UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08352

LKCM Funds

(Exact name of registrant as specified in charter)

c/o Luther King Capital Management Corporation

301 Commerce Street, Suite 1600

Fort Worth, TX 76102

(Address of principal executive offices) (Zip code)

K&L Gates LLP

1601 K Street, NW

Washington, DC 20006

(Name and address of agent for service)

1-800-688-LKCM and 1-800-423-6369

Registrant’s telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Stockholders.

The Registrant’s Annual Shareholder Reports for the fiscal year ended December 31, 2024, which were transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended, are as follows:

(a)

| | |

| LKCM Small Cap Equity Fund | |

| LKSCX |

| Annual Shareholder Report | December 31, 2024 |

This annual shareholder report contains important information about the LKCM Small Cap Equity Fund for the period of January 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://lkcmfunds.com/lkcmfund/lkcm-small-cap-equity-fund/. You can also request this information by contacting us at 1-800-688-LKCM.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| LKCM Small Cap Equity Fund | $106 | 1.00% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

• The Fund returned 15.45% for the year ended December 31, 2024. The Fund’s benchmark, the Russell 2000® Index, returned 11.54% for the year ended December 31, 2024.

• Moderating inflation, strong corporate earnings growth, expectations for interest rate cuts and other factors contributed to strong performance in the overall equity markets and benefited the Fund.

• Stock selection decisions in the Energy, Financials and Consumer Staples sectors were the largest contributors to the Fund’s relative performance.

• The Fund’s underweight positions in the Healthcare and Real Estate sectors and overweight position in the Industrials sector also contributed to the Fund’s relative performance.

• The Fund benefited from a bias towards growth-oriented companies during the year.

• Stock selection decisions in the Healthcare and Industrials sectors were the largest detractors from the Fund’s relative performance.

• The Fund’s overweight positions in the Energy and Materials sectors also detracted from the Fund’s relative performance.

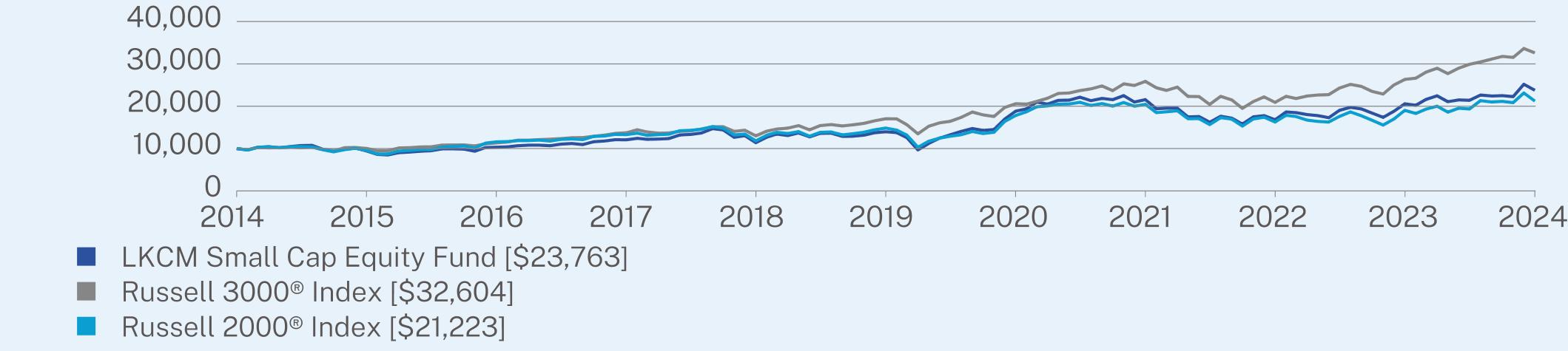

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The following chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| LKCM Small Cap Equity Fund | PAGE 1 | TSR-AR-501885107 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

LKCM Small Cap Equity Fund | 15.45 | 11.21 | 9.04 |

Russell 3000® Index ** | 23.81 | 13.86 | 12.55 |

Russell 2000® Index | 11.54 | 7.40 | 7.82 |

Visit https://lkcmfunds.com/lkcmfund/lkcm-small-cap-equity-fund/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

| ** | In accordance with new regulatory requirements, the Fund has selected a new broad-based securities market index. The former performance index is being maintained as an additional index as it shows how the Fund’s performance compares to an index with characteristics that are more representative of the Fund’s investment strategy. |

KEY FUND STATISTICS (as of December 31, 2024)

| |

Net Assets | $283,014,030 |

Number of Holdings | 75 |

Net Advisory Fee | $1,814,814 |

Portfolio Turnover | 29% |

WHAT DID THE FUND INVEST IN? (as of December 31, 2024)

| |

Top Sectors | (% of Net

Assets) |

Financials | 19.9% |

Industrials | 19.2% |

Information Technology | 15.1% |

Consumer Discretionary | 11.2% |

Health Care | 10.3% |

Energy | 6.2% |

Consumer Staples | 5.8% |

Materials | 5.3% |

Communication Services | 3.1% |

Cash & Other | 2.4% |

Real Estate | 1.5% |

| |

Top 10 Issuers | (% of Net

Assets) |

Primo Brands Corp. | 2.4% |

ESAB Corp. | 2.3% |

Q2 Holdings, Inc. | 2.2% |

Altair Engineering, Inc. - Class A | 2.2% |

Tower Semiconductor Ltd. | 2.2% |

Hawkins, Inc. | 2.1% |

Palomar Holdings, Inc. | 2.1% |

BellRing Brands, Inc. | 2.0% |

Piper Sandler Cos. | 1.9% |

Pinnacle Financial Partners Inc. | 1.9% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://lkcmfunds.com/lkcmfund/lkcm-small-cap-equity-fund/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-688-LKCM, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| LKCM Small Cap Equity Fund | PAGE 2 | TSR-AR-501885107 |

1000094421031712075113871397118832215611679420584237631000010048113271372113002170352059325877209072633432604100009559115951329411830148491781320453162731902821223

| | |

| LKCM Small-Mid Cap Equity Fund | |

| LKSMX |

| Annual Shareholder Report | December 31, 2024 |

This annual shareholder report contains important information about the LKCM Small-Mid Cap Equity Fund for the period of January 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://lkcmfunds.com/lkcmfund/lkcm-small-mid-cap-equity-fund/. You can also request this information by contacting us at 1-800-688-LKCM.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| LKCM Small-Mid Cap Equity Fund | $108 | 1.00% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

• The Fund returned 15.64% for the year ended December 31, 2024. The Fund’s benchmark, the Russell 2500® Index, returned 12.00% for the year ended December 31, 2024.

• Moderating inflation, strong corporate earnings growth, expectations for interest rate cuts and other factors contributed to strong performance in the overall equity markets and benefited the Fund.

• Stock selection decisions in the Information Technology and Industrials sectors were the largest contributors to the Fund’s relative performance.

• The Fund’s underweight position in the Healthcare sector and overweight positions in the Industrials and Financials sectors also contributed to the Fund’s relative performance.

• Stock selection decisions in the Consumer Staples and Real Estate sectors were the largest detractors from the Fund’s relative performance.

• The Fund’s underweight position in the Utilities sector also detracted from the Fund’s relative performance.

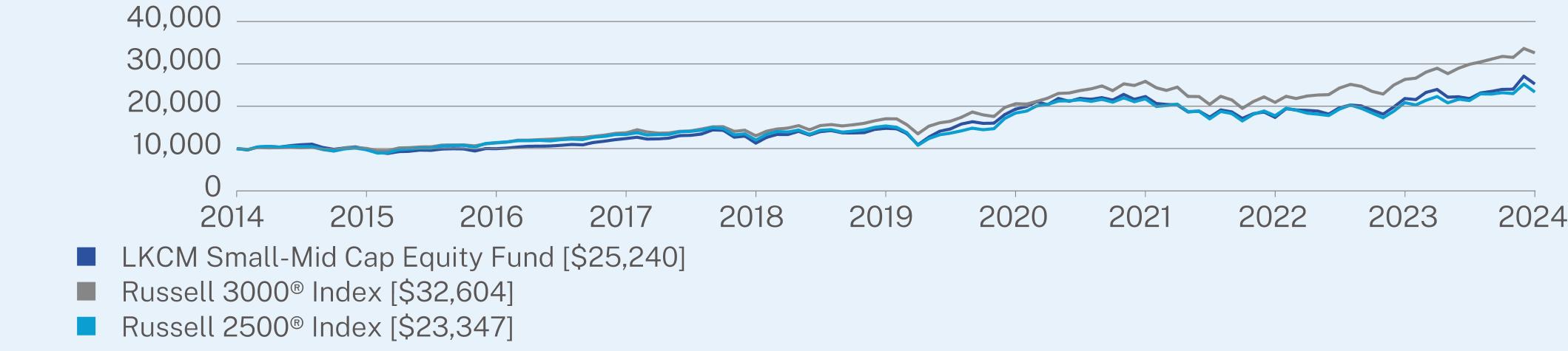

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The following chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| LKCM Small-Mid Cap Equity Fund | PAGE 1 | TSR-AR-501885859 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

LKCM Small-Mid Cap Equity Fund | 15.64 | 11.29 | 9.70 |

Russell 3000® Index** | 23.81 | 13.86 | 12.55 |

Russell 2500® Index | 12.00 | 8.77 | 8.85 |

Visit https://lkcmfunds.com/lkcmfund/lkcm-small-mid-cap-equity-fund/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

| ** | In accordance with new regulatory requirements, the Fund has selected a new broad-based securities market index. The former performance index is being maintained as an additional index as it shows how the Fund’s performance compares to an index with characteristics that are more representative of the Fund’s investment strategy. |

KEY FUND STATISTICS (as of December 31, 2024)

| |

Net Assets | $39,019,871 |

Number of Holdings | 54 |

Net Advisory Fee | $118,002 |

Portfolio Turnover | 31% |

WHAT DID THE FUND INVEST IN? (as of December 31, 2024)

| |

Top Sectors | (% of Net

Assets) |

Industrials | 26.4% |

Financials | 21.0% |

Information Technology | 14.1% |

Consumer Discretionary | 9.9% |

Health Care | 8.8% |

Cash & Other | 5.4% |

Real Estate | 3.9% |

Materials | 3.6% |

Energy | 3.3% |

Consumer Staples | 2.4% |

Communication Services | 1.2% |

| |

Top 10 Issuers | (% of Net

Assets) |

Q2 Holdings, Inc. | 4.8% |

Axon Enterprise, Inc. | 2.9% |

Palomar Holdings, Inc. | 2.7% |

Twilio Inc. - Class A | 2.6% |

Natera, Inc. | 2.6% |

Tower Semiconductor Ltd. | 2.6% |

CBIZ, Inc. | 2.5% |

Goosehead Insurance, Inc. - Class A | 2.4% |

LPL Financial Holdings, Inc. | 2.3% |

MSILF Government Portfolio | 2.3% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://lkcmfunds.com/lkcmfund/lkcm-small-mid-cap-equity-fund/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-688-LKCM, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| LKCM Small-Mid Cap Equity Fund | PAGE 2 | TSR-AR-501885859 |

100009859997512382112811478319315222851735521826252401000010048113271372113002170352059325877209072633432604100009710114181333712003153361840221748177532084623347

| | |

| LKCM Equity Fund | |

| LKEQX |

| Annual Shareholder Report | December 31, 2024 |

This annual shareholder report contains important information about the LKCM Equity Fund for the period of January 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://lkcmfunds.com/lkcmfund/lkcm-equity-fund/. You can also request this information by contacting us at 1-800-688-LKCM.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| LKCM Equity Fund | $81 | 0.80% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

• The Equity Fund returned 14.44% for the year ended December 31, 2024. The Fund’s benchmark, the S&P 500® Index, returned 25.02% for the year ended December 31, 2024.

• Moderating inflation, strong corporate earnings growth, expectations for interest rate cuts and other factors contributed to strong performance in the overall equity markets and benefited the Fund.

• The Fund’s investment strategy focuses on portfolio diversification and therefore was underweight the relative small number of technology-related companies that drove the majority of the benchmark’s performance.

• Stock selection decisions in the Industrials sector were the largest contributors to the Fund’s relative performance.

• The Fund’s underweight position in the Real Estate sector also contributed to the Fund’s relative performance.

• Stock selection decisions in the Information Technology, Healthcare and Consumer Discretionary sectors were the largest detractors from the Fund’s relative performance.

• The Fund’s overweight positions in the Materials and Industrials sectors and underweight position in the Consumer Discretionary sector detracted from the Fund’s relative performance.

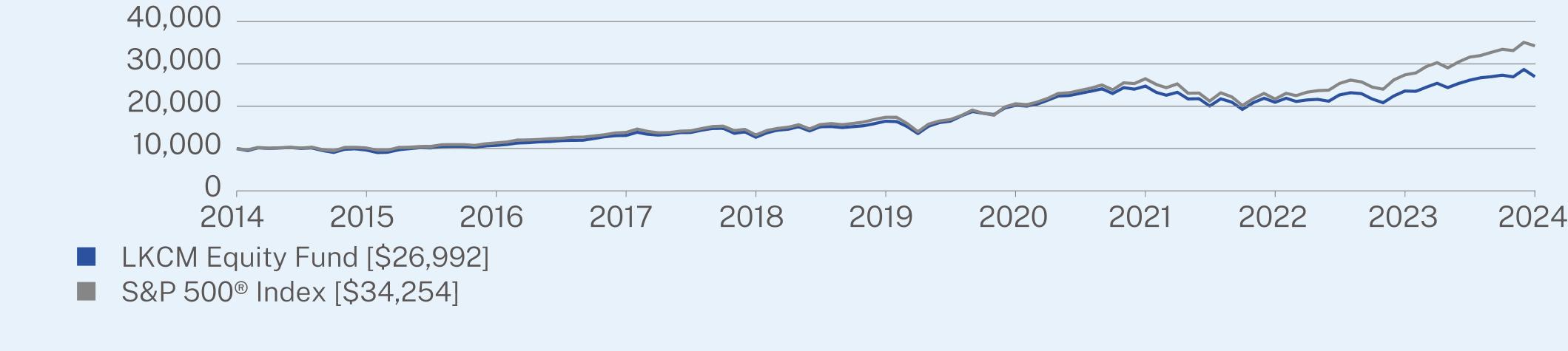

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The following chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| LKCM Equity Fund | PAGE 1 | TSR-AR-501885206 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

LKCM Equity Fund | 14.44 | 10.40 | 10.44 |

S&P 500® Index | 25.02 | 14.53 | 13.10 |

Visit https://lkcmfunds.com/lkcmfund/lkcm-equity-fund/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

KEY FUND STATISTICS (as of December 31, 2024)

| |

Net Assets | $508,483,159 |

Number of Holdings | 55 |

Net Advisory Fee | $2,662,788 |

Portfolio Turnover | 9% |

WHAT DID THE FUND INVEST IN? (as of December 31, 2024)

| |

Top Sectors | (% of Net

Assets) |

Information Technology | 25.4% |

Industrials | 23.8% |

Health Care | 11.9% |

Consumer Discretionary | 7.5% |

Materials | 6.8% |

Financials | 6.6% |

Energy | 6.6% |

Communication Services | 4.1% |

Consumer Staples | 4.0% |

Cash & Other | 3.3% |

| |

Top 10 Issuers | (% of Net

Assets) |

Microsoft Corp. | 6.6% |

Apple Inc. | 4.7% |

Alphabet, Inc. - Class A | 4.1% |

NVIDIA Corp. | 4.0% |

Oracle Corp. | 3.9% |

Waste Connections, Inc. | 3.0% |

FTAI Aviation Ltd. | 2.7% |

Ecolab, Inc. | 2.5% |

Trimble, Inc. | 2.4% |

JPMorgan Chase & Co. | 2.4% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://lkcmfunds.com/lkcmfund/lkcm-equity-fund/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-688-LKCM, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| LKCM Equity Fund | PAGE 2 | TSR-AR-501885206 |

1000096461077113107126771646120218247622093923587269921000010138113511382913223173862058526494216962739934254

| | |

| LKCM Balanced Fund | |

| LKBAX |

| Annual Shareholder Report | December 31, 2024 |

This annual shareholder report contains important information about the LKCM Balanced Fund for the period of January 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://lkcmfunds.com/lkcmfund/lkcm-balanced-fund/. You can also request this information by contacting us at 1-800-688-LKCM.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| LKCM Balanced Fund | $82 | 0.80% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

• The Fund returned 10.99% for the year ended December 31, 2024. One of the Fund’s benchmarks, the S&P 500® Index, returned 25.02% for the year ended December 31, 2024. The Fund’s other benchmark, the Bloomberg Intermediate Government/Credit Bond Index, returned 3.00% for the year ended December 31, 2024.

• Moderating inflation, strong corporate earnings growth, expectations for interest rate cuts and other factors contributed to strong performance in the overall equity markets and benefited the Fund.

• The Fund’s investment strategy for its equity portfolio focuses on portfolio diversification and therefore was underweight the relative small number of technology-related companies that drove the majority of the benchmark’s performance.

• Stock selection decisions in the Energy and Materials sectors were the largest contributors to the performance of the Fund’s equity portfolio.

• The Fund’s underweight position in the Real Estate sector also contributed to the performance of the Fund’s equity portfolio.

• Stock selection decisions in the Information Technology, Industrials and Healthcare sectors were the largest detractors from the performance of the Fund’s equity portfolio.

• The Fund’s overweight positions in the Materials and Energy sectors and underweight position in the Information Technology sector also detracted from the performance of the Fund’s equity portfolio.

• The Fund’s fixed income portfolio outperformed and benefited from a focus on corporate bonds with the intermediate-term maturities.

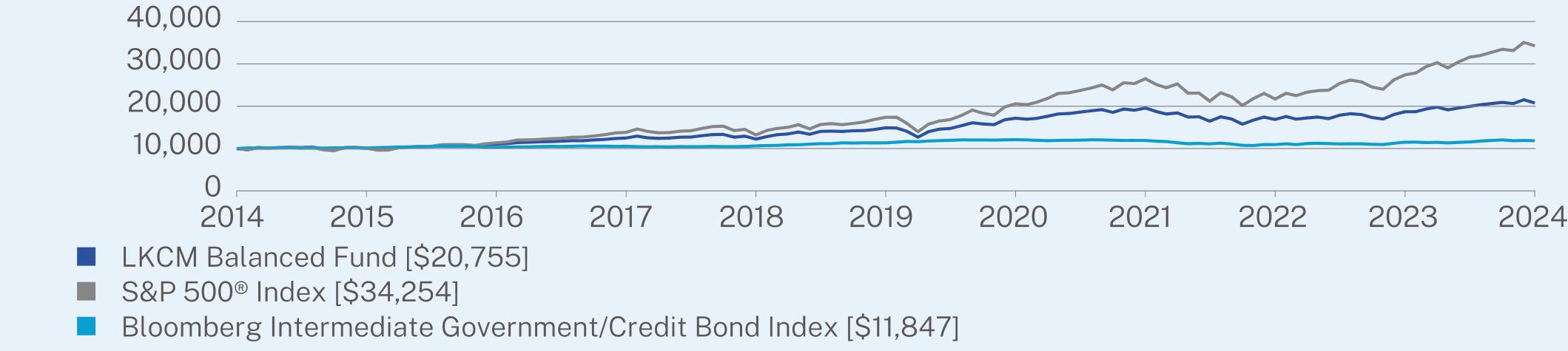

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The following chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| LKCM Balanced Fund | PAGE 1 | TSR-AR-501885305 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

LKCM Balanced Fund | 10.99 | 6.86 | 7.58 |

S&P 500® Index | 25.02 | 14.53 | 13.10 |

Bloomberg Intermediate Government/Credit Bond Index | 3.00 | 0.86 | 1.71 |

Visit https://lkcmfunds.com/lkcmfund/lkcm-balanced-fund/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

KEY FUND STATISTICS (as of December 31, 2024)

| |

Net Assets | $114,922,770 |

Number of Holdings | 141 |

Net Advisory Fee | $502,832 |

Portfolio Turnover | 15% |

WHAT DID THE FUND INVEST IN? (as of December 31, 2024)

| |

Top Sectors (% of Net Assets) |

Information Technology | 21.7% |

Industrials | 14.6% |

Health Care | 11.4% |

Financials | 9.9% |

Consumer Staples | 9.3% |

Energy | 8.8% |

Communication Services | 7.4% |

Materials | 7.2% |

Consumer Discretionary | 6.8% |

Cash & Other | 2.9% |

| |

Security Type (% of Net Assets) |

Common Stocks | 69.5% |

Corporate Bonds | 29.8% |

Cash & Other | 0.7% |

| |

Top 10 Issuers (% of Net Assets) |

Apple Inc. | 3.5% |

Amazon.com, Inc. | 2.9% |

Meta Platforms, Inc. | 2.8% |

NVIDIA Corp. | 2.7% |

Microsoft Corp. | 2.7% |

Oracle Corp. | 2.6% |

Alphabet Inc. - Class C | 2.3% |

Home Depot, Inc. | 2.1% |

Cullen/Frost Bankers, Inc. | 1.8% |

Waste Management, Inc. | 1.8% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://lkcmfunds.com/lkcmfund/lkcm-balanced-fund/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-688-LKCM, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| LKCM Balanced Fund | PAGE 2 | TSR-AR-501885305 |

100001009111070124951222614898171751958116871187002075510000101381135113829132231738620585264942169627399342541000010107103171053810630113531208411910109291150211847

| | |

| LKCM Fixed Income Fund | |

| LKFIX |

| Annual Shareholder Report | December 31, 2024 |

This annual shareholder report contains important information about the LKCM Fixed Income Fund for the period of January 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://lkcmfunds.com/lkcmfund/lkcm-fixed-income-fund/. You can also request this information by contacting us at 1-800-688-LKCM.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| LKCM Fixed Income Fund | $51 | 0.50% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

• The Fund returned 3.06% for the year ended December 31, 2024. The Fund’s benchmark, the Bloomberg Intermediate Government/Credit Bond Index, returned 3.00% for the year ended December 31, 2024.

• The U.S. Treasury curve steepened with yields on longer-dated issues increasing substantially and yields on shorter-dated issues declining as the Federal Reserve cut the Federal funds rate by 1.00%.

• The Fund benefited from having a shorter average duration (3.5 years) relative to the benchmark (3.7 years).

• The Fund’s relative performance benefited from an overweight position in high-quality corporate bonds, as corporate bonds outperformed U.S. Treasuries and Government Agency issues during the year as credit spreads tightened substantially.

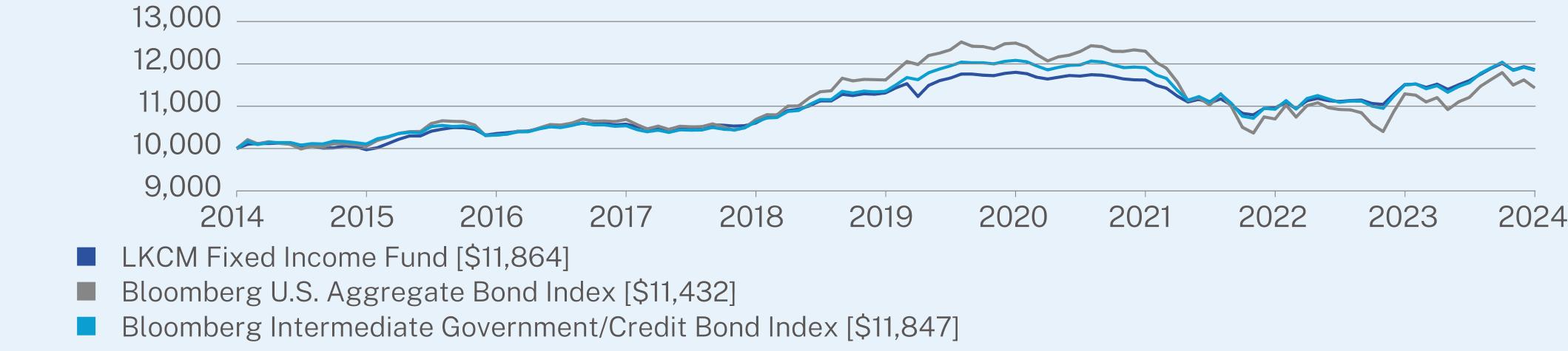

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The following chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| LKCM Fixed Income Fund | PAGE 1 | TSR-AR-501885404 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

LKCM Fixed Income Fund | 3.06 | 0.95 | 1.72 |

Bloomberg U.S. Aggregate Bond Index ** | 1.25 | -0.33 | 1.35 |

Bloomberg Intermediate Government/Credit Bond Index | 3.00 | 0.86 | 1.71 |

Visit https://lkcmfunds.com/lkcmfund/lkcm-fixed-income-fund/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

| ** | In accordance with new regulatory requirements, the Fund has selected a new broad-based securities market index. The former performance index is being maintained as an additional index as it shows how the Fund’s performance compares to an index with characteristics that are more representative of the Fund’s investment strategy. |

KEY FUND STATISTICS (as of December 31, 2024)

| |

Net Assets | $277,122,376 |

Number of Holdings | 94 |

Net Advisory Fee | $529,058 |

Portfolio Turnover | 25% |

Effective Duration | 3.49 years |

30-Day SEC Yield | 4.07% |

WHAT DID THE FUND INVEST IN? (as of December 31, 2024)

| |

Top Sectors | (% of Net

Assets) |

U.S. Government Sponsored Entities | 22.2% |

Industrials | 12.0% |

Health Care | 11.5% |

Government Bonds | 10.9% |

Information Technology | 10.7% |

Energy | 9.1% |

Consumer Discretionary | 5.1% |

Communication Services | 5.1% |

Financials | 4.3% |

Cash & Other | 4.2% |

Real Estate | 2.5% |

Materials | 2.4% |

| |

Top 10 Issuers | (% of Net

Assets) |

United States Treasury Note/Bond, 4.13%, 11/15/32 | 3.0% |

Intuit Inc., 5.20%, 09/15/33 | 2.7% |

Emerson Electric Co., 3.15%, 06/01/25 | 2.7% |

Kinder Morgan Inc., 5.20%, 06/01/33 | 2.6% |

L3Harris Technologies Inc., 5.40%, 07/31/33 | 2.0% |

Danaher Corp., 3.35%, 09/15/25 | 2.0% |

Trimble Inc., 6.10%, 03/15/33 | 1.9% |

ONEOK Inc., 6.05%, 09/01/33 | 1.9% |

Tractor Supply Co., 5.25%, 05/15/33 | 1.8% |

Federal Home Loan Banks, 4.00%, 04/14/25 | 1.8% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://lkcmfunds.com/lkcmfund/lkcm-fixed-income-fund/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-688-LKCM, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| LKCM Fixed Income Fund | PAGE 2 | TSR-AR-501885404 |

10000997310355105771060511316118011161910965115121186410000100551032110687106881162012492122991069911291114321000010107103171053810630113531208411910109291150211847

| | |

| LKCM International Equity Fund | |

| LKINX |

| Annual Shareholder Report | December 31, 2024 |

This annual shareholder report contains important information about the LKCM International Equity Fund for the period of January 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://lkcmfunds.com/lkcmfund/lkcm-international-equity-fund/. You can also request this information by contacting us at 1-800-688-LKCM.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| LKCM International Equity Fund | $100 | 1.00% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

• The Fund returned 4.83% for the year ended December 31, 2024. The Fund’s benchmark, the MSCI/EAFE® Index, returned 4.35% for the year ended December 31, 2024.

• International equity markets continued to be more cyclically challenged than United States equity markets during the year.

• Stock selection decisions in the Materials, Energy and Financials sectors were the largest contributors to the Fund’s relative performance.

• The Fund’s overweight position in the Industrials sector and underweight positions in the Utilities and Healthcare sectors also contributed to the Fund’s relative performance.

• Stock selection decisions in the Industrials and Healthcare sectors were the largest detractors from the Fund’s relative performance.

• The Fund’s underweight position in the Financials sector and overweight position in the Energy sector also detracted from the Fund’s relative performance.

• The Fund’s tilt towards growth-oriented companies was a modest detractor from the Fund’s relative performance.

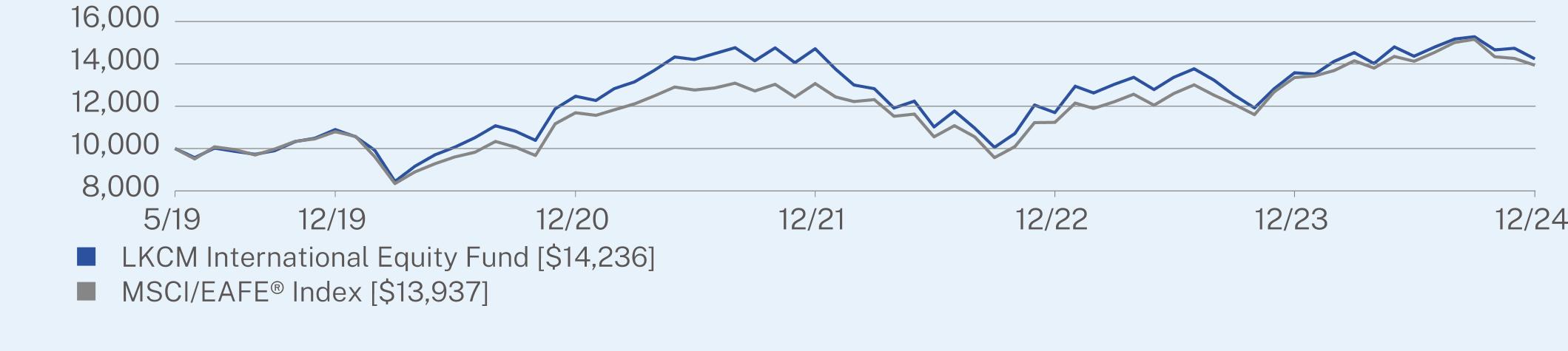

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The following chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| LKCM International Equity Fund | PAGE 1 | TSR-AR-501885834 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(05/01/2019) |

LKCM International Equity Fund | 4.83 | 5.49 | 6.43 |

MSCI/EAFE® Index | 4.35 | 5.24 | 6.03 |

Visit https://lkcmfunds.com/lkcmfund/lkcm-international-equity-fund/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

KEY FUND STATISTICS (as of December 31, 2024)

| |

Net Assets | $60,328,858 |

Number of Holdings | 49 |

Net Advisory Fee | $324,873 |

Portfolio Turnover | 17% |

WHAT DID THE FUND INVEST IN? (as of December 31, 2024)

| |

Top Sectors (% of Net Assets) |

Industrials | 21.2% |

Financials | 20.2% |

Information Technology | 12.8% |

Consumer Discretionary | 10.9% |

Health Care | 9.0% |

Consumer Staples | 7.6% |

Energy | 6.2% |

Materials | 6.0% |

Communication Services | 4.8% |

Cash & Other | 1.3% |

| |

Top 10 Issuers (% of Net Assets) |

Deutsche Telekom AG | 2.9% |

Barclays PLC | 2.8% |

SAP SE | 2.8% |

Euronext NV | 2.8% |

Lonza Group AG | 2.7% |

Air Liquide SA | 2.7% |

Alcon AG | 2.7% |

Sage Group PLC | 2.6% |

Unilever PLC | 2.6% |

Fluidra SA | 2.6% |

| |

Top Ten Countries (% of Net Assets) |

United Kingdom | 25.8% |

Germany | 13.6% |

France | 13.0% |

Netherlands | 10.0% |

Switzerland | 9.6% |

Canada | 6.4% |

Japan | 4.4% |

Australia | 3.7% |

Spain | 2.6% |

United States | 2.6% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://lkcmfunds.com/lkcmfund/lkcm-international-equity-fund/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-688-LKCM, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| LKCM International Equity Fund | PAGE 2 | TSR-AR-501885834 |

1000010897124721471611698135801423610000107981169213069112381335613937

| | |

| LKCM Aquinas Catholic Equity Fund | |

| AQEIX |

| Annual Shareholder Report | December 31, 2024 |

This annual shareholder report contains important information about the LKCM Aquinas Catholic Equity Fund for the period of January 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://www.aquinasfunds.com/applications-documents/. You can also request this information by contacting us at 1-800-423-6369.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| LKCM Aquinas Catholic Equity Fund | $102 | 1.00% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

• The Fund returned 13.37% for the year ended December 31, 2024. The Fund’s benchmark, the S&P 500® Index, returned 25.02% for the year ended December 31, 2024.

• Moderating inflation, strong corporate earnings growth, expectations for interest rate cuts and other factors contributed to strong performance in the overall equity markets and benefited the Fund.

• The Fund’s investment strategy focuses on portfolio diversification and therefore was underweight the relative small number of technology-related companies that drove the majority of the benchmark’s performance.

• Stock selection decisions in the Materials, Energy and Financials sectors were the largest contributors to the Fund’s relative performance.

• The Fund’s underweight positions in the Healthcare and Real Estate sectors also contributed to the Fund’s relative performance.

• Stock selection decisions in the Information Technology, Consumer Staples, Consumer Discretionary and Industrials sectors were the largest detractors from the Fund’s relative performance.

• The Fund’s overweight positions in the Materials and Energy sectors and underweight position in the Communication Services sector also detracted from the Fund’s relative performance.

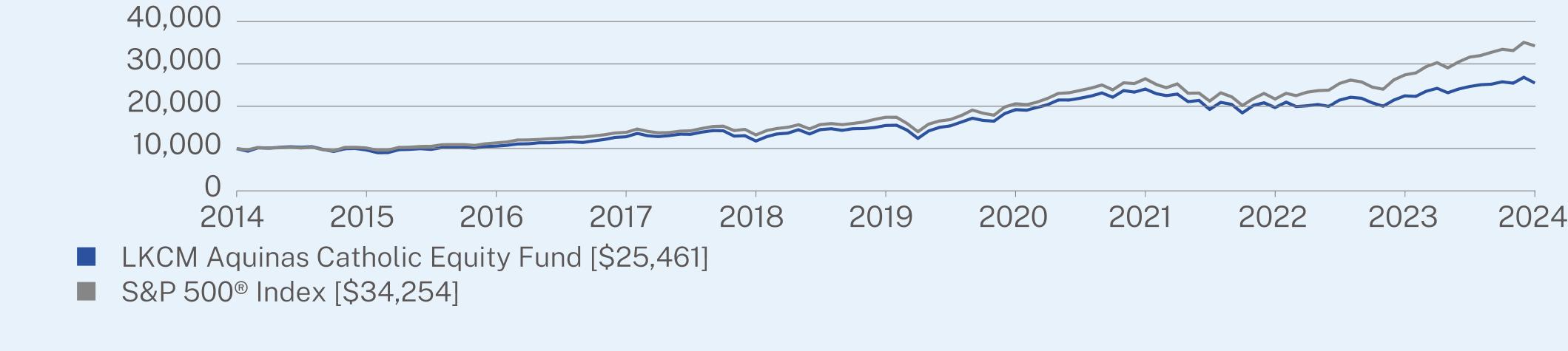

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The following chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| LKCM Aquinas Catholic Equity Fund | PAGE 1 | TSR-AR-501885883 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

LKCM Aquinas Catholic Equity Fund | 13.37 | 10.51 | 9.80 |

S&P 500® Index | 25.02 | 14.53 | 13.10 |

Visit https://www.aquinasfunds.com/applications-documents/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. Performance information reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. |

KEY FUND STATISTICS (as of December 31, 2024)

| |

Net Assets | $60,109,295 |

Number of Holdings | 44 |

Net Advisory Fee | $258,774 |

Portfolio Turnover | 11% |

WHAT DID THE FUND INVEST IN? (as of December 31, 2024)

| |

Top Sectors | (% of Net

Assets) |

Information Technology | 31.0% |

Industrials | 13.2% |

Materials | 12.0% |

Consumer Discretionary | 10.4% |

Energy | 8.5% |

Health Care | 7.9% |

Consumer Staples | 5.5% |

Communication Services | 4.9% |

Financials | 4.3% |

Cash & Other | 2.3% |

| |

Top 10 Issuers | (% of Net

Assets) |

NVIDIA Corp. | 5.1% |

Alphabet, Inc. - Class A | 4.9% |

Microsoft Corp. | 4.6% |

Oracle Corp. | 4.2% |

Apple Inc. | 3.7% |

Roper Technologies, Inc. | 3.5% |

Stryker Corp. | 3.3% |

Trimble, Inc. | 2.9% |

Amazon.com, Inc. | 2.9% |

Sherwin-Williams Co. | 2.8% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.aquinasfunds.com/applications-documents/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-423-6369, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| LKCM Aquinas Catholic Equity Fund | PAGE 2 | TSR-AR-501885883 |

1000096721059212794117761544519195240591968822459254611000010138113511382913223173862058526494216962739934254

Item 2. Code of Ethics.

The Registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The Registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Richard J. Howell is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The Registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the Registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The following table details the aggregate fees billed or expected to be billed by the principal accountant for each of the last two fiscal years for audit services (which are reflected under “Audit Fees”), audit-related services (which are reflected under “Audit-Related Fee”), tax services (which are reflected under “Tax Fees”), and other services fees (which are reflected under “All Other Fees”).

| | FYE 12/31/2024 | FYE 12/31/2023 |

| Audit Fees | $175,000 | $172,470 |

| Audit-Related Fees | — | — |

| Tax Fees | 38,396 | 37,820 |

| All Other Fees | — | — |

The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the Registrant, including services provided to any entity affiliated with the Registrant.

The percentage of fees billed by the principal accountant applicable to non-audit services pursuant to a waiver of pre-approval requirements were as follows:

| | FYE 12/31/2024 | FYE 12/31/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

All of the principal accountant’s hours spent on auditing the Registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

The following table indicates the non-audit fees billed or expected to be billed by the Registrant’s principal accountant for services to the Registrant and to the Registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| Non-Audit Related Fees | FYE 12/31/2024 | FYE 12/31/2023 |

| Registrant | $38,396 | $37,820 |

| Registrant’s Investment Adviser | — | — |

The audit committee of the board of trustees has considered whether the provision of non-audit services that were rendered to the Registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

The Registrant has not been identified by the U.S. Securities and Exchange Commission as having filed an annual report issued by a registered public accounting firm branch or office that is located in a foreign jurisdiction where the Public Company Accounting Oversight Board is unable to inspect or completely investigate because of a position taken by an authority in that jurisdiction.

The Registrant is not a foreign issuer.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

| (a) | The Schedule of Investments is included within the financial statements filed under Item 7 of this Form N-CSR. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

(a)

FUNDS

LKCM SMALL CAP EQUITY FUND

LKCM SMALL-MID CAP EQUITY FUND

LKCM EQUITY FUND

LKCM BALANCED FUND

LKCM FIXED INCOME FUND

LKCM INTERNATIONAL EQUITY FUND

Annual Financial Statements and Other Information

December 31, 2024

TABLE OF CONTENTS

| | | | |

Schedules of Investments

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Financial Highlights

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

TABLE OF CONTENTS

LKCM SMALL CAP EQUITY FUND

Schedule of Investments

December 31, 2024

| | | | | | | |

COMMON STOCKS - 97.4%

| | | | | | |

Aerospace & Defense - 0.9%

| | | | | | |

Mercury Systems, Inc.(a) | | | 60,778 | | | $2,552,676 |

Banks - 8.7%

| | | | | | |

Cadence Bank | | | 106,080 | | | 3,654,456 |

Cullen/Frost Bankers, Inc. | | | 9,622 | | | 1,291,753 |

Hilltop Holdings, Inc. | | | 72,049 | | | 2,062,763 |

Home BancShares, Inc. | | | 162,789 | | | 4,606,929 |

Pinnacle Financial Partners, Inc. | | | 47,082 | | | 5,385,710 |

UMB Financial Corp. | | | 34,624 | | | 3,907,665 |

Webster Financial Corp. | | | 64,812 | | | 3,578,918 |

| | | | | | 24,488,194 |

Beverages - 2.4%

| | | | | | |

Primo Brands Corp. | | | 219,278 | | | 6,747,184 |

Broadline Retail - 1.7%

| | | | | | |

Ollie's Bargain Outlet Holdings, Inc.(a) | | | 44,941 | | | 4,931,376 |

Building Products - 2.5%

| | | | | | |

CSW Industrials, Inc. | | | 7,748 | | | 2,733,495 |

Zurn Elkay Water Solutions Corp. | | | 117,884 | | | 4,397,073 |

| | | | | | 7,130,568 |

Capital Markets - 1.9%

| | | | | | |

Piper Sandler Cos. | | | 18,161 | | | 5,447,392 |

Chemicals - 3.0%

| | | | | | |

Hawkins, Inc. | | | 48,811 | | | 5,987,645 |

Quaker Chemical Corp. | | | 17,138 | | | 2,412,345 |

| | | | | | 8,399,990 |

Communications Equipment - 1.4%

| | | | | | |

Lumentum Holdings, Inc.(a) | | | 47,993 | | | 4,029,012 |

Construction Materials - 1.2%

| | | | | | |

Eagle Materials, Inc. | | | 14,319 | | | 3,533,356 |

Consumer Finance - 1.1%

| | | | | | |

FirstCash Holdings, Inc. | | | 29,091 | | | 3,013,828 |

Electrical Equipment - 0.9%

| | | | | | |

Generac Holdings, Inc.(a) | | | 16,020 | | | 2,483,901 |

Energy Equipment & Services - 2.2%

| | | | | | |

Archrock, Inc. | | | 150,259 | | | 3,739,946 |

Weatherford International PLC | | | 35,852 | | | 2,568,079 |

| | | | | | 6,308,025 |

Financial Services - 4.8% | | | | | | |

AvidXchange Holdings, Inc.(a) | | | 401,642 | | | 4,152,978 |

Euronet Worldwide, Inc.(a) | | | 33,688 | | | 3,464,474 |

Repay Holdings Corp.(a) | | | 119,937 | | | 915,119 |

Shift4 Payments, Inc. - Class A(a) | | | 47,429 | | | 4,922,182 |

| | | | | | 13,454,753 |

| | | | | | | |

| | | | | | | |

Food Products - 1.3%

| | | | | | |

Utz Brands, Inc. | | | 241,022 | | | $3,774,405 |

Health Care Equipment & Supplies - 4.7%

|

Alphatec Holdings, Inc.(a) | | | 423,269 | | | 3,885,610 |

Enovis Corp.(a) | | | 85,780 | | | 3,764,026 |

Merit Medical Systems, Inc.(a) | | | 39,861 | | | 3,855,356 |

Neogen Corp.(a) | | | 146,272 | | | 1,775,742 |

| | | | | | 13,280,734 |

Health Care Providers & Services - 3.9%

|

Addus HomeCare Corp.(a) | | | 21,456 | | | 2,689,509 |

Ensign Group, Inc. | | | 30,087 | | | 3,997,359 |

HealthEquity, Inc.(a) | | | 44,387 | | | 4,258,933 |

| | | | | | 10,945,801 |

Hotels, Restaurants & Leisure - 6.8%

| | | | | | |

Everi Holdings, Inc.(a) | | | 342,821 | | | 4,631,511 |

Kura Sushi USA, Inc. - Class A(a) | | | 18,460 | | | 1,672,107 |

Lucky Strike Entertainment Corp. | | | 223,885 | | | 2,241,089 |

Playa Hotels & Resorts NV(a) | | | 378,895 | | | 4,793,022 |

Red Rock Resorts, Inc. - Class A | | | 62,227 | | | 2,877,376 |

Wingstop, Inc. | | | 10,484 | | | 2,979,553 |

| | | | | | 19,194,658 |

Insurance - 3.8%

| | | | | | |

Goosehead Insurance, Inc. - Class A(a) | | | 44,511 | | | 4,772,469 |

Palomar Holdings, Inc.(a) | | | 56,625 | | | 5,979,034 |

| | | | | | 10,751,503 |

Life Sciences Tools & Services - 1.7%

| | | | | | |

Medpace Holdings, Inc.(a) | | | 14,794 | | | 4,915,011 |

Machinery - 9.6%

| | | | | | |

Alamo Group, Inc. | | | 19,787 | | | 3,678,601 |

Chart Industries, Inc.(a) | | | 20,882 | | | 3,985,121 |

ESAB Corp. | | | 53,383 | | | 6,402,757 |

Franklin Electric Co., Inc. | | | 30,970 | | | 3,018,026 |

Helios Technologies, Inc. | | | 54,993 | | | 2,454,888 |

ITT, Inc. | | | 31,035 | | | 4,434,281 |

Watts Water Technologies, Inc. - Class A | | | 16,359 | | | 3,325,785 |

| | | | | | 27,299,459 |

Media - 3.1%

| | | | | | |

Magnite, Inc.(a) | | | 334,804 | | | 5,330,080 |

Nexstar Media Group, Inc. - Class A | | | 21,672 | | | 3,423,526 |

| | | | | | 8,753,606 |

Metals & Mining - 1.1%

| | | | | | |

Materion Corp. | | | 31,279 | | | 3,092,868 |

Oil, Gas & Consumable Fuels - 4.0%

| | | | | | |

CNX Resources Corp.(a) | | | 136,350 | | | 4,999,955 |

Magnolia Oil & Gas Corp. - Class A | | | 152,130 | | | 3,556,799 |

Northern Oil and Gas, Inc. | | | 41,056 | | | 1,525,641 |

Permian Resources Corp. | | | 79,941 | | | 1,149,552 |

| | | | | | 11,231,947 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

LKCM SMALL CAP EQUITY FUND

Schedule of Investments

December 31, 2024 (Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Personal Care Products - 2.0%

| | | | | | |

BellRing Brands, Inc.(a) | | | 76,977 | | | $5,799,447 |

Professional Services - 3.6%

| | | | | | |

CBIZ, Inc.(a) | | | 46,306 | | | 3,789,220 |

NV5 Global, Inc.(a) | | | 135,684 | | | 2,556,286 |

Upwork, Inc.(a) | | | 229,376 | | | 3,750,298 |

| | | | | | 10,095,804 |

Real Estate Management & Development - 1.5%

| | | | | | |

FirstService Corp. | | | 23,654 | | | 4,281,847 |

Semiconductors & Semiconductor Equipment - 2.2%

| | | | | | |

Tower Semiconductor Ltd.(a) | | | 118,777 | | | 6,118,203 |

Software - 11.1%

| | | | | | |

Altair Engineering, Inc. - Class A(a) | | | 56,148 | | | 6,126,308 |

Appian Corp. - Class A(a) | | | 89,506 | | | 2,951,908 |

Braze, Inc. - Class A(a) | | | 68,112 | | | 2,852,531 |

Five9, Inc.(a) | | | 50,122 | | | 2,036,958 |

LiveRamp Holdings, Inc.(a) | | | 110,777 | | | 3,364,297 |

Onestream, Inc.(a) | | | 90,831 | | | 2,590,500 |

Q2 Holdings, Inc.(a) | | | 61,906 | | | 6,230,839 |

Workiva Inc.(a) | | | 48,843 | | | 5,348,309 |

| | | | | | 31,501,650 |

Specialty Retail - 1.5%

| | | | | | |

Academy Sports & Outdoors, Inc. | | | 71,776 | | | 4,129,273 |

Textiles, Apparel & Luxury Goods - 1.2%

|

Crocs, Inc.(a) | | | 31,208 | | | 3,418,212 |

Trading Companies & Distributors - 1.6%

|

Global Industrial Co. | | | 78,793 | | | 1,953,278 |

SiteOne Landscape Supply, Inc.(a) | | | 20,432 | | | 2,692,325 |

| | | | | | 4,645,603 |

TOTAL COMMON STOCKS

(Cost $186,217,791) | | | | | | 275,750,286 |

| | | | | | | |

| | | | | | | |

SHORT-TERM INVESTMENTS - 2.5%

|

Money Market Funds - 2.5%

| | | | | | |

Invesco Short-Term Investments Trust - Government & Agency Portfolio - Institutional Shares, 4.43%(b) | | | 6,941,861 | | | $6,941,861 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $6,941,861) | | | | | | 6,941,861 |

TOTAL INVESTMENTS - 99.9%

(Cost $193,159,652) | | | | | | $282,692,147 |

Other Assets in Excess of Liabilities - 0.1% | | | | | | 321,883 |

TOTAL NET ASSETS - 100.0% | | | | | | $283,014,030 |

| | | | | | | |

Percentages are stated as a percent of net assets.

NV - Naamloze Vennootschap

PLC - Public Limited Company

(a)

| Non-income producing security. |

(b)

| The rate shown represents the 7-day annualized effective yield as of December 31, 2024. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (“GICS®”) which was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

LKCM SMALL-MID CAP EQUITY FUND

SCHEDULE OF INVESTMENTS

December 31, 2024

| | | | | | | |

COMMON STOCKS - 94.8%

| | | | | | |

Aerospace & Defense - 4.5%

| | | | | | |

Axon Enterprise, Inc. (a) | | | 1,883 | | | $1,119,105 |

BWX Technologies, Inc. | | | 5,621 | | | 626,123 |

| | | | | | 1,745,228 |

Banks - 5.2%

| | | | | | |

Pinnacle Financial Partners, Inc. | | | 6,315 | | | 722,373 |

UMB Financial Corp. | | | 6,087 | | | 686,979 |

Webster Financial Corp. | | | 11,236 | | | 620,452 |

| | | | | | 2,029,804 |

Beverages - 0.3%

| | | | | | |

Celsius Holdings, Inc.(a) | | | 4,149 | | | 109,285 |

Biotechnology - 2.6%

| | | | | | |

Natera, Inc. (a) | | | 6,383 | | | 1,010,429 |

Building Products - 5.9%

| | | | | | |

A O Smith Corp. | | | 6,893 | | | 470,171 |

Builders FirstSource, Inc.(a) | | | 4,347 | | | 621,317 |

CSW Industrials, Inc. | | | 2,130 | | | 751,464 |

Zurn Elkay Water Solutions Corp. | | | 11,940 | | | 445,362 |

| | | | | | 2,288,314 |

Capital Markets - 4.6%

| | | | | | |

LPL Financial Holdings, Inc. | | | 2,798 | | | 913,575 |

SEI Investments Co. | | | 10,635 | | | 877,175 |

| | | | | | 1,790,750 |

Chemicals - 0.7%

| | | | | | |

Quaker Chemical Corp. | | | 1,838 | | | 258,717 |

Commercial Services & Supplies - 2.0%

| | | | | | |

Tetra Tech, Inc. | | | 19,363 | | | 771,422 |

Construction & Engineering - 2.0%

| | | | | | |

AECOM | | | 7,255 | | | 774,979 |

Construction Materials - 1.5%

| | | | | | |

Eagle Materials, Inc. | | | 2,373 | | | 585,562 |

Distributors - 1.0%

| | | | | | |

Pool Corp. | | | 1,121 | | | 382,194 |

Electronic Equipment, Instruments & Components - 2.0%

| | | | | | |

Trimble, Inc.(a) | | | 11,038 | | | 779,945 |

Financial Services - 5.1%

| | | | | | |

AvidXchange Holdings, Inc.(a) | | | 45,965 | | | 475,278 |

Corpay, Inc.(a) | | | 2,438 | | | 825,068 |

Euronet Worldwide, Inc.(a) | | | 6,623 | | | 681,109 |

| | | | | | 1,981,455 |

Health Care Equipment & Supplies - 1.7%

|

Merit Medical Systems, Inc.(a) | | | 6,846 | | | 662,145 |

| | | | | | | |

| | | | | | | |

Health Care Providers & Services - 3.2%

|

Addus HomeCare Corp.(a) | | | 3,911 | | | $490,244 |

Ensign Group, Inc. | | | 5,833 | | | 774,972 |

| | | | | | 1,265,216 |

Hotels, Restaurants & Leisure - 1.6%

| | | | | | |

Wingstop, Inc. | | | 2,225 | | | 632,345 |

Insurance - 6.2%

| | | | | | |

Baldwin Insurance Group, Inc. - Class A(a) | | | 11,142 | | | 431,864 |

Goosehead Insurance, Inc. - Class A(a) | | | 8,862 | | | 950,184 |

Palomar Holdings, Inc.(a) | | | 9,799 | | | 1,034,676 |

| | | | | | 2,416,724 |

IT Services - 2.6%

| | | | | | |

Twilio Inc. - Class A(a) | | | 9,465 | | | 1,022,977 |

Life Sciences Tools & Services - 1.3%

| | | | | | |

Medpace Holdings, Inc.(a) | | | 1,522 | | | 505,654 |

Machinery - 3.3%

| | | | | | |

ITT, Inc. | | | 4,712 | | | 673,250 |

Kadant, Inc. | | | 1,811 | | | 624,777 |

| | | | | | 1,298,027 |

Media - 1.1%

| | | | | | |

Nexstar Media Group, Inc. - Class A | | | 2,719 | | | 429,520 |

Metals & Mining - 1.5%

| | | | | | |

Reliance, Inc. | | | 2,144 | | | 577,293 |

Oil, Gas & Consumable Fuels - 3.3%

| | | | | | |

Expand Energy Corp. | | | 6,482 | | | 645,283 |

Permian Resources Corp. | | | 45,711 | | | 657,324 |

| | | | | | 1,302,607 |

Personal Care Products - 2.1%

| | | | | | |

BellRing Brands, Inc.(a) | | | 11,131 | | | 838,610 |

Professional Services - 6.3%

| | | | | | |

Broadridge Financial Solutions, Inc. | | | 3,063 | | | 692,514 |

CBIZ, Inc.(a) | | | 12,135 | | | 993,007 |

Paylocity Holding Corp.(a) | | | 3,820 | | | 761,975 |

| | | | | | 2,447,496 |

Real Estate Management & Development - 3.9%

|

Colliers International Group, Inc. | | | 6,075 | | | 826,018 |

FirstService Corp. | | | 3,873 | | | 701,090 |

| | | | | | 1,527,108 |

Semiconductors & Semiconductor Equipment - 2.6%

| | | | | | |

Tower Semiconductor Ltd.(a) | | | 19,580 | | | 1,008,566 |

Software - 6.9%

| | | | | | |

Altair Engineering, Inc. - Class A(a) | | | 7,562 | | | 825,090 |

Q2 Holdings, Inc.(a) | | | 18,543 | | | 1,866,353 |

| | | | | | 2,691,443 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

LKCM SMALL-MID CAP EQUITY FUND

SCHEDULE OF INVESTMENTS

December 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Specialty Retail - 5.0%

| | | | | | |

Academy Sports & Outdoors, Inc. | | | 10,829 | | | $622,993 |

Floor & Decor Holdings, Inc. -

Class A(a) | | | 4,429 | | | 441,571 |

Murphy USA, Inc. | | | 1,775 | | | 890,606 |

| | | | | | 1,955,170 |

Textiles, Apparel & Luxury Goods - 2.3%

| | | |

On Holding AG - Class A(a) | | | 16,351 | | | 895,544 |

Trading Companies & Distributors - 2.5%

|

SiteOne Landscape Supply, Inc.(a) | | | 2,695 | | | 355,120 |

Watsco, Inc. | | | 1,350 | | | 639,752 |

| | | | | | 994,872 |

TOTAL COMMON STOCKS

(Cost $26,472,496) | | | | | | 36,979,401 |

SHORT-TERM INVESTMENTS - 5.3%

| | | |

Money Market Funds - 5.3%

| | | | | | |

Invesco Short-Term Investments Trust - Government & Agency Portfolio - Institutional Shares, 4.43%(b) | | | 1,170,795 | | | 1,170,795 |

MSILF Government Portfolio - Class Institutional, 4.43%(b) | | | 904,837 | | | 904,837 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $2,075,632) | | | | | | 2,075,632 |

TOTAL INVESTMENTS - 100.1%

(Cost $28,548,128) | | | | | | $39,055,033 |

Liabilities in Excess of Other

Assets - (0.1)% | | | | | | (35,162) |

TOTAL NET ASSETS - 100.0% | | | | | | $39,019,871 |

| | | | | | | |

Percentages are stated as a percent of net assets.

AG - Aktiengesellschaft

(a)

| Non-income producing security. |

(b)

| The rate shown represents the 7-day annualized effective yield as of December 31, 2024. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (“GICS®”) which was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

LKCM EQUITY FUND

SCHEDULE OF INVESTMENTS

December 31, 2024

| | | | | | | |

COMMON STOCKS - 97.0%

| | | | | | |

Banks - 5.1%

| | | | | | |

Bank of America Corp. | | | 160,000 | | | $7,032,000 |

Cullen/Frost Bankers, Inc. | | | 50,000 | | | 6,712,500 |

JPMorgan Chase & Co. | | | 50,000 | | | 11,985,500 |

| | | | | | 25,730,000 |

Beverages - 1.2%

| | | | | | |

Coca-Cola Co. | | | 95,000 | | | 5,914,700 |

Biotechnology - 1.4%

| | | | | | |

Amgen, Inc. | | | 28,000 | | | 7,297,920 |

Broadline Retail - 1.6%

| | | | | | |

Amazon.com, Inc.(a) | | | 38,000 | | | 8,336,820 |

Chemicals - 4.4%

| | | | | | |

Ecolab, Inc. | | | 55,000 | | | 12,887,600 |

Linde PLC | | | 22,000 | | | 9,210,740 |

| | | | | | 22,098,340 |

Commercial Services & Supplies - 5.3%

| | | |

Cintas Corp. | | | 64,000 | | | 11,692,800 |

Waste Connections, Inc. | | | 90,000 | | | 15,442,200 |

| | | | | | 27,135,000 |

Construction & Engineering - 3.3%

| | | | | | |

Fluor Corp.(a) | | | 125,000 | | | 6,165,000 |

Valmont Industries, Inc. | | | 35,000 | | | 10,733,450 |

| | | | | | 16,898,450 |

Construction Materials - 1.8%

| | | | | | |

Martin Marietta Materials, Inc. | | | 18,000 | | | 9,297,000 |

Electrical Equipment - 2.9%

| | | | | | |

Emerson Electric Co. | | | 75,000 | | | 9,294,750 |

Generac Holdings, Inc.(a) | | | 35,000 | | | 5,426,750 |

| | | | | | 14,721,500 |

Electronic Equipment, Instruments & Components - 4.6%

| | | | | | |

Teledyne Technologies, Inc.(a) | | | 25,000 | | | 11,603,250 |

Trimble, Inc.(a) | | | 170,000 | | | 12,012,200 |

| | | | | | 23,615,450 |

Financial Services - 1.6%

| | | | | | |

Mastercard, Inc. - Class A | | | 15,000 | | | 7,898,550 |

Food Products - 0.6%

| | | | | | |

Kraft Heinz Co. | | | 100,000 | | | 3,071,000 |

Ground Transportation - 1.1%

| | | | | | |

Union Pacific Corp. | | | 24,000 | | | 5,472,960 |

Health Care Equipment & Supplies - 3.5%

|

Alcon AG | | | 60,000 | | | 5,093,400 |

Neogen Corp.(a) | | | 450,000 | | | 5,463,000 |

Stryker Corp. | | | 20,000 | | | 7,201,000 |

| | | | | | 17,757,400 |

| | | | | | | |

| | | | | | | |

Household Durables - 1.0%

| | | | | | |

Newell Brands, Inc. | | | 500,000 | | | $4,980,000 |

Household Products - 2.3%

| | | | | | |

Kimberly-Clark Corp. | | | 50,000 | | | 6,552,000 |

Procter & Gamble Co. | | | 30,000 | | | 5,029,500 |

| | | | | | 11,581,500 |

Interactive Media & Services - 4.1%

| | | | | | |

Alphabet, Inc. - Class A | | | 110,000 | | | 20,823,000 |

Life Sciences Tools & Services - 2.8%

| | | | | | |

Danaher Corp. | | | 32,750 | | | 7,517,763 |

Thermo Fisher Scientific, Inc. | | | 13,000 | | | 6,762,990 |

| | | | | | 14,280,753 |

Machinery - 7.0%

| | | | | | |

Chart Industries, Inc.(a) | | | 40,000 | | | 7,633,600 |

Franklin Electric Co., Inc. | | | 85,000 | | | 8,283,250 |

IDEX Corp. | | | 30,000 | | | 6,278,700 |

Toro Co. | | | 80,000 | | | 6,408,000 |

Xylem, Inc. | | | 60,000 | | | 6,961,200 |

| | | | | | 35,564,750 |

Marine Transportation - 1.6%

| | | | | | |

Kirby Corp.(a) | | | 75,000 | | | 7,935,000 |

Metals & Mining - 0.6%

| | | | | | |

Wheaton Precious Metals Corp. | | | 55,000 | | | 3,093,200 |

Oil, Gas & Consumable Fuels - 6.6%

| | | | | | |

Cameco Corp. | | | 90,000 | | | 4,625,100 |

Chevron Corp. | | | 42,500 | | | 6,155,700 |

ConocoPhillips Co. | | | 100,000 | | | 9,917,000 |

Coterra Energy, Inc. | | | 384,000 | | | 9,807,360 |

Kimbell Royalty Partners LP | | | 180,000 | | | 2,921,400 |

| | | | | | 33,426,560 |

Pharmaceuticals - 4.2%

| | | | | | |

Merck & Co., Inc. | | | 80,000 | | | 7,958,400 |

Pfizer Inc. | | | 220,000 | | | 5,836,600 |

Zoetis, Inc. | | | 47,000 | | | 7,657,710 |

| | | | | | 21,452,710 |

Semiconductors & Semiconductor

Equipment - 4.0%

|

NVIDIA Corp. | | | 150,000 | | | 20,143,500 |

Software - 12.1%

| | | | | | |

Adobe, Inc.(a) | | | 18,000 | | | 8,004,240 |

Microsoft Corp. | | | 80,000 | | | 33,720,000 |

Oracle Corp. | | | 120,000 | | | 19,996,800 |

| | | | | | 61,721,040 |

Specialty Retail - 4.9%

| | | | | | |

Academy Sports & Outdoors, Inc. | | | 90,000 | | | 5,177,700 |

O'Reilly Automotive, Inc.(a) | | | 8,000 | | | 9,486,400 |

The Home Depot, Inc. | | | 26,500 | | | 10,308,235 |

| | | | | | 24,972,335 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

LKCM EQUITY FUND

SCHEDULE OF INVESTMENTS

December 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Technology Hardware, Storage & Peripherals - 4.7%

| | | | | | |

Apple Inc. | | | 96,000 | | | $24,040,320 |

Trading Companies & Distributors - 2.7%

|

FTAI Aviation Ltd. | | | 95,000 | | | 13,683,800 |

TOTAL COMMON STOCKS

(Cost $229,438,538) | | | | | | 492,943,558 |

| | | | | | |

SHORT-TERM INVESTMENTS - 3.2%

| | | |

Money Market Funds - 3.2%

| | | | | | |

Invesco Short-Term Investments Trust - Government & Agency Portfolio - Institutional Shares, 4.43%(b) | | | 15,244,132 | | | 15,244,132 |

MSILF Government Portfolio - Class Institutional, 4.43%(b) | | | 1,105,082 | | | 1,105,082 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $16,349,214) | | | | | | 16,349,214 |

TOTAL INVESTMENTS - 100.2%

(Cost $245,787,752) | | | | | | $509,292,772 |

Liabilities in Excess of Other

Assets - (0.2)% | | | | | | (809,613) |

TOTAL NET ASSETS - 100.0% | | | | | | $508,483,159 |

| | | | | | | |

Percentages are stated as a percent of net assets.

AG - Aktiengesellschaft

PLC - Public Limited Company

(a)

| Non-income producing security. |

(b)

| The rate shown represents the 7-day annualized effective yield as of December 31, 2024. |

Investments are classified by industry pursuant to the Global Industry Classification Standard (“GICS®”) which was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

LKCM BALANCED FUND

SCHEDULE OF INVESTMENTS

December 31, 2024

| | | | | | | |

COMMON STOCKS - 68.6%

| | | | | | |

Aerospace & Defense - 1.1%

| | | | | | |

L3Harris Technologies, Inc. | | | 5,850 | | | $1,230,138 |

Banks - 3.8%

| | | | | | |

Bank of America Corp. | | | 33,100 | | | 1,454,745 |

Cullen/Frost Bankers, Inc. | | | 9,700 | | | 1,302,225 |

JPMorgan Chase & Co. | | | 6,700 | | | 1,606,057 |

| | | | | | 4,363,027 |

Beverages - 2.9%

| | | | | | |

Coca-Cola Co. | | | 21,400 | | | 1,332,364 |

Keurig Dr Pepper, Inc. | | | 35,000 | | | 1,124,200 |

PepsiCo, Inc. | | | 5,750 | | | 874,345 |

| | | | | | 3,330,909 |

Broadline Retail - 2.1%

| | | | | | |

Amazon.com, Inc.(a) | | | 11,200 | | | 2,457,168 |

Capital Markets - 1.1%

| | | | | | |

Moody's Corp. | | | 2,650 | | | 1,254,431 |

Chemicals - 3.3%

| | | | | | |

Air Products and Chemicals, Inc. | | | 800 | | | 232,032 |

Corteva, Inc. | | | 7,658 | | | 436,200 |

DuPont de Nemours, Inc. | | | 9,658 | | | 736,422 |

Ecolab Inc. | | | 3,600 | | | 843,552 |

Linde PLC | | | 3,600 | | | 1,507,212 |

| | | | | | 3,755,418 |

Commercial Services & Supplies - 3.5%

| | | |

Cintas Corp. | | | 8,800 | | | 1,607,760 |

Waste Connections, Inc. | | | 8,100 | | | 1,389,798 |

Waste Management, Inc. | | | 5,250 | | | 1,059,398 |

| | | | | | 4,056,956 |

Construction Materials - 1.4%

| | | | | | |

Martin Marietta Materials, Inc. | | | 3,100 | | | 1,601,150 |

Consumer Staples Distribution & Retail - 1.4%

| | | | | | |

Walmart, Inc. | | | 17,300 | | | 1,563,055 |

Diversified Telecommunication Services - 0.8%

| | | | | | |

Verizon Communications Inc. | | | 23,841 | | | 953,402 |

Electrical Equipment - 1.8%

| | | | | | |

Emerson Electric Co. | | | 8,800 | | | 1,090,584 |

Rockwell Automation, Inc. | | | 3,325 | | | 950,252 |

| | | | | | 2,040,836 |

Electronic Equipment, Instruments & Components - 2.0%

| | | | | | |

Teledyne Technologies, Inc.(a) | | | 2,450 | | | 1,137,118 |

Trimble Inc.(a) | | | 17,150 | | | 1,211,819 |

| | | | | | 2,348,937 |

| | | | | | | |

| | | | | | | |

Entertainment - 1.0%

| | | | | | |

Netflix, Inc.(a) | | | 900 | | | $802,188 |

Walt Disney Co. | | | 2,800 | | | 311,780 |

| | | | | | 1,113,968 |

Financial Services - 1.6%

| | | | | | |

Visa, Inc. - Class A | | | 5,650 | | | 1,785,626 |

Ground Transportation - 0.6%

| | | | | | |

Union Pacific Corp. | | | 3,200 | | | 729,728 |

Health Care Equipment & Supplies - 2.0%

| | | |

Abbott Laboratories | | | 6,800 | | | 769,148 |

Alcon AG | | | 17,900 | | | 1,519,531 |

| | | | | | 2,288,679 |

Health Care Providers & Services - 0.8%

| | | |

UnitedHealth Group, Inc. | | | 1,700 | | | 859,962 |

Household Products - 2.1%

| | | | | | |

Colgate-Palmolive Co. | | | 13,400 | | | 1,218,194 |

Kimberly-Clark Corp. | | | 5,100 | | | 668,304 |

Procter & Gamble Co. | | | 3,250 | | | 544,862 |

| | | | | | 2,431,360 |

Industrial Conglomerates - 1.0%

| | | | | | |

Honeywell International Inc. | | | 5,200 | | | 1,174,628 |

Insurance - 0.8%

| | | | | | |

Arthur J Gallagher & Co. | | | 3,400 | | | 965,090 |

Interactive Media & Services - 4.0%

| | | | | | |

Alphabet Inc. - Class C | | | 13,800 | | | 2,628,072 |

Meta Platforms, Inc. - Class A | | | 3,275 | | | 1,917,545 |

| | | | | | 4,545,617 |

IT Services - 0.8%

| | | | | | |

Accenture PLC - Class A | | | 2,600 | | | 914,654 |

Life Sciences Tools & Services - 2.1%

| | | | | | |

Danaher Corp. | | | 5,800 | | | 1,331,390 |

Thermo Fisher Scientific, Inc. | | | 2,000 | | | 1,040,460 |

| | | | | | 2,371,850 |

Machinery - 1.8%

| | | | | | |

Chart Industries, Inc.(a) | | | 3,000 | | | 572,520 |

Fortive Corp. | | | 9,350 | | | 701,250 |

IDEX Corp. | | | 4,000 | | | 837,160 |

| | | | | | 2,110,930 |

Metals & Mining - 0.6%

| | | | | | |

Newmont Goldcorp Corp. | | | 17,700 | | | 658,794 |

Oil, Gas & Consumable Fuels - 5.3%

| | | | | | |

Chevron Corp. | | | 8,695 | | | 1,259,384 |

ConocoPhillips Co. | | | 10,900 | | | 1,080,953 |

Coterra Energy, Inc. | | | 25,000 | | | 638,500 |

EOG Resources, Inc. | | | 4,450 | | | 545,481 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

LKCM BALANCED FUND

SCHEDULE OF INVESTMENTS

December 31, 2024(Continued)

| | | | | | | | |

COMMON STOCKS - (Continued)

| |

Oil, Gas & Consumable Fuels - (Continued)

| | | | | | |

Exxon Mobil Corp. | | | 12,127 | | | $1,304,501 | |

Kinder Morgan, Inc. | | | 48,000 | | | 1,315,200 | |

| | | | | | 6,144,019 | |

Pharmaceuticals - 2.2%

| | | | | | | |

Merck & Co., Inc. | | | 12,500 | | | 1,243,500 | |

Zoetis Inc. | | | 8,026 | | | 1,307,676 | |

| | | | | | 2,551,176 | |

Professional Services - 1.0%

| | | | | | | |

Broadridge Financial Solutions, Inc. | | | 5,250 | | | 1,186,973 | |

Semiconductors & Semiconductor Equipment - 3.3%

| | | | | | | |

NVIDIA Corp. | | | 20,000 | | | 2,685,800 | |

QUALCOMM, Inc. | | | 7,000 | | | 1,075,340 | |

| | | | | | 3,761,140 | |

Software - 7.4%

| | | | | | | |

Adobe Inc.(a) | | | 1,850 | | | 822,658 | |

Microsoft Corp. | | | 6,750 | | | 2,845,125 | |

Oracle Corp. | | | 11,900 | | | 1,983,016 | |

Roper Technologies, Inc. | | | 2,600 | | | 1,351,610 | |

Salesforce, Inc. | | | 4,550 | | | 1,521,201 | |

| | | | | | 8,523,610 | |

Specialty Retail - 1.5%

| | | | | | | |

Home Depot, Inc. | | | 4,500 | | | 1,750,455 | |

Technology Hardware, Storage & Peripherals - 3.5%

| | | | | | | |

Apple Inc. | | | 15,950 | | | 3,994,199 | |

TOTAL COMMON STOCKS

(Cost $38,579,771) | | | | | | 78,817,885 | |

| | | Par | | | | |

CORPORATE BONDS - 29.7%

| | | | | | | |

Aerospace & Defense - 2.0%

| | | | | | | |

L3Harris Technologies, Inc.,

5.40%, 07/31/2033

(Callable 04/30/2033) | | | $750,000 | | | 748,849 | |

Lockheed Martin Corp.,

4.50%, 02/15/2029

(Callable 01/15/2029) | | | 785,000 | | | 776,730 | |

RTX Corp., 5.15%, 02/27/2033

(Callable 11/27/2032) | | | 800,000 | | | 793,819 | |

| | | | | | 2,319,398 | |

Banks - 0.8%

| | | | | | | |

Cullen/Frost Bankers, Inc.,

4.50%, 03/17/2027

(Callable 02/17/2027) | | | 750,000 | | | 730,529 | |

JPMorgan Chase & Co.,

3.20%, 06/15/2026

(Callable 03/15/2026) | | | 200,000 | | | 196,317 | |

| | | | | | 926,846 | |

| | | | | | | | |

| | | | | | | |

Beverages - 1.0%

| | | | | | |

Keurig Dr Pepper, Inc.,

2.55%, 09/15/2026

(Callable 06/15/2026) | | | $750,000 | | | $725,139 |

PepsiCo, Inc.,

2.38%, 10/06/2026

(Callable 07/06/2026) | | | 435,000 | | | 420,629 |

| | | | | | 1,145,768 |

Biotechnology - 1.5%

| | | | | | |

AbbVie, Inc.

| | | | | | |

3.20%, 05/14/2026

(Callable 02/14/2026) | | | 600,000 | | | 589,661 |

4.95%, 03/15/2031

(Callable 01/15/2031) | | | 250,000 | | | 250,070 |

Amgen, Inc.

| | | | | | |

2.60%, 08/19/2026

(Callable 05/19/2026) | | | 450,000 | | | 435,513 |

5.25%, 03/02/2030

(Callable 01/02/2030) | | | 450,000 | | | 454,382 |

| | | | | | 1,729,626 |

Broadline Retail - 0.8%

| | | | | | |

Amazon.com, Inc.

| | | | | | |

1.20%, 06/03/2027

(Callable 04/03/2027) | | | 260,000 | | | 241,096 |

4.55%, 12/01/2027

(Callable 11/01/2027) | | | 550,000 | | | 553,442 |

4.65%, 12/01/2029

(Callable 10/01/2029) | | | 125,000 | | | 125,860 |

| | | | | | 920,398 |

Chemicals - 2.0%

| | | | | | |

Air Products and Chemicals, Inc., 1.85%, 05/15/2027

(Callable 03/15/2027) | | | 675,000 | | | 634,747 |

DuPont de Nemours, Inc.,

4.73%, 11/15/2028

(Callable 08/15/2028) | | | 650,000 | | | 647,325 |

Ecolab, Inc.

| | | | | | |

2.70%, 11/01/2026

(Callable 08/01/2026) | | | 500,000 | | | 484,591 |

5.25%, 01/15/2028

(Callable 12/15/2027) | | | 475,000 | | | 484,114 |

| | | | | | 2,250,777 |

Commercial Services & Supplies - 1.5%

| | | |

Republic Services, Inc.,

4.88%, 04/01/2029

(Callable 03/01/2029) | | | 750,000 | | | 748,466 |

Waste Management, Inc.

| | | | | | |

4.63%, 02/15/2030

(Callable 12/15/2029) | | | 500,000 | | | 495,389 |

4.15%, 04/15/2032

(Callable 01/15/2032) | | | 500,000 | | | 472,793 |

| | | | | | 1,716,648 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

LKCM BALANCED FUND

SCHEDULE OF INVESTMENTS

December 31, 2024(Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Communications Equipment - 0.6%

| | | | | | |

Cisco Systems, Inc.,

5.05%, 02/26/2034

(Callable 11/26/2033) | | | $750,000 | | | $748,394 |

Consumer Finance - 0.7%

| | | | | | |

American Express Co.,

4.05%, 05/03/2029

(Callable 03/03/2029) | | | 850,000 | | | 830,173 |

Consumer Staples Distribution & Retail - 1.3%

| | | | | | |

Costco Wholesale Corp.,

1.38%, 06/20/2027

(Callable 04/20/2027) | | | 690,000 | | | 641,659 |

Dollar Tree, Inc.,

4.00%, 05/15/2025

(Callable 03/15/2025) | | | 825,000 | | | 822,092 |

| | | | | | 1,463,751 |

Diversified Telecommunication Services - 0.2%

| | | | | | |

Verizon Communications Inc.,

2.63%, 08/15/2026 | | | 250,000 | | | 242,673 |

Electric Utilities - 0.7%

| | | | | | |

Duke Energy Corp.

| | | | | | |

5.00%, 12/08/2027

(Callable 11/08/2027) | | | 345,000 | | | 347,662 |

4.50%, 08/15/2032

(Callable 05/15/2032) | | | 500,000 | | | 476,619 |

| | | | | | 824,281 |

Financial Services - 1.1%

| | | | | | |

Mastercard, Inc.,

4.85%, 03/09/2033

(Callable 12/09/2032) | | | 500,000 | | | 495,931 |

Visa Inc.

| | | | | | |

3.15%, 12/14/2025

(Callable 09/14/2025) | | | 300,000 | | | 296,652 |

1.90%, 04/15/2027

(Callable 02/15/2027) | | | 500,000 | | | 472,816 |

| | | | | | 1,265,399 |

Health Care Equipment & Supplies - 0.5%

| | | |

Abbott Laboratories

| | | | | | |

3.88%, 09/15/2025

(Callable 06/15/2025) | | | 255,000 | | | 253,962 |

3.75%, 11/30/2026

(Callable 08/30/2026) | | | 355,000 | | | 350,911 |

| | | | | | 604,873 |

Household Products - 0.5%

| | | | | | |

Colgate-Palmolive Co.,

3.10%, 08/15/2027

(Callable 07/15/2027) | | | 595,000 | | | 575,710 |

| | | | | | | |

| | | | | | | |

Industrial Conglomerates - 0.1%

| | | | | | |

Honeywell International, Inc.,

4.88%, 09/01/2029

(Callable 08/01/2029) | | | $150,000 | | | $150,962 |

Interactive Media & Services - 1.3%

| | | | | | |

Alphabet, Inc.,

2.00%, 08/15/2026

(Callable 05/15/2026) | | | 200,000 | | | 192,686 |

Meta Platforms, Inc.

| | | | | | |

3.50%, 08/15/2027

(Callable 07/15/2027) | | | 250,000 | | | 244,440 |

4.60%, 05/15/2028

(Callable 04/15/2028) | | | 250,000 | | | 250,367 |

4.55%, 08/15/2031

(Callable 06/15/2031) | | | 550,000 | | | 541,166 |

4.75%, 08/15/2034

(Callable 05/15/2034) | | | 250,000 | | | 243,627 |

| | | | | | 1,472,286 |

IT Services - 0.1%

| | | | | | |

International Business Machines Corp., 4.75%, 02/06/2033

(Callable 11/06/2032) | | | 125,000 | | | 122,463 |

Life Sciences Tools & Services - 0.9%

| | | | | | |

Danaher Corp.,

3.35%, 09/15/2025

(Callable 06/15/2025) | | | 250,000 | | | 248,219 |

Thermo Fisher Scientific, Inc.,

4.95%, 11/21/2032

(Callable 08/21/2032) | | | 750,000 | | | 745,533 |

| | | | | | 993,752 |

Oil, Gas & Consumable Fuels - 3.4%

| | | | | | |

Chevron Corp.,

2.00%, 05/11/2027

(Callable 03/11/2027) | | | 400,000 | | | 378,218 |

ConocoPhillips Co.

| | | | | | |

6.95%, 04/15/2029 | | | 500,000 | | | 542,571 |

5.05%, 09/15/2033

(Callable 06/15/2033) | | | 250,000 | | | 246,939 |

Devon Energy Corp.,

4.50%, 01/15/2030

(Callable 01/15/2025) | | | 500,000 | | | 484,048 |

Enterprise Products Operating LLC, 5.05%, 01/10/2026 | | | 100,000 | | | 100,544 |

EOG Resources, Inc.,

4.38%, 04/15/2030

(Callable 01/15/2030) | | | 750,000 | | | 729,572 |

Exxon Mobil Corp.,

3.04%, 03/01/2026

(Callable 12/01/2025) | | | 400,000 | | | 393,896 |

Kinder Morgan, Inc.,

5.20%, 06/01/2033

(Callable 03/01/2033) | | | 325,000 | | | 317,840 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

LKCM BALANCED FUND

SCHEDULE OF INVESTMENTS

December 31, 2024(Continued)

| | | | | | | |