UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| Investment Company Act file number 811-08690 |

|

| MassMutual Premier Funds |

| (Exact name of registrant as specified in charter) |

| | |

| 100 Bright Meadow Blvd., Enfield, CT | | 06082 |

| (Address of principal executive offices) | | (Zip code) |

| Eric Wietsma | | |

| 100 Bright Meadow Blvd., Enfield, CT | | 06082 |

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (860) 562-1000

Date of fiscal year end: 9/30/2019

Date of reporting period: 9/30/2019

Item 1. Reports to Stockholders.

Table of Contents

This material must be preceded or accompanied by a current prospectus (or summary prospectus, if available) for the MassMutual Premier Funds. Investors should consider a Fund’s investment objective, risks, and charges and expenses carefully before investing. This and other information about the investment company is available in the prospectus (or summary prospectus, if available). Read it carefully before investing.

Important Notice: Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund (or from your financial intermediary, such as a broker-dealer, bank, or retirement plan recordkeeper). Instead, the reports will be made available on the Fund’s website (http://www.massmutual.com/funds), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you would like to receive shareholder reports and other communications electronically from the Fund and are either a direct investor in the Fund or MassMutual serves as your retirement plan recordkeeper, please call (800) 767-1000 extension 43012 or send your request to enroll to RSProspectusFulfillment@massmutual.com. If you have invested in the Fund through another financial intermediary (such as a broker-dealer, bank, or retirement plan recordkeeper), you can request electronic delivery by contacting that financial intermediary. Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. If you invest directly with the MassMutual Funds or MassMutual serves as your retirement plan recordkeeper, you can call (800) 767-1000 extension 43012 or send an email request to RSProspectusFulfillment@massmutual.com to inform the Funds or MassMutual that you wish to continue receiving paper copies of your shareholder reports. If you invest through a financial intermediary other than MassMutual, you can contact that financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held within the fund complex if you invest directly with a Fund.

MassMutual Premier Funds – President’s Letter to Shareholders (Unaudited)

To Our Shareholders

Eric Wietsma

“When it comes to retirement planning, MassMutual focuses on the long term and encourages all retirement investors to do the same. We believe that those who invest with an approach that’s designed to help their retirement savings withstand all market conditions have the potential to enjoy more financial security in retirement.”

September 30, 2019

Despite economic slowdowns and political tensions, markets remained strong

I am pleased to present you with the MassMutual Premier Funds Annual Report, covering the year ended September 30, 2019 (the “fiscal year” or the “period”). During the first three quarters of 2019, U.S. stocks experienced a good deal of volatility, as the White House led a protracted trade war against China, with tariffs being imposed on both sides. Nevertheless, total returns for domestic equities during the period were positive, although gains were more muted than in the prior fiscal year.

Recently, we have seen indications that the global economy appears to be slowing down. For example, Chinese industrial production dropped to its lowest level since 2002 in August 2019, while the country’s retail sales slowed by more than 2%. The European Union also showed signs of weakness, with the German economy contracting by 0.1% in the second quarter of 2019. Foreign stocks in developed markets trailed their domestic counterparts for the period and lost a bit of traction for the year, but generally outpaced their emerging-market competitors.

U.S. consumer spending, which is key for the U.S.’sconsumption-led economy, remained a bright spot, as retail sales continued to post strong gains throughout the year. Nevertheless, the temporary inversion of the U.S. yield curve troubled investors. That is because historically, yield curve inversions, which occur when short-term interest rates are higher than their long-term counterparts, have often signaled an impending recession.

In a turnaround from 2018, bond investors in the United States experienced strong returns during fiscal year 2019, outperforming stocks for the first time in years. This was largely due to the U.S. Federal Reserve’s actions on interest rates, with its Federal Open Market Committee lowering rates twice in 2019 in an effort to stabilize the economy.

In MassMutual’s view, savvy retirement investors maintain a long-term perspective when planning for the future. As a result, they understand that current headlines ordinarily have limited impact on their retirement planning. We also believe that individuals who follow certain investment guidelines, such as the ones below, may help themselves prepare for a stronger financial future.

Suggestions for retirement investors underany market conditions

View time as your ally

Investing for retirement is a decades-long process for most people. The financial markets will be volatile from time to time, but many patient investors who have taken a long-term approach have managed to ride out the downturns and have successfully grown their account balances and reached their retirement goals over time.

Save as much as possible

Of course, you cannot control – or predict the direction of – the investment markets. But youcan control how often and how much you contribute to your retirement savings account. Saving as much as possible and increasing your contributions regularly is one way smart retirement investors know they can help themselves reach their retirement income goals,regardless of how markets perform.

(Continued)

1

MassMutual Premier Funds – President’s Letter to Shareholders (Unaudited)(Continued)

Continue to invest

Seasoned investors believe that “down” markets offer the potential to be rewarded by amassing larger positions at more favorable prices, as compared to investors who do not continue to invest when the market is down. That is why many financial professionals believe it is important to stay in the market, regardless of near-term results.

Monitor your asset allocation and diversify*

Stocks, bonds, and short-term/money market investments typically behave differently from one another depending upon the economic and market environment. Those broad investment types contain an even greater array ofsub-categories (such assmall-cap stocks, international stocks, high-yield bonds, etc.). Many financial experts believe that investors can take advantage of different opportunities in the market and reduce the risk of over-exposure to one or two poorly performing investment types by maintaining a portfolio that includes a mix of investment types andsub-categories.

Choose the investments you feel are right for you – and seek professional guidance

Many financial advisors suggest that retirement savers who select an appropriate combination of investments that aligns with both their retirement income goals and how they feel about investing can help them withstand the inevitable ups and downs of the markets.

If you work with a financial professional, you may wish to consider reaching out to him or her to help ensure:

| | • | | you are saving enough for retirement; |

| | • | | your retirement account is invested properly for all market conditions, based on your goals and objectives, as well as on your investment time horizon; and |

| | • | | you are taking the right steps to help reduce your longevity risk, which is related to the chance that your retirement savings could “run out” during your lifetime. |

Retirement is a moment you plan for

MassMutual believes that retirement planning is not about crunching numbers – it’s about those moments when it all pays off. The more you plan for life’s greatest moments, the more you can relax and enjoy them. That is why our ongoing commitment is to help people financially protect their familiestoday, so they can put themselves on the path to a more secure retirement. When it comes to retirement planning, MassMutual focuses on the long term and encourages all retirement investors to do the same. We believe that those who invest with an approach that is designed to help their retirement savings withstand all market conditions have the potential to enjoy more financial security in retirement. Thank you for your continued confidence and trust in MassMutual.

Sincerely,

Eric Wietsma

President

© 2019 Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA. All rights reserved. www.massmutual.com Underwriter: MML Distributors, LLC (MMLD) Member FINRA and SIPC (www.FINRA.org and www.SIPC.org), 100 Bright Meadow Blvd., Enfield, CT 06082. MMLD is a wholly-owned subsidiary of MassMutual. Investment advisory services provided to the Funds by MML Investment Advisers, LLC (MML Advisers), a wholly-owned subsidiary of MassMutual. The information provided is the opinion of MML Advisers as of 10/1/19 and is subject to change without notice. It is not to be construed as tax, legal, or investment advice. Of course, past performance does not guarantee future results.

The information provided is the opinion of MassMutual Funds Investment Management Group as of 10/1/19 and is subject to change without notice. It is not to be construed as tax, legal, or investment advice. Of course, past performance does not guarantee future results.

* Diversification and asset allocation do not ensure a profit or protect against loss in a declining market.

2

MassMutual Premier Funds Annual Report – Economic and Market Overview (Unaudited)

September 30, 2019

Market Highlights

| • | | For the reporting period from October 1, 2018 through September 30, 2019, U.S. stocks ended slightly higher, though they hit record levels in late July. |

| • | | Global economic optimism faded during the period under the weight of global and domestic political tensions, mixed economic results, and the impact of existing tariffs and rhetoric threatening additional tariffs. |

| • | | The Federal Open Market Committee (FOMC), in response to slowing global growth, announced two rate decreases in 2019 after one rate hike in December 2018. |

| • | | Foreign stocks in developed markets and emerging markets saw losses over the reporting period, aggravated by a strengthening U.S. dollar. |

| • | | U.S. bond investors enjoyed positive returns in a falling yield environment fueled by rate decreases and supportive central bank policy. |

Market Environment

U.S. equity investors watched stock markets move mostly sideways for the fiscal year beginning October 1, 2018. U.S. stocks fell sharply in the first quarter of the period, suffering their worst quarterly decline in nearly a decade. They rebounded during the remaining quarters and crossed into record territory in late July 2019, but succumbed to volatility and uncertainty fueled by slowing global economic growth indicators and ongoing trade war acrimony between the U.S. and China. Both the S&P 500® Index* (S&P 500) and the Dow Jones Industrial AverageSM (Dow) ended the fiscal year only slightly ahead of where they started.

Global economic growth seemed to slow with less synchronized and more restrained economic indicators than in the recent past. The U.S. economy has shown signs that it may be in the late stages of the current business cycle. For example, a tightening labor market typically results in low unemployment rates, but tends to drive up wage growth, putting pressure on corporate earnings. Declining unemployment claims may point to a nearer-term plateau in employment growth. Mixed signals in housing data also tend to be consistent with late cycle trends. As a result, pundits’ speculation about recession has begun to emerge. Consensus still deems the risk of near-term recession to be low, but more possible than in recent years.

Global and domestic political tensions fueled market volatility throughout 2019. The U.S. threatened and imposed tariffs on Chinese goods, which prompted retaliatory responses from China.On-again,off-again trade talks added further turbulence. In Great Britain, negotiations for a Brexit deal broke down threatening a“no-deal” Brexit, which could create serious trade obstacles in Europe. (“Brexit” – an abbreviation for “British exit” – refers to the United Kingdom’s referendum to leave the European Union.) At the end of the reporting period, parties were no closer to a deal, despite the looming October 31, 2019 deadline. Domestically, political rancor between the White House and theDemocratic-led House of Representatives culminated in a call for the launch of a formal impeachment inquiry at the end of September. There does not appear to be an end in sight for the current political battles.

With these various tensions at play, the FOMC not only halted their previously announced calendar of rate hikes, but tapped the brakes and reduced rates twice during the period. Bond investors enjoyed some of the best returns they have seen in recent years, as bond indexes generally outperformed stock indexes for the period.

The broad market S&P 500 delivered a modest 4.25% return for the fiscal year. The Dow followed a similar pattern to end the period with a 4.21% advance. The technology-heavy NASDAQ Composite Index, which led returns in the last fiscal year, rose just overone-half of one percent for the period. Small- andmid-cap stocks underperformed their larger peers, as small-caps lagged significantly. Growth stocks outperformed their value counterparts during the period, although value investors enjoyed a resurgence toward the end of the fiscal year.

Six of 11 sectors in the S&P 500 delivered positive returns for the reporting period, led by the utilities, real estate, and consumer staples sectors, which all enjoyed double-digit growth and beat the S&P 500. The energy sector was the worst laggard for the fiscal year. The financials, materials, industrials, and health care sectors also ended in negative territory.

| * | Indexes referenced, other than the MSCI Indexes, are unmanaged, do not incur fees, expenses, or taxes, and cannot be purchased directly for investment. The MSCI Indexes are unmanaged, do not incur fees or expenses, and cannot be purchased directly for investment. |

3

MassMutual Premier Funds Annual Report – Economic and Market Overview (Unaudited)(Continued)

Developed international markets, as measured by the MSCI EAFE® Index, not only trailed their domestic peers during the period, but also ended the fiscal year in negative territory, down 1.34%. Developed international markets struggled to gain traction under the weight of a strengthening U.S. dollar, widespread local political issues, including floundering Brexit negotiations, and trade war rhetoric. Emerging-market stocks, as measured by the MSCI Emerging Markets Index, ended down 2.02% for the period.

Bond yields rose during the fiscal year, with the10-year U.S. Treasury bond crossing the 3.00% threshold for a short period in November 2018 before dropping back to 1.68% at the close of the period. Falling yields generally produce rising bond prices; therefore, bond index returns benefited. The Bloomberg Barclays U.S. Aggregate Bond Index ended the period up 10.30%.High-yield corporate bonds did not fare as well, but ended in positive territory. The Bloomberg Barclays U.S. Corporate High Yield Index advanced 6.36% by the end of the fiscal year.

Review and maintain your strategy

At MassMutual, we help people look out for those they love. We believe planning and saving for retirement continues to be an important and urgent challenge for many of our customers. Investing in stock and bond mutual funds can play an important role in helping build a stable source of retirement income that allows investors the freedom to retire any way they’d like. Maintaining a long-term perspective and setting realistic expectations about the future performance of your investment portfolio is very important. Financial markets can behave unpredictably. Our multi-managed and subadvised mutual funds tap into the deep expertise of seasoned asset managers who are committed to helping long-term investors prepare for retirement – in all market conditions. As always, we recommend that you work with a personal financial professional, who can help you define an investment strategy that aligns with your comfort level in changing markets, with how long you have to save and invest, and with your specific financial goals and risk tolerance. Thank you for your confidence in MassMutual.

The information provided is the opinion of MML Investment Advisers, LLC as of 10/1/19 and is subject to change without notice. It is not to be construed as tax, legal, or investment advice. Of course, past performance does not guarantee future results.

4

MassMutual Premier U.S. Government Money Market Fund – Portfolio Manager Report (Unaudited)

What is the investment approach of MassMutual Premier U.S. Government Money Market Fund, and who is the Fund’s subadviser?

The Fund seeks current income consistent with preservation of capital and liquidity. The Fund normally invests at least 99.5% of its total assets in cash, U.S. Government securities, and/or repurchase agreements fully collateralized by cash or U.S. Government securities. Under normal circumstances, the Fund invests at least 80% of its net assets in U.S. Government securities and repurchase agreements that are fully collateralized by U.S. Government securities. The Fund’s subadviser is Barings LLC (Barings). The Fund seeks to maintain, but does not guarantee, a stable $1.00 share price.You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time.

How did the Fund perform during the 12 months ended September 30, 2019?

The Fund’s Class R5 shares returned 1.85%, underperforming the 2.36% return of the FTSE3-Month Treasury Bill Index (the “benchmark”), which measures the performance of the last three three-month Treasury billmonth-end rates.

For a discussion on the economic and market environment during the12-month period ended September 30, 2019, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

The U.S. Federal Reserve Board (the Fed) increased the federal funds target rate in December 2018 and then reversed course twice in the third quarter of 2019 by lowering the target rate as fears of slowing global growth affecting the United States continued to gain traction. (The federal funds rate is the interest rate that banks and financial institutions charge each other for borrowing funds overnight.)

December 2018 saw the highest short-term rates in more than 10 years, but short-term rates responded to the Fed’s recent actions by moving lower, as monetary policy continued to ease. LIBOR (London Interbank Offered Rate, which is an interest rate used in the short-term international interbank market) rates decreased, with1-month LIBOR down 0.24% to 2.02% over the year – and3-month LIBOR down 0.31% to 2.09% over the12-month period. During 2019, LIBOR rates dropped 0.72%. While the Fund benefited from the purchase of longer-dated Treasuries in December 2018, when yields were at their highest, the sharp drop in LIBOR dragged on Fund results due to the large percentage of adjustable-rate issues that were negatively affected by the unexpected drop.

Subadviser outlook

Barings believes that global growth remains positive, though it continues to weaken from quite strong levels. While investors have been worried about the “end of the cycle” in the United States for some time, the economy seems stubbornly robust. Fund management would be surprised to see corporate spreads tighten much throughout the remainder of 2019, and believes it is more likely that they could revisit long-term averages.

As Barings believes that the Fed’s easing policy may persist, Fund management has been buying longer-dated fixed-rate paper that Fund management believes has the potential to look very attractive in the short term. While they need to buy some adjustable-rate issues due to the more stringent Weighted Average Maturity rules imposed by the Securities and Exchange Commission (SEC) a few years ago, Fund management plans to focus more on longer-dated fixed-rate purchases in the near future until they are confident that this mini-easing cycle is coming to an end.

5

MassMutual Premier U.S. Government Money Market Fund – Portfolio Manager Report (Unaudited)(Continued)

| | | | |

| |

MassMutual Premier

U.S. Government Money Market Fund

Portfolio Characteristics

(% of Net Assets) on 9/30/19 | |

| | |

Discount Notes | | | 83.6 | % |

Repurchase Agreement | | | 13.5 | % |

U.S. Treasury Bonds & Notes | | | 10.0 | % |

| | | | | |

Total Short-Term Investments | | | 107.1 | % |

Other Assets and Liabilities | | | (7.1 | )% |

| | | | | |

Net Assets | | | 100.0 | % |

| | | | | |

6

MassMutual Premier U.S. Government Money Market Fund – Portfolio Manager Report (Unaudited)(Continued)

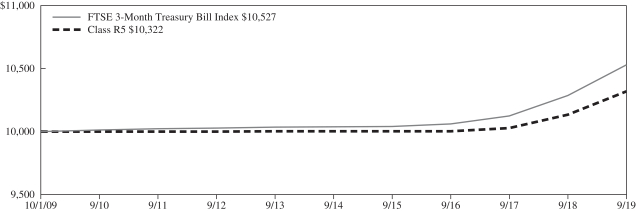

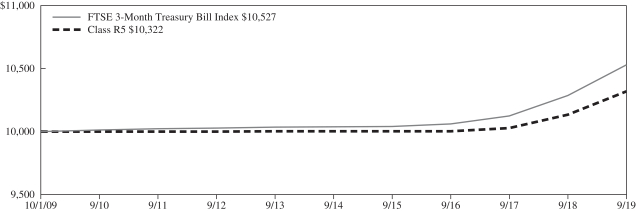

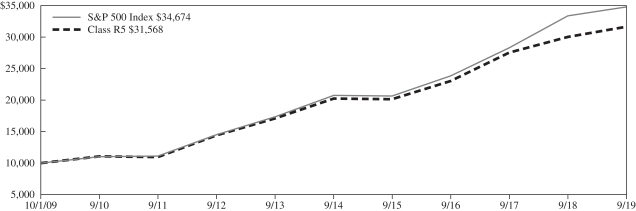

GROWTH OF $10,000 INVESTMENT

The graph above illustrates the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable.

| | | | | | | | |

| Average Annual Total Returns(for the periods ended 09/30/2019) |

| | | | | |

| | | Inception Date

of Class | | 1 Year | | 5 Years | | 10 Years |

| Class R5 | | 10/03/1994 | | 1.85% | | 0.63% | | 0.32% |

| FTSE 3-Month Treasury Bill Index | | 2.36% | | 0.96% | | 0.52% |

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table are shown both with and without the imposition of the maximum applicable sales charge (if applicable) and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month end may be obtained by calling1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges.

7

MassMutual Premier Short-Duration Bond Fund – Portfolio Manager Report (Unaudited)

What is the investment approach of MassMutual Premier Short-Duration Bond Fund, and who is the Fund’s subadviser?

The Fund seeks to achieve a high total rate of return primarily from current income while minimizing fluctuations in capital values by investing primarily in a diversified portfolio of short-term investment grade fixed income securities. Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in investment grade fixed income securities (rated Baa3 or higher by Moody’s,BBB- or higher by Standard & Poor’s or the equivalent by any NRSRO, or, if unrated, determined to be of comparable quality by the subadviser). The Fund’s subadviser is Barings LLC (Barings).

How did the Fund perform during the 12 months ended September 30, 2019?

The Fund’s Class R5 shares returned 3.92%, underperforming the 4.42% return of the Bloomberg Barclays U.S.1-3 Year Government Bond Index (the “benchmark”), which measures the performance of the U.S. Treasury and U.S. Agency Indexes with maturities of1-3 years, including Treasuries and U.S. agency debentures. It is a component of the U.S. Government/Credit Index and the U.S. Aggregate Index.

For a discussion on the economic and market environment during the12-month period ended September 30, 2019, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

The U.S. Treasury yield curve between 3 months and 3 years inverted, causing short-dated yields to rise above longer-dated yields. The U.S. Federal Reserve lowered rates at its July and September 2019 Federal Open Market Committee (FOMC) meetings. As a result of anticipation of the interest rate cuts, earlier in the year the short end of the yield curve between 3 months and 3 years flattened, as expectations for higher growth and inflation dissipated. The yield curve is a graph showing the term structure of interest rates by plotting the yields of all bonds of comparable quality with maturities ranging from the shortest – typically one month – to the longest – typically 30 years – available. The resulting curve shows whether short-term interest rates are higher or lower than long-term rates.

Bond duration and maturity positioning detracted from the Fund’s performance, as the Fund shifted duration in accordance with its duration management process. (Duration is a measure of a bond fund’s sensitivity to interest rates. The longer the duration, the greater the price impact on the fund when interest rates rise or fall.) Duration of the Fund ended the period at 0.26 years. An underweight to U.S. Agency debentures, relative to the benchmark, also detracted from Fund performance. (“Agency” refers to debt issued by U.S. federal government agencies or government-sponsored entities for financing purposes.) The sector offers little income and the Fund held an underweight stake throughout the period.

An allocation to corporate credit was the primary positive contributor to Fund performance. Investment-grade and high-yield bonds rated BB contributed. Fund holdings in the banking, leasing and chemical companiessub-sectors were the best performers. The Fund continued to favor industries less susceptible to merger and acquisition (M&A) risk. Secondary oil & gas producers, service, and gaming companies underperformed the most of any of thesub-sectors.

The Fund’s allocation to asset-backed securities was a positive contributor to performance. (Bond issuers create securitized bonds by pooling various types of contractual debt – such as mortgages, auto loans, or credit card debt.) Fund management continued to find value across both traditional consumer and commercial deals, where there was strong market demand for those investments. The Fund’s modest overweight position in commercial mortgage-backed securities also contributed positively to performance during the period.

The Fund uses derivative instruments on occasion for yield curve, duration, downside risk management and to gain exposures. (Derivatives are securities that derive their value from the performance of one or more other investments and take the form of a contract between two or more parties. Most derivatives are used for hedging, speculation, or both.) Overall, derivatives contributed positively to performance over the last year.

8

MassMutual Premier Short-Duration Bond Fund – Portfolio Manager Report (Unaudited)(Continued)

Subadviser outlook

Barings believes that global growth remains positive, though it continues to weaken from quite strong levels. While investors have been worried about the “end of the cycle” in the United States for some time, the economy seems stubbornly robust. Fund management would be surprised to see corporate spreads tighten much throughout the remainder of 2019, and believes it is more likely that they could revisit long-term averages. Fund management continues to overweight the Fund’s allocation to securitized credit as a late-cycle defensive allocation, as securitized credit provides broad exposure to the positively trending consumer market.

As of September 30, 2019, the Fund maintained overweights in sectors such as corporates and securitized products, relative to liquid products, such as governments and agencies. In addition, Fund management will continue to focus onbottom-up security selection.

| | | | |

| |

MassMutual Premier

Short-Duration Bond Fund

Portfolio Characteristics

(% of Net Assets) on 9/30/19 | |

| | |

Non-U.S. Government Agency Obligations | | | 54.3 | % |

Corporate Debt | | | 39.8 | % |

U.S. Government Agency Obligations and Instrumentalities | | | 1.2 | % |

Purchased Options | | | 0.8 | % |

U.S. Treasury Obligations | | | 0.3 | % |

Municipal Obligations | | | 0.2 | % |

| | | | | |

Total Long-Term Investments | | | 96.6 | % |

Short-Term Investments and Other Assets and Liabilities | | | 3.4 | % |

| | | | | |

Net Assets | | | 100.0 | % |

| | | | | |

9

MassMutual Premier Short-Duration Bond Fund – Portfolio Manager Report (Unaudited)(Continued)

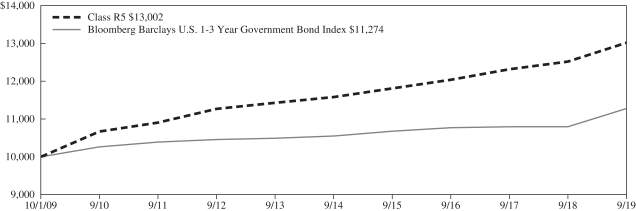

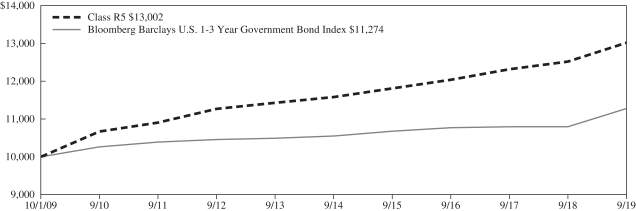

GROWTH OF $10,000 INVESTMENT

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

| | | | | | | | | | | | |

| Average Annual Total Returns(for the periods ended 09/30/2019) |

| | | | | | | |

| | | Inception Date

of Class | | 1 Year | | 5 Years | | 10 Years | | Since Inception

12/03/2010 | | Since Inception

04/01/2014 |

| Class I | | 12/03/2010 | | 4.05% | | 2.45% | | | | 2.44% | | |

| Class R5 | | 10/03/1994 | | 3.92% | | 2.34% | | 2.66% | | | | |

| Service Class | | 01/01/1998 | | 3.82% | | 2.24% | | 2.57% | | | | |

| Administrative Class | | 05/03/1999 | | 3.76% | | 2.14% | | 2.48% | | | | |

| Class R4 | | 04/01/2014 | | 3.57% | | 1.99% | | | | | | 1.90% |

| Class A | | 01/01/1998 | | 3.44% | | 1.89% | | 2.23% | | | | |

| Class A (sales load deducted)* | | 01/01/1998 | | 0.86% | | 1.38% | | 1.97% | | | | |

| Class R3 | | 12/31/2002 | | 3.29% | | 1.72% | | 1.99% | | | | |

| Bloomberg Barclays U.S. 1-3 Year Government Bond Index | | 4.42% | | 1.34% | | 1.21% | | 1.09% | | 1.27% |

* Class A (sales load deducted) returns include the 2.50% maximum sales charge.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table are shown both with and without the imposition of the maximum applicable sales charge (if applicable) and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month end may be obtained by calling1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges.

10

MassMutual Premier Inflation-Protected and Income Fund – Portfolio Manager Report (Unaudited)

What is the investment approach of MassMutual Premier Inflation-Protected and Income Fund, and who is the Fund’s subadviser?

The Fund seeks to achieve as high a total rate of real return on an annual basis as is considered consistent with prudent investment risk and the preservation of capital by investing, under normal circumstances, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in inflation-indexed bonds and other income-producing securities. The Fund’s subadviser is Barings LLC (Barings).

How did the Fund perform during the 12 months ended September 30, 2019?

The Fund’s Class R5 shares returned 6.68%, underperforming the 7.13% return of the Bloomberg Barclays U.S. Treasury Inflation Protected Securities (TIPS) Index(Series-L) (the “benchmark”), which measures the performance of rules-based, market value-weighted inflation-protected securities issued by the U.S. Treasury. It is a subset of the Global Inflation-Linked Index(Series-L).

How do inflation-indexed bonds protect against inflation?

Like many other fixed-income securities, inflation-indexed bonds pay income twice a year, based on a stated coupon rate. However, both the principal and the interest payment are adjusted for the level of inflation. The inflation rate – as measured by the Consumer Price Index for All Urban Consumers(“CPI-U”) – results in an adjustment to the principal amount of an inflation-protected security. The coupon rate is then applied to the adjusted principal amount to determine the interest payment. For example, assuming an inflation rate of 3%, a security with a par value of $1,000 and an annual coupon rate of 1.75%, the adjusted principal amount after one year would be $1,030 ($1,000 increased by 3%). The semi-annual interest payment would be calculated by multiplying $1,030 by 1.75% and dividing by 2 instead of using the original $1,000 par value to calculate the amount of interest.

For a discussion on the economic and market environment during the12-month period ended September 30, 2019, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

The rate of consumer price increases, as measured by the U.S. Bureau of Labor Statistics, were down foryear-to-date 2019 as unadjusted Headline CPI came in at 1.7% in the third quarter of 2019, down from 1.9% atyear-end 2018. (The Consumer Price Index [CPI] measures changes in the price of a market basket of consumer goods and services; Core CPI does not include food and energy prices. Headline CPI includes food and energy.) While shelter costs continued to be a major driver of inflation, the headlineyear-to-date increase was driven in large part by service prices. Core CPI increased to 2.4% in the third quarter of 2019, up from 2.2% atyear-end 2018. Core CPI is running modestly above the 2% inflation objective of the Federal Open Market Committee (FOMC).

In addition to TIPS, the Fund also invested in high-quality, income-producing securities, including asset-backed and money market securities. The income earned by these asset classes contributed positively over the reporting period. Allocations to asset-backed securities (ABS) and high-quality commercial paper were the main drivers of performance. (Bond issuers create securitized bonds by pooling various types of contractual debt – such as mortgages, auto loans, and credit card debt. Commercial paper is the commonly used name for short-term unsecured promissory notes sold by banks and corporations to meet short-term debt obligations.) Security selections in auto loans and student loans within the ABS sector were the primary contributors to the Fund’s performance during the period.

The Fund may use derivative instruments for yield curve and duration management, as well as for replicating cash bonds and gaining market exposure in order to implement Fund manager views. (Derivatives are securities that derive their value from the performance of one or more other investments and take the form of a contract between two or more parties. Most derivatives are used for hedging, speculation, or both.) During the period, Fund management used repurchase agreements, Treasury futures, CPI swaps, credit default swaps to hedge whole business ABS exposure, CMBX as a proxy for commercial mortgage-backed

11

MassMutual Premier Inflation-Protected and Income Fund – Portfolio Manager Report (Unaudited)(Continued)

securities, and interest rate swaptions. (An interest rate swaption is anover-the-counter option that grants its owner the right but not the obligation to enter an underlying interest rate swap.) The Fund’s use of derivatives marginally contributed to its performance over the reporting period.

Subadviser outlook

Inflation markets underperformed the nominal Treasury market again during the third quarter of 2019, as the overall spike in interest rate volatility dampened returns. The Federal Reserve (the Fed) delivered on the expected 0.25% cut. While the Fed raised the bar for future easing, Barings expects a dovish tilt and attention to funding markets to remain in focus through the end of 2019. Inflation markets have been volatile along with the broader rates market, and data has been mixed as the market trades from one headline to the next. Barings’ inflation outlook is constructive, given the Fed’s commitment to 2% inflation; however, Barings believes that recent weaker-than-expected economic data could create a drag on prices in the fourth quarter of 2019.

| | | | |

| |

MassMutual Premier

Inflation-Protected and Income Fund

Portfolio Characteristics

(% of Net Assets) on 9/30/19 | |

| | |

U.S. Treasury Obligations | | | 52.4 | % |

Non-U.S. Government Agency Obligations | | | 29.7 | % |

Corporate Debt | | | 0.3 | % |

Purchased Options | | | 0.4 | % |

U.S. Government Agency Obligations and Instrumentalities | | | 0.2 | % |

| | | | | |

Total Long-Term Investments | | | 83.0 | % |

Short-Term Investments and Other Assets and Liabilities | | | 17.0 | % |

| | | | | |

Net Assets | | | 100.0 | % |

| | | | | |

12

MassMutual Premier Inflation-Protected and Income Fund – Portfolio Manager Report (Unaudited)(Continued)

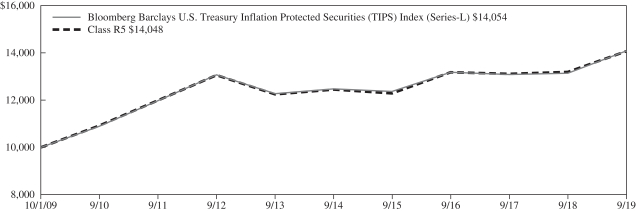

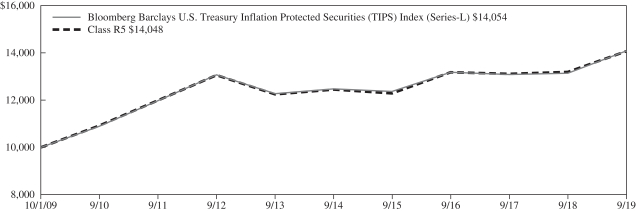

GROWTH OF $10,000 INVESTMENT

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

| | | | | | | | | | | | |

| Average Annual Total Returns(for the periods ended 09/30/2019) |

| | | | | | | |

| | | Inception Date

of Class | | 1 Year | | 5 Years | | 10 Years | | Since Inception

03/01/2011 | | Since Inception

04/01/2014 |

| Class I | | 03/01/2011 | | 6.80% | | 2.59% | | | | 3.09% | | |

| Class R5 | | 12/31/2003 | | 6.68% | | 2.48% | | 3.46% | | | | |

| Service Class | | 12/31/2003 | | 6.60% | | 2.38% | | 3.35% | | | | |

| Administrative Class | | 12/31/2003 | | 6.53% | | 2.29% | | 3.23% | | | | |

| Class R4 | | 04/01/2014 | | 6.27% | | 2.15% | | | | | | 2.22% |

| Class A | | 12/31/2003 | | 6.16% | | 2.03% | | 3.01% | | | | |

| Class A (sales load deducted)* | | 12/31/2003 | | 1.65% | | 1.15% | | 2.56% | | | | |

| Class R3 | | 12/31/2003 | | 6.03% | | 1.87% | | 2.78% | | | | |

| Bloomberg Barclays U.S. Treasury Inflation Protected Securities (TIPS) Index (Series-L) | | 7.13% | | 2.45% | | 3.46% | | 2.97% | | 2.54% |

* Class A (sales load deducted) returns include the 4.25% maximum sales charge.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table are shown both with and without the imposition of the maximum applicable sales charge (if applicable) and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month end may be obtained by calling1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges.

13

MassMutual Premier Core Bond Fund – Portfolio Manager Report (Unaudited)

What is the investment approach of MassMutual Premier Core Bond Fund, and who is the Fund’s subadviser?

The Fund seeks to achieve a high total rate of return consistent with prudent investment risk and the preservation of capital by investing primarily in a diversified portfolio of investment grade fixed income securities. Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in investment grade fixed income securities (rated Baa3 or higher by Moody’s,BBB- or higher by Standard & Poor’s or the equivalent by any NRSRO, or, if unrated, determined to be of comparable quality by the subadviser). The Fund’s subadviser is Barings LLC (Barings).

How did the Fund perform during the 12 months ended September 30, 2019?

The Fund’s Class R5 shares returned 9.92%, underperforming the 10.30% return of the Bloomberg Barclays U.S. Aggregate Bond Index (the “benchmark”), which measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, agency mortgage-backed securities (MBS) (agency fixed-rate and hybrid ARM pass-throughs), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS). (“Agency” refers to debt issued by U.S. federal government agencies or government-sponsored entities for financing purposes.)

For a discussion on the economic and market environment during the12-month period ended September 30, 2019, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

Securitized asset classes such as MBS detracted from performance. The Fund had an underweight allocation to the sector, relative to the benchmark. Within MBS, an overweight stake in30-year securities versus15-year securities hampered performance. Fund holdings in30-year securities issued by Fannie Mae detracted from MBS performance. On the other hand, CMBS holdings contributed to performance.

The Fund’s overweight to investment-grade corporate bonds was the primary contributor to performance. Corporate fundamentals were positive over the year, which proved positive for the sector. As many global investment-grade markets are returning negative yields and U.S. interest rates are falling, U.S. corporate bonds have outperformed.

Credit selection also benefited performance. Investments in the banking and property & casualty insurance industries helped the most. The electronics and secondary oil & gas producing industries detracted from performance over the period.

The ABS sector was the second top contributor to performance, and the Fund held an overweight stake in the sector. The asset class is generally shorter in duration and, as a result, less sensitive to increases in interest rates that can hurt a bond’s performance. (Duration is a measure of a bond fund’s sensitivity to interest rates. The longer the duration, the greater the price impact on the fund when interest rates rise or fall.) Somesub-sectors, such as student loans, are adjustable-rate bonds tied to3-month LIBOR (London Interbank Offered Rate), where their coupons reset on a quarterly basis. (LIBOR is an interest rate used in the short-term international interbank market.) The student loans segment was the largest positive contributor within the ABS sector. An allocation to high-quality, short-weighted average life collateralized loan obligations contributed to Fund performance during the year. The Fund has a modest allocation in theout-of-benchmark sector.

The Fund uses derivative instruments for yield curve, duration, downside hedging and to gain exposures. Derivatives are securities that derive their value from the performance of one or more other investments and take the form of a contract between two or more parties. Most derivatives are used for hedging, speculation, or both. They may also be used as a substitute for a direct investment. In aggregate, these positions positively contributed to performance over the year.

Subadviser outlook

Barings believes that global growth remains positive, though it continues to weaken from quite strong levels. While investors have been worried about the “end of the cycle” in the United States for some time, the economy seems stubbornly robust. Fund management would be surprised to see corporate spreads tighten much throughout the remainder of 2019, and believes it is more

14

MassMutual Premier Core Bond Fund – Portfolio Manager Report (Unaudited)(Continued)

likely that they could revisit long-term averages. Fund management continues to overweight the Fund’s allocation to securitized credit as a late-cycle defensive allocation, as securitized credit provides broad exposure to the positively trending consumer market.

Going into the next reporting period, the Fund maintains overweight allocations in sectors such as corporates and securitized products, relative to liquid products, such as governments and agencies. In addition, Fund management continues to focus onbottom-up security selection.

| | | | |

| |

MassMutual Premier

Core Bond Fund

Portfolio Characteristics

(% of Net Assets) on 9/30/19 | |

| | |

Corporate Debt | | | 34.6 | % |

Non-U.S. Government Agency Obligations | | | 32.1 | % |

U.S. Government Agency Obligations and Instrumentalities | | | 25.9 | % |

U.S. Treasury Obligations | | | 5.2 | % |

Sovereign Debt Obligations | | | 0.7 | % |

Municipal Obligations | | | 0.6 | % |

Purchased Options | | | 0.5 | % |

Mutual Funds | | | 0.3 | % |

Preferred Stock | | | 0.2 | % |

| | | | | |

Total Long-Term Investments | | | 100.1 | % |

Short-Term Investments and Other Assets and Liabilities | | | (0.1 | )% |

| | | | | |

Net Assets | | | 100.0 | % |

| | | | | |

15

MassMutual Premier Core Bond Fund – Portfolio Manager Report (Unaudited)(Continued)

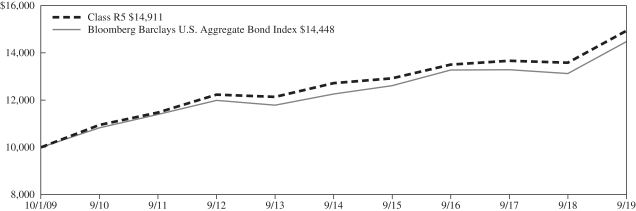

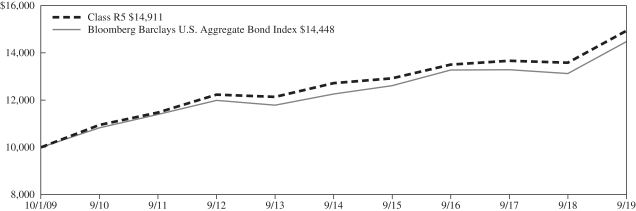

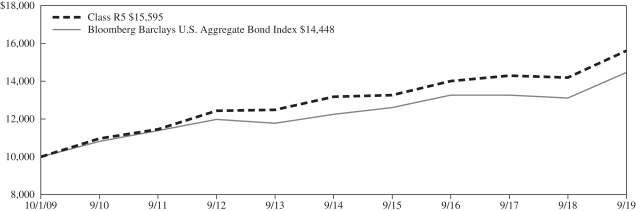

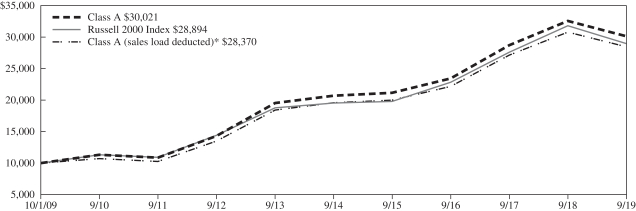

GROWTH OF $10,000 INVESTMENT

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

| | | | | | | | | | | | |

| Average Annual Total Returns(for the periods ended 09/30/2019) |

| | | | | | | |

| | | Inception Date

of Class | | 1 Year | | 5 Years | | 10 Years | | Since Inception

12/03/2010 | | Since Inception

04/01/2014 |

| Class I | | 12/03/2010 | | 9.98% | | 3.36% | | | | 3.83% | | |

| Class R5 | | 10/03/1994 | | 9.92% | | 3.27% | | 4.08% | | | | |

| Service Class | | 01/01/1998 | | 9.67% | | 3.16% | | 3.98% | | | | |

| Administrative Class | | 05/03/1999 | | 9.65% | | 3.06% | | 3.90% | | | | |

| Class R4 | | 04/01/2014 | | 9.47% | | 2.92% | | | | | | 3.07% |

| Class A | | 01/01/1998 | | 9.32% | | 2.80% | | 3.64% | | | | |

| Class A (sales load deducted)* | | 01/01/1998 | | 4.67% | | 1.91% | | 3.19% | | | | |

| Class R3 | | 12/31/2002 | | 9.24% | | 2.67% | | 3.41% | | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index | | 10.30% | | 3.38% | | 3.75% | | 3.45% | | 3.48% |

* Class A (sales load deducted) returns include the 4.25% maximum sales charge.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table are shown both with and without the imposition of the maximum applicable sales charge (if applicable) and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month end may be obtained by calling1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges.

16

MassMutual Premier Diversified Bond Fund – Portfolio Manager Report (Unaudited)

What is the investment approach of MassMutual Premier Diversified Bond Fund, and who is the Fund’s subadviser?

The Fund seeks a superior total rate of return by investing in fixed income instruments. Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in fixed income securities. The Fund’s subadviser is Barings LLC (Barings).

How did the Fund perform during the 12 months ended September 30, 2019?

The Fund’s Class R5 shares returned 9.99%, underperforming the 10.30% return of the Bloomberg Barclays U.S. Aggregate Bond Index (the “benchmark”), which measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, agency mortgage-backed securities (MBS) (agency fixed-rate and hybrid ARM pass-throughs), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS). (“Agency” refers to debt issued by U.S. federal government agencies or government-sponsored entities for financing purposes.)

For a discussion on the economic and market environment during the12-month period ended September 30, 2019, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

Securitized asset classes such as MBS detracted from Fund performance. The Fund had an underweight allocation to the sector, relative to the benchmark. Within MBS, an overweight stake in30-year securities versus15-year securities hampered performance. Fund holdings in30-year securities issued by Fannie Mae detracted from MBS performance. On the other hand, CMBS holdings contributed to performance.

The Fund’s overweight to investment-grade corporate bonds was the primary contributor to performance. Corporate fundamentals were positive over the year, which proved positive for the sector. Demand from foreign investors remains strong in the U.S. corporate bond market, which is positive for the sector. As many global investment-grade markets are returning negative yields and U.S. interest rates are falling, U.S. corporate bonds have outperformed.

Credit selection also benefited performance. Allocations within the financial and industrial sectors contributed positively to returns, while allocations within the utility sector detracted slightly. The Fund’s higher allocation to high yield bonds detracted from performance.

The ABS sector was the second top contributor to performance, and the Fund held an overweight stake in the sector. The asset class is generally shorter in duration and, as a result, less sensitive to increases in interest rates that can hurt a bond’s performance. (Duration is a measure of a bond fund’s sensitivity to interest rates. The longer the duration, the greater the price impact on the fund when interest rates rise or fall.) Somesub-sectors, such as student loans, are adjustable-rate bonds tied to3-month LIBOR, where their coupons reset on a quarterly basis. (LIBOR, the London Interbank Offered Rate, is an interest rate used in the short-term international interbank market.) The student loans segment was the largest positive contributor within the ABS sector. An allocation to high-quality, short-weighted average life collateralized loan obligations contributed to Fund performance during the year. The Fund has a modest allocation in thisout-of-benchmark sector. However, an underweight to Treasuries detracted from performance.

The Fund uses derivative instruments for yield curve, duration, downside hedging and to gain exposures. Derivatives are securities that derive their value from the performance of one or more other investments and take the form of a contract between two or more parties. Most derivatives are used for hedging, speculation, or both. They may also be used as a substitute for a direct investment. In aggregate, these positions positively contributed to performance over the year.

Subadviser outlook

Barings believes that global growth remains positive, though it continues to weaken from quite strong levels. While investors have been worried about the “end of the cycle” in the United States for some time, the economy seems stubbornly robust. Fund

17

MassMutual Premier Diversified Bond Fund – Portfolio Manager Report (Unaudited)(Continued)

management would be surprised to see corporate spreads tighten much throughout the remainder of 2019, and believes it is more likely that they could revisit long-term averages. Fund management continues to overweight the Fund’s allocation to securitized credit as a late-cycle defensive allocation, as securitized credit provides broad exposure to the positively trending consumer market.

Going into the next reporting period, the Fund maintains overweight allocations in sectors such as corporates and securitized products, relative to liquid products, such as governments and agencies. In addition, Fund management continues to focus onbottom-up security selection.

| | | | |

| |

MassMutual Premier

Diversified Bond Fund

Portfolio Characteristics

(% of Net Assets) on 9/30/19 | |

| | |

Corporate Debt | | | 41.3 | % |

Non-U.S. Government Agency Obligations | | | 30.2 | % |

U.S. Government Agency Obligations and Instrumentalities | | | 20.9 | % |

U.S. Treasury Obligations | | | 2.9 | % |

Mutual Funds | | | 1.2 | % |

Purchased Options | | | 0.8 | % |

Sovereign Debt Obligations | | | 0.7 | % |

Municipal Obligations | | | 0.3 | % |

Preferred Stock | | | 0.1 | % |

Common Stock | | | 0.0 | % |

Warrants | | | 0.0 | % |

| | | | | |

Total Long-Term Investments | | | 98.4 | % |

Short-Term Investments and Other Assets and Liabilities | | | 1.6 | % |

| | | | | |

Net Assets | | | 100.0 | % |

| | | | | |

18

MassMutual Premier Diversified Bond Fund – Portfolio Manager Report (Unaudited)(Continued)

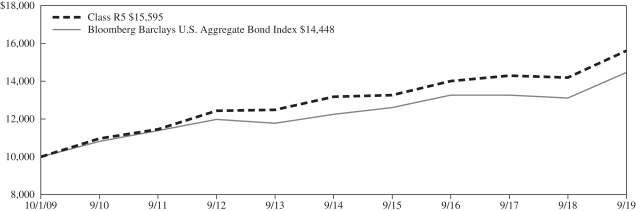

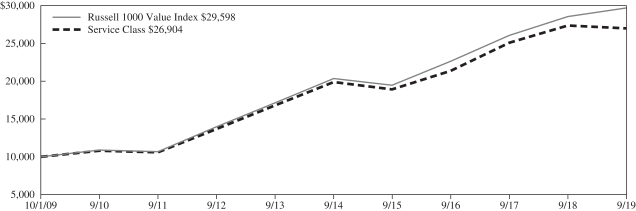

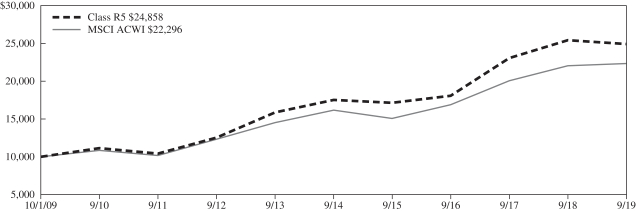

GROWTH OF $10,000 INVESTMENT

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

| | | | | | | | | | | | |

| Average Annual Total Returns(for the periods ended 09/30/2019) |

| | | | | | | |

| | | Inception Date

of Class | | 1 Year | | 5 Years | | 10 Years | | Since Inception

12/03/2010 | | Since Inception

04/01/2014 |

| Class I | | 12/03/2010 | | 10.08% | | 3.55% | | | | 4.54% | | |

| Class R5 | | 05/03/1999 | | 9.99% | | 3.45% | | 4.54% | | | | |

| Service Class | | 05/03/1999 | | 9.80% | | 3.36% | | 4.47% | | | | |

| Administrative Class | | 05/03/1999 | | 9.79% | | 3.26% | | 4.40% | | | | |

| Class R4 | | 04/01/2014 | | 9.49% | | 3.08% | | | | | | 3.27% |

| Class A | | 05/03/1999 | | 9.45% | | 2.99% | | 4.13% | | | | |

| Class A (sales load deducted)* | | 05/03/1999 | | 4.80% | | 2.10% | | 3.68% | | | | |

| Class R3 | | 04/01/2014 | | 9.35% | | 2.85% | | | | | | 3.02% |

| Bloomberg Barclays U.S. Aggregate Bond Index | | 10.30% | | 3.38% | | 3.75% | | 3.45% | | 3.48% |

* Class A (sales load deducted) returns include the 4.25% maximum sales charge.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table are shown both with and without the imposition of the maximum applicable sales charge (if applicable) and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month end may be obtained by calling1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges.

19

MassMutual Premier High Yield Fund – Portfolio Manager Report (Unaudited)

What is the investment approach of MassMutual Premier High Yield Fund, and who is the Fund’s subadviser?

The Fund seeks to achieve a high level of total return, with an emphasis on current income, by investing primarily in high yield debt and related securities. Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in lower rated fixed income securities (rated below Baa3 by Moody’s, below BBB- by Standard & Poor’s or the equivalent by any NRSRO (using the lower rating) or, if unrated, determined to be of below investment grade quality by the Fund’s subadviser). The Fund’s subadviser is Barings LLC (Barings).

How did the Fund perform during the 12 months ended September 30, 2019?

The Fund’s Service Class shares returned 5.20%, underperforming the 6.36% return of the Bloomberg Barclays U.S. Corporate High-Yield Bond Index (the “benchmark”), which measures the performance of U.S. dollar-denominated,non-investment grade, fixed-rate, taxable corporate bonds, including corporate bonds, fixed-rate bullet, puttable, and callable bonds, SEC Rule 144A securities, original issue zeros,pay-in-kind bonds, fixed-rate andfixed-to-floating capital securities.

For a discussion on the economic and market environment during the12-month period ended September 30, 2019, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s performance

The U.S. high-yield bond market turned in positive absolute performance for the period, driven by stable corporate fundamentals, accommodative central bank policies, and subdued inflationary pressures, despite a bout of extreme volatility in the fourth quarter of 2018.

Returns were mostly positive across industries, led by the banking sector, and followed by the electric and consumer cyclical sectors. The energy sector was the lone detractor from performance in the high-yield market, driven by substantial volatility in crude oil prices throughout much of the year. Much of that volatility was focused within the oil field services and independent subsectors, which saw double-digit declines during the course of the year.

As previously mentioned, the fourth quarter of 2018 saw significant instability and declines across the high-yield market, only to rally throughout the first three quarters of 2019, recouping more than its losses from the end of the prior year. However, the extent of the rally was bifurcated between the higher and lower ends of the credit quality spectrum. Issues rated BB returned almost twice that of whatCCC-rated issues did through September 30, 2019, as high-yield investors remained wary of riskier assets going into what Barings believes may be a late- toend-of-cycle period. Bonds rated B also advanced, modestly lagging their counterparts rated BB during the period.

As it relates to the Fund, credit selection was the primary driver of the Fund’s benchmark-relative performance. Bonds within the Fund’s portfolio rated B and CCC outperformed the benchmark due to strong selection, although an overweight allocation (relative to the benchmark) to bonds rated CCC offset much of the contribution. Fund holdings rated BB lagged the benchmark due to an overweight allocation within the Fund’s portfolio, although credit selection, again, proved positive. The Fund had a modest allocation to holdings rated BBB, which benefited performance due to both prudent credit selection and an overweight allocation.

Across industries, the Fund outperformed relative to the benchmark in the communications and capital goods sectors, due to credit selection, while specific Fund holdings within the consumernon-cyclical and basic industry sectors drove the Fund to lag in these areas. Similar to the broader market, energy was the only industry sector within the Fund to generate a negative return during the year.

The Fund’stop-performing holdings were JBS, an American protein producer that mainly processes beef and pork; Bausch Health Companies, a specialty pharmaceutical manufacturer; and Sprint, a wireless operator in the United States. Fund holdings that proved to be the largest detractors from performance were EP Energy, a public, independent energy exploration and production firm; Mallinckrodt, a global specialty pharmaceutical company; and Envision Healthcare, a leading national provider of outsourced physician services and ambulatory surgery centers.

20

MassMutual Premier High Yield Fund – Portfolio Manager Report (Unaudited)(Continued)

Subadviser outlook

Driven by a reasonably strong economic backdrop over the past few years, corporate earnings have been solid and leverage levels largely stable. In Barings’ view, corporate fundamentals overall remain relatively healthy. Growth appears to be slowing, but measured, and Barings believes most companies have capital structures in place that can withstand and adjust to a slowdown. Additionally, due in part to lower financing costs over the last decade, Barings believes interest coverage ratios appear relatively healthy. As a result, defaults – the biggest potential risk for high-yield investors – continue to remain slightly below long-term historical averages. While an increase in defaults across more challenged sectors – namely, energy, and retail – has contributed to a slight uptick in overall defaults over the past year, Fund management does not expect to see a widespread or material increase in defaults in the near term.

| | | | |

| |

MassMutual Premier

High Yield Fund

Portfolio Characteristics

(% of Net Assets) on 9/30/19 | |

| | |

Corporate Debt | | | 92.8 | % |

Bank Loans | | | 5.2 | % |

Mutual Funds | | | 3.8 | % |

Common Stock | | | 0.4 | % |

Preferred Stock | | | 0.0 | % |

Warrants | | | 0.0 | % |

| | | | | |

Total Long-Term Investments | | | 102.2 | % |

Short-Term Investments and Other Assets and Liabilities | | | (2.2 | )% |

| | | | | |

Net Assets | | | 100.0 | % |

| | | | | |

21

MassMutual Premier High Yield Fund – Portfolio Manager Report (Unaudited)(Continued)

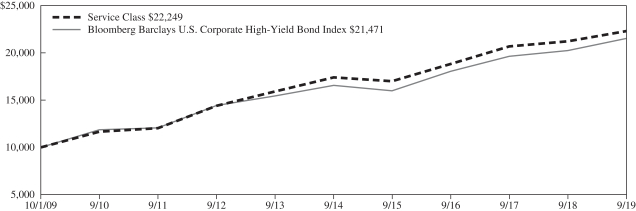

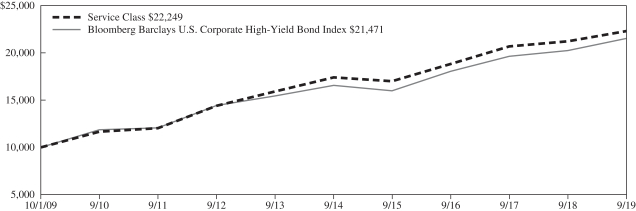

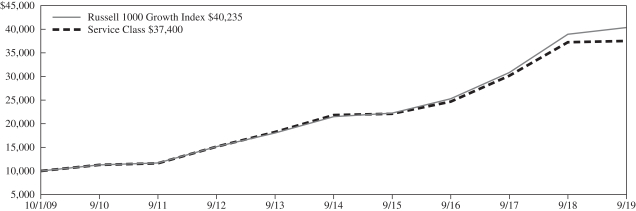

GROWTH OF $10,000 INVESTMENT

The graph above illustrates a representative class of the Fund’s historical performance for the past 10 fiscal years or since inception (for Funds lacking 10-year records) in comparison to its benchmark index, as well as one or more additional indexes, if applicable. The performance of other share classes will be greater than or less than the class depicted above.

| | | | | | | | | | | | |

| Average Annual Total Returns(for the periods ended 09/30/2019) |

| | | | | | | |

| | | Inception Date

of Class | | 1 Year | | 5 Years | | 10 Years | | Since Inception

03/01/2011 | | Since Inception

04/01/2014 |

| Class I | | 03/01/2011 | | 5.45% | | 5.29% | | | | 7.18% | | |

| Class R5 | | 11/01/2004 | | 5.29% | | 5.17% | | 8.39% | | | | |

| Service Class | | 09/05/2000 | | 5.20% | | 5.08% | | 8.33% | | | | |

| Administrative Class | | 11/01/2004 | | 5.13% | | 4.98% | | 8.19% | | | | |

| Class R4 | | 04/01/2014 | | 4.97% | | 4.83% | | | | | | 4.62% |

| Class A | | 11/01/2004 | | 4.89% | | 4.72% | | 7.92% | | | | |

| Class A (sales load deducted)* | | 11/01/2004 | | -0.88% | | 3.54% | | 7.31% | | | | |

| Class R3 | | 11/01/2004 | | 4.71% | | 4.57% | | 7.70% | | | | |

| Bloomberg Barclays U.S. Corporate High-Yield Bond Index | | 6.36% | | 5.37% | | 7.94% | | 6.35% | | 4.97% |

* Class A (sales load deducted) returns include the 5.50% maximum sales charge.

Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes only, and as such, the total return based on the unadjusted net asset value per share may differ from the total return reported in the financial highlights.

Performance results in the graph and table are shown both with and without the imposition of the maximum applicable sales charge (if applicable) and reflect the percentage change in net asset value, including reinvestment of dividends and capital gains distributions. Investors should note that the Fund is a professionally managed mutual fund, while the index or indexes shown above are unmanaged, cannot be purchased directly, and, with the exception of any peer group index, do not incur expenses.

Performance data quoted in the graph and table represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund fluctuate, so your shares, when sold, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. The performance shown does not reflect the deduction of taxes, if any, that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data current to the most recent month end may be obtained by calling1-888-309-3539.

Investors should read the Fund’s prospectus with regard to the Fund’s investment objectives, risks, and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges.

22

MassMutual Premier Balanced Fund – Portfolio Manager Report (Unaudited)

What is the investment approach of MassMutual Premier Balanced Fund, and who is the Fund’s subadviser?

The Fund seeks to achieve a high total rate of return over an extended period of time consistent with the preservation of capital by investing in a diversified portfolio of equity securities, fixed income securities, and money market instruments. The Fund invests across different asset classes (U.S. equity securities, international equity securities, fixed income securities, including bank loans and Rule 144A securities, and money market instruments), each represented by a different segment of the Fund’s portfolio. The subadviser typically adjusts the allocation among the four segments, based on its judgment about each segment’s potential for returns in comparison with those of other segments and corresponding risk. The Fund’s subadviser is Barings LLC (Barings).

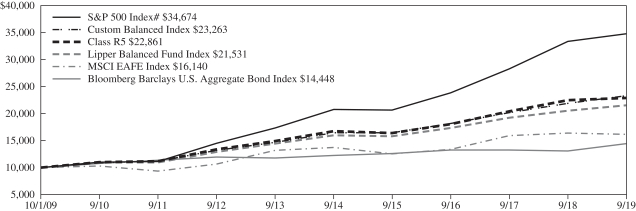

How did the Fund perform during the 12 months ended September 30, 2019?

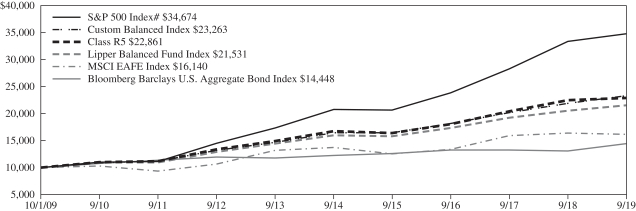

The Fund’s Class R5 shares returned 1.88%, underperforming the 4.25% return of the S&P 500® Index (“the Fund’s benchmark”), which measures the performance of 500 widely held stocks in the U.S. equity market, and outperforming the-1.34% return of the MSCI EAFE Index (“the international component’s benchmark”), which measures the performance of thelarge-andmid-cap segments of developed markets, excluding the U.S. and Canada equity securities. It is free float-adjusted market-capitalization weighted. The Fund substantially underperformed the 10.30% return of the Bloomberg Barclays U.S. Aggregate Bond Index (“the bond component’s benchmark”), which measures the performance of the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (MBS) (agency fixed-rate and hybrid ARM pass-throughs), asset-backed securities (ABS), and commercial mortgage-backed securities (CMBS). Additionally, the Fund’s Class R5 shares underperformed the 4.94% return of the Lipper Balanced Fund Index, an unmanaged, equally weighted index of the 30 largest mutual funds within the Lipper Balanced Category; and underperformed the 6.49% return of the Custom Balanced Index, which comprises the stock component’s benchmark, the bond component’s benchmark, and the international component’s benchmark. The weightings of each index in the Custom Balanced Index are 50%, 40% and 10%, respectively.

For a discussion on the economic and market environment during the12-month period ended September 30, 2019, please see the Economic and Market Overview, beginning on page 3.

Subadviser discussion of factors that contributed to the Fund’s stock component performance

U.S. stocks outperformed the international component’s benchmark, but underperformed the bond component’s benchmark. The Fund held an overweight allocation in domestic equities, relative to bonds, and this dragged on the Fund’s performance. Even though the trade war, rising rates and a hangover from the previous year’s tax cut contributed to slowing growth and caused stocks to plunge in the fourth quarter of 2018, equities recouped most of their losses early in 2019 on the expectation of easier monetary policy. However, stocks significantly underperformed bonds for the fiscal year.

Foreign stocks underperformed their U.S. counterparts for the year. The Fund held an underweight stake in foreign stocks, which helped performance. Because profits generated by stocks relative to their prices were unusually high as compared to profit potential from fixed income alternatives, Fund management chose to overweight stocks relative to bonds. However, based on the belief that those earnings may not hold up in a recession, Fund management moved money from stocks to bonds. While this proved to be a correct move, the Fund was still overweight equities, which ultimately hindered performance.

With respect to specific Fund holdings, having an underweight stake in NVIDIA, a semiconductor company, relative to the stock component’s benchmark, helped the Fund’s returns, as NVIDIA’s shares fell 38% during the period. However, the Fund’s overweight allocation to department store Nordstrom’s hampered returns, as it fell 41% during the year.

Subadviser discussion of factors that contributed to the Fund’s bond component performance

In the fixed income component, an overweight allocation to investment-grade corporate bonds, relative to the bond component’s benchmark, was the primary contributor to performance. The Fund’s allocation to asset-backed securities (ABS) was also a strong contributor, while its mortgage-backed securities (MBS) allocation detracted from performance.

23

MassMutual Premier Balanced Fund – Portfolio Manager Report (Unaudited)(Continued)

The Fund occasionally uses derivatives. In the stock component of the Fund, this detracted from performance. Derivatives are securities that derive their value from the performance of one or more other investments and take the form of a contract between two or more parties. Most derivatives are used for hedging, speculation, or both.

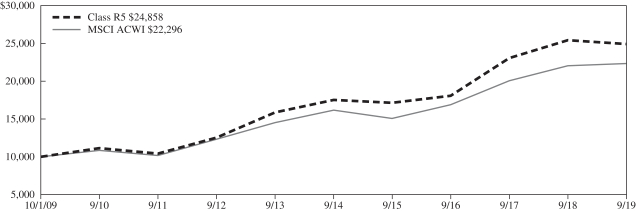

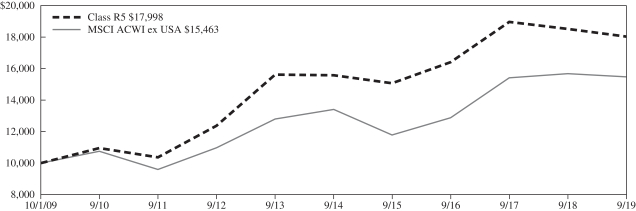

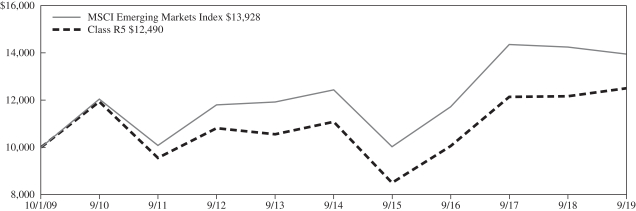

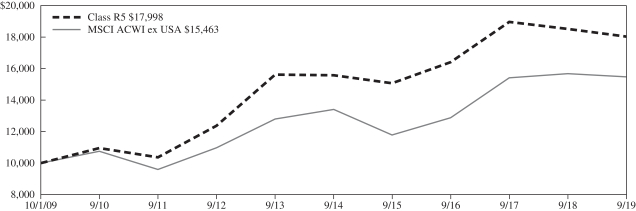

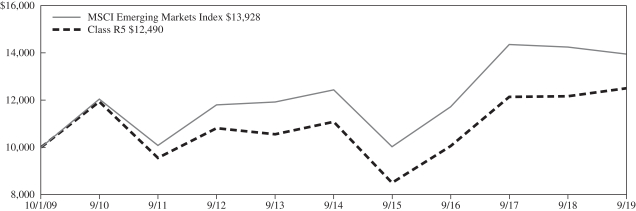

Subadviser outlook