UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07209

| T. Rowe Price Value Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

Item 1. Report to Shareholders

| Value Fund | December 31, 2016 |

The views and opinions in this report were current as of December 31, 2016. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our Email Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

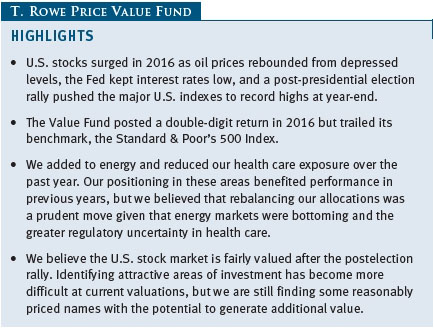

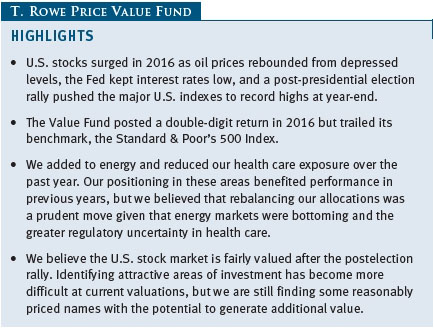

U.S. stocks rose in 2016, a tumultuous year for investors. After one of the worst starts to a new year, stocks turned a corner in February as China-focused fears receded, oil prices rebounded, and the Federal Reserve signaled that it would proceed cautiously in raising interest rates. Two political upsets rocked global markets in the ensuing months: the UK’s vote to leave the European Union in June and Donald Trump’s win in the U.S. presidential election in November. After a bout of volatility accompanying both events, global stock markets resumed their upswing as investors digested the longer-term implications of Brexit and a Trump presidency. By year-end, the major U.S. stock indexes ended near record highs as investors anticipated that the new administration would implement policies spurring faster growth and inflation. Against this volatile backdrop, the Value Fund posted a double-digit return in 2016.

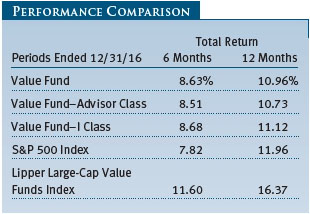

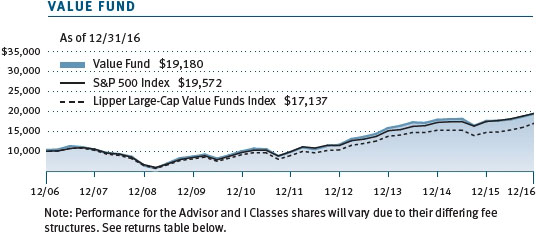

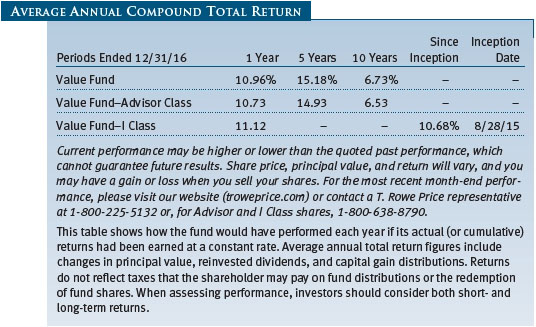

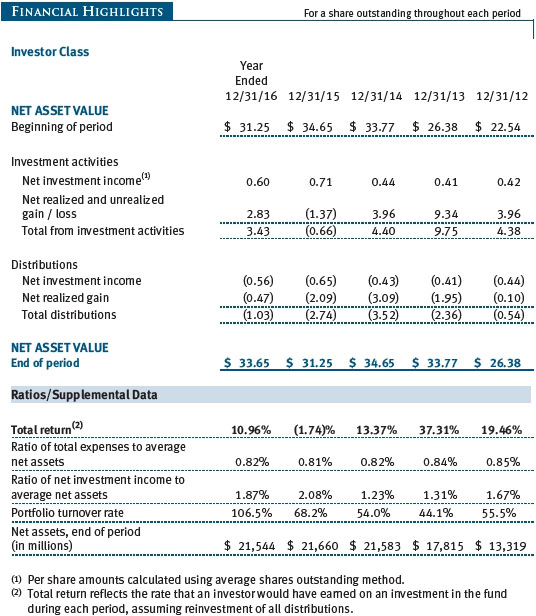

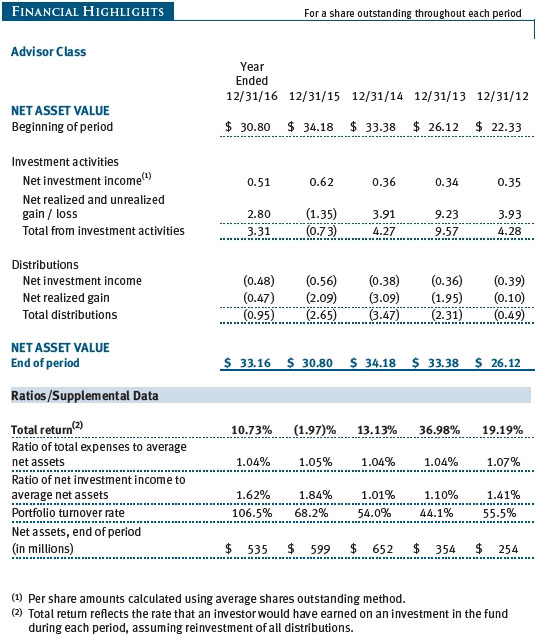

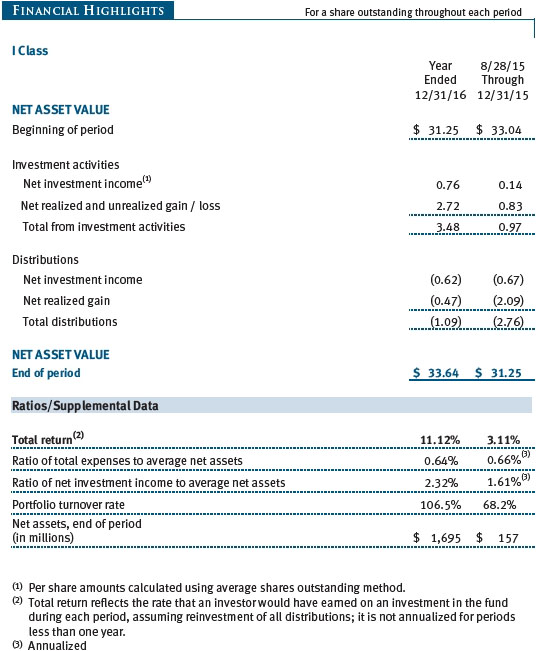

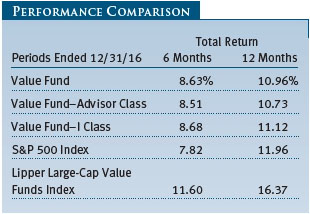

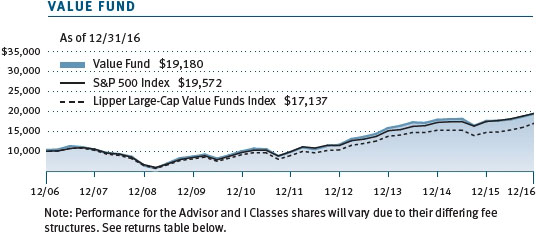

The Value Fund returned 8.63% and 10.96% for the six and 12 months ended December 31, 2016, respectively, versus 7.82% and 11.96% for the Standard & Poor’s 500 Index over the same periods. The fund lagged the return of its peer group, the Lipper Large-Cap Value Funds Index, for both periods. (Returns for Advisor and I Classes reflect their different fee structures.) The fund’s performance versus its peers over longer time periods remained solid. The Value Fund is in the 85th percentile of its Lipper peer group for the trailing one-year period, the 34th percentile for the trailing three-year period, the top decile for the trailing five-year period, and the top quintile for the trailing 10-year period. Based on cumulative total return, Lipper ranked the fund 406 of 479, 139 of 413, 30 of 369, and 26 of 255 large-cap value funds for the 1-, 3-, 5-, and 10-year periods ended December 31, 2016, respectively. Since your fund’s inception on September 30, 1994, it has outpaced both the broad market and its Lipper peer group by posting an annualized gain of 10.92% compared with the S&P 500’s return of 9.43% and the Lipper index’s return of 8.57%. Past performance cannot guarantee future results.

MARKET ENVIRONMENT

U.S. stocks retreated at the start of 2016 as worries about China’s economic slowdown and collapsing oil prices spurred fears of a worldwide recession. Sentiment began to turn in mid-February as concerns about a global oversupply in oil abated and the Fed held back on raising interest rates. The market’s advance was curtailed in June by Brexit, which sparked a two-day global stock sell-off and upheaval in foreign currencies. However, U.S. stocks proved resilient and resumed their ascent over the summer, aided by improving economic data and a stabilization in corporate earnings. Stocks drifted lower in the weeks preceding the U.S. elections in November but rallied after the outcome as investors bet that the new president and a Republican-controlled Congress would cut taxes, loosen regulations, and step up infrastructure spending.

Value stocks outpaced growth across the capitalization spectrum. Large-cap stocks lagged mid- and small-cap stocks as investors deemed that smaller companies with greater exposure to the domestic economy would benefit more from Trump’s homeward-focused policies and a strong dollar than larger, more globally exposed companies.

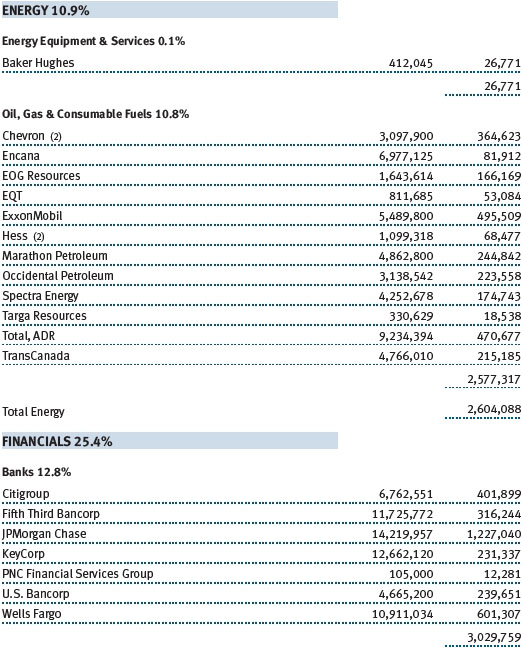

Nine of 11 sectors in the S&P 500 advanced, led by energy and financials, which both returned more than 20%. Energy stocks rallied as U.S. oil prices climbed from decade lows and ended the year above the $50 per barrel threshold, lifted by an unexpected deal among the world’s leading oil producers in November to reduce oil output starting in 2017. Financial stocks advanced as investors anticipated that the new administration’s policies would lead to a faster pace of interest rate increases, corporate tax cuts, and less regulatory oversight—all of which would boost profitability for banks. The real estate and health care sectors posted modest declines.

PORTFOLIO REVIEW

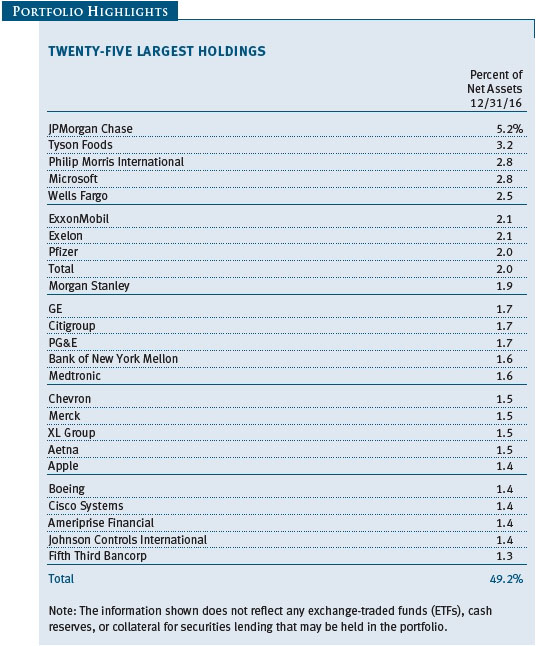

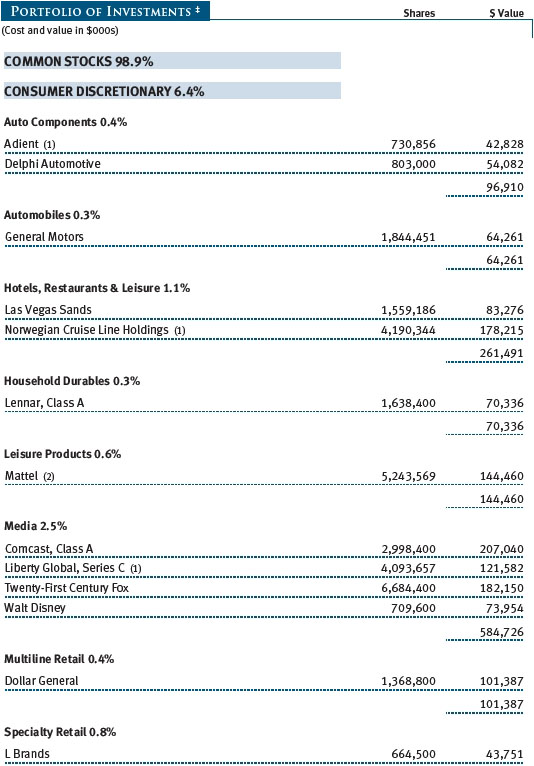

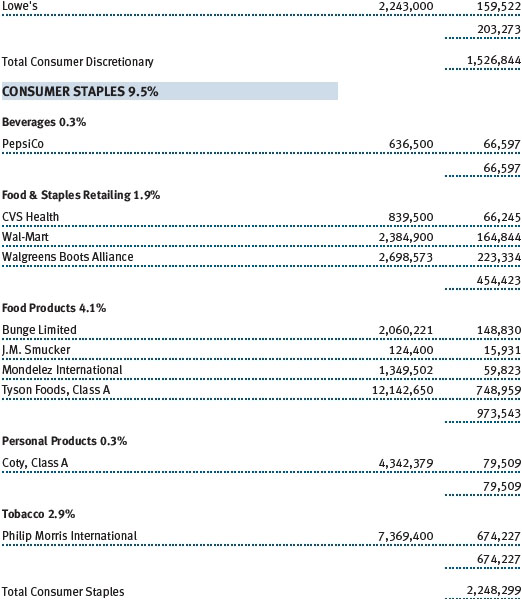

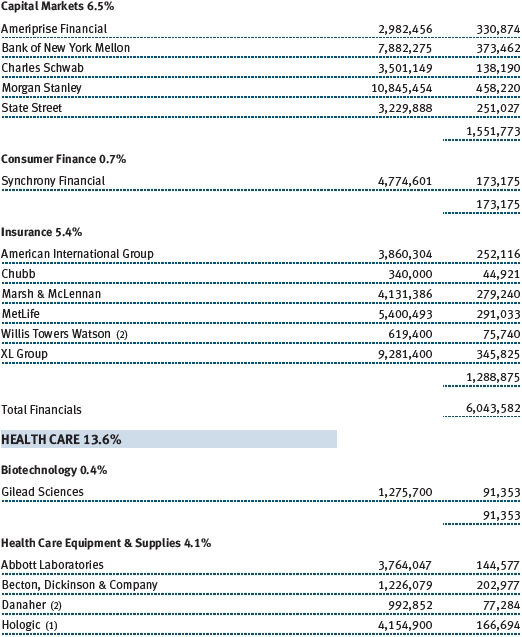

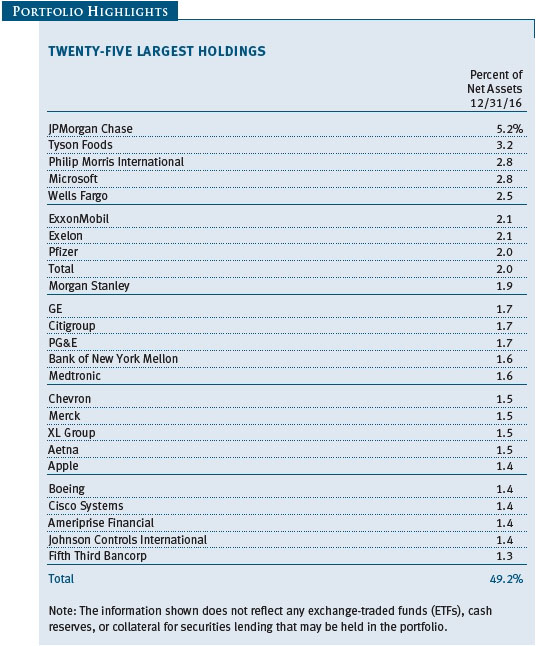

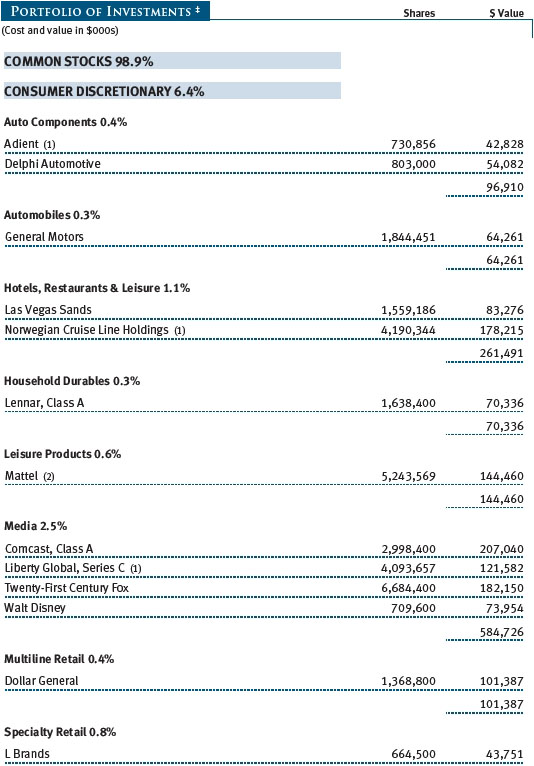

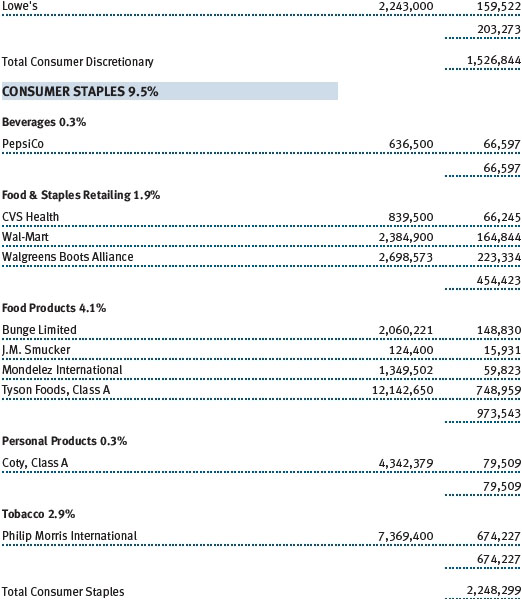

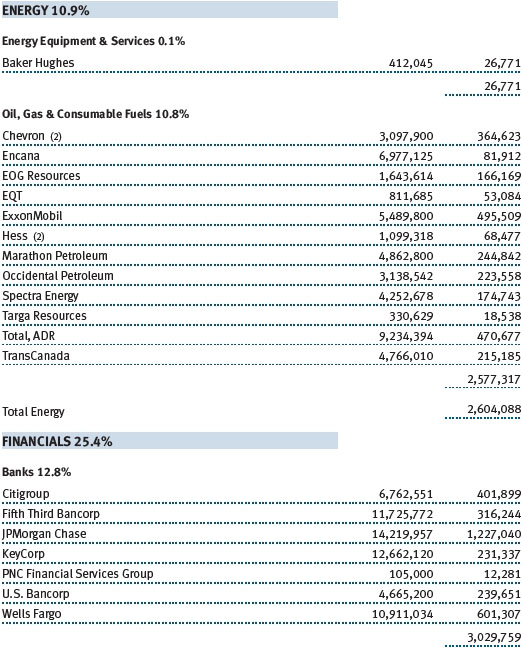

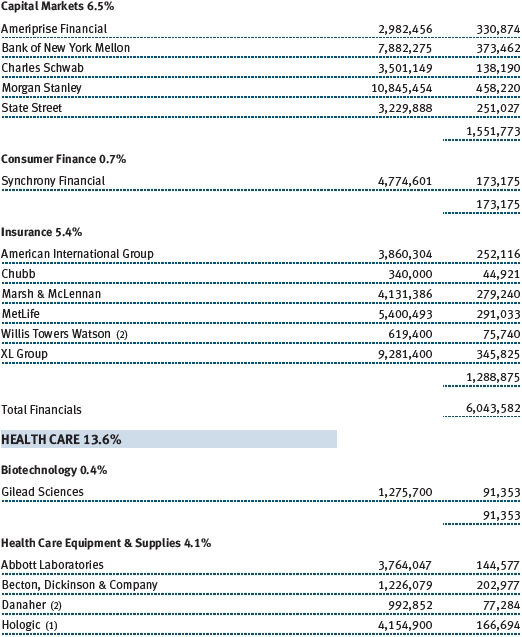

Financial stocks contributed the most to performance. The postelection financials rally marked a turnaround from the first half of 2016, when tepid U.S. economic data and ultralow interest rates caused the sector to underperform. JPMorgan Chase, Morgan Stanley, Midwestern lender KeyCorp, and insurance broker Marsh & McLennan participated in the rally and ranked among the fund’s biggest contributors. Our stock picking was strongest in the consumer staples sector, which also helped performance. Tyson Foods led contributors in this area. Tyson shares rose to record levels over the year as the meat processing company reaped the benefits of its 2014 Hillshire Brands acquisition, which transformed it into a more profitable packaged foods company. Tobacco company Philip Morris International was another solid contributor amid strong demand for high dividend-paying companies in a low interest rate environment. (Please refer to our portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

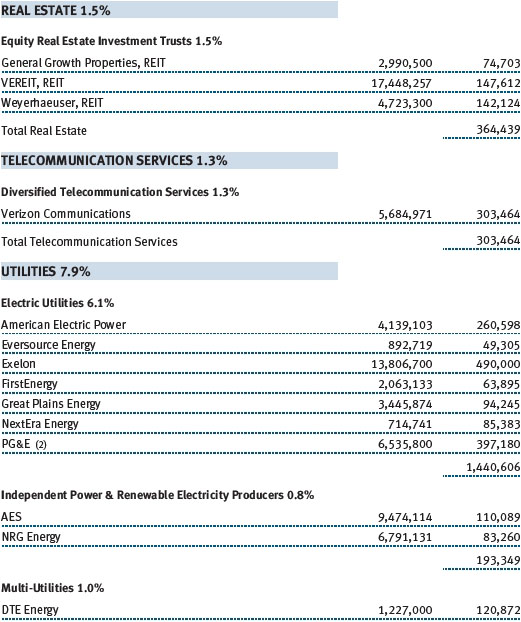

The utilities sector also lifted performance through a favorable overweight allocation and stock selection, led by our holdings in electricity providers PG&E, AES, and CenterPoint Energy. These names generated double-digit returns in 2016 as low interest rates lured yield-seeking investors into utilities, which tend to pay hefty dividends and deliver dependable earnings. We trimmed our position in AES and eliminated CenterPoint Energy after their strong performance, but still hold a meaningful position in PG&E.

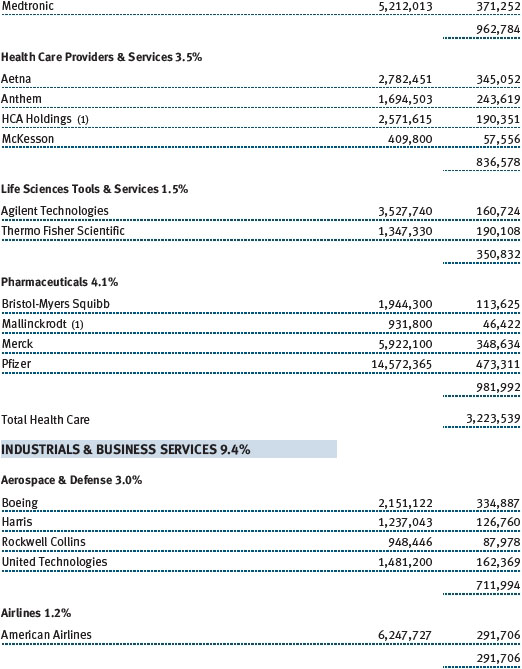

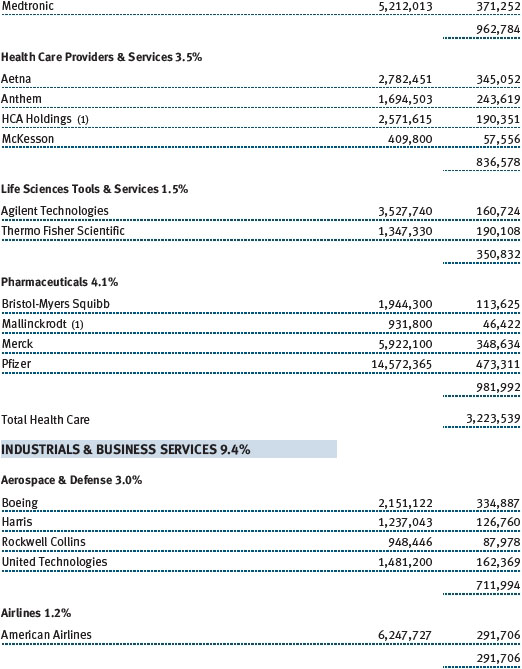

Conversely, adverse selection in industrials and business services stocks detracted the most from the fund’s performance against the benchmark. While our core industrials holdings GE and Boeing posted solid returns, our lack of exposure to several more cyclical names that delivered outsized gains in 2016 drove underperformance in this sector.

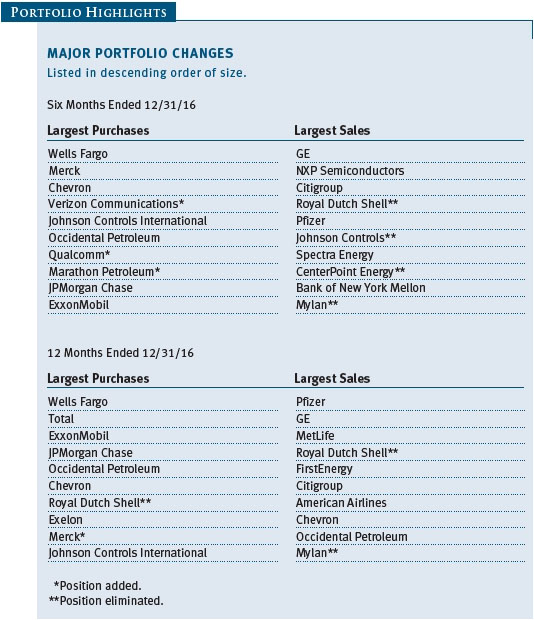

Unfavorable positioning in the telecommunication services sector also weighed on performance. Our holdings in UK mobile phone company Vodafone ranked among the top detractors as its shares sank after Brexit, which triggered widespread uncertainty across the Continent and steep losses in the euro and pound, eroding the returns from European investments in dollar terms. We eliminated our Vodafone position in the second half of 2016 in favor of initiating a position in U.S. wireless leader Verizon Communications, after it dramatically sold off.

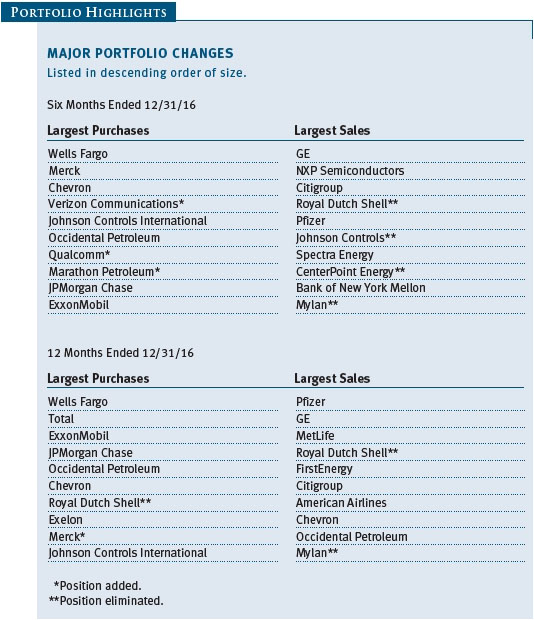

PORTFOLIO STRATEGY AND CHANGES

To provide some context to our recent positioning changes, we would like to recap our investment strategy. The Value Fund buys and holds fundamentally strong, attractively valued companies with the potential for better performance. We spend much effort determining the potential return and risk associated with a particular company. Specifically, we try to identify companies in which we believe an investment’s implicit upside is significantly greater than its inherent risk. We strongly favor companies that generate strong free cash flow and trade at a discount to our estimated sum-of-the-parts valuation. If we can continue to successfully identify companies with asymmetric return potential, then we should be able to outperform the market and our peers over the long term.

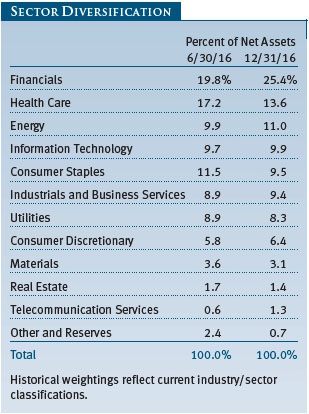

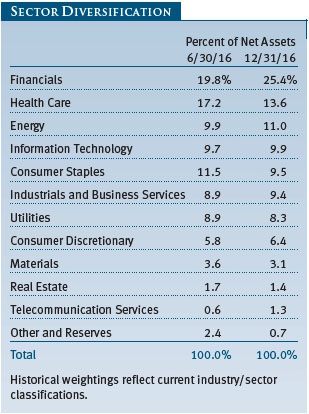

Throughout 2016, we sought to rebalance your fund by paring the size of our larger underweight and overweight positions versus the benchmark. We believe that trimming some of our larger relative bets was a prudent move given an unusually high level of uncertainty in the U.S. outlook and our expectations for elevated volatility in the near term. Our most significant positioning changes last year were reducing our relatively large health care allocation and increasing our energy exposure. While our previous positioning in these sectors helped drive strong returns in your fund for several years, changing industry conditions—namely, the energy downturn that began in 2014 and rising regulatory risk for health care companies—led us to believe that these shifts were necessary to help ensure good performance over the long term.

In the second half of 2016, we reduced our positions in Pfizer and biotech company Gilead Sciences and eliminated specialty drugmaker Mylan and insurer UnitedHealth Group. Even after these trades, however, health care remains a significant allocation for its defensive qualities, strong long-term demographic tailwinds, and still-attractive valuations. We used proceeds from these sales to add to our positions in the energy sector, including U.S. oil majors Chevron and ExxonMobil, oil and gas producer Occidental Petroleum, and oil refining and marketing company Marathon Petroleum. These are high-quality companies with strong dividend yields, solid balance sheets, low cost structures, good cash flow generation, and access to relatively low-cost sources of oil and natural gas. We believe that our energy holdings have unique attributes that will allow them to hold up well even if oil prices enter another downturn.

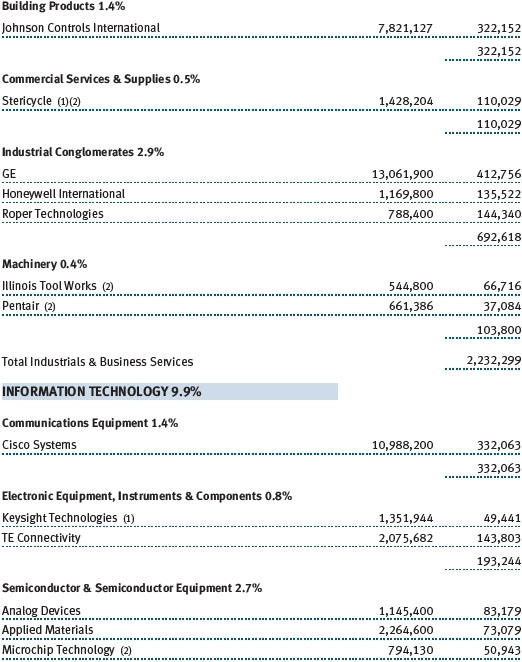

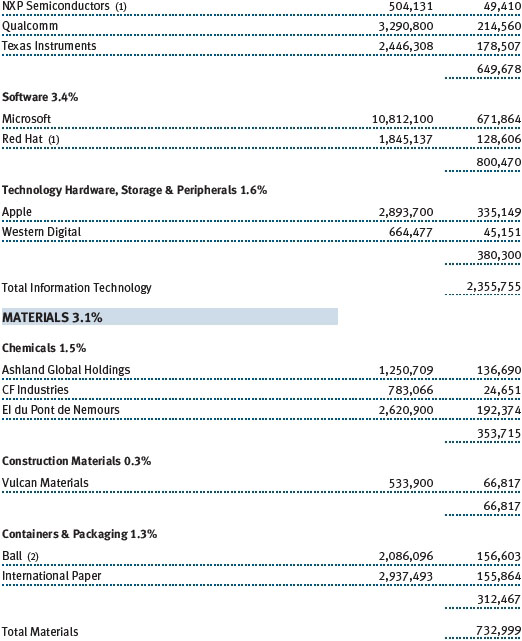

We took advantage of market upswings to reduce positions in companies that are more sensitive to industry cycles in favor of adding to more defensive areas, including consumer staples and utilities. For example, we trimmed our exposure to semiconductor companies, which have recently benefited from strong demand and a wave of consolidation that has lifted valuations across the industry. In recent months, we reduced positions in Texas Instruments and NXP Semiconductors, which agreed to be acquired by mobile phone chipmaker Qualcomm in October. However, we added to our positions in financials—the one cyclical sector where valuations still appear reasonable, in our view. We accumulated shares of Wells Fargo, whose shares sank to multiyear lows in September after reports surfaced of a fraudulent customer accounts scandal at its retail banks. Despite Wells Fargo’s well-publicized troubles, we believe that the bank has taken the appropriate steps to recover from the crisis and its shares represented a good buying opportunity. We also added to our position in JPMorgan Chase, our top holding at year-end.

OUTLOOK

We believe the U.S. stock market is fairly valued after the rally since Election Day. While we are still finding some reasonably priced names with the potential to generate additional value, identifying attractive investment areas has become more difficult at current valuation levels.

Much of the stock market’s postelection gains have been driven by speculation about the new president’s policies and market participants trying to identify potential winners and losers under the new administration. However, predicting the near-term direction of the economy, stock market, or individual companies is a difficult exercise made more challenging by the high level of unknowns about Donald Trump’s first year as president. Valuations in some sectors appear to be pricing in the most optimistic of Trump’s pro-growth proposals, yet the timing and substance of the new administration’s policies on the economy, taxation, and trade remain unclear. Only time will tell if the policies put forth by Trump match the market’s expectations.

The combination of U.S. policy instability and elevated valuations lends itself to heightened volatility and muted returns in the stock market in the near term, in our view. Last year ranked among the most volatile years for the stock market since the 2007–2008 global financial crisis, and we see little indication that volatility will subside in the coming months. While we realize that market swings can be unsettling, we would remind our shareholders that volatility is a friend to active investors since it allows us to buy and sell companies at more attractive prices. In light of the unusually uncertain outlook, we believe that our long-held strategy of buying high-quality, undervalued companies and holding them until they reach their full potential will continue to reward shareholders with solid returns.

Thank you for investing with T. Rowe Price.

Respectfully submitted,

Mark S. Finn

President of the fund and chairman of its Investment Advisory Committee

January 20, 2017

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF INVESTING IN THE FUND

Value investors seek to invest in companies whose stock prices are low in relation to their real worth or future prospects. By identifying companies whose stocks are currently out of favor or misunderstood, value investors hope to realize significant appreciation as other investors recognize the stock’s intrinsic value and the price rises accordingly. The value approach carries the risk that the market will not recognize a security’s intrinsic value for a long time or that a stock judged to be undervalued may actually be appropriately priced.

GLOSSARY

Lipper index: An index of mutual fund performance returns for specified periods in defined categories as tracked by Lipper Inc.

S&P 500 Index: A market cap-weighted index of 500 widely held stocks often used as a proxy for the overall stock market. Performance is reported on a total return basis.

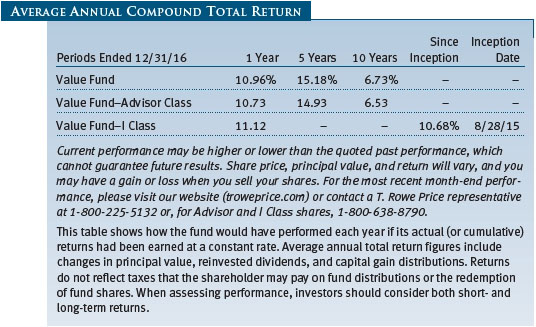

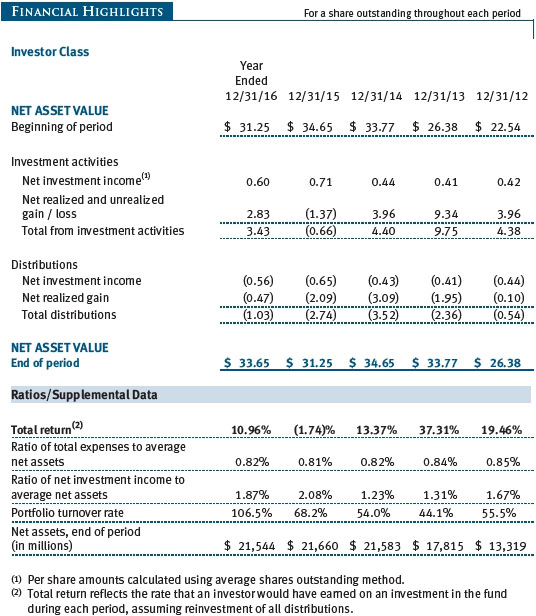

Performance and Expenses

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

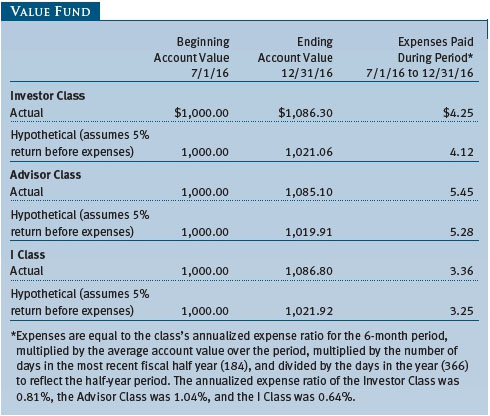

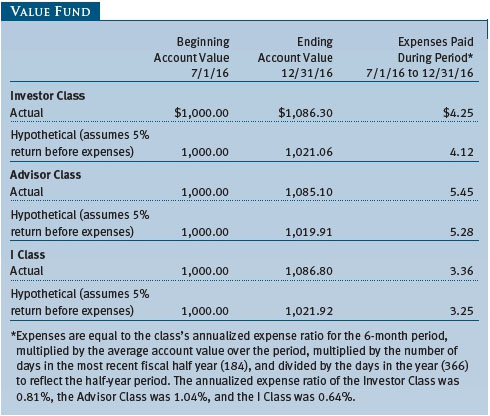

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

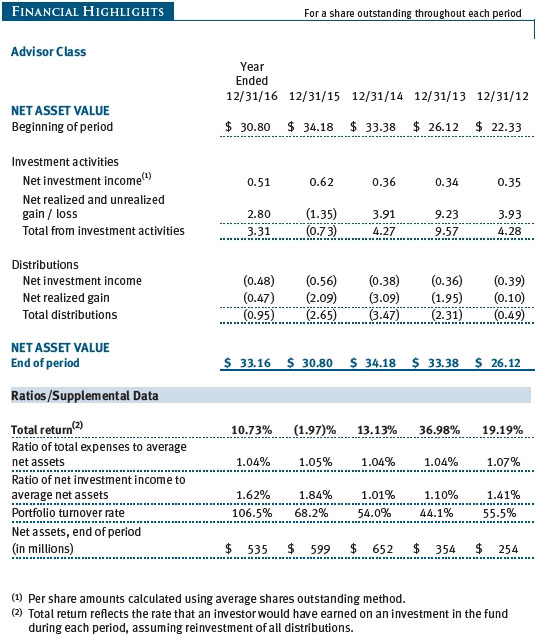

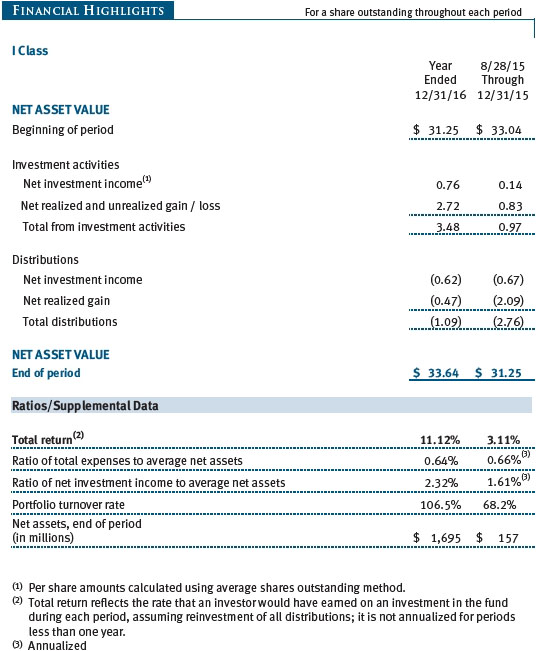

Please note that the fund has three share classes: The original share class (Investor Class) charges no distribution and service (12b-1) fee, the Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee, and I Class shares are available to institutionally oriented clients and impose no 12b-1 or administrative fee payment. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual account service fee of $20, generally for accounts with less than $10,000. The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $50,000 or more; accounts electing to receive electronic delivery of account statements, transaction confirmations, prospectuses, and shareholder reports; or accounts of an investor who is a T. Rowe Price Preferred Services, Personal Services, or Enhanced Personal Services client (enrollment in these programs generally requires T. Rowe Price assets of at least $100,000). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

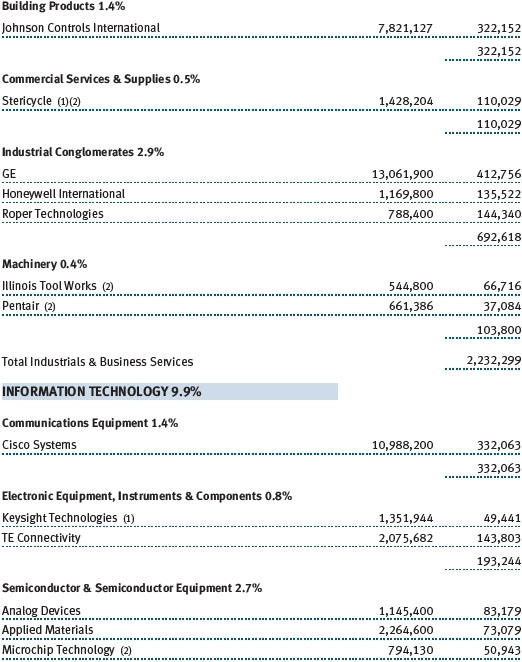

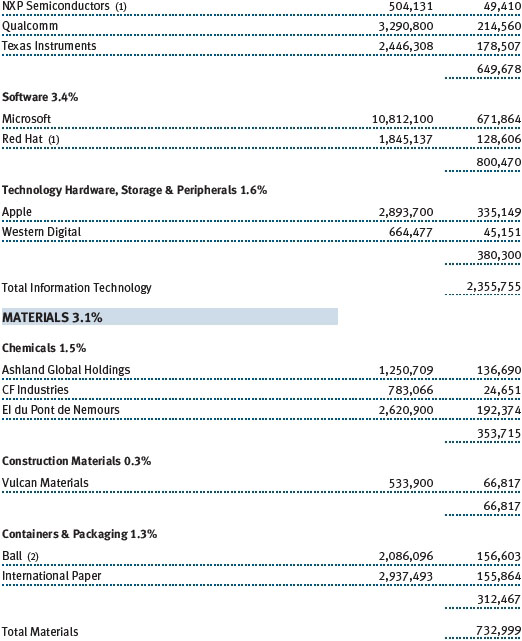

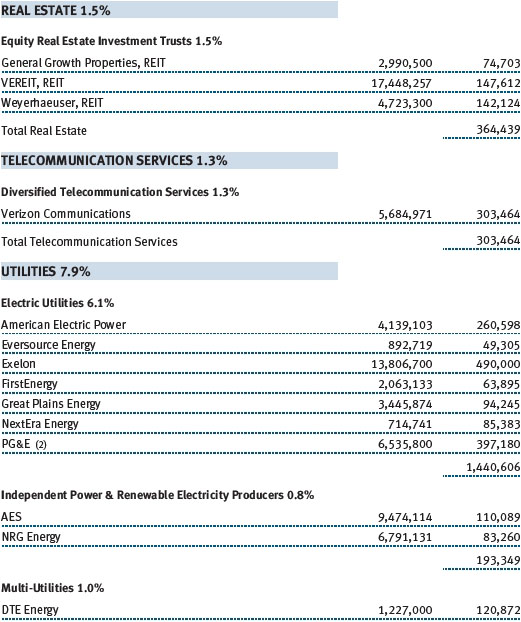

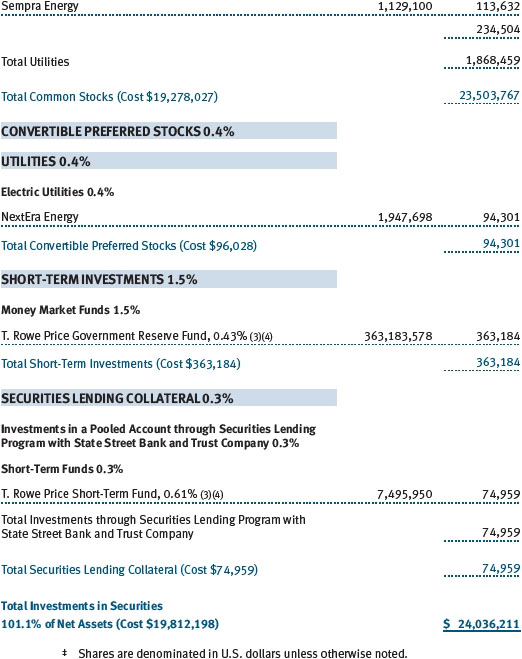

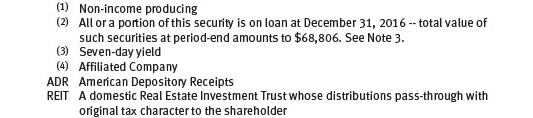

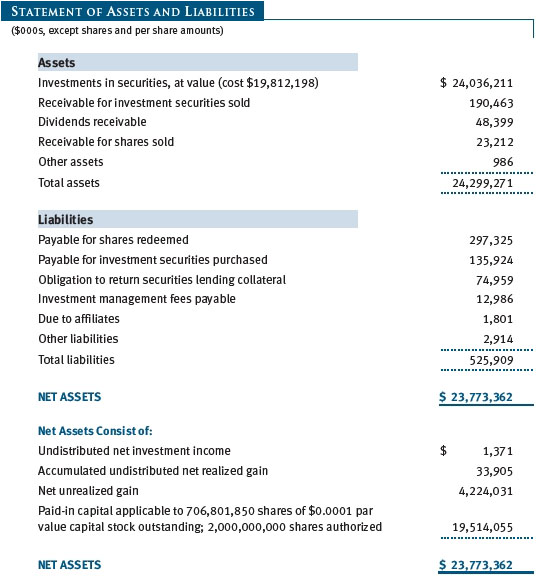

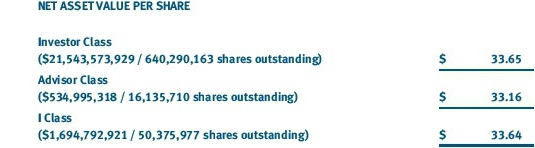

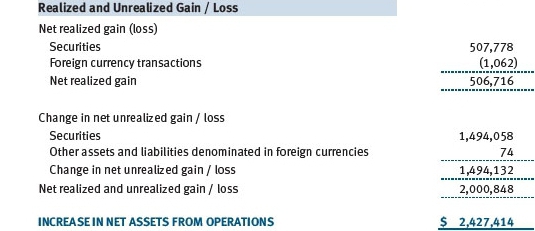

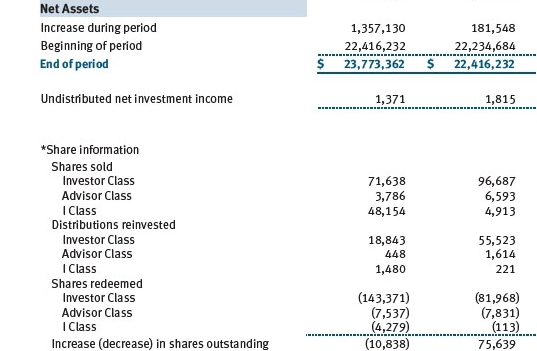

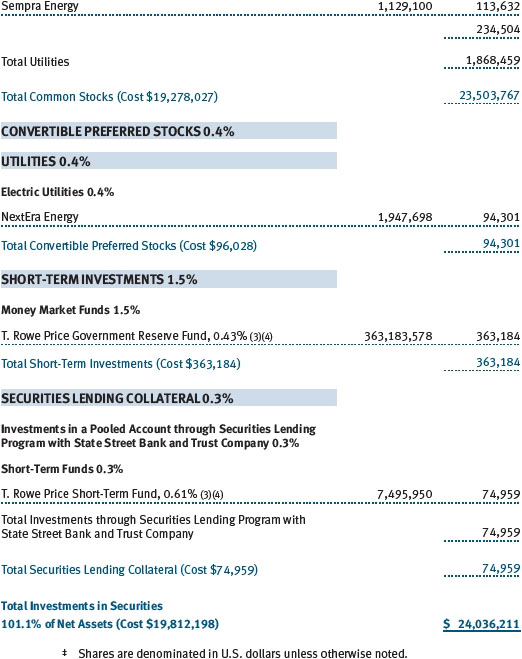

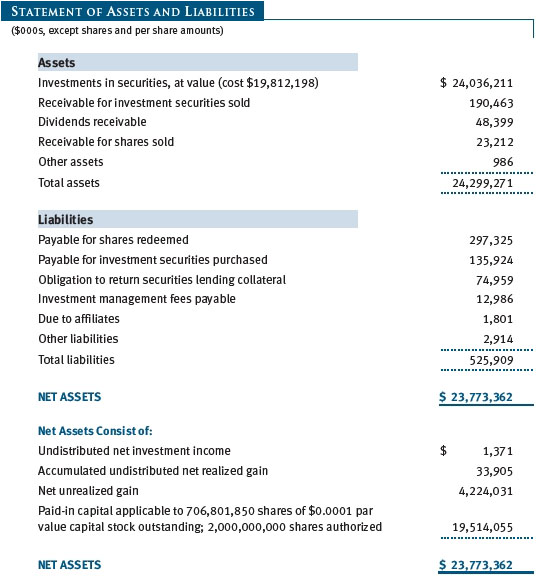

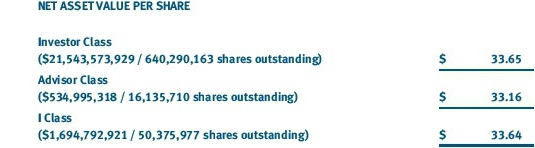

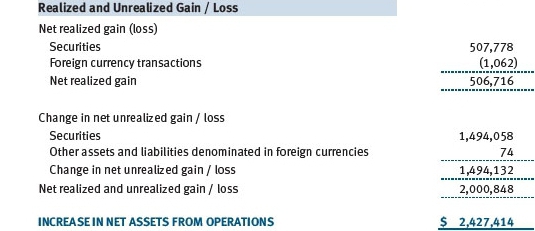

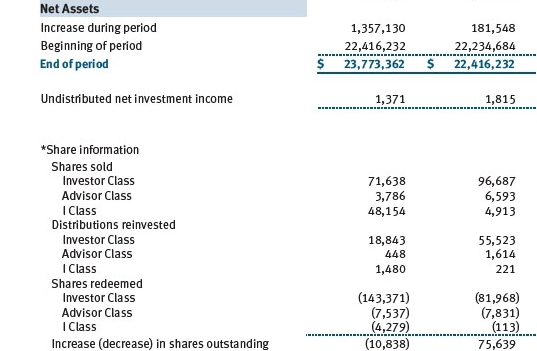

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| Notes to Financial Statements |

T. Rowe Price Value Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund seeks to provide long-term capital appreciation by investing in common stocks believed to be undervalued. Income is a secondary objective. The fund has three classes of shares: the Value Fund (Investor Class), the Value Fund–Advisor Class (Advisor Class), and the Value Fund–I Class (I Class). Advisor Class shares are sold only through unaffiliated brokers and other unaffiliated financial intermediaries. I Class shares generally are available only to investors meeting a $1,000,000 minimum investment or certain other criteria. The Advisor Class operates under a Board-approved Rule 12b-1 plan pursuant to which the class compensates financial intermediaries for distribution, shareholder servicing, and/or certain administrative services; the Investor and I Classes do not pay Rule 12b-1 fees. Each class has exclusive voting rights on matters related solely to that class; separate voting rights on matters that relate to all classes; and, in all other respects, the same rights and obligations as the other classes.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions from REITs are initially recorded as dividend income and, to the extent such represent a return of capital or capital gain for tax purposes, are reclassified when such information becomes available. Income distributions are declared and paid by each class annually. Distributions to shareholders are recorded on the ex-dividend date. Capital gain distributions are generally declared and paid by the fund annually.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Class Accounting Shareholder servicing, prospectus, and shareholder report expenses incurred by each class are charged directly to the class to which they relate. Expenses common to all classes, investment income, and realized and unrealized gains and losses are allocated to the classes based upon the relative daily net assets of each class. The Advisor Class pays Rule 12b-1 fees, in an amount not exceeding 0.25% of the class’s average daily net assets.

Rebates Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are reflected as realized gain on securities in the accompanying financial statements and totaled $859,000 for the year ended December 31, 2016.

In-Kind Redemptions In accordance with guidelines described in the fund’s prospectus, and when considered to be in the best interest of all shareholders, the fund may distribute portfolio securities rather than cash as payment for a redemption of fund shares (in-kind redemption). Gains and losses realized on in-kind redemptions are not recognized for tax purposes and are reclassified from undistributed realized gain (loss) to paid-in capital. During the year ended December 31, 2016, the fund realized $114,491,000 of net gain on $398,808,000 of in-kind redemptions.

New Accounting Guidance In October 2016, the Securities and Exchange Commission (SEC) issued a new rule, Investment Company Reporting Modernization, which, among other provisions, amends Regulation S-X to require standardized, enhanced disclosures, particularly related to derivatives, in investment company financial statements. Compliance with the guidance is effective for financial statements filed with the SEC on or after August 1, 2017; adoption will have no effect on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s financial instruments are valued and each class’s net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business. However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC.

Fair Value The fund’s financial instruments are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The T. Rowe Price Valuation Committee (the Valuation Committee) is an internal committee that has been delegated certain responsibilities by the fund’s Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures and approves all fair value determinations. Specifically, the Valuation Committee establishes procedures to value securities; determines pricing techniques, sources, and persons eligible to effect fair value pricing actions; oversees the selection, services, and performance of pricing vendors; oversees valuation-related business continuity practices; and provides guidance on internal controls and valuation-related matters. The Valuation Committee reports to the Board and has representation from legal, portfolio management and trading, operations, risk management, and the fund’s treasurer.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made. OTC Bulletin Board securities are valued at the mean of the closing bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the closing bid and asked prices. Actively traded equity securities listed on a domestic exchange generally are categorized in Level 1 of the fair value hierarchy. OTC Bulletin Board securities, certain preferred securities, and equity securities traded in inactive markets generally are categorized in Level 2 of the fair value hierarchy.

Investments in mutual funds are valued at the mutual fund’s closing NAV per share on the day of valuation and are categorized in Level 1 of the fair value hierarchy. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value.

Thinly traded financial instruments and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee. The objective of any fair value pricing determination is to arrive at a price that could reasonably be expected from a current sale. Financial instruments fair valued by the Valuation Committee are primarily private placements, restricted securities, warrants, rights, and other securities that are not publicly traded.

Subject to oversight by the Board, the Valuation Committee regularly makes good faith judgments to establish and adjust the fair valuations of certain securities as events occur and circumstances warrant. For instance, in determining the fair value of an equity investment with limited market activity, such as a private placement or a thinly traded public company stock, the Valuation Committee considers a variety of factors, which may include, but are not limited to, the issuer’s business prospects, its financial standing and performance, recent investment transactions in the issuer, new rounds of financing, negotiated transactions of significant size between other investors in the company, relevant market valuations of peer companies, strategic events affecting the company, market liquidity for the issuer, and general economic conditions and events. In consultation with the investment and pricing teams, the Valuation Committee will determine an appropriate valuation technique based on available information, which may include both observable and unobservable inputs. The Valuation Committee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants, transaction information can be reliably obtained, and prices are deemed representative of fair value. However, the Valuation Committee may also consider other valuation methods such as market-based valuation multiples; a discount or premium from market value of a similar, freely traded security of the same issuer; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the issue. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants. Depending on the relative significance of unobservable inputs, including the valuation technique(s) used, fair valued securities may be categorized in Level 2 or 3 of the fair value hierarchy.

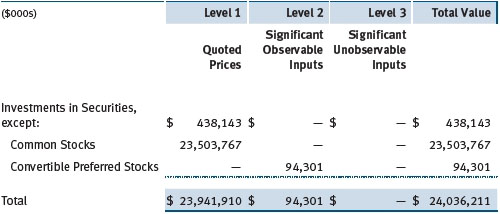

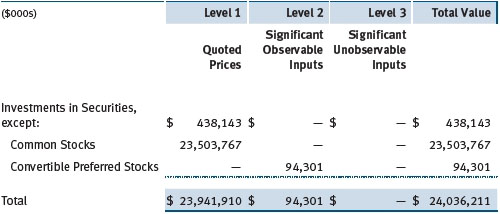

Valuation Inputs The following table summarizes the fund’s financial instruments, based on the inputs used to determine their fair values on December 31, 2016:

There were no material transfers between Levels 1 and 2 during the year ended December 31, 2016.

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Securities Lending The fund may lend its securities to approved brokers to earn additional income. Its securities lending activities are administered by a lending agent in accordance with a securities lending agreement. Security loans generally do not have stated maturity dates, and the fund may recall a security at any time. The fund receives collateral in the form of cash or U.S. government securities, valued at 102% to 105% of the value of the securities on loan. Collateral is maintained over the life of the loan in an amount not less than the value of loaned securities; any additional collateral required due to changes in security values is delivered to the fund the next business day. Cash collateral is invested by the lending agent(s) in accordance with investment guidelines approved by fund management. Additionally, the lending agent indemnifies the fund against losses resulting from borrower default. Although risk is mitigated by the collateral and indemnification, the fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities, collateral investments decline in value, and the lending agent fails to perform. Securities lending revenue consists of earnings on invested collateral and borrowing fees, net of any rebates to the borrower, compensation to the lending agent, and other administrative costs. In accordance with GAAP, investments made with cash collateral are reflected in the accompanying financial statements, but collateral received in the form of securities is not. At December 31, 2016, the value of loaned securities was $68,806,000; the value of cash collateral and related investments was $74,959,000.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $23,964,667,000 and $24,746,775,000, respectively, for the year ended December 31, 2016.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

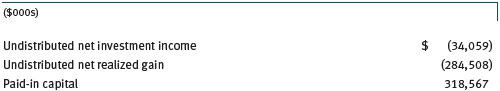

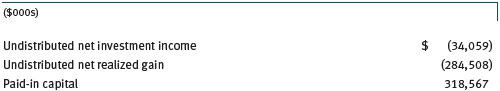

Reclassifications to paid-in capital relate primarily to redemptions in kind and a tax practice that treats a portion of the proceeds from each redemption of capital shares as a distribution of taxable net investment income or realized capital gain. For the year ended December 31, 2016, the following reclassifications were recorded to reflect tax character (there was no impact on results of operations or net assets):

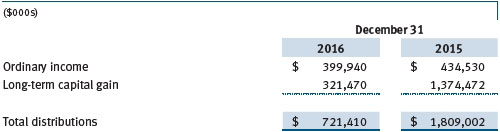

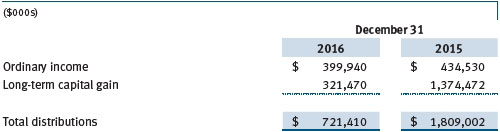

Distributions during the years ended December 31, 2016 and December 31, 2015, were characterized for tax purposes as follows:

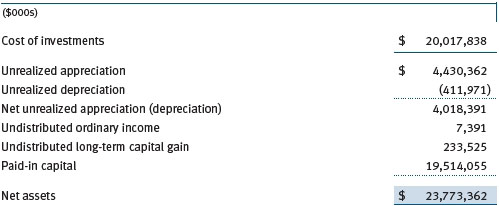

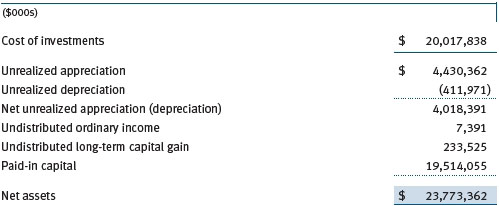

At December 31, 2016, the tax-basis cost of investments and components of net assets were as follows:

The difference between book-basis and tax-basis net unrealized appreciation (depreciation) is attributable to the deferral of losses from wash sales for tax purposes.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management agreement between the fund and Price Associates provides for an annual investment management fee that consists of an individual fund fee and a group fee; management fees are computed daily and paid monthly. The investment management agreement provides for an individual fund fee equal to 0.35% of the fund’s average daily net assets. Through April 30, 2017, Price Associates agreed to reduce the fund’s individual fee to 0.2975% for the portion of average daily net assets equal to or in excess of $20 billion. This contractual arrangement will renew automatically for one-year terms thereafter and may be revised, revoked, or terminated only with approval of the fund’s Board. Further, the fund has no obligation to repay fees reduced under this arrangement. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.270% for assets in excess of $500 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At December 31, 2016, the effective annual group fee rate was 0.29%.

The I Class is subject to an operating expense limitation (I Class limit) pursuant to which Price Associates is contractually required to pay all operating expenses of the I Class, excluding management fees, interest, expenses related to borrowings, taxes, and brokerage, and other non-recurring expenses permitted by the investment management agreement, to the extent such operating expenses, on an annualized basis, exceed 0.05% of average net assets. This agreement will continue until April 30, 2018, and may be renewed, revised, or revoked only with approval of the fund’s Board. The I Class is required to repay Price Associates for expenses previously paid to the extent the class’s net assets grow or expenses decline sufficiently to allow repayment without causing the class’s operating expenses to exceed the I Class limit in effect at the time of the waiver. However, no repayment will be made more than three years after the date of a payment or waiver. For the year ended December 31, 2016, the I Class operated below its expense limitation.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates provides certain accounting and administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend-disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and recordkeeping services for certain retirement accounts invested in the Investor Class and I Class. For the year ended December 31, 2016, expenses incurred pursuant to these service agreements were $67,000 for Price Associates; $1,117,000 for T. Rowe Price Services, Inc.; and $1,019,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

Additionally, the fund is one of several mutual funds in which certain college savings plans managed by Price Associates may invest. As approved by the fund’s Board of Directors, shareholder servicing costs associated with each college savings plan are borne by the fund in proportion to the average daily value of its shares owned by the college savings plan. For the year ended December 31, 2016, the fund was charged $697,000 for shareholder servicing costs related to the college savings plans, of which $591,000 was for services provided by Price. The amount payable at period-end pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At December 31, 2016, approximately 2% of the outstanding shares of the Investor Class were held by college savings plans.

The fund is also one of several mutual funds sponsored by Price Associates (underlying Price funds) in which the T. Rowe Price Spectrum Funds (Spectrum Funds), T. Rowe Price Retirement Funds (Retirement Funds), and T. Rowe Price Target Funds (Target Funds) may invest. None of the Spectrum Funds, Retirement Funds, or Target Funds invest in the underlying Price funds for the purpose of exercising management or control. Pursuant to special servicing agreements, expenses associated with the operation of the Spectrum Funds and Retirement Funds are borne by each underlying Price fund to the extent of estimated savings to it and in proportion to the average daily value of its shares owned by the Spectrum Funds and Retirement Funds. Prior to February 1, 2016, the Target Funds were subject to the same special servicing agreements; thus expenses associated with the operation of the Target Funds prior to that date were borne by the underlying Price Funds. Effective February 1, 2016, expenses associated with the operation of the Target Funds are borne by the Target Funds. Expenses allocated under these agreements are reflected as shareholder servicing expense in the accompanying financial statements. For the year ended December 31,2016, the fund was allocated $501,000 of Spectrum Funds’ expenses, $30,120,000 of Retirement Funds’ expenses, and $30,000 of Target Funds’ expenses. Of these amounts, $12,040,000 related to services provided by Price. At period-end, the amount payable to Price pursuant to these agreements is reflected as Due to Affiliates in the accompanying financial statements. At December 31, 2016, approximately 80% of the outstanding shares of the Investor Class were held by the Spectrum Funds and Retirement Funds, and approximately 6% of the outstanding shares of the I Class were held by the Target Funds.

In addition, other mutual funds, trusts, and other accounts managed by Price Associates or its affiliates (collectively, Price funds and accounts) may invest in the fund and are not subject to the special servicing agreements disclosed above. No Price fund or account may invest for the purpose of exercising management or control over the fund. At December 31, 2016, approximately 53% of the I Class’s outstanding shares were held by Price funds and accounts.

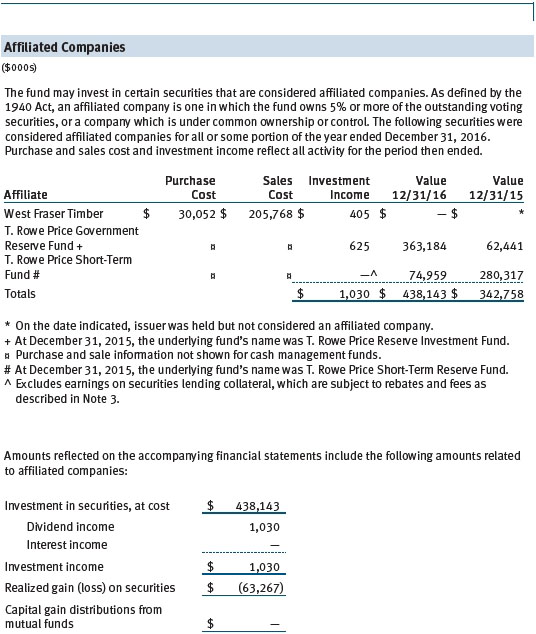

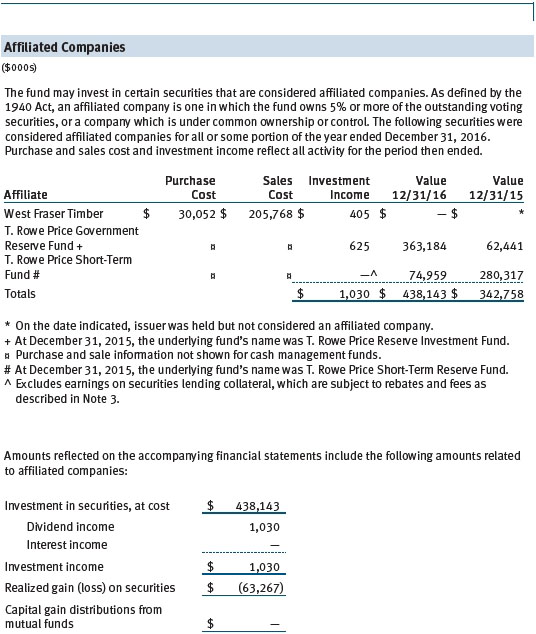

The fund may invest in the T. Rowe Price Government Reserve Fund, the T. Rowe Price Treasury Reserve Fund, or the T. Rowe Price Short-Term Fund (collectively, the Price Reserve Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The Price Reserve Funds are offered as short-term investment options to mutual funds, trusts, and other accounts managed by Price Associates or its affiliates and are not available for direct purchase by members of the public. The Price Reserve Funds pay no investment management fees.

As of December 31, 2016, T. Rowe Price Group, Inc., or its wholly owned subsidiaries owned 1,424,653 shares of the Investor Class, representing less than 1% of the fund’s net assets.

The fund may participate in securities purchase and sale transactions with other funds or accounts advised by Price Associates (cross trades), in accordance with procedures adopted by the fund’s Board and Securities and Exchange Commission rules, which require, among other things, that such purchase and sale cross trades be effected at the independent current market price of the security. During the year ended December 31, 2016, the aggregate value of purchases and sales cross trades with other funds or accounts advised by Price Associates was less than 1% of the fund’s net assets as of December 31, 2016.

NOTE 6 - BORROWING

To provide temporary liquidity, the fund may borrow from other T. Rowe Price-sponsored mutual funds under an interfund borrowing program developed and managed by Price Associates. The program permits the borrowing and lending of cash at rates beneficial to both the borrowing and lending funds. Pursuant to program guidelines, loans totaling 10% or more of a borrowing fund’s total assets require collateralization at 102% of the value of the loan; loans of less than 10% are unsecured. During the year ended December 31, 2016, the fund incurred less than $1,000 in interest expense related to outstanding borrowings on one day in the average amount of $13,100,000 and at an average annual rate of 1.31%. At December 31, 2016, there were no borrowings outstanding.

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Shareholders of

T. Rowe Price Value Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of T. Rowe Price Value Fund, Inc. (the “Fund”) as of December 31, 2016, the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated therein, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities as of December 31, 2016 by correspondence with the custodian and brokers, and confirmation of the underlying funds by correspondence with the transfer agent, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

February 16, 2017

| Tax Information (Unaudited) for the Tax Year Ended 12/31/16 |

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

The fund’s distributions to shareholders included:

| ● | $6,988,000 from short-term capital gains,

|

| ● | $498,091,000 from long-term capital gains, subject to a long-term capital gains tax rate of not greater than 20%. |

For taxable non-corporate shareholders, $425,730,000 of the fund’s income represents qualified dividend income subject to a long-term capital gains tax rate of not greater than 20%.

For corporate shareholders, $425,730,000 of the fund’s income qualifies for the dividends-received deduction.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our corporate website. To access it, please visit the following Web page:

https://www3.troweprice.com/usis/corporate/en/utility/policies.html

Scroll down to the section near the bottom of the page that says, “Proxy Voting Policies.” Click on the Proxy Voting Policies link in the shaded box.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through T. Rowe Price, visit the website location shown above, and scroll down to the section near the bottom of the page that says, “Proxy Voting Records.” Click on the Proxy Voting Records link in the shaded box.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 100 F St. N.E., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| About the Fund’s Directors and Officers |

Your fund is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting or potentially affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and business and regulatory affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of the Board’s members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and its affiliates; “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-638-5660.

| Independent Directors | | |

| | | |

| Name | | |

| (Year of Birth) | | |

| Year Elected* | | |

| [Number of T. Rowe Price | | Principal Occupation(s) and Directorships of Public Companies and |

| Portfolios Overseen] | | Other Investment Companies During the Past Five Years |

| | | |

| William R. Brody, M.D., Ph.D. | | President and Trustee, Salk Institute for Biological Studies (2009 to |

| (1944) | | present); Director, BioMed Realty Trust (2013 to 2016); Chairman |

| 2009 | | of the Board, Mesa Biotech, a molecular diagnostic company |

| [187] | | (March 2016 to present); Director, Radiology Partners, an integrated |

| | radiology practice management company (June 2016 to present); |

| | Director, Novartis, Inc. (2009 to 2014); Director, IBM (2007 |

| | to present) |

| | | |

| Anthony W. Deering | | Chairman, Exeter Capital, LLC, a private investment firm (2004 to |

| (1945) | | present); Director, Brixmor Real Estate Investment Trust (2012 to |

| 2001 | | present); Director and Advisory Board Member, Deutsche Bank |

| [187] | | North America (2004 to present); Director, Under Armour (2008 |

| | to present); Director, Vornado Real Estate Investment Trust (2004 |

| | to 2012) |

| | | |

| Bruce W. Duncan | | Chief Executive Officer and Director (2009 to present), Chairman |

| (1951) | | of the Board (January 2016 to present), and President (2009 |

| 2013 | | to September 2016), First Industrial Realty Trust, an owner and |

| [187] | | operator of industrial properties; Chairman of the Board (2005 to |

| | May 2016) and Director (1999 to May 2016), Starwood Hotels & |

| | Resorts, a hotel and leisure company; Director, Boston Properties |

| | (May 2016 to present) |

| | | |

| Robert J. Gerrard, Jr. | | Advisory Board Member, Pipeline Crisis/Winning Strategies, a |

| (1952) | | collaborative working to improve opportunities for young African |

| 2012 | | Americans (1997 to present) |

| [187] | | |

| | | |

| Paul F. McBride | | Advisory Board Member, Vizzia Technologies (2015 to present) |

| (1956) | | |

| 2013 | | |

| [187] | | |

| | | |

| Cecilia E. Rouse, Ph.D. | | Dean, Woodrow Wilson School (2012 to present); Professor and |

| (1963) | | Researcher, Princeton University (1992 to present); Director, MDRC, |

| 2012 | | a nonprofit education and social policy research organization (2011 |

| [187] | | to present); Member of National Academy of Education (2010 to |

| | present); Research Associate of Labor Program (2011 to present) |

| | and Board Member (2015 to present), National Bureau of Economic |

| | Research (2011 to present); Chair of Committee on the Status of |

| | Minority Groups in the Economic Profession (2012 to present) and |

| | Vice President (2015 to present), American Economic Association |

| | | |

| John G. Schreiber | | Owner/President, Centaur Capital Partners, Inc., a real estate |

| (1946) | | investment company (1991 to present); Cofounder, Partner, and |

| 2001 | | Cochairman of the Investment Committee, Blackstone Real Estate |

| [187] | | Advisors, L.P. (1992 to 2015); Director, General Growth Properties, |

| | Inc. (2010 to 2013); Director, Blackstone Mortgage Trust, a real |

| | estate finance company (2012 to 2016); Director and Chairman of |

| | the Board, Brixmor Property Group, Inc. (2013 to present); Director, |

| | Hilton Worldwide (2013 to present); Director, Hudson Pacific |

| | Properties (2014 to 2016) |

| | | |

| Mark R. Tercek | | President and Chief Executive Officer, The Nature Conservancy (2008 |

| (1957) | | to present) |

| 2009 | | |

| [187] | | |

| |

| *Each independent director serves until retirement, resignation, or election of a successor. |

| |

| Inside Directors | | |

| |

| Name | | |

| (Year of Birth) | | |

| Year Elected* | | |

| [Number of T. Rowe Price | | Principal Occupation(s) and Directorships of Public Companies and |

| Portfolios Overseen] | | Other Investment Companies During the Past Five Years |

| | | |

| Edward C. Bernard | | Director and Vice President, T. Rowe Price; Vice Chairman of the |

| (1956) | | Board, Director, and Vice President, T. Rowe Price Group, Inc.; |

| 2006 | | Chairman of the Board, Director, and President, T. Rowe Price |

| [187] | | Investment Services, Inc.; Chairman of the Board and Director, |

| | T. Rowe Price Retirement Plan Services, Inc., and T. Rowe Price |

| | Services, Inc.; Chairman of the Board, Chief Executive Officer, |

| | Director, and President, T. Rowe Price International and T. Rowe |

| | Price Trust Company; Chairman of the Board, all funds |

| | | |

| Brian C. Rogers, CFA, CIC | | Chief Investment Officer, Director, and Vice President, T. Rowe Price; |

| (1955) | | Chairman of the Board, Chief Investment Officer, Director, and Vice |

| 2006 | | President, T. Rowe Price Group, Inc.; Vice President, T. Rowe Price |

| [131] | | Trust Company; Director, United Technologies (January 2016 to |

| | present); Vice President, Value Fund |

| |

| *Each inside director serves until retirement, resignation, or election of a successor. |

| Officers | | |

| |

| Name (Year of Birth) | | |

| Position Held With Value Fund | | Principal Occupation(s) |

| | | |

| Peter J. Bates, CFA (1974) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Jason A. Bauer (1979) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Darrell N. Braman (1963) | | Vice President, Price Hong Kong, Price |

| Vice President and Secretary | | Singapore, T. Rowe Price, T. Rowe Price Group, |

| | Inc., T. Rowe Price International, T. Rowe Price |

| | Investment Services, Inc., and T. Rowe Price |

| | Services, Inc. |

| | | |

| Ira W. Carnahan, CFA (1963) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Andrew S. Davis (1978) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Mark S. Finn, CFA, CPA (1963) | | Vice President, T. Rowe Price, T. Rowe Price |

| President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| John R. Gilner (1961) | | Chief Compliance Officer and Vice President, |

| Chief Compliance Officer | | T. Rowe Price; Vice President, T. Rowe Price |

| | Group, Inc., and T. Rowe Price Investment |

| | Services, Inc. |

| | | |

| Joel Grant (1978) | | Vice President, T. Rowe Price and T. Rowe |

| Vice President | | Price Group, Inc.; formerly, Analyst, Fidelity |

| | International (to 2014) |

| | | |

| Paul J. Krug, CPA (1964) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| John D. Linehan, CFA (1965) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Daniel Martino, CFA (1974) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Catherine D. Mathews (1963) | | Vice President, T. Rowe Price, T. Rowe Price |

| Treasurer and Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Heather K. McPherson, CPA (1967) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| David Oestreicher (1967) | | Director, Vice President, and Secretary, T. Rowe |

| Vice President | | Price Investment Services, Inc., T. Rowe Price |

| | Retirement Plan Services, Inc., T. Rowe |

| | Price Services, Inc., and T. Rowe Price Trust |

| | Company; Chief Legal Officer, Vice President, |

| | and Secretary, T. Rowe Price Group, Inc.; Vice |

| | President and Secretary, T. Rowe Price and |

| | T. Rowe Price International; Vice President, |

| | Price Hong Kong and Price Singapore |

| | | |

| Christian M. O’Neill (1969) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc.; formerly, Analyst, Lord Abbett & |

| | Company, LLC (to 2013) |

| | | |

| John W. Ratzesberger (1975) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company; |

| | formerly, North American Head of Listed |

| | Derivatives Operation, Morgan Stanley (to 2013) |

| | | |

| Shannon H. Rauser (1987) | | Employee, T. Rowe Price |

| Assistant Secretary | | |

| | | |

| Deborah D. Seidel (1962) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., T. Rowe Price Investment Services, |

| | Inc., and T. Rowe Price Services, Inc. |

| | | |

| Weijie Si (1983) | | Vice President, T. Rowe Price and T. Rowe |

| Vice President | | Price Group, Inc.; formerly, student, Harvard |

| | Business School (to 2012) |

| | | |

| Joshua K. Spencer, CFA (1973) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Tamara P. Wiggs (1979) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Jon D. Wood, CFA (1979) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc.; formerly, Senior Vice President and |

| | Senior Research Analyst, Jeffries & Company, |

| | Inc. (to 2013) |

| |

| Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for at least 5 years. |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Bruce W. Duncan qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Duncan is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

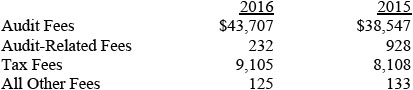

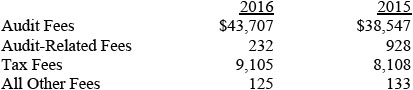

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $2,146,000 and $2,158,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Value Fund, Inc.

| | By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date February 16, 2017 | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date February 16, 2017 | | |

| |

| |

| By | /s/ Catherine D. Mathews |

| | Catherine D. Mathews |

| | Principal Financial Officer |

| |

| Date February 16, 2017 | | |