UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08268

Firsthand Funds

(Exact name of registrant as specified in charter)

150 Almaden Blvd., Suite 1250

San Jose, CA 95113

(Address of principal executive offices) (Zip code)

Firsthand Capital Management, Inc.

150 Almaden Blvd., Suite 1250

San Jose, CA 95113

(Name and address of agent for service)

Registrant's telephone number, including area code: (408) 624-9527

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

As permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the shareholder reports of the Firsthand Funds (each, a “Fund” and, collectively, the “Funds”) will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds, or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website, www.firsthandfunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 1-888-884-2675 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held with the fund complex if you invest directly with a Fund.

CONTENTS

| | |

Performance Summary | 2 |

President’s Letter | 4 |

Shareholder Fee Example | 7 |

Performance and Portfolio Discussion | 9 |

Audit Letter | 15 |

Portfolio of Investments | 18 |

Statements of Assets and Liabilities | 21 |

Statements of Operations | 22 |

Statements of Changes in Net Assets | 23 |

Financial Highlights | 25 |

Notes to Financial Statements | 27 |

Additional Information | 41 |

Performance Summary

Period Returns (Average Annual Total Returns as of 12/31/21)

FUND | 1-YEAR | 3-YEAR | 5-YEAR | 10-YEAR | GROSS EXPENSE RATIO* |

Firsthand Technology Opportunities Fund | -16.69% | 28.14% | 27.82% | 20.28% | 1.85% |

Firsthand Alternative Energy Fund | -5.09% | 34.87% | 20.53% | 11.91% | 2.12% |

NASDAQ Composite Index | 22.18% | 34.26% | 24.97% | 20.96% | ● |

S&P 500 Index | 28.71% | 26.07% | 18.47% | 16.55% | ● |

WilderHill Clean Energy Index | -30.21% | 50.04% | 32.08% | 11.74% | ● |

* | After fee waivers, Firsthand Technology Opportunities Fund’s total net operating expenses are 1.85% and Firsthand Alternative Energy Fund’s total net operating expenses are 2.01%. Please see the Funds’ prospectus for more information about fund expenses. |

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

The Nasdaq Composite Index (NASDAQ) is a capitalization-weighted index of all common stocks listed with NASDAQ. The Standard & Poor’s 500 Index (S&P 500) is a market-weighted index of 500 stocks of well-established companies. Each index represents an unmanaged, broad-based basket of stocks. These indices are typically used as benchmarks for overall market performance. The WilderHill Clean Energy Index is a market-weighted index of 58 companies in the cleaner fuel, energy conversion, energy storage, greener utilities, power delivery and conservation, and renewable energy harvesting sectors. The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. You cannot invest directly in an index.

Returns Since Inception (Average Annual Total Returns as of 12/31/21)

FUND (inception Date) | Average Annual Total Returns | NASDAQ composite index | s&p 500 index | wilderhill

clean

energy

index |

Firsthand Technology Opportunities Fund (09/30/99) | 5.72% | 9.18% | 8.12% | ● |

Firsthand Alternative Energy Fund (10/29/07) | 2.12% | 14.05% | 10.55% | -3.39% |

Each Fund may invest in small-capitalization companies and Initial Public Offerings (“IPOs”). These investments will be more volatile than investments in large-capitalization companies and loss of principal could be greater. The Funds may invest in foreign securities, which will be subject to greater risks than investing in domestic securities. Because the Funds are not diversified, they can take larger positions in fewer companies, increasing their risk profile. The Funds invest in several industries within the technology sector and the relative weightings of these industries in a Fund’s portfolio may change at any time.

Holdings by Industry - % of Net Assets (as of 12/31/21)

INDUSTRY | FIRSTHAND technology

opportunities fund | FIRSTHAND alternative

energy fund |

Advanced Materials | ● | 3.8% |

Agriculture | ● | 0.0% |

Alternative Energy | ● | 6.3% |

Automotive | ● | 4.3% |

Biotech | 0.1% | 0.7% |

Communications | 0.6% | ● |

Consumer Electronics | 19.6% | ● |

Defense & Aerospace | 3.3% | 7.8% |

Education | 4.2% | ● |

Electrical Equipment | ● | 1.9% |

Energy Efficiency | ● | 3.1% |

Engineering Service | ● | 3.5% |

Industrials | ● | 0.3% |

Intellectual Property | ● | 0.0% |

Internet | 8.7% | ● |

Materials | ● | 10.8% |

Other Electronics | ● | 2.6% |

Renewable Energy | 6.3% | 33.2% |

Semiconductor Equipment | 9.8% | ● |

Semiconductors | 8.0% | 7.8% |

Services | 0.1% | 3.7% |

Software | 38.6% | ● |

Waste & Environment Service | ● | 0.3% |

Investment Company | 1.0% | 9.5% |

Net Other Assets/(Liabilities) | (0.3)% | 0.4% |

Portfolio holdings are subject to change.

President’s Letter

Fellow Shareholders,

The world began to emerge from the gloom of the COVID-19 pandemic in 2021, as vaccines became readily available in many parts of the world. As I’m sure you recall, though, the Delta variant and the later Omicron variant drove new waves of infection, which delayed what was hoped to be a straightforward return to normalcy in the U.S. and elsewhere. The stock market continued its upward trajectory through much of the year, fueled by accommodative monetary policy and a recovering U.S. economy with a rapidly falling unemployment rate. For the year ended December 31, 2021, the Nasdaq Composite Index was up 22.18% and the S&P 500 Index gained 28.71%. I am disappointed to report that Firsthand Technology Opportunities Fund underperformed its benchmarks, with a loss of 16.69% for the period. Firsthand Alternative Energy Fund suffered a loss of 5.09% in 2021, though it outperformed its primary benchmark, the WilderHill Clean Energy Index, which declined 30.21% during the period.

One might describe the stock market of 2020 as “a rising tide lifting all boats.” Conversely in 2021, we witnessed decreasing correlation among stocks in the market, as compared with 2020. Investment dollars flowed away from “stay-at-home” stocks and toward stocks expected to benefit from the apparent economic recovery. In addition, inflation concerns caused investors to opt for value-oriented tech names and away from high growth tech names trading at richer multiples. The greatest beneficiaries of this rotation were mega cap tech stocks. Several of these mega cap companies are among the largest constituents of both the Nasdaq Composite Index and the S&P 500 Index, with Apple (AAPL), Alphabet (GOOG) and Meta Platforms (FB), formerly Facebook, faring particularly well in 2021. At the same time, the market was turning its back on other companies that were not able to maintain the pace of growth they set in 2020 under COVID or suffered from ongoing supply chain issues. Several of 2020’s stock market darlings, including Peloton (PTON), Zoom Video (ZOOM), and Docusign (DOCU), dropped 30% or more in 2021.

Firsthand Technology Opportunities Fund

We shifted priorities in the portfolio in 2021 as the economy began to open up and we deemphasized the shelter-in-place, remote work stocks that we leaned on in 2020. We managed to sidestep some, but not all, losses in Splunk (SPLK) and Peloton (PTON) by exiting our positions during the year. Three of our holdings, namely Slack, Proofpoint, and GW Pharmaceuticals were acquired by other firms in 2021 and we realized gains on the sale of each of them.

PRESIDENT’S LETTER - continued

Unfortunately, we had more losers than winners in the portfolio in 2021, and the largest of each are documented in the Performance and Portfolio Discussion that begins on page 8. We suffered losses for the year among several of our business software stocks, led by Docusign (DOCU), Coupa Software (COUP), Upwork (UPWK), Domo (DOMO), and Twilio (TWLO). After achieving strong performance in 2020, education technology stocks underperformed in 2021. We experienced declines in our Chegg (CHGG), 2U (TWOU), and Coursera (COUR) holdings during the year.

Despite the losses, there were a few bright spots in the portfolio. The Australian-listed stock of Revasum (ASX: RVS) gained approximately 80% during the year as the semiconductor equipment company reported increasing revenues and customer interest in its silicon carbide grinding and polishing tools. Palo Alto Networks (PANW) grew revenues sequentially in each quarter of 2021 as network security has remained a hot button issue in the industry. The company enjoyed stock price gains of nearly 57% for the year.

Firsthand Alternative Energy Fund

Solar stocks had a rough year, despite record solar energy installations worldwide in 2021. Solar suppliers were burdened by supply chain constraints, higher input costs, and regulatory uncertainty during the year. Of particular note, California is in the process of updating its “net metering” regulations which, among other things, set the rates at which retail customers may sell excess power back to utilities via the grid. In late 2021, solar stocks tumbled as the prospects for passing the President’s Build Back Better plan dimmed in the U.S. Senate.

It was a busy year for merger and acquisition activity in the portfolio. In November, we realized a small gain resulting from the completion of EQT Infrastructure’s acquisition of Covanta Holdings in an all-cash deal. Earlier, GW Pharmaceuticals was bought by Jazz Pharmaceuticals (JAZZ) in May in a cash plus stock deal.

Several of the special purpose acquisition companies (SPACs) that we owned early in the year completed mergers in 2021. We sold our stakes in Qell Acquisition Corp. and Sustainable Opportunities Acquisition Corp. in the weeks before their respective mergers. Climate Change Crisis Real Impact I Acquisition Corp. and Decarbonization Plus Acquisition Corp. completed mergers with EVgo (EVGO) and Hyzon Motors (HYZN), respectively, in July. EVgo operates one of the largest public fast charging networks for electric vehicles in the U.S. For its part, Hyzon is a supplier of hydrogen fuel cell powered commercial vehicles, including heavy duty trucks, buses, and coaches.

PRESIDENT’S LETTER - continued

Looking Ahead

As the U.S. economy continues to demonstrate resilience in the face of adversity, inflation has become a key concern for investors. We expect the Federal Open Market Committee to aggressively tighten monetary policy in 2022 and beyond with the goal of keeping inflation in check. Though course correction is never easy, we remain cautiously optimistic that the U.S. economy and the markets will enjoy a healthy year ahead. The technology sector is as dynamic as ever, and we are excited by the prospects of the outstanding companies in our portfolios.

Thank you for your continued investment in Firsthand Funds.

Sincerely,

Kevin Landis

President, Firsthand Funds

Shareholder Fee Example (unaudited)

Example — In general, mutual fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees, and exchange fees; and (2) ongoing costs, including management fees, 12b-1 distribution and service fees, non-12b-1 service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Note that Firsthand Funds (“Trust”) does not charge transaction fees for 12b-1 distribution and service fees, though you may incur transaction fees if you purchase shares through a broker.

The example on the following page is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2021 through December 31, 2021.

Actual Expenses — The section of the table at right entitled “Actual” provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the section entitled “Actual” under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. If your account is an IRA or other tax-qualified savings plan, your expenses may also have included a $10 annual fee. In either case, the amount of any fee paid through your account would increase the estimate of expenses you paid during the period and decrease your ending account value.

Hypothetical Example for Comparison Purposes — The section of the table at right entitled “Hypothetical” provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate your actual ending account balance or the expenses you paid for the period. However, you may use this information to compare the ongoing costs of investing in the Trust to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. As in the case of the actual expense example, if your account is subject to an IRA fee, the amount of the fee paid through your account would increase the hypothetical expenses you would have paid during the period and decrease the hypothetical ending account value.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The examples also assume all dividends and distributions have been reinvested.

SHAREHOLDER FEE EXAMPLE (unaudited) - continued

Firsthand Technology Opportunities Fund

| BEGINNING

ACCOUNT VALUE

7/1/21 | ENDING

ACCOUNT

VALUE

12/31/21 | EXPENSES PAID

DURING

PERIOD*

7/1/21 - 12/31/21 | ANNUALIZED

EXPENSE RATIO |

Actual | $1,000 | $ 739.90 | $ 8.01 | 1.83% |

Hypothetical** | $1,000 | $ 1,016.00 | $ 9.28 | 1.83% |

Firsthand Alternative Energy Fund

| BEGINNING

ACCOUNT VALUE

7/1/21 | ENDING

ACCOUNT

VALUE

12/31/21 | EXPENSES PAID

DURING

PERIOD*

7/1/21 - 12/31/21 | ANNUALIZED

EXPENSE RATIO |

Actual | $1,000 | $ 924.20 | $ 9.60 | 1.98% |

Hypothetical** | $1,000 | $ 1,015.22 | $ 10.06 | 1.98% |

* | Expenses are calculated by multiplying the Fund’s annualized expense ratio listed above by the average account value over the period and multiplying that number by 184/365 (to reflect the one-half year period). |

** | 5% return per year before expenses. |

| The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial Intermediaries, or other financial institutions. |

FIRSTHAND TECHNOLOGY OPPORTUNITIES FUND

Performance and Portfolio Discussion

How did the Fund perform in 2021?

Firsthand Technology Opportunities Fund (TEFQX) posted a loss of 16.69% in 2021 versus a gain of 22.18% for the NASDAQ Composite Index and a 28.71% gain for the S&P 500 Index. For the six months ended December 31, 2021, Firsthand Technology Opportunities Fund was down 26.01% compared to gains of 8.23% and 11.66% for the NASDAQ Composite Index and the S&P 500 Index, respectively.

Which industries had the greatest impact on the Fund’s performance?

For the year ended December 31, 2021, software companies represented the portfolio’s largest industry weighting, followed by holdings in the consumer electronics and semiconductor equipment industries. The portfolio’s exposure to the consumer electronics and education industries contributed most to the Fund’s underperformance versus its primary benchmark in 2021.

Which individual holdings were the largest contributors to the Fund’s performance?

Cloud security software company Zscaler (ZS) achieved sequential revenue growth in each quarter of 2021 and was the leading contributor to the Fund’s performance for the year. Despite significant volatility in Q4, the company’s stock finished the year up more than 60%.

Another leading contributor to the Fund’s performance during the year was Bill.com Holdings (BILL). The company is a provider of cloud-based back-office software for small and midsize businesses. During the year, Bill.com completed acquisitions of Divvy and Invoice2go, providers of spend management and account receivables software, respectively. The company’s stock soared in August 2021 after the firm reported fiscal Q4 revenues that handily beat analysts’ expectations.

Cloudflare (NET) also was significant contributor to the Fund’s performance during 2021. The cloud-based security software company posted revenue growth of more than 50% for the first nine months of 2021, as compared to the same period in 2020. Cloudflare stock sold off sharply in December as inflation concerns took hold in the market, but the stock finished the year up more than 73% nonetheless.

Which holdings were the greatest detractors from the Fund’s performance?

After being the leading contributor to the performance of the Fund in the first half of 2021, streaming technology company Roku (ROKU) ended the year as the largest detractor from Fund performance for 2021. In recent quarters the company’s rate of growth of active user accounts has decelerated, with ROKU’s reported active user accounts coming up short of analysts’ expectations in both Q2 and Q3. Roku stock was down more than 50% in the second half of the year as a result.

FIRSTHAND TECHNOLOGY OPPORTUNITIES FUND - continued

Performance and Portfolio Discussion

Education technology company Chegg (CHGG) was another significant detractor from fund performance in 2021. Chegg’s stock lost more than half of its value in November after the company announced a decline in subscribers in the face of a slowdown in the education industry. The company noted at the time that a combination of factors had led to “significantly fewer college enrollments than expected this semester, and that those students who have enrolled are taking fewer and less rigorous classes.”

The Fund’s third largest detractor from fund performance was social networking company Pinterest (PINS). After achieving spectacular revenue and user growth in 2020, Pinterest suffered a reversal of fortune in 2021 as user growth slowed and later turned negative in the second and third quarters. Pinterest stock finished the year down more than 44%.

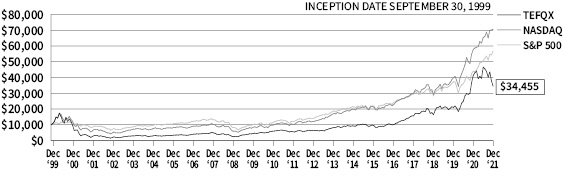

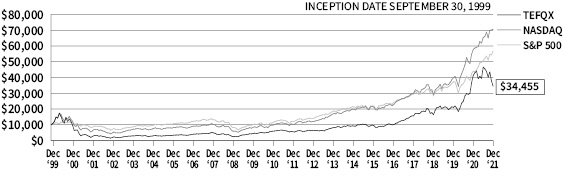

Fund Performance and Holdings Information (as of 12/31/21)

Firsthand Technology Opportunities Fund vs. Market Indices

| FIRSTHAND

TECHNOLOGY

OPPORTUNITIES FUND | NASDAQ

COMPOSITE INDEX | S&P 500 INDEX |

Since Inception (9/30/99) | 5.72% | 9.18% | 8.12% |

10-year | 20.28% | 20.96% | 16.55% |

5-year | 27.82% | 24.97% | 18.47% |

3-year | 28.14% | 34.26% | 26.07% |

1-year | -16.69% | 22.18% | 28.71% |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

HOLDINGS BY INDUSTRY* | % NET ASSETS | | TOP 10 HOLDINGS** | % NET ASSETS |

Software | 38.6% | | Roku, Inc. | 19.6% |

Consumer Electronics | 19.6% | | Wolfspeed, Inc. | 8.0% |

Semiconductor Equipment | 9.8% | | Pivotal Systems Corp. | 6.3% |

Internet | 8.7% | | Zscaler, Inc. | 5.8% |

Semiconductors | 8.0% | | Cloudflare, Inc. | 4.7% |

Renewable Energy | 6.3% | | Bill.com Holdings, Inc. | 4.5% |

Education | 4.2% | | Domo, Inc. | 4.1% |

Defense & Aerospace | 3.3% | | Revasum, Inc. | 3.4% |

Net Other Assets and Liabilities | 1.5% | | Chegg, Inc. | 3.4% |

| | | | | |

* | Based on percentage of net assets as of 12/31/21. ** Top 10 stock holdings total 63.6% of net assets. These holdings are current as of 12/31/21, and may not be representative of current or future investments. |

FIRSTHAND ALTERNATIVE ENERGY FUND

Performance and Portfolio Discussion

How did the Fund perform in 2021?

Firsthand Alternative Energy Fund (ALTEX) posted a 5.09% loss in 2021 versus a loss of 30.21% for the WilderHill Clean Energy Index and a 28.71% gain for the S&P 500 Index. For the six months ended December 31, 2021, Firsthand Alternative Energy Fund was down 7.55% compared to a loss of 22.79% and a gain of 11.66% for the WilderHill Clean Energy Index and the S&P 500 Index, respectively.

Which industries had the greatest impact on the Fund’s performance?

For the year ended December 31, 2021, renewable energy companies represented the portfolio’s largest industry weighting, followed by materials and defense & aerospace companies. Our renewable energy stocks contributed most to the Fund’s underperformance versus its primary benchmark in 2021.

Which individual holdings were the largest contributors to the Fund’s performance?

The largest contributor to fund performance in 2021 was Aspen Aerogels (ASPN), a supplier of insulation materials to the energy, building, and automotive industries. The company posted revenue growth of more than 16% for the first nine months of 2021 and surpassed analysts’ revenue estimates in each of the first three quarters of the year. Aspen Aerogels is in the early stages of commercializing new materials for the electric vehicle market, including its PyroThin line of thermal barriers for use in battery packs for electric vehicles.

Quanta Services (PWR) is an energy infrastructure provider and was the second largest contributor to the Fund’s performance in 2021. The company’s stock received a positive jolt in early September upon the announcement of Quanta’s purchase of Blattner Holding Company, a leading provider of utility-scale renewable energy infrastructure in North America. Quanta’s stock was up more than 59% in 2021, net of dividends paid.

Another significant contributor to the Fund’s performance was ABB, a Swiss company that is among the leaders in electric vehicle charging equipment. In September ABB announced what it calls the world’s fastest electric car charger. Orders and revenues for the company rebounded in 2021 after a COVID-related slump in 2020, though ABB noted that supply chain problems constrained revenues during the year.

Which holdings were the greatest detractors from the Fund’s performance?

Solar stocks came under fire in 2021 and Solar installer Sunrun (RUN) and microinverter supplier SolarEdge (SEDG) were the largest detractors from fund performance during the year. After peaking in January, Sunrun and SolarEdge stocks were hit by news of a proposal by California utilities to reduce credits for solar customers under the state’s net metering policies. These stocks were also pressured during the year by investor concerns over supply

FIRSTHAND ALTERNATIVE ENERGY FUND - continued

Performance and Portfolio Discussion

chain problems eroding margins and slowing new solar installations. After rallying early in Q4, solar stocks finished the year in a slide after the President’s Build Back Better Act apparently died in the U.S. Senate.

Vestas Wind Systems (VWSYF) was also among the biggest detractors from the Fund’s performance in 2021. The stock of the wind turbine manufacturer suffered a dramatic sell off in November after the company cut its full-year financial outlook for the second time in 2021. Vestas cited rising costs and supply chain instability as having impacted the company’s profit margins. The company’s stock finished the year near its 52-week low.

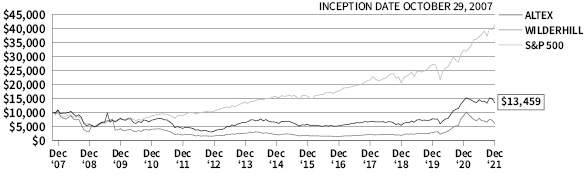

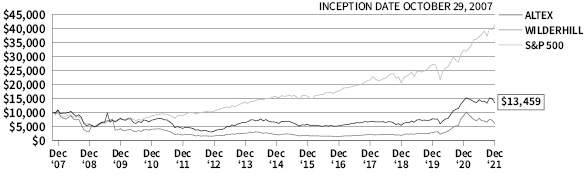

Fund Performance and Holdings Information (as of 12/31/21)

Firsthand Alternative Energy Fund vs. Market Indices

| FIRSTHAND

ALTERNATIVE

ENERGY FUND | WILDERHILL CLEAN

ENERGY INDEX | S&P 500 INDEX |

Since Inception (10/29/07) | 2.12% | -3.39% | 10.55% |

10-year | 11.91% | 11.74% | 16.55% |

5-year | 20.53% | 32.08% | 18.47% |

3-year | 34.87% | 50.04% | 26.07% |

1-year | -5.09% | -30.21% | 28.71% |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

HOLDINGS BY INDUSTRY* | % NET ASSETS | | TOP 10 HOLDINGS** | % NET ASSETS |

Renewable Energy | 33.2% | | SolarEdge Technologies, Inc. | 12.1% |

Materials | 10.8% | | Aspen Aerogels, Inc. | 10.8% |

Semiconductors | 7.8% | | Wolfspeed, Inc. | 6.9% |

Defense & Aerospace | 7.8% | | Enphase Energy, Inc. | 5.6% |

Alternative Energy | 6.3% | | Hyzon Motors, Inc. | 4.3% |

Automotive | 4.3% | | Corning, Inc. | 3.8% |

Advanced Materials | 3.8% | | EVgo, Inc. | 3.7% |

Services | 3.7% | | Maxar Technologies, Inc. | 3.7% |

Engineering Service | 3.5% | | Kratos Defense & Security Solutions, Inc. | 3.6% |

Energy Efficiency | 3.1% | | Quanta Services, Inc. | 3.5% |

Other Electronics | 2.6% | | | |

Electrical Equipment | 1.9% | | | |

Net Other Assets and Liabilities | 11.2% | | | |

* | Based on percentage of net assets as of 12/31/21. ** Top 10 stock holdings total 58.0% of net assets. These holdings are current as of 12/31/21, and may not be representative of current or future investments. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of Firsthand Funds

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Firsthand Technology Opportunities Fund and Firsthand Alternative Energy Fund, each a series of Firsthand Funds (the “Funds”), including the schedules of investments, as of December 31, 2021, the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of Firsthand Funds as of December 31, 2021, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the Funds’ auditor since 1997.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Funds are not required to have, nor were we engaged to perform, an audit of their internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures also included confirmation of securities owned as of December 31, 2021 by correspondence with the custodian and company. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

February 22, 2022

FIRSTHAND TECHNOLOGY OPPORTUNITIES FUND

Portfolio of Investments, December 31, 2021

| | SHARES | | | MARKET VALUE | |

COMMON STOCKS — 99.2% ($276,689,025) | | | | | | | | |

Biotech — 0.1% ($220,213) | | | | | | | | |

CytoDyn, Inc.* | | | 222,730 | | | $ | 220,213 | |

Communications — 0.6% ($1,781,600) | | | | | | | | |

ViaSat, Inc.* | | | 40,000 | | | | 1,781,600 | |

Consumer Electronics — 19.6% ($54,768,000) | | | | | | | | |

Roku, Inc.* | | | 240,000 | | | | 54,768,000 | |

Defense & Aerospace — 3.2% ($9,035,000) | | | | | | | | |

AeroVironment, Inc.* | | | 20,000 | | | | 1,240,600 | |

Kratos Defense & Security Solutions, Inc.* | | | 280,000 | | | | 5,432,000 | |

Maxar Technologies, Inc. | | | 80,000 | | | | 2,362,400 | |

Education — 4.2% ($11,768,400) | | | | | | | | |

2U, Inc.* | | | 100,000 | | | | 2,007,000 | |

Chegg, Inc.* | | | 310,000 | | | | 9,517,000 | |

Coursera, Inc.* | | | 10,000 | | | | 244,400 | |

Internet — 8.7% ($24,193,200) | | | | | | | | |

Netflix, Inc.* | | | 10,000 | | | | 6,024,400 | |

PayPal Holdings, Inc.* | | | 10,000 | | | | 1,885,800 | |

Pinterest, Inc., Class A* | | | 260,000 | | | | 9,451,000 | |

Upwork, Inc.* | | | 200,000 | | | | 6,832,000 | |

Renewable Energy — 6.3% ($17,564,100) | | | | | | | | |

Enphase Energy, Inc.* | | | 50,000 | | | | 9,147,000 | |

SolarEdge Technologies, Inc.* | | | 30,000 | | | | 8,417,100 | |

Semiconductor Equipment — 9.8% ($27,221,312) | | | | | | | | |

Pivotal Systems Corp.*(2) | | | 27,650,000 | | | | 17,602,163 | |

Revasum, Inc.*(1)(2) | | | 15,413,753 | | | | 6,358,494 | |

Revasum, Inc.*(2) | | | 7,113,796 | | | | 3,260,655 | |

Semiconductors — 8.0% ($22,354,000) | | | | | | | | |

Wolfspeed, Inc.* | | | 200,000 | | | | 22,354,000 | |

Services — 0.1% ($159,600) | | | | | | | | |

Net 1 UEPS Technologies, Inc.* | | | 30,000 | | | | 159,600 | |

see accompanying notes to financial statements

FIRSTHAND TECHNOLOGY OPPORTUNITIES FUND - continued

Portfolio of Investments, December 31, 2021

| | SHARES | | | MARKET VALUE | |

Software — 38.6% ($107,623,600) | | | | | | | | |

Adobe Systems, Inc.* | | | 5,000 | | | $ | 2,835,300 | |

Bill.com Holdings, Inc.* | | | 50,000 | | | | 12,457,500 | |

Cloudflare, Inc., Class A* | | | 100,000 | | | | 13,150,000 | |

Coupa Software, Inc.* | | | 20,000 | | | | 3,161,000 | |

DocuSign, Inc.* | | | 60,000 | | | | 9,138,600 | |

Domo, Inc., Class B* | | | 230,000 | | | | 11,408,000 | |

MongoDB, Inc.* | | | 20,000 | | | | 10,587,000 | |

Okta, Inc.* | | | 10,000 | | | | 2,241,700 | |

PagerDuty, Inc.* | | | 100,000 | | | | 3,475,000 | |

Palo Alto Networks, Inc.* | | | 10,000 | | | | 5,567,600 | |

Twilio, Inc., Class A* | | | 30,000 | | | | 7,900,200 | |

Workday, Inc., Class A* | | | 20,000 | | | | 5,463,600 | |

Zendesk, Inc.* | | | 40,000 | | | | 4,171,600 | |

Zscaler, Inc.* | | | 50,000 | | | | 16,066,500 | |

WARRANTS — 0.1% ($163,999) | | | | | | | | |

Defense & Aerospace — 0.1% ($163,999) | | | | | | | | |

Lilium N.V. * | | | 133,333 | | | | 163,999 | |

| | | | | | | | | |

INVESTMENT COMPANY — 1.0% ($2,925,446) | | | | | | | | |

Fidelity Investments Money Market Fund - Treasury Portfolio(3) | | | 2,925,446 | | | | 2,925,446 | |

Total Investments | | | | | | | | |

(Cost $145,123,806) — 100.3% | | | | | | | 279,778,470 | |

Liabilities in excess of other assets — (0.3)% | | | | | | | (745,080 | ) |

| | | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 279,033,390 | |

* | Non-income producing security. |

(1) | Restricted/illiquid security (2.28% of net assets). |

(3) | The Fidelity Investments Money Market Fund invests primarily in U.S. Treasury Securities. |

see accompanying notes to financial statements

FIRSTHAND ALTERNATIVE ENERGY FUND

Portfolio of Investments, December 31, 2021

| | SHARES | | | MARKET VALUE | |

COMMON STOCKS — 89.5% ($14,469,263) | | | | | | | | |

Advanced Materials — 3.8% ($612,806) | | | | | | | | |

Corning, Inc. | | | 16,460 | | | $ | 612,806 | |

Agriculture — 0.0% ($0) | | | | | | | | |

Growlife, Inc.* | | | 1 | | | | 0 | |

Alternative Energy — 6.2% ($1,004,200) | | | | | | | | |

Queen’s Gambit Growth Capital , Class A* | | | 40,000 | | | | 396,000 | |

Social Capital Hedosophia Holdings Corp. VI , Class A* | | | 40,000 | | | | 407,600 | |

Spring Valley Acquisition Corp. , Class A* | | | 20,000 | | | | 200,600 | |

Automotive — 4.0% ($641,179) | | | | | | | | |

Hyzon Motors, Inc.* | | | 98,795 | | | | 641,179 | |

Biotech — 0.7% ($105,288) | | | | | | | | |

Curaleaf Holdings, Inc.* | | | 10,000 | | | | 90,000 | |

Jazz Pharmaceuticals PLC* | | | 120 | | | | 15,288 | |

Defense & Aerospace — 7.8% ($1,258,660) | | | | | | | | |

Kratos Defense & Security Solutions, Inc.* | | | 30,000 | | | | 582,000 | |

Maxar Technologies, Inc. | | | 20,000 | | | | 590,600 | |

Raytheon Technologies Corp. | | | 1,000 | | | �� | 86,060 | |

Electrical Equipment — 1.7% ($267,190) | | | | | | | | |

ABB, Ltd. - SP ADR | | | 7,000 | | | | 267,190 | |

Energy Efficiency — 3.1% ($502,250) | | | | | | | | |

Honeywell International, Inc. | | | 580 | | | | 120,936 | |

Itron, Inc.* | | | 5,565 | | | | 381,314 | |

Engineering Service — 3.5% ($573,300) | | | | | | | | |

Quanta Services, Inc. | | | 5,000 | | | | 573,300 | |

Industrials — 0.3% ($54,240) | | | | | | | | |

Carrier Global Corp. | | | 1,000 | | | | 54,240 | |

Intellectual Property — 0.0% ($54) | | | | | | | | |

Silicon Genesis Corp., Common*(1) | | | 181,407 | | | | 54 | |

Materials — 10.8% ($1,742,650) | | | | | | | | |

Aspen Aerogels, Inc.* | | | 35,000 | | | | 1,742,650 | |

see accompanying notes to financial statements

FIRSTHAND ALTERNATIVE ENERGY FUND - continued

Portfolio of Investments, December 31, 2021

| | SHARES | | | MARKET VALUE | |

Other Electronics — 2.6% ($428,504) | | | | | | | | |

Intevac, Inc.* | | | 5,800 | | | $ | 27,318 | |

Koninklijke Philips Electronics N.V. | | | 10,887 | | | | 401,186 | |

Renewable Energy — 33.2% ($5,371,388) | | | | | | | | |

Amtech Systems, Inc.* | | | 6,600 | | | | 65,208 | |

Enphase Energy, Inc.* | | | 5,000 | | | | 914,700 | |

First Solar, Inc.* | | | 5,000 | | | | 435,800 | |

Iberdrola S.A. | | | 24,425 | | | | 289,480 | |

Maxeon Solar Technologies, Ltd.* | | | 2,491 | | | | 34,625 | |

Orion Energy Systems, Inc.* | | | 14,000 | | | | 50,680 | |

Sharp Corp. | | | 1,100 | | | | 12,632 | |

Siemens Gamesa Renewable Energy S.A.* | | | 7,271 | | | | 174,418 | |

SolarEdge Technologies, Inc.* | | | 7,000 | | | | 1,963,990 | |

SunPower Corp. , Class B* | | | 19,931 | | | | 415,960 | |

Sunrun, Inc.* | | | 11,600 | | | | 397,880 | |

ULVAC, Inc. | | | 2,700 | | | | 169,000 | |

Vestas Wind Systems A.S. | | | 15,000 | | | | 447,015 | |

Semiconductors — 7.8% ($1,266,138) | | | | | | | | |

Power Integrations, Inc. | | | 1,598 | | | | 148,438 | |

Wolfspeed, Inc.* | | | 10,000 | | | | 1,117,700 | |

Services — 3.7% ($596,400) | | | | | | | | |

EVgo, Inc.* | | | 60,000 | | | | 596,400 | |

Waste & Environment Service — 0.3% ($45,016) | | | | | | | | |

Advanced Emissions Solutions, Inc.* | | | 6,800 | | | | 45,016 | |

PREFERRED STOCKS — 0.0% ($248) | | | | | | | | |

Intellectual Property — 0.0% ($248) | | | | | | | | |

Silicon Genesis Corp., Series 1-C*(1) | | | 152 | | | | 4 | |

Silicon Genesis Corp., Series 1-E*(1) | | | 3,000 | | | | 244 | |

see accompanying notes to financial statements

FIRSTHAND ALTERNATIVE ENERGY FUND - continued

Portfolio of Investments, December 31, 2021

| | SHARES | | | MARKET VALUE | |

WARRANTS — 0.6% ($96,068) | | | | | | | | |

Alternative Energy — 0.1% ($8,536) | | | | | | | | |

Queen’s Gambit Growth Capital * | | | 13,333 | | | $ | 8,536 | |

Automotive — 0.3% ($57,000) | | | | | | | | |

Hyzon Motors, Inc. * | | | 30,000 | | | | 57,000 | |

Electrical Equipment — 0.2% ($30,532) | | | | | | | | |

Solid Power, Inc. * | | | 13,333 | | | | 30,532 | |

INVESTMENT COMPANY — 9.5% ($1,530,082) | | | | | | | | |

Fidelity Investments Money Market Fund - Treasury Portfolio(2) | | | 1,530,082 | | | | 1,530,082 | |

Total Investments | | | | | | | | |

(Cost $10,586,392) — 99.6% | | | | | | | 16,095,661 | |

Other assets in excess of liabilities — 0.4% | | | | | | | 72,397 | |

| | | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 16,168,058 | |

* | Non-income producing security. |

(1) | Restricted/illiquid security (0.00% of net assets). |

(2) | The Fidelity Investments Money Market Fund invests primarily in U.S. Treasury Securities. |

PLC | Public Limited Company |

SP ADR | Sponsored American Depositary Receipt |

see accompanying notes to financial statements

Statements of Assets and Liabilities

December 31, 2021

| | | Firsthand

Technology

Opportunities

Fund | | | Firsthand

Alternative

Energy Fund | |

ASSETS | | | | | | | | |

Investment securities: | | | | | | | | |

Acquisition cost | | $ | 145,123,806 | | | $ | 10,586,392 | |

Market value (Note 2) | | | 279,778,470 | | | | 16,095,661 | |

Receivable from dividends, interest, and reclaims | | | 8 | | | | 2,120 | |

Receivable for capital shares sold | | | 624,360 | | | | 110,479 | |

TOTAL ASSETS | | | 280,402,838 | | | | 16,208,260 | |

| | | | | | | | | |

LIABILITIES | | | | | | | | |

Payable to affiliates (Note 4) | | | 443,511 | | | | 27,988 | |

Payable for capital shares redeemed | | | 925,937 | | | | 12,214 | |

TOTAL LIABILITIES | | | 1,369,448 | | | | 40,202 | |

NET ASSETS | | $ | 279,033,390 | | | $ | 16,168,058 | |

| | | | | | | | | |

Net Assets consist of: | | | | | | | | |

Paid-in Capital | | $ | 130,342,858 | | | $ | 11,427,822 | |

Total distributable earnings (loss) | | | 148,690,532 | | | | 4,740,236 | |

NET ASSETS | | $ | 279,033,390 | | | $ | 16,168,058 | |

| | | | | | | | | |

Shares Outstanding | | | 16,577,847 | | | | 1,204,637 | |

Net asset value, redemption price and offering price per share (Note 2) | | $ | 16.83 | | | $ | 13.42 | |

see accompanying notes to financial statements

Statements of Operations

For the Year Ended December 31, 2021

| | | Firsthand

Technology

Opportunities

Fund | | | Firsthand

Alternative

Energy Fund | |

INVESTMENT INCOME | | | | | | | | |

Dividends | | $ | 3,680 | | | $ | 49,643 | |

Foreign tax withholding | | | — | | | | (2,960 | ) |

TOTAL INVESTMENT INCOME | | | 3,680 | | | | 46,683 | |

| | | | | | | | | |

EXPENSES | | | | | | | | |

Investment advisory fees (Note 4) | | | 5,213,486 | | | | 304,933 | |

Administration fees (Note 4) | | | 1,589,568 | | | | 89,686 | |

Trustees fees | | | 9,000 | | | | 9,000 | |

GROSS EXPENSES | | | 6,812,054 | | | | 403,619 | |

Trustees fees reimbursement | | | (9,000 | ) | | | (9,000 | ) |

TOTAL NET EXPENSES | | | 6,803,054 | | | | 394,619 | |

| | | | | | | | | |

NET INVESTMENT LOSS | | | (6,799,374 | ) | | | (347,936 | ) |

| | | | | | | | | |

Net Realized and Unrealized Gain (Loss) on Investments: | | | | | | | | |

Net realized gains (losses) from security transactions | | | 36,926,728 | | | | (118,799 | ) |

Net realized losses on foreign currency | | | — | | | | (453 | ) |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

Non-affiliated investments and foreign currency | | | (89,000,335 | ) | | | (719,374 | ) |

Affiliated investments | | | (2,560,030 | ) | | | — | |

Net Realized and Unrealized (Loss) on Investments | | | (54,633,637 | ) | | | (838,626 | ) |

| | | | | | | | | |

Net Decrease In Net Assets Resulting From Operations | | $ | (61,433,011 | ) | | $ | (1,186,562 | ) |

see accompanying notes to financial statements

Statements of Changes in Net Assets

For the Years Ended December 31, 2021, and December 31, 2020

| | | Firsthand Technology

Opportunities Fund | |

| | | YEAR ENDED

12/31/2021 | | | YEAR ended

12/31/2020 | |

FROM OPERATIONS: | | | | | | | | |

Net investment loss | | $ | (6,799,374 | ) | | $ | (4,564,496 | ) |

Net realized gains from security transactions, foreign currency, and written options | | | 36,926,728 | | | | 55,224,328 | |

Net change in unrealized (depreciation) appreciation on investments, foreign currency | | | (91,560,365 | ) | | | 130,148,479 | |

Net increase (decrease) in net assets from operations | | | (61,433,011 | ) | | | 180,808,311 | |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

Distributions | | | (18,303,178 | ) | | | (49,026,363 | ) |

Total Distributions | | | (18,303,178 | ) | | | (49,026,363 | ) |

| | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

Proceeds from shares sold | | | 88,974,325 | | | | 48,831,049 | |

Dividends reinvested | | | 17,561,924 | | | | 46,980,637 | |

Payment for shares redeemed | | | (116,461,647 | ) | | | (113,945,622 | ) |

Net decrease in net assets from capital share transactions | | | (9,925,398 | ) | | | (18,133,936 | ) |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (89,661,587 | ) | | | 113,648,012 | |

| | | | | | | | | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 368,694,977 | | | | 255,046,965 | |

End of year | | $ | 279,033,390 | | | $ | 368,694,977 | |

| | | | | | | | | |

COMMON STOCK ACTIVITY: | | | | | | | | |

Shares sold | | | 3,896,815 | | | | 2,943,552 | |

Shares reinvested | | | 1,050,354 | | | | 2,163,013 | |

Shares redeemed | | | (5,436,544 | ) | | | (8,192,580 | ) |

Net (decrease) in shares outstanding | | | (489,375 | ) | | | (3,086,015 | ) |

Shares outstanding, beginning of year | | | 17,067,222 | | | | 20,153,237 | |

Shares outstanding, end of year | | | 16,577,847 | | | | 17,067,222 | |

see accompanying notes to financial statements

STATEMENTS OF CHANGES IN NET ASSETS

For the Years Ended December 31, 2021, and December 31, 2020

| | | Firsthand Alternative

energy Fund | |

| | | YEAR ENDED

12/31/2021 | | | YEAR ended

12/31/2020 | |

FROM OPERATIONS: | | | | | | | | |

Net investment loss | | $ | (347,936 | ) | | $ | (111,694 | ) |

Net realized (loss) gains from security transactions, foreign currency | | | (119,252 | ) | | | 540,675 | |

Net change in unrealized (depreciation) appreciation on investments, foreign currency | | | (719,374 | ) | | | 5,097,239 | |

Net increase (decrease) in net assets from operations | | | (1,186,562 | ) | | | 5,526,220 | |

| | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

Proceeds from shares sold | | | 16,154,833 | | | | 10,472,874 | |

Dividends reinvested | | | — | | | | — | |

Payment for shares redeemed | | | (17,508,014 | ) | | | (3,449,030 | ) |

Net increase (decrease) in net assets from capital share transactions | | | (1,353,181 | ) | | | 7,023,844 | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (2,539,743 | ) | | | 12,550,064 | |

| | | | | | | | | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 18,707,801 | | | | 6,157,737 | |

End of year | | $ | 16,168,058 | | | $ | 18,707,801 | |

| | | | | | | | | |

COMMON STOCK ACTIVITY: | | | | | | | | |

Shares sold | | | 1,092,194 | | | | 874,618 | |

Shares reinvested | | | — | | | | — | |

Shares redeemed | | | (1,210,795 | ) | | | (352,525 | ) |

Net increase (decrease) in shares outstanding | | | (118,601 | ) | | | 522,093 | |

Shares outstanding, beginning of year | | | 1,323,238 | | | | 801,145 | |

Shares outstanding, end of year | | | 1,204,637 | | | | 1,323,238 | |

see accompanying notes to financial statements

Financial Highlights

Selected per share data and ratios for a share outstanding throughout each year

FIRSTHAND TECHNOLOGY OPPORTUNITIES FUND

| | | YEAR

ENDED

12/31/21 | | | YEAR

ENDED

12/31/20 | | | YEAR

ENDED

12/31/19 | | | YEAR

ENDED

12/31/18 | | | YEAR

ENDED

12/31/17 | |

Net asset value at beginning of year | | $ | 21.60 | | | $ | 12.66 | | | $ | 10.41 | | | $ | 9.98 | | | $ | 6.42 | |

| | | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.41 | ) | | | (0.27 | ) | | | (0.19 | ) | | | (0.18 | ) | | | (0.12 | ) |

Net realized and unrealized gains (losses) on investments | | | (3.20 | ) | | | 12.51 | | | | 3.14 | | | | 0.61 | | | | 3.68 | |

| | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (3.61 | ) | | | 12.24 | | | | 2.95 | | | | 0.43 | | | | 3.56 | |

| | | | | | | | | | | | | | | | | | | | | |

Distributions from: | | | | | | | | | | | | | | | | | | | | |

Realized capital gains | | | (1.16 | ) | | | (3.30 | ) | | | (0.70 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of year | | $ | 16.83 | | | $ | 21.60 | | | $ | 12.66 | | | $ | 10.41 | | | $ | 9.98 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return | | | (16.69 | %) | | | 96.52 | % | | | 28.51 | % | | | 4.31 | % | | | 55.45 | % |

Net assets at end of year (millions) | | $ | 279.0 | | | $ | 368.7 | | | $ | 255.0 | | | $ | 158.1 | | | $ | 124.5 | |

Ratio of gross expenses to average net assets before waiver | | | 1.83 | % | | | 1.84 | % | | | 1.84 | % | | | 1.86 | % | | | 1.86 | % |

Ratio of net expenses to average net assets after waiver | | | 1.83 | % | | | 1.84 | % | | | 1.83 | % | | | 1.85 | % | | | 1.85 | % |

Ratio of net investment loss to average net assets | | | (1.83 | %) | | | (1.81 | %) | | | (1.28 | %) | | | (1.54 | %) | | | (1.57 | %) |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 16 | % | | | 65 | % | | | 43 | % | | | 25 | % | | | 19 | % |

see accompanying notes to financial statements

FINANCIAL HIGHLIGHTS

Selected per share data and ratios for a share outstanding throughout each year

FIRSTHAND ALTERNATIVE ENERGY FUND

| | | YEAR

ENDED

12/31/21 | | | YEAR

ENDED

12/31/20 | | | YEAR

ENDED

12/31/19 | | | YEAR

ENDED

12/31/18 | | | YEAR

ENDED

12/31/17 | |

Net asset value at beginning of year | | $ | 14.14 | | | $ | 7.69 | | | $ | 5.47 | | | $ | 6.72 | | | $ | 5.29 | |

| | | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.29 | ) | | | (0.08 | ) | | | (0.05 | ) | | | (0.04 | ) | | | 0.02 | |

Net realized and unrealized gains (losses) on investments | | | (0.43 | ) | | | 6.53 | | | | 2.27 | | | | (1.21 | ) | | | 1.43 | |

| | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | (0.72 | ) | | | 6.45 | | | | 2.22 | | | | (1.25 | ) | | | 1.45 | |

| | | | | | | | | | | | | | | | | | | | | |

Distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | — | | | | — | | | | — | (a) | | | (0.02 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of year | | $ | 13.42 | | | $ | 14.14 | | | $ | 7.69 | | | $ | 5.47 | | | $ | 6.72 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return | | | (5.09 | %) | | | 83.88 | % | | | 40.59 | % | | | (18.57 | %) | | | 27.35 | % |

Net assets at end of year (millions) | | $ | 16.2 | | | $ | 18.7 | | | $ | 6.2 | | | $ | 4.4 | | | $ | 5.9 | |

Ratio of gross expenses to average net assets before waiver | | | 2.03 | % | | | 2.09 | % | | | 2.15 | % | | | 2.15 | % | | | 2.15 | % |

Ratio of net expenses to average net assets after waiver | | | 1.98 | % | | | 1.98 | % | | | 1.98 | % | | | 1.98 | % | | | 1.98 | % |

Ratio of net investment income (loss) to average net assets | | | (1.75 | %) | | | (1.41 | %) | | | (0.72 | %) | | | (0.68 | %) | | | 0.30 | % |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 23 | % | | | 14 | % | | | 0 | % | | | 7 | % | | | 0 | % |

(a) | Amount represents less than $0.01 per share |

see accompanying notes to financial statements

Notes to Financial Statements

December 31, 2021

1. ORGANIZATION

Each of Firsthand Technology Opportunities Fund and Firsthand Alternative Energy Fund (individually the “Fund”, and collectively the “Funds”) is a non-diversified series of Firsthand Funds (the “Trust”), an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust, a Delaware statutory trust, was organized on November 8, 1993. Each Fund currently offers one class of shares—Investor Class shares. The inception dates for the Funds (the date on which a net asset value was first determined for that Fund) follow:

FUND | INCEPTION DATE |

Firsthand Technology Opportunities Fund | September 30, 1999 |

Firsthand Alternative Energy Fund | October 29, 2007 |

Each Fund’s investment objective is long-term growth of capital.

Firsthand Technology Opportunities Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in equity securities of high-technology companies in the industries and markets that the Investment Adviser believes hold the most growth potential within the technology sector.

Firsthand Alternative Energy Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in alternative energy and energy technology companies, both U.S. and international.

The Funds are an investment company and follow accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the Funds’ significant accounting policies:

Securities Valuation — A Fund’s portfolio of securities is valued as follows:

| | 1. | Securities traded on stock exchanges, or quoted by NASDAQ, are valued according to the NASDAQ official closing price, if applicable, or at their last reported sale price as of the close of trading on the New York Stock Exchange (“NYSE”) (normally 4:00 P.M. Eastern Time). If a security is not traded that day, the security will be valued at its most recent bid price. |

| | 2. | Securities traded in the over-the-counter market, but not quoted by NASDAQ, are valued at the last sale price (or, if the last sale price is not readily available, at the most recent closing bid price as quoted by brokers that make markets in the securities) at the close of trading on the NYSE. |

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2021

| | 3. | Securities traded both in the over-the-counter market and on a stock exchange are valued according to the broadest and most representative market. |

| | 4. | Securities and other assets that do not have market quotations readily available are valued at their fair value as determined in good faith using procedures established by the Board of Trustees. |

In pricing illiquid, privately placed securities, the advisor follows well-accepted valuation techniques. Initial valuations are generally determined by the initial purchase price for each security. Subsequent to initial purchase, securities are repriced from time to time to reflect changes to the companies’ valuations caused by various events. Such events include, among others, a new round of financing establishing a new valuation for the company; material changes to a company’s business or business prospects, either due to company-specific internal issues (gaining or losing a major customer, missing a significant milestone, etc.) or macroeconomic events affecting the industry or the world. In analyzing a company’s valuation, factors that are also considered include a company’s cash flow, revenues, profitability, financial forecasts, and probability of success in those measures. Other potential factors include the value of comparable public and private companies and general market conditions.

FAIR VALUE MEASUREMENT — In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, each Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities (level 1 measurement) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (level 3 measurements).

The guidance establishes three levels of the fair value hierarchy as follows:

| | LEVEL 1 | – Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access. |

| | LEVEL 2 | – Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risks, yield curves, default rates, and similar data. |

| | LEVEL 3 | – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2021

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the following Funds’ net assets as of December 31, 2021:

FUND* | | LEVEL 1

QUOTED PRICES | | | LEVEL 2

OTHER SIGNIFICANT

OBSERVABLE INPUTS | | | LEVEL 3

SIGNIFICANT

OBSERVABLE INPUTS | |

TEFQX | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Biotech | | $ | 220,213 | | | $ | — | | | $ | — | |

Communications | | | 1,781,600 | | | | — | | | | — | |

Consumer Electronics | | | 54,768,000 | | | | — | | | | — | |

Defense & Aerospace | | | 9,035,000 | | | | — | | | | — | |

Education | | | 11,768,400 | | | | — | | | | — | |

Internet | | | 24,193,200 | | | | — | | | | — | |

Renewable Energy | | | 17,564,100 | | | | — | | | | — | |

Semiconductor Equipment | | | 20,862,818 | | | | 6,358,494 | | | | — | |

Semiconductors | | | 22,354,000 | | | | — | | | | — | |

Services | | | 159,600 | | | | — | | | | — | |

Software | | | 107,623,600 | | | | — | | | | — | |

Total Common Stocks | | | 270,330,531 | | | | 6,358,494 | | | | — | |

Warrants | | | | | | | | | | | | |

Defense & Aerospace | | | 163,999 | | | | — | | | | — | |

Investment Company | | | 2,925,446 | | | | — | | | | — | |

Total | | $ | 273,419,976 | | | $ | 6,358,494 | | | $ | — | |

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2021

FUND* | | LEVEL 1

QUOTED PRICES | | | LEVEL 2

OTHER SIGNIFICANT

OBSERVABLE INPUTS | | | LEVEL 3

SIGNIFICANT

OBSERVABLE INPUTS | |

ALTEX | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Advanced Materials | | $ | 612,806 | | | $ | — | | | $ | — | |

Agriculture | | | — | | | | — | | | | — | |

Alternative Energy | | | 1,004,200 | | | | — | | | | — | |

Automotive | | | 641,179 | | | | — | | | | — | |

Biotech | | | 105,288 | | | | — | | | | — | |

Defense & Aerospace | | | 1,258,660 | | | | — | | | | — | |

Electrical Equipment | | | 267,190 | | | | — | | | | — | |

Energy Efficiency | | | 502,250 | | | | — | | | | — | |

Engineering Service | | | 573,300 | | | | — | | | | — | |

Industrials | | | 54,240 | | | | — | | | | — | |

Intellectual Property | | | — | | | | — | | | | 54 | |

Materials | | | 1,742,650 | | | | — | | | | — | |

Other Electronics | | | 428,504 | | | | — | | | | — | |

Renewable Energy | | | 5,371,388 | | | | — | | | | — | |

Semiconductors | | | 1,266,138 | | | | — | | | | — | |

Services | | | 596,400 | | | | — | | | | — | |

Waste & Environment Service | | | 45,016 | | | | — | | | | — | |

Total Common Stocks | | | 14,469,209 | | | | — | | | | 54 | |

Preferred Stocks | | | | | | | | | | | | |

Intellectual Property | | | — | | | | — | | | | 248 | |

Warrants | | | | | | | | | | | | |

Alternative Energy | | | 8,536 | | | | — | | | | — | |

Automotive | | | 57,000 | | | | — | | | | — | |

Electrical Equipment | | | 30,532 | | | | — | | | | — | |

Investment Company | | | 1,530,082 | | | | — | | | | — | |

Total | | $ | 16,095,359 | | | $ | — | | | $ | 302 | |

* | TEFQX: Firsthand Technology Opportunities Fund; ALTEX: Firsthand Alternative Energy Fund. |

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2021

At the end of each calendar quarter, management evaluates the Level 2 and 3 assets and liabilities for changes in liquidity, including but not limited to: whether a broker is willing to execute at the quoted price, the depth and consistency of prices from third party services, and the existence of contemporaneous, observable trades in the market. Additionally, management evaluates the Level 1 and 2 assets and liabilities on a quarterly basis for changes in listings or delistings on national exchanges.

INVESTMENTS AT

FAIR VALUE USING

SIGNIFICANT

UNOBSERVABLE

INPUTS (LEVEL 3) | | BALANCE

AS OF

12/31/20 | | | NET

PURCHASES | | | NET

SALES | | | NET

REALIZED

GAINS/

(LOSSES) | | | NET

UNREALIZED

APPRECIATION

(DEPRECIATION) | | | TRANSFERS

IN (OUT)

OF

LEVEL 3 | | | BALANCE

AS OF

12/31/21 | |

Common Stocks | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Intellectual Property | | $ | 109 | | | $ | — | | | $ | — | | | $ | — | | | $ | (55 | ) | | $ | — | | | $ | 54 | |

Preferred Stocks | | | 335 | | | | — | | | | — | | | | — | | | | (87 | ) | | | — | | | | 248 | |

Total | | $ | 444 | | | $ | — | | | $ | — | | | $ | — | | | $ | (142 | ) | | $ | — | | | $ | 302 | |

As of the year ended December 31, 2021, these investments were valued in accordance with procedures approved by the Board of Trustees. These investments did not have a material impact on the Fund’s net assets and, therefore, disclosure of unobservable inputs used in formulating valuations is not presented.

SHARE VALUATION — The net asset value (“NAV”) per share of each Fund is calculated by dividing the net assets of the Fund (i.e., the sum of the value of the securities held by the Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses)) by the total number of shares outstanding of the Fund, rounded to the nearest cent. A Fund’s shares will not be priced on the days on which the NYSE is closed for trading. The offering and redemption price per share of each Fund is equal to a Fund’s NAV per share.

INVESTMENT INCOME — Dividend income is recorded in the ex-dividend date. Interest income is accrued as earned. Discounts and premiums on securities purchased are amortized over the lives of the respective securities. Other non-cash dividends are recognized as investment income at the fair value of the property received. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

CASH AND CASH EQUIVALENTS — The Funds consider liquid assets deposited with a bank, money market funds, and certain short-term debt instruments with maturities of 3 months or less to be cash equivalents. These investments represent amounts held with financial institutions that are readily accessible to pay Fund expenses or purchase investments. Cash and cash equivalents are valued at cost plus accrued interest, which approximates market value.

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2021

FOREIGN SECURITIES — Each Fund may invest in companies that trade on U.S. exchanges as American Depositary Receipts (“ADRs”), on foreign exchanges, or on foreign over-the- counter markets. Investing in the securities of foreign companies exposes your investment in a Fund to risk. Foreign stock markets tend to be more volatile than the U.S. market due to economic and/or political instability and the regulatory conditions in some countries. In addition, some of the securities in which the Fund may invest may be denominated in foreign currencies, the value of which may decline against the U.S. dollar. An investment in foreign securities may be subject to high levels of foreign taxation, including foreign taxes withheld at the source. Neither Fund isolates the portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Reported net realized foreign exchange gains or losses arise from sales of portfolio securities, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Funds’ books and the U.S. dollar equivalent of the amounts actually received or paid.

OPTIONS — The Funds are subject to equity price risk in the normal course of pursuing their investment objectives and may enter into options written to hedge against changes in the value of equities. The Funds may purchase put and call options to attempt to provide protection against adverse price effects from anticipated changes in prevailing prices of securities or stock indices. The Funds may also write put and call options. When a Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current fair value of the option written. Premiums received from writing options that expire unexercised are treated by the Fund on the expiration date as realized gains from investments. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or, if the premium is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security or currency in determining whether the Fund has realized a gain or loss. The Fund as writer of an option bears the market risk of an unfavorable change in the price of the security underlying the written option. The net realized gains/(loss) from written options for the year ended December 31, 2021 can be found on the Statements of Operations.

The average volume of derivatives during the year ended December 31, 2021 is as follows:

| | | WRITTEN OPTIONS

(Value) | |

Firsthand Technology Opportunities Fund | | $ | 10,108 | |

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2021

DISTRIBUTIONS TO SHAREHOLDERS — Each Fund expects to distribute its net investment income and net realized gains, if any, annually. Distributions from net investment income and capital gains are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from accounting principles generally accepted in the United States.

SHORT POSITIONS — Firsthand Alternative Energy Fund may sell securities short for economic hedging purposes. Short sales are transactions in which the Fund sells a security it does not own, in anticipation of a decline in the market value of that security. To initiate such a transaction, the Fund must borrow the security to deliver to the buyer upon the short sale; the Fund is then obligated to replace the security borrowed by purchasing it in the open market at some later date, completing the transaction. The Fund is liable for any dividends payable on securities while those securities are in a short position.

The Fund will incur a loss if the market price of the security increases between the date of the short sale and the date on which the Fund replaces the borrowed security. The Fund will realize a gain if the security declines in value between those dates.

All short sales must be fully collateralized. The Fund maintains the collateral in a segregated account consisting of cash, cash equivalents and/or liquid securities sufficient to collateralize the market value of its short positions. Typically, the segregated cash with brokers and other financial institutions exceeds the minimum required. Deposits with brokers for securities sold short are invested in money market instruments. The Fund did not invest in short sales for the year ended December 31, 2021.

Reclassification of Capital Accounts — Permanent book and tax differences resulted in reclassifications for the year ended December 31, 2021 as follows:

| | | INCREASE (DECREASE) | |

| | | Paid-in-Capital | | | Distributable

Earnings | |

Firsthand Technology Opportunities Fund | | $ | (1,460,697 | ) | | $ | 1,460,697 | |

Firsthand Alternative Energy Fund | | | (348,389 | ) | | | 348,389 | |

These reclassifications, related to different treatment of current year write off of net operating loss, and has no effect on net asset value per share.

SECURITY TRANSACTIONS — Security transactions are accounted for no later than one business day following the trade date, however, for financial reporting purposes, security transactions are accounted for on trade date. Realized gains and losses are calculated on a specific identification basis.

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2021

ESTIMATES — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

FEDERAL INCOME TAX — Each Fund has elected, and intends to qualify annually, for the special tax treatment afforded regulated investment companies under the Internal Revenue Code of 1986, as amended (the “Code”). As provided in the Code, in any fiscal year in which a Fund so qualifies and distributes at least 90% of its taxable net income, the Fund (but not the shareholders) will be relieved of federal income tax on the income distributed. Accordingly, no provision for income taxes has been made. To avoid imposition of the excise tax applicable to regulated investment companies, each Fund intends to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98% of its net realized capital gains (earned during the 12 months ended October 31) plus undistributed amounts, if any, from prior years.

The tax character of distributions paid for the year ended December 31, 2021 and 2020 was as follows:

| | | FIRSTHAND TECHNOLOGY

OPPORTUNITIES FUND | |

| | | 2021 | | | 2020 | |

From ordinary income | | $ | 665,672 | | | $ | 6,192,164 | |

From long-term capital gains | | $ | 17,637,506 | | | $ | 42,834,199 | |

The following information is based upon the federal income tax cost of portfolio investments as of December 31, 2021.

| | | FIRSTHAND

TECHNOLOGY

OPPORTUNITIES FUND | | | FIRSTHAND

ALTERNATIVE

ENERGY FUND | |

Gross unrealized appreciation | | $ | 154,496,436 | | | $ | 6,746,632 | |

Gross unrealized depreciation | | | (22,703,990 | ) | | | (1,243,018 | ) |

Net unrealized appreciation (depreciation) | | $ | 131,792,446 | | | $ | 5,503,614 | |

Federal income tax cost | | $ | 147,986,024 | | | $ | 10,592,010 | |

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2021

As of December 31, 2021, the Funds had capital loss carryforwards for federal income tax purposes as follows:

| | | SHORT-TERM

NO EXPIRATION | | | LONG-TERM

NO EXPIRATION | | | TOTAL | |

TEFQX* | | $ | — | | | $ | — | | | $ | — | |

ALTEX* | | | (470,132 | ) | | | (293,246 | ) | | | (763,378 | ) |

* | TEFQX: Firsthand Technology Opportunities Fund; ALTEX: Firsthand Alternative Energy Fund. |

Components of Distributable Earnings (as of December 31, 2021)

| | | FIRSTHAND

TECHNOLOGY

OPPORTUNITIES FUND | | | FIRSTHAND

ALTERNATIVE

ENERGY FUND | |

Net Unrealized Appreciation (Depreciation)* | | $ | 131,792,446 | | | $ | 5,503,614 | |

Undistributed Ordinary Income | | | — | | | | — | |

Undistributed Long Term Capital Gains | | | 16,898,086 | | | | — | |

Qualified Late Year Losses Deferred** | | | — | | | | — | |

Other Temporary Differences | | | — | | | | — | |

Accumulated Capital Loss Carryforward | | | — | | | | (763,378 | ) |

Total Distributable Earnings/Accumulated Loss | | $ | 148,690,532 | | | $ | 4,740,236 | |

* | The differences between book-basis and tax-basis unrealized appreciation (depreciation) is attributable primarily to tax deferral of losses on wash sales. |

** | Under current tax law, capital and currency losses realized after October 31 and prior to the Fund’s fiscal year end may be deferred as occurring on the first day of the following fiscal year. |

The Funds are subject to tax provisions that establish a minimum threshold for recognizing, and a system for measuring, the benefits of a tax position taken or expected to be taken in a tax return. Taxable years ending 2021, 2020, 2019 and 2018 remain open to federal and state audit. As of December 31, 2021, management has evaluated the application of these provisions to the Funds, and has determined that no provision for income tax is required in the Funds’ financial statements for uncertain tax provisions.

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2021

3. INVESTMENT TRANSACTIONS (EXCLUDING SHORT-TERM INVESTMENTS) WERE AS FOLLOWS FOR THE YEAR ENDED DECEMBER 31, 2021

| | | FIRSTHAND

TECHNOLOGY

OPPORTUNITIES FUND | | | FIRSTHAND

ALTERNATIVE

ENERGY FUND | |

Purchase of investment securities | | $ | 59,368,040 | | | $ | 5,059,556 | |

Proceeds from sales and maturities of investment securities | | $ | 94,116,431 | | | $ | 3,607,330 | |

4. INVESTMENT ADVISORY AND ADMINISTRATION AGREEMENTS; CERTAIN TRUSTEES AND OFFICERS OF THE TRUST ARE ALSO OFFICERS OF THE INVESTMENT ADVISER AND BNY MELLON

Certain trustees and officers of the Trust are also officers of the Investment Adviser or BNY Mellon. BNY Mellon serves as the sub-administrator, investment accounting agent, and shareholder servicing and transfer agent.

INVESTMENT ADVISORY AGREEMENT