united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-08542

The Saratoga Advantage Trust

(Exact name of registrant as specified in charter)

12725 W. Indian School Rd, Suite E-101, Avondale, AZ 85392

(Address of principal executive offices) (Zip code)

Stuart M Strauss, Esq. Dechert LLP

1095 Avenue of the Americas, New York, NY, 10036

(Name and address of agent for service)

Registrant's telephone number, including area code: 623-266-4567

Date of fiscal year end: 8/31

Date of reporting period: 8/31/23

Item 1. Reports to Stockholders.

| |

| |

|

| |

| |

| Class A and C Shares |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | ANNUAL REPORT | |

| | As Of August 31, 2023 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| THIS REPORT IS AUTHORIZED FOR DISTRIBUTION ONLY TO SHAREHOLDERS |

| AND TO OTHERS WHO HAVE RECEIVED A COPY OF THE PROSPECTUS. |

| |

| |

| |

| |

TABLE OF CONTENTS

| Chairman’s Letter | Page 1 |

| Investment Review | Page 6 |

| Schedules of Investments | Page 46 |

| Statements of Assets and Liabilities | Page 85 |

| Statements of Operations | Page 89 |

| Statements of Changes in Net Assets | Page 93 |

| Notes to Financials | Page 99 |

| Financial Highlights | Page 120 |

| Report of Independent Registered Public Accounting Firm | Page 138 |

| Supplemental Information | Page 140 |

| Privacy Notice | Page 150 |

TRUSTEES AND OFFICERS

| Bruce E. Ventimiglia | Trustee, Chairman, President & CEO |

| Patrick H. McCollough | Trustee |

| Udo W. Koopmann | Trustee |

| Floyd E. Seal | Trustee |

| Stephen H. Hamrick | Trustee |

| Stephen Ventimiglia | Vice President & Secretary |

| Jonathan W. Ventimiglia | Vice President, Assistant Secretary, |

| | Treasurer & Chief Financial Officer |

| Frederick C. Teufel, Jr | Chief Compliance Officer |

| Timothy J. Burdick | Assistant Secretary |

| Richard S. Gleason | Assistant Treasurer |

| | |

| Investment Manager | Distributor |

| Saratoga Capital Management, LLC | Northern Lights Distributors, LLC |

| 12725 W. Indian School Road, Suite E-101 | 4221 N 203rd Street, Suite 100 |

| Avondale, Arizona 85392 | Elkhorn, Nebraska 68022 |

| | |

| Transfer & Shareholder Servicing Agent | Custodian |

| Ultimus Fund Solutions, LLC | BNY Mellon Corp. |

| 4221 N 203rd Street, Suite 100 | 225 Liberty Street |

| Elkhorn, Nebraska 68022 | New York, New York 10286 |

| | |

| Administrator & Fund Accounting Agent | Custody Administrator |

| Ultimus Fund Solutions, LLC | Ultimus Fund Solutions, LLC |

| 4221 N 203rd Street, Suite 100 | 4221 N 203rd Street, Suite 100 |

| Elkhorn, Nebraska 68022 | Elkhorn, Nebraska 68022 |

THE SARATOGA ADVANTAGE TRUST

Annual Report to Shareholders

October 23, 2023

Dear Shareholder:

We are pleased to provide you with this annual report on the investment strategies and performance of the portfolios in the Saratoga Advantage Trust (the “Trust”). This report covers the twelve months from September 1, 2022, through August 31, 2023.

We believe that successful investing requires discipline and patience. Try to stay focused on your long-term investment goals. Don’t let short-term stock and bond market fluctuations or investment manias change your long-term investment strategy. The Saratoga Advantage Trust’s portfolios are managed by some of the world’s leading institutional investment advisory firms. Combining the strength of the Trust’s performance with a well-designed asset allocation plan can help you to achieve your long-term investment goals.

ECONOMIC OVERVIEW

As measured by Real Gross Domestic Product (GDP), the value of the production of goods and services in the United States grew by 2.1% during the second quarter of 2023, down from 2.2% during the previous quarter (all GDP growth rates discussed are seasonally adjusted annualized rates unless otherwise noted). Within the main components of GDP, consumer spending as measured by Personal Consumption Expenditures (PCE) advanced by 0.8%, while private sector investment as measured by Gross Private Domestic Investment (GPDI) grew 5.2%, though both one- and two-year trends remain negative. Government spending, which accounts for both consumption and gross investment, rose 3.3%. Both State & Local and Federal Government spending increased for the fourth consecutive quarter. While imports fell -7.6% for the quarter, exports fell even further to -9.3%. Net exports, however, retained a slightly positive impact on GDP, keeping a streak alive that began in the first quarter of 2022.

Americans buying services from one another has been the largest component of US GDP since the first quarter of 1970, when services spending passed goods spending for the first time. Services spending growth has been positive for twelve straight quarters, though it came in at just 1.0% for the quarter, below 12- and 24-month trends. While the consumer environment remained adequate to keep GDP in positive growth mode, we are now well removed from the heady consumer spending environment that drove 5+% GDP growth in 2021.

After a brutal stretch from 2Q22 through 2Q23, private sector investment grew 5.2% during the quarter. Within GPDI, corporate spending on structures and equipment was up 7.4%, led by a massive boom in spending on Manufacturing facilities. We generally view corporate spending on equipment as a positive leading indicator, though much of this quarter’s growth occurred in the notoriously volatile transportation sector. Once again, private investment in the residential sector

was negative, falling -2.2%, unable to reverse trend even off of a drastically low floor; investment in the country’s housing stock has now fallen for two straight years as the Fed continues to pressure the market.

Government spending and investment has settled back towards a 17% share of the economy, right around its 10- year average, after hitting a cycle-high over 20% during the pandemic. Over the past 70 years, it has been relatively normal for government spending to make up over 20% of the economy during times of war or recession, however there is always concern as spending normalizes and for much of 2021 and 2022 reduced relative government spending was a drag on GDP. 2023 has presented somewhat of a leveling-off, as public spending is now trending ahead of GDP for the past year.

Monetary Policy: The Federal Reserve continues its tapering program into year two. The Fed balance sheet peaked at roughly $8.96 trillion in April 2022, and has dropped to $8.00t at the end of September 2023. Notwithstanding a $400 billion uptick in March, as the collapse of SVB drove banks to take advantage of Fed liquidity programs, the balance sheet has marched steadily downwards for the past 17 months.

The Fed remains persistent in squeezing the country’s money supply, though certain elements of this policy have hit a lower gear. As of August, the monetary base fell -0.4% y-o-y, down from a cycle high of 57.7%. Within the monetary base, we see the Fed is still manipulating policy considerably via currency in circulation (CiC). CiC hit a pandemic-high growth rate of 17% y-o-y in 2020; that figure has now dropped to 2.0% y-o-y, far below its modern historical y-o-y growth rate of roughly 7.0%.

M2, one of the most widely used monetary figures for measuring liquidity in the economy, is also down massively from its cycle-high 22% y-o- y growth in February 2021 to -3.67% y-o-y currently; like CiC, M2 is also well below its modern historical growth rate of 7.1% y-o- y. We do note, however, that though M2 dropped again from July to August, it has finally flashed a positive three-month trend, which we view as the Fed potentially starting to neutralize its money policy.

Interest Rates: After extremely volatile trading in February and March, the one-year treasury rate grew towards 5.5% during the summer and has since settled into a range between 5.3 - 5.5%. We generally see this treasury issue move up when inflation is high and the market is anticipating the Fed will move their target rates higher to fight said inflation. In late 2022, it seemed the market was convinced the Fed would stop pushing rates before they hit 5%; with that target well surpassed, and the effective federal funds rate over 5.3%, it seems the market is convinced we may have one more rate increase to go. After posting strong gains in 2022, three-, five-, and ten-year treasury rates spent the first two quarters of the year relatively range-bound a bit below their cycle-highs. That dynamic changed during 3Q23, as longer-term treasuries moved up mostly in tandem. In good news for the yield curve, the longer the treasury, the higher it moved during the quarter, though the yield curve remains nearly entirely inverted.

Regarding long-term corporate bonds, the quality spread as measured by Moody’s-rated Baa bonds minus Aaa bonds is reflecting a similar sentiment as yield spreads. The quality spread has historically been a good predictor of confidence in the corporate bond market and helps us establish a baseline expectation for corporate earnings. The quality spread approached a long-term low of 0.65 during June 2021 and steadily moved up for the next year and a half, reaching 1.16 in December 2022. A move back to 1.03 this quarter is an improvement, and we view this level as neutral with regard to future corporate earnings.

Equity Valuations: As of September 30, 2023, the S&P 500 index was at 4,288. Our proprietary valuation work suggests a fair value for the S&P 500 around 4,214. Earnings growth has stabilized for now, and projections are on their way back up with March 2023 representing the first quarter of positive earnings growth since March 2022. We believe PE levels are likely to stay slightly below their modern historical mean of roughly 25, though only slightly so; improving inflation data has pushed our P/E estimates upward, while intermediate-to-long-term interest rates are still presenting a headwind to valuations. Earnings are generally a leading indicator, peaking slightly before recessions. We wrote previously that earnings had potentially put in cycle-high last spring, and now, after three consecutive negative quarters, it’s possible December 31, 2022 will be the ensuing cycle-low. This potentially supports the notion that the economy entered and exited a recession in early 2022, a topic that seems destined for years of debate.

To create a range of equity market outcomes, we use a valuation tool which we refer to as our Proper PE Valuation™ tool. Among other things, this analysis provides us with a set of ranges above and below which we consider the S&P 500 overvalued or undervalued, respectively. Our proprietary valuation work currently sets an appropriate S&P 500 PE from 22 to 24.5. This produces a fair value range of 4,501 to 5,012 over the next six months. Earnings growth remains soft, and the recent rapid rise in the 10-year treasury knocked down our PE range a bit from last quarter’s report.

Inflation: Our past few inflation reports have focused on the clarity wage data brought to our analysis of inflation, however wage data has become more complicated over the past quarter. Where it was clear for much of 2022 and early 2023 that wages were likely “pulling down” inflation, summer 2023 has been a mixed bag. A number of our favored wage datapoints are now near or solidly above headline inflation rates, meaning that they could potentially begin pushing inflation back up, as opposed to pulling it down. Production-line workers producing goods, whom we have referenced in a number of our recent reports as Goods Workers, have seen wage gains remain steady around 5%, with a y-o-y figure of 5.69% in August, well above 3% inflation. On the other side of the leading wage argument, another important wage datapoint, Private Service Providing Hourly Wages, is a significant outlier to the downside.

Looking beyond wages, we’re interested in certain Producer Price Index (PPI) inputs to give us some guidance on where inflation may be headed. Processed Goods for Intermediate Demand and Unprocessed Goods for Intermediate Demand, though both slightly ticking up last month, are in deep downtrends. Services for Intermediate Demand are also falling.

After months of data confirming inflation’s downtrend, the picture has become a bit cloudier. That being said, we believe the current inflation environment remains muted enough that the Fed should be comfortable with a neutral policy stance.

COMPARING THE PORTFOLIOS’ PERFORMANCE TO BENCHMARKS

When reviewing the performance of the portfolios against their benchmarks, it is important to note that the Trust is designed to help investors to implement an asset allocation strategy to meet their individual needs as well as select individual investments within each asset category among the myriad of choices available. Each Saratoga portfolio was formed to represent an asset class, and each portfolio’s institutional money manager was selected based on their ability to manage money within that class.

Therefore, the Saratoga portfolios may help investors to properly implement their asset allocation decisions and keep their investments within the risk parameters that they establish with their investment consultants. Without the intended asset class consistency of the Saratoga portfolios, even the most carefully crafted allocation strategy could be negated. Furthermore, the benchmarks do not necessarily provide precise standards against which to measure the portfolios, in that the characteristics of the benchmarks can vary widely at different points in time from the Saratoga portfolios (e.g., characteristics such as: average market capitalizations, price-to-earnings and price-to-book ratios, bond quality ratings and maturities, etc.). In addition, the benchmarks can potentially have a survivor bias built into them (i.e., the performance of only funds that are still in existence may remain part of the benchmark’s performance while funds that do not exist anymore may be removed from the benchmark’s performance).

ELECTRONIC DELIVERY AVAILABLE

This report can be delivered to you electronically. Electronic delivery can help simplify your record keeping. With electronic delivery, you’ll receive an email with a link to your Saratoga Advantage Trust quarterly statement, daily confirmations and/or semi-annual and annual reports each time one is available. You have the ability to choose which items you want delivered electronically. Choose one item or all items. It’s up to you. Please call our Customer Service Department toll-free at 1-888-672-4839 for instructions on how to establish electronic delivery.

AUTOMATED ACCOUNT UPDATES

I am pleased to inform you that you can get automated updates on your investments in the Saratoga Advantage Trust 24 hours a day, every day, by calling toll-free 1-888- 672-4839. For additional information about the Trust, please call your financial advisor, visit our website at www.saratogacap.com or call 1-800-807-FUND.

Finally, following you will find specific information on the investment strategy and performance of each of the Trust’s portfolios. Please speak with your financial advisor if you have any questions about your investment in the Saratoga Advantage Trust or your allocation of assets among the Trust’s portfolios.

We remain dedicated to serving your investment needs.

Thank you for investing with us.

Best wishes,

Bruce E. Ventimiglia

Chairman, President and

Chief Executive Officer

Investors should consider the investment objectives, risks, charges, and expenses of the Saratoga Funds carefully. This and other information about the Saratoga Funds is contained in your prospectus, which should be read carefully. To obtain an additional copy of the prospectus, please call (800) 807-FUND. Past performance is not indicative of future results. Investments in stocks, bonds and mutual funds are not guaranteed and the principal value and investment return can fluctuate. Consequently, investors may receive back less than invested.

The S&P 500 is an unmanaged, capitalization-weighted index. It is not possible to invest directly in the S&P 500.

The security holdings discussed may not be representative of the Funds’ current or future investments. Portfolio holdings are subject to change and should not be considered to be investment advice. Any statements not of a factual nature constitute opinions which are subject to change without notice. Information contained herein was obtained from recognized statistical services and other sources believed to be reliable and we therefore cannot make any representation as to its completeness or accuracy. The Funds of the Saratoga Advantage Trust are distributed by Northern Lights Distributors, LLC, member FINRA/SIPC; the Saratoga Advantage Trust and Northern Lights Distributors, LLC are not affiliated entities. 7888-NLD 10/25/2023

LARGE CAPITALIZATION VALUE PORTFOLIO

Advised by: M.D. Sass Investors Services, Inc., New York, New York

Objective: The Portfolio seeks total return consisting of capital appreciation and dividend income.

| Total Aggregate Return for the Year Ended August 31, 2023 |

| | One Year: | Five Year: | Ten Year: | Inception: | Inception: |

| | 9/1/22 – 8/31/23 | 9/1/18 –8/31/23* | 9/1/13 – 8/31/23* | 1/4/99 – 8/31/23* | 2/14/06 – 8/31/23* |

| Class A | | | | | |

| With Sales Charge | 2.45% | 8.81% | 8.49% | NA | 4.78% |

| Without Sales Charge | 8.71% | 10.10% | 9.14% | NA | 5.13% |

| Class C | | | | | |

| With Sales Charge | 7.09% | 9.45% | 8.49% | 3.68% | NA |

| Without Sales Charge | 8.09% | 9.45% | 8.49% | 3.68% | NA |

| * | Annualized performance for periods greater than one year. |

Performance data quoted above is historical. Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate, so that shares when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call (800) 807-FUND. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of fund shares. The total operating expense ratios as stated in the fee table to the Portfolio’s prospectus dated December 28, 2022, are 2.12% and 2.68% for the A and C Classes, respectively.

PORTFOLIO INVESTMENT STRATEGIES AND TECHNIQUES

In determining which securities to buy, hold or sell, the Portfolio’s Adviser focuses its investment selection on finding high quality companies with compelling valuations, measurable catalysts to unlock value and above-average long-term earnings growth potential. In general, the Adviser looks for companies that have value-added product lines to help preserve pricing power, a strong history of free cash flow generation, strong balance sheets, competent management with no record of misleading shareholders, and financially sound customers. Independent research is used to produce estimates for future earnings, which are inputs into the Adviser’s proprietary valuation model. The Adviser focuses its investments where it has a differentiated view and there exists, in its view, significant price appreciation potential to its estimate of the stocks’ intrinsic value.

PORTFOLIO ADVISER COMMENTARY

The Saratoga Large Cap Value Portfolio posted solid relative and absolute performance for the annual period ended August 31, 2023. Portfolio outperformance was primarily due to strength in Communication Services, Industrials and Healthcare sector allocations within the holdings.

The portfolio’s top contributor during the fiscal year was API Group (7.18%). We believe this is a leading company in the highly fragmented Safety Service market; the company raised synergy guidance for its potentially transformational acquisition of Chubb Fire and Safety, improved free cash flow conversion and has grown organically. The company affirmed margin expansion at Chubb and has plans to de-lever the balance sheet which could lead to more multiple expansion. Mastec Inc. (0.00%) was the portfolio’s second-best performing stock during this period. Mastec has benefitted from electrical grid modernization, infrastructure investments and renewable energy buildouts and we held them with a belief they were strongly positioned to profit from large federal stimulus actions, including the Inflation Reduction Act and the Infrastructure Investment & Jobs Act. After a strong period, we believe the time was right sell out of the Mastec position, and the portfolio no longer holds the position.

The portfolio’s main detractors were First Republic (0.00%), and PayPal (0.00%). First Republic came under considerable pressure due to the ripple effects from the collapse of Silicon Valley Bank. Generally, banks are only as good as their customers’ confidence in them. A somewhat unique risk of banks is that a downward spiral in their stock price can lead to a deterioration in the business (deposit exodus) which ends up causing a feedback loop. Due to a lack of customer confidence and a risk of HTM securities sales, the company was bailed out by regulators and subsequently sold to JP Morgan. We exited the position prior to the company being placed under receivership. PayPal underperformed due to market share concerns, compressing gross margins on core checkout, and execution issues. We have also exited PayPal.

We expect a slowing economy with wide divergence in performance among different stocks and sectors which we think could favor the portfolio’s value-oriented, relatively concentrated approach to stock selection.

Within the discussion above, the percentages shown next to specific securities are the percentages of the Portfolio represented by the security on 8/31/23. The securities held in the Portfolio are subject to change and any discussion of those securities should not be considered investment advice.

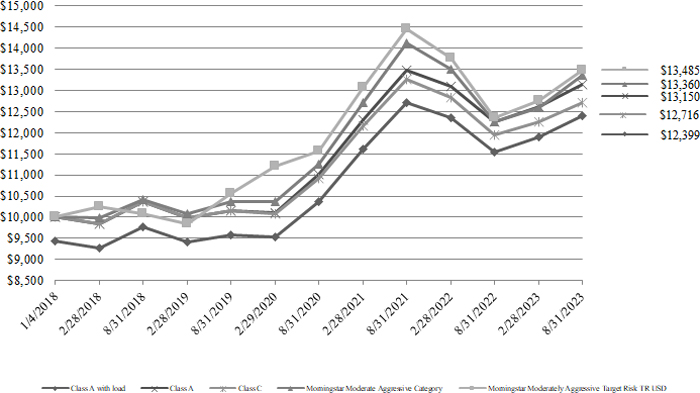

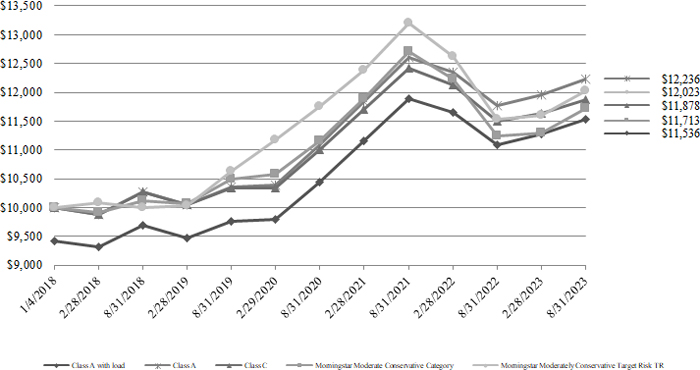

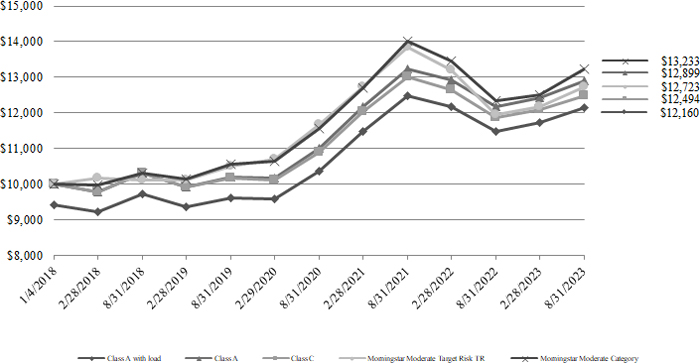

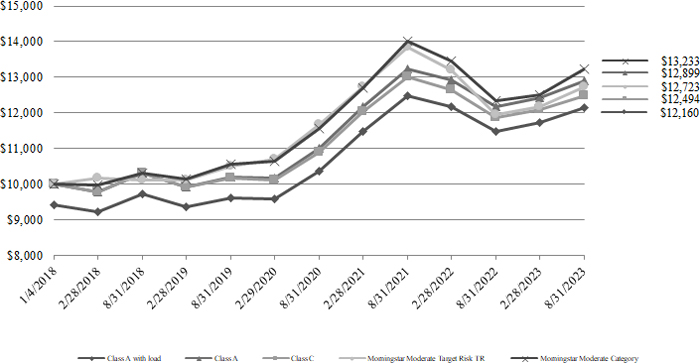

LARGE CAPITALIZATION VALUE PORTFOLIO

A HYPOTHETICAL COMPARISON OF THE GROWTH OF $10,000 INVESTED IN THE

LARGE CAPITALIZATION VALUE PORTFOLIO VS. BENCHMARK

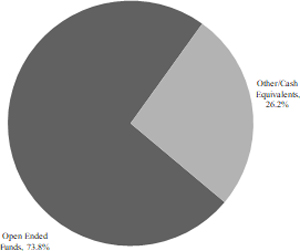

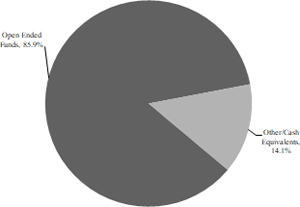

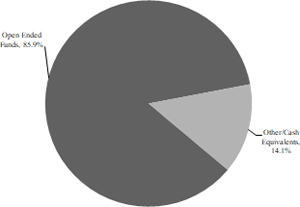

SIGNIFICANT AREAS OF INVESTMENT

AS A PERCENTAGE OF NET ASSETS

| Top 10 Portfolio Holdings* |

| |

| | % of |

| Company | Net Assets |

| API Group Corporation | 7.2% |

| Charles River Laboratories International, Inc. | 6.3% |

| Cencora, Inc. | 5.7% |

| CACI International, Inc. | 5.4% |

| Liberty Media Corp-Liberty Formula One | 5.4% |

| World Wrestling Entertainment, Inc. | 5.2% |

| Blue Owl Capital, Inc. | 5.2% |

| Flex Ltd. | 5.1% |

| Chemed Corporation | 4.7% |

| ON Semiconductor Corporation | 4.6% |

| * | Based on total net assets as of August 31, 2023. |

Excludes short-term investments.

Portfolio Composition*

The Morningstar Large Value Average (“Large Value Average”), as of August 31, 2023, consisted of 1,141 mutual funds comprised of large market capitalization value stocks. The Large Value Average is not managed and it is not possible to invest directly in the Large Value Average.

The S&P 500/Citigroup Value Index, is broad, unmanaged-capitalization weighted index which is the successor to the S&P 500/BARRA Value Index, uses a multifactor methodology to score constituents, which are weighted according to market cap and classified as growth, value, or a mix of growth and value. The S&P 500/Citigroup Value Index does not include fees and expenses, and investor may not invest directly in an index.

Past performance is not predictive of future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of the fund shares.

Large Capitalization Value Portfolio is not sponsored, endorsed, sold or promoted by Morningstar, Inc. or any of its affiliates (all such entities, collectively, “Morningstar Entities”). The Morningstar Entities make no representation or warranty, express or implied, to the owners of the Large Capitalization Value Portfolio or any member of the public regarding the advisability of investing in mutual funds comprised of large market capitalization value stocks generally or in the Large Capitalization Value Portfolio in particular or the ability of the Morningstar Large Value Average to track general large market capitalization value stocks market performance.

THE MORNINGSTAR ENTITIES DO NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE MORNINGSTAR LARGE VALUE AVERAGE CATEGORY OR ANY DATA INCLUDED THEREIN AND MORNINGSTAR ENTITIES SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN.

LARGE CAPITALIZATION GROWTH PORTFOLIO

Advised by: Smith Group Asset Management, Dallas, Texas

Objective: The Portfolio seeks capital appreciation.

| Total Aggregate Return for the Year Ended August 31, 2023 |

| | One Year: | Five Year: | Ten Year: | Inception: | Inception: |

| | 9/1/22 – 8/31/23 | 9/1/18 – 8/31/23* | 9/1/13 – 8/31/23* | 1/4/99 – 8/31/23* | 2/14/06 – 8/31/23* |

| Class A | | | | | |

| With Sales Charge | 7.50% | 8.55% | 12.71% | NA | 9.64% |

| Without Sales Charge | 14.05% | 9.84% | 13.38% | NA | 10.01% |

| Class C | | | | | |

| With Sales Charge | 12.43% | 9.19% | 12.71% | 5.36% | NA |

| Without Sales Charge | 13.43% | 9.19% | 12.71% | 5.36% | NA |

| * | Annualized performance for periods greater than one year. |

Performance data quoted above is historical. Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate, so that shares when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call (800) 807-FUND. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of fund shares. The total operating expense ratios as stated in the fee table to the Portfolio’s prospectus dated December 28, 2022, are 2.06% and 2.68% for the A and C Classes, respectively.

PORTFOLIO INVESTMENT STRATEGIES AND TECHNIQUES

The Portfolio’s Adviser employs quantitative and qualitative analysis that seeks to identify high quality companies that it believes have the ability to accelerate earnings growth and exceed investor expectations. The Adviser’s selection process consists of three steps. First, the Adviser reviews a series of screens utilizing the Adviser’s investment models, which are based on fundamental characteristics, designed to eliminate companies that the Adviser’s research shows have a high probability of underperformance. Factors considered when reviewing the screens include a multi-factor valuation framework, earnings quality, capital structure and financial quality. Next, securities that pass the initial screens are then evaluated to try to identify stocks with the highest probability of producing an earnings growth rate that exceeds investor expectations. This process incorporates changes in earnings expectations and earnings quality analysis. Finally, these steps produce a list of eligible companies which are subjected to analysis by the Adviser to further understand each company’s business prospects and earnings potential. The Adviser uses the results of this analysis to construct the Portfolio’s security positions.

PORTFOLIO ADVISOR COMMENTARY

For the annual period ended August 31, 2023, the Saratoga Large Cap Growth Portfolio posted solid performance in an environment that was favorable to both large cap stocks and growth stocks. When the Federal Reserve began their tightening cycle in March 2022, the unemployment rate stood at 3.6%, exactly where it stood at the end of August 2023. We remain pessimistic about the Fed’s ability to achieve its 2% target without inflecting significant economic pain, as many of the drivers that led to low inflation are no longer present- most notably the reversal in the drive toward globalization. The Fed has made significant progress in their war on inflation, but to date they have actually fallen short of the typical retracement off an inflationary peak, despite raising rates at a pace only matched by the 1980-81 rate cycle.

There are myriad concerns facing a US and global economy that already looks to be operating only modesty above stall speed, but most of those concerns, such as shrinking money supply, inverted yield curves and tightening lending standards have been present for some time now. Nevertheless, equity markets have continued their upward march. We believe inflation will be in the range of 2-3% by year-end 2023 and that the Fed will ultimately accept this range, instead of a hard 2% target. We expect earnings to continue a modest downturn but at the median stock level it appears much of that is already priced into equity markets. While not an easy needle to thread, avoiding a deep recession in 2023 and moving toward a significant upturn in earnings in 2024 appears a likely outcome to us.

Performance in the portfolio during the period was weighed down by an underweight to mega-cap stocks and a lower valuation profile (i.e., a lower P/E ratio). From a sector perspective, Health Care and Communication Services hindered relative performance while the Financial Services sector was a small lift. Top contributing stock Arista Networks (2.14%) continued to produce earnings greater than expected, while Molina Healthcare (1.65%) struggled to convince investors that they had adequately accounted for the possibility of a worsening risk pool.

Within the discussion above, the percentages shown next to specific securities are the percentages of the Portfolio represented by the security on 8/31/23. The securities held in the Portfolio are subject to change and any discussion of those securities should not be considered investment advice.

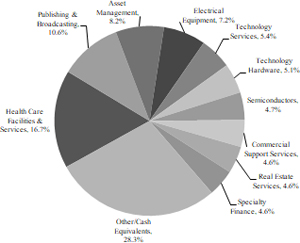

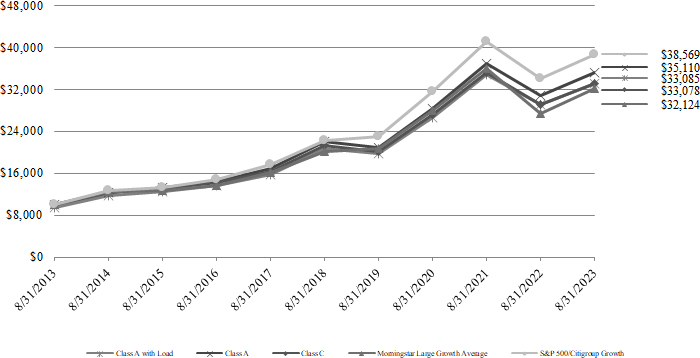

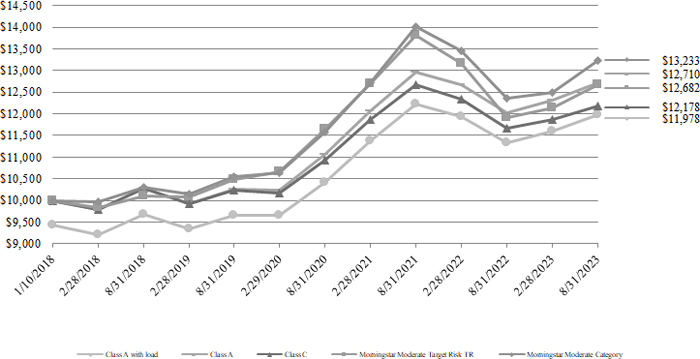

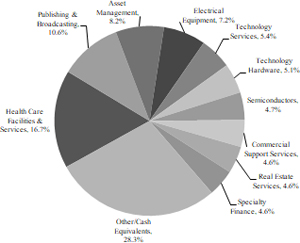

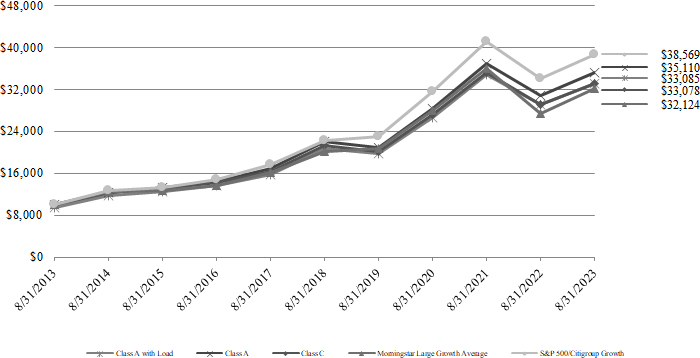

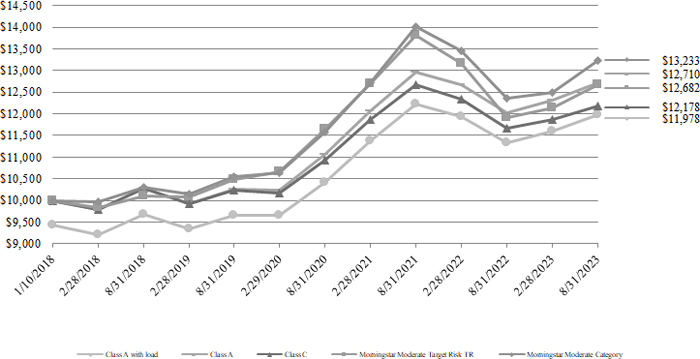

LARGE CAPITALIZATION GROWTH PORTFOLIO

A HYPOTHETICAL COMPARISON OF THE GROWTH OF $10,000 INVESTED IN THE

LARGE CAPITALIZATION GROWTH PORTFOLIO VS. BENCHMARK

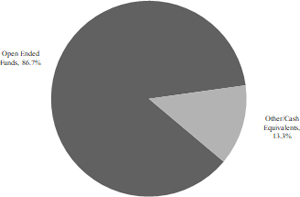

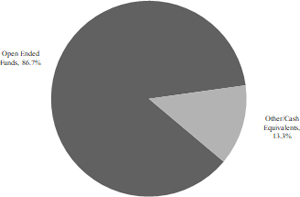

SIGNIFICANT AREAS OF INVESTMENT

AS A PERCENTAGE OF NET ASSETS

| Top 10 Portfolio Holdings* |

| | |

| | % of |

| Company | Net Assets |

| Apple, Inc. | 10.6% |

| Microsoft Corporation | 9.6% |

| NVIDIA Corporation | 4.9% |

| Amazon.com, Inc. | 4.4% |

| Airbnb, Inc. | 2.4% |

| Alphabet, Inc., Class C | 2.3% |

| Alphabet, Inc., Class A | 2.3% |

| NVR, Inc. | 2.2% |

| Palo Alto Networks, Inc. | 2.2% |

| Arch Capital Group Ltd. | 2.2% |

| * | Based on total net assets as of August 31, 2023. |

Excludes short-term investments.

Portfolio Composition*

The Morningstar Large Growth Average (“Large Growth Average”), as of August 31, 2023, consisted of 1,122 mutual funds comprised of large market capitalization growth stocks. The Large Growth Average is not managed and it is not possible to invest directly in the Large Growth Average.

The S&P 500/Citigroup Growth Index, is broad, unmanaged-capitalization weighted index which is the successor to the S&P 500/BARRA Growth Index, uses a multifactor methodology to score constituents, which are weighted according to market cap and classified as growth, value, or a mix of growth and value. The S&P 500/Citigroup Value Index does not include fees and expenses, and investor may not invest directly in an index.

Past performance is not predictive of future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of the fund shares.

Large Capitalization Growth Portfolio is not sponsored, endorsed, sold or promoted by Morningstar, Inc. or any of its affiliates (all such entities, collectively, “Morningstar Entities”). The Morningstar Entities make no representation or warranty, express or implied, to the owners of the Large Capitalization Growth Portfolio or any member of the public regarding the advisability of investing in mutual funds comprised of large market capitalization growth stocks generally or in the Large Capitalization Growth Portfolio in particular or the ability of the Morningstar Large Growth Average to track general large market capitalization growth stocks market performance.

THE MORNINGSTAR ENTITIES DO NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE MORNINGSTAR LARGE GROWTH AVERAGE CATEGORY OR ANY DATA INCLUDED THEREIN AND MORNINGSTAR ENTITIES SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN.

MID CAPITALIZATION PORTFOLIO

Advised by: Vaughn Nelson Investment Management, L.P., Houston, Texas

Objective: The Portfolio seeks long-term capital appreciation.

| Total Aggregate Return for the Year Ended August 31, 2023 |

| | One Year: | Five Year: | Ten Year: | Inception: |

| | 9/1/22 – 8/31/23 | 9/1/18 – 8/31/23* | 9/1/13 - 8/31/23* | 6/28/02 – 8/31/23* |

| Class A | | | | |

| With Sales Charge | (1.62)% | 3.43% | 5.95% | 6.92% |

| Without Sales Charge | 4.41% | 4.66% | 6.58% | 7.22% |

| Class C | | | | |

| With Sales Charge | 2.78% | 4.04% | 5.95% | 6.59% |

| Without Sales Charge | 3.78% | 4.04% | 5.95% | 6.59% |

| * | Annualized performance for periods greater than one year. |

Performance data quoted above is historical. Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate, so that shares when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call (800) 807-FUND. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of fund shares. The total operating expense ratios as stated in the fee table to the Portfolio’s prospectus dated December 28, 2022, are 2.42% and 3.02% for the A and C Classes, respectively.

PORTFOLIO INVESTMENT STRATEGIES AND TECHNIQUES

The Portfolio invests in securities of companies that are believed by the Adviser to be undervalued, thereby offering above-average potential for capital appreciation. The Portfolio may also invest in equity securities of foreign companies. The Adviser invests in medium capitalization companies with a focus on total return using a bottom-up value oriented investment process. The Adviser seeks companies with the following characteristics, although not all of the companies it selects will have these attributes: (i) companies earning a positive economic margin with stable-to-improving returns; (ii) companies valued at a discount to their asset value; and (iii) companies with an attractive dividend yield and minimal basis risk. In selecting investments, the Adviser generally employs the following strategy: (i) value-driven investment philosophy that selects stocks selling at attractive values based upon business fundamentals, economic margin analysis, discounted cash flow models and historical valuation multiples. The Adviser reviews companies that it believes are out-of-favor or misunderstood; (ii) use of value-driven screens to create a research universe of companies with market capitalizations of at least $1 billion; and (iii) use of fundamental and risk analysis to construct a portfolio of securities that the Adviser believes has an attractive return potential.

PORTFOLIO ADVISOR COMMENTARY

To start the annual period, US equity markets staged a modest rally in the fourth quarter of 2022. The recovery in equity markets was largely driven by peaking inflationary conditions and the rapid increase in non-US interest rates relative to US interest rates, which triggered a broad-based decline in the US dollar. Slowing economic growth, falling inflationary pressures, and developing stress in the banking system were dominant factors in the first quarter of 2023. These factors led to a divergence in equity markets with value stocks materially underperforming growth stocks across all market capitalizations. With sequential growth slowing in 23Q1, the US earnings recession that began in 22Q4 became a broader economic recession in the short term. Banking stress developed, as the ability for borrowers to service debt becomes impaired. Given the rapid increase in interest rates, regional banks were under tremendous pressure despite credit costs remaining well below historical norms.

During 23Q2, global growth continued to deteriorate as aggressive rate increases impacted economic fundamentals. In the US, the manufacturing and transport sectors entered a recession and the service sector slowed. Employment conditions loosened. Offsetting the deteriorating economic environment was continued liquidity injections by the major non-US central banks and the US Federal Reserve’s reverse repo facility, which became the primary source of liquidity for rebuilding the US Treasury’s general account. This flood of liquidity boosted equity markets and dampened fixed income volatility, compressing fixed income spreads.

For the annual period ending August 31, 2023, the Saratoga Mid Cap Portfolio posted solid absolute and relative performance. An underweight to REITs was the largest contributor to relative performance. In addition, stock selection in Information Technology delivered further outperformance. The greatest detractors were an overweight to Utilities and Energy stock selection.

Interest rate increases generally impact the economy on a long and variable lag of twelve months or more. A year ago, the Fed Funds rate stood at 1.75% compared to today’s rate of 5.25%. The economy is still very early in absorbing the higher interest rate environment. Stress in the banking system continues to build and without a cut in interest rates or suspension of quantitative tightening, we expect further troubled banks and tightening credit availability. To cut interest rates or suspend quantitative tightening the Federal Reserve will need a better line of sight to reach their 2% inflation target. We see inflation as set to stabilize at approximately 3.5% to 4.0% in the next few months, but the disinflationary conditions that have rapidly reduced inflation are abating, with leading inflation indicators signaling the possibility of rising inflation in early 2024. We expect the Federal Reserve to maintain current tight monetary conditions until there is a material decline in financial conditions or the inflationary trend breaks through 3% with visibility to reaching their inflation objective.

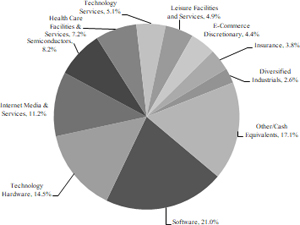

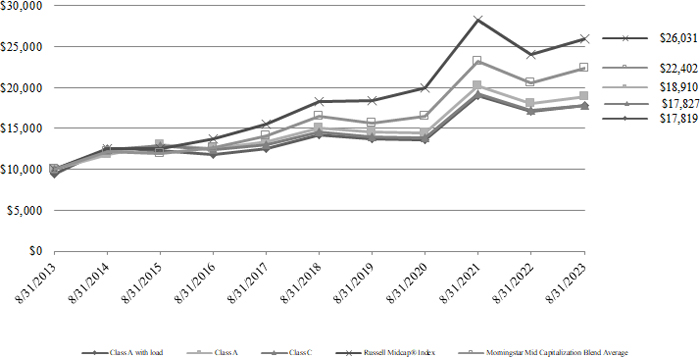

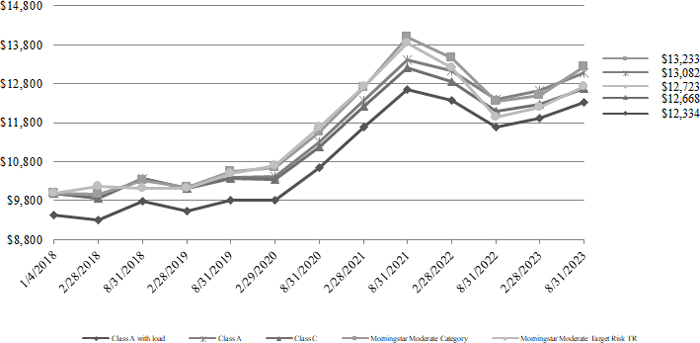

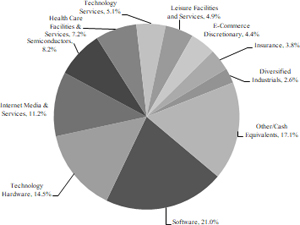

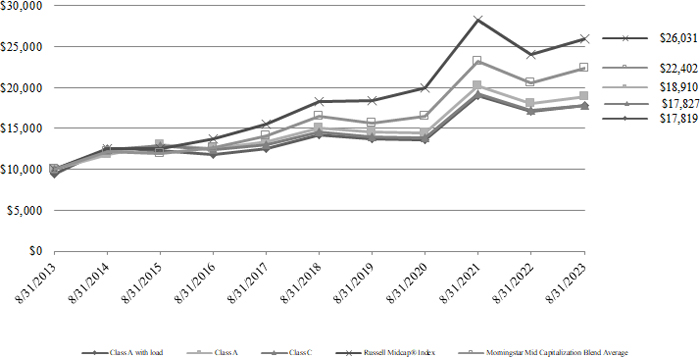

MID CAPITALIZATION PORTFOLIO

A HYPOTHETICAL COMPARISON OF THE GROWTH OF $10,000 INVESTED IN THE

MID CAPITALIZATION PORTFOLIO VS. BENCHMARK

SIGNIFICANT AREAS OF INVESTMENT

AS A PERCENTAGE OF NET ASSETS

| Top 10 Portfolio Holdings* |

| | |

| | % of |

| Company | Net Assets |

| AutoZone, Inc. | 4.2% |

| Republic Services, Inc. | 4.0% |

| Cencora, Inc. | 3.9% |

| EastGroup Properties, Inc. | 3.5% |

| FactSet Research Systems, Inc. | 3.2% |

| Performance Food Group Company | 3.0% |

| CACI International, Inc. | 2.6% |

| Nasdaq, Inc. | 2.6% |

| MAXIMUS, Inc. | 2.5% |

| Tyler Technologies, Inc. | 2.5% |

| * | Based on total net assets as of August 31, 2023. |

Excludes short-term investments.

Portfolio Composition*

The Russell Midcap® Index measures the performance of the mid-cap segment of the US equity universe. The Russell Midcap Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The Russell Midcap® Index represents approximately 27% of the total market capitalization of the Russell 1000® companies, as of the most recent reconstitution. The Russell Midcap Index is constructed to provide a comprehensive and unbiased barometer for the mid-cap segment. The index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true midcap opportunity set. Investors may not invest in the Index directly; unlike the Portfolio’s return, the Index does not reflect any fees or expenses.

The Morningstar Mid Capitalization Blend Average (“Mid Cap Blend Average”), as of August 31, 2023, consisted of 382 mutual funds comprised of mid market capitalization stocks. The Mid Cap Blend Average is not managed and it is not possible to invest directly in the Mid Cap Blend Average.

Past performance is not predictive of future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of the fund shares.

Mid Capitalization Portfolio is not sponsored, endorsed, sold or promoted by Morningstar, Inc. or any of its affiliates (all such entities, collectively, “Morningstar Entities”). The Morningstar Entities make no representation or warranty, express or implied, to the owners of the Mid Capitalization Portfolio or any member of the public regarding the advisability of investing in mutual funds comprised of mid market capitalization stocks generally or in the Mid Capitalization Portfolio in particular or the ability of the Morningstar Mid Cap Blend Average to track general mid market capitalization stocks market performance.

THE MORNINGSTAR ENTITIES DO NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE MORNINGSTAR MID CAP BLEND AVERAGE OR ANY DATA INCLUDED THEREIN AND MORNINGSTAR ENTITIES SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN.

SMALL CAPITALIZATION PORTFOLIO

Advised by: Zacks Investment Management, Inc., Chicago, Illinois

Objective: The Portfolio seeks maximum capital appreciation.

| Total Aggregate Return for the Year Ended August 31, 2023 |

| | One Year: | Five Year: | Ten Year: | Inception: | Inception: |

| | 9/1/22 – 8/31/23 | 9/1/18 – 8/31/23* | 9/1/13 – 8/31/23* | 1/4/99 – 8/31/23* | 2/14/06 – 8/31/23* |

| Class A | | | | | |

| With Sales Charge | (3.58)% | 3.43% | 6.03% | NA | 5.67% |

| Without Sales Charge | 2.30% | 4.67% | 6.66% | NA | 6.03% |

| Class C | | | | | |

| With Sales Charge | 0.82% | 4.18% | 6.08% | 7.34% | NA |

| Without Sales Charge | 1.82% | 4.18% | 6.08% | 7.34% | NA |

| * | Annualized performance for periods greater than one year. |

Performance data quoted above is historical. Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate, so that shares when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call (800) 807-FUND. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of fund shares. The total operating expense ratios as stated in the fee table to the Portfolio’s prospectus dated December 28, 2022, are 2.47% and 3.05% for the A and C Classes, respectively.

PORTFOLIO INVESTMENT STRATEGIES AND TECHNIQUES

In selecting securities for the Portfolio, the Adviser begins with a screening process that seeks to identify growing companies whose stocks sell at discounted price-to-earnings and price-to-cash flow multiples. The Adviser also attempts to discern situations where intrinsic asset values are not widely recognized. The Adviser favors such higher-quality companies that generate strong cash flow, provide above-average free cash flow yields and maintain sound balance sheets. Rigorous fundamental analysis, from both a quantitative and qualitative standpoint, is applied to all investment candidates. While the Adviser employs a disciplined “bottom-up” approach that attempts to identify undervalued stocks, it nonetheless is sensitive to emerging secular trends. The Adviser does not, however, rely on macroeconomic forecasts in its stock selection efforts and prefers to remain fully invested.

PORTFOLIO ADVISOR COMMENTARY

During 22Q4, small-cap stocks as an asset class underperformed mid-cap and large-cap stocks. During the quarter, US employment and economic growth remained strong. Towards the end of the quarter, China started relaxing its strict covid lockdown. Energy prices also began moving lower. Inflation remained uncomfortably high. In order to bring down inflation, the Federal Reserve maintained the tightening of financial conditions by raising interest rates at a fast pace while also winding down its balance sheet. Markets started weighing the pros of a still-strong economy with employment growth versus the cons of an economy with tighter financial conditions, which may lead to a future economic slowdown and a potential recession. Due in part to this environment, smaller stocks underperformed their larger counterparts. The Saratoga Small Cap Portfolio’s overweight in energy, industrials, and consumer discretionary helped relative performance. Similarly, an underweight position in the health care sector also contributed to the relative performance. The portfolio’s underweight to materials, utilities, and consumer staples sectors and overweight to technology sector hurt relative performance.

During 23Q1, small-cap stocks as an asset class underperformed mid-cap and large-cap stocks. During the quarter, US economic and employment growth stayed strong and inflation started lowering. The pace of the Federal Reserve’s interest rate increases slowed moderately and during the early part of the quarter there was optimism that the economy may avoid a recession. Due to this, smaller stocks performed well. This was offset towards the end of the quarter by the failure of two regional banks and the emergence of contagion fears in other banks. Additionally, tighter lending by the banks and the subsequent slowdown in economic growth added to an increased potential of a recession. In this volatile environment, investor preference leaned toward larger stocks as opposed to their smaller counterparts. These smaller stocks are more exposed to risks stemming from a lack of economic growth and bank lending. The portfolio’s overweight to the technology and consumer discretionary sectors helped relative performance, while an underweight to the consumer staples sector hurt relative performance.

During 23Q2, small-cap stocks as an asset class underperformed large-cap stocks but outperformed mid- cap stocks. During the quarter, US employment growth remained strong, economic growth positive, and inflation continued its downward trend. The Federal Reserve started projecting a near end to their interest rate increases. The emergence of generative AI as a new growth engine for the technology sector increased market optimism about the future. Positive economic characteristics combined with

confidence in the market’s ability to handle future interest rate hikes allowed companies more exposed to the strength of the economy to perform better. The portfolio’s overweight to the consumer discretionary sector and underweight to the health care sector hurt relative performance. Our overweight to the information technology and industrial sectors and underweight to the utility and consumer staples sectors helped relative performance.

During 23Q3, small-cap stocks as an asset class underperformed large-cap stocks but outperformed mid-cap stocks. During the quarter, the Federal Reserve maintained a tighter monetary policy stance and raised interest rates once during the quarter. Equity markets endured pressure from persistent inflation, volatile energy prices, and the expectation that the Fed may keep interest rates higher for longer. During the quarter, the portfolio’s overweight to consumer staples, and underweight to health care and utilities sectors helped relative performance. The portfolio’s overweight to consumer discretionary and technology, and underweight to the energy and financials sectors, hurt relative performance.

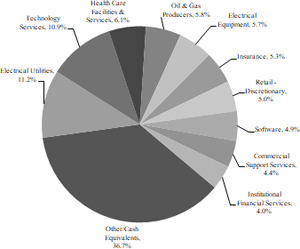

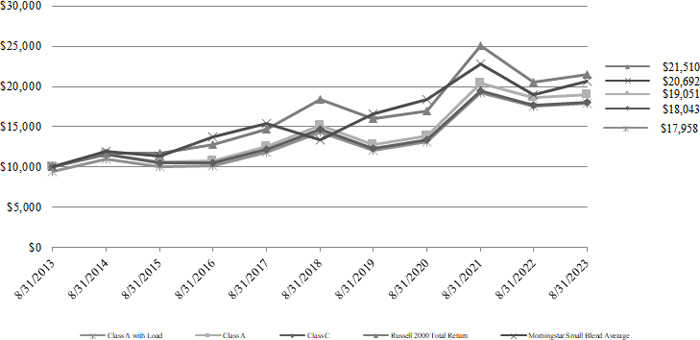

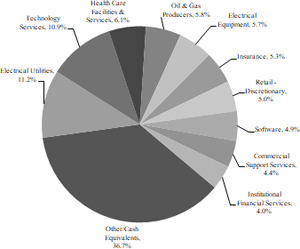

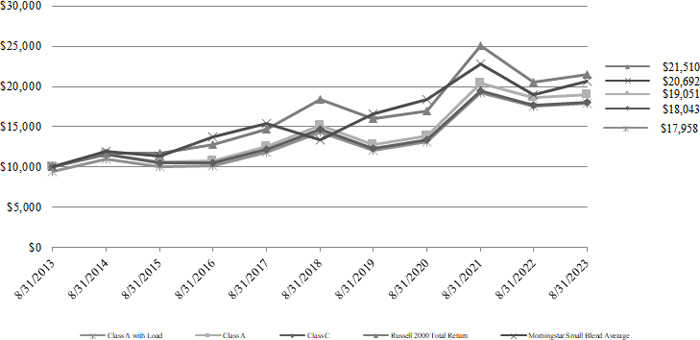

SMALL CAPITALIZATION PORTFOLIO

A HYPOTHETICAL COMPARISON OF THE GROWTH OF $10,000 INVESTED IN THE

SMALL CAPITALIZATION PORTFOLIO VS. BENCHMARK

SIGNIFICANT AREAS OF INVESTMENT

AS A PERCENTAGE OF NET ASSETS

| Top 10 Portfolio Holdings* |

| |

| | % of |

| Company | Net Assets |

| EMCOR Group, Inc. | 2.4% |

| Applied Industrial Technologies, Inc. | 2.1% |

| Super Micro Computer, Inc. | 2.1% |

| Sterling Infrastructure, Inc. | 2.0% |

| WESCO International, Inc. | 1.9% |

| Encore Wire Corporation | 1.7% |

| Simpson Manufacturing Company, Inc. | 1.6% |

| Badger Meter, Inc. | 1.5% |

| Builders FirstSource, Inc. | 1.5% |

| GATX Corporation | 1.5% |

| * | Based on total net assets as of August 31, 2023. |

Excludes short-term investments.

Portfolio Composition*

The Russell 2000 Index is comprised of the 2,000 smallest U.S domicile publicly traded common stock which are included in the Russell 3000 Index. The common stock included in the Russell 2000 Index represent approximately 10% of the U.S equity market as measured by market capitalization. The Russell 3000 Index is an unmanaged index of the 3,000 largest U.S domicile publicity traded common stocks by market capitalization representing approximately 98% of the U.S publicity traded equity market. The Russell 2000 Index is an unmanaged index which does not include fees and expenses, and whose performance reflects reinvested dividends. Investors may not invest in the Index directly.

The Morningstar Small Blend Average (“Small Blend Average”), as of August 31, 2023, consisted of 593 mutual funds comprised of small market capitalization stocks. The Small Blend Average is not managed and it is not possible to invest directly in the Small Blend Average.

Past performance is not predictive of future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of the fund shares.

Small Capitalization Portfolio is not sponsored, endorsed, sold or promoted by Morningstar, Inc. or any of its affiliates (all such entities, collectively, “Morningstar Entities”). The Morningstar Entities make no representation or warranty, express or implied, to the owners of the Small Capitalization Portfolio or any member of the public regarding the advisability of investing in mutual funds comprised of small market capitalization stocks generally or in the Small Capitalization Portfolio in particular or the ability of the Morningstar Small Blend Average to track general small market capitalization stocks market performance.

THE MORNINGSTAR ENTITIES DO NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE MORNINGSTAR SMALL CAP BLEND AVERAGE OR ANY DATA INCLUDED THEREIN AND MORNINGSTAR ENTITIES SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN.

INTERNATIONAL EQUITY PORTFOLIO

Advised by: Smith Group Asset Management, Dallas, Texas

Objective: The Portfolio seeks long-term capital appreciation.

| Total Aggregate Return for the Year Ended August 31, 2023 |

| | One Year: | Five Year: | Ten Year: | Inception: | Inception: |

| | 9/1/22 – 8/31/23 | 9/1/18 – 8/31/23* | 9/1/13 – 8/31/23* | 1/4/99 – 8/31/23* | 2/14/06 – 8/31/23* |

| Class A | | | | | |

| With Sales Charge | 9.31% | 0.04% | (0.03)% | NA | (0.45)% |

| Without Sales Charge | 16.03% | 1.22% | 0.57% | NA | (0.11)% |

| Class C | | | | | |

| With Sales Charge | 14.46% | 0.65% | (0.04)% | (0.41)% | NA |

| Without Sales Charge | 15.46% | 0.65% | (0.04)% | (0.41)% | NA |

| * | Annualized performance for periods greater than one year. |

Performance data quoted above is historical. Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate, so that shares when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call (800) 807-FUND. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of fund shares. The total operating expense ratios as stated in the fee table to the Portfolio’s prospectus dated December 28, 2022, are 3.78% and 4.18% for the A and C Classes, respectively.

PORTFOLIO INVESTMENT STRATEGIES AND TECHNIQUES

The Adviser seeks to purchase reasonably valued stocks it believes have the ability to accelerate earnings growth and exceed investor expectations. The Adviser utilizes a three step process in stock selection. First, the Adviser reviews a series of screens utilizing the Adviser’s investment models, which are based on fundamental characteristics, designed to eliminate companies that the Adviser’s research shows have a high probability of underperformance. Factors considered when reviewing the screens include a multi-factor valuation framework, earnings quality, capital structure and financial quality. Next, securities that pass the initial screens are then evaluated to try to identify stocks with the highest probability of producing an earnings growth rate that exceeds investor expectations. This process incorporates changes in earnings expectations and earnings quality analysis. Finally, these steps produce a list of eligible companies which are subjected to analysis by the Adviser to further understand each company’s business prospects and earnings potential. A stock is sold when it no longer meets the Adviser’s criteria.

PORTFOLIO ADVISOR COMMENTARY

The Saratoga International Equity Portfolio posted solid absolute and relative performance during the annual period ended August 31, 2023. The first part of the period was dominated by stubbornly high inflation and sharply higher interest rates which incited fears of recession and pressured corporate profits. Russia’s continued war on Ukraine, lingering supply chain issues, and a slower than expected recovery in China added to worries. As the months wore on, given the resolute commitment of central banks to combat inflation, inflation receded significantly, though fears of recession remained. In its June report, the World Bank cut its forecast for 2024 global growth from an already sluggish 2.7% to 2.4%. This below-trend growth will almost assuredly lead to at least a modest adjustment in the outlook for corporate earnings, but that comes off much lower market multiples than have been seen for quite some time.

In the portfolio, Emerging Asia was the top contributor during the period, led by Taiwanese holdings, with tech hardware company Quanta Computer (2.54%) being the top portfolio performer during the period. Holdings in Indonesia and Thailand added to excess return, as did the absence on holdings in India. A trio of Developed European countries – Switzerland, Denmark, and Spain – helped this region claim the second largest outperformer spot. Emerging Europe, Middle East & Africa (EMEA) was the only detractor over the last year.

From a sector standpoint, the Financials sector was the largest outperformer, led by Swiss bank UBS (2.67%) and Spanish bank Banco Santander (2.65%). The Information Technology sector was the second largest contributor. Consumer Discretionary holdings accounted for most of the drag on relative performance during the twelve months.

Within the discussion above, the percentages shown next to specific securities are the percentages of the Portfolio represented by the security on 8/31/23. The securities held in the Portfolio are subject to change and any discussion of those securities should not be considered investment advice.

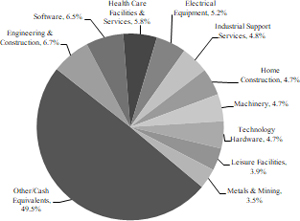

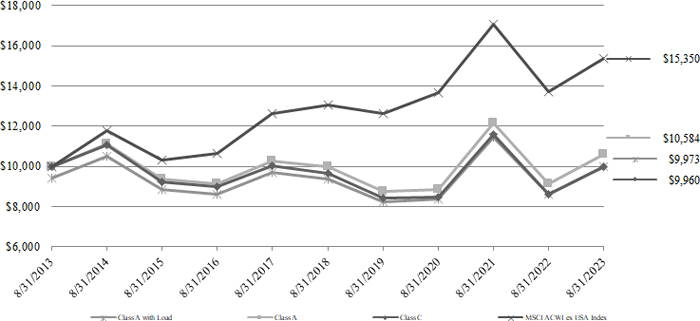

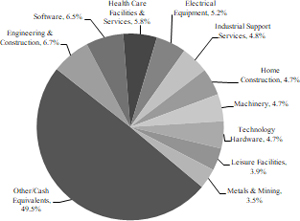

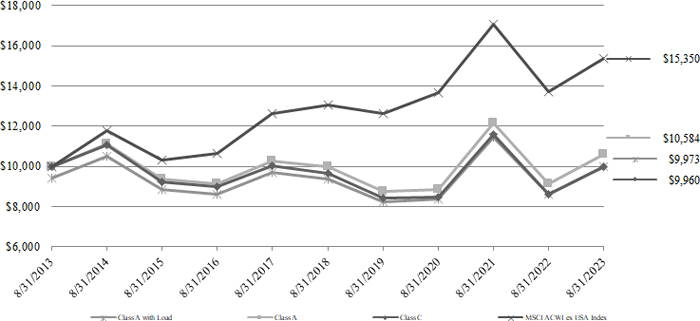

INTERNATIONAL EQUITY PORTFOLIO

A HYPOTHETICAL COMPARISON OF THE GROWTH OF $10,000 INVESTED IN THE

INTERNATIONAL EQUITY PORTFOLIO VS. BENCHMARK

SIGNIFICANT AREAS OF INVESTMENT

AS A PERCENTAGE OF NET ASSETS

| Top 10 Portfolio Holdings* |

| | |

| | % of |

| Company | Net Assets |

| Haidilao International Holding Ltd. | 2.8% |

| Arkema S.A. | 2.7% |

| Cie de Saint-Gobain | 2.7% |

| UBS Group A.G. | 2.7% |

| Bumrungrad Hospital PCL | 2.6% |

| Coca-Cola Europacific Partners plc | 2.6% |

| Banco Santander S.A. | 2.6% |

| BP plc - ADR | 2.6% |

| Hoshizaki Corporation | 2.6% |

| Novo Nordisk A/S, Class B | 2.6% |

| * | Based on total net assets as of August 31, 2023. |

Excludes short-term investments.

Portfolio Compositions*

MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets countries (excluding the US) and 21 Emerging Markets countries. With 1,824 constituents, the index covers approximately 85% of the global equity opportunity set outside the US.

Past performance is not predictive of future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of the fund shares.

HEALTH & BIOTECHNOLOGY PORTFOLIO

Advised by: Oak Associates, Ltd., Akron, Ohio

Objective: The Portfolio seeks long-term capital growth.

| Total Aggregate Return for Year Ended August 31, 2023 |

| | One Year: | Five Year: | Ten Year: | Inception: | Inception: |

| | 9/1/22 – 8/31/23 | 9/1/18 – 8/31/23* | 9/1/13 – 8/31/23* | 7/15/99 – 8/31/23* | 1/18/00 – 8/31/23* |

| Class A | | | | | |

| With Sales Charge | 0.03% | 2.90% | 6.94% | 6.93% | N/A |

| Without Sales Charge | 6.12% | 4.13% | 7.58% | 7.19% | N/A |

| Class C | | | | | |

| With Sales Charge | 4.45% | 3.51% | 6.94% | N/A | 4.50% |

| Without Sales Charge | 5.45% | 3.51% | 6.94% | N/A | 4.50% |

| * | Annualized performance for periods greater than one year. |

Performance data quoted above is historical. Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate, so that shares when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call (800) 807-FUND. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of fund shares. The total operating expense ratios as stated in the fee table to the Portfolio’s prospectus dated December 28, 2022, are 2.90% and 3.50% for the A and C Classes, respectively.

PORTFOLIO INVESTMENT STRATEGIES AND TECHNIQUES

The Adviser utilizes a top-down investment approach focused on long-term economic trends. The Adviser begins with the overall outlook for the economy, then seeks to identify specific industries with attractive characteristics and long-term growth potential. Ultimately, the Adviser seeks to identify high-quality companies within the selected industries and to acquire them at attractive prices. The Adviser’s stock selection process is based on an analysis of individual companies’ fundamental values, such as earnings growth potential and the quality of corporate management.

PORTFOLIO ADVISOR COMMENTARY

The fiscal year ended August 31, 2023 showed a remarkable recovery from the previous year’s market slump. The economy proved resilient, driven in part by a tight labor market, which supported consumer spending, coupled with demand related to artificial intelligence (AI). Better than expected economic growth and excitement surrounding AI pushed the Technology sector to the front of the pack during the period. Given the risk-on posture of markets this year, defensive sectors, such as Healthcare, mostly trailed on a relative basis.

Though it lagged on a relative basis, the Healthcare sector did provide solidly positive absolute returns. While Healthcare Suppliers and Healthcare facilities greatly underperformed the market last year, they were significant outperformers this year. These companies benefitted from the higher levels of medical activity and the increased volume of procedures that had been slow to ramp up post-Covid. The medical drug price segment of the Inflation Reduction Act has progressed largely as anticipated but its ultimate long-term impact remains uncertain and will continue to garner scrutiny primarily for the largest drug makers.

While we have likely seen the peak in inflation and the Federal Reserve appears to be in the final innings of its interest rate hiking campaign, the lagged impact of monetary policy means the majority of the effect has yet to be felt by the economy. We expect this headwind, combined with uncertainties such as rising geopolitical tensions with China and the continued war in Ukraine, to keep volatility in the market elevated. That said, for those willing to look beyond the next six to twelve months, we believe there is cause for optimism. Although rates have risen, they remain relatively low and certainly in a range that we believe can support growth in sectors with attractive characteristics such as Healthcare.

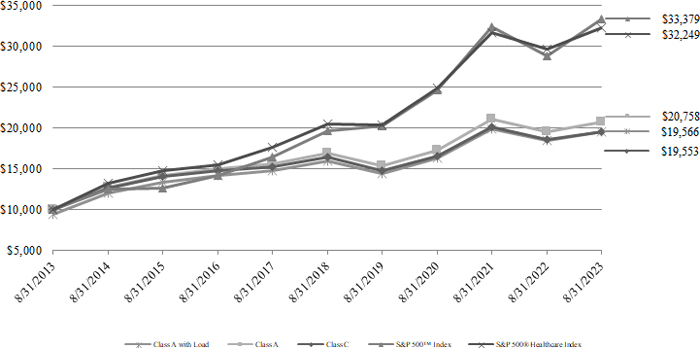

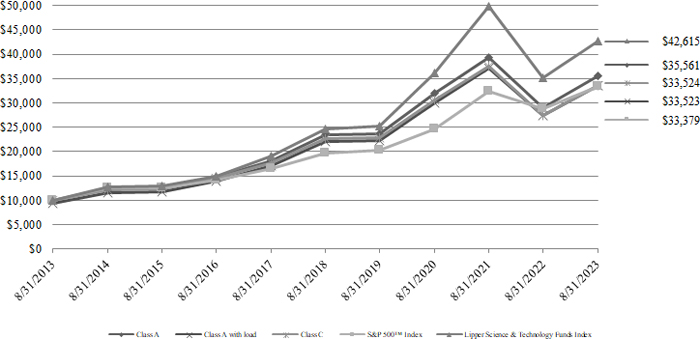

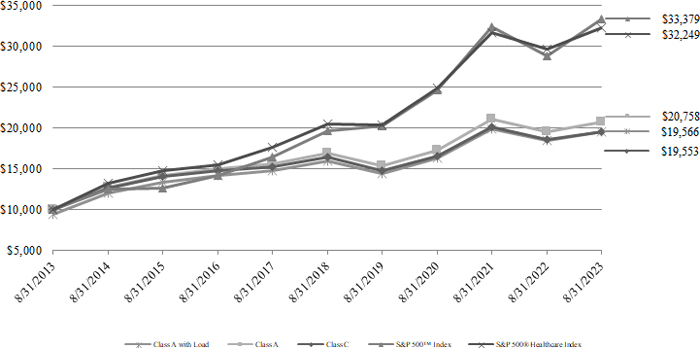

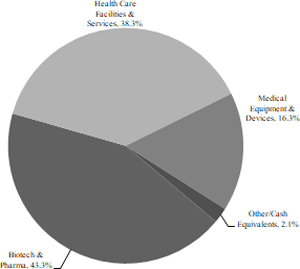

HEALTH & BIOTECHNOLOGY PORTFOLIO

A HYPOTHETICAL COMPARISON OF THE GROWTH OF $10,000 INVESTED IN THE

HEALTH & BIOTECHNOLOGY PORTFOLIO VS. BENCHMARK

SIGNIFICANT AREAS OF INVESTMENT

AS A PERCENTAGE OF NET ASSETS

| Top 10 Portfolio Holdings* |

| |

| | % of |

| Company | Net Assets |

| Amgen, Inc. | 5.2% |

| Regeneron Pharmaceuticals, Inc. | 5.1% |

| Cencora, Inc. | 4.0% |

| McKesson Corporation | 4.0% |

| Humana, Inc. | 3.8% |

| Intuitive Surgical, Inc. | 3.8% |

| Jazz Pharmaceuticals plc | 3.8% |

| Cardinal Health, Inc. | 3.7% |

| Exelixis, Inc. | 3.7% |

| Vertex Pharmaceuticals, Inc. | 3.7% |

| * | Based on total net assets as of August 31, 2023. |

Excludes short-term investments.

Portfolio Composition*

The S&P 500™ Index is an unmanaged index. Index returns assume reinvestment of dividends. Investors may not invest in the Index directly; unlike the Portfolio’s returns, the Index does not reflect any fees or expenses.

The S&P 500® Healthcare Index is a widely-recognized, unmanaged, equally-weighted Index, adjusted for capital gains distribution and income dividends, of securities of companies engaged in the healthcare/biotechnology and medical industries. Index returns assume reinvestment of dividends; unlike the Portfolio’s returns, however, Index returns do not reflect any fees or expenses. Such costs would lower performance. It is not possible to invest directly in an Index.

Past performance is not predictive of future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of the fund shares.

TECHNOLOGY & COMMUNICATIONS PORTFOLIO

Advised by: Oak Associates, Ltd., Akron, Ohio

Objective: The Portfolio seeks long-term growth of capital.

| Total Aggregate Return for the Year Ended August 31, 2023 |

| | One Year: | Five Year: | Ten Year: | Inception: | Inception: |

| | 9/1/22 – 8/31/23 | 9/1/18 – 8/31/23* | 9/1/13 – 8/31/23* | 10/22/97 – 8/31/23* | 1/14/00 – 8/31/23* |

| Class A | | | | | |

| With Sales Charge | 15.53% | 7.45% | 12.86% | 7.26% | NA |

| Without Sales Charge | 22.58% | 8.73% | 13.53% | 7.51% | NA |

| Class C | | | | | |

| With Sales Charge | 20.90% | 8.11% | 12.86% | NA | 1.58% |

| Without Sales Charge | 21.90% | 8.11% | 12.86% | NA | 1.58% |

| * | Annualized performance for periods greater than one year. |

Performance data quoted above is historical. Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate, so that shares when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call (800) 807-FUND. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of fund shares. The total operating expense ratios as stated in the fee table to the Portfolio’s prospectus dated December 28, 2022, are 2.53% and 3.27% for the A and C Classes, respectively.

PORTFOLIO INVESTMENT STRATEGIES AND TECHNIQUES

In buying and selling securities for the Portfolio, the Adviser relies on fundamental analysis of each issuer and its potential for success in light of its current financial condition, its industry position and economic and market conditions. Factors considered include growth potential, earnings, valuation, competitive advantages and management.

PORTFOLIO ADVISOR COMMENTARY

Following a challenged 2022, US markets rallied significantly in the fiscal year ended August 31st, 2023. The period was marked by the Federal Reserve’s historic interest rate hiking campaign designed to tame extreme inflationary pressures. A myriad of additional factors also impacted the economy and markets including a banking crisis, debt-ceiling quandary, the continued war in Ukraine and increased geopolitical tensions with China. Despite these ongoing uncertainties, a strong consumer and boom in artificial intelligence (AI) allowed the economy to outpace growth expectations and drive equity prices higher.

Since reaching lows in early November, the Technology sector has significantly outperformed the broader market on the back of attractive valuations and AI driven demand. Within the industry, outperformance came from companies with the ability to harness the power and potential of artificial intelligence along with those focused on increasing efficiency through expense controls as growth moderates. Large capitalization companies in the Semiconductor and Software spaces have been the biggest beneficiaries thus far.

While inflation looks to have peaked and the Fed appears to be in the final innings of its restrictive policy moves, uncertainties remain. Looking ahead, we expect the higher-for-longer monetary policy outlook to continue to restrict economic growth and reduce inflation. The Saratoga Technology & Communications Portfolio benefitted during the period from its allocation to large cap, blue-chip technology companies, and during this seasonally slower period of the year for markets, we continue to believe that these stocks will maintain leadership. Despite their outperformance thus far in 2023, we see valuations as reasonable among these types of stocks and think their superior profitability and cash flow generation metrics are sought after characteristics during periods of economic uncertainty.

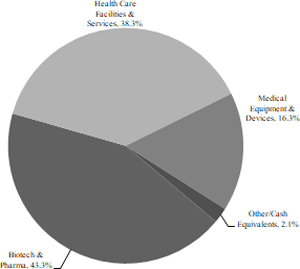

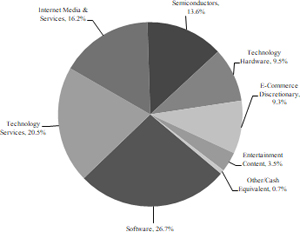

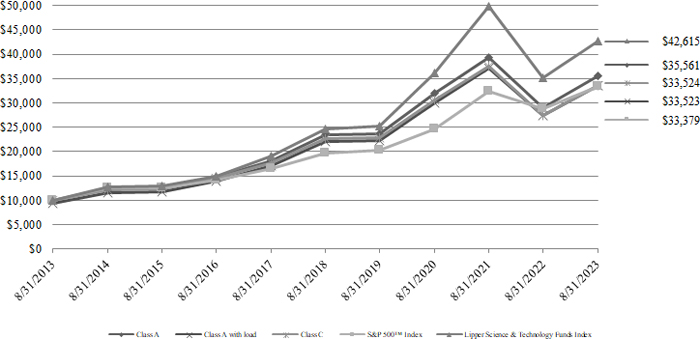

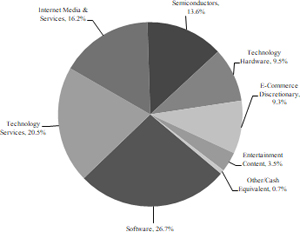

TECHNOLOGY & COMMUNICATIONS PORTFOLIO

A HYPOTHETICAL COMPARISON OF THE GROWTH OF $10,000 INVESTED IN THE

TECHNOLOGY & COMMUNICATIONS PORTFOLIO VS. BENCHMARK

SIGNIFICANT AREAS OF INVESTMENT

AS A PERCENTAGE OF NET ASSETS

| Top 10 Portfolio Holdings* |

| |

| | % of |

| Company | Net Assets |

| Alphabet, Inc., Class C | 8.3% |

| Amazon.com, Inc. | 7.1% |

| Cisco Systems, Inc. | 6.4% |

| Microsoft Corporation | 6.1% |

| Oracle Corporation | 6.0% |

| Meta Platforms, Inc., Class A | 5.9% |

| Visa, Inc., Class A | 5.5% |

| KLA Corporation | 5.2% |

| QUALCOMM, Inc. | 4.1% |

| Synopsys, Inc. | 4.0% |

| * | Based on total net assets as of August 31, 2023. |

Excludes short-term investments.

Portfolio Composition*

The S&P 500™ Index is an unmanaged index. Index returns assume reinvestment of dividends. Investors may not invest in the Index directly; unlike the Portfolio’s returns, the Index does not reflect any fees or expenses.

The Lipper Science & Technology Funds Index is an equal-weighted performance Index, adjusted for capital gain distribution and income dividends, of the largest qualifying funds within the Science and Technology fund classification, as defined by Lipper. Indexes are not managed and it is not possible directly in an Index.

Past performance is not predictive of future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of the fund shares.

ENERGY & BASIC MATERIALS PORTFOLIO

Advised by: Smith Group Asset Management, Dallas, Texas

Objective: The Portfolio seeks long-term growth of capital.

| Total Aggregate Return for the Year Ended August 31, 2023 |

| | One Year: | Five Year: | Ten Year: | Inception: | Inception: |

| | 9/1/22 – 8/31/23 | 9/1/18 – 8/31/23* | 9/1/13 – 8/31/23* | 10/23/97 – 8/31/23* | 1/7/03 - 8/31/23* |

| Class A | | | | | |

| With Sales Charge | 8.31% | (1.12)% | (1.67)% | 3.76% | NA |

| Without Sales Charge | 14.93% | 0.07% | (1.08)% | 4.00% | NA |

| Class C | | | | | |

| With Sales Charge | 13.11% | (0.26)% | (1.54)% | NA | 3.93% |

| Without Sales Charge | 14.11% | (0.26)% | (1.54)% | NA | 3.93% |

| * | Annualized performance for periods greater than one year. |

Performance data quoted above is historical. Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate, so that shares when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call (800) 807-FUND. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of fund shares. The total operating expense ratios as stated in the fee table to the Portfolio’s prospectus dated December 28, 2022, are 3.30% and 4.23% for the A and C Classes, respectively.

PORTFOLIO INVESTMENT STRATEGIES AND TECHNIQUES

The Adviser employs quantitative and qualitative analysis that seeks to identify reasonably valued, high quality companies within the energy and basic materials sectors. The Adviser’s selection process incorporates a multi-factor valuation framework, capital structure, and financial quality analysis. The valuation framework includes, but is not limited to, analysis of price to earnings, price to sales, price to book, and price to operating cash flow. Valuation methodology is industry-specific within the energy and basic materials sectors. This process produces a list of eligible companies which are then subjected to analysis by the Adviser to further understand each company’s business prospects and earnings potential. The Adviser uses the results of this analysis to construct the Portfolio’s security positions.

PORTFOLIO ADVISOR COMMENTARY

For the year ended August 31, 2023, the Saratoga Energy & Basic Materials Portfolio posted solid absolute and relative performance. The price of West Texas Intermediate (WTI) finished the twelve months just slightly below where it started ($90/bbl on August 31, 2022 to $84/bbl on August 31, 2023). Natural gas (Henry Hub) however, was multiples higher at the beginning of the period than at the end ($8.93/mmcf versus $2.56/mmcf), as August 2022 marked the peak of concern around natural gas shortages in Europe due to Russia’s war on Ukraine. The US economy has seen two consecutive quarters of negative growth and further downturns are likely in our opinion. Long-term inflation expectations seem firmly anchored and the Federal Reserve appears quite vigilant in assuring that remains the case, including tolerating a recession to avoid a double-top in inflation.

The portfolio’s Energy holdings (59% of portfolio weight on average during the period) returned 17.4% and accounted for about two-thirds of the portfolio’s excess return. The best stock selection was in the Exploration & Production and Refining & Marketing sub-industries, but stock selection was positive in all sub-industries. An underweight to Storage & Transportation was additive and offset the negative impact of the underweight to Equipment & Services.

The portfolio’s Basic Materials holdings (40% of portfolio weight on average during the period) returned 20.2%. Steel holdings made the greatest contribution to excess return by a wide margin, with Specialty Chemicals and Diversified Chemicals also making notable contributions. Diversified Metals & Mining was the biggest detractor in the portfolio. The underweight to Industrial Gases was a significant drag on relative return while the underweight to Fertilizers & Agricultural Chemicals helped.

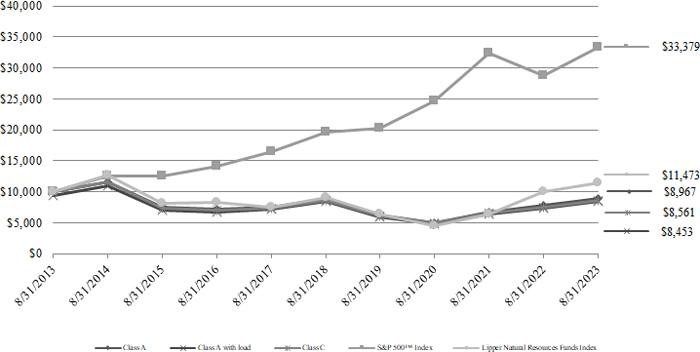

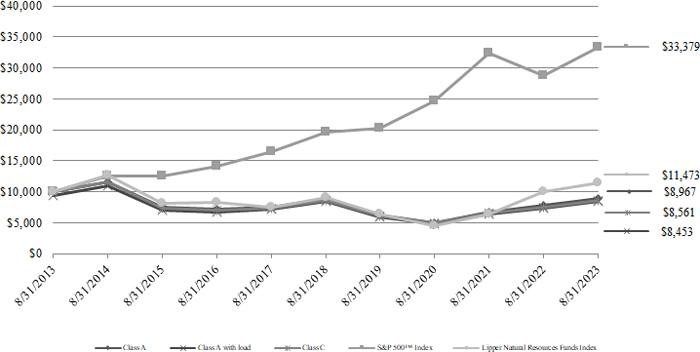

ENERGY & BASIC MATERIALS PORTFOLIO

A HYPOTHETICAL COMPARISON OF THE GROWTH OF $10,000 INVESTED IN THE

ENERGY & BASIC MATERIALS PORTFOLIO VS. BENCHMARK

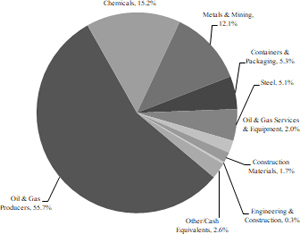

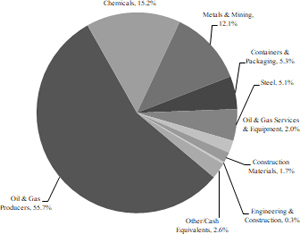

SIGNIFICANT AREAS OF INVESTMENT

AS A PERCENTAGE OF NET ASSETS

| Top 10 Portfolio Holdings* |

| |

| | % of |

| Company | Net Assets |

| Exxon Mobil Corporation | 7.1% |

| Chevron Corporation | 6.9% |

| New Linde plc | 4.1% |

| Shell plc | 3.9% |

| ConocoPhillips | 3.6% |

| POSCO - ADR | 3.3% |

| TotalEnergies S.E. - ADR | 3.2% |

| Eni SpA | 3.0% |

| Suncor Energy, Inc. | 3.0% |

| Canadian Natural Resources Ltd. | 2.7% |

| * | Based on total net assets as of August 31, 2023. |

Excludes short-term investments.

Portfolio Composition*

The S&P 500™ Index is an unmanaged index. Index returns assume reinvestment of dividends. Investors may not invest in the Index directly; unlike the Portfolio’s returns, the Index does not reflect any fees or expenses.

The Lipper Natural Resources Funds Index is an equal-weighted performance Index, adjusted for capital gain distributions and income dividends, of the largest qualifying funds within the Natural Resources fund classification, as defined by Lipper. Indexes are not managed and it is not possible to invest directly in an Index.

Past performance is not predictive of future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of the fund shares.

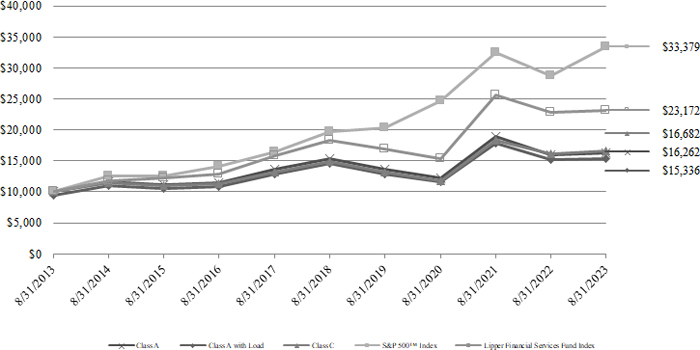

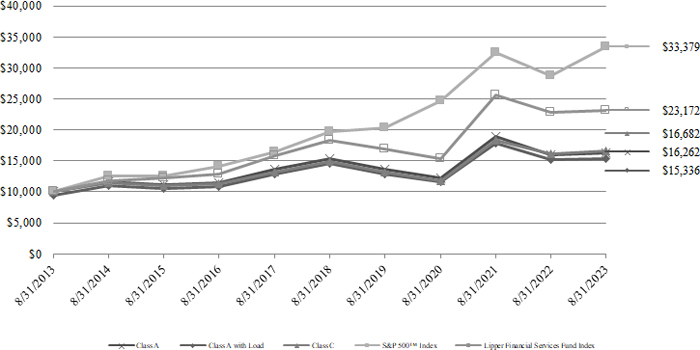

FINANCIAL SERVICES PORTFOLIO

Advised by: Smith Group Asset Management, Dallas, Texas

Objective: The Portfolio seeks long-term growth of capital.

| Total Aggregate Return for the Year Ended August 31, 2023 |

| | One Year: | Five Year: | Ten Year: | Inception: |

| | 9/1/22 – 8/31/23 | 9/1/18 – 8/31/23* | 9/1/13 – 8/31/23* | 8/1/00 – 8/31/23* |

| Class A | | | | |

| With Sales Charge | (4.57)% | (0.08)% | 4.37% | 2.18% |

| Without Sales Charge | 1.22% | 1.11% | 4.98% | 2.44% |

| Class C | | | | |

| With Sales Charge | 2.57% | 2.23% | 5.25% | 2.21% |

| Without Sales Charge | 3.57% | 2.23% | 5.25% | 2.21% |

| * | Annualized performance for periods greater than one year. |

Performance data quoted above is historical. Past performance does not guarantee future results and current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate, so that shares when redeemed, may be worth more or less than their original cost. For more performance numbers current to the most recent month-end please call (800) 807-FUND. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemptions of fund shares. The total operating expense ratios as stated in the fee table to the Portfolio’s prospectus dated December 28, 2022 are 3.68% and 4.28% for the A and C Classes, respectively.

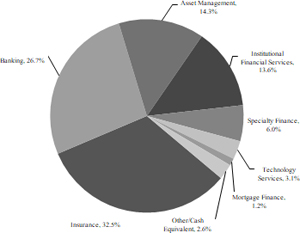

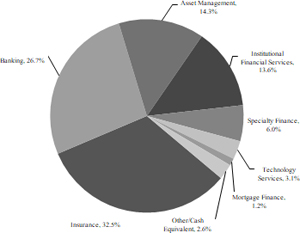

PORTFOLIO INVESTMENT STRATEGIES AND TECHNIQUES

The Adviser employs quantitative and qualitative analysis that seeks to identify reasonably valued, high quality financial services companies that it believes have the ability to accelerate earnings growth and exceed investor expectations. The Adviser’s selection process consists of three steps. First, the Adviser reviews a series of screens utilizing the Adviser’s investment models, which are based on fundamental characteristics designed to eliminate companies that the Adviser’s research shows have a high probability of underperformance. Factors considered when reviewing the screens include a multi-factor valuation framework, earnings quality, and capital structure. The valuation framework includes, but is not limited to, analysis of price to earnings, price to sales, price to book, cash held to price and various cash flow ratios. Valuation methodology is industry-specific within the financial services sector. Next, securities that pass the initial screens are then evaluated to try to identify stocks with the highest probability of producing an earnings growth rate that exceeds investor expectations. This process incorporates changes in earnings expectations and earnings quality analysis. Finally, these steps produce a list of eligible companies which are subjected to analysis by the Adviser to further understand each company’s business prospects and earnings potential. The Adviser uses the results of this analysis to construct the Portfolio’s security positions.

PORTFOLIO ADVISOR COMMENTARY

For the annual period ended August 31, 2023, the Saratoga Financial Service Portfolio posted positive absolute returns, but struggled on a relative basis while financial service companies significantly trailed broad market averages.