UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08200

BRIDGEWAY FUNDS, INC.

(Exact name of registrant as specified in charter)

5615 Kirby Drive, Suite 518

Houston, Texas 77005-2448

(Address of principal executive offices) (Zip code)

Michael D. Mulcahy, President

Bridgeway Funds, Inc.

5615 Kirby Drive, Suite 518

Houston, Texas 77005-2448

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 661-3500

Date of fiscal year end: June 30

Date of reporting period: July 1, 2009 through December 31, 2009

| Item 1. | Reports to Stockholders. |

| | |

| | A no-load mutual fund family of domestic funds |

| | |

| |

| | Semi-Annual Report December 31, 2009 (Unaudited) |

| | | | |

| | |

| | AGGRESSIVE INVESTORS 1 | | BRAGX |

| | (Closed to New Investors) | | |

| | |

| | AGGRESSIVE INVESTORS 2 | | BRAIX |

| | |

| | ULTRA-SMALL COMPANY | | BRUSX |

| | (Open to Existing Investors—Direct Only) | | |

| | |

| | ULTRA-SMALL COMPANY MARKET | | BRSIX |

| | |

| | MICRO-CAP LIMITED | | BRMCX |

| | |

| | SMALL-CAP GROWTH | | BRSGX |

| | |

| | SMALL-CAP VALUE | | BRSVX |

| | |

| | LARGE-CAP GROWTH | | BRLGX |

| | |

| | LARGE-CAP VALUE | | BRLVX |

| | |

| | BLUE CHIP 35 INDEX | | BRLIX |

| | |

| | BALANCED | | BRBPX |

TABLE OF CONTENTS

Bridgeway Funds Standardized Returns as of December 31, 2009*

| | | | | | | | | | | | | | | |

| | | | | Annualized | | | | | |

| Fund | | Dec. Qtr. 10/1/09

to 12/31/09 | | 1 Year | | 5 Years | | 10 Years | | Inception

to Date | | Inception

Date | | Gross

Expense

Ratio | |

Aggressive Investors 1 | | 5.46% | | 23.98% | | -3.39% | | 1.86% | | 13.29% | | 8/5/1994 | | 0.34% | |

Aggressive Investors 2 | | 5.84% | | 29.84% | | -0.73% | | NA | | 3.84% | | 10/31/2001 | | 1.20% | |

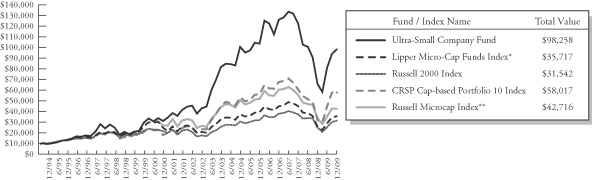

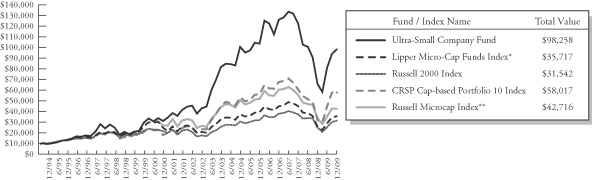

Ultra-Small Company | | 4.26% | | 48.93% | | -0.51% | | 12.71% | | 15.99% | | 8/5/1994 | | 1.16% | |

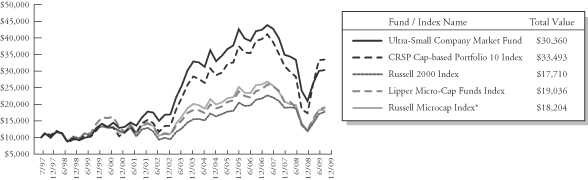

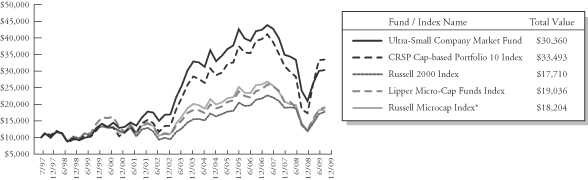

Ultra-Small Company Market | | 1.16% | | 25.96% | | -3.51% | | 8.97% | | 9.35% | | 7/31/97 | | 0.79% | 1 |

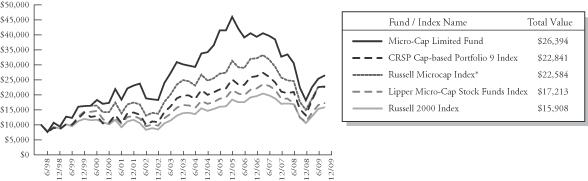

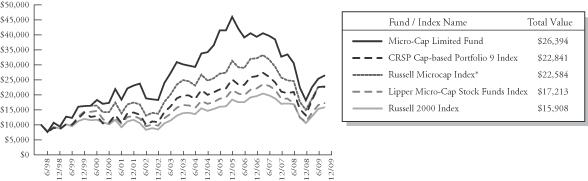

Micro-Cap Limited | | 4.16% | | 17.65% | | -4.86% | | 5.07% | | 8.80% | | 6/30/1998 | | 0.87% | |

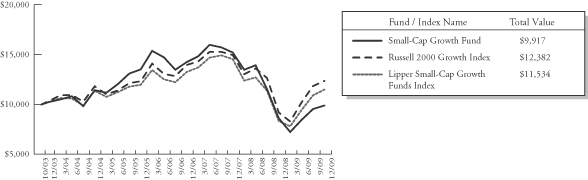

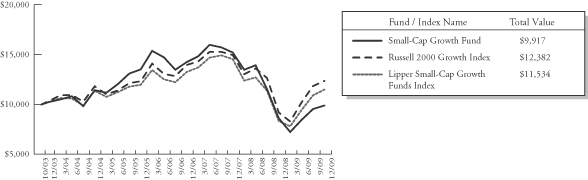

Small-Cap Growth | | 3.62% | | 15.04% | | -2.85% | | NA | | -0.14% | | 10/31/2003 | | 0.94% | |

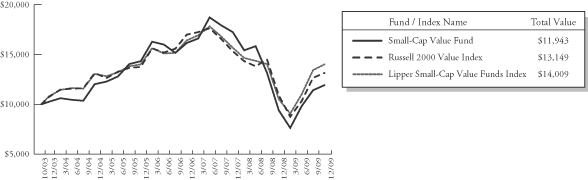

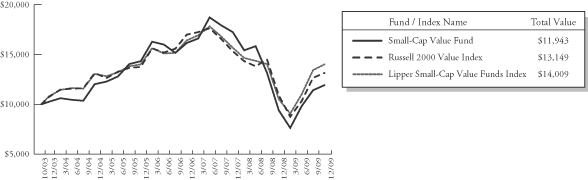

Small-Cap Value | | 4.57% | | 26.98% | | -0.18% | | NA | | 2.92% | | 10/31/2003 | | 0.92% | |

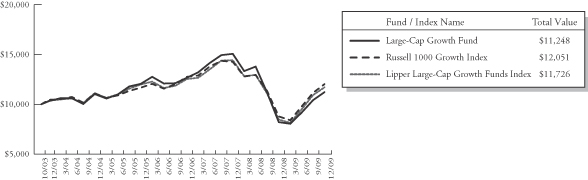

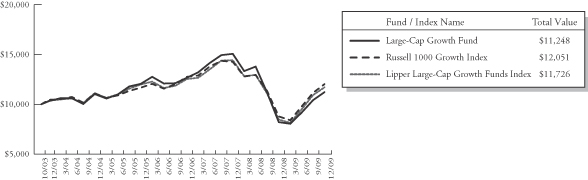

Large-Cap Growth | | 7.81% | | 36.66% | | 0.37% | | NA | | 1.92% | | 10/31/2003 | | 0.82% | |

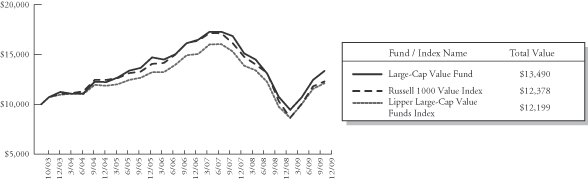

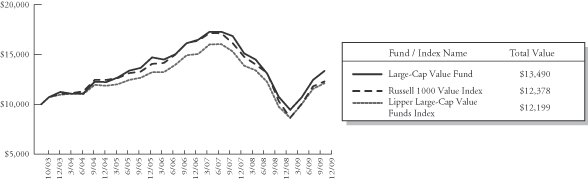

Large-Cap Value | | 7.40% | | 24.92% | | 1.75% | | NA | | 4.97% | | 10/31/2003 | | 0.98% | 1 |

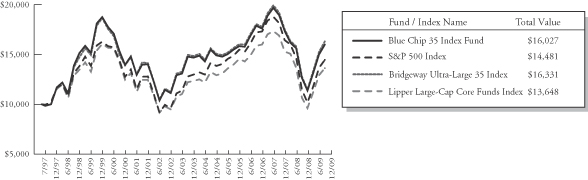

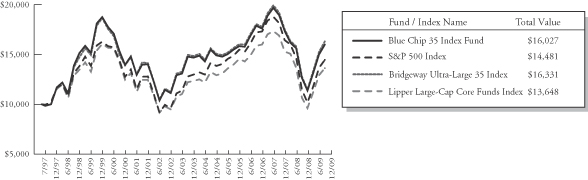

Blue Chip 35 Index | | 6.78% | | 26.61% | | 0.68% | | -1.23% | | 3.87% | | 7/31/97 | | 0.25% | 1 |

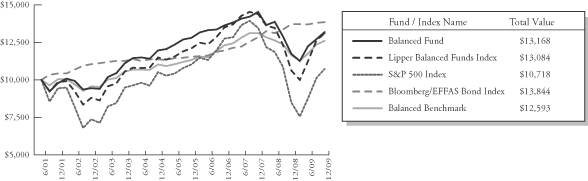

Balanced | | 3.57% | | 12.39% | | 1.95% | | NA | | 3.29% | | 6/30/2001 | | 1.01% | 1 |

1 Some of the Fund’s fees were waived or expenses reimbursed, otherwise returns would have been lower. The Adviser has contractually agreed to waive fees and/or reimburse expenses such that the total operating expenses do not exceed 0.75% for the Ultra-Small Company Market Fund, 0.84% for the Large-Cap Value Fund, 0.15% for the Blue Chip 35 Index Fund and 0.94% for the Balanced Fund. Any material change to this Fund policy would require a vote by shareholders.

Bridgeway Funds Returns for Calendar Years 1995 through 2009*

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1995 | | 1996 | | 1997 | | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 |

Aggressive Investors 1 | | 27.10% | | 32.20% | | 18.27% | | 19.28% | | 120.62% | | 13.58% | | -11.20% | | -18.01% | | 53.97% | | 12.21% | | 14.93% | | 7.11% | | 25.80% | | -56.16% | | 23.98% |

Aggressive Investors 2 | | | | | | | | | | | | | | | | -19.02% | | 44.01% | | 16.23% | | 18.59% | | 5.43% | | 32.19% | | -55.07% | | 29.84% |

Ultra-Small Company | | 39.84% | | 29.74% | | 37.99% | | -13.11% | | 40.41% | | 4.75% | | 34.00% | | 3.98% | | 88.57% | | 23.33% | | 2.99% | | 21.55% | | -2.77% | | -46.24% | | 48.93% |

Ultra-Small Company Market | | | | | | | | -1.81% | | 31.49% | | 0.67% | | 23.98% | | 4.90% | | 79.43% | | 20.12% | | 4.08% | | 11.48% | | -5.40% | | -39.49% | | 25.96% |

Micro-Cap Limited | | | | | | | | | | 49.55% | | 6.02% | | 30.20% | | -16.61% | | 66.97% | | 9.46% | | 22.55% | | -2.34% | | -4.97% | | -41.74% | | 17.65% |

Small-Cap Growth | | | | | | | | | | | | | | | | | | | | 11.59% | | 18.24% | | 5.31% | | 6.87% | | -43.48% | | 15.04% |

Small-Cap Value | | | | | | | | | | | | | | | | | | | | 17.33% | | 18.92% | | 12.77% | | 6.93% | | -45.57% | | 26.98% |

Large-Cap Growth | | | | | | | | | | | | | | | | | | | | 6.77% | | 9.33% | | 4.99% | | 19.01% | | -45.42% | | 36.66% |

Large-Cap Value | | | | | | | | | | | | | | | | | | | | 15.15% | | 11.62% | | 18.52% | | 4.49% | | -36.83% | | 24.92% |

Blue Chip 35 Index | | | | | | | | 39.11% | | 30.34% | | -15.12% | | -9.06% | | -18.02% | | 28.87% | | 4.79% | | 0.05% | | 15.42% | | 6.07% | | -33.30% | | 26.61% |

Balanced | | | | | | | | | | | | | | | | -3.51% | | 17.82% | | 7.61% | | 6.96% | | 6.65% | | 6.58% | | -19.38% | | 12.39% |

Performance figures quoted represent past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than original cost. To obtain performance current to the most recent month-end, please visit our website at www.bridgeway.com or call 1-800-661-3550. Total return figures include the reimbursement of dividends and capital gains. The recent growth rate in the stock market has helped to produce short-term returns that are not typical and may not continue in the future.

This report is submitted for the general information of the shareholders of each Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding a Fund’s risks, objectives, fees and expenses, experience of its management, and other information. Investors should read the prospectus carefully before investing in a Fund. For questions or other Fund information, call 1-800-661-3550 or visit the Funds’ website www.bridgeway.com. Funds are available for purchase by residents of the United States, Puerto Rico, U.S. Virgin Islands and Guam only. Foreside Fund Services, LLC, Distributor.

The views expressed here are exclusively those of Fund management. These views, including those relating to the market, sectors or individual stocks are not meant as investment advice and should not be considered predictive in nature.

| * | Numbers with green highlight indicate periods when the Fund outperformed its primary benchmark. |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM

December 31, 2009

Dear Fellow Shareholders,

Our Funds generally followed the trends of the broader market in the December quarter, delivering single digit positive returns across the board. It was the third quarter of an extraordinary “bounceback” period following the worst bear market since the 1930’s. A review of the 2009 market environment appears on page 2. On a relative basis, seven of our eleven Funds beat their market benchmarks for the quarter, reflecting early signs of a leveling off of the truly dramatic low quality/financially distressed stock rally of March through October 2009. As described in more detail on page 3, there are preliminary signs of a return of “traction,” that is, reengagement of stock prices being driven by underlying company financial performance. However, this was exhibited more narrowly among very small companies (Micro-Cap Limited and Ultra-Small Company Funds) and on the value (not growth) stock end of the spectrum (Large-Cap Value and Small-Cap Value Funds). We will see if there is followthrough in the March 2010 quarter.

You are probably aware that Bridgeway strongly discourages market timing by investors. Since we continue to see strong evidence that investors are continuing this dangerous practice, we have devoted several sections to the topic (beginning on page 3), including a risk we are calling the “Landmine of the New Decade” on page 4.

Overall, calendar year 2009 was disappointing, in that we were hoping for far stronger relative performance following the extreme bear market of 2008. Only four of our Funds beat their primary market benchmark for the year. As shown in the bottom section of the previous page, we are used to a much better record on a calendar year basis. Yet the market environment of 2009 was definitely not one favorable to our quantitative stock picking models. One major exception to that statement, however, was the standout performance of our Blue Chip 35 Index Fund. On the strength of the fourth quarter, this Fund slightly edged out the S&P 500 Index, in an environment that would generally not be favorable to the Fund.

Finally, each calendar year we have a friendly competition against Morningstar’s “Fund picks.” 2009 goes to Morningstar. The “score” was Bridgeway 2, Morningstar 9.

As always, we appreciate your feedback. We take your comments very seriously and regularly discuss them internally to help in managing our Funds and this company. Please keep your ideas coming—both favorable and critical. They provide us with a vital tool that helps us serve you better.

Sincerely,

Your Investment Management Team

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

Market Review of Calendar 2009

The Short Version: A strong December quarter contributed to a continuing stock market recovery.

The stock market produced one of its strongest rallies in history from the March 9 low through the end of 2009 as broad U.S. equity indexes surged over 60%. Over this period, large-cap stocks (as represented by the Russell 1000 Index) were up 68%, while small-cap stocks (as represented by the Russell 2000 Index) jumped 80%. Mid-cap stocks (as represented by the Russell Midcap Index) did even better still, gaining 83%.

Three straight quarters of positive returns have quelled some of the gloom and doom in the marketplace, but the sentiment is still murky. Headlines continue highlighting falling real estate prices, high unemployment, and a weak dollar, not to mention terrorist activities. The average consumer may still be reeling from the reality of the recent recession, but the market is showing signs of improvement. More and more companies are posting positive earnings and improving outlooks. Even with the tremendous uptick of stock performance, investors continue to put record amounts of money into bonds and money market funds—indicative of shaken confidence in equities.

For the first two-plus months at the beginning of 2009, the financial world still seemed to be coming to an end. Bailouts and stimulus plans dominated the news and automakers joined financial services firms in search of government handouts and bankruptcy protection. Credit (corporate borrowing) was all but non-existent; equities continued their tailspin; nervous investors sought the safe-haven of Treasuries and even gold. By early March, stocks had fallen to their lowest level in 12 years.

But an interesting thing happened as the first quarter neared a close. Some investors looked at the carnage and found value in certain decimated sectors: financials, energy, and basic materials. March 2009 was the best performing month for domestic equities since October 2002, and emerging markets once again regained some luster. Slowly but surely, banks began paying off their bailout loans; automakers came up with restructuring plans; technology experienced a resurgence as analysts predicted a buying spree once the recession came to a close. By the third quarter, confidence returned to some corporate boardrooms in the form of enhanced IPO and M&A activity coming back from a very low base; earnings began beating expectations; and the Dow Jones enjoyed its best performance since 1998. Some naysayers expressed concerns that stocks had moved “too far, too fast,” but the newfound, friendly bullish trend took on a life of its own.

The fourth quarter saw more positive returns, though at a calmer pace, and the first signs of interest in higher-quality firms. Earnings looked strong, at least compared to the dismal results of the prior 12-months. Information Technology stocks led the way during the quarter while Financial Services stocks brought up the rear as the only sector with a loss for the period.

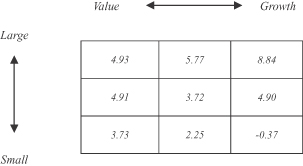

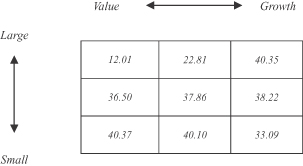

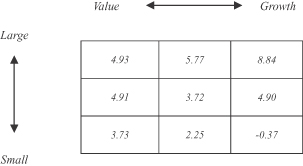

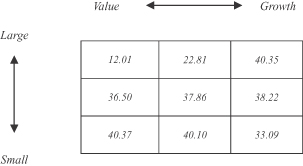

As presented below, each “corner” of the domestic market had a positive return for the December quarter, with the exception of small-cap growth. Helped by the market rally starting in March, stocks posted double digit positive returns for the year across the style spectrum.

Following are the stock market “style box” returns from Morningstar for the quarter and year:

| | |

Dec 2009 Quarter | | Calendar 2009 |

| |  |

| | |

| 2 | | Semi-Annual Report | December 31, 2009 (Unaudited) |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

Lack of Traction—Part 3

The Short Version: We may be seeing the first signs of a return of “traction,” a connection between the underlying fundamental financial health of a company and the relative performance of its stock price—but only among stocks on the value end of the spectrum (those companies more cheaply priced relative to some economic measures).

In each of the last two quarters, we discussed a dramatic market environment we call “lack of traction,” a period within which some of the most financially distressed stocks outperformed stronger ones, some companies with stellar financial reports were left behind in the market “bounceback” period, and generally a period in which our models that focus on financial health of companies did poorly. While Bridgeway’s investment management team has seen this phenomenon before, e.g. in the middle of calendar year 2006, this period has been the longest and most dramatic of any period we can remember.

Has the tide turned? The performance of models Bridgeway uses to stay away from companies with a high risk of bankruptcy indicates that things have at least “leveled off” in the November/December timeframe. Will this trend continue in the March 2010 quarter (i.e. return to normal), or is the recent period similar to June 2009, when things leveled off, but then distressed companies continued their dramatic march upward in July and August? Only time will tell; we are unable to predict these specific market movements, just as we are unable to predict the next short-term direction of the overall market. Furthermore, we believe that it is perilous to try to predict the market.

The table below shows another way of looking at this issue and the possibility of early signs of a return to traction, an environment in which we believe our models and Funds may perform better. This table presents the percentages of companies held by each Fund that beat Wall Street earnings estimates and compares that to the same statistic for the Fund’s primary market benchmark. (See the column labeled “difference.”) In a majority of market environments (but definitely not for the period from March through October 2009), companies with stronger than expected financial performance tend to beat market averages. Most of our Funds, with the exception of Aggressive Investors 1 and 2, significantly outperformed their relevant market benchmark on this measure in the December quarter. However, this strong performance actually translated to market beating returns only among the very small company Funds (Micro-Cap Limited and Ultra-Small Company) and on the value end of the spectrum (Large-Cap Value and Small-Cap Value Funds). We believe that we may be seeing the first signs of a return of traction, but that this has shown up among more value driven models, and even then, not yet to a dramatic degree.

| | | | | | | | |

| Fund | | Fund

Positive

Surprises | | Benchmark

Positive

Surprises | | Difference | | Return vs.

Benchmark |

Aggressive Investors 1 | | 84% | | 84% | | 0% | | -0.57% |

Aggressive Investors 2 | | 83% | | 84% | | -1% | | -0.20% |

Ultra-Small Company | | 69% | | 57% | | 12% | | 3.81% |

Micro-Cap Limited | | 77% | | 62% | | 15% | | 3.19% |

Small-Cap Growth | | 80% | | 69% | | 11% | | -0.52% |

Small-Cap Value | | 75% | | 63% | | 12% | | 0.94% |

Large-Cap Growth | | 95% | | 82% | | 13% | | -0.13% |

Large-Cap Value | | 92% | | 76% | | 16% | | 3.19% |

Investing During (Coming out of?) a Recession (contributed by Bridgeway Partner, Mike Mulcahy)

The Short Version: You can spend a lot of time trying to forecast how the market will react in 2010. The bottom line, however, is that you can’t forecast the market. We continue to encourage investors to a) create a long-term financial plan which takes into account the time horizon of cash needs, diversification, and personal tolerance for risk, b) commit that plan to writing, and c) follow it through thick and thin, including and especially when it feels least comfortable to do so.

Reading the headlines today can make your head spin. Who do you believe? What data is most reliable? Here is just a recent sampling of headlines:

| | • | | Sales of existing homes are up… Sales of new homes are down |

| | • | | Job market is stable…fewer people file initial job loss claims…more people drop out of workforce because of discouragement |

| | • | | Published unemployment hovers around 10%…Economists argue real unemployment is 17% |

| | • | | Productive gains are strong…inflation looms on horizon…deflation still possible |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

| | • | | Jeremy Siegel (Yale) sees the market undervalued and corporate earnings getting stronger |

| | • | | Muhammed El-Eheian of PIMCO sees the market overvalued and looking for a correction |

What do we actually know? The fact is there are only thirteen recessionary data points since 1929. This is hardly enough data from which to derive an accurate forecasting model. Each recession we have experienced since 1929 is markedly different. Job losses, our government’s response, foreign governments’ response, the degree to which our economies are intertwined, inflation and interest rates, international trade, oil/commodity price response, production gains and losses . . . In the short term (from an hour to a year) the market reacts rather unpredictably. The biggest single day market moves have been during recessions. Over the long term, however, markets do react rationally. Valuations are derived on real business results and cash flows.

If you have been reading Bridgeway’s letters over the years through radically different market environments, we can sound like a broken record. Our most basic advice does not change. Investing during a recession should be just like investing when not in a recession. Taking emotion out of the process is key; otherwise you may end up like the significant majority of investors: taking money from the market when prices are down, investing more when things have already been looking up—a formula for financial disaster. While we don’t know your specific situation and are thus not in a position to offer investment advice, here are some principles we believe in:

| | • | | Keep a long-term perspective that is independent of the current market environment |

| | • | | Target adequate diversification |

| | • | | Get a long-term investment plan (including what percentage of your holdings to commit to stocks) and write it down. |

| | • | | Until or unless your financial goals or situation changes, follow your long-term plan, especially when it feels least comfortable to do so |

| | • | | Under no circumstance try to time the market |

In times like this, human behavior makes it difficult to keep a long-term perspective. Numerous studies show that mutual fund investors’ actual long-term results significantly lag the overall market because of the tendency to a) time the market, b) chase hot returns, and c) follow the crowd. We feel this might be happening again (see next section).

Investment Landmine of the New Decade?

The Short Version: In 2009, most of the flows into mutual funds were into fixed income (bond and money market) instruments. These tend to be highly subject to inflation risk, the risk that the purchase power of an investment erodes very significantly as inflation heats up. Based on the huge and increasing national debt, we caution investors to count the potential real cost of moving away from stocks into fixed income instruments, which seem on the surface to be safe, but which can be decimated by inflation.

Even with the tremendous uptick of stock performance since March 2009, investors continued to put record amounts of money into bond and money market funds—indicative of shaken confidence in the equity world. This development is a sad and alarming one to Bridgeway’s investment team and smacks of market timing. Sadly, we see this over and over. Investors buy internet stocks at the peak and sell them after a plunge, just in time to miss their recovery. They sell a well managed fund that goes through a period of underperformance, just in time to miss its recovery. Many investors and even many institutions spurn what has done poorly recently in favor of what has done relatively well. After a year like 2008, this means selling stocks (which caused the most pain) in favor of fixed income (what is perceived as “safe”). Fixed income instruments are hardly safe with respect to inflation risk, however, and even though the inflation rate (CPI) in December was a meager 0.1%, we see the risk of mounting inflation as very serious. We would like to ask two key questions here: “What does history teach us about inflation risk?” and “How might that play out in the coming decade?”

If we turn back the hands of time to the period after the deepest recession of the last century, we may see in vivid terms what could be in store, or at least the risk that presents itself. Take a sixty-year old retiree in 1940. She has just lived through the Great Depression and is convinced that the stock market is for speculators only. Looking for the “safest” instrument around, she invests in 90-day U.S. Treasury Bills. As long as America is in business, these investments can’t go down . . . or can they? Each month over the decade of the 1940’s, her monthly statement shows an increasing balance as interest is reinvested. However, putting her money in Treasury Bills over this ten year period from 1940-1950 would have yielded a

| | |

| 4 | | Semi-Annual Report | December 31, 2009 (Unaudited) |

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

dramatic, portfolio destroying, inflation-adjusted drop of 41%. Note that at no time was there a sudden decline; she may even have been lured into a false sense of security. But “waking up” in 1950 to the reality that food, rent, and other expenses have increased far faster than her account balances leaves her unable to maintain her previous standard of living. Perhaps even worse, there is no hope of such a fixed income investment ever recovering from such a major hit. Coming off the heels of the second worst recession and worst bear market since 1940, one has to wonder if investors aren’t once again taking money from stocks and positioning it into one of the most risky asset classes—fixed income—for the decade of the 2010’s. It seems extremely likely that the only way out of the mounting national debt is for the U.S. government to “inflate” its way out. Only time will tell, but we are highly concerned that investors have just moved their commitment away from stocks into fixed income at the worst possible moment.

How are stocks likely to do in an inflationary environment? In the short-term, equity instruments such as Bridgeway’s Funds may take a “hit” as companies’ margins and profits come under pressure. In the long-term, however, companies tend to raise the prices of their products and services, and equity prices historically have followed suit. Thus, equities have historically been a good long-term hedge against inflation.

Wouldn’t It Be Great if We Could Time the Market?

Decades ago, I remember reading what seemed like a “sure-fire” way to time the market. The “Super Bowl Indicator” postulates that when a team from the old American Football League wins, the market will go down that year, but that a National Football League team win means a bull market year. According to a recent update, this indicator correctly called the direction of the market from 1967 through 1997 in 28 of 31 years. Sounds like a way to print money.

Not so fast. This strategy reflects a statistical problem called “data mining.” No one thinks there is a causal link between the outcome of a football game and the direction of the market. But if one looks at enough data, you can find a correlation. My (John’s) philosophy professor in college used to say, “If you study the phone book long enough, you will come up with at least one interesting fact.” I have to say, I haven’t studied any phone books since college and I haven’t invested any money on the basis of the Super Bowl. As another historical footnote, this indicator has apparently done “OK” since 1997, but doesn’t have nearly the track record of the prior years.

Further footnote: the New Orleans Saints beat the Indianapolis Colts on February 7. It turns out you didn’t need to know the outcome of the game this year, however. Both teams are from the old NFL, so it turns out there is no chance of a market decline in 2010.

. . . Don’t believe it. Three in ten years historically have been down years. That’s probably a much better indicator of the likelihood of a market decline.

How Does Your Political Party Affiliation Affect Your Investment Portfolio?

The Short Version: It turns out that the political party you belong to affects your investment returns.

According to recent research by Yosef Bonaparte, Alok Kumar, and Jeremy Page (“Political Climate, Optimism, and Investment Decisions“), it turns out that when your political party is in power, you are more confident about the economy—no big surprise. What is surprising is that this also means you are significantly more likely to increase your holdings of risky stocks, own fewer foreign stocks, and trade less. For reasons tying back to the latter inclination, you would also be more likely to earn a higher return, because lower turnover means lower expenses means higher returns.

So if you are a member of the Democratic Party, that’s probably a good thing for the returns of your portfolio (unless, of course, foreign stocks do particularly well in the next few years).

What do we conclude? We’re not suggesting you consider changing your political affiliation. We believe you should work hard to take emotion out of your investment process, as we do with our quantitative focus at Bridgeway. Get a long term investment plan, write it down, and follow it regardless of who is in office. Oh, . . . and trading less might be a very good thing.

LETTER FROM THE INVESTMENT MANAGEMENT TEAM (continued)

Performance Versus Morningstar Analyst Picks

The Short Version: Bridgeway 2, Morningstar 9.

Morningstar, the Chicago-based independent research firm, publishes a list of “best funds” for each asset class as determined by its analysts every year. In January when the final tallies are in, we compare the performance of each of our Funds to the average returns of Morningstar’s top picks for the comparable asset class. How did we do in 2009?

In the environment of low quality stock resurgence and a “lack of traction” for a broad array of Bridgeway’s quantitative models, 2009 was a poor year relative to our market benchmarks—five of eleven Funds beat their market benchmarks. We scored even more poorly against the “higher hurdle” of Morningstar’s “top picks”; only two of our eleven Funds beat these benchmarks, our worst year of relative performance by this measure since we began looking at it in 2002.

The table below depicts the results by Morningstar category and relevant Bridgeway Fund.

| | | | | | |

| Bridgeway Funds | | Morningstar Analyst “Picks” |

| Name | | 2009 Return | | Morningstar Category | | 2009 Return |

Aggressive Investors 1 | | 23.98% | | Mid-Cap Growth | | 40.42% |

Aggressive Investors 2 | | 29.84% | | Mid-Cap Growth | | 40.42% |

Ultra-Small Company | | 48.93% | | Small Growth | | 36.00% |

Ultra-Small Co. Market | | 25.95% | | Small Blend | | 30.90% |

Micro-Cap Limited | | 17.65% | | Small Growth | | 36.00% |

Small-Cap Growth | | 15.04% | | Small Growth | | 36.00% |

Small-Cap Value | | 26.98% | | Small Value | | 36.92% |

Large-Cap Growth | | 36.66% | | Large Growth | | 35.62% |

Large-Cap Value | | 24.92% | | Large Value | | 28.83% |

Blue Chip 35 Index | | 26.61% | | Large Blend | | 34.78% |

Balanced | | 12.39% | | Conservative Allocation | | 20.21% |

Past performance is not an indicator of future results. The Bridgeway Funds’ adviser, Bridgeway Capital Management, Inc., does not have any influence on the selection of the funds chosen by Morningstar’s analysts. The number and specific funds used in the comparison are in the control and discretion of Morningstar and their analysts and are subject to change. Morningstar’s criteria for choosing Analyst Picks includes, but is not limited to, factors such as performance, expenses, and quality of fund management. In addition, the comparison of Bridgeway Funds to the Morningstar Analyst Picks is limited to performance only and does not take into consideration other factors that are considered by Morningstar when compiling their list of Analyst Picks.

Each Bridgeway Fund is compared to the average total return of the group of funds selected by Morningstar at the beginning of 2009 for the one-year period ended December 31, 2009. The averages in the table are comprised of between three and thirteen funds from within each category. In an effort to provide a complete and balanced assessment, all of the Bridgeway Funds are used in the comparison table shown above such that no attempt is made to cull out unfavorable results. The purpose of this comparison is to “raise the bar” on performance, as this analysis uses an arguably higher benchmark by comparing the Bridgeway Funds to other funds chosen by an independent source that specializes in investment research.

| | |

| 6 | | Semi-Annual Report | December 31, 2009 (Unaudited) |

THIS PAGE INTENTIONALLY LEFT BLANK

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY

(Unaudited)

December 31, 2009

Dear Fellow Aggressive Investors 1 Fund Shareholder,

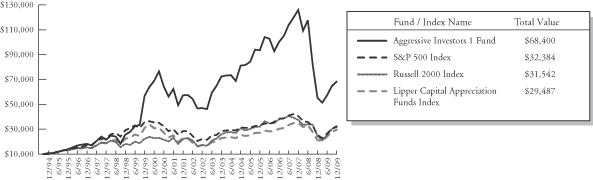

Emerging from the worst bear market since the 1930’s, our Fund had its third positive quarterly return in a row in the December quarter. The Fund was up 5.47%, lagging our primary market benchmark by 0.57%, but beating each of our other benchmarks. Large companies took back the quarterly lead as the S&P 500 Index rose 6.04% relative to 3.87% for the Russell 2000 Index. Our peer benchmark, the Lipper Capital Appreciation Funds Index, rose 5.26%. It was an “OK” quarter, but reflects the fact our models haven’t yet “kicked in” in a market not yet focused on the underlying health of companies’ financial statements.

For the six-month “semi-annual” period ending December 31, 2009, our Fund returned 19.25%, underperforming the 22.59% return of our primary market benchmark, the 22.50% return of our peer benchmark, and the 23.90% return of our small-cap benchmark as presented in the table below. This six month period includes a portion of the strong “bounceback” market environment which began in March 2009 and was characterized by a) the remarkable surge of financially distressed and low quality stocks that our Fund tends to avoid, as well as b) a lack of traction, as described more fully on page 3. The strong absolute returns are welcome, but our five year numbers below still reflect the “damage” done by 2008.

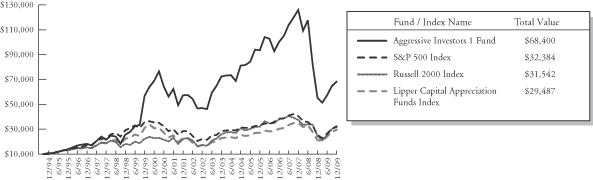

The table below presents our December quarter, six-month, one-year, five-year, ten-year and life-to-date financial results according to the formula required by the Securities and Exchange Commission. See the next page for a graph of performance from inception to December 31, 2009.

| | | | | | | | | | | | |

| | | Dec. Qtr. 10/1/09

to 12/31/09 | | 6 Month

7/1/09

to 12/31/09 | | 1 Year 1/1/09

to 12/31/09 | | 5 Year 1/1/05

to 12/31/09 | | 10 Year 1/1/00

to 12/31/09 | | Life-to-Date 8/5/94 to 12/31/09 |

| | | | | | |

Aggressive Investors 1 Fund | | 5.47% | | 19.25% | | 23.98% | | -3.39% | | 1.86% | | 13.29% |

S&P 500 Index (large companies) | | 6.04% | | 22.59% | | 26.47% | | 0.42% | | -0.95% | | 7.93% |

Russell 2000 Index (small companies) | | 3.87% | | 23.90% | | 27.17% | | 0.51% | | 3.51% | | 7.74% |

Lipper Capital Appreciation Funds Index | | 5.26% | | 22.50% | | 37.36% | | 3.05% | | -0.57% | | 7.27% |

Performance figures quoted in the table above and graph below represent past performance and are no guarantee of future results. Total return figures in the table above and the graph below include the reinvestment of dividends and capital gains. The table above and the graph below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The recent growth rate in the stock market has helped to produce short-term returns that are not typical and may not continue in the future.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions, based on the average of 500 widely held common stocks with dividends reinvested, while the Russell 2000 Index is an unmanaged, market value weighted index that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The Lipper Capital Appreciation Funds Index reflects the record of the 30 largest funds in this category, comprised of more aggressive domestic growth mutual funds, as reported by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

According to data from Lipper, Inc. as of December 31, 2009, Aggressive Investors 1 Fund ranked 219th of 286 capital appreciation funds for the twelve months ending December 31, 2009, 207nd of 209 over the last five years, 46th of 125 over the last ten years, and 2nd of 52 since inception in August, 1994. These long-term numbers and the graph below give two snapshots of our long term success. Lipper, Inc. is an independent mutual fund rating service that ranks funds in various fund categories by making comparative calculations using total returns.

| | |

| 8 | | Semi-Annual Report | December 31, 2009 (Unaudited) |

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

Performance of a $10,000 Investment from Inception (August 5, 1994) to December 31, 2009

Detailed Explanation of Quarterly Performance

The Short Version: Technology stocks helped and consumer discretionary stocks hurt in the December quarter. Mostly, we were just “treading water” as we have only a preliminary indication of a return of “traction,” and then not so much on the growth stock end of the spectrum, our staple.

As reflected in our “ten best” performers list below, information technology was a strong performing sector among our Fund holdings for the December quarter. Three of our ten best performers were related to information technology. The single top performing stock was Ford Motor Company, reflecting the fact that some of the market’s riskiest and most depressed stocks were the ones that have bounced back the most in 2009. Four of our worst ten performing stocks were consumer discretionary stocks (services, retailing, and autos), as investors are still worried about the depth of the economic recovery. Our worst performing stock was Corinthian Colleges, a company whose fundamentals are very strong, despite the fact that the stock price has declined in both the quarter and year.

These are the ten best performers for the quarter ended December 31, 2009:

| | | | | | |

| Rank | | Description | | Industry | | % Gain |

| 1 | | Ford Motor Co. | | Automobiles | | 38.7% |

| 2 | | Unisys Corp. | | IT Services | | 35.4% |

| 3 | | Jo-Ann Stores, Inc. | | Specialty Retail | | 35.1% |

| 4 | | Longtop Financial Technologies, Ltd. | | Software | | 30.1% |

| 5 | | American Italian Pasta Co. | | Food Products | | 28.0% |

| 6 | | Medicis Pharmaceutical Corp. | | Pharmaceuticals | | 26.7% |

| 7 | | Mead Johnson Nutrition Co., Class A | | Personal Products | | 23.5% |

| 8 | | NewMarket Corp. | | Chemicals | | 23.4% |

| 9 | | Seagate Technology | | Computers & Peripherals | | 22.5% |

| 10 | | American Superconductor Corp. | | Electrical Equipment | | 22.3% |

| | | | | | | |

While other major domestic automakers turned to the government for a “handout” during the economic crisis, Ford chose to go it alone and the decision is paying off. The company avoided bankruptcy protection and earned the respect of consumers and investors alike. While the summer’s “cash for clunkers” program brought buyers back to the auto lots for the first time in what seemed like eternity, Ford managed to keep the ball rolling in the months that followed and posted a better than expected third quarter with an optimistic outlook for the years ahead. Its product line has been seen as vastly improved, and the deal to sell Volvo to China’s Geely has progressed much more smoothly than its rivals’ would-be transactions. Its stock price soared to a four-year high late in the year and noted investor George Soros upped his already significant stake in the company. Ford was the Fund’s top performer over the past three months and contributed 0.4% to the overall return.

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

These are the ten stocks that performed the worst in the quarter ended December 31, 2009:

| | | | | | |

| Rank | | Description | | Industry | | % Loss |

| 1 | | Corinthian Colleges, Inc. | | Diversified Consumer Services | | -25.8% |

| 2 | | Barclays PLC | | Commercial Banks | | -25.6% |

| 3 | | Cal Dive International, Inc. | | Energy Equipment & Services | | -23.6% |

| 4 | | Aeropostale Inc. | | Specialty Retail | | -21.7% |

| 5 | | AirTran Holdings Inc. | | Airlines | | -20.3% |

| 6 | | Apollo Group Inc. | | Diversified Consumer Services | | -17.8% |

| 7 | | Radian Group Inc. | | Thrifts & Mortgage Finance | | -17.5% |

| 8 | | Fuel Systems Solutions, Inc. | | Auto Components | | -16.3% |

| 9 | | Central Garden and Pet Co. | | Household Products | | -13.5% |

| 10 | | Diebold Inc. | | Computers & Peripherals | | -13.1% |

| | | | | | | |

When the going gets tough…folks go back to school. Corinthian Colleges, Inc. operates for-profit secondary educational institutions throughout the United States and Canada. Enrollment tends to increase during difficult economic times as many out-of-work adults look to better themselves and enhance their career options. Revenues and earnings have soared in this environment, easily surpassing Wall Street’s expectations. Unfortunately, a cloud surrounds this company over concerns of potential default rates and criticism of aggressive marketing practices. Corinthian lost over 25% of value during the quarter, down 37% off of its early 2009 peak, and was the Fund’s poorest performer. Our Fund continues to hold this smaller diversifying position.

Detailed Explanation of Calendar Year Performance

The Short Version: The stocks that contributed most to our double digit calendar year returns included some financial and energy companies purchased (or added to) closer to the market bottom, as well as some materials stocks, some of which finally bounced back from their poor 2008 performance. Factors that held back our performance relative to the broader market were the surge of financially distressed and low quality stocks, which were underrepresented in our Fund, as well as a lack of traction (see page 3).

While most folks tend to focus on banks and investment banking firms (and their bailout woes) when referring to the financial sector, two other related companies made the list of top ten Fund performers for the calendar year. The top performer provides supplemental insurance to individuals, while the fourth best owns and manages real estate properties. Both of these financial companies more than doubled in value during the 12-month period, and combined, they added almost three percent in performance to the Fund.

Not surprising for a deep recession, industrial companies (e.g. airlines, electronics, and electrical components) highlighted the worst performers for the calendar year. Given the state of the economy early on and the continued caution exhibited by many throughout the year, pleasure and business travel declined as companies and individuals sought cost-cutting/budgetary measures. Each of the ten worst performing companies dropped 24% or more during the 12-month period.

These are the ten best performers for the calendar year ended December 31, 2009:

| | | | | | |

| Rank | | Description | | Industry | | % Gain |

| 1 | | Aflac, Inc. | | Insurance | | 122.7% |

| 2 | | Cerner Corp. | | Health Care Technology | | 114.0% |

| 3 | | Atwood Oceanics, Inc. | | Energy Equipment & Services | | 106.9% |

| 4 | | Weingarten Realty Investors | | Real Estate Investment Trusts | | 102.1% |

| 5 | | Life Technologies Corp. | | Life Sciences Tools & Services | | 82.6% |

| 6 | | National Oilwell Varco, Inc. | | Energy Equipment & Services | | 81.1% |

| 7 | | FMC Technologies Inc. | | Energy Equipment & Services | | 71.6% |

| 8 | | Warnaco Group Inc. | | Textiles, Apparel & Luxury Goods | | 70.5% |

| 9 | | Cognizant Technology Solutions Corp. | | IT Services | | 68.0% |

| 10 | | NewMarket Corp. | | Chemicals | | 60.7% |

| | | | | | | |

| | |

| 10 | | Semi-Annual Report | December 31, 2009 (Unaudited) |

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

Aflac, Inc. (American Family Life Assurance Company of Columbus) provides supplemental health, disability, and life insurance to individuals and operates primarily in the United States and Japan. Early in the year, the company found its stock price beaten down along with its insurance counterparts, many of which maintained far riskier investment portfolios and engaged in more speculative business practices. Concerned that the company was being lumped together with many competitors, management has worked hard to enhance its branding campaign while growing revenues through its specialized lines of insurance products. In October, the company posted profits that far exceeded analysts’ expectations. Management has rewarded its shareholders for their confidence by returning excess capital through an attractive dividend policy and a stock repurchase program. The moves have paid off in price appreciation, and in November, Credit Suisse increased its rating on Aflac to outperform. The company was our Fund’s top performer for the year and more than doubled in value.

These are the ten stocks that performed the worst for the calendar year ended December 31, 2009:

| | | | | | |

| Rank | | Description | | Industry | | % Loss |

| 1 | | Woodward Governor Co. | | Electrical Equipment | | -49.6% |

| 2 | | Dow Chemical Co. | | Chemicals | | -43.5% |

| 3 | | US Bancorp | | Commercial Banks | | -39.9% |

| 4 | | Alaska Air Group, Inc. | | Airlines | | -33.6% |

| 5 | | FLIR Systems, Inc. | | Electronic Equip., Instruments | | -30.3% |

| 6 | | W&T Offshore, Inc. | | Oil, Gas & Consumable Fuels | | -29.7% |

| 7 | | Comtech Telecommunications Corp. | | Communications Equipment | | -27.0% |

| 8 | | AirTran Holdings, Inc. | | Airlines | | -26.6% |

| 9 | | Laclede Group, Inc. | | Gas Utilities | | -25.5% |

| 10 | | ACI Worldwide, Inc. | | Software | | -24.7% |

| | | | | | | |

Woodward Governor dropped just less than 50% during our holding period in calendar 2009 and was the Fund’s worst performing stock. The industrial manufacturer and servicer of energy optimization solutions for the transportation sector struggled mightily early in the year as much of its revenue is derived from out-of-favor industries: aerospace and alternative energy. Like many industrial companies, Woodward General suffered from a decline in demand for its products as many clients saw dramatic cutbacks in their operations. Boeing and Otter Trail, to name a few, were forced to reduce their workforce, and the tight credit (borrowing) environment made it difficult for others to expand their energy efficiency programs. Additionally, as oil prices plummeted from mid-summer 2008 into early 2009, companies had little incentive to focus on fuel efficiency and other energy controls. As the stimulus package went into effect, some analysts believed Woodward Governor and other related companies might be primed to benefit from moneys set aside for alternative energy programs.

Top Ten Holdings as of December 31, 2009

Information technology was the highlight of the Fund’s top ten holdings, as three related stocks made the list at year-end. Still, the Fund was broadly diversified across nine different industries. Three of our largest positions were also among the Fund’s top performers for the quarter (Newmarket, American Superconductor, Unisys). No single holding accounted for greater than five percent of the net assets, indicating that the Fund was also well-diversified across many companies. The ten largest positions represented just over 27% of the total assets of the Fund, lower than in some previous market environments.

| | | | | | |

| Rank | | Description | | Industry | | Percent of

Net Assets |

| 1 | | Equinix, Inc. | | Internet Software & Services | | 4.5% |

| 2 | | NewMarket Corp. | | Chemicals | | 3.2% |

| 3 | | Tech Data Corp. | | Electronic Equipment & Instruments | | 2.7% |

| 4 | | American Superconductor Corp. | | Electrical Equipment | | 2.6% |

| 5 | | Chiquita Brands International, Inc. | | Food Products | | 2.5% |

| 6 | | Unisys Corp. | | IT Services | | 2.5% |

| 7 | | Aflac, Inc. | | Insurance | | 2.5% |

| 8 | | ev3, Inc. | | Health Care Equipment & Supplies | | 2.3% |

| 9 | | TRW Automotive Holdings Corp. | | Auto Components | | 2.2% |

| 10 | | Fuel Systems Solutions, Inc. | | Auto Components | | 2.2% |

| | | | | | | |

| Total | | | | | | 27.2% |

Aggressive Investors 1 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

Industry Sector Representation as of December 31, 2009

The biggest disparities between the Fund and the S&P 500 index were in the consumer-related sectors. While both the Fund and Index maintained allocations in excess of 20% consumer-related holdings, we owned more discretionary companies while the Index held more consumer staples. The Fund’s largest allocation was in information technology, a sector that performed well for us during the past three months.

| | | | | | |

| | | % of Portfolio | | % S&P 500 Index | | Difference |

Consumer Discretionary | | 17.8% | | 9.6% | | 8.2% |

Consumer Staples | | 5.3% | | 11.4% | | -6.1% |

Energy | | 8.6% | | 11.4% | | -2.8% |

Financials | | 13.4% | | 14.4% | | -1.0% |

Health Care | | 14.8% | | 12.6% | | 2.2% |

Industrials | | 8.9% | | 10.2% | | -1.3% |

Information Technology | | 23.3% | | 19.9% | | 3.4% |

Materials | | 5.8% | | 3.6% | | 2.2% |

Telecommunication Services | | 2.1% | | 3.2% | | -1.1% |

Utilities | | 0.0% | | 3.7% | | -3.7% |

Cash | | 0.0% | | 0.0% | | 0.0% |

| | | | | | | |

Total | | 100.0% | | 100.0% | | |

Disclaimer

The views expressed here are exclusively those of Fund management. These views, including those related to market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter end, December 31, 2009, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and may not be indicative of future performance.

Market volatility can significantly affect short-term performance. The Fund is not an appropriate investment for short-term investors. Investments in the small companies within this multi-cap fund generally carry greater risk than is customarily associated with larger companies. This additional risk is attributable to a number of factors, including the relatively limited financial resources that are typically available to small companies, and the fact that small companies often have comparatively limited product lines. In addition, the stock of small companies tends to be more volatile than the stock of large companies, particularly in the short term and particularly in the early stages of an economic or market downturn. The Fund’s use of options, futures, and leverage can magnify the risk of loss in an unfavorable market, and the Fund’s use of short-sale positions can, in theory, expose shareholders to unlimited loss. Finally, the Fund exposes shareholders to “focus risk” which may add to Fund volatility through the possibility that a single company could significantly affect total return. Shareholders of the Fund, therefore, are taking on more risk than they would if they invested in the stock market as a whole.

Conclusion

Thank you for your continued investment in Aggressive Investors 1 Fund. We encourage your feedback; your reactions and concerns are extremely important to us.

Sincerely,

Your Investment Management Team

| | |

| 12 | | Semi-Annual Report | December 31, 2009 (Unaudited) |

THIS PAGE INTENTIONALLY LEFT BLANK

Aggressive Investors 1 Fund

SCHEDULE OF INVESTMENTS

Showing percentage of net assets as of December 31, 2009 (Unaudited)

| | | | | | | |

| Industry | | Company | | Shares | | Value |

|

COMMON STOCKS - 99.94% |

Auto Components - 4.40% |

| | Fuel Systems Solutions, Inc.*+ | | 63,500 | | $ | 2,618,740 |

| | TRW Automotive Holdings Corp.* | | 110,200 | | | 2,631,576 |

| | | | | | | |

| | | | | | | 5,250,316 |

|

Automobiles - 1.36% |

| | Ford Motor Co.* | | 162,000 | | | 1,620,000 |

|

Beverages - 1.01% |

| | Coca-Cola Enterprises, Inc. | | 57,100 | | | 1,210,520 |

|

Biotechnology - 0.87% |

| | Amgen, Inc.* | | 18,400 | | | 1,040,888 |

|

Capital Markets - 1.19% |

| | Goldman Sachs Group, Inc. | | 8,400 | | | 1,418,256 |

|

Chemicals - 5.15% |

| | NewMarket Corp. | | 33,700 | | | 3,867,749 |

| | Potash Corp. of Saskatchewan, Inc. | | 10,000 | | | 1,085,000 |

| | The Lubrizol Corp. | | 16,400 | | | 1,196,380 |

| | | | | | | |

| | | | | | | 6,149,129 |

|

Commercial Banks - 0.88% |

| | Barclays PLC - Sponsored ADR+ | | 59,600 | | | 1,048,960 |

|

Commercial Services & Supplies - 1.80% |

| | EnerNOC, Inc.*+ | | 38,700 | | | 1,176,093 |

| | Tetra Tech, Inc.* | | 35,900 | | | 975,403 |

| | | | | | | |

| | | | | | | 2,151,496 |

|

Computers & Peripherals - 1.27% |

| | Seagate Technology+ | | 83,100 | | | 1,511,589 |

|

Construction & Engineering - 0.52% |

| | EMCOR Group, Inc.* | | 23,000 | | | 618,700 |

|

Consumer Finance - 1.04% |

| | SLM Corp.* | | 110,400 | | | 1,244,208 |

|

Diversified Consumer Services - 1.77% |

| | Apollo Group, Inc., Class A*+ | | 18,600 | | | 1,126,788 |

| | Corinthian Colleges, Inc.*+ | | 71,500 | | | 984,555 |

| | | | | | | |

| | | | | | | 2,111,343 |

|

Diversified Telecommunication Services - 2.12% |

| | AT&T, Inc. | | 43,200 | | | 1,210,896 |

| | Verizon Communications, Inc. | | 40,000 | | | 1,325,200 |

| | | | | | | |

| | | | | | | 2,536,096 |

| | | | | | | |

| Industry | | Company | | Shares | | Value |

|

|

Electrical Equipment - 3.81% |

| | American Superconductor Corp.*+ | | 75,400 | | $ | 3,083,860 |

| | Cooper Industries PLC, Class A | | 34,300 | | | 1,462,552 |

| | | | | | | |

| | | | | | | 4,546,412 |

|

Electronic Equipment & Instruments - 3.77% |

| | Multi-Fineline Electronix, Inc.* | | 44,400 | | | 1,259,628 |

| | Tech Data Corp.* | | 69,500 | | | 3,242,870 |

| | | | | | | |

| | | | | | | 4,502,498 |

|

Energy Equipment & Services - 6.51% |

| | Atwood Oceanics, Inc.* | | 62,700 | | | 2,247,795 |

| | Cal Dive International, Inc.* | | 132,100 | | | 998,676 |

| | Diamond Offshore Drilling, Inc.+ | | 16,300 | | | 1,604,246 |

| | National Oilwell Varco, Inc.* | | 39,500 | | | 1,741,555 |

| | TETRA Technologies, Inc.* | | 106,400 | | | 1,178,912 |

| | | | | | | |

| | | | | | | 7,771,184 |

|

Food Products - 3.55% |

| | American Italian Pasta Co., Class A*+ | | 34,500 | | | 1,200,255 |

| | Chiquita Brands International, Inc.*+ | | 168,300 | | | 3,036,132 |

| | | | | | | |

| | | | | | | 4,236,387 |

|

Health Care Equipment & Supplies - 6.30% |

| | Align Technology, Inc.*+ | | 141,300 | | | 2,517,966 |

| | ev3, Inc.*+ | | 202,800 | | | 2,705,352 |

| | Sirona Dental Systems, Inc.* | | 72,600 | | | 2,304,324 |

| | | | | | | |

| | | | | | | 7,527,642 |

|

Health Care Providers & Services - 1.09% |

| | Express Scripts, Inc.* | | 15,100 | | | 1,305,395 |

|

Health Care Technology - 2.06% |

| | Cerner Corp.*+ | | 29,900 | | | 2,464,956 |

|

Household Durables - 1.52% |

| | American Greetings Corp., Class A+ | | 83,500 | | | 1,819,465 |

|

Insurance - 6.31% |

| | Aflac, Inc. | | 64,500 | | | 2,983,125 |

| | AmTrust Financial Services, Inc. | | 33,200 | | | 392,424 |

| | Assurant, Inc. | | 36,100 | | | 1,064,228 |

| | Conseco, Inc.*+ | | 198,666 | | | 993,330 |

| | Prudential Financial, Inc. | | 23,600 | | | 1,174,336 |

| | XL Capital, Ltd., Class A+ | | 50,400 | | | 923,832 |

| | | | | | | |

| | | | | | | 7,531,275 |

| | |

| 14 | | Semi-Annual Report | December 31, 2009 (Unaudited) |

Aggressive Investors 1 Fund

SCHEDULE OF INVESTMENTS (continued)

Showing percentage of net assets as of December 31, 2009 (Unaudited)

| | | | | | | |

| Industry | | Company | | Shares | | Value |

|

Common Stocks (continued) |

Internet Software & Services - 6.67% |

| | EarthLink, Inc.+ | | 157,200 | | $ | 1,306,332 |

| | Equinix, Inc.*+ | | 50,800 | | | 5,392,420 |

| | United Online, Inc. | | 176,100 | | | 1,266,159 |

| | | | | | | |

| | | | | | | 7,964,911 |

|

IT Services - 4.93% |

| | Cognizant Technology Solutions Corp., Class A* | | 34,800 | | | 1,576,440 |

| | MasterCard, Inc., Class A+ | | 5,100 | | | 1,305,498 |

| | Unisys Corp.* | | 77,900 | | | 3,003,824 |

| | | | | | | |

| | | | | | | 5,885,762 |

|

Life Sciences Tools & Services - 1.46% |

| | Life Technologies Corp.*+ | | 33,500 | | | 1,749,705 |

|

Marine - 0.00% |

| | Kirby Corp.*+ | | 20 | | | 697 |

|

Metals & Mining - 0.63% |

| | IAMGOLD Corp.+ | | 48,000 | | | 750,720 |

|

Multiline Retail - 1.94% |

| | Dollar Tree, Inc.* | | 25,300 | | | 1,221,990 |

| | Family Dollar Stores, Inc. | | 39,400 | | | 1,096,502 |

| | | | | | | |

| | | | | | | 2,318,492 |

|

Oil, Gas & Consumable Fuels - 2.11 % |

| | ConocoPhillips | | 27,000 | | | 1,378,890 |

| | Exxon Mobil Corp. | | 16,700 | | | 1,138,773 |

| | | | | | | |

| | | | | | | 2,517,663 |

|

Personal Products - 0.70% |

| | Mead Johnson Nutrition Co., Class A | | 19,189 | | | 838,559 |

|

Pharmaceuticals - 3.01% |

| | Bristol-Myers Squibb Co.+ | | 26,003 | | | 656,576 |

| | Medicis Pharmaceutical Corp., Class A | | 63,000 | | | 1,704,150 |

| | Pfizer, Inc. | | 67,700 | | | 1,231,463 |

| | | | | | | |

| | | | | | | 3,592,189 |

|

Professional Services - 0.99% |

| | The Corporate Executive Board Co. | | 51,600 | | | 1,177,512 |

|

Real Estate Investment Trusts (REITs) - 2.10% |

| | BioMed Realty Trust, Inc. | | 84,500 | | | 1,333,410 |

| | Weingarten Realty Investors+ | | 59,200 | | | 1,171,568 |

| | | | | | | |

| | | | | | | 2,504,978 |

| | | | | | | |

| Industry | | Company | | Shares | | Value |

|

|

Semiconductors & Semiconductor Equipment - 4.30% |

| | Applied Materials, Inc. | | 93,900 | | $ | 1,308,966 |

| | Intel Corp. | | 63,900 | | | 1,303,560 |

| | Micron Technology, Inc.* | | 238,500 | | | 2,518,560 |

| | | | | | | |

| | | | | | | 5,131,086 |

|

Software - 2.36% |

| | Longtop Financial Technologies, Ltd.-Sponsored ADR*+ | | 44,400 | | | 1,643,688 |

| | Tyler Technologies, Inc.*+ | | 59,200 | | | 1,178,672 |

| | | | | | | |

| | | | | | | 2,822,360 |

|

Specialty Retail - 6.77% |

| | Aeropostale, Inc.*+ | | 34,900 | | | 1,188,345 |

| | CarMax, Inc.*+ | | 58,700 | | | 1,423,475 |

| | DSW, Inc., Class A* | | 100,200 | | | 2,593,176 |

| | J. Crew Group, Inc.*+ | | 28,200 | | | 1,261,668 |

| | Jo-Ann Stores, Inc.* | | 44,800 | | | 1,623,552 |

| | | | | | | |

| | | | | | | 8,090,216 |

|

Thrifts & Mortgage Finance - 1.88% |

| | Hudson City Bancorp, Inc. | | 90,600 | | | 1,243,938 |

| | Radian Group, Inc.+ | | 137,800 | | | 1,007,318 |

| | | | | | | |

| | | | | | | 2,251,256 |

|

Trading Companies & Distributors - 1.79% |

| | WW Grainger, Inc. | | 22,100 | | | 2,139,943 |

| | | | | | | |

| |

TOTAL COMMON STOCKS - 99.94% | | | 119,352,764 |

| | | | | | | |

(Cost $100,217,534) | | | |

| |

TOTAL INVESTMENTS - 99.94% | | $ | 119,352,764 |

(Cost $100,217,534) | | | |

Other Assets in Excess of Liabilities - 0.06% | | | 66,879 |

| | | | | | | |

NET ASSETS - 100.00% | | $ | 119,419,643 |

| | | | | | | |

| * | Non-Income Producing Security. |

| + | This security or a portion of the security is out on loan at December 31, 2009. Total loaned securities had a market value of $39,397,030 at December 31, 2009. |

ADR - American Depositary Receipt

Ltd - Limited

See Notes to Financial Statements.

Aggressive Investors 2 Fund

MANAGER’S COMMENTARY

(Unaudited)

December 31, 2009

Dear Fellow Aggressive Investors 2 Fund Shareholder,

Emerging from the worst bear market since the 1930’s, our Fund had its third positive quarterly return in a row in the December quarter. Our Fund was up 5.84%, lagging our primary market benchmark by 0.20%, but beating each of our other benchmarks. Large companies took back the quarterly lead as the S&P 500 Index rose 6.04% relative to 3.87% for the Russell 2000 Index. Our peer benchmark, the Lipper Capital Appreciation Funds Index, rose 5.26%. It was an “OK” quarter.

For the six-month “semi-annual” period ending December 31, 2009, the Fund slightly edged out our primary market benchmark and our peer benchmark, but slightly underperformed our small cap benchmark. (See the table below.) This six month period includes a portion of the strong “bounceback” market environment begun in March 2009 which was characterized by a) the remarkable surge of financially distressed and low quality stocks that our Fund tends to avoid, as well as b) a lack of traction, as described more fully on page 3. The strong absolute returns are welcome, but our five year numbers below still reflect the “damage” done by 2008.

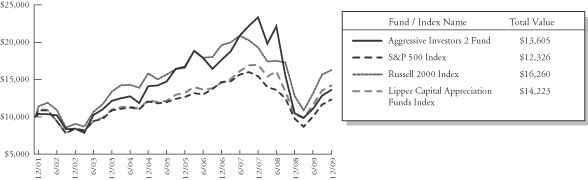

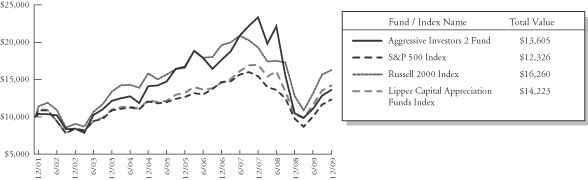

The table below presents our December quarter, six-month, one-year, five-year and life-to-date financial results according to the formula required by the Securities and Exchange Commission. See the next page for a graph of performance from inception to December 31, 2009.

| | | | | | | | | | |

| | | Dec. Qtr. 10/1/09

to 12/31/09 | | 6 Month

7/1/09

to 12/31/09 | | 1 Year 1/1/09

to 12/31/09 | | 5 Year 1/1/05

to 12/31/09 | | Life-to-Date 10/31/01

to 12/31/09 |

| | | | | |

Aggressive Investors 2 Fund | | 5.84% | | 22.69% | | 29.84% | | -0.73% | | 3.84% |

S&P 500 Index (large companies) | | 6.04% | | 22.59% | | 26.47% | | 0.42% | | 2.59% |

Russell 2000 Index (small companies) | | 3.87% | | 23.90% | | 27.17% | | 0.51% | | 6.13% |

Lipper Capital Appreciation Funds Index | | 5.26% | | 22.25% | | 37.36% | | 3.05% | | 4.41% |

Performance figures quoted in the table above and graph below represent past performance and are no guarantee of future results. Total return figures in the table above and the graph below include the reinvestment of dividends and capital gains. The table above and the graph below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The recent growth rate in the stock market has helped to produce short-term returns that are not typical and may not continue in the future.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions, based on the average of 500 widely held common stocks with dividends reinvested, while the Russell 2000 Index is an unmanaged, market value weighted index that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The Lipper Capital Appreciation Funds Index reflects the record of the 30 largest funds in this category, comprised of more aggressive domestic growth mutual funds, as reported by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

According to data from Lipper, Inc. as of December 31, 2009, Aggressive Investors 2 Fund ranked 187th of 286 capital appreciation funds for the twelve months ending December 31, 2009, 167th of 209 over the last five years, and 87th of 172 since inception in October, 2001. Lipper, Inc. is an independent mutual fund rating service that ranks funds in various fund categories by making comparative calculations using total returns.

| | |

| 16 | | Semi-Annual Report | December 31, 2009 (Unaudited) |

Aggressive Investors 2 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

Performance of a $10,000 Investment from Inception (October 31, 2001) to December 31, 2009

Detailed Explanation of Quarterly Performance

The Short Version: Technology stocks helped and consumer discretionary stocks hurt in the December quarter. Mostly, we were just “treading water” as we have only a preliminary indication of a return of “traction,” and then not so much on the growth stock end of the spectrum, our staple.

As reflected in our “top ten” list below, information technology was a strong performing sector among our Fund holdings for the December quarter. Four of our ten best performers hailed from that sector. The single top performing stock was Ford Motor Company, reflecting the fact that some of the market’s riskiest and most depressed stocks were the ones that have bounced back the most in 2009. Four of our worst ten performing stocks were from the consumer discretionary sector (services, retailing, and autos), reflecting the fact that investors are still worried about the depth of the economic recovery. Our worst performing stock was Corinthian Colleges, a company whose fundamentals are very strong, despite the fact that the stock price has declined in both the quarter and year.

These are the ten best performers for the quarter ended December 31, 2009:

| | | | | | |

| Rank | | Description | | Industry | | % Gain |

| 1 | | Ford Motor Co. | | Automobiles | | 38.7% |

| 2 | | Unisys Corp. | | IT Services | | 31.7% |

| 3 | | Longtop Financial Technologies, Ltd. | | Software | | 30.1% |

| 4 | | American Italian Pasta Co. | | Food Products | | 28.0% |

| 5 | | Medicis Pharmaceutical Corp. | | Pharmaceuticals | | 26.7% |

| 6 | | Visa Inc. | | IT Services | | 26.6% |

| 7 | | Seagate Technology | | Computers & Peripherals | | 24.0% |

| 8 | | NewMarket Corp. | | Chemicals | | 23.4% |

| 9 | | American Superconductor Corp. | | Electrical Equipment | | 22.3% |

| 10 | | Fibria Celulose SA | | Paper & Forest Products | | 22.0% |

| | | | | | | |

While other major domestic automakers turned to the government for a “handout” during the economic crisis, Ford chose to go it alone and the decision is paying off. The company avoided bankruptcy protection and earned the respect of consumers and investors alike. While the summer’s “cash for clunkers” program brought buyers back to the auto lots for the first time in what seemed like eternity, Ford managed to keep the ball rolling in the months that followed and posted a better than expected third quarter with an optimistic outlook for the years ahead. Its product line has been seen as vastly improved, and the deal to sell Volvo to China’s Geely has progressed much more smoothly than its rivals’ would-be transactions. Its stock price soared to a four-year high late in the year and noted investor George Soros upped his already significant stake in the company. Ford was the Fund’s top performer over the past three months and contributed 0.3% to the overall return.

Aggressive Investors 2 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

Our ten worst performing stocks in the December quarter were:

| | | | | | |

| Rank | | Description | | Industry | | % Loss |

| 1 | | Corinthian Colleges, Inc. | | Diversified Consumer Services | | -25.8% |

| 2 | | Barclays PLC | | Commercial Banks | | -25.6% |

| 3 | | Conseco, Inc. | | Insurance | | -23.1% |

| 4 | | Aeropostale, Inc. | | Specialty Retail | | -21.7% |

| 5 | | Netease.com | | Internet Software & Services | | -20.2% |

| 6 | | AirTran Holdings Inc. | | Airlines | | -19.4% |

| 7 | | Radian Group, Inc. | | Thrifts & Mortgage Finance | | -17.9% |

| 8 | | Apollo Group, Inc. | | Diversified Consumer Services | | -17.8% |

| 9 | | Fuel Systems Solutions, Inc. | | Auto Components | | -17.0% |

| 10 | | Diebold Inc. | | Computers & Peripherals | | -15.4% |

| | | | | | | |

When the going gets tough… folks go back to school. Corinthian Colleges, Inc. operates for-profit secondary educational institutions throughout the United States and Canada. Enrollments tend to increase during difficult economic times as many out-of-work adults look to better themselves and enhance their career options. Revenues and earnings have soared in this environment, easily surpassing Wall Street’s expectations. Unfortunately, a cloud surrounds this company over concerns of potential default rates and criticism of aggressive marketing practices. Corinthian lost over 25% of value during the quarter, ended December down 37% off of its early 2009 peak, and was the Fund’s poorest performer. Our Fund continues to hold this smaller diversifying position.

Detailed Explanation of Calendar Year Performance

The Short Version: The stocks that contributed most to our double digit calendar year returns included some financial and energy companies purchased (or added to) closer to the market bottom, as well as some stocks that finally bounced back nicely from their poor 2008 performance. Factors that held back our performance relative to the broader market were the surge of financially distressed and low quality stocks, which were underrepresented in our Fund, as well as a lack of traction (see page 3).

While most folks tend to focus on banks and investment banking firms (and their bailout woes) when referring to the financial sector, three other related companies made the list of top ten Fund performers for the calendar year. Two are REITs, which own and manage real estate properties, and the other financial firm provides supplemental insurance to individuals. Combined, these holdings added three percent in performance to the Fund.

Not surprising for a deep recession, industrial companies (e.g. airlines and electrical equipment) were the worst performers for the calendar year. Given the state of the economy early on and the continued caution exhibited by many throughout the year, pleasure and business travel declined as companies and individuals sought cost-cutting/budgetary measures. Each of the ten worst performing companies dropped 25% or more during the 12-month period.

These are the ten best performers for the calendar year ended December 31, 2009:

| | | | | | |

| Rank | | Description | | Industry | | % Gain |

| 1 | | Life Technologies Corp. | | Life Sciences Tools & Services | | 118.9% |

| 2 | | Weingarten Realty Investors | | Real Estate Investment Trusts | | 115.5% |

| 3 | | Cerner Corp. | | Health Care Technology | | 112.5% |

| 4 | | Atwood Oceanics, Inc. | | Energy Equipment & Services | | 110.4% |

| 5 | | Aflac, Inc. | | Insurance | | 108.4% |

| 6 | | Warnaco Group Inc. | | Textiles, Apparel & Luxury Goods | | 104.7% |

| 7 | | Cognizant Technology Solutions Corp. | | IT Services | | 99.1% |

| 8 | | National Oilwell Varco, Inc. | | Energy Equipment & Services | | 81.2% |

| 9 | | Aeropostale, Inc. | | Specialty Retail | | 68.5% |

| 10 | | BioMed Realty Trust, Inc. | | Real Estate Investment Trusts | | 68.2% |

| | | | | | | |

| | |

| 18 | | Semi-Annual Report | December 31, 2009 (Unaudited) |

Aggressive Investors 2 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

Aflac, Inc. (American Family Life Assurance Company of Columbus) provides supplemental health, disability, and life insurance to individuals and operates primarily in the United States and Japan. Early in the year, the company found its stock price beaten down along with its insurance counterparts, many of which maintained far more risky investment portfolios and engaged in more speculative business practices. Concerned that the company was being lumped together with many competitors, management has worked hard to enhance its branding campaign, while growing revenues through its specialized lines of insurance products. In October, the company posted profits that far exceeded analysts’ expectations. Management has rewarded its shareholders for their confidence by returning excess capital through an attractive dividend policy and a stock repurchase program. The moves have paid off in price appreciation, and in November, Credit Suisse increased its rating on Aflac to outperform. The company was one of six holdings that doubled in value during the 12-month period.

The ten worst performing stocks for the calendar year were:

| | | | | | |

| Rank | | Description | | Industry | | % Loss |

| 1 | | Dow Chemical Co. | | Chemicals | | -44.3% |

| 2 | | US Bancorp. | | Commercial Banks | | -37.3% |

| 3 | | Hot Topic, Inc. | | Specialty Retail | | -36.1% |

| 4 | | Alaska Air Group, Inc. | | Airlines | | -35.2% |

| 5 | | W&T Offshore, Inc. | | Oil, Gas & Consumable Fuels | | -31.7% |

| 6 | | FLIR Systems, Inc. | | Electronic Equip., Instruments | | -29.7% |

| 7 | | Woodward Governor Co. | | Electrical Equipment | | -28.0% |

| 8 | | NII Holdings, Inc. | | Wireless Telecommunication Services | | -26.8% |

| 9 | | AirTran Holdings, Inc. | | Airlines | | -26.2% |

| 10 | | Darling International, Inc. | | Food Products | | -26.1% |

| | | | | | | |

Certain retailers seemed to pick up steam late in the year and their stock prices reflected the enhanced activity. Unfortunately, pop-culture oriented Hot Topic was not one such company. After beating the odds (and its competitors) and riding its gothic (vampire) theme to strong results early in the year, the teen retailer hit a major speed bump in May when it reported sales that dramatically unperformed analysts’ expectations. While management seemed to shrug off the results and related stock pullback as a “healthy correction,” the company continued to struggle and reported a third-quarter revenue decline in November as well. In December, Hot Topic announced that same-store sales dropped over 11%, a poor showing for the holiday season. The holding lost over a third of its value during the 12-month period.

Top Ten Holdings as of December 31, 2009

Reflecting our largest sector representation, information technology stocks comprised four of the top ten Fund holdings. However, the top ten holdings also represented nine different industries, and only one holding represented a concentrated position of more than 5% of Fund net assets. The top ten stocks together comprised only 28% of Fund net assets, lower than in some previous market environments.

| | | | | | |

| Rank | | Description | | Industry | | Percent of

Net Assets |

| 1 | | Equinix Inc. | | Internet Software & Services | | 5.2% |

| 2 | | TRW Automotive Holdings Corp. | | Auto Components | | 2.9% |

| 3 | | Life Technologies Corp. | | Life Sciences Tools & Services | | 2.8% |

| 4 | | NewMarket Corp. | | Chemicals | | 2.8% |

| 5 | | Tech Data Corp. | | Electronic Equipment & Instruments | | 2.6% |

| 6 | | American Superconductor Corp. | | Electrical Equipment | | 2.5% |

| 7 | | Unisys Corp. | | IT Services | | 2.5% |

| 8 | | Fuel Systems Solutions, Inc. | | Auto Components | | 2.2% |

| 9 | | Micron Technology, Inc. | | Semiconductors & Semiconductor Equip | | 2.1% |

| 10 | | Cerner Corp. | | Health Care Technology | | 1.9% |

| | | | | | | |

| | | | | | 27.5% |

Aggressive Investors 2 Fund

MANAGER’S COMMENTARY (continued)

(Unaudited)

Industry Sector Representation as of December 31, 2009

Most notable among the sector differences between our Fund and its primary market benchmark is our overweighting of consumer discretionary stocks (mostly retail stores) and an underweighting of consumer staples. These are well within our risk management boundaries.

| | | | | | |

| | | % of Portfolio | | % S&P 500 Index | | Difference |

Consumer Discretionary | | 18.1% | | 9.6% | | 8.5% |

Consumer Staples | | 4.8% | | 11.4% | | -6.6% |

Energy | | 8.8% | | 11.4% | | -2.6% |

Financials | | 13.0% | | 14.4% | | -1.4% |

Health Care | | 10.8% | | 12.6% | | -1.8% |

Industrials | | 8.7% | | 10.2% | | -1.5% |

Information Technology | | 26.0% | | 19.9% | | 6.1% |

Materials | | 6.5% | | 3.6% | | 2.9% |

Telecommunication Services | | 2.1% | | 3.2% | | -1.1% |

Utilities | | 0.0% | | 3.7% | | -3.7% |

Cash | | 1.2% | | 0.0% | | 1.2% |

| | | | | | | |

Total | | 100.0% | | 100.0% | | |

Disclaimer

The views expressed here are exclusively those of Fund management. These views, including those related to market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter end, December 31, 2009, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and are not indicative of future performance.

Market volatility can significantly affect short-term performance. The Fund is not an appropriate investment for short-term investors. Investments in the small companies within this multi-cap fund generally carry greater risk than is customarily associated with larger companies. This additional risk is attributable to a number of factors, including the relatively limited financial resources that are typically available to small companies, and the fact that small companies often have comparatively limited product lines. In addition, the stock of small companies tends to be more volatile than the stock of large companies, particularly in the short term and particularly in the early stages of an economic or market downturn. The Fund’s use of options, futures, and leverage can magnify the risk of loss in an unfavorable market, and the Fund’s use of short-sale positions can, in theory, expose shareholders to unlimited loss. Finally, the Fund exposes shareholders to “focus risk” which may add to Fund volatility through the possibility that a single company could significantly affect total return. Shareholders of the Fund, therefore, are taking on more risk than they would if they invested in the stock market as a whole.

Conclusion

Thank you for your continued investment in Aggressive Investors 2 Fund. We encourage your feedback; your reactions and concerns are important to us.

Sincerely,

Your Investment Management Team

| | |

| 20 | | Semi-Annual Report | December 31, 2009 (Unaudited) |

THIS PAGE INTENTIONALLY LEFT BLANK

Aggressive Investors 2 Fund

SCHEDULE OF INVESTMENTS

Showing percentage of net assets as of December 31, 2009 (Unaudited)

| | | | | | | |

| Industry | | Company | | Shares | | Value |

|

COMMON STOCKS - 98.81% |

Auto Components - 5.04% |

| | Fuel Systems Solutions, Inc.*+ | | 214,600 | | $ | 8,850,104 |

| | TRW Automotive Holdings Corp.* | | 488,900 | | | 11,674,932 |

| | | | | | | |

| | | | | | | 20,525,036 |

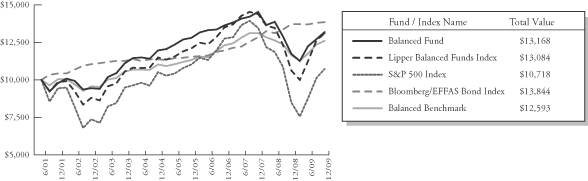

|