,445 | | | | 2,255,000 | | |

| | 1,510,485 | | | U.S. Treasury Inflation Indexed Bond

1.375% due 02/15/44 | |

| | | 1,596,149

| | | | 1,758,181

| | |

| | Total U.S. Bonds | | | | | | | | 3,592,594 | | | | 4,013,181 | | |

Contracts | | | | Strike Price | | Expiration Date | | | |

Call Options Purchased — 0.25% | | | |

| | 600 | | | CBOE SPX Volatility Index

(Cost: $57,924) | | $ | 21.00

| | | June 2015

| | | 63,000

| | |

| Total Investment Portfolio

Excluding Options Written — 97.02% (Cost: $24,348,946) | | | | | | | | | | 24,651,560 | | |

Covered Call Options Written — (0.29)% | | | |

| | 300 | | | CBOE SPX Volatility Index

(Premium Received $71,538) | | | 15.00

| | | June 2015

| | | (73,500

| ) | |

| | Total Investments — 96.73% (Cost: $24,277,408) | | | | | | | | | | 24,578,060 | | |

| | Other Assets in Excess of Liabilities — 3.27% | | | | | | | | | | 830,444 | | |

| | Net Assets — 100.00% | | | | | | | | | $ | 25,408,504 | | |

(a) Non-income producing security/commodity.

At April 30, 2015, cost is substantially identical for both book and federal income tax purposes. Net unrealized appreciation consisted of:

Gross unrealized appreciation | | $ | 963,994 | | |

Gross unrealized depreciation | | | (663,342 | ) | |

Net unrealized appreciation | | $ | 300,652 | | |

Abbreviations used in this schedule include:

CBOE — Chicago Board Options Exchange

ETF — Exchange Traded Fund

SPDR — Standard & Poor's Depository Receipts

SPX — Standard & Poor's 500 Index

See Notes to Financial Statements.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

12

First Eagle Absolute Return Fund | Schedule of Investments | Six-Month Period Ended April 30, 2015 (unaudited)

Centrally Cleared Credit Default Swaps:

Clearing

Broker | | Exchange | | Referenced

Obligation | | Fixed

Rate

(Pay)

Receive | | Implied

Credit

Spread | | Termination

Date | | Notional

Amount | | Upfront

fees

paid/

(received) | | Market

Value | | Unrealized

Appreciation/

(Depreciation) | |

Buy Protection: | |

Morgan

Stanley &

Co., LLC | |

ICE | | Market CDX

North

American

High Yield

Series 24

5 Year Index | | (5.00)% | | 1.08% | | 06/20/20 | | $3,000,000 | | $(208,577) | | $(228,870) | | $(20,293) | |

Sell Protection: | |

Morgan

Stanley &

Co., LLC | |

ICE | | Market CDX

North

American

Investment

Grade

Series 24

5 Year Index | | 1.00% | | 0.63% | | 06/20/20 | | $16,000,000 | | $291,504 | | $301,865 | | $10,361 | |

Total | | | | | | | | | | | | $ | 19,000,000 | | | | | $ | 72,995 | | | $ | (9,932 | ) | |

Over-the-Counter Credit Default Swaps:

Counterparty | | Referenced

Obligation | | Fixed

Rate

(Pay)

Receive | | Implied

Credit

Spread | | Termination

Date | | Notional

Amount | | Upfront

fees

paid/

(received) | | Market

Value | | Unrealized

Depreciation | | Credit

Rating of

Referenced

Obligation | |

Buy Protection: | |

Bank of

America | | United Mexican

States 5.95%

due 03/19/19 | | | (1.00 | )% | | | 0.64 | % | | 06/20/20 | | $ | 4,000,000 | | | $ | 48,124 | | | $ | 36,928 | | | $ | (11,196 | ) | | BBB+ | |

Over-the-Counter Total Return Swaps:

| | | Rate Type | | | | | | | |

Counterparty | | Referenced Index | | Payment

made by

Fund | | Payment

received by

Fund | | Termination

Date | | Notional

Amount | | Unrealized

Appreciation/

(Depreciation) | |

Barclays Bank PLC | | Barclays US Intermediate

Aggregate Ex-Credit Index | | 1Mo.LIBOR +

18BPS | | Index Return | | 05/01/15 | | $ | 9,000,000 | | | $ | (3,823 | ) | |

Goldman Sachs

International | | Barclays US Inflation Linked

Bonds 1 to 10 Year Total

Return Index | | 1Mo.LIBOR +

20BPS | | Index Return | | 05/01/15 | | | 4,000,000 | | | | 33,360 | | |

Total | | | | | | | | | | $ | 13,000,000 | | | $ | 29,537 | | |

Abbreviations used in this schedule include:

ICE — Intercontinental Exchange

LIBOR — London Interbank Offered Rate

See Notes to Financial Statements.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

13

First Eagle Absolute Return Fund | Schedule of Investments | Six-Month Period Ended April 30, 2015 (unaudited)

Industry Diversification For Portfolio Holdings | | Percent of

Net Assets | |

Exchange Traded Funds | | | 31.17 | % | |

Investment Company | | | 49.81 | | |

U.S. Bonds

Government Issues | | | 15.79 | | |

Total U.S. Bonds | | | 15.79 | | |

Call Options Purchased | | | 0.25 | | |

Covered Call Options Written | | | (0.29 | ) | |

Total Investments | | | 96.73 | % | |

See Notes to Financial Statements.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

14

This page was intentionally left blank.

Statement of Assets and Liabilities April 30, 2015 (unaudited)

| | | First Eagle Absolute

Return Fund | |

Assets | |

Investments, at Cost (Note 1) | |

Unaffiliated issuers | | $ | 24,348,946 | | |

Total Investments, at Cost | | | 24,348,946 | | |

Investments, at Value (Note 1) | |

Investments | | | 24,651,560 | | |

Total Investments, at Value | | | 24,651,560 | | |

Cash | | | 22,327 | | |

Restricted cash* | | | 397,230 | | |

Due from broker | | | 219,935 | | |

Receivable from Investment Adviser | | | 65,600 | | |

Accrued interest and dividends receivable | | | 35,443 | | |

Variation margin on open swap agreements (Note 1) | | | 62,317 | | |

Unrealized appreciation on open swap agreements (Note 1) | | | 33,360 | | |

Premium paid on open swap agreements (Note 1) | | | 48,124 | | |

Other assets | | | 33,137 | | |

Total Assets | | | 25,569,033 | | |

Liabilities | |

Option contracts written, at value (premiums received $71,538) (Note 1) | | | 73,500 | | |

Distribution fees payable (Note 3) | | | 83 | | |

Services fees payable (Note 3) | | | 21 | | |

Unrealized depreciation on open swap agreements (Note 1) | | | 15,019 | | |

Administrative fees payable (Note 2) | | | 1,048 | | |

Trustee fees payable | | | 1,015 | | |

Accrued expenses and other liabilities | | | 69,843 | | |

Total Liabilities | | | 160,529 | | |

Net Assets | | $ | 25,408,504 | | |

Net Assets Consist of | |

Capital stock (par value, $0.001 per share) | | $ | 2,500 | | |

Capital surplus | | | 24,990,869 | | |

Net unrealized appreciation (depreciation) on: | |

Investments | | | 302,614 | | |

Swap agreements | | | 8,409 | | |

Written options | | | (1,962 | ) | |

Undistributed net realized gains on investments | | | 159,201 | | |

Accumulated net investment loss | | | (53,127 | ) | |

Net Assets | | $ | 25,408,504 | | |

* The amount of $397,230 represents restricted cash used as collateral for call options.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

16

Statement of Assets and Liabilities (continued)

| | | First Eagle Absolute

Return Fund | |

Class A | |

Net assets | | $ | 101,394 | | |

Shares outstanding | | | 10,000 | | |

Net asset value per share and redemption proceeds per share(1) | | $ | 10.14 | | |

Offering price per share (NAV per share plus maximum sales charge) | | $ | 10.67 | (2) | |

Class C | |

Net assets | | $ | 100,668 | | |

Shares outstanding | | | 10,000 | | |

Net asset value per share | | $ | 10.07 | | |

Redemption proceeds per share (NAV per share less maximum contingent

deferred sale charge)(3) | | $ | 9.97 | | |

Class I | |

Net assets | | $ | 25,206,442 | | |

Shares outstanding | | | 2,480,000 | | |

Net asset value per share and redemption proceeds per share | | $ | 10.16 | | |

(1) A contingent deferred sales charge of 1.00% may apply on redemptions of Class A shares made within 18 months following a purchase of $1,000,000 or more without an initial sales charge.

(2) The maximum sales charge is 5.00% for Class A shares. Classes C and I have no front-end sales charges.

(3) The maximum CDSC (Contingent Deferred Sales Charge) is 1.00% for Class C shares, which is charged on the lesser of the offering price or the net asset value at the time of sale by shareholder. This pertains to investments of one year or less.

See Notes to Financial Statements.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

17

Statement of Operations April 30, 2015 (unaudited)

| | | First Eagle Absolute

Return Fund | |

Investment Income | |

Interest | | $ | 22,314 | | |

Dividends | | | 63,418 | | |

Total Income | | | 85,732 | | |

Expenses | |

Investment advisory fees (Note 2) | | | 106,789 | | |

Administrative costs (Note 2) | | | 6,282 | | |

Distribution fees (Note 3) | |

Class A | | | 125 | | |

Class C | | | 374 | | |

Service fees - Class C (Note 3) | | | 125 | | |

Shareholder servicing agent fees | | | 323 | | |

Custodian and accounting fees | | | 31,494 | | |

Professional fees | | | 66,065 | | |

Shareholder reporting fees | | | 24,797 | | |

Trustees' fees | | | 724 | | |

Registration and filing fees | | | 1,810 | | |

Other Expenses | | | 403,715 | | |

Total Expenses | | | 642,623 | | |

Expense Waiver | | | (503,764 | ) | |

Net expenses | | | 138,859 | | |

Net Investment Loss (Note 1) | | | (53,127 | ) | |

Realized and Unrealized Gains (Losses) on Investments,

Swap Agreements and Written Options (Note 1) | |

Net realized gains (losses) from: | |

Investment transactions | | | (218,452 | ) | |

Swap agreements | | | 233,962 | | |

Written options | | | 141,961 | | |

| | | | 157,471 | | |

Changes in unrealized appreciation (depreciation) of: | |

Investment transactions | | | 113,946 | | |

Swap agreements | | | (52,320 | ) | |

Written options | | | (11,866 | ) | |

| | | | 49,760 | | |

Net realized and unrealized gains (losses) on investments, swap agreements and

written options | | | 207,231 | | |

Net Increase in Net Assets Resulting from Operations | | $ | 154,104 | | |

See Notes to Financial Statements.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

18

Statements of Changes in Net Assets

| | | First Eagle Absolute

Return Fund | |

| | | Six-Months Ended

April 30, 2015

(unaudited) | | Period

May 14, 2014^ to

October 31, 2014 | |

Operations | |

Net investment loss | | $ | (53,127 | ) | | $ | (23,956 | ) | |

Net realized gain from investments, swap agreements and

written options | | | 157,471 | | | | 19,055 | | |

Change in unrealized appreciation of investments,

swap agreements and written options | | | 49,760 | | | | 259,301 | | |

Net increase in net assets resulting from operations | | | 154,104 | | | | 254,400 | | |

Fund Share Transactions (Note 6) | |

Net proceeds from shares sold | | | — | | | | 25,000,000 | | |

Increase in net assets from Fund share transactions | | | — | | | | 25,000,000 | | |

Net increase in net assets | | | 154,104 | | | | 25,254,400 | | |

Net Assets (Note 1) | |

Beginning of period | | | 25,254,400 | | | | — | | |

End of period | | $ | 25,408,504 | | | $ | 25,254,400 | | |

Accumulated net investment loss | | $ | (53,127 | ) | | $ | — | | |

^ Commencement of investment operations.

See Notes to Financial Statements.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

19

First Eagle Absolute Return Fund

| | | Six-Months Ended

April 30, 2015 (unaudited) | | Period May 14, 2014^ to

October 31, 2014 | |

| | | Class A | | Class C | | Class I | | Class A | | Class C | | Class I | |

Selected data for a share of beneficial interest outstanding throughout

each period is presented below:* | |

Net asset value, beginning of

period ($) | | | 10.09 | | | | 10.06 | | | | 10.10 | | | | 10.00 | | | | 10.00 | | | | 10.00 | | |

Income (loss) from investment operations: | |

Net investment loss ($) | | | -0.03 | | | | -0.07 | | | | -0.02 | | | | -0.02 | | | | -0.06 | | | | -0.01 | | |

Net realized and unrealized gains

on investments | | | 0.08 | | | | 0.08 | | | | 0.08 | | | | 0.11 | | | | 0.12 | | | | 0.11 | | |

Total income from investment

operations | | | 0.05 | | | | 0.01 | | | | 0.06 | | | | 0.09 | | | | 0.06 | | | | 0.10 | | |

Net asset value, end of period ($) | | | 10.14 | | | | 10.07 | | | | 10.16 | | | | 10.09 | | | | 10.06 | | | | 10.10 | | |

Total Return(c) (%) | | | 0.50 | (a) | | | 0.10 | (a) | | | 0.59 | (a) | | | 0.90 | (a) | | | 0.60 | (a) | | | 1.00 | (a) | |

Ratios and supplemental data | |

Net assets, end of period

(thousands) ($) | | | 101 | | | | 101 | | | | 25,206 | | | | 101 | | | | 101 | | | | 25,053 | | |

Ratio of operating expenses to

average net assets including fee

waivers and reimbursements (%) | | | 1.35 | (b) | | | 2.10 | (b) | | | 1.10 | (b) | | | 1.35 | (b)(d) | | | 2.10 | (b)(d) | | | 1.10 | (b)(d) | |

Ratio of operating expenses to

average net assets excluding fee

waivers and reimbursements (%) | | | 5.50 | (b) | | | 6.25 | (b) | | | 5.11 | (b) | | | 3.53 | (b)(d) | | | 4.27 | (b)(d) | | | 3.28 | (b)(d) | |

Ratio of net investment income to

average net assets including fee

waivers and reimbursements (%) | | | -0.67 | (b) | | | -1.42 | (b) | | | -0.42 | (b) | | | -0.45 | (b)(d) | | | -1.20 | (b)(d) | | | -0.20 | (b)(d) | |

Ratio of net investment income to

average net assets excluding fee

waivers and reimbursements (%) | | | -4.82 | (b) | | | -5.57 | (b) | | | -4.43 | (b) | | | -2.63 | (b)(d) | | | -3.37 | (b)(d) | | | -2.38 | (b)(d) | |

Portfolio turnover rate (%) | | | — | (a) | | | — | (a) | | | — | (a) | | | 9.77 | (a) | | | 9.77 | (a) | | | 9.77 | (a) | |

^ Commencement of investment operations.

* Per share amounts have been calculated using the average shares method.

(a) Not Annualized

(b) Annualized

(c) Does not take into account the sales charge of 5.00% for Class A and the CDSC (Contingent Deferred Sales Charge) of 1.00% for Class C shares. A CDSC of 1.00% may apply on redemptions of Class A shares made within 18 months following a purchase of $1,000,000 or more without an initial sales charge.

(d) Certain non-recurring expenses incurred by the Fund were not annualized for the period ended October 31, 2014.

See Notes to Financial Statements.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

20

This page was intentionally left blank.

Notes to Financial Statements (unaudited)

Note 1 — Significant Accounting Policies

First Eagle Absolute Return Fund (the "Fund"), is an open-end management investment company registered under the Investment Company Act of 1940, as amended ("1940 Act"). The Fund is one of the portfolios in the First Eagle Funds (the "Trust" or "Funds"). The Trust consists of eight separate portfolios, First Eagle Global Fund, First Eagle Overseas Fund, First Eagle U.S. Value Fund, First Eagle Gold Fund, First Eagle Global Income Builder Fund, First Eagle High Yield Fund, First Eagle Fund of America and First Eagle Absolute Return Fund. The Trust is a Delaware statutory trust. Information about the other First Eagle Funds are described in a Prospectus and Annual Report separate from that for the Fund discussed here. The Fund seeks long-term absolute returns and is a non-diversified mutual fund. An "absolute" return refers to a return on investment that is evaluated on its own merits and not by reference to a benchmark or other similar "relative" return. The Fund commenced operations on May 14, 2014.

First Eagle Investment Management, LLC (the "Adviser"), a subsidiary of Arnhold and S. Bleichroeder Holdings, Inc. ("ASB Holdings"), manages the Fund. The following is a summary of significant accounting policies adhered to by the Fund. These accounting policies are in conformity with U.S. generally accepted accounting principles ("GAAP").

a) Investment valuation — The Fund computes its net asset value once daily as of the close of trading on each day the New York Stock Exchange ("NYSE") is open for trading. The net asset value per share is computed by dividing the total current value of the assets of the Fund, less its liabilities, by the total number of shares outstanding at the time of such computation.

A portfolio security (including an option), other than a bond, which is traded on a U.S. national securities exchange or a securities exchange abroad is normally valued at the price of the last sale on the exchange as of the close of business on the date on which assets are valued. If there are no sales on such date, such portfolio investment will be valued at the mean between the closing bid and asked prices (and if there is only a bid or only an asked price on such date, valuation will be at such bid or asked price for long or short positions, respectively). Securities, other than bonds, traded in the over-the-counter market are valued at the mean between the last bid and asked prices prior to the time of valuation (and if there is only a bid or only an asked price on such date, valuation will be at such bid or asked price for long or short positions, respectively), except if such unlisted security traded on the NASDAQ, in which case it is valued at its last sale price (or, if available, the NASDAQ Official Closing Price).

All bonds, whether listed on an exchange or traded in the over-the-counter market, for which market quotations are readily available are valued at the mean between the last bid and asked prices received from dealers in the over-the-counter market in the United States or abroad, except that when no asked price is available, bonds are valued at the last bid price alone. Broker-Dealers or pricing services use multiple valuation techniques to determine value. In instances where sufficient market activity exists, dealers or pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the dealers or pricing services also utilize proprietary valuation models which may consider market

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

22

Notes to Financial Statements (unaudited)

transactions in comparable securities and the various relationships between securities in determining value and/or market characteristics such as benchmark yield curves, option-adjusted spreads, credit spreads, estimated default rates, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair values. Short-term investments, maturing in sixty days or less, will be valued at market price.

Any security that is listed or traded on more than one exchange (or traded in multiple markets) is valued at the relevant quotation on the exchange or market deemed to be the primary trading venue for that security. In the absence of such a quotation, a quotation from the exchange or market deemed by the Adviser to be the secondary trading venue for the particular security shall be used. The Fund uses pricing services to identify the market prices of publicly traded securities in their portfolios. When market prices are determined to be "stale" as a result of limited market activity for a particular holding, or in other circumstances when market prices are unavailable, such as for private placements, or determined to be unreliable for a particular holding, such holdings may be "fair valued" in accordance with procedures approved by the Board of Trustees ("Board"). Additionally, with respect to foreign holdings, specifically in circumstances leading the Adviser to believe that significant events occurring after the close of a foreign market have materially affected the value of a Fund's holdings in that market, such holdings may be fair valued to reflect the events in accordance with procedures approved by the Board. The determination of whether a particular foreign investment should be fair valued will be based on review of a number of factors, including developments in foreign markets, the performance of U.S. securities markets and security-specific events. The values assigned to a Fund's holdings therefore may differ on occasion from reported market values.

Swaps and other derivatives are valued daily, primarily using independent pricing services, and their independent pricing models using market inputs.

The Fund adopted provisions surrounding fair value measurements and disclosures that define fair value, establish a framework for measuring fair value in GAAP and expand disclosures about fair value measurements. This applies to fair value measurements that are already required or permitted by other accounting standards and is intended to increase consistency of those measurements and applies broadly to securities and other types of assets and liabilities.

The Fund discloses the fair value of their investments in a hierarchy that prioritizes the inputs or assumptions to valuation techniques used to measure fair value. These inputs are used in determining the value of the Funds' investments and are summarized in the following fair value hierarchy:

Level 1 — Quoted prices in active markets for identical securities.

Level 2 — Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 — Other significant unobservable inputs (including the Fund's own assumption in determining the fair value of investments).

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

23

Notes to Financial Statements (unaudited)

The significant unobservable inputs that may be used in determining valuations for investments identified within Level 3 are market comparables and the enterprise value of a company. Indications of value and quotations may be observable at any given time, but are currently treated by the Fund as unobservable. Significant changes in any of the unobservable inputs may significantly impact the fair value measurement. The impact is based on the relationship between each unobservable input and the fair value measurement.

Significant increases (decreases) in enterprise multiples may increase (decrease) the fair value measurement. Significant increases (decreases) in the discount for marketability, probability of insolvency and probability of default may decrease (increase) the fair value measurement.

Fair valuation of securities, other financial investments or other assets (collectively, "securities") held by the Fund shall be determined in good faith by or under the direction of the Board, generally acting through its designated Board Valuation Committee or Valuation Committee (collectively, the "Committees"). The Committees' responsibilities include making determinations regarding Level 3 fair value measurements and providing the results to the Board, in accordance with the Fund's valuation policies.

It is the policy of the Fund to recognize significant transfers between Levels 1, 2 and 3 and to disclose those transfers as of the date of the underlying event which caused the movement.

The following is a summary of the Fund's inputs used to value the Fund's investments as of April 30, 2015:

Description | | Level 1 | | Level 2 | | Level 3 | | Total | |

Assets:† | |

Exchange-Traded Funds | | $ | 7,919,634 | | | $ | — | | | $ | — | | | $ | 7,919,634 | | |

Investment Company | | | 12,655,745 | | | | — | | | | — | | | | 12,655,745 | | |

U.S. Bonds | | | — | | | | 4,013,181 | | | | — | | | | 4,013,181 | | |

Call Options Purchased | | | 63,000 | | | | — | | | | — | | | | 63,000 | | |

Centrally Cleared Credit Default Swaps | | | — | | | | 10,361 | | | | — | | | | 10,361 | | |

Over-the-Counter Total Return Swaps | | | — | | | | 33,360 | | | | — | | | | 33,360 | | |

Total | | $ | 20,638,379 | | | $ | 4,056,902 | | | $ | — | | | $ | 24,695,281 | | |

Liabilities: | |

Covered Call Options Written | | $ | 73,500 | | | $ | — | | | $ | — | | | $ | 73,500 | | |

Centrally Cleared Credit Default Swaps | | | — | | | | 20,293 | | | | — | | | | 20,293 | | |

Over-the-Counter Credit Default Swaps | | | — | | | | 11,196 | | | | — | | | | 11,196 | | |

Over-the-Counter Total Return Swaps | | | — | | | | 3,823 | | | | — | | | | 3,823 | | |

Total | | $ | 73,500 | | | $ | 35,312 | | | $ | — | | | $ | 108,812 | | |

†See Schedule of Investments for additional detailed categorizations.

For the six-month period ended April 30, 2015, there was no security transfer activity from Level 1 to Level 2 and no security transfer activity from Level 2 to Level 1.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

24

Notes to Financial Statements (unaudited)

b) Investment transactions and income — Investment transactions are accounted for on a trade date basis. The specific identification method is used in determining realized gains and losses from investment transactions. Dividend income is recorded on the ex-dividend date. Interest income is recorded daily on the accrual basis. In computing investment income, the Fund accretes discounts and amortizes premiums on debt obligations using the effective yield method. Investment income is allocated to the Fund's share class in proportion to its relative net assets. Payments received from certain investments held by the Fund may be comprised of dividends, capital gains and return of capital. The Fund originally estimates the expected classification of such payments. The amounts may subsequently be reclassified upon receipt of information from the issuer.

c) Expenses — Expenses arising in connection with a Fund are charged directly to that Fund. Expenses common to all Funds may be allocated to each Fund in proportion to its relative net assets. Certain expenses are shared with the First Eagle Variable Funds, an affiliated fund group. Such costs are generally allocated using the ratio of the Fund's average daily net assets relative to the total average daily net assets of the First Eagle Variable Funds. Earnings credits may reduce shareholder servicing agent fees by the amount of interest earned on balances with such service provider.

d) Exchange Traded Funds — The Fund may invest in ETFs, which are investment companies or special purpose trusts whose primary objective is to achieve the same rate of return as a particular market index or commodity while trading throughout the day on an exchange. Most ETF shares are sold initially in the primary market in units of 50,000 or more ("creation units"). A creation unit represents a bundle of securities (or other assets) that replicates, or is a representative sample of, the ETF's holdings and that is deposited with the ETF. Once owned, the individual shares comprising each creation unit are traded on an exchange in secondary market transactions for cash. The secondary market for ETF shares allows them to be readily converted into cash, like commonly traded stocks. The combination of primary and secondary markets permits ETF shares to be traded throughout the day close to the value of the ETF's underlying holdings. The Fund would purchase and sell individual shares of ETFs in the secondary market. These secondary market transactions require the payment of commissions.

Furthermore, there may be times when the exchange halts trading, in which case the Fund owning ETF shares would be unable to sell them until trading is resumed. In addition, because ETFs often invest in a portfolio of common stocks and "track" a designated index, an overall decline in stocks comprising an ETF's benchmark index could have a greater impact on the ETF and investors than might be the case in an investment company with a more widely diversified portfolio. Losses could also occur if the ETF is unable to replicate the performance of the chosen benchmark index. ETFs tracking the return of a particular commodity (e.g., gold or oil) are exposed to the volatility and other financial risks relating to commodities investments.

Other risks associated with ETFs include the possibility that: (i) an ETF's distributions may decline if the issuers of the ETF's portfolio securities fail to continue to pay dividends; and (ii) under certain circumstances, an ETF could be terminated. Should termination occur, the

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

25

Notes to Financial Statements (unaudited)

ETF could have to liquidate its portfolio when the prices for those assets are falling. In addition, inadequate or irregularly provided information about an ETF or its investments, because ETFs are passively managed, could expose investors in ETFs to unknown risks.

e) Options — For hedging and investment purposes, the Fund may purchase and write (sell) put and call options on U.S. and foreign securities, including government securities, and foreign currencies that are traded on U.S. and foreign securities exchanges and over-the-counter markets. Among other things, the Fund may use options transactions for non-hedging purposes as a means of making direct investments in foreign currencies, or use options strategies involving the purchase and/or writing of various combinations of call and/or put options, for hedging and investment purposes.

The risk associated with purchasing an option is that the Fund pays a premium whether or not the option is exercised. Additionally, the Fund bears the risk of loss of the premium and change in market value should the counterparty not perform under the contract. Put and call options purchased are accounted for in the same manner as portfolio securities. The cost of securities acquired through the exercise of call options is increased by premiums paid. The proceeds from securities sold through the exercise of put options are decreased by the premiums paid.

When the Fund writes an option, the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current market value of the option written. Premiums received from written options which expire unexercised are recorded by the Fund on the expiration date as realized gains from options written. The difference between the premium received and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or if the premium received is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium received is added to the proceeds from the sale of the underlying security or currency in determining whether the Fund has realized a gain or loss. If a put option is exercised, the premium received reduces the cost basis of the security or currency purchased by the Fund. In writing an option, the Fund bears the market risk of an unfavorable change in the price of the security or currency underlying the written option. Exercise of an option written by the Fund could result in the Fund selling or buying a security or currency at a price different from the current market value.

The Fund may be required to segregate assets to cover its obligation under option contracts through posting collateral to the Fund's custodian according to the tri-party agreement.

For the six-month period ended April 30, 2015, the Fund held purchased options and written options for hedging purposes.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

26

Notes to Financial Statements (unaudited)

For the six-month period ended April 30, 2015, the Fund had the following options transactions:

Written Options | | Number of

Contracts | | Premium

Received | |

Options outstanding at October 31, 2014 | | | 300 | | | $ | 66,904 | | |

Options written | | | 1,800 | | | | 485,741 | | |

Options assigned | | | 0 | | | | 0 | | |

Options expired/closed | | | (1,800 | ) | | | (481,107 | ) | |

Options outstanding at April 30, 2015 | | | 300 | | | $ | 71,538 | | |

Purchased Options | | Number of

Contracts | | Cost | |

Options outstanding at October 31, 2014 | | | 600 | | | $ | 71,633 | | |

Options purchased | | | 3,600 | | | | 440,949 | | |

Options closed | | | (3,600 | ) | | | (454,658 | ) | |

Options outstanding at April 30, 2015 | | | 600 | | | $ | 57,924 | | |

As of April 30, 2015, cash amount of $397,230 was segregated for options collateral.

Outstanding contracts at period-end are indicative of the volume of activity during the period.

At April 30, 2015, the Fund had the following options grouped into appropriate risk categories illustrated below:

| | | | | | | Gain or (Loss)

Derivative Recognized

in Income | |

Risk Type | | Asset Derivative

Fair Value(1) | | Liability Derivative

Fair Value(2) | | Realized

Gain (Loss)(3) | | Change in

Appreciation

(Depreciation)(4) | |

Equity — Written options | | $ | 0 | | | $ | 73,500 | | | $ | 141,961 | | | $ | (11,866 | ) | |

Equity — Purchased options | | | 63,000 | | | | 0 | | | | (218,452 | ) | | | 16,709 | | |

(1) Statement of Assets and Liabilities location: Investments, at Value.

(2) Statement of Assets and Liabilities location: Option contracts written, at value.

(3) Statement of Operations location: Net realized gains (losses) from Written options & Investment transactions.

(4) Statement of Operations location: Changes in unrealized appreciation (depreciation) of Written options & Investment transactions.

f) Swaps — The Fund may enter into swaps to hedge its exposure to interest rates, credit risk, or currencies. The Fund may also enter into swaps for non- hedging purposes as a means of gaining market exposures, including by making direct investments in foreign currencies, or in order to take a "long" or "short" position with respect to an underlying referenced asset described below under "Total Return Swaps". A swap is an agreement that obligates two parties to exchange a series of cash flows at specified intervals based upon or calculated by reference to changes in specified prices or rates for a specified amount of an underlying asset. The payment flows are

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

27

Notes to Financial Statements (unaudited)

usually netted against each other, with the difference being paid by one party to the other. In addition, collateral may be pledged or received by the Fund in accordance with the terms of the respective swaps to provide value and recourse to the Fund or its counterparties in the event of default, bankruptcy or insolvency by one of the parties to the swap. The purchase of a cap entitles the purchaser, to the extent that a specified index or other underlying financial measure exceeds a predetermined value on a predetermined date or dates, to receive payments on a notional principal amount from the party selling the cap. The purchase of a floor entitles the purchaser, to the extent that a specified index or other underlying financial measure falls below a predetermined value on a predetermined date or dates, to receive payments on a notional principal amount from the party selling the floor. A collar combines elements of a cap and a floor.

Risks may arise as a result of the failure of the counterparty to the swap to comply with the terms of the contract. Therefore, the Fund considers the creditworthiness of each counterparty to a swap in evaluating potential counterparty risk. This risk is mitigated by having a netting arrangement between the Fund and the counterparty and by the posting of collateral by the counterparty to the Fund's custodian according to the tri-party agreement to cover the Fund's exposure to the counterparty. Additionally, risks may arise from unanticipated movements in interest rates or in the value of the underlying securities. The Fund accrues for the interim payments on swaps on a daily basis, with the net amount recorded within unrealized appreciation/depreciation of swaps on the statement of assets and liabilities, where applicable. Once the interim payments are settled in cash, the net amount is recorded as realized gain/(loss) on swaps on the statement of operations, in addition to any realized gain/(loss) recorded upon the termination of swaps. Upfront premiums paid or received are recognized as cost or proceeds on the statement of assets and liabilities and are amortized on a straight line basis over the life of the contract. Amortized upfront premiums are included in net realized gain/(loss) from swaps on the statement of operations. Fluctuations in the value of swaps are recorded as a component of net change in unrealized appreciation/depreciation of swaps on the statement of operations.

In order to better define its contractual rights and to secure rights that will help the Fund mitigate its counterparty risk, the Fund may enter into an International Swaps and Derivatives Association, Inc. Master Agreement and Credit Support Annex ("ISDA Master Agreement") or similar agreement with its derivative contract counterparties. An ISDA Master Agreement is a bilateral agreement between the Fund and a counterparty that governs over-the-counter ("OTC") derivatives and typically contains, among other things, collateral posting terms and netting provisions in the event of a default and/or termination event. Under ISDA Master Agreement, the Fund may, under certain circumstances, offset with the counterparty certain derivative financial instrument's payables and/or receivables with collateral held and/or posted and create one single net payment. The provisions of the ISDA Master Agreement typically permit a single net payment in the event of default (close-out netting) including the bankruptcy or insolvency of the counterparty. Note, however, that bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against the right of offset in bankruptcy, insolvency or other events.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

28

Notes to Financial Statements (unaudited)

For financial reporting purposes, the Fund does not offset derivative assets and derivative liabilities that are subject to netting arrangements in the Statement of Asset and Liabilities.

Certain standardized swaps, including certain interest rate swaps and credit default swaps, are (or soon will be) subject to mandatory central clearing. Cleared swaps are transacted through futures commission merchants ("FCMs") that are members of central clearinghouses, with the clearinghouse serving as central counterparty, similar to transactions in futures contracts. Centralized clearing will be required for additional categories of swaps on a phased-in basis based on requirements published by the Securities Exchange Commission and Commodity Futures Trading Commission.

At the time the Fund enters into a centrally cleared swap, the Fund deposits and maintains as collateral an initial margin with the broker, as required by the FCM and the exchange on which the transaction is effected. Pursuant to the contract, the Fund agrees to receive from or pay to the broker an amount of cash equal to the daily fluctuation in the value of the contract. Such receipts or payments are known as variation margin and are recorded by the Fund as unrealized gains or losses. Risks may arise from the potential of counterparty to meet the terms of the contract. The credit/counterparty risk for exchange-traded swaps is generally less than privately negotiated swaps, since the clearinghouse, which is the issuer or counterparty to each exchange-traded swap, has robust risk mitigation standards, including the requirement to provide initial and variation margin. When the contract is closed, the Fund records a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the time it was closed.

For OTC swaps, collateral may be posted initially by one party to the swap to the custodian according to the tri-party agreement, and additional collateral may be transferred periodically as the fair value of the swap becomes more favorable to one party and less favorable to the counterparty. The fair value of OTC derivative instruments, collateral received or pledged and net exposure by counterparty as of period end, is disclosed in the subsequent table.

Credit Default Swap

The Fund may enter into credit default swaps, including to manage its exposure to the market or certain sectors of the market, to reduce its risk exposure to defaults by corporate and sovereign issuers held by the Fund, or to create exposure to corporate or sovereign issuers to which it is not otherwise exposed. The Fund may purchase credit protection ("Buy Contract") or provide credit protection ("Sale Contract") on the referenced obligation of the credit default swap. During the term of the swap, the Fund receives/(pays) fixed payments from/(to) the respective counterparty, calculated at the agreed upon rate applied to the notional amount. If the Fund is a buyer/(seller) of protection and a credit event occurs, as defined under the terms of the swap, the Fund will either (i) receive from the seller/(pay to the buyer) of protection an amount equal to the notional amount of the swap (the "Maximum Payout Amount") and deliver/(take delivery of) the referenced obligation or (ii) receive/(pay) a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

29

Notes to Financial Statements (unaudited)

Credit default swaps may involve greater risks than if the Fund had invested in the referenced obligation directly. Credit default swaps are subject to general market risk, liquidity risk, counterparty risk and credit risk. If the Fund is a buyer of protection and no credit event occurs, it will lose the payments it made to its counterparty. If the Fund is a seller of protection and a credit event occurs, the value of the referenced obligation received by the Fund coupled with the periodic payments previously received may be less than the Maximum Payout Amount it pays to the buyer, resulting in a net loss to the Fund.

For the six-month period ended April 30, 2015, the Fund held credit default swaps for hedging and non-hedging purposes.

Implied credit spreads utilized in determining the market value of credit default swaps on issuers as of period end are disclosed in the portfolio of investments. The implied spreads serve as an indicator of the current status of the payment/performance risk and typically reflect the likelihood of default by the issuer of the referenced obligation. The implied credit spread of a particular reference obligation also reflects the cost of buying/selling protection and may reflect upfront payments required to be made to enter into the agreement. Widening credit spreads typically represent a deterioration of the referenced obligation's credit soundness and greater likelihood of default or other credit event occurring as defined under the terms of the agreement. A credit spread identified as "Defaulted" indicates a credit event has occurred for the referenced obligation.

At April 30, 2015, the Fund had Sale Contracts outstanding with Maximum Payout Amounts aggregating $16,000,000, with net unrealized appreciation of $10,361, and terms of less than 5 years, as reflected in the schedule of investments.

Total Return Swaps

The Fund may enter into total return swaps in order to take a "long" or "short" position with respect to an underlying referenced asset. The Fund is subject to market price volatility of the underlying referenced asset. A total return swap involved commitments to pay interest in exchange for a market linked return based on a notional amount. To the extent that the total return of the security, group of securities or index underlying the transaction exceeds or falls short of the offsetting interest obligation, the Fund will receive a payment from or make a payment to the counterparty.

Interest Rate Swap Contracts

The Fund may enter into interest rate swap contracts, which are arrangements between two parties to exchange cash flows based on a notional principal amount, to hedge interest rate risk, to gain exposure on interest rates, and to hedge prepayment risk. The Fund may be exposed to credit or market risk due to unfavorable changes in the fluctuation of interest rates or if the counterparty defaults on its obligation to perform. Interest rate swap contracts may be purchased or sold with upfront premium payments which will be recorded as realized gains or losses at the closing of the contract. Payments related to these swap contracts will accrue based

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

30

Notes to Financial Statements (unaudited)

on the terms of the particular contract. The Fund's maximum risk of loss from counterparty risk is the fair value of the contract, which may be, in some cases, mitigated by entering into a master netting arrangement with the counterparty.

At April 30, 2015, the Fund had the following swaps grouped into appropriate risk categories illustrated below:

| | | | | | Gain or (Loss)

Derivative Recognized

in Income | |

| Risk Type | | Asset Derivative

Fair Value(1) | | Liability Derivative

Fair Value(2) | | Realized

Gain (Loss)(3) | | Change in

Appreciation

(Depreciation)(4) | |

OTC Credit Default Swap

agreement-Credit Risk | | $ | — | | | $ | 11,196 | | | $ | 108,951 | | | $ | 3,722 | | |

Centrally Cleared Credit

Default Swap

agreements-Credit Risk | | | 10,361 | (a) | | | 20,293 | (a) | | | (67,710 | ) | | | (7,715 | ) | |

OTC Total Return Swap

agreements-Credit Risk | | | 33,360 | | | | 3,823 | | | | 192,721 | | | | (48,327 | ) | |

(1) Statement of Assets and Liabilities location: Unrealized appreciation on open swap agreements.

(2) Statement of Assets and Liabilities location: Unrealized depreciation on open swap agreements.

(3) Statement of Operations location: Net realized gains (losses) from swap agreements.

(4) Statement of Operations location: Changes in unrealized appreciation (depreciation) of swap agreements.

(a) This amount represents the cumulative appreciation (depreciation) as reported in the Schedule of Investments. The Statement of Assets and Liabilities only reflects the current day's net variation margin.

The following table presents the Fund's gross derivative assets and liabilities by counterparty net of amounts available for offset under netting arrangements and any related collateral received or pledged by the Fund as of April 30, 2015:

| Counterparty | | Gross Amounts

of Assets | | Derivatives

Available for

Offset | | Collateral

Received | | Net Amount

(Not Less

Than $0) | |

Goldman Sachs International | | $ | 33,360 | | | $ | — | | | $ | — | | | $ | 33,360 | | |

| Counterparty | | Gross Amounts

of Liabilities | | Derivatives

Available for

Offset | | Collateral

Pledged | | Net Amount

(Not Less

Than $0) | |

Bank of America | | $ | 11,196 | | | $ | — | | | $ | — | | | $ | 11,196 | | |

Barclays Bank PLC | | | 3,823 | | | | — | | | | — | | | | 3,823 | | |

| | $ | 15,019 | | | $ | — | | | $ | — | | | $ | 15,019 | | |

Currency Transactions

To manage its exposure to foreign currencies, the Fund may engage in foreign currency exchange transactions, including purchasing and selling foreign currency, foreign currency

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

31

Notes to Financial Statements (unaudited)

options, foreign currency forward contracts and foreign currency futures contracts and related options. In addition, the Fund may engage in these transactions for the purpose of increasing its return. Foreign currency transactions involve costs, and, if unsuccessful, may reduce the Fund's return.

Generally, the Fund may engage in both "transaction hedging" and "position hedging." The Fund may also engage in foreign currency transactions for non-hedging purposes, subject to applicable law. When it engages in transaction hedging, the Fund enters into foreign currency transactions with respect to specific receivables or payables, generally arising in connection with the purchase or sale of portfolio securities. The Fund will engage in transaction hedging when it desires to "lock in" the U.S. dollar price of a security it has agreed to purchase or sell, or the U.S. dollar equivalent of a dividend or interest payment in a foreign currency. By transaction hedging the Fund will attempt to protect itself against a possible loss resulting from an adverse change in the relationship between the U.S. dollar and the applicable foreign currency during the period between the date on which the security is purchased or sold, or on which the dividend or interest payment is earned, and the date on which such payments are made or received. The Fund may also engage in position hedging to protect against a decline in the value relative to the U.S. dollar of the currencies in which its portfolio securities are denominated or quoted (or an increase in the value of the currency in which securities the Fund intends to buy are denominated or quoted). The Fund's currency hedging transactions may call for the delivery of one foreign currency in exchange for another foreign currency and may at times not involve currencies in which its portfolio securities are then denominated. The Adviser will engage in such "cross hedging" activities when it believes that such transactions provide significant hedging opportunities for the Fund. Cross hedging transactions by the Fund involve the risk of imperfect correlation between changes in the values of the currencies to which such transactions relate and changes in the value of the currency or other asset or liability which is the subject of the hedge.

Transaction and position hedging do not eliminate fluctuations in the underlying prices of the securities that the Fund owns or intends to purchase or sell. They simply establish a rate of exchange which one can achieve at some future point in time. Additionally, although these techniques tend to minimize the risk of loss due to a decline in the value of the hedged currency, they involve costs to the Fund and tend to limit any potential gain which might result from the increase in value of such currency.

The Fund may purchase or sell a foreign currency on a spot (or cash) basis at the prevailing spot rate in connection with the settlement of transactions in portfolio securities denominated in that foreign currency or for other hedging or non-hedging purposes. The Fund may also purchase or sell exchange-listed and over the-counter call and put options on foreign currency futures contracts and on foreign currencies. Foreign currency options are traded primarily in the over-the-counter market, although options on foreign currencies are also listed on several exchanges. Options are traded not only on the currencies of individual nations, but also on the euro, the joint currency of most countries in the European Union. The Fund will only purchase or write foreign currency options when the Adviser believes that a liquid secondary market exists for such options. There can be no assurance that a liquid secondary market will exist for a

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

32

Notes to Financial Statements (unaudited)

particular option at any specific time. Options on foreign currencies may be affected by all of those factors which influence foreign exchange rates and investments generally. Similarly, the Fund may also engage in currency exchange transactions through a forward currency exchange contract ("Forward Contract"). A Forward Contract is an agreement to purchase or sell a specified currency at a specified future date (or within a specified time period) at a price set at the time of the contract. Forward Contracts are usually entered into with banks and broker/dealers, are not exchange traded and are usually for less than one year.

Currency exchange transactions may involve currencies of the different countries in which the Fund may invest, and may serve as hedges against possible variations in the exchange rates between these currencies and the U.S. dollar. The Fund's currency transactions may include transaction hedging and portfolio hedging involving either specific transactions or portfolio positions.

It is impossible to forecast with absolute precision the market value of portfolio securities at the expiration of a Forward Contract.

The Fund may also purchase or sell exchange-listed and over-the-counter call and put options on foreign currency futures contracts and on foreign currencies. A foreign currency futures contract is a standardized exchange-traded contract for the future delivery of a specified amount of a foreign currency at a price set at the time of the contract. Foreign currency futures contracts traded in the United States are designed by and traded on exchanges regulated by the CFTC, such as the New York Mercantile Exchange, and have margin requirements. Although the Fund intends to purchase or sell foreign currency futures contracts only on exchanges or boards of trade where there appears to be an active secondary market, there is no assurance that a secondary market on an exchange or board of trade will exist for any particular contract or at any particular time. In such event, it may not be possible to close a futures position and, in the event of adverse price movements, the Fund would continue to be required to make daily cash payments of variation margin.

The value of any currency, including U.S. dollars and foreign currencies, may be affected by complex political and economic factors applicable to the issuing country.

The value of a foreign currency option, forward contract or futures contract reflects the value of an exchange rate, which in turn reflects relative values of two currencies — the U.S. dollar and the foreign currency in question. Although foreign exchange dealers do not charge a fee for currency conversion, they do realize a profit based on the spread between prices at which they are buying and selling various currencies. Thus, a dealer may offer to sell a foreign currency to the Fund at one rate, while offering a lesser rate of exchange should the Fund desire to resell that currency to the dealer. Because foreign currency transactions occurring in the interbank market involve substantially larger amounts than those that may be involved in the exercise of foreign currency options, forward contracts and futures contracts, investors may be disadvantaged by having to deal in an odd-lot market for the underlying foreign currencies in connection with options at prices that are less favorable than for round lots. Foreign governmental restrictions or taxes could result in adverse changes in the cost of acquiring or disposing of foreign currencies.

First Eagle Funds : Absolute Return Fund | Semi-Annual Report | April 30, 2015

33

Notes to Financial Statements (unaudited)