UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08200

Bridgeway Funds, Inc.

(Exact name of registrant as specified in charter)

20 Greenway Plaza, Suite 450

Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Tammira Philippe, President

Bridgeway Funds, Inc.

20 Greenway Plaza, Suite 450

Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 661-3500

Date of fiscal year end: June 30

Date of reporting period: June 30, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained inForm N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Ano-load mutual fund family

| | | | |

| | Annual Report June 30, 2019 |

| | |

| | AGGRESSIVE INVESTORS 1 | | BRAGX |

| | ULTRA-SMALL COMPANY | | BRUSX |

| | (Open to Existing Investors — Direct Only) | | |

| | ULTRA-SMALL COMPANY MARKET | | BRSIX |

| | SMALL-CAP GROWTH | | BRSGX |

| | SMALL-CAP VALUE | | BRSVX |

| | BLUE CHIP (Formerly, Blue Chip 35 Index) | | BRLIX |

| | MANAGED VOLATILITY | | BRBPX |

|

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.bridgeway.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling800-661-3550. Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call800-661-3550 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or to all Funds held with the fund complex if you invest directly with a Fund. |

| | |

| | | | |

| | www.bridgeway.com | | |

| | |

| TABLE OF CONTENTS | |  |

Bridgeway Funds Standardized Returns as of June 30, 2019* (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Annualized | | | | | |

| Fund1 | | Quarter | | | Six Months | | | 1 Year | | | 5 Years | | | 10 Years | | | 15 Years | | | Inception

to Date | | | Inception

Date | | | Gross

Expense

Ratio2 | | Net

Expense

Ratio2 |

Aggressive Investors 1 | | | 4.13% | | | | 18.30% | | | | -6.67% | | | | 4.21% | | | | 11.36% | | | | 5.67% | | | | 12.00% | | | | 8/5/1994 | | | 0.96% | | 0.96% |

Ultra-Small Company | | | -5.22% | | | | 7.76% | | | | -14.48% | | | | -2.71% | | | | 8.32% | | | | 5.18% | | | | 12.32% | | | | 8/5/1994 | | | 2.03% | | 2.03% |

Ultra-Small Co Market | | | -2.66% | | | | 11.07% | | | | -16.98% | | | | 3.27% | | | | 11.23% | | | | 5.82% | | | | 9.71% | | | | 7/31/1997 | | | 0.86% | | 0.86% |

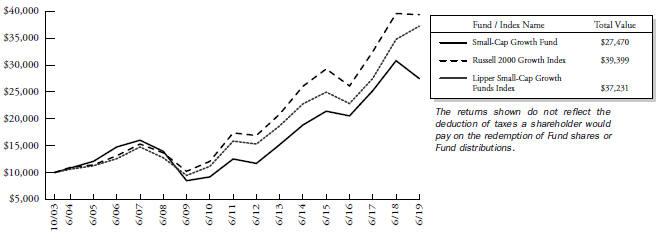

Small-Cap Growth | | | 0.92% | | | | 10.11% | | | | -10.81% | | | | 7.81% | | | | 12.50% | | | | 6.40% | | | | 6.66% | | | | 10/31/2003 | | | 1.08% | | 0.94% |

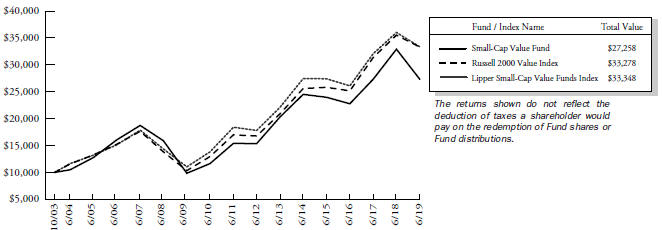

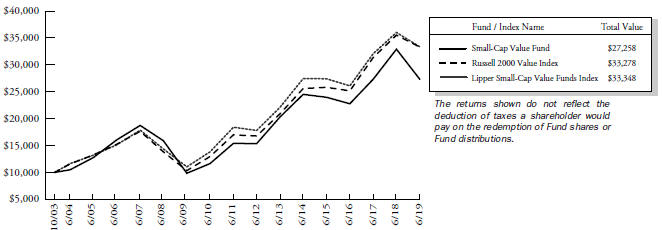

Small-Cap Value | | | -2.50% | | | | 6.36% | | | | -17.12% | | | | 2.17% | | | | 10.76% | | | | 6.59% | | | | 6.61% | | | | 10/31/2003 | | | 0.94% | | 0.94% |

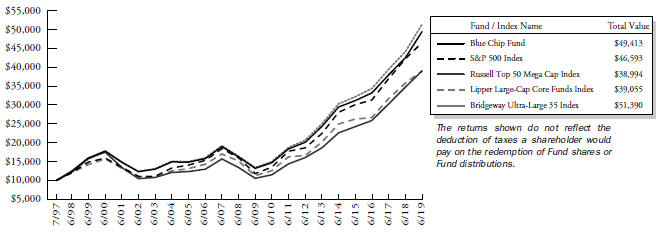

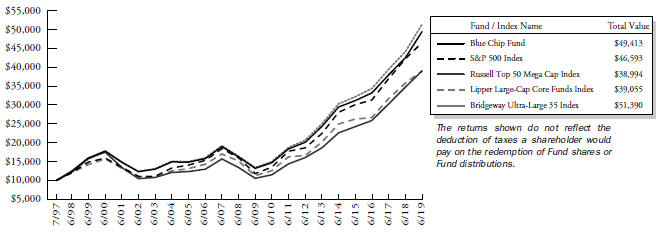

Blue Chip | | | 5.19% | | | | 18.41% | | | | 16.26% | | | | 10.91% | | | | 14.14% | | | | 8.32% | | | | 7.56% | | | | 7/31/1997 | | | 0.22% | | 0.15% |

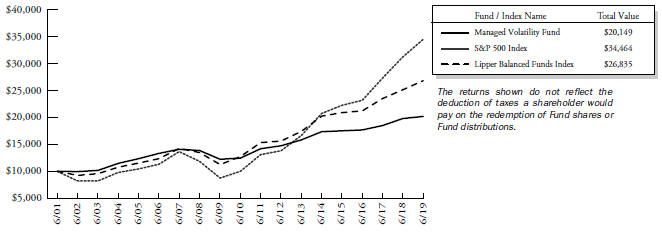

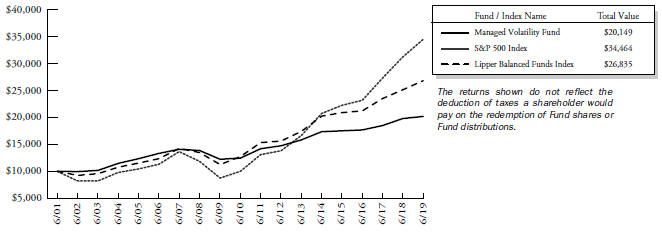

Managed Volatility | | | 1.90% | | | | 8.43% | | | | 1.74% | | | | 3.06% | | | | 5.11% | | | | 3.81% | | | | 3.97% | | | | 6/30/2001 | | | 1.21% | | 0.95% |

Bridgeway Funds Returns for Calendar Years 2003 through 2018* (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | | 2015 | | 2016 | | 2017 | | 2018 |

Aggressive Investors 1 | | | | 53.98 | % | | | | 12.21 | % | | | | 14.93 | % | | | | 7.11 | % | | | | 25.80 | % | | | | -56.16 | % | | | | 23.98 | % | | | | 17.82 | % | | | | -10.31 | % | | | | 21.58 | % | | | | 42.21 | % | | | | 14.99 | % | | | | -9.82 | % | | | | 19.47 | % | | | | 18.44 | % | | | | -22.44 | % |

Ultra-Small Company | | | | 88.57 | % | | | | 23.34 | % | | | | 2.99 | % | | | | 21.55 | % | | | | -2.77 | % | | | | -46.24 | % | | | | 48.93 | % | | | | 23.55 | % | | | | -14.64 | % | | | | 24.49 | % | | | | 55.77 | % | | | | -0.56 | % | | | | -16.12 | % | | | | 14.06 | % | | | | 3.88 | % | | | | -15.68 | % |

Ultra-Small Co Market | | | | 79.43 | % | | | | 20.12 | % | | | | 4.08 | % | | | | 11.48 | % | | | | -5.40 | % | | | | -39.49 | % | | | | 25.96 | % | | | | 24.86 | % | | | | -7.86 | % | | | | 19.83 | % | | | | 50.91 | % | | | | 4.61 | % | | | | -8.28 | % | | | | 21.47 | % | | | | 12.47 | % | | | | -17.12 | % |

Small-Cap Growth | | | | | | | | | 11.59 | % | | | | 18.24 | % | | | | 5.31 | % | | | | 6.87 | % | | | | -43.48 | % | | | | 15.05 | % | | | | 11.77 | % | | | | -0.63 | % | | | | 11.05 | % | | | | 48.52 | % | | | | 6.13 | % | | | | 4.93 | % | | | | 16.10 | % | | | | 19.62 | % | | | | -11.21 | % |

Small-Cap Value | | | | | | | | | 17.33 | % | | | | 18.92 | % | | | | 12.77 | % | | | | 6.93 | % | | | | -45.57 | % | | | | 26.98 | % | | | | 16.56 | % | | | | 1.05 | % | | | | 20.99 | % | | | | 39.72 | % | | | | 0.79 | % | | | | -9.43 | % | | | | 26.79 | % | | | | 7.11 | % | | | | -13.06 | % |

Blue Chip | | | | 28.87 | % | | | | 4.79 | % | | | | 0.05 | % | | | | 15.42 | % | | | | 6.07 | % | | | | -33.30 | % | | | | 26.61 | % | | | | 10.60 | % | | | | 3.17 | % | | | | 15.20 | % | | | | 31.67 | % | | | | 11.51 | % | | | | 2.17 | % | | | | 13.18 | % | | | | 18.43 | % | | | | -1.48 | % |

Managed Volatility | | | | 17.82 | % | | | | 7.61 | % | | | | 6.96 | % | | | | 6.65 | % | | | | 6.58 | % | | | | -19.38 | % | | | | 12.39 | % | | | | 5.41 | % | | | | 1.94 | % | | | | 6.46 | % | | | | 9.25 | % | | | | 5.95 | % | | | | 0.17 | % | | | | 2.42 | % | | | | 8.18 | % | | | | -3.97 | % |

Performance figures quoted represent past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than original cost. To obtain performance current to the most recentmonth-end, please visit www.bridgeway.com or call1-800-661-3550. Total return figures include the reinvestment of dividends and capital gains. Periods of less than one year are not annualized.

| | 1 | Some of the Fund’s fees were waived or expenses reimbursed; otherwise, returns would have been lower. The Adviser is contractually obligated to waive fees and/or pay expenses. Any material change to this Fund policy would require a vote by shareholders. |

| | 2 | Expense ratios are as stated in the current prospectus. Please see financial highlights for expense ratios as of June 30, 2019. |

* Numbers highlighted indicate periods when the Fund outperformed its primary benchmark.

This report is submitted for the general information of the shareholders of each Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding a Fund’s risks, objectives, fees and expenses, experience of its management, and other information. Investors should read the prospectus carefully before investing in a Fund. For questions or other Fund information, call1-800-661-3550 or visit the Funds’ website at www.bridgeway.com. Funds are available for purchase by residents of the United States, Puerto Rico, U.S. Virgin Islands and Guam only.

The views expressed here are exclusively those of Fund management. These views, including those relating to the market, sectors, or individual stocks, are not meant as investment advice and should not be considered predictive in nature.

Effective May 31, 2019, the name of the Blue Chip 35 Index Fund was changed to Blue Chip Fund. Effective July 31, 2019, the Fund’s principal strategies were modified, as indicated in the Supplement dated May 31, 2019 to the Prospectus dated October 31, 2018.

| | | | |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (UNAUDITED) | | |  | |

June 30, 2019

Dear Fellow Shareholders,

Performance across domestic equity markets was generally positive for the second quarter and the 12 months ended June 30, 2019. However, smaller stocks continued to lag larger stocks, resulting in negative returns forsmall-cap stocks this fiscal year. Growth stocks also continued to outperform value stocks across size categories. As a result,small-cap value stocks delivered the year’s worst performance. Market highlights appear on page 2. In this environment, the Bridgeway Funds performed within design expectations, guided by our statistically driven, evidence-based investment approach. Please see the enclosed letters for a detailed explanation of each Fund’s performance during the quarter and the fiscal year. We hope you find the letters helpful.

This August, Bridgeway is marking a major milestone: It’s been 25 years since the launch of the first Bridgeway Funds. To honor this anniversary, President and CEO Tammira Philippe describes the values and practices that have guided Bridgeway for the past 25 years — and that provide a strong foundation to position Bridgeway as an enduring firm for many years to come. Read her thoughts in “Celebrating the First 25 Years of the Bridgeway Funds” on page 2.

One of these foundational values is our commitment to transparency with our shareholders. That’s why we reserve space in our annual report to review a major challenge from the past 12 months. This year, we acknowledge the poor performance of our Select strategies during the quarter ended December 31, 2018. You can read about the market conditions that created headwinds for these strategies in “The Worst Thing of the Fiscal Year” on page 4.

Finally, Bridgeway is celebrating another milestone from the past year: Shannon Sedgwick Davis, President and CEO of the Bridgeway Foundation, recently published her first book,To Stop a Warlord: My Story of Justice, Grace, and the Fight for Peace.On page 4, read about Shannon’s inspiring transformative change work to foster a better world.

As always, we appreciate your feedback. We take your comments very seriously and regularly discuss them to help us manage our Funds and this company. Please keep your ideas coming — both favorable and critical. They provide us with a vital tool to serve you better.

Sincerely,

Your Investment Management Team

| | | | |

| |

| |

|

| John Montgomery | | Christine L. Wang | | Michael Whipple |

| |

| | |

| | |

| Elena Khoziaeva | | Dick Cancelmo | | |

| | | | |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (UNAUDITED)(continued) | | |  | |

Market Review

Domestic equity markets rose during the quarter ended June 30, 2019, despite periods of volatility brought on by an escalating U.S.-China trade war and concerns about slowing economic growth. The S&P 500 returned +4.3% for the quarter, and the Dow Jones Industrial Average returned +3.2%. For the fiscal year, the S&P 500 and the DJIA returned +10.4% and +12.2%, respectively.

All U.S. equity style categories, as defined by Russell Indices, recorded positive returns for the quarter. However, larger stocks outperformed smaller stocks across style categories, and growth stocks continued to outperform value stocks in both thelarge-cap andsmall-cap spaces. For the quarter,large-cap growth stocks returned +4.64%, while small-value stocks returned +1.38%.

All sectors of the S&P 500 except Energy had positive returns for the quarter. The Financials sector led the gains, returning +8.0%, followed by Materials (+6.3%) and Information Technology (+6.1%). Among lagging sectors, Energy returned-2.8%, followed by Health Care (+1.4%).

Below are the stock market style box returns for the quarter and the fiscal year.

| | | | | | | | | | | | | | | | | | |

| | | June 2019 Quarter | | | | | | Fiscal Year Ended June 30, 2019 | | |

| | Value | | All | | Growth | | | | | | Value | | All | | Growth | | |

Large | |

3.84%

| |

4.25%

| |

4.64%

| | | | Large | |

8.46%

| |

10.02%

| |

11.56%

| | |

Mid | |

3.19%

| |

4.13%

| |

5.40%

| | | | Mid | |

3.68%

| |

7.83%

| |

13.94%

| | |

Small | |

1.38%

| |

2.10%

| |

2.75%

| | | | Small | |

-6.24%

| |

-3.31%

| |

-0.49%

| | |

Celebrating the First 25 Years of the Bridgeway Funds

By Tammira Philippe, President and CEO

What were you doing in August 1994? In August of that year, I was working as an intern at Andersen Consulting in Houston before the start of my senior year at Texas A&M University, where I would complete my undergraduate degree in Computer Science. At the same time, in the same city, and totally unknown to me, a visionary named John Montgomery had recently founded this great company called Bridgeway Capital Management — and was about to launch Bridgeway’s first mutual fund.

I couldn’t have predicted that our paths would cross in 2005, and today I’m thrilled to be working alongside John as President and CEO of a firm that’s grown to a team of 37 committed Partners, stewarding almost $8 billion for our clients.

I’ve been here for half of Bridgeway’s first 25 years, which means I’ve witnessed a large part of our changes first-hand. But it’s whathas notchanged about Bridgeway that has me even more excited for the next 25 years — and beyond.

From the beginning, we wanted Bridgeway to be a different kind of investment manager and mutual fund company — one focused on a purpose that would support and enhance every aspect of our firm. That mission has endured. People traditionally evaluate asset managers like Bridgeway by looking at the “4 Ps” —People, Process, Philosophy, and Performance. We believe it’s vital to consider a fifth “P” —Purpose,which in our experience over the last 25 years, is the source of excellence in the four other “Ps” that most people evaluate. Let’s examine Purpose, People, Philosophy, Process, and Performance further and look at what started 25 years ago, what’s evolved, and what we expect to endure.

| | |

| 2 | | Annual Report | June 30, 2019 |

| | | | |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (UNAUDITED)(continued) | | |  | |

Purpose

John founded Bridgeway to do more than just design excellent investment strategies. The firm’s purpose — then and now — was to create positive change for our clients, our Partners and the world at large. We manage our mutual funds and investment strategies to help our clients achieve their most important goals. We’ve created a company culture that helps our Partners make the best use of their unique talents. And we give back to the communities that sustain us, through volunteering and donations from the Bridgeway Foundation.

We define our mission and purpose in a simple but powerful way. Our vision is: “A world without genocide. Partnering to create an extraordinary future for our clients, community and world.”

People

One of John’s dreams for Bridgeway was that it would not be only his dream. He envisioned aBridgeway familysharing his vision and shaping the company as much or more than he would. Since 1993, he has invited others like you and me into this family, helping make Bridgeway a shared dream among clients, colleagues, and community.

We have built an incredible team to fulfill our commitment to clients like you. And we rely on our culture and processes to guide us as we continue striving toward our vision. Our diverse group of Partners come to Bridgeway for different reasons, but they all cite the importance of our purpose in their decisions to join and stay with our team. The average tenure at Bridgeway of our investment and risk professionals is more than a decade, and we intend to foster that stability and longevity to maintain an enduring culture in the years to come. One way that we do that is through our focus on servant leadership — a deep investment in ongoing professional development to “serve first” and improve our capabilities that keeps our team engaged and committed.

Philosophy, Process and Performance

From the beginning, Bridgeway’s steadfast commitment to our investment philosophy has driven both our process and our performance. The core of that philosophy — first articulated 25 years ago and maintained today — is that investment factors shape returns, and that data, evidence, and logic should guide investment decisions.

How we communicate and implement that philosophy has evolved since 1994 as the financial industry itself has evolved. Just consider the changes we’ve seen in the availability of data on factors such as small size and momentum, the rise of electronic trading, and the emergence of new investment vehicles like ETFs andfunds-of-funds. We’ve also expanded our outreach by developing strong relationships with like-minded financial advisors and consultants who serve retirement plans. But in all these conversations, our focus remains solely on caring for each client.

That commitment to stewardship has been in place since the beginning and will endure. I like to define stewardship as having the passion and discipline to care for an asset for the benefit of others. For Bridgeway, that means we strive to put your needs first and ask, “What is in the best long-term interest of our clients?” in every decision we make.

Another enduring feature is Bridgeway’s commitment to donate 50% of profits to support transformative change in communities. Nearly 15 years ago, John wrote a letter in Bridgeway’s semi-annual report that described the most important change he wants to help achieve: fostering world peace and stopping genocide. We’ve never wavered from that goal. You can turn to page 4 of this report to read how Shannon Sedgwick Davis, President and CEO of the Bridgeway Foundation, has chronicled our efforts to achieve this vision in her new book,To Stop a Warlord.

We are immensely proud of what we’ve achieved in the past 25 years, but a core practice from Bridgeway’s servant leadership development is to express gratitude and appreciation regularly. Whether you’ve been with us for one year or 25, we recognize the commitment you have made by investing with Bridgeway, and we appreciate the trust you have placed in us. In the next 25 years, Bridgeway will remain true to our vision while we raise our profile, diversify our client base, and broaden our capabilities.

| | | | |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (UNAUDITED)(continued) | | |  | |

We aspire to build an extraordinary future together as we honor the achievements of the past 25 years. Please celebrate this milestone with us by telling someone close to you how much you appreciate something special they have done for you — whether in the last 25 minutes, 25 hours or even 25 years.

Thank you!

The Worst Thing of the Fiscal Year

Our annual report is not just a place to highlight our achievements from the past 12 months (or the past 25 years, in this case). It is also an opportunity to acknowledge and review the challenges that our company and our shareholders experienced. For that reason, we have made it a tradition to include a discussion of the “worst thing” of the previous fiscal year.

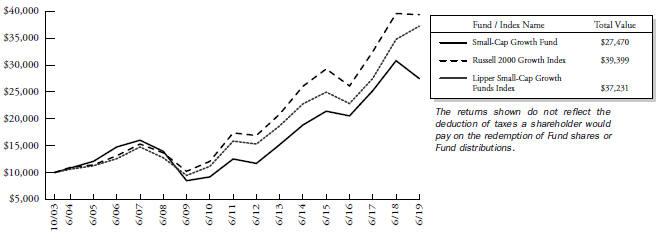

The worst thing in Fiscal Year 2019 was the poor performance of our Select strategies during the fourth quarter of 2018. Many shareholders probably remember that turbulent quarter, when concerns about slowing economic growth and rising trade tensions drove down major stock indices and contributed to stocks recording their first calendar-year decline in nine years. Amid this volatility, all our Select strategies had negative absolute returns for the quarter. And three of these select strategies —Aggressive Investors 1,Small-Cap Value andSmall-Cap Growth— underperformed their respective benchmarks.

The fourth quarter of 2018 was an extreme“risk-off” environment, in which investors widely sold off stocks they perceived to be risky. Unfortunately, many of these stocks are the types that we target in our investment models, including smaller stocks and higher beta and higher momentum stocks. Riskier stocks weren’t the only types that suffered, though. The fourth quarter of 2018 was also a high correlation quarter — when stocks of all sizes and styles move in tandem. That fact meant our Funds’ diversifying model exposures largely failed to cushion declines elsewhere in the portfolios. For details on how these conditions affected specific Funds, please review the December 31, 2018 shareholder letters and the explanation of fiscal year performance in this report.

We understand how difficult it is to experience a poor quarter like we did in the fourth quarter of 2018 — and how difficult it is to remain patient while waiting for Fund performance to recover.Small-Cap Growth andSmall-Cap Value continued to lag their benchmarks in the second half of the 2019 fiscal year. And while strong, positive market performance over the past two quarters is helping Aggressive Investors 1 to catch up, the Fund still ended the fiscal year trailing the S&P 500 Index significantly.

Yet we encourage our shareholders to maintain a long-term perspective. As data-driven, statistical investors, Bridgeway believes that the historical premiums offered by investment factors such as small size and valuation, will continue to hold true in the future — even as we experience shorter periods of underperformance.

Our research-driven approach to designing investment strategies also means we continue to investigate ways to mitigate the effects of high-correlation markets, as we discussed in comments about the Aggressive Investors 1 Fund in our 2018 semi-annual report. We are committed to transparency with our shareholders, and we will update you on the outcomes of this research.

Inspiring Action to Create a Better World: Shannon Sedgwick Davis’ new book, To Stop a Warlord

Ten years ago, Shannon Sedgwick-Davis presented a major concern to the board of the Bridgeway Foundation, the charitable organization created and funded by Bridgeway Capital Management. Her appeal: The Foundation needed to do more to live up to its mission of stopping genocide.

As CEO of the Bridgeway Foundation, Shannon had been working in areas of Central Africa being terrorized by warlord Joseph Kony and his Lord’s Resistance Army (LRA). Amid mounting violence and the abduction of thousands of children to serve as LRA soldiers, she realized it was not enough to help communitiesrecoverfrom LRA attacks. The Bridgeway Foundation had to work topreventthese atrocities from continuing.

This insight sparked a multi-year campaign to help end the conflict in Central Africa — work that’s recounted in her new book,To Stop a Warlord: My Story of Grace, Justice, and the Fight for Peace.

| | |

| 4 | | Annual Report | June 30, 2019 |

| | | | |

| LETTER FROM THE INVESTMENT MANAGEMENT TEAM (UNAUDITED)(continued) | | |  | |

Published this spring,To Stop a Warlorddescribes the unique collaboration between the Bridgeway Foundation and Central African people and organizations desiring change for their region. It is a story of innovative solutions, including the development of an early-warning radio network to alert villages of LRA activity and the creation of a program to train Ugandan soldiers to track and rescue LRA hostages. It is likewise a story of restorative justice, reflected in the efforts of LRA victims and former LRA soldiers to reconcile and move forward, together, for a safer future.

While the book celebrates many achievements —among them, a 90% reduction of LRA violence and the defection of more than 700 LRA soldiers— it also acknowledges the work that remains. As Tammira Philippe notes in her piece on Bridgeway’s 25th anniversary, our mission statement is, “A world without genocide. Partnering to create an extraordinary future for our clients, community, and world.” Yet, we know that this mission remains merely a goal until peopleact, which is why we work continually to effect transformative change in ways big and small.

To Stop a Warlordprovides examples of what action looks like, especially in the face of problems that seem unsolvable. The Bridgeway Foundation’s work in Central Africa could only happen through the dedication and commitment of hundreds of individuals — and each person’s contribution was essential. We hope you take a few moments to read Shannon’s book, feel our appreciation for what you helped make happen, and come away inspired in your service to others — finding your own ways to make a difference in the world.

| | |

| Aggressive Investors 1 Fund | |

|

MANAGER’S COMMENTARY (Unaudited) |

| | |

June 30, 2019

Dear Fellow Aggressive Investors 1 Fund Shareholder,

For the quarter ended June 30, 2019, our Fund returned +4.13%, slightly underperforming our primary market benchmark, the S&P 500 Index (+4.30%), and our peer benchmark, the Lipper Capital Appreciation Funds Index (+4.35%), but outperforming the Russell 2000 Index (+2.10%). It was a poor quarter on a relative basis.

For the fiscal year, our Fund returned-6.67%, underperforming our primary market benchmark, the S&P 500 Index (+10.42%), our peer benchmark, the Lipper Capital Appreciation Funds Index (+6.87%), and the Russell 2000 Index(-3.31%).

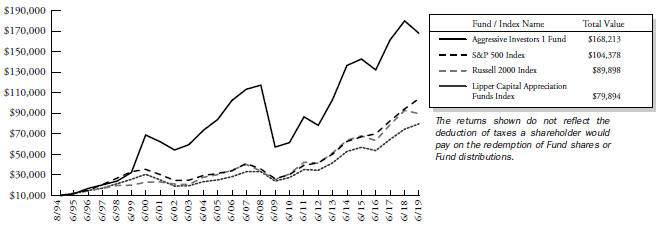

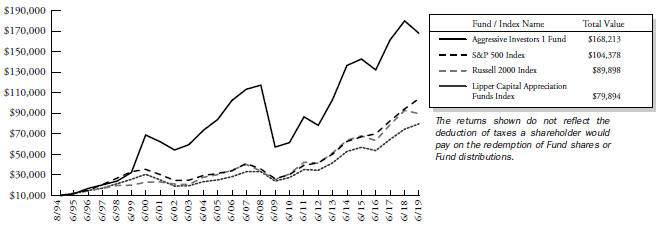

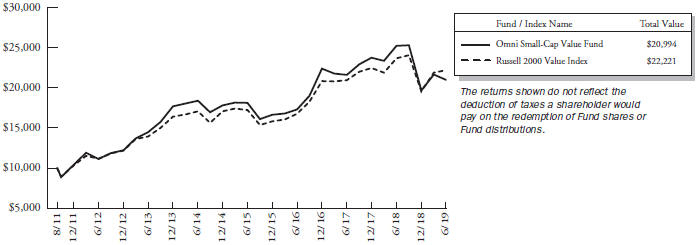

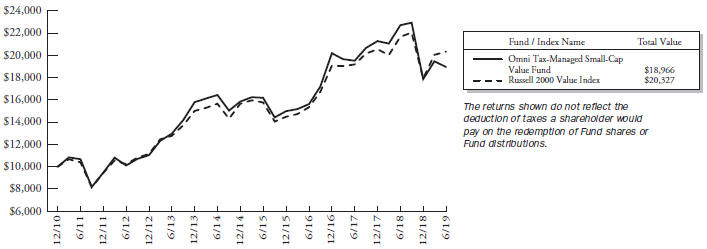

The table below presents our June quarter,one-year, five-year,10-year,15-year, andinception-to-date financial results. See the next page for a graph of performance since inception.

Standardized Returns as of June 30, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Annualized | | |

| | | Quarter | | 1 Year | | 5 Years | | 10 Years | | 15 Years | | Since Inception

(8/5/94) |

| | | | | | |

Aggressive Investors 1 Fund | | | | 4.13 | % | | | | -6.67 | % | | | | 4.21 | % | | | | 11.36 | % | | | | 5.67 | % | | | | 12.00 | % |

S&P 500 Index | | | | 4.30 | % | | | | 10.42 | % | | | | 10.71 | % | | | | 14.70 | % | | | | 8.75 | % | | | | 9.84 | % |

Russell 2000 Index | | | | 2.10 | % | | | | -3.31 | % | | | | 7.06 | % | | | | 13.45 | % | | | | 8.15 | % | | | | 9.19 | % |

Lipper Capital Appreciation Funds Index | | | | 4.35 | % | | | | 6.87 | % | | | | 8.56 | % | | | | 12.76 | % | | | | 8.46 | % | | | | 8.63 | % |

Performance figures quoted in the table above represent past performance and are no guarantee of future results. Total return figures in the table above include the reinvestment of dividends and capital gains. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions, based on the average of 500 widely held common stocks with dividends reinvested. The Russell 2000 Index is an unmanaged, market value weighted index that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market with dividends reinvested. The Lipper Capital Appreciation Funds Index reflects the record of the 30 largest funds in the category of more aggressive domestic growth mutual funds, as reported by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

| | |

| 6 | | Annual Report | June 30, 2019 |

| | |

| Aggressive Investors 1 Fund | |  |

MANAGER’S COMMENTARY (Unaudited)(continued) | | |

| | |

Growth of a $10,000 Investment

from Inception August 5, 1994 to June 30, 2019

Detailed Explanation of Quarterly Performance

The Fund’s company financial health models underperformed the benchmark and detracted from relative results, as higher quality and stronger fundamentals stocks were not rewarded by the market during the quarter. However, outperformance by the Fund’s diversifying price momentum and value metrics models helped offset much of that negative impact, though not enough to outpace the benchmark overall. By design, the Fund tends to invest in higher beta and higher volatility stocks, and these holdings detracted from relative performance. The Fund’s investments in smaller stocks also reduced relative returns as smaller stocks underperformed larger stocks during the quarter.

From a sector perspective, the Fund’s allocation effect was slightly positive, with all sector positionings except an underweighting in Communication Services making small positive contributions to relative results. In contrast, the Fund’s stock selection effect was slightly negative. Holdings in the Energy, Information Technology, and Materials sectors detracted the most from relative performance.

Detailed Explanation of Fiscal Year Performance

The Fund significantly trailed the S&P 500 Index during the fiscal year. Most of this underperformance occurred during the first half of the12-month period, when market conditions — including a high-correlation,risk-off second fiscal quarter — created significant headwinds for the Fund.

The Fund’s company financial health and value metrics models underperformed the benchmark and detracted from relative results. Strong outperformance by the Fund’s price momentum model category did not offset this negative impact. The Fund’s investments in higher volatility stocks detracted significantly from relative results, while the Fund’s investments in smaller stocks and its overweighting in deeper value stocks hurt to a lesser degree.

From a sector perspective, the Fund’s allocation effect was slightly negative, with an underweighting in the Health Care sector and an overweighting in the Materials sector detracting somewhat from relative results. The Fund’s stock selection effect was significantly negative, largely driven by poor performance from holdings in the Information Technology, Consumer Discretionary, Industrials, Energy, and Health Care sectors.

| | |

| Aggressive Investors 1 Fund | |

|

MANAGER’S COMMENTARY (Unaudited)(continued) |

| | |

Top Ten Holdings as of June 30, 2019

| | | | | | | | | |

| Rank | | Description | | Industry | | % of Net

Assets |

| 1 | | HCA Healthcare, Inc. | | Health Care | | | | 2.5% | |

| 2 | | Applied Materials, Inc. | | Information Technology | | | | 2.5% | |

| 3 | | Church & Dwight Co., Inc. | | Consumer Staples | | | | 2.4% | |

| 4 | | Cadence Design Systems, Inc. | | Information Technology | | | | 2.3% | |

| 5 | | Merck & Co., Inc. | | Health Care | | | | 2.3% | |

| 6 | | Micron Technology, Inc. | | Information Technology | | | | 2.1% | |

| 7 | | Xilinx, Inc. | | Information Technology | | | | 2.0% | |

| 8 | | Ensign Group, Inc. (The) | | Health Care | | | | 2.0% | |

| 9 | | Lululemon Athletica, Inc. | | Consumer Discretionary | | | | 1.9% | |

| 10 | | Credit Acceptance Corp. | | Financials | | | | 1.8% | |

| | | |

| | Total | | | | | | 21.8% | |

Industry Sector Representation as of June 30, 2019

| | | | | | | | | | | | | | | |

| | | % of Net Assets | | % of S&P 500

Index | | Difference |

Communication Services | | | | 5.9% | | | | | 10.2% | | | | | -4.3% | |

Consumer Discretionary | | | | 14.5% | | | | | 10.2% | | | | | 4.3% | |

Consumer Staples | | | | 4.5% | | | | | 7.3% | | | | | -2.8% | |

Energy | | | | 3.6% | | | | | 5.0% | | | | | -1.4% | |

Financials | | | | 16.7% | | | | | 13.1% | | | | | 3.6% | |

Health Care | | | | 9.2% | | | | | 14.2% | | | | | -5.0% | |

Industrials | | | | 14.2% | | | | | 9.4% | | | | | 4.8% | |

Information Technology | | | | 22.4% | | | | | 21.5% | | | | | 0.9% | |

Materials | | | | 5.8% | | | | | 2.8% | | | | | 3.0% | |

Real Estate | | | | 2.2% | | | | | 3.1% | | | | | -0.9% | |

Utilities | | | | 0.0% | | | | | 3.3% | | | | | -3.3% | |

Cash & Other Assets | | | | 1.0% | | | | | -0.1% | | | | | 1.1% | |

| | | |

Total | | | | 100.0% | | | | | 100.0% | | | | | | |

Disclaimer

The views expressed here are exclusively those of Fund management. These views, including those related to market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter end, June 30, 2019, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and may not be indicative of future performance.

Market volatility can significantly affect short-term performance. The Fund is not an appropriate investment for short-term investors. Investments in the small companies within thismulti-cap fund generally carry greater risk than is customarily associated with larger companies. This additional risk is attributable to a number of factors, including the relatively limited financial resources that are typically available to small companies and the fact that small companies often have comparatively limited product lines. In addition, the stock of small companies tends to be more volatile than the stock of large companies, particularly in the short term and particularly in the early stages of an economic or market downturn. The Fund’s use of options, futures, and leverage can magnify the risk of loss in an unfavorable market, and the Fund’s use of short-sale positions can, in theory, expose shareholders to unlimited loss. Finally, the Fund exposes shareholders to “focus risk,” which may add to Fund volatility through the possibility that a single company could significantly affect total return. Shareholders of the Fund, therefore, are taking on more risk than they would if they invested in the stock market as a whole.

| | |

| 8 | | Annual Report | June 30, 2019 |

| | |

| Aggressive Investors 1 Fund | |  |

MANAGER’S COMMENTARY (Unaudited)(continued) | | |

| | |

Conclusion

Thank you for your continued investment in Aggressive Investors 1 Fund. We encourage your feedback; your reactions and concerns are important to us.

Sincerely,

The Investment Management Team

| | |

| Aggressive Investors 1 Fund | |

|

| SCHEDULE OF INVESTMENTS |

| Showing percentage of net assets as of June 30, 2019 | | |

| | | | | | | | | | | | | | | | |

| Industry Company | | Shares | | | Value | | | | | | | |

| | | | |

COMMON STOCKS - 99.00% | | | | | | | | | | | | | | | | |

Communication Services - 5.87% | | | | | | | | | |

Altice USA, Inc., Class A* | | | 88,300 | | | $ | 2,150,105 | | | | | | | | | |

AMC Networks, Inc., Class A* | | | 30,000 | | | | 1,634,700 | | | | | | | | | |

Charter Communications, Inc., Class A* | | | 7,000 | | | | 2,766,260 | | | | | | | | | |

DISH Network Corp., Class A* | | | 45,200 | | | | 1,736,132 | | | | | | | | | |

United States Cellular Corp.* | | | 33,300 | | | | 1,487,511 | | | | | | | | | |

WideOpenWest, Inc.* | | | 120,000 | | | | 871,200 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | 10,645,908 | | | | | | | |

| | |

Consumer Discretionary - 14.48% | | | | | | | | | |

Abercrombie & Fitch Co., Class A | | | 89,300 | | | | 1,432,372 | | | | | | | | | |

Chipotle Mexican Grill, Inc.* | | | 2,700 | | | | 1,978,776 | | | | | | | | | |

Core-Mark Holding Co., Inc. | | | 50,000 | | | | 1,986,000 | | | | | | | | | |

Fiat Chrysler Automobiles NV | | | 215,000 | | | | 2,971,300 | | | | | | | | | |

Fossil Group, Inc.* | | | 50,000 | | | | 575,000 | | | | | | | | | |

K12, Inc.* | | | 53,700 | | | | 1,633,017 | | | | | | | | | |

Lear Corp. | | | 12,300 | | | | 1,713,021 | | | | | | | | | |

Lululemon Athletica, Inc.* | | | 19,300 | | | | 3,478,053 | | | | | | | | | |

RH* | | | 17,600 | | | | 2,034,560 | | | | | | | | | |

SeaWorld Entertainment, Inc.* | | | 74,500 | | | | 2,309,500 | | | | | | | | | |

Sonic Automotive, Inc., Class A | | | 58,000 | | | | 1,354,300 | | | | | | | | | |

Starbucks Corp. | | | 28,000 | | | | 2,347,240 | | | | | | | | | |

TopBuild Corp.* | | | 22,700 | | | | 1,878,652 | | | | | | | | | |

Vista Outdoor, Inc.* | | | 65,000 | | | | 577,200 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | 26,268,991 | | | | | | | |

| | |

Consumer Staples - 4.51% | | | | | | | | | |

Church & Dwight Co., Inc. | | | 60,300 | | | | 4,405,518 | | | | | | | | | |

Coca-Cola Consolidated, Inc. | | | 6,000 | | | | 1,795,500 | | | | | | | | | |

Ingles Markets, Inc., Class A | | | 24,700 | | | | 768,911 | | | | | | | | | |

Tyson Foods, Inc., Class A | | | 15,000 | | | | 1,211,100 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | 8,181,029 | | | | | | | |

| | |

Energy - 3.65% | | | | | | | | | |

CONSOL Energy, Inc.* | | | 37,000 | | | | 984,570 | | | | | | | | | |

Continental Resources, Inc.* | | | 42,000 | | | | 1,767,780 | | | | | | | | | |

Halliburton Co. | | | 60,000 | | | | 1,364,400 | | | | | | | | | |

ProPetro Holding Corp.* | | | 90,000 | | | | 1,863,000 | | | | | | | | | |

Renewable Energy Group, Inc.* | | | 40,000 | | | | 634,400 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | 6,614,150 | | | | | | | | | |

| | | | | | | | | | | | |

| Industry Company | | | Shares | | | | Value | | | | | |

| | | | | |

Financials - 16.72% | | | | | |

Aflac, Inc. | | | 41,800 | | | $ | 2,291,058 | | | | | |

Ameriprise Financial, Inc. | | | 15,500 | | | | 2,249,980 | | | | | |

Bank of Montreal | | | 12,000 | | | | 905,400 | | | | | |

Canadian Imperial Bank of Commerce+ | | | 21,000 | | | | 1,649,760 | | | | | |

Charles Schwab Corp. (The) | | | 40,500 | | | | 1,627,695 | | | | | |

Credit Acceptance Corp.* | | | 6,900 | | | | 3,338,427 | | | | | |

Enova International, Inc.* | | | 61,000 | | | | 1,406,050 | | | | | |

Erie Indemnity Co., Class A | | | 12,200 | | | | 3,102,216 | | | | | |

MarketAxess Holdings, Inc. | | | 6,700 | | | | 2,153,514 | | | | | |

Progressive Corp. (The) | | | 32,000 | | | | 2,557,760 | | | | | |

Prudential Financial, Inc. | | | 22,000 | | | | 2,222,000 | | | | | |

Santander Consumer USA Holdings, Inc. | | | 105,000 | | | | 2,515,800 | | | | | |

Synchrony Financial | | | 27,200 | | | | 943,024 | | | | | |

TD Ameritrade Holding Corp. | | | 33,500 | | | | 1,672,320 | | | | | |

Unum Group | | | 50,500 | | | | 1,694,275 | | | | | |

| | | | | | | | | | | | |

| | | |

| | | | | | 30,329,279 | | | | |

| |

Health Care - 9.21% | | | | | |

AmerisourceBergen Corp. | | | 20,900 | | | | 1,781,934 | | | | | |

Endo International PLC* | | | 142,800 | | | | 588,336 | | | | | |

Ensign Group, Inc. (The) | | | 62,000 | | | | 3,529,040 | | | | | |

HCA Healthcare, Inc. | | | 33,800 | | | | 4,568,746 | | | | | |

Incyte Corp.* | | | 25,000 | | | | 2,124,000 | | | | | |

Merck & Co., Inc. | | | 49,000 | | | | 4,108,650 | | | | | |

| | | | | | | | | | | | |

| | | |

| | | | | | 16,700,706 | | | | |

| |

Industrials - 14.22% | | | | | |

Allison Transmission Holdings, Inc. | | | 36,600 | | | | 1,696,410 | | | | | |

ArcBest Corp. | | | 38,000 | | | | 1,068,180 | | | | | |

BMC Stock Holdings, Inc.* | | | 72,000 | | | | 1,526,400 | | | | | |

Caterpillar, Inc. | | | 15,000 | | | | 2,044,350 | | | | | |

CNH Industrial NV | | | 175,000 | | | | 1,799,000 | | | | | |

CoStar Group, Inc.* | | | 3,300 | | | | 1,828,398 | | | | | |

CSX Corp. | | | 26,500 | | | | 2,050,305 | | | | | |

Insperity, Inc. | | | 25,900 | | | | 3,163,426 | | | | | |

Matson, Inc. | | | 26,300 | | | | 1,021,755 | | | | | |

NOW, Inc.* | | | 135,500 | | | | 1,999,980 | | | | | |

Spirit AeroSystems Holdings, Inc., Class A | | | 24,400 | | | | 1,985,428 | | | | | |

United Airlines Holdings, Inc.* | | | 20,400 | | | | 1,786,020 | | | | | |

United Rentals, Inc.* | | | 21,500 | | | | 2,851,545 | | | | | |

Wabash National Corp. | | | 60,000 | | | | 976,200 | | | | | |

| | | | | | | | | | | | |

| | | |

| | | | | | 25,797,397 | | | | |

| | |

| 10 | | Annual Report | June 30, 2019 |

| | |

| Aggressive Investors 1 Fund | |  |

SCHEDULE OF INVESTMENTS(continued) | | |

| Showing percentage of net assets as of June 30, 2019 | | |

| | | | | | | | | | | | | | | | | | | | |

| Industry Company | | | | | Shares | | | Value | | | | | | | |

| | | | |

Common Stocks (continued) | | | | | | | | | | | | | | | | | |

Information Technology - 22.35% | | | | | | | | | |

Alliance Data Systems Corp. | | | | 11,300 | | | $ | 1,583,469 | | | | | | | | | |

Apple, Inc. | | | | 16,000 | | | | 3,166,720 | | | | | | | | | |

Applied Materials, Inc. | | | | 99,900 | | | | 4,486,509 | | | | | | | | | |

Cadence Design Systems, Inc.* | | | | 58,400 | | | | 4,135,304 | | | | | | | | | |

EPAM Systems, Inc.* | | | | 10,300 | | | | 1,782,930 | | | | | | | | | |

Intuit, Inc. | | | | 7,400 | | | | 1,933,842 | | | | | | | | | |

Lam Research Corp. | | | | 9,700 | | | | 1,822,048 | | | | | | | | | |

Micron Technology, Inc.* | | | | 100,000 | | | | 3,859,000 | | | | | | | | | |

OSI Systems, Inc.* | | | | 21,500 | | | | 2,421,545 | | | | | | | | | |

RingCentral, Inc., Class A* | | | | 14,600 | | | | 1,677,832 | | | | | | | | | |

Seagate Technology PLC | | | | 39,900 | | | | 1,880,088 | | | | | | | | | |

ServiceNow, Inc.* | | | | 6,600 | | | | 1,812,162 | | | | | | | | | |

Unisys Corp.* | | | | 96,000 | | | | 933,120 | | | | | | | | | |

VeriSign, Inc.* | | | | 10,500 | | | | 2,196,180 | | | | | | | | | |

Western Digital Corp. | | | | 27,000 | | | | 1,283,850 | | | | | | | | | |

Xilinx, Inc. | | | | 30,500 | | | | 3,596,560 | | | | | | | | | |

Zendesk, Inc.* | | | | 22,000 | | | | 1,958,660 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | 40,529,819 | | | | | | | |

Materials - 5.77% | | | | | | | | | |

Ecolab, Inc. | | | | 9,400 | | | | 1,855,936 | | | | | | | | | |

Freeport-McMoRan, Inc. | | | | 164,800 | | | | 1,913,328 | | | | | | | | | |

Packaging Corp. of America | | | | 20,900 | | | | 1,992,188 | | | | | | | | | |

SunCoke Energy, Inc.* | | | | 201,300 | | | | 1,787,544 | | | | | | | | | |

Teck Resources, Ltd., Class B | | | | 95,000 | | | | 2,190,700 | | | | | | | | | |

Verso Corp., Class A* | | | | 38,000 | | | | 723,900 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | 10,463,596 | | | | | | | |

Real Estate - 2.22% | | | | | | | | | | | | | |

American Tower Corp. | | | | 11,000 | | | | 2,248,950 | | | | | | | | | |

Lamar Advertising Co., Class A | | | | 22,000 | | | | 1,775,620 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | 4,024,570 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

TOTAL COMMON STOCKS - 99.00% | | | | 179,555,445 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

(Cost $170,835,476) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Rate^ | | | Shares | | | Value | | | | | | | |

MONEY MARKET FUND - 1.02% | | | | | | | | | |

Fidelity Investments Money Market Government Portfolio Class I | | | 2.25 | % | | | 1,854,453 | | | | 1,854,453 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

TOTAL MONEY MARKET FUND - 1.02% | | | | 1,854,453 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

(Cost $1,854,453) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Rate^ | | | Shares | | | Value | | | | |

INVESTMENTS PURCHASED WITH CASH PROCEEDS FROM SECURITIES LENDING - 0.90% | | | | | |

Fidelity Investments Money Market Government Portfolio Class I** | | | 2.25 | % | | | 1,631,234 | | | | $1,631,234 | | | | | |

| | | | | | | | | | | | | | | | |

TOTAL INVESTMENTS PURCHASED WITH CASH PROCEEDS FROM SECURITIES LENDING - 0.90% | | | | 1,631,234 | | | | | |

| | | | | | | | | | | | | | | | |

(Cost $1,631,234) | | | | | | | | | | | | | | | | |

TOTAL INVESTMENTS - 100.92% | | | $ | 183,041,132 | | | | | |

(Cost $174,321,163) | | | | | | | | | |

Liabilities in Excess of Other Assets - (0.92%) | | | | (1,674,552 | ) | | | | |

| | | | | | | | | | | | | | | | |

| | |

NET ASSETS - 100.00% | | | $ | 181,366,580 | | | | | |

| | | | | | | | | | | | | | | | |

| * | Non-income producing security. |

| ** | This security represents the investment of the collateral received in connection with securities out on loan as of June 30, 2019. |

| ^ | Rate disclosed as of June 30, 2019. |

| + | This security or a portion of the security is out on loan as of June 30, 2019. Total loaned securities had a value of $1,612,837 as of June 30, 2019. |

PLC - Public Limited Company

Summary of inputs used to value the Fund’s investments as of 06/30/2019 (See Note 2 in Notes to Financial Statements):

| | | | | | | | | | | | | | | | |

| Valuation Inputs | |

| Investment in Securities (Value) | |

| | | Level 1 Quoted Prices | | | Level 2

Significant Observable Inputs | | | Level 3

Significant Unobservable

Inputs | | | Total | |

Common Stocks (a) | | $ | 179,555,445 | | | $ | — | | | $ | — | | | $ | 179,555,445 | |

Money Market Fund | | | — | | | | 1,854,453 | | | | — | | | | 1,854,453 | |

Investments Purchased with Cash Proceeds from Securities Lending | | | — | | | | 1,631,234 | | | | — | | | | 1,631,234 | |

| | | | | | | | | | | | | | | | |

TOTAL | | $ | 179,555,445 | | | $ | 3,485,687 | | | $ | — | | | $ | 183,041,132 | |

| | | | | | | | | | | | | | | | |

(a) - Please refer to the Schedule of Investments for the industry classifications of these portfolio holdings.

See Notes to Financial Statements.

| | |

| Ultra-Small Company Fund | |

|

MANAGER’S COMMENTARY (Unaudited) |

| | |

June 30, 2019

Dear Fellow Ultra-Small Company Fund Shareholder,

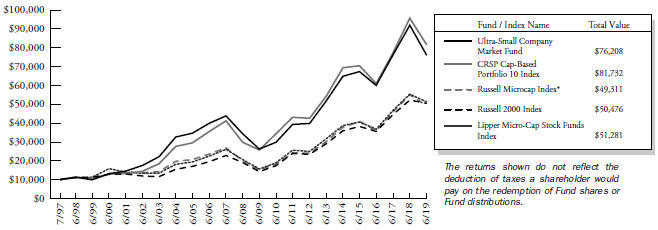

For the quarter ended June 30, 2019, our Fund returned-5.22%, lagging our primary market benchmark, the CRSPCap-Based Portfolio 10 Index(-4.00%), and our peer benchmark, the LipperMicro-Cap Stock Funds Index (+1.11%), as well as the Russell 2000 Index (+2.10%) and the Russell Microcap Index (+0.92%). It was a poor quarter.

For the fiscal year, our Fund returned-14.48%, performing in line with the CRSPCap-Based Portfolio 10 Index(-14.49%), but underperforming the LipperMicro-Cap Stock Funds Index(-7.23%), the Russell 2000 Index(-3.31%) and the Russell Microcap Index(-10.39%).

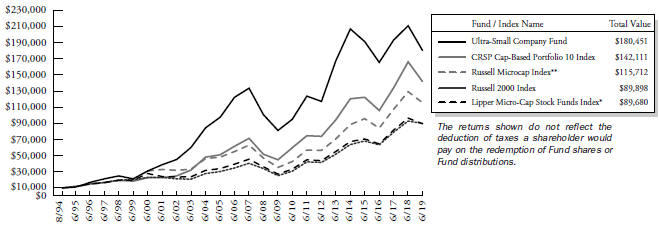

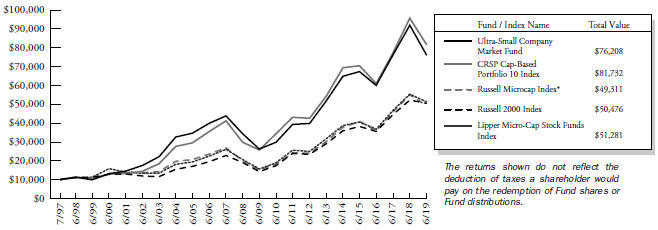

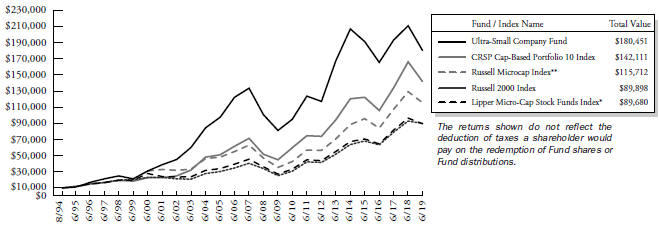

The table below presents our June quarter,one-year, five-year,10-year,15-year, andinception-to-date financial results. See the next page for a graph of performance since inception.

Standardized Returns as of June 30, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Annualized | | |

| | | Quarter | | 1 Year | | 5 Years | | 10 Years | | 15 Years | | Since Inception

(8/5/94) |

| | | | | | |

Ultra-Small Company Fund | | | | -5.22 | % | | | | -14.48 | % | | | | -2.71 | % | | | | 8.32 | % | | | | 5.18 | % | | | | 12.32 | % |

CRSPCap-Based Portfolio 10 Index | | | | -4.00 | % | | | | -14.49 | % | | | | 3.36 | % | | | | 12.24 | % | | | | 7.49 | % | | | | 11.24 | % |

Russell 2000 Index | | | | 2.10 | % | | | | -3.31 | % | | | | 7.06 | % | | | | 13.45 | % | | | | 8.15 | % | | | | 9.19 | % |

Russell Microcap Index | | | | 0.92 | % | | | | -10.39 | % | | | | 5.52 | % | | | | 12.54 | % | | | | 6.28 | % | | | | N/A | |

LipperMicro-Cap Stock Funds Index | | | | 1.11 | % | | | | -7.23 | % | | | | 5.82 | % | | | | 12.65 | % | | | | 7.15 | % | | | | N/A | |

Performance figures quoted in the table above represent past performance and are no guarantee of future results. Total return figures in the table above include the reinvestment of dividends and capital gains. The table above does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

The CRSPCap-Based Portfolio 10 Index is an unmanaged index of 699 of the smallest publicly traded U.S. stocks (with dividends reinvested), as reported by the Center for Research in Security Prices. The Russell Microcap Index is an unmanaged, market value weighted index that measures performance of 1,000 of the smallest securities in the Russell 2000 Index. The Russell 2000 Index is an unmanaged, market value weighted index that measures performance of the 2,000 companies that are between the 1,000th and 3,000th largest in the market (with dividends reinvested). The LipperMicro-Cap Stock Funds Index is an index ofmicro-cap funds compiled by Lipper, Inc. It is not possible to invest directly in an index. Periods longer than one year are annualized.

| | |

| 12 | | Annual Report | June 30, 2019 |

| | |

| Ultra-Small Company Fund | |  |

MANAGER’S COMMENTARY (Unaudited)(continued) | | |

| | |

Growth of a $10,000 Investment

from Inception August 5, 1994 to June 30, 2019

| * | The LipperMicro-Cap Stock Funds Index began on 12/31/1995, and the line graph for the Index begins at the same value as the Fund on that date. |

| ** | The Russell Microcap Index began on 6/30/2000, and the line graph for the Index begins at the same value as the Fund on that date. |

Detailed Explanation of Quarterly Performance

The Fund’s value metrics models lagged the benchmark and detracted from relative performance during the quarter. However, this negative impact was partially offset by outperformance from the Fund’s price momentum and company financial health model categories. The impact of the Fund’s tilt toward deeper value stocks across multiple valuation metrics was generally positive.

The Fund held approximately 18% of its assets, on average, outside of CRSP 10 during the quarter, including stocks that appreciated to CRSP 9. The Fund’s CRSP 9 holdings underperformed the benchmark and detracted from relative results. Interestingly, the Fund’s overweighting of CRSP 10’s smallest stocks also detracted from returns.

From a sector perspective, the Fund’s allocation effect was positive. An underweighting in the Energy sector and an overweighting in the Information Technology sector made the largest positive contributions to relative returns. However, the Fund’s stock selection effect was negative, largely driven by poor performance from holdings in the Health Care and Information Technology sectors.

| | |

| Ultra-Small Company Fund | |

|

MANAGER’S COMMENTARY (Unaudited)(continued) |

| | |

The table below presents index performance numbers for stocks in the different CRSP deciles during various time periods.

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | Annualized | |

| CRSP Decile1 | | Quarter | | | 1 Year | | | 5 Years | | 10 Years | | | 93.5 Years | |

1 (ultra-large) | | | 4.21% | | | | 10.52% | | | 11.17% | | | 14.47% | | | | 9.44% | |

2 | | | 4.85% | | | | 11.33% | | | 9.83% | | | 15.44% | | | | 10.60% | |

3 | | | 4.51% | | | | 4.99% | | | 9.61% | | | 15.90% | | | | 11.06% | |

4 | | | 4.42% | | | | 7.21% | | | 7.29% | | | 14.83% | | | | 10.88% | |

5 | | | 2.17% | | | | -0.17% | | | 5.29% | | | 13.91% | | | | 11.33% | |

6 | | | 0.77% | | | | -4.65% | | | 5.51% | | | 13.98% | | | | 11.28% | |

7 | | | 2.82% | | | | 1.78% | | | 8.72% | | | 15.81% | | | | 11.57% | |

8 | | | -0.36% | | | | -8.65% | | | 4.98% | | | 13.33% | | | | 11.35% | |

9 | | | -0.66% | | | | -9.53% | | | 6.08% | | | 13.41% | | | | 11.40% | |

10 (ultra-small) | | | -4.00% | | | | -14.49% | | | 3.36% | | | 12.24% | | | | 13.04% | |

| 1 | Performance figures are as of the period ended June 30, 2019. The CRSPCap-Based Portfolio Indexes are unmanaged indexes of publicly traded U.S. stocks with dividends reinvested, grouped by market capitalization, as reported by the Center for Research in Security Prices. Past performance is no guarantee of future results. |

Detailed Explanation of Fiscal Year Performance

The Fund’s company financial health models slightly lagged the benchmark during the fiscal year, but its value metrics and price momentum models outperformed and helped offset this negative impact. The Fund’s tilt toward deeper value stocks across multiple valuation metrics hurt relative performance.

The Fund held approximately 18% of its assets, on average, outside of CRSP 10 during the year, including stocks that appreciated to CRSP 9. The Fund’s CRSP 9 holdings underperformed the benchmark and detracted from relative performance. As with the quarter, the Fund’s overweighting of CRSP 10’s smallest stocks also detracted from returns.

From a sector perspective, the Fund’s allocation effect was positive, with an overweighting in the Information Technology sector and an underweighting in the Energy sector improving relative results the most. The Fund’s stock selection effect was flat overall. Strong performance from holdings in the Health Care and Communication Services sectors was offset by the negative impact from holdings in the Information Technology and Energy sectors.

Top Ten Holdings as of June 30, 2019

| | | | | | | | | |

| Rank | | Description | | Industry | | % of Net

Assets |

| 1 | | Misonix, Inc. | | Health Care | | | | 2.5% | |

| 2 | | Lifevantage Corp. | | Consumer Staples | | | | 2.4% | |

| 3 | | Consumer Portfolio Services, Inc. | | Financials | | | | 2.2% | |

| 4 | | RF Industries, Ltd. | | Information Technology | | | | 2.2% | |

| 5 | | Genie Energy, Ltd., Class B | | Utilities | | | | 2.0% | |

| 6 | | Capitala Finance Corp. | | Financials | | | | 2.0% | |

| 7 | | Inseego Corp. | | Information Technology | | | | 2.0% | |

| 8 | | Rocky Brands, Inc. | | Consumer Discretionary | | | | 2.0% | |

| 9 | | Victory Capital Holdings, Inc., Class A | | Financials | | | | 1.9% | |

| 10 | | Ocwen Financial Corp. | | Financials | | | | 1.9% | |

| | Total | | | | | | 21.1% | |

| | |

| 14 | | Annual Report | June 30, 2019 |

| | |

| Ultra-Small Company Fund | |  |

MANAGER’S COMMENTARY (Unaudited)(continued) | | |

| | |

Industry Sector Representation as of June 30, 2019

| | | | | | | | | | | | | | | |

| | | % of Net Assets | | % of CRSP 10 Index | | Difference |

Communication Services | | | | 4.8% | | | | | 6.5% | | | | | -1.7% | |

Consumer Discretionary | | | | 12.0% | | | | | 9.7% | | | | | 2.3% | |

Consumer Staples | | | | 3.9% | | | | | 2.5% | | | | | 1.4% | |

Energy | | | | 4.2% | | | | | 8.1% | | | | | -3.9% | |

Financials | | | | 21.6% | | | | | 24.5% | | | | | -2.9% | |

Health Care | | | | 22.4% | | | | | 21.5% | | | | | 0.9% | |

Industrials | | | | 10.1% | | | | | 10.3% | | | | | -0.2% | |

Information Technology | | | | 15.3% | | | | | 9.9% | | | | | 5.4% | |

Materials | | | | 3.4% | | | | | 3.6% | | | | | -0.2% | |

Real Estate | | | | 0.6% | | | | | 1.9% | | | | | -1.3% | |

Utilities | | | | 2.0% | | | | | 1.5% | | | | | 0.5% | |

Liabilities in Excess of Other Assets | | | | -0.3% | | | | | 0.0% | | | | | -0.3% | |

Total | | | | 100.0% | | | | | 100.0% | | | | | | |

Disclaimer

The views expressed here are exclusively those of Fund management. These views, including those related to market sectors or individual stocks, are not meant as investment advice and should not be considered predictive in nature. Any favorable (or unfavorable) description of a holding applies only as of the quarter end, June 30, 2019, unless otherwise stated. Security positions can and do change thereafter. Discussions of historical performance do not guarantee and may not be indicative of future performance.

The Fund is subject to very high, above market risk (volatility) and is not an appropriate investment for short-term investors. Investments in ultra-small companies generally carry greater risk than is customarily associated with larger companies and even “small companies” for various reasons, such as narrower markets (fewer investors), limited financial resources, and greater trading difficulty.

Conclusion

Ultra-Small Company Fund remains closed to new investors. We encourage your feedback; your reactions and concerns are important to us.

Sincerely,

The Investment Management Team

| | |

| Ultra-Small Company Fund | |

|

SCHEDULE OF INVESTMENTS |

| Showing percentage of net assets as of June 30, 2019 | | |

| | | | | | | | | | | | | | | | |

| Industry Company | | Shares | | | Value | | | | | | | |

| COMMON STOCKS - 100.28% | | | | | | | | | | |

Communication Services - 4.83% | | | | | |

Alaska Communications Systems Group, Inc.* | | | 381,200 | | | $ | 651,852 | | | | | | | | | |

Cinedigm Corp., Class A* | | | 32,000 | | | | 43,200 | | | | | | | | | |

Cumulus Media, Inc., Class A*+ | | | 25,700 | | | | 476,735 | | | | | | | | | |

DHI Group, Inc.* | | | 157,900 | | | | 563,703 | | | | | | | | | |

IDT Corp., Class B* | | | 25,000 | | | | 236,750 | | | | | | | | | |

Marchex, Inc., Class B* | | | 71,000 | | | | 333,700 | | | | | | | | | |

Travelzoo* | | | 82,300 | | | | 1,270,712 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | 3,576,652 | | | | | | | | | |

Consumer Discretionary - 11.96% | | | | | |

AMCON Distributing Co. | | | 2,100 | | | | 201,243 | | | | | | | | | |

Bassett Furniture Industries, Inc. | | | 8,700 | | | | 132,675 | | | | | | | | | |

Build-A-Bear Workshop, Inc.*+ | | | 71,500 | | | | 399,685 | | | | | | | | | |

Century Casinos, Inc.* | | | 21,000 | | | | 203,700 | | | | | | | | | |

Charles & Colvard, Ltd.* | | | 200,600 | | | | 316,948 | | | | | | | | | |

China XD Plastics Co., Ltd.*+ | | | 86,300 | | | | 181,230 | | | | | | | | | |

Comstock Holding Cos, Inc.*+ | | | 54,400 | | | | 144,160 | | | | | | | | | |

Delta Apparel, Inc.* | | | 18,200 | | | | 421,876 | | | | | | | | | |

Destination Maternity Corp.* | | | 31,900 | | | | 42,108 | | | | | | | | | |

Destination XL Group, Inc.* | | | 17,400 | | | | 30,624 | | | | | | | | | |

Educational Development Corp. | | | 62,000 | | | | 433,380 | | | | | | | | | |

J. Jill, Inc.+ | | | 231,800 | | | | 461,282 | | | | | | | | | |

Lakeland Industries, Inc.* | | | 47,000 | | | | 526,400 | | | | | | | | | |

Lincoln Educational Services Corp.*+ | | | 49,564 | | | | 114,493 | | | | | | | | | |

Live Ventures, Inc.*+ | | | 7,302 | | | | 50,749 | | | | | | | | | |

ONE Group Hospitality, Inc. (The)*+ | | | 27,400 | | | | 87,680 | | | | | | | | | |

Rocky Brands, Inc. | | | 53,700 | | | | 1,464,936 | | | | | | | | | |

RTW RetailWinds, Inc.* | | | 174,400 | | | | 296,480 | | | | | | | | | |

Rubicon Project, Inc. (The)* | | | 59,700 | | | | 379,692 | | | | | | | | | |

TravelCenters of America, LLC* | | | 349,600 | | | | 1,265,552 | | | | | | | | | |

Tuesday Morning Corp.*+ | | | 513,400 | | | | 867,646 | | | | | | | | | |

Vince Holding Corp.*+ | | | 47,100 | | | | 657,045 | | | | | | | | | |

Vitamin Shoppe, Inc.*+ | | | 43,800 | | | | 172,572 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | 8,852,156 | | | | | | | | | |

Consumer Staples - 3.93% | | | | | |

Alico, Inc. | | | 1,400 | | | | 42,476 | | | | | | | | | |

Lifevantage Corp.* | | | 136,600 | | | | 1,773,068 | | | | | | | | | |

Mannatech, Inc. | | | 13,809 | | | | 234,615 | | | | | | | | | |

Natural Alternatives International, Inc.* | | | 26,300 | | | | 306,658 | | | | | | | | | |

| | | | | | | | | | | | |

| Industry Company | | | Shares | | | | Value | | | | | |

| | | | | | | | | | | | |

Consumer Staples (continued) | |

Natural Grocers by Vitamin Cottage, Inc.* | | | 19,700 | | | $ | 197,985 | | | | | |

Reliv International, Inc.*+ | | | 26,939 | | | | 113,683 | | | | | |

Village Super Market, Inc., Class A+ | | | 9,100 | | | | 241,241 | | | | | |

| | | | | | | | | | | | |

| | | |

| | | | | | | 2,909,726 | | | | | |

Energy - 4.20% | |

Chaparral Energy, Inc., Class A*+ | | | 6,500 | | | | 30,615 | | | | | |

Earthstone Energy, Inc., Class A* | | | 16,000 | | | | 97,920 | | | | | |

Enservco Corp.* | | | 496,100 | | | | 186,583 | | | | | |

Lonestar Resources US, Inc., Class A* | | | 196,700 | | | | 450,443 | | | | | |

Midstates Petroleum Co., Inc.* | | | 48,100 | | | | 283,309 | | | | | |

Mitcham Industries, Inc.* | | | 93,000 | | | | 367,350 | | | | | |

NACCO Industries, Inc., Class A | | | 800 | | | | 41,552 | | | | | |

PrimeEnergy Resources Corp.* | | | 300 | | | | 39,939 | | | | | |

SilverBow Resources, Inc.* | | | 6,700 | | | | 92,795 | | | | | |

Superior Drilling Products, Inc.* | | | 122,800 | | | | 124,028 | | | | | |

Teekay Tankers, Ltd., Class A* | | | 299,300 | | | | 383,104 | | | | | |

TransAtlantic Petroleum, Ltd.* | | | 482,400 | | | | 347,376 | | | | | |

VAALCO Energy, Inc.* | | | 399,100 | | | | 666,497 | | | | | |

| | | | | | | | | | | | |

| | | |

| | | | | | | 3,111,511 | | | | | |

Financials - 21.56% | |

1347 Property Insurance Holdings, Inc.*+ | | | 7,800 | | | | 38,610 | | | | | |

A-Mark Precious Metals, Inc.*+ | | | 65,900 | | | | 859,995 | | | | | |

AmeriServ Financial, Inc. | | | 11,600 | | | | 48,140 | | | | | |

BCB Bancorp, Inc. | | | 8,200 | | | | 113,570 | | | | | |

C&F Financial Corp. | | | 13,652 | | | | 745,536 | | | | | |

Capitala Finance Corp. | | | 157,500 | | | | 1,488,375 | | | | | |

Central Federal Corp.* | | | 4,800 | | | | 57,792 | | | | | |

CM Finance, Inc. | | | 92,800 | | | | 706,208 | | | | | |

Codorus Valley Bancorp, Inc. | | | 2,672 | | | | 61,456 | | | | | |

Community West Bancshares | | | 5,000 | | | | 48,250 | | | | | |

Consumer Portfolio Services, Inc.* | | | 435,100 | | | | 1,653,380 | | | | | |

Elevate Credit, Inc.* | | | 59,200 | | | | 243,904 | | | | | |

FedNat Holding Co. | | | 87,300 | | | | 1,245,771 | | | | | |

| | |

| 16 | | Annual Report | June 30, 2019 |

| | |

| Ultra-Small Company Fund | |  |

SCHEDULE OF INVESTMENTS(continued) | | |

| Showing percentage of net assets as of June 30, 2019 | | |

| | | | | | | | | | | | | | | | |

| Industry Company | | | Shares | | | | Value | | | | | | | | | |

Common Stocks (continued) | | | | | | | | | | | | | |

Financials (continued) | | | | | |

First Business Financial Services, Inc. | | | 2,500 | | | $ | 58,750 | | | | | | | | | |

First Savings Financial Group, Inc.+ | | | 1,100 | | | | 66,000 | | | | | | | | | |

First United Corp.+ | | | 9,800 | | | | 193,158 | | | | | | | | | |

GAMCO Investors, Inc., Class A | | | 1,900 | | | | 36,423 | | | | | | | | | |

Hallmark Financial Services, Inc.* | | | 13,700 | | | | 194,951 | | | | | | | | | |

Horizon Technology Finance Corp. | | | 51,300 | | | | 605,340 | | | | | | | | | |

Impac Mortgage Holdings, Inc.*+ | | | 68,381 | | | | 211,981 | | | | | | | | | |

Manning & Napier, Inc. | | | 134,900 | | | | 236,075 | | | | | | | | | |

Marlin Business Services Corp. | | | 3,200 | | | | 79,776 | | | | | | | | | |

Monroe Capital Corp.+ | | | 23,700 | | | | 273,498 | | | | | | | | | |

National Holdings Corp.* | | | 80,400 | | | | 217,884 | | | | | | | | | |

Northeast Bank | | | 41,200 | | | | 1,136,296 | | | | | | | | | |

Oaktree Strategic, Income Corp. | | | 7,300 | | | | 61,977 | | | | | | | | | |

Ocwen Financial Corp.* | | | 675,500 | | | | 1,398,285 | | | | | | | | | |

Orrstown Financial Services, Inc. | | | 1,800 | | | | 39,582 | | | | | | | | | |

Portman Ridge Finance Corp.+ | | | 380,600 | | | | 856,350 | | | | | | | | | |

Provident Financial Holdings, Inc. | | | 2,800 | | | | 58,772 | | | | | | | | | |

Pzena Investment Management, Inc., Class A | | | 64,300 | | | | 552,337 | | | | | | | | | |

Sachem Capital Corp.+ | | | 45,200 | | | | 240,012 | | | | | | | | | |

SB Financial Group, Inc.+ | | | 17,422 | | | | 286,766 | | | | | | | | | |

Security National Financial Corp., Class A* | | | 86,334 | | | | 433,397 | | | | | | | | | |

Victory Capital Holdings, Inc., Class A* | | | 81,700 | | | | 1,403,606 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | 15,952,203 | | | | | | | | | |

Health Care - 22.38% | | | | | |

Allied Healthcare Products, Inc.* | | | 66,481 | | | | 123,655 | | | | | | | | | |

Alphatec Holdings, Inc.*+ | | | 142,900 | | | | 648,766 | | | | | | | | | |

American Shared Hospital Services* | | | 101,400 | | | | 291,018 | | | | | | | | | |

Applied Genetic Technologies Corp.* | | | 42,600 | | | | 161,454 | | | | | | | | | |

Apyx Medical Corp.* | | | 25,000 | | | | 168,000 | | | | | | | | | |

Aquinox Pharmaceuticals, Inc.* | | | 17,800 | | | | 42,008 | | | | | | | | | |

Aravive, Inc.* | | | 22,000 | | | | 132,000 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Industry Company | | | Shares | | | | Value | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Health Care (continued) | | | | | |

Bioanalytical Systems, Inc.* | | | 121,110 | | | $ | 238,587 | | | | | | | | | |

Castlight Health, Inc., Class B* | | | 125,000 | | | | 403,750 | | | | | | | | | |

Celldex Therapeutics, Inc.*+ | | | 204,900 | | | | 549,132 | | | | | | | | | |

Cidara Therapeutics, Inc.* | | | 24,400 | | | | 40,992 | | | | | | | | | |

Community Health Systems, Inc.*+ | | | 76,300 | | | | 203,721 | | | | | | | | | |

Computer Programs & Systems, Inc. | | | 28,700 | | | | 797,573 | | | | | | | | | |

Conformis, Inc.*+ | | | 220,500 | | | | 961,380 | | | | | | | | | |

Cross Country Healthcare, Inc.* | | | 141,500 | | | | 1,327,270 | | | | | | | | | |

Cumberland Pharmaceuticals, Inc.* | | | 16,400 | | | | 104,468 | | | | | | | | | |

CynergisTek, Inc.*+ | | | 109,000 | | | | 527,560 | | | | | | | | | |

Daxor Corp.*+ | | | 4,400 | | | | 34,980 | | | | | | | | | |

Digirad Corp. | | | 44,090 | | | | 304,662 | | | | | | | | | |

ElectroCore, Inc.*+ | | | 45,800 | | | | 91,600 | | | | | | | | | |

Electromed, Inc.* | | | 207,638 | | | | 1,131,627 | | | | | | | | | |

Enzo Biochem, Inc.* | | | 214,300 | | | | 722,191 | | | | | | | | | |

Harvard Bioscience, Inc.* | | | 322,600 | | | | 645,200 | | | | | | | | | |

Infinity Pharmaceuticals, Inc.* | | | 147,900 | | | | 266,220 | | | | | | | | | |

InfuSystem Holdings, Inc.* | | | 273,798 | | | | 1,177,331 | | | | | | | | | |

IntriCon Corp.* | | | 12,000 | | | | 280,320 | | | | | | | | | |

InVivo Therapeutics Holdings Corp.* | | | 25,000 | | | | 18,500 | | | | | | | | | |

IRIDEX Corp.*+ | | | 20,900 | | | | 95,095 | | | | | | | | | |

IVERIC bio, Inc.* | | | 35,900 | | | | 46,670 | | | | | | | | | |

Jounce Therapeutics, Inc.* | | | 27,300 | | | | 135,135 | | | | | | | | | |

Kewaunee Scientific Corp. | | | 16,100 | | | | 308,154 | | | | | | | | | |

Lannett Co., Inc.*+ | | | 67,600 | | | | 409,656 | | | | | | | | | |

Misonix, Inc.* | | | 72,400 | | | | 1,840,408 | | | | | | | | | |

NantHealth, Inc.*+ | | | 60,900 | | | | 32,021 | | | | | | | | | |

Otonomy, Inc.* | | | 43,300 | | | | 119,075 | | | | | | | | | |

Pro-Dex, Inc.*+ | | | 28,200 | | | | 366,036 | | | | | | | | | |

RadNet, Inc.* | | | 15,000 | | | | 206,850 | | | | | | | | | |

RTI Surgical Holdings, Inc.* | | | 224,890 | | | | 955,782 | | | | | | | | | |

SeaSpine Holdings Corp.* | | | 33,900 | | | | 449,175 | | | | | | | | | |

SIGA Technologies, Inc.* | | | 34,100 | | | | 193,688 | | | | | | | | | |

SunLink Health Systems, Inc.* | | | 4,700 | | | | 6,909 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | 16,558,619 | | | | | | | | | |

Industrials - 10.12% | | | | | |

Acme United Corp.+ | | | 12,000 | | | | 270,960 | | | | | | | | | |

ARC Document Solutions, Inc.* | | | 130,600 | | | | 266,424 | | | | | | | | | |

Avalon Holdings Corp., Class A*+ | | | 14,700 | | | | 36,604 | | | | | | | | | |

| | |

| Ultra-Small Company Fund | |

|

SCHEDULE OF INVESTMENTS (continued) |

| Showing percentage of net assets as of June 30, 2019 | | |

| | | | | | | | | | | | |

| Industry Company | | Shares | | | Value | | | | |

| | | |

Common Stocks (continued) | | | | | | | | | | | | |

Industrials (continued) | | | | | |

BG Staffing, Inc. | | | 11,600 | | | $ | 219,008 | | | | | |

Chicago Rivet & Machine Co. | | | 1,900 | | | | 54,131 | | | | | |

Commercial Vehicle Group, Inc.* | | | 91,000 | | | | 729,820 | | | | | |

Construction Partners, Inc., Class A* | | | 4,300 | | | | 64,586 | | | | | |

Continental Materials Corp.* | | | 4,150 | | | | 66,400 | | | | | |

DLH Holdings Corp.* | | | 7,500 | | | | 38,100 | | | | | |

Eastern Co. (The) | | | 2,400 | | | | 67,248 | | | | | |

Ecology and Environment, Inc., Class A | | | 43,732 | | | | 476,679 | | | | | |

Fuel Tech, Inc.* | | | 203,500 | | | | 284,900 | | | | | |

Houston Wire & Cable Co.* | | | 7,400 | | | | 38,776 | | | | | |

Hudson Global, Inc.* | | | 2,019 | | | | 25,137 | | | | | |

Jason Industries, Inc.* | | | 234,900 | | | | 152,685 | | | | | |

LB Foster Co., Class A* | | | 2,100 | | | | 57,414 | | | | | |

Limbach Holdings, Inc.* | | | 22,500 | | | | 204,750 | | | | | |

LS Starrett Co. (The), Class A* | | | 32,300 | | | | 213,826 | | | | | |

LSI Industries, Inc. | | | 137,200 | | | | 500,780 | | | | | |

Miller Industries, Inc. | | | 3,200 | | | | 98,400 | | | | | |

Orion Energy Systems, Inc.* | | | 90,900 | | | | 269,973 | | | | | |

Preformed Line Products Co. | | | 1,200 | | | | 66,624 | | | | | |

Quest Resource Holding Corp.* | | | 22,000 | | | | 60,940 | | | | | |

Radiant Logistics, Inc.* | | | 217,600 | | | | 1,336,064 | | | | | |

Sterling Construction Co., Inc.* | | | 3,000 | | | | 40,260 | | | | | |

Sunworks, Inc.* | | | 119,600 | | | | 65,182 | | | | | |

Tel-Instrument Electronics Corp.* | | | 11,400 | | | | 26,904 | | | | | |

Transcat, Inc.* | | | 19,300 | | | | 493,887 | | | | | |

Virco Manufacturing Corp. | | | 17,600 | | | | 82,192 | | | | | |

Volt Information Sciences, Inc.* | | | 87,600 | | | | 393,324 | | | | | |

Willis Lease Finance Corp.* | | | 13,500 | | | | 787,320 | | | | | |

| | | | | | | | | | | | |

| | | |

| | | | | | | 7,489,298 | | | | | |

| |

Information Technology - 15.29% | | | | | |

AstroNova, Inc. | | | 8,800 | | | | 227,392 | | | | | |

Aviat Networks, Inc.* | | | 70,213 | | | | 961,918 | | | | | |

Blonder Tongue Laboratories, Inc.* | | | 290,100 | | | | 281,397 | | | | | |

Computer Task Group, Inc.* | | | 37,100 | | | | 148,771 | | | | | |

Digital Turbine, Inc.*+ | | | 90,000 | | | | 450,000 | | | | | |

Finjan Holdings, Inc.* | | | 334,100 | | | | 741,702 | | | | | |

Inseego Corp.*+ | | | 309,300 | | | | 1,481,547 | | | | | |

inTEST Corp.* | | | 220,100 | | | | 1,058,681 | | | | | |

Intevac, Inc.* | | | 6,700 | | | | 32,428 | | | | | |

Luna Innovations, Inc.* | | | 235,630 | | | | 1,060,335 | | | | | |

| | | | | | | | | | | | | | | | | | |

| Industry Company | | | | Shares | | | Value | | | | | | | |

| | |

Information Technology (continued) | | | | | | | | | |

NetSol Technologies, Inc.*+ | | | 47,600 | | | $ | 266,084 | | | | | | | | | |

PCM, Inc.* | | | 14,100 | | | | 494,064 | | | | | | | | | |

PC-Tel, Inc. | | | 77,800 | | | | 344,654 | | | | | | | | | |

PRGX Global, Inc.* | | | 20,000 | | | | 134,400 | | | | | | | | | |

RF Industries, Ltd.+ | | | 193,898 | | | | 1,636,499 | | | | | | | | | |

Richardson Electronics, Ltd. | | | 12,600 | | | | 70,560 | | | | | | | | | |

Schmitt Industries, Inc.*+ | | | 70,802 | | | | 164,969 | | | | | | | | | |

Synacor, Inc.* | | | 26,000 | | | | 40,560 | | | | | | | | | |

Taitron Components, Inc., Class A+ | | | 68,500 | | | | 219,200 | | | | | | | | | |

TESSCO Technologies, Inc. | | | 44,500 | | | | 794,770 | | | | | | | | | |

TransAct Technologies, Inc. | | | 62,800 | | | | 707,128 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | 11,317,059 | | | | | | | | | |

| | |

Materials - 3.42% | | | | | | | | | |

China Advanced Construction Materials Group, Inc./Cayman*+ | | | 15,700 | | | | 56,363 | | | | | | | | | |

Flexible Solutions International, Inc.+ | | | 37,200 | | | | 167,772 | | | | | | | | | |

Friedman Industries, Inc. | | | 71,800 | | | | 499,728 | | | | | | | | | |

Gold Resource Corp. | | | 115,300 | | | | 389,714 | | | | | | | | | |

Gulf Resources, Inc.* | | | 536,800 | | | | 526,064 | | | | | | | | | |

Olympic Steel, Inc. | | | 29,700 | | | | 405,405 | | | | | | | | | |

UFP Technologies, Inc.* | | | 11,600 | | | | 482,676 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | 2,527,722 | | | | | | | | | |

| | |

Real Estate - 0.56% | | | | | | | | | |

BRT Apartments Corp. | | | 8,900 | | | | 125,757 | | | | | | | | | |

Condor Hospitality Trust, Inc.+ | | | 4,800 | | | | 43,536 | | | | | | | | | |

Griffin Industrial Realty, Inc. | | | 7,000 | | | | 247,450 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | 416,743 | | | | | | | | | |

| | |

Utilities - 2.03% | | | | | | | | | |

Genie Energy, Ltd., Class B | | | 140,800 | | | | 1,499,520 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | |

TOTAL COMMON STOCKS - 100.28% | | | | 74,211,209 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

(Cost $80,619,609) | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Rate^ | | Shares | | | Value | | | | | | | |

MONEY MARKET FUND - 0.00% | | | | | | | | | |

Fidelity Investments Money Market Government Portfolio Class I | | 2.25% | | | 779 | | | | 779 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | |

TOTAL MONEY MARKET FUND - 0.00% | | | | 779 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

(Cost $779) | | | | | | | | | | | | | | | | | | |

| | |

| 18 | | Annual Report | June 30, 2019 |

| | |

| Ultra-Small Company Fund | |  |

SCHEDULE OF INVESTMENTS (continued) | | |

| Showing percentage of net assets as of June 30, 2019 | | |

| | | | | | | | | | | | | | | | |

| | | Rate^ | | | Shares | | | Value | | | | |

| |

| INVESTMENTS PURCHASED WITH CASH PROCEEDS FROM SECURITIES LENDING - 7.68% | | | | | |

Fidelity Investments Money Market Government Portfolio Class I** | | | 2.25 | % | | | 5,682,874 | | | | $5,682,874 | | | | | |

| | | | | | | | | | | | | | | | |