UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-07888

Limited Term Tax-Exempt Bond Fund of America

(Exact Name of Registrant as Specified in Charter)

333 South Hope Street

Los Angeles, California 90071

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (213) 486-9200

Date of fiscal year end: July 31

Date of reporting period: January 31, 2017

Steven I. Koszalka

Limited Term Tax-Exempt Bond Fund of America

333 South Hope Street

Los Angeles, California 90071

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

| American Funds Short-Term Tax-Exempt Bond Fund®

Limited Term Tax-Exempt Bond Fund of America®

The Tax-Exempt Bond Fund of America®

American High-Income Municipal Bond Fund®

The Tax-Exempt Fund of California®

American Funds Tax-Exempt Fund of New York® Semi-annual reports for the six months

ended January 31, 2017 |

American Funds Short-Term Tax-Exempt Bond Fund seeks to provide you with current income exempt from regular federal income tax, consistent with the maturity and quality standards described in the prospectus, and to preserve capital.

Limited Term Tax-Exempt Bond Fund of America seeks to provide you with current income exempt from regular federal income tax, consistent with the maturity and quality standards described in the prospectus, and to preserve capital.

The Tax-Exempt Bond Fund of America seeks to provide you with a high level of current income exempt from federal income tax, consistent with the preservation of capital.

American High-Income Municipal Bond Fund seeks to provide you with a high level of current income exempt from regular federal income tax.

The Tax-Exempt Fund of California seeks to provide you with a high level of current income exempt from regular federal and California state income taxes. Its secondary objective is preservation of capital.

American Funds Tax-Exempt Fund of New York seeks to provide you with a high level of current income exempt from regular federal, New York state and New York City income taxes. Its secondary objective is preservation of capital.

Each fund is one of more than 40 offered by one of the nation’s largest mutual fund families, American Funds, from Capital Group. For more than 85 years, Capital has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class A shares at net asset value. If a sales charge had been deducted (maximum 2.50% for American Funds Short-Term Tax-Exempt Bond Fund and Limited Term Tax-Exempt Bond Fund of America; 3.75% for The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund, The Tax-Exempt Fund of California and American Funds Tax-Exempt Fund of New York), the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value. For current information and month-end results, visit americanfunds.com.

Here are the total returns on a $1,000 investment with all distributions reinvested for periods ended December 31, 2016 (the most recent calendar quarter-end), and the total annual fund operating expense ratios as of the prospectus dated January 1, 2017.

| | | Cumulative total returns | | Average annual total returns | | Gross |

| Class A shares | | 1 year | | 5 years | | 10 years/Lifetime* | | expense ratios |

| | | | | | | | | |

| Reflecting 2.50% maximum sales charge | | | | | | | | | | | | | | | | |

| American Funds Short-Term Tax-Exempt Bond Fund | | | –2.53 | % | | | 0.18 | % | | | 1.05 | % | | | 0.59 | % |

| Limited Term Tax-Exempt Bond Fund of America | | | –2.75 | | | | 1.11 | | | | 2.76 | | | | 0.59 | |

| | | | | | | | | | | | | | | | | |

| Reflecting 3.75% maximum sales charge | | | | | | | | | | | | | | | | |

| The Tax-Exempt Bond Fund of America | | | –3.41 | | | | 2.96 | | | | 3.55 | | | | 0.54 | |

| American High-Income Municipal Bond Fund | | | –2.27 | | | | 5.11 | | | | 3.86 | | | | 0.67 | |

| The Tax-Exempt Fund of California | | | –3.86 | | | | 3.41 | | | | 3.75 | | | | 0.60 | |

| American Funds Tax-Exempt Fund of New York | | | –3.75 | | | | 2.41 | | | | 3.10 | | | | 0.72 | † |

| | |

| * | Applicable only to American Funds Tax-Exempt Fund of New York, which began operations on 11/1/10. All other funds reflect 10-year results. |

| † | The net expense ratio for American Funds Tax-Exempt Fund of New York is 0.69% as of the prospectus dated January 1, 2017. |

For other share class results, visit americanfunds.com.

The 10-year investment result for American Funds Short-Term Tax-Exempt Bond Fund includes the fund’s results as a money market fund through the date of its conversion (August 7, 2009) to a short-term tax-exempt bond fund, and therefore is not representative of the fund’s results had it operated as a short-term tax-exempt bond fund for the full term of that period. Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, investment results reflect fee waivers and/or expense reimbursements, without which results would have been lower. The investment adviser is currently reimbursing a portion of other expenses for American Funds Tax-Exempt Fund of New York. Investment results reflect the reimbursement, without which the results would have been lower. This reimbursement will be in effect through at least January 1, 2018, unless modified or terminated by the fund’s board. The adviser may elect at its discretion to extend, modify or terminate the reimbursement at that time. Visit americanfunds.com for more information.

A summary of each fund’s 30-day yield can be found on page 3.

Fellow investors:

This report covers the results of American Funds Short-Term Tax-Exempt Bond Fund, Limited Term Tax-Exempt Bond Fund of America, The Tax-Exempt Bond Fund of America, American High-Income Municipal Bond Fund, The Tax-Exempt Fund of California and American Funds Tax-Exempt Fund of New York for the six months ended January 31, 2017.

Volatility returned to the municipal bond market during the first half of the funds’ fiscal year as investors weighed the potential impact of the U.S. presidential election, strengthening economic conditions and rising interest rates. The market was further pressured by a record level of municipal bond issuance in 2016. Against this backdrop, all six funds registered declines, ranging from –0.92% for American Funds Short-Term Tax-Exempt Bond Fund to –3.77% for American High-Income Municipal Bond Fund. (See pages 4 through 10 for fund specific results and information.)

Economic and market overview

The first half of the fiscal year began as the prior ended, with a strong showing for municipal bond markets on the whole. In August, the unmanaged Bloomberg Barclays Municipal Bond Index, a broad measure of the tax-exempt investment-grade market (bonds rated BBB/Baa and above), recorded its 14th consecutive month of positive returns. By September, however, that trend reversed sharply and the tax-exempt market experienced a high level of volatility.

This abrupt shift in market sentiment was attributable to several factors, including upbeat economic news. Gross Domestic Product (GDP) rose an annualized rate of 3.5% in the third quarter of 2016, up from 1.4% in the second. Wages also improved, climbing nearly 3.0% year over year in December. In response to expectations for tax cuts and a pro-growth agenda from the new administration, bond yields spiked in November and December.

Inflation expectations also increased significantly. In December, U.S. consumer prices rose 2.1% on a year-over-year basis, the largest inflation bump since June 2014. In a widely anticipated move, the U.S. Federal Reserve raised the federal funds target rate to a range of 0.50%–0.75% in mid-December. Longer term interest rates also rose during the period, depressing U.S. Treasury bond prices. Tax-exempt bonds sold off along with the broader bond market.

Municipal bond issuance reached an all-time high in 2016, further pressuring the market. The year’s $445 billion in offerings — driven by refundings mid-year as issuers looked to take advantage of low borrowing costs — eclipsed the old record of $433 billion set in 2010. After experiencing inflows for the first 10 months of the year, muni fund flows turned negative in November and December, further contributing to the volatility.

In the closing weeks of the period however, fund flows turned positive

| American Funds Tax-Exempt Funds | 1 |

again, helping drive a modest muni market rebound.

In general, municipal bonds of lower credit quality suffered more pronounced declines than higher rated issues, and longer term bonds tended to trail those with shorter maturities. Given the accelerating growth of the U.S. economy and anticipation of the Fed’s rate hike in December, most of the funds covered in this report entered the period with a conservative approach, maintaining a relatively short duration position. This helped mitigate the worst of the declines during the heightened volatility that characterized the final months of the calendar year. That said, the funds tended to lag the broader market during the rebound that occurred during the closing weeks of the period.

Looking ahead

As we look to the months ahead, there remains a great deal of uncertainty. The United States economy appears to be gaining momentum, and bond and equity markets alike have appeared to price in the potential effect of any shifts in policy under President Trump. That said, it is important to recognize that the details of future policy and their potential impact remain unclear. The possibility of both higher inflation and interest rates presents further challenges for municipal bond investors. Fed officials have in fact signaled that more rate increases are likely in 2017.

At this time we do not expect municipal bond returns to match the strong levels of the last few years. Faced with higher uncertainty and probable market volatility, we expect to maintain relatively neutral duration and curve investment positions. That being said, we believe that in the current low-yield environment we may continue to uncover potentially compelling income opportunities through comprehensive credit research.

We appreciate the trust you have placed in us and look forward to reporting back to you at the close of the fiscal year.

Sincerely,

Neil L. Langberg

President, American Funds Short-Term

Tax-Exempt Bond Fund, Limited Term

Tax-Exempt Bond Fund of America,

The Tax-Exempt Bond Fund of America

and The Tax-Exempt Fund of California

Jerry H. Solomon

President, American Funds Tax-Exempt

Fund of New York

Karl J. Zeile

President, American High-Income

Municipal Bond Fund

March 17, 2017

For current information about the funds, visit americanfunds.com.

| 2 | American Funds Tax-Exempt Funds |

Funds’ 30-day yields

Below is a summary of each fund’s 30-day yield and 12-month distribution rate for Class A shares as of February 28, 2017. Both measures reflect the 2.50%/3.75% maximum sales charge. Each fund’s 30-day yield is calculated in accordance with the U.S. Securities and Exchange Commission (SEC) formula. The SEC yield reflects the rate at which each fund is earning income on its current portfolio of securities while the distribution rate reflects the funds’ past dividends paid to shareholders. Accordingly, the funds’ SEC yields and distribution rates may differ. The equivalent taxable yield assumes a 43.4% tax rate.1

| Class A shares | | SEC

30-day yield | | Equivalent

taxable yield | | 12-month

distribution rate |

| Reflecting 2.50% maximum sales charge | | | | | | | | | | | | |

| American Funds Short-Term Tax-Exempt Bond Fund | | | 1.06 | % | | | 1.87 | % | | | 1.06 | % |

| Limited Term Tax-Exempt Bond Fund of America | | | 1.31 | | | | 2.31 | | | | 2.00 | |

| | | | | | | | | | | | | |

| Reflecting 3.75% maximum sales charge | | | | | | | | | | | | |

| The Tax-Exempt Bond Fund of America | | | 2.17 | | | | 3.83 | | | | 3.02 | |

| American High-Income Municipal Bond Fund | | | 3.35 | | | | 5.92 | | | | 3.68 | |

| The Tax-Exempt Fund of California | | | 2.01 | | | | 4.10 | 2 | | | 2.96 | |

| American Funds Tax-Exempt Fund of New York | | | 2.10 | 3 | | | 4.07 | 4 | | | 2.42 | |

| | |

| 1 | Based on 2016 federal tax rates. For the year 2016, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 43.4% marginal tax rate on their investment income. The federal rates do not include an adjustment for the loss of personal exemptions and the phaseout of itemized deductions that are applicable to certain taxable income levels. |

| 2 | For investors in the 50.93% federal and California state tax bracket. |

| 3 | The SEC 30-day yield for American Funds Tax-Exempt Fund of New York is 2.10% with the fund’s reimbursement. |

| 4 | For investors in the 48.39% federal and New York state tax bracket. |

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Income may be subject to state or local income taxes and/or federal alternative minimum taxes. Also, certain other income (such as distributions from gains on the sale of certain bonds purchased at less than par value, for The Tax-Exempt Bond Fund of America), as well as capital gain distributions, may be taxable. High-yield/lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than investment-grade/higher rated bonds. The Tax-Exempt Fund of California and American Funds Tax-Exempt Fund of New York are more susceptible to factors adversely affecting issuers of each state’s tax-exempt securities than a more widely diversified municipal bond fund. Refer to the funds’ prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the funds.

| American Funds Tax-Exempt Funds | 3 |

American Funds Short-Term Tax-Exempt Bond Fund

The fund registered a total return of –0.92% for the first half of the fiscal year, trailing the –0.68% return of the Lipper Short Municipal Debt Funds Average, a peer group measure. The fund also lagged the –0.88% decline of the Bloomberg Barclays Municipal Short 1–5 Years Index.

The fund paid monthly dividends totaling 6 cents a share for the six months. This amounts to a federally tax-exempt income return of 0.55% for investors who reinvested dividends. This is equivalent to a taxable income return of 0.97% for investors in the 43.4%1 maximum federal tax bracket. A portion of the fund’s return also may be exempt from some state and local taxes.

In an uncertain market environment, the fund’s managers sought to provide relative stability. With yields near multiyear lows, the fund maintained its focus on high-quality issues of shorter duration. Municipal bonds on the whole struggled during the period; among the fund’s biggest detractors were revenue bonds supporting single-family housing and hospital facilities.

The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Thomson Reuters Lipper.

Tax-exempt yields vs. taxable yields

Find your estimated taxable income below to determine your federal tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 1.06% tax-exempt distribution rate3 as of January 31, 2017.

| If your taxable income is … | | … then your federal | The fund’s tax-exempt

distribution rate of 1.06% is |

| Single | | Joint | | tax rate is … | equivalent to a taxable rate of … |

| $ | 0 – | 9,275 | | | $ | 0 – | 18,550 | | | | 10.0 | % | | | 1.18 | % |

| | 9,276 – | 37,650 | | | | 18,551 – | 75,300 | | | | 15.0 | | | | 1.25 | |

| | 37,651 – | 91,150 | | | | 75,301 – | 151,900 | | | | 25.0 | | | | 1.41 | |

| | 91,151 – | 190,150 | | | | 151,901 – | 231,450 | | | | 28.0 | | | | 1.47 | |

| | 190,151 – | 413,350 | | | | 231,451 – | 413,350 | | | | 36.8 | 1 | | | 1.68 | |

| | 413,351 – | 415,050 | | | | 413,351 – | 466,950 | | | | 38.8 | 1 | | | 1.73 | |

| | Over 415,050 | | | | Over 466,950 | | | | 43.4 | 1 | | | 1.87 | |

| | |

| 1 | For the year 2016, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 43.4% marginal tax rate on their investment income. |

| 2 | Based on 2016 federal tax rates. The federal rates do not include an adjustment for the loss of personal exemptions and the phaseout of itemized deductions that are applicable to certain taxable income levels. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of January 31, 2017. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown are for Class A shares at net asset value. If a sales charge (maximum 2.50%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 4 | American Funds Tax-Exempt Funds |

Limited Term Tax-Exempt Bond Fund of America

The fund recorded a decline of –1.75% for the six months ended January 31, a result that bested the –1.91% total return of the Bloomberg Barclays Municipal Short-Intermediate 1–10 Years Index. The fund’s result was in line with the –1.78% total return of the Lipper Short-Intermediate Municipal Debt Funds Average, a peer group measure.

The fund paid monthly dividends totaling 16 cents a share for the period. Those individuals who reinvested dividends received a federally tax-exempt income return of 1.00%. This is equivalent to a taxable income return of 1.77% for investors in the 43.4%1 maximum federal tax bracket.

The fund focuses primarily on investment-grade bonds (those rated BBB/Baa and above). The fund’s managers positioned the portfolio fairly conservatively, seeking to maintain a relatively short duration. This approach dampened returns to an extent as the broader municipal bond market experienced a solid rebound in the final weeks of the period.

The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Thomson Reuters Lipper.

Tax-exempt yields vs. taxable yields

Find your estimated taxable income below to determine your federal tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 2.02% tax-exempt distribution rate3 as of January 31, 2017.

| If your taxable income is … | | ... then your federal | The fund’s tax-exempt

distribution rate of 2.02% is |

| Single | | Joint | | tax rate is … | equivalent to a taxable rate of ... |

| $ | 0 – | 9,275 | | | $ | 0 – | 18,550 | | | | 10.0 | % | | | 2.24 | % |

| | 9,276 – | 37,650 | | | | 18,551 – | 75,300 | | | | 15.0 | | | | 2.38 | |

| | 37,651 – | 91,150 | | | | 75,301 – | 151,900 | | | | 25.0 | | | | 2.69 | |

| | 91,151 – | 190,150 | | | | 151,901 – | 231,450 | | | | 28.0 | | | | 2.81 | |

| | 190,151 – | 413,350 | | | | 231,451 – | 413,350 | | | | 36.8 | 1 | | | 3.20 | |

| | 413,351 – | 415,050 | | | | 413,351 – | 466,950 | | | | 38.8 | 1 | | | 3.30 | |

| | Over 415,050 | | | | Over 466,950 | | | | 43.4 | 1 | | | 3.57 | |

| | |

| 1 | For the year 2016, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 43.4% marginal tax rate on their investment income. |

| 2 | Based on 2016 federal tax rates. The federal rates do not include an adjustment for the loss of personal exemptions and the phaseout of itemized deductions that are applicable to certain taxable income levels. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of January 31, 2017. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown are for Class A shares at net asset value. If a sales charge (maximum 2.50%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| American Funds Tax-Exempt Funds | 5 |

The Tax-Exempt Bond Fund of America

The fund logged a total return of –3.37% during the six-month period, a result that was in line with the –3.34% decline of the Bloomberg Barclays Municipal Bond Index. However, the fund outpaced the –3.59% total return of the Lipper General & Insured Municipal Debt Funds Average, a peer group measure.

During the period, the fund paid monthly dividends totaling 20 cents a share, amounting to a federally tax-exempt income return of 1.51% for investors who reinvested dividends. This is equivalent to a taxable income return of 2.67% for investors in the 43.4%1 maximum federal tax bracket. The fund does not invest in bonds subject to the Alternative Minimum Tax (AMT).

The fund’s managers continued on a relatively conservative path during the first half of the fiscal year, focusing on minimizing risk in an uncertain environment. They continue to seek out opportunities for incremental yield through deep credit research while remaining mindful of improving economic conditions and the potential for rising interest rates. At the close of the period about 93% of the portfolio consisted of revenue bonds. The largest concentrations were in holdings backing health care and transportation initiatives.

Amid declines across most areas of the market, holdings of bonds supporting hospital facilities were particularly detrimental to fund returns.

The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Thomson Reuters Lipper.

Tax-exempt yields vs. taxable yields

Find your estimated taxable income below to determine your federal tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 3.04% tax-exempt distribution rate3 as of January 31, 2017.

| If your taxable income is … | | ... then your federal | The fund’s tax-exempt

distribution rate of 3.04% is |

| Single | | Joint | | tax rate is … | equivalent to a taxable rate of ... |

| $ | 0 – | 9,275 | | | $ | 0 – | 18,550 | | | | 10.0 | % | | | 3.38 | % |

| | 9,276 – | 37,650 | | | | 18,551 – | 75,300 | | | | 15.0 | | | | 3.58 | |

| | 37,651 – | 91,150 | | | | 75,301 – | 151,900 | | | | 25.0 | | | | 4.05 | |

| | 91,151 – | 190,150 | | | | 151,901 – | 231,450 | | | | 28.0 | | | | 4.22 | |

| | 190,151 – | 413,350 | | | | 231,451 – | 413,350 | | | | 36.8 | 1 | | | 4.81 | |

| | 413,351 – | 415,050 | | | | 413,351 – | 466,950 | | | | 38.8 | 1 | | | 4.97 | |

| | Over 415,050 | | | | Over 466,950 | | | | 43.4 | 1 | | | 5.37 | |

| | |

| 1 | For the year 2016, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 43.4% marginal tax rate on their investment income. |

| 2 | Based on 2016 federal tax rates. The federal rates do not include an adjustment for the loss of personal exemptions and the phaseout of itemized deductions that are applicable to certain taxable income levels. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of January 31, 2017. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown are for Class A shares at net asset value. If a sales charge (maximum 3.75%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 6 | American Funds Tax-Exempt Funds |

American High-Income Municipal Bond Fund

The fund registered a total return of –3.77% for the first half of its fiscal year. This result exceeded both the –3.91% loss of the Bloomberg Barclays High Yield Municipal Bond Index, and the –4.25% total return of the Lipper High Yield Municipal Debt Funds Average, a measure of the fund’s peer group.

For the six months, the fund paid monthly dividends totaling 29 cents a share, amounting to a federally tax-exempt income return of 1.83% for investors who reinvested dividends. This is equivalent to a taxable income return of 3.23% for investors in the 43.4%1 maximum federal tax bracket. A portion of the fund’s return also may be exempt from some state and local taxes.

Rigorous credit research helped the fund mitigate the impact of some of the more extreme crosscurrents in the municipal bond market. Holdings of bonds backing hospitals, senior living facilities and airports posted some of the worst declines for the period.

The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Thomson Reuters Lipper.

Tax-exempt yields vs. taxable yields

Find your estimated taxable income below to determine your federal tax rate,2 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 3.73% tax-exempt distribution rate3 as of January 31, 2017.

| If your taxable income is … | | ... then your federal | The fund’s tax-exempt

distribution rate of 3.73% is |

| Single | | Joint | | tax rate is … | equivalent to a taxable rate of ... |

| $ | 0 – | 9,275 | | | $ | 0 – | 18,550 | | | | 10.0 | % | | | 4.14 | % |

| | 9,276 – | 37,650 | | | | 18,551 – | 75,300 | | | | 15.0 | | | | 4.39 | |

| | 37,651 – | 91,150 | | | | 75,301 – | 151,900 | | | | 25.0 | | | | 4.97 | |

| | 91,151 – | 190,150 | | | | 151,901 – | 231,450 | | | | 28.0 | | | | 5.18 | |

| | 190,151 – | 413,350 | | | | 231,451 – | 413,350 | | | | 36.8 | 1 | | | 5.90 | |

| | 413,351 – | 415,050 | | | | 413,351 – | 466,950 | | | | 38.8 | 1 | | | 6.09 | |

| | Over 415,050 | | | | Over 466,950 | | | | 43.4 | 1 | | | 6.59 | |

| | |

| 1 | For the year 2016, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 43.4% marginal tax rate on their investment income. |

| 2 | Based on 2016 federal tax rates. The federal rates do not include an adjustment for the loss of personal exemptions and the phaseout of itemized deductions that are applicable to certain taxable income levels. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of January 31, 2017. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown are for Class A shares at net asset value. If a sales charge (maximum 3.75%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| American Funds Tax-Exempt Funds | 7 |

The Tax-Exempt Fund of California

The fund posted a total return of –3.66% for the six months. This result bested the –4.22% total return of the Lipper California Municipal Debt Funds Average, a peer group measure. However, the fund trailed the –3.54% return of the Bloomberg Barclays California Municipal Index.

For the period, the fund paid monthly dividends totaling 27 cents a share. Those investors who reinvested dividends received an income return of 1.48%. This is equivalent to a taxable income return of 3.02% for investors in the 50.93%1 effective combined federal and California state tax bracket.

Holdings of tax assessment bonds and issues backing hospitals and school districts dampened fund returns.

The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Thomson Reuters Lipper.

Tax-exempt yields vs. taxable yields

Find your estimated 2016 taxable income below to determine your combined federal and California tax rate2, then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 2.99% tax-exempt distribution rate3 at January 31, 2017.

| If your taxable income is … | | … then your combined

federal and California | The fund’s tax-exempt

distribution rate of 2.99% is |

| Single | | Joint | | state tax rate is … | equivalent to a taxable rate of ... |

| $ | 0 – | 8,015 | | | $ | 0 – | 16,030 | | | | 10.90 | % | | | 3.36 | % |

| | 8,016 – | 9,275 | | | | 16,031 – | 18,550 | | | | 11.80 | | | | 3.39 | |

| | 9,276 – | 19,001 | | | | 18,551 – | 38,002 | | | | 16.70 | | | | 3.59 | |

| | 19,002 – | 29,989 | | | | 38,003 – | 59,978 | | | | 18.40 | | | | 3.66 | |

| | 29,990 – | 37,650 | | | | 59,979 – | 75,300 | | | | 20.10 | | | | 3.74 | |

| | 37,651 – | 41,629 | | | | 75,301 – | 83,258 | | | | 29.50 | | | | 4.24 | |

| | 41,630 – | 52,612 | | | | 83,259 – | 105,224 | | | | 31.00 | | | | 4.33 | |

| | 52,613 – | 91,150 | | | | 105,225 – | 151,900 | | | | 31.98 | | | | 4.40 | |

| | 91,151 – | 190,150 | | | | 151,901 – | 231,450 | | | | 34.70 | | | | 4.58 | |

| | 190,151 – | 268,750 | | | | 231,451 – | 413,350 | | | | 42.68 | 1 | | | 5.22 | |

| | 268,751 – | 322,499 | | | | – | | | | | 43.31 | 1 | | | 5.27 | |

| | 322,500 – | 413,350 | | | | – | | | | | 43.94 | 1 | | | 5.33 | |

| | – | | | | | 413,351 – | 466,950 | | | | 44.49 | 1 | | | 5.39 | |

| | 413,351 – | 415,050 | | | | – | | | | | 45.72 | 1 | | | 5.51 | |

| | – | | | | | 466,951 – | 537,500 | | | | 48.66 | 1 | | | 5.82 | |

| | – | | | | | 537,501 – | 644,998 | | | | 49.23 | 1 | | | 5.89 | |

| | 415,051 – | 537,498 | | | | 644,999 – | 1,000,000 | | | | 49.80 | 1 | | | 5.96 | |

| | 537,499 – | 1,000,000 | | | | 1,000,001 – | 1,074,996 | | | | 50.36 | 1 | | | 6.02 | |

| | Over – | 1,000,000 | | | | Over 1,074,996 | | | | 50.93 | 1 | | | 6.09 | |

1 | For the year 2016, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 50.93% marginal tax rate on their investment income. |

| 2 | Based on 2016 federal and 2016 California state tax rates. (State rates from 1.0% to 13.3% are individually calculated for each bracket. The federal brackets are expanded to include additional state brackets.) The effective combined tax rates paid by California residents may be lower than those shown due to the availability of income tax deductions. |

| 3 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of January 31, 2017. Capital gains distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown are for Class A shares at net asset value. If a sales charge (maximum 3.75%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| 8 | American Funds Tax-Exempt Funds |

American Funds Tax-Exempt Fund of New York

The fund recorded a total return of –3.55%, trailing the –3.22% decline of the Bloomberg Barclays New York Municipal Index. By way of comparison, the Lipper New York Municipal Debt Funds Average, a peer group measure, posted a –3.51% total return.

The fund paid monthly dividends totaling 14 cents a share for the six months. This represents an income return of 1.23% for those who reinvested dividends. For investors in the 48.39%1,2 combined effective federal and New York state tax bracket, this is equivalent to a taxable income return of 2.38%.

Revenue bonds supporting higher education and hospitals and general obligation bonds were among those holdings that detracted from the fund’s overall total return.

The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Thomson Reuters Lipper.

Tax-exempt yields vs. taxable yields

Find your estimated 2016 taxable income below to determine your combined federal and New York state tax rate,2,3 then look in the far right column to see what you would have had to earn from a taxable investment to equal the fund’s 2.43% tax-exempt distribution rate4 at January 31, 2017.

| If your taxable income is … | | … then your combined

federal and New York | The fund’s tax-exempt

distribution rate of 2.43% is |

| Single | | Joint | | state tax rate is … | equivalent to a taxable rate of ... |

| $ | 0 – | 8,450 | | | $ | 0 – | 17,050 | | | | 13.60 | % | | | 2.81 | % |

| | 8,451 – | 9,275 | | | | 17,051 – | 18,550 | | | | 14.05 | | | | 2.83 | |

| | 9,276 – | 11,650 | | | | 18,551 – | 23,450 | | | | 18.83 | | | | 2.99 | |

| | 11,651 – | 13,850 | | | | 23,451 – | 27,750 | | | | 19.46 | | | | 3.02 | |

| | 13,851 – | 21,300 | | | | 27,751 – | 42,750 | | | | 20.02 | | | | 3.04 | |

| | 21,301 – | 37,650 | | | | 42,751 – | 75,300 | | | | 20.48 | | | | 3.06 | |

| | 37,651 – | 80,150 | | | | 75,301 – | 151,900 | | | | 29.84 | | | | 3.46 | |

| | 80,151 – | 91,150 | | | | – | | | | | 29.99 | | | | 3.47 | |

| | – | | | | | 151,901 – | 160,500 | | | | 32.64 | | | | 3.61 | |

| | 91,151 – | 190,150 | | | | 160,501 – | 231,450 | | | | 32.79 | | | | 3.62 | |

| | 190,151 – | 214,000 | | | | 231,451 – | 321,050 | | | | 41.00 | 1 | | | 4.12 | |

| | 214,001 – | 413,350 | | | | 321,051 – | 413,350 | | | | 41.13 | 1 | | | 4.13 | |

| | 413,351 – | 415,050 | | | | 413,351 – | 466,950 | | | | 42.99 | 1 | | | 4.26 | |

| | 415,051 – | 1,070,350 | | | | 466,951 – | 2,140,900 | | | | 47.28 | 1 | | | 4.61 | |

| | over – | 1,070,350 | | | | over – | 2,140,900 | | | | 48.39 | 1 | | | 4.71 | |

1 | For the year 2016, there will be an Unearned Income Medicare Contribution Tax of 3.8% that applies to net investment income for taxpayers whose modified adjusted gross income exceeds $200,000 (for single filers) and $250,000 (for married filing jointly). Thus taxpayers in the highest tax bracket will face a combined 48.39% marginal tax rate on their investment income. |

| 2 | Income generated by the fund’s investments is also generally exempt from New York City taxes, offering additional tax advantages to New York City residents. |

| 3 | Based on 2016 federal and 2016 New York state tax rates. (State rates from 4.00% to 8.82% are individually calculated for each bracket. The federal brackets are expanded to include additional state brackets.) The effective combined tax rates assume full deductibility of state taxes. |

| 4 | The distribution rate is based on dividends paid over the last 12 months divided by the maximum offering price as of January 31, 2017. Capital gain distributions, if any, are added back at the maximum offering price to determine the rate. |

Fund results shown are for Class A shares at net asset value. If a sales charge (maximum 3.75%) had been deducted, the results would have been lower. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. For current information and month-end results, visit americanfunds.com.

| American Funds Tax-Exempt Funds | 9 |

Results at a glance

For periods ended January 31, 2017, with distributions reinvested

| | | Cumulative total returns | | Average annual total returns |

| | | 1 year | | 5 years | | 10 years | | Lifetime1 |

American Funds Short-Term Tax-Exempt Bond Fund

(Class A shares) | | | –0.11 | % | | | 0.66 | % | | | — | | | | 1.22 | % |

| Bloomberg Barclays Municipal Short 1–5 Years Index2 | | | 0.12 | | | | 1.12 | | | | — | | | | 1.74 | |

| Lipper Short Municipal Debt Funds Average | | | –0.10 | | | | 0.59 | | | | — | | | | 1.13 | |

| | | | | | | | | | | | | | | | | |

Limited Term Tax-Exempt Bond Fund of America

(Class A shares) | | | –0.56 | | | | 1.50 | | | | 3.09 | % | | | 3.95 | |

| Bloomberg Barclays Municipal Short-Intermediate 1–10 Years Index3 | | | –0.36 | | | | 1.77 | | | | 3.58 | | | | 4.20 | |

| Lipper Short-Intermediate Municipal Debt Funds Average | | | –0.46 | | | | 1.14 | | | | 2.58 | | | | 3.45 | |

| | | | | | | | | | | | | | | | | |

The Tax-Exempt Bond Fund of America

(Class A shares) | | | –0.25 | | | | 3.25 | | | | 4.01 | | | | 6.49 | |

| Bloomberg Barclays Municipal Bond Index | | | –0.28 | | | | 2.94 | | | | 4.34 | | | | — | 4 |

| Lipper General & Insured Municipal Debt Funds Average | | | –0.45 | | | | 2.94 | | | | 3.65 | | | | 6.24 | |

| | | | | | | | | | | | | | | | | |

American High-Income Municipal Bond Fund

(Class A shares) | | | 1.04 | | | | 5.38 | | | | 4.31 | | | | 5.50 | |

| Bloomberg Barclays Municipal Bond Index | | | –0.28 | | | | 2.94 | | | | 4.34 | | | | 5.38 | |

| Bloomberg Barclays High Yield Municipal Bond Index | | | 3.85 | | | | 5.44 | | | | 4.14 | | | | — | 4 |

| Lipper High Yield Municipal Debt Funds Average | | | 0.66 | | | | 4.65 | | | | 3.42 | | | | 4.99 | |

| | | | | | | | | | | | | | | | | |

The Tax-Exempt Fund of California

(Class A shares) | | | –0.75 | | | | 3.70 | | | | 4.20 | | | | 5.53 | |

| Bloomberg Barclays California Municipal Index | | | –0.45 | | | | 3.48 | | | | 4.54 | | | | — | 4 |

| Lipper California Municipal Debt Funds Average | | | –0.51 | | | | 3.63 | | | | 3.98 | | | | 5.53 | |

| | | | | | | | | | | | | | | | | |

American Funds Tax-Exempt Fund of New York

(Class A shares) | | | –0.24 | | | | 2.75 | | | | — | | | | 3.80 | |

| Bloomberg Barclays New York Municipal Index | | | –0.26 | | | | 2.93 | | | | — | | | | 3.62 | |

| Lipper New York Municipal Debt Funds Average | | | –0.02 | | | | 2.68 | | | | — | | | | 3.33 | |

| | |

| 1 | Since 8/7/09 (American Funds Short-Term Tax-Exempt Bond Fund), 10/6/93 (Limited Term Tax-Exempt Bond Fund of America), 10/3/79 (The Tax-Exempt Bond Fund of America), 9/26/94 (American High-Income Municipal Bond Fund), 10/28/86 (The Tax-Exempt Fund of California) and 11/1/10 (American Funds Tax-Exempt Fund of New York). |

| 2 | Bloomberg Barclays Municipal Short 1–5 Years Index is a market value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to five years. |

| 3 | Bloomberg Barclays Municipal Short-Intermediate 1–10 Years Index is a market value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to 10 years. |

| 4 | This index did not exist at the fund’s inception. |

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Bloomberg Barclays source: Bloomberg Index Services Ltd. Lipper averages reflect the current composition of all eligible mutual funds (all share classes) within a given category. Lipper source: Thomson Reuters Lipper.

| 10 | American Funds Tax-Exempt Funds |

| American Funds Short-Term Tax-Exempt Bond Fund | unaudited |

| Summary investment portfolio January 31, 2017 | |

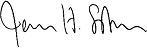

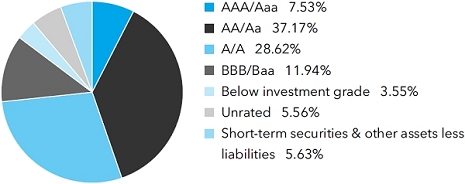

| Portfolio quality summary* | Percent of net assets |

| | |

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. |

| Bonds, notes & other debt instruments 91.44% | Principal amount

(000) | | | Value

(000) | |

| Alabama 2.28% | | | | | | | | |

| Black Belt Energy Gas Dist., Gas Supply Rev. Bonds, Series 2016-A, 4.00% 2046 (put 2021) | | $ | 9,500 | | | $ | 10,185 | |

| Federal Aid Highway Fin. Auth., Federal Highway Grant Anticipation Bonds, Series 2012, 5.00% 2018 | | | 3,315 | | | | 3,519 | |

| Other securities | | | | | | | 5,372 | |

| | | | | | | | 19,076 | |

| | | | | | | | | |

| California 10.54% | | | | | | | | |

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2006-C-1, 1.56% 2045 (put 2023)1 | | | 6,600 | | | | 6,551 | |

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2007-E-3, 1.33% 2047 (put 2019)1 | | | 3,000 | | | | 2,995 | |

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2014-G, 1.26% 2034 (put 2020)1 | | | 2,000 | | | | 2,001 | |

| Health Facs. Fncg. Auth., Rev. Bonds (Sutter Health), Series 2016-C, 1.00% 2053 (put 2019) | | | 5,000 | | | | 4,933 | |

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (St. Joseph Health System), Series 2009-C, 5.00% 2034 (put 2022) | | | 2,200 | | | | 2,514 | |

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (St. Joseph Health System), Series 2013-B, 5.00% 2043 (put 2017) | | | 1,145 | | | | 1,177 | |

| Health Facs. Fncg. Auth., Rev. Ref. Bonds (St. Joseph Health System), Series 2013-D, 5.00% 2043 (put 2020) | | | 1,500 | | | | 1,676 | |

| Infrastructure and Econ. Dev. Bank, Rev. Ref. Bonds (J. Paul Getty Trust), Series 2013-A-2, 1.043% 2047 (put 2019)1 | | | 3,500 | | | | 3,483 | |

| Los Angeles County, Metropolitan Transportation Auth., Proposition A, Sales Tax Rev. Ref. Bonds, Series 2013-A, 5.00% 2018 | | | 3,000 | | | | 3,174 | |

| Statewide Communities Dev. Auth., Rev. Bonds (Hebrew Home for Aged Disabled), Series 2016, 3.50% 2021 | | | 3,350 | | | | 3,504 | |

| Other securities | | | | | | | 56,183 | |

| | | | | | | 88,191 | |

| | | | | | | | | |

| Connecticut 1.54% | | | | | | | | |

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2014-C-1, 4.00% 2044 | | | 825 | | | | 866 | |

| Housing Fin. Auth., Housing Mortgage Fin. Program Bonds, Series 2016-E-1, 3.50% 2046 | | | 1,300 | | | | 1,366 | |

| Housing Fin. Auth., Housing Mortgage Fin. Program Rev. Ref. Bonds, 4.00% 2044 | | | 1,345 | | | | 1,396 | |

| Housing Fin. Auth., Housing Mortgage Fin. Program Rev. Ref. Bonds, Series 2012-F-2, AMT, 2.75% 2035 | | | 570 | | | | 577 | |

| Housing Fin. Auth., Housing Mortgage Fin. Program Rev. Ref. Bonds, Series 2015-A, 3.50% 2044 | | | 3,240 | | | | 3,372 | |

| American Funds Tax-Exempt Funds | 11 |

American Funds Short-Term Tax-Exempt Bond Fund

| Bonds, notes & other debt instruments (continued) | Principal amount

(000) | | | Value

(000) | |

| Connecticut (continued) | | | | | | |

| Housing Fin. Auth., Housing Mortgage Fin. Program Rev. Ref. Bonds, Series 2015-C-1, 3.50% 2045 | | $ | 1,925 | | | $ | 2,006 | |

| Housing Fin. Auth., Housing Mortgage Fin. Program Rev. Ref. Bonds, Series 2016-A-1, 4.00% 2045 | | | 1,365 | | | | 1,456 | |

| Other securities | | | | | | | 1,861 | |

| | | | | | | | 12,900 | |

| | | | | | | | | |

| Florida 4.40% | | | | | | | | |

| Citizens Property Insurance Corp., Coastal Account Secured Bonds, Series 2011-A-1, 5.00% 2019 | | | 1,660 | | | | 1,797 | |

| Citizens Property Insurance Corp., High-Risk Account Secured Bonds, Series 2009-A-1, 6.00% 2017 | | | 1,300 | | | | 1,322 | |

| Citizens Property Insurance Corp., Personal Lines Account/Commercial Lines Account Secured Bonds, Series 2012-A-1, 5.00% 2017 | | | 1,000 | | | | 1,014 | |

| Citizens Property Insurance Corp., Personal Lines Account/Commercial Lines Account Secured Bonds, Series 2012-A-1, 5.00% 2019 | | | 7,450 | | | | 8,064 | |

| Health and Educational Facs. Auth., Rev. Bonds (Ascension Health Credit Group), Series 1999-B, 1.65% 2029 (put 2019) | | | 1,500 | | | | 1,500 | |

| Health and Educational Facs. Auth., Rev. Bonds (Ascension Senior Credit Group), Series 2013-B-1, 1.375% 2038 (put 2019) | | | 2,225 | | | | 2,203 | |

| Health Facs. Fncg. Auth., Rev. Bonds (Ascension Health Credit Group), Series 2001-A-2, 4.00% 2036 (put 2019) | | | 1,500 | | | | 1,579 | |

| City of Lakeland, Energy System Rev. Ref. Bonds, Series 2012, 1.41% 20171 | | | 3,800 | | | | 3,801 | |

| Other securities | | | | | | | 15,523 | |

| | | | | | | | 36,803 | |

| | | | | | | | | |

| Georgia 2.81% | | | | | | | | |

| Dev. Auth. Of Floyd County, Pollution Control Rev. Bonds (Georgia Power Company Plant Hammond Project), 2.35% 2022 (put 2020) | | | 4,000 | | | | 4,007 | |

| Metropolitan Atlanta Rapid Transit Auth., Sales Tax Rev. Ref. Bonds (Third Indenture Series), Series 2014-A, 0.93% 2025 (put 2017)1 | | | 5,250 | | | | 5,246 | |

| Metropolitan Atlanta Rapid Transit Auth., Sales Tax Rev. Ref. Bonds, Series 2014-B, 0.91% 2025 (put 2017)1 | | | 3,500 | | | | 3,497 | |

| Other securities | | | | | | | 10,740 | |

| | | | | | | | 23,490 | |

| | | | | | | | | |

| Illinois 6.96% | | | | | | | | |

| Build Bonds (Sales Tax Rev. Bonds), Series June 2013, 5.00% 2020 | | | 3,500 | | | | 3,848 | |

| Build Illinois Bonds, Sales Tax Rev. Ref. Bonds, Series 2016-D, 4.00% 2021 | | | 3,000 | | | | 3,233 | |

| Educational Facs. Auth., Rev. Bonds (University of Chicago), Series 1998-B, 1.65% 2025 (put 2019) | | | 10,390 | | | | 10,429 | |

| Educational Facs. Auth., Rev. Bonds (University of Chicago), Series 2001-B-1, 1.10% 2036 (put 2018) | | | 1,250 | | | | 1,250 | |

| Housing Dev. Auth., Multifamily Housing Rev. Notes (Marshall Field Garden Apartment Homes), 1.66% 2050 (put 2025)1 | | | 3,400 | | | | 3,366 | |

| Other securities | | | | | | | 36,171 | |

| | | | | | | | 58,297 | |

| | | | | | | | | |

| Indiana 2.54% | | | | | | | | |

| Dev. Fin. Auth., Solid Waste Disposal Rev. Bonds (Waste Management, Inc. Project), Series 2001, AMT, 1.75% 2031 (put 2015) | | | 500 | | | | 502 | |

| Fin. Auth., Hospital Rev. Ref. Bonds (Indiana University Health Obligated Group), Series 2011-N, 5.00% 2017 | | | 2,500 | | | | 2,509 | |

| Fin. Auth., Hospital Rev. Ref. Bonds (Indiana University Health Obligated Group), Series 2016-A, 5.00% 2019 | | | 1,100 | | | | 1,211 | |

| Fin. Auth., Hospital Rev. Ref. Bonds (Indiana University Health Obligated Group), Series 2016-A, 5.00% 2022 | | | 2,500 | | | | 2,905 | |

| Fin. Auth., Hospital Rev. Ref. Bonds (Indiana University Health Obligated Group), Series 2016-A, 5.00% 2023 | | | 2,000 | | | | 2,345 | |

| 12 | American Funds Tax-Exempt Funds |

American Funds Short-Term Tax-Exempt Bond Fund

| | Principal amount

(000) | | | Value

(000) | |

| Health and Educational Fac. Fncg. Auth., Rev. Bonds (Ascension Health Credit Group), Series 2005-A-5, 2.00% 2027 (put 2017) | | $ | 2,615 | | | $ | 2,626 | |

| Hobart Building Corp. (Lake County), First Mortgage Bonds, Series 2006, National insured, 6.50% 2029 (preref. 2020) | | | 6,000 | | | | 6,897 | |

| Other securities | | | | | | | 2,276 | |

| | | | | | | | 21,271 | |

| | | | | | | | | |

| Kentucky 0.62% | | | | | | | | |

| State Property and Buildings Commission, Rev. Ref. Bonds (Project No. 112), Series 2016-B, 5.00% 2022 | | | 4,500 | | | | 5,156 | |

| | | | | | | | | |

| Maryland 1.03% | | | | | | | | |

| Montgomery County, G.O. Consolidated Public Improvement Bonds, Series 2011-A, 5.00% 2024 (preref. 2019) | | | 900 | | | | 982 | |

| Other securities | | | | | | | 7,608 | |

| | | | | | | | 8,590 | |

| | | | | | | | | |

| Massachusetts 4.01% | | | | | | | | |

| Dev. Fin. Agcy., Rev. Bonds (Partners HealthCare System), Series 2014-M-3, 1.18% 2038 (put 2018)1 | | | 8,315 | | | | 8,315 | |

| Dev. Fin. Agcy., Rev. Bonds (Partners HealthCare System), Series 2014-M-5, 0.96% 2038 (put 2018)1 | | | 1,075 | | | | 1,075 | |

| Educational Fncg. Auth., Education Loan Rev. Bonds, Series 2016-J, AMT, 5.00% 2024 | | | 3,000 | | | | 3,361 | |

| Educational Fncg. Auth., Education Loan Rev. Bonds, Series 2014-I, AMT, 5.00% 2021 | | | 3,000 | | | | 3,272 | |

| Housing Fin. Agcy., Single Family Housing Rev. Bonds, Series 167, 4.00% 2043 | | | 765 | | | | 794 | |

| Housing Fin. Agcy., Single Family Housing Rev. Bonds, Series 169, 4.00% 2044 | | | 820 | | | | 855 | |

| Housing Fin. Agcy., Single Family Housing Rev. Bonds, Series 172, 4.00% 2045 | | | 1,345 | | | | 1,415 | |

| Housing Fin. Agcy., Single Family Housing Rev. Bonds, Series 181, 4.00% 2044 | | | 965 | | | | 1,025 | |

| Housing Fin. Agcy., Single Family Housing Rev. Bonds, Series 183, 3.50% 2046 | | | 1,000 | | | | 1,043 | |

| Housing Fin. Agcy., Single Family Housing Rev. Ref. Bonds, Series 160, AMT, 3.75% 2034 | | | 400 | | | | 411 | |

| Housing Fin. Agcy., Single Family Housing Rev. Ref. Bonds, Series 162, 2.75% 2041 | | | 450 | | | | 455 | |

| Housing Fin. Agcy., Single Family Housing Rev. Ref. Bonds, Series 165, 2.65% 2041 | | | 1,445 | | | | 1,463 | |

| Housing Fin. Agcy., Single Family Housing Rev. Ref. Bonds, Series 171, 4.00% 2044 | | | 850 | | | | 904 | |

| Housing Fin. Agcy., Single Family Housing Rev. Ref. Bonds, Series 177, AMT, 4.00% 2039 | | | 3,220 | | | | 3,402 | |

| Other securities | | | | | | | 5,740 | |

| | | | | | | | 33,530 | |

| | | | | | | | | |

| Michigan 4.32% | | | | | | | | |

| State Hospital Fin. Auth., Project Rev. Ref. Bonds (Ascension Health Credit Group), Series 2010-F3, 1.40% 2047 (put 2018) | | | 1,500 | | | | 1,501 | |

| Other securities | | | | | | | 34,703 | |

| | | | | | | | 36,204 | |

| | | | | | | | | |

| Minnesota 1.20% | | | | | | | | |

| Housing Fin. Agcy., Homeownership Fin. Bonds (Mortgage-Backed Securities Program), Series 2011-G, 4.25% 2035 | | | 530 | | | | 551 | |

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2012-D, 4.00% 2040 | | | 730 | | | | 756 | |

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2013-A, AMT, 3.00% 2031 | | | 595 | | | | 604 | |

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2014-A, 4.00% 2038 | | | 1,115 | | | | 1,187 | |

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2014-C, AMT, 4.00% 2045 | | | 4,365 | | | | 4,598 | |

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2015-A, AMT, 4.00% 2041 | | | 870 | | | | 921 | |

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2015-E, AMT, 3.50% 2046 | | | 890 | | | | 923 | |

| Housing Fin. Agcy., Residential Housing Fin. Bonds, Series 2016-E, 4.00% 2047 | | | 250 | | | | 267 | |

| Other securities | | | | | | | 269 | |

| | | | | | | 10,076 | |

| | | | | | | | | |

| Nebraska 1.60% | | | | | | | | |

| Central Plains Energy Project, Gas Supply Rev. Ref. Bonds, Series 2014, 5.00% 2039 (put 2019) | | | 4,200 | | | | 4,554 | |

| Other securities | | | | | | | 8,809 | |

| | | | | | | | 13,363 | |

| American Funds Tax-Exempt Funds | 13 |

American Funds Short-Term Tax-Exempt Bond Fund

| Bonds, notes & other debt instruments (continued) | Principal amount

(000) | | | Value

(000) | |

| Nevada 1.56% | | | | | | | | |

| Clark County, Pollution Control Rev. Ref. Bonds (Southern California Edison Company), Series 2010, 1.875% 2031 (put 2020) | | $ | 5,500 | | | $ | 5,519 | |

| Other securities | | | | | | | 7,576 | |

| | | | | | | | 13,095 | |

| | | | | | | | | |

| New Jersey 2.48% | | | | | | | | |

| Econ. Dev. Auth., School Facs. Construction Rev. Ref. Bonds, Series 2014-PP, 5.00% 2019 | | | 4,000 | | | | 4,196 | |

| Higher Education Student Assistance Auth., Student Loan Rev. Bonds, Series 2012-1A, AMT, 4.00% 2017 | | | 3,500 | | | | 3,562 | |

| Higher Education Student Assistance Auth., Student Loan Rev. Bonds, Series 2012-1A, AMT, 5.00% 2018 | | | 2,000 | | | | 2,105 | |

| Higher Education Student Assistance Auth., Student Loan Rev. Bonds, Series 2016-1-A, AMT, 5.00% 2020 | | | 750 | | | | 813 | |

| Higher Education Student Assistance Auth., Student Loan Rev. Bonds, Series 2016-1-A, AMT, 5.00% 2021 | | | 2,000 | | | | 2,187 | |

| Higher Education Student Assistance Auth., Student Loan Rev. Ref. Bonds, Series 2014-1A1, AMT, 5.00% 2018 | | | 2,250 | | | | 2,368 | |

| Other securities | | | | | | | 5,521 | |

| | | | | | | | 20,752 | |

| | | | | | | | | |

| New Mexico 0.83% | | | | | | | | |

| City of Farmington, Pollution Control Rev. Ref. Bonds (Southern California Edison | | | | | | | | |

| Company Four Corners Project), 1.875% 2029 (put 2020) | | | 2,000 | | | | 2,012 | |

| City of Farmington, Pollution Control Rev. Ref. Bonds (Southern California Edison Company Four Corners Project), Series 2005-B, 1.875% 2029 (put 2020) | | | 2,250 | | | | 2,245 | |

| Other securities | | | | | | | 2,697 | |

| | | | | | | | 6,954 | |

| | | | | | | | | |

| New York 8.21% | | | | | | | | |

| Metropolitan Transportation Auth., Transportation Rev. Bonds, Series 2014-A-1, 4.00% 2019 | | | 750 | | | | 803 | |

| Metropolitan Transportation Auth., Transportation Rev. Bonds, Series 2014-C, 5.00% 2020 | | | 2,000 | | | | 2,250 | |

| Metropolitan Transportation Auth., Transportation Rev. Bonds, Series 2015-A-2, 1.24% 2039 (put 2020)1 | | | 6,250 | | | | 6,243 | |

| Mortgage Agcy., Homeowner Mortgage Rev. Bonds, Series 178, 3.50% 2043 | | | 1,530 | | | | 1,568 | |

| Mortgage Agcy., Homeowner Mortgage Rev. Bonds, Series 191, AMT, 3.50% 2034 | | | 2,855 | | | | 2,935 | |

| Mortgage Agcy., Homeowner Mortgage Rev. Bonds, Series 195, 4.00% 2046 | | | 2,985 | | | | 3,196 | |

| Mortgage Agcy., Homeowner Mortgage Rev. Bonds, Series 197, 3.50% 2044 | | | 1,000 | | | | 1,051 | |

| Mortgage Agcy., Homeowner Mortgage Rev. Bonds, Series 200, 3.50% 2045 | | | 650 | | | | 685 | |

| Mortgage Agcy., Homeowner Mortgage Rev. Bonds, Series 52, AMT, 3.50% 2030 | | | 950 | | | | 986 | |

| City of New York, G.O. Bonds, Fiscal 2014 Series A-6, 1.13% 20311 | | | 2,500 | | | | 2,497 | |

| City of New York, G.O. Bonds, Series 2008-J-4, 1.21% 20251 | | | 6,000 | | | | 6,000 | |

| City of New York, G.O. Bonds, Series 2012-I, 5.00% 2018 | | | 1,000 | | | | 1,059 | |

| City of New York, G.O. Bonds, Series 2014-A, 5.00% 2020 | | | 1,500 | | | | 1,681 | |

| New York City Transitional Fin. Auth., Future Tax Secured Bonds, Series B, 5.00% 2017 | | | 1,000 | | | | 1,000 | |

| Thruway Auth., General Rev. Junior Indebtedness Obligations, Series 2013-A, 5.00% 2019 | | | 4,700 | | | | 5,081 | |

| Other securities | | | | | | | 31,728 | |

| | | | | | | 68,763 | |

| | | | | | | | | |

| Ohio 1.66% | | | | | | | | |

| Solid Waste Disposal Rev. Bonds (Waste Management Inc. Project), Series 2002, AMT, 1.70% 2022 (put 2018) | | | 2,500 | | | | 2,508 | |

| Other securities | | | | | | | 11,376 | |

| | | | | | | | 13,884 | |

| 14 | American Funds Tax-Exempt Funds |

American Funds Short-Term Tax-Exempt Bond Fund

| | Principal amount

(000) | | | Value

(000) | |

| Oregon 1.20% | | | | | | | | |

| Facs. Auth., Rev. Ref. Bonds (Providence Health & Services), Series 2013-C, 1.66% 2022 (put 2018)1 | | $ | 3,000 | | | $ | 3,000 | |

| Facs. Auth., Rev. Ref. Bonds (Providence Health & Services), Series 2013-C, 1.51% 2020 (put 2017)1 | | | 1,500 | | | | 1,500 | |

| Other securities | | | | | | | 5,581 | |

| | | | | | | | 10,081 | |

| | | | | | | | | |

| Pennsylvania 3.12% | | | | | | | | |

| Econ. Dev. Fncg. Auth., Unemployment Compensation Rev. Bonds, Series 2012-B, 5.00% 2021 | | | 4,000 | | | | 4,152 | |

| Housing Fin. Agcy., Single Family Mortgage Rev. Bonds, Series 2015-117-A, AMT, 3.50% 2040 | | | 1,675 | | | | 1,736 | |

| Housing Fin. Agcy., Single Family Mortgage Rev. Bonds, Series 2015-118-A, AMT, 3.50% 2040 | | | 1,775 | | | | 1,839 | |

| Housing Fin. Agcy., Single Family Mortgage Rev. Bonds, Series 2016-119, 3.50% 2041 | | | 905 | | | | 943 | |

| Housing Fin. Agcy., Single Family Mortgage Rev. Bonds, Series 2016-120, 3.50% 2046 | | | 985 | | | | 1,030 | |

| Housing Fin. Agcy., Single Family Mortgage Rev. Bonds, Series 2017-122, 4.00% 2046 | | | 3,440 | | | | 3,682 | |

| Turnpike Commission, Turnpike Rev. Bonds, Series 2016, 5.00% 2021 | | | 3,500 | | | | 3,930 | |

| Other securities | | | | | | | 8,769 | |

| | | | | | | | 26,081 | |

| | | | | | | | | |

| Rhode Island 1.09% | | | | | | | | |

| Housing and Mortgage Fin. Corp., Homeownership Opportunity Bonds, Series 66-A-1, 4.00% 2033 | | | 3,010 | | | | 3,157 | |

| Other securities | | | | | | | 5,979 | |

| | | | | | | | 9,136 | |

| | | | | | | | | |

| South Carolina 0.73% | | | | | | | | |

| Public Service Auth., Rev. Obligations (Santee Cooper), Series 2012-A, 4.00% 2020 | | | 2,945 | | | | 3,207 | |

| Other securities | | | | | | | 2,905 | |

| | | | | | | | 6,112 | |

| | | | | | | | | |

| Tennessee 1.52% | | | | | | | | |

| Housing Dev. Agcy., Homeownership Program Bonds, Issue 2012-2-C, 4.00% 2038 | | | 565 | | | | 594 | |

| Housing Dev. Agcy., Homeownership Program Bonds, Issue 2012-1-C, 4.50% 2037 | | | 785 | | | | 832 | |

| Housing Dev. Agcy., Homeownership Program Rev. Ref. Bonds, Issue 2011-1-A, AMT, 4.50% 2031 | | | 1,345 | | | | 1,415 | |

| Housing Dev. Agcy., Homeownership Program Rev. Ref. Bonds, Issue 2012-1-A, AMT, 4.50% 2038 | | | 660 | | | | 695 | |

| Housing Dev. Agcy., Residential Fin. Program Bonds, 4.00% 2046 | | | 455 | | | | 484 | |

| Housing Dev. Agcy., Residential Fin. Program Bonds, Issue 2013-1-C, 3.00% 2038 | | | 1,235 | | | | 1,266 | |

| Housing Dev. Agcy., Residential Fin. Program Bonds, Series 2013-2-A, AMT, 4.00% 2043 | | | 1,220 | | | | 1,271 | |

| Housing Dev. Agcy., Residential Fin. Program Bonds, Series 2014-1-A, AMT, 4.00% 2039 | | | 1,605 | | | | 1,686 | |

| Housing Dev. Agcy., Residential Fin. Program Bonds, Series 2014-2-A, AMT, 4.00% 2045 | | | 1,375 | | | | 1,452 | |

| Housing Dev. Agcy., Residential Fin. Program Bonds, Series 2014-2-C, 4.00% 2045 | | | 1,040 | | | | 1,095 | |

| Housing Dev. Agcy., Residential Fin. Program Bonds, Series 2016-1-B, 3.50% 2047 | | | 930 | | | | 978 | |

| Other securities | | | | | | | 1,000 | |

| | | | | | | | 12,768 | |

| | | | | | | | | |

| Texas 8.83% | | | | | | | | |

| Mission Econ. Dev. Corp., Solid Waste Disposal Rev. Bonds (Waste Management, Inc. Project), Series 2008, AMT, 2.50% 2020 (put 2013) | | | 2,000 | | | | 2,030 | |

| City of San Antonio, Electric and Gas Systems Rev. Ref. Bonds, 5.00% 2018 | | | 2,000 | | | | 2,082 | |

| City of San Antonio, Electric and Gas Systems Rev. Ref. Bonds, Series 2009-A, 5.25% 2024 (preref. 2019) | | | 1,100 | | | | 1,188 | |

| City of San Antonio, Electric and Gas Systems Rev. Ref. Bonds, Series 2012-C, 2.00% 2027 (put 2018) | | | 1,625 | | | | 1,641 | |

| City of San Antonio, Electric and Gas Systems Rev. Ref. Bonds, Series 2015-A, 2.25% 2033 (put 2019) | | | 5,500 | | | | 5,584 | |

| City of San Antonio, Electric and Gas Systems Rev. Ref. Bonds, Series 2015-B, 1.040% 2033 (put 2018)1 | | | 6,000 | | | | 5,987 | |

| American Funds Tax-Exempt Funds | 15 |

American Funds Short-Term Tax-Exempt Bond Fund

| Bonds, notes & other debt instruments (continued) | Principal amount

(000) | | | Value

(000) | |

| Texas (continued) | | | | | | | | |

Transportation Commission, G.O. Mobility Fund Bonds, Series 2014-B, 1.040% 2041

(put 2018)1 | | $ | 6,500 | | | $ | 6,496 | |

| Board of Regents of The University of Texas System, Rev. Fncg. System Bonds, Series 2016-J, 5.00% 2024 | | | 5,000 | | | | 5,990 | |

| Other securities | | | | | | | 42,953 | |

| | | | | | | | 73,951 | |

| | | | | | | | | |

| Virginia 0.79% | | | | | | | | |

| Commonwealth Transportation Board, Federal Transportation Grant Anticipation Rev. Notes, Series 2013-A, 5.00% 2020 | | | 3,000 | | | | 3,335 | |

| Other securities | | | | | | | 3,284 | |

| | | | | | | | 6,619 | |

| | | | | | | | | |

| Washington 3.26% | | | | | | | | |

| Econ. Dev. Fin. Auth., Solid Waste Disposal Rev. Bonds (Waste Management, Inc. Project), Series 2008, 2.125% 20202 | | | 5,000 | | | | 5,021 | |

| Health Care Facs. Auth., Rev. Bonds (Providence Health & Services), Series 2012-B, 4.00% 2042 (put 2021) | | | 250 | | | | 273 | |

| Health Care Facs. Auth., Rev. Ref. Bonds (Providence Health & Services), Series 2012-A, 5.00% 2018 | | | 500 | | | | 532 | |

| Health Care Facs. Auth., Rev. Ref. Bonds (Providence Health & Services), Series 2012-B, 5.00% 2042 (put 2021) | | | 2,550 | | | | 2,893 | |

| Other securities | | | | | | | 18,559 | |

| | | | | | | | 27,278 | |

| | | | | | | | | |

| Wisconsin 2.52% | | | | | | | | |

| Health and Educational Facs. Auth., Rev. Bonds (Ascension Health Alliance Senior Credit Group), Series 2013-B-2, 4.00% 2043 (put 2019) | | | 1,000 | | | | 1,060 | |

| Health and Educational Facs. Auth., Rev. Bonds (Ascension Health Alliance Senior Credit Group), Series 2013-B-3, 5.00% 2043 (put 2020) | | | 4,500 | | | | 4,989 | |

| Housing and Econ. Dev. Auth., Home Ownership Rev. Bonds, Series 2016-A, AMT, 3.50% 2046 | | | 3,855 | | | | 3,994 | |

| Public Fin. Auth., Solid Waste Disposal Rev. Ref. Bonds (Waste Management, Inc. Project), Series 2016-A-4, AMT, 2.00% 2033 (put 2021) | | | 1,500 | | | | 1,482 | |

| Other securities | | | | | | | 9,539 | |

| | | | | | | | 21,064 | |

| | | | | | | | | |

| Other states & U.S. territories 9.79% | | | | | | | | |

| Other securities | | | | | | | 81,850 | |

| | | | | | | | | |

| Total bonds, notes & other debt instruments (cost: $767,110,000) | | | | | | | 765,335 | |

| | | | | | | | | |

| Short-term securities 8.35% | | | | | | | | |

| State of Maryland, Montgomery County, Consolidated Public Improvement Bond Anticipation Notes, Series 2009-B, 0.74% 3/1/2017 | | | 10,000 | | | | 10,000 | |

| State of Mississippi, Business Fin. Corp., Gulf Opportunity Zone Industrial Dev. Rev. Bonds (Chevron U.S.A. Inc. Project), Series 2010-J, 0.58% 20351 | | | 7,000 | | | | 7,000 | |

| State of Mississippi, Business Fin. Corp., Gulf Opportunity Zone Industrial Dev. Rev. Bonds (Chevron U.S.A. Inc. Project), Series 2011-E, 0.58% 20351 | | | 3,000 | | | | 3,000 | |

| State of New York, City of New York, G.O. Bonds, Series 2006-H-1, 0.63% 20361 | | | 7,300 | | | | 7,300 | |

| State of New York, City of New York, G.O. Bonds, Series 2006-L-5, 0.63% 20351 | | | 3,700 | | | | 3,700 | |

| State of New York, City of New York, G.O. Bonds, Series 2008-J-5, 0.63% 20281 | | | 3,310 | | | | 3,310 | |

| State of New York, City of New York, G.O. Bonds, Series 2008-L-4, 0.62% 20381 | | | 3,100 | | | | 3,100 | |

| State of New York, New York City Transitional Fin. Auth., Future Tax Secured Rev. Ref. Bonds, Series 2015-E-3, 0.63% 20451 | | | 2,000 | | | | 2,000 | |

| State of New York, New York City Transitional Fin. Auth., Future Tax Secured Rev. Ref. Bonds, Series 2016-E-4, 0.63% 20451 | | | 10,700 | | | | 10,700 | |

| 16 | American Funds Tax-Exempt Funds |

American Funds Short-Term Tax-Exempt Bond Fund

| | Principal amount

(000) | | | Value

(000) | |

| State of New York, New York City Transitional Fin. Auth., New York City Recovery Bonds, Fiscal 2003, Series 2002-1-C, 0.63% 20221 | | $ | 7,160 | | | $ | 7,160 | |

| State of New York, New York City, Municipal Water Fin. Auth., Water and Sewer System Rev. Bonds, Series 2003-F-2, 0.62% 20351 | | | 5,650 | | | | 5,650 | |

| Other securities | | | | | | | 7,006 | |

| | | | | | | | | |

| Total short-term securities (cost: $69,926,000) | | | | | | | 69,926 | |

| Total investment securities 99.79% (cost: $837,036,000) | | | | | | | 835,261 | |

| Other assets less liabilities 0.21% | | | | | | | 1,762 | |

| | | | | | | | | |

| Net assets 100.00% | | | | | | $ | 837,023 | |

This summary investment portfolio is designed to streamline the report and help investors better focus on the fund’s principal holdings. See the inside back cover for details on how to obtain a complete schedule of portfolio holdings.

“Other securities” includes all issues that are not disclosed separately in the summary investment portfolio.

| 1 | Coupon rate may change periodically. For short-term securities, the date of the next scheduled coupon rate change is considered to be the maturity date. |

| 2 | Acquired in a transaction exempt from registration under Rule 144A of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities was $5,021,000, which represented .60% of the net assets of the fund. |

Key to abbreviations

Agcy. = Agency

AMT = Alternative Minimum Tax

Auth. = Authority

Certs. of Part. = Certificates of Participation

Dept. = Department

Dev. = Development

Dist. = District

Econ. = Economic

Fac. = Facility

Facs. = Facilities

Fin. = Finance

Fncg. = Financing

G.O. = General Obligation

LOC = Letter of Credit

Preref. = Prerefunded

Redev. = Redevelopment

Ref. = Refunding

Rev. = Revenue

TECP = Tax-Exempt Commercial Paper

See Notes to Financial Statements

| American Funds Tax-Exempt Funds | 17 |

| Limited Term Tax-Exempt Bond Fund of America | unaudited |

| Summary investment portfolio January 31, 2017 | |

| | |

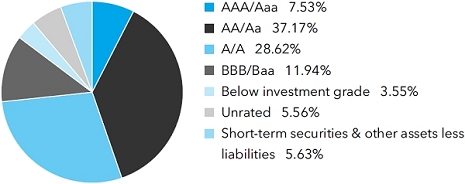

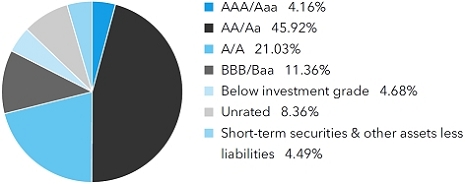

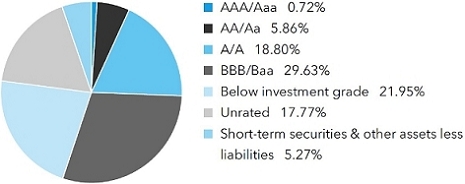

| Portfolio quality summary* | Percent of net assets |

| * | Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch as an indication of an issuer’s creditworthiness. In assigning a credit rating to a security, the fund looks specifically to the ratings assigned to the issuer of the security by Standard & Poor’s, Moody’s and/or Fitch. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund’s investment policies. Securities in the “unrated” category (above) have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with the fund’s investment policies. |

| Bonds, notes & other debt instruments 93.48% | Principal amount

(000) | | | Value

(000) | |

| Alabama 1.01% | | | | | | | | |

| Black Belt Energy Gas Dist., Gas Supply Rev. Bonds, Series 2016-A, 4.00% 2046 (put 2021) | | $ | 14,500 | | | $ | 15,545 | |

| Other securities | | | | | | | 22,027 | |

| | | | | | | | 37,572 | |

| | | | | | | | | |

| California 10.93% | | | | | | | | |

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2006-C-1, 1.56% 2045 (put 2023)1 | | | 20,500 | | | | 20,348 | |

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2007-C-1, 1.56% 2047 (put 2023)1 | | | 3,500 | | | | 3,474 | |

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2007-E-3, 1.33% 2047 (put 2019)1 | | | 1,000 | | | | 999 | |

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2008-B-1, 1.76% 2045 (put 2024)1 | | | 2,500 | | | | 2,500 | |

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2014-G, 1.26% 2034 (put 2020)1 | | | 2,500 | | | | 2,501 | |

| Bay Area Toll Auth., San Francisco Bay Area Toll Bridge Rev. Ref. Bonds, Series 2014-H, 1.36% 2034 (put 2021)1 | | | 10,480 | | | | 10,474 | |

| Econ. Recovery Bonds, Ref. Series 2009-A, 5.00% 2020 (preref. 2019) | | | 9,000 | | | | 9,833 | |

| Other securities | | | | | | | 358,150 | |

| | | | | | | | 408,279 | |

| | | | | | | | | |

| Connecticut 1.36% | | | | | | | | |

| Special Tax Obligation Ref. Bonds, Transportation Infrastructure Purposes, Series 2009-1, 5.00% 2019 | | | 8,550 | | | | 9,176 | |

| Other securities | | | | | | | 41,534 | |

| | | | | | | | 50,710 | |

| | | | | | | | | |

| Florida 7.64% | | | | | | | | |

| Citizens Property Insurance Corp., Coastal Account Secured Bonds, Series 2011-A-1, 5.00% 2018 | | | 2,000 | | | | 2,102 | |

| Citizens Property Insurance Corp., Coastal Account Secured Bonds, Series 2011-A-1, 5.00% 2019 | | | 5,000 | | | | 5,412 | |

| Citizens Property Insurance Corp., High-Risk Account Secured Bonds, Series 2009-A-1, 5.50% 2017 | | | 10,035 | | | | 10,191 | |

| Citizens Property Insurance Corp., High-Risk Account Secured Rev. Ref. Bonds, Series 2015-A-1, 5.00% 2020 | | | 3,500 | | | | 3,830 | |

| Citizens Property Insurance Corp., Personal Lines Account/Commercial Lines Account Secured Bonds, Series 2012-A-1, 5.00% 2019 | | | 3,600 | | | | 3,897 | |

| Citizens Property Insurance Corp., Personal Lines Account/Commercial Lines Account Secured Bonds, Series 2012-A-1, 5.00% 2020 | | | 4,500 | | | | 4,993 | |

| 18 | American Funds Tax-Exempt Funds |

Limited Term Tax-Exempt Bond Fund of America

| | Principal amount

(000) | | | Value

(000) | |

| Citizens Property Insurance Corp., Personal Lines Account/Commercial Lines Account Secured Bonds, Series 2012-A-1, 5.00% 2021 | | $ | 1,000 | | | $ | 1,132 | |

| Citizens Property Insurance Corp., Personal Lines Account/Commercial Lines Account Secured Bonds, Series 2012-A-1, 5.00% 2022 | | | 10,200 | | | | 11,742 | |

| Fin. Auth., Econ. Dev. Rev. Bonds (Republic Services, Inc. Project), Series 2010-B, 0.90% 2028 (put 2017)1 | | | 10,500 | | | | 10,500 | |

| Lee County, Industrial Dev. Auth., Healthcare Facs. Rev. Ref. Bonds (Shell Point/Alliance Obligated Group, Shell Point Village/Alliance Community Project), Series 2007, 5.00% 2029 | | | 13,000 | | | | 13,073 | |

| Miami-Dade County, Aviation Rev. Ref. Bonds, Series 2012-A, AMT, 5.00% 2021 | | | 11,600 | | | | 13,082 | |

| Putnam County Dev. Auth., Pollution Control Rev. Ref. Bonds (Seminole Electric Cooperative, Inc. Project), Series 2007-B, AMBAC insured, 5.35% 2042 (put 2018) | | | 10,370 | | | | 10,874 | |

| Other securities | | | | | | | 194,628 | |

| | | | | | | | 285,456 | |

| | | | | | | | | |

| Georgia 2.74% | | | | | | | | |

| Municipal Electric Auth., Project 1, Series 2008-D, 5.75% 2019 (preref. 2018) | | | 11,840 | | | | 12,627 | |

| Public Gas Partners, Inc., Gas Project Rev. Ref. Bonds (Gas Supply Pool No. 1), Series A, 5.00% 2018 | | | 10,930 | | | | 11,594 | |

| Other securities | | | | | | | 78,267 | |

| | | | | | | | 102,488 | |

| | | | | | | | | |

| Hawaii 0.53% | | | | | | | | |

| Airports System Rev. Bonds, Series 2010-B, AMT, 5.00% 2018 | | | 9,900 | | | | 10,409 | |

| Other securities | | | | | | | 9,522 | |

| | | | | | | | 19,931 | |

| | | | | | | | | |

| Illinois 9.59% | | | | | | | | |

| City of Chicago, O’Hare International Airport, General Airport Rev. Bonds, Series 2011-B, 5.00% 2019 | | | 2,785 | | | | 2,975 | |

| City of Chicago, O’Hare International Airport, General Airport Rev. Bonds, Series 2012-B, AMT, 5.00% 2024 | | | 2,000 | | | | 2,216 | |

| City of Chicago, O’Hare International Airport, General Airport Rev. Bonds, Series 2013-A, AMT, 5.00% 2022 | | | 3,055 | | | | 3,415 | |

| City of Chicago, O’Hare International Airport, General Airport Rev. Ref. Bonds, Series 2012-A, AMT, 5.00% 2025 | | | 6,170 | | | | 6,816 | |

| City of Chicago, O’Hare International Airport, General Airport Rev. Ref. Bonds, Series 2013-A, AMT, 5.00% 2021 | | | 10,000 | | | | 11,053 | |

| City of Chicago, O’Hare International Airport, Passenger Fac. Charge Rev. Ref. Bonds, Series 2012-B, AMT, 5.00% 2018 | | | 2,000 | | | | 2,064 | |

| City of Chicago, O’Hare International Airport, Passenger Fac. Charge Rev. Ref. Bonds, Series 2012-B, AMT, 5.00% 2019 | | | 2,000 | | | | 2,123 | |

| City of Chicago, O’Hare International Airport, Passenger Fac. Charge Rev. Ref. Bonds, Series 2013-B, AMT, 5.00% 2022 | | | 3,000 | | | | 3,354 | |

| City of Chicago, O’Hare International Airport, General Airport Rev. Bonds, Series 2017-D, 5.00% 2026 | | | 4,000 | | | | 4,687 | |

| City of Chicago, O’Hare International Airport, General Airport Rev. Bonds, Series 2017-D, 5.25% 2029 | | | 1,500 | | | | 1,762 | |

| City of Chicago, O’Hare International Airport, General Airport Rev. Ref. Bonds, Series 2008-A, Assured Guaranty Municipal insured, 5.00% 2019 (preref. 2018) | | | 2,000 | | | | 2,074 | |

| City of Chicago, O’Hare International Airport, General Airport Rev. Ref. Bonds, Series 2013-A, AMT, 5.00% 2023 | | | 5,000 | | | | 5,636 | |

| City of Chicago, O’Hare International Airport, General Airport Rev. Ref. Bonds, Series 2015-B, 5.00% 2023 | | | 1,500 | | | | 1,732 | |

| City of Chicago, O’Hare International Airport, General Airport Rev. Ref. Bonds, Series 2016-B, 5.00% 2019 | | | 2,500 | | | | 2,671 | |

| City of Chicago, O’Hare International Airport, General Airport Rev. Ref. Bonds, Series 2016-C, 5.00% 2028 | | | 3,145 | | | | 3,602 | |

| City of Chicago, Water Rev. Bonds, Series 2000, 5.00% 2022 | | | 10,500 | | | | 11,774 | |

| American Funds Tax-Exempt Funds | 19 |

Limited Term Tax-Exempt Bond Fund of America