UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | | | | | | | | | | | | | | | | | | | |

| Investment Company Act file number | 811-08532 |

| |

| AMERICAN CENTURY STRATEGIC ASSET ALLOCATIONS, INC. |

| (Exact name of registrant as specified in charter) |

| |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| |

JOHN PAK

4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| |

| Date of fiscal year end: | 07-31 |

| |

| Date of reporting period: | 07-31-2022 |

ITEM 1. REPORTS TO STOCKHOLDERS.

(a) Provided under separate cover.

| | | | | |

| |

| Annual Report |

| |

| July 31, 2022 |

| |

| Strategic Allocation: Aggressive Fund |

| Investor Class (TWSAX) |

| I Class (AAAIX) |

| A Class (ACVAX) |

| C Class (ASTAX) |

| R Class (AAARX) |

| R5 Class (ASAUX) |

| R6 Class (AAAUX) |

| | | | | |

| President’s Letter | |

| Performance | |

| Portfolio Commentary | |

| Fund Characteristics | |

| Shareholder Fee Example | |

| Schedule of Investments | |

| Statement of Assets and Liabilities | |

| Statement of Operations | |

| Statement of Changes in Net Assets | |

| Notes to Financial Statements | |

| Financial Highlights | |

| Report of Independent Registered Public Accounting Firm | |

| Management | |

| Approval of Management Agreement | |

| Liquidity Risk Management Program | |

| |

| Additional Information | |

| |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the period ended July 31, 2022. Annual reports help convey important information about fund returns, including market factors that affected performance. For additional investment insights, please visit americancentury.com.

2022 Sell-Off Sank Stock Returns for the Fiscal Year

Stock market performance changed dramatically during the 12-month period. In the first five months, generally upbeat economic activity and corporate earnings supported solid returns for most broad U.S. and global stock indices. Performance remained positive despite rapidly rising inflation and waning central bank support.

The market climate changed considerably in early 2022. Inflation, which was already at multiyear highs, rose to levels last seen in the early 1980s. The massive fiscal and monetary support unleashed during the pandemic was partly to blame. In addition, escalating energy prices, supply chain breakdowns and labor market shortages further aggravated the inflation rate in the U.S. and other developed markets. Russia’s invasion of Ukraine in February also exacerbated global inflationary pressures.

The Federal Reserve responded to surging inflation in March, launching an aggressive rate-hike campaign and ending its asset purchase program. Policymakers indicated taming inflation remains their priority, even as the economy contracted for two consecutive quarters. Despite a rate-hike total of 2.25 percentage points through July 31, U.S. inflation climbed to a 41-year high of 9.1% in June before easing to 8.5% in July.

The combination of accelerating inflation, tighter monetary policy, geopolitical strife and weakening economies triggered sharp market volatility and fueled recession fears. U.S. and global stocks erased their late 2021 gains and declined for the 12-month period. U.S. stocks generally fared better than non-U.S. stocks, large caps outpaced small caps, and value outperformed growth.

Staying Disciplined in Uncertain Times

We expect market volatility to linger as investors navigate a complex environment of high inflation, rising interest rates and economic uncertainty. In addition, Russia’s invasion of Ukraine complicates a tense geopolitical backdrop. We will continue to monitor this evolving situation and what it broadly means for our clients and investment exposure.

We appreciate your confidence in us during these extraordinary times. Our firm has a long history of helping clients weather unpredictable markets, and we’re confident we will continue to meet today’s challenges.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

| | | | | | | | | | | | | | | | | | | | | |

| Total Returns as of July 31, 2022 |

| | | | Average Annual Returns | |

| Ticker Symbol | | 1 year | 5 years | 10 years | Since

Inception | Inception Date |

| Investor Class | TWSAX | | -10.38% | 7.71% | 8.74% | — | 2/15/96 |

| S&P 500 Index | — | | -4.64% | 12.82% | 13.79% | — | — |

| Bloomberg U.S. Aggregate Bond Index | — | | -9.12% | 1.28% | 1.65% | — | — |

| Bloomberg U.S. 1-3 Month Treasury Bill Index | — | | 0.26% | 1.05% | 0.60% | — | — |

| I Class | AAAIX | | -10.28% | 7.92% | 8.96% | — | 8/1/00 |

| A Class | ACVAX | | | | | — | 10/2/96 |

| No sales charge | | | -10.64% | 7.44% | 8.47% | — | |

| With sales charge | | | -15.77% | 6.19% | 7.83% | — | |

| C Class | ASTAX | | -11.30% | 6.62% | 7.66% | — | 11/27/01 |

| R Class | AAARX | | -10.88% | 7.17% | 8.20% | — | 3/31/05 |

| R5 Class | ASAUX | | -10.28% | 7.90% | — | 8.56% | 4/10/17 |

| R6 Class | AAAUX | | -10.05% | 8.09% | — | 8.16% | 7/26/13 |

Average annual returns since inception are presented when ten years of performance history is not available.

Fund returns would have been lower if a portion of the fees had not been waived.

C Class shares will automatically convert to A Class shares after being held for approximately eight years. C Class average annual returns do not reflect this conversion.

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

| | |

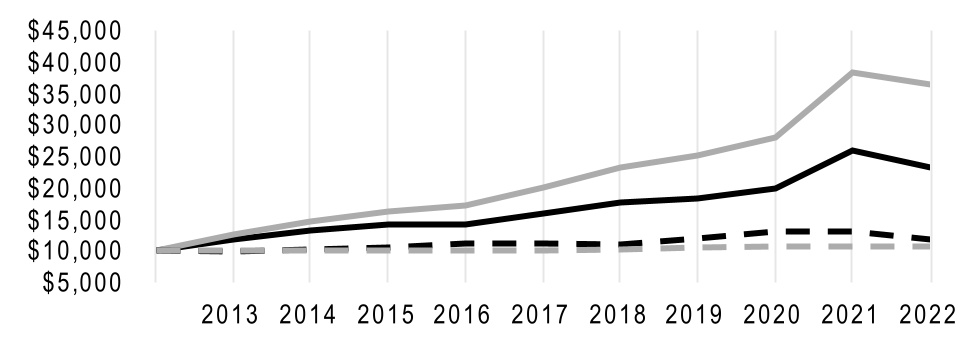

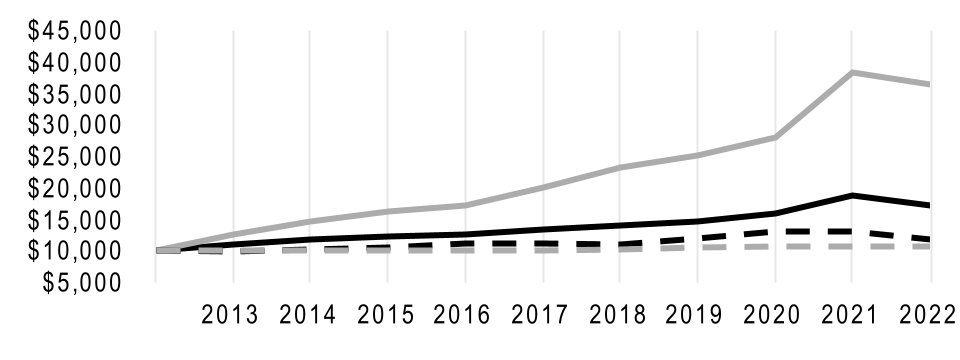

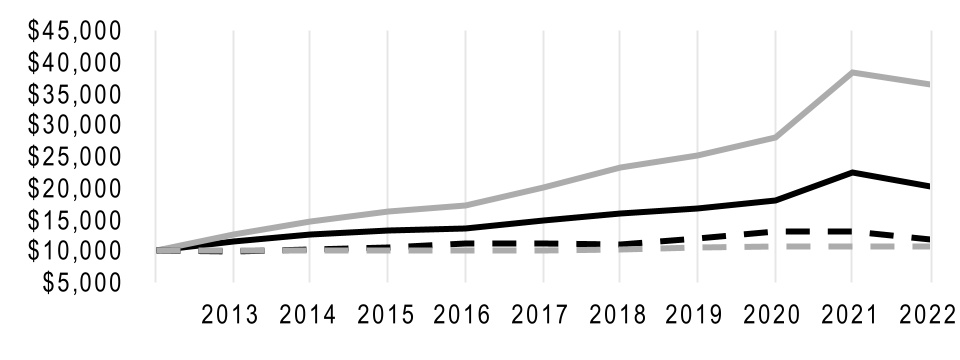

| Growth of $10,000 Over 10 Years |

| $10,000 investment made July 31, 2012 |

| Performance for other share classes will vary due to differences in fee structure. |

| | | | | |

| Value on July 31, 2022 |

| Investor Class — $23,131 |

|

| S&P 500 Index — $36,428 |

|

| Bloomberg U.S. Aggregate Bond Index — $11,776 |

|

| Bloomberg U.S. 1-3 Month Treasury Bill Index — $10,621 |

|

Ending value of Investor Class would have been lower if a portion of the fees had not been waived.

| | | | | | | | | | | | | | | | | | | | |

Total Annual Fund Operating Expenses | | |

| Investor Class | I Class | A Class | C Class | R Class | R5 Class | R6 Class |

| 1.33% | 1.13% | 1.58% | 2.33% | 1.83% | 1.13% | 0.98% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

Portfolio Managers: Rich Weiss, Scott Wilson, Radu Gabudean, Vidya Rajappa and Brian Garbe

Performance Summary

Strategic Allocation: Aggressive returned -10.38%* for the fiscal period ended July 31, 2022. In a difficult market environment, our strategic diversification helped manage volatility. While many stock and bond holdings delivered negative absolute returns, positions in U.S. value stocks actually gained during the period. Similarly, short-term cash-equivalent securities also delivered positive returns. Because of the fund’s strategic exposure to a variety of asset classes, a review of the financial markets helps provide context around performance for the reporting period.

Market Overview

Early in the period, global equity markets rose, aided by positive corporate earnings, increasing vaccination rates and economic optimism. The market encountered periods of volatility as the spread of a more-transmissible COVID-19 variant led to uncertainty and renewed restrictions in some regions. Nevertheless, stocks gained throughout 2021, as investors revised their worst-case fears about the omicron variant and global economic growth. As the period progressed, higher inflation, rising interest rates and mounting geopolitical tensions weighed on investor confidence. Tighter central bank policy ignited recession fears in many countries, and global stocks suffered widespread declines. During the final month of the period, investor sentiment shifted again. Global equities gained in July on hopes that weaker economic data would moderate inflation and allow central banks to slow the pace and magnitude of monetary tightening.

U.S. stock returns were initially buoyed by upbeat economic and earnings data and accommodative monetary policy. The Federal Reserve (Fed) appeared unfazed by inflation, viewing rising prices as a temporary economic consequence of the pandemic recovery. But as inflation surged toward multidecade highs, the Fed began tightening monetary policy by ending bond buying and hiking the federal funds rate target from near zero to 2.50% between March and July. In that environment, U.S. equities sold off on fears that higher rates and inflation could trigger a recession and weaken corporate profits. Value stocks outperformed growth stocks across capitalization categories for much of the period.

European stocks experienced broad-based declines as higher energy costs, signs of slowing economic growth and the war in Ukraine all weighed on investor sentiment. Stocks in the U.K., Japan and emerging markets declined as well. In July, non-U.S. developed markets stocks rose on better-than-expected corporate earnings, retreating commodity prices and hopes that market valuations already reflected a severe downturn. Emerging markets stocks declined throughout the period as risk premiums rose. Regulatory uncertainty and credit concerns in China also dampened sentiment toward emerging markets.

In the global bond market, yields rose as central banks became less accommodating. Surging inflation, resurgent waves of COVID-19 cases, lockdowns in China and Russia’s invasion of Ukraine contributed to rate volatility during the period. Rising interest rates and widening credit spreads drove fixed-income returns lower throughout much of the period. In July, investor sentiment shifted, and global bonds produced positive returns as yields moved lower (bond yields and prices move in opposite directions).

In the U.S. bond market, renewed COVID-19 worries triggered a global flight to quality that sent U.S. Treasury yields lower early in the period. That changed as investors refocused on inflation pressures, and the Fed raised its rate target at the most rapid pace in decades. Economically sensitive corporate bonds fell sharply, with high-yield bonds underperforming investment-grade corporates.

*All fund returns referenced in this commentary are for Investor Class shares. Fund returns would have been lower if a portion of the fees had not been waived. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the fund’s benchmark, other share classes may not. See page 3 for returns for all share classes.

It was a similar story in Europe, where bonds initially gained. But Russia’s invasion of Ukraine sent fuel prices surging, contributing to higher inflation and European Central Bank rate hikes. Bonds lost value in the U.K., too, as inflation there reached a 40-year high. Japan’s benchmark 10-year government bond yield edged higher alongside global bond yields. In emerging markets, bonds declined as the U.S. dollar strengthened, interest rates rose and risk premiums increased.

Strategic Allocation: Aggressive’s neutral asset mix throughout the period was 79% stocks, 20% bonds and 1% cash-equivalent investments. However, the portfolio’s actual asset weightings varied based on short-term tactical adjustments and fluctuating securities prices.

Tactical Positioning

The value of a diversified approach is clear during periods of intense volatility. As rising interest rates, inflation and recession fears weighed on financial markets, the portfolio’s strategic diversification helped manage volatility. In an effort to add value and improve the fund’s ability to achieve its objective, we made modest adjustments to the asset allocation. Our tactical decisions detracted from performance on the margin, while security selection had a positive effect.

Our decision to overweight small- versus large-capitalization stocks detracted the most. On the other hand, our management of exposure to non-U.S. versus U.S. equities also added value. Non-U.S. developed markets equities have lagged U.S. equities for several years, resulting in comparatively more attractive valuations. As a result, we swung from an underweight to an overweight allocation to non-U.S. equity during the period, benefiting performance.

The portfolio was underweight real estate investment trusts on a tactical basis because rising mortgage rates, indications of a slowing economy and widening credit spreads undermined their attractiveness. Stock selection and asset allocation decisions in global real estate benefited performance. In fixed income, a tactical overweight to cash in favor of global bonds benefited performance.

Outlook

Recession risk has increased, given changes in U.S. consumer spending and signs of slowing growth across many global economies. However, stagflation remains our base case for the U.S. economy in 2022, with sustained high inflation and sluggish growth. Outside the U.S., recession risk is higher, particularly in Europe, where high energy prices likely will persist for the foreseeable future.

Inflation may be moderating, but it is nevertheless likely to remain elevated for some time. Our fixed-income team sees anecdotal evidence that inflation may be nearing a peak. For example, wage increases appear to be leveling off, some retail prices are declining and retail inventories are high. Global supply chains have started to unkink, but the invasion of Ukraine provides an additional layer of complexity and may affect industries ranging from food products to semiconductors and semiconductor equipment to automobiles and auto components.

| | | | | |

| JULY 31, 2022 |

Types of Investments in Portfolio | % of net assets |

| Affiliated Funds | 54.7% |

| Common Stocks | 30.3% |

| U.S. Treasury Securities | 5.2% |

| Sovereign Governments and Agencies | 2.7% |

| Corporate Bonds | 1.6% |

| Collateralized Loan Obligations | 0.6% |

| Asset-Backed Securities | 0.3% |

| Preferred Stocks | 0.3% |

| Collateralized Mortgage Obligations | 0.2% |

| Municipal Securities | 0.1% |

| Exchange-Traded Funds | 0.1% |

| U.S. Government Agency Mortgage-Backed Securities | 0.1% |

| Short-Term Investments | 3.9% |

| Other Assets and Liabilities | (0.1)% |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from February 1, 2022 to July 31, 2022.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not through a financial intermediary or employer-sponsored retirement plan account), American Century Investments may charge you a $25.00 annual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $25.00 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments brokerage accounts, you are currently not subject to this fee. If you are subject to the account maintenance fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | |

| Beginning

Account Value

2/1/22 | Ending

Account Value

7/31/22 | Expenses Paid During Period(1) 2/1/22 - 7/31/22 | Annualized Expense Ratio(1) |

Actual |

| Investor Class | $1,000 | $917.20 | $2.99 | 0.63% |

| I Class | $1,000 | $917.60 | $2.04 | 0.43% |

| A Class | $1,000 | $915.70 | $4.18 | 0.88% |

| C Class | $1,000 | $912.60 | $7.73 | 1.63% |

| R Class | $1,000 | $915.60 | $5.37 | 1.13% |

| R5 Class | $1,000 | $917.60 | $2.04 | 0.43% |

| R6 Class | $1,000 | $919.80 | $1.33 | 0.28% |

| Hypothetical |

| Investor Class | $1,000 | $1,021.67 | $3.16 | 0.63% |

| I Class | $1,000 | $1,022.66 | $2.16 | 0.43% |

| A Class | $1,000 | $1,020.43 | $4.41 | 0.88% |

| C Class | $1,000 | $1,016.71 | $8.15 | 1.63% |

| R Class | $1,000 | $1,019.19 | $5.66 | 1.13% |

| R5 Class | $1,000 | $1,022.66 | $2.16 | 0.43% |

| R6 Class | $1,000 | $1,023.41 | $1.40 | 0.28% |

(1)Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 181, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses.

JULY 31, 2022

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

AFFILIATED FUNDS(1) — 54.7% |

|

|

|

| American Century Diversified Corporate Bond ETF | | 288,278 | | $ | 13,697,126 | |

| American Century Emerging Markets Bond ETF | | 133,102 | | 5,182,992 | |

American Century Focused Dynamic Growth ETF(2) | | 526,227 | | 31,492,265 | |

| American Century Focused Large Cap Value ETF | | 715,221 | | 42,098,623 | |

| American Century Multisector Income ETF | | 531,791 | | 23,858,378 | |

| American Century Quality Diversified International ETF | | 690,784 | | 28,342,798 | |

| American Century STOXX U.S. Quality Growth ETF | | 527,613 | | 32,959,984 | |

| American Century STOXX U.S. Quality Value ETF | | 884,288 | | 43,020,876 | |

| Avantis Emerging Markets Equity ETF | | 742,776 | | 38,564,930 | |

| Avantis International Equity ETF | | 526,129 | | 28,132,118 | |

| Avantis International Small Cap Value ETF | | 149,924 | | 8,392,746 | |

| Avantis U.S. Equity ETF | | 622,975 | | 44,231,225 | |

| Avantis U.S. Small Cap Value ETF | | 211,403 | | 16,011,663 | |

TOTAL AFFILIATED FUNDS (Cost $314,385,194) | | | 355,985,724 | |

| COMMON STOCKS — 30.3% | | | |

| Aerospace and Defense — 0.5% | | | |

Aerojet Rocketdyne Holdings, Inc.(2) | | 2,184 | | 95,419 | |

CAE, Inc.(2) | | 20,321 | | 537,640 | |

| Curtiss-Wright Corp. | | 3,147 | | 451,406 | |

| HEICO Corp. | | 3,345 | | 527,540 | |

| Hensoldt AG | | 2,831 | | 72,585 | |

| Huntington Ingalls Industries, Inc. | | 2,312 | | 501,334 | |

| Leonardo SpA | | 9,508 | | 89,058 | |

| Lockheed Martin Corp. | | 1,209 | | 500,296 | |

Mercury Systems, Inc.(2) | | 1,816 | | 107,162 | |

| QinetiQ Group PLC | | 14,452 | | 67,308 | |

| Thales SA | | 2,956 | | 367,607 | |

| | | 3,317,355 | |

| Air Freight and Logistics — 0.1% | | | |

| United Parcel Service, Inc., Class B | | 2,765 | | 538,871 | |

| Airlines — 0.1% | | | |

Southwest Airlines Co.(2) | | 22,364 | | 852,516 | |

| Auto Components — 0.6% | | | |

Aptiv PLC(2) | | 8,989 | | 942,856 | |

| BorgWarner, Inc. | | 20,688 | | 795,661 | |

| Bridgestone Corp. | | 3,600 | | 140,421 | |

CIE Automotive SA(3) | | 1,407 | | 37,012 | |

| Continental AG | | 9,240 | | 658,268 | |

Fox Factory Holding Corp.(2) | | 996 | | 94,281 | |

| Hyundai Mobis Co. Ltd. | | 1,733 | | 305,020 | |

| Linamar Corp. | | 10,356 | | 472,128 | |

| Sumitomo Rubber Industries Ltd. | | 30,400 | | 274,098 | |

| | | 3,719,745 | |

| Automobiles — 0.4% | | | |

| Bayerische Motoren Werke AG | | 12,063 | | 985,708 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

| Mercedes-Benz Group AG | | 17,039 | | $ | 1,004,858 | |

Tesla, Inc.(2) | | 858 | | 764,864 | |

| | | 2,755,430 | |

| Banks — 1.6% | | | |

| AIB Group PLC | | 33,384 | | 75,937 | |

| Banco Bilbao Vizcaya Argentaria SA | | 97,831 | | 443,338 | |

| Banco Bradesco SA | | 161,989 | | 453,961 | |

| Banco de Sabadell SA | | 75,994 | | 48,656 | |

| Banco do Brasil SA | | 73,100 | | 510,729 | |

Bancorp, Inc.(2) | | 2,984 | | 73,406 | |

| Bank Central Asia Tbk PT | | 859,900 | | 427,594 | |

| Bank of America Corp. | | 4,063 | | 137,370 | |

| Barclays PLC | | 349,707 | | 669,886 | |

| BNP Paribas SA | | 11,502 | | 543,438 | |

| Commerce Bancshares, Inc. | | 320 | | 22,237 | |

| First Hawaiian, Inc. | | 30,553 | | 778,796 | |

| Fukuoka Financial Group, Inc. | | 6,300 | | 111,666 | |

| HDFC Bank Ltd., ADR | | 6,257 | | 392,940 | |

| HSBC Holdings PLC | | 78,400 | | 492,365 | |

| JPMorgan Chase & Co. | | 4,996 | | 576,339 | |

Jyske Bank A/S(2) | | 1,695 | | 88,710 | |

| Mitsubishi UFJ Financial Group, Inc. | | 62,700 | | 353,283 | |

| Mizuho Financial Group, Inc. | | 30,050 | | 358,387 | |

| Prosperity Bancshares, Inc. | | 10,802 | | 800,320 | |

| Regions Financial Corp. | | 26,754 | | 566,650 | |

Silvergate Capital Corp., Class A(2) | | 825 | | 76,964 | |

| Standard Chartered PLC (London) | | 56,352 | | 388,417 | |

| Sumitomo Mitsui Financial Group, Inc. | | 11,100 | | 348,230 | |

| Truist Financial Corp. | | 16,386 | | 827,001 | |

| UniCredit SpA | | 40,884 | | 404,330 | |

| Westamerica Bancorporation | | 5,249 | | 314,992 | |

| | | 10,285,942 | |

| Beverages — 0.3% | | | |

Celsius Holdings, Inc.(2) | | 7,543 | | 671,025 | |

Duckhorn Portfolio, Inc.(2) | | 4,613 | | 84,602 | |

| MGP Ingredients, Inc. | | 1,474 | | 155,035 | |

| PepsiCo, Inc. | | 4,179 | | 731,158 | |

| Pernod Ricard SA | | 1,062 | | 208,624 | |

| Royal Unibrew A/S | | 1,028 | | 87,672 | |

| | | 1,938,116 | |

| Biotechnology — 0.9% | | | |

| AbbVie, Inc. | | 3,526 | | 506,016 | |

ADC Therapeutics SA(2)(3) | | 3,201 | | 23,719 | |

Alnylam Pharmaceuticals, Inc.(2) | | 1,485 | | 210,929 | |

| Amgen, Inc. | | 701 | | 173,476 | |

Arcus Biosciences, Inc.(2) | | 786 | | 20,900 | |

Arcutis Biotherapeutics, Inc.(2) | | 3,799 | | 92,164 | |

Biohaven Pharmaceutical Holding Co. Ltd.(2) | | 1,373 | | 200,485 | |

Blueprint Medicines Corp.(2) | | 1,348 | | 68,829 | |

Bridgebio Pharma, Inc.(2) | | 2,351 | | 20,360 | |

Celldex Therapeutics, Inc.(2) | | 1,393 | | 42,793 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

Centessa Pharmaceuticals PLC, ADR(2)(3) | | 3,831 | | $ | 16,550 | |

| CSL Ltd. | | 2,949 | | 600,467 | |

Cytokinetics, Inc.(2) | | 2,979 | | 126,101 | |

Erasca, Inc.(2)(3) | | 2,362 | | 17,810 | |

Fate Therapeutics, Inc.(2)(3) | | 1,601 | | 48,879 | |

Global Blood Therapeutics, Inc.(2) | | 2,660 | | 87,035 | |

Halozyme Therapeutics, Inc.(2) | | 3,647 | | 178,338 | |

Horizon Therapeutics PLC(2) | | 7,399 | | 613,895 | |

Insmed, Inc.(2) | | 4,337 | | 95,934 | |

Intellia Therapeutics, Inc.(2) | | 544 | | 35,229 | |

Iovance Biotherapeutics, Inc.(2) | | 1,184 | | 13,794 | |

KalVista Pharmaceuticals, Inc.(2) | | 3,504 | | 43,274 | |

Karuna Therapeutics, Inc.(2) | | 444 | | 57,831 | |

Kinnate Biopharma, Inc.(2)(3) | | 2,376 | | 25,423 | |

Kymera Therapeutics, Inc.(2) | | 1,525 | | 33,596 | |

Natera, Inc.(2) | | 2,283 | | 107,301 | |

Neurocrine Biosciences, Inc.(2) | | 7,658 | | 720,848 | |

Relay Therapeutics, Inc.(2) | | 1,554 | | 29,557 | |

Sarepta Therapeutics, Inc.(2) | | 9,116 | | 847,332 | |

Seagen, Inc.(2) | | 4,006 | | 721,000 | |

Vertex Pharmaceuticals, Inc.(2) | | 671 | | 188,155 | |

| Vitrolife AB | | 1,449 | | 47,274 | |

| | | 6,015,294 | |

| Building Products — 0.4% | | | |

| Cie de Saint-Gobain | | 9,693 | | 451,983 | |

Hayward Holdings, Inc.(2) | | 8,241 | | 96,172 | |

| Johnson Controls International PLC | | 8,235 | | 443,949 | |

| Masco Corp. | | 4,162 | | 230,492 | |

Masonite International Corp.(2) | | 780 | | 71,003 | |

| Sanwa Holdings Corp. | | 7,100 | | 76,699 | |

| Trane Technologies PLC | | 5,058 | | 743,475 | |

Trex Co., Inc.(2) | | 1,080 | | 69,682 | |

| Zurn Elkay Water Solutions Corp. | | 12,079 | | 349,687 | |

| | | 2,533,142 | |

| Capital Markets — 1.3% | | | |

| Ameriprise Financial, Inc. | | 3,382 | | 912,869 | |

| Ares Management Corp., Class A | | 4,347 | | 311,463 | |

| Bank of New York Mellon Corp. | | 27,505 | | 1,195,367 | |

| BlackRock, Inc. | | 608 | | 406,861 | |

| Intercontinental Exchange, Inc. | | 1,711 | | 174,505 | |

| LPL Financial Holdings, Inc. | | 5,717 | | 1,200,113 | |

| Morgan Stanley | | 7,871 | | 663,525 | |

| MSCI, Inc. | | 1,565 | | 753,297 | |

| Northern Trust Corp. | | 12,835 | | 1,280,676 | |

Open Lending Corp., Class A(2) | | 4,353 | | 45,097 | |

| S&P Global, Inc. | | 1,279 | | 482,094 | |

| State Street Corp. | | 2,499 | | 177,529 | |

| T. Rowe Price Group, Inc. | | 7,167 | | 884,910 | |

| | | 8,488,306 | |

| Chemicals — 0.7% | | | |

| Air Liquide SA | | 2,520 | | 346,455 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

| Air Products and Chemicals, Inc. | | 753 | | $ | 186,917 | |

| Akzo Nobel NV | | 6,102 | | 410,667 | |

| Albemarle Corp. | | 531 | | 129,729 | |

| Avient Corp. | | 7,770 | | 335,275 | |

Axalta Coating Systems Ltd.(2) | | 16,323 | | 411,666 | |

Diversey Holdings Ltd.(2) | | 18,789 | | 140,730 | |

| Ecolab, Inc. | | 1,203 | | 198,699 | |

| Element Solutions, Inc. | | 28,260 | | 558,418 | |

| K+S AG | | 917 | | 19,336 | |

| Koninklijke DSM NV | | 2,994 | | 479,486 | |

| Linde PLC | | 1,801 | | 543,902 | |

| OCI NV | | 640 | | 22,219 | |

| Sherwin-Williams Co. | | 367 | | 88,792 | |

| Sika AG | | 1,036 | | 255,983 | |

| Symrise AG | | 3,687 | | 430,220 | |

| Tokyo Ohka Kogyo Co. Ltd. | | 700 | | 36,295 | |

| | | 4,594,789 | |

| Commercial Services and Supplies — 0.2% | | | |

| Brink's Co. | | 2,354 | | 134,037 | |

Clean Harbors, Inc.(2) | | 1,538 | | 150,093 | |

| Cleanaway Waste Management Ltd. | | 14,574 | | 28,076 | |

Driven Brands Holdings, Inc.(2) | | 7,573 | | 230,068 | |

| Elis SA | | 5,397 | | 80,555 | |

| GFL Environmental, Inc. | | 13,145 | | 363,459 | |

| Republic Services, Inc. | | 1,712 | | 237,386 | |

| SPIE SA | | 3,346 | | 80,354 | |

| | | 1,304,028 | |

| Communications Equipment — 0.5% | | | |

Arista Networks, Inc.(2) | | 10,888 | | 1,269,867 | |

| Cisco Systems, Inc. | | 17,006 | | 771,562 | |

F5, Inc.(2) | | 6,891 | | 1,153,278 | |

| Juniper Networks, Inc. | | 5,487 | | 153,801 | |

| | | 3,348,508 | |

| Construction and Engineering — 0.2% | | | |

| Arcadis NV | | 1,229 | | 45,443 | |

Construction Partners, Inc., Class A(2) | | 6,460 | | 153,619 | |

| Eiffage SA | | 4,213 | | 395,344 | |

| Hazama Ando Corp. | | 12,100 | | 81,454 | |

| SHO-BOND Holdings Co. Ltd. | | 1,600 | | 70,791 | |

| Vinci SA | | 3,423 | | 328,124 | |

| | | 1,074,775 | |

Construction Materials† | | | |

| Eagle Materials, Inc. | | 617 | | 78,020 | |

Summit Materials, Inc., Class A(2) | | 4,259 | | 117,165 | |

| | | 195,185 | |

Consumer Finance† | | | |

| American Express Co. | | 1,468 | | 226,101 | |

| Containers and Packaging — 0.4% | | | |

| Amcor PLC | | 8,966 | | 116,110 | |

| AptarGroup, Inc. | | 776 | | 83,622 | |

| Avery Dennison Corp. | | 3,061 | | 582,998 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

| Ball Corp. | | 4,237 | | $ | 311,080 | |

| Graphic Packaging Holding Co. | | 5,394 | | 120,016 | |

| Huhtamaki Oyj | | 2,669 | | 104,034 | |

| Packaging Corp. of America | | 4,593 | | 645,822 | |

SIG Group AG(2) | | 4,055 | | 105,788 | |

| Sonoco Products Co. | | 7,190 | | 456,493 | |

| | | 2,525,963 | |

Distributors† | | | |

| D'ieteren Group | | 749 | | 122,930 | |

Diversified Consumer Services† | | | |

| European Wax Center, Inc., Class A | | 5,537 | | 115,834 | |

| IDP Education Ltd. | | 3,549 | | 71,405 | |

| | | 187,239 | |

Diversified Financial Services† | | | |

| Zenkoku Hosho Co. Ltd. | | 1,700 | | 57,836 | |

| Diversified Telecommunication Services — 0.1% | | | |

| Cellnex Telecom SA | | 7,487 | | 334,886 | |

IHS Holding Ltd.(2) | | 2,767 | | 23,824 | |

| Internet Initiative Japan, Inc. | | 1,900 | | 77,147 | |

| Verizon Communications, Inc. | | 11,183 | | 516,543 | |

| | | 952,400 | |

| Electric Utilities — 0.6% | | | |

Acciona SA(3) | | 526 | | 108,235 | |

| Contact Energy Ltd. | | 5,763 | | 27,802 | |

| Edison International | | 15,623 | | 1,058,771 | |

| Evergy, Inc. | | 2,147 | | 146,554 | |

| Eversource Energy | | 2,260 | | 199,377 | |

| Iberdrola SA | | 51,205 | | 546,791 | |

| IDACORP, Inc. | | 658 | | 73,512 | |

| NextEra Energy, Inc. | | 10,933 | | 923,729 | |

| Pinnacle West Capital Corp. | | 7,473 | | 549,041 | |

| | | 3,633,812 | |

| Electrical Equipment — 1.0% | | | |

| AMETEK, Inc. | | 6,355 | | 784,842 | |

Atkore, Inc.(2) | | 2,555 | | 253,635 | |

| Eaton Corp. PLC | | 2,199 | | 326,310 | |

| Emerson Electric Co. | | 12,094 | | 1,089,307 | |

Generac Holdings, Inc.(2) | | 1,792 | | 480,794 | |

Hexatronic Group AB(3) | | 9,073 | | 110,063 | |

| Hubbell, Inc. | | 921 | | 201,717 | |

| Nexans SA | | 814 | | 78,180 | |

| nVent Electric PLC | | 35,092 | | 1,239,098 | |

Plug Power, Inc.(2)(3) | | 7,784 | | 166,110 | |

| Regal Rexnord Corp. | | 4,446 | | 597,098 | |

| Rockwell Automation, Inc. | | 1,564 | | 399,258 | |

| Schneider Electric SE | | 4,577 | | 633,017 | |

| Sensata Technologies Holding PLC | | 2,716 | | 120,780 | |

| Ushio, Inc. | | 5,200 | | 71,896 | |

| | | 6,552,105 | |

| Electronic Equipment, Instruments and Components — 0.6% | |

| CDW Corp. | | 2,325 | | 422,057 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

| Cognex Corp. | | 14,363 | | $ | 732,226 | |

| Hexagon AB, B Shares | | 24,429 | | 287,640 | |

| Jabil, Inc. | | 1,972 | | 117,019 | |

| Keyence Corp. | | 1,100 | | 435,976 | |

Keysight Technologies, Inc.(2) | | 8,680 | | 1,411,368 | |

| National Instruments Corp. | | 3,107 | | 118,066 | |

| Sesa SpA | | 252 | | 35,768 | |

| TE Connectivity Ltd. | | 3,892 | | 520,477 | |

| | | 4,080,597 | |

| Energy Equipment and Services — 0.2% | | | |

| Aker Solutions ASA | | 24,948 | | 77,330 | |

| Baker Hughes Co. | | 15,622 | | 401,329 | |

| Schlumberger NV | | 22,342 | | 827,324 | |

| Worley Ltd. | | 6,306 | | 63,642 | |

| | | 1,369,625 | |

| Entertainment — 0.3% | | | |

CTS Eventim AG & Co. KGaA(2) | | 184 | | 10,135 | |

| Electronic Arts, Inc. | | 1,445 | | 189,627 | |

Live Nation Entertainment, Inc.(2) | | 4,038 | | 379,532 | |

ROBLOX Corp., Class A(2) | | 3,022 | | 129,735 | |

Roku, Inc.(2) | | 2,460 | | 161,179 | |

| Universal Music Group NV | | 19,132 | | 433,082 | |

Walt Disney Co.(2) | | 3,272 | | 347,159 | |

| | | 1,650,449 | |

| Equity Real Estate Investment Trusts (REITs) — 1.6% | | | |

| Agree Realty Corp. | | 2,145 | | 170,721 | |

| Alexandria Real Estate Equities, Inc. | | 641 | | 106,265 | |

| American Homes 4 Rent, Class A | | 1,885 | | 71,404 | |

| American Tower Corp. | | 247 | | 66,895 | |

| Americold Realty Trust, Inc. | | 2,720 | | 89,080 | |

| Arena REIT | | 8,700 | | 29,533 | |

| AvalonBay Communities, Inc. | | 497 | | 106,328 | |

| Big Yellow Group PLC | | 1,341 | | 23,262 | |

| Camden Property Trust | | 1,120 | | 158,032 | |

| CapitaLand Integrated Commercial Trust | | 31,500 | | 49,761 | |

Comforia Residential REIT, Inc.(3) | | 27 | | 68,196 | |

| Corporate Office Properties Trust | | 1,606 | | 45,209 | |

| Digital Realty Trust, Inc. | | 1,080 | | 143,046 | |

| Dream Industrial Real Estate Investment Trust | | 2,077 | | 20,469 | |

| Duke Realty Corp. | | 1,409 | | 88,147 | |

| Embassy Office Parks REIT | | 5,523 | | 25,391 | |

| Equinix, Inc. | | 1,297 | | 912,751 | |

| Equity LifeStyle Properties, Inc. | | 1,386 | | 101,899 | |

| Essential Properties Realty Trust, Inc. | | 2,987 | | 72,046 | |

| Essex Property Trust, Inc. | | 1,707 | | 489,107 | |

| GLP J-Reit | | 38 | | 49,976 | |

| Goodman Group | | 7,709 | | 112,822 | |

| Healthcare Realty Trust, Inc., Class A | | 13,979 | | 366,949 | |

| Healthpeak Properties, Inc. | | 27,741 | | 766,484 | |

| Host Hotels & Resorts, Inc. | | 5,176 | | 92,185 | |

| Invincible Investment Corp. | | 347 | | 109,160 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

| Invitation Homes, Inc. | | 3,137 | | $ | 122,437 | |

| Iron Mountain, Inc. | | 1,603 | | 77,729 | |

| Japan Hotel REIT Investment Corp. | | 271 | | 140,637 | |

| Kimco Realty Corp. | | 5,776 | | 127,707 | |

| Kite Realty Group Trust | | 6,012 | | 119,579 | |

| Life Storage, Inc. | | 574 | | 72,261 | |

| Link REIT | | 12,300 | | 103,004 | |

| NETSTREIT Corp. | | 3,135 | | 64,267 | |

| Orix JREIT, Inc. | | 43 | | 61,691 | |

| Prologis, Inc. | | 11,164 | | 1,479,900 | |

| Public Storage | | 744 | | 242,849 | |

| Realty Income Corp. | | 8,824 | | 652,888 | |

| Regency Centers Corp. | | 10,254 | | 660,665 | |

| Rexford Industrial Realty, Inc. | | 8,171 | | 534,465 | |

Ryman Hospitality Properties, Inc.(2) | | 2,102 | | 186,111 | |

| Sabra Health Care REIT, Inc. | | 2,740 | | 42,169 | |

| Scentre Group | | 20,410 | | 41,825 | |

| Segro PLC | | 32,420 | | 433,714 | |

Shaftesbury PLC(3) | | 4,419 | | 27,116 | |

| Shopping Centres Australasia Property Group | | 16,653 | | 34,754 | |

| SOSiLA Logistics REIT, Inc. | | 47 | | 54,279 | |

| Suntec Real Estate Investment Trust | | 14,000 | | 16,352 | |

| Tritax Big Box REIT PLC | | 36,147 | | 86,967 | |

| UDR, Inc. | | 2,765 | | 133,826 | |

| Ventas, Inc. | | 1,974 | | 106,162 | |

| VICI Properties, Inc. | | 7,991 | | 273,212 | |

| Vicinity Centres | | 50,819 | | 74,358 | |

| Welltower, Inc. | | 2,525 | | 218,008 | |

| Weyerhaeuser Co. | | 4,284 | | 155,595 | |

| | | 10,679,645 | |

| Food and Staples Retailing — 0.4% | | | |

| Axfood AB | | 1,321 | | 41,940 | |

BJ's Wholesale Club Holdings, Inc.(2) | | 2,187 | | 148,060 | |

| Costco Wholesale Corp. | | 590 | | 319,367 | |

Grocery Outlet Holding Corp.(2) | | 1,879 | | 80,271 | |

| Kobe Bussan Co. Ltd. | | 13,600 | | 387,670 | |

| Koninklijke Ahold Delhaize NV | | 31,917 | | 878,954 | |

| Kroger Co. | | 3,455 | | 160,450 | |

| MARR SpA | | 2,415 | | 33,424 | |

| MatsukiyoCocokara & Co. | | 2,500 | | 94,389 | |

| Metcash Ltd. | | 6,546 | | 19,081 | |

| Sysco Corp. | | 6,286 | | 533,681 | |

| | | 2,697,287 | |

| Food Products — 0.6% | | | |

| Bakkafrost P/F | | 714 | | 49,777 | |

| Conagra Brands, Inc. | | 27,484 | | 940,228 | |

Freshpet, Inc.(2) | | 1,770 | | 94,589 | |

| General Mills, Inc. | | 1,661 | | 124,226 | |

| Hershey Co. | | 5,594 | | 1,275,208 | |

| J.M. Smucker Co. | | 3,348 | | 443,007 | |

| Kellogg Co. | | 1,908 | | 141,039 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

| Mondelez International, Inc., Class A | | 5,630 | | $ | 360,545 | |

| Orkla ASA | | 28,871 | | 249,222 | |

Sovos Brands, Inc.(2) | | 6,654 | | 94,221 | |

| Tate & Lyle PLC | | 6,973 | | 68,310 | |

| Toyo Suisan Kaisha Ltd. | | 2,500 | | 106,220 | |

Vital Farms, Inc.(2) | | 1,987 | | 23,447 | |

| | | 3,970,039 | |

| Gas Utilities — 0.2% | | | |

| Atmos Energy Corp. | | 1,173 | | 142,390 | |

Brookfield Infrastructure Corp., Class A(3) | | 1,848 | | 84,657 | |

| Italgas SpA | | 5,864 | | 33,547 | |

| Nippon Gas Co. Ltd. | | 6,600 | | 99,096 | |

| Spire, Inc. | | 10,933 | | 822,599 | |

| | | 1,182,289 | |

| Health Care Equipment and Supplies — 1.0% | | | |

| Alcon, Inc. | | 6,500 | | 511,577 | |

| Baxter International, Inc. | | 4,014 | | 235,461 | |

| Becton Dickinson and Co. | | 974 | | 237,958 | |

CryoPort, Inc.(2) | | 2,933 | | 109,108 | |

| DENTSPLY SIRONA, Inc. | | 8,765 | | 316,942 | |

DexCom, Inc.(2) | | 7,708 | | 632,673 | |

Edwards Lifesciences Corp.(2) | | 4,195 | | 421,765 | |

Embecta Corp.(2) | | 10,909 | | 321,052 | |

Establishment Labs Holdings, Inc.(2)(3) | | 1,346 | | 79,804 | |

IDEXX Laboratories, Inc.(2) | | 2,221 | | 886,579 | |

Inari Medical, Inc.(2) | | 2,180 | | 169,124 | |

Inmode Ltd.(2) | | 1,693 | | 56,275 | |

| Jeol Ltd. | | 1,700 | | 77,291 | |

| Koninklijke Philips NV, NY Shares | | 9,209 | | 190,995 | |

| Medtronic PLC | | 973 | | 90,022 | |

| Menicon Co. Ltd. | | 2,400 | | 60,519 | |

NeuroPace, Inc.(2)(3) | | 4,131 | | 24,208 | |

| ResMed, Inc. | | 426 | | 102,461 | |

SI-BONE, Inc.(2) | | 5,863 | | 78,799 | |

Silk Road Medical, Inc.(2) | | 3,989 | | 181,539 | |

Tandem Diabetes Care, Inc.(2) | | 1,915 | | 126,792 | |

| Zimmer Biomet Holdings, Inc. | | 13,920 | | 1,536,629 | |

| | | 6,447,573 | |

| Health Care Providers and Services — 1.1% | | | |

| Alfresa Holdings Corp. | | 1,674 | | 22,341 | |

Amedisys, Inc.(2) | | 3,112 | | 372,973 | |

| AmerisourceBergen Corp. | | 3,904 | | 569,711 | |

Amvis Holdings, Inc.(3) | | 2,000 | | 70,527 | |

| Cardinal Health, Inc. | | 5,625 | | 335,025 | |

| Chartwell Retirement Residences | | 6,378 | | 56,680 | |

| Cigna Corp. | | 2,336 | | 643,241 | |

| CVS Health Corp. | | 5,259 | | 503,181 | |

| Encompass Health Corp. | | 1,546 | | 78,258 | |

Enhabit, Inc.(2) | | 773 | | 13,535 | |

| Ensign Group, Inc. | | 1,575 | | 125,512 | |

HealthEquity, Inc.(2) | | 1,931 | | 112,326 | |

Henry Schein, Inc.(2) | | 10,407 | | 820,384 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

| Humana, Inc. | | 469 | | $ | 226,058 | |

Progyny, Inc.(2) | | 2,284 | | 69,731 | |

| Quest Diagnostics, Inc. | | 6,967 | | 951,483 | |

R1 RCM, Inc.(2) | | 18,656 | | 466,400 | |

Signify Health, Inc., Class A(2)(3) | | 4,124 | | 70,562 | |

Tenet Healthcare Corp.(2) | | 1,592 | | 105,263 | |

| UnitedHealth Group, Inc. | | 1,485 | | 805,375 | |

| Universal Health Services, Inc., Class B | | 7,150 | | 804,160 | |

| | | 7,222,726 | |

| Health Care Technology — 0.2% | | | |

Health Catalyst, Inc.(2) | | 5,614 | | 93,978 | |

OptimizeRx Corp.(2) | | 3,129 | | 70,309 | |

Schrodinger, Inc.(2) | | 2,903 | | 90,864 | |

Veeva Systems, Inc., Class A(2) | | 3,565 | | 797,063 | |

| | | 1,052,214 | |

| Hotels, Restaurants and Leisure — 0.9% | | | |

Airbnb, Inc., Class A(2) | | 6,253 | | 693,958 | |

Basic-Fit NV(2)(3) | | 1,821 | | 73,855 | |

Booking Holdings, Inc.(2) | | 140 | | 270,997 | |

Chipotle Mexican Grill, Inc.(2) | | 827 | | 1,293,610 | |

| Churchill Downs, Inc. | | 836 | | 175,393 | |

| Compass Group PLC | | 18,452 | | 432,449 | |

Corporate Travel Management Ltd.(2) | | 5,039 | | 67,197 | |

Cracker Barrel Old Country Store, Inc.(3) | | 1,284 | | 122,070 | |

Expedia Group, Inc.(2) | | 1,128 | | 119,624 | |

| Greggs PLC | | 1,094 | | 27,276 | |

| Hilton Worldwide Holdings, Inc. | | 9,744 | | 1,247,914 | |

Planet Fitness, Inc., Class A(2) | | 2,569 | | 202,463 | |

Scandic Hotels Group AB(2)(3) | | 15,655 | | 64,109 | |

SeaWorld Entertainment, Inc.(2) | | 2,078 | | 99,183 | |

| Sodexo SA | | 6,280 | | 510,272 | |

| Wingstop, Inc. | | 1,487 | | 187,630 | |

| Wyndham Hotels & Resorts, Inc. | | 1,495 | | 103,768 | |

| | | 5,691,768 | |

| Household Durables — 0.2% | | | |

| Electrolux AB, B Shares | | 24,278 | | 350,181 | |

| Open House Group Co. Ltd. | | 1,100 | | 47,988 | |

| Taylor Wimpey PLC | | 315,958 | | 491,782 | |

| Token Corp. | | 1,100 | | 73,463 | |

| | | 963,414 | |

| Household Products — 0.3% | | | |

| Colgate-Palmolive Co. | | 2,649 | | 208,582 | |

| Henkel AG & Co. KGaA, Preference Shares | | 4,615 | | 294,821 | |

| Kimberly-Clark Corp. | | 5,358 | | 706,131 | |

| Procter & Gamble Co. | | 3,637 | | 505,216 | |

| | | 1,714,750 | |

Independent Power and Renewable Electricity Producers† | | |

West Holdings Corp.(3) | | 2,000 | | 61,604 | |

| Industrial Conglomerates — 0.1% | | | |

| Honeywell International, Inc. | | 2,027 | | 390,116 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

| Insurance — 0.8% | | | |

| Aegon NV | | 56,363 | | $ | 247,558 | |

| Aflac, Inc. | | 10,982 | | 629,269 | |

| Allstate Corp. | | 7,858 | | 919,150 | |

| ASR Nederland NV | | 3,127 | | 130,701 | |

| Chubb Ltd. | | 1,294 | | 244,100 | |

Goosehead Insurance, Inc., Class A(3) | | 1,869 | | 105,056 | |

| Hanover Insurance Group, Inc. | | 2,973 | | 405,725 | |

| Kinsale Capital Group, Inc. | | 738 | | 179,489 | |

| Marsh & McLennan Cos., Inc. | | 1,860 | | 304,966 | |

| Prudential Financial, Inc. | | 3,186 | | 318,568 | |

| Reinsurance Group of America, Inc. | | 6,730 | | 779,199 | |

| RLI Corp. | | 1,202 | | 132,196 | |

| Selective Insurance Group, Inc. | | 836 | | 65,091 | |

| Steadfast Group Ltd. | | 12,175 | | 45,645 | |

| Storebrand ASA | | 13,139 | | 110,513 | |

| Travelers Cos., Inc. | | 1,762 | | 279,629 | |

| Unipol Gruppo SpA | | 10,237 | | 42,941 | |

| | | 4,939,796 | |

| Interactive Media and Services — 0.7% | | | |

Alphabet, Inc., Class A(2) | | 18,900 | | 2,198,448 | |

| Autohome, Inc., ADR | | 7,855 | | 280,345 | |

Baidu, Inc., Class A(2) | | 29,900 | | 516,803 | |

Cargurus, Inc.(2) | | 4,442 | | 107,896 | |

| carsales.com Ltd. | | 1,455 | | 21,211 | |

Eventbrite, Inc., Class A(2)(3) | | 9,103 | | 85,204 | |

Match Group, Inc.(2) | | 8,583 | | 629,220 | |

QuinStreet, Inc.(2) | | 6,842 | | 73,552 | |

| Tencent Holdings Ltd. | | 13,000 | | 502,435 | |

| | | 4,415,114 | |

| Internet and Direct Marketing Retail — 0.4% | | | |

Alibaba Group Holding Ltd.(2) | | 42,900 | | 482,345 | |

Amazon.com, Inc.(2) | | 10,720 | | 1,446,664 | |

ASOS PLC(2) | | 16,298 | | 207,426 | |

Chewy, Inc., Class A(2)(3) | | 6,253 | | 242,679 | |

Etsy, Inc.(2) | | 1,535 | | 159,210 | |

| JD.com, Inc., Class A | | 10,466 | | 312,227 | |

| | | 2,850,551 | |

| IT Services — 0.8% | | | |

| Accenture PLC, Class A | | 1,666 | | 510,229 | |

Adyen NV(2) | | 234 | | 420,913 | |

| Alten SA | | 142 | | 19,232 | |

| Amdocs Ltd. | | 4,645 | | 404,394 | |

| Capgemini SE | | 2,587 | | 493,436 | |

Capita PLC(2) | | 157,273 | | 55,225 | |

Cloudflare, Inc., Class A(2) | | 6,610 | | 332,615 | |

Endava PLC, ADR(2) | | 647 | | 65,994 | |

EPAM Systems, Inc.(2) | | 1,930 | | 674,052 | |

Euronet Worldwide, Inc.(2) | | 1,205 | | 118,415 | |

| Indra Sistemas SA | | 18,937 | | 173,230 | |

| Mastercard, Inc., Class A | | 1,545 | | 546,606 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

NEXTDC Ltd.(2) | | 14,524 | | $ | 120,906 | |

Okta, Inc.(2) | | 1,508 | | 148,463 | |

Perficient, Inc.(2) | | 1,432 | | 151,105 | |

| SCSK Corp. | | 3,900 | | 68,680 | |

| Switch, Inc., Class A | | 4,372 | | 147,817 | |

TDCX, Inc., ADR(2) | | 3,394 | | 26,677 | |

Thoughtworks Holding, Inc.(2) | | 5,779 | | 90,499 | |

| Visa, Inc., Class A | | 3,785 | | 802,836 | |

| | | 5,371,324 | |

| Leisure Products — 0.1% | | | |

| Brunswick Corp. | | 1,606 | | 128,673 | |

Callaway Golf Co.(2) | | 6,148 | | 141,097 | |

| MIPS AB | | 329 | | 17,601 | |

| Polaris, Inc. | | 1,869 | | 219,196 | |

| | | 506,567 | |

| Life Sciences Tools and Services — 0.7% | | | |

| Agilent Technologies, Inc. | | 6,587 | | 883,317 | |

| Bio-Techne Corp. | | 1,556 | | 599,496 | |

ICON PLC(2) | | 2,497 | | 602,401 | |

IQVIA Holdings, Inc.(2) | | 3,308 | | 794,813 | |

| Lonza Group AG | | 897 | | 545,153 | |

MaxCyte, Inc.(2)(3) | | 11,379 | | 62,016 | |

Mettler-Toledo International, Inc.(2) | | 456 | | 615,477 | |

| Thermo Fisher Scientific, Inc. | | 872 | | 521,813 | |

| | | 4,624,486 | |

| Machinery — 0.7% | | | |

| AGCO Corp. | | 750 | | 81,690 | |

| Astec Industries, Inc. | | 2,651 | | 130,244 | |

ATS Automation Tooling Systems, Inc.(2) | | 4,657 | | 147,469 | |

| Cummins, Inc. | | 4,032 | | 892,322 | |

| Deere & Co. | | 487 | | 167,129 | |

| Graco, Inc. | | 6,967 | | 467,904 | |

| IHI Corp. | | 2,500 | | 65,919 | |

| IMI PLC | | 15,997 | | 261,215 | |

| John Bean Technologies Corp. | | 1,395 | | 156,672 | |

| Metso Outotec Oyj | | 6,708 | | 55,453 | |

| Mueller Water Products, Inc., Class A | | 9,672 | | 125,929 | |

| Oshkosh Corp. | | 9,640 | | 830,004 | |

| PACCAR, Inc. | | 2,399 | | 219,556 | |

| Parker-Hannifin Corp. | | 2,443 | | 706,247 | |

| Stanley Black & Decker, Inc. | | 1,924 | | 187,263 | |

| Trelleborg AB, B Shares | | 2,362 | | 58,036 | |

| Xylem, Inc. | | 2,059 | | 189,490 | |

| | | 4,742,542 | |

| Media — 0.3% | | | |

| Comcast Corp., Class A | | 4,484 | | 168,240 | |

| Fox Corp., Class B | | 22,707 | | 701,646 | |

| Publicis Groupe SA | | 8,115 | | 431,843 | |

| WPP PLC | | 52,644 | | 568,154 | |

| | | 1,869,883 | |

| Metals and Mining — 0.1% | | | |

| AMG Advanced Metallurgical Group NV | | 1,651 | | 46,346 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

ERO Copper Corp.(2) | | 33,512 | | $ | 331,574 | |

| IGO Ltd. | | 6,488 | | 50,839 | |

Lynas Rare Earths Ltd.(2) | | 9,563 | | 58,806 | |

MMC Norilsk Nickel PJSC(4) | | 2,446 | | — | |

| OZ Minerals Ltd. | | 2,825 | | 37,729 | |

| SSR Mining, Inc. (NASDAQ) | | 4,029 | | 66,317 | |

| | | 591,611 | |

Mortgage Real Estate Investment Trusts (REITs)† | | | |

| AGNC Investment Corp. | | 1,962 | | 24,741 | |

| Multi-Utilities — 0.1% | | | |

| NorthWestern Corp. | | 11,494 | | 637,342 | |

| Multiline Retail — 0.2% | | | |

Dollar Tree, Inc.(2) | | 5,303 | | 876,904 | |

Ollie's Bargain Outlet Holdings, Inc.(2) | | 1,794 | | 105,756 | |

| Target Corp. | | 1,072 | | 175,144 | |

| | | 1,157,804 | |

| Oil, Gas and Consumable Fuels — 0.7% | | | |

| ConocoPhillips | | 9,340 | | 909,996 | |

| Devon Energy Corp. | | 8,042 | | 505,440 | |

| Diamondback Energy, Inc. | | 2,040 | | 261,161 | |

| Enterprise Products Partners LP | | 22,664 | | 605,809 | |

| Euronav NV | | 5,285 | | 72,160 | |

Excelerate Energy, Inc., Class A(2) | | 8,224 | | 182,079 | |

| Hess Corp. | | 6,135 | | 690,004 | |

Kosmos Energy Ltd.(2) | | 37,320 | | 236,609 | |

| Matador Resources Co. | | 4,631 | | 267,579 | |

| Phillips 66 | | 4,614 | | 410,646 | |

| Pioneer Natural Resources Co. | | 1,353 | | 320,593 | |

Whitecap Resources, Inc.(3) | | 47,491 | | 363,076 | |

| | | 4,825,152 | |

Paper and Forest Products† | | | |

| Holmen AB, B Shares | | 738 | | 30,326 | |

| Mondi PLC | | 14,484 | | 274,866 | |

| | | 305,192 | |

| Personal Products — 0.1% | | | |

| Estee Lauder Cos., Inc., Class A | | 727 | | 198,544 | |

| Medifast, Inc. | | 767 | | 129,002 | |

| Rohto Pharmaceutical Co. Ltd. | | 3,300 | | 98,913 | |

| | | 426,459 | |

| Pharmaceuticals — 1.1% | | | |

ALK-Abello A/S(2) | | 2,916 | | 58,220 | |

Arvinas, Inc.(2) | | 1,096 | | 58,208 | |

| AstraZeneca PLC | | 5,458 | | 717,952 | |

| AstraZeneca PLC, ADR | | 11,768 | | 779,395 | |

| Bristol-Myers Squibb Co. | | 7,724 | | 569,877 | |

Edgewise Therapeutics, Inc.(2)(3) | | 2,295 | | 22,193 | |

| GSK PLC | | 31,137 | | 654,195 | |

Harmony Biosciences Holdings, Inc.(2) | | 1,659 | | 84,161 | |

| Hikma Pharmaceuticals PLC | | 14,918 | | 315,322 | |

Intra-Cellular Therapies, Inc.(2) | | 2,079 | | 112,515 | |

| Laboratorios Farmaceuticos Rovi SA | | 345 | | 18,064 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

| Merck & Co., Inc. | | 5,253 | | $ | 469,303 | |

| Novartis AG | | 4,521 | | 388,488 | |

| Novo Nordisk A/S, B Shares | | 9,210 | | 1,072,723 | |

| Sanofi | | 1,711 | | 170,028 | |

| Sanofi, ADR | | 16,745 | | 832,226 | |

| Takeda Pharmaceutical Co. Ltd. | | 15,600 | | 457,707 | |

Ventyx Biosciences, Inc.(2)(3) | | 3,329 | | 50,301 | |

| Zoetis, Inc. | | 2,195 | | 400,697 | |

| | | 7,231,575 | |

| Professional Services — 0.4% | | | |

| ALS Ltd. | | 10,450 | | 85,830 | |

BayCurrent Consulting, Inc.(3) | | 300 | | 93,859 | |

| Bureau Veritas SA | | 17,430 | | 480,730 | |

| DKSH Holding AG | | 1,353 | | 111,215 | |

| Jacobs Engineering Group, Inc. | | 5,900 | | 810,070 | |

| Teleperformance | | 866 | | 289,591 | |

| Verisk Analytics, Inc. | | 3,091 | | 588,063 | |

Visional, Inc.(2)(3) | | 1,300 | | 71,199 | |

| | | 2,530,557 | |

| Real Estate Management and Development — 0.1% | | | |

Altus Group Ltd.(3) | | 2,788 | | 114,455 | |

| Capitaland Investment Ltd. | | 30,100 | | 85,644 | |

| City Developments Ltd. | | 3,900 | | 21,911 | |

| CK Asset Holdings Ltd. | | 7,000 | | 49,558 | |

| Colliers International Group, Inc. (Toronto) | | 310 | | 38,714 | |

DigitalBridge Group, Inc.(2) | | 20,040 | | 109,819 | |

| Grainger PLC | | 13,553 | | 48,983 | |

| PSP Swiss Property AG | | 673 | | 80,485 | |

| Tokyu Fudosan Holdings Corp. | | 14,500 | | 78,575 | |

| Tricon Residential, Inc. | | 820 | | 8,922 | |

| Tricon Residential, Inc. (Toronto) | | 12,023 | | 130,694 | |

| VGP NV | | 85 | | 14,929 | |

| | | 782,689 | |

| Road and Rail — 0.4% | | | |

| Canadian Pacific Railway Ltd. | | 8,106 | | 639,149 | |

| Heartland Express, Inc. | | 21,579 | | 342,675 | |

Lyft, Inc., Class A(2) | | 11,994 | | 166,237 | |

| Nagoya Railroad Co. Ltd. | | 5,000 | | 80,600 | |

| Norfolk Southern Corp. | | 3,711 | | 932,092 | |

Saia, Inc.(2) | | 316 | | 75,161 | |

Uber Technologies, Inc.(2) | | 2,789 | | 65,402 | |

| Union Pacific Corp. | | 1,041 | | 236,619 | |

| | | 2,537,935 | |

| Semiconductors and Semiconductor Equipment — 1.0% | | |

Advanced Micro Devices, Inc.(2) | | 2,835 | | 267,822 | |

Ambarella, Inc.(2) | | 742 | | 64,220 | |

| Analog Devices, Inc. | | 3,040 | | 522,758 | |

| Applied Materials, Inc. | | 5,844 | | 619,347 | |

| ASML Holding NV | | 494 | | 283,930 | |

| BE Semiconductor Industries NV | | 496 | | 26,626 | |

Enphase Energy, Inc.(2) | | 2,707 | | 769,275 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

| Infineon Technologies AG | | 8,992 | | $ | 246,601 | |

Lattice Semiconductor Corp.(2) | | 3,423 | | 210,515 | |

MACOM Technology Solutions Holdings, Inc.(2) | | 1,566 | | 90,734 | |

| Marvell Technology, Inc. | | 8,820 | | 491,098 | |

| Monolithic Power Systems, Inc. | | 1,671 | | 776,547 | |

Nova Ltd.(2) | | 727 | | 76,589 | |

| NVIDIA Corp. | | 3,938 | | 715,259 | |

Onto Innovation, Inc.(2) | | 1,867 | | 155,428 | |

| Power Integrations, Inc. | | 1,954 | | 166,110 | |

Semtech Corp.(2) | | 648 | | 40,390 | |

| Skyworks Solutions, Inc. | | 2,421 | | 263,599 | |

| SUMCO Corp. | | 24,900 | | 348,419 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. | | 29,000 | | 497,337 | |

| | | 6,632,604 | |

| Software — 2.2% | | | |

Adobe, Inc.(2) | | 587 | | 240,740 | |

Atlassian Corp. PLC, Class A(2) | | 1,426 | | 298,490 | |

Box, Inc., Class A(2) | | 5,808 | | 165,180 | |

Cadence Design Systems, Inc.(2) | | 11,794 | | 2,194,628 | |

| Dassault Systemes SE | | 9,055 | | 388,384 | |

Datadog, Inc., Class A(2) | | 6,807 | | 694,382 | |

Descartes Systems Group, Inc.(2) | | 746 | | 51,534 | |

DocuSign, Inc.(2) | | 2,821 | | 180,488 | |

Five9, Inc.(2) | | 1,093 | | 118,175 | |

HubSpot, Inc.(2) | | 707 | | 217,756 | |

JFrog Ltd.(2) | | 3,232 | | 71,750 | |

Kinaxis, Inc.(2) | | 782 | | 93,482 | |

| m-up Holdings, Inc. | | 3,800 | | 44,190 | |

Manhattan Associates, Inc.(2) | | 9,963 | | 1,401,495 | |

| Microsoft Corp. | | 12,840 | | 3,604,702 | |

nCino, Inc.(2)(3) | | 3,936 | | 127,093 | |

| Open Text Corp. | | 12,299 | | 503,029 | |

Palo Alto Networks, Inc.(2) | | 4,051 | | 2,021,854 | |

Paycor HCM, Inc.(2) | | 5,805 | | 154,936 | |

Paylocity Holding Corp.(2) | | 1,124 | | 231,465 | |

QT Group Oyj(2)(3) | | 179 | | 14,474 | |

Salesforce, Inc.(2) | | 1,654 | | 304,369 | |

ServiceNow, Inc.(2) | | 261 | | 116,578 | |

Sprout Social, Inc., Class A(2) | | 2,211 | | 115,193 | |

SPS Commerce, Inc.(2) | | 1,331 | | 159,401 | |

Tenable Holdings, Inc.(2) | | 4,561 | | 176,283 | |

Trade Desk, Inc., Class A(2) | | 11,688 | | 525,960 | |

Workday, Inc., Class A(2) | | 539 | | 83,599 | |

| | | 14,299,610 | |

| Specialty Retail — 0.5% | | | |

| Advance Auto Parts, Inc. | | 4,910 | | 950,674 | |

Burlington Stores, Inc.(2) | | 2,727 | | 384,862 | |

Five Below, Inc.(2) | | 1,724 | | 219,069 | |

| Home Depot, Inc. | | 2,420 | | 728,275 | |

Leslie's, Inc.(2) | | 9,703 | | 147,097 | |

| Nextage Co. Ltd. | | 4,300 | | 95,112 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

Petco Health & Wellness Co., Inc.(2)(3) | | 5,812 | | $ | 80,903 | |

| Pets at Home Group PLC | | 1,795 | | 7,202 | |

| TJX Cos., Inc. | | 5,754 | | 351,915 | |

| Tractor Supply Co. | | 719 | | 137,674 | |

Watches of Switzerland Group PLC(2) | | 6,568 | | 71,199 | |

| | | 3,173,982 | |

| Technology Hardware, Storage and Peripherals — 0.4% | | |

| Apple, Inc. | | 13,329 | | 2,166,096 | |

| HP, Inc. | | 13,479 | | 450,064 | |

Pure Storage, Inc., Class A(2) | | 2,035 | | 57,692 | |

| | | 2,673,852 | |

| Textiles, Apparel and Luxury Goods — 0.5% | | | |

Asics Corp.(3) | | 3,800 | | 72,403 | |

Crocs, Inc.(2) | | 1,550 | | 111,042 | |

Deckers Outdoor Corp.(2) | | 459 | | 143,764 | |

| EssilorLuxottica SA | | 2,333 | | 365,773 | |

| Li Ning Co. Ltd. | | 49,500 | | 401,526 | |

lululemon athletica, Inc.(2) | | 2,711 | | 841,793 | |

| LVMH Moet Hennessy Louis Vuitton SE | | 715 | | 496,463 | |

| NIKE, Inc., Class B | | 2,486 | | 285,691 | |

| Puma SE | | 3,991 | | 269,487 | |

| | | 2,987,942 | |

Thrifts and Mortgage Finance† | | | |

| Capitol Federal Financial, Inc. | | 20,946 | | 200,872 | |

| Trading Companies and Distributors — 0.4% | | | |

| AddTech AB, B Shares | | 3,502 | | 59,950 | |

| Ashtead Group PLC | | 5,602 | | 315,335 | |

Beacon Roofing Supply, Inc.(2) | | 4,942 | | 296,619 | |

| Diploma PLC | | 1,971 | | 66,191 | |

| Finning International, Inc. | | 1,907 | | 41,698 | |

| H&E Equipment Services, Inc. | | 4,095 | | 146,396 | |

| MonotaRO Co. Ltd. | | 15,000 | | 267,830 | |

| MSC Industrial Direct Co., Inc., Class A | | 10,755 | | 889,008 | |

NOW, Inc.(2) | | 8,948 | | 98,965 | |

| RS GROUP PLC | | 5,389 | | 68,034 | |

| Yamazen Corp. | | 6,700 | | 50,658 | |

| | | 2,300,684 | |

Transportation Infrastructure† | | | |

Japan Airport Terminal Co. Ltd.(2) | | 1,500 | | 58,798 | |

SATS Ltd.(2) | | 27,100 | | 78,125 | |

| | | 136,923 | |

Water Utilities† | | | |

| SJW Group | | 2,296 | | 150,755 | |

TOTAL COMMON STOCKS (Cost $164,286,678) |

| | 197,323,028 | |

| U.S. TREASURY SECURITIES — 5.2% |

|

|

|

U.S. Treasury Bonds, 2.375%, 2/15/42(5) | | $ | 5,000,000 | | 4,356,250 | |

| U.S. Treasury Bonds, 3.00%, 5/15/42 | | 250,000 | | 241,016 | |

| U.S. Treasury Bonds, 3.75%, 11/15/43 | | 40,000 | | 42,827 | |

| U.S. Treasury Bonds, 3.125%, 8/15/44 | | 350,000 | | 339,240 | |

| U.S. Treasury Bonds, 3.00%, 5/15/45 | | 100,000 | | 94,797 | |

| U.S. Treasury Bonds, 3.00%, 11/15/45 | | 50,000 | | 47,522 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

| U.S. Treasury Inflation Indexed Bonds, 2.375%, 1/15/25 | | $ | 775,335 | | $ | 824,113 | |

| U.S. Treasury Inflation Indexed Bonds, 2.375%, 1/15/27 | | 289,884 | | 321,606 | |

| U.S. Treasury Inflation Indexed Bonds, 2.50%, 1/15/29 | | 2,927,053 | | 3,384,447 | |

| U.S. Treasury Inflation Indexed Bonds, 2.125%, 2/15/40 | | 486,846 | | 604,458 | |

| U.S. Treasury Inflation Indexed Bonds, 0.75%, 2/15/42 | | 853,756 | | 841,920 | |

| U.S. Treasury Inflation Indexed Bonds, 0.625%, 2/15/43 | | 394,115 | | 375,808 | |

| U.S. Treasury Inflation Indexed Bonds, 1.375%, 2/15/44 | | 1,442,296 | | 1,586,521 | |

| U.S. Treasury Inflation Indexed Bonds, 0.75%, 2/15/45 | | 1,452,286 | | 1,405,853 | |

| U.S. Treasury Inflation Indexed Bonds, 0.875%, 2/15/47 | | 484,348 | | 481,258 | |

| U.S. Treasury Inflation Indexed Bonds, 0.125%, 2/15/51 | | 617,485 | | 514,272 | |

| U.S. Treasury Inflation Indexed Notes, 0.125%, 4/15/25 | | 2,093,479 | | 2,110,186 | |

| U.S. Treasury Inflation Indexed Notes, 0.625%, 1/15/26 | | 1,476,168 | | 1,516,129 | |

| U.S. Treasury Inflation Indexed Notes, 0.125%, 4/15/26 | | 3,343,710 | | 3,371,428 | |

| U.S. Treasury Inflation Indexed Notes, 0.125%, 4/15/27 | | 2,344,819 | | 2,368,921 | |

| U.S. Treasury Inflation Indexed Notes, 0.875%, 1/15/29 | | 405,160 | | 426,410 | |

| U.S. Treasury Inflation Indexed Notes, 0.125%, 1/15/32 | | 1,613,309 | | 1,610,999 | |

| U.S. Treasury Notes, 2.25%, 8/15/27 | | 200,000 | | 195,484 | |

U.S. Treasury Notes, 1.50%, 11/30/28(5) | | 6,900,000 | | 6,406,488 | |

TOTAL U.S. TREASURY SECURITIES (Cost $34,367,883) |

| | 33,467,953 | |

| SOVEREIGN GOVERNMENTS AND AGENCIES — 2.7% |

|

|

Australia† | | | |

| Australia Government Bond, 3.00%, 3/21/47 | AUD | 120,000 | | 77,762 | |

| New South Wales Treasury Corp., 3.00%, 3/20/28 | AUD | 110,000 | | 75,823 | |

| | | 153,585 | |

Austria† | | | |

Republic of Austria Government Bond, 0.75%, 10/20/26(6) | EUR | 41,000 | | 42,134 | |

Republic of Austria Government Bond, 4.15%, 3/15/37(6) | EUR | 29,000 | | 39,233 | |

| | | 81,367 | |

Belgium† | | | |

Kingdom of Belgium Government Bond, 4.25%, 3/28/41(6) | EUR | 27,000 | | 37,273 | |

| Canada — 0.2% | | | |

| Canadian Government Bond, 0.25%, 3/1/26 | CAD | 850,000 | | 608,319 | |

| Province of British Columbia Canada, 2.85%, 6/18/25 | CAD | 201,000 | | 155,878 | |

| Province of Quebec Canada, 3.00%, 9/1/23 | CAD | 215,000 | | 167,494 | |

| Province of Quebec Canada, 5.75%, 12/1/36 | CAD | 108,000 | | 103,919 | |

| Province of Quebec Canada, 3.50%, 12/1/48 | CAD | 20,000 | | 14,960 | |

| | | 1,050,570 | |

| China — 1.9% | | | |

| China Government Bond, 2.64%, 8/13/22 | CNY | 63,500,000 | | 9,430,033 | |

| China Government Bond, 2.88%, 11/5/23 | CNY | 19,000,000 | | 2,851,015 | |

| China Government Bond, 3.25%, 6/6/26 | CNY | 400,000 | | 61,204 | |

| China Government Bond, 3.29%, 5/23/29 | CNY | 300,000 | | 46,217 | |

| | | 12,388,469 | |

Czech Republic† | | | |

| Czech Republic Government Bond, 4.70%, 9/12/22 | CZK | 610,000 | | 25,291 | |

Denmark† | | | |

| Denmark Government Bond, 0.50%, 11/15/27 | DKK | 245,000 | | 33,069 | |

| Denmark Government Bond, 4.50%, 11/15/39 | DKK | 62,000 | | 12,496 | |

| | | 45,565 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

| Finland — 0.1% | | | |

Finland Government Bond, 4.00%, 7/4/25(6) | EUR | 58,000 | | $ | 65,382 | |

Finland Government Bond, 0.125%, 4/15/36(6) | EUR | 350,000 | | 294,724 | |

| | | 360,106 | |

| France — 0.2% | | | |

French Republic Government Bond OAT, 0.00%, 11/25/31(7) | EUR | 1,050,000 | | 958,224 | |

Germany† | | | |

Bundesrepublik Deutschland Bundesanleihe, 0.00%, 8/15/52(7) | EUR | 40,000 | | 29,706 | |

Ireland† | | | |

| Ireland Government Bond, 3.40%, 3/18/24 | EUR | 74,000 | | 79,409 | |

| Italy — 0.1% | | | |

| Italy Buoni Poliennali Del Tesoro, 1.50%, 6/1/25 | EUR | 35,000 | | 35,560 | |

| Italy Buoni Poliennali Del Tesoro, 2.00%, 12/1/25 | EUR | 223,000 | | 229,029 | |

| | | 264,589 | |

Malaysia† | | | |

| Malaysia Government Bond, 3.96%, 9/15/25 | MYR | 250,000 | | 56,810 | |

Mexico† | | | |

| Mexico Government International Bond, 4.15%, 3/28/27 | | $ | 200,000 | | 201,203 | |

Netherlands† | | | |

Netherlands Government Bond, 0.50%, 7/15/26(6) | EUR | 100,000 | | 101,897 | |

Netherlands Government Bond, 2.75%, 1/15/47(6) | EUR | 27,000 | | 35,670 | |

| | | 137,567 | |

Norway† | | | |

Norway Government Bond, 2.00%, 5/24/23(6) | NOK | 85,000 | | 8,764 | |

Norway Government Bond, 1.75%, 2/17/27(6) | NOK | 510,000 | | 50,685 | |

| | | 59,449 | |

Peru† | | | |

| Peruvian Government International Bond, 5.625%, 11/18/50 | | $ | 60,000 | | 65,809 | |

Poland† | | | |

| Republic of Poland Government Bond, 4.00%, 10/25/23 | PLN | 215,000 | | 44,990 | |

Singapore† | | | |

| Singapore Government Bond, 3.125%, 9/1/22 | SGD | 90,000 | | 65,185 | |

Switzerland† | | | |

| Swiss Confederation Government Bond, 1.25%, 5/28/26 | CHF | 147,000 | | 161,897 | |

| Swiss Confederation Government Bond, 2.50%, 3/8/36 | CHF | 3,000 | | 3,932 | |

| | | 165,829 | |

Thailand† | | | |

| Thailand Government Bond, 3.625%, 6/16/23 | THB | 1,150,000 | | 31,890 | |

| Thailand Government Bond, 3.85%, 12/12/25 | THB | 3,200,000 | | 91,957 | |

| | | 123,847 | |

| United Kingdom — 0.2% | | | |

| United Kingdom Gilt, 0.125%, 1/30/26 | GBP | 1,100,000 | | 1,272,699 | |

Uruguay† | | | |

| Uruguay Government International Bond, 4.125%, 11/20/45 | | $ | 30,000 | | 29,587 | |

TOTAL SOVEREIGN GOVERNMENTS AND AGENCIES (Cost $18,776,792) |

| | 17,697,129 | |

| CORPORATE BONDS — 1.6% |

|

|

|

| Aerospace and Defense — 0.1% | | | |

| Boeing Co., 5.81%, 5/1/50 | | 50,000 | | 49,787 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

| TransDigm, Inc., 6.375%, 6/15/26 | | $ | 50,000 | | $ | 49,806 | |

| TransDigm, Inc., 4.625%, 1/15/29 | | 190,000 | | 171,222 | |

| | | 270,815 | |

| Airlines — 0.1% | | | |

American Airlines, Inc. / AAdvantage Loyalty IP Ltd., 5.50%, 4/20/26(6) | | 198,077 | | 195,080 | |

| United Airlines Holdings, Inc., 5.00%, 2/1/24 | | 140,000 | | 137,626 | |

| | | 332,706 | |

Auto Components† | | | |

ZF North America Capital, Inc., 4.75%, 4/29/25(6) | | 110,000 | | 104,841 | |

| Automobiles — 0.1% | | | |

| Ford Motor Credit Co. LLC, 3.625%, 6/17/31 | | 370,000 | | 314,678 | |

| General Motors Co., 5.15%, 4/1/38 | | 120,000 | | 108,247 | |

| | | 422,925 | |

| Banks — 0.4% | | | |

| Akbank T.A.S., 5.00%, 10/24/22 | | 70,000 | | 69,688 | |

Avi Funding Co. Ltd., 3.80%, 9/16/25(6) | | 143,000 | | 143,450 | |

| Banco Santander SA, 2.50%, 3/18/25 | EUR | 100,000 | | 103,148 | |

| Bank of America Corp., 2.30%, 7/25/25 | GBP | 100,000 | | 118,904 | |

| CaixaBank SA, VRN, 2.75%, 7/14/28 | EUR | 100,000 | | 101,248 | |

| CaixaBank SA, VRN, 2.25%, 4/17/30 | EUR | 100,000 | | 97,064 | |

| Commerzbank AG, 4.00%, 3/23/26 | EUR | 150,000 | | 156,358 | |

| Credit Agricole SA, 7.375%, 12/18/23 | GBP | 50,000 | | 63,681 | |

| European Financial Stability Facility, 2.125%, 2/19/24 | EUR | 93,000 | | 97,040 | |

| European Financial Stability Facility, 0.40%, 5/31/26 | EUR | 200,000 | | 199,683 | |

European Union, 0.00%, 7/4/31(7) | EUR | 1,450,000 | | 1,303,969 | |

| ING Groep NV, 2.125%, 1/10/26 | EUR | 200,000 | | 205,915 | |

| Lloyds Bank PLC, 7.625%, 4/22/25 | GBP | 20,000 | | 26,660 | |

| | | 2,686,808 | |

Biotechnology† | | | |

| AbbVie, Inc., 4.40%, 11/6/42 | | $ | 280,000 | | 268,778 | |

Chemicals† | | | |

Equate Petrochemical BV, 4.25%, 11/3/26(6) | | 46,000 | | 45,494 | |

| Olin Corp., 5.125%, 9/15/27 | | 70,000 | | 67,440 | |

| | | 112,934 | |

Containers and Packaging† | | | |

| Ball Corp., 5.25%, 7/1/25 | | 35,000 | | 35,475 | |

Mauser Packaging Solutions Holding Co., 5.50%, 4/15/24(6) | | 40,000 | | 39,612 | |

Sealed Air Corp., 5.125%, 12/1/24(6) | | 105,000 | | 106,432 | |

| | | 181,519 | |

Diversified Financial Services† | | | |

| Allen C Stonecipher Life Insurance Trust, VRDN, 2.44%, 8/5/22 (LOC: FHLB) | | 5,000 | | 5,000 | |

| Diversified Telecommunication Services — 0.1% | | | |

| AT&T, Inc., 4.90%, 8/15/37 | | 59,000 | | 60,571 | |

Level 3 Financing, Inc., 4.625%, 9/15/27(6) | | 136,000 | | 124,643 | |

Turk Telekomunikasyon AS, 4.875%, 6/19/24(6) | | 115,000 | | 99,492 | |

| | | 284,706 | |

Electric Utilities† | | | |

| Duke Energy Florida LLC, 3.85%, 11/15/42 | | 40,000 | | 36,186 | |

| Duke Energy Progress LLC, 4.15%, 12/1/44 | | 40,000 | | 37,720 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

| Exelon Corp., 4.45%, 4/15/46 | | $ | 20,000 | | $ | 18,818 | |

Israel Electric Corp. Ltd., 6.875%, 6/21/23(6) | | 57,000 | | 58,403 | |

| MidAmerican Energy Co., 4.40%, 10/15/44 | | 60,000 | | 58,973 | |

| | | 210,100 | |

| Equity Real Estate Investment Trusts (REITs) — 0.1% | | | |

| EPR Properties, 4.95%, 4/15/28 | | 292,000 | | 272,808 | |

VICI Properties LP / VICI Note Co., Inc., 5.625%, 5/1/24(6) | | 90,000 | | 90,154 | |

| | | 362,962 | |

| Health Care Providers and Services — 0.1% | | | |

| CVS Health Corp., 4.78%, 3/25/38 | | 40,000 | | 40,101 | |

DaVita, Inc., 4.625%, 6/1/30(6) | | 270,000 | | 221,916 | |

| Kaiser Foundation Hospitals, 3.00%, 6/1/51 | | 70,000 | | 53,857 | |

| | | 315,874 | |

| Hotels, Restaurants and Leisure — 0.2% | | | |

Caesars Entertainment, Inc., 4.625%, 10/15/29(6) | | 110,000 | | 93,516 | |

| MGM Resorts International, 6.00%, 3/15/23 | | 135,000 | | 136,332 | |

| MGM Resorts International, 4.625%, 9/1/26 | | 39,000 | | 36,328 | |

Penn National Gaming, Inc., 5.625%, 1/15/27(6) | | 175,000 | | 162,830 | |

Penn National Gaming, Inc., 4.125%, 7/1/29(6) | | 43,000 | | 35,839 | |

Station Casinos LLC, 4.625%, 12/1/31(6) | | 530,000 | | 463,202 | |

Wynn Las Vegas LLC / Wynn Las Vegas Capital Corp., 5.25%, 5/15/27(6) | | 200,000 | | 185,988 | |

| | | 1,114,035 | |

| Household Durables — 0.1% | | | |

| KB Home, 4.80%, 11/15/29 | | 253,000 | | 227,966 | |

| Meritage Homes Corp., 5.125%, 6/6/27 | | 190,000 | | 186,290 | |

Tempur Sealy International, Inc., 3.875%, 10/15/31(6) | | 136,000 | | 110,500 | |

| | | 524,756 | |

Interactive Media and Services† | | | |

Tencent Holdings Ltd., 3.80%, 2/11/25(6) | | 86,000 | | 85,670 | |

Media† | | | |

| Charter Communications Operating LLC / Charter Communications Operating Capital, 5.125%, 7/1/49 | | 85,000 | | 73,406 | |

| DISH DBS Corp., 7.75%, 7/1/26 | | 165,000 | | 137,410 | |

| | | 210,816 | |

| Metals and Mining — 0.1% | | | |

Alcoa Nederland Holding BV, 4.125%, 3/31/29(6) | | 200,000 | | 188,413 | |

| ATI, Inc., 4.875%, 10/1/29 | | 240,000 | | 205,659 | |

Cleveland-Cliffs, Inc., 4.625%, 3/1/29(6) | | 235,000 | | 219,679 | |

| Freeport-McMoRan, Inc., 5.40%, 11/14/34 | | 215,000 | | 214,816 | |

| Teck Resources Ltd., 6.25%, 7/15/41 | | 60,000 | | 61,402 | |

| | | 889,969 | |

Mortgage Real Estate Investment Trusts (REITs)† | | | |

Ladder Capital Finance Holdings LLLP / Ladder Capital Finance Corp., 4.75%, 6/15/29(6) | | 204,000 | | 174,424 | |

Multi-Utilities† | | | |

| Dominion Energy, Inc., 4.90%, 8/1/41 | | 30,000 | | 30,033 | |

| Oil, Gas and Consumable Fuels — 0.1% | | | |

Antero Resources Corp., 7.625%, 2/1/29(6) | | 111,000 | | 117,124 | |

| Crestwood Midstream Partners LP / Crestwood Midstream Finance Corp., 5.75%, 4/1/25 | | 90,000 | | 88,746 | |

| Enterprise Products Operating LLC, 4.85%, 3/15/44 | | 130,000 | | 124,932 | |

| | | | | | | | | | | |

| | Shares/

Principal Amount | Value |

| KazMunayGas National Co. JSC, 4.75%, 4/19/27 | | $ | 300,000 | | $ | 272,452 | |

| Kinder Morgan Energy Partners LP, 6.50%, 9/1/39 | | 60,000 | | 64,066 | |

MEG Energy Corp., 5.875%, 2/1/29(6) | | 120,000 | | 114,190 | |

| Petroleos Mexicanos, 3.50%, 1/30/23 | | 50,000 | | 49,795 | |

| Petroleos Mexicanos, 6.50%, 3/13/27 | | 60,000 | | 54,332 | |

| Southwestern Energy Co., 5.95%, 1/23/25 | | 21,000 | | 21,282 | |

| | | 906,919 | |

Road and Rail† | | | |

| Burlington Northern Santa Fe LLC, 4.45%, 3/15/43 | | 12,000 | | 12,145 | |

| Burlington Northern Santa Fe LLC, 4.15%, 4/1/45 | | 80,000 | | 77,311 | |

| | | 89,456 | |

Software† | | | |

NCR Corp., 5.125%, 4/15/29(6) | | 100,000 | | 96,227 | |

| Wireless Telecommunication Services — 0.1% | | | |

C&W Senior Financing DAC, 6.875%, 9/15/27(6) | | 130,000 | | 116,272 | |

Millicom International Cellular SA, 5.125%, 1/15/28(6) | | 128,700 | | 118,502 | |

| Sprint Corp., 7.875%, 9/15/23 | | 70,000 | | 72,669 | |

| Sprint Corp., 7.125%, 6/15/24 | | 315,000 | | 330,491 | |

| T-Mobile USA, Inc., 4.75%, 2/1/28 | | 240,000 | | 239,969 | |

| T-Mobile USA, Inc., 3.50%, 4/15/31 | | 15,000 | | 13,892 | |

| | | 891,795 | |

TOTAL CORPORATE BONDS (Cost $11,547,663) |

| | 10,574,068 | |

| COLLATERALIZED LOAN OBLIGATIONS — 0.6% |

|

|

|

Ares XL CLO Ltd., Series 2016-40A, Class CRR, VRN, 5.31%, (3-month LIBOR plus 2.80%), 1/15/29(6) | | 250,000 | | 231,027 | |

Ares XXXIV CLO Ltd., Series 2015-2A, Class BR2, VRN, 4.34%, (3-month LIBOR plus 1.60%), 4/17/33(6) | | 375,000 | | 357,550 | |

Ares XXXIX CLO Ltd., Series 2016-39A, Class CR2, VRN, 4.79%, (3-month LIBOR plus 2.05%), 4/18/31(6) | | 325,000 | | 307,595 | |

Cook Park CLO Ltd., Series 2018-1A, Class C, VRN, 4.49%, (3-month LIBOR plus 1.75%), 4/17/30(6) | | 250,000 | | 236,005 | |