UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08004

Aston Funds

(Exact name of registrant as specified in charter)

120 North LaSalle Street, 25th Floor

Chicago, IL 60602

(Address of principal executive offices) (Zip code)

Kenneth C. Anderson, President

Aston Funds

120 North LaSalle Street, 25th Floor

Chicago, IL 60602

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 268-1400

Date of fiscal year end: October 31

Date of reporting period: April 30, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

This Privacy Statement is not part of the Semi Annual Report

PRIVACY STATEMENT

At Aston Funds, we appreciate the privacy concerns and expectations of our customers and we have established the following policies to maintain the privacy of information you share with us.

INFORMATION WE COLLECT

We collect and retain nonpublic personal information about you that may include:

| | • | | Information we receive on your account applications or other forms such as your name, address, financial information and/or social security number; |

| | • | | Information we receive about your mutual fund transactions, such as purchases, sales, exchanges and account balances; and |

| | • | | Information we collect through the use of Internet “cookies” when you access our website. Cookies are software files we use to track which of our sites you visit. |

INFORMATION WE MAY SHARE

We do not sell any of your nonpublic personal information to third parties. We may share the information we collect with affiliates or with non-affiliated third parties only when those parties are acting on our behalf in servicing your account, or as required by law. These third parties may include:

| | • | | Administrative service providers who, for example, process transactions for your account, print checks or prepare account statements; |

| | • | | Companies that provide services for us to help market our products to you; and |

| | • | | Governmental or other legal agencies, as required by law |

When information is shared with third parties, they are legally obligated to maintain the confidentiality of the information and to limit their use of it to servicing your account, except as permitted or required by law.

CONFIDENTIALITY AND SECURITY

We restrict access to your nonpublic personal information to authorized employees who need to access such information in order to provide services or products to you. We maintain physical, electronic and procedural safeguards to protect your nonpublic personal information.

As previously mentioned, we may collect information through the use of Internet “cookies” on our Web site. In addition, in order to provide you with access to your account via the web, it is necessary for us to collect certain nonpublic personal information such as your name, social security number and account information. Special measures such as data encryption and authentication apply to all nonpublic personal information and communications on our Web site.

APPLICABILITY

Our privacy policies apply only to those individual investors who have a direct customer relationship with us. If you are an individual shareholder of record of any of the Funds, the Funds consider you to be their customer. Shareholders purchasing or owning shares of any of the Funds through their bank, broker, or other financial institution should also consult that financial institution’s privacy policies.

Aston Funds values your business. We understand the importance of maintaining the integrity of your personal information and are committed to keeping your trust. Please contact us at 800-992-8151 if you have any questions concerning our policy, or visit us at www.astonfunds.com for additional copies of this policy.

This page intentionally left blank.

Large Cap Funds

ASTON/Montag & Caldwell Growth Fund

ASTON/Veredus Select Growth Fund

ASTON/TAMRO Diversified Equity Fund

ASTON/Herndon Large Cap Value Fund

ASTON/Cornerstone Large Cap Value Fund

Equity Income Fund

ASTON/River Road Dividend All Cap Value Fund

Mid Cap Funds

ASTON/Fairpointe Mid Cap Fund

ASTON/Montag & Caldwell Mid Cap Growth Fund

ASTON/Cardinal Mid Cap Value Fund

Table of Contents

Small Cap Funds

ASTON/Veredus Small Cap Growth Fund

(formerly the ASTON/Veredus Aggressive Growth Fund)

ASTON Small Cap Growth Fund

(formerly the ASTON/Crosswind Small Cap Growth Fund)

ASTON/Silvercrest Small Cap Fund

ASTON/TAMRO Small Cap Fund

ASTON/River Road Select Value Fund

ASTON/River Road Small Cap Value Fund

ASTON/River Road Independent Value Fund

Fixed Income Funds

ASTON/DoubleLine Core Plus Fixed Income Fund

ASTON/TCH Fixed Income Fund

Alternative Funds

ASTON/Lake Partners LASSO Alternatives Fund

ASTON Dynamic Allocation Fund

ASTON/M.D. Sass Enhanced Equity Fund

ASTON/River Road Long-Short Fund

International Funds

ASTON/Neptune International Fund

ASTON/Barings International Fund

Sector Fund

ASTON/Harrison Street Real Estate Fund

Balanced Fund

ASTON/Montag & Caldwell Balanced Fund

This report is submitted for general information to the shareholders of the funds. It is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus which includes details regarding the funds’ objectives, policies, expenses and other information.

Aston Funds are distributed by Foreside Funds Distributors LLC, 400 Berwyn Park, 899 Cassatt Road, Berwyn, PA 19312

Shareholder Services 800-992-8151 • www.astonfunds.com

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

| | |

| Aston Funds | | |

| Performance Summary (unaudited) | | As of April 30, 2012 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Average Annual Total Returns | | | | | | | | | | | | | |

| | | Class | | | Six Month

Total

Return (a) | | | One

Year | | | Five

Year | | | Ten

Year | | | Since

Inception | | | Total

Expense

Ratio (b) | | | Net

Expense

Ratio (b) | | | Inception

Date | |

Equity Funds | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ASTON/Montag & Caldwell Growth Fund | | | N | | | | 11.27 | % | | | 6.94 | % | | | 4.74 | % | | | 3.96 | % | | | 8.70 | % | | | 1.07 | % | | | 1.07 | % | | | 11/02/94 | |

| | | I | | | | 11.45 | | | | 7.22 | | | | 5.01 | | | | 4.24 | | | | 6.90 | | | | 0.82 | | | | 0.82 | | | | 06/28/96 | |

| | | R | | | | 11.15 | | | | 6.70 | | | | 4.49 | | | | N/A | | | | 6.35 | | | | 1.32 | | | | 1.32 | | | | 12/31/02 | |

ASTON/Veredus Select Growth Fund (c) | | | N | | | | 4.92 | | | | -15.23 | | | | -1.17 | | | | 3.94 | | | | 2.79 | | | | 1.31 | | | | 1.31 | | | | 12/31/01 | |

| | | I | | | | 4.93 | | | | -15.12 | | | | -0.94 | | | | N/A | | | | 2.10 | | | | 1.06 | | | | 1.06 | | | | 09/11/06 | |

ASTON/TAMRO Diversified Equity Fund (c) | | | N | | | | 11.28 | | | | -0.57 | | | | 2.76 | | | | 5.66 | | | | 5.15 | | | | 1.63 | | | | 1.21 | | | | 11/30/00 | |

| | | I | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 1.28 | (d) | | | 1.38 | | | | 0.96 | | | | 03/02/12 | |

ASTON/Herndon Large Cap Value Fund (c) | | | N | | | | 11.71 | | | | 4.25 | | | | N/A | | | | N/A | | | | 11.98 | | | | 2.39 | | | | 1.31 | | | | 03/31/10 | |

| | | I | | | | 11.91 | | | | 4.53 | | | | N/A | | | | N/A | | | | 8.91 | | | | 2.14 | | | | 1.06 | | | | 03/02/11 | |

ASTON/Cornerstone Large Cap Value Fund(c) (e) | | | N | | | | 9.13 | | | | 3.60 | | | | 0.21 | | | | 5.45 | | | | 7.27 | | | | 1.61 | | | | 1.30 | | | | 01/04/93 | |

| | | I | | | | 9.16 | | | | 3.88 | | | | 0.47 | | | | N/A | | | | 4.47 | | | | 1.36 | | | | 1.05 | | | | 09/20/05 | |

ASTON/River Road Dividend All Cap Value Fund (c) | | | N | | | | 8.87 | | | | 3.85 | | | | 1.84 | | | | N/A | | | | 6.05 | | | | 1.15 | | | | 1.15 | | | | 06/28/05 | |

| | | I | | | | 9.01 | | | | 4.11 | | | | N/A | | | | N/A | | | | 1.62 | | | | 0.90 | | | | 0.90 | | | | 06/28/07 | |

ASTON/Fairpointe Mid Cap Fund | | | N | | | | 8.91 | | | | -5.50 | | | | 4.80 | | | | 8.73 | | | | 11.93 | | | | 1.14 | | | | 1.14 | | | | 09/19/94 | |

| | | I | | | | 9.08 | | | | -5.26 | | | | 5.06 | | | | N/A | | | | 7.70 | | | | 0.89 | | | | 0.89 | | | | 07/06/04 | |

ASTON/Montag & Caldwell Mid Cap Growth Fund (c)(f) | | | N | | | | 11.23 | | | | 3.45 | | | | N/A | | | | N/A | | | | 1.77 | | | | 3.08 | | | | 1.26 | | | | 11/02/07 | |

ASTON/Cardinal Mid Cap Value Fund (c) | | | N | | | | 9.46 | | | | -2.45 | | | | N/A | | | | N/A | | | | 0.53 | | | | 6.23 | | | | 1.58 | | | | 11/02/07 | |

ASTON/Veredus Small Cap Growth Fund (c) | | | N | | | | 7.12 | | | | -15.72 | | | | -0.76 | | | | 1.86 | | | | 7.15 | | | | 1.66 | | | | 1.50 | | | | 06/30/98 | |

| | | I | | | | 7.18 | | | | -15.56 | | | | -0.52 | | | | 2.13 | | | | 1.28 | | | | 1.41 | | | | 1.25 | | | | 10/05/01 | |

ASTON Small Cap Growth Fund (c) | | | N | | | | 11.76 | | | | -11.75 | | | | N/A | | | | N/A | | | | 7.38 | | | | 8.28 | | | | 1.36 | | | | 11/03/10 | |

| | | I | | | | 11.84 | | | | N/A | | | | N/A | | | | N/A | | | | -10.08 | (d) | | | 8.03 | | | | 1.11 | | | | 06/01/11 | |

ASTON/Silvercrest Small Cap Fund (c) | | | N | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 10.10 | (d) | | | 3.34 | | | | 1.41 | | | | 12/27/11 | |

| | | I | | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 10.20 | (d) | | | 3.09 | | | | 1.16 | | | | 12/27/11 | |

ASTON/TAMRO Small Cap Fund (c) | | | N | | | | 10.70 | | | | -3.35 | | | | 3.85 | | | | 8.58 | | | | 10.64 | | | | 1.30 | | | | 1.30 | | | | 11/30/00 | |

| | | I | | | | 10.88 | | | | -3.12 | | | | 4.11 | | | | N/A | | | | 7.72 | | | | 1.05 | | | | 1.05 | | | | 01/04/05 | |

ASTON/River Road Select Value Fund (c) | | | N | | | | 9.94 | | | | 1.73 | | | | 0.89 | | | | N/A | | | | 1.21 | | | | 1.43 | | | | 1.43 | | | | 03/29/07 | |

| | | I | | | | 10.14 | | | | 2.16 | | | | N/A | | | | N/A | | | | 0.51 | | | | 1.18 | | | | 1.18 | | | | 06/28/07 | |

ASTON/River Road Small Cap Value Fund | | | N | | | | 9.02 | | | | -0.08 | | | | -0.94 | | | | N/A | | | | 5.16 | | | | 1.52 | | | | 1.52 | | | | 06/28/05 | |

| | | I | | | | 9.17 | | | | 0.15 | | | | -0.70 | | | | N/A | | | | 0.34 | | | | 1.27 | | | | 1.27 | | | | 12/13/06 | |

ASTON/River Road Independent Value Fund(c) | | | N | | | | 2.33 | | | | 1.20 | | | | N/A | | | | N/A | | | | 7.42 | | | | 1.64 | | | | 1.47 | | | | 12/31/10 | |

| | | I | | | | 2.52 | | | | N/A | | | | N/A | | | | N/A | | | | 1.01 | (d) | | | 1.39 | | | | 1.22 | | | | 06/01/11 | |

Fixed Income Funds | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ASTON/DoubleLine Core Plus Fixed Income Fund (c) | | | N | | | | 5.34 | | | | N/A | | | | N/A | | | | N/A | | | | 10.95 | (d) | | | 3.18 | | | | 0.96 | | | | 07/18/11 | |

| | | I | | | | 5.48 | | | | N/A | | | | N/A | | | | N/A | | | | 11.16 | (d) | | | 2.93 | | | | 0.71 | | | | 07/18/11 | |

ASTON/TCH Fixed Income Fund (c) | | | N | | | | 3.74 | | | | 6.90 | | | | 7.01 | | | | 5.81 | | | | 6.06 | | | | 1.15 | | | | 0.95 | | | | 12/13/93 | |

| | | I | | | | 3.94 | | | | 7.23 | | | | 7.24 | | | | 6.05 | | | | 6.47 | | | | 0.90 | | | | 0.70 | | | | 07/31/00 | |

| | | | |

| Aston Funds | | | |

| Performance Summary (unaudited) | | | As of April 30, 2012 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Average Annual Total Returns | | | | | | | | | | | | | |

| | | Class | | | Six Month

Total

Return (a) | | | One

Year | | | Five

Year | | | Ten

Year | | | Since

Inception | | | Total

Expense

Ratio (b) | | | Net

Expense

Ratio (b) | | | Inception

Date | |

Alternative Funds | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ASTON/Lake Partners LASSO Alternatives Fund (c) | | | N | | | | 4.74 | | | | -1.61 | | | | N/A | | | | N/A | | | | 4.60 | | | | 3.07 | | | | 2.99 | | | | 03/03/10 | |

| | | I | | | | 4.88 | | | | -1.38 | | | | N/A | | | | N/A | | | | 8.54 | | | | 2.82 | | | | 2.74 | | | | 04/01/09 | |

ASTON/Dynamic Allocation Fund (c) | | | N | | | | -2.33 | | | | -5.69 | | | | N/A | | | | N/A | | | | 1.28 | | | | 1.85 | | | | 1.57 | | | | 01/10/08 | |

| | | I | | | | -2.29 | | | | -5.46 | | | | N/A | | | | N/A | | | | 2.95 | | | | 1.60 | | | | 1.32 | | | | 11/02/10 | |

ASTON/M.D. Sass Enhanced Equity Fund (c) | | | N | | | | 4.61 | | | | 5.00 | | | | N/A | | | | N/A | | | | 4.13 | | | | 1.24 | | | | 1.24 | | | | 01/15/08 | |

| | | I | | | | 4.84 | | | | 5.26 | | | | N/A | | | | N/A | | | | 8.36 | | | | 0.99 | | | | 0.99 | | | | 03/03/10 | |

ASTON/River Road Long-Short Fund (c) | | | N | | | | 5.04 | | | | N/A | | | | N/A | | | | N/A | | | | 4.20 | (d) | | | 8.70 | | | | 2.75 | | | | 05/04/11 | |

International Funds | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ASTON/Neptune International Fund (c) | | | N | | | | 3.44 | | | | -11.74 | | | | N/A | | | | N/A | | | | -6.16 | | | | 7.74 | | | | 1.28 | | | | 06/17/08 | |

| | | I | | | | 3.49 | | | | -11.57 | | | | N/A | | | | N/A | | | | -2.43 | | | | 7.49 | | | | 1.03 | | | | 08/06/07 | |

ASTON/Barings International Fund (c) | | | N | | | | 5.19 | | | | -8.28 | | | | N/A | | | | N/A | | | | 5.63 | | | | 1.69 | | | | 1.41 | | | | 03/03/10 | |

| | | I | | | | 5.33 | | | | -8.02 | | | | N/A | | | | N/A | | | | -6.58 | | | | 1.44 | | | | 1.16 | | | | 11/02/07 | |

Sector Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ASTON/Harrison Street Real Estate Fund (c) | | | N | | | | 15.38 | | | | 9.52 | | | | -0.79 | | | | 10.35 | | | | 8.80 | | | | 1.69 | | | | 1.37 | | | | 12/30/97 | |

| | | I | | | | 15.56 | | | | 9.77 | | | | -0.55 | | | | N/A | | | | 5.17 | | | | 1.44 | | | | 1.12 | | | | 09/20/05 | |

Balanced Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ASTON/Montag & Caldwell Balanced

Fund (c) | | | N | | | | 7.25 | | | | 6.14 | | | | 5.15 | | | | 4.22 | | | | 7.62 | | | | 1.58 | | | | 1.36 | | | | 11/02/94 | |

| | | I | | | | 7.31 | | | | 6.39 | | | | 5.35 | | | | 4.43 | | | | 3.55 | | | | 1.33 | | | | 1.11 | | | | 12/31/98 | |

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that an investor’s shares, upon redemption may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. For performance data current as of the most recent month-end, please visit our website at www.astonfunds.com

Performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of fund shares.

| (b) | The expense ratios presented above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report. |

| (c) | Certain expenses were subsidized. If these subsidies were not in effect, the returns would have been lower. The Adviser is contractually obligated to waive management fees and/or reimburse expenses through February 28, 2013. |

| (d) | Returns are cumulative since inception and are not annualized. |

| (e) | Effective February 29, 2012, the voluntary expense limitations were removed and replaced with contractual expense limitations of 1.30% for Class N and 1.05% for Class I. |

| (f) | Effective February 29, 2012, the voluntary expense limitation was removed and replaced with a contractual expense limitation of 1.25%. |

Mid and small company stocks may be subject to a higher degree of market risk because they tend to be more volatile and less liquid. Bond and balanced funds have the same interest rate, high yield, and credit risks associated with the underlying bonds in the portfolio, all of which could reduce a fund’s value. Exchange-Traded funds (ETFs) are securities of other investment companies. An ETF seeks to track the performance of an index by holding all or a sampling, of the securities of that index. ETFs invest in many different areas of the market, each of which may involve its own element of risk. By selling covered call options, a Fund limits its opportunity to profit from an increase in the price of the underlying stock above the exercise price, but continues to bear the risk of a decline in the stock. Sector funds may be subject to a higher degree of market risk because of concentration in a specific industry sector. International investing may include the risk of social and political instability, market illiquidity and currency volatility. Hedged mutual funds use derivative instruments, short selling, leveraging and investing in commodities, commodity-linked instruments and non-U.S. companies that involve significant risks. Real estate funds are non-diversified and may be more susceptible to risk than funds that invest more broadly and may be subject to a higher degree of market risk because of changes in property values of the underlying property and defaults by borrowers.

| | | | |

Aston Funds | | | | |

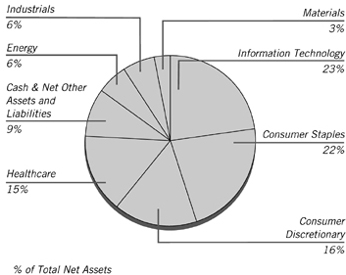

| ASTON/Montag & Caldwell Growth Fund | | | April 30, 2012 | |

Schedule of Investments (unaudited) | | | | |

| | |

| | | | | | | | |

| Shares | | | | | Market

Value | |

| COMMON STOCKS—91.20% | | | | |

| | | | Consumer Discretionary – 15.82% | |

| | 300,250 | | | Amazon.com * | | $ | 69,627,975 | |

| | 1,438,600 | | | Bed Bath & Beyond * | | | 101,263,054 | |

| | 1,243,000 | | | Las Vegas Sands | | | 68,974,070 | |

| | 1,143,100 | | | McDonald’s | | | 111,395,095 | |

| | 480,000 | | | NIKE, Class B | | | 53,697,600 | |

| | 1,559,800 | | | Omnicom Group | | | 80,033,338 | |

| | 2,855,100 | | | TJX | | | 119,086,221 | |

| | | | | | | | |

| | | | | | | 604,077,353 | |

| | | | | | | | |

| | | | Consumer Staples – 21.79% | |

| | 2,317,900 | | | Coca-Cola | | | 176,902,128 | |

| | 1,233,300 | | | Colgate-Palmolive | | | 122,022,702 | |

| | 1,323,400 | | | Costco Wholesale | | | 116,684,178 | |

| | 3,887,000 | | | Kraft Foods, Class A | | | 154,974,690 | |

| | 1,574,600 | | | PepsiCo | | | 103,923,600 | |

| | 1,293,500 | | | Procter & Gamble | | | 82,318,340 | |

| | 2,200,000 | | | Unilever (Netherlands) | | | 75,570,000 | |

| | | | | | | | |

| | | | | | | 832,395,638 | |

| | | | | | | | |

| | | | Energy – 6.48% | | | | |

| | 1,474,300 | | | Cameron International * | | | 75,557,875 | |

| | 974,100 | | | Occidental Petroleum | | | 88,857,402 | |

| | 1,119,000 | | | Schlumberger | | | 82,962,660 | |

| | | | | | | | |

| | | | | | | 247,377,937 | |

| | | | | | | | |

| | | | Healthcare – 14.91% | | | | |

| | 2,797,500 | | | Abbott Laboratories | | | 173,612,850 | |

| | 1,574,500 | | | Allergan | | | 151,152,000 | |

| | 1,825,600 | | | AmerisourceBergen | | | 67,930,576 | |

| | 1,225,854 | | | Express Scripts * | | | 68,390,395 | |

| | 1,988,000 | | | Stryker | | | 108,485,160 | |

| | | | | | | | |

| | | | | | | 569,570,981 | |

| | | | | | | | |

| | | | | | | | |

| Shares | | | | | Market

Value | |

| | | | Industrials – 6.08% | | | | |

| | 5,588,300 | | | General Electric | | $ | 109,418,914 | |

| | 1,572,500 | | | United Parcel Service, Class B | | | 122,875,150 | |

| | | | | | | | |

| | | | | | | 232,294,064 | |

| | | | | | | | |

| | | | Information Technology – 23.39% | |

| | 1,476,100 | | | Accenture, Class A (Ireland) | | | 95,872,695 | |

| | 272,000 | | | Apple * | | | 158,913,280 | |

| | 3,445,500 | | | Cisco Systems | | | 69,426,825 | |

| | 1,983,600 | | | eBay * | | | 81,426,780 | |

| | 1,344,100 | | | EMC * | | | 37,917,061 | |

| | 113,100 | | | Google, Class A * | | | 68,451,513 | |

| | 1,807,600 | | | Juniper Networks * | | | 38,736,868 | |

| | 1,927,700 | | | Oracle | | | 56,655,103 | |

| | 2,380,000 | | | Qualcomm | | | 151,939,200 | |

| | 1,089,800 | | | Visa, Class A | | | 134,023,604 | |

| | | | | | | | |

| | | | | | | 893,362,929 | |

| | | | | | | | |

| | | | Materials – 2.73% | | | | |

| | 1,368,000 | | | Monsanto | | | 104,214,240 | |

| | | | | | | | |

| | | | Total Common Stocks

(Cost $2,863,206,610) | | | 3,483,293,142 | |

| | | | | | | | |

| INVESTMENT COMPANY – 5.67% | |

| | 216,621,763 | | | BlackRock Liquidity Funds TempCash Portfolio | | | 216,621,763 | |

| | | | | | | | |

| | | | Total Investment Company

(Cost $216,621,763) | | | 216,621,763 | |

| | | | | | | | |

| Total Investments – 96.87%

(Cost $3,079,828,373)** | | | 3,699,914,905 | |

| | | | | | | | |

| Net Other Assets and Liabilities –

3.13% | | | 119,396,477 | |

| | | | | | | | |

| Net Assets – 100.00% | | $ | 3,819,311,382 | |

| | | | | | | | |

| * | Non-income producing security. |

| ** | At April 30, 2012, cost is identical for book and Federal income tax purposes. |

| | | | |

Gross unrealized appreciation | | $ | 624,612,750 | |

Gross unrealized depreciation | | | (4,526,218 | ) |

| | | | |

Net unrealized appreciation | | $ | 620,086,532 | |

| | | | |

|

See accompanying Notes to Financial Statements. |

| 4 |

| |

| | | | |

Aston Funds | | | | |

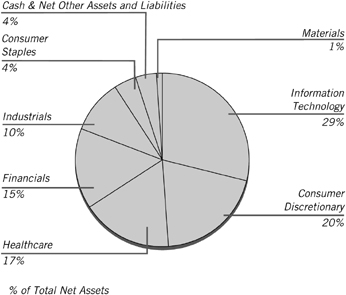

| ASTON/Veredus Select Growth Fund | | | April 30, 2012 | |

Schedule of Investments (unaudited) | | | | |

| | |

| | | | | | | | |

| Shares | | | | | Market

Value | |

| COMMON STOCKS – 95.74% | | | | |

| | | | Consumer Discretionary – 19.94% | |

| | 54,425 | | | CBS, Class B | | $ | 1,815,073 | |

| | 44,250 | | | D.R. Horton | | | 723,488 | |

| | 67,975 | | | Dish Network, Class A | | | 2,173,161 | |

| | 46,300 | | | Lennar, Class A | | | 1,284,362 | |

| | 37,900 | | | Lowe’s | | | 1,192,713 | |

| | 42,025 | | | Mattel | | | 1,412,040 | |

| | 5,525 | | | Ralph Lauren | | | 951,792 | |

| | | | | | | | |

| | | | | | | 9,552,629 | |

| | | | | | | | |

| | | | Consumer Staples – 4.41% | | | | |

| | 17,225 | | | Estee Lauder, Class A | | | 1,125,653 | |

| | 14,050 | | | Herbalife (Cayman) | | | 987,996 | |

| | | | | | | | |

| | | | | | | 2,113,649 | |

| | | | | | | | |

| | | | Financials – 14.54% | | | | |

| | 27,975 | | | American Express | | | 1,684,374 | |

| | 100,000 | | | Blackstone Group | | | 1,356,000 | |

| | 32,550 | | | Comerica | | | 1,042,251 | |

| | 114,525 | | | Fifth Third Bancorp | | | 1,629,691 | |

| | 10,900 | | | Goldman Sachs Group | | | 1,255,135 | |

| | | | | | | | |

| | | | | | | 6,967,451 | |

| | | | | | | | |

| | | | Healthcare – 17.37% | | | | |

| | 9,925 | | | Biogen Idec * | | | 1,330,049 | |

| | 61,625 | | | HCA Holdings | | | 1,658,945 | |

| | 45,025 | | | Hologic * | | | 860,878 | |

| | 14,225 | | | Humana | | | 1,147,673 | |

| | 23,225 | | | Illumina * | | | 1,034,209 | |

| | 1,850 | | | Intuitive Surgical * | | | 1,069,670 | |

| | 19,400 | | | Zimmer Holdings | | | 1,220,842 | |

| | | | | | | | |

| | | | | | | 8,322,266 | |

| | | | | | | | |

| | | | | | | | |

| Shares | | | | | Market

Value | |

| | | | Industrials – 10.20% | | | | |

| | 15,875 | | | BE Aerospace * | | $ | 746,601 | |

| | 13,950 | | | Fluor | | | 805,613 | |

| | 7,875 | | | Hubbell, Class B | | | 631,890 | |

| | 58,450 | | | Quanta Services * | | | 1,292,914 | |

| | 64,425 | | | United Continental Holdings * | | | 1,412,196 | |

| | | | | | | | |

| | | | | | | 4,889,214 | |

| | | | | | | | |

| | | | Information Technology – 28.53% | |

| | 19,025 | | | Accenture, Class A (Ireland) | | | 1,235,674 | |

| | 2,100 | | | Apple * | | | 1,226,904 | |

| | 27,275 | | | eBay * | | | 1,119,639 | |

| | 37,475 | | | Intel | | | 1,064,290 | |

| | 76,700 | | | Microsoft | | | 2,455,934 | |

| | 40,400 | | | Qualcomm | | | 2,579,136 | |

| | 20,625 | | | Rackspace Hosting * | | | 1,198,106 | |

| | 17,325 | | | Teradata * | | | 1,208,939 | |

| | 12,850 | | | Visa, Class A | | | 1,580,293 | |

| | | | | | | | |

| | | | | | | 13,668,915 | |

| | | | | | | | |

| | | | Materials – 0.75% | | | | |

| | 8,450 | | | Vulcan Materials | | | 361,745 | |

| | | | | | | | |

| | | | Total Common Stocks

(Cost $41,020,514) | | | 45,875,869 | |

| | | | | | | | |

| INVESTMENT COMPANY – 6.57% | |

| | 3,149,909 | | | BlackRock Liquidity Funds TempCash Portfolio | | | 3,149,909 | |

| | | | | | | | |

| | | | Total Investment Company

(Cost $3,149,909) | | | 3,149,909 | |

| | | | | | | | |

| Total Investments – 102.31%

(Cost $44,170,423)** | | | 49,025,778 | |

| | | | | | | | |

| Net Other Assets and Liabilities – (2.31)% | | | (1,107,163 | ) |

| | | | | | | | |

| Net Assets – 100.00% | | $ | 47,918,615 | |

| | | | | | | | |

| * | Non-income producing security. |

| ** | At April 30, 2012, cost is identical for book and Federal income tax purposes. |

| | | | |

Gross unrealized appreciation | | $ | 5,504,218 | |

Gross unrealized depreciation | | | (648,863 | ) |

| | | | |

Net unrealized appreciation | | $ | 4,855,355 | |

| | | | |

| | | | |

See accompanying Notes to Financial Statements. | | | | |

| | | 5 | |

| | | | |

| | | | |

Aston Funds | | | | |

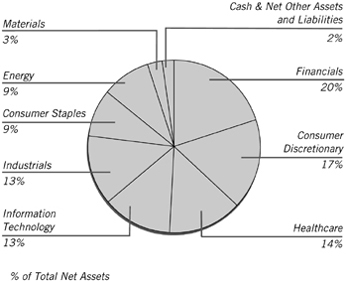

| ASTON/TAMRO Diversified Equity Fund | | | April 30, 2012 | |

Schedule of Investments (unaudited) | | | | |

| | |

| | | | | | | | |

| Shares | | | | | Market

Value | |

| COMMON STOCKS – 98.06% | | | | |

| | | | Consumer Discretionary – 16.72% | |

| | 3,108 | | | Amazon.com * | | $ | 720,745 | |

| | 17,836 | | | Arcos Dorados Holdings, Class A (Argentina) | | | 318,728 | |

| | 14,668 | | | CarMax * | | | 452,801 | |

| | 11,118 | | | GNC Holdings, Class A | | | 434,269 | |

| | 9,985 | | | Home Depot | | | 517,123 | |

| | 13,234 | | | Johnson Controls | | | 423,091 | |

| | 10,748 | | | Macy’s | | | 440,883 | |

| | 15,535 | | | Toll Brothers * | | | 394,589 | |

| | | | | | | | |

| | | | | | | 3,702,229 | |

| | | | | | | | |

| | | | Consumer Staples – 8.72% | | | | |

| | 11,373 | | | Kraft Foods, Class A | | | 453,442 | |

| | 8,052 | | | McCormick & Co (Non-Voting Shares) | | | 450,187 | |

| | 6,163 | | | Philip Morris International | | | 551,650 | |

| | 9,668 | | | United Natural Foods * | | | 476,536 | |

| | | | | | | | |

| | | | | | | 1,931,815 | |

| | | | | | | | |

| | | | Energy – 9.14% | | | | |

| | 4,860 | | | EOG Resources | | | 533,677 | |

| | 6,552 | | | Exxon Mobil | | | 565,700 | |

| | 7,497 | | | Range Resources | | | 499,750 | |

| | 13,472 | | | Southwestern Energy * | | | 425,446 | |

| | | | | | | | |

| | | | | | | 2,024,573 | |

| | | | | | | | |

| | | | Financials – 19.62% | | | | |

| | 10,360 | | | American Express | | | 623,776 | |

| | 5,420 | | | Berkshire Hathaway, Class B * | | | 436,039 | |

| | 3,530 | | | Franklin Resources | | | 443,050 | |

| | 3,809 | | | Goldman Sachs Group | | | 438,606 | |

| | 7,772 | | | Iberiabank | | | 396,916 | |

| | 13,260 | | | JPMorgan Chase | | | 569,915 | |

| | | | | | | | |

| Shares | | | | | Market

Value | |

| | | | Financials (continued) | | | | |

| | 11,404 | | | MetLife | | $ | 410,886 | |

| | 14,758 | | | Raymond James Financial | | | 540,438 | |

| | 6,813 | | | T. Rowe Price Group | | | 430,003 | |

| | 2,975 | | | Western Union | | | 54,681 | |

| | | | | | | | |

| | | | | | | 4,344,310 | |

| | | | | | | | |

| | | | Healthcare – 13.66% | | | | |

| | 6,273 | | | Advisory Board * | | | 571,847 | |

| | 5,542 | | | Allergan | | | 532,032 | |

| | 6,551 | | | Athenahealth * | | | 474,620 | |

| | 5,945 | | | DaVita * | | | 526,608 | |

| | 6,638 | | | Johnson & Johnson | | | 432,067 | |

| | 10,691 | | | Teva Pharmaceutical, SP ADR (Israel) | | | 489,006 | |

| | | | | | | | |

| | | | | | | 3,026,180 | |

| | | | | | | | |

| | | | Industrials – 13.46% | | | | |

| | 5,986 | | | AGCO * | | | 278,828 | |

| | 5,179 | | | Boeing | | | 397,747 | |

| | 13,859 | | | Cintas | | | 542,857 | |

| | 12,213 | | | Colfax * | | | 413,899 | |

| | 10,112 | | | Danaher | | | 548,273 | |

| | 6,249 | | | Fluor | | | 360,880 | |

| | 7,597 | | | Morningstar | | | 438,499 | |

| | | | | | | | |

| | | | | | | 2,980,983 | |

| | | | | | | | |

| | | | Information Technology – 13.25% | |

| | 1,655 | | | Apple * | | | 966,917 | |

| | 8,304 | | | BMC Software * | | | 342,623 | |

| | 21,323 | | | Cisco Systems | | | 429,658 | |

| | 1,754 | | | F5 Networks * | | | 234,913 | |

| | 3,917 | | | Factset Research Systems | | | 410,737 | |

| | 910 | | | Google, Class A * | | | 550,759 | |

| | | | | | | | |

| | | | | | | 2,935,607 | |

| | | | | | | | |

| | | | Materials – 3.49% | | | | |

| | 5,767 | | | Monsanto | | | 439,330 | |

| | 6,295 | | | Mosaic | | | 332,502 | |

| | | | | | | | |

| | | | | | | 771,832 | |

| | | | | | | | |

| | | | Total Common Stocks

(Cost $17,280,430) | | | 21,717,529 | |

| | | | | | | | |

| | | | | | | | |

Number of

Contracts | | | | | | |

| PURCHASED OPTIONS – 0.43% | |

| | 29 | | | Boeing - Call Strike @ $80

Exp 01/13 | | | 10,730 | |

| | 439 | | | Cisco - Call Strike @ $20

Exp 01/13 | | | 77,703 | |

| | 63 | | | Johnson & Johnson - Call Strike @ $70 Exp 01/13 | | | 3,780 | |

| | 50 | | | JPMorgan Chase - Call Strike @ $55 Exp 01/13 | | | 1,950 | |

| | | | | | | | |

| | | | Total Purchased Options

(Premiums Paid $111,357) | | | 94,163 | |

| | | | | | | | |

|

See accompanying Notes to Financial Statements. |

| 6 |

| |

| | | | |

Aston Funds | | | | |

ASTON/TAMRO Diversified Equity Fund | | | April 30, 2012 | |

Schedule of Investments (unaudited) – continued | | | | |

| | |

| | | | | | | | |

Shares | | | | | Market

Value | |

| INVESTMENT COMPANY – 1.41% | | | | |

| | 313,373 | | | BlackRock Liquidity Funds

TempCash Portfolio | | $ | 313,373 | |

| | | | | | | | |

| | | | Total Investment Company

(Cost $313,373) | | | 313,373 | |

| | | | | | | | |

| Total Investments – 99.90%

(Cost $17,705,160)** | | | 22,125,065 | |

| | | | | | | | |

| Net Other Assets and Liabilities – 0.10% | | | 23,204 | |

| | | | | | | | |

| Net Assets – 100.00% | | $ | 22,148,269 | |

| | | | | | | | |

| * | Non-income producing security. |

| ** | At April 30, 2012, cost is identical for book and Federal income tax purposes. |

| | | | |

| Gross unrealized appreciation | | $ | 4,692,198 | |

| Gross unrealized depreciation | | | (272,293 | ) |

| | | | |

| Net unrealized appreciation | | $ | 4,419,905 | |

| | | | |

| SP ADR | Sponsored American Depositary Receipt |

| | | | |

See accompanying Notes to Financial Statements. | | | | |

| | | 7 | |

| | | | |

| | | | |

Aston Funds | | | | |

ASTON/Herndon Large Cap Value Fund | | | April 30, 2012 | |

Schedule of Investments (unaudited) | | | | |

| | |

| | | | | | | | |

| Shares | | | | | Market

Value | |

| COMMON STOCKS – 96.22% | | | | |

| | | | Consumer Discretionary – 10.86% | |

| | 20,433 | | | Coach | | $ | 1,494,878 | |

| | 19,810 | | | Ross Stores | | | 1,220,098 | |

| | 42,957 | | | TJX | | | 1,791,737 | |

| | 9,568 | | | Yum! Brands | | | 695,881 | |

| | | | | | | | |

| | | | | | | 5,202,594 | |

| | | | | | | | |

| | | | Consumer Staples – 13.43% | | | | |

| | 38,150 | | | Altria Group | | | 1,228,812 | |

| | 14,155 | | | Campbell Soup | | | 478,864 | |

| | 8,128 | | | Colgate-Palmolive | | | 804,184 | |

| | 22,182 | | | Herbalife (Cayman) | | | 1,559,838 | |

| | 21,874 | | | Kellogg | | | 1,106,168 | |

| | 13,993 | | | Philip Morris International | | | 1,252,513 | |

| | | | | | | | |

| | | | | | | 6,430,379 | |

| | | | | | | | |

| | | | Energy – 20.67% | | | | |

| | 8,869 | | | Apache | | | 850,892 | |

| | 8,725 | | | Chevron | | | 929,736 | |

| | 9,177 | | | Core Laboratories (Netherlands) | | | 1,257,065 | |

| | 13,416 | | | Diamond Offshore Drilling | | | 919,667 | |

| | 19,116 | | | Exxon Mobil | | | 1,650,475 | |

| | 36,785 | | | Halliburton | | | 1,258,783 | |

| | 28,109 | | | HollyFrontier | | | 866,319 | |

| | 33,767 | | | Marathon Oil | | | 990,724 | |

| | 28,087 | | | RPC | | | 290,420 | |

| | 35,949 | | | Valero Energy | | | 887,940 | |

| | | | | | | | |

| | | | | | | 9,902,021 | |

| | | | | | | | |

| | | | Financials – 18.36% | | | | |

| | 16,853 | | | Aflac | | | 759,059 | |

| | 36,566 | | | American Capital Agency, REIT | | | 1,142,322 | |

| | 47,636 | | | Annaly Capital Management, REIT | | | 777,420 | |

| | 34,817 | | | Apartment Investment & Management, Class A, REIT | | | 945,282 | |

| | 16,920 | | | CBOE Holdings | | | 447,365 | |

| | 369,671 | | | Chimera Investment, REIT | | | 1,068,349 | |

| | 14,792 | | | Discover Financial Services | | | 501,449 | |

| | | | | | | | |

| Shares | | | | | Market

Value | |

| | | | Financials (continued) | | | | |

| | 31,072 | | | Eaton Vance | | $ | 817,194 | |

| | 65,065 | | | Federated Investors, Class B | | | 1,436,635 | |

| | 28,109 | | | Waddell & Reed Financial, Class A | | | 898,926 | |

| | | | | | | | |

| | | | | | | 8,794,001 | |

| | | | | | | | |

| | | | Healthcare – 8.42% | | | | |

| | 29,981 | | | Endo Pharmaceuticals Holdings * | | | 1,053,532 | |

| | 20,289 | | | Express Scripts * | | | 1,131,923 | |

| | 21,606 | | | Gilead Sciences * | | | 1,123,728 | |

| | 8,574 | | | Waters * | | | 721,159 | |

| | | | | | | | |

| | | | | | | 4,030,342 | �� |

| | | | | | | | |

| | | | Industrials – 8.92% | | | | |

| | 4,174 | | | Caterpillar | | | 428,962 | |

| | 21,688 | | | Copa Holdings SA, Class A (Panama) | | | 1,763,451 | |

| | 8,972 | | | Cummins | | | 1,039,227 | |

| | 11,482 | | | Lockheed Martin | | | 1,039,580 | |

| | | | | | | | |

| | | | | | | 4,271,220 | |

| | | | | | | | |

| | | | Information Technology – 10.54% | |

| | 2,696 | | | Apple * | | | 1,575,111 | |

| | 5,391 | | | International Business Machines | | | 1,116,368 | |

| | 40,928 | | | Microsoft | | | 1,310,515 | |

| | 26,977 | | | Western Digital * | | | 1,046,977 | |

| | | | | | | | |

| | | | | | | 5,048,971 | |

| | | | | | | | |

| | | | Materials – 5.02% | | | | |

| | 5,062 | | | CF Industries Holdings | | | 977,270 | |

| | 16,071 | | | Cliffs Natural Resources | | | 1,000,580 | |

| | 11,154 | | | Freeport-McMoRan Copper & Gold | | | 427,198 | |

| | | | | | | | |

| | | | | | | 2,405,048 | |

| | | | | | | | |

| | | | Total Common Stocks

(Cost $43,535,833) | | | 46,084,576 | |

| | | | | | | | |

| INVESTMENT COMPANY – 3.57% | | | | |

| | 1,709,736 | | | BlackRock Liquidity Funds TempCash Portfolio | | | 1,709,736 | |

| | | | | | | | |

| | | | Total Investment Company

(Cost $1,709,736) | | | 1,709,736 | |

| | | | | | | | |

| Total Investments – 99.79%

(Cost $45,245,569)** | | | 47,794,312 | |

| | | | | | | | |

| Net Other Assets and Liabilities – 0.21% | | | 102,977 | |

| | | | | | | | |

| | Net Assets – 100.00% | | $ | 47,897,289 | |

| | | | | | | | |

| * | Non-income producing security. |

| ** | At April 30, 2012, cost is identical for book and Federal income tax purposes. |

| | | | |

| Gross unrealized appreciation | | $ | 3,317,743 | |

| Gross unrealized depreciation | | | (769,000 | ) |

| | | | |

| Net unrealized appreciation | | $ | 2,548,743 | |

| | | | |

| REIT | Real Estate Investment Trust |

|

See accompanying Notes to Financial Statements. |

| 8 |

| |

| | | | |

Aston Funds | | | | |

ASTON/Cornerstone Large Cap Value Fund | | | April 30, 2012 | |

Schedule of Investments (unaudited) | | | | |

| | |

| | | | | | | | |

| Shares | | | | | Market

Value | |

| COMMON STOCKS – 97.13% | | | | |

| | | | Consumer Discretionary – 7.12% | |

| | 16,850 | | | GameStop, Class A | | $ | 383,506 | |

| | 27,875 | | | Mattel | | | 936,600 | |

| | 3,520 | | | VF | | | 535,216 | |

| | | | | | | | |

| | | | | | | 1,855,322 | |

| | | | | | | | |

| | | | Consumer Staples – 3.39% | |

| | 14,975 | | | Wal-Mart Stores | | | 882,177 | |

| | | | | | | | |

| | | | Energy – 11.17% | | | | |

| | 10,375 | | | Chevron | | | 1,105,560 | |

| | 18,012 | | | Hess | | | 939,146 | |

| | 12,100 | | | Royal Dutch Shell PLC, ADR

(United Kingdom) | | | 865,634 | |

| | | | | | | | |

| | | | | | | 2,910,340 | |

| | | | | | | | |

| | | | Financials – 14.39% | | | | |

| | 10,925 | | | ACE (Switzerland) | | | 829,972 | |

| | 17,400 | | | Capital One Financial | | | 965,352 | |

| | 30,350 | | | Citigroup | | | 1,002,764 | |

| | 54,950 | | | Morgan Stanley | | | 949,536 | |

| | | | | | | | |

| | | | | | | 3,747,624 | |

| | | | | | | | |

| | | | Healthcare – 17.30% | | | | |

| | 18,475 | | | Bristol-Myers Squibb | | | 616,511 | |

| | 21,200 | | | Eli Lilly | | | 877,468 | |

| | 26,200 | | | Merck | | | 1,028,088 | |

| | 22,550 | | | Sanofi, ADR (France) | | | 860,959 | |

| | 24,550 | | | Teva Pharmaceutical, SP ADR

(Israel) | | | 1,122,917 | |

| | | | | | | | |

| | | | | | | 4,505,943 | |

| | | | | | | | |

| | | | Industrials – 8.74% | | | | |

| | 12,425 | | | General Dynamics | | | 838,687 | |

| | 7,700 | | | Lockheed Martin | | | 697,158 | |

| | 8,450 | | | Parker Hannifin | | | 740,981 | |

| | | | | | | | |

| | | | | | | 2,276,826 | |

| | | | | | | | |

| | | | | | | | |

| Shares | | | | | Market

Value | |

| | | | Information Technology – 30.34% | |

| | 1,950 | | | Apple * | | $ | 1,139,268 | |

| | 14,550 | | | eBay * | | | 597,277 | |

| | 1,725 | | | Google, Class A * | | | 1,044,022 | |

| | 29,375 | | | Hewlett-Packard | | | 727,325 | |

| | 23,200 | | | Intel | | | 658,880 | |

| | 3,455 | | | International Business Machines | | | 715,461 | |

| | 33,000 | | | Microsoft | | | 1,056,660 | |

| | 30,550 | | | Oracle | | | 897,865 | |

| | 27,500 | | | Western Digital * | | | 1,067,275 | |

| | | | | | | | |

| | | | | | | 7,904,033 | |

| | | | | | | | |

| | | | Materials – 2.37% | | | | |

| | 27,850 | | | Vale SA, SP ADR (Brazil) | | | 618,270 | |

| | | | | | | | |

| | | | Telecommunication Services – 2.31% | |

| | 18,325 | | | AT&T | | | 603,076 | |

| | | | | | | | |

| | | | Total Common Stocks

(Cost $23,573,733) | | | 25,303,611 | |

| | | | | | | | |

| INVESTMENT COMPANY – 2.91% | | | | |

| | 757,761 | | | BlackRock Liquidity Funds TempCash Portfolio | | | 757,761 | |

| | | | | | | | |

| | | | Total Investment Company

(Cost $757,761) | | | 757,761 | |

| | | | | | | | |

| Total Investments – 100.04%

(Cost $24,331,494)** | | | 26,061,372 | |

| | | | | | | | |

| Net Other Assets and Liabilities – (0.04)% | | | (11,220 | ) |

| | | | | | | | |

| Net Assets – 100.00% | | $ | 26,050,152 | |

| | | | | | | | |

| * | Non-income producing security. |

| ** | At April 30, 2012, cost is identical for book and Federal income tax purposes. |

| | | | |

Gross unrealized appreciation | | $ | 2,151,665 | |

Gross unrealized depreciation | | | (421,787 | ) |

| | | | |

Net unrealized appreciation | | $ | 1,729,878 | |

| | | | |

| ADR | American Depositary Receipt |

| SP ADR | Sponsored American Depositary Receipt |

| | | | |

See accompanying Notes to Financial Statements. | | | | |

| | | 9 | |

| | | | |

| | | | |

Aston Funds | | | | |

ASTON/River Road Dividend All Cap Value Fund | | | April 30, 2012 | |

Schedule of Investments (unaudited) | | | | |

| | |

| | | | | | | | |

| Shares | | | | | Market

Value | |

| COMMON STOCKS – 95.25% | | | | |

| | | | Consumer Discretionary – 13.55% | |

| | 459,225 | | | American Greetings, Class A | | $ | 7,347,600 | |

| | 331,960 | | | Bob Evans Farms | | | 12,694,150 | |

| | 75,455 | | | Cracker Barrel Old Country Store | | | 4,340,172 | |

| | 227,770 | | | Darden Restaurants | | | 11,406,722 | |

| | 198,805 | | | Genuine Parts | | | 12,878,588 | |

| | 242,275 | | | Hasbro | | | 8,901,184 | |

| | 544,030 | | | Hillenbrand | | | 11,391,988 | |

| | 141,160 | | | Meredith | | | 4,069,643 | |

| | 450,175 | | | National CineMedia | | | 6,433,001 | |

| | 643,270 | | | Regal Entertainment Group, Class A | | | 8,754,905 | |

| | 254,580 | | | Target | | | 14,750,365 | |

| | 437,790 | | | Thomson Reuters | | | 13,054,898 | |

| | | | | | | | |

| | | | | | | 116,023,216 | |

| | | | | | | | |

| | | | Consumer Staples – 17.69% | |

| | 270,615 | | | Dr Pepper Snapple Group | | | 10,981,557 | |

| | 512,510 | | | General Mills | | | 19,931,514 | |

| | 240,170 | | | Kimberly-Clark | | | 18,846,140 | |

| | 169,195 | | | McCormick & Co (Non-Voting Shares) | | | 9,459,692 | |

| | 156,580 | | | Molson Coors Brewing, Class B | | | 6,510,596 | |

| | 276,410 | | | PepsiCo | | | 18,243,060 | |

| | 170,790 | | | Procter & Gamble | | | 10,869,076 | |

| | 630,350 | | | Sara Lee | | | 13,892,914 | |

| | 106,940 | | | Smucker (J.M.) | | | 8,515,632 | |

| | 552,155 | | | Sysco | | | 15,957,280 | |

| | 166,735 | | | Wal-Mart Stores | | | 9,822,359 | |

| | 242,155 | | | Walgreen | | | 8,489,954 | |

| | | | | | | | |

| | | | | | | 151,519,774 | |

| | | | | | | | |

| | | | Energy – 5.79% | | | | |

| | 852,980 | | | BreitBurn Energy Partners LP | | | 16,232,209 | |

| | 152,215 | | | Chevron | | | 16,220,030 | |

| | 186,020 | | | ConocoPhillips | | | 13,324,613 | |

| | 259,870 | | | Nordic American Tankers (Bermuda) | | | 3,773,312 | |

| | | | | | | | |

| | | | | | | 49,550,164 | |

| | | | | | | | |

| | | | | | | | |

| Shares | | | | | Market

Value | |

| | | | Financials – 12.27% | | | | |

| | 61,900 | | | BlackRock | | $ | 11,858,802 | |

| | 237,395 | | | Chubb | | | 17,346,453 | |

| | 14,450 | | | CME Group | | | 3,841,099 | |

| | 196,959 | | | Commerce Bancshares | | | 7,898,056 | |

| | 368,815 | | | Compass Diversified Holdings | | | 5,414,204 | |

| | 327,575 | | | OneBeacon Insurance Group, Class A (Bermuda) | | | 4,661,392 | |

| | 175,890 | | | PartnerRe (Bermuda) | | | 12,245,462 | |

| | 180,870 | | | PNC Financial Services Group | | | 11,995,298 | |

| | 670,545 | | | Sabra Health Care, REIT | | | 11,224,923 | |

| | 186,865 | | | Safety Insurance Group | | | 7,446,570 | |

| | 245,935 | | | Tower Group | | | 5,307,277 | |

| | 179,975 | | | U.S. Bancorp | | | 5,789,796 | |

| | | | | | | | |

| | | | | | | 105,029,332 | |

| | | | | | | | |

| | | | Healthcare – 7.94% | | | | |

| | 239,475 | | | AstraZeneca PLC, SP ADR (United Kingdom) | | | 10,512,953 | |

| | 90,905 | | | Becton, Dickinson | | | 7,131,497 | |

| | 190,450 | | | Johnson & Johnson | | | 12,396,391 | |

| | 110,491 | | | Landauer | | | 5,825,086 | |

| | 281,270 | | | Medtronic | | | 10,744,514 | |

| | 276,927 | | | Owens & Minor | | | 8,097,345 | |

| | 579,580 | | | Pfizer | | | 13,289,769 | |

| | | | | | | | |

| | | | | | | 67,997,555 | |

| | | | | | | | |

| | | | Industrials – 15.49% | | | | |

| | 83,990 | | | 3M | | | 7,505,346 | |

| | 391,345 | | | ABM Industries | | | 9,110,512 | |

| | 101,250 | | | General Dynamics | | | 6,834,375 | |

| | 58,145 | | | Grupo Aeroportuario del Sureste SAB de CV, ADR (Mexico) | | | 4,762,657 | |

| | 250,540 | | | Iron Mountain | | | 7,608,900 | |

| | 157,365 | | | Lockheed Martin | | | 14,247,827 | |

| | 260,765 | | | Norfolk Southern | | | 19,017,591 | |

| | 203,185 | | | Raytheon | | | 11,000,436 | |

| | 288,055 | | | Republic Services | | | 7,884,065 | |

| | 230,750 | | | United Parcel Service, Class B | | | 18,030,805 | |

| | 126,530 | | | United Technologies | | | 10,329,909 | |

| | 475,895 | | | Waste Management | | | 16,275,609 | |

| | | | | | | | |

| | | | | | | 132,608,032 | |

| | | | | | | | |

| | | | Information Technology – 8.28% | |

| | 371,745 | | | Automatic Data Processing | | | 20,676,456 | |

| | 156,430 | | | CA | | | 4,132,881 | |

| | 863,540 | | | Intel | | | 24,524,536 | |

| | 58,380 | | | j2 Global | | | 1,508,066 | |

| | 367,730 | | | Microsoft | | | 11,774,715 | |

| | 267,800 | | | Paychex | | | 8,296,444 | |

| | | | | | | | |

| | | | | | | 70,913,098 | |

| | | | | | | | |

| | | | Materials – 2.50% | | | | |

| | 236,920 | | | Bemis | | | 7,673,839 | |

| | 55,500 | | | Newmont Mining | | | 2,644,575 | |

| | 282,255 | | | Nucor | | | 11,067,219 | |

| | | | | | | | |

| | | | | | | 21,385,633 | |

| | | | | | | | |

| | | | Telecommunication Services – 5.80% | |

| | 120,715 | | | Atlantic Tele-Network | | | 4,111,552 | |

| | 456,802 | | | Telefonica Brasil SA ADR (Brazil) | | | 13,005,153 | |

| | 355,365 | | | Verizon Communications | | | 14,349,639 | |

| | 654,455 | | | Vodafone Group, SP ADR

(United Kingdom) | | | 18,213,483 | |

| | | | | | | | |

| | | | | | | 49,679,827 | |

| | | | | | | | |

|

See accompanying Notes to Financial Statements. |

| 10 |

| |

| | | | |

Aston Funds | | | | |

ASTON/River Road Dividend All Cap Value Fund | | | April 30, 2012 | |

Schedule of Investments (unaudited) – continued | | | | |

| | |

| | | | | | | | |

| Shares | | | | | Market

Value | |

| | | | Utilities – 5.94% | | | | |

| | 401,720 | | | Avista | | $ | 10,621,477 | |

| | 572,120 | | | Duke Energy | | | 12,260,532 | |

| | 113,390 | | | Entergy | | | 7,433,848 | |

| | 219,695 | | | Southern | | | 10,092,788 | |

| | 288,025 | | | Unisource Energy | | | 10,484,110 | |

| | | | | | | | |

| | | | | | | 50,892,755 | |

| | | | | | | | |

| | | | Total Common Stocks

(Cost $723,694,616) | | | 815,599,386 | |

| | | | | | | | |

| INVESTMENT COMPANY – 4.37% | | | | |

| | 37,398,099 | | | BlackRock Liquidity Funds TempCash Portfolio | | | 37,398,099 | |

| | | | | | | | |

| | | | Total Investment Company

(Cost $37,398,099) | | | 37,398,099 | |

| | | | | | | | |

| Total Investments – 99.62%

(Cost $761,092,715)* | | | 852,997,485 | |

| | | | | | | | |

| | Net Other Assets and Liabilities – 0.38% | | | 3,230,381 | |

| | | | | | | | |

| | Net Assets – 100.00% | | $ | 856,227,866 | |

| | | | | | | | |

| * | At April 30, 2012, cost is identical for book and Federal income tax purposes. |

| | | | |

Gross unrealized appreciation | | $ | 96,768,745 | |

Gross unrealized depreciation | | | (4,863,975 | ) |

| | | | |

Net unrealized appreciation | | $ | 91,904,770 | |

| | | | |

| ADR | American Depositary Receipt |

| REIT | Real Estate Investment Trust |

| SP | ADR Sponsored American Depositary Receipt |

| | | | |

See accompanying Notes to Financial Statements. | | | | |

| | | 11 | |

| | | | |

| | | | |

Aston Funds | | | | |

ASTON/Fairpointe Mid Cap Fund | | | April 30, 2012 | |

Schedule of Investments (unaudited) | | | | |

| | |

| | | | | | | | |

| Shares | | | | | Market

Value | |

| COMMON STOCKS – 99.21% | | | | |

| | | | Consumer Discretionary – 23.16% | |

| | 7,610,078 | | | Belo, Class A | | $ | 51,291,927 | |

| | 782,300 | | | BorgWarner * | | | 61,832,993 | |

| | 6,875,800 | | | Gannett | | | 95,023,556 | |

| | 7,725,464 | | | H&R Block | | | 113,564,321 | |

| | 8,315,468 | | | Interpublic Group | | | 98,205,677 | |

| | 1,792,600 | | | Mattel | | | 60,231,360 | |

| | 1,590,655 | | | McGraw-Hill | | | 78,212,506 | |

| | 13,417,354 | | | New York Times, Class A * | | | 84,663,504 | |

| | 1,458,297 | | | Scholastic | | | 44,550,973 | |

| | | | | | | | |

| | | | | | | 687,576,817 | |

| | | | | | | | |

| | | | Consumer Staples – 4.23% | |

| | 763,360 | | | Bunge | | | 49,236,720 | |

| | 1,838,186 | | | Molson Coors Brewing, Class B | | | 76,431,774 | |

| | | | | | | | |

| | | | | | | 125,668,494 | |

| | | | | | | | |

| | | | Energy – 4.95% | | | | |

| | 1,436,299 | | | Compagnie Generale de | | | | |

| | | | Geophysique-Veritas, SP ADR (France) * | | | 41,307,959 | |

| | 1,501,829 | | | Denbury Resources * | | | 28,594,824 | |

| | 1,638,092 | | | FMC Technologies * | | | 76,990,324 | |

| | | | | | | | |

| | | | | | | 146,893,107 | |

| | | | | | | | |

| | | | Financials – 6.79% | | | | |

| | 1,941,528 | | | Cincinnati Financial | | | 69,157,227 | |

| | 2,294,585 | | | Eaton Vance | | | 60,347,586 | |

| | 1,515,688 | | | Northern Trust | | | 72,131,592 | |

| | | | | | | | |

| | | | | | | 201,636,405 | |

| | | | | | | | |

| | | | Healthcare – 16.76% | | | | |

| | 20,813,236 | | | Boston Scientific * | | | 130,290,857 | |

| | 2,040,919 | | | Charles River Laboratories * | | | 72,513,852 | |

| | 2,553,268 | | | Forest Laboratories * | | | 88,930,324 | |

| | 2,316,081 | | | Hospira * | | | 81,340,765 | |

| | | | | | | | |

| Shares | | | | | Market

Value | |

| | | | Healthcare (continued) | | | | |

| | 1,933,345 | | | Lincare Holdings | | $ | 47,173,618 | |

| | 1,218,853 | | | Varian Medical Systems * | | | 77,299,657 | |

| | | | | | | | |

| | | | | | | 497,549,073 | |

| | | | | | | | |

| | | | Industrials – 11.65% | | | | |

| | 1,599,200 | | | Chicago Bridge & Iron (Netherlands) | | | 71,036,464 | |

| | 1,886,300 | | | Con-way | | | 61,304,750 | |

| | 1,382,444 | | | Manpower | | | 58,892,114 | |

| | 10,435,200 | | | Southwest Airlines | | | 86,403,456 | |

| | 2,897,500 | | | Werner Enterprises | | | 68,438,950 | |

| | | | | | | | |

| | | | | | | 346,075,734 | |

| | | | | | | | |

| | | | Information Technology – 27.29% | |

| | 2,987,464 | | | Akamai Technologies * | | | 97,391,326 | |

| | 2,063,951 | | | CA | | | 54,529,585 | |

| | 868,400 | | | Cree * | | | 26,833,560 | |

| | 1,366,900 | | | Harris | | | 62,248,626 | |

| | 2,288,398 | | | Itron * | | | 93,366,638 | |

| | 2,571,100 | | | Jabil Circuit | | | 60,292,295 | |

| | 2,682,350 | | | Lexmark International Group, Class A | | | 80,738,735 | |

| | 928,804 | | | Mentor Graphics * | | | 13,421,218 | |

| | 1,883,786 | | | Molex | | | 51,973,656 | |

| | 1,819,864 | | | Molex, Class A | | | 41,674,886 | |

| | 3,210,500 | | | Nuance Communications * | | | 78,464,620 | |

| | 4,333,108 | | | Unisys * | | | 80,855,795 | |

| | 1,763,759 | | | Zebra Technologies, Class A * | | | 68,416,212 | |

| | | | | | | | |

| | | | | | | 810,207,152 | |

| | | | | | | | |

| | | | Materials – 4.38% | | | | |

| | 528,400 | | | FMC | | | 58,361,780 | |

| | 1,009,800 | | | Sigma-Aldrich | | | 71,594,820 | |

| | | | | | | | |

| | | | | | | 129,956,600 | |

| | | | | | | | |

| | | | Total Common Stocks

(Cost $2,5 07,724,478) | | | 2,945,563,382 | |

| | | | | | | | |

| | INVESTMENT COMPANY – 1.16% | |

| | 34,447,522 | | | BlackRock Liquidity Funds TempCash Portfolio | | | 34,447,522 | |

| | | | | | | | |

| | | | Total Investment Company

(Cost $34,447,522) | | | 34,447,522 | |

| | | | | | | | |

| Total Investments – 100.37%

(Cost $2,542,172,000)** | | | 2,980,010,904 | |

| | | | | | | | |

| | Net Other Assets and Liabilities – (0.37)% | | | (11,020,298 | ) |

| | | | | | | | |

| | Net Assets – 100.00% | | $ | 2,968,990,606 | |

| | | | | | | | |

| * | Non-income producing security. |

| ** | At April 30,2012, cost is identical for book and Federal income tax purposes. |

| | | | |

Gross unrealized appreciation | | $ | 588,500,574 | |

Gross unrealized depreciation | | | (150,661,670 | ) |

| | | | |

Net unrealized appreciation | | $ | 437,838,904 | |

| | | | |

| SP ADR | Sponsored American Depositary Recceipt |

|

See accompanying Notes to Financial Statements. |

| 12 |

| |

| | | | |

Aston Funds | | | | |

ASTON/Montag & Caldwell Mid Cap Growth Fund | | | April 30, 2012 | |

Schedule of Investments (unaudited) | | | | |

| | |

| | | | | | | | |

| Shares | | | | | Market

Value | |

| COMMON STOCKS – 96.13% | | | | |

| | | | Consumer Discretionary – 21.51% | |

| | 1,410 | | | Bed Bath & Beyond * | | $ | 99,250 | |

| | 1,220 | | | BorgWarner * | | | 96,429 | |

| | 1,740 | | | Dick’s Sporting Goods | | | 88,044 | |

| | 1,550 | | | Harman International Industries | | | 76,849 | |

| | 5,120 | | | LKQ * | | | 171,264 | |

| | 1,770 | | | O’Reilly Automotive * | | | 186,664 | |

| | 3,570 | | | Omnicom Group | | | 183,177 | |

| | 530 | | | Panera Bread, Class A * | | | 83,698 | |

| | 1,320 | | | PVH | | | 117,216 | |

| | 530 | | | Ralph Lauren | | | 91,303 | |

| | 1,750 | | | TJX | | | 72,992 | |

| | 850 | | | Tractor Supply | | | 83,649 | |

| | 1,820 | | | Warnaco Group (The) * | | | 96,387 | |

| | | | | | | | |

| | | | | | | 1,446,922 | |

| | | | | | | | |

| | | | Consumer Staples – 5.87% | | | | |

| | 2,950 | | | Church & Dwight | | | 149,860 | |

| | 2,450 | | | McCormick & Co (Non Voting Shares) | | | 136,979 | |

| | 1,260 | | | Mead Johnson Nutrition | | | 107,806 | |

| | | | | | | | |

| | | | | | | 394,645 | |

| | | | | | | | |

| | | | Energy – 7.23% | | | | |

| | 2,470 | | | Cameron International * | | | 126,587 | |

| | 840 | | | Core Laboratories (Netherlands) | | | 115,063 | |

| | 2,660 | | | Oceaneering International | | | 137,336 | |

| | 1,620 | | | SM Energy | | | 107,098 | |

| | | | | | | | |

| | | | | | | 486,084 | |

| | | | | | | | |

| | | | Financials – 4.73% | | | | |

| | 1,180 | | | IntercontinentalExchange * | | | 156,987 | |

| | 4,410 | | | MSCI, Class A * | | | 161,362 | |

| | | | | | | | |

| | | | | | | 318,349 | |

| | | | | | | | |

| | | | | | |

Shares | | | | Market

Value | |

| | Healthcare – 12.37% | | | | |

| 3,810 | | Dentsply International | | $ | 156,439 | |

| 1,410 | | Edwards Lifesciences * | | | 116,988 | |

| 1,480 | | Henry Schein * | | | 113,575 | |

| 800 | | Perrigo | | | 83,920 | |

| 2,830 | | Quality Systems | | | 105,842 | |

| 2,030 | | Varian Medical Systems * | | | 128,743 | |

| 1,500 | | Waters * | | | 126,165 | |

| | | | | | |

| | | | | 831,672 | |

| | | | | | |

| | Industrials – 21.01% | | | | |

| 2,800 | | AMETEK | | | 140,924 | |

| 3,610 | | Donaldson | | | 125,123 | |

| 3,450 | | Expeditors International Washington | | | 138,000 | |

| 1,650 | | Fastenal | | | 77,253 | |

| 1,750 | | J.B. Hunt Transport Services | | | 96,827 | |

| 3,500 | | Jacobs Engineering Group * | | | 153,405 | |

| 1,310 | | Joy Global | | | 92,709 | |

| 5,770 | | Robert Half International | | | 171,946 | |

| 1,290 | | Roper Industries | | | 131,451 | |

| 1,500 | | Stericycle * | | | 129,900 | |

| 3,180 | | Verisk Analytics, Class A * | | | 155,661 | |

| | | | | | |

| | | | | 1,413,199 | |

| | | | | | |

| | Information Technology – 19.94% | | | | |

| 3,940 | | Altera | | | 140,146 | |

| 2,470 | | Amphenol, Class A | | | 143,606 | |

| 2,330 | | ANSYS * | | | 156,273 | |

| 1,360 | | F5 Networks * | | | 182,145 | |

| 1,150 | | FactSet Research Systems | | | 120,589 | |

| 2,220 | | Fiserv * | | | 156,044 | |

| 7,870 | | Juniper Networks * | | | 168,654 | |

| 5,410 | | NVIDIA * | | | 70,330 | |

| 7,190 | | Sapient | | | 86,064 | |

| 1,680 | | Teradata * | | | 117,230 | |

| | | | | | |

| | | | | 1,341,081 | |

| | | | | | |

| | Materials – 3.47% | | | | |

| 3,660 | | Ecolab | | | 233,105 | |

| | | | | | |

| | Total Common Stocks

(Cost $5,148,106) | | | 6,465,057 | |

| | | | | | |

| |

INVESTMENT COMPANY – 4.81% | | | | |

| 323,290 | | BlackRock Liquidity Funds TempCash Portfolio | | | 323,290 | |

| | | | | | |

| | Total Investment Company

(Cost $323,290) | | | 323,290 | |

| | | | | | |

Total Investments – 100.94%

(Cost $5,471,396)** | | | 6,788,347 | |

Net Other Assets and Liabilities – (0.94)% | | | (63,180 | ) |

| | | | | | |

Net Assets – 100.00% | | $ | 6,725,167 | |

| | | | | | |

| * | Non-income producing security. |

| ** | At April 30, 2012, cost is identical for book and Federal income tax purposes. |

| | | | |

Gross unrealized appreciation. | | $ | 1,378,686 | |

Gross unrealized depreciation. | | | (61,735 | ) |

| | | | |

Net unrealized appreciation | | $ | 1,316,951 | |

| | | | |

| | | | |

See accompanying Notes to Financial Statements. | | | | |

| | | 13 | |

| | | | |

| | | | |

Aston Funds | | | | |

ASTON/Cardinal Mid Cap Value Fund | | | April 30, 2012 | |

Schedule of Investments (unaudited) | | | | |

| | |

| | | | | | | | |

| | | | | | Market | |

| Shares | | | | | Value | |

| COMMON STOCKS – 94.81% | | | | |

| | | | Consumer Discretionary – 12.28% | | | | |

| | 750 | | | HSN | | $ | 29,025 | |

| | 410 | | | John Wiley & Sons, Class A | | | 18,528 | |

| | 1,500 | | | Six Flags Entertainment | | | 71,865 | |

| | 935 | | | Stanley Black & Decker | | | 68,405 | |

| | 1,874 | | | Virgin Media | | | 46,025 | |

| | | | | | | | |

| | | | | | | 233,848 | |

| | | | | | | | |

| | | | Consumer Staples – 3.60% | | | | |

| | 860 | | | Smucker (J.M.) | | | 68,482 | |

| | | | | | | | |

| | | | Energy – 6.77% | | | | |

| | 1,820 | | | Chesapeake Energy | | | 33,561 | |

| | 440 | | | Concho Resources * | | | 47,159 | |

| | 1,095 | | | World Fuel Services | | | 48,246 | |

| | | | | | | | |

| | | | | | | 128,966 | |

| | | | | | | | |

| | | | Financials – 18.23% | | | | |

| | 1,780 | | | Ares Capital | | | 28,551 | |

| | 6,450 | | | CapitalSource | | | 41,602 | |

| | 1,035 | | | Cash America International | | | 48,386 | |

| | 3,330 | | | CYS Investments, REIT | | | 45,721 | |

| | 650 | | | Entertainment Properties Trust, REIT | | | 31,193 | |

| | 1,430 | | | Hatteras Financial, REIT | | | 41,656 | |

| | 2,020 | | | Nelnet, Class A | | | 52,156 | |

| | 1,260 | | | Starwood Property Trust, REIT | | | 26,296 | |

| | 500 | | | T. Rowe Price Group | | | 31,558 | |

| | | | | | | | |

| | | | | | | 347,119 | |

| | | | | | | | |

| | | | Healthcare – 3.33% | | | | |

| | 311 | | | Henry Schein * | | | 23,866 | |

| | 630 | | | Teleflex | | | 39,482 | |

| | | | | | | | |

| | | | | | | 63,348 | |

| | | | | | | | |

| | | | | | |

| | | | | Market | |

Shares | | | | Value | |

| | Industrials – 12.81% | | | | |

| 1,480 | | Atlas Air Worldwide Holdings * | | $ | 68,154 | |

| 1,001 | | Equifax | | | 45,866 | |

| 3,000 | | KAR Auction Services * | | | 55,200 | |

| 1,156 | | Teledyne Technologies * | | | 74,701 | |

| | | | | | |

| | | | | 243,921 | |

| | | | | | |

| | Information Technology – 27.63% | | | | |

| 1,250 | | Atmel * | | | 11,087 | |

| 1,220 | | Broadridge Financial Solutions | | | 28,316 | |

| 3,640 | | Convergys * | | | 48,667 | |

| 760 | | Fiserv * | | | 53,420 | |

| 860 | | Global Payments | | | 39,930 | |

| 380 | | Harris | | | 17,305 | |

| 1,270 | | IAC/InterActiveCorp | | | 61,151 | |

| 1,000 | | InterDigital | | | 27,720 | |

| 555 | | Intuit | | | 32,173 | |

| 2,085 | | j2 Global | | | 53,856 | |

| 1,150 | | Skyworks Solutions * | | | 31,211 | |

| 2,100 | | ValueClick * | | | 44,478 | |

| 3,130 | | Western Union | | | 57,529 | |

| 1,240 | | Yahoo! * | | | 19,270 | |

| | | | | | |

| | | | | 526,113 | |

| | | | | | |

| | Materials – 8.87% | | | | |

| 300 | | Albemarle | | | 19,590 | |

| 610 | | FMC | | | 67,375 | |

| 1,870 | | Silgan Holdings | | | 82,037 | |

| | | | | | |

| | | | | 169,002 | |

| | | | | | |

| | Telecommunication Services – 1.29% | |

| 2,183 | | Windstream | | | 24,537 | |

| | | | | | |

| | Total Common Stocks

(Cost $1,445,921) | | | 1,805,336 | |

| | | | | | |

INVESTMENT COMPANY – 5.09% | | | | |

| 96,914 | | BlackRock Liquidity Funds

TempCash Portfolio | | | 96,914 | |

| | | | | | |

| | Total Investment Company

(Cost $96,914) | | | 96,914 | |

| | | | | | |

Total Investments – 99.90%

(Cost $1,542,835)** | | | 1,902,250 | |

| | | | | | |

Net Other Assets and Liabilities – 0.10% | | | 1,840 | |

| | | | | | |

Net Assets – 100.00% | | $ | 1,904,090 | |

| | | | | | |

| * | Non-income producing security. |

| ** | At April 30, 2012, cost is identical for book and Federal income tax purposes. |

| | | | |

Gross unrealized appreciation | | $ | 400,352 | |

Gross unrealized depreciation | | | (40,937 | ) |

| | | | |

Net unrealized appreciation | | $ | 359,415 | |

| | | | |

| REIT | Real Estate Investment Trust |

|

See accompanying Notes to Financial Statements. |

| 14 |

| |

| | | | |

Aston Funds | | | | |

ASTON/Veredus Small Cap Growth Fund (formerly the ASTON/Veredus Aggressive Growth Fund) | | | April 30, 2012 | |

Schedule of Investments (unaudited) | | | | |

| | |

| | | | | | | | |

| | | | | | Market | |

| Shares | | | | | Value | |

| COMMON STOCKS – 96.81% | | | | |

| | | | Consumer Discretionary – 22.78% | |

| | 34,708 | | | Amerigon * | | $ | 496,324 | |

| | 13,651 | | | Caribou Coffee * | | | 224,013 | |

| | 3,874 | | | DSW, Class A | | | 217,951 | |

| | 21,294 | | | Francesca’s Holdings * | | | 667,567 | |

| | 7,924 | | | Genesco * | | | 594,300 | |

| | 21,350 | | | MDC Holdings | | | 600,149 | |

| | 14,945 | | | Monro Muffler Brake | | | 616,631 | |

| | 29,673 | | | Pier 1 Imports | | | 509,782 | |

| | 11,915 | | | Select Comfort * | | | 344,105 | |

| | 34,275 | | | Sinclair Broadcast Group, Class A | | | 352,347 | |

| | 30,092 | | | Sonic Automotive, Class A | | | 506,147 | |

| | 9,832 | | | Steven Madden * | | | 424,841 | |

| | 7,090 | | | Ulta Salon Cosmetics & Fragrance | | | 625,196 | |

| | | | | | | | |

| | | | | | | 6,179,353 | |

| | | | | | | | |

| | | | Consumer Staples – 4.02% | | | | |

| | 7,760 | | | Elizabeth Arden * | | | 302,485 | |

| | 11,932 | | | Hain Celestial Group * | | | 564,384 | |

| | 13,550 | | | Schiff Nutrition International * | | | 222,898 | |

| | | | | | | | |

| | | | | | | 1,089,767 | |

| | | | | | | | |

| | | | Energy – 1.02% | | | | |

| | 20,325 | | | Matrix Service * | | | 277,436 | |

| | | | | | | | |

| | | | Financials – 8.92% | | | | |

| | 23,950 | | | Apollo Global Management LLC, Class A | | | 307,518 | |

| | 9,000 | | | Banner | | | 197,550 | |

| | 17,999 | | | Calamos Asset Management, Class A | | | 232,547 | |

| | 21,200 | | | Old National Bancorp | | | 271,784 | |

| | 12,750 | | | Piper Jaffray * | | | 309,188 | |

| | 6,692 | | | Portfolio Recovery Associates * | | | 460,543 | |

| | 9,005 | | | Post Properties, REIT | | | 438,544 | |

| | 29,666 | | | Strategic Hotels & Resorts, REIT * | | | 202,025 | |

| | | | | | | | |

| | | | | | | 2,419,699 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | Market | |

| Shares | | | | | Value | |

| | | | Healthcare – 15.34% | | | | |

| | 7,075 | | | ABIOMED * | | $ | 172,134 | |

| | 57,376 | | | Akorn * | | | 695,970 | |

| | 12,892 | | | Cepheid * | | | 495,182 | |

| | 8,575 | | | Cynosure * | | | 177,245 | |

| | 22,521 | | | Exact Sciences * | | | 242,551 | |

| | 55,925 | | | Health Management Associates, Class A * | | | 402,660 | |

| | 21,642 | | | Healthstream * | | | 496,035 | |

| | 10,225 | | | PerkinElmer | | | 282,210 | |

| | 13,280 | | | Questcor Pharmaceuticals * | | | 596,272 | |

| | 24,785 | | | Vivus * | | | 600,293 | |

| | | | | | | | |

| | | | | | | 4,160,552 | |

| | | | | | | | |

| | | | Industrials – 16.34% | | | | |

| | 9,350 | | | Acacia Research - Acacia Technologies * | �� | | 383,350 | |

| | 6,575 | | | Azz | | | 339,993 | |

| | 70,225 | | | Builders FirstSource * | | | 292,838 | |

| | 30,869 | | | Dycom Industries * | | | 722,026 | |

| | 14,950 | | | Granite Construction | | | 416,208 | |

| | 11,200 | | | Hexcel * | | | 306,656 | |

| | 29,465 | | | MasTec * | | | 512,396 | |

| | 19,828 | | | Mistras Group * | | | 465,363 | |

| | 10,675 | | | Team * | | | 316,300 | |

| | 65,900 | | | US Airways Group * | | | 676,134 | |

| | | | | | | | |

| | | | | | | 4,431,264 | |

| | | | | | | | |

| | | | Information Technology – 21.48% | |

| | 16,185 | | | ACI Worldwide * | | | 645,134 | |

| | 21,950 | | | Allot Communications * | | | 538,653 | |

| | 14,900 | | | Anaren * | | | 268,796 | |

| | 11,494 | | | Cadence Design Systems * | | | 134,134 | |

| | 32,575 | | | Callidus Software * | | | 257,994 | |

| | 9,150 | | | Cirrus Logic * | | | 250,527 | |

| | 25,550 | | | Emulex * | | | 221,774 | |

| | 18,512 | | | Heartland Payment Systems | | | 564,061 | |

| | 9,950 | | | JDS Uniphase * | | | 120,893 | |

| | 25,802 | | | LivePerson * | | | 409,736 | |

| | 13,519 | | | Manhattan Associates * | | | 677,978 | |

| | 29,100 | | | Move * | | | 253,170 | |

| | 18,125 | | | Sanmina-SCI * | | | 161,313 | |

| | 33,150 | | | ServiceSource International * | | | 549,627 | |

| | 77,772 | | | Silicon Image * | | | 466,632 | |

| | 6,400 | | | Tangoe Inc * | | | 131,072 | |

| | 25,760 | | | TeleNav * | | | 174,395 | |

| | | | | | | | |

| | | | | | | 5,825,889 | |

| | | | | | | | |

| | | | Materials – 6.91% | | | | |

| | 12,800 | | | Cabot | | | 552,064 | |

| | 16,225 | | | Eagle Materials | | | 571,445 | |

| | 11,325 | | | Kronos Worldwide | | | 268,856 | |

| | 36,950 | | | Zagg * | | | 481,459 | |

| | | | | | | | |

| | | | | | | 1,873,824 | |

| | | | | | | | |

| | | | Total Common Stocks

(Cost $22,726,111) | | | 26,257,784 | |

| | | | | | | | |

| WARRANTS – 0% | | | | |

| | | | Energy – 0.00% | | | | |

| | 4,906 | | | Magnum Hunter Resources, Expiration 10/14/13 | | | 0 | |

| | | | | | | | |

| | | | Total Warrants

(Cost $0) | | | 0 | |

| | | | | | | | |

| | | | |

See accompanying Notes to Financial Statements. | | | | |

| | | 15 | |

| | | | |

| | | | |

Aston Funds | | | | |

ASTON/Veredus Small Cap Growth Fund (formerly the ASTON/Veredus Aggressive Growth Fund) | | | April 30, 2012 | |

Schedule of Investments (unaudited) – continued | | | | |

| | |

| | | | | | |

Shares | | | | Market

Value | |

INVESTMENT COMPANY – 4.30% | | | | |

1,167,274 | | BlackRock Liquidity Funds TempCash Portfolio | | $ | 1,167,274 | |

| | | | | | |

| | Total Investment Company

(Cost $1,167,274) | | | 1,167,274 | |

| | | | | | |

Total Investments – 101.11%

(Cost $23,893,385)** | | | 27,425,058 | |

| | | | | | |

Net Other Assets and Liabilities – (1.11)% | | | (300,163 | ) |

| | | | | | |

Net Assets – 100.00% | | $ | 27,124,895 | |

| | | | | | |

| * | Non-income producing security. |

| ** | At April 30, 2012, cost is identical for book and Federal income tax purposes. |

| | | | |

Gross unrealized appreciation | | $ | 4,166,223 | |

Gross unrealized depreciation | | | (634,550 | ) |

| | | | |

Net unrealized appreciation | | $ | 3,531,673 | |

| | | | |

| REIT | Real Estate Investment Trust |

|

See accompanying Notes to Financial Statements. |

| 16 |

| |

| | | | |

Aston Funds | | | | |

ASTON Small Cap Growth Fund (formerly the ASTON/Crosswind Small Cap Growth Fund) | | | April 30, 2012 | |

Schedule of Investments (unaudited) | | | | |

| | |

| | | | | | | | |

| | | | | | Market | |

| Shares | | | | | Value | |

| COMMON STOCKS – 95.94% | | | | |

| | | | Consumer Discretionary – 11.08% | | | | |

| | 2,422 | | | G-III Apparel Group * | | $ | 65,031 | |

| | 1,180 | | | GNC Holdings, Class A | | | 46,091 | |

| | 3,438 | | | Jarden | | | 144,155 | |

| | 9,182 | | | Knology * | | | 178,590 | |

| | 55,008 | | | Office Depot * | | | 167,224 | |

| | 15,139 | | | OfficeMax * | | | 70,396 | |

| | 6,339 | | | Shutterfly * | | | 197,270 | |

| | 2,549 | | | Wolverine World Wide | | | 106,931 | |

| | | | | | | | |

| | | | | | | 975,688 | |

| | | | | | | | |

| | | | Energy – 4.03% | | | | |

| | 594 | | | CARBO Ceramics | | | 49,949 | |

| | 2,177 | | | Carrizo Oil & Gas * | | | 61,043 | |

| | 927 | | | Dril-Quip * | | | 62,471 | |

| | 18,273 | | | Magnum Hunter Resources * | | | 113,475 | |

| | 2,046 | | | Oasis Petroleum * | | | 67,661 | |

| | | | | | | | |

| | | | | | | 354,599 | |

| | | | | | | | |

| | | | Financials – 3.70% | | | | |

| | 11,136 | | | DFC Global * | | | 194,657 | |

| | 3,308 | | | Ezcorp, Class A * | | | 88,621 | |

| | 2,116 | | | Walter Investment Management REIT * | | | 42,807 | |

| | | | | | | | |

| | | | | | | 326,085 | |

| | | | | | | | |

| | | | Healthcare – 22.90% | | | | |

| | 16,075 | | | Allscripts Healthcare Solutions * | | | 178,111 | |

| | 10,090 | | | DexCom * | | | 98,781 | |

| | 7,467 | | | Hanger Orthopedic Group * | | | 175,848 | |

| | 48,068 | | | Health Management Associates, Class A * | | | 346,090 | |

| | 21,912 | | | HealthSouth * | | | 490,610 | |

| | 1,902 | | | HeartWare International * | | | 148,280 | |

| | 2,402 | | | Incyte * | | | 54,477 | |

| | 1,427 | | | Onyx Pharmaceuticals * | | | 64,943 | |

| | 35,541 | | | Tenet Healthcare * | | | 184,458 | |

| | | | | | | | |

| | | | | | Market | |

| Shares | | | | | Value | |

| | | | Health Care (continued) | | | | |

| | 7,758 | | | Threshold Pharmaceuticals * | | $ | 56,478 | |

| | 13,541 | | | Vanguard Health Systems * | | | 120,244 | |

| | 3,644 | | | Volcano * | | | 98,935 | |

| | | | | | | | |

| | | | | | | 2,017,255 | |

| | | | | | | | |

| | | | Industrials – 22.19% | | | | |

| | 5,300 | | | ACCO Brands * | | | 55,650 | |

| | 5,793 | | | DigitalGlobe * | | | 71,080 | |

| | 6,082 | | | Encore Capital Group * | | | 144,143 | |

| | 1,059 | | | Genesee & Wyoming, Class A * | | | 57,091 | |

| | 21,269 | | | Geo Group * | | | 440,481 | |

| | 8,714 | | | Hexcel * | | | 238,589 | |

| | 11,069 | | | Kelly Services, Class A | | | 154,855 | |

| | 1,496 | | | Navistar International * | | | 50,789 | |

| | 2,413 | | | Portfolio Recovery Associates * | | | 166,063 | |

| | 8,325 | | | RailAmerica * | | | 192,974 | |

| | 3,870 | | | Triumph Group | | | 243,114 | |

| | 3,174 | | | TrueBlue * | | | 54,783 | |

| | 2,051 | | | Woodward | | | 85,301 | |

| | | | | | | | |

| | | | | | | 1,954,913 | |

| | | | | | | | |

| | | | Information Technology – 27.80% | | | | |

| | 4,826 | | | ADTRAN | | | 147,290 | |

| | 4,908 | | | Ariba * | | | 187,486 | |

| | 2,118 | | | Aruba Networks * | | | 44,732 | |

| | 5,024 | | | Aspen Technology * | | | 99,375 | |

| | 14,242 | | | AVG Technologies (Netherlands) * | | | 197,252 | |

| | 7,131 | | | Fairchild Semiconductor International * | | | 101,046 | |

| | 3,044 | | | Finisar * | | | 50,287 | |

| | 2,341 | | | Fusion-io * | | | 60,047 | |

| | 1,981 | | | Infoblox * | | | 40,412 | |

| | 19,143 | | | Internap Network Services * | | | 134,767 | |

| | 8,079 | | | Kenexa * | | | 263,941 | |

| | 9,875 | | | Microsemi * | | | 212,510 | |

| | 2,988 | | | Millennial Media * | | | 56,682 | |

| | 13,182 | | | OCZ Technology Group * | | | 77,774 | |

| | 2,957 | | | Polycom * | | | 39,239 | |

| | 4,207 | | | Riverbed Technology * | | | 83,004 | |

| | 1,705 | | | Semtech * | | | 46,478 | |

| | 697 | | | Sourcefire * | | | 35,540 | |

| | 2,859 | | | Vantiv, Class A * | | | 64,385 | |

| | 4,719 | | | VeriFone Systems * | | | 224,813 | |

| | 7,704 | | | Virtusa * | | | 116,253 | |

| | 6,275 | | | Vocus * | | | 81,136 | |

| | 1,327 | | | Wright Express * | | | 84,689 | |

| | | | | | | | |

| | | | | | | 2,449,138 | |

| | | | | | | | |

| | | | Materials – 1.48% | | | | |

| | 2,486 | | | Kaiser Aluminum | | | 130,689 | |

| | | | | | | | |

| | | | Telecommunication Services – 2.76% | | | | |

| | 11,167 | | | tw telecom * | | | 243,217 | |

| | | | | | | | |

| | | | Total Common Stocks

(Cost $8,070,208) | | | 8,451,584 | |

| | | | | | | | |

| WARRANTS – 0% | | | | |

| | | | Energy – 0.00% | | | | |