| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

FORM N-CSR |

| |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

MANAGEMENT INVESTMENT COMPANIES |

| |

| |

| |

| Investment Company Act File Number: 811-07145 |

|

| |

| T. Rowe Price International Series, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

| |

| |

| Registrant’s telephone number, including area code: (410) 345-2000 |

| |

| |

| Date of fiscal year end: December 31 |

| |

| |

| Date of reporting period: June 30, 2009 |

Item 1: Report to Shareholders| International Stock Portfolio | June 30, 2009 |

• International stock markets were volatile in the six-month period ended June 30, 2009, plunging in the early months of the reporting period and surging from the mid-March lows.

• Your portfolio posted a solid six-month gain—powered by our holdings in financials and information technology—that outperformed our MSCI and Lipper benchmarks.

• A few months ago, investors were well compensated for taking bold risks, but we believe the landscape has changed, leading us to moderate the portfolio’s risk characteristics.

• We remain focused on owning businesses that, over time, should have solid growth by taking market share, improving margins, or deploying capital in a value-creating manner.

The views and opinions in this report were current as of June 30, 2009. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

Manager’s Letter

T. Rowe Price International Stock Portfolio

Dear Investor

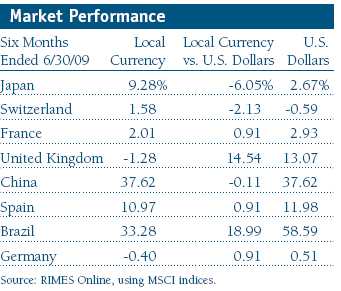

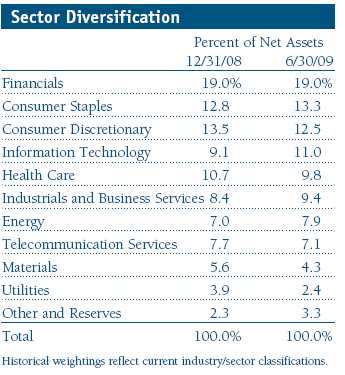

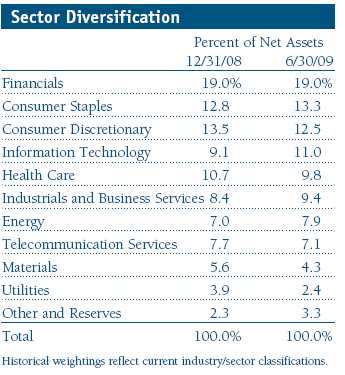

We are pleased to report positive results for the six months ended June 30, 2009. Stock markets around the globe rebounded sharply from mid-March into June. Volatility was at extreme levels during the period due to heightened credit market turmoil and the global economic slowdown. The portfolio’s financials and information technology stocks generated the best results in the last six months. Health care and utilities were the portfolio’s only sectors to post losses. While we haven’t recouped all of the ground lost in 2008, the first-half stock market rally is encouraging.

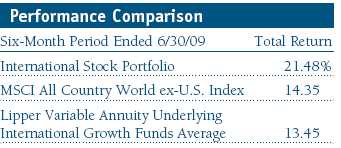

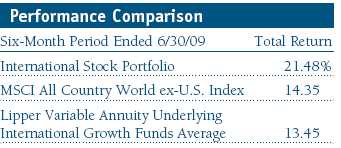

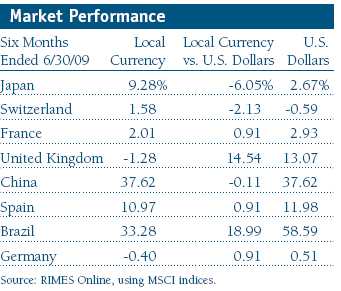

The International Stock Portfolio posted a 21.48% gain for the six-month period ended June 30, 2009. As shown in the Performance Comparison table, the portfolio outperformed the Lipper Variable Annuity Underlying International Growth Funds Average and the benchmark MSCI All Country World ex-U.S. Index. Our performance versus the MSCI index benefited from stock selection, especially in the financials and industrials and business services sectors. Overall, sector allocation decisions were a modest detractor, mostly due to our overweight in health care stocks and an underweight in materials and financials. In general, the portfolio’s emerging markets holdings were strong contributors.

Portfolio Strategy

Given the ongoing tumult, we think it is appropriate to review our strategy. We believe that stock prices move with earnings and cash flow growth over time, meaning simply that if a company grows free cash flow by 15% per year, its stock should appreciate at roughly the same rate. We search for companies we think can generate double-digit earnings growth over time by participating in expanding markets, taking market share, or improving profitability at a rate much faster than sales. We think that if we can find those companies and pay a fair price for their stock, we can compound absolute returns at double-digit levels and provide solid long-term relative returns.

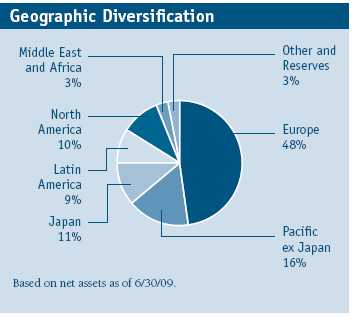

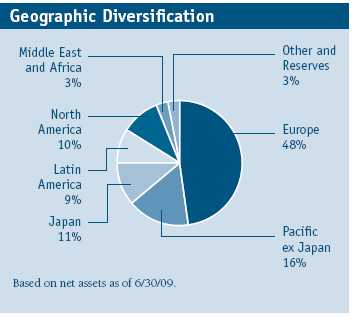

With this objective in mind, our industry analysts, and other T. Rowe Price portfolio managers, travel the world to find companies that fit these criteria. We look for the best non-U.S. stocks wherever we may find them rather than employing a regional or country focus. While we consider broad economic conditions in regions and countries, portfolio composition is primarily determined by individual stock considerations.

Market Review

As I reflect on the extraordinary events in the world’s markets over the past several months, I am reminded of a trip I took with a friend to the Grand Canyon several decades ago. I stood looking over the South Rim of the canyon with my camera in hand, but after contemplating the picture for a time, I put the camera away. I could not capture the immensity of what I saw with a snapshot; you had to see it, feel it, and experience it for yourself. I feel a little like that now—looking at a strong six-month result masks several enormous shifts. Perhaps it is better to describe the period in several smaller stories.

Starting late last year, and continuing into the first part of March, many businesses and, to some extent, entire industries came to a virtual standstill. In China, for example, several of the busiest ports practically shut down as shipping demand came to a screeching halt—import and export traffic had effectively dried up. Banks around the globe stopped lending and borrowing. Because of the widespread uncertainty, many companies stopped providing future sales and earnings guidance. I’ve seen a lot of sales and earnings shortfalls over the years, but one of the most extreme examples I can recall happened late last year at Volvo. The company, one of the world’s largest truck makers (it also produces autos and heavy-duty construction equipment), reported that its third-quarter orders for trucks in Europe fell to 115, a 99.7% decline from 41,970 in the previous year.

As worries about a new Great Depression escalated, the fear spilled over from Wall Street onto Main Street. I know this firsthand because my mother called me on several occasions to ask whether she should move her money out of her bank (a well-known, established U.S. institution) even though she had far less than the $250,000 that would have been covered by FDIC insurance in the event of her bank’s bankruptcy. I knew that the fear was rampant when my wife suggested that we stash some cash in a jar in the basement.

It has been said that investors make decisions based on two primary emotions: fear and greed—and fear clearly had the upper hand for the first part of the reporting period. The fear of owning stocks continued across equity markets into March. However, positive signs began to emerge in the fixed-income market a bit sooner. Dribs and drabs of liquidity began to appear, coined “green shoots” by the media, which many hoped was signaling the beginning of the end of the recession. Banks began to lend—if only a little—and the yields on non-Treasury debt instruments began to fall.

While we can’t know for certain, equities appear to have bottomed in early March, and as stocks began to rebound, we witnessed an abrupt shift in investor sentiment—fear of owning stocks turned into fear of not owning stocks and missing the rebound. While we are relieved and relatively satisfied that the worst of the markets’ performance is behind us, the economic recovery is likely to progress in fits and starts, as will any rebound in stock prices. We think that markets will likely face some resistance after the “relief rally.” The next up-leg will require tangible economic and earnings improvement from currently depressed levels. While we are pleased to report solid returns for the past six months, stocks in general remain significantly below year-ago levels.

Portfolio Review

In our annual report (dated December 31, 2008), we talked about our rationale for having an oversized position in emerging markets stocks and that it hurt our performance as global growth slowed dramatically. We said, “While we cannot predict the future, it is safe to say the market is forecasting a very bleak one. We think economies will continue to slow and unemployment will rise, but we believe that prices already discount this scenario. However, we see some signs of the credit crisis bottoming, and we think most governments are putting concerted efforts into lowering interest rates and providing liquidity, which gives us reasons for optimism about where stocks will go from here.”

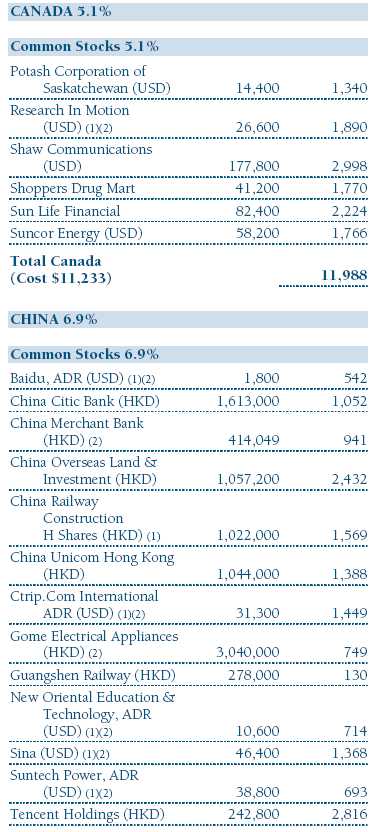

We continue to believe it makes sense to remain overweight in emerging markets. Liquidity and a modicum of optimism are now evident. We benefited from sticking with our developing markets holdings but did not take full advantage by aggressively adding to stocks in South Korea and Taiwan (both performed exceptionally well in the past six months). Our Chinese and Indian holdings rallied nicely, but our overall performance grade in emerging markets was pedestrian. Our rotation out of several high-risk stocks generated mixed results. Although we generally produced good returns on new investments, we left money on the table.

Where We Were Positioned and Why

While we are happy to report good performance in the last six months, we are not entirely satisfied with several of our decisions. The first issue was that we underestimated the severity and effect of the liquidity crisis and the depth of the economic carnage that followed. In addition, although we made several opportunistic purchases in January and February, we did not fully take advantage of fire-sale prices in the heat of the panic sell-off. This criticism aside, we are always trying to improve the portfolio’s quality overall, and we remain vigilant in managing the risk and the potential return trade-off of our holdings.

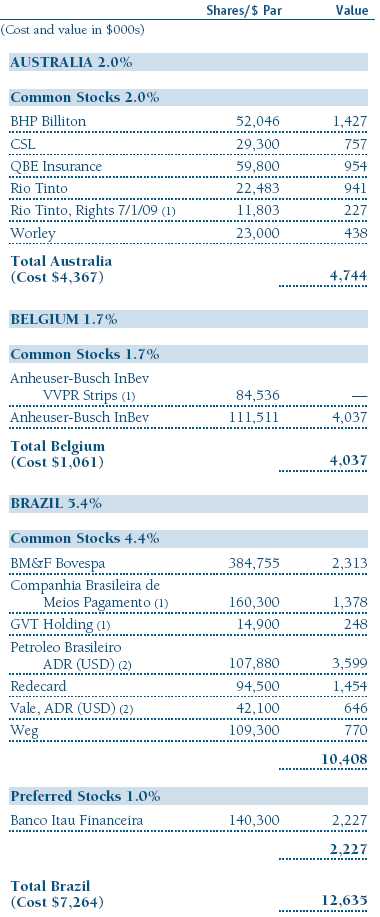

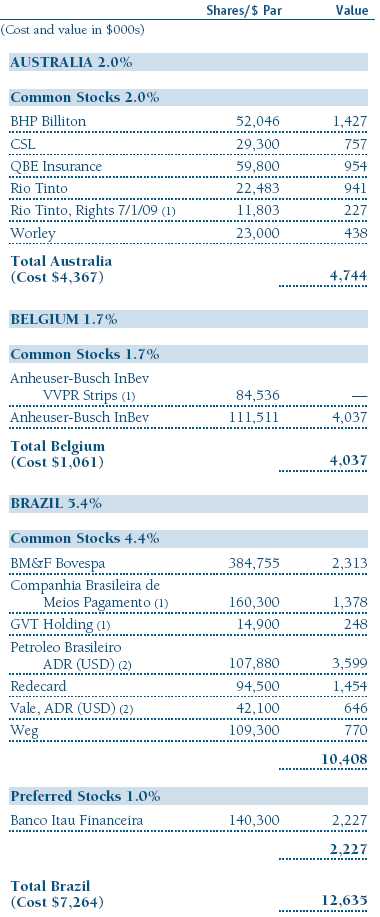

Early in the period, we opportunistically bought several well-positioned companies in China and Brazil. Those markets were among the best-performing countries in the world. We also took advantage of investors’ fear of owning well-established companies with a large amount of debt, such as Anheuser-Busch InBev. During the period, we added to our stake in the Belgium-based brewer, and it generated good results for the portfolio. The market rally from mid-March to early June stalled in the last few weeks of the reporting period. We viewed this pause as healthy for international stock markets, which needed to consolidate after posting an extraordinary recovery. As the period came to a close, we again shifted our focus toward companies that can generate consistent earnings. (Please refer to the portfolio of investments for a complete listing of holdings and the amount each represents in the portfolio.)

Notable Portfolio Contributors and Detractors

Financials were the best first-half contributors due to the strong results of our commercial banking and real estate holdings. Both industries had endured a horrendous sell-off and then rebounded sharply at the end of the reporting period as credit markets improved. Among our commercial banks, Banco Santander, National Bank of Greece, and Standard Chartered were among our best contributors, and each was among our 25 largest holdings (see the table on page 6). Santander offers retail banking, commercial lending, and asset management services in both emerging and developed markets. We believe the company can continue to generate resilient revenue growth thanks to market share gains in Latin America and can continue to bolster solid and steady earnings gains through its cost-cutting initiatives in the U.K. and Brazil. However the best performer in the sector was BM&F Bovespa. This Brazilian diversified financial services company controls the Sao Paulo Stock Exchange and its futures and commodities exchanges. The stock benefited from the sharp rebound in Brazilian equities and active trading activity.

We also bought financials companies that were able to access capital through new issuance at what we viewed as extremely favorable prices. National Bank of Greece, which provides retail and corporate banking services primarily in Greece, Turkey, and southeastern Europe, raised capital to strengthen its existing capital position. We think it can opportunistically take advantage of the difficult operating environment. Another prominent example of a company that was able to add to its capital base was U.K.-based Standard Chartered. The multinational commercial bank offers specialized banking products to corporations and institutions in Asia, Africa, Europe, the Middle East, and the Americas.

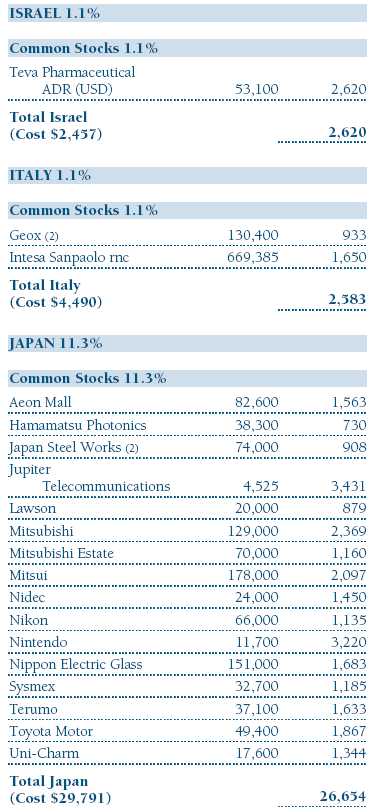

Most of our real estate investments are Asia-focused, where we think there is a secular story of limited supply. China Overseas Land & Investment, one of the region’s largest residential property developers, was the best performer in the real estate management and development segment. Its conservative management and ability to hold the line on pricing better than its competitors helped provide strong first-half returns. Similarly, we logged good gains from our position in Hong Kong-based Shun Tak Holdings. After a brutal 2008, in which profits plunged about 90%, the shipping, property, and hospitality conglomerate flourished in the first six months of 2009. Investors appear to be optimistic about the prospects for the company’s Macau properties, including a shopping mall due to open in late 2009 and a hotel scheduled for completion in the first quarter of 2010.

Our information technology holdings were the second-best contributors to six-month results. Sector performance was led by electronic equipment maker Hon Hai Precision (Taiwan), which has been described as “the biggest electronics company you never heard of” and is one of the world’s largest contract electronics manufacturers (for the likes of Apple, Sony, and Dell) and also provides design engineering and mechanical tooling services. The company has begun to improve margins by moving its manufacturing facilities to inland China where labor costs are lower. Nippon Electric Glass (Japan), another top-10 first-half contributor, primarily produces glass used in CRT, LCD, and flat panel display monitors, electronic devices, and specialized building materials for customers primarily outside of Japan.

In the last six months, we added to our position in Baidu (Internet search) and established a new position in Sina (Internet portal), which posted strong gains. One of our largest concerns about our Chinese Internet holdings is the level of government control. However, in Baidu’s case, we think the government is an ally of sorts because it wants its people to use a domestic search engine like Baidu rather than Google or an alternative where it has less control. In the case of Sina, the portal company (much like Yahoo!), we like its stable and growing advertising-based revenue stream. However, Sina announced that it was combining with Focus Media’s outdoor business in December, and the market didn’t like the merger. Investors dumped the stock, sending Sina sharply lower. We think it is a reasonable deal—Sina bought the assets at a good price, and Focus has good businesses. Despite the company’s first-quarter earnings miss, we think the merger will increase earnings and provide a more stable revenue base over the long term. Over time, the growth potential for Baidu and Sina is huge; they have great business models, and there is little chance of either going bankrupt.

We increased our allocation in Chinese Internet software and services companies because we believe China will be one of the first countries to recover from this recession and can generate durable economic growth. We believe the government has the resources and will take the necessary steps to revive its ailing economy. It made sense to add in a slow period and when investors were fearful—an example of our willingness to buy solid growth stocks at depressed prices. We think Baidu and Sina are appealing for several reasons. First, they have a low fixed-cost base that eliminates some of the worry about high capital costs and servicing a debt-laden balance sheet. In general, Internet companies have strong balance sheets because they generate steady cash flow. Finally, if the companies miss their earnings and revenue forecasts, it is generally by a little, not a giant shortfall that could send the stock plunging.

We also added to our position in Tencent Holdings. The firm was already a sizable position, and it generated a strong contribution, but we didn’t add as aggressively as we did in Baidu and Sina. Tencent, also referred to as QQ, is the most popular free instant messaging service in China and one of the most popular in the world.

We also generated strong returns from our holdings in the industrials and business services segment. Jaiprakash Associates (an industrial conglomerate), a holding that we reported on in our December report, performed exceptionally well. This infrastructure construction conglomerate was our best contributor in the last six months and has been a prime beneficiary of the lower interest rate environment and liquidity coming back in India. The stock moved sharply higher in the March/April rally. Jaiprakash is primarily involved in infrastructure and power plant construction and real estate. However, all of its projects are longer term, which means it needs a large amount of financing. When liquidity in India became scarce during the credit crisis, the stock got crushed and sold off dramatically last year. Jaiprakash has very good business opportunities, but funding them is the issue. We believe the company has solid growth potential and is well managed. As a more enduring recovery takes hold, we think the stock should continue its ascent.

Health care was our worst-performing sector in the first half, and the pharmaceuticals segment posted the largest losses. Switzerland-based Roche Holding and Novartis, our largest health care holdings at the start of the reporting period, were among the portfolio’s poorest performers. During the period, we eliminated our position in Novartis and redeployed the proceeds in other health care holdings that offered better prospects. Roche is now the portfolio’s largest holding, and we still like the company’s prospects. We think the company’s decision to purchase Genentech was sound and will help the drugmaker increase earnings. The combined company should generate solid double-digit growth, and we believe the stock is significantly undervalued.

Among our other large holdings, the Spanish diversified telecommunications services provider Telefonica posted modest losses. Although we have trimmed the size of the position over the past six months, we like the company’s long-term prospects. However, our other telecommunications services providers, including Mexico’s America Movil and India’s Bharti Airtel, also generated decent results.

As oil prices retreated during the period, the portfolio’s largest energy sector holdings produced diverging results. Total, a large integrated oil company based in France, had generated good results at the beginning of the oil price collapse largely because the biggest companies in the sector were viewed as the safest. However, it posted a small loss during the past six months as fear abated and oil prices advanced. Petroleo Brasileiro generated the second-best performance in the past six months. Brazil’s largest oil exploration and production company is benefiting from less investor caution, strong results posted by Brazil’s market, and the potentially huge oil discovery off its coast. By some estimates, the new oil find could represent 30 billion to 50 billion barrels of oil—two to four times the company’s current reserves.

Investment Outlook

The opportunity to load up the truck with risky, high-return prospects is behind us, as is the time for panic. Now is a time to sift and filter. It is neither a time to be too aggressive, nor overly risk averse. We believe there are exceptional opportunities in lower-risk, solidly managed consumer staples companies such as Nestle and Danone, but we also intend to maintain some exposure to higher-risk and potentially higher-return stocks such as Jaiprakash, Hon Hai Industries, WPP Group, and Nextel International. Overall, we have slightly moderated the portfolio’s risk characteristics as we move into the second half of the year and after the significant rebound in stocks worldwide.

The economic backdrop appears to have stopped getting worse, and the markets have rallied since mid-March on “less bad” news. However, as we stated earlier in this report, an enduring economic recovery will likely come slowly and in fits and starts. For those reasons, we intend to stick to our knitting. For us, that means doing the research and legwork to find great growth stocks that can take market share no matter how roiled the economic environment. We also want to ensure that we maintain a diverse portfolio of holdings across geographies as well as sectors. Key tenets of our investment analysis include challenging the assumptions and opinions we made as recently as three months ago, tactically taking advantage of overly fearful or optimistic markets, and remaining objective and skeptical of consensus opinion. At the moment, we are finding slightly better risk-adjusted value in stable growth stocks in industries that are typically viewed as defensive.

We have witnessed and endured extreme conditions during the past few reporting cycles; it has been a challenging and humbling experience. Our focus throughout this period and for the long term is to target companies with good global franchises and attempt to buy them at reasonable prices or when they are out of favor. Ultimately, the goals of identifying the best long-term investment opportunities and delivering superior long-run returns for our clients are at the forefront of all our investment decisions.

Respectfully submitted,

Robert W. Smith

Chairman of the Investment Advisory Committee

July 10, 2009

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing its investment program.

| Risks of International Investing |

Portfolios that invest overseas generally carry more risk than those that invest strictly in U.S. assets. Portfolios investing in a single country or in a limited geographic region tend to be riskier than more diversified funds. Risks can result from varying stages of economic and political development; differing regulatory environments, trading days, and accounting standards; and higher transaction costs of non-U.S. markets. Non-U.S. investments are also subject to currency risk, or a decline in the value of a foreign currency versus the U.S. dollar, which reduces the dollar value of securities denominated in that currency.

Lipper averages: The averages of available mutual fund performance returns for specified periods in defined categories as tracked by Lipper Inc.

MSCI All Country World ex-U.S. Index: An index that measures equity market performance of developed and emerging countries, excluding the U.S.

Portfolio Highlights

Performance and Expenses

T. Rowe Price International Stock Portfolio

This chart shows the value of a hypothetical $10,000 investment in the portfolio over the past 10 fiscal year periods or since inception (for portfolios lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from portfolio returns as well as mutual fund averages and indexes.

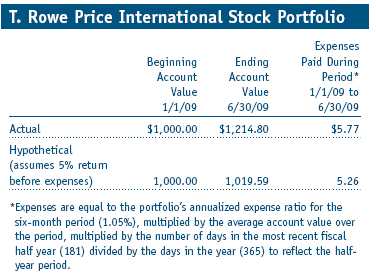

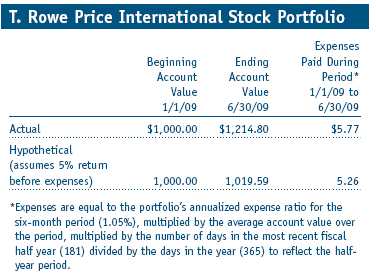

Fund Expense Example

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and actual expenses. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

Financial Highlights

T. Rowe Price International Stock Portfolio

(Unaudited)

The accompanying notes are an integral part of these financial statements.

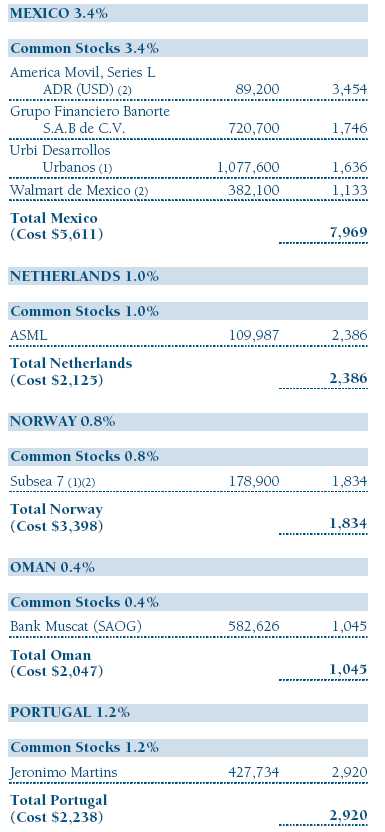

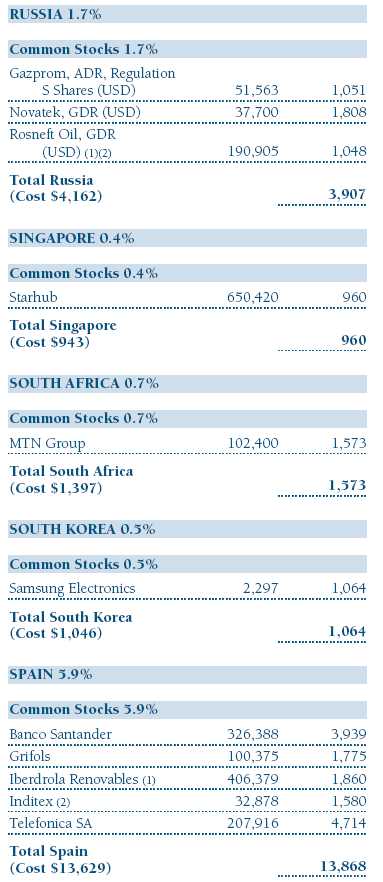

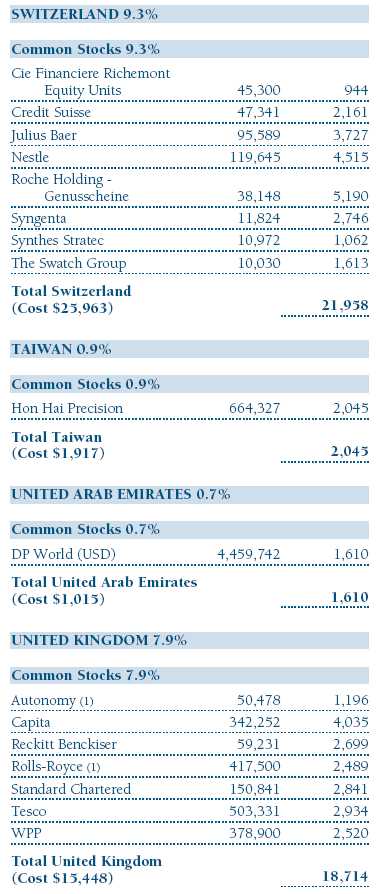

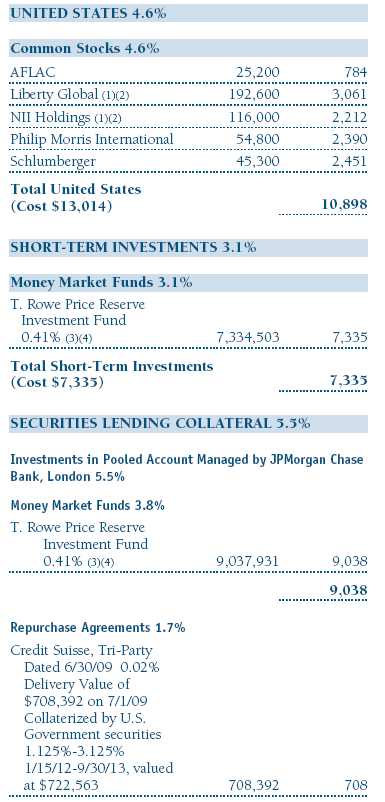

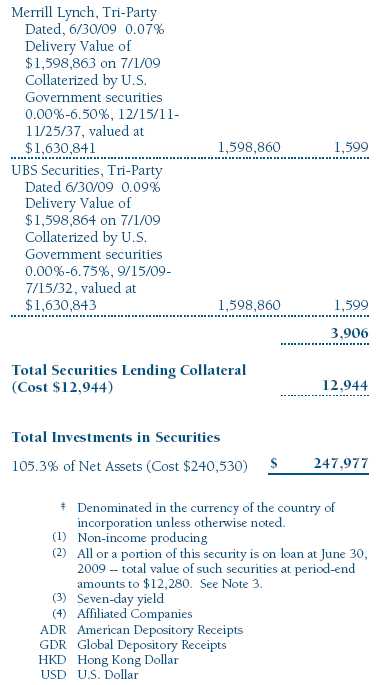

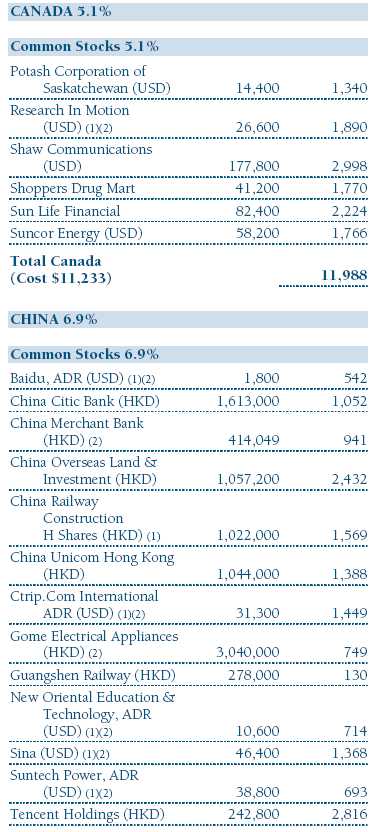

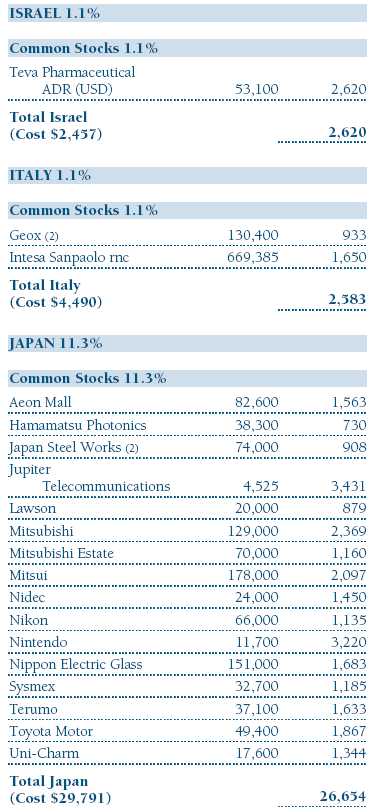

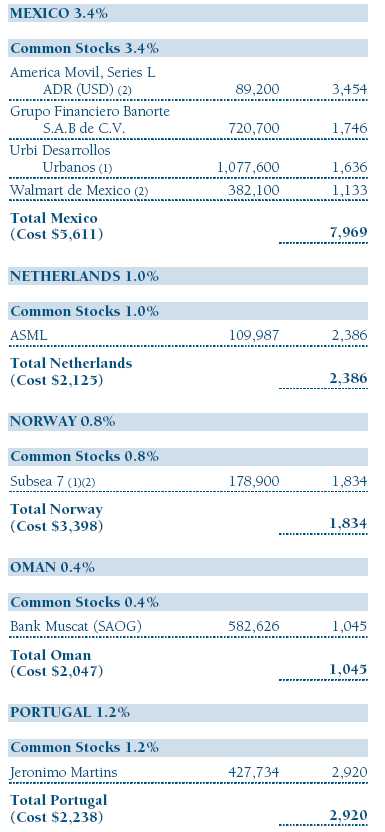

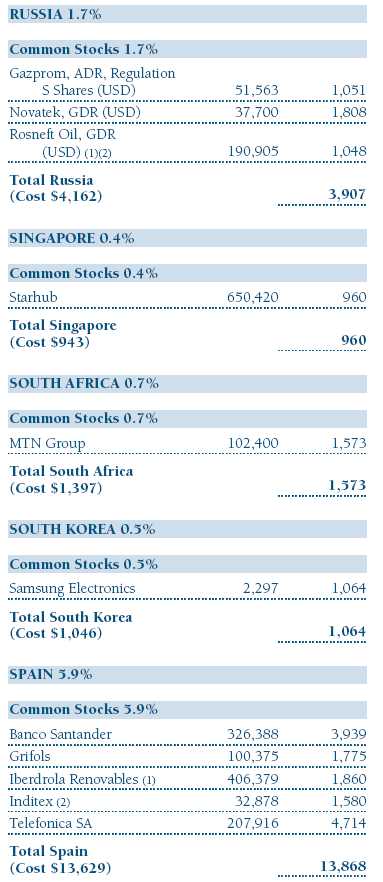

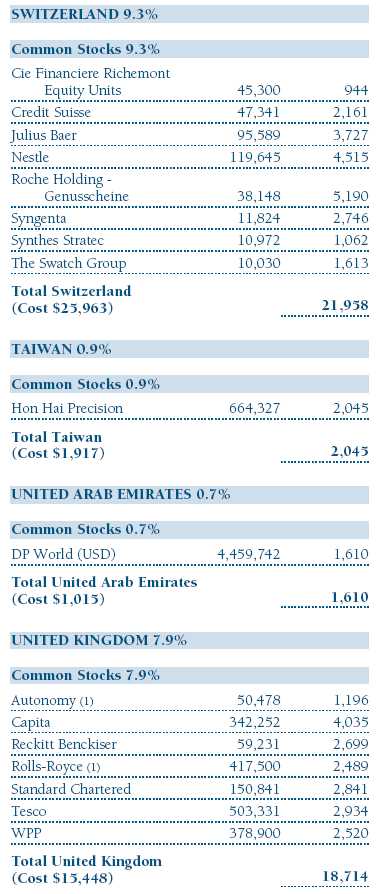

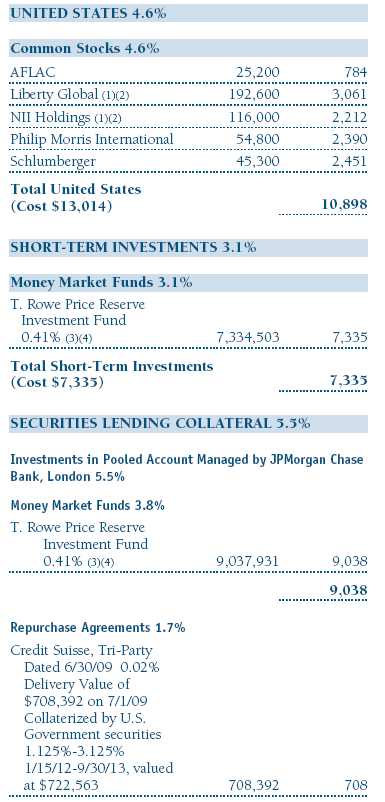

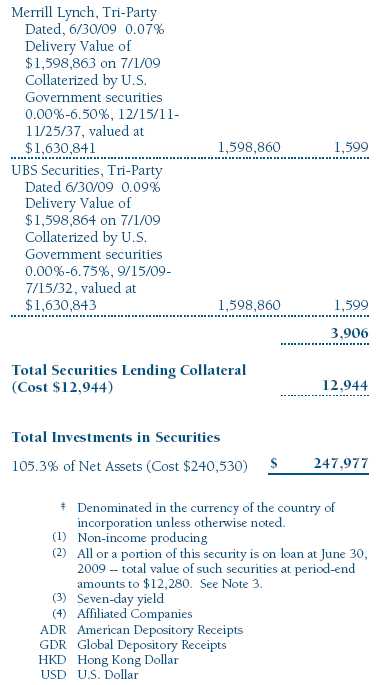

Portfolio of Investments ‡

T. Rowe Price International Stock Portfolio

June 30, 2009 (Unaudited)

The accompanying notes are an integral part of these financial statements.

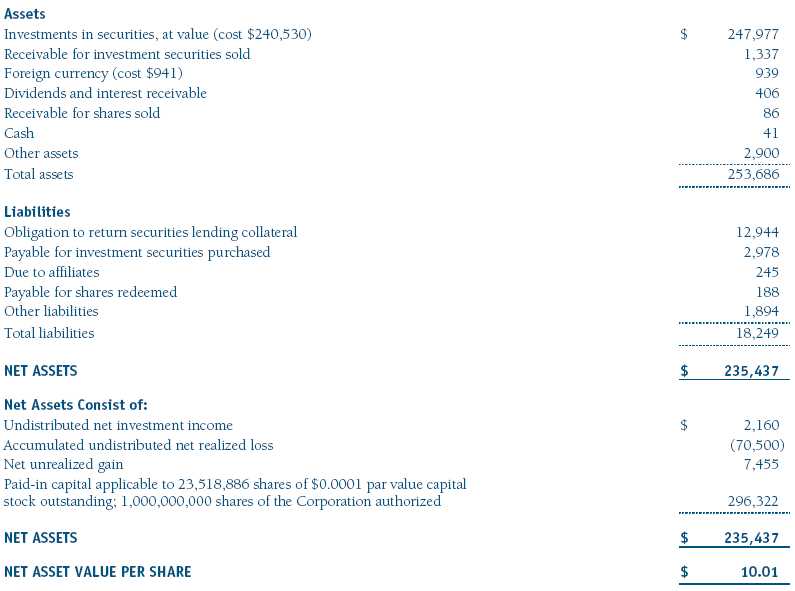

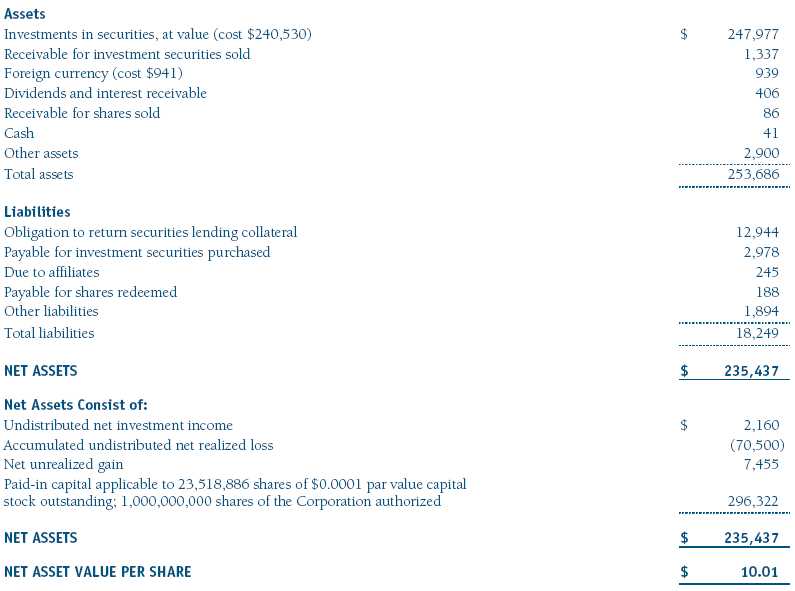

Statement of Assets and Liabilities

T. Rowe Price International Stock Portfolio

June 30, 2009 (Unaudited)

($000s, except shares and per share amounts)

The accompanying notes are an integral part of these financial statements.

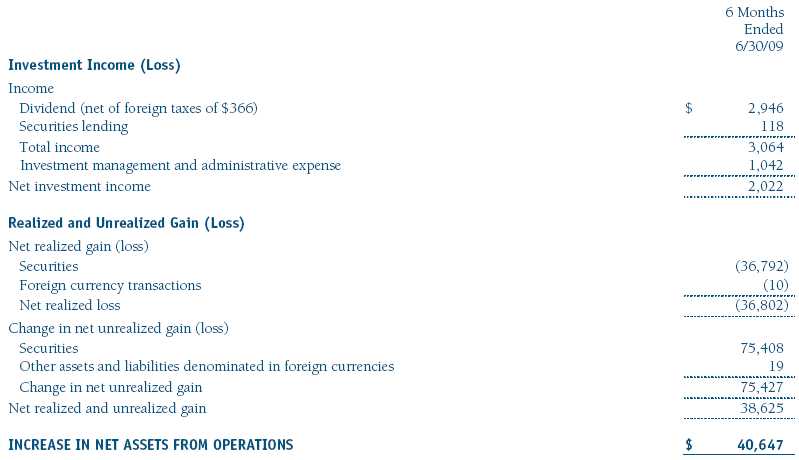

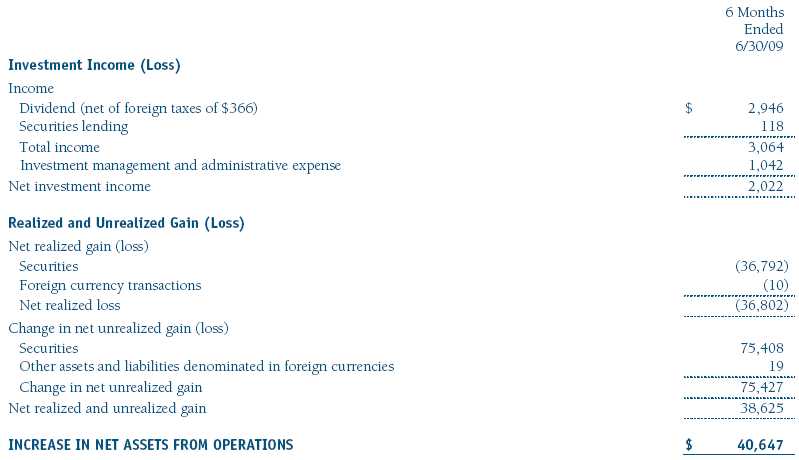

Statement of Operations

T. Rowe Price International Stock Portfolio

(Unaudited)

($000s)

The accompanying notes are an integral part of these financial statements.

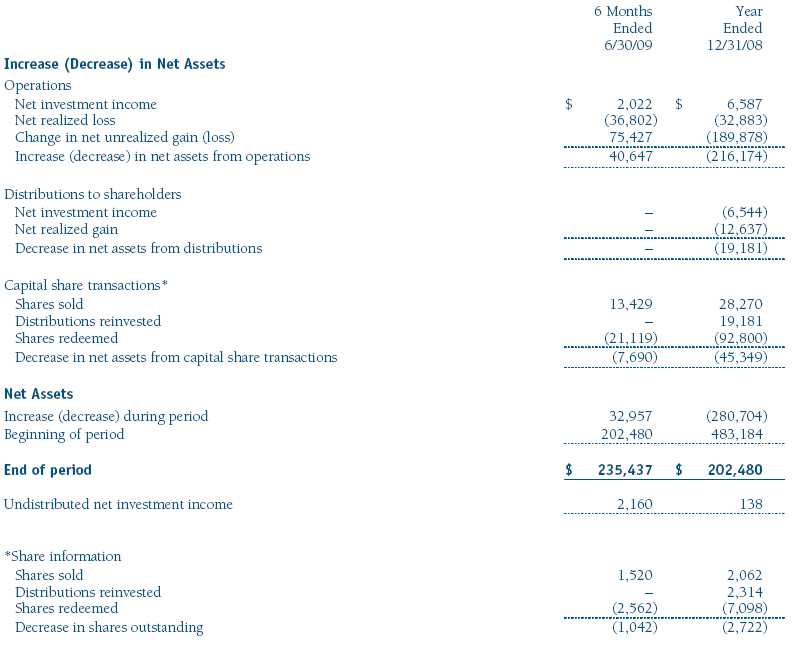

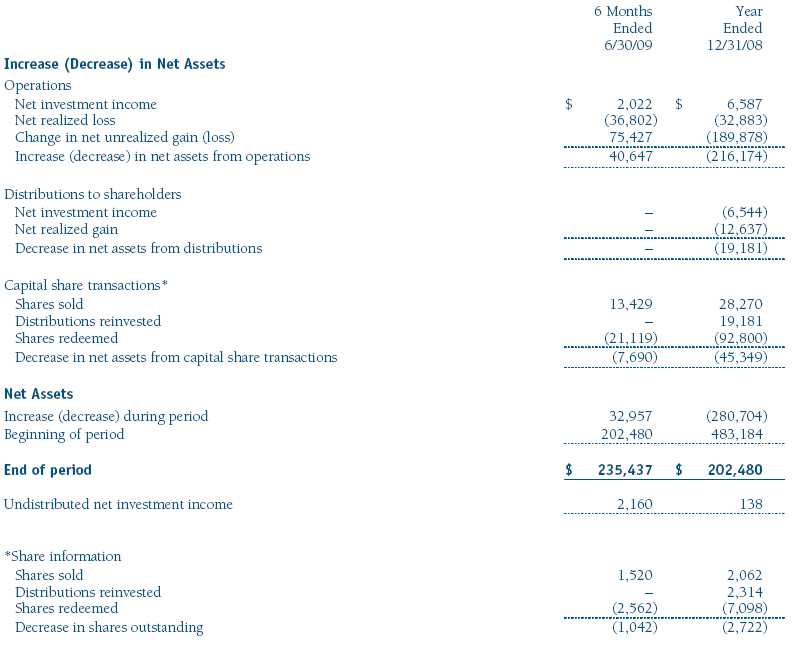

Statement of Changes in Net Assets

T. Rowe Price International Stock Portfolio

(Unaudited)

($000s)

The accompanying notes are an integral part of these financial statements.

Notes to Financial Statements

T. Rowe Price International Stock Portfolio

June 30, 2009 (Unaudited)

T. Rowe Price International Series, Inc. (the corporation), is registered under the Investment Company Act of 1940 (the 1940 Act). The International Stock Portfolio (the fund), a diversified, open-end management investment company, is one portfolio established by the corporation. The fund commenced operations on March 31, 1994. The fund seeks long-term growth of capital through investments primarily in the common stocks of established, non-U.S. companies. Shares of the fund are currently offered only through certain insurance companies as an investment medium for both variable annuity contracts and variable life insurance policies.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, which require the use of estimates made by fund management. Fund management believes that estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the fund ultimately realizes upon sale of the securities. Further, fund management believes no events have occurred between June 30, 2009 and August 20, 2009, the date of issuance of the financial statements, that require adjustment of, or disclosure in, the accompanying financial statements.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid on an annual basis. Capital gain distributions, if any, are declared and paid by the fund, typically on an annual basis.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

New Accounting Pronouncement On January 1, 2009, the fund adopted Statement of Financial Accounting Standards No. 161 (FAS 161), Disclosures about Derivative Instruments and Hedging Activities. FAS 161 requires enhanced disclosures about derivative and hedging activities, including how such activities are accounted for and their effect on financial position, performance and cash flows. Adoption of FAS 161 had no impact on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s investments are reported at fair value as defined under Statement of Financial Accounting Standards No. 157 (FAS 157), Fair Value Measurements. The fund values its investments and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business.

Valuation Methods Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made, except for OTC Bulletin Board securities, which are valued at the mean of the latest bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the latest bid and asked prices for domestic securities and the last quoted sale price for international securities. Debt securities with remaining maturities of less than one year at the time of acquisition generally use amortized cost in local currency to approximate fair value. However, if amortized cost is deemed not to reflect fair value or the fund holds a significant amount of such securities with remaining maturities of more than 60 days, the securities are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation.

Other investments, including restricted securities, and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted under the circumstances described below. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, the fund will adjust the previous closing prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust closing prices to reflect fair value, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. A fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. The fund uses outside pricing services to provide it with closing prices and information to evaluate and/or adjust those prices. The fund cannot predict how often it will use closing prices and how often it will determine it necessary to adjust those prices to reflect fair value. As a means of evaluating its security valuation process, the fund routinely compares closing prices, the next day’s opening prices in the same markets, and adjusted prices.

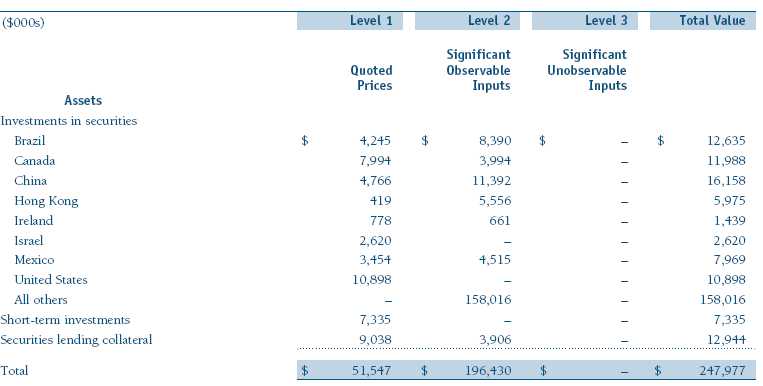

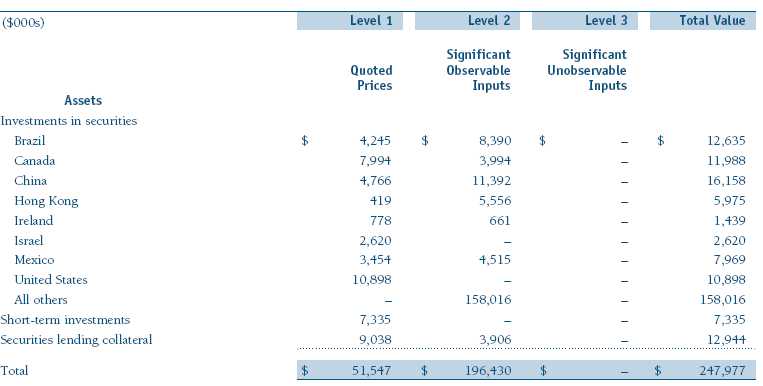

Valuation Inputs Various inputs are used to determine the value of the fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar securities, interest rates, prepayment speeds, credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, non-U.S. equity securities actively traded in foreign markets generally are reflected in Level 2 despite the availability of closing prices because the fund evaluates and determines whether those closing prices reflect fair value at the close of the NYSE or require adjustment, as described above. The following table summarizes the fund’s investments, based on the inputs used to determine their values on June 30, 2009:

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Emerging Markets At June 30, 2009, approximately 25% of the fund’s net assets were invested, directly or indirectly, in securities of companies located in emerging markets or denominated in or linked to the currencies of emerging market countries. Future economic or political developments could adversely affect the liquidity or value, or both, of such securities.

Repurchase Agreements All repurchase agreements are fully collateralized by U.S. government securities. Collateral is in the possession of the fund’s custodian or, for tri-party agreements, the custodian designated by the agreement. Collateral is evaluated daily to ensure that its market value exceeds the delivery value of the repurchase agreements at maturity. Although risk is mitigated by the collateral, the fund could experience a delay in recovering its value and a possible loss of income or value if the counterparty fails to perform in accordance with the terms of the agreement.

Securities Lending The fund lends its securities to approved brokers to earn additional income. It receives as collateral cash and U.S. government securities valued at 102% to 105% of the value of the securities on loan. Cash collateral is invested by the fund’s lending agent(s) in accordance with investment guidelines approved by fund management. Although risk is mitigated by the collateral, the fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities or if collateral investments decline in value. Securities lending revenue recognized by the fund consists of earnings on invested collateral and borrowing fees, net of any rebates to the borrower and compensation to the lending agent. On June 30, 2009, the value of loaned securities was $12,280,000.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $58,590,000 and $67,404,000, respectively, for the six months ended June 30, 2009.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions are determined in accordance with Federal income tax regulations, which differ from generally accepted accounting principles, and, therefore, may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of June 30, 2009.

In accordance with federal tax regulations, the fund deferred recognition of certain capital loss amounts previously recognized in the prior fiscal year for financial reporting purposes until the current fiscal period for tax purposes. Such deferrals amounted to $30,799,000 and related to net capital losses realized between November 1 and the fund’s fiscal year-end date.

At June 30, 2009, the cost of investments for federal income tax purposes was $240,530,000. Net unrealized gain aggregated $7,454,000 at period-end, of which $42,284,000 related to appreciated investments and $34,830,000 related to depreciated investments.

NOTE 5 - FOREIGN TAXES

The fund is subject to foreign income taxes imposed by certain countries in which it invests. Additionally, capital gains realized by the fund upon disposition of securities issued in or by certain foreign countries are subject to capital gains tax imposed by those countries. All taxes are computed in accordance with the applicable foreign tax law, and, to the extent permitted, capital losses are used to offset capital gains. Tax expense attributable to income is accrued by the fund as a reduction of income. Current and deferred tax expense attributable to net capital gains is reflected as a component of realized and/or change in unrealized gain/loss on securities in the accompanying financial statements. At June 30, 2009, the fund had no deferred tax liability attributable to foreign securities and $4,587,000 of foreign capital loss carryforwards, including $1,239,000 that expire in 2010, $518,000 that expire in 2011, $1,243,000 that expire in 2012, $50,000 that expire in 2013, $690,000 that expire in 2017, and $847,000 that expire in 2018.

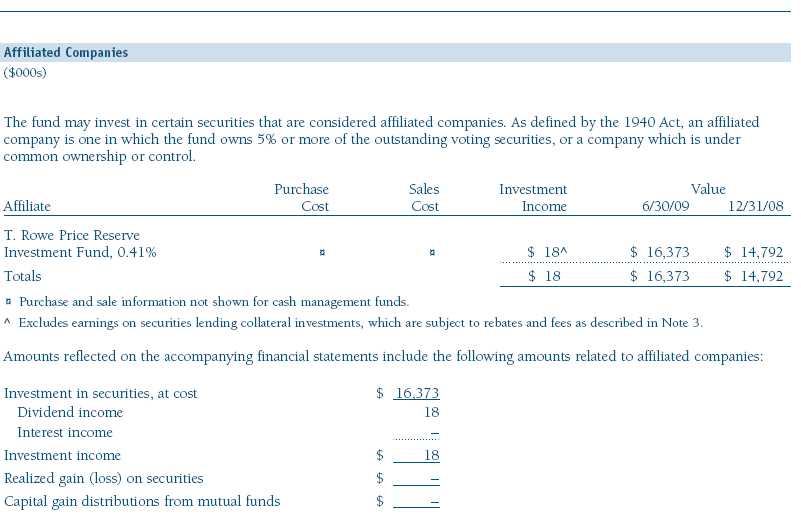

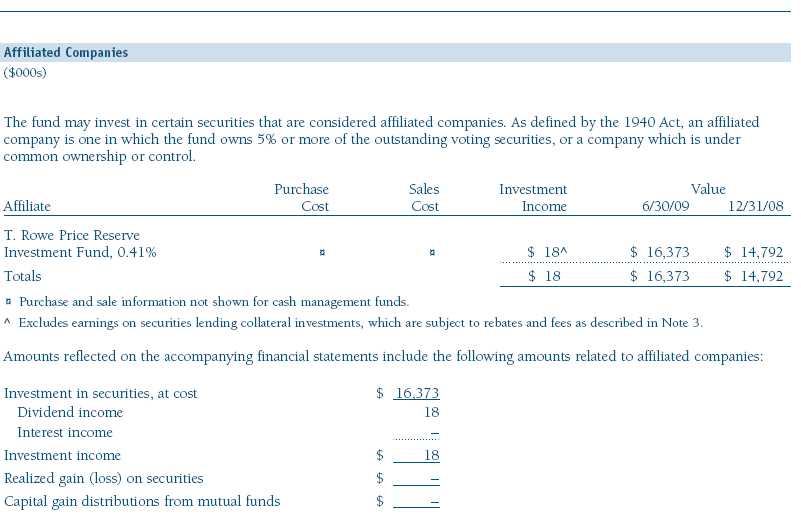

NOTE 6 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price International, Inc. (the manager), a wholly owned subsidiary of T. Rowe Price Associates, Inc. (Price Associates), which is wholly owned by T. Rowe Price Group, Inc. The investment management and administrative agreement between the fund and the manager provides for an all-inclusive annual fee equal to 1.05% of the fund’s average daily net assets. The fee is computed daily and paid monthly. The agreement provides that investment management, shareholder servicing, transfer agency, accounting, custody services, and directors’ fees and expenses are provided to the fund, and interest, taxes, brokerage commissions, and extraordinary expenses are paid directly by the fund.

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The T. Rowe Price Reserve Investment Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Investment Funds pay no investment management fees.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s Web site, www.sec.gov. The description of our proxy voting policies and procedures is also available on our Web site, www.troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our Web site and through the SEC’s Web site. To access it through our Web site, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s Web site (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public

Reference Room, call 1-800-SEC-0330.

| Approval of Investment Management Agreement |

On March 10, 2009, the fund’s Board of Directors (Board) unanimously approved the investment advisory contract (Contract) between the fund and its investment manager, T. Rowe Price International, Inc. (Manager). The Board considered a variety of factors in connection with its review of the Contract, also taking into account information provided by the Manager during the course of the year, as discussed below:

Services Provided by the Manager

The Board considered the nature, quality, and extent of the services provided to the fund by the Manager. These services included, but were not limited to, management of the fund’s portfolio and a variety of related activities, as well as financial and administrative services, reporting, and communications. The Board also reviewed the background and experience of the Manager’s senior management team and investment personnel involved in the management of the fund. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Manager.

Investment Performance of the Fund

The Board reviewed the fund’s average annual total returns over the 1-, 3-, 5-, and 10-year periods as well as the fund’s year-by-year returns and compared these returns with previously agreed upon comparable performance measures and market data, including those supplied by Lipper and Morningstar, which are independent providers of mutual fund data. On the basis of this evaluation and the Board’s ongoing review of investment results, and factoring in the severity of the market turmoil in 2008, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Manager under the Contract and other benefits that the Manager (and its affiliates) may have realized from its relationship with the fund, including research received under “soft dollar” agreements. The Board noted that soft dollars were not used to pay for third-party, non-broker research during 2008. The Board also received information on the estimated costs incurred and profits realized by the Manager and its affiliates from advising T. Rowe Price mutual funds, as well as estimates of the gross profits realized from managing the fund in particular. The Board concluded that the Manager’s profits were reasonable in light of the services provided to the fund. The Board also considered whether the fund or other funds benefit under the fee levels set forth in the Contract from any economies of scale realized by the Manager. The Board noted that, under the Contract, the fund pays the Manager a single fee based on the fund’s assets and the Manager, in turn, pays all expenses of the fund, with certain exceptions. The Board concluded that, based on the profitability data it reviewed and consistent with this single-fee structure, the Contract provided for a reasonable sharing of benefits from any economies of scale with the fund.

Fees

The Board reviewed the fund’s single-fee structure and compared the rate with fees and expenses of other comparable funds based on information and data supplied by Lipper. (For these purposes, the Board assumed the management fee rate was equal to the single fee less the fund’s operating expenses.) The information provided to the Board indicated that the fund’s management fee rate was above the median for comparable funds and that the expense ratio was at or below the median for comparable funds. The Board also reviewed the fee schedules for comparable privately managed accounts of the Manager and its affiliates. Management informed the Board that the Manager’s responsibilities for privately managed accounts are more limited than its responsibilities for the fund and other T. Rowe Price mutual funds that it or its affiliates advise. On the basis of the information provided, the Board concluded that the fees paid by the fund under the Contract were reasonable.

Approval of the Contract

As noted, the Board approved the continuation of the Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund to approve the continuation of the Contract, including the fees to be charged for services thereunder.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

| | |

SIGNATURES |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the |

| undersigned, thereunto duly authorized. |

| |

| T. Rowe Price International Series, Inc. |

| |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | August 20, 2009 |

| |

| |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, this report has been signed below by the following persons on behalf of |

| the registrant and in the capacities and on the dates indicated. |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | August 20, 2009 |

| |

| |

| |

| By | /s/ Gregory K. Hinkle |

| | Gregory K. Hinkle |

| | Principal Financial Officer |

| |

| Date | August 20, 2009 |