Exhibit 99.4

Deposits– ASignificant

ContributortoBB&T’s Success

Agenda

Managing Deposits as a Line of Business

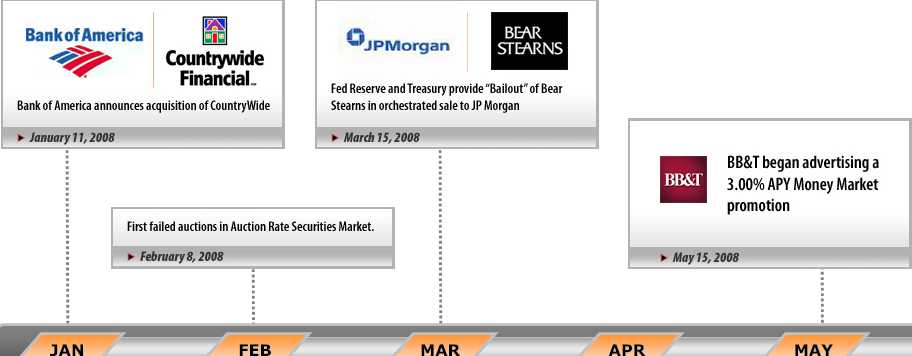

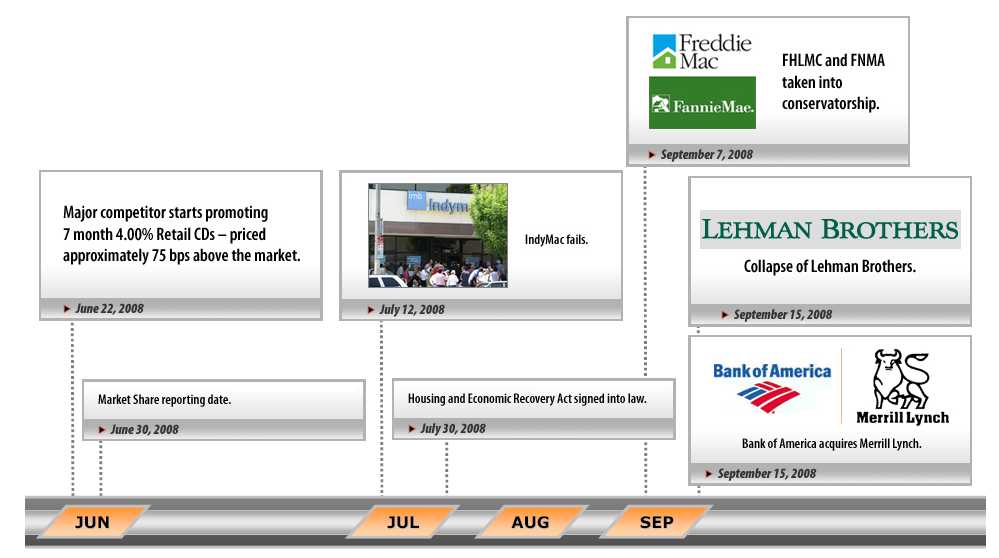

2008 Financial Crisis Timeline

Deposit Highlights for 2008

Key Initiatives for 2009

2

Managing Depositsas a Line ofBusiness

3

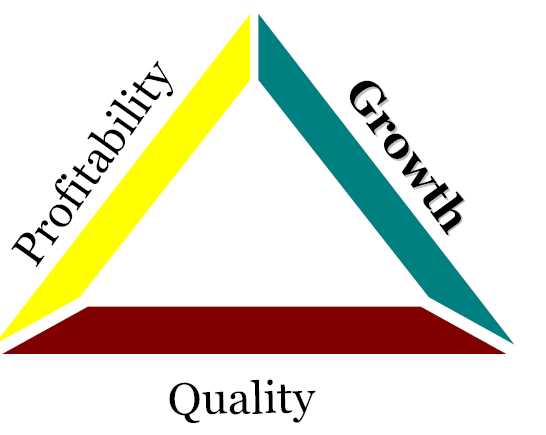

Mission

To drive coredeposit growthwhilebalancing

4

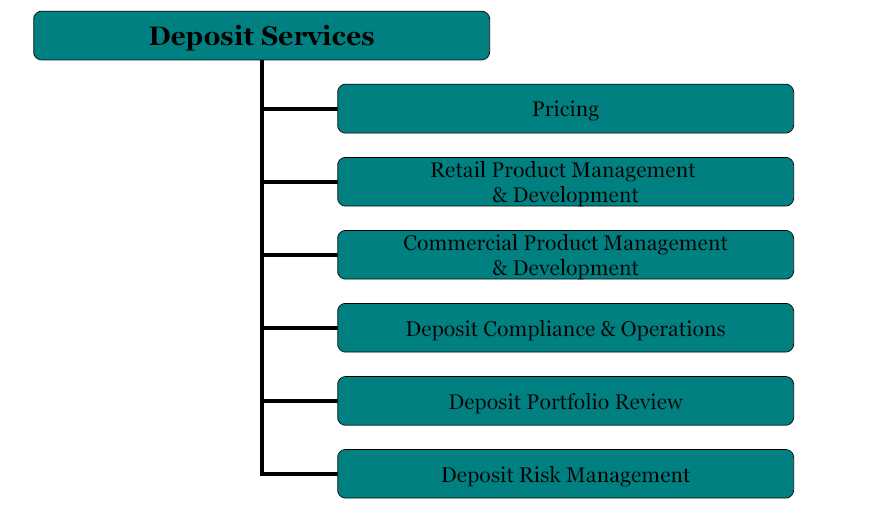

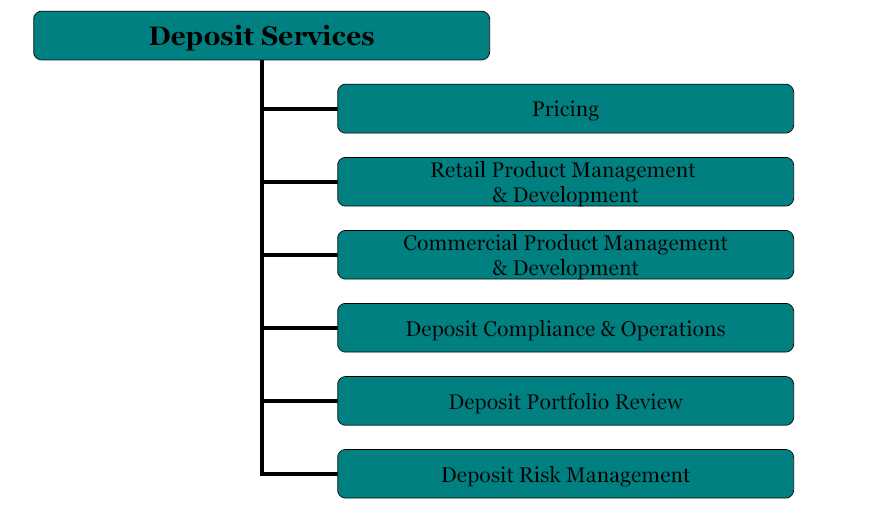

Deposit Services

Achieve balanced performancewithin thecontextofliquidity, balancesheetgrowthandmarket conditions.

5

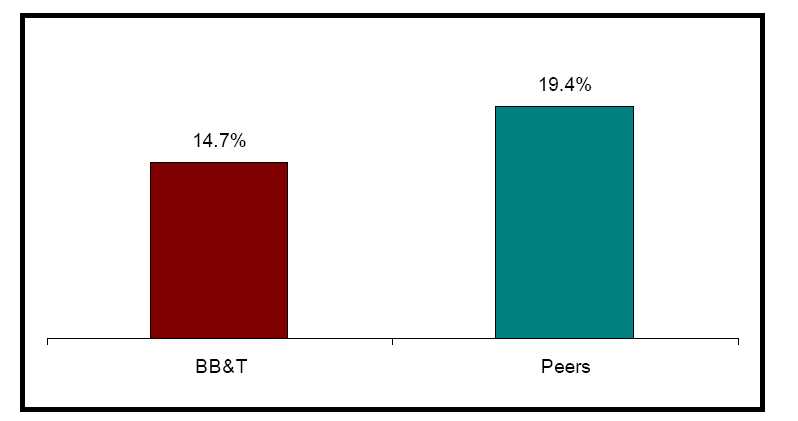

Deposit Services

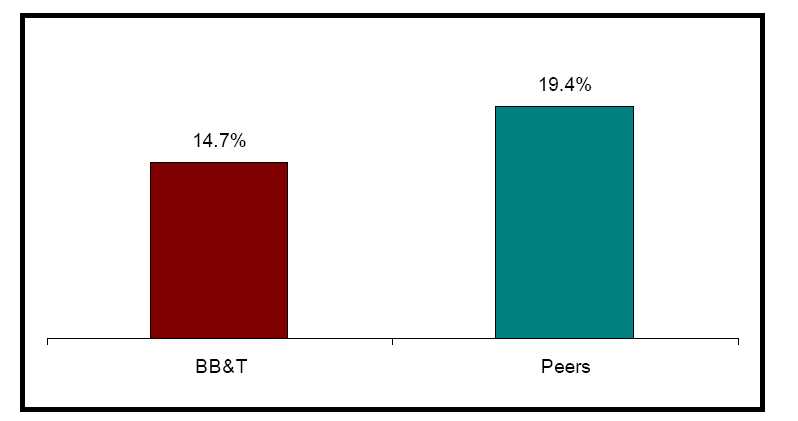

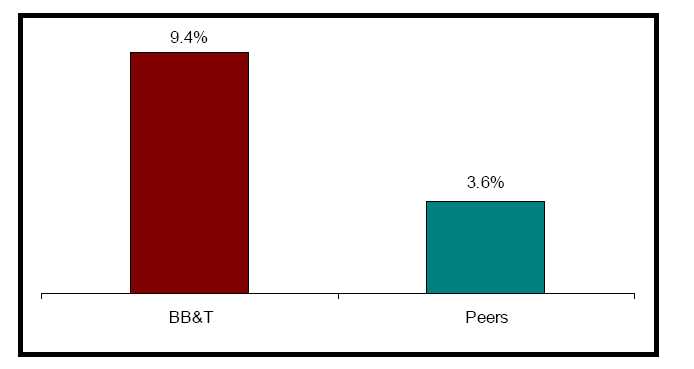

% ofAverage Noninterest Bearingas a % of TotalAverage Deposits

2008

| | |

| National Peers consist of CMA, FITB, HBAN, KEY, M&T, | |

| |

| M&I, PNC, BPOP, RF, STI, USB and Zions | Source: Earnings Releases |

| | | Restated for Acquisitions |

6

Deposit Services

Achieve balanced performancewithin thecontextofliquidity, balancesheetgrowthandmarket conditions.

7

Deposit Services

Achieve balanced performancewithin thecontextofliquidity, balancesheetgrowthandmarket conditions.

8

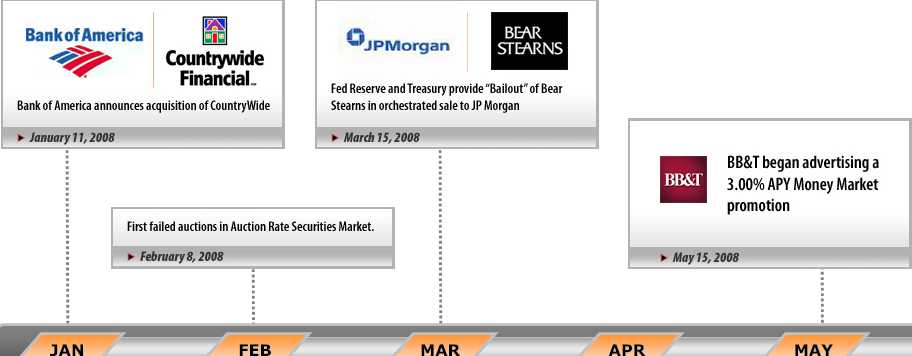

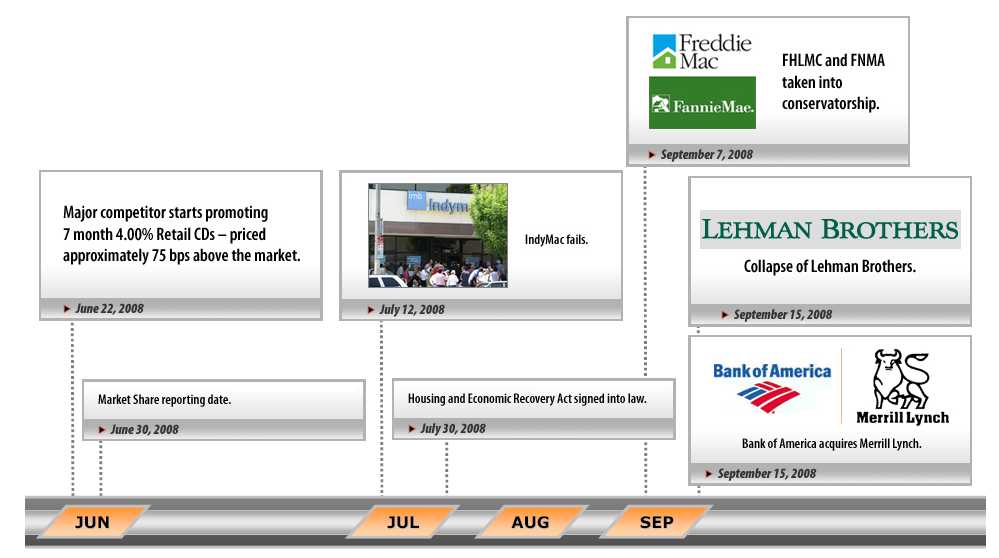

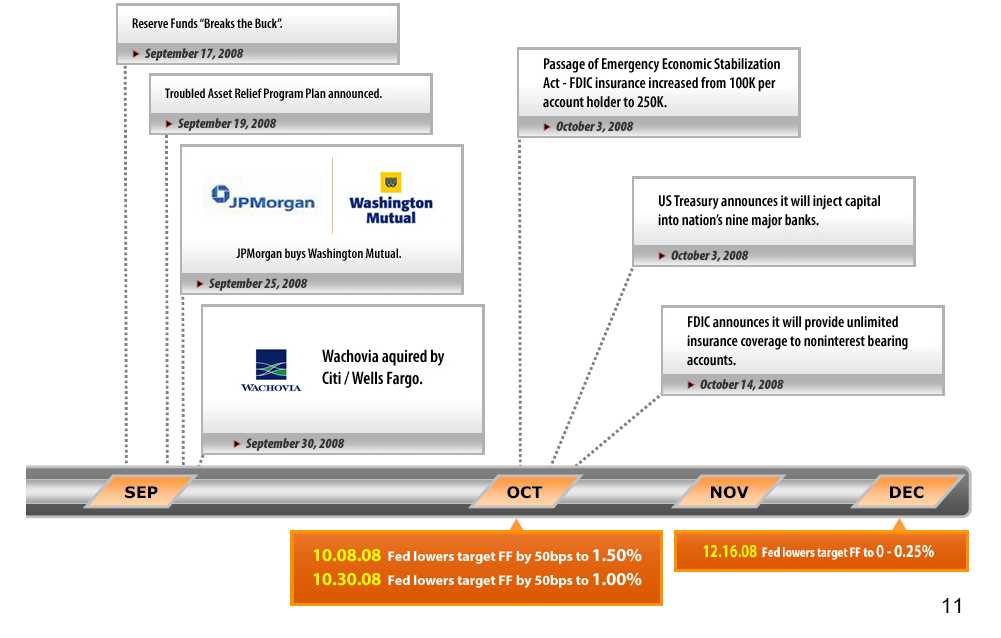

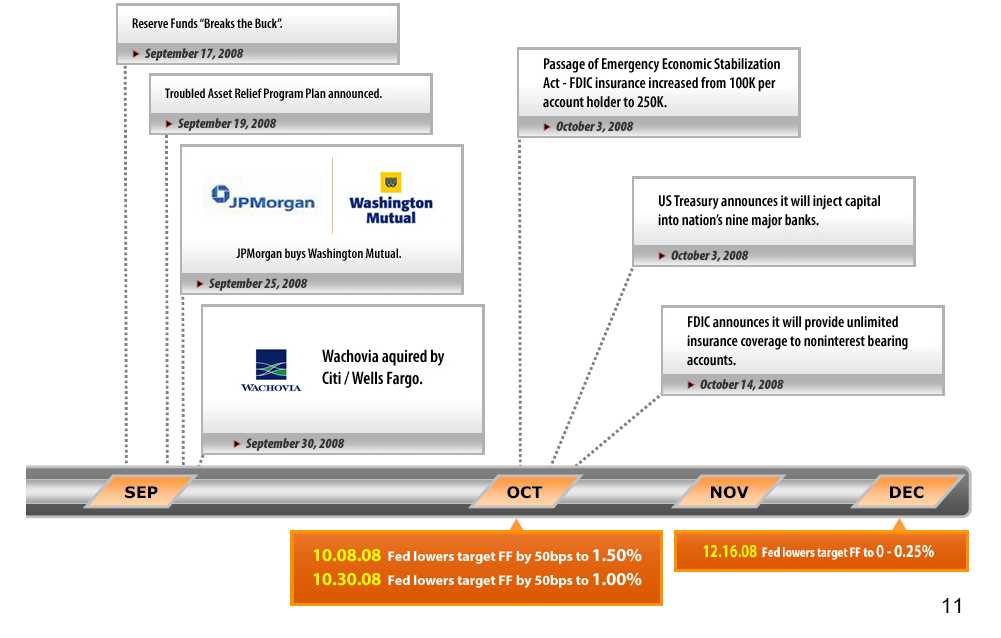

2008FinancialCrisisTimeline

2008FinancialCrisisTimeline

10

2008FinancialCrisisTimeline

Deposit Highlights

for 2008

12

Deposit Services

Experienced accelerated growth in deposits inthe second half of the year including stronggrowth in transaction and money market accountbalances

Grew net new transaction accounts by 94,012 accounts

Dramatically improved our cross-sell ratios in 2008 ataccount opening and for existing clients

Aggressively managed deposit costs in response to rapidlyfalling interest rates

Demonstrated strong service charge growth in 2008

13

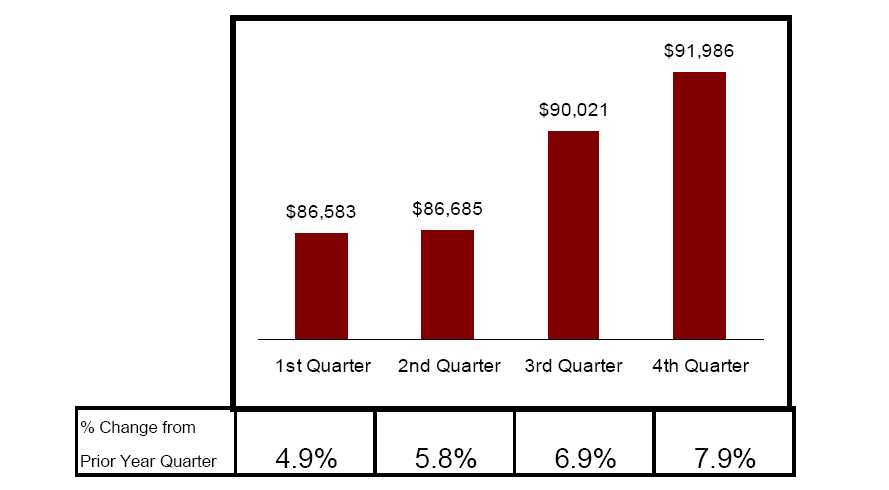

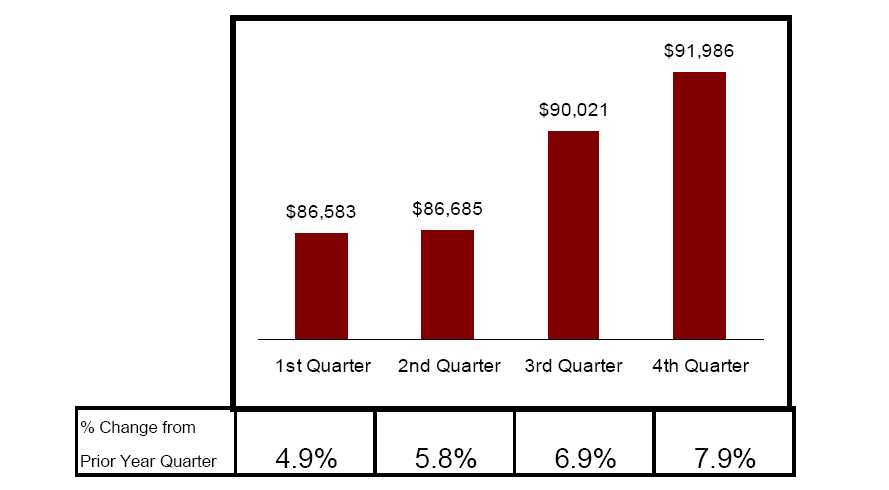

Deposit Services

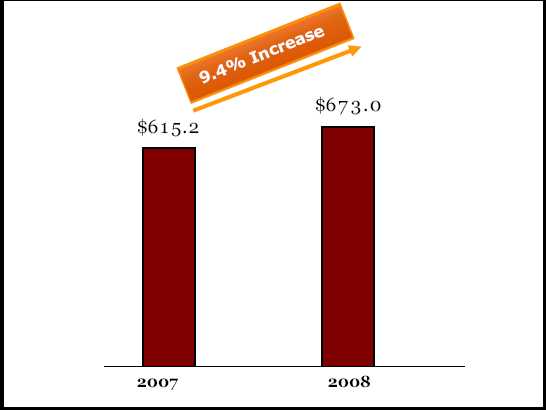

TotalAverage Deposits

($ inmillions)

Source: Earnings Releaseasreported

14

Deposit Services

TotalAverage Transaction, Savings&Money Market Accounts

($ inmillions)

Source: Earnings Releaseasreported

15

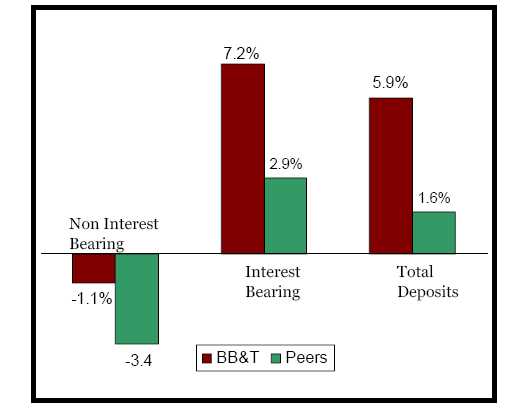

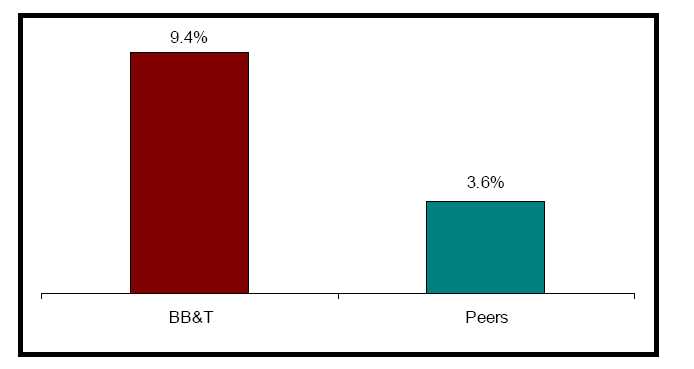

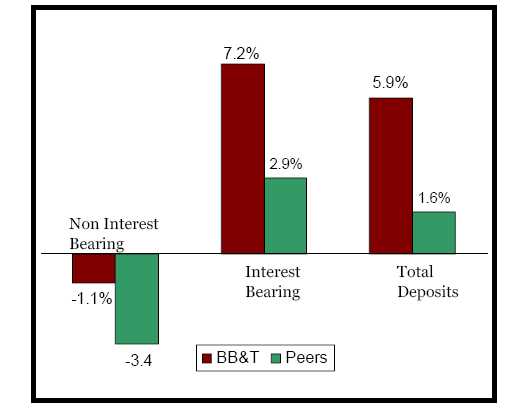

Deposit Services

Deposit Growth

PeerComparison

2007 vs. 2008 YTD

NationalPeersconsistof CMA, FITB,HBAN,KEY, M&T,

M&I, PNC, BPOP, RF, STI, USB and Zions

Source: Earnings Release

RestatedforAcquisitions

16

Deposit Services

Experienced accelerated growth in deposits in the secondhalf of the year including strong growth in transactionand money market account balances

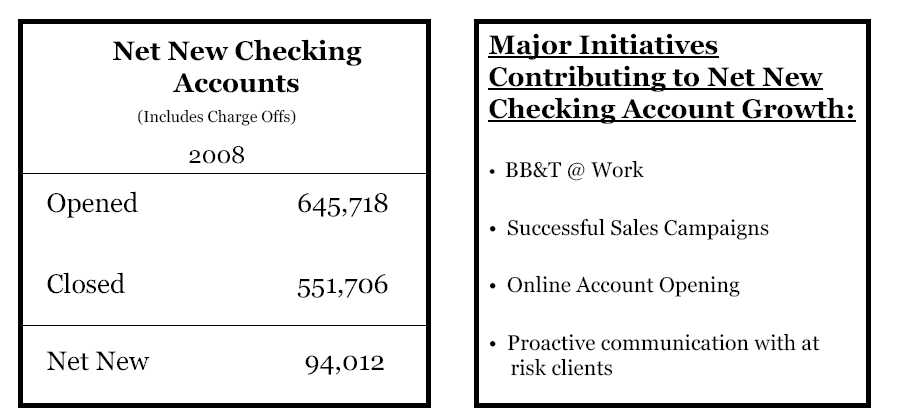

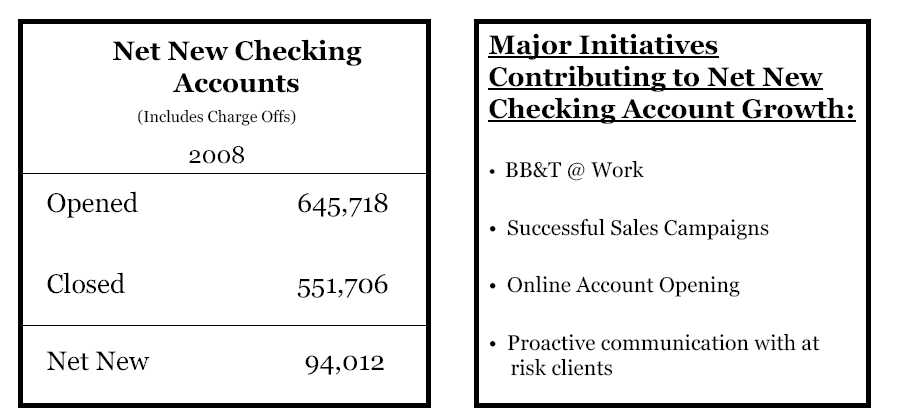

Grew net new transaction accounts by 94,012accounts

Dramatically improved our cross-sell ratios in 2008 ataccount opening and for existing clients

Aggressively managed deposit costs in response torapidly falling interest rates

Demonstrated strong service charge growth in 2008

17

Deposit Services

Net NewChecking Accounts

18

Deposit Services

Experienced accelerated growth in deposits in the secondhalf of the year including strong growth in transactionand money market account balances

Grew net new transaction accounts by 94,012 accounts

Dramatically improved our cross-sell ratios in2008 at account opening and for existing clients

Aggressively managed deposit costs in response torapidly falling interest rates

Demonstrated strong service charge growth in 2008

19

“Bundle” Results

| | | | | | |

| | 2007 | | 2008 | | % Improvement | |

| | (Before Implementation) | | (Year End) | | | |

| New Retail DDA + 3 or | 25.3% | | 41.1% | | 15.6% | |

| more services | | | | | | |

| households (1-30 days) | | | | | | |

| New Business DDA + 3 | 4.8% | | 12.9% | | 8.1% | |

| or more services | | | | | | |

| households (1-60 days) | | | | | | |

20

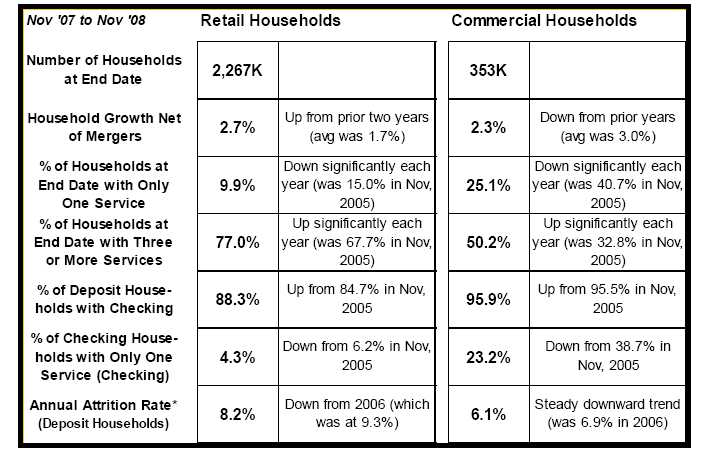

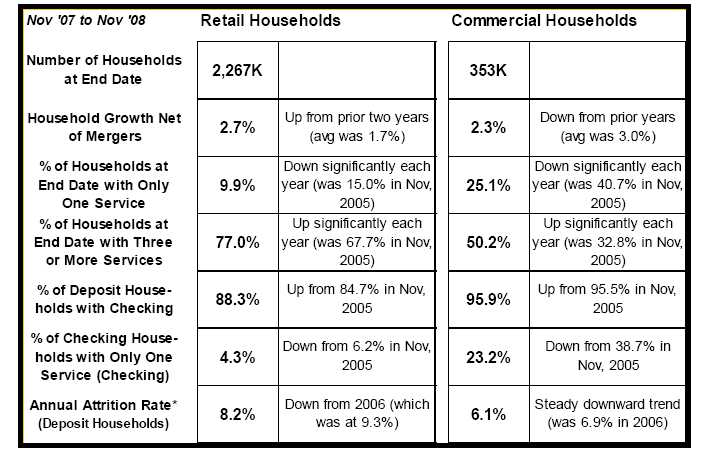

Deposit Households (Network Assigned)

* Total LostHouseholds(Nov ’07 to Nov ’08)consideredonly from thebaseline populationas of Nov, 2007 – this is a moretraditional measureofattritionthat also tends to report lowerattritionrates since theattritionon new clients is notconsideredand new clients attrite at a higher rate than olderclients.Thismethodischosenherebecausetheindustrytends to reportattritionthis way so it is morecomparableto peers.

21

Deposit Services

Experienced accelerated growth in deposits in the secondhalf of the year including strong growth in transaction andmoney market account balances

Grew net new transaction accounts by 94,012 accounts

Dramatically improved our cross-sell ratios in 2008 ataccount opening and for existing clients

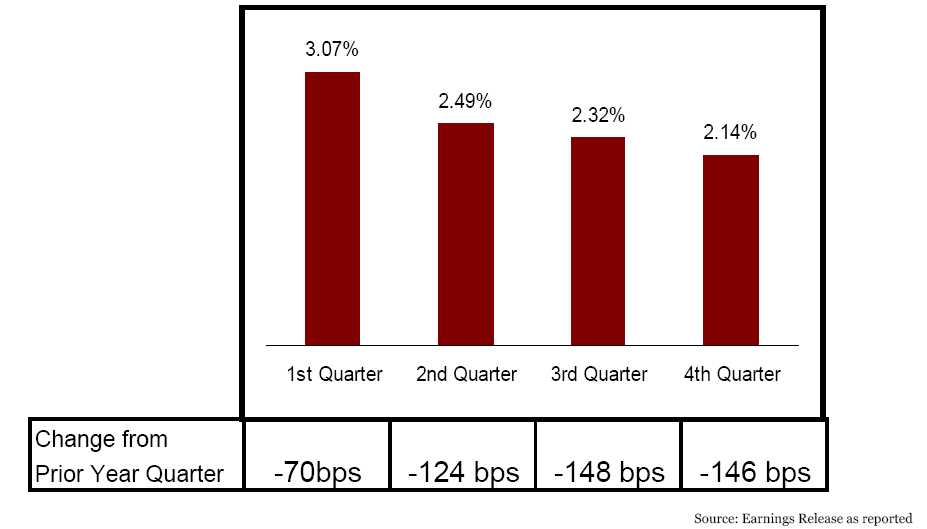

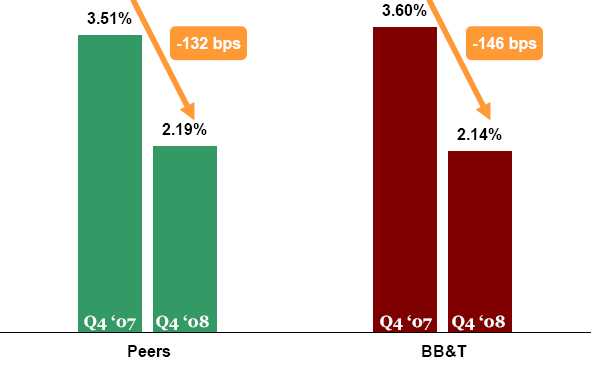

Aggressively managed deposit costs in responseto rapidly falling interest rates

Demonstrated strong service charge growth in 2008

22

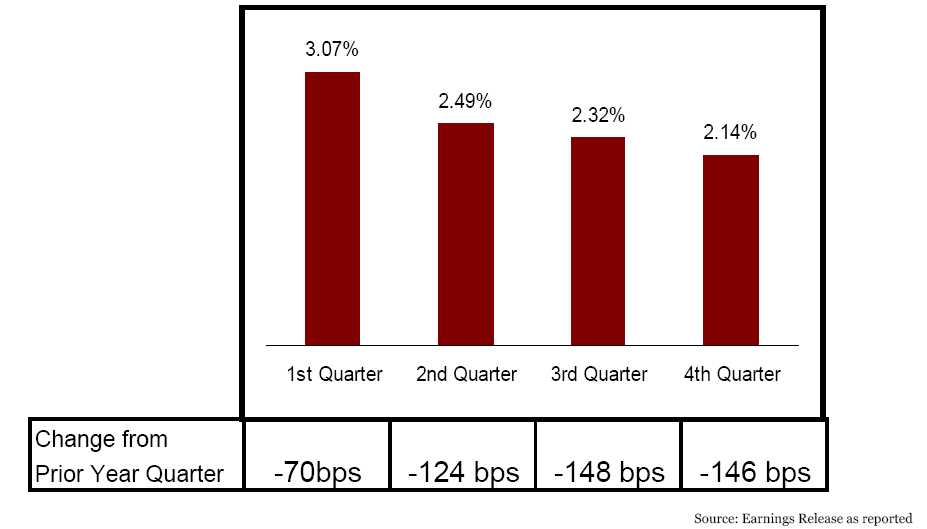

Deposit Services

Cost ofInterest Bearing Depositsfor 2008

23

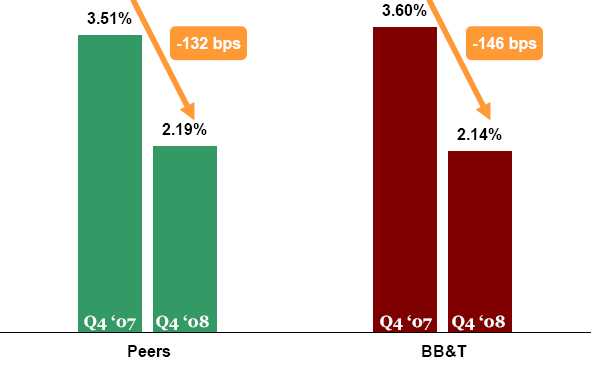

Deposit Services

Cost ofInterest Bearing DepositsPeerComparison

NationalPeersconsistof CMA, FITB,HBAN,KEY, M&T,

M&I, PNC, BPOP, RF, STI, USB and Zions

Source:Earnings Release

24

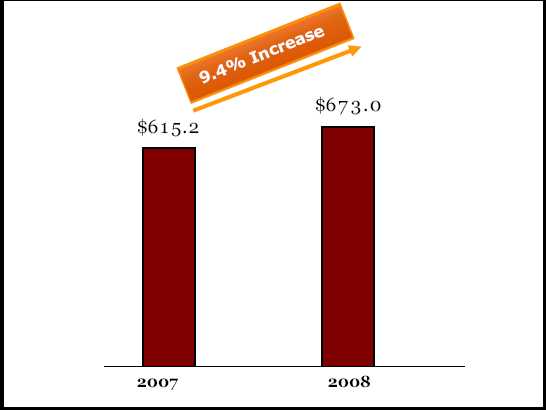

Deposit Services

Experienced accelerated growth in deposits in the secondhalf of the year including strong growth in transaction andmoney market account balances

Grew net new transaction accounts by 94,012 accounts

Dramatically improved our cross-sell ratios in 2008 ataccount opening and for existing clients

Aggressively managed deposit costs in response to rapidlyfalling interest rates

Demonstrated strong service charge growth in2008

25

Deposit Services

Service ChargesonDeposits

($ inmillions)

Source: Earnings Release

RestatedforAcquisitions

26

Deposit Services

Service Charges

PeerComparison

2007 vs. 2008 YTD

NationalPeersconsistof CMA, FITB,HBAN,KEY, M&T,

M&I, PNC, BPOP, RF, STI, USB and Zions

Source: Earnings Releases

RestatedforAcquisitions

27

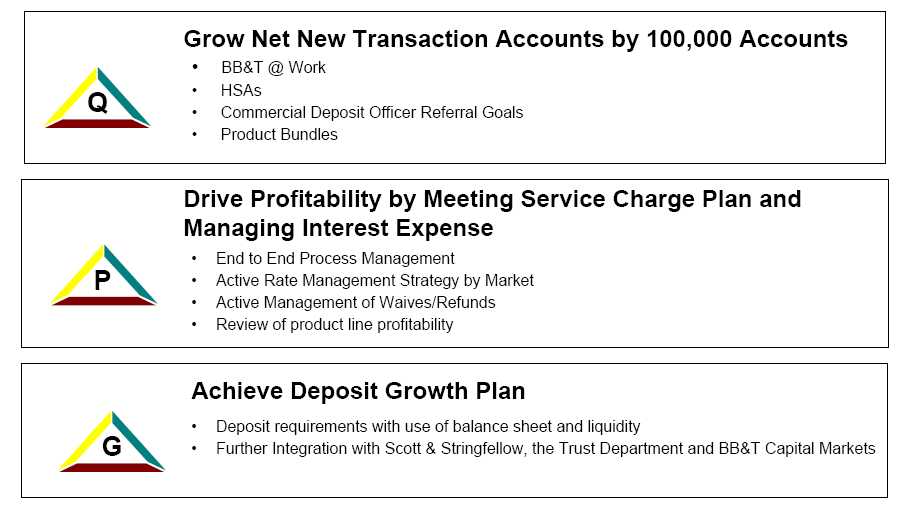

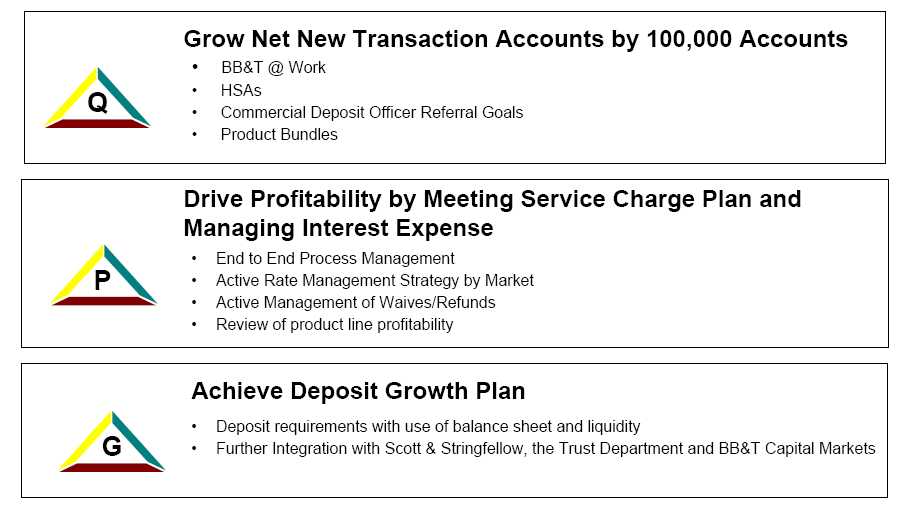

2009 KeyInitiatives

28

2009InitiativestoObtain Balanced Performance

29