Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08200

BRIDGEWAY FUNDS, INC.

(Exact name of registrant as specified in charter)

5615 Kirby Drive, Suite 518

Houston, Texas 77005-2448

(Address of principal executive offices) (Zip code)

Michael D. Mulcahy, President

Bridgeway Funds, Inc.

5615 Kirby Drive, Suite 518

Houston, Texas 77005-2448

(Name and address of agent for service)

Registrant's Telephone Number, including Area Code: (713) 661-3500

Date of fiscal year end: June 30

Date of reporting period: December 31, 2005

Item 1.—Reports to Stockholders

The following is a copy of the report to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

1

A no-load mutual fund family of domestic funds

Semi-Annual Report

December 31, 2005 (Unaudited)

AGGRESSIVE INVESTORS 1

(Closed to New Investors)

AGGRESSIVE INVESTORS 2

ULTRA-SMALL COMPANY

(Closed)

ULTRA-SMALL COMPANY MARKET

MICRO-CAP LIMITED

(Closed to New Investors)

SMALL-CAP GROWTH

SMALL-CAP VALUE

LARGE-CAP GROWTH

LARGE-CAP VALUE

BLUE CHIP 35 INDEX

BALANCED

www.Bridgeway.com

Table of Contents

Letter from the Investment Management Team

December 31, 2005

Dear Fellow Shareholders,

Calendar year 2005 was excellent for Bridgeway and its shareholders across the majority of our Funds. All of our actively managed Funds beat their market benchmarks for the year, while our index and passively managed Funds did exactly what they are designed to do: reasonably match the performance of their underlying indexes. You can find our usual detailed discussion of performance by individual fund, beginning on page 12.

In addition to performance and financial information, we'd like to highlight several sections of this report. First, a discussion of the market context of our performance is found on page 5. At Bridgeway, we like competition (it helps keep everyone on their toes). However, it's one thing to beat a peer average, but how do we compare to the recommended "picks" of a high profile rating agency? This analysis is presented on pages 6 and 7.

We solicit shareholder feedback with each letter, and a number of investors who have studied our lists of worst-performing stocks have written to us with the following question, "Why don't you set 'stop loss orders' to limit exposure to losses on individual stocks we own?" It seems to make sense that if you could limit your losses, you'd improve overall returns. Not necessarily: see our take on pages 7 and 8.

As many of you know, one of Bridgeway's four business values is achieving superior (efficient) cost structure, and it's useful at times to step back and look at the big picture. Are costs headed in the right direction? We try to answer this question on pages 8 and 9. Finally, you may know that the Funds' adviser donates half of its own net profits to charitable and non-profit organizations. On pages 10 and 11, John gives a report of a trip to Africa and highlights two organizations that the Adviser is particularly proud to help support.

As always, we appreciate your feedback. This is a brand new format for our semi-annual report and we are considering using it twice a year, with the annual and semi-annual reports, when we present the Funds' financial statements. Let us know how you like it at feedback@bridgeway.com. We take your comments seriously and discuss them regularly. Please keep your ideas coming—both favorable and critical. They are a vital tool in helping us serve you better.

Sincerely,

John Montgomery | |

Richard P. Cancelmo, Jr. |

Michael A. Whipple |

|

Elena Khoziaeva |

Your investment management team

4

Market Commentary

As you probably know, we don't pay a lot of attention to market trends at Bridgeway. Our investment process looks the same in a bear or bull market. I have four computer screens in my office, and not one of them runs a ticker tape. Our disciplined rule of thumb is: "If it's not going to make a difference in a decision you make, don't look." This saves a lot of time and emotional energy and lets our investment management team concentrate on what we think we do best—running our models in search of both the next good stock and the appropriate time to sell.

With this as a preface you may be wondering what we would possibly have to say about the market overall. Actually, market trends sometimes do help to explain the context within which our various funds operate. For example, surging energy prices and their effect on energy stocks help explain a portion of both Aggressive Investors Funds' market-beating performance in 2005.

One of the interesting trends since 1999 has been the dramatic lead of small companies over larger ones. By many (but not all) measures, 2005 was the seventh year in a row that small companies have outperformed large ones. For example, this is the seventh year in a row that the smallest companies ("ultra-small" or those in the smallest "decile" of the market) have outperformed the largest companies (those in the top "decile") according to data from the Center for Research in Security Prices ("CRSP"). It is the longest "small cap run" in the 79-year history of the CRSP database; however, we believe that large companies will have their "day in the sun" over the next three- to five-year period. We certainly don't claim to know when the turning point will come, and we don't think it's a good idea for anyone to try to "time" the market. Nor do we think you should go out and sell all your small or ultra-small stocks. However, we do think this would be a good time to make sure your portfolio is in line with your original plan, and that you are not inadvertently over-weighted in small or ultra-small stocks or funds due to their great performance over the last few years.

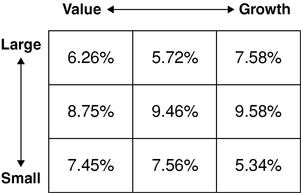

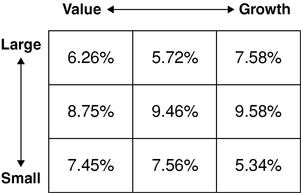

Like small stocks, "value" stocks have also had a great run in recent years. These stocks, which are characterized by their comparatively low prices (based on certain financial measures), dominated growth-oriented stocks over each of the last six years. On a contrarian basis, we believe growth stocks are also due for a "day in the sun." Indeed, growth stocks did outperform value stocks in the December quarter and in some isolated examples for all of 2005. (For example, large-cap growth mutual funds outperformed large-cap value mutual funds.) Thus, we also think this is a poor time for you to be over-weighted in value stocks or value-oriented funds—and a good time to check your portfolio for inadvertent over-weighting. The box below presents style box returns for 2005 according to data from Lipper.

Lipper Fund Category Returns by Style Box for Calendar 2005

Finally, one of the major market trends of 2005 was the boom in energy stocks, driven by rising oil prices. As a group, these stocks zoomed up by an average of 33%—more than twice the return of any other sector of the economy. Most of our Funds benefited from this trend; our Aggressive Investors Funds, in particular, had substantial weightings in energy, and included energy companies that performed better than the average ones. However, there was some reversal of fortune in the last quarter of the calendar year, as energy lagged all other market sectors.

5

Bridgeway Funds Standardized Returns for One, Five and Ten Years and Inception to Date As of December 31, 2005*

Fund

| | 1 year

| | 5 year

| | 10 Year

| | Inception to date

| | Inception

|

|---|

| Aggressive Investors 1 | | 14.93 | % | 7.65 | % | 21.05 | % | 21.64 | % | August 5, 1994 |

| Aggressive Investors 2 | | 18.59 | % | | | | | 13.15 | % | October 31, 2001 |

| Ultra-Small Company | | 2.99 | % | 27.26 | % | 22.54 | % | 22.77 | % | August 5, 1994 |

| Ultra-Small Company Market | | 4.08 | % | 23.88 | % | | | 17.10 | % | July 31, 1997 |

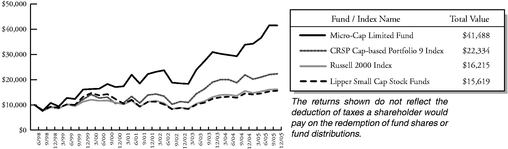

| Micro-Cap Limited | | 22.55 | % | 19.45 | % | | | 20.88 | % | June 30, 1998 |

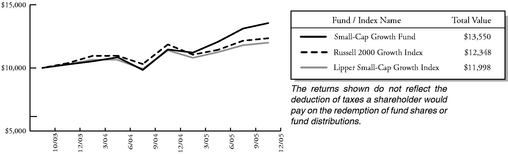

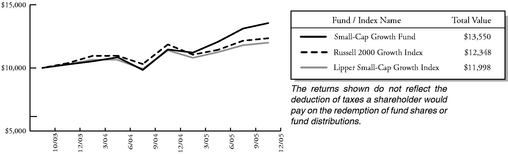

| Small-Cap Growth | | 18.24 | % | | | | | 15.05 | % | October 31, 2003 |

| Small-Cap Value | | 18.92 | % | | | | | 18.06 | % | October 31, 2003 |

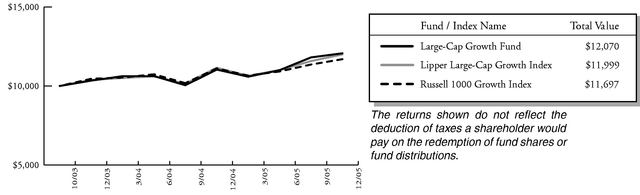

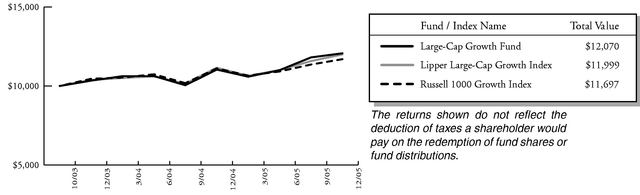

| Large-Cap Growth | | 9.33 | % | | | | | 9.07 | % | October 31, 2003 |

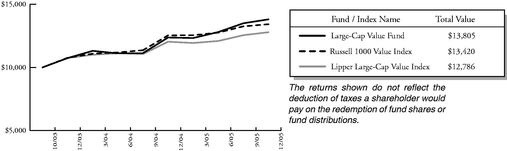

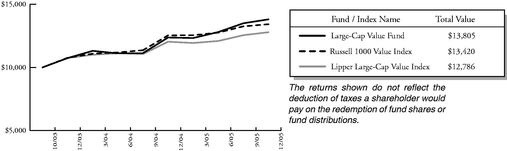

| Large-Cap Value | | 11.62 | % | | | | | 16.04 | % | October 31, 2003 |

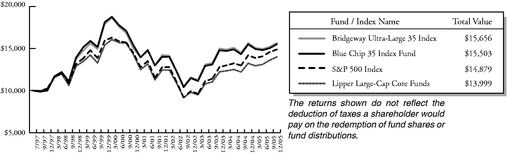

| Blue Chip 35 Index | | 0.05 | % | 0.14 | % | | | 5.35 | % | July 31, 1997 |

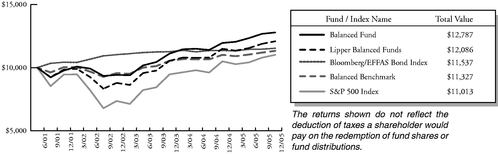

| Balanced | | 6.96 | % | | | | | 5.61 | % | June 30, 2001 |

- *

- Performance figures quoted represent past performance and are no guarantee of future results. Current performance may be lower or higher than the performance figures quoted, and an investor's shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call 1-800-661-3550 or visit the Fund's website at www.bridgeway.com.

Bridgeway 8, Morningstar 3

The Short Version: In 2005, Bridgeway's Funds beat Morningstar's "analyst picks" in eight of eleven equivalent categories.

One of the arguments in favor of purchasing actively managed funds is the desire to do better than average. Usually, our Bridgeway fund performance tables compare our returns to relevant market indexes. We think of indexes as "average," but in fact we believe indexes have beaten roughly 80% of actively managed mutual funds over the long haul historically. So comparing our performance against indexes rather than the "average" mutual fund is actually a very high hurdle. Nevertheless, we'd still like to know that we don't just beat the indexes or the average of our peers, but that we also beat comparable actively managed funds. After all, nobody wants an average doctor—we want a superior one. Likewise with mutual funds, we want to know how we stack up against other funds as chosen by an independent firm specializing in investment research.

Of course, the difficult part is identifying "best" funds up front, at the beginning of the performance period in question. For this purpose we turn to Morningstar, an independent Chicago-based firm, which publishes a list of fund "picks" selected by their analysts. We then look at how the performance of Bridgeway Funds compares with the average performance of these "best" funds. Thus, we pit the Bridgeway Funds in a given category against Morningstar's candidates for best funds. Think of it as a friendly competition.

In 2005, the results of this competition: eight to three in favor of Bridgeway. Of our 11 funds, eight beat the average for the Morningstar "analysts' picks" funds in the equivalent category, including

6

all but one of our actively managed funds. The table below presents the results by category and Bridgeway Fund.

Bridgeway Funds

| | Morningstar Analyst "Picks"

|

|---|

Name

| | 2005 Return

| | Morningstar Category

| | 2005 Return

|

|---|

| Large-Cap Value | | 11.62 | | Large-cap value | | 5.04 |

| Blue Chip 35 Index | | 0.05 | | Large-cap blend | | 4.86 |

| Large-Cap Growth | | 9.33 | | Large-cap growth | | 9.03 |

| Aggressive Investors 1 | | 14.93 | | Mid-cap growth | | 10.33 |

| Aggressive Investors 2 | | 18.59 | | Mid-cap growth | | 10.33 |

| Small-Cap Value | | 18.92 | | Small-Value | | 5.51 |

| Ultra-Small Co. Market | | 4.08 | | Small Blend | | 13.50 |

| Ultra-Small Company | | 2.99 | | Small-Growth | | 7.29 |

| Micro-Cap Limited | | 22.55 | | Small-Growth | | 7.29 |

| Small-Cap Growth | | 18.24 | | Small-Growth | | 7.29 |

| Balanced | | 6.96 | | Conservative Allocation | | 4.70 |

Past performance is not an indicator of future results. The Bridgeway Funds' adviser, Bridgeway Capital Management, does not have any influence on the selection of the funds chosen by Morningstar's analysts. The number and specific funds used in the comparison are in the control and discretion of Morningstar and their analysts and are subject to change. Morningstar's criteria for choosing Analyst Picks includes, but is not limited to, factors such as performance, expenses, and quality of fund management. In addition, the comparison of Bridgeway Funds to the Morningstar Analyst Picks is limited to performance only and does not take into consideration other factors that are considered by Morningstar when compiling their list of Analyst Picks.

Each Bridgeway Fund is compared to the average total return of the group of funds selected by Morningstar at the beginning of 2005 for the one year period ended December 31, 2005. Although these Analyst Picks changed from the beginning of the year to the final quarter, the same eight Bridgeway Funds beat the average of the end of year Morningstar picks as well. These averages in the table are comprised of between one and eight funds from within each category. In an effort to provide a complete and balanced assessment, all of the Bridgeway Funds are used in the comparison table shown above such that no attempt is made to cull out unfavorable results. The purpose of this comparison is to "raise the bar" on performance comparison, as this analysis uses an arguably higher benchmark by comparing the Bridgeway Funds to other funds chosen by an independent source that specializes in investment research.

Could One Limit Losses and Improve Returns with "Stop Loss" Orders?

The Short Version: It's tempting to think that we could save money and improve returns by instituting "stop loss" orders to eradicate our biggest declining stocks in a period. However, our simplified analysis indicates that is not the case.

For some shareholders, it's painful when the end-of-the-year round-up shows stock performance with a lot of red ink. Sure, the portfolio as a whole might have beaten the market, the peer-group average, or some other benchmark. But some can't help thinking how much better things might have been if your manager had sold earlier.

For example, take a look at the calendar year "losers" for Aggressive Investors 1 Fund on page 15. Even in an "up market" year, ten of our stocks declined more than 22%; one declined 58%. That list is ugly, a blot on an otherwise strong record, and it's only natural to want to wipe it out. A number of our shareholders have suggested we do just that, by setting stop-loss orders. Essentially, these are sell orders that execute automatically if a stock drops below a certain price. Would stop-loss orders have

7

increased our returns? We asked Elena Khoziaeva to test out this hypothesis under one scenario, using an analysis similar to one we did a number of years ago.

To perform the test, Elena looked at the results from stocks in our aggressive investors style for a representative period, from June 30, 2004 through October 31, 2005. She then set a theoretical stop loss of 20% (i.e. 20% less than either the price on June 30 or else 20% less than the purchase price) on all stocks in Aggressive Investors 1. If a stock continued dropping to, say, a total loss of 40%, Elena assumed that we had sold at the 20% drop and reinvested the proceeds in the remaining stocks in our portfolio. (There are any number of other stop loss programs we could have studied; this is just one, but reflects an answer to a specific suggestion by a shareholder and is representative of other work we have done previously.)

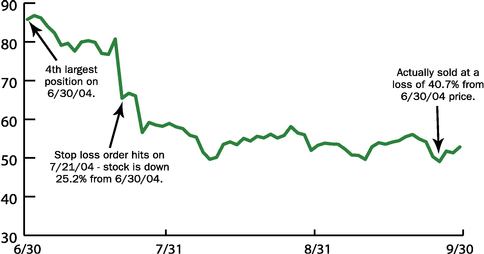

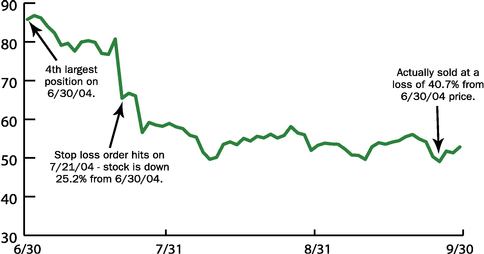

It sounds like it should have been a "slam-dunk" strategy. See the graph of ImClone Systems below. If we had sold the ImClone when the 20% stop order hit, we could have avoided a substantial additional loss of another 15% and increased the Fund's total return for the period by about 0.9%.

ImClone Systems from 6/30/04 to 9/30/04

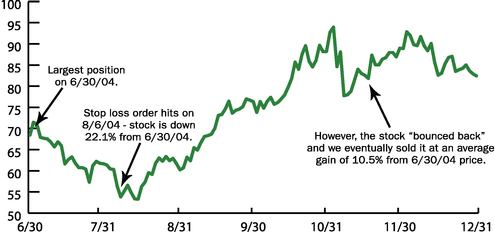

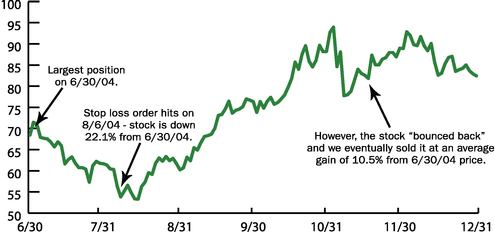

The problem, though, is that there are plenty of stocks that drop by more than 20% but eventually bounce back up above the 20% level. Sometimes, in fact, they bounce up higher than the price at which we bought, for a nice gain. One example is Research In Motion Ltd., which was our largest position on June 30, 2004. If we had sold this stock when it declined below our theoretical stop loss limit of 20%, we would have missed out on the 33% gain from the stop loss point. Selling at the 20%-down mark would have decreased the Fund's total return for the period by about 4.4% (since this was a core holding).

Research in Motion Ltd. from 6/30/04 to 12/31/04

So, what was the bottom line on Elena's analysis? The answer was interesting. According to the analysis, we would have gained nothing by implementing "stop loss" orders. The actual return of the

8

Fund over the period in question was 28.00%, while the hypothetical "stop loss" portfolio return was 27.99%—call it a wash. However, those figures don't include all transaction costs, such as trading commissions; we believe that adding those costs in tips the scales in favor of not setting stop loss orders under the specific stop loss program proposed. On top of that, setting stop loss orders would disrupt part of the process we used to manage the Fund's tax-efficiency, thus hurting after-tax returns for shareholders in taxable accounts. Our conclusion from this and other analysis is that setting stop-loss orders sounds good on paper, but our time and efforts are better focused elsewhere.

Six and a Half Years of Expenses

The Short Version: In our fiscal year (June) report we reviewed some data comparing our expense ratios to those of other funds. In our semi-annual report, however, we review our trend of expenses over time, to see whether we're doing a good job of keeping costs low or (ideally) pushing them even lower.

Bridgeway's four business values are integrity, investment performance, efficient cost, and friendly service. In every report we talk a lot about performance and not infrequently about integrity, but I thought it would be appropriate to revisit the record on expenses. We may be doing well relative to our peers, but one of our Bridgeway colleagues recently reviewed our expenses to test our goal of becoming even more efficient.

Overall, the trend is definitely in the right direction, and you, our shareholders, deserve some thanks for that. When investors buy shares in the Funds, the company's net assets increase (good performance on the part of the Funds' stocks has the same effect). Growth in assets is important in helping to drive expenses down on a per share basis, as it allows the Funds' costs to be spread over a larger base. This trend can go the other direction, however, when assets decline or when growth in costs outstrips asset growth. Thus, it is very important to do a good job of managing costs independent of the direction of asset growth.

The table below presents the operating costs for each of our Funds over the past several years. I'm excluding management fees because we covered those separately in our last annual report and because the performance-based fees on some of the Funds can cloud the picture. Thus, expenses in the table are not total operating expenses, but correspond to the "other expenses" category in our prospectus fee table.

One area of greatly increased costs in the last year has been in compliance-related activities. A recent survey of advisory firms indicated that the average firm saw compliance costs rise by 60% in 2005 as firms responded to an abundance of new regulations. These costs have increased for Bridgeway as well, and we'll cover this topic separately in a future letter. Overall, however, we continue to make progress on the expense front, and I am proud of our record of reducing expense ratios in the current decade. As the numbers get leaner, the job gets harder, but we are committed to vigilance in cost management.

9

Bridgeway Funds Expense Trends 2000 - 2005

"Other expenses" before waivers and reimbursements

| | Year

ended

6/30/2000

| | Year

ended

6/30/2001

| | Year

ended

6/30/2002

| | Year

ended

6/30/2003

| | Year

ended

6/30/2004

| | Year

ended

6/30/2005

| | 6 Months

ended

12/31/2005

annualized

| | Decline

Over

Period

Shown

| |

|---|

| Aggressive Investors 1 | | 0.54 | % | 0.20 | % | 0.21 | % | 0.30 | % | 0.23 | % | 0.19 | % | 0.34 | % | 0.20 | % |

| Aggressive Investors 2 | | | | | | 1.40 | %* | 1.05 | % | 0.27 | % | 0.28 | % | 0.25 | % | 1.15 | % |

| Ultra-Small Company | | 0.56 | % | 0.52 | % | 0.36 | % | 0.39 | % | 0.25 | % | 0.22 | % | 0.16 | % | 0.40 | % |

| Ultra-Small Company Market | | 1.44 | % | 1.11 | % | 0.51 | % | 0.35 | % | 0.17 | % | 0.23 | % | 0.16 | % | 1.28 | % |

| Micro-Cap Limited | | 0.78 | % | 0.49 | % | 0.34 | % | 0.52 | % | 0.23 | % | 0.30 | % | 0.24 | % | 0.54 | % |

| Small-Cap Growth | | | | | | | | | | 0.65 | %** | 0.48 | % | 0.26 | % | 0.39 | % |

| Small-Cap Value | | | | | | | | | | 0.89 | %** | 0.47 | % | 0.20 | % | 0.69 | % |

| Large-Cap Growth | | | | | | | | | | 0.63 | %** | 0.53 | % | 0.31 | % | 0.32 | % |

| Large-Cap Value | | | | | | | | | | 1.02 | %** | 0.60 | % | 0.32 | % | 0.70 | % |

| Blue Chip 35 Index | | 0.39 | % | 0.60 | % | 0.85 | % | 0.99 | % | 0.50 | % | 0.48 | % | 0.26 | % | 0.13 | % |

| Balanced | | | | | | 1.47 | %* | 1.06 | % | 0.91 | % | 0.59 | % | 0.45 | % | 1.02 | % |

Simple Average of Funds

existing in FY2000 | | 0.74 | % | 0.58 | % | 0.45 | % | 0.51 | % | 0.28 | % | 0.28 | % | 0.23 | % | 0.51 | % |

- *

- inception date was 10/31/01

- **

- Class N only, from inception date 10/31/03

Comfort in the Mediocre

The Short Version: I'd rather settle for market beating performance.

Sometimes I'm amazed at the reasoning that accompanies lousy performance. I've come to expect it in the "management discussion and analysis" from funds that continually under perform. I was surprised at the following rationale by a rating agency that accompanied market lagging performance, however. (Names have been changed to protect the. .. uh, people involved.)

On November 5 Joe Manager Smith stepped down from Mediocre Fund's ZZZ class shares. This month would have marked Smith's seventh year managing the fund. Before taking the helm of these funds, he was an analyst for more than ten funds. While the funds were rarely top-quartile performers—indeed, they haven't beaten the S&P in years—his lengthy experience and the structural setup of the fund gave us comfort.

Comfort? OK, but experience isn't a good thing unless it's good experience, and structure only helps if it's is likely to lead to good results. Where else do you look for proof, if not the long term performance and consistency of performance of a fund?

Some Personal Thoughts on Genocide by John Montgomery

Genocide is not a typical subject for a portfolio manager's letter. However, the Bridgeway Funds are unusual in a number of ways, including the fact that the Funds' Adviser, Bridgeway Capital Management, donates half of its after-tax profits to charitable and non-profit organizations. Some of the projects the Adviser has helped to finance include a college preparatory high school for low-income students, an arts program for bereaved children, and a clean-water system for a small town in Honduras. But one of the Adviser's "core missions" is working to further global peace and to help end genocide. In September, a colleague and I traveled to Africa for two weeks to deepen our understanding of human rights issues, establish new relationships, and find new opportunities to make a difference. After concluding that Sudan and the Congo were currently too dangerous to visit, we

10

traveled instead to a somewhat safer, yet war-ravaged region of Uganda, and to Rwanda, where in 1994—over a span of just 100 days—800,000 civilians were killed for no reason other than their ethnicity.

Of course, that kind of atrocity is nothing new for the world. Thirty-eight years ago, my life was changed when a seventh-grade history class introduced me to the Holocaust. The horror was almost inconceivable to me, and as a twelve-year-old boy in Houston, Texas, those dreadful events seemed like ancient history, and as remote as a distant planet. But they planted a seed for future action and commitment. With all that we know about that hideous chapter in world history, it seems incredible to me that genocide is still being perpetrated today. And yet, the genocide in Africa is not ancient history; it continues as I write this letter. And thanks to instant news reporting and economic globalization, distances have shrunk to the point that Africa now seems as close as our own back yard. There is no aspect of society, whether family structure, cultural traditions, economic well-being, physical health, or spiritual life, that is undamaged by the violence.

One of the most painful, most unbelievable aspects of our trip involved listening to the personal testimony of Ugandan children, typically between the ages of eight and twelve, who were kidnapped, horribly abused by their captors, trained as soldiers, and forced to mutilate and kill other children from their own villages. I shuddered to think what I would do had my own daughters been among those children. In Rwanda, I stood on a hill where 250,000 victims of the genocide lie buried. How would I feel if my family and friends were in that grave? Such inhumanity is unfathomable and soul wrenching, and yet it continues to exist.

Despite the painful thoughts, the trip was also enormously uplifting. I met some people who had made the courageous decision to turn away from revenge, others who work relentlessly for justice and real reconciliation. I met many individuals who were devoting their energy and creativity to work in government service or with non-governmental or with religious organizations or with philanthropic projects undertaken by small, local businesses. And I met many, many people who were and are making a difference one relationship, one opportunity at a time. So how can you and I make a difference as we go about our own lives here in the United States? To answer that, I'd like to tell you a little about a couple of the organizations that we help fund.

One, about which we're very excited, is called Invisible Children (www.invisiblechildren.com). The children in question are the children of northern Uganda like the ones I met, abducted and forced into a world of brutality that for most of us is simply beyond imagining. As the Invisible Children project comes to fruition, however, we won't need to imagine this world: It will be up in front of us on a movie screen. The three young filmmakers, all of them in their 20s, who created the Invisible Children documentary, have traveled extensively in Uganda. They have filmed hundreds and hundreds of hours' worth of interviews—with children, with their families, with government officials, including the President of Uganda, with members of the military and local NGOs. Young and a little shaggy, with equipment purchased mostly on Ebay, the group appears to present relatively little threat, and this has helped them gain access to some areas that would be unlikely to admit a CNN camera crew. At the same time, the Ugandan children have been willing to open up to these young filmmakers in a way they would probably not have opened up to a team of older journalists.

The Invisible Children: Rough Cut film, complete with an MTV-style soundtrack, is currently being made available, for free, to college and high-school groups around the United States. Students are encouraged to gather their friends and their friends' friends, and their friends' friends' friends to watch and learn and "blog" about what they've learned, to raise money and donate time and energy, to get involved. The filmmakers intend on releasing the Invisible Children: Final Cut in theatres nationwide in early 2007. The immediate cause, of course, is help for the children of Uganda and the restoration of peace, which this area has not seen for 20 years. But perhaps just as important is the cause of helping

11

America's young people realize that with their time and their energy and their networks of friends, they can help shape the world.

Another group of young people striving for social change, the Genocide Intervention Network (www.genocideinterventionnetwork.com) is focused on helping to end the terrible violence that is ravaging the Darfur region of Sudan. "GI-Net" was started by students and recent alumni of Swarthmore College (which happens to be my alma mater); among their founding members are a Christian, a Jew whose grandparents were Holocaust survivors, and an observant Muslim. The group produces educational materials about Darfur, which it offers to student organizations across the U.S. Last spring, in commemoration of the "100 Days" of genocide in Rwanda, and in concert with hundreds and hundreds of young people from all over the U.S., they raised a quarter of a million dollars for the African Union's peacekeeping efforts in Darfur. I am proud to help support their work.

You might be asking how this all relates to investment. One answer is that there are many different ways to invest, and different ways of defining profit. I regard our support of groups such as GI-Net and Invisible Children (as well as more mature organizations, such as Amnesty International and Human Rights Watch) as investments in the hope for a better world. If these investments help produce a better world for my daughters, and for their families, I will regard that as a very significant profit indeed.

Another answer is that as a money manager, I have always looked for opportunities across the full range of alternatives. Both the world of money-management and the world of philanthropy tend to be very conservative, focused almost exclusively on large, well known companies and organizations. There is no question that large companies such as Apple Computer and well known organizations such as Amnesty International can produce impressive results, and I am happy to invest in them. At the same time, however, I believe it's a mistake to disregard smaller, young companies and organizations. The best of them have energy and fresh, valuable approaches to contribute to the market and the marketplace of ideas. For example, the Bridgeway Ultra-Small Company Fund earned more than 200% on both Quicksilver Resources (an energy company) and SPC Pool (a distributor of swimming-pool supplies). These were tiny companies that yielded enormous gains. Invisible Children and GI-Net may not even be in existence in ten years—or they may be our "ten baggers" that make the difference in actually helping stop a war or end genocide. If we don't take a chance on them, we risk missing out on something extraordinary.

12

Aggressive Investors 1 Fund

MANAGER'S COMMENTARY

(Unaudited)

December 31, 2005

Dear Fellow Aggressive Investors 1 Fund Shareholder,

Our Fund was down 0.57% in the December quarter compared to a gain of 2.09% for our primary benchmark, the S&P 500 Index and 1.81% for our peer benchmark, the Lipper Capital Appreciation Funds Index. It was a poor quarter.

On the heels of three very fine quarters, however, our calendar year return was very strong: 14.93% compared to 4.91% for our primary benchmark, the S&P 500 Index and 7.96% for our peer benchmark, the Lipper Capital Appreciation Funds Index.

The table below presents our December quarter, six-month, one-year, five-year, ten-year and life-to-date financial results according to the formula required by the SEC.

| | Dec. Qtr.

10/1/05

to 12/31/05

| | 6 Months

7/1/05

to 12/31/05

| | 1 Year

1/1/05

to 12/31/05

| | 5 Year

1/1/01

to 12/31/05

| | 10 Year

1/1/96

to 12/31/05

| | Life-to-Date

8/5/94

to 12/31/05

| |

|---|

| Aggressive Investors 1 Fund | | -0.57 | % | 10.83 | % | 14.93 | % | 7.65 | % | 21.05 | % | 21.64 | % |

| S&P 500 Index (large companies) | | 2.09 | % | 5.77 | % | 4.91 | % | 0.54 | % | 9.06 | % | 11.12 | % |

| Russell 2000 Index (small companies) | | 1.13 | % | 5.88 | % | 4.55 | % | 8.22 | % | 9.26 | % | 10.78 | % |

| Lipper Capital Appreciation Funds | | 1.81 | % | 8.56 | % | 7.96 | % | 0.15 | % | 7.28 | % | 9.24 | % |

Performance figures quoted represent past performance and are no guarantee of future results. Current performance may be lower or higher than the performance figures quoted, and an investor's shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call 1-800-661-3550 or visit the Fund's website at www.bridgeway.com.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks with dividends reinvested, while the Russell 2000 Index is an unmanaged, market value weighted index, that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The Lipper Capital Appreciation Funds Index reflects the aggregate record of more aggressive domestic growth mutual funds, as reported by Lipper, Inc. It is not possible to invest directly in an index or average. Periods longer than one year are annualized.

For the six-month semi-annual period, our Fund was up 10.83%, compared to 5.77% for the S&P 500 Index of large companies. As reported last quarter, our substantial energy holdings had a very favorable impact in the September quarter, although they "gave back" a bit of return in the December quarter.

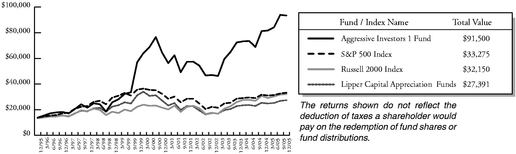

According to data from Lipper, Inc. as of December 31, 2005, Aggressive Investors 1 Fund ranked 63rd of 445 capital appreciation funds for 2005, 32nd of 284 over the last five years, 1st of 101 over the last ten years, and 1st of 74 since inception in August, 1994. Lipper, Inc. is an independent mutual fund rating service that ranks funds in various fund categories by making comparative calculations using total returns.

13

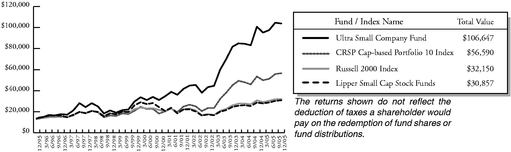

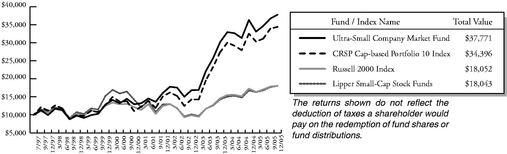

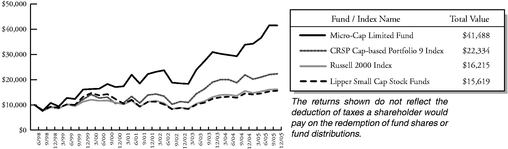

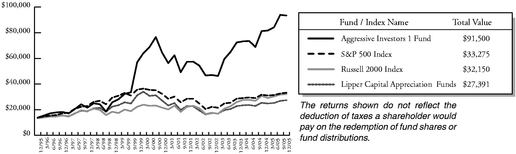

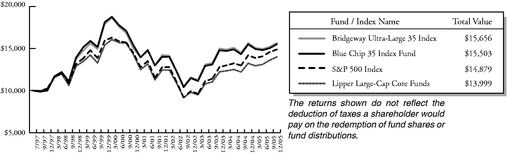

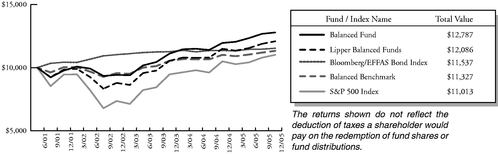

Growth of $10,000 Invested in Aggressive Investors 1 Fund and Indexes from 12/31/95 to 12/31/05

Detailed Explanation of Quarterly Performance—What Worked Well

The Short Version: Energy stocks took a back seat this quarter, making way for good performers from a variety of industries.

These are the ten best-performers for the December quarter:

Rank

| | Description

| | Industry

| | % Gain

| |

|---|

| 1 | | Hansen Natural Corp | | Beverages | | 67.4 | % |

| 2 | | Apple Computer Inc | | Computers | | 34.6 | % |

| 3 | | Coldwater Creek Inc | | Retail | | 32.2 | % |

| 4 | | LCA-Vision Inc | | Healthcare-Products | | 28.0 | % |

| 5 | | Joy Global Inc | | Machinery-Const & Mining | | 28.0 | % |

| 6 | | WESCO International Inc | | Distribution/Wholesale | | 26.2 | % |

| 7 | | Marvell Technology Group Ltd | | Semiconductors | | 21.6 | % |

| 8 | | Red Hat Inc | | Software | | 17.7 | % |

| 9 | | Cal Dive International Inc | | Oil & Gas Services | | 13.2 | % |

| 10 | | Goodyear Tire & Rubber Co | | Auto Parts & Equipment | | 11.9 | % |

While last quarter's best performers list was packed with energy stocks, you may be surprised to see only one on our list of gainers above. Our models are still enamored by energy and energy-related companies. However, when we see a run up in a fairly volatile sector that takes its weighting in the portfolio over 35%, our "top-down" risk management strategy may dictate that we begin to trim our holdings, as happened with energy at the beginning of October. Our sector representation went from 35.8% to 22.6% during the quarter.

You might say that our top performer, Hansen Natural, is also involved in energy—energy drinks. Hubert Hansen started making fresh, non-pasteurized juices for film studios and retailers in Southern California in the 30's. Lately, with the addition of smoothies, ready-to-drink iced teas, juice cocktails and energy drinks, its brands have caught the public's attention. Forbes listed Hansen in first place in its "200 Best Small Companies" for 2005, with "new energy drinks targeted at the youth sports market and white-collar workforce." (We gathered our staff recently for a Hansen taste test—the juices were the staff's favorites; I liked the ginseng drink.) Hansen also tops our list of performers for the year, increasing over 166% since our original purchase in March.

Apple's iPod products continue to grow in popularity and to spawn derivative products, which provide diversity for the company beyond personal computers. Although the tremendous price appreciation since our first purchase almost a year and a half ago means this stock is not nearly as cheap as it was, our models still like it, and currently, we're holding.

14

Detailed Explanation of Quarterly Performance—What Didn't Work

The Short Version: Careful trimming of our energy holdings gave us a softer landing this quarter than I would have expected.

These are the ten stocks that performed the worst in the December quarter:

Rank

| | Description

| | Industry

| | % Loss

| |

|---|

| 1 | | Forward Industries Inc | | Textiles | | -58.3 | % |

| 2 | | Building Material Holding Corp | | Distribution/Wholesale | | -26.3 | % |

| 3 | | UGI Corp | | Gas | | -23.0 | % |

| 4 | | Digital River Inc | | Internet | | -21.7 | % |

| 5 | | Toll Brothers Inc | | Home Builders | | -18.0 | % |

| 6 | | Chesapeake Energy Corp | | Oil & Gas | | -17.5 | % |

| 7 | | Tenaris SA | | Iron/Steel | | -16.9 | % |

| 8 | | ConocoPhillips | | Oil & Gas | | -16.8 | % |

| 9 | | Consol Energy Inc | | Coal | | -15.2 | % |

| 10 | | Overseas Shipholding Group | | Transportation | | -14.6 | % |

Although significantly reduced, our exposure to the energy sector was still more than twice that of the broader market, which hurt our quarterly performance. Our energy-related stocks fell 8.17% on average, more favorable than the S&P 500 Index's 9.8% decline of energy stocks. In summary, our energy stocks performed better than average, but still held back our performance substantially in the December quarter.

Forward Industries, maker of carrying cases for cell phones, laptops and other equipment, is our worst performer for the quarter. Timing of product shipments, pricing pressures and higher operating costs are a bad combination and caused the Florida-based company's recent price tumble, which in turn cost the fund 0.5% in performance for the quarter. Digital River was a strong performer through the summer, but by the time we sold the last of our holdings in late October, it had given back most of its gains.

Detailed Explanation of Calendar Year Performance—What Worked Well

The Short Version: Energy, energy, energy.

These are the ten best-performers for the calendar year:

Rank

| | Description

| | Industry

| | % Gain

| |

|---|

| 1 | | Hansen Natural Corp | | Beverages | | 166.8 | % |

| 2 | | Valero Energy Corp | | Oil & Gas | | 105.6 | % |

| 3 | | Tesoro Corp | | Oil & Gas | | 94.1 | % |

| 4 | | Chesapeake Energy Corp | | Oil & Gas | | 91.3 | % |

| 5 | | Coldwater Creek Inc | | Retail | | 62.0 | % |

| 6 | | Foundation Coal Holdings Inc | | Coal | | 61.6 | % |

| 7 | | Kos Pharmaceuticals Inc | | Pharmaceuticals | | 59.9 | % |

| 8 | | Southwestern Energy Co | | Oil & Gas | | 48.8 | % |

| 9 | | Brookfield Asset Management Inc | | Real Estate | | 48.6 | % |

| 10 | | Marvell Technology Group Ltd | | Semiconductors | | 47.8 | % |

Two-thirds of our performance for the calendar year can be attributed to energy stocks. Six of the ten companies listed above also appeared in our fiscal year winners in June; however, five are in industries other than oil and gas, which helped our diversity later in the year as energy stock prices

15

began to decline. Coldwater Creek, which provides specialty clothing and gifts purchased through catalogs or the Internet, was our number two performer for the fiscal year (through last June 2005) and a steady performer through the calendar year. Although our Retail weighting was about equal to the market, our stocks did particularly well and gave us a 2% performance boost above the market during the quarter.

Detailed Explanation of Calendar Year Performance—What Didn't Work

The Short Version: Compared to seven companies that appreciated at least 50% in the calendar year, only one declined that much. Still, it hurt.

The stocks that performed worst for the calendar year:

Rank

| | Description

| | Industry

| | % Loss

| |

|---|

| 1 | | Forward Industries Inc | | Textiles | | -58.3 | % |

| 2 | | Oregon Steel Mills Inc | | Iron/Steel | | -44.0 | % |

| 3 | | AK Steel Holding Corp | | Iron/Steel | | -37.3 | % |

| 4 | | Deckers Outdoor Corp | | Apparel | | -32.6 | % |

| 5 | | Ford Motor Co | | Auto Manufacturers | | -31.3 | % |

| 6 | | eBay Inc | | Internet | | -29.5 | % |

| 7 | | Digital River Inc | | Internet | | -25.4 | % |

| 8 | | Cleveland-Cliffs Inc | | Iron/Steel | | -23.7 | % |

| 9 | | Commercial Metals Co | | Metal Fabricate/Hardware | | -22.7 | % |

| 10 | | Petroleum Development Corp | | Oil & Gas | | -22.2 | % |

A number of our problem holdings for the year centered on two disparate industries: steel and the Internet. Both of these industries did well for the year overall but some of our individual picks did not. In the case of Oregon Steel, the company also did very well for the year, but unfortunately, the timing of our purchase and sale was particularly poor. As reported above, Forward Industries is facing some order-timing and production expense challenges. Personally, I'm kind of sad to see Ford Motor go (we sold earlier in the year, but not before a substantial loss), but our models know no such emotion. Here are our worst ten for the year:

Top Ten Holdings

At quarter end, Goodyear Tire & Rubber Company comprised our largest company representation at 6.9% of net assets, followed by Apple Computer at 4.0% and Joy Global at 3.8%. From the standpoint of diversification, I love seeing three such disparate companies at the top of our list. Our top ten holdings represented 36.5% of net assets.

Rank

| | Description

| | Industry

| | Percent of

Net Assets

| |

|---|

| 1 | | Goodyear Tire & Rubber Co | | Auto Parts & Equipment | | 6.9 | % |

| 2 | | Apple Computer Inc | | Computers | | 4.0 | % |

| 3 | | Joy Global Inc | | Machinery-Const & Mining | | 3.8 | % |

| 4 | | Valero Energy Corp | | Oil & Gas | | 3.7 | % |

| 5 | | McDermott International Inc | | Engineering & Const | | 3.3 | % |

| 6 | | Dress Barn Inc | | Retail | | 3.2 | % |

| 7 | | BMC Software Inc | | Software | | 3.1 | % |

| 8 | | Quanta Services Inc | | Commercial Services | | 3.0 | % |

| 9 | | Tesoro Corp | | Oil & Gas | | 3.0 | % |

| 10 | | Sunoco Inc | | Oil & Gas | | 2.5 | % |

| | | | | | |

| |

| | Total | | | | 36.5 | % |

16

Industry Sector Representation as of December 31, 2005

Energy continues as our Fund's largest sector, but we trimmed it substantially, down from 35.8% last quarter. The industry we are most underrepresented in is Financial.

| | % of Net Assets

| | S&P 500 Index

| | Difference

| |

|---|

| Basic Materials | | 1.0 | % | 2.9 | % | -1.9 | % |

| Communications | | 9.2 | % | 10.2 | % | -1.0 | % |

| Consumer, Cyclical | | 15.8 | % | 8.5 | % | 7.3 | % |

| Consumer, Non-cyclical | | 16.0 | % | 21.6 | % | -5.6 | % |

| Energy | | 22.6 | % | 9.6 | % | 13.0 | % |

| Financial | | 5.3 | % | 21.1 | % | -15.8 | % |

| Industrial | | 15.8 | % | 11.3 | % | 4.5 | % |

| Technology | | 13.4 | % | 11.4 | % | 2.0 | % |

| Utilities | | 0.0 | % | 3.4 | % | -3.4 | % |

| Cash | | 0.9 | % | 0.0 | % | 0.9 | % |

| | |

| |

| | | |

| | Total | | 100.0 | % | 100.0 | % | | |

Disclaimer

The following is a reminder from the friendly folks at your Fund who worry about liability. The views expressed here are exclusively those of Fund management. These views, including those of market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter end, December 31, 2005, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and are not indicative of future performance.

The Fund is subject to above average market risk (volatility) and is not an appropriate investment for short-term investors. Investments in the small companies within this multi-cap fund generally carry greater risk than is customarily associated with larger companies for various reasons such as narrower markets, limited financial resources and less liquid stock.

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding the Fund's risks, objectives, fees and expenses, experience of its management, and other information. The prospectus and other fund information may be obtained by calling 1800-661-3550 or visiting the Fund's website www.bridgeway.com. Foreside Fund Services, LLC, distributor.

Conclusion

Thank you for your continued investment in Aggressive Investors 1. This Fund remains open only to current investors as we seek to keep the nimbleness that has fared well through the years. As always, we appreciate your feedback.

Sincerely,

John Montgomery

17

DISCLOSURE OF FUND EXPENSES

(Unaudited)

As a shareholder of the Fund, you will incur no transaction costs from the Fund, including sales charges (loads) on purchases, on reinvested dividends, or on other distributions. There are also no redemption fees or exchange fees. However, as a shareholder of the Fund, you will incur ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on July 1, 2005 and held until December 31, 2005.

Actual Return. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading "Expense Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical 5% Return. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds, because other funds may also have transaction costs, such as sales charges, redemption fees or exchange fees.

Bridgeway Aggressive Investors 1 Fund

| | Beginning Account

Value at 7/1/05

| | Ending Account

Value at 12/31/05

| | Expense Paid

During Period*

7/1/05 - 12/31/05

|

|---|

| Actual Fund Return | | $ | 1,000.00 | | $ | 1,108.30 | | $ | 9.25 |

| Hypothetical Fund Return | | $ | 1,000.00 | | $ | 1,016.43 | | $ | 8.84 |

- *

- Expenses are equal to the Fund's annualized expense ratio of 1.74% multiplied by the average account value over the period, multiplied by the number of days in the first fiscal half-year divided by 365 days in the current year (to reflect the one half-year period).

18

SCHEDULE OF INVESTMENTS

Showing percentage of net assets as of December 31, 2005

(Unaudited)

Industry

| | Company

| | Shares

| | Value

|

|---|

COMMON STOCKS—99.1% |

|

|

|

|

|

| Apparel—2.1% | | | | | |

| | | Guess? Inc* | | 240,000 | | $ | 8,544,000 |

Auto Parts & Equipment—6.9% |

|

|

|

|

|

| | | The Goodyear Tire & Rubber Co* | | 1,599,000 | | | 27,790,620 |

Banks—1.4% |

|

|

|

|

|

| | | US Bancorp | | 187,400 | | | 5,601,386 |

Beverages—2.4% |

|

|

|

|

|

| | | Hansen Natural Corp*+ | | 124,800 | | | 9,835,488 |

Coal—1.0% |

|

|

|

|

|

| | | Foundation Coal Holdings Inc | | 102,000 | | | 3,876,000 |

Commercial Services—4.0% |

|

|

|

|

|

| | | Administaff Inc | | 97,400 | | | 4,095,670 |

| | | Quanta Services Inc* | | 924,500 | | | 12,175,665 |

| | | | | | |

|

| | | | | | | | 16,271,335 |

Computers—6.1% |

|

|

|

|

|

| | | Apple Computer Inc* | | 223,800 | | | 16,088,982 |

| | | Sandisk Corp* | | 136,700 | | | 8,587,494 |

| | | | | | |

|

| | | | | | | | 24,676,476 |

Distribution/Wholesale—2.5% |

|

|

|

|

|

| | | WESCO International Inc* | | 233,300 | | | 9,968,909 |

Diversified Financial Services—1.6% |

|

|

|

|

|

| | | Merrill Lynch & Co | | 92,400 | | | 6,258,252 |

Electronics—2.2% |

|

|

|

|

|

| | | Agilent Technologies* | | 241,200 | | | 8,029,548 |

| | | American Science & Engineering* | | 12,500 | | | 779,625 |

| | | | | | |

|

| | | | | | | | 8,809,173 |

Engineering & Construction—3.3% |

|

|

|

|

|

| | | McDermott International* | | 302,000 | | | 13,472,220 |

Healthcare Products—4.1% |

|

|

|

|

|

| | | Alcon Inc | | 67,300 | | | 8,722,080 |

| | | LCA-Vision Inc | | 162,000 | | | 7,696,620 |

| | | | | | |

|

| | | | | | | | 16,418,700 |

Internet—1.7% |

|

|

|

|

|

| | | Nutri System Inc* | | 195,000 | | | 7,023,900 |

Iron & Steel—1.0% |

|

|

|

|

|

| | | Tenaris | | 35,800 | | | 4,099,100 |

| | | | | | | | |

19

Machinery—Construction & Mining—5.8% |

|

|

|

|

|

| | | JLG Industries Inc | | 178,800 | | $ | 8,164,008 |

| | | Joy Global Inc | | 382,350 | | | 15,294,000 |

| | | | | | |

|

| | | | | | | | 23,458,008 |

Metal Fabricate/Hardware—1.2% |

|

|

|

|

|

| | | NS Group Inc* | | 112,800 | | | 4,716,168 |

Miscellaneous Manufacturing—1.9% |

|

|

|

|

|

| | | Ceradyne Inc* | | 170,000 | | | 7,446,000 |

Oil & Gas—19.1% |

|

|

|

|

|

| | | Anadarko Petroleum Corp | | 65,900 | | | 6,244,025 |

| | | Chesapeake Energy Corp | | 102,800 | | | 3,261,844 |

| | | ConocoPhillips | | 83,000 | | | 4,828,940 |

| | | EOG Resources Inc | | 97,600 | | | 7,160,912 |

| | | Occidental Petroleum Corp | | 71,700 | | | 5,727,396 |

| | | Southwestern Energy Co* | | 193,000 | | | 6,936,420 |

| | | Sunoco Inc | | 130,800 | | | 10,252,104 |

| | | Tesoro Petroleum Corp | | 193,400 | | | 11,903,770 |

| | | Valero Energy Corp | | 285,200 | | | 14,716,320 |

| | | XTO Energy Inc | | 136,442 | | | 5,995,247 |

| | | | | | |

|

| | | | | | | | 77,026,978 |

Oil & Gas Services—2.5% |

|

|

|

|

|

| | | Cal Dive International Inc* | | 281,600 | | | 10,106,624 |

Pharmaceuticals—5.4% |

|

|

|

|

|

| | | Bristol-Myers Squibb Co | | 367,500 | | | 8,445,150 |

| | | Express Scripts Inc* | | 102,000 | | | 8,547,600 |

| | | Merck & Co Inc | | 151,200 | | | 4,809,672 |

| | | | | | |

|

| | | | | | | | 21,802,422 |

Real Estate Operations—1.3% |

|

|

|

|

|

| | | Brookfield Asset Management | | 102,900 | | | 5,178,957 |

Retail—4.3% |

|

|

|

|

|

| | | Dress Barn Inc* | | 334,373 | | | 12,910,142 |

| | | Nordstrom Inc | | 118,200 | | | 4,420,680 |

| | | | | | |

|

| | | | | | | | 17,330,822 |

Savings & Loans—1.1% |

|

|

|

|

|

| | | Washington Mutual Inc | | 101,100 | | | 4,397,850 |

Semiconductors—2.5% |

|

|

|

|

|

| | | Marvell Technology Group Ltd* | | 177,800 | | | 9,972,802 |

Software—4.8% |

|

|

|

|

|

| | | BMC Software Inc* | | 608,000 | | | 12,457,920 |

| | | Red Hat Inc* | | 258,000 | | | 7,027,920 |

| | | | | | |

|

| | | | | | | | 19,485,840 |

| | | | | | | | |

20

Telecommunications—7.5% |

|

|

|

|

|

| | | AT&T Inc | | 388,300 | | $ | 9,509,467 |

| | | BellSouth Corp | | 148,500 | | | 4,024,350 |

| | | Corning Inc* | | 209,000 | | | 4,108,940 |

| | | Dobson Communications* | | 594,500 | | | 4,458,750 |

| | | Motorola Inc | | 181,500 | | | 4,100,085 |

| | | Powerwave Technologies* | | 316,800 | | | 3,982,176 |

| | | | | | |

|

| | | | | | | | 30,183,768 |

Transportation—0.0%^ |

|

|

|

|

|

| | | Kirby Corp* | | 10 | | | 522 |

Trucking & Leasing—1.4% |

|

|

|

|

|

| | | GATX Corp | | 158,000 | | | 5,700,640 |

| | | | | | |

|

TOTAL COMMON STOCKS

(Cost $326,464,093) | | | | | 399,452,960 |

| | | | | | |

|

PURCHASED CALL OPTIONS—LONG—0.1% |

|

|

|

|

|

| |

| | Number of contracts

| |

|

|---|

| ConocoPhillips | | | | | |

| | | expiring Jan 06 at $62.50 | | 300 | | | 6,750 |

| The Goodyear Tire & Rubber Co | | | | | |

| | | expiring Jan 06 at $17.50 | | 1,000 | | | 50,000 |

| Joy Global Inc | | | | | |

| | | expiring Feb 06 at $40.00 | | 250 | | | 65,625 |

| | | expiring Apr 06 at $40.00 | | 650 | | | 260,000 |

| | | | | | |

|

TOTAL PURCHASED CALL OPTIONS

(Cost $625,844) | | | | | 382,375 |

| | | | | | |

|

MONEY MARKET MUTUAL FUNDS—0.6% |

|

|

|

|

|

| First American Treasury Obligations Fund—Class S | | 2,317,457 | | | 2,317,457 |

| | | | | | |

|

TOTAL MONEY MARKET MUTUAL FUNDS

(Cost $2,317,457) | | | | | 2,317,457 |

| | | | | | |

|

TOTAL INVESTMENTS—99.7%

(Cost $329,407,394) |

|

|

|

$ |

402,152,792 |

| Other Assets in excess of Liabilities—0.3% | | | | | 1,093,094 |

| | | | | | |

|

| NET ASSETS—100.0% | | | | $ | 403,245,886 |

| | | | | | |

|

- *

- Non-income producing security

- ^

- Less than 0.05% of net assets

- +

- This security or a portion of this security is out on loan at December 31, 2005. Total loaned securities had a market value of $9,835,488 at December 31, 2005.

See Notes to Financial Statements

21

Aggressive Investors 2 Fund

MANAGER'S COMMENTARY

(Unaudited)

December 31, 2005

Dear Fellow Aggressive Investors 2 Fund Shareholder,

Our Fund had a positive return of 1.72% in the December quarter, compared with 2.09% for the S&P 500 Index and 1.81% for our peer benchmark, the Lipper Capital Appreciation Funds Index. It was a poor quarter.

On the heels of three very fine quarters, however, our calendar year return was very strong: 18.59% compared to 4.91% for our primary benchmark, the S&P 500 Index and 7.96% for our peer benchmark, the Lipper Capital Appreciation Funds Index.

The table below presents our December quarter, six-month, one-year, and life-to-date financial results according to the formula required by the SEC.

| | Dec. Qtr.

10/1/05

to 12/31/05

| | 6 Months

7/1/05

to 12/31/05

| | 1 Year

1/1/05

to 12/31/05

| | Life-to-Date

10/31/01

to 12/31/05

| |

|---|

| Aggressive Investors 2 Fund | | 1.72 | % | 13.68 | % | 18.59 | % | 13.15 | % |

| S&P 500 Index (large companies) | | 2.09 | % | 5.77 | % | 4.91 | % | 5.83 | % |

| Russell 2000 Index (small companies) | | 1.13 | % | 5.88 | % | 4.55 | % | 12.89 | % |

| Lipper Capital Appreciation Funds | | 1.81 | % | 8.56 | % | 7.96 | % | 6.91 | % |

Performance figures quoted represent past performance and are no guarantee of future results. Current performance may be lower or higher than the performance figures quoted, and an investor's shares, when redeemed, may be worth more or less than original cost. For the most recent month-end performance, please call 1-800-661-3550 or visit the Fund's website at www.bridgeway.com.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks with dividends reinvested, while the Russell 2000 Index is an unmanaged, market value weighted index that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The Lipper Capital Appreciation Funds Index reflects the aggregate record of more aggressive domestic growth mutual funds, as reported by Lipper, Inc. It is not possible to invest directly in an index or average. Periods longer than one year are annualized.

For the six-month semi-annual period, our Fund was up 13.68%, compared to 5.77% for the S&P 500 Index of large companies. As reported last quarter, our substantial energy holdings had a very favorable impact in the September quarter, although they "gave back" a bit of returns in the December quarter.

According to data from Lipper, Inc. as of December 31, 2005, Aggressive Investors 2 Fund ranked 35th of 445 capital appreciation funds for 2005 and 31st of 319 such funds since inception in October, 2001. Lipper, Inc. is an independent mutual fund rating service that ranks funds in various fund categories by making comparative calculations using total returns.

22

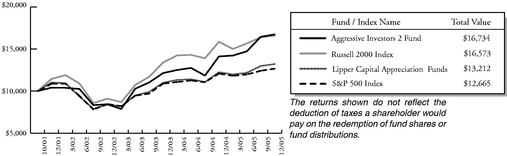

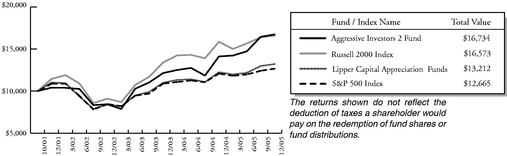

Growth of $10,000 Invested in Aggressive Investors 2 Fund and Indexes from 10/31/01 (inception) to 12/31/05

Detailed Explanation of Quarterly Performance—What Worked Well

The Short Version: Energy stocks had much less effect on performance this quarter, making way for good performers from a variety of industries.

These are the ten best-performers for the December quarter:

Rank

| | Description

| | Industry

| | % Gain

| |

|---|

| 1 | | Hansen Natural Corp | | Beverages | | 67.4 | % |

| 2 | | Apple Computer Inc | | Computers | | 34.6 | % |

| 3 | | LCA-Vision Inc | | Healthcare-Products | | 28.0 | % |

| 4 | | Coldwater Creek Inc | | Retail | | 26.7 | % |

| 5 | | WESCO International Inc | | Distribution/Wholesale | | 26.2 | % |

| 6 | | Joy Global Inc | | Machinery-Constr & Mining | | 24.8 | % |

| 7 | | Red Hat Inc | | Software | | 17.3 | % |

| 8 | | JPMorgan Chase & Co | | Diversified Financial Services | | 17.0 | % |

| 9 | | Parker Drilling Co | | Oil & Gas | | 15.1 | % |

| 10 | | Cal Dive International Inc | | Oil & Gas Services | | 13.4 | % |

While last quarter's best performers list was packed with energy stocks, you may be surprised to see only two on our list of gainers above. Our models are still enamored by energy and energy-related companies. However, when we see a run up in a fairly volatile sector that takes its weighting in the portfolio over 33%, our "top-down" risk management strategy may dictate that we begin to trim our holdings, as happened with energy at the beginning of October. Our sector representation went from 34.5% to 19.2% during the quarter.

You might say that our top performer, Hansen Natural, is also involved in energy—energy drinks. Hubert Hansen started making fresh, non-pasteurized juices for film studios and retailers in Southern California in the 30's. Lately, with the addition of smoothies, ready-to-drink iced teas, juice cocktails and energy drinks, its brands have caught the public's attention. Forbes listed Hansen in first place in its "200 Best Small Companies" for 2005, with "new energy drinks targeted at the youth sports market and white-collar workforce." (We gathered our staff recently for a Hansen taste test—the juices were the staff's favorites; I liked the ginseng drink.) Hansen also tops our list of performers for the year, increasing over 164.6% since our original purchase in March.

Apple's iPod products continue to grow in popularity and to spawn derivative products, which provide diversity for the company beyond personal computers. Although the tremendous price appreciation since our first purchase almost a year and a half ago means this stock is not nearly as cheap as it was, our models still like it, and currently, we're holding.

23

Detailed Explanation of Quarterly Performance—What Didn't Work

The Short Version: Careful trimming of our energy holdings gave us a softer landing this quarter than I would have expected.

These are the ten stocks that performed the worst in the December quarter:

Rank

| | Description

| | Industry

| | % Loss

| |

|---|

| 1 | | Forward Industries Inc | | Textiles | | -57.4 | % |

| 2 | | Building Material Holding Corp | | Distribution/Wholesale | | -26.9 | % |

| 3 | | Comtech Telecomm. Corp | | Telecommunications | | -25.4 | % |

| 4 | | UGI Corp | | Gas | | -23.0 | % |

| 5 | | Digital River Inc | | Internet | | -21.6 | % |

| 6 | | Toll Brothers Inc | | Home Builders | | -18.0 | % |

| 7 | | Chesapeake Energy Corp | | Oil & Gas | | -17.1 | % |

| 8 | | Tenaris SA | | Iron/Steel | | -16.9 | % |

| 9 | | ConocoPhillips | | Oil & Gas | | -16.8 | % |

| 10 | | Gold Kist Inc | | Food | | -15.1 | % |

Although significantly reduced, our exposure to the energy sector was still more than twice that of the broader market, which hurt our quarterly performance. On the other hand, our energy-related stocks fell only 7.06% on average versus the S&P 500 Index's 9.8% decline of energy stocks. In summary, while we picked better energy stocks than average, our sizeable weighting of energy still held back our performance substantially in the December quarter.

Forward Industries, maker of carrying cases for cell phones, laptops and other equipment, is our worst performer for the quarter. Timing of product shipments, pricing pressures and higher operating costs are a bad combination and caused the Florida-based company's recent price tumble, which in turn cost the fund 0.5% in performance for the quarter. Digital River was a strong performer through the summer, but by the time we sold the last of our holdings in late October, it had given back most of its gains.

Detailed Explanation of Calendar Year Performance—What Worked Well

The Short Version: Energy, energy, energy.

These are the ten best-performers for the calendar year:

Rank

| | Description

| | Industry

| | % Gain

| |

|---|

| 1 | | Hansen Natural Corp | | Beverages | | 164.6 | % |

| 2 | | Chesapeake Energy Corp | | Oil & Gas | | 92.3 | % |

| 3 | | America Movil SA de CV | | Telecommunications | | 74.5 | % |

| 4 | | Tesoro Corp | | Oil & Gas | | 69.5 | % |

| 5 | | Foundation Coal Holdings Inc | | Coal | | 63.2 | % |

| 6 | | Valero Energy Corp | | Oil & Gas | | 59.8 | % |

| 7 | | Coldwater Creek Inc | | Retail | | 55.2 | % |

| 8 | | Kos Pharmaceuticals Inc | | Pharmaceuticals | | 53.2 | % |

| 9 | | Sunoco Inc | | Oil & Gas | | 51.7 | % |

| 10 | | Brookfield Asset Management | | Real Estate | | 49.9 | % |

Half of our performance for the calendar year can be attributed to energy stocks. Our number one and four other top performers are in industries other than oil and gas, which helped our diversification later in the year as energy stock prices began to decline. Of our 18.59% return for the year, Hansen contributed approximately 2.8%. Coldwater Creek, which provides specialty clothing and gifts

24

purchased through catalogs or the Internet, was our number two performer for the fiscal year and a steady performer through the calendar year. Although our Retail weighting was about equal to the market, our stocks did particularly well and gave us a 2% performance boost above the market during the quarter.

Detailed Explanation of Calendar Year Performance—What Didn't Work

The Short Version: Compared to nine companies that appreciated at least 50% in the calendar year, only one declined that much. Still, it hurt.

The stocks that performed worst for the calendar year:

Rank

| | Description

| | Industry

| | % Loss

| |

|---|

| 1 | | Forward Industries Inc | | Textiles | | -57.4 | % |

| 2 | | Oregon Steel Mills Inc | | Iron/Steel | | -47.8 | % |

| 3 | | AK Steel Holding Corp | | Iron/Steel | | -40.6 | % |

| 4 | | eBay Inc | | Internet | | -29.5 | % |

| 5 | | Digital River Inc | | Internet | | -29.4 | % |

| 6 | | Ford Motor Co | | Auto Manufacturers | | -28.5 | % |

| 7 | | Deckers Outdoor Corp | | Apparel | | -26.7 | % |

| 8 | | Commercial Metals Co | | Metal Fabricate/Hardware | | -25.6 | % |

| 9 | | Petroleum Development Corp | | Oil & Gas | | -23.2 | % |

| 10 | | Overseas Shipholding Group | | Transportation | | -22.1 | % |

Only one company lost over 50% for the calendar year. As reported for the quarter, Forward Industries tops our worst performers. Increases in energy, raw materials and employment costs have affected the Iron/Steel industry. However, the combined effect of Oregon Steel and AK Steel on our performance for the year was about -1.6%.

Top Ten Holdings

At quarter end, Energy comprised our largest sector representation at 19.2% of net assets, followed by Industrial at 16.6% and Technology at 15.7%. Our top ten holdings represented 31.6% of net assets.

Rank

| | Description

| | Industry

| | Percent of

Net Assets

| |

|---|

| 1 | | Goodyear Tire & Rubber Co | | Auto Parts & Equipment | | 5.3 | % |

| 2 | | McDermott International Inc | | Engineering & Construction | | 3.6 | % |

| 3 | | Joy Global Inc | | Machinery-Constr & Mining | | 3.4 | % |

| 4 | | SanDisk Corp | | Computers | | 3.2 | % |

| 5 | | Marvell Technology Group Ltd | | Semiconductors | | 3.0 | % |

| 6 | | Apple Computer Inc | | Computers | | 3.0 | % |

| 7 | | Express Scripts Inc | | Pharmaceuticals | | 2.8 | % |

| 8 | | Hansen Natural Corp | | Beverages | | 2.5 | % |

| 9 | | BMC Software Inc | | Software | | 2.5 | % |

| 10 | | Valero Energy Corp | | Oil & Gas | | 2.3 | % |

| | | | | | |

| |

| | Total | | | | 31.6 | % |

25

Industry Sector Representation as of December 31, 2005

Energy continues as our Fund's largest sector, but we trimmed it substantially, down from 34.5% last quarter. The industry we are most underrepresented in is Financial.

| | % of Net Assets

| | S&P 500 Index

| | Difference

| |

|---|

| Basic Materials | | 0.6 | % | 2.9 | % | -2.3 | % |

| Communications | | 10.4 | % | 10.2 | % | 0.2 | % |

| Consumer, Cyclical | | 11.4 | % | 8.5 | % | 2.9 | % |

| Consumer, Non-cyclical | | 14.8 | % | 21.6 | % | -6.8 | % |

| Energy | | 19.2 | % | 9.6 | % | 9.6 | % |

| Financial | | 7.1 | % | 21.1 | % | -14.0 | % |

| Industrial | | 16.6 | % | 11.3 | % | 5.3 | % |

| Technology | | 15.7 | % | 11.4 | % | 4.4 | % |

| Utilities | | 0.00 | % | 3.4 | % | -3.4 | % |

| Cash | | 4.2 | % | 0.0 | % | 4.2 | % |

| | |

| |

| | | |

| | Total | | 100.0 | % | 100.0 | % | | |

Disclaimer

The following is a reminder from the friendly folks at your Fund who worry about liability. The views expressed here are exclusively those of Fund management. These views, including those of market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter end, December 31, 2005, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and are not indicative of future performance.

The Fund is subject to above average market risk (volatility) and is not an appropriate investment for short-term investors. Investments in the small companies within this multi-cap fund generally carry greater risk than is customarily associated with larger companies for various reasons such as narrower markets, limited financial resources and less liquid stock.

This report is submitted for the general information of the shareholders of the Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding the Fund's risks, objectives, fees and expenses, experience of its management, and other information. For questions or other Fund information, call 1-800-661-3550 or visit the Fund's website www.bridgeway.com. Foreside Fund Services, LLC, distributor.

Conclusion

Thank you for your continued investment in Aggressive Investors 2. This Fund remains open to both current and new investors. As always, we appreciate your feedback.

Sincerely,

John Montgomery

26

DISCLOSURE OF FUND EXPENSES

(Unaudited)

As a shareholder of the Fund, you will incur no transaction costs from the Fund, including sales charges (loads) on purchases, on reinvested dividends, or on other distributions. There are also no redemption fees or exchange fees. However, as a shareholder of the Fund, you will incur ongoing costs, including management fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The examples are based on an investment of $1,000 invested on July 1, 2005 and held until December 31, 2005.

Actual Return. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading "Expense Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical 5% Return. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

The expenses shown in the table are meant to highlight ongoing Fund costs only. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds, because other funds may also have transaction costs, such as sales charges, redemption fees or exchange fees.

Bridgeway Aggressive Investors 2 Fund

| | Beginning Account

Value at 7/1/05

| | Ending Account

Value at 12/31/05

| | Expense Paid

During Period*

7/1/05 - 12/31/05

|

|---|

| Actual Fund Return | | $ | 1,000.00 | | $ | 1,136.80 | | $ | 6.62 |

| Hypothetical Fund Return | | $ | 1,000.00 | | $ | 1,019.00 | | $ | 6.26 |

- *

- Expenses are equal to the Fund's annualized expense ratio of 1.23% multiplied by the average account value over the period, multiplied by the number of days in the first fiscal half-year divided by 365 days in the current year (to reflect the one half-year period).

27

Aggressive Investors 2 Fund

SCHEDULE OF INVESTMENTS

Showing percentage of net assets as of December 31, 2005

(Unaudited)

Industry

| | Company

| | Shares

| | Value

|

|---|

COMMON STOCKS—95.7% |

|

|

|

|

|

| Aerospace/Defense—0.7% | | | | | |

| | | Armor Holdings Inc* | | 50,200 | | $ | 2,141,030 |

Apparel—1.9% |

|

|

|

|

|

| | | Guess? Inc* | | 164,200 | | | 5,845,520 |

Auto Parts & Equipment—5.3% |

|

|

|

|

|

| | | The Goodyear Tire & Rubber Co* | | 940,600 | | | 16,347,628 |

Banks—1.6% |

|

|

|

|

|

| | | Corus Bankshares Inc | | 45,146 | | | 2,540,365 |

| | | US Bancorp | | 79,000 | | | 2,361,310 |

| | | | | | |

|

| | | | | | | | 4,901,675 |

Beverages—2.5% |

|

|

|

|

|

| | | Hansen Natural Corp*+ | | 99,800 | | | 7,865,238 |

Biotechnology—1.1% |

|

|

|

|

|

| | | Amgen Inc* | | 44,500 | | | 3,509,270 |

Building Materials—0.8% |

|

|

|

|

|

| | | USG Corp* | | 36,100 | | | 2,346,500 |

Coal—1.4% |

|

|

|

|

|

| | | Foundation Coal | | | | | |

| | | Holdings Inc | | 52,000 | | | 1,976,000 |

| | | Peabody Energy Corp | | 28,700 | | | 2,365,454 |

| | | | | | |

|

| | | | | | | | 4,341,454 |

Commercial Services—0.9% |

|

|

|

|

|

| | | Administaff Inc | | 62,100 | | | 2,611,305 |

Computers—7.4% |

|

|

|

|

|

| | | Apple Computer Inc* | | 126,700 | | | 9,108,463 |

| | | Komag Inc* | | 115,900 | | | 4,017,094 |

| | | Sandisk Corp* | | 154,200 | | | 9,686,844 |

| | | | | | |

|

| | | | | | | | 22,812,401 |

Distribution/Wholesale—2.2% |

|

|

|

|

|

| | | Building Material Holding | | | | | |

| | | Corp | | 49,200 | | | 3,355,932 |

| | | WESCO International Inc* | | 81,600 | | | 3,486,768 |

| | | | | | |

|

| | | | | | | | 6,842,700 |

| | | | | | | | |

28

Diversified Financial Services—3.2% |

|

|

|

|

|

| | | Chicago Mercantile Exchange | | 10,000 | | $ | 3,674,900 |

| | | JPMorgan Chase & Co | | 62,800 | | | 2,492,532 |

| | | Merrill Lynch & Co | | 56,800 | | | 3,847,064 |

| | | | | | |

|

| | | | | | | | 10,014,496 |

Electrical Components & Equipment—1.0% |

|

|

|

|

|

| | | Lamson & Sessions Co* | | 120,400 | | | 3,012,408 |

Electronics—1.5% |

|

|

|

|

|

| | | American Science & Engineering* | | 13,800 | | | 860,706 |

| | | NovAtel Inc* | | 141,300 | | | 3,901,293 |

| | | | | | |

|

| | | | | | | | 4,761,999 |

Engineering & Construction—3.6% |

|

|

|

|

|

| | | McDermott International* | | 245,300 | | | 10,942,833 |

Food—0.0%^ |

|

|

|

|

|

| | | Gold Kist Inc* | | 4,208 | | | 62,910 |

Healthcare Products—4.5% |

|

|

|

|

|

| | | Alcon Inc | | 34,500 | | | 4,471,200 |

| | | Hologic Inc* | | 166,000 | | | 6,294,720 |

| | | LCA-Vision Inc | | 67,300 | | | 3,197,423 |

| | | | | | |

|

| | | | | | | | 13,963,343 |

Insurance—1.0% |

|

|

|

|

|

| | | Selective Insurance | | 55,900 | | | 2,968,290 |

Internet—1.9% |

|

|

|

|

|

| | | j2 Global Communications Inc* | | 70,200 | | | 3,000,348 |

| | | Nutri System Inc* | | 78,400 | | | 2,823,968 |

| | | | | | |

|

| | | | | | | | 5,824,316 |

Iron & Steel—0.6% |

|

|

|

|

|

| | | Tenaris | | 17,300 | | | 1,980,850 |

Machinery—Construction & Mining—5.2% |

|

|

|

|

|

| | | JLG Industries Inc | | 121,700 | | | 5,556,822 |

| | | Joy Global Inc | | 261,400 | | | 10,456,000 |

| | | | | | |

|

| | | | | | | | 16,012,822 |