As filed with the Securities and Exchange Commission on March 7, 2008

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-08200 |

BRIDGEWAY FUNDS, INC.

5615 Kirby Drive, Suite 518

Houston, Texas 77005-2448

(800) 661-3550

Michael D. Mulcahy, President

Bridgeway Funds, Inc.

5615 Kirby Drive, Suite 518

Houston, Texas 77005-2448

Date of fiscal year end: June 30

Date of reporting period: July 1, 2007 - December 31, 2007

| ITEM 1. | REPORT TO STOCKHOLDERS |

| | |

| | A no-load mutual fund family of domestic funds |

| | |

| |

| | Semi-Annual Report December 31, 2007 (Unaudited) |

| | | | |

| | |

| | AGGRESSIVE INVESTORS 1 | | BRAGX |

| | (Closed to New Investors) | | |

| | |

| | AGGRESSIVE INVESTORS 2 | | BRAIX |

| | |

| | ULTRA-SMALL COMPANY | | BRUSX |

| | (Closed) | | |

| | |

| | ULTRA-SMALL COMPANY MARKET | | BRSIX |

| | |

| | MICRO-CAP LIMITED | | BRMCX |

| | (Closed to New Investors) | | |

| | |

| | SMALL-CAP GROWTH | | BRSGX |

| | |

| | SMALL-CAP VALUE | | BRSVX |

| | |

| | LARGE-CAP GROWTH | | BRLGX |

| | |

| | LARGE-CAP VALUE | | BRLVX |

| | |

| | BLUE CHIP 35 INDEX | | BRLIX |

| | |

| | BALANCED | | BRBPX |

TABLE OF CONTENTS

Bridgeway Funds Standardized Returns as of December 31, 2007*

| | | | | | | | | | | | | | | | | |

| | | Dec. Qtr.

10/1/07

to 12/31/07 | | 6 Month

7/1/07

to 12/31/07 | | Annualized | | | | | |

| Fund | | | | 1 Year | | 5 Years | | 10 Years | | Inception

to Date | | Inception

Date | | Gross

Expense

Ratio1 | |

Aggressive Investors 1 | | 5.26% | | 10.66% | | 25.80% | | 21.76% | | 19.26% | | 20.79% | | 8/5/1994 | | 1.69% | |

Aggressive Investors 2 | | 5.02% | | 11.62% | | 32.19% | | 22.57% | | | | 14.72% | | 10/31/2001 | | 1.19% | |

Ultra-Small Company | | -7.00% | | -8.22% | | -2.77% | | 23.14% | | 17.56% | | 20.57% | | 8/5/1994 | | 1.06% | |

Ultra-Small Co Market | | -6.78% | | -9.21% | | -5.40% | | 18.79% | | 14.87% | | 14.18% | | 7/31/1997 | | 0.65% | |

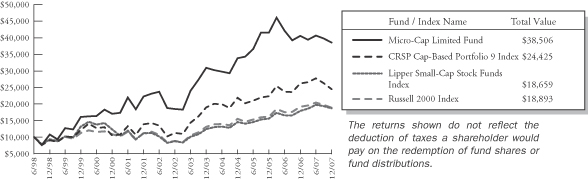

Micro-Cap Limited | | -3.16% | | -5.19% | | -4.97% | | 15.76% | | | | 15.24% | | 6/30/1998 | | 0.79% | |

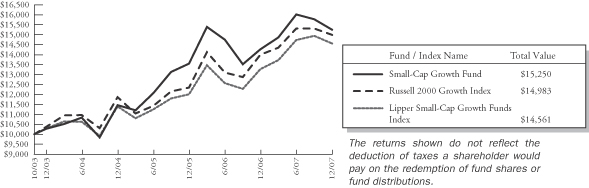

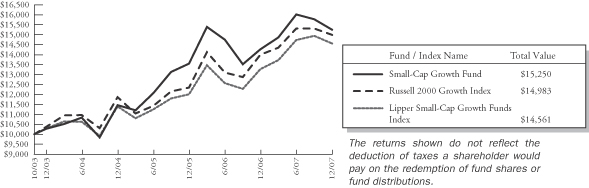

Small-Cap Growth | | -3.30% | | -4.75% | | 6.87% | | | | | | 10.66% | | 10/31/2003 | | 0.88% | |

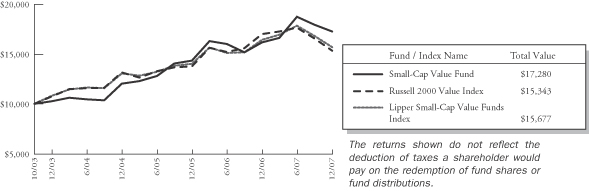

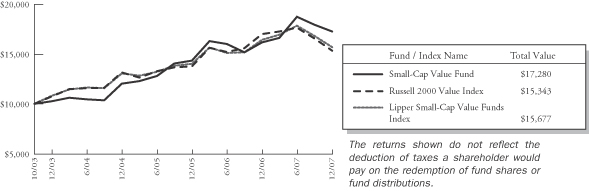

Small-Cap Value | | -3.63% | | -7.79% | | 6.93% | | | | | | 14.03% | | 10/31/2003 | | 0.84% | |

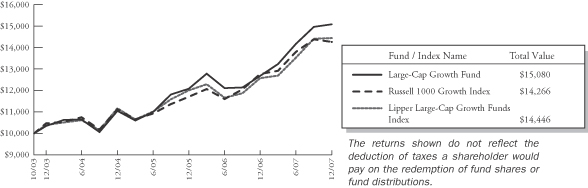

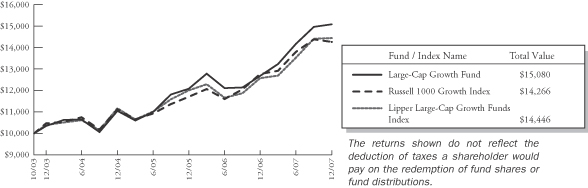

Large-Cap Growth | | 0.81% | | 6.45% | | 19.01% | | | | | | 10.36% | | 10/31/2003 | | 0.73% | |

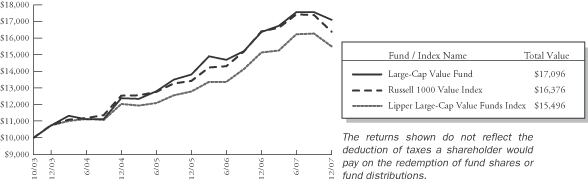

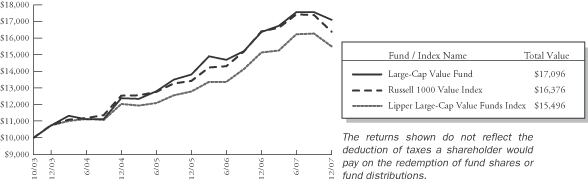

Large-Cap Value | | -2.55% | | -2.61% | | 4.49% | | | | | | 13.73% | | 10/31/2003 | | 0.74% | |

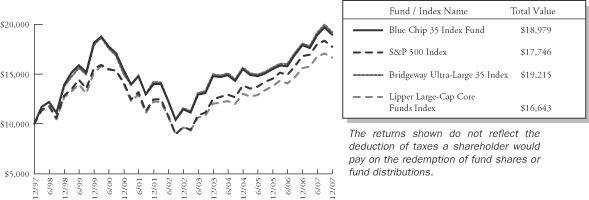

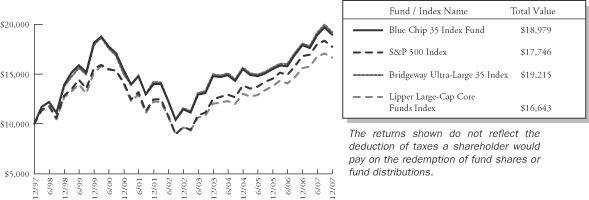

Blue Chip 35 Index | | -3.73% | | 0.34% | | 6.07% | | 10.59% | | 6.62% | | 6.34% | | 7/31/1997 | | 0.30% | 2 |

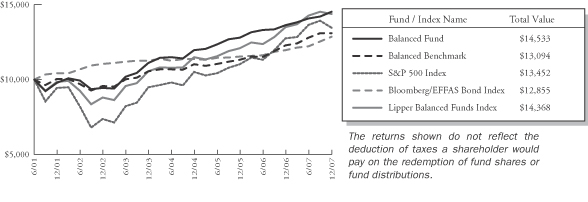

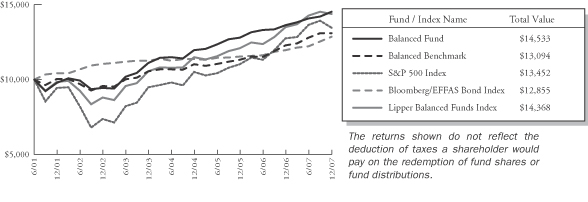

Balanced | | 2.26% | | 3.21% | | 6.58% | | 9.04% | | | | 5.92% | | 6/30/2001 | | 0.93% | |

1 Expense ratio for the fiscal year ended June 30, 2007 restated to reflect current Fund Administration, Fund Accountant and Fund Transfer Agency Service fees.

2 Some of the Fund’s fees were waived or expenses reimbursed otherwise returns would have been lower. The Adviser has contractually agreed to waive fees and/or reimburse expenses such that the total operating expenses of the Fund do not exceed 0.15%. Any material change to this Fund policy would require a vote by shareholders.

Bridgeway Funds Returns for Calendar Years 1995 through 2007*

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1995 | | 1996 | | 1997 | | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 |

Aggressive Investors 1 | | 27.10% | | 32.20% | | 18.27% | | 19.28% | | 120.62% | | 13.58% | | -11.20% | | -18.01% | | 53.97% | | 12.21% | | 14.93% | | 7.11% | | 25.80% |

Aggressive Investors 2 | | | | | | | | | | | | | | | | -19.02% | | 44.01% | | 16.23% | | 18.59% | | 5.43% | | 32.19% |

Ultra-Small Company | | 39.84% | | 29.74% | | 37.99% | | -13.11% | | 40.41% | | 4.75% | | 34.00% | | 3.98% | | 88.57% | | 23.33% | | 2.99% | | 21.55% | | -2.77% |

Ultra-Small Co Market | | | | | | | | -1.81% | | 31.49% | | 0.67% | | 23.98% | | 4.90% | | 79.43% | | 20.12% | | 4.08% | | 11.48% | | -5.40% |

Micro-Cap Limited | | | | | | | | | | 49.55% | | 6.02% | | 30.20% | | -16.61% | | 66.97% | | 9.46% | | 22.55% | | -2.34% | | -4.97% |

Small-Cap Growth | | | | | | | | | | | | | | | | | | | | 11.59% | | 18.24% | | 5.31% | | 6.87% |

Small-Cap Value | | | | | | | | | | | | | | | | | | | | 17.33% | | 18.92% | | 12.77% | | 6.93% |

Large-Cap Growth | | | | | | | | | | | | | | | | | | | | 6.77% | | 9.33% | | 4.99% | | 19.01% |

Large-Cap Value | | | | | | | | | | | | | | | | | | | | 15.15% | | 11.62% | | 18.52% | | 4.49% |

Blue Chip 35 Index | | | | | | | | 39.11% | | 30.34% | | -15.12% | | -9.06% | | -18.02% | | 28.87% | | 4.79% | | 0.05% | | 15.42% | | 6.07% |

Balanced | | | | | | | | | | | | | | | | -3.51% | | 17.82% | | 7.61% | | 6.96% | | 6.65% | | 6.58% |

Performance figures quoted represent past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Total return figures include the reimbursement of dividends and capital gains.

This report is submitted for the general information of the shareholders of each Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding a Fund’s risks, objectives, fees and expenses, experience of its management, and other information. Investors should read the prospectus carefully before investing in a Fund. For questions or other Fund information, call 1-800-661-3550 or visit the Funds’ website www.bridgeway.com. Funds are available for purchase by residents of the United States, Puerto Rico, U.S. Virgin Islands and Guam only. Foreside Fund Services, LLC, Distributor.

The views expressed here are exclusively those of Fund management. These views including those relating to the market, sectors or individual stocks are not meant as investment advice and should not be considered predictive in nature.

| * | Numbers with green highlight indicate periods when the Fund outperformed its primary benchmark. |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM

February 25, 2008

Dear Fellow Shareholders,

Fighting the broader market benchmark declines, four of eleven Bridgeway Funds ended the December 2007 quarter in positive territory. In addition, nine of eleven Funds beat their primary market benchmark. For the second quarter in a row, our Aggressive Investors 1 and 2 Funds were the performance standouts, both with returns exceeding 5%—quite favorable in a bear market environment. Our “laggard” of the prior two years, Micro-Cap Limited Fund, completed its second quarter in a row beating its primary market benchmark, though with an absolute return of -3.16%.

Of course, our primary focus is on long-term numbers. We like to think of an individual quarter as a single and statistically insignificant data point. With this in mind, both the quarterly and long-term performance numbers for each of our Funds are presented on the top of the adjacent page. Green indicates a Fund beating its primary market benchmark for the relevant period. In the top table, green on the left hand side (shorter term performance) is good, but doesn’t mean a lot. Moving right, green is more significant, and one of our goals is to have green in the “inception” column of each Fund and wherever we have 10-year numbers to report.

Perhaps most notable in the market landscape for calendar 2007 was the return—and it’s been a long time coming—to better performance by larger and especially faster-growing companies. Against this backdrop, our ultra-small, micro-cap, and small-cap Funds ended the year in negative, though, market-beating territory—with one exception (Small-Cap Growth Fund). A short market commentary is offered on page 3. Think a recession’s in store? See page 3.

One of the arguments against comparing mutual fund performance to peer indexes is that “mediocrity” is not a good benchmark, nor a high enough standard. This is one reason we also compare our Funds’ performance to that of market benchmarks, which have the advantage of zero operating and transaction costs, making them generally harder to beat. Additionally, in recent years we have had a “friendly competition” against Morningstar’s analyst picks. Interesting results for 2007 appear on page 4.

Occasionally, investors or journalists draw inappropriate conclusions about one or more of our Funds, and we try to set the record straight. Recently, our Ultra-Small Company Market Fund was highlighted in an article about “shock absorber” funds, funds that should do well in a market downturn. We like our Ultra-Small Company and Ultra-Small Company Market Funds as long term, aggressive holdings and as good diversifiers of what most people otherwise hold, regardless of market conditions. However, “shock absorber” is not one of the adjectives that first pops to mind. The section on page 4 explains our view.

Page 5 presents our brief commentary on the sub-prime lending debacle and what we really don’t like about it. A section on the same page gives an update on our report of investors redeeming shares of Aggressive Investors 2 Fund in early calendar year 2007—more data supporting our view that timing the market or the Fund’s short-term performance, is a poor and inappropriate use of our Funds.

Last quarter marked the twentieth anniversary of Black Monday, the largest single day drop of the Dow Jones Industrial Average. Being the oldest member of our team, John can recount the day and reveal what he learned from it on page 6. Page 7 ends with a review of two trade journal subjects.

A detailed review of performance by Fund starts on page 8 (see table of contents). Unaudited financial statements for the six month period ending December 31, 2007 begin on page 112.

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

As always, we appreciate your feedback. We take your comments very seriously and regularly discuss them internally to help in managing our Funds and this company. Please keep your ideas coming—both favorable and critical. They provide us with a vital tool in helping us serve you better.

Sincerely,

| | |

| |

|

| John Montgomery | | Richard P. Cancelmo |

| |

| |  |

| Elena Khoziaeva | | Michael Whipple |

Rasool Shaik | | |

| | |

| 2 | | Semi-Annual Report | December 31, 2007 (Unaudited) |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

Market Review

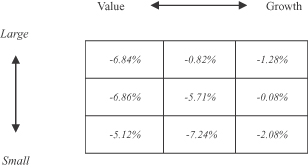

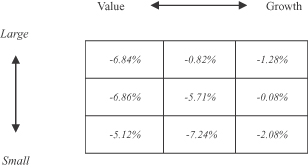

The Short Version: The largest companies (as measured by data from the Center for Research in Securities Prices) returned 7% more than ultra-small companies for the quarter ended December 31, 2007. Likewise, growth companies returned 3% to 7% more than value companies.

The December quarter stock market results were negative for all “style” segments of the U.S. market (see the table below). Nevertheless, growth stocks (those growing sales and earnings at a faster rate) declined by much smaller amounts than value stocks (those which appear cheaper based on certain economic measures) across the board. The segments’ performance for the full calendar year of 2007 gives evidence that the trend in favor of smaller and more value-oriented companies of the prior seven years has finally turned. We will see in 2008 whether the pendulum continues in this direction. Below are the style box stock returns for the December quarter (data from Morningstar):

Recession or not—what to do—and not do

The Short Version: Looking at prior history, by the time you know for sure it’s a recession, the horse has probably already left the barn. If so, it would be a poor time to “pull out.”

The current period could be seen as one of the most confusing economic periods since the 1930’s. Seemingly everywhere you look and in everything you read, there are predictions of recession, inflation, the “uncoupling” of world economies, the devaluation of the dollar and other economic projections that could make your head swim. You might ask, what is a recession, and what can I do to protect my resources?

In the February 4, 2008 issue of Newsweek, Daniel Gross defines recession as: “a widespread contraction in economic activity lasting more than a few months, and because of the lag in financial data, recessions typically aren’t officially declared until long after they start.” There is no major economic sector that has not experienced challenges lately. The effect of scaled-back spending in the holiday season rippled through the U.S. economy and abroad. In a recent story, Wall Street Journal writer Paul J. Lim says that “it’s often the anticipation of a recession that depresses stock prices, not the actual experience of a recession.” His research showed that once the recession is in full force, historically, prices have stabilized. In other words, by the time you can actually see a recession in the economy, the “stock market horse” has already left the barn. Recessionary periods since World War II have lasted on average ten months, during which stock prices have been fairly stable. In ten of the last eleven recessions, stocks rose an average of 24% after the low. Alas, no one knows when the low will occur.

So if you believe in “buy low, sell high,” then you’ve probably already missed a recent “high.” And if you go ahead and get out of the market, then you may also miss buying at the “low.” That’s the problem with timing the market: you have to make two very good calls, and the chances of this are stacked wildly against you. The real risk may be that you are out of the market during the exact period of its rise. If you are a Bridgeway Funds shareholder and have been with Bridgeway for awhile, you have “heard” me say, “get a good, diversified plan consistent with your investment horizon (when you’ll actually need the money) and risk profile (how much up and down of the market you’re willing to endure), write it down, and stick with it.” We stick to this at Bridgeway in bull markets and bear markets, good times and bad. Taking a long-term perspective can take much of the stress out of investing.

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

Bridgeway 8, Morningstar 3

The Short Version: After an off year in 2006, most of our Funds returned to their winning ways in 2007.

Morningstar, the Chicago-based independent research firm publishes a list of “best funds” for each asset class as determined by its analysts every year. In January when the final tallies are in, we compare the performance of each of our Funds to the average returns of Morningstar’s top picks for the comparable asset class. (Of particular note: part way through 2007, two Bridgeway Funds made the Morningstar “best of” lists in their respective classes: Small-Cap Value and Small-Cap Growth.) We enjoy seeing how we stack up against the “best of the best.”

By a wide 8-3 margin, the Bridgeway Funds came out on top of the Morningstar picks in calendar year 2007. In fact, the three Funds that underperformed (Micro-Cap Limited Fund., Ultra-Small Company Fund, and Ultra-Small Company Market Fund) actually beat their own market benchmarks. In a period when very small stocks badly lagged the broader market, the headwinds were too strong for these funds compared to the larger company (but still small) peers.

The table below depicts the results by Morningstar category and relevant Bridgeway Fund.

| | | | | | |

| Bridgeway Funds | | Morningstar Analyst "Picks" |

| Name | | 2007 Return | | Morningstar Category | | 2007 Return |

Large-Cap Value | | 4.49% | | Large-Cap Value | | -1.18% |

Blue Chip 35 Index | | 6.07% | | Large-Cap Blend | | 2.17% |

Large-Cap Growth | | 19.01% | | Large-Cap Growth | | 16.88% |

Aggressive Investors 1 | | 25.80% | | Mid-Cap Growth | | 11.74% |

Aggressive Investors 2 | | 32.19% | | Mid-Cap Growth | | 11.74% |

Small-Cap Value | | 6.93% | | Small-Value | | -2.74% |

Ultra-Small Co. Market | | -5.40% | | Small Blend | | -1.23% |

Ultra-Small Company | | -2.77% | | Small-Growth | | 5.01% |

Micro-Cap Limited | | -4.97% | | Small-Growth | | 5.01% |

Small-Cap Growth | | 6.87% | | Small-Growth | | 5.01% |

Balanced | | 6.58% | | Conservative Allocation | | 5.99% |

Past performance is not an indicator of future results. The Bridgeway Funds’ adviser, Bridgeway Capital Management, Inc., does not have any influence on the selection of the funds chosen by Morningstar’s analysts. The number and specific funds used in the comparison are in the control and discretion of Morningstar and their analysts and are subject to change. Morningstar’s criteria for choosing Analyst Picks includes, but is not limited to, factors such as performance, expenses, and quality of fund management. In addition, the comparison of Bridgeway Funds to the Morningstar Analyst Picks is limited to performance only and does not take into consideration other factors that are considered by Morningstar when compiling their list of Analyst Picks.

Each Bridgeway Fund is compared to the average total return of the group of funds selected by Morningstar at the beginning of 2007 for the one year period ended December 31, 2007. Although these Analyst Picks changed from the beginning of the year to the final quarter, the same Bridgeway Funds beat the average of the end of year Morningstar picks as well. These averages in the table are comprised of between three and nine funds from within each category. In an effort to provide a complete and balanced assessment, all of the Bridgeway Funds are used in the comparison table shown above such that no attempt is made to cull out unfavorable results. The purpose of this comparison is to “raise the bar” on performance comparison as this analysis uses an arguably higher benchmark by comparing the Bridgeway Funds to other funds chosen by an independent source that specializes in investment research.

Shock Absorber Funds and a Lesson in Ultra-Small Stocks

An article recently highlighted Bridgeway’s Ultra-Small Company Market Fund among those funds that let you sleep better at night. All of us on the investment management team at Bridgeway own at least one of our ultra-small company funds. We all sleep pretty well at night because we have a long term view, keep appropriate diversification in mind, and plan to sleep through some future daunting corrections in the ultra-small company market. It’s most definitely not because we think they are

| | |

| 4 | | Semi-Annual Report | December 31, 2007 (Unaudited) |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

“tamer.” Indeed, John watched in 1998 as ultra-small stocks dropped almost in half from their peak in April to the bottom in October. It tested even his steel stomach, but he stayed put to watch them recover handsomely over the next five years. Looking farther back in history over the last eight decades of data on such stocks, one would have to conclude that they are significantly more volatile than the broader stock market, including during a bear market. Did the writer of this recent article get it wrong? How did he come to this conclusion?

Ultra-small stocks were surprisingly tame during the broader bear market of 2000-2002. Indeed, our ultra-small company Funds had positive returns each year of the bear market and continued to do so until last year (although they still beat their market benchmark in 2007). The early part of this decade was a very unusual period for ultra-small stocks, primarily because it followed a dramatic period of large stock dominance (1994-1998). It was time for the pendulum to swing back the other direction, and swing it did from 1999 to 2006—the longest running dominance of ultra-small and small stocks on record. The conclusion of the writer above was a fair assumption based on data from only the last decade. However, Bridgeway’s methods caution us to look at longer periods across multiple market “cycles.” Any examination of the longer-term data before 2000 will paint a picture of a higher level of ultra-small company short-term risk, including during most market declines. (Specifically, from 1926 to 2000, ultra-small stocks fell an average of 35% more than large stocks during the average calendar year market decline.)

What does this mean for future downturns? First, we discourage investors from trying to time the market. Second, the best clues about risk come from the long-term historical view. The vast majority of calendar year stock market declines have resulted in bigger declines for ultra-small stocks. The period earlier this decade was an anomaly. Does that mean one should sell his or her ultra-small stock funds? Our best generalized advice is not to have more in these funds than an investor means to have for the long haul, nor more than an investor can afford to hold through a downturn. This is actually pretty good generalized advice for holding any kind of stocks.

Alas. Where to turn if you really want a less bumpy ride? There are a number of ways to reduce risk in a portfolio. For example, holding some cash. Among the Bridgeway Funds, our Balanced Fund, which is designed to give you roughly 40% of the volatility of the broader market, is on the tamer end of the spectrum. In addition to the section on Balanced Fund following, you can learn more about objectives, risks, and fees in the prospectus at www.bridgeway.com.

Sub-Prime Lending Debacle

Apart from the obvious and significant destructive effects on homeowners and their families, companies and their employees, and the broader economy and stock market, these are the parts of the subprime lending debacle that outrage us the most:

| | a) | mortgage originators not counting the downstream cost of lending money to people beyond their means, |

| | b) | the lack of serious efforts to educate borrowers about the potential risks of high interest, low/no down payment, and variable rate mortgages, and |

| | c) | fees that get paid to “middle-men,” regardless of the ultimate outcome of the transactions they make. |

Bridgeway is also in the financial services business, and we have always considered it our duty to address concerns such as these: fair and open communication of risk, education, and serious examination of all fees ultimately borne by a Bridgeway shareholder. These efforts may result in less money in our pockets in the short-term, but may also help avoid situations that would be devastating for shareholders. Ultimately, we believe such efforts lead to better outcomes for our investors, for our corporation, and for the communities we serve. Some of this is very easy, and some of it takes a lot of work, creativity, and strong moral compass. The scary part is that most people who really get off track (we’re students of our hometown’s Enron debacle, for example), don’t start out thinking they’re doing anything remotely wrong. It takes diligence to stay on track.

“Timing” Aggressive Investors 2—an Update

In Bridgeway’s June 30, 2007 annual report, we discussed the problem of investors chasing hot returns, buying after a big run-up and selling in a downturn. Aggressive Investors 2 is a case in point. 2006 was the first calendar year that the Fund underperformed its primary market benchmark. During the following March 2007 quarter, shareholders redeemed 17% of their investment in the Fund. Not only did these shareholders miss the 11% returns of the June quarter previously reported,

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

they also failed to earn the 12% return over the following six months. Altogether, they missed the best calendar year relative returns since inception. The moral of the story… Know why you’re investing, understand the strategy and risks of your Fund, invest in stocks (and stock funds) only when you have a long term investment need, and stay put for the long haul as long as your needs remain the same. As highlighted in the prospectus, our Funds are not meant to be a short-term investment vehicle, nor for those who would panic in a market downturn.

Celebrating Black Monday or What I learned from a two day 21% market drop (from John)

We passed an interesting milestone last quarter, the twentieth anniversary of Black Monday, or the single biggest percentage drop of the Dow Jones Industrial Average (and other major market averages). Here’s what I remember about that day more than twenty years ago.

| • | | I had been a serious investor for just over two years. I used quantitative methods in investing even at that time and had measured what I thought were the risks of my strategy. I had done some “stress testing” to see what things might look like in a major market downturn. However, I hadn’t stress-tested them for a sudden downturn of this magnitude, because such data didn’t exist. |

| • | | I had a “day job” in the public sector. This was six years before starting Bridgeway. |

| • | | The market had dropped 5.2% on Friday, the previous market day. That day didn’t really get my attention. I generally yawn through market downturns, and in my book that one was just a normal (if compressed) downturn. |

| • | | At noontime on Black Monday I was delivering the eulogy for the father of a close friend. However, I had made a habit of not checking the market. My philosophy was, “if it doesn’t make a difference in a decision you make, don’t look.” So I actually didn’t know how much the market was down until I heard it on the evening news. |

| • | | A corollary to my rule about not looking is: “Don’t waste time following the market, and have a real life.” Following stocks (or mutual funds) is not it. Having three creative, energetic young daughters helped a lot back then. An active faith life is central. (Having three creative, energetic adult daughters still works pretty well; I ran my first half marathon with my eldest recently.) |

| • | | My most nervous moment through the Black Monday experience was checking my brokerage account balance on Tuesday before the market opened on a pay phone (no cell phones in 1987.) I had calculated the decline of my investment capital, manually putting in prices from the newspaper into my “visicalc” spreadsheet on an early generation Apple computer, but I thought I’d just confirm the balance to make sure. Some people couldn’t even get through by phone to their brokers that morning. (There was no Internet to look up prices or balances or to download information.) When I did get through to my brokerage firm, my broker was busy. The junior broker I talked to was obviously harried and read me an incorrect number that was much lower than my actual balance. That did increase my heart rate, but I led him through finding the correct numbers and was satisfied. |

| • | | From the peak in August 1987 to the bottom in December 1987, my account fell a total of 41%. It recovered to the prior peak level before a year was up. I didn’t change anything about my strategy or methods during the downturn. |

What did I learn from this experience?

| • | | Have a plan and stick with it. That really helped in 1987 and has helped a lot since then. It was also very beneficial in the week following 9/11. |

| • | | Stress test models to a deeper level. I didn’t expect things to move so quickly in 1987. Now I routinely expect things to get worse than what I think is reasonable. I study markets back to the 1920’s and another database back to the nineteenth century. I think about what it would be like to live through “another” Great Depression. And I plan accordingly. This stress testing, along with other strongly held principles such as diversification, is what helped Bridgeway when some other quant shops were severely “tested” in August of last year. |

| • | | If it doesn’t make a difference in a decision to be made, don’t look. I have taken this even further since 1987. For example, I have four computer screens in my office, and none carries a ticker tape or market average. I have a general idea of |

| | |

| 6 | | Semi-Annual Report | December 31, 2007 (Unaudited) |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

| | market averages, but I can’t tell you within a thousand points the level of the Dow. I don’t open my quarterly account statements except to make sure any transactions are correct and that I don’t need to fill out some administrative or regulatory form. I can’t tell you within a 15% range what my investments (retirement funds) are worth. With all the time and emotional energy I save, I focus on things I think will actually add value. |

| • | | Have a real life. I have an amazing and blessed life. It’s about relationships, not prices and indexes. I didn’t learn this from Black Monday, but it reinforced it. I do really enjoy what I do at Bridgeway, but the relationships we have built together are a big part of that. |

| • | | Derivatives are securities or contracts whose price are dependent upon or “derived” from one or more underlying assets. Futures contracts, options and swaps are the most common types of derivatives. Investing in this type of instrument is surely an example of where a little knowledge can be a very dangerous thing. It’s OK to use them if you understand exactly how they work, but derivatives are significantly more complex than they may appear with many subtle ways to lose capital. Perhaps the greatest lure of derivatives is the leverage (trading with borrowed money.) Many investors lost more money than they ever thought possible during the 1987 crash using various derivative contracts. The market crash effectively took investors out of their positions at the worst possible time. They were not in control; the market was, leaving them with little or no opportunity to recover in the years ahead. |

Patience

We like the following quote from another fund manager, Bill Nygren.

Nygren called the performance of his fund “dreadful” and noted that although the market overall had suffered, ‘our Fund [sic] has fared meaningfully worse.’ The waiting part can be frustrating, especially in a time when our stock prices are moving in the wrong direction. But there are only two ways we can fail—we can fail if our analysis is wrong, and we can fail if we run out of patience.

We like it when a manager refuses, against marketing and competitive and perhaps personal pressures, to sugarcoat the bad stuff, and Nygren earns our respect for refusing to do so. It’s something we aspire to and work on. We also like the exhortation to patience. In our case, most of our Funds went the right direction relative to their market benchmarks last quarter. . . . but we have seen and will see more downturns also. Patience is a good quality in investing, whether times are good or bad, during euphoria and stress.

The Real Expense of Soft Dollars

Last quarter we wrote about the problems of an industry practice called soft dollars (using your fund trading commission dollars to pay for your fund company’s research and brokerage services) and why we stay away from them at Bridgeway. I was amused by a recent article in a trade journal:

As scrutiny over how fund managers choose, use and value the research [writer’s note: presumably paid for with soft dollars] on which they base investment decisions increases, so too will the amount shops need to spend on systems to help track it. That’s according to a recently released report from TowerGroup.

Not only do the commissions cost you more. But someone has to pay for the increased costs of systems to track it, lawyers to review it and compliance people to ensure it follows regulations. Why not just keep it simple? This is one more reason to “just say no.”

Thanks to a Shareholder

A shareholder, Mr. Shuster, made the following suggestion:

I was unaware that Bridgeway had the option of electronic delivery of annual reports. To reduce paper and operating costs, Bridgeway should devote some space in its shareholder publications to promote shareholders to electronic delivery.

If you received this bulky report (or worse, multiple copies of it) in snail mail, but would prefer only to see it online, just call 800-661-3550, extension 2, or email funds@bridgeway.com to make this switch.

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY

(Unaudited)

December 31, 2007

Dear Fellow Aggressive Investors 1 Fund Shareholder,

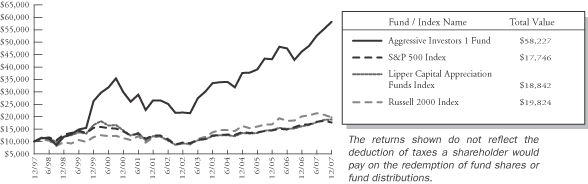

For the fifth quarter in a row, Aggressive Investors 1 Fund outperformed both its primary market benchmark and also its peer benchmark. Our Fund appreciated an impressive 5.26%, compared to a decline of 3.33% for the S&P 500 Index and a small gain of 0.42% for the Lipper Capital Appreciation Funds Index. The Russell 2000 Index of small companies, which had done so well in recent prior years, declined over 4.58%. It was an excellent quarter for our Fund.

For the six month semi-annual period, our Fund gained 10.66%, significantly beating the S&P 500 Index (-1.37%), the Lipper Capital Appreciation Funds Index (5.35%), and the Russell 2000 Index (-7.53%). This period was marked by extreme market volatility as investors faced the growing subprime debacle that morphed into a true credit crisis, and our Fund performed quite well under those difficult conditions.

Likewise, we are quite pleased with our Fund’s calendar year performance for 2007, both on an absolute and relative return basis. Aggressive Investors 1 Fund gained more than 25% for the twelve months ending December 31, 2007, far exceeding the performance of the S&P 500 Index (5.49%), the Lipper Capital Appreciation Funds Index (16.39%), and the Russell 2000 Index (-1.57%). You may recall that 2006 was the first year since 1998 that we had underperformed the S&P 500 Index. It has not been that unusual for a poorer period such as 2006 to be followed by a strong one such as 2007—one more reason I think it’s a bad idea to leave our Funds for reasons related to short-term performance. As always, long-term performance and risk management remain our key objectives. The information below bears out our historical success in these areas.

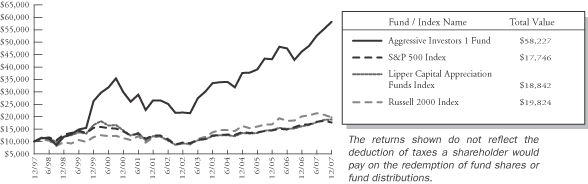

The table below presents our December quarter, six-month, one-year, five-year, ten-year and life-to-date financial results according to the formula required by the SEC. See the next page for a graph of performance for the last ten years.

| | | | | | | | | | | | | | | | | | |

| | | Dec. Qtr. 10/1/07

to 12/31/07 | | | 6 Month. 7/1/07

to 12/31/07 | | | 1 Year 1/1/07

to 12/31/07 | | | 5 Year 1/1/03

to 12/31/07 | | | 10 Year 1/1/98

to 12/31/07 | | | Life-to-Date 8/5/94 to 12/31/07 | |

| | | | | | |

Aggressive Investors 1 Fund | | 5.26 | % | | 10.66 | % | | 25.80 | % | | 21.76 | % | | 19.26 | % | | 20.79 | % |

S&P 500 Index (large companies) | | -3.33 | % | | -1.37 | % | | 5.49 | % | | 12.82 | % | | 5.91 | % | | 11.05 | % |

Lipper Capital Appreciation Funds Index | | 0.42 | % | | 5.35 | % | | 16.39 | % | | 15.18 | % | | 6.54 | % | | 9.85 | % |

Russell 2000 Index (small companies) | | -4.58 | % | | -7.53 | % | | -1.57 | % | | 16.25 | % | | 7.08 | % | | 10.35 | % |

Performance figures quoted in the table above and graph below represent past performance and are no guarantee of future results. The table above and the graph below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks with dividends reinvested, while the Russell 2000 Index is an unmanaged, market value weighted index, that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The Lipper Capital Appreciation Funds Index reflects the record of the 30 largest funds in this category, comprised of more aggressive domestic growth mutual funds, as reported by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

According to data from Lipper, Inc. as of December 31, 2007, Aggressive Investors 1 Fund ranked 45th of 357 capital appreciation funds for the twelve months ending December 31, 2007, 15th of 247 over the last five years, 2nd of 124 over the last ten years, and 1st of 60 since inception in August 1994. These long-term numbers and the graph below give two snapshots of our long-term success. Lipper, Inc. is an independent mutual fund rating service that ranks funds in various fund categories by making comparative calculations using total returns.

| | |

| 8 | | Semi-Annual Report | December 31, 2007 (Unaudited) |

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

Aggressive Investors 1 Fund vs. S & P 500 Index & Lipper Capital Appreciation Funds Index & Russell 2000 Index 1/1/98 to 12/31/07

Detailed Explanation of Quarterly Performance—What Worked Well

The Short Version: Talk about a chemical reaction. Chemical companies highlighted our top performers during the quarter. Four were among the top ten. Combined, these companies contributed over 4% to the return of the Fund. Our top two performers, both of which were chemical-related, each earned over 50% during the three-month period. The Fund also benefited from a bit of a global flavor as two of our top holdings are internationally based companies. (The Fund may invest up to 15% in foreign stocks, though the actual number has historically been, and is currently, significantly less than this.)

These are the ten best performers for the quarter ended December 31, 2007:

| | | | | | |

| Rank | | Description | | Industry | | % Gain |

| 1 | | Mosaic Co | | Chemicals | | 56.6% |

| 2 | | Terra Industries Inc | | Chemicals | | 52.8% |

| 3 | | Mobile Telesystems OJSC ADR | | Telecommunications (Russia) | | 39.7% |

| 4 | | Intuitive Surgical Inc | | Healthcare-Products | | 37.3% |

| 5 | | CF Industries Holdings Inc | | Chemicals | | 36.7% |

| 6 | | Deckers Outdoor Corp | | Apparel | | 36.7% |

| 7 | | Potash Corp of Saskatchewan | | Chemicals (Canada) | | 36.2% |

| 8 | | priceline.com Inc | | Internet | | 29.4% |

| 9 | | Apple Inc | | Computers | | 29.1% |

| 10 | | Owens-Illinois Inc | | Packaging & Containers | | 19.4% |

| | | | | | | |

The Mosaic Company was the Fund’s top performer and appreciated over 56% for the three-month period. Based in Minneapolis, Minnesota, the chemical company is a leading global manufacturer of crop nutrients, which serve as primary ingredients for fertilizer. Two significant factors have surfaced as of late that greatly benefited fertilizer companies like Mosaic. Rising oil prices and government subsidies have led to increased demand for ethanol which has prompted greater production of corn. Additionally, as the populations in China and other developing Asian and Latin American countries become increasingly affluent, their residents are adding more meat to their diets. As a result, corn and others feed grains have been met with even greater global demand and thus, the need for more fertilizer. During the past quarter, the company used its recent windfall from ongoing business operations to pay down long-term debt and strengthen its overall financial position. The stock contributed over 1.6% to the performance of the Fund during the three-month period.

Intuitive Surgical Inc. is a healthcare-related company that manufactures and markets specialty surgical products for a variety of medical applications. In particular, the company has designed robotic tools known as da Vinci systems which are used for urology, cardiology, gynecology, and general surgeries. In its most recent quarter, company profits doubled and sales increased by over 60%. Additionally, Intuitive has started to make inroads into the international medical markets. While many analysts remain quite positive about the company’s prospects for continued growth, others express concerns that it could

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

encounter future challenges because it essentially remains a one-product company. To counter these fears, management points out that revenue is also tied to sales of accessories, system service and training; therefore, the potential for recurring revenue streams is becoming more substantial. Intuitive Systems contributed 1.10% to the performance of the Fund this past quarter.

Detailed Explanation of Quarterly Performance—What Didn’t Work

The Short Version: Companies from five different sectors were represented in our list of weak performers; no one industry served as the primary (negative) catalyst. Interestingly, the stock that made the greatest negative contribution to the Fund’s performance during the last three months had been our top performer over the prior two quarters. Nine companies lost over 20% during the past quarter.

These are the ten stocks that performed the worst in the quarter ended December 31, 2007:

| | | | | | |

| Rank | | Description | | Industry | | % Loss |

| 1 | | WellCare Health Plans Inc | | Healthcare-Services | | -78.6% |

| 2 | | CROCS Inc | | Apparel | | -45.3% |

| 3 | | Cooper Tire & Rubber Co | | Auto Parts & Equipment | | -32.2% |

| 4 | | Ceradyne Inc | | Miscellaneous Manufacturing | | -30.8% |

| 5 | | Perini Corp | | Engineering & Construction | | -29.9% |

| 6 | | Amkor Technology Inc | | Semiconductors | | -29.2% |

| 7 | | Big Lots Inc | | Retail | | -27.5% |

| 8 | | Jones Lang LaSalle Inc | | Real Estate | | -27.1% |

| 9 | | Varian Semiconductor Equipment Assoc | | Semiconductors | | -20.4% |

| 10 | | Synaptics Inc | | Computers | | -19.4% |

| | | | | | | |

Our worst performer for the quarter, managed care company, WellCare Health Plans offers government-sponsored healthcare and prescription drug programs through Medicare and Medicaid. In late October, federal investigators raided company headquarters and initiated an investigation over what most believe to be fraud-related issues. Unfortunately, our models can’t identify issues like this before they happen. To add insult to injury, company execs sold off over $45 million in stock during the year in advance of the raid, far more than the insider sales totaled for all of 2006. The company’s stock priced plunged over 70% in one day. News did not get any better for the company as the quarter progressed, as shareholder lawsuits ensued and plan enrollments declined. Fortunately, our position in this lightly-traded company is relatively small, and it cost the Fund less than 0.75% in return for the quarter. We purchased this stock late in the September quarter and our models jettisoned it a couple of months later.

Trendy shoemaker, CROCS, has been a dependable performer for several quarters. CROCS was the Fund’s top performer, and returned over 50% during the three months ended September 30, 2007. While its latest earnings report actually beat Wall Street forecasts, its future guidance on revenues fell short of expectations. In reality, CROCS had trouble keeping up with the increasing demand for its products throughout Europe and Japan, an issue that cost the company about $30 million in potential quarterly sales. Its stock price fell by almost half for the quarter and a few shareholder suits followed. The holding cost the Fund over 2% during the past three months. Despite the down quarter, CROCS remained our sixth best performer for the calendar year and appreciated more than 70%.

Detailed Explanation of Calendar Year Performance—What Worked Well

The Short Version: With a gain of over 25%, lots of things went right for the Fund during the calendar year. Our two top holdings (both technology companies) earned well in excess of 100% and a total of 12 stocks returned over 50% for the calendar year. Basic materials and technology highlighted the list, as six companies came from those two sectors.

| | |

| 10 | | Semi-Annual Report | December 31, 2007 (Unaudited) |

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

These are the ten best performers for the calendar year ended December 31, 2007:

| | | | | | |

| Rank | | Description | | Industry | | % Gain |

| 1 | | Research In Motion Ltd | | Computers | | 166.2% |

| 2 | | Apple Inc | | Computers | | 132.6% |

| 3 | | priceline.com Inc | | Internet | | 87.5% |

| 4 | | Terra Industries Inc | | Chemicals | | 86.2% |

| 5 | | Potash Corp of Saskatchewan | | Chemicals | | 84.8% |

| 6 | | CROCS Inc | | Apparel | | 70.4% |

| 7 | | Chaparral Steel Co | | Iron/Steel | | 70.1% |

| 8 | | National Oilwell Varco Inc | | Oil & Gas Services | | 67.9% |

| 9 | | Vimpel-Communications ADR | | Telecommunications | | 62.8% |

| 10 | | Mosaic Co | | Chemicals | | 56.6% |

| | | | | | | |

A strong fourth quarter showing pushed Mosaic into the list of top 10 performers where it was joined by two other chemical companies (Terra Industries and Potash Corp of Saskatchewan). Increased global demand for basic materials, particularly from emerging markets like China, led to strong sales of related products. The weaker dollar throughout the year also sparked higher exports. These three chemical companies contributed over 4% to the return of the Fund.

The Fund’s best two performers, Research in Motion and Apple, topped the list with returns greater than 100% in 2007. Consumers are still in love with their time-tested Blackberries (Research in Motion), even after the successful debut of the iPhone (Apple) in June. (Apparently there is room for both in this growing global market.) In its most recent report, Research in Motion more than doubled its profits and beat Wall Street expectations once again; the company is reaping benefits of higher sales of its Pearl and Curve. Likewise, Apple reported a 67% increase in earnings in its latest report as all the publicity related to the iPhone has led to increased demand for the old trusted iPods and Macs. The company also successfully launched the iPhone in Europe later in the year and has its sights set on Asia for 2008. Combined, these two techs contributed over 3.5% to the Fund’s performance in 2007.

Detailed Explanation of Calendar Year Performance—What Didn’t Work

The Short Version: Six industry sectors were represented in the list of poor performers, highlighted by three financials firms. Combined, those three holdings only cost the Fund about 1% in performance. Fortunately, only one company lost over 50% for the calendar year, and the Fund owned a relatively small position of that stock.

These are the ten stocks that performed the worst for the calendar year ended December 31, 2007:

| | | | | | |

| Rank | | Description | | Industry | | % Loss |

| 1 | | WellCare Health Plans Inc | | Healthcare-Services | | -77.5% |

| 2 | | First Marblehead Corp | | Diversified Financial Services | | -36.0% |

| 3 | | Perini Corp | | Engineering & Construction | | -29.9% |

| 4 | | Valueclick Inc | | Internet | | -29.3% |

| 5 | | Cooper Tire & Rubber Co | | Auto Parts & Equipment | | -29.3% |

| 6 | | NutriSystem Inc | | Internet | | -28.9% |

| 7 | | Western Refining Inc | | Oil & Gas | | -27.4% |

| 8 | | Jones Lang LaSalle Inc | | Real Estate | | -27.1% |

| 9 | | Washington Mutual Inc | | Savings & Loans | | -27.0% |

| 10 | | Baldor Electric Co | | Hand/Machine Tools | | -23.0% |

| | | | | | | |

The year 2007 turned out to be highly volatile for Cooper Tire and Rubber. After trading around $28 in July, the stock plunged over 20% in one day following its recent quarterly earnings announcement and closed the year around $16.50. While higher sales in Europe and Asia contributed to a quarterly profit, U.S. analysts remained concerned about plant inefficiencies and how the company will handle rising costs of raw materials in 2008. The stock cost the Fund 0.8% in annual return.

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

Managing Risks (on the margin) with Puts and Calls

We have mentioned in previous letters the occasional use of calls to provide some exposure to a stock’s “upside,” while limiting the risk of a stock’s major decline. A related strategy is even more defensive in nature and involves selling calls or buying puts on Fund stocks in order to “manage down” (in accordance with our investment objective) the risk that our Fund might fall faster than the market overall. As our Fund had become measurably more volatile than we would like over the last two years, we employed such a strategy in the fourth quarter with a portion of the Fund. The total capital employed with this strategy is small, equal to 0.5% of net assets. In the downturn between mid-October to mid-December, this strategy provided a bit of cushion, however, as our options returned a 0.6% of net assets gain. The purpose is not really to add to returns significantly over the long haul, but rather to decrease downside volatility or short term risk.

Top Ten Holdings as of December 31, 2007

Six of our top holdings at the end of the calendar year were among the Fund’s best performers during the December quarter: Decker Outdoor, Owens-Illinois, Mosaic Co., Intuitive Surgical, Potash Corp., and Apple Inc. Combined, these six companies contributed almost 7% to the overall performance of the Fund during the quarter. The top 10 holdings represented almost 44% of the net assets of the Fund.

| | | | | | |

| Rank | | Description | | Industry | | Percent of

Net Assets |

| 1 | | Deckers Outdoor Corp | | Apparel | | 5.5% |

| 2 | | Owens-Illinois Inc | | Packaging & Containers | | 5.4% |

| 3 | | OSI Pharmaceuticals Inc | | Pharmaceuticals | | 4.8% |

| 4 | | Mosaic Co | | Chemicals | | 4.6% |

| 5 | | Invitrogen Corp | | Biotechnology | | 4.6% |

| 6 | | Perrigo Co | | Pharmaceuticals | | 4.6% |

| 7 | | Intuitive Surgical Inc | | Healthcare-Products | | 4.0% |

| 8 | | Potash Corp of Saskatchewan | | Chemicals | | 3.7% |

| 9 | | Apple Inc | | Computers | | 3.6% |

| 10 | | CROCS Inc | | Apparel | | 2.9% |

| | | | | | | |

| | | | | | 43.7% |

Industry Sector Representation as of December 31, 2007

Our Fund’s strong relative weighting in basic materials has had a strong positive effect in the December quarter, as our “picks” performed well as a group. Interestingly, our under-representation of financial stocks also helped significantly, as many finance stocks got pounded by the subprime lending and related credit crisis. Our largest sector was consumer, non-cyclicals, probably a good place to be if we should enter a recession in 2008. None of this reflects a view of the economy at Bridgeway, however. It is simply the sum total of our individual stock picks.

| | | | | | |

| | | % of Portfolio | | % S&P 500 Index | | Difference |

Basic Materials | | 15.6% | | 3.4% | | 12.2% |

Communications | | 6.1% | | 11.3% | | -5.2% |

Consumer, Cyclical | | 9.1% | | 7.1% | | 2.0% |

Consumer, Non-cyclical | | 27.0% | | 20.5% | | 6.5% |

Energy | | 4.5% | | 12.9% | | -8.4% |

Financial | | 3.9% | | 17.6% | | -13.7% |

Industrial | | 18.3% | | 11.8% | | 6.5% |

Technology | | 13.0% | | 11.8% | | 1.2% |

Utilities | | 0.0% | | 3.5% | | -3.5% |

Diversified | | 0.0% | | 0.1% | | -0.1% |

Cash | | 2.5% | | 0.0% | | 2.5% |

| | | | | | | |

Total | | 100.0% | | 100.0% | | |

| | |

| 12 | | Semi-Annual Report | December 31, 2007 (Unaudited) |

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

Interesting Historical Statistics

Of the surviving 127 members of the triple digit club (Funds that appreciated at least 100%) of 1999, only three beat the market each year of the bear market following. During that three year period (2000-2002), Aggressive Investors 1 Fund declined 17%, the S&P 500 Index declined 38%, and the entire triple digit club (only the surviving members) declined a whopping 59%. That’s part of our Fund design: when we do underperform the market for a year or two, we try not to do it in a bear market. Past history (and Fund design) does not guarantee future performance. We do and have underperformed for shorter down periods such as months and quarters.

Disclaimer

The following is a reminder from the friendly folks at your Fund who worry about liability. The views expressed here are exclusively those of Fund management. These views, including those of market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter end, December 31, 2007, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and may not be indicative of future performance.

Market volatility can significantly affect short-term performance. The Fund is not an appropriate investment for short-term investors. Investments in the small companies within this multi-cap fund generally carry greater risk than is customarily associated with larger companies. This additional risk is attributable to a number of factors, including the relatively limited financial resources that are typically available to small companies, and the fact that small companies often have comparatively limited product lines. In addition, the stock of small companies tends to be more volatile than the stock of large companies, particularly in the short term and particularly in the early stages of an economic or market downturn. The Fund’s use of options, futures, and leverage magnifies the risk of loss in an unfavorable market, and the Fund’s use of short-sale positions can, in theory, expose shareholders to unlimited loss. Finally, the Fund exposes shareholders to “focus risk” which adds to Fund volatility through the possibility that a single company could significantly affect total return. Shareholders of the Fund, therefore, are taking on more risk than they would if they invested in the stock market as a whole.

Conclusion

Thank you for your continued investment in Aggressive Investors 1 Fund. We encourage your feedback; your reactions and concerns are important to us.

Sincerely,

Your Investment Management Team

Aggressive Investors 1 Fund

SCHEDULE OF INVESTMENTS

Showing percentage of net assets as of December 31, 2007 (Unaudited)

| | | | | | | |

| Industry | | Company | | Shares | | Value |

|

COMMON STOCKS - 99.81% |

Aerospace/Defense - 1.50% |

| | Lockheed Martin Corp. | | 53,400 | | $ | 5,620,884 |

|

Apparel - 9.31% |

| | CROCS, Inc.*(a) | | 290,800 | | | 10,704,348 |

| | Deckers Outdoor Corp.*(a) | | 133,300 | | | 20,669,498 |

| | Warnaco Group, Inc.* | | 101,200 | | | 3,521,760 |

| | | | | | | |

| | | | | | | 34,895,606 |

|

Banks - 1.19% |

| | US Bancorp(a) | | 141,000 | | | 4,475,340 |

|

Biotechnology - 4.57% |

| | Invitrogen Corp.* | | 183,400 | | | 17,131,394 |

|

Chemicals - 12.84% |

| | CF Industries Holdings, Inc. | | 91,600 | | | 10,081,496 |

| | Mosaic Co.* | | 184,000 | | | 17,358,560 |

| | Potash Corp. of Saskatchewan | | 95,100 | | | 13,690,596 |

| | Terra Industries, Inc.* | | 146,370 | | | 6,990,631 |

| | | | | | | |

| | | | | | | 48,121,283 |

|

Commercial Services - 0.65% |

| | Apollo Group, Inc.* | | 34,600 | | | 2,427,190 |

|

Computers - 10.44% |

| | Apple, Inc.* | | 67,400 | | | 13,350,592 |

| | Research In Motion, Ltd.* | | 94,200 | | | 10,682,280 |

| | Sigma Designs, Inc.*(a) | | 155,300 | | | 8,572,560 |

| | Sun Microsystems, Inc.* | | 180,725 | | | 3,276,544 |

| | Synaptics, Inc.* | | 79,000 | | | 3,251,640 |

| | | | | | | |

| | | | | | | 39,133,616 |

|

Diversified Financial Services - 2.03% |

| | Goldman Sachs Group, Inc. | | 17,900 | | | 3,849,395 |

| | Greenhill & Co., Inc.(a) | | 56,800 | | | 3,776,064 |

| | | | | | | |

| | | | | | | 7,625,459 |

|

Electrical Components & Equipment - 1.26% |

| | GrafTech International, Ltd.*(a) | | 265,100 | | | 4,705,525 |

|

Electronics - 1.77% |

| | Garmin, Ltd.(a) | | 68,500 | | | 6,644,500 |

|

Energy-Alternative Sources - 1.54% |

| | Sunpower Corp.*(a) | | 44,400 | | | 5,789,316 |

|

Engineering & Construction - 3.51% |

| | McDermott International, Inc.* | | 177,900 | | | 10,501,437 |

| | Perini Corp.* | | 63,900 | | | 2,646,738 |

| | | | | | | |

| | | | | | | 13,148,175 |

| | | | | | | |

| Industry | | Company | | Shares | | Value |

|

|

Food - 2.80% |

| | Fresh Del Monte Produce, Inc.* | | 313,000 | | $ | 10,510,540 |

|

Healthcare-Products - 4.05% |

| | Intuitive Surgical, Inc.* | | 46,800 | | | 15,186,600 |

|

Internet - 3.29% |

| | Amazon.com, Inc.* | | 53,900 | | | 4,993,296 |

| | priceline.com, Inc.*(a) | | 64,000 | | | 7,351,040 |

| | | | | | | |

| | | | | | | 12,344,336 |

|

Machinery-Diversified - 2.56% |

| | AGCO Corp.* | | 141,000 | | | 9,585,180 |

|

Metal Fabrication - Hardware - 2.74% |

| | Precision Castparts Corp. | | 44,000 | | | 6,102,800 |

| | Valmont Industries, Inc. | | 47,000 | | | 4,188,640 |

| | | | | | | |

| | | | | | | 10,291,440 |

Mining - 3.11% |

| | Freeport-McMoRan Copper & Gold, Inc. | | 57,200 | | | 5,859,568 |

| | Southern Copper Corp.(a) | | 55,100 | | | 5,792,663 |

| | | | | | | |

| | | | | | | 11,652,231 |

|

Oil & Gas Services - 3.03% |

| | National Oilwell Varco, Inc.* | | 97,200 | | | 7,140,312 |

| | Oceaneering International, Inc.* | | 62,600 | | | 4,216,110 |

| | | | | | | |

| | | | | | | 11,356,422 |

|

Packaging & Containers - 5.41% |

| | Owens-Illinois, Inc.* | | 409,600 | | | 20,275,200 |

|

Pharmaceuticals - 15.59% |

| | Bristol-Myers Squibb Co. | | 174,300 | | | 4,622,436 |

| | Gilead Sciences, Inc.* | | 117,600 | | | 5,410,776 |

| | Medco Health Solutions, Inc.* | | 34,100 | | | 3,457,740 |

| | Onyx Pharmaceuticals, Inc.* | | 176,800 | | | 9,833,616 |

| | OSI Pharmaceuticals, Inc.*(a) | | 371,700 | | | 18,031,167 |

| | Perrigo Co. | | 488,000 | | | 17,084,880 |

| | | | | | | |

| | | | | | | 58,440,615 |

|

Real Estate - 0.76% |

| | Jones Lang LaSalle, Inc. | | 40,200 | | | 2,860,632 |

|

Semiconductors - 0.95% |

| | NVIDIA Corp.*(a) | | 104,500 | | | 3,555,090 |

| | |

| 14 | | Semi-Annual Report | December 31, 2007 (Unaudited) |

Aggressive Investors 1 Fund

SCHEDULE OF INVESTMENTS (continued)

Showing percentage of net assets as of December 31, 2007 (Unaudited)

| | | | | | | |

| Industry | | Company | | Shares | | Value |

|

Common Stocks (continued) |

Software - 1.90% |

| | Oracle Corp.* | | 315,200 | | $ | 7,117,216 |

|

Telecommunications - 3.01% |

| | Cisco Systems, Inc.* | | 131,200 | | | 3,551,584 |

| | Nokia OYJ, ADR | | 114,300 | | | 4,387,977 |

| | Telefonica SA(a) | | 34,400 | | | 3,357,096 |

| | | | | | | |

| | | | | | | 11,296,657 |

|

Transportation - 0.00% |

| | Kirby Corp.* | | 20 | | | 930 |

| | | | | | | |

| |

TOTAL COMMON STOCKS - 99.81% | | | 374,191,377 |

| | | | | | | |

(Cost $289,769,329) | | | |

| | | | | | | | |

|

MONEY MARKET FUNDS - 2.58% | |

| | | |

| | | Rate^ | | Shares | | Value | |

BlackRock TempCash Liquidity Fund, Institutional Shares #21 | | 4.78% | | 9,668,243 | | | 9,668,243 | |

| | | | | | | | |

| |

TOTAL MONEY MARKET FUNDS - 2.58% | | | 9,668,243 | |

| | | | | | | | |

(Cost $9,668,243) | | | | | | | | |

| |

TOTAL INVESTMENTS - 102.39% | | $ | 383,859,620 | |

(Cost $299,437,572) | | | | |

Liabilities in Excess of Other Assets - (2.39)% | | | (8,956,140 | ) |

| | | | | | | | |

NET ASSETS - 100.00% | | $ | 374,903,480 | |

| | | | | | | | |

| * | Non-income producing security. |

| ^ | Rate disclosed is as of December 31, 2007. |

| (a) | This security or a portion of the security is out on loan at December 31, 2007. Total loaned securities had a market value of $71,389,161 at December 31, 2007. |

ADR American Depositary Receipt

See Notes to Financial Statements.

Aggressive Investors 2 Fund

MANAGER’S COMMENTARY

(Unaudited)

December 31, 2007

Dear Fellow Aggressive Investors 2 Fund Shareholder,

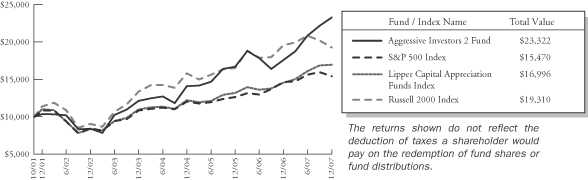

For the fifth quarter in a row, Aggressive Investors 2 Fund outperformed both its primary market benchmark and also its peer benchmark. Our Fund earned an impressive 5.02%, compared to a decline of 3.33% for the S&P 500 Index and a small gain of 0.42% for the Lipper Capital Appreciation Funds Index. The Russell 2000 Index of small companies, which had done so well in recent prior years, declined over 4.5%. It was an excellent quarter for our Fund.

For the six month semi-annual period, our Fund gained 11.62%, significantly beating the S&P 500 Index (-1.37%), the Lipper Capital Appreciation Funds Index (5.35%), and the Russell 2000 Index (-7.53%). This period was marked by extreme market volatility as investors faced the growing subprime debacle that morphed into a true credit crisis, and our Fund performed quite well under those difficult conditions.

Likewise, we are quite pleased with our Fund’s calendar year performance for 2007, both on an absolute and relative return basis. Aggressive Investors 2 Fund gained more than 30% for the 12-months ending December 31, 2007, far exceeding the performance of the S&P 500 Index (5.49%), the Lipper Capital Appreciation Funds Index (16.39%), and the Russell 2000 Index (-1.57%). You may recall that 2006 was the first year since inception that we had underperformed the S&P 500 Index. It has not been that unusual for a poorer period such as 2006 to be followed by a strong one such as 2007—one more reason I think it’s a bad idea to leave our Funds for reasons related to short-term performance. As always, long-term performance and risk management remain our key objectives. The information below bears out our historical success in these areas.

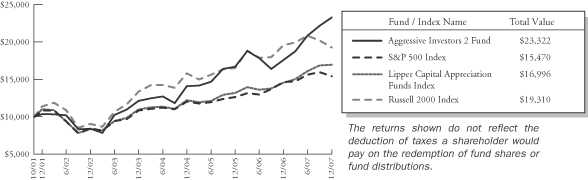

The table below presents our December quarter, six-month, one-year, five-year and life-to-date financial results according to the formula required by the SEC. See the next page for a graph of performance since inception.

| | | | | | | | | | |

| | | Dec. Qtr. 10/1/07

to 12/31/07 | | 6 Month. 7/1/07

to 12/31/07 | | 1 Year 1/1/07

to 12/31/07 | | 5 Year 1/1/03

to 12/31/07 | | Life-to-Date 10/31/01 to 12/31/07 |

| | | | | |

Aggressive Investors 2 Fund | | 5.02% | | 11.62% | | 32.19% | | 22.57% | | 14.72% |

S&P 500 Index (large companies) | | -3.33% | | -1.37% | | 5.49% | | 12.82% | | 7.33% |

Lipper Capital Appreciation Funds Index | | 0.42% | | 5.35% | | 16.39% | | 15.18% | | 8.98% |

Russell 2000 Index (small companies) | | -4.58% | | -7.53% | | -1.57% | | 16.25% | | 11.26% |

Performance figures quoted in the table above and graph below represent past performance and are no guarantee of future results. The table above and the graph below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks with dividends reinvested, while the Russell 2000 Index is an unmanaged, market value weighted index, that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The Lipper Capital Appreciation Funds Index reflects the record of the 30 largest funds in this category, comprised of more aggressive domestic growth mutual funds, as reported by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

According to data from Lipper, Inc. as of December 31, 2007, Aggressive Investors 2 Fund ranked 12th of 357 capital appreciation funds for the twelve months ending December 31, 2007, 14th of 247 over the last five years, 16th of 225 since inception in October, 2001. Lipper, Inc. is an independent mutual fund rating service that ranks funds in various fund categories by making comparative calculations using total returns.

| | |

| 16 | | Semi-Annual Report | December 31, 2007 (Unaudited) |

Aggressive Investors 2 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

Aggressive Investors 2 Fund vs. S&P 500 Index & Lipper Capital Appreciation Funds Index & Russell 2000 Index 10/31/01 to 12/31/07

Detailed Explanation of Quarterly Performance—What Worked Well

The Short Version: Talk about a chemical reaction. Chemical companies highlighted our top performers during the quarter. Four were among the top ten. Combined, these companies contributed over 4% to the return of the Fund. Our top two performers, both of which were chemical-related, each earned over 50% during the three-month period. The Fund also benefited from a bit of a global flavor as two of our top holdings are internationally based companies. (The Fund may invest up to 15% in foreign stocks, though the actual number has historically been, or is currently, significantly less than this.)

These are the ten best performers for the quarter ended December 31, 2007:

| | | | | | |

| Rank | | Description | | Industry | | % Gain |

| 1 | | Mosaic Co | | Chemicals | | 55.8% |

| 2 | | Terra Industries Inc | | Chemicals | | 52.8% |

| 3 | | Mobile Telesystems OJSC ADR | | Telecommunications | | 46.9% |

| 4 | | Deckers Outdoor Corp | | Apparel | | 37.7% |

| 5 | | Potash Corp of Saskatchewan | | Chemicals | | 36.5% |

| 6 | | Intuitive Surgical Inc | | Healthcare-Products | | 36.2% |

| 7 | | CF Industries Holdings Inc | | Chemicals | | 36.1% |

| 8 | | Apple Inc | | Computers | | 29.1% |

| 9 | | priceline.com Inc | | Internet | | 23.4% |

| 10 | | Belden Inc | | Electrical Compo & Equip | | 21.1% |

| | | | | | | |

The Mosaic Company was the Fund’s top performer and earned over 55% for the three-month period. Based in Minneapolis, Minnesota, the chemical company is a leading global manufacturer of crop nutrients which serve as primary ingredients for fertilizer. Two significant factors have surfaced as of late that greatly benefited fertilizer companies like Mosaic. Rising oil prices and government subsidies have led to increased demand for ethanol which has prompted greater production of corn. Additionally, as the populations in China and other developing Asian and Latin American countries become increasingly affluent, their residents are adding more meat to their diets. As a result, corn and others feed grains have been met with even greater global demand and thus, the need for more fertilizer. During the past quarter, the company used its recent windfall from ongoing business operations to pay down long-term debt and strengthen its overall financial position. The stock contributed over 1.7% to the performance of the Fund during the three-month period.

Intuitive Surgical Inc. is a healthcare-related company that manufactures and markets specialty surgical products for a variety of medical applications. In particular, the company has designed robotic tools known as da Vinci systems which are used for urology, cardiology, gynecology, and general surgeries. In its most recent quarter, company profits doubled and sales increased by over 60%. Additionally, Intuitive has started to make inroads into the international medical markets. While many

Aggressive Investors 2 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

analysts remain quite positive about the company’s prospects for continued growth, others express concerns that it could encounter future challenges because it essentially remains a one-product company. To counter these fears, management points out that revenue is also tied to sales of accessories, system service and training; therefore, the potential for recurring revenue streams is becoming more substantial. Intuitive Systems contributed just over 1.0% to the performance of the Fund this past quarter.

Detailed Explanation of Quarterly Performance—What Didn’t Work

The Short Version: Companies from five different sectors were represented in our list of weak performers; no one industry served as the primary (negative) catalyst. Interestingly, the stock (CROCS) that made the greatest negative contribution to the Fund’s performance during the last three months had been our top performer over the prior two quarters. Nine companies lost 20% or more during the past quarter.

These are the ten stocks that performed the worst in the quarter ended December 31, 2007:

| | | | | | |

| Rank | | Description | | Industry | | % Loss |

| 1 | | WellCare Health Plans Inc | | Healthcare-Services | | -78.6% |

| 2 | | CROCS Inc | | Apparel | | -45.3% |

| 3 | | Cooper Tire & Rubber Co | | Auto Parts & Equipment | | -35.4% |

| 4 | | Ceradyne Inc | | Miscellaneous Manufacturing | | -32.5% |

| 5 | | Perini Corp | | Engineering & Construction | | -29.6% |

| 6 | | Amkor Technology Inc | | Semiconductors | | -29.2% |

| 7 | | Jones Lang LaSalle Inc | | Real Estate | | -29.2% |

| 8 | | Big Lots Inc | | Retail | | -28.5% |

| 9 | | Varian Semiconductor Equipment Assoc | | Semiconductors | | -20.0% |

| 10 | | Synaptics Inc | | Computers | | -19.6% |

| | | | | | | |

Our worst performer for the quarter, managed care company, WellCare Health Plans offers government-sponsored healthcare and prescription drug programs through Medicare and Medicaid. In late October, federal investigators raided company headquarters and initiated an investigation over what most believe to be fraud-related issues. Unfortunately, our models can’t identify issues like this before they happen. To add insult to injury, company execs sold off over $45 million in stock during the year in advance of the raid, far more than the insider sales totaled for all of 2006. The company’s stock priced plunged over 70% in one day. News did not get any better for the company as the quarter progressed as shareholder lawsuits ensued and plan enrollments declined. Fortunately, our position in this lightly traded company is relatively small and it cost the Fund less than 0.80% in return for the quarter. We purchased this stock late in the September quarter and our models jettisoned it a couple of months later.

Trendy shoemaker, CROCS has been a dependable performer for several quarters. CROCS was the Fund’s top performer, and returned over 50% during the three months ended September 30, 2007. While its latest earnings report actually beat Wall Street forecasts, its future guidance on revenues fell short of expectations. In reality, CROCS had trouble keeping up with the increasing demand for its products throughout Europe and Japan, an issue that cost the company about $30 million in potential quarterly sales. Its stock price fell by almost half for the quarter and a few shareholder suits followed. The holding cost the Fund just under 2% during the past three months. Despite the down quarter, CROCS remained our fourth best performer for the calendar year and appreciated more than 70%.

Detailed Explanation of Calendar Year Performance—What Worked Well

The Short Version: With a gain of over 30%, lots of things went right for the Fund during the prior 12-months. Our three top holdings (including two technology companies) earned well in excess of 100% and a total of 14 stocks returned over 50% for the calendar year. Basic materials and energy highlighted the list of top 10 performers as six companies came from those two sectors.

| | |

| 18 | | Semi-Annual Report | December 31, 2007 (Unaudited) |

Aggressive Investors 2 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

These are the ten best performers for the calendar year ended December 31, 2007:

| | | | | | |

| Rank | | Description | | Industry | | % Gain |

| 1 | | Research In Motion Ltd | | Computers | | 166.2% |

| 2 | | Apple Inc | | Computers | | 132.6% |

| 3 | | Potash Corp of Saskatchewan | | Chemicals | | 113.3% |

| 4 | | CROCS Inc | | Apparel | | 70.4% |

| 5 | | Chaparral Steel Co | | Iron/Steel | | 69.8% |

| 6 | | Terra Industries Inc | | Chemicals | | 69.3% |

| 7 | | National Oilwell Varco Inc | | Oil & Gas Services | | 67.6% |

| 8 | | Frontier Oil Corp | | Oil & Gas | | 66.8% |

| 9 | | Vimpel-Communications ADR | | Telecommunications | | 66.0% |

| 10 | | Tesoro Corp | | Oil & Gas | | 62.6% |

| | | | | | | |

The Fund’s best two performers, Research in Motion and Apple, topped the list with returns greater than 100% in 2007. Consumers are still in love with their time-tested Blackberries (Research in Motion), even after the successful debut of the iPhone (Apple) in June. (Apparently there is room for both in this growing global market.) In its most recent report, Research in Motion more than doubled its profits and beat Wall Street expectations once again; the company is reaping benefits of higher sales of its Pearl and Curve. Likewise, Apple reported a 67% increase in earnings in its latest report as all the publicity related to the iPhone has led to increased demand for the old trusted iPods and Macs. The company also successfully launched the iPhone in Europe later in the year and has it sights set on Asia for 2008. Combined, these two techs contributed over 4.25% to the Fund’s performance in 2007.

Detailed Explanation of Calendar Year Performance—What Didn’t Work

The Short Version: Six industry sectors were represented in the list of poor performers, highlighted by three financials firms. Combined, those three holdings only cost the Fund just over 1% in performance. Fortunately, only one company lost over 50% for the calendar year and the Fund owned a relatively small position of that stock.

These are the ten stocks that performed the worst for the calendar year ended December 31, 2007:

| | | | | | |

| Rank | | Description | | Industry | | % Loss |

| 1 | | WellCare Health Plans Inc | | Healthcare-Services | | -77.5% |

| 2 | | Cooper Tire & Rubber Co | | Auto Parts & Equipment | | -41.1% |

| 3 | | First Marblehead Corp/The | | Diversified Financial Svcs | | -37.8% |

| 4 | | Jones Lang LaSalle Inc | | Real Estate | | -36.6% |

| 5 | | Perini Corp | | Engineering & Construction | | -29.6% |

| 6 | | Valueclick Inc | | Internet | | -29.1% |

| 7 | | Western Refining Inc | | Oil & Gas | | -28.4% |

| 8 | | Washington Mutual Inc | | Savings & Loans | | -27.0% |

| 9 | | Baldor Electric Co | | Hand/Machine Tools | | -23.2% |

| 10 | | China Southern Airlines Co Ltd ADR | | Airlines | | -23.2% |

| | | | | | | |

The year 2007 turned out to be highly volatile for Cooper Tire and Rubber. After trading around $28 in July, the stock plunged over 20% in one day following its recent quarterly earnings announcement and closed the year around $16.50. While higher sales in Europe and Asia contributed to a quarterly profit, U.S. analysts remained concerned about plant inefficiencies and how the company will handle rising costs of raw materials in 2008. The stock cost the Fund less than 0.5% in annual return.

Aggressive Investors 2 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

Managing Risks (on the margin) with Puts and Calls

We have mentioned in previous letters the occasional use of calls to provide some exposure to a stock’s “upside,” while limiting the risk of a stock’s major decline. A related strategy is even more defensive in nature and involves selling calls or buying puts on Fund stocks in order to “manage down” (in accordance with our investment objective) the risk that our Fund might fall faster than the market overall. As our Fund had measurably become more volatile than we would like over the last two years, we employed such a strategy in the fourth quarter with a portion of the Fund. The total capital employed with this strategy is small, equal to 0.5% of net assets. In the downturn between mid-October to mid-December, this strategy provided a bit of cushion, however, as our options returned a 0.6% of net assets gain. The purpose here is not really to add to returns significantly over the long haul, but rather to decrease downside volatility or short term risk.

Top Ten Holdings as of December 31, 2007

Five of our top holdings at the end of the calendar year were among the Fund’s best performers during the December quarter: Decker Outdoor, Mosaic Co., Intuitive Surgical, Potash Corp., and Apple Inc. Combined, these five companies contributed over 6% to the overall performance of the Fund during the quarter. The top 10 holdings represented just under 40% of the net assets of the Fund.

| | | | | | |

| Rank | | Description | | Industry | | Percent of

Net Assets |

| 1 | | Deckers Outdoor Corp | | Apparel | | 5.4% |

| 2 | | Owens-Illinois Inc | | Packaging & Containers | | 4.5% |

| 3 | | Mosaic Co | | Chemicals | | 4.3% |

| 4 | | Invitrogen Corp | | Biotechnology | | 4.2% |

| 5 | | AGCO Corp | | Machinery-Diversified | | 3.8% |