0000924628 sat:C000196881Member sat:SaratogaMidCapitalizationFundClassIMember 2024-08-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-08542 | |

| The Saratoga Advantage Trust |

| (Exact name of registrant as specified in charter) |

| 12725 W. Indian School Rd, Suite E-101, Avondale, AZ | | 85392 |

| (Address of principal executive offices) | | (Zip code) |

Stuart M Strauss, Esq. Dechert LLP 1095 Avenue of the Americas, New York, NY, 10036 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | 623-266-4567 | |

| Date of fiscal year end: | 8/31 | |

| | | |

| Date of reporting period: | 8/31/24 | |

| Item 1. | Reports to Stockholders. |

Saratoga LARGE CAPITALIZATION VALUE Fund |  |

| Annual Shareholder Report | 8/31/2024 | SLVYX | Class A | |

| This annual shareholder report contains important information about the Saratoga Large Capitalization Value Fund for the period 9/1/2023 through 8/31/2024, as well as certain changes to the Fund, if applicable. You can find additional information about the Fund at www.saratogacap.com/fund-reports or by contacting us at 1-888-672-4839. |

| What were the Fund’s costs for the last year (based on a hypothetical $10,000 investment)? |

| Fund | Costs of a $10,000 Investment | Costs paid as a % of a $10,000 Investment |

| Saratoga Large Capitalization Value Fund, Class A | $245 | 2.28% |

| What affected the Fund’s performance during this period? |

The Fund’s top contributor during the fiscal year was CACI International. This government IT services leader beat consensus expectations for margins and revenue. Throughout the year, they also announced meaningful new IT wins with key government entities. Clean Harbors Inc. was the Fund’s 2nd top performing stock during this period. This hazardous waste collection and disposal company has benefitted from pricing actions and increased volume. The company has consistently beat and raised expectations in their Environmental Solutions segment which has led to a re-rating. Favorable tailwinds in environmental regulation around PFAS has also propelled the stock. Clean Harbors and CACI are both top positions currently. The Fund’s main detractors were Lamb Weston, and Dollar General. Lamb Weston underperformed due to a large earnings and revenue cut. They experienced issues with their ERP transition which led to volumes meaningfully missing estimates. They also issued guidance for their 2025 fiscal year that raised caution around overcapacity and pricing. As a result, the stock de-rated significantly. We exited Lamb Weston after the 2025 fiscal year guide. Dollar General underperformed due to concerns around the lower end consumer. This led to sales and earnings missing estimates. Concerns around ceding market share to Walmart and Amazon has also led to a multiple de-rating. We still own Dollar General, but we are evaluating the merits of the original investment thesis and whether it should remain a long-term holding. |

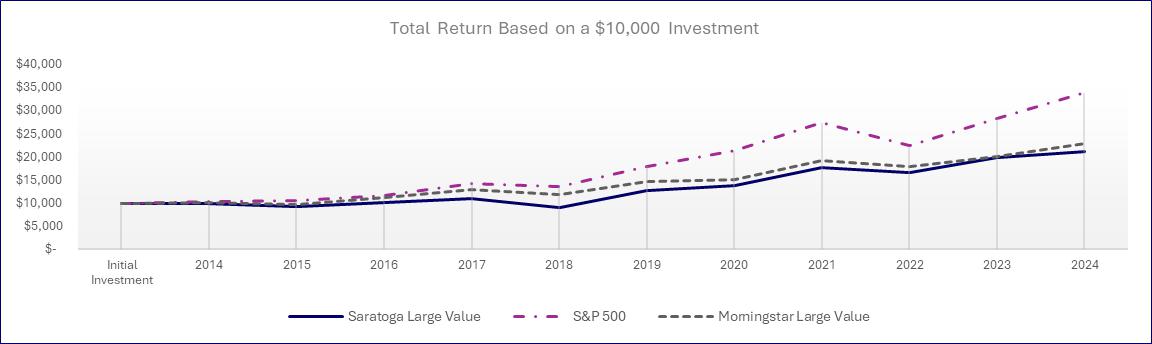

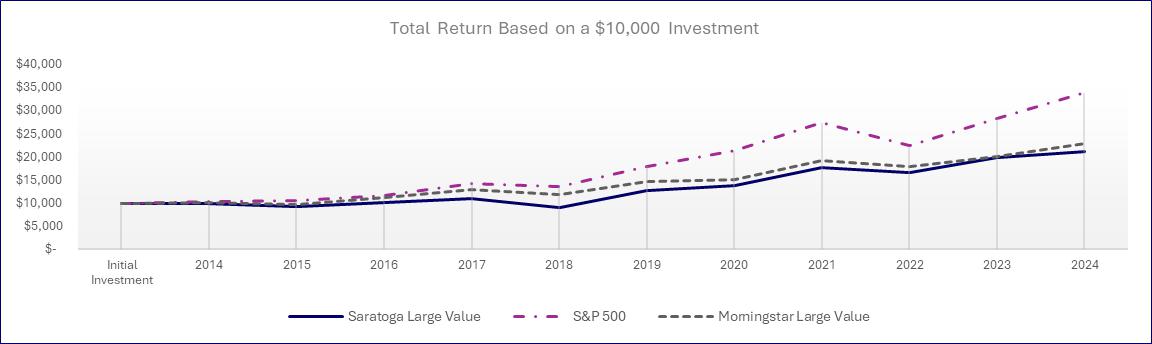

How did the Fund perform over the past 10 years?

The chart below represents the historical performance of a hypothetical $10,000 investment over the past 10 years in the class of shares noted and assumes the reinvestment of dividends and capital gains and the maximum sales charge, if any. Fund expenses, including management fees, 12b-1 fees, if any, and other expenses were deducted.

| Years | Years | Saratoga Large Value (with load) | S&P 500 | Morningstar Large Value |

|---|

| Initial Investment | Initial Investment | $10,000 | $10,000 | $10,000 |

| 2014 | 8/31/2014 | $9,348 | $10,346 | $10,136 |

| 2015 | 8/31/2015 | $8,680 | $10,489 | $9,723 |

| 2016 | 8/31/2016 | $9,437 | $11,744 | $11,141 |

| 2017 | 8/31/2017 | $10,214 | $14,308 | $12,932 |

| 2018 | 8/31/2018 | $8,386 | $13,680 | $11,819 |

| 2019 | 8/31/2019 | $11,767 | $17,988 | $14,773 |

| 2020 | 8/31/2020 | $12,653 | $21,297 | $15,168 |

| 2021 | 8/31/2021 | $16,285 | $27,411 | $19,125 |

| 2022 | 8/31/2022 | $15,082 | $22,447 | $17,975 |

| 2023 | 8/31/2023 | $18,070 | $28,347 | $20,092 |

| 2024 | 8/31/2024 | $19,133 | $33,882 | $23,017 |

| Average Annual Total Returns |

| | 1 Year | 5 Years | 10 Years |

| Saratoga Large Capitalization Value Fund, Class A (with load) | 8.12% | 11.96% | 6.70% |

| Saratoga Large Capitalization Value Fund, Class A | 14.72% | 13.30% | 7.34% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Morningstar US Fund Large Value Category | 21.17% | 11.74% | 8.96% |

Performance data quoted represents past performance, which is not a good predictor of the Fund’s future performance. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. The average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains. Call 1-888-672-4839 for current performance information or questions.

THE SARATOGA ADVANTAGE TRUST

| Fund Statistics |

| Total Net Assets | $20,248,191 | Advisory Fees Paid by the Fund | $135,474 |

| Number of Portfolio Holdings | 20 | Portfolio Turnover Rate | 83% |

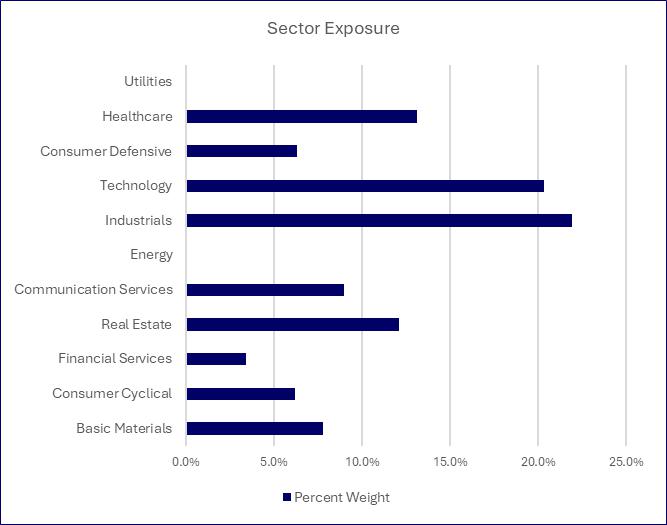

What did the Fund invest in (as a % of the Fund’s net assets)?

| Utilities | 0.0% |

| Healthcare | 13.1% |

| Consumer Defensive | 6.3% |

| Technology | 20.3% |

| Industrials | 21.9% |

| Energy | 0.0% |

| Communication Services | 9.0% |

| Real Estate | 12.1% |

| Financial Services | 3.4% |

| Consumer Cyclical | 6.2% |

| Basic Materials | 7.8% |

| Top Holdings (%) |

| Dreyfus Inst Prefer Govt Money Mkt Inst Class | 11.31 |

| CACI International Inc | 8.14 |

| Liberty Media Corp-Formula One | 7.96 |

| Clean Harbors Inc | 6.47 |

| CBRE Group Inc Class A | 5.54 |

| Crown Holdings Inc | 5.48 |

| APi Group Corp | 5.32 |

| Charles River Laboratories International | 5.22 |

| Marvell Technology Inc | 5.18 |

| SBA Communications Corp Class A | 5.18 |

| Material Fund changes during the period. |

| Below is a summary of certain changes, and planned changes, to the Fund during the reporting period. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by December 31, 2024, at www.saratogacap.com/fund-reports or upon request at 1-888-672-4839. |

| During the period there were no material changes to the Fund. |

| Changes in, or disagreements with, Fund accountants. |

| During the period there were not changes in, or disagreements with, Fund accountants. |

| Householding for the Fund. |

| To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (often referred to as “householding”). If you would prefer that your Fund documents not be householded, please contact the Saratoga Advantage Trust at 1-888-672-4839 or contact your financial intermediary. |

| Electronic access to this report, or additional information. |

| For additional information about this Fund, including its prospectus, financial information, and holdings, please visit www.saratogacap.com/fund-reports. |

THE SARATOGA ADVANTAGE TRUST

Saratoga LARGE CAPITALIZATION VALUE Fund |  |

| Annual Shareholder Report | 8/31/2024 | SLVCX | Class C | |

| This annual shareholder report contains important information about the Saratoga Large Capitalization Value Fund for the period 9/1/2023 through 8/31/2024, as well as certain changes to the Fund, if applicable. You can find additional information about the Fund at www.saratogacap.com/fund-reports or by contacting us at 1-888-672-4839. |

| What were the Fund’s costs for the last year (based on a hypothetical $10,000 investment)? |

| Fund | Costs of a $10,000 Investment | Costs paid as a % of a $10,000 Investment |

| Saratoga Large Capitalization Value Fund, Class C | $306 | 2.86% |

| What affected the Fund’s performance during this period? |

The Fund’s top contributor during the fiscal year was CACI International. This government IT services leader beat consensus expectations for margins and revenue. Throughout the year, they also announced meaningful new IT wins with key government entities. Clean Harbors Inc. was the Fund’s 2nd top performing stock during this period. This hazardous waste collection and disposal company has benefitted from pricing actions and increased volume. The company has consistently beat and raised expectations in their Environmental Solutions segment which has led to a re-rating. Favorable tailwinds in environmental regulation around PFAS has also propelled the stock. Clean Harbors and CACI are both top positions currently. The Fund’s main detractors were Lamb Weston, and Dollar General. Lamb Weston underperformed due to a large earnings and revenue cut. They experienced issues with their ERP transition which led to volumes meaningfully missing estimates. They also issued guidance for their 2025 fiscal year that raised caution around overcapacity and pricing. As a result, the stock de-rated significantly. We exited Lamb Weston after the 2025 fiscal year guide. Dollar General underperformed due to concerns around the lower end consumer. This led to sales and earnings missing estimates. Concerns around ceding market share to Walmart and Amazon has also led to a multiple de-rating. We still own Dollar General, but we are evaluating the merits of the original investment thesis and whether it should remain a long-term holding. |

How did the Fund perform over the past 10 years?

The chart below represents the historical performance of a hypothetical $10,000 investment over the past 10 years in the class of shares noted and assumes the reinvestment of dividends and capital gains and the maximum sales charge, if any. Fund expenses, including management fees, 12b-1 fees, if any, and other expenses were deducted.

| Years | Years | Saratoga Large Value (with load) | S&P 500 | Morningstar Large Value |

|---|

| Initial Investment | Initial Investment | $10,000 | $10,000 | $10,000 |

| 2014 | 8/31/2014 | $9,908 | $10,346 | $10,136 |

| 2015 | 8/31/2015 | $9,143 | $10,489 | $9,723 |

| 2016 | 8/31/2016 | $9,880 | $11,744 | $11,141 |

| 2017 | 8/31/2017 | $10,632 | $14,308 | $12,932 |

| 2018 | 8/31/2018 | $8,675 | $13,680 | $11,819 |

| 2019 | 8/31/2019 | $12,104 | $17,988 | $14,773 |

| 2020 | 8/31/2020 | $12,934 | $21,297 | $15,168 |

| 2021 | 8/31/2021 | $16,547 | $27,411 | $19,125 |

| 2022 | 8/31/2022 | $15,234 | $22,447 | $17,975 |

| 2023 | 8/31/2023 | $18,142 | $28,347 | $20,092 |

| 2024 | 8/31/2024 | $19,130 | $33,882 | $23,017 |

| Average Annual Total Returns |

| | 1 Year | 5 Years | 10 Years |

| Saratoga Large Capitalization Value Fund, Class C (with load) | 13.02% | 12.62% | 6.70% |

| Saratoga Large Capitalization Value Fund, Class C | 14.02% | 12.62% | 6.70% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Morningstar US Fund Large Value Category | 21.17% | 11.74% | 8.96% |

Performance data quoted represents past performance, which is not a good predictor of the Fund’s future performance. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. The average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains. Call 1-888-672-4839 for current performance information or questions.

THE SARATOGA ADVANTAGE TRUST

| Fund Statistics |

| Total Net Assets | $20,248,191 | Advisory Fees Paid by the Fund | $135,474 |

| Number of Portfolio Holdings | 20 | Portfolio Turnover Rate | 83% |

What did the Fund invest in (as a % of the Fund’s net assets)?

| Utilities | 0.0% |

| Healthcare | 13.1% |

| Consumer Defensive | 6.3% |

| Technology | 20.3% |

| Industrials | 21.9% |

| Energy | 0.0% |

| Communication Services | 9.0% |

| Real Estate | 12.1% |

| Financial Services | 3.4% |

| Consumer Cyclical | 6.2% |

| Basic Materials | 7.8% |

| Top Holdings (%) |

| Dreyfus Inst Prefer Govt Money Mkt Inst Class | 11.31 |

| CACI International Inc | 8.14 |

| Liberty Media Corp-Formula One | 7.96 |

| Clean Harbors Inc | 6.47 |

| CBRE Group Inc Class A | 5.54 |

| Crown Holdings Inc | 5.48 |

| APi Group Corp | 5.32 |

| Charles River Laboratories International | 5.22 |

| Marvell Technology Inc | 5.18 |

| SBA Communications Corp Class A | 5.18 |

| Material Fund changes during the period. |

| Below is a summary of certain changes, and planned changes, to the Fund during the reporting period. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by December 31, 2024, at www.saratogacap.com/fund-reports or upon request at 1-888-672-4839. |

| During the period there were no material changes to the Fund. |

| Changes in, or disagreements with, Fund accountants. |

| During the period there were not changes in, or disagreements with, Fund accountants. |

| Householding for the Fund. |

| To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (often referred to as “householding”). If you would prefer that your Fund documents not be householded, please contact the Saratoga Advantage Trust at 1-888-672-4839 or contact your financial intermediary. |

| Electronic access to this report, or additional information. |

| For additional information about this Fund, including its prospectus, financial information, and holdings, please visit www.saratogacap.com/fund-reports. |

THE SARATOGA ADVANTAGE TRUST

Saratoga LARGE CAPITALIZATION VALUE Fund |  |

| Annual Shareholder Report | 8/31/2024 | SLCVX | Class I | |

| This annual shareholder report contains important information about the Saratoga Large Capitalization Value Fund for the period 9/1/2023 through 8/31/2024, as well as certain changes to the Fund, if applicable. You can find additional information about the Fund at www.saratogacap.com/fund-reports or by contacting us at 1-888-672-4839. |

| What were the Fund’s costs for the last year (based on a hypothetical $10,000 investment)? |

| Fund | Costs of a $10,000 Investment | Costs paid as a % of a $10,000 Investment |

| Saratoga Large Capitalization Value Fund, Class I | $201 | 1.87% |

| What affected the Fund’s performance this period? |

The Fund’s top contributor during the fiscal year was CACI International. This government IT services leader beat consensus expectations for margins and revenue. Throughout the year, they also announced meaningful new IT wins with key government entities. Clean Harbors Inc. was the Fund’s 2nd top performing stock during this period. This hazardous waste collection and disposal company has benefitted from pricing actions and increased volume. The company has consistently beat and raised expectations in their Environmental Solutions segment which has led to a re-rating. Favorable tailwinds in environmental regulation around PFAS has also propelled the stock. Clean Harbors and CACI are both top positions currently. The Fund’s main detractors were Lamb Weston, and Dollar General. Lamb Weston underperformed due to a large earnings and revenue cut. They experienced issues with their ERP transition which led to volumes meaningfully missing estimates. They also issued guidance for their 2025 fiscal year that raised caution around overcapacity and pricing. As a result, the stock de-rated significantly. We exited Lamb Weston after the 2025 fiscal year guide. Dollar General underperformed due to concerns around the lower end consumer. This led to sales and earnings missing estimates. Concerns around ceding market share to Walmart and Amazon has also led to a multiple de-rating. We still own Dollar General, but we are evaluating the merits of the original investment thesis and whether it should remain a long-term holding. |

How did the Fund perform over the past 10 years?

The chart below represents the historical performance of a hypothetical $10,000 investment over the past 10 years in the class of shares noted and assumes the reinvestment of dividends and capital gains and the maximum sales charge, if any. Fund expenses, including management fees, 12b-1 fees, if any, and other expenses were deducted.

| Years | Years | Saratoga Large Value | S&P 500 | Morningstar Large Value |

|---|

| Initial Investment | Initial Investment | $10,000 | $10,000 | $10,000 |

| 2014 | 8/31/2014 | $9,934 | $10,346 | $10,136 |

| 2015 | 8/31/2015 | $9,258 | $10,489 | $9,723 |

| 2016 | 8/31/2016 | $10,106 | $11,744 | $11,141 |

| 2017 | 8/31/2017 | $10,981 | $14,308 | $12,932 |

| 2018 | 8/31/2018 | $9,054 | $13,680 | $11,819 |

| 2019 | 8/31/2019 | $12,753 | $17,988 | $14,773 |

| 2020 | 8/31/2020 | $13,775 | $21,297 | $15,168 |

| 2021 | 8/31/2021 | $17,798 | $27,411 | $19,125 |

| 2022 | 8/31/2022 | $16,550 | $22,447 | $17,975 |

| 2023 | 8/31/2023 | $19,906 | $28,347 | $20,092 |

| 2024 | 8/31/2024 | $21,134 | $33,882 | $23,017 |

| Average Annual Total Returns |

| | 1 Year | 5 Years | 10 Years |

| Saratoga Large Capitalization Value Fund, Class I | 15.20% | 13.76% | 7.77% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Morningstar US Fund Large Value Category | 21.17% | 11.74% | 8.96% |

Performance data quoted represents past performance, which is not a good predictor of the Fund’s future performance. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. The average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains. Call 1-888-672-4839 for current performance information or questions.

THE SARATOGA ADVANTAGE TRUST

| Fund Statistics |

| Total Net Assets | $20,248,191 | Advisory Fees Paid by the Fund | $135,474 |

| Number of Portfolio Holdings | 20 | Portfolio Turnover Rate | 83% |

What did the Fund invest in (as a % of the Fund’s net assets)?

| Utilities | 0.0% |

| Healthcare | 13.1% |

| Consumer Defensive | 6.3% |

| Technology | 20.3% |

| Industrials | 21.9% |

| Energy | 0.0% |

| Communication Services | 9.0% |

| Real Estate | 12.1% |

| Financial Services | 3.4% |

| Consumer Cyclical | 6.2% |

| Basic Materials | 7.8% |

| Top Holdings (%) |

| Dreyfus Inst Prefer Govt Money Mkt Inst Class | 11.31 |

| CACI International Inc | 8.14 |

| Liberty Media Corp-Formula One | 7.96 |

| Clean Harbors Inc | 6.47 |

| CBRE Group Inc Class A | 5.54 |

| Crown Holdings Inc | 5.48 |

| APi Group Corp | 5.32 |

| Charles River Laboratories International | 5.22 |

| Marvell Technology Inc | 5.18 |

| SBA Communications Corp Class A | 5.18 |

| Material Fund changes during the period. |

| Below is a summary of certain changes, and planned changes, to the Fund during the reporting period. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by December 31, 2024, at www.saratogacap.com/fund-reports or upon request at 1-888-672-4839. |

| During the period there were no material changes to the Fund. |

| Changes in, or disagreements with, Fund accountants. |

| During the period there were not changes in, or disagreements with, Fund accountants. |

| Householding for the Fund. |

| To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (often referred to as “householding”). If you would prefer that your Fund documents not be householded, please contact the Saratoga Advantage Trust at 1-888-672-4839 or contact your financial intermediary. |

| Electronic access to this report, or additional information. |

| For additional information about this Fund, including its prospectus, financial information, and holdings, please visit www.saratogacap.com/fund-reports. |

THE SARATOGA ADVANTAGE TRUST

SARATOGA LARGE CAPITALIZATION GROWTH FUND |  |

| Annual Shareholder Report | 8/31/2024 | SLGYX | Class A | |

| This annual shareholder report contains important information about the Saratoga Large Capitalization Growth Fund for the period 9/1/2023 through 8/31/2024, as well as certain changes to the Fund, if applicable. You can find additional information about the Fund at www.saratogacap.com/fund-reports or by contacting us at 1-888-672-4839. |

| What were the Fund’s costs for the last year (based on a hypothetical $10,000 investment)? |

| Fund | Costs of a $10,000 Investment | Costs paid as a % of a $10,000 Investment |

| Saratoga Large Capitalization Growth Fund, Class A | $249 | 2.11% |

| What affected the Fund’s performance during this period? |

Despite rising equity prices during the period, the Fund remained focused on stock selection, which amounted for the entirety of the Fund's excess return. This stock selection impact was most apparent in the Information Technology and Consumer Discretionary sectors. Smaller sectors such as Energy, Utilities, Materials, and Real Estate had little impact due to limited stock selection opportunities. AppLovin Corp. (+121.4%) was the top Fund holding. We view AppLovin as a high-growth mobile app platform that excels in monetization, marketing, and analytics. We see potential double-digit growth in the company's software revenue, driven primarily by its gaming division, through 2026. Due to threshold limits set by mutual fund diversification rules that this Fund is privy to, the Fund held a significant underweight position in Mega-Cap Technology, Communication Services, and Consumer Discretionary stocks relative to common growth indexes, which was a headwind to relative performance. For example, key stocks such as Microsoft, Apple, Nvidia, Alphabet, and Amazon made up 43.4% of the Russell 1000 Growth Index, while the Fund allocated 32.7% on average to these names. These stocks outpaced the index and returned 48.5%, and the Fund's underweight position created a 1.4% performance drag. From a risk perspective, the Fund's active weight constraints helped reduce exposure to market volatility and sentiment shifts during the period. |

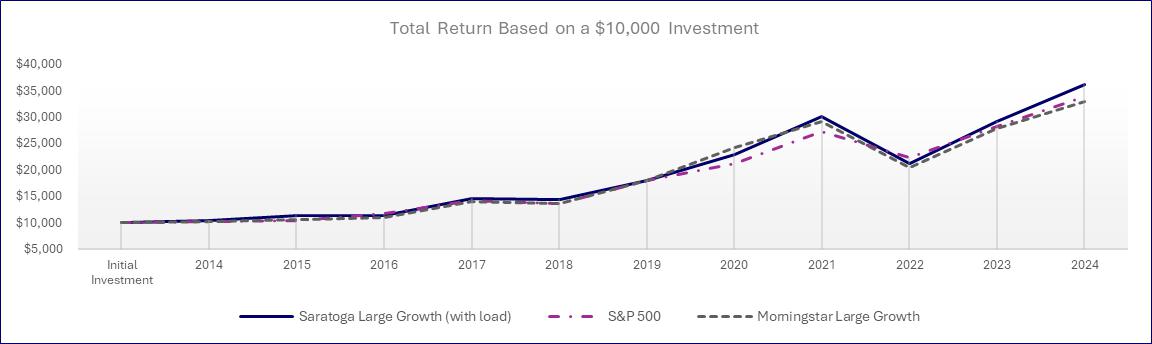

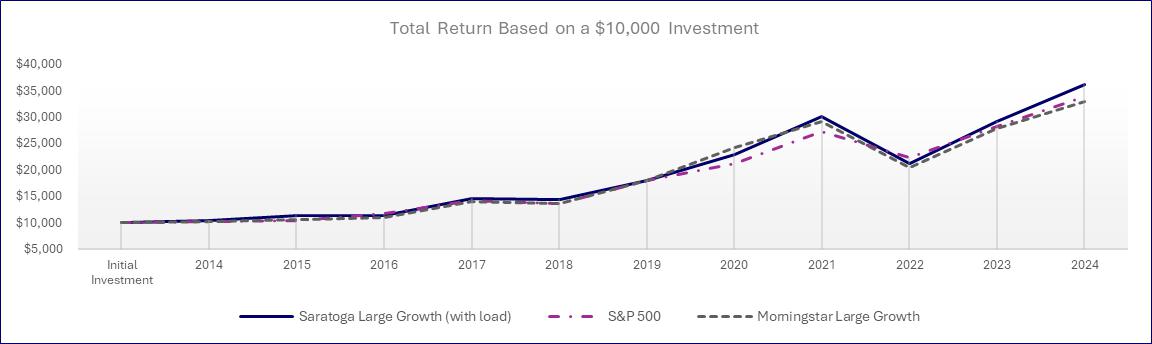

How did the Fund perform over the past 10 years?

The chart below represents the historical performance of a hypothetical $10,000 investment over the past 10 years in the class of shares noted and assumes the reinvestment of dividends and capital gains and the maximum sales charge, if any. Fund expenses, including management fees, 12b-1 fees, if any, and other expenses were deducted.

| Years | Years | Saratoga Large Growth (with load) | S&P 500 | Morningstar Large Growth |

|---|

| Initial Investment | Initial Investment | $10,000 | $10,000 | $10,000 |

| 2014 | 8/31/2014 | $9,953 | $10,346 | $10,242 |

| 2015 | 8/31/2015 | $10,907 | $10,489 | $10,608 |

| 2016 | 8/31/2016 | $10,861 | $11,744 | $10,946 |

| 2017 | 8/31/2017 | $14,102 | $14,308 | $13,994 |

| 2018 | 8/31/2018 | $13,976 | $13,680 | $13,690 |

| 2019 | 8/31/2019 | $17,607 | $17,988 | $18,031 |

| 2020 | 8/31/2020 | $22,574 | $21,297 | $24,310 |

| 2021 | 8/31/2021 | $29,733 | $27,411 | $29,290 |

| 2022 | 8/31/2022 | $21,112 | $22,447 | $20,444 |

| 2023 | 8/31/2023 | $29,158 | $28,347 | $27,799 |

| 2024 | 8/31/2024 | $36,307 | $33,882 | $33,065 |

| Average Annual Total Returns |

| | 1 Year | 5 Years | 10 Years |

| Saratoga Large Capitalization Growth Fund, Class A (with load) | 28.10% | 16.54% | 13.76% |

| Saratoga Large Capitalization Growth Fund, Class A | 35.90% | 17.93% | 14.44% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Morningstar US Fund Large Growth Category | 28.28% | 15.37% | 13.24% |

Performance data quoted represents past performance, which is not a good predictor of the Fund’s future performance. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. The average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains. Call 1-888-672-4839 for current performance information or questions.

THE SARATOGA ADVANTAGE TRUST

| Fund Statistics |

| Total Net Assets | $33,018,984 | Advisory Fees Paid by the Fund | $192,725 |

| Number of Portfolio Holdings | 51 | Portfolio Turnover Rate | 99% |

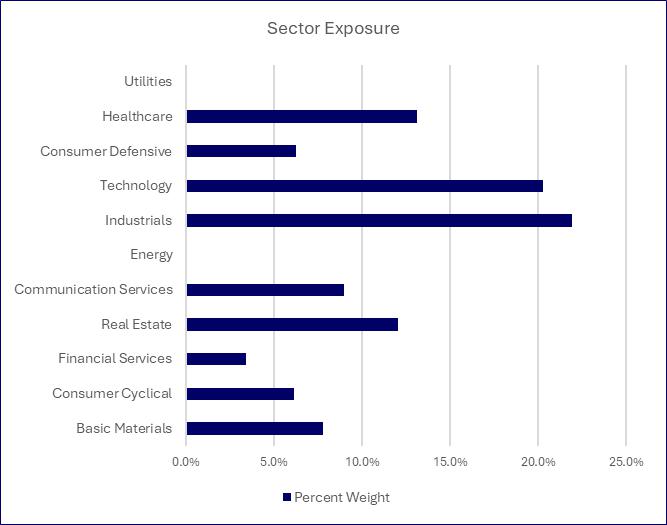

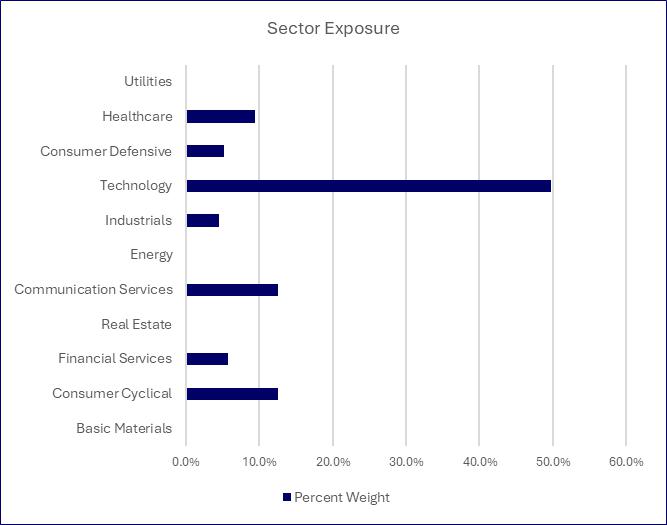

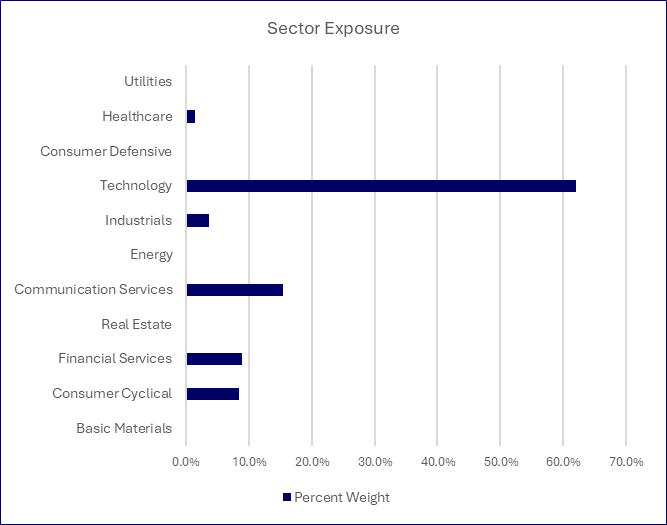

What did the Fund invest in (as a % of the Fund’s net assets)?

| Utilities | 0.0% |

| Healthcare | 9.5% |

| Consumer Defensive | 5.3% |

| Technology | 49.7% |

| Industrials | 4.6% |

| Energy | 0.0% |

| Communication Services | 12.6% |

| Real Estate | 0.0% |

| Financial Services | 5.7% |

| Consumer Cyclical | 12.6% |

| Basic Materials | 0.0% |

| Top Holdings (%) |

| Microsoft Corp | 7.86 |

| Apple Inc | 7.54 |

| NVIDIA Corp | 6.68 |

| Meta Platforms Inc Class A | 4.36 |

| Amazon.com Inc | 4.04 |

| Broadcom Inc | 2.65 |

| Progressive Corp | 2.57 |

| Arista Networks Inc | 2.45 |

| AppLovin Corp Class A | 2.44 |

| Spotify Technology | 2.38 |

| Material Fund changes during the period. |

| Below is a summary of certain changes, and planned changes, to the Fund during the reporting period. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by December 31, 2024, at www.saratogacap.com/fund-reports or upon request at 1-888-672-4839. |

| During the period there were no material changes to the Fund. |

| Changes in, or disagreements with, Fund accountants. |

| During the period there were not changes in, or disagreements with, Fund accountants. |

| Householding for the Fund. |

| To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (often referred to as “householding”). If you would prefer that your Fund documents not be householded, please contact the Saratoga Advantage Trust at 1-888-672-4839 or contact your financial intermediary. |

| Electronic access to this report, or additional information. |

| For additional information about this Fund, including its prospectus, financial information, and holdings, please visit www.saratogacap.com/fund-reports. |

THE SARATOGA ADVANTAGE TRUST

SARATOGA LARGE CAPITALIZATION GROWTH FUND |  |

| Annual Shareholder Report | 8/31/2024 | SLGCX | Class C | |

| This annual shareholder report contains important information about the Saratoga Large Capitalization Growth Fund for the period 9/1/2023 through 8/31/2024, as well as certain changes to the Fund, if applicable. You can find additional information about the Fund at www.saratogacap.com/fund-reports or by contacting us at 1-888-672-4839. |

| What were the Fund’s costs for the last year (based on a hypothetical $10,000 investment)? |

| Fund | Costs of a $10,000 Investment | Costs paid as a % of a $10,000 Investment |

| Saratoga Large Capitalization Growth Fund, Class C | $314 | 2.67% |

| What affected the Fund’s performance during this period? |

Despite rising equity prices during the period, the Fund remained focused on stock selection, which amounted for the entirety of the Fund's excess return. This stock selection impact was most apparent in the Information Technology and Consumer Discretionary sectors. Smaller sectors such as Energy, Utilities, Materials, and Real Estate had little impact due to limited stock selection opportunities. AppLovin Corp. (+121.4%) was the top Fund holding. We view AppLovin as a high-growth mobile app platform that excels in monetization, marketing, and analytics. We see potential double-digit growth in the company's software revenue, driven primarily by its gaming division, through 2026. Due to threshold limits set by mutual fund diversification rules that this Fund is privy to, the Fund held a significant underweight position in Mega-Cap Technology, Communication Services, and Consumer Discretionary stocks relative to common growth indexes, which was a headwind to relative performance. For example, key stocks such as Microsoft, Apple, Nvidia, Alphabet, and Amazon made up 43.4% of the Russell 1000 Growth Index, while the Fund allocated 32.7% on average to these names. These stocks outpaced the index and returned 48.5%, and the Fund's underweight position created a 1.4% performance drag. From a risk perspective, the Fund's active weight constraints helped reduce exposure to market volatility and sentiment shifts during the period. |

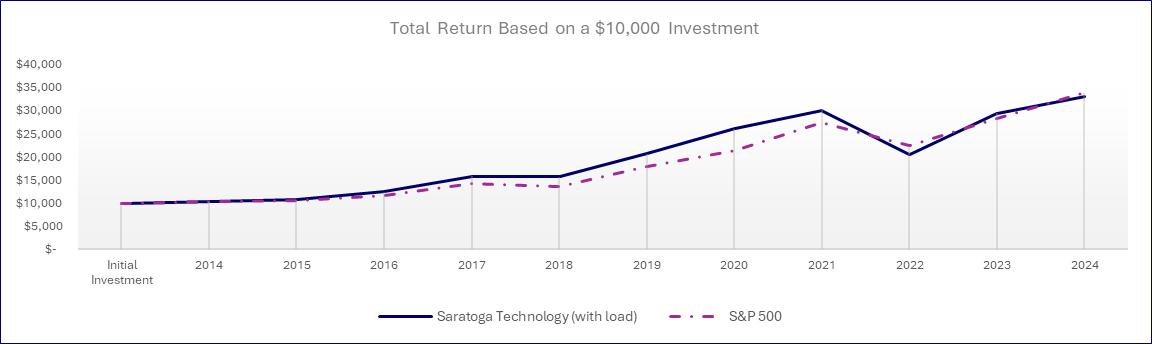

How did the Fund perform over the past 10 years?

The chart below represents the historical performance of a hypothetical $10,000 investment over the past 10 years in the class of shares noted and assumes the reinvestment of dividends and capital gains and the maximum sales charge, if any. Fund expenses, including management fees, 12b-1 fees, if any, and other expenses were deducted.

| Years | Years | Saratoga Large Growth (with load) | S&P 500 | Morningstar Large Growth |

|---|

| Initial Investment | Initial Investment | $10,000 | $10,000 | $10,000 |

| 2014 | 8/31/2014 | $10,537 | $10,346 | $10,242 |

| 2015 | 8/31/2015 | $11,484 | $10,489 | $10,608 |

| 2016 | 8/31/2016 | $11,372 | $11,744 | $10,946 |

| 2017 | 8/31/2017 | $14,678 | $14,308 | $13,994 |

| 2018 | 8/31/2018 | $14,445 | $13,680 | $13,690 |

| 2019 | 8/31/2019 | $18,096 | $17,988 | $18,031 |

| 2020 | 8/31/2020 | $23,054 | $21,297 | $24,310 |

| 2021 | 8/31/2021 | $30,203 | $27,411 | $29,290 |

| 2022 | 8/31/2022 | $21,321 | $22,447 | $20,444 |

| 2023 | 8/31/2023 | $29,281 | $28,347 | $27,799 |

| 2024 | 8/31/2024 | $36,282 | $33,882 | $33,065 |

| Average Annual Total Returns |

| | 1 Year | 5 Years | 10 Years |

| Saratoga Large Capitalization Growth Fund, Class C (with load) | 34.00% | 17.22% | 13.75% |

| Saratoga Large Capitalization Growth Fund, Class C | 35.00% | 17.22% | 13.75% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Morningstar US Fund Large Growth Category | 28.28% | 15.37% | 13.24% |

Performance data quoted represents past performance, which is not a good predictor of the Fund’s future performance. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. The average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains. Call 1-888-672-4839 for current performance information or questions.

THE SARATOGA ADVANTAGE TRUST

| Fund Statistics |

| Total Net Assets | $33,018,984 | Advisory Fees Paid by the Fund | $192,725 |

| Number of Portfolio Holdings | 51 | Portfolio Turnover Rate | 99% |

What did the Fund invest in (as a % of the Fund’s net assets)?

| Utilities | 0.0% |

| Healthcare | 9.5% |

| Consumer Defensive | 5.3% |

| Technology | 49.7% |

| Industrials | 4.6% |

| Energy | 0.0% |

| Communication Services | 12.6% |

| Real Estate | 0.0% |

| Financial Services | 5.7% |

| Consumer Cyclical | 12.6% |

| Basic Materials | 0.0% |

| Top Holdings (%) |

| Microsoft Corp | 7.86 |

| Apple Inc | 7.54 |

| NVIDIA Corp | 6.68 |

| Meta Platforms Inc Class A | 4.36 |

| Amazon.com Inc | 4.04 |

| Broadcom Inc | 2.65 |

| Progressive Corp | 2.57 |

| Arista Networks Inc | 2.45 |

| AppLovin Corp Class A | 2.44 |

| Spotify Technology | 2.38 |

| Material Fund changes during the period. |

| Below is a summary of certain changes, and planned changes, to the Fund during the reporting period. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by December 31, 2024, at www.saratogacap.com/fund-reports or upon request at 1-888-672-4839. |

| During the period there were no material changes to the Fund. |

| Changes in, or disagreements with, Fund accountants. |

| During the period there were not changes in, or disagreements with, Fund accountants. |

| Householding for the Fund. |

| To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (often referred to as “householding”). If you would prefer that your Fund documents not be householded, please contact the Saratoga Advantage Trust at 1-888-672-4839 or contact your financial intermediary. |

| Electronic access to this report, or additional information. |

| For additional information about this Fund, including its prospectus, financial information, and holdings, please visit www.saratogacap.com/fund-reports. |

THE SARATOGA ADVANTAGE TRUST

SARATOGA LARGE CAPITALIZATION GROWTH FUND |  |

| Annual Shareholder Report | 8/31/2024 | SLCGX | Class I | |

| This annual shareholder report contains important information about the Saratoga Large Capitalization Growth Fund for the period 9/1/2023 through 8/31/2024, as well as certain changes to the Fund, if applicable. You can find additional information about the Fund at www.saratogacap.com/fund-reports or by contacting us at 1-888-672-4839. |

| What were the Fund’s costs for the last year (based on a hypothetical $10,000 investment)? |

| Fund | Costs of a $10,000 Investment | Costs paid as a % of a $10,000 Investment |

| Saratoga Large Capitalization Growth Fund, Class I | $201 | 1.70% |

| What affected the Fund’s performance during this period? |

Despite rising equity prices during the period, the Fund remained focused on stock selection, which amounted for the entirety of the Fund's excess return. This stock selection impact was most apparent in the Information Technology and Consumer Discretionary sectors. Smaller sectors such as Energy, Utilities, Materials, and Real Estate had little impact due to limited stock selection opportunities. AppLovin Corp. (+121.4%) was the top Fund holding. We view AppLovin as a high-growth mobile app platform that excels in monetization, marketing, and analytics. We see potential double-digit growth in the company's software revenue, driven primarily by its gaming division, through 2026. Due to threshold limits set by mutual fund diversification rules that this Fund is privy to, the Fund held a significant underweight position in Mega-Cap Technology, Communication Services, and Consumer Discretionary stocks relative to common growth indexes, which was a headwind to relative performance. For example, key stocks such as Microsoft, Apple, Nvidia, Alphabet, and Amazon made up 43.4% of the Russell 1000 Growth Index, while the Fund allocated 32.7% on average to these names. These stocks outpaced the index and returned 48.5%, and the Fund's underweight position created a 1.4% performance drag. From a risk perspective, the Fund's active weight constraints helped reduce exposure to market volatility and sentiment shifts during the period. |

How did the Fund perform over the past 10 years?

The chart below represents the historical performance of a hypothetical $10,000 investment over the past 10 years in the class of shares noted and assumes the reinvestment of dividends and capital gains and the maximum sales charge, if any. Fund expenses, including management fees, 12b-1 fees, if any, and other expenses were deducted.

| Years | Years | Saratoga Large Growth | S&P 500 | Morningstar Large Growth |

|---|

| Initial Investment | Initial Investment | $10,000 | $10,000 | $10,000 |

| 2014 | 8/31/2014 | $10,571 | $10,346 | $10,242 |

| 2015 | 8/31/2015 | $11,634 | $10,489 | $10,608 |

| 2016 | 8/31/2016 | $11,635 | $11,744 | $10,946 |

| 2017 | 8/31/2017 | $15,167 | $14,308 | $13,994 |

| 2018 | 8/31/2018 | $15,086 | $13,680 | $13,690 |

| 2019 | 8/31/2019 | $19,087 | $17,988 | $18,031 |

| 2020 | 8/31/2020 | $24,565 | $21,297 | $24,310 |

| 2021 | 8/31/2021 | $32,489 | $27,411 | $29,290 |

| 2022 | 8/31/2022 | $23,154 | $22,447 | $20,444 |

| 2023 | 8/31/2023 | $32,116 | $28,347 | $27,799 |

| 2024 | 8/31/2024 | $40,091 | $33,882 | $33,065 |

| Average Annual Total Returns |

| | 1 Year | 5 Years | 10 Years |

| Saratoga Large Capitalization Growth Fund, Class I | 36.43% | 18.40% | 14.90% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Morningstar US Fund Large Growth Category | 28.28% | 15.37% | 13.24% |

Performance data quoted represents past performance, which is not a good predictor of the Fund’s future performance. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. The average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains. Call 1-888-672-4839 for current performance information or questions.

THE SARATOGA ADVANTAGE TRUST

| Fund Statistics |

| Total Net Assets | $33,018,984 | Advisory Fees Paid by the Fund | $192,725 |

| Number of Portfolio Holdings | 51 | Portfolio Turnover Rate | 99% |

What did the Fund invest in (as a % of the Fund’s net assets)?

| Utilities | 0.0% |

| Healthcare | 9.5% |

| Consumer Defensive | 5.3% |

| Technology | 49.7% |

| Industrials | 4.6% |

| Energy | 0.0% |

| Communication Services | 12.6% |

| Real Estate | 0.0% |

| Financial Services | 5.7% |

| Consumer Cyclical | 12.6% |

| Basic Materials | 0.0% |

| Top Holdings (%) |

| Microsoft Corp | 7.86 |

| Apple Inc | 7.54 |

| NVIDIA Corp | 6.68 |

| Meta Platforms Inc Class A | 4.36 |

| Amazon.com Inc | 4.04 |

| Broadcom Inc | 2.65 |

| Progressive Corp | 2.57 |

| Arista Networks Inc | 2.45 |

| AppLovin Corp Class A | 2.44 |

| Spotify Technology | 2.38 |

| Material Fund changes during the period. |

| Below is a summary of certain changes, and planned changes, to the Fund during the reporting period. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by December 31, 2024, at www.saratogacap.com/fund-reports or upon request at 1-888-672-4839. |

| During the period there were no material changes to the Fund. |

| Changes in, or disagreements with, Fund accountants. |

| During the period there were not changes in, or disagreements with, Fund accountants. |

| Householding for the Fund. |

| To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (often referred to as “householding”). If you would prefer that your Fund documents not be householded, please contact the Saratoga Advantage Trust at 1-888-672-4839 or contact your financial intermediary. |

| Electronic access to this report, or additional information. |

| For additional information about this Fund, including its prospectus, financial information, and holdings, please visit www.saratogacap.com/fund-reports. |

THE SARATOGA ADVANTAGE TRUST

SARATOGA MID CAPITALIZATION FUND |  |

| Annual Shareholder Report | 8/31/2024 | SPMAX | Class A | |

| This annual shareholder report contains important information about the Saratoga Mid Capitalization Fund for the period 9/1/2023 through 8/31/2024, as well as certain changes to the Fund, if applicable. You can find additional information about the Fund at www.saratogacap.com/fund-reports or by contacting us at 1-888-672-4839. |

| What were the Fund’s costs for the last year (based on a hypothetical $10,000 investment)? |

| Fund | Costs of a $10,000 Investment | Costs paid as a % of a $10,000 Investment |

| Saratoga Mid Capitalization Fund, Class A | $227 | 2.03% |

| What affected the Fund’s performance this period? |

During the period, stock selection in Utilities was the largest contributor to positive relative performance, with Vistra Corp as the top name. Industrials stock selection delivered outperformance with Vertiv Holdings Co. the strongest performer. Stock selection within Consumer Discretionary contributed to performance with Royal Caribbean Group as the top performer. Within Health Care, stock selection delivered outperformance with Cencora, Inc the leading name. Stock selection within Information Technology contributed, led by Monolithic Power Systems. Stock selection within Energy, with top name Diamondback Energy, Inc., contributed to outperformance. Outperformance within Financials came from both an overweight to the sector, and security selection, with Reinsurance Group of America, Incorporated leading. The portfolio was underweight Communication Services and Consumer Staples, which underperformed the benchmark, benefitting performance. The greatest detractor to performance was an overweight in Materials which underperformed the benchmark, while an underweight in Real Estate, an outperforming sector, detracted from performance as well. |

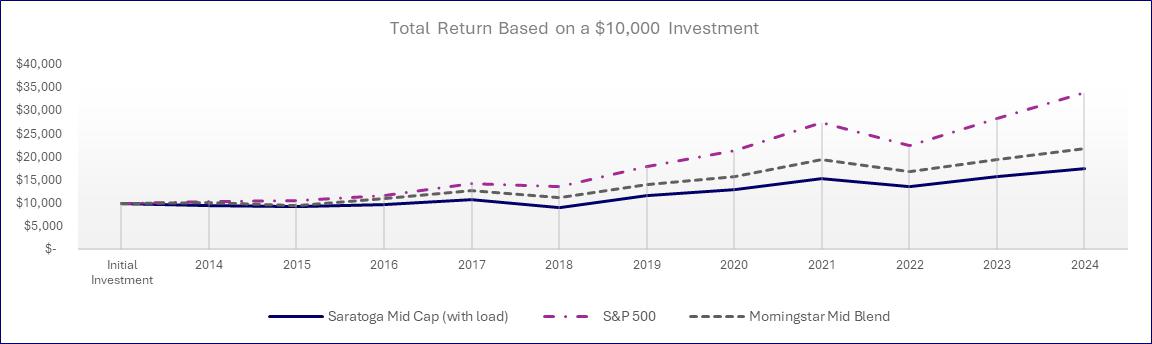

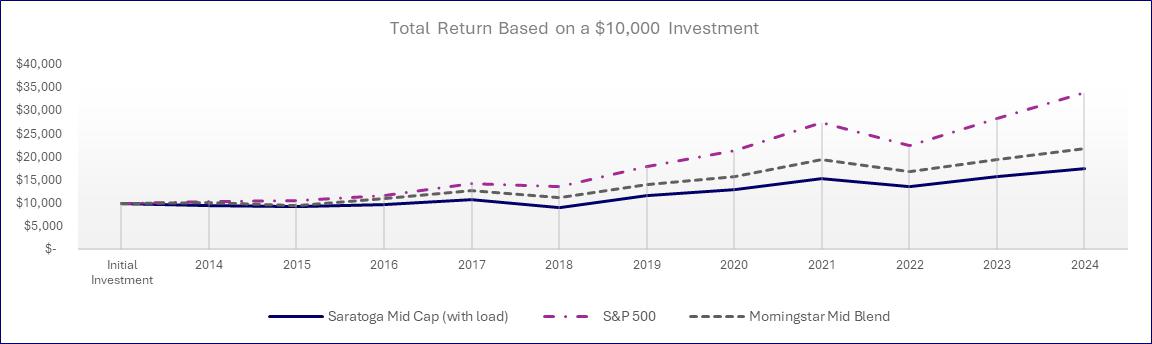

How did the Fund perform over the past 10 years?

The chart below represents the historical performance of a hypothetical $10,000 investment over the past 10 years in the class of shares noted and assumes the reinvestment of dividends and capital gains and the maximum sales charge, if any. Fund expenses, including management fees, 12b-1 fees, if any, and other expenses were deducted.

| Year | Year | Saratoga Mid Cap (with load) | S&P 500 | Morningstar Mid Blend |

Initial

Investment | Initial Investments | $ 10,000 | $ 10,000 | $ 10,000 |

| 2014 | 8/31/2014 | $ 9,589 | $ 10,346 | $ 10,051 |

| 2015 | 8/31/2015 | $ 9,200 | $ 10,489 | $ 9,598 |

| 2016 | 8/31/2016 | $ 9,645 | $ 11,744 | $ 10,908 |

| 2017 | 8/31/2017 | $ 10,893 | $ 14,308 | $ 12,638 |

| 2018 | 8/31/2018 | $ 9,034 | $ 13,680 | $ 11,205 |

| 2019 | 8/31/2019 | $ 11,739 | $ 17,988 | $ 14,104 |

| 2020 | 8/31/2020 | $ 12,881 | $ 21,297 | $ 15,825 |

| 2021 | 8/31/2021 | $ 15,438 | $ 27,411 | $ 19,554 |

| 2022 | 8/31/2022 | $ 13,601 | $ 22,447 | $ 16,789 |

| 2023 | 8/31/2023 | $ 15,711 | $ 28,347 | $ 19,461 |

| 2024 | 8/31/2024 | $ 17,537 | $ 33,882 | $ 21,876 |

| Average Annual Total Returns |

| | 1 Year | 5 Years | 10 Years |

| Saratoga Mid Capitalization Fund, Class A (with load) | 16.24% | 8.64% | 5.78% |

| Saratoga Mid Capitalization Fund, Class A | 23.32% | 9.92% | 6.41% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Morningstar US Fund Mid Capitalization Blend Category | 19.35% | 11.31% | 8.80% |

| Performance data quoted represents past performance, which is not a good predictor of the Fund’s future performance. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. The average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains. Call 1-888-672-4839 for current performance information or questions. |

THE SARATOGA ADVANTAGE TRUST

| Fund Statistics |

| Total Net Assets | $12,705,597 | Advisory Fees Paid by the Fund | $86,852 |

| Number of Portfolio Holdings | 59 | Portfolio Turnover Rate | 129% |

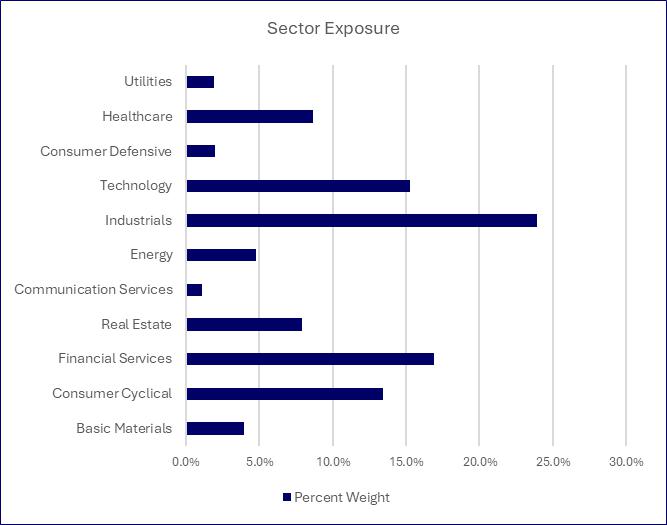

What did the Fund invest in (as a % of the Fund’s net assets)?

| Utilities | 1.9% |

| Healthcare | 8.7% |

| Consumer Defensive | 2.0% |

| Technology | 15.3% |

| Industrials | 23.9% |

| Energy | 4.8% |

| Communication Services | 1.1% |

| Real Estate | 7.9% |

| Financial Services | 16.9% |

| Consumer Cyclical | 13.4% |

| Basic Materials | 4.0% |

| Top Holdings (%) |

| Royal Caribbean Group | 3.89 |

| Monolithic Power Systems Inc | 3.13 |

| Cencora Inc. | 2.83 |

| EastGroup Properties Inc | 2.80 |

| Vulcan Materials Co | 2.78 |

| Tyler Technologies Inc | 2.75 |

| Nasdaq Inc | 2.52 |

| Extra Space Storage Inc | |

| Cushman & Wakefield plc | 2.49 |

| Axon Enterprise Inc | 2.34 |

| Material Fund changes during the period. |

| Below is a summary of certain changes, and planned changes, to the Fund during the reporting period. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by December 31, 2024, at www.saratogacap.com/fund-reports or upon request at 1-888-672-4839. |

| During the period there were no material changes to the Fund. |

| Changes in, or disagreements with, Fund accountants. |

| During the period there were not changes in, or disagreements with, Fund accountants. |

| Householding for the Fund. |

| To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (often referred to as “householding”). If you would prefer that your Fund documents not be householded, please contact the Saratoga Advantage Trust at 1-888-672-4839 or contact your financial intermediary. |

| Electronic access to this report, or additional information. |

| For additional information about this Fund, including its prospectus, financial information, and holdings, please visit www.saratogacap.com/fund-reports. |

THE SARATOGA ADVANTAGE TRUST

SARATOGA MID CAPITALIZATION FUND |  |

| Annual Shareholder Report | 8/31/2024 | SPMCX | Class C | |

| This annual shareholder report contains important information about the Saratoga Mid Capitalization Fund for the period 9/1/2023 through 8/31/2024, as well as certain changes to the Fund, if applicable. You can find additional information about the Fund at www.saratogacap.com/fund-reports or by contacting us at 1-888-672-4839. |

| What were the Fund’s costs for the last year (based on a hypothetical $10,000 investment)? |

| Fund | Costs of a $10,000 Investment | Costs paid as a % of a $10,000 Investment |

| Saratoga Mid Capitalization Fund, Class C | $293 | 2.63% |

| What affected the Fund’s performance this period? |

During the period, stock selection in Utilities was the largest contributor to positive relative performance, with Vistra Corp as the top name. Industrials stock selection delivered outperformance with Vertiv Holdings Co. the strongest performer. Stock selection within Consumer Discretionary contributed to performance with Royal Caribbean Group as the top performer. Within Health Care, stock selection delivered outperformance with Cencora, Inc the leading name. Stock selection within Information Technology contributed, led by Monolithic Power Systems. Stock selection within Energy, with top name Diamondback Energy, Inc., contributed to outperformance. Outperformance within Financials came from both an overweight to the sector, and security selection, with Reinsurance Group of America, Incorporated leading. The portfolio was underweight Communication Services and Consumer Staples, which underperformed the benchmark, benefitting performance. The greatest detractor to performance was an overweight in Materials which underperformed the benchmark, while an underweight in Real Estate, an outperforming sector, detracted from performance as well. |

How did the Fund perform over the past 10 years?

The chart below represents the historical performance of a hypothetical $10,000 investment over the past 10 years in the class of shares noted and assumes the reinvestment of dividends and capital gains and the maximum sales charge, if any. Fund expenses, including management fees, 12b-1 fees, if any, and other expenses were deducted.

| Years | Years | Saratoga Mid Cap (with load) | S&P 500 | Morningstar Mid Blend |

Initial

Investment | Initial

Investment | $ 10,000 | $ 10,000 | $ 10,000 |

| 2014 | 8/31/2014 | $ 10,178 | $ 10,346 | $ 10,051 |

| 2015 | 8/31/2015 | $ 9,702 | $ 10,489 | $ 9,598 |

| 2016 | 8/31/2016 | $ 10,114 | $ 11,744 | $ 10,908 |

| 2017 | 8/31/2017 | $ 11,353 | $ 14,308 | $ 12,638 |

| 2018 | 8/31/2018 | $ 9,359 | $ 13,680 | $ 11,205 |

| 2019 | 8/31/2019 | $ 12,079 | $ 17,988 | $ 14,104 |

| 2020 | 8/31/2020 | $ 13,178 | $ 21,297 | $ 15,825 |

| 2021 | 8/31/2021 | $ 15,719 | $ 27,411 | $ 19,554 |

| 2022 | 8/31/2022 | $ 13,752 | $ 22,447 | $ 16,789 |

| 2023 | 8/31/2023 | $ 15,794 | $ 28,347 | $ 19,461 |

| 2024 | 8/31/2024 | $ 17,559 | $ 33,882 | $ 21,876 |

| Average Annual Total Returns |

| | 1 Year | 5 Years | 10 Years |

| Saratoga Mid Capitalization Fund, Class C (with load) | 21.64% | 9.28% | 5.79% |

| Saratoga Mid Capitalization Fund, Class C | 22.64% | 9.28% | 5.79% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Morningstar US Fund Mid Capitalization Blend Category | 19.35% | 11.31% | 8.80% |

| Performance data quoted represents past performance, which is not a good predictor of the Fund’s future performance. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. The average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains. Call 1-888-672-4839 for current performance information or questions. |

THE SARATOGA ADVANTAGE TRUST

| Fund Statistics |

| Total Net Assets | $12,705,597 | Advisory Fees Paid by the Fund | $86,852 |

| Number of Portfolio Holdings | 59 | Portfolio Turnover Rate | 129% |

What did the Fund invest in (as a % of the Fund’s net assets)?

| Utilities | 1.9% |

| Healthcare | 8.7% |

| Consumer Defensive | 2.0% |

| Technology | 15.3% |

| Industrials | |

| Energy | 4.8% |

| Communication Services | 1.1% |

| Real Estate | 7.9% |

| Financial Services | 16.9% |

| Consumer Cyclical | 13.4% |

| Basic Materials | 4.0% |

| Top Holdings (%) |

| Royal Caribbean Group | 3.89 |

| Monolithic Power Systems Inc | 3.13 |

| Cencora Inc. | 2.83 |

| EastGroup Properties Inc | 2.80 |

| Vulcan Materials Co | 2.78 |

| Tyler Technologies Inc | 2.75 |

| Nasdaq Inc | 2.52 |

| Extra Space Storage Inc | |

| Cushman & Wakefield plc | 2.49 |

| Axon Enterprise Inc | 2.34 |

| Material Fund changes during the period. |

| Below is a summary of certain changes, and planned changes, to the Fund during the reporting period. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by December 31, 2024, at www.saratogacap.com/fund-reports or upon request at 1-888-672-4839. |

| During the period there were no material changes to the Fund. |

| Changes in, or disagreements with, Fund accountants. |

| During the period there were not changes in, or disagreements with, Fund accountants. |

| Householding for the Fund. |

| To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (often referred to as “householding”). If you would prefer that your Fund documents not be householded, please contact the Saratoga Advantage Trust at 1-888-672-4839 or contact your financial intermediary. |

| Electronic access to this report, or additional information. |

| For additional information about this Fund, including its prospectus, financial information, and holdings, please visit www.saratogacap.com/fund-reports. |

THE SARATOGA ADVANTAGE TRUST

SARATOGA MID CAPITALIZATION FUND |  |

| Annual Shareholder Report | 8/31/2024 | SMIPX | Class I | |

| This annual shareholder report contains important information about the Saratoga Mid Capitalization Fund for the period 9/1/2023 through 8/31/2024, as well as certain changes to the Fund, if applicable. You can find additional information about the Fund at www.saratogacap.com/fund-reports or by contacting us at 1-888-672-4839. |

| What were the Fund’s costs for the last year (based on a hypothetical $10,000 investment)? |

| Fund | Costs of a $10,000 Investment | Costs paid as a % of a $10,000 Investment |

| Saratoga Mid Capitalization Fund, Class I | $182 | 1.63% |

| What affected the Fund’s performance this period? |

During the period, stock selection in Utilities was the largest contributor to positive relative performance, with Vistra Corp as the top name. Industrials stock selection delivered outperformance with Vertiv Holdings Co. the strongest performer. Stock selection within Consumer Discretionary contributed to performance with Royal Caribbean Group as the top performer. Within Health Care, stock selection delivered outperformance with Cencora, Inc the leading name. Stock selection within Information Technology contributed, led by Monolithic Power Systems. Stock selection within Energy, with top name Diamondback Energy, Inc., contributed to outperformance. Outperformance within Financials came from both an overweight to the sector, and security selection, with Reinsurance Group of America, Incorporated leading. The portfolio was underweight Communication Services and Consumer Staples, which underperformed the benchmark, benefitting performance. The greatest detractor to performance was an overweight in Materials which underperformed the benchmark, while an underweight in Real Estate, an outperforming sector, detracted from performance as well. |

How did the Fund perform over the past 10 years?

The chart below represents the historical performance of a hypothetical $10,000 investment over the past 10 years in the class of shares noted and assumes the reinvestment of dividends and capital gains and the maximum sales charge, if any. Fund expenses, including management fees, 12b-1 fees, if any, and other expenses were deducted.

| Years | Years | Saratoga Mid Cap | S&P 500 | Morningstar Mid Blend |

Initial

Investment | Initial

Investment | $ 10,000 | $ 10,000 | $ 10,000 |

| 2014 | 8/31/2014 | $ 10,190 | $ 10,346 | $ 10,051 |

| 2015 | 8/31/2015 | $ 9,814 | $ 10,489 | $ 9,598 |

| 2016 | 8/31/2016 | $ 10,337 | $ 11,744 | $ 10,908 |

| 2017 | 8/31/2017 | $ 11,713 | $ 14,308 | $ 12,638 |

| 2018 | 8/31/2018 | $ 9,754 | $ 13,680 | $ 11,205 |

| 2019 | 8/31/2019 | $ 12,718 | $ 17,988 | $ 14,104 |

| 2020 | 8/31/2020 | $ 14,018 | $ 21,297 | $ 15,825 |

| 2021 | 8/31/2021 | $ 16,881 | $ 27,411 | $ 19,554 |

| 2022 | 8/31/2022 | $ 14,922 | $ 22,447 | $ 16,789 |

| 2023 | 8/31/2023 | $ 17,317 | $ 28,347 | $ 19,461 |

| 2024 | 8/31/2024 | $ 19,369 | $ 33,882 | $ 21,876 |

| Average Annual Total Returns |

| | 1 Year | 5 Years | 10 Years |

| Saratoga Mid Capitalization Fund, Class I | 23.90% | 10.37% | 6.83% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Morningstar US Fund Mid Capitalization Blend Category | 19.35% | 11.31% | 8.80% |

| Performance data quoted represents past performance, which is not a good predictor of the Fund’s future performance. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. The average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains. Call 1-888-672-4839 for current performance information or questions. |

THE SARATOGA ADVANTAGE TRUST

| Fund Statistics |

| Total Net Assets | $12,705,597 | Advisory Fees Paid by the Fund | $86,852 |

| Number of Portfolio Holdings | 59 | Portfolio Turnover Rate | 129% |

What did the Fund invest in (as a % of the Fund’s net assets)?

| Utilities | 1.9% |

| Healthcare | 8.7% |

| Consumer Defensive | 2.0% |

| Technology | 15.3% |

| Industrials | 23.9% |

| Energy | 4.8% |

| Communication Services | 1.1% |

| Real Estate | 7.9% |

| Financial Services | 16.9% |

| Consumer Cyclical | 13.4% |

| Basic Materials | 4.0% |

| Top Holdings (%) |

| Royal Caribbean Group | 3.89 |

| Monolithic Power Systems Inc | 3.13 |

| Cencora Inc. | 2.83 |

| EastGroup Properties Inc | 2.80 |

| Vulcan Materials Co | 2.78 |

| Tyler Technologies Inc | 2.75 |

| Nasdaq Inc | 2.52 |

| Extra Space Storage Inc | |

| Cushman & Wakefield plc | 2.49 |

| Axon Enterprise Inc | 2.34 |

| Material Fund changes during the period. |

| Below is a summary of certain changes, and planned changes, to the Fund during the reporting period. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by December 31, 2024, at www.saratogacap.com/fund-reports or upon request at 1-888-672-4839. |

| During the period there were no material changes to the Fund. |

| Changes in, or disagreements with, Fund accountants. |

| During the period there were not changes in, or disagreements with, Fund accountants. |

| Householding for the Fund. |

| To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (often referred to as “householding”). If you would prefer that your Fund documents not be householded, please contact the Saratoga Advantage Trust at 1-888-672-4839 or contact your financial intermediary. |

| Electronic access to this report, or additional information. |

| For additional information about this Fund, including its prospectus, financial information, and holdings, please visit www.saratogacap.com/fund-reports. |

THE SARATOGA ADVANTAGE TRUST

Saratoga SMALL CAPITALIZATION Fund |  |

| Annual Shareholder Report | 8/31/2024 | SSCYX | Class A | |

| This annual shareholder report contains important information about the Saratoga Small Capitalization Fund for the period 9/1/2023 through 8/31/2024, as well as certain changes to the Fund, if applicable. You can find additional information about the Fund at www.saratogacap.com/fund-reports or by contacting us at 1-888-672-4839. |

| What were the Fund’s costs for the last year (based on a hypothetical $10,000 investment)? |

| Fund | Costs of a $10,000 Investment | Costs paid as a % of a $10,000 Investment |

| Saratoga Small Capitalization Fund, Class A | $251 | 2.28% |

| What affected the Fund’s performance this period? |

During the period, portfolio management was keenly focused on the impacts of balance sheet health and interest rates on smaller companies. The stress of the higher cost of capital on the sector led the portfolio to overweight sectors sometimes viewed as more defensive and value-based: Materials, Industrials, and Consumer Staples. These localized producers, distributors, and consumer staples companies have realized an uptick in demand over the past several years. As supply chain disruptions have occurred - Covid-19, the Evergreen running aground in the Suez Canal, the tragic Baltimore bridge collapse – some national and multinational distributors and manufacturers have faced issues importing and exporting their goods. The overweight in these defensive sectors helped performance during the period. Towards the end of the period, the portfolio trimmed its Consumer Staples holdings and added to Consumer Discretionary in light of positive economic data, including sustained consumer spending and falling inflation, benefitting performance. The portfolio held underweights in Financials, Energy, and Real Estate. Smaller banks have been under more pressure from higher interest rates than larger national and global banks. Smaller banks are generally paying higher interest premiums, which has dented their bottom line; the portfolio’s underweight to these companies benefitted performance. The underweight to Energy and Real Estate were a detractor from performance. |

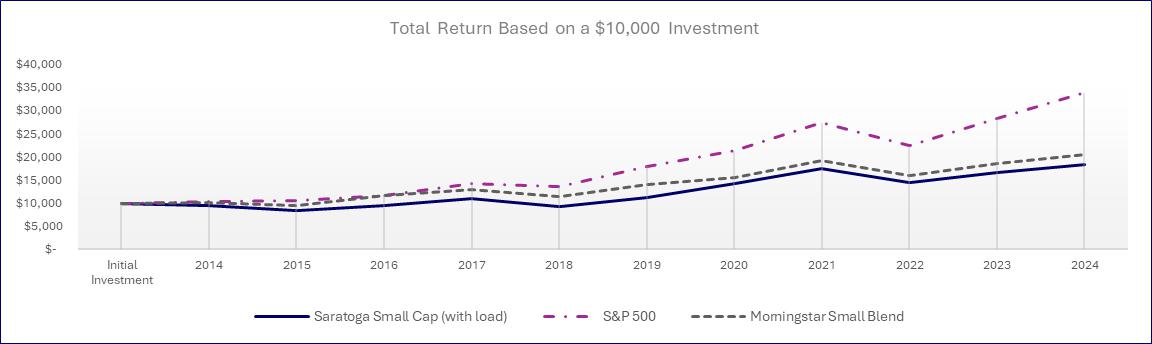

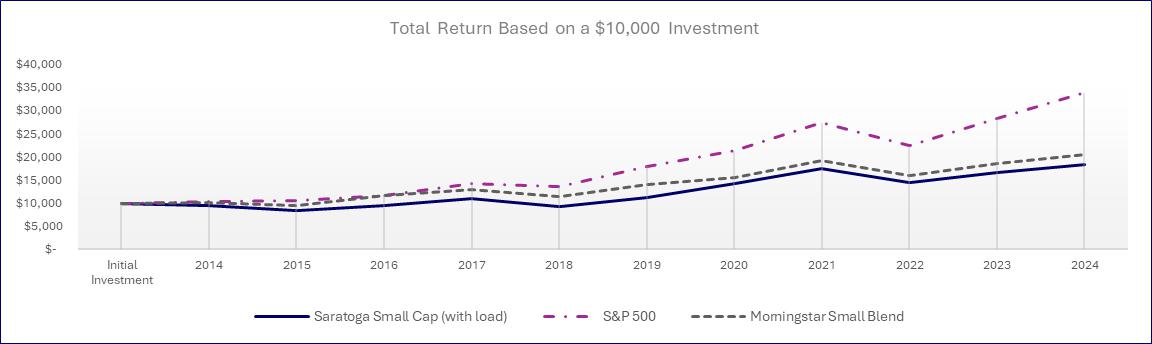

How did the Fund perform over the past 10 years?

The chart below represents the historical performance of a hypothetical $10,000 investment over the past 10 years in the class of shares noted and assumes the reinvestment of dividends and capital gains and the maximum sales charge, if any. Fund expenses, including management fees, 12b-1 fees, if any, and other expenses were deducted.

| Years | Years | Saratoga Small Cap (with load) | S&P 500 | Morningstar Small Blend |

Initial

Investment | Initial Investment | $ 10,000 | $ 10,000 | $ 10,000 |

| 2014 | 8/31/2014 | $ 9,448 | $ 10,346 | $ 10,132 |

| 2015 | 8/31/2015 | $ 8,495 | $ 10,489 | $ 9,592 |

| 2016 | 8/31/2016 | $ 9,575 | $ 11,744 | $ 11,568 |

| 2017 | 8/31/2017 | $ 11,032 | $ 14,308 | $ 13,003 |

| 2018 | 8/31/2018 | $ 9,189 | $ 13,680 | $ 11,347 |

| 2019 | 8/31/2019 | $ 11,312 | $ 17,988 | $ 14,015 |

| 2020 | 8/31/2020 | $ 14,189 | $ 21,297 | $ 15,513 |

| 2021 | 8/31/2021 | $ 17,584 | $ 27,411 | $ 19,212 |

| 2022 | 8/31/2022 | $ 14,461 | $ 22,447 | $ 16,071 |

| 2023 | 8/31/2023 | $ 16,590 | $ 28,347 | $ 18,645 |

| 2024 | 8/31/2024 | $ 18,442 | $ 33,882 | $ 20,549 |

| Average Annual Total Returns |

| | 1 Year | 5 Years | 10 Years |

| Saratoga Small Capitalization Fund, Class A (with load) | 12.86% | 10.96% | 6.32% |

| Saratoga Small Capitalization Fund, Class A | 19.75% | 12.30% | 6.94% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Morningstar US Fund Small Capitalization Blend Category | 17.61% | 10.62% | 7.99% |

Performance data quoted represents past performance, which is not a good predictor of the Fund’s future performance. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. The average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains. Call 1-888-672-4839 for current performance information or questions.

THE SARATOGA ADVANTAGE TRUST

| Fund Statistics |

| Total Net Assets | $7,385,089 | Advisory Fees Paid by the Fund | $43,510 |

| Number of Portfolio Holdings | 102 | Portfolio Turnover Rate | 135% |

What did the Fund invest in (as a % of the Fund’s net assets)?

| Utilities | 0.4% |

| Healthcare | 14.9% |

| Consumer Defensive | 4.3% |

| Technology | 17.0% |

| Industrials | 12.1% |

| Energy | 3.5% |

| Communication Services | 0.7% |

| Real Estate | 6.7% |

| Financial Services | 21.7% |

| Consumer Cyclical | 13.0% |

| Basic Materials | 5.7% |

| Top Holdings (%) |

| Sylvamo Corp | 2.02 |

| Mercury General Corp | 2.00 |

| ProAssurance Corp | 1.99 |

| Financial Institutions Inc | 1.98 |

| Kennedy-Wilson Holdings Inc | 1.98 |

| ADMA Biologics Inc | 1.97 |

| Madison Square Garden Entertainment | 1.94 |

| Applied Industrial Technologies Inc | 1.89 |

| ChoiceOne Financial Services Inc | 1.89 |

| Dreyfus Inst Prefer Govt Money Mkt Inst Class | 1.85 |

| Material Fund changes during the period. |

| Below is a summary of certain changes, and planned changes, to the Fund during the reporting period. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by December 31, 2024, at www.saratogacap.com/fund-reports or upon request at 1-888-672-4839. |

| During the period there were no material changes to the Fund. |

| Changes in, or disagreements with, Fund accountants. |

| During the period there were not changes in, or disagreements with, Fund accountants. |

| Householding for the Fund. |

| To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (often referred to as “householding”). If you would prefer that your Fund documents not be householded, please contact the Saratoga Advantage Trust at 1-888-672-4839 or contact your financial intermediary. |

| Electronic access to this report, or additional information. |

| For additional information about this Fund, including its prospectus, financial information, and holdings, please visit www.saratogacap.com/fund-reports. |

THE SARATOGA ADVANTAGE TRUST

Saratoga SMALL CAPITALIZATION Fund |  |

| Annual Shareholder Report | 8/31/2024 | SSCCX | Class C | |

| This annual shareholder report contains important information about the Saratoga Small Capitalization Fund for the period 9/1/2023 through 8/31/2024, as well as certain changes to the Fund, if applicable. You can find additional information about the Fund at www.saratogacap.com/fund-reports or by contacting us at 1-888-672-4839. |

| What were the Fund’s costs for the last year (based on a hypothetical $10,000 investment)? |

| Fund | Costs of a $10,000 Investment | Costs paid as a % of a $10,000 Investment |

| Saratoga Small Capitalization Fund, Class C | $319 | 2.91% |

| What affected the Fund’s performance this period? |

During the period, portfolio management was keenly focused on the impacts of balance sheet health and interest rates on smaller companies. The stress of the higher cost of capital on the sector led the portfolio to overweight sectors sometimes viewed as more defensive and value-based: Materials, Industrials, and Consumer Staples. These localized producers, distributors, and consumer staples companies have realized an uptick in demand over the past several years. As supply chain disruptions have occurred - Covid-19, the Evergreen running aground in the Suez Canal, the tragic Baltimore bridge collapse – some national and multinational distributors and manufacturers have faced issues importing and exporting their goods. The overweight in these defensive sectors helped performance during the period. Towards the end of the period, the portfolio trimmed its Consumer Staples holdings and added to Consumer Discretionary in light of positive economic data, including sustained consumer spending and falling inflation, benefitting performance. The portfolio held underweights in Financials, Energy, and Real Estate. Smaller banks have been under more pressure from higher interest rates than larger national and global banks. Smaller banks are generally paying higher interest premiums, which has dented their bottom line; the portfolio’s underweight to these companies benefitted performance. The underweight to Energy and Real Estate were a detractor from performance. |

How did the Fund perform over the past 10 years?

The chart below represents the historical performance of a hypothetical $10,000 investment over the past 10 years in the class of shares noted and assumes the reinvestment of dividends and capital gains and the maximum sales charge, if any. Fund expenses, including management fees, 12b-1 fees, if any, and other expenses were deducted.

| Years | Years | Saratoga Small Cap (with load) | S&P 500 | Morningstar Small Blend |

Initial

Investment | Initial Investment | $ 10,000 | $ 10,000 | $ 10,000 |

| 2014 | 8/31/2014 | $ 9,991 | $ 10,346 | $ 10,132 |

| 2015 | 8/31/2015 | $ 8,941 | $ 10,489 | $ 9,592 |

| 2016 | 8/31/2016 | $ 10,025 | $ 11,744 | $ 11,568 |

| 2017 | 8/31/2017 | $ 11,472 | $ 14,308 | $ 13,003 |

| 2018 | 8/31/2018 | $ 9,521 | $ 13,680 | $ 11,347 |

| 2019 | 8/31/2019 | $ 11,621 | $ 17,988 | $ 14,015 |

| 2020 | 8/31/2020 | $ 14,515 | $ 21,297 | $ 15,513 |

| 2021 | 8/31/2021 | $ 17,855 | $ 27,411 | $ 19,212 |

| 2022 | 8/31/2022 | $ 14,575 | $ 22,447 | $ 16,071 |

| 2023 | 8/31/2023 | $ 16,728 | $ 28,347 | $ 18,645 |

| 2024 | 8/31/2024 | $ 18,550 | $ 33,882 | $ 20,549 |

| Average Annual Total Returns |

| | 1 Year | 5 Years | 10 Years |

| Saratoga Small Capitalization Fund, Class C (with load) | 18.15% | 11.76% | 6.37% |

| Saratoga Small Capitalization Fund, Class C | 19.15% | 11.76% | 6.37% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

| Morningstar US Fund Small Capitalization Blend Category | | 10.62% | 7.99% |

Performance data quoted represents past performance, which is not a good predictor of the Fund’s future performance. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. The above table and graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Current performance may be lower or higher than the performance data quoted. The average annual total return is the annual compound return for the indicated period and reflects the change in share price and the reinvestment of all dividends and capital gains. Call 1-888-672-4839 for current performance information or questions.

THE SARATOGA ADVANTAGE TRUST

| Fund Statistics |

| Total Net Assets | $7,385,089 | Advisory Fees Paid by the Fund | $43,510 |

| Number of Portfolio Holdings | 102 | Portfolio Turnover Rate | 135% |

What did the Fund invest in (as a % of the Fund’s net assets)?

| Utilities | 0.4% |

| Healthcare | 14.9% |

| Consumer Defensive | 4.3% |

| Technology | 17.0% |

| Industrials | 12.1% |

| Energy | 3.5% |

| Communication Services | 0.7% |

| Real Estate | 6.7% |

| Financial Services | 21.7% |

| Consumer Cyclical | 13.0% |

| Basic Materials | 5.7% |

| Top Holdings (%) |

| Sylvamo Corp | 2.02 |

| Mercury General Corp | 2.00 |

| ProAssurance Corp | 1.99 |

| Financial Institutions Inc | 1.98 |

| Kennedy-Wilson Holdings Inc | 1.98 |

| ADMA Biologics Inc | 1.97 |

| Madison Square Garden Entertainment | 1.94 |

| Applied Industrial Technologies Inc | 1.89 |

| ChoiceOne Financial Services Inc | 1.89 |

| Dreyfus Inst Prefer Govt Money Mkt Inst Class | 1.85 |

| Material Fund changes during the period. |

| Below is a summary of certain changes, and planned changes, to the Fund during the reporting period. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by December 31, 2024, at www.saratogacap.com/fund-reports or upon request at 1-888-672-4839. |

| During the period there were no material changes to the Fund. |

| Changes in, or disagreements with, Fund accountants. |

| During the period there were not changes in, or disagreements with, Fund accountants. |

| Householding for the Fund. |

| To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (often referred to as “householding”). If you would prefer that your Fund documents not be householded, please contact the Saratoga Advantage Trust at 1-888-672-4839 or contact your financial intermediary. |

| Electronic access to this report, or additional information. |

| For additional information about this Fund, including its prospectus, financial information, and holdings, please visit www.saratogacap.com/fund-reports. |

THE SARATOGA ADVANTAGE TRUST

Saratoga SMALL CAPITALIZATION Fund |  |

| Annual Shareholder Report | 8/31/2024 | SSCPX | Class I | |

| This annual shareholder report contains important information about the Saratoga Small Capitalization Fund for the period 9/1/2023 through 8/31/2024, as well as certain changes to the Fund, if applicable. You can find additional information about the Fund at www.saratogacap.com/fund-reports or by contacting us at 1-888-672-4839. |

| What were the Fund’s costs for the last year (based on a hypothetical $10,000 investment)? |

| Fund | Costs of a $10,000 Investment | Costs paid as a % of a $10,000 Investment |

| Saratoga Small Capitalization Fund, Class I | $207 | 1.88% |

| What affected the Fund’s performance during this period? |

During the period, portfolio management was keenly focused on the impacts of balance sheet health and interest rates on smaller companies. The stress of the higher cost of capital on the sector led the portfolio to overweight sectors sometimes viewed as more defensive and value-based: Materials, Industrials, and Consumer Staples. These localized producers, distributors, and consumer staples companies have realized an uptick in demand over the past several years. As supply chain disruptions have occurred - Covid-19, the Evergreen running aground in the Suez Canal, the tragic Baltimore bridge collapse – some national and multinational distributors and manufacturers have faced issues importing and exporting their goods. The overweight in these defensive sectors helped performance during the period. Towards the end of the period, the portfolio trimmed its Consumer Staples holdings and added to Consumer Discretionary in light of positive economic data, including sustained consumer spending and falling inflation, benefitting performance. The portfolio held underweights in Financials, Energy, and Real Estate. Smaller banks have been under more pressure from higher interest rates than larger national and global banks. Smaller banks are generally paying higher interest premiums, which has dented their bottom line; the portfolio’s underweight to these companies benefitted performance. The underweight to Energy and Real Estate were a detractor from performance. |

How did the Fund perform over the past 10 years?

The chart below represents the historical performance of a hypothetical $10,000 investment over the past 10 years in the class of shares noted and assumes the reinvestment of dividends and capital gains and the maximum sales charge, if any. Fund expenses, including management fees, 12b-1 fees, if any, and other expenses were deducted.

| Years | Years | Saratoga Small Cap | S&P 500 | Morningstar Small Blend |

Initial

Investment | Initial

Investment | $ 10,000 | $ 10,000 | $ 10,000 |

| 2014 | 8/31/2014 | $ 10,034 | $ 10,346 | $ 10,132 |

| 2015 | 8/31/2015 | $ 9,064 | $ 10,489 | $ 9,592 |

| 2016 | 8/31/2016 | $ 10,254 | $ 11,744 | $ 11,568 |

| 2017 | 8/31/2017 | $ 11,851 | $ 14,308 | $ 13,003 |

| 2018 | 8/31/2018 | $ 9,918 | $ 13,680 | $ 11,347 |

| 2019 | 8/31/2019 | $ 12,270 | $ 17,988 | $ 14,015 |

| 2020 | 8/31/2020 | $ 15,383 | $ 21,297 | $ 15,513 |

| 2021 | 8/31/2021 | $ 19,154 | $ 27,411 | $ 19,212 |

| 2022 | 8/31/2022 | $ 15,812 | $ 22,447 | $ 16,071 |

| 2023 | 8/31/2023 | $ 18,208 | $ 28,347 | $ 18,645 |

| 2024 | 8/31/2024 | $ 20,292 | $ 33,882 | $ 20,549 |

| Average Annual Total Returns |

| | 1 Year | 5 Years | 10 Years |

| Saratoga Small Capitalization Fund, Class I | 20.22% | 12.68% | 7.33% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

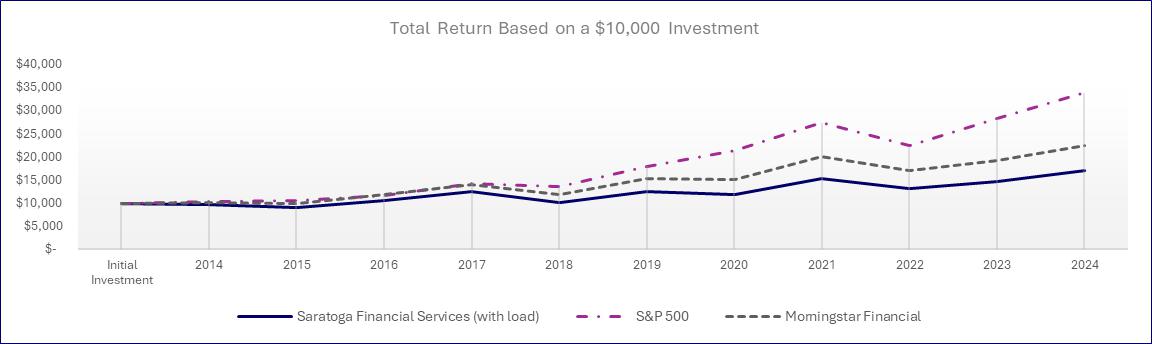

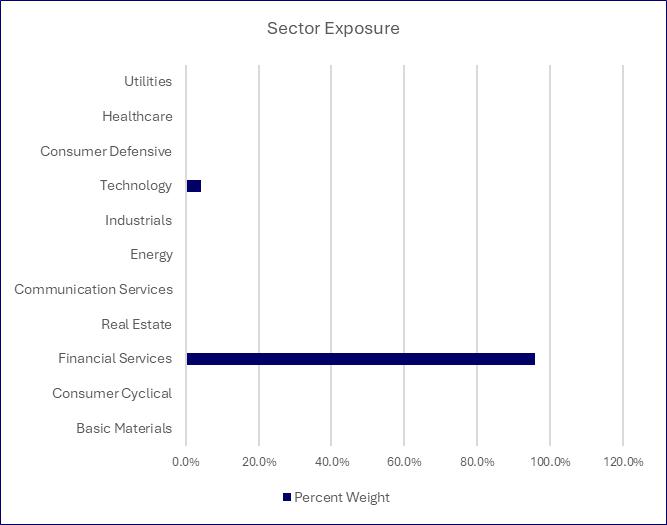

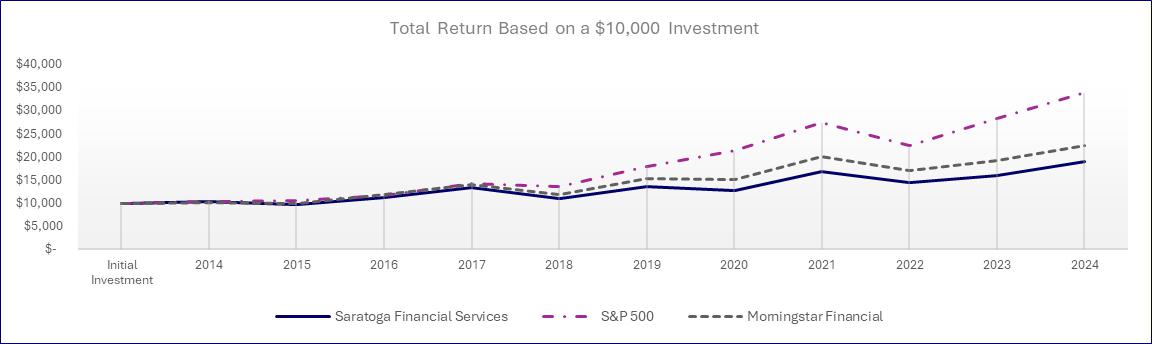

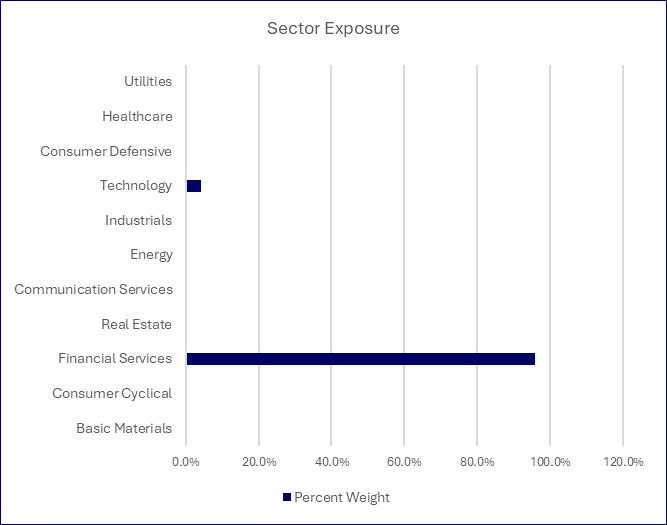

| Morningstar US Fund Small Capitalization Blend Category | 17.61% | 10.62% | 7.99% |