UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08510

Matthews International Funds

(Exact name of registrant as specified in charter)

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Address of principal executive offices) (Zip code)

William J. Hackett, President

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-788-7553

Date of fiscal year end: December 31

Date of reporting period: December 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Matthews Asia Funds | Annual Report

December 31, 2017 | matthewsasia.com

ASIA FIXED INCOME STRATEGIES

Matthews Asia Strategic Income Fund

Matthews Asia Credit Opportunities Fund

ASIA GROWTH AND INCOME STRATEGIES

Matthews Asian Growth and Income Fund

Matthews Asia Dividend Fund

Matthews China Dividend Fund

ASIA VALUE STRATEGY

Matthews Asia Value Fund

ASIA GROWTH STRATEGIES

Matthews Asia Focus Fund

Matthews Asia Growth Fund

Matthews Pacific Tiger Fund

Matthews Asia ESG Fund

Matthews Emerging Asia Fund

Matthews Asia Innovators Fund

Matthews China Fund

Matthews India Fund

Matthews Japan Fund

Matthews Korea Fund

ASIA SMALL COMPANY STRATEGIES

Matthews Asia Small Companies Fund

Matthews China Small Companies Fund

Investor Class Performance and Expenses (December 31, 2017)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investor Class | | | | | Average Annual Total Return† | | | Inception

Date | | | 2017 Annual

Operating

Expenses** | | | 2017 Annual

Operating Expenses

after Fee Waiver and Expense

Reimbursement* | | | Prospectus

Expense

Ratios‡ | | | Prospectus

Expense Ratios

after Fee Waiver

and Expense

Reimbursement‡ | |

| | 1 year | | | 5 years | | | 10 years | | | Since

Inception | | | | | | |

ASIA FIXED INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Strategic Income Fund (MAINX) | | | 9.40% | | | | 3.85% | | | | n.a. | | | | 5.25% | | | | 11/30/11 | | | | 1.29% | | | | 1.15% | 1 | | | 1.33% | | | | 1.15% | 1 |

Asia Credit Opportunities Fund (MCRDX) | | | 7.86% | | | | n.a. | | | | n.a. | | | | 7.52% | | | | 4/29/16 | | | | 1.86% | | | | 1.15% | 1 | | | 2.24% | | | | 1.15% | 1 |

ASIA GROWTH AND INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

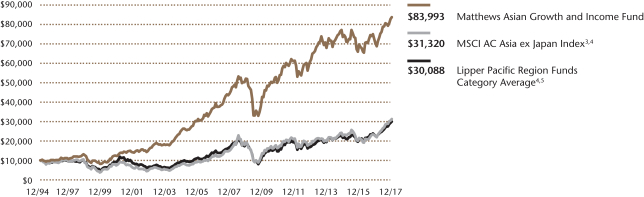

Asian Growth and Income Fund (MACSX) | | | 21.85% | | | | 4.20% | | | | 4.78% | | | | 9.56% | | | | 9/12/94 | | | | 1.07% | | | | 1.07% | 2 | | | 1.09% | | | | 1.09% | |

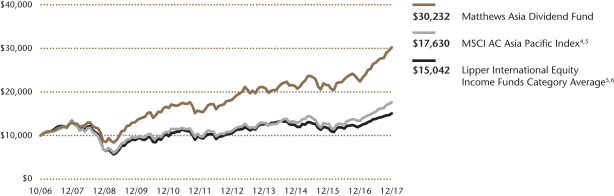

Asia Dividend Fund (MAPIX) | | | 34.69% | | | | 10.07% | | | | 9.03% | | | | 10.41% | | | | 10/31/06 | | | | 1.03% | | | | 1.02% | 3 | | | 1.06% | | | | 1.06% | |

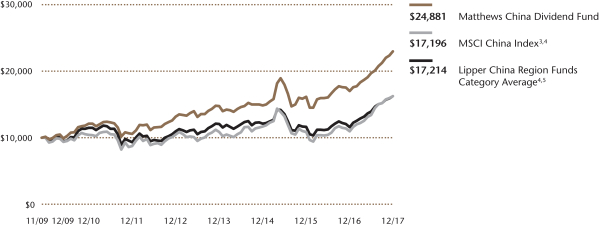

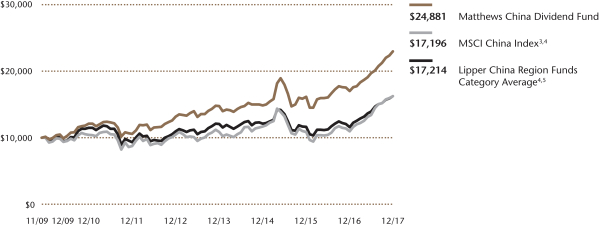

China Dividend Fund (MCDFX) | | | 37.69% | | | | 12.77% | | | | n.a. | | | | 11.93% | | | | 11/30/09 | | | | 1.19% | | | | 1.19% | 2 | | | 1.22% | | | | 1.22% | |

ASIA VALUE STRATEGY | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

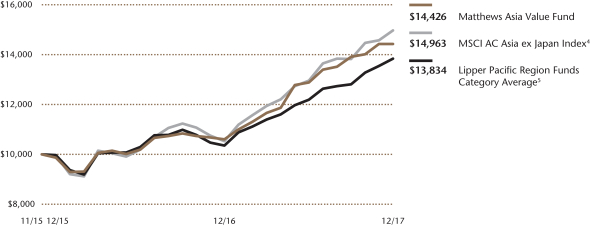

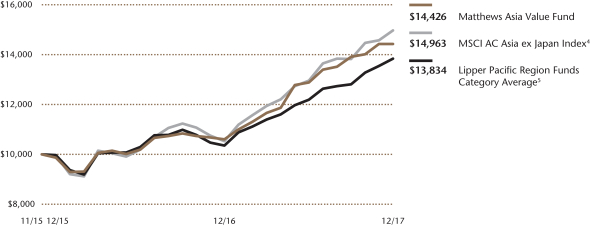

Asia Value Fund (MAVRX) | | | 36.12% | | | | n.a. | | | | n.a. | | | | 19.22% | | | | 11/30/15 | | | | 2.32% | | | | 1.50% | 4 | | | 11.48% | | | | 1.50% | 4 |

ASIA GROWTH STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

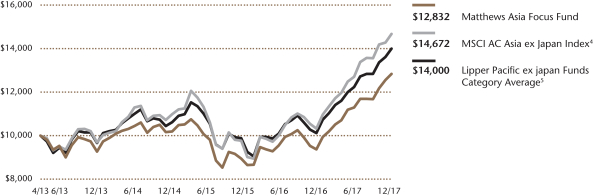

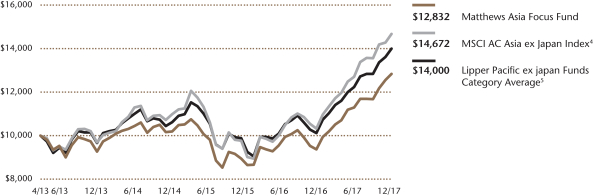

Asia Focus Fund (MAFSX) | | | 36.98% | | | | n.a. | | | | n.a. | | | | 5.48% | | | | 4/30/13 | | | | 2.45% | | | | 1.50% | 4 | | | 2.47% | | | | 1.50% | 4 |

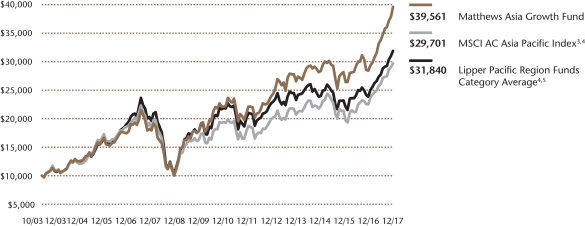

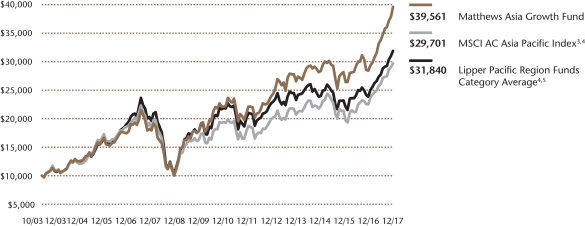

Asia Growth Fund (MPACX) | | | 39.39% | | | | 11.23% | | | | 7.21% | | | | 10.19% | | | | 10/31/03 | | | | 1.12% | | | | 1.12% | 2 | | | 1.14% | | | | 1.14% | |

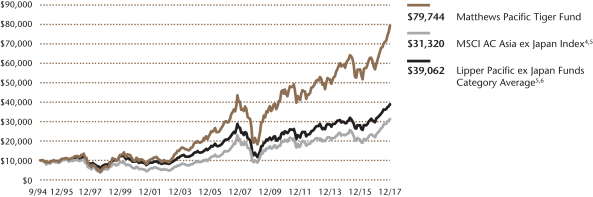

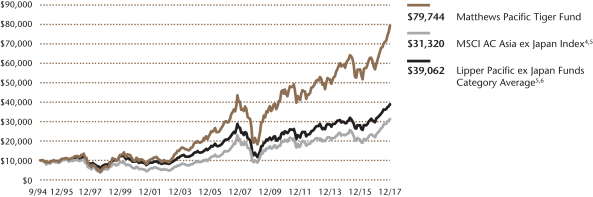

Pacific Tiger Fund (MAPTX) | | | 39.96% | | | | 9.83% | | | | 7.07% | | | | 9.32% | | | | 9/12/94 | | | | 1.08% | | | | 1.06% | 3 | | | 1.09% | | | | 1.08% | 3 |

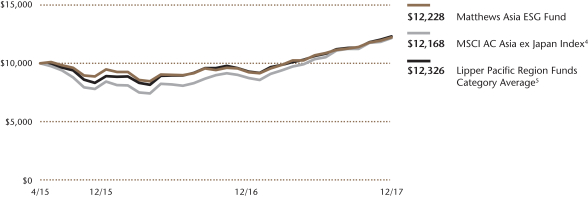

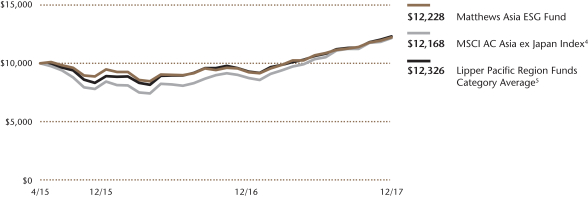

Asia ESG Fund (MASGX) | | | 33.79% | | | | n.a. | | | | n.a. | | | | 7.82% | | | | 4/30/15 | | | | 2.65% | | | | 1.50% | 4 | | | 3.54% | | | | 1.48% | 4 |

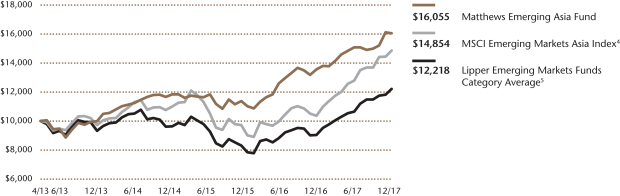

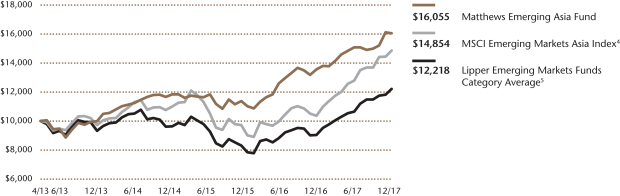

Emerging Asia Fund (MEASX) | | | 18.42% | | | | n.a. | | | | n.a. | | | | 10.67% | | | | 4/30/13 | | | | 1.70% | | | | 1.48% | 4 | | | 1.77% | | | | 1.47% | 4 |

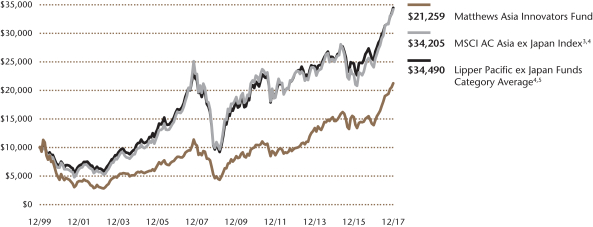

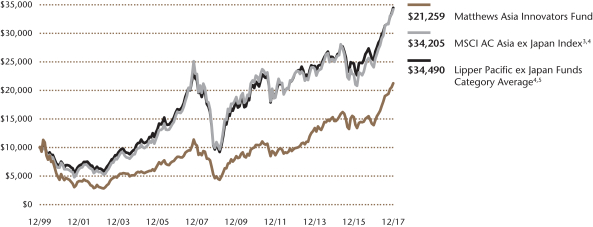

Asia Innovators Fund (MATFX) | | | 52.88% | | | | 16.55% | | | | 7.46% | | | | 4.28% | | | | 12/27/99 | | | | 1.24% | | | | 1.24% | 2 | | | 1.24% | | | | 1.24% | |

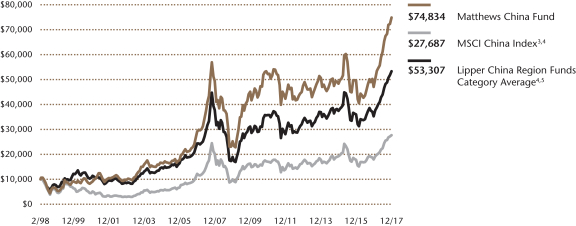

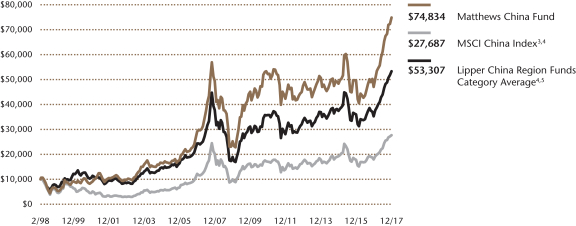

China Fund (MCHFX) | | | 59.37% | | | | 9.59% | | | | 4.22% | | | | 10.66% | | | | 2/19/98 | | | | 1.09% | | | | 1.09% | 2 | | | 1.18% | | | | 1.18% | |

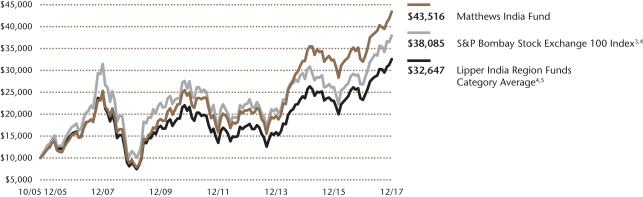

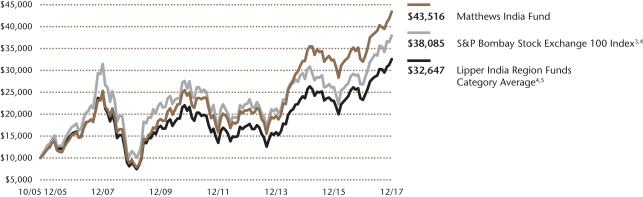

India Fund (MINDX) | | | 35.79% | | | | 15.83% | | | | 5.55% | | | | 12.85% | | | | 10/31/05 | | | | 1.09% | | | | 1.09% | 2 | | | 1.12% | | | | 1.12% | |

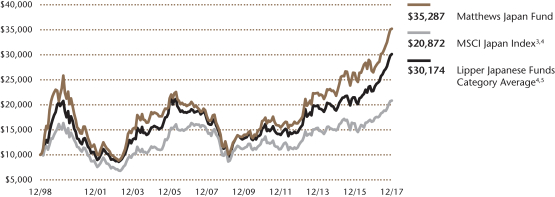

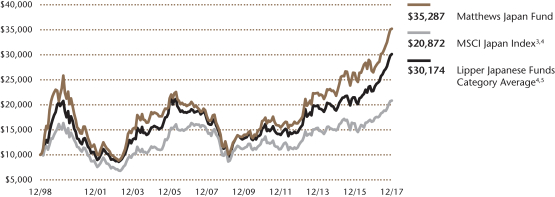

Japan Fund (MJFOX) | | | 33.14% | | | | 16.09% | | | | 7.11% | | | | 6.86% | | | | 12/31/98 | | | | 0.95% | | | | 0.94% | 3 | | | 0.98% | | | | 0.98% | |

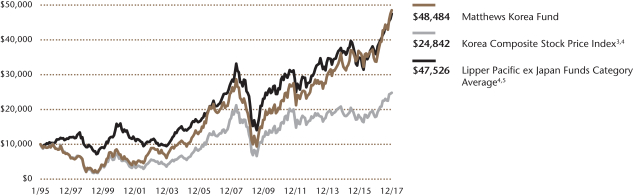

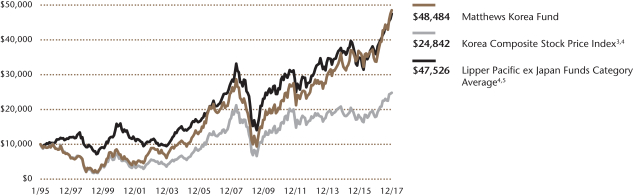

Korea Fund (MAKOX) | | | 43.70% | | | | 11.13% | | | | 6.34% | | | | 7.11% | | | | 1/3/95 | | | | 1.15% | | | | 1.15% | 2 | | | 1.15% | | | | 1.15% | |

ASIA SMALL COMPANY STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

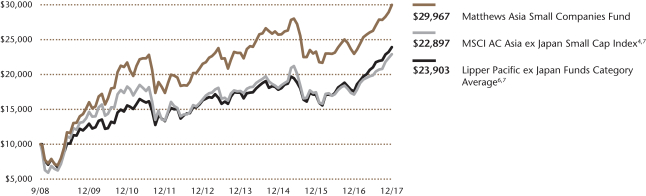

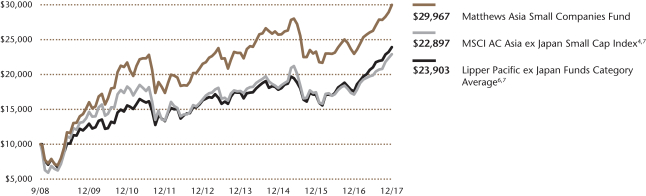

Asia Small Companies Fund (MSMLX) | | | 30.59% | | | | 6.83% | | | | n.a. | | | | 12.54% | | | | 9/15/08 | | | | 1.49% | | | | 1.46% | 4 | | | 1.49% | | | | 1.47% | 4 |

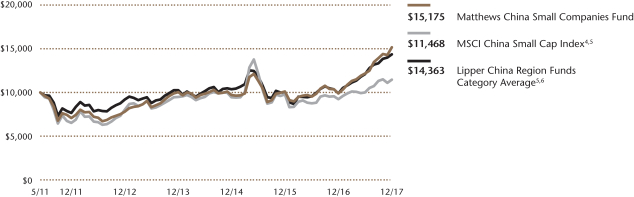

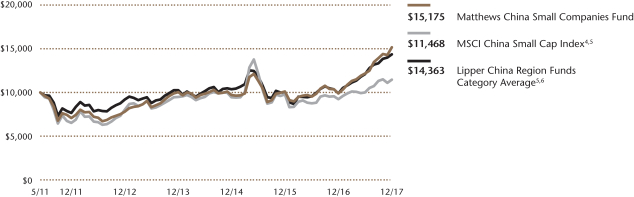

China Small Companies Fund (MCSMX) | | | 53.88% | | | | 14.26% | | | | n.a. | | | | 6.54% | | | | 5/31/11 | | | | 2.34% | | | | 1.50% | 4 | | | 2.24% | | | | 1.50% | 4 |

| * | Expense ratio represents the actual expense ratio a shareholder would have paid if they had been invested the entire year. |

| ** | Before fee waivers and expense reimbursement. |

| † | Annualized performance for periods of at least one year, otherwise cumulative. |

| ‡ | These figures are from the Funds’ prospectus dated as of April 28, 2017, and may differ from the actual expense ratios for fiscal year 2017, as shown in the financial highlights section of this report. |

| 1 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of the (i) expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2019 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 2 | Fund had no waivers or reimbursements. |

| 3 | Matthews has contractually agreed to waive a portion of its advisory fee and administrative and shareholder services fee if the Fund’s average daily net assets are over $3 billion, as follows: for every $2.5 billion average daily net assets of the Fund that are over $3 billion, the advisory fee rate and the administrative and shareholder services fee rate for the Fund with respect to such excess average daily net assets will be each reduced by 0.01%, in each case without reducing such fee rate below 0.00%. Any amount waived by Matthews pursuant to this agreement may not be recouped by Matthews. This agreement will remain in place until April 30, 2019 and may be terminated at any time (i) by the Trust on behalf of the Fund or by the Board of Trustees upon 60 days’ prior written notice to Matthews; or (ii) by Matthews upon 60 days’ prior written notice to the Trust, in each case without payment of any penalty. |

| 4 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 1.25% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 1.25% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 1.25%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2019 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

Institutional Class Performance and Expenses (December 31, 2017)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Institutional Class | | | | | Average Annual Total Return† | | | Inception

Date | | | 2017

Annual

Operating

Expenses** | | | 2017 Annual

Operating Expenses

after Fee Waiver and Expense

Reimbursement* | | | Prospectus

Expense

Ratios‡ | | | Prospectus

Expense Ratios

after Fee Waiver

and Expense

Reimbursement‡ | |

| | 1 year | | | 5 years | | | 10 years | | | Since

Inception | | | | | | |

ASIA FIXED INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Strategic Income Fund (MINCX) | | | 9.67% | | | | 4.08% | | | | n.a. | | | | 5.46% | | | | 11/30/11 | | | | 1.08% | | | | 0.90% | 1 | | | 1.12% | | | | 0.90% | 1 |

Asia Credit Opportunities Fund (MICPX) | | | 8.13% | | | | n.a. | | | | n.a. | | | | 7.78% | | | | 4/29/16 | | | | 1.62% | | | | 0.90% | 1 | | | 1.99% | | | | 0.90% | 1 |

ASIA GROWTH AND INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asian Growth and Income Fund (MICSX) | | | 22.00% | | | | 4.36% | | | | n.a. | | | | 5.24% | | | | 10/29/10 | | | | 0.93% | | | | 0.93% | 2 | | | 0.94% | | | | 0.94% | |

Asia Dividend Fund (MIPIX) | | | 34.77% | | | | 10.20% | | | | n.a. | | | | 8.83% | | | | 10/29/10 | | | | 0.92% | | | | 0.91% | 3 | | | 0.94% | | | | 0.93% | 3 |

China Dividend Fund (MICDX) | | | 37.88% | | | | 12.99% | | | | n.a. | | | | 10.90% | | | | 10/29/10 | | | | 1.04% | | | | 1.04% | 2 | | | 1.06% | | | | 1.06% | |

ASIA VALUE STRATEGY | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Value Fund (MAVAX) | | | 36.35% | | | | n.a. | | | | n.a. | | | | 19.50% | | | | 11/30/15 | | | | 2.08% | | | | 1.25% | 4 | | | 11.26% | | | | 1.25% | 4 |

ASIA GROWTH STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Focus Fund (MIFSX) | | | 37.35% | | | | n.a. | | | | n.a. | | | | 5.74% | | | | 4/30/13 | | | | 2.27% | | | | 1.25% | 4 | | | 2.29% | | | | 1.25% | 4 |

Asia Growth Fund (MIAPX) | | | 39.64% | | | | 11.46% | | | | n.a. | | | | 8.68% | | | | 10/29/10 | | | | 0.93% | | | | 0.93% | 2 | | | 0.96% | | | | 0.96% | |

Pacific Tiger Fund (MIPTX) | | | 40.17% | | | | 10.01% | | | | n.a. | | | | 8.07% | | | | 10/29/10 | | | | 0.91% | | | | 0.89% | 3 | | | 0.91% | | | | 0.90% | 3 |

Asia ESG Fund (MISFX) | | | 34.11% | | | | n.a. | | | | n.a. | | | | 8.09% | | | | 4/30/15 | | | | 2.46% | | | | 1.25% | 4 | | | 3.36% | | | | 1.25% | 4 |

Emerging Asia Fund (MIASX) | | | 18.70% | | | | n.a. | | | | n.a. | | | | 10.92% | | | | 4/30/13 | | | | 1.52% | | | | 1.25% | 4 | | | 1.62% | | | | 1.25% | 4 |

Asia Innovators Fund (MITEX) | | | 53.18% | | | | n.a. | | | | n.a. | | | | 15.98% | | | | 4/30/13 | | | | 1.05% | | | | 1.05% | 2 | | | 1.01% | | | | 1.01% | |

China Fund (MICFX) | | | 59.71% | | | | 9.75% | | | | n.a. | | | | 5.09% | | | | 10/29/10 | | | | 0.93% | | | | 0.93% | 2 | | | 1.03% | | | | 1.03% | |

India Fund (MIDNX) | | | 36.05% | | | | 16.04% | | | | n.a. | | | | 7.93% | | | | 10/29/10 | | | | 0.89% | | | | 0.89% | 2 | | | 0.91% | | | | 0.91% | |

Japan Fund (MIJFX) | | | 33.23% | | | | 16.23% | | | | n.a. | | | | 12.72% | | | | 10/29/10 | | | | 0.87% | | | | 0.86% | 3 | | | 0.88% | | | | 0.88% | |

Korea Fund (MIKOX) | | | 44.11% | | | | 11.24% | | | | n.a. | | | | 11.31% | | | | 10/29/10 | | | | 1.01% | | | | 1.01% | 2 | | | 0.97% | | | | 0.97% | |

ASIA SMALL COMPANY STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Small Companies Fund (MISMX) | | | 30.85% | | | | n.a. | | | | n.a. | | | | 5.98% | | | | 4/30/13 | | | | 1.35% | | | | 1.25% | 4 | | | 1.34% | | | | 1.25% | 4 |

China Small Companies Fund (MICHX)5 | | | 53.92% | | | | 14.27% | | | | n.a. | | | | 6.54% | | | | 11/30/17 | | | | 2.09% | | | | 1.25% | 4 | | | 2.19% | | | | 1.25% | 4 |

| * | Expense ratio represents the actual expense ratio a shareholder would have paid if they had been invested the entire year. |

| ** | Before fee waivers and expense reimbursement. |

| † | Annualized performance for periods of at least one year, otherwise cumulative. |

| ‡ | These figures are from the Funds’ prospectus dated as of April 28, 2017, and may differ from the actual expense ratios for fiscal year 2017, as shown in the financial highlights section of this report. |

| 1 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of the (i) expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2019 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 2 | Fund had no waivers or reimbursements. |

| 3 | Matthews has contractually agreed to waive a portion of its advisory fee and administrative and shareholder services fee if the Fund’s average daily net assets are over $3 billion, as follows: for every $2.5 billion average daily net assets of the Fund that are over $3 billion, the advisory fee rate and the administrative and shareholder services fee rate for the Fund with respect to such excess average daily net assets will be each reduced by 0.01%, in each case without reducing such fee rate below 0.00%. Any amount waived by Matthews pursuant to this agreement may not be recouped by Matthews. This agreement will remain in place until April 30, 2019 and may be terminated at any time (i) by the Trust on behalf of the Fund or by the Board of Trustees upon 60 days’ prior written notice to Matthews; or (ii) by Matthews upon 60 days’ prior written notice to the Trust, in each case without payment of any penalty. |

| 4 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 1.25% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 1.25% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 1.25%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2019 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 5 | Institutional Class Shares were first offered on November 30, 2017. For performance since that date, please see the Fund’s performance table in the report. Performance for the Institutional Class Shares prior to its inception represents the performance of the Investor Class. Performance differences between the Institutional Class and Investor Class may arise due to differences in fees charged to each class. |

Past Performance: All performance quoted in this report is past performance and is no guarantee of future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the returns quoted. If certain of the Funds’ fees and expenses had not been waived, returns would have been lower. For the Funds’ most recent month-end performance, please call 800.789.ASIA (2742) or visit matthewsasia.com.

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 2 | |

Contents

Cover photo: Beautiful garden with Chinese architectural bridge and reflection in the lake.

This report has been prepared for Matthews International Funds (d/b/a Matthews Asia Funds) shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Matthews Asia Funds prospectus, which contains more complete information about the Funds’ investment objectives, risks and expenses. Additional copies of the prospectus or summary prospectus may be obtained at matthewsasia.com. Please read the prospectus carefully before you invest or send money.

The views and opinions in this report were current as of December 31, 2017. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of a Fund’s future investment intent. Current and future portfolio holdings are subject to risk.

Statements of fact are from sources considered reliable, but neither the Funds nor the Investment Advisor makes any representation or guarantee as to their completeness or accuracy.

Investment Risk: Mutual fund shares are not deposits or obligations of, or guaranteed by, any depositary institution. Shares are not insured by the FDIC, Federal Reserve Board or any government agency and are subject to investment risks, including possible loss of principal amount invested. Investing in international and emerging markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Fixed income investments are subject to additional risks, including, but not limited to, interest rate, credit and inflation risks. In addition, single-country and sector funds may be subject to a higher degree of market risk than diversified funds because of a concentration in a specific industry, sector or geographic location. Investing in small and mid-size companies is more risky than investing in large companies as they may be more volatile and less liquid than larger companies. Please see the Funds’ prospectus and Statement of Additional Information for more risk disclosure.

Message to Shareholders from the

President of the Matthews Asia Funds

Dear Valued Shareholder,

Asian and other emerging equity markets delivered strong absolute performance during 2017 with the world’s two largest economies, the U.S. and China, posting solid economic results. 2017 will be remembered as a year of renewal for Asia markets as the region delivered the best results since 2009, with strong earnings growth, reform-minded governments and the continued opening of China’s equity and fixed income markets. Against this backdrop, I am proud of the strong absolute performance across all the Matthews Asia Funds with noteworthy performance from our three dedicated China strategies.

The shift in sentiment and views toward China, and the role it plays in global investment allocations became a focus once again for investors in 2017 with the inclusion of China’s domestic A-shares in the MSCI indices—a welcome development that will continue to have significant implications in the months and years to come. In recent years, we have witnessed the evolution of China’s A-share market, not only in terms of the number of listed companies, which have been growing substantially, but also in overall quality. There were improvements made to China’s general regulatory and corporate governance environment and accessibility with schemes such as the “Stock Connect” programs of the Shanghai and Shenzhen stock exchanges and the Mainland China–Hong Kong Bond Market Connect. With China’s A-share market no longer ignored, we believe global asset allocators will rightly focus on the unique opportunity to participate directly in companies that are benefiting from the world’s second-largest economy.

Asia continues to be one of the world’s most dynamic and fastest-growing regions, representing one-third of global GDP and one-fifth of the world stock market capitalization. Yet, Asia still remains fundamentally underweighted and underappreciated by most global investors, or lumped together within an Emerging Markets (EM) construct. Grouping countries together in the early days of the EM asset class might have made sense. Today, however, the economic growth engines of the countries within EM are fundamentally different. With a combination of large populations, relatively high economic growth, rising wages and a shift toward sophisticated services and consumption, the economies of Asia stand out relative to other EM countries. Asia will continue to be an ever-increasing contributor to global growth and consumption over the next several decades. Ensuring Asia has its own distinct allocation is essential in a globally diversified portfolio.

2018 and Beyond

For 2018, we are optimistic about the prospects for Asian securities with continued economic growth, stable politics and reformist governments. Far from being a single homogeneous region dependent on exports, the economies in Asia today are as varied as the countries themselves. This has broadened the investment universe and the diversity of the region creates new and significant investment opportunities and, with it, the potential for investors to gain exposure to different aspects of the region’s economy. But successful investment in Asia doesn’t come from passively following market indices—it requires actively identifying individual companies that stand to benefit from Asia’s rising wealth and changing consumption patterns. It requires feet on the ground, conducting company analysis, getting a first-hand, face-to-face evaluation of both prospective and current portfolio companies that we believe are best-positioned to grow profitably over the years to come.

I’m pleased that Matthews Asia continues to provide a distinctive active approach to investing in Asia for the benefit of our valued and growing shareholder base. Our investment team continues to seek sustainable opportunities that are being created by Asia’s ongoing transformation, looking for well-managed, transformative businesses that are trading at reasonable valuations on behalf of our clients. Thank you for being a valued shareholder.

William Hackett

President of the Matthews Asia Funds

Message to Shareholders from the Investment Advisor

Dear Valued Investors,

2017 was a strong year for Asia’s markets. Japan continued to reflate and China joined it. This allowed corporate profit growth to accelerate. The rest of the region also saw improved performance, but policymakers in India and throughout most of Southeast Asia did not move to significantly stimulate their economies. As a consequence, currencies across the region were strong, and it was their strength that helped fixed income returns and bolstered confidence among foreign investors to the region. However, I would’ve thought a bit more stimulus was warranted in several economies. Had they received such stimulus, currencies might not have been quite as strong, but equity returns might well have been even better.

For the benchmarks, most of the performance was concentrated in relatively few names, which made the benchmarks tough to beat. This is largely a portfolio construction issue. Although some of the best-performing names were indeed good companies and companies that we held in our portfolios, it is not always wise to hold such concentrated positions from a risk standpoint. In single country portfolios, there may be greater justification for large positions in individual names, but it is a bit harder to justify doing so in core regional portfolios that aim to diversify across country and sector. For the dividend-focused portfolios, the issue was complicated further by the fact that many of these companies did not pay a dividend, or they had yields that were severely compressed by expensive valuations. These strong-performing names were largely in the technology sector and thus the relative performance of portfolios was impacted this year by technology weightings relative to benchmarks.

Even where portfolio managers were unable or felt it unwise to build outsize positions in some of these mega-cap growth companies, however, they were able to find good ideas elsewhere. Many of our portfolios benefited from stock picking in mid- and small-cap companies and particularly among China’s domestically listed A-shares, where years of research is now paying off for clients, as access to these companies has improved dramatically over the course of the past 24 months.

In 2017, we also saw some signs of excess. The bitcoin phenomenon has been an exhilarating one to watch, even as the idea of intrinsic value remains elusive for cryptocurrencies and underappreciated by their backers. Hong Kong’s IPO market ran hot too as retail participation soared. This speculation, coupled with the extreme concentration of returns in a few stocks, led some to fear that markets are vulnerable to a setback. Whilst this may be true in the limited sense of the benchmarks, I am less concerned about broad markets and economies. In a broad sense, economic growth seems strong globally and monetary policy is relatively benign. The big risks seem to be the possibility of overtightening by the Fed or understimulation by ASEAN (Association of Southeast Asian Nations). However, risks of a big monetary mistake by policymakers appear slight at the moment. If this is so, then growth can continue to be strong and hopefully market performance can continue to broaden across sectors, countries and down the market-cap spectrum. It may be a year in which markets do better than benchmarks.

In such an improved atmosphere for economic growth, as growth becomes less scarce, I would expect mid- and small-cap companies to do better and growth-at-a-reasonable-price stocks to outperform pure growth strategies. It will be interesting to see if investor sentiment changes too—whilst global clients have generally become less bearish on Asia, few are overweight the region. Much of the allocations we have seen this year appear to be tactical in nature and focused on large exchange-traded funds. It could be that next year might see more enthusiasm for active strategies.

A Word on Valuations

Whereas average valuations in the region might appear neither obviously cheap nor extremely expensive, this average does obscure a significant divergence in valuations between fast-growing and slower-growing companies. Whilst such a divergence always exists, in my opinion it is currently quite large. This doesn’t necessarily have implications for the performance of the broader market but it does mean that long-term investors have to be cautious when they think about growth. As all businesses can face disruptions and competition, it is risky to “straight-line” current growth into the far future. If it appears that market valuations imply such expectations, it may be wise to explore better value in stocks that perhaps have not been so much the focus of attention recently.

For me personally, I remain optimistic about economies and markets. However, I am one of life’s worriers and I am disturbed by the speculative activity in some stocks, IPOs and yes, the cryptocurrencies. It can be hard as fundamental investors to watch these trends unfold and accelerate, even while trying to remain calm. But that is why we have a committed team of portfolio managers seeking to filter out fundamental nuggets from the silt of rumor and noise. It’s our job to keep our heads clear and focused on long-term, bottom-up investing in Asia’s businesses and domestic growth. If we can do that and avoid the excess, I am hopeful that we will do a good job and manage the risks.

As always, it is a privilege to be your investment advisor. Here’s to a great 2018 in everything you do!

Robert Horrocks, PhD

Chief Investment Officer

Matthews International Capital Management, LLC

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 5 | |

| | | | |

| PORTFOLIO MANAGERS |

| Teresa Kong, CFA | | |

Lead Manager | | |

| Satya Patel | | |

Co-Manager | | |

|

| FUND FACTS |

| | | Investor | | Institutional |

Ticker | | MAINX | | MINCX |

CUSIP | | 577125503 | | 577125602 |

Inception | | 11/30/11 | | 11/30/11 |

NAV | | $10.98 | | $10.97 |

Initial Investment | | $2,500 | | $100,000 |

Gross Expense Ratio1 | | 1.29% | | 1.08% |

After Fee Waiver and Reimbursement2 | | 1.15% | | 0.90% |

Portfolio Statistics | | | | |

Total # of Positions | | 37 |

Net Assets | | $94.6 million |

Modified Duration3 | | 3.14 |

Portfolio Turnover4 | | 36.58% |

Benchmark | | |

Markit iBoxx Asian Local Bond Index* |

OBJECTIVE

Total return over the long term with an emphasis on income.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in income-producing securities including, but not limited to, dividend paying equity securities, and debt and debt-related instruments issued by governments, quasi-governmental entities, supra-national institutions, and companies in Asia. Asia consists of all countries and markets in Asia, such as China and India, and includes developed, emerging, and frontier countries and markets in the Asian region. Investments may be denominated in any currency, and may represent any part of a company’s capital structure from debt to equity or with features of both.

Matthews Asia Strategic Income Fund

Portfolio Manager Commentary (unaudited)

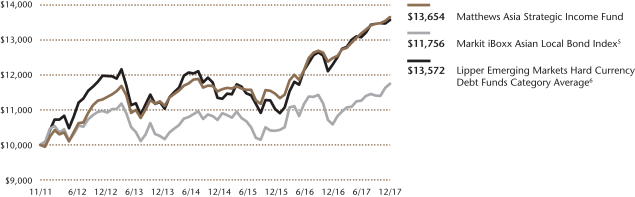

For the year ending December 31, 2017, the Matthews Asia Strategic Income Fund returned 9.40% (Investor Class) and 9.67% (Institutional Class) while its benchmark, the Markit iBoxx Asian Local Bond Index, returned 11.04%. For the fourth quarter, the Fund returned 1.37% (Investor Class) and 1.43% (Institutional Class) versus 2.98% for the Index.

Market Environment:

2017 was characterized by synchronized global growth for the first time since the financial crisis of 2007–2008. The world’s three biggest economic areas (the U.S., Europe and China) all posted solid growth. Inflation was nevertheless lower than expected, driving interest rates lower across many Asian countries. This meant Asian bonds experienced tailwinds in 2017 from all three drivers of returns: credit, currencies and interest rates.

While interest rates fell across most Asian countries, some countries did experience rising rates as markets priced in higher inflation and an increased supply of government bonds to fund fiscal spending. These countries included the Philippines and India. Another notable exception was China, where the government sought to lower financial leverage given to retail investors through lending and wealth management products by tightening liquidity in the interbank market.

Most Asian currencies saw strong gains versus the U.S. dollar in 2017, led by the currencies of open, export-oriented economies such as South Korea, Malaysia and Thailand. The Pakistani rupee and the Sri Lankan rupee underperformed the U.S. dollar by the greatest margin. Both are currencies of relatively closed economies that did not benefit from the recovery in global trade.

Credit spreads were relatively stable throughout the year, with high yield Asian spreads closing the year 12 basis points (0.12%) tighter. Dispersion among credit was also very low, driven by continued demand for yield among global investors. We viewed lower dispersion as a signal of a more selective investor base.

Performance Contributors and Detractors:

The biggest contributors to returns in 2017 were our holdings of rupiah-denominated bonds issued by the Indonesian government, followed by our holdings of ringgit-denominated Malaysian government bonds and U.S. dollar-denominated debt of Vietnam’s Debt and Asset Trading. On the back of currency stability, falling rates and expectation of its inclusion into the Barclays Global Aggregate Index, our Indonesian government bonds outperformed. Malaysian government bonds recovered on improved fundamentals and capital outflows reversed to inflows on expectations of currency appreciation and stable interest rates. The biggest detractors from our performance were currency forwards, including shorts in the South Korean won, Taiwanese dollar, and our long in the Australian dollar.

In the fourth quarter, the biggest contributors were our holdings in Malaysian government bonds, Debt and Asset Trading, and CP Foods. The Malaysian ringgit was one of the strongest-performing Asian currencies in the fourth quarter, and it drove returns of our Malaysian government bonds. Vietnam’s Debt and Asset Trading bonds improved as Vietnam’s banking system recovery continued and nonperforming loans stabilized. The convertible bonds of CP Foods performed well as

(continued)

| * | The Index performance reflects the returns of the discontinued predecessor HSBC Asian Local Bond Index up to December 31, 2012 and the returns of the successor Markit iBoxx Asian Local Bond Index thereafter. |

| 1 | Actual 2017 expense ratios. |

| 2 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2019 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 3 | Modified duration measures the percent change in value of the fixed income portion of the portfolio in response to a 1% change in interest rates. In a multi-currency denominated portfolio with sensitivities to different interest rate regimes, modified duration will not accurately reflect the change in value of the overall portfolio from a change in any one interest rate regime. |

| 4 | The lesser of fiscal year 2017 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| PERFORMANCE AS OF DECEMBER 31, 2017 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Average Annual Total Returns | | | | |

| | | 3 Months | | | 1 Year | | | 3 Years | | | 5 Years | | | Since

Inception | | | Inception

Date | |

| Investor Class (MAINX) | | | 1.37% | | | | 9.40% | | | | 5.79% | | | | 3.85% | | | | 5.25% | | | | 11/30/11 | |

| Institutional Class (MINCX) | | | 1.43% | | | | 9.67% | | | | 6.04% | | | | 4.08% | | | | 5.46% | | | | 11/30/11 | |

| Markit iBoxx Asian Local Bond Index5 | | | 2.98% | | | | 11.04% | | | | 3.14% | | | | 1.38% | | | | 2.69% | | | | | |

| Lipper Emerging Markets Hard Currency Debt Funds Category Average6 | | | 0.74% | | | | 10.67% | | | | 5.83% | | | | 2.39% | | | | 5.05% | | | | | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance visit matthewsasia.com.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| INCOME DISTRIBUTION HISTORY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2017 | | | | | | 2016 | |

| | | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Total | | | | | | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Total | |

| Investor (MAINX) | | $ | 0.07 | | | $ | 0.08 | | | $ | 0.13 | | | $ | 0.14 | | | $ | 0.42 | | | | | | | $ | 0.06 | | | $ | 0.11 | | | $ | 0.11 | | | $ | 0.13 | | | $ | 0.41 | |

| Inst’l (MINCX) | | $ | 0.08 | | | $ | 0.08 | | | $ | 0.14 | | | $ | 0.15 | | | $ | 0.45 | | | | | | | $ | 0.06 | | | $ | 0.12 | | | $ | 0.12 | | | $ | 0.13 | | | $ | 0.43 | |

Note: This table does not include capital gains distributions. Totals may differ by $0.02 due to rounding. For income distribution history, visit matthewsasia.com.

| | | | |

30-DAY YIELD: Investor Class: 4.28% (4.16% excluding waivers) Institutional Class: 4.53% (4.36% excluding waivers) The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 12/31/17, expressed as an annual percentage rate based on the Fund’s share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate. Source: BNY Mellon Investment Servicing (US) Inc. | | | | YIELD TO WORST: 5.88% Yield to worst is the lowest yield that can be received on a bond assuming that the issuer does not default. It is calculated by utilizing the worst case assumptions for a bond with respect to certain income-reducing factors, including prepayment, call or sinking fund provisions. It does not represent the yield that an investor should expect to receive. Past yields are no guarantee of future yields. Source: FactSet Research Systems |

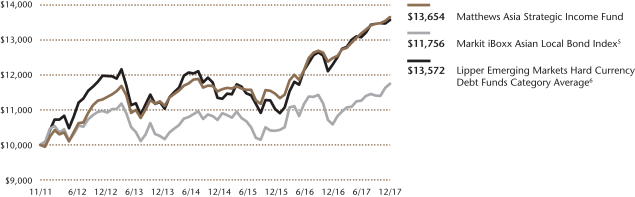

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION—INVESTOR CLASS

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions or redemption of Fund shares. Values are in US$.

| | 5 | It is not possible to invest directly in an index. Source: Index data from HSBC, Markit iBoxx and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 92 for index definitions. The Index performance reflects the returns of the discontinued predecessor HSBC Asian Local Bond Index up to December 31, 2012 and the returns of the successor Markit iBoxx Asian Local Bond Index thereafter. |

| | 6 | The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods. |

| | | | | | | | |

| | | | |

| TOP TEN HOLDINGS | | | | | | | |

| | | Sector | | Currency | | % of Net Assets | |

| Malaysia Government Investment Issue, 3.508%, 05/15/2018 | | Foreign Government Bonds | | Malaysian Ringgit | | | 4.5% | |

| Malaysia Government Investment Issue, 3.226%, 04/15/2020 | | Foreign Government Bonds | | Malaysian Ringgit | | | 4.3% | |

| Wanda Properties International Co., Ltd., 7.250%, 01/29/2024 | | Real Estate | | U.S. Dollar | | | 4.2% | |

| Debt and Asset Trading Corp., 1.000%, 10/10/2025 | | Financials | | U.S. Dollar | | | 4.1% | |

| Standard Chartered PLC, 6.500%, 12/29/2049 | | Financials | | U.S. Dollar | | | 4.0% | |

| LIC Housing Finance, Ltd., 7.830%, 09/25/2026 | | Financials | | Indian Rupee | | | 4.0% | |

| Delta Investment Horizon International, Ltd., Cnv., 3.000%, 05/26/2020 | | Telecommunication Services | | U.S. Dollar | | | 3.7% | |

| Indonesia Treasury Bond, 8.375%, 03/15/2034 | | Foreign Government Bonds | | Indonesian Rupiah | | | 3.6% | |

| Ctrip.com International, Ltd., Cnv., 1.250%, 09/15/2022 | | Consumer Discretionary | | U.S. Dollar | | | 3.6% | |

| Indonesia Treasury Bond, 8.375%, 03/15/2024 | | Foreign Government Bonds | | Indonesian Rupiah | | | 3.5% | |

| % OF ASSETS IN TOP TEN | | | | | | | 39.5% | |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 7 | |

| | | | |

| |

| CURRENCY ALLOCATION (%)7,8 | |

U.S. Dollar (USD) | | | 44.6 | |

Chinese Renminbi (CNY) | | | 13.0 | |

Indian Rupee (INR) | | | 11.6 | |

Indonesian Rupiah (IDR) | | | 11.3 | |

Malaysian Ringgit (MYR) | | | 10.3 | |

Vietnamese Dong (VND) | | | 2.1 | |

South Korean Won (KRW) | | | 0.4 | |

Cash and Other Assets, Less Liabilities | | | 6.8 | |

| | | | |

| |

| COUNTRY ALLOCATION (%)7,8,9 | |

| China/Hong Kong | | | 32.5 | |

| Indonesia | | | 19.2 | |

| India | | | 11.6 | |

| Malaysia | | | 10.3 | |

| Vietnam | | | 6.2 | |

| Sri Lanka | | | 5.0 | |

| Thailand | | | 3.3 | |

| Japan | | | 2.8 | |

| United States | | | 2.0 | |

| South Korea | | | 0.4 | |

| Cash and Other Assets, Less Liabilities | | | 6.8 | |

| | | | |

| |

| SECTOR ALLOCATION (%)7,8 | |

| Foreign Government Bonds | | | 27.5 | |

| Financials | | | 26.6 | |

| Telecommunication Services | | | 8.4 | |

| Real Estate | | | 8.4 | |

| Utilities | | | 5.8 | |

| Consumer Discretionary | | | 5.4 | |

| Energy | | | 4.6 | |

| Consumer Staples | | | 3.3 | |

| Materials | | | 3.2 | |

| Cash and Other Assets, Less Liabilities | | | 6.8 | |

Please note: Foreign Government Bonds category includes Supranationals.

| | | | |

| |

| ASSET TYPE BREAKDOWN (%)7,8 | |

| Non-Convertible Corporate Bonds | | | 49.3 | |

| Government Bonds | | | 31.6 | |

| Convertible Corporate Bonds | | | 12.3 | |

| Cash and Other Assets, Less Liabilities | | | 6.8 | |

| 7 | Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent, so the values may not sum to 100% due to rounding. Percentage values may be derived from different data sources and may not be consistent with other Fund literature. |

| 8 | Cash and other assets may include forward currency exchange contracts and certain derivative instruments that have been marked-to-market. |

| 9 | Not all countries where the Fund may invest are included in the benchmark index. |

Matthews Asia Strategic Income Fund

Portfolio Manager Commentary (unaudited) (continued)

shares in the underlying equity rallied 15% on the back of solid results and strengthening domestic operations. The biggest detractors were our holdings in the convertible bonds of Ctrip.com and Sprint.

Notable Portfolio Changes:

Through 2017, we steadily increased our exposure to local currency bonds as the global recovery gathered steam. We started the year with the conviction that Asian currencies would end the year outperforming the U.S. dollar, but that the momentum in U.S. dollar strength would continue into the first quarter of 2017. The biggest increases in currency allocation were in the South Korean won, the Chinese renminbi and the Singapore dollar. Our expectation was for rates to rise in South Korea and Singapore, thus, we expressed our positive investment thesis in currency forward. In the case of China, our favorable view on the currency and short-end rates translated into our purchase of local currency bonds instead.

In the fourth quarter, we added local currency bonds issued by the Malaysian government, as well as Petrochina, and U.S. dollar-denominated bonds issued by Softbank Group and Vipshop. We also sold a handful of longer-duration U.S. dollar-denominated sovereign bonds, including issues from Pakistan, Vietnam and Sri Lanka.

Outlook:

We expect Asian fixed income to continue to be attractive in 2018. Credit spreads and currency appreciation will likely be tailwinds that drive returns, while interest rates could present a slight headwind in some countries.

We expect U.S. rates to set the tone for local rates in Asia as the U.S. economic cycle gathers momentum and finally starts to create mild inflation. The next Federal Reserve Chairman, Jerome Powell, will likely continue on the current dovish path, raising the Fed’s target benchmark rate an estimated three times over the next year. The gentle tapping of the economic brakes at this stage of the economic cycle is a prudent measure to slow a robust U.S. economy and should not disrupt the current synchronous growth story.

The factors behind the strong Asian currency performance in 2017 will likely continue next year. They include synchronized global growth, a recovery in world exports and a relative undervaluation of several Asian currencies. While much uncertainty surrounds the recently passed U.S. tax bill, we do not think it will result in dollar strength as large U.S. multinationals are already flush with cash and have been deploying capital to buy back stock. Whether corporate cash is in local currency or U.S. dollars is dictated more by business needs like working capital than by the U.S. tax code. Thus, we don’t expect the tax bill to reverse the depreciation trend for the U.S. dollar. We expect currencies of countries with growing current accounts to disproportionately benefit from synchronized global growth. In terms of further currency depreciation, the one country we are most concerned about is Pakistan. As such, we have no exposure to the country either in U.S. dollars or local currency.

Finally, we expect credit spreads to remain at current levels or even tighten in 2018, offsetting any headwinds from rising rates. Asia high yield spreads are still hovering around historical averages, with room to fall more at this stage of the economic cycle. Given default rates of less than 2%, and the attractive relative value of Asia high yield relative to its U.S. and European counterparts, we expect more inflows into Asia, which should also drive spreads lower.

Fixed income investments are subject to risks, including, but not limited to, interest rate, credit and inflation risks. Investing in emerging markets involves different and greater risks, as these countries are substantially smaller, less liquid and more volatile than securities markets in more developed markets.

Matthews Asia Strategic Income Fund

December 31, 2017

Schedule of Investmentsa

NON-CONVERTIBLE CORPORATE BONDS: 49.3%

| | | | | | | | |

| | | Face Amount* | | | Value | |

| CHINA/HONG KONG: 23.7% | |

Wanda Properties International Co., Ltd.

7.250%, 01/29/24c | | | 4,000,000 | | | | $4,005,164 | |

Standard Chartered PLC

6.500%b, 04/02/20c,d | | | 3,700,000 | | | | 3,783,250 | |

China Hongqiao Group, Ltd.

6.875%, 05/03/18c | | | 3,000,000 | | | | 3,007,494 | |

PetroChina Co., Ltd., Series A

3.030%, 01/19/21 | | | CNY 20,000,000 | | | | 2,888,747 | |

State Grid Corp. of China, Series B

3.150%, 11/14/21 | | | CNY 20,000,000 | | | | 2,855,802 | |

HSBC Holdings PLC

6.375%b, 03/30/25d | | | 2,500,000 | | | | 2,687,500 | |

China Southern Power Grid Co., Ltd.

3.140%, 03/11/21 | | | CNY 12,000,000 | | | | 1,734,195 | |

China National Petroleum Corp., Series INBK | |

4.690%, 01/11/22 | | | CNY 10,000,000 | | | | 1,507,852 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 22,470,004 | |

| | | | | | | | |

| | | | | | | | |

| INDIA: 11.6% | | | | | | | | |

LIC Housing Finance, Ltd., Series 309

7.830%, 09/25/26 | | | INR 240,000,000 | | | | 3,744,342 | |

Housing Development Finance Corp., Ltd., | |

Series M009 9.240%, 06/24/24 | | | INR 100,000,000 | | | | 1,653,784 | |

Housing Development Finance Corp., Ltd., | |

Series K-24 8.950%, 03/21/23 | | | INR 100,000,000 | | | | 1,621,567 | |

Power Finance Corp., Ltd., Series 151A

7.470%, 09/16/21 | | | INR 90,000,000 | | | | 1,386,952 | |

Power Grid Corp. of India, Ltd., Series B

9.300%, 09/04/24 | | | INR 52,000,000 | | | | 873,491 | |

Rural Electrification Corp., Ltd., Series 123

9.340%, 08/25/24 | | | INR 52,000,000 | | | | 870,480 | |

Rural Electrification Corp., Ltd., Series 122

9.020%, 06/18/19 | | | INR 50,000,000 | | | | 798,219 | |

| | | | | | | | |

Total India | | | | | | | 10,948,835 | |

| | | | | | | | |

| | | | | | | | |

| SRI LANKA: 5.0% | | | | | | | | |

DFCC Bank PLC

9.625%, 10/31/18c | | | 2,650,000 | | | | 2,730,109 | |

National Savings Bank

5.150%, 09/10/19c | | | 2,000,000 | | | | 2,024,800 | |

| | | | | | | | |

Total Sri Lanka | | | | | | | 4,754,909 | |

| | | | | | | | |

| | | | | | | | |

| INDONESIA: 4.2% | | | | | | | | |

Modernland Overseas Pte, Ltd.

6.950%, 04/13/24c | | | 1,900,000 | | | | 1,939,218 | |

Alam Synergy Pte, Ltd.

6.950%, 03/27/20d,e | | | 1,500,000 | | | | 1,515,000 | |

Alam Synergy Pte, Ltd.

6.950%, 03/27/20c | | | 500,000 | | | | 505,000 | |

| | | | | | | | |

Total Indonesia | | | | | | | 3,959,218 | |

| | | | | | | | |

| | | | | | | | |

| JAPAN: 2.8% | | | | | | | | |

SoftBank Group Corp.

6.000%b, 07/19/23c,d | | | 2,650,000 | | | | 2,617,723 | |

| | | | | | | | |

Total Japan | | | | | | | 2,617,723 | |

| | | | | | | | |

| | | | | | | | |

| | | Face Amount* | | | Value | |

| UNITED STATES: 2.0% | |

Sprint Communications, Inc.

6.000%, 11/15/22 | | | 1,863,000 | | | | $1,863,000 | |

| | | | | | | | |

Total United States | | | | | | | 1,863,000 | |

| | | | | | | | |

| | | | | | | | |

| TOTAL NON-CONVERTIBLE CORPORATE BONDS | | | | 46,613,689 | |

| | | | | | | | |

(Cost $45,661,707) | | | | | | | | |

| | | | | | | | |

FOREIGN GOVERNMENT OBLIGATIONS: 31.6% | | | | | |

| INDONESIA: 11.3% | | | | | | | | |

Indonesia Treasury Bond

8.375%, 03/15/34 | | | IDR 42,000,000,000 | | | | 3,451,631 | |

Indonesia Treasury Bond

8.375%, 03/15/24 | | | IDR 40,500,000,000 | | | | 3,318,839 | |

Indonesia Treasury Bond

7.875%, 04/15/19 | | | IDR 38,000,000,000 | | | | 2,887,154 | |

Indonesia Treasury Bond

7.000%, 05/15/27 | | | IDR 13,000,000,000 | | | | 1,004,164 | |

| | | | | | | | |

Total Indonesia | | | | | | | 10,661,788 | |

| | | | | | | | |

| | | | | | | | |

| MALAYSIA: 10.3% | | | | | | | | |

Malaysia Government Investment Issue | |

3.508%, 05/15/18 | | | MYR 17,300,000 | | | | 4,280,602 | |

Malaysia Government Investment Issue | |

3.226%, 04/15/20 | | | MYR 16,600,000 | | | | 4,078,477 | |

Malaysia Government Investment Issue | |

3.872%, 08/30/18 | | | MYR 5,500,000 | | | | 1,364,769 | |

| | | | | | | | |

Total Malaysia | | | | | | | 9,723,848 | |

| | | | | | | | |

| | | | | | | | |

| VIETNAM: 6.1% | | | | | | | | |

Debt and Asset Trading Corp.

1.000%, 10/10/25c | | | 5,469,000 | | | | 3,863,165 | |

Socialist Republic of Vietnam

5.200%, 01/12/22 | | | VND 43,000,000,000 | | | | 1,972,639 | |

| | | | | | | | |

Total Vietnam | | | | | | | 5,835,804 | |

| | | | | | | | |

| | | | | | | | |

| CHINA/HONG KONG: 3.5% | | | | | | | | |

China Government Bond

3.550%, 12/12/21c | | | CNY 22,000,000 | | | | 3,282,945 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 3,282,945 | |

| | | | | | | | |

| | | | | | | | |

| SOUTH KOREA: 0.4% | | | | | | | | |

Korea Treasury Bond

3.500%, 03/10/24 | | | KRW 400,000,000 | | | | 396,486 | |

| | | | | | | | |

Total South Korea | | | | | | | 396,486 | |

| | | | | | | | |

| | | | | | | | |

| TOTAL FOREIGN GOVERNMENT OBLIGATIONS | | | | 29,900,871 | |

| | | | | | | | |

(Cost $28,241,769) | | | | | | | | |

| | | | | | | | |

CONVERTIBLE CORPORATE BONDS: 12.3% | | | | | |

| CHINA/HONG KONG: 5.3% | | | | | | | | |

Ctrip.com International, Ltd., Cnv.

1.250%, 09/15/22 | | | 3,300,000 | | | | 3,370,125 | |

Vipshop Holdings, Ltd., Cnv.

1.500%, 03/15/19 | | | 1,700,000 | | | | 1,691,500 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 5,061,625 | |

| | | | | | | | |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 9 | |

Matthews Asia Strategic Income Fund

December 31, 2017

Schedule of Investmentsa (continued)

CONVERTIBLE CORPORATE BONDS (continued)

| | | | | | | | |

| | | Face Amount* | | | Value | |

| INDONESIA: 3.7% | | | | | | | | |

Delta Investment Horizon International, Ltd., Cnv. | |

3.000%, 05/26/20c | | | 3,500,000 | | | | $3,504,375 | |

| | | | | | | | |

Total Indonesia | | | | 3,504,375 | |

| | | | | | | | |

| | | | | | | | |

| THAILAND: 3.3% | | | | | | | | |

CP Foods Holdings, Ltd., Cnv.

0.500%, 09/22/21c | | | 2,800,000 | | | | 3,094,000 | |

| | | | | | | | |

Total Thailand | | | | 3,094,000 | |

| | | | | | | | |

| | | | | | | | |

| TOTAL CONVERTIBLE CORPORATE BONDS | | | | 11,660,000 | |

| | | | | | | | |

(Cost $11,429,132) | | | | | | | | |

| | | | | | | | |

| TOTAL INVESTMENTS: 93.2% | | | | | | | 88,174,560 | |

(Cost $85,332,608) | | | | | | | | |

| | | | | | | | |

CASH AND OTHER ASSETS,

LESS LIABILITIES: 6.8% | | | | | | | 6,417,595 | |

| | | | | | | | |

| | |

NET ASSETS: 100.0% | | | | | | | $94,592,155 | |

| | | | | | | | |

| a | Certain securities were fair valued under the valuation policies approved by the Board of Trustees (Note 2-A). |

| b | Variable rate security. Security may be issued at a fixed coupon rate, which converts to a variable rate at a specified date. Rate shown is the rate in effect as of period end. |

| c | The securities may be resold to qualified foreign investors and foreign institutional buyers under Regulation S of the Securities Act of 1933. |

| d | Perpetual security with no stated maturity date. First call date is disclosed. |

| e | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The security may be resold in transactions exempt from registration normally to qualified institutional buyers. The security has been determined to be liquid in accordance with procedures adopted by the Fund’s Board of Trustees. At December 31, 2017, the aggregate value is $1,515,000, which is 1.60% of net assets. |

| * | All Values in USD unless otherwise specified |

| CNY | Chinese Renminbi (Yuan) |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS:

| | | | | | | | | | | | | | | | | | |

| | | Currency Purchased | | | Currency Sold | | | Counterparty | | Settlement

Date | | | Unrealized

Appreciation | |

| | THB | 174,930,000 | | | | USD 5,250,000 | | | Merrill Lynch & Co., Inc. | | | 01/12/18 | | | | $119,736 | |

| | SGD | 9,517,550 | | | | USD 7,000,000 | | | Merrill Lynch & Co., Inc. | | | 01/29/18 | | | | 119,758 | |

| | KRW | 3,908,880,000 | | | | USD 3,600,000 | | | Merrill Lynch & Co., Inc. | | | 03/21/18 | | | | 65,942 | |

| | KRW | 2,154,800,000 | | | | USD 2,000,000 | | | Merrill Lynch & Co., Inc. | | | 03/28/18 | | | | 20,993 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | $326,429 | |

| | | | | | | | | | | | | | | | | | |

See accompanying notes to financial statements.

| | | | |

| PORTFOLIO MANAGERS |

| Teresa Kong, CFA | | Satya Patel |

Lead Manager | | Lead Manager |

| | |

| FUND FACTS | | | | |

| | | Investor | | Institutional |

Ticker | | MCRDX | | MICPX |

CUSIP | | 577130677 | | 577130669 |

Inception | | 4/29/16 | | 4/29/16 |

NAV | | $10.39 | | $10.39 |

Initial Investment | | $2,500 | | $100,000 |

Gross Expense Ratio1 | | 1.86% | | 1.62% |

After Fee Waiver and Reimbursement2 | | 1.15% | | 0.90% |

Portfolio Statistics | | |

Total # of Positions | | 30 |

Net Assets | | $31.7 million |

Modified Duration3 | | 3.47 |

Portfolio Turnover4 | | 27.86% |

Benchmark | | | | |

J.P. Morgan Asia Credit Index |

OBJECTIVE

Total return over the long term.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in debt and debt-related instruments issued by companies as well as governments, quasi-governmental entities, and supranational institutions in Asia. Debt and debt-related instruments typically include bonds, debentures, bills, securitized instruments (which are vehicles backed by pools of assets such as loans or other receivables), notes, certificates of deposit and other bank obligations, bank loans, senior secured bank debt, convertible debt securities, credit-linked notes, inflation linked instruments, repurchase agreements, payment-in-kind securities and derivative instruments with fixed income characteristics. Asia consists of all countries and markets in Asia, such as China and Indonesia, in addition to the developed, emerging, and frontier countries and markets in the Asian region.

Matthews Asia Credit Opportunities Fund

Portfolio Manager Commentary (unaudited)

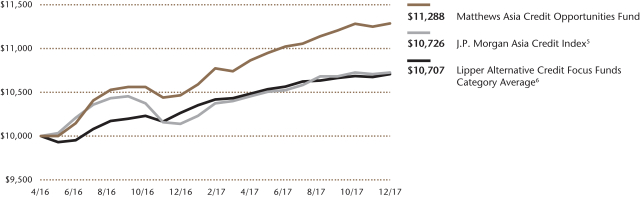

For the year ending December 31, 2017, the Matthews Asia Credit Opportunities Fund returned 7.86% (Investor Class) and 8.13% (Institutional Class) while its benchmark, the J.P. Morgan Asia Credit Index, returned 5.77% over the same period. For the fourth quarter, the Fund returned 0.70% (Investor Class) and 0.73% (Institutional Class) while its benchmark returned 0.41% over the same period.

Market Environment:

2017 was another great year for Asia credit, with the J.P. Morgan Asia Credit Index (JACI) returning 5.77% for the year. We were prescient in reminding our investors earlier that this credit cycle might be atypical in length and strength compared to past cycles. Asia high yield continued to be attractive compared with its U.S., European and Latin America counterparts as spreads hovered around historical averages for the year. U.S., Europe and Latin American high yield spreads, meanwhile, were trading within 200 to 500 basis points (2.0% to 5.0%) of historical averages.

2017 was a banner year in terms of U.S. dollar (USD) issuance, with the highest issuance by Asian borrowers in USD in the past decade. This trend was driven by the low all-in cost of financing for most Asian companies, even as U.S. interest rates inched up over the year, with credit spreads tightening and Asian currencies appreciating. Most of the issuance came from China. As the renminbi resumed its appreciation trend relative to the U.S. dollar and local interest rates and credit spreads rose, many Chinese corporations found USD funding attractive relative to local currency funding.

Performance Contributors and Detractors:

For 2017, the biggest contributors to returns were our holdings of Debt and Asset Trading Corp., Standard Chartered PLC and Sri Lanka government bonds. The price of Vietnam’s Debt and Asset Trading Corp. bonds rose as Vietnam’s banks’ recovery continued and nonperforming loans stabilized. Standard Chartered PLC’s contingent convertible bonds recovered as worries about Europe’s banks subsided. Finally, Sri Lanka government bonds traded higher on further stability of the country’s currency and fiscal accounts under the International Monetary Fund program.

The only detractor to returns in 2017 was the holding in renminbi-denominated bonds of PetroChina. Onshore Chinese bond yields rose late in the year, causing the price of the bond to fall and leading to a slight loss on the position.

In the fourth quarter, the biggest contributors to returns were our holdings in Debt and Asset Trading Corp., CP Foods and China Hongqiao Group. The convertible bonds of CP Foods performed well as shares in the underlying equity rallied 15% on the back of solid results and strengthening domestic operations. China Hongqiao performed well as the company’s shares resumed trading after a halt following a short seller report earlier in the year.

The largest detractors in the fourth quarter were the bonds of Ctrip.com and Sprint. Ctrip shares were weak in the quarter over concerns that regulatory actions against automatic bundling of travel services could impact earnings in the

(continued)

| 1 | Actual 2017 expense ratios. |

| 2 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2019 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 3 | Modified duration measures the percent change in value of the fixed income portion of the portfolio in response to a 1% change in interest rates. In a multi-currency denominated portfolio with sensitivities to different interest rate regimes, modified duration will not accurately reflect the change in value of the overall portfolio from a change in any one interest rate regime. |

| 4 | The lesser of fiscal year 2017 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 11 | |

| | | | | | | | | | | | | | | | |

| | | | |

| PERFORMANCE AS OF DECEMBER 31, 2017 | | | | | | | | | |

| | | | | | | | | Average Annual

Total Returns | |

| | | 3 Months | | | 1 Year | | | Since Inception | | | Inception

Date | |

| Investor Class (MCRDX) | | | 0.70% | | | | 7.86% | | | | 7.52% | | | | 4/29/2016 | |

| Institutional Class (MICPX) | | | 0.73% | | | | 8.13% | | | | 7.78% | | | | 4/29/2016 | |

| J.P. Morgan Asia Credit Index5 | | | 0.41% | | | | 5.77% | | | | 4.28% | | | | | |

| Lipper Alternative Credit Focus Funds Category Average6 | | | 0.37% | | | | 4.26% | | | | 8.07% | | | | | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance, visit matthewsasia.com.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| INCOME DISTRIBUTION HISTORY | | | | | | | | | |

| | | 2017 | | | | | | 2016 | |

| | | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Total | | | | | | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Total | |

| Investor (MCRDX) | | $ | 0.12 | | | $ | 0.08 | | | $ | 0.14 | | | $ | 0.10 | | | $ | 0.43 | | | | | | | | n.a. | | | $ | 0.06 | | | $ | 0.10 | | | $ | 0.16 | | | $ | 0.32 | |

| Inst’l (MICPX) | | $ | 0.12 | | | $ | 0.08 | | | $ | 0.15 | | | $ | 0.10 | | | $ | 0.46 | | | | | | | | n.a. | | | $ | 0.06 | | | $ | 0.11 | | | $ | 0.16 | | | $ | 0.33 | |

Note: This table does not include capital gains distributions. Totals may differ by $0.02 due to rounding. For income distribution history, visit matthewsasia.com.

| | | | |

30-DAY YIELD: Investor Class: 3.69% (3.13% excluding waivers) Institutional Class: 3.94% (3.30% excluding waivers) The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 12/31/17, expressed as an annual percentage rate based on the Fund’s share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate. Source: BNY Mellon Investment Servicing (US) Inc. | | | | YIELD TO WORST: 5.58% Yield to worst is the lowest yield that can be received on a bond assuming that the issuer does not default. It is calculated by utilizing the worst case assumptions for a bond with respect to certain income-reducing factors, including prepayment, call or sinking fund provisions. It does not represent the yield that an investor should expect to receive. Past yields are no guarantee of future yields. Source: FactSet Research Systems |

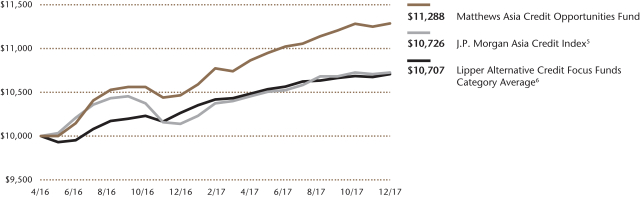

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION—INVESTOR CLASS

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions, or redemption of Fund shares. Values are in US$.

| | 5 | It is not possible to invest directly in an index. Source: Index data from J.P. Morgan and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 92 for index definition. |

| | 6 | The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods. |

| | | | | | | | |

| | | | |

| TOP TEN HOLDINGS | | | | | | | |

| | | Sector | | Currency | | % of Net Assets | |

| Socialist Republic of Vietnam, 4.000%, 03/12/2028 | | Foreign Government Bonds | | U.S. Dollar | | | 4.7% | |

| Standard Chartered PLC, 6.500%, 12/29/2049 | | Financials | | U.S. Dollar | | | 4.2% | |

| Delta Investment Horizon International, Ltd., Cnv., 3.000%, 05/26/2020 | | Telecommunication Services | | U.S. Dollar | | | 4.1% | |

| Wanda Properties International Co., Ltd., 7.250%, 01/29/2024 | | Real Estate | | U.S. Dollar | | | 3.9% | |

| DFCC Bank PLC, 9.625%, 10/31/2018 | | Financials | | U.S. Dollar | | | 3.9% | |

| Ctrip.com International, Ltd., Cnv., 1.250%, 09/15/2022 | | Consumer Discretionary | | U.S. Dollar | | | 3.9% | |

| Modernland Overseas Pte, Ltd., 6.950%, 04/13/2024 | | Real Estate | | U.S. Dollar | | | 3.9% | |

| Debt and Asset Trading Corp., 1.000%, 10/10/2025 | | Financials | | U.S. Dollar | | | 3.8% | |

| SoftBank Group Corp., 6.000%, 07/19/2049 | | Telecommunication Services | | U.S. Dollar | | | 3.7% | |

| HSBC Holdings PLC, 6.375%, 12/29/2049 | | Financials | | U.S. Dollar | | | 3.7% | |

| % OF ASSETS IN TOP TEN | | | | | | | 39.8% | |

Matthews Asia Credit Opportunities Fund

Portfolio Manager Commentary (unaudited) (continued)

short term. Sprint bonds were down as the company decided not to pursue a merger with its competitor, T-Mobile, the mobile communications subsidiary of German telecommunications company Deutsche Telekom AG.

Notable Portfolio Changes:

In 2017, the biggest change in our portfolio was our increase in holdings of local currency bonds of Chinese state-owned enterprises (SOEs). During the year, Chinese authorities sought to bring down leverage in retail and wealth management products by tightening liquidity in the interbank market. Not only did short-end rates rise, but credit spreads also widened—especially for high-quality corporate bonds. We took advantage of this classic credit opportunity and bought bonds of several Chinese SOEs. Notable reductions in exposure included selling our holdings of Pakistan government bonds and reducing our holdings in Sprint bonds as we saw more downside than upside potential at what we considered to be expensive valuations.

For the fourth quarter, we added a number of positions, including bonds of Vipshop and the Socialist Republic of Vietnam. Tencent and JD.com acquired a stake in Vipshop, which is a leading online discount retailer in China. We bought Vipshop’s convertible bonds as the company’s fundamentals could improve via this partnership. We also bought “Brady Bonds” issued by Vietnam in 1998. These bonds have an attractive yield and have limited credit risk because they are partly collateralized by U.S. Treasuries.*

Outlook:

In our view, Asia high yield bonds look reasonably valued, while U.S. and European high yield bonds appear overvalued. Credit spreads for Asia high yield bonds are near historic averages. In contrast, spreads for U.S. high yield bonds are about 200 basis points (2.0%) below average while spreads for European high yield bonds are 300 basis points (3.0%) below average. In simple terms, Asia high yield bonds are compensating investors for taking credit risk, in our view, while U.S. and European high yield bonds are not.

In 2018, we expect to see a bit more volatility in bond prices and credit spreads. At the same time, the relatively attractive yields in Asia offer a strong base for positive returns. A bond that starts with a 5% yield and has 25 basis points (0.25%) of credit spread compression, for example, could potentially generate attractive returns for investors.

In terms of risks, we expect some headwinds from regions such as the Middle East to potentially affect investors’ appetite for emerging markets. The current political unrest in Saudi Arabia and Iran will remain at the front of our minds. We see most of these risks as idiosyncratic, however, and unlikely to spread to Asia.

| * | The reference to bonds partially collateralized by U.S. Treasuries refers to an underlying security in the portfolio. The Fund itself is not guaranteed by the U.S. Government or any governmental agency. |

| | | | |

| |

| CURRENCY ALLOCATION (%)7,8 | |