UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08194

FINANCIAL INVESTORS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Cara Owen, Esq., Secretary

Financial Investors Trust

1290 Broadway, Suite 1000

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: April 30

Date of reporting period: April 30, 2021

Explanatory Note

The Registrant is filing this amendment to its Form N-CSR for the period ended April 30, 2021, originally filed with the Securities and Exchange Commission on July 9, 2021 (Accession Number 0001398344-21-014213) (the “Original Filing”), to amend Item 1, “Reports to Stockholders.” The purpose of the amendment to Item 1 is to supplement the Annual Shareholder Report for the Grandeur Peak Emerging Markets Opportunities Fund, Grandeur Peak Global Contrarian Fund, Grandeur Peak Global Micro Cap Fund, Grandeur Peak Global Opportunities Fund, Grandeur Peak Global Reach Fund, Grandeur Peak Global Stalwarts Fund, Grandeur Peak International Opportunities Fund, Grandeur Peak International Stalwarts Fund, and Grandeur Peak US Stalwarts Fund (the “Grandeur Peak Report”) to include disclosure related to the annual Liquidity Risk Management Program review, which was inadvertently omitted from the Grandeur Peak Report.

The remainder of Item 1 and Items 2 through 12 of the Original Filing are incorporated by reference.

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Performance Update | 7 |

| Disclosure of Fund Expenses | 34 |

| Portfolio of Investments | |

| Grandeur Peak Emerging Markets Opportunities Fund | 36 |

| Grandeur Peak Global Contrarian Fund | 40 |

| Grandeur Peak Global Micro Cap Fund | 43 |

| Grandeur Peak Global Opportunities Fund | 47 |

| Grandeur Peak Global Reach Fund | 51 |

| Grandeur Peak Global Stalwarts Fund | 57 |

| Grandeur Peak International Opportunities Fund | 61 |

| Grandeur Peak International Stalwarts Fund | 65 |

| Grandeur Peak US Stalwarts Fund | 68 |

| Statements of Assets and Liabilities | 70 |

| Statements of Operations | 73 |

| Statements of Changes in Net Assets | |

| Grandeur Peak Emerging Markets Opportunities Fund | 76 |

| Grandeur Peak Global Contrarian Fund | 77 |

| Grandeur Peak Global Micro Cap Fund | 78 |

| Grandeur Peak Global Opportunities Fund | 79 |

| Grandeur Peak Global Reach Fund | 80 |

| Grandeur Peak Global Stalwarts Fund | 81 |

| Grandeur Peak International Opportunities Fund | 82 |

| Grandeur Peak International Stalwarts Fund | 83 |

| Grandeur Peak US Stalwarts Fund | 84 |

| Financial Highlights | |

| Grandeur Peak Emerging Markets Opportunities Fund | 85 |

| Grandeur Peak Global Contrarian Fund | 87 |

| Grandeur Peak Global Micro Cap Fund | 88 |

| Grandeur Peak Global Opportunities Fund | 89 |

| Grandeur Peak Global Reach Fund | 91 |

| Grandeur Peak Global Stalwarts Fund | 93 |

| Grandeur Peak International Opportunities Fund | 95 |

| Grandeur Peak International Stalwarts Fund | 97 |

| Grandeur Peak US Stalwarts Fund | 99 |

| Notes to Financial Statements | 100 |

| Report of Independent Registered Public Accounting Firm | 115 |

| Additional Information | 116 |

| Liquidity Risk Management Program | 118 |

| Trustees and Officers | 119 |

| Privacy Policy | 123 |

| Grandeur Peak Funds® | Shareholder Letter |

April 30, 2021 (Unaudited)

Dear Fellow Shareholders,

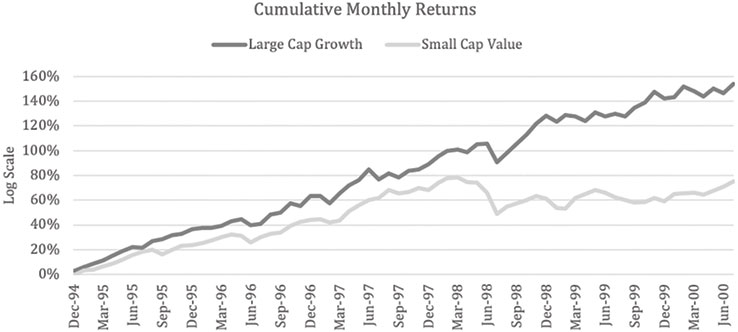

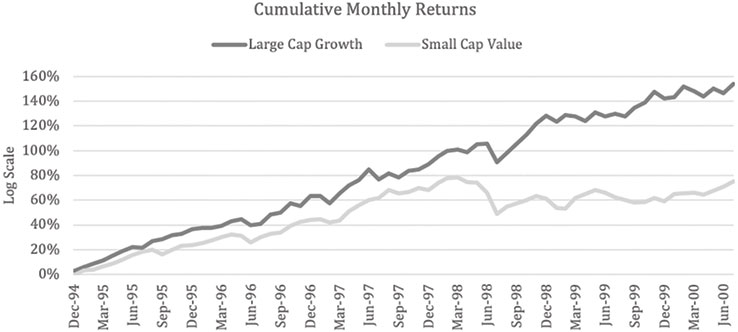

In June 1992, Eugene Fama and Kenneth French published their seminal paper, “Common Risk Factors in the Returns on Stocks and Bonds,” in the Journal of Financial Economics. With this paper, the era of Factor Investing was born and equity portfolios the world over began to be allocated into buckets of Small Cap vs. Large Cap and Value vs. Growth. To build their Size and Value Factors, Fama/French used excess returns on 25 portfolios, formed on market cap (Size) and book-to-market equity (Value) as dependent variables in the time-series regressions. The Size factor was named SMB: “Small minus Big” and the Value Factor was named HML: “High minus Low (Book-to-Market Equity Ratio).” The irony of the timing of their paper is that Large Cap Growth stocks1, the very type of stocks that the paper claimed underperform markets on a regular basis, went on a tear in the latter half of the 1990s, outperforming Small Cap Value stocks2 by 255% on a cumulative basis from January 1995 – August 2000, when Large Cap growth stocks peaked, as shown in Exhibit 1.

Exhibit 1: Large Cap Growth (Russell 200 Growth Index) vs. Small Cap Value (Russell 2000 Value Index)

Source: FTSE Russell (data from January 1995 – August 2000).

Past performance is no indication of future returns.

In the close to 30 years since the Fama/French paper was published, the academics have discovered a myriad of other market factors, and the opportunists have launched a host of indexes and investment products based on those factors. And yet the debate still rages: Growth vs. Value, Small Cap vs. Large Cap, and Quality vs. Junk. Hopefully you know how we view the world at Grandeur Peak Global Advisors. We believe that Quality outperforms, but that Valuation is incredibly important. We also like hunting for great investments among the small cap names across the globe, not because we necessarily think the Fama/French Size Factor leads to excess return, but because we believe that smaller companies can grow faster for longer than large companies. We also believe that the enormity of the global small cap market makes for better fishing, and we like to throw as wide a net as possible when looking for opportunity, and we like to fish in lakes where there are fewer people casting their nets.

Index provider MSCI is one of the opportunists that have created a slew of Factor-based indexes over the years, and as we come up on our 10th anniversary as a firm, we thought it would be interesting to compare how our “Quality at a Reasonable Price,” investment style has fared. As Global investors, we like to compare MSCI’s series of World Indexes.

| 1 | As measured by the Russell 200 Large Cap Growth Index |

| 2 | As measured by the Russell 2000 Small Cap Value Index |

| Annual Report | April 30, 2021 | 1 |

| Grandeur Peak Funds® | Shareholder Letter |

April 30, 2021 (Unaudited)

The MSCI World Index captures Large- and Mid-cap representation across 23 Developed Market countries. The MSCI World Large Cap Index is a subset to the MSCI World Index, which captures the largest companies in each country (approximately 70% of the free float-adjusted market capitalization). The MSCI World Small Cap Index captures the smallest companies in each country (approximately 14% of the free float-adjusted market capitalization).

The MSCI World Growth Index is a subset of the MSCI World Index of stocks that exhibits overall Growth Characteristics using 5 variables3. The MSCI World Value Index is a subset of the MSCI World Index of stocks that exhibit Value Characteristics using 3 variables4.

The MSCI World Quality Index is a subset of the MSCI World Index of stocks that exhibit Quality Characteristics using 3 variables5. The MSCI World Prime Value Index is designed to represent the performance of companies with relatively low valuations and high quality characteristics. It can be considered a “Quality Value” index where the MSCI World Quality Index can be considered “Quality Growth”.

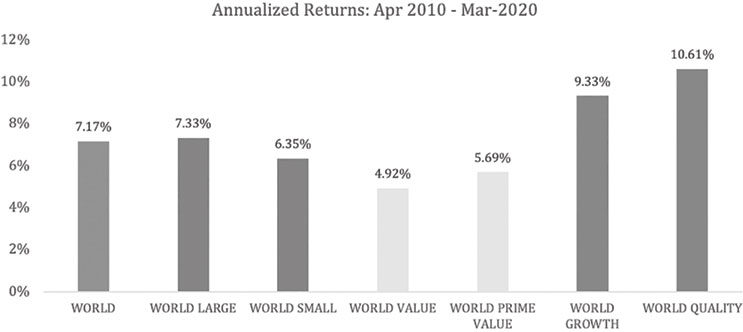

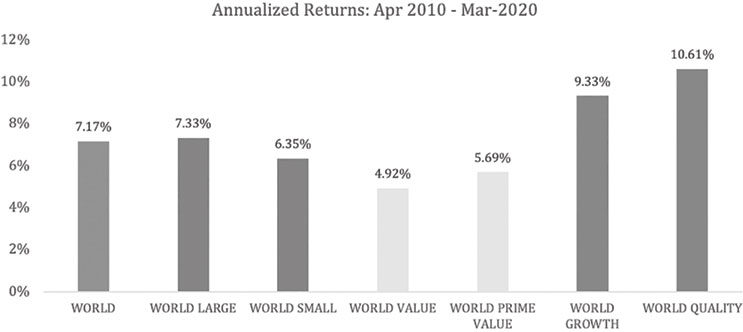

Exhibit 2 shows the 10yr annualized returns of these 7 indexes from April 2010 through the market meltdown of March 2020 (we’ll look at how they’ve done since then in just a moment).

Exhibit 2: Annualized 10-yr Returns through March 2020

Source: MSCI (data from 3/31/2011 – 3/31/2021).

Past performance is no indication of future returns.

As you can see, over the 10 years ended March 31, 2020, Large companies outperformed Small (but not by much), Growth outperformed Value by a lot, and Quality outperformed generic stocks, both in the Growth and Value space. The Prime Value Index (Quality Value) outperformed the traditional Value index, and the Quality Index (Quality Growth) outperformed the traditional Growth index. Fortunately, for Grandeur Peak and our clients Quality Growth was the place to be.

Exhibit 3 takes a longer term view and shows Annualized returns from January 2001 through March 2020.

| 3 | Long-term forward Earnings-Per-Share (EPS) growth rate, Short-term forward EPS growth rate, Current internal growth rate, Long-term historical EPS growth trend, and Long-term historical sales per share growth trend |

| 4 | Book value-to-price ratio, 12-month forward earnings-to-price ratio, and Dividend yield |

| 5 | High return on equity (ROE), Stable year-over-year earnings growth, and Low financial leverage |

| 2 | 1.855.377.7325 | www.GrandeurPeakGlobal.com |

| Grandeur Peak Funds® | Shareholder Letter |

April 30, 2021 (Unaudited)

Exhibit 3: Annualized Returns Jan 2001 – Mar 2020

Source: MSCI (data from 12/31/2000 – 3/31/2021).

Past performance is no indication of future returns.

Longer-term, since the dot.com crash of 2001, Small Caps outperformed Large Caps by a lot. But more interesting for us is that while traditional Growth outperformed traditional Value, the difference between Quality Value and Quality Growth was negligible.

Exhibit 4 shows more recent returns for these indexes, for the last 12 months through from the 3/31/2020 market bottom through 3/31/2021.

Exhibit 4: Last 12-month Returns Apr 2020 – Mar 2021

Source: MSCI (data from 3/31/2020 – 3/31/2021).

Past performance is no indication of future returns.

| Annual Report | April 30, 2021 | 3 |

| Grandeur Peak Funds® | Shareholder Letter |

April 30, 2021 (Unaudited)

Since the market bottom last March (2020), Small caps have come screaming back and traditional Growth continues to outperform traditional Value as of the date of this report. But again, as of April 30th, Quality Value has continued to perform, even as Quality Growth has underperformed traditional Growth.

As you may recall, in September 2019 we launched a Quality Value strategy, Grandeur Peak Global Contrarian. Within our traditional Quality, Value, Momentum (QVM) framework, the Global Contrarian team is taking more of a VQM approach. That is, Value first, Quality second. While the Global Contrarian strategy is the purest expression of our Quality Value approach, the best thing about our QVM framework (in our opinion), is that we can be flexible across the Quality spectrum. So, while Quality Growth has been the place to be for the past 10 years, there may come a time where a more disciplined approach on valuation becomes warranted. That is, while we will never be able to guess which Factors may outperform over the next 10 years, we believe that we are well prepared to continue finding high quality companies, on both the Value and Growth side of the equation going forward.

Business Update

We recently closed several Funds to new investments due to the continued strength of global markets. We continuously monitor capacity at both the strategy and firm level. We are committed to keeping our investment strategies nimble to pursue their investment objectives without being unduly encumbered by their individual asset base or the firm’s collective assets. Achieving performance for Grandeur Peak clients is our paramount objective.6

Our tag line, “Elevated Global Investing,” highlights our focus and approach to go above and beyond in covering the global investable universe. We believe by seeing the global opportunity set, we can make elevated investment decisions. We’ve recently extended the tag line to include, “Active At Its Best,” to emphasize what we believe is a key differentiator of our investment approach… to very actively engage, and dig deep to understand, each company in which we invest. Active investing7 is a hallmark of our firm, and in an industry that has been shifting towards passive investments over the past decade, we feel our very active approach provides an increasingly distinct and exciting opportunity to outperform over the long-term. We are not shying away from our strength as active investors.

Our Sustainability Team has begun a quarterly report which summarizes many of the efforts being made across the investment team on ESG ("Environmental, Social and Governance") topics. The report includes details of our Sustainability Framework, company engagement and collaboration, our independent research and answers to frequently asked questions. It also includes sustainability profiles of our Funds and our owned companies for your reference.

Fund Performance & Attribution

The market has been favoring a very different set of companies to begin 2021 vs what we saw in 2020. With growing hope that we have turned the corner on COVID-19, many of what we would consider lower quality companies have been seeing a nice rebound, while many of our solid executors from last year have seen their stock prices underperform in markets rotating away from quality. Over the last several months we have been buying these higher quality names opportunistically in the Funds, taking advantage of the volatility, as we believe quality is the right space for long-term investments.

The last twelve months have been a very unusual period for global equity markets, with very strong absolute returns. It was definitely a period that brings to mind the common disclosure “past performance is no indication of future results.” We are very pleased to report the sizeable outperformance of the Grandeur Peak Funds vs their benchmarks for the year ending April 30, 2021. Given our quality focus, we generally seek to just keep up in strong bull markets, but the markets favored our style this year, and when combined with solid stock picking across our team, the nine Grandeur Peak Funds all delivered very nice gains, ranging from 59.92% to 102.43%.

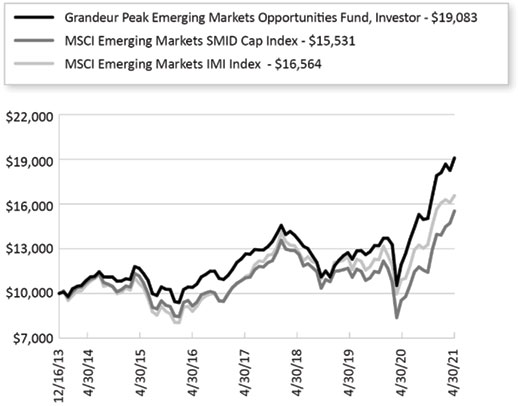

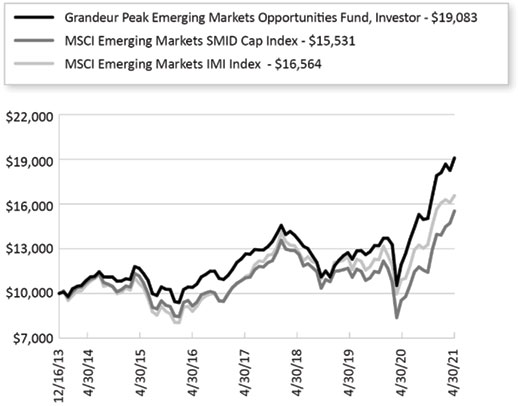

Emerging Markets Opportunities: For the year, the Institutional share class returned a healthy +60.30% vs +63.05% for the benchmark. All regions of the emerging markets benchmark index posted very strong returns for the year. The Fund’s best returns came in Central Asia, but the Fund’s small underperformance in Asia Pacific, where the majority of the portfolio and benchmark reside, outweighed other areas of outperformance. Across sectors, the Fund outperformed the benchmark in Technology, but lagged in Consumer and Healthcare.

| 6 | The Grandeur Peak Funds’ investment objective is long-term growth of capital; Grandeur Peak Funds’ Prospectus dated 8/31/2020. |

| 7 | If you’re not familiar with the terms “Active” and “Passive” investing, Active investing refers to the process of actively evaluating individual companies and selecting investments based on the merits of each company, while Passive investing refers to investing in a bundle of companies, typically in the form of Index Funds (a group of companies compiled to mimic a specific index – e.g. the S&P 500) or ETFs (Exchange Traded Funds, which are also a basic group of companies designed to mimic an index, industry, geography, or such) without evaluating the individual companies within the bundle. |

| 4 | 1.855.377.7325 | www.GrandeurPeakGlobal.com |

| Grandeur Peak Funds® | Shareholder Letter |

April 30, 2021 (Unaudited)

Global Contrarian: For the year, the Fund outperformed with a +78.51% return vs +66.94% for the benchmark. The Fund outperformed the benchmark in every region except Eastern Europe and a slight underperformance in North America, which together only make up about 17% of the portfolio. The Fund’s largest concentration is in Asia Pacific, where the Fund outperformed by more than 29 percentage points. Across sectors, Technology was a large contributor to performance, as was Financials, while the Fund lagged in Consumer.

Global Micro Cap: For the year, the Fund enjoyed a return of +102.43% return vs +67.65% for the benchmark, as micro caps finally enjoyed a tailwind. Every geography saw positive returns, but the biggest drivers of Fund performance were Western Europe and Asia Pacific where the Fund was overweight and outperformed. The biggest detractor was North America, where the Fund still outperformed the benchmark, but was significantly underweight. From a sector standpoint, the Fund outperformed across each sector, but the underweight to Industrials detracted slightly from performance.

Global Opportunities/International Opportunities: For the year, the Global Opportunities Institutional share class returned +83.44% vs +67.65% for the benchmark, and the International Opportunities Institutional share class also returned relative outperformance of +76.29% vs 58.94% for the benchmark. The Funds’ common big weights are in Asia Pacific and Western Europe. The Funds outperformed and were overweight in both these geographies. The Global Fund’s underweight to North America was detractor to performance, even though the Fund slightly outperformed in that region as well. The International Fund outperformed the benchmark across sectors, while the Global Fund did so except in the Consumer sector.

Global Reach: For the year, the Institutional share class returned +77.81% vs +67.65% for the benchmark. Stock picking and the Fund’s underweight in the US contributed positively to performance during the period. The Fund’s big weights were in Asia Pacific, Western Europe, and North America. The Fund outperformed and was overweight in both Asia Pacific and Western Europe. The Fund slightly underperformed in the North American markets. The Fund outperformed the benchmark across Technology, Healthcare, Financials and Industrials, but slightly underperformed in the Consumer sector.

Global Stalwarts/International Stalwarts: For the year, the Global Stalwarts Institutional share class returned +68.62% vs +54.93% for the benchmark, and the International Stalwarts Institutional share class returned relative performance of +67.61% vs +47.49% for the benchmark. The Funds’ outperformance came from all regions, except Eastern Europe, which makes up less than 2% of either Fund. The Funds’ strength in Asia Pacific was a key driver to the Funds’ outperformance. The Global Fund remained a little underweight in the North America markets, but its outperformance in that region helped lessen the impact. The Funds outperformed the benchmark across sectors, with Consumer being the smallest outperformance for both Funds.

US Stalwarts: For the year, the Fund outperformed with a +73.67% return vs +62.89% for the benchmark. Health Care was the Fund’s strongest sector, and it helped to be a little overweight there. Fund performance also saw positive contributions from the Consumer and Industrials sectors. The Fund’s two largest sector weights were in Technology and Financials, both of which the Fund slightly underperformed the benchmark.

We are optimistic about the general decline in COVID-19 cases in Utah, which we hope will allow for a carefully planned return to our offices this summer. Regardless of where our team sits, we are fully engaged in our efforts to serve you, our clients, in seeking to find the most interesting investment opportunities around the world.

As always, please feel free to reach out any time with any questions, requests or comments. We appreciate the opportunity to work on your behalf.

Sincerely,

Your Grandeur Peak Team

The objective of all Grandeur Peak Funds is long-term growth of capital.

RISKS: Investing in small and micro-cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds. Investing in foreign securities entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investments in emerging markets are subject to the same risks as other foreign securities and may be subject to greater risks than investments in foreign countries with more established economies and securities markets.

An investor should consider investment objectives, risks, charges, and expenses carefully before investing. To obtain a Grandeur Peak Funds prospectus, containing this and other information, visit www.grandeurpeakglobal.com or call 1-855-377-7325. Please read it carefully before investing.

The views and information discussed in this commentary are as of the date of publication, are subject to change, and may not reflect the writer’s current views. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to

| Annual Report | April 30, 2021 | 5 |

| Grandeur Peak Funds® | Shareholder Letter |

April 30, 2021 (Unaudited)

buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the Funds or any securities or any sectors mentioned herein. The subject matter contained herein has been derived from several sources believed to be reliable and accurate at the time of compilation. The Funds do not accept any liability for losses either direct or consequential caused by the use of this information.

Past performance does not guarantee future results.

Grandeur Peak Funds are distributed by ALPS Distributors, Inc. (ADI). ADI is not affiliated with Grandeur Peak Global Advisors.

A mortgage-backed security is a type of asset-backed security which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals that securitizes, or packages, the loans together into a security that investors can buy.

The term “high-yield funds” generally refers to mutual funds or exchange-traded funds (ETFs) that hold stocks that pay above-average dividends, bonds with above-average interest payments, or a combination of both.

Investing in securities that meet ESG criteria may result in the Funds forgoing otherwise attractive opportunities, which may result in underperformance when compared to funds that do not consider ESG factors.

Quantitative easing is a monetary policy whereby a central bank purchases at scale government bonds or other financial assets in order to inject money into the economy to expand economic activity.

The S&P 500® Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in the Index.

| 6 | 1.855.377.7325 | www.GrandeurPeakGlobal.com |

| Grandeur Peak Emerging Markets Opportunities Fund | Performance Update |

April 30, 2021 (Unaudited)

Annualized Total Return Performance for the periods ended April 30, 2021

| | | | | Since | Expense Ratio(b) |

| | 1 Year | 3 Years | 5 Years | Inception(a) | Gross | Net(c) |

Grandeur Peak Emerging Markets Opportunities Fund – Investor (GPEOX) | 59.92% | 11.11% | 12.85% | 9.16% | 1.78% | 1.78% |

Grandeur Peak Emerging Markets Opportunities Fund – Institutional (GPEIX) | 60.30% | 11.36% | 13.11% | 9.41% | 1.53% | 1.53% |

MSCI Emerging Markets SMID Cap Index(d) | 63.05% | 6.43% | 10.27% | 6.16% | | |

MSCI Emerging Markets IMI Index(e) | 51.70% | 7.88% | 12.64% | 7.09% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| (a) | Fund inception date of December 16, 2013. |

| (b) | Ratios as of the Prospectus dated August 31, 2020 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement (excluding acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to 1.95% and 1.70% of the Fund’s average daily net assets for the Fund’s Investor Class Shares and Institutional Class Shares, respectively. This agreement (the “Expense Agreement”) is in effect through August 31, 2021. The Adviser will be permitted to recover, on a class- by-class basis, expenses it has borne through the Expense Agreement to the extent that a Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture. Notwithstanding the foregoing, the Fund will not be obligated to pay any such deferred fees and expenses more than three years after the date on which the fee and expenses was deferred. The Expense Agreement may not be terminated or modified prior to August 31, 2021 except with the approval of the Fund’s Board of Trustees. |

| (d) | The MSCI Emerging Markets SMID Cap Index is designed to measure the equity market performance of small and mid-cap companies across emerging markets. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI Emerging Markets IMI Index is designed to measure the equity market performance of large, mid, and small-cap companies across emerging markets. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| Annual Report | April 30, 2021 | 7 |

| Grandeur Peak Emerging Markets Opportunities Fund | Performance Update |

April 30, 2021 (Unaudited)

Growth of $10,000 for the period ended April 30, 2021

The chart shown above represents a hypothetical investment of $10,000 in the Fund’s Investor Class shares for the period from inception to April 30, 2021. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

The Fund also offers Institutional Class shares, performance for which is not reflected in the graphs above. The performance of Institutional Class shares may be higher or lower than the performance of the Investor Class shares shown in the graphs above based upon differences in fees paid by shareholders investing in the Investor Class shares and Institutional Class shares.

| 8 | 1.855.377.7325 | www.GrandeurPeakGlobal.com |

| Grandeur Peak Emerging Markets Opportunities Fund | Performance Update |

April 30, 2021 (Unaudited)

| Regional Allocation (as a % of Net Assets)* | |

| Asia ex Japan | 70.6% |

| Latin America | 10.6% |

| Europe | 8.7% |

| Africa/Middle East | 3.8% |

| North America | 3.4% |

| Cash, Cash Equivalents, & Other Net Assets | 2.9% |

| Total | 100.0% |

| | |

| Top 10 Holdings (as a % of Net Assets)* | |

| Silergy Corp. | 3.9% |

| WNS Holdings, Ltd. | 2.4% |

| Metropolis Healthcare, Ltd. | 1.9% |

| Poya International Co., Ltd. | 1.9% |

| Dino Polska SA | 1.8% |

| IndiaMart InterMesh, Ltd. | 1.8% |

| Pagseguro Digital, Ltd. | 1.5% |

| Genpact, Ltd. | 1.5% |

| Locaweb Servicos de Internet SA | 1.5% |

| Tokai Carbon Korea Co., Ltd. | 1.4% |

| Total | 19.6% |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| Annual Report | April 30, 2021 | 9 |

| Grandeur Peak Global Contrarian Fund | Performance Update |

April 30, 2021 (Unaudited)

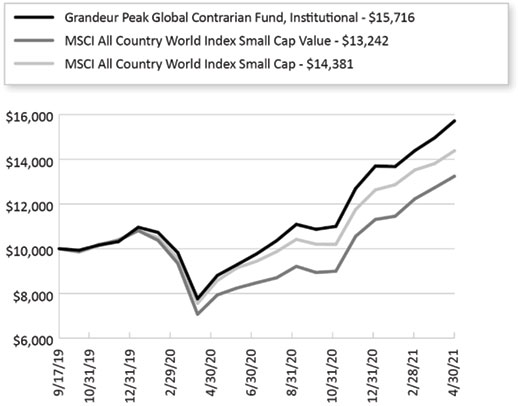

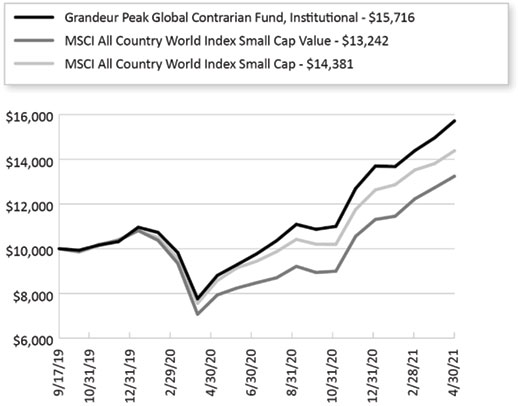

Annualized Total Return Performance for the periods ended April 30, 2021

| | | Since | Expense Ratio(b) |

| | 1 Year | Inception(a) | Gross | Net(c) |

Grandeur Peak Global Contrarian Fund – Institutional (GPGCX) | 78.51% | 32.21% | 4.08% | 1.36% |

| MSCI All Country World Index Small Cap Value(d) | 66.94% | 18.94% | | |

| MSCI All Country World Index Small Cap(e) | 67.65% | 25.16% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| (a) | Fund inception date of September 17, 2019. |

| (b) | Ratios as of the Prospectus dated August 31, 2020 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement (excluding acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to 1.35% of the Fund’s average daily net assets for the Fund’s Institutional Class Shares. This agreement (the “Expense Agreement”) is in effect through August 31, 2021. The Adviser will be permitted to recover, on a class- by-class basis, expenses it has borne through the Expense Agreement to the extent that a Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture. Notwithstanding the foregoing, the Fund will not be obligated to pay any such deferred fees and expenses more than three years after the date on which the fee and expenses was deferred. The Expense Agreement may not be terminated or modified prior to August 31, 2021 except with the approval of the Fund’s Board of Trustees. |

| (d) | The MSCI ACWI Small Cap Value Index is designed to measure small cap companies exhibiting overall value style characteristics across developed and emerging markets globally. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI ACWI Small Cap Index is designed to measure the equity market performance of performance of small-cap companies across developed and emerging markets globally. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| 10 | 1.855.377.7325 | www.GrandeurPeakGlobal.com |

| Grandeur Peak Global Contrarian Fund | Performance Update |

April 30, 2021 (Unaudited)

Growth of $10,000 for the period ended April 30, 2021

The chart shown above represents a hypothetical investment of $10,000 in the Fund’s Institutional Class shares for the period from inception to April 30, 2021. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

| Annual Report | April 30, 2021 | 11 |

| Grandeur Peak Global Contrarian Fund | Performance Update |

April 30, 2021 (Unaudited)

| Regional Allocation (as a % of Net Assets)* | |

| Asia ex Japan | 30.2% |

| Europe | 22.5% |

| North America | 21.9% |

| Japan | 14.4% |

| Australia/New Zealand | 4.8% |

| Africa/Middle East | 2.5% |

| Latin America | 0.8% |

| Cash, Cash Equivalents, & Other Net Assets | 2.9% |

| Total | 100.0% |

| | |

| Top 10 Holdings (as a % of Net Assets)* | |

| Seria Co., Ltd. | 2.8% |

| Barrett Business Services, Inc. | 2.6% |

| Bank of NT Butterfield & Son, Ltd. | 2.5% |

| Fiducian Group, Ltd. | 2.5% |

| Ultra Electronics Holdings PLC | 2.0% |

| Guardian Capital Group, Ltd. | 2.0% |

| Plover Bay Technologies, Ltd. | 1.9% |

| Hackett Group, Inc. | 1.9% |

| Naigai Trans Line, Ltd. | 1.9% |

| Esquire Financial Holdings, Inc. | 1.7% |

| Total | 21.8% |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| 12 | 1.855.377.7325 | www.GrandeurPeakGlobal.com |

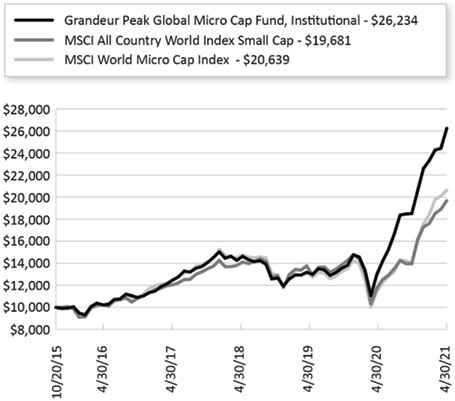

| Grandeur Peak Global Micro Cap Fund | Performance Update |

April 30, 2021 (Unaudited)

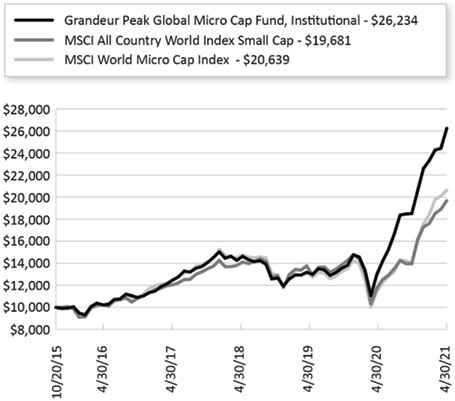

Annualized Total Return Performance for the periods ended April 30, 2021

| | | | | Since | Expense Ratio(b) |

| | 1 Year | 3 Years | 5 Years | Inception(a) | Gross | Net(c) |

Grandeur Peak Global Micro Cap Fund – Institutional (GPMCX) | 102.43% | 22.51% | 20.37% | 19.06% | 2.06% | 2.00% |

MSCI All Country World Index Small Cap(d) | 67.65% | 12.55% | 14.11% | 13.03% | | |

| MSCI World Micro Cap Index(e) | 80.94% | 12.44% | 14.81% | 14.00% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| (a) | Fund inception date of October 20, 2015. |

| (b) | Ratios as of the Prospectus dated August 31, 2020 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/ Expense Reimbursement (excluding acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to 2.00% of the Fund’s average daily net assets for the Fund’s Institutional Class Shares. This agreement is in effect through August 31, 2021. The Adviser will be permitted to recover expenses it has borne through this agreement to the extent that a Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture. Notwithstanding the foregoing, the Fund will not be obligated to pay any such deferred fees and expenses more than three years after the date on which the fee and expenses was deferred . This agreement may not be terminated or modified prior to August 31, 2021 except with the approval of the Fund’s Board of Trustees. |

| (d) | The MSCI ACWI Small Cap Index is designed to measure the equity market performance of performance of small-cap companies across developed and emerging markets globally. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI World Micro Cap Index is designed to measure the equity market performance of micro-cap companies across developed markets globally. It does not include emerging markets. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| Annual Report | April 30, 2021 | 13 |

| Grandeur Peak Global Micro Cap Fund | Performance Update |

April 30, 2021 (Unaudited)

Growth of $10,000 for the period ended April 30, 2021

The chart shown above represents a hypothetical investment of $10,000 in the Fund’s Institutional Class shares for the period from inception to April 30, 2021. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

| 14 | 1.855.377.7325 | www.GrandeurPeakGlobal.com |

| Grandeur Peak Global Micro Cap Fund | Performance Update |

April 30, 2021 (Unaudited)

| Regional Allocation (as a % of Net Assets)* | |

| Europe | 41.4% |

| Asia ex Japan | 19.9% |

| Japan | 15.8% |

| North America | 15.1% |

| Australia/New Zealand | 5.7% |

| Latin America | 1.3% |

| Africa/Middle East | 0.5% |

| Cash, Cash Equivalents, & Other Net Assets | 0.3% |

| Total | 100.0% |

| | |

| Top 10 Holdings (as a % of Net Assets)* | |

| SwedenCare AB | 3.7% |

| Joint Corp. | 3.6% |

| Musti Group Oyj | 2.4% |

| Impax Asset Management Group PLC | 1.8% |

| K3 Capital Group PLC | 1.8% |

| Sarantis SA | 1.8% |

| Westwing Group AG | 1.8% |

| Kogan.com, Ltd. | 1.6% |

| Syuppin Co., Ltd. | 1.5% |

| TK Group Holdings, Ltd. | 1.5% |

| Total | 21.5% |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| Annual Report | April 30, 2021 | 15 |

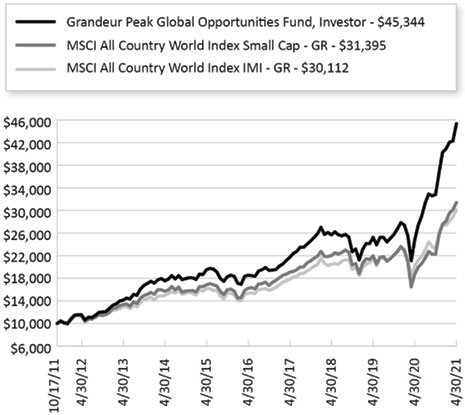

| Grandeur Peak Global Opportunities Fund | Performance Update |

April 30, 2021 (Unaudited)

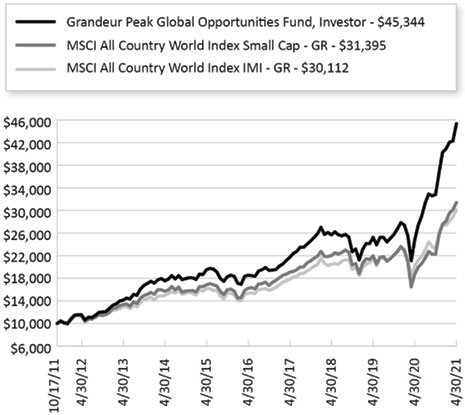

Annualized Total Return Performance for the periods ended April 30, 2021

| | | | | Since | Expense Ratio(b) |

| | 1 Year | 3 Years | 5 Years | Inception(a) | Gross | Net(c) |

Grandeur Peak Global Opportunities Fund – Investor (GPGOX) | 82.94% | 20.84% | 19.60% | 17.18% | 1.62% | 1.62% |

Grandeur Peak Global Opportunities Fund – Institutional (GPGIX) | 83.44% | 21.08% | 19.93% | 17.49% | 1.37% | 1.37% |

MSCI All Country World Index Small Cap(d) | 67.65% | 12.55% | 14.11% | 12.75% | | |

| MSCI All Country World Index IMI(e) | 48.76% | 13.72% | 14.40% | 12.25% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| (a) | Fund inception date of October 17, 2011. |

| (b) | Ratios as of the Prospectus dated August 31, 2020 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/ Expense Reimbursement (excluding acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to 1.75% and 1.50% of the Fund’s average daily net assets for the Fund’s Investor Class Shares and Institutional Class Shares, respectively. This agreement (the “Expense Agreement”) is in effect through August 31, 2021. The Adviser will be permitted to recover, on a class- by-class basis, expenses it has borne the Expense Agreement to the extent that a Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture . Notwithstanding the foregoing, the Fund will not be obligated to pay any such deferred fees and expenses more than three years after the date on which the fee and expenses was deferred. The Expense Agreement may not be terminated or modified prior to August 31, 2021 except with the approval of the Fund’s Board of Trustees. |

| (d) | The MSCI ACWI Small Cap Index is designed to measure the equity market performance of performance of small-cap companies across developed and emerging markets globally. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI ACWI IMI Index is designed to measure the equity market performance of large, mid, and small-cap companies across developed and emerging markets globally. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| 16 | 1.855.377.7325 | www.GrandeurPeakGlobal.com |

| Grandeur Peak Global Opportunities Fund | Performance Update |

April 30, 2021 (Unaudited)

Growth of $10,000 for the period ended April 30, 2021

The chart shown above represents a hypothetical investment of $10,000 in the Fund’s Investor Class shares for the period from inception to April 30, 2021. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

The Fund also offers Institutional Class shares, performance for which is not reflected in the graphs above. The performance of Institutional Class shares may be higher or lower than the performance of the Investor Class shares shown in the graphs above based upon differences in fees paid by shareholders investing in the Investor Class shares and Institutional Class shares.

| Annual Report | April 30, 2021 | 17 |

| Grandeur Peak Global Opportunities Fund | Performance Update |

April 30, 2021 (Unaudited)

| Regional Allocation (as a % of Net Assets)* | |

| Europe | 42.0% |

| North America | 25.7% |

| Asia ex Japan | 18.6% |

| Japan | 8.9% |

| Latin America | 2.7% |

| Africa/Middle East | 1.2% |

| Australia/New Zealand | 0.7% |

| Cash, Cash Equivalents, & Other Net Assets | 0.2% |

| Total | 100.0% |

| | |

| Top 10 Holdings (as a % of Net Assets)* | |

| Dechra Pharmaceuticals PLC | 2.5% |

| Silergy Corp. | 2.2% |

| EPAM Systems, Inc. | 2.1% |

| Endava PLC | 2.0% |

| B&M European Value Retail SA | 1.9% |

| CVS Group PLC | 1.9% |

| Metropolis Healthcare, Ltd. | 1.4% |

| First Republic Bank | 1.4% |

| Heska Corp. | 1.3% |

| WNS Holdings, Ltd. | 1.3% |

| Total | 18.0% |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| 18 | 1.855.377.7325 | www.GrandeurPeakGlobal.com |

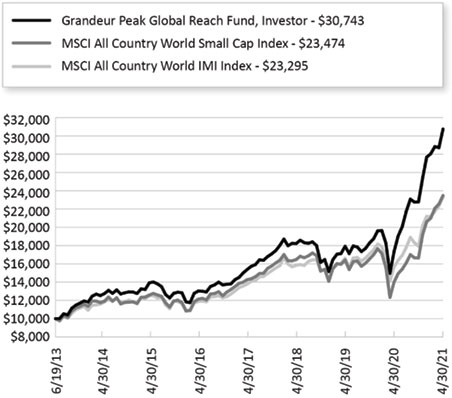

| Grandeur Peak Global Reach Fund | Performance Update |

April 30, 2021 (Unaudited)

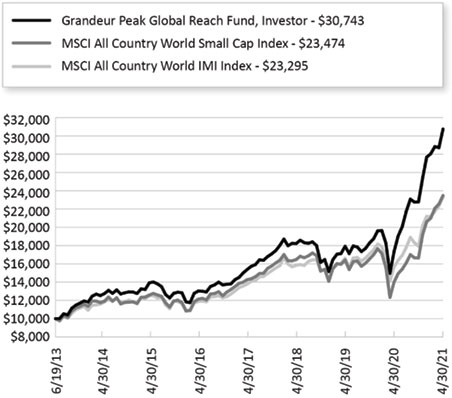

Annualized Total Return Performance for the periods ended April 30, 2021

| | | | | Since | Expense Ratio(b) |

| | 1 Year | 3 Years | 5 Years | Inception(a) | Gross | Net(c) |

Grandeur Peak Global Reach Fund – Investor (GPROX) | 77.38% | 19.06% | 18.74% | 15.35% | 1.52% | 1.52% |

Grandeur Peak Global Reach Fund – Institutional (GPRIX) | 77.81% | 19.35% | 19.02% | 15.62% | 1.27% | 1.27% |

MSCI All Country World Small Cap Index(d) | 67.65% | 12.55% | 14.11% | 11.46% | | |

MSCI All Country World IMI Index(e) | 48.76% | 13.72% | 14.40% | 11.35% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| (a) | Fund inception date of June 19, 2013. |

| (b) | Ratios as of the Prospectus dated August 31, 2020 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement (excluding acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to 1.60% and 1.35% of the Fund’s average daily net assets for the Fund’s Investor Class Shares and Institutional Class Shares, respectively. This agreement (the “Expense Agreement”) is in effect through August 31, 2021. The Adviser will be permitted to recover, on a class- by-class basis, expenses it has borne through the Expense Agreement to the extent that a Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture . Notwithstanding the foregoing, the Fund will not be obligated to pay any such deferred fees and expenses more than three years after the date on which the fee and expenses was deferred. The Expense Agreement may not be terminated or modified prior to August 31, 2021 except with the approval of the Fund’s Board of Trustees. |

| (d) | The MSCI ACWI Small Cap Index is designed to measure the equity market performance of performance of small-cap companies across developed and emerging markets globally. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI ACWI IMI Index is designed to measure the equity market performance of large, mid, and small-cap companies across developed and emerging markets globally. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| Annual Report | April 30, 2021 | 19 |

| Grandeur Peak Global Reach Fund | Performance Update |

April 30, 2021 (Unaudited)

Growth of $10,000 for the period ended April 30, 2021

The chart shown above represents a hypothetical investment of $10,000 in the Fund’s Investor Class shares for the period from inception to April 30, 2021. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

The Fund also offers Institutional Class shares, performance for which is not reflected in the graphs above. The performance of Institutional Class shares may be higher or lower than the performance of the Investor Class shares shown in the graphs above based upon differences in fees paid by shareholders investing in the Investor Class shares and Institutional Class shares.

| 20 | 1.855.377.7325 | www.GrandeurPeakGlobal.com |

| Grandeur Peak Global Reach Fund | Performance Update |

April 30, 2021 (Unaudited)

| Regional Allocation (as a % of Net Assets)* | |

| Europe | 34.9% |

| North America | 29.3% |

| Asia ex Japan | 18.3% |

| Japan | 7.4% |

| Latin America | 3.9% |

| Australia/New Zealand | 3.1% |

| Africa/Middle East | 2.5% |

| Cash, Cash Equivalents, & Other Net Assets | 0.6% |

| Total | 100.0% |

| | |

| Top 10 Holdings (as a % of Net Assets)* | |

| Silergy Corp. | 1.6% |

| Impax Asset Management Group PLC | 1.5% |

| First Republic Bank | 1.4% |

| Esker SA | 1.4% |

| Endava PLC | 1.3% |

| EPAM Systems, Inc. | 1.2% |

| Wix.com, Ltd. | 1.2% |

| EQT AB | 1.1% |

| B&M European Value Retail SA | 1.0% |

| Vietnam Technological & Commercial Joint Stock Bank | 1.0% |

| Total | 12.7% |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| Annual Report | April 30, 2021 | 21 |

| Grandeur Peak Global Stalwarts Fund | Performance Update |

April 30, 2021 (Unaudited)

Annualized Total Return Performance for the periods ended April 30, 2021

| | | | | Since | Expense Ratio(b) |

| | 1 Year | 3 Years | 5 Years | Inception(a) | Gross | Net(c) |

Grandeur Peak Global Stalwarts Fund – Investor (GGSOX)* | 68.24% | 18.74% | 18.74% | 18.08% | 1.24% | 1.24% |

Grandeur Peak Global Stalwarts Fund – Institutional (GGSYX)* | 68.62% | 19.05% | 19.04% | 18.38% | 0.99% | 0.99% |

| MSCI All Country World Mid Cap Index(d) | 54.93% | 11.88% | 12.86% | 12.49% | | |

| MSCI All Country World Small Cap Index(e) | 67.65% | 12.55% | 14.11% | 13.50% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| * | Excludes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value and total return for shareholder transactions reported to the market may differ from the net asset value for financial reporting purposes. |

| (a) | Fund inception date of September 1, 2015. |

| (b) | Ratios as of the Prospectus dated August 31, 2020 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/ Expense Reimbursement (excluding acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to 1.35% and 1.10% of the Fund’s average daily net assets for the Fund’s Investor Class Shares and Institutional Class Shares, respectively. This agreement is in effect through August 31, 2021. The Adviser will be permitted to recover, on a class-by-class basis, expenses it has borne through this agreement to the extent that a Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture . Notwithstanding the foregoing, the Fund will not be obligated to pay any such deferred fees and expenses more than three years after the date on which the fee and expenses was deferred. This agreement may not be terminated or modified prior to August 31, 2021 except with the approval of the Fund’s Board of Trustees. |

| (d) | The MSCI ACWI Mid Cap Index is designed to measure the equity market performance of performance of mid-cap companies across developed and emerging markets globally. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI ACWI Small Cap Index is designed to measure the equity market performance of small-cap companies across developed and emerging markets globally. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| 22 | 1.855.377.7325 | www.GrandeurPeakGlobal.com |

| Grandeur Peak Global Stalwarts Fund | Performance Update |

April 30, 2021 (Unaudited)

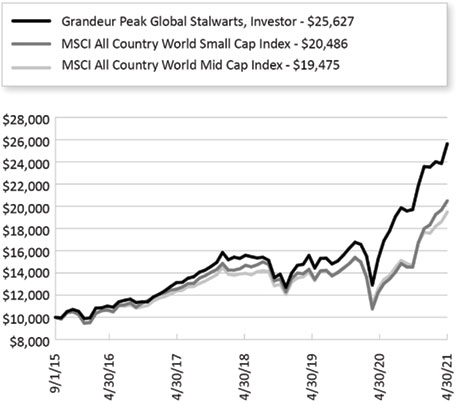

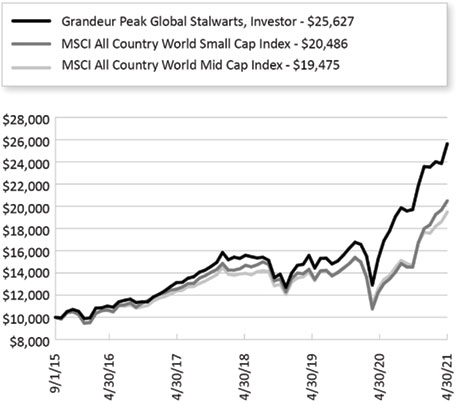

Growth of $10,000 for the period ended April 30, 2021

The chart shown above represents a hypothetical investment of $10,000 in the Fund’s Investor Class shares for the period from inception to April 30, 2021. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

The Fund also offers Institutional Class shares, performance for which is not reflected in the graphs above. The performance of Institutional Class shares may be higher or lower than the performance of the Investor Class shares shown in the graphs above based upon differences in fees paid by shareholders investing in the Investor Class shares and Institutional Class shares.

| Annual Report | April 30, 2021 | 23 |

| Grandeur Peak Global Stalwarts Fund | Performance Update |

April 30, 2021 (Unaudited)

| Regional Allocation (as a % of Net Assets)* | |

| North America | 43.1% |

| Europe | 25.5% |

| Asia ex Japan | 19.9% |

| Japan | 6.6% |

| Latin America | 2.0% |

| Africa/Middle East | 1.1% |

| Australia/New Zealand | 1.0% |

| Cash, Cash Equivalents, & Other Net Assets | 0.8% |

| Total | 100.0% |

| | |

| Top 10 Holdings (as a % of Net Assets)* | |

| Silergy Corp. | 4.0% |

| First Republic Bank | 3.3% |

| EPAM Systems, Inc. | 2.8% |

| Dechra Pharmaceuticals PLC | 2.6% |

| WNS Holdings, Ltd. | 2.4% |

| B&M European Value Retail SA | 2.2% |

| Endava PLC | 2.0% |

| St. James’s Place PLC | 1.5% |

| Intertek Group PLC | 1.3% |

| Fastenal Co. | 1.2% |

| Total | 23.3% |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| 24 | 1.855.377.7325 | www.GrandeurPeakGlobal.com |

| Grandeur Peak International Opportunities Fund | Performance Update |

April 30, 2021 (Unaudited)

Annualized Total Return Performance for the periods ended April 30, 2021

| | | | | Since | Expense Ratio(b) |

| | 1 Year | 3 Years | 5 Years | Inception(a) | Gross | Net(c) |

Grandeur Peak International Opportunities Fund – Investor (GPIOX) | 75.87% | 15.34% | 16.55% | 15.25% | 1.62% | 1.62% |

Grandeur Peak International Opportunities Fund – Institutional (GPIIX) | 76.29% | 15.59% | 16.74% | 15.50% | 1.37% | 1.37% |

MSCI All Country World Index ex USA Small Cap Index(d) | 58.94% | 8.22% | 11.21% | 9.51% | | |

MSCI All Country World IMI ex USA Index(e) | 45.53% | 7.57% | 10.46% | 7.96% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| (a) | Fund inception date of October 17, 2011. |

| (b) | Ratios as of the Prospectus dated August 31, 2020 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursements (excluding acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to 1.75% and 1.50% of the Fund’s average daily net assets for the Fund’s Investor Class Shares and Institutional Class Shares, respectively. This agreement (the “Expense Agreement”) is in effect through August 31, 2021. The Adviser will be permitted to recover, on a class- by-class basis, expenses it has borne through the Expense Agreement to the extent that a Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture . Notwithstanding the foregoing, the Funds will not be obligated to pay any such deferred fees and expenses more than three years after the date on which the fee and expenses was deferred. The Expense Agreement may not be terminated or modified prior to August 31, 2021 except with the approval of the Fund’s Board of Trustees. |

| (d) | The MSCI ACWI ex USA Small Cap Index is designed to measure the equity market performance of small-cap companies across developed and emerging markets globally, excluding the United States. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI ACWI ex USA IMI Index is designed to measure the equity market performance of large, mid, and small-cap companies across developed and emerging markets globally, excluding the United States. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| Annual Report | April 30, 2021 | 25 |

| Grandeur Peak International Opportunities Fund | Performance Update |

April 30, 2021 (Unaudited)

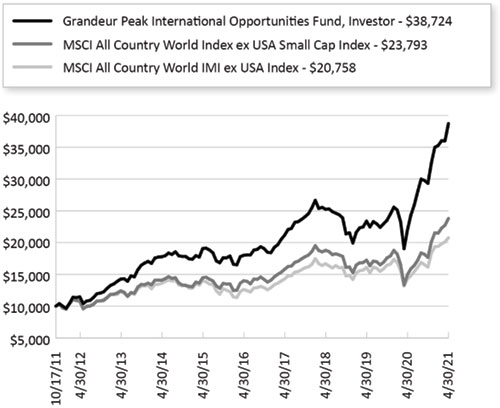

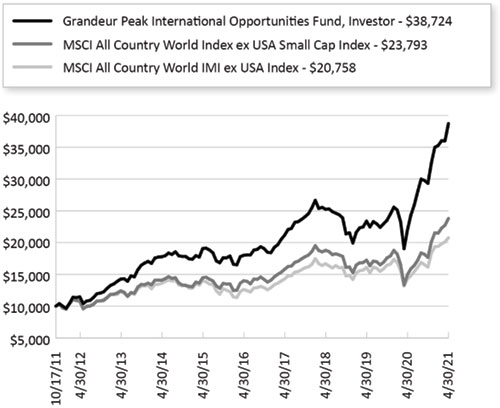

Growth of $10,000 for the period ended April 30, 2021

The chart shown above represents a hypothetical investment of $10,000 in the Fund’s Investor Class shares for the period from inception to April 30, 2021. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

The Fund also offers Institutional Class shares, performance for which is not reflected in the graphs above. The performance of Institutional Class shares may be higher or lower than the performance of the Investor Class shares shown in the graphs above based upon differences in fees paid by shareholders investing in the Investor Class shares and Institutional Class shares.

| 26 | 1.855.377.7325 | www.GrandeurPeakGlobal.com |

| Grandeur Peak International Opportunities Fund | Performance Update |

April 30, 2021 (Unaudited)

| Regional Allocation (as a % of Net Assets)* | |

| Europe | 47.5% |

| Asia ex Japan | 23.0% |

| Japan | 12.2% |

| North America | 7.4% |

| Latin America | 3.4% |

| Australia/New Zealand | 2.1% |

| Africa/Middle East | 1.4% |

| Cash, Cash Equivalents, & Other Net Assets | 3.0% |

| Total | 100.0% |

| | |

| Top 10 Holdings (as a % of Net Assets)* | |

| Dechra Pharmaceuticals PLC | 2.2% |

| CVS Group PLC | 2.2% |

| Silergy Corp. | 2.1% |

| EPAM Systems, Inc. | 2.1% |

| WNS Holdings, Ltd. | 1.7% |

| Endava PLC | 1.5% |

| B&M European Value Retail SA | 1.5% |

| Esker SA | 1.5% |

| Aalberts NV | 1.2% |

| Metropolis Healthcare, Ltd. | 1.2% |

| Total | 17.2% |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| Annual Report | April 30, 2021 | 27 |

| Grandeur Peak International Stalwarts Fund | Performance Update |

April 30, 2021 (Unaudited)

Annualized Total Return Performance for the periods ended April 30, 2021

| | | | | Since | Expense Ratio(b) |

| | 1 Year | 3 Years | 5 Years | Inception(a) | Gross | Net(c) |

Grandeur Peak International Stalwarts Fund – Investor (GISOX)* | 67.13% | 16.90% | 17.97% | 17.71% | 1.17% | 1.17% |

Grandeur Peak International Stalwarts Fund – Institutional (GISYX)* | 67.61% | 17.20% | 18.26% | 17.99% | 0.92% | 0.92% |

| MSCI All Country World ex USA Mid Cap Index(d) | 47.49% | 6.85% | 9.66% | 9.75% | | |

| MSCI All Country World ex USA Small Index(e) | 58.94% | 8.22% | 11.21% | 11.35% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| * | Excludes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value and total return for shareholder transactions reported to the market may differ from the net asset value for financial reporting purposes. |

| (a) | Fund inception date of September 1, 2015. |

| (b) | Ratios as of the Prospectus dated August 31, 2020 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/ Expense Reimbursements (excluding acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to 1.35% and 1.10% of the Fund’s average daily net assets for the Fund’s Investor Class Shares and Institutional Class Shares, respectively. This agreement is in effect through August 31, 2021. The Adviser will be permitted to recover, on a class-by-class basis, expenses it has borne through this agreement to the extent that a Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture . Notwithstanding the foregoing, the Funds will not be obligated to pay any such deferred fees and expenses more than three years after the date on which the fee and expenses was deferred This agreement may not be terminated or modified prior to August 31, 2021 except with the approval of the Fund’s Board of Trustees. |

| (d) | The MSCI ACWI ex USA Mid Cap Index is designed to measure the equity market performance of midcap companies across developed and emerging markets globally, excluding the United States. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI ACWI ex USA Small Cap Index is designed to measure the equity market performance of small-cap companies across developed and emerging markets globally, excluding the United States. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| 28 | 1.855.377.7325 | www.GrandeurPeakGlobal.com |

| Grandeur Peak International Stalwarts Fund | Performance Update |

April 30, 2021 (Unaudited)

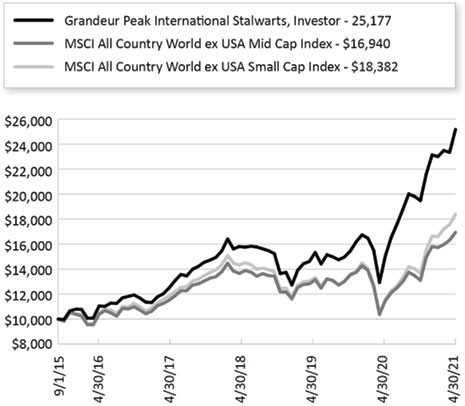

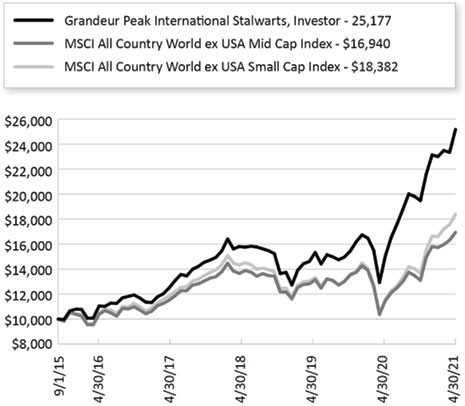

Growth of $10,000 for the period ended April 30, 2021

The chart shown above represents a hypothetical investment of $10,000 in the Fund’s Investor Class shares for the period from inception to April 30, 2021. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

The Fund also offers Institutional Class shares, performance for which is not reflected in the graphs above. The performance of Institutional Class shares may be higher or lower than the performance of the Investor Class shares shown in the graphs above based upon differences in fees paid by shareholders investing in the Investor Class shares and Institutional Class shares.

| Annual Report | April 30, 2021 | 29 |

| Grandeur Peak International Stalwarts Fund | Performance Update |

April 30, 2021 (Unaudited)

| Regional Allocation (as a % of Net Assets)* | |

| Europe | 41.5% |

| Asia ex Japan | 28.8% |

| North America | 12.3% |

| Japan | 10.0% |

| Latin America | 3.1% |

| Africa/Middle East | 1.8% |

| Australia/New Zealand | 1.4% |

| Cash, Cash Equivalents, & Other Net Assets | 1.1% |

| Total | 100.0% |

| | |

| Top 10 Holdings (as a % of Net Assets)* | |

| Silergy Corp. | 5.4% |

| EPAM Systems, Inc. | 4.1% |

| Dechra Pharmaceuticals PLC | 3.8% |

| B&M European Value Retail SA | 3.4% |

| WNS Holdings, Ltd. | 3.3% |

| Endava PLC | 2.4% |

| St. James’s Place PLC | 2.1% |

| EQT AB | 1.9% |

| Intertek Group PLC | 1.9% |

| Wix.com, Ltd. | 1.8% |

| Total | 30.1% |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| 30 | 1.855.377.7325 | www.GrandeurPeakGlobal.com |

| Grandeur Peak US Stalwarts Fund | Performance Update |

April 30, 2021 (Unaudited)

Annualized Total Return Performance for the periods ended April 30, 2021

| | | Since | Expense Ratio(b) |

| | 1 Year | Inception(a) | Gross | Net(c) |

| Grandeur Peak US Stalwarts Fund – Institutional (GUSYX) | 73.67% | 109.72% | 6.10% | 1.00% |

| MSCI USA Mid Cap Index(d) | 62.89% | 88.61% | | |

| MSCI USA Small Cap Index(e) | 76.25% | 104.36% | | |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. The Fund imposes a 2.00% redemption fee on shares held for less than 60 days. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data, please call 1-855-377-PEAK (7325).

The table does not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| (a) | Fund inception date of March 19, 2020. |

| (b) | Ratios as of the Prospectus dated August 31, 2020 and may differ from the ratios presented in the Financial Highlights. |

| (c) | Grandeur Peak Global Advisors, LLC (the “Adviser”), has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement (excluding acquired fund fees and expenses, brokerage expenses, interest expenses, taxes and extraordinary expenses) to 1.00% of the Fund’s average daily net assets for the Fund’s Institutional Class Shares. This agreement (the “Expense Agreement”) is in effect through August 31, 2021. The Adviser will be permitted to recover, on a class- by-class basis, expenses it has borne through the Expense Agreement to the extent that a Fund’s expenses in later periods fall below annual rates set forth in the Expense Agreement; provided, however, that such recapture payments do not cause the Fund’s expense ratio (after recapture) to exceed the lesser of (i) the expense cap in effect at the time of the waiver and (ii) the expense cap in effect at the time of the recapture. Notwithstanding the foregoing, the Fund will not be obligated to pay any such deferred fees and expenses more than three years after the date on which the fee and expenses was deferred. The Expense Agreement may not be terminated or modified prior to August 31, 2021 except with the approval of the Fund’s Board of Trustees. |

| (d) | The MSCI USA Mid Cap Index is designed to measure the performance of the mid cap segments of the US market. With 339 constituents, the index covers approximately 15% of the free float-adjusted market capitalization in the US. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| (e) | The MSCI USA Small Cap Index is designed to measure the performance of the small cap segment of the US equity market. With 1,740 constituents, the index represents approximately 14% of the free float-adjusted market capitalization in the US. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly into the Index. |

| Annual Report | April 30, 2021 | 31 |

| Grandeur Peak US Stalwarts Fund | Performance Update |

April 30, 2021 (Unaudited)

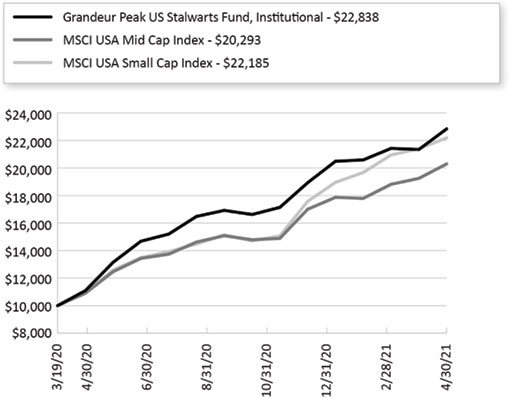

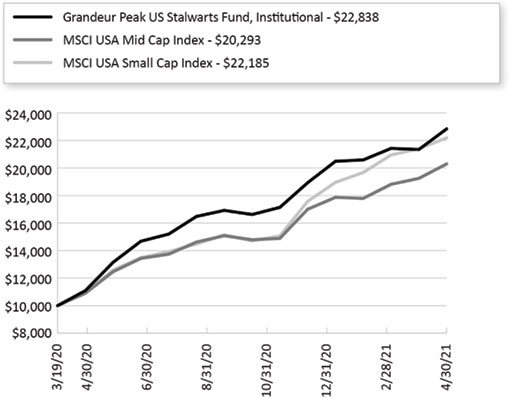

Growth of $10,000 for the period ended April 30, 2021

The chart shown above represent a hypothetical investment of $10,000 in the Fund’s Institutional Class shares for the period from inception to April 30, 2021. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that an investor would pay on distributions or redemptions.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

| 32 | 1.855.377.7325 | www.GrandeurPeakGlobal.com |

| Grandeur Peak US Stalwarts Fund | Performance Update |

April 30, 2021 (Unaudited)

| Regional Allocation (as a % of Net Assets)* | |

| North America | 88.9% |

| Europe | 3.3% |

| Asia ex Japan | 3.0% |

| Africa/Middle East | 2.1% |

| Latin America | 1.5% |

| Cash, Cash Equivalents, & Other Net Assets | 1.2% |

| Total | 100.0% |

| | |

| Top 10 Holdings (as a % of Net Assets)* | |

| First Republic Bank | 3.9% |

| EPAM Systems, Inc. | 3.4% |

| Heska Corp. | 2.7% |

| Endava PLC | 2.6% |

| Pool Corp. | 2.6% |

| PJT Partners, Inc. | 2.5% |

| Paycom Software, Inc. | 2.1% |

| Wix.com, Ltd. | 2.1% |

| WNS Holdings, Ltd. | 2.1% |

| Genpact, Ltd. | 2.0% |

| Total | 26.0% |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| Annual Report | April 30, 2021 | 33 |

| Grandeur Peak Funds® | Disclosure of Fund Expenses |

April 30, 2021

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of November 1, 2020 through April 30, 2021.

Actual Expenses The first line of the table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.