UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | | | | | | | | | | | | | | | | | | | |

| Investment Company Act file number | 811-08532 |

| |

| AMERICAN CENTURY STRATEGIC ASSET ALLOCATIONS, INC. |

| (Exact name of registrant as specified in charter) |

| |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| |

JOHN PAK

4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| |

| Date of fiscal year end: | 07-31 |

| |

| Date of reporting period: | 07-31-2023 |

ITEM 1. REPORTS TO STOCKHOLDERS.

(a) Provided under separate cover.

| | | | | |

| |

| Annual Report |

| |

| July 31, 2023 |

| |

| Strategic Allocation: Aggressive Fund |

| Investor Class (TWSAX) |

| I Class (AAAIX) |

| A Class (ACVAX) |

| C Class (ASTAX) |

| R Class (AAARX) |

| R5 Class (ASAUX) |

| R6 Class (AAAUX) |

| | | | | |

| President’s Letter | |

| Performance | |

| Portfolio Commentary | |

| Fund Characteristics | |

| Shareholder Fee Example | |

| Schedule of Investments | |

| Statement of Assets and Liabilities | |

| Statement of Operations | |

| Statement of Changes in Net Assets | |

| Notes to Financial Statements | |

| Financial Highlights | |

| Report of Independent Registered Public Accounting Firm | |

| Management | |

| Approval of Management Agreement | |

| Liquidity Risk Management Program | |

| Proxy Voting Results | |

| Additional Information | |

| |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the period ended July 31, 2023. Annual reports help convey important information about fund returns, including market factors that affected performance. For additional investment insights, please visit americancentury.com.

Stocks Rallied Despite Ongoing Challenges

After delivering modest gains early in the fiscal year, global stocks—most notably U.S. stocks—rallied through the first seven months of 2023. This bounce back, which occurred despite ongoing volatility and rising interest rates, led to strong 12-month performance for most broad stock indices. Investor expectations for the Federal Reserve (Fed) to conclude its rate-hike campaign largely fueled the optimism.

Inflation’s steady slowdown, mounting recession worries and a series of U.S. regional bank failures prompted investors to regularly recalibrate their monetary policy outlooks. However, with inflation still higher than central bank targets, the Fed and its developed markets peers continued to raise rates through period-end.

In June, the Fed bucked the trend of developed markets central banks and paused after 10 consecutive rate hikes. But the break was short-lived. The central bank resumed its tightening campaign in July, raising rates another quarter point to a range of 5.25% to 5.5%, a 22-year high. Citing still-higher-than-target inflation and still-strong economic data, policymakers left their tightening options open. Inflation remained even higher in the eurozone and the U.K., prompting central bankers there to steadily raise interest rates.

Despite the inflation and rate backdrops, better-than-expected corporate earnings helped the S&P 500 Index return 21% for the seven months ended July 31, 2023. For the 12-month period, the S&P 500 Index returned 13%. Global and style-focused stock index returns were even stronger. Meanwhile, amid high inflation and central bank tightening, government bond yields surged, and global and U.S. bond returns declined for the period.

Remaining Diligent in Uncertain Times

We expect market volatility to linger as investors navigate a complex environment of persistent inflation, tighter financial conditions, banking industry turbulence and recession risk. In addition, increasingly tense geopolitical considerations complicate the market backdrop.

We appreciate your confidence in us during these extraordinary times. American Century Investments has a long history of helping clients weather unpredictable and volatile markets, and we’re confident we will continue to meet today’s challenges.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

| | | | | | | | | | | | | | | | | | | | | |

| Total Returns as of July 31, 2023 |

| | | | Average Annual Returns | |

| Ticker Symbol | | 1 year | 5 years | 10 years | Since

Inception | Inception Date |

| Investor Class | TWSAX | | 8.35% | 7.39% | 7.86% | — | 2/15/96 |

| S&P 500 Index | — | | 13.02% | 12.19% | 12.65% | — | — |

| Bloomberg U.S. Aggregate Bond Index | — | | -3.37% | 0.75% | 1.49% | — | — |

| Bloomberg U.S. 1-3 Month Treasury Bill Index | — | | 4.09% | 1.59% | 1.00% | — | — |

| I Class | AAAIX | | 8.51% | 7.59% | 8.07% | — | 8/1/00 |

| A Class | ACVAX | | | | | | 10/2/96 |

| No sales charge | | | 8.12% | 7.12% | 7.59% | — | |

| With sales charge | | | 1.90% | 5.86% | 6.95% | — | |

| C Class | ASTAX | | 7.29% | 6.33% | 6.78% | — | 11/27/01 |

| R Class | AAARX | | 7.71% | 6.84% | 7.32% | — | 3/31/05 |

| R5 Class | ASAUX | | 8.66% | 7.59% | — | 8.57% | 4/10/17 |

| R6 Class | AAAUX | | 8.71% | 7.77% | 8.24% | — | 7/26/13 |

Average annual returns since inception are presented when ten years of performance history is not available.

Fund returns would have been lower if a portion of the fees had not been waived.

C Class shares will automatically convert to A Class shares after being held for approximately eight years. C Class average annual returns do not reflect this conversion.

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

| | |

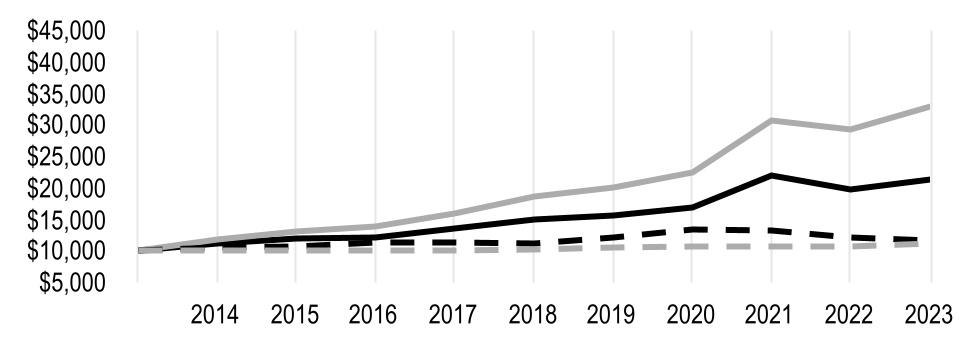

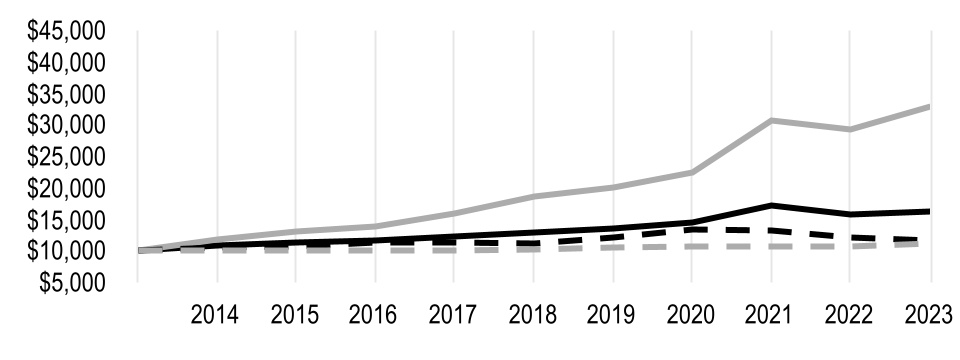

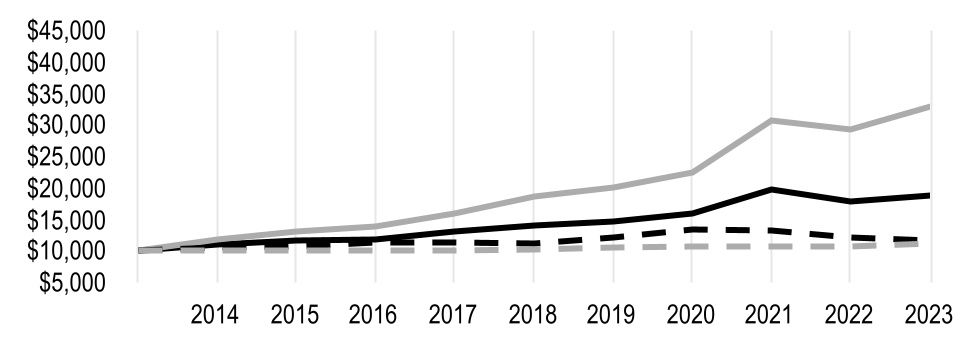

| Growth of $10,000 Over 10 Years |

| $10,000 investment made July 31, 2013 |

| Performance for other share classes will vary due to differences in fee structure. |

| | | | | |

| Value on July 31, 2023 |

| Investor Class — $21,317 |

|

| S&P 500 Index — $32,936 |

|

| Bloomberg U.S. Aggregate Bond Index — $11,601 |

|

| Bloomberg U.S. 1-3 Month Treasury Bill Index — $11,048 |

|

Ending value of Investor Class would have been lower if a portion of the fees had not been waived.

| | | | | | | | | | | | | | | | | | | | |

Total Annual Fund Operating Expenses | | |

| Investor Class | I Class | A Class | C Class | R Class | R5 Class | R6 Class |

| 1.34% | 1.14% | 1.59% | 2.34% | 1.84% | 1.14% | 0.99% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

Portfolio Managers: Richard Weiss, Scott Wilson, Radu Gabudean, Vidya Rajappa and Brian Garbe

Performance Summary

Strategic Allocation: Aggressive returned 8.35%* for the fiscal period ended July 31, 2023. Because of the fund’s strategic exposure to a variety of asset classes, a review of the financial markets helps provide context around performance for the reporting period.

Market Overview

Global stocks produced strong gains over the past 12 months amid considerable volatility. After falling sharply in the second half of 2022 due to rising inflation, the Federal Reserve’s (Fed) interest rate increases and the ongoing war in Ukraine, stocks staged a strong rebound from October 2022 through period-end. They benefited as inflation eased, concerns about a possible recession faded and corporate earnings mostly beat consensus expectations. Non-U.S. developed markets equities outperformed U.S. stocks, which in turn did better than emerging markets equities.

Bonds produced negative returns, having declined substantially early in the 12-month period before rebounding early in 2023. Nevertheless, stronger-than-expected economic data and the debt ceiling crisis weighed on U.S. government bonds in particular. Corporate bonds held up better, while more economically sensitive high-yield bonds produced positive absolute returns. Non-U.S. bonds outperformed those of the U.S. after hedging out currency effects.

Tactical Positioning

Strategic Allocation: Aggressive’s neutral asset mix throughout the period was 79% stocks, 20% bonds and 1% cash-equivalent investments. However, the portfolio’s actual asset weightings varied based on short-term tactical adjustments and fluctuating securities prices.

The value of a diversified approach is clear during periods of intense volatility. As rising interest rates, inflation and recession fears weighed on financial markets, the portfolio’s strategic diversification helped manage volatility. In an effort to add value and improve the fund’s ability to achieve its objective, we made modest adjustments to the asset allocation. Our tactical allocation and security selection decisions contributed to performance on the margin.

Our decision to favor cash over stocks and long-term bonds had a mixed effect. Continued Fed rate hikes meant cash performed well, while global bonds produced negative absolute returns. It was also beneficial to hold a modest cash overweight relative to stocks amid sharp volatility early in the period. Nevertheless, stocks ultimately produced strong positive returns, so it detracted from performance on the margin to be underweight stocks for the full reporting period. Similarly, it detracted modestly from performance to be overweight emerging markets equities for a time.

The portfolio was also underweight real estate investment trusts on a tactical basis because rising mortgage rates, indications of a slowing economy and widening credit spreads undermined their attractiveness. Stock selection and asset allocation decisions in global real estate benefited performance.

*All fund returns referenced in this commentary are for Investor Class shares. Fund returns would have been lower if a portion of the fees had not been waived. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the fund’s benchmark, other share classes may not. See page 3 for returns for all share classes.

| | | | | |

| JULY 31, 2023 |

| Types of Investments in Portfolio | % of net assets |

| Affiliated Funds | 53.6% |

| Common Stocks | 30.6% |

| U.S. Treasury Securities | 6.1% |

| Sovereign Governments and Agencies | 1.4% |

| Corporate Bonds | 1.4% |

| Collateralized Loan Obligations | 0.5% |

| Municipal Securities | 0.5% |

| Preferred Stocks | 0.2% |

| Asset-Backed Securities | 0.2% |

| Exchange-Traded Funds | 0.2% |

| Collateralized Mortgage Obligations | 0.1% |

| U.S. Government Agency Mortgage-Backed Securities | 0.1% |

| Short-Term Investments | 5.3% |

| Other Assets and Liabilities | (0.2)% |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from February 1, 2023 to July 31, 2023.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments mutual fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not through a financial intermediary or employer-sponsored retirement plan account), American Century Investments may charge you a $25 annual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $25 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments brokerage accounts, you are currently not subject to this fee. If you are subject to the account maintenance fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| Beginning

Account Value

2/1/23 | Ending

Account Value

7/31/23 | Expenses Paid During Period(1) 2/1/23 - 7/31/23 | Annualized Expense Ratio(1) |

| Actual |

| Investor Class | $1,000 | $1,051.20 | $3.20 | 0.63% |

| I Class | $1,000 | $1,050.30 | $2.19 | 0.43% |

| A Class | $1,000 | $1,049.10 | $4.47 | 0.88% |

| C Class | $1,000 | $1,045.10 | $8.27 | 1.63% |

| R Class | $1,000 | $1,047.80 | $5.74 | 1.13% |

| R5 Class | $1,000 | $1,051.70 | $2.19 | 0.43% |

| R6 Class | $1,000 | $1,051.90 | $1.42 | 0.28% |

| Hypothetical |

| Investor Class | $1,000 | $1,021.67 | $3.16 | 0.63% |

| I Class | $1,000 | $1,022.66 | $2.16 | 0.43% |

| A Class | $1,000 | $1,020.43 | $4.41 | 0.88% |

| C Class | $1,000 | $1,016.71 | $8.15 | 1.63% |

| R Class | $1,000 | $1,019.19 | $5.66 | 1.13% |

| R5 Class | $1,000 | $1,022.66 | $2.16 | 0.43% |

| R6 Class | $1,000 | $1,023.41 | $1.40 | 0.28% |

(1)Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses.

JULY 31, 2023

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

AFFILIATED FUNDS(1) — 53.6% | | | |

| American Century Diversified Corporate Bond ETF | | 288,278 | | $ | 13,162,572 | |

| American Century Emerging Markets Bond ETF | | 133,102 | | 5,057,996 | |

American Century Focused Dynamic Growth ETF(2) | | 558,118 | | 38,370,612 | |

| American Century Focused Large Cap Value ETF | | 662,536 | | 40,047,519 | |

| American Century Multisector Income ETF | | 531,791 | | 22,734,065 | |

| American Century Quality Diversified International ETF | | 721,671 | | 32,947,962 | |

| American Century Short Duration Strategic Income ETF | | 70,956 | | 3,589,068 | |

| American Century U.S. Quality Growth ETF | | 528,367 | | 37,392,533 | |

| American Century U.S. Quality Value ETF | | 813,148 | | 41,187,816 | |

Avantis Emerging Markets Equity ETF(3) | | 500,812 | | 28,696,528 | |

| Avantis International Equity ETF | | 520,872 | | 31,049,180 | |

| Avantis International Small Cap Value ETF | | 144,366 | | 8,793,333 | |

| Avantis U.S. Equity ETF | | 565,043 | | 44,350,225 | |

Avantis U.S. Small Cap Value ETF(3) | | 120,663 | | 10,163,444 | |

TOTAL AFFILIATED FUNDS (Cost $290,353,770) | | | 357,542,853 | |

| COMMON STOCKS — 30.6% | | | |

| Aerospace and Defense — 0.7% | | | |

| Airbus SE | | 2,788 | | 410,672 | |

CAE, Inc.(2) | | 18,048 | | 412,381 | |

| Curtiss-Wright Corp. | | 4,818 | | 921,973 | |

| General Dynamics Corp. | | 1,106 | | 247,279 | |

| HEICO Corp. | | 3,767 | | 662,917 | |

| Hensoldt AG | | 1,980 | | 67,320 | |

| Huntington Ingalls Industries, Inc. | | 2,827 | | 649,277 | |

| Lockheed Martin Corp. | | 1,055 | | 470,920 | |

| Melrose Industries PLC | | 74,493 | | 506,967 | |

Mercury Systems, Inc.(2) | | 1,718 | | 65,250 | |

| QinetiQ Group PLC | | 9,063 | | 37,526 | |

| | | 4,452,482 | |

| Air Freight and Logistics — 0.1% | | | |

Cargojet, Inc.(3) | | 1,058 | | 77,770 | |

| Cia de Distribucion Integral Logista Holdings SA | | 3,764 | | 104,734 | |

GXO Logistics, Inc.(2) | | 978 | | 65,594 | |

| United Parcel Service, Inc., Class B | | 2,106 | | 394,096 | |

| | | 642,194 | |

| Automobile Components — 0.7% | | | |

Aptiv PLC(2) | | 13,195 | | 1,444,720 | |

| BorgWarner, Inc. | | 9,894 | | 460,071 | |

| Cie Generale des Etablissements Michelin SCA | | 11,039 | | 361,495 | |

| Continental AG | | 6,072 | | 484,786 | |

Forvia(2) | | 3,972 | | 99,812 | |

Fox Factory Holding Corp.(2) | | 883 | | 98,808 | |

Gentherm, Inc.(2) | | 874 | | 52,239 | |

| Hyundai Mobis Co. Ltd. | | 2,483 | | 453,685 | |

| Linamar Corp. | | 8,563 | | 496,903 | |

Mobileye Global, Inc., Class A(2) | | 9,673 | | 369,315 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

| Nifco, Inc. | | 3,400 | | $ | 101,340 | |

| Toyo Tire Corp. | | 5,600 | | 75,825 | |

| | | 4,498,999 | |

| Automobiles — 0.4% | | | |

| Bayerische Motoren Werke AG | | 4,759 | | 580,360 | |

| Ferrari NV | | 1,920 | | 615,526 | |

| Mercedes-Benz Group AG | | 10,658 | | 851,179 | |

Tesla, Inc.(2) | | 2,133 | | 570,428 | |

Volvo Car AB, Class B(2) | | 56,034 | | 276,976 | |

| | | 2,894,469 | |

| Banks — 1.2% | | | |

| AIB Group PLC | | 19,596 | | 92,173 | |

| Banco Bradesco SA | | 214,089 | | 672,318 | |

| Banco do Brasil SA | | 32,700 | | 333,517 | |

| Bank Central Asia Tbk PT | | 1,010,900 | | 612,233 | |

| Bank of America Corp. | | 12,928 | | 413,696 | |

| Barclays PLC | | 265,691 | | 527,214 | |

| BNP Paribas SA | | 6,290 | | 414,812 | |

| BPER Banca | | 31,026 | | 107,359 | |

| Capitol Federal Financial, Inc. | | 19,317 | | 128,072 | |

| Commerce Bancshares, Inc. | | 905 | | 48,128 | |

| First Hawaiian, Inc. | | 22,597 | | 467,532 | |

| Fukuoka Financial Group, Inc. | | 3,600 | | 86,744 | |

| HDFC Bank Ltd., ADR | | 7,355 | | 502,199 | |

| HSBC Holdings PLC | | 80,000 | | 669,490 | |

| JPMorgan Chase & Co. | | 4,482 | | 707,977 | |

Jyske Bank A/S(2) | | 1,194 | | 90,320 | |

| Prosperity Bancshares, Inc. | | 4,459 | | 282,344 | |

| Regions Financial Corp. | | 14,922 | | 303,961 | |

| Standard Chartered PLC (London) | | 22,619 | | 217,268 | |

| Truist Financial Corp. | | 15,962 | | 530,258 | |

| U.S. Bancorp | | 8,561 | | 339,700 | |

| UniCredit SpA | | 3,863 | | 97,812 | |

| Westamerica Bancorporation | | 3,696 | | 181,806 | |

| | | 7,826,933 | |

| Beverages — 0.3% | | | |

Celsius Holdings, Inc.(2) | | 7,762 | | 1,123,161 | |

Duckhorn Portfolio, Inc.(2) | | 5,770 | | 72,587 | |

| MGP Ingredients, Inc. | | 1,090 | | 124,271 | |

| PepsiCo, Inc. | | 3,745 | | 702,038 | |

| | | 2,022,057 | |

| Biotechnology — 0.7% | | | |

| AbbVie, Inc. | | 3,513 | | 525,475 | |

ADMA Biologics, Inc.(2) | | 6,423 | | 26,655 | |

Alkermes PLC(2) | | 2,285 | | 66,905 | |

| Amgen, Inc. | | 1,160 | | 271,614 | |

Amicus Therapeutics, Inc.(2) | | 30,581 | | 416,513 | |

Arcus Biosciences, Inc.(2) | | 801 | | 15,940 | |

Arcutis Biotherapeutics, Inc.(2)(3) | | 2,122 | | 23,151 | |

Biohaven Ltd.(2) | | 1,800 | | 35,784 | |

BioMarin Pharmaceutical, Inc.(2) | | 3,946 | | 346,972 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

Blueprint Medicines Corp.(2) | | 864 | | $ | 57,024 | |

Bridgebio Pharma, Inc.(2) | | 878 | | 30,739 | |

Celldex Therapeutics, Inc.(2) | | 662 | | 23,408 | |

Centessa Pharmaceuticals PLC, ADR(2)(3) | | 2,615 | | 20,659 | |

Cerevel Therapeutics Holdings, Inc.(2)(3) | | 1,154 | | 35,301 | |

| CSL Ltd. | | 2,305 | | 415,168 | |

Cytokinetics, Inc.(2) | | 15,395 | | 513,423 | |

Halozyme Therapeutics, Inc.(2) | | 2,101 | | 90,259 | |

ImmunoGen, Inc.(2) | | 2,612 | | 46,546 | |

Insmed, Inc.(2) | | 2,368 | | 52,309 | |

Karuna Therapeutics, Inc.(2) | | 145 | | 28,967 | |

Keros Therapeutics, Inc.(2) | | 801 | | 33,546 | |

Kymera Therapeutics, Inc.(2)(3) | | 847 | | 18,532 | |

Madrigal Pharmaceuticals, Inc.(2) | | 183 | | 37,570 | |

Mineralys Therapeutics, Inc.(2) | | 1,719 | | 24,289 | |

Natera, Inc.(2) | | 1,897 | | 85,782 | |

Neurocrine Biosciences, Inc.(2) | | 7,671 | | 781,598 | |

Relay Therapeutics, Inc.(2) | | 1,285 | | 16,191 | |

Sarepta Therapeutics, Inc.(2) | | 4,569 | | 495,234 | |

Vaxcyte, Inc.(2) | | 1,325 | | 63,680 | |

Vertex Pharmaceuticals, Inc.(2) | | 497 | | 175,113 | |

Viking Therapeutics, Inc.(2) | | 10,569 | | 153,250 | |

| Vitrolife AB | | 2,880 | | 42,735 | |

| | | 4,970,332 | |

| Broadline Retail — 0.3% | | | |

Alibaba Group Holding Ltd.(2) | | 38,200 | | 488,172 | |

Amazon.com, Inc.(2) | | 8,303 | | 1,109,945 | |

| B&M European Value Retail SA | | 12,401 | | 88,083 | |

Etsy, Inc.(2) | | 1,139 | | 115,780 | |

| JD.com, Inc., Class A | | 14,016 | | 290,182 | |

Ollie's Bargain Outlet Holdings, Inc.(2) | | 1,323 | | 96,420 | |

| Ryohin Keikaku Co. Ltd. | | 1,600 | | 20,776 | |

Savers Value Village, Inc.(2) | | 659 | | 15,928 | |

| | | 2,225,286 | |

| Building Products — 0.4% | | | |

AZEK Co., Inc.(2) | | 4,348 | | 135,658 | |

| Cie de Saint-Gobain | | 14,880 | | 1,006,354 | |

Hayward Holdings, Inc.(2) | | 8,811 | | 117,715 | |

JELD-WEN Holding, Inc.(2) | | 6,981 | | 124,332 | |

| Johnson Controls International PLC | | 7,354 | | 511,471 | |

| Masco Corp. | | 3,737 | | 226,761 | |

| Trane Technologies PLC | | 3,812 | | 760,265 | |

Trex Co., Inc.(2) | | 836 | | 57,801 | |

| | | 2,940,357 | |

| Capital Markets — 1.4% | | | |

| Ameriprise Financial, Inc. | | 819 | | 285,380 | |

| Ares Management Corp., Class A | | 8,367 | | 830,174 | |

| Bank of New York Mellon Corp. | | 20,864 | | 946,391 | |

| BlackRock, Inc. | | 470 | | 347,259 | |

| Charles Schwab Corp. | | 4,239 | | 280,198 | |

| Evercore, Inc., Class A | | 329 | | 44,435 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

| Hamilton Lane, Inc., Class A | | 1,102 | | $ | 97,450 | |

| Intercontinental Exchange, Inc. | | 1,933 | | 221,908 | |

| Intermediate Capital Group PLC | | 3,823 | | 68,998 | |

| Julius Baer Group Ltd. | | 4,722 | | 334,448 | |

| London Stock Exchange Group PLC | | 6,370 | | 691,748 | |

| LPL Financial Holdings, Inc. | | 3,875 | | 888,770 | |

M&A Capital Partners Co. Ltd.(2) | | 2,400 | | 49,223 | |

| Man Group PLC | | 33,301 | | 102,087 | |

| Morgan Stanley | | 7,835 | | 717,373 | |

| MSCI, Inc. | | 1,987 | | 1,089,035 | |

| Northern Trust Corp. | | 13,430 | | 1,076,011 | |

| S&P Global, Inc. | | 671 | | 264,716 | |

| T. Rowe Price Group, Inc. | | 5,449 | | 671,644 | |

| | | 9,007,248 | |

| Chemicals — 0.7% | | | |

| Air Liquide SA | | 2,963 | | 532,730 | |

| Air Products & Chemicals, Inc. | | 817 | | 249,454 | |

| Akzo Nobel NV | | 7,251 | | 620,309 | |

| Avient Corp. | | 13,791 | | 558,949 | |

Axalta Coating Systems Ltd.(2) | | 2,506 | | 80,192 | |

| DSM-Firmenich AG | | 5,444 | | 600,087 | |

| Ecolab, Inc. | | 1,083 | | 198,341 | |

| Element Solutions, Inc. | | 31,232 | | 654,623 | |

| Kansai Paint Co. Ltd. | | 5,800 | | 95,070 | |

| Linde PLC | | 1,546 | | 603,976 | |

Perimeter Solutions SA(2) | | 8,470 | | 47,093 | |

| Sika AG | | 1,217 | | 378,776 | |

| Tokyo Ohka Kogyo Co. Ltd. | | 1,000 | | 63,161 | |

| | | 4,682,761 | |

| Commercial Services and Supplies — 0.4% | | | |

Clean Harbors, Inc.(2) | | 626 | | 104,079 | |

Driven Brands Holdings, Inc.(2) | | 4,940 | | 127,798 | |

| Elis SA | | 7,307 | | 150,963 | |

| GFL Environmental, Inc. | | 12,611 | | 430,539 | |

| Healthcare Services Group, Inc. | | 7,328 | | 92,406 | |

| Rentokil Initial PLC | | 58,684 | | 478,519 | |

| Republic Services, Inc. | | 7,464 | | 1,127,885 | |

| SPIE SA | | 4,356 | | 130,758 | |

| | | 2,642,947 | |

| Communications Equipment — 0.3% | | | |

Arista Networks, Inc.(2) | | 2,372 | | 367,874 | |

Ciena Corp.(2) | | 1,401 | | 59,122 | |

| Cisco Systems, Inc. | | 10,235 | | 532,629 | |

F5, Inc.(2) | | 3,351 | | 530,262 | |

| Juniper Networks, Inc. | | 11,656 | | 324,037 | |

| | | 1,813,924 | |

| Construction and Engineering — 0.2% | | | |

| Balfour Beatty PLC | | 23,393 | | 105,053 | |

Construction Partners, Inc., Class A(2) | | 2,800 | | 82,320 | |

| Eiffage SA | | 4,517 | | 469,938 | |

| Sacyr SA | | 30,322 | | 103,662 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

| SNC-Lavalin Group, Inc. | | 1,595 | | $ | 46,339 | |

| Vinci SA | | 4,408 | | 517,708 | |

| | | 1,325,020 | |

Construction Materials† | | | |

| Eagle Materials, Inc. | | 463 | | 85,363 | |

Summit Materials, Inc., Class A(2) | | 1,760 | | 63,677 | |

| Taiheiyo Cement Corp. | | 3,100 | | 64,741 | |

| | | 213,781 | |

Consumer Finance† | | | |

| American Express Co. | | 1,453 | | 245,383 | |

| Consumer Staples Distribution & Retail — 0.5% | | | |

BJ's Wholesale Club Holdings, Inc.(2) | | 769 | | 50,992 | |

| Costco Wholesale Corp. | | 512 | | 287,063 | |

| CP ALL PCL | | 185,000 | | 342,225 | |

Dollar Tree, Inc.(2) | | 5,075 | | 783,225 | |

Grocery Outlet Holding Corp.(2) | | 2,507 | | 83,859 | |

| Kobe Bussan Co. Ltd. | | 2,000 | | 53,253 | |

| Koninklijke Ahold Delhaize NV | | 24,620 | | 848,617 | |

| Kroger Co. | | 5,853 | | 284,690 | |

| MatsukiyoCocokara & Co. | | 1,600 | | 93,635 | |

Redcare Pharmacy NV(2) | | 581 | | 67,363 | |

| Sysco Corp. | | 5,837 | | 445,421 | |

| Target Corp. | | 2,276 | | 310,606 | |

| | | 3,650,949 | |

| Containers and Packaging — 0.5% | | | |

| Amcor PLC | | 55,310 | | 567,481 | |

| AptarGroup, Inc. | | 540 | | 65,588 | |

| Avery Dennison Corp. | | 3,303 | | 607,785 | |

| Ball Corp. | | 3,827 | | 224,607 | |

| DS Smith PLC | | 49,403 | | 196,419 | |

O-I Glass, Inc.(2) | | 2,849 | | 65,413 | |

| Packaging Corp. of America | | 5,447 | | 835,297 | |

| Smurfit Kappa Group PLC | | 17,620 | | 697,241 | |

| Sonoco Products Co. | | 3,433 | | 201,311 | |

| Verallia SA | | 3,524 | | 156,203 | |

| | | 3,617,345 | |

| Distributors — 0.1% | | | |

| D'ieteren Group | | 241 | | 42,090 | |

| LKQ Corp. | | 5,136 | | 281,401 | |

| | | 323,491 | |

Diversified Consumer Services† | | | |

European Wax Center, Inc., Class A(2) | | 4,090 | | 79,223 | |

| Diversified REITs — 0.1% | | | |

| Essential Properties Realty Trust, Inc. | | 4,963 | | 121,842 | |

| Land Securities Group PLC | | 23,133 | | 192,115 | |

| Stockland | | 23,749 | | 67,495 | |

| WP Carey, Inc. | | 3,761 | | 253,980 | |

| | | 635,432 | |

| Diversified Telecommunication Services — 0.2% | | | |

| BCE, Inc. | | 6,383 | | 275,718 | |

| Cellnex Telecom SA | | 9,756 | | 398,426 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

IHS Holding Ltd.(2)(3) | | 4,180 | | $ | 33,858 | |

| Internet Initiative Japan, Inc. | | 5,800 | | 107,993 | |

Usen-Next Holdings Co. Ltd.(3) | | 3,000 | | 69,391 | |

| Verizon Communications, Inc. | | 13,856 | | 472,212 | |

| | | 1,357,598 | |

| Electric Utilities — 0.6% | | | |

| Duke Energy Corp. | | 7,309 | | 684,268 | |

| Edison International | | 14,508 | | 1,043,996 | |

| Evergy, Inc. | | 6,961 | | 417,451 | |

| Eversource Energy | | 4,680 | | 338,504 | |

| Iberdrola SA | | 38,190 | | 476,670 | |

| IDACORP, Inc. | | 719 | | 73,928 | |

| NextEra Energy, Inc. | | 10,516 | | 770,823 | |

| Pinnacle West Capital Corp. | | 4,385 | | 363,166 | |

| | | 4,168,806 | |

| Electrical Equipment — 0.8% | | | |

| AMETEK, Inc. | | 5,735 | | 909,571 | |

| Eaton Corp. PLC | | 2,056 | | 422,138 | |

| Emerson Electric Co. | | 9,713 | | 887,282 | |

Generac Holdings, Inc.(2) | | 520 | | 79,924 | |

| Legrand SA | | 317 | | 31,781 | |

| nVent Electric PLC | | 7,131 | | 377,087 | |

Plug Power, Inc.(2)(3) | | 6,605 | | 86,658 | |

| Regal Rexnord Corp. | | 5,297 | | 827,285 | |

| Schneider Electric SE | | 3,720 | | 663,544 | |

| Sensata Technologies Holding PLC | | 1,871 | | 79,050 | |

| Signify NV | | 12,501 | | 393,050 | |

| Vertiv Holdings Co., Class A | | 12,195 | | 317,192 | |

| | | 5,074,562 | |

| Electronic Equipment, Instruments and Components — 0.6% | | |

| CDW Corp. | | 2,100 | | 392,847 | |

| Cognex Corp. | | 11,825 | | 645,882 | |

| Corning, Inc. | | 5,394 | | 183,072 | |

Fabrinet(2) | | 336 | | 41,543 | |

| Jenoptik AG | | 2,311 | | 74,748 | |

| Keyence Corp. | | 1,200 | | 538,490 | |

Keysight Technologies, Inc.(2) | | 6,749 | | 1,087,129 | |

| Littelfuse, Inc. | | 359 | | 109,351 | |

Mirion Technologies, Inc., Class A(2) | | 4,990 | | 37,675 | |

| National Instruments Corp. | | 1,843 | | 108,737 | |

| Spectris PLC | | 1,335 | | 60,245 | |

| Taiyo Yuden Co. Ltd. | | 700 | | 20,874 | |

| TE Connectivity Ltd. | | 3,179 | | 456,155 | |

| | | 3,756,748 | |

| Energy Equipment and Services — 0.3% | | | |

| Aker Solutions ASA | | 17,087 | | 75,955 | |

| Baker Hughes Co. | | 13,308 | | 476,293 | |

Expro Group Holdings NV(2) | | 6,003 | | 133,207 | |

| Schlumberger NV | | 11,251 | | 656,383 | |

Seadrill Ltd.(2) | | 4,575 | | 223,763 | |

TechnipFMC PLC(2) | | 4,250 | | 77,945 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

Transocean Ltd.(2) | | 9,548 | | $ | 84,023 | |

Weatherford International PLC(2) | | 2,568 | | 213,401 | |

| | | 1,940,970 | |

| Entertainment — 0.3% | | | |

| CTS Eventim AG & Co. KGaA | | 1,243 | | 84,830 | |

| Electronic Arts, Inc. | | 3,004 | | 409,595 | |

Liberty Media Corp.-Liberty Formula One, Class C(2) | | 1,370 | | 99,462 | |

Spotify Technology SA(2) | | 5,546 | | 828,628 | |

Take-Two Interactive Software, Inc.(2) | | 3,706 | | 566,796 | |

Walt Disney Co.(2) | | 2,169 | | 192,802 | |

| | | 2,182,113 | |

| Financial Services — 0.4% | | | |

Adyen NV(2) | | 526 | | 976,264 | |

AvidXchange Holdings, Inc.(2) | | 4,173 | | 51,787 | |

| Edenred | | 5,376 | | 349,173 | |

Euronet Worldwide, Inc.(2) | | 486 | | 42,705 | |

| GMO Payment Gateway, Inc. | | 1,000 | | 76,289 | |

| Mastercard, Inc., Class A | | 1,342 | | 529,124 | |

Shift4 Payments, Inc., Class A(2) | | 1,057 | | 72,922 | |

| Visa, Inc., Class A | | 3,315 | | 788,075 | |

| | | 2,886,339 | |

| Food Products — 0.6% | | | |

| Conagra Brands, Inc. | | 30,258 | | 992,765 | |

| Hershey Co. | | 6,072 | | 1,404,514 | |

| J.M. Smucker Co. | | 2,173 | | 327,363 | |

| Kerry Group PLC, A Shares | | 3,797 | | 377,235 | |

| Kotobuki Spirits Co. Ltd. | | 1,200 | | 91,338 | |

| Mondelez International, Inc., Class A | | 4,898 | | 363,089 | |

Nomad Foods Ltd.(2) | | 3,446 | | 61,270 | |

Sovos Brands, Inc.(2) | | 2,643 | | 47,045 | |

SunOpta, Inc.(2) | | 9,004 | | 59,697 | |

| Toyo Suisan Kaisha Ltd. | | 2,500 | | 103,405 | |

| Yamazaki Baking Co. Ltd. | | 4,700 | | 67,639 | |

| | | 3,895,360 | |

| Gas Utilities — 0.2% | | | |

| Atmos Energy Corp. | | 1,977 | | 240,621 | |

| Brookfield Infrastructure Corp., Class A | | 2,363 | | 110,399 | |

Nippon Gas Co. Ltd.(3) | | 2,900 | | 42,675 | |

| Spire, Inc. | | 11,771 | | 748,283 | |

| | | 1,141,978 | |

| Ground Transportation — 0.4% | | | |

| Canadian Pacific Kansas City Ltd. | | 8,280 | | 681,288 | |

| Heartland Express, Inc. | | 18,898 | | 308,982 | |

| Norfolk Southern Corp. | | 3,874 | | 904,928 | |

Saia, Inc.(2) | | 117 | | 49,507 | |

Uber Technologies, Inc.(2) | | 2,579 | | 127,557 | |

| Union Pacific Corp. | | 628 | | 145,709 | |

XPO, Inc.(2) | | 1,655 | | 114,592 | |

| | | 2,332,563 | |

| Health Care Equipment and Supplies — 1.0% | | | |

Alphatec Holdings, Inc.(2) | | 5,478 | | 96,796 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

| Becton Dickinson & Co. | | 604 | | $ | 168,287 | |

| ConvaTec Group PLC | | 15,560 | | 41,687 | |

| DENTSPLY SIRONA, Inc. | | 6,893 | | 286,197 | |

DexCom, Inc.(2) | | 9,490 | | 1,182,074 | |

| Embecta Corp. | | 11,112 | | 237,130 | |

Envista Holdings Corp.(2) | | 10,383 | | 357,279 | |

| EssilorLuxottica SA | | 1,988 | | 399,936 | |

Establishment Labs Holdings, Inc.(2) | | 1,059 | | 76,259 | |

| GE HealthCare Technologies, Inc. | | 4,490 | | 350,220 | |

Glaukos Corp.(2) | | 5,365 | | 413,856 | |

Hologic, Inc.(2) | | 1,755 | | 139,382 | |

ICU Medical, Inc.(2) | | 419 | | 74,657 | |

Inari Medical, Inc.(2) | | 1,435 | | 81,895 | |

Inmode Ltd.(2) | | 2,287 | | 98,135 | |

Intuitive Surgical, Inc.(2) | | 544 | | 176,474 | |

Lantheus Holdings, Inc.(2) | | 5,305 | | 458,830 | |

| Nakanishi, Inc. | | 1,900 | | 43,779 | |

PROCEPT BioRobotics Corp.(2) | | 2,114 | | 72,806 | |

| ResMed, Inc. | | 372 | | 82,714 | |

Silk Road Medical, Inc.(2) | | 1,933 | | 44,150 | |

Smith & Nephew PLC, ADR(3) | | 7,526 | | 228,640 | |

| Terumo Corp. | | 13,800 | | 451,937 | |

TransMedics Group, Inc.(2) | | 504 | | 46,963 | |

| Zimmer Biomet Holdings, Inc. | | 7,193 | | 993,713 | |

| | | 6,603,796 | |

| Health Care Providers and Services — 1.0% | | | |

Acadia Healthcare Co., Inc.(2) | | 1,232 | | 97,365 | |

| AmerisourceBergen Corp. | | 1,942 | | 362,960 | |

| Amvis Holdings, Inc. | | 4,700 | | 95,413 | |

| Cardinal Health, Inc. | | 4,400 | | 402,468 | |

Centene Corp.(2) | | 4,870 | | 331,598 | |

| Chartwell Retirement Residences | | 7,827 | | 59,416 | |

| Cigna Group | | 2,118 | | 625,022 | |

| CVS Health Corp. | | 4,884 | | 364,786 | |

| Ensign Group, Inc. | | 1,024 | | 99,195 | |

HealthEquity, Inc.(2) | | 1,707 | | 115,974 | |

Henry Schein, Inc.(2) | | 11,160 | | 879,296 | |

| Humana, Inc. | | 423 | | 193,239 | |

| Laboratory Corp. of America Holdings | | 2,490 | | 532,686 | |

Option Care Health, Inc.(2) | | 3,013 | | 101,779 | |

| Quest Diagnostics, Inc. | | 5,472 | | 739,869 | |

R1 RCM, Inc.(2) | | 21,491 | | 371,364 | |

Surgery Partners, Inc.(2) | | 1,831 | | 70,732 | |

| UnitedHealth Group, Inc. | | 1,725 | | 873,488 | |

| Universal Health Services, Inc., Class B | | 4,479 | | 622,402 | |

| | | 6,939,052 | |

| Health Care REITs — 0.2% | | | |

| Healthpeak Properties, Inc. | | 26,547 | | 579,521 | |

| Omega Healthcare Investors, Inc. | | 2,315 | | 73,849 | |

| Sabra Health Care REIT, Inc. | | 7,177 | | 93,229 | |

| Ventas, Inc. | | 3,692 | | 179,136 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

| Welltower, Inc. | | 1,456 | | $ | 119,610 | |

| | | 1,045,345 | |

Health Care Technology† | | | |

Evolent Health, Inc., Class A(2) | | 2,856 | | 86,794 | |

Schrodinger, Inc.(2) | | 901 | | 47,131 | |

| | | 133,925 | |

| Hotel & Resort REITs — 0.1% | | | |

| Invincible Investment Corp. | | 474 | | 196,371 | |

| Japan Hotel REIT Investment Corp. | | 193 | | 95,835 | |

| Park Hotels & Resorts, Inc. | | 3,108 | | 42,362 | |

| Ryman Hospitality Properties, Inc. | | 1,456 | | 138,743 | |

| | | 473,311 | |

| Hotels, Restaurants and Leisure — 0.7% | | | |

Airbnb, Inc., Class A(2) | | 9,221 | | 1,403,344 | |

Basic-Fit NV(2)(3) | | 1,265 | | 42,699 | |

Chipotle Mexican Grill, Inc.(2) | | 233 | | 457,211 | |

| Churchill Downs, Inc. | | 524 | | 60,705 | |

| Food & Life Cos. Ltd. | | 3,300 | | 64,934 | |

| Greggs PLC | | 1,368 | | 48,514 | |

H World Group Ltd., ADR(2) | | 9,598 | | 461,088 | |

| Hilton Worldwide Holdings, Inc. | | 9,143 | | 1,421,645 | |

| Hyatt Hotels Corp., Class A | | 495 | | 62,543 | |

Planet Fitness, Inc., Class A(2) | | 1,915 | | 129,339 | |

| Starbucks Corp. | | 2,282 | | 231,783 | |

Trainline PLC(2) | | 12,142 | | 41,031 | |

| Wingstop, Inc. | | 408 | | 68,781 | |

| | | 4,493,617 | |

| Household Durables — 0.2% | | | |

| Barratt Developments PLC | | 78,680 | | 460,562 | |

| Bellway PLC | | 1,611 | | 45,811 | |

| SEB SA | | 555 | | 62,130 | |

| Taylor Wimpey PLC | | 341,431 | | 501,173 | |

TopBuild Corp.(2) | | 252 | | 69,030 | |

| | | 1,138,706 | |

| Household Products — 0.3% | | | |

| Colgate-Palmolive Co. | | 2,278 | | 173,720 | |

| Henkel AG & Co. KGaA, Preference Shares | | 5,305 | | 409,367 | |

| Kimberly-Clark Corp. | | 5,026 | | 648,857 | |

| Procter & Gamble Co. | | 2,737 | | 427,793 | |

| Reckitt Benckiser Group PLC | | 6,303 | | 472,171 | |

| | | 2,131,908 | |

| Industrial Conglomerates — 0.1% | | | |

| Honeywell International, Inc. | | 1,832 | | 355,646 | |

| Industrial REITs — 0.3% | | | |

| Americold Realty Trust, Inc. | | 2,216 | | 71,843 | |

| EastGroup Properties, Inc. | | 396 | | 70,163 | |

| GLP J-Reit | | 56 | | 55,169 | |

| Goodman Group | | 16,670 | | 230,499 | |

| Mapletree Logistics Trust | | 71,100 | | 90,388 | |

| Prologis, Inc. | | 11,000 | | 1,372,250 | |

| Segro PLC | | 10,345 | | 101,376 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

| Terreno Realty Corp. | | 1,206 | | $ | 71,564 | |

| Tritax Big Box REIT PLC | | 49,636 | | 88,015 | |

| | | 2,151,267 | |

| Insurance — 0.9% | | | |

| Aflac, Inc. | | 7,107 | | 514,120 | |

| AIA Group Ltd. | | 54,800 | | 548,260 | |

| Allstate Corp. | | 9,239 | | 1,041,051 | |

| ASR Nederland NV | | 1,439 | | 65,229 | |

Goosehead Insurance, Inc., Class A(2) | | 983 | | 65,733 | |

| Hanover Insurance Group, Inc. | | 3,312 | | 375,846 | |

| Kinsale Capital Group, Inc. | | 341 | | 127,067 | |

| Marsh & McLennan Cos., Inc. | | 1,816 | | 342,171 | |

Palomar Holdings, Inc.(2) | | 945 | | 57,229 | |

| Prudential Financial, Inc. | | 2,878 | | 277,698 | |

| Reinsurance Group of America, Inc. | | 4,492 | | 630,452 | |

| RLI Corp. | | 683 | | 91,119 | |

Ryan Specialty Holdings, Inc., Class A(2) | | 12,868 | | 557,699 | |

Skyward Specialty Insurance Group, Inc.(2) | | 2,047 | | 48,493 | |

| Steadfast Group Ltd. | | 18,591 | | 72,937 | |

| Storebrand ASA | | 7,296 | | 63,775 | |

| Travelers Cos., Inc. | | 2,030 | | 350,398 | |

| Willis Towers Watson PLC | | 3,231 | | 682,807 | |

| | | 5,912,084 | |

| Interactive Media and Services — 0.8% | | | |

Alphabet, Inc., Class A(2) | | 14,825 | | 1,967,574 | |

| Autohome, Inc., ADR | | 9,125 | | 291,726 | |

Baidu, Inc., Class A(2) | | 22,000 | | 430,117 | |

| carsales.com Ltd. | | 5,179 | | 86,571 | |

Eventbrite, Inc., Class A(2) | | 9,823 | | 113,063 | |

Match Group, Inc.(2) | | 10,402 | | 483,797 | |

Meta Platforms, Inc., Class A(2) | | 2,564 | | 816,891 | |

| Tencent Holdings Ltd. | | 25,900 | | 1,190,393 | |

| | | 5,380,132 | |

| IT Services — 0.4% | | | |

| Accenture PLC, Class A | | 1,550 | | 490,342 | |

Alten SA(3) | | 700 | | 100,824 | |

| Amdocs Ltd. | | 6,000 | | 561,840 | |

Cloudflare, Inc., Class A(2) | | 9,462 | | 650,702 | |

| International Business Machines Corp. | | 2,620 | | 377,751 | |

NEXTDC Ltd.(2) | | 78,711 | | 675,538 | |

Perficient, Inc.(2) | | 552 | | 35,212 | |

| | | 2,892,209 | |

| Leisure Products — 0.1% | | | |

| Brunswick Corp. | | 1,047 | | 90,367 | |

| Games Workshop Group PLC | | 504 | | 75,351 | |

| Sankyo Co. Ltd. | | 1,900 | | 80,373 | |

| Sega Sammy Holdings, Inc. | | 3,700 | | 80,899 | |

Topgolf Callaway Brands Corp.(2) | | 4,183 | | 83,534 | |

| | | 410,524 | |

| Life Sciences Tools and Services — 1.0% | | | |

| Agilent Technologies, Inc. | | 10,139 | | 1,234,629 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

Avantor, Inc.(2) | | 12,540 | | $ | 257,948 | |

| Bio-Techne Corp. | | 9,390 | | 783,126 | |

| Danaher Corp. | | 1,502 | | 383,100 | |

| Gerresheimer AG | | 1,141 | | 135,145 | |

ICON PLC(2) | | 1,985 | | 499,049 | |

IQVIA Holdings, Inc.(2) | | 5,074 | | 1,135,358 | |

| Lonza Group AG | | 1,134 | | 658,895 | |

MaxCyte, Inc.(2) | | 7,139 | | 31,911 | |

Mettler-Toledo International, Inc.(2) | | 919 | | 1,155,615 | |

| Thermo Fisher Scientific, Inc. | | 764 | | 419,176 | |

| | | 6,693,952 | |

| Machinery — 0.7% | | | |

| Astec Industries, Inc. | | 1,704 | | 84,178 | |

ATS Corp.(2) | | 922 | | 41,812 | |

| Cummins, Inc. | | 2,554 | | 666,083 | |

| Deere & Co. | | 580 | | 249,168 | |

| Graco, Inc. | | 5,208 | | 413,151 | |

| Hoshizaki Corp. | | 1,800 | | 69,032 | |

| IMI PLC | | 17,560 | | 367,134 | |

| Interpump Group SpA | | 1,128 | | 61,373 | |

| Interroll Holding AG | | 14 | | 44,782 | |

| KION Group AG | | 1,083 | | 45,381 | |

Kornit Digital Ltd.(2) | | 2,079 | | 65,883 | |

| Metso Oyj | | 5,749 | | 65,332 | |

Organo Corp.(3) | | 2,600 | | 75,357 | |

| Oshkosh Corp. | | 9,340 | | 859,934 | |

| Parker-Hannifin Corp. | | 2,099 | | 860,611 | |

| Trelleborg AB, B Shares | | 2,537 | | 67,542 | |

Valmet Oyj(3) | | 1,684 | | 44,669 | |

| Weir Group PLC | | 3,441 | | 81,041 | |

| Xylem, Inc. | | 1,851 | | 208,700 | |

| | | 4,371,163 | |

| Media — 0.4% | | | |

| Fox Corp., Class B | | 16,982 | | 533,405 | |

| Interpublic Group of Cos., Inc. | | 12,072 | | 413,225 | |

| Omnicom Group, Inc. | | 2,806 | | 237,444 | |

Trade Desk, Inc., Class A(2) | | 12,021 | | 1,097,036 | |

| WPP PLC | | 53,592 | | 585,156 | |

| | | 2,866,266 | |

| Metals and Mining — 0.1% | | | |

| Alamos Gold, Inc., Class A | | 7,502 | | 92,676 | |

Allkem Ltd.(2) | | 8,181 | | 81,905 | |

AMG Critical Materials NV(3) | | 2,604 | | 106,465 | |

Capstone Copper Corp.(2) | | 37,031 | | 193,488 | |

ERO Copper Corp.(2) | | 13,035 | | 313,358 | |

MMC Norilsk Nickel PJSC(2)(4) | | 2,446 | | — | |

| | | 787,892 | |

| Multi-Utilities — 0.1% | | | |

| NorthWestern Corp. | | 12,625 | | 712,934 | |

Office REITs† | | | |

| Boston Properties, Inc. | | 1,465 | | 97,613 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

SL Green Realty Corp.(3) | | 1,484 | | $ | 55,962 | |

| | | 153,575 | |

| Oil, Gas and Consumable Fuels — 0.8% | | | |

Antero Resources Corp.(2) | | 4,561 | | 122,007 | |

| ConocoPhillips | | 5,871 | | 691,134 | |

| Devon Energy Corp. | | 6,635 | | 358,290 | |

| Diamondback Energy, Inc. | | 2,566 | | 378,023 | |

| Enterprise Products Partners LP | | 28,072 | | 744,189 | |

| EOG Resources, Inc. | | 4,653 | | 616,662 | |

| EQT Corp. | | 7,799 | | 328,962 | |

| Euronav NV | | 772 | | 12,683 | |

| Excelerate Energy, Inc., Class A | | 7,797 | | 165,452 | |

| Golar LNG Ltd. | | 732 | | 17,656 | |

| Hess Corp. | | 10,756 | | 1,632,008 | |

| | | 5,067,066 | |

| Paper and Forest Products — 0.1% | | | |

| Louisiana-Pacific Corp. | | 923 | | 70,268 | |

| Mondi PLC | | 24,486 | | 429,499 | |

| Stella-Jones, Inc. | | 2,388 | | 121,261 | |

| | | 621,028 | |

| Passenger Airlines — 0.1% | | | |

| Southwest Airlines Co. | | 20,849 | | 712,202 | |

Personal Care Products† | | | |

Beauty Health Co.(2)(3) | | 6,490 | | 53,802 | |

| Rohto Pharmaceutical Co. Ltd. | | 6,200 | | 132,151 | |

| | | 185,953 | |

| Pharmaceuticals — 1.1% | | | |

Arvinas, Inc.(2) | | 961 | | 23,756 | |

| AstraZeneca PLC | | 5,790 | | 831,885 | |

| AstraZeneca PLC, ADR | | 8,771 | | 628,881 | |

| Bristol-Myers Squibb Co. | | 7,472 | | 464,684 | |

Edgewise Therapeutics, Inc.(2) | | 2,306 | | 16,811 | |

| Eli Lilly & Co. | | 447 | | 203,184 | |

| GSK PLC | | 49,468 | | 880,587 | |

Harmony Biosciences Holdings, Inc.(2) | | 584 | | 20,656 | |

| Hikma Pharmaceuticals PLC | | 11,983 | | 321,802 | |

Indivior PLC(2) | | 3,487 | | 78,533 | |

Intra-Cellular Therapies, Inc.(2) | | 1,509 | | 93,317 | |

| Merck & Co., Inc. | | 3,770 | | 402,071 | |

| Novo Nordisk A/S, B Shares | | 7,434 | | 1,198,749 | |

Reata Pharmaceuticals, Inc., Class A(2) | | 196 | | 32,454 | |

| Roche Holding AG | | 1,451 | | 449,884 | |

| Sanofi, ADR | | 15,150 | | 808,555 | |

| Takeda Pharmaceutical Co. Ltd. | | 6,200 | | 189,564 | |

| UCB SA | | 4,062 | | 359,679 | |

Ventyx Biosciences, Inc.(2) | | 1,063 | | 39,384 | |

Verona Pharma PLC, ADR(2) | | 1,026 | | 22,664 | |

| Zoetis, Inc. | | 1,978 | | 372,042 | |

| | | 7,439,142 | |

| Professional Services — 0.5% | | | |

| Adecco Group AG | | 19,267 | | 785,214 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

| BayCurrent Consulting, Inc. | | 14,100 | | $ | 455,356 | |

CACI International, Inc., Class A(2) | | 306 | | 107,234 | |

First Advantage Corp.(2) | | 2,683 | | 40,245 | |

| Jacobs Solutions, Inc. | | 6,469 | | 811,277 | |

| Korn Ferry | | 1,175 | | 61,899 | |

| Paycom Software, Inc. | | 1,440 | | 531,014 | |

Paycor HCM, Inc.(2) | | 2,474 | | 66,452 | |

| TechnoPro Holdings, Inc. | | 1,500 | | 38,835 | |

UT Group Co. Ltd.(2) | | 2,800 | | 56,596 | |

| Verisk Analytics, Inc. | | 2,452 | | 561,361 | |

| | | 3,515,483 | |

| Real Estate Management and Development — 0.1% | | | |

| FirstService Corp. | | 698 | | 109,328 | |

| FirstService Corp. (Toronto) | | 643 | | 100,703 | |

| Mitsui Fudosan Co. Ltd. | | 4,600 | | 94,507 | |

| PSP Swiss Property AG | | 739 | | 87,084 | |

| Tokyu Fudosan Holdings Corp. | | 23,500 | | 139,706 | |

| | | 531,328 | |

| Residential REITs — 0.2% | | | |

| American Homes 4 Rent, Class A | | 4,365 | | 163,600 | |

| AvalonBay Communities, Inc. | | 1,727 | | 325,799 | |

| Boardwalk Real Estate Investment Trust | | 785 | | 38,998 | |

| Canadian Apartment Properties REIT | | 3,053 | | 119,027 | |

Comforia Residential REIT, Inc.(3) | | 17 | | 40,697 | |

| Essex Property Trust, Inc. | | 2,723 | | 663,187 | |

| Invitation Homes, Inc. | | 4,651 | | 165,111 | |

| Sun Communities, Inc. | | 388 | | 50,556 | |

| UDR, Inc. | | 2,095 | | 85,644 | |

| | | 1,652,619 | |

| Retail REITs — 0.3% | | | |

| Agree Realty Corp. | | 955 | | 61,865 | |

| Brixmor Property Group, Inc. | | 3,387 | | 77,020 | |

| Kite Realty Group Trust | | 8,860 | | 202,717 | |

| Link REIT | | 8,200 | | 46,093 | |

| NETSTREIT Corp. | | 2,206 | | 39,465 | |

| Realty Income Corp. | | 11,948 | | 728,470 | |

| Regency Centers Corp. | | 9,042 | | 592,522 | |

| Simon Property Group, Inc. | | 1,796 | | 223,782 | |

| Urban Edge Properties | | 5,880 | | 100,019 | |

| Vicinity Ltd. | | 28,430 | | 37,801 | |

| | | 2,109,754 | |

| Semiconductors and Semiconductor Equipment — 1.4% | | | |

Advanced Micro Devices, Inc.(2) | | 3,243 | | 370,999 | |

| AIXTRON SE | | 1,542 | | 61,175 | |

| Analog Devices, Inc. | | 2,346 | | 468,097 | |

| Applied Materials, Inc. | | 3,745 | | 567,705 | |

| ASML Holding NV | | 411 | | 294,387 | |

Credo Technology Group Holding Ltd.(2) | | 4,383 | | 74,380 | |

Enphase Energy, Inc.(2) | | 4,152 | | 630,398 | |

GLOBALFOUNDRIES, Inc.(2) | | 1,770 | | 112,731 | |

| Infineon Technologies AG | | 14,524 | | 638,119 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

Lattice Semiconductor Corp.(2) | | 995 | | $ | 90,485 | |

MACOM Technology Solutions Holdings, Inc.(2) | | 1,337 | | 93,483 | |

| Marvell Technology, Inc. | | 7,285 | | 474,472 | |

| Monolithic Power Systems, Inc. | | 1,268 | | 709,433 | |

Nova Ltd.(2)(3) | | 717 | | 88,865 | |

| NVIDIA Corp. | | 3,348 | | 1,564,487 | |

Onto Innovation, Inc.(2) | | 1,023 | | 127,179 | |

| Power Integrations, Inc. | | 1,561 | | 151,636 | |

Silicon Laboratories, Inc.(2) | | 489 | | 72,929 | |

| Socionext, Inc. | | 700 | | 82,828 | |

| SUMCO Corp. | | 51,400 | | 748,997 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. | | 45,000 | | 812,592 | |

| Teradyne, Inc. | | 10,126 | | 1,143,630 | |

| | | 9,379,007 | |

| Software — 1.8% | | | |

Adobe, Inc.(2) | | 304 | | 166,036 | |

Blackbaud, Inc.(2) | | 947 | | 71,451 | |

Box, Inc., Class A(2) | | 3,195 | | 99,844 | |

Cadence Design Systems, Inc.(2) | | 4,663 | | 1,091,189 | |

CyberArk Software Ltd.(2) | | 336 | | 55,779 | |

Datadog, Inc., Class A(2) | | 7,296 | | 851,589 | |

Descartes Systems Group, Inc.(2) | | 591 | | 46,096 | |

DocuSign, Inc.(2) | | 9,719 | | 523,077 | |

DoubleVerify Holdings, Inc.(2) | | 1,334 | | 56,161 | |

Five9, Inc.(2) | | 628 | | 55,107 | |

Guidewire Software, Inc.(2) | | 952 | | 80,749 | |

HubSpot, Inc.(2) | | 2,085 | | 1,210,447 | |

JFrog Ltd.(2) | | 1,521 | | 46,801 | |

Kinaxis, Inc.(2) | | 713 | | 96,813 | |

Manhattan Associates, Inc.(2) | | 4,982 | | 949,669 | |

| Microsoft Corp. | | 10,649 | | 3,577,212 | |

| m-up Holdings, Inc. | | 5,100 | | 40,302 | |

nCino, Inc.(2) | | 2,218 | | 71,752 | |

New Relic, Inc.(2) | | 620 | | 52,068 | |

Palantir Technologies, Inc., Class A(2) | | 34,181 | | 678,151 | |

Palo Alto Networks, Inc.(2) | | 3,048 | | 761,878 | |

QT Group Oyj(2) | | 758 | | 62,871 | |

Salesforce, Inc.(2) | | 2,137 | | 480,846 | |

| SAP SE | | 2,209 | | 301,333 | |

ServiceNow, Inc.(2) | | 187 | | 109,021 | |

SPS Commerce, Inc.(2) | | 841 | | 151,708 | |

TeamViewer SE(2) | | 2,685 | | 45,641 | |

Tenable Holdings, Inc.(2) | | 3,693 | | 179,701 | |

Workday, Inc., Class A(2) | | 674 | | 159,826 | |

| | | 12,073,118 | |

| Specialized REITs — 0.4% | | | |

| Big Yellow Group PLC | | 4,592 | | 63,196 | |

| Digital Realty Trust, Inc. | | 2,430 | | 302,827 | |

| Equinix, Inc. | | 926 | | 749,986 | |

| Extra Space Storage, Inc. | | 1,109 | | 154,783 | |

| Iron Mountain, Inc. | | 3,175 | | 194,945 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

| Keppel DC REIT | | 56,100 | | $ | 92,455 | |

| Public Storage | | 2,202 | | 620,413 | |

| VICI Properties, Inc. | | 12,906 | | 406,281 | |

| Weyerhaeuser Co. | | 2,350 | | 80,041 | |

| | | 2,664,927 | |

| Specialty Retail — 0.6% | | | |

Burlington Stores, Inc.(2) | | 3,572 | | 634,459 | |

CarMax, Inc.(2) | | 1,323 | | 109,293 | |

Chewy, Inc., Class A(2)(3) | | 6,941 | | 235,300 | |

Dufry AG(2) | | 1,430 | | 73,886 | |

| Fast Retailing Co. Ltd. | | 2,000 | | 501,025 | |

Five Below, Inc.(2) | | 1,461 | | 304,385 | |

| Home Depot, Inc. | | 2,352 | | 785,192 | |

| Kingfisher PLC | | 166,081 | | 523,715 | |

| Murphy USA, Inc. | | 205 | | 62,941 | |

Nextage Co. Ltd.(3) | | 2,000 | | 52,531 | |

| Pets at Home Group PLC | | 9,625 | | 48,367 | |

| TJX Cos., Inc. | | 5,223 | | 451,946 | |

| Tractor Supply Co. | | 739 | | 165,529 | |

| | | 3,948,569 | |

| Technology Hardware, Storage and Peripherals — 0.5% | | | |

| Apple, Inc. | | 11,890 | | 2,335,790 | |

| HP, Inc. | | 13,966 | | 458,504 | |

Pure Storage, Inc., Class A(2) | | 1,588 | | 58,740 | |

| Samsung Electronics Co. Ltd. | | 8,502 | | 465,507 | |

| | | 3,318,541 | |

| Textiles, Apparel and Luxury Goods — 0.4% | | | |

| Asics Corp. | | 4,500 | | 141,953 | |

Crocs, Inc.(2) | | 670 | | 72,595 | |

Deckers Outdoor Corp.(2) | | 408 | | 221,826 | |

| HUGO BOSS AG | | 1,259 | | 101,663 | |

| Li Ning Co. Ltd. | | 73,000 | | 445,039 | |

lululemon athletica, Inc.(2) | | 746 | | 282,383 | |

| LVMH Moet Hennessy Louis Vuitton SE | | 783 | | 727,225 | |

On Holding AG, Class A(2) | | 16,523 | | 594,828 | |

Tod's SpA(2) | | 1,949 | | 88,511 | |

| | | 2,676,023 | |

| Trading Companies and Distributors — 0.4% | | | |

AddTech AB, B Shares(3) | | 2,295 | | 42,755 | |

Beacon Roofing Supply, Inc.(2) | | 3,447 | | 295,305 | |

| Beijer Ref AB | | 5,586 | | 75,961 | |

| Bunzl PLC | | 6,696 | | 248,207 | |

| Diploma PLC | | 2,282 | | 94,914 | |

| Finning International, Inc. | | 2,682 | | 92,380 | |

| H&E Equipment Services, Inc. | | 1,667 | | 80,983 | |

| MonotaRO Co. Ltd. | | 19,200 | | 234,333 | |

MRC Global, Inc.(2) | | 5,935 | | 67,006 | |

| MSC Industrial Direct Co., Inc., Class A | | 6,584 | | 664,457 | |

NOW, Inc.(2) | | 7,980 | | 90,892 | |

| Rexel SA | | 21,932 | | 529,049 | |

| | | 2,516,242 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

Transportation Infrastructure† | | | |

| Japan Airport Terminal Co. Ltd. | | 2,600 | | $ | 121,161 | |

Water Utilities† | | | |

| SJW Group | | 1,544 | | 108,790 | |

| Wireless Telecommunication Services — 0.1% | | | |

| TIM SA | | 156,900 | | 474,142 | |

TOTAL COMMON STOCKS (Cost $157,360,370) | | | 204,210,049 | |

| U.S. TREASURY SECURITIES — 6.1% | | | |

| U.S. Treasury Bonds, 2.00%, 11/15/41 | | $ | 3,150,000 | | 2,262,032 | |

| U.S. Treasury Bonds, 2.375%, 2/15/42 | | 5,000,000 | | 3,815,918 | |

| U.S. Treasury Bonds, 3.00%, 5/15/42 | | 250,000 | | 210,767 | |

| U.S. Treasury Bonds, 3.75%, 11/15/43 | | 40,000 | | 37,404 | |

| U.S. Treasury Bonds, 3.125%, 8/15/44 | | 350,000 | | 296,194 | |

| U.S. Treasury Bonds, 3.00%, 5/15/45 | | 100,000 | | 82,533 | |

| U.S. Treasury Bonds, 3.00%, 11/15/45 | | 50,000 | | 41,156 | |

| U.S. Treasury Inflation Indexed Bonds, 2.375%, 1/15/25 | | 806,715 | | 797,579 | |

| U.S. Treasury Inflation Indexed Bonds, 2.375%, 1/15/27 | | 301,616 | | 303,545 | |

| U.S. Treasury Inflation Indexed Bonds, 2.125%, 2/15/40 | | 506,552 | | 536,027 | |

| U.S. Treasury Inflation Indexed Bonds, 0.75%, 2/15/42 | | 888,314 | | 743,921 | |

| U.S. Treasury Inflation Indexed Bonds, 0.625%, 2/15/43 | | 410,068 | | 330,157 | |

| U.S. Treasury Inflation Indexed Bonds, 1.375%, 2/15/44 | | 1,500,681 | | 1,387,123 | |

| U.S. Treasury Inflation Indexed Bonds, 0.75%, 2/15/45 | | 3,060,879 | | 2,478,979 | |

| U.S. Treasury Inflation Indexed Bonds, 0.875%, 2/15/47 | | 503,956 | | 413,929 | |

| U.S. Treasury Inflation Indexed Bonds, 0.125%, 2/15/51 | | 642,477 | | 416,639 | |

| U.S. Treasury Inflation Indexed Bonds, 0.125%, 2/15/52 | | 1,092,510 | | 704,739 | |

| U.S. Treasury Inflation Indexed Notes, 0.125%, 4/15/25 | | 2,178,209 | | 2,075,964 | |

| U.S. Treasury Inflation Indexed Notes, 0.875%, 1/15/29 | | 421,558 | | 401,264 | |

| U.S. Treasury Inflation Indexed Notes, 0.125%, 1/15/32 | | 1,678,609 | | 1,476,834 | |

| U.S. Treasury Notes, 2.00%, 5/31/24 | | 4,000,000 | | 3,890,782 | |

| U.S. Treasury Notes, 1.875%, 8/31/24 | | 4,000,000 | | 3,854,688 | |

| U.S. Treasury Notes, 2.75%, 7/31/27 | | 311,000 | | 293,306 | |

| U.S. Treasury Notes, 2.25%, 8/15/27 | | 200,000 | | 184,895 | |

| U.S. Treasury Notes, 3.875%, 11/30/27 | | 3,895,000 | | 3,835,738 | |

U.S. Treasury Notes, 1.50%, 11/30/28(5) | | 6,900,000 | | 6,027,393 | |

| U.S. Treasury Notes, 3.50%, 4/30/30 | | 3,550,000 | | 3,427,553 | |

| U.S. Treasury Notes, 3.375%, 5/15/33 | | 29,000 | | 27,666 | |

| U.S. Treasury Notes, VRN, 5.39%, (3-month USBMMY plus 0.04%), 10/31/23 | | 500,000 | | 500,116 | |

TOTAL U.S. TREASURY SECURITIES (Cost $45,037,561) | | | 40,854,841 | |

| SOVEREIGN GOVERNMENTS AND AGENCIES — 1.4% | | | |

Australia† | | | |

| Australia Government Bond, 3.00%, 3/21/47 | AUD | 120,000 | | 64,131 | |

| New South Wales Treasury Corp., 3.00%, 3/20/28 | AUD | 110,000 | | 70,355 | |

| | | 134,486 | |

Austria† | | | |

Republic of Austria Government Bond, 0.75%, 10/20/26(6) | EUR | 41,000 | | 42,038 | |

Republic of Austria Government Bond, 4.15%, 3/15/37(6) | EUR | 29,000 | | 35,114 | |

| | | 77,152 | |

Belgium† | | | |

Kingdom of Belgium Government Bond, 4.25%, 3/28/41(6) | EUR | 27,000 | | 33,014 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

| Canada — 0.4% | | | |

| Canadian Government Bond, 0.25%, 3/1/26 | CAD | 850,000 | | $ | 579,662 | |

| Canadian Government Bond, 3.50%, 3/1/28 | CAD | 1,785,000 | | 1,331,294 | |

| Province of British Columbia Canada, 2.85%, 6/18/25 | CAD | 201,000 | | 146,862 | |

| Province of Quebec Canada, 3.00%, 9/1/23 | CAD | 215,000 | | 162,760 | |

| Province of Quebec Canada, 5.75%, 12/1/36 | CAD | 108,000 | | 93,764 | |

| Province of Quebec Canada, 3.50%, 12/1/48 | CAD | 20,000 | | 13,321 | |

| | | 2,327,663 | |

| China — 0.4% | | | |

| China Government Bond, 2.88%, 11/5/23 | CNY | 19,000,000 | | 2,667,761 | |

| China Government Bond, 3.25%, 6/6/26 | CNY | 400,000 | | 57,738 | |

| China Government Bond, 3.29%, 5/23/29 | CNY | 300,000 | | 43,909 | |

| | | 2,769,408 | |

Denmark† | | | |

| Denmark Government Bond, 0.50%, 11/15/27 | DKK | 245,000 | | 32,915 | |

| Denmark Government Bond, 4.50%, 11/15/39 | DKK | 62,000 | | 11,135 | |

| | | 44,050 | |

| Finland — 0.1% | | | |

Finland Government Bond, 4.00%, 7/4/25(6) | EUR | 58,000 | | 64,694 | |

Finland Government Bond, 0.125%, 4/15/36(6) | EUR | 350,000 | | 263,713 | |

| | | 328,407 | |

| France — 0.1% | | | |

French Republic Government Bond OAT, 0.00%, 11/25/31(7) | EUR | 1,050,000 | | 909,737 | |

Germany† | | | |

Bundesrepublik Deutschland Bundesanleihe, 0.00%, 8/15/52(7) | EUR | 40,000 | | 21,512 | |

Ireland† | | | |

| Ireland Government Bond, 3.40%, 3/18/24 | EUR | 74,000 | | 81,419 | |

| Italy — 0.1% | | | |

| Italy Buoni Poliennali Del Tesoro, 1.50%, 6/1/25 | EUR | 35,000 | | 37,072 | |

| Italy Buoni Poliennali Del Tesoro, 2.00%, 12/1/25 | EUR | 223,000 | | 236,888 | |

| | | 273,960 | |

| Japan — 0.1% | | | |

| Japan Government Thirty Year Bond, 1.40%, 3/20/53 | JPY | 58,700,000 | | 408,144 | |

Malaysia† | | | |

| Malaysia Government Bond, 3.96%, 9/15/25 | MYR | 250,000 | | 56,069 | |

Mexico† | | | |

| Mexico Government International Bond, 4.15%, 3/28/27 | | $ | 200,000 | | 195,832 | |

Netherlands† | | | |

Netherlands Government Bond, 0.50%, 7/15/26(6) | EUR | 100,000 | | 102,513 | |

Netherlands Government Bond, 2.75%, 1/15/47(6) | EUR | 27,000 | | 29,384 | |

| | | 131,897 | |

Norway† | | | |

Norway Government Bond, 1.75%, 2/17/27(6) | NOK | 510,000 | | 46,515 | |

Peru† | | | |

| Peruvian Government International Bond, 5.625%, 11/18/50 | | $ | 60,000 | | 61,319 | |

Poland† | | | |

| Republic of Poland Government Bond, 4.00%, 10/25/23 | PLN | 215,000 | | 53,399 | |

Switzerland† | | | |

| Swiss Confederation Government Bond, 1.25%, 5/28/26 | CHF | 147,000 | | 169,359 | |

| Swiss Confederation Government Bond, 2.50%, 3/8/36 | CHF | 3,000 | | 4,073 | |

| | | 173,432 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

Thailand† | | | |

| Thailand Government Bond, 3.85%, 12/12/25 | THB | 3,200,000 | | $ | 96,934 | |

| United Kingdom — 0.2% | | | |

| United Kingdom Gilt, 0.125%, 1/30/26 | GBP | 1,100,000 | | 1,261,547 | |

Uruguay† | | | |

| Uruguay Government International Bond, 4.125%, 11/20/45 | | $ | 30,000 | | 27,246 | |

TOTAL SOVEREIGN GOVERNMENTS AND AGENCIES (Cost $10,778,973) | | | 9,513,142 | |

| CORPORATE BONDS — 1.4% | | | |

Aerospace and Defense† | | | |

| TransDigm, Inc., 6.375%, 6/15/26 | | 50,000 | | 49,534 | |

| TransDigm, Inc., 4.625%, 1/15/29 | | 190,000 | | 169,803 | |

| | | 219,337 | |

Automobile Components† | | | |

ZF North America Capital, Inc., 4.75%, 4/29/25(6) | | 110,000 | | 107,058 | |

| Automobiles — 0.1% | | | |

| Ford Motor Credit Co. LLC, 3.625%, 6/17/31 | | 370,000 | | 306,181 | |

| Banks — 0.5% | | | |

Avi Funding Co. Ltd., 3.80%, 9/16/25(6) | | 143,000 | | 138,357 | |

| Banco Santander SA, 2.50%, 3/18/25 | EUR | 100,000 | | 106,738 | |

| Bank of America Corp., 2.30%, 7/25/25 | GBP | 100,000 | | 119,512 | |

| CaixaBank SA, VRN, 2.25%, 4/17/30 | EUR | 100,000 | | 103,179 | |

| Commerzbank AG, 4.00%, 3/23/26 | EUR | 150,000 | | 162,009 | |

| Credit Agricole SA, 7.375%, 12/18/23 | GBP | 50,000 | | 64,280 | |

| European Financial Stability Facility, 2.125%, 2/19/24 | EUR | 93,000 | | 101,467 | |

| European Financial Stability Facility, 0.40%, 5/31/26 | EUR | 200,000 | | 203,462 | |

European Union, 0.00%, 7/4/31(7) | EUR | 1,450,000 | | 1,259,390 | |

| ING Groep NV, 2.125%, 1/10/26 | EUR | 200,000 | | 211,912 | |

| Lloyds Bank PLC, 7.625%, 4/22/25 | GBP | 20,000 | | 26,154 | |

| Toronto-Dominion Bank, VRN, 5.875%, 5/1/24 | | $ | 1,000,000 | | 997,187 | |

| | | 3,493,647 | |

| Biotechnology — 0.1% | | | |

| AbbVie, Inc., 4.40%, 11/6/42 | | 280,000 | | 248,856 | |

Chemicals† | | | |

MEGlobal BV, 4.25%, 11/3/26(6) | | 46,000 | | 44,183 | |

| Olin Corp., 5.125%, 9/15/27 | | 70,000 | | 66,981 | |

| | | 111,164 | |

Commercial Services and Supplies† | | | |

Clean Harbors, Inc., 6.375%, 2/1/31(6) | | 190,000 | | 191,080 | |

Containers and Packaging† | | | |

Sealed Air Corp., 5.125%, 12/1/24(6) | | 105,000 | | 103,584 | |

| Diversified Telecommunication Services — 0.1% | | | |

| AT&T, Inc., 4.90%, 8/15/37 | | 59,000 | | 54,234 | |

| Sprint Capital Corp., 6.875%, 11/15/28 | | 342,000 | | 362,845 | |

Turk Telekomunikasyon AS, 4.875%, 6/19/24(6) | | 115,000 | | 111,642 | |

| | | 528,721 | |

Electric Utilities† | | | |

| Duke Energy Florida LLC, 3.85%, 11/15/42 | | 40,000 | | 32,372 | |

| Duke Energy Progress LLC, 4.15%, 12/1/44 | | 40,000 | | 33,481 | |

| MidAmerican Energy Co., 4.40%, 10/15/44 | | 60,000 | | 52,367 | |

| NextEra Energy Capital Holdings, Inc., 5.25%, 2/28/53 | | 43,000 | | 41,188 | |

| | | 159,408 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

Financial Services† | | | |

| Allen C Stonecipher Life Insurance Trust, VRDN, 5.45%, 8/7/23 (LOC: FHLB) | | $ | 5,000 | | $ | 5,000 | |

Ground Transportation† | | | |

| Burlington Northern Santa Fe LLC, 4.45%, 3/15/43 | | 12,000 | | 10,824 | |

| Burlington Northern Santa Fe LLC, 4.15%, 4/1/45 | | 80,000 | | 69,483 | |

| | | 80,307 | |

| Health Care Providers and Services — 0.1% | | | |

| CVS Health Corp., 4.78%, 3/25/38 | | 40,000 | | 36,938 | |

DaVita, Inc., 4.625%, 6/1/30(6) | | 270,000 | | 230,634 | |

| Kaiser Foundation Hospitals, 3.00%, 6/1/51 | | 70,000 | | 48,566 | |

| | | 316,138 | |

| Hotels, Restaurants and Leisure — 0.2% | | | |

Caesars Entertainment, Inc., 4.625%, 10/15/29(6) | | 110,000 | | 96,934 | |

Caesars Entertainment, Inc., 7.00%, 2/15/30(6) | | 142,000 | | 143,556 | |

| MGM Resorts International, 4.625%, 9/1/26 | | 39,000 | | 37,029 | |

Station Casinos LLC, 4.625%, 12/1/31(6) | | 530,000 | | 448,327 | |

Wynn Las Vegas LLC / Wynn Las Vegas Capital Corp., 5.25%, 5/15/27(6) | | 200,000 | | 190,268 | |

| | | 916,114 | |

| Household Durables — 0.1% | | | |

| KB Home, 4.80%, 11/15/29 | | 253,000 | | 233,682 | |

| Meritage Homes Corp., 5.125%, 6/6/27 | | 190,000 | | 184,066 | |

Tempur Sealy International, Inc., 3.875%, 10/15/31(6) | | 136,000 | | 110,198 | |

| | | 527,946 | |

Interactive Media and Services† | | | |

Tencent Holdings Ltd., 3.80%, 2/11/25(6) | | 86,000 | | 83,943 | |

Leisure Products† | | | |

| Mattel, Inc., 5.45%, 11/1/41 | | 200,000 | | 172,620 | |

Media† | | | |

| Charter Communications Operating LLC / Charter Communications Operating Capital, 5.125%, 7/1/49 | | 85,000 | | 66,711 | |

| Metals and Mining — 0.1% | | | |

| ATI, Inc., 4.875%, 10/1/29 | | 240,000 | | 219,276 | |

Cleveland-Cliffs, Inc., 6.75%, 4/15/30(6) | | 230,000 | | 224,031 | |

| Freeport-McMoRan, Inc., 5.40%, 11/14/34 | | 215,000 | | 209,311 | |

| | | 652,618 | |

Multi-Utilities† | | | |

| Dominion Energy, Inc., 4.90%, 8/1/41 | | 30,000 | | 27,098 | |

| Oil, Gas and Consumable Fuels — 0.1% | | | |

Antero Resources Corp., 7.625%, 2/1/29(6) | | 65,000 | | 66,636 | |

| Crestwood Midstream Partners LP / Crestwood Midstream Finance Corp., 5.75%, 4/1/25 | | 90,000 | | 88,734 | |

| Enterprise Products Operating LLC, 4.85%, 3/15/44 | | 92,000 | | 84,096 | |

| Kinder Morgan Energy Partners LP, 6.50%, 9/1/39 | | 42,000 | | 42,942 | |

MEG Energy Corp., 5.875%, 2/1/29(6) | | 70,000 | | 67,169 | |

| Southwestern Energy Co., 5.70%, 1/23/25 | | 21,000 | | 20,887 | |

| | | 370,464 | |

Passenger Airlines† | | | |

American Airlines, Inc. / AAdvantage Loyalty IP Ltd., 5.50%, 4/20/26(6) | | 149,487 | | 147,392 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

Personal Care Products† | | | |

Edgewell Personal Care Co., 4.125%, 4/1/29(6) | | $ | 180,000 | | $ | 157,630 | |

Specialty Retail† | | | |

Murphy Oil USA, Inc., 3.75%, 2/15/31(6) | | 210,000 | | 178,426 | |

Wireless Telecommunication Services† | | | |

C&W Senior Financing DAC, 6.875%, 9/15/27(6) | | 130,000 | | 118,152 | |

TOTAL CORPORATE BONDS (Cost $10,047,530) | | | 9,289,595 | |

| COLLATERALIZED LOAN OBLIGATIONS — 0.5% | | | |

Cerberus Loan Funding XXVIII LP, Series 2020-1A, Class A, VRN, 7.42%, (3-month SOFR plus 2.11%), 10/15/31(6) | | 206,970 | | 206,779 | |

Cerberus Loan Funding XXXI LP, Series 2021-1A, Class A, VRN, 7.07%, (3-month SOFR plus 1.76%), 4/15/32(6) | | 218,491 | | 216,923 | |

Cook Park CLO Ltd., Series 2018-1A, Class C, VRN, 7.32%, (3-month SOFR plus 2.01%), 4/17/30(6) | | 250,000 | | 241,731 | |

Dewolf Park CLO Ltd., Series 2017-1A, Class CR, VRN, 7.42%, (3-month SOFR plus 2.11%), 10/15/30(6) | | 200,000 | | 195,333 | |

Goldentree Loan Opportunities X Ltd., Series 2015-10A, Class AR, VRN, 6.71%, (3-month SOFR plus 1.38%), 7/20/31(6) | | 175,000 | | 174,591 | |

KKR CLO Ltd., Series 2018, Class CR, VRN, 7.67%, (3-month SOFR plus 2.36%), 7/18/30(6) | | 175,000 | | 172,414 | |

KKR CLO Ltd., Series 2022A, Class B, VRN, 7.19%, (3-month SOFR plus 1.86%), 7/20/31(6) | | 300,000 | | 296,850 | |

Magnetite VIII Ltd., Series 2014-8A, Class BR2, VRN, 7.07%, (3-month SOFR plus 1.76%), 4/15/31(6) | | 300,000 | | 296,795 | |

Magnetite XXV Ltd., Series 2020-25A, Class C, VRN, 7.71%, (3-month SOFR plus 2.36%), 1/25/32(6) | | 300,000 | | 294,928 | |

Marathon CLO Ltd., Series 2021-17A, Class B1, VRN, 8.27%, (3-month SOFR plus 2.94%), 1/20/35(6) | | 200,000 | | 197,815 | |

MF1 Ltd., Series 2021-FL7, Class AS, VRN, 6.79%, (1-month SOFR plus 1.56%), 10/16/36(6) | | 398,000 | | 385,139 | |

Rockford Tower CLO Ltd., Series 2020-1A, Class C, VRN, 7.94%, (3-month SOFR plus 2.61%), 1/20/32(6) | | 200,000 | | 197,876 | |

Symphony CLO XXII Ltd., Series 2020-22A, Class B, VRN, 7.27%, (3-month SOFR plus 1.96%), 4/18/33(6) | | 500,000 | | 493,400 | |

TOTAL COLLATERALIZED LOAN OBLIGATIONS (Cost $3,416,114) | | | 3,370,574 | |

| MUNICIPAL SECURITIES — 0.5% | | | |

| Bay Area Toll Authority Rev., 6.92%, 4/1/40 | | 100,000 | | 115,753 | |

| Harris County Industrial Development Corp. Rev., (Exxon Mobil Corp.) VRDN, 4.58%, 8/1/23 | | 2,450,000 | | 2,450,000 | |

| New Jersey Turnpike Authority Rev., 7.41%, 1/1/40 | | 40,000 | | 49,424 | |

| New Jersey Turnpike Authority Rev., 7.10%, 1/1/41 | | 30,000 | | 36,131 | |

| New York City GO, 6.27%, 12/1/37 | | 5,000 | | 5,549 | |

| Port Authority of New York & New Jersey Rev., 4.93%, 10/1/51 | | 35,000 | | 34,761 | |

| Regents of the University of California Medical Center Pooled Rev., 3.26%, 5/15/60 | | 100,000 | | 68,941 | |

| Rutgers The State University of New Jersey Rev., 5.67%, 5/1/40 | | 90,000 | | 94,237 | |

| Sacramento Municipal Utility District Rev., 6.16%, 5/15/36 | | 140,000 | | 151,924 | |

| San Francisco Public Utilities Commission Water Rev., 6.00%, 11/1/40 | | 10,000 | | 10,581 | |

| State of California GO, 4.60%, 4/1/38 | | 30,000 | | 28,391 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |

| State of California GO, 7.55%, 4/1/39 | | $ | 20,000 | | $ | 24,922 | |

| State of California GO, 7.30%, 10/1/39 | | 25,000 | | 29,884 | |

| State of California GO, 7.60%, 11/1/40 | | 40,000 | | 50,231 | |

| State of Washington GO, 5.14%, 8/1/40 | | 20,000 | | 20,015 | |

| Texas Natural Gas Securitization Finance Corp. Rev., 5.17%, 4/1/41 | | 30,000 | | 30,435 | |

TOTAL MUNICIPAL SECURITIES (Cost $3,195,559) | | | 3,201,179 | |

| PREFERRED STOCKS — 0.2% | | | |

Automobiles† | | | |

| Volkswagen International Finance NV, 3.875% | | 300,000 | | 281,779 | |

| Diversified Telecommunication Services — 0.1% | | | |

| Telefonica Europe BV, 3.00% | | 300,000 | | 328,218 | |

Electric Utilities† | | | |

| Electricite de France SA, 3.375% | | 200,000 | | 174,196 | |

| Enel SpA, 2.25% | | 100,000 | | 97,155 | |

| | | 271,351 | |

| Insurance — 0.1% | | | |

| Allianz SE, 2.625% | | 200,000 | | 157,831 | |

| Allianz SE, 4.75% | | 100,000 | | 110,041 | |

| Assicurazioni Generali SpA, 4.60% | | 100,000 | | 107,831 | |

| Intesa Sanpaolo Vita SpA, 4.75% | | 100,000 | | 108,053 | |

| | | 483,756 | |

Oil, Gas and Consumable Fuels† | | | |

| Eni SpA, 3.375% | | 200,000 | | 188,299 | |

TOTAL PREFERRED STOCKS (Cost $2,003,350) | | | 1,553,403 | |

| ASSET-BACKED SECURITIES — 0.2% | | | |

Blackbird Capital Aircraft, Series 2021-1A, Class A, SEQ, 2.44%, 7/15/46(6) | | $ | 198,398 | | 171,481 | |

BRE Grand Islander Timeshare Issuer LLC, Series 2017-1A, Class A, SEQ, 2.94%, 5/25/29(6) | | 26,731 | | 26,077 | |

FirstKey Homes Trust, Series 2020-SFR1, Class C, 1.94%, 8/17/37(6) | | 300,000 | | 273,198 | |

Lunar Aircraft Ltd., Series 2020-1A, Class A, SEQ, 3.38%, 2/15/45(6) | | 326,127 | | 283,292 | |

MAPS Trust, Series 2021-1A, Class A, SEQ, 2.52%, 6/15/46(6) | | 517,494 | | 448,595 | |

VSE VOI Mortgage LLC, Series 2018-A, Class B, 3.72%, 2/20/36(6) | | 75,802 | | 72,971 | |

TOTAL ASSET-BACKED SECURITIES (Cost $1,451,873) | | | 1,275,614 | |

| EXCHANGE-TRADED FUNDS — 0.2% | | | |

| iShares Core S&P 500 ETF | | 125 | | 57,523 | |

iShares Russell Mid-Cap Value ETF(3) | | 9,397 | | 1,077,648 | |

TOTAL EXCHANGE-TRADED FUNDS (Cost $1,046,115) | | | 1,135,171 | |

| COLLATERALIZED MORTGAGE OBLIGATIONS — 0.1% | | | |

| Private Sponsor Collateralized Mortgage Obligations — 0.1% |

| ABN Amro Mortgage Corp., Series 2003-4, Class A4, 5.50%, 3/25/33 | | $ | 2,460 | | 2,210 | |

Radnor RE Ltd., Series 2021-1, Class M1B, VRN, 6.77%, (30-day average SOFR plus 1.70%), 12/27/33(6) | | 314,852 | | 314,555 | |

| | | | | | | | | | | |

| | Shares/Principal

Amount | Value |