UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07874

JPMorgan Insurance Trust

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta

270 Park Avenue

New York, NY 10017

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: December 31

Date of reporting period: January 1, 2014 through June 30, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Semi-Annual Report

JPMorgan Insurance Trust

June 30, 2014 (Unaudited)

JPMorgan Insurance Trust Core Bond Portfolio

| | | | |

NOT FDIC INSURED Ÿ NO BANK GUARANTEE Ÿ MAY LOSE VALUE

| | |  | |

CONTENTS

Investments in the Portfolio are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Portfolio’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of the Portfolio or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of the Portfolio.

This Portfolio is intended to be a funding vehicle for variable annuity contracts and variable life insurance policies (collectively “Policies”) offered by separate accounts of participating insurance companies. Portfolio shares are also offered through qualified pension and retirement plans (“Eligible Plans”). Individuals may not purchase shares directly from the Portfolio.

Prospective investors should refer to the Portfolio’s prospectus for a discussion of the Portfolio’s investment objective, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about the Portfolio, including management fees and other expenses. Please read it carefully before investing.

CEO’S LETTER

JULY 15, 2014 (Unaudited)

Dear Shareholder:

While the U.S. and the global economic recoveries continued to strengthen, financial markets in the U.S. withstood brief disruptions and posted robust returns for the six months ended June 30, 2014. Throughout the period, major central banks maintained closely aligned policies of historically low interest rates. During this period, the U.S. unemployment rate fell to 6.09% from 6.68%. In response to improving economic conditions domestically, the U.S. Federal Reserve (the “Fed”) began scaling back its monthly asset purchases under its Quantitative Easing (“QE”) program. The Fed proceeded to taper off in increments of $10 billion and by the end of June, the central bank’s monthly purchases of U.S. Treasuries and mortgage backed assets had shrunk to $45 billion from $85 billion.

| | |

| | “The strength with which equity and fixed income markets in developed and emerging markets ended the reporting period serves as a clear reminder that patience, combined with a diversified portfolio, is a crucial virtue for investors seeking long-term return on their investments.” |

Though the Fed’s actions signaled a strengthening domestic economy, the winter months brought severe weather across much of the U.S. that curbed consumer spending to a larger extent than was known at the time. Snowstorms grounded airlines — affecting passengers and parcels alike — and shuttered businesses and schools throughout the country. Consumer spending and construction slowed and U.S. gross domestic product shrank by 2.13% during the first three months of 2014. Economists attributed nearly half of that contraction to severe weather.

Signs of slower growth in China raised concerns that the nation’s economy might be in for a “hard landing” that would reverberate through emerging market nations, as well as developed economies. While the Chinese government’s efforts to restrain growth in real estate prices did impact property companies on the mainland as well as in Hong Kong, where the real estate sector makes up a significant portion of the local economy, China’s economy continued to grow at better than 7% per quarter.

After a brief pause in early 2014, U.S. equity markets hit record highs and marched steadily higher in the following months, notching 22 record high closings by the end of June. Volatility virtually disappeared in the final months of the reporting period and the Standard & Poor’s 500 Index did not move higher or lower by more than 1 percent for 51 consecutive days ended June 30, 2014. The last time the index moved so little was in 1995, when it went 95 days without moving a full percentage point. The Chicago Board Options Exchange Volatility Index ended the period near its lowest level since February 2007. At June 30, 2014, the S&P 500 produced a six month return of 7.14% and extended its longest stretch of consecutive quarterly gains in 16 years.

The U.S. bond market rebounded in 2014, as slower-than-expected domestic growth and instability in emerging markets lifted demand for fixed income securities. The Barclays U.S.

Aggregate Index returned 3.93% for the six months ended June 30, 2014.

In Europe, by the start of the 2014, Ireland had become the first nation to exit the European Union (EU) bailout program. Healthy corporate earnings and robust mergers and acquisitions activity bolstered equity markets. While the crisis in Ukraine appeared to have little impact on the EU economy, the European Central Bank (ECB) began to confront the threat of price deflation. In an unprecedented move on June 5, 2014, the ECB President Mario Draghi cut the deposit rate to negative 0.10% from 0.00%, effectively charging European banks for parking excess cash with the ECB. In Japan, Prime Minister Shinzo Abe’s economic policies appeared to be successful in pushing the economy out of a decade of stagnation and price deflation. However, as 2014 began, investors grew less confident in “Abenomics” and an April increase in Japan’s consumption tax raised concerns that consumer spending would slow, removing a key support of the nation’s economic growth. The MSCI Europe, Australasia and Far East Index returned 4.78% for the six months ended June 30, 2014.

From Turbulence to Turnaround

Prior to the start of the reporting period, emerging markets experienced a sell off in the wake of the Fed’s initial decision to taper its QE program. Emerging market investors also faced political unrest in Ukraine, Thailand and Turkey, a potential bond default in Argentina, and uncertainty surrounding pending elections in India and Indonesia, two of the world’s largest democracies. Despite the headwinds and perhaps due to the “low for long” message on interest rates from both the Fed and the ECB, emerging markets rebounded and ended at June 30, 2014 with the strongest quarterly performance since 2012. The MSCI Emerging Markets Index returned 6.14% for the six months ended June 30, 2014.

The past six months witnessed periodic sell offs in equities and bonds in both developed and emerging markets. Market volatility was driven by comments as well as actions from the Fed and the ECB, along with external events around the globe. However, equity markets — and also fixed income markets to some extent — proved resilient in the face of a variety of shocks and headwinds. The strength with which equity and fixed income markets in developed and emerging markets ended the reporting period serves as a clear reminder that patience, combined with a diversified portfolio, is a crucial virtue for investors seeking long-term return on their investments.

On behalf of everyone at J.P. Morgan Asset Management, thank you for your continued support. We look forward to managing your investment needs for years to come. If you should have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

George C.W. Gatch

CEO, Global Funds Management

J.P. Morgan Asset Management

| | | | | | | | |

| | | |

| JUNE 30, 2014 | | JPMORGAN INSURANCE TRUST | | | | | 1 | |

JPMorgan Insurance Trust Core Bond Portfolio

PORTFOLIO COMMENTARY

SIX MONTHS ENDED JUNE 30, 2014 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Portfolio (Class 1 Shares)* | | | 3.14% | |

| Barclays U.S. Aggregate Index | | | 3.93% | |

| |

| Net Assets as of 6/30/2014 | | $ | 202,662,288 | |

| Duration as of 6/30/2014 | | | 4.76 years | |

INVESTMENT OBJECTIVE**

The JPMorgan Insurance Trust Core Bond Portfolio (the “Portfolio”) seeks to maximize total return by investing primarily in a diversified portfolio of intermediate- and long-term debt securities.

HOW DID THE MARKET PERFORM?

For the first three months of 2014, bonds outperformed equities in developed markets. The Barclays Global Corporate Index returned 2.7%, compared with Standard & Poor’s 500 Index return of 1.8% for the quarter ended March 31, 2014. U.S. Treasuries also strengthened with the Barclays U.S. Treasury Index returning 1.3% for the quarter. Concerns about an uneven U.S. economy, a slowdown in the emerging markets, and turmoil in Ukraine benefited U.S. Treasuries, while emerging market equities and bonds suffered. The U.S. Federal Reserve’s (the “Fed”) initiation of its tapering off from in its Quantitative Easing program led to a “liquidity squeeze” in emerging market countries that had relied on the influx of global liquidity over the last few years.

However, the accommodative policies of key central banks helped bolster fixed-income securities, equities and commodities prices through the latter half of the reporting period. While Chairwoman Janet Yellen confirmed the Fed’s commitment to maintaining low rates for as long as needed to support economic growth, the European Central Bank (ECB) announced extraordinary measures in June to expand credit and reverse the trend of extremely low inflation rates. The Bank of Japan continued its aggressive bond purchase program and the effects of China’s mini-stimulus effort — a series of targeted interest rate cuts and liquidity easing — began to benefit growth. While geopolitical concerns in Iraq and Ukraine caused oil prices to rise, they did not derail financial markets.

WHAT WERE THE MAIN DRIVERS OF THE PORTFOLIO’S PERFORMANCE?

The Portfolio underperformed the Barclays U.S. Aggregate Index (the “Benchmark”) for the six months ended June 30, 2014. The Portfolio’s underweight position in the credit sector — particularly the non-corporate segment — detracted from

performance relative to the Benchmark. The Portfolio’s allocation and selection in the agency mortgage securities also detracted from relative performance, with current coupon mortgages finding a strong bid into falling rates, low issuance and historically low volatility. The Portfolio’s shorter duration and its position on the yield curve also detracted from performance relative to the Benchmark, as interest rates fell during the reporting period. Duration measures the price sensitivity of a portfolio of bonds to relative changes in interest rates. Generally, bonds with longer duration will experience a larger increase or decrease in price as interest rates go down or up, respectively, versus bonds with shorter duration. The yield curve shows the relationship between yields and maturity dates for a set of similar bonds.

The Portfolio’s underweight to Treasury securities contributed to performance, as all major spread sectors outperformed their risk free counterpart. The Portfolio’s security selection in asset-backed mortgage and commercial mortgage-backed sectors also contributed to relative performance, as did security selection in the industrial sector.

HOW WAS THE PORTFOLIO POSITIONED?

The Portfolio’s primary strategy continued to be security selection and relative value, which seeks to identify undervalued bonds between individual securities and across market sectors. The Portfolio managers used bottom-up fundamental research to construct, in their view, a portfolio of undervalued fixed income securities. Portfolio construction is strategic in nature, so sector allocation changes should be gradual and a function of relative value. The Portfolio remained underweight in U.S. Treasury securities, underweight in corporate credit debt, and an overweight to securitized sectors including asset-backed, commercial-backed, and mortgage-backed securities, which include both agency and non-agency varieties. The Portfolio was overweight in the intermediate part of the yield curve (5 to 10 year maturities) as the Portfolio’s managers believed that this had the most attractive risk/reward profile and its steepness should benefit the portfolio as securities roll-down the yield curve. The Portfolio maintained a shorter duration posture versus the index during the calendar year.

| | | | | | |

| | | |

| 2 | | | | JPMORGAN INSURANCE TRUST | | JUNE 30, 2014 |

| | | | |

PORTFOLIO COMPOSITION*** | |

| U.S. Treasury Obligations | | | 28.0 | % |

| Collateralized Mortgage Obligations | | | 25.5 | |

| Corporate Bonds | | | 16.2 | |

| U.S. Government Agency Securities | | | 14.0 | |

| Mortgage Pass-Through Securities | | | 7.8 | |

| Asset-Backed Securities | | | 2.5 | |

| Commercial Mortgage-Backed Securities | | | 2.4 | |

| Others (each less than 1.0%) | | | 0.7 | |

| Short-Term Investment | | | 2.9 | |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Portfolio’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of June 30, 2014. The Portfolio’s composition is subject to change. |

| | | | | | | | |

| | | |

| JUNE 30, 2014 | | JPMORGAN INSURANCE TRUST | | | | | 3 | |

JPMorgan Insurance Trust Core Bond Portfolio

PORTFOLIO COMMENTARY

SIX MONTHS ENDED JUNE 30, 2014 (Unaudited) (continued)

| | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2014 | |

| | | | | |

| | | INCEPTION DATE OF

CLASS | | 6 MONTH* | | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS 1 SHARES | | May 1, 1997 | | | 3.14 | % | | | 3.42 | % | | | 5.65 | % | | | 5.08 | % |

CLASS 2 SHARES | | August 16, 2006 | | | 3.01 | | | | 3.11 | | | | 5.40 | | | | 4.87 | |

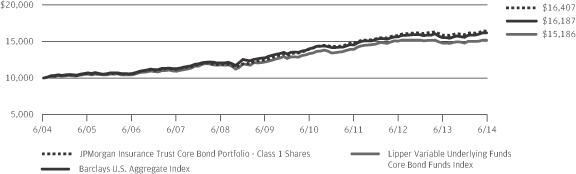

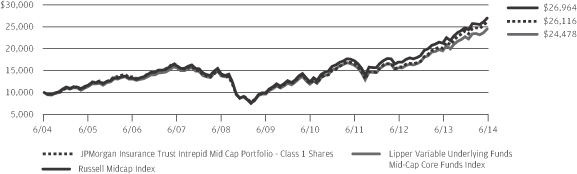

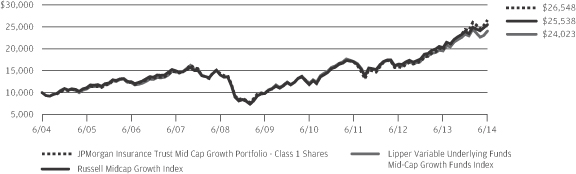

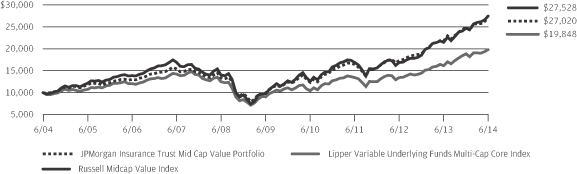

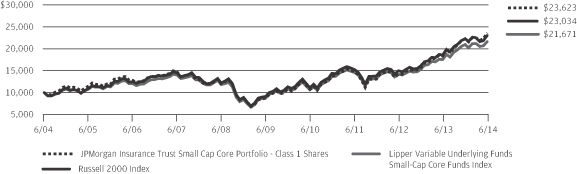

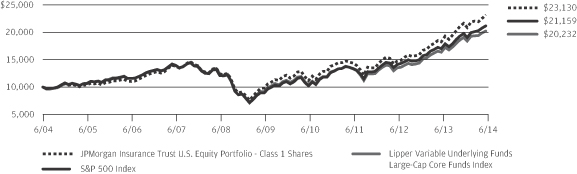

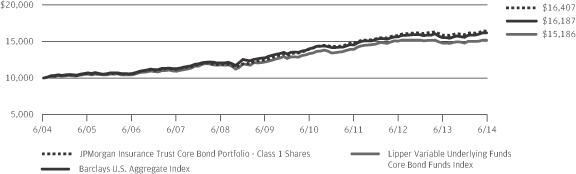

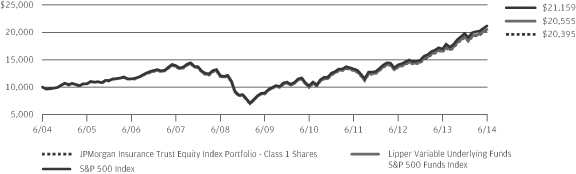

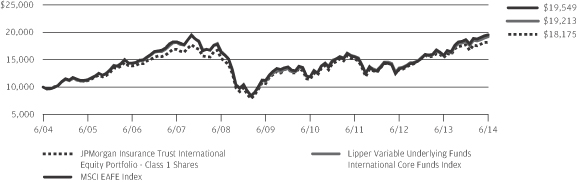

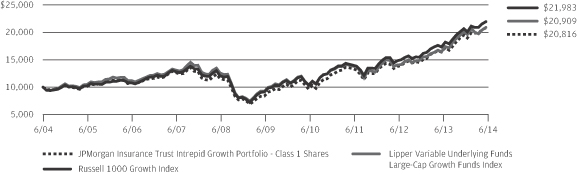

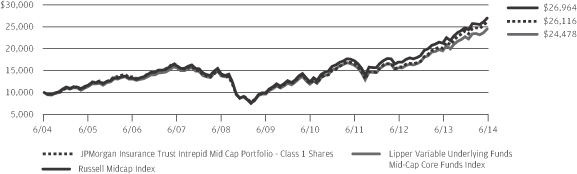

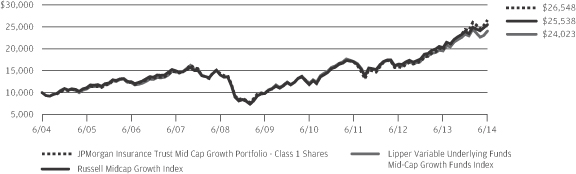

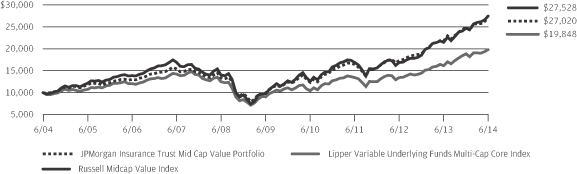

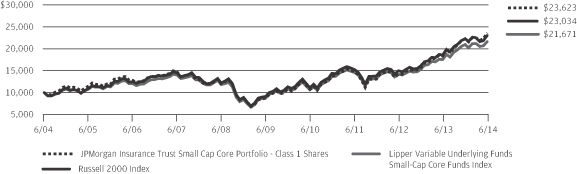

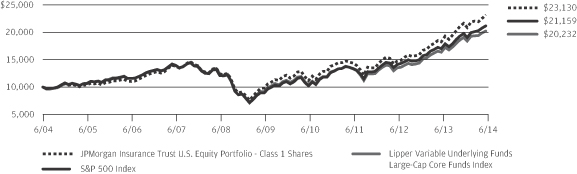

TEN YEAR PERFORMANCE (6/30/04 TO 6/30/14)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class 2 Shares prior to its inception date are based on the performance of Class 1 Shares. The actual returns of Class 2 Shares would have been lower than those shown because Class 2 Shares have higher expenses than Class 1 Shares.

The graph illustrates comparative performance for $10,000 invested in Class 1 Shares of the JPMorgan Insurance Trust Core Bond Portfolio, the Barclays U.S. Aggregate Index and the Lipper Variable Underlying Funds Core Bond Funds Index from June 30, 2004 to June 30, 2014. The performance of the Portfolio assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Barclays U.S. Aggregate Index does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper

Variable Underlying Funds Core Bond Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Portfolio. The Barclays U.S. Aggregate Index is an unmanaged index that represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. The Lipper Variable Underlying Funds Core Bond Funds Index is an index based on the total returns of certain mutual funds within the Portfolio’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Portfolio performance does not reflect any charges imposed by the Policies or Eligible Plans. If these charges were included, the returns would be lower than shown. Portfolio performance may reflect the waiver of the Portfolio’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 4 | | | | JPMORGAN INSURANCE TRUST | | JUNE 30, 2014 |

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2014 (Unaudited)

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| Asset-Backed Securities — 2.5% | |

| | 172,000 | | | Ally Auto Receivables Trust, Series 2013-2, Class A3, 0.790%, 01/15/18 | | | 172,486 | |

| | 274,462 | | | American Credit Acceptance Receivables Trust, Series 2014-2, Class A, 0.990%, 10/10/17 (e) | | | 274,311 | |

| | 42,095 | | | AmeriCredit Automobile Receivables Trust, Series 2013-4, Class A2, 0.740%, 11/08/16 | | | 42,141 | |

| | 21,444 | | | Bear Stearns Asset-Backed Securities Trust, Series 2006-SD1, Class A, VAR, 0.522%, 04/25/36 | | | 20,520 | |

| | 156,279 | | | CarFinance Capital Auto Trust,

Series 2014-1A, Class A, 1.460%, 12/17/18 (e) | | | 155,969 | |

| | | | CarMax Auto Owner Trust, | | | | |

| | 62,000 | | | Series 2013-4, Class A3, 0.800%, 07/16/18 | | | 61,976 | |

| | 55,000 | | | Series 2013-4, Class A4, 1.280%, 05/15/19 | | | 54,967 | |

| | 126,689 | | | Centex Home Equity Loan Trust,

Series 2004-D, Class AF4, SUB, 4.680%, 06/25/32 | | | 130,652 | |

| | 62,032 | | | CNH Equipment Trust, Series 2011-A, Class A4, 2.040%, 10/17/16 | | | 62,469 | |

| | | | Countrywide Asset-Backed Certificates, | | | | |

| | 1,056 | | | Series 2004-1, Class 3A, VAR, 0.712%, 04/25/34 | | | 982 | |

| | 111,473 | | | Series 2004-1, Class M1, VAR, 0.902%, 03/25/34 | | | 106,338 | |

| | 13,050 | | | Series 2004-1, Class M2, VAR, 0.977%, 03/25/34 | | | 12,465 | |

| | 12,852 | | | CWABS Revolving Home Equity Loan Trust, Series 2004-K, Class 2A, VAR, 0.452%, 02/15/34 | | | 11,358 | |

| | 120,000 | | | Exeter Automobile Receivables Trust, Series 2014-2A, Class A, 1.060%, 08/15/18 (e) | | | 119,801 | |

| | 145,988 | | | Flagship Credit Auto Trust, Series 2014-1, Class A, 1.210%, 04/15/19 (e) | | | 145,642 | |

| | 200,000 | | | HLSS Servicer Advance Receivables Backed Notes, Series 2013-T2, Class A2, 1.147%, 05/16/44 (e) | | | 200,040 | |

| | 180,000 | | | HLSS Servicer Advance Receivables Trust, Series 2013-T1, Class A2, 1.495%, 01/16/46 (e) | | | 180,090 | |

| | | | Hyundai Auto Receivables Trust, | | | | |

| | 169,000 | | | Series 2013-A, Class A3, 0.560%, 07/17/17 | | | 169,191 | |

| | 200,000 | | | Series 2013-A, Class A4, 0.750%, 09/17/18 | | | 199,631 | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| | | | | | | | |

| | 27,310 | | | Lake Country Mortgage Loan Trust, Series 2006-HE1, Class A3, VAR, 0.502%, 07/25/34 (e) | | | 27,233 | |

| | | | Long Beach Mortgage Loan Trust, | | | | |

| | 127,601 | | | Series 2003-4, Class M1, VAR, 1.172%, 08/25/33 | | | 121,934 | |

| | 190,000 | | | Series 2004-1, Class M1, VAR, 0.902%, 02/25/34 | | | 178,945 | |

| | 29,228 | | | Series 2004-1, Class M2, VAR, 0.977%, 02/25/34 | | | 28,405 | |

| | 18,886 | | | Series 2006-WL2, Class 2A3, VAR, 0.352%, 01/25/36 | | | 17,822 | |

| | 102,000 | | | Nationstar Agency Advance Funding Trust, Series 2013-T1A, Class AT1, 0.997%, 02/15/45 (e) | | | 101,839 | |

| | 125,000 | | | New Century Home Equity Loan Trust, Series 2005-1, Class M1, VAR, 0.827%, 03/25/35 | | | 117,697 | |

| | 481,727 | | | Normandy Mortgage Loan Co. LLC, Series 2013-NPL3, Class A, SUB, 4.949%, 09/16/43 (e) | | | 481,004 | |

| | 106,981 | | | Park Place Securities, Inc., Asset-Backed Pass-Through Certificates,

Series 2004-MCW1, Class M1, VAR, 1.090%, 10/25/34 | | | 106,301 | |

| | 7,637 | | | RASC Trust, Series 2003-KS9, Class A2B, VAR, 0.792%, 11/25/33 | | | 6,283 | |

| | | | Santander Drive Auto Receivables Trust, | | | | |

| | 1,352 | | | Series 2011-1, Class B, 2.350%, 11/16/15 | | | 1,352 | |

| | 2,791 | | | Series 2011-S2A, Class B, 2.060%, 06/15/17 (e) | | | 2,791 | |

| | | | SNAAC Auto Receivables Trust, | | | | |

| | 21,414 | | | Series 2013-1A, Class A, 1.140%, 07/16/18 (e) | | | 21,437 | |

| | 109,057 | | | Series 2014-1A, Class A, 1.030%, 09/17/18 (e) | | | 108,942 | |

| | | | Springleaf Funding Trust, | | | | |

| | 450,000 | | | Series 2013-AA, Class A, 2.580%, 09/15/21 (e) | | | 453,298 | |

| | 583,000 | | | Series 2014-AA, Class A, 2.410%, 12/15/22 (e) | | | 584,029 | |

| | 500,000 | | | Vericrest Opportunity Loan Transferee LLC, Series 2014-NPL4, Class A1, 2.875%, 04/27/54 (e) | | | 502,550 | |

| | 151,736 | | | VOLT NPL IX LLC, Series 2013-NPL3, Class A1, SUB, 4.250%, 04/25/53 (e) | | | 152,630 | |

| | | | | | | | |

| | | | Total Asset-Backed Securities (Cost $5,147,352) | | | 5,135,521 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2014 | | JPMORGAN INSURANCE TRUST | | | | | 5 | |

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2014 (Unaudited) (continued)

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| Collateralized Mortgage Obligations — 25.5% | |

| | | | Agency CMO — 17.8% | |

| | 133,450 | | | Federal Home Loan Mortgage Corp. - Government National Mortgage Association, Series 8, Class ZA, 7.000%, 03/25/23 | | | 148,697 | |

| | | | Federal Home Loan Mortgage Corp. REMIC, | | | | |

| | 720 | | | Series 1065, Class J, 9.000%, 04/15/21 | | | 846 | |

| | 1,658 | | | Series 11, Class D, 9.500%, 07/15/19 | | | 1,727 | |

| | 54,559 | | | Series 1113, Class J, 8.500%, 06/15/21 | | | 58,454 | |

| | 4,002 | | | Series 1250, Class J, 7.000%, 05/15/22 | | | 4,514 | |

| | 8,517 | | | Series 1316, Class Z, 8.000%, 06/15/22 | | | 9,631 | |

| | 13,627 | | | Series 1324, Class Z, 7.000%, 07/15/22 | | | 15,309 | |

| | 59,631 | | | Series 1343, Class LA, 8.000%, 08/15/22 | | | 69,604 | |

| | 12,275 | | | Series 1343, Class LB, 7.500%, 08/15/22 | | | 14,367 | |

| | 8,803 | | | Series 1394, Class ID, IF, 9.566%, 10/15/22 | | | 10,737 | |

| | 8,538 | | | Series 1395, Class G, 6.000%, 10/15/22 | | | 9,176 | |

| | 5,870 | | | Series 1505, Class Q, 7.000%, 05/15/23 | | | 6,473 | |

| | 10,822 | | | Series 1518, Class G, IF, 8.865%, 05/15/23 | | | 12,747 | |

| | 10,640 | | | Series 1541, Class O, VAR, 1.890%, 07/15/23 | | | 10,413 | |

| | 254,463 | | | Series 1577, Class PV, 6.500%, 09/15/23 | | | 282,778 | |

| | 193,834 | | | Series 1584, Class L, 6.500%, 09/15/23 | | | 215,925 | |

| | 2,087 | | | Series 1609, Class LG, IF, 17.005%, 11/15/23 | | | 2,234 | |

| | 210,520 | | | Series 1633, Class Z, 6.500%, 12/15/23 | | | 233,225 | |

| | 238,960 | | | Series 1638, Class H, 6.500%, 12/15/23 | | | 265,114 | |

| | 2,387 | | | Series 1671, Class QC, IF, 10.000%, 02/15/24 | | | 3,034 | |

| | 37,161 | | | Series 1694, Class PK, 6.500%, 03/15/24 | | | 41,029 | |

| | 8,412 | | | Series 1700, Class GA, PO, 02/15/24 | | | 8,234 | |

| | 28,137 | | | Series 1798, Class F, 5.000%, 05/15/23 | | | 30,708 | |

| | 57,349 | | | Series 1863, Class Z, 6.500%, 07/15/26 | | | 63,325 | |

| | 4,026 | | | Series 1865, Class D, PO, 02/15/24 | | | 3,612 | |

| | 20,589 | | | Series 1981, Class Z, 6.000%, 05/15/27 | | | 22,973 | |

| | 27,492 | | | Series 1987, Class PE, 7.500%, 09/15/27 | | | 30,492 | |

| | 101,174 | | | Series 1999, Class PU, 7.000%, 10/15/27 | | | 115,255 | |

| | 152,579 | | | Series 2031, Class PG, 7.000%, 02/15/28 (m) | | | 172,184 | |

| | 6,450 | | | Series 2033, Class SN, HB, IF, 28.368%, 03/15/24 | | | 3,168 | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| | | | | | | | |

| | | | Agency CMO — continued | |

| | 150,266 | | | Series 2035, Class PC, 6.950%, 03/15/28 | | | 174,054 | |

| | 11,111 | | | Series 2038, Class PN, IO, 7.000%, 03/15/28 | | | 2,351 | |

| | 36,071 | | | Series 2054, Class PV, 7.500%, 05/15/28 | | | 41,522 | |

| | 177,753 | | | Series 2057, Class PE, 6.750%, 05/15/28 | | | 200,766 | |

| | 51,871 | | | Series 2064, Class TE, 7.000%, 06/15/28 | | | 59,451 | |

| | 36,323 | | | Series 2075, Class PH, 6.500%, 08/15/28 | | | 40,810 | |

| | 120,309 | | | Series 2095, Class PE, 6.000%, 11/15/28 | | | 133,324 | |

| | 7,097 | | | Series 2132, Class SB, HB, IF, 29.896%, 03/15/29 | | | 11,844 | |

| | 11,394 | | | Series 2134, Class PI, IO, 6.500%, 03/15/19 | | | 1,270 | |

| | 59,767 | | | Series 2178, Class PB, 7.000%, 08/15/29 | | | 69,158 | |

| | 98,229 | | | Series 2182, Class ZB, 8.000%, 09/15/29 | | | 114,461 | |

| | 3,082 | | | Series 22, Class C, 9.500%, 04/15/20 | | | 3,382 | |

| | 15,127 | | | Series 2247, Class Z, 7.500%, 08/15/30 | | | 17,547 | |

| | 203,334 | | | Series 2259, Class ZC, 7.350%, 10/15/30 | | | 234,337 | |

| | 3,676 | | | Series 2261, Class ZY, 7.500%, 10/15/30 | | | 4,247 | |

| | 50,476 | | | Series 2283, Class K, 6.500%, 12/15/23 | | | 56,473 | |

| | 7,432 | | | Series 2306, Class K, PO, 05/15/24 | | | 7,132 | |

| | 17,836 | | | Series 2306, Class SE, IF, IO, 8.030%, 05/15/24 | | | 3,248 | |

| | 20,368 | | | Series 2325, Class PM, 7.000%, 06/15/31 | | | 21,827 | |

| | 115,370 | | | Series 2344, Class ZD, 6.500%, 08/15/31 | | | 132,424 | |

| | 18,877 | | | Series 2344, Class ZJ, 6.500%, 08/15/31 | | | 21,411 | |

| | 12,179 | | | Series 2345, Class NE, 6.500%, 08/15/31 | | | 13,703 | |

| | 43,741 | | | Series 2345, Class PQ, 6.500%, 08/15/16 | | | 45,896 | |

| | 15,539 | | | Series 2355, Class BP, 6.000%, 09/15/16 | | | 16,143 | |

| | 71,557 | | | Series 2359, Class ZB, 8.500%, 06/15/31 | | | 86,140 | |

| | 177,818 | | | Series 2367, Class ME, 6.500%, 10/15/31 | | | 196,347 | |

| | 16,402 | | | Series 2390, Class DO, PO, 12/15/31 | | | 15,500 | |

| | 21,148 | | | Series 2391, Class QR, 5.500%, 12/15/16 | | | 21,952 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 6 | | | | JPMORGAN INSURANCE TRUST | | JUNE 30, 2014 |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| Collateralized Mortgage Obligations — continued | |

| | | | Agency CMO — continued | |

| | 22,468 | | | Series 2394, Class MC, 6.000%, 12/15/16 | | | 23,466 | |

| | 31,115 | | | Series 2410, Class OE, 6.375%, 02/15/32 | | | 33,527 | |

| | 31,242 | | | Series 2410, Class QS, IF, 19.105%, 02/15/32 | | | 47,633 | |

| | 32,411 | | | Series 2410, Class QX, IF, IO, 8.498%, 02/15/32 | | | 8,438 | |

| | 35,305 | | | Series 2412, Class SP, IF, 15.797%, 02/15/32 | | | 48,282 | |

| | 67,426 | | | Series 2423, Class MC, 7.000%, 03/15/32 | | | 77,669 | |

| | 114,241 | | | Series 2423, Class MT, 7.000%, 03/15/32 | | | 131,839 | |

| | 227,841 | | | Series 2435, Class CJ, 6.500%, 04/15/32 | | | 248,766 | |

| | 42,664 | | | Series 2444, Class ES, IF, IO, 7.798%, 03/15/32 | | | 11,321 | |

| | 28,443 | | | Series 2450, Class SW, IF, IO, 7.848%, 03/15/32 | | | 7,167 | |

| | 95,448 | | | Series 2455, Class GK, 6.500%, 05/15/32 | | | 107,485 | |

| | 57,092 | | | Series 2484, Class LZ, 6.500%, 07/15/32 | | | 64,527 | |

| | 242,596 | | | Series 2500, Class MC, 6.000%, 09/15/32 | | | 276,666 | |

| | 12,640 | | | Series 2503, Class BH, 5.500%, 09/15/17 | | | 13,353 | |

| | 108,698 | | | Series 2527, Class BP, 5.000%, 11/15/17 | | | 114,431 | |

| | 84,008 | | | Series 2535, Class BK, 5.500%, 12/15/22 | | | 92,471 | |

| | 2,472,602 | | | Series 2543, Class YX, 6.000%, 12/15/32 (m) | | | 2,754,421 | |

| | 172,076 | | | Series 2544, Class HC, 6.000%, 12/15/32 | | | 191,248 | |

| | 353,633 | | | Series 2575, Class ME, 6.000%, 02/15/33 | | | 392,726 | |

| | 911,769 | | | Series 2578, Class PG, 5.000%, 02/15/18 | | | 962,160 | |

| | 25,351 | | | Series 2586, Class WI, IO, 6.500%, 03/15/33 | | | 5,041 | |

| | 43,007 | | | Series 2626, Class NS, IF, IO, 6.398%, 06/15/23 | | | 3,225 | |

| | 27,992 | | | Series 2638, Class DS, IF, 8.448%, 07/15/23 | | | 32,238 | |

| | 128,247 | | | Series 2647, Class A, 3.250%, 04/15/32 | | | 132,655 | |

| | 498,141 | | | Series 2651, Class VZ, 4.500%, 07/15/18 | | | 523,908 | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| | | | | | | | |

| | | | Agency CMO — continued | |

| | 950,953 | | | Series 2656, Class BG, 5.000%, 10/15/32 | | | 1,005,340 | |

| | 119,946 | | | Series 2682, Class LC, 4.500%, 07/15/32 | | | 123,855 | |

| | 12,435 | | | Series 2780, Class JG, 4.500%, 04/15/19 | | | 12,777 | |

| | 458,927 | | | Series 2827, Class DG, 4.500%, 07/15/19 | | | 484,744 | |

| | 6,892 | | | Series 2989, Class PO, PO, 06/15/23 | | | 6,889 | |

| | 300,000 | | | Series 3047, Class OD, 5.500%, 10/15/35 | | | 338,474 | |

| | 184,129 | | | Series 3085, Class VS, HB, IF, 28.113%, 12/15/35 | | | 301,023 | |

| | 59,980 | | | Series 3117, Class EO, PO, 02/15/36 | | | 52,422 | |

| | 58,179 | | | Series 3260, Class CS, IF, IO, 5.988%, 01/15/37 | | | 8,530 | |

| | 148,075 | | | Series 3385, Class SN, IF, IO, 5.848%, 11/15/37 | | | 17,310 | |

| | 155,799 | | | Series 3387, Class SA, IF, IO, 6.268%, 11/15/37 | | | 18,470 | |

| | 119,340 | | | Series 3451, Class SA, IF, IO, 5.898%, 05/15/38 | | | 16,088 | |

| | 417,257 | | | Series 3455, Class SE, IF, IO, 6.048%, 06/15/38 | | | 54,881 | |

| | 465,002 | | | Series 3688, Class NI, IO, 5.000%, 04/15/32 | | | 45,383 | |

| | 152,686 | | | Series 3759, Class HI, IO, 4.000%, 08/15/37 | | | 18,693 | |

| | 200,200 | | | Series 3772, Class IO, IO, 3.500%, 09/15/24 | | | 11,553 | |

| | 463 | | | Series 47, Class F, 10.000%, 06/15/20 | | | 526 | |

| | 411 | | | Series 99, Class Z, 9.500%, 01/15/21 | | | 464 | |

| | | | Federal Home Loan Mortgage Corp. STRIPS, | | | | |

| | 145,855 | | | Series 233, Class 11, IO, 5.000%, 09/15/35 | | | 24,095 | |

| | 182,452 | | | Series 239, Class S30, IF, IO, 7.548%, 08/15/36 | | | 36,414 | |

| | 450,669 | | | Series 262, Class 35, 3.500%, 07/15/42 | | | 462,230 | |

| | 462,153 | | | Series 299, Class 300, 3.000%, 01/15/43 | | | 459,164 | |

| | | | Federal Home Loan Mortgage Corp. Structured Pass-Through Securities, | | | | |

| | 16,690 | | | Series T-41, Class 3A, VAR, 6.732%, 07/25/32 | | | 19,160 | |

| | 107,882 | | | Series T-54, Class 2A, 6.500%, 02/25/43 | | | 127,565 | |

| | 50,107 | | | Series T-54, Class 3A, 7.000%, 02/25/43 | | | 60,746 | |

| | 211,041 | | | Series T-56, Class APO, PO, 05/25/43 | | | 185,850 | |

| | 28,003 | | | Series T-58, Class APO, PO, 09/25/43 | | | 23,068 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2014 | | JPMORGAN INSURANCE TRUST | | | | | 7 | |

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2014 (Unaudited) (continued)

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| Collateralized Mortgage Obligations — continued | |

| | | | Agency CMO — continued | |

| | 1,000,000 | | | Federal National Mortgage Association - ACES, Series 2014-M3, Class A2, VAR, 3.501%, 01/25/24 | | | 1,050,556 | |

| | | | Federal National Mortgage Association REMIC, | | | | |

| | 4,602 | | | Series 1988-16, Class B, 9.500%, 06/25/18 | | | 4,997 | |

| | 3,833 | | | Series 1989-83, Class H, 8.500%, 11/25/19 | | | 4,298 | |

| | 739 | | | Series 1990-1, Class D, 8.800%, 01/25/20 | | | 832 | |

| | 4,744 | | | Series 1990-10, Class L, 8.500%, 02/25/20 | | | 5,331 | |

| | 492 | | | Series 1990-93, Class G, 5.500%, 08/25/20 | | | 528 | |

| | 18 | | | Series 1990-140, Class K, HB, 652.145%, 12/25/20 | | | 190 | |

| | 1,093 | | | Series 1990-143, Class J, 8.750%, 12/25/20 | | | 1,260 | |

| | 19,012 | | | Series 1992-101, Class J, 7.500%, 06/25/22 | | | 21,401 | |

| | 8,645 | | | Series 1992-143, Class MA, 5.500%, 09/25/22 | | | 9,356 | |

| | 29,076 | | | Series 1993-146, Class E, PO, 05/25/23 | | | 28,105 | |

| | 67,067 | | | Series 1993-155, Class PJ, 7.000%, 09/25/23 | | | 76,944 | |

| | 2,092 | | | Series 1993-165, Class SD, IF, 13.410%, 09/25/23 | | | 2,700 | |

| | 10,432 | | | Series 1993-165, Class SK, IF, 12.500%, 09/25/23 | | | 12,118 | |

| | 91,043 | | | Series 1993-203, Class PL, 6.500%, 10/25/23 | | | 101,606 | |

| | 9,296 | | | Series 1993-205, Class H, PO, 09/25/23 | | | 8,970 | |

| | 457,570 | | | Series 1993-223, Class PZ, 6.500%, 12/25/23 | | | 503,243 | |

| | 90,712 | | | Series 1993-225, Class UB, 6.500%, 12/25/23 | | | 102,079 | |

| | 2,639 | | | Series 1993-230, Class FA, VAR, 0.752%, 12/25/23 | | | 2,673 | |

| | 86,506 | | | Series 1993-250, Class Z, 7.000%, 12/25/23 | | | 88,371 | |

| | 217,192 | | | Series 1994-37, Class L, 6.500%, 03/25/24 | | | 244,067 | |

| | 1,872,946 | | | Series 1994-72, Class K, 6.000%, 04/25/24 | | | 2,048,782 | |

| | 20,039 | | | Series 1995-2, Class Z, 8.500%, 01/25/25 | | | 23,372 | |

| | 83,206 | | | Series 1995-19, Class Z, 6.500%, 11/25/23 | | | 95,333 | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| | | | | | | | |

| | | | Agency CMO — continued | |

| | 3,965 | | | Series 1996-59, Class J, 6.500%, 08/25/22 | | | 4,333 | |

| | 132,008 | | | Series 1997-20, Class IB, IO, VAR, 1.840%, 03/25/27 | | | 5,049 | |

| | 17,982 | | | Series 1997-39, Class PD, 7.500%, 05/20/27 | | | 21,039 | |

| | 35,611 | | | Series 1997-46, Class PL, 6.000%, 07/18/27 | | | 38,855 | |

| | 86,317 | | | Series 1997-61, Class ZC, 7.000%, 02/25/23 | | | 97,495 | |

| | 14,322 | | | Series 1998-36, Class ZB, 6.000%, 07/18/28 | | | 16,033 | |

| | 31,885 | | | Series 1998-43, Class SA, IF, IO, 17.447%, 04/25/23 | | | 12,600 | |

| | 46,908 | | | Series 1998-46, Class GZ, 6.500%, 08/18/28 | | | 52,665 | |

| | 87,164 | | | Series 1998-58, Class PC, 6.500%, 10/25/28 | | | 97,858 | |

| | 203,773 | | | Series 1999-39, Class JH, IO, 6.500%, 08/25/29 | | | 38,406 | |

| | 6,091 | | | Series 2000-52, Class IO, IO, 8.500%, 01/25/31 | | | 1,580 | |

| | 79,501 | | | Series 2001-4, Class PC, 7.000%, 03/25/21 | | | 87,606 | |

| | 66,748 | | | Series 2001-30, Class PM, 7.000%, 07/25/31 | | | 76,285 | |

| | 222,926 | | | Series 2001-33, Class ID, IO, 6.000%, 07/25/31 | | | 43,209 | |

| | 99,612 | | | Series 2001-36, Class DE, 7.000%, 08/25/31 | | | 114,500 | |

| | 10,501 | | | Series 2001-44, Class PD, 7.000%, 09/25/31 | | | 11,900 | |

| | 12,606 | | | Series 2001-52, Class XN, 6.500%, 11/25/15 | | | 12,967 | |

| | 163,867 | | | Series 2001-61, Class Z, 7.000%, 11/25/31 | | | 185,790 | |

| | 27,300 | | | Series 2001-69, Class PG, 6.000%, 12/25/16 | | | 28,367 | |

| | 18,579 | | | Series 2001-71, Class QE, 6.000%, 12/25/16 | | | 19,329 | |

| | 23,938 | | | Series 2002-1, Class HC, 6.500%, 02/25/22 | | | 26,558 | |

| | 7,963 | | | Series 2002-1, Class SA, HB, IF, 24.694%, 02/25/32 | | | 12,716 | |

| | 33,577 | | | Series 2002-2, Class UC, 6.000%, 02/25/17 | | | 35,146 | |

| | 31,967 | | | Series 2002-3, Class OG, 6.000%, 02/25/17 | | | 33,244 | |

| | 205,282 | | | Series 2002-13, Class SJ, IF, IO, 1.600%, 03/25/32 | | | 11,876 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 8 | | | | JPMORGAN INSURANCE TRUST | | JUNE 30, 2014 |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| Collateralized Mortgage Obligations — continued | |

| | | | Agency CMO — continued | |

| | 163,287 | | | Series 2002-15, Class PO, PO, 04/25/32 | | | 140,412 | |

| | 75,927 | | | Series 2002-28, Class PK, 6.500%, 05/25/32 | | | 85,557 | |

| | 205,291 | | | Series 2002-62, Class ZE, 5.500%, 11/25/17 | | | 216,749 | |

| | 147,888 | | | Series 2002-68, Class SH, IF, IO, 7.846%, 10/18/32 | | | 36,387 | |

| | 16,313 | | | Series 2002-77, Class S, IF, 14.205%, 12/25/32 | | | 21,120 | |

| | 132,991 | | | Series 2002-94, Class BK, 5.500%, 01/25/18 | | | 139,417 | |

| | 248,354 | | | Series 2003-7, Class A1, 6.500%, 12/25/42 | | | 285,709 | |

| | 293,000 | | | Series 2003-22, Class UD, 4.000%, 04/25/33 | | | 308,410 | |

| | 78,210 | | | Series 2003-44, Class IU, IO, 7.000%, 06/25/33 | | | 15,888 | |

| | 61,172 | | | Series 2003-47, Class PE, 5.750%, 06/25/33 | | | 67,442 | |

| | 13,124 | | | Series 2003-64, Class SX, IF, 13.372%, 07/25/33 | | | 15,703 | |

| | 20,958 | | | Series 2003-66, Class PA, 3.500%, 02/25/33 | | | 21,735 | |

| | 44,952 | | | Series 2003-71, Class DS, IF, 7.265%, 08/25/33 | | | 47,043 | |

| | 62,573 | | | Series 2003-71, Class IM, IO, 5.500%, 12/25/31 | | | 1,074 | |

| | 81,217 | | | Series 2003-80, Class SY, IF, IO, 7.498%, 06/25/23 | | | 7,314 | |

| | 1,074,226 | | | Series 2003-81, Class MC, 5.000%, 12/25/32 | | | 1,110,113 | |

| | 464,427 | | | Series 2003-82, Class VB, 5.500%, 08/25/33 | | | 491,185 | |

| | 24,872 | | | Series 2003-91, Class SD, IF, 12.247%, 09/25/33 | | | 30,318 | |

| | 206,175 | | | Series 2003-116, Class SB, IF, IO, 7.448%, 11/25/33 | | | 44,817 | |

| | 1,187,072 | | | Series 2003-128, Class DY, 4.500%, 01/25/24 | | | 1,286,354 | |

| | 13,732 | | | Series 2003-130, Class SX, IF, 11.292%, 01/25/34 | | | 16,174 | |

| | 31,187 | | | Series 2003-132, Class OA, PO, 08/25/33 | | | 30,129 | |

| | 633,681 | | | Series 2004-2, Class OE, 5.000%, 05/25/23 | | | 658,333 | |

| | 100,106 | | | Series 2004-4, Class QM, IF, 13.896%, 06/25/33 | | | 120,994 | |

| | 55,331 | | | Series 2004-10, Class SC, HB, IF, 27.992%, 02/25/34 | | | 77,642 | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| | | | | | | | |

| | | | Agency CMO — continued | |

| | 145,310 | | | Series 2004-36, Class SA, IF, 19.107%, 05/25/34 | | | 202,202 | |

| | 91,228 | | | Series 2004-46, Class SK, IF, 16.082%, 05/25/34 | | | 117,297 | |

| | 14,389 | | | Series 2004-51, Class SY, IF, 13.936%, 07/25/34 | | | 18,425 | |

| | 73,889 | | | Series 2004-61, Class SK, IF, 8.500%, 11/25/32 | | | 89,285 | |

| | 67,982 | | | Series 2004-76, Class CL, 4.000%, 10/25/19 | | | 71,149 | |

| | 567 | | | Series 2004-92, Class JO, PO, 12/25/34 | | | 567 | |

| | 216,880 | | | Series 2005-45, Class DC, HB, IF, 23.753%, 06/25/35 | | | 326,786 | |

| | 34,001 | | | Series 2005-52, Class PA, 6.500%, 06/25/35 | | | 36,375 | |

| | 417,687 | | | Series 2005-68, Class BC, 5.250%, 06/25/35 | | | 451,527 | |

| | 238,543 | | | Series 2005-84, Class XM, 5.750%, 10/25/35 | | | 259,891 | |

| | 539,581 | | | Series 2005-110, Class MN, 5.500%, 06/25/35 | | | 577,155 | |

| | 84,456 | | | Series 2006-22, Class AO, PO, 04/25/36 | | | 76,680 | |

| | 33,716 | | | Series 2006-46, Class SW, HB, IF, 23.642%, 06/25/36 | | | 47,260 | |

| | 67,063 | | | Series 2006-59, Class QO, PO, 01/25/33 | | | 66,552 | |

| | 100,454 | | | Series 2006-110, Class PO, PO, 11/25/36 | | | 89,582 | |

| | 147,651 | | | Series 2006-117, Class GS, IF, IO, 6.498%, 12/25/36 | | | 29,144 | |

| | 42,337 | | | Series 2007-7, Class SG, IF, IO, 6.348%, 08/25/36 | | | 8,387 | |

| | 270,740 | | | Series 2007-53, Class SH, IF, IO, 5.948%, 06/25/37 | | | 37,578 | |

| | 245,831 | | | Series 2007-88, Class VI, IF, IO, 6.388%, 09/25/37 | | | 40,981 | |

| | 211,914 | | | Series 2007-100, Class SM, IF, IO, 6.298%, 10/25/37 | | | 28,558 | |

| | 208,387 | | | Series 2008-1, Class BI, IF, IO, 5.758%, 02/25/38 | | | 27,529 | |

| | 61,601 | | | Series 2008-16, Class IS, IF, IO, 6.048%, 03/25/38 | | | 8,470 | |

| | 139,996 | | | Series 2008-46, Class HI, IO, VAR, 1.776%, 06/25/38 | | | 13,880 | |

| | 82,166 | | | Series 2008-53, Class CI, IF, IO, 7.048%, 07/25/38 | | | 16,053 | |

| | 179,861 | | | Series 2009-112, Class ST, IF, IO, 6.098%, 01/25/40 | | | 24,846 | |

| | 101,899 | | | Series 2010-35, Class SB, IF, IO, 6.268%, 04/25/40 | | | 13,144 | |

| | 387,020 | | | Series 2013-128, Class PO, PO, 12/25/43 | | | 291,821 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2014 | | JPMORGAN INSURANCE TRUST | | | | | 9 | |

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2014 (Unaudited) (continued)

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| Collateralized Mortgage Obligations — continued | |

| | | | Agency CMO — continued | |

| | 2,138 | | | Series G92-42, Class Z, 7.000%, 07/25/22 | | | 2,373 | |

| | 31,792 | | | Series G92-44, Class ZQ, 8.000%, 07/25/22 | | | 34,373 | |

| | 23,139 | | | Series G92-54, Class ZQ, 7.500%, 09/25/22 | | | 25,631 | |

| | 1,558 | | | Series G92-59, Class F, VAR, 1.382%, 10/25/22 | | | 1,580 | |

| | 4,289 | | | Series G92-61, Class Z, 7.000%, 10/25/22 | | | 4,934 | |

| | 9,946 | | | Series G92-66, Class KA, 6.000%, 12/25/22 | | | 10,754 | |

| | 47,043 | | | Series G92-66, Class KB, 7.000%, 12/25/22 | | | 52,688 | |

| | 12,427 | | | Series G93-1, Class KA, 7.900%, 01/25/23 | | | 14,045 | |

| | 13,438 | | | Series G93-17, Class SI, IF, 6.000%, 04/25/23 | | | 14,778 | |

| | | | Federal National Mortgage Association REMIC Trust, | | | | |

| | 51,498 | | | Series 1999-W1, Class PO, PO, 02/25/29 | | | 47,987 | |

| | 197,546 | | | Series 1999-W4, Class A9, 6.250%, 02/25/29 | | | 221,232 | |

| | 423,945 | | | Series 2002-W7, Class A4, 6.000%, 06/25/29 | | | 464,651 | |

| | 364,595 | | | Series 2003-W1, Class 1A1, VAR, 5.913%, 12/25/42 | | | 412,151 | |

| | 49,053 | | | Series 2003-W1, Class 2A, VAR, 6.633%, 12/25/42 | | | 57,659 | |

| | | | Federal National Mortgage Association STRIPS, | | | | |

| | 13,860 | | | Series 329, Class 1, PO, 01/01/33 | | | 12,931 | |

| | 64,151 | | | Series 365, Class 8, IO, 5.500%, 05/01/36 | | | 11,871 | |

| | 47,122 | | | Federal National Mortgage Association Trust, Series 2004-W2, Class 2A2, 7.000%, 02/25/44 | | | 54,597 | |

| | | | Government National Mortgage Association, | | | | |

| | 157,755 | | | Series 1994-7, Class PQ, 6.500%, 10/16/24 | | | 181,060 | |

| | 92,621 | | | Series 1998-22, Class PD, 6.500%, 09/20/28 | | | 98,446 | |

| | 29,481 | | | Series 1999-17, Class L, 6.000%, 05/20/29 | | | 33,125 | |

| | 37,152 | | | Series 1999-41, Class Z, 8.000%, 11/16/29 | | | 44,015 | |

| | 26,754 | | | Series 1999-44, Class PC, 7.500%, 12/20/29 | | | 31,148 | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| | | | | | | | |

| | | | Agency CMO — continued | |

| | 35,809 | | | Series 1999-44, Class ZG, 8.000%, 12/20/29 | | | 42,387 | |

| | 151,873 | | | Series 2000-21, Class Z, 9.000%, 03/16/30 | | | 182,166 | |

| | 2,720 | | | Series 2000-36, Class IK, IO, 9.000%, 11/16/30 | | | 553 | |

| | 474,444 | | | Series 2000-36, Class PB, 7.500%, 11/16/30 | | | 565,083 | |

| | 1,028,289 | | | Series 2001-10, Class PE, 6.500%, 03/16/31 (m) | | | 1,170,016 | |

| | 159,540 | | | Series 2001-22, Class PS, HB, IF, 20.607%, 03/17/31 | | | 247,713 | |

| | 63,741 | | | Series 2001-36, Class S, IF, IO, 7.898%, 08/16/31 | | | 15,848 | |

| | 45,622 | | | Series 2001-53, Class SR, IF, IO, 7.997%, 10/20/31 | | | 2,418 | |

| | 83,743 | | | Series 2001-64, Class MQ, 6.500%, 12/20/31 | | | 96,578 | |

| | 1,000,000 | | | Series 2001-64, Class PB, 6.500%, 12/20/31 | | | 1,144,266 | |

| | 11,549 | | | Series 2002-24, Class SB, IF, 11.697%, 04/16/32 | | | 14,793 | |

| | 5,910 | | | Series 2003-24, Class PO, PO, 03/16/33 | | | 5,065 | |

| | 300,543 | | | Series 2004-11, Class SW, IF, IO, 5.347%, 02/20/34 | | | 38,584 | |

| | 34,718 | | | Series 2004-28, Class S, IF, 19.245%, 04/16/34 | | | 50,383 | |

| | 215,109 | | | Series 2007-45, Class QA, IF, IO, 6.487%, 07/20/37 | | | 35,254 | |

| | 168,265 | | | Series 2007-76, Class SA, IF, IO, 6.377%, 11/20/37 | | | 24,190 | |

| | 158,323 | | | Series 2008-2, Class MS, IF, IO, 7.008%, 01/16/38 | | | 25,005 | |

| | 116,999 | | | Series 2008-55, Class SA, IF, IO, 6.047%, 06/20/38 | | | 17,593 | |

| | 94,854 | | | Series 2009-6, Class SA, IF, IO, 5.948%, 02/16/39 | | | 13,375 | |

| | 250,361 | | | Series 2009-6, Class SH, IF, IO, 5.887%, 02/20/39 | | | 36,109 | |

| | 174,120 | | | Series 2009-14, Class KI, IO, 6.500%, 03/20/39 | | | 37,287 | |

| | 121,895 | | | Series 2009-14, Class NI, IO, 6.500%, 03/20/39 | | | 26,847 | |

| | 365,917 | | | Series 2009-22, Class SA, IF, IO, 6.117%, 04/20/39 | | | 52,542 | |

| | 331,105 | | | Series 2009-31, Class ST, IF, IO, 6.197%, 03/20/39 | | | 43,288 | |

| | 331,105 | | | Series 2009-31, Class TS, IF, IO, 6.147%, 03/20/39 | | | 42,864 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 10 | | | | JPMORGAN INSURANCE TRUST | | JUNE 30, 2014 |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| Collateralized Mortgage Obligations — continued | |

| | | | Agency CMO — continued | |

| | 341,586 | | | Series 2009-64, Class SN, IF, IO, 5.948%, 07/16/39 | | | 45,831 | |

| | 126,166 | | | Series 2009-79, Class OK, PO, 11/16/37 | | | 118,510 | |

| | 176,846 | | | Series 2009-102, Class SM, IF, IO, 6.248%, 06/16/39 | | | 18,365 | |

| | 535,224 | | | Series 2009-106, Class ST, IF, IO, 5.847%, 02/20/38 | | | 78,927 | |

| | 179,436 | | | Series 2010-130, Class CP, 7.000%, 10/16/40 | | | 211,289 | |

| | 335,389 | | | Series 2011-75, Class SM, IF, IO, 6.447%, 05/20/41 | | | 80,186 | |

| | 914,309 | | | Series 2013-H08, Class FC, VAR, 0.601%, 02/20/63 | | | 908,897 | |

| | 495,540 | | | Series 2013-H09, Class HA, 1.650%, 04/20/63 | | | 492,038 | |

| | | | Vendee Mortgage Trust, | | | | |

| | 63,431 | | | Series 1994-1, Class 1, VAR, 5.576%, 02/15/24 | | | 69,522 | |

| | 145,919 | | | Series 1996-1, Class 1Z, 6.750%, 02/15/26 | | | 167,326 | |

| | 80,317 | | | Series 1996-2, Class 1Z, 6.750%, 06/15/26 | | | 92,806 | |

| | 289,057 | | | Series 1997-1, Class 2Z, 7.500%, 02/15/27 | | | 341,449 | |

| | 79,765 | | | Series 1998-1, Class 2E, 7.000%, 03/15/28 | | | 92,806 | |

| | | | | | | | |

| | | | | | | 36,082,931 | |

| | | | | | | | |

| | | | Non-Agency CMO — 7.7% | |

| | | | Alternative Loan Trust, | | | | |

| | 17,350 | | | Series 2003-J1, Class PO, PO, 10/25/33 | | | 14,714 | |

| | 1,999,848 | | | Series 2004-2CB, Class 1A9, 5.750%, 03/25/34 | | | 2,020,603 | |

| | 10,950 | | | Series 2004-18CB, Class 2A4, 5.700%, 09/25/34 | | | 11,024 | |

| | 601,682 | | | Series 2005-20CB, Class 3A8, IF, IO, 4.598%, 07/25/35 | | | 72,751 | |

| | 855,337 | | | Series 2005-28CB, Class 1A4, 5.500%, 08/25/35 | | | 806,305 | |

| | 430,001 | | | Series 2005-54CB, Class 1A11, 5.500%, 11/25/35 | | | 389,977 | |

| | 789,997 | | | Series 2005-22T1, Class A2, IF, IO, 4.918%, 06/25/35 | | | 105,863 | |

| | 683,174 | | | Series 2005-J1, Class 1A4, IF, IO, 4.948%, 02/25/35 | | | 67,981 | |

| | 4,306 | | | Alternative Loan Trust Resecuritization, Series 2005-5R, Class A1, 5.250%, 12/25/18 | | | 4,302 | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| | | | | | | | |

| | | | Non-Agency CMO — continued | |

| | 48,411 | | | American General Mortgage Loan Trust, Series 2009-1, Class A7, VAR, 5.750%, 09/25/48 (e) | | | 48,423 | |

| | | | Banc of America Alternative Loan Trust, | | | | |

| | 35,426 | | | Series 2003-9, Class 1CB2, 5.500%, 11/25/33 | | | 36,183 | |

| | 314,167 | | | Series 2004-5, Class 3A3, PO, 06/25/34 | | | 297,852 | |

| | 36,393 | | | Series 2004-6, Class 15PO, PO, 07/25/19 | | | 35,406 | |

| | | | Banc of America Funding Trust, | | | | |

| | 42,986 | | | Series 2004-1, Class PO, PO, 03/25/34 | | | 34,175 | |

| | 318,474 | | | Series 2005-6, Class 2A7, 5.500%, 10/25/35 | | | 318,951 | |

| | 49,314 | | | Series 2005-7, Class 30PO, PO, 11/25/35 | | | 37,008 | |

| | 197,268 | | | Series 2005-E, Class 4A1, VAR, 2.682%, 03/20/35 | | | 198,073 | |

| | | | Banc of America Mortgage Trust, | | | | |

| | 13,389 | | | Series 2003-8, Class APO, PO, 11/25/33 | | | 10,769 | |

| | 59,575 | | | Series 2004-3, Class 1A26, 5.500%, 04/25/34 | | | 61,286 | |

| | 10,257 | | | Series 2004-4, Class APO, PO, 05/25/34 | | | 8,928 | |

| | 183,712 | | | Series 2004-5, Class 2A2, 5.500%, 06/25/34 | | | 187,269 | |

| | 165,160 | | | Series 2004-6, Class 2A5, PO, 07/25/34 | | | 136,961 | |

| | 36,136 | | | Series 2004-6, Class APO, PO, 07/25/34 | | | 32,765 | |

| | 34,775 | | | Series 2004-7, Class 1A19, PO, 08/25/34 | | | 29,986 | |

| | 151,675 | | | Series 2004-J, Class 3A1, VAR, 2.913%, 11/25/34 | | | 152,087 | |

| | | | BCAP LLC Trust, | | | | |

| | 119,119 | | | Series 2011-RR5, Class 11A3, VAR, 0.302%, 05/28/36 (e) | | | 116,881 | |

| | 37,206 | | | Series 2011-RR5, Class 14A3, VAR, 2.624%, 07/26/36 (e) | | | 37,046 | |

| | | | Bear Stearns ARM Trust, | | | | |

| | 57,697 | | | Series 2003-7, Class 3A, VAR, 2.431%, 10/25/33 | | | 58,135 | |

| | 110,040 | | | Series 2005-5, Class A1, VAR, 2.150%, 08/25/35 | | | 111,751 | |

| | 365,716 | | | Series 2006-1, Class A1, VAR, 2.369%, 02/25/36 | | | 368,223 | |

| | | | CHL Mortgage Pass-Through Trust, | | | | |

| | 134,359 | | | Series 2003-26, Class 1A6, 3.500%, 08/25/33 | | | 136,157 | |

| | 14,530 | | | Series 2003-J7, Class 4A3, IF, 9.576%, 08/25/18 | | | 15,204 | |

| | 78,555 | | | Series 2004-7, Class 2A1, VAR, 2.477%, 06/25/34 | | | 77,622 | |

| | 48,786 | | | Series 2004-HYB1, Class 2A, VAR, 2.546%, 05/20/34 | | | 46,791 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2014 | | JPMORGAN INSURANCE TRUST | | | | | 11 | |

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2014 (Unaudited) (continued)

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| Collateralized Mortgage Obligations — continued | |

| | | | Non-Agency CMO — continued | |

| | 61,785 | | | Series 2004-HYB3, Class 2A, VAR, 2.317%, 06/20/34 | | | 59,419 | |

| | 72,364 | | | Series 2004-J8, Class 1A2, 4.750%, 11/25/19 | | | 74,072 | |

| | 7,656 | | | Series 2004-J8, Class POA, PO, 11/25/19 | | | 7,146 | |

| | 183,302 | | | Series 2005-16, Class A23, 5.500%, 09/25/35 | | | 169,218 | |

| | 329,751 | | | Series 2005-22, Class 2A1, VAR, 2.564%, 11/25/35 | | | 277,661 | |

| | | | Citigroup Mortgage Loan Trust, Inc., | | | | |

| | 12,315 | | | Series 2003-UP3, Class A3, 7.000%, 09/25/33 | | | 12,750 | |

| | 13,581 | | | Series 2003-UST1, Class A1, 5.500%, 12/25/18 | | | 13,876 | |

| | 4,516 | | | Series 2003-UST1, Class PO1, PO, 12/25/18 | | | 4,268 | |

| | 4,042 | | | Series 2003-UST1, Class PO3, PO, 12/25/18 | | | 3,798 | |

| | 110,957 | | | Series 2005-1, Class 2A1A, VAR, 2.669%, 04/25/35 | | | 87,323 | |

| | 250,826 | | | Series 2010-8, Class 6A6, 4.500%, 12/25/36 (e) | | | 258,591 | |

| | 6,215 | | | Credit Suisse First Boston Mortgage Securities Corp., Series 2004-5, Class 5P, PO, 08/25/19 | | | 5,768 | |

| | | | CSMC, | | | | |

| | 185,532 | | | Series 2010-11R, Class A6, VAR, 1.150%, 06/28/47 (e) | | | 177,569 | |

| | 10,720 | | | Series 2011-7R, Class A1, VAR, 1.401%, 08/28/47 (e) | | | 10,715 | |

| | 113,908 | | | Series 2011-9R, Class A1, VAR, 2.151%, 03/27/46 (e) | | | 114,404 | |

| | 68,415 | | | FDIC Trust, Series 2013-N1, Class A, 4.500%, 10/25/18 (e) | | | 69,371 | |

| | 256,731 | | | First Horizon Alternative Mortgage Securities Trust, Series 2005-FA8, Class 1A19, 5.500%, 11/25/35 | | | 227,945 | |

| | | | First Horizon Mortgage Pass-Through Trust, | | | | |

| | 223,234 | | | Series 2004-AR7, Class 2A2, VAR, 2.554%, 02/25/35 | | | 223,963 | |

| | 170,176 | | | Series 2005-AR1, Class 2A2, VAR, 2.575%, 04/25/35 | | | 170,724 | |

| | | | GMACM Mortgage Loan Trust, | | | | |

| | 125,421 | | | Series 2003-AR1, Class A4, VAR, 2.922%, 10/19/33 | | | 125,223 | |

| | 117,822 | | | Series 2004-J5, Class A7, 6.500%, 01/25/35 | | | 123,782 | |

| | 555,799 | | | Series 2005-AR3, Class 3A4, VAR, 2.802%, 06/19/35 | | | 552,032 | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| | | | | | | | |

| | | | Non-Agency CMO — continued | |

| | | | GSR Mortgage Loan Trust, | | | | |

| | 134,826 | | | Series 2004-6F, Class 1A2, 5.000%, 05/25/34 | | | 141,509 | |

| | 365,415 | | | Series 2004-6F, Class 3A4, 6.500%, 05/25/34 | | | 392,290 | |

| | 86,135 | | | Series 2004-13F, Class 3A3, 6.000%, 11/25/34 | | | 85,140 | |

| | 59,897 | | | Impac Secured Assets Trust, Series 2006-1, Class 2A1, VAR, 0.502%, 05/25/36 | | | 59,368 | |

| | 1,316,368 | | | IndyMac INDX Mortgage Loan Trust, Series 2005-AR11, Class A7, IO, VAR, 0.000%, 08/25/35 | | | 412 | |

| | 125,711 | | | JP Morgan Mortgage Trust, Series 2006-A2, Class 5A3, VAR, 2.547%, 11/25/33 | | | 125,664 | |

| | 75,106 | | | MASTR Adjustable Rate Mortgages Trust, Series 2004-13, Class 2A1, VAR, 2.642%, 04/21/34 | | | 75,998 | |

| | | | MASTR Alternative Loan Trust, | | | | |

| | 101,469 | | | Series 2003-9, Class 8A1, 6.000%, 01/25/34 | | | 101,620 | |

| | 194,121 | | | Series 2004-4, Class 10A1, 5.000%, 05/25/24 | | | 205,601 | |

| | 203,127 | | | Series 2004-6, Class 7A1, 6.000%, 07/25/34 | | | 206,675 | |

| | 26,015 | | | Series 2004-7, Class 30PO, PO, 08/25/34 | | | 20,754 | |

| | 130,458 | | | Series 2004-8, Class 6A1, 5.500%, 09/25/19 | | | 135,369 | |

| | 99,465 | | | Series 2004-10, Class 1A1, 4.500%, 09/25/19 | | | 101,347 | |

| | | | MASTR Asset Securitization Trust, | | | | |

| | 277,717 | | | Series 2003-11, Class 9A6, 5.250%, 12/25/33 | | | 292,545 | |

| | 18,371 | | | Series 2003-12, Class 15PO, PO, 12/25/18 | | | 16,882 | |

| | 34,842 | | | Series 2004-6, Class 15PO, PO, 07/25/19 | | | 32,346 | |

| | 19,160 | | | Series 2004-8, Class PO, PO, 08/25/19 | | | 17,668 | |

| | 71,142 | | | Series 2004-10, Class 15PO, PO, 10/25/19 | | | 65,567 | |

| | 133,979 | | | MASTR Resecuritization Trust, Series 2005-PO, Class 3PO, PO, 05/28/35 (e) | | | 107,183 | |

| | 65,604 | | | MortgageIT Trust, Series 2005-1, Class 1A1, VAR, 0.472%, 02/25/35 | | | 64,262 | |

| | 52,837 | | | NACC Reperforming Loan REMIC Trust, Series 2004-R2, Class A1, VAR, 6.500%, 10/25/34 (e) | | | 53,941 | |

| | 392,265 | | | PHH Alternative Mortgage Trust, Series 2007-2, Class 2X, IO, 6.000%, 05/25/37 | | | 78,779 | |

| | | | RALI Trust, | | | | |

| | 39,596 | | | Series 2002-QS8, Class A5, 6.250%, 06/25/17 | | | 40,210 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 12 | | | | JPMORGAN INSURANCE TRUST | | JUNE 30, 2014 |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| Collateralized Mortgage Obligations — continued | |

| | | | Non-Agency CMO — continued | |

| | 814,789 | | | Series 2003-QR19, Class CB4, 5.750%, 10/25/33 | | | 848,077 | |

| | 12,287 | | | Series 2003-QS3, Class A2, IF, 16.166%, 02/25/18 | | | 13,899 | |

| | 17,190 | | | Series 2003-QS3, Class A8, IF, IO, 7.448%, 02/25/18 | | | 575 | |

| | 84,531 | | | Series 2003-QS9, Class A3, IF, IO, 7.398%, 05/25/18 | | | 9,296 | |

| | 118,692 | | | Series 2003-QS14, Class A1, 5.000%, 07/25/18 | | | 120,679 | |

| | 38,279 | | | Series 2003-QS18, Class A1, 5.000%, 09/25/18 | | | 39,186 | |

| | 9,059 | | | Residential Asset Securitization Trust, Series 2003-A14, Class A1, 4.750%, 02/25/19 | | | 9,289 | |

| | 149,920 | | | RFMSI Trust, Series 2005-SA4, Class 1A1, VAR, 2.814%, 09/25/35 | | | 125,592 | |

| | 4,699 | | | SACO I, Inc., Series 1997-2, Class 1A5, 7.000%, 08/25/36 (e) | | | 4,814 | |

| | | | Salomon Brothers Mortgage Securities VII, Inc., | | | | |

| | 75,427 | | | Series 2003-HYB1, Class A, VAR, 2.618%, 09/25/33 | | | 77,055 | |

| | 3,105 | | | Series 2003-UP2, Class PO1, PO, 12/25/18 | | | 2,717 | |

| | | | Springleaf Mortgage Loan Trust, | | | | |

| | 43,231 | | | Series 2011-1A, Class A1, VAR, 4.050%, 01/25/58 (e) | | | 45,063 | |

| | 68,061 | | | Series 2012-2A, Class A, VAR, 2.220%, 10/25/57 (e) | | | 68,927 | |

| | 227,736 | | | Series 2013-1A, Class A, VAR, 1.270%, 06/25/58 (e) | | | 226,922 | |

| | 124,000 | | | Series 2013-1A, Class M1, VAR, 2.310%, 06/25/58 (e) | | | 121,056 | |

| | 108,000 | | | Series 2013-1A, Class M2, VAR, 3.140%, 06/25/58 (e) | | | 107,276 | |

| | 178,384 | | | Series 2013-2A, Class A, VAR, 1.780%, 12/25/65 (e) | | | 178,080 | |

| | 125,000 | | | Series 2013-2A, Class M1, VAR, 3.520%, 12/25/65 (e) | | | 127,661 | |

| | 162,671 | | | Structured Adjustable Rate Mortgage Loan Trust, Series 2004-6, Class 5A4, VAR, 2.398%, 06/25/34 | | | 161,792 | |

| | 114,751 | | | Structured Asset Securities Corp. Mortgage Pass-Through Certificates,

Series 2003-33H, Class 1A1, 5.500%, 10/25/33 | | | 117,327 | |

| | | | WaMu Mortgage Pass-Through Certificates Trust, | | | | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| | | | | | | | |

| | | | Non-Agency CMO — continued | |

| | 22,132 | | | Series 2003-AR8, Class A, VAR, 2.414%, 08/25/33 | | | 22,430 | |

| | 97,023 | | | Series 2003-AR9, Class 1A6, VAR, 2.417%, 09/25/33 | | | 98,954 | |

| | 6,707 | | | Series 2003-S4, Class 3A, 5.500%, 06/25/33 | | | 6,737 | |

| | 37,753 | | | Series 2004-AR3, Class A2, VAR, 2.377%, 06/25/34 | | | 38,464 | |

| | | | Washington Mutual Mortgage Pass-Through Certificates WMALT Trust, | | | | |

| | 1,461,992 | | | Series 2005-2, Class 1A4, IF, IO, 4.898%, 04/25/35 | | | 212,087 | |

| | 411,000 | | | Series 2005-2, Class 2A3, IF, IO, 4.848%, 04/25/35 | | | 53,550 | |

| | 377,773 | | | Series 2005-3, Class CX, IO, 5.500%, 05/25/35 | | | 80,421 | |

| | 362,869 | | | Series 2005-4, Class CB7, 5.500%, 06/25/35 | | | 337,513 | |

| | 20,170 | | | Series 2005-4, Class DP, PO, 06/25/20 | | | 19,504 | |

| | 119,044 | | | Series 2005-6, Class 2A4, 5.500%, 08/25/35 | | | 109,232 | |

| | | | Wells Fargo Mortgage-Backed Securities Trust, | | | | |

| | 30,527 | | | Series 2003-K, Class 1A1, VAR, 2.490%, 11/25/33 | | | 30,539 | |

| | 61,054 | | | Series 2003-K, Class 1A2, VAR, 2.490%, 11/25/33 | | | 61,477 | |

| | 68,709 | | | Series 2004-EE, Class 3A1, VAR, 2.561%, 12/25/34 | | | 69,826 | |

| | 185,359 | | | Series 2004-P, Class 2A1, VAR, 2.613%, 09/25/34 | | | 189,433 | |

| | 346,200 | | | Series 2005-AR3, Class 1A1, VAR, 2.620%, 03/25/35 | | | 352,031 | |

| | 101,437 | | | Series 2005-AR8, Class 2A1, VAR, 2.615%, 06/25/35 | | | 102,360 | |

| | 82,240 | | | Series 2005-AR16, Class 2A1, VAR, 2.611%, 02/25/34 | | | 83,818 | |

| | | | | | | | |

| | | | | | | 15,551,859 | |

| | | | | | | | |

| | | | Total Collateralized Mortgage Obligations (Cost $47,679,441) | | | 51,634,790 | |

| | | | | | | | |

| Commercial Mortgage-Backed Securities — 2.4% | | | | |

| | 227,095 | | | A10 Securitization LLC, Series 2013-1, Class A, 2.400%, 11/15/25 (e) | | | 228,099 | |

| | 287,000 | | | A10 Term Asset Financing LLC, Series 2013-2, Class A, 2.620%, 11/15/27 (e) | | | 287,244 | |

| | 242,882 | | | Banc of America Commercial Mortgage Trust, Series 2006-4, Class A4, 5.634%, 07/10/46 | | | 260,710 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2014 | | JPMORGAN INSURANCE TRUST | | | | | 13 | |

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2014 (Unaudited) (continued)

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| Commercial Mortgage-Backed Securities — continued | |

| | | | Banc of America Merrill Lynch Commercial Mortgage, Inc., | | | | |

| | 125,000 | | | Series 2005-3, Class A4, 4.668%, 07/10/43 | | | 128,430 | |

| | 125,000 | | | Series 2005-3, Class AM, 4.727%, 07/10/43 | | | 128,288 | |

| | 12,550 | | | Series 2005-6, Class ASB, VAR, 5.349%, 09/10/47 | | | 12,549 | |

| | | | BB-UBS Trust, | | | | |

| | 100,000 | | | Series 2012-SHOW, Class A, 3.430%, 11/05/36 (e) | | | 99,142 | |

| | 100,000 | | | Series 2012-TFT, Class A, 2.892%, 06/05/30 (e) | | | 98,220 | |

| | | | Bear Stearns Commercial Mortgage Securities Trust, | | | | |

| | 227,473 | | | Series 2005-PWR8, Class A4, 4.674%, 06/11/41 | | | 233,264 | |

| | 360,000 | | | Series 2006-PW11, Class A4, VAR, 5.605%, 03/11/39 | | | 380,814 | |

| | 11,032,029 | | | CD Commercial Mortgage Trust, Series 2007-CD4, Class XC, IO, VAR, 0.559%, 12/11/49 (e) | | | 93,982 | |

| | | | Citigroup Commercial Mortgage Trust, | | | | |

| | 100,000 | | | Series 2005-C3, Class AM, VAR, 4.830%, 05/15/43 | | | 102,764 | |

| | 96,202 | | | Series 2013-SMP, Class A, 2.110%, 01/12/30 (e) | | | 97,848 | |

| | 125,000 | | | COMM Mortgage Trust, Series 2013-SFS, Class A2, VAR, 3.086%, 04/12/35 (e) | | | 123,370 | |

| | 565,000 | | | Commercial Mortgage Pass-Through Certificates, Series 2006-C1, Class A4, VAR, 5.609%, 02/15/39 | | | 596,555 | |

| | 229,000 | | | Federal Home Loan Mortgage Corp., Multifamily Structured Pass-Through Certificates, Series K038, Class A2, 3.389%, 03/25/24 | | | 238,892 | |

| | 95,328 | | | GMAC Commercial Mortgage Securities, Inc. Trust, Series 2006-C1, Class A4, VAR, 5.238%, 11/10/45 | | | 99,144 | |

| | 122,000 | | | GS Mortgage Securities Corp. Trust, Series 2013-NYC5, Class A, 2.318%, 01/10/30 (e) | | | 123,302 | |

| | 59,790 | | | LB-UBS Commercial Mortgage Trust, Series 2005-C1, Class A4, 4.742%, 02/15/30 | | | 60,495 | |

| | 2,517 | | | Merrill Lynch Mortgage Trust, Series 2005-MCP1, Class ASB, VAR, 4.674%, 06/12/43 | | | 2,517 | |

| | 3,333,368 | | | Morgan Stanley Capital I Trust, Series 2006-IQ12, Class X1, IO, VAR, 0.682%, 12/15/43 (e) | | | 35,414 | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| | | | | | | | |

| | 10,007 | | | Morgan Stanley Re-REMIC Trust, Series 2011-IO, Class A, 2.500%, 03/23/51 (e) | | | 10,045 | |

| | 656,189 | | | NCUA Guaranteed Notes Trust, Series 2010-C1, Class APT, 2.650%, 10/29/20 | | | 673,562 | |

| | 107,880 | | | TIAA Seasoned Commercial Mortgage Trust, Series 2007-C4, Class A3, VAR, 5.562%, 08/15/39 | | | 109,559 | |

| | 116,000 | | | UBS-BAMLL Trust, Series 2012-WRM, Class A, 3.663%, 06/10/30 (e) | | | 117,112 | |

| | 104,000 | | | UBS-Barclays Commercial Mortgage Trust, Series 2012-C2, Class A4, 3.525%, 05/10/63 | | | 107,365 | |

| | 200,000 | | | VNDO Mortgage Trust, Series 2013-PENN, Class A, 3.808%, 12/13/29 (e) | | | 212,520 | |

| | 35,199 | | | Wachovia Bank Commercial Mortgage Trust, Series 2004-C11, Class A5, VAR, 5.215%, 01/15/41 | | | 35,243 | |

| | 110,000 | | | WFRBS Commercial Mortgage Trust, Series 2011-C3, Class A4, 4.375%, 03/15/44 (e) | | | 120,385 | |

| | | | | | | | |

| | | | Total Commercial Mortgage-Backed Securities (Cost $4,618,083) | | | 4,816,834 | |

| | | | | | | | |

| Corporate Bonds — 16.2% | | | | |

| | | | Consumer Discretionary — 1.3% | |

| | | | Auto Components — 0.0% (g) | |

| | 7,000 | | | Johnson Controls, Inc., 4.950%, 07/02/64 | | | 7,091 | |

| | | | | | | | |

| | | | Automobiles — 0.1% | |

| | 150,000 | | | Daimler Finance North America LLC, 1.875%, 01/11/18 (e) | | | 151,358 | |

| | | | | | | | |

| | | | Media — 1.1% | |

| | | | 21st Century Fox America, Inc., | | | | |

| | 50,000 | | | 6.650%, 11/15/37 | | | 63,487 | |

| | 50,000 | | | 7.250%, 05/18/18 | | | 60,099 | |

| | 150,000 | | | 7.300%, 04/30/28 | | | 189,556 | |

| | | | CBS Corp., | | | | |

| | 21,000 | | | 5.750%, 04/15/20 | | | 24,336 | |

| | 100,000 | | | 7.875%, 07/30/30 | | | 134,378 | |

| | 75,000 | | | Comcast Cable Holdings LLC, 10.125%, 04/15/22 | | | 104,745 | |

| | | | Comcast Corp., | | | | |

| | 87,000 | | | 4.250%, 01/15/33 | | | 89,369 | |

| | 50,000 | | | 5.900%, 03/15/16 | | | 54,434 | |

| | 50,000 | | | 6.450%, 03/15/37 | | | 63,775 | |

| | 30,000 | | | 6.500%, 01/15/17 | | | 34,124 | |

| | 35,000 | | | 6.500%, 11/15/35 | | | 45,343 | |

| | | | Cox Communications, Inc., | | | | |

| | 9,000 | | | 5.450%, 12/15/14 | | | 9,199 | |

| | 20,000 | | | 8.375%, 03/01/39 (e) | | | 28,021 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 14 | | | | JPMORGAN INSURANCE TRUST | | JUNE 30, 2014 |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| Corporate Bonds — continued | | | | |

| | | | Media — continued | |

| | | | DIRECTV Holdings LLC/DIRECTV Financing Co., Inc., | | | | |

| | 125,000 | | | 4.600%, 02/15/21 | | | 136,479 | |

| | 67,000 | | | 5.000%, 03/01/21 | | | 74,793 | |

| | 125,000 | | | 6.000%, 08/15/40 | | | 143,917 | |

| | 78,000 | | | Discovery Communications LLC, 4.375%, 06/15/21 | | | 84,430 | |

| | 100,000 | | | Historic TW, Inc., 9.150%, 02/01/23 | | | 138,525 | |

| | 75,000 | | | NBCUniversal Media LLC, 5.950%, 04/01/41 | | | 92,082 | |

| | 84,000 | | | Thomson Reuters Corp., (Canada), 3.950%, 09/30/21 | | | 87,952 | |

| | | | Time Warner Cable, Inc., | | | | |

| | 50,000 | | | 6.550%, 05/01/37 | | | 62,215 | |

| | 50,000 | | | 6.750%, 07/01/18 | | | 59,165 | |

| | 50,000 | | | 7.300%, 07/01/38 | | | 67,261 | |

| | | | Time Warner Entertainment Co. LP, | | | | |

| | 50,000 | | | 8.375%, 03/15/23 | | | 67,622 | |

| | 25,000 | | | 8.375%, 07/15/33 | | | 36,678 | |

| | | | Time Warner, Inc., | | | | |

| | 35,000 | | | 4.750%, 03/29/21 | | | 38,810 | |

| | 75,000 | | | 6.200%, 03/15/40 | | | 89,160 | |

| | 7,000 | | | 6.250%, 03/29/41 | | | 8,424 | |

| | 15,000 | | | 6.500%, 11/15/36 | | | 18,355 | |

| | | | Viacom, Inc., | | | | |

| | 13,000 | | | 1.250%, 02/27/15 | | | 13,073 | |

| | 22,000 | | | 3.250%, 03/15/23 | | | 21,718 | |

| | 43,000 | | | 3.875%, 12/15/21 | | | 45,038 | |

| | 20,000 | | | 4.500%, 02/27/42 | | | 19,086 | |

| | | | | | | | |

| | | | | | | 2,205,649 | |

| | | | | | | | |

| | | | Multiline Retail — 0.0% (g) | |

| | | | Macy’s Retail Holdings, Inc., | | | | |

| | 18,000 | | | 4.375%, 09/01/23 | | | 19,075 | |

| | 9,000 | | | 5.125%, 01/15/42 | | | 9,546 | |

| | | | | | | | |

| | | | | | | 28,621 | |

| | | | | | | | |

| | | | Specialty Retail — 0.1% | |

| | 30,000 | | | Gap, Inc. (The), 5.950%, 04/12/21 | | | 34,719 | |

| | 70,000 | | | Home Depot, Inc. (The), 5.400%, 03/01/16 | | | 75,536 | |

| | 75,000 | | | Lowe’s Cos., Inc., Series B, 7.110%, 05/15/37 | | | 100,164 | |

| | | | | | | | |

| | | | | | | 210,419 | |

| | | | | | | | |

| | | | Total Consumer Discretionary | | | 2,603,138 | |

| | | | | | | | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| | | | | | | | |

| | | | Consumer Staples — 0.7% | |

| | | | Beverages — 0.2% | |

| | 125,000 | | | Anheuser-Busch InBev Worldwide, Inc., 7.750%, 01/15/19 | | | 154,429 | |

| | 95,000 | | | Diageo Capital plc, (United Kingdom), 5.750%, 10/23/17 | | | 108,329 | |

| | 20,000 | | | Diageo Finance B.V., (Netherlands), 5.300%, 10/28/15 | | | 21,260 | |

| | 15,000 | | | FBG Finance Pty Ltd., (Australia), 5.125%, 06/15/15 (e) | | | 15,620 | |

| | | | | | | | |

| | | | | | | 299,638 | |

| | | | | | | | |

| | | | Food & Staples Retailing — 0.2% | |

| | | | CVS Caremark Corp., | | | | |

| | 36,000 | | | 4.000%, 12/05/23 | | | 37,673 | |

| | 16,000 | | | 5.300%, 12/05/43 | | | 18,087 | |

| | 60,000 | | | 5.750%, 05/15/41 | | | 71,942 | |

| | 30,000 | | | 6.125%, 09/15/39 | | | 37,355 | |

| | | | Kroger Co. (The), | | | | |

| | 67,000 | | | 4.000%, 02/01/24 | | | 69,506 | |

| | 18,000 | | | 5.400%, 07/15/40 | | | 19,853 | |

| | 25,000 | | | 7.500%, 04/01/31 | | | 32,946 | |

| | 70,000 | | | Wal-Mart Stores, Inc., 6.500%, 08/15/37 | | | 93,040 | |

| | | | | | | | |

| | | | | | | 380,402 | |

| | | | | | | | |

| | | | Food Products — 0.3% | |

| | 25,000 | | | Archer-Daniels-Midland Co., 5.935%, 10/01/32 | | | 30,597 | |

| | 55,000 | | | Bunge Ltd. Finance Corp., 8.500%, 06/15/19 | | | 69,114 | |

| | 27,000 | | | Bunge N.A. Finance LP, 5.900%, 04/01/17 | | | 29,961 | |

| | 10,000 | | | ConAgra Foods, Inc., 2.100%, 03/15/18 | | | 10,032 | |

| | 13,000 | | | Kellogg Co., 1.750%, 05/17/17 | | | 13,155 | |

| | | | Kraft Foods Group, Inc., | | | | |

| | 66,000 | | | 5.375%, 02/10/20 | | | 75,071 | |

| | 122,000 | | | 6.125%, 08/23/18 | | | 141,602 | |

| | 100,000 | | | 6.875%, 01/26/39 | | | 130,791 | |

| | 75,000 | | | Mondelez International, Inc., 4.000%, 02/01/24 | | | 77,684 | |

| | | | | | | | |

| | | | | | | 578,007 | |

| | | | | | | | |

| | | | Household Products — 0.0% (g) | |

| | 63,989 | | | Procter & Gamble - ESOP, Series A, 9.360%, 01/01/21 | | | 80,567 | |

| | | | | | | | |

| | | | Total Consumer Staples | | | 1,338,614 | |

| | | | | | | | |

| | | | Energy — 1.5% | |

| | | | Energy Equipment & Services — 0.1% | |

| | 54,000 | | | Halliburton Co., 3.500%, 08/01/23 | | | 55,380 | |

| | 5,000 | | | Noble Holding International Ltd., (Cayman Islands), 3.950%, 03/15/22 | | | 5,121 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| JUNE 30, 2014 | | JPMORGAN INSURANCE TRUST | | | | | 15 | |

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2014 (Unaudited) (continued)

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| Corporate Bonds — continued | | | | |

| | | | Energy Equipment & Services — continued | |

| | | | Transocean, Inc., (Cayman Islands), | | | | |

| | 18,000 | | | 6.375%, 12/15/21 | | | 20,823 | |

| | 75,000 | | | 6.500%, 11/15/20 | | | 86,742 | |

| | 14,000 | | | 7.350%, 12/15/41 | | | 17,742 | |

| | | | | | | | |

| | | | | | | 185,808 | |

| | | | | | | | |

| | | | Oil, Gas & Consumable Fuels — 1.4% | |

| | 50,000 | | | Apache Corp., 6.900%, 09/15/18 | | | 59,872 | |

| | | | BP Capital Markets plc, (United Kingdom), | | | | |

| | 71,000 | | | 2.750%, 05/10/23 | | | 68,201 | |

| | 150,000 | | | 4.742%, 03/11/21 | | | 168,176 | |

| | 100,000 | | | Canadian Natural Resources Ltd., (Canada), 5.900%, 02/01/18 | | | 114,050 | |

| | | | Cenovus Energy, Inc., (Canada), | | | | |

| | 13,000 | | | 3.000%, 08/15/22 | | | 12,773 | |

| | 31,000 | | | 4.450%, 09/15/42 | | | 30,704 | |

| | 20,000 | | | Chevron Corp., 2.355%, 12/05/22 | | | 19,225 | |

| | 200,000 | | | CNOOC Nexen Finance ULC, (Canada), 4.250%, 04/30/24 | | | 204,004 | |

| | | | ConocoPhillips, | | | | |

| | 25,000 | | | 5.750%, 02/01/19 | | | 29,108 | |

| | 120,000 | | | 6.000%, 01/15/20 | | | 142,772 | |

| | 75,000 | | | ConocoPhillips Canada Funding Co. I, (Canada), 5.625%, 10/15/16 | | | 83,100 | |

| | | | Devon Energy Corp., | | | | |

| | 47,000 | | | 3.250%, 05/15/22 | | | 47,345 | |

| | 21,000 | | | 4.750%, 05/15/42 | | | 21,821 | |

| | | | Enterprise Products Operating LLC, | | | | |

| | 25,000 | | | 3.900%, 02/15/24 | | | 25,862 | |

| | 16,000 | | | 5.100%, 02/15/45 | | | 17,079 | |

| | 15,000 | | | EOG Resources, Inc., 2.625%, 03/15/23 | | | 14,476 | |

| | 50,000 | | | Kerr-McGee Corp., 7.875%, 09/15/31 | | | 70,617 | |

| | 76,000 | | | Magellan Midstream Partners LP, 5.150%, 10/15/43 | | | 83,275 | |

| | 150,000 | | | Marathon Oil Corp., 6.000%, 10/01/17 | | | 171,491 | |

| | 100,000 | | | NGPL PipeCo LLC, 7.119%, 12/15/17 (e) | | | 101,500 | |

| | | | Petrobras Global Finance B.V., (Netherlands), | | | | |

| | 56,000 | | | 4.375%, 05/20/23 | | | 53,931 | |

| | 147,000 | | | 6.250%, 03/17/24 | | | 156,467 | |

| | | | Petrobras International Finance Co., (Cayman Islands), | | | | |

| | 45,000 | | | 5.375%, 01/27/21 | | | 46,900 | |

| | 25,000 | | | 7.875%, 03/15/19 | | | 29,146 | |

| | 60,000 | | | Petro-Canada, (Canada), 6.800%, 05/15/38 | | | 79,424 | |

| | | | | | | | |

PRINCIPAL

AMOUNT($) | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | |

| | | | | | | | |

| | | | Oil, Gas & Consumable Fuels — continued | |

| | | | Petroleos Mexicanos, (Mexico), | | | | |