UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08268

Firsthand Funds

(Exact name of registrant as specified in charter)

150 Almaden Blvd., Suite 1250

San Jose, CA 95113

(Address of principal executive offices) (Zip code)

Firsthand Capital Management, Inc.

150 Almaden Blvd., Suite 1250

San Jose, CA 95113

(Name and address of agent for service)

Registrant's telephone number, including area code: (408) 624-9527

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the shareholder reports of the Firsthand Funds (each, a “Fund” and, collectively, the “Funds”) will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds, or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website, www.firsthandfunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Fund, or from your financial intermediary, electronically anytime by contacting your financial intermediary or, if you are a direct investor, by calling 1-888-884-2675.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 1-888-884-2675 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held with the fund complex if you invest directly with a Fund.

CONTENTS

| | |

Performance Summary | 2 |

President’s Letter | 5 |

Shareholder Fee Example | 8 |

Performance and Portfolio Discussion | 10 |

Audit Letter | 16 |

Portfolio of Investments | 17 |

Statements of Assets and Liabilities | 23 |

Statements of Operations | 24 |

Statements of Changes in Net Assets | 25 |

Financial Highlights | 27 |

Notes to Financial Statements | 29 |

Additional Information | 42 |

Performance Summary

Period Returns (Average Annual Total Returns as of 12/31/20)

FUND | 1-year | 3-year | 5-year | 10-year | Gross

expense

ratio* |

Firsthand Technology Opportunities Fund | 96.52% | 38.11% | 34.12% | 21.11% | 1.87% |

Firsthand Alternative Energy Fund | 83.88% | 28.16% | 19.46% | 6.91% | 2.15% |

NASDAQ Composite Index | 44.92% | 24.39% | 22.12% | 18.46% | ● |

S&P 500 Index | 18.40% | 14.18% | 15.22% | 13.88% | ● |

WilderHill Clean Energy Index | 203.78% | 60.50% | 35.05% | 7.98% | ● |

Returns Since Inception (Average Annual Total Returns as of 12/31/20)

FUND (inception Date) | Average

Annual

Total

Returns | NASDAQ

composite

index | s&p 500

index | wilderhill

clean

energy

index |

Firsthand Technology Opportunities Fund (09/30/99) | 6.91% | 8.60% | 7.23% | ● |

Firsthand Alternative Energy Fund (10/29/07) | 2.69% | 13.50% | 9.31% | -0.96% |

* | After fee waivers, Firsthand Technology Opportunities Fund’s total net operating expenses are 1.86% and Firsthand Alternative Energy Fund’s total net operating expenses are 1.98%. Please see the Funds’ prospectus for more information about fund expenses. |

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

The Nasdaq Composite Index (NASDAQ) is a capitalization-weighted index of all common stocks listed with NASDAQ. The Standard & Poor’s 500 Index (S&P 500) is a market-weighted index of 500 stocks of well-established companies. Each index represents an unmanaged, broad-based basket of stocks. These indices are typically used as benchmarks for overall market performance. The WilderHill Clean Energy Index is a market-weighted index of 58 companies in the cleaner fuel, energy conversion, energy storage, greener utilities, power delivery and conservation, and renewable energy harvesting sectors. The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. You cannot invest directly in an index.

Each Fund may invest in small-capitalization companies and Initial Public Offerings (“IPOs”). These investments will be more volatile than investments in large-capitalization companies and loss of principal could be greater. The Funds may invest in foreign securities, which will be subject to greater risks than investing in domestic securities. Because the Funds are not diversified, they can take larger positions in fewer companies, increasing their risk profile. The Funds invest in several industries within the technology sector and the relative weightings of these industries in a Fund’s portfolio may change at any time.

Holdings by Industry - % of Net Assets (as of 12/31/20)

INDUSTRY | FIRSTHAND technology

opportunities fund | FIRSTHAND alternative

energy fund |

Advanced Materials | ● | 1.2% |

Aerospace | ● | 0.4% |

Agriculture | ● | 0.0% |

Alternative Energy SPAC | 1.4% | 18.1% |

Biotech | 0.8% | 1.3% |

Communications | 0.4% | ● |

Consumer Electronics | 25.7% | ● |

Consumer Staples | 0.1% | ● |

Defense & Aerospace | 2.4% | ● |

Education | 9.8% | ● |

Electrical Equipment | ● | 1.0% |

Energy Efficiency | ● | 3.5% |

Engineering Service | ● | 1.9% |

Industrials | ● | 0.2% |

Intellectual Property | ● | 0.0% |

Internet | 8.9% | ● |

Materials | ● | 3.1% |

Networking | 3.7% | ● |

Other Electronics | 6.0% | 6.5% |

Renewable Energy | 5.0% | 35.7% |

Semiconductor Equipment | 2.7% | ● |

Semiconductors | 0.1% | 0.7% |

Services | 0.0% | ● |

Software | 32.3% | ● |

Waste & Environment Service | ● | 0.9% |

Investment Company | 0.9% | 23.3% |

Net Other Assets/(Liabilities) | (0.2)% | 2.2% |

Portfolio holdings are subject to change.

President’s Letter

Fellow Shareholders,

There is no doubt that 2020 will be remembered by many as a year to forget. Work-from-home, learn-from-home, and dine-at-home became the norm for many Americans and, unfortunately, record unemployment claims and business failures soon followed. Despite the economic fallout from the global COVID-19 pandemic, U.S. equity markets performed well in 2020. For the year ended December 31, 2020, the Nasdaq Composite Index was up 44.92% and the S&P 500 Index gained 18.40%. I am pleased to report that Firsthand Technology Opportunities Fund outperformed its benchmarks, with a gain of 96.52% for the period. Firsthand Alternative Energy Fund had a great year as well, posting a gain of 83.88% for the period. However, the Fund underperformed its primary benchmark, the WilderHill Clean Energy Index, which gained 203.78% during the period.

Although many technology companies reported improving fundamentals in 2020, we believe much of the credit for the broad stock market rally during the year goes to the monetary stimulus measures enacted by central banks around the world. Lower interest rates encourage more spending, and typically result in higher prices for assets, including stocks.

One noteworthy trend in the market in 2020 was the rise of the special purpose acquisition company (“SPAC”). These so-called “blank check” companies are formed and taken public for the purpose of acquiring a suitable target company within an allotted time period, usually 18 to 24 months. By merging with a SPAC, a private company can access the public markets while bypassing the traditional initial public offering (IPO). In 2020, SPAC IPOs raised more capital than traditional IPOs for the first time ever. This wave of SPACs portends a shift in the way companies go public for the foreseeable future. It is a trend that bears watching.

Firsthand Technology Opportunities Fund

We executed a significant repositioning of the portfolio in 2020, including the liquidation of our remaining holdings in Alphabet (GOOG), Amazon (AMZN), Facebook (FB), Microsoft (MSFT), and NVIDIA (NVDA). Our goal was to replace these holdings with companies that would stand to benefit from the shift in behaviors brought about by shelter-in-place, remote work, and remote learning mandates. To that end, we established new positions in stocks such as Docusign (DOCU), Peloton (PTON), Pinterest (PINS), and Slack (WORK).

Cord cutting accelerated in 2020, and Netflix (NFLX) and Roku (ROKU) were the primary beneficiaries in the portfolio. Roku, in fact, was the largest contributor to the Fund’s performance during the year. More time at home led to greater user engagement for companies such as Peloton and Pinterest as well, and their stocks were also among our top performers for the year.

PRESIDENT’S LETTER - continued

Companies with solutions for remote learning and remote work also enjoyed accelerated adoption of their technologies. Education technology company Chegg (CHGG) was among the biggest contributors to the Fund’s performance. While we failed to catch the Zoom Video Communications (ZM) wave, several of our remote work-related companies, including Docusign (DOCU), Domo (DOMO), and Zscaler (ZS), posted stock price gains of 200%, 194% and 329%, respectively, in 2020.

Firsthand Alternative Energy Fund

Solar stocks performed well in 2020. Despite the COVID pandemic, the U.S. was expected to add a record 19 gigawatts (GW) of new solar photovoltaic (PV) capacity in 2020. Utility-scale PV installations were the primary driver of the new capacity additions, though the residential market appears to have rebounded from a Q2 slump to post gains for the year as well. Our holdings in SolarEdge (SEDG), Ephase (ENPH), and SunRun (RUN) were among the biggest gainers for the Fund this year.

It appears likely that global wind power installations set another record in 2020, with the Global Wind Energy Council expecting 71.3GW of capacity added during the year, up from 60.4GW in 2019. Our investment in Vestas Wind Systems (VWSYF) performed well, with the company’s stock gaining well over 100% for the year.

Cree (CREE) was another outstanding performer for the Fund in 2020. The company announced in October that it plans to sell its LED products business to SMART Global Holdings, Inc. (SGH). By divesting this legacy business, Cree will become more focused on providing silicon carbide and gallium nitride materials and components to some of the fastest-growing application markets, including electric vehicles, 5G wireless communications, and renewable energy generation and storage.

With an eye toward the cleantech companies of tomorrow, we purchased shares in four SPACs late in the year: Climate Change Crisis Real Impact I Acquisition Corp. (CLII), Qell Acquisition Corp. (QELL), Spring Valley Acquisition Corp. (SV), Decarbonization Plus Acquisition Corp. (DCRB). These SPAC investments, by their nature, give us the right to redeem our shares prior to any merger transaction. This effectively gives us the right of first refusal on newly-listed cleantech companies, with the option to recover our initial investment via redemption. As I write this, both Climate Change Crisis Real Impact I Acquisition Corp. and Decarbonization Plus Acquisition Corp. have recently announced plans to merge with companies in the electric vehicle industry.

PRESIDENT’S LETTER - continued

Looking Ahead

There is reason to be cautiously optimistic now in early 2021 as the global rollout of COVID-19 vaccines is well underway. While it will take many months, and possibly many quarters, for the economy to return to some sense of normalcy, I take comfort in the resilience displayed by global consumers and businesses throughout this crisis. As always, technology companies continue to bring new capabilities to market, and we will continue to follow these developments closely and invest in the most promising opportunities in the sector.

Thank you for your continued investment in Firsthand Funds.

Sincerely,

Kevin Landis

President, Firsthand Funds

Shareholder Fee Example (UNAUDITED)

Example—In general, mutual fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees, and exchange fees; and (2) ongoing costs, including management fees, 12b-1 distribution and service fees, non-12b-1 service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Note that Firsthand Funds (“Trust”) does not charge transaction fees for 12b-1 distribution and service fees, though you may incur transaction fees if you purchase shares through a broker.

The example on the following page is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2020 through December 31, 2020.

Actual Expenses—The section of the table at right entitled “Actual” provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the section entitled “Actual” under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. If your account is an IRA or other tax-qualified savings plan, your expenses may also have included a $10 annual fee. In either case, the amount of any fee paid through your account would increase the estimate of expenses you paid during the period and decrease your ending account value.

Hypothetical Example for Comparison Purposes—The section of the table at right entitled “Hypothetical” provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate your actual ending account balance or the expenses you paid for the period. However, you may use this information to compare the ongoing costs of investing in the Trust to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. As in the case of the actual expense example, if your account is subject to an IRA fee, the amount of the fee paid through your account would increase the hypothetical expenses you would have paid during the period and decrease the hypothetical ending account value.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The examples also assume all dividends and distributions have been reinvested.

SHAREHOLDER FEE EXAMPLE (UNAUDITED) - continued

Firsthand Technology Opportunities Fund

| BEGINNING

ACCOUNT VALUE

7/1/20 | ENDING

ACCOUNT

VALUE

12/31/20 | EXPENSES PAID

DURING

PERIOD*

7/1/20 - 12/31/20 | ANNUALIZED

EXPENSE RATIO |

Actual | $1,000 | $ 1,652.00 | $ 12.27 | 1.84% |

Hypothetical** | $1,000 | $ 1,015.89 | $ 9.32 | 1.84% |

Firsthand Alternative Energy Fund

| BEGINNING

ACCOUNT VALUE

7/1/20 | ENDING

ACCOUNT

VALUE

12/31/20 | EXPENSES PAID

DURING

PERIOD*

7/1/20 - 12/31/20 | ANNUALIZED

EXPENSE RATIO |

Actual | $1,000 | $ 1,794.40 | $ 13.91 | 1.98% |

Hypothetical** | $1,000 | $ 1,015.18 | $ 10.03 | 1.98% |

* | Expenses are calculated by multiplying the Fund’s annualized expense ratio listed above by the average account value over the period and multiplying that number by 184/366 (to reflect the one-half year period). |

** | 5% return per year before expenses. |

| The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial Intermediaries, or other financial institutions. |

FIRSTHAND TECHNOLOGY OPPORTUNITIES FUND

Performance and Portfolio Discussion

How did the Fund perform in 2020?

Firsthand Technology Opportunities Fund (TEFQX) posted a gain of 96.52% in 2020 versus a gain of 44.92% for the NASDAQ Composite Index and a 18.40% gain for the S&P 500 Index. For the six months ended December 31, 2020, Firsthand Technology Opportunities Fund was up 65.20% compared to gains of 28.67% and 22.16% for the NASDAQ Composite Index and the S&P 500 Index, respectively.

Which industries had the greatest impact on the Fund’s performance?

For the period ended December 31, 2020, software companies represented the portfolio’s largest industry weighting, followed by holdings in the internet and networking industries. The portfolio’s exposure to the consumer electronics and software industries contributed most to the Fund’s outperformance versus its primary benchmark in 2020.

Which individual holdings were the largest contributors to the Fund’s performance?

After being the biggest detractor from fund performance in the first half of the year, Roku (ROKU) ended up as the top contributor to fund performance for the full year. The video streaming hardware and software company was a beneficiary of the stay-at-home culture imposed by COVID-19 and registered strong revenue growth throughout the year. The company’s highly profitable platform business continues to grow more quickly than its player business, and the Roku platform surpassed 50 million active accounts in late 2020. Roku’s shares finished the year up more than 145%.

Another leading contributor to the Fund’s performance during the year was education technology company Chegg (CHGG). The company benefited in 2020 from the growth in online learning driven by the ongoing pandemic, and its stock rose nearly 140% during the year. Chegg reported that its Chegg Services segment enjoyed accelerated revenue growth in 2020 and now accounts for approximately 80% of company revenues.

Shares of cloud security vendor Zscaler (ZS) rose a whopping 329% in 2020, and the company was the third largest contributor to the Fund’s performance during the year. Zscaler reported sequential revenue growth in each quarter of 2020, and its stock rose sharply in December in response to the SolarWinds hack by Russian interests.

Which holdings were the greatest detractors from the Fund’s performance?

The largest detractor from Fund performance for the period was the Fund’s hedging strategy, designed to soften the blow of negative market movements during the volatile March/April time period. As the market rallied in April, the Fund realized losses resulting from the expiration of various options.

FIRSTHAND TECHNOLOGY OPPORTUNITIES FUND - continued

Performance and Portfolio Discussion

Our holdings in Match Group (MTCH) were another significant detractor from fund performance in 2020. While the Fund realized a gain from the liquidation of our Match Group position in March, the stock was sold in the midst of the market downturn at prices below its 2019 year-end close.

The Fund’s third largest detractor from fund performance during the quarter was Revasum (ASX: RVS). The California-based company, whose shares are listed on the Australian Securities Exchange, struggled with declining revenues, when compared to 2019, and endured the departure of both its CEO and CFO during the year. In November, Revasum announced the first shipment of its flagship 6EZ silicon carbide wafer polisher to a customer in North America. While the stock rebounded sharply on this announcement, it was not enough to recover the losses sustained earlier in the year.

Fund Performance and Holdings Information (as of 12/31/20)

Firsthand Technology Opportunities Fund vs. Market Indices

| FIRSTHAND

TECHNOLOGY

OPPORTUNITIES FUND | NASDAQ

COMPOSITE INDEX | S&P 500 INDEX |

Since Inception (9/30/99) | 6.91% | 8.60% | 7.23% |

10-year | 21.11% | 18.46% | 13.88% |

5-year | 34.12% | 22.12% | 15.22% |

3-year | 38.11% | 24.39% | 14.18% |

1-year | 96.52% | 44.92% | 18.40% |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

HOLDINGS BY INDUSTRY* | % NET ASSETS | | TOP 10 HOLDINGS** | % NET ASSETS |

Software | 32.3% | | Roku, Inc. | 21.6% |

Consumer Electronics | 25.7% | | Chegg, Inc. | 8.4% |

Education | 9.8% | | Cree, Inc. | 6.0% |

Internet | 8.9% | | Zscaler, Inc. | 5.4% |

Other Electronics | 6.0% | | Pinterest, Inc. | 4.7% |

Renewable Energy | 5.0% | | Domo, Inc. | 4.3% |

Networking | 3.7% | | Peloton Interactive, Inc. | 4.1% |

Semiconductor Equipment | 2.7% | | Nutanix, Inc. | 3.7% |

Defense & Aerospace | 2.4% | | Slack Technologies, Inc. | 3.0% |

Alternative Energy SPAC | 1.4% | | Twilio, Inc. | 2.8% |

Net Other Assets and Liabilities | 2.1% | | | |

* | Based on percentage of net assets as of 12/31/20.** Top 10 stock holdings total 64.0% of net assets. These holdings are current as of 12/31/20, and may not be representative of current or future investments. |

FIRSTHAND ALTERNATIVE ENERGY FUND

Performance and Portfolio Discussion

How did the Fund perform in 2020?

Firsthand Alternative Energy Fund (ALTEX) posted an 83.88% gain in 2020 versus a gain of 203.78% for the WilderHill Clean Energy Index and a 18.40% gain for the S&P 500 Index. For the six months ended December 31, 2020, Firsthand Alternative Energy Fund was up 79.44% compared to gains of 154.24% and 22.16% for the WilderHill Clean Energy Index and the S&P 500 Index, respectively.

Which industries had the greatest impact on the Fund’s performance?

For the period ended December 31, 2020, renewable energy companies represented the portfolio’s largest industry weighting, followed by alternative energy SPACs and other electronics companies. Our relative underweighting of electric vehicle-related stocks contributed most to the Fund’s underperformance versus its primary benchmark in 2020.

Which individual holdings were the largest contributors to the Fund’s performance?

Solar stocks had a remarkable year in 2020, and the two largest contributors to Fund performance for the year were SolarEdge (SEDG) and Enphase (ENPH), both manufacturers of electronic components for solar system installations. Despite revenue growth of just 9% for the first nine months of 2020, SolarEdge stock climbed 236% during the year. For its part, Enphase reported 23% revenue growth for the first nine months of the year, and enjoyed stock price appreciation of over 570% in 2020.

In October, SunRun (RUN) completed its previously-announced acquisition of Vivint Solar. The combined entity is now the largest residential solar installer in the U.S., in terms of megawatts deployed, and continued to achieve increasing revenues in 2020, despite the COVID pandemic. We held shares in both Vivint and SunRun prior to the business combination and together those holdings were the third largest contributor to the Fund’s performance in 2020.

Another significant contributor to the Fund’s performance was Cree (CREE), a supplier of semiconductor materials and devices. The company’s stock was up more than 125% during the year, and rallied more than 66% in Q4 alone, after reporting better than expected quarterly revenues and earnings in late October.

Which holdings were the greatest detractors from the Fund performance?

Only a few of our portfolio holdings declined in 2020, and those losses were relatively modest. We liquidated our position in conglomerate 3M (MMM) in March, after the stock had declined more than 20% to start the year. Similarly, we sold out of our position in Linde (LIN) after shares of the industrial gas supplier slumped along with the broad market in the first quarter of the year.

FIRSTHAND ALTERNATIVE ENERGY FUND - continued

Performance and Portfolio Discussion

The third-largest detractor from the Fund’s performance during the year was Advanced Emissions Solutions (ADES), a provider of emission reduction technologies. Through the first nine months of 2020, the company suffered a 20% decline in revenues, compared with the same period in 2019, and swung to a loss for the period. The company’s stock fell more than 45% during 2020.

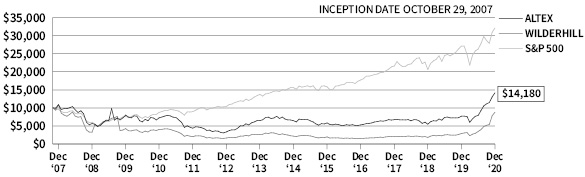

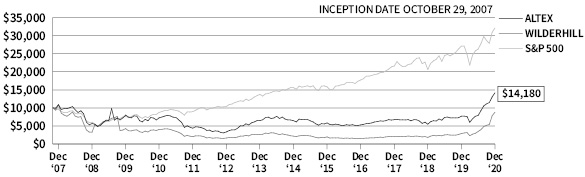

Fund Performance and Holdings Information (as of 12/31/20)

Firsthand Alternative Energy Fund vs. Market Indices

| FIRSTHAND

ALTERNATIVE

ENERGY FUND | WILDERHILL CLEAN

ENERGY INDEX | S&P 500 INDEX |

Since Inception (10/29/07) | 2.69% | -0.96% | 9.31% |

10-year | 6.91% | 7.98% | 13.88% |

5-year | 19.46% | 35.05% | 15.22% |

3-year | 28.16% | 60.50% | 14.18% |

1-year | 83.88% | 203.78% | 18.40% |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

HOLDINGS BY INDUSTRY* | % NET ASSETS | | TOP 10 HOLDINGS** | % NET ASSETS |

Renewable Energy | 35.7% | | SolarEdge Technologies, Inc. | 11.9% |

Alternative Energy SPAC | 18.1% | | Enphase Energy, Inc. | 4.7% |

Other Electronics | 6.5% | | Cree, Inc. | 4.6% |

Energy Efficiency | 3.5% | | Sunrun, Inc. | 4.3% |

Materials | 3.1% | | Qell Acquisition Corp. | 3.9% |

Engineering Service | 1.9% | | Vestas Wind Systems A.S. | 3.8% |

Biotech | 1.3% | | Decarbonization Plus Acquisition Corp. | 3.7% |

Advanced Materials | 1.2% | | Spring Valley Acquisition Corp. | 3.6% |

Net Other Assets and Liabilities | 28.7% | | Sustainable Opportunities Acquisition Corp. | 3.5% |

| | | | Climate Change Crisis Real Impact I Acquisition Corp. | 3.4% |

* | Based on percentage of net assets as of 12/31/20. ** Top 10 stock holdings total 47.4% of net assets. These holdings are current as of 12/31/20, and may not be representative of current or future investments. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of Firsthand Funds

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Firsthand Technology Opportunities Fund and Firsthand Alternative Energy Fund, each a series of Firsthand Funds (the “Funds”), including the schedules of investments, as of December 31, 2020, the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of Firsthand Funds as of December 31, 2020, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the Funds’ auditor since 1997.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Funds are not required to have, nor were we engaged to perform, an audit of their internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures also included confirmation of securities owned as of December 31, 2020 by correspondence with the custodian and company. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

February 23, 2021

FIRSTHAND TECHNOLOGY OPPORTUNITIES FUND

Portfolio of Investments, December 31, 2020

| | SHARES | | | MARKET VALUE | |

COMMON STOCKS — 99.2% ($365,815,050) | | | | | | | | |

Alternative Energy SPAC — 1.3% ($4,916,000) | | | | | | | | |

Qell Acquisition Corp., Class A* | | | 400,000 | | | $ | 4,916,000 | |

Biotech — 0.8% ($2,893,615) | | | | | | | | |

CytoDyn, Inc.* | | | 322,730 | | | | 1,739,515 | |

GW Pharmaceuticals PLC ADR* | | | 10,000 | | | | 1,154,100 | |

Communications — 0.4% ($1,306,000) | | | | | | | | |

ViaSat, Inc.* | | | 40,000 | | | | 1,306,000 | |

Consumer Electronics — 25.7% ($94,856,800) | | | | | | | | |

Peloton Interactive, Inc., Class A* | | | 100,000 | | | | 15,172,000 | |

Roku, Inc.* | | | 240,000 | | | | 79,684,800 | |

Consumer Staples — 0.1% ($279,500) | | | | | | | | |

Blue Apron Holdings, Inc., Class A* | | | 50,000 | | | | 279,500 | |

Defense & Aerospace — 2.4% ($8,898,600) | | | | | | | | |

Kratos Defense & Security Solutions, Inc.* | | | 240,000 | | | | 6,583,200 | |

Maxar Technologies, Inc. | | | 60,000 | | | | 2,315,400 | |

Education — 9.8% ($35,913,500) | | | | | | | | |

2U, Inc.* | | | 130,000 | | | | 5,201,300 | |

Chegg, Inc.* | | | 340,000 | | | | 30,712,200 | |

Internet — 8.9% ($32,836,450) | | | | | | | | |

Akamai Technologies, Inc.* | | | 50,000 | | | | 5,249,500 | |

Netflix, Inc.* | | | 15,000 | | | | 8,110,950 | |

PayPal Holdings, Inc.* | | | 10,000 | | | | 2,342,000 | |

Pinterest, Inc., Class A* | | | 260,000 | | | | 17,134,000 | |

Networking — 3.7% ($13,704,100) | | | | | | | | |

Nutanix, Inc., Class A* | | | 430,000 | | | | 13,704,100 | |

Other Electronics — 6.0% ($22,239,000) | | | | | | | | |

Cree, Inc.* | | | 210,000 | | | | 22,239,000 | |

Renewable Energy — 5.0% ($18,347,100) | | | | | | | | |

Enphase Energy, Inc.* | | | 50,000 | | | | 8,773,500 | |

SolarEdge Technologies, Inc.* | | | 30,000 | | | | 9,573,600 | |

see accompanying notes to financial statements

FIRSTHAND TECHNOLOGY OPPORTUNITIES FUND - continued

Portfolio of Investments, December 31, 2020

| | SHARES | | | MARKET VALUE | |

Semiconductor Equipment — 2.7% ($9,999,860) | | | | | | | | |

Pivotal Systems Corp.* | | | 11,150,000 | | | $ | 8,080,327 | |

Revasum, Inc.* | | | 7,113,796 | | | | 1,919,533 | |

Semiconductors — 0.1% ($327,300) | | | | | | | | |

ON Semiconductor Corp.* | | | 10,000 | | | | 327,300 | |

Services — 0.0% ($147,600) | | | | | | | | |

Net 1 UEPS Technologies, Inc.* | | | 30,000 | | | | 147,600 | |

Software — 32.3% ($119,149,625) | | | | | | | | |

Adobe Systems, Inc.* | | | 10,000 | | | | 5,001,200 | |

Bill.com Holdings, Inc.* | | | 50,000 | | | | 6,825,000 | |

Cloudflare, Inc., Class A* | | | 100,000 | | | | 7,599,000 | |

Coupa Software, Inc.* | | | 20,000 | | | | 6,778,200 | |

DocuSign, Inc.* | | | 30,000 | | | | 6,669,000 | |

Domo, Inc., Class B* | | | 250,000 | | | | 15,942,500 | |

Guidewire Software, Inc.* | | | 22,500 | | | | 2,896,425 | |

MongoDB, Inc.* | | | 10,000 | | | | 3,590,400 | |

Okta, Inc.* | | | 10,000 | | | | 2,542,600 | |

Palo Alto Networks, Inc.* | | | 10,000 | | | | 3,553,900 | |

Proofpoint, Inc.* | | | 20,000 | | | | 2,728,200 | |

Slack Technologies, Inc., Class A* | | | 260,000 | | | | 10,982,400 | |

Splunk, Inc.* | | | 20,000 | | | | 3,397,800 | |

Twilio, Inc., Class A* | | | 30,000 | | | | 10,155,000 | |

Workday, Inc., Class A* | | | 20,000 | | | | 4,792,200 | |

Zendesk, Inc.* | | | 40,000 | | | | 5,724,800 | |

Zscaler, Inc.* | | | 100,000 | | | | 19,971,000 | |

WARRANTS — 0.1% ($419,996) | | | | | | | | |

Alternative Energy SPAC — 0.1% ($419,996) | | | | | | | | |

Qell Acquisition Corp. * | | | 133,332 | | | | 419,996 | |

see accompanying notes to financial statements

FIRSTHAND TECHNOLOGY OPPORTUNITIES FUND - continued

Portfolio of Investments, December 31, 2020

| | SHARES | | | MARKET VALUE | |

INVESTMENT COMPANY — 0.9% ($3,275,968) | | | | | | | | |

Fidelity Investments Money Market Fund - Treasury Portfolio(1) | | | 3,275,968 | | | $ | 3,275,968 | |

Total Investments (Cost $143,295,985) — 100.2% | | | | | | | 369,511,014 | |

Liabilities in excess of other assets — (0.2)% | | | | | | | (816,037 | ) |

| | | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 368,694,977 | |

* | Non-income producing security. |

(1) | The Fidelity Investments Money Market Fund invests primarily in U.S. Treasury Securities. |

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

see accompanying notes to financial statements

FIRSTHAND ALTERNATIVE ENERGY FUND

Portfolio of Investments, December 31, 2020

| | SHARES | | | MARKET VALUE | |

COMMON STOCKS — 73.9% ($13,834,741) | | | | | | | | |

Advanced Materials — 1.2% ($232,560) | | | | | | | | |

Corning, Inc. | | | 6,460 | | | $ | 232,560 | |

Aerospace — 0.4% ($71,510) | | | | | | | | |

Raytheon Technologies Corp. | | | 1,000 | | | | 71,510 | |

Agriculture — 0.0% ($0) | | | | | | | | |

Growlife, Inc.* | | | 1 | | | | 0 | |

Alternative Energy SPAC — 17.5% ($3,268,800) | | | | | | | | |

Climate Change Crisis Real Impact I Acquisition Corp., Class A* | | | 60,000 | | | | 642,600 | |

Decarbonization Plus Acquisition Corp., Class A* | | | 60,000 | | | | 636,000 | |

Qell Acquisition Corp., Class A* | | | 60,000 | | | | 737,400 | |

Spring Valley Acquisition Corp., Class A* | | | 60,000 | | | | 607,200 | |

Sustainable Opportunities Acquisition Corp., Class A* | | | 60,000 | | | | 645,600 | |

Biotech — 1.3% ($235,127) | | | | | | | | |

Curaleaf Holdings, Inc.* | | | 10,000 | | | | 119,717 | |

GW Pharmaceuticals PLC ADR* | | | 1,000 | | | | 115,410 | |

Electrical Equipment — 1.0% ($195,720) | | | | | | | | |

ABB, Ltd. - SP ADR | | | 7,000 | | | | 195,720 | |

Energy Efficiency — 3.5% ($657,049) | | | | | | | | |

Honeywell International, Inc. | | | 580 | | | | 123,366 | |

Itron, Inc.* | | | 5,565 | | | | 533,683 | |

Engineering Service — 1.9% ($360,100) | | | | | | | | |

Quanta Services, Inc. | | | 5,000 | | | | 360,100 | |

Industrials — 0.2% ($37,720) | | | | | | | | |

Carrier Global Corp. | | | 1,000 | | | | 37,720 | |

Intellectual Property — 0.0% ($109) | | | | | | | | |

Silicon Genesis Corp., Common*(1) | | | 181,407 | | | | 109 | |

Materials — 3.1% ($584,150) | | | | | | | | |

Aspen Aerogels, Inc.* | | | 35,000 | | | | 584,150 | |

see accompanying notes to financial statements

FIRSTHAND ALTERNATIVE ENERGY FUND - continued

Portfolio of Investments, December 31, 2020

| | SHARES | | | MARKET VALUE | |

Other Electronics — 6.5% ($1,207,917) | | | | | | | | |

Cree, Inc.* | | | 8,000 | | | $ | 847,200 | |

Intevac, Inc.* | | | 5,800 | | | | 41,818 | |

Koninklijke Philips Electronics N.V.* | | | 5,887 | | | | 318,899 | |

Renewable Energy — 35.7% ($6,684,467) | | | | | | | | |

Amtech Systems, Inc.* | | | 6,600 | | | | 42,108 | |

Enphase Energy, Inc.* | | | 5,000 | | | | 877,350 | |

First Solar, Inc.* | | | 5,000 | | | | 494,600 | |

Iberdrola S.A. | | | 23,495 | | | | 335,821 | |

Maxeon Solar Technologies, Ltd.* | | | 2,491 | | | | 70,670 | |

Motech Industries, Inc.* | | | 38,147 | | | | 46,974 | |

Orion Energy Systems, Inc.* | | | 14,000 | | | | 138,180 | |

Sharp Corp. | | | 1,100 | | | | 16,662 | |

Siemens Gamesa Renewable Energy S.A. | | | 7,271 | | | | 293,926 | |

SolarEdge Technologies, Inc.* | | | 7,000 | | | | 2,233,840 | |

SunPower Corp., Class B* | | | 19,931 | | | | 511,031 | |

Sunrun, Inc.* | | | 11,600 | | | | 804,808 | |

ULVAC, Inc. | | | 2,700 | | | | 115,447 | |

Vestas Wind Systems A.S. | | | 3,000 | | | | 703,050 | |

Semiconductors — 0.7% ($130,812) | | | | | | | | |

Power Integrations, Inc. | | | 1,598 | | | | 130,812 | |

Waste & Environment Service — 0.9% ($168,700) | | | | | | | | |

Advanced Emissions Solutions, Inc. | | | 6,800 | | | | 37,400 | |

Covanta Holding Corp. | | | 10,000 | | | | 131,300 | |

PREFERRED STOCKS — 0.0% ($335) | | | | | | | | |

Intellectual Property — 0.0% ($335) | | | | | | | | |

Silicon Genesis Corp., Series 1-C*(1) | | | 152 | | | | 8 | |

Silicon Genesis Corp., Series 1-E*(1) | | | 3,000 | | | | 327 | |

WARRANTS — 0.6% ($104,400) | | | | | | | | |

Alternative Energy SPAC — 0.6% ($104,400) | | | | | | | | |

Decarbonization Plus Acquisition Corp. * | | | 30,000 | | | | 54,900 | |

Spring Valley Acquisition Corp. * | | | 30,000 | | | | 49,500 | |

see accompanying notes to financial statements

FIRSTHAND ALTERNATIVE ENERGY FUND - continued

Portfolio of Investments, December 31, 2020

| | SHARES | | | MARKET VALUE | |

INVESTMENT COMPANY — 23.3% ($4,350,930) | | | | | | | | |

Fidelity Investments Money Market Fund - Treasury Portfolio(2) | | | 4,350,930 | | | $ | 4,350,930 | |

Total Investments (Cost $12,061,902) — 97.8% | | | | | | | 18,290,406 | |

Other assets in excess of liabilities — 2.2% | | | | | | | 417,395 | |

| | | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 18,707,801 | |

* | Non-income producing security. |

(1) | Restricted/illiquid security (0.002% of net assets). Fair valued in accordance with procedures approved by the Board of Trustees. |

(2) | The Fidelity Investments Money Market Fund invests primarily in U.S. Treasury Securities. |

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

| SP ADR | Sponsored American Depositary Receipt |

see accompanying notes to financial statements

Statements of Assets and Liabilities

December 31, 2020

| | | Firsthand

Technology

Opportunities

Fund | | | Firsthand

Alternative

Energy Fund | |

ASSETS | | | | | | | | |

Investment securities: | | | | | | | | |

Acquisition cost | | $ | 143,295,985 | | | $ | 12,061,902 | |

Market value (Note 2) | | | 369,511,014 | | | | 18,290,406 | |

Foreign Currency at value (cost $0 and $319) | | | — | | | | 330 | |

Receivable from dividends, interest, and reclaims | | | 37 | | | | 2,992 | |

Receivable for capital shares sold | | | 648,070 | | | | 504,292 | |

TOTAL ASSETS | | | 370,159,121 | | | | 18,798,020 | |

| | | | | | | | | |

LIABILITIES | | | | | | | | |

Payable to affiliates (Note 4) | | | 540,973 | | | | 26,880 | |

Payable for capital shares redeemed | | | 923,171 | | | | 63,339 | |

TOTAL LIABILITIES | | | 1,464,144 | | | | 90,219 | |

NET ASSETS | | $ | 368,694,977 | | | $ | 18,707,801 | |

| | | | | | | | | |

Net Assets consist of: | | | | | | | | |

Paid-in Capital | | $ | 141,728,953 | | | $ | 13,129,392 | |

Total distributable earnings (loss) | | | 226,966,024 | | | | 5,578,409 | |

NET ASSETS | | $ | 368,694,977 | | | $ | 18,707,801 | |

| | | | | | | | | |

Shares Outstanding | | | 17,067,222 | | | | 1,323,238 | |

Net asset value, redemption price and offering price per share (Note 2) | | $ | 21.60 | | | $ | 14.14 | |

see accompanying notes to financial statements

Statements of Operations

For the Year Ended December 31, 2020

| | | Firsthand

Technology

Opportunities

Fund | | | Firsthand

Alternative

Energy Fund | |

INVESTMENT INCOME | | | | | | | | |

Dividends | | $ | 66,687 | | | $ | 45,983 | |

Foreign tax withholding | | | (218 | ) | | | (920 | ) |

TOTAL INVESTMENT INCOME | | | 66,469 | | | | 45,063 | |

| | | | | | | | | |

EXPENSES | | | | | | | | |

Investment advisory fees (Note 4) | | | 3,524,805 | | | | 121,130 | |

Administration fees (Note 4) | | | 1,106,160 | | | | 35,627 | |

Trustees fees | | | 9,000 | | | | 9,000 | |

GROSS EXPENSES | | | 4,639,965 | | | | 165,757 | |

Trustees fees reimbursement | | | (9,000 | ) | | | (9,000 | ) |

TOTAL NET EXPENSES | | | 4,630,965 | | | | 156,757 | |

| | | | | | | | | |

NET INVESTMENT LOSS | | | (4,564,496 | ) | | | (111,694 | ) |

| | | | | | | | | |

Net Realized and Unrealized Gain (Loss) on Investments: | | | | | | | | |

Net realized gains from security transactions | | | 55,833,688 | | | | 540,566 | |

Net realized gains on foreign currency | | | 1,211 | | | | 109 | |

Net realized losses from purchased options(1) | | | (3,185,837 | ) | | | — | |

Net realized gains from written options transactions(1) | | | 2,575,266 | | | | — | |

Net change in unrealized appreciation on investment and foreign currency | | | 130,148,479 | | | | 5,097,239 | |

Net Realized and Unrealized Gain on Investments | | | 185,372,807 | | | | 5,637,914 | |

| | | | | | | | | |

Net Increase In Net Assets Resulting From Operations | | $ | 180,808,311 | | | $ | 5,526,220 | |

(1) | Primary risk exposure is equity contracts. |

see accompanying notes to financial statements

Statements of Changes in Net Assets

For the Years Ended December 31, 2020, and December 31, 2019

| | | Firsthand Technology

Opportunities Fund | |

| | | YEAR ended

12/31/20 | | | YEAR ended

12/31/19 | |

FROM OPERATIONS: | | | | | | | | |

Net investment loss | | $ | (4,564,496 | ) | | $ | (3,829,873 | ) |

Net realized gains from security transactions, foreign currency, purchased options and written options | | | 55,224,328 | | | | 14,553,246 | |

Net change in unrealized appreciation on investments, foreign currency | | | 130,148,479 | | | | 37,309,097 | |

Net increase in net assets from operations | | | 180,808,311 | | | | 48,032,470 | |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

Distributions | | | (49,026,363 | ) | | | (14,016,728 | ) |

Total Distributions | | | (49,026,363 | ) | | | (14,016,728 | ) |

| | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

Proceeds from shares sold | | | 48,831,049 | | | | 240,911,290 | |

Dividends reinvested | | | 46,980,637 | | | | 13,446,038 | |

Payment for shares redeemed | | | (113,945,622 | ) | | | (191,387,341 | ) |

Net increase (decrease) in net assets from capital share transactions | | | (18,133,936 | ) | | | 62,969,987 | |

TOTAL INCREASE IN NET ASSETS | | | 113,648,012 | | | | 96,985,729 | |

| | | | | | | | | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 255,046,965 | | | | 158,061,236 | |

End of year | | $ | 368,694,977 | | | $ | 255,046,965 | |

| | | | | | | | | |

COMMON STOCK ACTIVITY: | | | | | | | | |

Shares sold | | | 2,943,552 | | | | 18,438,378 | |

Shares reinvested | | | 2,163,013 | | | | 1,086,988 | |

Shares redeemed | | | (8,192,580 | ) | | | (14,551,456 | ) |

Net increase (decrease) in shares outstanding | | | (3,086,015 | ) | | | 4,973,910 | |

Shares outstanding, beginning of year | | | 20,153,237 | | | | 15,179,327 | |

Shares outstanding, end of year | | | 17,067,222 | | | | 20,153,237 | |

see accompanying notes to financial statements

STATEMENTS OF CHANGES IN NET ASSETS

For the Years Ended December 31, 2020, and December 31, 2019

| | | Firsthand Alternative

energy Fund | |

| | | YEAR ended

12/31/20 | | | YEAR ended

12/31/19 | |

FROM OPERATIONS: | | | | | | | | |

Net investment loss | | $ | (111,694 | ) | | $ | (40,387 | ) |

Net realized gains (loss) from security transactions, foreign currency | | | 540,675 | | | | (136,715 | ) |

Net change in unrealized appreciation (depreciation) on investments, foreign currency | | | 5,097,239 | | | | 1,925,243 | |

Net increase in net assets from operations | | | 5,526,220 | | | | 1,748,141 | |

| | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

Proceeds from shares sold | | | 10,472,874 | | | | 1,412,166 | |

Dividends reinvested | | | — | | | | — | |

Payment for shares redeemed | | | (3,449,030 | ) | | | (1,443,230 | ) |

Net increase (decrease) in net assets from capital share transactions | | | 7,023,844 | | | | (31,064 | ) |

TOTAL INCREASE IN NET ASSETS | | | 12,550,064 | | | | 1,717,077 | |

| | | | | | | | | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 6,157,737 | | | | 4,440,660 | |

End of year | | $ | 18,707,801 | | | $ | 6,157,737 | |

| | | | | | | | | |

COMMON STOCK ACTIVITY: | | | | | | | | |

Shares sold | | | 874,618 | | | | 196,092 | |

Shares reinvested | | | — | | | | — | |

Shares redeemed | | | (352,525 | ) | | | (206,443 | ) |

Net increase (decrease) in shares outstanding | | | 522,093 | | | | (10,351 | ) |

Shares outstanding, beginning of year | | | 801,145 | | | | 811,496 | |

Shares outstanding, end of year | | | 1,323,238 | | | | 801,145 | |

see accompanying notes to financial statements

Financial Highlights

Selected per share data and ratios for a share outstanding throughout each year

FIRSTHAND TECHNOLOGY OPPORTUNITIES FUND

| | | YEAR

ENDED

12/31/20 | | | YEAR

ENDED

12/31/19 | | | YEAR

ENDED

12/31/18 | | | YEAR

ENDED

12/31/17 | | | YEAR

ENDED

12/31/16 | |

Net asset value at beginning of year | | $ | 12.66 | | | $ | 10.41 | | | $ | 9.98 | | | $ | 6.42 | | | $ | 7.74 | |

| | | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.27 | ) | | | (0.19 | ) | | | (0.18 | ) | | | (0.12 | ) | | | (0.10 | ) |

Net realized and unrealized gains on investments | | | 12.51 | | | | 3.14 | | | | 0.61 | | | | 3.68 | | | | 0.56 | |

| | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 12.24 | | | | 2.95 | | | | 0.43 | | | | 3.56 | | | | 0.46 | |

| | | | | | | | | | | | | | | | | | | | | |

Distributions from: | | | | | | | | | | | | | | | | | | | | |

Realized capital gains | | | (3.30 | ) | | | (0.70 | ) | | | — | | | | — | | | | (1.78 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of year | | $ | 21.60 | | | $ | 12.66 | | | $ | 10.41 | | | $ | 9.98 | | | $ | 6.42 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return | | | 96.52 | % | | | 28.51 | % | | | 4.31 | % | | | 55.45 | % | | | 5.99 | % |

Net assets at end of year (millions) | | $ | 368.7 | | | $ | 255.0 | | | $ | 158.1 | | | $ | 124.5 | | | $ | 76.9 | |

Ratio of gross expenses to average net assets before waiver | | | 1.84 | % | | | 1.84 | % | | | 1.86 | % | | | 1.86 | % | | | 1.86 | % |

Ratio of net expenses to average net assets after waiver | | | 1.84 | % | | | 1.83 | % | | | 1.85 | % | | | 1.85 | % | | | 1.85 | % |

Ratio of net investment loss to average net assets | | | (1.81 | %) | | | (1.28 | %) | | | (1.54 | %) | | | (1.57 | %) | | | (1.45 | %) |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 65 | % | | | 43 | % | | | 25 | % | | | 19 | % | | | 18 | % |

see accompanying notes to financial statements

FINANCIAL HIGHLIGHTS

Selected per share data and ratios for a share outstanding throughout each year

FIRSTHAND ALTERNATIVE ENERGY FUND

| | | YEAR

ENDED

12/31/20 | | | YEAR

ENDED

12/31/19 | | | YEAR

ENDED

12/31/18 | | | YEAR

ENDED

12/31/17 | | | YEAR

ENDED

12/31/16 | |

Net asset value at beginning of year | | $ | 7.69 | | | $ | 5.47 | | | $ | 6.72 | | | $ | 5.29 | | | $ | 5.83 | |

| | | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.08 | ) | | | (0.05 | ) | | | (0.04 | ) | | | 0.02 | | | | (0.05 | ) |

Net realized and unrealized gains (losses) on investments | | | 6.53 | | | | 2.27 | | | | (1.21 | ) | | | 1.43 | | | | (0.49 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 6.45 | | | | 2.22 | | | | (1.25 | ) | | | 1.45 | | | | (0.54 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | — | | | | — | (a) | | | (0.02 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of year | | $ | 14.14 | | | $ | 7.69 | | | $ | 5.47 | | | $ | 6.72 | | | $ | 5.29 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return | | | 83.88 | % | | | 40.59 | % | | | (18.57 | %) | | | 27.35 | % | | | (9.26 | %) |

Net assets at end of year (millions) | | $ | 18.7 | | | $ | 6.2 | | | $ | 4.4 | | | $ | 5.9 | | | $ | 5.1 | |

Ratio of gross expenses to average net assets before waiver | | | 2.09 | % | | | 2.15 | % | | | 2.15 | % | | | 2.15 | % | | | 2.14 | % |

Ratio of net expenses to average net assets after waiver | | | 1.98 | % | | | 1.98 | % | | | 1.98 | % | | | 1.98 | % | | | 1.98 | % |

Ratio of net investment gain (loss) to average net assets | | | (1.41 | %) | | | (0.72 | %) | | | (0.68 | %) | | | 0.30 | % | | | (0.75 | %) |

| | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 14 | % | | | 0 | % | | | 7 | % | | | 0 | % | | | 10 | % |

(a) | Amount represents less than $0.01 per share |

see accompanying notes to financial statements

Notes to Financial Statements

December 31, 2020

1. ORGANIZATION

Each of Firsthand Technology Opportunities Fund and Firsthand Alternative Energy Fund (individually the “Fund”, and collectively the “Funds”) is a non-diversified series of Firsthand Funds (the “Trust”), an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust, a Delaware statutory trust, was organized on November 8, 1993. Each Fund currently offers one class of shares—Investor Class shares. The inception dates for the Funds (the date on which a net asset value was first determined for that Fund) follow:

FUND | INCEPTION DATE |

Firsthand Technology Opportunities Fund | September 30, 1999 |

Firsthand Alternative Energy Fund | October 29, 2007 |

Each Fund’s investment objective is long-term growth of capital.

Firsthand Technology Opportunities Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in equity securities of high-technology companies in the industries and markets that the Investment Adviser believes hold the most growth potential within the technology sector.

Firsthand Alternative Energy Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in alternative energy and energy technology companies, both U.S. and international.

The Funds are an investment company and follow accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the Funds’ significant accounting policies:

Securities Valuation — A Fund’s portfolio of securities is valued as follows:

| | 1. | Securities traded on stock exchanges, or quoted by NASDAQ, are valued according to the NASDAQ official closing price, if applicable, or at their last reported sale price as of the close of trading on the New York Stock Exchange (“NYSE”) (normally 4:00 P.M. Eastern Time). If a security is not traded that day, the security will be valued at its most recent bid price. |

| | 2. | Securities traded in the over-the-counter market, but not quoted by NASDAQ, are valued at the last sale price (or, if the last sale price is not readily available, at the most recent closing bid price as quoted by brokers that make markets in the securities) at the close of trading on the NYSE. |

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2020

| | 3. | Securities traded both in the over-the-counter market and on a stock exchange are valued according to the broadest and most representative market. |

| | 4. | Securities and other assets that do not have market quotations readily available are valued at their fair value as determined in good faith using procedures established by the Board of Trustees. |

In pricing illiquid, privately placed securities, the advisor follows well-accepted valuation techniques. Initial valuations are generally determined by the initial purchase price for each security. Subsequent to initial purchase, securities are repriced from time to time to reflect changes to the companies’ valuations caused by various events. Such events include, among others, a new round of financing establishing a new valuation for the company; material changes to a company’s business or business prospects, either due to company-specific internal issues (gaining or losing a major customer, missing a significant milestone, etc.) or macroeconomic events affecting the industry or the world. In analyzing a company’s valuation, factors that are also considered include a company’s cash flow, revenues, profitability, financial forecasts, and probability of success in those measures. Other potential factors include the value of comparable public and private companies and general market conditions.

FAIR VALUE MEASUREMENT — In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, each Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities (level 1 measurement) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (level 3 measurements).

The guidance establishes three levels of the fair value hierarchy as follows:

| | LEVEL 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access. |

| | LEVEL 2 – | Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risks, yield curves, default rates, and similar data. |

| | LEVEL 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2020

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the following Funds’ net assets as of December 31, 2020:

FUND* | | LEVEL 1

QUOTED PRICES | | | LEVEL 2

OTHER SIGNIFICANT

OBSERVABLE INPUTS | | | LEVEL 3

SIGNIFICANT

OBSERVABLE INPUTS | |

TEFQX | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Alternative Energy SPAC | | $ | 4,916,000 | | | $ | — | | | $ | — | |

Biotech | | | 2,893,615 | | | | — | | | | — | |

Communications | | | 1,306,000 | | | | — | | | | — | |

Consumer Electronics | | | 94,856,800 | | | | — | | | | — | |

Consumer Staples | | | 279,500 | | | | — | | | | — | |

Defense & Aerospace | | | 8,898,600 | | | | — | | | | — | |

Education | | | 35,913,500 | | | | — | | | | — | |

Internet | | | 32,836,450 | | | | — | | | | — | |

Networking | | | 13,704,100 | | | | — | | | | — | |

Other Electronics | | | 22,239,000 | | | | — | | | | — | |

Renewable Energy | | | 18,347,100 | | | | — | | | | — | |

Semiconductor Equipment | | | 9,999,860 | | | | — | | | | — | |

Semiconductors | | | 327,300 | | | | — | | | | — | |

Services | | | 147,600 | | | | — | | | | — | |

Software | | | 119,149,625 | | | | — | | | | — | |

Total Common Stocks | | | 365,815,050 | | | | — | | | | — | |

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2020

FUND* | | LEVEL 1

QUOTED PRICES | | | LEVEL 2

OTHER SIGNIFICANT

OBSERVABLE INPUTS | | | LEVEL 3

SIGNIFICANT

OBSERVABLE INPUTS | |

TEFQX cont. | | | | | | | | | | | | |

Warrants | | | | | | | | | | | | |

Alternative Energy SPAC | | $ | 419,996 | | | $ | — | | | $ | — | |

Investment Company | | | 3,275,968 | | | | — | | | | — | |

Total | | $ | 369,511,014 | | | $ | — | | | $ | — | |

FUND* | | LEVEL 1

QUOTED PRICES | | | LEVEL 2

OTHER SIGNIFICANT

OBSERVABLE INPUTS | | | LEVEL 3

SIGNIFICANT

OBSERVABLE INPUTS | |

ALTEX | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Advanced Materials | | $ | 232,560 | | | $ | — | | | $ | — | |

Aerospace | | | 71,510 | | | | — | | | | — | |

Agriculture | | | — | | | | — | | | | — | |

Alternative Energy SPAC | | | 3,268,800 | | | | — | | | | — | |

Biotech | | | 235,127 | | | | — | | | | — | |

Electrical Equipment | | | 195,720 | | | | — | | | | — | |

Energy Efficiency | | | 657,049 | | | | — | | | | — | |

Engineering Service | | | 360,100 | | | | — | | | | — | |

Industrials | | | 37,720 | | | | — | | | | — | |

Intellectual Property | | | — | | | | — | | | | 109 | |

Materials | | | 584,150 | | | | — | | | | — | |

Other Electronics | | | 1,207,917 | | | | — | | | | — | |

Renewable Energy | | | 6,684,467 | | | | — | | | | — | |

Semiconductors | | | 130,812 | | | | — | | | | — | |

Waste & Environment Service | | | 168,700 | | | | — | | | | — | |

Total Common Stocks | | | 13,834,632 | | | | — | | | | 109 | |

Preferred Stocks | | | | | | | | | | | | |

Intellectual Property | | | — | | | | — | | | | 335 | |

Warrants | | | | | | | | | | | | |

Alternative Energy SPAC | | | 104,400 | | | | — | | | | — | |

Investment Company | | | 4,350,930 | | | | — | | | | — | |

Total | | $ | 18,289,962 | | | $ | — | | | $ | 444 | |

* | TEFQX: Firsthand Technology Opportunities Fund; ALTEX: Firsthand Alternative Energy Fund. |

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2020

At the end of each calendar quarter, management evaluates the Level 2 and 3 assets and liabilities for changes in liquidity, including but not limited to: whether a broker is willing to execute at the quoted price, the depth and consistency of prices from third party services, and the existence of contemporaneous, observable trades in the market. Additionally, management evaluates the Level 1 and 2 assets and liabilities on a quarterly basis for changes in listings or delistings on national exchanges.

INVESTMENTS AT

FAIR VALUE USING

SIGNIFICANT

UNOBSERVABLE

INPUTS (LEVEL 3) | | BALANCE

AS OF

12/31/19 | | | NET

PURCHASES | | | NET

SALES | | | NET

REALIZED

GAINS/

(LOSSES) | | | NET

UNREALIZED

APPRECIATION

(DEPRECIATION) | | | TRANSFERS

IN (OUT)

OF

LEVEL 3 | | | BALANCE

AS OF

12/31/20 | |

Common Stocks | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Intellectual Property | | $ | 145 | | | $ | — | | | $ | — | | | $ | — | | | $ | (36 | ) | | $ | — | | | $ | 109 | |

Preferred Stocks | | | 356 | | | | — | | | | — | | | | — | | | | (21 | ) | | | — | | | | 335 | |

Total | | $ | 501 | | | $ | — | | | $ | — | | | $ | — | | | $ | (57 | ) | | $ | — | | | $ | 444 | |

As of the year ended December 31, 2020, these investments were valued in accordance with procedures approved by the Board of Trustees. These investments did not have a material impact on the Fund’s net assets and, therefore, disclosure of unobservable inputs used in formulating valuations is not presented.

SHARE VALUATION — The net asset value (“NAV”) per share of each Fund is calculated by dividing the net assets of the Fund (i.e., the sum of the value of the securities held by the Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses)) by the total number of shares outstanding of the Fund, rounded to the nearest cent. A Fund’s shares will not be priced on the days on which the NYSE is closed for trading. The offering and redemption price per share of each Fund is equal to a Fund’s NAV per share.

INVESTMENT INCOME — Dividend income is recorded on the ex-dividend date. Interest income is accrued as earned. Discounts and premiums on securities purchased are amortized over the lives of the respective securities. Other non-cash dividends are recognized as investment income at the fair value of the property received. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

CASH AND CASH EQUIVALENTS — The Funds consider liquid assets deposited with a bank, money market funds, and certain short-term debt instruments with maturities of 3 months or less to be cash equivalents. These investments represent amounts held with financial institutions that are readily accessible to pay fund expenses or purchase investments. Cash and cash equivalents are valued at cost plus accrued interest, which approximates market value.

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2020

FOREIGN SECURITIES — Each Fund may invest in companies that trade on U.S. exchanges as American Depositary Receipts (“ADRs”), on foreign exchanges, or on foreign over-the-counter markets. Investing in the securities of foreign companies exposes your investment in a Fund to risk. Foreign stock markets tend to be more volatile than the U.S. market due to economic and/or political instability and the regulatory conditions in some countries. In addition, some of the securities in which the Fund may invest may be denominated in foreign currencies, the value of which may decline against the U.S. dollar. An investment in foreign securities may be subject to high levels of foreign taxation, including foreign taxes withheld at the source. Neither Fund isolates the portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Reported net realized foreign exchange gains or losses arise from sales of portfolio securities, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Funds’ books and the U.S. dollar equivalent of the amounts actually received or paid.

OPTIONS — The Funds are subject to equity price risk in the normal course of pursuing their investment objectives and may enter into options written to hedge against changes in the value of equities. The Funds may purchase put and call options to attempt to provide protection against adverse price effects from anticipated changes in prevailing prices of securities or stock indices. The Funds may also write put and call options. When a Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current fair value of the option written. Premiums received from writing options that expire unexercised are treated by the Fund on the expiration date as realized gains from investments. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or, if the premium is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security or currency in determining whether the Fund has realized a gain or loss. The Fund as writer of an option bears the market risk of an unfavorable change in the price of the security underlying the written option. The net realized gains/(loss) from purchased and written options for the year ended December 31, 2020 can be found on the Statements of Operations.

The average volume of derivatives during the year ended December 31, 2020 is as follows:

| | | PURCHASED OPTIONS

(Value) | | | WRITTEN OPTIONS

(Value) | |

Firsthand Technology Opportunities Fund | | $ | 320,077 | | | $ | 62,573 | |

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2020

Distributions to Shareholders — Each Fund expects to distribute its net investment income and net realized gains, if any, annually. Distributions from net investment income and capital gains are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from accounting principles generally accepted in the United States.

Short Positions — Firsthand Alternative Energy Fund may sell securities short for economic hedging purposes. Short sales are transactions in which the Fund sells a security it does not own, in anticipation of a decline in the market value of that security. To initiate such a transaction, the Fund must borrow the security to deliver to the buyer upon the short sale; the Fund is then obligated to replace the security borrowed by purchasing it in the open market at some later date, completing the transaction. The Fund is liable for any dividends payable on securities while those securities are in a short position.

The Fund will incur a loss if the market price of the security increases between the date of the short sale and the date on which the Fund replaces the borrowed security. The Fund will realize a gain if the security declines in value between those dates.

All short sales must be fully collateralized. The Fund maintains the collateral in a segregated account consisting of cash, cash equivalents and/or liquid securities sufficient to collateralize the market value of its short positions. Typically, the segregated cash with brokers and other financial institutions exceeds the minimum required. Deposits with brokers for securities sold short are invested in money market instruments. The Fund did not invest in short sales for the year ended December 31, 2020.

Reclassification of Capital Accounts — Permanent book and tax differences resulted in reclassifications for the year ended December 31, 2020 as follows:

| | | INCREASE (DECREASE) | |

| | | Paid-in-Capital | | | Distributable Earnings | |

Firsthand Technology Opportunities Fund | | $ | — | | | $ | — | |

Firsthand Alternative Energy Fund | | | (116,485 | ) | | | 116,485 | |

These reclassifications, related to different treatment of current year write off of net operating loss, and different book and tax treatment for gain/loss on foreign currency, have no effect on net asset value per share.

SECURITY TRANSACTIONS — Security transactions are accounted for no later than one business day following the trade date, however, for financial reporting purposes, security transactions are accounted for on trade date. Realized gains and losses are calculated on a specific identification basis.

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2020

ESTIMATES — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

FEDERAL INCOME TAX — Each Fund has elected, and intends to qualify annually, for the special tax treatment afforded regulated investment companies under the Internal Revenue Code of 1986, as amended (the “Code”). As provided in the Code, in any fiscal year in which a Fund so qualifies and distributes at least 90% of its taxable net income, the Fund (but not the shareholders) will be relieved of federal income tax on the income distributed. Accordingly, no provision for income taxes has been made. To avoid imposition of the excise tax applicable to regulated investment companies, each Fund intends to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98% of its net realized capital gains (earned during the 12 months ended October 31) plus undistributed amounts, if any, from prior years.

The tax character of distributions paid for the year ended December 31, 2020 and 2019 was as follows:

| | | FIRSTHAND TECHNOLOGY

OPPORTUNITIES FUND | |

| | | 2020 | | | 2019 | |

From ordinary income | | $ | 6,192,164 | | | $ | 2,159,563 | |

From long-term capital gains | | $ | 42,834,199 | | | $ | 11,857,165 | |

The following information is based upon the federal income tax cost of portfolio investments as of December 31, 2020.

| | | FIRSTHAND

TECHNOLOGY

OPPORTUNITIES FUND | | | FIRSTHAND

ALTERNATIVE

ENERGY FUND | |

Gross unrealized appreciation | | $ | 236,200,023 | | | $ | 6,801,617 | |

Gross unrealized depreciation | | | (12,865,099 | ) | | | (546,781 | ) |

Net unrealized appreciation | | $ | 223,334,924 | | | $ | 6,254,836 | |

Federal income tax cost | | $ | 146,176,090 | | | $ | 12,035,672 | |

The difference between the acquisition cost and the federal income tax cost of portfolio investments is due to certain timing differences in the recognition of capital losses under accounting principles generally accepted in the United States and income tax regulations.

NOTES TO FINANCIAL STATEMENTS - continued

December 31, 2020

As of December 31, 2020, the Funds had capital loss carryforwards for federal income tax purposes as follows:

| | | SHORT-TERM

NO EXPIRATION | | | LONG-TERM

NO EXPIRATION | | | TOTAL | |

TEFQX* | | $ | — | | | $ | — | | | $ | — | |

ALTEX* | | | (431,105 | ) | | | (245,322 | ) | | | (676,427 | ) |

* | TEFQX: Firsthand Technology Opportunities Fund; ALTEX: Firsthand Alternative Energy Fund. |

Components of Distributable Earnings

| | | FIRSTHAND

TECHNOLOGY

OPPORTUNITIES FUND | | | FIRSTHAND

ALTERNATIVE

ENERGY FUND | |

Net Unrealized Appreciation (Depreciation)* | | $ | 223,334,924 | | | $ | 6,254,836 | |

Undistributed Ordinary Income | | | 665,672 | | | | — | |

Undistributed Long Term Capital Gains | | | 2,965,428 | | | | — | |

Qualified Late Year Losses Deferred** | | | — | | | | — | |

Other Temporary Differences | | | — | | | | — | |

Accumulated Capital Loss Carryforward | | | — | | | | (676,427 | ) |

Total Distributable Earnings/Accumulated Loss | | $ | 226,966,024 | | | $ | 5,578,409 | |

* | The differences between book-basis and tax-basis unrealized appreciation (depreciation) is attributable primarily to tax deferral of losses on wash sales. |

** | Under current tax law, capital and currency losses realized after October 31 and prior to the Fund’s fiscal year end may be deferred as occurring on the first day of the following fiscal year. |