UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-08614

Brandes Investment Trust

(Exact name of registrant as specified in charter)

4275 Executive Square, 5th Floor

La Jolla, CA 92037

(Address of principal executive offices) (Zip code)

Lea Anne Copenhefer

Morgan, Lewis & Bockius LLP

One Federal Street

Boston, MA 02110-1726

(Name and address of agent for service)

(858) 755-0239

Registrant’s telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: March 31, 2022

Item 1. Reports to Stockholders.

(a) The following is a copy of the reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”) (17 CFR 270.30e-1):

SEMI-ANNUAL REPORT INTERNATIONAL EQUITY FUND GLOBAL EQUITY FUND EMERGING MARKETS VALUE FUND INTERNATIONAL SMALL CAP EQUITY FUND SMALL CAP VALUE FUND U.S. VALUE FUND CORE PLUS FIXED INCOME FUND For the six months ended March 31, 2022

Table of Contents

1

Brandes International Equity Fund

Dear Fellow Investor,

The net asset value of the Brandes International Equity Fund (Class I Shares) declined 3.39% in the six months ended March 31, 2022. During the same period, the MSCI EAFE Index declined 3.38%.

From a country perspective, holdings in Brazil helped performance, led by Telefonica Brasil and Petroleo Brasileiro (Petrobras). Select holdings in the United Kingdom (e.g., pharmaceutical firm GlaxoSmithKline) and Switzerland (e.g., financial services company UBS Group) also did well.

From an industry perspective, beverage companies Ambev (Brazil) and Anheuser-Busch InBev (Belgium) aided returns. The Fund also saw positive contributions from select insurance holdings, notably Swiss Re and AEGON (Netherlands), as they benefited from improved prospects for increased interest rates and strengthening business results.

Furthermore, our underweight to technology aided relative returns as the sector declined significantly more than the broader market (MSCI EAFE).

The most significant detractors were our holdings in Russia (Mobile TeleSystems and Surgutneftegas). Our thoughts continue to be with the people of Ukraine, as well as those in Russia that are advocating for peace. The events that have unfolded since the start of the Russian invasion of Ukraine in February have significantly elevated the risks and uncertainties associated with investments in Russian securities.

Other detractors included consumer-related holdings, namely Germany-based Henkel and France-based Danone, as well as U.K.-based Marks & Spencer, J Sainsbury and Kingfisher.

Furthermore, Brazilian regional jet manufacturer Embraer gave back some of its strong performance over the past 18 months as it declined on lowered short- term margin guidance. We believe the market underappreciates the ongoing cycle recovery across Embraer’s products, which have seen their order backlog rise above pre-COVID levels. As the market is heavily focused on short-term, one-off item margin distortions, Embraer now trades at a wide discount to our estimate of its intrinsic value.

Select Portfolio Activity

The investment committee initiated new positions in Japan-based SoftBank Group and U.K-based TechnipFMC during the period.

TechnipFMC (FTI) is the product of a 2016 merger between Technip, a leading engineering, procurement and construction company (EPC), and FMC, a leading provider of subsea production and processing equipment. The rationale of the merger was to combine equipment manufacturing with engineering and construction of subsea oilfields. In 2021, the company completed a long-planned separation of its onshore EPC business, making it purely focused on offshore oilfield exploration and development.

With an over 40% market share, FTI is the industry leader in subsea systems, highly engineered capital goods that reside on the seabed producing and processing

| | |

| 2 | | Past Performance is not a guarantee of future results. |

Brandes International Equity Fund

hydrocarbons. The subsea industry has been in a multi-year slump following a decade of high oil prices. Capital expenditures (capex) among upstream oil and gas companies (FTI’s customer base) reached highs in 2014 and are estimated to be less than half of the peak levels in 2021. In addition to the collapse in capex, there has been a shift of investment to unconventional opportunities on land. The overall effect has been a sustained period of low manufacturing utilization, high price competition and distressed profitability for the subsea industry.

While a return to peak capex is unlikely, we believe a gradual increase in offshore activity is in the cards given two main factors: 1) global demand growth has been stable or growing; and 2) poor returns from onshore unconventional production over the past decade may be an indication that more capital should flow elsewhere (or oil prices need to be substantially higher). In our view, FTI is well positioned to benefit from the potentially improved offshore activity considering its industry-leading position in subsea equipment and engineering, as well as its fully integrated business model. Furthermore, we appreciate that FTI has made several investments to capitalize on its offshore development expertise and seek to benefit from a global energy transition, including subsea carbon transportation and storage, floating renewable power generation (offshore wind) and hydrogen production, storage and re-electrification.

SoftBank Group is a holding company whose primary assets include technology and wireless companies, such as internet company Alibaba, semiconductor firm Arm and wireless telecommunication company Softbank Corp, as well as its two Vision funds, which are venture capital funds that invest in technology companies. SoftBank’s stock fell at the beginning of the year due to Alibaba’s share-price decline, as well as a widening discount to its net asset value (NAV). SoftBank now trades near its largest NAV discount in its history (as of March 31).

Other major portfolio activity included the divestments of German chemical company BASF, Ireland-based building materials business CRH and Canadian uranium company Cameco, which appreciated significantly on a potentially improved uranium outlook.

Looking Forward

As of March 31, 2022, the Brandes International Equity Fund held its key overweights to communication services, health care, energy and consumer staples, while maintaining significantly lower allocations to technology and industrials than the benchmark. Geographically, we continued to have overweight positions in France and emerging markets, and underweight positions in Australia and Japan. We believe the differences between our Fund and the benchmark continue to make it an attractive complement to index-tracking or growth-oriented alternatives.

Value stocks (as measured by the MSCI EAFE Value Index) outperformed the broader market (MSCI EAFE Index) noticeably at the start of the year when rising inflation and interest rates caused the valuations of many high-flying growth companies to compress.

3

Brandes International Equity Fund

Geopolitical developments in the second half of the quarter (i.e., the Russia/Ukraine conflict) have exacerbated inflationary trends and triggered concerns about an economic slowdown, raising the potential for a “stagflationary” environment (low economic growth and elevated inflation).

In the beginning of 2022, we were optimistic that improving economic growth and an uptick in inflation (after a decade-plus of weak growth and almost no inflation before COVID-19) would benefit value stocks—especially given the historically wide valuation discounts at which value stocks traded relative to growth (MSCI EAFE Growth Index). However, with inflation persisting and economic growth potentially slowing, we are often asked if these factors change our outlook for value stocks. While it is true that weaker growth may present a headwind for value stocks (all else being equal), it has not always been the case. In fact, two of the best periods for value versus growth were the post-Nifty Fifty era in the 1970s (during which the term “stagflation” was first widely used) and the post-tech bubble correction of the early 2000s. These periods shared common attributes that catalyzed the favorable environment for value: they were preceded by a period of elevated general market valuations and historically wide discount levels for value relative to growth.

Today, even after outperforming growth in the past 18 months, value stocks continue to trade at historically high discount levels relative to growth stocks, leading us to believe that the current environment still bodes well for value despite diminished optimism about economic growth.

We remain optimistic about the prospects of the Brandes International Equity Fund and appreciate your continued trust.

Thank you for the trust you have placed in us.

Sincerely yours,

The Brandes International Large-Cap Investment Committee

Brandes Investment Trust

Dividend Yield: Dividends per share divided by price per share.

Net Asset Value: A company’s total assets minus its liabilities, divided by the number of outstanding shares.

Nifty Fifty: A popular name in the 1960s and 70s for a group of the largest U.S. companies.

Return on Invested Capital: Net income minus dividends divided by total capital; used to assess a company’s efficiency at allocating the capital under its control to profitable investments.

Stagflation: Combination of slow economic growth and high inflation.

Diversification does not assure a profit or protect against a loss in a declining market.

Brandes International Equity Fund

Because the values of the Fund’s investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund, or the Fund could underperform other investments. The values of the Fund’s investments fluctuate in response to the activities of individual companies and general stock market and economic conditions. In addition, the performance of foreign securities depends on the political and economic environments and other overall economic conditions in the countries where the Fund invests. Emerging country markets involve greater risk and volatility than more developed markets. Some emerging markets countries may have fixed or managed currencies that are not free-floating against the U.S. dollar. Certain of these currencies have experienced, and may experience in the future, substantial fluctuations or a steady devaluation relative to the U.S. dollar. Value stocks typically are less volatile than growth stocks; however, issues of value stocks typically have a lower expected growth rate in earnings and sales than issues of growth stocks.

Please refer to the Schedule of Investments in the report for complete holdings information. Fund holdings, geographic allocations and/or sector allocations are subject to change at any time and are not considered a recommendation to buy or sell any security.

The foregoing reflects the thoughts and opinions of Brandes Investment Partners® exclusively and is subject to change without notice.

Brandes Investment Partners® is a registered trademark of Brandes Investment Partners, L.P. in the United States and Canada.

Must be preceded or accompanied by a prospectus.

Index Guide

The MSCI EAFE Index with net dividends captures large and mid cap representation of developed market countries excluding the U.S. and Canada.

The MSCI EAFE Value Index with gross dividends captures large and mid cap securities across developed market countries, excluding the United States and Canada, exhibiting value style characteristics, defined using book value to price, 12-month forward earnings to price, and dividend yield.

The MSCI EAFE Growth Index with gross dividends captures large and mid cap securities across developed market countries, excluding the United States and Canada, exhibiting growth style characteristics, defined using long-term forward earnings per share (EPS) growth rate, short-term forward EPS growth rate, current internal growth rate, long-term historical EPS growth trend, and long-term historical sales per share growth trend.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

5

Brandes International Equity Fund

One cannot invest directly in an index.

The Brandes International Equity Fund is distributed by ALPS Distributors, Inc.

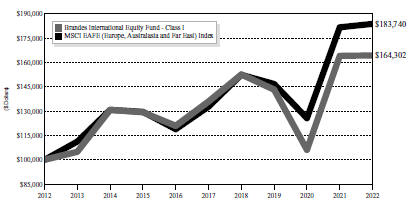

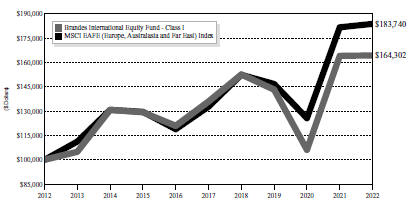

The following chart compares the value of a hypothetical $100,000 investment in the Brandes International Equity Fund – Class I from March 31, 2012 to March 31, 2022 with the value of such an investment in the MSCI EAFE (Europe, Australasia and Far East) Index for the same period.

Value of $100,000 Investment vs MSCI

EAFE (Europe, Australasia and Far East) Index (Unaudited)

| | | | | | | | | | | | | | | | |

| | | Average Annual Total Return | |

| | | Periods Ended March 31, 2022 | |

| | | One | | | Five | | | Ten | | | Since | |

| | | Year | | | Years | | | Years | | | Inception(1) | |

Brandes International Equity Fund | | | | | | | | | | | | | | | | |

Class A(2) | | | -0.07 | % | | | 3.60 | % | | | 4.87 | % | | | 6.97% | |

Class A (2) (with maximum sales charge) | | | -5.84 | % | | | 2.37 | % | | | 4.25 | % | | | 6.72% | |

Class C(3) | | | -0.55 | % | | | 2.88 | % | | | 4.23 | % | | | 6.17% | |

Class C (3) (with maximum sales charge) | | | -1.51 | % | | | 2.88 | % | | | 4.23 | % | | | 6.17% | |

Class I | | | 0.16 | % | | | 3.86 | % | | | 5.09 | % | | | 7.21% | |

Class R6(4) | | | 0.23 | % | | | 3.97 | % | | | 5.20 | % | | | 7.28% | |

MSCI EAFE (Europe, Australasia and Far East) Index | | | 1.16 | % | | | 6.72 | % | | | 6.27 | % | | | 4.96% | |

| (1) | The inception date is January 2, 1997. |

| (2) | Performance shown prior to January 31, 2011 for Class A shares reflects the performance of Class I shares adjusted to reflect Class A expenses. |

6

Brandes International Equity Fund

| (3) | Performance shown prior to January 31, 2013 for Class C shares reflects the performance of Class I shares adjusted to reflect Class C expenses. Class C shares automatically convert to Class A shares if held for 8 years. The Class C shares’ average annual total return for the 10-year period assumes that Class C shares automatically converted to Class A shares on January 1, 2021. The Class C shares’ average annual total return for the since inception period does not reflect the automatic conversion to Class A shares, as Class A shares did not yet exist 8 years after the Fund’s inception date. |

| (4) | Performance shown prior to February 1, 2016 for Class R6 shares reflects the performance of Class I shares adjusted to reflect Class R6 expenses. |

Performance data quoted represents past performance; past performance does not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800-331-2979.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Brandes Investment Partners, L.P., the Advisor, has a fee waiver arrangement in place to limit the Fund’s annual operating expenses.

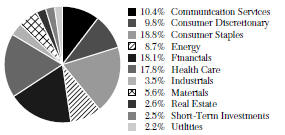

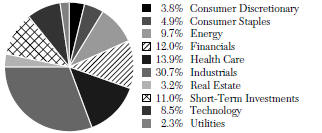

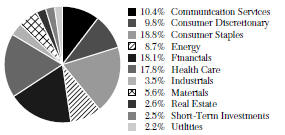

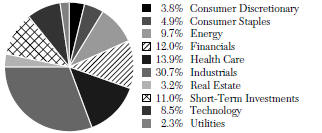

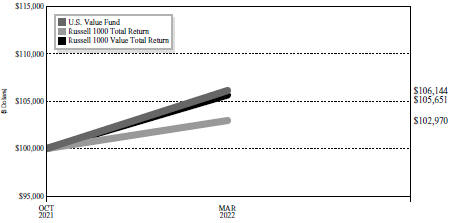

Sector Allocation as a Percentage of Total Investments as of

March 31, 2022 (Unaudited)

The sector classifications represented in the graph above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC.

7

Brandes Global Equity Fund

Dear Fellow Investor,

The net asset value of the Brandes Global Equity Fund (Class I Shares) increased 0.86% in the six months ended March 31, 2022. During the same period, the MSCI World Index increased 2.21%.

Rising energy prices benefited our oil-related holdings, including integrated oil firms Shell and BP, as well as oil field services company Halliburton. Additionally, financial firms UBS Group, Wells Fargo and AIG rose.

Other contributors included aerospace and defense company General Dynamics and several of our health care holdings, notably McKesson, Pfizer, GlaxoSmithKline and Merck.

As geopolitical concerns increased in lock step with worries about sustained increased inflation and the potential for slowing economic growth, European markets and emerging markets experienced the deepest decline. The impact was primarily led by technology and consumer discretionary companies because their valuations are materially influenced by rising interest rates and consumer companies are likely to see the largest demand impact from rising inflation. Our largest detractors included several of our consumer holdings, such as U.S. flooring company Mohawk Industries, U.K. home retailer Kingfisher, South Korean auto manufacturer Hyundai Motor and Chinese major appliance manufacturer Gree Electric.

We had no direct exposure to securities in Russia or Ukraine; while some of our holdings have indirect exposure, our overall portfolio revenue exposure is less than those in the MSCI World Index. Excluding energy-related holdings, Mohawk has the highest exposure to Russia at about 4% of total sales. The company has also confronted significant cost inflation, which we expect to blunt its short-term margins. Longer term, we believe Mohawk is well positioned and can contend with cost inflation. After its recent stock price decline, it now trades at a single digit multiple of earnings.

Other detractors included Embraer, Citigroup and Alibaba Group. Embraer saw its stock decline on its reduced short-term margin guidance. However, over the longer term, we believe the market is missing the ongoing cycle recovery across the company’s portfolio. While the market is heavily focused on short-term, one-off item margin distortions, Embraer’s order backlog has already risen above pre-COVID levels. The company is therefore trading at a wide discount to our estimate of its long-term intrinsic value.

Select Portfolio Activity

The investment committee initiated a position in U.K.-based bank NatWest, while selling our holdings in U.K-based Barclays.

NatWest, formerly RBS, is the U.K.’s fourth-largest bank. Since its government bailout during the financial crisis, the company has pursued its turnaround to become a financial institution focused on retail and commercial banking. The bank has de-risked its balance sheet, built capital and focused on reducing costs. The U.K. government still owns just over half of its outstanding shares, but NatWest has targeted fully exiting its majority government ownership over the next three to four years. Through its

| | |

| 8 | | Past Performance is not a guarantee of future results. |

Brandes Global Equity Fund

simplified positioning, we believe NatWest could benefit from a rise in interest rates as it is likely the most interest rate-sensitive of the U.K.-listed banks.

NatWest trades at what we believe to be an attractive valuation of less than 80% of tangible book, and a single digit multiple of earnings that have not yet been materially affected by increasing interest rates. In our opinion, it offers a very strong capital position, has plans to distribute about 15 to 20% of its current market cap to shareholders over the next few years and currently offers a 7% dividend yield.

We therefore decided to sell our stake in Barclays, which has tended to be less rate sensitive and more complex given its corporate and investment banking exposure, and bought a position in NatWest.

The investment committee also added China-based sportswear retailer Topsports Holdings International to the Fund, while divesting Mexican beverage firm Fomento Economico Mexicano(FEMSA) and U.S. food products company Ingredion as they reached our estimates of their intrinsic value.

The investment committee bought Ingredion during the market downturn of early 2020. The company’s share price came under pressure due to concerns around global trade, as well as the risk of a significant recession as COVID-19 began to spread globally. However, we thought Ingredion offered an attractive long-term opportunity as it had exposure to the growing specialty ingredients market and at its valuation, it also offered a significant margin of safety. Over our holding period, the company has executed well and its share price climbed significantly in 2021. When it reached our estimate of its intrinsic value, we divested.

Looking Forward

Value stocks (as measured by the MSCI World Value Index) outperformed the broader market (MSCI World Index) noticeably at the start of the year when rising inflation and interest rates caused many high-flying growth company valuations to compress. Geopolitical developments in the second half of the quarter (i.e., the invasion of Ukraine) have exacerbated inflationary trends and increased worries about a slowdown in growth, raising the potential for a “stagflationary” environment (low economic growth and elevated inflation).

Heading into 2022, we were optimistic that improving economic growth and an uptick in inflation (after a decade-plus of weak growth and almost no inflation before COVID-19) would benefit value stocks—especially against the wide valuation discounts value stocks traded at relative to growth. With inflation persisting and growth potentially slowing, we are often asked if these factors change our outlook for value stocks. Weaker growth may be a headwind for value stocks all else being equal, but that has rarely been the case. In fact, two of the best periods for value versus growth were in the 1970s post-“Nifty Fifty” era (during which the term “stagflation” was first widely used) and the post-tech bubble correction of the early 2000s.

The common factors of these two periods resulting in highly favorable value environments were: markets were in a state of elevated valuations and the spread

9

Brandes Global Equity Fund

between value and growth was at historically wide levels. The 1970s experienced one of the strongest value performance relative to growth of any decade in the Ken French Data Library (data from 1930 to 2020)1—and it was a period of weak real U.S. GDP (gross domestic product) growth and elevated U.S. inflation. However, and significantly for our analysis, it was preceded by a wide divergence between value and growth stock valuations—just like today. The tailwinds for value that were driving relative returns earlier this year still appear evident to us. Valuation spreads are almost as wide as they have ever been, and we are as bullish about value as we have been for more than a decade.

From an industry/sector standpoint, the Fund’s largest relative overweight positions remained in three main areas. These are: the economically sensitive financials and energy sector, and the more defensive, but (from our perspective) meaningfully undervalued, health care sector. Besides many of the attractive defensive and high-quality characteristics of many of our health care holdings, some also show potential for a cyclical rebound from a pick-up in demand for elective procedures, which had been restricted during the pandemic. We expect our financial holdings to benefit from an increase in interest rates, which is finally starting to occur and will affect their net interest margins.

Our most significant underweights were in technology, consumer staples, and communication services, which appear generally expensive to us, excluding a few specific value opportunities. These areas include several appealingly priced companies that have exposure to robust secular trends, such as 5G, AI, and fintech. They include semiconductor companies, like Samsung and SK Hynix, which trade at much more attractive valuations than a company like Nvidia, yet should benefit from the growth in artificial intelligence and the Internet of Things proliferation. Additionally, instead of holding fintech darling Square (now called Block), whose high valuation reflects market admiration, we invested in Fiserv, which owns Square competitor, Clover, and trades at much more appealing valuation levels.

We are also being careful with our exposure to companies that may be hurt by continued inflation. Generally, these include businesses with low margins, low returns on equity, low pricing power, or high labor cost, as well as those with balance sheet leverage.

From a country/region perspective, we remained overweight in the United Kingdom, France and emerging markets; we were underweight in the United States and Japan.

Looking ahead for the remainder of this year and beyond, we remain optimistic about the prospects for the Global Equity Fund given its history of outperforming the MSCI World Value Index during periods of strong value performance. Furthermore, we are encouraged by the potential for earnings recoveries among our holdings, as well as their attractive valuation discounts relative to growth stocks and the broad market.

10

Brandes Global Equity Fund

We believe the differences between the Fund and the broader market continue to make it an intelligent complement to index-tracking or growth-oriented alternatives. We remain excited about the Fund’s potential, and we thank you for the trust you have placed in us.

Sincerely yours,

The Brandes Global Large-Cap Investment Committee

Brandes Investment Trust

1Dec. 31, 1929 to Dec. 31, 2019. Based on the Ken French Data Library. Value stocks represented by the cheapest quintile of the universe – all listed NYSE, AMEX, and Nasdaq stocks – on a book to price basis, relative to growth stocks represented by the most expensive quintile of the universe on a book to price basis.

Dividend Yield: Dividends per share divided by price per share.

Margin of Safety: The discount of a security’s market price to what the firm believes is the intrinsic value of that security.

Market Capitalization (Cap): The number of common shares outstanding multiplied by the current market price per common share.

Nifty Fifty: A popular name in the 1960s and ‘70s for a group of the largest U.S. companies.

Return on Equity: Net income divided by shareholder’s equity.

Stagflation: Combination of slow economic growth and high inflation.

Tangible Book Value: Book value minus intangible assets (e.g., goodwill).

Yield: Annual income from the investment (dividend, interest, etc.) divided by the current market price of the investment.

Diversification does not assure a profit or protect against a loss in a declining market.

Because the values of the Fund’s investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund, or the Fund could underperform other investments. The values of the Fund’s investments fluctuate in response to the activities of individual companies and general stock market and economic conditions. In addition, the performance of foreign securities depends on the political and economic environments and other overall economic conditions in the countries where the Fund invests. Emerging country markets involve greater risk and volatility than more developed markets. Some emerging markets countries may have fixed or managed currencies that are not free-floating against the U.S. dollar. Certain of these currencies have experienced, and may experience in the future, substantial fluctuations or a steady devaluation relative to the U.S. dollar. Value stocks typically are less volatile than growth stocks; however, issues of value stocks typically have a lower expected growth rate in earnings and sales than issues of growth stocks.

11

Brandes Global Equity Fund

Please refer to the Schedule of Investments in the report for complete holdings information. Fund holdings, geographic allocations and/or sector allocations are subject to change at any time and are not considered a recommendation to buy or sell any security.

The foregoing reflects the thoughts and opinions of Brandes Investment Partners® exclusively and is subject to change without notice.

Brandes Investment Partners® is a registered trademark of Brandes Investment Partners, L.P. in the United States and Canada.

Must be preceded or accompanied by a prospectus.

Index Guide

The MSCI World Index with net dividends captures large and mid cap representation of developed markets.

The MSCI World Value Index with gross dividends captures large and mid cap securities across developed market countries exhibiting value style characteristics, defined using book value to price, 12-month forward earnings to price, and dividend yield.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

One cannot invest directly in an index.

The Brandes Global Equity Fund is distributed by ALPS Distributors, Inc.

12

Brandes Global Equity Fund

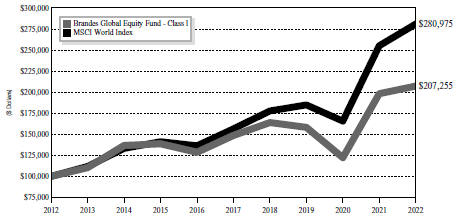

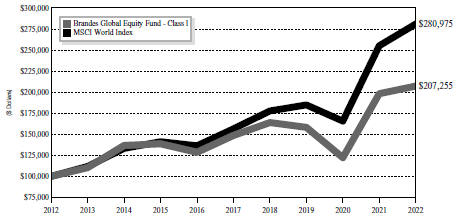

The following chart compares the value of a hypothetical $100,000 investment in the Brandes Global Equity Fund – Class I from March 31, 2012 to March 31, 2022 with the value of such an investment in the MSCI World Index for the same period.

Value of $100,000 Investment vs MSCI

World Index (Unaudited)

| | | | | | | | | | | | | | | | |

| | | Average Annual Total Return

Periods Ended March 31, 2022 | |

| | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception(1) | |

Brandes Global Equity Fund | | | | | | | | | | | | | | | | |

Class A (2) | | | 4.31 | % | | | 6.62 | % | | | 7.29 | % | | | 6.93% | |

Class A (2) (with maximum sales charge) | | | -1.68 | % | | | 5.36 | % | | | 6.66 | % | | | 6.46% | |

Class C(3) | | | 3.54 | % | | | 5.83 | % | | | 6.66 | % | | | 6.11% | |

Class C (3) (with maximum sales charge) | | | 2.56 | % | | | 5.83 | % | | | 6.66 | % | | | 6.11% | |

Class I | | | 4.56 | % | | | 6.89 | % | | | 7.56 | % | | | 7.17% | |

MSCI World Index | | | 10.12 | % | | | 12.42 | % | | | 10.88 | % | | | 10.21% | |

| (1) | The inception date is October 6, 2008. |

| (2) | Performance shown prior to January 31, 2011 for Class A shares reflects the performance of Class I shares adjusted to reflect Class A expenses. |

| (3) | Performance shown prior to January 31, 2013 for Class C shares reflects the performance of Class I shares adjusted to reflect Class C expenses. Class C shares automatically convert to Class A shares if held for 8 years. The Class C shares’ average annual total return for the 10-year period assumes that Class C shares automatically converted to Class A shares on January 1, 2021. The Class C shares’ average annual total return for the since inception period does not reflect the automatic conversion to Class A shares. |

Performance data quoted represents past performance; past performance does not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the

13

Brandes Global Equity Fund

performance quoted. Performance data current to the most recent month end may be obtained by calling 800-331-2979.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Brandes Investment Partners, L.P., the Advisor, has a fee waiver arrangement in place to limit the Fund’s annual operating expenses.

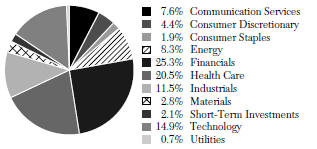

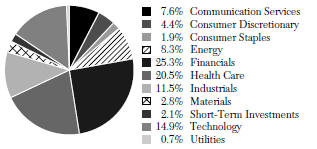

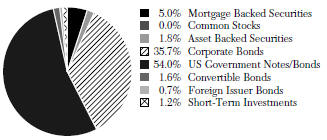

Sector Allocation as a Percentage of Total Investments as of

March 31, 2022 (Unaudited)

The sector classifications represented in the graph above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC.

14

Brandes Emerging Markets Value Fund

Dear Fellow Investor,

The net asset value of the Brandes Emerging Markets Value Fund (Class I Shares) declined 11.23% in the six months ended March 31, 2022. During the same period, the MSCI Emerging Markets Index declined 8.20%.

At the onset, we are deeply saddened by the loss of life and the disruption being forced upon the people of Ukraine. Our thoughts continue to be with the people of Ukraine, as well as those in Russia that are advocating for peace. The events that have unfolded since the start of the Russian invasion of Ukraine in February have significantly elevated the risks and uncertainties associated with investments in Russian securities. The most significant detractors in the Fund during the period were our holdings domiciled in Russia, including Lukoil, Mobile TeleSystems and Sberbank.

Beyond Russia, we have also observed increased volatility within the Chinese equity market. Fresh COVID-related lockdowns and geopolitical issues (e.g., relations with Russia and Taiwan) were notable overhangs. Continued investor unease with ADRs (American depositary receipts) and overseas listings further pressured the market, along with regulatory risk on technology-related companies, property market instability, and concerns about economic growth. In mid-March, Vice Premier Liu He announced that the government would introduce policies that are expected to be favorable to the market. While the statement stabilized China’s financial markets momentarily, several of our holdings there performed poorly in recent months, most notably China Education Group, Chinasoft International, Midea and Weichai Power.

Other poor performers included Brazilian regional jet manufacturer Embraer and Mexican cement company Cemex. Embraer’s shares declined on lowered short-term margin guidance. We believe the market underappreciates the ongoing cycle recovery across Embraer’s products, which have seen their order backlog rise above pre-COVID levels. As the market is heavily focused on short-term, one-off item margin distortions, Embraer now trades at a wide discount to our estimate of its intrinsic value.

Additionally, our underweight to non-Russian commodities-oriented companies and allocation to the financials sector weighed on returns relative to the MSCI Emerging Markets Index.

Strong performers in the Fund included Brazilian holdings such as oil and gas firm Petrobras, Telefonica Brasil and wireless telecommunication services company TIM. Additionally, China based Wens Foodstuff Group saw its shares rise as strong peak-season demand led hog prices to increase materially from October 2021’s lows.

Although our overall exposure to the financials sector hurt relative returns, select bank holdings performed well. These included Bank Rakyat Indonesia, Thailand-based Bangkok Bank, Bank of the Philippine Islands, and newly added Erste Group Bank. Furthermore, the Fund’s underweight to China helped returns relative to the benchmark.

Select Portfolio Activity

| | | | |

| | | Past Performance is not a guarantee of future results. | | 15 |

Brandes Emerging Markets Value Fund

The emerging markets investment committee initiated several positions, including Erste Group Bank and LG Household & Healthcare.

Erste is a bank that we know well, having held it on multiple occasions, most recently in early 2020. While it is domiciled in Austria, the company operates throughout emerging Europe with a strong market position. Erste fell nearly 50% amid the Russia/Ukraine conflict, despite having no direct exposure to Russia, Ukraine, and Belarus. The company has performed stress-testing on its loans to account for the energy price increases and concluded there was no need for materially higher provisions, highlighting the strength of its loan portfolio.

LG Household & Health Care (LGHH) is a diversified consumer goods company based in South Korea. The company has enjoyed consistent growth, with revenues growing at a 10-year compounded rate of 13% annually (pre-pandemic) and operating profit at 18%, leading it to become South Korea’s top player in all three of its divisions: Beauty (cosmetic products), Health (health care and household products) and Refreshment (beverages).

LGHH’s flagship luxury cosmetics brand, The History of Whoo, has steadily been gaining share in the Chinese beauty market (its main market) as it benefited from the shift in consumer preferences from value to premium products, a trend that is expected to continue in the foreseeable future. Recently, however, sales have started to slow down, mainly due to the strict lockdowns in China and the related decline in the duty-free sales channel. As a result, LGHH’s shares fell over 30% in 2021.

We believe the market is applying an overly harsh scenario of permanently slower sales growth of LGHH’s cosmetic products, providing us with an opportunity to invest in a company with a solid market presence at appealing valuations. In our opinion, LGHH remains well positioned to benefit from the premiumization of China’s beauty market and from a rebound in sales as mobility restrictions ease in its main markets.

The emerging markets investment committee also took advantage of the increased volatility in China to add Topsports International Holdings to the Fund.

As China’s largest sportwear retailer, Topsports partners with international brands to sell their products through the company’s directly operated stores. Topsports’ largest and most significant partners are Nike and Adidas, two highly popular brands in China that account for nearly half of the country’s sportswear market in terms of sales. Topsports is Adidas’ largest global partner and Nike’s second-largest global partner, representing roughly half of Nike’s total sales in China.

In March 2021, Topsports’ shares reached highs after Nike reported strong sales in China, suggesting that the post-COVID demand recovery was underway. Since then, however, Topsports’ shares have declined materially on several factors:

• Short-term concerns around inventory shortages due to government-mandated production shutdowns;

• Increased geopolitical risks for Western brands selling in China;

• Tension over labor treatment in cotton-growing Xinjiang region;

16

Brandes Emerging Markets Value Fund

• Fresh lockdowns triggered by the Delta variant;

• Worries about the spillover effects of the property market downturn on consumption.

We believe these concerns have been accounted for in Topsports’ share price. Topsports is one of two Chinese sportwear companies (the other one being Pou Sheng International) with a national network of retail outlets. Over the past five years, it has outpaced its rival, achieving better topline growth and higher average operating margins. It is our view that the current manufacturing challenges will eventually subside and that Topsports is well positioned to benefit from China’s sportswear market growth, which is expected to be double-digit annually over the medium term. Furthermore, Adidas and Nike are looking to consolidate their retail partnerships, and we believe Topsports should be a beneficiary of this trend given its strong position in China and its established relationships with both brands.

Other major activity included the full sells of Thailand-based Siam Commercial Bank, India-based media company Zee Entertainment Enterprises, and Mexican beverage company Fomento Economico Mexicano (FEMSA). The committee also exited the Fund’s positions in China-based Wens Foodstuff, Argentina’s YPF and O2 Czech Republic, as well as Greece’s Hellenic Telecommunications. We exited these positions as the shares appreciated toward our estimates of their intrinsic values.

Looking Forward

As of March 31, 2022, the Fund held large sector overweights in real estate (note that we do not own any real estate holdings in China) and consumer discretionary, and key underweights to materials and financials. From a country perspective, even though Chinese companies made up the Fund’s largest allocation, we remained underweight relative to the benchmark. We also continued to be underweight India and Taiwan, while having a significant overweight to companies in Mexico, Indonesia and Brazil.

The world has changed significantly in the past couple months. With so many moving parts and ever-changing news flow, it is easy to get lost in the myriad of topical questions. It would be impossible to predict the outcomes of current world events and their impact on investment portfolios.

Looking forward, we believe the Brandes Emerging Markets Value Fund offers a diversified portfolio with exposure to the following factors:

• Post-COVID economic reopening/normalization: We believe our holdings in air travel, casino gaming and luxury retail, as well as those in China, Southeast Asia, and Latin America from a geographic standpoint, will benefit assuming the pandemic’s economic impact continues to ease.

• Inflation: While we make no attempt to forecast inflation, we believe the portfolio is well positioned for a rising inflation environment through our holdings in financials and real estate investment trusts with inflation-indexed rents, as well as high-yielding businesses. These holdings may benefit from net interest margin expansion should the

17

Brandes Emerging Markets Value Fund

yield curve steepen. Additionally, we have reduced the exposure to financial leverage among our non-financial holdings, which we believe is prudent given the potential impact of rising interest rates on the cash flows of these businesses.

• Long-term growth drivers in emerging markets: Our positions in consumer-related fields (e.g., e-commerce, food products, appliances, sportswear, cosmetics, education) provide exposure to the growing middle-class consumption in emerging markets.

We believe this positioning, combined with the Fund’s overall attractive valuation levels, bodes well for the Fund’s returns in the long term.

Sincerely yours,

The Brandes Emerging Markets Investment Committee

Brandes Investment Trust

American Depositary Receipt: A negotiable certificate issued by a U.S. depositary bank representing a specified number of shares—usually one share—of a foreign company’s stock.

Cash Flow: The amount of cash generated minus the amount of cash used by a company in a given period.

Net Interest Margin: Interest income generated by a financial institution minus the amount of interest paid to its lenders, divided by average earning assets.

Operating Margin: Operating income divided by net sales; used to measure a company’s operating efficiency.

Operating Profit: Earnings before interests and taxes.

Yield Curve: A yield curve shows the relation between the yield on debt instruments (i.e., annual income from the investment, divided by the current market price of the investment) and their times to maturity. A typical yield curve slopes upward to reflect higher interest rates for longer maturities.

Diversification does not assure a profit or protect against a loss in a declining market.

Because the values of the Fund’s investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund, or the Fund could underperform other investments. The values of the Fund’s investments fluctuate in response to the activities of individual companies and general stock market and economic conditions. In addition, the performance of foreign securities depends on the political and economic environments and other overall economic conditions in the countries where the Fund invests. Emerging markets involve greater risk and volatility than more developed markets. Some emerging markets may have fixed or managed currencies that are not free-floating against the U.S. dollar. Certain of these currencies have experienced, and may experience in the future, substantial fluctuations or a steady devaluation relative to the U.S. dollar. Investments in small and medium capitalization companies tend to have limited liquidity and greater price volatility than investments in larger capitalization companies. Value

18

Brandes Emerging Markets Value Fund

stocks typically are less volatile than growth stocks; however, issues of value stocks typically have a lower expected growth rate in earnings and sales than issues of growth stocks.

Please refer to the Schedule of Investments in the report for complete holdings information. Fund holdings, geographic allocations and/or sector allocations are subject to change at any time and are not considered a recommendation to buy or sell any security.

The foregoing reflects the thoughts and opinions of Brandes Investment Partners® exclusively and is subject to change without notice.

Brandes Investment Partners® is a registered trademark of Brandes Investment Partners, L.P. in the United States and Canada.

Must be preceded or accompanied by a prospectus.

Index Guide

The MSCI Emerging Markets Index with net dividends captures large and mid cap representation of emerging market countries.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

One cannot invest directly in an index.

The Brandes Emerging Markets Value Fund is distributed by ALPS Distributors, Inc.

19

Brandes Emerging Markets Value Fund

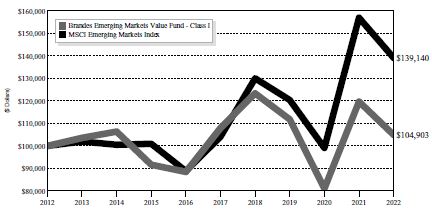

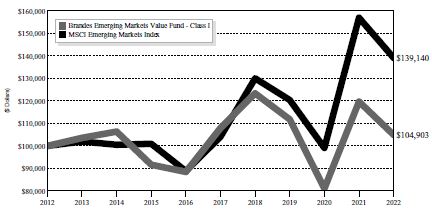

The following chart compares the value of a hypothetical $100,000 investment in the Brandes Emerging Markets Value Fund – Class I from March 31, 2012 to March 31, 2022 with the value of such an investment in the MSCI Emerging Markets Index for the same period.

Value of $100,000 Investment vs MSCI

Emerging Markets Index (Unaudited)

| | | | | | | | | | | | | | | | |

| | | Average Annual Total Return | |

| | | Periods Ended March 31, 2022(1) | |

| | | One | | | Five | | | Ten | | | Since | |

| | | Year | | | Years | | | Years | | | Inception(2) | |

Brandes Emerging Markets Value Fund | | | | | | | | | | | | | | | | |

Class A | | | -12.39 | % | | | -0.78 | % | | | 0.25 | % | | | 5.89% | |

Class A (with maximum sales charge) | | | -17.42 | % | | | -1.94 | % | | | -0.34 | % | | | 5.65% | |

Class C(3) | | | -12.70 | % | | | -1.43 | % | | | -0.34 | % | | | 5.08% | |

Class C (3) (with maximum sales charge) | | | -13.55 | % | | | -1.43 | % | | | -0.34 | % | | | 5.08% | |

Class I | | | -12.35 | % | | | -0.58 | % | | | 0.48 | % | | | 6.11% | |

Class R6(4) | | | -12.18 | % | | | -0.42 | % | | | 0.60 | % | | | 6.20% | |

MSCI Emerging Markets Index | | | -11.37 | % | | | 5.98 | % | | | 3.36 | % | | | 5.93% | |

| (1) | Prior to January 31, 2011, the Advisor managed a private investment fund with an investment objective, investment policies and strategies that were, in all material respects, equivalent to those of the Brandes Emerging Markets Value Fund. The performance information shown for the Class I shares for periods before January 31, 2011 is that of the private investment fund and reflects the net expenses of the private investment fund. The performance of the private investment fund prior to January 31, 2011 is based on a calculation method that is different from the standardized calculation method prescribed by the SEC. The performance information shown for the Class A shares has been adjusted to reflect the differences in the net expense ratios between the Class I and A shares. The private investment fund was not registered under the Investment Company Act of 1940 (“1940 Act”) and was not subject to certain investment limitations, diversification requirements, and other restrictions imposed by the 1940 Act and the Internal Revenue Code of 1986, which, if applicable, may have adversely affected its performance. |

20

Brandes Emerging Markets Value Fund

| (2) | The inception date is August 20, 1996. |

| (3) | Performance shown prior to January 31, 2013 for Class C shares reflects the performance of Class I shares adjusted to reflect Class C expenses. Class C shares automatically convert to Class A shares if held for 8 years. The Class C shares’ average annual total return for the 10-year period assumes that Class C shares automatically converted to Class A shares on January 1, 2021. The Class C shares’ average annual total return for the since inception period does not reflect the automatic conversion to Class A shares, as Class A shares did not yet exist 8 years after the Fund’s inception date. |

| (4) | Performance shown prior to July 11, 2016 for Class R6 shares reflects the performance of Class I shares adjusted to reflect Class R6 expenses. |

Performance data quoted represents past performance; past performance does not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800-331-2979.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Brandes Investment Partners, L.P., the Advisor, has a fee waiver arrangement in place to limit the Fund’s annual operating expenses.

Sector Allocation as a Percentage of Total Investments as of

March 31, 2022 (Unaudited)

The sector classifications represented in the graph above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC.

21

Brandes International Small Cap Equity Fund

Dear Fellow Investor,

The net asset value of the Brandes International Small Cap Equity Fund (Class I Shares) fell 10.21% in the six months ended March 31, 2022. During the same period, the S&P Developed Ex-U.S. SmallCap Index fell 8.52%.

From a country perspective, holdings in Canada contributed meaningfully to performance, led by Dorel Industries and uranium companies Cameco Corporation and Sprott Physical Uranium Trust, which both benefited from a sharp increase in commodity prices.

Other notable positive contributors included South Korean gas utility Samchully,U.K. energy equipment company TechnipFMC, Mexican real estate investment trust Fibra Uno,and Japan Petroleum Exploration. Additionally, Italian defense company Leonardo SpA, a new addition in the first quarter, saw its share price increase on the prospect for higher defense spending in Europe.

European markets and emerging markets experienced the steepest decline in the period as geopolitical concerns related to the Russia/Ukraine conflict exacerbated inflationary trends and triggered worries about an economic slowdown. The Fund does not have any direct investments in Russia or Ukraine. While select holdings do have some indirect exposure to the countries, our overall portfolio revenue exposure is less than that of the S&P Developed ex-U.S. SmallCap Index.

Among the Fund’s largest detractors were several of our consumer and construction materials-related holdings, led by French catering services provider Elior Group and U.K. retailer Marks & Spencer, as well as cement companies Buzzi Unicem (Italy), Cemex (Mexico) and Vicat (France). Elior suspended its earnings guidance in January, citing a lack of visibility regarding the impact of the strict health protocols implemented to stifle the Omicron COVID variant. In early March, the company’s chief executive officer unexpectedly resigned. We believe that these challenges are temporary in nature and that the company warrants a continued inclusion in the Fund’s portfolio.

Other detractors included industrial holdings Embraer and De La Rue,German health care equipment supplier Draegerwerk, and Hong Kong-based payment services provider PAX Global Technology Limited.

Brazilian jet manufacturer Embraer gave back some of its strong performance over the past 18 months as it declined on lowered short-term margin guidance. We believe the market underappreciates the ongoing cycle recovery across Embraer’s products, which have seen their order backlog rise above pre-COVID levels. As the market is heavily focused on short-term, one-off item margin distortions, Embraer now trades at a wide discount to our estimate of its intrinsic value.

Select Portfolio Activity

The small-cap investment committee initiated positions in Hong Kong-based YueYuen, U.K. defense technology company QinetiQ, Ireland-based food products company Greencore Group, Japanese entertainment business DeNA,

| | | | |

| 22 | | Past Performance is not a guarantee of future results. | | |

Brandes International Small Cap Equity Fund

U.K.-domiciled energy equipment company TechnipFMC, as well as the aforementioned Leonardo SpA.

Founded in 1988, Yue Yuen is the world’s largest manufacturer of branded athletic and casual footwear, producing nearly 250 million pairs of shoes in the fiscal year 2020 as an original equipment manufacturer for major brands such as Nike and Adidas, which together account for almost two-thirds of Yue Yuen’s sales, as well as Reebok, Asics, New Balance, and Puma. The company also has a majority stake in sportswear (athletic shoes and apparel) retailer Pou Sheng.

We see significant value potential in Yue Yuen. While volume growth has been muted in recent years as key customers have been working to reduce inventories and demanding shorter lead times, Yue Yuen has maintained a strong pricing power which is attributable to increased popularity of athletic shoes and a style shift toward more complex designs. Provided COVID-related conditions continue to improve, the industry is expected to grow at mid-single digits. Furthermore, we believe Yue Yuen is well positioned to expand its operating margins, which have been negatively affected by forced factory closures and occupancy reductions (for social distancing). Although the timing of the recovery is impossible to predict, it is our opinion that Yue Yuen’s current share price is overly discounted, providing us with what we consider a compelling entry point for an investment.

TechnipFMC (FTI) is the product of a 2016 merger between Technip, a leading engineering, procurement and construction company (EPC), and FMC, a leading provider of subsea production and processing equipment. The rationale of the merger was to combine equipment manufacturing with engineering and construction of subsea oilfields. Earlier this year, the company completed a long-planned separation of its onshore EPC business, making it purely focused on offshore oilfield exploration and development.

With an over 40% market share, FTI is the industry leader in subsea systems, highly engineered capital goods that reside on the seabed producing and processing hydrocarbons. The subsea industry has been in a multi-year slump following a decade of high oil prices. Capital expenditures (capex) among upstream oil and gas companies (FTI’s customer base) reached highs in 2014 and are estimated to be less than half of the peak levels in 2021. In addition to the collapse in capex, there has been a shift of investment to unconventional opportunities on land. The overall effect has been a sustained period of low manufacturing utilization, high price competition and distressed profitability for the subsea industry.

While a return to peak capex is unlikely, we believe a gradual increase in offshore activity is in the cards given two main factors: 1) global demand growth has been stable or growing; and 2) poor returns from onshore unconventional production over the past decade may be an indication that more capital should flow elsewhere (or oil prices need to be substantially higher). In our view, FTI is well positioned to benefit from the potentially improved offshore activity considering its industry-leading position in subsea equipment and engineering, as well as its fully integrated business model.

23

Brandes International Small Cap Equity Fund

Furthermore, we appreciate that FTI has made several investments to capitalize on its offshore development expertise and seek to benefit from a global energy transition, including subsea carbon transportation and storage, floating renewable power generation (offshore wind) and hydrogen production, storage and re-electrification.

During the period, the investment committee exited several positions in Spain, namely Atresmedia, Bankinter, CaixaBank and Linea Directa Aseguradora. Other full sells were Canadian Corby Spirit and Wine and insurer E-L Financial, utility First Philippine Holdings, and South Korea-based Lotte Confectionary.

Looking Forward

Value stocks (as measured by the S&P Developed ex-U.S. SmallCap Value Index) outperformed the broader market (S&P Developed ex-U.S. SmallCap Index) noticeably at the start of the year when rising inflation and interest rates caused the valuations of many high-flying growth companies to compress. Geopolitical developments in the second half of the quarter (i.e., the Russia/Ukraine conflict) have exacerbated inflationary trends and triggered concerns about an economic slowdown, raising the potential for a “stagflationary” environment (low economic growth and elevated inflation).

In the beginning of 2022, we were optimistic that improving economic growth and an uptick in inflation (after a decade-plus of weak growth and almost no inflation before COVID-19) would benefit value stocks—especially given the historically wide valuation discounts at which value stocks traded relative to growth (S&P Developed ex-U.S. SmallCap Growth Index). However, with inflation persisting and economic growth potentially slowing, we are often asked if these factors change our outlook for value stocks. While it is true that weaker growth may present a headwind for value stocks (all else being equal), it is not always the case. In fact, two of the best periods for value versus growth were the post-Nifty Fifty era in the 1970s (during which the term “stagflation” was first widely used) and the post-tech bubble correction of the early 2000s. These periods shared common attributes that catalyzed the favorable environment for value: they were preceded by a period of elevated general market valuations and historically wide discount levels for value relative to growth.

In terms of portfolio positioning, there were no wholesale changes in the period. From a sector standpoint, the Fund held its largest weights in industrials (although underweight relative to the benchmark), consumer staples and financials. While returns for the industrials sector were negative in the quarter, the Fund’s weighting to industrials increased slightly with the additions of defense companies Leonardo SpA and QinetiQ. The Fund maintained underweights in technology and materials, and continued to have significant exposure to Japan, the U.K., and emerging markets.

We remain excited about the prospects of the Brandes International Small Cap Equity Fund and appreciate your continued trust.

24

Brandes International Small Cap Equity Fund

Sincerely yours,

The Brandes Small-Cap Investment Committee

Brandes Investment Trust

Dividend Yield: Dividends per share divided by price per share.

Nifty Fifty: A popular name in the 1960s and 70s for a group of the largest US companies.

Operating Margin: Operating income divided by net sales; used to measure a company’s operating efficiency.

Stagflation: Combination of slow economic growth and high inflation.

Diversification does not assure a profit or protect against a loss in a declining market.

Because the values of the Fund’s investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund, or the Fund could underperform other investments. The values of the Fund’s investments fluctuate in response to the activities of individual companies and general stock market and economic conditions. In addition, the performance of foreign securities depends on the political and economic environments and other overall economic conditions in the countries where the Fund invests. Emerging country markets involve greater risk and volatility than more developed markets. Some emerging markets countries may have fixed or managed currencies that are not free-floating against the U.S. dollar. Certain of these currencies have experienced, and may experience in the future, substantial fluctuations or a steady devaluation relative to the U.S. dollar. Investments in small and medium capitalization companies tend to have limited liquidity and greater price volatility than investments in larger capitalization companies. Value stocks typically are less volatile than growth stocks; however, issues of value stocks typically have a lower expected growth rate in earnings and sales than issues of growth stocks.

Please refer to the Schedule of Investments in the report for complete holdings information. Fund holdings, geographic allocations and/or sector allocations are subject to change at any time and are not considered a recommendation to buy or sell any security.

The foregoing reflects the thoughts and opinions of Brandes Investment Partners® exclusively and is subject to change without notice.

Brandes Investment Partners® is a registered trademark of Brandes Investment Partners, L.P. in the United States and Canada.

Must be preceded or accompanied by a prospectus.

Index Guide

The S&P Developed Ex-U.S. SmallCap Index with net dividends measures the equity performance of small-capitalization companies from developed markets excluding the United States.

25

Brandes International Small Cap Equity Fund

The S&P Developed Ex U.S. SmallCap Value Index with net dividends measures the equity performance of small cap companies in developed markets excluding the United States, which are classified as value stocks by book value-to-price, sales-to-price, cash flow-to-price, and dividend yield.

The S&P Developed Ex-U.S. SmallCap Growth Index measures the equity performance of small cap companies in developed markets excluding the United States, which are classified as growth stocks by 5-year historical earnings per share growth, 5-year historical sales per share growth, and 5-year average annual internal growth rate.

One cannot invest directly in an index.

The Brandes International Small Cap Equity Fund is distributed by ALPS Distributors, Inc.

26

Brandes International Small Cap Equity Fund

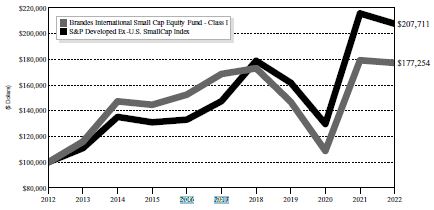

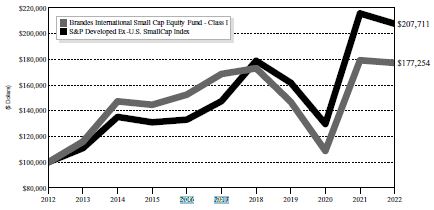

The following chart compares the value of a hypothetical $100,000 investment in the Brandes International Small Cap Fund – Class I from March 31, 2012 to March 31, 2022 with the value of such an investment in the S&P Developed Ex-U.S. SmallCap Index for the same period.

Value of $100,000 Investment vs S&P Developed

Ex-U.S. SmallCap Index (Unaudited)

| | | | | | | | | | | | | | | | |

| | | Average Annual Total Return | |

| | | Periods Ended March 31, 2022(1) | |

| | | One | | | Five | | | Ten | | | Since | |

| | | Year | | | Years | | | Years | | | Inception(2) | |

Brandes International Small Cap Equity Fund | | | | | | | | | | | | | | | | |

Class A | | | -1.28 | % | | | 0.80 | % | | | 5.66 | % | | | 8.19% | |

Class A (with maximum sales charge) | | | -6.95 | % | | | -0.38 | % | | | 5.04 | % | | | 7.94% | |

Class C(3) | | | -1.52 | % | | | 0.15 | % | | | 5.05 | % | | | 7.40% | |

Class C (3) (with maximum sales charge) | | | -2.45 | % | | | 0.15 | % | | | 5.05 | % | | | 7.40% | |

Class I | | | -1.14 | % | | | 1.00 | % | | | 5.89 | % | | | 8.43% | |

Class R6(4) | | | -1.06 | % | | | 1.10 | % | | | 5.98 | % | | | 8.50% | |

S&P Developed Ex-U.S. SmallCap Index | | | -3.72 | % | | | 7.09 | % | | | 7.58 | % | | | 6.71% | |

| (1) | Prior to February 1, 2012, the Advisor managed a private investment fund with an investment objective, investment policies and strategies that were, in all material respects, equivalent to those of the Brandes International Small Cap Fund. The performance information shown for the Class I shares for periods before February 1, 2012 is that of the private investment fund and reflects the net expenses of the private investment fund. The performance of the private investment fund prior to February 1, 2012 is based on a calculation method that is different from the standardized calculation method prescribed by the SEC. The performance information shown for the Class A shares has been adjusted to reflect the differences in the net expense ratios between the Class I and A shares. The private investment fund was not registered under the Investment Company Act of 1940 (“1940 Act”) and was not subject to certain investment |

Brandes International Small Cap Equity Fund

| | limitations, diversification requirements, and other restrictions imposed by the 1940 Act and the Internal Revenue Code of 1986, which, if applicable, may have adversely affected its performance. |

| (2) | The inception date is August 19, 1996. |

| (3) | Performance shown prior to January 31, 2013 for Class C shares reflects the performance of Class I shares adjusted to reflect Class C expenses. Class C shares automatically convert to Class A shares if held for 8 years. The Class C shares’ average annual total return for the 10-year period assumes that Class C shares automatically converted to Class A shares on January 1, 2021. The Class C shares’ average annual total return for the since inception period does not reflect the automatic conversion to Class A shares, as Class A shares did not yet exist 8 years after the Fund’s inception date. |

| (4) | Performance shown prior to June 27, 2016 for Class R6 shares reflects the performance of Class I shares adjusted to reflect Class R6 expenses. |

Performance data quoted represents past performance; past performance does not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800-331-2979.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Brandes Investment Partners, L.P., the Advisor, has a fee waiver arrangement in place to limit the Fund’s annual operating expenses.

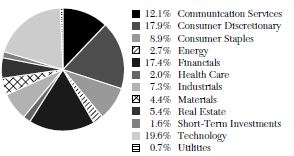

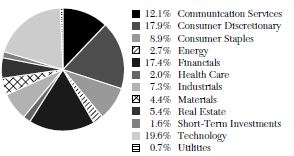

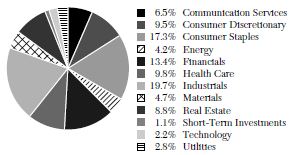

Sector Allocation as a Percentage of Total Investments as of

March 31, 2022 (Unaudited)

The sector classifications represented in the graph above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC.

28

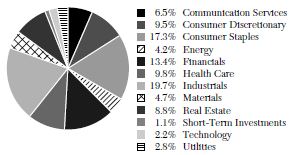

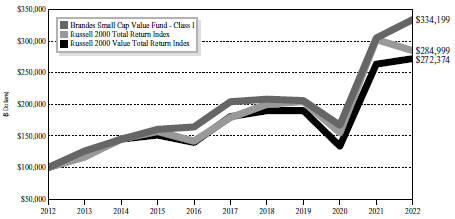

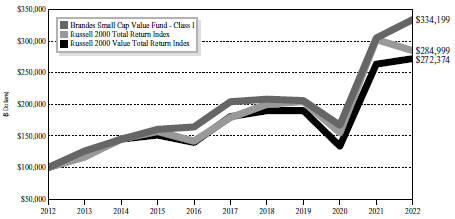

Brandes Small Cap Value Fund

Dear Fellow Investor,

The net asset value of the Brandes Small Cap Value Fund (Class I Shares) rose 2.58% in the six months ended March 31, 2022. During the same period, the Russell 2000 Index fell 5.55%.

Given the recent sharp increase in commodity prices, the strongest performers were companies that directly benefitted from that increase. Oil- and gas-related companies performed exceptionally well, led by Dril-Quip, Helmerich & Payne, Chesapeake Energy and Halliburton. Uranium company Sprott Physical Uranium Trust also performed well.

Other strong contributors included Canadian household durables manufacturer Dorel Industries, machinery business Flowserve, professional services companies Kelly Services and Science Applications International (SAIC).

As geopolitical concerns increased in lock step with worries about inflation and the potential for “stagflation,” the broad U.S. small cap market (as measured by the Russell 2000 Index) declined. The impact was primarily led by technology companies because their valuations tend to be materially influenced by rising interest rates. For the Fund, major detractors included communications equipment companies Ribbon Communications and NETGEAR.

Other detractors included holdings in the industrials sector, namely aircraft manufacturer Embraer, vacuum and heat transfer equipment manufacturer Graham Corporation and Orion Group. Embraer saw its stock decline on its reduced short-term margin guidance. However, over the longer term, we believe the market is missing the ongoing cycle recovery across the company’s portfolio. While the market is heavily focused on short-term, one-off item margin distortions, Embraer’s order backlog has already risen above pre-COVID levels. The company is trading at a wide discount to our estimate of its long-term intrinsic value, and we added to our position.

Select Portfolio Activity

We sold our stakes in Varex Imaging Corporation, Utah Medical Products, Halliburton and Helmerich & Payne.

During the period, the small-cap investment committee initiated positions in Kelly Services, Science Applications International Corporation, office furniture company Kimball International, Ribbon Communications, commercial services & supplies provider Steelcase, and machinery business Flowserve. We also took advantage of share price weakness and added to our investments in consumer products company Edgewell Personal Care, computer networking company NETGEAR.

Founded in 1946, Kelly Services has evolved from a U.S.-based company concentrating primarily on traditional office staffing into a global workforce solutions provider. Kelly Services is the fourth-largest staffing company in the U.S. Most of its operations are still derived from lower-end office services, education, contact center, light industrial and

| | | | |

| | | Past Performance is not a guarantee of future results. | | 29 |

Brandes Small Cap Value Fund

electronic assembly staffing. It has also been attempting to expand into more complex areas and claims to have a unique talent supply chain management approach to help many of the world’s largest companies plan for and manage their workforces. Those areas involve outsourcing, consulting, recruitment, career transition and vendor management services.

Kelly Services had begun to recover from the unemployment peak (revenues and unemployment have typically been inversely related) caused by COVID-19 and had proceeded with its plan to expand into higher-margin, specialty businesses. However, the share price was down in the second half of 2021 and early 2022, likely due to COVID spikes derailing the path to a more normal business environment. We believe this offered an opportunity to purchase one of the top players in the professional services industry trading at a discount to tangible book value with a strong net cash balance sheet, enabling it to weather economic volatility.

Science Applications International Corporation is the fifth-largest government IT services contractor and operates a capital-light business model that has generated strong free cash flow. We believe that SAIC trades at an attractive valuation and should continue to be a defensive business with at least low single-digit organic growth driven by greater alignment with budget priorities of the defense and civilian agencies. Continued solid free cash flow generation would allow it to deleverage its balance sheet over the next few years, and it also has a track record of returning some excess free cash flow to shareholders via buybacks and dividends.

Under the name of a predecessor entity, Flowserve was founded in 1912. Today, the firm develops and manufactures precision-engineered equipment integral to the movement, control and protection of the flow of materials in critical processes and also provides aftermarket services for these complex systems. Flowserve has underperformed during the past year due to the cyclical aspects of its business; recent results were also hampered by supply chain issues affecting many businesses around the world. However, we believe these challenges are temporary and have created a buying opportunity.

Looking Forward

Value stocks (as measured by the Russell 2000 Value Index) outperformed the broader market (Russell 2000 Index) noticeably at the start of the year when rising inflation and interest rates caused many high-flying growth company valuations to compress. Geopolitical developments in the second half of the quarter (i.e., the invasion of Ukraine) have exacerbated inflationary trends and increased worries about a slowdown in growth, raising the potential for a “stagflationary” environment (low economic growth and elevated inflation).

In the beginning of 2022, we were optimistic that improving economic growth and an uptick in inflation (after a decade-plus of weak growth and almost no inflation before COVID-19) would benefit value stocks—especially against the preferable valuation

30

Brandes Small Cap Value Fund

discounts value stocks traded at relative to growth. With inflation persisting and growth potentially slowing, we are often asked if these factors change our outlook for value stocks. Weaker growth may be a headwind for value stocks all else being equal, but that has rarely been the case. In fact, two of the best periods for value versus growth were the post-Nifty Fifty era in the 1970s (during which the term “stagflation” was first widely used) and the post-tech bubble correction of the early 2000s. The common factors of these two periods resulting in highly favorable value environments were: markets were in a state of elevated valuations and the spread between value and growth was at historical levels.

From a positioning standpoint, our largest sector overweights were in industrials and energy, and we continued to find value in health care companies, although we are underweight relative to the Russell 2000 Index. We are markedly underweight companies in the financials, real estate, information technology and consumer discretionary sectors.

In our opinion, the differences between the Brandes Small Cap Value Fund and the broader market continue to make it an attractive complement to other small-cap offerings. The Fund exhibits lower valuations than the Russell 2000 Index. We believe our holdings have strong balance sheets, compelling growth prospects and are able to generate durable free cash flow. Compared with the Russell 2000 Value Index, the Fund has significantly less exposure to financials and real estate.

As always, we appreciate the trust you have placed in us.

Sincerely yours,

The Brandes Small-Cap Investment Committee

Brandes Investment Trust

Book Value: Assets minus liabilities. Also known as shareholders’ equity.

Cash Flow: The amount of cash generated minus the amount of cash used by a company in a given period.

Free Cash Flow: Total cash flow from operations less capital expenditures.

Forward Price/Earnings: Price per share divided by earnings per share expected over the next 12 months.

Net Cash: Total cash minus total debt.

Nifty Fifty: A popular name in the 1960s and ‘70s for a group of the largest U.S. companies.

Stagflation: Combination of slow economic growth and high inflation.

Tangible Book Value: Book value minus intangible assets (e.g., goodwill).

Diversification does not assure a profit or protect against a loss in a declining market.

31

Brandes Small Cap Value Fund

Because the values of the Fund’s investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund, or the Fund could underperform other investments. The values of the Fund’s investments fluctuate in response to the activities of individual companies and general stock market and economic conditions. Investments in small and medium capitalization companies tend to have limited liquidity and greater price volatility than investments in larger capitalization companies. Value stocks typically are less volatile than growth stocks; however, issues of value stocks typically have a lower expected growth rate in earnings and sales than issues of growth stocks.

Please refer to the Schedule of Investments in the report for complete holdings information. Fund holdings, geographic allocations and/or sector allocations are subject to change at any time and are not considered a recommendation to buy or sell any security.

The foregoing reflects the thoughts and opinions of Brandes Investment Partners® exclusively and is subject to change without notice.

Brandes Investment Partners® is a registered trademark of Brandes Investment Partners, L.P. in the United States and Canada.

Must be preceded or accompanied by a prospectus.

Index Guide

The Russell 2000 Index with gross dividends measures the performance of the small cap segment of the U.S. equity universe.

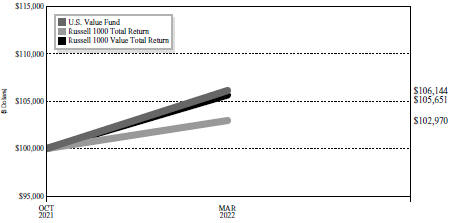

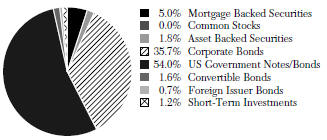

The Russell 2000 Value Index with gross dividends measures performance of the small cap value segment of the U.S. equity universe. Securities are categorized as growth or value based on their relative book-to-price ratios, historical sales growth, and expected earnings growth.