AQUILA THREE PEAKS OPPORTUNITY GROWTH FUND

NOTES TO FINANCIAL STATEMENTS (continued)

DECEMBER 31, 2011

Management has reviewed the tax positions for each of the open tax years (2008-2010) or expected to be taken in the Fund’s 2011 tax returns and has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements.

| f) | Multiple class allocations: All income, expenses (other than class-specific expenses), and realized and unrealized gains or losses are allocated daily to each class of shares based on the relative net assets of each class. Class-specific expenses, which include distribution and service fees and any other items that are specifically attributed to a particular class, are also charged directly to such class on a daily basis. |

| g) | Use of estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. |

| h) | Reclassification of capital accounts: Accounting principles generally accepted in the United States of America require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. On December 31, 2011 the Fund decreased undistributed net investment loss by $60,030, decreased accumulated net gain on investments by $92,606 and increased additional paid-in capital by $32,576. These reclassifications were due to a net investment loss and tax equalization and had no effect on net assets or net asset value per share. |

| i) | Accounting pronouncements: In May 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2011-04, “Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and International Financial Reporting Standards (“IFRS”). ASU No. 2011-04 clarifies existing requirements for measuring fair value and for disclosure about fair value measurements in converged guidance of the FASB and the International Accounting Standards Board. The amendments are effective during interim and annual periods beginning after December 15, 2011. |

In December 2011, FASB issued ASU No. 2011-11 related to disclosures about offsetting assets and liabilities. The amendments in this ASU require an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The ASU is effective for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. The guidance requires retrospective application for all comparative periods presented.

Management is currently evaluating the impact these updates and amendments may have on the Fund’s financial statements.

AQUILA THREE PEAKS OPPORTUNITY GROWTH FUND

NOTES TO FINANCIAL STATEMENTS (continued)

DECEMBER 31, 2011

3. Fees and Related Party Transactions

a) Management Arrangements:

Aquila Investment Management LLC (the “Manager”), a wholly-owned subsidiary of Aquila Management Corporation, the Fund’s founder and sponsor, serves as the Manager for the Fund under an Advisory and Administration Agreement with the Fund. The portfolio management of the Fund has been delegated to a Sub-Adviser as described below. Under the Advisory and Administrative Agreement, the Manager provides all administrative services to the Fund, other than those relating to the day-to-day portfolio management. The Manager’s services include providing the office of the Fund and all related services as well as overseeing the activities of the Sub-Adviser and all the various support organizations to the Fund such as the shareholder servicing agent, custodian, legal counsel, fund accounting agent, auditors and distributor. For its services, the Manager is entitled to receive a fee which is payable monthly and computed as of the close of business each day at the annual rate of 0.90 of 1% on the Fund’s net assets up to $100 million, 0.85 of 1% on such assets above $100 million up to $250 million, and 0.80% of 1% on assets above $250 million.

Three Peaks Capital Management, LLC (the “Sub-Adviser”) serves as the Investment Sub-Adviser for the Fund under a Sub-Advisory Agreement between the Manager and the Sub-Adviser. Under this agreement, the Sub-Adviser continuously provides, subject to oversight of the Manager and the Board of Trustees of the Fund, the investment program of the Fund and the composition of its portfolio and arranges for the purchases and sales of portfolio securities. For its services, the Sub-Adviser is entitled to receive a fee from the Manager which is payable monthly and computed as of the close of business each day at the annual rate of 0.50 of 1% on the Fund’s net assets up to $100 million, 0.45 of 1% on such assets above $100 million up to $250 million, and 0.40 of 1% on assets above $250 million.

For the year ended December 31, 2011, the Fund incurred management fees of $173,746, all of which were waived. Additionally, during this period the Manager reimbursed the Fund for other expenses in the amount of $77,093. The Manager has contractually undertaken to waive fees and/or reimburse Fund expenses during the period May 1, 2011 through April 30, 2012 so that total Fund expenses will not exceed 1.50% for Class A Shares, 2.25% for Class C Shares, 1.18% for Class I Shares and 1.25% for Class Y Shares. The Sub-Adviser has agreed to waive its fee in the same proportion as the Manager is required to waive its fee in connection with the aforementioned undertaking. Beginning in fiscal 2011, for a period of three years, subsequent to the end of each of the Fund’s fiscal years, the Manager may recover from the Fund certain fees and expenses waived or reimbursed subject to contractual limitations. As of December 31, 2011, the total of these fees and expenses was $250,839 which expires on December 31, 2014.

Under a Compliance Agreement with the Manager, the Manager is compensated for Chief Compliance Officer related services provided to enable the Fund to comply with Rule 38a-1 of the Investment Company Act of 1940.

AQUILA THREE PEAKS OPPORTUNITY GROWTH FUND

NOTES TO FINANCIAL STATEMENTS (continued)

DECEMBER 31, 2011

Specific details as to the nature and extent of the services provided by the Manager are more fully defined in the Fund’s Prospectus and Statement of Additional Information.

b) Distribution and Service Fees:

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 (the “Rule”) under the Investment Company Act of 1940. Under one part of the Plan, with respect to Class A Shares, the Fund is authorized to make distribution fee payments to broker-dealers or others (“Qualified Recipients”) selected by Aquila Distributors, Inc. (the “Distributor”), including, but not limited to, any principal underwriter of the Fund, with which the Distributor has entered into written agreements contemplated by the Rule and which have rendered assistance in the distribution and/or retention of the Fund’s shares or servicing of shareholder accounts. The Fund makes payment of this distribution fee at the annual rate of 0.30% of the Fund’s average net assets represented by Class A Shares. During the period of October 15, 2010 to April 30, 2012, 0.05% of the fee has been and will continue to be waived. For the year ended December 31, 2011, $6,173 was waived. For the year ended December 31, 2011, distribution fees on Class A Shares amounted to $37,035, excluding waivers, of which the Distributor retained $2,154.

Under another part of the Plan, the Fund is authorized to make payments with respect to Class C Shares to Qualified Recipients which have rendered assistance in the distribution and/or retention of the Fund’s Class C shares or servicing of shareholder accounts. These payments are made at the annual rate of 0.75% of the Fund’s average net assets represented by Class C Shares and for the year ended December 31, 2011, amounted to $13,023. In addition, under a Shareholder Services Plan, the Fund is authorized to make service fee payments with respect to Class C Shares to Qualified Recipients for providing personal services and/or maintenance of shareholder accounts. These payments are made at the annual rate of 0.25% of the Fund’s average net assets represented by Class C Shares and for the year ended December 31, 2011, amounted to $4,341. The total of these payments with respect to Class C Shares amounted to $17,364 of which the Distributor retained $2,100.

Under another part of the Plan, the Fund is authorized to make payments with respect to Class I Shares to Qualified Recipients. Class I payments, under the Plan, may not exceed, for any fiscal year of the Fund a rate (currently 0.20%) set from time to time by the Board of Trustees of not more than 0.25% of the average annual net assets represented by the Class I Shares. In addition, the Fund has a Shareholder Services Plan under which it may pay service fees (currently 0.15%) of not more than 0.25% of the average annual net assets of the Fund represented by Class I Shares. That is, the total payments under both plans will not exceed 0.50% of such net assets. For the year ended December 31, 2011, these payments were made at the average annual rate of 0.35% of such net assets and amounted to $63 of which $36 related to the Plan and $27 related to the Shareholder Services Plan.

Specific details about the Plans are more fully defined in the Fund’s Prospectus and Statement of Additional Information.

AQUILA THREE PEAKS OPPORTUNITY GROWTH FUND

NOTES TO FINANCIAL STATEMENTS (continued)

DECEMBER 31, 2011

Under a Distribution Agreement, the Distributor serves as the exclusive distributor of the Fund’s shares. Through agreements between the Distributor and various brokerage and advisory firms (“intermediaries”), the Fund’s shares are sold primarily through these intermediaries with the bulk of any sales commissions inuring to such intermediaries. For the year ended December 31, 2011, total commissions on sales of Class A Shares amounted to $124,315 of which the Distributor received $11,300.

c) Other Related Party Transactions:

On June 1, 2011, Bingham McCutchen LLP replaced Butzel Long PC (“Butzel”) as counsel to the Fund. During the period January 1, 2011 to May 31, 2011, the Fund incurred $40,470 of legal fees allocable to Butzel for legal services in conjunction with the Fund’s ongoing operations. During this period, the Fund’s former Secretary was Of Counsel to Butzel.

4. Purchases and Sales of Securities

During the year ended December 31, 2011, purchases of securities and proceeds from the sales of securities (excluding short-term investments) aggregated $13,162,141 and $7,208,732, respectively.

At December 31, 2011, the aggregate tax cost for all securities was $18,995,398. At December 31, 2011, the aggregate gross unrealized appreciation for all securities in which there is an excess of market value over tax cost amounted to $1,392,197 and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over market value amounted to $1,939,541 for a net unrealized depreciation of $547,344.

5. Expenses

The Fund has negotiated an expense offset arrangement with its custodian wherein it receives credit toward the reduction of custodian fees and other Fund expenses whenever there are uninvested cash balances. The Statement of Operations reflects the total expenses before any offset, the amount of offset and the net expenses.

6. Portfolio Orientation

The Fund may invest no less than 70% of its net assets in equity securities believed to have the potential for capital appreciation. The Fund may invest in a range of stock market capitalizations that could include small-cap, mid-cap, and large cap. Thus the Fund may invest in common stocks without regard to whether they could be described as “growth” or “value”. The Fund may, from time-to-time, hold as much as 30% of its net assets in fixed-income securities including lower quality corporate debt securities (often referred to as high yield or “junk” bonds). These bonds generally have a greater credit risk than other types of fixed-income securities.

AQUILA THREE PEAKS OPPORTUNITY GROWTH FUND

NOTES TO FINANCIAL STATEMENTS (continued)

DECEMBER 31, 2011

7. Capital Share Transactions

a) Transactions in Capital Shares of the Fund were as follows:

| | | Year Ended | | | Year Ended | |

| | | December 31, 2011 | | | December 31, 2010 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Class A Shares: | | | | | | | | | | | | |

| Proceeds from shares sold | | | 212,236 | | | $ | 5,747,454 | | | | 162,683 | | | $ | 4,211,631 | |

| Reinvested distributions | | | 41,885 | | | | 960,843 | | | | – | | | | – | |

| Cost of shares redeemed | | | (112,449 | ) | | | (3,004,779 | )(a) | | | (163,656 | ) | | | (3,844,553 | )(a) |

| Net change | | | 141,672 | | | | 3,703,518 | | | | (973 | ) | | | 367,078 | |

| Class C Shares: | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | 82,163 | | | | 2,009,564 | | | | 20,684 | | | | 480,090 | |

| Reinvested distributions | | | 6,844 | | | | 137,223 | | | | – | | | | – | |

| Cost of shares redeemed | | | (36,489 | ) | | | (848,131 | ) | | | (15,601 | ) | | | (325,494 | ) |

| Net change | | | 52,518 | | | | 1,298,656 | | | | 5,083 | | | | 154,596 | |

| Class I Shares: | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | 309 | | | | 8,007 | | | | 520 | | | | 13,250 | |

| Reinvested distributions | | | 93 | | | | 2,188 | | | | – | | | | – | |

| Cost of shares redeemed | | | (362 | ) | | | (9,809 | ) | | | – | | | | – | |

| Net change | | | 40 | | | | 386 | | | | 520 | | | | 13,250 | |

| Class Y Shares: | | | | | | | | | | | | | | | | |

| Proceeds from shares sold | | | 157,869 | | | | 4,473,884 | | | | 100,521 | | | | 2,680,454 | |

| Reinvested distributions | | | 18,804 | | | | 450,531 | | | | – | | | | – | |

| Cost of shares redeemed | | | (91,441 | ) | | | (2,389,889 | )(b) | | | (4,341 | ) | | | (105,223 | )(b) |

| Net change | | | 85,232 | | | | 2,534,526 | | | | 96,180 | | | | 2,575,231 | |

| Total transactions in Fund | | | | | | | | | | | | | | | | |

| shares | | | 279,462 | | | $ | 7,537,086 | | | | 100,810 | | | $ | 3,110,155 | |

(a) Net of short-term trading redemption fees of $3,500 and $408 for 2011 and 2010, respectively. (See note 7b)

(b) Net of short-term trading redemption fees of $4,020 and $148 for 2011 and 2010, respectively. (See note 7b)

| b) | Short-Term Trading Redemption Fee: The Fund and the Distributor may reject any order for the purchase of shares, on a temporary or permanent basis, from investors exhibiting a pattern of frequent or short-term trading in Fund shares. In addition, the Fund imposes a redemption fee of 2.00% of the shares’ redemption value on any redemption of Class A Shares on which a sales charge is not imposed or of Class I and Class Y Shares, if the redemption occurs within 90 days of purchase. The fee is paid to the Fund and is designed |

AQUILA THREE PEAKS OPPORTUNITY GROWTH FUND

NOTES TO FINANCIAL STATEMENTS (continued)

DECEMBER 31, 2011

to offset the costs to the Fund caused by short-term trading in Fund shares. The Fund retains the fee charged as paid-in capital which becomes part of the Fund’s daily net asset value (NAV) calculation. The fee does not apply to shares sold under an Automatic Withdrawal Plan, or sold due to the shareholder’s death or disability.

8. Income Tax Information and Distributions

The Fund declares annual distributions to shareholders from net investment income, if any, and from net realized capital gains, if any. Distributions are recorded by the Fund on the ex-dividend date and paid in additional shares at the net asset value per share, in cash, or in a combination of both, at the shareholder’s option. Dividends from net investment income and distributions from realized gains from investment transactions are determined in accordance with Federal income tax regulations, which may differ from investment income and realized gains determined under generally accepted accounting principles. These “book/tax” differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences do not require reclassification. To the extent dividends exceed net investment income and net realized capital gains for tax purposes, they are reported as distributions from paid-in capital. As of December 31, 2011, there were post October capital loss deferrals of $72,311 which will be recognized in the following year.

The tax character of distributions:

| | | Year Ended December 31, | |

| | | 2011 | | | 2010 | |

| Ordinary income | | $ | 4,208 | | | $ | – | |

| Long-term capital gain | | | 1,927,599 | | | | – | |

| | | $ | 1,931,807 | | | $ | – | |

| | |

| As of December 31, 2011, the components of distributable earnings on a tax basis were as follows: | |

| | |

| Accumulated net realized gains | | $ | 1,860 | | | | | |

| Deferred post October losses | | | (72,311 | ) | | | | |

| Undistributed net investment income | | | 12,842 | | | | | |

| Unrealized appreciation | | | (547,344 | ) | | | | |

| | | $ | (604,953 | ) | | | | |

AQUILA THREE PEAKS OPPORTUNITY GROWTH FUND

FINANCIAL HIGHLIGHTS

For a share outstanding throughout each period

| | | Class A | | Class C |

| | | Year Ended December 31, | | Year Ended December 31, |

| | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 |

| | |

| Net asset value, beginning of period | | $ | 26.64 | | | $ | 22.95 | | | $ | 17.57 | | | $ | 30.39 | | | $ | 32.47 | | | | 23.81 | | | $ | 20.67 | | | $ | 15.94 | | | $ | 27.84 | | | $ | 30.11 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | (0.08 | ) | | | (0.09 | ) | | | (0.05 | ) | | | (0.17 | ) | | | (0.20 | ) | | | (0.24 | ) | | | (0.23 | ) | | | (0.18 | ) | | | (0.33 | ) | | | (0.42 | ) |

Net gain (loss) on securities (both realized and unrealized) | | | (1.00 | ) | | | 3.78 | | | | 5.43 | | | | (12.31 | ) | | | (0.19 | ) | | | (0.89 | ) | | | 3.37 | | | | 4.91 | | | | (11.23 | ) | | | (0.16 | ) |

| Total from investment operations | | | (1.08 | ) | | | 3.69 | | | | 5.38 | | | | (12.48 | ) | | | (0.39 | ) | | | (1.13 | ) | | | 3.14 | | | | 4.73 | | | | (11.56 | ) | | | (0.58 | ) |

| Less distributions (note 8): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions from capital gains | | | (2.64 | ) | | | – | | | | – | | | | (0.34 | ) | | | (1.69 | ) | | | (2.64 | ) | | | – | | | | – | | | | (0.34 | ) | | | (1.69 | ) |

| Paid-in capital from redemption fees (note 7b) | | | 0.01 | | | | – | | | | – | | | | – | | | | – | | | | – | (4) | | | – | (4) | | | – | (4) | | | – | (4) | | | – | (4) |

| Net asset value, end of period | | $ | 22.93 | | | $ | 26.64 | | | $ | 22.95 | | | $ | 17.57 | | | $ | 30.39 | | | $ | 20.04 | | | $ | 23.81 | | | $ | 20.67 | | | $ | 15.94 | | | $ | 27.84 | |

| Total return | | | (4.01 | )%(2) | | | 16.08 | %(2) | | | 30.62 | %(2) | | | (41.07 | )%(2) | | | (1.34 | )%(2) | | | (4.74 | )%(3) | | | 15.19 | %(3) | | | 29.67 | %(3) | | | (41.53 | )%(3) | | | (2.08 | )%(3) |

| Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 11,904 | | | $ | 10,053 | | | $ | 8,682 | | | $ | 8,822 | | | $ | 20,950 | | | $ | 1,772 | | | $ | 855 | | | $ | 637 | | | $ | 940 | | | $ | 2,845 | |

| Ratio of expenses to average net assets | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 1.51 | % | | | 1.54 | % | | | 2.25 | % | | | 2.25 | % | | | 2.25 | % | | | 2.26 | % | | | 2.29 | % |

Ratio of net investment loss to average net assets | | | (0.31 | )% | | | (0.40 | )% | | | (0.26 | )% | | | (0.67 | )% | | | (0.64 | )% | | | (1.03 | )% | | | (1.11 | )% | | | (1.04 | )% | | | (1.43 | )% | | | (1.38 | )% |

| Portfolio turnover rate | | | 39 | % | | | 116 | % | | | 3 | % | | | 4 | % | | | 17 | % | | | 39 | % | | | 116 | % | | | 3 | % | | | 4 | % | | | 17 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| The expense and net investment income ratios without the effect of the contractual expense cap were (note 3): | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 2.87 | % | | | 7.47 | % | | | 4.79 | % | | | 3.51 | % | | | 2.73 | % | | | 3.50 | % | | | 8.27 | % | | | 5.58 | % | | | 4.22 | % | | | 3.47 | % |

Ratio of net investment loss to average net assets | | | (1.68 | )% | | | (6.37 | )% | | | (3.55 | )% | | | (2.68 | )% | | | (1.82 | )% | | | (2.27 | )% | | | (7.13 | )% | | | (4.37 | )% | | | (3.39 | )% | | | (2.56 | )% |

| | | | | | | | | | | | | | | | | | |

| The expense ratios after giving effect to the contractual expense cap and expense offset for uninvested cash balances were (note 3): | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 2.25 | % | | | 2.25 | % | | | 2.25 | % | | | 2.25 | % | | | 2.25 | % |

_______________

(1) Per share amounts have been calculated using the daily average shares method.

(2) Not reflecting sales charges.

(3) Not reflecting CDSC.

(4) Not applicable.

Note: On October 15, 2010, the Fund began operations under the name Aquila Three Peaks Opportunity Growth Fund, with Three Peaks Capital Management, LLC as investment sub-adviser and an investment strategy that differs meaningfully from the prior strategy pursued by the Fund.

See accompanying notes to financial statements.

AQUILA THREE PEAKS OPPORTUNITY GROWTH FUND

FINANCIAL HIGHLIGHTS (continued)

For a share outstanding throughout each period

| | | Class I | | | Class Y | |

| | | Year Ended December 31, | | | Year Ended December 31, | |

| | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 |

| Net asset value, beginning of period | | $ | 27.08 | | | $ | 23.24 | | | $ | 17.73 | | | $ | 30.58 | | | $ | 32.51 | | | $ | 27.63 | | | $ | 23.74 | | | $ | 18.13 | | | $ | 31.25 | | | $ | 33.25 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | 0.04 | | | | 0.06 | | | | 0.03 | | | | (0.11 | ) | | | (0.14 | ) | | | (0.02 | ) | | | 0.08 | | | | (0.01 | ) | | | (0.11 | ) | | | (0.12 | ) |

Net gain (loss) on securities (both realized and unrealized) | | | (1.03 | ) | | | 3.78 | | | | 5.48 | | | | (12.40 | ) | | | (0.10 | ) | | | (1.03 | ) | | | 3.81 | | | | 5.62 | | | | (12.67 | ) | | | (0.19 | ) |

| Total from investment operations | | | (0.99 | ) | | | 3.84 | | | | 5.51 | | | | (12.51 | ) | | | (0.24 | ) | | | (1.05 | ) | | | 3.89 | | | | 5.61 | | | | (12.78 | ) | | | (0.31 | ) |

| Less distributions (note 8): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distributions from capital gains | | | (2.64 | ) | | | – | | | | – | | | | (0.34 | ) | | | (1.69 | ) | | | (2.64 | ) | | | – | | | | – | | | | (0.34 | ) | | | (1.69 | ) |

| Paid-in capital from redemption fees (note 7b) | | | – | | | | – | | | | – | | | | – | | | | – | | | | 0.02 | | | | – | | | | – | | | | – | | | | – | |

| Net asset value, end of period | | $ | 23.45 | | | $ | 27.08 | | | $ | 23.24 | | | $ | 17.73 | | | $ | 30.58 | | | $ | 23.96 | | | $ | 27.63 | | | $ | 23.74 | | | $ | 18.13 | | | $ | 31.25 | |

| Total return | | | (3.65 | )% | | | 16.52 | % | | | 31.08 | % | | | (40.92 | )% | | | (0.87 | )% | | | (3.72 | )% | | | 16.39 | % | | | 30.94 | % | | | (40.90 | )% | | | (1.07 | )% |

| Ratios/supplemental data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 21 | | | $ | 24 | | | $ | 8 | | | $ | 6 | | | $ | 11 | | | $ | 4,799 | | | $ | 3,178 | | | $ | 447 | | | $ | 558 | | | $ | 1,667 | |

| Ratio of expenses to average net assets | | | 1.13 | % | | | 1.13 | % | | | 1.12 | % | | | 1.30 | % | | | 1.38 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.26 | % | | | 1.29 | % |

Ratio of net investment income (loss) to average net assets | | | 0.14 | % | | | 0.26 | % | | | 0.14 | % | | | (0.46 | )% | | | (0.46 | )% | | | (0.06 | )% | | | 0.31 | % | | | (0.03 | )% | | | (0.43 | )% | | | (0.39 | )% |

| Portfolio turnover rate | | | 39 | % | | | 116 | % | | | 3 | % | | | 4 | % | | | 17 | % | | | 39 | % | | | 116 | % | | | 3 | % | | | 4 | % | | | 17 | % |

| | | | | | | | | | | | | | | | | | | | | | |

| The expense and net investment income ratios without the effect of the contractual expense cap were (note 3): | |

| | | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 2.76 | % | | | 8.68 | % | | | 4.40 | % | | | 3.37 | % | | | 2.55 | % | | | 2.52 | % | | | 9.48 | % | | | 4.55 | % | | | 3.21 | % | | | 2.48 | % |

Ratio of net investment loss to average net assets | | | (1.48 | )% | | | (7.29 | )% | | | (3.14 | )% | | | (2.53 | )% | | | (1.63 | )% | | | (1.34 | )% | | | (7.93 | )% | | | (3.33 | )% | | | (2.38 | )% | | | (1.59 | )% |

| | | | | | | | | | | | | | | | | | |

| The expense ratios after giving effect to the contractual expense cap and expense offset for uninvested cash balances were: | |

| | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 1.13 | % | | | 1.13 | % | | | 1.12 | % | | | 1.29 | % | | | 1.34 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % |

_______________

(1) Per share amounts have been calculated using the daily average shares method.

Note: On October 15, 2010, the Fund began operations under the name Aquila Three Peaks Opportunity Growth Fund, with Three Peaks Capital Management, LLC as investment sub-adviser and an investment strategy that differs meaningfully from the prior strategy pursued by the Fund.

See accompanying notes to financial statements.

| Additional Information (unaudited) | | | | | | |

| | | | | | | | | |

Trustees(1) | | | | | | | | |

| and Officers | | | | | | | | |

| | | | | | | Number of | | |

| | | Positions | | | | Portfolios | | |

| | | Held with | | | | in Fund | | |

| Name, | | Fund and | | Principal | | Complex | | Other Directorships |

Address(2) | | Length of | | Occupation(s) | | Overseen | | Held by Trustee |

| and Date of Birth | | Service(3) | | During Past 5 Years | | by Trustee | | During Past 5 Years |

| |

Interested Trustee(4) |

| | | | | | | | | |

Diana P. Herrmann New York, NY (02/25/58) | | Trustee since 1997 and President since 2002 | | Vice Chair and Chief Executive Officer of Aquila Management Corporation, Founder of the Aquila Group of Funds(5) and parent of Aquila Investment Management LLC, Manager, since 2004, President since 1997, Chief Operating Officer, 1997-2008, a Director since 1984, Secretary since 1986 and previously its Executive Vice President, Senior Vice President or Vice President, 1986-1997; Chief Executive Officer and Vice Chair since 2004, President and Manager since 2003, and Chief Operating Officer (2003-2008), of the Manager; Chair, Vice Chair, President, Executive Vice President and/or Senior Vice President of funds in the Aquila Group of Funds since 1986; Director of the Distributor since 1997; Governor, Investment Company Institute (the trade organization for the U.S. mutual fund industry dedicated to protecting shareholder interests and educating the public about investing) for various periods since 2004, and head of its Small Funds Committee, 2004-2009; active in charitable and volunteer organizations. | | 12 | | ICI Mutual Insurance Company, a Risk Retention Group (2006-2009 and since 2010) |

| | | | | | | | | |

Non-interested Trustees |

| | | | | | | | | |

Tucker Hart Adams Colorado Springs, CO (01/11/38) | | Chair of the Board of Trustees since 2005 and Trustee since 1993 | | Senior Partner, Summit Economics, since 2010; President, The Adams Group, an economic consulting firm, 1989-2010; formerly Chief Economist, United Banks of Colorado; currently or formerly active with numerous professional and community organizations. | | 4 | | Trustee, Colorado Health Facilities Authority; advisory board, Griffis/Blessings, Inc. (commercial property development and management); advisory board, Kachi Partners (middle market buyouts); formerly Director, Touch America and Mortgage Analysis Computer Corp. |

| | | | | | | | | |

| | | | | | | Number of | | |

| | | Positions | | | | Portfolios | | |

| | | Held with | | | | in Fund | | |

| Name, | | Fund and | | Principal | | Complex | | Other Directorships |

Address(2) | | Length of | | Occupation(s) | | Overseen | | Held by Trustee |

| and Date of Birth | | Service(3) | | During Past 5 Years | | by Trustee | | During Past 5 Years |

| | | | | | | | | |

Gary C. Cornia Orem, UT (06/24/48) | | Trustee since 2002 | | Dean, Marriott School of Management, Brigham Young University, since 2008; Director, Romney Institute of Public Management, Marriott School of Management, 2004-2008; Professor, Marriott School of Management, 1980-present; Past President, National Tax Association; Fellow, Lincoln Institute of Land Policy, 2002-present; Associate Dean, Marriott School of Management, Brigham Young University, 1991-2000; member, Utah Governor’s Tax Review Committee, 1993-2009. | | 5 | | Utah Foundation, Salt Lake City, UT; formerly director, Lincoln Institute of Land Policy, Cambridge, MA |

| | | | | | | | | |

Grady Gammage, Jr. Phoenix, AZ (10/01/51) | | Trustee since 2004 | | Founding partner, Gammage & Burnham, PLC, a law firm, Phoenix, Arizona, since 1983; director, Central Arizona Water Conservation District, 1992-2004; director, Arizona State University Foundation since 1998; Senior Fellow, Morrison Institute for Public Policy; active with Urban Land Institute. | | 4 | | None |

| | | | | | | | | |

Glenn P. O’Flaherty Denver, CO (08/03/58) | | Trustee since 2007 | | Chief Financial Officer and Chief Operating Officer of Lizard Investors, LLC, February-December 2008; Co-Founder, Chief Financial Officer and Chief Compliance Officer of Three Peaks Capital Management, LLC, 2003-2005; Vice President –Investment Accounting, Global Trading and Trade Operations, Janus Capital Corporation, and Chief Financial Officer and Treasurer, Janus Funds, 1991-2002. | | 3 | | Trustee of the Pacific Capital Funds of Cash Assets Trust (Aquila Money-Market Funds) 2009-2012 |

The specific experience, qualifications, attributes or skills that led to the conclusion that these persons should serve as Trustees of the Fund at this time in light of the Fund’s business and structure, in addition to those listed above, were as follows.

| Diana P. Herrmann: | Over 25 years of experience in mutual fund management. |

| | |

| Tucker Hart Adams: | Experienced economist. |

| | |

| Gary C. Cornia: | Experienced educator in business and finance. |

| | |

| Grady Gammage, Jr.: | Lawyer, educator, active in land use, water issues and other public affairs. |

| | |

| Glenn P. O’Flaherty: | Knowledgeable about financial markets and operation of mutual funds. |

References to the qualifications, attributes and skills of Trustees are pursuant to requirements of the Securities and Exchange Commission (the “SEC”), do not constitute holding out of the Board or any Trustee as having any special expertise or experience, and shall not impose any greater responsibility or liability on any such person or on the Board by reason thereof.

| | | | | |

| | | | | |

| | | Positions | | |

| | | Held with | | |

| Name, | | Fund and | | |

Address(2) | | Length of | | |

| and Date of Birth | | Service(3) | | Principal Occupation(s) During Past 5 Years |

| |

Chairman Emeritus(6) |

| | | | | |

Lacy B. Herrmann New York, NY (05/12/29) | | Founder and Chairman Emeritus since 2006, Chairman of the Board of Trustees, 1993-2005 | | Founder and Chairman of the Board, Aquila Management Corporation, the sponsoring organization and parent of the Manager or Administrator and/or Adviser to each fund of the Aquila Group of Funds; Chairman of the Manager or Administrator and/or Adviser to each since 2004; Founder and Chairman Emeritus of each fund in the Aquila Group of Funds; previously Chairman and a Trustee of each fund in the Aquila Group of Funds since its establishment until 2004 or 2005; Director of the Distributor since 1981 and formerly Vice President or Secretary, 1981-1998; Director or trustee, Premier VIT, 1994-2009; Director or trustee of Oppenheimer Quest Value Funds Group, Oppenheimer Small Cap Value Fund, Oppenheimer Midcap Fund, 1987-2009, and Oppenheimer Rochester Group of Funds, 1995-2009; Trustee Emeritus, Brown University and the Hopkins School; active in university, school and charitable organizations. |

| | | | | |

Officers |

| | | | | |

Charles E. Childs, III New York, NY (04/01/57) | | Executive Vice President since 2006 and Secretary since 2011 | | Executive Vice President of all funds in the Aquila Group of Funds and the Manager and the Manager’s parent since 2003; Chief Operating Officer of the Manager and the Manager’s parent since 2008; Secretary of all funds in the Aquila Group of Funds since 2011; formerly Senior Vice President, corporate development, Vice President, Assistant Vice President and Associate of the Manager’s parent since 1987; Senior Vice President, Vice President or Assistant Vice President of the Aquila money-market Funds, 1988-2003. |

| | | | | |

Marie E. Aro Denver, CO (02/10/55) | | Senior Vice President since 2004 | | Co-President of the Distributor since 2010, Vice President, 1993-1997; Senior Vice President, Aquila Three Peaks Opportunity Growth Fund since 2004; Senior Vice President, Tax-Free Trust of Arizona since 2010 and Vice President, 2004-2010; Senior Vice President, Aquila Three Peaks High Income Fund since 2006; Senior Vice President, Churchill Tax-Free Fund of Kentucky, Hawaiian Tax-Free Trust, Narragansett Insured Tax-Free Income Fund, Tax-Free Fund of Colorado, Tax-Free Fund For Utah and Tax-Free Trust of Oregon since 2010; Vice President, INVESCO Funds Group, 1998-2003. |

| | | | | |

Paul G. O’Brien Charlotte, NC (11/28/59) | | Senior Vice President since 2010 | | Co-President, Aquila Distributors, Inc. since 2010, Managing Director, 2009-2010; Senior Vice President of Aquila Three Peaks High Income Fund, Aquila Three Peaks Opportunity Growth Fund, and each of the Aquila Municipal Bond Funds since 2010; held various positions to Senior Vice President and Chief Administrative Officer of Evergreen Investments Services, Inc., 1997-2008; Mergers and Acquisitions Coordinator for Wachovia Corporation, 1994-1997. |

| | | | | |

| | | | | |

| | | Positions | | |

| | | Held with | | |

| Name, | | Fund and | | |

Address(2) | | Length of | | |

| and Date of Birth | | Service(3) | | Principal Occupation(s) During Past 5 Years |

| |

Stephen J. Caridi New York, NY (05/06/61) | | Vice President since 2006 | | Vice President of the Distributor since 1995; Vice President, Hawaiian Tax-Free Trust since 1998; Senior Vice President, Narragansett Insured Tax-Free Income Fund since 1998, Vice President 1996-1997; Senior Vice President, Tax-Free Fund of Colorado 2004-2009; Vice President, Aquila Three Peaks Opportunity Growth Fund since 2006. |

| | | | | |

Sherri Foster Lahaina, HI (07/27/50) | | Vice President since 2006 | | Senior Vice President, Hawaiian Tax-Free Trust since 1993 and formerly Vice President or Assistant Vice President; Vice President since 1997 and formerly Assistant Vice President of the three Aquila Money-Market Funds; Vice President, Aquila Three Peaks Opportunity Growth Fund since 2006; Registered Representative of the Distributor since 1985. |

| | | | | |

Jason T. McGrew Elizabethtown, KY (08/14/71) | | Vice President since 2006 | | Vice President, Churchill Tax-Free Fund of Kentucky since 2001, Assistant Vice President, 2000-2001; Vice President, Aquila Three Peaks Opportunity Growth Fund since 2006; Investment Broker with Raymond James Financial Services 1999-2000 and with J.C. Bradford and Company 1997-1999; Associate Broker at Prudential Securities 1996-1997. |

| | | | | |

Christine L. Neimeth Portland, OR (02/10/64) | | Vice President since 1999 | | Vice President of Aquila Three Peaks Opportunity Growth Fund and Tax-Free Trust of Oregon. |

| | | | | |

Alan R. Stockman Glendale, AZ (07/31/54) | | Vice President since 1999 | | Senior Vice President, Tax-Free Fund of Colorado, since 2009; Senior Vice President, Tax-Free Trust of Arizona since 2001, Vice President, 1999-2001; Vice President, Aquila Three Peaks Opportunity Growth Fund since 1999; Bank One, Commercial Client Services representative, 1997-1999; Trader and Financial Consultant, National Bank of Arizona (Zions Investment Securities Inc.), Phoenix, Arizona 1996-1997. |

| | | | | |

M. Kayleen Willis Salt Lake City, UT (06/11/63) | | Vice President since 2004 | | Vice President, Tax-Free Fund For Utah since September 2003, Assistant Vice President, 2002-2003; Vice President, Aquila Three Peaks Opportunity Growth Fund, since 2004. |

| | | | | |

Robert S. Driessen New York, NY (10/12/47) | | Chief Compliance Officer since 2009 | | Chief Compliance Officer of each fund in the Aquila Group of Funds, the Manager and the Distributor since 2009; Vice President, Chief Compliance Officer, Curian Capital, LLC, 2004-2008; Vice President, Chief Compliance Officer, Phoenix Investment Partners, Ltd., 1999- 2004; Vice President, Risk Liaison, Corporate Compliance, Bank of America, 1996-1999; Vice President, Securities Compliance, Prudential Insurance Company of America, 1993-1996; various positions to Branch Chief, U.S. Securities and Exchange Commission, 1972-1993. |

| | | | | |

| | | | | |

| | | Positions | | |

| | | Held with | | |

| Name, | | Fund and | | |

Address(2) | | Length of | | |

| and Date of Birth | | Service(3) | | Principal Occupation(s) During Past 5 Years |

| |

Joseph P. DiMaggio New York, NY (11/06/56) | | Chief Financial Officer since 2003 and Treasurer since 2000 | | Chief Financial Officer of each fund in the Aquila Group of Funds since 2003 and Treasurer since 2000. |

| | | | | |

Yolonda S. Reynolds New York, NY (04/23/60) | | Assistant Treasurer since 2010 | | Assistant Treasurer of each fund in the Aquila Group of Funds since 2010; Director of Fund Accounting for the Aquila Group of Funds since 2007; Investment Accountant, TIAA-CREF, 2007; Senior Fund Accountant, JP Morgan Chase, 2003-2006. |

| | | | | |

Lori A. Vindigni New York, NY (11/02/66) | | Assistant Treasurer since 2000 | | Assistant Treasurer of each fund in the Aquila Group of Funds since 2000; Assistant Vice President of the Manager or its predecessor and current parent since 1998; Fund Accountant for the Aquila Group of Funds, 1995-1998. |

____________________

(1) The Fund’s Statement of Additional Information includes additional information about the Trustees and is available, without charge, upon request by calling 800-437-1020 (toll-free) or by visiting www.aquilafunds.com or the EDGAR Database at the SEC’s internet site at www.sec.gov.

(2) The mailing address of each Trustee and officer is c/o Aquila Three Peaks Opportunity Growth Fund, 380 Madison Avenue, Suite 2300, New York, NY 10017.

(3) Because the Fund does not hold annual meetings, each Trustee holds office for an indeterminate term. The term of office of each officer is one year.

(4) Ms. Herrmann is an interested person of the Fund as an officer of the Fund, as a director, officer and shareholder of the Manager’s corporate parent, as an officer and Manager of the Manager, and as a shareholder and director of the Distributor. Ms. Herrmann is the daughter of Lacy B. Herrmann, the Founder and Chairman Emeritus of the Fund.

(5) The “Aquila Group of Funds” includes: Tax-Free Trust of Arizona, Tax-Free Fund of Colorado, Hawaiian Tax-Free Trust, Churchill Tax-Free Fund of Kentucky, Tax-Free Trust of Oregon, Narragansett Insured Tax-Free Income Fund (Rhode Island) and Tax-Free Fund For Utah, each of which is a tax-free municipal bond fund and are called the “Aquila Municipal Bond Funds”; Aquila Three Peaks Opportunity Growth Fund, which is an equity fund; and Aquila Three Peaks High Income Fund, which is a high-income corporate bond fund.

(6) The Chairman Emeritus may attend Board meetings but has no voting power.

Analysis of Expenses (unaudited)

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs, including front-end sales charges with respect to Class A shares or contingent deferred sales charges (“CDSC”) with respect to Class C shares; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. The table below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The table below is based on an investment of $1,000 invested on July 1, 2011 and held for the six months ended December 31, 2011.

Actual Expenses

This table provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Six months ended December 31, 2011

| | Actual | | | |

| | Total Return | Beginning | Ending | Expenses |

| | Without | Account | Account | Paid During |

| | Sales Charges(1) | Value | Value | the Period(2) |

| Class A | (10.53)% | $1,000.00 | $894.70 | $ 7.16 |

| Class C | (10.88)% | $1,000.00 | $891.20 | $10.73 |

| Class I | (10.37)% | $1,000.00 | $896.30 | $ 5.64 |

| Class Y | (10.37)% | $1,000.00 | $896.30 | $ 5.97 |

| (1) | Assumes reinvestment of all dividends and capital gain distributions, if any, at net asset value and does not reflect the deduction of the applicable sales charges with respect to Class A shares or the applicable contingent deferred sales charges (“CDSC”) with respect to Class C shares. Total return is not annualized, as it may not be representative of the total return for the year. |

| (2) | Expenses are equal to the annualized expense ratio of 1.50%, 2.25%, 1.18% and 1.25% for the Fund’s Class A, C, I and Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

Analysis of Expenses (unaudited) (continued)

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of other mutual funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs with respect to Class A shares. The example does not reflect the deduction of contingent deferred sales charges (“CDSC”) with respect to Class C shares. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different mutual funds. In addition, if these transaction costs were included, your costs would have been higher.

Six months ended December 31, 2011

| | Hypothetical | | | |

| | Annualized | Beginning | Ending | Expenses |

| | Total | Account | Account | Paid During |

| | Return | Value | Value | the Period(1) |

| Class A | 5.00% | $1,000.00 | $1,017.64 | $ 7.63 |

| Class C | 5.00% | $1,000.00 | $1,013.86 | $11.42 |

| Class I | 5.00% | $1,000.00 | $1,019.26 | $ 6.01 |

| Class Y | 5.00% | $1,000.00 | $1,018.90 | $ 6.36 |

| (1) | Expenses are equal to the annualized expense ratio of 1.50%, 2.25%, 1.18% and 1.25% for the Fund’s Class A, C , I and Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

Information Available (unaudited)

Much of the information that the funds in the Aquila Group of Funds produce is automatically sent to you and all other shareholders. Specifically, you are routinely sent your Fund’s entire list of portfolio securities twice a year in the semi-annual and annual reports you receive. Additionally, under Fund policies, the Fund may also disclose other portfolio holdings as of a specified date (currently the Fund discloses its five largest holdings by value as of the close of the last business day of each calendar quarter in a posting to its website on approximately the 30th business day following the month end). Such information remains accessible until the next schedule is made publicly available. You may obtain a copy of the Fund’s portfolio holdings schedule for the most recently completed period by visiting the Fund’s website at www.aquilafunds.com. Whenever you wish to see a listing of your Fund’s portfolio other than in your shareholder reports, please check our website at www.aquilafunds.com or call us at 1-800-437-1020.

The Fund additionally files a complete list of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available free of charge on the SEC website at www.sec.gov. You may also review or, for a fee, copy the forms at the SEC’s Public Reference Room in Washington, D.C. or by calling 1-800-SEC-0330.

Proxy Voting Record (unaudited)

Proxy Voting Guidelines and Procedures of the Fund are available without charge, upon request, by calling our toll-free number (1-800-437-1020). This information is also available at www.aquilafunds.com/ATPOGF/ATPOGFproxy.htm or on the SEC’s website www.sec.gov.

Federal Tax Status of Distributions (unaudited)

This information is presented in order to comply with a requirement of the Internal Revenue Code and no current action on the part of shareholders is required.

For the calendar year ended December 31, 2011, 99.78% of distributions paid by Aquila Three Peaks Opportunity Growth Fund during calendar year 2011 are taxable as long-term capital gains, and the balance (0.22%) was ordinary income.

Prior to February 15, 2012, shareholders were mailed the appropriate tax form(s) which contained information on the status of distributions paid for the 2011 calendar year.

Additional Information (unaudited)

Renewal of the Advisory and Administration Agreement

Renewal until June 30, 2012 of the Advisory and Administration Agreement (the “Advisory Agreement”) between the Fund and Aquila Investment Management LLC (the “Manager”) was approved by the Board of Trustees and the independent Trustees in June, 2011. At a meeting called and held for the foregoing purpose at which the independent Trustees were present in person, the following materials were considered:

| | · | Copies of the agreement to be renewed; |

| | · | A term sheet describing the material terms of the agreement; |

| | · | The Annual Report of the Fund for the year ended December 31, 2010; |

| | · | A report, prepared by the Manager containing data about the performance of the Fund compared to its benchmark, data about its fees, expenses and purchases and redemptions together with comparisons of such data with similar data about other comparable funds, as well as data as to the profitability of the Manager and the Sub-Adviser; and |

| | · | Quarterly materials reviewed at prior meetings on the Fund’s performance, operations, portfolio and compliance. |

The Trustees reviewed materials relevant to, and considered the following factors:

The nature, extent, and quality of the services provided by the Manager.

The Manager has provided all administrative services to the Fund. The Board considered the nature and extent of the Manager’s supervision of third-party service providers, including the Fund’s shareholder servicing agent and custodian.

The Manager has arranged for Three Peaks Capital Management, LLC (the “Sub-Adviser”) to provide investment management of the Fund’s portfolio. The Trustees noted the extensive experience of the Sub-Adviser’s Chief Executive Officer/Chief Investment Officer and Director of Research, Mr. Sandy Rufenacht and Mr. Brent D. Olson, respectively, each co-portfolio managers. Mr. Rufenacht and Mr. Olson also serve as co-portfolio managers to Aquila Three Peaks High Income Fund (the “High Income Fund”), one of the Aquila Group of Funds, which was launched in 2006, and had net assets as of April 30, 2011 of $334 million. The Sub-Adviser initially provided only fixed income investment management services to its clientele; it began introducing its equity strategies to a limited number of its clients in early 2008. Mr. Rufenacht and his investment management team have also been available and have met with the brokerage and financial planner community and with investors and prospective investors to provide them with information generally about the Fund’s portfolio, with which to assess the Fund as an investment vehicle in light of prevailing interest rates and economic conditions.

The Board concluded that the services provided were appropriate and satisfactory and that the Fund would be well served if they continued. Evaluation of this factor weighed in favor of renewal of the Advisory Agreement.

The investment performance of the Fund.

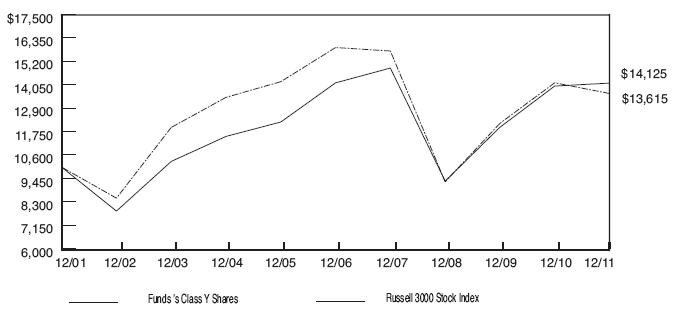

The Board determined it appropriate to consider the Fund’s performance, particularly for the period since the Sub-Adviser commenced portfolio management responsibilities. The Board reviewed the Fund’s performance and compared its performance with that of its benchmark index, the Russell 3000. It was noted that the materials provided by the Manager indicated that the Fund had performed in a manner consistent with the investment strategy of the Sub-Adviser and had outperformed the benchmark since the Sub-Adviser commenced portfolio management operations in mid-October, 2010.

The Board concluded that the performance of the Fund was competitive, recognizing the short duration of performance data. Evaluation of this factor indicated to the Trustees that renewal of the Advisory Agreement would be appropriate.

The costs of the services to be provided and profits to be realized by the Manager, and its affiliates from the relationship with the Fund.

The information provided in connection with renewal contained expense data for the Fund and a peer group was provided to the Trustees for their review and discussion. The materials also showed the lack of profitability to the Manager of its services to the Fund because the Manager had waived all fees and the Manager had reimbursed a significant portion of the Fund’s expense in the past year.

The Board compared the expense and fee data with respect to the Fund to data about other funds, including those of similar asset size that it found to be relevant. The Board concluded that the expenses of the Fund and the fees (after waivers) paid were similar to and were reasonable as compared to those being paid by the peer group.

It was noted that the Manager had contractually undertaken to waive fees and/or reimburse Fund expenses during the period May 1, 2011 through April 30, 2012 so that the total Fund expenses did not exceed 1.50% for Class A Shares, 2.25% for Class C Shares, 1.18% for Class I Shares and 1.25% for Class Y Shares.

The Board considered that the foregoing indicated the appropriateness of the costs of the services to the Fund.

The Board further concluded that the lack of profitability to the Manager was consistent with approval of the fees to be paid under the Advisory Agreement. (The Board noted that the Distributor did not derive profits from its relationship with the Fund.)

The extent to which economies of scale would be realized as the Fund grows.

The Fund has in place breakpoints in the management fee which would be realized as the Fund grows. Under the Advisory Agreement the Manager will be compensated at the annual rate of 0.90 of 1% on the Fund’s net assets up to $100 million, of which it will retain 0.40 of 1% and pay 0.50 of 1% to the Sub-Adviser; 0.85 of 1% on such assets above $100 million up to $250 million, of which it will retain 0.40 of 1% and pay to the Sub-Adviser 0.45 of 1%; and 0.80 of 1% on assets

above $250 million, of which it will retain 0.40 of 1 % and pay to the Sub-Adviser 0.40 of 1%. The Board noted that reaching asset levels where the breakpoints would be relevant would be unlikely in the near future. Evaluation of this factor indicated to the Board that the Advisory Agreement should be renewed at this time.

Benefits derived or to be derived by the Manager and its affiliates from the relationship with the Fund.

The Board observed that, as is generally true of most fund complexes, the Manager and its affiliates, by providing services to a number of funds including the Fund, were able to spread costs as it would otherwise be unable to do. The Board noted that while that produces efficiencies and increased profitability or in this case decreased losses for the Manager and its affiliates, it also makes its services available to the Fund at favorable levels of quality and cost which are more advantageous to the Fund than would otherwise have been possible.

PRIVACY NOTICE (unaudited)

Aquila Three Peaks Opportunity Growth Fund

Our Privacy Policy. In providing services to you as an individual who owns or is considering investing in shares of the Fund, we collect certain non-public personal information about you. Our policy is to keep this information strictly safeguarded and confidential, and to use or disclose it only as necessary to provide services to you or as otherwise permitted by law. Our privacy policy applies equally to former shareholders and persons who inquire about the Fund.

Information We Collect. ”Non-public personal information” is personally identifiable financial information about you as an individual or your family. The kinds of non-public personal information we have about you may include the information you provide us on your share purchase application or in telephone calls or correspondence with us, and information about your fund transactions and holdings, how you voted your shares and the account where your shares are held.

Information We Disclose. We disclose non-public personal information about you to companies that provide necessary services to us, such as the Fund’s transfer agent, distributor, investment adviser or sub-adviser, if any, as permitted or required by law, or as authorized by you. Any other use is strictly prohibited. We do not sell information about you or any of our fund shareholders to anyone.

Non-California Residents: We also may disclose some of this information to another fund in the Aquila Group of Funds (or its service providers) under joint marketing agreements that permit the funds to use the information only to provide you with information about other funds in the Aquila Group of Funds or new services we are offering that may be of interest to you.

California Residents Only: In addition, unless you “opt-out” of the following disclosures using the form that was mailed to you under separate cover, we may disclose some of this information to another fund in the Aquila Group of Funds (or its service providers) under joint marketing agreements that permit the funds to use the information only to provide you with information about other funds in the Aquila Group of Funds or new services we are offering that may be of interest to you.

How We Safeguard Your Information. We restrict access to non-public personal information about you to only those persons who need it to provide services to you or who are permitted by law to receive it. We maintain physical, electronic and procedural safeguards to protect the confidentiality of all non-public personal information we have about you.

If you have any questions regarding our Privacy Policy, please contact us at 1-800-437-1020.

Aquila Distributors, Inc.

Aquila Investment Management LLC

This Privacy Policy also has been adopted by Aquila Distributors, Inc. and Aquila Investment Management LLC and applies to all non-public information about you that each of these companies may obtain in connection with services provided to the Fund or to you as a shareholder of the Fund.

(THIS PAGE INTENTIONALLY LEFT BLANK)

(THIS PAGE INTENTIONALLY LEFT BLANK)

Founders

Lacy B. Herrmann, Chairman Emeritus

Aquila Management Corporation

Manager

AQUILA INVESTMENT MANAGEMENT LLC

380 Madison Avenue, Suite 2300

New York, New York 10017

Investment Sub-Adviser

THREE PEAKS CAPITAL MANAGEMENT, LLC

3750 Dacoro Lane, Suite 100

Castle Rock, Colorado 80109

Board of Trustees

Tucker Hart Adams, Chair

Gary C. Cornia

Grady Gammage, Jr.

Diana P. Herrmann

Glenn P. O’Flaherty

Officers

Diana P. Herrmann, President

Charles E. Childs, III, Executive Vice President and Secretary

Marie E. Aro, Senior Vice President

Paul G. O’Brien, Senior Vice President

Robert S. Driessen, Chief Compliance Officer

Joseph P. DiMaggio, Chief Financial Officer and Treasurer

Distributor

AQUILA DISTRIBUTORS, INC.

380 Madison Avenue, Suite 2300

New York, New York 10017

Transfer and Shareholder Servicing Agent

BNY MELLON

4400 Computer Drive

Westborough, Massachusetts 01581

Custodian

JPMORGAN CHASE BANK, N.A.

1111 Polaris Parkway

Columbus, Ohio 43240

Independent Registered Public Accounting Firm

TAIT, WELLER & BAKER LLP

1818 Market Street, Suite 2400

Philadelphia, Pennsylvania 19103

Further information is contained in the Prospectus,

which must precede or accompany this report.

(a) As of December 31, 2011 (the end of the reporting period) the Registrant has adopted a code of ethics that applies to the Registrant's principal executive officer(s)and principal financial officer(s) and persons performing similar functions ("Covered Officers") as defined in the Aquila Group of Funds Code of Ethics for Principal Executive and Senior Financial Officers under Section 406 of the Sarbanes-Oxley Act of 2002;

(f)(1) Pursuant to Item 10(a)(1), a copy of the Registrant's Code of Ethics that applies to the Registrant's principal executive officer(s) and principal financial officer(s) and persons performing similar functions is included as an exhibit to its annual report on this Form N-CSR;

(f)(2) The text of the Registrant's Code of Ethics that applies to the Registrant's principal executive officer(s) and principal financial officer(s) and persons performing similar functions has been posted on its Internet website which can be found at the Registrant's Internet address at www.aquilafunds.com.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

(a)(1)(i) The Registrant's Board of Trustees has determined that Mr. Glenn O'Flaherty, a member of its Audit Committee, is an audit committee financial expert. Mr. O'Flaherty is 'independent' as such term is defined in Form N-CSR.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

a) Audit Fees - The aggregate fees billed for professional services rendered by the principal accountant for the audit of the Registrant's annual financial statements were $11,000 in 2010 and $10,300 in 2011.

b) Audit Related Fees - There were no amounts billed for audit-related fees over the past two years.

c) Tax Fees - The Registrant was billed by the principal accountant $3,200 and $3,300 in 2010 and 2011, respectively, for return preparation and tax compliance.

d) All Other Fees - There were no additional fees paid for audit and non-audit services other than those disclosed in a) thorough c) above.

e)(1) Currently, the audit committee of the Registrant pre-approves audit services and fees on an engagement-by-engagement basis

e)(2) None of the services described in b) through d) above were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X, all were pre-approved on an engagement-by-engagement basis.

f) No applicable.

g) There were no non-audit services fees billed by the Registrant's accountant to the Registrant's investment adviser or distributor over the past two years

h) Not applicable.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable

| ITEM 6. | SCHEDULE OF INVESTMENTS. |

Included in Item 1 above

| ITEM 7. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FORCLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 9. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENTCOMPANY AND AFFILIATED PURCHASERS. |

Not applicable.

| ITEM 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

The Board of Directors of the Registrant has adopted a Nominating Committee Charter which provides that the Nominating Committee (the 'Committee') may consider and evaluate nominee candidates properly submitted by shareholders if a vacancy among the Independent Trustees of the Registrant occurs and if, based on the Board's then current size, composition and structure, the Committee determines that the vacancy should be filled. The Committee will consider candidates submitted by shareholders on the same basis as it considers and evaluates candidates recommended by other sources. A copy of the qualifications and procedures that must be met or followed by shareholders to properly submit a nominee candidate to the Committee may be obtained by submitting a request in writing to the Secretary of the Registrant.

| ITEM 11. | CONTROLS AND PROCEDURES. |

(a) Based on their evaluation of the Registrant's disclosure controls and procedures (as defined in Rule 30a-2(c) under the Investment Company Act of 1940) as of a date within 90 days of the filing of this report, the Registrant's chief financial and executive officers have concluded that the disclosure controls and procedures of the Registrant are appropriately designed to ensure that information required to be disclosed in the Registrant's reports that are filed under the Securities Exchange Act of 1934 are accumulated and communicated to Registrant's management, including its principal executive officer(s) and principal financial officer(s), to allow timely decisions regarding required disclosure and is recorded, processed, summarized and reported, within the time periods specified in the rules and forms adopted by the Securities and Exchange Commission.

(b) There have been no significant changes in Registrant's internal controls or in other factors that could significantly affect Registrant's internal controls subsequent to the date of the most recent evaluation, including no significant deficiencies or material weaknesses that required corrective action.

(a)(1) Aquila Group of Funds Code of Ethics for Principal Executive and Senior Financial Officers under Section 406 of the Sarbanes-Oxley Act of 2002, as amended.

(a)(2) Certifications of principal executive officer and principal financial officer as required by Rule 30a-2(a) under the Investment Company Act of 1940.

(b) Certifications of principal executive officer and principal financial officer as required by Rule 30a-2(b) under the Investment Company Act of 1940.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

AQUILA THREE PEAKS OPPORTUNITY GROWTH FUND

| By: | /s/ Diana P. Herrmann | |

| | March 7, 2012 | |

| | | |

| | | |

| By: | /s/ Joseph P. DiMaggio | |

| | Chief Financial Officer and Treasurer | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| By: | /s/ Diana P. Herrmann | |

| | Diana P. Herrmann President and Trustee | |

| | | |

| | | |

| By: | /s/ Joseph P. DiMaggio | |

| | Joseph P. DiMaggioChief Financial Officer and Treasurer | |

AQUILA THREE PEAKS OPPPORTUNITY GROWTH FUND

EXHIBIT INDEX

(a)(1) Aquila Group of Funds Code of Ethics for Principal Executive and Senior Financial Officers under Section 406 of the Sarbanes-Oxley Act of 2002, as amended.

(a) (2) Certifications of principal executive officer and principal financial officer as required by Rule 30a-2(a) under the Investment Company Act of 1940.

(b) Certification of chief executive officer and chief financial officer as required by Rule 30a-2(b) of the Investment Company Act of 1940.