UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2008 |

COMMISSION FILE NUMBER: 0-24484

MPS GROUP, INC.

(Exact name of registrant as specified in its charter)

| | |

| Florida | | 59-3116655 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| 1 Independent Drive, Jacksonville, FL | | 32202 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number including area code: (904) 360-2000

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Common Stock, Par Value $0.01 Per Share | | New York Stock Exchange |

| (Title of each class) | | (Name of each exchange on which registered) |

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | |

| Large accelerated filer | | x | | | | Accelerated filer | | ¨ |

| Non-accelerated filer | | ¨ | | | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the Registrant, based upon the closing sale price of common stock on, June 30, 2008, the last business day of the registrant’s most recently completed second fiscal quarter, as reported by the New York Stock Exchange, was approximately $992,959,791.

As of February 13, 2009 the number of shares outstanding of the Registrant’s common stock was 90,822,776.

DOCUMENTS INCORPORATED BY REFERENCE.

Portions of the Registrant’s Proxy Statement for its 2009 Annual Meeting of shareholders are incorporated by reference in Part III.

This Annual Report on Form 10-K contains forward-looking statements that are subject to certain risks, uncertainties or assumptions and may be affected by certain factors, including but not limited to the specific factors discussed in Part I, Item 1A under ‘Risk Factors,’ in Part II, Item 5 under ‘Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities,’ and Part II, Item 7 under ‘Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.’ In some cases, you can identify forward-looking statements by terminology such as ‘may,’ ‘should,’ ‘could,’ ‘expects,’ ‘plans,’ ‘indicates,’ ‘projects,’ ‘anticipates,’ ‘believes,’ ‘estimates,’ ‘appears,’ ‘predicts,’ ‘potential,’ ‘continues,’ ‘can,’ ‘hopes,’ ‘perhaps,’ ‘would,’ or ‘become,’ or the negative of these terms or other comparable terminology. In addition, except for historical facts, all information provided in Part II, Item 7A, under ‘Quantitative and Qualitative Disclosures About Market Risk’ should be considered forward-looking statements. Should one or more of these risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results, performance or achievements of the Company may vary materially from any future results, performance or achievements expressed or implied by such forward-looking statements.

Forward-looking statements are based on beliefs and assumptions of the Company’s management and on information currently available to such management. Forward looking statements speak only as of the date they are made, and the Company undertakes no obligation to publicly update any of them in light of new information or future events. Undue reliance should not be placed on such forward-looking statements, which are based on current expectations. Forward-looking statements are not guarantees of performance.

2

TABLE OF CONTENTS

PART III

Information required by Part III (Items 10-14) is to be included in the Registrant’s Definitive Proxy Statement to be filed pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this report, and is hereby incorporated herein by reference.

PART IV

3

PART I

References to “we,” “our,” “us,” the “Company,” or “MPS” in this Annual Report on Form 10-K refer to MPS Group, Inc. and its consolidated subsidiaries, unless the context requires otherwise.

Overall

MPS Group, Inc. is a leading provider of business services with over 220 offices in the United States, Canada, the United Kingdom, continental Europe, Australia, and Asia. We deliver specialty staffing, consulting and business solutions to virtually all industries in the following primary disciplines, through the following primary brands:

| | |

Discipline | | Brand(s) |

Information Technology (IT) Services | | Modis® |

Accounting and Finance | | Badenoch & Clark®, Accounting Principals® |

Engineering | | Entegee® |

Legal | | Special Counsel® |

IT Solutions | | Idea Integration® |

Healthcare | | Soliant Health® |

Workforce Automation | | Beeline® |

The Company was incorporated under the laws of the State of Florida in 1992 under the name Accustaff Incorporated, and changed its name to MPS Group, Inc. in 2002. Our headquarters are located in Jacksonville, Florida. Strategically, our operations are coordinated primarily from facilities in Jacksonville, Florida, and London, England, and to a lesser extent, Burlington, Massachusetts. Both our Jacksonville and London facilities provide support and centralized services to our offices in the administrative, marketing, public relations, accounting, training and legal areas. Regional and local office managers are responsible for most activities of their offices, including sales, local and regional marketing and recruitment.

In all of our markets and disciplines, we encounter aggressive and capable competition, with a number of firms offering services similar to ours on a national, regional or local basis. Our ability to compete successfully depends on our reputation, pricing and quality of service provided, our understanding of clients’ specific job requirements, and our ability to provide qualified personnel in a timely manner.

We have historically targeted acquisitions that either increased the geographic presence of our businesses or offered complementary service offerings. Our target acquisitions have generally ranged from $5 million to $25 million in annual revenue. We acquired four businesses in 2008 that contributed $46 million to our 2008 revenue. In 2007, we acquired seven businesses that contributed $79 million to our 2007 revenue. In 2006, we acquired six businesses that contributed $65 million to our 2006 revenue.

4

Segments

We present the financial results of our operations under our four reporting segments: North American Professional Services, International Professional Services, North American IT Services and International IT Services. In addition, we have both a Professional Services and an IT Services division. The Professional Services division is comprised of the North American Professional Services segment and the International Professional Services segment. The IT services division is comprised of the North American IT Services segment and the International IT Services segment. The table below highlights the percentage contribution of revenue and gross profit from our four segments for 2008 and 2007:

| | | | | | | | | | | | |

| | | 2008

Revenue | | | 2007

Revenue | | | 2008

Gross Profit | | | 2007

Gross Profit | |

North American Professional Services | | 32.7 | % | | 31.8 | % | | 35.1 | % | | 35.3 | % |

International Professional Services | | 24.9 | % | | 25.2 | % | | 25.9 | % | | 26.4 | % |

| | | | | | | | | | | | |

Professional Services Division | | 57.6 | % | | 57.0 | % | | 61.0 | % | | 61.7 | % |

| | | | |

North American IT Services | | 27.6 | % | | 28.9 | % | | 29.9 | % | | 29.7 | % |

International IT Services | | 14.8 | % | | 14.1 | % | | 9.1 | % | | 8.6 | % |

| | | | | | | | | | | | |

IT Services Division | | 42.4 | % | | 43.0 | % | | 39.0 | % | | 38.3 | % |

| | | | |

North American Segments | | 60.3 | % | | 60.7 | % | | 65.0 | % | | 65.0 | % |

International Segments | | 39.7 | % | | 39.3 | % | | 35.0 | % | | 35.0 | % |

No one customer represents more than 5% of our overall revenue. Additional financial information relating to our segments can be found in Footnote 15 to the Consolidated Financial Statements.

Professional Services Division

Our Professional Services division provides specialized staffing and recruiting in the disciplines of accounting and finance, law, engineering, healthcare, and property for varying periods of time to companies or other organizations (including government agencies) that have a need for such personnel, but are unable to, or choose not to, engage certain personnel as their own employees. Businesses increasingly view the use of temporary employees as a means of controlling personnel costs and converting the nature of such costs from fixed to variable. Examples of client needs for staffing solutions include the need for specialized or highly-skilled personnel for the completion of a specific project or subproject, substitution for regular employees during vacation or sick leave, and staffing of high turnover positions or during seasonal peaks.

We operate this division under a variable cost business model whereby revenue and cost of revenue are primarily recognized and incurred on a time-and-materials basis. The vast majority of our billable consultants are compensated on an hourly basis only for the hours which are billed to our clients.

Clients also hire our skilled consultants on a permanent basis, whether it is from a conversion of a temporary assignment to, or a permanent placement of, a full-time position. We earn a one-time fee for these services. These fees represented approximately 8% of this division’s revenue in 2008.

The principal national and international competitors of our Professional Services division include Robert Half International Inc., Resources Connection, Inc., Spherion Corporation, Kelly Law Registry, Adecco SA, Michael Page International, Robert Walters PLC, Hays PLC, AMN Healthcare Services, Inc., On Assignment Inc., Kforce Inc., Aerotek (a division of Allegis Group), Hudson Highland Group Inc., and CDI Corporation.

5

North American Professional Services Segment

Our North American Professional Services segment goes to market under the primary brands and operating unitsEntegee,Special Counsel,Accounting Principals, andSoliant Health. The demands of our clients, including the need for confidentiality, accuracy, reliability, cost-effectiveness, and frequent peak workload periods, are similar among the businesses within this segment.

Entegee

Entegee provides technical and engineering strategic workforce solutions. From on-site management consulting and in-house project services to temporary and permanent placement,Entegee combines industry knowledge and experience to fill highly skilled technical and engineering positions. These positions include, but are not limited to, engineers, designers, drafters, inspectors and assemblers.Entegee operates through a domestic network of national practice branches with offices in 20 markets, and employed approximately 2,500 billable consultants at the end of 2008.Entegee also provides engineering and drafting design services through two company-owned centers that utilize state-of-the-art computer technology. Its primary clients include government, aerospace and defense contractors, manufacturing and engineering companies.

Special Counsel

Special Counsel staffs temporary and full-time employees in attorney, paralegal, legal administrative and legal secretarial positions for workload management, litigation support, business transaction support, pre-litigation and document management support, as well as e-discovery, medical document review, deposition digesting, court reporting and other trial-related services.Special Counsel has a network of 48 offices across the United States, and employed approximately 1,500 billable consultants at the end of 2008. Its primary clients are Fortune 1000 companies and law firms.

Accounting Principals

Accounting Principals specializes in placing a broad spectrum of temporary and full-time employees in accounting and finance, tax, and audit positions.Accounting Principals’ temporary staffing services allow its customers to better manage personnel costs through uneven or peak work load levels.Accounting Principals has a network of 39 offices across the United States, and employed approximately 1,100 billable consultants at the end of 2008.

Soliant Health

Soliant Health specializes primarily in placing traveling healthcare professionals in the areas of nursing, physical and occupational therapy, speech and language therapy, along with imaging technicians.Soliant Health operates through a domestic network of national practice branches with offices in 7 locations.Soliant Health employed approximately 1,400 consultants at the end of 2008, and its clients include hospitals and healthcare providers across the United States. In 2008, we increasedSoliant Healths’market penetration with the acquisition of a pharmacy staffing business.

International Professional Services Segment

Since 1980, our International Professional Services business,Badenoch & Clark, has specialized in placing temporary, permanent, and contract employees in accounting and finance, financial services, legal, human resources, and marketing positions.Badenoch & Clark has 19 offices across the United Kingdom along with offices in Germany, Hungary, Luxembourg, the Netherlands, Australia, and Hong Kong.Badenoch & Clark employed approximately 4,300 billable consultants at the end of 2008.

6

IT Services Division

Our IT Services division provides specialty staffing, consulting and business solutions, and marketing and creative solutions under the brands/operating unitsModis,Modis International,Idea Integration andBeeline. We utilize the brandModis in both our North American and International segments; however, the overall business culture distinguishes the operation of these two segments.

We operate this division primarily under a variable cost business model whereby revenue and cost of revenue are primarily recognized and incurred on a time-and-materials basis. The vast majority of the billable consultants are compensated on an hourly basis only for the hours which are billed to our clients. Approximately 2% of this division’s revenue is generated from fees for clients hiring our skilled consultants on a permanent basis, whether it is from a conversion of a temporary assignment to, or a permanent placement of, a full-time position.

The principal national and international competitors of our IT Services division include Keane, Inc., Comsys IT Partners, Inc., CIBER, Inc., Adecco Information Technology (a division of Adecco SA), Hays PLC, Elan, and TEKsystems (a division of Allegis Group). In addition, we may compete against the internal management information services and IT departments of our clients and potential clients.

North American IT Services Segment

Modis

Modis specializes in the placement of IT contract consultants for IT project support and staffing, recruitment of full-time positions, project-based solutions, supplier management solutions, and on-site recruiting support for application development, systems integration, and enterprise application integration.Modis has a network of 48 offices across the United States and Canada, and employed approximately 3,600 billable consultants at the end of 2008. Its primary clients are Fortune 1000 companies.

Idea Integration

Idea Integration specializes in Web design and development, application development, digital data management, business intelligence, infrastructure and security, and interactive marketing.Ideautilizes both salaried and hourly consultants to deliver solutions to its clients, which include Fortune 1000 companies, government and middle-market companies. In 2008, we enhancedIdea Integration’smarket penetration and product offerings with the acquisition of an IT solutions business.

Beeline

Beeline provides software-based workforce solutions that allow leading companies, healthcare organizations and government entities to effectively manage employee recruitment, development, and retention.Beeline streamlines the deployment of permanent, contract and project based labor through learning management, performance management, talent management, and eLearning.Beeline operates primarily in the United States and its clients include leading global companies, healthcare organizations, and government entities.

Beeline maintains a full-time staff to support its operations and seeks to collect a service charge based upon the usage of this service. Subsequent to the initial start up costs and time, minimal cost and resources are required by the client for the usage ofBeeline’s services. In 2008, we enhancedBeeline’smarket penetration with the acquisition of certain assets of a vendor management solutions business.

7

International IT Services segment

Our International IT Services segment is comprised ofModis International. Headquartered in the United Kingdom,Modis Internationalspecializes in providing IT contract consultants and solutions similar toModis.Modis International’scustomers include FTSE 1000 companies and government entities throughout the United Kingdom and certain continental European markets.Modis International, and its predecessors, has been in operation for over 30 years. It has 9 offices across the United Kingdom, an office each in Belgium, Germany, Poland, and two in the Netherlands. It employed approximately 2,000 billable consultants at the end of 2008.

Employees

MPS employed approximately 16,900 consultants and approximately 3,500 full-time staff employees at the end of 2008. Approximately 280 of the employees work at corporate headquarters.

As described below, in most jurisdictions, we, as the employer of the consultants or as otherwise required by applicable law, are responsible for employment administration. This administration includes collection of withholding taxes, employer contributions for social security or its equivalent outside the United States, unemployment tax, maintaining workers’ compensation and fiduciary and liability insurance, and other governmental requirements imposed on employers. Full-time employees are covered by life and disability insurance and receive health insurance and other benefits.

Government Regulations

Outside of the United States and Canada, the staffing services industry is closely regulated. These regulations differ among countries but generally may regulate: (i) the relationship between us and our temporary employees; (ii) registration, licensing, record keeping, and reporting requirements; and (iii) types of operations permitted. Regulation within the United States and Canada has not materially impacted our operations.

In many countries, including the United States and the United Kingdom, staffing services firms are considered the legal employers of the temporary consultants while the consultant is on assignment with a company client. Therefore, laws regulating the employer/employee relationship, such as tax withholding or reporting, social security or retirement, anti-discrimination, and workers’ compensation govern us. In other countries, staffing services firms, while not the direct legal employer of the consultant, are still responsible for collecting taxes and social security deductions and transmitting such amounts to the taxing authorities.

Intellectual Property

We seek to protect our intellectual property through copyright, trade secret and trademark law and through contractual non-disclosure restrictions. Our services often involve the development of work and materials for specific client engagements, the ownership of which is frequently assigned to the client. We do at times, and when appropriate, negotiate to retain the ownership or continued use of development tools or know how created or generated by us for a client in the delivery of our services, which we may then license or use in the delivery of our services to other clients.

Seasonality

Our quarterly operating results are affected by the number of billing days in a quarter and the seasonality of our customers’ businesses. Demand for our services has historically been lower during the calendar year-end, as a result of holidays, through February of the following year. Extreme weather conditions may also affect demand in the early part of the year as certain of our clients’ facilities are located in geographic areas subject to closure or

8

reduced hours due to inclement weather. In addition, we experience an increase in our cost of sales and a corresponding decrease in gross profit and gross margin in the first fiscal quarter of each year, as a result of certain U.S. state and federal employment tax resets.

Access to Company Information

Our common stock is listed on the New York Stock Exchange (‘NYSE’) under the ticker symbol ‘MPS’. Our Internet address is www.mpsgroup.com. We make available through our Internet website our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, as soon as reasonably practicable after filing such material with, or furnishing it to, the Securities and Exchange Commission. The information contained on our website, or on other websites linked to our website, is not part of this document.

Our results of operations and financial condition can be adversely affected by numerous risks and uncertainties. The risks and uncertainties that we currently believe are most important are described below. You should carefully consider the risk factors detailed below in conjunction with the other information contained in this document. Should any of these risks actually materialize, our business, financial condition, and future prospects could be negatively impacted.

Demand for our services is affected by the economic climate in the industries and markets we serve.The demand for our services is highly dependent upon the state of the economy and upon the staffing needs of our clients. During the fourth quarter of 2008, the downturn in the economic condition in the countries in which we do business, primarily the United States and the United Kingdom, reduced the demand for our services resulting in a significant decrease in our revenues and profits. Further deterioration of the economic condition in the countries in which we do business may continue to reduce the demand for our services and our related revenues and profits. While we may attempt to manage our cost structure in response to reduced demand for our services, the associated costs may negatively impact our results and these efforts may not be successful in having us remain profitable or, if profitable, maintain our current profit margins.

In addition, a country’s currency is impacted by its economic condition. Our results of operations are therefore exposed to exchange rate fluctuations due to the level of our international operations, primarily in the United Kingdom. Upon translation, operating results may differ materially from expectations. We have not entered and do not currently anticipate entering into hedging instruments to mitigate this risk.

Our market is highly competitive with low barriers to entry.Our industry is intensely competitive and highly fragmented, and the barriers to entry are quite low. There are many competitors, and new ones are entering the market continually. In addition, some of these competitors have greater resources than us. Competition arises locally, regionally, nationally, internationally and in certain cases from remote locations, particularly from offshore locations such as India and China. This competition could make it difficult to maintain our current revenue levels and profit margins.

Certain of our contracts are awarded on the basis of competitive proposals, which can be periodically re-bid by the client. There can be no assurance that existing contracts will be renewed on satisfactory terms or that additional or replacement contracts will be awarded to us. In addition, long-term contracts form a negligible portion of our revenue. There can be no assurance we will be able to retain clients or market share in the future. Nor can there be any assurance that we will, in light of competitive pressures, be able to remain profitable or, if profitable, maintain our current profit margins.

9

Our business requires a qualified candidate pool, which we may not be able to recruit or maintain. Our staffing services consist of the placement of individuals seeking employment in specialized IT and professional positions. Some of these sectors are characterized by a shortage of qualified candidates. There can be no assurance that suitable candidates for employment will continue to be available or will continue to seek employment through us. Candidates generally seek temporary or regular positions through multiple sources, including our competitors and us. Any shortage of qualified candidates could materially adversely affect us.

Our business depends on key personnel, including executive officers, local managers and field personnel.We are engaged in a services business. As such, our success or failure is highly dependent upon the performance of our management personnel and employees, rather than upon technology or upon tangible assets (of which we have few). There can be no assurance that we will be able to attract and retain the personnel that are essential to our success.

We have to comply with existing government regulation and are exposed to increasing regulation of the workplace.Our business is subject to regulation or licensing in many states and in certain foreign countries. There can be no assurance we will be able to continue to obtain all necessary licenses or approvals or that the cost of compliance will not prove to be material in the future. Any inability to comply with government regulation or licensing requirements, or increase in the cost of compliance, could materially adversely affect us. Additionally, our staffing services entail employing individuals on a temporary basis and placing such individuals in clients’ workplaces. Increased government regulation of the workplace or of the employer-employee relationship could materially adversely affect us.

We are exposed to claims and costs, liabilities and litigation arising from the delivery of our services. Our recruiting services involve our referring candidates to clients for potential employment, and our staffing services entail employing or retaining individuals on a temporary basis and placing such individuals in clients’ workplaces. Our recruiting services entail a risk of liability to our clients and others, contractually and otherwise, arising from allegations of inadequate background checks, inadequate credentialing of our nursing and healthcare workers, and negligent referral of candidates to our clients. Our staffing services entail a risk of liability to our clients and others, contractually and otherwise, arising from various workplace events, often beyond our control, including allegations of errors and omissions, injury to property or persons, or misappropriation or theft of property or proprietary information allegedly caused or contributed to by our temporary workers. Our staffing services in the healthcare sector carry the particular risk of potentially substantial claims we place associated with allegations of professional liability for the acts or omissions of medical professionals we place, including nurses, pharmacists, physicians and healthcare technicians.

Our staffing services also entail a risk of employment and co-employment liability, to either or both our clients and our temporary workers, arising from allegations by our temporary workers of discrimination, harassment, inadequate workplace conditions, or entitlement to employee benefits or pay from clients to which they are assigned. We maintain insurance for many of the aforementioned claims, but there can be no assurance that we will continue to be able to obtain insurance at a cost that does not have a material adverse effect upon us, that these policies will sufficiently cover all potential claims, most particularly those associated with professional liability in the healthcare field, or that such claims (whether by reason of not having insurance or by reason of such claims being outside the scope of the insurance) will not have a material adverse effect upon us.

We have acquired, and may continue to acquire, companies, and these acquisitions could disrupt our business or adversely affect our earnings. We have acquired several companies and may continue to acquire companies in the future. Entering into an acquisition entails many risks, any of which could harm our business, including failure to successfully integrate the acquired company with our existing business, alienation or impairment of relationships with substantial customers or key employees of the acquired business or our existing business, and assumption of liabilities of the acquired business. Any acquisition that we consummate also may have an adverse affect on our liquidity or earnings and may be dilutive to our earnings. Adverse business conditions or developments suffered by or associated with any business we acquire additionally could result in

10

impairment to the goodwill or intangible assets associated with the acquired business and a related write down of the value of these assets, adversely affecting our earnings.

We may be subject to additional income tax liabilities.We are subject to income taxes in the United States and other jurisdictions in which we do business. Significant judgment is required in evaluating our worldwide provision for income taxes. During the ordinary course of business, there are many transactions for which the ultimate tax determination is uncertain. We are subject to audit in various jurisdictions, and such jurisdictions may assess additional income tax against us. Although we believe our tax estimates are reasonable, the final determination of tax audits and any related litigation could be materially different from our historical income tax provisions and accruals. The results of an audit or litigation could have a material effect on our operating results or cash flows in the period or periods for which that determination is made.

The price of our common stock has and may continue to fluctuate significantly.The market price for our common stock can fluctuate as a result of a variety of factors, including the factors listed above, many of which are beyond our control. These factors include: actual or anticipated variations in quarterly operating results; announcements of new services by our competitors or us; announcements relating to strategic relationships or acquisitions; changes in financial estimates or other statements by securities analysts; and other changes in general economic conditions. Because of this, we may fail to meet or exceed the expectations of our shareholders or of our securities analysts and the market price for our common stock could fluctuate as a result.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

There are no unresolved comments from the Staff of the Securities and Exchange Commission concerning our periodic or current reports under the Securities Exchange Act of 1934.

Our corporate headquarters, located in Jacksonville, Florida, is on lease through 2012. Our business services are conducted through more than 220 offices located in the United States, Canada, the United Kingdom, continental Europe, Australia, and Asia. Almost all of our offices are on lease, with the terms of an average office lease being from three to six years.

We believe our facilities are generally adequate for our needs and do not anticipate difficulty replacing such facilities or locating additional facilities, if needed. Additional information on lease commitments can be found in Footnote 6 to the Consolidated Financial Statements.

We are a party to a number of lawsuits and claims arising out of the ordinary conduct of our business. In the opinion of management, based on the advice of in-house and external legal counsel, the lawsuits and claims pending are not expected to have a material adverse effect on us, our financial position, our results of operations, or our cash flows, but litigation is subject to inherent uncertainties.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matters were submitted to a vote of security holders during the fourth quarter of 2008.

11

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Price and Related Matters

The following table sets forth the high and low sale prices of our common stock, as reported by the NYSE, during the two years ended December 31, 2008:

| | | | | | | | | | | | |

| | | 2008 | | 2007 |

| | | High | | Low | | High | | Low |

Period: | | | | | | | | | | | | |

First Quarter | | $ | 12.50 | | $ | 8.68 | | $ | 15.97 | | $ | 13.44 |

Second Quarter | | $ | 12.59 | | $ | 10.54 | | $ | 15.11 | | $ | 12.91 |

Third Quarter | | $ | 12.77 | | $ | 9.47 | | $ | 16.08 | | $ | 11.07 |

Fourth Quarter | | $ | 10.20 | | $ | 4.74 | | $ | 13.48 | | $ | 10.27 |

See the factors set forth above in ‘Risk Factors,’ for factors that may impact the price of our common stock. As of February 13, 2009, there were approximately 977 holders of record of our common stock.

We have never paid, nor do we currently intend to pay, a cash dividend or other cash distribution with respect to our common stock.

Issuer Repurchases of Equity Securities

Our Board of Directors has authorized certain repurchases of our common stock. We repurchased 7.6 million shares at a cost of $75.8 million in the twelve months ended December 31, 2008. The following table sets forth information about our common stock repurchases for the three months ended December 31, 2008. From the third quarter of 2002 through February 13, 2009, we have repurchased a total of 27.4 million shares at a cost of $293.2 million under this plan. We have approximately $24.3 million remaining under this authorization as of February 13, 2009. There is no expiration date for this authorization.

| | | | | | | | | | |

Period (1) | | Total Number

of Shares

Repurchased | | Average Price

Paid per Share | | Total Number of

Shares Purchased

As Part of Publicly

Announced

Plans or Programs | | Maximum Number (or

Approximate Dollar

Value) of Shares That

May Yet be Purchased

Under the

Plans or Programs |

October 1, 2008 to October 31, 2008 | | 591,000 | | $ | 6.99 | | 591,000 | | $ | 31,595,260 |

November 1, 2008 to November 30, 2008 | | 1,176,900 | | | 6.19 | | 1,176,900 | | | 24,311,305 |

December 1, 2008 to December 31, 2008 | | — | | | — | | — | | | 24,311,305 |

| | | | | | | | | | |

Total | | 1,767,900 | | $ | 6.46 | | 1,767,900 | | $ | 24,311,305 |

| | | | | | | | | | |

| (1) | Based on trade date, not settlement date. |

12

Performance Graph

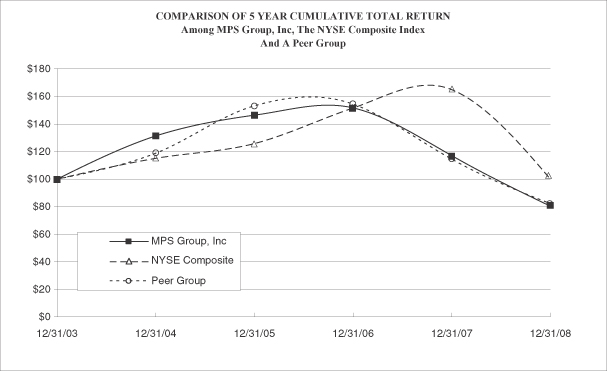

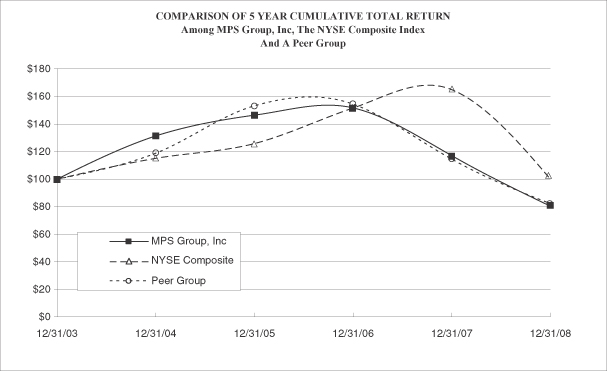

The following Performance Graph and related information shall not be deemed “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing.

The following graph and table compare the cumulative total return of our common stock, the NYSE composite market index (U.S. companies), and an index of selected publicly traded employment services and consulting companies (the “Self-Determined Peer Group”), as described below, for the period beginning December 31, 2003 and ending December 31, 2008 (the last trading dates in our 2003 and 2008 fiscal years), assuming an initial investment of $100 and the reinvestment of any dividends. We obtained the information reflected in the graph and table from independent sources we believe to be reliable, but we have not independently verified the information.

| | | | | | | | | | | | |

| Total Returns Index for: | | 12/31/03 | | 12/31/04 | | 12/31/05 | | 12/31/06 | | 12/31/07 | | 12/31/08 |

MPS Group, Inc | | 100.00 | | 131.12 | | 146.20 | | 151.66 | | 117.01 | | 80.53 |

NYSE Composite | | 100.00 | | 114.97 | | 125.73 | | 151.46 | | 164.89 | | 100.16 |

Self-Determined Peer Group | | 100.00 | | 118.80 | | 153.06 | | 154.38 | | 114.51 | | 82.31 |

Companies in the Self-Determined Peer Group | | | | | | | | | | | | |

CDI Corporation | | Kforce Inc | | | | |

Comsys IT Partners Inc | | On Assignment Inc | | | | |

Hudson Highland Group Inc | | Robert Half International, Inc. | | | | |

13

| ITEM 6. | SELECTED FINANCIAL DATA |

| | | | | | | | | | | | | | | | | |

| | | Years Ended | |

(amounts in thousands except common share

amounts) | | Dec. 31,

2008 | | | Dec. 31,

2007 | | Dec. 31,

2006 | | Dec. 31,

2005 | | Dec. 31,

2004 | |

Consolidated Statements of Operations data: | | | | | | | | | | | | | | | | | |

Revenue | | $ | 2,222,300 | | | $ | 2,171,835 | | $ | 1,876,622 | | $ | 1,684,699 | | $ | 1,426,842 | |

Cost of revenue | | | 1,585,406 | | | | 1,549,547 | | | 1,359,580 | | | 1,242,331 | | | 1,066,055 | |

| | | | | | | | | | | | | | | | | |

Gross profit | | | 636,894 | | | | 622,288 | | | 517,042 | | | 442,368 | | | 360,787 | |

Operating expenses | | | 521,524 | | | | 488,652 | | | 402,498 | | | 355,382 | | | 309,551 | |

Goodwill and intangible impairment charge | | | 379,269 | | | | — | | | — | | | — | | | — | |

Exit recapture | | | — | | | | — | | | — | | | — | | | (897 | ) |

| | | | | | | | | | | | | | | | | |

Operating income (loss) | | | (263,899 | ) | | | 133,636 | | | 114,544 | | | 86,986 | | | 52,133 | |

Other income (expense), net | | | (5,649 | ) | | | 6,911 | | | 5,991 | | | 3,799 | | | 1,437 | |

| | | | | | | | | | | | | | | | | |

Income (loss) before provision for (benefit from) income taxes | | | (269,548 | ) | | | 140,547 | | | 120,535 | | | 90,785 | | | 53,570 | |

Provision for (benefit from) income taxes | | | (33,586 | ) | | | 53,459 | | | 45,321 | | | 31,188 | | | 18,150 | |

| | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (235,962 | ) | | $ | 87,088 | | $ | 75,214 | | $ | 59,597 | | $ | 35,420 | |

| | | | | | | | | | | | | | | | | |

Basic income (loss) per common share | | $ | (2.64 | ) | | $ | 0.88 | | $ | 0.74 | | $ | 0.59 | | $ | 0.34 | |

| | | | | | | | | | | | | | | | | |

Diluted income (loss) per common share | | $ | (2.64 | ) | | $ | 0.86 | | $ | 0.72 | | $ | 0.56 | | $ | 0.33 | |

| | | | | | | | | | | | | | | | | |

Basic average common shares outstanding | | | 89,391 | | | | 98,998 | | | 101,340 | | | 101,719 | | | 102,804 | |

| | | | | | | | | | | | | | | | | |

Diluted average common shares outstanding | | | 89,391 | | | | 101,086 | | | 104,090 | | | 105,832 | | | 106,842 | |

| | | | | | | | | | | | | | | | | |

| |

| | | December 31, | |

(amounts in thousands) | | 2008 | | | 2007 | | 2006 | | 2005 | | 2004 | |

Consolidated Balance Sheet data: | | | | | | | | | | | | | | | | | |

Working capital | | $ | 223,710 | | | $ | 265,150 | | $ | 318,879 | | $ | 279,859 | | $ | 232,133 | |

Total assets | | $ | 795,892 | | | $ | 1,209,651 | | $ | 1,142,279 | | $ | 1,028,006 | | $ | 954,604 | |

Stockholders’ equity | | $ | 591,470 | | | $ | 976,345 | | $ | 963,298 | | $ | 876,040 | | $ | 835,663 | |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

MPS Group, Inc. is a leading provider of business services with over 220 offices in the United States, Canada, the United Kingdom, continental Europe, Australia, and Asia. We deliver specialty staffing, consulting and business solutions to virtually all industries in the following disciplines and through the following primary brands:

| | |

Discipline | | Brand(s) |

Information Technology (IT) Services | | Modis® |

Accounting and Finance | | Badenoch & Clark®,Accounting Principals® |

Engineering | | Entegee® |

Legal | | Special Counsel® |

IT Solutions | | Idea Integration® |

Healthcare | | Soliant Health® |

Workforce Automation | | Beeline® |

14

We present the financial results of the above brands under our four reporting segments: North American Professional Services, International Professional Services, North American IT Services and International IT Services.

Non-GAAP Financial Measures

From time to time we may measure certain financial information on a ‘constant currency’ basis. Such constant currency financial data is not a U.S. generally accepted accounting principles (‘GAAP’) financial measure. Constant currency removes from financial data the impact of changes in exchange rates between the U.S. dollar and the functional currencies of our foreign subsidiaries, by translating the current period financial data into U.S. dollars using the same foreign currency exchange rates that were used to translate the financial data for the previous period. We believe presenting certain results on a constant currency basis is useful to investors because it allows a more meaningful comparison of the performance of our foreign operations from period to period. Additionally, certain internal reporting and compensation targets are based on constant currency financial data for our various foreign subsidiaries. However, constant currency measures should not be considered in isolation or as an alternative to financial measures that reflect current period exchange rates, or to other financial measures calculated and presented in accordance with GAAP.

From time to time we may measure certain financial information excluding the effect of acquisitions. Such financial data that excludes the effect of businesses we acquire is not a GAAP financial measure. We believe presenting some results excluding the effects of businesses we acquire is helpful to investors because it permits a comparison of the performance of our core internal operations from period to period. Additionally, certain internal reporting and compensation targets are based on the performance of core internal operations. The effect of a business we acquire is generally excluded for only the first 12 months following the acquisition date. Subsequent to this, a business is considered to be integrated for reporting purposes. Again, however, such measures should be considered only in conjunction with the correlative measures that include the results from acquisitions, as calculated and presented in accordance with GAAP.

We may use EBITDA to measure results of operations. EBITDA is a non-GAAP financial measure that is defined as earnings before interest, taxes, depreciation and amortization. We believe EBITDA is a meaningful measure of operating performance as it gives management a consistent measurement tool for evaluating the operating activities of the business as a whole, as well as, the various operating units, before the effect of investing activities, interest and taxes. In addition, we believe EBITDA provides useful information to investors, analysts, lenders, and other interested parties because it excludes transactions that management considers unrelated to core business operations, thereby helping interested parties to more meaningfully evaluate, trend and analyze the operating performance of our business. We also use EBITDA for certain internal reporting purposes, and certain compensation targets may be based on EBITDA. Finally, certain covenants in our debt facility are based on EBITDA performance measures. EBITDA, as with all non-GAAP financial measures, should be considered only in conjunction with the comparable measures, as calculated and presented in accordance with GAAP, including net income.

Critical Accounting Policies

We prepare our financial statements in conformity with GAAP. We believe the following are our most critical accounting policies in that they are the most important to the portrayal of our financial condition and results of operations and require management’s most difficult, subjective or complex judgments.

Revenue Recognition

We recognize substantially all revenue at the time services are provided, and on a time and materials basis. In most cases, the consultant is our employee and all costs of employing the worker are our responsibility and are included in cost of revenue. Revenues generated when we permanently place an individual with a client are recorded on the date the individual begins employment with the client.

15

Allowance for Doubtful Accounts

We regularly monitor and assess our risk of not collecting amounts we are owed by our customers. This evaluation is based upon a variety of factors including, an analysis of amounts current and past due along with relevant history and facts particular to the customer. Based upon the results of this analysis, we record an allowance for uncollectible accounts for this risk. Our allowance for doubtful accounts, as a percentage of gross accounts receivable was 6.8%, 5.8% and 5.0% as of December 31, 2008, 2007 and 2006 respectively. The increase from 2007 to 2008 in the allowance for doubtful accounts as a percentage of gross accounts receivable was primarily due to worsening economic conditions. The increase from 2006 to 2007 in the allowance for doubtful accounts as a percentage of gross accounts receivable was primarily due to the write-off of receivables from one customer, the vendor management service provider, Ensemble Chimes Global, which filed for bankruptcy. As of December 31, 2008, a five-percentage point deviation in our allowance for doubtful accounts would have resulted in an increase or decrease to the allowance of $1.0 million. This analysis requires us to make significant estimates, and changes in facts and circumstances could result in material changes in the allowance for doubtful accounts.

Income Taxes

We adopted FASB Interpretation No. (“FIN”) 48,Accounting for Uncertainty in Income Taxes, on January 1, 2007. FIN 48 prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. Additionally, FIN 48 provides guidance on recognition, classification, and disclosure of tax positions.

The provision for income taxes is based on income before taxes as reported in the Consolidated Statements of Operations. Deferred tax assets and liabilities are recognized for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and liabilities are determined based on the differences between the financial statement carrying amounts and the tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. An assessment is made as to whether or not a valuation allowance is required to offset deferred tax assets. This assessment includes anticipating future income.

Significant management judgment is required in determining the provision for income taxes, deferred tax assets and liabilities and any valuation allowance recorded against our deferred tax assets. Management evaluates all available evidence to determine whether it is more likely than not that some portion or all of the deferred income tax assets will not be realized. The establishment and amount of a valuation allowance requires significant estimates and judgment and can materially affect our results of operations. Our effective tax rate may vary from period to period based, for example, on changes in estimated taxable income or loss, changes to the valuation allowance, changes to federal, state or foreign tax laws, completion of federal, state or foreign audits, deductibility of certain costs and expenses by jurisdiction, and as a result of acquisitions.

Our tax basis in tax-deductible goodwill is deducted in our income tax returns. Accordingly, we expect future tax deductions of $268.1 million associated with tax-deductible goodwill. While these deductions are expected to span the next fifteen years, approximately 70% are anticipated to be generated over the next five years. In addition, we have a net deferred tax asset as of December 31, 2008, and a net deferred tax liability as of December 31, 2007. The components of our net deferred tax liabilities and assets, as well as other information on income taxes can be found in Footnote 7 to the Consolidated Financial Statements.

Impairment of Tangible and Intangible Assets

For acquisitions, we allocate the excess of the cost of the acquisition over the fair market value of the net tangible assets acquired first to identifiable intangible assets, if any, and then to goodwill. In connection with Statement of Financial Accounting Standards (“SFAS”) No. 142,Goodwill and Other Intangible Assets, we are required to perform goodwill impairment reviews, at least annually, utilizing a fair-value approach. We evaluate

16

goodwill for impairment using the two-step process prescribed in SFAS No. 142. The first step is to identify potential impairment by comparing the fair value of a reporting unit to the book value, including goodwill. If the fair value of a reporting unit exceeds the book value, goodwill is not considered impaired. If the book value exceeds the fair value, the second step of the process is performed to measure the amount of impairment.

In accordance with SFAS No. 142, we perform valuation testing annually as of October 1 and between tests if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount. We did not incur any goodwill impairment resulting from our valuation testing performed in the fourth quarters of 2007 and 2006. During the first three quarters of 2008, we did not experience significant adverse changes in the business climate that would cause us to accelerate the timing of our valuation testing. During the fourth quarter of 2008, we experienced the acceleration of certain negative trends in our business operations and financial results which were occurring in conjunction with evidence of a significant downturn in the macroeconomic conditions of the United States and the United Kingdom, the primary countries in which we do business. During the latter half of the fourth quarter of 2008, it became apparent that the deterioration of macroeconomic conditions in the United States and the United Kingdom would continue into 2009 resulting in a significant decrease in our revenues and profits. In addition, during the fourth quarter of 2008 we experienced a material decline in our market capitalization along with the valuations of our market comparable companies. Our valuation testing performed as of October 1, 2008 considered this continued economic and market deterioration that occurred during the fourth quarter.

Based on the results of our valuation testing performed in the fourth quarter of 2008, we recorded a goodwill and intangible impairment charge of $379.3 million, or $303.4 million net of the related tax benefit. This goodwill and intangible impairment charge was comprised of $205.1 million for a reporting unit included in our North American IT Services segment, $94.3 million for reporting units included in our International Professional Services segment, $49.9 million for a reporting unit included in our North American Professional Services segment, and $29.9 million for a reporting unit included in our International IT Services segment. We used a blended value of a discounted cash flow methodology and guideline public company methodology to arrive at fair value for SFAS No. 142. The discounted cash flow methodology establishes fair value by estimating the present value of the projected future cash flows to be generated from the reporting unit. The discount rate applied to the projected future cash flows to arrive at the present value is intended to reflect all risks of ownership and the associated risks of realizing the stream of projected future cash flows. The discounted cash flow methodology uses our projections of financial performance for a five-year period. The most significant assumptions used in the discounted cash flow methodology are the discount rate, the terminal value and expected future revenues, gross margins, operating margins, and working capital levels, which vary among reporting units. The guideline public company methodology establishes fair value by comparing us to other publicly traded companies that are similar to us from an operational and economic standpoint. The guideline public company methodology compares us to the comparable companies on the basis of risk characteristics in order to determine our risk profile relative to the comparable companies as a group. This analysis generally focuses on quantitative considerations, which include financial performance and other quantifiable data, and qualitative considerations, which include any factors which are expected to impact future financial performance. The most significant assumptions affecting the market multiple methodology are the market multiples and control premium. The market multiples we use for each reporting unit are: a) enterprise value to revenue and b) enterprise value to EBITDA. A control premium represents the value an investor would pay above minority interest transaction prices in order to obtain a controlling interest in the respective company.

As previously mentioned, the process of evaluating goodwill for impairment involves the determination of the fair values of our reporting units. Inherent in such fair value determinations are certain judgments and estimates relating to future cash flows, including our interpretation of current economic indicators and market valuations, and assumptions about our strategic plans with regard to our operations. To the extent additional information arises, market conditions change or our strategies change, it is possible that our conclusion regarding whether remaining goodwill is impaired could change and result in an additional goodwill and intangible impairment charge, which could have a material effect on our consolidated financial position or results of operations. Additional information on Goodwill can be found in Footnote 5 to the Consolidated Financial Statements.

17

We amortize the cost of identifiable intangible assets (either through acquisition or as part of our internally generated intellectual property) over their estimated useful lives unless such lives are deemed indefinite. We review our long-lived assets and identifiable intangibles for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. In performing the review for recoverability, we estimate the future cash flows expected to result from the use of the asset and its eventual disposition. If the sum of the expected future cash flows (undiscounted and without interest charges) is less than the carrying amount of the asset, an impairment charge is recognized. Otherwise, an impairment charge is not recognized. Measurement of an impairment charge for long-lived assets and identifiable intangibles would be based on the fair value of the asset. Included in the aforementioned goodwill and intangible impairment charge was a $2.5 million impairment charge to identifiable intangible assets.

Share-Based Compensation

Under our employee and director share-based compensation plans, participants have received or may receive grants of stock options, stock appreciation rights, restricted stock, restricted stock units, and performance shares. For 2008, we have solely utilized restricted stock for our share-based awards. Historically, we have utilized both restricted stock and stock options.

Effective January 1, 2006, we adopted the provisions of SFAS 123R,Share-Based Payment, using the modified prospective transition method to all past awards outstanding and unvested as of the effective date of January 1, 2006; accordingly, prior periods have not been restated. SFAS 123R requires the recognition of expense only for awards that are expected to vest, rather than recording forfeitures when they occur as previously permitted. Our forfeiture rates are based mainly upon historical share-based compensation cancellations. However, if the actual number of forfeitures differs from those estimated by management, additional adjustments to compensation expense may be required in future periods. A one-percentage point deviation in the estimated forfeiture rates would have resulted in a $100,000 increase or decrease in compensation expense related to restricted stock for the year ended December 31, 2008. Additional information on share-based compensation can be found in Footnote 9 to the Consolidated Financial Statements.

EXECUTIVE SUMMARY

Our consolidated revenue in 2008 increased 2% compared to 2007. This contrasts to the first 9 months of 2008, where our consolidated revenue had increased 8% compared to the same period for 2007. The demand for our services is highly dependent upon the state of the economy in the markets in which we operate, particularly the United States and the United Kingdom, and upon the staffing needs of our clients. During the fourth quarter of 2008, we experienced the acceleration of certain negative trends in our business operations and financial results which were occurring in conjunction with evidence of a significant downturn in the macroeconomic conditions of the United States and the United Kingdom. This deterioration was evident in both our North American and International segments, but was more pronounced in our permanent placement business than in our staffing business. In particular, our permanent placement fees generated from our North American and International Professional Services segments together decreased 29% from the third quarter of 2008 to the fourth quarter of 2008. This is significant as more than 80% of our permanent placement fees are generated by our North American and International Professional Services segments. In the third quarter of 2008, permanent placement weakening occurred primarily in our International Professional Services segment and to a lesser extent in our North American Professional Services segment. Staffing services in both our North American and International segments were also impacted by worsening economic conditions as staffing services revenue decreased 15% from the third quarter of 2008 to the fourth quarter of 2008. Prior to the third quarter of 2008, our staffing services were not as impacted by worsening economic conditions. We believe that economic conditions will continue to erode demand for both our permanent placement and staffing services, further decreasing our revenues and profits. However, our ability to provide guidance on future results is impaired by the uncertain economic conditions.

18

Our revenue and to a lesser extent profits, are impacted by fluctuations in foreign currency exchange rates. The British Pound, the main functional currency for our international segments, weakened against the United States Dollar in the third quarter of 2008. This devaluation of the British Pound accelerated in the fourth quarter of 2008 and continued into the first quarter of 2009. If this trend does not reverse for the remainder of the first quarter of 2009, our revenue for the first quarter will be reduced.

We expect to realize a decrease in compensation expenses associated with decreases in revenue as many of our employees are compensated based on revenue production. As economic conditions weakened, we have taken steps to improve our cost efficiency including slowing the hiring of new staff, reducing personnel through attrition and eliminating certain staff positions. If we do not continue to undertake short-term steps to improve our cost efficiency, the revenue declines discussed above could have a greater negative impact on our operating income. However, we do not want to take actions that may impede our ability to grow revenue once the economic conditions strengthen.

In accordance with SFAS No. 142, we performed our valuation testing for goodwill impairment during the fourth quarter of 2008. Based on the results of this testing, we recorded a goodwill and intangible impairment charge of $379.3 million, or $303.4 net of the related tax benefit. Although the goodwill and intangible impairment charge impacted operating income, it was a non-cash charge. Our operating loss for both the fourth quarter and year of 2008 of $359.9 million and $263.9 million, respectively, included this charge. In discussing profits for the first quarter of 2009 above, we are comparing profits to the fourth quarter level before this charge.

The following detailed analysis of operations should be read in conjunction with the 2008 Consolidated Financial Statements and related footnotes included elsewhere in this Form 10-K.

Results of Operations for the Three Years Ended December 31, 2008—Consolidated

Consolidated revenue was $2,222.3 million, $2,171.8 million, and $1,876.6 million in 2008, 2007 and 2006, respectively, increasing by 2.3% and 15.7% in 2008 and 2007, respectively.

Consolidated gross profit was $636.9 million, $622.3 million, and $517.0 million in 2008, 2007 and 2006, respectively, increasing by 2.3% and 20.4% in 2008 and 2007, respectively. The consolidated gross margin was 28.7% in 2008 and 2007, and 27.5% in 2006.

Consolidated operating expenses were $900.8 million, $488.7 million, and $402.5 million, in 2008, 2007 and 2006, respectively, increasing by 84.3% and 21.4% in 2008 and 2007, respectively. General and administrative (G&A) expenses, which are included in operating expenses, were $499.7 million, $468.5 million, and $386.6 million, in 2008, 2007 and 2006, respectively, increasing by 6.7% and 21.2% in 2008 and 2007, respectively. Operating expenses include a $379.3 million goodwill and intangible impairment charge. $49.9 million and $94.4 million of the goodwill and intangible impairment charge were recorded in our North American and International Professional Services segments, respectively, and $205.1 million and $29.9 million of the goodwill and intangible impairment charge were booked in our North American and International IT Services segments, respectively.

Unallocated corporate expenses, included in consolidated operating expenses, pertain to certain functions, such as executive management, accounting, administration, tax, and treasury that are not attributable to our operating units. Unallocated corporate expenses were $30.9 million, $30.4 million and $28.1 million, in 2008, 2007 and 2006, respectively, increasing 1.6% and 8.2% in 2008 and 2007, respectively. As a percentage of revenue, unallocated corporate expenses were 1.4% for 2008 and 2007, and 1.5% for 2006. The increase in unallocated corporate expense in 2007 was due primarily to a combination of higher compensation and benefits cost, and an increase in non-cash compensation expense from our use of restricted stock.

19

Consolidated operating loss was $263.9 million in 2008, and consolidated operating income was $133.6 million and $114.5 million in 2007 and 2006, respectively, decreasing by 297.5% in 2008 and increasing by 16.7% in 2007. Operating loss as a percentage of revenue was 11.9% in 2008, and operating income as a percentage of revenue was 6.2% and 6.1% in 2007 and 2006, respectively.

Consolidated other expense, net, was $5.6 million in 2008, and consolidated other income, net, was $6.9 million and $6.0 million in 2007 and 2006, respectively. Other income (expense), net, primarily includes changes in the cash surrender value of our company-owned life insurance, interest income related to our investments and cash on hand, net of interest expense related to notes issued in connection with acquisitions and fees and interest on our credit facility. The change from other income, net in 2007 to other expense, net, in 2008 was due primarily to a decrease in the cash surrender value of our company-owned life insurance, and to a lesser extent a decrease in interest income and an increase in interest expense. The cash surrender value of our company-owned life insurance decreased by $7.3 million from the twelve months ended December 31, 2007 to the twelve months ended December 31, 2008. The decrease in the cash surrender value of our company-owned life insurance was due to a decrease in the value of the equity mutual funds within our company-owned life insurance.

The consolidated income tax benefit was $33.6 million in 2008, and the consolidated income tax provision was $53.5 million and $45.3 million in 2007 and 2006, respectively. The effective tax rate was 12.5%, 38.0% and 37.6%, for 2008, 2007 and 2006, respectively. The effective tax rate in 2008 decreased because a significant portion of the goodwill and intangible impairment charge was related to non-deductible goodwill. Included in the 2007 and 2006 tax provisions were $1.6 million and $1.1 million, respectively, of tax benefits due primarily to valuation allowance reductions associated with state net operating loss and foreign tax credit carryforwards, and favorable settlements of certain state income tax audits.

Consolidated net loss was $236.0 million in 2008, and consolidated net income was $87.1 million and $75.2 million in 2007 and 2006, respectively.

Results of Operations for the Three Years Ended December 31, 2008 – By Business Segment

Professional Services division

North American Professional Services segment

Revenue in our North American Professional Services segment was $726.5 million, $690.1 million, and $617.2 million, for 2008, 2007 and 2006, respectively, increasing by 5.3% and by 11.8% in 2008 and 2007, respectively. North American Professional Acquisitions contributed $28.3 million, $26.4 million, and $33.2 million in revenue in 2008, 2007 and 2006, respectively. The increase in revenue for 2008 was due primarily to acquisitions in ourSoliant Health andSpecial Counsel business units, and to a lesser extent to internal growth, most notably in the segment’sSpecial Counsel andEntegee business units. The increase in revenue for 2007 was due primarily to internal growth, most notably in the segment’sEntegee business unit, and to a lesser extent due to acquisitions, most notably in the segment’sSpecial Counselbusiness unit.

Revenue contribution from the North American Professional Services businesses for 2008, 2007 and 2006 were as follows:

| | | | | | | | | |

| | | 2008 | | | 2007 | | | 2006 | |

Entegee | | 43.9 | % | | 44.6 | % | | 44.9 | % |

Special Counsel | | 25.2 | | | 23.4 | | | 22.2 | |

Accounting Principals | | 13.3 | | | 16.2 | | | 16.9 | |

Soliant Health | | 17.6 | | | 15.8 | | | 16.0 | |

20

Gross profit in our North American Professional Services segment was $223.3 million, $219.8 million, and $189.1 million, for 2008, 2007 and 2006, respectively, increasing by 1.6% and by 16.2% in 2008 and 2007, respectively. North American Professional Acquisitions contributed $10.7 million, $12.0 million, and $10.7 million in gross profit in 2008, 2007 and 2006, respectively. Gross margin in our North American Professional services segment was 30.7%, 31.9% and 30.6% in 2008, 2007 and 2006, respectively. The segment’s gross margin decreased in 2008 due primarily to a decrease in permanent placement fees, most notably in theAccounting Principals andSpecial Counsel business units, and to a lesser extent a decrease in the staffing gross margins in theSpecial Counsel business unit resulting from increased sales and delivery of document review services, which typically generate a lower staffing margin. Permanent placement fees, which generate higher margins, decreased to 5.6% of the segment’s revenue in 2008, from 6.5% and 5.9% in 2007 and 2006, respectively The increase in gross margins in 2007 was due primarily to improved staffing services gross margins, and to a lesser extent increased permanent placement fees.

G&A expenses in our North American Professional Services segment were $152.5 million, $143.5 million, and $125.1 million, in 2008, 2007 and 2006, respectively, increasing by 6.3% and by 14.7% in 2008 and 2007, respectively. G&A expenses as a percentage of revenue were 21.0%, 20.8%, and 20.3% for 2008, 2007 and 2006, respectively. The increase in G&A expenses for 2008 was due primarily to additional G&A from North American Professional Acquisitions. The increase in G&A expenses for 2007 was due primarily to the increase in compensation expense related to the increases in the segment’s revenue and additional G&A from North American Professional Acquisitions.

Operating income was $15.5 million, $70.9 million, and $59.2 million in 2008, 2007 and 2006, respectively, decreasing by 78.1% in 2008 and increasing by 19.8% in 2007. Operating income as a percentage of revenue was 2.1%, 10.3% and 9.6% in 2008, 2007 and 2006, respectively. The 2008 operating income includes the aforementioned $49.9 million goodwill and intangible impairment charge.

International Professional Services segment

Revenue in our International Professional Services segment was $553.2 million, $547.5 million, and $431.4 million, for 2008, 2007 and 2006, respectively, increasing by 1.0% and 26.9% in 2008 and 2007, respectively. Changes in foreign currency exchange rates decreased revenue by $41.1 million from 2007 to 2008, and increased revenue by $44.1 million from 2006 to 2007. International Professional Acquisitions contributed $28.8 million and $30.4 million in revenue in 2008 and 2007, respectively. Apart from changes in foreign currency exchange rates and acquisitions, the increase in revenue in 2008 and 2007 was due to increased demand for our services. This revenue growth was driven primarily by our public sector clients.

Gross profit in our International Professional Services segment was $165.1 million, $164.1 million, and $123.1 million, in 2008, 2007 and 2006, respectively, increasing by .6% and by 33.3% in 2008 and 2007, respectively. Changes in foreign currency exchange rates decreased gross profit by $11.0 million from 2007 to 2008, and increased gross profit by $13.2 million from 2006 to 2007. International Professional Acquisitions contributed $18.3 million and $17.6 million in gross profit in 2008 and 2007, respectively. Gross margin in our International Professional Services segment was 29.8%, 30.0%, and 28.5% in 2008, 2007 and 2006, respectively. The decrease in gross margin in 2008 was due to reduced gross margin from the segment’s staffing services, which more than offset an increase in permanent placement fees. The increase in gross margin in 2007 was due to increased permanent placement fees, as these permanent placement fees more than offset the reduced gross margin from the segment’s staffing services. Permanent placement fees increased to 11.1% of the segment’s revenue in 2008, from 10.8% and 8.5% in 2007 and 2006, respectively. The gross margin from the segment’s staffing services decreased in 2008 and 2007 primarily due to the mix of staffing services, as revenue from our public sector clients increased. The gross margin on public sector business is lower than that of our other clients. As this staffing gross margin decrease was expected, we concentrated on growing our permanent placement revenue in an effort to maintain the overall gross margin. However, we expect we will be less successful in this effort in 2009 due to the weaker permanent placement demand environment we are experiencing.

21

G&A expenses in our International Professional Services segment were $133.7 million, $122.6 million, and $88.1 million, in 2008, 2007 and 2006, respectively, increasing by 9.1% and by 39.2% in 2008 and 2007, respectively As a percentage of revenue, G&A expenses were 24.2%, 22.4%, and 20.4%, for 2008, 2007 and 2006, respectively. The increase in G&A expenses for 2008 was due to additional G&A expenses from the International Professional Acquisition. The increase in G&A expenses for 2007 was due primarily to additional sales and recruiting personnel, increases in compensation expense related to the increases in the segment’s revenue, and additional G&A expenses from the International Professional Acquisitions.

Operating loss was $68.5 million in 2008, and operating income was $37.3 million and $31.9 million in 2007 and 2006, respectively, decreasing by 283.6% and increasing by 16.9% in 2008 and 2007, respectively. Operating loss as a percentage of revenue was 12.4% in 2008, and operating income as a percentage of revenue was 6.8% and 7.4% in 2007 and 2006 respectively. The 2008 operating loss includes the aforementioned $94.4 million goodwill and intangible impairment charge.

IT Services division

North American IT Services segment

Revenue in our North American IT Services segment was $613.7 million, $628.6 million, and $561.0 million, for 2008, 2007 and 2006, respectively, decreasing by 2.4% in 2008 and increasing by 12.0% in 2007. North American IT Acquisitions contributed $11.8 million and $18.8 million in revenue in 2008 and 2007, respectively. The decrease in revenue in 2008 was due to reduced demand from our clients, most notably in ourModis business unit. The increase in revenue in 2007 was due primarily to increased spending on IT initiatives by our clients and our investment in additional sales and recruiting personnel.

Revenue within the North American IT Services segment is generated primarily fromModis, as it generated 78.8%, 81.8% and 84.2% of the segment’s revenue for 2008, 2007 and 2006, respectively.Idea Integration andBeeline are responsible for the remainder of this segment’s revenue.

Gross profit in our North American IT Services segment was $190.4 million, $184.8 million, and $162.0 million, in 2008, 2007 and 2006, respectively, increasing by 3.0% and 14.1% in 2008 and 2007, respectively. North American IT Acquisitions contributed $8.3 million and $9.7 million in gross profit in 2008 and 2007, respectively. Gross margin in our North American IT Services segment was 31.0%, 29.4% and 28.9% in 2008, 2007 and 2006, respectively. Fees generated from ourBeeline unit, which generates higher margin than the segment’s staffing services, increased in both 2008 and 2007. In addition in 2008, an increase in gross margin on the segment’s staffing services more than offset the impact of decreased permanent placement fees. Conversely, in 2007, the increased permanent placement fees offset the impact of decreased gross margins from the segment’s staffing services.

G&A expenses in our North American IT Services segment were $139.5 million, $134.1 million, and $110.8 million, in 2008, 2007 and 2006, respectively, increasing by 4.0% and 21.0% in 2008 and 2007, respectively. As a percentage of revenue, G&A expenses were 22.7%, 21.3%, and 19.8%, for 2008, 2007 and 2006, respectively. The increase in G&A expenses for 2008 was due to additional G&A expenses from the North American IT Acquisitions. The increase in G&A for 2007 was due primarily to the increase in compensation expense related to this segment’s increases in revenue and our investment in additional sales and recruiting personnel.

Operating loss was $162.9 million in 2008, and operating income was $42.8 million and $45.1 million in 2007 and 2006, respectively, decreasing by 480.6%, and 5.1% in 2008 and 2007, respectively. Operating loss as a percentage of revenue was 26.5% in 2008, and operating income as a percentage of revenue was 6.8% and 8.0% in 2007 and 2006, respectively. The 2008 operating loss includes the aforementioned $205.1 million goodwill and intangible impairment charge.

22

International IT Services segment

Revenue in our International IT Services segment was $328.8 million, $305.7 million, and $267.1 million, for 2008, 2007 and 2006, respectively, increasing by 7.6% and 14.5% in 2008 and 2007, respectively. Changes in foreign currency exchange rates decreased revenue by $26.5 million from 2007 to 2008, and increased revenue by $24.6 million from 2006 to 2007. The International IT Acquisition contributed $18.6 million and $3.3 million in revenue in 2008 and 2007, respectively. Apart from the increased revenue from the International IT Acquisition, the increase in revenue in 2008 is due primarily to increased spending on IT initiatives by our UK market clients. The increase in revenue in 2007 was due primarily to changes in foreign currency exchange rates, and the increased spending on IT initiatives by our UK market clients.