UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08510

Matthews International Funds

(Exact name of registrant as specified in charter)

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Address of principal executive offices) (Zip code)

William J. Hackett, President

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-788-7553

Date of fiscal year end: December 31

Date of reporting period: December 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Performance and Expenses

| | | | | Average Annual Total Return | | | | 2012

Annual | | 2011

Annual | |

| | 1 year | | 5 years | | 10 years | | Since

Inception | | Inception

Date | | Operating

Expenses | | Operating

Expenses* | |

Matthews Asia Strategic Income Fund | |

Investor Class (MAINX) | | | 13.62 | % | | | n.a. | | | | n.a. | | | | 11.95 | % | | | 11/30/11 | | | | 1.85 | % | | | 1.93 | %1 | |

After Fee Waiver and Reimbursement | | | | | | | | | | | | | | | | | | | | | | | 1.17 | %2 | | | 1.40 | %2 | |

Institutional Class (MINCX) | | | 13.74 | % | | | n.a. | | | | n.a. | | | | 12.07 | % | | | 11/30/11 | | | | 1.70 | % | | | 1.78 | %1 | |

After Fee Waiver and Reimbursement | | | | | | | | | | | | | | | | | | | | | | | 1.00 | %2 | | | 1.25 | %2 | |

Matthews Asian Growth and Income Fund | |

Investor Class (MACSX) | | | 26.90 | % | | | 5.37 | % | | | 14.27 | % | | | 11.08 | % | | | 9/12/94 | | | | 1.11 | % | | | 1.12 | % | |

Institutional Class (MICSX) | | | 27.09 | % | | | n.a. | | | | n.a. | | | | 7.29 | % | | | 10/29/10 | | | | 0.97 | % | | | 0.99 | % | |

Matthews Asia Dividend Fund | |

Investor Class (MAPIX) | | | 21.63 | % | | | 7.99 | % | | | n.a. | | | | 10.69 | % | | | 10/31/06 | | | | 1.09 | % | | | 1.10 | % | |

Institutional Class (MIPIX) | | | 21.70 | % | | | n.a. | | | | n.a. | | | | 5.72 | % | | | 10/29/10 | | | | 0.97 | % | | | 1.00 | % | |

Matthews China Dividend Fund | |

Investor Class (MCDFX) | | | 27.81 | % | | | n.a. | | | | n.a. | | | | 10.59 | % | | | 11/30/09 | | | | 1.47 | % | | | 1.52 | % | |

After Fee Waiver, Reimbursement and Recapture | | | | | | | | | | | | | | | | | | | | | | | 1.50 | %3 | | | 1.50 | %3 | |

Institutional Class (MICDX) | | | 27.90 | % | | | n.a. | | | | n.a. | | | | 6.22 | % | | | 10/29/10 | | | | 1.29 | % | | | 1.31 | % | |

Matthews Asia Growth Fund | |

Investor Class (MPACX) | | | 17.47 | % | | | 3.34 | % | | | n.a. | | | | 9.63 | % | | | 10/31/03 | | | | 1.16 | % | | | 1.18 | % | |

Institutional Class (MIAPX) | | | 17.63 | % | | | n.a. | | | | n.a. | | | | 2.57 | % | | | 10/29/10 | | | | 0.98 | % | | | 1.03 | % | |

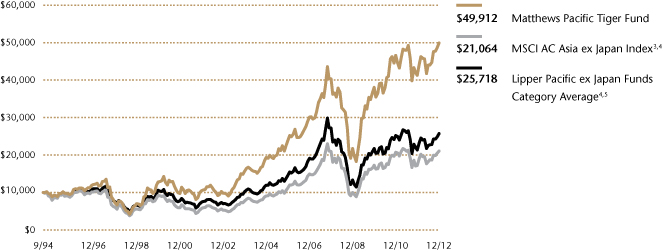

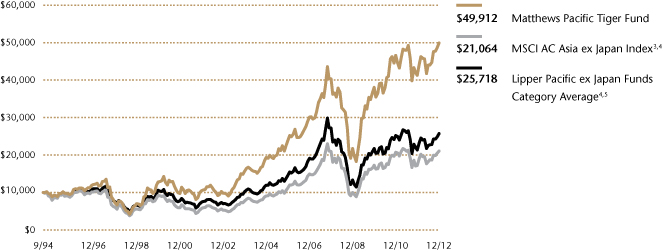

Matthews Pacific Tiger Fund | |

Investor Class (MAPTX) | | | 21.00 | % | | | 4.38 | % | | | 17.69 | % | | | 9.18 | % | | | 9/12/94 | | | | 1.11 | % | | | 1.11 | % | |

Institutional Class (MIPTX) | | | 21.24 | % | | | n.a. | | | | n.a. | | | | 3.73 | % | | | 10/29/10 | | | | 0.95 | % | | | 0.95 | % | |

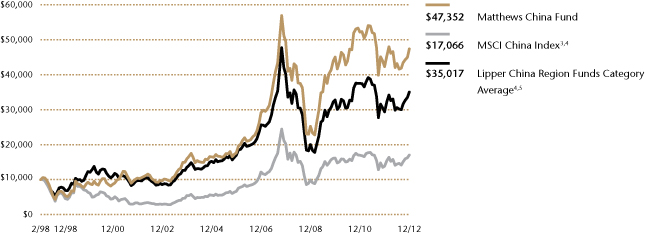

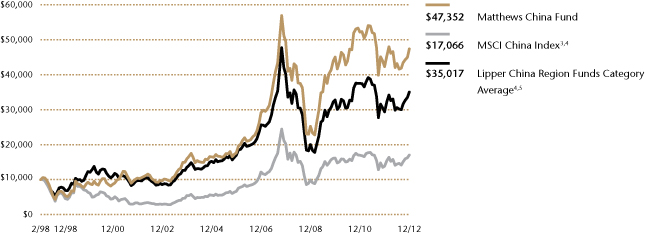

Matthews China Fund | |

Investor Class (MCHFX) | | | 11.96 | % | | | -0.88 | % | | | 17.26 | % | | | 11.03 | % | | | 2/19/98 | | | | 1.12 | % | | | 1.13 | % | |

Institutional Class (MICFX) | | | 12.22 | % | | | n.a. | | | | n.a. | | | | -4.90 | % | | | 10/29/10 | | | | 0.91 | % | | | 0.96 | % | |

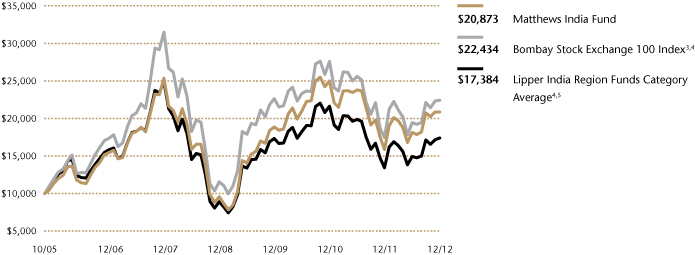

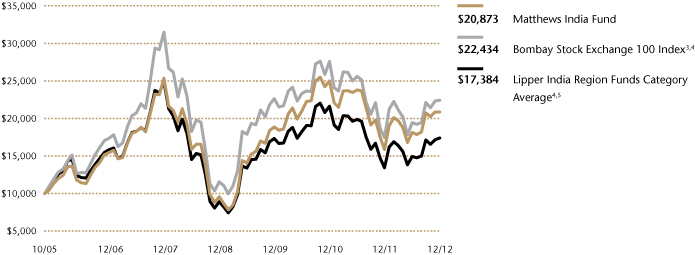

Matthews India Fund | |

Investor Class (MINDX) | | | 31.54 | % | | | -3.82 | % | | | n.a. | | | | 10.81 | % | | | 10/31/05 | | | | 1.18 | % | | | 1.18 | % | |

Institutional Class (MIDNX) | | | 31.74 | % | | | n.a. | | | | n.a. | | | | -8.64 | % | | | 10/29/10 | | | | 0.98 | % | | | 0.99 | % | |

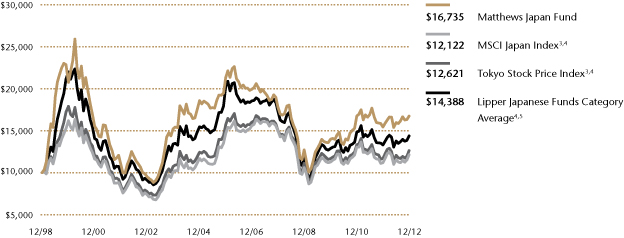

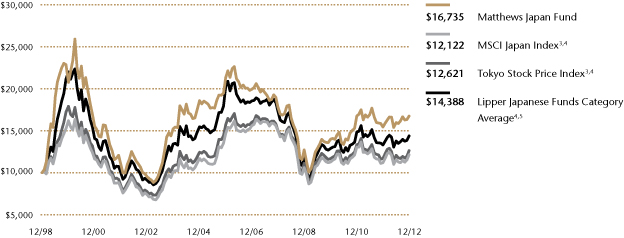

Matthews Japan Fund | |

Investor Class (MJFOX) | | | 8.32 | % | | | -1.18 | % | | | 5.78 | % | | | 3.75 | % | | | 12/31/98 | | | | 1.20 | % | | | 1.21 | % | |

Institutional Class (MIJFX) | | | 8.47 | % | | | n.a. | | | | n.a. | | | | 5.06 | % | | | 10/29/10 | | | | 1.04 | % | | | 1.07 | % | |

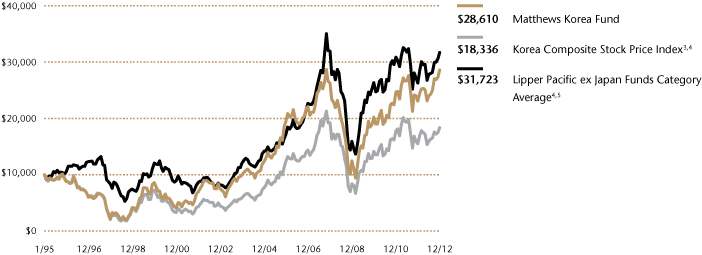

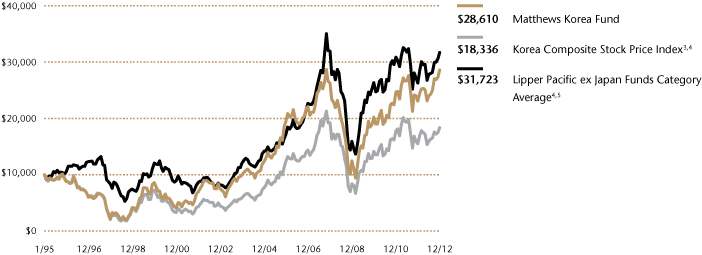

Matthews Korea Fund | |

Investor Class (MAKOX) | | | 24.05 | % | | | 1.75 | % | | | 14.37 | % | | | 6.02 | % | | | 1/3/95 | | | | 1.16 | % | | | 1.18 | % | |

Institutional Class (MIKOX) | | | 24.16 | % | | | n.a. | | | | n.a. | | | | 11.46 | % | | | 10/29/10 | | | | 1.00 | % | | | 1.07 | % | |

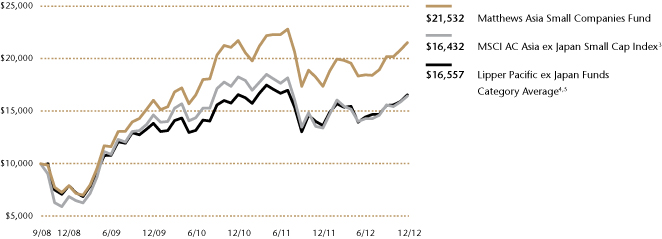

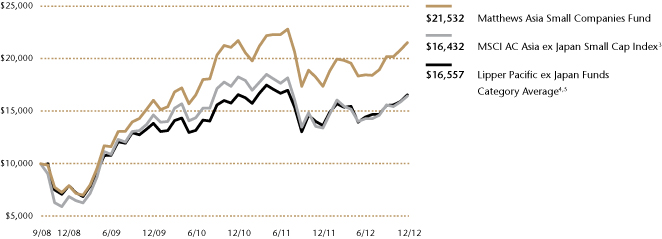

Matthews Asia Small Companies Fund | |

Investor Class (MSMLX) | | | 23.92 | % | | | n.a. | | | | n.a. | | | | 19.56 | % | | | 9/15/08 | | | | 1.50 | % | | | 1.52 | % | |

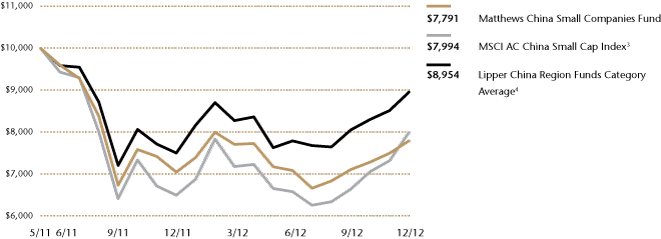

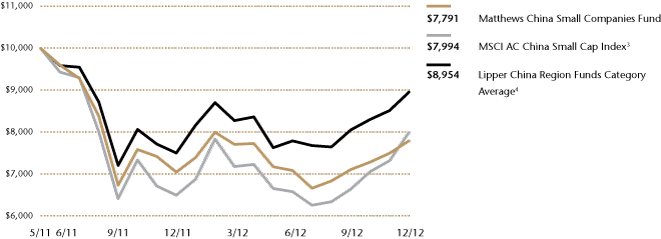

Matthews China Small Companies Fund | |

Investor Class (MCSMX) | | | 10.53 | % | | | n.a. | | | | n.a. | | | | -14.56 | % | | | 5/31/11 | | | | 3.26 | % | | | 5.32 | %1 | |

After Fee Waiver and Reimbursement | | | | | | | | | | | | | | | | | | | | | | | 2.00 | %4 | | | 2.00 | %4 | |

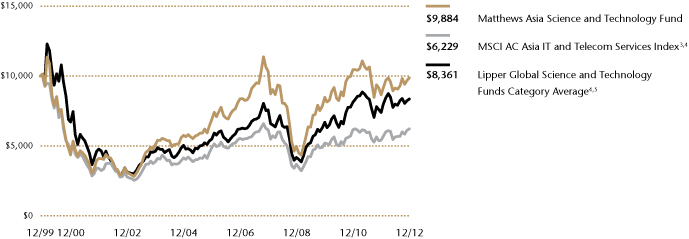

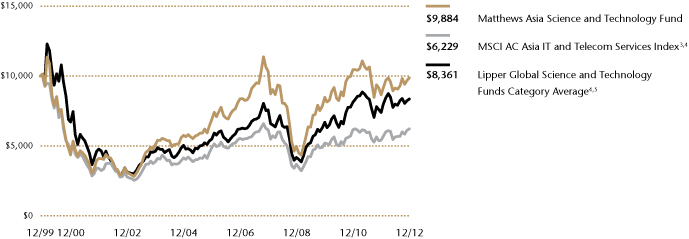

Matthews Asia Science and Technology Fund | |

Investor Class (MATFX) | | | 14.11 | % | | | -0.92 | % | | | 12.32 | % | | | -0.09 | % | | | 12/27/99 | | | | 1.18 | % | | | 1.21 | % | |

* These figures are from the Funds' current prospectus and may differ from the actual expense ratios for 2011, as shown in the Financial Highlights section of this report.

1 Annual operating expenses for 2011 are annualized.

2 Matthews has contractually agreed to waive fees and reimburse expenses until August 31, 2014 to the extent needed to limit Total Annual Fund Operating Expenses to 1.25% for the Institutional Class and agreed to reduce the expense ratio by an equal amount for the Investor Class. Because certain expenses of the Investor Class may be higher than the Institutional Class, the Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may exceed 1.25%. Matthews has also agreed to waive fees and reimburse additional expenses for the Institutional Class on a voluntary basis if its expense ratio exceeds 1.00%. Furthermore, any amounts voluntarily waived by Matthews in respect of the Institutional Class, excluding any voluntary waiver of class-specific shareholder servicing fees, will also be waived for the Investor Class. For 2011, the amounts of the waivers and reimbursements are based on estimated Fund expenses.

3 The Advisor has contractually agreed to waive the Fund's fees and reimburse expenses until at least August 31, 2013 to the extent needed to limit total annual operating expenses to 1.50%.

4 The Advisor has contractually agreed to waive the Fund's fees and reimburse expenses until at least August 31, 2014 to the extent needed to limit total annual operating expenses to 2.00%.

Past Performance: All performance quoted in this report is past performance and is no guarantee of future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the returns quoted. If certain of the Funds' fees and expenses had not been waived, returns would have been lower. For the Funds' most recent month-end performance, please call 800.789.ASIA (2742) or visit matthewsasia.com.

Investment Risk: Mutual fund shares are not deposits or obligations of, or guaranteed by, any depositary institution. Shares are not insured by the FDIC, Federal Reserve Board or any government agency and are subject to investment risks, including possible loss of principal amount invested. Investing in international and emerging markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Fixed income investments are subject to additional risks, including, but not limited to, interest rate, credit and inflation risks. In addition, single-country and sector funds may be subject to a higher degree of market risk than diversified funds because of concentration in a specific industry, sector or geographic location. Investing in small and mid-size companies is more risky than investing in large companies as they may be more volatile and less liquid than larger companies. Please see the Funds' prospectus and Statement of Additional Information for more risk disclosure.

Message to Shareholders | | | 2 | | |

Manager Commentaries, Fund Characteristics and Schedules of Investments: | |

ASIA FIXED INCOME STRATEGY | |

Matthews Asia Strategic Income Fund | | | 4 | | |

ASIA GROWTH AND INCOME STRATEGIES | |

Matthews Asian Growth and Income Fund | | | 10 | | |

Matthews Asia Dividend Fund | | | 15 | | |

Matthews China Dividend Fund | | | 20 | | |

ASIA GROWTH STRATEGIES | |

Matthews Asia Growth Fund | | | 25 | | |

Matthews Pacific Tiger Fund | | | 30 | | |

Matthews China Fund | | | 35 | | |

Matthews India Fund | | | 40 | | |

Matthews Japan Fund | | | 45 | | |

Matthews Korea Fund | | | 50 | | |

ASIA SMALL COMPANY STRATEGIES | |

Matthews Asia Small Companies Fund | | | 55 | | |

Matthews China Small Companies Fund | | | 60 | | |

ASIA SPECIALTY STRATEGY | |

Matthews Asia Science and Technology Fund | | | 65 | | |

Disclosures | | | 70 | | |

Index Definitions | | | 71 | | |

Disclosure of Fund Expenses | | | 72 | | |

Statements of Assets and Liabilities | | | 74 | | |

Statements of Operations | | | 77 | | |

Statements of Changes in Net Assets | | | 80 | | |

Financial Highlights | | | 87 | | |

Notes to Financial Statements | | | 100 | | |

Report of Independent Registered Public Accounting Firm | | | 117 | | |

Tax Information | | | 118 | | |

Approval of Investment Advisory Agreement | | | 120 | | |

Trustees and Officers of the Funds | | | 124 | | |

Cover photo: Matsumoto Castle, Japan

This report has been prepared for Matthews Asia Funds shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Matthews Asia Funds prospectus, which contains more complete information about the Funds' investment objectives, risks and expenses. Additional copies of the prospectus may be obtained at matthewsasia.com. Please read the prospectus carefully before you invest or send money.

The views and opinions in this report were current as of December 31, 2012. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of a Fund's future investment intent. Current and future portfolio holdings are subject to risk.

Statements of fact are from sources considered reliable, but neither the Funds nor the Investment Advisor makes any representation or guarantee as to their completeness or accuracy.

Matthews Asia Funds are distributed in the United States by Foreside Funds Distributors LLC, Berwyn, Pennsylvania

Matthews Asia Funds are distributed in Latin America by HMC Partners

"Our focus should remain on the long-term trends in Asian household and government consumption and the industries that are likely to benefit from the way Asia changes its patterns of consumption."

Message to Shareholders

from the Investment Advisor

Dear Fellow Shareholders,

It seems that 2012 was a year in which Asia's markets rallied without much conviction. Investors appeared more concerned about chasing yield; growth in earnings was something that just happened whilst they were looking the other way. Bonds and dividend-paying stocks performed relatively well, whereas companies that retained capital for long-term growth struggled against investors' fears over 12-month GDP numbers. I readily agree that yield is a good thing to demand; we often argue that reasonable dividend yields can be a symptom of strong corporate governance and sustainable earnings growth. But reaching for high yields without thinking about growth or financial risk can be just as dangerous as blindly chasing high growth. I believe there are times when there is actually safety in growth!

I say this not just because of recent economic trends, but also because of the different approaches to government policy that emerged in the world over the past year. 2012 saw elections in Europe, the U.S., and across Asia. The results of these elections were also a product of the different economic environments across the globe. In heavily indebted countries, such as France and the U.S., elections were won on a platform of redistribution of wealth; taxation of productivity and investment; and encouragement of consumption. In Asia, where the fiscal position of most countries is much healthier, governments in favor of promoting profits and investment won or retained power.

It is perhaps not surprising that the consumption argument won elections for the West. In a depressed economy, more consumption may increase the circular flow of incomes and grow the economy. During the Great Depression of the 1930s, British economist John Maynard Keynes scorned the "purposive man" who pursued the accumulation of wealth over time at the expense of consumption in the present: "For him jam is not jam unless it is a case of jam tomorrow and never jam today." But Keynes' "purposive man" is also the entrepreneur, the investor and the creator of long-term growth. In taxing him, policymakers risk permanently reducing investment. Despite this risk, the temptation to consume more today is often irresistible.

Much of Asia has a different view of Keynes's purposive man. With the fiscal demons of temptation for the most part at bay, Asia continues to champion entrepreneurship and investment and to try to lure both to its shores. Tax rates on income are for the most part lower than the West and so, too, are corporate taxes and capital gains taxes, the latter of which are zero in Hong Kong and Singapore. China modified its visa laws to encourage the immigration of more foreign talent to help run and transform its businesses. In Asia, the purposive man is a hero not a Scrooge!

Asia's immediate challenge, therefore, is to facilitate investment. Such investment will still include physical infrastructure. However, it will probably focus increasingly on capital goods—the equipment and machinery necessary for improvements in manufacturing productivity and to produce a consistent quality of manufactured goods. In addition, investment in software and virtual infrastructure will increase in importance. IT spending across the region is likely to increase as wages rise, in order to get the most out of a more skilled labor force. Wages will continue to rise as people invest in their own education to reap the benefits of acquiring greater skills. Of all the challenges facing Asia,

2 MATTHEWS ASIA FUNDS

developing capital markets and the institutions to attract and grow capital are among the most important. As Asian governments continue to support and champion entrepreneurs, so Asian assets are likely to be in demand from both foreign and domestic investors. These are the channels by which Asia will allow the purposive man to accumulate wealth.

But What of Asia's Jam Tomorrow?

Asia will continue to build up its wealth. But the ultimate point of economic activity is still consumption, and for Asia that means the ability to enjoy a middle-class lifestyle. These changes are underway and will take time. They will probably take the form of more efficient use of natural resources to protect the environment; more money spent on leisure and the redevelopment of cities from production centers to consumption centers; and higher quality, modern housing. And, yes, Asia is also building welfare states: Indonesia wants universal health insurance by 2014; universal pensions a year later. China has set up its own welfare system; richer economies, such as South Korea, have had systems in place for some time. Yet, Asia's welfare systems are likely to be more efficient than in the West and also less generous. According to the Asian Development Bank, Asia's spending on social welfare based on 2008 data averaged nearly 5% of GDP and ranges from approximately 2% in Indonesia, less than 5% in India and China; 8% in Korea and 16% in Japan. Data from the Organization for Economic Cooperation and Development, which measures public and private "social expenditure" suggests that governments in Europe and the U.S. spend between two and three times the amount than, for example, Korea.

I therefore remain confident that over the coming decade, Asia will retain its lead in terms of rates of investment and economic growth. Nevertheless, I also believe that our focus should remain on the long-term trends in Asian household and government consumption and the industries that are likely to benefit from the way Asia changes its patterns of consumption. In buoyant markets, there may be many short-term trades to make in distressed businesses—"cigar butt stocks" with "one last puff" in them. As tempting as these can be, trading on short-term market sentiment is not our way. We still believe in patience and we don't want to end up holding a business that we wished we had never bought into. As we look to the year ahead, the most attractive opportunities seem to be in businesses in which the long-term growth is undervalued, or where the short-term cyclicality of the business has frightened investors seeking instant returns, even if the business has a strong competitive position in its industry.

Patience and delayed gratification, traits of the purposive man, remain key to long-run accumulation of wealth.

As always, we feel privileged to be your investment advisor for Asia and thank you for your support.

Robert Horrocks, PhD

Chief Investment Officer

Matthews International Capital Management, LLC

matthewsasia.com | 800.789.ASIA 3

ASIA FIXED INCOME STRATEGY

PORTFOLIO MANAGERS

Teresa Kong, CFA

Lead Manager

Gerald M. Hwang, CFA, Robert J. Horrocks, PhD

Co-Managers

FUND FACTS

| | | Investor Class | | Institutional Class | |

Ticker | | MAINX | | MINCX | |

CUSIP | | 577125503 | | 577125602 | |

Inception | | 11/30/11 | | 11/30/11 | |

NAV | | $10.84 | | $10.83 | |

Initial Investment | | $2,500 | | $3 million | |

Gross Expense Ratio1 | | 1.85% | | 1.70% | |

After fee waiver and

Reimbursement | | 1.17% | | 1.00% | |

Portfolio Statistics

Total # of Positions | | 61 | |

Net Assets | | $35.7 million | |

Modified Duration | | 4.92 | |

Portfolio Turnover | | 18.45%3 | |

Benchmarks

HSBC Asian Local Bond Index

J.P. Morgan Asia Credit Index

Redemption Fee

2% within first 90 calendar days of purchase

OBJECTIVE

Total return over the long term with an emphasis on income.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its total assets, which include borrowings for investment purposes, in income-producing securities including, but not limited to, debt and debt-related instruments issued by governments, quasi-governmental entities, supra-national institutions, and companies in Asia. Investments may be denominated in any currency, and may represent any part of a company's capital structure from debt to equity or with features of both.

1 The Advisor has contractually and voluntarily agreed to waive certain fees and reimburse certain expenses for Matthews Asia Strategic Income Fund. Please see page 111 for additional information. Matthews Asia Funds does not charge 12b-1 fees.

2 Modified duration measures the percent change in value of the fixed income portion of the portfolio in response to a 1% change in interest rates. In a multi-currency denominated portfolio with sensitivities to different interest rate regimes, modified duration will not accurately reflect the change in value of the overall portfolio from a change in any one interest rate regime.

3 The lesser of fiscal year 2012 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities.

Matthews Asia Strategic Income Fund

Portfolio Manager Commentary

For the year ending December 31, 2012, the Matthews Asia Strategic Income Fund returned 13.62% (Investor Class) and 13.74% (Institutional Class), while its primary benchmark, the HSBC Asian Local Bond Index (ALBI) and its secondary benchmark, the J.P. Morgan Asia Credit Index (JACI), gained 8.93% and 14.27%, respectively. For the fourth quarter, the Fund returned 3.56% (Investor Class) and 3.53% (Institutional Class) versus 2.28% and 2.24% for its primary and secondary benchmarks, respectively.

2012 was a special year in that all three drivers of return—credit, currency, and interest rates—contributed positively. From a historical perspective, returns in local currency Asia bonds were positive while returns in U.S. dollar-denominated Asia bonds were exceptionally strong. The annual return for the U.S. dollar-denominated Asia bond was the second highest since the JACI was created in 2005 and easily beat the average of 8.59%. The ALBI's return for the year beat its historical average of 8.44% since the benchmark was created in 2001.

It is no surprise that the U.S. dollar-denominated positions outperformed our local currency holdings as the returns for the JACI were high. Despite having less than half of our portfolio allocated to U.S. dollar-denominated bonds, we were able to generate high overall returns because of our nearly 50% allocation to sub-investment grade credit, which generated an attractive 20.42% return in 2012 (as measured by the JACI Sub-Investment Grade Index).

Over the year, we steadily increased our allocation to corporate bonds and moved away from government bonds. This was largely driven by our bottom-up, security selection process. We started the year with an allocation of approximately 33% to corporates and ended the year with approximately 50% as we found more compelling opportunities in this sub-segment. One example was our decision to initiate positions in Chinese property companies in the second quarter. In the past, Chinese property bonds did not price in the full risk of the sector that included bondholders securing property in cases of distress, a sector dependent on capital markets to access liquidity. However, once the bonds reached double-digit yields we believed they priced in these risks and provided attractive total return opportunities. Over the course of the year, with respect to our interest rate exposures, we shifted our allocation away from the Indonesian rupiah, and toward Philippine peso-denominated bonds. Again, this decision was taken following a bottom up analysis of the fundamentals driving the countries. In this case, our view was that the Philippine economy was finally gaining traction, driven by falling interest rates, low inflation, rising business sentiment and increases in infrastructure spending.

Overall returns for Asia's currencies were also positive at 2.6% (using the spot return of the currencies in the ALBI index as proxy). The best performer was the Korean won, followed by the Philippine peso and the Singaporean dollar, returning approximately 8.3%, 7.0%, and 6.1% respectively. The biggest underperformers were the Japanese yen, the Indonesian rupiah, and the Indian rupee at –11.3%, –7.4%, and –3.5% respectively. Our portfolio benefited from having generally higher weights in the outperformers and lower weights in the underperformers.

The Philippine government was a top contributor to our performance by issuer selection, and the portfolio was overweight this issuer. Other top

4 MATTHEWS ASIA FUNDS

PERFORMANCE AS OF DECEMBER 31, 2012

| | | | | | Average Annual

Total Returns | | | |

| | 3 Months | | 1 Year | | Since

Inception | | Inception

Date | |

Investor Class (MAINX) | | | 3.56 | % | | | 13.62 | % | | | 11.95 | % | | 11/30/11 | |

Institutional Class (MINCX) | | | 3.53 | % | | | 13.74 | % | | | 12.07 | % | | 11/30/11 | |

HSBC Asian Local Bond Index4 | | | 2.28 | % | | | 8.93 | % | | | 8.96 | % | | | | | |

J.P. Morgan Asia Credit Index4 | | | 2.24 | % | | | 14.27 | % | | | 14.01 | % | | | | | |

Lipper Emerging Markets Debt Funds Category Average5 | | | 3.62 | % | | | 18.48 | % | | | 17.88 | % | | | | | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund's fees and expenses had not been waived. For the Fund's most recent month-end performance visit matthewsasia.com.

INCOME DISTRIBUTION HISTORY

| | 2012 | | 2011 | |

| | Q1 | | Q2 | | Q3 | | Q4 | | Total | | Q1 | | Q2 | | Q3 | | Q4 | | Total | |

Investor (MAINX) | | $ | 0.09 | | | $ | 0.07 | | | $ | 0.11 | | | $ | 0.15 | | | $ | 0.42 | | | | n.a. | | | | n.a. | | | | n.a. | | | $ | 0.02 | | | $ | 0.02 | | |

Institutional (MINCX) | | $ | 0.10 | | | $ | 0.07 | | | $ | 0.12 | | | $ | 0.15 | | | $ | 0.44 | | | | n.a. | | | | n.a. | | | | n.a. | | | $ | 0.02 | | | $ | 0.02 | | |

Note: This table does not include capital gains distributions. Totals may differ by $0.01 due to rounding. For income distribution history, visit matthewsasia.com.

30-DAY YIELD:

3.15% (Investor Class) 3.35% (Institutional Class)

The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 12/31/12, expressed as an annual percentage rate based on the Fund's share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund's rate of investment income, and it may not equal the Fund's actual income distribution rate.

Source: BNY Mellon Investment Servicing (US) Inc.

YIELD TO WORST:

4.35%

Yield to worst is the lowest yield that can be received on a bond assuming that the issuer does not default. It is calculated by utilizing the worst case assumptions for a bond with respect to certain income-reducing factors, including prepayment, call or sinking fund provisions. It does not represent the yield that an investor should expect to receive. Past yields are no guarantee of future yields.

Source: FactSet Research Systems

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION—INVESTOR CLASS

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions or redemption of Fund shares. Values are in US$.

4 It is not possible to invest directly in an index. Source: Index data from HSBC, J.P. Morgan and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 71 for index definitions.

5 The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods.

TOP TEN POSITIONS6

| | Sector | | Currency | | % of Net Assets | |

Malaysian Government Bond, 4.160%, 7/15/2021 | | Government Bonds | | Malaysian Ringgit | | | 4.8 | % | |

KWG Property Holding, Ltd., 12.500%, 8/18/2017 | | Financials | | U.S. Dollar | | | 4.2 | % | |

Macquarie Bank, Ltd., 6.625%, 4/7/2021 | | Financials | | U.S. Dollar | | | 3.4 | % | |

Galaxy Entertainment Group, Ltd., 4.625%, 12/16/2013 | | Consumer Discretionary | | Chinese Renminbi | | | 3.4 | % | |

Republic of Philippines, 6.250%, 1/14/2036 | | Government Bonds | | Philippine Peso | | | 3.3 | % | |

Indonesia Government Bond, 8.250%, 7/15/2021 | | Government Bonds | | Indonesian Rupiah | | | 3.2 | % | |

Home Inns & Hotels Management, Inc., 2.000%, 12/15/2015 | | Consumer Discretionary | | U.S. Dollar | | | 3.1 | % | |

Malayan Banking BHD, 3.250%, 9/20/2022 | | Financials | | U.S. Dollar | | | 2.8 | % | |

Mongolia International Bond, 5.125%, 12/5/2022 | | Government Bonds | | U.S. Dollar | | | 2.7 | % | |

Korea Treasury Bond, 3.500%, 9/10/2016 | | Government Bonds | | Korean Won | | | 2.7 | % | |

% OF ASSETS IN TOP TEN | | | | | | | 33.6 | % | |

6 Holdings may combine more than one security from same issuer and related depositary receipts.

matthewsasia.com | 800.789.ASIA 5

CURRENCY ALLOCATION (%)7,8

U.S. Dollar (USD) | | | 48.0 | | |

Chinese Renminbi (CNY) | | | 8.9 | | |

Philippine Peso (PHP) | | | 7.6 | | |

Malaysian Ringgit (MYR) | | | 7.4 | | |

Korean Won (KRW) | | | 7.1 | | |

Australian Dollar (AUD) | | | 5.4 | | |

Thai Baht (THB) | | | 3.8 | | |

Singapore Dollar (SGD) | | | 3.7 | | |

Indonesian Rupiah (IDR) | | | 3.2 | | |

Hong Kong Dollar (HKD) | | | 2.2 | | |

Cash and Other Assets,

Less Liabilities | | | 2.7 | | |

COUNTRY ALLOCATION (%)8,9

(By issuer's country of risk)

China/Hong Kong | | | 24.6 | | |

Philippines | | | 12.3 | | |

Malaysia | | | 12.2 | | |

South Korea | | | 9.5 | | |

Australia | | | 9.4 | | |

Thailand | | | 8.3 | | |

Indonesia | | | 5.5 | | |

Singapore | | | 5.1 | | |

United Kingdom | | | 3.1 | | |

India | | | 2.8 | | |

Mongolia | | | 2.7 | | |

Sri Lanka | | | 1.1 | | |

Japan | | | 0.7 | | |

Cash and Other Assets, Less Liabilities | | | 2.7 | | |

SECTOR ALLOCATION (%)8

Government Bonds | | | 32.8 | | |

Financials | | | 30.9 | | |

Consumer Discretionary | | | 14.7 | | |

Industrials | | | 7.2 | | |

Telecommunication Services | | | 4.2 | | |

Energy | | | 3.3 | | |

Utilities | | | 3.1 | | |

Information Technology | | | 1.1 | | |

Cash and Other Assets, Less Liabilities | | | 2.7 | | |

ASSET TYPE BREAKDOWN (%)7,8

Corporate Bonds | | | 54.0 | | |

Government Bonds | | | 32.8 | | |

Common Equities and ADRs | | | 7.4 | | |

Convertible Bonds | | | 3.1 | | |

Cash and Other Assets, Less Liabilities | | | 2.7 | | |

7 Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding.

8 Cash and other assets may include forward currency exchange contracts and certain derivative instruments that have been marked-to-market.

9 Not all countries are included in the benchmark index(es).

Matthews Asia Strategic Income Fund

Portfolio Manager Commentary (continued)

contributors were Korean government bonds, which benefited from both strong currency appreciation and falling interest rates, and KWG Property Group, a Chinese property company. The main detractors to performance came from our tactical U.S. Treasury hedge, Chunghwa Telecom and a Mongolia government bond. But just to put the magnitude of the performance in perspective, none of these detractors contributed more than –75 basis points (–0.75%) to overall returns.

When we launched this strategy in November of 2011, we sought to provide a fixed income fund with low volatility but high risk-adjusted returns to our investors. Based on our analysis, the most effective way to achieve this over multi-year periods is to take a blended approach with the flexibility to invest across currencies (both U.S. dollar and local currencies of Asia) as well as across the credit spectrum. Importantly, while returns were strong in 2012, they were also attractive on a risk-adjusted basis.

Looking forward, we expect returns may likely be less dependent on credit and falling interest rates and more on currency appreciation. While the magnitude of the spread tightening might not match the 111 basis points (1.11%) experienced in 2012, we still see potential for some credit spread tightening. Historically, one of the best predictors of high yield spread is the default rate. Moody's Global high yield rate reached a low of 1.8% in fourth quarter of December 2011 and has gradually risen to 3.0% as of October 2012. Given that credit cycles typically last about 8 to 10 years, defaults tend to stay at trough levels for several years before spiking, and since we are just over two years from the last peak in defaults, we expect defaults to remain low in 2013.

In terms of interest rates in Asia, we expect they will be driven less by regional events and influenced more by what happens in the U.S. and Europe. Our base case, therefore, is for a small rise in U.S. interest rates, reflecting continued slow growth. However, while we expect rates to rise, we believe this should not have a material impact on most Asian countries. In addition, by taking on greater interest rate exposure to Asian countries experiencing falling interesting rates, such as Malaysia and Korea, and less exposure to those with the highest likelihood to rise, such as Hong Kong and Singapore, we aim to cushion our portfolio returns from an overall rising interest rate environment.

Finally on the currency front, we expect most of Asia's currencies to continue on their slow, secular appreciation relative to the U.S. dollar. The primary exception is Japan's yen. Japan's ruling Liberal Democratic Party campaigned on looser monetary policies and won with an overwhelming majority. We are seeing a rare alignment of political will to undertake the difficult policies necessary to kick-start the Japanese economy. As for the rest of Asia's currencies, the key currency to watch is China's renminbi. With China's political leadership transition behind us, the country can carry on with the hard work of steering the economy toward more balanced growth, increasing services and consumption and away from being export dependent. One key to success is a greater liberalization of interest rates in China. By widening the band by which banks can lend, policymakers are slowly incentivizing banks to price loans based on risk. We welcome these small and measured steps to further allow markets to determine the price of its capital.

Fixed income investments are subject to additional risks, including, but not limited to, interest rate, credit and inflation risks. Investing in emerging markets involves different and greater risks, as these countries are substantially smaller, less liquid and more volatile than securities markets in more developed markets.

6 MATTHEWS ASIA FUNDS

Matthews Asia Strategic Income Fund December 31, 2012

Schedule of Investmentsa

FOREIGN GOVERNMENT OBLIGATIONS: 32.8%

| | | Face Amount* | | Value | |

SOUTH KOREA: 7.1% | |

Korea Treasury Bond

3.500%, 09/10/16 | | KRW | 1,000,000,000 | | | $ | 952,113 | | |

Korea Treasury Bond

5.750%, 09/10/18 | | KRW | 500,000,000 | | | | 532,968 | | |

Korea Treasury Bond

3.250%, 12/10/14 | | KRW | 500,000,000 | | | | 470,813 | | |

Korea Treasury Bond

4.000%, 09/10/15 | | KRW | 300,000,000 | | | | 288,479 | | |

Korea Treasury Bond

3.250%, 06/10/15 | | KRW | 300,000,000 | | | | 282,969 | | |

Total South Korea | | | | | 2,527,342 | | |

PHILIPPINES: 6.7% | |

Republic of Philippines

6.250%, 01/14/36 | | PHP | 40,000,000 | | | | 1,168,950 | | |

Republic of Philippines

3.900%, 11/26/22 | | PHP | 30,000,000 | | | | 756,164 | | |

Republic of Philippines

4.950%, 01/15/21 | | PHP | 18,000,000 | | | | 483,836 | | |

Total Philippines | | | | | 2,408,950 | | |

MALAYSIA: 6.6% | |

Malaysian Government Bond

4.160%, 07/15/21 | | MYR | 5,000,000 | | | | 1,708,278 | | |

Malaysian Government Bond

3.580%, 09/28/18 | | MYR | 1,000,000 | | | | 331,276 | | |

Malaysia Investment Issue

3.309%, 08/30/17 | | MYR | 1,000,000 | | | | 326,498 | | |

Total Malaysia | | | | | 2,366,052 | | |

INDONESIA: 4.0% | |

Indonesia Government Bond

8.250%, 07/15/21 | | IDR | 9,000,000,000 | | | | 1,128,670 | | |

Republic of Indonesia

5.875%, 03/13/20 | | | 250,000 | | | | 300,625 | | |

Total Indonesia | | | | | 1,429,295 | | |

THAILAND: 2.8% | |

Thailand Government Bond

3.250%, 06/16/17 | | THB | 15,000,000 | | | | 493,362 | | |

Thailand Government Bond

4.250%, 03/13/13 | | THB | 15,000,000 | | | | 491,688 | | |

Total Thailand | | | | | 985,050 | | |

MONGOLIA: 2.7% | |

Mongolia Government International Bond

5.125%, 12/05/22b | | | 1,000,000 | | | | 980,000 | | |

Total Mongolia | | | | | 980,000 | | |

AUSTRALIA: 1.8% | |

Australian Government Bond

5.750%, 07/15/22 | | AUD | 500,000 | | | | 626,032 | | |

Total Australia | | | | | 626,032 | | |

| | | Face Amount* | | Value | |

SRI LANKA: 1.1% | |

Republic of Sri Lanka

7.400%, 01/22/15 | | | 350,000 | | | $ | 376,250 | | |

Total Sri Lanka | | | | | 376,250 | | |

TOTAL FOREIGN GOVERNMENT OBLIGATIONS: | | | | | 11,698,971 | | |

(Cost $11,235,532) | | | | | |

CORPORATE BONDS: 57.2%

CHINA/HONG KONG: 22.4% | |

KWG Property Holding, Ltd.

12.500%, 08/18/17 | | | 1,300,000 | | | | 1,493,849 | | |

Galaxy Entertainment Group, Ltd.

4.625%, 12/16/13 | | CNY | 7,470,000 | | | | 1,201,519 | | |

Home Inns & Hotels Management, Inc.

2.000%, 12/15/15 | | | 1,300,000 | | | | 1,117,187 | | |

Longfor Properties Co., Ltd.

9.500%, 04/07/16 | | | 750,000 | | | | 826,875 | | |

Melco Crown Entertainment, Ltd.

3.750%, 05/09/13 | | CNY | 5,000,000 | | | | 799,532 | | |

FPT Finance, Ltd.

6.375%, 09/28/20 | | | 550,000 | | | | 617,454 | | |

Hutchison Whampoa International 11, Ltd.

4.625%, 01/13/22b | | | 500,000 | | | | 557,139 | | |

Wharf Finance No. 1, Ltd.

4.500%, 07/20/21 | | SGD | 500,000 | | | | 418,231 | | |

Tencent Holdings, Ltd.

4.625%, 12/12/16b | | | 350,000 | | | | 376,739 | | |

Fita International, Ltd.

7.000%, 02/10/20 | | | 300,000 | | | | 338,865 | | |

Beijing Enterprises Water Group, Ltd.

3.750%, 06/30/14 | | CNY | 1,500,000 | | | | 240,605 | | |

Total China/Hong Kong | | | | | 7,987,995 | | |

AUSTRALIA: 7.0% | |

Macquarie Bank, Ltd.

6.625%, 04/07/21 | | | 1,100,000 | | | | 1,214,779 | | |

SPI Electricity & Gas Australia Holdings Pty, Ltd.

5.750%, 06/28/22 | | AUD | 500,000 | | | | 535,130 | | |

Crown Group Finance, Ltd.

5.750%, 07/18/17 | | AUD | 500,000 | | | | 531,781 | | |

Lend Lease Financial International, Ltd.

4.625%, 07/24/17 | | SGD | 250,000 | | | | 212,844 | | |

Total Australia | | | | | 2,494,534 | | |

MALAYSIA: 4.9% | |

Malayan Banking BHD

3.250%c, 09/20/22 | | | 1,000,000 | | | | 997,314 | | |

Axiata SPV1 Labuan, Ltd.

5.375%, 04/28/20 | | | 650,000 | | | | 739,720 | | |

Total Malaysia | | | | | 1,737,034 | | |

matthewsasia.com | 800.789.ASIA 7

Matthews Asia Strategic Income Fund December 31, 2012

Schedule of Investmentsa (continued)

CORPORATE BONDS (continued)

| | | Face Amount* | | Value | |

PHILIPPINES: 4.8% | |

Alliance Global Group, Inc.

6.500%, 08/18/17 | | | 550,000 | | | $ | 605,773 | | |

International Container Terminal Services, Inc.

7.375%, 03/17/20 | | | 500,000 | | | | 587,617 | | |

SM Investments Corp.

5.500%, 10/13/17 | | | 500,000 | | | | 535,839 | | |

Total Philippines | | | | | 1,729,229 | | |

THAILAND: 4.4% | |

Bangkok Bank Public Co., Ltd.

9.025%, 03/15/29 | | | 500,000 | | | | 672,500 | | |

PTTEP Canada International Finance, Ltd.

6.350%, 06/12/42 | | | 500,000 | | | | 622,130 | | |

PTTEP Canada International Finance, Ltd.

5.692%, 04/05/21b | | | 250,000 | | | | 288,788 | | |

Total Thailand | | | | | 1,583,418 | | |

SINGAPORE: 3.2% | |

Global Logistic Properties, Ltd.

3.375%, 05/11/16 | | CNY | 4,500,000 | | | | 711,329 | | |

Oversea-Chinese Banking Corp., Ltd.

3.750%c, 11/15/22 | | | 400,000 | | | | 421,156 | | |

Total Singapore | | | | | 1,132,485 | | |

UNITED KINGDOM: 3.1% | |

Jaguar Land Rover PLC

7.750%, 05/15/18b | | | 500,000 | | | | 545,000 | | |

Jaguar Land Rover PLC

7.750%, 05/15/18, Reg S | | | 500,000 | | | | 545,000 | | |

Total United Kingdom | | | | | 1,090,000 | | |

INDIA: 2.8% | |

Axis Bank, Ltd.

7.250%c, 08/12/21 | | | 500,000 | | | | 510,109 | | |

Bank of Baroda

6.625%c, 05/25/22 | | | 500,000 | | | | 504,709 | | |

Total India | | | | | 1,014,818 | | |

SOUTH KOREA: 2.4% | |

Kia Motors Corp.

3.625%, 06/14/16 | | | 500,000 | | | | 523,985 | | |

Korea Hydro & Nuclear Power Co., Ltd.

4.750%, 07/13/21 | | | 300,000 | | | | 339,001 | | |

Total South Korea | | | | | 862,986 | | |

INDONESIA: 1.5% | |

Theta Capital Pte., Ltd.

7.000%, 05/16/19 | | | 500,000 | | | | 521,579 | | |

Total Indonesia | | | | | 521,579 | | |

| | | Face Amount* | | Value | |

JAPAN: 0.7% | |

ORIX Corp.

4.000%, 11/29/14 | | CNY | 1,500,000 | | | $ | 242,242 | | |

Total Japan | | | | | 242,242 | | |

TOTAL CORPORATE BONDS | | | | | 20,396,320 | | |

(Cost $19,471,524) | | | | | |

COMMON EQUITIES: 7.3%

| | | Shares | | | |

CHINA/HONG KONG: 2.2% | |

The Link REIT | | | 55,000 | | | | 275,446 | | |

HSBC Holdings PLC | | | 24,000 | | | | 254,383 | | |

Kunlun Energy Co., Ltd. | | | 120,000 | | | | 253,721 | | |

Total China/Hong Kong | | | | | 783,550 | | |

SINGAPORE: 1.9% | |

StarHub, Ltd. | | | 90,000 | | | | 281,898 | | |

Ascendas REIT | | | 110,000 | | | | 215,261 | | |

Mapletree Logistics Trust, REIT | | | 200,000 | | | | 188,228 | | |

Total Singapore | | | | | 685,387 | | |

THAILAND: 1.1% | |

Kasikornbank Public Co., Ltd. | | | 60,000 | | | | 381,811 | | |

Total Thailand | | | | | 381,811 | | |

PHILIPPINES: 0.8% | |

Alliance Global Group, Inc. | | | 700,000 | | | | 286,846 | | |

Total Philippines | | | | | 286,846 | | |

MALAYSIA: 0.7% | |

Axiata Group BHD | | | 120,000 | | | | 259,553 | | |

Total Malaysia | | | | | 259,553 | | |

AUSTRALIA: 0.6% | |

Telstra Corp., Ltd. | | | 50,000 | | | | 227,837 | | |

Total Australia | | | | | 227,837 | | |

TOTAL COMMON EQUITIES | | | | | 2,624,984 | | |

(Cost $2,038,735) | | | | | |

8 MATTHEWS ASIA FUNDS

Matthews Asia Strategic Income Fund December 31, 2012

Schedule of Investmentsa (continued)

| | | Value | |

TOTAL INVESTMENTS: 97.3% | | $ | 34,720,275 | | |

(Cost $32,745,791d) | | | |

CASH AND OTHER ASSETS,

LESS LIABILITIES: 2.7% | | | 963,582 | | |

NET ASSETS: 100.0% | | $ | 35,683,857 | | |

a Certain securities were fair valued under the discretion of the Board of Trustees (Note 2-A).

b Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The security may be resold in transactions exempt from registration normally to qualified institutional buyers. The security has been determined to be liquid in accordance with procedures adopted by the Fund's Board of Directors.

c Variable rate security. The rate represents the rate in effect at December 31, 2012.

d Cost for federal income tax purposes is $32,879,848 and net unrealized appreciation consists of:

Gross unrealized appreciation | | $ | 1,932,007 | | |

Gross unrealized depreciation | | | (91,580 | ) | |

Net unrealized appreciation | | $ | 1,840,427 | | |

* All values are in USD unless otherwise noted

AUD Australian Dollar

CNY Chinese Renminbi (Yuan)

IDR Indonesian Rupiah

KRW Korean Won

MYR Malaysian Ringgit

PHP Philippine Peso

REIT Real Estate Investment Trust

SGD Singapore Dollar

THB Thai Baht

USD U.S. Dollar

See accompanying notes to financial statements.

matthewsasia.com | 800.789.ASIA 9

ASIA GROWTH AND INCOME STRATEGIES

PORTFOLIO MANAGERS

Robert J. Horrocks, PhD

Lead Manager

Kenneth Lowe, CFA

Co-Manager

FUND FACTS

| | | Investor Class | | Institutional Class | |

Ticker | | MACSX | | MICSX | |

CUSIP | | 577130206 | | 577130842 | |

Inception | | 9/12/94 | | 10/29/10 | |

NAV | | $18.61 | | $18.60 | |

Initial Investment | | $2,500 | | $3 million | |

Gross Expense Ratio1 | | 1.11% | | 0.97% | |

Portfolio Statistics

Total # of Positions | | 63 | |

Net Assets | | $4.1 billion | |

Weighted Average Market Cap | | $31.8 billion | |

Portfolio Turnover | | 17.43%2 | |

Benchmark

MSCI AC Asia ex Japan Index

Redemption Fee

2% within first 90 calendar days of purchase

OBJECTIVE

Long-term capital appreciation. The Fund also seeks to provide some current income.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in dividend-paying common stock, preferred stock and other equity securities, and convertible securities as well as fixed-income securities, of any duration or quality, of companies located in Asia, including developed, emerging and frontier countries and markets in the Asian region.

1 Matthews Asia Funds does not charge 12b-1 fees.

2 The lesser of fiscal year 2012 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities.

Matthews Asian Growth and Income Fund

Portfolio Manager Commentary

For the year ending December 31, 2012, the Matthews Asian Growth and Income Fund gained 26.90% (Investor Class) and 27.09% (Institutional Class) while its benchmark, the MSCI All Country Asia ex Japan Index, gained 22.70%. For the fourth quarter of the year, the Fund returned 4.99% (Investor Class) and 4.94% (Institutional Class) versus 5.70% for the Index.

Much like the prior 12 months, 2012 was a year of much pessimism, uncertainty and a somewhat blinkered fixation by many market participants with the major macroeconomic issues of the day. These included not just political events such as the U.S. Presidential election, the ongoing power shift in China and yet another new prime minister in Japan, but also the continuation of unorthodox monetary policy that Western central banks appear keen to persist with for the foreseeable future. Given this volatile backdrop, many Asia investors gravitated, over the course of the year, toward those companies that displayed both sustainable and visible earnings growth as well as some form of current income. This naturally played into the Fund's core philosophy of trying to mitigate the region's inherently volatile markets by investing in quality companies with tangible asset bases and sustainable cash flow generation at attractive valuations. What resulted was strong performance for the strategy in both relative and absolute terms.

Somewhat unsurprisingly, these more predictable types of firms provided the largest contribution to performance over the Year of the Dragon. This is particularly true of higher return and market-leading companies within more economically sensitive sectors such as industrials, consumer discretionary and financials. As such, the Fund's largest contributor to performance was amongst Singaporean industrial companies—from those in the aerospace maintenance, repair and overhaul businesses to offshore marine equipment manufacturers. The top contributor was Singapore Technologies Engineering, which is the city state's largest aviation, defense and electronics contractor. A common denominator across the wide and varied divisions that ST Engineering operates in is that they are market leaders and thus, despite a tough macroeconomic backdrop for defense budgets and airplane overhauls, the firm has been able to continue to win orders at high incremental returns. This order flow, combined with the ability and willingness to distribute cash to shareholders, offered a potent combination for investors.

Within the financials sector, the firms that performed well were again those with more conservative balance sheets and strong management teams that remain focused on returns. These included companies such as HSBC and United Overseas Bank—both well-positioned to take advantage of the profitable and sustainable credit growth on offer across a number of Asian countries, given the relatively low leverage at the corporate and consumer levels. Within real estate, Thai property developer, Land & Houses Public, and the Singaporean real estate investment trust, Ascendas REIT, rallied during the year. This was driven by both core domestic demand and the backdrop of looser monetary policy in the West filtering into Asian countries, and boosting asset prices further helped by their already strong operations.

While we are pleased with the Fund's annual performance, the Fund did slightly underperform its benchmark during the fourth quarter. We have

10 MATTHEWS ASIA FUNDS

PERFORMANCE AS OF DECEMBER 31, 2012

| | | | | | | Average Annual Total Returns | | | |

| | 3 Months | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Since

Inception | | Inception

Date | |

Investor Class (MACSX) | | | 4.99 | % | | | 26.90 | % | | | 10.57 | % | | | 5.37 | % | | | 14.27 | % | | | 11.08 | % | | 9/12/94 | |

Institutional Class (MICSX) | | | 4.94 | % | | | 27.09 | % | | | n.a. | | | | n.a. | | | | n.a. | | | | 7.29 | % | | 10/29/10 | |

MSCI AC Asia ex Japan Index3 | | | 5.70 | % | | | 22.70 | % | | | 6.86 | % | | | 0.12 | % | | | 14.95 | % | | | 4.15 | %4 | | | |

Lipper Pacific Region Funds Category Average5 | | | 7.33 | % | | | 22.25 | % | | | 5.38 | % | | | -1.51 | % | | | 10.21 | % | | | 3.77 | %4 | | | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund's fees and expenses had not been waived. For the Fund's most recent month-end performance, visit matthewsasia.com.

INCOME DISTRIBUTION HISTORY

| | 2012 | | 2011 | |

| | June | | December | | Total | | June | | December | | Total | |

Investor (MACSX) | | $ | 0.20 | | | $ | 0.27 | | | $ | 0.47 | | | $ | 0.27 | | | $ | 0.21 | | | $ | 0.48 | | |

Institutional (MICSX) | | $ | 0.21 | | | $ | 0.28 | | | $ | 0.49 | | | $ | 0.28 | | | $ | 0.22 | | | $ | 0.50 | | |

Note: This table does not include capital gains distributions. Totals may differ by $0.01 due to rounding. For income distribution history, visit matthewsasia.com.

30-DAY YIELD:

1.58% (Investor Class) 1.73% (Institutional Class)

The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 12/31/12, expressed as an annual percentage rate based on the Fund's share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund's rate of investment income, and it may not equal the Fund's actual income distribution rate.

Source: BNY Mellon Investment Servicing (US) Inc.

DIVIDEND YIELD: 2.98%

The dividend yield (trailing) for the portfolio is the weighted average sum of the dividend paid per share during the last 12 months divided by the current price. The annualized dividend yield for the Fund is for the equity-only portion of the portfolio. Please note that this is based on gross portfolio holdings and does not reflect the actual yield an investor in the Fund would receive. Past yields are no guarantee of future yields.

Source: FactSet Research Systems, Bloomberg, MICM

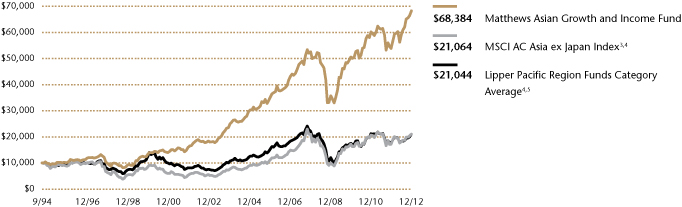

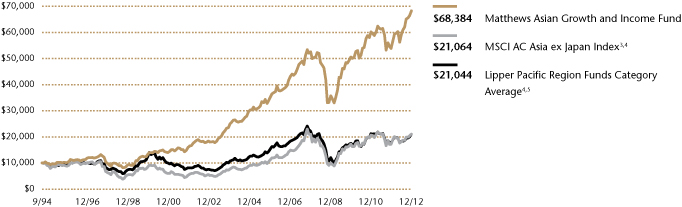

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION—INVESTOR CLASS

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions or redemption of Fund shares. Values are in US$.

3 It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 71 for index definition.

4 Calculated from 8/31/94.

5 The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods.

TOP TEN HOLDINGS6

| | Sector | | Country | | % of Net Assets | |

Singapore Technologies Engineering, Ltd. | | Industrials | | Singapore | | | 4.0 | % | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | Information Technology | | Taiwan | | | 3.2 | % | |

HSBC Holdings PLC | | Financials | | China/Hong Kong | | | 2.9 | % | |

Keppel Corp., Ltd. | | Industrials | | Singapore | | | 2.8 | % | |

Ascendas REIT | | Financials | | Singapore | | | 2.6 | % | |

China Petroleum & Chemical Corp. (Sinopec), Cnv., 0.000%, 4/24/2014 | | Energy | | China/Hong Kong | | | 2.6 | % | |

AMMB Holdings BHD | | Financials | | Malaysia | | | 2.4 | % | |

CLP Holdings, Ltd. | | Utilities | | China/Hong Kong | | | 2.4 | % | |

Hisamitsu Pharmaceutical Co., Inc. | | Health Care | | Japan | | | 2.4 | % | |

PTT Public Co., Ltd. | | Energy | | Thailand | | | 2.3 | % | |

% OF ASSETS IN TOP TEN | | | | | | | 27.6 | % | |

6 Holdings may combine more than one security from same issuer and related depositary receipts.

matthewsasia.com | 800.789.ASIA 11

COUNTRY ALLOCATION (%)7

China/Hong Kong | | | 27.5 | | |

Singapore | | | 16.1 | | |

Japan | | | 8.5 | | |

Australia | | | 8.2 | | |

Thailand | | | 7.6 | | |

South Korea | | | 6.8 | | |

Malaysia | | | 5.0 | | |

India | | | 4.7 | | |

Taiwan | | | 4.3 | | |

Indonesia | | | 2.7 | | |

United Kingdom | | | 2.0 | | |

Philippines | | | 1.4 | | |

Vietnam | | | 0.9 | | |

Cash and Other Assets,

Less Liabilities | | | 4.3 | | |

SECTOR ALLOCATION (%)

Financials | | | 29.4 | | |

Industrials | | | 15.6 | | |

Telecommunication Services | | | 10.7 | | |

Consumer Staples | | | 7.9 | | |

Consumer Discretionary | | | 7.2 | | |

Utilities | | | 6.9 | | |

Energy | | | 5.9 | | |

Information Technology | | | 4.6 | | |

Health Care | | | 3.9 | | |

Materials | | | 3.6 | | |

Cash and Other Assets,

Less Liabilities | | | 4.3 | | |

MARKET CAP EXPOSURE (%)8

Large Cap (over $5B) | | | 68.5 | | |

Mid Cap ($1B–$5B) | | | 24.4 | | |

Small Cap (under $1B) | | | 2.8 | | |

Cash and Other Assets,

Less Liabilities | | | 4.3 | | |

ASSET TYPE BREAKDOWN (%)9

Common Equities and ADRs | | | 79.9 | | |

Corporate Bonds | | | 12.8 | | |

Preferred Equities | | | 3.0 | | |

Convertible Bonds | | | 0.0 | | |

Cash and Other Assets, Less Liabilities | | | 4.3 | | |

7 Not all countries are included in the benchmark index(es).

8 Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding.

9 Bonds are not included in the MSCI All Country Asia ex Japan Index.

Matthews Asian Growth and Income Fund

Portfolio Manager Commentary (continued)

noted in commentaries past that we are comfortable not holding Chinese banking stocks due to their somewhat dubious capital positions, asset quality issues and potential for dividend cuts. While our conviction here has not waned, in a relative sense, this positioning hurt us as these stocks were strong performers late in the year. In addition, two of our health care stocks, Hisamitsu Pharmaceutical and Shandong Weigao Group Medical Polymer, disappointed. The former is the maker of leading pain relieving patches that struggled during the fourth quarter as it faced increasing raw material costs and pricing pressure that resulted from National Health Insurance price negotiations with the Japanese government. Despite these issues, we continue to believe that the company offers a defensive business model with growth opportunities in new drugs via their patented distribution methods. Shandong Weigao, however, is a holding that we exited over the fourth quarter as the Chinese medical consumables company announced weaker-than-expected results and guidance. Although the firm is still a fast grower, increasing competition at China's Tier 2 and Tier 3 city hospitals for products, such as needles, as well as higher raw material and labor costs led us to believe that the stock had become somewhat overvalued relative to future prospects.

Convertible bonds have always been a core part of this strategy and historically they have been able to provide the positive asymmetry in returns that we seek. However, the fourth quarter also demonstrated some of the difficulties associated with the riskier credit available in this asset class, as our holding in OLAM International saw some concerns raised by a well-known U.S.-based research firm. These worries revolved around the overstatement of earnings and of the valuation of certain assets. Whilst these allegations might have been overly aggressive, the opacity of certain elements of the firm and the potential for raising capital led us to exit this position. Despite this experience, we still believe that interesting opportunities exist within the sphere of convertible bonds.

During the fourth quarter we also added to our Japanese holdings with Japan Tobacco, a tobacco company with truly global brands and reach, and Lawson, one of Japan's three largest convenience store operators. Both companies offer not only growth opportunities outside their domestic market, but strong cash generation and, most importantly, management teams that appear to be re-engaged with the metrics that long-term minority shareholders like ourselves seek, notably return on capital and dividends.

We remain optimistic on the outlook for Asian equities as, despite lackluster growth in the developed world, supportive macroeconomic policy and healthy domestic demand should lead to sustained real income and GDP growth across the majority of the region. Further, valuations are trading at approximately 12x forward earnings and 1.6x book value, whilst idea generation from the team remains positive despite the rally in share prices over the preceding 12 months. We will continue to focus on those businesses that we believe are appropriate for a portfolio that seeks upside participation in these growth markets, whilst continuing to protect capital during more volatile times.

12 MATTHEWS ASIA FUNDS

Matthews Asian Growth and Income Fund December 31, 2012

Schedule of Investmentsa

COMMON EQUITIES: 79.9%

| | | Shares | | Value | |

CHINA/HONG KONG: 21.8% | |

HSBC Holdings PLC ADR | | | 2,230,333 | | | $ | 118,363,772 | | |

CLP Holdings, Ltd. | | | 11,771,700 | | | | 98,903,884 | | |

Jardine Matheson Holdings, Ltd. | | | 1,491,200 | | | | 93,046,137 | | |

AIA Group, Ltd. | | | 21,765,600 | | | | 86,329,668 | | |

Hang Lung Properties, Ltd. | | | 21,426,920 | | | | 86,230,890 | | |

China Pacific Insurance Group Co., Ltd.

H Shares | | | 20,355,800 | | | | 76,751,594 | | |

Television Broadcasts, Ltd. | | | 8,897,000 | | | | 66,894,657 | | |

China Mobile, Ltd. ADR | | | 1,077,500 | | | | 63,270,800 | | |

VTech Holdings, Ltd. | | | 5,029,400 | | | | 56,765,269 | | |

Vitasoy International Holdings, Ltd.† | | | 51,771,000 | | | | 53,265,796 | | |

Cafe' de Coral Holdings, Ltd. | | | 17,486,000 | | | | 49,865,600 | | |

Citic Telecom International

Holdings, Ltd.† | | | 139,126,000 | | | | 38,086,439 | | |

Total China/Hong Kong | | | | | 887,774,506 | | |

SINGAPORE: 13.9% | |

Singapore Technologies Engineering, Ltd. | | | 52,104,125 | | | | 164,451,333 | | |

Keppel Corp., Ltd. | | | 12,280,900 | | | | 112,143,814 | | |

Ascendas REIT | | | 53,925,000 | | | | 105,526,972 | | |

United Overseas Bank, Ltd. | | | 3,861,000 | | | | 63,336,008 | | |

SIA Engineering Co., Ltd. | | | 13,277,000 | | | | 47,874,902 | | |

ARA Asset Management, Ltd. | | | 28,381,100 | | | | 37,954,630 | | |

Singapore Post, Ltd. | | | 38,209,000 | | | | 36,005,824 | | |

Total Singapore | | | | | 567,293,483 | | |

JAPAN: 8.5% | |

Hisamitsu Pharmaceutical Co., Inc. | | | 1,983,600 | | | | 98,724,492 | | |

Japan Tobacco, Inc. | | | 2,796,800 | | | | 79,007,854 | | |

Japan Real Estate Investment Corp., REIT | | | 7,889 | | | | 77,723,472 | | |

Lawson, Inc. | | | 1,022,000 | | | | 69,327,505 | | |

NTT DoCoMo, Inc. | | | 13,623 | | | | 19,637,830 | | |

Total Japan | | | | | 344,421,153 | | |

THAILAND: 7.6% | |

PTT Public Co., Ltd. | | | 8,719,200 | | | | 95,321,164 | | |

BEC World Public Co., Ltd. | | | 30,807,800 | | | | 71,805,885 | | |

Glow Energy Public Co., Ltd. | | | 21,887,400 | | | | 55,524,022 | | |

Land & Houses Public Co., Ltd. NVDR | | | 145,090,300 | | | | 46,529,259 | | |

Banpu Public Co., Ltd. | | | 3,045,850 | | | | 41,340,144 | | |

Total Thailand | | | | | 310,520,474 | | |

AUSTRALIA: 6.5% | |

Telstra Corp., Ltd. | | | 16,073,997 | | | | 73,245,130 | | |

Macquarie Group, Ltd. | | | 1,879,326 | | | | 70,401,770 | | |

Orica, Ltd. | | | 2,358,586 | | | | 62,045,579 | | |

CSL, Ltd. | | | 1,044,381 | | | | 58,963,176 | | |

Total Australia | | | | | 264,655,655 | | |

| | | Shares | | Value | |

MALAYSIA: 5.0% | |

AMMB Holdings BHD | | | 44,727,600 | | | $ | 99,347,781 | | |

Axiata Group BHD | | | 29,634,423 | | | | 64,097,464 | | |

Telekom Malaysia BHD | | | 20,245,551 | | | | 39,987,943 | | |

Total Malaysia | | | | | 203,433,188 | | |

TAIWAN: 4.3% | |

Taiwan Semiconductor Manufacturing

Co., Ltd. | | | 20,673,187 | | | | 69,147,892 | | |

Taiwan Semiconductor Manufacturing

Co., Ltd. ADR | | | 3,558,724 | | | | 61,067,704 | | |

Chunghwa Telecom Co., Ltd. ADR | | | 1,277,525 | | | | 41,315,159 | | |

Taiwan Hon Chuan Enterprise Co., Ltd. | | | 1,533,875 | | | | 3,375,103 | | |

Total Taiwan | | | | | 174,905,858 | | |

SOUTH KOREA: 3.8% | |

KT&G Corp. | | | 805,633 | | | | 61,096,620 | | |

S1 Corp. | | | 771,922 | | | | 50,461,378 | | |

GS Home Shopping, Inc. | | | 298,935 | | | | 43,012,531 | | |

Total South Korea | | | | | 154,570,529 | | |

INDONESIA: 2.7% | |

PT Perusahaan Gas Negara Persero | | | 141,686,000 | | | | 67,845,347 | | |

PT Telekomunikasi Indonesia Persero ADR | | | 1,153,600 | | | | 42,625,520 | | |

Total Indonesia | | | | | 110,470,867 | | |

UNITED KINGDOM: 2.0% | |

BHP Billiton PLC | | | 2,296,898 | | | | 81,020,010 | | |

Total United Kingdom | | | | | 81,020,010 | | |

INDIA: 1.5% | |

Housing Development Finance Corp. | | | 3,875,750 | | | | 59,209,084 | | |

Total India | | | | | 59,209,084 | | |

PHILIPPINES: 1.4% | |

Globe Telecom, Inc. | | | 2,065,510 | | | | 55,112,293 | | |

Total Philippines | | | | | 55,112,293 | | |

VIETNAM: 0.9% | |

Vietnam Dairy Products JSC | | | 9,093,803 | | | | 38,494,291 | | |

Total Vietnam | | | | | 38,494,291 | | |

TOTAL COMMON EQUITIES | | | | | 3,251,881,391 | | |

(Cost $2,520,042,341) | | | | | |

matthewsasia.com | 800.789.ASIA 13

Matthews Asian Growth and Income Fund December 31, 2012

Schedule of Investmentsa (continued)

PREFERRED EQUITIES: 3.0%

| | | Shares | | Value | |

SOUTH KOREA: 3.0% | |

Samsung Fire & Marine Insurance Co.,

Ltd., Pfd. | | | 515,311 | | | $ | 39,323,917 | | |

Hyundai Motor Co., Ltd., Pfd. | | | 541,280 | | | | 35,381,076 | | |

Hyundai Motor Co., Ltd., 2nd Pfd. | | | 386,773 | | | | 27,442,447 | | |

LG Household & Health Care, Ltd., Pfd. | | | 121,855 | | | | 21,406,124 | | |

Total South Korea | | | | | 123,553,564 | | |

TOTAL PREFERRED EQUITIES | | | | | 123,553,564 | | |

(Cost $54,435,184) | | | | | |

CORPORATE BONDS: 12.8%

| | | Face Amount* | | | |

CHINA/HONG KONG: 5.7% | |

China Petroleum & Chemical Corp.

(Sinopec), Cnv.

0.000%, 04/24/14 | | HKD | 676,210,000 | | | | 104,168,542 | | |

Hong Kong Exchanges and

Clearing, Ltd., Cnv.

0.500%, 10/23/17 | | | 64,000,000 | | | | 69,280,000 | | |

Power Regal Group, Ltd., Cnv.

2.250%, 06/02/14 | | HKD | 234,020,000 | | | | 36,865,430 | | |

PB Issuer No. 2, Ltd., Cnv.

1.750%, 04/12/16 | | | 21,820,000 | | | | 21,361,780 | | |

Total China/Hong Kong | | | | | 231,675,752 | | |

INDIA: 3.2% | |

Tata Power Co., Ltd., Cnv.

1.750%, 11/21/14 | | | 56,200,000 | | | | 58,925,700 | | |

Larsen & Toubro, Ltd., Cnv.

3.500%, 10/22/14 | | | 41,200,000 | | | | 43,713,200 | | |

Sintex Industries, Ltd., Cnv.

0.000%, 03/13/13 | | | 22,700,000 | | | | 28,715,500 | | |

Total India | | | | | 131,354,400 | | |

SINGAPORE: 2.2% | |

CapitaLand, Ltd., Cnv.

3.125%, 03/05/18 | | SGD | 62,000,000 | | | | 54,625,271 | | |

CapitaLand, Ltd., Cnv.

2.875%, 09/03/16 | | SGD | 41,750,000 | | | | 36,630,152 | | |

Total Singapore | | | | | 91,255,423 | | |

AUSTRALIA: 1.7% | |

QBE Funding Trust, Cnv.

0.000%, 05/12/30 | | | 104,571,000 | | | | 67,971,150 | | |

Total Australia | | | | | 67,971,150 | | |

TOTAL CORPORATE BONDS | | | | | 522,256,725 | | |

(Cost $509,681,094) | | | | | |

| | | Value | |

TOTAL INVESTMENTS: 95.7% | | $ | 3,897,691,680 | | |

(Cost $3,084,158,619b) | | | |

CASH AND OTHER ASSETS,

LESS LIABILITIES: 4.3% | | | 174,168,971 | | |

NET ASSETS: 100.0% | | $ | 4,071,860,651 | | |

a Certain securities were fair valued under the discretion of the Board of Trustees (Note 2-A).

b Cost for federal income tax purposes is $3,121,303,675 and net unrealized appreciation consists of:

Gross unrealized appreciation | | $ | 818,972,346 | | |

Gross unrealized depreciation | | | (42,584,341 | ) | |

Net unrealized appreciation | | $ | 776,388,005 | | |

† Affiliated Issuer, as defined under the Investment Company Act of 1940 (ownership of 5% or more of the outstanding voting securities of this issuer)

* All values are in USD unless otherwise noted.

ADR American Depositary Receipt

BHD Berhad

Cnv. Convertible

HKD Hong Kong Dollar

JSC Joint Stock Co.

NVDR Non-voting Depositary Receipt

Pfd. Preferred

REIT Real Estate Investment Trust

SGD Singapore Dollar

USD U.S. Dollar

See accompanying notes to financial statements.

14 MATTHEWS ASIA FUNDS

ASIA GROWTH AND INCOME STRATEGIES

PORTFOLIO MANAGERS

Jesper O. Madsen, CFA

Lead Manager

Yu Zhang, CFA

Co-Manager

FUND FACTS

| | | Investor Class | | Institutional Class | |

Ticker | | MAPIX | | MIPIX | |

CUSIP | | 577125107 | | 577130750 | |

Inception | | 10/31/06 | | 10/29/10 | |

NAV | | $14.58 | | $14.57 | |

Initial Investment | | $2,500 | | $3 million | |

Gross Expense Ratio1 | | 1.09% | | 0.97% | |

Portfolio Statistics

Total # of Positions | | 61 | |

Net Assets | | $3.7 billion | |

Weighted Average Market Cap | | $29.4 billion | |

Portfolio Turnover | | 9.17%2 | |

Benchmark

MSCI AC Asia Pacific Index

Redemption Fee

2% within first 90 calendar days of purchase

OBJECTIVE

Total return with an emphasis on providing current income.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in income-paying equity securities of companies located in Asia, including developed, emerging and frontier countries and markets in the Asian region. The Fund may also invest in convertible debt and equity securities.

1 Matthews Asia Funds does not charge 12b-1 fees.

2 The lesser of fiscal year 2012 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities.

Matthews Asia Dividend Fund

Portfolio Manager Commentary

For the year ending December 31, 2012, the Matthews Asia Dividend Fund rose 21.63% (Investor Class) and 21.70% (Institutional Class), outperforming its benchmark, the MSCI All Country Asia Pacific Index, which rose 17.05%. For the fourth quarter of the year, the Fund returned 4.99% (Investor Class) and 5.03% (Institutional Class) versus 5.92% for the Index.

The Fund began 2012 with a share price of $12.48, and shareholders who were invested throughout the year would have received income distributions totaling approximately 55.83 cents per share (Investor Class), or 4.47%. The fourth quarter distribution of 22.92 cents per share was substantially higher than 2011 due to the tax treatment of Passive Foreign Investment Companies (PFICs) held by the Fund. U.S. tax code requires investors under certain circumstances to distribute unrealized capital gain from PFICs as income. The Fund's PFIC holdings in real estate investment trusts (REITs) and ORIX all delivered positive performance for 2012 and unrealized capital gains from these PFICs accounted for the majority of the fourth quarter distribution. As illustrated in the fourth quarter, PFICs can increase the variability of distributions. However, we believe that the PFICs held by the Fund also offer an attractive yield combined with the potential for dividend growth and therefore continue to hold them in the Fund.

In general, the Fund's holdings delivered growing dividends: Of the 59 holdings in the portfolio that announced dividends as of year-end, 37 companies raised dividends on a year-over-year basis while 10 cut them. The most notable dividend grower was Johnson Health Tech (JHT), a Taiwanese manufacturer of gym equipment. The company grew its dividend by 300% year-over-year, exemplifying the Fund's dual aim of seeking not just yield, but also dividend growth. When we initiated the position in JHT in early 2011, the company was facing overcapacity issues after a sharp drop in demand during the global financial crisis, which depressed earnings and resulted in a dividend yield of just 0.7%. Much of JHT's costs are fixed so a recovery in sales is amplified in terms of earnings growth, and hence, dividend growth. While the yield was low when the position was initiated, the dividend has since expanded 566% and is today equivalent to a 4.7% yield on the original purchase price.

During the year, the Fund's Japanese holdings delivered the most impactful growth in dividend payments given the larger position sizes in companies such as Itochu and Japan Tobacco, which increased their dividends by 86% and 50%, respectively. However, not all holdings delivered positive performance with apparel makers Esprit and Li Ning, among others, slashing their dividends as a turnaround in their business fundamentals failed to materialize. Both positions in the portfolio were exited as they no longer met our requirements. Other notable firms which cut dividends were QBE Insurance Group and David Jones, both of Australia. The two firms remain portfolio holdings, albeit with lower weights.

Over the year, new additions to the Fund were generally businesses exposed to the economic cycle that held a strong competitive position within their respective industries. This may seem counter-intuitive at first glance since the outlook for global economic growth remains muted at best. However, risk aversion remains elevated in equity markets and, as a result, more cyclical businesses are selling at significant discounts compared to both historical valuation metrics as well as to companies believed to exhibit stable earnings growth. In an uncertain world, many investors prefer to invest in assets that deliver what is perceived to be a

matthewsasia.com | 800.789.ASIA 15

PERFORMANCE AS OF DECEMBER 31, 2012

| | | | | | | Average Annual Total Returns | | | |

| | 3 Months | | 1 Year | | 3 Years | | 5 Years | | Since

Inception | | Inception

Date | |

Investor Class (MAPIX) | | | 4.99 | % | | | 21.63 | % | | | 10.37 | % | | | 7.99 | % | | | 10.69 | % | | 10/31/06 | |

Institutional Class (MIPIX) | | | 5.03 | % | | | 21.70 | % | | | n.a. | | | | n.a. | | | | 5.72 | % | | 10/29/10 | |

MSCI AC Asia Pacific Index3 | | | 5.92 | % | | | 17.05 | % | | | 5.30 | % | | | -1.23 | % | | | 2.25 | %4 | | | |

Lipper Pacific Region Funds Category Average5 | | | 7.33 | % | | | 22.25 | % | | | 5.38 | % | | | -1.51 | % | | | 2.63 | %4 | | | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund's fees and expenses had not been waived. For the Fund's most recent month-end performance, visit matthewsasia.com.

INCOME DISTRIBUTION HISTORY

| | 2012 | | 2011 | |

| | Q1 | | Q2 | | Q3 | | Q4 | | Total | | Q1 | | Q2 | | Q3 | | Q4 | | Total | |

Investor (MAPIX) | | $ | 0.06 | | | $ | 0.14 | | | $ | 0.13 | | | $ | 0.23 | | | $ | 0.56 | | | $ | 0.10 | | | $ | 0.11 | | | $ | 0.12 | | | $ | 0.03 | | | $ | 0.36 | | |

Institutional (MIPIX) | | $ | 0.06 | | | $ | 0.14 | | | $ | 0.13 | | | $ | 0.23 | | | $ | 0.56 | | | $ | 0.11 | | | $ | 0.12 | | | $ | 0.12 | | | $ | 0.03 | | | $ | 0.38 | | |

Note: This table does not include capital gains distributions. Totals may differ by $0.01 due to rounding. For income distribution history, visit matthewsasia.com.

30-DAY YIELD:

2.18% (Investor Class) 2.28% (Institutional Class)

The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 12/31/12, expressed as an annual percentage rate based on the Fund's share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund's rate of investment income, and it may not equal the Fund's actual income distribution rate.

Source: BNY Mellon Investment Servicing (US) Inc.

DIVIDEND YIELD: 3.70%

The dividend yield (trailing) for the portfolio is the weighted average sum of the dividend paid per share during the last 12 months divided by the current price. The annualized dividend yield for the Fund is for the equity-only portion of the portfolio. Please note that this is based on gross portfolio holdings and does not reflect the actual yield an investor in the Fund would receive. Past yields are no guarantee of future yields.

Source: FactSet Research Systems, Bloomberg, MICM.

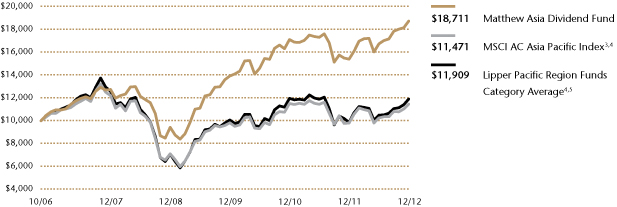

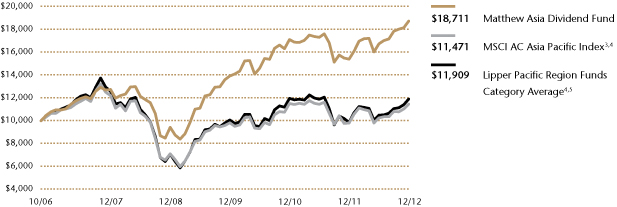

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION—INVESTOR CLASS

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions or redemption of Fund shares. Values are in US$.

3 It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 71 for index definition.

4 Calculated from 10/31/06.

5 The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods.

TOP TEN HOLDINGS6

| | Sector | | Country | | % of Net Assets | |

ITOCHU Corp. | | Industrials | | Japan | | | 4.0 | % | |

ORIX Corp. | | Financials | | Japan | | | 3.9 | % | |

Japan Tobacco, Inc. | | Consumer Staples | | Japan | | | 3.8 | % | |

HSBC Holdings PLC | | Financials | | China/Hong Kong | | | 3.5 | % | |

China Mobile, Ltd. | | Telecommunication Services | | China/Hong Kong | | | 3.4 | % | |

China Shenhua Energy Co., Ltd. | | Energy | | China/Hong Kong | | | 2.8 | % | |

Singapore Technologies Engineering, Ltd. | | Industrials | | Singapore | | | 2.6 | % | |

Television Broadcasts, Ltd. | | Consumer Discretionary | | China/Hong Kong | | | 2.5 | % | |