UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-08614

Brandes Investment Trust

(Exact name of registrant as specified in charter)

11988 El Camino Real, Suite 600

San Diego, CA 92130

(Address of principal executive offices) (Zip code)

Lea Anne Copenhefer

Morgan, Lewis & Bockius LLP

One Federal Street

Boston, MA 02110-1726

(Name and address of agent for service)

800-331-2979

Registrant’s telephone number, including area code

Date of fiscal year end: September 30, 2019

Date of reporting period: March 31, 2019

Item 1. Reports to Stockholders.

SEMI-ANNUAL REPORT INTERNATIONAL EQUITY FUND GLOBAL EQUITY FUND GLOBAL EQUITY INCOME FUND GLOBAL OPPORTUNITIES VALUE FUND EMERGING MARKETS VALUE FUND INTERNATIONAL SMALL CAP EQUITY FUND SMALL CAP VALUE FUND CORE PLUS FIXED INCOME FUND For the six months ended March 31, 2019 Beginning in January 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (http://www.brandesfunds.com/literature.html), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker-dealer or a bank) or, if you are a direct investor, by calling 1-800-395-3807, sending an e-mail request to info@brandesfunds.com, or by enrolling at http://www.brandesfunds.com/literature.html. You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 1-800-395-3807 or send an email request to info@brandesfunds.com to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account with that intermediary if you invest through your financial intermediary or all Funds held with the fund complex if you invest directly with the Funds.

Table of Contents

1

Brandes International Equity Fund

Dear Fellow Investor,

The net asset value of the Brandes International Equity Fund (Class I Shares) declined 5.03% in the six months ending March 31, 2019. For the same period, the MSCI EAFE Index fell 3.81%.

Portfolio holdings in the Diversified Telecommunication Services, Equity Real Estate Investment Trusts and Oil, Gas & Consumable Fuels industries were contributors to performance, while holdings in Capital Markets, Banks and Food & Staples Retailing detracted from returns.

Holdings in Brazil, Russia and Finland contributed to performance, while results were hampered by holdings in the United Kingdom, Switzerland and Japan.

Three of the largest individual contributors to performance were Fibra Uno Administracion SA de CV (Mexico — Equity Real Estate Investment Trusts), Telefonica Brasil SA (Brazil — Diversified Telecommunication Services) and Petroleo Brasileiro SA (Brazil — Oil, Gas & Consumable Fuels). Conversely, WPP Plc (United Kingdom — Media), Cemex SAB de CV (Mexico — Construction Materials) and UBS Group AG (Switzerland — Capital Markets) were three of the largest detractors from performance.

At the close of the period, the Fund’s largest country weights were in the United Kingdom and France, and the Fund’s largest industry weights were in Pharmaceuticals and Oil, Gas & Consumable Fuels. Please note that while macro conditions are considered when we determine valuation estimates for individual companies, our country and industry weightings are aby-product ofbottom-up stock selection, not the result oftop-down observations.

For 45 years, Brandes Investment Partners has had the same goal: Seek better-than-market returns to help you pursue your long-term investment goals. We believe steadfast adherence to our value investing approach can help us achieve this aim because it compels us to invest in companies we view as strong yet appealingly priced. We thank you for your confidence and for investing with us.

Sincerely yours,

The Brandes InternationalLarge-Cap Investment Committee

Brandes Investment Trust

Because the values of the Fund’s investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund, or the Fund could underperform other investments. The values of the Fund’s investments fluctuate in response to the activities of individual companies and general stock market and economic conditions. In addition, the performance of foreign securities depends on the political and economic environments and other overall economic conditions in the countries where the Fund invests. Emerging

2

Brandes International Equity Fund

country markets involve greater risk and volatility than more developed markets. Some emerging markets countries may have fixed or managed currencies that are not free-floating against the U.S. dollar. Certain of these currencies have experienced, and may experience in the future, substantial fluctuations or a steady devaluation relative to the U.S. dollar. Value stocks typically are less volatile than growth stocks; however, issues of value stocks typically have a lower expected growth rate in earnings and sales than issues of growth stocks.

Please refer to the Schedule of Investments in the report for complete holdings information. Fund holdings, geographic allocations and/or sector allocations are subject to change at any time and are not considered a recommendation to buy or sell any security.

The foregoing reflects the thoughts and opinions of Brandes Investment Partners® exclusively and is subject to change without notice.

Brandes Investment Partners® is a registered trademark of Brandes Investment Partners, L.P. in the United States and Canada.

Must be preceded or accompanied by a prospectus.

Index Guide

The MSCI EAFE Index with net dividends captures large and mid cap representation of developed market countries excluding the U.S. and Canada.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

One cannot invest directly in an index.

The Brandes International Equity Fund is distributed by ALPS Distributors, Inc.

3

Brandes International Equity Fund

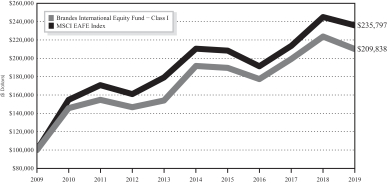

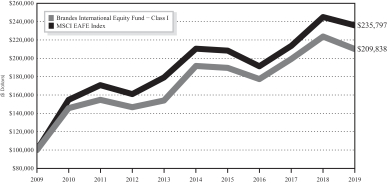

The following chart compares the value of a hypothetical $100,000 investment in the Brandes International Equity Fund – Class I from March 31, 2009 to March 31, 2019 with the value of such an investment in the MSCI EAFE (Europe, Australasia and Far East) Index for the same period.

Value of $100,000 Investment vs MSCI EAFE (Europe, Australasia and Far East) Index (Unaudited)

| | | | | | | | | | | | | | | | |

| | | Average Annual Total Return

Periods Ended March 31, 2019 | |

| | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception(1) | |

Brandes International Equity Fund | | | | | | | | | | | | | | | | |

Class A* | | | -6.31 | % | | | 1.65 | % | | | 7.50 | % | | | 7.32 | % |

Class A* (with maximum sales charge) | | | -11.68 | % | | | 0.45 | % | | | 6.87 | % | | | 7.04 | % |

Class C* | | | -7.04 | % | | | 0.88 | % | | | 6.66 | % | | | 6.50 | % |

Class C* (with maximum sales charge) | | | -7.95 | % | | | 0.88 | % | | | 6.66 | % | | | 6.50 | % |

Class I | | | -6.14 | % | | | 1.83 | % | | | 7.69 | % | | | 7.55 | % |

Class R6* | | | -5.97 | % | | | 1.96 | % | | | 7.79 | % | | | 7.63 | % |

MSCI EAFE (Europe, Australasia, and Far East) Index | | | -3.71 | % | | | 2.33 | % | | | 8.96 | % | | | 4.54 | % |

| (1) | The inception date is January 2, 1997. |

| * | Performance shown prior to January 31, 2011 for Class A shares reflects the performance of Class I shares adjusted to reflect Class A expenses. Performance shown prior to January 31, 2013 for Class C shares reflects the performance of Class I shares adjusted to reflect Class C expenses. Performance shown prior to February 1, 2016 for Class R6 shares reflects the performance of Class I shares adjusted to reflect Class R6 expenses. |

Performance data quoted represents past performance; past performance does not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or

4

Brandes International Equity Fund

higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800-331-2979.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Advisor has a fee waiver arrangement in place to limit the Fund’s annual operating expenses.

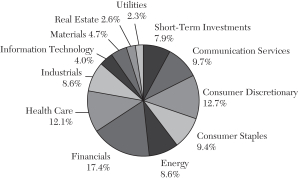

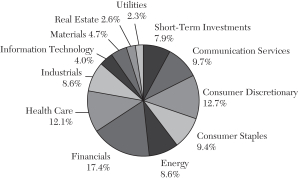

Sector Allocation as a Percentage of Total Investments as of

March 31, 2019 (Unaudited)

The sector classifications represented in the graph above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC.

5

Brandes Global Equity Fund

Dear Fellow Investor,

The net asset value of the Brandes Global Equity Fund (Class I Shares) fell 5.20% in the six months ending March 31, 2019. For the same period, the MSCI World Index declined 2.61%.

Portfolio holdings in the Pharmaceuticals, Equity Real Estate Investment Trusts and Construction Materials industries were contributors to performance, while holdings in Capital Markets, Banks and Oil, Gas & Consumable Fuels detracted from returns.

Holdings in Mexico, Ireland and Netherlands contributed to performance, while results were hampered by holdings in the United States, Switzerland and the United Kingdom.

Three of the largest individual contributors to performance were Merck & Co., Inc. (United States — Pharmaceuticals), Fibra Uno Administracion SA de CV (Mexico — Equity Real Estate Investment Trusts) and GlaxoSmithKline Plc (United Kingdom — Pharmaceuticals). Conversely, UBS Group AG (Switzerland — Capital Markets), Credit Suisse Group AG (Switzerland — Capital Markets) and Cigna Corp. (United States — Health Care Providers & Services) were three of the largest detractors from performance.

At the close of the period, the Fund’s largest country weights were in the United States and the United Kingdom, and the Fund’s largest industry weights were in Pharmaceuticals and Banks. Please note that while macro conditions are considered when we determine valuation estimates for individual companies, our country and industry weightings are aby-product ofbottom-up stock selection, not the result oftop-down observations.

Brandes Investment Partners has had the same goal since we started 45 years ago: Realize above-market gains to help you pursue your long-term investment objectives. We aim to do so by staying true to our value approach, which seeks fundamentally sound but potentially undervalued companies for the Fund. Thank you for investing with us.

Sincerely yours,

The Brandes GlobalLarge-Cap Investment Committee

Brandes Investment Trust

Because the values of the Fund’s investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund, or the Fund could underperform other investments. The values of the Fund’s investments fluctuate in response to the activities of individual companies and general stock market and economic conditions. In addition, the performance of foreign securities depends on the political and economic environments and other overall

6

Brandes Global Equity Fund

economic conditions in the countries where the Fund invests. Emerging country markets involve greater risk and volatility than more developed markets. Some emerging markets countries may have fixed or managed currencies that are not free-floating against the U.S. dollar. Certain of these currencies have experienced, and may experience in the future, substantial fluctuations or a steady devaluation relative to the U.S. dollar. Value stocks typically are less volatile than growth stocks; however, issues of value stocks typically have a lower expected growth rate in earnings and sales than issues of growth stocks.

Please refer to the Schedule of Investments in the report for complete holdings information. Fund holdings, geographic allocations and/or sector allocations are subject to change at any time and are not considered a recommendation to buy or sell any security.

The foregoing reflects the thoughts and opinions of Brandes Investment Partners® exclusively and is subject to change without notice.

Brandes Investment Partners® is a registered trademark of Brandes Investment Partners, L.P. in the United States and Canada.

Must be preceded or accompanied by a prospectus.

Index Guide

The MSCI World Index with net dividends captures large and mid cap representation of developed markets.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

One cannot invest directly in an index.

The Brandes Global Equity Fund is distributed by ALPS Distributors, Inc.

7

Brandes Global Equity Fund

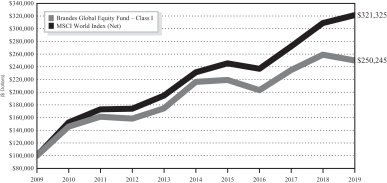

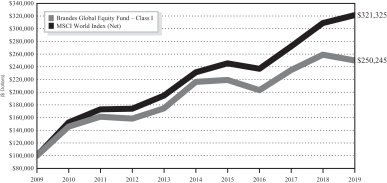

The following chart compares the value of a hypothetical $100,000 investment in the Brandes Global Equity Fund – Class I from March 31, 2009 to March 31, 2019 with the value of such an investment in the MSCI World Index for the same period.

Value of $100,000 Investment vs MSCI World Index (Unaudited)

| | | | | | | | | | | | | | | | |

| | | Average Annual Total Return

Periods Ended March 31, 2019 | |

| | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception(1) | |

Brandes Global Equity Fund | | | | | | | | | | | | | | | | |

Class A* | | | -3.73 | % | | | 2.69 | % | | | 9.36 | % | | | 6.30 | % |

Class A* (with maximum sales charge) | | | -9.26 | % | | | 1.48 | % | | | 8.72 | % | | | 5.70 | % |

Class C* | | | -4.44 | % | | | 1.93 | % | | | 8.52 | % | | | 5.49 | % |

Class C* (with maximum sales charge) | | | -5.34 | % | | | 1.93 | % | | | 8.52 | % | | | 5.49 | % |

Class I | | | -3.48 | % | | | 2.95 | % | | | 9.61 | % | | | 6.54 | % |

MSCI World Index | | | 4.01 | % | | | 6.78 | % | | | 12.38 | % | | | 8.88 | % |

| (1) | The inception date is October 6, 2008. |

| * | Performance shown prior to January 31, 2011 for Class A shares reflects the performance of Class I shares adjusted to reflect Class A expenses. Performance shown prior to January 31, 2013 for Class C shares reflects the performance of Class I shares adjusted to reflect Class C expenses. |

Performance data quoted represents past performance; past performance does not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800-331-2979.

8

Brandes Global Equity Fund

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Advisor has a fee waiver arrangement in place to limit the Fund’s annual operating expenses.

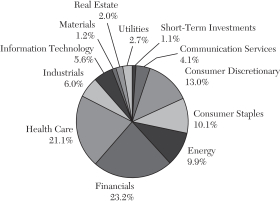

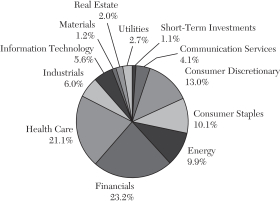

Sector Allocation as a Percentage of Total Investments as of

March 31, 2019 (Unaudited)

The sector classifications represented in the graph above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC.

9

Brandes Global Equity Income Fund

Dear Fellow Investor,

The net asset value of the Brandes Global Equity Income Fund (Class I Shares) declined 1.93% in the six months ending March 31, 2019. For the same period, the MSCI World Index fell 2.61%.

Portfolio holdings in the Electric Utilities, Diversified Telecommunication Services and Pharmaceuticals industries were contributors to performance, while holdings in Capital Markets, Banks and Oil, Gas & Consumable Fuels detracted from returns.

Holdings in Brazil, Mexico and Chile contributed to performance, while results were hampered by holdings in the United Kingdom, the United States and Switzerland.

Three of the largest individual contributors to performance were Companhia Paranaense de Energia (Brazil — Electric Utilities), Telefonica Brasil SA (Brazil — Diversified Telecommunication Services) and Merck & Co., Inc. (United States — Pharmaceuticals). WPP Plc (United Kingdom — Media), UBS Group AG (Switzerland — Capital Markets) and J Sainsbury Plc (United Kingdom — Food & Staples Retailing) were three of the largest detractors from performance.

At the close of the period, the Fund’s largest country weights were in the United States and the United Kingdom, and the Fund’s largest industry weights were in Pharmaceuticals and Capital Markets. Please note that while macro conditions are considered when we determine valuation estimates for individual companies, our country and industry weightings are aby-product ofbottom-up stock selection, not the result oftop-down observations.

After nearly a half-century of professional investing, Brandes Investment Partners remains fixed on its original goal. We pursue above-market returns to help you fulfill your long-term investment objectives. Our approach remains deeply rooted in the value philosophy and seeks to identify worthy but potentially underpriced companies. Thank you for your confidence in our approach.

Sincerely yours,

The Brandes GlobalLarge-Cap Investment Committee

Brandes Investment Trust

Because the values of the Fund’s investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund, or the Fund could underperform other investments. The values of the Fund’s investments fluctuate in response to the activities of individual companies and general stock market and economic conditions. In addition, the performance of foreign securities depends on the political and economic environments and other overall economic conditions in the countries where the Fund invests. Emerging

10

Brandes Global Equity Income Fund

country markets involve greater risk and volatility than more developed markets. Some emerging markets countries may have fixed or managed currencies that are not free-floating against the U.S. dollar. Certain of these currencies have experienced, and may experience in the future, substantial fluctuations or a steady devaluation relative to the U.S. dollar. Value stocks typically are less volatile than growth stocks; however, issues of value stocks typically have a lower expected growth rate in earnings and sales than issues of growth stocks.

Please refer to the Schedule of Investments in the report for complete holdings information. Fund holdings, geographic allocations and/or sector allocations are subject to change at any time and are not considered a recommendation to buy or sell any security.

The foregoing reflects the thoughts and opinions of Brandes Investment Partners® exclusively and is subject to change without notice.

Brandes Investment Partners® is a registered trademark of Brandes Investment Partners, L.P. in the United States and Canada.

Must be preceded or accompanied by a prospectus.

Index Guide

The MSCI World Index with net dividends captures large and mid cap representation of developed markets.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

One cannot invest directly in an index.

The Brandes Global Equity Income Fund is distributed by ALPS Distributors, Inc.

11

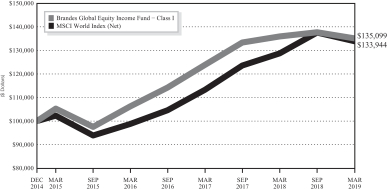

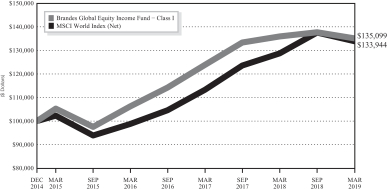

Brandes Global Equity Income Fund

The following chart compares the value of a hypothetical $100,000 investment in the Brandes Global Equity Income Fund – Class I from its inception (December 31, 2014) to March 31, 2019 with the value of such an investment in the MSCI World Index for the same period.

Value of $100,000 Investment vs MSCI World Index (Unaudited)

| | | | | | | | | | | | |

| | | Average Annual Total Return

Periods Ended March 31, 2019 | |

| | | One

Year | | | Three

Years | | | Since

Inception(1) | |

Brandes Global Equity Income Fund | | | | | | | | | | | | |

Class A | | | -0.94 | % | | | 8.77 | % | | | 7.66 | % |

Class A (with maximum sales charge) | | | -6.63 | % | | | 6.65 | % | | | 6.17 | % |

Class C | | | -1.40 | % | | | 7.55 | % | | | 6.53 | % |

Class C (with maximum sales charge) | | | -2.33 | % | | | 7.55 | % | | | 6.53 | % |

Class I | | | -0.67 | % | | | 8.31 | % | | | 7.34 | % |

MSCI World Index | | | 4.01 | % | | | 10.68 | % | | | 7.12 | % |

| (1) | The inception date is December 31, 2014. |

Performance data quoted represents past performance; past performance does not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800-331-2979.

12

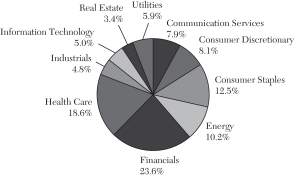

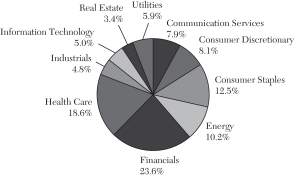

Brandes Global Equity Income Fund

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Advisor has a fee waiver arrangement in place to limit the Fund’s annual operating expenses.

Sector Allocation as a Percentage of Total Investments as of March 31, 2019 (Unaudited)

The sector classifications represented in the graph above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC.

13

Brandes Global Opportunities Value Fund

Dear Fellow Investor,

The net asset value of the Brandes Global Opportunities Value Fund (Class I Shares) fell 6.68% in the six months ending March 31, 2019. For the same period, the MSCI ACWI Index declined 2.13%.

Portfolio holdings in the Diversified Telecommunication Services, Oil, Gas & Consumable Fuels and Electric Utilities industries were contributors to performance, while holdings in Health Care Providers & Services, Capital Markets and Machinery detracted from returns.

Holdings in Brazil, Panama and Slovenia contributed to performance, while results were hampered by holdings in the United States, the United Kingdom and Mexico.

Three of the largest individual contributors to performance were Companhia Paranaense de Energia (Brazil — Electric Utilities), Telefonica Brasil SA (Brazil — Diversified Telecommunication Services) and Petroleo Brasileiro SA (Brazil — Oil, Gas & Consumable Fuels). Conversely, Owens & Minor, Inc. (United States — Health Care Providers & Services), Briggs & Stratton Corp. (United States — Machinery) and Engie SA (France — Multi-Utilities) were three of the largest detractors from performance.

At the close of the period, the Fund’s largest country weights were in the United Kingdom and the United States, and the Fund’s largest industry weights were in Oil, Gas & Consumable Fuels and Banks. Please note that while macro conditions are considered when we determine valuation estimates for individual companies, our country and industry weightings are aby-product ofbottom-up stock selection, not the result oftop-down observations.

In the45-plus years since Brandes Investment Partners was founded, our goal has remained the same: pursue above-market gains to help you move closer to your long-term investment objectives. We believe that our unwavering commitment to value investing will lead us to attractively priced, fundamentally sound companies worthy of inclusion in the Fund. Thank you for your business and continued trust.

Sincerely yours,

The BrandesAll-Cap Investment Committee

Brandes Investment Trust

Because the values of the Fund’s investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund, or the Fund could underperform other investments. The values of the Fund’s investments fluctuate in response to the activities of individual companies and general stock market and economic conditions. In addition, the performance of foreign securities depends on the political and economic environments and other overall economic conditions in the countries where the Fund invests. Emerging

14

Brandes Global Opportunities Value Fund

country markets involve greater risk and volatility than more developed markets. Some emerging markets countries may have fixed or managed currencies that are not free-floating against the U.S. dollar. Certain of these currencies have experienced, and may experience in the future, substantial fluctuations or a steady devaluation relative to the U.S. dollar. Investments in small and medium capitalization companies tend to have limited liquidity and greater price volatility than investments in larger capitalization companies. Value stocks typically are less volatile than growth stocks; however, issues of value stocks typically have a lower expected growth rate in earnings and sales than issues of growth stocks.

Please refer to the Schedule of Investments in the report for complete holdings information. Fund holdings, geographic allocations and/or sector allocations are subject to change at any time and are not considered a recommendation to buy or sell any security.

The foregoing reflects the thoughts and opinions of Brandes Investment Partners® exclusively and is subject to change without notice.

Brandes Investment Partners® is a registered trademark of Brandes Investment Partners, L.P. in the United States and Canada.

Must be preceded or accompanied by a prospectus.

Index Guide

The MSCI ACWI Index with net dividends captures large and mid cap representation of developed and emerging markets.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

One cannot invest directly in an index.

The Brandes Global Opportunities Value Fund is distributed by ALPS Distributors, Inc.

15

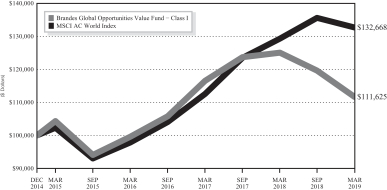

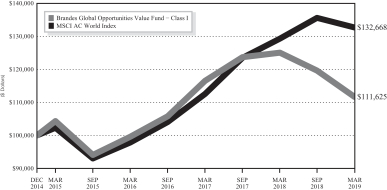

Brandes Global Opportunities Value Fund

The following chart compares the value of a hypothetical $100,000 investment in the Brandes Global Opportunities Value Fund – Class I from its inception (December 31, 2014) to March 31, 2019 with the value of such an investment in the MSCI All Country World Index for the same period.

Value of $100,000 Investment vs MSCI All Country World Index (Unaudited)

| | | | | | | | | | | | |

| | | Average Annual Total Return

Periods Ended March 31, 2019 | |

| | | One

Year | | | Three

Years | | | Since

Inception(1) | |

Brandes Global Opportunities Value Fund | | | | | | | | | | | | |

Class A | | | -10.83 | % | | | 3.65 | % | | | 2.49 | % |

Class A (with maximum sales charge) | | | -15.99 | % | | | 1.64 | % | | | 1.07 | % |

Class C | | | -11.54 | % | | | 2.85 | % | | | 1.70 | % |

Class C (with maximum sales charge) | | | -12.36 | % | | | 2.85 | % | | | 1.70 | % |

Class I | | | -10.73 | % | | | 3.88 | % | | | 2.62 | % |

MSCI All Country World Index | | | 2.60 | % | | | 10.67 | % | | | 6.88 | % |

| (1) | The inception date is December 31, 2014. |

Performance data quoted represents past performance; past performance does not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800-331-2979.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Advisor has a fee waiver arrangement in place to limit the Fund’s annual operating expenses.

16

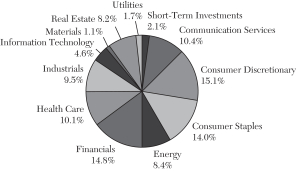

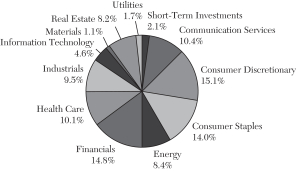

Brandes Global Opportunities Value Fund

Sector Allocation as a Percentage of Total Investments as of March 31, 2019 (Unaudited)

The sector classifications represented in the graph above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC.

17

Brandes Emerging Markets Value Fund

Dear Fellow Investor,

The net asset value of the Brandes Emerging Markets Value Fund (Class I Shares) increased 2.54% in the six months ending March 31, 2019. For the same period, the MSCI Emerging Markets Index gained 1.71%.

Portfolio holdings in the Banks, Electric Utilities and Textiles, Apparel & Luxury Goods industries were contributors to performance, while holdings in Construction Materials, Technology Hardware, Storage & Peripherals and Automobiles detracted from returns.

Holdings in Brazil, China and Indonesia contributed to performance, while results were hampered by holdings in Mexico, South Korea and Malaysia.

Three of the largest individual contributors to performance were Bank Rakyat Indonesia Persero Tbk PT (Indonesia — Banks), Companhia Paranaense de Energia (Brazil — Electric Utilities) and Petroleo Brasileiro SA (Brazil — Oil, Gas & Consumable Fuels). Conversely, Cemex SAB de CV (Mexico — Construction Materials), Genting Berhad (Malaysia — Hotels, Restaurants & Leisure) and Asustek Computer, Inc. (Taiwan — Technology Hardware, Storage & Peripherals) were three of the largest detractors from performance.

At the close of the period, the Fund’s largest country weights were in South Korea and Brazil, and the Fund’s largest industry weights were in Banks and Wireless Telecommunication Services. Please note that while macro conditions are considered when we determine valuation estimates for individual companies, our country and industry weightings are aby-product ofbottom-up stock selection, not the result oftop-down observations.

For 45 years, Brandes Investment Partners has had the same goal: Seek better-than-market returns to help you pursue your long-term investment goals. We believe steadfast adherence to our value investing approach can help us achieve this aim because it compels us to invest in companies we view as strong yet appealingly priced. We thank you for your confidence and for investing with us.

Sincerely yours,

The Brandes Emerging Markets Investment Committee

Brandes Investment Trust

Because the values of the Fund’s investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund, or the Fund could underperform other investments. The values of the Fund’s investments fluctuate in response to the activities of individual companies and general stock market and economic conditions. In addition, the performance of foreign securities depends on the political and economic environments and other overall economic conditions in the countries where the Fund invests. Emerging

18

Brandes Emerging Markets Value Fund

country markets involve greater risk and volatility than more developed markets. Some emerging markets countries may have fixed or managed currencies that are not free-floating against the U.S. dollar. Certain of these currencies have experienced, and may experience in the future, substantial fluctuations or a steady devaluation relative to the U.S. dollar. Investments in small and medium capitalization companies tend to have limited liquidity and greater price volatility than investments in larger capitalization companies. Value stocks typically are less volatile than growth stocks; however, issues of value stocks typically have a lower expected growth rate in earnings and sales than issues of growth stocks.

Please refer to the Schedule of Investments in the report for complete holdings information. Fund holdings, geographic allocations and/or sector allocations are subject to change at any time and are not considered a recommendation to buy or sell any security.

The foregoing reflects the thoughts and opinions of Brandes Investment Partners® exclusively and is subject to change without notice.

Brandes Investment Partners® is a registered trademark of Brandes Investment Partners, L.P. in the United States and Canada.

Must be preceded or accompanied by a prospectus.

Index Guide

The MSCI Emerging Markets Index with net dividends captures large and mid cap representation of emerging market countries.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

One cannot invest directly in an index.

The Brandes Emerging Markets Value Fund is distributed by ALPS Distributors, Inc.

19

Brandes Emerging Markets Value Fund

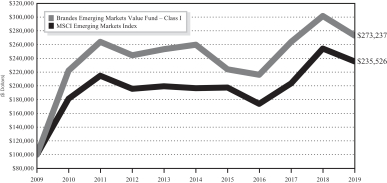

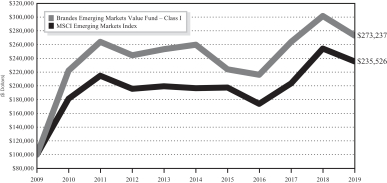

The following chart compares the value of a hypothetical $100,000 investment in the Brandes Emerging Markets Value Fund – Class I from March 31, 2009 to March 31, 2019 with the value of such an investment in the MSCI Emerging Markets Index for the same period.

Value of $100,000 Investment vs MSCI Emerging Markets Index (Unaudited)

| | | | | | | | | | | | | | | | |

| | | Average Annual Total Return

Periods Ended March 31, 2019** | |

| | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception(1) | |

Brandes Emerging Markets Value Fund | | | | | | | | | | | | | | | | |

Class A | | | -9.64 | % | | | 0.71 | % | | | 10.30 | % | | | 6.98 | % |

Class A (with maximum sales charge) | | | -14.84 | % | | | -0.47 | % | | | 9.65 | % | | | 6.70 | % |

Class C* | | | -10.34 | % | | | -0.03 | % | | | 9.48 | % | | | 6.18 | % |

Class C* (with maximum sales charge) | | | -11.23 | % | | | -0.03 | % | | | 9.48 | % | | | 6.18 | % |

Class I | | | -9.36 | % | | | 1.00 | % | | | 10.57 | % | | | 7.25 | % |

Class R6* | | | -9.28 | % | | | 1.10 | % | | | 10.65 | % | | | 7.31 | % |

MSCI Emerging Markets Index | | | -7.41 | % | | | 3.68 | % | | | 8.94 | % | | | 6.13 | % |

| (1) | The inception date is August 20, 1996. |

| * | Performance shown prior to January 31, 2013 for Class C shares reflects the performance of Class I shares adjusted to reflect Class C expenses. Performance shown prior to July 11, 2016 for Class R6 shares reflects the performance of Class I shares adjusted to reflect Class R6 expenses. |

| ** | Prior to January 31, 2011, the Advisor managed a private investment fund with an investment objective, investment policies and strategies that were, in all material respects, equivalent to those of the Brandes Emerging Markets Value Fund. The performance information shown for the Class I shares for periods before January 31, 2011 is that of the private investment fund and reflects the net expenses of the private investment fund. The performance of the private investment fund prior to January 31, 2011 is based on a calculation method that is different from the standardized calculation method prescribed by the SEC. The performance information shown for the Class A shares has been adjusted to reflect the differences in the net expense ratios between the Class I and A shares. The private investment fund was not registered under the Investment Company Act of 1940 (“1940 Act”) and was not subject to certain |

20

Brandes Emerging Markets Value Fund

| | investment limitations, diversification requirements, and other restrictions imposed by the 1940 Act and the Internal Revenue Code of 1986, which, if applicable, may have adversely affected its performance. |

Performance data quoted represents past performance; past performance does not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800-331-2979.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Advisor has a fee waiver arrangement in place to limit the Fund’s annual operating expenses.

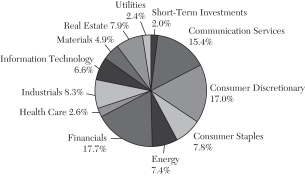

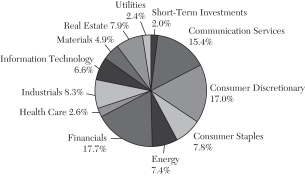

Sector Allocation as a Percentage of Total Investments as of

March 31, 2019 (Unaudited)

The sector classifications represented in the graph above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC.

21

Brandes International Small Cap Equity Fund

Dear Fellow Investor,

The net asset value of the Brandes International Small Cap Equity Fund (Class I Shares) fell 7.93% in the six months ending March 31, 2019. For the same period, the S&P DevelopedEx-U.S. SmallCap Index declined 8.04%.

Portfolio holdings in the Electric Utilities, Trading Companies & Distributors and Diversified Telecommunication Services industries were contributors to performance, while holdings in Household Durables, Food & Staples Retailing and Pharmaceuticals detracted from returns.

Holdings in Brazil, Hungary and Slovenia contributed to performance, while results were hampered by holdings in the United Kingdom, Canada and Japan.

Three of the largest individual contributors to performance were Companhia Paranaense de Energia (Brazil — Electric Utilities), Mills Estruturas e Servicos de Engenharia SA (Brazil — Trading Companies & Distributors) and Fibra Uno Administracion SA de CV (Brazil — Equity Real Estate Investment Trusts). Conversely, Dorel Industries, Inc. (Canada — Household Durables), J Sainsbury Plc (United Kingdom — Food & Staples Retailing) and Sierra Wireless, Inc. (Canada — Communications Equipment) were three of the largest detractors from performance.

At the close of the period, the Fund’s largest country weights were in Japan and the United Kingdom, and the Fund’s largest industry weights were in Food & Staples Retailing and Food Products. Please note that while macro conditions are considered when we determine valuation estimates for individual companies, our country and industry weightings are aby-product ofbottom-up stock selection, not the result oftop-down observations.

Brandes Investment Partners has had the same goal since we started 45 years ago: Realize above-market gains to help you pursue your long-term investment objectives. We aim to do so by staying true to our value approach, which seeks fundamentally sound but potentially undervalued companies for the Fund. Thank you for investing with us.

Sincerely yours,

The BrandesSmall-Cap Investment Committee

Brandes Investment Trust

Because the values of the Fund’s investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund, or the Fund could underperform other investments. The values of the Fund’s investments fluctuate in response to the activities of individual companies and general stock market and economic conditions. In addition, the performance of foreign securities depends on the political and economic environments and other overall

22

Brandes International Small Cap Equity Fund

economic conditions in the countries where the Fund invests. Emerging country markets involve greater risk and volatility than more developed markets. Some emerging markets countries may have fixed or managed currencies that are not free-floating against the U.S. dollar. Certain of these currencies have experienced, and may experience in the future, substantial fluctuations or a steady devaluation relative to the U.S. dollar. Investments in small and medium capitalization companies tend to have limited liquidity and greater price volatility than investments in larger capitalization companies. Value stocks typically are less volatile than growth stocks; however, issues of value stocks typically have a lower expected growth rate in earnings and sales than issues of growth stocks.

Please refer to the Schedule of Investments in the report for complete holdings information. Fund holdings, geographic allocations and/or sector allocations are subject to change at any time and are not considered a recommendation to buy or sell any security.

The foregoing reflects the thoughts and opinions of Brandes Investment Partners® exclusively and is subject to change without notice.

Brandes Investment Partners® is a registered trademark of Brandes Investment Partners, L.P. in the United States and Canada.

Must be preceded or accompanied by a prospectus.

Index Guide

The S&P DevelopedEx-U.S. SmallCap Index with net dividends measures the equity performance of small-capitalization companies from developed markets excluding the United States.

One cannot invest directly in an index.

The Brandes International Equity Small Cap Equity Fund is distributed by ALPS Distributors, Inc.

23

Brandes International Small Cap Equity Fund

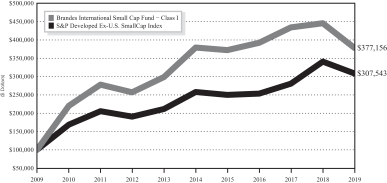

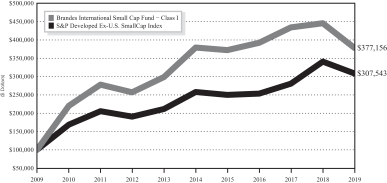

The following chart compares the value of a hypothetical $100,000 investment in the Brandes International Small Cap Fund – Class I from March 31, 2009 to March 31, 2019 with the value of such an investment in the S&P DevelopedEx-U.S. SmallCap Index for the same period.

Value of $100,000 Investment vs S&P Developed

Ex-U.S. SmallCap Index (Unaudited)

| | | | | | | | | | | | | | | | |

| | | Average Annual Total Return

Periods Ended March 31, 2019** | |

| | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception(1) | |

Brandes International Small Cap Fund | | | | | | | | | | | | | | | | |

Class A | | | -15.27 | % | | | -0.26 | % | | | 13.94 | % | | | 8.44 | % |

Class A (with maximum sales charge) | | | -20.14 | % | | | -1.44 | % | | | 13.27 | % | | | 8.16 | % |

Class C* | | | -15.87 | % | | | -1.00 | % | | | 13.10 | % | | | 7.64 | % |

Class C* (with maximum sales charge) | | | -16.68 | % | | | -1.00 | % | | | 13.10 | % | | | 7.64 | % |

Class I | | | -15.08 | % | | | -0.05 | % | | | 14.20 | % | | | 8.70 | % |

Class R6* | | | -14.94 | % | | | 0.03 | % | | | 14.27 | % | | | 8.77 | % |

S&P Developed Ex-U.S. SmallCap Index | | | -9.55 | % | | | 3.65 | % | | | 11.89 | % | | | 6.45 | % |

| (1) | The inception date is August 19, 1996. |

| * | Performance shown prior to January 31, 2013 for Class C shares reflects the performance of Class I shares adjusted to reflect Class C expenses. Performance shown prior to June 27, 2016 for Class R6 shares reflects the performance of Class I shares adjusted to reflect Class R6 expenses. |

| ** | Prior to February 1, 2012, the Advisor managed a private investment fund with an investment objective, investment policies and strategies that were, in all material respects, equivalent to those of the Brandes International Small Cap Fund. The performance information shown for the Class I shares for periods before February 1, 2012 is that of the private investment fund and reflects the net expenses of the private investment fund. The performance of the private investment fund prior to February 1, 2012 is based on a calculation method that is different from the standardized calculation method prescribed by the SEC. The performance information shown for the Class A shares has been adjusted to reflect the differences in the net expense ratios between the Class I and A shares. The private investment fund was not registered under the Investment Company Act of 1940 (“1940 Act”) and was not subject to certain investment limitations, diversification requirements, and other restrictions imposed by the 1940 Act and the Internal Revenue Code of 1986, which, if applicable, may have adversely affected its performance. |

24

Brandes International Small Cap Equity Fund

Performance data quoted represents past performance; past performance does not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800-331-2979.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Advisor has a fee waiver arrangement in place to limit the Fund’s annual operating expenses.

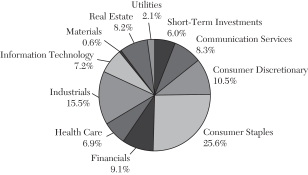

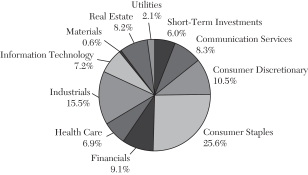

Sector Allocation as a Percentage of Total Investments as of

March 31, 2019 (Unaudited)

The sector classifications represented in the graph above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC.

25

Brandes Small Cap Value Fund

Dear Fellow Investor,

The net asset value of the Brandes Small Cap Value Fund (Class I Shares) declined 8.13% in the six months ending March 31, 2019. For the same period, the Russell 2000 Index fell 8.56%.

Portfolio holdings in the Biotechnology, Specialty Retail and Capital Markets industries were contributors to performance, while holdings in Machinery, Household Durables and Construction & Engineering detracted from returns.

Three of the largest individual contributors to performance were PDL BioPharma, Inc. (Biotechnology),Rent-A-Center, Inc. (Specialty Retail) and Federated Investors, Inc. (Capital Markets). Conversely, Briggs & Stratton Corp. (Machinery), Owens & Minor, Inc. (Health Care Providers & Services) and Orion Group Holdings, Inc. (Construction & Engineering) were three of the largest detractors from performance.

At the close of the period, the Fund’s largest industry weights were in Household Durables and Biotechnology. Please note that while macro conditions are considered when we determine valuation estimates for individual companies, our industry weightings are aby-product ofbottom-up stock selection, not the result oftop-down observations.

After nearly a half-century of professional investing, Brandes Investment Partners remains fixed on its original goal. We pursue above-market returns to help you fulfill your long-term investment objectives. Our approach remains deeply rooted in the value philosophy and seeks to identify worthy but potentially underpriced companies. Thank you for your confidence in our approach.

Sincerely yours,

The BrandesSmall-Cap Investment Committee

Brandes Investment Trust

Because the values of the Fund’s investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund, or the Fund could underperform other investments. The values of the Fund’s investments fluctuate in response to the activities of individual companies and general stock market and economic conditions. Investments in small and medium capitalization companies tend to have limited liquidity and greater price volatility than investments in larger capitalization companies. Value stocks typically are less volatile than growth stocks; however, issues of value stocks typically have a lower expected growth rate in earnings and sales than issues of growth stocks.

26

Brandes Small Cap Value Fund

Please refer to the Schedule of Investments in the report for complete holdings information. Fund holdings, geographic allocations and/or sector allocations are subject to change at any time and are not considered a recommendation to buy or sell any security.

The foregoing reflects the thoughts and opinions of Brandes Investment Partners® exclusively and is subject to change without notice.

Brandes Investment Partners® is a registered trademark of Brandes Investment Partners, L.P. in the United States and Canada.

Must be preceded or accompanied by a prospectus.

Index Guide

The Russell 2000 Index with gross dividends measures the performance of the small cap segment of the U.S. equity universe.

One cannot invest directly in an index.

The Brandes Small Cap Value Fund is distributed by ALPS Distributors, Inc.

27

Brandes Small Cap Value Fund

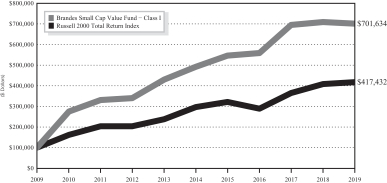

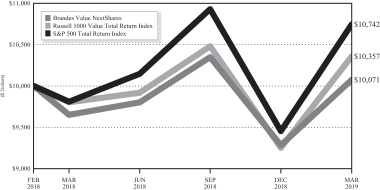

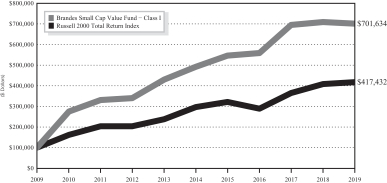

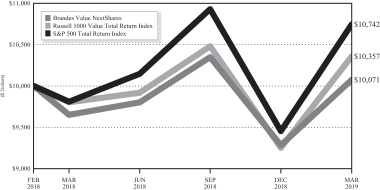

The following chart compares the value of a hypothetical $100,000 investment in the Brandes Small Cap Value Fund – Class I from March 31, 2009 to March 31, 2019 with the value of such an investment in the Russell 2000 Total Return Index for the same period.

Value of $100,000 Investment vs Russell 2000 Total Return Index (Unaudited)

| | | | | | | | | | | | | | | | |

| | | Average Annual Total Return

Periods Ended March 31, 2019* | |

| | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception(1) | |

Brandes Small Cap Value Fund | | | | | | | | | | | | | | | | |

Class A | | | -1.29 | % | | | 7.05 | % | | | 21.20 | % | | | 6.46 | % |

Class A (with maximum sales charge) | | | -6.94 | % | | | 5.79 | % | | | 20.49 | % | | | 6.17 | % |

Class I | | | -1.10 | % | | | 7.33 | % | | | 21.51 | % | | | 6.73 | % |

Class R6 | | | -0.85 | % | | | 7.45 | % | | | 21.58 | % | | | 6.76 | % |

Russell 2000 Total Return Index | | | 2.05 | % | | | 7.05 | % | | | 15.36 | % | | | 7.25 | % |

| (1) | The inception date is September 30, 1997. |

| * | Prior to January 2, 2018, the Advisor managed a private investment fund with an investment objective, investment policies and strategies that were, in all material respects, equivalent to those of the Brandes Small Cap Value Fund. The performance information shown for the Class I shares for periods before January 2, 2018 is that of the private investment fund and reflects the net expenses of the private investment fund. The performance of the private investment fund prior to January 2, 2018 is based on a calculation method that is different from the standardized calculation method prescribed by the SEC. The performance information shown for the Class A shares has been adjusted to reflect the differences in the net expense ratios between the Class I and A shares. Performance shown prior to January 2, 2018 for Class R6 shares reflects the performance of Class I shares. The private investment fund was not registered under the Investment Company Act of 1940 (“1940 Act”) and was not subject to certain investment limitations, diversification requirements, and other restrictions imposed by the 1940 Act and the Internal Revenue Code of 1986, which, if applicable, may have adversely affected its performance. |

28

Brandes Small Cap Value Fund

Performance data quoted represents past performance; past performance does not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800-331-2979.

The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Advisor has a fee waiver arrangement in place to limit the Fund’s annual operating expenses.

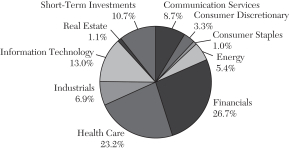

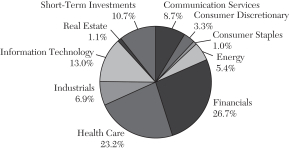

Sector Allocation as a Percentage of Total Investments as of

March 31, 2019 (Unaudited)

The sector classifications represented in the graph above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC.

29

Brandes Core Plus Fixed Income Fund

Dear Fellow Investor,

The net asset value of the Brandes Core Plus Fixed Income Fund (Class I Shares) gained 3.34% in the six months ending March 31, 2019. For the same period, the Bloomberg Barclays Aggregate Bond Index increased 4.63%.

Portfolio holdings in select corporate bonds detracted from performance.

Within corporate bonds holdings in Metals & Mining (Cloud Peak Energy), Telecommunications (Frontier Communications Corp.) and Banks & Thrifts (USB Capital IX) detracted from performance.

An underweight to U.S. agency mortgage-backed securities (MBS) was a positive performance factor, while duration positioning detracted from returns.

At the close of the period, the Fund continues to favor short maturity corporate bonds and those that we believe exhibit strong, tangible asset coverage. The Fund is underweight agency MBS. The duration is positioned toward the shorter end of our duration-controlled range. The Fund has a high allocation, relative to the benchmark, to U.S. Treasuries that we will look to redeploy thoughtfully and efficiently — if and when market uncertainty and volatility cause credit fundamentals to become mispriced from our estimates of intrinsic value.

In the45-plus years since Brandes Investment Partners was founded, our goal has remained the same: pursue above-market gains to help you move closer to your long-term investment objectives. We believe that our unwavering commitment to value investing will lead us to attractively priced, fundamentally sound companies worthy of inclusion in the fund.

Sincerely Yours,

The Brandes Fixed Income Investment Committee

Brandes Investment Trust

Because the values of the Fund’s investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund, or the Fund could underperform other investments. The values of the Fund’s investments fluctuate in response to the activities of individual companies and general stock market and economic conditions. In addition, the performance of foreign securities depends on the political and economic environments and other overall economic conditions in the countries where the Fund invests. Emerging country markets involve greater risk and volatility than more developed markets. Some emerging markets countries may have fixed or managed currencies that are not free-floating against the U.S. dollar. Certain of these currencies have experienced, and may experience in the future, substantial fluctuations or a steady devaluation relative to the U.S. dollar. It is not possible to invest directly in an index.

30

Brandes Core Plus Fixed Income Fund

As with most fixed income funds, the income on and value of your shares in the Fund will fluctuate along with interest rates. When interest rates rise, the market prices of the debt securities the Fund owns usually decline. When interest rates fall, the prices of these securities usually increase. Generally, the longer the Fund’s average portfolio maturity and the lower the average quality of its portfolio, the greater the price fluctuation. The price of any security owned by the Fund may also fall in response to events affecting the issuer of the security, such as its ability to continue to make principal and interest payments or its credit rating. Below investment grade debt securities are speculative and involve a greater risk of default and price change due to changes in the issuer’s creditworthiness. The market prices of these debt securities may fluctuate more than the market prices of investment grade debt securities and may decline significantly in periods of general economic difficulty.

Asset coverage: Assets available to cover debt obligations after all other liabilities have been satisfied.

Duration: The weighted maturity of a fixed-income investment’s cash flows, used in the estimation of the price sensitivity of fixed-income securities for a given change in interest rates.

Please refer to the Schedule of Investments in the report for complete holdings information. Fund holdings, geographic allocations and/or sector allocations are subject to change at any time and are not a recommendation to buy or sell any security.

The foregoing reflects the thoughts and opinions of Brandes Investment Partners® exclusively and is subject to change without notice.

Brandes Investment Partners® is a registered trademark of Brandes Investment Partners, L.P. in the United States and Canada.

Must be preceded or accompanied by a prospectus.

Index Guide

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. This index is a total return index which reflects the price changes and interest of each bond in the index.

The Brandes Core Plus Fixed Income Fund is distributed by ALPS Distributors, Inc.

31

Brandes Core Plus Fixed Income Fund

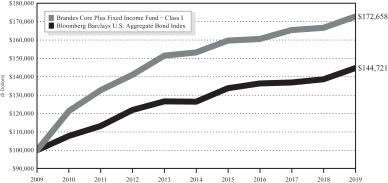

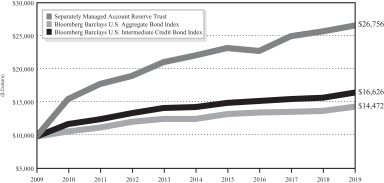

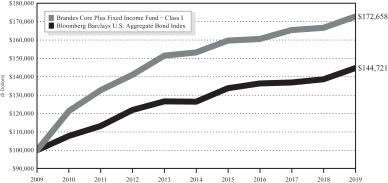

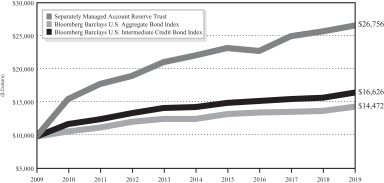

The following chart compares the value of a hypothetical $100,000 investment in the Brandes Core Plus Fixed Income Fund – Class I from March 31, 2009 to March 31, 2019 with the value of such an investment in the Bloomberg Barclays U.S. Aggregate Bond Index for the same period.

Value of $100,000 Investment vs Bloomberg Barclays U.S. Aggregate Bond Index (Unaudited)

| | | | | | | | | | | | | | | | |

| | | Average Annual Total Return

Periods Ended March 31, 2019 | |

| | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception(1) | |

Brandes Core Plus Fixed Income Fund | | | | | | | | | | | | | | | | |

Class A* | | | 3.26 | % | | | 2.12 | % | | | 5.29 | % | | | 3.40 | % |

Class A* (with maximum sales charge) | | | -0.62 | % | | | 1.34 | % | | | 4.88 | % | | | 3.04 | % |

Class I | | | 3.58 | % | | | 2.41 | % | | | 5.61 | % | | | 3.70 | % |

Class R6* | | | 4.40 | % | | | 2.71 | % | | | 5.79 | % | | | 3.86 | % |

Bloomberg Barclays U.S. Aggregate Bond Index | | | 4.48 | % | | | 2.74 | % | | | 3.77 | % | | | 3.85 | % |

| (1) | The inception date is December 28, 2007. |

| * | Performance shown prior to January 31, 2013 for Class A shares reflects the performance of Class I shares adjusted to reflect Class A expenses. Performance shown prior to October 10, 2017 for Class R6 shares reflects the performance of Class I shares adjusted to reflect Class R6 expenses. |

Performance data quoted represents past performance; past performance does not indicate future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 800-331-2979.

32

Brandes Core Plus Fixed Income Fund

The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of Fund shares. The Advisor has a fee waiver arrangement in place to limit the Fund’s annual operating expenses.

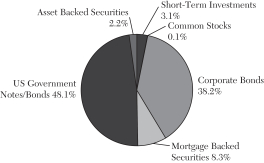

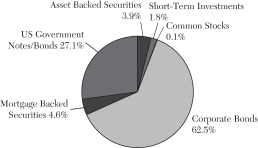

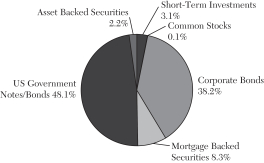

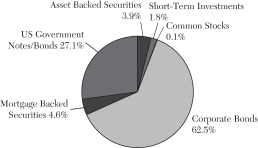

Asset Allocation as a Percentage of Total Investments as of

March 31, 2019 (Unaudited)

33

Brandes Investment Trust

Expense Example (Unaudited)

As a shareholder of a Fund, you incur ongoing costs, including investment advisory and administrative fees and other fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2018 to March 31, 2019 (the “Period”).

Actual Expenses

This section provides information about actual account values and actual expenses. The “Ending Account Value” shown is derived from each Fund’s actual return. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | | | | | | | | | | | | | | | |

| | | Class A | |

Fund | | Beginning

Account

Value | | | Ending

Account

Value | | | Annual

Expense

Ratio | | | Expenses

Paid

During

the Period* | |

International Equity Fund | | $ | 1,000.00 | | | $ | 949.00 | | | | 1.16 | % | | $ | 5.64 | |

Global Equity Fund | | $ | 1,000.00 | | | $ | 946.50 | | | | 1.25 | % | | $ | 6.07 | |

Global Equity Income Fund | | $ | 1,000.00 | | | $ | 979.70 | | | | 1.25 | % | | $ | 6.17 | |

Global Opportunities Value Fund | | $ | 1,000.00 | | | $ | 932.10 | | | | 1.40 | % | | $ | 6.74 | |

Emerging Markets Value Fund | | $ | 1,000.00 | | | $ | 1,023.30 | | | | 1.36 | % | | $ | 6.86 | |

International Small Cap Fund | | $ | 1,000.00 | | | $ | 919.90 | | | | 1.36 | % | | $ | 6.51 | |

Small Cap Value Fund | | $ | 1,000.00 | | | $ | 917.10 | | | | 1.15 | % | | $ | 5.50 | |

Core Plus Fixed Income Fund | | $ | 1,000.00 | | | $ | 1,031.40 | | | | 0.70 | % | | $ | 3.55 | |

| | | | | | | | | | | | | | | | |

| | | Class C | |

Fund | | Beginning

Account

Value | | | Ending

Account

Value | | | Annual

Expense

Ratio | | | Expenses

Paid

During

the Period* | |

International Equity Fund | | $ | 1,000.00 | | | $ | 944.90 | | | | 1.91 | % | | $ | 9.26 | |

Global Equity Fund | | $ | 1,000.00 | | | $ | 943.20 | | | | 2.00 | % | | $ | 9.69 | |

Global Equity Income Fund | | $ | 1,000.00 | | | $ | 976.30 | | | | 2.00 | % | | $ | 9.85 | |

Global Opportunities Value Fund | | $ | 1,000.00 | | | $ | 928.60 | | | | 2.15 | % | | $ | 10.34 | |

Emerging Markets Value Fund | | $ | 1,000.00 | | | $ | 1,018.90 | | | | 2.10 | % | | $ | 10.57 | |

International Small Cap Fund | | $ | 1,000.00 | | | $ | 916.10 | | | | 2.11 | % | | $ | 10.08 | |

34

Brandes Investment Trust

| | | | | | | | | | | | | | | | |

| | | Class I | |

Fund | | Beginning

Account

Value | | | Ending

Account

Value | | | Annual

Expense

Ratio | | | Expenses

Paid

During

the Period* | |

International Equity Fund | | $ | 1,000.00 | | | $ | 949.70 | | | | 0.96 | % | | $ | 4.67 | |

Global Equity Fund | | $ | 1,000.00 | | | $ | 948.00 | | | | 1.00 | % | | $ | 4.86 | |

Global Equity Income Fund | | $ | 1,000.00 | | | $ | 980.70 | | | | 1.00 | % | | $ | 4.94 | |

Global Opportunities Value Fund | | $ | 1,000.00 | | | $ | 933.20 | | | | 1.15 | % | | $ | 5.54 | |

Emerging Markets Value Fund | | $ | 1,000.00 | | | $ | 1,025.40 | | | | 1.12 | % | | $ | 5.66 | |

International Small Cap Fund | | $ | 1,000.00 | | | $ | 920.70 | | | | 1.15 | % | | $ | 5.51 | |

Small Cap Value Fund | | $ | 1,000.00 | | | $ | 918.70 | | | | 0.90 | % | | $ | 4.31 | |

Core Plus Fixed Income Fund | | $ | 1,000.00 | | | $ | 1,033.40 | | | | 0.50 | % | | $ | 2.53 | |

| | | | | | | | | | | | | | | | |

| | | Class R6 | |

Fund | | Beginning

Account

Value | | | Ending

Account

Value | | | Annual

Expense

Ratio | | | Expenses

Paid

During

the Period* | |

International Equity Fund | | $ | 1,000.00 | | | $ | 950.10 | | | | 0.82 | % | | $ | 3.99 | |

Emerging Markets Value Fund | | $ | 1,000.00 | | | $ | 1,024.40 | | | | 0.97 | % | | $ | 4.90 | |

International Small Cap Fund | | $ | 1,000.00 | | | $ | 921.70 | | | | 1.00 | % | | $ | 4.79 | |

Small Cap Value Fund | | $ | 1,000.00 | | | $ | 919.30 | | | | 0.72 | % | | $ | 3.45 | |

Core Plus Fixed Income Fund | | $ | 1,000.00 | | | $ | 1,036.40 | | | | 0.35 | % | | $ | 1.78 | |

| * | Expenses are equal to the Fund’s expense ratio for the period, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

Hypothetical Example for Comparison Purposes

This section provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other mutual funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as brokerage commissions on purchase and sales of Fund shares. Therefore, the last column of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

35

Brandes Investment Trust

| | | | | | | | | | | | | | | | |

| | | Class A | |

Fund | | Beginning

Account

Value | | | Ending

Account

Value | | | Annual

Expense

Ratio | | | Expenses

Paid

During

the Period* | |

International Equity Fund | | $ | 1,000.00 | | | $ | 1,019.15 | | | | 1.16% | | | $ | 5.84 | |

Global Equity Fund | | $ | 1,000.00 | | | $ | 1,018.70 | | | | 1.25% | | | $ | 6.29 | |

Global Equity Income Fund | | $ | 1,000.00 | | | $ | 1,018.70 | | | | 1.25% | | | $ | 6.29 | |

Global Opportunities Value Fund | | $ | 1,000.00 | | | $ | 1,017.95 | | | | 1.40% | | | $ | 7.04 | |

Emerging Markets Value Fund | | $ | 1,000.00 | | | $ | 1,018.15 | | | | 1.36% | | | $ | 6.84 | |

International Small Cap Fund | | $ | 1,000.00 | | | $ | 1,018.15 | | | | 1.36% | | | $ | 6.84 | |

Small Cap Value Fund | | $ | 1,000.00 | | | $ | 1,019.20 | | | | 1.15% | | | $ | 5.79 | |

Core Plus Fixed Income Fund | | $ | 1,000.00 | | | $ | 1,021.44 | | | | 0.70% | | | $ | 3.53 | |

| | | | | | | | | | | | | | | | |

| | | Class C | |

Fund | | Beginning

Account

Value | | | Ending

Account

Value | | | Annual

Expense

Ratio | | | Expenses

Paid

During

the Period* | |

International Equity Fund | | $ | 1,000.00 | | | $ | 1,015.41 | | | | 1.91% | | | $ | 9.60 | |

Global Equity Fund | | $ | 1,000.00 | | | $ | 1,014.96 | | | | 2.00% | | | $ | 10.05 | |

Global Equity Income Fund | | $ | 1,000.00 | | | $ | 1,014.96 | | | | 2.00% | | | $ | 10.05 | |

Global Opportunities Value Fund | | $ | 1,000.00 | | | $ | 1,014.21 | | | | 2.15% | | | $ | 10.80 | |

Emerging Markets Value Fund | | $ | 1,000.00 | | | $ | 1,014.46 | | | | 2.10% | | | $ | 10.55 | |

International Small Cap Fund | | $ | 1,000.00 | | | $ | 1,014.41 | | | | 2.11% | | | $ | 10.60 | |

| | | | | | | | | | | | | | | | |

| | | Class I | |

Fund | | Beginning

Account

Value | | | Ending

Account

Value | | | Annual

Expense

Ratio | | | Expenses

Paid

During

the

Period* | |

International Equity Fund | | $ | 1,000.00 | | | $ | 1,020.14 | | | | 0.96 | % | | $ | 4.84 | |

Global Equity Fund | | $ | 1,000.00 | | | $ | 1,019.95 | | | | 1.00 | % | | $ | 5.04 | |

Global Equity Income Fund | | $ | 1,000.00 | | | $ | 1,019.95 | | | | 1.00 | % | | $ | 5.04 | |

Global Opportunities Value Fund | | $ | 1,000.00 | | | $ | 1,019.20 | | | | 1.15 | % | | $ | 5.79 | |

Emerging Markets Value Fund | | $ | 1,000.00 | | | $ | 1,019.35 | | | | 1.12 | % | | $ | 5.64 | |

International Small Cap Fund | | $ | 1,000.00 | | | $ | 1,019.20 | | | | 1.15 | % | | $ | 5.79 | |

Small Cap Value Fund | | $ | 1,000.00 | | | $ | 1,020.44 | | | | 0.90 | % | | $ | 4.53 | |

Core Plus Fixed Income Fund | | $ | 1,000.00 | | | $ | 1,022.44 | | | | 0.50 | % | | $ | 2.52 | |

36

Brandes Investment Trust

| | | | | | | | | | | | | | | | |

| | | Class R6 | |

Fund | | Beginning

Account

Value | | | Ending

Account

Value | | | Annual

Expense

Ratio | | | Expenses

Paid

During

the Period* | |

International Equity Fund | | $ | 1,000.00 | | | $ | 1,020.84 | | | | 0.82% | | | $ | 4.13 | |

Emerging Markets Value Fund | | $ | 1,000.00 | | | $ | 1,020.09 | | | | 0.97% | | | $ | 4.89 | |

International Small Cap Fund | | $ | 1,000.00 | | | $ | 1,019.95 | | | | 1.00% | | | $ | 5.04 | |

Small Cap Value Fund | | $ | 1,000.00 | | | $ | 1,021.34 | | | | 0.72% | | | $ | 3.63 | |

Core Plus Fixed Income Fund | | $ | 1,000.00 | | | $ | 1,023.19 | | | | 0.35% | | | $ | 1.77 | |

| * | Expenses are equal to the Fund’s expense ratio for the period, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

37

Brandes International Equity Fund

SCHEDULE OF INVESTMENTS — March 31, 2019 (Unaudited)

| | | | | | | | |

| Shares | | | | | Value | |

| | COMMON STOCKS – 87.61% | |

|

| | Brazil – 1.78% | |

| | 748,399 | | | Embraer SA Sponsored – ADR | | $ | 14,227,065 | |

| | | | | | | | |

|

| | China – 1.58% | |

| | 1,241,000 | | | China Mobile Ltd. | | | 12,663,576 | |

| | | | | | | | |

|

| | Finland – 1.60% | |

| | 2,255,736 | | | Nokia OYJ | | | 12,850,134 | |

| | | | | | | | |

|

| | France – 16.69% | |

| | 1,054,578 | | | Carrefour SA | | | 19,696,592 | |

| | 416,063 | | | Compagnie de Saint-Gobain SA | | | 15,086,088 | |

| | 1,220,263 | | | Engie SA | | | 18,197,684 | |

| | 878,202 | | | Orange SA | | | 14,317,439 | |

| | 254,592 | | | Publicis Groupe SA | | | 13,631,420 | |

| | 119,629 | | | Renault SA | | | 7,909,635 | |

| | 329,123 | | | Sanofi | | | 29,102,563 | |

| | 158,566 | | | Schneider Electric SE | | | 12,445,680 | |

| | 36,882 | | | Societe BIC SA | | | 3,287,971 | |

| | | | | | | | |

| | | | | | | 133,675,072 | |

| | | | | | | | |

|

| | Germany – 1.01% | |

| | 109,498 | | | BASF SE | | | 8,075,167 | |

| | | | | | | | |

|

| | Hong Kong – 0.54% | |

| | 11,842,000 | | | First Pacific Co. Ltd. | | | 4,326,627 | |

| | | | | | | | |

|

| | Ireland – 1.60% | |

| | 412,717 | | | CRH Plc | | | 12,787,911 | |

| | | | | | | | |

|

| | Italy – 6.16% | |

| | 1,019,158 | | | Eni SpA | | | 18,007,110 | |

| | 5,328,543 | | | Intesa Sanpaolo SpA | | | 13,004,464 | |

| | 30,748,839 | | | Telecom Italia Rsp | | | 17,462,951 | |

| | 1,365,052 | | | Telecom Italia SpA(a) | | | 850,221 | |

| | | | | | | | |

| | | | | | | 49,324,746 | |

| | | | | | | | |

|

| | Japan – 13.66% | |

| | 542,400 | | | Dai Nippon Printing Co. Ltd. | | | 12,992,039 | |

| | 107,002 | | | Daiichi Sankyo

Co. Ltd. | | | 4,941,105 | |

| | 426,900 | | | Honda Motor Co. Ltd. | | | 11,594,936 | |

| | 1,042,900 | | | Mitsubishi Tanabe Pharma Corp. | | | 13,969,001 | |

| | 2,739,600 | | | Mitsubishi UFJ Financial Group, Inc. | | | 13,549,498 | |

| | | | | | | | |

| Shares | | | | | Value | |

| | 471,999 | | | MS&AD Insurance Group Holdings, Inc. | | $ | 14,381,139 | |

| | 760,700 | | | Nissan Motor Co. Ltd. | | | 6,246,981 | |

| | 364,800 | | | Sumitomo Mitsui Trust Holdings, Inc. | | | 13,110,588 | |

| | 45,500 | | | Taisho Pharmaceutical Holdings Co. Ltd. | | | 4,346,745 | |

| | 348,983 | | | Takeda Pharmaceutical

Co. Ltd. | | | 14,291,637 | |

| | | | | | | | |

| | | | | | | 109,423,669 | |

| | | | | | | | |

|

| | Mexico – 4.10% | |

| | 2,620,613 | | | Cemex SAB de CV Sponsored – ADR(a) | | | 12,159,644 | |

| | 14,973,608 | | | Fibra Uno Administracion SA de CV | | | 20,635,696 | |

| | | | | | | | |

| | | | | | | 32,795,340 | |

| | | | | | | | |

|

| | Netherlands – 2.31% | |

| | 2,056,796 | | | Aegon NV | | | 9,879,787 | |

| | 97,546 | | | NXP Semiconductors NV | | | 8,622,091 | |

| | | | | | | | |

| | | | | | | 18,501,878 | |

| | | | | | | | |

|

| | Russia – 1.25% | |

| | 1,556,496 | | | Mobile TeleSystems PJSC | | | 5,988,531 | |

| | 1,780,571 | | | Public Joint-Stock Co. Gazprom | | | 4,059,914 | |

| | | | | | | | |

| | | | | | | 10,048,445 | |

| | | | | | | | |

|

| | South Korea – 4.74% | |

| | 181,653 | | | Hana Financial Group, Inc. | | | 5,832,507 | |

| | 74,446 | | | Hyundai Mobis

Co. Ltd. | | | 13,690,196 | |

| | 60,185 | | | Hyundai Motor Co. | | | 6,345,731 | |

| | 85,611 | | | KT&G Corp. | | | 7,806,599 | |

| | 19,278 | | | POSCO | | | 4,304,775 | |

| | | | | | | | |

| | | | | | | 37,979,808 | |

| | | | | | | | |

|

| | Spain – 1.73% | |

| | 808,294 | | | Repsol SA | | | 13,828,584 | |

| | | | | | | | |

|

| | Switzerland – 6.76% | |

| | 1,430,909 | | | Credit Suisse Group AG | | | 16,679,277 | |

| | 20,996 | | | Swatch Group Ltd. Bearer | | | 6,013,291 | |

The accompanying notes to financial statements are an integral part of these Schedule of Investments.

38

Brandes International Equity Fund

SCHEDULE OF INVESTMENTS — March 31, 2019 (Unaudited) (continued)

| | | | | | | | |

| Shares | | | | | Value | |

| | 79,685 | | | Swatch Group Ltd. Registered | | $ | 4,412,249 | |

| | 105,291 | | | Swiss Resources AG | | | 10,291,692 | |

| | 1,377,705 | | | UBS Group AG | | | 16,716,452 | |

| | | | | | | | |

| | | | | | | 54,112,961 | |

| | | | | | | | |

|

| | Taiwan – 1.30% | |

| | 1,436,000 | | | Asustek Computer, Inc. | | | 10,405,742 | |

| | | | | | | | |

|

| | United Kingdom – 20.80% | |

| | 5,919,246 | | | Barclays Plc | | | 11,923,020 | |

| | 1,766,562 | | | BP Plc | | | 12,827,914 | |

| | 4,123,077 | | | G4S Plc | | | 9,866,402 | |

| | 1,400,888 | | | GlaxoSmithKline Plc | | | 29,104,717 | |

| | 959,386 | | | HSBC Holdings Plc | | | 7,795,873 | |

| | 273,504 | | | Imperial Brands Plc | | | 9,355,849 | |

| | 4,063,197 | | | J Sainsbury Plc | | | 12,468,630 | |

| | 4,889,136 | | | Kingfisher Plc | | | 14,993,667 | |

| | 4,179,971 | | | Marks & Spencer Group Plc | | | 15,170,347 | |

| | | | | | | | |

| Shares | | | | | Value | |

| | 4,544,469 | | | Tesco Plc | | $ | 13,753,894 | |

| | 3,807,408 | | | Wm Morrison Supermarkets Plc | | | 11,295,001 | |

| | 1,701,792 | | | WPP Plc | | | 17,977,917 | |

| | | | | | | | |

| | | | | | | 166,533,231 | |

| | | | | | | | |

| TOTAL COMMON STOCKS

(Cost $820,906,614) | | $ | 701,559,956 | |

| | | | | | | | |

| | PREFERRED STOCKS – 3.32% | |

|

| | Brazil – 1.83% | |

| | 1,028,300 | | | Petroleo Brasileiro SA | | $ | 7,309,076 | |

| | 602,600 | | | Telefonica Brasil SA | | | 7,310,585 | |

| | | | | | | | |

| | | | | | | 14,619,661 | |

| | | | | | | | |

|

| | Russia – 1.49% | |

| | 19,087,950 | | | Surgutneftegas PJSC | | | 11,921,417 | |

| | | | | | | | |

| TOTAL PREFERRED STOCKS

(Cost $18,585,933) | | $ | 26,541,078 | |

| | | | | | | | |

| | | | | | | | | | |

| | | Principal

Amount | | | Value | |

| REPURCHASE AGREEMENTS – 7.78% | | | | | | | | |

State Street Bank and Trust Repurchase Agreement,

(Dated 03/29/19), due 04/01/19, 1.20% [Collateralized

by $57,650,000 US Treasury Notes TIPS, 0.125%, 01/15/22,

(Market Value $63,554,455)] (proceeds $62,310,829) | | $ | 62,304,599 | | | $ | 62,304,599 | |

| | | | | | | | |

TOTAL REPURCHASE AGREEMENTS